UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07959

Advisors Series Trust

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jeffrey T. Rauman, President/Chief Executive Officer

Advisors Series Trust

c/o U.S. Bancorp Fund Services, LLC

777 East Wisconsin Avenue, 4th Floor

Milwaukee, WI 53202

(Name and address of agent for service)

(626) 914-7235

Registrant’s telephone number, including area code

Date of fiscal year end: November 30

Date of reporting period: May 31, 2024

Item 1. Reports to Stockholders.

| | |

| PIA BBB Bond Fund | |

| PBBBX |

| Semi-Annual Shareholder Report | May 31, 2024 |

This semi-annual shareholder report contains important information about the PIA BBB Bond Fund for the period of December 1, 2023, to May 31, 2024. You can find additional information about the Fund at https://www.pacificincome.com/mutual-funds/. You can also request this information by contacting us at 1-800-251-1970.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| PIA BBB Bond Fund | $9 | 0.17% |

KEY FUND STATISTICS (as of May 31, 2024)

| |

Net Assets | $202,736,530 |

Number of Holdings | 297 |

Portfolio Turnover | 6% |

Average Credit Quality | BBB |

Effective Duration | 6.80 yrs |

Weighted Average Maturity | 11.00 yrs |

Weighted Average Life | 10.67 yrs |

Distribution Yield | 4.21% |

30-Day SEC Yield | 5.55% |

30-Day SEC Yield Unsubsidized | 5.55% |

Visit https://www.pacificincome.com/mutual-funds/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of May 31, 2024)

Sector Breakdown (% of net assets)

| |

Top 10 Issuers | (%) |

Verizon Communications, Inc. | 2.4% |

AT&T, Inc. | 2.4% |

Oracle Corp. | 2.2% |

CVS Health Corp. | 1.8% |

Pacific Gas and Electric Co. | 1.6% |

Mexico Government International Bond | 1.6% |

T-Mobile USA, Inc. | 1.5% |

Boeing Co. | 1.5% |

Amgen, Inc. | 1.5% |

General Motors Financial Co., Inc. | 1.5% |

| PIA BBB Bond Fund | PAGE 1 | TSR_SAR_007989577 |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.pacificincome.com/mutual-funds/

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Pacific Income Advisers, Inc. documents not be householded, please contact Pacific Income Advisers, Inc. at 1-800-251-1970, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Pacific Income Advisers, Inc. or your financial intermediary.

| PIA BBB Bond Fund | PAGE 2 | TSR_SAR_007989577 |

20.817.510.99.28.88.77.56.56.23.9

| | |

| PIA MBS Bond Fund | |

| PMTGX |

| Semi-Annual Shareholder Report | May 31, 2024 |

This semi-annual shareholder report contains important information about the PIA MBS Bond Fund for the period of December 1, 2023, to May 31, 2024. You can find additional information about the Fund at https://www.pacificincome.com/mutual-funds/. You can also request this information by contacting us at 1-800-251-1970.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| PIA MBS Bond Fund | $13 | 0.25% |

KEY FUND STATISTICS (as of May 31, 2024)

| |

Net Assets | $88,571,743 |

Number of Holdings | 79 |

Portfolio Turnover | 11% |

Average Credit Quality | AAA |

Effective Duration | 5.70 yrs |

Weighted Average Maturity | 25.60 yrs |

Weighted Average Life | 8.70 yrs |

Distribution Yield | 4.13% |

30-Day SEC Yield | 3.87% |

30-Day SEC Yield Unsubsidized | 3.89% |

Visit https://www.pacificincome.com/mutual-funds/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of May 31, 2024)

Sector Breakdown (% of net assets)

| |

Top 10 Issuers | (%) |

FHLMC | 37.9% |

FNMA | 37.1% |

GNMA | 16.9% |

U.S. Treasury Bill | 2.3% |

Cold Storage Trust | 1.7% |

CF Hippolyta Issuer LLC | 1.4% |

Fidelity Government Portfolio | 1.2% |

SAFCO Auto Receivables Trust | 0.6% |

BX Trust | 0.5% |

| PIA MBS Bond Fund | PAGE 1 | TSR_SAR_007989494 |

HOW HAS THE FUND CHANGED?

This is a summary of certain changes to the Fund since December 1, 2023. For more complete information, you may review the Fund’s prospectus, dated March 31, 2024 at https://www.pacificincome.com/mutual-funds/ or upon request at 1-800-251-1970.

Change to the Fund’s Expense Cap.

Effective March 31, 2024, Pacific Income Advisors, Inc. (the “Adviser”) agreed to modify the PIA MBS Bond Fund’s (the “Fund”) Expense Limitation Agreement. The Board of Trustees (the “Trust”) approved a revised Expense Limitation Agreement between the Fund and the Trust, which increases the Fund’s expense cap from 0.23% to 0.28%. This means that the Adviser will be required to reimburse the Fund if expenses exceed 0.28%.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.pacificincome.com/mutual-funds/

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Pacific Income Advisers, Inc. documents not be householded, please contact Pacific Income Advisers, Inc. at 1-800-251-1970, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Pacific Income Advisers, Inc. or your financial intermediary.

| PIA MBS Bond Fund | PAGE 2 | TSR_SAR_007989494 |

94.12.03.9

| | |

| PIA High Yield MACS Fund | |

| PIAMX |

| Semi-Annual Shareholder Report | May 31, 2024 |

This semi-annual shareholder report contains important information about the PIA High Yield MACS Fund for the period of December 1, 2023, to May 31, 2024. You can find additional information about the Fund at https://www.pacificincome.com/mutual-funds/. You can also request this information by contacting us at 1-800-251-1970.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| PIA High Yield MACS Fund | $9 | 0.17% |

KEY FUND STATISTICS (as of May 31, 2024)

| |

Net Assets | $169,604,664 |

Number of Holdings | 107 |

Portfolio Turnover | 15% |

Average Credit Quality | B |

Effective Duration | 2.90 yrs |

Weighted Average Maturity | 4.10 yrs |

Weighted Average Life | 4.10 yrs |

Distribution Yield | 9.25% |

30-Day SEC Yield | 10.05% |

30-Day SEC Yield Unsubsidized | 10.05% |

Visit https://www.pacificincome.com/mutual-funds/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of May 31, 2024)

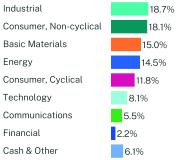

Sector Breakdown (% of net assets)

| |

Top 10 Issuers | (%) |

Fidelity Government Portfolio | 5.4% |

Alta Equipment Group, Inc. | 2.1% |

TKC Holdings, Inc. | 1.7% |

Verde Purchaser LLC | 1.7% |

Summit Midstream Holdings LLC / Summit Midstream Finance Corp. | 1.6% |

Rocket Software, Inc. | 1.5% |

GPD Cos., Inc. | 1.5% |

ITT Holdings LLC | 1.5% |

TMS International Corp./DE | 1.4% |

VistaJet Malta Finance PLC / Vista Management Holding, Inc. | 1.4% |

| PIA High Yield MACS Fund | PAGE 1 | TSR_SAR_00770X378 |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.pacificincome.com/mutual-funds/

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Pacific Income Advisers, Inc. documents not be householded, please contact Pacific Income Advisers, Inc. at 1-800-251-1970, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Pacific Income Advisers, Inc. or your financial intermediary.

| PIA High Yield MACS Fund | PAGE 2 | TSR_SAR_00770X378 |

18.718.115.014.511.88.15.52.26.1

| | |

| PIA High Yield Fund | |

| PHYSX |

| Semi-Annual Shareholder Report | May 31, 2024 |

This semi-annual shareholder report contains important information about the PIA High Yield Fund for the period of December 1, 2023, to May 31, 2024. You can find additional information about the Fund at https://www.pacificincome.com/mutual-funds/. You can also request this information by contacting us at 1-800-251-1970.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| PIA High Yield Fund | $44 | 0.86% |

KEY FUND STATISTICS (as of May 31, 2024)

| |

Net Assets | $61,993,702 |

Number of Holdings | 106 |

Portfolio Turnover | 17% |

Average Credit Quality | B |

Effective Duration | 2.90 yrs |

Weighted Average Maturity | 4.20 yrs |

Weighted Average Life | 4.20 yrs |

Distribution Yield | 8.45% |

30-Day SEC Yield | 9.38% |

30-Day SEC Yield Unsubsidized | 9.24% |

Visit https://www.pacificincome.com/mutual-funds/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of May 31, 2024)

Sector Breakdown (% of net assets)

| |

Top 10 Issuers | (%) |

Alta Equipment Group, Inc. | 2.1% |

Fidelity Government Portfolio | 2.0% |

Summit Midstream Holdings LLC / Summit Midstream Finance Corp. | 1.8% |

TKC Holdings, Inc. | 1.6% |

ITT Holdings LLC | 1.5% |

Mercer International, Inc. | 1.5% |

TMS International Corp./DE | 1.5% |

Pitney Bowes, Inc. | 1.5% |

Verde Purchaser LLC | 1.4% |

Consolidated Energy Finance SA | 1.4% |

| PIA High Yield Fund | PAGE 1 | TSR_SAR_007989163 |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.pacificincome.com/mutual-funds/

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Pacific Income Advisers, Inc. documents not be householded, please contact Pacific Income Advisers, Inc. at 1-800-251-1970, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Pacific Income Advisers, Inc. or your financial intermediary.

| PIA High Yield Fund | PAGE 2 | TSR_SAR_007989163 |

20.118.815.615.111.48.15.82.32.8

| | |

| PIA Short Term Securities Fund | |

| PIASX |

| Semi-Annual Shareholder Report | May 31, 2024 |

This semi-annual shareholder report contains important information about the PIA Short Term Securities Fund for the period of December 1, 2023, to May 31, 2024. You can find additional information about the Fund at https://www.pacificincome.com/mutual-funds/. You can also request this information by contacting us at 1-800-251-1970.

This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| PIA Short Term Securities Fund | $20 | 0.39% |

KEY FUND STATISTICS (as of May 31, 2024)

| |

Net Assets | $146,272,278 |

Number of Holdings | 110 |

Portfolio Turnover | 38% |

Average Credit Quality | A |

Effective Duration | 1.20 yrs |

Weighted Average Maturity | 2.80 yrs |

Weighted Average Life | 1.40 yrs |

Distribution Yield | 5.12% |

30-Day SEC Yield | 5.11% |

30-Day SEC Yield Unsubsidized | 5.10% |

Visit https://www.pacificincome.com/mutual-funds/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of May 31, 2024)

Sector Breakdown (% of net assets)

| |

Top 10 Issuers | (%) |

U.S. Treasury Note/Bond | 14.9% |

U.S. Treasury Bill | 11.8% |

Cold Storage Trust | 4.4% |

BX Trust | 2.7% |

AEGON Funding Co. LLC | 2.0% |

Ares Capital Corp. | 1.4% |

Camden Property Trust | 1.4% |

Carrier Global Corp. | 1.4% |

NextEra Energy Capital Holdings, Inc. | 1.4% |

Citizens Bank NA | 1.4% |

| PIA Short Term Securities Fund | PAGE 1 | TSR_SAR_007989551 |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.pacificincome.com/mutual-funds/

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Pacific Income Advisers, Inc. documents not be householded, please contact Pacific Income Advisers, Inc. at 1-800-251-1970, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Pacific Income Advisers, Inc. or your financial intermediary.

| PIA Short Term Securities Fund | PAGE 2 | TSR_SAR_007989551 |

23.014.912.29.46.16.05.14.13.016.2

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

| (a) | Schedule of Investments is included within the financial statements filed under Item 7 of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

PIA BBB Bond Fund

PIA MBS Bond Fund

PIA High Yield (MACS) Fund

Core Financial Statements

May 31, 2024

Back to Table of Contents

PIA BBB Bond Fund

Schedule of Investments

as of May 31, 2024 (Unaudited)

| | | | | | | |

CORPORATE BONDS - 92.7%

|

Aerospace/Defense - 3.4%

| | | | | | |

Boeing Co.

| | | | | | |

5.15%, 05/01/2030 | | | $ 1,950,000 | | | $ 1,858,300 |

5.71%, 05/01/2040 | | | 1,400,000 | | | 1,285,508 |

L3Harris Technologies, Inc., 6.15%, 12/15/2040 | | | 500,000 | | | 522,610 |

Northrop Grumman Corp.

| | | | | | |

4.40%, 05/01/2030 | | | 1,000,000 | | | 960,835 |

4.95%, 03/15/2053 | | | 500,000 | | | 451,232 |

RTX Corp.

| | | | | | |

3.50%, 03/15/2027 | | | 1,000,000 | | | 957,027 |

4.35%, 04/15/2047 | | | 1,000,000 | | | 823,066 |

| | | | | | 6,858,578 |

Agriculture - 2.2%

| | | | | | |

Altria Group, Inc.

| | | | | | |

4.80%, 02/14/2029 | | | 148,000 | | | 145,029 |

3.40%, 05/06/2030 | | | 1,600,000 | | | 1,437,030 |

BAT Capital Corp.

| | | | | | |

2.26%, 03/25/2028 | | | 1,000,000 | | | 891,629 |

4.54%, 08/15/2047 | | | 400,000 | | | 309,903 |

5.65%, 03/16/2052 | | | 800,000 | | | 718,881 |

Bunge Ltd. Finance Corp., 3.75%, 09/25/2027 | | | 600,000 | | | 570,700 |

Reynolds American, Inc., 4.45%, 06/12/2025 | | | 372,000 | | | 367,498 |

| | | | | | 4,440,670 |

Airlines - 0.4%

| | | | | | |

Southwest Airlines Co., 5.13%, 06/15/2027 | | | 500,000 | | | 496,333 |

United Airlines 2020-1 Class B Pass Through Trust, Series B, 4.88%, 01/15/2026 | | | 252,000 | | | 247,680 |

| | | | | | 744,013 |

Auto Manufacturers - 2.9%

| | | | | | |

Ford Motor Credit Co. LLC

| | | | | | |

3.82%, 11/02/2027 | | | 500,000 | | | 467,028 |

6.80%, 11/07/2028 | | | 500,000 | | | 515,935 |

7.12%, 11/07/2033 | | | 1,000,000 | | | 1,053,507 |

6.13%, 03/08/2034 | | | 500,000 | | | 491,914 |

General Motors Co., 5.20%, 04/01/2045 | | | 400,000 | | | 351,134 |

General Motors Financial Co., Inc.

| | | | | | |

4.00%, 01/15/2025 | | | 600,000 | | | 593,819 |

3.60%, 06/21/2030 | | | 1,300,000 | | | 1,160,197 |

2.35%, 01/08/2031 | | | 1,500,000 | | | 1,222,772 |

| | | | | | 5,856,306 |

Banks - 7.1%

| | | | | | |

Barclays PLC

| | | | | | |

4.84%, 05/09/2028 | | | 1,000,000 | | | 964,640 |

5.75% to 08/09/2032 then 1 yr. CMT Rate + 3.00%, 08/09/2033 | | | 1,000,000 | | | 997,465 |

3.33% to 11/24/2041 then 1 yr. CMT Rate + 1.30%, 11/24/2042 | | | 700,000 | | | 505,973 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

PIA BBB Bond Fund

Schedule of Investments

as of May 31, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Banks - (Continued)

|

Citigroup, Inc.

| | | | | | |

4.45%, 09/29/2027 | | | $ 1,700,000 | | | $ 1,653,533 |

5.30%, 05/06/2044 | | | 540,000 | | | 511,293 |

Citizens Financial Group, Inc., 5.84% to 01/23/2029 then SOFR +

2.01%, 01/23/2030 | | | 500,000 | | | 496,403 |

Comerica, Inc., 5.98% to 01/30/2029 then SOFR + 2.16%, 01/30/2030 | | | 500,000 | | | 492,540 |

Cooperatieve Rabobank UA, 3.75%, 07/21/2026 | | | 1,000,000 | | | 961,011 |

Deutsche Bank AG/New York NY, 4.10%, 01/13/2026 | | | 1,000,000 | | | 974,882 |

Fifth Third Bancorp

| | | | | | |

4.06% to 04/25/2027 then SOFR + 1.36%, 04/25/2028 | | | 500,000 | | | 476,563 |

8.25%, 03/01/2038 | | | 225,000 | | | 263,346 |

Goldman Sachs Group, Inc., 6.75%, 10/01/2037 | | | 950,000 | | | 1,028,901 |

HSBC Holdings PLC, 7.40% to 11/13/2033 then SOFR + 3.02%, 11/13/2034 | | | 1,100,000 | | | 1,193,358 |

Lloyds Banking Group PLC, 4.65%, 03/24/2026 | | | 800,000 | | | 784,412 |

M&T Bank Corp., 6.08% to 03/13/2031 then SOFR + 2.26%, 03/13/2032 | | | 500,000 | | | 495,420 |

Morgan Stanley, 2.48% to 09/16/2031 then SOFR + 1.36%, 09/16/2036 | | | 900,000 | | | 709,238 |

Santander Holdings USA, Inc.

| | | | | | |

3.45%, 06/02/2025 | | | 700,000 | | | 683,483 |

6.34% to 05/31/2034 then SOFR + 2.14%, 05/31/2035 | | | 1,000,000 | | | 999,689 |

Westpac Banking Corp., 3.13%, 11/18/2041 | | | 300,000 | | | 209,988 |

| | | | | | 14,402,138 |

Beverages - 1.0%

| | | | | | |

Constellation Brands, Inc., 2.88%, 05/01/2030 | | | 700,000 | | | 611,332 |

Keurig Dr Pepper, Inc.

| | | | | | |

3.20%, 05/01/2030 | | | 1,000,000 | | | 896,417 |

4.50%, 04/15/2052 | | | 500,000 | | | 416,303 |

| | | | | | 1,924,052 |

Biotechnology - 2.6%

| | | | | | |

Amgen, Inc.

| | | | | | |

2.20%, 02/21/2027 | | | 1,000,000 | | | 924,061 |

5.25%, 03/02/2033 | | | 1,000,000 | | | 990,901 |

2.80%, 08/15/2041 | | | 500,000 | | | 351,697 |

4.66%, 06/15/2051 | | | 1,006,000 | | | 859,227 |

Biogen, Inc., 2.25%, 05/01/2030 | | | 700,000 | | | 588,542 |

Gilead Sciences, Inc.

| | | | | | |

1.65%, 10/01/2030 | | | 1,100,000 | | | 895,764 |

2.60%, 10/01/2040 | | | 500,000 | | | 342,419 |

Royalty Pharma PLC, 2.15%, 09/02/2031 | | | 500,000 | | | 398,562 |

| | | | | | 5,351,173 |

Building Materials - 0.4%

| | | | | | |

Carrier Global Corp., 2.70%, 02/15/2031 | | | 240,000 | | | 205,195 |

Vulcan Materials Co., 3.90%, 04/01/2027 | | | 620,000 | | | 600,352 |

| | | | | | 805,547 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

PIA BBB Bond Fund

Schedule of Investments

as of May 31, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Chemicals - 1.5%

| | | | | | |

Dow Chemical Co.

| | | | | | |

7.38%, 11/01/2029 | | | $ 396,000 | | | $ 434,593 |

6.90%, 05/15/2053 | | | 500,000 | | | 560,291 |

DuPont de Nemours, Inc., 4.73%, 11/15/2028 | | | 1,000,000 | | | 992,526 |

Nutrien Ltd., 2.95%, 05/13/2030 | | | 700,000 | | | 616,905 |

Sherwin-Williams Co., 2.20%, 03/15/2032 | | | 600,000 | | | 483,336 |

| | | | | | 3,087,651 |

Commercial Services - 0.6%

| | | | | | |

Equifax, Inc., 3.10%, 05/15/2030 | | | 500,000 | | | 443,628 |

Global Payments, Inc., 1.20%, 03/01/2026 | | | 500,000 | | | 463,542 |

Moody’s Corp.

| | | | | | |

2.00%, 08/19/2031 | | | 250,000 | | | 201,485 |

3.10%, 11/29/2061 | | | 250,000 | | | 152,478 |

| | | | | | 1,261,133 |

Computers - 1.2%

| | | | | | |

Dell International LLC / EMC Corp.

| | | | | | |

6.02%, 06/15/2026 | | | 642,000 | | | 647,748 |

6.20%, 07/15/2030 | | | 500,000 | | | 522,415 |

3.45%, 12/15/2051 | | | 181,000 | | | 122,927 |

Hewlett Packard Enterprise Co., 4.90%, 10/15/2025 | | | 700,000 | | | 694,494 |

HP, Inc., 5.50%, 01/15/2033 | | | 500,000 | | | 499,574 |

| | | | | | 2,487,158 |

Diversified Financial Services - 3.8%

| | | | | | |

AerCap Ireland Capital DAC / AerCap Global Aviation Trust, 3.30%, 01/30/2032 | | | 1,500,000 | | | 1,276,085 |

Air Lease Corp.

| | | | | | |

2.88%, 01/15/2026 | | | 450,000 | | | 430,137 |

5.30%, 02/01/2028 | | | 1,000,000 | | | 995,002 |

Ally Financial, Inc., 2.20%, 11/02/2028 | | | 500,000 | | | 430,037 |

Brightsphere Investment Group, Inc., 4.80%, 07/27/2026 | | | 1,000,000 | | | 959,945 |

Capital One Financial Corp., 3.65%, 05/11/2027 | | | 1,400,000 | | | 1,335,178 |

Jefferies Financial Group, Inc., 6.20%, 04/14/2034 | | | 500,000 | | | 501,789 |

Nasdaq, Inc., 5.55%, 02/15/2034 | | | 500,000 | | | 498,562 |

Nomura Holdings, Inc., 2.17%, 07/14/2028 | | | 1,000,000 | | | 876,756 |

Synchrony Financial, 4.50%, 07/23/2025 | | | 500,000 | | | 490,731 |

| | | | | | 7,794,222 |

Electric - 6.9%

| | | | | | |

AEP Texas, Inc., 5.45%, 05/15/2029 | | | 500,000 | | | 499,219 |

American Electric Power Co., Inc., 5.95%, 11/01/2032 | | | 500,000 | | | 510,366 |

Black Hills Corp., 6.00%, 01/15/2035 | | | 500,000 | | | 499,456 |

Constellation Energy Generation LLC, 5.75%, 03/15/2054 | | | 250,000 | | | 241,961 |

Dominion Energy, Inc., 2.25%, 08/15/2031 | | | 500,000 | | | 404,065 |

Dominion Resources, Inc., 4.90%, 08/01/2041 | | | 470,000 | | | 415,219 |

DTE Energy Co., 1.05%, 06/01/2025 | | | 600,000 | | | 574,077 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

PIA BBB Bond Fund

Schedule of Investments

as of May 31, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Electric - (Continued)

|

Duke Energy Corp.

| | | | | | |

2.45%, 06/01/2030 | | | $ 950,000 | | | $ 809,319 |

3.30%, 06/15/2041 | | | 1,000,000 | | | 726,650 |

El Paso Electric Co., 6.00%, 05/15/2035 | | | 850,000 | | | 845,683 |

Eversource Energy, 2.55%, 03/15/2031 | | | 500,000 | | | 412,820 |

Exelon Corp., 5.45%, 03/15/2034 | | | 600,000 | | | 594,034 |

FirstEnergy Corp., 2.25%, 09/01/2030 | | | 700,000 | | | 578,051 |

NextEra Energy Capital Holdings, Inc.

| | | | | | |

4.63%, 07/15/2027 | | | 500,000 | | | 490,555 |

2.25%, 06/01/2030 | | | 400,000 | | | 337,391 |

5.25%, 03/15/2034 | | | 600,000 | | | 586,926 |

Pacific Gas and Electric Co., 3.50%, 08/01/2050 | | | 5,000,000 | | | 3,290,447 |

Sempra, 4.13% to 04/01/2027 then 5 yr. CMT Rate + 2.87%, 04/01/2052 | | | 600,000 | | | 554,240 |

Southern Co., 3.25%, 07/01/2026 | | | 1,000,000 | | | 959,835 |

Southwestern Electric Power Co., 3.25%, 11/01/2051 | | | 400,000 | | | 254,720 |

Xcel Energy, Inc., 2.35%, 11/15/2031 | | | 500,000 | | | 400,773 |

| | | | | | 13,985,807 |

Electronics - 0.4%

| | | | | | |

Fortive Corp., 3.15%, 06/15/2026 | | | 750,000 | | | 716,796 |

Entertainment - 1.0%

| | | | | | |

Warnermedia Holdings, Inc.

| | | | | | |

4.28%, 03/15/2032 | | | 1,000,000 | | | 874,093 |

5.14%, 03/15/2052 | | | 1,500,000 | | | 1,181,225 |

| | | | | | 2,055,318 |

Environmental Control - 0.7%

| | | | | | |

Republic Services, Inc., 0.88%, 11/15/2025 | | | 1,000,000 | | | 937,211 |

Waste Connections, Inc., 4.20%, 01/15/2033 | | | 500,000 | | | 462,013 |

| | | | | | 1,399,224 |

Food - 2.8%

| | | | | | |

ConAgra Brands, Inc., 7.00%, 10/01/2028 | | | 1,300,000 | | | 1,379,123 |

General Mills, Inc., 2.25%, 10/14/2031 | | | 700,000 | | | 573,513 |

Kroger Co., 2.20%, 05/01/2030 | | | 1,000,000 | | | 845,743 |

Mondelez International, Inc., 1.50%, 02/04/2031 | | | 2,000,000 | | | 1,589,454 |

Sysco Corp.

| | | | | | |

5.95%, 04/01/2030 | | | 464,000 | | | 480,836 |

3.15%, 12/14/2051 | | | 400,000 | | | 261,519 |

Tyson Foods, Inc., 4.35%, 03/01/2029 | | | 600,000 | | | 575,775 |

| | | | | | 5,705,963 |

Forest Products & Paper - 0.3%

| | | | | | |

International Paper Co., 6.00%, 11/15/2041 | | | 700,000 | | | 688,907 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

PIA BBB Bond Fund

Schedule of Investments

as of May 31, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Gas - 0.3%

| | | | | | |

NiSource Finance Corp., 5.25%, 02/15/2043 | | | $ 400,000 | | | $ 369,379 |

NiSource, Inc., 5.35%, 04/01/2034 | | | 250,000 | | | 244,154 |

| | | | | | 613,533 |

Hand/Machine Tools - 0.1%

| | | | | | |

Kennametal, Inc., 2.80%, 03/01/2031 | | | 330,000 | | | 276,337 |

Healthcare-Products - 1.4%

| | | | | | |

Agilent Technologies, Inc., 2.30%, 03/12/2031 | | | 215,000 | | | 178,468 |

Boston Scientific Corp., 2.65%, 06/01/2030 | | | 560,000 | | | 487,592 |

GE HealthCare Technologies, Inc., 5.86%, 03/15/2030 | | | 500,000 | | | 512,117 |

Solventum Corp., 5.60%, 03/23/2034(a) | | | 500,000 | | | 490,404 |

Stryker Corp., 1.95%, 06/15/2030 | | | 700,000 | | | 585,895 |

Zimmer Biomet Holdings, Inc., 3.05%, 01/15/2026 | | | 500,000 | | | 481,014 |

| | | | | | 2,735,490 |

Healthcare-Services - 3.0%

| | | | | | |

CommonSpirit Health, 2.78%, 10/01/2030 | | | 600,000 | | | 516,085 |

Elevance Health, Inc.

| | | | | | |

5.50%, 10/15/2032 | | | 500,000 | | | 504,494 |

4.65%, 08/15/2044 | | | 600,000 | | | 524,008 |

5.13%, 02/15/2053 | | | 1,000,000 | | | 916,583 |

HCA, Inc.

| | | | | | |

4.13%, 06/15/2029 | | | 1,000,000 | | | 941,075 |

5.60%, 04/01/2034 | | | 1,000,000 | | | 989,705 |

4.38%, 03/15/2042 | | | 600,000 | | | 492,885 |

Humana, Inc., 4.88%, 04/01/2030 | | | 500,000 | | | 487,226 |

Laboratory Corp. of America Holdings, 3.25%, 09/01/2024 | | | 640,000 | | | 636,094 |

| | | | | | 6,008,155 |

Home Builders - 0.2%

| | | | | | |

DR Horton, Inc., 2.60%, 10/15/2025 | | | 500,000 | | | 480,653 |

Household Products/Wares - 0.2%

| | | | | | |

Church & Dwight Co., Inc., 3.15%, 08/01/2027 | | | 500,000 | | | 473,268 |

Insurance - 3.4%

| | | | | | |

Aon Corp., 2.80%, 05/15/2030 | | | 600,000 | | | 522,312 |

CNA Financial Corp., 5.13%, 02/15/2034 | | | 500,000 | | | 478,423 |

Corebridge Financial, Inc.

| | | | | | |

3.90%, 04/05/2032 | | | 500,000 | | | 446,045 |

6.05%, 09/15/2033(a) | | | 500,000 | | | 510,696 |

Fidelity National Financial, Inc., 2.45%, 03/15/2031 | | | 2,000,000 | | | 1,618,557 |

Lincoln National Corp.

| | | | | | |

3.80%, 03/01/2028 | | | 120,000 | | | 113,946 |

5.85%, 03/15/2034 | | | 500,000 | | | 496,831 |

Mercury General Corp., 4.40%, 03/15/2027 | | | 500,000 | | | 481,963 |

Metlife, Inc., 6.40%, 12/15/2036 | | | 855,000 | | | 863,902 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

PIA BBB Bond Fund

Schedule of Investments

as of May 31, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Insurance - (Continued)

|

Old Republic International Corp., 5.75%, 03/28/2034 | | | $ 1,000,000 | | | $ 993,158 |

Prudential Financial, Inc., 5.13% to 02/28/2032 then 5 yr. CMT Rate +

3.16%, 03/01/2052 | | | 500,000 | | | 464,607 |

| | | | | | 6,990,440 |

Internet - 0.2%

| | | | | | |

eBay, Inc., 2.60%, 05/10/2031 | | | 500,000 | | | 424,067 |

Investment Companies - 1.2%

| | | | | | |

Blackstone Private Credit Fund, 5.95%, 07/16/2029(a) | | | 500,000 | | | 491,693 |

Blackstone Secured Lending Fund, 3.63%, 01/15/2026 | | | 1,000,000 | | | 959,109 |

FS KKR Capital Corp., 4.63%, 07/15/2024 | | | 1,000,000 | | | 997,645 |

| | | | | | 2,448,447 |

Iron/Steel - 0.2%

| | | | | | |

Vale Overseas Ltd., 6.13%, 06/12/2033 | | | 500,000 | | | 501,612 |

Lodging - 0.7%

| | | | | | |

Marriott International, Inc./MD, 4.90%, 04/15/2029 | | | 500,000 | | | 491,104 |

Sands China Ltd., 2.30%, 03/08/2027 | | | 1,000,000 | | | 911,128 |

| | | | | | 1,402,232 |

Machinery-Diversified - 0.9%

| | | | | | |

CNH Industrial Capital LLC, 5.10%, 04/20/2029 | | | 500,000 | | | 495,665 |

IDEX Corp., 3.00%, 05/01/2030 | | | 1,000,000 | | | 873,251 |

Westinghouse Air Brake Technologies Corp., 5.61%, 03/11/2034 | | | 500,000 | | | 500,876 |

| | | | | | 1,869,792 |

Media - 2.2%

| | | | | | |

Charter Communications Operating LLC / Charter Communications Operating Capital

|

2.80%, 04/01/2031 | | | 1,000,000 | | | 815,054 |

2.30%, 02/01/2032 | | | 1,000,000 | | | 765,591 |

3.90%, 06/01/2052 | | | 1,000,000 | | | 627,493 |

Discovery Communications LLC, 3.63%, 05/15/2030 | | | 1,000,000 | | | 878,866 |

Paramount Global, 4.38%, 03/15/2043 | | | 610,000 | | | 417,789 |

Time Warner Cable Enterprises LLC, 8.38%, 07/15/2033 | | | 810,000 | | | 895,737 |

| | | | | | 4,400,530 |

Mining - 0.8%

| | | | | | |

Newmont Corp., 4.88%, 03/15/2042 | | | 800,000 | | | 729,693 |

Southern Copper Corp., 6.75%, 04/16/2040 | | | 750,000 | | | 819,181 |

| | | | | | 1,548,874 |

Miscellaneous Manufacturing - 0.5%

| | | | | | |

Parker-Hannifin Corp., 3.25%, 06/14/2029 | | | 550,000 | | | 502,654 |

Textron, Inc., 6.10%, 11/15/2033 | | | 500,000 | | | 515,180 |

| | | | | | 1,017,834 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

PIA BBB Bond Fund

Schedule of Investments

as of May 31, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Oil & Gas - 2.4%

| | | | | | |

Canadian Natural Resources Ltd., 4.95%, 06/01/2047 | | | $ 700,000 | | | $ 612,679 |

Diamondback Energy, Inc., 3.13%, 03/24/2031 | | | 500,000 | | | 437,476 |

Hess Corp., 5.60%, 02/15/2041 | | | 800,000 | | | 795,450 |

Marathon Petroleum Corp., 3.63%, 09/15/2024 | | | 500,000 | | | 496,605 |

Phillips 66, 1.30%, 02/15/2026 | | | 950,000 | | | 887,441 |

Suncor Energy, Inc., 3.75%, 03/04/2051 | | | 500,000 | | | 357,677 |

Valero Energy Corp.

| | | | | | |

2.80%, 12/01/2031 | | | 750,000 | | | 632,155 |

6.63%, 06/15/2037 | | | 655,000 | | | 698,117 |

| | | | | | 4,917,600 |

Oil & Gas Services - 0.5%

| | | | | | |

Halliburton Co.

| | | | | | |

3.80%, 11/15/2025 | | | 24,000 | | | 23,444 |

2.92%, 03/01/2030 | | | 1,000,000 | | | 889,879 |

| | | | | | 913,323 |

Packaging & Containers - 0.2%

| | | | | | |

WRKCo, Inc., 3.90%, 06/01/2028 | | | 500,000 | | | 473,784 |

Pharmaceuticals - 3.7%

| | | | | | |

AbbVie, Inc., 4.75%, 03/15/2045 | | | 268,000 | | | 244,040 |

Becton Dickinson & Co., 4.69%, 12/15/2044 | | | 550,000 | | | 484,434 |

Cardinal Health, Inc., 3.41%, 06/15/2027 | | | 125,000 | | | 118,589 |

Cigna Group/The

| | | | | | |

4.50%, 02/25/2026 | | | 327,000 | | | 322,306 |

2.40%, 03/15/2030 | | | 1,391,000 | | | 1,192,069 |

3.40%, 03/15/2050 | | | 600,000 | | | 407,706 |

CVS Health Corp.

| | | | | | |

3.75%, 04/01/2030 | | | 2,150,000 | | | 1,961,535 |

5.13%, 07/20/2045 | | | 500,000 | | | 440,347 |

5.05%, 03/25/2048 | | | 1,000,000 | | | 859,645 |

6.05%, 06/01/2054 | | | 500,000 | | | 489,214 |

Viatris, Inc., 2.70%, 06/22/2030 | | | 600,000 | | | 504,296 |

Zoetis, Inc., 2.00%, 05/15/2030 | | | 600,000 | | | 500,534 |

| | | | | | 7,524,715 |

Pipelines - 5.9%

| | | | | | |

Boardwalk Pipelines LP, 3.60%, 09/01/2032 | | | 500,000 | | | 428,653 |

Enbridge, Inc.

| | | | | | |

3.13%, 11/15/2029 | | | 1,000,000 | | | 899,558 |

3.40%, 08/01/2051 | | | 250,000 | | | 168,518 |

Energy Transfer LP, 5.00%, 05/15/2050 | | | 1,000,000 | | | 847,073 |

Enterprise Products Operating LLC

| | | | | | |

4.85%, 08/15/2042 | | | 850,000 | | | 772,098 |

3.30%, 02/15/2053 | | | 500,000 | | | 336,712 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

PIA BBB Bond Fund

Schedule of Investments

as of May 31, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Pipelines - (Continued)

|

Kinder Morgan Energy Partners, 5.80%, 03/15/2035 | | | $ 1,270,000 | | | $ 1,267,427 |

Kinder Morgan, Inc.

| | | | | | |

2.00%, 02/15/2031 | | | 600,000 | | | 487,556 |

5.55%, 06/01/2045 | | | 700,000 | | | 654,885 |

MPLX LP

| | | | | | |

4.25%, 12/01/2027 | | | 1,315,000 | | | 1,270,034 |

4.95%, 03/14/2052 | | | 600,000 | | | 509,784 |

ONEOK, Inc.

| | | | | | |

3.20%, 03/15/2025 | | | 500,000 | | | 489,727 |

6.10%, 11/15/2032 | | | 500,000 | | | 514,598 |

Plains All American Pipeline LP / PAA Finance Corp., 3.80%, 09/15/2030 | | | 546,000 | | | 496,396 |

Targa Resources Corp., 5.20%, 07/01/2027 | | | 500,000 | | | 497,754 |

TransCanada PipeLines Ltd., 4.10%, 04/15/2030 | | | 1,100,000 | | | 1,029,958 |

Williams Cos., Inc.

| | | | | | |

3.90%, 01/15/2025 | | | 800,000 | | | 791,560 |

5.10%, 09/15/2045 | | | 500,000 | | | 452,730 |

| | | | | | 11,915,021 |

REITs - 5.3%

| | | | | | |

Alexandria Real Estate Equities, Inc., 1.88%, 02/01/2033 | | | 650,000 | | | 486,578 |

American Tower Corp.

| | | | | | |

2.75%, 01/15/2027 | | | 500,000 | | | 468,765 |

1.88%, 10/15/2030 | | | 1,000,000 | | | 806,468 |

Boston Properties LP, 3.25%, 01/30/2031 | | | 675,000 | | | 568,487 |

COPT Defense Properties LP, 2.75%, 04/15/2031 | | | 500,000 | | | 411,053 |

Crown Castle, Inc.

| | | | | | |

3.65%, 09/01/2027 | | | 500,000 | | | 473,869 |

2.25%, 01/15/2031 | | | 600,000 | | | 490,834 |

Equinix, Inc.

| | | | | | |

1.55%, 03/15/2028 | | | 500,000 | | | 435,144 |

3.90%, 04/15/2032 | | | 100,000 | | | 90,042 |

Essex Portfolio LP, 3.38%, 04/15/2026 | | | 1,000,000 | | | 961,555 |

Extra Space Storage LP, 5.90%, 01/15/2031 | | | 500,000 | | | 508,465 |

GLP Capital LP / GLP Financing II, Inc., 3.25%, 01/15/2032 | | | 250,000 | | | 207,610 |

Healthpeak OP LLC, 2.13%, 12/01/2028 | | | 350,000 | | | 307,136 |

Kimco Realty OP LLC, 6.40%, 03/01/2034 | | | 500,000 | | | 526,620 |

Omega Healthcare Investors, Inc., 3.25%, 04/15/2033 | | | 1,000,000 | | | 801,524 |

Sabra Health Care LP, 3.90%, 10/15/2029 | | | 1,000,000 | | | 894,000 |

Store Capital LLC, 4.50%, 03/15/2028 | | | 810,000 | | | 766,189 |

Ventas Realty LP, 5.63%, 07/01/2034 | | | 600,000 | | | 590,636 |

Welltower OP LLC, 2.75%, 01/15/2031 | | | 700,000 | | | 598,054 |

Weyerhaeuser Co., 7.38%, 03/15/2032 | | | 226,000 | | | 253,082 |

| | | | | | 10,646,111 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

PIA BBB Bond Fund

Schedule of Investments

as of May 31, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Retail - 3.5%

| | | | | | |

AutoNation, Inc., 3.50%, 11/15/2024 | | | $ 200,000 | | | $ 197,688 |

AutoZone, Inc., 4.75%, 08/01/2032 | | | 500,000 | | | 477,319 |

Genuine Parts Co., 1.88%, 11/01/2030 | | | 500,000 | | | 404,308 |

Lowe’s Cos., Inc.

| | | | | | |

4.50%, 04/15/2030 | | | 1,000,000 | | | 965,691 |

1.70%, 10/15/2030 | | | 500,000 | | | 404,607 |

5.63%, 04/15/2053 | | | 1,000,000 | | | 965,516 |

McDonald’s Corp.

| | | | | | |

3.50%, 07/01/2027 | | | 1,100,000 | | | 1,048,749 |

4.88%, 12/09/2045 | | | 550,000 | | | 494,866 |

Starbucks Corp., 2.55%, 11/15/2030 | | | 1,000,000 | | | 855,577 |

Tractor Supply Co., 1.75%, 11/01/2030 | | | 500,000 | | | 402,184 |

Walgreens Boots Alliance, Inc., 3.20%, 04/15/2030 | | | 1,000,000 | | | 873,350 |

| | | | | | 7,089,855 |

Semiconductors - 1.7%

| | | | | | |

Broadcom, Inc.

| | | | | | |

4.15%, 11/15/2030 | | | 431,000 | | | 403,035 |

3.42%, 04/15/2033(a) | | | 1,500,000 | | | 1,278,504 |

3.19%, 11/15/2036(a) | | | 55,000 | | | 43,051 |

4.93%, 05/15/2037(a) | | | 583,000 | | | 541,769 |

Micron Technology, Inc., 2.70%, 04/15/2032 | | | 250,000 | | | 205,964 |

NXP BV / NXP Funding LLC / NXP USA, Inc.

| | | | | | |

4.40%, 06/01/2027 | | | 500,000 | | | 487,295 |

2.50%, 05/11/2031 | | | 500,000 | | | 417,096 |

| | | | | | 3,376,714 |

Software - 3.6%

| | | | | | |

Fidelity National Information Services, Inc., 5.10%, 07/15/2032 | | | 600,000 | | | 591,577 |

Fiserv, Inc.

| | | | | | |

3.85%, 06/01/2025 | | | 600,000 | | | 589,325 |

5.63%, 08/21/2033 | | | 500,000 | | | 502,074 |

Oracle Corp.

| | | | | | |

1.65%, 03/25/2026 | | | 1,685,000 | | | 1,576,222 |

3.65%, 03/25/2041 | | | 1,400,000 | | | 1,071,040 |

3.95%, 03/25/2051 | | | 1,350,000 | | | 992,277 |

5.55%, 02/06/2053 | | | 1,000,000 | | | 942,576 |

Roper Technologies, Inc., 1.40%, 09/15/2027 | | | 650,000 | | | 575,111 |

VMware LLC, 4.65%, 05/15/2027 | | | 550,000 | | | 539,275 |

| | | | | | 7,379,477 |

Telecommunications - 8.5%

| | | | | | |

AT&T, Inc.

| | | | | | |

2.30%, 06/01/2027 | | | 1,400,000 | | | 1,286,077 |

2.55%, 12/01/2033 | | | 875,000 | | | 688,933 |

3.50%, 09/15/2053 | | | 2,368,000 | | | 1,596,709 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

PIA BBB Bond Fund

Schedule of Investments

as of May 31, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Telecommunications - (Continued)

|

3.55%, 09/15/2055 | | | $1,196,000 | | | $ 801,627 |

3.80%, 12/01/2057 | | | 727,000 | | | 504,675 |

British Telecommunications PLC, 9.63%, 12/15/2030 | | | 855,000 | | | 1,037,877 |

Deutsche Telekom International Finance, 8.75%, 06/15/2030 | | | 345,000 | | | 401,860 |

France Telecom SA, 5.38%, 01/13/2042 | | | 575,000 | | | 553,171 |

Motorola Solutions, Inc., 5.40%, 04/15/2034 | | | 500,000 | | | 493,124 |

Rogers Communications, Inc., 5.00%, 03/15/2044 | | | 989,000 | | | 883,749 |

Telefonica Emisiones SA, 7.05%, 06/20/2036 | | | 475,000 | | | 514,781 |

T-Mobile USA, Inc.

| | | | | | |

3.88%, 04/15/2030 | | | 1,600,000 | | | 1,484,647 |

2.25%, 11/15/2031 | | | 600,000 | | | 486,467 |

3.40%, 10/15/2052 | | | 1,100,000 | | | 745,783 |

5.65%, 01/15/2053 | | | 500,000 | | | 491,482 |

Verizon Communications, Inc.

| | | | | | |

3.00%, 03/22/2027 | | | 1,000,000 | | | 944,050 |

3.15%, 03/22/2030 | | | 550,000 | | | 492,281 |

2.55%, 03/21/2031 | | | 336,000 | | | 282,913 |

4.86%, 08/21/2046 | | | 1,500,000 | | | 1,366,879 |

3.55%, 03/22/2051 | | | 2,000,000 | | | 1,427,551 |

2.99%, 10/30/2056 | | | 600,000 | | | 364,469 |

Vodafone Group PLC, 4.38%, 05/30/2028 | | | 400,000 | | | 390,191 |

| | | | | | 17,239,296 |

Transportation - 2.1%

| | | | | | |

Canadian Pacific Railway Co., 2.90%, 02/01/2025 | | | 700,000 | | | 687,732 |

CSX Corp., 6.22%, 04/30/2040 | | | 1,390,000 | | | 1,489,224 |

FedEx Corp., 3.25%, 05/15/2041 | | | 1,000,000 | | | 727,030 |

Kirby Corp., 4.20%, 03/01/2028 | | | 450,000 | | | 433,711 |

Norfolk Southern Corp.

| | | | | | |

2.30%, 05/15/2031 | | | 250,000 | | | 208,391 |

2.90%, 08/25/2051 | | | 1,000,000 | | | 620,296 |

| | | | | | 4,166,384 |

Trucking & Leasing - 0.5%

| | | | | | |

GATX Corp., 1.90%, 06/01/2031 | | | 1,300,000 | | | 1,028,044 |

Water - 0.3% | | | | | | |

American Water Capital Corp., 2.80%, 05/01/2030 | | | 650,000 | | | 567,939 |

TOTAL CORPORATE BONDS

(Cost $213,686,543) | | | | | | 187,994,183 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

PIA BBB Bond Fund

Schedule of Investments

as of May 31, 2024 (Unaudited) (Continued)

| | | | | | | |

FOREIGN GOVERNMENT DEBT OBLIGATIONS - 5.2%

|

Columbia Government International Bond, 3.88%, 04/25/2027 | | | $ 600,000 | | | $ 563,900 |

Indonesia Government International Bond

| | | | | | |

3.85%, 10/15/2030 | | | 500,000 | | | 461,347 |

4.70%, 02/10/2034 | | | 500,000 | | | 480,000 |

Mexico Government International Bond

| | | | | | |

4.50%, 04/22/2029 | | | 1,300,000 | | | 1,243,833 |

4.75%, 03/08/2044 | | | 2,490,000 | | | 2,020,173 |

Panama Government International Bond

| | | | | | |

2.25%, 09/29/2032 | | | 1,700,000 | | | 1,214,564 |

6.70%, 01/26/2036 | | | 750,000 | | | 721,030 |

Peruvian Government International Bond

| | | | | | |

3.00%, 01/15/2034 | | | 400,000 | | | 320,840 |

6.55%, 03/14/2037 | | | 1,050,000 | | | 1,107,701 |

Philippine Government International Bond, 5.00%, 01/13/2037 | | | 1,625,000 | | | 1,565,639 |

Uruguay Government International Bond, 4.38%, 01/23/2031 | | | 800,000 | | | 773,953 |

TOTAL FOREIGN GOVERNMENT DEBT OBLIGATIONS

(Cost $12,680,504) | | | | | | 10,472,980 |

| | | | | | | |

| |

U.S. Treasury Note/Bond

| | | | | | |

4.50%, 11/15/2033 | | | 500,000 | | | 499,180 |

4.25%, 02/15/2054 | | | 1,500,000 | | | 1,402,734 |

TOTAL U.S. TREASURY OBLIGATIONS

(Cost $1,928,789) | | | | | | 1,901,914 |

| | | Shares | |

SHORT-TERM INVESTMENTS - 0.1%

|

Money Market Funds - 0.1%

|

Fidelity Government Portfolio - Class Institutional, 5.21%(b) | | | 249,742 | | | 249,742 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $249,742) | | | | | | 249,742 |

TOTAL INVESTMENTS - 99.0%

(Cost $228,545,578) | | | | | | $200,618,819 |

Other Assets in Excess of Liabilities - 1.0% | | | | | | 2,117,711 |

TOTAL NET ASSETS - 100.0% | | | | | | $202,736,530 |

| | | | | | | |

Percentages are stated as a percent of net assets.

CMT - Constant Maturity Treasury Rate

PLC - Public Limited Company

SOFR - Secured Overnight Financing Rate

(a)

| Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of May 31, 2024, the value of these securities total $3,356,117 or 1.7% of the Fund’s net assets.

|

(b)

| The rate shown represents the 7-day effective yield as of May 31, 2024. |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

PIA MBS Bond Fund

Schedule of Investments

as of May 31, 2024 (Unaudited)

| | | | | | | |

MORTGAGE-BACKED SECURITIES - 94.1%

|

BX Trust, Series 2021-RISE, Class B, 6.68% (1 mo. Term SOFR + 1.36%), 11/15/2036(a) | | | $ 403,495 | | | $ 401,096 |

Cold Storage Trust, Series 2020-ICE5, Class A, 6.33% (1 mo. Term SOFR + 1.01%), 11/15/2037(a) | | | 1,474,486 | | | 1,472,753 |

FHLMC

| | | | | | |

Pool G04832, 5.00%, 10/01/2038 | | | 52,388 | | | 51,706 |

Pool G08741, 3.00%, 01/01/2047 | | | 285,476 | | | 246,433 |

Pool QD0505, 2.50%, 11/01/2051 | | | 1,486,825 | | | 1,199,778 |

Pool QD2700, 2.50%, 12/01/2051 | | | 1,322,999 | | | 1,070,120 |

Pool QD3120, 3.00%, 12/01/2051 | | | 1,407,951 | | | 1,185,290 |

Pool QD7063, 2.50%, 02/01/2052 | | | 761,808 | | | 616,260 |

Pool QD7338, 2.00%, 02/01/2052 | | | 1,340,619 | | | 1,036,389 |

Pool QF6264, 2.50%, 01/01/2053 | | | 296,131 | | | 238,976 |

Pool RA5559, 2.50%, 07/01/2051 | | | 1,886,603 | | | 1,522,407 |

Pool RA6012, 3.00%, 10/01/2051 | | | 1,480,349 | | | 1,246,263 |

Pool RA6528, 2.50%, 02/01/2052 | | | 1,896,049 | | | 1,534,476 |

Pool SD1285, 3.50%, 06/01/2052 | | | 1,491,598 | | | 1,307,518 |

Pool SD1287, 3.50%, 06/01/2052 | | | 1,480,098 | | | 1,296,831 |

Pool SD3275, 5.50%, 07/01/2053 | | | 1,909,248 | | | 1,879,305 |

Pool SD8172, 2.00%, 10/01/2051 | | | 1,885,578 | | | 1,457,951 |

Pool SD8193, 2.00%, 02/01/2052 | | | 1,760,155 | | | 1,358,087 |

Pool SD8194, 2.50%, 02/01/2052 | | | 1,306,020 | | | 1,056,261 |

Pool SD8199, 2.00%, 03/01/2052 | | | 1,341,308 | | | 1,035,333 |

Pool SD8204, 2.00%, 04/01/2052 | | | 1,802,648 | | | 1,392,292 |

Pool SD8214, 3.50%, 05/01/2052 | | | 1,776,521 | | | 1,557,317 |

Pool SD8275, 4.50%, 12/01/2052 | | | 1,383,097 | | | 1,294,223 |

Pool SD8284, 3.00%, 01/01/2053 | | | 2,486,091 | | | 2,089,442 |

Pool SD8312, 2.50%, 01/01/2053 | | | 1,124,260 | | | 907,802 |

Pool SD8336, 3.50%, 04/01/2053 | | | 1,948,670 | | | 1,707,581 |

Pool SD8341, 5.00%, 07/01/2053 | | | 1,949,623 | | | 1,875,471 |

Pool SD8383, 5.50%, 12/01/2053 | | | 1,951,428 | | | 1,918,031 |

Pool SD8428, 4.00%, 05/01/2054 | | | 1,483,105 | | | 1,345,323 |

FNMA

| | | | | | |

Pool AU3363, 3.00%, 08/01/2043 | | | 391,576 | | | 341,829 |

Pool AZ0504, 3.00%, 06/01/2045 | | | 509,660 | | | 441,821 |

Pool BM4135, 4.50%, 05/01/2048 | | | 353,104 | | | 336,498 |

Pool BU7884, 2.50%, 01/01/2052 | | | 1,584,535 | | | 1,281,385 |

Pool BV2451, 3.00%, 06/01/2052 | | | 1,956,866 | | | 1,645,361 |

Pool BV5577, 2.50%, 05/01/2052 | | | 1,941,848 | | | 1,569,093 |

Pool BW1298, 5.50%, 11/01/2052 | | | 1,768,593 | | | 1,743,620 |

Pool BW9886, 4.50%, 10/01/2052 | | | 1,883,287 | | | 1,762,328 |

Pool CB0381, 2.00%, 05/01/2051 | | | 1,918,659 | | | 1,480,135 |

Pool FM7827, 3.00%, 12/01/2050 | | | 1,079,748 | | | 922,319 |

Pool FM8407, 3.00%, 08/01/2051 | | | 1,210,980 | | | 1,031,621 |

Pool FM9646, 2.00%, 11/01/2051 | | | 1,192,273 | | | 919,746 |

Pool FS5387, 2.50%, 05/01/2052 | | | 1,977,787 | | | 1,595,948 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

PIA MBS Bond Fund

Schedule of Investments

as of May 31, 2024 (Unaudited) (Continued)

| | | | | | | |

MORTGAGE-BACKED SECURITIES - (Continued)

|

Pool MA2670, 3.00%, 07/01/2046 | | | $ 342,175 | | | $295,580 |

Pool MA3415, 4.00%, 07/01/2048 | | | 130,385 | | | 120,323 |

Pool MA4547, 2.00%, 02/01/2052 | | | 1,777,822 | | | 1,373,612 |

Pool MA4548, 2.50%, 02/01/2052 | | | 1,733,795 | | | 1,402,399 |

Pool MA4563, 2.50%, 03/01/2052 | | | 1,674,751 | | | 1,353,005 |

Pool MA4577, 2.00%, 04/01/2052 | | | 1,559,835 | | | 1,204,285 |

Pool MA4578, 2.50%, 04/01/2052 | | | 1,782,451 | | | 1,441,096 |

Pool MA4579, 3.00%, 04/01/2052 | | | 1,765,658 | | | 1,484,017 |

Pool MA4654, 3.50%, 07/01/2052 | | | 1,501,090 | | | 1,315,946 |

Pool MA4732, 4.00%, 09/01/2052 | | | 1,391,622 | | | 1,263,942 |

Pool MA4783, 4.00%, 10/01/2052 | | | 1,378,451 | | | 1,251,565 |

Pool MA4867, 4.50%, 01/01/2053 | | | 1,921,516 | | | 1,798,097 |

Pool MA4940, 5.00%, 03/01/2053 | | | 1,883,799 | | | 1,813,101 |

Pool MA5037, 4.50%, 06/01/2053 | | | 1,910,904 | | | 1,788,156 |

GNMA

| | | | | | |

Pool 726311, 5.00%, 09/15/2039 | | | 123,544 | | | 121,353 |

Pool AM8608, 4.00%, 06/15/2045 | | | 100,301 | | | 93,612 |

Pool AQ0545, 4.00%, 10/15/2046 | | | 50,227 | | | 46,751 |

Pool AQ0562, 4.00%, 12/15/2046 | | | 64,086 | | | 59,401 |

Pool AR3772, 4.00%, 02/15/2046 | | | 76,892 | | | 71,321 |

Pool AW1730, 3.00%, 05/15/2047 | | | 767,111 | | | 664,641 |

Pool AZ5554, 3.00%, 08/15/2047 | | | 326,138 | | | 283,690 |

Pool MA6089, 3.00%, 08/20/2049 | | | 144,079 | | | 125,320 |

Pool MA6153, 3.00%, 09/20/2049 | | | 376,453 | | | 327,285 |

Pool MA6338, 3.00%, 12/20/2049 | | | 395,264 | | | 342,987 |

Pool MA7826, 2.00%, 01/20/2052 | | | 1,696,874 | | | 1,360,324 |

Pool MA7827, 2.50%, 01/20/2052 | | | 1,678,137 | | | 1,398,088 |

Pool MA7880, 2.00%, 02/20/2052 | | | 1,854,074 | | | 1,486,104 |

Pool MA7936, 2.50%, 03/20/2052 | | | 1,274,964 | | | 1,062,167 |

Pool MA7987, 2.50%, 04/20/2052 | | | 1,840,724 | | | 1,533,496 |

Pool MA8099, 3.50%, 06/20/2052 | | | 1,765,271 | | | 1,574,753 |

Pool MA8147, 2.50%, 07/20/2052 | | | 1,816,283 | | | 1,514,804 |

Pool MA8266, 3.50%, 09/20/2052 | | | 1,500,000 | | | 1,338,106 |

Pool MA8267, 4.00%, 09/20/2052 | | | 1,862,813 | | | 1,711,136 |

TOTAL MORTGAGE-BACKED SECURITIES

(Cost $91,828,403) | | | | | | 83,392,882 |

ASSET-BACKED SECURITIES - 2.0%

|

CF Hippolyta Issuer LLC, Series 2020-1, Class A1, 1.69%, 07/15/2060(a) | | | 1,349,178 | | | 1,273,163 |

SAFCO Auto Receivables Trust, Series 2024-1A, Class B, 6.31%, 11/20/2028(a) | | | 500,000 | | | 498,525 |

TOTAL ASSET-BACKED SECURITIES

(Cost $1,848,933) | | | | | | 1,771,688 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

PIA MBS Bond Fund

Schedule of Investments

as of May 31, 2024 (Unaudited) (Continued)

| | | | | | | |

SHORT-TERM INVESTMENTS - 3.5%

|

Money Market Funds - 1.2%

|

Fidelity Government Portfolio - Class Institutional, 5.21%(b) | | | 1,086,467 | | | $ 1,086,467 |

| | | | | | | |

| | | | | | | |

U.S. Treasury Bills - 2.3%

|

5.31%, 08/15/2024(c) | | | $2,000,000 | | | 1,978,751 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $3,064,634) | | | | | | 3,065,218 |

TOTAL INVESTMENTS - 99.6%

(Cost $96,741,970) | | | | | | $88,229,788 |

Other Assets in Excess of Liabilities - 0.4% | | | | | | 341,955 |

TOTAL NET ASSETS - 100.0% | | | | | | $88,571,743 |

| | | | | | | |

Percentages are stated as a percent of net assets.

FHLMC - Federal Home Loan Mortgage Corporation

FNMA - Federal National Mortgage Association

GNMA - Government National Mortgage Association

SOFR - Secured Overnight Financing Rate

(a)

| Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of May 31, 2024, the value of these securities total $3,645,537 or 4.1% of the Fund’s net assets.

|

(b)

| The rate shown represents the 7-day effective yield as of May 31, 2024.

|

(c)

| The rate shown is the effective yield as of May 31, 2024. |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

PIA High Yield (MACS) Fund

Schedule of Investments

as of May 31, 2024 (Unaudited)

| | | | | | | |

CORPORATE BONDS - 93.9%

|

Advertising - 1.1%

|

Clear Channel Outdoor Holdings, Inc., 7.88%, 04/01/2030(a) | | | $ 1,800,000 | | | $ 1,791,766 |

Agriculture - 0.9%

|

Vector Group Ltd., 5.75%, 02/01/2029(a) | | | 1,700,000 | | | 1,561,454 |

Airlines - 1.4%

|

VistaJet Malta Finance PLC / Vista Management Holding, Inc.,

6.38%, 02/01/2030(a) | | | 2,945,000 | | | 2,367,024 |

Auto Manufacturers - 1.1%

|

PM General Purchaser LLC, 9.50%, 10/01/2028(a) | | | 1,750,000 | | | 1,777,543 |

Building Materials - 3.7%

|

Eco Material Technologies, Inc., 7.88%, 01/31/2027(a) | | | 1,995,000 | | | 1,997,101 |

Miter Brands Acquisition Holdco, Inc. / MIWD Borrower LLC,

6.75%, 04/01/2032(a) | | | 750,000 | | | 746,592 |

MIWD Holdco II LLC / MIWD Finance Corp., 5.50%, 02/01/2030(a) | | | 1,775,000 | | | 1,623,882 |

Smyrna Ready Mix Concrete LLC

|

6.00%, 11/01/2028(a) | | | 1,650,000 | | | 1,594,062 |

8.88%, 11/15/2031(a) | | | 350,000 | | | 368,805 |

| | | 6,330,442 |

Chemicals - 10.1%

|

ASP Unifrax Holdings, Inc., 5.25%, 09/30/2028(a) | | | 2,372,000 | | | 1,194,705 |

Consolidated Energy Finance SA

|

5.63%, 10/15/2028(a) | | | 1,675,000 | | | 1,439,542 |

12.00%, 02/15/2031(a) | | | 750,000 | | | 784,590 |

GPD Cos., Inc., 10.13%, 04/01/2026(a) | | | 2,570,000 | | | 2,476,989 |

Herens Holdco Sarl, 4.75%, 05/15/2028(a) | | | 1,784,000 | | | 1,530,272 |

Iris Holdings, Inc., 8.75% (9.50% PIK), 02/15/2026(a)(f) | | | 2,495,000 | | | 2,039,663 |

Mativ Holdings, Inc., 6.88%, 10/01/2026(a) | | | 1,940,000 | | | 1,911,996 |

Polar US Borrower LLC / Schenectady International Group, Inc.,

6.75%, 05/15/2026(a) | | | 2,465,000 | | | 705,002 |

Rain Carbon, Inc., 12.25%, 09/01/2029(a) | | | 1,910,000 | | | 2,034,225 |

SCIH Salt Holdings, Inc., 4.88%, 05/01/2028(a) | | | 1,000,000 | | | 936,830 |

SK Invictus Intermediate II Sarl, 5.00%, 10/30/2029(a) | | | 2,250,000 | | | 1,999,734 |

| | | 17,053,548 |

Coal - 1.1%

|

SunCoke Energy, Inc., 4.88%, 06/30/2029(a) | | | 2,065,000 | | | 1,859,200 |

Commercial Services - 10.8%

|

Alta Equipment Group, Inc.

|

5.63%, 04/15/2026(a) | | | 1,745,000 | | | 1,775,538 |

9.00%, 06/01/2029(a) | | | 1,950,000 | | | 1,888,907 |

Champions Financing, Inc., 8.75%, 02/15/2029(a) | | | 1,600,000 | | | 1,646,976 |

Cimpress PLC, 7.00%, 06/15/2026 | | | 1,925,000 | | | 1,920,716 |

CPI CG, Inc., 8.63%, 03/15/2026(a) | | | 1,804,000 | | | 1,818,757 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

PIA High Yield (MACS) Fund

Schedule of Investments

as of May 31, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Commercial Services - (Continued)

|

NESCO Holdings II, Inc., 5.50%, 04/15/2029(a) | | | $ 2,000,000 | | | $ 1,835,322 |

PROG Holdings, Inc., 6.00%, 11/15/2029(a) | | | 1,990,000 | | | 1,865,276 |

StoneMor, Inc., 8.50%, 05/15/2029(a) | | | 2,130,000 | | | 1,725,535 |

VT Topco, Inc., 8.50%, 08/15/2030(a) | | | 1,610,000 | | | 1,684,335 |

WASH Multifamily Acquisition, Inc., 5.75%, 04/15/2026(a) | | | 2,224,000 | | | 2,163,925 |

| | | 18,325,287 |

Computers - 2.0%

|

Conduent Business Services LLC / Conduent State & Local Solutions, Inc.,

6.00%, 11/01/2029(a) | | | 1,900,000 | | | 1,768,056 |

NCR Atleos Corp., 9.50%, 04/01/2029(a) | | | 1,475,000 | | | 1,593,074 |

| | | 3,361,130 |

Distribution/Wholesale - 2.7%

|

Verde Purchaser LLC, 10.50%, 11/30/2030(a) | | | 2,700,000 | | | 2,848,973 |

Windsor Holdings III LLC, 8.50%, 06/15/2030(a) | | | 1,695,000 | | | 1,772,958 |

| | | 4,621,931 |

Diversified Financial Services - 2.2%

|

Burford Capital Global Finance LLC

|

6.25%, 04/15/2028(a) | | | 700,000 | | | 680,688 |

6.88%, 04/15/2030(a) | | | 1,255,000 | | | 1,235,888 |

9.25%, 07/01/2031(a) | | | 300,000 | | | 315,157 |

Macquarie Airfinance Holdings Ltd., 8.13%, 03/30/2029(a) | | | 1,400,000 | | | 1,473,595 |

| | | 3,705,328 |

Engineering & Construction - 3.0%

|

Brand Industrial Services, Inc., 10.38%, 08/01/2030(a) | | | 1,560,000 | | | 1,677,217 |

Brundage-Bone Concrete Pumping Holdings, Inc., 6.00%, 02/01/2026(a) | | | 1,550,000 | | | 1,531,415 |

Railworks Holdings LP / Railworks Rally, Inc., 8.25%, 11/15/2028(a) | | | 1,885,000 | | | 1,912,116 |

| | | 5,120,748 |

Entertainment - 1.8%

|

Premier Entertainment Sub LLC / Premier Entertainment Finance Corp.,

5.88%, 09/01/2031(a) | | | 2,175,000 | | | 1,518,355 |

Scientific Games Holdings LP/Scientific Games US FinCo, Inc.,

6.63%, 03/01/2030(a) | | | 1,625,000 | | | 1,536,494 |

| | | 3,054,849 |

Food - 2.2%

|

H-Food Holdings LLC / Hearthside Finance Co., Inc., 8.50%, 06/01/2026(a) | | | 1,400,000 | | | 126,210 |

KeHE Distributors LLC / KeHE Finance Corp. / NextWave Distribution, Inc.,

9.00%, 02/15/2029(a) | | | 1,635,000 | | | 1,657,390 |

Simmons Foods, Inc./Simmons Prepared Foods, Inc./Simmons Pet Food, Inc./Simmons Feed, 4.63%, 03/01/2029(a) | | | 2,250,000 | | | 1,958,932 |

| | | 3,742,532 |

| | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

PIA High Yield (MACS) Fund

Schedule of Investments

as of May 31, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Food Service - 1.7%

|

TKC Holdings, Inc.

|

6.88%, 05/15/2028(a) | | | $ 835,000 | | | $ 816,518 |

10.50%, 05/15/2029(a) | | | 2,065,000 | | | 2,037,118 |

| | | 2,853,636 |

Forest Products & Paper - 1.3%

|

Mercer International, Inc.

|

12.88%, 10/01/2028(a) | | | 700,000 | | | 758,967 |

5.13%, 02/01/2029 | | | 1,725,000 | | | 1,512,051 |

| | | 2,271,018 |

Healthcare-Products - 0.6%

|

Sotera Health Holdings LLC, 7.38%, 06/01/2031(a) | | | 1,050,000 | | | 1,044,175 |

Healthcare-Services - 2.9%

|

Heartland Dental LLC / Heartland Dental Finance Corp., 10.50%, 04/30/2028(a) | | | 775,000 | | | 823,670 |

Kedrion SpA, 6.50%, 09/01/2029(a) | | | 2,265,000 | | | 2,072,758 |

ModivCare Escrow Issuer, Inc., 5.00%, 10/01/2029(a) | | | 2,850,000 | | | 2,038,339 |

| | | 4,934,767 |

Household Products/Wares - 0.7%

|

Kronos Acquisition Holdings, Inc. / KIK Custom Products, Inc.,

5.00%, 12/31/2026(a) | | | 1,250,000 | | | 1,213,414 |

Internet - 1.2%

|

ION Trading Technologies Sarl

|

5.75%, 05/15/2028(a) | | | 1,680,000 | | | 1,528,228 |

9.50%, 05/30/2029(a) | | | 525,000 | | | 528,507 |

| | | 2,056,735 |

Iron/Steel - 1.4%

|

TMS International Corp./DE, 6.25%, 04/15/2029(a) | | | 2,600,000 | | | 2,405,033 |

Leisure Time - 0.9%

|

Lindblad Expeditions Holdings, Inc., 9.00%, 05/15/2028(a) | | | 1,500,000 | | | 1,533,264 |

Machinery-Diversified - 2.9%

|

GrafTech Finance, Inc., 4.63%, 12/15/2028(a) | | | 2,220,000 | | | 1,434,984 |

GrafTech Global Enterprises, Inc., 9.88%, 12/15/2028(a) | | | 550,000 | | | 415,798 |

Husky Injection Molding Systems Ltd. / Titan Co.-Borrower LLC,

9.00%, 02/15/2029(a) | | | 1,900,000 | | | 1,954,501 |

OT Merger Corp., 7.88%, 10/15/2029(a) | | | 2,156,000 | | | 1,127,415 |

| | | 4,932,698 |

Media - 3.2%

|

Beasley Mezzanine Holdings LLC, 8.63%, 02/01/2026(a) | | | 2,230,000 | | | 1,332,425 |

Spanish Broadcasting System, Inc., 9.75%, 03/01/2026(a) | | | 2,000,000 | | | 912,075 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

PIA High Yield (MACS) Fund

Schedule of Investments

as of May 31, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Media - (Continued)

|

Univision Communications, Inc.

|

4.50%, 05/01/2029(a) | | | $ 1,375,000 | | | $ 1,177,680 |

7.38%, 06/30/2030(a) | | | 400,000 | | | 378,993 |

Urban One, Inc., 7.38%, 02/01/2028(a) | | | 2,012,000 | | | 1,606,854 |

| | | 5,408,027 |

Metal Fabricate/Hardware - 1.1%

|

Park-Ohio Industries, Inc., 6.63%, 04/15/2027 | | | 2,008,000 | | | 1,922,113 |

Mining - 2.2%

|

Arsenal AIC Parent LLC, 8.00%, 10/01/2030(a) | | | 1,550,000 | | | 1,616,262 |

Compass Minerals International, Inc., 6.75%, 12/01/2027(a) | | | 2,255,000 | | | 2,151,562 |

| | | 3,767,824 |

Miscellaneous Manufacturing - 1.2%

|

Calderys Financing LLC, 11.25%, 06/01/2028(a) | | | 1,950,000 | | | 2,081,424 |

Office-Business Equipment - 2.3%

|

Pitney Bowes, Inc., 6.88%, 03/15/2027(a) | | | 2,400,000 | | | 2,229,685 |

Xerox Holdings Corp., 5.50%, 08/15/2028(a) | | | 1,900,000 | | | 1,670,597 |

| | | 3,900,282 |

Oil & Gas Services - 3.3%

|

Bristow Group, Inc., 6.88%, 03/01/2028(a) | | | 2,000,000 | | | 1,964,887 |

Enerflex Ltd., 9.00%, 10/15/2027(a) | | | 1,885,000 | | | 1,925,603 |

Welltec International ApS, 8.25%, 10/15/2026(a) | | | 1,600,000 | | | 1,629,214 |

| | | 5,519,704 |

Packaging & Containers - 3.0%

|

Clearwater Paper Corp., 4.75%, 08/15/2028(a) | | | 1,550,000 | | | 1,454,511 |

LABL, Inc.

|

5.88%, 11/01/2028(a) | | | 1,350,000 | | | 1,216,508 |

9.50%, 11/01/2028(a) | | | 950,000 | | | 967,488 |

Trident TPI Holdings, Inc., 12.75%, 12/31/2028(a) | | | 1,325,000 | | | 1,441,338 |

| | | 5,079,845 |

Pipelines - 9.0%

|

Global Partners LP / GLP Finance Corp.

|

7.00%, 08/01/2027 | | | 625,000 | | | 628,215 |

6.88%, 01/15/2029 | | | 1,175,000 | | | 1,157,603 |

8.25%, 01/15/2032(a) | | | 390,000 | | | 401,512 |

ITT Holdings LLC, 6.50%, 08/01/2029(a) | | | 2,699,000 | | | 2,473,106 |

Martin Midstream Partners LP / Martin Midstream Finance Corp.,

11.50%, 02/15/2028(a) | | | 1,915,000 | | | 2,061,298 |

NGL Energy Operating LLC / NGL Energy Finance Corp.

|

8.13%, 02/15/2029(a) | | | 875,000 | | | 891,677 |

8.38%, 02/15/2032(a) | | | 1,080,000 | | | 1,100,864 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

PIA High Yield (MACS) Fund

Schedule of Investments

as of May 31, 2024 (Unaudited) (Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Pipelines - (Continued)

|

Summit Midstream Holdings LLC / Summit Midstream Finance Corp.

|

9.50%, 10/15/2026(a)(b) | | | $ 1,890,000 | | | $1,940,626 |

12.00%, 10/15/2026(a) | | | 700,000 | | | 711,363 |

TransMontaigne Partners LP/TLP Finance Corp., 6.13%, 02/15/2026 | | | 1,972,000 | | | 1,882,556 |

Venture Global LNG, Inc., 8.13%, 06/01/2028(a) | | | 1,875,000 | | | 1,917,514 |

| | | 15,166,334 |

Retail - 2.2%

|

Ferrellgas LP / Ferrellgas Finance Corp., 5.88%, 04/01/2029(a) | | | 1,875,000 | | | 1,771,139 |

Staples, Inc., 7.50%, 04/15/2026(a) | | | 2,010,000 | | | 2,013,052 |

| | | 3,784,191 |

Software - 3.8%

|

Consensus Cloud Solutions, Inc., 6.50%, 10/15/2028(a) | | | 2,295,000 | | | 2,113,415 |

Helios Software Holdings, Inc. / ION Corporate Solutions Finance Sarl

|

4.63%, 05/01/2028(a) | | | 1,625,000 | | | 1,448,858 |

8.75%, 05/01/2029(a) | | | 370,000 | | | 374,268 |

Rocket Software, Inc.

|

9.00%, 11/28/2028(a) | | | 1,090,000 | | | 1,108,378 |

6.50%, 02/15/2029(a) | | | 1,735,000 | | | 1,463,619 |

| | | 6,508,538 |

Transportation - 3.3%

|

Brightline East LLC, 11.00%, 01/31/2030(a) | | | 2,020,000 | | | 1,916,914 |

First Student Bidco, Inc. / First Transit Parent, Inc., 4.00%, 07/31/2029(a) | | | 1,900,000 | | | 1,713,651 |

Rand Parent LLC, 8.50%, 02/15/2030(a) | | | 2,000,000 | | | 1,957,794 |

| | | 5,588,359 |

Trucking & Leasing - 0.5%

|

Fortress Transportation and Infrastructure Investors LLC, 7.00%, 05/01/2031(a) | | | 750,000 | | | 759,279 |

Water - 1.1%

|

Solaris Midstream Holdings LLC, 7.63%, 04/01/2026(a) | | | 1,835,000 | | | 1,843,463 |

TOTAL CORPORATE BONDS

|

(Cost $167,198,865) | | | | | | 159,246,905 |

| | | Shares | | | |

COMMON STOCKS - 0.1%

|

Building Materials - 0.1%

| | | | |

Northwest Hardwoods(c)(d) | | | 2,996 | | | 149,800 |

TOTAL COMMON STOCKS

(Cost $137,017) | | | | | | 149,800 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

PIA High Yield (MACS) Fund

Schedule of Investments

as of May 31, 2024 (Unaudited) (Continued)

| | | | | | | |

SHORT-TERM INVESTMENTS - 5.4%

|

Money Market Funds - 5.4%

| | | | | | |

Fidelity Government Portfolio - Class Institutional, 5.20%(e) | | | 9,176,477 | | | $9,176,477 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $9,176,477) | | | | | | 9,176,477 |

TOTAL INVESTMENTS - 99.4%

(Cost $176,512,359) | | | | | | $ 168,573,182 |

Other Assets in Excess of Liabilities - 0.6% | | | | | | 1,031,482 |

TOTAL NET ASSETS - 100.0% | | | | | | $ 169,604,664 |

| | | | | | | |

Percentages are stated as a percent of net assets.

(a)

| Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of May 31, 2024, the value of these securities total $150,223,651 or 88.6% of the Fund’s net assets.

|

(b)

| Step coupon bond. The rate disclosed is as of May 31, 2024.

|

(c)

| Fair value determined using significant unobservable inputs in accordance with procedures established by and under the supervision of the Adviser, acting as Valuation Designee. These securities represented $149,800 or 0.1% of net assets as of May 31, 2024.

|

(d)

| Non-income producing security.

|

(e)

| The rate shown represents the 7-day effective yield as of May 31, 2024.

|

(f)

| Payment-in-kind interest is generally paid by issuing additional par of the security rather than paying cash. |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

Statements of Assets and Liabilities

May 31, 2024 (Unaudited)

| | | | | | | | | | |

Assets:

| | | |

Investments in securities, at value (cost $228,545,578, $96,741,970, and $176,512,359, respectively) | | | $200,618,819 | | | $88,229,788 | | | $168,573,182 |

Receivable for fund shares sold | | | 151,968 | | | 154,083 | | | 52,620 |

Interest receivable | | | 2,148,608 | | | 264,608 | | | 2,935,537 |

Due from investment adviser (Note 4) | | | — | | | 2,924 | | | — |

Prepaid expenses | | | 19,635 | | | 14,559 | | | 30,047 |

Total assets | | | 202,939,030 | | | 88,665,962 | | | 171,591,386 |

Liabilities:

| | | | | | | | | |

Payable for securities purchased | | | — | | | — | | | 1,902,180 |

Payable for fund shares redeemed | | | 96,671 | | | 10,526 | | | — |

Administration fees | | | 33,496 | | | 32,559 | | | 32,640 |

Custody fees | | | 3,052 | | | 1,790 | | | 2,324 |

Transfer agent fees and expenses | | | 24,961 | | | 17,500 | | | 13,885 |

Fund accounting fees | | | 13,094 | | | 4,497 | | | 7,124 |

Audit fees | | | 11,033 | | | 11,033 | | | 11,033 |

Chief Compliance Officer fee | | | 3,666 | | | 3,666 | | | 3,666 |

Trustees’ fees and expenses | | | 5,603 | | | 5,603 | | | 5,320 |

Accrued expenses | | | 10,924 | | | 7,045 | | | 8,550 |

Total liabilities | | | 202,500 | | | 94,219 | | | 1,986,722 |

Net Assets | | | $202,736,530 | | | $88,571,743 | | | $169,604,664 |

|

Net Assets Consist of:

| | | | | | | | | |

Paid-in capital | | | $242,885,331 | | | $99,666,655 | | | $183,097,560 |

Total Accumulated deficit | | | (40,148,801) | | | (11,094,912) | | | (13,492,896) |

Net assets | | | $202,736,530 | | | $88,571,743 | | | $169,604,664 |

Net asset value, offering price and redemption price per share | | | $8.26 | | | $8.04 | | | $8.53 |

Shares issued and outstanding (unlimited number of shares authorized, par value $0.01) | | | 24,549,572 | | | 11,018,543 | | | 19,876,405 |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

Statements of Operations

Six Months Ended May 31, 2024 (Unaudited)

| | | | | | | | | | |

Investment Income:

| | | | | | | | | |

Interest (net of interest tax withheld of $0, $0, and $19,041, respectively) | | | $3,895,384 | | | $1,907,877 | | | $6,856,748 |

Total investment income | | | 3,895,384 | | | 1,907,877 | | | 6,856,748 |

Expenses:

| | | | | | | | | |

Administration fees (Note 4) | | | 50,046 | | | 48,919 | | | 49,063 |

Transfer agent fees and expenses (Note 4) | | | 40,031 | | | 31,693 | | | 21,385 |

Fund accounting fees (Note 4) | | | 18,300 | | | 6,783 | | | 10,056 |

Registration fees | | | 13,664 | | | 13,112 | | | 11,487 |

Audit fees | | | 11,434 | | | 11,434 | | | 11,434 |

Trustees’ fees and expenses | | | 8,647 | | | 8,647 | | | 8,789 |

Custody fees (Note 4) | | | 8,403 | | | 6,183 | | | 7,119 |

Chief Compliance Officer fee (Note 4) | | | 5,499 | | | 5,499 | | | 5,499 |

Reports to shareholders | | | 4,024 | | | 3,043 | | | 3,197 |

Insurance | | | 3,224 | | | 2,213 | | | 2,645 |

Legal fees | | | 3,007 | | | 3,068 | | | 3,009 |

Miscellaneous | | | 1,902 | | | 1,891 | | | 2,313 |

Interest expense (Note 6) | | | 812 | | | — | | | — |

Total expenses | | | 168,993 | | | 142,485 | | | 135,996 |

Less: Expense reimbursement from adviser (Note 4) | | | — | | | (33,061) | | | — |

Net expenses | | | 168,993 | | | 109,424 | | | 135,996 |

Net investment income | | | 3,726,391 | | | 1,798,453 | | | 6,720,752 |

Realized and Unrealized Gain/(Loss) on Investments

| | | | | | | | | |

Net realized loss on investments | | | (397,691) | | | (360,735) | | | (997,317) |

Net change in unrealized appreciation/(depreciation) on investments | | | 2,879,986 | | | (11,254) | | | 4,973,544 |

Net gain/(loss) on investments | | | 2,482,295 | | | (371,989) | | | 3,976,227 |

Net increase in net assets resulting from operations | | | $6,208,686 | | | $1,426,464 | | | $10,696,979 |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

Statements of Changes in Net Assets

| | | | | | | | | | |

Increase/(Decrease) in Net Assets From Operations:

|

Net investment

income | | | $3,726,391 | | | $7,374,416 | | | $1,798,453 | | | $2,571,182 | | | $6,720,752 | | | $11,330,179 |

Net realized loss on investments | | | (397,691) | | | (6,498,454) | | | (360,735) | | | (504,595) | | | (997,317) | | | (1,256,154) |

Net change in unrealized appreciation/

(depreciation)

on investments | | | 2,879,986 | | | 8,098,012 | | | (11,254) | | | (2,290,137) | | | 4,973,544 | | | 5,823,534 |

Net increase/(decrease) in net assets resulting from operations | | | 6,208,686 | | | 8,973,974 | | | 1,426,464 | | | (223,550) | | | 10,696,979 | | | 15,897,559 |

Distributions Paid to Shareholders:

|

Net dividends and distributions to shareholders | | | (3,745,662) | | | (7,381,399) | | | (1,814,756) | | | (2,462,974) | | | (6,738,404) | | | (11,311,354) |

Total dividends and distributions | | | (3,745,662) | | | (7,381,399) | | | (1,814,756) | | | (2,462,974) | | | (6,738,404) | | | (11,311,354) |

Capital Share Transactions:

|

Net proceeds from shares sold | | | 26,677,832 | | | 33,593,171 | | | 8,933,351 | | | 44,034,255 | | | 21,941,162 | | | 17,472,044 |

Distributions reinvested | | | 3,432,365 | | | 6,835,650 | | | 1,531,919 | | | 2,073,852 | | | 6,432,708 | | | 11,136,841 |

Payment for shares redeemed | | | (20,966,106) | | | (73,229,425) | | | (7,257,205) | | | (11,982,947) | | | (11,361,179) | | | (8,778,078) |

Net increase/(decrease) in net assetsfrom capital share transactions | | | 9,144,091 | | | (32,800,604) | | | 3,208,065 | | | 34,125,160 | | | 17,012,691 | | | 19,830,807 |

Total increase/(decrease) in net assets | | | 11,607,115 | | | (31,208,029) | | | 2,819,773 | | | 31,438,636 | | | 20,971,266 | | | 24,417,012 |

Net Assets, Beginning of period | | | 191,129,415 | | | 222,337,444 | | | 85,751,970 | | | 54,313,334 | | | 148,633,398 | | | 124,216,386 |

Net Assets, End of period | | | $202,736,530 | | | $191,129,415 | | | $88,571,743 | | | $85,751,970 | | | $169,604,664 | | | $148,633,398 |

| | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

Statements of Changes in Net Assets (Continued)

| | | | | | | | | | |

Transactions in Shares:

|

Shares sold | | | 3,205,622 | | | 4,124,938 | | | 1,096,774 | | | 5,290,189 | | | 2,586,089 | | | 2,111,522 |

Shares issued on reinvestment of distributions | | | 413,194 | | | 843,440 | | | 187,890 | | | 253,983 | | | 755,729 | | | 1,358,716 |

Shares redeemed | | | (2,513,667) | | | (8,986,059) | | | (890,061) | | | (1,451,260) | | | (1,342,043) | | | (1,058,902) |

Net increase/(decrease) in shares outstanding | | | 1,105,149 | | | (4,017,681) | | | 394,603 | | | 4,092,912 | | | 1,999,775 | | | 2,411,336 |

| | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

Back to Table of Contents

BBB BOND FUND

Financial Highlights

(For a fund share outstanding throughout each period)

| | | | | | | |

Per Share Operating Performance

|

Net asset value, beginning of period | | | $8.15 | | | $8.10 | | | $9.97 | | | $10.32 | | | $9.76 | | | $8.67 |

Income From Investment Operations:

|

Net investment income | | | 0.16 | | | 0.30 | | | 0.29 | | | 0.28 | | | 0.33 | | | 0.37 |

Net realized and unrealized gain/(loss) on investments | | | 0.11 | | | 0.05 | | | (1.87) | | | (0.35) | | | 0.56 | | | 1.09 |

Total from investment operations | | | 0.27 | | | 0.35 | | | (1.58) | | | (0.07) | | | 0.89 | | | 1.46 |

|

Less Distributions:

|

Distributions from net investment income | | | (0.16) | | | (0.30) | | | (0.29) | | | (0.28) | | | (0.33) | | | (0.37) |

Total distributions | | | (0.16) | | | (0.30) | | | (0.29) | | | (0.28) | | | (0.33) | | | (0.37) |

Net asset value, end of period | | | $8.26 | | | $8.15 | | | $8.10 | | | $9.97 | | | $10.32 | | | $9.76 |