Value Line Larger Companies Fund, Inc.

Enclosed is your annual report for the twelve month period ending December 31, 2011. We encourage you to carefully review this report, which includes economic observations, your Fund’s performance data and highlights, schedule of investments, and financial statements.

Prospects of a slow yet continuing economic recovery coupled with better than expected corporate profit reports boosted stock prices for the first six months of the year. Many companies reported record profits and cash flows driven by improved demand and in some cases, higher commodity prices. At mid-year, the market came under heavy pressure from worries about a European debt crisis and fears that a double dip recession was taking shape. Global financial system fears, anemic U.S. economic and employment growth, and the perception that there is no credible plan to correct these measures due to a myriad of fiscal and political reasons carried stock prices lower. The market posted a strong rally in October through early November from oversold levels as fears were somewhat tempered as news regarding progress in the European debt crisis began to emerge and U.S. economic data came in slightly better than expected. The S&P 500 Index closed out the year with a gain of 2.11%.

Results in the Fund for the year benefitted from an underweighted position and good stock selection in the financial services and consumer discretionary sectors. However, an underweighted position and stock selection in the consumer staples sector and stock selection in the technology sector detracted from the Fund’s performance for the year.

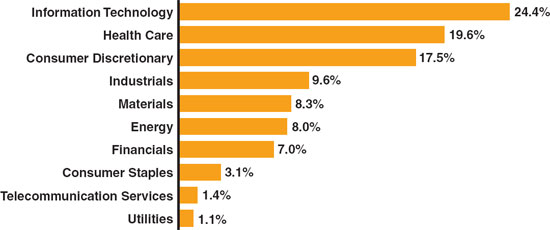

We continue to emphasize larger-capitalized stocks in the Fund that generally are ranked in the higher categories of 1, 2 or 3 in the Value Line Timeliness Ranking System. The Fund ended the period with over weighted positions in the consumer discretionary, healthcare, materials, and technology sectors, while being underweighted in the consumer staples, energy, and financial services sectors.

We believe the current environment is especially conducive to a well-diversified portfolio. Our goal is to generate solid returns through capital growth across economic cycles.

Thank you for investing with the Value Line Funds.

Value Line Larger Companies Fund, Inc.

The first half of 2011 saw the broad U.S. stock market rising on the heels of strengthening corporate profits. The S&P 500 returned 6% for the first six months of the year despite significant global economic concerns. Several members of the European Union continued to face a serious debt crisis including Greece, Portugal, Ireland, and Spain. Further, the nuclear disaster in Japan and the geopolitical upheaval in commodity markets added to investor concerns. At home, disappointing job growth in the United States kept the national unemployment rate firmly above 9% for the second quarter.

By mid-year there was mounting evidence that the U.S. recovery had slowed to a crawl. Consumer spending, which accounts for roughly 70% of economic activity, declined in June for the first time in 2 years. First quarter GDP was up by only 0.4%, and second quarter GDP growth, while stronger, was still disappointing at 1.3%. Employment growth in July lagged June numbers, and it was reported that the level of new factory orders decreased. By August, only 58% of the population was working, the lowest level in nearly 3 decades. Housing prices remained almost uniformly weak. There were additional pressures on the market coming from Europe stemming from the sovereign debt crisis and increasing fears of a double dip recession.

The bond market rallied as stocks took a dive. Yields fell and prices rose across fixed income markets as investors looked for safer havens. Despite the rating downgrade, investor demand for Treasuries soared, and by early September, 10-year Treasury note yields had fallen to an all-time low of 1.90%. This downward pressure on Treasury yields came largely from an employment report showing no new jobs being added in August. While modestly better job creation was reported in September, it was not enough to move the unemployment level below 9.1%.

The market posted a strong rally in final quarter of 2011. Investors increased their purchase of risk assets as news regarding progress in the European debt crisis began to emerge and U.S. economic data came in slightly better than expected. The S&P 500 Index closed out the year with a gain of 2.1%.

Value Line Larger Companies Fund, Inc.

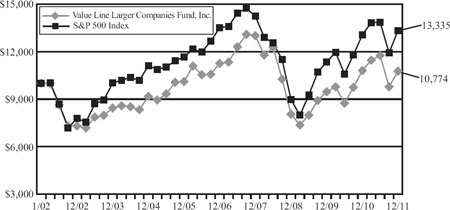

The following graph compares the performance of the Value Line Larger Companies Fund, Inc. to that of the S&P 500 Index (the “Index”). The Value Line Larger Companies Fund, Inc. is a professionally managed mutual fund, while the Index is not available for investment and is unmanaged. The returns for the Index do not reflect charges, expenses or taxes, but do include the reinvestment of dividends. The comparison is shown for illustrative purposes only.

Line Larger Companies Fund, Inc. and the S&P 500 Index*

Value Line Larger Companies Fund, Inc.

As a shareholder of the Fund, you incur ongoing costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2011 through December 31, 2011).

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if transactional costs were included, your costs would have been higher.

Value Line Larger Companies Fund, Inc.

Value Line Larger Companies Fund, Inc.

Value Line Larger Companies Fund, Inc.

Value Line Larger Companies Fund, Inc.

Value Line Larger Companies Fund, Inc.

Value Line Larger Companies Fund, Inc., (the “Fund”) is registered under the Investment Company Act of 1940, as amended, as a diversified, open-end management investment company whose sole investment objective is to realize capital growth.

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

Transfers between investment levels may occur as the markets fluctuate and/or the availability of data used in an investment’s valuation changes. The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Value Line Larger Companies Fund, Inc.

The following table summarizes the inputs used to value the Fund’s investments in securities as of December 31, 2011:

| | | | | | | | | | | | | |

| Investments in Securities: | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets | | | | | | | | | | | | |

| Common Stocks | | $ | 177,559,945 | | | $ | 0 | | | $ | 0 | | | $ | 177,559,945 | |

| Short-Term Investments | | | 0 | | | | 1,100,000 | | | | 0 | | | | 1,100,000 | |

| | | | | | | | | | | | | | | | | |

| Total Investments in Securities | | $ | 177,559,945 | | | $ | 1,100,000 | | | $ | 0 | | | $ | 178,659,945 | |

In May 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update No. 2011-04, “Fair Value Measurements and Disclosures (Topic 820) - Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs” (“ASU 2011-04”). ASU 2011-04 clarifies the application of existing fair value measurement requirements, changes certain principles related to measuring fair value, and requires additional disclosures about fair value measurements.

Specifically, the guidance specifies that the concepts of highest and best use and valuation premise in a fair value measurement are only relevant when measuring the fair value of nonfinancial assets whereas they are not relevant when measuring the fair value of financial assets and liabilities.

Required disclosures are expanded under the new guidance, especially for fair value measurements that are categorized within Level 3 of the fair value hierarchy, for which quantitative information about the unobservable inputs used, and a narrative description of the valuation processes in place and sensitivity of recurring Level 3 measurements to changes in unobservable inputs will be required. Entities will also be required to disclose the categorization by level of the fair value hierarchy for items that are not measured at fair value in the statement of financial position but for which the fair value is required to be disclosed.

ASU 2011-04 is effective for annual periods beginning after December 15, 2011 and is to be applied prospectively. The Fund is currently assessing the impact of this guidance on its financial statements.

The Fund follows the updated provisions surrounding fair value measurements and disclosures on transfers in and out of all levels of the fair value hierarchy on a gross basis and the reasons for the transfers as well as to disclosures about the valuation techniques and inputs used to measure fair value for investments that fall in either Level 2 or Level 3 fair value hierarchy.

For the year ended December 31, 2011, there was no significant transfer activity between Level 1 and Level 2.

For the year ended December 31, 2011, there were no Level 3 investments. The Schedule of Investments includes a breakdown of the Schedule’s investments by category.

(C) Repurchase Agreements: In connection with transactions in repurchase agreements, the Fund’s custodian takes possession of the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction exceeds one business day, it is the Fund’s policy to mark-to-market on a daily basis to ensure the adequacy of the collateral. In the event of default of the obligation to repurchase, the Fund has the right to liquidate the collateral and apply the proceeds in satisfaction of the obligation. Under certain circumstances, in the event of default or bankruptcy by the other party to the agreement, realization and/or retention of the collateral or proceeds may be subject to legal proceedings.

Value Line Larger Companies Fund, Inc.

| Notes to Financial Statements |

(D) Federal Income Taxes: It is the policy of the Fund to qualify as a regulated investment company by complying with the provisions available to regulated investment companies, as defined in applicable sections of the Internal Revenue Code, and to distribute all of its investment income and capital gains to its shareholders. Therefore, no provision for federal income tax is required.

Management has analyzed the Fund’s tax positions taken on federal and state income tax returns for all open tax years (fiscal years ended December 31, 2008 through December 31, 2011), and has concluded that no provision for federal or state income tax is required in the Fund’s financial statements. The Fund’s federal and state income tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

(E) Security Transactions and Distributions: Security transactions are accounted for on the date the securities are purchased or sold. Interest income is accrued as earned. Realized gains and losses on sales of securities are calculated for financial accounting and federal income tax purposes on the identified cost basis. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Distributions are determined in accordance with income tax regulations, which may differ from generally accepted accounting principles.

(F) Foreign Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Assets and liabilities which are denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange. The Fund does not isolate changes in the value of investments caused by foreign exchange rate differences from the changes due to other circumstances.

Income and expenses are translated to U.S. dollars based upon the rates of exchange on the respective dates of such transactions.

Net realized foreign exchange gains or losses arise from currency fluctuations realized between the trade and settlement dates on securities transactions, the differences between the U.S. dollar amounts of dividends, interest, and foreign withholding taxes recorded by the Fund, and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities, other than investments, at the end of the fiscal period, resulting from changes in the exchange rates. The effect of the change in foreign exchange rates on the value of investments is included in realized gain/loss on investments and change in net unrealized appreciation/depreciation on investments.

(G) Representations and Indemnifications: In the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote.

(H) Foreign Taxes: The Fund may be subject to foreign taxes on income, gains on investments, or currency repatriation, a portion of which may be recoverable. The Fund will accrue such taxes and recoveries as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

(I) Subsequent Events: Management has evaluated all subsequent transactions and events through the date on which these financial statements were issued, and except as already included in the notes to these financial statements, has determined that no additional items require disclosure.

Value Line Larger Companies Fund, Inc.

| 2. | Capital Share Transactions, Dividends and Distributions to Shareholders |

Transactions in capital stock were as follows:

| | | | | | | |

| | | Year Ended December 31, 2011 | | | Year Ended December 31, 2010 | |

| Shares sold | | | 220,351 | | | | 187,259 | |

| Shares issued to shareholders in reinvestment of dividends and distributions | | | 47,021 | | | | 62,344 | |

| Shares redeemed | | | (1,374,704 | ) | | | (1,973,150 | ) |

| Net decrease | | | (1,107,332 | ) | | | (1,723,547 | ) |

| Dividends per share from net investment income | | $ | 0.0825 | | | $ | 0.1003 | |

| 3. | Purchases and Sales of Securities |

Purchases and sales of investment securities, excluding short-term securities, were as follows:

| | | | | |

| | | Year Ended December 31, 2011 | |

| Purchases: | | | | |

| Investment Securities | | $ | 58,046,457 | |

| Sales: | | | | |

| Investment Securities | | $ | 76,579,327 | |

At December 31, 2011, information on the tax components of capital is as follows:

| | | | | |

| Cost of investments for tax purposes | | $ | 151,239,167 | |

| Gross tax unrealized appreciation | | $ | 34,138,105 | |

| Gross tax unrealized depreciation | | $ | (6,717,327 | ) |

| Net tax unrealized appreciation on investments | | $ | 27,420,778 | |

| Undistributed ordinary income | | $ | 1,170,640 | |

| Capital loss carryforward, expires | | | | |

| December 31, 2016 | | $ | (11,295,931 | ) |

| December 31, 2017 | | $ | (39,301,496 | ) |

During the year ended December 31, 2011, as permitted under federal income tax regulations, the Fund elected to defer $5 of late year ordinary losses and $581,047 of post-October net short term capital losses to the next taxable year and utilized $13,259,065 of capital loss carryforwards.

To the extent that current or future capital gains are offset by capital losses, the Fund does not anticipate distributing any such gains to shareholders.

It is uncertain whether the Fund will be able to realize the benefits of the losses before they expire.

The differences between book basis and tax basis unrealized appreciation/(depreciation) on investments were primarily attributed to wash sales and investments in partnerships.

Value Line Larger Companies Fund, Inc.

| Notes to Financial Statements |

Permanent book-tax differences relating to the current year were reclassified within the composition of the net asset accounts. The Fund increased undistributed net investment income by $7,986, increased accumulated realized loss by $7,882, and decreased additional paid-in-capital by $104. Net assets were not affected by these reclassifications. These reclassifications were primarily due to differing treatments of foreign currency translation and investment in partnerships for tax purposes.

On December 22, 2010, the Regulated Investment Company Modernization Act of 2010 (“the Act”) was signed by the President. Under the Act, net capital losses recognized by the Fund after December 31, 2010, may get carried forward indefinitely, and retain their character as short-term and/or long term losses. Prior to this Act, pre-enactment net capital losses incurred by the Fund were carried forward for eight years and treated as short-term losses. The Act requires under the transition that post-enactment net capital loses are used before pre-enactment net capital losses.

The tax composition of distributions to shareholders for the years ended December 31, 2011 and December 31, 2010 were as follows:

| | | | | | | |

| | | 2011 | | 2010 | |

| Ordinary income | | $ | 848,007 | | | $ | 1,142,925 | |

| 5. | Investment Advisory Fees, Service and Distribution Fees, and Transactions With Affiliates |

An advisory fee of $1,463,191 before fee waivers was paid or payable to EULAV Asset Management (the “Adviser”) for the year ended December 31, 2011. This was computed at an annual rate of 0.75% of the daily net assets during the period and paid monthly. The Adviser provides research, investment programs, supervision of the investment portfolio and pays costs of administrative services, office space, equipment and compensation of administrative, bookkeeping, and clerical personnel necessary for managing the affairs of the Fund. The Adviser also provides persons, satisfactory to the Fund’s Board of Directors, to act as officers and employees of the Fund and pays their salaries.

The Fund has a Service and Distribution Plan (the “Plan”), adopted pursuant to Rule 12b-1 under the Investment Company Act of 1940, which compensates EULAV Securities LLC (the “Distributor”) for advertising, marketing and distributing the Fund’s shares and for servicing the Fund’s shareholders at an annual rate of 0.25% of the Fund’s average daily net assets. For the year ended December 31, 2011, fees amounting to $487,730, before fee waivers, were accrued under the Plan. Effective May 1, 2007 through April 30, 2012, the Distributor contractually agreed to waive the Fund’s 12b-1 fee for one year periods. For the year ended December 31, 2011, all 12b-1 fees were waived. The Distributor has no right to recoup previously waived amounts.

For the year ended December 31, 2011, the Fund’s expenses were reduced by $198 under a custody credit arrangement with the custodian.

Direct expenses of the Fund are charged to the Fund while common expenses of the Value Line Funds are allocated proportionately based upon the Funds’ respective net assets. The Fund bears all other costs and expenses.

Certain officers and a Trustee of the Adviser are also officers and a director of the Fund. At December 31, 2011, the officers and directors of the Fund as a group owned 558 shares, representing less than 1% of the outstanding shares.

Value Line Larger Companies Fund, Inc.

Selected data for a share of capital stock outstanding throughout each year:

| | | | | | | | | | | | | | | | |

| | | Years Ended December 31, | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| Net asset value, beginning of year | | $ | 17.47 | | | $ | 15.40 | | | $ | 13.18 | | | $ | 21.63 | | | $ | 21.37 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.12 | | | | 0.09 | | | | 0.10 | | | | 0.09 | | | | 0.11 | |

| Net gains or (losses) on securities (both realized and unrealized) | | | (0.17 | ) | | | 2.08 | | | | 2.22 | | | | (8.34 | ) | | | 3.15 | |

| Total from investment operations | | | (0.05 | ) | | | 2.17 | | | | 2.32 | | | | (8.25 | ) | | | 3.26 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.08 | ) | | | (0.10 | ) | | | (0.10 | ) | | | (0.03 | ) | | | (0.08 | ) |

| Distributions from net realized gains | | | — | | | | — | | | | — | | | | (0.17 | ) | | | (2.92 | ) |

| Total distributions | | | (0.08 | ) | | | (0.10 | ) | | | (0.10 | ) | | | (0.20 | ) | | | (3.00 | ) |

| Net asset value, end of year | | $ | 17.34 | | | $ | 17.47 | | | $ | 15.40 | | | $ | 13.18 | | | $ | 21.63 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return | | | (0.27 | )% | | | 14.09 | % | | | 17.62 | % | | | (38.12 | )% | | | 15.55 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in thousands) | | $ | 178,783 | | | $ | 199,524 | | | $ | 202,454 | | | $ | 191,950 | | | $ | 304,192 | |

Ratio of expenses to average net assets (1) | | | 1.25 | % | | | 1.21 | %(3) | | | 1.26 | % | | | 1.18 | % | | | 1.13 | % |

Ratio of expenses to average net assets(2) | | | 1.00 | % | | | 0.92 | %(4) | | | 1.01 | % | | | 0.93 | % | | | 0.88 | % |

| Ratio of net investment income to average net assets | | | 0.60 | % | | | 0.44 | % | | | 0.62 | % | | | 0.53 | % | | | 0.47 | % |

| Portfolio turnover rate | | | 30 | % | | | 153 | % | | | 157 | % | | | 157 | % | | | 112 | % |

| (1) | Ratio reflects expenses grossed up for the custody credit arrangement and grossed up for the waiver of the service and distribution plan fees by the Distributor. The ratio of expenses to average net assets net of custody credits but exclusive of the fee waivers, would have been 1.17% for the year ended December 31, 2008 and would not have changed for the other years shown. |

| | |

| (2) | Ratio reflects expenses net of the service and distribution fees by the Distributor, but exclusive of the custody credit arrangement. |

| | |

| (3) | Ratio reflects expenses grossed up for the reimbursement by Value Line, Inc. of certain expenses incurred by the Fund. |

| | |

| (4) | Ratio reflects expenses net of the reimbursement by Value Line, Inc. of certain expenses incurred by the Fund. |

See Notes to Financial Statements.

Value Line Larger Companies Fund, Inc.

| Report of Independent Registered Public Accounting Firm |

To the Board of Directors and Shareholders of Value Line Larger Companies Fund, Inc.

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Value Line Larger Companies Fund, Inc. (the “Fund”) at December 31, 2011, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2011 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

New York, New York

February 27, 2012

Value Line Larger Companies Fund, Inc.

| 2011 Annual Report (unaudited) |

FACTORS CONSIDERED BY THE BOARD IN APPROVING CONTINUANCE

OF THE INVESTMENT ADVISORY AGREEMENT

FOR VALUE LINE LARGER COMPANIES FUND, INC.

The Investment Company Act of 1940 (the “1940 Act”) requires the Board of Directors, including a majority of Directors who are not “interested persons” of Value Line Larger Companies Fund, Inc. (the “Fund”), as that term is defined in the 1940 Act (the “Independent Directors”), to annually consider the continuance of the Fund’s investment advisory agreement (“Agreement”) with its investment adviser, EULAV Asset Management.1

In considering whether the continuance of the Agreement was in the best interests of the Fund and its shareholders, the Board requested and the Adviser provided such information as the Board deemed to be reasonably necessary to evaluate the terms of the Agreement. At meetings held throughout the year, including the meeting specifically focused upon the review of the Agreement, the Independent Directors met in executive sessions separately from the non-Independent Director of the Fund and any officers of the Adviser. In selecting the Adviser and approving the continuance of the Agreement, the Independent Directors relied upon the assistance of counsel to the Independent Directors.

Both in the meeting that specifically addressed the continuance of the Agreement and at other meetings, the Board, including the Independent Directors, received materials relating to the Adviser’s investment and management services under the Agreement. These materials included information on: (i) the investment performance of the Fund, compared to a peer group of funds consisting of the Fund and all retail and institutional large-cap growth funds regardless of asset size or primary channel of distribution (the “Performance Universe”), and its benchmark index, each as classified by Lipper Inc., an independent evaluation service (“Lipper”); (ii) the investment process, portfolio holdings, investment restrictions, valuation procedures, and financial statements for the Fund; (iii) sales and redemption data with respect to the Fund; (iv) the general investment outlook in the markets in which the Fund invests; (v) arrangements with respect to the distribution of the Fund’s shares; (vi) the allocation and cost of the Fund’s brokerage (none of which was effected through any affiliate of the Adviser); and (vii) the overall nature, quality and extent of services provided by the Adviser.

As part of their review, the Board requested, and the Adviser provided, additional information in order to evaluate the quality of the Adviser’s services and the reasonableness of its fees under the Agreement. In a separate executive session, the Independent Directors reviewed information, which included data comparing: (i) the Fund’s management fee rate, transfer agent and custodian fee rates, service fee (including 12b-1 fees) rates, and the rate of the Fund’s other non-management fees, to those incurred by a peer group of funds consisting of the Fund and 13 other retail no-load large-cap growth funds (excluding outliers), as selected objectively by Lipper (“Expense Group”), and a peer group of funds consisting of the Fund, the Expense Group and all other retail no-load large-cap growth funds (excluding outliers), as selected objectively by Lipper (“Expense Universe”); (ii) the Fund’s expense ratio to those of its Expense Group and Expense Universe; and (iii) the Fund’s investment performance over various time periods to the average performance of the Performance Universe as well as the appropriate Lipper Index, as selected objectively by Lipper (the “Lipper Index”).

1 For periods prior to December 23, 2010, the term “Adviser” means the Adviser’s predecessor entities that previously served as the Fund’s adviser, EULAV Asset Management, LLC and Value Line, Inc. (“VLI”). In accordance with the 1940 Act, the Agreement had a two-year initial term ending December 2012. Nevertheless, the Board determined to consider the Agreement’s continuance annually and undertook that review in June 2011.

Value Line Larger Companies Fund, Inc.

| 2011 Annual Report (unaudited) |

In the separate executive session, the Independent Directors also reviewed information regarding: (a) the financial results and condition of the Adviser both before and after its restructuring on December 23, 2010,2 and the Adviser’s and certain of its affiliates’ profitability from the services that have been performed for the Fund and the Value Line family of funds; (b) the Adviser’s investment management staffing and resources; (c) the ownership, control and day-today management of the Adviser, including representations of VLI that it does not “control” (as that term is defined in the 1940 Act) either the Adviser or Value Line Securities, Inc. (the “Distributor”) after the restructuring; and (d) the Fund’s potential for achieving economies of scale. In support of its review of the statistical information, the Board was provided with a detailed description of the methodology used by Lipper to determine the Expense Group, the Expense Universe and the Performance Universe to prepare its information.

The following summarizes matters considered by the Board in connection with its continuance of the Agreement. However, the Board did not identify any single factor as all-important or controlling, and the summary does not detail all the matters that were considered.

Investment Performance. The Board reviewed the Fund’s overall investment performance and compared it to its Performance Universe and the Lipper Index. The Board noted that the Fund outperformed the Performance Universe average and the Lipper Index for the one-year period ended March 31, 2011. The Board also noted that the Fund’s performance for the three-year, five-year and ten-year periods ended March 31, 2011 was below the performance of the Performance Universe average and the Lipper Index.

The Adviser’s Personnel and Methods. The Board reviewed the background of the portfolio manager responsible for the daily management of the Fund’s portfolio, seeking to achieve the Fund’s investment objective and adhering to the Fund’s investment strategies. The Independent Directors also engaged in discussions with the Adviser’s senior management responsible for the overall functioning of the Fund’s investment operations. The Board viewed favorably (i) the Adviser’s commitment of resources to acquire analytic tools in support of the portfolio management and compliance functions, (ii) actions taken by the Adviser to attract and retain personnel, including improvements to the Adviser’s employee benefit programs and increased merit-based compensation for certain staff members, and (iii) that the Adviser continues to receive the Value Line ranking systems without cost. The Board concluded that the Fund’s management team and the Adviser’s overall resources were adequate and that the Adviser had investment management capabilities and personnel essential to performing its duties under the Agreement.

Management Fee and Expenses. The Board considered the Adviser’s fee rate under the Agreement relative to the management fee rates applicable to the funds in the Expense Group and Expense Universe averages, both before and after applicable fee waivers. Before giving effect to fee waivers applicable to certain funds in the Expense Group, the Board noted that, for the most recent fiscal year for which audited financial data is available, the Fund’s management fee rate was less than that of the Expense Group average. After giving effect to applicable fee waivers, the Board also noted that, for the most recent fiscal year for which audited financial data is available, the Fund’s management fee rate was less than that of the Expense Group average and slightly more than that of the Expense Universe average. The Board concluded that the Fund’s management fee rate was satisfactory for the purpose of approving continuance of the Agreement.

2 On December 23, 2010, the Adviser was restructured as a Delaware statutory trust and renamed EULAV Asset Management. It had formerly been organized as a limited liability company named EULAV Asset Management, LLC.

Value Line Larger Companies Fund, Inc.

| 2011 Annual Report (unaudited) |

The Board also considered the Fund’s total expense ratio relative to its Expense Group and Expense Universe averages. The Board noted that the Distributor and the Board previously agreed that the Distributor would contractually waive the Fund’s Rule 12b-1 fee, effectively reducing the Fund’s Rule 12b-1 fee rate from 0.25% to 0.00% of the Fund’s average daily net assets for the one-year period ended April 30, 2011 and that the Distributor and the Board have currently agreed to extend this contractual Rule 12b-1 fee waiver through April 30, 2012. Such waiver cannot be changed during the contractual waiver period without the Board’s approval. The Board noted that, for the most recent fiscal year for which audited financial data is available, the Fund’s expense ratio was less than that of both the Expense Group average and the Expense Universe average, after giving effect to fee waivers applicable to the Fund and certain funds in the Expense Group and Universe. The Board concluded that the average expense ratio was satisfactory for the purpose of approving continuance of the Agreement.

Nature, Extent and Quality of Services. The Board considered the nature, extent and quality of other services provided by the Adviser and the Distributor. At meetings held throughout the year, the Board reviewed the resources and effectiveness of the Adviser’s overall compliance program, as well as the services provided by the Distributor. The Board viewed favorably the additional resources devoted by the Adviser to enhance its and the Fund’s overall compliance program as well as steps being undertaken to enhance the shareholders’ experience with the Fund, such as a more robust website. The Board reviewed the services provided by the Adviser and its affiliates in supervising the Fund’s third party service providers. Based on this review, the Board concluded that the nature, quality, cost, and extent of such other services provided by the Adviser and its affiliates were satisfactory, reliable and beneficial to the Fund’s shareholders.

Profitability. The Board considered the level of profitability of the Adviser and its affiliates with respect to the Fund individually and in the aggregate for all the funds within the Value Line group of funds, including the impact of the restructuring and certain actions taken during prior years. These actions included the reduction (voluntary in some instances and contractual in other instances) of management and/or Rule 12b-1 fees for certain funds, the Adviser’s termination of the use of soft dollar research, and the cessation of trading through the Distributor. The Board also considered the Adviser’s continued attention to the rationalization and differentiation of funds within the Value Line group of funds to better identify opportunities for savings and efficiencies among the funds. The Board concluded that the profitability of the Adviser and its affiliates with respect to the Fund, including the financial results derived from the Fund’s Agreement, were within a range the Board considered reasonable.

Other Benefits. The Board also considered the character and amount of other direct and incidental benefits received by the Adviser and its affiliates from their association with the Fund. The Board concluded that potential “fallout” benefits that the Adviser and its affiliates may receive, such as greater name recognition, appear to be reasonable, and may in some cases benefit the Fund.

Economies of Scale. The Board considered that, given the current and anticipated size of the Fund, any perceived and potential economies of scale were not yet a significant consideration for the Fund and that the addition of break points to the fee structure was not currently necessary.

Value Line Larger Companies Fund, Inc.

| 2011 Annual Report (unaudited) |

Fees and Services Provided for Other Comparable Funds/Accounts Managed by the Adviser and its Affiliates. The Board was informed by the Adviser that the Adviser does not manage any non-mutual fund account that has similar objectives and policies as those of the Fund.

Conclusion. The Board examined the totality of the information it was provided at the meeting specifically addressing approval of the Agreement and at other meetings held during the past year and did not identify any single controlling factor. Based on its evaluation of all material factors deemed relevant and with the advice of independent counsel, the Board concluded that the rate at which the Fund pays a management fee to the Adviser under the Agreement does not constitute a fee that is so disproportionately large as to bear no reasonable relationship to the services rendered and that could not have been the product of arm’s-length bargaining. Further, the Board concluded that the Fund’s Agreement, and the management fee rate thereunder, is fair and reasonable and voted to continue the Agreement as in the best interest of the Fund and its shareholders.

Value Line Larger Companies Fund, Inc.

| Federal Tax Notice (unaudited) |

For corporate taxpayers, 100% of the ordinary income distribution paid during the calendar year 2011, qualify for the corporate dividends received deductions. During the calendar year 2011, 100% of the ordinary income distribution are treated as qualified dividends. |

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, and information regarding how the Fund voted these proxies for the 12-month period ended June 30 is available through the Fund’s website at http://www.vlfunds.com and on the SEC’s website at http://www.sec.gov. The description of the policies and procedures is also available without charge, upon request, by calling 1-800-243-2729.

Value Line Larger Companies Fund, Inc.

MANAGEMENT INFORMATION

The business and affairs of the Fund are managed by the Fund’s officers under the direction of the Board of Directors. The following table sets forth information on each Director and Officer of the Fund. Each Director serves as a director or trustee of each of the 13 Value Line Funds. Each Director serves until his or her successor is elected and qualified.

| | | | | | | | | |

| Name, Address, and YOB | | Position | | Length of Time Served | | Principal Occupation During the Past 5 Years | | Other Directorships Held by Director |

| Interested Director* | | | | | | | | |

Mitchell E. Appel YOB: 1970 | | Director | | Since 2010 | | President of each of the Value Line Funds since June 2008; Chief Financial Officer of Value Line, Inc. (“Value Line”) from April 2008 to December 2010 and from September 2005 to November 2007; Director from February 2010 to December 2010; Chief Financial Officer of XTF Asset Management from November 2007 to April 2008; Chief Financial Officer of the Distributor since April 2008 and President since February 2009; President of the Adviser since February 2009, Trustee since December 2010 and Treasurer since January 2011. | | None |

| Non-Interested Directors | | | | | | | | |

Joyce E. Heinzerling 500 East 77th Street New York, NY 10162 YOB: 1956 | | Director | | Since 2008 | | President, Meridian Fund Advisers LLC. (consultants) since April 2009; General Counsel, Archery Capital LLC (private investment fund) until April 2009. | | Burnham Investors Trust, since 2004

(4 funds). |

Francis C. Oakley 54 Scott Hill Road Williamstown, MA 01267 YOB: 1931 | | Director | | Since 2000 | | Professor of History, Williams College, (1961-2002). Professor Emeritus since 2002; President Emeritus since 1994 and President, (1985-1994); Chairman (1993-1997) and Interim President (2002-2003) of the American Council of Learned Societies. Trustee since 1997 and Chairman of the Board since 2005, National Humanities Center. | | None |

David H. Porter 5 Birch Run Drive Saratoga Springs, NY 12866 YOB: 1935 | | Director | | Since 1997 | | Professor, Skidmore College since 2008; Visiting Professor of Classics, Williams College, (1999-2008); President Emeritus, Skidmore College since 1999 and President, (1987-1998). | | None |

Value Line Larger Companies Fund, Inc.

| Name, Address, and YOB | | Position | | Length of Time Served | | Principal Occupation During the Past 5 Years | | Other Directorships Held by Director |

Paul Craig Roberts 169 Pompano St. Panama City Beach, FL 32413 YOB: 1939 | | Director | | Since 1983 | | Chairman, Institute for Political Economy. | | None |

Nancy-Beth Sheerr 1409 Beaumont Drive Gladwyne, PA 19035 YOB: 1949 | | Director | | Since 1996 | | Senior Financial Adviser, Veritable L.P. (Investment Adviser). | | None |

Daniel S. Vandivort 59 Indian Head Road Riverside, CT 06878 YOB: 1954 | | Director (Chairman of Board since 2010) | | Since 2008 | | President, Chief Investment Officer, Weiss, Peck and Greer/Robeco Investment Management (2005-2007); Managing Director, Weiss, Peck and Greer, (1995-2005). | | None |

| Officers | | | | | | | | |

Mitchell E. Appel YOB: 1970 | | President | | Since 2008 | | President of each of the Value Line Funds since June 2008; Chief Financial Officer of Value Line from April 2008 to December 2010 and from September 2005 to November 2007; Director from February 2010 to December 2010; Chief Financial Officer of XTF Asset Management from November 2007 to April 2008; Chief Financial Officer of the Distributor since April 2008 and President since February 2009; President of the Adviser since February 2009, Trustee since December 2010 and Treasurer since January 2011. |

Michael J. Wagner YOB: 1950 | | Chief Compliance Officer | | Since 2009 | | Chief Compliance Officer of Value Line Funds since June 2009; President of Northern Lights Compliance Service, LLC (formerly Fund Compliance Services, LLC (2006 – present)) and Senior Vice President (2004 – 2006) and President and Chief Operations Officer (2003 – 2006) of Gemini Fund Services, LLC; Director of Constellation Trust Company until 2008. |

Emily D. Washington YOB: 1979 | | Treasurer and Secretary | | Since 2008 | | Treasurer and Chief Financial Officer (Principal Financial and Accounting Officer) of each of the Value Line Funds since August 2008 and secretary since 2010; Associate Director of Mutual Fund Accounting at Value Line until August 2008. |

| * | Mr. Appel is an “interested person” as defined in the Investment Company Act of 1940 by virtue of his position with the Adviser and Distributor. |

Unless otherwise indicated, the address for each of the above officers is c/o Value Line Funds, 7 Times Square, New York, NY 10036.

| The Fund’s Statement of Additional Information (SAI) includes additional information about the Fund’s Directors and is available, without charge, upon request by calling 1-800-243-2729 or on the Fund’s website, www.vlfunds.com. |

Value Line Larger Companies Fund, Inc.

[This Page Intentionally Left Blank.]

Value Line Larger Companies Fund, Inc.

[This Page Intentionally Left Blank.]

Value Line Larger Companies Fund, Inc.

[This Page Intentionally Left Blank.]

Value Line Larger Companies Fund, Inc.

| The Value Line Family of Funds |

1950 — The Value Line Fund seeks long-term growth of capital. Current income is a secondary objective.

1952 — Value Line Income and Growth Fund’s primary investment objective is income, as high and dependable as is consistent with reasonable risk. Capital growth to increase total return is a secondary objective.

1956 — Value Line Premier Growth Fund seeks long-term growth of capital. No consideration is given to current income in the choice of investments.

1972 — Value Line Larger Companies Fund’s sole investment objective is to realize capital growth.

1979 — Value Line U.S. Government Money Market Fund, a money market fund, seeks to secure as high a level of current income as is consistent with maintaining liquidity and preserving capital. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

1981 — Value Line U.S. Government Securities Fund seeks maximum income without undue risk to capital. Under normal conditions, at least 80% of the value of its net assets will be invested in securities issued or guaranteed by the U.S. Government and its agencies and instrumentalities.

1983 — Value Line Centurion Fund* seeks long-term growth of capital.

1984 — The Value Line Tax Exempt Fund seeks to provide investors with the maximum income exempt from federal income taxes while avoiding undue risk to principal. The fund may be subject to state and local taxes and the Alternative Minimum Tax (if applicable).

1986 — Value Line Aggressive Income Trust seeks to maximize current income.

1987 — Value Line New York Tax Exempt Trust seeks to provide New York taxpayers with the maximum income exempt from New York State, New York City and federal income taxes while avoiding undue risk to principal. The Trust may be subject to state and local taxes and the Alternative Minimum Tax (if applicable).

1987 — Value Line Strategic Asset Management Trust* seeks to achieve a high total investment return consistent with reasonable risk.

1993 — Value Line Emerging Opportunities Fund invests in US common stocks of small capitalization companies, with its primary objective being long-term growth of capital.

1993 — Value Line Asset Allocation Fund seeks high total investment return, consistent with reasonable risk. The Fund invests in stocks, bonds and money market instruments utilizing quantitative modeling to determine the asset mix.

| * | Only available through the purchase of Guardian Investor, a tax deferred variable annuity, or ValuePlus, a variable life insurance policy. |

For more complete information about any of the Value Line Funds, including charges and expenses, send for a prospectus from EULAV Securities LLC, 7 Times Square, New York, New York 10036-6524 or call 1-800-243-2729, 9am-5pm CST, Monday-Friday, or visit us at www.vlfunds.com. Read the prospectus carefully before you invest or send money.

Item 2. Code of Ethics

(a) The Registrant has adopted a Code of Ethics that applies to its principal executive officer, and principal financial officer and principal accounting officer.

(f) Pursuant to item 12(a), the Registrant is attaching as an exhibit a copy of its Code of Ethics that applies to its principal executive officer, and principal financial officer and principal accounting officer.

Item 3. Audit Committee Financial Expert.

(a)(1)The Registrant has an Audit Committee Financial Expert serving on its Audit Committee.

(2) The Registrant’s Board has designated Daniel S. Vandivort, a member of the Registrant’s Audit Committee, as the Registrant’s Audit Committee Financial Expert. Mr. Vandivort is an independent director who has served as President, Chief Investment Officer to Weis, Peck and Greer/Robeco Investment Management. He has also previously served as Managing Director for Weis, Peck and Greer (1995-2005).

A person who is designated as an “audit committee financial expert” shall not make such person an "expert" for any purpose, including without limitation under Section 11 of the Securities Act of 1933 or under applicable fiduciary laws, as a result of being designated or identified as an audit committee financial expert. The designation or identification of a person as an audit committee financial expert does not impose on such person any duties, obligations, or liabilities that are greater than the duties, obligations, and liabilities imposed on such person as a member of the audit committee and Board of Trustees in the absence of such designation or identification.

Item 4. Principal Accountant Fees and Services

(a)Audit Fees 2011 - $43,150

(b) Audit-Related fees – None.

(c) Tax Preparation Fees 2011 -$20,262

(d) All Other Fees – None

(e) (1) Audit Committee Pre-Approval Policy. All services to be performed for the Registrant by PricewaterhouseCoopers LLP must be pre-approved by the audit committee. All services performed were pre-approved by the committee.

(f) Not applicable.

(g) Aggregate Non-Audit Fees 2011 -$2,400

(h) Not applicable.

Item 11. Controls and Procedures.

| | (a) | The registrant’s principal executive officer and principal financial officer have concluded that the registrant’s disclosure controls and procedures (as defined in rule 30a-2(c) under the Act (17 CFR 270.30a-2(c)) based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this report, are appropriately designed to ensure that material information relating to the registrant is made known to such officers and are operating effectively. |

| | (b) | The registrant’s principal executive officer and principal financial officer have determined that there have been no significant changes in the registrant’s internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation, including corrective actions with regard to significant deficiencies and material weaknesses. |

Item 12. Exhibits.

| (a) | Code of Business Conduct and Ethics for Principal Executive and Senior Financial Officers attached hereto as Exhibit 100.COE |

| (b) | (1) Certification pursuant to Rule 30a-2(a) under the Investment Company Act of 1940 (17 CFR 270.30a-2) attached hereto as Exhibit 99.CERT. |

| | (2) Certification pursuant to Rule 30a-2(a) under the Investment Company Act of 1940 (17 CFR 270.30a-2) attached hereto as Exhibit 99.CERT. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| By: | /s/ Mitchell E. Appel | |

| | Mitchell E. Appel, President | |

| | | |

| | | |

| Date: | March 6, 2012 | |

| | | |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. |

| | | |

| | | |

| By: | /s/ Mitchell E. Appel | |

| | Mitchell E. Appel, President, Principal Executive Officer |

| | | |

| | | |

| By: | /s/ Emily D. Washington | |

| | Emily D. Washington, Treasurer, Principal Financial Officer |

| | | |

| | | |

| Date: | March 6, 2012 | |