UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number 001-31930

ATLATSA RESOURCES CORPORATION

(Exact name of Registrant as specified in its charter)

NOT APPLICABLE

(Translation of Registrant’s name into English)

BRITISH COLUMBIA, CANADA

(Jurisdiction of incorporation or organization)

Suite 1020, 800 West Pender Street

Vancouver, British Columbia, Canada, V6C 2V6

(Address of principal executive offices)

De Wet Schutte; Tel-27-11-779-6830; Fax-27-11-883-0836

4th Floor, 82 Grayston Drive, Sandton, Johannesburg, 2146, South Africa

(Name, Telephone, E-mail, and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of each exchange on which registered |

| Common Shares without par value | | NYSE Amex Equities |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Number of outstanding shares of Registrant’s only class of common stock as of December 31, 2012:

201,888,472 common shares without par value

Indicate by check mark whether Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes ¨ No x

If this report is an annual or transition report, indicate by check mark if Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the Registrant (1) has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act

| | | | |

| Large accelerated Filer ¨ | | Accelerated Filer x | | Non-accelerated Filer ¨ |

Indicate by check mark which basis of accounting the Registrant has used to prepare the financial statements included in this filing:

| | | | |

| U.S. GAAP ¨ | | International Financial Reporting Standards as issued by the International Accounting Standards Board x | | Other ¨ |

If “Other” has been check in response to the previous question, by check mark which financial statement item Registrant has elected to follow: Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

TABLE OF CONTENTS

3

GENERAL MATTERS

In this Annual Report on Form 20-F for the fiscal year ended December 31, 2012 (“Annual Report”), all references to the “Company” or to “Atlatsa” refer to Atlatsa Resources Corporation and its subsidiaries, unless the context clearly requires otherwise. Certain terms used herein are defined in the text and others are included in the glossary of terms. See “Glossary of Terms”.

Atlatsa uses the Canadian dollar as its reporting currency. All references in this document to “CAD”, “dollars” or “$” are to Canadian dollars, unless otherwise indicated. On February 28, 2013 the noon exchange rate for Canadian dollars as reported by the Bank of Canada was CAD 1.00 = USD 0.972. On February 28, 2013 the noon exchange rate for South African Rand as reported by the Bank of Canada was ZAR8.97 = USD 1.00. See also Item 3 - “Key Information” for more detailed currency and conversion information.

Except as noted, the information set forth in this Annual Report is as of March 28, 2013 and all information included in this document should only be considered correct as of such date.

This Annual Report is dated March 28, 2013.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report includes certain statements that may be deemed “forward-looking statements” or “forward-looking information” within the meaning of applicable securities laws. All statements in this Annual Report, other than statements of historical facts, that address the proposed Bokoni Group (as defined below) restructuring and refinancing transaction, potential acquisitions, future production, reserve potential, exploration drilling, exploitation activities and events or developments that Atlatsa expects, are forward-looking statements. These statements appear in a number of different places in this Annual Report and can be identified by words such as “anticipates”, “estimates”, “projects”, “expects”, “intends”, “believes”, “plans”, “will”, “could”, “may”, “projects”, or their negatives or other comparable words. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements. Examples of such forward-looking statements include, but are not limited to:

| | • | | Bokoni Mine is expected to achieve production levels similar to previous years. |

| | • | | The Company expects to be able to continue its financing strategy on favorable terms. |

| | • | | The Company expects the Bokoni Group restructuring and refinancing transaction to be implemented on favourable terms. |

Atlatsa believes that such forward-looking statements are based on material factors and reasonable assumptions, including assumptions that: the proposed Restructure Plan will be completed on favourable terms and in a timely manner; the Bokoni Mine (as defined below) will increase production levels from the previous years; the Ga-Phasha, Project (as defined below; also described below under ITEM 4 “Restructure Plan” and 4.D. Property, Plants and Equipment); the Boikgantsho Project (as defined below; also described below under ITEM 4 “Restructure Plan” and 4.D. Property, Plants and Equipment); the Kwanda Project (as defined below; also described below under 4.D. Property, Plants and Equipment and Platreef project exploration results will continue to be positive; contracted parties provide goods and/or services on the agreed timeframes; equipment necessary for construction and development is available as scheduled and does not incur unforeseen breakdowns; no material labor slowdowns or strikes are incurred; plant and equipment functions as specified; geological or financial parameters do not necessitate future mine plan changes; and no geological or technical problems occur.

Forward-looking statements, however, are not guarantees of future performance and actual results or developments may differ materially from those projected in forward-looking statements. Factors that could cause actual results to differ materially from those in forward looking statements include the failure to implement the proposed Bokoni Group restructuring and refinancing transaction on favorable terms, or at all, labor disputes, fluctuations in market prices, the levels of exploitation and exploration successes, changes in and the effect of government policies with respect to mining and natural resource exploration and exploitation, continued availability of capital and financing, general economic, market or business conditions, failure of plant, equipment or processes to operate as anticipated, accidents, industrial unrest and strikes, political instability, insurrection or war, the effect of HIV/AIDS on labor force availability and turnover, and delays in obtaining government approvals. These factors and other risk factors that could cause actual results to differ materially from those in forward-looking statements are described in further detail under Item 3D “Risk Factors” in this Annual Report.

Atlatsa advises you that these cautionary remarks expressly qualify in their entirety all forward-looking statements in this Annual Report. The Company assumes no obligation to update its forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting such statements, except as required by law. You should carefully review the cautionary statements and risk factors contained in this and other documents that the Company files from time to time with, or

4

furnishes to, the United States Securities and Exchange Commission (the “SEC”) and the applicable Canadian securities regulators.

CAUTIONARY NOTE TO U.S. INVESTORS

This Annual Report uses the terms “measured resources” and “indicated resources”. The Company advises investors that while those terms are recognized and required by Canadian regulations, the SEC does not recognize them. The requirements of National Instrument 43-101 Standard of Disclosure for Mineral Projects (“NI 43-101”) for identification of “reserves” are also not the same as those of the SEC, and reserves reported by the Company in compliance with NI 43-101 may not qualify as “reserves” under SEC standards. Under U.S. standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves.

This Annual Report also uses the term “inferred resources”. The Company advises investors that while this term is recognized and required by Canadian regulations, the SEC does not recognize it. “Inferred resources” have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of a mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred resources may not form the basis of economic studies, except in rare cases. Investors are cautioned not to assume that any part or all of an inferred resource exists, or is economically or legally mineable.

In addition, disclosure of “contained ounces” in a mineral resource is permitted disclosure under Canadian regulations. However, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place for tonnage and grade, without reference to unit measures.

Investors should refer to the disclosure under the heading “Resource Category (Classification) Definitions” in the “Glossary of Terms” below.

CAUTIONARY NOTE TO READERS CONCERNING TECHNICAL REVIEW OF BOKONI MINE, GA-PHASHA PROJECT AND BOIKGANTSHO PROJECT

The following are the principal risk factors and uncertainties which, in management’s opinion, are likely to most directly affect the conclusions of the technical review of Bokoni Mine, Ga-Phasha Project and Boikgantsho Project. Some of the mineralized material classified as a measured and indicated resource has been used in the cash flow analysis. For U.S. mining standards, a full feasibility study would be required, which would require more detailed studies. Additionally, all necessary mining permits would be required in order to classify this part of Bokoni Mine’s, Ga-Phasha Project’s and Boikgantsho Project’s mineralized material as a mineral reserve. There can be no assurance that this mineralized material will become classifiable as a reserve and there is no assurance as to the amount, if any, which might ultimately qualify as a reserve or what the grade of such reserve amounts would be. Data is not complete and cost estimates have been developed, in part, based on the expertise of the individuals participating in the preparation of the technical review and on costs at projects believed to be comparable, and not based on firm price quotes. Costs, including design, procurement, construction and on-going operating costs and metal recoveries could be materially different from those contained in the technical review. There can be no assurance that mining can be conducted at the rates and grades assumed in the technical review. There can be no assurance that the infrastructure facilities can be developed on a timely and cost-effective basis. Energy risks include the potential for significant increases in the cost of fuel and electricity, and fluctuation in the availability of electricity. Projected metal prices have been used for the technical review. The prices of these metals are historically volatile, and the Company has no control of or influence on the prices, which are determined in international markets. There can be no assurance that the prices of platinum, palladium, rhodium, gold, copper and nickel will continue at current levels or that they will not decline below the prices assumed in the technical review. Prices for these commodities have been below the price ranges assumed in the technical report at times during the past ten years, and for extended periods of time. The expansion projects described herein will require major financing; probably a combination of debt and equity financing. There can be no assurance that debt and/or equity financing will be available on acceptable terms or at all. A significant increase in costs of capital could materially adversely affect the value and feasibility of constructing the expansions. Other general risks include those ordinary to large construction projects, including the general uncertainties inherent in engineering and construction cost, the need to comply with generally increasing environmental obligations, and accommodation of local and community concerns. The economics are sensitive to the currency exchange rates, which have been subject to large fluctuations in the last several years. See also Item 3.D. “Risk factors”.

5

GLOSSARY OF TERMS

Certain terms used in this Annual Report are defined as follows:

| | |

A Preference Shares | | Cumulative redeemable preference shares in the authorized capital of Plateau. |

| |

Affiliate | | As ascribed thereto in theSecurities Act(British Columbia), as amended, except as otherwise provided herein. |

| |

Anglo Platinum | | Anglo American Platinum Limited, a public company incorporated under the laws of South Africa and whose common shares are listed on the JSE, and includes its subsidiaries where the context requires. |

| |

Asset Sale | | The proposed sale of Atlatsa’s interest in the Asset Sale Properties to RPM pursuant to the Boikgantsho Asset Sale Agreement and the Ga-Phasha Asset Sale Agreement. |

| |

Asset Sale Agreements | | Collectively the Ga-Phasha Asset Sale Agreement and the Boikgantsho Asset Sale Agreement |

| |

Asset Sale Properties | | The properties that are to be transferred under the Asset Sale Agreements |

| |

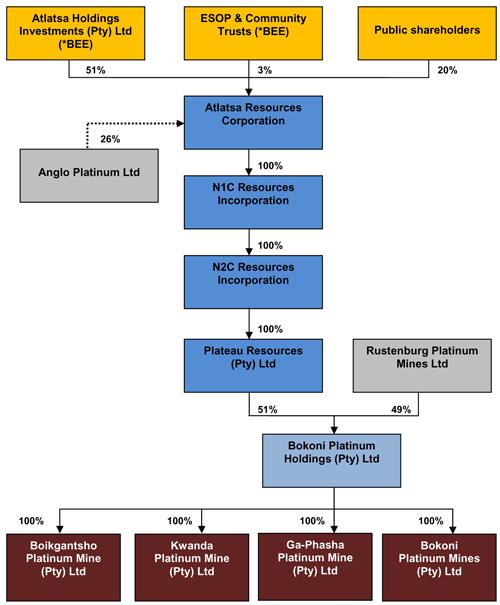

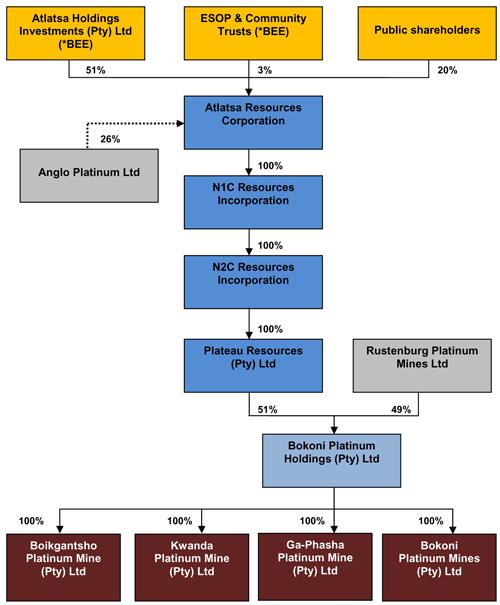

Atlatsa or the Company | | Atlatsa Resources Corporation (previously Anooraq Resources Corporation), a corporation incorporated under the laws of the Province of British Columbia and listed on the TSX-V, the JSE and the NYSE MKT, and includes its subsidiaries where the context requires. |

| |

Atlatsa Shareholders Agreement | | The shareholders agreement between Pelawan, Atlatsa, the Pelawan Trust and Plateau, dated as of June 12, 2009, which has replaced the Pelawan Reverse Take-Over Share Exchange Agreement between Pelawan and Atlatsa made as of January 21, 2004 and as amended from time to time, the Pelawan Reverse Take-Over Shareholders Agreement between Pelawan, Atlatsa and the Pelawan Trust made as of September 19, 2004 and the settlement agreement between the Company and Pelawan, dated as of December 28, 2006, as of July 1, 2009, the effective date of the Bokoni Transaction. |

| |

Atlatsa Holdings | | Atlatsa Holdings (Proprietary) Limited, a private company incorporated under the laws of South Africa. Formerly known as Pelawan. |

| |

B1 Preference Shares | | Cumulative convertible preference shares in the authorized capital of Pelawan SPV. |

| |

B2 Preference Shares | | Cumulative convertible redeemable preference shares in the capital of Plateau. |

| |

BEE | | Black Economic Empowerment, as envisaged pursuant to the Mineral Development Act and related legislation and guidelines, being a strategy aimed at substantially increasing participation by HDPs at all levels in the economy of South Africa. BEE is aimed at redressing the imbalances of the past caused by the Apartheid system in South Africa, by seeking to substantially and equitably increase the ownership and management of South Africa’s resources by the majority of its citizens and so ensure broader and more meaningful participation in the economy by HDPs. |

| |

Beneficial Shareholder | | A Shareholder who beneficially owns and holds Common Shares through a broker (or some other intermediary) and who does not hold Common Shares in his, her or its own name. |

| |

Board of Directors or Board | | The board of directors of Atlatsa. |

| |

Boikgantsho Asset Sale Agreement | | The sale of assets agreement to be entered into in 2013 between RPM and Boikgantsho pursuant to which RPM will purchase and Boikgantsho will sell the Boikgantsho Project assets. |

| |

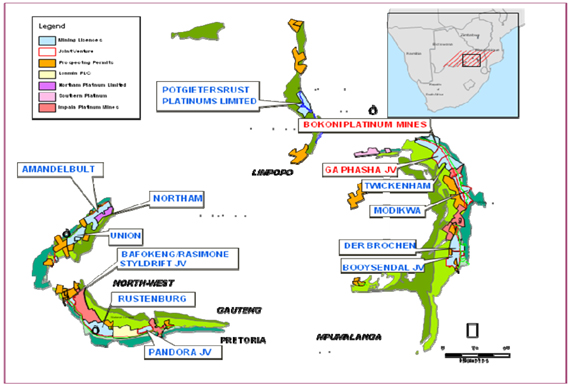

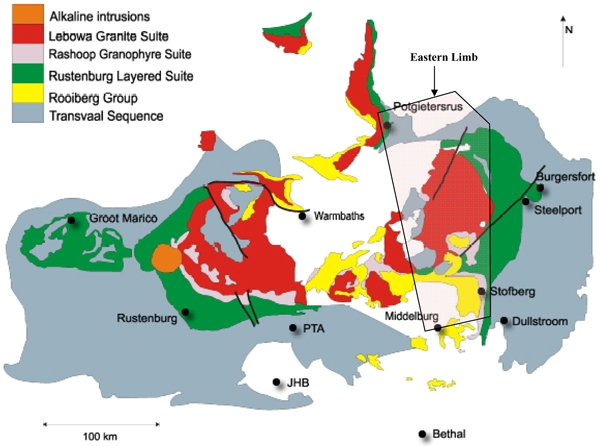

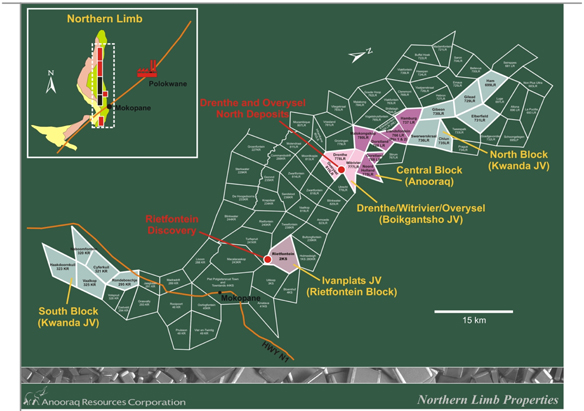

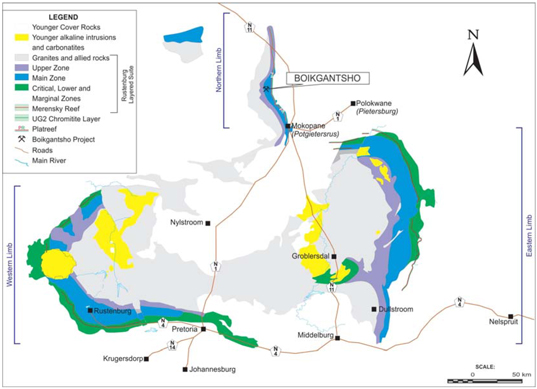

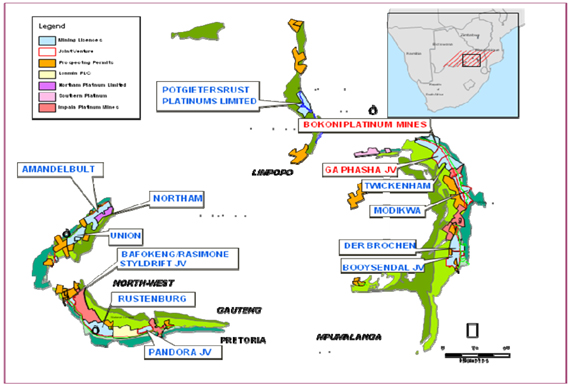

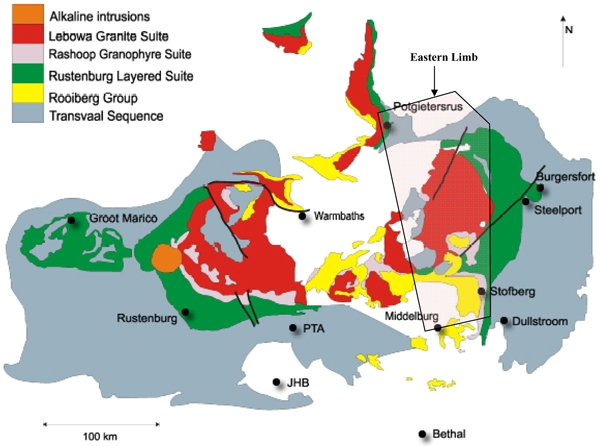

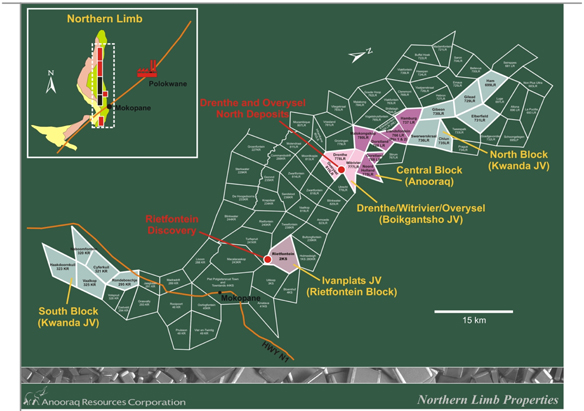

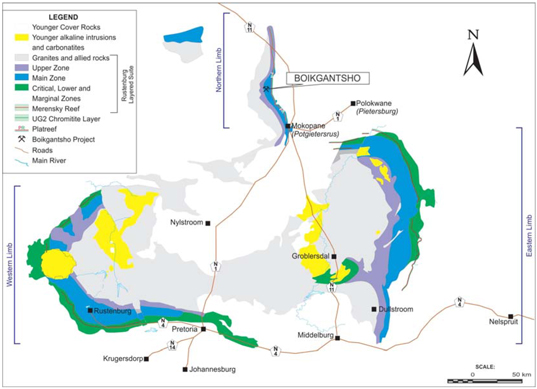

Boikgantsho Project | | The Boikgantsho PGM project, located on the Northern Limb of the Bushveld Complex in South Africa, on the Drenthe and Witrivier farms, and the northern portion of the Overysel |

6

| | |

| | farm. |

| |

Boikgantsho | | Boikgantsho Platinum Mine (Proprietary) Limited, a private company incorporated under the laws of South Africa which holds the mineral title in respect of the Boikgantsho Project. |

| |

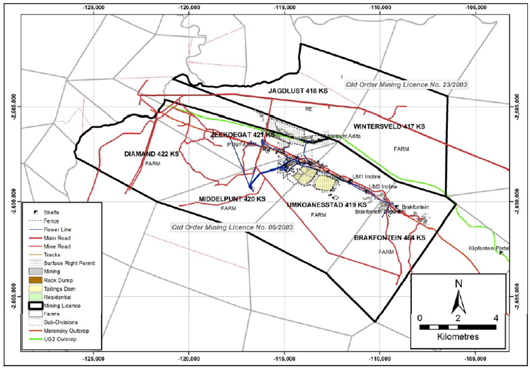

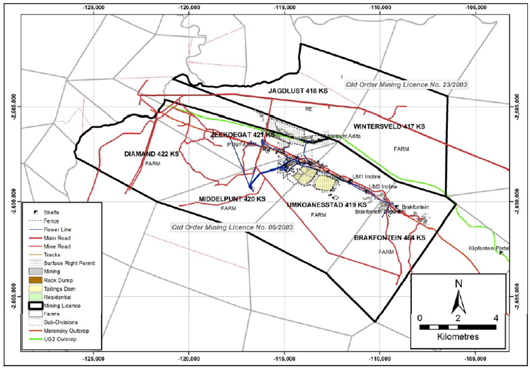

Bokoni Mine | | Bokoni Platinum Mines (Proprietary) Limited, a private company incorporated under the laws of South Africa, formerly named Richtrau No. 177 (Proprietary) Limited and which is a wholly owned subsidiary of Holdco. A PGM mine, located on the Eastern Limb of the Bushveld Complex in South Africa on the Diamond, Wintersveld, Jagdlust, Middelpunt, Umkoanesstad and Zeekoegat farms, formerly named the Lebowa Platinum Mine. |

| |

Bokoni Transaction | | The transaction pursuant to which the Company acquired an effective 51% interest in Bokoni Mine and an additional 1% interest in the Ga-Phasha Project, Boikgantsho Project and Kwanda Project pursuant to the acquisition by Plateau of 51% of the shares in, and claims on shareholders loan account against, Holdco (which, following implementation of the transaction, owns 100% of Bokoni Mine, and 100% of Ga-Phasha, Boikgantsho and Kwanda, for an aggregate cash consideration of $327 million (ZAR2.6 billion). The transaction was also previously known as the “Lebowa Transaction”. |

| |

Bokoni Transaction Agreements | | The Boikgantsho Sale of Rights Agreement, the Kwanda Sale of Rights Agreement, the Plateau Sale of Boikgantsho Shares and Claims Agreement, the Plateau Sale of Kwanda Shares Agreement, the Plateau Sale of Ga-Phasha Shares and Claims Agreement, the Holdco Sale of Shares Agreement, the Holdco Shareholders Agreement and the Phase 3 Implementation Agreement, and any amendments to such agreements, collectively. |

| |

Bokoni Group | | Holdco and all of its subsidiaries. |

| |

Common Shares | | Common shares without par value in the capital of the Company. |

| |

Debt Conversion | | The issuance by Atlatsa to Anglo Platinum of 125,000 Common Shares to settle ZAR 750 million ($87.4 million) of the outstanding debt owed by Atlatsa to Anglo Platinum under the New Debt Facility. |

| |

Debt Facility | | The Senior Debt Facility with Standard Chartered Bank plc, made available to Plateau Resources amounting to $94.4 million (ZAR750 million), including capitalised interest up to a maximum of three years or $31.5 million (ZAR250 million). On April 28, 2011, the amounts outstanding under this facility were acquired by RPM, who increased the facility to $117.1 million (ZAR930 million). |

| |

Debt Refinancing Transactions | | As set forth under “Restructuring Transactions”. |

| |

Disinterested Shareholders | | In respect of any resolution, all Shareholders except those Shareholders that have an interest in that resolution and in the case of the resolutions to approve the Asset Sale and the Debt Refinancing Transactions. |

| |

DMR | | The Government of South Africa acting through the Minister of Mineral Resources and the Department of Mineral Resources and their respective successors and delegates. |

| |

Elemental Symbols | | Pt – Platinum; Pd – Palladium; Au – Gold; Ag – Silver; Cu – Copper; Cr – Chromium; Ni – Nickel; Pb – Lead; Rh – Rhodium; Ru – Ruthenium. |

| |

EBIT | | Earnings before interest and taxes. |

| |

Farm | | A term commonly used in South Africa to describe the area of a mineral interest. |

| |

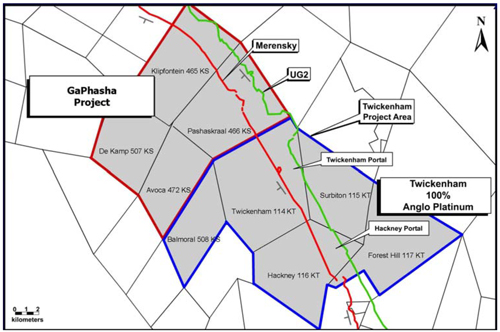

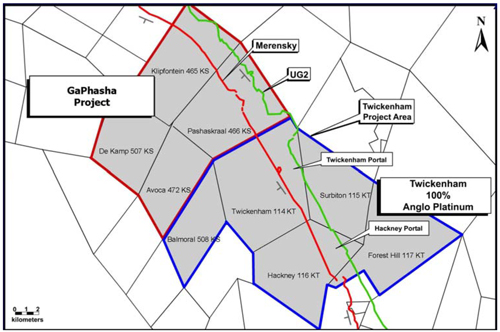

Ga-Phasha Project | | The Ga-Phasha PGM project, located on the Eastern Limb of the Bushveld Complex in South Africa, on the Paschaskraal, Klipfontein, Avoca and De Kamp farms. |

7

| | |

Ga-Phasha /GPM | | Ga-Phasha Platinum Mine (Proprietary) Limited, a private company incorporated under the laws of South Africa which, as of July 1, 2009, is a wholly owned subsidiary of Holdco and which owns the Ga-Phasha Project. |

| |

Ga-Phasha Asset Sale Agreement | | The sale of a portion of a mining right agreement to be entered into in 2013 between RPM and Ga-Phasha pursuant to which RPM will purchase and Ga-Phasha will sell the Eastern section of the Ga-Phasha Project, comprised of Paschaskraal and De Kamp farms. |

| |

Ga-Phasha Mining Right | | The converted mining right granted to Ga-Phasha over the area comprising the farms Avoca, De Kamp, Klipfontein and Paschaskraal |

| |

Ga-Phasha Sale Assets | | The portion of the Ga-Phasha Mining Right relating to the Eastern section of the Ga-Phasha Project, comprising the Paschaskraal and De Kamp farms. |

| |

HDP | | A “historically disadvantaged person” as contemplated in the Mineral Development Act, being a person who was discriminated against under the Apartheid system, and includes certain trusts and companies in which such persons have interests, as contemplated in the Holdco Shareholders Agreement. |

| |

HDSI | | Hunter Dickinson Services Inc., a corporation incorporated under the laws of Canada. |

| |

Holdco | | Bokoni Holdings (Proprietary) Limited, a private company incorporated under the laws of South Africa, formerly named Richtrau No. 179 (Proprietary) Limited. |

| |

Holdco Shareholders Agreement | | The Shareholders’ Agreement entered into between Plateau, RPM and Holdco, dated March 28, 2008, as amended on May 6, 2009, to govern the relationship between Plateau and RPM as shareholders of Holdco. |

| |

IASB | | International Accounting Standards Board. |

| |

Implementation Agreement | | The implementation agreement entered into between Atlatsa, NIC Resources, Inc. N2C Resources Inc., RPM, Plateau, Bokoni Holdco and Bokoni Mine relating to the implementation of the closing of the Restructuring Transactions, including all condition precedents thereto. |

| |

Interim Implementation Agreement | | The amendment and interim implementation agreement entered into between Atlatsa, N2C Resources Inc., RPM, Plateau, Bokoni Holdco and Bokoni Mine relating to Phase One of the Restructure Plan. |

| |

Intermediaries | | Brokers, investment firms, cleaning houses and similar entities that own and hold Common Shares on behalf of Beneficial Shareholders. |

| |

JIBAR | | Johannesburg Interbank Agreed Rate. |

| |

JSE | | JSE Limited, a company incorporated in accordance with the laws of South Africa, licensed as an exchange under the South African Securities Services Act, 2004. |

| |

Ktp | | Kilo tonnes per month. |

| |

Kwanda Project | | The Kwanda PGM Project, located on the Northern Limb of the Bushveld Complex in South Africa, on 12 farms. |

| |

Kwanda | | Kwanda Platinum Mine (Proprietary) Limited, a private company incorporated under the laws of South Africa which, as of July 1, 2009, is a wholly owned subsidiary of Holdco and owns the Kwanda Project. |

8

| | |

Lebowa | | Lebowa Platinum Mines (Proprietary) Limited, a private company incorporated under the laws of South Africa. |

| |

Minxcon | | Minxcon (Pty) Limited, a private company incorporated under the laws of South Africa. |

| |

MPH | | Middlepunt Hill |

| |

Mineral Development Act | | The Mineral and Petroleum Resources Development Act, 2002 (South Africa). |

| |

Mining Charter | | The Broad Based Socio-Economic Empowerment Charter for the South African mining industry, signed by the DMR, the South African Chamber of Mines and others on October 11, 2002. |

| |

N1C | | N1C Resources Inc., a wholy owned subsidiary of Atlatsa incorporated on December 2, 1999 under the laws of the Cayman Islands. |

| |

N2C | | N2C Resources Inc., a wholly owned indirect subsidiary of Atlatsa incorporated on December 2, 1999 under the laws of the Cayman Islands. |

| |

New Debt Facility | | The new senior term loan and revolving facility agreement to be signed between, among others, Atlatsa, Plateau and RPM, pursuant to which RPM will make available to Plateau a senior term loan and revolving facility in a total amount of up to ZAR1.55 billion ($181.7 million). |

| |

NYSE Amex | | NYSE Amex Equities, formerly the American Stock Exchange. |

| |

OCSF | | Operating Cash Flow Shortfall Facility. |

| |

Pelawan | | Pelawan Investments (Proprietary) Limited, a private company incorporated under the laws of South Africa. |

| |

Pelawan Lock-Up Amendments | | The amendment agreement entered into between Atlatsa, Plateau and Atlatsa Holdings pursuant to which Atlatsa Holdings has agreed, subject to the completion of the Restructuring Transactions, to an extension of its lock-up undertakings contained in the Pelawan Shareholders Agreement. |

| |

Pelawan Shareholders Agreement | | The shareholders agreement between Atlatsa, Plateau, the Pelawan Trust and Atlatsa Holdings dated June 12, 2009. |

| |

Pelawan SPV | | The Pelawan Finance SPV Proprietary Limited, a special purpose vehicle established by, and wholly-owned subsidiary of, Atlatsa Holdings. |

| |

Pelawan Trust | | The independent South African trust established in accordance with a trust deed dated September 2, 2004, the trustees of which are Andre Visser, Tumelo Motsisi and Asna Chris Harold Motaung. |

| |

PGM | | Platinum group metals, comprising platinum, palladium, rhodium, ruthenium, osmium and iridium. |

| |

Plateau | | Plateau Resources (Proprietary) Limited, a private company incorporated under the laws of South Africa, being an indirect wholly owned subsidiary of Atlatsa. |

| |

Platreef Properties | | The Platreef PGM properties located on the Northern Limb of the Bushveld Complex in South Africa, which includes the Kwanda, Boikgantsho and Rietfontein projects. |

| |

Registered Shareholder | | A Shareholder whose name appears on Atlatsa’s central security register as a registered holder of Common Shares as of the Record Date. |

| |

Related Party Transactions | | The Asset Sale and the Debt Refinancing Transactions. |

| |

Restructuring Transactions | | The Asset Sale and the Debt Refinancing Transactions. |

9

| | |

Royalty Act | | The Mineral and Petroleum Resources Royalty Act, Act No 28 of 2008, in relation to royalties to be levied by the South African state in respect of the transfer of mineral or petroleum resources. |

| |

RPM | | Rustenburg Platinum Mines Limited, a public company incorporated under the laws of South Africa, being a wholly owned subsidiary of Anglo Platinum. |

| |

SEDAR | | System for Electronic Document Analysis and Retrieval. |

| |

Senior Debt Facility | | The existing senior term loan facility provided by RPM to Plateau in connection with the Bokoni Transaction in the principal amount of $58.6 million (ZAR500 million) and amended on September 28, 2012 to increase the total amount available to facilitate the repayment of amounts owed to Anglo Platinum under the OCSF and A Preference Share Facility at this date with the effect that all outstanding debt was consolidated into one single facility. |

| |

South Africa | | The Republic of South Africa. |

| |

tpm | | tonnes per month |

| |

TSX-V | | TSX Venture Exchange. |

| |

Transition date | | The Company’s transition date for converting to IFRS, which was January 1, 2008. |

| |

ZAR | | South African Rand, the currency of South Africa. |

Geological/Exploration Terms

| | |

4E grade | | The 4E grade is the sum of the grade of Pt, Pd, Rh and Au. |

| |

Chromitite | | An igneous rock composed mostly of the mineral chromite and found in ultramafic to mafic layered intrusions. |

| |

Feldspar | | A group of abundant rock-forming minerals, the most widespread of any mineral group and constituting 60% of the earth’s crust. |

| |

Feldspathic | | Containing feldspar as a principal ingredient. |

| |

Gabbro | | Course grained mafic igneous rock. |

| |

Lithology | | Rock composition and structure. |

| |

Mafic | | Composed of dark ferromagnesian minerals. |

| |

Mineral Deposit | | A deposit of mineralization that may or may not be ore. Under SEC rules, a mineral reserves or ore is determined by a full feasibility study, and mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally extracted or produced at the time the reserve determination is made. Under Canadian rules, mineral reserves may be determined by a preliminary feasibility study. |

| |

Mineralized Material | | A mineralized body that has been delineated by appropriately spaced drilling and/or underground sampling to support a sufficient tonnage and average grade of metals to warrant further exploration. Such a deposit does not qualify as a reserve until a comprehensive evaluation based upon unit cost, grade, recoveries, and other material factors conclude legal and economic feasibility. Mineralization classified as “inferred”, is a classification that is acceptable under Canadian regulations (see “Resource Category (Classification) Definitions” below) but cannot be used in a feasibility study and is not recognized by the SEC. |

| |

Norite | | A coarse-grained plutonic rock in which the chief constituent is basic plagioclase feldspar (labradorite) and the dominant mafic mineral is orthopyroxene (hypersthene). |

| |

Pyroxenite | | A medium or coarse-grained rock consisting essentially of pyroxene, a common rock forming mineral. |

10

| | |

SAMREC Code | | South African Code for Reporting of Mineral Resources and Mineral Reserves. |

| |

Technical Report | | Means a report prepared and filed in accordance with National Instrument 43-101 on the Company’s profile with the Canadian Security Administrators on SEDAR at www.sedar.com. |

Resource Category (Classification) Definitions

| | |

Mineral Reserve | | Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) states that the terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” have the meanings ascribed to those terms by the Canadian Institute of Mining, Metallurgy and Petroleum as the CIM Definition Standards on Mineral Resources and Mineral Reserves adopted by CIM Council, as amended (“CIM Standards”). CIM Standards defines a “Mineral Reserve” as the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, and economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined. |

| |

| | Mineral reserves are subdivided in order of increasing confidence into Probable Mineral Reserves and Proven Mineral Reserves. A Probable Mineral Reserve has a lower level of confidence than a Proven Mineral Reserve. |

| |

| | (1) A “Proven Mineral Reserve” is the economically mineable part of a Measured Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified. |

| |

| | (2) A “Probable Mineral Reserve” is the economically mineable part of an Indicated and, in some circumstances, a Measured Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. |

| |

| | Industry Guide 7 – “Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations” (“Industry Guide 7”) of the SEC defines a “reserve” as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. See “Cautionary Note to U.S. Investors”. |

| |

Mineral Resource | | NI 43-101 states that the terms “mineral resource”, “inferred mineral resource”, “indicated mineral resource” and “measured mineral resource” have the meanings ascribed in those terms by CIM Standards. CIM Standards defines a “Mineral Resource” as a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge. |

| |

| | Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories. An Inferred Mineral Resource has a lower level of confidence than that applied to an Indicated Mineral Resource. An Indicated Mineral Resource has a higher level of confidence than an Inferred Mineral Resource but has a lower level of confidence than a Measured Mineral Resource. |

11

| | |

| | (1)Measured Mineral Resource. A “Measured Mineral Resource” is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and other physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. |

| |

| | (2)Indicated Mineral Resource.An “Indicated Mineral Resource” is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. Mineralization may be classified as an Indicated Mineral Resource by the qualified person, as such term is defined in NI 43-101 (“QP”), when the nature, quality, quantity and distribution of data are such as to allow confident interpretation of the geological framework and to reasonably assume the continuity of mineralization. An Indicated Mineral Resource estimate is of sufficient quality to support a Preliminary Feasibility Study which can serve as the basis for major development decisions. |

| |

| | (3)Inferred Mineral Resource.An “Inferred Mineral Resource” is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. Due to the uncertainty that may be attached to Inferred Mineral Resources, it cannot be assumed that all or any part of an Inferred Mineral Resource will be upgraded to an Indicated or Measured Mineral Resource as a result of continued exploration. Confidence in the estimate is insufficient to allow the meaningful application of technical and economic parameters or to enable an evaluation of economic viability worthy of public disclosure. Inferred Mineral Resources must be excluded from estimates forming the basis of feasibility or other economic studies. |

| |

| | Mineralization or other natural material of economic interest may be classified as a Measured Mineral Resource by the QP when the nature, quality, quantity and distribution of data are such that the tonnage and grade of the mineralization can be estimated to within close limits and that variation from the estimate would not significantly affect potential economic viability. This category requires a high level of confidence in, and understanding of, the geology and controls of the mineral deposit. |

| |

| | Industry Guide 7 does not define or recognize resources. As used in this Annual Report, “mineral resources” are as defined in NI 43-101. See “Cautionary Note to U.S. Investors”. |

12

Currency and Measurement

All currency amounts in this Annual Report are stated in Canadian dollars unless otherwise indicated. See “Item 3 – Key Information”.

Conversion of metric units into imperial equivalents is as follows:

| | | | | | |

Metric Units | | Multiply

by | | | Imperial

Units |

hectares | | | 2.471 | | | = acres |

meters | | | 3.281 | | | = feet |

kilometers | | | 0.621 | | | = miles (5,280 feet) |

grams | | | 0.032 | | | = ounces (troy) |

tonnes | | | 1.102 | | | = tons (short) (2,000 lbs) |

grams/tonne | | | 0.029 | | | = ounces (troy)/ton |

13

PART I

| ITEM 1 | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

14

| ITEM 2 | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

15

| | 3.A. | Selected Financial Data |

The following selected consolidated financial data should be read in conjunction with “Item 5 – Operating and Financial Review and Prospects” and the audited consolidated financial statements, the accompanying notes and other financial information included elsewhere in this Annual Report.

The selected consolidated financial data set forth below for the years ended as at December 31, 2012 and 2011 and for each of the years in the three-year period ended December 31, 2012 have been derived from the Company’s audited consolidated financial statements included in Item 18 of this Annual Report.

Selected consolidated financial data as at December 31, 2011, 2010 and 2009 and for each of the years ended December 31, 2011, 2010 and 2009 have been derived from the Company’s previously filed audited consolidated financial statements not included in this document.

The selected consolidated financial data as at December 31, 2012 and 2011 and for each of the years in the three-year period ended December 31, 2012 should be read in conjunction with, and are qualified in their entirety by reference to, the Company’s audited consolidated financial statements included in Item 18.

The audited consolidated financial statements from which the following financial data have been derived were prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the IASB.

| | | | | | | | |

| | | Year ended | |

| | | December 31,

2012 | | | December 31,

2011 | |

| | | (CAD in thousands) | |

| | | (Except per share info and

weighted average shares in issue) | |

Consolidated statement of comprehensive loss information: | | | | | | | | |

Revenue | | | 117,557 | | | | 144,407 | |

Operating loss | | | (2,548 | ) | | | (89,233 | ) |

Net loss | | | (95,567 | ) | | | (147,865 | ) |

Loss attributable to owners of Atlatsa | | | (18,718 | ) | | | (81,929 | ) |

| | |

Statement of financial position data: | | | | | | | | |

Total assets | | | 814,065 | | | | 893,009 | |

Total equity | | | 205,257 | | | | (28,085 | ) |

Share capital | | | 71,967 | | | | 71,967 | |

| | |

Per share information (CAD cents) | | | | | | | | |

Basic loss per share | | | 4 cents | | | | 19 cents | |

Diluted loss per share | | | 4 cents | | | | 19 cents | |

| | |

Weighted average shares in issue (number): | | | | | | | | |

Average shares outstanding – basic | | | 424,791,411 | | | | 424,783,603 | |

Average shares outstanding – diluted | | | 424,791,411 | | | | 424,783,603 | |

No dividends have been declared for any of the periods above.

16

| | | | | | | | | | | | |

| | | Year ended | |

| | | December 31,

2010 | | | December 31,

2009 | | | December 31,

2008 | |

| | | (CAD in thousands) | |

| | | (Except per share info and weighted average shares

in issue) | |

Consolidated statement of comprehensive loss information: | | | | | | | | | | | | |

Revenue | | | 148,287 | | | | 62,628 | | | | — | |

Operating loss | | | (44,541 | ) | | | (39,383 | ) | | | (12,066 | ) |

Net loss | | | (93,659 | ) | | | (51,781 | ) | | | (13,840 | ) |

Loss attributable to owners of Atlatsa | | | (51,721 | ) | | | (35,532 | ) | | | (13,970 | ) |

| | | |

Statement of financial position data: | | | | | | | | | | | | |

Total assets | | | 1,092,106 | | | | 1,014,215 | | | | 12,899 | |

Total equity | | | 121,366 | | | | 209,508 | | | | (3,603 | ) |

Share capital | | | 71,853 | | | | 71,713 | | | | 54,948 | |

| | | |

Per share information (CAD cents) | | | | | | | | | | | | |

Basic loss per share | | | 12 cents | | | | 12 cents | | | | 8 cents | |

Diluted loss per share | | | 12 cents | | | | 12 cents | | | | 8 cents | |

| | | |

Weighted average shares in issue (number): | | | | | | | | | | | | |

Average shares outstanding – basic | | | 424,665,314 | | | | 305,971,455 | | | | 185,775,361 | |

Average shares outstanding – diluted | | | 424,665,314 | | | | 305,971,455 | | | | 185,775,361 | |

No dividends have been declared for any of the periods above.

Exchange rate information

The following table sets forth, for the U.S. dollars, expressed in Canadian dollars, (i) the average of the exchange rates in effect during each period, and (ii) the high and low exchange rates during each period.

| | | | | | | | | | | | |

The U.S. dollar expressed in Canadian dollars for the year ended December 31, or the respective

month (1)(2)(3) | | Average | | | High | | | Low | |

| | | |

2008 | | | 1.06 | | | | 1.29 | | | | 0.98 | |

2009 | | | 1.15 | | | | 1.31 | | | | 1.03 | |

2010 | | | 1.03 | | | | 1.08 | | | | 0.99 | |

2011 | | | 0.99 | | | | 1.06 | | | | 0.94 | |

2012 | | | 1.00 | | | | 1.04 | | | | 0.97 | |

September 2012 | | | 0.98 | | | | 0.99 | | | | 0.97 | |

October 2012 | | | 0.99 | | | | 1.00 | | | | 0.98 | |

November 2012 | | | 1.00 | | | | 1.00 | | | | 0.99 | |

December 2012 | | | 0.99 | | | | 1.00 | | | | 0.98 | |

January 2013 | | | 0.99 | | | | 1.01 | | | | 0.98 | |

February 2013 | | | 1.01 | | | | 1.03 | | | | 1.00 | |

| (1) | The average exchange rates for each full year are calculated using the average exchange rate on the last day of each month during the period. The average exchange rate for each month is calculated using the average of the daily exchange rates during the period. |

| (2) | Based on noon buying rates as published by the Bank of Canada. |

| (3) | The average rates for 2013 have been calculated with information up to February 28, 2013. |

17

The following table sets forth, for ZAR, expressed in Canadian dollar, (i) the average of the exchange rates in effect during each period, and (ii) high and low exchange rates during each period.

| | | | | | | | | | | | |

ZAR expressed in Canadian dollars for the year ended December 31, or the respective month (1)(2) | | Average | | | High | | | Low | |

| | | |

2008 | | | 0.123 | | | | 0.151 | | | | 0.110 | |

2009 | | | 0.136 | | | | 0.150 | | | | 0.120 | |

2010 | | | 0.141 | | | | 0.151 | | | | 0.133 | |

2011 | | | 0.137 | | | | 0.149 | | | | 0.123 | |

2012 | | | 0.122 | | | | 0.132 | | | | 0.111 | |

September 2012 | | | 0.119 | | | | 0.120 | | | | 0.117 | |

October 2012 | | | 0.114 | | | | 0.118 | | | | 0.111 | |

November 2012 | | | 0.113 | | | | 0.115 | | | | 0.111 | |

December 2012 | | | 0.115 | | | | 0.117 | | | | 0.112 | |

January 2013 | | | 0.113 | | | | 0.116 | | | | 0.110 | |

February 2012 | | | 0.114 | | | | 0.116 | | | | 0.112 | |

The average exchange rates for each full year are calculated using the average exchange rate on the last day of each month during the period. The average exchange rate for each month is calculated using the average of the daily exchange rates during the period.

| (1) | Based on noon buying rates as published by the Bank of Canada. |

| (2) | The average rates for 2013 have been calculated with information up to February 28, 2013. |

| | | | | | | | | | | | |

ZAR expressed in U.S. dollars for the year ended December 31, or the respective month (1)(2) | | Average | | | High | | | Low | |

| | | |

2008 | | | 0.122 | | | | 0.148 | | | | 0.089 | |

2009 | | | 0.156 | | | | 0.138 | | | | 0.094 | |

2010 | | | 0.137 | | | | 0.152 | | | | 0.125 | |

2011 | | | 0.138 | | | | 0.152 | | | | 0.117 | |

2012 | | | 0.122 | | | | 0.134 | | | | 0.111 | |

September 2012 | | | 0.121 | | | | 0.123 | | | | 0.119 | |

October 2012 | | | 0.116 | | | | 0.120 | | | | 0.114 | |

November 2012 | | | 0.114 | | | | 0.116 | | | | 0.111 | |

December 2012 | | | 0.116 | | | | 0.118 | | | | 0.113 | |

January 2013 | | | 0.114 | | | | 0.118 | | | | 0.110 | |

February 2013 | | | 0.113 | | | | 0.114 | | | | 0.111 | |

The average exchange rates for each full year are calculated using the average exchange rate on the last day of each month during the period. The average exchange rate for each month is calculated using the average of the daily exchange rates during the period.

| (1) | Based on noon buying rates as published by the Bank of Canada. |

| (2) | The average rates for 2012 have been calculated with information up to February 28, 2013. |

| | 3.B. | Capitalization and Indebtedness |

Not applicable.

| | 3.C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

18

Investment in mining companies such as Atlatsa is highly speculative and subject to numerous and substantial risks.

The Company faces risks in executing its business plan and achieving revenues. The following risks are the known, material risks that the Company faces. If any of these risks occur, the Company’s business, operating results, cash flows and financial condition could be seriously harmed and, under certain circumstances, the Company may not be able to continue business operations as a going concern. Additional risks not currently known to the Company or that the Company currently deems immaterial may also materially and adversely affect the Company’s business, operating results, cash flows and financial condition.

In addition to the risks described below, see “Cautionary Note to Readers Concerning Technical Review of Bokoni Mine, Ga-Phasha Project and Boikgantsho Project” for a discussion of the principal risks and uncertainties which, in management’s opinion, are likely to most directly affect the conclusions of the technical review of each of the Bokoni Mine, the Ga-Phasha Project and the Boikgantsho Project.

Industry Risks

Bokoni Mine’s operations and profits have been and may be adversely affected by union activity and new and existing labor laws

There has been an increase in union activity in South Africa and, in recent years, there have been new labor laws introduced or amendments to existing labor laws that impose additional obligations or grant additional rights to workers, thereby increasing compliance and other costs. In fiscal 2012, labor unrest had a material adverse impact on Bokoni Mine’s operations, production and financial performance. The occurrence of any such events in the future could have further negative impacts upon financial performance and condition.

Greater union activity, including the entry of rival unions, has resulted in more frequent industrial disputes, including violent protests and clashes with police authorities, and has impacted labor negotiations. In the second half of fiscal 2012, there was heightened labor unrest in the South African Mining industry. A number of unions in various industries have threathened to or have recently gone on strike, causing work stoppages and production losses. As a result, on September 27, 2012, South Africa’s soverign debt credit rating, along with the credit ratings of a number of the country’s leading mining companies was downgraded.

In the event that Bokoni Mines experiences strikes or work stoppages, delays, sabotage, go-slow actions, lower productivity levels than envisaged or any other industrial relations related interruptions or increased employment related costs due to union or employee activity, these may have a material adverse effect on it business, production levels, production targets, results of operations, financial condition and reputation and future prospects. In addition lower levels of mining activity can have a longer term impact on production levels and operating costs, particularly since mining conditions can deteriorate during extended periods without production.

See “Illegal Strike Action at Bokoni Mine”.

Cost of compliance with, or changes in, current and future governmental regulations may have a material adverse effect on the Company’s business, operating results, cash flows and financial condition

The exploration and mining activities of Atlatsa are subject to various South African national, provincial and local laws governing prospecting, development, production, taxes, labor standards and occupational health, mine safety, toxic substance and other matters. Exploration activities and mining are also subject to various national, provincial and local laws and regulations relating to the protection of the environment. These laws mandate, among other things, the maintenance of certain air and water quality standards, and land reclamation. These laws also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. No assurance can be given that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner which could limit or curtail production or development. Amendments to current laws and regulations governing operations and activities of exploration, mining and milling or more stringent implementation thereof could have a material adverse effect on Atlatsa’s business, results of operation and financial condition.

Metal price volatility may render continued commercial production at the Bokoni Mine uneconomic

Atlatsa’s business is strongly affected by the world market price of PGM. PGM prices can be subject to volatile price movements, which can be material and can occur over short periods of time and are affected by numerous factors, all of which are beyond Atlatsa’s control. Industry factors that may affect PGM prices are as follows: the demand in the automotive sectors; industrial and jewellery demand; central bank lending, sales and purchases of PGM; speculative trading; and costs of and levels

19

of global PGM production by producers of PGM. PGM prices may also be affected by macroeconomic factors, including: expectations of the future rate of inflation; the strength of, and confidence in, the U.S. dollar, the currency in which the price of PGM is generally quoted, and other currencies; interest rates; and global or regional, political or economic uncertainties.

In the future, if PGM market prices were to drop and the prices realized by Atlatsa on PGM sales were to decrease significantly and remain at such a level for any substantial period, Atlatsa’s profitability and cash flows would be negatively affected. Depending on the market price of PGM, Atlatsa may determine that it is not economically feasible to continue commercial production at the Bokoni Mine, which would have an adverse impact on Atlatsa’s financial performance and results of operations. In such a circumstance, Atlatsa may also curtail or suspend some or all of its exploration activities, with the result that depleted reserves are not replaced.

Price volatility and the unavailability of other commodities may adversely affect the timing and cost of the Company’s projects

The profitability of Atlatsa’s business is affected by the market prices of commodities produced as products and by-products at Atlatsa’s mines, such as platinum, palladium, rhodium, gold, nickel and certain other base metals, as well as the cost and availability of commodities which are consumed or otherwise used in connection with Atlatsa’s operations and projects, including, but not limited to, diesel fuel, natural gas, electricity, water, steel and concrete. Prices of such commodities can be subject to volatile price movements, which can be material and can occur over short periods of time, and are affected by factors that are beyond Atlatsa’s control. An increase in the cost, or decrease in the availability, of construction materials such as steel and concrete may affect the timing and cost of Atlatsa’s projects. If Atlatsa’s proceeds from the sale of by-products were to decrease significantly, or the costs of certain commodities consumed or otherwise used in connection with Atlatsa’s operations and projects were to increase, or their availability to decrease significantly and remain at such levels for a substantial period of time, Atlatsa may determine that it is not economically feasible to continue commercial production at some or all of Atlatsa’s operations or the development of some or all of Atlatsa’s current projects, which could have an adverse impact on Atlatsa.

The Company is required to obtain and renew governmental permits in order to conduct mining operations, which is often a costly and time-consuming process

The Company’s current and anticipated future operations, including continued production at the Bokoni Mine, and further exploration or the development of new projects, require permits from various governmental authorities. Obtaining or renewing governmental permits is a complex and time-consuming process. The duration and success of permitting efforts are contingent upon many variables not within the Company’s control, including the interpretation of requirements implemented by the applicable permitting authority. The Company may not be able to obtain or renew permits that are necessary to its operations, or the cost to obtain or renew permits may exceed the Company’s expectations. Failure to comply with permits may disrupt the Company’s operations. Any unexpected delays or costs associated with the permitting process could delay the development or impede the operation of a mine, which could materially adversely affect the Company’s revenues and future growth.

A shortage of electricity and high electricity prices could adversely affect the Company’s ability to operate its business

The National Energy Regulator of South Africa (“NERSA”) revised Eskom’s (South African national power supplier) power tariff increase during February 2013. The effect of its revision is that power tariff increases in South Africa will be increased as follows:

2013 - 2018: 8%

The Bokoni Mine operations are currently mining at relatively shallow depths with no major refrigeration requirements expected for the next 30 years of mining. Power costs currently comprise approximately 4% (varying summer and winter tariffs) of total operating costs at the mine operations. The Bokoni Mine continues to focus efforts on power usage reduction initiatives as part of the efficiency improvement initiatives currently being implemented at the operations.

The Bokoni Mine is also dependent on power generated by Eskom. In the past number of years, there has been an increase in the number of electricity supply interruptions, resulting mainly from recent economic growth exceeding expectations and delayed investments in infrastructure upgrades and development. Although Eskom has announced a number of short- and long-term mitigation plans, there can be no assurance that the Company will not experience power supply interruptions.

The above increases in prices and possible supply interruptions may have a material adverse effect on Atlatsa’s business, results of operations and financial condition.

20

Deterioration of economic conditions may adversely affect our business, operating results, cash flows and financial condition

The prices of PGM are volatile, and are affected by numerous economic factors beyond Atlatsa’s control. The level of interest rates, the rate of inflation, world supply of PGM and stability of exchange rates can all cause fluctuations in these prices. Such external economic factors are in turn influenced by changes in international investment patterns, monetary systems and political developments. The prices of PGM have fluctuated in recent years, and future significant price declines could cause commercial production to be uneconomic and may have a material adverse effect on Atlatsa’s business, results of operations and financial condition.

Changes to the regulatory environment have been proposed that would significantly affect the mining industry in South Africa

The mining industry in South Africa, where the Company’s projects are located, is subject to extensive government regulation. The regulatory environment is developing, lacks clarity in a number of areas and is subject to interpretation, review and amendment as the mining industry is further developed and liberalized. In addition, the regulatory process entails a public comment process, which makes the outcome of the legislation uncertain and may cause delays in the regulatory process. A number of significant matters have not been finalized, including the legislation dealing with beneficiation. Mineral beneficiation has become one of the major drivers in advancing the empowerment of historically disadvantaged communities in South Africa. It also presents opportunities for development of new entrepreneurs in large and small mining industries. Atlatsa cannot predict the outcome or timing of any amendments or modifications to applicable regulations or the interpretation thereof, the release of new regulations or their impact on its business.

In October 2002, the South African government enacted the Mineral Development Act that deals with the state’s policy towards the future of ownership of minerals rights and the procedures for conducting mining transactions in South Africa. The Mineral Development Act is an ambitious statute with wide-ranging objectives, including sustainable development and the promotion of equitable access to South Africa’s mineral wealth by the inclusion of HDP into the industry. The Mineral Development Act came into effect in May 2004.

In December 2012, proposed revisions were made to the Mineral Development Act and the Company is currently in the process of evaluating any potential impact on its business.

The South African government issues permits and licences for prospecting and mining rights to applicants using a “scorecard” approach. Applicants need to demonstrate their eligibility for consideration based upon the number of credits accumulated in terms of quantifiable ownership transformation criteria, such as employment equity and human resource development.

Future amendments to, and interpretations of, the economic empowerment initiatives by the South African Government and the South African courts could adversely affect the business of Atlatsa and its operations and financial condition.

The risks associated with mining and processing pose operational and environmental risks that may not be covered by insurance and may increase costs

The mining industry is subject to significant risks and hazards, including environmental hazards, industrial accidents, unusual or unexpected geological conditions, labor force disruptions, civil strife, unavailability of materials and equipment, weather conditions, pit wall failures, rock bursts, cave-ins, flooding, seismic activity, water conditions and precious metal losses, most of which are beyond Atlatsa’s control. These risks and hazards could result in the following: damage to, or destruction of, mineral properties or producing facilities; personal injury or death; environmental damage; delays in mining; and monetary losses and possible legal liability. As a result, production may fall below historic or estimated levels and Atlatsa may incur significant costs or experience significant delays that could have a material adverse effect on Atlatsa’s financial performance, liquidity and results of operation.

No assurance can be given that the Company’s insurance will cover such risks and hazards, that the insurance will continue to be available, that it will be available at economically feasible premiums, or that Atlatsa will maintain such insurance. In addition, Atlatsa does not have coverage for certain environmental losses and other risks, as such coverage cannot be purchased at a commercially reasonable cost. The lack of, or insufficiency of, insurance coverage could adversely affect Atlatsa’s cash flow and overall profitability.

The Company’s property interests and operations are subject to political risks and uncertainties associated with investment in a foreign country

South Africa has recently undergone major constitutional changes to effect majority rule, and affecting mineral title. Accordingly, all laws may be considered relatively new, resulting in risks such as possible misinterpretation of new laws, unilateral modification of mining or exploration rights, operating restrictions, increased taxes and royalties, environmental

21

regulation, mine safety and other risks arising out of a new sovereignty over mining, any or all of which could have an adverse impact upon Atlatsa. Atlatsa’s operations may also be affected in varying degrees by political and economic instability, terrorism, crime, extreme fluctuations in currency exchange rates, and inflation.

Changes, if any, in mining or investment policies or shifts in political attitude in South Africa may adversely affect Atlatsa’s operations or likelihood of future profitability. Operations may be affected in varying degrees by government regulations with respect to, but not limited to, restrictions on production, price controls, export controls, currency remittance, income taxes, royalties, expropriation of property, foreign investment, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety. For instance, the South African government enacted the Royalty Act, which came into operation on March 1, 2010. The Royalty Act imposes a royalty payable to the South African government by businesses based upon financial profits made through the transfer of mineral resources. As the Bokoni Mine produces metal-in-concentrate, a royalty is payable to the South African government between 0.5% and 7% of gross sales of unrefined mineral resources. Although this royalty payable has been taken into consideration with regard to the Company’s current budgeting and other financial planning processes, any future change in the royalties payable could have a material adverse effect on our results of operations and financial condition.

The Company is subject to extensive environmental legislation and the costs of complying with these applicable laws and regulations may be significant

Environmental legislation is evolving in a manner that will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. There can be no assurance that future changes to environmental regulation, if any, will not adversely affect Atlatsa’s operations. Environmental hazards may exist on the properties in which Atlatsa holds interests which are unknown to Atlatsa at present and which have been caused by previous or existing owners or operators of the properties. Furthermore, compliance with environmental reclamation, closure and other requirements may involve significant costs and other liabilities. In particular, Atlatsa’s operations and exploration activities are subject to South African national and provincial laws and regulations governing protection of the environment. These laws are continually changing and, in general, are becoming more restrictive.

Fluctuations in foreign currency exchange rates in relation to the United States dollar may have an adverse effect on the Company’s operating results

Atlatsa conducts operations in currencies other than United States or Canadian dollars. Of particular significance is the fact that Atlatsa’s operations in South Africa are almost entirely paid for in ZAR, which has historically devalued against the United States dollar as well as the Canadian dollar.

The price of PGM is denominated in United States dollars and, accordingly, Atlatsa’s revenues, if any, are linked to the United States dollars. In order to earn or maintain property interests, certain of Atlatsa’s payments are to be made in ZAR. As a result, fluctuations in the United States dollar against the ZAR could have a material adverse effect on Atlatsa’s financial results, which are reported in Canadian dollars.

Atlatsa’s share price is volatile

The market price of a publicly traded stock, especially a resource company like Atlatsa, is affected by many variables not directly related to the mining and exploration success of Atlatsa, including the market for junior resource stocks, the strength of the economy generally, the availability and attractiveness of alternative investments, and the breadth of the public market for the stock. The effect of these and other factors on the market price of the common shares suggests Atlatsa’s share price will continue to be volatile.

There are uncertainties as to title matters in the mining industry. Any defects in such title could cause the Company to lose its rights in mineral properties and jeopardize its operations.

Title to mining properties is subject to potential claims by third parties claiming an interest in them. The mineral properties may be subject to previous unregistered agreements or transfers, and title may be affected by undetected defects or changes in mineral tenure laws. The Company’s mineral interests consist of mineral claims, which have not been surveyed, and therefore, the precise area and location of such claims or rights may be in doubt. The failure to comply with all applicable laws and regulations, including the failure to pay taxes or to carry out and file assessment work, may invalidate title to portions of the properties where the mineral rights are held by Atlatsa.

The Company faces intense competition in the mining industry

The mineral exploration and mining business is competitive in all of its phases. Atlatsa competes with numerous other companies and individuals, including competitors with greater financial, technical and other resources than Atlatsa, in the

22

search for and the acquisition of attractive mineral properties and the recruitment and retention of skilled labor. Atlatsa’s ability to acquire properties in the future will depend not only on its ability to develop its present properties, but also on its ability to select and acquire suitable producing properties or prospects for mineral exploration. There is no assurance that Atlatsa will continue to be able to compete successfully with its competitors in acquiring such properties or prospects. Further, Atlatsa has encountered increased competition from other mining companies in its efforts to hire experienced mining professionals. Competition for skilled personnel at all levels is currently very intense, particularly in the mining processing and engineering disciplines. If Atlatsa is unable to recruit and retain qualified employees, this could result in interruptions or decreases in Atlatsa’s production or exploration activities that could have a material adverse effect on its results of operations, financial condition and cash flows.

Business Risks

Failure to repay long term borrowings and the level of indebtedness may adversely affect the Company as a going concern

As of February 28, 2013, Atlatsa had cash and cash equivalents of approximately $4.7 million and capital leases and loans and borrowings of approximately $591 million. There can be no assurance that Atlatsa will be successful in repaying all of its indebtedness. Atlatsa’s level of indebtedness could have important consequences for its operations, including:

| • | | The Company will need to use a large portion of its cash flow to repay principal and pay interest on its debt, which will reduce the amount of funds available to finance its operations and other business activities; and |

| • | | The Company’s debt level may limit its ability to pursue other business opportunities, borrow money for operations or capital expenditures in the future, or implement its business strategy. |

Atlatsa expects to obtain the funds to pay its operational and capital expenditures in 2013 through its future cash flows from the Bokoni Mine operations as well as available facilities from the Consolidated Debt Facility which came into effect on September 28, 2012 as a part of Phase One of its Restructure Plan, see “Restructure Plan” under Item 4, as well as Section 1.13 “Financial Instruments and Risk Management - Debt Arrangements” and Section 1.2 under subheading “Restructure Plan” in the Company’s Management Discussion and Analysis for the fiscal year ended December 31, 2012 (filed on March 28, 2013).

The Company is dependent on the current facility in place provided by Anglo Platinum as well as stable production from the Bokoni Mine. The funds available from this facility are expected to meet the Group’s projected cash flow requirements until approximately May 2013.

These conditions give rise to a material uncertainty which may cast significant doubt about the Company’s ability to continue as a going concern and, therefore that it may be unable to realize its assets and discharge its liabilities in the normal course of business. For details regarding the Company’s proposed Restructure Plan, which is intended to address the foregoing issues, see Item 4 “Restructure Plan” and Item 5 “Operating and Financial Review and Prospects”.

Atlatsa’s ability to meet its payment obligations will depend on its future financial performance, which will be affected by financial, business, economic and other factors. Atlatsa will not be able to control many of these factors, such as economic conditions in the markets in which it operates. Atlatsa cannot be certain that its existing capital resources and future cash flows from operations will be sufficient to allow it to pay principal and interest on Atlatsa’s debt and meet its other obligations. If these amounts are insufficient or if there is a contravention of its debt covenants, Atlatsa may be required to refinance all or part of its existing debt, sell assets, borrow more money or issue additional equity.

Atlatsa has no history of realising net earnings

Atlatsa has a long history of losses and there can be no assurance that Atlatsa will achieve or sustain profitability. Atlatsa has not paid any dividends on its shares since incorporation. Atlatsa anticipates that it will retain future earnings and other cash resources for the future operation and development of its business. Atlatsa does not intend to declare or pay any cash dividends in the foreseeable future. Payment of any future dividends is at the discretion of Atlatsa’s board of directors after taking into account many factors including Atlatsa’s operating results, financial conditions and anticipated cash needs.

Capital structure and ability to raise new equity

23

Atlatsa’s ability to raise new equity in the equity capital markets is subject to the mandatory requirement that Atlatsa Holdings, its majority BEE shareholder, retain a 51% fully diluted shareholding in the Company up until December 31, 2020, as required by covenants given by Atlatsa Holdings and Atlatsa in favour of the SARB and Anglo Platinum; post transaction. The ability of Atlatsa to access the bank public debt or equity capital markets on an efficient basis may be constrained by the dislocation in the credit markets, capital and/or liquidity constraints in the banking markets and equity conditions at the time of issuance.

The Company may not meet its production level and operating cost estimates and, if it does not, its results of operations may be adversely affected

Atlatsa prepares estimates of future production, cash costs and capital costs of production for particular operations. No assurance can be given that such estimates will be achieved. Failure to achieve production or cost estimates or material increases in costs could have an adverse impact on Atlatsa’s future cash flows, profitability, results of operations and financial condition.

Atlatsa’s actual production and costs may vary from estimates for a variety of reasons, including the following: actual ore mined varying from estimates of grade, tonnage, dilution and metallurgical and other characteristics; short-term operating factors relating to the ore reserves, such as the need for sequential development of orebodies and the processing of new or different ore grades; revisions to mine plans; risks and hazards associated with mining; natural phenomena, such as inclement weather conditions, water availability, floods, and earthquakes; and unexpected labor shortages or strikes. Costs of production may also be affected by a variety of factors, including: changing waste-to-ore ratios, ore grade metallurgy, labor costs, the cost of commodities, safety related stoppages, general inflationary pressures and currency exchange rates.

The loss of key personnel and workforce unavailability could harm the Company’s mining operations and projects

Atlatsa is dependent on a relatively small number of key employees (such as the Chief Executive Officer and the Chief Financial Officer), the loss of any of whom could have an adverse effect on Atlatsa. The Company also does not maintain any “key person” insurance.

HIV/AIDS is prevalent in Southern Africa. Employees or contractors of the Company may have or could contract this potentially deadly virus. There has been a steady emigration of skilled personnel from South Africa in recent years. Generally, the prevalence of HIV/AIDS could cause lost employee man hours and the emigration of skilled employees could adversely affect Atlatsa’s ability to retain its employees.

Atlatsa is dependent on a workforce which is heavily unionised with approximately 95% of the workforce belonging to three competing unions. This poses a risk in that union disputes may give rise to industrial action and work stoppages, including strikes, from time to time. Communication and negotiating forums have been established with all unions participating therein.

See “Illegal Strike Action at Bokoni Mine”