UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or 12(g) OF THESECURITIES EXCHANGE ACT OF 1934

OR

[ x ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THESECURITIES EXCHANGE ACT OF 1934

For the Fiscal year ended December 31, 2008

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THESECURITIES EXCHANGE ACT OF 1934

OR

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THESECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________to _______________

Commission file number 0-30622

ANOORAQ RESOURCES CORPORATION

(Exact name of Registrant specified in its charter)

NOT APPLICABLE

(Translation of Registrant's name into English)

BRITISH COLUMBIA, CANADA

(Jurisdiction of incorporation or organization)

Suite 1020, 800 West Pender Street

Vancouver, British Columbia, Canada, V6C 2V6

(Address of principal executive offices)

Name, Telephone, E-mail, and/or Facsimile number and Address of Company Contact Person)

Iemrahn Hassen ;Tel-27-11-779-6830;Fax-27-11-883-0836;

E-Mail:Iemrahn@anooraqresources.co.za

- 2 -

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of each exchange on which registered |

| Common Shares | The NYSE Amex Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Number of outstanding shares of Registrant's only class of common stock as of December 31, 2008

186,640,007 Common Shares

Indicate by check mark whether Registrant is a well-known seasoned issuer, as defined in Rule 405 Yes [ ] No [ x ]

If this report is an annual or transition report, indicate by check mark if Registrant is not required to file reports pursuant to Section 13 or 15(d) of theSecurities Exchange Act of 1934.

Yes [ ] No [ x ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [ x ] No [ ]

Indicate by check mark whether the registrant (1) has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405of this chapter) during the preceding 12 months (or for such period that the registrant was required to submit and post such files).

Yes [ x ] No [ ]

Indicate by check mark whether Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act

| Large accelerated Filer [ ] | Accelerated Filer [ x ] | Non-accelerated Filer [ ] |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP [ ] | International Financial Reporting Standards as issued

by the International Accounting Standards Board [ ] | Other [ x ] |

If “"Other”" has been check in response to the previous question, by check mark which financial statement item Registrant has elected to follow:

Item 17 [ x ] Item 18 [ ]

- 3 -

If this is an annual report, indicate by check mark whether Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.

Yes [ ] No [ x ]

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether Registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of theSecurities Exchange Act of 1934subsequent to the distribution of securities under a plan confirmed by a court.

NOT APPLICABLE

CURRENCY AND EXCHANGE RATES

All monetary amounts contained in this Annual Report are, unless otherwise indicated, expressed in Canadian Dollars. On July 1, 2009, the Federal Reserve noon rate for Canadian Dollars was 1 USD = CAD 1.1446 (see Item 3 – "Key Information" for further historical exchange rate information).

T A B L E O F C O N T E N T S

- 2 -

PART 1

In this Annual Report on Form 20-F, all references to the "Company" or to "Anooraq" refer to Anooraq Resources Corporation and its subsidiaries, unless the context clearly otherwise requires. Certain terms used herein are defined in the text and others are included in this glossary of terms.

Anooraq uses the Canadian dollar as its reporting currency. All references in this document to "dollars" or "$" are expressed in Canadian dollars, unless otherwise indicated. On July 1, 2009 the Federal Reserve noon rate for Canadian dollars was 1 USD = CAD 1.1446. See also Item 3 - "Key Information" for more detailed currency and conversion information.

Except as noted, the information set forth in this Annual Report is as of July 1, 2009 and all information included in this document should only be considered correct as of such date References to this "Annual Report" are references to this Annual Report on Form 20-F for the fiscal year ended December 31, 2008.

FORWARD LOOKING STATEMENTS

Cautionary Notes to Readers

This Annual Report on Form 20-F includes certain statements that may be deemed "forward looking statements". All statements in this Annual Report, other than statements of historical facts, are forward looking statements. These statements appear in a number of different places in this Annual Report and can be identified by words such as "anticipates", "estimates", "projects", "expects", "intends", "believes", "plans", or their negatives or other comparable words. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the Company's actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements. The Company believes that such forward looking statements are based on reasonable assumptions, including assumptions that: Lebowa will achieve production levels similar to previous years; the Company will be able to continue its financing strategy on favourable terms; and the Ga-Phasha Project and Boikgantsho Project exploration results will continue to be positive. Forward looking statements however, are not guarantees of future performance and actual results or developments may differ materially from those in forward looking statements. Factors that could cause actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, changes in and the effect of government policies with respect to mining and natural resource exploration and exploitation, continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and that actual results or developments may differ materially from those projected in the forward looking statements.

The Company advises you that these cautionary remarks expressly qualify in their entirety all forward-looking statements attributable to the Company or persons acting on its behalf. The Company assumes no obligation to update its forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting such statements. You should carefully review the cautionary statements and risk factors contained in this and other documents that the Company files from time to time with the Securities and Exchange Commission.

- 3 -

Cautionary Note to U.S. Investors

This Annual Report uses the terms "measured resources" and "indicated resources". The Company advises investors that while those terms are recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. Investors should refer to the disclosure under the heading "Resource Category (Classification) Definitions" below.

This Annual Report uses the term "inferred resources". The Company advises investors that while this term is recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize it. "Inferred resources" have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of a mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of economic studies, except in rare cases. Investors are cautioned not to assume that any part or all of an inferred resource exists, or is economically or legally mineable.

Cautionary Note to Readers Concerning Technical Review of Lebowa Platinum Mine

The following are the principal risk factors and uncertainties which, in management's opinion, are likely to most directly affect the conclusions of the technical review of Lebowa. Some of the mineralized material classified as a measured and indicated resource has been used in the cash flow analysis. For US mining standards, a full feasibility study would be required, which would require more detailed studies. Additionally all necessary mining permits would be required in order to classify this part of Lebowa’s mineralized material as an economically exploitable reserve. There can be no assurance that this mineralized material will become classifiable as a reserve and there is no assurance as to the amount, if any, which might ultimately qualify as a reserve or what the grade of such reserve amounts would be. Data is not complete and cost estimates have been developed, in part, based on the expertise of the individuals participating in the preparation of the technical review and on costs at projects believed to be comparable, and not based on firm price quotes. Costs, including design, procurement, construction and on-going operating costs and metal recoveries could be materially different from those contained in the technical review. There can be no assurance that mining can be conducted at the rates and grades assumed in the technical review. There can be no assurance that the infrastructure facilities can be developed on a timely and cost-effective basis. Energy risks include the potential for significant increases in the cost of fuel and electricity, and fluctuation in the availability of electricity. Projected metal prices have been used for the technical review. The prices of these metals are historically volatile, and the Company has no control of or influence on the prices, which are determined in international markets. There can be no assurance that the prices of platinum, palladium, rhodium, gold, copper and nickel will continue at current levels or that they will not decline below the prices assumed in the technical review. Prices for these commodities have been below the price ranges assumed in the technical report at times during the past ten years, and for extended periods of time. The expansion projects described herein will require major financing, probably a combination of debt and equity financing. There can be no assurance that debt and/or equity financing will be available on acceptable terms. A significant increase in costs of capital could materially adversely affect the value and feasibility of constructing the expansions. Other general risks include those ordinary to large construction projects, including the general uncertainties inherent in engineering and construction cost, the need to comply with generally increasing environmental obligations, and accommodation of local and community concerns. The economics are sensitive to the currency exchange rates, which have been subject to large fluctuations in the last several years.

Certain terms used herein are defined as follows:

| Anglo Platinum | Anglo Platinum Limited, a public company incorporated under the laws of South Africa. |

| | |

AnooraqShareholders

Agreement | The shareholders agreement between Pelawan, Anooraq, the Pelawan Trust and Plateau, dated as of June 12, 2009, which has replaced the Pelawan RTO Share Exchange Agreement, the Pelawan RTO Shareholders Agreement and the settlement agreement between the Company and Pelawan dated as of December 28, 2006, as of July 1, 2009, the effective date of the Lebowa Transaction. |

| | |

| BEE | Broad based Black Economic Empowerment, as envisaged pursuant to the Mineral Development Act and related legislation and guidelines, being a strategy aimed at substantially increasing participation by HDPs at all levels in the economy of South Africa. BEE is aimed at redressing the imbalances of the past caused by the Apartheid system in South Africa, by seeking to substantially and equitably increase the ownership and management of South Africa's resources by the majority of its citizens and so ensure broader and more meaningful participation in the economy by HDPs. |

| | |

| BEE Warrants | The warrants for the issue of 167 million Anooraq Common Shares, issued by the Company to the Pelawan Trust pursuant to the settlement agreement with Pelawan dated as of December 28, 2006. The BEE Warrants expired without issuance of the Common Shares. |

| | |

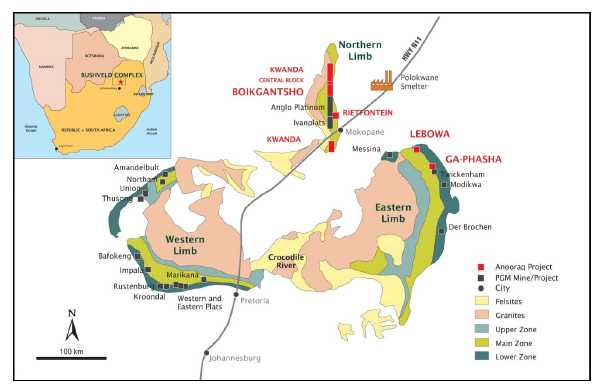

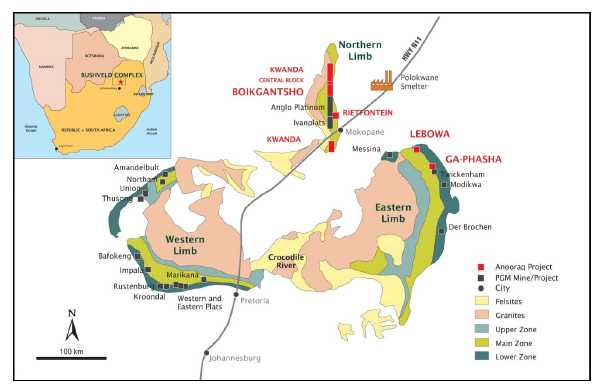

| Boikgantsho Project | The Boikgantsho PGM project, located on the Northern Limb of the Bushveld Complex in South Africa, on the Drenthe and Witrivier farms, and the northern portion of the Overysel farm. |

| | |

| Boikgantsho | Boikgantsho Platinum Mine (Proprietary) Limited, a private company incorporated under the laws of South Africa which as of July 1, 2009, is a wholly owned subsidiary of Holdco and owns the respective interest in, and assets relating to, the Boikghantsho Project. |

| | |

| Common Shares | Common shares without par value in the capital of the Company. |

| | |

| Debt Facility | The Senior Debt Facility with Standard Chartered Bank plc, made available to Plateau Resources amounting to ZAR 750 million including capitalised interest up to a maximum of three years or ZAR 250 million. |

| | |

| DME | The Government of South Africa acting through the Minister of Minerals and Energy and the Department of Minerals and Energy and their respective successors and delegates. |

| | |

| Elemental Symbols | Pt – Platinum; Pd – Palladium; Au – Gold; Ag – Silver; Cu – Copper; Cr – Chromium; Ni – Nickel; Pb – Lead; Rh – Rhodium; Ru – Ruthenium. |

| | |

| Farm | A term commonly used in South Africa to describe the area of a mineral interest. |

- 5 -

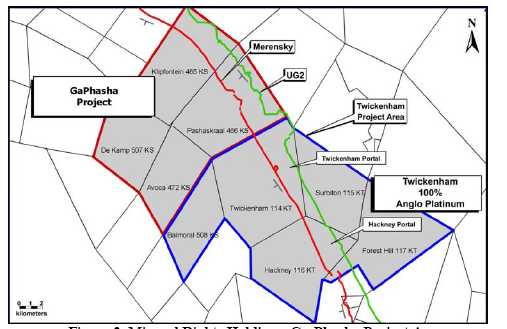

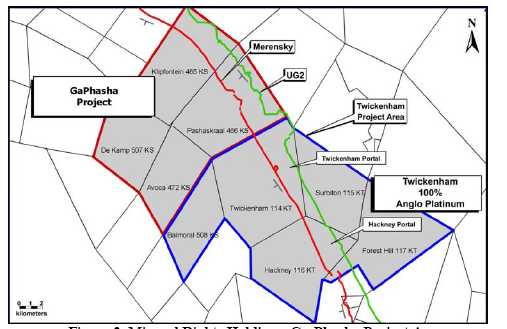

| Ga-Phasha Project | The Ga-Phasha PGM project, located on the Eastern Limb of the Bushveld Complex in South Africa, on the Paschaskraal, Klipfontein, Avoca and De Kamp farms. |

| | |

| Ga-Phasha /GPM | Ga-Phasha Platinum Mine (Proprietary) Limited, a private company incorporated under the laws of South Africa which as of July 1,2009, is a wholly owned subsidiary of Holdco and owns the respective interest in and assets relating to the Ga-Phasha Project. |

| | |

| HDP | A "historically disadvantaged person" as contemplated in the Mineral Development Act, being a person who was discriminated against under the Apartheid system, and includes certain trusts and companies in which such a person has interests, as contemplated in the Holdco Shareholders Agreement. |

| | |

| HDSI | Hunter Dickinson Services Inc., a corporation incorporated under the laws of Canada, which is a related party to Anooraq. |

| | |

| Holdco | Richtrau No. 179 (Proprietary) Limited, a private company incorporated under the laws of South Africa, which will be renamed Bokoni Platinum Holdings (Proprietary) Limited. |

| | |

Holdco Shareholders

Agreement | The shareholders' agreement entered into between Plateau, RPM and Holdco dated March 28, 2008, as amended on May 13, 2009, to govern the relationship between Plateau and RPM as shareholders of Holdco. |

| | |

| Kwanda Project | The Kwanda PGM Project, located on the Northern Limb of the Bushveld Complex in South Africa, on 12 farms. |

| | |

| Kwanda | Kwanda Platinum Mine (Proprietary) Limited, a private company incorporated under the laws of South Africa which as of July 1, 2009, is a wholly owned subsidiary of Holdco and owns the respective interest in and assets relating to the Kwanda Project. |

| | |

| Lebowa | Lebowa Platinum Mine, a PGM mine, located on the Eastern Limb of the Bushveld Complex in South Africa on the Diamand, Wintersveld, Jagdlust, Middelpunt, Umkoanesstad and Zeekoegat farms. |

| | |

| Lebowa Transaction | The transaction pursuant to which the Company has acquired an effective 51% interest in Lebowa and an additional 1% interest in the Ga-Phasha Project, Boikgantsho Project and Kwanda Project pursuant to the acquisition by Plateau of 51% of the shares in, and claims on shareholders loan account against, Holdco, which, following implementation of the transaction, now owns 100% of New Opco, 100% Ga-Phasha Platinum Mine (Proprietary) Limited, Boikgantsho Platinum Mine (Proprietary) Limited, Kwanda Platinum Mine (Proprietary) Limited, for an aggregate cash consideration of ZAR2.6 billion. |

| | |

Lebowa Transaction

Agreements | The Boikgantsho Sale of Rights Agreement, the Kwanda Sale of Rights Agreement, the Plateau Sale of Boikgantsho Shares and Claims Agreement, the Plateau Sale of Kwanda Shares Agreement, the Plateau Sale of Ga-Phasha Shares and Claims Agreement, the Holdco Sale of Shares Agreement, the Holdco Shareholders Agreement and the Phase 3 Implementation Agreement, as more fully defined in the May 2009 Circular, and any amendments to such agreements, collectively. |

- 6 -

| LPM | Lebowa Platinum Mines Limited, a public company incorporated under the laws of South Africa and which is a wholly owned subsidiary of Holdco. |

| | |

| May 2009 Circular | The management information circular dated May 13, 2009 in respect of the annual and extraordinary general meeting of the Company held on June 15, 2009, available on SEDAR at www.sedar.com. |

| | |

| MineralDevelopment Act | TheMineral and Petroleum Resources Development Act, 2002 (South Africa). |

| | |

| Mining Charter | The Broad Based Socio-Economic Empowerment Charter for the South African mining industry, signed by the DME, the South African Chamber of Mines and others on October 11, 2002. |

| | |

| New Opco | Richtrau No. 177 (Proprietary) Limited, a private company incorporated under the laws of South Africa, which is to be renamed Bokoni Platinum Mines (Proprietary) Limited and which is a wholly owned subsidiary of Holdco. |

| | |

| NYSE Amex | The NYSE Amex formerly the American Stock Exchange (Amex). |

| | |

| Pelawan | Pelawan Investments (Proprietary) Limited, a private company incorporated under the laws of South Africa. |

| | |

Pelawan RTO Share

Exchange Agreement | The Share Exchange Agreement between Pelawan and Anooraq made as of January 21, 2004 and as amended from time to time. |

| | |

Pelawan RTO

ShareholdersAgreement | The Shareholders Agreement between Pelawan, Anooraq and the Pelawan Trust made as of September 19, 2004. |

| | |

| Pelawan Trust | The independent South African trust established in accordance with a trust deed dated September 2, 2004, the trustees of which are Deneys Reitz Trustees (Proprietary) Limited, Tumelo Motsisi and Asna Chris Harold Motaung. |

| | |

| PGM | Platinum group metals, comprising platinum, palladium, rhodium, ruthenium, osmium and iridium. |

| | |

| Plateau | Plateau Resources (Proprietary) Limited, a private company incorporated under the laws of South Africa, being an indirect wholly owned subsidiary of Anooraq. |

| | |

| Platreef Properties | The Platreef PGM properties located on the Northern Limb of the Bushveld Complex in South Africa, which includes the Kwanda, Boikgantsho and Rietfontein projects. |

| | |

| PPRust | Potgietersrust Platinum Limited, a private company incorporated under the laws of South Africa, being a wholly owned subsidiary of Anglo Platinum. |

| | |

| Royalty Act | TheMineral and Petroleum Resources Royalty Act, Act No 28 of 2008, in relation to royalties to be levied by the South African state in respect of the transfer of mineral or petroleum resources. |

- 7 -

| RPM | Rustenburg Platinum Mines Limited, a public company incorporated under the laws of South Africa, being a wholly owned subsidiary of Anglo Platinum. |

| | |

| RTO | Reverse Take-Over whereby Pelawan acquired a controlling share of Anooraq Resources pursuant to the Pelawan RTO Share Exchange Agreement. |

| | |

| SARB | The Exchange Control Department of the South African Reserve Bank. |

| | |

| South Africa | The Republic of South Africa. |

| | |

| TSXV | TSX Venture Exchange Inc. |

| | |

| ZAR | South African Rand, the currency of South Africa. |

Geological/Exploration Terms

| 4E grade | The 4E grade is the sum of the grade of Pt, Pd, Rh and Au. |

| | |

| Chromitite | An igneous rock composed mostly of the mineral chromite and found in ultramafic to mafic layered intrusions. |

| | |

| Feldspar | A group of abundant rock-forming minerals, the most widespread of any mineral group and constituting 60% of the earth's crust. |

| | |

| Feldspathic | Containing feldspar as a principal ingredient. |

| | |

| Gabbro | Course grained mafic igneous rock. |

| | |

| Lithology | Rock composition and structure. |

| | |

| Mafic | Composed of dark ferromagnesian minerals. |

| | |

| Mineral Deposit | A deposit of mineralization that may or may not be ore. Under US rules, a mineral reserves or ore is determined by a full feasibility study. and mineralization may not be classified as a "reserve”" unless the determination has been made that the mineralization could be economically and legally extracted or produced at the time the reserve determination is made Under Canadian rules, Mineral reserves may be determined by a preliminary feasibility study. |

| | |

| Mineralized Material | A mineralized body that has been delineated by appropriately spaced drilling and/or underground sampling to support a sufficient tonnage and average grade of metals to warrant further exploration. Such a deposit does not qualify as a reserve until a comprehensive evaluation based upon unit cost, grade, recoveries, and other material factors conclude legal and economic feasibility. Mineralization classified as "inferred", is a classification that is acceptable under Canadian regulations (see "Resource Category (Classification) Definitions" below) but cannot be used in a feasibility study and is not recognized by the United States Securities and Exchange Commission. |

- 8 -

| Norite | A coarse-grained plutonic rock in which the chief constituent is basic plagioclase feldspar (labradorite) and the dominant mafic mineral is orthopyroxene (hypersthene). |

| | |

| Pyroxenite | A medium or coarse-grained rock consisting essentially of pyroxene, a common rock forming mineral. |

| | |

| Technical Report | Means a report prepared and filed in accordance with National Instrument 43-101 on the Company’s profile with the Canadian Security Administrators on www.sedar.com. This document refers to the May 2009 Technical Report entitled “Technical Report: Lebowa Platinum Mine, Limpopo Province, South Africa dated May 12 2009; the October 2007 Technical Report entitled “Technical Report on the Updated Resource Estimates on the Merensky Reef and UG2 Deposits, Ga-Phasha PGM Project, Eastern Limb, Bushveld Complex, Limpopo Province, South Africa dated October 19 2007; and the December 2004 Technical Report entitled “Technical Report Resource Estimate on the Boikgantsho Joint Venture, Eastern Limb, Bushveld Complex, Limpopo Province, South Africa dated December 22, 2004”. |

Resource Category (Classification) Definitions

| mineral reserve | Canadian National Instrument 43-101Standards of Disclosure for MineralProjects("NI 43-101") defines a "Mineral Reserve" as the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, and economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined. |

| | |

| Mineral reserves are subdivided in order of increasing confidence into Probable Mineral Reserves and Proven Mineral Reserves. A Probable Mineral Reserve has a lower level of confidence than a Proven Mineral Reserve. |

| | |

| (1) A "Probable Mineral Reserve" is the economically mineable part of an Indicated and, in some circumstances, a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. |

| | |

| (2) A "Proven Mineral Reserve" is the economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified. |

| | |

| Industry Guide 7 – "Description of Property by Issuers Engaged or to beEngaged in Significant Mining Operations" of the Securities and Exchange Commission defines a 'reserve' as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. |

| | |

| mineral resource | Canadian National Instrument 43-101Standards of Disclosure for MineralProjects("NI 43-101") defines a "Mineral Resource" as a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth's crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge. |

| | |

| | Mineral Resources are sub-divided, in order of increasing geological |

- 9 -

confidence, into Inferred, Indicated and Measured categories. An Inferred Mineral Resource has a lower level of confidence than that applied to an Indicated Mineral Resource. An Indicated Mineral Resource has a higher level of confidence than an Inferred Mineral Resource but has a lower level of confidence than a Measured Mineral Resource.

(1)Inferred Mineral Resource.An 'Inferred Mineral Resource' is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

Due to the uncertainty that may be attached to Inferred Mineral Resources, it cannot be assumed that all or any part of an Inferred Mineral Resource will be upgraded to an Indicated or Measured Mineral Resource as a result of continued exploration. Confidence in the estimate is insufficient to allow the meaningful application of technical and economic parameters or to enable an evaluation of economic viability worthy of public disclosure. Inferred Mineral Resources must be excluded from estimates forming the basis of feasibility or other economic studies.

(2)Indicated Mineral Resource.An 'Indicated Mineral Resource' is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. Mineralization may be classified as an Indicated Mineral Resource by the Qualified Person when the nature, quality, quantity and distribution of data are such as to allow confident interpretation of the geological framework and to reasonably assume the continuity of mineralization. An Indicated Mineral Resource estimate is of sufficient quality to support a Preliminary Feasibility Study which can serve as the basis for major development decisions.

(3)Measured Mineral Resource.A 'Measured Mineral Resource' is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and other physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity.

Mineralization or other natural material of economic interest may be classified as a Measured Mineral Resource by the Qualified Person when the nature, quality, quantity and distribution of data are such that the tonnage and grade of the mineralization can be estimated to within close limits and that variation from the estimate would not significantly affect potential economic viability. This category requires a high level of confidence in, and understanding of, the

- 10 -

| | geology and controls of the mineral deposit. |

| | |

| Industry Guide 7 – "Description of Property by Issuers Engaged or to beEngaged in Significant Mining Operations"of the Securities and Exchange Commission does not define or recognize resources. As used in this Annual Report, "mineral resources" are as defined in NI 43-101. |

Currency and Measurement

All currency amounts in this Annual Report are stated in Canadian dollars unless otherwise indicated.

Conversion of metric units into imperial equivalents is as follows:

| Metric Units | Multiply by | Imperial Units |

| hectares | 2.471 | = acres |

| meters | 3.281 | = feet |

| kilometers | 0.621 | = miles (5,280 feet) |

| grams | 0.032 | = ounces (troy) |

| tonnes | 1.102 | = tons (short) (2,000 lbs) |

| grams/tonne | 0.029 | = ounces (troy)/ton |

- 11 -

| ITEM 1 | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

- 12 -

| ITEM 2 | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

- 13 -

| | A. | Selected Financial Data |

The following table presents selected financial data for the Company for the last five fiscal periods. This information should be read in conjunction with the consolidated financial statements included elsewhere in this document.

The Company's annual financial statements have been audited by its independent registered public accounting firm, KPMG LLP, Chartered Accountants, for the fiscal years ended December 31, 2008, 2007, 2006, 2005 and the fourteen month fiscal year ended December 31, 2004. The financial statements have been prepared in accordance with Canadian generally accepted accounting principles ("Canadian GAAP"). Note 13 to the financial statements included herein provides descriptions of the material measurement differences between Canadian GAAP and United States generally accepted accounting principles ("US GAAP") as they relate to the Company and a reconciliation to US GAAP of the Company's financial statements.

The selected financial data is presented in Canadian dollars and in accordance with Canadian GAAP and United States GAAP.

- 14 -

CONSOLIDATED BALANCE SHEET DATA(in thousands of Canadian dollars)

| CANADIAN GAAP | | December 31, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| Period End Balances | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| Total assets | $ | 15,173 | | $ | 16,953 | | $ | 21,829 | | $ | 13,836 | | $ | 24,480 | |

| Total liabilities | | 16,502 | | | 12,220 | | | 12,853 | | | 379 | | | 1,413 | |

| Share capital and | | | | | | | | | | | | | | | |

| contributed surplus | | 72,532 | | | 65,110 | | | 55,056 | | | 55,032 | | | 52,338 | |

| Deficit | | (73,862 | ) | | (60,376 | ) | | (46,080 | ) | | (41,575 | ) | | (29,271 | ) |

| Working capital | | 587 | | | 4,988 | | | 12,143 | | | 4,781 | | | 14,375 | |

| Equipment, net | | 469 | | | 105 | | | 73 | | | 174 | | | 198 | |

| Mineral property | | 8,993 | | | 9,079 | | | 8,241 | | | 8,502 | | | 8,494 | |

| interests | | | | | | | | | | | | | | | |

| Shareholders' equity | | (1,328 | ) | | 4,734 | | | 8,976 | | | 13,457 | | | 23,067 | |

| (deficit) | | | | | | | | | | | | | | | |

| Number of shares | | | | | | | | | | | | | | | |

| outstanding | | 186,640,007 | | | 185,208,607 | | | 148,220,407 | | | 148,220,407 | | | 148,020,407 | |

| US GAAP | | December 31 | | | December 31 | | | December 31 | | | December 31 | | | December 31 | |

| Period End Balances | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| Total assets | $ | 15,335 | | $ | 17,227 | | $ | 21,829 | | $ | 13,836 | | $ | 24,480 | |

| Total liabilities | | 16,664 | | | 12,493 | | | 12,853 | | | 379 | | | 1,413 | |

| Share capital and | | | | | | | | | | | | | | | |

| contributed surplus | | 72,532 | | | 65,110 | | | 55,056 | | | 55,032 | | | 52,338 | |

| Deficit | | (73,859 | ) | | (60,376 | ) | | (46,080 | ) | | (41,575 | ) | | (29,271 | ) |

| Working capital | | 587 | | | 4,988 | | | 12,143 | | | 4,781 | | | 14,375 | |

| Equipment, net | | 469 | | | 105 | | | 73 | | | 174 | | | 198 | |

| Mineral property | | 8,993 | | | 9,079 | | | 8,241 | | | 8,502 | | | 8,494 | |

| interests | | | | | | | | | | | | | | | |

| Shareholders' equity | | (1,328 | ) | | 4,734 | | | 8,976 | | | 13,457 | | | 23,067 | |

| (deficit) | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Number of shares | | | | | | | | | | | | | | | |

| outstanding | | 186,640,007 | | | 185,208,607 | | | 148,220,407 | | | 148,220,407 | | | 148,020,407 | |

No dividends have been declared for any periods above.

- 15 -

CONSOLIDATED STATEMENT OF OPERATIONS DATA

(in thousands of Canadian dollars, except per-share amounts)

| | | 12 months | | | 12 months | | | 12 months | | | 12 months | | | 14 months | |

| CANADIAN GAAP | | ended | | | ended | | | ended | | | ended | | | ended | |

| Statement of | | December 31 | | | December 31 | | | December 31 | | | December 31 | | | December 31 | |

| Operations Data | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| Interest income | $ | 179 | | $ | 800 | | $ | 264 | | $ | 120 | | $ | 486 | |

| General and administrative | | | | | | | | | | | | | | | |

| expenses | | 13,325 | | | 12,891 | | | 4,153 | | | 6,534 | | | 4,612 | |

| Exploration expenditures | | 341 | | | 2,344 | | | 736 | | | 5,955 | | | 8,901 | |

| Loss | | (13,485 | ) | | (14,296 | ) | | (4,505 | ) | | (12,304 | ) | | (13,027 | ) |

| Loss per Common Share | | (0.07 | ) | | (0.08 | ) | | (0.03 | ) | | (0.08 | ) | | (0.18 | ) |

| | | 12 months | | | 12 months | | | 12 months | | | 12 months | | | 14 months | |

| US GAAP | | ended | | | ended | | | ended | | | ended | | | ended | |

| Statement of | | December 31 | | | December 31 | | | December 31 | | | December 31 | | | December 31 | |

| Operations Data | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| Interest income | $ | 179 | | $ | 800 | | $ | 264 | | $ | 120 | | $ | 486 | |

| General and administrative | | | | | | | | | | | | | | | |

| expenses | | 13,325 | | | 12,891 | | | 4,153 | | | 6,534 | | | 4,612 | |

| Exploration expenditures | | 341 | | | 2,344 | | | 736 | | | 5,955 | | | 8,901 | |

| Loss | | (13,485 | ) | | (14,296 | ) | | (4,505 | ) | | (12,304 | ) | | (13,027 | ) |

| Loss per Common Share | | (0.07 | ) | | (0.08 | ) | | (0.03 | ) | | (0.08 | ) | | (0.18 | ) |

See Item 17 for accompanying consolidated financial statements reconciled to United States generally accepted accounting principles for further details.

Annual Exchange Rates

The following table sets out the exchange rates, based on noon buying rates as published by the Bank of Canada, for the conversion of United States Dollars (USD) into Canadian Dollars (CAD) in effect at the end of the following periods, and the average exchange rates and the range of high and low exchange rates for such periods.

USD/CAD

| | | 12 months | | | 12 months | | | 12 months | | | 12 months | | | 14 months | |

| | | ended | | | ended | | | ended | | | ended | | | ended | |

| USD/CAD | | December 31 | | | December 31 | | | December 31 | | | December 31 | | | October 31 | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| End of Period | | 1.21 | | | 0.99 | | | 1.17 | | | 1.16 | | | 1.20 | |

| Average for Period | | 1.06 | | | 1.08 | | | 1.13 | | | 1.21 | | | 1.30 | |

| High for Period | | 1.29 | | | 1.19 | | | 1.17 | | | 1.27 | | | 1.38 | |

| Low for Period | | 0.98 | | | 0.92 | | | 1.09 | | | 1.15 | | | 1.20 | |

The following table sets out the exchange rates, based on noon buying rates as certified by the Bank of Canada, for the conversion of South African Rand (ZAR) into Canadian Dollars in effect at the end of the following periods, and the average exchange rates and the range of high and low exchange rates for such periods.

- 16 -

| | | 12 months | | | 12 months | | | 12 months | | | 12 months | | | 14 months | |

| | | ended | | | ended | | | ended | | | ended | | | ended | |

| ZAR/CAD | | December 31 | | | December 31 | | | December 31 | | | December 31 | | | December 31 | |

| | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| End of Period | | 0.131 | | | 0.145 | | | 0.165 | | | 0.184 | | | 0.213 | |

| Average for Period | | 0.123 | | | 0.152 | | | 0.169 | | | 0.191 | | | 0.202 | |

| High for Period | | 0.151 | | | 0.169 | | | 0.195 | | | 0.213 | | | 0.222 | |

| Low for Period | | 0.110 | | | 0.142 | | | 0.142 | | | 0.175 | | | 0.178 | |

Monthly Exchange Rates

The following table sets out the high and low exchange rates, based on noon buying rates as certified by the Bank of Canada, for the conversion of United States Dollars into Canadian Dollars in effect for the following months.

| USD/CAD | | January | | | February | | | March | | | April | | | May | | | June | |

| | | 2009 | | | 2009 | | | 2009 | | | 2009 | | | 2009 | | | 2009 | |

| Low for the period | | 1.178 | | | 1.2164 | | | 1.2225 | | | 1.1930 | | | 1.0910 | | | 1.0810 | |

| High for the period | | 1.268 | | | 1.2914 | | | 1.2991 | | | 1.2610 | | | 1.1859 | | | 1.1190 | |

The following table sets out the high and low exchange rates, based on noon buying rates as certified by the Bank of Canada, for the conversion of South African Rand into Canadian Dollars in effect for the following months.

| ZAR/CAD | | January | | | February | | | March | | | April | | | May | | | June | |

| | | 2009 | | | 2009 | | | 2009 | | | 2009 | | | 2009 | | | 2009 | |

| Low for the period | | 0.1195 | | | 0.1210 | | | 0.1209 | | | 0.1315 | | | 0.1345 | | | 0.1348 | |

| High for the period | | 0.1299 | | | 0.1283 | | | 0.1322 | | | 0.1415 | | | 0.1411 | | | 0.1386 | |

| | B. | Capitalization and Indebtedness |

Not applicable.

| | C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

Investment in mining companies such as Anooraq is highly speculative and subject to numerous and substantial risks.

- 17 -

The Company faces risks in executing its business plan and achieving revenues. The following risks are material risks that the Company faces. The Company also faces the risks identified elsewhere in this Annual Report. If any of these risks occur, the Company's business and its operating results and financial condition could be seriously harmed and, under certain circumstances, the Company may not be able to continue business operations as a going concern.

Exploration and Development

The exploration for and development of mineral deposits involves significant risks, which even a combination of careful evaluation, experience and knowledge may not eliminate. Although the discovery of an ore body may result in substantial rewards, few properties explored are ultimately developed into producing mines. Significant expenditures are required to locate and establish ore reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. It is impossible to ensure that the current exploration programs planned by Anooraq and its joint venture partners will result in a profitable commercial mining operation.

The commercial viability of a mineral deposit is dependent upon a number of factors. These include deposit attributes such as size, grade and proximity to infrastructure, current and future metal prices (which can be cyclical), and government regulations, including those relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and necessary supplies and environmental protection. The complete effect of these factors, either alone or in combination, cannot be entirely predicted, and their impact may result in Anooraq not receiving an adequate return on invested capital.

The figures for mineral resources incorporated by reference herein are estimates and no assurance can be given that the anticipated tonnages and grades will be achieved or that the indicated level of recovery will be realized. Market fluctuations and the prices of metals may render resources uneconomic. Moreover, short-term operating factors relating to the mineral deposits, such as the need for orderly development of the deposits or the processing of new or different grades of ore, may cause a mining operation to be unprofitable in any particular accounting period.

No Ore at Exploration Projects

Anooraq’s mineral projects are at varied stages of exploration. The Ga-Phasha Project and the Boikgantsho Project are at a prefeasibility study stage, and the Kwanda Projects is at an early exploration stage. The Platreef Properties and the Ga-Phasha Project are in the exploration as opposed to the development stage and have no known body of economic mineralization. The known mineralization at these projects has not been determined to be ore. Although the Company believes that exploration data available is encouraging, particularly in respect to the Boikgantsho and Ga-Phasha Projects, there can be no assurance that commercially mineable ore bodies exist. There is no certainty that any expenditure made in the exploration of the Company's mineral properties will result in discoveries of commercially recoverable quantities of ore. Completion of final comprehensive feasibility studies and, possibly, further associated exploration and other work will be required before it can be concluded that a potential mine at any of these projects is likely to be economic.

Economic Risk

The future profitability of Anooraq's operations may be significantly affected by changes in the market price of the metals it mines or explores. The prices of PGM are volatile, and are affected by numerous factors beyond Anooraq's control. The level of interest rates, the rate of inflation, world supply of PGM and instability of exchange rates can all cause fluctuations in these prices. Such external economic factors are in turn influenced by changes in international investment patterns, monetary systems and political developments. The prices of PGM have fluctuated in recent years, and future significant price

- 18 -

declines could cause commercial production to be uneconomic and could have a material adverse effect on Anooraq's business, results of operations and financial condition.

Additional Funding Requirements

The further development and exploration of the various mineral properties in which Anooraq holds interests is dependent upon Anooraq's ability to obtain debt financing, equity financing or other means for financing. There is no assurance that Anooraq will be successful in obtaining the required financing.

Mining

Mining operations generally involve a high degree of risk. Anooraq's operations are subject to all the hazards and risks normally encountered in the exploration, development and production of minerals. These include unusual and unexpected geological formations, rock falls, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible liability. Notwithstanding precautions to minimize risk, mining and milling operations are subject to hazards such as equipment failure or failure of retaining dams which may result in environmental pollution and consequent liability, any of which may have a material adverse effect on Anooraq's business and results of operation and financial condition.

Government Regulation

The exploration and mining activities of Anooraq are subject to various South African national, provincial and local laws governing prospecting, development, production, taxes, royalties, labour standards and occupational health, mine safety, toxic substances and other matters. Exploration and mining activities are also subject to various national, provincial and local laws and regulations relating to the protection of the environment. These laws mandate, among other things, the maintenance of certain air and water quality standards, and land reclamation. These laws also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Although Anooraq's activities are currently carried out in accordance with all applicable rules and regulations, no assurance can be given that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner which could limit or curtail exploration, production or development. Amendments to current laws and regulations governing operations and activities of exploration, mining and milling or more stringent implementation thereof could have a material adverse effect on Anooraq's business, results of operation and financial condition.

The mining industry in South Africa is subject to extensive regulation. The regulatory environment is developing and lacks clarity in a number of areas and laws and regulations are subject to interpretation, review and amendment. In addition, the regulatory process entails a public comment process, which could make the outcome of legislation more uncertain and cause delays in the regulatory process. A number of significant matters have not been finalized, including legislation dealing with royalties and beneficiation. Anooraq cannot predict the outcome or timing of any amendments or modifications to applicable laws and regulations or the interpretation thereof, the enactment of new laws and regulations, or their impact on its business.

In March 2003, the South African government released a Royalty Bill relating to royalties payable to the State in respect of mineral and petroleum resources. A revised version of the Royalty Bill was released in October 2006. In December 2007, a third (and final) draft Bill was released for public comment and Parliamentary review. The third draft of the Royalty Bill confirmed gross sales as the tax base, but took the process of beneficiation into account. This Bill moved away from a dual rates system (differential rates for refined and unrefined minerals) towards an allowance for deductions of beneficiation related

- 19 -

expenses. The revised tax base will thus be equal to gross sales less allowable beneficiation related expenses and transport expenses between the seller and buyer of the final product. The Royalty Bill was enacted in November 2008, as theMineral and Petroleum Resources Royalty Act, Act 28 of 2008. According to the Royalty Act, a royalty on the transfer of mineral or petroleum resources would be payable to the South African government from May 1, 2009. In his Budget Speech of February 11, 2009, the Minister of Finance announced that the implementation of the Royalty Act will be delayed to March 2010.

South African Government Empowerment Initiatives

In October 2002, the South African Government enacted the Mineral Development Act that deals with the state's policy towards the future of ownership of minerals rights and the procedures for conducting mining transactions in South Africa. The Mineral Development Act is an ambitious statute with wide-ranging objectives, including sustainable development and the promotion of equitable access to South Africa's mineral wealth by the inclusion of HDP into the industry. The Mineral Development Act came into effect in May 2004.

The South African Government has stated it will be issuing permits and licenses for prospecting and mining rights to applicants using a "scorecard" approach. These scorecards are contained in and interpreted in accordance with the Mining Charter and the Codes of Good Practice for the Minerals Industry ("the Minerals Code") developed in terms of Section 100 of the Mineral Development Act. Applicants will need to demonstrate their eligibility for consideration based upon the number of credits accumulated in terms of quantifiable ownership transformation criteria, such as employment equity and human resource development.

Future amendments to, and interpretations of, the economic empowerment initiatives by the South African Government and the South African courts could adversely affect the business of Anooraq and its operations and financial condition.

Joint Venture Risks

Anooraq may explore, develop and operate properties in the future through joint ventures. Plateau's interests in these projects are subject to the risks normally associated with the conduct of joint ventures. The existence or occurrence of one or more of the following circumstances and events could have a material adverse impact on Plateau's profitability or the viability of its interests held through joint ventures, which could have a material adverse impact on Anooraq's future cash flows, earnings, results of operations and financial condition: (i) disagreement with joint venture partners on how to proceed with exploration programs and how to develop and operate mines efficiently; (ii) inability of joint venture partners to meet their obligations to the joint venture or third parties; and (iii) litigation between joint venture partners regarding joint venture matters. See Item 4D - "The Platreef Properties – Location and Property Description - Rietfontein Block" for a discussion of a current dispute with a joint venture partner.

Title Matters

While Anooraq has no reason to believe that the title to any of its properties is in doubt, title to mining properties is subject to potential claims by third parties claiming an interest in them. The mineral properties may be subject to previous unregistered agreements or transfers, and title may be affected by undetected defects or changes in mineral tenure laws. Certain of the Company's mineral interests consist of mineral claims, which have not been surveyed, and therefore, the precise area and location of such claims or rights may be in doubt. The failure to comply with all applicable laws and regulations, including

- 20 -

the failure to pay taxes or to carry out and file assessment work may invalidate title to portions of the properties.

The Company's mineral properties are subject to land claims which may adversely impact the Company's mineral rights

Certain of the properties in which the Company has mineral rights are the subject of restitution claims by local communities. These restitution claims are against the government of South Africa and not the Company. While the Company does not believe that these claims will have a material adverse impact on the Company's mineral rights or operations, there can be no assurance that the restitution claims may not have some adverse impact on the Company's mineral rights or ability to explore, develop or mine its mineral properties.

Insurance and Uninsured Risks

Anooraq's operations are subject to a number of risks and hazards generally, including adverse environmental conditions, industrial accidents, labour disputes, unusual or unexpected geological conditions, ground or slope failures, cave-ins, changes in the regulatory environment and natural phenomena such as inclement weather conditions, floods and earthquakes. Such occurrences could result in damage to mineral properties or production facilities, personal injury or death, environmental damage to Anooraq's properties or the properties of others, delays in mining, monetary losses and possible legal liability.

Although Anooraq maintains insurance to protect against certain risks in such amounts as it considers reasonable, its insurance may not cover all the potential risks typically associated with a mining company's operations. Anooraq may also be unable to maintain insurance to cover these risks at affordable premiums.

Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. Moreover, insurance against risks such as environmental pollution is not generally available to Anooraq or to other companies in the mining industry on acceptable terms. Anooraq might also become subject to liability for hazards which Anooraq may elect not to insure against because of premium costs or other reasons. Losses from these events may cause Anooraq to incur significant costs that could have a material adverse effect upon its financial performance and results of operations.

Political & Legislative Risk

The principal assets of Anooraq are located in South Africa. As a result, it may be difficult for investors to enforce judgments obtained against Anooraq in Canada or the United States.

South Africa has recently effected major legislative and regulatory changes to its mineral law, affecting mineral title. Many applicable laws are relatively new, resulting in risks such as possible misinterpretation. In addition, the Company is subject to possible unilateral modification of mining or exploration rights, operating restrictions, increased taxes, environmental regulation, and mine safety and other risks arising out of a new sovereignty over mining, any or all of which could have an adverse impact upon Anooraq. Anooraq's operations may also be affected in varying degrees by political and economic instability, power interruptions, terrorism and crime.

Changes, if any, in mining or investment policies or shifts in political attitude in South Africa may adversely affect Anooraq's operations or likelihood of future profitability. Operations may be affected in varying degrees by government regulations with respect to, but not limited to, restrictions on production, price controls, export controls, currency remittance, taxes, expropriation of property, foreign investment,

- 21 -

maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety.

The Government of South Africa exercises control over such matters as exploration and mining licensing and permitting, which may adversely impact on Anooraq's ability to carry out exploration, development and mining activities. Failure to comply strictly with applicable laws, regulations and local practices relating to mineral right applications and tenure could result in loss, reduction or expropriation of entitlements, or the imposition of additional local or foreign parties as joint venture partners with carried or other interests.

Competition

The mineral exploration and mining business is competitive in all of its phases. Anooraq competes with numerous other companies and individuals, including competitors with greater financial, technical and other resources than Anooraq, in the search for and the acquisition of attractive mineral properties. Anooraq's ability to acquire properties in the future will depend not only on its ability to develop its present properties, but also on its ability to select and acquire suitable producing properties or prospects for mineral exploration. There is no assurance that Anooraq will continue to be able to compete successfully with its competitors in acquiring such properties or prospects.

Environmental Risks

Environmental legislation is evolving in a manner that will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. There can be no assurance that future changes to environmental regulation, if any, will not adversely affect Anooraq's operations. Environmental hazards may exist on the properties in which Anooraq holds interests which are unknown to Anooraq at present and which have been caused by previous or existing owners or operators of the properties. Furthermore, compliance with environmental reclamation, closure and other requirements may involve significant costs and other liabilities. In particular, Anooraq's operations and exploration activities are subject to South African national and provincial laws and regulations governing protection of the environment. These laws are continually changing and, in general, are becoming more restrictive.

Dependence on Key Personnel

Anooraq is dependent on a relatively small number of key employees, the loss of any of whom may have an adverse effect on Anooraq. The success of Anooraq and its ability to continue to carry on operations is dependent upon its ability to retain the services of certain key employees and members of its board of directors.

HIV/AIDS is prevalent in Southern Africa. Employees or contractors of the Company may have or could contract this potentially deadly virus. There has been a steady emigration of skilled personnel from Southern Africa in recent years. Generally, the prevalence of HIV/AIDS could cause lost employee hours and the emigration of skilled employees could adversely affect Anooraq's ability to retain its employees.

Exchange Rate Fluctuations

Anooraq conducts operations in currencies other than Canadian dollars. The Company maintains most of its working capital in South African rand ("ZAR") or ZAR-denominated securities and converts its Canadian funds to foreign currencies, predominantly South African rand, as certain payment obligations become due. The Company does not hedge the Company's foreign currency exposure. Accordingly, the

- 22 -

Company is subject to fluctuations in the rates of currency exchange between the Canadian dollar and these foreign currencies, and these fluctuations could materially affect its financial position and results of operations.

The prices of PGM are denominated in United States dollars and, accordingly, Anooraq's future revenues will be determined relative to the United States dollars as a key input parameter. Although PGM concentrate is sold to RPM at USD equivalent prices, all revenues received by Anooraq will be in ZAR and not USD. Most of its operating expenses are in ZAR. As a result, fluctuations in the United States dollar against the Canadian dollar and in each of those currencies against the South African Rand could have a material adverse effect on Anooraq's financial results which are denominated and reported in Canadian dollars.

Foreign Subsidiaries

Anooraq conducts operations through foreign subsidiaries and joint ventures, and substantially all of its assets are held in such entities. Accordingly, any limitation on the transfer of cash or other assets between the parent corporation and such entities, or among such entities, could restrict Anooraq's ability to fund its operations efficiently or its ability to transfer funds between the various entities within the Anooraq group of companies. Any such limitations, or the perception that such limitations may exist in the future, could have an adverse impact upon Anooraq's valuation and stock price.

Anooraq Has No History of Earnings

Anooraq has a long history of losses and there can be no assurance that Anooraq will ever be profitable. Anooraq has paid no dividends on its shares since incorporation. Anooraq anticipates that it will retain any future earnings and other cash resources for debt repayment and for the future operation and development of its business. Anooraq does not intend to declare or pay any cash dividends in the foreseeable future. Payment of any future dividends is at the discretion of Anooraq's board of directors after taking into account many factors including Anooraq's debt covenants and obligations, operating results, financial condition and anticipated cash needs.

Going Concern Assumption

Anooraq's consolidated financial statements have been prepared assuming Anooraq will continue as a going concern, which contemplates the realization of assets and settlement of liabilities in the normal course of operations as they come due. Prior to July 1, 2009, the Company had historically been an exploration-stage company and did not have any sources of revenues and has incurred recurring operating losses since inception.

As at December 31, 2008, the Company had cash and cash equivalents of $3,850,674 and working capital of $587,726 and subsequent to year end to the date of this Annual Report, incurred and continued to incur expenditures related to the completion of the Lebowa Transaction. Effective July 1, 2009, the Company completed the acquisition of an effective 51% interest in an operating mine, which is expected to result in immediate cash flows from operations but which requires debt and equity financing.

- 23 -

As a result of the completion of the transaction and the related additional financial resources that the Company has secured, Management of the Company now expects that the cash flows from the acquired mining operations and the additional financing available are sufficient to meet ongoing operating and administration cash requirements.

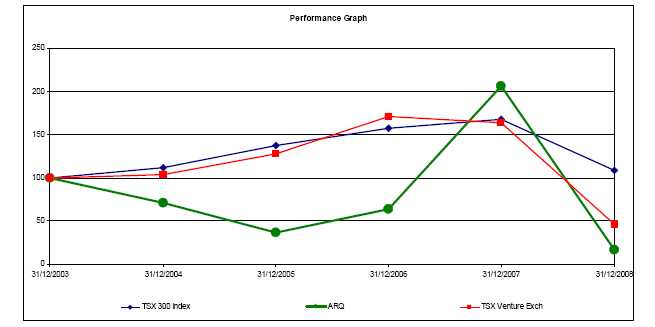

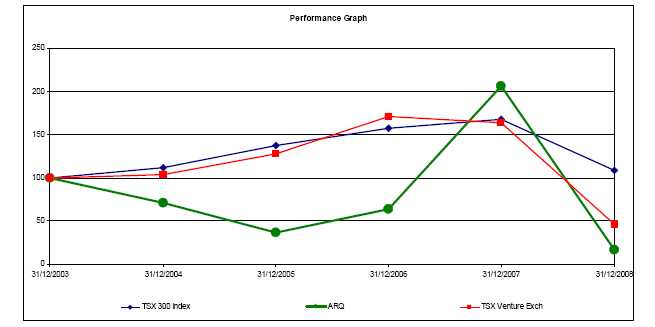

Anooraq's Share Price is Volatile

The market price of the stock of a resource issuer such as Anooraq is affected by many variables, including results of operations and exploration, the market for junior resource stocks, the strength of the economy generally, the availability and attractiveness of alternative investments, and the breadth of the public market for the stock. The effect of these and other factors on the market price of the Common Shares suggests Anooraq's shares will continue to be volatile.

Certain of Anooraq's Directors and Officers are Part-time and Serve as Directors and Officers of Other Companies

Certain of the directors and officers of Anooraq serve as officers and/or directors of other resource exploration companies and are engaged in, and will continue to be engaged in, the search for additional resource opportunities on their own behalf and on behalf of other companies, and situations may arise where these directors and officers will be in direct competition with Anooraq. Such potential conflicts, if any, will be dealt with in accordance with the relevant provisions of British Columbia corporate and common law. In order to avoid the possible conflict of interest which may arise between the directors' and officers' duties to Anooraq and their duties to the other companies in which they have interests, the directors and officers of Anooraq expect that participation in business opportunities offered to directors and officers or companies in which they have interests will be allocated on the basis of prudent business judgement and the relative financial abilities and needs of the companies to participate.

Significant Potential Equity Dilution

As at July 1, 2009 there were 8,061,000 Anooraq stock options outstanding. All of these stock options were repriced to $1.29, at the Extraordinary General Meeting of the shareholders of the Company held on June 15, 2009. The shareholders also approved an amendment to increase the maximum number of Common Shares issuable under the Stock Option Plan to 32,600,000, less the 8,464,000 shares that have already been issued under the Plan. The exercise of options issued by the Company will result in the issuance of additional Common Shares, and the unrestricted resale of these additional Common Shares could have a depressing effect on the current trading price of the Company's Common Shares.

Anglo Platinum has provided vendor financing for the majority of the Lebowa Transaction purchase price. This vendor finance facility includes a ZAR 1.1 billion share settled financing to Plateau, which will have the effect that: (i) RPM will ultimately receive a total of 115.8 million Common Shares (see definition of Common Shares); and (ii) Pelawan will receive 111.6 million Common Shares in order to maintain Pelawan's minimum 51% shareholding in Anooraq. (These Common Shares issued to Pelewan will be subject to a rigid lock-up that will prevent Pelawan from disposing of such shareholding for as long as Pelawan is required to maintain a minimum 51% shareholding in Anooraq). The total number of Common Shares that will be issued on implementation of the share settled financing is 227.4 million Common Shares with 115.8 million Common shares able to be traded by RPM on an unrestricted basis. The Common Shares available for unrestricted resale could have a depressing effect on the current trading price of the Company's Common Shares.

- 24 -

Possible failure to realize anticipated benefits of the Lebowa Transaction

As a result of the completion of the Lebowa Transaction, the Company is in the process of realizing its goal of becoming a significant PGM producer. Achieving the benefits of this and future acquisitions depends in part on successfully consolidating functions and integrating operations, procedures and personnel in a timely and efficient manner, as well as the Company's ability to realize the anticipated growth opportunities and synergies from combining the acquired businesses and operations with those of the Company. The integration of acquired businesses requires the dedication of substantial management effort, time and resources which may divert management's focus and resources from other strategic opportunities and from operational matters during this process. The integration process may result in the loss of key employees and the disruption of ongoing business, customer and employee relationships that could adversely affect the Company's ability to achieve the anticipated benefits of these and future acquisitions.

Operational and resources and reserves risks relating to the Lebowa Assets

The risk factors set forth herein relating to the mining business and the operations of the Company apply equally in respect of the recently acquired Lebowa assets. In particular, the resources and reserve information contained in the technical report prepared by Deloitte in respect of Lebowa is only an estimate of future production from, and the ultimate resources and reserves of, those properties. Mineral reserves of Lebowa may be materially greater or less than the estimates contained in the technical report.

Risks related to the acquisition of mining properties

The acquisition of mining properties or companies are, including the Lebowa Transactions, is based in large part on engineering, environmental and economic assessments made by the acquirer, independent engineers and consultants. These assessments include assumptions regarding such factors as recoverability and marketability of PGM, environmental restrictions and prohibitions regarding releases and emissions of various harmful substances, future prices of PGM, future operating costs, future capital expenditures and royalties and other government levies which may be imposed over the producing life of the reserves. Many of these factors are subject to change and are beyond the control of the Company. All such assessments involve a measure of geologic, engineering, statistical, environmental and regulatory uncertainty that could result in lower production and reserves or higher operating or capital expenditures than anticipated.

Although title and environmental reviews are conducted prior to any purchase of resource assets, such reviews cannot guarantee that any unforeseen defects in the chain of title will not arise to defeat the Company's title to certain assets or those environmental defects or deficiencies do not exist. Such deficiencies or defects could increase costs and/or reduce the value of the Company's assets, and could have a material adverse effect upon the Company and the value of its shares.

Provisions in favour of Anglo Platinum in the Lebowa Transaction Agreements may adversely affect the Company's interest in Lebowa, the Boikgantsho Project, the Ga-Phasha Project and the Kwanda Project

The Holdco Shareholders Agreement places a variety of restrictions on Plateau, its subsidiaries and its controlling shareholders which are designed to safeguard the HDP status of Holdco for an initial period, and at all times to provide Anglo Platinum with a degree of control, independent of BEE considerations, over whom is the ultimate controlling shareholder of Holdco. Anooraq has given certain undertakings to Anglo Platinum in relation to the maintenance of its status as an HDP controlled company. If a breach of these undertakings occurs and Plateau fails to "remedy" or "cure" (as such terms are defined in the Holdco Shareholders Agreement) such breach within the periods specified in the Holdco Shareholders

- 25 -

Agreement, then RPM may compel Plateau to sell its interests in Holdco to another HDP at the best possible price in the circumstances. If Plateau were forced to sell its interest in Holdco pursuant to the minority protections in the Holdco Shareholders Agreement, such a sale would have a materially adverse impact on the Company's financial condition, cash flows and results of operations.

At any time during the term of the Holdco Shareholders Agreement, if a change in control of Holdco occurs (including a change in control approved of by the DME, or that arises out of a "cure" described above), then Plateau is required to "remedy" the change. If Plateau fails to "remedy" the change in control within the period specified in the Holdco Shareholders Agreement, then RPM will be entitled to compel the purchase by Plateau of RPM's interests in Holdco for fair market value. There can be no assurance that Plateau will have sufficient funds to affect such a purchase.

The Company's operations may be adversely affected by the current South African electricity crisis

The Company's mineral projects are supplied with power from Eskom, the South African national electricity provider. Since mid-January 2008, South Africa has been in the midst of an electrical energy supply crisis. This crisis has arisen as a result of a gap between electrical generation capacity and rapidly growing demand. In January 2008, Eskom announced a three phase National Stabilization Plan which focuses on both demand side management and supply side stabilization. Eskom is moving through power rationing and power conservation phases during 2008/09 and 2009 which require a national consumption reduction of 3,000 megawatts (MW). This has resulted in a planned load shedding across the country, with effect from April 1, 2008, to ensure system stability. The mining and industrial sectors have been operating under a 90% to 95% power supply constraint, which is likely to remain in force for the remainder of 2009 and with a real likelihood of short duration outages. The first meaningful supply side increase from Eskom is anticipated to occur in 2012 when the first phase of the new Medupi Power Station comes on line. There can be no assurance that Eskom will deliver increased supply within this timeline. The Company is currently investigating supplementary power generation options and is taking steps to reduce its rate of electrical consumption. However, there can be no assurance that the supply of electricity from Eskom will be adequate or that the Company will be able to obtain supplementary sources of power. If Eskom is not able to supply a sufficient amount of electricity to the Company's mineral projects, this will have an adverse impact on the Company's operations and on the Company's financial condition.

- 26 -

| ITEM 4 | INFORMATION ON THE COMPANY |

SUMMARY

| A. | History and Development of the Company |

| | |

| 1. | Name, Address and Incorporation; Trading Markets |

Anooraq Resources Corporation was incorporated on April 19, 1983 under the laws of the Province of British Columbia, Canada. The Company was transitioned under theBusiness Corporations Act on June 11, 2004, on which date the Company altered its Notice of Articles to change its authorized share structure from 200,000,000 Common Shares without par value to an unlimited number of Common Shares without par value.

The Company's registered office is care of its Canadian attorneys, McCarthy Tétrault LLP, at Suite 1300 – 777 Dunsmuir Street, Vancouver, British Columbia, Canada V7Y 1K2, telephone (604) 643 7100, facsimile (604) 643 7900.The operating office of the Company in South Africa is located at 4th Floor, 82 Grayston Drive, Sandton, Johannesburg, 2146, South Africa, telephone +27 (11) 883 0831 and facsimile +27 (11) 883 0836.

The Company trades on the TSX-V (symbol ARQ) and NYSE Amex (symbol ANO). In 2006, Anooraq affected an inward listing on the JSE Limited and began trading on the JSE on December 19, 2006 under the trading symbol of ARQ.

| 2. | Summary Corporate History and Intercorporate Relationships |

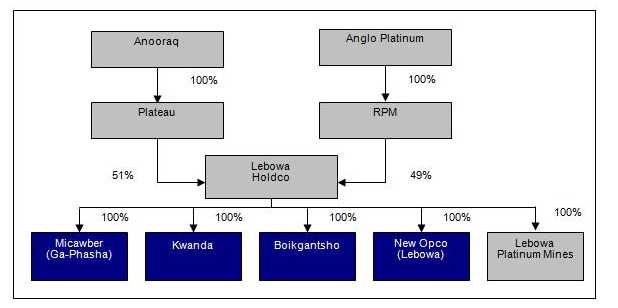

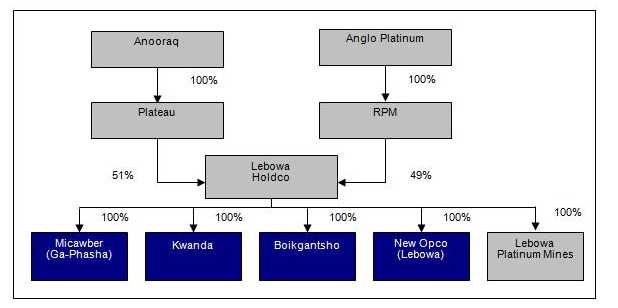

From 1996 to mid-1999, the Company's mineral exploration was focused on metal prospects located in Mexico. In October 1999, the Company refocused its exploration on a South African PGM project, the Platreef Properties (see Item 4D - "Further Particulars of Anooraq's Properties - The Platreef Properties"). The Company has two active Cayman Islands subsidiaries, N1C Resources Inc. ("N1C") and N2C Resources Inc. ("N2C"). These two subsidiaries were incorporated on December 2, 1999 under the laws of the Cayman Islands, and their use represents a common method for Canadian mining companies to hold foreign resource assets. The Company holds 100% of the shares of N1C, which in turn holds 100% of the N2C shares. N2C holds 100% of the shares of Plateau, a private South African mining corporation through which Anooraq holds its interests in South Africa.

In January 2004, the Company announced that it had agreed to terms whereby the Company and Pelawan, a private South African company, would combine their respective PGM assets, comprising the Company's PGM projects on the Northern Limb of the "Bushveld Complex" and Pelawan's 50% participation interest in the Ga-Phasha (previously known as "Paschaskraal") Project on the Eastern Limb of the Bushveld in the Republic of South Africa. The Ga-Phasha Project, located approximately 250 kilometers northeast of Johannesburg, has significant mineral resources outlined as well as encouraging potential.

Pursuant to the terms of the Pelawan RTO Share Exchange Agreement, the Pelawan transaction, which was completed in September 2004 and which constituted a reverse take-over ("RTO") under the policies of the TSX-V, the Company acquired Pelawan's 50% shareholding in Ga-Phasha and the rights to its 50% participation interest in the Ga-Phasha Project in return for 91.2 million Anooraq Common Shares (the "Consideration Shares") and cash payments totaling ZAR 15.7 million. The number of Consideration Shares issued took into account the potential dilutive effect of financings expected to be undertaken in the future to develop PGM mines, for example on the Ga-Phasha and the Drenthe-North Overysel deposits, such that Pelawan's ownership (initially 63%) of the issued and outstanding shares of Anooraq would remain at a certain minimum level (defined as 52%) on a going forward basis to maintain Anooraq as a BEE company, and consequently affording Anooraq with additional opportunities and greater flexibility

- 27 -