UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

Syntroleum Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

March 29, 2004

To Our Stockholders:

You are cordially invited to attend the 2004 annual meeting of stockholders of Syntroleum Corporation. On the following pages you will find a proxy statement that provides detailed information concerning the annual meeting, including the following matters to be acted upon at the meeting:

| | • | | the election of three directors to serve three-year terms; |

| | • | | a proposal to approve the issuance of warrants to purchase up to 1,170,000 shares of our common stock to Mr. Ziad Ghandour, one of our directors and a business consultant to us; |

| | • | | a proposal to approve the grant of options to purchase up to 25,000 shares of our common stock to Mr. James R. Seward, one of our directors; |

| | • | | a proposal to approve the issuance of warrants to purchase up to 500,000 shares of our common stock pursuant to a Joint Development Agreement with Sovereign Oil & Gas Company II, LLC; and |

| | • | | a proposal to ratify the appointment of Grant Thornton LLP as our independent public accountants for the year ending December 31, 2004. |

The record date for determining stockholders entitled to notice of and to vote at the annual meeting is March 22, 2004. The date, time and place of the annual meeting are:

April 26, 2004

10:00 a.m. local time

Tulsa Community College, West Campus

7505 West 41st Street

Tulsa, Oklahoma 74107

A copy of our 2003 annual report to stockholders is enclosed.

I hope you will be able to attend the annual meeting in person. Whether or not you plan to attend, please be sure to date, sign and return the proxy card in the enclosed envelope as promptly as possible so that your shares may be represented at the meeting and voted in accordance with your wishes. Your vote is important regardless of the number of shares you own.

|

Sincerely, |

|

|

Kenneth L. Agee |

Chief Executive Officer |

and Chairman of the Board |

SYNTROLEUM CORPORATION

4322 South 49th West Avenue

Tulsa, Oklahoma 74107

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held April 26, 2004

To the Stockholders:

The 2004 annual meeting of stockholders of Syntroleum Corporation will be held at Tulsa Community College, West Campus, 7505 West 41st Street, Tulsa, Oklahoma 74107, on April 26, 2004, at 10:00 a.m. local time. At the annual meeting, the following matters will be voted upon:

| | (1) | | A proposal to elect three Class B directors as members of our board of directors to serve until the 2007 annual meeting of stockholders or until their respective successors have been duly elected and qualified (Proposal 1); |

| | (2) | | A proposal to approve the issuance of warrants to purchase up to 1,170,000 shares of our common stock to Mr. Ziad Ghandour, one of our directors and a business consultant to us (Proposal 2); |

| | (3) | | A proposal to approve the grant of options to purchase up to 25,000 shares of our common stock to Mr. James R. Seward, one of our directors (Proposal 3); |

| | (4) | | A proposal to approve the issuance of warrants to purchase up to 500,000 shares of our common stock pursuant to a Joint Development Agreement with Sovereign Oil & Gas Company II, LLC (Proposal 4); |

| | (5) | | A proposal to ratify the appointment of Grant Thornton LLP as our independent public accountants for the year ending December 31, 2004 (Proposal 5); and |

| | (6) | | Such other business as may properly come before the meeting or any adjournment of the meeting. |

These matters are described more fully in the accompanying proxy statement.

Only stockholders of record at the close of business on March 22, 2004, are entitled to notice of and to vote at the annual meeting.

Your vote is important—as is the vote of every stockholder—and the board of directors appreciates the cooperation of stockholders in directing proxies to vote at the meeting. It is important that your shares be represented at the meeting by your signing and returning the enclosed proxy card in the accompanying envelope as promptly as possible, whether or not you expect to be present in person.

You may revoke your proxy at any time by following the procedures set forth in the accompanying proxy statement.

|

By Order of the Board of Directors, |

|

Richard L. Edmonson |

Vice President, General Counsel and Corporate Secretary |

March 29, 2004

SYNTROLEUM CORPORATION

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation of proxies by our board of directors for use at our 2004 annual meeting of stockholders to be held at the time and place set forth in the accompanying notice. This proxy statement and accompanying proxies are initially being mailed to our stockholders on or about March 26, 2004. As used in this Proxy Statement, the terms “we,” “our” or “us” mean Syntroleum Corporation, a Delaware corporation, unless the context indicates otherwise.

GENERAL INFORMATION

Voting

Only stockholders of record at the close of business on March 22, 2004 are entitled to notice of, and to vote at, the annual meeting. As of such date, 39,616,456 shares of common stock were outstanding. Each outstanding share entitles the holder to one vote on each matter submitted to a vote of stockholders at the meeting. No other class of stock with voting rights is outstanding. Cumulative voting is not allowed in the election of directors.

Stockholders may vote in person or by proxy at the annual meeting. All properly executed proxies received prior to the commencement of voting at the annual meeting will be voted in accordance with the specification made on the proxy. Proxies submitted without specification will be voted (except to the extent that authority to vote has been withheld) (1) FOR Proposal 1 to elect the nominees for director proposed by the board of directors, (2) FOR Proposal 2 to approve the issuance of warrants to purchase up to 1,170,000 shares of our common stock to Mr. Ziad Ghandour, one of our directors and a business consultant to us, (3) FOR Proposal 3 to approve the grant of options to purchase up to 25,000 shares of our common stock to Mr. James R. Seward, one of our directors, (4) FOR Proposal 4 to approve the issuance of warrants to purchase up to 500,000 shares of our common stock pursuant to a Joint Development Agreement with Sovereign Oil & Gas Company II, LLC, and (5) FOR Proposal 5 to ratify the appointment of Grant Thornton LLP as our independent public accountants for the year ending December 31, 2004. In connection with any other business that may properly come before the meeting, proxies will be voted in the discretion of the persons named in the proxy, except that proxies voted against the proposal to elect each of the three nominees as directors will not be voted in favor of any adjournment of the annual meeting for the purpose of soliciting additional proxies. The persons named as proxies were designated by the board of directors and are officers.

Quorum

The holders of a majority of the shares entitled to vote at the annual meeting, represented in person or by proxy, constitute a quorum for the transaction of business at the annual meeting. Abstentions and broker “non-votes” will be counted as present for purposes of determining whether there is a quorum at the annual meeting. The term broker “non-votes” refers to shares held by brokers and other nominees or fiduciaries that are present at the annual meeting but are not voted on a particular matter because those persons are precluded from exercising their voting authority because of the matter’s “non-routine” nature.

Matters to be Voted Upon

At the annual meeting, the following matters will be voted upon:

| | (1) | | A proposal to elect three Class B directors as members of our board of directors to serve until the 2007 annual meeting of stockholders or until their respective successors have been duly elected and qualified (Proposal 1); |

1

| | (2) | | A proposal to approve the issuance of warrants to purchase up to 1,170,000 shares of our common stock to Mr. Ziad Ghandour, one of our directors and a business consultant to us (Proposal 2); |

| | (3) | | A proposal to approve the grant of options to purchase up to 25,000 shares of our common stock to Mr. James R. Seward, one of our directors (Proposal 3); |

| | (4) | | A proposal to approve the issuance of warrants to purchase up to 500,000 shares of our common stock pursuant to a Joint Development Agreement with Sovereign Oil & Gas Company II, LLC (Proposal 4); |

| | (5) | | A proposal to ratify the appointment of Grant Thornton LLP as our independent public accountants for the year ending December 31, 2004 (Proposal 5); and |

| | (6) | | Such other business as may properly come before the meeting or any adjournment of the meeting. |

We know of no other matters that are likely to be brought before the annual meeting.

Votes Required

Proposal 1— Election of Directors. In accordance with our bylaws, the directors will be elected by a plurality of the votes cast in person or by proxy at the annual meeting. Accordingly, abstentions and broker “non-votes” marked on proxy cards will not be included in the tabulation of the votes cast.

Proposal 2 — Approval of the Issuance of Warrants to Mr. Ziad Ghandour. In accordance with our bylaws and the rules of the Nasdaq Stock Market, the approval of the proposal to approve the issuance of warrants to purchase up to 1,170,000 shares of our common stock to Mr. Ziad Ghandour requires the affirmative vote of a majority of the shares of common stock present in person or by proxy at the meeting and entitled to vote on the matter. Accordingly, abstentions will have the effect of a vote against the proposal. Broker “non-votes” will be treated as not present and entitled to vote and will therefore not be included in determining the percentage of shares voting in favor of the proposal.

Proposal 3 — Approval of the Grant of Stock Options to Mr. James R. Seward.In accordance with our bylaws and the rules of the Nasdaq Stock Market, the approval of the proposal to approve the grant of options to purchase up to 25,000 shares of our common stock to Mr. James R. Seward requires the affirmative vote of a majority of the shares of common stock present in person or by proxy at the meeting and entitled to vote on the matter. Accordingly, abstentions will have the effect of a vote against the proposal. Broker “non-votes” will be treated as not present and entitled to vote and will therefore not be included in determining the percentage of shares voting in favor of the proposal.

Proposal 4 — Approval of the Issuance of Warrants pursuant to a Joint Development Agreement with Sovereign Oil & Gas Company II, LLC. In accordance with our bylaws and the rules of the Nasdaq Stock Market, the approval of the proposal to approve the issuance of warrants to purchase up to 500,000 shares of our common stock pursuant to a Joint Development Agreement with Sovereign Oil & Gas Company II, LLC requires the affirmative vote of a majority of the shares of common stock present in person or by proxy at the meeting and entitled to vote on the matter. Accordingly, abstentions will have the effect of a vote against the proposal. Broker “non-votes” will be treated as not present and entitled to vote and will therefore not be included in determining the percentage of shares voting in favor of the proposal.

Proposal 5— Ratification of Appointment of Independent Public Accountants.In accordance with our bylaws, the approval of the proposal to ratify the appointment of Grant Thornton LLP as our independent public accountants for the year ending December 31, 2004 requires the affirmative vote of a majority of the shares of common stock present in person or by proxy at the meeting and entitled to vote on the matter. Accordingly, abstentions will have the effect of a vote against the proposal. Broker “non-votes” will be treated as not present and entitled to vote and will therefore not be included in determining the percentage of shares voting in favor of the proposal.

2

Revoking a Proxy

Any stockholder may revoke his or her proxy at any time before it is voted at the meeting by (1) duly executing and delivering to our corporate secretary a proxy bearing a later date, (2) filing with our corporate secretary a written notice of revocation or (3) voting in person at the meeting. The mailing address of our executive office is 4322 South 49th West Avenue, Tulsa, Oklahoma 74107. A stockholder’s presence without voting at the annual meeting will not automatically revoke a previously delivered proxy, and any revocation during the meeting will not affect votes previously taken.

Solicitation

Solicitation of proxies will be primarily by mail. In addition to solicitation by mail, our officers, directors and employees may solicit proxies in person or by telephone and facsimile transmission, for which such persons will receive no additional compensation. We will pay all costs of soliciting proxies. We will reimburse brokerage houses, banks and other custodians, nominees and fiduciaries for their reasonable expenses in forwarding proxy material to beneficial owners of our common stock. We may engage third parties to assist in the solicitation of proxies, and in that event would incur additional costs.

PROPOSAL 1—ELECTION OF DIRECTORS

Our certificate of incorporation divides the board of directors into three classes, with each class serving three-year terms. The members of each class serve until the annual meeting of stockholders in the third year following their election, with one class being elected each year. In February 2004, in accordance with our bylaws, the board of directors adopted a resolution increasing the size of the board from nine to ten members. To fill the vacancy created by the increase in the size of the board, in February 2004 the board appointed Mr. Ziad Ghandour to serve as a Class A director.

The persons named in the accompanying proxy intend to vote such proxy in favor of the election of the nominees named below, who are currently directors, unless authority to vote for the director is withheld in the proxy. Although the board of directors has no reason to believe that the nominees will be unable to serve as directors, if a nominee withdraws or otherwise becomes unavailable to serve, the persons named as proxies will vote for any substitute nominee designated by the board of directors, unless contrary instructions are given in the proxy.

The board of directors recommends that stockholders vote FOR the election of the three Class B directors.

Nominees — Class B Directors

Set forth below is certain information with respect to each nominee for election as a director. Except as indicated, each nominee has served as a director of our company since the closing of the merger of Syntroleum Corporation and SLH Corporation on August 7, 1998 and, before the merger, as a director of our predecessor company, Syntroleum Corporation, an Oklahoma corporation.

| | |

Name and Business Experience

| | Age

|

Kenneth L. Agee | | 47 |

| |

| Mr. Agee is our Chief Executive Officer and Chairman of the Board. Mr. Agee founded our company in 1984 and initially served as President and a director. He became Chief Executive Officer in February 1996 and Chairman of the Board in November 1995. He also served as President from June 2002 to September 2002. He is a graduate of Oklahoma State University with a degree in Chemical Engineering. He has over 23 years of experience in the energy industry and is listed as inventor on several U.S. and foreign patents, with several more patent applications pending, all of which have been assigned to us by Mr. Agee. | | |

3

| | |

P. Anthony Jacobs | | 62 |

| |

| Mr. Jacobs has served as a director since December 1996. Mr. Jacobs also served as the Chairman of the Board of SLH Corporation from December 1996 through the closing date of the merger of Syntroleum Corporation and SLH Corporation. Mr. Jacobs served as President and Chief Executive Officer of Lab Holdings, Inc., a company principally engaged in the laboratory testing business, a position he held from September 1997 until August of 1999 when the company merged with Lab One, Inc. From 1990 to 1993, he served as Executive Vice President and Chief Operating Officer of Lab Holdings, and from May 1993 to September 1997, he served as President and Chief Operating Officer of Lab Holdings. Mr. Jacobs holds an M.B.A. from the University of Kansas and is also a Chartered Financial Analyst. | | |

| |

James R. Seward | | 51 |

| |

| Mr. Seward has served as a director since December 1988. Mr. Seward also served as the President, Chief Executive Officer and director of SLH Corporation from February 1997 through the closing date of the merger of Syntroleum Corporation and SLH Corporation. From 1990 to September 1997, Mr. Seward served as Chief Financial Officer and a director of Lab Holdings. From 1990 to May 1993, he served as Senior Vice President of Lab Holdings, and from May 1993 to September 1997, he served as Executive Vice President. He also serves as a director of Tamarack Funds, Lab One, Inc. and Concorde Career Colleges. Mr. Seward holds an M.B.A. in Finance and a M.P.A. from the University of Kansas and is also a Chartered Financial Analyst. | | |

Continuing Directors

Set forth below is comparable information for those directors whose terms will expire in 2005 and 2006. Unless otherwise noted, each of such directors has served as a director since August 7, 1998, the closing date of the merger of Syntroleum Corporation and SLH Corporation, and before the merger, as a director of our predecessor company, Syntroleum Corporation, an Oklahoma corporation. References to positions held with us before the date of the merger refer to positions held with our predecessor company.

2005 — Class C Directors

| | |

Name and Business Experience

| | Age

|

Alvin R. Albe, Jr. | | 50 |

| |

| Mr. Albe became a director in December 1988. Mr. Albe is currently Executive Vice President of the TCW Group, Inc., a capital management firm. Prior to joining TCW in 1991, Mr. Albe was President of Oakmont Corporation, a privately held corporation that administers and manages assets for several families and individuals. Mr. Albe was associated with Oakmont Corporation from 1982 to 1991. Before that time, he was Manager of Accounting at McMoRan Oil and Gas Co., and a Certified Public Accountant with Arthur Andersen & Co. in New Orleans. Mr. Albe graduated from the University of New Orleans with a B.S. in Accounting. | | |

| |

Robert A. Day | | 60 |

| |

| Mr. Day became a director in March 2000. He is currently Chairman of the Board and Chief Executive Officer of Oakmont Corporation, an investment management company, Chairman of the Board and Chief Executive Officer of Trust Company of the West, an investment management company, and Chairman and President of W.M. Keck Foundation, a philanthropic organization. Mr. Day also serves on the board of directors of Fisher Scientific International, Inc., Freeport-McMoRan, Inc., McMoRan Exploration Company, Freeport-McMoRan Copper & Gold, Inc. and Société Générale. Mr. Day is also the founder of Cypress Funds, LLC, an investment management company founded in 1998. Mr. Day holds a B.S. in Economics from Claremont McKenna College. | | |

4

| | |

J. Edward Sheridan | | 69 |

| |

| Mr. Sheridan became a director in November 1995. In 1985, Mr. Sheridan founded and since that time has served as President of Sheridan Management Corporation, a company whose purpose is to provide support services to businesses in industries with global markets for their products and services. From 1973 to 1975, he was Chief Financial Officer at Fairchild Industries, and from 1975 to 1985, he was Chief Financial Officer at AMF, Inc. Mr. Sheridan is also a director of AuthentiDate Holding Corp. Mr. Sheridan holds an M.B.A. from Harvard University with an emphasis on Finance and International Operations and a B.A. from Dartmouth College. | | |

2006 — Class A Directors

| | |

Name and Business Experience

| | Age

|

Frank M. Bumstead | | 62 |

| |

| Mr. Bumstead became a director in May 1993. He has served as the President of Flood, Bumstead, McCready & McCarthy, Inc., a financial and business management firm, since 1990. Mr. Bumstead has served as Vice Chairman of the Board of Response Oncology, Inc., a health care services firm, since 1986. He has served as a director of First Union National Bank of Tennessee since 1996. Mr. Bumstead has also served as a director of American Retirement Corp. and as a director of Imprint Records, Inc. since 1995 and as a director of TBA Entertainment, Inc. since 1994. | | |

| |

Ziad Ghandour | | 36 |

| |

| Mr. Ghandour became a director in February 2004. Mr. Ghandour is principal and founder of TI Capital, a Los Angeles-based venture capital firm founded in 2002, and since 1990 has served as Vice President of Falcon International, a transporter and marketer of oil and oil-related products in Europe and the Middle East. Mr. Ghandour has been a business consultant to us since October 2003. Mr. Ghandour holds a B.S. in Business Administration and a B.A. in Political Science from Pepperdine University. | | |

| |

John B. Holmes, Jr. | | 57 |

| |

| Mr. Holmes is our President, Chief Operating Officer and a director. Prior to joining Syntroleum in October 2002, Mr. Holmes was Chief Operating Officer of El Paso Merchant Energy Company, beginning in January 2001, where he had operating responsibility for all assets, including power generation, refining and chemical terminals and marine assets throughout the U.S. and overseas. Before becoming the Chief Operating Officer of El Paso, Mr. Holmes was the President of Oil and Gas Operations from 1999 to 2001. Prior to joining El Paso in 1999, he was President and Chief Operating Officer of Zilkha Energy Company from 1986 to 1998 and, upon its merger with Sonat, Inc. in 1998, he served as President and Chief Executive Officer of Sonat Exploration until 1999. He holds a B.S. in Chemical Engineering from the University of Mississippi. | | |

| |

Robert B. Rosene, Jr. | | 50 |

| |

| Mr. Rosene became a director in March 1985. Mr. Rosene is President of Seminole Energy Services, L.L.C., a natural gas marketing and gathering company. From 1984 to August 1998, he was Vice President of Boyd Rosene and Associates, Inc., a natural gas consulting and marketing firm which he co-founded. From 1976 to 1984, he was employed with Transok Pipeline Company, where he served in various positions, including Manager of Rates and Contract Administration and director of Gas Acquisitions. In 1987, Mr. Rosene co-founded MBR Resources, an oil and gas production company with operations in Arkansas, New Mexico, Oklahoma and Texas. Mr. Rosene holds a B.A. in Accounting from Oklahoma Baptist University. | | |

5

There are no family relationships, of first cousin or closer, among our directors and executive officers, by blood, marriage or adoption.

Affirmative Determinations Regarding Director Independence and Other Matters

Our board of directors has determined each of the following directors to be an “independent director” as such term is defined in Marketplace Rule 4200A(a)(14) of the National Association of Securities Dealers (the “NASD”):

|

Alvin R. Albe, Jr. |

Frank M. Bumstead |

Robert A. Day |

P. Anthony Jacobs |

Robert B. Rosene, Jr. |

J. Edward Sheridan |

In this proxy statement these six directors are each referred to individually as an “independent director” and collectively as the “independent directors.”

The board of directors has also determined that each member of the two committees of the board meets the independence requirements applicable to those committees prescribed by the NASD, the Securities and Exchange Commission (“SEC”) and the Internal Revenue Service. The board of directors has further determined that each of Messrs. Albe and Sheridan, members of the audit committee of the board of directors, is an “audit committee financial expert” as such term is defined in Item 401(h) of Regulation S-K promulgated by the SEC.

The nominating and compensation committee reviewed the applicable legal standards for board member and board committee independence and the criteria applied to determine “audit committee financial expert” status. On the basis of this review, the nominating and compensation committee delivered a report to the full board of directors and the board made its independence and “audit committee financial expert” determinations based upon the nominating and compensation committee’s report and each member’s review of the information made available to the nominating and compensation committee.

Board Compensation

During 2003, the board of directors held a total of six meetings and took action by unanimous written consent on six occasions. No director attended fewer than 75 percent of the aggregate of board meetings and meetings of any committee on which he served in 2003.

We do not pay our outside directors a cash retainer. All directors are reimbursed for their travel and other expenses involved in attendance at board and committee meetings. Directors who are employees are not paid any fees or additional remuneration for services as members of the board of directors or any committee.

Non-employee directors are participants in our Stock Option Plan for Outside Directors. Under this plan, each nonemployee director is granted, on January 1 of each year, an option to purchase a number of shares of our common stock determined by dividing $18,000 by the fair market value of our common stock on that date. Except for the initial grant of options to an outside director under the plan, which is 100% vested, the vesting of options granted is based on the percentage of total board meetings attended by a director during the preceding year. The exercise price per share of each option equals the fair market value of a share of our common stock on the date the option is granted.

Board Committees

The board of directors has two standing committees: the audit committee and the nominating and compensation committee.

6

Audit Committee

The audit committee consists of Messrs. Albe (Chairman), Bumstead, Rosene and Sheridan. The committee met four times during 2003. The board of directors has determined that each of Messrs. Albe, Bumstead, Rosene and Sheridan meets the independence criteria prescribed by applicable law and the rules of the SEC for audit committee membership and is an “independent director” as defined in NASD Rule 4200A(a)(14). Each committee member meets the NASD’s financial knowledge requirements, and Messrs. Albe and Sheridan, designated by the board of directors as the “audit committee financial experts” under SEC rules, meet the NASD’s professional experience requirements as well. The audit committee operates pursuant to a written charter, a copy of which is attached as Appendix A to this Proxy Statement. As more fully described in the charter, the committee recommends to the board of directors independent public accountants as auditors and reviews the scope, plan and findings of the annual audit, recommendations of the independent public accountants, the adequacy of internal accounting controls and audit procedures, our audited financial statements, non-audit services performed by the independent public accountants and fees paid to the independent public accountants for audit and non-audit services. The audit committee expects to adopt an amended and restated charter that includes provisions required by the NASD Rules on the date of the annual meeting of stockholders.

Nominating and Compensation Committee

The nominating and compensation committee consists of Messrs. Albe (Chairman), Rosene and Sheridan. The committee did not meet during 2003, but took action by unanimous written consent on 11 occasions. The board of directors has determined that each director who served on the nominating and compensation committee during 2003 qualifies as an “outside director” under Section 162(m) of the Internal Revenue Code (the “Code”), a “non-employee director” as such term is defined in Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and an “independent director” as such term is defined in NASD Rule 4200A(a)(14). The nominating and compensation committee operates pursuant to a written charter, a copy of which is attached as Appendix B to this Proxy Statement. As more fully described in the charter, the committee establishes and reports to the full board with respect to compensation plans under which officers and directors are eligible to participate, and recommends to the board for approval the salary for the chief executive officer and other executive officers. The committee administers our 1993 Stock Option and Incentive Plan and 1997 Stock Incentive Plan, and reviews our compensation program on a regular basis. The committee also recommends policies concerning director compensation to the board of directors.

Director Nominations Process

The nominating and compensation committee is responsible for searching for, identifying, evaluating the qualifications of and recommending to the board of directors and our stockholders the slate of qualified director nominees to be elected by the stockholders in connection with each annual meeting, and any directors to be elected by the board to fill vacancies of newly created directorships between annual meetings. As noted earlier, one of our current directors, Mr. Ziad Ghandour, was appointed by the board in February 2004 to fill a newly created board vacancy and has not been previously elected by the stockholders. Mr. Ghandour was recommended by one of our executive officers.

In assessing the qualifications of prospective nominees to the board, the nominating and compensation committee considers each nominee’s personal and professional integrity, experience, skills, ability and willingness to devote the time and effort necessary to be an effective board member, and commitment to acting in the best interests of our company and our stockholders. The nominating and compensation committee also considers whether candidates provide an appropriate mix of backgrounds and skills to the board.

Internal Process for Identifying Candidates

The nominating and compensation committee has two primary methods for identifying candidates (other than those proposed by our stockholders, as discussed below). First, on a periodic basis, the nominating and compensation committee solicits ideas for possible candidates from a number of sources, including members of the board, our senior level executives and individuals personally known to the members of the board.

7

Second, the nominating and compensation committee may from time to time use its authority under its charter to retain at our expense one or more search firms to identify candidates (and to approve such firms’ fees and other retention terms). If the nominating and compensation committee retains one or more search firms, they may be asked to identify possible candidates, to interview and screen such candidates (including conducting appropriate background and reference checks), to act as a liaison among the board, the nominating and compensation committee and each candidate during the screening and evaluation process and thereafter to be available for consultation as needed by the nominating and compensation committee.

Nominations by Stockholders

The nominating and compensation committee will consider nominees for director recommended by our stockholders. Please submit your recommendation in writing along with:

| | • | | a resume of the candidate’s qualifications and business and educational experience; |

| | • | | a signed statement of the proposed candidate consenting to be named as a candidate and, if nominated and elected, to serve as a director; |

| | • | | a statement that the writer is a stockholder and is proposing a candidate for consideration by the nominating and compensation committee; |

| | • | | the name of and contact information for the candidate; |

| | • | | information regarding the qualifications and qualities described under “Director Nominations Process” above; |

| | • | | a statement detailing any relationship between the candidate and any of our customers, suppliers or competitors; |

| | • | | financial and accounting background, to enable the nominating and compensation committee to determine whether the candidate would be suitable for audit committee membership; and |

| | • | | detailed information about any relationship or understanding between the proposing stockholder and the candidate. |

Submit recommendations to Richard L. Edmonson, Vice President, General Counsel and Corporate Secretary, Syntroleum Corporation, 4322 South 49th West Avenue, Tulsa, Oklahoma 74107.

In addition to recommending director nominees to the nominating and compensation committee, any stockholder may nominate one or more persons for election as one of our directors at an annual meeting of stockholders if the stockholder complies with the notice, information and consent provisions contained in our bylaws, as described under “Stockholder Proposals” elsewhere in this proxy statement.

Evaluation of Candidates

The nominating and compensation committee will consider all candidates identified through the processes described above. The extent to which the committee dedicates time and resources to the consideration and evaluation of any potential nominee brought to its attention depends on the information available to the committee about the qualifications and suitability of the individual, viewed in light of the needs of the board, and is at the committee’s discretion. The committee evaluates the desirability for incumbent directors to continue on the board following the expiration of their respective terms, taking into account their contributions as board members and the benefit that results from increasing insight and experience developed over a period of time. Although the committee will consider candidates for director recommended by stockholders, it may determine not to recommend that the board, and the board may determine not to, nominate those candidates for election to our board.

8

Timing of the Identification and Evaluation Process

The nominating and compensation committee usually meets at the first regularly scheduled meeting of the board in a calendar year to consider, among other things, candidates to be recommended to the board for inclusion in our recommended slate of director nominees for the next annual meeting and our proxy statement. The board usually meets each February to vote on, among other things, the slate of director nominees to be submitted to and recommended for election by stockholders at the annual meeting, which is typically held in April of that year.

Communication with Directors

Interested persons may send written communications to the board by mailing those communications to the audit committee at:

Syntroleum Corporation

c/o Audit Committee of the Board of Directors

4322 South 49th West Avenue

Tulsa, Oklahoma 74107

The audit committee will forward communications to individual directors, as appropriate.

We do not maintain a policy regarding director attendance at our annual meeting of stockholders. There were nine directors at the time of the 2003 Annual Meeting of Stockholders, and four directors attended the meeting.

9

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table sets forth the number of shares of our common stock beneficially owned as of March 1, 2004, by (1) each director and nominee for director, (2) each of the executive officers named in the Summary Compensation Table under the caption “Executive Compensation” in this proxy statement, (3) all directors and executive officers as a group and (4) all persons known by us to be the beneficial owners of at least five percent of our outstanding common stock. As of March 1, 2004, 39,591,078 shares of our common stock were issued and outstanding.

| | | | |

Name (1)(2)

| | Shares

| | Percentage of Class

|

Kenneth L. Agee(3) | | 4,082,721 | | 10.3 |

John B. Holmes, Jr. | | 699,531 | | 1.8 |

Larry J. Weick(4) | | 525,024 | | 1.3 |

Jeffrey M. Bigger | | 104,714 | | * |

Kenneth R. Roberts | | 101,554 | | * |

Alvin R. Albe, Jr. | | 146,307 | | * |

Frank M. Bumstead(5) | | 117,412 | | * |

Robert A. Day | | 7,216,143 | | 18.2 |

Ziad Ghandour | | 1,440,000 | | 3.6 |

P. Anthony Jacobs(6) | | 446,186 | | 1.1 |

Robert B. Rosene, Jr.(7) | | 193,938 | | * |

James R. Seward(8) | | 363,697 | | * |

J. Edward Sheridan | | 48,983 | | * |

All directors and executive officers as a group (18 persons) | | 15,708,367 | | 39.7 |

| * | | Represents ownership of less than 1%. |

| (1) | | Except as otherwise noted and subject to applicable community property laws, each stockholder has sole voting and investment power with respect to the shares beneficially owned. The business address of each director and executive officer is c/o Syntroleum Corporation, 4322 South 49th West Avenue, Tulsa, Oklahoma 74107. |

| (2) | | Shares of common stock subject to options that are exercisable within 60 days of the date of this proxy statement are deemed outstanding for purposes of determining the beneficial ownership and computing the percentage ownership of such person, but are not deemed outstanding for purposes of computing the percentage ownership of any other person. Accordingly, the following shares of common stock subject to stock options are included in the table: Kenneth L. Agee—125,000; John B. Holmes, Jr.—666,667; Larry J. Weick—251,597; Jeffrey M. Bigger—94,667; Kenneth R. Roberts—96,307; Alvin R. Albe, Jr.—22,007; Frank M. Bumstead—22,007; Robert A. Day—14,403; P. Anthony Jacobs—117,007; Robert B. Rosene, Jr.—22,007; James R. Seward—30,341; J. Edward Sheridan—22,007; and all directors and executive officers as a group—1,920,562. |

| (3) | | Includes 82,956 shares of common stock owned by two of Mr. Agee’s children. |

| (4) | | Includes 12,200 shares of common stock held by Mr. Weick as custodian for his daughters. |

| (5) | | Includes 13,847 shares of common stock held by Mr. Bumstead’s wife, as to which he disclaims beneficial ownership. |

| (6) | | Includes 1,500 shares of common stock held by Mr. Jacobs’ wife, as to which he disclaims beneficial ownership. |

| (7) | | Includes 10,200 shares of common stock owned by trusts the beneficiaries of which are Mr. Rosene’s children, as to which Mr. Rosene disclaims beneficial ownership. |

10

| (8) | | Includes 2,250 shares of common stock held in a family trust for which Mr. Seward serves as a co-trustee with his mother (and in that capacity shares voting and investment powers). |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our directors, executive officers and owners of 10% or more of our common stock to file with the SEC and the Nasdaq Stock Market initial reports of ownership and reports of changes in ownership of common stock. Based solely on a review of the copies of reports furnished to us and representations that no other reports were required, we believe that all of our directors, executive officers and 10% or more stockholders during the fiscal year ended December 31, 2003 complied on a timely basis with all applicable filing requirements under Section 16(a) of the Exchange Act, except that Alvin R. Albe, Jr., Jeffrey M. Bigger, Frank M. Bumstead, Robert A. Day, P. Anthony Jacobs, Kenneth R. Roberts, Robert B. Rosene, Jr., James R. Seward, J. Edward Sheridan and Larry J. Weick each failed to timely file one report on Form 4 with respect to one transaction each.

11

EXECUTIVE COMPENSATION

The following tables show the compensation for our chief executive officer and each of our other four most highly compensated executive officers serving as such on December 31, 2003.

Summary Compensation Table

| | | | | | | | | |

Name and Principal Position

| | Year

| | Annual Compensation (1)

| | Long Term

Compensation

|

| | | Salary ($)

| | Bonus ($)

| | Securities

Underlying

Options

|

Kenneth L. Agee Chairman of the Board and Chief Executive Officer | | 2003

2002

2001 | | $

| 255,000

255,000

255,000 | | —

—

— | | —

300,000

— |

| | | | |

John B. Holmes, Jr.(2) President and Chief Operating Officer | | 2003

2002

2001 | | $

| 230,000

57,500

— | | —

—

— | | —

1,000,000

— |

| | | | |

Larry J. Weick Senior Vice President and Chief Financial Officer | | 2003

2002

2001 | | $

| 215,000

203,750

200,000 | | —

—

— | | 50,000

100,000

20,000 |

| | | | |

Jeffrey M. Bigger Senior Vice President and Chief Technology Officer | | 2003

2002

2001 | | $

| 185,000

167,292

160,000 | | —

—

— | | 50,000

60,000

27,500 |

| | | | |

Kenneth R. Roberts Senior Vice President of Licensing and Business Development | | 2003

2002

2001 | | $

| 185,000

149,583

135,000 | | —

—

35,000 | | 50,000

100,000

16,750 |

| (1) | | The named executive officers did not receive any annual compensation not properly categorized as salary or bonus, except for certain perquisites and other personal benefits that are not shown because the aggregate amount of such compensation, if any, for the named executive officers during the fiscal year did not exceed the lesser of $50,000 or 10% of total salary and bonus reported for such executive officer. |

| (2) | | Mr. Holmes joined Syntroleum as our President and Chief Operating Officer on October 1, 2002. See “—Executive Employment Agreements.” |

12

The following table provides information concerning grants of stock options made to the named executive officers during 2003.

Option Grants in Last Fiscal Year

| | | | | | | | | | | | |

Name

| | Individual Grants

| | |

| | Number of Securities Underlying Options Granted

| | % of Total Options Granted to Employees in Fiscal

Year

| | Exercise or Base Price ($/Share)(1)

| | Expiration

Date

| | Potential Realizable

Value at Assumed Annual Rates of Stock Price

Appreciation for

Option Term(2)

|

| | | | | | 5%($)

| | 10%($)

|

Kenneth L. Agee | | — | | — | | — | | — | | — | | — |

John B. Holmes, Jr. | | — | | — | | — | | — | | — | | — |

Larry J. Weick | | 50,000 | | 1.58 | | 2.17 | | 3/14/13 | | 68,235 | | 172,921 |

Jeffrey M. Bigger | | 50,000 | | 1.58 | | 2.17 | | 3/14/13 | | 68,235 | | 172,921 |

Kenneth R. Roberts | | 50,000 | | 1.58 | | 2.17 | | 3/14/13 | | 68,235 | | 172,921 |

| (1) | | The exercise price of the options granted is equal to the market value of the common stock on the date of grant. |

| (2) | | Potential realizable value of each grant assumes that the market prices of the underlying security appreciates at annualized rates of 5% and 10% over the term of the award. These rates are specified by the SEC. Actual gains, if any, on stock option exercises are dependent on the future performance of the common stock and overall market conditions. There can be no assurance that the amounts reflected on this table will be achieved. |

The following table provides information concerning each stock option exercised during 2003 by each of the named executive officers and the value of unexercised options held by such officers at the end of 2003.

Aggregated Option Exercises in Last Fiscal Year

and Fiscal Year-End Option Values

| | | | | | | | | | | | |

Name

| | Shares

Acquired on

Exercise(#)

| | Value

Realized

($)(1)

| | Number of Securities Underlying Unexercised Options at Fiscal Year-End

| | Value of Unexercised In- the-Money Options at Fiscal Year-End ($)(2)

|

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Kenneth L. Agee | | — | | — | | 160,000 | | 200,000 | | 278,000 | | 556,000 |

John B. Holmes, Jr. | | — | | — | | 666,667 | | 333,333 | | 1,846,668 | | 923,332 |

Larry J. Weick | | — | | — | | 234,930 | | 116,666 | | 87,335 | | 282,165 |

Jeffrey M. Bigger | | — | | — | | 78,000 | | 90,000 | | 52,400 | | 212,300 |

Kenneth R. Roberts | | — | | — | | 76,307 | | 119,999 | | 87,335 | | 282,165 |

| (1) | | Value realized is calculated based on the difference between the option exercise price and the closing market price of the common stock on the date of exercise, multiplied by the number of shares underlying the options. |

| (2) | | Based on the closing price of the common stock of $4.32 on December 31, 2003, the last trading day of 2003. |

Board Compensation Committee Report on Executive Compensation

Our executive compensation programs are designed to attract and retain highly qualified executives and to motivate them to maximize stockholder returns by achieving our short- and long-term strategic goals. The compensation programs are designed to link each executive’s compensation directly to individual and company performance.

13

There are three basic components to our compensation system:

| | • | | long-term equity-based incentive compensation. |

We address each of these components within the context of individual and company performance and competitive conditions. In determining competitive compensation levels, we consider data that includes information regarding other companies engaged in the development of new technologies, including energy companies engaged in technology development. Some, but not all of these companies, are engaged in the development of gas-to-liquids technologies. In determining executive compensation, the nominating and compensation committee does not compare our financial and operating performance with that of the companies and indices shown in the performance graph.

The nominating and compensation committee determines bonuses and stock option and restricted stock awards and changes in remuneration to our executive officers. Bonuses and grants or awards of stock options and restricted stock are individually determined and administered by the nominating and compensation committee. The nominating and compensation committee takes into account our financial position, including the need to conserve cash resources in order to satisfy anticipated capital and operating expenses, in determining executive compensation and places more emphasis on stock-based compensation as a result. The chief executive and chief operating officers work with the nominating and compensation committee in the design of the plans and make recommendations to the committee regarding the salaries and bonuses of executive officers that report directly to them as well as the salaries and bonuses and the award of options and restricted stock to other employees.

Base Pay

Base pay is designed to be competitive with salary levels for comparable executive positions at other companies engaged in the development of new technologies. The nominating and compensation committee reviews such comparable salary information as one factor to be considered in determining the base pay for our executive officers. The nominating and compensation committee also considers other factors, including that officer’s responsibilities, experience, leadership, potential future contribution and demonstrated individual performance (measured against strategic business objectives such as achieving commercial application of our gas-to-liquids technology and continued development of improvements to that technology designed to improve performance and reduce capital costs). The nominating and compensation committee also considers internal pay equity among the executive officers and employees generally. The types and relative importance of the strategic business objectives and financial objectives vary among our executives depending on their positions and the particular operations and functions for which they are responsible. Our philosophy and practice is to place a significant emphasis on the incentive component of compensation. The compensation committee reviews base salaries annually. Annual base salaries for Messrs. Kenneth L. Agee, John B. Holmes, Jr., Larry J. Weick, Jeffrey M. Bigger and Kenneth R. Roberts are currently $255,000, $230,000, $215,000, $185,000, and $185,000, respectively.

Cash Bonuses

Our cash bonuses are designed to reward executive officers for individual performance and for contributing to the attainment of strategic business objectives and certain financial objectives. The amount each executive officer receives is determined by the nominating and compensation committee and depends on the individual’s performance and level of responsibility, as well as our financial position. No particular formula is used in determining the amount of the awards. No cash bonuses were paid during 2003.

Long-Term Equity-Based Compensation

Long-term equity-based compensation is tied directly to stockholder return. Long-term incentive compensation consists of stock options and restricted stock, which generally vest in one-third increments in each

14

of the three years following the date of the grant, although vesting can be accelerated if deemed appropriate by the nominating and compensation committee. The exercise price of stock options and restricted stock granted is generally equal to the fair market value of the common stock on the date of grant. Accordingly, executives receiving stock options and restricted stock are rewarded only if the market price of the common stock appreciates. Stock options and restricted stock are thus designed to align the interests of our executive officers and other employees with those of our stockholders by encouraging executives to enhance our value and, hence, the price of the common stock and stockholder return. In determining whether to grant stock options or restricted stock to executive officers, the nominating and compensation committee considers a variety of factors, including that executive’s current ownership stake in our company, the degree to which increasing that ownership stake would provide the executive with additional incentives for future performance, the likelihood that the grant of those options or restricted stock would encourage the executive to remain with our company, prior option grants (including the size of previous grants and the number of options and shares of restricted stock held) and the value of the executive’s service to our company. The compensation committee also considers these factors when determining whether to grant stock options or restricted stock to other employees. Options were granted to Messrs. Larry J. Weick, Jeffrey M. Bigger and Kenneth R. Roberts during 2003. No restricted stock awards were made during 2003.

Compensation of the Chief Executive Officer

The nominating and compensation committee designs Mr. Kenneth L. Agee’s compensation package using the same components and methodology as apply to other executive officers, taking into account his high level of importance and accountability. In reviewing Mr. Agee’s performance in 2003, the nominating and compensation committee focused primarily on our attainment of certain strategic goals, including progress in the development of certain of our technologies, progress in certain of our commercial projects, implementation of certain corporate reorganization plans and achievement of certain cost control objectives.

Compliance with Internal Revenue Code Section 162(m)

Section 162(m) of the Internal Revenue Code generally disallows a deduction to public companies to the extent of excess annual compensation over one million dollars paid to the chief executive officer or to any of the four other most highly compensated executive officers, except for qualified performance-based compensation. We had no non-deductible compensation expense for fiscal year 2003. We plan to review executive compensation as appropriate and take action as may be necessary to preserve the deductibility of compensation payments to the extent reasonably practical and consistent with our compensation objectives.

Determination of executive compensation is an evolving discipline. The nominating and compensation committee monitors trends in this area, as well as changes in law, regulation and accounting practices, that may affect either its compensation practices or its philosophy. Accordingly, the nominating and compensation committee reserves the right to alter its approach in response to changing conditions.

Nominating and Compensation Committee

Alvin R. Albe, Jr. (Chairman)

Robert B. Rosene, Jr.

J. Edward Sheridan

Compensation Committee Interlocks and Insider Participation

Our nominating and compensation committee consists of Messrs. Albe, Rosene and Sheridan, each of whom is a non-employee director. None of our executive officers has served as a member of a compensation committee or board of directors of any other entity which has an executive officer serving as a member of our board of directors, and there are no other matters relating to interlocks or insider participation that we are required to report.

15

Performance Graph

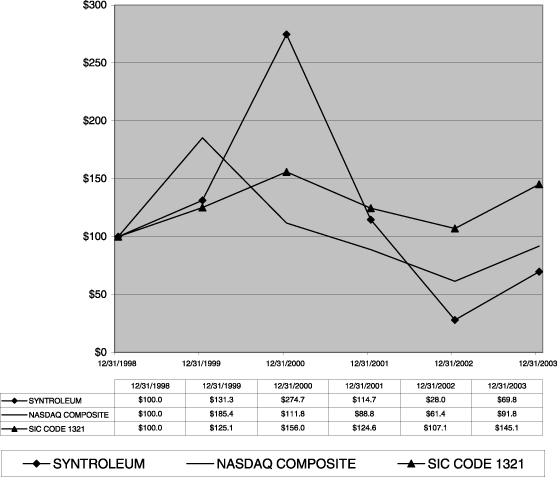

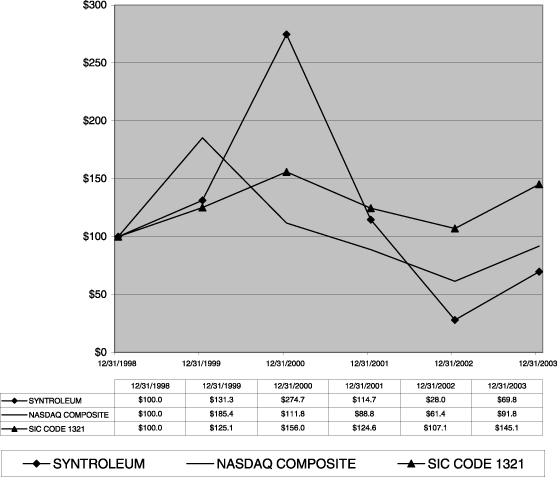

The following performance graph compares the performance of our common stock during the period beginning on December 31, 1998 and ending on December 31, 2003 to the Nasdaq Stock Market index consisting of United States companies (the “Nasdaq Composite”) and an index consisting of 116 publicly traded companies having a segment of business with SIC code 1321 for the same period. SIC code 1321 covers establishments primarily engaged in producing hydrocarbons from oil and gas field gases. The graph assumes a $100 investment in our common stock and in each of the indexes at the beginning of the period and a reinvestment of dividends paid on such investments throughout the period.

VALUE OF $100 INVESTMENT

ASSUMING REINVESTMENT OF DIVIDENDS AT DECEMBER 31, 1998,

AND AT THE END OF EVERY FISCAL YEAR, AND THROUGH DECEMBER 31, 2003

16

Executive Employment Agreements

We have entered into employment agreements with each of our executive officers. These agreements provide for annual base salaries that we may increase from time to time. In addition, each employment agreement entitles the employee to participate in employee benefit plans that we may offer to our employees from time to time.

The employment agreement with Mr. John B. Holmes, Jr., our President and Chief Operating Officer, provides that Mr. Holmes will be paid an annual base salary of $230,000 in 2004. As an inducement to his employment, we granted Mr. Holmes stock options to purchase one million shares of our common stock, one third of which vested immediately, one third of which vested on October 1, 2003 and one third of which will vest on October 1, 2004.

Each agreement provides for an initial term of 12 months and is automatically renewed for successive terms of 12 months unless sooner terminated. Under each agreement, employment may be terminated as follows:

| | • | | by us upon the employee’s death, disability or retirement; |

| | • | | by us upon the dissolution and liquidation of our company (unless our business is thereafter continued); |

| | • | | by the mutual agreement of the employee and us; and |

| | • | | by either us or the employee upon 60 days’ written notice. |

If we terminate the employee’s employment for any reason other than as noted in the first three items above, the employee is entitled to receive his monthly salary for a period of one or two years, as applicable, following the date of termination. In addition, if there is a change in control of our company and

| | • | | we terminate the employee’s employment for any reason other than the employee’s death, disability, retirement or just cause during the one-year period immediately following the change of control, |

| | • | | the employee terminates his employment for good reason, or |

| | • | | during the 60-day period immediately following the lapse of one year after any change of control, we or the employee terminate the employee’s employment for any reason, |

then, in lieu of any further payments for periods subsequent to the date of termination, we or our successor will pay the employee an amount equal to one or two times, as applicable, the employee’s full base salary in effect on the date of termination payable in equal monthly installments for a period of 12 or 24 months, as applicable. Mr. Holmes will be entitled to receive his monthly salary for a period of two years following the date of termination, in accordance with the provisions described above, as well as for the following reasons:

| | • | | we terminate Mr. Holmes’ employment for any reason other than just cause; |

| | • | | Mr. Holmes is assigned to duties materially inconsistent with his position, authority, duties or responsibilities without his agreement; or |

| | • | | we require Mr. Holmes to be based at any office outside the Tulsa metropolitan area without his agreement. |

Pursuant to each agreement, the employee is prohibited from disclosing to third parties, directly or indirectly, our trade secrets, either during or after the employee’s employment with our company, other than as required in the performance of the employee’s duties. The agreement also provides that the employee will not have or claim any right, title or interest in any trademark, service mark or trade name that we own or use. The employee also agrees to irrevocably assign to us all of the employee’s right, title and interest in and to any and all inventions and works of authorship made, generated or conceived by the employee during his or her period of

17

employment with us and which related to our business or which were not developed on the employee’s own time. Each employee further agrees that during the period of employment with us and for a period of two years following the termination of employment, the employee will not engage in certain activities related to our business, including a covenant not to compete.

Equity Compensation Plan Information

The following table provides information concerning securities authorized for issuance under our equity compensation plans as of December 31, 2003.

| | | | | | | |

Plan Category

| | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights (a)

| | Weighted-average Exercise Price of Outstanding Options, Warrants and Rights (b)

| | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (excluding securities reflected in column (a)) (c)

|

Equity Compensation Plans Approved by Security Holders (1)(2) | | 3,627,640 | | $ | 6.30 | | 1,737,770 |

| | | |

Equity Compensation Plans Not Approved by Security Holders (3) (4) | | 1,025,198 | | $ | 1.72 | | — |

| | | |

Total | | 4,652,838 | | $ | 5.29 | | 1,737,770 |

| (1) | | Includes the 1993 Stock Option and Incentive Plan, the 1997 Stock Incentive Plan, and the Stock Option Plan for Outside Directors. |

| (2) | | Includes 346,253 shares to be issued upon exercise of options with a weighted average exercise price of $12.45 that were granted under our 1993 Stock Option and Incentive Plan and our Stock Option Plan for Outside Directors assumed by us in connection with the merger of Syntroleum Corporation and SLH Corporation on August 7, 1998, which were approved by our stockholders. |

| (3) | | On August 31, 2002, we granted options to purchase 1,000,000 shares of our common stock at an exercise price of $1.55 to our President and Chief Operating Officer, John B. Holmes, Jr., as an inducement to his employment with Syntroleum. The rights to exercise the options and purchase 333,334 shares vested on October 1, 2002, the rights to exercise the options and purchase an additional 333,333 shares vested on October 1, 2003, and the rights to exercise the options and purchase an additional 333,333 shares will vest on October 1, 2004. Vesting of the options will accelerate upon termination of Mr. Holmes’ employment for any reason other than just cause. The ability to exercise the options will terminate upon the earliest of: (a) the tenth anniversary of the date of the grant; (b) 12 months after the date of the termination of Mr. Holmes’ employment by reason of death or disability; (c) the third annual anniversary of Mr. Holmes’ retirement; or (d) the date 12 months following the date upon which Mr. Holmes’ employment terminates for any reason other than those described in (b) or (c) above. |

| (4) | | On June 30, 1997 and on February 3, 1999, we granted options to purchase 17,198 and 8,000 shares of common stock at exercise prices of $9.30 and $6.88, respectively, to our Business Development Consultant, John Hutton. The rights to exercise the options and purchase shares vest in three equal installments each year on the anniversary of each grant. |

On December 20, 2002, subject to stockholder approval, we granted options to purchase up to 25,000 shares of our common stock to Mr. James R. Seward, one of our directors. See “Proposal 3—Approval of the Grant of Stock Options to Mr. James R. Seward” for a description of these options.

18

In October 2003, subject to stockholder approval, we granted options to purchase up to 600,000 shares of our common stock to Mr. Ziad Ghandour, a consultant to us and now a member of our board of directors, at an exercise price of $4.50 per share. These options were to vest upon the occurrence of certain events specified in the consulting agreement between us and Mr. Ghandour and expire two years from the date of vesting.

In February 2004, subject to stockholder approval, we issued warrants to purchase up to 1,170,000 shares of our common stock to Mr. Ghandour pursuant to an amended and restated consulting agreement. See “Proposal 2—Approval of the Issuance of Warrants to Mr. Ziad Ghandour” for a description of these warrants. These warrants replace the 600,000 options that were granted to Mr. Ghandour in October 2003.

In March 2004, subject to stockholder approval, we issued warrants to purchase up to 50,000 shares of our common stock to Sovereign Oil & Gas Company II, LLC (“Sovereign”), a consulting firm that we have retained to assist us in acquiring stranded natural gas fields worldwide, pursuant to a joint development agreement. See “Proposal 4—Approval of the Issuance of Warrants Pursuant to a Joint Development Agreement with Sovereign Oil & Gas II, LLC” for a description of these warrants.

CERTAIN TRANSACTIONS

In June 1995, Larry J. Weick, our Senior Vice President of Finance, Planning and Administration and Chief Financial Officer, purchased 200,000 shares of our predecessor company’s common stock for a purchase price of $0.50 per share, paid by delivery of promissory notes totaling $100,000, the amount of the aggregate purchase price. In September 1997, our predecessor company loaned Mr. Weick $117,000, the proceeds of which were used to repay his previously outstanding note and accrued interest. To secure his note, Mr. Weick pledged to us shares of our common stock with a market value equal to no less than two times the indebtedness under his note. Mr. Weick’s currently outstanding note bears interest at the rate of 6.1% per year and matures in May 2004. The largest aggregate amount outstanding at any time during 2003 pursuant to this note was $169,000. As of March 1, 2004, Mr. Weick owed approximately $170,000 pursuant to this note.

In February 1999, we loaned $29,000 to Paul F. Schubert, previously our Vice President of Research and Development. In September 1999, we loaned Mr. Schubert an additional $30,000. These notes were unsecured and bore interest rates of 5.18% and 5.98%, respectively. The initial note matured on February 25, 2003, on which date Mr. Schubert settled the note by paying $35,000 in principal and interest. On April 11, 2003, Mr. Schubert left Syntroleum and in connection with his separation, the second note was forgiven. The largest aggregate amount outstanding at any time during 2003 pursuant to each of these notes was $35,000 and $37,000, respectively.

During 2001, we loaned Kenneth L. Agee, our Chairman and Chief Executive Officer, $300,000 under a loan agreement that allowed up to $1,100,000 in loan advances and which matured on June 25, 2002. In May and June 2002, we made additional advances of $683,000 to Mr. Agee. On June 25, 2002, the promissory note was renewed for an additional year with an interest rate of 3.75%. The renewal of the promissory note increased to $1,460,000 the amount available to be borrowed. On June 26 and July 6, 2002, we loaned an additional $458,000 to Mr. Agee. At the maturity of the promissory note on June 25, 2003, Mr. Agee paid us $1,513,000, which represented the entire outstanding balance of the loans, including accrued interest. As a result of this transaction, we have no additional loans outstanding with Mr. Agee. The largest amount outstanding at any time during 2003 pursuant to this note was $1,513,000.

In October 2003, Ziad Ghandour, one of our directors and a business consultant to us, purchased 400,000 shares of our common stock for a purchase price of $4.50 per share, for an aggregate purchase price of $1.8 million, paid in cash, pursuant to a consulting agreement. In February 2004, pursuant to an amendment to the consulting agreement, we issued to Mr. Ghandour warrants to purchase up to 1,170,000 shares of our common stock. The warrants are exercisable beginning on the later of stockholder approval and the date the warrants vest in accordance with the agreement and ending on November 4, 2007. The exercise prices of the warrants range from $4.50 to $5.25 per share.

19

PROPOSAL 2—APPROVAL OF THE ISSUANCE OF

WARRANTS TO MR. ZIAD GHANDOUR

The board of directors recommends that stockholders vote FOR the proposal to approve the issuance of warrants to purchase up to 1,170,000 shares of our common stock to Mr. Ziad Ghandour.

Mr. Ghandour is one of our directors and provides consulting services to us pursuant to a consulting agreement we entered into with him in October 2003, which was amended and restated in February 2004. The warrants to purchase 170,000 shares at an exercise price of $5.00 per share are exercisable from the date of stockholder approval. The warrants to purchase 500,000 shares at an exercise price of $5.25 per share are exercisable upon the later of October 1, 2004 and the execution of an agreement with Repsol YPF, S.A., Saudi Aramco or another company approved by us with terms that we and Mr. Ghandour mutually agree will result in the exercisability of the warrants. The warrants to purchase 500,000 shares at an exercise price of $4.50 per share are exercisable upon the execution of an agreement with Dragados Industrial S.A. or another company approved by us with terms that we and Mr. Ghandour mutually agree will result in the exercisability of the warrants. All warrants will expire on November 4, 2007. Copies of the Amended and Restated Letter Agreement and the Warrant Agreement with Mr. Ghandour are attached as Annex C to this Proxy Statement.

On March 1, 2004, the market value of the common stock underlying these warrants was $9,090,900.

PROPOSAL 3—APPROVAL OF THE GRANT OF

STOCK OPTIONS TO MR. JAMES. R. SEWARD

The board of directors recommends that stockholders vote FOR the proposal to approve the grant of options to purchase up to 25,000 shares of our common stock to Mr. James R. Seward. Mr. Seward is one of our directors.

On December 20, 2002, subject to stockholder approval, we granted the options to Mr. Seward. The board determined to make this grant to provide additional compensation to Mr. Seward for his services as a director, including an increased time commitment, during the period following the resignation in June 2002 of Mr. Mark Agee, our former President and Chief Operating Officer, and the appointment in October 2002 of Mr. John B. Holmes, Jr. as our President and Chief Operating Officer. The options have an exercise price of $1.40. The rights to exercise the options and purchase shares vest on the first anniversary of the grant and remain exercisable until the tenth anniversary of the grant unless Mr. Seward ceases to be a director. A copy of the stock option agreement with Mr. Seward is attached as Annex D to this Proxy Statement.

On March 1, 2004, the market value of the common stock underlying these options was $194,250.

PROPOSAL 4—APPROVAL OF THE ISSUANCE OF WARRANTS PURSUANT TO A JOINT

DEVELOPMENT AGREEMENT WITH SOVEREIGN OIL & GAS COMPANY II, LLC

The board of directors recommends that stockholders vote FOR the proposal to approve the issuance of warrants to purchase up to 500,000 shares of our common stock pursuant to a Joint Development Agreement with Sovereign Oil & Gas Company II, LLC.

Under this agreement, which is attached as Annex E to this Proxy Statement, Sovereign will work exclusively with us to acquire and develop stranded natural gas fields worldwide using our proprietary GTL synthetic fuels technology. We expect that the agreement will enhance our ability to identify and license proven gas fields in remote locations for use as feedstock to supply one or more petrochemical plants mounted on an inland barge employing our GTL technology. We anticipate that the barge will produce environmentally friendly synthetic fuels from natural gas at a competitive price to replace high-sulfur diesel and other conventional fuel.

20

Under the agreement, we agreed to issue warrants to purchase 50,000 shares of our common stock at an exercise price of $6.40 upon stockholder approval of the agreement. These warrants are exercisable for five years beginning on the date of stockholder approval. In addition, under the agreement we are required to issue warrants to purchase 25,000 shares upon our acquisition of an interest in a property proposed by Sovereign, the acquisition from us by another company of such property or the execution of an agreement by us and another company regarding joint participation in the project involving such a property, exercisable five years from the acquisition or agreement date. If we and Sovereign do not receive a cash bonus or overriding royalty interest in connection with the acquisition from us by another company of such property or the execution of an agreement by us and another company regarding our joint participation in the project involving such a property, we will issue an additional 25,000 warrants exercisable for five years from the acquisition or agreement date plus an additional 50,000 warrants exercisable for five years from the date of first production of hydrocarbons from the property. We are required under the agreement to issue warrants to purchase 12,500 shares upon our acquisition of an interest in a property proposed by us and accepted by Sovereign or for which we initiated negotiations, the acquisition from us by another company of such property or the execution of an agreement by us and another company regarding participation in the project involving such a property, exercisable for five years from the acquisition or agreement date. Warrants issued in connection with properties acquired or third-party participation achieved between March 1, 2004 and March 1, 2005 will have an exercise price of $6.40. Warrants issued in connection with properties acquired or third-party participation achieved after March 1, 2005 will have exercise prices per share to be determined based on the price for our common stock on March 1 of the contract year stated in the agreement during which the project commences.

The exercisability of all of the warrants issuable pursuant to the agreement is subject to stockholder approval of the agreement. No more than 2,000,000 shares of our common stock are issuable upon exercise of the warrants issued pursuant to the agreement. We are seeking stockholder approval at the annual meeting of the issuance of warrants to purchase up to 500,000 shares of our common stock pursuant to the agreement.

On March 1, 2004, the market value of the common stock underlying these warrants was $3,885,000.

FEDERAL INCOME TAX CONSEQUENCES OF OPTIONS AND WARRANTS

The holder of a stock option or warrant recognizes no taxable income as a result of the grant of the stock option or warrant. Upon the exercise of a nonqualified stock option or warrant, however, the holder recognizes ordinary income in an amount equal to the difference between the then fair market value of the shares on the date of exercise and the exercise or purchase price and, correspondingly, we will be entitled to an income tax deduction for such amount.

This tax information is only a summary, does not purport to be complete and does not cover, among other things, foreign, state and local tax treatment of the grant or exercise of stock options and warrants pursuant to the various agreements with Messrs. Ghandour and Seward and with Sovereign, respectively.

PROPOSAL 5—RATIFICATION OF APPOINTMENT OF INDEPENDENT PUBLIC ACCOUNTANTS

Our board of directors, upon recommendation of the audit committee, has appointed Grant Thornton LLP as our independent public accountants for the year ending December 31, 2004. Although the selection and appointment of independent public accountants is not required to be submitted to a vote of stockholders, the board of directors has decided to ask our stockholders to approve this appointment. The board of directors recommends that stockholders vote FOR the ratification of the appointment of Grant Thornton LLP as our independent public accountants for the year ending December 31, 2004.

Representatives of Grant Thornton LLP will be present at the meeting, will be given the opportunity to make a statement if they so desire and will be available to respond to appropriate questions of any stockholders.

21

BOARD AUDIT COMMITTEE REPORT

Our committee has reviewed and discussed Syntroleum’s audited financial statements for the year ended December 31, 2003 with management. In addition, we have discussed with Grant Thornton LLP, Syntroleum’s independent auditing firm, the matters required by Codification of Statements on Auditing Standards No. 61 (SAS 61).

We have received the written disclosures and the letter from Grant Thornton LLP required by Independence Standards Board Standard No. 1, and we have reviewed, evaluated and discussed the written disclosures with that firm and its independence from Syntroleum. We also have discussed with management and the auditing firm such other matters and received such assurances from them as we deemed appropriate.

Based on the foregoing review and discussions and relying thereon, we have recommended to the board of directors the inclusion of Syntroleum’s audited financial statements for the year ended December 31, 2003 in Syntroleum’s Annual Report on Form 10-K for such year filed with the SEC.

Audit Committee

Alvin R. Albe, Jr. (Chairman)

Frank M. Bumstead

Robert B. Rosene, Jr.

J. Edward Sheridan

CHANGE IN INDEPENDENT PUBLIC ACCOUNTANTS

Based on the recommendation of the audit committee, on July 16, 2002, our Board of Directors approved the dismissal of our independent auditors, Arthur Andersen LLP, and engaged Grant Thornton LLP to serve as our independent auditors for the fiscal year ending December 31, 2002.