UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

Syntroleum Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

March 22, 2006

To Our Stockholders:

You are cordially invited to attend the 2006 annual meeting of stockholders of Syntroleum Corporation. On the following pages you will find a proxy statement that provides detailed information concerning the annual meeting, including the following matters to be acted upon at the meeting:

| | • | | the election of four directors to serve three-year terms; |

| | • | | a proposal to approve an amendment of our Joint Development Agreement with Sovereign Oil & Gas Company II, LLC; and |

| | • | | a proposal to ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the year ending December 31, 2006. |

The record date for determining stockholders entitled to notice of and to vote at the annual meeting is March 15, 2006. The date, time and place of the annual meeting are:

April 24, 2006

3:00 p.m. local time

Tulsa Community College, West Campus

7505 West 41st Street

Tulsa, Oklahoma 74107

A copy of our 2005 annual report to stockholders is enclosed.

I hope you will be able to attend the annual meeting in person. Whether or not you plan to attend, please be sure to mark, sign, date and return the proxy card in the enclosed envelope, or submit your proxy by telephone or the Internet, as promptly as possible so that your shares may be represented at the meeting and voted in accordance with your wishes. Your vote is important regardless of the number of shares you own.

|

| Sincerely, |

|

|

John B. Holmes, Jr. President and Chief Executive Officer |

SYNTROLEUM CORPORATION

4322 South 49th West Avenue

Tulsa, Oklahoma 74107

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held April 24, 2006

To the Stockholders:

The 2006 annual meeting of stockholders of Syntroleum Corporation will be held at Tulsa Community College, West Campus, 7505 West 41st Street, Tulsa, Oklahoma 74107, on April 24, 2006, at 3:00 p.m. local time. At the annual meeting, the following matters will be voted upon:

| | (1) | A proposal to elect four Class A directors as members of our board of directors to serve until the 2009 annual meeting of stockholders or until their respective successors have been duly elected and qualified (Proposal 1); |

| | (2) | A proposal to approve an amendment of our Joint Development Agreement with Sovereign Oil & Gas Company II, LLC to change the date upon which the exercise price of the warrants issued after the first contract year is determined (Proposal 2); |

| | (3) | A proposal to ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the year ending December 31, 2006 (Proposal 3); and |

| | (4) | Such other business as may properly come before the meeting or any adjournment of the meeting. |

These matters are described more fully in the accompanying proxy statement.

Only stockholders of record at the close of business on March 15, 2006, are entitled to notice of and to vote at the annual meeting.

Your vote is important — as is the vote of every stockholder — and the board of directors appreciates the cooperation of stockholders in directing proxies to vote at the meeting. It is important that your shares be represented at the meeting by your marking, signing, dating and returning the enclosed proxy card in the accompanying envelope, or by submitting your proxy by telephone or the Internet, as promptly as possible, whether or not you expect to be present in person. For additional instructions on voting by telephone or the Internet, please refer to your proxy card.

You may revoke your proxy at any time by following the procedures set forth in the accompanying proxy statement.

|

| By Order of the Board of Directors, |

|

|

Richard L. Edmonson Senior Vice President, General Counsel and Corporate Secretary |

March 22, 2006

SYNTROLEUM CORPORATION

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation of proxies by our board of directors for use at our 2006 annual meeting of stockholders to be held at the time and place set forth in the accompanying notice. This proxy statement and accompanying proxies are initially being mailed to our stockholders on or about March 22, 2006. As used in this proxy statement, the terms “we,” “our” or “us” mean Syntroleum Corporation, a Delaware corporation, unless the context indicates otherwise.

GENERAL INFORMATION

Voting

Only stockholders of record at the close of business on March 15, 2006 are entitled to notice of, and to vote at, the annual meeting. As of such date, 55,782,490 shares of common stock were outstanding. Each outstanding share entitles the holder to one vote on each matter submitted to a vote of stockholders at the meeting. No other class of stock with voting rights is outstanding. Cumulative voting is not allowed in the election of directors.

Stockholders may vote in any of the four following ways: (1) by attending the 2006 annual meeting of stockholders; (2) by calling the toll-free number listed on the proxy card; (3) by voting on the Internet at the address listed on the proxy card; or (4) by marking, signing, dating and mailing the proxy card in the enclosed envelope. For additional instructions on voting by telephone or the Internet, please refer to the proxy card.

All properly executed proxies received prior to the commencement of voting at the annual meeting will be voted in accordance with the specification made on the proxy. Proxies submitted without specification will be voted (except to the extent that authority to vote has been withheld) (1) FOR Proposal 1 to elect the nominees for director proposed by the board of directors, (2) FOR Proposal 2 to approve an amendment of our Joint Development Agreement with Sovereign Oil & Gas Company II, LLC to change the date upon which the exercise price of the warrants issued after the first contract year is determined; and (3) FOR Proposal 3 to ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the year ending December 31, 2006. In connection with any other business that may properly come before the meeting, proxies will be voted in the discretion of the persons named in the proxy, except that proxies voted against the proposal to elect each of the three nominees as directors will not be voted in favor of any adjournment of the annual meeting for the purpose of soliciting additional proxies. The persons named as proxies were designated by the board of directors and are officers.

Quorum

The holders of a majority of the shares entitled to vote at the annual meeting, represented in person or by proxy, constitute a quorum for the transaction of business at the annual meeting. Abstentions and broker “non-votes” will be counted as present for purposes of determining whether there is a quorum at the annual meeting. The term broker “non-votes” refers to shares held by brokers and other nominees or fiduciaries that are present at the annual meeting but are not voted on a particular matter because those persons are precluded from exercising their voting authority because of the matter’s “non-routine” nature.

2

Matters to be Voted Upon

At the annual meeting, the following matters will be voted upon:

| | (1) | A proposal to elect four Class A directors as members of our board of directors to serve until the 2009 annual meeting of stockholders or until their respective successors have been duly elected and qualified (Proposal 1); |

| | (2) | A proposal to approve an amendment of our Joint Development Agreement with Sovereign Oil & Gas Company II, LLC to change the date upon which the exercise price of the warrants issued after the first contract year is determined (Proposal 2); |

| | (3) | A proposal to ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the year ending December 31, 2006 (Proposal 3); and |

| | (4) | Such other business as may properly come before the meeting or any adjournment of the meeting. |

We know of no other matters that are likely to be brought before the annual meeting.

Votes Required

Proposal 1— Election of Directors. In accordance with our bylaws, the directors will be elected by a plurality of the votes cast in person or by proxy at the annual meeting. Accordingly, abstentions and broker “non-votes” marked on proxy cards will not be included in the tabulation of the votes cast.

Proposal 2— Approval of Amendment of Joint Development Agreement.In accordance with our bylaws and the rules of the Nasdaq Stock Market, the approval of the proposal to amend our Joint Development Agreement with Sovereign Oil & Gas Company II, LLC requires the affirmative vote of a majority of the shares of common stock present in person or by proxy at the meeting and entitled to vote on the matter. Accordingly, abstentions will have the effect of a vote against the proposal. Broker “non-votes” will be treated as not present and entitled to vote and will therefore not be included in determining the percentage of shares voting in favor of the proposal.

Proposal 3— Ratification of Appointment of Independent Registered Public Accounting Firm.In accordance with our bylaws, the approval of the proposal to ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the year ending December 31, 2006 requires the affirmative vote of a majority of the shares of common stock present in person or by proxy at the meeting and entitled to vote on the matter. Accordingly, abstentions will have the effect of a vote against the proposal. Broker “non-votes” will be treated as not present and entitled to vote and will therefore not be included in determining the percentage of shares voting in favor of the proposal.

Revoking a Proxy

Any stockholder may revoke his or her proxy at any time before it is voted at the meeting by (1) duly executing and delivering to our corporate secretary a proxy bearing a later date, (2) filing with our corporate secretary a written notice of revocation or (3) voting in person at the meeting. The mailing address of our executive office is 4322 South 49th West Avenue, Tulsa, Oklahoma 74107. A stockholder’s presence without voting at the annual meeting will not automatically revoke a previously delivered proxy, and any revocation during the meeting will not affect votes previously taken.

Solicitation

Solicitation of proxies will be primarily by mail. In addition to solicitation by mail, our officers, directors and employees may solicit proxies in person or by telephone and facsimile transmission, for which such persons will receive no additional compensation. In addition, we have hired The Altman Group to solicit proxies on our behalf, at an expected cost of approximately $6,000, plus out-of-pocket expenses. We will pay all costs of soliciting proxies. We will reimburse brokerage houses, banks and other custodians, nominees and fiduciaries for their reasonable expenses in forwarding proxy material to beneficial owners of our common stock.

3

PROPOSAL 1—ELECTION OF DIRECTORS

Our certificate of incorporation divides the board of directors into three classes, with each class serving three-year terms. The members of each class serve until the annual meeting of stockholders in the third year following their election, with one class being elected each year.

The persons named in the accompanying proxy intend to vote such proxy in favor of the election of the nominees named below, who are currently directors, unless authority to vote for the director is withheld in the proxy. Although the board of directors has no reason to believe that the nominees will be unable to serve as directors, if a nominee withdraws or otherwise becomes unavailable to serve, the persons named as proxies will vote for any substitute nominee designated by the board of directors, unless contrary instructions are given in the proxy.

The board of directors recommends that stockholders vote FOR the election of the four Class A directors.

Nominees — Class A Directors

Set forth below is certain information with respect to each nominee for election as a director. Except as indicated, each nominee has served as a director of our company since the closing of the merger of Syntroleum Corporation and SLH Corporation on August 7, 1998 and, before the merger, as a director of our predecessor company, Syntroleum Corporation, an Oklahoma corporation.

| | |

| Name and Business Experience | | Age |

| |

Frank M. Bumstead | | 64 |

Mr. Bumstead became a director in May 1993. He has served as the Chairman of Flood, Bumstead, McCready & McCarthy, Inc., a financial and business management firm, since 2001 and managing member of FBM Consults, LLC since January 1, 2001. Mr. Bumstead has also served as a director of American Retirement Corp. and as a director of United Supermarkets, Inc.; Nashville Wire Products, Inc. and The Memorial Foundation. Mr. Bumstead holds a B.S. in Business Administration from Southern Methodist University and an M.B.A. from Vanderbilt Owen Graduate School of Management.

Mr. Ghandour became a director in February 2004. Mr. Ghandour is principal and founder of TI Capital Management, a Los Angeles-based venture capital firm founded in 2002, and since 1990 has served as Vice President of Falcon International, a transporter and marketer of oil and oil-related products in Europe and the Middle East. Mr. Ghandour has been a business consultant to us since October 2003 and became our employee in October 2005. Mr. Ghandour holds a B.S. in Business Administration and a B.A. in Political Science from Pepperdine University.

Mr. Holmes is our President and Chief Executive Officer and a director. Mr. Holmes has been our President and Chief Executive Officer since January 3, 2005. From October 2002 until January 2005, Mr. Holmes was our President and Chief Operating Officer. Mr. Holmes became a director in October 2002. Prior to joining Syntroleum in October 2002, Mr. Holmes was Chief Operating Officer of El Paso Merchant Energy Company, beginning in January 2001, where he had operating responsibility for all assets, including power generation, refining and chemical terminals and marine assets throughout the U.S. and overseas. Before becoming the Chief Operating Officer of El Paso, Mr. Holmes was the President of Oil and Gas Operations from 1999 to 2001. Prior to joining El Paso in 1999, he was President and Chief Operating Officer of Zilkha Energy Company from 1986 to 1998 and, upon its merger with Sonat, Inc. in 1998, he served as President and Chief Executive Officer of Sonat Exploration until 1999. Mr. Holmes holds a B.S. in Chemical Engineering from the University of Mississippi.

4

Mr. Rosene became a director in March 1985. Mr. Rosene is President of Seminole Energy Services, L.L.C., a natural gas marketing and gathering company. From 1984 to August 1998, he was Vice President of Boyd Rosene and Associates, Inc., a natural gas consulting and marketing firm which he co-founded. From 1976 to 1984, he was employed with Transok Pipeline Company, where he served in various positions, including Manager of Rates and Contract Administration and director of Gas Acquisitions. In 1987, Mr. Rosene co-founded MBR Resources, an oil and gas production company with operations in Arkansas, New Mexico, Oklahoma and Texas. Mr. Rosene holds a B.A. in Accounting from Oklahoma Baptist University.

Continuing Directors

Set forth below is comparable information for those directors whose terms will expire in 2007 and 2008. Unless otherwise noted, each of such directors has served as a director since August 7, 1998, the closing date of the merger of Syntroleum Corporation and SLH Corporation, and before the merger, as a director of our predecessor company, Syntroleum Corporation, an Oklahoma corporation. References to positions held with us before the date of the merger refer to positions held with our predecessor company.

2007 — Class B Directors

| | |

| Name and Business Experience | | Age |

| |

Kenneth L. Agee | | 49 |

Mr. Agee is our Chairman of the Board and Chief Technology Officer. Mr. Agee founded our company in 1984 and initially served as President and a director. He served as Chief Executive Officer from February 1996 until January 2005. He became Chairman of the Board in November 1995. He also served as President from June 2002 to September 2002. He became the Chief Technology Officer in April 2005. He is a graduate of Oklahoma State University with a degree in Chemical Engineering. He has over 23 years of experience in the energy industry and is listed as inventor on several U.S. and foreign patents, with several more patent applications pending, all of which have been assigned to us by Mr. Agee.

Mr. Jacobs has served as a director since November 1995. Mr. Jacobs also served as the Chairman of the Board of SLH Corporation from December 1996 through the closing date of the merger of Syntroleum Corporation and SLH Corporation. Mr. Jacobs served as President and Chief Executive Officer of Lab Holdings, Inc., a company principally engaged in the laboratory testing business, a position he held from September 1997 until August of 1999 when the company merged with Lab One, Inc. From 1990 to 1993, he served as Executive Vice President and Chief Operating Officer of Lab Holdings, and from May 1993 to September 1997, he served as President and Chief Operating Officer of Lab Holdings. Mr. Jacobs holds a B.A. and an M.B.A. from the University of Kansas and is also a Chartered Financial Analyst.

Mr. Seward has served as a director since December 1988. Mr. Seward also served as the President, Chief Executive Officer and director of SLH Corporation from February 1997 through the closing date of the merger of Syntroleum Corporation and SLH Corporation. From 1990 to September 1997, Mr. Seward served as Chief Financial Officer and a director of Lab Holdings. From 1990 to May 1993, he served as Senior Vice President of Lab Holdings, and from May 1993 to September 1997, he served as Executive Vice President. He also serves as a director of Tamarack Funds and American Retirement Corporation. Mr. Seward holds a B.A. from Baker University and an M.B.A. in Finance and a M.P.A. from the University of Kansas and is also a Chartered Financial Analyst.

5

2008 — Class C Directors

| | |

| Name and Business Experience | | Age |

| |

Alvin R. Albe, Jr. | | 52 |

Mr. Albe became a director in December 1988. Mr. Albe is currently Executive Vice President of the TCW Group, Inc., a financial and business management firm and President and Chief Executive Officer of TCW Galileo Funds Inc. Prior to joining TCW in 1991, Mr. Albe was President of Oakmont Corporation, a privately held corporation that administers and manages assets for several families and individuals. Mr. Albe was associated with Oakmont Corporation from 1982 to 1991. Before that time, he was Manager of Accounting at McMoRan Oil and Gas Co., and a Certified Public Accountant with Arthur Andersen & Co. in New Orleans. Mr. Albe graduated from the University of New Orleans with a B.S. in Accounting.

Mr. Day became a director in March 2000. He is currently Chairman of the Board and Investment Advisor of Oakmont Corporation, an investment management company, Chairman of the Board and Chief Executive Officer of Trust Company of the West, an investment management company, and Chairman and President of W.M. Keck Foundation, a philanthropic organization. Mr. Day also serves on the board of directors of Freeport-McMoRan, Inc., McMoRan Exploration Company, Freeport-McMoRan Copper & Gold, Inc. and Société Générale. Mr. Day is also the founder and investment advisor of Cypress Funds, LLC, an investment management company founded in 1998. Mr. Day holds a B.S. in Economics from Claremont McKenna College.

There are no family relationships, of first cousin or closer, among our directors and executive officers, by blood, marriage or adoption.

Affirmative Determinations Regarding Director Independence and Other Matters

Our board of directors has determined each of the following directors to be an “independent director” as such term is defined in Marketplace Rule 4200(a)(15) of the National Association of Securities Dealers (the “NASD”):

Alvin R. Albe, Jr.

Frank M. Bumstead

Robert A. Day

P. Anthony Jacobs

Robert B. Rosene, Jr.

James R. Seward

In this proxy statement, these six directors are each referred to individually as an “independent director” and collectively as the “independent directors.”

The board of directors has also determined that each member of the two committees of the board meets the independence requirements applicable to those committees prescribed by the NASD, the Securities and Exchange Commission (“SEC”) and the Internal Revenue Service. The board of directors has further determined that Mr. Albe, chairman of the audit committee of the board of directors, is an “audit committee financial expert” as such term is defined in Item 401(h) of Regulation S-K promulgated by the SEC.

The nominating and compensation committee reviewed the applicable legal standards for board member and board committee independence and the criteria applied to determine “audit committee financial expert” status. On the basis of this review, the nominating and compensation committee delivered a report to the full board of directors and the board made its independence and “audit committee financial expert” determinations based upon the

6

nominating and compensation committee’s report and each member’s review of the information made available to the nominating and compensation committee.

Board Compensation

During 2005, the board of directors held a total of four regular meetings and seven special meetings and took action by unanimous written consent on seven occasions. No director attended fewer than 75 percent of the aggregate of board meetings and meetings of any committee on which he served in 2005, with the exception of Messrs. Day and Jacobs, who attended 55% and 64% of such meetings, respectively.

We do not pay our outside directors a cash retainer. All directors are reimbursed for their travel and other expenses involved in attendance at board and committee meetings. With the exception of Mr. Ziad Ghandour, who was granted shares of our common stock under our 2005 Stock Incentive Plan equal in amount to shares granted to each non-employee director as discussed below, directors who are employees are not paid any fees or additional remuneration for services as members of the board of directors or any committee. Mr. Ghandour also receives a salary of $100,000 a year for being an employee of our company. This salary is not remuneration for his services as a member of our board of directors.

Under the 2005 Stock Incentive Plan, non-employee directors are eligible to receive grants of options to purchase shares of our common stock or awards of common stock or restricted stock. On January 1 of each year, non-employee directors and Mr. Ghandour receive annual grants of a number of shares of our common stock determined by dividing $50,000 by the closing price of our common stock on the last trading day of the previous year. On January 1, 2006, non-employee directors and Mr. Ghandour received 5,537 shares of our common stock under the 2005 Stock Incentive Plan. The board expects that these annual grants of shares of our common stock will continue to be a part of the compensation to non-employee directors and Mr. Ghandour for their service on the board.

Board Committees

The board of directors has two standing committees: the audit committee and the nominating and compensation committee.

Audit Committee

During 2005, the audit committee consisted of Messrs. Albe (Chairman), Bumstead and Rosene. The committee met five times during 2005. During 2006, the audit committee will consist of Messrs. Albe (Chairman), Bumstead, Jacobs, Rosene and Seward. The board of directors has determined that each of Messrs. Albe, Bumstead, Jacobs, Rosene, and Seward meets the independence criteria prescribed by applicable law and the rules of the SEC for audit committee membership and is an “independent director” as defined in NASD Rule 4200(a)(15). Each committee member meets the NASD’s financial knowledge requirements, and Mr. Albe, designated by the board of directors as the “audit committee financial expert” under SEC rules, meets the NASD’s professional experience requirements as well. The audit committee operates pursuant to a written charter, a copy of which was included as Annex A to our Proxy Statement for the 2005 Annual Meeting of Stockholders. As more fully described in the charter, the committee recommends to the board of directors the independent registered public accounting firm as auditors and reviews the scope, plan and findings of the annual audit, recommendations of the independent registered public accounting firm, the adequacy of internal accounting controls and audit procedures, our audited financial statements, non-audit services performed by the independent registered public accounting firm and fees paid to the independent registered public accounting firm for audit and non-audit services.

Nominating and Compensation Committee

During 2005, the nominating and compensation committee consisted of Messrs. Albe, Rosene (Chairman) and Bumstead. The committee met two times during 2005 and took action by unanimous written consent on thirteen occasions. During 2006, the nominating and compensation committee will consist of Messrs. Albe, Bumstead, Jacobs, Rosene (Chairman) and Seward. The board of directors has determined that each director who

7

served on the nominating and compensation committee during 2005 and will serve during 2006 qualifies as an “outside director” under Section 162(m) of the Internal Revenue Code (the “Code”), a “non-employee director” as such term is defined in Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and an “independent director” as such term is defined in NASD Rule 4200(a)(15). The nominating and compensation committee operates pursuant to a written charter, a copy of which was included as Annex B to our Proxy Statement for the 2004 Annual Meeting of Stockholders. As more fully described in the charter, the committee establishes and reports to the full board with respect to compensation plans under which officers and directors are eligible to participate, and recommends to the board for approval the salary for the chief executive officer and other executive officers. The committee administers our 2005 Stock Incentive Plan and reviews our compensation program on a regular basis. The committee also recommends policies concerning director compensation to the board of directors.

Director Nominations Process

The nominating and compensation committee is responsible for searching for, identifying, evaluating the qualifications of and recommending to the board of directors and our stockholders the slate of qualified director nominees to be elected by the stockholders in connection with each annual meeting, and any directors to be elected by the board to fill vacancies of newly created directorships between annual meetings.

In assessing the qualifications of prospective nominees to the board, the nominating and compensation committee considers each nominee’s personal and professional integrity, experience, skills, ability and willingness to devote the time and effort necessary to be an effective board member, and commitment to acting in the best interests of our company and our stockholders. The nominating and compensation committee also considers whether candidates provide an appropriate mix of backgrounds and skills to the board.

Internal Process for Identifying Candidates

The nominating and compensation committee has two primary methods for identifying candidates (other than those proposed by our stockholders, as discussed below). First, on a periodic basis, the nominating and compensation committee solicits ideas for possible candidates from a number of sources, including members of the board, our senior level executives and individuals personally known to the members of the board.

Second, the nominating and compensation committee may from time to time use its authority under its charter to retain at our expense one or more search firms to identify candidates (and to approve such firms’ fees and other retention terms). If the nominating and compensation committee retains one or more search firms, they may be asked to identify possible candidates, to interview and screen such candidates (including conducting appropriate background and reference checks), to act as a liaison among the board, the nominating and compensation committee and each candidate during the screening and evaluation process and thereafter to be available for consultation as needed by the nominating and compensation committee.

Nominations by Stockholders

The nominating and compensation committee will consider nominees for director recommended by our stockholders. Please submit your recommendation in writing along with:

| | • | | the name of and contact information for the candidate; |

| | • | | a resume of the candidate’s qualifications and business and educational experience; |

| | • | | information regarding the qualifications and qualities described under “Director Nominations Process” above; |

| | • | | a signed statement of the proposed candidate consenting to be named as a candidate and, if nominated and elected, to serve as a director; |

8

| | • | | a statement that the writer is a stockholder and is proposing a candidate for consideration by the nominating and compensation committee; |

| | • | | a statement detailing any relationship between the candidate and any of our customers, suppliers or competitors; |

| | • | | financial and accounting background, to enable the nominating and compensation committee to determine whether the candidate would be suitable for audit committee membership; and |

| | • | | detailed information about any relationship or understanding between the proposing stockholder and the candidate. |

Submit recommendations to Richard L. Edmonson, Senior Vice President, General Counsel and Corporate Secretary, Syntroleum Corporation, 4322 South 49th West Avenue, Tulsa, Oklahoma 74107.

In addition to recommending director nominees to the nominating and compensation committee, any stockholder may nominate one or more persons for election as one of our directors at an annual meeting of stockholders if the stockholder complies with the notice, information and consent provisions contained in our bylaws, as described under “Stockholder Proposals” elsewhere in this proxy statement.

Evaluation of Candidates

The nominating and compensation committee will consider all candidates identified through the processes described above. The extent to which the committee dedicates time and resources to the consideration and evaluation of any potential nominee brought to its attention depends on the information available to the committee about the qualifications and suitability of the individual, viewed in light of the needs of the board, and is at the committee’s discretion. The committee evaluates the desirability for incumbent directors to continue on the board following the expiration of their respective terms, taking into account their contributions as board members and the benefit that results from increasing insight and experience developed over a period of time. Although the committee will consider candidates for director recommended by stockholders, it may determine not to recommend that the board, and the board may determine not to, nominate those candidates for election to our board.

Timing of the Identification and Evaluation Process

The nominating and compensation committee usually meets at the first regularly scheduled meeting of the board in a calendar year to consider, among other things, candidates to be recommended to the board for inclusion in our recommended slate of director nominees for the next annual meeting and our proxy statement. The board usually meets each February to vote on, among other things, the slate of director nominees to be submitted to and recommended for election by stockholders at the annual meeting, which is typically held in April of that year.

Communication with Directors

Interested persons may send written communications to the board by mailing those communications to the audit committee at:

Syntroleum Corporation

c/o Audit Committee of the Board of Directors

4322 South 49th West Avenue

Tulsa, Oklahoma 74107

The audit committee will forward communications to individual directors, as appropriate.

We do not maintain a policy regarding director attendance at our annual meeting of stockholders. There were 10 directors at the time of the 2005 Annual Meeting of Stockholders, and two directors attended the meeting.

9

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table sets forth the number of shares of our common stock beneficially owned as of March 1, 2006, by (1) each director and nominee for director, (2) each of the executive officers named in the Summary Compensation Table under the caption “Executive Compensation” in this proxy statement, (3) all directors and executive officers as a group and (4) all persons known by us to be the beneficial owners of at least five percent of our outstanding common stock. As of March 1, 2006, 55,694,877 shares of our common stock were issued and outstanding.

| | | | | |

Name (1)(2) | | Shares | | Percentage of Class | |

Kenneth L. Agee(3) | | 4,284,399 | | 7.7 | % |

John B. Holmes, Jr.(4) | | 1,121,691 | | 2.0 | % |

Greg G. Jenkins | | 343,334 | | * | |

Larry J. Weick(5) | | 597,253 | | 1.1 | % |

Edward G. Roth | | 150,505 | | * | |

Alvin R. Albe, Jr. | | 208,252 | | * | |

Frank M. Bumstead(6) | | 135,357 | | * | |

Robert A. Day/Peak Investments, LLC(7) | | 7,321,088 | | 13.1 | % |

Ziad Ghandour | | 1,582,513 | | 2.8 | % |

P. Anthony Jacobs(8) | | 481,631 | | * | |

Robert B. Rosene, Jr.(9) | | 205,883 | | * | |

James R. Seward(10) | | 392,308 | | * | |

All directors and executive officers as a group (17 persons) | | 17,625,435 | | 29.5 | % |

Legg Mason Opportunity Trust(11) 100 Light Street Baltimore, MD 20202 | | 7,845,600 | | 14.1 | % |

Wellington Management Company, LLP(12) 75 State Street Boston, MA 02109 | | 4,091,168 | | 7.3 | % |

| * | Represents ownership of less than 1%. |

| (1) | Except as otherwise noted and subject to applicable community property laws, each stockholder has sole voting and investment power with respect to the shares beneficially owned. The business address of each director and executive officer is c/o Syntroleum Corporation, 4322 South 49th West Avenue, Tulsa, Oklahoma 74107. |

| (2) | Shares of common stock subject to options and warrants that are exercisable within 60 days of the date of this proxy statement are deemed outstanding for purposes of determining the beneficial ownership and computing the percentage ownership of such person, but are not deemed outstanding for purposes of computing the percentage ownership of any other person. Accordingly, the following shares of common stock subject to stock options or warrants are included in the table: Kenneth L. Agee—307,000; John B. Holmes, Jr.—1,015,000; Greg G. Jenkins—343,334; Larry J. Weick—359,930; Edward G. Roth—123,668; Alvin R. Albe, Jr.—28,415; Frank M. Bumstead—28,415; Robert A. Day—21,311; Ziad Ghandour—975,671; P. Anthony Jacobs—18,011; Robert B. Rosene, Jr.—28,415; James R. Seward—4,254; and all directors and executive officers as a group—3,995,449. |

| (3) | Includes 90,744 shares of common stock owned by two of Mr. Agee’s children. |

| (4) | Includes 776 shares of common stock held by Mr. Holmes’ wife, as to which he disclaims beneficial ownership. |

10

| (5) | Includes 12,200 shares of common stock held by Mr. Weick as custodian for his daughters. |

| (6) | Includes 13,847 shares of common stock held by Mr. Bumstead’s wife, as to which he disclaims beneficial ownership. |

| (7) | Based upon information set forth in a Schedule 13G filed with the SEC on February 14, 2006 by Mr. Day and a Schedule 13G filed with the SEC on February 14, 2006 by Peak Investments, LLC (“Peak”). Peak is the Investment Advisor for Oakmont Corporation (“Oakmont”) and Mr. Day. This amount includes 4,986,817 shares of our common stock held by Mr. Day. This amount also includes 2,307,423 shares of our common stock held by Oakmont, as to which Mr. Day disclaims beneficial ownership. Mr. Day is the Chairman of Oakmont. In addition, this amount includes 21,311 stock options granted to Mr. Day in prior years and 5,537 shares of common stock granted to Mr. Day in January 2006 as compensation for serving on our board of directors. The Schedule 13G filed by Peak reports that Peak holds sole voting power for 0 shares of our common stock, shared voting power for 7,294,240 shares of our common stock, sole dispositive power for 0 shares of our common stock and shared dispositive power for 7,294,240 shares of our common stock. |

| (8) | Includes 25,000 shares of common stock held by Mr. Jacobs’ wife, as to which he disclaims beneficial ownership, and 429,741 shared held by the P. Anthony Jacobs Trust. |

| (9) | Includes 10,200 shares of common stock owned by trusts the beneficiaries of which are Mr. Rosene’s children, as to which Mr. Rosene disclaims beneficial ownership. |

| (10) | Includes 2,250 shares of common stock held in a family trust for which Mr. Seward serves as a co-trustee with his mother (and in that capacity shares voting and investment powers). |

| (11) | Based upon information set forth in a Schedule 13G/A filed with the SEC on February 14, 2006 by Legg Mason Opportunity Trust (“Legg Mason”). The Schedule 13G reports that Legg Mason holds sole voting power for 0 shares of our common stock, shared voting power for 7,845,600 shares of our common stock, sole dispositive power for 0 shares of our common stock and shared dispositive power for 7,845,600 shares of our common stock. |

| (12) | Based upon information set forth in a Schedule 13G/A filed with the SEC on January 10, 2006 by Wellington Management Company, LLP (“Wellington”). The Schedule 13G reports that Wellington holds sole voting power for 0 shares of our common stock, shared voting power for 2,477,508 shares of our common stock, sole dispositive power for 0 shares of our common stock and shared dispositive power for 4,091,168 shares of our common stock. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our directors, executive officers and owners of 10% or more of our common stock to file with the SEC and the Nasdaq Stock Market initial reports of ownership and reports of changes in ownership of common stock. Based solely on a review of the copies of reports furnished to us and representations that no other reports were required, we believe that all of our directors, executive officers and 10% or more stockholders during the fiscal year ended December 31, 2005 complied on a timely basis with all applicable filing requirements under Section 16(a) of the Exchange Act, except that Mr. Roth failed to timely file one report on Form 4 with respect to one transaction.

11

EXECUTIVE COMPENSATION

The following tables show the compensation for our chief executive officer and each of our other four most highly compensated executive officers serving as such on December 31, 2005.

Summary Compensation Table

| | | | | | | | | | | | | | | |

| | | Year | | Annual Compensation (1) | | Long Term

Compensation | | All Other

Compensation |

Name and Principal Position | | | Salary ($) | | Bonus ($) | | Restricted

Stock

Awards | | Securities

Underlying

Options | |

Kenneth L. Agee (2) Chairman of the Board Chief Technology Officer | | 2005

2004

2003 | | $

| 255,000

255,000

255,000 | | $

| 114,750

250,000

— | | —

50,000

— | | 250,000

—

— | | $

| 8,516

5,453

5,453 |

John B. Holmes, Jr. (3) President and Chief Executive Officer | | 2005

2004

2003 | | $

| 242,600

230,000

230,000 | | $

| 191,250

500,000

— | | —

150,000

— | | 1,000,000

—

— | | $

| 3,831

—

— |

Greg G. Jenkins (4) Executive Vice President of Finance and Business Development and Chief Financial Officer | | 2005

2004 | | $

| 220,000

— | | $

| 132,000

— | | —

— | | 500,000

500,000 | | $

| 3,179

— |

Larry J. Weick Senior Vice President of Business Development | | 2005

2004

2003 | | $

| 215,000

215,000

215,000 | |

| —

—

— | | 4,377

20,000

— | | 100,000

25,000

50,000 | | $

| 3,342

—

— |

Edward G. Roth (5) Senior Vice President, Chief Engineer | | 2005 | | $

| 192,600

89,100 | | $

| 90,000

— | | 1,837

10,000 | | 350,000

150,000 | | $

| 2,903

— |

| (1) | The named executive officers did not receive any annual compensation not properly categorized as salary or bonus, except for certain perquisites and other personal benefits that are not shown because the aggregate amount of such compensation, if any, for the named executive officers during the fiscal year did not exceed the lesser of $50,000 or 10% of total salary and bonus reported for such executive officer. |

| (2) | The amounts listed under “All Other Compensation” include payment of insurance disability premiums by the Company. An additional amount of $5,453 for Mr. Agee relate to automobile lease payments. |

| (3) | Mr. Holmes’ base salary was increased to $255,000 effective July 1, 2005. |

| (4) | Mr. Jenkins has been our Executive Vice President of Finance and Business Development and Chief Financial Officer since January 3, 2005. |

| (5) | Mr. Roth’s base salary was increased to $200,000 effective July 1, 2005. |

12

The following table provides information concerning grants of stock options made to the named executive officers during 2005.

Option Grants in Last Fiscal Year

| | | | | | | | | | | | | | | | |

| | | Individual Grants | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (2) |

Name | | Number of Securities Underlying Options Granted | | % of Total Options Granted to Employees in Fiscal

Year | | | Exercise or

Base Price ($/Share)(1) | | Expiration

Date | |

| | | | | | | | | | | | 5%($) | | 10%($) |

Kenneth L. Agee | | 250,000 | | 8.7 | % | | $ | 10.52 | | 6/30/2015 | | $ | 1,654,000 | | $ | 4,192,000 |

John B. Holmes, Jr. | | 1,000,000 | | 34.7 | % | | $ | 10.52 | | 6/30/2015 | | $ | 6,616,000 | | $ | 16,766,000 |

Greg G. Jenkins | | 500,000 | | 17.4 | % | | $ | 10.52 | | 6/30/2015 | | $ | 3,308,000 | | $ | 8,383,000 |

Larry J. Weick | | 100,000 | | 3.5 | % | | $ | 10.14 | | 7/27/2015 | | $ | 638,000 | | $ | 1,616,000 |

Edward G. Roth | | 250,000 | | 8.7 | % | | $ | 10.52 | | 6/30/2015 | | $ | 1,654,000 | | $ | 4,192,000 |

Edward G. Roth | | 100,000 | | 3.5 | % | | $ | 10.10 | | 4/15/2015 | | $ | 635,000 | | $ | 1,610,000 |

| (1) | The exercise price of the options granted is equal to the market value of the common stock on the date of grant. |

| (2) | Potential realizable value of each grant assumes that the market prices of the underlying security appreciates at annualized rates of 5% and 10% over the term of the award. These rates are specified by the SEC. Actual gains, if any, on stock option exercises are dependent on the future performance of the common stock and overall market conditions. There can be no assurance that the amounts reflected on this table will be achieved. |

The following table provides information concerning each stock option exercised during 2005 by each of the named executive officers and the value of unexercised options held by such officers at the end of 2005.

Aggregated Option Exercises in Last Fiscal Year

and Fiscal Year-End Option Values

| | | | | | | | | | | | | | |

Name | | Shares

Acquired on

Exercise(#) | | Value

Realized

($)(1) | | Number of Securities Underlying Unexercised Options at Fiscal Year-End | | Value of Unexercised In- the-Money Options at Fiscal Year-End ($)(2) |

| | | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

Kenneth L. Agee | | — | | — | | 300,000 | | 250,000 | | $ | 2,247,000 | | | — |

John B. Holmes, Jr. | | — | | — | | 1,000,000 | | 1,000,000 | | $ | 7,480,000 | | | — |

Greg G. Jenkins | | — | | — | | 166,667 | | 833,333 | | $ | 358,000 | | $ | 717,000 |

Larry J. Weick | | — | | — | | 343,264 | | 133,332 | | $ | 1,205,000 | | $ | 153,000 |

Edward G. Roth | | — | | — | | 50,001 | | 449,999 | | $ | 156,000 | | $ | 313,000 |

| (1) | Value realized is calculated based on the difference between the option exercise price and the closing market price of the common stock on the date of exercise, multiplied by the number of shares underlying the options. |

13

| (2) | Based on the closing price of the common stock of $9.03 on December 30, 2005, the last trading day of 2005. |

Board Compensation Committee Report on Executive Compensation

Our executive compensation programs are designed to attract and retain highly qualified executives and to motivate them to maximize stockholder returns by achieving our short- and long-term strategic goals. The compensation programs are designed to link each executive’s compensation directly to individual and company performance.

There are four basic components to our compensation system:

| | • | | long-term equity-based incentive compensation; and |

| | • | | annual incentive compensation. |

We address each of these components within the context of individual and company performance and competitive conditions. In determining competitive compensation levels, we consider data that includes information regarding other companies engaged in the development of new technologies, including energy companies engaged in technology development. Some, but not all of these companies, are engaged in the development of gas-to-liquids technologies. In determining executive compensation, the nominating and compensation committee does not compare our financial and operating performance with that of the companies and indices shown in the performance graph.

The nominating and compensation committee determines bonuses and stock option and restricted stock awards and changes in remuneration to our executive officers. Bonuses and grants or awards of stock options and restricted stock are individually determined and administered by the nominating and compensation committee. The nominating and compensation committee takes into account our financial position, including the need to conserve cash resources in order to satisfy anticipated capital and operating expenses, in determining executive compensation and places more emphasis on stock-based compensation as a result. The chief executive officer works with the nominating and compensation committee in the design of the plans and make recommendations to the committee regarding the salaries and bonuses of executive officers that report directly to him as well as the salaries and bonuses and the award of options and restricted stock to other employees.

Base Pay

Base pay is designed to be competitive with salary levels for comparable executive positions at other companies engaged in the development of new technologies. The nominating and compensation committee reviews such comparable salary information as one factor to be considered in determining the base pay for our executive officers. The nominating and compensation committee also considers other factors, including that officer’s responsibilities, experience, leadership, potential future contribution and demonstrated individual performance (measured against strategic business objectives such as achieving commercial application of our gas-to-liquids technology and continued development of improvements to that technology designed to improve performance and reduce capital costs). The nominating and compensation committee also considers internal pay equity among the executive officers and employees generally. The types and relative importance of the strategic business objectives and financial objectives vary among our executives depending on their positions and the particular operations and functions for which they are responsible. Our philosophy and practice is to place a significant emphasis on the incentive component of compensation. The compensation committee reviews base salaries annually. Annual base salaries for Messrs. Kenneth L. Agee, John B. Holmes, Jr., Greg G. Jenkins, Larry J. Weick and Edward G. Roth are currently $255,000, $255,000, $220,000, $215,000 and $200,000, respectively.

14

Cash Bonuses

Annual bonuses are paid to our executive officers pursuant to our annual incentive compensation plan, which provides for equity-based or cash bonuses based on achievement over the course of the year of performance objectives approved by the board prior to that year’s annual meeting of stockholders. Our cash bonuses are designed to reward executive officers for individual performance and for contributing to the attainment of strategic business objectives and certain financial objectives. The amount each executive officer receives is determined by the nominating and compensation committee and depends on the individual’s performance and level of responsibility, as well as our financial position. Executive officers may receive cash bonuses of up to 75% of their annual salary depending on the achievement of individual and company goals during the year. Cash bonuses for Messrs. Kenneth L. Agee, John B. Holmes, Jr., Greg G. Jenkins and Edward G. Roth were $114,750, $191,250, $132,000 and $90,000, respectively. These bonuses were paid for achievement of the Company’s 2005 goals and objectives which included the following:

| | • | | defining our Syntroleum Process-based design for GTL FPSO installations; |

| | • | | evaluating alternatives for raising funds for acquiring additional stranded gas and liquids projects, and if feasible, implementing a plan to secure funds; |

| | • | | securing additional capital resources to support general corporate purposes; |

| | • | | identifying and commencing negotiations on three additional integrated stranded gas and liquids projects; |

| | • | | evaluating alternatives for catalyst development, including possible participation of a third party; |

| | • | | implementing a new oil and gas accounting software package and completing the documentation and testing of internal controls for the new system in compliance with the Sarbanes-Oxley Act; |

| | • | | completing the evaluation of the properties we have leased in Central Kansas for production of low BTU gas, and developing a plan to optimize value; and |

| | • | | continuing the demonstration and documentation of our Syntroleum GTL Technologies. |

Long-Term Equity-Based Compensation

Long-term equity-based compensation is tied directly to stockholder return. Long-term incentive compensation consists of stock options and restricted stock, which generally vest in equal annual increments for up to five years following the date of the grant, although vesting can be accelerated if deemed appropriate by the nominating and compensation committee. The exercise price of stock options and restricted stock granted is generally equal to the fair market value of the common stock on the date of grant. Accordingly, executives receiving stock options and restricted stock are rewarded only if the market price of the common stock appreciates. Stock options and restricted stock are thus designed to align the interests of our executive officers and other employees with those of our stockholders by encouraging executives to enhance our value and, hence, the price of the common stock and stockholder return. In determining whether to grant stock options or restricted stock to executive officers, the nominating and compensation committee considers a variety of factors, including that executive’s current ownership stake in our company, the degree to which increasing that ownership stake would provide the executive with additional incentives for future performance, the likelihood that the grant of those options or restricted stock would encourage the executive to remain with our company, prior option grants (including the size of previous grants and the number of options and shares of restricted stock held) and the value of the executive’s service to our company. The compensation committee also considers these factors when determining whether to grant stock options or restricted stock to other employees.

In 2005, we entered into stock option award agreements with Messrs. Agee, Holmes, Jenkins, Weick and Roth. These grants are included in the Option Grants in Last Fiscal Year information on page 13. The agreements

15

granted these officers options to purchase shares of our common stock at an exercise price equal to the market value per share on the date of grant. Depending on either the sustained stock price (as defined below) of our common stock or the net present value of future cash flows (as defined below), a percentage of the options will vest as determined in a performance vesting schedule with respect to the period commencing on the date of grant and ending on December 31, 2010 (the “Performance Period”). The term of each option is ten years from the date of grant. The performance vesting schedule is defined below.

| | | | | | | | | | | | | | | |

| | | Net Present Value of Future Cash Flows | |

Sustained Stock Price | | Less than

$1,375

million | | | $1,375 million

but less than

$1,650 million | | | $1,650 million

but less than

$1,925 million | | | $1,925 million

but less than

$2,200 million | | | $2,200 million

or more | |

$40 or more | | 100 | % | | 100 | % | | 100 | % | | 100 | % | | 100 | % |

$35 but less than $40 | | 75 | % | | 75 | % | | 75 | % | | 75 | % | | 100 | % |

$30 but less than $35 | | 50 | % | | 50 | % | | 50 | % | | 75 | % | | 100 | % |

$25 but less than $30 | | 25 | % | | 25 | % | | 50 | % | | 75 | % | | 100 | % |

Less than $25 | | 0 | % | | 25 | % | | 50 | % | | 75 | % | | 100 | % |

“Sustained stock price” means the average fair market value of a share of our common stock during any six-month period commencing on or after the first day of the Performance Period and ending on or before the last day of the Performance Period. “Net present value of future cash flows” means the net present value of estimated future cash flows from executed agreements (such as a contract to supply natural gas), proven reserves or any other source of future cash flows with analogous certainty to the aforementioned sources as estimated by an independent auditor designated by our Board of Directors. For this purpose, an annual discount rate of 10% is used to calculate net present value.

Short-Term Equity-Based Compensation

Annual bonuses are paid to our executive officers pursuant to our annual incentive compensation plan, which provides for equity-based stock or cash bonuses based on achievement over the course of the year of performance objectives approved by the board prior to that year’s annual meeting of stockholders. Incentive bonuses for Messrs. Kenneth L. Agee, John B. Holmes, Jr., Greg G. Jenkins and Edward G. Roth included options to purchase 35,000, 75,000, 50,000 and 35,000 shares of our common stock, respectively. These options have an exercise price of $9.67 per share and vest over a five-year period, beginning on the date of grant. These options were issued in 2006 for achievement of our 2005 goals and objectives which are detailed above.

Compensation of the Chief Executive Officer

The nominating and compensation committee designs Mr. John B. Holmes, Jr.’s compensation package using the same components and methodology as apply to other executive officers, taking into account his high level of importance and accountability. In reviewing Mr. Holmes’ performance in 2005, the nominating and compensation committee focused primarily on our attainment of certain strategic goals, including progress in the development of certain of our technologies, progress in certain of our commercial projects, implementation of certain corporate reorganization plans and achievement of certain cost control objectives.

Compliance with Internal Revenue Code Section 162(m)

Section 162(m) of the Internal Revenue Code generally disallows a deduction to public companies to the extent of excess annual compensation over one million dollars paid to the chief executive officer or to any of the four other most highly compensated executive officers, except for qualified performance-based compensation. We had no non-deductible compensation expense for fiscal year 2005. We plan to review executive compensation as appropriate and take action as may be necessary to preserve the deductibility of compensation payments to the extent reasonably practical and consistent with our compensation objectives.

16

Determination of executive compensation is an evolving discipline. The nominating and compensation committee monitors trends in this area, as well as changes in law, regulation and accounting practices, that may affect either its compensation practices or its philosophy. Accordingly, the nominating and compensation committee reserves the right to alter its approach in response to changing conditions.

Nominating and Compensation Committee

Alvin R. Albe, Jr.

Frank M. Bumstead

P. Anthony Jacobs

Robert B. Rosene, Jr. (Chairman)

James R. Seward

Compensation Committee Interlocks and Insider Participation

Our nominating and compensation committee consists of Messrs. Albe, Bumstead, Jacobs, Rosene and Seward, each of whom is a non-employee director. None of our executive officers has served as a member of a compensation committee or board of directors of any other entity which has an executive officer serving as a member of our board of directors, and there are no other matters relating to interlocks or insider participation that we are required to report.

17

Performance Graph

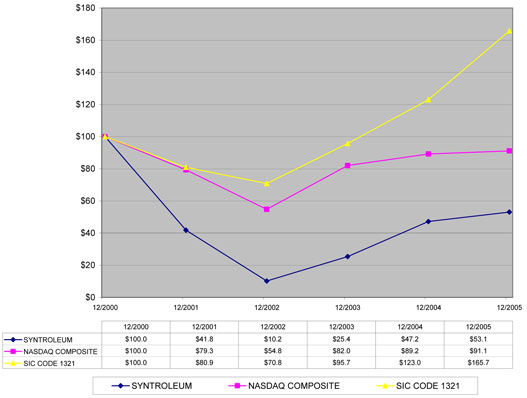

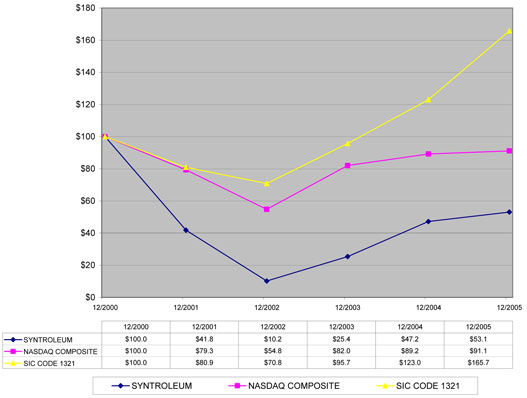

The following performance graph compares the performance of our common stock during the period beginning on December 31, 2000 and ending on December 31, 2005 to the Nasdaq Stock Market index consisting of United States companies (the “Nasdaq Composite”) and an index consisting of 116 publicly traded companies having a segment of business with Standard Industrial Code 1321 for the same period. SIC 1321 covers establishments primarily engaged in producing hydrocarbons from oil and gas field gases. The graph assumes a $100 investment in our common stock and in each of the indexes at the beginning of the period and a reinvestment of dividends paid on such investments throughout the period.

VALUE OF $100 INVESTMENT

ASSUMING REINVESTMENT OF DIVIDENDS AT DECEMBER 31, 2000, AND AT THE END OF

EVERY FISCAL YEAR, AND THROUGH DECEMBER 31, 2005

Executive Employment Agreements

We have entered into employment agreements with each of our executive officers. These agreements provide for annual base salaries that we may increase from time to time. In addition, each employment agreement entitles the employee to participate in employee benefit plans that we may offer to our employees from time to time.

Each agreement provides for an initial term of 12 months and is automatically renewed for successive terms of 12 months unless sooner terminated. Under each agreement, employment may be terminated as follows:

| | • | | by us upon the employee’s death, disability or retirement; |

| | • | | by us upon the dissolution and liquidation of our company (unless our business is thereafter continued); |

18

| | • | | by the mutual agreement of the employee and us; and |

| | • | | by either us or the employee upon 60 days’ written notice. |

If we terminate the employee’s employment for any reason other than as noted in the first three items above, the employee is entitled to receive his monthly salary for a period of one or two years, as applicable, following the date of termination. In addition, if there is a change in control of our company and

| | • | | we terminate the employee’s employment for any reason other than the employee’s death, disability, retirement or just cause during the one-year period immediately following the change of control, |

| | • | | the employee terminates his employment for good reason, or |

| | • | | during the 60-day period immediately following the lapse of one year after any change of control, we or the employee terminate the employee’s employment for any reason, |

then, in lieu of any further payments for periods subsequent to the date of termination, we or our successor will pay the employee an amount equal to one or two times, as applicable, the employee’s full base salary in effect on the date of termination payable in equal monthly installments for a period of 12 or 24 months, as applicable. Mr. John B. Holmes, Jr., our President and Chief Executive Officer, will be entitled to receive his monthly salary for a period of two years following the date of termination, in accordance with the provisions described above, as well as for the following reasons:

| | • | | we terminate Mr. Holmes’ employment for any reason other than just cause; |

| | • | | Mr. Holmes is assigned to duties materially inconsistent with his position, authority, duties or responsibilities without his agreement; or |

| | • | | we require Mr. Holmes to be based at any office outside the Tulsa metropolitan area without his agreement. |

Pursuant to each agreement, the employee is prohibited from disclosing to third parties, directly or indirectly, our trade secrets, either during or after the employee’s employment with our company, other than as required in the performance of the employee’s duties. The agreement also provides that the employee will not have or claim any right, title or interest in any trademark, service mark or trade name that we own or use. The employee also agrees to irrevocably assign to us all of the employee’s right, title and interest in and to any and all inventions and works of authorship made, generated or conceived by the employee during his or her period of employment with us and which related to our business or which were not developed on the employee’s own time. Each employee further agrees that during the period of employment with us and for a period of two years following the termination of employment, the employee will not engage in certain activities related to our business, including a covenant not to compete.

19

Equity Compensation Plan Information

The following table provides information concerning securities authorized for issuance under our equity compensation plans as of December 31, 2005.

Equity Compensation Plan Information

| | | | | | | |

Plan Category | | Number of Securities to

be Issued Upon

Exercise of

Outstanding Options,

Warrants and Rights (a) | | Weighted-average

Exercise Price of

Outstanding Options,

Warrants and Rights (b) | | Number of Securities

Remaining Available

for Future Issuance Under

Equity Compensation

Plans (excluding securities

reflected in column (a)) (c) |

Equity Compensation Plans Approved by Security Holders (1)(2)(3)(4) | | 8,245,120 | | $ | 7.45 | | 4,709,234 |

Equity Compensation Plans Not Approved by Security Holders (5)(6) | | 1,025,198 | | $ | 1.72 | | 1,500,000 |

| | | | | | | |

Total | | 9,270,318 | | $ | 6.82 | | 6,209,234 |

| | | | | | | |

| (1) | Includes the 1993 Stock Option and Incentive Plan, the 1997 Stock Incentive Plan, the 2005 Stock Incentive Plan and the Stock Option Plan for Outside Directors. |

| (2) | Includes 346,253 shares to be issued upon exercise of options with a weighted average exercise price of $12.45 that were granted under our 1993 Stock Option and Incentive Plan and our Stock Option Plan for Outside Directors assumed by us in connection with the merger of Syntroleum Corporation and SLH Corporation on August 7, 1998, which were approved by our stockholders. |

| (3) | Includes up to 1,170,000 shares to be issued upon exercise of warrants granted to Mr. Ziad Ghandour, one of our directors, at exercise prices ranging from $4.50 per share to $5.25 per share, which were approved by our stockholders. An additional 1,000,000 warrants to purchase shares of common stock at an exercise price of $11.21 per share may be issued to Mr. Ghandour upon the achievement of certain performance objectives. These warrants were approved by our stockholders in April 2005. |

| (4) | Includes up to 116,250 shares to be issued upon exercise of warrants issued to Sovereign Oil & Gas Company II, LLC (“Sovereign”), a consulting firm that we have retained to assist us in acquiring stranded natural gas fields worldwide using the Syntroleum Process as a feedstock for our GTL Mobile Facility, which were approved by our stockholders. The warrants are issuable in varying amounts upon the acquisition of properties of the achievement of third-party participation in a project, and have an exercise price of between $6.40 and $11.16 per share for warrants issued since March 1, 2004. The exercise price per share for any additional warrants issued is to be determined based on the price for our common stock on March 1 of the contract year stated in the joint development agreement between us and Sovereign during which the project commences. If however, shareholders approve an amendment to the joint development agreement with Sovereign to change the exercise price of warrants issued to the closing per share sale price of our common stock as of December 1 prior to a contract year in which the warrants are issued, for the 2005 and 2006 contract years, the exercise price for all warrants issued will be $6.94 and $7.98 per share, respectively. If shareholder approval is not received, all warrants related to projects in the 2005 contract year will have an exercise price of $11.16 per share. Under the joint development agreement, we have agreed to issue to Sovereign warrants to purchase up to an aggregate of 2,000,000 shares of our common stock in varying amounts upon the acquisition of properties or |

20

| | the achievement of third-party participation in a project. The issuance of warrants to purchase up to 500,000 shares of our common stock has been approved by our stockholders. |

| (5) | On August 31, 2002, we granted options to purchase 1,000,000 shares of our common stock at an exercise price of $1.55 to our President and Chief Executive Officer, John B. Holmes, Jr., as an inducement to his employment with Syntroleum. The rights to exercise the options and purchase 333,334 shares vested on October 1, 2002, the rights to exercise the options and purchase an additional 333,333 shares vested on October 1, 2003, and the rights to exercise the options and purchase an additional 333,333 shares vested on October 1, 2004. The ability to exercise the options will terminate upon the earliest of: (a) the tenth anniversary of the date of the grant; (b) 12 months after the date of the termination of Mr. Holmes’ employment by reason of death or disability; (c) the third annual anniversary of Mr. Holmes’ retirement; or (d) the date 12 months following the date upon which Mr. Holmes’ employment terminates for any reason other than those described in (b) or (c) above. |

| (6) | On June 30, 1997, and on February 3, 1999, we granted options to purchase 17,198 and 8,000 shares of common stock at exercise prices of $9.30 and $6.88, respectively, to a Business Development Consultant. The rights to exercise the options and purchase shares vest in three equal installments each year on the anniversary of each grant. |

CERTAIN TRANSACTIONS

In February 2004, pursuant to an amendment to our consulting agreement with TI Capital Management, we issued to Mr. Ghandour warrants to purchase up to 1,170,000 shares of our common stock. Warrants to purchase 170,000 shares of our common stock became exercisable upon stockholder approval, warrants to purchase 500,000 shares of our common stock became exercisable upon the execution of an agreement between us and Dragados Industrial, S.A. in August 2004, and warrants to purchase 500,000 shares of our common stock became exercisable upon the execution of an agreement between us and Bluewater Energy Services B.V. in February 2005. All of the warrants expire on November 4, 2007. The exercise prices of the warrants range from $4.50 to $5.25 per share.

In March 2005, pursuant to an amendment to our consulting agreement with TI Capital Management, we agreed to issue shares of our common stock and warrants to purchase shares of our common stock to Mr. Ghandour, upon the occurrence of certain events specified in the amendment. Pursuant to the amendment, in 2005 we issued to Mr. Ghandour 103,627 shares of our common stock and $600,000 in cash.

In February 2006, we entered into an amendment to our consulting agreement with TI Capital Management, pursuant to which we have agreed to pay Mr. Ghandour, in connection with the closing of a financing with a group of entities for the construction, ownership and operation of a GTL Mobile Unit or a GTL Fixed Unit an amount equal to 1.5% of total equity and debt financing provided by parties other than us for each of the first two GTL Units (whether Mobile or Fixed) in which we have an equity ownership; provided that under no circumstances will the cumulative amount of the two payments exceed $50,000,000.00.

For purposes of the foregoing, GTL Mobile Unit shall mean a barge or floating, production, storage and offtake vessel having Fischer-Tropsch gas to liquids conversion capability. For purposes of the foregoing, GTL Fixed Unit shall mean a land based or platform based facility having Fischer-Tropsch gas to liquids conversion capability the financing of which is with entities introduced by Mr. Ghandour to us, entities with whom Mr. Ghandour has a business relationship, or entities in which Mr. Ghandour develops a business relationship at our request. If there is a change in our control prior to the closing of the financing of the first GTL Unit (whether Mobile or Fixed) Mr. Ghandour will have the option to terminate the payment set out in the February 2006 amendment and receive in lieu thereof a lump sum payment of $2,000,000. If there is a change in our control during the two year period following the closing of the financing of the first GTL Unit (whether Mobile or Fixed) and before the closing of the financing of the second GTL Unit, Mr. Ghandour will have the option to terminate the payment set out in the February 2006 amendment and receive in lieu thereof a lump sum payment of $10,000,000.

The term of the February 2006 amendment will continue until December 31, 2010; provided that the Consultant and us may extend the term of the February 2006 amendment by mutual agreement.

21

PROPOSAL 2—APPROVAL OF THE AMENDMENT TO OUR JOINT DEVELOPMENT AGREEMENT

WITH SOVEREIGN OIL & GAS COMPANY II, LLC

Description of the Proposal

Our board of directors recommends that stockholders vote FOR the proposal to approve the amendment of our Joint Development Agreement with Sovereign Oil & Gas Company II, LLC to change the date upon which the exercise price of the warrants issued after the first contract year is determined from the closing price for our common stock on the first trading day of the contract year during which specified events occur to the closing per share sale price of our common stock on the December 1 prior to the contract year in which the warrants are issued.

We are proposing to change the date of determination of the exercise price because December 1 of each year is the date by which we must either give notice of termination of the Joint Development Agreement or, absent such notice of termination, the Joint Development Agreement automatically renews for another contract year. Thus, both Sovereign and us will have a better understanding of the possible warrant price at the time the parties are deciding whether to extend the Joint Development Agreement for an additional year. We discussed this change with Sovereign in December 2004 and reached a verbal understanding with them to seek to amend our Joint Development Agreement to reflect this change. For the 2005 and 2006 contract years, the exercise price for all warrants issued, after shareholder approval, is $6.94 and $7.98 per share, respectively. This would result in a change in the Black-Scholes valuation for warrants already earned of approximately $26,000. Absent this change, all warrants related to projects in the 2005 contract year would have had an exercise price of $11.16 per share.

Summary of our Joint Development Agreement

The following summary of our Joint Development Agreement with Sovereign Oil & Gas Company II, LLC is qualified by reference to the full text of the agreement and the amendment, which is attached as Annex A to this proxy statement. This summary reflects the proposed amendment.

Under the agreement, Sovereign will work exclusively with us to acquire and develop oil and gas fields worldwide but primarily focused on stranded natural gas fields using our proprietary GTL synthetic fuels technology.