SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12

RALCORP HOLDINGS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total Fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

RALCORP HOLDINGS, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

DEAR SHAREHOLDERS:

The 2005 Annual Meeting of Shareholders of Ralcorp Holdings, Inc. will be held at 8:30 a.m. local time, on Wednesday, February 2, 2005, at the Bank of America Plaza, 800 Market St., 30th floor, St. Louis, Missouri, for the following purposes:

| | • | To elect five directors; |

| |

| | • | To amend the 2002 Incentive Stock Plan; and |

| |

| | • | To transact any other business that may properly be presented at the Annual Meeting. |

If you were a shareholder of record at the close of business on November 26, 2004, then you may vote on these matters.

It is important that your shares be represented and voted at the Annual Meeting. Whether you plan to attend the Annual Meeting or not, we encourage you to vote in one of these ways:

| | • | USE THE INTERNET WEBSITE shown on the Proxy Card; |

| |

| | • | USE THE TOLL-FREE TELEPHONE NUMBER shown on the Proxy Card; or |

| |

| | • | MARK, SIGN, DATE, and PROMPTLY RETURN the Proxy Card in the postage-paid envelope provided. |

By Order of the Board of Directors,

Charles G. Huber, Jr.

Secretary

December 14, 2004

RALCORP HOLDINGS, INC.

800 Market Street

St. Louis, MO 63101

PROXY STATEMENT

1

RALCORP HOLDINGS, INC.

PROXY STATEMENT FOR THE

2005 ANNUAL MEETING OF SHAREHOLDERS

Why Am I Receiving These Materials?

The Board of Directors of Ralcorp Holdings, Inc. (“Ralcorp” or “Company”) is soliciting proxies to be used at the 2005 Annual Meeting. This Proxy Statement and Proxy Card are being mailed to shareholders on or about December 20, 2004. A copy of Ralcorp’s Annual Report containing financial statements for the fiscal year ended September 30, 2004 has been mailed with this Proxy Statement.

YOUR VOTE IS VERY IMPORTANT AND YOU ARE ENCOURAGED TO VOTE WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING.

Where And When Is The Annual Meeting?

The Annual Meeting will take place at 8:30 a.m. local time, on Wednesday, February 2, 2005, at the Bank of America Plaza, 800 Market St., 30th floor, St. Louis, Missouri.

Who Can Vote?

Record holders of Ralcorp Common Stock on November 26, 2004 may vote at the Annual Meeting. On that date, there were 29,451,282 shares of Ralcorp Common Stock outstanding.

How Do I Vote?

Shares Registered In Your Name:

| | • | Vote by Internet. Go to http://www.eproxyvote.com/rah and follow the instructions provided. |

| |

| | • | Vote by Telephone. Using a touch-tone telephone, call 1-877-779-8683 toll-free and follow the instructions provided. |

| |

| | • | Vote by Mail. Mark your Proxy Card, sign, date, and return it in the postage-paid envelope provided. |

| |

| | • | Attend the Annual Meeting and cast your vote there. |

To vote by Internet or telephone, you will need your Voter Control Number located above your name on your Proxy Card. Internet and telephone voting are available twenty-four hours a day until midnight on Tuesday, February 1, 2005, the day before the Annual Meeting.If you vote by Internet or telephone, then please do not return your Proxy Card.

Shares Held By Your Bank Or Broker:

If your Ralcorp Common Stock is held in the name of a bank or broker, then follow the voting instructions you receive from your bank or broker. If you wish to attend the Annual Meeting and vote your shares, then you will need to bring an account statement or letter from your bank or broker indicating that you were the record holder of your shares as of November 26, 2004.

Shares Held In The Savings Investment Plan:

If you participate in the Company’s Savings Investment Plan (SIP) and are the record holder of Ralcorp Common Stock in exactly the same name as you are identified by in the SIP, then you will receive a single

2

Proxy Card to vote all of your shares. If your plan account is not in exactly the same name as your shares of record, then you will receive one Proxy Card for your SIP shares and one for your record shares.

If you own shares through the plan and we have not received your vote by February 1, 2005, then the trustee will vote your shares in the same proportion as the shares that are voted on behalf of the other participants in the plan. The trustee will also vote unallocated shares of Ralcorp Common Stock held in the plan in direct proportion to the voting of allocated shares in the plan as to which voting instructions have been received, unless doing so would be inconsistent with the trustee’s duties.

How Many Votes Are Needed?

If a quorum is represented at the Annual Meeting, then the following votes are required:

• Election of Directors

A majority of shares entitled to vote and present (in person or by proxy) at the Annual Meeting must be voted“FOR”a nominee.

• Amendment of 2002 Incentive Stock Plan

A majority of shares entitled to vote and present (in person or by proxy) at the Annual Meeting must be voted“FOR”the amendment.

• Other Matters

| | Generally, a majority of the shares entitled to vote and present (in person or by proxy) at the Annual Meeting must be voted“FOR”such other matter. However, the Company does not know of any other matter that will be presented at this Annual Meeting. |

How Can I Change My Vote?

You can change your vote in one of three ways:

| | • | Send in another proxy or vote again electronically after your original vote; |

| |

| | • | Notify Ralcorp’s Corporate Secretary in writing before the Annual Meeting that you have revoked your proxy; or |

| |

| | • | Vote in person at the Annual Meeting. |

How Many Votes Do I Have?

You are entitled to cast one vote for each share of Ralcorp Common Stock you own on the record date. A majority of the outstanding shares entitled to vote must be present (in person or by proxy) in order to conduct the election of directors and other matters in this Proxy Statement.

What Constitutes A Quorum?

A majority of the outstanding shares entitled to vote at the Annual Meeting represented in person or by proxy constitutes a quorum.

How Are Votes Counted?

We treat a Proxy Card marked “withhold” for a nominee or nominees as a vote against such nominee or nominees. A Proxy Card marked “abstain” on a matter will be considered to be represented at the Annual Meeting, but not voted, for these purposes. Shares registered in the name of a bank, broker, or other “street name” agent, for which proxies are voted on some, but not all matters, will be considered to be represented at the Annual Meeting and voted only as to those matters marked on the Proxy Card.

All shares that are properly voted—whether by Internet, telephone, or mail—will be voted at the Annual Meeting in accordance with your instructions. If you sign the Proxy Card but do not give voting

3

instructions, then the shares represented by your Proxy Card will be voted as recommended by the Board of Directors.

If any other matters are properly presented at the Annual Meeting, then the people named on the Proxy Card will use their discretion to vote on your behalf.

What Does The Board Recommend?

The Board recommends you vote“FOR”the five nominees for director and“FOR”the amendment to 2002 Incentive Stock Plan.

Ten members serve on the Board of Directors. The Board is currently divided into three classes, with one class consisting of four members and two classes consisting of three members. Directors for each class are elected at the Annual Meeting held in the year in which the term for their class expires. Messrs. Banks, Hunt, Ingram and Kemper constitute the class whose term expires at the 2005 Annual Meeting. Under the Company’s current Bylaws, Mr. Ingram can no longer stand for re-election due to his age. In September the Board elected Bill G. Armstrong and the Company’s Co-Chief Executive Officers, Kevin J. Hunt and David P. Skarie, as directors.

In order to equalize the class sizes resulting from the retirement of Mr. Ingram and election of three new directors, the Board has organized directors into three classes each consisting of three directors. The Board recommends that three directors be elected at the 2005 Annual Meeting to serve for a three-year term ending in 2008 at our Annual Meeting; that one director be elected to a two-year term expiring in 2007 at our Annual Meeting; and that one director be elected to a one-year term ending in 2006 at our Annual Meeting.

The Board has nominated Messrs. Banks, Hunt and Kemper for election as directors at the Annual Meeting, to serve until the 2008 Annual Meeting. Also, the Board has nominated Mr. Armstrong for election as a director at the Annual Meeting, to serve until the 2007 Annual Meeting. Further, the Board has nominated Mr. Skarie for election as a director at the Annual Meeting, to serve until the 2006 Annual Meeting.

Mr. Goodall, Chairman of the Corporate Governance and Compensation Committee, and Mr. Stiritz, Chairman of the Board, discussed the desirability of replacing Mr. Ingram who will retire in early 2005. Messrs. Goodall and Stiritz discussed the need to fill Mr. Ingram’s position with a candidate who was familiar with the Company and had experience as an operations executive. Mr. Armstrong’s name surfaced as a candidate familiar with Ralcorp and who had a strong background in operations. Mr. Stiritz contacted Mr. Armstrong to initiate a discussion about joining the Board. At the September 23, 2004 board meeting the Committee reviewed Mr. Armstrong’s qualifications and his responses to a director’s questionnaire. Each member of the Committee was afforded the opportunity to contact Mr. Armstrong prior to the meeting. At the same meeting the Committee and entire Board reviewed Messrs. Hunt’s and Skarie’s performance during their first year as Co-Chief Executive Officers and concluded their performance warranted election to the Board. The Company has never paid a fee to a third party for assisting in a search for director candidates.

Each nominee has agreed to serve and the Board does not contemplate that any of the nominees will be unable to stand for election. However, if any nominee becomes unable to serve before the Annual Meeting, then your Proxy Card will be voted for a person that the Board nominates in such nominee’s place, unless you have withheld authority to vote for all nominees. There are no family relationships among our directors and corporate officers.

Other directors not up for election this year will continue in office for the remainder of their terms or until their death, resignation or removal. Proxies may not be voted for a greater number of persons than the nominees listed below.

4

Biographical information on Messrs. Armstrong, Banks, Hunt, Kemper and Skarie, and all other directors, is set forth below. Directors’ ages are as of December 31, 2004.

| | |

|

BILL G. ARMSTRONG—Standing for election at this meeting for a term expiring 2007

|

| Age: | 56 |

| Director Since: | October 2004 |

Principal Occupation/

Recent Business

Experience: | Mr. Armstrong served as Executive Vice President and Chief Operating Officer of Cargill Animal Nutrition from May 2001 to September 2004 and as Chief Operating Officer of Agribrands International, Inc. from April 1998 to April 2001. |

| Other Directorships: | Energizer Holdings, Inc. |

|

DAVID R. BANKS—Standing for election at this meeting for a term expiring 2008

|

| Age: | 67 |

| Director Since: | May 2001 |

Principal Occupation/

Recent Business

Experience: | Private equity investor. Mr. Banks served as Chairman of the Board of Beverly Enterprises, Inc. (health care) from May 1989 to December 2001 and as Chief Executive Officer from May 1989 to February 2001. |

| Other Directorships: | Nationwide Health Properties, Inc. |

|

JACK W. GOODALL—Continuing in office—Term expiring 2006

|

| Age: | 66 |

| Director Since: | March 1994 |

Principal Occupation/

Recent Business

Experience: | Mr. Goodall served as Chairman of the Board of Jack in the Box Inc. (restaurants) from April 1996 to February 2001. |

| Other Directorships: | Rubio’s Restaurants, Inc. |

|

KEVIN J. HUNT—Standing for election at this meeting for a term expiring 2008

|

| Age: | 53 |

| Director Since: | October 2004 |

Principal Occupation/

Recent Business

Experience: | Mr. Hunt has been Co-Chief Executive Officer and President of Ralcorp Holdings, Inc. since September 2003 and Chief Executive Officer of Bremner, Inc. since 1995 and Nutcracker Brands, Inc. since September 2003. Mr. Hunt has been employed with the Company since 1985. |

|

M. DARRELL INGRAM—Term expires at the 2005 Annual Meeting

|

| Age: | 72 |

| Director Since: | May 2001 |

Principal Occupation/

Recent Business

Experience: | Mr. Ingram has been a private equity investor since July 1998. |

|

5

| | |

|

DAVID W. KEMPER—Standing for election at this meeting for a term expiring 2008

|

| Age: | 54 |

| Director Since: | October 1994 |

Principal Occupation/

Recent Business

Experience: | Mr. Kemper has been Chairman, President and Chief Executive Officer of Commerce Bancshares, Inc. (bank holding company) since October 1991. |

| Other Directorships: | Tower Properties Company |

|

RICHARD A. LIDDY—Continuing in office—Term expiring 2007

|

| Age: | 69 |

| Director Since: | February 2001 |

Principal Occupation/

Recent Business

Experience: | Mr. Liddy served as Chairman of the Board of GenAmerica Financial (financial and insurance products) from September 2000 to April 2002. He also served as Chairman of the Board of Reinsurance Group of America from May 1993 to April 2002. Mr. Liddy was President of General American Life Insurance Company from May 1988 to September 2000 and Chief Executive Officer of General American Life Insurance Company from May 1992 to September 2000. In January 2000, while Mr. Liddy served as President of GenAmerica Financial Corporation, GenAmerica sold its mutual holding company to Metropolitan Life Insurance Company. At the request of the Missouri State Insurance Department, a receiver was appointed in order to oversee the equitable distribution of proceeds to policyholders. |

| Other Directorships: | Ameren Corporation, Brown Shoe Company, Inc. and Energizer Holdings, Inc. |

|

JOE R. MICHELETTO—Continuing in office—Term expiring 2006

|

| Age: | 68 |

| Director Since: | January 1994 |

Principal Occupation/

Recent Business

Experience: | Mr. Micheletto has been Vice-Chairman of the Board of Directors of Ralcorp Holdings, Inc. since September 2003. Mr. Micheletto served as Chief Executive Officer and President of Ralcorp Holdings, Inc. from September 1996 to September 2003. |

| Other Directorships: | Energizer Holdings, Inc. and Vail Resorts, Inc. |

|

DAVID P. SKARIE—Standing for election at this meeting for a term expiring 2006

|

| Age: | 58 |

| Director Since: | October 2004 |

Principal Occupation/

Recent Business

Experience: | Mr. Skarie has been Co-Chief Executive Officer and President of Ralcorp Holdings, Inc. since September 2003 and Chief Executive Officer and President of The Carriage House Companies, Inc. and Ralston Foods since January 2002. Mr. Skarie has been employed with the Company since 1986. |

|

6

| | |

|

WILLIAM P. STIRITZ, Chairman of the Board—Continuing in office—Term expiring 2007

|

| Age: | 70 |

| Director Since: | January 1994 |

Principal Occupation/

Recent Business

Experience: | Private equity investor. Mr. Stiritz is Chairman of the Board of Energizer Holdings, Inc. (batteries) and Chairman of the Energizer Holdings, Inc. Management Strategy and Finance Committee since April 2000. Mr. Stiritz served as Chairman of the Board of Ralston Purina Company from January 1982 to December 2001. He also served as Chairman of the Board, Chief Executive Officer and President of Agribrands International, Inc. from April 1998 to May 2001. |

| Other Directorships: | Ball Corporation, Energizer Holdings, Inc., The May Department Stores Company, and Vail Resorts, Inc. |

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE

“FOR” MESSRS. ARMSTRONG, BANKS, HUNT, KEMPER AND SKARIE.

Beneficial Ownership of More than 5% of Ralcorp Common Stock

| | Name and Address

of Beneficial Owner

| | Number of Shares

Beneficially

Owned

| | % of

Shares

Outstanding

| | Explanatory

Notes

|

| | Barclays Global Investors, NA

45 Fremont Street

San Francisco, California 94105 | | | 2,721,359 | | | | 9.4 | | | (a) (b) |

|

| (a) | Based on its filings with the Securities and Exchange Commission, Barclays Global Investors, N.A. possessed sole voting and dispositive power over 1,931,068 shares; Barclays Global Fund Advisors possessed sole voting and dispositive power over 516,376 shares; and Barclays Bank PLC possessed sole voting and dispositive power over 49,000 shares.

|

| (b) | As reported by the beneficial owner in a filing dated February 13, 2004 with the Securities and Exchange Commission. |

7

Directors and Executive Officers

The following table shows, as of November 26, 2004, the shares of Ralcorp Common Stock beneficially owned by Ralcorp directors and executive officers. Except as noted, all such persons possess sole voting and investment powers with respect to the shares listed. An asterisk in the column listing the percentage of shares outstanding indicates the person owns less than 1% of the Common Stock outstanding.

Directors &

Executive Officers

| | Number

of Shares(a)

| | Exercisable

Options(b)

| | Total

| | % of Shares

Outstanding

|

| Bill G. Armstrong | | | — | | | | 10,281 | | | 10,281 | | | * | |

| David R. Banks | | | 1,000 | | | | 23,131 | | | 24,131 | | | * | |

| Jack W. Goodall | | | 30,900 | | | | 23,131 | | | 54,031 | | | * | |

| M. Darrell Ingram | | | 5,000 | | | | 23,131 | | | 28,131 | | | * | |

| David W. Kemper | | | 9,000 | | | | 23,131 | | | 32,131 | | | * | |

| Richard A. Liddy | | | 10,000 | (c) | | | 23,131 | | | 33,131 | | | * | |

| Joe R. Micheletto | | | 48,431 | | | | 430,262 | | | 478,693 | | | 1.6 | |

| William P. Stiritz | | | 883,994 | (d) | | | 205,621 | | | 1,089,615 | | | 3.6 | |

| Kevin J. Hunt | | | 33,047 | | | | 55,101 | | | 88,148 | | | * | |

| David P. Skarie | | | 40,173 | | | | 36,207 | | | 76,380 | | | * | |

| David L. Beré | | | — | | | | — | | | — | | | * | |

| Richard R. Koulouris | | | 21,078 | | | | 10,979 | | | 32,057 | | | * | |

| Ronald D. Wilkinson | | | 16,963 | | | | 23,645 | | | 40,608 | | | * | |

| All Directors and Executive Officers as a Group (16 people) | | | 1,140,179 | | | | 916,078 | | | 2,056,257 | | | 6.5 | |

|

| (a) | Includes the following:

|

| | • | Shares held directly and Restricted Stock subject to forfeiture, a vesting schedule and other restrictions described in footnote 4 to the Summary Compensation Table on page 16;

|

| | • | Shares (or share equivalents) held indirectly in the Company’s Saving Investment Plan (SIP), Executive Savings Investment Plan (Executive SIP) and Deferred Compensation Plan for Key Employees. Shares in the SIP and Executive SIP are held in a separate fund in which participants acquire units. The fund also holds cash and short-term investments. The shares reported for a participant approximate the number of shares in the fund allocable to that participant and fluctuate due to the cash in the fund and the Common Stock’s price.

|

| (b) | Shares that could be acquired by exercising stock options through January 25, 2005. Options granted to a director become exercisable upon that director’s termination, retirement, disability or death.

|

| (c) | Shares of Common Stock owned by Mr. Liddy’s wife.

|

| (d) | Includes 18,333 shares of Common Stock owned by Mr. Stiritz’s wife. |

The Board of Directors has adopted independence standards, which are described in the Company’s Corporate Governance Guidelines and are available on the Company’s website, www.ralcorp.com/corporategovernance.htm. The Board has determined, in its judgment, that Messrs. Armstrong, Banks, Goodall, Ingram, Kemper, Liddy, and Stiritz are independent directors as defined in the NYSE listing standards and the SEC rules and regulations. The Guidelines also address qualifications for directors. Generally, the Guidelines provide that directors should have the skills, expertise, integrity and knowledge of the industries in which the Company competes necessary to enhance the long-term interest of shareholders. The Guidelines do not contain any specific limitations on a director’s ability to serve on boards or committees, including audit committees, of other organizations. The Board has determined, in its judgment, that Mr. Banks qualifies as an “audit committee financial expert” as defined by the SEC and that Mr. Banks

8

has accounting and related financial management expertise within the meaning of the NYSE listing standards.

Generally, at each regularly scheduled meeting, the non-management directors meet without the presence of management. The independent directors meet without the presence of management and any non-independent director twice each year. When the Board meets without management, Mr. Stiritz, or the Chairman of the Board Committee then in session, act as the presiding director.

Information concerning the standing Committees of the Board is provided below.

Audit Committee

The Committee’s primary responsibilities are to monitor and oversee (a) the quality and integrity of the Company’s financial statements and financial reporting, (b) the independence and qualifications of the Company’s independent auditors, (c) the performance of the Company’s independent audit, (d) the Company’s systems of internal accounting, financial controls and disclosure controls, and (e) the Company’s compliance with legal and regulatory requirements, codes of conduct and ethics programs.

The Audit Committee currently consists of six directors. The Board has determined, in its judgement, that the Audit Committee is comprised solely of independent directors as defined in the NYSE listing standards and Rule 10A-3 of the Securities Exchange Act of 1934. The Committee operates under a written charter, adopted by the entire board, which is available on the Company’s website at www.ralcorp.com/corporategovernance.htm. The Audit Committee’s report is on page 22 of this Proxy Statement.

Corporate Governance and Compensation Committee

The Corporate Governance and Compensation Committee reviews and revises, as necessary, the Company’s Corporate Governance Guidelines. The Committee also recommends to the Board nominees for directors and executive officers of the Company. The Committee will consider suggestions from shareholders regarding possible director nominees. Such suggestions, together with appropriate biographical information, should be submitted in writing to the Secretary of the Company. The Committee relies primarily on the recommendations from management and members of the Board to identify director nominee candidates. However, the Committee will consider timely written suggestions from shareholders. Shareholders wishing to suggest a candidate for director nomination for the 2006 Annual Meeting should mail their suggestions to Ralcorp Holdings, Inc., P.O. Box 618, St. Louis, MO 63188-0618, Attn: Corporate Secretary. Suggestions must be received by the Secretary of the Company no later than August 22, 2005. The Committee also makes recommendations to the Board regarding CEO and other executive compensation. The Committee also administers the Company’s Deferred Compensation and Incentive Stock Plans.

The Committee currently consists of seven directors. The Board has determined, in its judgement, that the Corporate Governance and Compensation Committee is comprised solely of independent directors as defined in the NYSE listing standards. The Committee operates under a written charter, adopted by the entire Board, which is available on the Company’s website at www.ralcorp.com/corporategovernance.htm. The Corporate Governance and Compensation Committee’s report on fiscal year 2004 executive compensation is on pages 20 & 21 of this Proxy Statement.

Executive Committee

The Executive Committee consists of two directors and may exercise all Board authority in the intervals between Board meetings, to the extent such authority is in compliance with the Corporate Governance Guidelines and does not infringe upon the duties and responsibilities of other Board committees.

Communication with the Board

Shareholders and other parties interested in communicating directly with an individual director or with the non-management directors as a group, may do so by writing to the individual director or group, c/o Ralcorp Holdings, P. O. Box 618, St. Louis, Missouri 63188-0618, Attn: Corporate Secretary. The Board has

9

directed that the Company’s Secretary forward shareholder communications to the Chairman of the Board and any other director to whom the communications are directed. In order to facilitate an efficient and reliable means for directors to receive all legitimate communications directed to them regarding the governance or operation of the Company, the Secretary will use his discretion to refrain from forwarding the following: sales literature; defamatory material regarding the Company and/or its directors; incoherent or inflammatory correspondence, particularly when such correspondence is repetitive and was addressed previously in some manner; and other correspondence unrelated to the Board’s corporate governance and oversight responsibilities.

Director Attendance at Annual Meeting

The Board has directed that the Company schedule, whenever practicable, a Board meeting and any Committee meetings on the same day as the Company’s Annual Meeting of Shareholders. The Board’s meetings on that day will be convened or adjourned to allow all directors who are physically present for the meetings to attend the Company’s Annual Meeting of Shareholders. The Company’s Corporate Governance Guidelines do not require the directors to attend the Annual Meeting. Typically the Company’s Annual Meeting is sparsely attended. Consequently, no director attended the 2004 Annual Meeting.

Code of Ethics

Our Standards of Business Conduct, applicable to all corporate officers and employees, set forth the Company’s expectations for the conduct of business by officers and employees. The directors have adopted and abide by the Directors Code of Ethics. Both documents are available on the Company’s website, www.ralcorp.com/corporategovernance.htm. In the event the Company modifies either document or waivers of compliance are granted to officers or directors, the Company will post such modifications or waivers on its website.

BOARD AND COMMITTEE SERVICE SUMMARY

Director

| | Board

| | Audit

| | Corporate

Governance &

Compensation

| | Executive

| | Attended 75% or More of

Board & Applicable

Committee Meetings(a)

|

| Bill G. Armstrong | | | X | | | | X | | | | X | | | | | | | (a) |

| David R. Banks | | | X | | | | X | * | | | X | | | | | | | X |

| Jack W. Goodall | | | X | | | | X | | | | X | * | | | | | | X |

| Kevin J. Hunt | | | X | | | | | | | | | | | | | | | (a) |

| M. Darrell Ingram | | | X | | | | X | | | | X | | | | | | | X |

| David W. Kemper | | | X | | | | X | | | | X | | | | | | | X |

| Richard A. Liddy | | | X | | | | X | | | | X | | | | | | | X |

| Joe R. Micheletto | | | X | | | | | | | | | | | | X | | | X |

| David P. Skarie | | | X | | | | | | | | | | | | | | | (a) |

| William P. Stiritz | | | X | * | | | | | | | X | | | | X | * | | X |

| Meetings Held in FY 2004 | | | 8 | | | | 6 | | | | 3 | | | | 6 | | | |

|

| * | Chair

|

| (a) | Messrs. Armstrong, Hunt and Skarie were not elected to the Board until October 2004. |

10

All non-employee directors receive an annual retainer of $30,000. The Company’s Chairman receives a retainer of $60,000. The Chairmen of the Audit Committee and Corporate Governance and Compensation Committee receive Chairman retainers of $10,000. Directors are paid $1,500 for each regular or special Board meeting, Committee meeting, telephonic meeting and consent to action without a meeting. The Company also pays the premiums on directors’ and officers’ liability and travel accident insurance policies insuring directors. On occasion, the Company provides directors with ski resort accommodations that the Company owns in Colorado. Non-employee directors also receive annual stock-based compensation. All awards vest at the director’s termination, retirement, disability or death.

In addition, certain members of the Board receive the following:

Chairman of the Board

| | • | Restricted stock grant with a fair market value of $50,000 each January. |

| |

| | • | Stock option grant of 10,000 shares each September. |

| |

| | Vice-Chairman of the Board |

| |

| • | Through December 31, 2003, Mr. Micheletto received salary and benefits as an employee of Ralcorp, serving as a consultant to the Company’s current Co-CEOs. | |

| |

| • | Restricted stock grant with a fair market value of $200,000 on January 1, 2004, which vested on October 30, 2004. | |

| |

| • | On January 1, 2004, Mr. Micheletto began receiving non-management director compensation. | |

| |

| • | Mr. Micheletto used Company aircraft for personal use. The cost to the Company of such use was $42,872. Mr. Micheletto no longer uses the Company plane for personal use. | |

| |

| • | Reimbursement of reasonable office expenses. | |

| |

| • | Stock option grant of 2,500 shares each September. | |

| |

| Other Non-Employee Directors | |

| |

| • | Initial stock option grant of 10,000 shares for newly elected directors. | |

| |

| • | Stock option grant of 2,500 shares each September. |

Ralcorp has a Deferred Compensation Plan for Non-Management Directors. Under this plan, any non-management director may elect to defer, with certain limitations, their retainer and fees until retirement or other termination of his directorship. Deferrals may be made in Common Stock equivalents in an Equity Option or may be made in cash under a number of funds operated by The Vanguard Group Inc. with a variety of investment strategies and objectives. Deferrals in the Equity Option receive a 33¹/3% Company matching contribution. All directors have elected to defer their retainers and fees into the Equity Option.

Proposal 2 seeks shareholder approval to change Section VI. F. of the 2002 Incentive Stock Plan to provide that, when the Board authorizes, in good faith, adjustments to awards impacted by distributions to shareholders other than for regular cash dividends, the number of shares available for future awards can be increased to reflect the adjustment to outstanding awards. The effect of the amendment will be to reduce the usage of existing shares available for awards. No other changes to the Plan are proposed.

When the Company paid the $1.00 special dividend in October, 2004, the share price declined approximately 2.8%. Thus, outstanding stock options declined in value by the same amount. The Board authorized anti-dilution adjustments to outstanding options. The adjustments used 76,281 shares available for awards. Since the shares available for awards cannot be increased without shareholder approval, the

11

Company now has fewer shares available for stock-based compensation awards. Stock-based compensation links compensation to share performance. In the event fewer shares are available for awards, management compensation may not be tied as directly to the Common Stock share price. The following sets forth significant features of the Plan.

What is the purpose of the Plan?

The purpose of the Plan is to enhance the profitability and value of the Company for the benefit of its shareholders by providing stock awards to attract, retain, compensate and motivate directors, officers and other key employees who make important contributions to the success of the Company. The Plan provides for the granting of stock options, restricted stock awards and other awards payable in Common Stock to Company directors and employees, including the Named Executive Officers set forth in the compensation table on page 16.

Where can I get a copy of the Plan?

A copy of the Plan as proposed to be amended is contained in Appendix A to this Proxy Statement. For your convenience we have underlined the proposed changes to the Plan.

Who administers the Plan?

The Plan is administered by the Corporate Governance and Compensation Committee of the Board of Directors although the Board also has the authority to perform certain administrative functions and to grant awards. Terms and conditions of awards will be set forth in written agreements approved by the Committee.

How many shares of stock can be granted?

The Plan authorized that 1,500,000 shares of Common Stock are available for the granting of awards under the Plan. Also, shares remaining for granting awards under the previous plan were available for awards under the new Plan. Currently, 773,402 shares are available for future awards. The closing per share price of the Common Stock on December 3, 2004 was $41.99.

Who is eligible to receive awards under the Plan?

Any director or employee of the Company or any of its subsidiaries is eligible for an award under the Plan if selected by the Board or the Committee. There are approximately 6,000 persons employed by the Company and its subsidiaries. Subject to the provisions of the Plan, the Committee has full authority and discretion to determine the individuals to whom awards are granted and the amount and form of such awards. No determination has been made by the Board or the Committee with respect to the specific recipients or the amount or nature of any future awards under the Plan. Shares that may be granted to a single individual by the Committee are limited to 1,000,000.

What type of Stock Options can be awarded?

Under the Plan, the Committee is authorized (i) to grant stock options that qualify as “Incentive Stock Options” (“ISOs”) under Section 422 of the Code and (ii) to grant stock options that do not so qualify. Stock options cannot be granted at an option price less than the fair market value of the Common Stock at the time of grant. The Plan allows for options granted to new employees or employees who are promoted to have an exercise price equal to the fair market value of the stock on the date of hire or promotion. No stock option can be exercised more than ten years after the date such option is granted. In the case of ISOs, the aggregate fair market value of the Common Stock with respect to which options are exercisable for the first time by any recipient during any calendar year cannot, under present tax rules, exceed $100,000.

12

Can the Committee grant other stock awards?

The Committee is also authorized to grant other stock awards including, but not limited to, restricted stock awards and deferrals of an employee’s cash bonus or other compensation in the form of stock equivalents under such terms and conditions as the Committee may prescribe. The shares of Common Stock that may be granted pursuant to a restricted stock award are restricted and may not be sold, pledged, transferred or otherwise disposed of until such restrictions lapse. Shares of Common Stock issued pursuant to a restricted stock award are issued for no monetary consideration. Presently, no more than 500,000 shares of Stock can be granted as Restricted Stock.

Will shares available under the Plan be granted under any other Company compensation plan?

The Committee has determined that the deferral of cash bonuses and other compensation under the Plan will be made in accordance with the provisions of the Deferred Compensation Plan for Key Employees. Pursuant to that plan, the Committee may, in its discretion, permit an eligible employee to defer payment of a cash bonus or other cash consideration under the Equity Option of that plan. Upon such deferral, an account in the employee’s name will be credited with an appropriate number of stock equivalents. Such employee’s account will be credited from time to time with dividend equivalents if dividends are paid by the Company. Distributions under the Equity Option may be made only upon the employee’s retirement or other termination of employment or at an earlier date as selected in advance by the employee. Upon distribution, the employee will receive shares of Common Stock equal to the number of equivalents in such employee’s vested balance account.

Can the Plan be amended?

The Plan provides that it may be amended by the Board, except that no such amendment can increase the number of shares of stock reserved for awards or change the terms of awards granted prior to the amendment without the consent of the recipient.

What happens to awards in the event of changes to the Company’s capitalization?

Appropriate adjustments will be made to the number of shares available for awards and the terms of outstanding awards under the Plan to reflect any issuance by the Company of another class of common, preferred, or otherwise targeted stock, any stock split-up, spin-off, issuance of targeted stock, stock dividend, combination or reclassification with respect to any outstanding series or class of stock of the Company, the consolidation or merger of the Company with any other entity or the sale of all or substantially all of the assets of the Company or any distribution to shareholders other than for regular cash dividends.

What are the key accounting consequences of the Plan?

Under the Company’s current accounting practices, stock options which contain no specific performance criterion and are granted with an option price at least equal to the market price of the Common Stock on the date of grant would not result in any charge against earnings of the Company either at the time of grant or upon exercise. Stock options with a performance component result in a charge to earnings if the performance criterion is met. If the options are exercised, the proceeds received will be credited to the Treasury Stock or Common Stock account and to the capital in excess of par account and the shares issued would be added to the total Common Stock outstanding. Other stock awards result in a charge against earnings. Presently, if anti-dilution adjustments are made to stock options in accordance with applicable accounting rules, the Company does not incur compensation expense.

What awards will be received by directors or key employees?

The Committee and the Board have the discretion to grant awards under the Plan and, as noted, no determination has been made as to specific recipients or the amount or nature of future awards to be made under the Plan. Currently, non-management directors defer all or portions of their annual cash retainer and meeting fees, receive annual stock option awards and, in the case of the Chairman of the Board, receive an

13

annual restricted stock award (see page 11). Since benefits granted to key employees in any particular year are solely in the discretion of the Committee, we cannot predict any awards that may be granted in future years under the Plan.

What are the tax consequences of Non-Qualified Stock Options?

Stock options issued under the Plan which do not satisfy the requirements of Section 422 of the Code have the following tax consequences:

| 1. | the optionee will have ordinary income at the time the option is exercised in an amount equal to the excess of the fair market value of the Common Stock acquired at the date of exercise over the option price; |

| 2. | the Company will have a deductible expense in an amount equal to the ordinary income of the optionee; |

| 3. | no amount other than the price paid upon exercise of the option shall be considered as received by the Company for shares so transferred; and |

| 4. | any gain from the subsequent sale of the shares of Common Stock acquired upon exercise for an amount in excess of fair market value on the date the option is exercised will be capital gain and any loss will be capital loss. |

What are the tax consequences of Incentive Stock Options?

Stock options to be issued under the Plan as ISOs will satisfy the requirements of Section 422 of the Code. Under the provisions of that section, the optionee will not be deemed to receive any income at the time an ISO is granted or exercised. If the optionee disposes of the shares of Common Stock acquired more than two years after the grant and one year after the exercise of the ISO, the gain, if any (i.e., the excess of the amount realized for the share over the option price) will be long-term capital gain. If the optionee disposes of the shares acquired on exercise of an ISO within two years after the date of grant or within one year after the exercise of the ISO, the disposition will constitute a “disqualifying disposition” and the optionee will have ordinary income in the year of the disqualifying disposition equal to the fair market value of the stock on the date of exercise minus the option price. The excess of the amount received for the shares over the fair market value at the time of exercise will be short-term capital gain if the shares are disposed of within one year after the ISO is exercised, or long-term capital gain if the shares are disposed of more than one year after the ISO is exercised. If the optionee disposes of the shares in a disqualifying disposition, and such disposition is a sale or exchange which would result in a loss to the optionee, then the amount treated as ordinary income shall not exceed the excess (if any) of the amount realized on such sale or exchange over the adjusted basis of such shares.

The Company is not entitled to a deduction as a result of the grant or exercise of an ISO. If the optionee has ordinary income as a result of a disqualifying disposition, the Company will have a corresponding deductible expense in an equivalent amount in the taxable year of the Company in which the disqualifying disposition occurs.

The difference between the fair market value of the option at the time of exercise and the option price is a tax preference item for alternative minimum tax purposes. The basis in stock acquired upon exercise of an ISO for alternative minimum tax purposes is increased by the amount of the preference.

What are the tax consequences of other stock awards?

In general, a recipient of other stock awards, including stock equivalents pursuant to the Deferred Compensation Plan for Key Employees, but excluding restricted stock awards (see below), will have ordinary income equal to the cash or fair market value of the Common Stock on the date received in the year in which the award is actually paid. The Company will have a corresponding deductible expense in an amount equal to that reported by the recipient as ordinary income in the same year so reported. The

14

recipient’s basis in the stock received will be equal to the fair market value of the Common Stock when received and his or her holding period will begin on that date.

Restricted stock awards do not constitute taxable income under existing federal tax law until such time as restrictions lapse with respect to any installment. When any installment of shares are released from restriction, the market value of such shares of Common Stock on the date the restrictions lapse constitutes income to the recipient in that year and is taxable at ordinary income rates.

The Code, however, permits a recipient of a restricted stock award to elect to have the award treated as taxable income in the year of the award and to pay tax at ordinary income tax rates on the fair market value of all of the shares awarded based on the price of the shares on the date the recipient receives a beneficial interest in such shares. The election must be made promptly within time limits prescribed by the Code and the regulations thereunder. Any appreciation in value thereafter would be taxed at capital gain rates when the restrictions lapse and the stock is subsequently sold. However, should the market value of the stock, at the time the restrictions lapse and the stock is sold, be lower than at the date acquired, the recipient would have a capital loss, to the extent of the difference. In addition, if, after electing to pay tax on the award in the year received, the recipient subsequently forfeits the award for any reason, the tax previously paid is not recoverable. Since the lapse of restrictions on restricted stock awards is accelerated in the event of a change in control of the Company, such acceleration may result in an excess parachute payment, as defined in Section 280G of the Code. In such event, the Company’s deduction with respect to such excess parachute payment is denied and the recipient is subject to a nondeductible 20% excise tax on such excess parachute.

When does the Plan expire?

The Committee may grant awards under the Plan until January 31, 2012. The Plan will remain effective with respect to all awards granted prior to expiration.

What vote is required to approve the amendment to the Plan?

The affirmative vote of a majority of the shares entitled to vote and present (in person or by proxy) is required for approval.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” ITEM 2, APPROVAL OF THE AMENDMENT TO THE 2002 INCENTIVE STOCK PLAN.

15

SUMMARYCOMPENSATION TABLE

| | | | | Annual Compensation

| | Long-Term Compensation

Compensation Awards

| | | | |

Name and

Principal Position

| | Year

| | Salary($)

| | Bonus($)

| | Other Annual

Compensation

($)(5)

| | Restricted

Stock

Award(s)

($)(4)

| | Securities

Underlying

Options/

SARs (#)

| | All Other

Compensation

($)(1)

|

| K. J. Hunt | | 2004 | | | 350,000 | | | | 348,000 | | | | 4,756 | | | | 1,071,000 | | | | 50,000 | | | | 34,035 | |

| Co-CEO & | | 2003 | | | 237,504 | | | | 185,000 | | | | 0 | | | | 0 | | | | 30,000 | | | | 15,676 | |

| President | | 2002 | | | 216,300 | | | | 120,000 | | | | 1,288 | | | | 0 | | | | 30,000 | | | | 10,449 | |

| |

| D. P. Skarie | | 2004 | | | 350,000 | | | | 375,000 | | | | 1,616 | | | | 1,071,000 | | | | 50,000 | | | | 39,375 | |

| Co-CEO & | | 2003 | | | 229,008 | | | | 185,000 | | | | 0 | | | | 0 | | | | 30,000 | | | | 10,741 | |

| President | | 2002 | | | 210,000 | | | | 137,000 | | | | 0 | | | | 0 | | | | 30,000 | | | | 10,335 | |

| |

| D. L. Beré(2) | | 2004 | | | 285,100 | | | | 80,649 | | | | 0 | | | | 0 | | | | 25,000 | | | | 0 | |

| Corporate VP & CEO | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Bakery Chef | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| R. R. Koulouris | | 2004 | | | 189,798 | | | | 97,500 | | | | 0 | | | | 535,500 | | | | 23,000 | | | | 93,351 | |

| Corporate VP & | | | | | | | | | | | | | | | | | | | | | | | | | | |

| President of | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Bremner Inc. | | | | | | | | | | | | | | | | | | | | | | | | | | |

| & Nutcracker | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Brands, Inc.(3) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| R. D. Wilkinson | | 2004 | | | 208,000 | | | | 126,000 | | | | 0 | | | | 535,500 | | | | 23,000 | | | | 8,580 | |

| Corporate VP & | | 2003 | | | 200,508 | | | | 125,000 | | | | 0 | | | | 0 | | | | 23,000 | | | | 7,558 | |

| Director of | | 2002 | | | 193,308 | | | | 114,600 | | | | 0 | | | | 0 | | | | 23,000 | | | | 7,299 | |

| Product Supply of | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ralston Foods and | | | | | | | | | | | | | | | | | | | | | | | | | | |

| The Carriage House | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Companies, Inc. | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | The amounts shown in this column consist of the following for fiscal years 2004, 2003 and 2002: |

| | • Company Matching Contributions or Accruals to the Company’s SIP and Executive SIP:

|

| | | | | Fiscal Year 2004

| | Fiscal Year 2003

| | Fiscal Year 2002

|

| | | Mr. Hunt | | $ | 34,035 | | $ | 13,071 | | $ | 10,449 |

| | | Mr. Skarie | | $ | 39,375 | | $ | 9,243 | | $ | 10,335 |

| | | Mr. Koulouris | | $ | 15,512 | | | (3) | | | (3) |

| | | Mr. Wilkinson | | $ | 8,580 | | $ | 6,015 | | $ | 7,299 |

| |

| | • Company reimbursement for relocation costs: Mr. Koulouris for fiscal year 2004, $77,839. |

| (2) | Mr. Beré became a Corporate Officer on December 3, 2003.

|

| (3) | Mr. Koulouris became a Corporate Officer on November 6, 2003.

|

| (4) | Restricted stock awards are valued by multiplying the closing market price of the Common Stock on the date of grant by the number of shares awarded. The Company pays dividends on shares of restricted stock at the same rate, if any, as paid to all Shareholders. Dividends are held in an account bearing interest at the prime rate until restrictions lapse. The restrictions lapse as follows: one-third on September 24 in 2011, 2012 and 2013. The number of shares of restricted stock awarded are as follows: Mr. Hunt - 30,000; Mr. Skarie - 30,000; Mr. Koulouris - 15,000; and Mr. Wilkinson - 15,000.

|

| (5) | Amounts reflect reimbursement for taxes associated with spouse/immediate family accompaniment on business travel. Consistent with applicable regulations, this column does not include perquisites that when aggregated did not exceed the lesser of $50,000 or 10% of any such officer’s salary and bonus. |

16

OPTION GRANTS IN LAST FISCAL YEAR

| | | Individual Grants

| | Grant Date

Value

|

Name

| | Number of

Securities

Underlying

Options

Granted(#)(1)

| | % of Total

Options

Granted to

Employees in

Fiscal Year(2)

| | Exercise

or Base

Price

($/Sh)

| | Expiration

Date

| | Grant Date

Present

Value($)(3)

|

| K. J. Hunt | | | 50,000 | | | | 12.0 | | | | 32.30 | | | 2/4/14 | | | 727,850 | |

| D. P. Skarie | | | 50,000 | | | | 12.0 | | | | 32.30 | | | 2/4/14 | | | 727,850 | |

| D. L. Beré | | | 25,000 | | | | 6.0 | | | | 32.30 | | | 2/4/14 | | | 363,925 | |

| R. R. Koulouris | | | 23,000 | | | | 5.5 | | | | 32.30 | | | 2/4/14 | | | 334,811 | |

| R. D. Wilkinson | | | 23,000 | | | | 5.5 | | | | 32.30 | | | 2/4/14 | | | 334,811 | |

| (1) | 25% of the total shares become exercisable on February 5 of 2007, 2008, 2009 and 2010 respectively.

|

| (2) | The number of options granted to all employees in fiscal year 2004 was 419,000.

|

| (3) | Grant date valuation amounts were determined by application of the Black-Scholes valuation method. Assumptions used were as follows: (i) interest rate equals the interpolated grant date Treasury rate for a term equal to the expected life of each option (averaging 3.75%); (ii) dividend yield equals 0%; (iii) expected volatility at grant date equals 35.06%; and (iv) expected exercise date equals the midpoint between the date exercisable and the expiration date.

|

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND

FISCAL YEAR-END OPTION VALUES

| | | | | | | | | | | Number of Securities Underlying

Unexercised Options at FY-End(#)

| | Value of Unexercised

In-the-Money

Options at FY-End($)

|

Name

| | Shares Acquired

on Exercise

(#)

| | Value

Realized($)

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

| K. J. Hunt | | | 0 | | | | 0 | | | | 67,700 | | | | 163,800 | | | | 1,400,091 | | | | 1,940,948 | |

| D. P. Skarie | | | 0 | | | | 0 | | | | 43,000 | | | | 157,750 | | | | 834,897 | | | | 1,831,347 | |

| D. L. Beré | | | 0 | | | | 0 | | | | 0 | | | | 25,000 | | | | 0 | | | | 85,000 | |

| R. R. Koulouris | | | 0 | | | | 0 | | | | 12,625 | | | | 49,250 | | | | 243,916 | | | | 492,075 | |

| R. D. Wilkinson | | | 27,244 | | | | 506,167 | | | | 35,500 | | | | 113,000 | | | | 681,679 | | | | 1,491,017 | |

LONG -TERM INCENTIVE PLANS -AWARDS IN LAST FISCAL YEAR

| | | | | | | | | | | Estimated Future Payouts Under

Non-Stock Price-Based Plans

|

Name

| | Number of

Shares, Units or

Other Rights(#)

| | Performance or

Other Period Until

Maturation or

Payout

| | Threshold

($ or #)

| | Target

($ or #)

| | Maximum

($ or #)

|

| K. J. Hunt | | | 0 | | | | 0 | | | | $0 | | | | $0 | | | | $0 | |

| D. P. Skarie | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| D. L. Beré | | | (1 | ) | | | 3 years | | | | 100,000 | | | | 0 | | | | 400,000 | |

| R. R. Koulouris | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| R. D. Wilkinson | | | 0 | | | | 0 | | | | 0 | | | | 0 | | | | 0 | |

| (1) | In September 2004, the Board of Directors awarded Mr. Beré a long-term special cash bonus. Under this program, Mr. Beré may receive a special cash bonus of $100,000, $200,000 or $400,000 based upon the achievement of certain pre-determined performance targets for the Company’s frozen bakery products segment. The payment date for any award amount earned under the program will be November 15, 2007. In order to be eligible to receive an award under the program, Mr. Beré must be considered an active employee of the Company on the payment date. |

17

EQUITY PLAN COMPENSATION INFORMATION

FOR FISCAL-YEAR END

Plan Category

| | Number of Securities to be

Issued Upon Exercise of

Outstanding Options

| | Weighted Average of Exercise

Price of Outstanding Options

($)

| | Number of Securities

Remaining Available for

Future Issuance Under Equity

Compensation Plans

(Excluding Securities Reflected

in Column a)

|

| Equity compensation plans approved by security holders | | | 2,681,457 | | | | 20.65 | | | | 933,683 | (1) |

| Equity compensation plans not approved by security holders | | | 0 | | | | 0 | | | | 0 | |

| Total (2) | | | 2,681,457 | | | | 20.65 | | | | 933,683 | |

| (1) | Approximately 84,000 shares of this number are reserved for issuance under the equity option of the Company’s Deferred Compensation Plan for Key Employees. This amount equals the dollar value of previous deferrals of income by executive officers and key employees.

|

| (2) | Does not include the 76,281 shares issued under the 2002 Incentive Stock Plan’s antidilution provision in connection with the Special Dividend paid on October 22, 2004. |

The Company has Management Continuity Agreements with the Named Executive Officers and each of the other corporate officers. The agreements provide severance compensation to each corporate officer in the event of the officer’s voluntary or involuntary termination after a change-in-control of the Company. The compensation provided would be in the form of a lump sum payment equal to the present value of continuing the executive officer’s salary and bonus for a specified period following the executive officer’s termination of employment, and the continuation of other executive benefits for the same period. The initial applicable period is three years in the event of an involuntary termination of employment (including a constructive termination) and one year in the event of a voluntary termination of employment.

No payments would be made if the executive officer’s termination is due to death, disability or normal retirement, or is “for cause,” nor would any payments continue beyond the executive officer’s normal retirement date. Contracts governing stock options and restricted stock provide that upon a change-in-control of the Company, any unexercised, unvested, unearned restricted or unpaid shares become 100% vested. The agreements provide that executives with a Management Continuity Agreement be indemnified from any tax under Section 4999 and Section 280G of the Internal Revenue Code of 1986, as amended, that is attributable to a parachute payment under the Code and any tax upon the payment of such amounts.

The Ralcorp Retirement Plan may provide pension benefits in the future to the named executive officers. Certain regular U.S. employees having one year of service with the Company or certain Company subsidiaries are eligible to participate in the Retirement Plan. Employees become vested after five years of service. Normal retirement is at age 65; however, employees who work beyond age 65 may continue to accrue benefits.

Annual benefits are computed by multiplying the participant’s Final Average Earnings (average of participant’s five highest consecutive annual earnings during ten years prior to retirement or earlier termination) by the product of 1.5% times the participant’s years of service (to a maximum of 40 years) and by subtracting from that amount up to one half of the participant’s primary social security benefit at retirement (with the actual amount of offset determined by age and years of service at retirement).

�� The following table shows the estimated annual retirement benefits that would be payable from the Retirement Plan to salaried employees, including the named executive officers, assuming age 65 retirement. To the extent an employee’s compensation or benefits exceed certain limits imposed by the Internal

18

Revenue Code of 1986, as amended, the table also includes benefits payable from an unfunded supplemental retirement plan. The table reflects benefits prior to the subtraction of social security benefits as described above. Effective December 31, 2003, the Company froze retirement benefits for administrative employees including corporate officers. Consequently, they no longer accrue defined pension benefits.

PENSION PLAN TABLE

| | | | Years of Service

|

| | Remuneration

(Final Average

Earnings)

| | 10

| | 15

| | 20

| | 25

| | 30

| | 35

| | 40

|

| | $ 100,000 | | $ | 15,000 | | | $ | 22,500 | | | $ | 30,000 | | | $ | 37,500 | | | $ | 45,000 | | | $ | 52,500 | | | $ | 60,000 | |

| | $ 200,000 | | $ | 30,000 | | | $ | 45,000 | | | $ | 60,000 | | | $ | 75,000 | | | $ | 90,000 | | | $ | 105,000 | | | $ | 120,000 | |

| | $ 300,000 | | $ | 45,000 | | | $ | 67,500 | | | $ | 90,000 | | | $ | 112,500 | | | $ | 135,000 | | | $ | 157,500 | | | $ | 180,000 | |

| | $ 400,000 | | $ | 60,000 | | | $ | 90,000 | | | $ | 120,000 | | | $ | 150,000 | | | $ | 180,000 | | | $ | 210,000 | | | $ | 240,000 | |

| | $ 500,000 | | $ | 75,000 | | | $ | 112,500 | | | $ | 150,000 | | | $ | 187,500 | | | $ | 225,000 | | | $ | 262,500 | | | $ | 300,000 | |

| | $ 600,000 | | $ | 90,000 | | | $ | 135,000 | | | $ | 180,000 | | | $ | 225,000 | | | $ | 270,000 | | | $ | 315,000 | | | $ | 360,000 | |

| | $ 700,000 | | $ | 105,000 | | | $ | 157,500 | | | $ | 210,000 | | | $ | 262,500 | | | $ | 315,000 | | | $ | 367,500 | | | $ | 420,000 | |

| | $ 800,000 | | $ | 120,000 | | | $ | 180,000 | | | $ | 240,000 | | | $ | 300,000 | | | $ | 360,000 | | | $ | 420,000 | | | $ | 480,000 | |

| | $ 900,000 | | $ | 135,000 | | | $ | 202,500 | | | $ | 270,000 | | | $ | 337,500 | | | $ | 405,000 | | | $ | 472,500 | | | $ | 540,000 | |

| | $1,000,000 | | $ | 150,000 | | | $ | 225,000 | | | $ | 300,000 | | | $ | 375,000 | | | $ | 450,000 | | | $ | 525,000 | | | $ | 600,000 | |

For the purpose of calculating retirement benefits, the Named Executive Officers had, as of September 30, 2004, the following years of credited service, calculated to the nearest year: Mr. Hunt—18 years; Mr. Skarie—18 years; Mr. Koulouris—24 years; and Mr. Wilkinson—8 years. Credited service includes service with Ralston Purina Company, the Company’s former parent corporation. Earnings used in calculating benefits under the Retirement Plan and any unfunded supplemental retirement plan previously described are approximately equal to amounts included in the Salary and Bonus columns in the Summary Compensation Table on page 16.

Other Benefit Plans

Beneficiaries of eligible retired executive officers will be provided a death benefit in an amount equal to 50% of the earnings recognized under the Company’s benefit plans for the executive officer during the last full year of employment. This benefit is not presently insured or funded.

In addition, the Executive Long-Term Disability Plan would provide benefits to its corporate officers, including certain executive officers, in the event they become disabled. The Long-Term Disability Plan, which is available to certain regular employees of the Company and in which officers must participate at their own expense in order to be eligible for the Executive Long-Term Disability Plan, imposes a limit of $10,000 per month (60% of a maximum annual salary of $200,000) on the amount paid to a disabled employee. The Executive Long-Term Disability Plan will provide a supplemental benefit equal to 60% of the difference between the executive officer’s previous year’s earnings recognized under the Company’s benefit plans and $200,000, with appropriate taxes withheld.

19

The Corporate Governance and Compensation Committee consists entirely of independent directors. It approves direct and indirect compensation of all executive officers, administers and makes awards under the Company’s existing Incentive Stock Plan. Stock-based awards such as stock options and restricted stock may be granted under that Plan to officers and other key employees of the Company.

Compensation Philosophy

The Company’s executive compensation program is designed to provide total compensation that can attract, retain and motivate key employees. The Committee’s intent is to provide overall cash compensation packages that have a greater “at risk” element than competitive norms, i.e., salaries below industry medians and performance-based bonuses which may permit recipients to achieve total cash compensation packages exceeding medians. The Committee generally reviews executive officer compensation including salaries, bonuses and any long-term compensation each September near the end of the Company’s fiscal year.

Salaries

The Committee establishes the salaries for executive officers based on its assessment of each individual’s responsibilities, experience, individual performance and contribution to the Company’s performance. The Committee also takes into account compensation data from other companies; length of service in current position and with the Company overall, historical compensation levels at the Company; the competitive environment for attracting and retaining executives; entitlement to employee retirement benefits (pension, 401k, etc.) and the recommendation of Messrs. Hunt and Skarie, except with respect to their own compensation. The Company attempts to set base salary levels at or below the median level for executives holding positions of similar responsibility and complexity at corporations as reflected in published surveys. The salaries and other compensation information for the Company’s Named Executive Officers are set forth in the Summary Compensation Table on page 16.

Bonuses

On September 23, 2004, the Committee awarded bonuses to all but one of the Named Executive Officers for the Company’s 2004 fiscal year. The amount of each such bonus was based on the officer’s total compensation package including salary, bonus, stock options, and long-term stock based awards; the financial performance of the officer’s business unit relative to the business plan (including such measures as sales volume, revenues, costs, cash flow and operating profit); Company financial performance (including the measures of business unit performance listed above and, in addition, earnings per share); the officer’s individual performance (including the quality of strategic plans, organizational and management development, participation in evaluations of potential acquisitions and similar manifestations of individual performance); and the business environment for the officer’s business unit. With the exception of their own bonuses, the Committee considered recommendations of Messrs. Hunt and Skarie, which were based on bonus targets (as a percent of salary) set prior to the beginning of the fiscal year. Mr. Beré was paid a bonus under the terms of the Bakery Chef bonus plan in place at the time of the acquisition in December 2003.

Although the foregoing factors were weighed heavily by the Committee, individual bonuses and the total bonus pool were not based on application of a strict numerical formula developed prior to the fiscal year, but were based on the Committee’s exercise of subjective judgment and discretion in light of the quantitative and qualitative factors listed above. Each of Messrs. Hunt’s and Skarie’s bonus was based on the Committee’s general assessment of the factors described above as well as their leadership in completing and managing the integration of key acquisitions during the year.

Long-Term Compensation

Long-term compensation currently consists of stock options and restricted stock awards (or a long-term cash incentive for Mr. Beré). Stock options entitle the recipient to purchase a specified number of shares of

20

the Company’s Common Stock after a specified period of time at an option price, which is ordinarily equal to the fair market value of the Common Stock at the time of grant. They provide executives with an opportunity to buy and maintain an equity interest in the Company while linking the executive’s compensation directly to shareholder value since the executive receives no benefit from the option unless all shareholders have benefited from an appreciation in the value of the Common Stock. In addition, since the options “vest” serially over a period of time after the date of grant (usually three to six years), they enhance the ability of the Company to retain the executive while encouraging the executive to take a longer-term view on decisions impacting the Company. Stock options were awarded in February 2004. The amount awarded to each Company officer was recommended by Messrs. Hunt and Skarie after consultation with the Committee’s Chairman. With respect to each of Messrs. Hunt and Skarie, the Committee authorized a stock option award of 50,000 shares. The amount reflected the increase in their responsibilities but was significantly lower than option awards granted to their predecessor. Long-term restricted stock awards were granted to all but one corporate officer in September 2004. The amounts awarded were recommended by Messrs. Hunt and Skarie after consultation with the Committee’s Chairman. The awards were designed to link compensation to long-term share price performance. Consequently, the awards do not begin vesting until 2011.

Additional Information

In September 2004, we retained an independent consulting firm to study existing salary, bonus and stock based compensation paid to corporate officers. The results confirmed that, after giving effect to the 2004 restricted stock awards, total direct compensation (salary, bonus and present value of long-term incentives) for corporate officers was consistent with or below median market levels. With respect to Messrs. Hunt and Skarie, the analysis compared their total direct compensation against that of the Chief Operating Officer at other companies using published data and an average of the first and second highest paid individuals against a publicly-traded peer group. The peer group was comprised of twelve U.S.-based publicly traded food companies with revenue ranging from $422 million to $3.8 billion.

Deductibility of Certain Executive Compensation

A feature of the Omnibus Budget Reconciliation Act of 1993 sets a limit on deductible compensation of $1,000,000 per person, per year for the Chief Executive Officer and the next four highest-paid executives. While it is the general intention of the Committee to meet the requirements for deductibility, the Committee may, in the exercise of its judgment, approve payment of compensation from time to time that may not be fully deductible. The Committee believes this flexibility will enable it to respond to changing business conditions, or to an executive’s exceptional individual performance. The Committee will continue to review and monitor its policy with respect to the deductibility of compensation.

| | J. W. Goodall—Chairman

| | M. D. Ingram | | D. W. Kemper |

| | D. R. Banks | | R. A. Liddy | | W. P. Stiritz |

The members of the Corporate Governance and Compensation Committee are listed on page 10 under the heading “Board and Committee Service Summary.” Mr. Micheletto, Vice-Chairman of the Board of Directors of Ralcorp and its former Chief Executive Officer and President, serves on the Board of Directors of Energizer Holdings, Inc. During the Company’s fiscal year, he sat on Energizer’s Executive and Finance Committees. On December 8, 2003, he ended his service on Energizer’s Nominating and Executive Compensation Committee. Mr. Stiritz, the Chairman of the Board of Energizer Holdings, Inc. and Chairman of its Management Strategy and Finance Committee, serves on Ralcorp’s Board of Directors and sits on its Corporate Governance and Compensation Committee.

21

The Board has determined, in its judgment, that the Audit Committee is comprised solely of independent directors as defined in the NYSE listing standards, Rule 10A-3 of the Securities Exchange Act of 1934 and the Company’s Corporate Governance Guidelines. The Audit Committee operates under a written charter, adopted by the entire Board, which is available on the Company’s website at www.ralcorp.com/corporategovernance.htm.

Management is responsible for the Company’s internal controls, financial reporting process and compliance with laws and regulations and ethical business standards. The independent accountants are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board and issuing a report thereon. Ernst & Young, LLP, the Company’s internal auditor, assists the Audit Committee with its responsibility to monitor and oversee these processes and internal controls. The Committee discussed with the Company’s internal and independent auditors the overall scopes and plans for their respective audits. The Committee met, at least quarterly, with the internal and independent auditors, with and without management present, and discussed the results of their examinations, their evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

With respect to the Company’s audited financial statements for the Company’s fiscal year ended September 30, 2004, management of the Company has represented to the Committee that the financial statements were prepared in accordance with generally accepted accounting principles and the Committee has reviewed and discussed those financial statements with management. The Audit Committee has also discussed with PricewaterhouseCoopers LLP, the Company’s independent accountants, the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees) as modified or supplemented.

The Audit Committee has received the written disclosures from PricewaterhouseCoopers required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), as modified or supplemented, and has discussed the independence of PricewaterhouseCoopers with members of that firm.

Based on the review and discussions referred to above, the Audit Committee recommended to the Company’s Board of Directors that the audited consolidated financial statements for the fiscal year ended September 30, 2004, be included in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission for that year.

| | D. R. Banks—Chairman

| | M. D. Ingram | | R. A. Liddy |

| | J. W. Goodall | | D. W. Kemper | | |

Mr. Kemper is Chairman, President and Chief Executive Officer of Commerce Bancshares, Inc., which is one of eight banks that participate in the Company’s committed credit facility. Commerce Bancshares’ lending commitment under that facility in Fiscal 2004 was limited to $25 million out of a total syndicate commitment of $275 million. During the fiscal year, the Company paid approximately $21,000 in interest to Commerce Bancshares, Inc. The Company’s corporate credit card program is administered through Commerce Bancshares, Inc., but there is no charge made to or fee paid by the Company for this service.

22

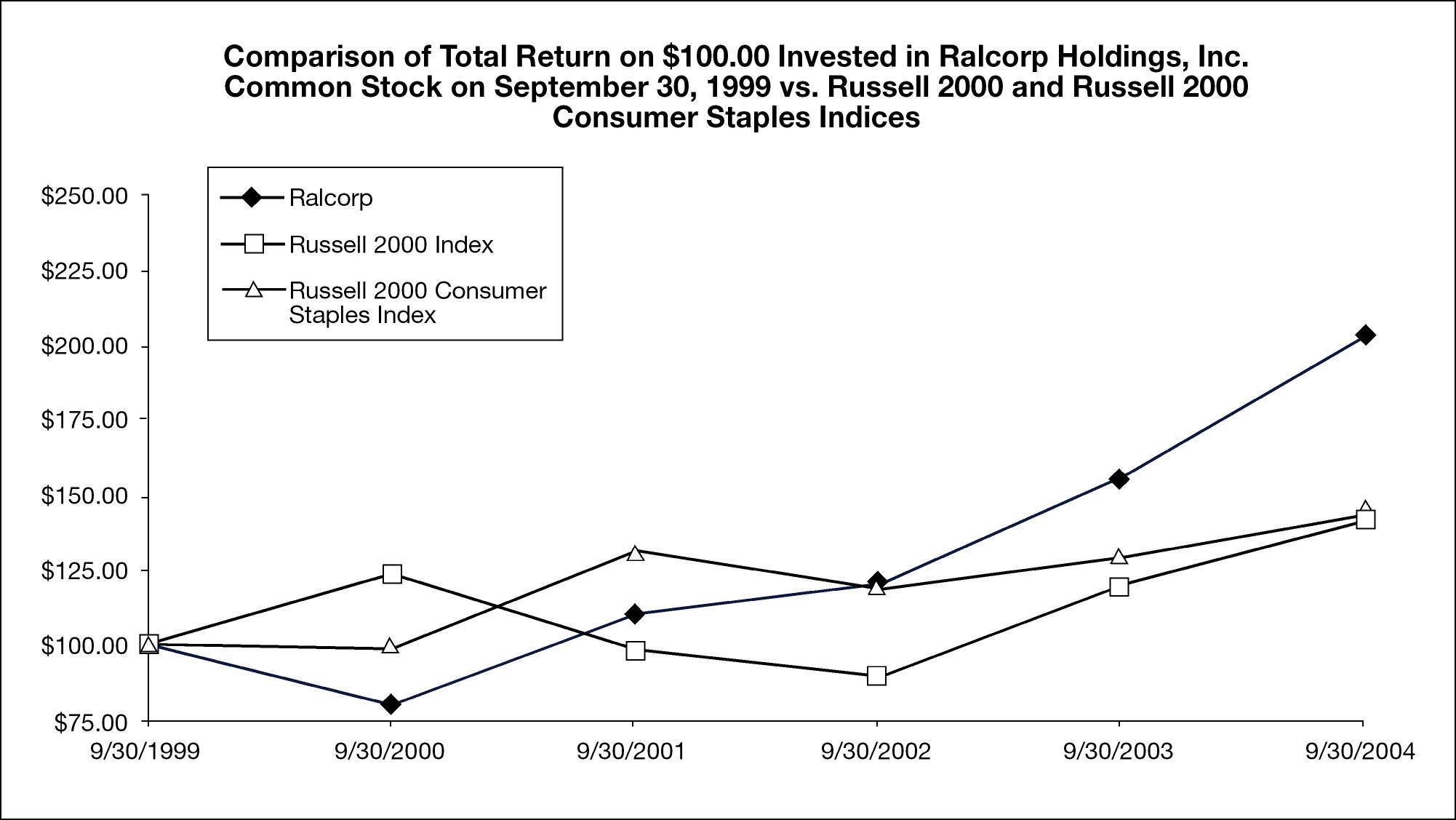

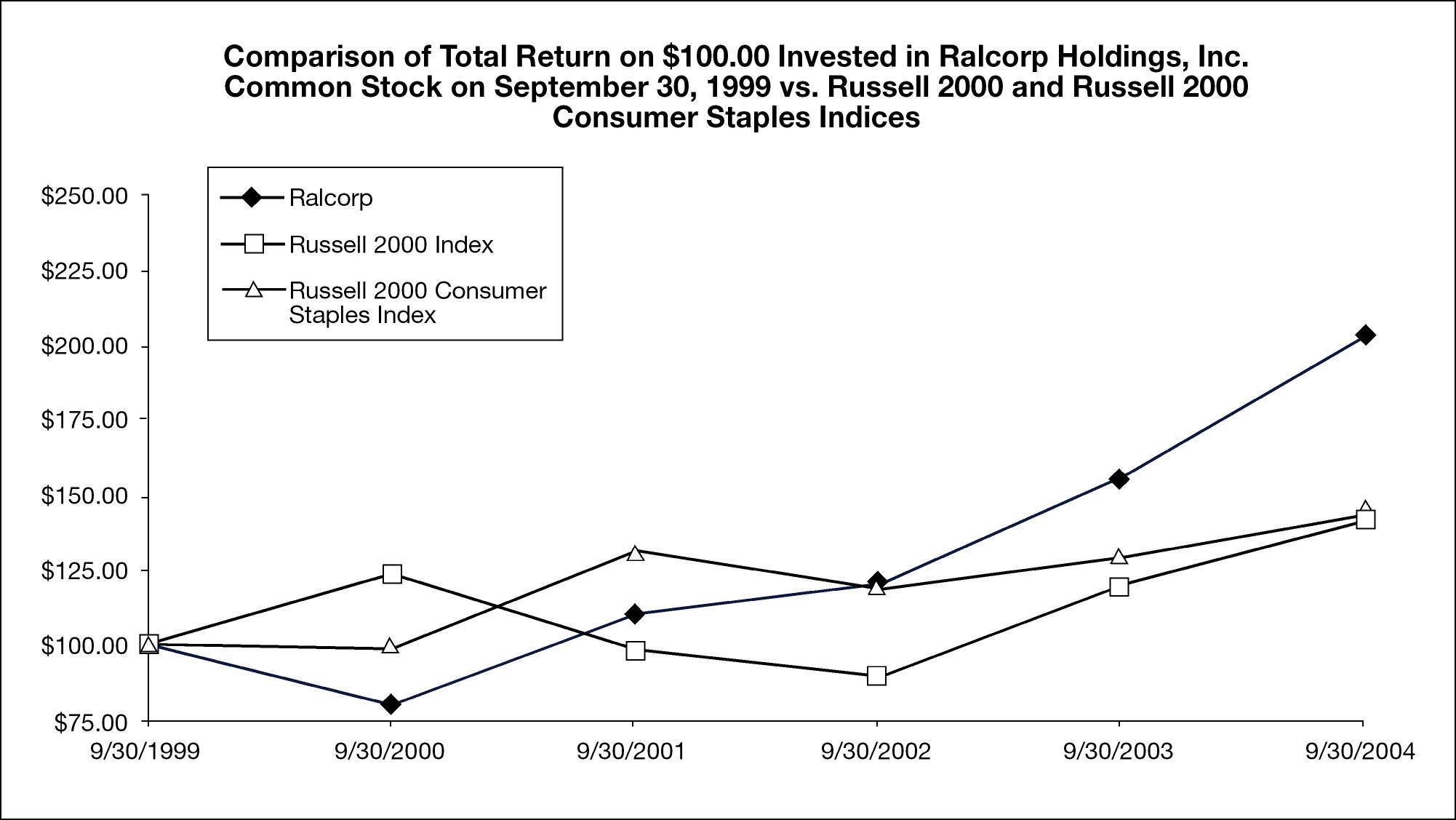

The following performance graph compares the changes, for the period indicated, in the cumulative total value of $100 hypothetically invested in each of (a) Ralcorp Common Stock, (b) the Russell 2000 Index, and (c) the Russell 2000 Consumer Staples Index.

Graph Data Points

| | | | Ralcorp

($)

| | Russell 2000

Index ($)

| | Russell 2000 Consumer

Staples Index ($)

|

| | 9/30/1999 | | | 100.00 | | | | 100.00 | | | | 100.00 | |

| | 9/30/2000 | | | 79.86 | | | | 123.55 | | | | 98.77 | |

| | 9/30/2001 | | | 110.02 | | | | 98.09 | | | | 131.29 | |

| | 9/30/2002 | | | 120.25 | | | | 89.58 | | | | 118.69 | |

| | 9/30/2003 | | | 156.61 | | | | 120.28 | | | | 129.29 | |

| | 9/30/2004 | | | 204.10 | | | | 141.72 | | | | 143.44 | |

Proxy Solicitation

Ralcorp has paid for preparing this Proxy Statement and the Proxy Card. Ralcorp will also pay for the solicitation of proxies. The Company hired Georgeson Shareholder Communications Inc. to assist in the solicitation of proxies for a fee of $9,000 plus expenses. Ralcorp will reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for costs, including postage and handling, reasonably incurred by them in sending proxy materials to the beneficial owners of Ralcorp’s Common Stock. In addition to the use of the mail, employees of the Company may make proxy solicitations, via telephone or personal contact.

23

Independent Registered Public Accounting Firm

PricewaterhouseCoopers LLP acted as Ralcorp’s independent accountants for fiscal year 2004 and has served in that capacity since 1994. The Board, upon the recommendation of the Audit Committee, appointed PricewaterhouseCoopers as independent accountants for the current fiscal year. A representative of that firm will be present at the Annual Meeting, will have an opportunity to make a statement, if they desire, and will be available to respond to appropriate questions.

Fees Paid to PricewaterhouseCoopers LLC

The following fees were paid for audit services rendered in conjunction with reviewing and auditing the Company’s fiscal years 2003 and 2004 financial statements and for other services during those fiscal years:

| | | | FY 2003

| | FY 2004

|

| | Audit Fees | | $ | 390,000 | | | $ | 556,500 | |

| | Audit-Related Fees | | $ | 15,000 | | | $ | 66,700 | |

| | Tax Fees | | $ | 0 | | | $ | 0 | |

| | All Other Fees | | $ | 1,400 | | | $ | 1,400 | |

The “Audit-Related Fees” paid for fiscal years 2003 and 2004 were for audits of employee benefit plans. For Fiscal 2004, audit-related fees also included assistance related to compliance with Section 404 of the Sarbanes-Oxley Act of 2002 covering reporting on internal controls over financial reporting. “All Other Fees” included amounts paid for the use of a proprietary accounting research database.