Focused on Our Future 2Q 2021 Strategic & Financial Highlights John W. Somerhalder II, Vice-Chairperson and Executive Director Steven E. Strah, President and CEO K. Jon Taylor, SVP and CFO

Forward-Looking Statements This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 based on information currently available to management. Such statements are subject to certain risks and uncertainties and readers are cautioned not to place undue reliance on these forward-looking statements. These statements include declarations regarding management’s intents, beliefs and current expectations. These statements typically contain, but are not limited to, the terms “anticipate,” “potential,” “expect,” “forecast,” “target,” “will,” “intend,” “believe,” “project,” “estimate,” “plan” and similar words. Forward-looking statements involve estimates, assumptions, known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, which may include the following: the potential liabilities, increased costs and unanticipated developments resulting from governmental investigations and agreements, including those associated with compliance with or failure to comply with the Deferred Prosecution Agreement with the U.S. Attorney’s Office for the S.D. Ohio; the results of the internal investigation and evaluation of our controls framework and remediation of our material weakness in internal control over financial reporting; the risks and uncertainties associated with government investigations regarding Ohio House Bill 6 and related matters including potential adverse impacts on federal or state regulatory matters including, but not limited to, matters relating to rates; the potential of non-compliance with debt covenants in our credit facilities due to matters associated with the government investigations regarding Ohio House Bill 6 and related matters; the risks and uncertainties associated with litigation, arbitration, mediation and similar proceedings; legislative and regulatory developments, including, but not limited to, matters related to rates, compliance and enforcement activity; the ability to accomplish or realize anticipated benefits from our FE Forward initiative and our other strategic and financial goals, including, but not limited to, maintaining financial flexibility, overcoming current uncertainties and challenges associated with the ongoing government investigations, executing our transmission and distribution investment plans, greenhouse gas reduction goals, controlling costs, improving our credit metrics, strengthening our balance sheet and growing earnings; economic and weather conditions affecting future operating results, such as a recession, significant weather events and other natural disasters, and associated regulatory events or actions in response to such conditions; mitigating exposure for remedial activities associated with retired and formerly owned electric generation assets; the ability to access the public securities and other capital and credit markets in accordance with our financial plans, the cost of such capital and overall condition of the capital and credit markets affecting us, including the increasing number of financial institutions evaluating the impact of climate change on their investment decisions; the extent and duration of COVID-19 and the impacts to our business, operations and financial condition resulting from the outbreak of COVID-19 including, but not limited to, disruption of businesses in our territories and governmental and regulatory responses to the pandemic; the effectiveness of our pandemic and business continuity plans, the precautionary measures we are taking on behalf of our customers, contractors and employees, our customers’ ability to make their utility payment and the potential for supply-chain disruptions; actions that may be taken by credit rating agencies that could negatively affect either our access to or terms of financing or our financial condition and liquidity; changes in assumptions regarding economic conditions within our territories, the reliability of our transmission and distribution system, or the availability of capital or other resources supporting identified transmission and distribution investment opportunities; changes in customers’ demand for power, including, but not limited to, the impact of climate change or energy efficiency and peak demand reduction mandates; changes in national and regional economic conditions affecting us and/or our major industrial and commercial customers or others with which we do business; the risks associated with cyber-attacks and other disruptions to our information technology system, which may compromise our operations, and data security breaches of sensitive data, intellectual property and proprietary or personally identifiable information; the ability to comply with applicable reliability standards and energy efficiency and peak demand reduction mandates; changes to environmental laws and regulations, including, but not limited to, those related to climate change; changing market conditions affecting the measurement of certain liabilities and the value of assets held in our pension trusts and other trust funds, or causing us to make contributions sooner, or in amounts that are larger, than currently anticipated; labor disruptions by our unionized workforce; changes to significant accounting policies; any changes in tax laws or regulations, or adverse tax audit results or rulings; and the risks and other factors discussed from time to time in our SEC filings. Dividends declared from time to time on FirstEnergy Corp.’s common stock during any period may in the aggregate vary from prior periods due to circumstances considered by FirstEnergy Corp.’s Board of Directors at the time of the actual declarations. A security rating is not a recommendation to buy or hold securities and is subject to revision or withdrawal at any time by the assigning rating agency. Each rating should be evaluated independently of any other rating. These forward-looking statements are also qualified by, and should be read together with, the risk factors included in FirstEnergy Corp.’s filings with the SEC, including but not limited to the most recent Annual Report on Form 10-K, any subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The foregoing review of factors also should not be construed as exhaustive. New factors emerge from time to time, and it is not possible for management to predict all such factors, nor assess the impact of any such factor on FirstEnergy Corp.’s business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statements. FirstEnergy Corp. expressly disclaims any obligation to update or revise, except as required by law, any forward-looking statements contained herein or in the information incorporated by reference as a result of new information, future events or otherwise. Strategic & Financial Highlights – Published July 22, 20212

Non-GAAP Financial Matters This presentation contains references to non-GAAP financial measures including, among others, Operating earnings (loss), Operating earnings (loss) per share, Operating earnings (loss) per share by segment, Adjusted Equity, Adjusted Debt, Adjusted Capitalization, Funds from Operations (FFO), Free Cash Flow (FCF), and Adjusted Cash from Operations. Generally, a non-GAAP financial measure is a numerical measure of a company’s historical or future financial performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with accounting principles generally accepted in the United States (GAAP). Operating earnings (loss), Operating earnings (loss) per share and Operating earnings (loss) per share by segment are not calculated in accordance with GAAP to the extent they exclude the impact of “special items.” Special items represent charges incurred or benefits realized that management believes are not indicative of, or may obscure trends useful in evaluating the company’s ongoing core activities and results of operations or otherwise warrant separate classification. FirstEnergy Corp. (FE or the Company) management cannot estimate on a forward-looking basis the impact of these items in the context of Operating earnings (loss) per share, because these items, which could be significant, are difficult to predict and may be highly variable. Special items are not necessarily non-recurring. Operating earnings (loss) per share and Operating earnings (loss) per share for each segment are calculated by dividing Operating earnings (loss), which excludes special items as discussed above, for the periods presented by 544 million shares for the second quarter, first six months, and full year 2021, 542 million shares for the second quarter and full year 2020 and 541 million shares for the first six months of 2020. Basic EPS (GAAP) is based on 544 million shares for the second quarter, first six months, and full year 2021, 542 million shares for the second quarter and full year 2020 and 541 million shares for the first six months of 2020. Management uses non-GAAP financial measures such as Operating earnings (loss), Operating earnings (loss) per share, FFO, FCF, and Adjusted Cash from Operations to evaluate the Company’s performance and manage its operations and frequently references these non-GAAP financial measures in its decision-making, using them to facilitate historical and ongoing performance comparisons. Additionally, management uses Operating earnings (loss) per share by segment to further evaluate the Company’s performance by segment and references this non-GAAP financial measure in its decision-making. Management believes that the non-GAAP financial measures of Operating earnings (loss), Operating earnings (loss) per share and Operating earnings (loss) per share by segment, Free Cash Flow, and Adjusted Cash from Operations provide consistent and comparable measures of performance of its businesses on an ongoing basis. Management uses Adjusted Equity, Adjusted Debt and Adjusted Capitalization to calculated and monitor its compliance with the debt to total capitalization financial covenant under the FE credit facility and term loans. These financial measures, as calculated in accordance with the FE Credit Facility and term loans, help shareholders understand FE’s compliance with and provide a basis for understanding FE’s incremental debt capacity under the debt to total capitalization financial covenants. The financial covenants under the FE Credit Facility and terms loans require FE to maintain a consolidated debt to total capitalization of no more than 65%, measured at the end of each fiscal quarter. Management also believes that such measures are useful to shareholders and other interested parties to understand performance trends and evaluate the Company against its peer group by presenting period-over-period operating results without the effect of certain charges or benefits that may not be consistent or comparable across periods or across the Company’s peer group. All of these non-GAAP financial measures are intended to complement, and are not considered as alternatives to, the most directly comparable GAAP financial measures. Also, the non-GAAP financial measures may not be comparable to similarly titled measures used by other entities. Pursuant to the requirements of Regulation G, FE has provided, where possible without unreasonable effort, quantitative reconciliations within this presentation of the non-GAAP financial measures to the most directly comparable GAAP financial measures. Strategic & Financial Highlights – Published July 22, 20213

2Q 2021 Strategic & Financial Highlights Steve Strah, President and CEO Strategic & Financial Highlights – Published July 22, 20214 ■ Update on DOJ and Other Investigations Related to House Bill 6 ■ Board Activity ■ Progress of Our Compliance Program ■ Recent Business Developments ■ 2Q21 Results and Other Financial Matters Focus for Today’s Call: Reported 2Q21 GAAP earnings of $0.11 per share and Operating (non-GAAP) earnings of $0.59 per share Introducing 3Q21 GAAP and Operating (non-GAAP) earnings guidance $0.70-$0.80 per share Updating 2021 GAAP earnings forecast to $1,000M-$1,110M, or $1.84-$2.04 per share Reaffirming 2021 Operating (non-GAAP) earnings guidance of $2.40-$2.60 per share; expect to be in the top half

DOJ Update Steve Strah, President and CEO Strategic & Financial Highlights – Published July 22, 20215 ■ Announced that we’ve entered into an agreement with the U.S. Attorney’s Office for the Southern District of Ohio to resolve the DOJ investigation into FirstEnergy – Under the 3-year Deferred Prosecution Agreement (DPA), we agreed to pay $230M (to be funded with cash on hand) – $115M designated for the U.S. Treasury and $115M directed for the benefit of Ohio utility customers by the Ohio Development Service Agency – Agreed to the single charge of honest services wire fraud, which eventually will be dismissed, provided we abide by all terms of the agreement – Agreed to provide regular reports to the government regarding our compliance program and internal controls and policies ■ The conduct that took place at the highest levels of our company was wrong and unacceptable ■ Our progress on these efforts, together with the DPA, demonstrate that we are making meaningful progress, and we are positioned to move forward as a stronger, integrity-bound organization – We will continue to cooperate fully with the ongoing investigations, audits, and related matters as we work to resolve these issues and rebuild trust with our employees, customers, regulators, and investors ■ We are intently focused on fostering a strong culture of compliance and ethics, and ensuring we have robust processes in place designed to ensure that nothing like this happens again

Strategic Overview Steve Strah, President and CEO Strategic & Financial Highlights – Published July 22, 20216 ■ In May, held our first town hall with employees to discuss what compliance, ethics and integrity mean at FirstEnergy and the importance of building a culture of trust ■ Next week, we plan to hold another town hall with employees – Updated mission statement (reinforcing the role of uncompromising integrity as the cornerstone of FirstEnergy’s identity and business strategies) – Refreshing our core values (to better reflect the importance of integrity, safety, diversity, equity & inclusion, performance excellence and stewardship) ■ All at FirstEnergy will receive training on the importance of each value as we work to ensure they are deeply ingrained in our culture Compliance Town Hall Meetings Leadership Appointments ■ Continue to strengthen our leadership team with two experienced professionals; confident they will help us build best-in-class audit and enterprise risk programs – Michael Montaque, VP of Internal Audit – Soubhagya Parija, VP and Chief Risk Officer, effective August 16

Board Activity John Somerhalder II, Vice-Chairperson and Executive Director ■ Jesse, Melvin, Lisa and Paul comprise our new Special Litigation Committee – This committee has full and binding authority to determine the company’s actions with respect to the pending shareholder derivative litigation – With the formation of the Special Litigation Committee the Board has dissolved the Demand Review Committee ■ The Board has dissolved the Independent Review Committee due to the significant review, investigation and related actions accomplished and the Company’s internal investigation transition from a proactive to a response mode ■ In a strong position to remediate the material weakness associated with our tone at the top by the time we file our 4Q21 results Strategic & Financial Highlights – Published July 22, 20217 New Board Members ■ In March, Jesse Lynn and Andrew Teno joined the Board from Icahn Capital – In July, Jesse and Andrew received FERC approval of voting rights with process continuing in Maryland ■ In May, Melvin Williams was elected at our Annual Meeting ■ In June, added two more independent directors, Lisa Winston Hicks and Paul Kaleta

Compliance Updates John Somerhalder II, Vice-Chairperson and Executive Director ■ We continue to make timely progress in our ethics and compliance program ■ Published our updated internal Code of Business Conduct; The Power of Integrity – Supported by ongoing education around behaviors and importance of reporting ethical violations ■ Continued to strengthen our policies, processes and internal controls, including those around 501(c)(4)s, other corporate engagement and advocacy, and business disbursements Strategic & Financial Highlights – Published July 22, 20218 While the transformation of our culture and steps to rebuild trust with all stakeholders will be long-term endeavors, this team has started building a stronger company built around a foundation of ethics, honesty and accountability

FE Forward Update Steve Strah, President and CEO ■ Included ethics and compliance into FE Forward ■ Entered third phase; a full-scale effort to execute our implementation plans ■ Expected to deliver immediate value and resilience – Cumulative free cash flow improvements of ~$800M from 2021 through 2023 – Annual run-rate capex efficiencies of ~$300M in 2024 and beyond ■ This program builds on our strong operations and business fundamentals ■ Realigned our business units last month around five pillars: Finance and Strategy, Human Resources & Corporate Services, Legal, Operations, and Customer Experience – New structure supports operational excellence, clarity in decision making and accountability, and less complexity ■ Created Customer Experience function – Will truly understand our customers’ evolving expectations to develop solutions and drive benefits to customers ■ Created the VP, Transformation position – Will shepherd the FE Forward initiatives and develop customer- focused emerging technology opportunities Strategic & Financial Highlights – Published July 22, 20219 Creating our Structure for SuccessUpdate FirstEnergy’s business strategies remain solid, and we continue to focus on our strong operating fundamentals and customer-driven growth opportunities Transformational effort to enhance value for all stakeholders by investing in modern and distinctive experiences that improve the way we do business

Regulatory Updates Steve Strah, President and CEO ■ In July, PUCO approved our filing to return ~$27 million to our Ohio utility customers, representing all revenues that were previously collected through the decoupling mechanism, plus interest ■ We remain committed to working with a broad range of parties in Ohio to resolve the range of issues that are still pending Strategic & Financial Highlights – Published July 22, 202110 Continue working through the regulatory audits in Ohio, New Jersey, Pennsylvania and with FERC ■ On April 27, NJ BPU approved JCP&L’s 3- year, $203M, Energy Efficiency and Conservation Plan – Includes a return on certain costs and the ability to recover lost distribution revenues Ohio New Jersey

2Q 2021 Earnings Summary Jon Taylor, SVP and CFO Strategic & Financial Highlights – Published July 22, 202111 ■ Reported 2Q 2021 GAAP earnings of $0.11 per share vs. $0.57 per share in 2Q 2020 – 2Q 2021 results include ($0.48) of special items, including investigation and other related costs ($0.45), regulatory charges ($0.01), and state tax legislative changes ($0.02) ■ Reported 2Q 2021 Operating (non-GAAP) earnings of $0.59 per share vs. $0.57 per share in 2Q 2020 Quarter-over-Quarter Operating EPS Summary • Delivered on our regulated growth strategy • Better than expected mix of weather-adjusted sales • Favorable weather vs. normal Vs. 2Q Guidance Midpoint (Range: $0.48 - $0.58) Note: Reconciliations between GAAP and Operating (non-GAAP) earnings and detailed information is available in the Earnings Supplement to the Financial Community and Investor FactBook RD: $0.47 RT: $0.21 Corp: ($0.11) RD: $0.51 RT: $0.22 Corp: ($0.14)

YTD June 2021 Earnings Summary Jon Taylor, SVP and CFO Strategic & Financial Highlights – Published July 22, 202112 RD: $1.01 RT: $0.43 Corp: ($0.21) RD: $1.12 RT: $0.42 Corp: ($0.26) Includes ($0.03) from RCF Borrowings ■ Reported YTD 2021 GAAP earnings of $0.72 per share vs. $0.71 per share in YTD 2020 – YTD 2021 results include ($0.56) of special items, including investigation and other related costs ($0.49), regulatory charges ($0.05), and state tax legislative changes ($0.02) – YTD 2020 results include ($0.52) of special items, including the impact of the non-cash pension and OPEB mark-to-market adjustment upon Energy Harbor emergence ($0.59), regulatory charges ($0.01) and the exit of generation credits +$0.08 ■ Reported YTD 2021 Operating (non-GAAP) earnings of $1.28 per share vs. $1.23 per share in YTD 2020 Year-over-Year Operating EPS Summary • Delivered on our regulated growth strategy • Better than expected mix of weather-adjusted sales • Favorable weather vs. normal Vs. 1Q/2Q Guidance Midpoint (Range: $1.10 - $1.30) Note: Reconciliations between GAAP and Operating (non-GAAP) earnings and detailed information is available in the Earnings Supplement to the Financial Community and Investor FactBook

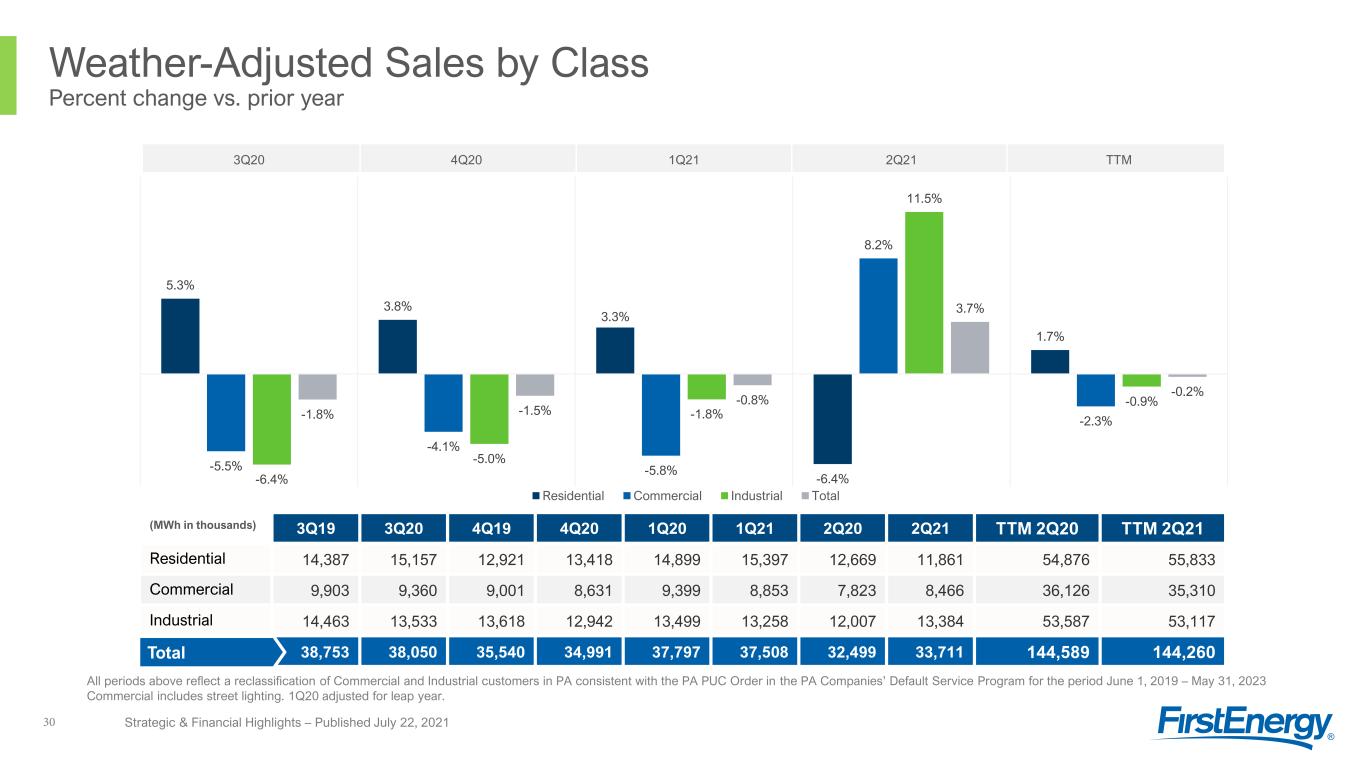

Financial Updates Jon Taylor, SVP and CFO ■ Weather-adjusted Residential sales consistently higher than pre-pandemic levels – Industrial sales are improving towards pre-pandemic levels; Commercial sales continue to lag ■ Our continued focus on financial discipline, and strong financial results, resulted in YTD Adjusted Cash From Operations (Non-GAAP) of $1,392M, a $196M increase vs. our plan and $264M increase vs YTD 2020(1) ■ Continue making progress on our 2021 debt financing plan; 5 of 6 transactions complete at investment-grade (IG) pricing Strategic & Financial Highlights – Published July 22, 202113 5.3% 3.8% 0.8% 7.5% 4.1% -5.5% -4.1% -8.4% -7.5% -6.4%-6.4% -5.0% -5.0% -1.6% -4.5% -1.8% -1.5% -3.6% -0.2% -1.9% 3Q20 vs. 3Q19 4Q20 vs. 4Q19 1Q21 vs. 1Q19 2Q21 vs. 2Q19 TTM (Illustrative) Residential Commercial Industrial Total (1) Adjusted Cash from Operations (Non-GAAP) for YTD21 of $1,392M reflects Cash from Operations (GAAP) of $1,347M adjusted for $45M in Investigation and other related costs and FE Forward costs. Adjusted Cash from Operations (Non-GAAP) for YTD20 of $1,128M reflects Cash from Operations (GAAP) of $150M adjusted for $978M in Energy Harbor settlement and tax sharing payments. There were no adjustments for the YTD21 Plan Adjusted Cash from Operations (Non-GAAP) and Cash from Operations (GAAP). Toledo Edison Senior Secured Notes, May 2021 $150M of 2.65% notes due 2028 Offering was oversubscribed and on par with an IG deal Used proceeds to repay short-term borrowings, fund TE’s ongoing capital expenditures and for other general corporate purposes MAIT Senior Unsecured Notes, May 2021 $150M notes due 2028 at an effective interest rate of ~2.55% Offering was oversubscribed and on par with an IG deal Used proceeds to repay borrowings outstanding under FirstEnergy’s regulated company money pool, to fund MAIT’s ongoing capital expenditures, to fund working capital and for other general corporate purposes JCP&L Senior Unsecured Notes, June 2021 $500M of 2.75% notes due 2032 Offering was oversubscribed and on par with an IG deal Used proceeds to repay $450M of short-term debt under the FE Revolving Facility, storm recovery and restoration costs and expenses, to fund JCP&L’s ongoing capital expenditures, working capital requirements and for other general corporate purposes

Financial Updates (Continued) Jon Taylor, SVP and CFO ■ Met our commitment to reduce short-term borrowings in 2021 by repaying all borrowings under our revolving credit facilities; plan to operate normal course moving forward – Repaid $950M in 2Q21 and the remaining $500M on Wednesday, July 21 – While we did obtain a waiver from our credit facilities related to the DPA, the repayment on July 21 was voluntary and not required by the bank group ■ Over the next few months, we plan to work with our bank group to evaluate and refinance the FE revolving credit facilities with the goal to complete this initiative before year-end 2021 – Both credit facilities expire in December 2022 ■ Continue to consider alternatives to traditional equity; including a minority sale of some RD and/or RT assets – Alternatives would raise substantial proceeds and eliminate all our expected non-SIP equity needs, ensure execution of our balance sheet improvement plans, and provide funding for strategic investments that support the transition to a cleaner electric grid – We expect to provide an update in 4Q21 Strategic & Financial Highlights – Published July 22, 202114 We are making substantial progress to transform FirstEnergy and deliver long-term value to all of our stakeholders

Earnings Supplement to the Financial Community Strategic & Financial Highlights – Published July 22, 202115 16. 2Q Earnings Summary and Reconciliation 17. 2Q Earnings Drivers by Segment 18. YTD Earnings Summary and Reconciliation 19. YTD Earnings Drivers by Segment 20. Special Items Descriptions 21. 2Q 2021 Earnings Results 22. 2Q 2020 Earnings Results 23. Quarter-over-Quarter Earnings Comparison 24. YTD 2021 Earnings Results 25. YTD 2020 Earnings Results 26. Year-over-Year Earnings Comparison 27. 2021F GAAP to Operating (Non-GAAP) Earnings Reconciliation TABLE OF CONTENTS (Slide) Irene M. Prezelj, Vice President prezelji@firstenergycorp.com 330.384.3859 Gina E. Caskey, Senior Advisor caskeyg@firstenergycorp.com 330.761.4185 Jake M. Mackin, Consultant mackinj@firstenergycorp.com 330.384.4829

EPS Variance Analysis Regulated Regulated Corporate / FirstEnergy Corp. (in millions, except per share amounts) Distribution Transmission Other Consolidated 2Q 2020 Net Income (Loss) (GAAP) $251 $114 $(56) $309 2Q 2020 Basic Earnings (Loss) Per Share (avg. shares outstanding 542M) $0.47 $0.21 $(0.11) $0.57 Special Items - 2020 Total Special Items - 2Q 2020 — — — — 2Q 2020 Operating Earnings (Loss) Per Share - Non-GAAP $0.47 $0.21 $(0.11) $0.57 Distribution - Rates & Riders 0.02 — — 0.02 Distribution Revenues - Weather-Adjusted Demand (0.02) — — (0.02) Distribution Revenues - Weather Demand 0.02 — — 0.02 Ohio Decoupling / Lost Distribution Revenue (0.03) — — (0.03) Regulated Generation Commodity Margin Demand 0.01 — — 0.01 Transmission Investment — 0.02 — 0.02 O&M Expenses 0.02 — — 0.02 Pension/OPEB 0.03 — 0.01 0.04 Net Financing Costs (0.01) (0.01) (0.01) (0.03) Effective Tax Rate — — (0.03) (0.03) 2Q 2021 Operating Earnings (Loss) Per Share - Non-GAAP $0.51 $0.22 $(0.14) $0.59 Special Items - 2021 Regulatory charges — (0.01) — (0.01) State tax legislative changes — — (0.02) (0.02) Investigation and other related costs — — (0.45) (0.45) Total Special Items - 2Q 2021 — (0.01) (0.47) (0.48) 2Q 2021 Basic Earnings (Loss) Per Share (avg. shares outstanding 544M) $0.51 $0.21 $(0.61) $0.11 2Q 2021 Net Income (Loss) (GAAP) $274 $116 $(332) $58 Per share amounts for the special items and earnings drivers above and throughout this report are based on the after-tax effect of each item divided by the number of shares outstanding for the period. The current and deferred income tax effect was calculated by applying the subsidiaries' statutory tax rate to the pre- tax amount if deductible/taxable. The income tax rates range from 21% to 29% in the second quarter of 2021 and 2020. Quarterly Summary Quarterly Reconciliation 2Q 2021 2Q 2020 Change GAAP Earnings Per Basic Share $0.11 $0.57 $(0.46) Special Items $0.48 $— $0.48 Operating (Non-GAAP) Earnings Per Share $0.59 $0.57 $0.02 Note: Refer to slide 3 for information on Non-GAAP Financial Matters. Strategic & Financial Highlights – Published July 22, 202116

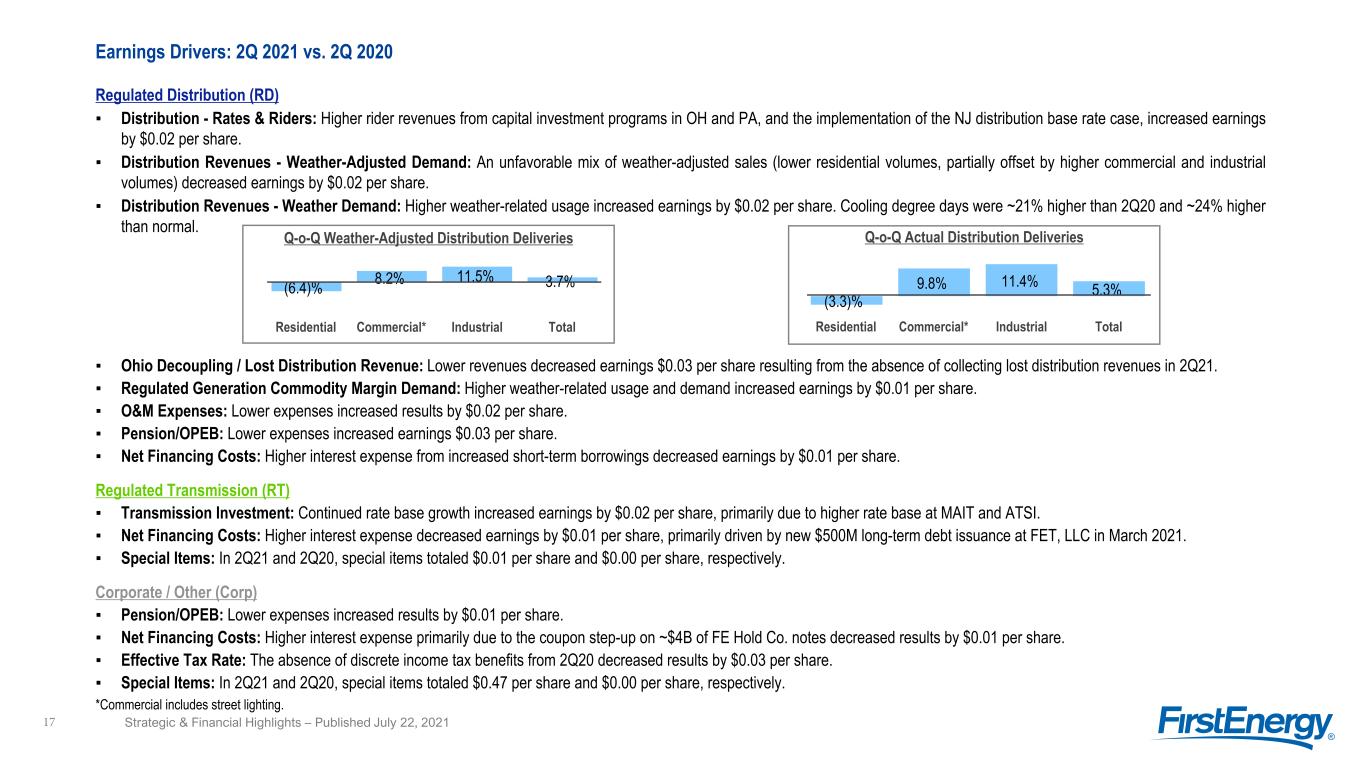

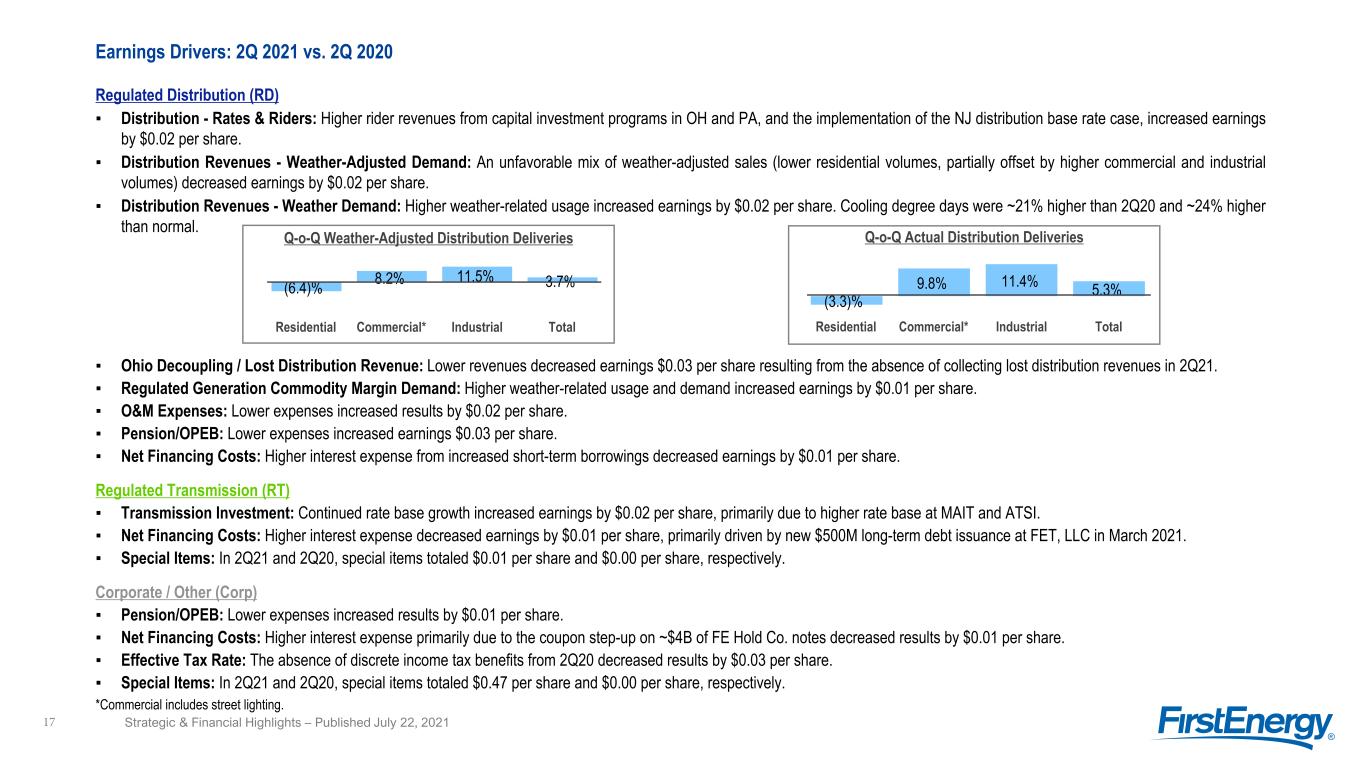

Earnings Drivers: 2Q 2021 vs. 2Q 2020 Regulated Distribution (RD) ▪ Distribution - Rates & Riders: Higher rider revenues from capital investment programs in OH and PA, and the implementation of the NJ distribution base rate case, increased earnings by $0.02 per share. ▪ Distribution Revenues - Weather-Adjusted Demand: An unfavorable mix of weather-adjusted sales (lower residential volumes, partially offset by higher commercial and industrial volumes) decreased earnings by $0.02 per share. ▪ Distribution Revenues - Weather Demand: Higher weather-related usage increased earnings by $0.02 per share. Cooling degree days were ~21% higher than 2Q20 and ~24% higher than normal. ▪ Ohio Decoupling / Lost Distribution Revenue: Lower revenues decreased earnings $0.03 per share resulting from the absence of collecting lost distribution revenues in 2Q21. ▪ Regulated Generation Commodity Margin Demand: Higher weather-related usage and demand increased earnings by $0.01 per share. ▪ O&M Expenses: Lower expenses increased results by $0.02 per share. ▪ Pension/OPEB: Lower expenses increased earnings $0.03 per share. ▪ Net Financing Costs: Higher interest expense from increased short-term borrowings decreased earnings by $0.01 per share. Regulated Transmission (RT) ▪ Transmission Investment: Continued rate base growth increased earnings by $0.02 per share, primarily due to higher rate base at MAIT and ATSI. ▪ Net Financing Costs: Higher interest expense decreased earnings by $0.01 per share, primarily driven by new $500M long-term debt issuance at FET, LLC in March 2021. ▪ Special Items: In 2Q21 and 2Q20, special items totaled $0.01 per share and $0.00 per share, respectively. Corporate / Other (Corp) ▪ Pension/OPEB: Lower expenses increased results by $0.01 per share. ▪ Net Financing Costs: Higher interest expense primarily due to the coupon step-up on ~$4B of FE Hold Co. notes decreased results by $0.01 per share. ▪ Effective Tax Rate: The absence of discrete income tax benefits from 2Q20 decreased results by $0.03 per share. ▪ Special Items: In 2Q21 and 2Q20, special items totaled $0.47 per share and $0.00 per share, respectively. (6.4)% 8.2% 11.5% 3.7% Residential Commercial* Industrial Total Q-o-Q Weather-Adjusted Distribution Deliveries Q-o-Q Actual Distribution Deliveries (3.3)% 9.8% 11.4% 5.3% Residential Commercial* Industrial Total *Commercial includes street lighting. Strategic & Financial Highlights – Published July 22, 202117

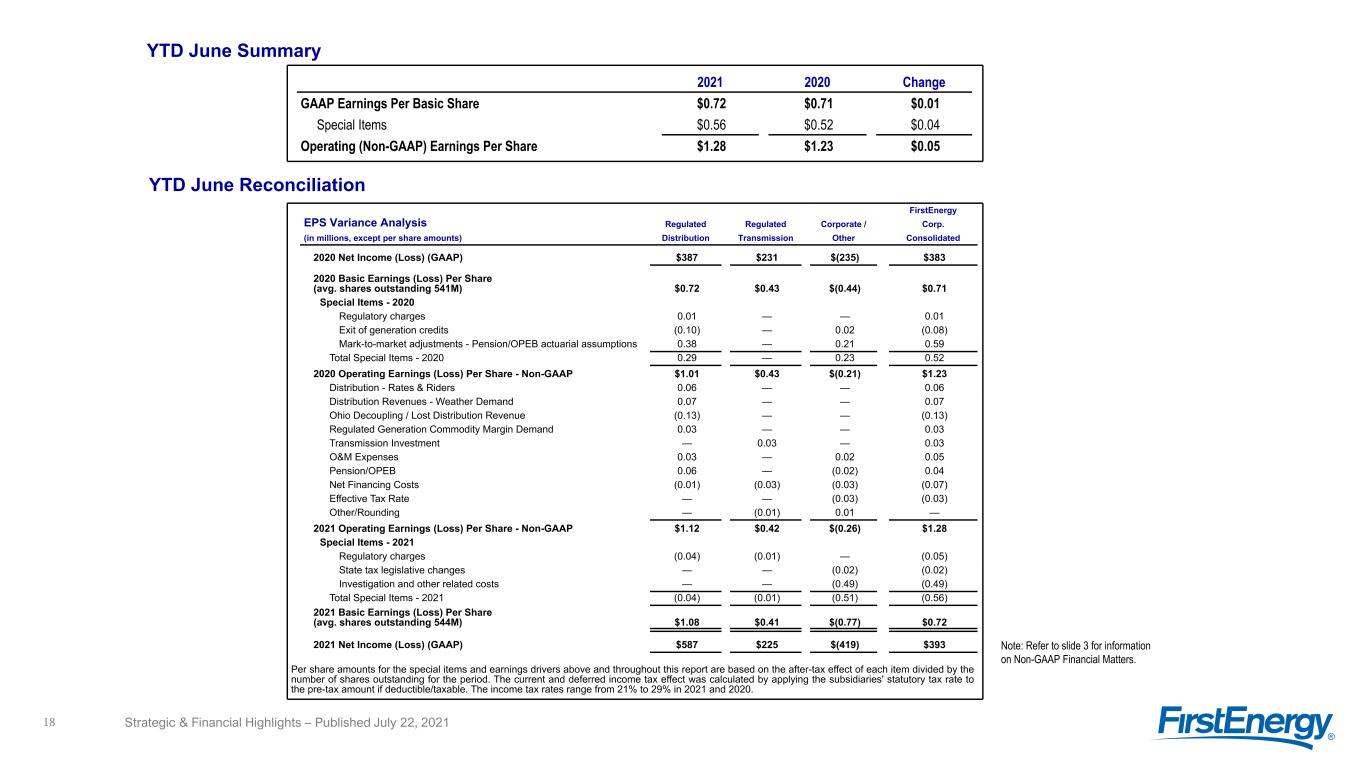

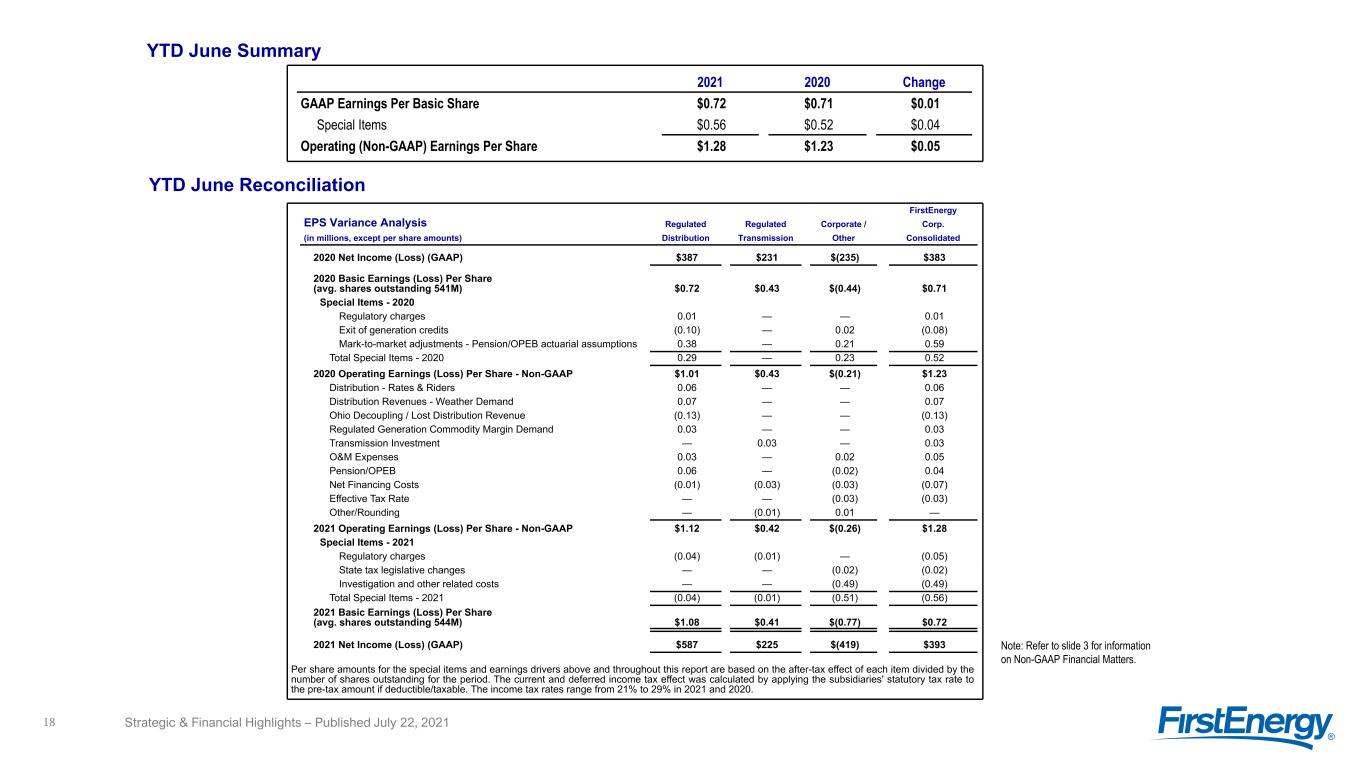

FirstEnergy EPS Variance Analysis Regulated Regulated Corporate / Corp. (in millions, except per share amounts) Distribution Transmission Other Consolidated 2020 Net Income (Loss) (GAAP) $387 $231 $(235) $383 2020 Basic Earnings (Loss) Per Share (avg. shares outstanding 541M) $0.72 $0.43 $(0.44) $0.71 Special Items - 2020 Regulatory charges 0.01 — — 0.01 Exit of generation credits (0.10) — 0.02 (0.08) Mark-to-market adjustments - Pension/OPEB actuarial assumptions 0.38 — 0.21 0.59 Total Special Items - 2020 0.29 — 0.23 0.52 2020 Operating Earnings (Loss) Per Share - Non-GAAP $1.01 $0.43 $(0.21) $1.23 Distribution - Rates & Riders 0.06 — — 0.06 Distribution Revenues - Weather Demand 0.07 — — 0.07 Ohio Decoupling / Lost Distribution Revenue (0.13) — — (0.13) Regulated Generation Commodity Margin Demand 0.03 — — 0.03 Transmission Investment — 0.03 — 0.03 O&M Expenses 0.03 — 0.02 0.05 Pension/OPEB 0.06 — (0.02) 0.04 Net Financing Costs (0.01) (0.03) (0.03) (0.07) Effective Tax Rate — — (0.03) (0.03) Other/Rounding — (0.01) 0.01 — 2021 Operating Earnings (Loss) Per Share - Non-GAAP $1.12 $0.42 $(0.26) $1.28 Special Items - 2021 Regulatory charges (0.04) (0.01) — (0.05) State tax legislative changes — — (0.02) (0.02) Investigation and other related costs — — (0.49) (0.49) Total Special Items - 2021 (0.04) (0.01) (0.51) (0.56) 2021 Basic Earnings (Loss) Per Share (avg. shares outstanding 544M) $1.08 $0.41 $(0.77) $0.72 2021 Net Income (Loss) (GAAP) $587 $225 $(419) $393 Per share amounts for the special items and earnings drivers above and throughout this report are based on the after-tax effect of each item divided by the number of shares outstanding for the period. The current and deferred income tax effect was calculated by applying the subsidiaries' statutory tax rate to the pre-tax amount if deductible/taxable. The income tax rates range from 21% to 29% in 2021 and 2020. YTD June Summary YTD June Reconciliation 2021 2020 Change GAAP Earnings Per Basic Share $0.72 $0.71 $0.01 Special Items $0.56 $0.52 $0.04 Operating (Non-GAAP) Earnings Per Share $1.28 $1.23 $0.05 Note: Refer to slide 3 for information on Non-GAAP Financial Matters. Strategic & Financial Highlights – Published July 22, 202118

Earnings Drivers: YTD June 2021 vs. YTD June 2020 Regulated Distribution (RD) ▪ Distribution - Rates & Riders: Higher rider revenues from capital investment programs in OH and PA, and the implementation of the NJ distribution base rate case, increased earnings by $0.06 per share. ▪ Distribution Revenues - Weather Demand: Higher weather-related usage increased earnings by $0.07 per share. ▪ Ohio Decoupling / Lost Distribution Revenue: Lower revenues decreased earnings $0.13 per share resulting from the partial settlement with the Ohio Attorney General and decision to not seek recovery of lost distribution revenues as authorized under the current Electric Security Plan. ▪ Regulated Generation Commodity Margin Demand: Higher weather-related usage and demand increased earnings by $0.03 per share. ▪ O&M Expenses: Lower expenses increased results by $0.03 per share. ▪ Pension/OPEB: Lower expenses increased earnings $0.06 per share. ▪ Net Financing Costs: Higher interest expense from increased short-term borrowings, partially offset by higher capitalized financing costs decreased earnings by $0.01 per share. ▪ Special Items: In YTD21 and YTD20, special items totaled $0.04 per share and $0.29 per share, respectively. Regulated Transmission (RT) ▪ Transmission Investment: Continued rate base growth increased earnings by $0.03 per share, primarily due to higher rate base at ATSI and MAIT. ▪ Net Financing Costs: Higher interest expense decreased earnings by $0.03 per share, primarily from increased short-term borrowings. ▪ Special Items: In YTD21 and YTD20, special items totaled $0.01 per share and $0.00 per share, respectively. Corporate / Other (Corp) ▪ O&M Expenses: Lower expenses increased results by $0.02 per share. ▪ Pension/OPEB: The absence of 1Q20 accelerated Pension/OPEB amortization credits as a result of Energy Harbor emergence, partially offset by lower expenses, decreased results by $0.02 per share. ▪ Net Financing Costs: Higher interest expense due to increased long-term debt and coupon step-up on FE Hold Co. notes decreased results by $0.03 per share. ▪ Effective Tax Rate: The absence of discrete income tax benefits from 2Q20 decreased results by $0.03 per share. ▪ Special Items: In YTD21 and YTD20, special items totaled $0.51 per share and $0.23 per share, respectively. (1.1)% 0.6% 4.4% 1.3% Residential Commercial* Industrial Total Y-o-Y Weather-Adjusted Distribution Deliveries (Adjusted for leap year) *Commercial includes street lighting. Y-o-Y Actual Distribution Deliveries 4.9% 3.0% 4.2% 4.2% Residential Commercial* Industrial Total Strategic & Financial Highlights – Published July 22, 202119

Special Items Descriptions ▪ Regulatory charges: Primarily reflects the impact of regulatory agreements, concessions or orders requiring certain commitments and/or disallowing the recoverability of costs, net of related credits. ▪ Exit of generation credits: Primarily reflects charges or credits resulting from the transfer of Three Mile Island Unit 2, exit of competitive operations, including adjustments related to the Energy Harbor bankruptcy settlement, and restructuring and strategic review costs. ▪ State tax legislative changes: Primarily reflects charges resulting from state tax legislative changes. ▪ FE Forward costs: Primarily reflects certain advisory costs incurred to transform the company for the future. ▪ Investigation and other related costs: Primarily reflects the DPA penalty and legal expenses related to the government investigations. ▪ Mark-to-market adjustments - Pension/OPEB actuarial assumptions: Reflects the change in fair value of plan assets and net actuarial gains and losses associated with the Company's pension and other post-employment benefit plans. Note: Special items represent charges incurred or benefits realized that management believes are not indicative of, or may obscure trends useful in evaluating, the Company’s ongoing core activities and results of operations or otherwise warrant separate classification. Special items are not necessarily non-recurring. Strategic & Financial Highlights – Published July 22, 202120

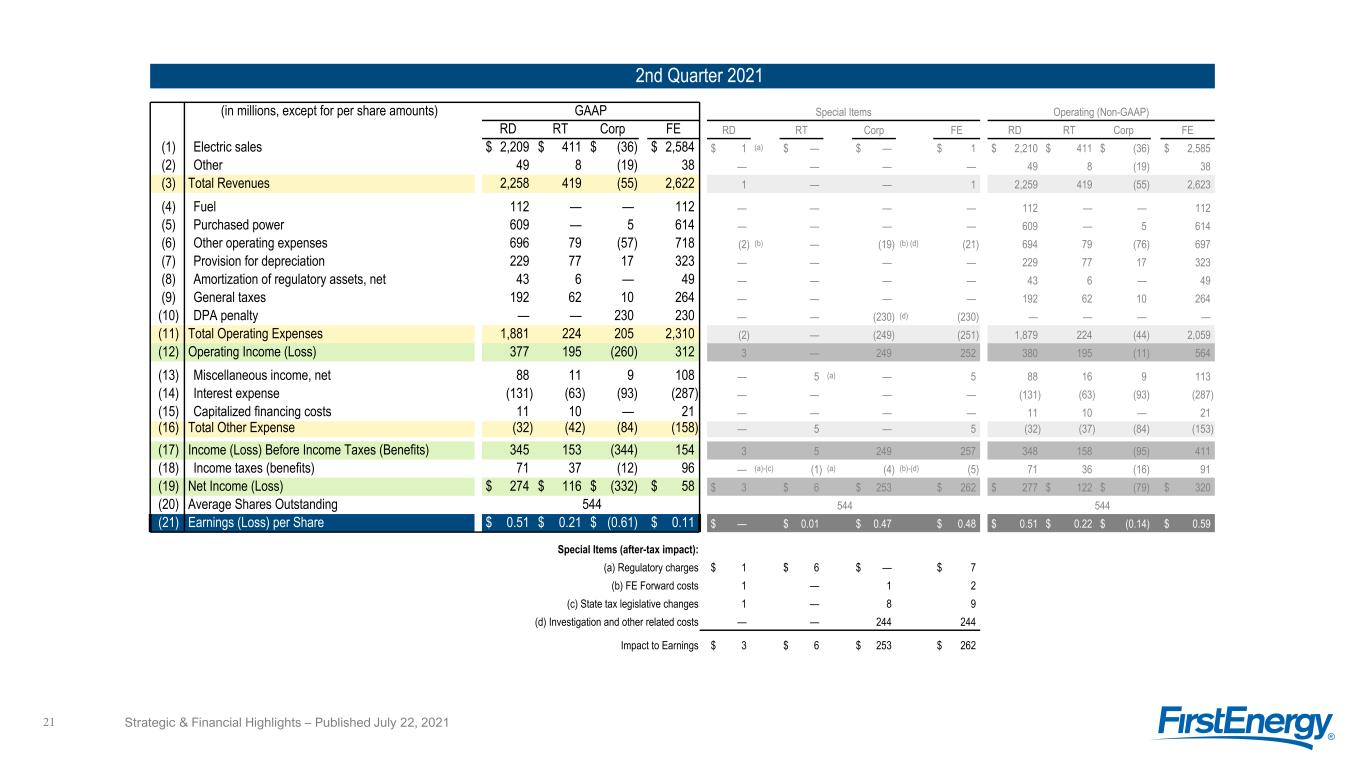

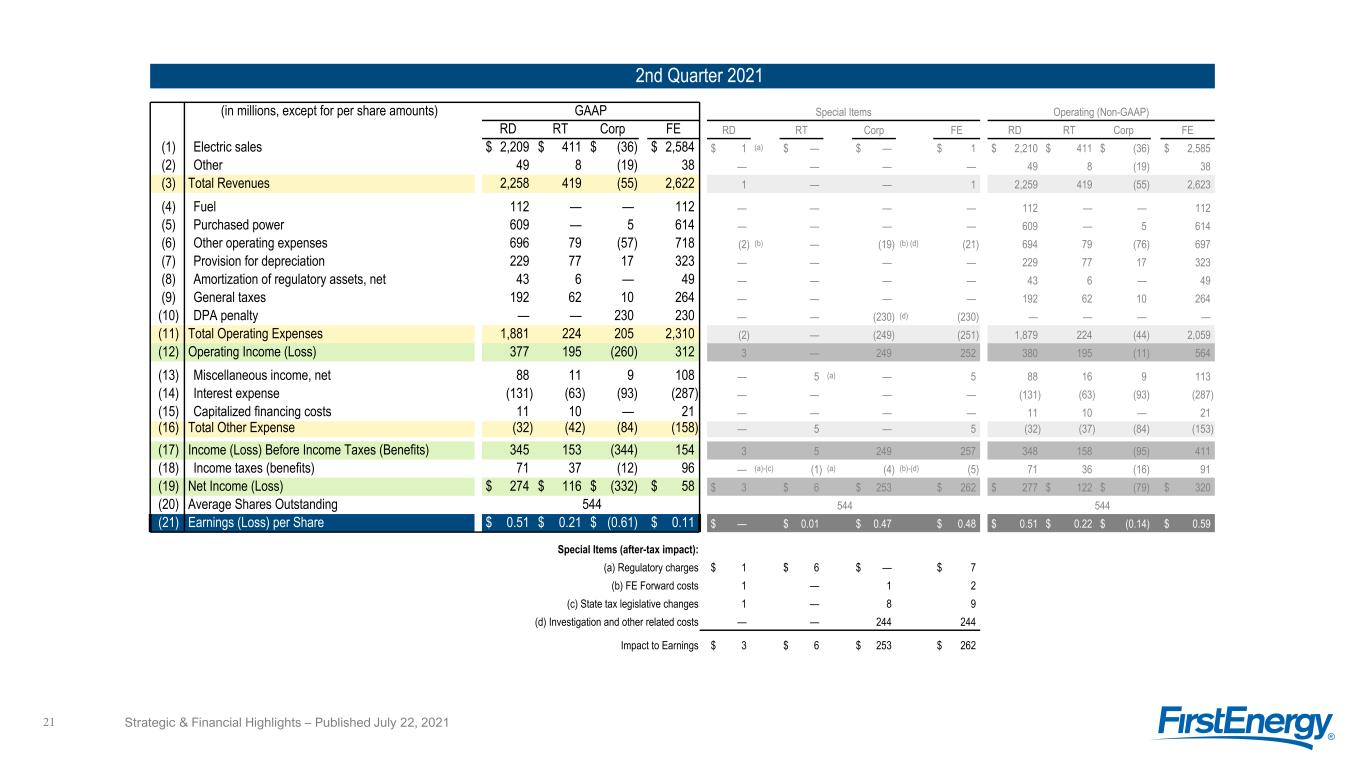

2nd Quarter 2021 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ 2,209 $ 411 $ (36) $ 2,584 $ 1 (a) $ — $ — $ 1 $ 2,210 $ 411 $ (36) $ 2,585 (2) Other 49 8 (19) 38 — — — — 49 8 (19) 38 (3) Total Revenues 2,258 419 (55) 2,622 1 — — 1 2,259 419 (55) 2,623 (4) Fuel 112 — — 112 — — — — 112 — — 112 (5) Purchased power 609 — 5 614 — — — — 609 — 5 614 (6) Other operating expenses 696 79 (57) 718 (2) (b) — (19) (b) (d) (21) 694 79 (76) 697 (7) Provision for depreciation 229 77 17 323 — — — — 229 77 17 323 (8) Amortization of regulatory assets, net 43 6 — 49 — — — — 43 6 — 49 (9) General taxes 192 62 10 264 — — — — 192 62 10 264 (10) DPA penalty — — 230 230 — — (230) (d) (230) — — — — (11) Total Operating Expenses 1,881 224 205 2,310 (2) — (249) (251) 1,879 224 (44) 2,059 (12) Operating Income (Loss) 377 195 (260) 312 3 — 249 252 380 195 (11) 564 (13) Miscellaneous income, net 88 11 9 108 — 5 (a) — 5 88 16 9 113 (14) Interest expense (131) (63) (93) (287) — — — — (131) (63) (93) (287) (15) Capitalized financing costs 11 10 — 21 — — — — 11 10 — 21 (16) Total Other Expense (32) (42) (84) (158) — 5 — 5 (32) (37) (84) (153) (17) Income (Loss) Before Income Taxes (Benefits) 345 153 (344) 154 3 5 249 257 348 158 (95) 411 (18) Income taxes (benefits) 71 37 (12) 96 — (a)-(c) (1) (a) (4) (b)-(d) (5) 71 36 (16) 91 (19) Net Income (Loss) $ 274 $ 116 $ (332) $ 58 $ 3 $ 6 $ 253 $ 262 $ 277 $ 122 $ (79) $ 320 (20) Average Shares Outstanding 544 544 544 (21) Earnings (Loss) per Share $ 0.51 $ 0.21 $ (0.61) $ 0.11 $ — $ 0.01 $ 0.47 $ 0.48 $ 0.51 $ 0.22 $ (0.14) $ 0.59 Special Items (after-tax impact): (a) Regulatory charges $ 1 $ 6 $ — $ 7 (b) FE Forward costs 1 — 1 2 (c) State tax legislative changes 1 — 8 9 (d) Investigation and other related costs — — 244 244 Impact to Earnings $ 3 $ 6 $ 253 $ 262 Strategic & Financial Highlights – Published July 22, 202121

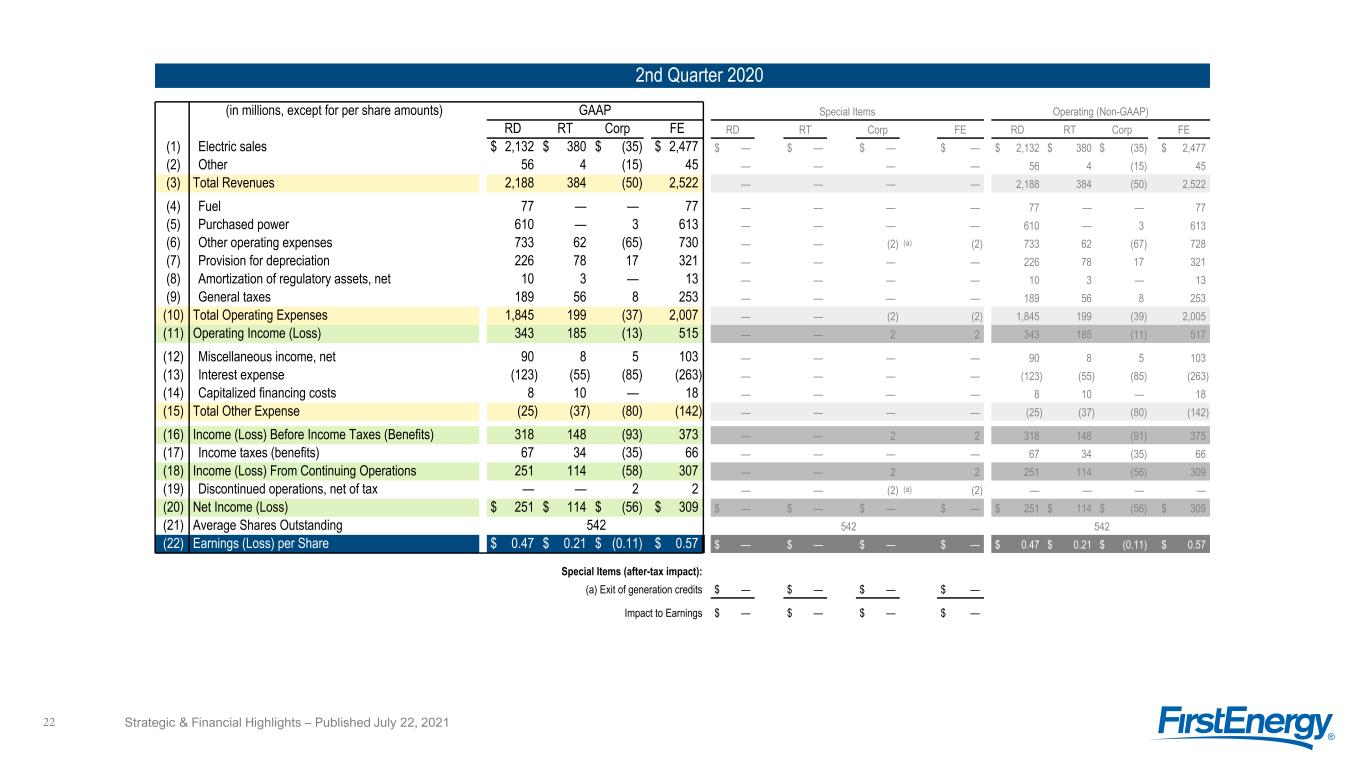

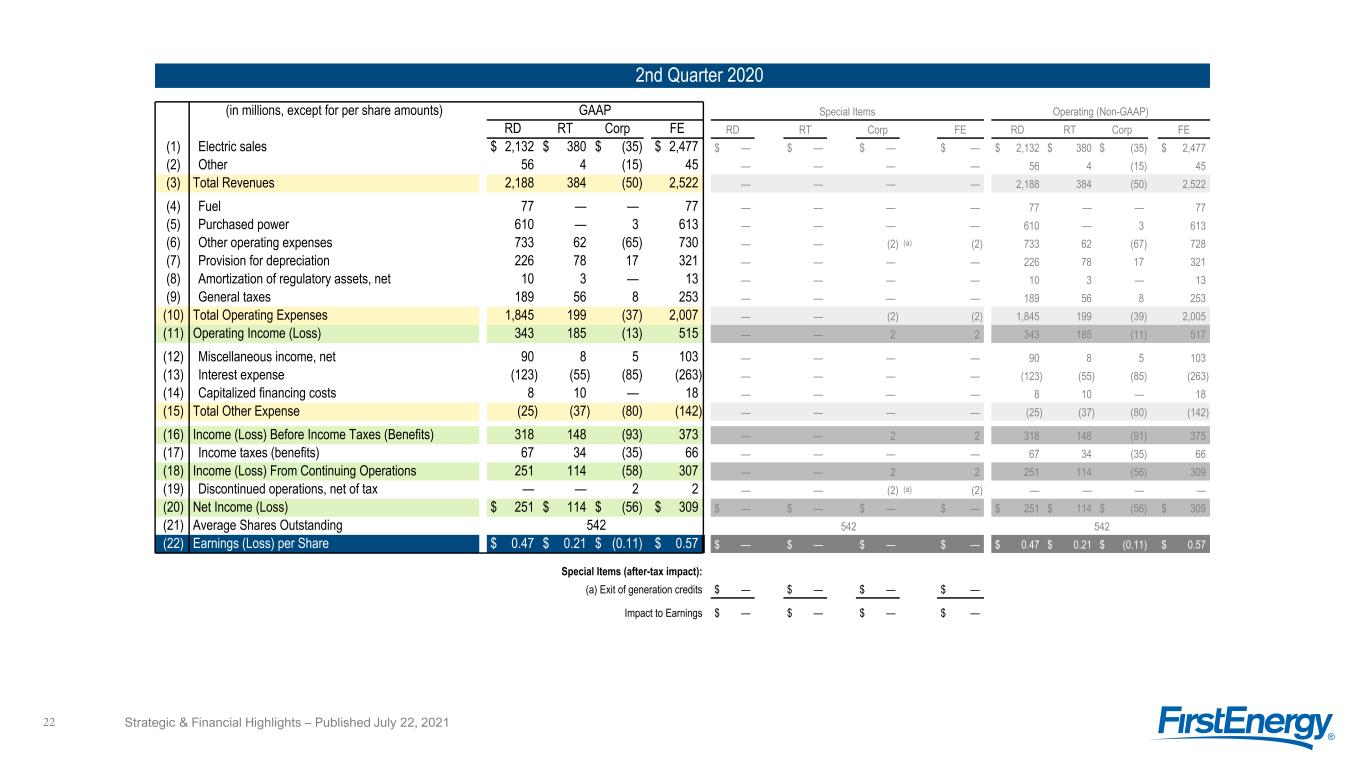

2nd Quarter 2020 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ 2,132 $ 380 $ (35) $ 2,477 $ — $ — $ — $ — $ 2,132 $ 380 $ (35) $ 2,477 (2) Other 56 4 (15) 45 — — — — 56 4 (15) 45 (3) Total Revenues 2,188 384 (50) 2,522 — — — — 2,188 384 (50) 2,522 (4) Fuel 77 — — 77 — — — — 77 — — 77 (5) Purchased power 610 — 3 613 — — — — 610 — 3 613 (6) Other operating expenses 733 62 (65) 730 — — (2) (a) (2) 733 62 (67) 728 (7) Provision for depreciation 226 78 17 321 — — — — 226 78 17 321 (8) Amortization of regulatory assets, net 10 3 — 13 — — — — 10 3 — 13 (9) General taxes 189 56 8 253 — — — — 189 56 8 253 (10) Total Operating Expenses 1,845 199 (37) 2,007 — — (2) (2) 1,845 199 (39) 2,005 (11) Operating Income (Loss) 343 185 (13) 515 — — 2 2 343 185 (11) 517 (12) Miscellaneous income, net 90 8 5 103 — — — — 90 8 5 103 (13) Interest expense (123) (55) (85) (263) — — — — (123) (55) (85) (263) (14) Capitalized financing costs 8 10 — 18 — — — — 8 10 — 18 (15) Total Other Expense (25) (37) (80) (142) — — — — (25) (37) (80) (142) (16) Income (Loss) Before Income Taxes (Benefits) 318 148 (93) 373 — — 2 2 318 148 (91) 375 (17) Income taxes (benefits) 67 34 (35) 66 — — — — 67 34 (35) 66 (18) Income (Loss) From Continuing Operations 251 114 (58) 307 — — 2 2 251 114 (56) 309 (19) Discontinued operations, net of tax — — 2 2 — — (2) (a) (2) — — — — (20) Net Income (Loss) $ 251 $ 114 $ (56) $ 309 $ — $ — $ — $ — $ 251 $ 114 $ (56) $ 309 (21) Average Shares Outstanding 542 542 542 (22) Earnings (Loss) per Share $ 0.47 $ 0.21 $ (0.11) $ 0.57 $ — $ — $ — $ — $ 0.47 $ 0.21 $ (0.11) $ 0.57 Special Items (after-tax impact): (a) Exit of generation credits $ — $ — $ — $ — Impact to Earnings $ — $ — $ — $ — Strategic & Financial Highlights – Published July 22, 202122

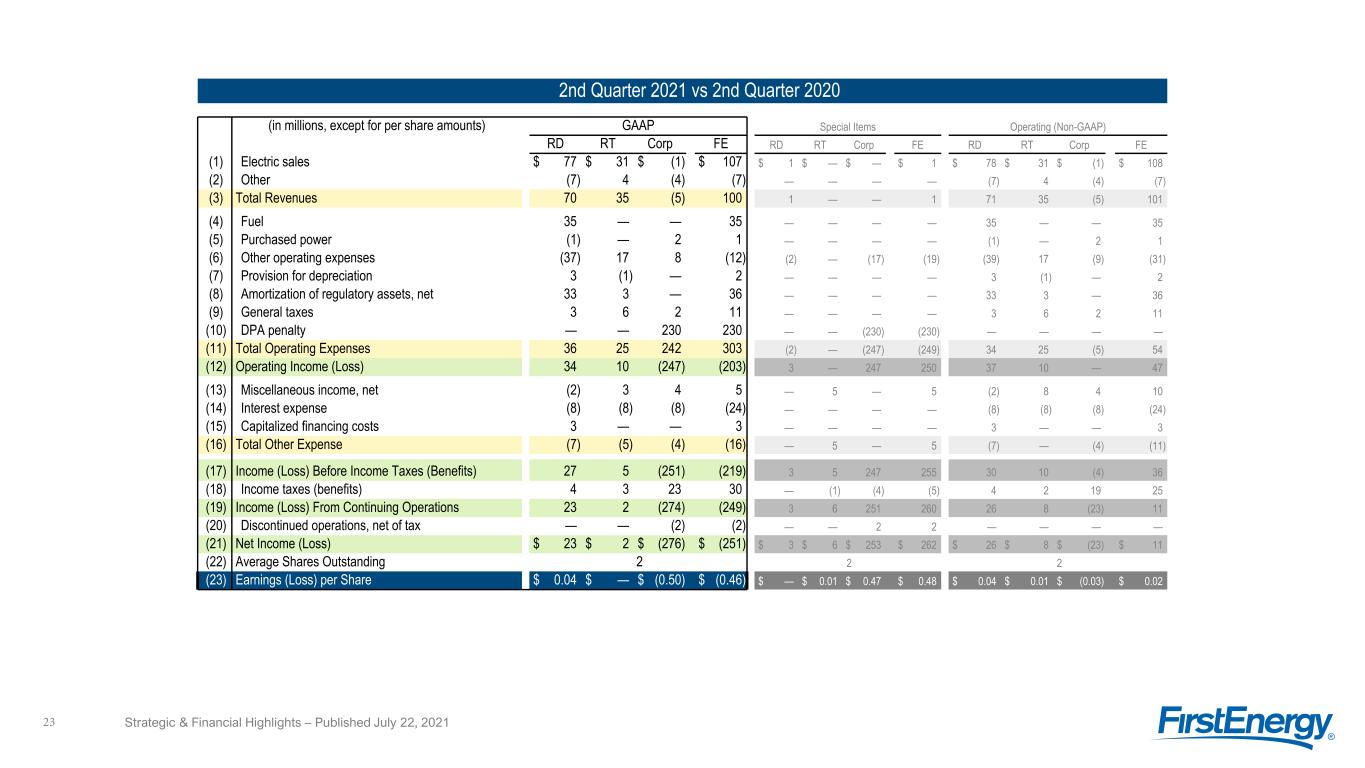

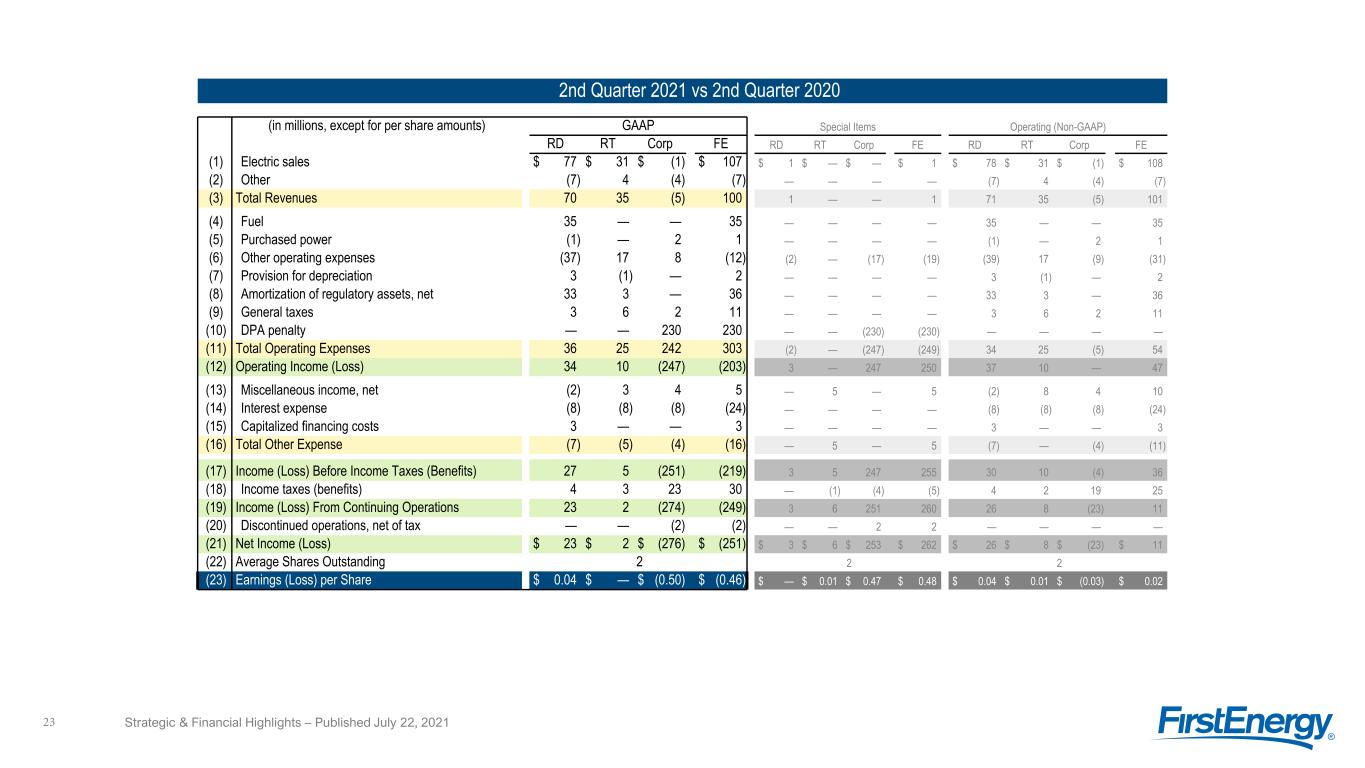

2nd Quarter 2021 vs 2nd Quarter 2020 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ 77 $ 31 $ (1) $ 107 $ 1 $ — $ — $ 1 $ 78 $ 31 $ (1) $ 108 (2) Other (7) 4 (4) (7) — — — — (7) 4 (4) (7) (3) Total Revenues 70 35 (5) 100 1 — — 1 71 35 (5) 101 (4) Fuel 35 — — 35 — — — — 35 — — 35 (5) Purchased power (1) — 2 1 — — — — (1) — 2 1 (6) Other operating expenses (37) 17 8 (12) (2) — (17) (19) (39) 17 (9) (31) (7) Provision for depreciation 3 (1) — 2 — — — — 3 (1) — 2 (8) Amortization of regulatory assets, net 33 3 — 36 — — — — 33 3 — 36 (9) General taxes 3 6 2 11 — — — — 3 6 2 11 (10) DPA penalty — — 230 230 — — (230) (230) — — — — (11) Total Operating Expenses 36 25 242 303 (2) — (247) (249) 34 25 (5) 54 (12) Operating Income (Loss) 34 10 (247) (203) 3 — 247 250 37 10 — 47 (13) Miscellaneous income, net (2) 3 4 5 — 5 — 5 (2) 8 4 10 (14) Interest expense (8) (8) (8) (24) — — — — (8) (8) (8) (24) (15) Capitalized financing costs 3 — — 3 — — — — 3 — — 3 (16) Total Other Expense (7) (5) (4) (16) — 5 — 5 (7) — (4) (11) (17) Income (Loss) Before Income Taxes (Benefits) 27 5 (251) (219) 3 5 247 255 30 10 (4) 36 (18) Income taxes (benefits) 4 3 23 30 — (1) (4) (5) 4 2 19 25 (19) Income (Loss) From Continuing Operations 23 2 (274) (249) 3 6 251 260 26 8 (23) 11 (20) Discontinued operations, net of tax — — (2) (2) — — 2 2 — — — — (21) Net Income (Loss) $ 23 $ 2 $ (276) $ (251) $ 3 $ 6 $ 253 $ 262 $ 26 $ 8 $ (23) $ 11 (22) Average Shares Outstanding 2 2 2 (23) Earnings (Loss) per Share $ 0.04 $ — $ (0.50) $ (0.46) $ — $ 0.01 $ 0.47 $ 0.48 $ 0.04 $ 0.01 $ (0.03) $ 0.02 Strategic & Financial Highlights – Published July 22, 202123

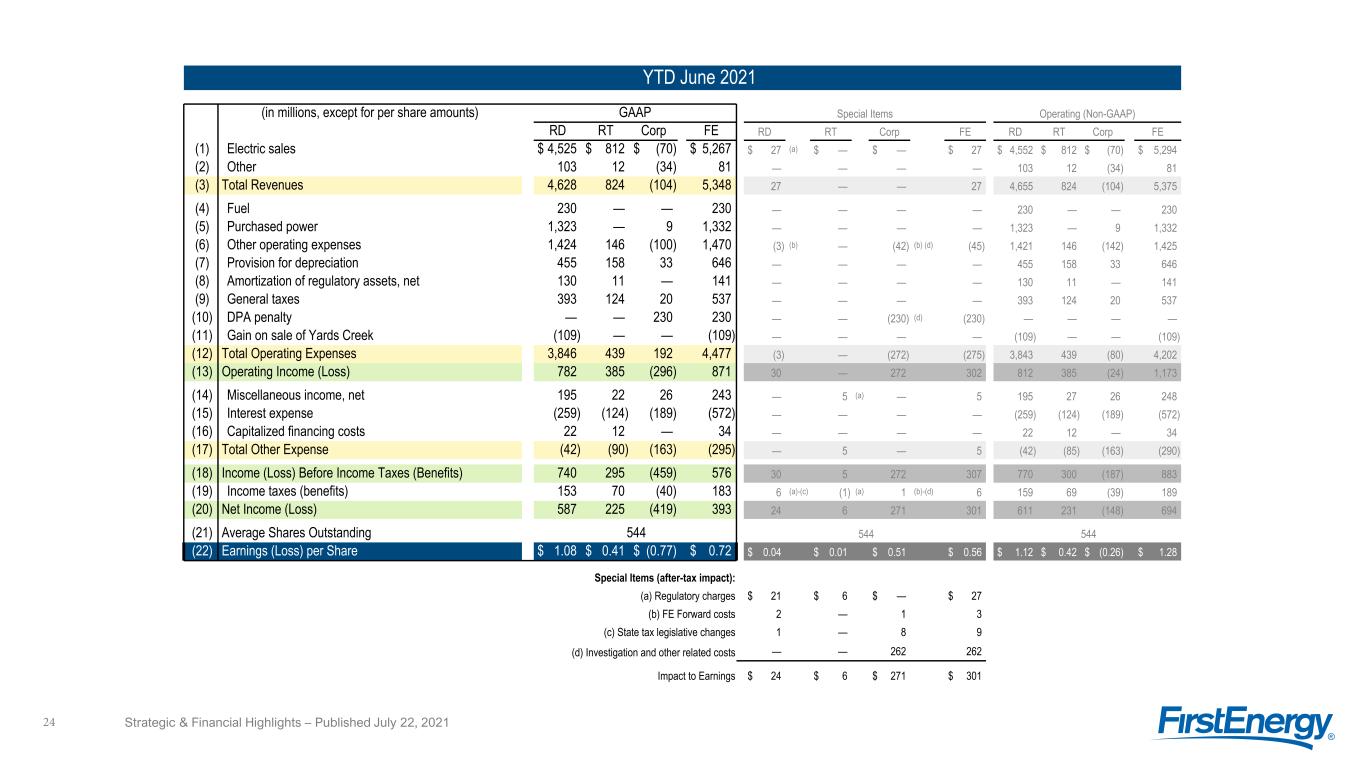

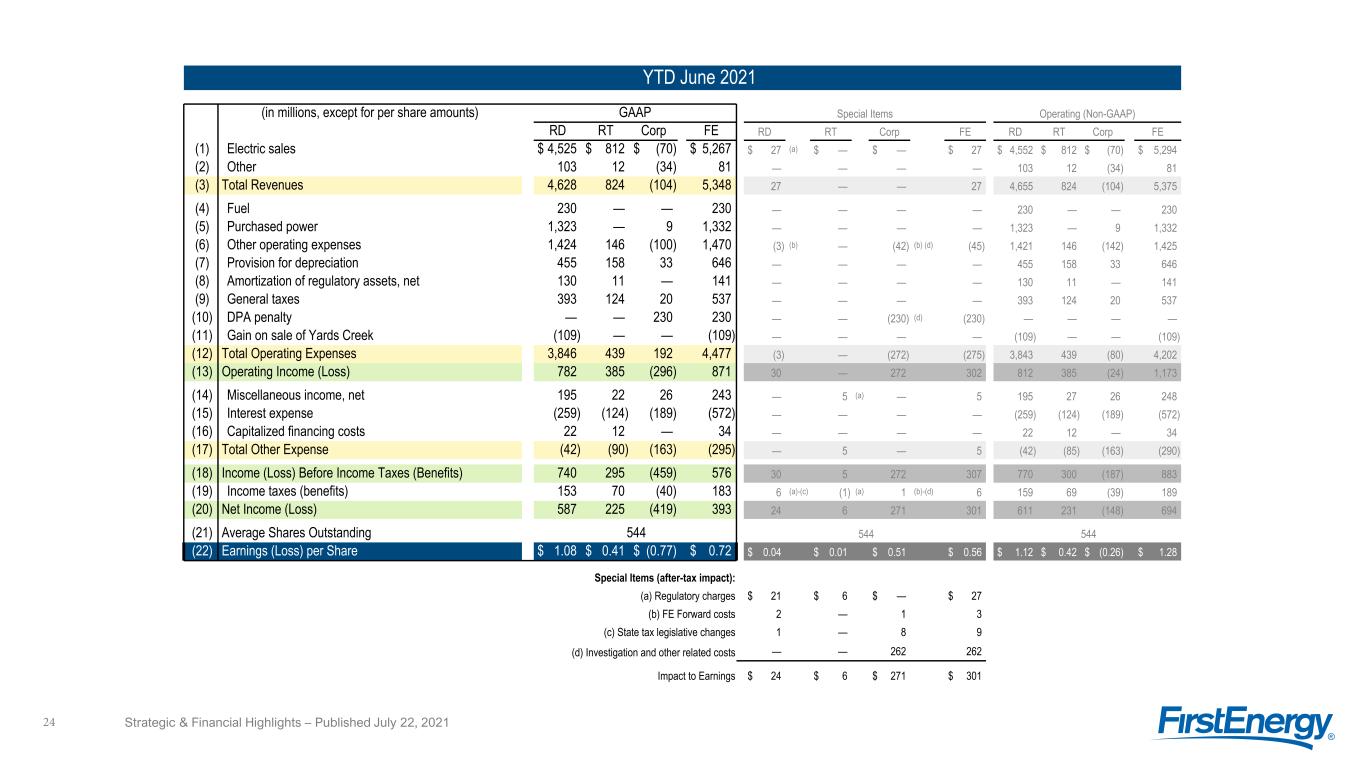

YTD June 2021 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ 4,525 $ 812 $ (70) $ 5,267 $ 27 (a) $ — $ — $ 27 $ 4,552 $ 812 $ (70) $ 5,294 (2) Other 103 12 (34) 81 — — — — 103 12 (34) 81 (3) Total Revenues 4,628 824 (104) 5,348 27 — — 27 4,655 824 (104) 5,375 (4) Fuel 230 — — 230 — — — — 230 — — 230 (5) Purchased power 1,323 — 9 1,332 — — — — 1,323 — 9 1,332 (6) Other operating expenses 1,424 146 (100) 1,470 (3) (b) — (42) (b) (d) (45) 1,421 146 (142) 1,425 (7) Provision for depreciation 455 158 33 646 — — — — 455 158 33 646 (8) Amortization of regulatory assets, net 130 11 — 141 — — — — 130 11 — 141 (9) General taxes 393 124 20 537 — — — — 393 124 20 537 (10) DPA penalty — — 230 230 — — (230) (d) (230) — — — — (11) Gain on sale of Yards Creek (109) — — (109) — — — — (109) — — (109) (12) Total Operating Expenses 3,846 439 192 4,477 (3) — (272) (275) 3,843 439 (80) 4,202 (13) Operating Income (Loss) 782 385 (296) 871 30 — 272 302 812 385 (24) 1,173 (14) Miscellaneous income, net 195 22 26 243 — 5 (a) — 5 195 27 26 248 (15) Interest expense (259) (124) (189) (572) — — — — (259) (124) (189) (572) (16) Capitalized financing costs 22 12 — 34 — — — — 22 12 — 34 (17) Total Other Expense (42) (90) (163) (295) — 5 — 5 (42) (85) (163) (290) (18) Income (Loss) Before Income Taxes (Benefits) 740 295 (459) 576 30 5 272 307 770 300 (187) 883 (19) Income taxes (benefits) 153 70 (40) 183 6 (a)-(c) (1) (a) 1 (b)-(d) 6 159 69 (39) 189 (20) Net Income (Loss) 587 225 (419) 393 24 6 271 301 611 231 (148) 694 (21) Average Shares Outstanding 544 544 544 (22) Earnings (Loss) per Share $ 1.08 $ 0.41 $ (0.77) $ 0.72 $ 0.04 $ 0.01 $ 0.51 $ 0.56 $ 1.12 $ 0.42 $ (0.26) $ 1.28 Special Items (after-tax impact): (a) Regulatory charges $ 21 $ 6 $ — $ 27 (b) FE Forward costs 2 — 1 3 (c) State tax legislative changes 1 — 8 9 (d) Investigation and other related costs — — 262 262 Impact to Earnings $ 24 $ 6 $ 271 $ 301 Strategic & Financial Highlights – Published July 22, 202124

YTD June 2020 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ 4,431 $ 777 $ (70) $ 5,138 $ — $ — $ — $ — $ 4,431 $ 777 $ (70) $ 5,138 (2) Other 115 8 (30) 93 — — — — 115 8 (30) 93 (3) Total Revenues 4,546 785 (100) 5,231 — — — — 4,546 785 (100) 5,231 (4) Fuel 175 — — 175 — — — — 175 — — 175 (5) Purchased power 1,300 — 7 1,307 (5) (a) — — (5) 1,295 — 7 1,302 (6) Other operating expenses 1,432 115 (68) 1,479 (6) (b) — (59) (b) (65) 1,426 115 (127) 1,414 (7) Provision for depreciation 449 154 35 638 — — — — 449 154 35 638 (8) Amortization of regulatory assets, net 59 6 — 65 — — — — 59 6 — 65 (9) General taxes 384 118 18 520 — — — — 384 118 18 520 (10) Total Operating Expenses 3,799 393 (8) 4,184 (11) — (59) (70) 3,788 393 (67) 4,114 (11) Operating Income (Loss) 747 392 (92) 1,047 11 — 59 70 758 392 (33) 1,117 (12) Miscellaneous income, net 165 14 24 203 — — — — 165 14 24 203 (13) Pension and OPEB mark-to-market adjustment (257) (19) (147) (423) 257 (c) — 147 (c) 404 — (19) — (19) (14) Interest expense (250) (107) (169) (526) — — — — (250) (107) (169) (526) (15) Capitalized financing costs 17 19 — 36 — — — — 17 19 — 36 (16) Total Other Expense (325) (93) (292) (710) 257 — 147 404 (68) (93) (145) (306) (17) Income (Loss) Before Income Taxes (Benefits) 422 299 (384) 337 268 — 206 474 690 299 (178) 811 (18) Income taxes (benefits) 35 68 (97) 6 110 (a)-(c) — 43 (b) (c) 153 145 68 (54) 159 (19) Income (Loss) From Continuing Operations 387 231 (287) 331 158 — 163 321 545 231 (124) 652 (20) Discontinued operations, net of tax — — 52 52 — — (38) (b) (38) — — 14 14 (21) Net Income (Loss) 387 231 (235) 383 158 — 125 283 545 231 (110) 666 (22) Average Shares Outstanding 541 541 541 (23) Earnings (Loss) per Share $ 0.72 $ 0.43 $ (0.44) $ 0.71 $ 0.29 $ — $ 0.23 $ 0.52 $ 1.01 $ 0.43 $ (0.21) $ 1.23 Special Items (after-tax impact): (a) Regulatory charges $ 4 $ — $ — $ 4 (b) Exit of generation credits (48) — 9 (39) (c) Mark-to-mark adjustments - Pension/ OPEB actuarial assumption 202 — 116 318 Impact to Earnings $ 158 $ — $ 125 $ 283 Strategic & Financial Highlights – Published July 22, 202125

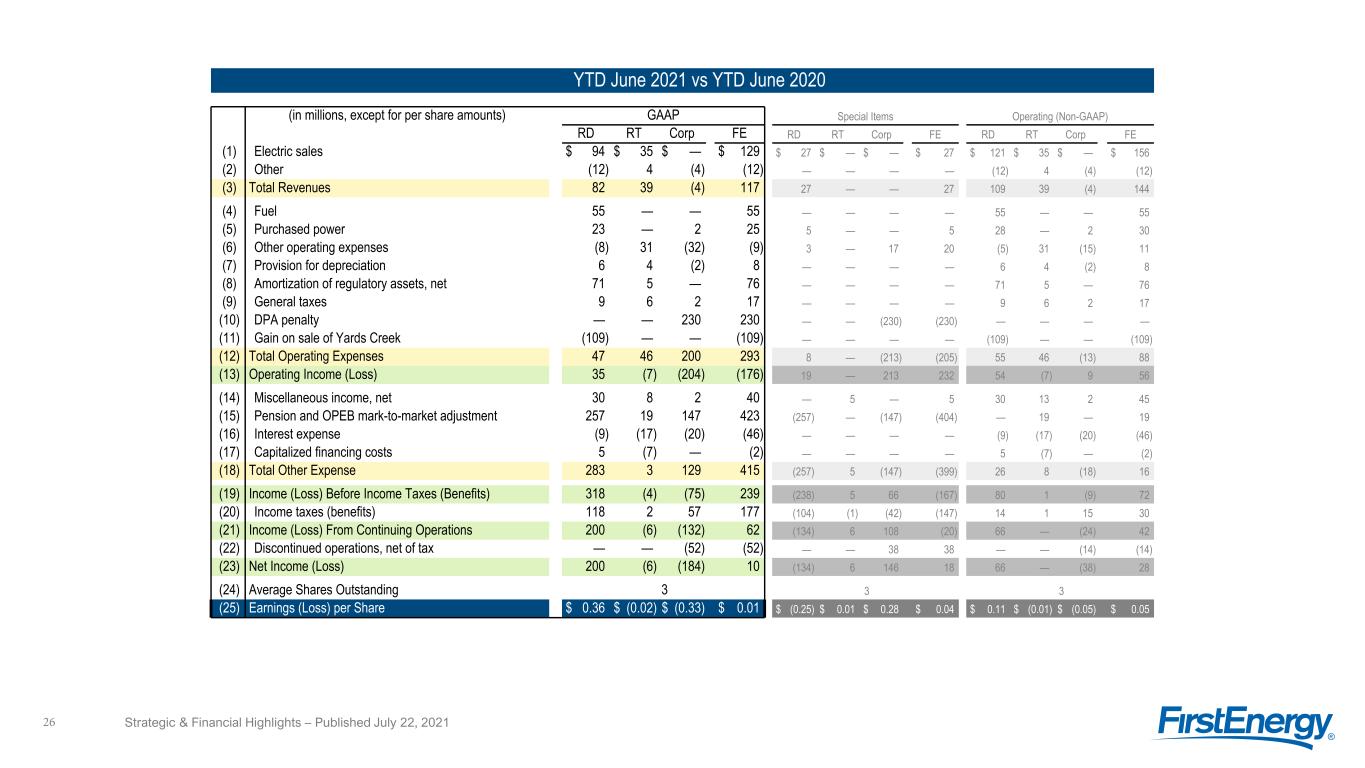

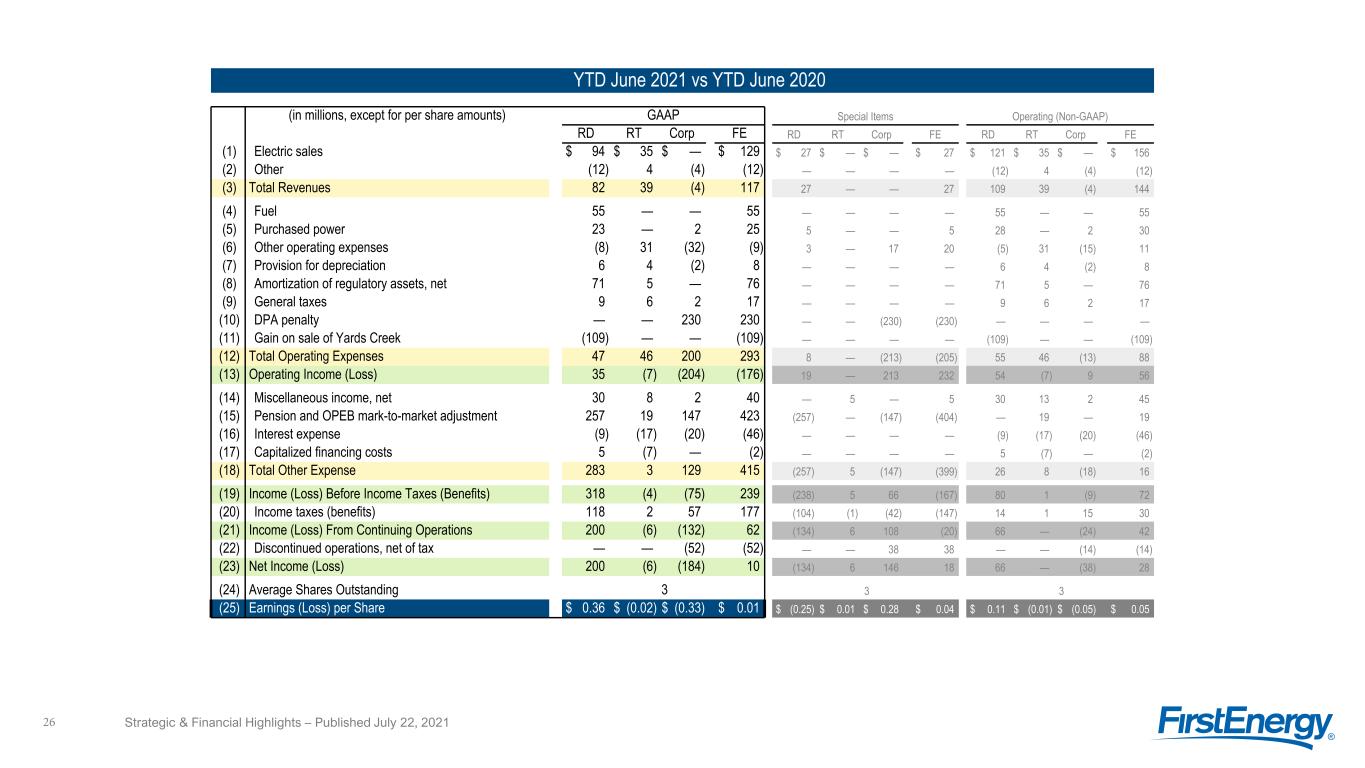

YTD June 2021 vs YTD June 2020 (in millions, except for per share amounts) GAAP Special Items Operating (Non-GAAP) RD RT Corp FE RD RT Corp FE RD RT Corp FE (1) Electric sales $ 94 $ 35 $ — $ 129 $ 27 $ — $ — $ 27 $ 121 $ 35 $ — $ 156 (2) Other (12) 4 (4) (12) — — — — (12) 4 (4) (12) (3) Total Revenues 82 39 (4) 117 27 — — 27 109 39 (4) 144 (4) Fuel 55 — — 55 — — — — 55 — — 55 (5) Purchased power 23 — 2 25 5 — — 5 28 — 2 30 (6) Other operating expenses (8) 31 (32) (9) 3 — 17 20 (5) 31 (15) 11 (7) Provision for depreciation 6 4 (2) 8 — — — — 6 4 (2) 8 (8) Amortization of regulatory assets, net 71 5 — 76 — — — — 71 5 — 76 (9) General taxes 9 6 2 17 — — — — 9 6 2 17 (10) DPA penalty — — 230 230 — — (230) (230) — — — — (11) Gain on sale of Yards Creek (109) — — (109) — — — — (109) — — (109) (12) Total Operating Expenses 47 46 200 293 8 — (213) (205) 55 46 (13) 88 (13) Operating Income (Loss) 35 (7) (204) (176) 19 — 213 232 54 (7) 9 56 (14) Miscellaneous income, net 30 8 2 40 — 5 — 5 30 13 2 45 (15) Pension and OPEB mark-to-market adjustment 257 19 147 423 (257) — (147) (404) — 19 — 19 (16) Interest expense (9) (17) (20) (46) — — — — (9) (17) (20) (46) (17) Capitalized financing costs 5 (7) — (2) — — — — 5 (7) — (2) (18) Total Other Expense 283 3 129 415 (257) 5 (147) (399) 26 8 (18) 16 (19) Income (Loss) Before Income Taxes (Benefits) 318 (4) (75) 239 (238) 5 66 (167) 80 1 (9) 72 (20) Income taxes (benefits) 118 2 57 177 (104) (1) (42) (147) 14 1 15 30 (21) Income (Loss) From Continuing Operations 200 (6) (132) 62 (134) 6 108 (20) 66 — (24) 42 (22) Discontinued operations, net of tax — — (52) (52) — — 38 38 — — (14) (14) (23) Net Income (Loss) 200 (6) (184) 10 (134) 6 146 18 66 — (38) 28 (24) Average Shares Outstanding 3 3 3 (25) Earnings (Loss) per Share $ 0.36 $ (0.02) $ (0.33) $ 0.01 $ (0.25) $ 0.01 $ 0.28 $ 0.04 $ 0.11 $ (0.01) $ (0.05) $ 0.05 Strategic & Financial Highlights – Published July 22, 202126

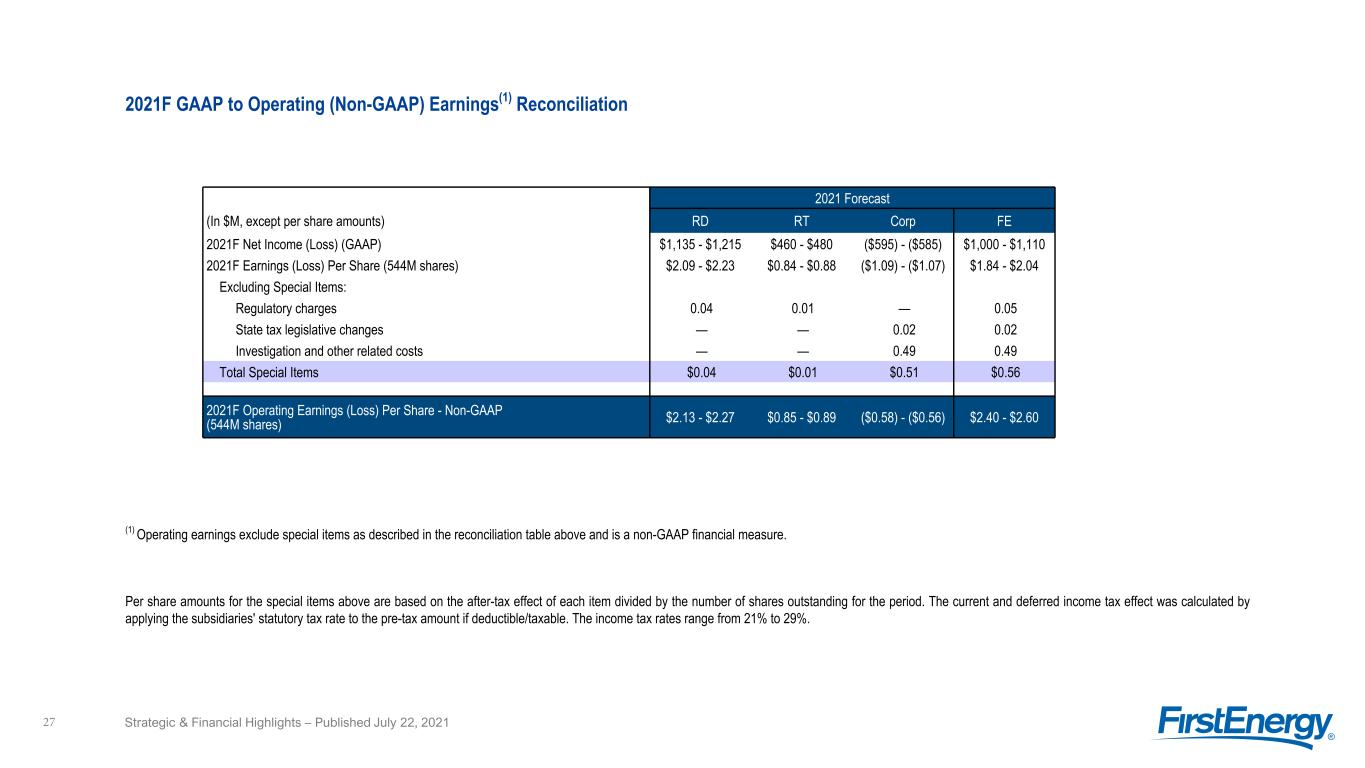

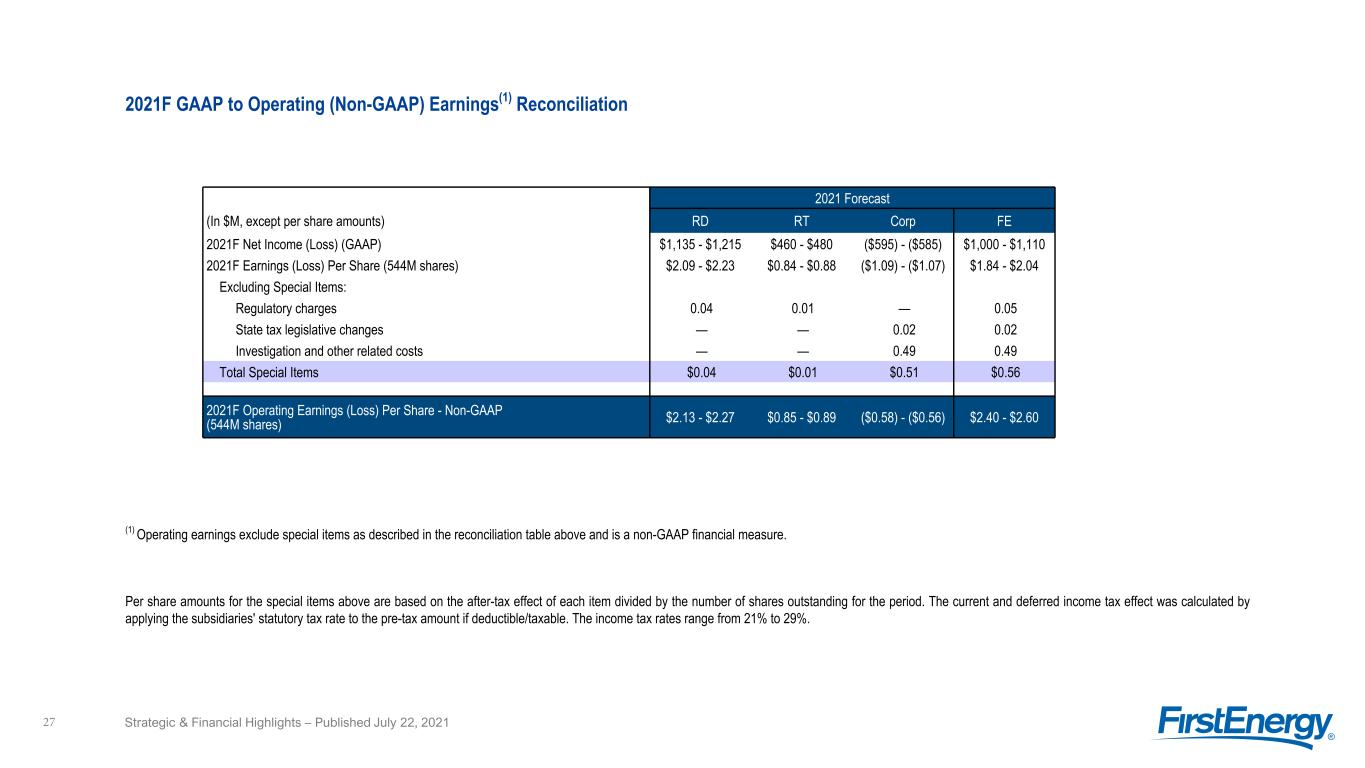

2021F GAAP to Operating (Non-GAAP) Earnings(1) Reconciliation (1) Operating earnings exclude special items as described in the reconciliation table above and is a non-GAAP financial measure. Per share amounts for the special items above are based on the after-tax effect of each item divided by the number of shares outstanding for the period. The current and deferred income tax effect was calculated by applying the subsidiaries' statutory tax rate to the pre-tax amount if deductible/taxable. The income tax rates range from 21% to 29%. 2021 Forecast (In $M, except per share amounts) RD RT Corp FE 2021F Net Income (Loss) (GAAP) $1,135 - $1,215 $460 - $480 ($595) - ($585) $1,000 - $1,110 2021F Earnings (Loss) Per Share (544M shares) $2.09 - $2.23 $0.84 - $0.88 ($1.09) - ($1.07) $1.84 - $2.04 Excluding Special Items: Regulatory charges 0.04 0.01 — 0.05 State tax legislative changes — — 0.02 0.02 Investigation and other related costs — — 0.49 0.49 Total Special Items $0.04 $0.01 $0.51 $0.56 2021F Operating Earnings (Loss) Per Share - Non-GAAP (544M shares) $2.13 - $2.27 $0.85 - $0.89 ($0.58) - ($0.56) $2.40 - $2.60 Strategic & Financial Highlights – Published July 22, 202127

Quarterly Appendix Information Strategic & Financial Highlights – Published July 22, 202128 SALES INFORMATION 29. TTM Actual Sales by Class 30. TTM Weather-Adjusted Sales 31. TTM Weather Impacts TABLE OF CONTENTS (Slide) Irene M. Prezelj, Vice President prezelji@firstenergycorp.com 330.384.3859 Gina E. Caskey, Senior Advisor caskeyg@firstenergycorp.com 330.761.4185 Jake M. Mackin, Consultant mackinj@firstenergycorp.com 330.384.4829

(MWh in thousands) 3Q19 3Q20 4Q19 4Q20 1Q20 1Q21 2Q20 2Q21 TTM 2Q20 TTM 2Q21 Residential 15,306 16,091 12,850 12,919 13,204 14,890 12,764 12,347 54,124 56,247 Commercial 10,148 9,589 8,980 8,496 8,901 8,631 7,825 8,590 35,854 35,306 Industrial 14,477 13,560 13,618 12,917 13,548 13,257 12,009 13,384 53,652 53,118 Total 39,931 39,240 35,448 34,332 35,653 36,778 32,598 34,321 143,630 144,671t l 5.1% 0.5% 12.8% -3.3% 3.9% -5.5% -5.4% -3.0% 9.8% -1.5% -6.3% -5.1% -2.1% 11.4% -1.0% -1.7% -3.1% 3.2% 5.3% 0.7% 3Q20 4Q20 1Q21 2Q21 TTM Residential Commercial Industrial Total Sales by Class Percent change vs. prior year Strategic & Financial Highlights – Published July 22, 202129 All periods above reflect a reclassification of Commercial and Industrial customers in PA consistent with the PA PUC Order in the PA Companies’ Default Service Program for the period June 1, 2019 – May 31, 2023 Commercial includes street lighting

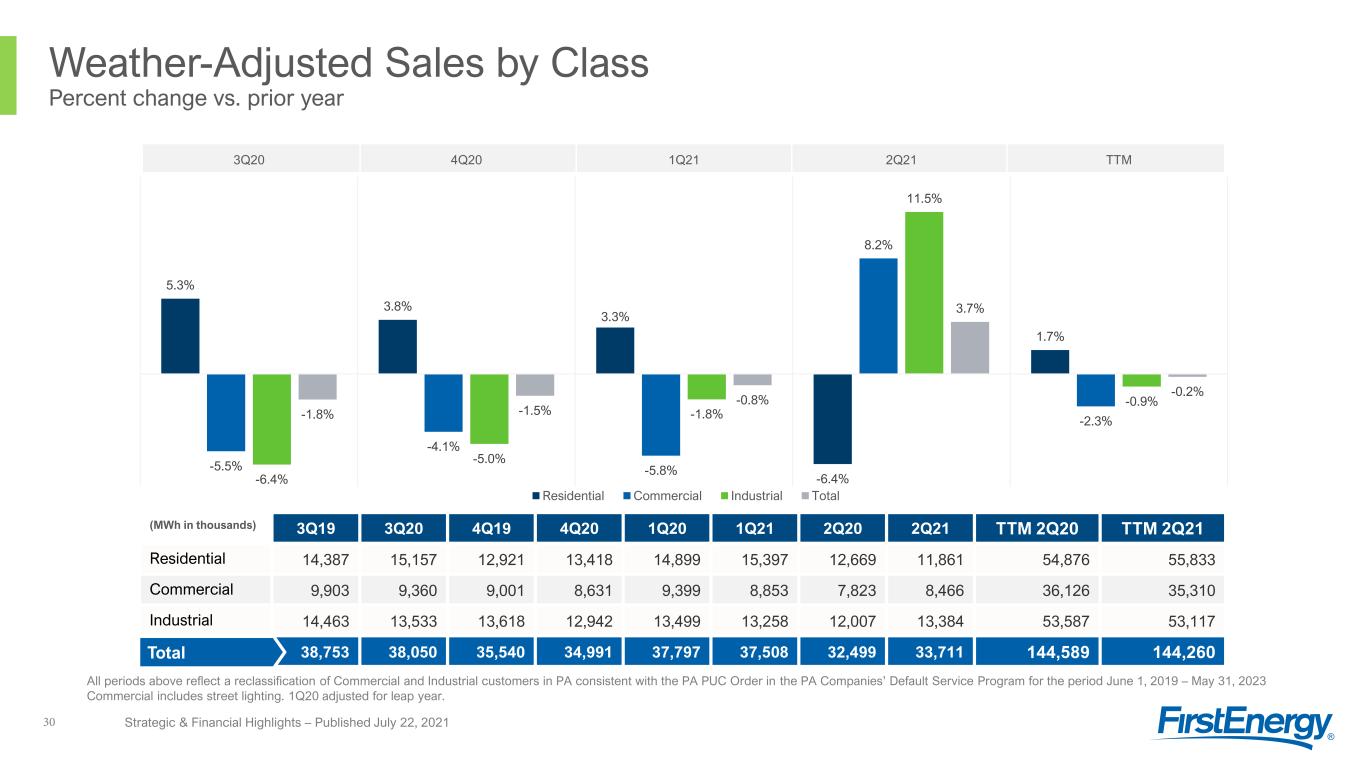

Weather-Adjusted Sales by Class Percent change vs. prior year Strategic & Financial Highlights – Published July 22, 202130 (MWh in thousands) 3Q19 3Q20 4Q19 4Q20 1Q20 1Q21 2Q20 2Q21 TTM 2Q20 TTM 2Q21 Residential 14,387 15,157 12,921 13,418 14,899 15,397 12,669 11,861 54,876 55,833 Commercial 9,903 9,360 9,001 8,631 9,399 8,853 7,823 8,466 36,126 35,310 Industrial 14,463 13,533 13,618 12,942 13,499 13,258 12,007 13,384 53,587 53,117 Total 38,753 38,050 35,540 34,991 37,797 37,508 32,499 33,711 144,589 144,260t l 5.3% 3.8% 3.3% -6.4% 1.7% -5.5% -4.1% -5.8% 8.2% -2.3% -6.4% -5.0% -1.8% 11.5% -0.9% -1.8% -1.5% -0.8% 3.7% -0.2% 3Q20 4Q20 1Q21 2Q21 TTM Residential Commercial Industrial Total All periods above reflect a reclassification of Commercial and Industrial customers in PA consistent with the PA PUC Order in the PA Companies’ Default Service Program for the period June 1, 2019 – May 31, 2023 Commercial includes street lighting. 1Q20 adjusted for leap year.

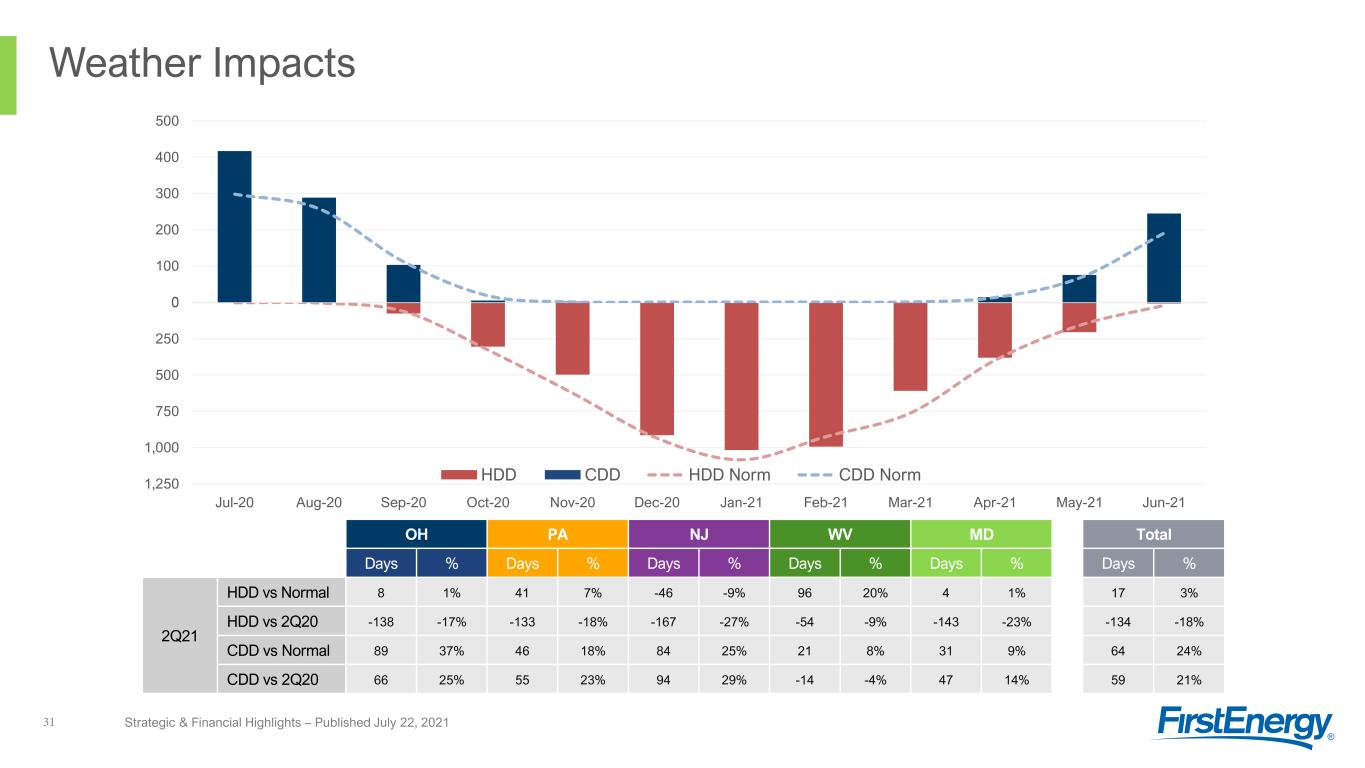

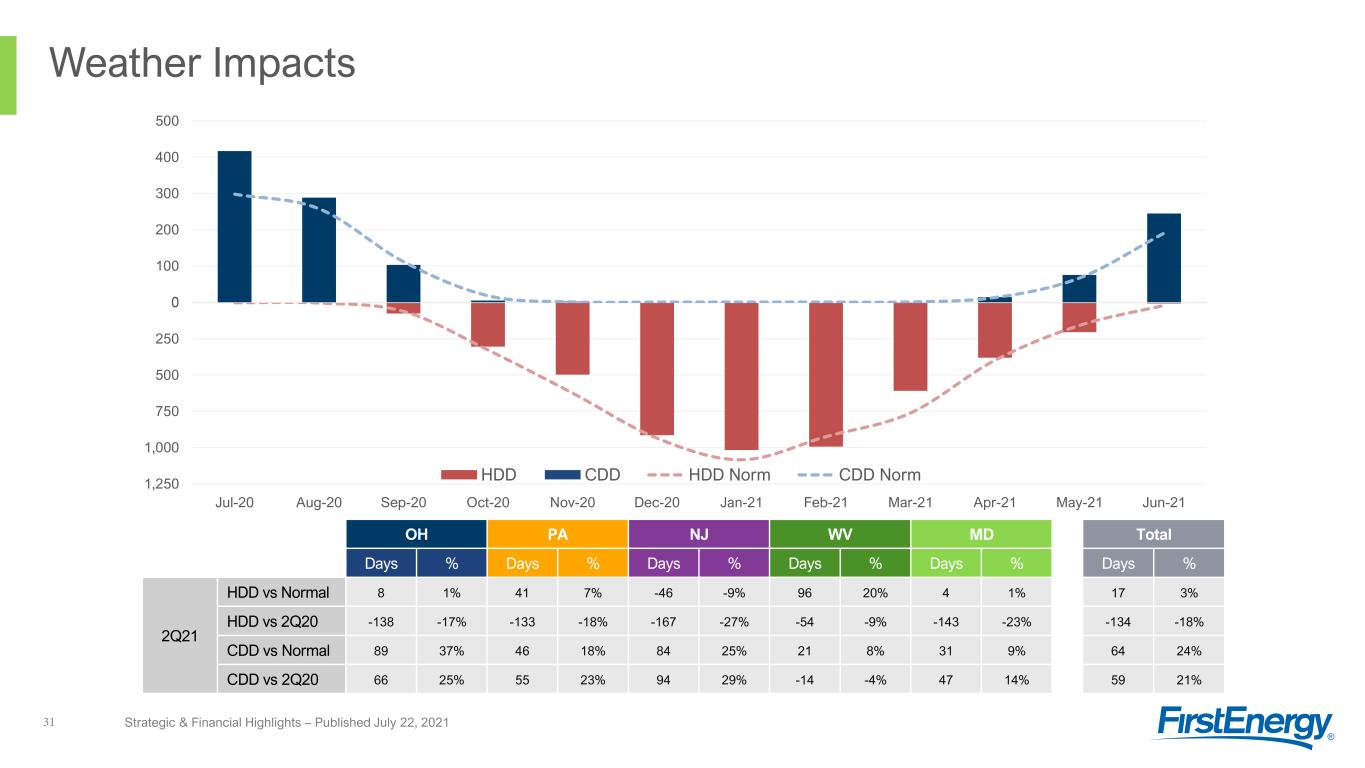

Weather Impacts Strategic & Financial Highlights – Published July 22, 202131 OH PA NJ WV MD Total Days % Days % Days % Days % Days % Days % 2Q21 HDD vs Normal 8 1% 41 7% -46 -9% 96 20% 4 1% 17 3% HDD vs 2Q20 -138 -17% -133 -18% -167 -27% -54 -9% -143 -23% -134 -18% CDD vs Normal 89 37% 46 18% 84 25% 21 8% 31 9% 64 24% CDD vs 2Q20 66 25% 55 23% 94 29% -14 -4% 47 14% 59 21% 1,250 1,000 750 500 250 0 Jul-20 Aug-20 Sep-20 Oct-20 Nov-20 Dec-20 Jan-21 Feb-21 Mar-21 Apr-21 May-21 Jun-21 HDD CDD HDD Norm CDD Norm 100 200 300 400 500