SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant o

Check the appropriate box:

o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to Rule 14a-12 |

ECHO THERAPEUTICS, INC.

(Name of the Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | | |

| | (3) | Filing Party: |

| | | |

| | | |

| | (4) | Date Filed: |

| | | |

ECHO THERAPEUTICS, INC.

8 Penn Center

1628 JFK Boulevard, Suite 300

Philadelphia, Pennsylvania 19103

NOTICE OF 2012 ANNUAL MEETING OF SHAREHOLDERS

To be held on June 20, 2012

To the Shareholders of Echo Therapeutics, Inc.:

Notice is hereby given that the 2012 Annual Meeting of Shareholders (the “Annual Meeting”) of Echo Therapeutics, Inc., a Delaware corporation (the “Company”), will be held at 1:00 p.m., local time, on June 20, 2012, at the Company’s offices located at 8 Penn Center, 1628 JFK Boulevard, Philadelphia, Pennsylvania 19103, to consider and act upon the following proposals:

| 1. | To elect two Class I directors to the Company’s Board of Directors; |

| 2. | To approve an amendment to the Company's Certificate of Incorporation to increase the number of authorized shares of common stock from one hundred million (100,000,000) to one hundred fifty million (150,000,000); |

| 3. | To approve an amendment to the Company’s 2008 Equity Incentive Plan (the “2008 Plan”) to increase the maximum number of shares of common stock available under the 2008 Plan from four million seven hundred thousand (4,700,000) to ten million (10,000,000); |

| 4. | To approve, on an advisory basis, the Company’s named executive officer compensation; |

| 5. | To approve, on an advisory basis, the frequency of future advisory executive compensation votes; |

| 6. | To ratify the appointment of Wolf & Company, P.C. as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012; and |

| 7. | To transact such other business, if any, as may properly come before the meeting or any adjournments thereof. |

The Board of Directors of the Company has no knowledge of any other business to be transacted at the Annual Meeting. Only holders of record of the Company’s common stock, $.01 par value per share, at the close of business on April 23, 2012 are entitled to notice of and to vote at the Annual Meeting. All shareholders are cordially invited to attend the Annual Meeting in person.

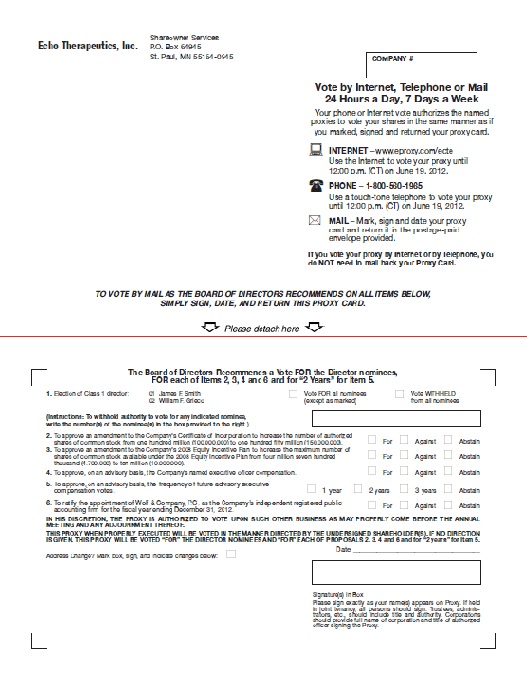

To ensure your representation at the Annual Meeting, you are urged to vote by (i) marking, signing and dating your proxy card and returning it in the postage-prepaid envelope, (ii) calling the toll-free number on your proxy card, (iii) visiting the website listed on your proxy card, or (iv) attending the Annual Meeting and voting in person. You may revoke your proxy in the manner described in the Proxy Statement at any time before it has been voted at the Annual Meeting. Any shareholder attending the Annual Meeting may vote in person even if he or she has returned a proxy.

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON JUNE 20, 2012: THE ANNUAL REPORT AND PROXY STATEMENT ARE ALSO AVAILABLE ONLINE AT WWW.PROXYCONNECT.COM/ECHO.

By Order of the Board of Directors,

Kimberly A. Burke, Secretary

Philadelphia, Pennsylvania

May 7, 2012

ECHO THERAPEUTICS, INC.

8 Penn Center

1628 JFK Boulevard, Suite 300

Philadelphia, Pennsylvania 19103

PROXY STATEMENT

For the 2012 Annual Meeting of Shareholders

To be held on June 20, 2012

GENERAL

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Directors of Echo Therapeutics, Inc., a Delaware corporation (the “Company,” “we,” “us” or “our”), for use at our 2012 Annual Meeting of Shareholders (the “Annual Meeting”) to be held at 1:00 p.m., local time, on June 20, 2012, at our offices located at 8 Penn Center, 1628 JFK Boulevard, Philadelphia, Pennsylvania 19103, or at any adjournments thereof. The Notice of Annual Meeting, this Proxy Statement, the accompanying proxy card and our Annual Report on Form 10-K for the fiscal year ended December 31, 2011 are expected to be first sent or given to shareholders commencing on or about May 7, 2012. Our principal executive offices are located at 8 Penn Center, 1628 JFK Boulevard, Suite 300, Philadelphia, Pennsylvania 19103, and our telephone number is 215-717-4100.

SOLICITATION

The cost of soliciting proxies, including expenses in connection with preparing and mailing the proxy materials, will be borne by the Company. Copies of solicitation materials will be furnished to brokerage houses, nominees, fiduciaries and custodians to forward to beneficial owners of the Company’s common stock, $.01 par value per share (“Common Stock”), held in their names. In addition, the Company will reimburse brokerage firms and other persons representing beneficial owners of the Common Stock for their reasonable expenses in forwarding solicitation materials to such beneficial owners. In addition to the original solicitation of proxies by mail, the Company’s directors, officers and other employees may, without additional compensation, solicit proxies by telephone, facsimile, electronic communication and personal interviews.

RECORD DATE, OUTSTANDING SHARES AND VOTING RIGHTS

The Board of Directors has fixed April 23, 2012 as the record date for determining holders of Common Stock who are entitled to vote at the Annual Meeting. As of April 13, 2012, the Company had approximately 38,836,022 shares of Common Stock outstanding and entitled to be voted. Each share of Common Stock entitles the record holder to one vote on each matter to be voted upon at the Annual Meeting. A majority of the shares of Common Stock issued and outstanding and entitled to vote at the Annual Meeting will constitute a quorum for all matters. Votes withheld, abstentions and broker non-votes shall be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting.

The affirmative vote of the holders of a plurality of the votes cast at the Annual Meeting is required for the election of the Class 1 directors (Proposal No. 1). The affirmative vote of the holders of a majority of the shares of Common Stock entitled to vote is required to approve the amendment to the Company’s Certificate of Incorporation to increase the number of authorized shares of Common Stock from one hundred million (100,000,000) to one hundred fifty million (150,000,000) (Proposal No. 2). The affirmative vote of the holders of a majority of the shares of Common Stock present or represented by proxy and voting on the matter is required to approve the amendment to the Company’s 2008 Equity Incentive Plan (the “2008 Plan”) to increase the maximum number of shares of Common Stock available under the 2008 Plan from four million seven hundred thousand (4,700,000) to ten million (10,000,000) (Proposal No. 3). The affirmative vote of the holders of a majority of the shares of Common Stock present or represented by proxy and voting on the matter is required to approve, on an advisory basis, the Company’s named executive officer compensation (Proposal No. 4). The affirmative vote of the holders of a plurality of the votes cast at the Annual Meeting is required to approve, on an advisory basis, the frequency of future advisory executive compensation votes (Proposal No 5). The affirmative vote of the holders of a majority of the shares of Common Stock present or represented by proxy and voting on the matter is required to ratify the appointment of Wolf & Company, P.C. (“Wolf & Company”) as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012 (Proposal No. 6).

With respect to the election of the directors, assuming a quorum is present, the nominees receiving the highest number of votes cast at the Annual Meeting will be elected. With respect to the approval of the amendment to the Company’s Certificate of Incorporation to increase the number of authorized shares of Common Stock, it will be approved if the holders of a majority of the shares of Common Stock entitled to vote on the proposal vote FOR the proposal. With respect to the approval, on an advisory basis, of the frequency of future advisory executive compensation votes, the alternative receiving the highest number of votes cast at the Annual Meeting will be the act of the stockholders. With respect to (i) the approval of the amendment of the 2008 Plan to increase the maximum number of shares of Common Stock, (ii) the approval, on an advisory basis, of the Company’s named executive officer compensation, and (iii) the ratification of the appointment of Wolf & Company as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012, each will be approved if a majority of the shares present in person or by proxy and casting a vote on the proposal vote FOR the proposal. If you mark your proxy as “Withhold Authority” or “Abstain” on any matter, or if you give specific instructions that no vote be cast on any specific matter, the shares represented by your proxy will not be voted on that matter, but will count in determining whether a quorum is present.

Proxies submitted by brokers that do not indicate a vote for some or all of the proposals because the brokers do not have discretionary voting authority and have not received instructions as to how to vote on those proposals (so called “broker non-votes”) are also considered in determining whether a quorum is present. Broker non-votes and abstentions will not affect the outcome of the vote on Proposal No. 6 but they will have the same effect as a vote “against” Proposal Nos. 1, 2, 3, 4 and 5.

To vote by mail, please sign, date and complete the enclosed proxy card and return it in the enclosed envelope. No postage is necessary if the proxy card is mailed in the United States. To vote by phone or electronically through the Internet, follow the instructions on the enclosed proxy card. If you hold your shares through a bank, broker or other nominee, they will give you separate instructions for voting your shares.

REVOCABILITY OF PROXY AND VOTING OF SHARES

Any shareholder giving a proxy has the power to revoke it at any time before it is exercised. The proxy may be revoked by filing an instrument of revocation or a duly executed proxy bearing a later date with the Secretary of the Company, at the Company’s principal executive offices, located at 8 Penn Center, 1628 JFK Boulevard, Suite 300, Philadelphia, Pennsylvania 19103. The proxy may also be revoked by attending the Annual Meeting, giving notice of revocation and voting in person. Attendance at the Annual Meeting, by itself, will not constitute revocation of a proxy. If not revoked, the proxy will be voted at the Annual Meeting in accordance with the shareholder’s instructions indicated on the proxy card. If no instructions are indicated, the proxy will be voted:

| • | FOR the election of the director nominees named herein; |

| • | FOR the approval of an amendment to the Company's Certificate of Incorporation to increase the number of authorized shares of Common Stock from one hundred million (100,000,000) to one hundred fifty million (150,000,000); |

| • | FOR the approval an of amendment to the 2008 Plan to increase the maximum number of shares of Common Stock available under the 2008 Plan from four million seven hundred thousand (4,700,000) to ten million (10,000,000); |

| • | FOR the approval, on an advisory basis, of the Company’s named executive officer compensation; |

| • | FOR the approval, on an advisory basis, of the frequency of future advisory executive compensation votes; |

| • | FOR the ratification of the appointment of Wolf & Company as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012; and |

| • | In accordance with the judgment of the proxy holders as to any other matter that may be properly brought before the Annual Meeting or any adjournments thereof. |

All shares represented by proxies will be voted in accordance with the shareholders’ instructions and, if no choice is specified, the shares represented by proxies will be voted in favor of the matters set forth in the accompanying Notice of Annual Meeting of Shareholders.

OTHER MATTERS

The Board of Directors does not know of any other matter which may come before the Annual Meeting. If any other matters are properly presented to the Annual Meeting, it is the intention of the person named as proxy in the accompanying proxy card to vote, or otherwise to act, in accordance with their best judgment on such matters.

PROPOSAL 1

ELECTION OF DIRECTORS

The Board of Directors is currently fixed at five directors divided into three classes with staggered terms for each class. As of April 13, 2012, we have four directors, two of whom are Class I directors whose terms expire in 2012, one of whom is a Class II director whose term expires in 2013 and one of whom is a Class III director whose term expires in 2014. We currently have one vacant Class III director position and our Nominating Committee is actively conducting a search for the appropriate candidate to fill this position.

As set forth in the following table, the Board of Directors has nominated and recommended William F. Grieco and James F. Smith for election to the Board of Directors as Class I directors for a term of three years. Each Class I director will hold office until a successor has been duly elected and qualified or until his earlier death, resignation or removal. Mr. Grieco and Mr. Smith are currently serving as Class I directors of the Company, Mr. Enright is currently serving as a Class II director of the Company, and Dr. Mooney is currently serving as a Class III director of the Company. Shares represented by all proxies received by the Board of Directors and not so marked as to withhold authority to vote for the nominees will be voted FOR the election of each nominee. The Board of Directors has no reason to believe that any nominee will be unable or unwilling to serve, but if such should be the case, the proxies may be voted for the election of one or more substitute nominees.

| Name and Year Director First Became a Director | | Position(s) with the Company |

| | | |

William F. Grieco (2011) | | Director |

James F. Smith (2011) | | Director |

* * * *

The Board of Directors unanimously recommends a vote “FOR” the nominees listed above.

Directors

Our current directors are as follows:

| Name | | Age | | Position(s) with the Company |

Vincent D. Enright (2008) (1)(2)(3) | | | 68 | | Director |

William F. Grieco (2011) (1)(2)(3) | | | 58 | | Director |

| Patrick T. Mooney, M.D. (2007) | | | 44 | | Chief Executive Officer, President and Chairman of the Board of Directors |

James F. Smith (2011) (1)(2)(3) | | | 62 | | Director |

| (1) | Member of Audit Committee of the Board of Directors. |

| | |

| (2) | Member of Compensation Committee of the Board of Directors. |

| | |

| (3) | Member of Nominating and Corporate Governance Committee of the Board of Directors. |

Set forth below is a biographical description of each of our directors based on information supplied by each individual.

Mr. Enright was appointed to our Board of Directors in March 2008 and his current term of office expires in 2013. Mr. Enright currently serves as a director of 16 funds, Chairman of the Audit Committee of six funds and as a member of the Audit Committee of 12 funds managed by Gabelli Funds, LLC, and a mutual fund manager, positions he has held since 1991. In July 2011, Mr. Enright became a member of the Board of Directors of The LGL Group, Inc., an electronics manufacturing company, where he serves as a member of the Auditing and Compensation Committees. Mr. Enright served as Senior Vice President and Chief Financial Officer of KeySpan Corporation, a NYSE public utility company, from 1994 to 1998. He previously served as a director of Aphton Corporation, a biopharmaceutical company, from September 2004 through November 2006 (NASDAQ: APHT). Mr. Enright holds a B.S. degree in Accounting from Fordham. Mr. Enright’s significant financial expertise, including his experience as Chief Financial Officer and Chairman of the Audit Committee at public companies, and his prior experience as a director of a public pharmaceutical company make him an integral member of our Board of Directors.

Mr. Grieco was appointed to our Board of Directors in February 2011 and his current term expires in 2012. He served as a Director of PHC, Inc., a behavioral health company, from 1997 to 2011. Since 2008, Mr. Grieco has served as the Managing Director of Arcadia Strategies, LLC, a legal and business consulting organization servicing healthcare, science and technology companies. From 2003 to 2008 he served as Senior Vice President and General Counsel of American Science and Engineering, Inc., an x-ray inspection technology company. He served as Senior Vice President and General Counsel of IDX Systems Corporation, a healthcare information technology company. Previously, he was Senior Vice President and General Counsel for Fresenius Medical Care North America, a dialysis products and services company. Prior to that, Mr. Grieco was a partner at Choate, Hall & Stewart, a general service law firm. Mr. Grieco received a B.S. from Boston College, a M.S. in Health Policy and Management from Harvard University and a J.D. from Boston College Law School. The Board determined that Mr. Grieco's legal and healthcare expertise, executive management and business experience, and his education and training make him a well-qualified addition to our Board and provide the Board with valuable expertise in the healthcare technology arena as it moves forward.

Dr. Mooney was engaged as our Chief Executive Officer in 2007 and as our President in 2009. In 2008, Dr. Mooney was appointed Chairman of the Board of Directors. Dr. Mooney’s current term of office as Chief Executive Officer, President and Chairman of the Board of Directors expires in 2012 and his term as a director expires in 2014. Dr. Mooney previously served as President, Chief Executive Officer and Director of Echo Therapeutics, Inc. (a privately-held pharmaceutical company prior to its merger with Sontra Medical Corporation) from 2006 to 2007. Prior to joining Echo Therapeutics, Inc., Dr. Mooney was President, Chief Executive Officer and Chairman of Aphton Corporation (NASDAQ: APHT), a biopharmaceutical company, from 2004 to 2006. Dr. Mooney was a Senior Biotechnology Analyst at Thomas Weisel Partners, LLC, a full service merchant banking firm, and a Senior Biotechnology Analyst at Janney Montgomery Scott, LLC, a full services investment banking firm. He graduated from the Jefferson Medical College of Thomas Jefferson University and trained as a surgical resident at Thomas Jefferson University Hospital. Dr. Mooney currently serves on the Board of Directors of Metastat, a cancer therapy company, to which he was appointed in March 2012. From June to September 2010, Dr. Mooney was a member of the Board of Directors of Quantrx Biomedical Corporation, a healthcare diagnostics company. Dr. Mooney’s knowledge of the capital markets, his experience as the Chief Executive Officer and Chief Medical Officer of Aphton, and his medical training provide invaluable expertise to our Board and executive management team in matters regarding our operations, product development, capital requirements and strategic direction. During Dr. Mooney’s tenure at Aphton Corporation, on May 23, 2006, Aphton Corporation declared bankruptcy under Chapter 11 of the United States Bankruptcy Code. At the time the bankruptcy was declared, James F. Smith, another director of the Company, was the Chief Financial Officer of Aphton Corporation.

Mr. Smith was appointed to our Board of Directors in February 2011 and his current term expires in 2012. From October 2007 to December 31, 2011, Mr. Smith served as Vice President and Chief Financial Officer of Orchid Cellmark (NASDAQ: ORCH), an international provider of DNA testing services primarily. From 2004 to 2006, Mr. Smith served as Vice President and Chief Financial Officer of Aphton Corporation (NASDAQ: APHT). Mr. Smith’s extensive financial management expertise and his experience with all aspects of finance, including control, financial reporting, tax, treasury, and merger and acquisitions, primarily in the healthcare industry, make him uniquely qualified to serve on our Board and as the Chairman of the Audit Committee.

PROPOSAL 2

APPROVAL OF AN AMENDMENT TO ECHO THERAPEUTICS, INC.’S CERTIFICATE OF INCORPORATION

TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK.

On January 23, 2012, the Board of Directors approved an amendment to the Company's Certificate of Incorporation to increase the authorized shares of Common Stock from ONE HUNDRED MILLION (100,000,000) to ONE HUNDRED FIFTY MILLION (150,000,000). A form of the Amended and Restated Certificate of Incorporation is attached hereto as Appendix A.

We are engaged in the research and development of our products and in conducting clinical trials. We have funded our operations since inception primarily through private sales of its Common Stock and preferred stock, the issuance of convertible promissory notes and secured promissory notes, and cash received from the exercises from Common Stock purchase options and warrants. We are currently authorized to issue 100,000,000 shares of Common Stock.

While a significant portion of these options and warrants have exercise prices that are in excess of the current market price of the Common Stock, we must keep a sufficient number of our authorized but unissued Common Stock reserved for issuance upon the exercise of these options and warrants so long as they are outstanding.

As of April 13, 2012, 38,836,022 shares of Common Stock were issued and outstanding excluding approximately:

(i) 6,518,138 shares reserved for issuance upon the exercise of options and awards currently outstanding or that may be in the future be outstanding under the Company's stock-based compensation plans;

(ii) 7,477,529 shares of Common Stock issuable upon the exercise of warrants; and

(iii) 12,980,185 shares of Common Stock issuable upon conversion of convertible preferred stock sold or issued in private placements.

We are currently authorized to issue 40,000,000 shares of preferred stock. As of April 13, 2012, approximately 3,015,974 shares of preferred stock, comprised of Series C Preferred Stock and Series D Convertible Preferred Stock, were outstanding.

Reasons for Amendment

We do not generate any revenues and will continue to finance our operations through the sale of our capital stock, including convertible securities. While we are exploring all financing and strategic alternatives, we will most likely need to continue to raise funds through the sale of our capital stock in order to continue our operations and product development without interruption. We are not currently negotiating any offering that would result in the issuance of the Common Stock which would become available for sale as a result of shareholder approval of this Proposal No. 2; however, we will not be able to conduct an offering at any future time unless we have sufficient authorized but unissued shares of Common Stock available under our Certificate of Incorporation.

The Board of Directors believes that it is prudent to increase the number of authorized shares of Common Stock to the proposed level in order to provide a reserve of shares available for issuance in connection with possible future action, including, without limitation, the issuance in private or public sales of equity securities or convertible securities as a means of raising working capital or in connection with strategic alliances. Having such additional authorized Common Stock available for issuance in the future would allow the Board of Directors to issue shares of Common Stock without delay and enable us to engage in financing transactions and/or strategic alliances and take advantage of changing market and financial conditions on a more timely basis as determined by the Board of Directors.

General Effect of the Amendment

Upon approval of this Proposal 2, the Amended and Restated Certificate of Incorporation (a form of which is attached hereto as Appendix A) will be filed with the Secretary of State of the State of Delaware and the number of authorized shares of Common Stock will be increased from 100,000,000 shares to 150,000,000 shares.

The additional Common Stock to be authorized by adoption of the Amendment would have rights identical to our currently outstanding Common Stock. Adoption of the proposed Amendment and subsequent issuance of the Common Stock would not affect the rights of the holders of currently outstanding Common Stock, except for effects incidental to increasing the number of shares of our Common Stock.

Current holders of Common Stock do not have preemptive or similar rights, which means that current shareholders do not have a prior right to purchase any new issue of capital stock of the Company in order to maintain their proportionate ownership of such stock. The authorization of additional shares of Common Stock might potentially dilute the voting power and percentage ownership of existing shareholders.

If the proposed Amendment is approved, the Board of Directors may cause the issuance of additional shares of Common Stock without further vote of our shareholders, except as provided under Delaware corporate law or under the rules of any national securities exchange or automated quotation system on which shares of our Common Stock are then listed. If the Amendment is adopted, it will become effective upon filing of the Amended and Restated Certificate of Incorporation (a form of which is attached hereto as Appendix A) with the Secretary of State of the State of Delaware.

The increase in authorized shares is not being proposed as a means of preventing or dissuading a change in control or takeover of the Company; however, use of these shares for such a purpose is possible. Shares of authorized but unissued or unreserved Common Stock, for example, could be issued in an effort to dilute the stock ownership and voting power of persons seeking to obtain control of the Company or could be issued to purchasers who would support the Board of Directors in opposing a takeover proposal. In addition, the increase in authorized shares, if approved, may have the effect of discouraging a challenge for control or make it less likely that such a challenge, if attempted, would be successful. Our Board of Directors and executive officers have no knowledge of any current effort to obtain control of the Company or to accumulate large amounts of Common Stock.

The Board of Directors unanimously recommends a vote “FOR” the amendment of the Company's Certificate of Incorporation to increase the number of authorized shares of Common Stock.

PROPOSAL 3

APPROVAL OF AN AMENDMENT TO ECHO THERAPEUTICS, INC. 2008 EQUITY INCENTIVE PLAN TO INCREASE THE NUMBER OF AUTHORIZED SHARES

At the 2008 Annual Meeting of Shareholders, the shareholders approved the Echo Therapeutics, Inc. 2008 Equity Incentive Plan (the “2008 Plan”) and at the 2010 Annual Meeting of Shareholders, the shareholders approved an amendment to the 2008 Plan which increased the maximum number of shares of our Common Stock that may be issued under the 2008 Plan to 4.7 million shares. The 2008 Plan currently authorizes 4.7 million shares of our Common Stock for awards.

At this Annual Meeting, shareholders will be asked to approve an amendment to the 2008 Plan in order to increase the maximum number of shares of our Common Stock that may be issued under the 2008 Plan by 5.3 million shares (the “Amendment”), to an aggregate of 10 million shares. As of April 13, 2012, there were 3,089,750 shares subject to outstanding grants and 1,480,250 shares remaining available for future grants under the 2008 Plan. The Amendment would result in 6,780,250 shares, subject to adjustment for certain changes in our capitalization as more fully described below, available for future grants under the 2008 Plan.

On January 23, 2012, our Board of Directors adopted the Amendment subject to approval by the shareholders. The Board of Directors believes that the ability to distribute equity grants under the 2008 Plan is important for our continued growth and success and that the number of shares available for future grants is inadequate to achieve the purpose of the Plan, which is to attract and retain the best possible individuals to promote our success. We are not seeking to increase the annual employee limit under the 2008 Plan or to amend any other feature of the 2008 Plan.

The 2008 Plan provides for grants of the following incentive awards to employees, consultants and non-employee directors of the Company and of certain of its affiliates: incentive stock options (to employees only), nonqualified stock options, and restricted stock. The following is a brief summary of the 2008 Plan. A copy of the 2008 Plan, as amended, is attached hereto as Appendix B. This summary is qualified in its entirety by the specific language of the 2008 Plan.

General

Common Stock Available. The maximum number of shares of our Common Stock available under the 2008 Plan for incentive stock options, nonqualified stock options and restricted stock awards as well as other types of awards is currently 4.7 million. The Amendment would increase this limit to 10 million. The 2008 Plan also includes annual limits on grants that may be made to individual employees. The 2008 Plan current limits and the annual employee limits for awards are as follows:

| Type of Award | | Current Plan Limit | | Annual Employee Limit |

Options | | 4.7 million shares | | 425,000 shares |

Restricted Stock | | 4.7 million shares | | 425,000 shares |

Each of the above limitations is subject to adjustment for certain changes in our capitalization such as stock dividends, stock splits, combinations or similar events. If an award expires, is terminated, canceled or forfeited, the Common Stock not issued under the award will again become available for grant under the 2008 Plan. If any option is exercised by surrendering Common Stock or by having Common Stock withheld, or if tax obligations are paid by surrendering Common Stock or by having Common Stock withheld, only the number of shares issued net of shares withheld or surrendered will be deemed delivered under the 2008 Plan. On April 13, 2012, the closing price reported on NASDAQ of a share of the Company’s Common Stock was $1.87.

Eligibility. Employees, consultants and non-employee directors of the Company and of certain affiliates are eligible to receive awards under the 2008 Plan; however, consultants and non-employee directors are not eligible to receive incentive stock options. There are approximately thirty employees, five consultants, and three non-employee directors who are eligible to receive awards under the 2008 Plan.

Administration. The 2008 Plan is administered by the Compensation Committee of the Board of Directors (the “Committee”), which has the authority to interpret the plan and to adopt, amend and repeal rules and regulations for its administration. In addition to the Committee, the Board has delegated to Dr. Mooney the power to grant awards under the Plan having an exercise price at or above fair market value; provided that Dr. Mooney may not grant more than 200,000 shares to any employee or consultant in a fiscal year, he may not grant more than an aggregate of 2,000,000 shares per fiscal year, and he may not make any awards to himself or any named executive officer.

Subject to any applicable limitations contained in the 2008 Plan, the Committee may select the recipients of awards and determine (i) the number of common shares covered by options and the dates upon which such options become exercisable, (ii) the exercise price of options (which may not be less than fair market value of the underlying shares), (iii) the duration of options (which may not be for longer than 10 years), (iv) the number of common shares subject to any restricted stock, and (v) the terms and conditions of such awards, including conditions for the vesting and purchase of such common shares.

The Committee is required to make appropriate adjustments in connection with the 2008 Plan and any outstanding awards to reflect stock splits, stock dividends, recapitalizations and other similar changes in our capitalization. If a “Change in Control” (as defined in the 2008 Plan) occurs, each outstanding award to an employee, consultant or non-employee director who has not yet had a termination of service will become fully vested (unless the applicable award agreement provides otherwise). The 2008 Plan also addresses the consequences of a merger or consolidation of the Company with or into another entity (and similar transactions), whether or not a Change in Control. In the event of such a transaction, the Committee may terminate all or a portion of any outstanding awards, if it determines that termination is in the best interests of the Company. If the Committee decides to terminate outstanding options, it will give each grantee holding an option to be terminated at least seven days’ advance notice of the termination. Upon such notice, any such option may be exercised before the termination of the option. Also, the Committee, in the event of such a transaction, may accelerate, in whole or in part, the vesting of any option and/or any restricted stock.

Stock Options

The Committee may award incentive stock options and nonqualified stock options. Incentive stock options offer employees certain tax advantages that are not available for nonqualified stock options. The Committee determines the terms of the options, including the number of shares of Common Stock subject to the options, the exercise price, and when the option becomes exercisable; however, the term of an incentive stock option may not exceed 10 years (five years in certain cases) and the exercise price per share may not be less than the fair market value of a share of Common Stock on the date the option is granted (110% of fair market value in certain cases).

When an employee, a consultant or a non-employee director terminates service, his or her option may expire before the end of the otherwise applicable option term. For example, if an employee, a consultant or a non-employee director terminates his or her service for a reason other than retirement, death or disability, his or her options generally remain exercisable for up to three months after termination of service, unless the award agreement provides for a different exercise period. Termination of service by reason of death or disability generally causes the option to terminate one year after such termination, unless the award agreement provides for a different exercise period.

The exercise price may be paid in cash. The Committee may also permit payment of the exercise price in any of the following ways: (i) in shares of our Common Stock previously acquired by the grantee, (ii) in shares of our Common Stock newly acquired by the grantee as a result of the exercise, (iii) through a so-called broker-financed transaction, (iv) through a loan from us that meets certain requirements, or (v) in any combination of the foregoing methods.

Restricted Stock

The Committee may make restricted stock awards to employees, consultants and non-employee directors (for any or no consideration), subject to any restrictions the Committee may determine. The Committee may accelerate the date(s) on which the restrictions will lapse. Before the lapse of restrictions on shares of restricted stock, the grantee will have voting and dividend rights on the shares. Any grantee who makes an election under section 83(b) of the Code with respect to restricted stock, regarding the immediate recognition of income, must provide the Company with a copy of the election within 10 days of filing the election with the Internal Revenue Service.

Miscellaneous

Transferability. Awards generally are not transferable, except by will or under the laws of descent and distribution. The Committee has the authority; however, to permit an employee, consultant or non-employee director to transfer nonqualified stock options to certain permitted transferees.

Acceleration of Vesting. The Committee may, in its discretion, accelerate the date on which stock options may be exercised, and may accelerate the date of termination of the restrictions applicable to restricted stock, if it determines that to do so would be in our best interests.

Effective Date. The 2008 Plan became effective April 1, 2008 and was amended and restated as of May 1, 2009 and August 1, 2010.

Amendment and Termination. The 2008 Plan will automatically terminate on April 1, 2018, unless it is terminated sooner by the Board of Directors. The Committee may amend outstanding awards, provided such amendment does not adversely affect the rights of the grantee. The Board of Directors may amend or suspend the 2008 Plan. Shareholder approval, however, is required for (i) any material amendment to the 2008 Plan, (ii) any change in the employees eligible to receive incentive stock options or the number of shares available for the granting of incentive stock options (other than adjustment for certain changes in our capitalization), and (iii) any change in the material terms of a “performance goal” (for purposes of section 162(m) of the Code).

Plan Benefits

The amount and timing of all awards under the 2008 Plan are determined in the sole discretion of the Committee and Dr. Mooney, as applicable, and therefore cannot be determined in advance.

The chart below sets forth the number of shares underlying options and restricted stock that the Company has granted to the following individuals and groups under the 2008 Plan:

Name and Position | | Dollar Value ($) (1) | | | Number of Shares Underlying Options (1)(2) | | | Dollar Value ($) (3) | | | Number of Shares Underlying Restricted Stock (3) | |

Patrick T. Mooney, M.D. | | | — | | | | — | | | | 2,111,250 | | | | 875,000 | |

| Chief Executive Officer and President | | | | | | | | | | | | | | | | |

Christopher P. Schnittker. | | | 818,000 | | | | 200,000 | | | | 63,750 | | | | 31,250 | |

| Chief Financial Officer and Treasurer | | | | | | | | | | | | | | | | |

Kimberly A. Burke | | | 58,000 | | | | 145,000 | | | | 446,740 | | | | 212,250 | |

| General Counsel, Sr. Vice President and Secretary | | | | | | | | | | | | | | | | |

Executive Officer Group | | | 876,000 | | | | 345,000 | | | | 2,621,240 | | | | 1,118,500 | |

Non-executive Director Group | | | 77,500 | | | | 50,000 | | | | 374,375 | | | | 108,750 | |

Non-executive Officer Employee Group | | | 3,650,100 | | | | 1,495,000 | | | | 129,750 | | | | 82,500 | |

| (1) | Incentive stock options were granted to non-executive officer employees on various dates from January 2009 to March 2012. Nonqualified stock options were granted to the Non-executive Director Group as of February 20, 2009. The value of each grant was determined to be at or above the stock closing price on the date of grant. |

| | |

| (2) | The Company has, in the past, also made grants of nonqualified stock options to both executive officers and directors pursuant to individually negotiated agreements and apart from any of our existing equity incentive plans. These grants have not been taken into account for purposes of the assumptions in this column. |

| | |

| (3) | Executive Officers and Non-executive Officer Employees were granted Restricted Stock as of February 20, 2009 and January 28, 2011 and Executive Officers were granted Restricted Stock on January 27, 2012. The value of each grant was determined to be at or above the stock closing price on the date of grant. |

Federal Income Tax Consequences — Options

The federal income tax consequences of granting and exercising options under the 2008 Plan are summarized as follows, based on federal tax laws and regulations in effect as of April 13, 2012:

| · | The grant of an option does not result in federal income tax consequences for the optionee or a deduction for us. |

| · | When an option is exercised, the federal income tax consequences depend on whether the option is an incentive stock option or a nonqualified stock option. An optionee exercising a nonqualified stock option will recognize ordinary income equal to the excess of the fair market value of executive officers Common Stock purchased (on the date of exercise) over the exercise price. An employee will not recognize ordinary taxable income as a result of acquiring stock by exercising an incentive stock option. The excess of the fair market value of the stock on the date of exercise over the exercise price will, however, generally be treated as an item of adjustment for purposes of calculating the employee’s alternative minimum taxable income. If the employee holds the stock he or she receives on exercise of an incentive stock option for a required period of time, the employee will have capital gain (or loss) when they later dispose of the stock. If the employee does not hold the stock for the required period of time, the employee will generally have ordinary income when the stock is disposed of, calculated as though the incentive stock option had been a nonqualified stock option. |

| · | When an optionee recognizes ordinary income on the exercise of a nonqualified stock option or the sale of stock acquired on the exercise of an incentive stock option, we are generally entitled to a deduction in the same amount. Certain requirements, such as reporting the income to the IRS, must be met for the deduction to be allowable. We believe that the 2008 Plan has been designed so that the amount of compensation that may be deducted with respect to options will not be limited by section 162(m) of the Code. |

The information above is in summary format and is provided for informational purposes only. It should not be relied upon for personal financial or tax planning purposes.

* * * *

The Board of Directors unanimously recommends that the shareholders vote FOR approval of the amendment to the Echo Therapeutics, Inc. 2008 Equity Incentive Plan to increase the number of shares authorized.

PROPOSAL 4

ADVISORY VOTE ON EXECUTIVE COMPENSATION

In accordance with the recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the "Dodd-Frank Act"), we are asking our shareholders to cast an advisory vote on the compensation of the named executive officers identified in the 2011 Summary Compensation Table in the "Executive Compensation" section of this Proxy Statement. This vote is advisory and not binding on the Company; however, our Board of Directors and Compensation Committee value the opinions expressed by our shareholders and will take the outcome of the vote into account in future determinations concerning our executive compensation program.

The Compensation Committee of the Board of Directors believes that our executive compensation program implements and achieves the goals of our executive compensation philosophy. That philosophy is to align each executive's compensation with the Company’s short-term and long-term performance and to provide the compensation and incentives needed to attract, motivate and retain key executives who are critical to our long-term success. As such, our executive compensation program is intended to:

| • | Attract and retain individuals with superior abilities in their area of expertise; |

| • | Align our executive officers’ incentives with our corporate strategies, business objectives and the long-term interests of our stockholders; and |

| • | Provide a strong incentive to achieve key strategic goals by providing a portion of total compensation opportunities for executive officers in the form of direct ownership of the Company. |

We believe the combination of long-term and short-term compensation and cash and non-cash compensation that we utilize in our executive compensation program, as well as meaningful performance incentives, align the interests of our named executive officers and shareholders and provide an incentive for the long-term continued employment of our key executives.

Please refer to the "Executive Compensation" section of this Proxy Statement for additional information regarding our executive compensation program and the compensation paid to our named executive officers.

* * * *

The Board of Directors unanimously recommends that the shareholders vote FOR the approval, on an advisory basis, of the compensation paid to the Company’s named executive officers,

PROPOSAL 5

ADVISORY VOTE ON FREQUENCY OF FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION

In addition to seeking our shareholders' advisory vote on the compensation of our named executive officers, and in accordance with the Dodd-Frank Act, we are asking our shareholders to express a preference as to how frequently future advisory votes on executive compensation should take place. We are giving shareholders the opportunity to express a preference to cast such advisory votes annually, every two years or every three years. Shareholders also have the option to abstain from voting on this matter. This is an advisory vote; therefore, the shareholder vote will not be binding on us. Nevertheless, our Board of Directors and Compensation Committee value our shareholders’ opinions and will carefully consider the outcome of the vote when considering the frequency of future advisory votes on executive compensation.

For the reasons discussed below, the Board of Directors recommends that advisory votes on executive compensation take place every two years, or biennially.

Our Board believes that a frequency of every two years is the optimal interval for conducting and responding to executive compensation advisory votes. This interval between votes will provide assurance that the Board and the Compensation Committee remain accountable for executive compensation decisions on a frequent basis while at the same time fostering a more long-term approach to evaluating our executive compensation program. Conducting an advisory vote on executive compensation every two years will provide our Board and Compensation Committee sufficient time to attempt to (i) evaluate the shareholders’ vote, (ii) determine the nature of any concerns regarding our executive compensation program and (iii) design and implement changes intended to address those concerns. We believe that allowing an interval of two years between advisory votes will also give our shareholders sufficient time to evaluate the effectiveness of our executive compensation program and any revisions that are made to such program to address shareholder concerns. Shareholders who have concerns about our executive compensation programs during the interval between advisory executive compensation votes may bring their concerns to the attention of our Board of Directors. Please refer to the "Communications with Our Board of Directors or Individual Directors" section of this Proxy Statement for information about communicating with our Board and individual directors.

For the reasons set forth above, our Board believes that a biennial advisory vote is preferable. If a plurality of the votes cast on this matter at the Annual Meeting are cast in favor of biennial advisory votes on executive compensation, we will adopt this approach.

* * * *

The Board of Directors unanimously recommends that the shareholders vote 2 YEARS with regards to the frequency of future advisory executive compensation votes.

PROPOSAL 6

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has appointed Wolf & Company, P.C., an independent registered public accounting firm, to audit the Company’s consolidated financial statements for the fiscal year ending December 31, 2012, and recommends that the shareholders vote for ratification of such appointment. If the shareholders do not ratify the selection of Wolf & Company as the Company’s independent registered public accounting firm, then the selection of such independent auditors will be reconsidered by the Audit Committee. A representative of Wolf & Company, which served as the Company’s independent auditors in the fiscal year ended December 31, 2011, is expected to be present at the Annual Meeting to be available to respond to appropriate questions from shareholders and to make a statement if he or she desires to do so.

Information regarding the fees paid to Wolf & Company for services rendered in 2011 and 2010 and our policies and procedures for the approval of such fees is set forth below.

Independent registered public accounting firm

The following is a summary of the fees billed to the Company by Wolf & Company for professional services rendered in connection with the fiscal years ended December 31, 2011 and 2010:

| Fee Category | | Fiscal 2011 | | | Fiscal 2010 | |

Audit Fees | | $ | 126,541 | | | $ | 92,307 | |

Audit-Related Fees | | | 28,585 | | | | 4,900 | |

Tax Fees | | | 6,850 | | | | — | |

Total Fees | | $ | 161,976 | | | $ | 97,207 | |

Audit Fees. Consists of fees billed for professional services rendered for the audit of the Company’s consolidated financial statements and review of the interim consolidated financial statements included in quarterly reports and services that are normally provided by Wolf & Company in connection with statutory and regulatory filings or engagements.

Audit-Related Fees. Consists of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s consolidated financial statements but are not reported under “Audit Fees.” These services consist of the provision of consents in connection with the Company’s registration statements filed under the Securities Act of 1933, as amended, assistance with SEC comment letters, and comfort letters and other due diligence assistance performed in connection with capital raising.

Tax Fees. Consists of fees billed for professional services rendered for tax compliance, tax advice and tax planning.

All of the Audit-Related Fees and Tax Fees set forth above were pre-approved by the Audit Committee in accordance with its pre-approval policy and procedures.

Audit committee policy on pre-approval of services of independent registered public accounting firm

The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by the Company’s independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. The Company’s independent registered public accounting firm and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date. The Audit Committee may also pre-approve particular services on a case-by-case basis.

* * * *

The Board of Directors unanimously recommends that the shareholders vote FOR the ratification of Wolf & Company, P.C. to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2012.

EXECUTIVE OFFICERS

Our current executive officers are as follows:

| Name | | Age | | Position(s) with the Company |

| Patrick T. Mooney, M.D. (2007) | | | 44 | | Chief Executive Officer, President and Chairman of the Board of Directors |

| Kimberly A. Burke (2011) | | | 37 | | General Counsel, Senior Vice President and Secretary |

| Christopher P. Schnittker (2011) | | | 43 | | Chief Financial Officer and Treasurer |

Biographical information for each of our executive officers is set forth below. Each executive officer is elected annually by our Board of Directors and serves until his or her successor is appointed and qualified, or until such individual's earlier resignation or removal.

Patrick T. Mooney, M.D.

The Company engaged Dr. Mooney as its Chief Executive Officer in 2007 and as its President in 2009. In 2008, Dr. Mooney was appointed Chairman of the Board of Directors. Dr. Mooney’s current term of office as Chief Executive Officer, President and Chairman of the Board of Directors expires in 2012 and his term as a director expires in 2014. Dr. Mooney previously served as President, Chief Executive Officer and Director of Echo Therapeutics, Inc. (a privately-held pharmaceutical company prior to its merger with Sontra Medical Corporation) from 2006 to 2007. Prior to joining Echo Therapeutics, Inc., Dr. Mooney was President, Chief Executive Officer and Chairman of Aphton Corporation (NASDAQ: APHT), a biopharmaceutical company, from 2004 to 2006. Dr. Mooney was a Senior Biotechnology Analyst at Thomas Weisel Partners, LLC, a full service merchant banking firm, and a Senior Biotechnology Analyst at Janney Montgomery Scott, LLC, a full services investment banking firm. He graduated from the Jefferson Medical College of Thomas Jefferson University and trained as a surgical resident at Thomas Jefferson University Hospital. Dr. Mooney currently serves on the Board of Directors of Metastat, a cancer therapy company, to which he was appointed in March 2012. From June to September 2010, Dr. Mooney was a member of the Board of Directors of Quantrx Biomedical Corporation, a healthcare diagnostics company. Dr. Mooney’s knowledge of the capital markets, his experience as the Chief Executive Officer and Chief Medical Officer of Aphton, and his medical training provide invaluable expertise to our Board and executive management team in matters regarding our operations, product development, capital requirements and strategic direction.

Christopher P. Schnittker

Mr. Schnittker was appointed as Chief Financial Officer and Treasurer of the Company in May 2011 and his current term of office expires in 2012. He brings a broad base of financial experience to the Company. Most recently, he served as Vice President – Administration, Corporate Secretary and Chief Accounting Officer of Soligenix, Inc., a publicly-traded biotechnology company, from 2009 to 2011. Prior to that, Mr. Schnittker served as the Senior Vice President and Chief Financial Officer for VioQuest Pharmaceuticals Inc. (2008 to 2009), Micromet Inc. (2006 to 2008), Cytogen Corporation (2003 to 2006), and Genaera Corporation (2000 to 2003), all publicly-traded biotechnology companies. Mr. Schnittker has also held prior financial management positions at GSI Commerce, Rhône-Poulenc Rorer (now part of Sanofi-Aventis), and PricewaterhouseCoopers. He received his B.A. degree in economics and business from Lafayette College and is a certified public accountant licensed in the State of New Jersey.

Kimberly A. Burke

Ms. Burke was appointed as General Counsel and Senior Vice President of the Company in January 2011 and she has served as Secretary of the Company since 2010. Her current term of office as General Counsel, Senior Vice President and Secretary expires in 2012. Ms. Burke joined the Company in 2008 after serving as General Counsel of privately-held Echo Therapeutics, Inc. from 2004 until its merger with Sontra Medical Corporation to form the Company in September 2007. From 2004 to 2008, she was Director of Legal Affairs at Cato Research Ltd., a global contract research and development organization, and an Associate with Cato BioVentures, a life sciences venture capital firm. Ms. Burke began her career with Devine, Millimet and Branch, a New England law firm, and then moved to Investors Title Company (NASDAQ: ITIC), a holding company engaged in title insurance and investment management services, where she oversaw corporate and securities law matters. She later served as General Counsel of Hemodynamic Therapeutics, a privately-held pharmaceutical company. Ms. Burke received her B.A. from Mount Holyoke College and her J.D. from the College of William and Mary, Marshall-Wythe School of Law.

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of our Common Stock as of April 13, 2012 (except as otherwise provided below) by the following individuals or entities: (i) each shareholder known to us to beneficially own more than 5% of the outstanding shares of our Common Stock; (ii) the Chief Executive Officer, any person serving as Chief Financial Officer during 2011, and the three most highly compensated executive officers other than the Chief Executive Officer and Chief Financial Officer who were serving as an executive officer as of December 31, 2011 (collectively, the “Named Executive Officers”); (iii) each director; and (iv) current executive officers and directors, as a group.

Beneficial ownership is determined in accordance with Securities and Exchange Commission (“SEC”) rules and includes voting and investment power with respect to the shares. Under such rules, beneficial ownership includes any shares as to which the individual has sole or shared voting power or investment power and also any shares which the individual has the right to acquire currently or within 60 days after April 13, 2012 through the exercise of any stock options or other rights, including upon the exercise of warrants to purchase shares of Common Stock and the conversion of preferred stock into Common Stock. Such shares are deemed outstanding for computing the percentage ownership of the person holding such options or rights, but are not deemed outstanding for computing the percentage ownership of any other person. As of April 13, 2012, there were 38,836,022 shares of Common Stock issued and outstanding.

| | | Amount and Nature of Beneficial Ownership of | |

| | | Common Stock as of April 13, 2012 | |

Name and Address of Beneficial Owner | | Number of Shares (2) | | | Percentage of Class | |

| | | | | | | |

| Beneficial Owners of More Than 5% of the Company’s Common Stock: | | | | | | |

Allen Cato, M.D., Ph.D. | | | 3,757,720 | (3) | | | 8.82 | % |

| Cato Holding Company | | | | | | | | |

| 4364 South Alston Avenue | | | | | | | | |

| Durham, NC 27713 | | | | | | | | |

| | | | | | | | | |

Platinum — Montaur Life Sciences, LLC | | | 5,969,062 | (4) | | | 9.99 | % |

152 West 57th Street, 54th Floor | | | | | | | | |

| New York, NY 10019 | | | | | | | | |

| | | | | | | | | |

| Directors and Executive Officers: | | | | | | | | |

Kimberly A. Burke, J.D. | | | 407,250 | (5) | | | 1.04 | % |

Vincent D. Enright | | | 206,250 | (6) | | | * | |

William F. Grieco | | | 326,250 | (7) | | | * | |

Harry G. Mitchell | | | 767,039 | | | | 1.94 | % |

Patrick T. Mooney, M.D. | | | 2,725,907 | (8) | | | 6.56 | % |

Christopher P. Schnittker | | | 81,250 | (9) | | | * | |

James F. Smith | | | 33,250 | | | | * | |

All directors and executive officers as a group (7 persons) | | | 5,773,103 | | | | 12.94 | % |

* Less than one percent.

| (1) | Unless otherwise noted, the address for each individual is c/o Echo Therapeutics, Inc., 8 Penn Center, 1628 JFK Blvd., Suite 300, Philadelphia, PA 19103. |

| (2) | The individuals and entities named in the table have sole voting and investment power with respect to all shares shown as beneficially owned by them, except as noted in the footnotes below. |

| (3) | Based on a Schedule 13D filed with the SEC on September 24, 2007 and information regarding (a) the 2008 conversion into Common Stock of amounts payable by us to Cato Research Ltd., an affiliate of Cato Holding Company, (b) the sale of 500,000 shares in 2009 and (c) the gift of 29,799 shares in 2011. Includes 111,771 shares of Common Stock held by Allen Cato, M.D., Ph.D. directly and 3,645,949 shares of Common Stock held by Cato Holding Company. |

| (4) | Based on information provided in a Schedule 13G filed with the SEC on December 31, 2010. Consists of (i) 1,805,016 shares that may be acquired by Platinum-Montaur Life Sciences, LLC (“Montaur”) upon conversion of Preferred Stock, (ii) 3,113,084 shares that may be acquired by Platinum Long Term Growth VII, LLC (“PLTG”) upon conversion of Preferred Stock, and (iii) 1,050,962 shares held by Platinum Partners Value Arbitrage Fund LP. This amount excludes (i) 1,200,085 shares held by PLTG that may be acquired upon the exercise of warrants, and (ii) 850,000 shares held by Montaur that may be acquired upon the exercise of warrants. The warrants and Preferred Stock provide a limitation on exercise such that the number of shares of Common Stock that may be acquired by the holder upon exercise or conversion is limited to the extent necessary to ensure that, following such exercise or conversion, the total number of shares of Common Stock then beneficially owned by the holder does not exceed 9.99% of the total number of issued and outstanding shares of Common Stock (including for such purpose the shares of Common Stock issuable upon such exercise or conversion) without providing us with 61 days’ prior notice of thereof. |

| (5) | Includes 145,000 shares that may be acquired by Ms. Burke within 60 days upon the exercise of stock options. |

| (6) | Represents 100,000 shares that may be acquired by Mr. Enright within 60 days upon the exercise of stock options. |

| (7) | Includes 150,000 shares that may be acquired by Mr. Grieco within 60 days upon exercise of warrants. |

| (8) | Includes 500,000 shares that may be acquired by Dr. Mooney within 60 days upon the exercise of stock options. |

| (9) | Includes 50,000 shares that may be acquired by Mr. Schnittker within 60 days upon the exercise of stock options. |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers, and persons who beneficially own more than ten percent of our Common Stock, to file reports of beneficial ownership and changes in beneficial ownership with the Securities and Exchange Commission. Based solely on its review of the copies of such forms received or written representations from certain reporting persons, we believe that, during fiscal 2011, our officers, directors and ten-percent shareholders complied with all Section 16(a) filing requirements applicable to such individuals.

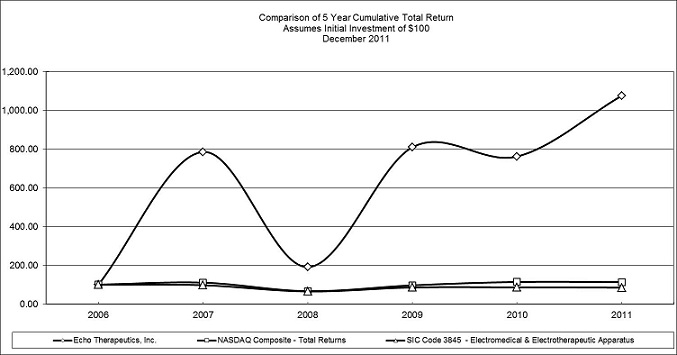

STOCK PERFORMANCE GRAPH

The following graph compares the yearly percentage change in the cumulative total shareholder return on our Common Stock during the five fiscal years ended December 31, 2011 with the cumulative total return on a peer group of other public companies who share our Standard Industry Classification code (SIC Code 3845) and the NASDAQ Composite Index. The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on the NASDAQ Stock Market.

The comparison assumes $100 was invested on December 31, 2006 in our Common Stock and in each of such indices and assumes reinvestment of any dividends.

TOTAL RETURN ANNUAL COMPARISON CUMULATIVE TOTAL RETURN SUMMARY | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| December 2011 | | | | | | | | | | | | | | | | | | | |

| | | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | 2011 | |

| | | | | | | | | | | | | | | | | | | | |

| Echo Therapeutics, Inc. | Return % | | | | | | 685.66 | | | | -75.75 | | | | 325.05 | | | | -5.89 | | | | 41.24 | |

| | Cum $ | | | 100.00 | | | | 785.66 | | | | 190.49 | | | | 809.69 | | | | 761.97 | | | | 1,076.19 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| NASDAQ Composite - Total Returns | Return % | | | | | | | 10.65 | | | | -39.98 | | | | 45.36 | | | | 18.15 | | | | -0.79 | |

| | Cum $ | | | 100.00 | | | | 110.65 | | | | 66.42 | | | | 96.54 | | | | 114.06 | | | | 113.16 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| SIC Code 3845 | Return % | | | | | | | -2.73 | | | | -33.31 | | | | 32.33 | | | | 0.63 | | | | -1.79 | |

| Electromedical & Electrotherapeutic Apparatus | Cum $ | | | 100.00 | | | | 97.27 | | | | 64.87 | | | | 85.84 | | | | 86.39 | | | | 84.84 | |

CORPORATE GOVERNANCE

Our Board of Directors

The Board of Directors is actively engaged in the oversight of the Company and its members routinely interact with management and with each other in the course of performing their duties. Board members receive regular updates from our senior executives on key financial, operational, contractual and strategic issues and advise the management team on matters within their areas of expertise. The Board met 12 times during 2011. During 2011, each of our incumbent directors attended at least 75% of the total number of meetings of the Board of Directors and at least 75% of the total number of meetings of committees of the Board of Directors on which he served.

Historically, the Company has held a Board of Directors meeting at the time of its annual meeting of shareholders and has requested that its directors attend the annual meeting of shareholders. All of the incumbent directors attended the 2011 annual meeting of shareholders in person or by teleconference.

Committees of Our Board of Directors

Our Board of Directors has three committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. Each of these committees operates under a written charter that has been approved by our Board. These charters are available in the Corporate Governance section of our website at www.echotx.com.

Audit Committee

The Board of Directors has a standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which assists the Board of Directors in fulfilling its responsibilities to our shareholders concerning our financial reporting and internal controls, and facilitates open communication among the Audit Committee, Board of Directors, our independent auditors and management. The Audit Committee currently consists of Mr. Smith, Mr. Enright and Mr. Grieco, each of whom is independent as defined under Nasdaq Stock Market, Inc. (“NASDAQ”) listing standards. Mr. Smith was appointed to the Audit Committee on February 8, 2011 and currently serves as Chair of the Audit Committee. Mr. Enright was appointed to the Audit Committee on March 28, 2008 and Mr. Grieco was appointed to the Audit Committee on February 8, 2011. The Audit Committee met four (4) times during 2011.

The Audit Committee discusses with our management and our independent auditors the financial information developed by us, our systems of internal controls and our audit process. The Audit Committee is solely and directly responsible for appointing, evaluating, retaining and, when necessary, terminating the engagement of our independent auditors. The independent auditors meet with the Audit Committee (both with and without the presence of our management) to review and discuss various matters pertaining to the audit, including our financial statements, the report of the independent auditors on the results, scope and terms of their work, and their recommendations concerning the financial practices, controls, procedures and policies employed by us. The Audit Committee pre-approves all audit services to be provided to us, whether provided by the principal independent auditors or other firms, and all other services (review, attest and non-audit) to be provided to us by the independent auditors. The Audit Committee coordinates the Board of Directors’ oversight of our internal control over financial reporting, disclosure controls and procedures and code of conduct. The Audit Committee is charged with establishing procedures for (i) the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters, and (ii) the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters. The Audit Committee reviews all related party transactions on an ongoing basis, and all such transactions must be approved by the Audit Committee. The Audit Committee is authorized, without further action by the Board of Directors, to engage such independent legal, accounting and other advisors as it deems necessary or appropriate to carry out its responsibilities.

Audit Committee Financial Expert

The Board of Directors has determined that each of Vincent D. Enright and James F. Smith is an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K. Mr. Enright and Mr. Smith are independent as defined under NASDAQ listing standards.

Nominating and Corporate Governance Committee

The Board of Directors has a Nominating and Corporate Governance Committee (the “Nominating Committee”), which identifies and recommends candidates for election to the Board of Directors, develops and maintains our corporate governance policies and procedures and advises the Board of Directors on our overall corporate governance as necessary. The Nominating Committee currently consists of Mr. Enright, Mr. Grieco and Mr. Smith, each of whom is independent as defined under NASDAQ listing standards. Mr. Grieco was appointed to the Nominating Committee on February 8, 2011 and currently serves as Chair of the Nominating Committee. Mr. Enright was appointed to the Nominating Committee on March 28, 2008 and Mr. Smith was appointed to the Nominating Committee on February 8, 2011. The Nominating Committee did not meet in 2011.

In recommending candidates for election to the Board of Directors, the Nominating Committee considers nominees recommended by directors, officers, employees, shareholders and others, using the same criteria to evaluate all candidates. The Nominating Committee reviews each candidate’s qualifications, including whether a candidate possesses any of the specific qualities and skills desirable in certain members of the Board of Directors. Evaluations of candidates generally involve a review of background materials, internal discussions and interviews with selected candidates as appropriate. Upon selection of a qualified candidate, the Nominating Committee would recommend the candidate for consideration by the full Board of Directors. The Nominating Committee may engage consultants or third-party search firms to assist in identifying and evaluating potential nominees.

All nominees for the Board of Directors must have a reputation for integrity, honesty and adherence to high ethical standards, as well as demonstrated business acumen, experience and ability to exercise sound judgment in matters that relate to the current and long-term objectives of the Company. Nominees must be willing and able to contribute positively to our decision-making process. In addition, nominees should have the interest and ability to understand the sometimes conflicting interests of our various constituencies, which include shareholders, employees, customers, governmental units, creditors and the general public, and to act in the interests of all the shareholders. The Nominating Committee takes into account the background of each Director and nominee in areas such as business, financial, legal, and product development and commercialization expertise, government regulation and science and strives to create and maintain a diverse Board of Directors. In addition, the Nominating Committee considers whether a particular Director or nominee has specific skills or attributes that may qualify him or her for service on a particular Board committee. The Nominating Committee also considers whether one or more Board members or Board nominees qualifies as an Audit Committee financial expert. Finally, the Nominating Committee annually reviews the independence of each Board member to ensure that a majority of the Board of Directors is independent.

The Nominating Committee will consider nominees for the Board of Directors recommended by shareholders. Shareholders wishing to propose director candidates for consideration by the Nominating Committee may do so by providing information regarding such candidate, including the candidate’s name, biographical data and qualifications and sending it to the Secretary of the Company at 8 Penn Center, 1628 JFK Boulevard, Suite 300, Philadelphia, PA 19103. Such information should be clearly marked as intended for the Nominating Committee. The Nominating Committee screens all potential candidates in the same manner regardless of the source of the recommendation.

Compensation Committee

The Board of Directors has a Compensation Committee, which generally assists the Board of Directors with respect to matters involving the compensation of our directors and executive officers. The Compensation Committee currently consists of Mr. Enright, Mr. Grieco and Mr. Smith, each of whom is independent as defined under NASDAQ listing standards. Mr. Enright was appointed to the Compensation Committee on March 28, 2008 and currently serves as Chair of the Compensation Committee. Mr. Grieco and Mr. Smith were appointed to the Compensation Committee on February 8, 2011. During 2011, the Compensation Committee met once.

The responsibilities of the Compensation Committee include determining salaries and other forms of compensation for the chief executive officer and the other executive officers of the Company, reviewing and making recommendations to the Board of Directors with respect to director compensation, periodically reviewing and making recommendations to the Board with respect to the design and operation of incentive compensation and equity-based plans and generally administering the Company’s equity-based incentive plans. The Compensation Committee is primarily responsible for considering and determining executive and director compensation. The Compensation Committee may form and delegate authority to one or more subcommittees as it deems appropriate under the circumstances. The Compensation Committee has the authority to retain and terminate any compensation consultant to be used to assist in the evaluation of executive officer compensation.

In addition, to the extent permitted by applicable law and the provisions of a given equity-based incentive plan, the Compensation Committee may delegate to one or more executive officers of the Company the power to grant options or other stock awards pursuant to such plan to consultants to and employees of the Company or any subsidiary of the Company who are not directors or executive officers of the Company. The chief executive officer, within certain per-person and per-year limits established by the Compensation Committee, has been authorized to make limited stock option grants and other stock awards to consultants to and employees and non-executive officers of the Company.

The Company’s chief executive officer generally makes recommendations to the Compensation Committee regarding the compensation of other executive officers. In addition, the chief executive officer is often invited to attend Compensation Committee meetings and participate in discussions regarding the compensation of other executive officers, but the Compensation Committee ultimately approves the compensation of all executive officers. Other than making recommendations and participating in discussions regarding the compensation of other executive officers, the Company’s chief executive officer generally does not play a role in determining the amount or form of executive compensation. Except for the participation by the chief executive officer in meetings regarding the compensation of other executive officers, the Compensation Committee meets without the presence of executive officers when approving or deliberating on executive officer compensation. The chief executive officer does not make proposals or recommendations regarding his own compensation.

Board Structure and Leadership