UNITED STATESSECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

ECHO THERAPEUTICS, INC.

(Name of the Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | |

| | (4) | |

April 15, 2014

Dear Stockholder:

We look forward to your attendance in person or by proxy at the 2014 Annual Meeting of Shareholders of Echo Therapeutics, Inc. We will hold the meeting on May 20 at 10:00 a.m. The formal notice of the meeting and proxy statement are attached and provide information about the matters to be acted upon by shareholders.

We are very pleased to report that the last year was one of significant accomplishments for Echo Therapeutics. While 2013 presented a number of challenges, the progress we made over the latter course of the year has set the stage for a productive 2014. Since I stepped in as Executive Chairman and Interim CEO in August, the following have been implemented:

| · | We successfully completed our multi-center clinical trial of the Symphony® CGM System in post-surgical patients in hospital critical care units. |

| · | We submitted data from the study to our European Notified Body in a Technical File to support our CE Mark application for potential market approval for our Symphony CGM System in Europe. |

| · | After assessing the needs of our Company following the transition of our former CEO in September, we implemented a number of substantial cost reduction measures to better align ongoing expenses with our short-term corporate objectives. As a result of these initiatives, our cash usage for the fourth quarter of 2013 decreased by approximately 39%. |

| · | In connection with a capital raising transaction, we entered into a license, development and commercialization agreement with Medical Technologies Innovation Asia (MTIA). As part of the agreement, MTIA will fund product development, clinical trials, regulatory approval and marketing of Symphony in the People’s Republic of China, including Hong Kong, Macau and Taiwan. Echo and MTIA will share future net sales of Symphony generated within these countries. |

| · | In December, Platinum Partners invested $5 million in the Company. |

| · | During our recent clinical study, we identified several product enhancements that are essential to the initial European launch, as well as to the planned U.S. pivotal trial. We are now focused on the development and implementation of those enhancements in 2014. |

| · | We initiated important changes in our product development efforts that include outsourcing software development and switching to a contract manufacturer that better meets our needs, which we believe will be beneficial in terms of productivity. |

We believe that with these significant changes and a dedicated management team we will be better positioned to realize the potential of our technology for the benefit of our stockholders, clinical practitioners and patients. We intend to leverage our existing capital to secure a corporate partnership as Symphony moves toward commercial approval. With a strengthened balance sheet, simplified capital structure, and experienced management team, Echo is focused on engaging a highly-qualified permanent CEO to continue to lead our accelerated pace of product finalization and clinical validation necessary for regulatory clearance of Symphony in Europe, China and the U.S.

Thank you for your investment in the continued success of our company. We intend to work diligently to maintain your confidence and support and look forward to keeping you informed of our progress throughout the year.

Your vote is important, and we urge you to cast your vote promptly. Whether you plan to attend the annual meeting or not, please sign, date and return the enclosed proxy card in the envelope provided, or you may vote your shares by telephone or the Internet as described on your proxy card.

Sincerely,

Robert F. Doman

Executive Chairman & Interim CEO

ECHO THERAPEUTICS, INC.

8 Penn Center

1628 JFK Boulevard, Suite 300

Philadelphia, Pennsylvania 19103

NOTICE OF 2014 ANNUAL MEETING OF STOCKHOLDERS

To be held on May 20, 2014

To the Stockholders of Echo Therapeutics, Inc.:

Notice is hereby given that the 2014 Annual Meeting of Stockholders (the “Annual Meeting”) of Echo Therapeutics, Inc., a Delaware corporation (the “Company”), will be held at 10:00 a.m., local time, on May 20, 2014, at the Company’s offices located at 10 Forge Parkway, Franklin, Massachusetts 02038, to consider and act upon the following proposals:

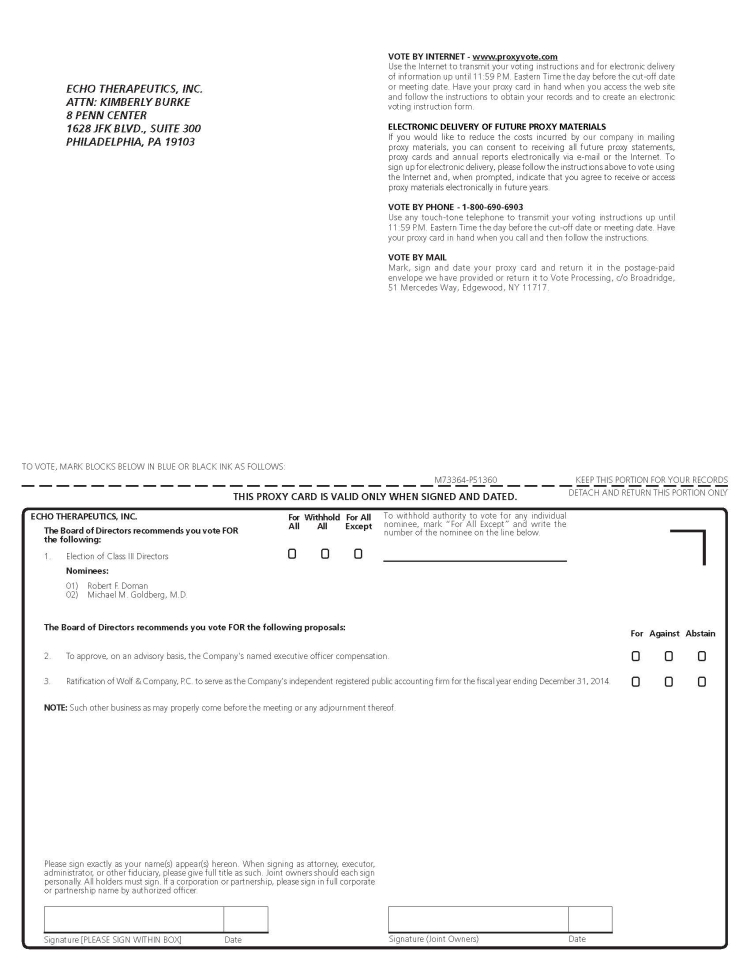

| 1. | To elect two Class III directors to the Company’s Board of Directors; |

| 2. | To approve, on an advisory basis, the Company’s named executive officer compensation; |

| 3. | To ratify the appointment of Wolf & Company, P.C. as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014; and |

| 4. | To transact such other business, if any, as may properly come before the meeting or any adjournments thereof. |

The Board of Directors of the Company has no knowledge of any other business to be transacted at the Annual Meeting. Only holders of record of the Company’s common stock, $.01 par value per share at the close of business on March 28, 2014 are entitled to notice of and to vote at the Annual Meeting. All stockholders are cordially invited to attend the Annual Meeting in person.

To ensure your representation at the Annual Meeting, you are urged to vote by (i) marking, signing and dating your proxy card and returning it in the postage-prepaid envelope, (ii) calling the toll-free number on your proxy card, (iii) visiting the website listed on your proxy card, or (iv) attending the Annual Meeting and voting in person. You may revoke your proxy in the manner described in the Proxy Statement at any time before it has been voted at the Annual Meeting. Any stockholder attending the Annual Meeting may vote in person even if he or she has returned a proxy.

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 20, 2014: THE ANNUAL REPORT AND PROXY STATEMENT ARE ALSO AVAILABLE ONLINE AT WWW.PROXYVOTE.COM.

By Order of the Board of Directors,

Kimberly A. Burke, Secretary

Philadelphia, Pennsylvania

ECHO THERAPEUTICS, INC.

8 Penn Center

1628 JFK Boulevard, Suite 300

Philadelphia, Pennsylvania 19103

PROXY STATEMENT

For the 2014 Annual Meeting of Stockholders

To be held on May 20, 2014

GENERAL

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Directors of Echo Therapeutics, Inc., a Delaware corporation (the “Company,” “we,” “us” or “our”), for use at our 2014 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at 10:00 a.m., local time, on May 20, 2014, at our offices located at 10 Forge Parkway, Franklin, Massachusetts 02038, or at any adjournments thereof. The Notice of Annual Meeting, this Proxy Statement, the accompanying proxy card and our Annual Report on Form 10-K for the fiscal year ended December 31, 2013 are expected to be first sent or given to stockholders commencing on or about April 15, 2014. Our principal executive offices are located at 8 Penn Center, 1628 JFK Boulevard, Suite 300, Philadelphia, Pennsylvania 19103, and our telephone number is 215-717-4100.

SOLICITATION

The cost of soliciting proxies, including expenses in connection with preparing and mailing the proxy materials, will be borne by the Company. Copies of solicitation materials will be furnished to brokerage houses, nominees, fiduciaries and custodians to forward to beneficial owners of our common stock, $.01 par value per share (“Common Stock”), held in their names. In addition, we will reimburse brokerage firms and other persons representing beneficial owners of the Common Stock for their reasonable expenses in forwarding solicitation materials to such beneficial owners. Proxies may be solicited by mail, telephone, Internet, facsimile or in person by our directors, officers, or regular employees. Directors, officers, and employees will not be paid any additional compensation for soliciting proxies. We have retained Laurel Hill Advisory Group, LLC (“Laurel Hill”) to aid in the solicitation of proxies, at an estimated cost of approximately $8,500 plus reimbursement for reasonable out-of-pocket expenses. We may incur other expenses in connection with the solicitation of proxies in connection with the Annual Meeting.

RECORD DATE, OUTSTANDING SHARES AND VOTING RIGHTS

The Board of Directors (the “Board”) has fixed March 28, 2014 as the record date for determining holders of Common Stock who are entitled to vote at the Annual Meeting. As of March 28, 2014, we had approximately 11,967,414 shares of Common Stock outstanding and entitled to be voted. Each share of Common Stock entitles the record holder to one vote on each matter to be voted upon at the Annual Meeting. A majority of the shares of Common Stock issued and outstanding and entitled to vote at the Annual Meeting will constitute a quorum for all matters. Votes withheld, abstentions and broker non-votes shall be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting.

The affirmative vote of the holders of a plurality of the votes cast at the Annual Meeting is required for the election of the Class III directors (Proposal No. 1). The affirmative vote of the holders of a majority of the shares of Common Stock present or represented by proxy and voting on the matter is required to approve, on an advisory basis, our named executive officer compensation (Proposal No. 2). The affirmative vote of the holders of a majority of the shares of Common Stock present or represented by proxy and voting on the matter is required to ratify the appointment of Wolf & Company, P.C. (“Wolf & Company”) as our independent registered public accounting firm for the fiscal year ending December 31, 2014 (Proposal No. 3).

With respect to the election of the directors, assuming a quorum is present, the nominees receiving the highest number of votes cast at the Annual Meeting will be elected. Approval of each of the other proposals requires the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote on that proposal at the Annual Meeting. If you mark your proxy as “Withhold Authority” or “Abstain” on any matter, or if you give specific instructions that no vote be cast on any specific matter, the shares represented by your proxy will not be voted on that matter, but will count in determining whether a quorum is present.

Proxies submitted by brokers that do not indicate a vote for some or all of the proposals because the brokers do not have discretionary voting authority and have not received instructions as to how to vote on those proposals (so called “broker non-votes”). Generally, brokers will have discretionary authority to vote your shares on “routine” matters such as the ratification of the appointment of Wolf & Company as the Company's independent registered public accounting firm for 2014 (Proposal No. 3), even if the brokers do not receive voting instructions from you. However, the brokers generally do not have discretionary authority to vote your shares on “non-routine” matters such as the election of directors (Proposal No. 1) or on the approval, on an advisory basis, of the Company’s named executive officer compensation (Proposal No. 2), without instructions from you, in which case a “broker non-vote” will occur and your shares will not be voted on that matter.

Broker non-votes are also considered in determining whether a quorum is present. Broker non-votes have no effect toward the vote total for any proposal. Abstentions will not affect the outcome of the vote on Proposal No. 1, but will have the effect of an AGAINST vote Proposal Nos. 2 and 3 because abstentions are considered shares entitled to vote on these proposals.

To vote by mail, please sign, date and complete the enclosed proxy card and return it in the enclosed envelope. No postage is necessary if the proxy card is mailed in the United States. To vote by phone or electronically through the Internet, follow the instructions on the enclosed proxy card. If you hold your shares through a bank, broker or other nominee, they will give you separate instructions for voting your shares.

REVOCABILITY OF PROXY AND VOTING OF SHARES

Any stockholder giving a proxy has the power to revoke it at any time before it is exercised. The proxy may be revoked by filing an instrument of revocation or a duly executed proxy bearing a later date with the Secretary of the Company, at our principal executive offices, located at 8 Penn Center, 1628 JFK Boulevard, Suite 300, Philadelphia, Pennsylvania 19103. The proxy may also be revoked by attending the Annual Meeting, giving notice of revocation and voting in person. Attendance at the Annual Meeting, by itself, will not constitute revocation of a proxy. If not revoked, the proxy will be voted at the Annual Meeting in accordance with the stockholder’s instructions indicated on the proxy card. If no instructions are indicated, the proxy will be voted:

| ● | FOR the election of the director nominees named herein; |

| ● | FOR the approval, on an advisory basis, of the Company’s named executive officer compensation; |

| ● | FOR the ratification of the appointment of Wolf & Company as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014; and |

| ● | In accordance with the judgment of the proxy holders as to any other matter that may be properly brought before the Annual Meeting or any adjournments thereof. |

All shares represented by proxies will be voted in accordance with the stockholders’ instructions and, if no choice is specified, the shares represented by proxies will be voted in favor of the matters set forth in the accompanying Notice of Annual Meeting of Stockholders.

OTHER MATTERS

The Board does not know of any other matter which may come before the Annual Meeting. If any other matters are properly presented to the Annual Meeting, it is the intention of the person named as proxy in the accompanying proxy card to vote, or otherwise to act, in accordance with their best judgment on such matters.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board is currently fixed at five directors divided into three classes with staggered terms for each class. We currently have five directors, two of whom are Class I directors whose terms expire in 2015, one of whom is a Class II director whose term expires in 2016 and two of whom are Class III directors whose terms expire in 2014.

As set forth in the following table, the Board has nominated and recommended Robert F. Doman and Michael M. Goldberg, M.D. for election to the Board as Class III directors for a term of three years. Each Class III director will hold office until a successor has been duly elected and qualified or until his earlier death, resignation or removal. Mr. Grieco and Mr. Smith are currently serving as Class I directors of the Company, Mr. Enright is currently serving as a Class II director of the Company, and Mr. Doman and Dr. Goldberg are currently serving as Class III directors of the Company. Shares represented by all proxies received by the Board and not so marked as to withhold authority to vote for the nominees will be voted FOR the election of each nominee. The Board has no reason to believe that any nominee will be unable or unwilling to serve, but if such should be the case, the proxies may be voted for the election of one or more substitute nominees.

| Name and Year Director First Became a Director | Position(s) with the Company |

Robert F. Doman (2013) | Executive Chairman, Interim Chief Executive Officer and Director |

Michael M. Goldberg, M.D (2014) | Director |

* * * *

The Board of Directors recommends a vote “FOR” the nominees listed above.

Directors

Our current directors are as follows:

| Name | Age | Position(s) with the Company | |

Robert F. Doman | 64 | Executive Chairman, Interim Chief Executive Officer and Director |

Vincent D. Enright (1)(2)(3) | 70 | Director | |

William F. Grieco (1)(2)(3) | 60 | Lead Independent Director | |

Michael M. Goldberg, M.D. | 55 | Director | |

James F. Smith (1)(2)(3) | 64 | Director | |

____________

| (1) | Member of the Audit Committee of the Board. |

| | |

| (2) | Member of the Compensation Committee of the Board. |

| | |

| (3) | Member of the Nominating and Corporate Governance Committee of the Board. |

Set forth below is a biographical description of each of our directors based on information supplied by each individual.

Mr. Doman was named Executive Chairman and Interim Chief Executive Officer in August 2013. He was appointed to our Board in March 2013 and his current term of office expires in 2014. Mr. Doman served as President and Chief Executive Officer of DUSA Pharmaceuticals, Inc. (NASDAQ: DUSA) from 2005 until he completed the sale of the company to Sun Pharmaceuticals in December 2012. From 2000 to 2004, Mr. Doman served as President of Leach Technology Group, the medical electronic device, design, product development and contract manufacturing services division of Leach Holding Corporation, which was sold to Esterline Technologies in 2004. He served as President of Device Product Development of West Pharmaceutical Services from 1999 to 2000. Prior to that, Mr. Doman held marketing and business development positions at the Convatec division of Bristol-Myers Squibb and Critikon, Inc., a Johnson & Johnson company. He earned his Bachelor’s degree from Saint Joseph’s University. Mr. Doman brings us over 30 years of executive level, international and domestic management, business development, sales and marketing, product development and strategic planning experience with specific concentrations in medical devices and pharmaceuticals, making him a valuable addition to our Board due to his extensive medical device product development and strategic sales, marketing and business development expertise.

Mr. Enright was appointed to our Board in March 2008 and his current term of office expires in 2016. Mr. Enright currently serves as a director of 15 funds, Chairman of the Audit Committee of six funds and as a member of the Audit Committee of 6 funds managed by Gabelli Funds, LLC, a mutual fund manager, positions he has held since 1991. In July 2011, Mr. Enright became a member of the Board of Directors of The LGL Group, Inc., an electronics manufacturing company, where he serves as Chairman of the Nominating Committee and a member of Compensation Committee. Mr. Enright served as Senior Vice President and Chief Financial Officer of KeySpan Corporation, a NYSE public utility company, from 1994 to 1998. He previously served as a director of Aphton Corporation, a biopharmaceutical company, from September 2004 through November 2006. Mr. Enright holds a B.S. degree in Accounting from Fordham. Mr. Enright’s significant financial expertise, including his experience as Chief Financial Officer and Chairman of the Audit Committee at public companies, and his prior experience as a director of a public pharmaceutical company make him an integral member of our Board.

Dr. Goldberg was appointed to our Board in February 2014 and his current term of office expires in 2014. Dr. Goldberg has been a Managing Member of Montaur Capital, LLC from February 2007 to present. Prior to that, Dr. Goldberg was with Emisphere Technologies, Inc., serving as Chief Executive Officer from August 1990 to January 2007, Chairman of the Board of Directors from November 1991 to January 2007, and President from August 1990 to October 1995. Before joining Emisphere, Dr. Goldberg served as Vice President of The First Boston Corp., where he was a founding member of the Healthcare Banking Group. Dr. Goldberg currently serves on the board of Navidea Biopharmaceuticals. He has been a Director of Alliqua, Inc., Urigen Pharmaceuticals, Inc., Adventrx Pharmaceuticals Inc. and several private companies. Dr. Goldberg received a B.S. from Rensselaer Polytechnic Institute, an MD from Albany Medical College of Union University and an MBA from Columbia University Graduate School of Business. Pursuant to a Securities Purchase Agreement between the Company and Platinum Partners Value Arbitrage Fund L.P. and Platinum Partners Liquid Opportunity Master Fund L.P. (collectively, “Platinum Partners”), and subject to certain conditions, the Company agreed to nominate and use its reasonable best efforts to cause to be elected and cause to remain as a director on the Board until the Annual Meeting, one individual designated by Platinum Partners (the “Platinum Partners Designee”). Additionally, subject to certain conditions, the Company agreed to nominate, and solicit for election by the stockholders, the Platinum Partners Designee at the Annual Meeting. Platinum Partners nominated Dr. Goldberg as the Platinum Partners Designee and, on February 28, 2014, the Board appointed Dr. Goldberg to fill a vacancy on the Board.

Mr. Grieco was appointed to our Board in February 2011 and named Lead Independent Director in August 2013. Mr. Grieco’s current term expires in 2015. Mr. Grieco served as a Director of PHC, Inc., a behavioral health company, from 1997 to 2011. From 2011 to present, he has also served as a Director of Acadia Healthcare, Inc., an inpatient behavioral healthcare corporation. Since 2008, Mr. Grieco has served as the Managing Director of Arcadia Strategies, LLC, a legal and business consulting organization servicing healthcare, science and technology companies. From 2003 to 2008 he served as Senior Vice President and General Counsel of American Science and Engineering, Inc., an x-ray inspection technology company. He served as Senior Vice President and General Counsel of IDX Systems Corporation, a healthcare information technology company. Previously, he was Senior Vice President and General Counsel for Fresenius Medical Care North America, a dialysis products and services company. Prior to that, Mr. Grieco was a partner in the healthcare department at Choate, Hall & Stewart, a general service law firm. Mr. Grieco received a B.S. from Boston College, a M.S. in Health Policy and Management from Harvard University and a J.D. from Boston College Law School. The Board determined that Mr. Grieco's legal and healthcare expertise, executive management and business experience, and his education and training make him a well-qualified addition to our Board and provide the Board with valuable expertise in the healthcare technology arena as it moves forward.

Mr. Smith was appointed to our Board in February 2011 and his current term expires in 2015. From October 2007 to December 31, 2011, Mr. Smith served as Vice President and Chief Financial Officer of Orchid Cellmark (NASDAQ: ORCH), an international provider of DNA testing services for forensic and family relationship applications. From 2004 to 2006, Mr. Smith served as Vice President and Chief Financial Officer of Aphton Corporation, a biotechnology company that developed cancer immunotherapies. Mr. Smith’s extensive financial management expertise and his experience with all aspects of finance, including control, financial reporting, tax, treasury, and merger and acquisitions, primarily in the healthcare industry, make him uniquely qualified to serve on our Board and as the Chairman of the Audit Committee. During Mr. Smith’s tenure at Aphton Corporation, on May 23, 2006, Aphton Corporation declared bankruptcy under Chapter 11 of the United States Bankruptcy Code. PROPOSAL NO. 2

ADVISORY VOTE ON EXECUTIVE COMPENSATION

In accordance with the recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the "Dodd-Frank Act"), we are asking our shareholders to cast an advisory vote on the compensation of the named executive officers identified in the 2013 Summary Compensation Table in the "Executive Compensation" section of this Proxy Statement.

Accordingly, the following resolution is being presented by the Board of Directors at the Annual Meeting:

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the compensation tables and narrative discussion, is hereby APPROVED.”

This vote is advisory and not binding on us; however, our Board of Directors and Compensation Committee value the opinions expressed by our shareholders and will take the outcome of the vote into account in future determinations concerning our executive compensation program.

The Compensation Committee of the Board of Directors believes that our executive compensation program implements and achieves the goals of our executive compensation philosophy. That philosophy is to align each executive's compensation with the Company’s short-term and long-term performance and to provide the compensation and incentives needed to attract, motivate and retain key executives who are critical to our long-term success. As such, our executive compensation program is intended to:

| ● | Attract and retain individuals with superior abilities in their area of expertise; |

| ● | Align our executive officers’ incentives with our corporate strategies, business objectives and the long-term interests of our stockholders; and |

| ● | Provide a strong incentive to achieve key strategic goals by providing a portion of total compensation opportunities for executive officers in the form of direct ownership of the Company. |

We believe the combination of long-term and short-term compensation and cash and non-cash compensation that we utilize in our executive compensation program, as well as meaningful performance incentives, align the interests of our named executive officers and shareholders and provide an incentive for the long-term continued employment of our key executives.

Please refer to the "Executive Compensation" section of this Proxy Statement for additional information regarding our executive compensation program and the compensation paid to our named executive officers.

* * * *

The Board of Directors recommends that the stockholders vote FOR the approval, on an advisory basis, of the following resolution:

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the compensation tables and narrative discussion, is hereby APPROVED.”

PROPOSAL NO. 3

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board has appointed Wolf & Company, P.C., an independent registered public accounting firm, to audit the Company’s consolidated financial statements for the fiscal year ending December 31, 2014, and recommends that the stockholders vote for ratification of such appointment. If the stockholders do not ratify the selection of Wolf & Company as the Company’s independent registered public accounting firm, then the selection of such independent auditors will be reconsidered by the Audit Committee. A representative of Wolf & Company, which served as the Company’s independent auditors in the fiscal year ended December 31, 2013, is expected to be present at the Annual Meeting to be available to respond to appropriate questions from stockholders and to make a statement if he or she desires to do so.

Information regarding the fees paid to Wolf & Company for services rendered for 2013 and 2012 and our policies and procedures for the approval of such fees is set forth below.

Independent registered public accounting firm

The following is a summary of the fees billed to us by Wolf & Company for professional services rendered in connection with the fiscal years ended December 31, 2013 and 2012:

| Fee Category | | Fiscal 2013 | | | Fiscal 2012 | |

Audit Fees | | $ | 150,667 | | | $ | 158,843 | |

Audit-Related Fees | | | 46,575 | | | | 44,000 | |

Total Fees | | $ | 197,242 | | | $ | 202,843 | |

Audit Fees. Consists of fees billed for professional services rendered for the audit of our consolidated financial statements and review of the interim consolidated financial statements included in quarterly reports and services that are normally provided by Wolf & Company in connection with statutory and regulatory filings or engagements.

Audit-Related Fees. Consists of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of our consolidated financial statements but are not reported under “Audit Fees.” These services consist of the issuance of consents in connection with our registration statements filed under the Securities Act of 1933, as amended, assistance with SEC comment letters, and comfort letters and other due diligence assistance performed in connection with capital raising.

Audit Committee policy on pre-approval of services of independent registered public accounting firm

The Audit Committee’s policy and procedures is to pre-approve all audit and permissible non-audit services provided by our independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. Our independent registered public accounting firm and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date. The Audit Committee may also pre-approve particular services on a case-by-case basis.

All of the fees set forth above were pre-approved by the Audit Committee in accordance with its pre-approval policy and procedures.

* * * *

The Board of Directors recommends that the stockholders vote FOR the ratification of Wolf & Company, P.C. to serve as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2014.

EXECUTIVE OFFICERS

Our current executive officers are as follows:

| Name | Age | Position(s) with the Company |

| Robert F. Doman. | 64 | Executive Chairman, Interim Chief Executive Officer and Director |

| Christopher P. Schnittker | 45 | Senior Vice President, Chief Financial Officer and Treasurer |

| Kimberly A. Burke | 39 | Senior Vice President, General Counsel, Chief Compliance Officer and Secretary |

Biographical information for each of our executive officers is set forth below. Each executive officer is elected annually by our Board and serves until his or her successor is appointed and qualified, or until such individual's earlier resignation or removal.

Robert F. Doman

Mr. Doman was named Executive Chairman and Interim Chief Executive Officer in August 2013. The Consulting Agreement pursuant to which he serves as Executive Chairman and Interim Chief Executive Officer expires on June 30, 2014. He was appointed to our Board in March 2013 and his current term of office expires in 2014. Mr. Doman served as President and Chief Executive Officer of DUSA Pharmaceuticals, Inc. (NASDAQ: DUSA) from 2005 until he completed the sale of the company to Sun Pharmaceuticals in December 2012. From 2000 to 2004, Mr. Doman served as President of Leach Technology Group, the medical electronic device, design, product development and contract manufacturing services division of Leach Holding Corporation, which was sold to Esterline Technologies in 2004. He served as President of Device Product Development of West Pharmaceutical Services from 1999 to 2000. Prior to that, Mr. Doman held marketing and business development positions at the Convatec division of Bristol-Myers Squibb and Critikon, Inc., a Johnson & Johnson company. He earned his Bachelor’s degree from Saint Joseph’s University.

Christopher P. Schnittker

Mr. Schnittker was appointed as our Chief Financial Officer and Treasurer in May 2011 and additionally as our Senior Vice President in June 2012. His current term of office expires in 2014. He brings a broad base of financial experience to the Company. Most recently, he served as Vice President – Administration, Corporate Secretary and Chief Accounting Officer of Soligenix, Inc., a publicly-traded biotechnology company, from 2009 to 2011. Prior to that, Mr. Schnittker served as the Senior Vice President and Chief Financial Officer for VioQuest Pharmaceuticals Inc. (2008 to 2009), Micromet Inc. (2006 to 2008), Cytogen Corporation (2003 to 2006), and Genaera Corporation (2000 to 2003), all publicly-traded biotechnology companies. Mr. Schnittker has also held prior financial management positions at GSI Commerce, Rhône-Poulenc Rorer (now part of Sanofi-Aventis), and PricewaterhouseCoopers. He received his B.A. degree in economics and business from Lafayette College and is a certified public accountant licensed in the State of New Jersey.

Kimberly A. Burke

Ms. Burke was appointed as our General Counsel and Senior Vice President in January 2011, as Chief Compliance Officer in April 2012, and she has served as our Secretary since 2010. Her current term of office as General Counsel, Senior Vice President and Secretary expires in 2014. Ms. Burke joined the Company as Vice President, Corporate Counsel in 2008 after serving as General Counsel of privately-held Echo Therapeutics, Inc. from 2004 until its merger with Sontra Medical Corporation to form the Company in September 2007. From 2004 to 2008, she was Director of Legal Affairs at Cato Research Ltd., a global contract research and development organization, and an Associate with Cato BioVentures, a life sciences venture capital firm. Ms. Burke began her career with Devine, Millimet and Branch, a New England law firm, and then moved to Investors Title Company (NASDAQ: ITIC), a holding company engaged in title insurance and investment management services, where she oversaw corporate and securities law matters. She later served as General Counsel of Hemodynamic Therapeutics, a privately-held pharmaceutical company. Ms. Burke received her B.A. from Mount Holyoke College and her J.D. from the College of William and Mary, Marshall-Wythe School of Law.

SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of our Common Stock as of April 3, 2014 (except as otherwise provided below) by the following individuals or entities: (i) each stockholder known to us to beneficially own more than 5% of the outstanding shares of our Common Stock; (ii) any person serving as Chief Executive Officer during 2013 and the two most highly compensated executive officers other than the Chief Executive Officer who were serving as an executive officer as of December 31, 2013 (collectively, the “Named Executive Officers”); (iii) each director; and (iv) current executive officers and directors, as a group.

Beneficial ownership is determined in accordance with Securities and Exchange Commission (“SEC”) rules and includes voting and investment power with respect to the shares. Under such rules, beneficial ownership includes any shares as to which the individual has sole or shared voting power or investment power and also any shares which the individual has the right to acquire currently or within 60 days after April 3, 2014 through the exercise of any stock options or other rights, including upon the exercise of warrants to purchase shares of Common Stock and the conversion of preferred stock into Common Stock. Such shares are deemed outstanding for computing the percentage ownership of the person holding such options or rights, but are not deemed outstanding for computing the percentage ownership of any other person. As of April 3, 2014, there were 11,967,414 shares of Common Stock issued and outstanding.

| | | Amount and Nature of Beneficial Ownership of Common Stock as of April 3, 2014 | |

Name and Address of Beneficial Owner | | Number of Shares (2) | | | Percentage of Class | |

| | | | | | | |

Platinum Partners Liquid Opportunity Master Fund L.P.c/o Platinum Management (NY) LLC 152 West 57th Street, 4th FloorNew York, NY 10019 | | | 778,452 | (3) | | | 6.1 | % |

Platinum Partners Value Arbitrage Fund L.P.c/o Platinum Management (NY) LLC 152 West 57th Street, 4th Floor New York, NY 10019 | | | 1,605,424 | (4) | | | 11.8 | % |

Platinum Management (NY) LLC | | | 1,605,424 | (5) | | | 11.8 | % |

Platinum Liquid Opportunity Management (NY) LLC | | | 778,452 | (6) | | | 6.1 | % |

| Mark Nordlict | | | 2,383,876 | (7) | | | 19.9 | % |

Uri Landesman | | | 2,383,876 | (8) | | | 19.9 | % |

Directors and Executive Officers: | | | | | | | | |

Kimberly A. Burke. | | | 47,000 | (9) | | | * | |

Robert F. Doman | | | 6,200 | (10) | | | * | |

Vincent D. Enright | | | 53,700 | (11) | | | * | |

Michael M. Goldberg, M.D. | | | 28,500 | (12) | | | * | |

William F. Grieco | | | 53,700 | (13) | | | * | |

Patrick T. Mooney, M.D. | | | 11,250 | (14) | | | * | |

Christopher P. Schnittker | | | 27,500 | (15) | | | * | |

James F. Smith | | | 38,400 | (16) | | | * | |

All directors and executive officers as a group (7 persons) | | | 255,000 | | | | 2.1 | % |

_______________________

* Less than one percent.

| (1) | Unless otherwise noted, the address for each stockholder known to us to beneficially own more than 5% of the outstanding shares of our Common Stock is 152 West 57th Street, 4th Floor, New York, NY 10019. The address for each director and executive officer is c/o Echo Therapeutics, Inc., 8 Penn Center, 1628 JFK Blvd., Suite 300, Philadelphia, PA 19103. |

| (2) | The individuals named in the table have sole voting and investment power with respect to all shares shown as beneficially owned by them, except as noted in the footnotes below. The entities named in the table, together with Mr. Nordlict and Mr. Landesman, have shared voting and investment power with respect to all shares shown as beneficially owned by them, as further described in the footnotes below. |

| (3) | Based on information provided in a Schedule 13D/A filed with the SEC on April 8, 2014. As of the close of business on April 7, 2014, Platinum Partners Liquid Opportunity Master Fund L.P. (“PPLO”) directly owned (i) 578,452 shares of Common Stock, (ii) beneficially owned 100,000 shares of Common Stock underlying currently convertible Series C Preferred Stock, (iii) beneficially owned 100,000 shares of Common Stock underlying currently convertible Series D Preferred Stock, (iv) directly owned 349,723 shares of Series E Preferred Stock (“Series E Stock”), and (v) directly owned 36,363 Warrants. The Warrants provide that at no time may a holder of any of the Warrants exercise such warrants if the number of shares of Common Stock to be issued pursuant to such exercise would exceed, when aggregated with all other shares of Common Stock owned by such holder at such time, the number of shares of Common Stock which would result in such holder beneficially owning more than 4.99% or 9.99%, as applicable, of all of the Common Stock outstanding at such time (the “9.99% Blocker”); provided, however, that upon a holder of any of the warrants providing the issuer with sixty one (61) days' notice that such holder would like to waive either or both such restrictions with regard to any or all shares of Common Stock issuable upon exercise of any of the Warrants, then such restriction shall be of no force or effect with regard to those Warrants referenced in such notice. The Series E Stock provides that at no time may a holder of any of the Series E Stock convert such stock if the number of shares of Common Stock to be issued pursuant to such conversion would exceed, when aggregated with all other shares of Common Stock owned by such holder at such time, the number of shares of Common Stock which would result in such holder beneficially owning more than 9.99% or 19.99%, as applicable, of all of the Common Stock outstanding at such time (the “19.99% Blocker”); provided, however, that upon both (A) a holder of Series E Stock providing the Company with a Waiver Notice that such holder would like to waive either or both such restrictions with regard to any or all shares of Common Stock issuable upon conversion of Series E Stock, and (B) the stockholders of the Company approving the waiver of such restrictions with regard to any or all shares of Common Stock issuable upon conversion of Series E Stock and the ownership by any holder of the Series E Stock of greater than 20% of the outstanding shares of Common Stock in accordance with the applicable NASDAQ listing standards, the applicable restrictions shall be of no force or effect. As of the date hereof, PPLO had not requested waiver of the 19.99% Blocker or 9.99% Blocker with respect to the Series E Stock or Warrants, respectively. |

| (4) | Based on information provided in a Schedule 13D/A filed with the SEC on April 8, 2014. As of the close of business on April 7, 2014, Platinum Partners Value Arbitrage Fund L.P. (“PPVA”) directly owned (i) 1,605,424 shares of Common Stock and (ii) 1,398,890 shares of Series E Stock, and (iii) 145,454 Warrants. The Series E Stock and the Warrants are currently subject to the 19.99% Blocker and 9.99% Blocker, respectively. As of the date hereof, PPVA had not requested waiver of the 19.99% Blocker or 9.99% Blocker with respect to the Series E Stock or Warrants, respectively. |

| (5) | Based on information provided in a Schedule 13D/A filed with the SEC on April 8, 2014. Platinum Management (NY) LLC (“Platinum Management”), as the Investment Manager of PPVA, may be deemed to beneficially own the securities directly owned by PPVA. |

| (6) | Based on information provided in a Schedule 13D/A filed with the SEC on April 8, 2014. Platinum Liquid Opportunity Management (NY) LLC (“Platinum Liquid Management”), as the Investment Manager of PPLO, may be deemed to beneficially own the securities directly owned by PPLO. Includes 100,000 shares of Common Stock underlying currently convertible Series C Preferred Stock and 100,000 shares of Common Stock underlying currently convertible Series D Preferred Stock. |

| (7) | Based on information provided in a Schedule 13D/A filed with the SEC on April 8, 2014. Mr. Nordlicht, as the Chief Investment Officer of Platinum Management, the Investment Manager of PPVA, and Chief Investment Manager of Platinum Liquid Management, the Investment Manager of PPLO, may be deemed to beneficially own the securities directly owned by PPVA and PPLO, respectively. Includes 100,000 shares of Common Stock underlying currently convertible Series C Preferred Stock and 100,000 shares of Common Stock underlying currently convertible Series D Preferred Stock. |

| (8) | Based on information provided in a Schedule 13D/A filed with the SEC on April 8, 2014. Mr. Landesman, as the President of Platinum Management, the Investment Manager of PPVA, and the President of Platinum Liquid Management, the Investment Manager of PPLO, may be deemed to beneficially own the securities directly owned by PPVA and PPLO, respectively. Includes 100,000 shares of Common Stock underlying currently convertible Series C Preferred Stock and 100,000 shares of Common Stock underlying currently convertible Series D Preferred Stock. |

| (9) | Includes 14,500 shares that may be acquired by Ms. Burke within 60 days upon the exercise of stock options. |

| (10) | Includes 1,500 shares that may be acquired by Mr. Doman within 60 day upon the exercise of stock options |

| (11) | Includes 25,500 shares that may be acquired by Mr. Enright within 60 days upon the exercise of stock options. |

| (12) | Includes 14,000 shares that may be acquired by Dr. Goldberg within 60 days upon the exercise of stock options. |

| (13) | Includes 15,500 shares that may be acquired by Mr. Grieco within 60 days upon the exercise of stock options. |

| (14) | Based on shares held by Dr. Mooney as of September 27, 2013, his last day of employment with the Company. |

| (15) | Includes 15,000 shares that may be acquired by Mr. Schnittker within 60 days upon the exercise of stock options |

| (16) | Includes 15,500 shares that may be acquired by Mr. Smith within 60 days upon the exercise of stock options. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors and executive officers, and persons who beneficially own more than ten percent of our Common Stock, to file reports of beneficial ownership and changes in beneficial ownership with the Securities and Exchange Commission. Based solely on our review of the copies of such forms received or written representations from certain reporting persons, we believe that, during fiscal 2013, our officers, directors and ten-percent stockholders complied with all Section 16(a) filing requirements applicable to such individuals except that our December 18, 2013 grant of 14,500 shares of restricted Common Stock and non-qualified options to purchase 56,000 shares of Common Stock made to each of Vincent Enright, William Grieco and James Smith was not timely reported by each of those individuals on a Form 4.

CORPORATE GOVERNANCE

Our Board of Directors

The Board is actively engaged in the oversight of the Company and its members routinely interact with management and with each other in the course of performing their duties. Board members receive regular updates from our senior executives on key financial, operational, contractual and strategic issues and advise the management team on matters within their areas of expertise. The Board met 28 times during 2013. During 2013, each of our incumbent directors attended at least 75% of the total number of meetings of the Board and at least 75% of the total number of meetings of committees of the Board on which he served during the period for which he was a member of the Board or the applicable committee of the Board.

Historically, the Company has held a Board meeting at the time of its annual meeting of stockholders and has requested that its directors attend the annual meeting of stockholders. All of the incumbent directors except Dr. Goldberg, who was not a member of our Board at that time, attended the 2013 annual meeting of stockholders in person.

Committees of Our Board of Directors

Our Board has three committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. Each of these committees operates under a written charter that has been approved by our Board. These charters are available in the Corporate Governance section of our website at www.echotx.com.

Audit Committee

The Board has a standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which assists the Board in fulfilling its responsibilities to our stockholders concerning our financial reporting and internal controls, and facilitates open communication among the Audit Committee, Board, our independent auditors and management. The Audit Committee currently consists of Mr. Smith, Mr. Enright, and Mr. Grieco, each of whom is independent as defined under Nasdaq Stock Market, Inc. (“NASDAQ”) listing standards applicable to audit committee members. Mr. Smith was appointed to the Audit Committee on February 8, 2011 and currently serves as Chair of the Audit Committee. Mr. Enright was appointed to the Audit Committee on March 28, 2008 and Mr. Grieco was appointed to the Audit Committee on February 8, 2011. The Audit Committee met four times during 2013.

The Audit Committee discusses with our management and our independent auditors the financial information developed by us, our systems of internal controls and our audit process. The Audit Committee is solely and directly responsible for appointing, evaluating, retaining and, when necessary, terminating the engagement of our independent auditors. The independent auditors meet with the Audit Committee (both with and without the presence of our management) to review and discuss various matters pertaining to the audit, including our financial statements, the report of the independent auditors on the results, scope and terms of their work, and their recommendations concerning the financial practices, controls, procedures and policies employed by us. The Audit Committee pre-approves all audit services to be provided to us, whether provided by the principal independent auditors or other firms, and all other services (review, attest and non-audit) to be provided to us by the independent auditors. The Audit Committee coordinates the Board’ oversight of our internal control over financial reporting, disclosure controls and procedures and code of conduct. The Audit Committee is charged with establishing procedures for (i) the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters, and (ii) the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters. The Audit Committee reviews all related party transactions on an ongoing basis, and all such transactions must be approved by the Audit Committee. The Audit Committee is authorized, without further action by the Board, to engage such independent legal, accounting and other advisors as it deems necessary or appropriate to carry out its responsibilities.

Audit Committee Financial Expert

The Board has determined that each of Vincent D. Enright and James F. Smith is an “audit committee financial expert” as defined in Item 407(d)(5) of Regulation S-K. Mr. Enright and Mr. Smith are independent as defined under NASDAQ listing standards.

Nominating and Corporate Governance Committee

The Board has a Nominating and Corporate Governance Committee (the “Nominating Committee”), which identifies and recommends candidates for election to the Board, develops and maintains our corporate governance policies and procedures and advises the Board on our overall corporate governance as necessary. The Nominating Committee currently consists of Mr. Enright, Mr. Grieco and Mr. Smith, each of whom is independent as defined under NASDAQ listing standards. Mr. Grieco was appointed to the Nominating Committee on February 8, 2011 and currently serves as Chair of the Nominating Committee. Mr. Enright was appointed to the Nominating Committee on March 28, 2008 and Mr. Smith was appointed to the Nominating Committee on February 8, 2011. The Nominating Committee met 15 times during 2013.

In recommending candidates for election to the Board, the Nominating Committee considers nominees recommended by directors, officers, employees, stockholders and others, using the same criteria to evaluate all candidates. The Nominating Committee reviews each candidate’s qualifications, including whether a candidate possesses any of the specific qualities and skills desirable in members of the Board. Evaluations of candidates generally involve a review of background materials, internal discussions and interviews with selected candidates as appropriate. Upon selection of a qualified candidate, the Nominating Committee would recommend the candidate for consideration by the full Board. The Nominating Committee may engage consultants or third-party search firms to assist in identifying and evaluating potential nominees.

All nominees for the Board must have a reputation for integrity, honesty and adherence to high ethical standards, as well as demonstrated business acumen, experience and ability to exercise sound judgment in matters that relate to the Company’s current and long-term objectives. Nominees must be willing and able to contribute positively to our decision-making process. In addition, nominees should have the interest and ability to understand the sometimes conflicting interests of our various constituencies, which include stockholders, employees, customers, governmental units, creditors and the general public, and to act in the interests of all the stockholders. The Nominating Committee considers diversity in identifying director nominees and takes into account the background of each Director and nominee in areas such as business, financial, legal, and product development and commercialization expertise, government regulation and science and strives to create and maintain a diverse Board. In addition, the Nominating Committee considers whether a particular Director or nominee has specific skills or attributes that may qualify him or her for service on a particular Board committee. The Nominating Committee also considers whether one or more Board members or Board nominees qualifies as an Audit Committee financial expert. Finally, the Nominating Committee annually reviews the independence of each Board member to ensure that a majority of the Board is independent.

The Nominating Committee will consider nominees for the Board recommended by stockholders. Stockholders wishing to propose director candidates for consideration by the Nominating Committee may do so by providing information regarding such candidate, including the candidate’s name, biographical data and qualifications and sending it to the Secretary of the Company at 8 Penn Center, 1628 JFK Boulevard, Suite 300, Philadelphia, PA 19103. Such information should be clearly marked as intended for the Nominating Committee. The Nominating Committee screens all potential candidates in the same manner regardless of the source of the recommendation.

Compensation Committee

The Board has a Compensation Committee, which generally assists the Board with respect to matters involving the compensation of our directors and executive officers. The Compensation Committee currently consists of Mr. Enright, Mr. Grieco and Mr. Smith, each of whom is independent as defined under NASDAQ listing standards applicable to compensation committee members. Mr. Enright was appointed to the Compensation Committee on March 28, 2008 and currently serves as Chair of the Compensation Committee. Mr. Grieco and Mr. Smith were appointed to the Compensation Committee on February 8, 2011. During 2013, the Compensation Committee met five times.

The responsibilities of the Compensation Committee include determining salaries and other forms of compensation for the chief executive officer and the other executive officers of the Company, reviewing and making recommendations to the Board with respect to director compensation, periodically reviewing and making recommendations to the Board with respect to the design and operation of incentive compensation and equity-based plans and generally administering the Company’s equity-based incentive plans. The Compensation Committee is primarily responsible for considering and determining executive and director compensation. The Compensation Committee may form and delegate authority to one or more subcommittees as it deems appropriate under the circumstances. The Compensation Committee has the authority to retain and terminate any compensation consultant to be used to assist in discharging its duties, including the evaluation and determination of executive officer compensation.

In addition, to the extent permitted by applicable law and the provisions of a given equity-based incentive plan, the Compensation Committee may delegate to one or more executive officers of the Company the power to grant options or other stock awards pursuant to such plan to consultants to and employees of the Company or any subsidiary of the Company who are not directors or executive officers of the Company. Our Chief Executive Officer, within certain per-person and per-year limits established by the Compensation Committee, is authorized to make limited stock option grants and other stock awards to consultants to and employees and non-executive officers of the Company pursuant to our 2008 Equity Incentive Plan.

Our Chief Executive Officer generally makes recommendations to the Compensation Committee regarding the compensation of other executive officers. In addition, the chief executive officer is often invited to attend Compensation Committee meetings and participate in discussions regarding the compensation of other executive officers, but the Compensation Committee ultimately approves the compensation of all executive officers. Other than making recommendations and participating in discussions regarding the compensation of other executive officers, the Company’s chief executive officer generally does not play a role in determining the amount or form of executive compensation. Except for the participation by the chief executive officer in meetings regarding the compensation of other executive officers, the Compensation Committee meets without the presence of executive officers when approving or deliberating on executive officer compensation. The chief executive officer does not make proposals or recommendations regarding his own compensation.

Board Structure and Leadership

The Board does not have a policy as to whether the roles of Chairman and CEO should be separate or combined. Instead, the Board has determined that the Nominating and Corporate Committee should periodically assess these roles and the merits of the Board’s leadership structure to ensure that the most efficient and appropriate structure is in place. Patrick T. Mooney served as both the Chairman of the Board and the Chief Executive Officer of the Company until August 23, 2013, at which time the Board appointed Robert F. Doman as both Executive Chairman and Interim Chief Executive Officer. Since his tenure as Executive Chairman of the Board and Interim Chief Executive Officer began, Mr. Doman has become intimately familiar with our business and his direct involvement in our operations put him in an ideal position to effectively identify strategic priorities, lead discussions of the Board and define the Company’s short-term and long-term objectives with respect to capital and operational requirements. Given the current regulatory and capital markets environment, and in light of our size, structure and development stage, the Board believes that having one leader serving as both the Executive Chairman and Chief Executive Officer is ideal for the Company at this time as it provides consistent, decisive and effective leadership and encourages robust communication between our management and the Board.

On August 23, 2013, the Board determined that it was appropriate and in the best interests of the Company and its stockholders to appoint a Lead Independent Director in addition to an Executive Chairman. Mr. Grieco, who serves as Chair of the Nominating and Corporate Governance Committee and has over 30 years’ experience in corporate governance matters, was appointed as Lead Independent Director of the Board. As Lead Independent Director, Mr. Grieco’s responsibilities include

| ● | providing independent leadership; |

| ● | overseeing the Board’s governance processes; |

● | communicating with the other independent directors to identify matters for discussion at executive sessions of independent directors and presiding over such executive sessions; |

| ● | facilitating communication between the independent directors and the Executive Chairman; and |

● | engaging with the Executive Chairman between Board meetings and assisting with informing or engaging non-employees directors as necessary and appropriate. |

Our independent directors routinely interact with executive management and they bring a wide variety of industry experience, oversight and expertise from outside the Company. In addition, all of the Board’s key Committees — Audit, Compensation, and Nominating — are comprised entirely of independent directors. The Board believes that these factors provide the appropriate balance between the authority of those individuals who oversee the Company and those who manage it on a daily basis.

The Board’s Role in Risk Oversight

One of the Board’s primary responsibilities is reviewing our strategic plans and objectives, including our principal risk exposures. The Audit Committee assists the Board in overseeing and monitoring our actual and potential legal and financial risks, determining management’s response to these risks and developing and implementing strategies for risk mitigation. Each of the Board’s key committees — Audit, Compensation, and Nominating — is responsible for overseeing and for recommending guidelines and policies governing their respective areas of responsibility. In consultation with our management team and outside advisors, the Board also considers specific areas of material risk to the Company, including operational, financial, legal, regulatory, strategic and reputation risks.

DIRECTOR INDEPENDENCE AND RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Independence of Members of Board of Directors

The Board has determined that each of Messrs. Enright, Goldberg, Grieco and Smith, constituting four of our five directors, satisfy the criteria for being an “independent director” under NASDAQ listing standards.

Policies and Procedures Regarding Related Party Transactions

The Company’s Audit Committee, which is composed entirely of independent directors, reviews all related person transactions on an ongoing basis. In accordance with the Audit Committee’s charter, it must approve any related person transaction before the Company enters into it. Any transaction that does not qualify as a related person transaction but may present a potential conflict of interest is governed by our written Code of Business Conduct and Ethics (the “Code”). Our General Counsel works with senior management to determine whether such transaction or relationship constitutes a conflict of interest that should be brought to the attention of the Nominating Committee. The Nominating Committee considers all requests for waivers from our Code of Business Conduct and Ethics and ensures that we disclose such waivers in accordance with applicable rules and regulations. The Nominating Committee is tasked with annually reviewing our program for monitoring compliance with the Code and making recommendations to the Board if it determines that any revisions are needed.

Related Party Transactions

Repayment of Outstanding Balance Under Non-revolving Draw Credit Facility

On March 1, 2013, we elected to prepay the entire outstanding balance of $3,113,366 under a non-revolving draw credit facility entered into between the Company and Platinum-Montaur Life Sciences, LLC, one of our largest institutional investors, on August 31, 2012. The amount repaid included interest accrued and unpaid to that date of $113,366. No principal amount is currently outstanding under the credit facility.

December 2013 Common Stock, Preferred Stock and Warrant Financing

In December 2013, we entered into a Securities Purchase Agreement with Platinum Partners Value Arbitrage Fund L.P. and Platinum Partners Liquid Opportunity Master Fund L.P. (collectively, “Platinum Partners”) (the “Securities Purchase Agreement”). Pursuant to the Securities Purchase Agreement, Platinum Partners purchased an aggregate of 1,818,182 of our Common Stock. In addition, Platinum Partners purchased a total of 1,748,613 shares of Series E Preferred Stock (“Preferred Stock”) at a purchase price of $2.75 per share, which, under certain conditions, are exchangeable into shares of Common Stock on a one-for-one basis. The conversion of Preferred Stock into shares of Common Stock, however, is subject to a restriction, which prohibits the conversion of shares of Preferred Stock if the number of shares of Common Stock to be issued pursuant to such conversion would exceed, when aggregated with all other shares of Common Stock owned by Platinum Partners and their affiliates at such time, the number of shares of Common Stock which would result in Platinum Partners and their affiliates beneficially owning in excess of 19.99% of all of Common Stock outstanding at such time. Under the terms of the Securities Purchase Agreement, Platinum Partners also received 181,818 warrants, having a five-year term and an exercise price of $2.75 per warrant. The warrants are exercisable six months and one day following the issuance date thereof. Under the terms of the Securities Purchase Agreement, we have, at the request of Platinum Partners, agreed to prepare a proxy statement and seek shareholder approval of the issuance of the Common Stock underlying the Preferred Stock and the warrants. We received the proceeds of $5,000,000 from the sale of the securities to Platinum Partners on December 10, 2013.

Doman Consulting Agreement

On August 26, 2013, we entered into a Consulting Agreement with Robert Doman, a member of the Board, pursuant to which Mr. Doman was engaged to serve as our Executive Chairman and Interim Chief Executive Officer (the “Consulting Agreement”) for a period of four months. The Consulting Agreement was subsequently amended on October 3, 2013, December 26, 2013 and April 3, 2014. The current term of the Consulting Agreement expires on June 30, 2014. The Consulting Agreement can be renewed upon mutual written agreement of the parties and either party can terminate the Consulting Agreement for any reason upon ten days’ prior written notice to the other party. In accordance with the Consulting Agreement, we pay Mr. Doman $8,000 per week for his services and reimburse him for all out-of-pocket expenses incurred in connection with the performance of services under the Consulting Agreement. Mr. Doman did not receive an equity grant pursuant to the Consulting Agreement and the Consulting Agreement states that he is not entitled to participate in or receive any benefits or rights under any Company employee benefit and welfare plans.

DIRECTOR COMPENSATION

Non-employee Director Compensation

From January 1 to August 15, 2013, each director who was neither an employee nor a consultant of the Company received cash compensation of $25,000 per year, to be paid in equal installments at the end of each fiscal quarter. Following an unanticipated leave of absence by our Chief Executive Officer in August 2013 and his subsequent departure in September 2013, the level of involvement in Company activities that was required by individual Board members, and by Board members as a group, increased dramatically for an extended period of time beyond that typically expected of a member of the Board of Directors of a similarly situated company. The Board and its committees held 34 meetings from August to December 2013 in addition to the 4 Board and committee meetings scheduled to take place during that time. Following consultation with an external compensation consultant, the Compensation Committee determined that it was in the best interests of the Company and the stockholders to adjust Board compensation levels to reflect the increased level of activity and to strengthen the Board members’ vested interest in both our short-term and long-term success.

Accordingly, from August 15 to December 31, 2013, each director who was neither an employee nor a consultant of the Company also received a fee, based on the length of the meeting, for each meeting he attended beyond the regularly-scheduled quarterly Board and Board committee meetings as follows: $200 for in person or telephonic meetings lasting from 20 minutes up to 1 hour; $300 for in person or telephonic meetings lasting from 1 hour up to 2 hours; $400 for in person or telephonic meetings lasting from 2 hours up to 4 hours; $800 for in person or telephonic meetings lasting half a day (4 hours); and $1,600 for in person or telephonic meetings lasting a full day (8 hours).

In addition, beginning on August 15, 2013, the Lead Independent Director received an annual retainer of $25,000, to be paid on a quarterly basis in arrears. Finally, at the end of each of the first three fiscal quarters of 2013, each director who was neither an employee nor a consultant of the Company received (i) a grant of 400 shares of Common Stock which will vest one year from the date of issuance and (ii) a non-qualified option to purchase 1,500 shares of Common Stock, with an exercise price equal to the closing price of the Common Stock on the last trading day of the quarter immediately preceding the issuance, which will vest one year from the date of issuance. Mr. Enright, Mr. Grieco and Mr. Smith received (i) a grant of 14,500 shares of Common Stock, 50% of which vest upon the filing of our submission of the Symphony CGM System technical file to the notified body and the remainder of which vest one year from the date of issuance, and (ii) a non-qualified option to purchase 56,000 shares of Common Stock, with an exercise price of $2.98 which vest in equal installments on March 18, June 18, September 18, and December 18, 2014. All directors were reimbursed for reasonable out-of-pocket expenses incurred in attending Board of Director and committee meetings in 2013.

2013 Director Compensation

The table below reflects compensation paid to directors who were neither an employee nor a consultant of the Company during 2013. Robert Doman received fees of $14,258.34 in his capacity as a director of the Company from March 12, 2013 to August 26, 2013. Upon Mr. Doman’s appointment as Executive Chairman and Interim Chief Executive Officer of the Company on August 26, 2013, Mr. Doman no longer received compensation as a director of the Company. All compensation received by Mr. Doman is his capacity as a director and as an executive officer of the Company is reflected in the 2013 Summary Compensation Table.

Name | | Fees Earned or Paid in Cash ($) | | | Stock Awards ($)(1) | | | Option Awards ($)(2) | | | All Other Compensation ($) | | | Total ($) | |

Vincent D. Enright | | | 29,400.00 | | | | 55,212.50 | | | | 786.51 | | | | –– | | | | 85,399.01 | |

William F. Grieco | | | 32,383.00 | | | | 55,212.50 | | | | 786.51 | | | | –– | | | | 88,382.01 | |

James F. Smith | | | 30,300.00 | | | | 55,212.50 | | | | 786.51 | | | | –– | | | | 86,299.01 | |

______________________

| (1) | The following summarizes the aggregate number of stock awards outstanding at the fiscal year end for each director above: Vincent Enright — 28,200, William Grieco — 20,200, and James Smith — 20,200. |

| (2) | The following summarizes the aggregate number of stock options outstanding at the fiscal year end for each director above: Vincent Enright — 70,500, William Grieco — 60,500, and James Smith — 60,500. |

EXECUTIVE COMPENSATION

Compensation Overview

This Compensation Overview should be read in conjunction with the compensation tables and narrative set forth below. For the fiscal year ended December 31, 2013, our Named Executive Officers are set forth below:

| · | Robert F. Doman, Executive Chairman and Interim Chief Executive Officer; |

| · | Patrick T. Mooney, former Chief Executive Officer, President and Chairman of the Board; |

| · | Christopher P. Schnittker, Senior Vice President, Chief Financial Officer and Treasurer; and |

| · | Kimberly A. Burke, Senior Vice President, General Counsel, Chief Compliance Officer and Secretary. |

Executive Compensation Objectives and Philosophy

The primary objective of our executive compensation program is to provide a compensation package that motivates its executives to achieve short-term and long-term strategic, operational and product development, approval and commercialization goals, while at the same time attracting and retaining a talented and dedicated management team. The compensation program is structured to reward Company financial and operational performance, as well as the overall qualitative contributions and performance of each individual towards our strategy.

To achieve this objective, we seek to provide our Named Executive Officers with a compensation package that ties a substantial portion of the executive's overall compensation to both Company objectives and the executive's individual performance. Base salary increases and annual performance bonuses are tied to our company and individual performance in relation to competitive market conditions. We seek to align our executive team’s interests with those of our stockholders by using equity-based long-term incentive awards. These awards generally consist of either stock options or shares of restricted stock that vest over time or upon achievement of a milestone, such as product approval. Equity-based incentive awards serve not only as a retention tool but also as a means to encourage enhanced performance of our Common Stock because executives obtain the opportunity for financial rewards as our stock price increases. In addition, we anticipate that our Named Executive Officers will be motivated to achieve product development and operating objectives through those components of our compensation program that reward the achievement of pre-determined performance objectives in areas that the Board believes are critical to our success.

We endeavor to attract and retain talented executives by offering compensation packages that we believe are competitive in relation to similar positions at comparable companies and by ensuring retention through time-vested equity-based incentive awards. We do this by using compensation survey data for the relevant position and ensuring that the various elements of compensation for the position present an appropriate mix for the position.

How Our Compensation Decisions are Made

Our Compensation Committee oversees our compensation and benefit plans and policies, administers our equity incentive plans and reviews and approves compensation decisions relating to our Named Executive Officers. When determining our executive compensation policies, reviewing the performance of our Named Executive Officers and establishing compensation levels and programs, our Compensation Committee relies on various factors, including the Company’s current financial position, its financial and operational performance, the achievement of or progress towards the Company’s predetermined goals, an executive’s individual performance and contributions to our strategic objectives, recommendations from the Chief Executive Officer (for Named Executive Officers other than himself) and internal pay equity. The Compensation Committee exercises discretion in setting the compensation of the Named Executive Officers and primarily considers the Company’s financial position, performance of the management team as a group, the Chief Executive Officer’s assessment of other executive’s performance and the Chief Executive Officer’s compensation recommendations with respect to the other executive officers as part of its process.

As a result of competitive pressures for talented executives, particularly in companies at an early stage of business development that have many positive challenges, an improving economy, major investor expectations for continuing improved Company performance and concerns for appropriate linkages between performance and rewards (both cash and equity) and the Company’s potential business opportunities, the Compensation Committee engaged WNB Consulting, LLC (“WNB”), an independent compensation consultant, in December 2012 to review the current level of all types of compensation provided to the Named Executive Officers for 2013.

The Compensation Committee has reviewed the independence of WNB’s advisory role relative to the applicable independence factors set forth in SEC rules and NASDAQ listing standards. Following its review, the Compensation Committee concluded that WNB has no conflicts of interest, and provides the Compensation Committee with objective and independent executive compensation advisory services.

WNB was engaged to (i) review our overall Named Executive Officer compensation, (ii) benchmark such compensation in relation to other comparable companies with which we may compete for talent, and (iii) provide recommendations to ensure that our compensation program enables us to continue to attract and retain qualified executives through competitive compensation packages. WNB assessed the current level of competitive compensation for the Named Executive Officers in the following areas:

| · | Total annual cash compensation (actual compensation) |

| · | Percentage opportunity (actual and target) for short-term incentive award (percentage of base salary) for meeting various levels of company performance; and |

| · | Estimated value of long-term incentive granted to these positions, primarily equity. |