Filed Pursuant to Rule 424(b)(5)

Registration No. 333-220257

The information in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 2, 2018

PRELIMINARY PROSPECTUS SUPPLEMENT

(To Prospectus dated January 2, 2018)

$2,500,000,000

Common Stock

The forward sellers referred to below are offering $2,500,000,000 of shares of our common stock, no par value. We expect to enter into forward sale agreements with each of Morgan Stanley & Co. LLC, an affiliate of RBC Capital Markets, LLC and an affiliate of Barclays Capital Inc., whom we refer to in such capacity as the “forward purchasers,” with respect to $2,500,000,000 of shares of our common stock. In connection with these forward sale agreements, the forward purchasers or their affiliates, whom we refer to in such capacity as the “forward sellers,” at our request, are borrowing from third parties and selling to the underwriters an aggregate of $2,500,000,000 of shares of our common stock. If the forward purchasers determine in good faith, after using commercially reasonable efforts, that the forward sellers are unable to borrow and deliver for sale on the anticipated closing date such number of shares of our common stock or that the forward sellers are unable to borrow, at a stock loan rate not greater than a specified rate, and deliver for sale on the anticipated closing date such number of shares of our common stock, then we will issue and sell to the underwriters a number of shares equal to the number of shares that the forward sellers do not borrow and sell.

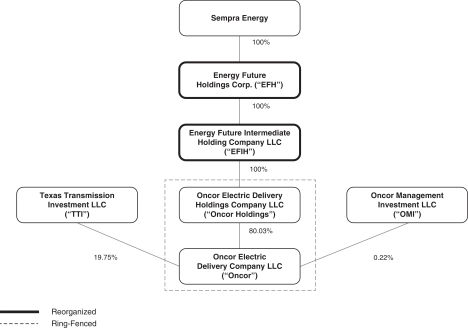

We will not initially receive any proceeds from the sale of our common stock sold by the forward sellers to the underwriters, except in certain circumstances described in this prospectus supplement. We expect to settle a portion of the forward sale agreements and receive proceeds, subject to certain adjustments, from the sale of those shares of common stock concurrently with, or prior to, the closing of our proposed merger (the “Merger”) with Energy Future Holdings Corp., as described herein under the heading “Summary Information – Recent Developments – Proposed Acquisition of Energy Future Holdings Corp.” We expect to settle the remaining portion of the forward sale agreements after the Merger, if completed, in multiple settlements on or prior to December 15, 2019, which is the scheduled final settlement date under the forward sale agreements. This offering is not contingent on the consummation of the Merger, which, if completed, will occur subsequent to the closing of this offering. If we elect to cash settle all or a portion of the forward sale agreements, we may not receive any proceeds from such election, and we may owe cash to the forward purchasers. If we elect to net share settle all or a portion of the forward sale agreements, we will not receive any cash proceeds from such election, and we may owe shares of our common stock to the forward purchasers. See “Underwriting (Conflicts of Interest) – Forward Sale Agreements.”

Concurrently with this offering, we have commenced an offering (the “Concurrent Offering”) of our % Mandatory Convertible Preferred Stock, Series A, which is being made by means of a separate prospectus supplement and not by means of this prospectus supplement. The completion of this offering is not contingent on completion of either the Concurrent Offering or the Merger, and the completion of the Concurrent Offering is not contingent on the completion of either this offering or the Merger.

We intend to use the net proceeds we receive from the sale of shares of our common stock pursuant to the forward sale agreements to finance a portion of the cost of the Merger and to pay related fees and expenses or, in the case of any forward sales that settle after the closing of the Merger, to repay indebtedness incurred to finance a portion of the cost of the Merger and to pay related fees and expenses. If for any reason the Merger has not closed on or prior to December 1, 2018 or if an Acquisition Termination Event (as defined herein) occurs, then we expect to use the net proceeds from this offering for general corporate purposes, which may include, in our sole discretion, the voluntary redemption of the % Mandatory Convertible Preferred Stock, Series A, if issued, debt repayment, including repayment of commercial paper, capital expenditures, investments and possibly, repurchases of our common stock at the discretion of our board of directors. See “Summary Information” and “Use of Proceeds.”

Our common stock is listed on the New York Stock Exchange under the symbol “SRE.” On December 27, 2017, the last reported sale price of our common stock on the New York Stock Exchange was $107.83 per share.

Investing in the shares involves risks. See the “Risk Factors” section on page S-25 of this prospectus supplement.

| | | | | | | | |

| | | Per Share | | | Total | |

Public Offering Price | | $ | | | | $ | | |

Underwriting Discount | | $ | | | | $ | | |

Proceeds to Sempra Energy (1) | | $ | | | | $ | | |

| (1) | We expect to receive net proceeds from the sale of our common stock of approximately $ billion upon full physical settlement of the forward sale agreements, which we expect will occur in multiple settlements on or prior to December 15, 2019. For the purpose of calculating the net proceeds to us, we have assumed the forward sale agreements will be fully physically settled at the initial forward sale price of $ per share, which is equal to the public offering price per share less the underwriting discount shown above. The forward sale price is subject to adjustment pursuant to the forward sale agreements, and the actual proceeds, if any, will be calculated as described in this prospectus supplement. If the overnight bank funding rate decreases substantially prior to the settlement of the forward sale agreements, we may receive less than the initial forward sale price per share upon full physical settlement of the forward sale agreements. Although we expect to settle the forward sale agreements entirely by the full physical delivery of shares of our common stock in exchange for cash proceeds, we may elect cash settlement or net share settlement for all or a portion of our obligations under the forward sale agreements, in which case we may receive no cash proceeds or substantially less cash proceeds than is reflected in the above table upon settlement, or we may be required to deliver cash or shares of our common stock to the forward purchasers. See “Underwriting (Conflicts of Interest)” for additional information. |

We have granted the underwriters the option, exercisable in whole or from time to time in part, to purchase up to an additional $375,000,000 of shares of our common stock directly from us solely to cover over-allotments, if any, at the public offering price per share shown above, less the underwriting discount and subject to possible adjustment as described under “Underwriting (Conflicts of Interest),” exercisable for 30 days after the date of this prospectus supplement.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on or about , 2018.

Joint Book-Running Managers

| | | | |

| Morgan Stanley | | RBC Capital Markets | | Barclays |

, 2018