SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ý

Filed by a Party other than the Registrant o

Check the appropriate box:

| |

| o | Preliminary Proxy Statement |

| |

| o | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| |

| ý | Definitive Proxy Statement |

| |

| o | Definitive Additional Materials |

| |

| o | Soliciting Material Pursuant to §240.14a-12 |

DIAMOND HILL FUNDS

(Name of Registrant as Specified in Its Charter)

Not Applicable

(Name of Person (s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

1) Title of each class of securities to which transaction applies: _________________________________________________________________________

2) Aggregate number of securities to which transaction applies: _________________________________________________________________________

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated

and state how it was determined): _________________________________________________________________________

4) Proposed maximum aggregate value of transaction: _________________________________________________________________________

5) Total fee paid: _________________________________________________________________________

| |

| o | Fee paid previously with preliminary materials: |

| |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

1) Amount Previously Paid: _________________________________________________________________________

2) Form, Schedule or Registration Statement No.: _________________________________________________________________________

3) Filing Party: ______________________________________________________________________

4) Date Filed: _________________________________________________________________________

Diamond Hill Funds

325 John H. McConnell Boulevard, Suite 200

Columbus, Ohio 43215

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held April 16, 2019

The Board of Trustees of Diamond Hill Funds, an open-end management investment company organized as an Ohio business trust (the “Trust”), has called a special meeting of the shareholders of the Diamond Hill Small Cap Fund, Diamond Hill Small-Mid Cap Fund, Diamond Hill Mid Cap Fund, Diamond Hill Large Cap Fund, Diamond Hill All Cap Select Fund, Diamond Hill Long-Short Fund, Diamond Hill Research Opportunities Fund, Diamond Hill Financial Long-Short Fund, Diamond Hill Global Fund, Diamond Hill Short Duration Total Return Fund, Diamond Hill Core Bond Fund, Diamond Hill Corporate Credit Fund and Diamond Hill High Yield Fund, each a series (“Fund”) of the Trust, to be held at the offices of the Trust, 325 John H. McConnell Boulevard, Suite 200, Columbus, Ohio 43215 on April 16, 2019 at 10:00 a.m., Eastern Time, for the following purposes:

|

| | | |

| | Proposals | Funds Voting | Recommendation of the Board of Trustees |

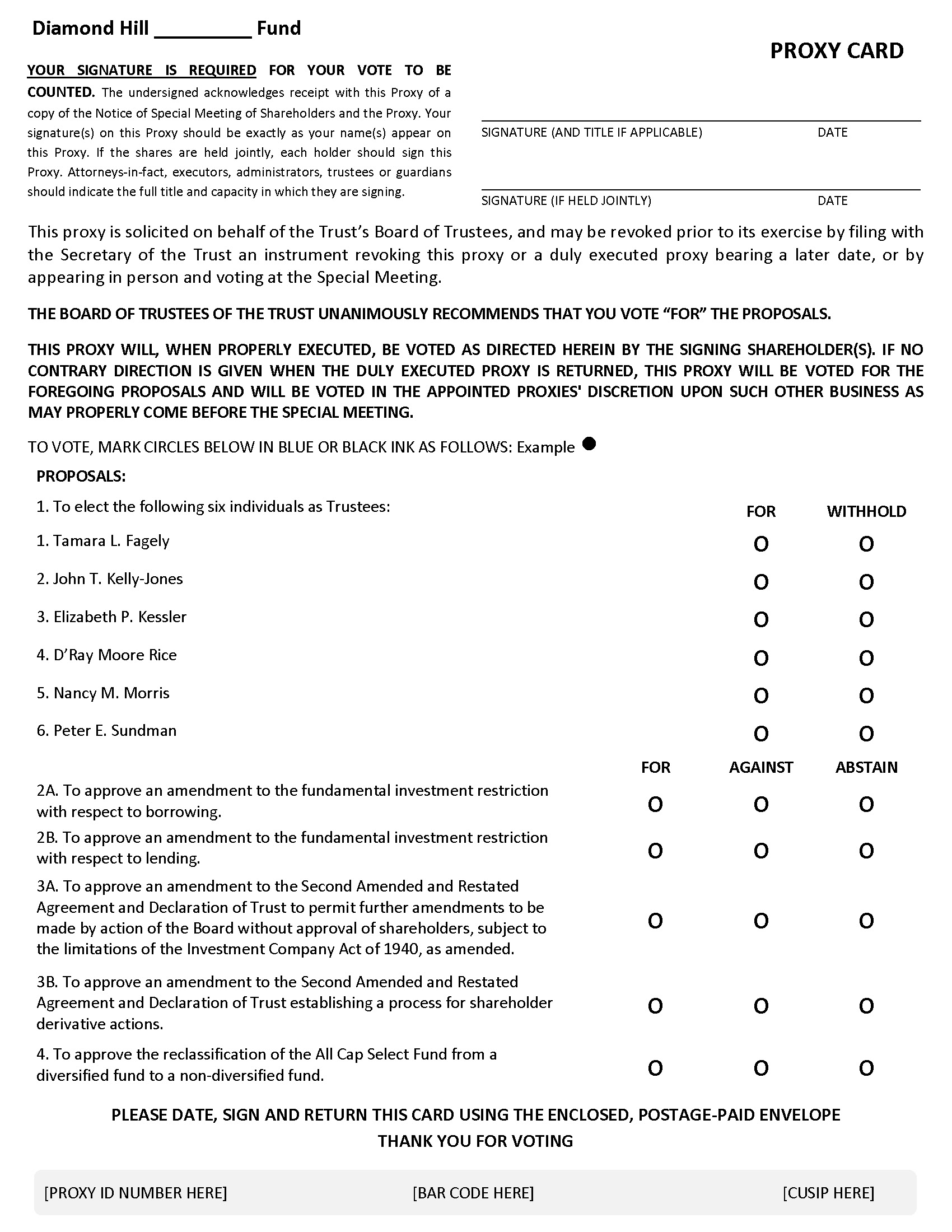

| 1 | To elect Tamara L. Fagely, John T. Kelly-Jones, Elizabeth P. Kessler, D’Ray Moore Rice, Nancy M. Morris, and Peter E. Sundman to the Board of Trustees of the Trust; | All Funds | FOR |

| 2-A | To amend each Fund’s fundamental investment restriction with respect to borrowing; | All Funds (voting separately) | FOR |

| 2-B | To amend each Fund’s fundamental investment restriction with respect to lending; | All Funds (voting separately) | FOR |

| 3-A | To approve an amendment to the Second Amended and Restated Agreement and Declaration of Trust to permit further amendments to be made by action of the Board without approval of shareholders, subject to the limitations of the Investment Company Act of 1940, as amended; | All Funds | FOR |

| 3-B | To approve an amendment to the Second Amended and Restated Agreement and Declaration of Trust establishing a process for shareholder derivative actions; | All Funds | FOR |

| 4 | To approve the reclassification of the All Cap Select Fund from a diversified fund to a non-diversified fund; and | All Cap Select Fund | FOR |

| 5 | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. | | |

Only shareholders of record at the close of business on January 24, 2019 are entitled to notice of, and to vote at, the special meeting and any adjournments or postponements thereof. The Notice of Meeting, Proxy Statement and accompanying form of proxy will first be mailed to shareholders on or about February 4, 2019.

By Order of the Board of Trustees

Gary Young, President

YOUR VOTE IS IMPORTANT

To assure your representation at the meeting, please complete, date and sign the enclosed proxy card and return it promptly in the accompanying envelope. You also may vote by telephone or via the Internet by following the instructions on the enclosed proxy card. Whether or not you plan to attend the meeting in person, please vote your shares; if you attend the meeting, you may revoke your proxy and vote your shares in person. For more information or assistance with voting, please call 877-283-0323.

Diamond Hill Funds

325 John H. McConnell Boulevard, Suite 200

Columbus, Ohio 43215

____________

PROXY STATEMENT

____________

SPECIAL MEETING OF SHAREHOLDERS

To Be Held April 16, 2019

____________

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board” or the “Trustees”) of Diamond Hill Funds (the “Trust”) for use at the Special Meeting of Shareholders of the Trust (the “Meeting”) to be held at the Trust’s offices, 325 John H. McConnell Boulevard, Suite 200, Columbus, Ohio 43215 on April 16, 2019 at 10:00 a.m., Eastern Time, and at any and all adjournments thereof. The Trust is soliciting proxies on behalf of the following series (each a “Fund” and collectively, the “Funds”) of the Trust:

|

| |

| Diamond Hill Small Cap Fund | Diamond Hill Financial Long-Short Fund |

| Diamond Hill Small-Mid Cap Fund | Diamond Hill Global Fund |

| Diamond Hill Mid Cap Fund | Diamond Hill Short Duration Total Return Fund |

| Diamond Hill Large Cap Fund | Diamond Hill Core Bond Fund |

| Diamond Hill All Cap Select Fund | Diamond Hill Corporate Credit Fund |

| Diamond Hill Long-Short Fund | Diamond Hill High Yield Fund |

| Diamond Hill Research Opportunities Fund | |

The Board called the Meeting for the following purposes:

|

| | |

| | Proposals | Funds Voting |

| 1 | To elect Tamara L. Fagely, John T. Kelly-Jones, Elizabeth P. Kessler, D’Ray Moore Rice, Nancy M. Morris, and Peter E. Sundman to the Board of Trustees of the Trust; | All Funds |

| 2-A | To amend each Fund’s fundamental investment restriction with respect to borrowing; | All Funds (voting separately) |

| 2-B | To amend each Fund’s fundamental investment restriction with respect to lending; | All Funds (voting separately) |

| 3-A | To approve an amendment to the Second Amended and Restated Agreement and Declaration of Trust to permit further amendments to be made by action of the Board without approval of shareholders, subject to the limitations of the Investment Company Act of 1940, as amended; | All Funds |

| 3-B | To approve an amendment to the Second Amended and Restated Agreement and Declaration of Trust establishing a process for shareholder derivative actions; | All Funds |

| 4 | To approve the reclassification of the All Cap Select Fund from a diversified fund to a non-diversified fund; and | All Cap Select Fund |

| 5 | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. | |

The Notice of Meeting, Proxy Statement and accompanying form of proxy will be mailed to shareholders on or about February 4, 2019.

The Meeting has been called by the Board of Trustees of the Trust for the election of six Trustees to the Board of Trustees, to consider the amendment to the Funds’ fundamental investment restrictions with respect to borrowing, to consider an amendment to the Funds’ fundamental investment restrictions with respect to lending, to consider an amendment to the Second Amended and Restated Agreement and Declaration of Trust (“Declaration of Trust”) permitting further amendment without shareholder approval, to consider an amendment to the Declaration of Trust establishing a process for shareholder derivative actions, and to consider the reclassification of the Diamond Hill All Cap Select Fund from a diversified fund to a non-diversified fund. The Meeting also has been called for the transaction of such other business as may properly come before the Meeting or any adjournments thereof. Only shareholders of record at the close of business on January 24, 2019 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting and any

adjournments or postponements thereof. Each Fund is managed by Diamond Hill Capital Management, Inc. (the “Adviser”), 325 John H. McConnell Boulevard, Suite 200, Columbus, Ohio 43215.

|

|

Important Notice Regarding Internet Availability of Proxy Materials This Proxy Statement and copies of the Trust’s most recent annual and semi-annual reports to shareholders are available at www.proxyonline.com/docs/DiamondHill2019/. The Trust’s annual and semi-annual reports are available at no charge by calling 888-226-5595. |

PROPOSAL 1

ELECTION OF TRUSTEES

In this proposal, shareholders of the Funds are being asked to elect Tamara L. Fagely, John T. Kelly-Jones, Elizabeth P. Kessler, D’Ray Moore Rice, Nancy M. Morris, and Peter E. Sundman (each a “Nominee,” together the “Nominees”) to the Board of Trustees of the Trust. Each Nominee has agreed to serve on the Board of Trustees for an indefinite term.

Ms. Kessler, Ms. Rice and Mr. Sundman are incumbent Trustees, having been elected to their positions by shareholders on November 5, 2012. Ms. Fagely also is an incumbent trustee, having been appointed to that position by the Board on November 20, 2014. The Investment Company Act of 1940, as amended, (the "1940 Act") requires a certain percentage of the Trustees to have been elected by shareholders before the Board can appoint any new Trustees. To facilitate future compliance with this requirement, the Board of Trustees now proposes to have shareholders elect Ms. Fagely, Ms. Kessler, Ms. Rice and Mr. Sundman to their current positions.

Mr. Kelly-Jones and Ms. Morris were nominated for election to the Board by the Nominating and Governance Committee (the “Committee”) of the Board of Trustees. The Committee consists of the four incumbent Trustees, each of whom is not an "interested person" of the Trust as that term is defined in Section 2(a)(19) of the 1940 Act (referred to hereafter as "Independent Trustees"). An incumbent Trustee recommended Mr. Kelly-Jones’ nomination, and an officer of the Adviser and the Trust recommended Ms. Morris’ nomination to the Board of Trustees.

The Committee, at a meeting held on November 14, 2018, recommended to the Board that Mr. Kelly-Jones and Ms. Morris be nominated to the Board of Trustees. The Board approved the nomination at a meeting held on November 14, 2018. If elected, Ms. Fagely, Mr. Kelly-Jones, Ms. Kessler, Ms. Rice, Ms. Morris and Mr. Sundman will be considered Independent Trustees. Even if shareholders do not elect Ms. Fagely, Ms. Kessler, Ms. Rice, and Mr. Sundman they will continue to serve in their current capacities pursuant to their election or appointment to the Board. If elected, Mr. Kelly-Jones and Ms. Morris will assume office on or about May 23, 2019.

Information about the Nominees

Below is information about each Nominee and the attributes that qualify each to serve as a Trustee. The information provided below is not all-inclusive. Many Trustee attributes involve intangible elements, such as intelligence, work ethic and the willingness to work together, as well as the ability to communicate effectively, exercise judgment, ask incisive questions, manage people and problems, and develop solutions. The Board does not believe any one factor is determinative in assessing a Trustee’s qualifications, but that the collective experiences of the Nominees makes each highly qualified.

The Board believes each Nominee possesses experiences, qualifications, and skills valuable to the Funds. Each Nominee has substantial business experience, effective leadership skills and ability to critically review, evaluate and assess information.

New Trustee Nominees

The Board believes that Mr. Kelly-Jones is qualified to serve as a Trustee of the Trust because of his more than 20 years’ experience in the investment management industry. Mr. Kelly-Jones was a founding partner, Chief Operations Officer and Chief Compliance Officer of Independent Franchise Partners, LLP (“IFP”), a registered investment adviser, overseeing all operational functions and establishing four funds of different structures. Mr. Kelly-Jones also previously served on the board of one of IFP’s Irish variable capital funds and of one U.S. private investment fund. In addition, he served in various roles and capacities at Morgan Stanley Asset Management, London from September 2002 through June 2009. His experience included working with mutual fund firms and investment advisers. The Board also noted that Mr. Kelly-Jones exhibits excellent communication skills, as well as an ability to work effectively with others. Finally, the Board determined that Mr. Kelly-Jones would bring a diversity of viewpoint, background and experience to the Board.

The Board believes that Ms. Morris is qualified to serve as a Trustee of the Trust because of her more than 30 years’ experience and leadership with the Securities and Exchange Commission and within the investment management industry. In addition to her role of Chief Compliance Officer of Wellington Management, LLC, the Trustees noted that during the course of her career, Ms. Morris served as Secretary of the Securities and Exchange Commission and as Deputy Chief Counsel in the Division of Investment Management. Her experience includes addressing investment company regulatory and compliance matters affecting mutual fund firms and investment advisers. Ms. Morris currently serves on the board of another registered investment company. The Board also noted that Ms. Morris exhibits excellent communication skills, possesses the ability to work collaboratively, and provides diversity of viewpoint and background.

Additional information about Mr. Kelly-Jones and Ms. Morris is set forth in the following table:

|

| | | | | |

Name, Address and Year of Birth1 | Position(s) Held with the Trust | Term of Office and Length of Time Served | Principal Occupation(s) During the Past 5 Years | Number of Funds in the Trust to be Overseen by Nominee | Other Trusteeships Held by the Nominee for Trustee |

John T. Kelly-Jones Year of Birth: 1960 | Trustee | NA | Retired: December 2017 to present; Partner, COO and CCO, Independent Franchise Partners, LLP June 2009 to November 2017 | 13 | None |

Nancy M. Morris Year of Birth: 1952

| Trustee | NA | Retired: August 2018 to present; Chief Compliance Officer, Wellington Management LLC April 2012 to July 2018 | 13 | Water Island Capital Funds, December 2018 to present |

_________________________________

1The mailing address of each Nominee is c/o Diamond Hill Funds, 325 John H. McConnell Boulevard, Suite 200, Columbus, Ohio 43215.

Incumbent Independent Trustee Nominees

Tamara L. Fagely was a business executive for a large mutual fund complex for over 20 years, leading back office operations that included administration, fund accounting, financial reporting, transfer agent, and technology. Her experience included roles as Treasurer, Chief Financial Officer, and Chief Operations Officer. In addition, Ms. Fagely has management experience in broker/dealer operations and as an audit manager conducting audits of financial service organizations and mutual funds. Ms. Fagely brings a detailed knowledge of the mutual fund industry and financial expertise to the Board.

Elizabeth P. Kessler has over 20 years of experience as an attorney at an international law firm, with a focus on product liability litigation. Ms. Kessler’s duties include serving as Partner in Charge of one of the firm’s offices. She has substantial experience practicing law and advising clients with respect to liability issues.

D’Ray Moore Rice has worked for a major service provider to investment managers and mutual funds for over 10 years, including serving as Senior Vice President for European Relationship Management. Ms. Rice’s experience also includes serving as

an Independent Trustee for other mutual funds, as well as 10 years of experience in banking and financial services, including retail investment sales and sales management.

Peter E. Sundman has more than 25 years’ experience in the investment management industry and has extensive mutual fund experience, including his 10 year service as the Chairman of a large mutual fund complex. During the course of his career, Mr. Sundman has served in senior executive roles within the investment management industry. Mr. Sundman has excellent communications skills, as well as an ability to work effectively with others. Mr. Sundman brings a diversity of viewpoint, background and experience to the Board.

The following table provides additional information regarding the incumbent trustees and the officers of the Trust. |

| | | | | |

Name, Address

and Year of Birth1 | Position(s) Held with the Trust | Term of Office and Length of Time Served | Principal Occupation(s) During the Past 5 Years | Number of Funds in the Trust to be Overseen by Trustee | Other Trusteeships Held by Trustee |

Tamara L. Fagely Year of Birth: 1958 | Trustee | Since November 2014 | Retired: January 2014 to present.

| 13 | Allianz Variable Insurance Products Trust and Allianz Variable Insurance Products Fund of Funds Trust, December 2017 to present |

Elizabeth P. Kessler Year of Birth: 1968 | Trustee | Since November 2005 | Partner in Charge, Columbus Ohio Office, Jones Day (law firm), January 2009 to present. | 13 | None |

D’Ray Moore Rice Year of Birth: 1959 | Trustee | Since August 2007 | Retired, Community Volunteer: November 2001 to present. | 13 | Advisers Investment Trust, July 2011 to present |

Peter E. Sundman Year of Birth: 1959 | Trustee | Since November 2012 | Retired: 2012 to present. | 13 | None |

____________

1The mailing address of each Trustee is c/o Diamond Hill Funds, 325 John H. McConnell Boulevard, Suite 200, Columbus, Ohio 43215.

Trust Officers

|

| | | | | |

Name, Address and Year of Birth1 | Position(s) Held with the Trust | Term of Office and Length of Time Served | Principal Occupation(s) During the Past 5 Years | Number of Funds in the Trust to be Overseen by Trustee | Other Trusteeships Held by Trustee |

Thomas E. Line Year of Birth: 1967 | Chief Executive Officer | Since November 2014 | Chief Financial Officer of Diamond Hill Investment Group, Inc., January 2015 to present; Managing Director-Finance of Diamond Hill Investment Group, Inc., April 2014 to December 2014; Chief Operating Officer, Lancaster Pollard (investment banking services) & Company, January 2012 to March 2014. | NA | None |

Gary R. Young Year of Birth: 1969 | President | Since November 2014 | Secretary of the Trust, May 2004 to November 2014; Chief Administrative Officer of the Trust, October 2010 to November 2014; Managing Director-Administration of Diamond Hill Capital Management, Inc., January 2015 to present; Chief Compliance Officer of Diamond Hill Capital Management Inc., October 2010 to present; Controller of Diamond Hill Investment Group, Inc., April 2004 to March 2015. | NA | None |

|

| | | | | |

Name, Address and Year of Birth1 | Position(s) Held with the Trust | Term of Office and Length of Time Served | Principal Occupation(s) During the Past 5 Years | Number of Funds in the Trust to be Overseen by Trustee | Other Trusteeships Held by Trustee |

Karen R. Colvin Year of Birth: 1966 | Vice President

Secretary

| Since November 2011 Since November 2014 | Director-Fund Administration & Sales Support, Diamond Hill Capital Management, Inc., June 2009 to present. | NA | None |

Maureen K. Goldenberg Year of Birth: 1968 | Chief Compliance Officer | Since October 2017 | Director-Compliance, Diamond Hill Capital Management, Inc., September 2017 to present; Chief Compliance Officer, Rockbridge Capital LLC, 2016 to 2017; Partner/ Chief Compliance Officer North America Investments & Canada, Mercer Investments, Inc., 2015 to 2016; Vice President and Chief Compliance Officer, Fund Evaluation Group, LLC, 2011 to 2015. | NA | None |

Julie A. Roach Year of Birth: 1971 | Treasurer | Since October 2017 | Director-Fund Administration, Diamond Hill Capital Management, Inc., September 2017 to present; Assistant Treasurer - Head of Valuation Oversight, J.P. Morgan Asset Management, February 2012 to August 2017. | NA | None |

___________________________

1The mailing address of each Officer is c/o Diamond Hill Funds, 325 John H. McConnell Boulevard, Suite 200, Columbus, Ohio 43215.

Each of the Nominees who are incumbent trustees own shares of the Trust. The following table shows the dollar range of the shares beneficially owned by each Nominee as of December 31, 2018.

|

| | | | | | | | | |

| Name of Trustee or Nominee | Dollar Range of Equity Securities in the Trust.1,2 | Aggregate Dollar Range of Shares in All Registered Investment Companies Overseen or to be Overseen by Incumbent Trustee or Nominee in Family of Investment Companies |

| Diamond Hill Small Cap Fund | Diamond Hill Small-Mid Cap Fund | Diamond Hill Large Cap Fund | Diamond Hill All Cap Select Fund | Diamond Hill Long- Short Fund | Diamond Hill Research Opportunities Fund | Diamond Hill Financial Long-Short Fund | Diamond Hill Corporate Credit Fund |

| Tamara L. Fagely | None | None | None | Over $100,000 | None | Over $100,000 | None | None | Over $100,000 |

| John T. Kelly-Jones | None | None | None | None | None | None | None | None | None |

| Elizabeth P. Kessler | Over $100,000 | None | None | None | Over $100,000 | None | None | None | Over $100,000 |

| D’Ray Moore Rice | None | Over $100,000 | None | None | Over $100,000 | None | None | Over $100,000 | Over $100,000 |

| Nancy M. Morris | None | None | None | None | None | None | None | None | None |

| Peter E. Sundman | $50,001-$100,000 | $50,001-$100,000 | $50,001-$100,000 | $10,001-$50,000 | $50,001-$100,000 | None | $10,001-$50,000 | $50,001-$100,000 | Over $100,000 |

1 Ownership disclosure is made using the following ranges: None; $1 - $10,000; $10,001 - $50,000; $50,001 - $100,000 and over $100,000.

2 None of the Trustees owned shares of the Mid Cap Fund, Global Fund, Short Duration Total Return Fund, Core Bond Fund or High Yield Fund.

Trustee Compensation

The Trust has a policy requiring that all Trustee compensation, except for that required to meet any tax liability resulting from the receipt of Trustee compensation, must be reinvested in the Funds and remain invested for a Trustee’s entire term in office. The following table sets forth information regarding compensation of Trustees by the Trust for the fiscal year ended December 31, 2018.

|

| | | | |

| Name and Position | Aggregate Compensation from the Funds for Service to the Trust | Pension or Retirement Benefits Accrued as Part of Fund Expenses | Estimated Annual Benefits Upon Retirement | Total Compensation Paid to Trustees by the Funds for Service to Trust and Trust Complex |

| Tamara L. Fagely | $88,000 | None | None | $88,000 |

| Elizabeth P. Kessler | $84,000 | None | None | $84,000 |

| D’Ray Moore Rice | $96,000 | None | None | $96,000 |

| Peter E. Sundman | $86,000 | None | None | $86,000 |

Leadership Structure and Board of Trustees

The primary responsibility of the Board of Trustees is to represent the interests of the shareholders of the Trust and to provide oversight of the management of the Trust. All of the Trustees on the Board, including the Chairman, are independent of and not affiliated with the Adviser or its affiliates. The same Trustees serve all thirteen Funds and have delegated responsibility for day-to day-operations to various service providers whose activities they oversee. The Trustees also have engaged legal counsel (who is also legal counsel to the Trust) that is independent of the Adviser or its affiliates to advise them on matters relating to their responsibilities in connection with the Trust. Each Trustee is expected to attend all meetings of the Board. The Board met five times in the last fiscal year. The Trustees meet separately in an executive session on a quarterly basis and meet separately in executive session with the Funds’ Chief Compliance Officer quarterly. On an annual basis, the Board conducts a self-assessment and evaluates its structure. Consistent with the Trust’s governing principles, each Trustee is a significant owner with other shareholders (see table set forth above), which is designed to align their interests with those of shareholders. The Board has determined that the leadership and committee structure is appropriate for the Trust and allows the Board to effectively and efficiently evaluate issues that impact the Trust as a whole, as well as issues that are unique to each Fund.

Board Oversight of Risk

The Funds are subject to a number of risks, including investment, compliance, operational and financial risks, among others. Risk oversight forms part of the Board’s

general oversight of the Funds and is addressed as part of various Board and committee activities. Day-to-day risk management with respect to the Funds resides with the Adviser or other service providers, subject to supervision by the Adviser and the Trust’s administrator. The Board oversees efforts by management and service providers to manage the risk to which the Funds may be exposed. For example, the Board meets with portfolio managers and receives regular reports regarding investment risk. The Board meets with the Chief Compliance Officer and receives regular reports regarding compliance and regulatory risks. The Audit Committee meets with the Trust’s Treasurer and receives regular reports regarding Fund operations and risks related to the valuation, liquidity, and overall financial reporting of the Funds. From its review of these reports and discussions with management, the Board learns in detail about the material risks to which the Funds are exposed, enabling a dialogue about how management and service providers can mitigate those risks. Not all risks that may affect a Fund can be identified nor can controls be developed to eliminate or mitigate their occurrence or effects. It may not be practical or cost effective to eliminate or mitigate certain risks, the processes and controls employed to address certain risks may be limited in their effectiveness, and some risks are simply beyond the reasonable control of the Funds or the Adviser, its affiliates, or other service providers. Moreover, it is necessary to bear certain risks (such as investment-related risks) to achieve a Fund’s goals. As a result of the foregoing and other factors, a Fund’s ability to manage risk is subject to substantial limitations. The Trustees believe that their current oversight approach is an appropriate way to manage risks facing the Funds, whether investment, compliance, financial, or otherwise. The Trustees may, at any time in their discretion, change the manner in which they conduct risk oversight of the Funds.

Board Committees

The Board has two standing committees: an Audit Committee and a Nominating and Governance Committee. All Independent Trustees, that is, the entire Board, are members of these Committees.

The Audit Committee’s function is to oversee the Trust’s accounting and financial reporting policies and practices, its internal controls and, as appropriate, the internal controls of certain service providers; to oversee the quality and objectivity of the Trust’s financial statements and the independent audit thereof; and to act as a liaison between the Trust’s independent registered public accounting firm and the full Board of Trustees. The Audit Committee held two regularly scheduled meetings during the fiscal year ended December 31, 2018. The Board has designated Ms. Fagely an “Audit Committee financial expert.”

Pursuant to its charter, the Nominating and Governance Committee reviews the qualifications of potential Trustee candidates and makes recommendations to the full Board. The charter is available for review at www.diamond-hill.com. In the evaluation process, the Committee and the Board take into account a variety of factors, including senior-level business, management or regulatory experience; character and integrity; financial literacy or other professional or business experience relevant to an understanding of the Trust and its business and diversity of viewpoints, backgrounds, experiences and

other demographics. Age, gender, race and national origin are relevant, but not determining, factors considered by the Committee. The Nominating and Governance Committee also considers the current composition of the Board and the interplay of a candidate’s individual experiences, lifestyle, education, skills, economic circumstances, background and other qualities and attributes with those of the other Board members. The Trust accepts trustee nominations from shareholders as discussed in “Shareholder Proposals” in this Proxy Statement.

In addition to the duties listed above, the Nominating and Governance Committee also reviews committee assignments at least annually, periodically reviews Board governance procedures, periodically reviews trustee compensation, and reviews as necessary the responsibilities of any committees of the Board. The Nominating and Governance Committee held one regularly scheduled meeting during the fiscal year ended December 31, 2018.

The Board of Trustees of the Trust, including the Independent Trustees, unanimously recommends that shareholders of each Fund vote “FOR” the election of the Nominees to the Board of Trustees.

PROPOSALS 2-A and 2-B

AMENDMENTS TO FUNDAMENTAL INVESTMENT RESTRICTIONS

The Board, on behalf of the Trust, has approved the filing of an application (the “Application”) for an order (the “Order”) from the Securities and Exchange Commission (“SEC”) permitting the Funds to participate in an interfund lending facility (the “Interfund Lending Program”) under which the Funds may directly lend to and borrow money from each other for temporary purposes, provided that the loans are made in accordance with the terms and conditions set forth in the Order. Without the relief provided by the Order, certain provisions of the 1940 Act would prohibit the Funds from borrowing from and lending to each other under the Interfund Lending Program. The Application was filed on December 19, 2018, but the Funds will not participate in the Interfund Lending Program unless and until Proposals 2-A and 2-B are approved by shareholders.

Currently, the Funds may invest their daily cash balances in money market funds and other short-term investments with banks or other lenders, or they may borrow money from banks or other lenders for temporary purposes to satisfy redemption requests or for other temporary purposes. If the Order is granted, the Funds would be permitted to lend money directly to, and borrow money directly from, each other for temporary purposes (loans made under the Interfund Lending Program must be paid within seven days). Through the use of the Interfund Lending Program, the Funds intend to: (i) reduce the costs that would be incurred in borrowing from banks and other lenders; (ii) enhance their ability to earn higher interest rates on their otherwise uninvested cash balances that would be available from such short-term investments; and (iii) improve their liquidity.

The Funds are each subject to a number of “fundamental” investment restrictions under the 1940 Act. A fundamental investment restriction may be changed or eliminated only by the vote of a majority of the outstanding voting securities of the Funds which, under the 1940 Act, means the lesser of (1) 67% of the shares of each Fund present at a meeting if the holders of more than 50% of the outstanding shares of that Fund are present in person or by proxy, or (2) more than 50% of the outstanding shares of that Fund. Two of the Funds’ fundamental investment restrictions, which relate to each Fund’s abilities to make loans and borrow money, would prohibit the Funds’ from being able to participate in the Interfund Lending Program as contemplated in the Application, even if the Order were granted. Proposals 2-A and 2-B, therefore, are being proposed to modify those two fundamental investment restrictions so that the Funds may, if the Order is granted, directly lend to and borrow money from each other under the Interfund Lending Program.

The proposed amendments to the Funds’ fundamental investment restrictions will not affect any Fund’s investment goal or its current principal investment strategies. The Board and Diamond Hill Capital Management, Inc. anticipate that the proposed changes in the investment restrictions will not materially change the manner in which the Funds are currently managed and operated. Although the proposed amendments will permit the Funds to participate in the Interfund Lending Program, the Board and the

Adviser at this time do not anticipate that the changes, individually or in the aggregate, will result in a material change in the current level of investment risk associated with an investment in any Fund.

Shareholders in each Fund will vote separately on Proposals 2-A and 2-B. If Proposals 2-A and 2-B are approved by the shareholders of a Fund, the changes will be effective for that Fund as of the date that shareholders are notified. Notification will be made through either (i) a supplement to the prospectus and/or Statement of Additional Information (“SAI”) or (ii) revisions to such documents at the time of the annual update to the Fund’s registration statement. Neither the Board nor the Adviser know of any contest or dispute as to the actions to be taken under Proposals 2-A and 2-B. If shareholders of a Fund fail to approve either Proposal 2-A or 2-B, none of the changes contemplated by Proposals 2-A and 2-B will be effective for that Fund.

The Board of Trustees of the Trust, including the Independent Trustees, unanimously recommends that shareholders of each Fund vote “FOR” Proposals 2-A and 2-B.

PROPOSAL 2-A

TO AMEND EACH FUND’S FUNDAMENTAL INVESTMENT RESTRICTIONS WITH RESPECT TO BORROWING

The 1940 Act imposes certain limitations on the borrowing activities of investment companies and those limitations must be fundamental. Borrowing limitations are generally designed to protect shareholders and their investments by restricting an investment company’s ability to subject its assets to the claims of creditors that, under certain circumstances, might have a claim to the fund’s assets that would take precedence over the claims of shareholders upon redemption or liquidation.

Under the 1940 Act, an open-end investment company may borrow up to 33 1/3% of its total assets (including the amount borrowed) from banks and may borrow up to an additional 5% of its total assets for temporary purposes from any other person. Generally, a loan is considered temporary if it is repaid within 60 days. Funds typically borrow money to meet redemptions or for other short-term cash needs in order to avoid forced, unplanned sales of portfolio securities. This technique affords a fund greater flexibility by allowing its investment manager to buy and sell portfolio securities primarily for investment or tax considerations, rather than for cash flow considerations.

Each Fund’s shareholders are being asked to approve amendments to the Fund’s fundamental investment restriction regarding borrowing. The Funds’ current investment restrictions regarding borrowing are more restrictive than required by federal securities laws and prohibit certain borrowing activities that the securities laws would permit.

The Funds’ current fundamental investment restriction regarding borrowing is as follows:

A Fund will not borrow money, except (a) from a bank, provided that immediately after such borrowing there is an asset coverage of 300% for all borrowings of the Fund; or (b) from a bank or other persons for temporary purposes only, provided that such temporary borrowings are in an amount not exceeding 5% of the Fund’s total assets at the time when the borrowing is made. This limitation does not preclude a Fund from entering into reverse repurchase transactions, provided that the Fund has an asset coverage of 300% for all borrowing and repurchase commitments of the Fund pursuant to reverse repurchase transactions.

If the Order were granted as contemplated by the Application, a Fund would be permitted to borrow from another Fund on a temporary basis in amounts that exceed 5% of the borrowing Fund’s total assets, subject to certain limitations. In particular, it is anticipated that under the Interfund Lending Program:

(i) Unsecured interfund loans may be made as long as the total borrowing from all sources after the loan does not exceed 10% of the borrower’s total assets; and

(ii) Interfund loans in excess of that amount must be secured by a pledge of segregated collateral with a market value of at least 102% of the outstanding principal amount of the loan; and

(iii) A Fund may not borrow through the Interfund Lending Program if, after the loan, total borrowing from all sources would exceed 33 1/3% of the Fund’s total assets.

As currently written, each Fund’s fundamental policy regarding borrowing would prohibit the Fund from making loans to another Fund to the extent contemplated by the Application, even if the Order were granted. As a result, to permit each Fund to participate in the Interfund Lending Program as contemplated by the Application, it is being proposed that each Fund’s fundamental policy regarding borrowing be amended to read as follows:

A Fund will not borrow money, except (a) from a bank or from another Fund of the Trust, provided that immediately after such borrowing there is an asset coverage of 300% for all borrowings of the Fund; or (b) from a bank or other persons for temporary purposes only, provided that such temporary borrowings are in an amount not exceeding 5% of the Fund’s total assets at the time when the borrowing is made. This limitation does not preclude a Fund from entering into reverse repurchase transactions, provided that the Fund has an asset coverage of 300% for all borrowing and repurchase commitments of the Fund pursuant to reverse repurchase transactions.

In the event that asset coverage at any time falls below 300%, a Fund will within three business days, or longer if permitted by the SEC, reduce the amount of borrowing to the extent that the asset coverage of the amounts borrowed is at least 300%. To the extent that the Fund may invest in reverse repurchase agreements, it will segregate with its custodian liquid securities equal to the Fund’s potential obligation. These securities will be marked-to-market daily.

The proposed investment restriction is substantially the same as the Funds’ current restriction, except that it also permits borrowing under an interfund lending program in accordance with the terms and conditions of the Order. Those terms and conditions are anticipated to impose specific limitations on the duration, rates and amounts of loans made under the Interfund Lending Program that are designed to reduce the risk of borrowing and provide more favorable interest rates than would otherwise be available. Those terms and conditions are anticipated to provide for substantial administrative oversight by the Board, the Trust’s Chief Compliance Officer ("CCO"), the Funds’ independent public accounting firm, and the Adviser. Therefore, adoption of the proposed

investment restriction is not expected to introduce additional material risk to the Funds or to affect the ways the Funds are managed.

The Board carefully reviewed the potential benefits and costs to each Fund of borrowing under an Interfund Lending Program and concluded that having the ability to participate in the program would be in the best interests of each Fund’s shareholders. The Adviser and the Board believe that the amended fundamental investment restriction regarding borrowing, along with permission from the SEC to participate in an Interfund Lending Program, would benefit the Funds by providing an additional source of liquidity at a lower cost than they could obtain elsewhere and greater flexibility to respond to changing market conditions. The Board considered that borrowing Funds would incur transaction costs and would be exposed to leverage risk because their investment exposure could exceed their net assets. The Board noted, however, that terms and conditions in the Order minimize leverage risk by capping interfund loan amounts and imposing strict asset coverage requirements. In all cases, any borrowing by a Fund under the Interfund Lending Program would be consistent with the Fund’s investment objective, strategies, policies and restrictions.

The Board therefore determined that it is advisable and prudent for the Funds to have the capability to engage in interfund lending. At a Board meeting held on November 14, 2018, the Trustees unanimously approved the changes to the fundamental investment restriction regarding borrowing.

The Board of Trustees of the Trust, including the Independent Trustees, unanimously recommends that shareholders of each Fund vote “FOR” approval of Proposal 2-A.

PROPOSAL 2-B

TO AMEND EACH FUND’S FUNDAMENTAL INVESTMENT

RESTRICTION WITH RESPECT TO LENDING

Each Fund’s shareholders are being asked to approve amendments to the Fund’s fundamental investment restriction with respect to lending. The Funds’ current investment restrictions regarding lending are more restrictive than required by federal securities laws and prohibit certain lending activities that the securities laws would permit.

The Funds’ current fundamental investment restriction regarding lending is as follows:

A Fund may not make loans to other persons, except (a) by loaning portfolio securities, (b) by engaging in repurchase agreements, or (c) by purchasing nonpublicly offered debt securities. The Diamond Hill Short Duration Total Return Fund, Diamond Hill Core Bond Fund, Diamond Hill Corporate Credit Fund, and Diamond Hill High Yield Fund may also make loans by purchasing or holding debt instruments in accordance with their investment objective and policies. For purposes of this limitation, the term “loans” shall not include the purchase of a portion of an issue of publicly distributed bonds, debentures or other securities.

As currently written, each Fund’s fundamental policy regarding loans would prohibit the Fund from making loans to another Fund under the Interfund Lending Program, even if the Order was granted. As a result, to permit each Fund to participate in the Interfund Lending Program, it is being proposed that each Fund’s fundamental policy regarding loans be amended to read as follows:

A Fund will not lend any security or make any other loan if, as a result, more than 33 1/3% of its total assets would be lent to other parties, but this limitation does not apply to purchases of debt securities or to repurchase agreements, or to acquisitions of loans, loan participations or other forms of debt instruments.

The proposed investment restriction is substantially the same as the Funds’ current restriction, except that it also permits interfund lending in accordance with the terms and conditions of the Order. Those terms and conditions are anticipated to impose specific limitations on the duration, rates and amounts of loans made under the Interfund Lending Program that are designed to reduce the risk of making such loans and provide more favorable interest rates than would otherwise be available. Those terms and conditions are also anticipated to provide for substantial administrative oversight by the Board, the Trust’s CCO, the Funds’ independent public accounting firm, and the Funds’ investment adviser. Therefore, adoption of the proposed investment restriction is not expected to introduce additional material risk to the Funds or to affect the ways the Funds are managed.

The Adviser and the Board believe that the amended fundamental investment restriction regarding lending, along with permission from the SEC to participate in an interfund lending program, would benefit the Funds by providing opportunities to earn interest at a rate greater than what they otherwise could obtain by investing excess cash in various short-term instruments. In all cases, any lending by a Fund under an interfund lending program would be consistent with the Fund’s investment objective, strategies, policies and restrictions.

At a Board meeting held on November 14, 2018, the Board carefully reviewed the potential benefits and costs to each Fund of lending under an interfund lending program and concluded that having the ability to participate in the program would be in the best interests of each Fund’s shareholders. As discussed above, the Board noted that terms and conditions in the Order minimize leverage risk by capping interfund loan amounts and imposing strict asset coverage requirements. The Board therefore determined that it is advisable and prudent for the Funds to have the capability to engage in interfund lending. The Trustees unanimously approved the changes to the fundamental investment restriction regarding lending.

The Board of Trustees of the Trust, including the Independent Trustees, unanimously recommends that shareholders of each Fund vote “FOR” approval of Proposal 2-B.

PROPOSALS 3-A and 3-B

APPROVAL OF AMENDMENTS TO THE DECLARATION OF TRUST

Although federal law, and particularly the 1940 Act, regulates many aspects of the governance of a mutual fund, every fund is organized as a legal entity under state law. The Trust is organized as a business trust under Ohio law, which provides a legal framework for the general powers, duties, rights and obligations of the Trustees and shareholders of the Funds, but leaves the more specific powers, duties, rights and obligations to be determined by the Trustees as set forth in the Trust’s Declaration of Trust. The Declaration of Trust can be amended by a vote of a majority of the Board of Trustees, except the Board may not, without shareholder approval, (i) repeal the limitations on personal liability of any shareholder or Trustee, (ii) repeal the prohibition of assessment upon the shareholders, or (iii) amend the Declaration of Trust in such a way as to adversely affect the rights of any shareholder or violate applicable law, including the 1940 Act.

The Board is recommending that shareholders approve (i) an amendment of the Declaration of Trust to permit the Trustees to amend the Declaration of Trust without shareholder approval, subject to certain limitations, and (ii) a new Section 6.8 of the Declaration of Trust that would establish a process for shareholder derivative actions. The Declaration of Trust is silent regarding shareholder derivative actions.

The Board of Trustees of the Trust, including the Independent Trustees, unanimously recommends that shareholders of each Fund vote “FOR” Proposals 3-A and 3-B.

PROPOSAL 3-A

TO AMEND THE DECLARATION OF TRUST TO PERMIT FURTHER AMENDMENTS WITHOUT SHAREHOLDER APPROVAL

At a meeting held on November 14, 2018, the Board of Trustees approved, subject to shareholder approval, a proposed amendment to the Declaration of Trust that would permit the Board to make further amendments to the Declaration of Trust without seeking shareholder approval, with the following limitations. The Board may not, without shareholder approval, (i) repeal the limitations on personal liability of any shareholder or Trustee, (ii) repeal the prohibition of assessment upon the shareholders, or (iii) amend the Declaration of Trust in such a way as to limit the voting powers granted to shareholders in the Declaration of Trust.

You are being asked to approve the amendment. Allowing future amendments to the Declaration of Trust without shareholder approval gives the Trustees the authority to react quickly to future contingencies without the costs or delay associated with obtaining shareholder approval and without sacrificing any shareholder’s fundamental rights. The Board would still be required to submit a future amendment to a vote of a Fund's shareholders if such a vote were required by applicable law. In addition, the Board could determine at any time to submit a future amendment of the Declaration of Trust for a vote of the shareholders, even though not required by law or by the Declaration of Trust itself. Adoption of the amendment will not remove any of the protections afforded to you, as a shareholder, under federal law, including voting rights, or alter in any way the Trustees’ existing fiduciary obligations to act with due care and in your best interest.

The existing provision in the Declaration Trust and the proposed amended provision are set forth below.

Existing Declaration:

Section 7.3 Amendments. All rights granted to the Shareholders under this Declaration of Trust are granted subject to the reservation of the right to amend this Declaration of Trust as herein provided, except that no amendment shall repeal the limitations on personal liability of any Shareholder or Trustee or repeal the prohibition of assessment upon the Shareholders without the express consent of each Shareholder or Trustee involved. Subject to the foregoing, the provisions of this Declaration of Trust (whether or not related to the rights of Shareholders) may be amended at any time so long as such amendment does not adversely affect the rights of any Shareholder with respect to which such amendment is or purports to be applicable and so long as such amendment is not in contravention of applicable law, including the 1940 Act, by an instrument in writing signed by a majority of the then Trustees (or by an officer of the Trust pursuant to the vote of a majority of such Trustees). Except as provided in the first sentence of this Section 7, any amendment to this Declaration of Trust that

adversely affects the rights of Shareholders may be adopted at any time by an instrument signed in writing by a majority of the then Trustees (or by an officer of the Trust pursuant to the vote of a majority of such Trustees) when authorized to do so by the vote in accordance with subsection (e) of Section 4.2 of Shareholders holding a majority of the Shares entitled to vote; (a "Majority Shareholder Vote"); provided, however, than an amendment that shall affect the Shareholders of one or more Series (or of one or more Classes), but not the Shareholders of all outstanding Series (or Classes), shall be authorized by a Majority Shareholder Vote of each Series (or Class, as the case may be) affected, and no vote of a Series (or Class) not affected shall be required. Subject to the foregoing, any such amendment shall be effective as provided in the instrument containing the terms of such amendment or, if there is no provision therein with respect to effectiveness, upon the execution of such instrument and of a certificate (which may be a part of such instrument) executed by a Trustee or officer to the effect that such amendment has been duly adopted. Copies of the amendment to this Declaration of Trust shall be filed as specified in Section 7.4. A restated Declaration of Trust, integrating into a single instrument all of the provisions of the Declaration of Trust which are then in effect and operative, may be executed from time to time by a majority of the then Trustees (or by an officer of the Trust pursuant to the vote of a majority of such Trustees) and shall be effective upon filing as specified in Section 7.4.

Proposed Amendment:

Section 7.3 Amendments. All rights granted to the Shareholders under this Declaration of Trust are granted subject to the reservation of the right to amend this Declaration of Trust as herein provided, except that no amendment shall repeal the limitations on personal liability of any Shareholder or Trustee or repeal the prohibition of assessment upon the Shareholders without the express consent of each Shareholder or Trustee involved. Subject to the foregoing, the provisions of this Declaration of Trust (whether or not related to the rights of Shareholders) may be amended at any time by a vote of a majority of the Trustees then in office or by an instrument in writing signed by a majority of the then Trustees (or by an officer of the Trust pursuant to the vote of a majority of such Trustees), so long as such amendment is not in contravention of applicable law, including the 1940 Act, and does not limit the voting powers granted to Shareholders in Section 5.1. Any such amendment shall be effective as provided in the instrument containing the terms of such amendment or, if there is no provision therein with respect to effectiveness, upon the execution of such instrument and of a certificate (which may be a part of such instrument) executed by a Trustee or officer to the effect that such amendment has been duly adopted. Any proposed amendment to this Declaration of Trust to limit the voting rights of Shareholders may be adopted at any time by an instrument signed in writing by a majority of the then Trustees (or by an officer of the Trust pursuant to the vote of a majority of such Trustees) when authorized to do so by a vote of Shareholders in accordance with Section 4.2(e) and 5.4 of this Declaration of

Trust. Copies of the amendment to this Declaration of Trust shall be filed as specified in Section 7.4. A restated Declaration of Trust, integrating into a single instrument all of the provisions of the Declaration of Trust which are then in effect and operative, may be executed from time to time by a majority of the then Trustees (or by an officer of the Trust pursuant to the vote of a majority of such Trustees) and shall be effective upon filing as specified in Section 7.4.

The Board of Trustees of the Trust, including the Independent Trustees, unanimously recommends that shareholders of each Fund vote “FOR” Proposal 3-A.

PROPOSAL 3-B

TO APPROVE AN AMENDMENT TO THE DECLARATION OF TRUST

ESTABLISHING A PROCESS FOR SHAREHOLDER DERIVATIVE ACTIONS

At a meeting of the Board held on November 14, 2018, the Board approved an amendment, subject to shareholder approval, that is designed to provide more flexibility to the Board in governing the Trust. The amendment sets forth a detailed process for the bringing of derivative actions by shareholders in order to permit legitimate inquiries and claims while avoiding the time, expense, distraction and other harm that can be caused to the Funds or their shareholders as a result of spurious shareholder demands and derivative actions. The proposed changes are intended to save the time and expense of bringing a suit that the Trustees, in their judgment, do not believe would be in the best interests of the Trust and its shareholders. The effect of these provisions may be to discourage suits brought in the name of the Fund by shareholders.

Under the amendment, prior to bringing a derivative action, a demand by three unrelated shareholders representing at least 5% of the voting power of a Fund or class of a Fund must be made on the Trustees. The amendment details various information, certifications, undertakings and acknowledgements that must be included in the demand. Following receipt of the demand, the Board has 90 days, which may be extended by an additional 60 days, to consider the demand. If a majority of the Independent Trustees determine that maintaining the suit would not be in the best interests of the Trust or any Fund, the Board is required to reject the demand and the complaining shareholders may not proceed with the derivative action unless the shareholders are able to sustain the burden of proof to a court that the decision of the Board not to pursue the requested action was not a good faith exercise of their business judgment on behalf of the Trust and the Funds.

If a demand is rejected, the complaining shareholders will be responsible for the costs and expenses (including attorneys’ fees) incurred by the Trust or Fund in connection with the Trust’s consideration of the demand, if a court determines the demand was made without reasonable cause or for an improper purpose. If a derivative action is brought in violation of these procedures, the shareholders bringing the action may be responsible for the Trust’s costs, including attorneys’ fees.

The Declaration of Trust is silent about derivative actions. The Declaration of Trust, however, does provide that shareholders shall have the same rights as an Ohio business corporation to vote on whether a lawsuit or claim should be brought derivatively or as a class action on behalf of the Fund or the shareholders thereof.

A copy of proposed new Section 6.8 to the Declaration of Trust is below:

Section 6.8 Derivative Actions. The purpose of this Section 6.8 is to protect the interests of the Trust and its Shareholders by establishing a process that will permit legitimate inquiries and claims

to be made and considered while avoiding the time, expense, distraction and other harm that can be caused to the Trust and its Shareholders as a result of spurious shareholder demands and derivative actions.

(a) No Shareholder may bring a derivative or similar action or proceeding in the right of the Trust or any Series to recover a judgment in its favor (a “Derivative Action”) unless each of the following conditions is met:

| |

| (i) | Each complaining Shareholder was a Shareholder of (1) the Series on behalf of or in the right of which the Derivative Action is proposed to be brought and (2) a Class of the Series affected by the action or failure to act complained of, to the extent that fewer than all Classes were affected, at the time of the action or failure to act complained of, or acquired the Shares afterwards by operation of law from a person who was a Shareholder at that time; |

| |

| (ii) | Each complaining Shareholder was a Shareholder of the affected Series or Class at the time the demand required by subparagraph (iii) below was made; |

| |

| (iii) | Prior to the commencement of such Derivative Action, the complaining Shareholders have made a written demand on the Trustees requesting that the Trustees cause the Trust to file the action itself on behalf of the Affected Series or Class, which demand (A) shall be executed by or on behalf of no less than three complaining Shareholders who together hold not less than five percent (5%) of the outstanding Shares of the affected Series or Class, none of which shall be related to (by blood or by marriage) or otherwise affiliated with any other complaining Shareholder (other than as Shareholders of the Trust); and (B) shall include at least the following: |

| |

| (1) | a copy of the proposed derivative complaint, setting forth a detailed description of the action or failure to act complained of, the facts upon which each such allegation is made and the reasonably estimated damages or other relief sought; |

| |

| (2) | a statement to the effect that the complaining Shareholders believe in good faith that they |

will fairly and adequately represent the interests of similarly situated Shareholders in enforcing the rights of the affected Series or Class and an explanation of why the complaining Shareholders believe that to be the case;

| |

| (3) | a certification that the requirements of sub-paragraphs (i) and (ii) of this paragraph (a) have been met, as well as information and documentation reasonably designed to allow the Trustees to verify that certification; |

| |

| (4) | a certification of the number of Shares of the affected Series or Class owned beneficially or of record by each complaining Shareholder at the time set forth in clauses (i), (ii) and (iii) of this subsection (a) and an undertaking that each complaining Shareholder will be a Shareholder of the affected Series or Class as of the commencement of and throughout the derivative action and will notify the Trust in writing of any sale, transfer or other disposition by any of the complaining Shareholders of any such Shares within three business days thereof; and |

| |

| (5) | an acknowledgment of the provisions of paragraphs (d) and (e) of this Section 6.8 below; and |

| |

| (iv) | The derivative action has not been barred in accordance with paragraph (b)(i) below. |

(b) Within 90 calendar days of the receipt of a Shareholder demand submitted in accordance with the requirements above, those Trustees who are not deemed to be “interested persons” of the Trust as that term is defined in the 1940 Act (i.e., independent Trustees) will consider, with the assistance of counsel who may be retained by such Trustees on behalf and at the expense of the Trust, the merits of the claim and determine whether maintaining a suit would be in the best interests of the Trust. If, during this 90-day period, those independent Trustees conclude that a determination as to the maintenance of a suit cannot reasonably be made within the 90-day

period, those independent Trustees may extend the 90-day period by a period of time that the independent Trustees consider will be sufficient to permit them to make such a determination, not to exceed 60 calendar days from the end of the initial 90-day period (such 90-day period, as may be extended as provided hereunder, the “review period”). Notice of any such decision to extend the review period shall be sent to the complaining Shareholders, or, the Shareholders’ counsel if represented by counsel, in writing within five business days of any decision to extend the period. A Trustee otherwise independent for purposes of considering the demand shall not be considered not to be independent solely by virtue of (i) the fact that such Trustee receives remuneration for his service as a Trustee of the Trust or as a trustee or director of one or more investment companies with the same or an affiliated investment adviser or underwriter, (ii) the amount of such remuneration, (iii) the fact that such Trustee was identified in the demand as a potential defendant or witness, or (iv) the fact that the Trustee approved the act being challenged in the demand if the act resulted in no material personal benefit to the Trustee or, if the Trustee is also a Shareholder, no material personal benefit that is not shared pro rata with other Shareholders.

| |

| (i) | If the demand has been properly made under paragraph (a) of this Section 6.8, and a majority of the independent Trustees have considered the merits of the claim and have determined that maintaining a suit would not be in the best interests of the Trust, the demand shall be rejected and the complaining Shareholders shall not be permitted to maintain a derivative action unless they first sustain the burden of proof to the court that the decision of the Trustees not to pursue the requested action was not a good faith exercise of their business judgment on behalf of the Trust. If upon such consideration a majority of the independent Trustees determine that such a suit should be maintained, then the appropriate officers of the Trust shall either cause the Trust to commence that suit and such suit shall proceed directly rather than derivatively, or permit the complaining Shareholders to proceed derivatively, provided however that any counsel representing the interests of the Trust shall be approved by the Trustees. The Trustees, or the appropriate officers of the Trust, shall inform the complaining Shareholders of any decision reached under this sub-paragraph (i) by sending written notice to each complaining Shareholder, or the Shareholder’s counsel, if represented by counsel, |

within five business days of such decision having been reached.

| |

| (ii) | If notice of a decision has not been sent to the complaining Shareholders or the Shareholders’ counsel within the time permitted by sub-paragraph (i) above, and sub-paragraphs (i) through (iv) of paragraph (a) above have been complied with, the complaining Shareholders shall not be barred by this Declaration of Trust from commencing a derivative action. |

(c) A complaining Shareholder whose demand is rejected pursuant to paragraph (b)(i) above shall be responsible for the costs and expenses (including attorneys’ fees) incurred by the Trust in connection with the Trust’s consideration of the demand if a court determines that the demand was made without reasonable cause or for an improper purpose. A Shareholder who commences or maintains a derivative action in violation of this Section 6.8 shall reimburse the Trust for the costs and expenses (including attorneys’ fees) incurred by the Trust in connection with the action if the action is dismissed on the basis of the failure to comply with this Section 6.8. If a court determines that any derivative action has been brought without reasonable cause or for an improper purpose, the costs and expenses (including attorneys’ fees) incurred by the Trust in connection with the action shall be borne by the Shareholders who commenced the action.

(d) The Trust shall be responsible for payment of attorneys’ fees and legal expenses incurred by a complaining Shareholder in any circumstances only if required by law. Any attorneys’ fees so incurred by a complaining Shareholder that the Trust is obligated to pay on the basis of hourly rates shall be calculated using reasonable hourly rates.

(e) A Shareholder of a particular Series of the Trust shall not be entitled in such capacity to commence a derivative action on behalf of any other Series of the Trust.

The Board of Trustees of the Trust, including the independent Trustees, unanimously recommends that shareholders of each Fund vote “FOR” approval of Proposal 3-B.

PROPOSAL 4

TO APPROVE THE RECLASSIFICATION OF THE DIAMOND HILL ALL CAP SELECT FUND FROM A DIVERSIFIED FUND TO A NON-DIVERSIFIED FUND

The Adviser has recommended to the Board of Trustees that the Diamond Hill All Cap Select Fund be reclassified as a “non-diversified fund”. The 1940 Act requires that shareholders approve any reclassification of a fund from “diversified” to “non-diversified.”

The 1940 Act requires each investment company to recite in its registration statement its status as either a diversified or a non-diversified fund. If an investment company is diversified, Section 5(b)(1) of the 1940 Act provides that it may not purchase the securities of any one issuer if, at the time of purchase, more than 5% of its total assets would be invested in the securities of that issuer, or the fund would own or hold more than 10% of the outstanding voting securities of that issuer. These limitations apply to 75% of a diversified fund’s total assets; up to 25% of a fund’s total assets may be invested without regard to these restrictions. Securities issued or guaranteed as to principal or interest by the U.S. government or any of its agencies or instrumentalities, and securities of other investment companies are not subject to the 5% limitation. The Trust has declared the Diamond Hill All Cap Select Fund to be a diversified fund.

Any fund that does not qualify as a diversified fund is deemed to be non-diversified. While the 1940 Act does not limit the amount of investments a non-diversified fund may make in a single issuer, the Internal Revenue Service (IRS) has adopted limitations similar to those of the 1940 Act, although the IRS rules are applied to a smaller percentage of a fund’s assets. Under the IRS rules, no mutual fund, whether diversified or non-diversified, may invest more than 5% of its total assets in the securities of a single issuer, nor may a fund own or hold more than 10% of the outstanding voting securities of that issuer. These limitations apply to 50% of a fund’s total assets. Up to 25% of the value of a fund’s total assets may, under IRS rules, be invested in the securities of a single issuer, or of two or more companies controlled by the mutual fund and which are determined to be engaged in the same or similar trades or businesses or related trades or businesses.

Under normal market conditions, the Diamond Hill All Cap Select Fund invests its assets in 30 to 40 select U.S. equity securities that the Adviser believes are undervalued. Approval of the proposal will give the Adviser more flexibility in managing the Fund because a non-diversified fund may invest a greater percentage of its assets in the securities of a single issuer than a diversified fund, may invest in fewer securities at any one time than a diversified fund and can take a more focused approach to asset allocation. Thus, the Fund may have fewer holdings than a diversified fund. Additional advantages of non-diversification include:

| |

| • | Flexibility and Opportunity. The adviser to a non-diversified fund may limit the fund’s investments to a smaller number of good ideas, allowing the adviser to potentially avoid overvalued securities and concentrate on a few securities of companies the Adviser believes are undervalued. |

| |

| • | Focus. Non-diversification allows the adviser to focus resources, knowledge and experience on its best investment selections |

| |

| • | Enhanced Performance. Non-diversification has the potential to enhance a fund’s returns because the fund can invest a greater percentage of its assets in securities that the adviser believes will outperform the market, which can have a meaningful impact on the fund’s return. |

| |

| • | Avoidance of Problem Sectors. Because a non-diversified fund can limit its investments to a small number of companies and industry sectors, the fund can more easily avoid investing in underperforming sectors. |

The risk with non-diversification is that adverse news from just one or two companies in a particular industry can hurt the prices of all stocks in that industry. A decline in the value of those investments can cause a fund’s overall value to decline to a greater degree than if the fund held a more diversified portfolio. In addition, changes in the value of a single security may have a more significant effect, either negative or positive, on the fund’s net asset value ("NAV"). As a result, the NAV of a non-diversified fund generally is more volatile, and a shareholder may have a greater risk of loss if the shareholder redeems during a period of high volatility. Lack of broad diversification also may cause a non-diversified fund to be more susceptible to economic, political, regulatory, liquidity or other events than a diversified fund.

The Adviser attempts to address these risks by typically investing no more than 35% of the Fund’s assets in companies in single industry sector. In addition, while approval of the proposal will provide the Adviser with additional flexibility, the Fund’s principal investment strategy is not expected to change. The Fund will continue to invest in approximately 30 to 40 companies and will continue to be subject to the IRS limitations discussed above.

The Board of Trustees of the Trust, including the Independent Trustees, unanimously recommends that shareholders vote “FOR” Proposal 4.

OTHER INFORMATION

OPERATION OF THE FUNDS

Each Fund is a series of Diamond Hill Funds, an open-end investment management company organized as an Ohio business trust on January 14, 1997. The Trust’s principal executive offices are located at 325 John H. McConnell Boulevard, Suite 200, Columbus, OH 43215. The Board of Trustees supervises the business activities of the Funds. Like other mutual funds, the Trust retains various organizations to perform specialized services. The Trust currently retains Diamond Hill Capital Management, Inc., 325 John H. McConnell Boulevard, Suite 200, Columbus, OH 43215, as the Trust’s investment adviser, administrator and transfer agent. Ultimus Fund Solutions, Inc. (“Ultimus”), 225 Pictoria Drive, Suite 450, Cincinnati, OH 45246, provides sub-transfer agency and sub-fund accounting services, and State Street Bank & Trust Company, 200 Clarendon Street, Boston, MA 02116, is the Trust’s custodian. Foreside Financial Services, LLC, Three Canal Plaza, Suite 100, Portland, ME 04101, is the Trust’s principal underwriter.

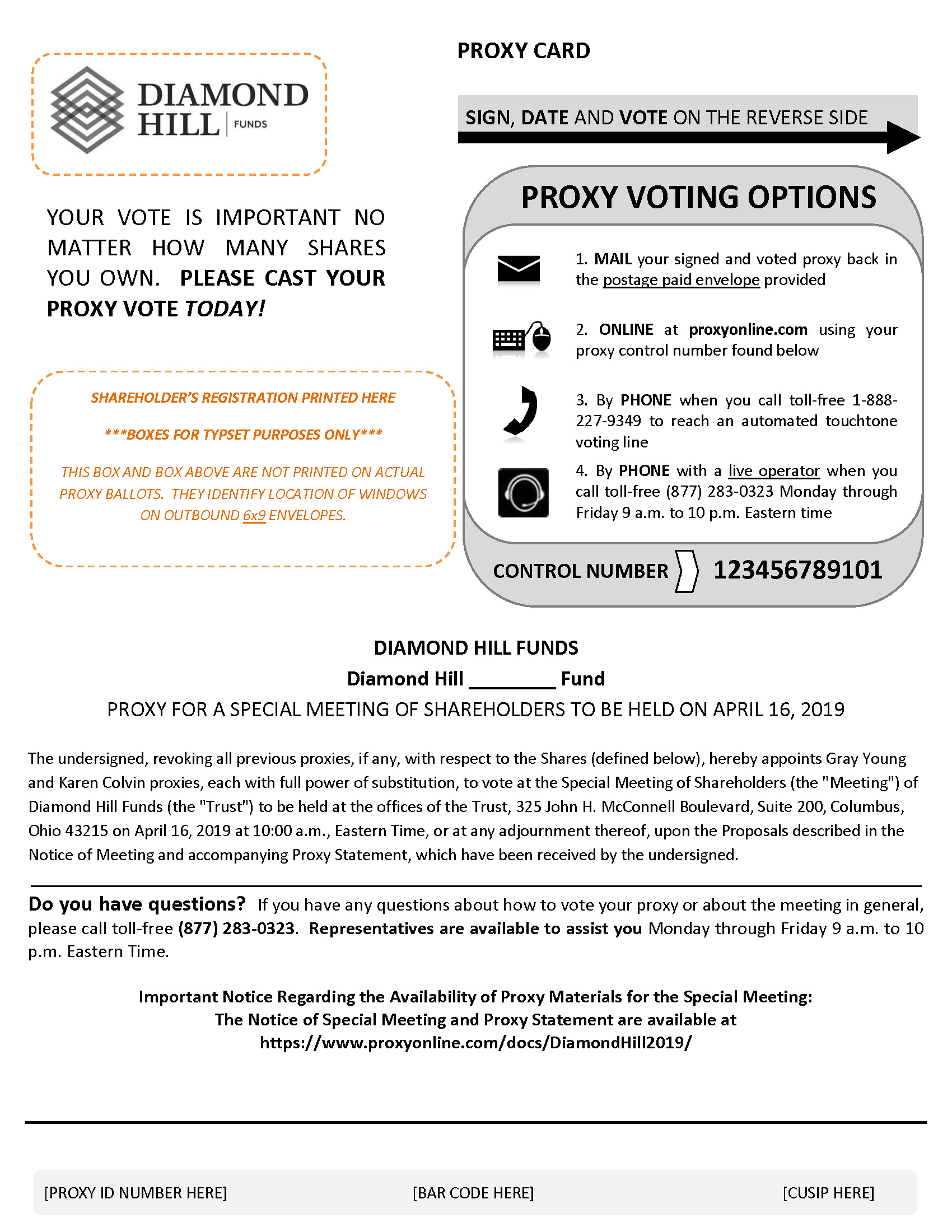

THE PROXY

The Board of Trustees is soliciting proxies so that each shareholder has the opportunity to vote on the proposals to be considered at the Meeting. A proxy card for voting your shares at the Meeting is enclosed. The shares represented by each valid proxy received in time will be voted at the Meeting as specified. If no specification is made, the shares represented by a duly executed proxy will be voted for the election of the Nominees, for the amendment to the fundamental investment restriction with respect to borrowing, for the amendment to the fundamental investment restriction with respect to lending, for the amendments to the Declaration of Trust, for the reclassification of the Diamond Hill All Cap Select Fund from a diversified fund to a non-diversified fund (if you are a shareholder of that Fund), and at the discretion of the holders of the proxy on any other matter that may come before the Meeting about which the Trust did not have notice of a reasonable time prior to the mailing of this Proxy Statement. You may revoke your proxy at any time before it is exercised by (1) submitting a duly executed proxy bearing a later date, (2) submitting a written notice to the Secretary of the Trust revoking the proxy, or (3) attending and voting in person at the Special Meeting.

VOTING SECURITIES AND VOTING

As of the Record Date, the following shares of beneficial interest of the Funds were issued and outstanding:

|

| | |

| Name of Fund | Shares Outstanding |

| Diamond Hill Small Cap Fund | 35,922,992 |

|

| Diamond Hill Small Mid Cap Fund | 106,969,902 |

|

| Diamond Hill Mid Cap Fund | 8,733,861 |

|

| Diamond Hill Large Cap Fund | 223,622,418 |

|

| Diamond Hill All Cap Select Fund | 15,413,491 |

|

| Diamond Hill Long-Short Fund | 154,444,023 |

|

| Diamond Hill Research Opportunities Fund | 2,732,808 |

|

| Diamond Hill Financial Long-Short Fund | 1,182,721 |

|

| Diamond Hill Global Fund | 1,262,684 |

|

| Diamond Hill Short Duration Total Return Fund | 58,453,872 |

|

| Diamond Hill Core Bond Fund | 5,684,861 |

|

| Diamond Hill Corporate Credit Fund | 70,698,181 |

|

| Diamond Hill High Yield Fund | 5,624,458 |

|

Only shareholders of record on the Record Date are entitled to vote at the Meeting. Each shareholder is entitled to one (1) vote per share held, and fractional votes for fractional shares held, on any matter submitted to a vote at the Meeting. A quorum of shareholders is required to take action at each Meeting. The quorum requirement for each Fund is one-third (1/3) of the outstanding shares of the Fund entitled to vote.

Approval of Proposal 1 requires the affirmative vote of a plurality of all votes at the Meeting. Under this plurality system, vacant Trustee positions are filled by the nominees who receive the largest number of votes, with no majority approval requirement, until all vacancies are filled.

Approval of Proposals 2-A and 2-B require the affirmative vote of a majority of the outstanding voting securities of each Fund. Shareholders in each Fund will vote. If Proposals 2-A and 2-B are approved by the shareholders of a Fund, the changes will be effective for that Fund as of the date that shareholders are notified that the changes will be made through either (i) a supplement to the prospectus and/or SAI or (ii) revisions to such documents at the time of the annual update to the Fund’s registration statement. If shareholders of any Fund fail to approve either of Proposal 2-A or 2-B, none of the changes contemplated by Proposals 2-A and 2-B will be effective for that Fund.

Approval of Proposals 3-A and 3-B require the affirmative vote of a majority of the shares entitled to vote at the Meeting.

Approval of Proposal 4 requires the affirmative vote of a majority of the outstanding voting securities of the Diamond Hill All Cap Select Fund.

The 1940 Act defines “majority of the outstanding voting securities” to mean the lesser of (i) of 67% or more of the voting securities (i.e., shares) present at the Meeting, if the holders of more than 50% of the outstanding voting securities of each Fund are present or represented by proxy; or (ii) of more than 50% of the outstanding voting securities of the Fund, whichever is less. This means that Proposals 2-A, 2-B and 4 may be approved by less than a majority of the outstanding shares of each Fund, provided a quorum is present at the Meeting.