UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08061

Diamond Hill Funds

(Exact name of registrant as specified in charter)

325 John H. McConnell Boulevard, Suite 200, Columbus, Ohio 43215

(Address of principal executive offices) (Zip code)

James F. Laird, Jr., 325 John H. McConnell Boulevard, Suite 200, Columbus, Ohio 43215

(Name and address of agent for service)

Registrant’s telephone number, including area code: 614-255-3333

Date of fiscal year end: December 31

Date of reporting period: June 30, 2014

| Item 1. | Reports to Stockholders. |

Semi-Annual Report

June 30, 2014

| | |

| Small Cap Fund | | Long-Short Fund |

| Small-Mid Cap Fund | | Research Opportunities Fund |

| Mid Cap Fund | | Financial Long-Short Fund |

| Large Cap Fund | | Strategic Income Fund |

| Select Fund | | |

This material must be preceded or accompanied by a current prospectus.

Not FDIC Insured. May Lose Value. No Bank Guarantee.

Table of Contents

Cautionary Statement: At Diamond Hill, we pledge that, “we will communicate with our clients about our investment performance in a manner that will allow them to properly assess whether we are deserving of their trust.” Our views and opinions regarding the investment prospects of our portfolio holdings and Funds are “forward looking statements” which may or may not be accurate over the long term. While we believe we have a reasonable basis for our opinions, actual results may differ materially from those we anticipate. Information provided in this report should not be considered a recommendation to purchase or sell any particular security.

You can identify forward looking statements by words like “believe,” “expect,” “anticipate,” or similar expressions when discussing prospects for particular portfolio holdings and/or one of the Funds. We cannot assure future results. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. We disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise.

This material is not authorized for distribution to prospective investors unless preceded or accompanied by a Prospectus. Investors should consider the investment objectives, risks, charges, and expenses of the Diamond Hill Funds carefully before investing. The prospectus or summary prospectus contain this and other important information about the Fund(s) and are available at diamond-hill.com or by calling 888.226.5595. Please read the prospectus or summary prospectus carefully before investing. The Diamond Hill Funds are distributed by BHIL Distributors, Inc. (Member FINRA), an affiliated company. Diamond Hill Capital Management, Inc., a registered investment adviser, serves as Investment Adviser to the Diamond Hill Funds and is paid a fee for its services. Diamond Hill Funds are not FDIC insured, may lose value, and have no bank guarantee.

Letter to Shareholders

Dear fellow shareholder:

We are pleased to provide this 2014 mid-year update for the Diamond Hill Funds. Since our firm’s inception, our primary goal has been to achieve the best value-added returns for our clients over rolling five-year periods. Our long-term focus is evident in our relatively low portfolio turnover, portfolio manager compensation that is directly tied to five-year investment results, and significant personal investment in our strategies. At Diamond Hill, our Code of Ethics prohibits employees from purchasing individual equity securities and third-party mutual funds that invest primarily in U.S. equity securities. As a result, substantially all employees’ equity investments are in Diamond Hill Funds. This is rare in our industry and clearly demonstrates our commitment to aligning our interests with those of our clients and our strong belief in our investment philosophy. You can be confident that our portfolio managers and analysts are spending their time managing your money – because it is also their own.

2014 Year-to-Date Market Review

U.S. equity markets rose during the first six months of 2014 with the Russell 1000 and Russell 2000 Indexes posting total returns of 7.27% and 3.19%, respectively. Equity markets were uneven during the first quarter of 2014, but the broad indexes managed to close higher as many of the big picture concerns weighing on the market faded. Europe, which had been a clear laggard over the past few years, continued to show signs of improvement, while most of Asia appeared to be growing at a healthy rate. In the U.S., some of the fiscal uncertainty was eliminated and employment showed signs of steady improvement, allowing the economy to continue its healing process.

U.S. stocks moved higher during the second quarter of 2014 as the primary factors supporting market valuations remained intact. The world’s major central banks remained extraordinarily accommodative, flooding the financial markets with money and providing a key tailwind for overall economic growth. The U.S. markets were also supported by the expectation that the U.S. economy, although still sluggish, will grow fast enough to support corporate profit growth. We continue to believe that the Federal Reserve is likely to maintain a very accommodative overall monetary policy well into 2015.

Sector Results

Year-to-date, the utilities sector was the best performing sector, followed by the energy and health care sectors. This represented a reversal from 2013 when the utilities sector was the worst performing sector. Higher usage rates due to the cold winter, as well as attractive dividend yields in a low interest rate environment, played a role in the outperformance. With interest rates remaining stubbornly low, investors have turned to equity securities that can provide a steady income stream through dividend payments, and utilities typically pay out bigger dividends relative to their share prices than most other sectors. However, we have tended to be underweight the utilities sector in most of our strategies over the past few

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | SEMI-ANNUAL REPORT | | | | | JUNE 30, 2014 | | | | | DIAMOND-HILL.COM | | | 1 | |

Letter to Shareholders

years. We believe utility company valuations in general are high given the limited growth opportunities within the highly regulated industry. We continue to have significant exposure to the financial sector across most of our strategies, finding value in insurance, insurance brokers, money center banks, and asset managers.

Market Outlook

We continue to be encouraged by the modest deleveraging of the U.S. household sector over the past five years. The slightly lower debt levels combined with very low interest rates has allowed consumer debt-service burdens to improve to relatively low levels by historical standards. Clearly this healthy debt service picture remains very much tied to historically low interest/mortgage rates, and any meaningful increase in those rates is likely to present an important headwind for growth.

Although the U.S. economy appears to be healing at a steady pace and looks poised to improve in the near term, we continue to expect positive but below average equity market returns over the next five years. Our conclusion is primarily based on the combination of above average price/earnings multiples applied to already very strong levels of corporate profit margins, which likely tempers prospective returns. We believe that we can achieve better than market returns over the next five years through active portfolio management and stock selection independent of benchmark weights.

| | |

| |  |

| |

Chris Bingaman, CFA Portfolio Manager, Co-Chief Investment Officer | | Chris Welch, CFA Portfolio Manager, Co-Chief Investment Officer |

The views expressed are those of the portfolio manager as of June 30, 2014, are subject to change, and may differ from the views of other portfolio managers or the firm as a whole. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice. All data referenced are from sources deemed to be reliable but cannot be guaranteed. Securities and sectors referenced should not be construed as a solicitation or recommendation or be used as the sole basis for any investment decision.

| | | | | | | | | | | | | | |

| 2 | | DIAMOND HILL FUNDS | | | | | SEMI-ANNUAL REPORT | | | | | JUNE 30, 2014 | | | | | DIAMOND-HILL.COM |

Our Mission

At Diamond Hill, we serve our clients by providing investment strategies that deliver lasting value through a shared commitment to our intrinsic value-based investment philosophy, long-term perspective, disciplined approach and alignment with our clients’ interests.

VALUE

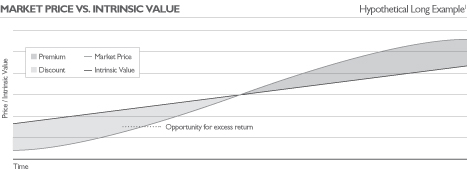

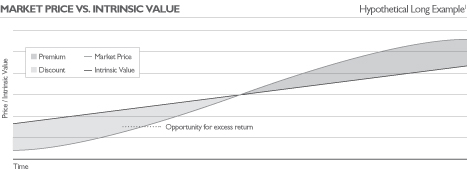

We believe market price and intrinsic value are independent in the short-term but tend to converge over time.

LONG-TERM

We maintain a long-term focus both in investment analysis and management of our business.

DISCIPLINE

We invest with discipline to increase potential return and protect capital.

PARTNERSHIP

We align our interests with those of our clients through significant personal investment in our strategies.

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | SEMI-ANNUAL REPORT | | | | | JUNE 30, 2014 | | | | | DIAMOND-HILL.COM | | | 3 | |

Fundamental Principles

The Importance of Valuation

We believe that a company’s intrinsic value is independent of its stock price and that intrinsic value can be reasonably estimated using a discounted cash flow methodology. Our entire investment team shares the same investment philosophy, which drives our investment process.

We focus on the fundamentals of intrinsic value, which are far less volatile than market price, and our actions are ultimately dictated by the price to intrinsic value relationship.

| | There is no guarantee that a discount to intrinsic value will be achieved or that market price and/or intrinsic value will increase over time. |

| 1 | The inverse is true for short position |

| | | | | | | | | | | | | | |

| 4 | | DIAMOND HILL FUNDS | | | | | SEMI-ANNUAL REPORT | | | | | JUNE 30, 2014 | | | | | DIAMOND-HILL.COM |

Fundamental Principles

Equity Investment Principles

Valuation

| Ÿ | | We believe that every share of stock has an intrinsic value that is independent of its current market price, and at any point in time, the market price may be higher or lower than intrinsic value. |

| Ÿ | | Over short periods of time, the market price is heavily influenced by the emotions of market participants, which are far more difficult to predict than intrinsic value. While market prices may experience extreme fluctuations on a particular day, we believe intrinsic value is far less volatile. |

| Ÿ | | Over sufficiently long periods of time, five years or longer, the stock market price tends to converge with intrinsic value. |

Intrinsic Value Estimate

| Ÿ | | We believe that we can determine a reasonable approximation of intrinsic value if we are confident in projecting the future cash flows of a business and use an appropriate discount rate. |

Suitable Investments

| Ÿ | | We only invest when the market price is lower than our conservative assessment of per share intrinsic value (or at a premium for short positions). |

| Ÿ | | We concentrate our investments in businesses whose per share intrinsic value is likely to increase. We invest in businesses that possess a competitive advantage, conservative balance sheet, and outstanding managers and employees. For short positions, the inverse is often true, and a growing intrinsic value is a detriment to the performance of the position. |

Risk & Return

| Ÿ | | We intend to achieve our return from both the closing of the gap between our purchase price and intrinsic value and the increase in per share intrinsic value. For short positions, an increasing intrinsic value may shorten the holding period. |

| Ÿ | | We define risk as the permanent loss of capital rather than price volatility. We manage risk by investing in companies selling at a discount (premium for short positions) to our estimate of intrinsic value. |

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | SEMI-ANNUAL REPORT | | | | | JUNE 30, 2014 | | | | | DIAMOND-HILL.COM | | | 5 | |

Fundamental Principles

Fixed Income Investment Principles

Business Analysis

| Ÿ | | We believe we can leverage our research team’s industry analysis of the fundamental economic drivers of the business to identify attractive corporate bonds and other senior corporate securities. |

| Ÿ | | We evaluate the quality of a firm’s management and their treatment of bondholders and stockholders. We believe managements that focus on growth, without regard to return on invested capital or long-term cost of capital, are more likely to destroy value for bondholders and stockholders. In contrast, managements that understand the competitive dynamics of their business and prudent capital allocation often produce value for both bondholders and stockholders. |

Valuation

| Ÿ | | We focus on the intrinsic value of the business in relation to the amount of debt in the capital structure. We also evaluate the sources and uses of cash for the business. |

| Ÿ | | The liquidity and expected volatility of a corporate bond are also important factors in valuation. Because of our long-term time horizon, we will invest in less liquid or more volatile securities; however, we require a higher yield as compensation. |

Suitable Investments

| Ÿ | | We generally invest in corporate bonds of companies with improving competitive positions and return on invested capital. |

| Ÿ | | Our core competency is the evaluation of credit risk. We typically favor lower duration, shorter maturity corporate bonds. We focus almost entirely on the secondary market for corporate bonds rather than the primary (new issue) market. We primarily invest in investment grade and below-investment grade (high yield) corporate bonds, including a significant allocation to defensive high yield corporate bonds (due to low duration and higher credit quality). |

Risk & Return

| Ÿ | | We define risk as the permanent loss of capital. We seek to avoid a permanent loss of capital and to earn a sufficient return on capital to grow our purchasing power. |

| Ÿ | | We expect to achieve our return objective by investing in corporate bonds when we believe the market price discounts a greater risk of default or a greater loss upon default than is warranted. An additional source of return exists when the market price provides attractive compensation for short-term illiquidity or volatility, both of which are of less concern to a long-term investor. |

| Ÿ | | We focus on credit risk, interest rate risk, liquidity risk, call risk, reinvestment risk and other risks when evaluating corporate bonds. |

| | | | | | | | | | | | | | |

| 6 | | DIAMOND HILL FUNDS | | | | | SEMI-ANNUAL REPORT | | | | | JUNE 30, 2014 | | | | | DIAMOND-HILL.COM |

Diamond Hill Small Cap Fund

Schedule of Investments

June 30, 2014 (Unaudited)

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Common Stocks — 81.6% | |

| Consumer Discretionary — 9.6% | |

Aaron’s, Inc.^ | | | 575,835 | | | $ | 20,522,759 | |

Callaway Golf Co.^ | | | 375,583 | | | | 3,124,851 | |

Carter’s, Inc.^ | | | 96,830 | | | | 6,674,492 | |

Global Sources Ltd.*^ | | | 749,948 | | | | 6,209,569 | |

Hillenbrand, Inc.^ | | | 372,900 | | | | 12,163,998 | |

Liquidity Services, Inc.*^ | | | 242,920 | | | | 3,828,419 | |

Live Nation Entertainment, Inc.* | | | 471,085 | | | | 11,631,089 | |

Steiner Leisure Ltd.*^ | | | 729,752 | | | | 31,590,965 | |

Tenneco, Inc.*^ | | | 368,580 | | | | 24,215,706 | |

Vail Resorts, Inc.^ | | | 198,385 | | | | 15,311,354 | |

| | | | | | | | 135,273,202 | |

|

| Consumer Staples — 4.1% | |

B&G Foods, Inc.^ | | | 623,325 | | | | 20,376,494 | |

Energizer Holdings, Inc.^ | | | 129,105 | | | | 15,754,683 | |

Flowers Foods, Inc.^ | | | 1,041,839 | | | | 21,961,967 | |

| | | | | | | | 58,093,144 | |

|

| Energy — 10.8% | |

Carrizo Oil & Gas, Inc.*^ | | | 235,411 | | | | 16,304,566 | |

Cimarex Energy Co.^ | | | 241,295 | | | | 34,616,181 | |

Contango Oil & Gas Co.*^ | | | 200,162 | | | | 8,468,854 | |

Denbury Resources, Inc.^ | | | 638,515 | | | | 11,786,987 | |

Rosetta Resources, Inc.*^ | | | 777,845 | | | | 42,664,798 | |

Southwestern Energy Co.* | | | 177,485 | | | | 8,073,793 | |

Whiting Petroleum Corp.* | | | 375,300 | | | | 30,117,825 | |

| | | | | | | | 152,033,004 | |

|

| Financials — 27.0% | |

Alleghany Corp.*^ | | | 36,757 | | | | 16,103,977 | |

American Equity Investment Life Holding Co.^ | | | 766,500 | | | | 18,855,900 | |

Assured Guaranty Ltd.^ | | | 379,152 | | | | 9,289,224 | |

Brown & Brown, Inc. | | | 742,790 | | | | 22,811,081 | |

Endurance Specialty Holdings Ltd. | | | 321,160 | | | | 16,568,644 | |

Enstar Group Ltd.*^ | | | 154,852 | | | | 23,340,842 | |

First Horizon National Corp.^ | | | 791,280 | | | | 9,384,581 | |

First Niagara Financial Group, Inc.^ | | | 648,415 | | | | 5,667,147 | |

First of Long Island Corp., The#^ | | | 159,419 | | | | 6,230,095 | |

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Financials — 27.0% continued | |

Fortress Investment Group LLC, Class A | | | 1,514,980 | | | $ | 11,271,451 | |

Greenlight Capital Re Ltd., Class A*^ | | | 580,240 | | | | 19,113,106 | |

HCC Insurance Holdings, Inc.^ | | | 727,735 | | | | 35,615,351 | |

Infinity Property & Casualty Corp.^ | | | 89,440 | | | | 6,013,051 | |

iStar Financial, Inc. REIT*^ | | | 2,559,945 | | | | 38,347,976 | |

Mid-America Apartment Communities, Inc. REIT^ | | | 224,204 | | | | 16,378,102 | |

National Penn Bancshares, Inc.^ | | | 856,140 | | | | 9,057,961 | |

Nationstar Mortgage Holdings, Inc.*^ | | | 199,105 | | | | 7,227,512 | |

Navigators Group, Inc.*^ | | | 550,828 | | | | 36,933,017 | |

Popular, Inc.*^ | | | 1,001,633 | | | | 34,235,816 | |

Reinsurance Group of America | | | 170,360 | | | | 13,441,404 | |

State Bank Financial Corp.^ | | | 208,585 | | | | 3,527,172 | |

Sterling Bancorp^ | | | 775,960 | | | | 9,311,520 | |

Winthrop Realty Trust REIT^ | | | 884,650 | | | | 13,579,378 | |

| | | | | | | | 382,304,308 | |

|

| Health Care — 5.9% | |

Alere, Inc.*^ | | | 762,615 | | | | 28,537,053 | |

Greatbatch, Inc.* | | | 374,260 | | | | 18,361,196 | |

LifePoint Hospitals, Inc.*^ | | | 75,750 | | | | 4,704,075 | |

Natus Medical, Inc.*^ | | | 847,635 | | | | 21,309,544 | |

Universal American Financial Corp.^ | | | 1,326,486 | | | | 11,049,628 | |

| | | | | | | | 83,961,496 | |

|

| Industrials — 16.9% | |

AAR Corp.^ | | | 343,967 | | | | 9,479,731 | |

Aircastle Ltd.^ | | | 620,323 | | | | 11,023,140 | |

Alaska Air Group, Inc.^ | | | 119,280 | | | | 11,337,564 | |

Avis Budget Group, Inc.*^ | | | 1,042,705 | | | | 62,239,060 | |

Brink’s Co., The^ | | | 364,190 | | | | 10,277,442 | |

Corrections Corp. of America^ | | | 641,908 | | | | 21,086,678 | |

Hub Group, Inc., Class A*^ | | | 478,215 | | | | 24,102,036 | |

Hyster-Yale Materials Handling, Inc.^ | | | 111,100 | | | | 9,836,794 | |

Kennametal, Inc.^ | | | 389,230 | | | | 18,013,564 | |

Toro Co., The | | | 188,380 | | | | 11,980,968 | |

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | SEMI-ANNUAL REPORT | | | | | JUNE 30, 2014 | | | | | DIAMOND-HILL.COM | | | 7 | |

Diamond Hill Small Cap Fund

Schedule of Investments (Continued)

June 30, 2014 (Unaudited)

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Common Stocks — 81.6% continued | |

| Industrials — 16.9% continued | |

TriMas Corp.*^ | | | 371,725 | | | $ | 14,173,874 | |

Trinity Industries, Inc.^ | | | 724,510 | | | | 31,675,578 | |

Xpo Logistics, Inc.*^ | | | 97,657 | | | | 2,794,943 | |

| | | | | | | | 238,021,372 | |

|

| Information Technology — 4.3% | |

Broadridge Financial | | | | | | | | |

Solutions, Inc. | | | 534,710 | | | | 22,265,324 | |

CSG Systems | | | | | | | | |

International, Inc.^ | | | 209,772 | | | | 5,477,147 | |

DST Systems, Inc. | | | 339,200 | | | | 31,264,064 | |

Rovi Corp.*^ | | | 85,985 | | | | 2,060,201 | |

| | | | | | | | 61,066,736 | |

|

| Utilities — 3.0% | |

Cleco Corp.^ | | | 205,390 | | | | 12,107,740 | |

ITC Holdings Corp.^ | | | 265,083 | | | | 9,670,228 | |

UGI Corp.^ | | | 402,620 | | | | 20,332,310 | |

| | | | | | | | 42,110,278 | |

| |

| Total Common Stocks | | | $ | 1,152,863,540 | |

|

| Registered Investment Companies — 28.3% | |

JPMorgan Prime Money Market Fund,

0.04%S | | | 2,914,297 | | | | 2,914,297 | |

State Street Institutional Liquid Reserves Fund, Premier Class, 0.06%S | | | 259,347,944 | | | | 259,347,944 | |

State Street Navigator Securities Lending Prime Portfolio, 0.14%†S | | | 137,192,511 | | | | 137,192,511 | |

| |

| Total Registered Investment Companies | | | $ | 399,454,752 | |

|

| Total Investment Securities — 109.9% | |

(Cost $1,151,207,707)** | | | $ | 1,552,318,292 | |

| |

Net Other Assets

(Liabilities) — (9.9)% | | | | (140,411,989 | ) |

| |

| Net Assets — 100.0% | | | $ | 1,411,906,303 | |

| ^ | All or a portion of the security is on loan. The total fair value of the securities on loan, as of June 30, 2014, was $134,534,587. |

| * | Non-income producing security. |

| † | This security, which was purchased using cash collateral received from securities on loan, represents collateral for securities loaned as of June 30, 2014. |

| S | Rate represents the daily yield on June 30, 2014. |

| ** | Represents cost for financial reporting purposes. |

| # | This security has been deemed illiquid: |

| | | | | | | | | | | | | | | | |

| | | Acquisition

Date | | | Current

Cost | | | Fair

Value | | | Value

as a

% of

Net

Assets | |

First of Long Island Corp., The | |

| February-13

through

April-13 |

| | $ | 4,767,707 | | | $ | 6,230,095 | | | | 0.4% | |

REIT – Real Estate Investment Trust

See accompanying Notes to Financial Statements

| | | | | | | | | | | | | | |

| 8 | | DIAMOND HILL FUNDS | | | | | SEMI-ANNUAL REPORT | | | | | JUNE 30, 2014 | | | | | DIAMOND-HILL.COM |

Diamond Hill Small-Mid Cap Fund

Schedule of Investments

June 30, 2014 (Unaudited)

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Common Stocks — 91.8% | |

| Consumer Discretionary — 10.3% | |

Aaron’s, Inc. | | | 146,305 | | | $ | 5,214,310 | |

Gannett Co., Inc.^ | | | 263,180 | | | | 8,240,166 | |

Jarden Corp.* | | | 168,130 | | | | 9,978,516 | |

Staples, Inc.^ | | | 876,175 | | | | 9,497,737 | |

Steiner Leisure Ltd.* | | | 223,275 | | | | 9,665,575 | |

Whirlpool Corp. | | | 49,565 | | | | 6,900,439 | |

| | | | | | | | 49,496,743 | |

|

| Consumer Staples — 12.4% | |

B&G Foods, Inc. | | | 306,968 | | | | 10,034,784 | |

ConAgra Foods, Inc. | | | 180,505 | | | | 5,357,388 | |

Coty, Inc.^ | | | 219,850 | | | | 3,766,031 | |

Energizer Holdings, Inc. | | | 75,895 | | | | 9,261,467 | |

Flowers Foods, Inc. | | | 557,273 | | | | 11,747,314 | |

Molson Coors Brewing | | | | | | | | |

Co., Class B | | | 145,600 | | | | 10,797,696 | |

Post Holdings, Inc.*^ | | | 171,172 | | | | 8,714,367 | |

| | | | | | | | 59,679,047 | |

|

| Energy — 9.5% | |

Cimarex Energy Co. | | | 128,435 | | | | 18,425,285 | |

Contango Oil & Gas Co.* | | | 56,084 | | | | 2,372,914 | |

Denbury Resources, Inc.^ | | | 138,653 | | | | 2,559,534 | |

Energen Corp. | | | 89,258 | | | | 7,933,251 | |

Noble Energy, Inc.^ | | | 71,750 | | | | 5,557,755 | |

Whiting Petroleum Corp.* | | | 109,110 | | | | 8,756,078 | |

| | | | | | | | 45,604,817 | |

|

| Financials — 29.0% | |

American Equity | | | | | | | | |

Investment Life | | | | | | | | |

Holding Co. | | | 273,460 | | | | 6,727,116 | |

Brown & Brown, Inc. | | | 418,185 | | | | 12,842,461 | |

Endurance Specialty Holdings Ltd. | | | 186,565 | | | | 9,624,888 | |

Enstar Group Ltd.* | | | 16,615 | | | | 2,504,379 | |

First Horizon National Corp. | | | 370,345 | | | | 4,392,292 | |

First Niagara Financial Group, Inc. | | | 631,340 | | | | 5,517,912 | |

First Republic Bank^ | | | 147,515 | | | | 8,111,850 | |

Greenlight Capital Re Ltd., Class A* | | | 191,715 | | | | 6,315,092 | |

HCC Insurance Holdings, Inc. | | | 152,520 | | | | 7,464,329 | |

Infinity Property & Casualty Corp. | | | 41,680 | | | | 2,802,146 | |

iStar Financial, Inc. REIT* | | | 624,065 | | | | 9,348,493 | |

Mid-America Apartment Communities, Inc. REIT | | | 87,955 | | | | 6,425,113 | |

National Penn Bancshares, Inc. | | | 410,310 | | | | 4,341,080 | |

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Financials — 29.0% continued | |

Nationstar Mortgage Holdings, Inc.*^ | | | 102,450 | | | $ | 3,718,935 | |

Navigators Group, Inc.* | | | 76,790 | | | | 5,148,770 | |

Popular, Inc.* | | | 261,392 | | | | 8,934,378 | |

Reinsurance Group of America | | | 85,025 | | | | 6,708,473 | |

Willis Group Holdings plc^ | | | 542,495 | | | | 23,490,033 | |

XL Group plc^ | | | 150,560 | | | | 4,927,829 | |

| | | | | | | | 139,345,569 | |

|

| Health Care — 10.7% | |

Boston Scientific Corp.*^ | | | 1,098,660 | | | | 14,029,888 | |

CareFusion Corp.* | | | 108,755 | | | | 4,823,284 | |

Catamaran Corp.* | | | 176,565 | | | | 7,797,110 | |

LifePoint Hospitals, Inc.* | | | 135,530 | | | | 8,416,413 | |

Orthofix International NV*^ | | | 211,922 | | | | 7,682,173 | |

Quest Diagnostics, Inc.^ | | | 55,250 | | | | 3,242,623 | |

Universal American Financial Corp. | | | 665,670 | | | | 5,545,031 | |

| | | | | | | | 51,536,522 | |

|

| Industrials — 11.5% | |

Aircastle Ltd. | | | 125,570 | | | | 2,231,379 | |

Brink’s Co., The | | | 142,015 | | | | 4,007,663 | |

Corrections Corp. of America | | | 193,411 | | | | 6,353,552 | |

Dover Corp. | | | 139,953 | | | | 12,728,725 | |

Hub Group, Inc., Class A* | | | 318,495 | | | | 16,052,148 | |

Kennametal, Inc. | | | 145,380 | | | | 6,728,186 | |

Knowles Corp.*^ | | | 67,051 | | | | 2,061,148 | |

Parker Hannifin Corp.^ | | | 21,700 | | | | 2,728,341 | |

Southwest Airlines Co.^ | | | 87,865 | | | | 2,360,054 | |

| | | | | | | | 55,251,196 | |

|

| Information Technology — 5.5% | |

Broadridge Financial Solutions, Inc. | | | 111,040 | | | | 4,623,706 | |

Juniper Networks, Inc.*^ | | | 448,100 | | | | 10,996,374 | |

Linear Technology Corp.^ | | | 69,975 | | | | 3,293,723 | |

Vantiv, Inc., Class A* | | | 231,245 | | | | 7,774,457 | |

| | | | | | | | 26,688,260 | |

|

| Utilities — 2.9% | |

Cleco Corp. | | | 33,005 | | | | 1,945,645 | |

ITC Holdings Corp. | | | 114,420 | | | | 4,174,041 | |

UGI Corp. | | | 152,660 | | | | 7,709,330 | |

| | | | | | | | 13,829,016 | |

| |

| Total Common Stocks | | | $ | 441,431,170 | |

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | SEMI-ANNUAL REPORT | | | | | JUNE 30, 2014 | | | | | DIAMOND-HILL.COM | | | 9 | |

Diamond Hill Small-Mid Cap Fund

Schedule of Investments (Continued)

June 30, 2014 (Unaudited)

Diamond Hill Mid Cap Fund

Schedule of Investments

June 30, 2014 (Unaudited)

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Registered Investment Companies — 15.5% | |

JPMorgan Prime Money Market Fund,

0.04%S | | | 111,379 | | | $ | 111,379 | |

State Street Institutional Liquid Reserves Fund, Premier Class,

0.06%S | | | 38,287,762 | | | | 38,287,762 | |

State Street Navigator Securities Lending Prime Portfolio, 0.14%†S | | | 36,431,533 | | | | 36,431,533 | |

| |

| Total Registered Investment Companies | | | $ | 74,830,674 | |

|

| Total Investment Securities — 107.3% | |

(Cost $444,666,447)** | | | $ | 516,261,844 | |

| |

Net Other Assets

(Liabilities) — (7.3)% | | | | (35,293,616 | ) |

| |

| Net Assets — 100.0% | | | $ | 480,968,228 | |

| ^ | All or a portion of the security is on loan. The total fair value of the securities on loan, as of June 30, 2014, was $35,899,859. |

| * | Non-income producing security. |

| † | This security, which was purchased using cash collateral received from securities on loan, represents collateral for securities loaned as of June 30, 2014. |

| S | Rate represents the daily yield on June 30, 2014. |

| ** | Represents cost for financial reporting purposes. |

REIT – Real Estate Investment Trust

See accompanying Notes to Financial Statements

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Common Stocks — 93.9% | |

| Consumer Discretionary — 10.8% | |

Aaron’s, Inc. | | | 3,594 | | | $ | 128,090 | |

Dollar General Corp.* | | | 1,908 | | | | 109,443 | |

Gannett Co., Inc. | | | 6,800 | | | | 212,908 | |

Jarden Corp.* | | | 4,377 | | | | 259,775 | |

Mattel, Inc.^ | | | 3,247 | | | | 126,536 | |

Ross Stores, Inc. | | | 1,835 | | | | 121,349 | |

Staples, Inc. | | | 17,765 | | | | 192,572 | |

Whirlpool Corp. | | | 1,706 | | | | 237,509 | |

| | | | | | | | 1,388,182 | |

|

| Consumer Staples — 13.6% | |

B&G Foods, Inc. | | | 7,970 | | | | 260,539 | |

ConAgra Foods, Inc. | | | 4,855 | | | | 144,096 | |

Coty, Inc. | | | 6,005 | | | | 102,866 | |

Energizer Holdings, Inc. | | | 2,000 | | | | 244,060 | |

Flowers Foods, Inc. | | | 15,526 | �� | | | 327,288 | |

Molson Coors Brewing Co., | | | | | | | | |

Class B | | | 4,092 | | | | 303,463 | |

Post Holdings, Inc.* | | | 3,709 | | | | 188,825 | |

Sysco Corp.^ | | | 4,735 | | | | 177,326 | |

| | | | | | | | 1,748,463 | |

| | |

| Energy — 10.8% | | | | | | | | |

Cimarex Energy Co. | | | 3,733 | | | | 535,537 | |

Energen Corp. | | | 2,435 | | | | 216,423 | |

Noble Energy, Inc. | | | 4,551 | | | | 352,520 | |

Southwestern Energy Co.* | | | 1,313 | | | | 59,728 | |

Whiting Petroleum Corp.* | | | 2,789 | | | | 223,817 | |

| | | | | | | | 1,388,025 | |

| | |

| Financials — 29.2% | | | | | | | | |

Alleghany Corp.* | | | 218 | | | | 95,510 | |

American Equity Investment | | | | | | | | |

Life Holding Co. | | | 7,228 | | | | 177,809 | |

Brown & Brown, Inc. | | | 11,370 | | | | 349,173 | |

Endurance Specialty Holdings Ltd. | | | 5,880 | | | | 303,349 | |

Enstar Group Ltd.* | | | 845 | | | | 127,367 | |

First Horizon National Corp. | | | 9,455 | | | | 112,136 | |

First Niagara Financial Group, Inc. | | | 18,938 | | | | 165,518 | |

First Republic Bank | | | 3,295 | | | | 181,192 | |

HCC Insurance Holdings, Inc. | | | 4,985 | | | | 243,966 | |

KeyCorp^ | | | 4,286 | | | | 61,418 | |

Mid-America Apartment | | | | | | | | |

Communities, Inc. REIT | | | 3,311 | | | | 241,869 | |

National Penn Bancshares, Inc. | | | 12,683 | | | | 134,186 | |

Nationstar Mortgage Holdings, Inc.* | | | 3,521 | | | | 127,812 | |

| | | | | | | | | | | | | | |

| 10 | | DIAMOND HILL FUNDS | | | | | SEMI-ANNUAL REPORT | | | | | JUNE 30, 2014 | | | | | DIAMOND-HILL.COM |

Diamond Hill Mid Cap Fund

Schedule of Investments (Continued)

June 30, 2014 (Unaudited)

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Common Stocks — 93.9% continued | |

| Financials — 29.2% continued | |

Popular, Inc.* | | | 7,001 | | | $ | 239,295 | |

Progressive Corp. | | | 4,217 | | | | 106,943 | |

Reinsurance Group of America | | | 2,314 | | | | 182,575 | |

SunTrust Banks, Inc.^ | | | 2,342 | | | | 93,821 | |

Willis Group Holdings plc | | | 14,657 | | | | 634,648 | |

XL Group plc | | | 5,411 | | | | 177,102 | |

| | | | | | | | 3,755,689 | |

|

| Health Care — 9.1% | |

Boston Scientific Corp.* | | | 38,478 | | | | 491,364 | |

CareFusion Corp.* | | | 3,671 | | | | 162,809 | |

Catamaran Corp.* | | | 4,680 | | | | 206,669 | |

LifePoint Hospitals, Inc.* | | | 3,525 | | | | 218,902 | |

Quest Diagnostics, Inc.^ | | | 1,561 | | | | 91,615 | |

| | | | | | | | 1,171,359 | |

|

| Industrials — 11.6% | |

Brink’s Co., The | | | 3,364 | | | | 94,932 | |

Corrections Corp. of America | | | 6,272 | | | | 206,035 | |

Dover Corp. | | | 4,455 | | | | 405,183 | |

Hub Group, Inc., Class A* | | | 7,315 | | | | 368,676 | |

Kennametal, Inc. | | | 4,001 | | | | 185,166 | |

Knowles Corp.*^ | | | 2,082 | | | | 64,001 | |

Parker Hannifin Corp. | | | 1,336 | | | | 167,975 | |

| | | | | | | | 1,491,968 | |

|

| Information Technology — 5.7% | |

Broadridge Financial Solutions, Inc. | | | 2,530 | | | | 105,349 | |

Juniper Networks, Inc.* | | | 12,141 | | | | 297,940 | |

Linear Technology Corp. | | | 2,525 | | | | 118,852 | |

Vantiv, Inc., Class A* | | | 6,180 | | | | 207,772 | |

| | | | | | | | 729,913 | |

|

| Utilities — 3.1% | |

Cleco Corp. | | | 1,123 | | | | 66,201 | |

ITC Holdings Corp. | | | 3,304 | | | | 120,530 | |

UGI Corp. | | | 4,163 | | | | 210,231 | |

| | | | | | | | 396,962 | |

| | |

| Total Common Stocks | | | | | | $ | 12,070,561 | |

|

| Registered Investment Companies — 11.6% | |

JPMorgan Prime Money Market Fund,

0.04%S | | | 2,939 | | | $ | 2,939 | |

State Street Institutional Liquid Reserves Fund, Premier Class,

0.06%S | | | 963,366 | | | | 963,366 | |

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Registered Investment Companies — 11.6% continued | |

State Street Navigator Securities Lending Prime Portfolio,

0.14%†S | | | 536,486 | | | $ | 536,486 | |

| | |

| Total Registered Investment Companies | | | | | | $ | 1,502,791 | |

|

| Total Investment Securities — 105.5% | |

(Cost $12,931,924)** | | | $ | 13,573,352 | |

| | |

Net Other Assets

(Liabilities) — (5.5)% | | | | | | | (711,762 | ) |

| |

| Net Assets — 100.0% | | | $ | 12,861,590 | |

| ^ | All or a portion of the security is on loan. The total fair value of the securities on loan, as of June 30, 2014, was $521,275. |

| * | Non-income producing security. |

| † | This security, which was purchased using cash collateral received from securities on loan, represents collateral for securities loaned as of June 30, 2014. |

| S | Rate represents the daily yield on June 30, 2014. |

| ** | Represents cost for financial reporting purposes. |

REIT – Real Estate Investment Trust

See accompanying Notes to Financial Statements

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | SEMI-ANNUAL REPORT | | | | | JUNE 30, 2014 | | | | | DIAMOND-HILL.COM | | | 11 | |

Diamond Hill Large Cap Fund

Schedule of Investments

June 30, 2014 (Unaudited)

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Common Stocks — 97.9% | |

| Consumer Discretionary — 12.9% | |

Comcast Corp., Class A^ | | | 1,141,410 | | | $ | 61,270,889 | |

Gannett Co., Inc. | | | 1,309,405 | | | | 40,997,471 | |

McDonald’s Corp. | | | 504,849 | | | | 50,858,488 | |

TJX Cos., Inc., The | | | 951,175 | | | | 50,554,951 | |

Twenty-First Century Fox, Inc. | | | 692,570 | | | | 23,706,671 | |

VF Corp. | | | 943,840 | | | | 59,461,920 | |

Walt Disney Co., The^ | | | 703,965 | | | | 60,357,959 | |

Whirlpool Corp. | | | 275,790 | | | | 38,395,484 | |

| | | | | | | | 385,603,833 | |

|

| Consumer Staples — 11.9% | |

General Mills, Inc.^ | | | 788,973 | | | | 41,452,641 | |

Kimberly-Clark Corp. | | | 531,165 | | | | 59,076,171 | |

PepsiCo, Inc. | | | 825,755 | | | | 73,772,952 | |

Philip Morris International | | | 489,810 | | | | 41,295,881 | |

Procter & Gamble Co., The | | | 1,227,137 | | | | 96,440,697 | |

Sysco Corp.^ | | | 1,166,084 | | | | 43,669,846 | |

| | | | | | | | 355,708,188 | |

|

| Energy — 11.8% | |

Cimarex Energy Co. | | | 453,330 | | | | 65,034,722 | |

Devon Energy Corp. | | | 1,229,407 | | | | 97,614,915 | |

EOG Resources, Inc. | | | 729,456 | | | | 85,244,228 | |

Noble Energy, Inc.^ | | | 417,610 | | | | 32,348,071 | |

Occidental Petroleum Corp. | | | 703,270 | | | | 72,176,600 | |

| | | | | | | | 352,418,536 | |

|

| Financials — 25.5% | |

American International | | | | | | | | |

Group, Inc. | | | 1,667,820 | | | | 91,029,615 | |

Citigroup, Inc. | | | 1,885,585 | | | | 88,811,054 | |

Franklin Resources, Inc.^ | | | 794,720 | | | | 45,966,605 | |

JPMorgan Chase & Co. | | | 1,551,768 | | | | 89,412,871 | |

Marsh & McLennan Cos., Inc.^ | | | 1,172,545 | | | | 60,761,282 | |

MetLife, Inc. | | | 692,175 | | | | 38,457,243 | |

Morgan Stanley | | | 2,904,745 | | | | 93,910,406 | |

PNC Financial Services | | | | | | | | |

Group, Inc. | | | 751,215 | | | | 66,895,696 | |

Progressive Corp. | | | 2,335,635 | | | | 59,231,704 | |

Prudential Financial, Inc. | | | 840,989 | | | | 74,654,593 | |

Wells Fargo & Co. | | | 1,104,990 | | | | 58,078,274 | |

| | | | | | | | 767,209,343 | |

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Health Care — 13.1% | |

Abbott Laboratories | | | 2,036,802 | | | $ | 83,305,202 | |

Baxter International, Inc. | | | 505,262 | | | | 36,530,443 | |

Boston Scientific Corp.* | | | 4,563,720 | | | | 58,278,704 | |

Express Scripts Holding Co.*^ | | | 667,810 | | | | 46,299,267 | |

Medtronic, Inc.^ | | | 1,342,682 | | | | 85,609,404 | |

Pfizer, Inc. | | | 2,744,392 | | | | 81,453,555 | |

| | | | | | | | 391,476,575 | |

|

| Industrials — 10.9% | |

3M Co.^ | | | 400,707 | | | | 57,397,271 | |

Dover Corp. | | | 653,038 | | | | 59,393,807 | |

Illinois Tool Works, Inc.^ | | | 551,579 | | | | 48,296,257 | |

Parker Hannifin Corp.^ | | | 450,899 | | | | 56,691,531 | |

United Technologies Corp. | | | 897,612 | | | | 103,629,305 | |

| | | | | | | | 325,408,171 | |

|

| Information Technology — 10.8% | |

Apple Computer, Inc. | | | 525,952 | | | | 48,876,719 | |

Cisco Systems, Inc. | | | 2,094,143 | | | | 52,039,454 | |

International Business | | | | | | | | |

Machines Corp.^ | | | 281,610 | | | | 51,047,444 | |

Juniper Networks, Inc.* | | | 1,234,445 | | | | 30,293,280 | |

Linear Technology Corp.^ | | | 597,800 | | | | 28,138,446 | |

Microsoft Corp. | | | 1,760,385 | | | | 73,408,055 | |

Vantiv, Inc., Class A*^ | | | 1,192,680 | | | | 40,097,902 | |

| | | | | | | | 323,901,300 | |

|

| Materials — 1.0% | |

Air Products & | | | | | | | | |

Chemicals, Inc.^ | | | 119,155 | | | | 15,325,716 | |

Praxair, Inc. | | | 121,245 | | | | 16,106,186 | |

| | | | | | | | 31,431,902 | |

| |

| Total Common Stocks | | | $ | 2,933,157,848 | |

|

| Registered Investment Companies — 7.9% | |

JPMorgan Prime Money Market Fund,

0.04%S | | | 1,033,868 | | | | 1,033,868 | |

State Street Institutional Liquid Reserves Fund, Premier Class,

0.06%S | | | 94,571,726 | | | | 94,571,726 | |

| | | | | | | | | | | | | | |

| 12 | | DIAMOND HILL FUNDS | | | | | SEMI-ANNUAL REPORT | | | | | JUNE 30, 2014 | | | | | DIAMOND-HILL.COM |

Diamond Hill Large Cap Fund

Schedule of Investments (Continued)

June 30, 2014 (Unaudited)

Diamond Hill Select Fund

Schedule of Investments

June 30, 2014 (Unaudited)

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Common Stocks — 97.9% continued | |

| Registered Investment Companies — 7.9% continued | |

State Street Navigator Securities Lending Prime Portfolio,

0.14%†S | | | 142,804,377 | | | $ | 142,804,377 | |

| |

| Total Registered Investment Companies | | | $ | 238,409,971 | |

|

Total Investment Securities — 105.8% | |

(Cost $2,344,693,084)** | | | $ | 3,171,567,819 | |

| |

Net Other Assets

(Liabilities) — (5.8)% | | | | (175,103,213 | ) |

| |

| Net Assets — 100.0% | | | $ | 2,996,464,606 | |

| ^ | All or a portion of the security is on loan. The total fair value of the securities on loan, as of June 30, 2014, was $139,362,595. |

| * | Non-income producing security. |

| † | This security, which was purchased using cash collateral received from securities on loan, represents collateral for securities loaned as of June 30, 2014. |

| S | Rate represents the daily yield on June 30, 2014. |

| ** | Represents cost for financial reporting purposes. |

See accompanying Notes to Financial Statements

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Common Stocks — 94.6% | |

| Consumer Discretionary — 13.3% | |

Jarden Corp.* | | | 35,548 | | | $ | 2,109,774 | |

TJX Cos., Inc., The | | | 21,665 | | | | 1,151,495 | |

Twenty-First Century Fox, Inc. | | | 49,307 | | | | 1,687,779 | |

VF Corp. | | | 26,935 | | | | 1,696,905 | |

Whirlpool Corp. | | | 16,947 | | | | 2,359,361 | |

| | | | | | | | 9,005,314 | |

|

| Consumer Staples — 5.3% | |

PepsiCo, Inc. | | | 20,583 | | | | 1,838,885 | |

Philip Morris International | | | 20,683 | | | | 1,743,784 | |

| | | | | | | | 3,582,669 | |

|

| Energy — 6.5% | |

Cimarex Energy Co. | | | 20,361 | | | | 2,920,989 | |

EOG Resources, Inc. | | | 12,510 | | | | 1,461,919 | |

| | | | | | | | 4,382,908 | |

|

| Financials — 27.5% | |

American International | | | | | | | | |

Group, Inc. | | | 37,064 | | | | 2,022,953 | |

Brown & Brown, Inc. | | | 54,380 | | | | 1,670,010 | |

Citigroup, Inc. | | | 24,137 | | | | 1,136,853 | |

Endurance Specialty Holdings Ltd. | | | 34,424 | | | | 1,775,934 | |

Franklin Resources, Inc.^ | | | 31,989 | | | | 1,850,244 | |

iStar Financial, Inc. REIT* | | | 108,803 | | | | 1,629,869 | |

MetLife, Inc. | | | 25,528 | | | | 1,418,336 | |

Navigators Group, Inc.* | | | 24,307 | | | | 1,629,784 | |

Popular, Inc.* | | | 59,937 | | | | 2,048,646 | |

Willis Group Holdings plc | | | 78,552 | | | | 3,401,302 | |

| | | | | | | | 18,583,931 | |

|

| Health Care — 15.6% | |

Boston Scientific Corp.* | | | 203,263 | | | | 2,595,669 | |

GlaxoSmithKline plc^ | | | 29,282 | | | | 1,566,001 | |

Pfizer, Inc.^ | | | 64,287 | | | | 1,908,038 | |

Teva Pharmaceutical Industries Ltd., SP ADR^ | | | 39,185 | | | | 2,054,078 | |

Valeant Pharmaceuticals | | | | | | | | |

International, Inc.* | | | 19,613 | | | | 2,473,591 | |

| | | | | | | | 10,597,377 | |

|

| Industrials — 9.8% | |

Dover Corp. | | | 13,062 | | | | 1,187,989 | |

Hub Group, Inc., Class A* | | | 43,825 | | | | 2,208,780 | |

Parker Hannifin Corp. | | | 7,804 | | | | 981,197 | |

United Technologies Corp.^ | | | 19,388 | | | | 2,238,344 | |

| | | | | | | | 6,616,310 | |

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | SEMI-ANNUAL REPORT | | | | | JUNE 30, 2014 | | | | | DIAMOND-HILL.COM | | | 13 | |

Diamond Hill Select Fund

Schedule of Investments (Continued)

June 30, 2014 (Unaudited)

Diamond Hill Long-Short Fund

Schedule of Investments

June 30, 2014 (Unaudited)

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Common Stocks — 94.6% continued | |

| Information Technology — 16.6% | |

Apple Computer, Inc.^ | | | 19,936 | | | $ | 1,852,652 | |

Cisco Systems, Inc. | | | 99,726 | | | | 2,478,191 | |

International Business | | | | | | | | |

Machines Corp.^ | | | 16,414 | | | | 2,975,366 | |

Juniper Networks, Inc.* | | | 65,421 | | | | 1,605,431 | |

Microsoft Corp. | | | 56,531 | | | | 2,357,343 | |

| | | | | | | | 11,268,983 | |

| |

| Total Common Stocks | | | $ | 64,037,492 | |

|

| Registered Investment Companies — 21.2% | |

JPMorgan Prime Money Market Fund,

0.04%S | | | 31,458 | | | | 31,458 | |

State Street Institutional Liquid Reserves Fund, Premier Class,

0.06%S | | | 3,175,000 | | | | 3,175,000 | |

State Street Navigator Securities Lending Prime Portfolio,

0.14%†S | | | 11,186,369 | | | | 11,186,369 | |

| |

| Total Registered Investment Companies | | | $ | 14,392,827 | |

|

| Total Investment Securities — 115.8% | |

(Cost $65,377,330)** | | | | | | $ | 78,430,319 | |

| |

Net Other Assets

(Liabilities) — (15.8%) | | | | (10,715,110 | ) |

| |

| Net Assets — 100.0% | | | $ | 67,715,209 | |

| * | Non-income producing security. |

| ^ | All or a portion of the security is on loan. The total fair value of the securities on loan, as of June 30, 2014, was $10,906,495. |

| * | Non-income producing security. |

| † | This security, which was purchased using cash collateral received from securities on loan, represents collateral for securities loaned as of June 30, 2014. |

| S | Rate represents the daily yield on June 30, 2014. |

| ** | Represents cost for financial reporting purposes. |

ADR – American Depositary Receipt

REIT – Real Estate Investment Trust

See accompanying Notes to Financial Statements

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Common Stocks — 80.4% | |

| Consumer Discretionary — 10.6% | |

Comcast Corp., Class A | | | 1,003,725 | | | $ | 53,879,958 | |

Gannett Co., Inc. | | | 1,398,655 | | | | 43,791,888 | |

Jarden Corp.*^ | | | 653,180 | | | | 38,766,233 | |

TJX Cos., Inc., The^ | | | 856,785 | | | | 45,538,122 | |

Twenty-First Century Fox, Inc. | | | 822,194 | | | | 28,143,701 | |

VF Corp.^ | | | 1,084,320 | | | | 68,312,160 | |

Walt Disney Co., The | | | 810,326 | | | | 69,477,352 | |

Whirlpool Corp. | | | 236,260 | | | | 32,892,117 | |

| | | | | | | | 380,801,531 | |

|

| Consumer Staples — 8.2% | |

General Mills, Inc.^ | | | 666,227 | | | | 35,003,567 | |

Kimberly-Clark Corp. | | | 610,210 | | | | 67,867,556 | |

PepsiCo, Inc. | | | 678,940 | | | | 60,656,500 | |

Procter & Gamble Co., The^ | | | 1,028,375 | | | | 80,819,991 | |

Sysco Corp.^ | | | 1,295,577 | | | | 48,519,358 | |

| | | | | | | | 292,866,972 | |

|

| Energy — 10.7% | |

Cimarex Energy Co. | | | 631,914 | | | | 90,654,382 | |

Devon Energy Corp. | | | 1,166,370 | | | | 92,609,778 | |

EOG Resources, Inc. | | | 995,522 | | | | 116,336,702 | |

Noble Energy, Inc. | | | 365,259 | | | | 28,292,962 | |

Occidental Petroleum Corp. | | | 528,608 | | | | 54,251,039 | |

| | | | | | | | 382,144,863 | |

|

| Financials — 23.1% | |

American International Group, Inc.^ | | | 1,886,355 | | | | 102,957,257 | |

Brown & Brown, Inc. | | | 1,754,420 | | | | 53,878,238 | |

Citigroup, Inc. | | | 1,876,569 | | | | 88,386,400 | |

Franklin Resources, Inc.^ | | | 1,357,850 | | | | 78,538,044 | |

JPMorgan Chase & Co.^ | | | 1,469,890 | | | | 84,695,062 | |

MetLife, Inc.^ | | | 798,475 | | | | 44,363,271 | |

Morgan Stanley^ | | | 1,531,170 | | | | 49,502,726 | |

PNC Financial Services Group, Inc.^ | | | 394,845 | | | | 35,160,947 | |

Popular, Inc.* | | | 2,725,517 | | | | 93,158,170 | |

Progressive Corp. | | | 1,222,760 | | | | 31,009,194 | |

Prudential Financial, Inc.^ | | | 496,853 | | | | 44,105,641 | |

Wells Fargo & Co.^ | | | 681,060 | | | | 35,796,514 | |

Willis Group Holdings plc^ | | | 1,990,690 | | | | 86,196,877 | |

| | | | | | | | 827,748,341 | |

| | | | | | | | | | | | | | |

| 14 | | DIAMOND HILL FUNDS | | | | | SEMI-ANNUAL REPORT | | | | | JUNE 30, 2014 | | | | | DIAMOND-HILL.COM |

Diamond Hill Long-Short Fund

Schedule of Investments (Continued)

June 30, 2014 (Unaudited)

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Common Stocks — 80.4% continued | |

| Health Care — 9.2% | |

Abbott Laboratories | | | 1,858,130 | | | $ | 75,997,517 | |

Baxter International, Inc.^ | | | 505,971 | | | | 36,581,703 | |

Boston Scientific Corp.* | | | 6,147,073 | | | | 78,498,123 | |

Medtronic, Inc.^ | | | 1,069,182 | | | | 68,171,044 | |

Pfizer, Inc.^ | | | 2,416,690 | | | | 71,727,359 | |

| | | | | | | | 330,975,746 | |

|

| Industrials — 8.9% | |

3M Co.^ | | | 395,140 | | | | 56,599,854 | |

Dover Corp. | | | 680,835 | | | | 61,921,943 | |

Illinois Tool Works, Inc.^ | | | 591,915 | | | | 51,828,077 | |

Parker Hannifin Corp. | | | 497,560 | | | | 62,558,219 | |

United Technologies Corp.^ | | | 741,835 | | | | 85,644,851 | |

| | | | | | | | 318,552,944 | |

|

| Information Technology — 9.7% | |

Apple Computer, Inc. | | | 721,826 | | | | 67,079,290 | |

Cisco Systems, Inc. | | | 2,478,925 | | | | 61,601,286 | |

International Business Machines Corp.^ | | | 360,255 | | | | 65,303,423 | |

Juniper Networks, Inc.* | | | 1,827,355 | | | | 44,843,292 | |

Microsoft Corp. | | | 1,411,309 | | | | 58,851,585 | |

Vantiv, Inc., Class A* | | | 1,527,580 | | | | 51,357,239 | |

| | | | | | | | 349,036,115 | |

| |

| Total Common Stocks | | | $ | 2,882,126,512 | |

|

| Registered Investment Companies — 21.0% | |

JPMorgan Prime Money Market Fund,

0.04%S | | | 20,907,419 | | | | 20,907,419 | |

State Street Institutional Liquid Reserves Fund, Premier Class, 0.06%S | | | 551,181,615 | | | | 551,181,615 | |

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Registered Investment Companies — 21.0% continued | |

State Street Navigator Securities Lending Prime Portfolio, 0.14%†S | | | 181,537,422 | | | $ | 181,537,422 | |

| |

| Total Registered Investment Companies | | | $ | 753,626,456 | |

|

| Total Investment Securities — 101.4% | |

Cost ($2,730,015,952)** | | | $ | 3,635,752,968 | |

| |

| Segregated Cash With Brokers — 21.1% | | | | 757,058,380 | |

|

| Securities Sold Short — (18.7)% | |

(Proceeds $534,429,779) | | | | (671,931,567 | ) |

| |

Net Other Assets

(Liabilities) — (3.8)% | | | | (136,866,019 | ) |

| |

| Net Assets — 100.0% | | | $ | 3,584,013,762 | |

| ^ | All or a portion of the security is on loan. The total fair value of the securities on loan, as of June 30, 2014, was $ 176,696,893. |

| * | Non-income producing security. |

| † | This security, which was purchased using cash collateral received from securities on loan, represents collateral for securities loaned as of June 30, 2014. |

| S | Rate represents the daily yield on June 30, 2014. |

| ** | Represents cost for financial reporting purposes. |

See accompanying Notes to Financial Statements

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | SEMI-ANNUAL REPORT | | | | | JUNE 30, 2014 | | | | | DIAMOND-HILL.COM | | | 15 | |

Diamond Hill Long-Short Fund

Schedule of Investments Sold Short

June 30, 2014 (Unaudited)

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Common Stocks — 18.7% | |

| Consumer Discretionary — 7.1% | |

Brunswick Corp. | | | 1,643,465 | | | $ | 69,239,180 | |

Gap, Inc., The | | | 810,465 | | | | 33,691,030 | |

Grand Canyon Education, Inc.* | | | 405,595 | | | | 18,645,202 | |

Life Time Fitness, Inc.* | | | 754,799 | | | | 36,788,903 | |

Macy’s, Inc. | | | 917,305 | | | | 53,222,036 | |

Sonic Corp.* | | | 424,345 | | | | 9,369,538 | |

Sotheby’s Holdings, Inc. | | | 341,050 | | | | 14,320,690 | |

Tractor Supply Co. | | | 334,043 | | | | 20,176,197 | |

| | | | | | | | 255,452,776 | |

|

| Consumer Staples — 1.9% | |

Campbell Soup Co. | | | 361,820 | | | | 16,574,974 | |

Colgate-Palmolive Co. | | | 502,860 | | | | 34,284,995 | |

Kellogg Co. | | | 252,630 | | | | 16,597,791 | |

| | | | | | | | 67,457,760 | |

|

| Financials — 2.6% | |

BancorpSouth, Inc. | | | 732,265 | | | | 17,991,751 | |

Cincinnati Financial Corp. | | | 609,315 | | | | 29,271,493 | |

First American Financial Corp. | | | 526,735 | | | | 14,637,966 | |

Hanover Insurance Group, Inc. | | | 249,050 | | | | 15,727,508 | |

Moody’s Corp. | | | 114,325 | | | | 10,021,730 | |

Rouse Properties, Inc. | | | 476,925 | | | | 8,160,187 | |

| | | | | | | | 95,810,635 | |

|

| Health Care — 1.4% | |

Bristol-Myers Squibb Co. | | | 577,590 | | | | 28,018,891 | |

Healthcare Services Group | | | 418,510 | | | | 12,320,934 | |

Intuitive Surgical, Inc.* | | | 23,185 | | | | 9,547,583 | |

| | | | | | | | 49,887,408 | |

|

| Industrials — 3.1% | |

Boeing Co., The | | | 666,090 | | | | 84,746,630 | |

Kansas City Southern Industries, Inc. | | | 155,700 | | | | 16,739,307 | |

Navistar International Corp.* | | | 236,580 | | | | 8,867,018 | |

| | | | | | | | 110,352,955 | |

|

| Information Technology — 1.2% | |

Advent Software, Inc. | | | 847,115 | | | | 27,590,536 | |

Ubiquiti Networks, Inc.* | | | 394,095 | | | | 17,809,153 | |

| | | | | | | | 45,399,689 | |

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Materials — 0.5% | |

Intrepid Potash, Inc.* | | | 968,840 | | | $ | 16,237,758 | |

|

| Telecommunication Services — 0.9% | |

AT&T, Inc. | | | 598,235 | | | | 21,153,589 | |

Level 3 Communications, Inc.* | | | 231,815 | | | | 10,178,997 | |

| | | | | | | | 31,332,586 | |

|

| Total Securities Sold Short — 18.7% | |

(Proceeds $534,429,779) | | | $ | 671,931,567 | |

| * | Non-dividend expense producing security. |

Percentages disclosed are based on total net assets of the Fund at June 30, 2014.

See accompanying Notes to Financial Statements

| | | | | | | | | | | | | | |

| 16 | | DIAMOND HILL FUNDS | | | | | SEMI-ANNUAL REPORT | | | | | JUNE 30, 2014 | | | | | DIAMOND-HILL.COM |

Diamond Hill Research Opportunities Fund

Schedule of Investments

June 30, 2014 (Unaudited)

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Common Stocks — 80.9% | |

| Consumer Discretionary — 12.4% | |

Aaron’s, Inc. | | | 9,274 | | | $ | 330,525 | |

Comcast Corp., Class A | | | 6,625 | | | | 355,630 | |

Dollar General Corp.* | | | 8,045 | | | | 461,461 | |

Dolphin Capital Investors Ltd. GB* | | | 900,000 | | | | 564,584 | |

Gannett Co., Inc. | | | 14,240 | | | | 445,854 | |

Groupon, Inc.*^ | | | 51,025 | | | | 337,786 | |

Jarden Corp.* | | | 15,200 | | | | 902,120 | |

LVMH Moet Hennessy Louis Vuitton SA FR | | | 2,300 | | | | 443,798 | |

Ross Stores, Inc.^ | | | 4,670 | | | | 308,827 | |

Staples, Inc.^ | | | 43,230 | | | | 468,614 | |

Steiner Leisure Ltd.* | | | 15,531 | | | | 672,337 | |

TJX Cos., Inc., The^ | | | 8,056 | | | | 428,176 | |

Twenty-First Century Fox, Inc. | | | 13,095 | | | | 448,242 | |

Vail Resorts, Inc. | | | 10,300 | | | | 794,954 | |

VF Corp.^ | | | 15,200 | | | | 957,600 | |

Whirlpool Corp. | | | 8,000 | | | | 1,113,760 | |

| | | | | | | | 9,034,268 | |

|

| Consumer Staples — 5.8% | |

B&G Foods, Inc. | | | 45,165 | | | | 1,476,443 | |

Coty, Inc. | | | 35,500 | | | | 608,115 | |

Philip Morris International | | | 5,000 | | | | 421,550 | |

Post Holdings, Inc.* | | | 26,298 | | | | 1,338,831 | |

Tesco plc | | | 31,635 | | | | 463,453 | |

| | | | | | | | 4,308,392 | |

|

| Energy — 2.8% | |

Cimarex Energy Co. | | | 10,250 | | | | 1,470,465 | |

Whiting Petroleum Corp.* | | | 6,750 | | | | 541,688 | |

| | | | | | | | 2,012,153 | |

|

| Financials — 21.0% | |

American International Group, Inc.^ | | | 18,910 | | | | 1,032,108 | |

Ashmore Group plc | | | 95,005 | | | | 599,776 | |

Brown & Brown, Inc. | | | 35,350 | | | | 1,085,599 | |

Endurance Specialty Holdings Ltd. | | | 13,930 | | | | 718,649 | |

Fortress Investment Group LLC, Class A | | | 173,786 | | | | 1,292,968 | |

Franklin Resources, Inc.^ | | | 13,945 | | | | 806,579 | |

iStar Financial, Inc. REIT* | | | 92,700 | | | | 1,388,646 | |

MetLife, Inc. | | | 8,655 | | | | 480,872 | |

Nationstar Mortgage Holdings, Inc.* | | | 14,000 | | | | 508,200 | |

Navigators Group, Inc.* | | | 26,435 | | | | 1,772,466 | |

Popular, Inc.* | | | 62,955 | | | | 2,151,802 | |

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Financials — 21.0% continued | |

Scor SA | | | 7,930 | | | $ | 273,035 | |

Willis Group Holdings plc | | | 57,005 | | | | 2,468,317 | |

Winthrop Realty Trust REIT | | | 42,500 | | | | 652,375 | |

| | | | | | | | 15,231,392 | |

|

| Health Care — 14.7% | |

Alere, Inc.* | | | 35,467 | | | | 1,327,175 | |

Boston Scientific Corp.* | | | 119,999 | | | | 1,532,386 | |

Catamaran Corp.* | | | 18,825 | | | | 831,311 | |

Express Scripts Holding Co.*^ | | | 11,400 | | | | 790,362 | |

GlaxoSmithKline plc^ | | | 14,902 | | | | 796,959 | |

Ipsen SA | | | 10,975 | | | | 496,096 | |

LifePoint Hospitals, Inc.* | | | 8,130 | | | | 504,873 | |

Natus Medical, Inc.* | | | 30,000 | | | | 754,200 | |

Orthofix International NV* | | | 18,032 | | | | 653,660 | |

Teva Pharmaceutical Industries Ltd., SP ADR^ | | | 8,600 | | | | 450,812 | |

UnitedHealth Group, Inc.^ | | | 5,430 | | | | 443,903 | |

Universal American Financial Corp. | | | 80,550 | | | | 670,982 | |

Valeant Pharmaceuticals International, Inc.* | | | 11,125 | | | | 1,403,085 | |

| | | | | | | | 10,655,804 | |

|

| Industrials — 8.4% | |

Aircastle Ltd. | | | 43,155 | | | | 766,864 | |

Corrections Corp. of America | | | 8,600 | | | | 282,510 | |

Hub Group, Inc., Class A* | | | 36,400 | | | | 1,834,560 | |

Kennametal, Inc. | | | 22,300 | | | | 1,032,044 | |

Parker Hannifin Corp. | | | 8,300 | | | | 1,043,559 | |

United Technologies Corp. | | | 8,800 | | | | 1,015,960 | |

Xpo Logistics, Inc.*^ | | | 6,390 | | | | 182,882 | |

| | | | | | | | 6,158,379 | |

|

| Information Technology — 15.8% | |

Apple Computer, Inc.^ | | | 9,975 | | | | 926,977 | |

Cisco Systems, Inc.^ | | | 70,444 | | | | 1,750,534 | |

International Business Machines Corp. | | | 15,167 | | | | 2,749,322 | |

Juniper Networks, Inc.* | | | 65,250 | | | | 1,601,235 | |

Linear Technology Corp. | | | 19,083 | | | | 898,237 | |

Microsoft Corp. | | | 66,610 | | | | 2,777,637 | |

Rovi Corp.* | | | 13,605 | | | | 325,976 | |

Samsung Electronics Co., Ltd. | | | 310 | | | | 404,884 | |

| | | | | | | | 11,434,802 | |

| |

| Total Common Stocks | | | $ | 58,835,190 | |

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | SEMI-ANNUAL REPORT | | | | | JUNE 30, 2014 | | | | | DIAMOND-HILL.COM | | | 17 | |

Diamond Hill Research Opportunities Fund

Schedule of Investments (Continued)

June 30, 2014 (Unaudited)

Diamond Hill Research Opportunities Fund

Schedule of Investments Sold Short

June 30, 2014 (Unaudited)

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Common Stocks — 80.9% continued | |

| Registered Investment Company — 22.7% | |

State Street Institutional Liquid Reserves Fund, Premier Class, 0.06%S | | | 12,503,325 | | | $ | 12,503,325 | |

State Street Navigator Securities Lending Prime Portfolio, 0.14%†S | | | 3,959,216 | | | | 3,959,216 | |

| |

| Total Registered Investment Companies | | | $ | 16,462,541 | |

|

| Total Investment Securities — 103.6% | |

Cost ($64,137,689)** | | | | | | $ | 75,297,731 | |

| |

Segregated Cash

With Brokers — 9.6% | | | | 6,975,598 | |

|

| Securities Sold Short — (9.4)% | |

(Proceeds $6,165,788) | | | | | | | (6,903,675 | ) |

| |

Net Other Assets

(Liabilities) — (3.8)% | | | | (2,693,923 | ) |

| |

| Net Assets — 100.0% | | | $ | 72,675,731 | |

| ^ | All or a portion of the security is on loan. The total fair value of the securities on loan, as of June 30, 2014, was $3,869,853. |

| * | Non-income producing security. |

| † | This security, which was purchased using cash collateral received from securities on loan, represents collateral for securities loaned as of June 30, 2014. |

| S | Rate represents the daily yield on June 30, 2014. |

| ** | Represents cost for financial reporting purposes. |

GB – British Security

FR – French Security

REIT – Real Estate Investment Trust

ADR – American Depositary Receipt

See accompanying Notes to Financial Statements

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Common Stocks — 9.4% | |

| Consumer Discretionary — 2.4% | |

Brunswick Corp. | | | 900 | | | $ | 37,917 | |

Gap, Inc., The | | | 6,145 | | | | 255,448 | |

Grand Canyon Education, Inc.* | | | 7,638 | | | | 351,119 | |

Life Time Fitness, Inc.* | | | 7,391 | | | | 360,237 | |

Macy’s, Inc. | | | 5,101 | | | | 295,960 | |

Sonic Corp.* | | | 8,200 | | | | 181,056 | |

Sotheby’s Holdings, Inc. | | | 5,511 | | | | 231,407 | |

| | | | | | | | 1,713,144 | |

|

| Financials — 2.9% | |

BancorpSouth, Inc. | | | 17,000 | | | | 417,690 | |

Cincinnati Financial Corp. | | | 11,745 | | | | 564,230 | |

First American Financial Corp. | | | 16,535 | | | | 459,508 | |

Hanover Insurance Group, Inc. | | | 9,555 | | | | 603,397 | |

Rouse Properties, Inc. | | | 4,880 | | | | 83,497 | |

| | | | | | | | 2,128,322 | |

|

| Health Care — 0.8% | |

Bristol-Myers Squibb Co. | | | 6,134 | | | | 297,560 | |

Healthcare Services Group | | | 4,500 | | | | 132,480 | |

Intuitive Surgical, Inc.* | | | 350 | | | | 144,130 | |

| | | | | | | | 574,170 | |

|

| Industrials — 1.0% | |

Boeing Co., The | | | 3,600 | | | | 458,028 | |

Kansas City Southern Industries, Inc. | | | 1,600 | | | | 172,016 | |

Navistar International Corp.* | | | 3,900 | | | | 146,172 | |

| | | | | | | | 776,216 | |

|

| Information Technology — 2.0% | |

Advent Software, Inc. | | | 17,674 | | | | 575,642 | |

Ubiquiti Networks, Inc.* | | | 19,950 | | | | 901,541 | |

| | | | | | | | 1,477,183 | |

|

| Materials — 0.3% | |

Intrepid Potash, Inc.* | | | 14,000 | | | | 234,640 | |

|

| Total Securities Sold Short — 9.4% | |

(Proceeds $6,165,788) | | | | | | $ | 6,903,675 | |

| * | Non-dividend expense producing security. |

Percentages disclosed are based on total net assets of the Fund at June 30, 2014.

See accompanying Notes to Financial Statements

| | | | | | | | | | | | | | |

| 18 | | DIAMOND HILL FUNDS | | | | | SEMI-ANNUAL REPORT | | | | | JUNE 30, 2014 | | | | | DIAMOND-HILL.COM |

Diamond Hill Financial Long-Short Fund

Schedule of Investments

June 30, 2014 (Unaudited)

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Common Stocks — 87.1% | |

| Banking Services — 32.5% | |

Bank of Marin Bancorp^ | | | 7,395 | | | $ | 337,138 | |

Bridge Bancorp, Inc.^ | | | 6,510 | | | | 156,175 | |

Capital City Bank Group, Inc. | | | 14,045 | | | | 204,074 | |

Citigroup, Inc. | | | 33,060 | | | | 1,557,126 | |

First Horizon National Corp. | | | 41,825 | | | | 496,045 | |

First Niagara Financial Group, Inc. | | | 20,535 | | | | 179,476 | |

First of Long Island Corp., The | | | 5,630 | | | | 220,020 | |

First Republic Bank | | | 6,360 | | | | 349,736 | |

JPMorgan Chase & Co. | | | 23,605 | | | | 1,360,120 | |

KeyCorp^ | | | 13,575 | | | | 194,530 | |

National Penn Bancshares, Inc. | | | 31,930 | | | | 337,819 | |

PNC Financial Services Group, Inc. | | | 6,119 | | | | 544,897 | |

Popular, Inc.* | | | 50,750 | | | | 1,734,633 | |

State Bank Financial Corp. | | | 16,390 | | | | 277,155 | |

Sterling Bancorp | | | 14,673 | | | | 176,076 | |

SunTrust Banks, Inc.^ | | | 7,417 | | | | 297,125 | |

Wells Fargo & Co. | | | 10,486 | | | | 551,144 | |

| | | | | | | | 8,973,289 | |

|

| Capital Markets — 11.5% | |

Fortress Investment Group LLC, Class A | | | 155,700 | | | | 1,158,408 | |

Franklin Resources, Inc.^ | | | 19,915 | | | | 1,151,884 | |

Morgan Stanley | | | 26,380 | | | | 852,865 | |

| | | | | | | | 3,163,157 | |

|

| Consumer Financial Services — 1.2% | |

Capital One Financial Corp. | | | 4,125 | | | | 340,725 | |

|

| Financial Services — 0.8% | |

Bank of New York Mellon Corp., The^ | | | 5,679 | | | | 212,849 | |

| | |

| Insurance — 32.5% | | | | | | | | |

ACE Ltd.^ | | | 3,080 | | | | 319,396 | |

American Equity Investment Life Holding Co. | | | 19,070 | | | | 469,122 | |

American International Group, Inc. | | | 30,265 | | | | 1,651,864 | |

Brown & Brown, Inc. | | | 27,005 | | | | 829,324 | |

Endurance Specialty Holdings Ltd. | | | 10,085 | | | | 520,285 | |

Enstar Group Ltd.* | | | 3,065 | | | | 461,987 | |

Greenlight Capital Re Ltd., Class A* | | | 9,315 | | | | 306,836 | |

HCC Insurance Holdings, Inc. | | | 4,875 | | | | 238,583 | |

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Insurance — 32.5% continued | |

Infinity Property & Casualty Corp. | | | 2,205 | | | $ | 148,242 | |

MetLife, Inc. | | | 12,655 | | | | 703,112 | |

Navigators Group, Inc.* | | | 10,355 | | | | 694,303 | |

Progressive Corp. | | | 12,790 | | | | 324,354 | |

Prudential Financial, Inc. | | | 7,900 | | | | 701,283 | |

Reinsurance Group of America | | | 3,285 | | | | 259,187 | |

Willis Group Holdings plc | | | 30,765 | | | | 1,332,125 | |

| | | | | | | | 8,960,003 | |

| | |

| IT Services — 2.1% | | | | | | | | |

Vantiv, Inc., Class A* | | | 17,465 | | | | 587,173 | |

|

| REITs & Real Estate Management — 5.0% | |

iStar Financial, Inc. REIT* | | | 79,273 | | | | 1,187,510 | |

Winthrop Realty Trust REIT | | | 13,337 | | | | 204,723 | |

| | | | | | | | 1,392,233 | |

|

| Thrifts & Mortgage Finance — 1.5% | |

Nationstar Mortgage Holdings, Inc.*^ | | | 11,105 | | | | 403,112 | |

| |

| Total Common Stocks | | | $ | 24,032,541 | |

|

| Registered Investment Company — 19.8% | |

State Street Institutional Liquid Reserves Fund, Premier Class, 0.06%S | | | 2,826,703 | | | $ | 2,826,703 | |

State Street Navigator Securities Lending Prime Portfolio, 0.14%†S | | | 2,630,168 | | | | 2,630,168 | |

| |

| Total Registered Investment Companies | | | $ | 5,456,871 | |

|

| Total Investment Securities — 106.9% | |

(Cost $24,112,811)** | | | | | | $ | 29,489,412 | |

| |

Segregated Cash

With Brokers — 10.8% | | | | 2,988,196 | |

|

| Securities Sold Short — (9.4)% | |

(Proceeds $2,237,880) | | | | (2,592,565 | ) |

| |

Net Other Assets

(Liabilities) — (8.3)% | | | | (2,299,689 | ) |

| |

| Net Assets — 100.0% | | | $ | 27,585,354 | |

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | SEMI-ANNUAL REPORT | | | | | JUNE 30, 2014 | | | | | DIAMOND-HILL.COM | | | 19 | |

Diamond Hill Financial Long-Short Fund

Schedule of Investments (Continued)

June 30, 2014 (Unaudited)

Diamond Hill Financial Long-Short Fund

Schedule of Investments Sold Short

June 30, 2014 (Unaudited)

| ^ | All or a portion of the security is on loan. The total fair value of the securities on loan, as of June 30, 2014, was $2,589,277. |

| * | Non-income producing security. |

| † | This security, which was purchased using cash collateral received from securities on loan, represents collateral for securities loaned as of June 30, 2014. |

| S | Rate represents the daily yield on June 30, 2014. |

| ** | Represents cost for financial reporting purposes. |

REIT – Real Estate Investment Trust

See accompanying Notes to Financial Statements

| | | | | | | | |

| | | Shares | | | Fair

Value | |

|

| Common Stocks — 9.4% | |

| Banking Services — 3.0% | |

BancorpSouth, Inc. | | | 17,230 | | | $ | 423,341 | |

Bank of The Ozarks, Inc. | | | 8,270 | | | | 276,632 | |

Home Bancshares, Inc. | | | 4,060 | | | | 133,249 | |

| | | | | | | | 833,222 | |

|

| Financial Services — 0.8% | |

Moody’s Corp. | | | 2,415 | | | | 211,699 | |

|

| Insurance — 4.8% | |

Cincinnati Financial Corp. | | | 11,190 | | | | 537,566 | |

First American Financial Corp. | | | 13,835 | | | | 384,475 | |

Hanover Insurance Group, Inc. | | | 6,425 | | | | 405,739 | |

| | | | | | | | 1,327,780 | |

|

| REITs & Real Estate Management — 0.8% | |

Rouse Properties, Inc. | | | 12,850 | | | | 219,864 | |

|

| Total Securities Sold Short — 9.4% | |

(Proceeds $2,237,880) | | | | | | $ | 2,592,565 | |

Percentages disclosed are based on total net assets of the Fund at June 30, 2014.

See accompanying Notes to Financial Statements

| | | | | | | | | | | | | | |

| 20 | | DIAMOND HILL FUNDS | | | | | SEMI-ANNUAL REPORT | | | | | JUNE 30, 2014 | | | | | DIAMOND-HILL.COM |

Diamond Hill Strategic Income Fund

Schedule of Investments

June 30, 2014 (Unaudited)

| | | | | | | | |

| | | Shares/

Par Value | | | Fair

Value | |

|

| Collateralized Debt Obligations — 0.4% | |

Alesco Preferred Funding Ltd., Class PPNE, 3/23/35#* | | $ | 336,608 | | | $ | 95,876 | |

Alesco Preferred Funding VI, Class PNN, 3/23/35#* | | | 621,631 | | | | 185,756 | |

Fort Sheridan ABS CDO Ltd., Class PPN2, 11/5/41#* | | | 611,948 | | | | 209,353 | |

Taberna Preferred Funding Ltd.,

Class PPN2, 7/5/35#* | | | 1,175,564 | | | | 350,836 | |

| |

| Total Collateralized Debt Obligations | | | $ | 841,821 | |

|

| Corporate Bonds — 91.2% | |

| Consumer Discretionary — 18.5% | |

Avis Budget Car Rental, LLC/Avis Budget Finance, Inc.,

4.88%, 11/15/17^ | | $ | 5,304,000 | | | | 5,516,159 | |

Expedia, Inc., 5.95%, 8/15/20^ | | | 4,600,000 | | | | 5,203,828 | |

Goodyear Tire & Rubber Co., The,

8.25%, 8/15/20 | | | 2,900,000 | | | | 3,182,750 | |

Goodyear Tire & Rubber Co., The,

8.75%, 8/15/20 | | | 3,957,000 | | | | 4,689,045 | |

Jarden Corp.,

6.13%, 11/15/22 | | | 2,614,000 | | | | 2,774,108 | |

Live Nation Entertainment,

7.00%, 9/1/20†† | | | 5,254,000 | | | | 5,753,129 | |

QVC, Inc.,

3.13%, 4/1/19^ | | | 4,275,000 | | | | 4,347,094 | |

Tenneco, Inc.,

6.88%, 12/15/20 | | | 4,436,000 | | | | 4,829,695 | |

Vail Resorts, Inc.,

6.50%, 5/1/19 | | | 3,543,000 | | | | 3,724,579 | |

| | | | | | | | 40,020,387 | |

|

| Consumer Staples — 2.1% | |

Post Holdings, Inc.,

7.38%, 2/15/22 | | | 4,295,000 | | | | 4,649,338 | |

|

| Energy — 6.9% | |

Carrizo Oil & Gas, Inc.,

7.50%, 9/15/20 | | | 2,730,000 | | | | 2,996,175 | |

| | | | | | | | |

| | | Shares/

Par Value | | | Fair

Value | |

|

| Energy — 6.9% continued | |

Carrizo Oil & Gas, Inc.,

8.63%, 10/15/18 | | $ | 4,150,000 | | | $ | 4,373,063 | |

Cimarex Energy Co.,

5.88%, 5/1/22 | | | 2,025,000 | | | | 2,237,625 | |

Diamondback Energy, Inc.,

7.63%, 10/1/21^†† | | | 4,796,000 | | | | 5,275,600 | |

| | | | | | | | 14,882,463 | |

|

| Financials — 26.3% | |

CNA Financial Corp.,

6.50%, 8/15/16 | | | 2,165,000 | | | | 2,411,238 | |

Cogent Communications Finance, Inc.,

5.63%, 4/15/21 | | | 4,750,000 | | | | 4,714,375 | |

Discover Financial Services,

6.45%, 6/12/17 | | | 2,700,000 | | | | 3,070,867 | |

First Horizon National Corp.,

5.38%, 12/15/15 | | | 3,000,000 | | | | 3,173,412 | |

First Tennessee Bank NA,

5.05%, 1/15/15 | | | 1,150,000 | | | | 1,175,550 | |

iStar Financial, Inc.,

4.88%, 7/1/18 | | | 4,725,000 | | | | 4,736,812 | |

iStar Financial, Inc.,

Series B,

9.00%, 6/1/17 | | | 3,605,000 | | | | 4,163,775 | |

MGIC Investment Corp.,

5.38%, 11/1/15 | | | 2,105,000 | | | | 2,194,463 | |

Nationstar Mortgage LLC/Nationstar Capital Corp.,

6.50%, 8/1/18 | | | 6,540,000 | | | | 6,719,849 | |

Popular, Inc.,

7.00%, 7/1/19 | | | 4,000,000 | | | | 4,060,000 | |

Radian Group, Inc.,

9.00%, 6/15/17 | | | 4,840,000 | | | | 5,566,000 | |

Regions Financial Corp.,

5.75%, 6/15/15 | | | 4,000,000 | | | | 4,180,679 | |

Symetra Financial Corp.,

6.13%, 4/1/16†† | | | 4,750,000 | | | | 5,097,520 | |

Synovus Financial Corp.,

7.88%, 2/15/19 | | | 1,775,000 | | | | 2,032,375 | |

Synovus Financial Corp.,

5.13%, 6/15/17 | | | 3,350,000 | | | | 3,492,375 | |

| | | | | | | | 56,789,290 | |

| | | | | | | | | | | | | | | | |

| DIAMOND HILL FUNDS | | | | | SEMI-ANNUAL REPORT | | | | | JUNE 30, 2014 | | | | | DIAMOND-HILL.COM | | | 21 | |

Diamond Hill Strategic Income Fund

Schedule of Investments (Continued)

June 30, 2014 (Unaudited)

| | | | | | | | |

| | | Shares/

Par Value | | | Fair

Value | |

|

| Corporate Bonds — 91.2% continued | |

| Health Care — 13.6% | |

Biomet, Inc.,

6.50%, 10/1/20 | | $ | 5,792,000 | | | $ | 6,182,960 | |

DaVita, Inc.,

6.63%, 11/1/20 | | | 5,184,000 | | | | 5,508,000 | |

HealthSouth Corp.,

7.75%, 9/15/22 | | | 2,747,000 | | | | 2,997,664 | |

HealthSouth Corp.,

7.25%, 10/1/18 | | | 3,439,000 | | | | 3,593,755 | |

Hospira, Inc.,

5.20%, 8/12/20 | | | 4,175,000 | | | | 4,568,803 | |

Valeant Pharmaceuticals International,

6.38%, 10/15/20†† | | | 4,000,000 | | | | 4,250,000 | |

Warner Chilcott Co. LLC, 7.75%, 9/15/18 | | | 2,335,000 | | | | 2,454,762 | |

| | | | | | | | 29,555,944 | |

|

| Industrials — 12.6% | |

Continental Airlines, Inc.,

6.75%, 9/15/15†† | | | 6,525,000 | | | | 6,582,094 | |

United Continental Holdings, Inc.,

6.38%, 6/1/18 | | | 5,392,000 | | | | 5,823,360 | |

United Rentals North America,

7.38%, 5/15/20^ | | | 6,733,000 | | | | 7,439,964 | |

US Airways Group, Inc.,

6.13%, 6/1/18^ | | | 6,970,000 | | | | 7,362,063 | |

| | | | | | | | 27,207,481 | |

|

| Information Technology — 2.4% | |

KLA-Tencor Corp.,

6.90%, 5/1/18 | | | 4,478,000 | | | | 5,268,054 | |

|

| Materials — 3.4% | |

Owens-Illinois, Inc., 7.80%, 5/15/18 | | | 6,321,000 | | | | 7,379,768 | |

|

| Telecommunication Services — 3.5% | |

Level 3 Financing, Inc.,

8.13%, 7/1/19 | | | 6,957,000 | | | | 7,591,826 | |

| | |

| Utilities — 1.9% | | | | | | | | |

Source Gas LLC,

5.90%, 4/1/17†† | | | 4,000,000 | | | | 4,213,816 | |

| |

| Total Corporate Bonds | | | $ | 197,558,367 | |

| | | | | | | | |

| | | Shares/

Par Value | | | Fair

Value | |

|

| Registered Investment Companies — 15.8% | |

JPMorgan Prime Money Market Fund,

0.04%S | | $ | 2,121,271 | | | $ | 2,121,271 | |

State Street Institutional Liquid Reserves Fund, Premier Class,0.06%S | | | 17,846,206 | | | | 17,846,206 | |

State Street Navigator Securities Lending Prime Portfolio, 0.14%†S | | | 14,366,588 | | | | 14,366,588 | |

| |

| Total Registered Investment Companies | | | | 34,334,065 | |

|

| Total Investment Securities — 107.4% | |