UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08061

Diamond Hill Funds

(Exact name of registrant as specified in charter)

325 John H. McConnell Boulevard, Suite 200, Columbus, Ohio 43215

(Address of principal executive offices) (Zip code)

Thomas E. Line, 325 John H. McConnell Boulevard, Suite 200, Columbus, Ohio 43215

(Name and address of agent for service)

Registrant’s telephone number, including area code: 614-255-3333

Date of fiscal year end: December 31

Date of reporting period: December 31, 2016

Item 1. Reports to Stockholders.

Annual Report

December 31, 2016

Small Cap Fund | Research Opportunities Fund |

Small-Mid Cap Fund | Financial Long-Short Fund |

Mid Cap Fund | Short Duration Total Return Fund |

Large Cap Fund | Core Bond Fund |

Select Fund | Corporate Credit Fund |

Long-Short Fund | High Yield Fund |

This material must be preceded or accompanied by a current prospectus.

Not FDIC Insured. May Lose Value. No Bank Guarantee.

Letter to Shareholders | 1 |

Mission Statement, Pledge, and Fundamental Principles | 4 |

| | |

Management Discussion of Fund Performance | |

Diamond Hill Small Cap Fund | 8 |

Diamond Hill Small-Mid Cap Fund | 11 |

Diamond Hill Mid Cap Fund | 14 |

Diamond Hill Large Cap Fund | 17 |

Diamond Hill Select Fund | 20 |

Diamond Hill Long-Short Fund | 23 |

Diamond Hill Research Opportunities Fund | 25 |

Diamond Hill Financial Long-Short Fund | 28 |

Diamond Hill Short Duration Total Return Fund | 31 |

Diamond Hill Core Bond Fund | 33 |

Diamond Hill Corporate Credit Fund | 36 |

Diamond Hill High Yield Fund | 39 |

| | |

Financial Statements | |

Schedules of Investments | 42 |

Statements of Assets & Liabilities | 88 |

Statements of Operations | 91 |

Statements of Changes in Net Assets | 94 |

Financial Highlights | 106 |

Notes to Financial Statements | 130 |

Report of Independent Registered Accounting Firm | 146 |

Other Items | 147 |

Schedule of Shareholder Expenses | 151 |

Management of the Trust | 154 |

Cautionary Statement: At Diamond Hill, we pledge that, “we will communicate with our clients about our investment performance in a manner that will allow them to properly assess whether we are deserving of their trust.” Our views and opinions regarding the investment prospects of our portfolio holdings and Funds are “forward looking statements” which may or may not be accurate over the long term. While we believe we have a reasonable basis for our opinions, actual results may differ materially from those we anticipate. Information provided in this report should not be considered a recommendation to purchase or sell any particular security.

You can identify forward looking statements by words like “believe,” “expect,” “anticipate,” or similar expressions when discussing prospects for particular portfolio holdings and/or one of the Funds. We cannot assure future results. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. We disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise.

This material is not authorized for distribution to prospective investors unless preceded or accompanied by a Prospectus. Investors should consider the investment objectives, risks, charges, and expenses of the Diamond Hill Funds carefully before investing. The prospectus or summary prospectus contain this and other important information about the Fund(s) and are available at diamond-hill.com or by calling 888.226.5595. Please read the prospectus or summary prospectus carefully before investing. The Diamond Hill Funds are distributed by BHIL Distributors, LLC (Member FINRA). Diamond Hill Capital Management, Inc., a registered investment adviser, serves as Investment Adviser to the Diamond Hill Funds and is paid a fee for its services. Diamond Hill Funds are not FDIC insured, may lose value, and have no bank guarantee.

Dear Fellow Shareholders:

We are pleased to provide you with this year-end update for the Diamond Hill Funds. 2016 was an interesting year, to say the least, with market volatility driven by uncertainty around interest rates, the U.K. Brexit vote, and a U.S. presidential election, among other factors.

Additionally, the ongoing rhetoric around active versus passive management continued in 2016. While market conditions over the past six years have made it difficult for many managers to outperform passive alternatives, we continue to expect, based on historical experience, that the cycle will turn in favor of active management. Dispersion between individual stock returns is increasing, which provides more opportunities for active managers to add value through security selection. We continue to believe that Diamond Hill strategies will outperform over a full market cycle, supported by a shared commitment to our intrinsic value-based investment philosophy, long-term perspective, disciplined approach, and alignment with our clients’ interests.

As of December 31, 2016, the since-inception returns for nearly all of our Funds exceeded their respective benchmark returns. Our Mid Cap, Short Duration Total Return, Core Bond, and High Yield Funds have less than a five-year track record and as always, we remain focused on five-year periods to evaluate our results.

2016 Financial Markets

Following three volatile quarters, U.S. equity markets rallied in the fourth quarter with all major indices posting well-above-average results for the year. As has been widely reported, the markets had a dramatic reaction to political events in the U.S. and abroad throughout 2016, but especially so in the fourth quarter. Financials and cyclical sectors including telecommunications, industrials, energy, and materials experienced the biggest gains post-election. These stocks became more fairly valued compared to historical standards, and valuation spreads tightened across sectors.

We also saw significant deviation between value and core benchmarks due to sector allocation post-election. The sectors mentioned above – financials, industrials, energy, and materials – make up over 50% of the Russell 1000 Value Index, compared to just 35% of the core Russell 1000 Index. Sector allocation had a larger impact on our portfolio results in the fourth quarter than what we typically see.

For the full-year 2016, the biggest gains were in the more cyclical sectors with the health care sector generally providing negative returns. Despite signs of improvement mid-year, health care has been negatively impacted by speculation about the future of the Affordable Care Act and continued rhetoric around drug pricing.

The financials sector was buoyed by the prospects of higher interest rates, lower taxes, less regulation, and a stronger economy under the new administration. We would expect financial stocks to continue to benefit more than other sectors should we see further interest rate increases and a stronger dollar, since banks are significant beneficiaries of higher rates and typically have less international exposure. However, these fundamental tailwinds may be partially offset by higher valuations.

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM 1 |

Credit markets were also deeply impacted by the events of 2016 including the U.S. election, and none more so than the U.S. Treasury market. The 10-year Treasury yield increased from 1.88% to 2.07% on the day following the election, which represents the largest single-day move since October 2011.

In the high yield market, cratering commodities prices and fears about illiquidity, among other issues, priced the market for a high likelihood of recession early in the year. When commodities prices stabilized and liquidity conditions improved, the high yield market began a sharp and sustained recovery. For the last half of the year, defaults fell to levels well below projections made earlier in the year.

Outlook

Although the U.S. economy appears to be healing at a steady pace, we continue to expect positive but below average equity market returns over the next five years. Our conclusion is primarily based on the combination of above-average price/earnings (P/E) multiples applied to already-high corporate profit margins, which likely tempers prospective returns. Stock valuations remain historically high in part because of the current low interest rate environment. As interest rates begin to normalize and if corporate earnings growth accelerates, P/E ratios may start to decline.

While the December 2016 Fed Funds rate increase indicates policymakers’ confidence in the recovery of U.S. labor markets and an expectation of slowly rising inflation, we expect the Federal Reserve to take a cautious near-term approach towards normalizing monetary policy. Lower household debt levels combined with very low interest rates have allowed consumer debt-service burdens to improve to very low levels by historical standards. Clearly, this remains very much tied to low interest/mortgage rates and any sharp increase in those rates is likely to present a headwind for growth.

Central banks across the world remain extraordinarily accommodative in an attempt to provide a backdrop for increased economic growth. Europe, which has been an economic laggard over the past few years, has witnessed increasing levels of activity in recent periods. Global growth may continue to be impacted by the outcome of the U.S. presidential election, as well as uncertainty created by the Brexit process and other events.

2 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM |

As always, our focus is on valuations, which we believe are the key determinant of long-term returns. We focus on companies with good franchises and the ability to take share, selling at reasonable valuations. Our equity and fixed income investment philosophy and processes continue to be focused on individual company and security analysis. Our intrinsic value investment philosophy is shared by all of our portfolio managers and research analysts, allowing us to apply our investment discipline consistently across strategies.

Thank you for your continued support.

Diamond Hill Capital Management, Inc.

|

|

Chris Welch, CFA

Co-Chief Investment Officer | Austin Hawley, CFA

Co-Chief Investment Officer |

| |

Bill Zox, CFA

Chief Investment Officer – Fixed Income | |

The views expressed are those of the portfolio managers as of December 31, 2016, are subject to change, and may differ from the views of other portfolio managers or the firm as a whole. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice. All data referenced are from sources deemed to be reliable but cannot be guaranteed. Securities and sectors referenced should not be construed as a solicitation or recommendation or be used as the sole basis for any investment decision.

The Russell 1000 Index is an unmanaged market capitalization-weighted index comprised of the largest 1,000 companies by market capitalization in the Russell 3000 Index. The Russell 1000 Value Index is an unmanaged index comprised of those Russell 1,000 companies with lower price/book ratios and lower forecasted growth values. These indexes do not incur fees and expenses (which would lower the return) and are not available for direct investment.

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM 3 |

Our Mission

At Diamond Hill, we serve our clients by providing investment strategies that deliver lasting value through a shared commitment to our intrinsic value-based investment philosophy, long-term perspective, disciplined approach and alignment with our clients’ interests.

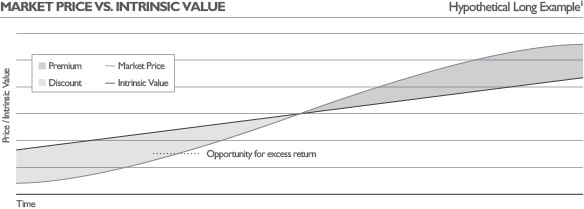

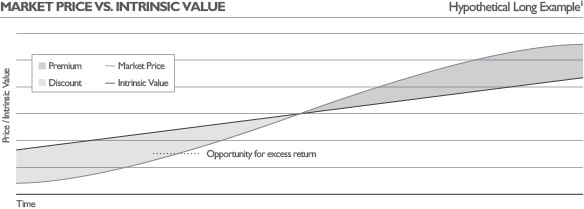

VALUE

We believe market price and intrinsic value are independent in the short-term but tend to converge over time.

LONG-TERM

We maintain a long-term focus both in investment analysis and management of our business.

DISCIPLINE

We invest with discipline to increase potential return and protect capital.

PARTNERSHIP

We align our interests with those of our clients through significant personal investment in our strategies.

4 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM |

The Importance of Valuation

We believe that a company’s intrinsic value is independent of its stock price and that intrinsic value can be reasonably estimated using a discounted cash flow methodology. Our entire investment team shares the same investment philosophy, which drives our investment process.

We focus on the fundamentals of intrinsic value, which are far less volatile than market price, and our actions are ultimately dictated by the price to intrinsic value relationship.

There is no guarantee that a discount to intrinsic value will be achieved or that market price and/or intrinsic value will increase over time.

1 | The inverse is true for short position |

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM 5 |

Equity Investment Principles

Valuation

● | We believe that every share of stock has an intrinsic value that is independent of its current market price, and at any point in time, the market price may be higher or lower than intrinsic value. |

● | Over short periods of time, the market price is heavily influenced by the emotions of market participants, which are far more difficult to predict than intrinsic value. While market prices may experience extreme fluctuations on a particular day, we believe intrinsic value is far less volatile. |

● | Over sufficiently long periods of time, five years or longer, the market price tends to converge with intrinsic value. |

Intrinsic Value Estimate

● | We believe that we can determine a reasonable approximation of intrinsic value if we are confident in projecting the future cash flows of a business and use an appropriate discount rate. |

Suitable Investments

● | We only invest when the market price is lower than our conservative assessment of per share intrinsic value (or at a premium for short positions). |

● | We concentrate our investments in businesses whose per share intrinsic value is likely to increase. We invest in businesses that possess a competitive advantage, conservative balance sheet, and outstanding managers and employees. For short positions, the inverse is often true, and a growing intrinsic value is a detriment to the performance of the position. |

Risk & Return

● | We intend to achieve our return from both the closing of the gap between our purchase price and intrinsic value and the increase in per share intrinsic value. For short positions, an increasing intrinsic value may shorten the holding period. |

● | We define risk as the permanent loss of capital rather than price volatility. We manage risk by investing in companies selling at a discount (premium for short positions) to our estimate of intrinsic value. |

6 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM |

Fixed Income Investment Principles

Business Analysis

● | We believe we can leverage our research team’s industry analysis of the fundamental economic drivers of the business to identify attractive corporate bonds and other senior corporate securities. |

● | We evaluate the quality of a firm’s management and their treatment of bondholders and stockholders. We believe managements that focus on growth, without regard to return on invested capital or long-term cost of capital, are more likely to destroy value for bondholders and stockholders. In contrast, managements that understand the competitive dynamics of their business and prudent capital allocation often produce value for both bondholders and stockholders. |

Valuation

● | We focus on the intrinsic value of the business in relation to the amount of debt in the capital structure. We also evaluate the sources and uses of cash for the business. |

● | The liquidity and expected volatility of a corporate bond are also important factors in valuation. Because of our long-term time horizon, we will invest in less liquid or more volatile securities; however, we require a higher yield as compensation. |

Suitable Investments

● | We generally invest in corporate bonds of companies with improving competitive positions and return on invested capital. |

● | Our core competency is the evaluation of credit risk. We typically favor lower duration, shorter maturity corporate bonds. We focus almost entirely on the secondary market for corporate bonds rather than the primary (new issue) market. We primarily invest in investment grade and below-investment grade (high yield) corporate bonds, including a significant allocation to defensive high yield corporate bonds (due to low duration and higher credit quality). |

Risk & Return

● | We define risk as the permanent loss of capital. We seek to avoid a permanent loss of capital and to earn a sufficient return on capital to grow our purchasing power. |

● | We expect to achieve our return objective by investing in corporate bonds when we believe the market price discounts a greater risk of default or a greater loss upon default than is warranted. An additional source of return exists when the market price provides attractive compensation for short-term illiquidity or volatility, both of which are of less concern to a long-term investor. |

● | We focus on credit risk, interest rate risk, liquidity risk, call risk, reinvestment risk, and other risks when evaluating corporate bonds. |

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM 7 |

Diamond Hill Small Cap Fund |

2016 Portfolio Commentary

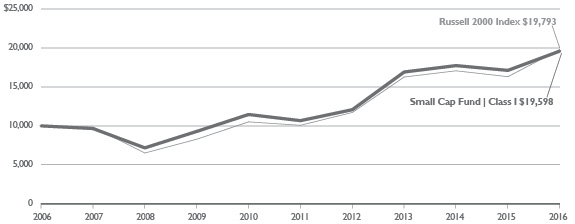

In 2016, the Diamond Hill Small Cap Fund returned 14.45% (Class I), trailing the Russell 2000 Index return of 21.31% by 680 basis points. Relative to the Index, Fund performance experienced large swings during the year. When equity markets were down early in the year, the Fund led the index by as much as 7.5 percentage points. During the third quarter, the Fund fell behind the Index, then recovered the relative ground in October and early November, only to fall meaningfully behind again post-election.

What spurred the equity market, and especially small cap stocks? Leading reasons were the prospects for lower corporate tax rates and a lighter regulatory burden, combined with rhetoric about dramatically increasing government spending on infrastructure. This overwhelmed what might otherwise have been viewed as the negative potential inflation implications of protectionist trade policies and increasing budget deficits, and the rise in the 10-year Treasury yield from 1.88% pre-election to 2.45% at year-end.

Relative to historic averages, small cap stocks currently trade at fairly expensive valuations. For the year ending December 31, 2016, the factsheet for the Russell 2000 Index lists the price-to-earnings (P/E) ratio, excluding those companies with negative earnings, at just below 29X. Other services that attempt to adjust to an operating earnings number by excluding charges seen as non-recurring in nature would place the multiple in the low 20s. Research (such as that published by Robert Shiller, among others) has shown that when the beginning P/E multiple reaches these levels, subsequent five and 10-year returns tend to be very subdued.

In a rough attribution of the year’s performance, there were four areas that contributed to the underperformance:

| | 1. | An average cash balance in the high teens as a percentage of net assets. |

| | 2. | A relative lack of exposure to the strong materials and information technology sectors. |

| | 3. | In health care, poor security selection only partially offset the Fund’s fairly low exposure to this weak sector. |

| | 4. | Four stocks comprising about 11% of the portfolio at year-end had fundamentals we believed to be performing in line with our internal expectations, yet were not recognized by the stock market in 2016. These included Avis Budget Group, Inc. (+1%), DST Systems, Inc. (-5%), Carter’s, Inc. (-2%), and Live Nation Entertainment, Inc. (+8%). |

Partially offsetting these factors were the following:

| | 1. | Fairly strong security selection in consumer discretionary stocks including Aaron’s, Inc., Vail Resorts, Inc., and Tenneco, Inc. |

| | 2. | Strong security selection in energy and utilities, albeit two sectors that were fairly low weights in both the Fund and the Index. |

| | 3. | Announced acquisitions of Fund holdings Endurance Specialty Holdings Ltd. and Universal American Corp. |

8 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM |

Diamond Hill Small Cap Fund |

Avis Budget is now the largest holding in the Fund. Avis Budget generates approximately $8.7 billion in revenue (about 70% North America and 30% international) from a fleet of approximately 550,000 cars worldwide. Despite pricing in the industry being lackluster for the past two years, the company has reported adjusted free cash flow of greater than $450 million for five consecutive years. In recent quarters, about 80% of this free cash flow has been used to repurchase shares, and the company will have reduced the share count in 2016 by more than 10% compared to year-end 2015. The company has set a goal to increase EBITDA margins to 13-15% (from just under 10% currently) in the next five years, which may be aggressive, but suggests that revenues and free cash flow are not in a stage of gradual or rapid descent. Thus, Avis Budget trades at the highest free cash flow yield in the portfolio. One potential explanation for the lack of a more positive stock market showing for Avis Budget in 2016 relates to the struggles of competitor Hertz, which has now replaced its CEO twice in the past four years. In November, Hertz substantially reduced earnings guidance to reflect lower assumed residual values for certain types of cars. Our current view is that this is a poor assumption on the part of Hertz, rather than a negative for Avis Budget, and would seem to make it less likely that Hertz would impede industry pricing action meant to offset any rise in fleet costs, either from lower residual values or higher upfront prices from the original equipment manufacturers (OEMs).

Health care was the most costly sector to Fund performance in 2016. Early in the year, Alere, Inc. agreed to be acquired by Abbott Laboratories at a substantial premium, but over the course of the year, doubts about this transaction’s completion led to small marginal gain. Other health care stocks including BioScrip, Inc., LifePoint Health, Inc., Integer Holdings Corp. (formerly known as Greatbatch, Inc.), and Natus Medical, Inc. also were negative for the year. However, Concordia International Corp., sold in October at a substantial loss, was the biggest individual detractor. Concordia’s U.S. business deteriorated meaningfully in 2016, and some major risks built up for its international business. Having made a large acquisition of U.K.-based Amdipharm Mercury Ltd. in autumn of 2015, the decline of the British pound after Brexit also contributed to the company’s troubles. Clearly, we expect to have better results from this sector and avoiding mistakes is a large factor in achieving those results.

Through the 16-year history of the Diamond Hill Small Cap Fund, the Fund has generated an annualized return of 11.02% (Class I), above the Russell 2000 Index return of 8.10%, by following an intrinsic value approach to investing. During 2016, the Fund fell well short of its objectives in terms of adding relative performance value. To achieve the Fund’s long-term goals, it will be incumbent on me as portfolio manager to both avoid mistakes like Concordia in the future and to maintain Diamond Hill’s long-term temperament, staying with stocks like Avis Budget Group, if in fact our analysis proves correct.

Thank you for your continued support.

|

Tom Schindler, CFA

Portfolio Manager |

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM 9 |

Diamond Hill Small Cap Fund |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2016

| Inception

Date | One

Year | Three

Years | Five

Years | Ten

Years | Expense

Ratio* |

PERFORMANCE AT NAV WITHOUT SALES CHARGES |

Class A Shares | 12/29/2000 | 14.10% | 4.74% | 12.62% | 6.62% | 1.31% |

Class C Shares | 2/20/2001 | 13.25 | 3.96 | 11.78 | 5.83 | 2.06 |

Class I Shares | 4/29/2005 | 14.45 | 5.03 | 12.93 | 6.96 | 1.01 |

Class Y Shares | 12/30/2011 | 14.57 | 5.17 | 13.08 | 6.84 | 0.91 |

BENCHMARK |

Russell 2000 Index | | 21.31 | 6.74 | 14.46 | 7.07 | — |

PERFORMANCE AT PUBLIC OFFERING PRICE INCLUDING SALES CHARGES** |

Class A Shares | 12/29/2000 | 8.38 | 2.97 | 11.48 | 6.08 | 1.31 |

Class C Shares | 2/20/2001 | 12.25 | 3.96 | 11.78 | 5.83 | 2.06 |

* ** | Reflects the expense ratio as reported in the Prospectus dated February 28, 2017. The maximum sales charge for Class A shares on purchases and for Class C shares on certain redemptions are 5.00% and 1.00%, respectively. |

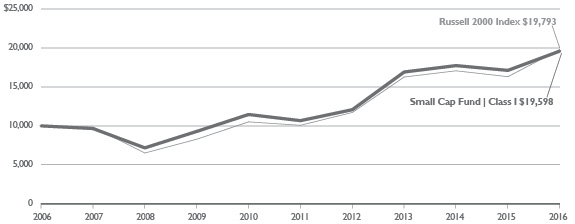

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill Small Cap Fund Class I(A) and the Russell 2000 Index.

(A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A, Class C and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell 2000 Index (“Index”). The Index is a market capitalization-weighted index measuring performance of the smallest 2,000 companies, on a market capitalization basis, in the Russell 3000 Index. The Index is unmanaged, and does not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

| Historical performance for Class Y shares prior to its inception is based on the performance of Class A shares. Class Y performance has been adjusted to reflect differences in sales charges and expenses between classes. |

| Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor��s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.diamond-hill.com. |

10 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM |

Diamond Hill Small-Mid Cap Fund |

2016 Portfolio Commentary

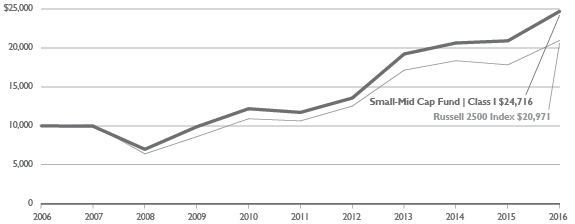

The Diamond Hill Small-Mid Cap Fund gained 18.18% (Class I) in 2016 compared to a 17.59% increase in the benchmark Russell 2500 Index. For the five-year period ended December 31, 2016, the Fund’s return was 16.08% annually while the Russell 2500 Index returned 14.54% over the same period. In the 11 years since inception, the Fund’s annual return of 9.54% outpaced the 8.43% benchmark return. The 2016 results were driven by favorable stock selection in the information technology and health care sectors, partially offset by a high single digit average cash weight which hurt returns in such a strong up year in the stock market. Three acquisitions also boosted portfolio results, as Linear Technology Corporation, Endurance Specialty Holdings Limited, and Universal American Corp. each announced they will be acquired at meaningful premiums.

At Diamond Hill, we focus on earning favorable long-term returns for our clients while minimizing the risk of permanent loss of capital. We’ve discussed in past letters investments that have generated returns that are a multiple of our initial purchase price, such as Boston Scientific and B&G Foods, Inc. It’s also worth noting that by limiting the frequency and magnitude of large losses, we have the opportunity to deliver market-beating returns with less need to first dig out of a deep hole.

One example of a situation where company fundamentals have been disappointing, but yet we’ve nevertheless avoided a loss on our investment, is our largest holding, Willis Towers Watson PLC. We first bought the stock in May 2013, and it has been our largest holding in the portfolio since the end of that year. Our investment thesis was that the company could achieve mid-single digit revenue growth and through cost cuts could improve its profit margins to levels closer to its peers, Marsh & McLennan Companies, Inc. and AON PLC. Over the period we’ve owned the stock, organic revenue growth has been closer to the low-single digit range and cost cuts have mostly been reinvested rather than increasing profit margins. While fundamental disappointments have caused the stock to underperform both the Russell 2500 Index and the Russell 2500 Financial Services Index since our purchase, we have still earned approximately 5% annually on our investment (versus approximately 10% and 13%, respectively, for the mentioned indexes).

Having our largest investment position underperform our benchmark and its sector has been a disappointment. However, we are pleased that while the mistake has had an opportunity cost, we have avoided an actual loss of money. This is an important aspect of our investment decision-making process, and our ability to have only modest losses or underperformance on many of our mistakes has allowed the big winners such as Boston Scientific and B&G Foods to tilt the scales of relative performance in our favor. We trimmed our position in Willis Towers Watson in the fourth quarter, but we continue to own a sizable weight in the stock because at the current valuation, we believe there remains very low risk of permanent loss of client capital.

We bought fewer new positions for the portfolio than in a typical year. However, we feel very positive about some of the purchases we made. SVB Financial Group is a very high-quality bank with a unique franchise lending to technology companies. We bought SVB in February when there were sharp concerns about technology company valuations and overall economic growth. As those concerns abated and eventually interest rates began to rise, the stock doubled from our

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM 11 |

Diamond Hill Small-Mid Cap Fund |

initial purchase price by year-end. Red Rock Resorts, Inc. is the leading local gaming company in Las Vegas. It has a loyalty program that includes nearly half of local residents as members, and those members visit Red Rock properties approximately 6-7 times per month. This creates favorable conditions for growing future profits and investment returns.

I’d like to once again highlight our excellent team of analysts and research associates who work hard to generate ideas and deliver strong returns to clients. They do outstanding work in pursuit of identifying long-term investment opportunities on your behalf.

The stock market rallied sharply following the election in anticipation of accelerated economic growth and increased company profits. There remains significant uncertainty regarding what outcomes may occur across a variety of policy issues including trade, taxes, and health care. In such environments of uncertainty, we look to valuation as our guide. In late 2008 and early 2009, stock valuations were unusually attractive, particularly for stocks with exposure to the economic cycle, and we invested aggressively to take advantage of the many opportunities. Today, stock market valuations are at historically high levels. As such, we have emphasized investing in companies where we believe there is low risk of permanent loss of investor capital. By limiting the frequency and magnitude of losses, we increase the odds that we will have enough successful investments to outperform both the benchmark and peers.

We appreciate your ongoing support and look forward to continuing to work with you in the coming years.

|

Chris Welch, CFA

Portfolio Manager |

12 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM |

Diamond Hill Small-Mid Cap Fund |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2016

| Inception

Date | One

Year | Three

Years | Five

Years | Ten

Years | Expense

Ratio* |

PERFORMANCE AT NAV WITHOUT SALES CHARGES |

Class A Shares | 12/30/2005 | 17.81% | 8.44% | 15.76% | 9.12% | 1.25% |

Class C Shares | 12/30/2005 | 16.98 | 7.63 | 14.91 | 8.32 | 2.00 |

Class I Shares | 12/30/2005 | 18.18 | 8.73 | 16.08 | 9.47 | 0.95 |

Class Y Shares | 12/30/2011 | 18.29 | 8.88 | 16.23 | 9.34 | 0.85 |

BENCHMARK |

Russell 2500 Index | | 17.59 | 6.93 | 14.54 | 7.69 | — |

PERFORMANCE AT PUBLIC OFFERING PRICE INCLUDING SALES CHARGES** |

Class A Shares | 12/30/2005 | 11.94 | 6.60 | 14.57 | 8.56 | 1.25 |

Class C Shares | 12/30/2005 | 15.98 | 7.63 | 14.91 | 8.32 | 2.00 |

* ** | Reflects the expense ratio as reported in the Prospectus dated February 28, 2017. The maximum sales charge for Class A shares on purchases and for Class C shares on certain redemptions are 5.00% and 1.00%, respectively. |

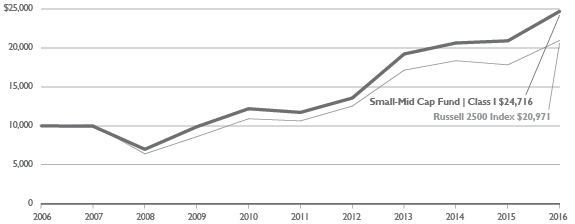

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill Small-Mid Cap Fund Class I(A) and the Russell 2500 Index.

(A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A, Class C and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell 2500 Index (“Index”). The Index is a market capitalization-weighted index measuring performance of the smallest 2,500 companies, on a market capitalization basis, in the Russell 3000 Index. The Index is unmanaged, and does not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

| Historical performance for Class Y shares prior to its inception is based on the performance of Class A shares. Class Y performance has been adjusted to reflect differences in sales charges and expenses between classes. |

| Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.diamond-hill.com. |

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM 13 |

Diamond Hill Mid Cap Fund |

2016 Portfolio Commentary

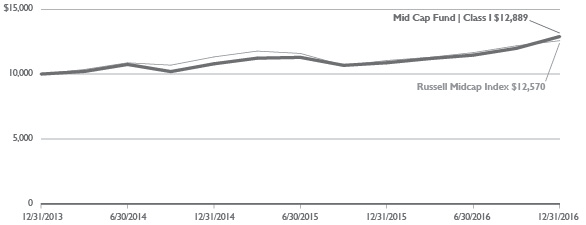

The Diamond Hill Mid Cap Fund gained 18.56% (Class I) in 2016 compared to a 13.80% increase in the benchmark Russell Midcap Index. For the three-year period since inception, the Fund’s return was 8.83% annually while the Russell Midcap Index returned 7.92% over the same period. The 2016 results were driven by favorable stock selection in the industrials sector and an overweight in financials sector stocks, partially offset by unfavorable stock selection in the materials sector and a high-single digit average cash weight, which hurt returns in such a strong up year in the stock market. Two acquisitions also boosted portfolio results, as Linear Technology Corporation and Endurance Specialty Holdings Limited announced they will be acquired at meaningful premiums.

At Diamond Hill, we focus on earning favorable long-term returns for our clients while minimizing the risk of permanent loss of capital. We’ve discussed in past letters investments that have generated returns that are a multiple of our initial purchase price, such as Post Holdings, Inc. It’s also worth noting that by limiting the frequency and magnitude of large losses, we have the opportunity to deliver market-beating returns with less need to first dig out of a deep hole.

One example of a situation where company fundamentals have been disappointing, but yet we’ve nevertheless avoided a loss on our investment, is our largest holding, Willis Towers Watson PLC. We bought the stock three years ago at the portfolio’s inception and it has been our largest holding over that period. Our investment thesis was that the company could achieve mid-single digit revenue growth and through cost cuts could improve its profit margins to levels closer to its peers, Marsh & McLennan Companies, Inc. and AON PLC. During the time we’ve owned the stock, organic revenue growth has been closer to the low-single digit range and cost cuts have mostly been reinvested rather than increasing profit margins. While fundamental disappointments have caused the stock to underperform both the Russell Mid Cap Index and the Russell Mid Cap Financial Services Index since our purchase, we have still earned approximately 3% annually on our investment (versus approximately 8% and 11%, respectively, for the mentioned indexes).

Having our largest investment position underperform our benchmark and its sector has been a disappointment. However, we are pleased that while the mistake has had an opportunity cost, we have avoided an actual loss of money. This is an important aspect of our investment decision-making process, and our ability to have only modest losses or underperformance on many of our mistakes has allowed the big winners such as Post Holdings to tilt the scales of relative performance in our favor. We trimmed our position in Willis Towers Watson in the fourth quarter, but we continue to own a sizable weight in the stock because at the current valuation, we believe there remains very low risk of permanent loss of client capital.

While it has been somewhat difficult to find attractive new opportunities, we feel very positive about some of the purchases we made this year. SVB Financial Group is a very high-quality bank with a unique franchise lending to technology companies. We bought SVB in June when there were sharp concerns about declining interest rates, which negatively impact the company’s net interest margin. As those concerns abated and eventually interest rates began to rise, the stock doubled from our initial purchase price by year-end. Red Rock Resorts, Inc. is the leading local

14 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM |

Diamond Hill Mid Cap Fund |

gaming company in Las Vegas. It has a loyalty program that includes nearly half of local residents as members, and those members visit Red Rock properties approximately 6-7 times per month. This creates favorable conditions for growing future profits and investment returns.

I’d like to once again highlight our excellent team of analysts and research associates who work hard to generate ideas and deliver strong returns to clients. They do outstanding work in pursuit of identifying long-term investment opportunities on your behalf.

The stock market rallied sharply following the election in anticipation of accelerated economic growth and increased company profits. There remains significant uncertainty regarding what outcomes may occur across a variety of policy issues including trade, taxes, and health care. In such environments of uncertainty, we look to valuation as our guide. Today, stock market valuations are at historically high levels. As such, we have emphasized investing in companies where we believe there is low risk of permanent loss of investor capital. By limiting the frequency and magnitude of losses, we increase the odds that we will have enough successful investments to outperform both the benchmark and peers.

We appreciate your ongoing support and look forward to continuing to work with you in the coming years.

|

Chris Welch, CFA

Portfolio Manager |

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM 15 |

Diamond Hill Mid Cap Fund |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2016

| Inception

Date | One

Year | Since Inception (12/31/13) | Expense

Ratio* |

PERFORMANCE AT NAV WITHOUT SALES CHARGES |

Class A Shares | 12/31/2013 | 18.29% | 8.52% | 1.10% |

Class I Shares | 12/31/2013 | 18.56 | 8.83 | 0.80 |

Class Y Shares | 12/31/2013 | 18.76 | 8.96 | 0.70 |

BENCHMARK |

Russell Midcap Index | | 13.80 | 7.92 | — |

PERFORMANCE AT PUBLIC OFFERING PRICE INCLUDING SALES CHARGES** |

Class A Shares | 12/31/2013 | 12.42 | 6.67 | 1.10 |

* ** | Reflects the expense ratio as reported in the Prospectus dated February 28, 2017. The maximum sales charge for Class A shares on purchases is 5.00%. |

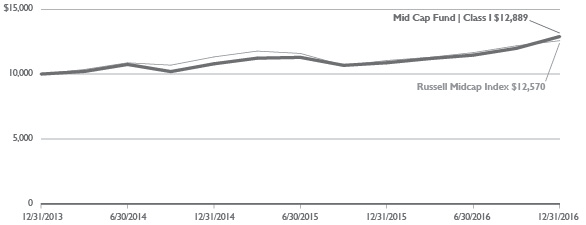

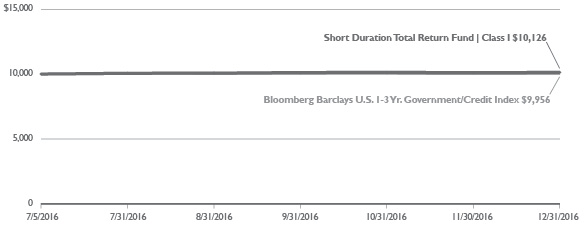

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill Mid Cap Fund Class I(A) and the Russell Midcap Index.

(A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell Midcap Index (“Index”). The Index is a market capitalization-weighted index measuring performance of the 800 smallest companies in the Russell 1000 Index. The Index is unmanaged, and does not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

| Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.diamond-hill.com. |

16 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM |

Diamond Hill Large Cap Fund |

2016 Portfolio Commentary

The Diamond Hill Large Cap Fund returned 14.63% (Class I) in 2016 compared to 12.05% for the Russell 1000 Index. This year was characterized by a difficult first half as falling commodity prices and interest rates caused investors to be concerned regarding the ramifications of a slow economy and deflation. This fear seemed to peak with the Brexit vote in the United Kingdom in late June, which led to a strengthening dollar and a further step down in interest rates. However, the continued growth of the U.S. economy, combined with signs of improved growth outside the U.S., caused investor optimism to improve and interest rates to return to the levels of early 2016. This all occurred within the backdrop of the surprising election of Donald Trump as president and the market’s positive reaction to the potential of increased economic growth.

The financials sector provided the greatest positive contribution to the Fund’s performance in 2016, despite the difficulties experienced in the beginning of the year caused by falling interest rates. Fortunately, we used that weakness to add to our portfolio holdings, resulting in our financials sector weighting becoming quite large. The subsequent rally in the second half of the year from very low valuation levels helped drive the performance of the Fund. This demonstrates the importance of the Diamond Hill valuation discipline. We added to those holdings during periods of short-term stress because our assessment of long-term fundamentals indicated the valuations were very attractive. Morgan Stanley and J.P. Morgan were examples of two positions which contributed strongly to the 2016 performance. The total return for Morgan Stanley in 2016 was 36.06% while J.P. Morgan returned 34.57%. These strong returns were driven by attractive valuations which went unappreciated in the market due to short-term concerns surrounding the macroeconomic environment. It is these types of concerns which often provide us the best opportunities.

Some of our most successful investments in 2016 were in the controversial energy sector. Cimarex Energy Co. returned 52.6% for the year, which was the largest gain in any one security. EOG Resources Inc. returned 44.0%. These returns greatly exceeded the return for the market as well as the energy sector, but our significant underweighting in energy meant our energy sector performance lagged the Index. We continue to maintain an underweight position in this sector as high valuations and secular pressure on pricing means there are limited long-term opportunities in the sector.

The information technology sector was the second biggest contributor to performance. Our holding in Linear Technology Corporation returned 41.0% as due its acquisition by a large semiconductor company. Vantiv Inc. (Class A) was the other strong technology holding, returning 25.7% as strong growth continued for this leading payments processing company.

The consumer discretionary sector was the most disappointing in 2016. We have a large exposure to this sector but performance within the sector was mixed. Several of our media holdings performed well, but companies exposed to the slowdown in the retailing sector detracted from performance. Hanesbrands, Inc. was down 19.0% on excess inventories in the retail supply chain and disappointing sales. The story was very similar with V.F. Corporation which was down 12.10% in 2016. V.F. Corporation owns several attractive apparel brands that retail vendors are eager to feature in their department stores. However, the slowdown in department store sales has directly

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM 17 |

Diamond Hill Large Cap Fund |

impacted the company. The company remains a holding in the portfolio as its brands remain dominant. However, the company will need to improve revenue growth in order to achieve its profit objectives.

There were also disappointing holdings in the consumer staples sector. Kimberly Clark has been a holding in the Fund for a considerable period of time and has performed quite well. However, increasing competition in 2016 caused the company to miss profitability targets and the stock was down 7.7% for the year. Coty was also a disappointment. This is a new holding and still a relatively small weighting, but the stock declined 24.7% due to disappointing revenue growth.

Several new names besides Coty Inc. were added to the portfolio in 2016, including Aetna Inc., Thermo Fisher Scientific Inc., Axalta Coatings Systems Ltd., and Ford Motor Company. So far their performance is mixed. Far more important to the performance of the portfolio were the additions to several of our current financial services holdings during the selloffs in the first quarter of the year. Taking advantage of the market’s overreaction to short-term concerns was important in helping the portfolio outperform the benchmark in 2016.

2016 was a gratifying year for investors after a difficult 2015. The recovery from the market lows of 2009 continues and the market achieved several record highs in 2016. As we enter 2017, there are many uncertainties surrounding a new presidential administration and the effect on investments. In my 34 years of investment experience, I have been through a variety of macroeconomic and political changes. Through it all I have found maintaining an intrinsic value discipline with a long-term perspective is the best way to successfully deal with the related uncertainty. I will continue to apply this discipline in the year ahead.

As always, I am grateful for the opportunity provided to me by the shareholders of the Diamond Hill Large Cap Fund. Thank you for your continued support.

|

Chuck Bath, CFA

Portfolio Manager |

18 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM |

Diamond Hill Large Cap Fund |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2016

| Inception

Date | One

Year | Three

Years | Five

Years | Ten

Years | Expense

Ratio* |

PERFORMANCE AT NAV WITHOUT SALES CHARGES |

Class A Shares | 6/29/2001 | 14.26% | 7.66% | 13.82% | 6.82% | 0.99% |

Class C Shares | 9/25/2001 | 13.40 | 6.86 | 12.98 | 6.02 | 1.74 |

Class I Shares | 1/31/2005 | 14.63 | 7.97 | 14.13 | 7.16 | 0.69 |

Class Y Shares | 12/30/2011 | 14.74 | 8.09 | 14.29 | 7.04 | 0.59 |

BENCHMARK |

Russell 1000 Index | | 12.05 | 8.59 | 14.69 | 7.08 | — |

PERFORMANCE AT PUBLIC OFFERING PRICE INCLUDING SALES CHARGES** |

Class A Shares | 6/29/2001 | 8.54 | 5.84 | 12.65 | 6.27 | 0.99 |

Class C Shares | 9/25/2001 | 12.40 | 6.86 | 12.98 | 6.02 | 1.74 |

* ** | Reflects the expense ratio as reported in the Prospectus dated February 28, 2017. The maximum sales charge for Class A shares on purchases and for Class C shares on certain redemptions are 5.00% and 1.00%, respectively. |

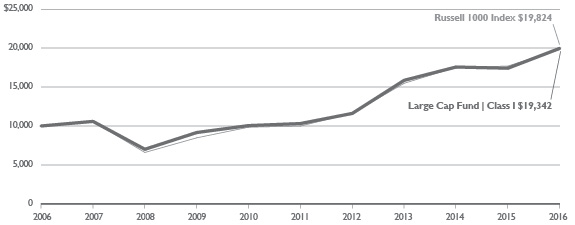

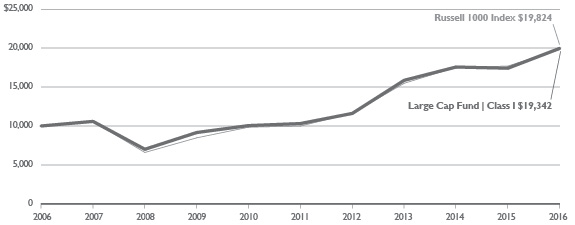

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill Large Cap Fund Class I(A) and the Russell 1000 Index.

(A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A, Class C and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell 1000 Index (“Index”). The Index is a market capitalization-weighted index measuring performance of the largest 1,000 companies, on a market capitalization basis, in the Russell 3000 Index. The Index is unmanaged, and does not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

| Historical performance for Class Y shares prior to its inception is based on the performance of Class A shares. Class Y performance has been adjusted to reflect differences in sales charges and expenses between classes. |

| Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.diamond-hill.com. |

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM 19 |

2016 Portfolio Commentary

The Diamond Hill Select Fund increased 9.62% (Class I) in 2016 compared to our benchmark, the Russell 3000 Index, which increased 12.74%.

Our 2015 letter to shareholders described the year as a “tale of two halves”. That depiction is apt once again as we review 2016. During the first six months of the year, the Fund declined by nearly 7%, lagging the Russell 3000 by more than 10%. Poor relative results were driven by unusually large sector allocation effects, with overweight sectors such as financials and consumer discretionary underperforming, and underweight sectors such as utilities and consumer staples outperforming, as well as a large negative contribution from our position in Valeant (more on that below). In the second half of 2016, the Fund increased by over 17%, outpacing the Russell 3000 by nearly 10%. Strong results in the final six months of the year were attributable to a reversal in sector performance, with cyclicals outperforming more stable sectors, and excellent security selection within the industrials sector. Five of our industrials holdings (United Continental, Colfax, Hub Group, Deere, and Parker-Hannifin) ended the year up more than 30%.

We are long-term investors and measure our results in years, not months. However, the volatility in results over shorter time periods serves as a good reminder that the Select Fund is a more concentrated strategy, investing in approximately 30 holdings (1% of the benchmark universe) across a wide range of market capitalizations. Our portfolio looks very different from the Index, and we expect results that are different from the Index. Over short time periods, it is difficult to predict whether performance variances will be positive or negative, but over the long term, we believe our philosophy and process give us an edge over passive alternatives and peers.

A year ago, we discussed five holdings whose poor stock performance derailed an otherwise good year for our portfolio. Today, three of those companies — Nationstar, Colfax, and Twenty-First Century Fox — are held in the Fund. The other two companies — Franklin Resources and Valeant — were sold during the year as fundamentals continually fell short of our expectations. During 2016, Nationstar and Colfax were two of the top three performers in the Fund, both up over 30%. Nationstar continued to grow its mortgage servicing portfolio, improve margins, and thoughtfully deployed its excess capital, repurchasing 10% of shares outstanding at a large discount to book value and retiring portions of its outstanding debt. Industrial manufacturer Colfax also took advantage of its depressed stock price to repurchase shares at a steep discount to our estimate of intrinsic value early in 2016, and new management exercised discipline in managing costs through a challenging market environment. Media conglomerate Twenty-First Century Fox reported good fundamental results including robust organic growth, but its stock price languished as uncertainty about evolving content distribution relationships in the industry weighed on valuation multiples.

Our appraisals of value for Franklin Resources and Valeant now appear to have been overly optimistic, even after reducing our estimates during 2015. Asset manager Franklin Resources is a conservatively managed business with a large net cash position on its balance sheet and attractive free cash flow generation. We purchased a position knowing that the near-term outlook for flows was poor, given sub-par results in some key products, but we believed there was a large margin of safety in the valuation and expected assets under management to stabilize. That thesis

20 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM |

was challenged by worse-than-anticipated outflows, at least partly due to increasing pressure from passive alternatives. While Franklin continued to look cheap compared to earnings, especially considering its large net cash position, we became concerned that the business would not recover over a 2- to 3-year horizon. We chose to sell Franklin and redeploy funds into more attractive ideas.

Valeant, a specialty pharmaceutical company, also had shortfalls in its core businesses that were larger than we expected. Reputational damage, key employee turnover, and pressure from supply chain partners all weighed on operations during the year, and led to impairments of the company’s earnings capacity. The resulting decline in Valeant’s business value was magnified by substantial financial leverage, which produced a dramatic reduction in equity value. Throughout our ownership of Valeant shares, we had taken comfort in the company’s strong cash generation and our calculation that the company could comfortably meet debt obligations for the foreseeable future without any asset sales or access to the capital markets. By the second half of 2016, however, the cumulative reduction in earnings power raised concerns about liquidity over coming years. We determined that further impairments of shareholder capital were increasingly likely and exited our position at a large loss.

We have now been managing the Select Fund for a little over four years. We have had some significant successes, and more recently, some notable failures. On balance, our successes have outweighed the failures, but the margin has not been as decisive as we would have liked. As significant owners and fiduciaries, we hope to grow that margin over the coming years.

Thank you for your support.

|

|

Austin Hawley, CFA

Portfolio Manager | Rick Snowdon, CFA

Portfolio Manager |

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM 21 |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2016

| Inception

Date | One

Year | Three

Years | Five

Years | Ten

Years | Expense

Ratio* |

PERFORMANCE AT NAV WITHOUT SALES CHARGES |

Class A Shares | 12/30/2005 | 9.37% | 6.26% | 13.97% | 6.93% | 1.19% |

Class C Shares | 12/30/2005 | 8.51 | 5.43 | 13.12 | 6.12 | 1.94 |

Class I Shares | 12/30/2005 | 9.62 | 6.54 | 14.25 | 7.25 | 0.89 |

Class Y Shares | 12/30/2011 | 9.72 | 6.65 | 14.41 | 7.13 | 0.79 |

BENCHMARK |

Russell 3000 Index | | 12.74 | 8.43 | 14.67 | 7.07 | — |

PERFORMANCE AT PUBLIC OFFERING PRICE INCLUDING SALES CHARGES** |

Class A Shares | 12/30/2005 | 3.91 | 4.47 | 12.81 | 6.38 | 1.19 |

Class C Shares | 12/30/2005 | 7.51 | 5.43 | 13.12 | 6.12 | 1.94 |

* ** | Reflects the expense ratio as reported in the Prospectus dated February 28, 2017. The maximum sales charge for Class A shares on purchases and for Class C shares on certain redemptions are 5.00% and 1.00%, respectively. |

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill Select Fund Class I(A) and the Russell 3000 Index.

(A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A, Class C and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell 3000 Index (“Index”). The Index is a widely recognized market capitalization-weighted index measuring the performance of the 3,000 largest U.S. companies based on total market capitalization. The Index is unmanaged, and does not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

| Historical performance for Class Y shares prior to its inception is based on the performance of Class A shares. Class Y performance has been adjusted to reflect differences in sales charges and expenses between classes. |

| Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.diamond-hill.com. |

22 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM |

Diamond Hill Long-Short Fund |

2016 Portfolio Commentary

The Diamond Hill Long-Short Fund returned 10.55% (Class I) in 2016 compared to 12.05% for the long-only Russell 1000 Index and a 7.32% return for the blended benchmark (60% Russell 1000 Index/40% Bank of America Merrill Lynch U.S. T-Bill 0-3 Month Index). While the portfolio lagged the long-only Russell 1000 Index, we were pleased that the Fund was ahead of the blended benchmark, which takes into account the portfolio’s general 60% net long bias. As we have communicated in the past, we strive to outperform the blended benchmark in all market environments. During 2016, the long side of the portfolio outperformed meaningfully, while the short portfolio was up more than the benchmark as three short positions had negative contributions approximating the overall amount of the underperformance.

During 2016, the bias for the portfolio was to remain roughly in line with our blended benchmark, maintaining net long exposure between 52% and 64% during most of the year. At year-end, the net long exposure was again very close to 54%.

Market leadership was a reversal of last year, with the more cyclical sectors — financials, industrials, materials, and energy — providing the biggest positive contribution to return in the long portfolio. Within the financials sector, Popular, Citigroup, and Capital One were the largest contributors; United Airlines, Cimarex, and Parker-Hannifin also contributed to return.

The short portfolio detracted from results in 2016 as three of our largest positions — Best Buy, Boeing, and Cincinnati Financial — appreciated considerably for the year. Importantly, in each case we have maintained our positions, as we believe these companies remain subject to disappointing fundamentals in the foreseeable future. In the case of Best Buy, our view is that the strong secular trend of the increasing importance of online shopping is problematic for traditional bricks-and-mortar retailers. Boeing, which benefited for years as a virtual duopoly with Airbus, now is facing growing competition from newer entrants such as Brazil’s Embraer and China’s COMAC. As a regional property casualty company, we believe Cincinnati Financial will be at a pricing disadvantage to the larger, national companies.

Finally, we continue to believe the five-year outlook for domestic equities includes total returns at the low end of historical ranges, and as always, we are focused on long time horizons and buying good (or better) businesses at average (or better) prices. Our exposures and net positioning will, at any given point in time, be dictated by the sum of the individual opportunities we are finding in the market. We are grateful for your continued support and appreciate the opportunity to continue to earn your trust in 2017.

|

|

Chris Bingaman, CFA

Portfolio Manager | Ric Dillon, CFA

Portfolio Manager |

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM 23 |

Diamond Hill Long-Short Fund |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2016

| Inception

Date | One

Year | Three

Years | Five

Years | Ten

Years | Expense

Ratio* |

PERFORMANCE AT NAV WITHOUT SALES CHARGES |

Class A Shares | 6/30/2000 | 10.26% | 5.15% | 9.16% | 3.99% | 2.08% |

Class C Shares | 2/13/2001 | 9.45 | 4.37 | 8.35 | 3.21 | 2.83 |

Class I Shares | 1/31/2005 | 10.55 | 5.44 | 9.45 | 4.31 | 1.78 |

Class Y Shares | 12/30/2011 | 10.69 | 5.58 | 9.61 | 4.20 | 1.68 |

BENCHMARK |

Russell 1000 Index | | 12.05 | 8.59 | 14.69 | 7.08 | — |

60% Russell 1000 Index/40% BofA

Merrill Lynch U.S. T-Bill 0-3 Mo. Index | | 7.32 | 5.26 | 8.77 | 4.81 | — |

PERFORMANCE AT PUBLIC OFFERING PRICE INCLUDING SALES CHARGES** |

Class A Shares | 6/30/2000 | 4.75 | 3.37 | 8.05 | 3.45 | 2.08 |

Class C Shares | 2/13/2001 | 8.45 | 4.37 | 8.35 | 3.21 | 2.83 |

* ** | Reflects the expense ratio as reported in the Prospectus dated February 28, 2017. The maximum sales charge for Class A shares on purchases and for Class C shares on certain redemptions are 5.00% and 1.00%, respectively. |

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill Long-Short Fund Class I(A), the Russell 1000 Index and the Blended Index (60% Russell 1000 Index and 40% BofA Merrill Lynch U.S. T-Bill 0-3 Month Index)

(A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A, Class C and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell 1000 Index and the blended index. The Russell 1000 Index is a market capitalization-weighted index measuring performance of the largest 1,000 companies on a market capitalization basis, in the Russell 3000 Index. The Blended Index represents a 60% weighting of the Russell 1000 Index as described above and a 40% weighting of the BofA Merrill Lynch U.S. T-Bill 0-3 Month Index. The BofA Merrill Lynch U.S. T-Bill 0-3 Month Index tracks the performance of U.S. dollar denominated U.S. Treasury Bills publicly issued in the U.S. domestic market with a remaining term to final maturity of less than 3 months. Both indices are unmanaged, and do not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

| Historical performance for Class Y shares prior to its inception is based on the performance of Class A shares. Class Y performance has been adjusted to reflect differences in sales charges and expenses between classes. |

| Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.diamond-hill.com. |

24 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM |

Diamond Hill Research Opportunities Fund |

2016 Portfolio Commentary

The Diamond Hill Research Opportunities Fund increased 9.89% (Class I) during 2016 compared to a 12.74% increase in our primary benchmark, the long-only Russell 3000 Index. At Diamond Hill, we have a long-term investment horizon and therefore evaluate our performance over rolling five-year periods. At the end of 2016, our five-year annualized return was 10.73% versus 14.67% for the Russell 3000 Index.

While the absolute returns of the Fund were adequate, we are disappointed with our relative results. In addition to negative contributions from the short portfolio, our willingness to take more concentrated positions was a drag on performance as some of our largest weights underperformed. We continue to believe our disciplined approach to capital allocation will deliver satisfactory absolute and relative results over most rolling five-year periods.

We thought it might be helpful to current and prospective Fund investors if we added a secondary blended benchmark that was more closely aligned with the historical net exposure of the Fund. This secondary benchmark was added in February 2016 and is a combination of 75% Russell 3000 Index and 25% Bank of America Merrill Lynch U.S. T-Bill 0-3 Month Index, in line with the Fund’s average net exposure of 76% over the trailing five years. Over the past one-year and five-year periods ended December 31, 2016, the blended benchmark returned 9.60% and 10.96%, respectively.

During 2016, the long portfolio contributed to the Fund’s return with an average long exposure of 108%, while the positions in the short portfolio detracted from the Fund’s return with an average short exposure of (28%). Beginning in the fourth quarter of 2015 and into 2016, as certain areas of the market sold off, the Fund utilized more of its gross exposure flexibility to increase positions in our higher conviction ideas. The average gross exposure for 2016 was 136%, versus 113% in 2015, while the average net exposure for both years was essentially equal at around 79%.

The largest positive contributors to performance in 2016 were long investments in Hub Group, United Continental Holdings, CommScope, and Nationstar Mortgage Holdings.

After selling off in the fourth quarter of 2015, freight transportation management company Hub Group, Inc. rebounded after reporting encouraging fundamental results and improving margins. The company also announced a stock repurchase authorization early in the year that represented 10% of the company’s market value at the time.

Shares of United Continental rallied throughout the second half of the year as the company announced further changes to its management team. The new executives are well-respected in the industry, particularly in the areas of revenue management and capital allocation. Revenue trends continued to improve through the fourth quarter and a company-hosted investor day increased investor confidence in management’s plan to improve margins.

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM 25 |

Diamond Hill Research Opportunities Fund |

CommScope’s share price appreciated strongly in 2016 as the firm exceeded cost savings targets associated with a large acquisition, reduced debt, and benefited from healthy demand for the firm’s fiber optics cabling products. We had increased our position size in the first quarter, as general stock price weakness of smaller cyclical companies allowed us to purchase the shares at a significant discount to our estimate of intrinsic value.

We benefited from our long-term perspective with Nationstar Mortgage Holdings, which we wrote about last year as a large detractor. The shares declined meaningfully in the first six weeks of the year, then rebounded as the company continued to focus on improving core operations while taking advantage of opportunities to repurchase stock and debt at attractive prices and increase the mix of the less-capital-intensive sub-servicing business.

The strong contribution from our investments in industrials, information technology, and financials was offset by especially poor performance from a handful of our health care investments. Pharmaceutical holdings in Valeant, Endo, and Concordia all detracted from performance as each company’s business deteriorated and industry-wide concerns over drug pricing grew. For each of the three companies, the combination of weaker fundamentals and drug pricing concerns, along with high levels of financial leverage, meaningfully eroded the intrinsic value of their businesses. In Valeant’s case, the company was also secretively using a specialty pharmacy called Philidor to maximize the use of, and reimbursement for, its products. Some aspects of Philidor’s operations were very aggressive, bringing increased regulatory, legal, and payer scrutiny on Valeant. Home infusion services provider BioScrip, Inc. underperformed after reporting weak fundamental results, with the company failing to execute on efforts by the previous CEO and COO to reduce expenses. New CEO Dan Greenleaf has taken corrective actions which we believe will help turn around company fundamentals.

Shares of Best Buy were a notable detractor on the short side as current company fundamentals have been better than we expected. Results have been boosted by continued disciplined cost management and share repurchases. We remain confident in our short thesis and believe structural headwinds exist, in addition to weak traffic trends and lack of pricing power.

As of December 31, 2016, the Fund held 72 long and 35 short positions, with the top ten positions representing 40% of net assets.

We want to thank shareholders for their support and look forward to working together in the years ahead.

Diamond Hill Research Analysts

26 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2016 | DIAMOND-HILL.COM |

Diamond Hill Research Opportunities Fund |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2016

| Inception

Date | One

Year | Three

Years | Five

Years | Since Inception* | Expense Ratio** |

PERFORMANCE AT NAV WITHOUT SALES CHARGES |

Class A Shares | 12/30/2011 | 9.64% | 3.56% | 10.44% | 13.21% | 2.03% |

Class C Shares | 12/30/2011 | 8.76 | 2.78 | 9.63 | 12.37 | 2.78 |

Class I Shares | 12/30/2011 | 9.89 | 3.82 | 10.73 | 13.51 | 1.73 |

Class Y Shares | 12/30/2011 | 10.05 | 3.96 | 10.88 | 13.66 | 1.63 |

BENCHMARK |

Russell 3000 Index | | 12.74 | 8.43 | 14.67 | 16.96 | — |

75% Russell 3000 Index/25% BofA Merrill Lynch

U.S. T-Bill 0-3 Mo. Index | | 9.60 | 6.41 | 10.96 | 12.71 | — |

PERFORMANCE AT PUBLIC OFFERING PRICE INCLUDING SALES CHARGES** |

Class A Shares | 12/30/2011 | 4.14 | 1.81 | 9.32 | 12.46 | 2.03 |

Class C Shares | 12/30/2011 | 7.76 | 2.78 | 9.63 | 12.37 | 2.78 |

* ** | Reflects the expense ratio as reported in the Prospectus dated February 28, 2017. The maximum sales charge for Class A shares on purchases and for Class C shares on certain redemptions are 5.00% and 1.00%, respectively. |

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill Research Opportunities Fund Class I(A), the Russell 3000 Index and the Blended Index (75% Russell 3000 Index and 25% BofA Merrill Lynch U.S. T-Bill 0-3 Mo. Index).

(A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A, Class C and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

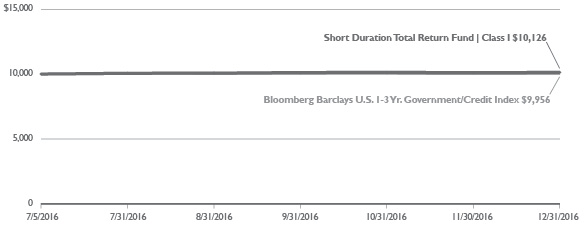

| The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell 3000 Index (“Index”). The Index is a widely recognized market capitalization-weighted index measuring the performance of the 3,000 largest U.S. companies based on total market capitalization. The Blended Index represents a 75% weighting of the Russell 3000 Index and a 25% weighting of the BofA Merrill Lynch U.S. T-Bill 0-3 Month Index. The BofA Merrill Lynch U.S. T-Bill 0-3 Month Index is comprised of U.S. dollar denominated U.S. Treasury Bills with a term to maturity of less than 3 months. These indexes are unmanaged, and do not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |