UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: | 811-08061 | |

Diamond Hill Funds

(Exact name of registrant as specified in charter)

| 325 John H. McConnell Boulevard, Suite 200, Columbus, Ohio | 43215 |

| (Address of principal executive offices) | (Zip code) |

Thomas E. Line, 325 John H. McConnell Boulevard, Suite 200, Columbus, Ohio 43215

(Name and address of agent for service)

| Registrant’s telephone number, including area code: | 614-255-3333 | |

| Date of fiscal year end: | December 31 | |

| Date of reporting period: | December 31, 2018 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Letter to Shareholders | 1 |

Mission and Guiding Principles | 5 |

| | |

Management Discussion of Fund Performance (Unaudited) | |

Diamond Hill Small Cap Fund | 7 |

Diamond Hill Small-Mid Cap Fund | 12 |

Diamond Hill Mid Cap Fund | 15 |

Diamond Hill Large Cap Fund | 18 |

Diamond Hill All Cap Select Fund | 21 |

Diamond Hill Long-Short Fund | 24 |

Diamond Hill Research Opportunities Fund | 27 |

Diamond Hill Financial Long-Short Fund | 30 |

Diamond Hill Global Fund | 33 |

Diamond Hill Short Duration Total Return Fund | 36 |

Diamond Hill Core Bond Fund | 39 |

Diamond Hill Corporate Credit Fund | 42 |

Diamond Hill High Yield Fund | 46 |

| | |

Financial Statements | |

Schedules of Investments | 50 |

Statements of Assets & Liabilities | 102 |

Statements of Operations | 105 |

Statements of Changes in Net Assets | 108 |

Financial Highlights | 122 |

Notes to Financial Statements | 148 |

Report of Independent Registered Public Accounting Firm | 166 |

Other Items | 168 |

Schedule of Shareholder Expenses | 173 |

Management of the Trust | 176 |

Cautionary Statement: At Diamond Hill, we pledge that, “we will communicate with our clients about our investment performance in a manner that will allow them to properly assess whether we are deserving of their trust.” Our views and opinions regarding the investment prospects of our portfolio holdings and Funds are “forward looking statements” which may or may not be accurate over the long term. While we believe we have a reasonable basis for our opinions, actual results may differ materially from those we anticipate. Information provided in this report should not be considered a recommendation to purchase or sell any particular security.

You can identify forward looking statements by words like “believe,” “expect,” “anticipate,” or similar expressions when discussing prospects for particular portfolio holdings and/or one of the Funds. We cannot assure future results. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. We disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise.

This material is not authorized for distribution to prospective investors unless preceded or accompanied by a Prospectus. Investors should consider the investment objectives, risks, charges, and expenses of the Diamond Hill Funds carefully before investing. The prospectus or summary prospectus contain this and other important information about the Fund(s) and are available at diamond-hill.com or by calling 888.226.5595. Please read the prospectus or summary prospectus carefully before investing. The Diamond Hill Funds are distributed by Foreside Financial Services, LLC (Member FINRA). Diamond Hill Capital Management, Inc., a registered investment adviser, serves as Investment Adviser to the Diamond Hill Funds and is paid a fee for its services. Diamond Hill Funds are not FDIC insured, may lose value, and have no bank guarantee.

Dear Fellow Shareholders:

We are pleased to provide you with this year-end update for the Diamond Hill Funds.

After finishing 2017 at all-time highs, U.S. equity markets declined in 2018. For the Russell 1000 Index, it was the first decline since 2008. The outperformance of growth over value was once again a major theme through the first three quarters of the year, although value regained some ground in the fourth quarter. Still, the year ended with the Russell 1000 Growth Index outperforming the Russell 1000 Value Index by nearly 7%.

The trend toward passive management persisted in 2018. We continue to believe that Diamond Hill strategies will outperform their respective passive benchmarks over a full market cycle, supported by a shared commitment to our intrinsic value-based investment philosophy, long-term perspective, disciplined approach, and alignment with our clients’ interests. As of December 31, 2018, the since-inception returns for most of our strategies exceeded their respective benchmark returns.

2018 Financial Markets

It was an eventful year for U.S. equity markets. Concern over rising interest rates and a budding global trade war drove a 10% decline in the Russell 1000 Index between late January and early February. Those fears were quickly overcome and from spring to fall the markets resembled 2017: a steady grind higher with little volatility. Driven by “growth” stocks, the Russell 1000 Index ended the third quarter up over 10% for the year.

Things had already started to change toward the end of September, though, which turned out to be the market’s peak for the year. Subsequently, the Russell 1000 Index declined approximately 20% at its low point and ended the year down nearly 5% on renewed concerns over the Federal Reserve’s policy, tariffs, and slowing global economic growth. Not surprisingly, small cap stocks fared worse in this challenging environment, with the Russell 2000 Index declining more than 11% for the year.

For the full year, only three sectors in the Russell 1000 Index had a positive return. Health care was the best-performing sector (+6.1%), followed by utilities (+4.6%) and information technology (+3.3%). Concern over a global economic slowdown made cyclical sectors the worst performers, with energy, materials, industrials, and financials all down over 10%.

The leading theme in the fixed income markets throughout the year was the Federal Reserve and its continued path towards rate normalization. For much of the year, Treasury yields climbed in tandem with the Federal Reserve’s ongoing rate hikes, although the long end of the curve did not increase as much as the front end, flattening the yield curve. However, Treasury yields peaked in early November as markets became more concerned about the risk of policy errors by governments across the globe. Risk assets, like stocks and high yield bonds, sold off and the Treasury market rallied into the end of the year.

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM 1 |

The Bloomberg Barclays U.S. Aggregate Index spent most of the year in negative territory until the final trading day of the year, when it delivered enough positive return to push the index return to 0.01% for 2018. This marked the lowest return for the index since 2013 and the second lowest return in the past eighteen years. The securitized market delivered strong returns for the year, leading the investment grade markets, while Treasuries experienced mixed results with the short end delivering positive returns and the long end delivering negative returns.

Investment grade and high yield corporate bonds followed a path similar to that of equities, with investment grade suffering its worst calendar year performance since 2008 and high yield delivering its worst performance since 2015. But, as corporate bonds are senior to equity in the capital structure, both investment grade and high yield held up better relative to equities in 2018. Fourteen out of the eighteen industries in the ICE BofAML U.S. High Yield Index delivered negative returns while financials, industrials and utilities in the Bloomberg Barclays U.S. Corporate Index were negative during the calendar year.

Outlook

Corporate tax reform benefitted U.S. companies throughout 2018. Repatriation of cash held overseas ticked up dramatically during the year, and we are seeing that cash being utilized for share repurchases and acquisitions. Lower tax rates also boosted earnings growth. However, the size of the boost will not repeat in 2019, and we believe that for many companies this benefit will largely be competed away over time. Our research team continues to evaluate the impact of tax reform on a company-by-company basis and updates estimates of intrinsic value accordingly.

Assessing the impact of macroeconomic factors has been more important in recent years, but it is just one of many factors that we consider. As always, bottom-up analysis is of primary importance in estimating the intrinsic value of an individual company, which includes both valuation and business fundamentals.

The size of previously implemented tariffs is small relative to the total economy, but larger and wider tariffs could be applied in the future, and for certain companies the impact is already large. We continually assess the impact on a company-by-company basis. Broadly speaking, we think cooler heads will prevail.

Low interest rates, high corporate profit margins, and steady economic growth with low inflation have driven strong equity market returns since the Great Recession. The high valuations that resulted made it challenging to find investment opportunities, but a broad range of businesses are becoming more attractive after the fourth quarter’s sell-off in equity markets. Discounts to intrinsic value have widened, and although we continue to be attracted to higher-quality businesses at this point in the economic cycle, we are incrementally spending more time analyzing cyclical businesses whose valuations seem to largely reflect a near-term recession. As always, we remain focused on assessing risk, which we define as the permanent loss of capital.

Despite the normalization of Fed policy and concern that it could push the economy into a recession, most economic indicators continue to show strength and suggest healthy near-term growth. With the fourth quarter’s sell-off in equity markets, price/earnings multiples are now lower than historical averages. Decent economic growth and a below-average starting point for

2 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM |

price/earnings multiples should support equity returns over the next five years. However, returns could be held back if historically high corporate profit margins and below-average interest rates revert toward long-term averages. Together, these factors suggest to us that high-single digits is a reasonable expectation for equity market returns over the next five years.

We expect volatility in the fixed income markets to remain elevated for the foreseeable future as is typical late in the economic and market cycles. As such, we believe strong fundamental analysis and a focus on long-term company and collateral performance are the keys to security selection in our fixed income strategies.

We believe we can achieve better-than-market returns over the next five years through active portfolio management, and our primary focus is always on achieving value-added results for our clients. Our intrinsic value investment philosophy is shared by all of our portfolio managers and research analysts, allowing us to apply our investment discipline consistently across strategies.

Thank you for your continued support.

Diamond Hill Capital Management, Inc.

|

|

|

Chris Welch, CFA

Co-Chief Investment Officer | Austin Hawley, CFA

Co-Chief Investment Officer | Bill Zox, CFA

Chief Investment Officer –

Fixed Income |

The views expressed are those of the portfolio managers as of December 31, 2018, are subject to change, and may differ from the views of other portfolio managers or the firm as a whole. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice. All data referenced are from sources deemed to be reliable but cannot be guaranteed. Securities and sectors referenced should not be construed as a solicitation or recommendation or be used as the sole basis for any investment decision.

The Russell 1000 Index is an unmanaged market-capitalization weighted index measuring the performance of the 1,000 largest companies, on a market capitalization basis, in the Russell 3000 Index. The Russell 1000 Value Index is an unmanaged market-capitalization weighted index measuring the performance of the large cap value segment of the U.S. equity universe including those Russell 1000 Index companies with lower expected growth values. The Russell 1000 Growth Index is a subset of the Russell 1000 Index and measures the performance of the large cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The Russell 2000 Index is an unmanaged market-capitalization weighted index measuring the performance of the 2,000 smallest U.S. companies, on a market capitalization basis, in the Russell 3000 Index.

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM 3 |

The Bloomberg Barclays U.S. Aggregate Index is an unmanaged index representing the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through, and asset-backed securities.

The ICE BofAML U.S. High Yield Index tracks the performance of the U.S. dollar denominated below investment grade corporate debt publicly issued in the U.S. domestic market. The index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its third party suppliers and has been licensed for use by Diamond Hill Capital Management, Inc. ICE Data and its third party suppliers accept no liability in connection with its use. See diamond-hill.com for a full copy of the disclaimer.

These indices do not incur fees and expenses (which would lower the return) and are not available for direct investment.

4 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM |

Our Mission

At Diamond Hill, we serve our clients by providing investment strategies that deliver lasting value through a shared commitment to our intrinsic value-based investment philosophy, long-term perspective, disciplined approach and alignment with our clients’ interests.

VALUE

We believe market price and intrinsic value are independent in the short-term but tend to converge over time.

LONG-TERM

We maintain a long-term focus both in investment analysis and management of our business.

DISCIPLINE

We invest with discipline to increase potential return and protect capital.

PARTNERSHIP

We align our interests with those of our clients through significant personal investment in our strategies.

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM 5 |

The Guiding Principles of our Intrinsic Value Philosophy |

| | ● | Recognize that market price and intrinsic value tend to converge over a reasonable period of time |

| | ● | Possess a long-term investment temperament (five years or longer) |

| | ● | Only invest when the market price is below (above for short positions) intrinsic value |

| | ● | Treat every investment as a partial ownership interest in that company |

Our intrinsic value philosophy is shared by all of our portfolio managers and research analysts, allowing us to apply our investment discipline consistently across all equity and fixed income strategies.

Each portfolio is supported by our entire research team, all of whom are dedicated to bottom-up, fundamental analysis and provide research coverage across the capital structure. Each team member covers small, mid and large capitalization companies, long and short opportunities, equity and debt, as well as global and domestic companies.

We believe we can achieve better-than-market returns over the long term through active portfolio management, and our primary focus is always on achieving value-added results for our clients.

6 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM |

Management Discussion of Fund Performance (Unaudited) |

Diamond Hill Small Cap Fund

2018 Portfolio Commentary

In 2018, the Diamond Hill Small Cap Fund (Class I) returned -14.88%, trailing the Russell 2000 Index return of -11.01% by 387 basis points, and the -12.86% return of the Russell 2000 Value Index by 202 basis points.

While growth indices once again outperformed value indices, one unusual (and painful) statistic is the uniformity with which more expensive stocks, as measured by P/E ratios, outperformed less expensive ones. According to Bank of America Merrill Lynch, returns by P/E quintile for the Russell 2000 Index in 2018 (with Quintile 1 representing the “cheapest” by P/E):

Quintile 1 – -21.1% |

Quintile 2 – -15.7% |

Quintile 3 – -11.1% |

Quintile 4 – -8.9% |

Quintile 5 – +1.6% |

Non-earners – -12.1% |

Also noteworthy, through the end of the third quarter, non-earners had actually outperformed companies with earnings by 8.7%. This corrected meaningfully in the fourth quarter sell-off. As seen above, non-earners trailed the Russell 2000 Index by about 1.1% for the full year,

In a rough attribution of the year’s performance relative to the Russell 2000 Index, factors leading to the underperformance included:

| | 1. | Very poor stock performance in the industrials sector and parts of the consumer discretionary sector, particularly among holdings that are seen as more cyclical, despite a lack of notable signs of earnings deterioration thus far, or that have higher debt levels. |

| | 2. | Very poor stock performance in the banking industry within the financials sector. Credit quality, for the most part, continues to be good. Net interest margin pressure from a flattening yield curve, as well as slower loan growth, have been cited as potential negatives weighing on sentiment for bank stocks. |

| | 3. | A relative lack of exposure to the information technology sector, which was second only to utilities as the best performing sector in the Index. This sector, along with health care, tends to hold the most stocks in the most expensive quintiles referenced above, as well as many of the non-earners. |

| | 4. | Poor security selection in the energy sector, the worst performing sector in both the Russell 2000 Index and the portfolio. |

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM 7 |

Diamond Hill Small Cap Fund |

Partially offsetting these factors were the following:

| | 1. | Strong security selection in the health care sector, tempered somewhat by the relatively low exposure to the part of the sector that held up better than the Russell 2000 Index. BioScrip (up 23%), and Integer Holdings (up 68%) were two standouts in this sector. |

| | 2. | Good performance in the insurance industry within the financials sector was aided by two acquisitions as well as Assured Guaranty (up 15%) and insurance broker Brown & Brown (up 8%). |

| | 3. | Our consumer staples holdings generally held their value better than other sectors in the market and the consumer staples holdings in the Russell 2000 Index. |

| | 4. | Concert promoter and ticketing company Live Nation Entertainment (up 16%), Puerto Rican bank Popular (up 36%), Post Holdings (up 12%), and utility UGI (up 16%) had continued solid fundamental performance and were rewarded by the equity market. |

Our holdings in airlines, Allegiant Travel and Alaska Air Group, are classified within the industrial sector, though Allegiant serves almost all leisure travelers and Alaska a mix of business and leisure. Both stocks fared poorly in 2018 with Alaska down 16% and Allegiant down 34%. There are concerns that the reduction in jet fuel prices will accrue to the benefit of consumers, both in the form of undisciplined capacity growth as well as fare reductions, rather than to the airlines through better profit margins. While we doubt that the airlines will retain all the benefits of lower jet fuel prices (some will go toward lower fares), we have been encouraged by data supportive of the earnings prospects for these two companies. Allegiant has embarked on a major hotel/condo project in southwest Florida that is outside the company’s core past business, which has been negatively received by the market. Still, so long as this project is not a financial disaster, we believe Allegiant’s stock is attractive.

Avis Budget Group continued to experience extreme volatility in its stock price, and finished the year down 48%. Overall, the company’s adjusted EBITDA will likely be about $780 million for 2018, the mid-point of the company’s guidance at the beginning of the year. This was achieved in a somewhat unexpected fashion, as used car prices were much stronger than expected, benefitting the company’s fleet costs, while pricing has continued to be stagnant and the company’s European business in the peak summer months was somewhat disappointing. Avis continues to trade at among the highest free cash flow yields, approximately 15%, in the portfolio, and continues to repurchase shares.

Red Rock Resorts, a “locals” Las Vegas casino operator, was down 39% for the year. The company has been undertaking major renovations at the Palace Station as well as the Palms Casino, which has interrupted operations at both properties. The Las Vegas economy appears to still be strong and we expect higher absolute EBITDA after renovations are complete, which we believe should lead to a much higher stock price.

Banks in the portfolio were nearly uniformly negative, with Bank OZK being the poorest performer for the year. The bank has been a public company for 21 years, during which time the company’s net charge-off ratio for non-purchased loans (those the company underwrote

8 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM |

Diamond Hill Small Cap Fund |

themselves rather than acquired through acquisition of another bank) has been better than the industry average every year, and has cumulatively averaged only 36% of the industry’s charge-off rate. With this credit performance and growing loan and deposit balances, the bank has compounded tangible book value at a 21.7% clip over the past 11 years. While the bank was previously afforded a premium price-to-book ratio for this performance, the Fund purchased shares after this valuation had fallen to around average for all regional banks. During the first nine months of 2018, the stock fared poorly due to concerns about net interest margin compression and slower loan growth. In reporting third quarter earnings, the company disclosed charge offs of two loans in the Real Estate Services Group, raising concerns about the health of the commercial real estate portfolio overall. The company went to considerable length in stating its belief that these were isolated issues. While the total amount of the charge-offs, $45 million for which a $19 million provision had already been made, was not alarming (the bank has average earning assets of about $20 billion), the contrast with the company’s previous stellar credit history did cause fear and the stock dropped materially further. If credit quality proves to be a non-issue going forward, and we believe this is likely given statistics for the bank’s low loan-to-value ratios, diversification, and past underwriting history, we believe Bank OZK has a mid-20% expected return over the next five years from the year-end price of under $23.

Merger and acquisition activity in 2018 produced mixed results for the portfolio. On the favorable side, DST Systems was the largest positive contributor to the Fund due to SS&C Technologies’ acquisition of the company, which led to a 35% gain. Insurer Navigators Group announced that they were being bought by Hartford Financial Services in a cash deal leading to a 43% gain on the year. Reinsurer Validus Holdings agreed to be bought by American International Group, leading to a 46% gain on the year. Finally, LifePoint Health agreed to be purchased by Apollo Global Management controlled RegionalCare Hospital Partners Holdings, producing a 30% return for the year.

Less favorably, several portfolio holdings made acquisitions that were not well received by the market. Cincinnati Bell announced the acquisition of Hawaiian Telecom in 2017, but closed the deal in mid-2018. The resulting combined company will carry fairly high leverage, making a wide range of potential per share values for the equity possible. The stock declined 63% for the full year. Similarly, CommScope agreed to acquire Arris International resulting in a more leveraged company with greater exposure to digital set-top boxes at a juncture when “over-the-top” streaming services like Netflix, Hulu, and others continue to make inroads with consumers. We expected CommScope to use free cash flow to de-lever, and thus sold the stock following this announcement. Finally, the sentiment for auto-related stocks other than electric vehicles (think Tesla) or autonomous driving has been terrible. Tenneco was faring poorly as a stock despite slow-growing earnings that were generally in-line with our expectations. The company announced an agreement to buy Federal Mogul for cash and stock as well as the assumption of debt with future plans to separate into two companies – one focused on emissions control and another on ride control. What appeared as a stock with low expectations at less than 9x earnings, fell further to 4.5x 2018 expected earnings. Unless there is a severe auto recession, we believe the expected return for Tenneco is very attractive.

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM 9 |

Diamond Hill Small Cap Fund |

While results in 2018 were disappointing from both an absolute and relative performance perspective, the portfolio at year-end traded at the largest discount to our estimate of intrinsic value for the individual holdings in many years. If corporate profit margins can be maintained near current levels, we believe these intrinsic value estimates will prove reasonably accurate, and the expected returns on the portfolio are now much higher given the lower starting equity prices. As we assume management of the Small Cap Fund, we are enthusiastic about these opportunities and the chance to earn favorable returns on your behalf.

Thank you for your continued support.

|

|

Aaron Monroe, CFA

Portfolio Manager | Chris Welch, CFA

Portfolio Manager |

10 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM |

Diamond Hill Small Cap Fund |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2018

| Inception

Date | One

Year | Three

Years | Five

Years | Ten

Years | Expense

Ratio* |

PERFORMANCE AT NAV WITHOUT SALES CHARGES |

Class A Shares | 12/29/2000 | -15.12% | 2.32% | 1.53% | 9.61% | 1.27% |

Class C Shares | 2/20/2001 | -15.77 | 1.56 | 0.77 | 8.80 | 2.02 |

Class I Shares | 4/29/2005 | -14.88 | 2.62 | 1.81 | 9.94 | 0.98 |

Class Y Shares | 12/30/2011 | -14.79 | 2.73 | 1.94 | 9.92 | 0.86 |

BENCHMARK |

Russell 2000 Index | | -11.01 | 7.36 | 4.41 | 11.97 | — |

PERFORMANCE AT PUBLIC OFFERING PRICE INCLUDING SALES CHARGES** |

Class A Shares | 12/29/2000 | -19.35 | 0.59 | 0.50 | 9.05 | 1.27 |

Class C Shares | 2/20/2001 | -16.53 | 1.56 | 0.77 | 8.80 | 2.02 |

| * | Reflects the expense ratio as reported in the Prospectus dated February 28, 2019. |

| ** | The maximum sales charge for Class A shares on purchases and for Class C shares on certain redemptions are 5.00% and 1.00%, respectively. |

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill Small Cap Fund Class I(A) and the Russell 2000 Index.

(A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A, Class C and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell 2000 Index (“Index”). The Index is a market capitalization-weighted index measuring performance of the smallest 2,000 companies, on a market capitalization basis, in the Russell 3000 Index. The Index is unmanaged and does not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

| Historical performance for Class Y shares prior to its inception is based on the performance of Class A shares. Class Y performance has been adjusted to reflect differences in sales charges and expenses between classes. |

| Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.diamond-hill.com. |

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM 11 |

Diamond Hill Small-Mid Cap Fund |

2018 Portfolio Commentary

The Diamond Hill Small-Mid Cap Fund (Class I) returned -12.56% in 2018 compared to a -10.00% return for the benchmark Russell 2500 Index. For the five-year period ended December 31, 2018, the Fund’s return was 4.07%, while the Russell 2500 Index returned 5.15% over the same period. In the 13 years since inception, the Fund’s return of 7.58% was approximately in-line with the 7.50% benchmark return. The 2018 results were driven by unfavorable stock selection in the consumer discretionary, information technology and industrials sectors, partially offset by favorable stock selection in the health care sector as well as our high single digit average cash position.

The first three quarters of the year was a period during which it was difficult to find attractively valued new ideas for the portfolio. That changed in the year’s final three months, as concerns about slowing economic growth led to a sharp decline in stock prices. These lower prices gave us the opportunity to deploy a meaningful amount of cash, both adding to existing positions as well as purchasing new businesses for the portfolio. After entering the fourth quarter with an 8.5% cash position, we closed out the year with cash at 3.1%, the lowest cash position we’ve held in seven years.

Our portfolio returns relative to the benchmark also differed dramatically over the course of the year. During the first nine months, our 2.58% return fell far behind the benchmark’s gain of 10.41%. However, as on a number of occasions in the past, the portfolio protected client capital notably better than the benchmark during the decline in the fourth quarter. Our portfolio gave up 14.76% in value in those three months, while the Russell 2500 Index dropped 18.49% in value. We are disappointed to trail the benchmark for the full year, but pleased that we were able to protect capital better than the benchmark during the year’s sharpest decline.

In 2018, four companies in the portfolio announced that they would be acquired at meaningful premiums to their prior trading prices. The acquisitions of Validus Holdings, XL Group and LifePoint Health were all completed during the year, while that of The Navigators Group is scheduled for completion in the first half of 2019. Such acquisitions have historically been a welcome contribution to our investment returns, and they are a natural result of our ownership of businesses that are trading comfortably below our estimates of their intrinsic value.

We bought as many new companies for the portfolio in 2018 as we had in the prior two years combined. Despite the new positions, our annual turnover of 26% was right in the middle of our long-term projected range of 20%-30%. Among our new holdings is WPX Energy, which has significant low-cost, oil-heavy acreage in the Permian Basin. WPX has the qualities we are looking for when seeking investments in energy stocks in this shale-driven environment: low-cost production, a solid balance sheet, and a strong management team. Oil prices fell sharply in the final quarter, leading to a significant decline in WPX’s stock price. Such declines give us opportunities to buy companies with advantageous positions at very attractive valuations.

Earlier in the year, we also initiated a new position in Alaska Air Group, which is a major user of oil and thus benefits on the cost side from price declines in the energy space. Alaska Air was suffering from a number of short-term challenges at the time of our purchase, including rising

12 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM |

Diamond Hill Small-Mid Cap Fund |

fuel and labor costs, increased competition in their California operations, and ongoing execution and balance sheet risk from the integration of their 2016 acquisition of Virgin America. Alaska Air’s management team is one of the very best in the business, and we have confidence they will lead the company through these challenges effectively whatever the macro environment brings.

I’d like to once again highlight our large team of analysts and research associates who work hard to generate ideas and deliver strong returns to clients. Their breadth and depth of research allows us to maintain at all times a portfolio that we believe is best positioned to deliver favorable returns to you over the next five years.

Following the year-end decline, stocks in the small-mid cap segment of the market appear as reasonably priced as they have been since late summer of 2015 and early 2016, though not quite to the levels we experienced in the fall of 2011, and nowhere near as attractive as during the depths of the Financial Crisis. While price-to-earnings ratios are modestly below long-term averages, the key variable will be the ability of companies to maintain profit margins at their current all-time high levels. If this can be accomplished, stocks look favorably priced and investors stand to earn quite satisfactory returns going forward. However, if profit margins come under pressure, the situation could change rapidly. Our approach to investing centers on always maintaining a margin of safety in our stock selections, and we remain ever-mindful of key risks when we assess investment opportunities for the portfolio.

We appreciate your ongoing support and look forward to continuing to work with you in the coming years.

Chris Welch, CFA

Portfolio Manager

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM 13 |

Diamond Hill Small-Mid Cap Fund |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2018

| Inception

Date | One

Year | Three

Years | Five

Years | Ten

Years | Expense

Ratio* |

PERFORMANCE AT NAV WITHOUT SALES CHARGES |

Class A Shares | 12/30/2005 | -12.80% | 3.63% | 3.79% | 12.54% | 1.22% |

Class C Shares | 12/30/2005 | -13.46 | 2.86 | 3.01 | 11.71 | 1.97 |

Class I Shares | 12/30/2005 | -12.56 | 3.93 | 4.07 | 12.88 | 0.93 |

Class Y Shares | 12/30/2011 | -12.42 | 4.06 | 4.22 | 12.86 | 0.81 |

BENCHMARK |

Russell 2500 Index | | -10.00 | 7.32 | 5.15 | 13.15 | — |

PERFORMANCE AT PUBLIC OFFERING PRICE INCLUDING SALES CHARGES** |

Class A Shares | 12/30/2005 | -17.16 | 1.88 | 2.74 | 11.97 | 1.22 |

Class C Shares | 12/30/2005 | -14.29 | 2.86 | 3.01 | 11.71 | 1.97 |

| * | Reflects the expense ratio as reported in the Prospectus dated February 28, 2019. |

| ** | The maximum sales charge for Class A shares on purchases and for Class C shares on certain redemptions are 5.00% and 1.00%, respectively. |

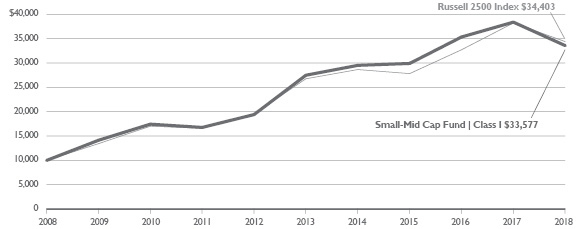

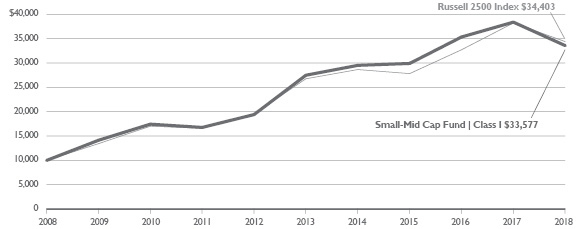

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill Small-Mid Cap Fund Class I(A) and the Russell 2500 Index.

| (A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A, Class C and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell 2500 Index (“Index”). The Index is a market capitalization-weighted index measuring performance of the smallest 2,500 companies, on a market capitalization basis, in the Russell 3000 Index. The Index is unmanaged and does not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

| Historical performance for Class Y shares prior to its inception is based on the performance of Class A shares. Class Y performance has been adjusted to reflect differences in sales charges and expenses between classes. |

| Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.diamond-hill.com. |

14 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM |

Diamond Hill Mid Cap Fund |

2018 Portfolio Commentary

The Diamond Hill Mid Cap Fund (Class I) returned -10.31% in 2018 compared to a -9.06% return for the benchmark Russell Midcap Index. For the five-year period ended December 31, 2018, the Fund’s return was 5.01%, while the Russell Midcap Index returned 6.26% over the same period. The 2018 results were driven by unfavorable stock selection in the energy, information technology, and consumer discretionary sectors, partially offset by favorable stock selection in the health care sector as well as our high single digit average cash position.

The first three quarters of the year was a period during which it was difficult to find attractively valued new ideas for the portfolio. That changed in the year’s final three months, as concerns about slowing economic growth led to a sharp decline in stock prices. These lower prices gave us the opportunity to deploy a meaningful amount of cash, both adding to existing positions as well as purchasing new businesses for the portfolio. After entering the fourth quarter with an 8.5% cash position, we closed out the year with cash at 3.5%, the lowest cash position we’ve held in the five years since the inception of the Mid Cap Fund.

Our portfolio returns relative to the benchmark also differed dramatically over the course of the year. During the first nine months, our 3.72% return fell far behind the benchmark’s gain of 7.46%. However, as on a number of occasions in the past, the portfolio protected client capital notably better than the benchmark during the decline in the fourth quarter. Our portfolio gave up 13.53% in value in those three months, while the Russell Midcap Index dropped 15.37% in value. We are disappointed to trail the benchmark for the full year, but pleased that we were able to protect capital better than the benchmark during the year’s sharpest decline.

In 2018, three companies in the portfolio announced that they would be acquired at meaningful premiums to their prior trading prices. The acquisitions of Validus Holdings Ltd., XL Group Ltd. and LifePoint Health were all completed during the year. Such acquisitions have historically been a welcome contribution to our investment returns, and they are a natural result of our ownership of businesses that are trading comfortably below our estimates of their intrinsic value.

We bought more new companies for the portfolio in 2018 than we had in either of the prior two years. Despite the new positions, our annual turnover of 20% was at the low end of our long-term projected range of 20-30%. Among our new holdings is Noble Energy. Noble has low-cost, oil-heavy acreage in the Permian Basin of west Texas as well as in Colorado’s DJ Basin. The company also is developing a large natural gas field in the Mediterranean Sea. Much of the future production from this field is now in contract, de-risking the project, and the pricing is linked to oil prices, providing a more stable revenue stream than one based on U.S. natural gas prices. Oil prices fell sharply in the final quarter, leading to a significant decline in Noble’s stock price. Such declines give us opportunities to buy companies with advantageous positions at very attractive valuations.

Earlier in the year, we also initiated a new position in Alaska Air Group, which is a major user of oil and thus benefits on the cost side from price declines in the energy space. Alaska Air was suffering from a number of short-term challenges at the time of our purchase, including rising fuel and labor costs, increased competition in their California operations, and ongoing execution

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM 15 |

Diamond Hill Mid Cap Fund |

and balance sheet risk from the integration of their 2016 acquisition of Virgin America. Alaska Air’s management team is one of the very best in the business, and we have confidence they will lead the company through these challenges effectively whatever the macro environment brings.

I’d like to once again highlight our large team of analysts and research associates who work hard to generate ideas and deliver strong returns to clients. Their breadth and depth of research allows us to maintain at all times a portfolio that we believe is best positioned to deliver favorable returns to you over the next five years.

Following the year-end decline, stocks in the mid cap segment of the market appear as reasonably priced as they have been since late summer of 2015 and early 2016, though not quite to the levels seen in the fall of 2011, and nowhere near as attractive as during the depths of the Financial Crisis. While price-to-earnings ratios are modestly below long-term averages, the key variable will be the ability of companies to maintain profit margins at their current all-time high levels. If this can be accomplished, stocks look favorably priced and investors stand to earn quite satisfactory returns going forward. However, if profit margins come under pressure, the situation could change rapidly. Our approach to investing centers on maintaining a margin of safety in our stock selections, and we remain ever-mindful of key risks when we assess investment opportunities for the portfolio.

We appreciate your ongoing support and look forward to continuing to work with you in the coming years.

Chris Welch, CFA

Portfolio Manager

16 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM |

Diamond Hill Mid Cap Fund |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2018

| Inception

Date | One

Year | Three

Years | Five

Years | Expense

Ratio* |

PERFORMANCE AT NAV WITHOUT SALES CHARGES |

Class A Shares | 12/31/2013 | -10.56% | 5.23% | 4.71% | 1.07% |

Class I Shares | 12/31/2013 | -10.31 | 5.51 | 5.01 | 0.78 |

Class Y Shares | 12/31/2013 | -10.17 | 5.64 | 5.13 | 0.66 |

BENCHMARK |

Russell Midcap Index | | -9.06 | 7.04 | 6.26 | — |

PERFORMANCE AT PUBLIC OFFERING PRICE INCLUDING SALES CHARGES** |

Class A Shares | 12/31/2013 | -15.04 | 3.46 | 3.64 | 1.07 |

| * | Reflects the expense ratio as reported in the Prospectus dated February 28, 2019. |

| ** | The maximum sales charge for Class A shares on purchases is 5.00%. |

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill Mid Cap Fund Class I(A) and the Russell Midcap Index.

(A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell Midcap Index (“Index”). The Index is a market capitalization-weighted index measuring performance of the 800 smallest companies in the Russell 1000 Index. The Index is unmanaged and does not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

| Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.diamond-hill.com. |

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM 17 |

Diamond Hill Large Cap Fund |

2018 Portfolio Commentary

The Diamond Hill Large Cap Fund (Class I) returned -9.63% in 2018 compared to -4.78% for the Russell 1000 Index. The year was very disappointing, as the positive performance in the first three quarters of the year was overwhelmed by the sharp sell-off in the fourth quarter. Many reasons were offered to explain this market behavior but in our opinion the dominant issue was the Federal Reserve’s decision to aggressively raise interest rates throughout the year. As interest rates rose, there were signs of economic slowdown in cyclically-sensitive industries, and commodity prices began a meaningful decline. As the year was ending, it became apparent the Federal Reserve was reviewing their policy regarding rising rates. It appears they will be more guarded in their actions until a clear understanding of the economic impact can be assessed. This has provided some reassurance to investors that interest rates appear to be stabilizing.

The impact of rising interest rates on the economy had their effects on the stock market as well. The financials sector performed poorly as investors became concerned asset quality could falter. Energy stocks also suffered due to falling oil prices. These impacts flowed through to our portfolios. Our financials holdings are substantial due to their inexpensive valuation. While our energy holdings are meaningfully smaller, these stocks are heavily levered to interest rates. As a result, many of the investments in these sectors proved to be a drag on portfolio performance.

Once again in 2018, the health care sector provided the greatest positive contribution to the Fund’s performance. We had a substantial investment in the sector in 2018, and the relative stability of the sector at a time of slowing economic activity made health care stocks attractive. Abbott Laboratories was the largest position in the portfolio by year-end, and the shares returned 29% for the year making it the leading health care performer in the portfolio. Continued strong earnings growth, which was aided by the successful consolidation of important recent acquisitions, helped drive the performance. Aetna and Pfizer were large positions which also returned in excess of 20%. Aetna benefited from the completion of the acquisition by CVS Health, while Pfizer’s improved new product pipeline made investors more optimistic. Gilead Sciences was a new position in 2018 and while its near-term performance has been disappointing, we still own the shares as we are quite positive regarding the long-term outlook.

The industrials holdings in the portfolio were also strong contributors to the Fund’s relative performance. While the sector itself performed poorly in 2018, our relatively small position combined with the strong performance of some individual investments led to the good relative, if not absolute, performance. Importantly, our position in United Continental Holdings performed particularly well, as strong revenue growth combined with the potential of margin expansion driven by reduced energy costs led to the shares appreciating over 24% in 2018. Verisk Analytics is a unique data services company that appreciated 13% as they experienced strong and economically-insensitive earnings growth. Parker-Hannifin is one industrial company that performed poorly due to concerns surrounding demand from its economically sensitive customers. We are optimistic regarding the long-term outlook of the company, so we have maintained our position.

18 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM |

Diamond Hill Large Cap Fund |

The performance of our energy holdings was disappointing in 2018. We kept a relatively small position in the sector due to secular pressure on the commodity price. However, we were disappointed our individual holdings performed poorly. Devon Energy and Cimarex Energy were selected because of their unique asset base. Their North American operations are politically secure, and their assets lend themselves to improving technology to drive volume growth. However, the fourth quarter sell-off in oil prices left them exposed to the possibilities of reduced earnings and cash flow. Both Devon and Cimarex were down in excess of 45% for the year. Most of this disappointing performance happened in the fourth quarter in reaction to falling oil prices. Both companies remain in the portfolio, as we see considerable opportunity for recovery in a better commodity price environment. Given a long-term perspective, these appear to be attractive investments.

The financials sector remains our largest investment in the portfolio, but the performance of the sector was disappointing in 2018. For the most part, this disappointment reflects market concerns of problems which may develop rather than the performance of individual companies. Asset quality remains a concern, but there is little indication that bank balance sheets are under pressure. This may simply reflect a hypersensitive population of investors who suffered considerably in the Financial Crisis of 2008. There is no indication of this kind of stress currently in the shares of our financial companies. For example, shares of Citigroup were down over 28% even as company fundamentals remained stable. The fourth quarter sell-off in the shares, in our opinion, are overdone due to fears of what might develop even as the company itself is meeting financial targets. Discover Financial Services is another large financial holding which was down over 21% in 2018. This performance was disappointing, but we see no fundamental issues with the company to justify the decline. Therefore, we have been happy to maintain the position.

2018 was a disappointing year for equity markets. Modest gains in the first three quarters of the year were overwhelmed by a disappointing fourth quarter. Much of this sell-off, in our opinion, was driven by rising interest rates as the Federal Reserve tightened lending conditions in response to what central bankers feared was an overheating economy. As the year was concluding, the Federal Reserve indicated more flexibility in 2019, but that was only after the considerable market sell-off. Still, we feel much of the interest rate increase is behind us leaving year end valuations very attractive. We remain fully invested as we continue to find meaningful opportunities in equity markets.

We remain grateful for the opportunities provided to us by shareholders and we look forward to 2019. While the market sell-off in the fourth quarter led to a disappointing year, it does not indicate a change in our long-term outlook. We have invested in a variety of markets and while the sell-off is disappointing, it is very similar to past declines. The sell-off certainly does not change our view that equity markets provide an attractive opportunity for long-term investors.

|

|

Chuck Bath, CFA

Portfolio Manager | Austin Hawley, CFA

Portfolio Manager |

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM 19 |

Diamond Hill Large Cap Fund |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2018

| Inception

Date | One

Year | Three

Years | Five

Years | Ten

Years | Expense

Ratio* |

PERFORMANCE AT NAV WITHOUT SALES CHARGES |

Class A Shares | 6/29/2001 | -9.88% | 7.29% | 6.17% | 11.64% | 0.96% |

Class C Shares | 9/25/2001 | -10.57 | 6.48 | 5.37 | 10.81 | 1.71 |

Class I Shares | 1/31/2005 | -9.63 | 7.61 | 6.47 | 11.97 | 0.67 |

Class Y Shares | 12/30/2011 | -9.53 | 7.72 | 6.59 | 11.96 | 0.55 |

BENCHMARK |

Russell 1000 Index | | -4.78 | 9.09 | 8.21 | 13.28 | — |

PERFORMANCE AT PUBLIC OFFERING PRICE INCLUDING SALES CHARGES** |

Class A Shares | 6/29/2001 | -14.38 | 5.47 | 5.09 | 11.07 | 0.96 |

Class C Shares | 9/25/2001 | -11.44 | 6.48 | 5.37 | 10.81 | 1.71 |

| * | Reflects the expense ratio as reported in the Prospectus dated February 28, 2019. |

| ** | The maximum sales charge for Class A shares on purchases and for Class C shares on certain redemptions are 5.00% and 1.00%, respectively. |

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill Large Cap Fund Class I(A) and the Russell 1000 Index.

(A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A, Class C and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell 1000 Index (“Index”). The Index is a market capitalization-weighted index measuring performance of the largest 1,000 companies, on a market capitalization basis, in the Russell 3000 Index. The Index is unmanaged and does not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

| Historical performance for Class Y shares prior to its inception is based on the performance of Class A shares. Class Y performance has been adjusted to reflect differences in sales charges and expenses between classes. |

| Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.diamond-hill.com. |

20 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM |

Diamond Hill All Cap Select Fund |

2018 Portfolio Commentary

Positive returns through the first three quarters of 2018 were overwhelmed by a sharp market sell-off in the fourth quarter, leaving equity indices in negative territory for the year. Growth stocks once again significantly outperformed Value stocks in 2018, with the Russell 3000 Growth Index returning -2.12%, while the Russell 3000 Value Index returned -8.58%, and larger companies outperformed smaller companies. This backdrop provided headwinds for the All Cap Select Fund relative to the Russell 3000 Index given our price conscious investment strategy and increasing exposure to small and mid-cap companies over the course of the year. For the year, the Fund (Class I) declined 12.02% while the Russell 3000 Index declined 5.24%.

Rising interest rates, slowing global growth and trade tensions between the U.S. and China were the most cited reasons for the end of year sell-off in equities. These factors disproportionately weighed on the shares of more cyclical companies, companies with leverage, and small cap companies. Financials declined sharply in the fourth quarter and ended the year as one of the worst performing sectors. Investors focused on the impact a slowing economy could have on the credit cycle, potentially leading to lower earnings for many companies in the financials sector, especially those facing revenue growth pressures from a flattening yield curve. Our overweight position in financials combined with poor security selection within the sector was the largest detractor from relative performance in 2018.

Financials has been the largest sector exposure in the Fund for the past several years, and we continue to be attracted to the valuations available across a number of industries within this sector. While we acknowledge that the current credit environment has been unusually benign for an extended period of time and is unlikely to continue indefinitely, we believe share prices reflect, in many cases, a dire scenario more similar to that experienced in the financial crisis of 2008 and not what is a more normal recessionary period. For instance, Bank OZK, a new position during 2018, declined more than 50% from our initial purchase after disclosing increased loan loss provision on two relatively small loans in the third quarter. Even after the increased provision, Bank OZK was solidly profitable for the quarter and is expected to have credit losses well below industry averages for the full year, consistent with its superior long-term credit underwriting. Yet the stock traded down to a single-digit multiple of earnings and a discount to tangible book value per share, levels consistent with those seen in the financial crisis of 2008. Many small and medium sized banks, such as Fund holding BankUnited, also experienced steep declines in their share prices throughout the year. Life insurance was another area within financials that continued to be out of favor. MetLife and Brighthouse Financial both saw significant declines in their share prices despite fundamentals that were consistent with our expectations. One notable success within financials during the year was Validus Holdings, the Bermuda-based reinsurer, which announced an all-cash sale to AIG during the first half of the year.

Energy was the worst performing sector in the Russell 3000 Index during 2018, and while we had a modest underweight allocation to the sector, poor security selection overwhelmed the impact of allocation and led to a negative relative contribution to return. We had no energy exposure entering the year and were clearly too early in re-initiating one as various near-term events

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM 21 |

Diamond Hill All Cap Select Fund |

pushed oil prices and stock prices lower. That said, we believe the long-term drivers are in place such that increasing volumes will be demanded of our Permian basin holdings and that higher oil prices will be realized.

Industrials was also one of the poorest performing sectors in the Russell 3000 Index during the year, but despite our overweight allocation, it generated significant positive relative results for the Fund. Our significant exposure to airline United Continental Holdings and commercial services provider Verisk Analytics were the key drivers of this performance, with both posting over 20% total returns. United has been successful in controlling costs even while growing, and filling capacity at above industry rates. The nature in which they have added this capacity, increasing connecting flights to United hub cities, has prevented a competitive industry response. Verisk Analytics posted impressive results throughout 2018, growing organic revenue at high single digit rates, driven in large part by strong demand for its growing suite of insurance industry products. We sold our position in Verisk Analytics late in the year to fund purchases of more discounted companies.

Two of the distinguishing characteristics of the All Cap Select Fund are its broad investable universe, composed of both small and large companies, and its limited number of holdings (30-40). We believe one of our jobs as capital allocators is to capture, to the best of our abilities, attractive investment opportunities as they arise within our broad universe. That means moving into small cap and out of large cap if that is where we see more value, and it also means becoming more concentrated in our best ideas when discounts to our estimates of intrinsic value are wide. Over the course of 2018 we did just that, increasing our weighting in small and medium sized companies as valuations became more attractive, and concentrating the Fund in a smaller number of high-conviction holdings. We ended 2018 with 31 holdings, near the low end of our stated range, and the median market capitalization of our holdings was approximately $9B, down from nearly $17B a year earlier. We are excited about the prospects for our portfolio holdings and the valuations at which we have been able to purchase them, and we believe we are well positioned to deliver excellent returns over the long term.

We appreciate your support.

|

|

Austin Hawley, CFA

Portfolio Manager | Rick Snowdon, CFA

Portfolio Manager |

22 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM |

Diamond Hill All Cap Select Fund |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2018

| Inception

Date | One

Year | Three

Years | Five

Years | Ten

Years | Expense

Ratio* |

PERFORMANCE AT NAV WITHOUT SALES CHARGES |

Class A Shares | 12/30/2005 | -12.31% | 4.77% | 4.76% | 11.19% | 1.16% |

Class C Shares | 12/30/2005 | -12.93 | 4.00 | 3.97 | 10.41 | 1.91 |

Class I Shares | 12/30/2005 | -12.02 | 5.09 | 5.06 | 11.59 | 0.87 |

Class Y Shares | 12/30/2011 | -11.95 | 5.18 | 5.17 | 11.50 | 0.75 |

BENCHMARK |

Russell 3000 Index | | -5.24 | 8.97 | 7.91 | 13.18 | — |

PERFORMANCE AT PUBLIC OFFERING PRICE INCLUDING SALES CHARGES** |

Class A Shares | 12/30/2005 | -16.68 | 3.00 | 3.70 | 10.62 | 1.16 |

Class C Shares | 12/30/2005 | -13.72 | 4.00 | 3.97 | 10.41 | 1.91 |

| * | Reflects the expense ratio as reported in the Prospectus dated February 28, 2019. |

| ** | The maximum sales charge for Class A shares on purchases and for Class C shares on certain redemptions are 5.00% and 1.00%, respectively. |

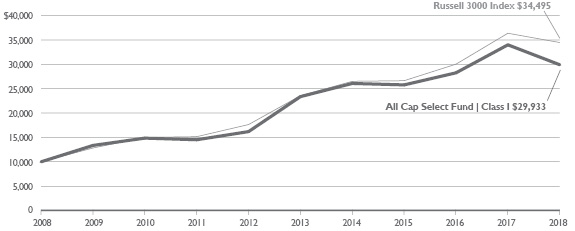

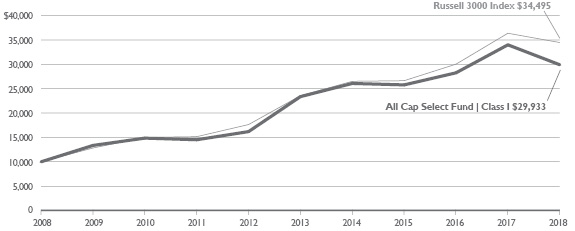

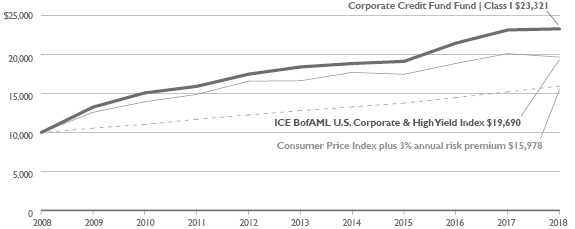

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill All Cap Select Fund Class I(A) and the Russell 3000 Index.

(A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A, Class C and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell 3000 Index (“Index”). The Index is a widely recognized market capitalization-weighted index measuring the performance of the 3,000 largest U.S. companies based on total market capitalization. The Index is unmanaged and does not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

| Historical performance for Class Y shares prior to its inception is based on the performance of Class A shares. Class Y performance has been adjusted to reflect differences in sales charges and expenses between classes. |

| Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.diamond-hill.com. |

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM 23 |

Diamond Hill Long-Short Fund |

2018 Portfolio Commentary

The Diamond Hill Long-Short Fund (Class I) returned -7.04% in 2018 compared to -4.78% for the long-only Russell 1000 Index and -1.92% for the blended benchmark (60% Russell 1000 Index/40% ICE Bank of America Merrill Lynch U.S. T-Bill 0-3 Month Index). The portfolio lagged the blended benchmark, which takes into account the portfolio’s general 60% net long bias, by over 5% for the year, while the five-year annualized return trailed by 2.32%. During the year, the long side of the portfolio underperformed the market; however, this was partially offset by the performance of our short portfolio, which also declined more than the Russell 1000 Index, as a number of our short positions saw meaningful declines late in the year.

The net exposure of the portfolio was modestly above our blended benchmark for the most of the year. We maintained net long exposure between 58% and 68% during 2018 and finished the year at the high end of that range. The increase was driven by a meaningful expansion in our long exposure during the fourth quarter combined with a more modest reduction in our gross short exposure.

On the long side of the portfolio, health care and information technology provided the biggest positive contributions to return. Abbott Laboratories, Medtronic, and Pfizer were all strong performers in a weak overall market environment. Abbott in particular performed very well fundamentally during 2018. However, its valuation has expanded over the past couple of years and now trades at only modest discount to fair value estimate. The current reduced position size reflects the narrower margin of safety . Within the information technology sector, Microsoft was clearly the largest contributor, as the company continued to demonstrate the power of its overall franchise and more specifically its growing presence within commercial cloud computing. Other long holdings that contributed to performance during the year were United Continental Holdings and Popular. United continued to perform very well within an airline industry that appears now to be sufficiently consolidated, so we should expect rational competitive behavior and attractive returns going forward. Popular is a Puerto Rico-based bank that has seen a strong recovery after the 2017 Hurricane Maria devastation. After the strong performance in 2018, the stock became much less attractive compared to other banks and was swapped into relatively higher expected return opportunities.

As mentioned above, the short portfolio underperformed the Russell 1000 by a nice margin for the year and provided some offset to the declines on the long side of the portfolio. Consumer discretionary and energy were the largest sector contributors. Retailers Big Lots and Children’s Place, along with apparel manufacturer Under Armour, were the biggest positive contributors within consumer discretionary. Meanwhile, the energy sector benefited from sharp declines in Core Laboratories and Southwestern Energy.

2018 was another growth-lead year, as evidenced by the performance gap in returns between the Russell 1000 Growth Index and the Russell 1000 Value Index. This was the second consecutive year of outperformance of growth vs. value and largest two-year spread we have seen since the 1998-1999 time period. However, we do not expect this dynamic to continue. Additionally, we now believe the outlook for domestic equities has improved meaningfully after the late year sell-

24 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM |

Diamond Hill Long-Short Fund |

off. As always, we are focused on long time horizons and buying good (or better) businesses at average (or better) prices. Our exposures and net positioning will, at any given point in time, be dictated by the sum of the individual opportunities we are finding in the market.

We appreciate your continued support.

|

|

|

Chris Bingaman, CFA

Portfolio Manager | Jason Downey, CFA

Portfolio Manager | Nate Palmer, CFA

Assistant Portfolio Manger |

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM 25 |

Diamond Hill Long-Short Fund |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2018

| Inception

Date | One

Year | Three

Years | Five

Years | Ten

Years | Expense

Ratio* |

PERFORMANCE AT NAV WITHOUT SALES CHARGES |

Class A Shares | 6/30/2000 | -7.30% | 2.59% | 2.63% | 6.28% | 1.74% |

Class C Shares | 2/13/2001 | -7.96 | 1.83 | 1.87 | 5.49 | 2.49 |

Class I Shares | 1/31/2005 | -7.04 | 2.89 | 2.93 | 6.59 | 1.45 |

Class Y Shares | 12/30/2011 | -6.89 | 3.01 | 3.05 | 6.59 | 1.33 |

BENCHMARK |

Russell 1000 Index | | -4.78 | 9.09 | 8.21 | 13.28 | — |

60% Russell 1000 Index/40% ICE BofAML U.S. T-Bill 0-3 Mo. Index | | -1.92 | 5.93 | 5.25 | 8.17 | — |

PERFORMANCE AT PUBLIC OFFERING PRICE INCLUDING SALES CHARGES** |

Class A Shares | 6/30/2000 | -11.95 | 0.85 | 1.58 | 5.73 | 1.74 |

Class C Shares | 2/13/2001 | -8.84 | 1.83 | 1.87 | 5.49 | 2.49 |

| * | Reflects the expense ratio as reported in the Prospectus dated February 28, 2019. |

| ** | The maximum sales charge for Class A shares on purchases and for Class C shares on certain redemptions are 5.00% and 1.00%, respectively. |

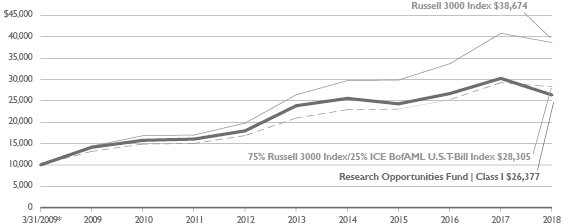

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill Long-Short Fund Class I(A), the Russell 1000 Index and the Blended Index (60% Russell 1000 Index and 40% ICE BofAML U.S. T-Bill 0-3 Month Index)

(A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A, Class C and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell 1000 Index and the blended index. The Russell 1000 Index is a market capitalization-weighted index measuring performance of the largest 1,000 companies on a market capitalization basis, in the Russell 3000 Index. The Blended Index represents a 60% weighting of the Russell 1000 Index as described above and a 40% weighting of the ICE BofAML U.S. T-Bill 0-3 Month Index. The ICE BofAML U.S. T-Bill 0-3 Month Index tracks the performance of U.S. dollar denominated U.S. Treasury Bills publicly issued in the U.S. domestic market with a remaining term to final maturity of less than 3 months. Both indices are unmanaged and do not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

| Historical performance for Class Y shares prior to its inception is based on the performance of Class A shares. Class Y performance has been adjusted to reflect differences in sales charges and expenses between classes. |

| Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.diamond-hill.com. |

26 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2018 | DIAMOND-HILL.COM |

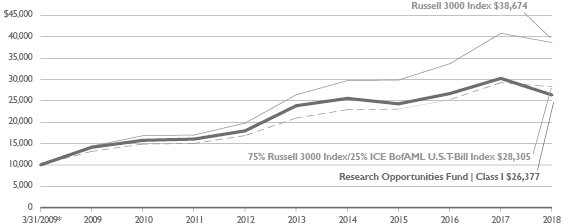

Diamond Hill Research Opportunities Fund |

2018 Portfolio Commentary

The Diamond Hill Research Opportunities Fund (Class I) returned -12.86% during 2018 compared to a -5.24% return for our primary benchmark, the long-only Russell 3000 Index. At Diamond Hill, we have a long-term investment horizon and evaluate our performance over rolling five-year periods. At the end of 2018, our five-year annualized return was 2.02% versus 7.91% for the Russell 3000 Index. During 2016, we added a secondary benchmark, which reflected our long-term average net exposure. This benchmark is comprised of 75% Russell 3000 Index and 25% ICE Bank of America Merrill Lynch U.S. T-Bill 0-3 Month Index. The performance of this secondary benchmark was -3.31% and 6.16% for the trailing one-year and five-year periods, respectively.

Our most recent five-year results have not met the standards we set for ourselves. During 2018, the underperformance was largely attributable to our long book, as our short portfolio was a net positive contributor on the year. Net exposure was relatively consistent throughout the year in the mid-to-high 80’s and we ended the year with net exposure of 85%, compared to the Fund’s five-year average of 79%. Gross exposure ended 2018 at 123%, which is consistent with the 123% at year-end 2017.

The two largest contributors to absolute performance during 2018 were holdings in airline United Continental Holdings and data analytics provider Verisk Analytics. United’s revenues continued to exceed market expectations due to strong demand and encouraging results from company-specific initiatives. Verisk delivered strong revenue and earnings growth. Results in the insurance portion of the business, which is over 70% of revenue and 80% of earnings, were particularly favorable.

The largest detractors from absolute return during the year were long positions in Bank OZK, Red Rock Resorts, and NVR. We initiated our investment in Bank OZK in January 2018 after following the company and its track record of compounding intrinsic value that is well above peers for many years. Fears of slowing loan growth, net interest margin pressure, and general concerns about commercial real estate began to weigh on the shares following second quarter earnings. Poor third quarter results that included more margin pressure than expected and two negative credit developments in their real estate book fueled investor concerns. We believe the credit developments are isolated incidents and the outsized reaction to the results was unwarranted.

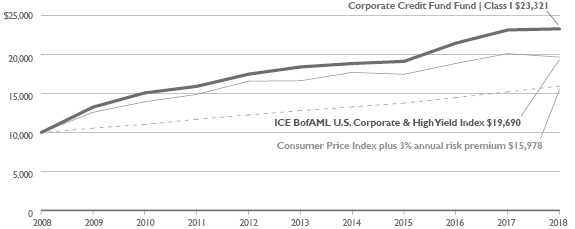

Red Rocks Resorts’ short-term results proved disappointing primarily due to renovation disruption at their Palace Stations and Palms properties. They also increased their budget for the construction at the Palms by over 10% due to increases in labor and material costs. We believe these developments were a reset to short-term expectations, but they do not impact our perception of the value or attractiveness of the business. Despite decent fundamental results, shares of NVR underperformed due to significant bearish sentiment toward the homebuilding industry stemming from the impact of rising interest rates and concerns regarding affordability.