UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08061

Diamond Hill Funds

(Exact name of registrant as specified in charter)

325 John H. McConnell Boulevard, Suite 200, Columbus, Ohio 43215

(Address of principal executive offices) (Zip code)

Thomas E. Line

325 John H. McConnell Boulevard, Suite 200, Columbus, Ohio 43215

(Name and address of agent for service)

Registrant’s telephone number, including area code:614-255-3333

Date of fiscal year end:December 31

Date of reporting period:December 31, 2019

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Diamond Hill Funds’ (“Fund”) shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary, such as a broker-dealer or bank, or from the Diamond Hill Funds, if you invest directly with the Fund. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the Fund, by calling 888-226-5595.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly in a Diamond Hill Fund, you can call 888-226-5595 to let the Fund know of your request. Your election to receive reports in paper will apply to all funds held in your account, if you invest through your financial intermediary, or all Diamond Hill Funds, if you invest directly with the Fund.

| | |

Letter to Shareholders | 1 |

Mission and Guiding Principles | 5 |

Management Discussion of Fund Performance (Unaudited) | |

Diamond Hill Small Cap Fund | 7 |

Diamond Hill Small-Mid Cap Fund | 10 |

Diamond Hill Mid Cap Fund | 13 |

Diamond Hill Large Cap Fund | 16 |

Diamond Hill All Cap Select Fund | 20 |

Diamond Hill Long-Short Fund | 23 |

Diamond Hill Research Opportunities Fund | 26 |

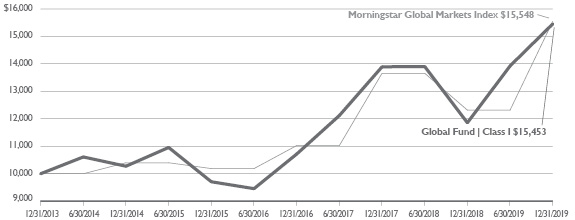

Diamond Hill Global Fund | 29 |

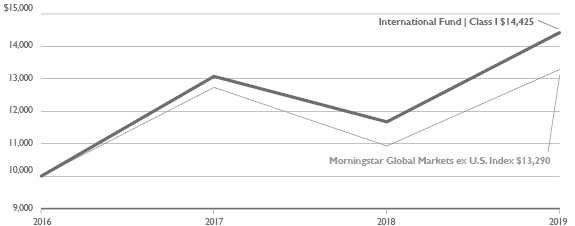

Diamond Hill International Fund | 32 |

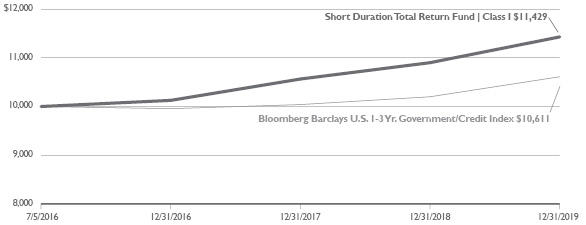

Diamond Hill Short Duration Total Return Fund | 35 |

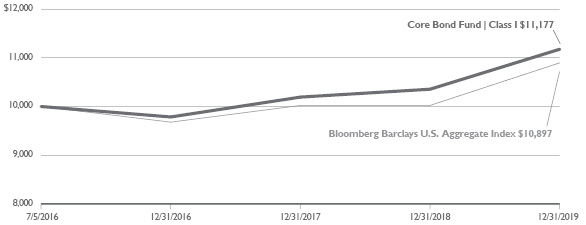

Diamond Hill Core Bond Fund | 38 |

Diamond Hill Corporate Credit Fund | 41 |

Diamond Hill High Yield Fund | 44 |

Financial Statements | |

Schedules of Investments | 47 |

Statements of Assets & Liabilities | 106 |

Statements of Operations | 109 |

Statements of Changes in Net Assets | 112 |

Financial Highlights | 128 |

Notes to Financial Statements | 154 |

Report of Independent Registered Public Accounting Firm | 174 |

Other Items | 176 |

Schedule of Shareholder Expenses | 182 |

Management of the Trust | 185 |

Cautionary Statement: At Diamond Hill, we pledge that, “we will communicate with our clients about our investment performance in a manner that will allow them to properly assess whether we are deserving of their trust.” Our views and opinions regarding the investment prospects of our portfolio holdings and Funds are “forward looking statements” which may or may not be accurate over the long term. While we believe we have a reasonable basis for our opinions, actual results may differ materially from those we anticipate. Information provided in this report should not be considered a recommendation to purchase or sell any particular security.

You can identify forward looking statements by words like “believe,” “expect,” “anticipate,” or similar expressions when discussing prospects for particular portfolio holdings and/or one of the Funds. We cannot assure future results. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. We disclaim any obligation to update or alter any forward-looking statements, whether as a result of new information, future events, or otherwise.

This material is not authorized for distribution to prospective investors unless preceded or accompanied by a Prospectus. Investors should consider the investment objectives, risks, charges, and expenses of the Diamond Hill Funds carefully before investing. The prospectus or summary prospectus contain this and other important information about the Fund(s) and are available at diamond-hill.com or by calling 888.226.5595. Please read the prospectus or summary prospectus carefully before investing. The Diamond Hill Funds are distributed by Foreside Financial Services, LLC (Member FINRA). Diamond Hill Capital Management, Inc., a registered investment adviser, serves as Investment Adviser to the Diamond Hill Funds and is paid a fee for its services. Diamond Hill Funds are not FDIC insured, may lose value, and have no bank guarantee.

Dear Fellow Shareholders:

We are pleased to provide you with this year-end update for the Diamond Hill Funds.

Equity markets reached new all-time highs in 2019, with the Russell 1000 Index returning 31.43% for the year, the strongest annual return for the Index since 2013 and the second-best return since 1997. Most of the market’s return was driven by price/earnings multiple expansion, as corporate earnings grew at a very modest rate. With the exception of a short rally for value stocks in September, growth stocks continued to outperform value stocks, with the Russell 1000 Growth Index outperforming the Russell 1000 Value index by just under 1,000 basis points for the year. The 50% return for the information technology sector was particularly notable.

The trend toward passive management persisted in 2019. We continue to believe that Diamond Hill strategies will outperform their respective passive benchmarks over a full market cycle, supported by a shared commitment to our intrinsic value-based investment philosophy, long-term perspective, disciplined approach, and alignment with our clients’ interests. As of December 31, 2019, the since-inception returns for most of our strategies exceeded their respective benchmark returns.

2019 Financial Markets

The first quarter of 2019 was the best in nearly a decade for the Russell 1000 Index, returning 14.0% and recovering nearly all of the double-digit decline in the fourth quarter of 2018. Concern that the Federal Reserve would tighten monetary policy too far contributed to the sell-off at the end of 2018, but Chairman Powell’s comments in January 2019 about being “patient and flexible” seemed to allay those fears.

Much of the market’s movement in the second quarter of 2019 was driven by interest rates and expectations around a resolution to global trade tensions. After a strong April, markets slid in May on concern that trade talks were falling apart. Renewed optimism around a deal, along with a developing perception that a low interest rate environment would persist for some time, led to a bounce-back in June.

Equity markets increased modestly in the third quarter. The on and off progress of trade negotiations continued to move markets, as did the rapid fluctuation of interest rates. Equity markets finished the year strong, with the Russell 1000 Index returning 9.04% in the fourth quarter to again reach new all-time highs. The sharp move was likely driven by incremental progress on a trade deal with China.

Interestingly, only three sectors outperformed the Russell 1000 Index for the full year, and two of them – financials and communication services – outperformed by just a small margin. This speaks to just how much the 50% return for the information technology sector drove the overall market in 2019, as the sector was responsible for approximately one-third of the overall market’s return. Drilling one level deeper, just four information technology stocks – Apple, Microsoft, Mastercard, and Visa – contributed about 17% of the Russell 1000 Index’s return.

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM 1 |

The dominant theme in the fixed income markets throughout the year was the complete suppression of volatility by the Federal Reserve, a theme that was evident in the two Federal Open Market Committee (FOMC) meetings in the fourth quarter. After spending the majority of 2018 working to get out of the business of suppressing volatility, we expected the Federal Reserve to recalibrate policy in 2019, as there was no need to push the economy close to recession with both actual and expected inflation contained. However, the Federal Reserve did far more than recalibrate policy. It reversed three of the four 2018 rate hikes and resumed balance sheet expansion in the fourth quarter to placate concerns that arose from money market volatility in September. The combination of the Federal Reserve’s lowering rates, increasing its balance sheet, resolution to the U.K. election (with Boris Johnson consolidating his power), and a potential agreement on a phase one trade deal between the U.S. and China fueled risk markets. Equity markets led the charge higher, with both high yield and investment grade corporate bonds following suit. Longer-term Treasury yields moved higher as investors moved away from haven assets and piled into risk.

The 30-year Treasury returned 16.43% in 2019, its best calendar year performance since 2014 (29.38%). Similar to the performance of the 30-year Treasury, the 2019 performance for the 10-year Treasury, 8.90%, was the best since 2014’s return of 10.74%. Overall, the Treasury market gained 6.86% in 2019.

The Bloomberg Barclays U.S. Corporate Index returned 14.54% in 2019. The Index finished the year with one month of negative performance (September’s decline of 65 bps, which was fueled by a deluge of new issuance), matching the record for positive performing months in a calendar year set in 1995. The ICE BofA U.S. High Yield Index also posted strong returns for the year, ending 2019 with a 14.41% return.

Outlook

U.S. real GDP growth remains healthy, driven by a strong labor market, business investment, and increased government spending. However, growth has slowed from peak levels in 2018 and some economic indicators suggest continued slowing. There is also the risk that things like domestic politics or geopolitical events can alter the trajectory of growth in the near term. For example, ongoing disputes over international trade policy have the potential to negatively impact growth if they are not resolved.

The size of recently implemented tariffs is small relative to the total economy, but for certain companies the impact is large. While tariffs are not impacting how we are positioning our portfolios, we continually assess the impact on a company-by-company basis. The likelihood of reaching a trade deal seems to rapidly fluctuate, but we believe cooler heads will eventually prevail and a deal will be reached.

Corporate tax reform provided a boost to corporate earnings in 2018, but the challenging year-over-year comparison made earnings growth more difficult in 2019. Earnings for many companies were also pressured by higher input costs, including wages and transportation. Earnings growth is expected to be higher in 2020 as some of these factors start to normalize.

2 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM |

The modest deleveraging of the U.S. household sector over the past several years continues to be a positive story. These lower debt levels combined with low interest rates have allowed consumer debt-service burdens to improve to very low levels by historical standards. This debt-service ability remains very much tied to interest rate levels, so the current low levels should continue to help support a strong consumer.

The Federal Reserve’s hawkish commentary in late 2018 spooked equity markets, causing concern that they may go too far in tightening monetary policy and increase the probability of a recession. The Federal Reserve walked back those comments in early 2019 by describing its approach as flexible, sparking a rally in equity markets and very strong returns for the year. The Federal Reserve cut the Federal Funds rate in July, September, and October, and along with its decision to leave rates unchanged in December, signaled that it is comfortable with current levels given its favorable economic outlook.

Low interest rates, high corporate profit margins, and steady economic growth with low inflation have driven strong equity market returns since the Great Recession of 2008, often making it difficult for us to find new investments for our portfolios. This continues to be the case after the market’s significant move upward in 2019. As always, we remain focused on assessing risk, which we define as the permanent loss of capital.

Current price/earnings multiples are slightly above historical averages, and although they are not excessive, expected returns could be held back if historically high corporate profit margins and below-average interest rates revert toward long-term averages. Considering these factors, mid-single digit returns seem reasonable for equity markets over the next five years.

We believe we can achieve better-than-market returns over the next five years through active portfolio management, and our primary focus is always on achieving value-added results for our existing clients. Our intrinsic value investment philosophy is shared by all of our portfolio managers and research analysts, allowing us to apply our investment discipline consistently across strategies.

Thank you for your continued support,

Diamond Hill Capital Management, Inc.

|

|

Austin Hawley, CFA

Chief Investment Officer | Bill Zox, CFA

Chief Investment Officer –

Fixed Income |

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM 3 |

The views expressed are as of December 31, 2019, and they are subject to change. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice. All data referenced are from sources deemed to be reliable but cannot be guaranteed. Securities and sectors referenced should not be construed as a solicitation or recommendation or be used as the sole basis for any investment decision.

The Russell 1000 Index is an unmanaged market capitalization weighted index measuring the performance of the largest 1,000 companies by market capitalization in the Russell 3000 Index. The Russell 3000 Index is an unmanaged market capitalization weighted index measuring the performance of the 3,000 largest U.S. companies based on total market capitalization. The Russell 1000 Value Index is an unmanaged market capitalization weighted index measuring the performance of the large cap value segment of the U.S. equity universe including those Russell 1000 Index companies with lower expected growth values. The Russell 1000 Growth Index is an unmanaged market capitalization weighted index measuring the performance of the large cap growth segment of the U.S. equity universe including those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values.

The Bloomberg Barclays U.S. Corporate Index is an unmanaged index measuring the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by U.S. and non-U.S. industrial, utility and financial issuers.

The ICE BofA U.S. High Yield Index is an unmanaged index measuring the performance of U.S. dollar denominated below investment grade corporate debt publicly issued in the U.S. domestic market. The index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its third party suppliers and has been licensed for use by Diamond Hill Capital Management, Inc. ICE Data and its third party suppliers accept no liability in connection with its use. See diamond-hill.com for a full copy of the disclaimer.

These indices do not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. Investors cannot invest directly in an index although they can invest in the underlying securities.

4 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM |

Our Mission

At Diamond Hill, we serve our clients by providing investment strategies that deliver lasting value through a shared commitment to our intrinsic value-based investment philosophy, long-term perspective, disciplined approach and alignment with our clients’ interests.

VALUE

We believe market price and intrinsic value are independent in the short-term but tend to converge over time.

LONG-TERM

We maintain a long-term focus both in investment analysis and management of our business.

DISCIPLINE

We invest with discipline to increase potential return and protect capital.

PARTNERSHIP

We align our interests with those of our clients through significant personal investment in our strategies.

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM 5 |

The Guiding Principles of our Intrinsic Value Philosophy |

| | ● | Recognize that market price and intrinsic value tend to converge over a reasonable period of time |

| | ● | Possess a long-term investment temperament (five years or longer) |

| | ● | Only invest when the market price is below (above for short positions) intrinsic value |

| | ● | Treat every investment as a partial ownership interest in that company |

Our intrinsic value philosophy is shared by all of our portfolio managers and research analysts, allowing us to apply our investment discipline consistently across all equity and fixed income strategies.

Each portfolio is supported by our entire research team, all of whom are dedicated to bottom-up, fundamental analysis and provide research coverage across the capital structure. Each team member covers small, mid and large capitalization companies, long and short opportunities, equity and debt, as well as global and domestic companies.

We believe we can achieve better-than-market returns over the long term through active portfolio management, and our primary focus is always on achieving value-added results for our clients.

6 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM |

Management Discussion of Fund Performance (Unaudited) |

Diamond Hill Small Cap Fund

2019 Portfolio Commentary

For 2019, the Small Cap Fund (Class I) delivered a 21.75% return. We are pleased with the absolute result for the year but continue to struggle to keep pace with the Russell 2000 Index’s 25.52% return. Hats off to our industrials team as they delivered nearly half the performance while representing less than a quarter the exposure. Two companies we would like to highlight are Aircastle and Allegiant Travel.

Aircastle is a superb example of patience. We have owned the business for over five years, watching book value compound at 6% and collecting a reasonable yield along the way, all while having the multiple contract. Then in early November, the company received a cash offer of $32 per share, delivering a 95% return for us this year and over 17% annualized since our initial purchase in 2014. While the market tests your commitment, we believe if we follow the fundamentals and trust our analysis, in time we will realize the true value of the business.

As for Allegiant Travel, this is an excellent illustration of our alignment with an owner’s mindset. The founder and management own over 20% of the business and believed an investment in refreshing the company’s portfolio of planes would deliver excellent results to both the customer and the bottom line. We agreed and felt we had the opportunity to acquire a portion of the company at a price which gave management little to no credit for margin improvement. Allegiant more than exceeded our expectations as on-time performance improved 7.5 percentage points over the last two years and profitability was up over 600 basis points through the first three quarters of 2019. With these results, the stock price followed, increasing over 75%. When incentives are aligned, it is a good recipe for positive outcomes for all constituencies.

Autophagy of a Portfolio

For those not familiar with the biological function of autophagy, it is essentially our body’s method of natural selection for cells. When the body is stressed through exercise, fasting, or other extreme processes, it breaks down weaker cellular structures and recycles those building blocks to construct a stronger, more durable entity. In essence, this is the same process we have put the portfolio through since taking over management in February. While we cannot guarantee performance, a hallmark that we would like our portfolio to possess is resiliency in the face of difficult market environments. Therefore, we have eliminated weaker positions and recycled the capital into higher quality companies or opportunities with a greater margin of safety. This is illustrated in many of the eliminated positions throughout the past year.

Inheriting a portfolio with 69 holdings, we immediately sold seven smaller positions of companies like TiVo, which lacked strategic direction, and Cincinnati Bell, where we weren’t comfortable with the level of financial leverage. We also eliminated companies where the market provided us opportunities to sell at narrowed discounts to our intrinsic value estimate for less-than-stellar businesses like Avis Budget which delivered a nearly 60% return this year or Option Care Health which rebounded after a difficult start.

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM 7 |

Diamond Hill Small Cap Fund |

The last category of portfolio autophagy we would like to highlight were situations where our thesis moved against us and risks began increasing to uncomfortable levels, such as Tenneco. The company had recently acquired Federal Mogul in an attempt to form a company that could be split into two more-focused entities. While we did not necessarily agree with the strategic rationale for the acquisition the valuation seemed too compelling to exit our position. After multiple operational missteps, continued fundamental deterioration, and a weakening balance sheet, we felt the eventual success or failure of the company was less in their control and would be dictated by the path of their end markets. Therefore, we exited this position with a 59% loss this year.

When the year was settled, we had decisively eliminated 16 positions and constructed a portfolio of 57 companies that we believe together represent a stronger, more resilient portfolio of diversified business cash flows. At the top of that list are companies like Live Nation Entertainment and Vail Resorts that we believe would be extremely difficult to replicate, cyclical companies such as Kirby and Cal-Maine Foods with the capacity to improve their position while others suffer, and uniquely positioned financial institutions such as Sterling Bancorp and Enstar Group.

The Future

We understand any portfolio management change can be unsettling. We greatly appreciate your continued support and partnership. Thank you. While we will not be flawless, through continued portfolio reflection we will strive to construct a collection of excellent long-term businesses with a significant margin of safety. We will be invested alongside you and will transparently strive to deliver strong and resilient risk-adjusted returns to our partners.

We would also like to thank our analyst team for their support throughout the year. We understand change is not easy for them either, so we thank them for their efforts to make this a successful long-term endeavor.

We are excited with the direction of the portfolio and remain convicted in our long-term, intrinsic value investment philosophy.

Sincerely,

|

|

Aaron Monroe, CFA

Portfolio Manager | Chris Welch, CFA

Portfolio Manager |

8 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM |

Diamond Hill Small Cap Fund |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2019

| Inception

Date | One

Year | Three

Years | Five

Years | Ten

Years | Expense

Ratio* |

PERFORMANCE AT NAV WITHOUT SALES CHARGES |

Class A Shares | 12/29/2000 | 21.36% | 4.45% | 4.59% | 8.95% | 1.26% |

Class C Shares | 2/20/2001 | 20.46 | 3.67 | 3.80 | 8.14 | 2.01 |

Class I Shares | 4/29/2005 | 21.75 | 4.76 | 4.90 | 9.26 | 0.97 |

Class Y Shares | 12/30/2011 | 21.88 | 4.87 | 5.01 | 9.31 | 0.85 |

BENCHMARK |

Russell 2000 Index | | 25.52 | 8.59 | 8.23 | 11.83 | — |

PERFORMANCE AT PUBLIC OFFERING PRICE INCLUDING SALES CHARGES** |

Class A Shares | 12/29/2000 | 15.29 | 2.68 | 3.52 | 8.40 | 1.26 |

Class C Shares | 2/20/2001 | 19.46 | 3.67 | 3.80 | 8.14 | 2.01 |

* Reflects the expense ratio as reported in the Prospectus dated February 28, 2020. ** The maximum sales charge for Class A shares on purchases and for Class C shares on certain redemptions are 5.00% and 1.00%, respectively. |

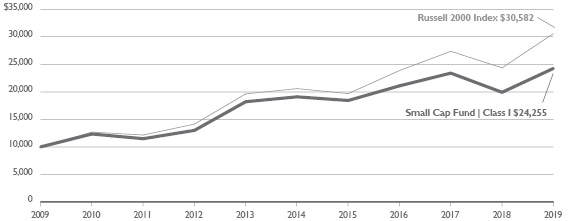

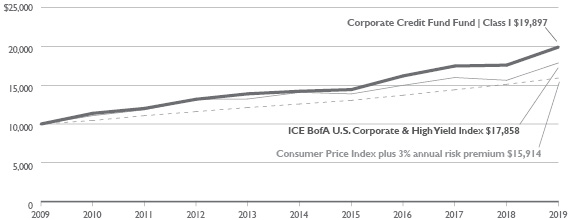

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill Small Cap Fund Class I(A) and the Russell 2000 Index.

(A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A, Class C and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell 2000 Index (“Index”). The Index is an unmanaged market capitalization weighted index measuring performance of the smallest 2,000 companies by market capitalization in the Russell 3000 Index. The Russell 3000 Index is an unmanaged market capitalization weighted index measuring the performance of the 3,000 largest U.S. companies based on total market capitalization. The Index does not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

| Historical performance for Class Y shares prior to its inception is based on the performance of Class A shares. Class Y performance has been adjusted to reflect differences in sales charges and expenses between classes. |

| Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.diamond-hill.com. |

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM 9 |

Diamond Hill Small-Mid Cap Fund |

2019 Portfolio Commentary

The Diamond Hill Small-Mid Cap Fund (Class I) returned 27.74% in 2019 compared to a 27.77% return for the benchmark Russell 2500 Index. For the five-year period ended December 31, 2019, the Fund’s return was 7.76%, while the Russell 2500 Index returned 8.93% over the same period. In the 14 years since inception, the Fund’s return of 8.91% was approximately in line with the 8.84% benchmark return. The 2019 results were positively impacted by favorable stock selection in the industrials and consumer discretionary sectors, offset by a sizable underweight in the high-returning information technology sector as well as our mid- to high-single-digit average cash position in the strong up market.

With U.S. equity markets hitting multiple new highs during 2019, it has been especially important for us to maintain our valuation discipline. We estimate the intrinsic value of businesses using our internal research and valuation framework, in which maintaining a long-term time horizon is an essential part of our process. We buy securities for the portfolio when we feel there is a satisfactory discount, or margin of safety, between the market price and our estimate of intrinsic value.

There were limited opportunities to deploy capital in such discounted equity securities in 2019, but we took advantage of the openings that arose. One such opportunity involved adding to our position in electrical industrial distributor WESCO International, Inc. (WCC) during the late summer time frame. We initially purchased WCC in the second quarter of 2019 after the stock sold off on fears of both an economic slowdown and competition from Amazon. We believed WCC was well-positioned for the long-term based on the value-added services it provides to customers, so we initiated a small position.

As the calendar moved to July and August, investor concerns continued, and WCC’s stock price eventually fell to approximately eight times our estimate of normalized earnings. We believed this valuation level implied either a steadily declining business, which we were confident was not the case, or a significantly lower level of normalized earnings relative to our estimates. After performing additional research and stress tests, we felt comfortable more than doubling the position size of WCC in the portfolio by the end of August to approximately 1.5%. As investors’ fears diminished over the course of the remainder of the year and WCC explored potential consolidation activity in the industrial distribution sector, the stock rose as much as 40% from our lowest purchase price in August.

We encountered a similar experience with auto supplier BorgWarner, Inc. (BWA), where we were also able to add to the position in August at a valuation of around eight times our estimate of normalized earnings, a level we viewed as far too low for a company with BWA’s favorable business position and strong balance sheet. The short-term concerns about tariff pressures and an economic slowdown faded through year-end, allowing the roughly 40% gain in BWA’s stock price from our lowest buy price.

The volatility in late summer also presented us with an opportunity to add another new position, Wolverine World Wide (WWW), to the portfolio at the lower end of our market cap range. We monitored WWW closely for the last two years and were drawn to the quality of its primary

10 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM |

Diamond Hill Small-Mid Cap Fund |

footwear brands, but we thought the valuation was too high to provide an adequate margin of safety. When WWW traded down sharply on trade concerns, we understood WWW’s exposure to tariffs and thought the decline in the stock price more than reflected the potential impact from tariffs. We took the opportunity to establish a position at a share price that has since increased more than 35% from our initial purchase.

In a market environment where valuations are high and opportunities are few, we must maintain our discipline while being aggressively optimistic when we get the chance. We did that in the case of the above examples, and also in the fourth quarter of 2018, as explained in last year’s annual letter. Despite these opportunities, cash averaged over 6% for the full year and was a meaningful drag on portfolio returns in the strong up market. We will continue to show patience and discipline, while maintaining our intent to stay at least 90% invested at all times.

I’d like to once again acknowledge our large team of analysts and research associates who work hard to generate ideas and deliver strong returns to clients. Their breadth and depth of research allows us to always maintain a portfolio that we believe is best positioned to deliver favorable returns to you over the next five years.

Historically low interest rates as well as renewed balance sheet expansion from the Federal Reserve have created a positive environment for equities. This has been reinforced by more favorable sentiment on trade. While price-to-earnings ratios are short of historical peak levels, a key variable will be the ability of companies to maintain profit margins at their current all-time high levels. This factor, largely the result of the favorable macro backdrop, has generally supported higher multiples and returns from equities. If we continue to benefit from this scenario, equities will likely generate adequate returns going forward. However, it would not take much to disrupt the favorable environment to which equity investors have grown accustomed, and the Federal Reserve has far less flexibility to support valuations through accommodative policy measures at this point.

We thus remind investors that our approach to investing centers on maintaining a margin of safety in our stock selections, and we remain ever-mindful of key risks when we assess investment opportunities for the portfolio. Through our focused research process, we are always prepared to take advantage of price dislocations to drive long-term favorable returns for our investors, but we are first and foremost focused on preserving the capital you place with us.

We appreciate your ongoing support and look forward to continuing to work with you in the coming years.

Chris Welch, CFA

Portfolio Manager

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM 11 |

Diamond Hill Small-Mid Cap Fund |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2019

| Inception

Date | One

Year | Three

Years | Five

Years | Ten

Years | Expense

Ratio* |

PERFORMANCE AT NAV WITHOUT SALES CHARGES |

Class A Shares | 12/30/2005 | 27.33% | 6.35% | 7.43% | 11.42% | 1.20% |

Class C Shares | 12/30/2005 | 26.40 | 5.55 | 6.64 | 10.59 | 1.95 |

Class I Shares | 12/30/2005 | 27.74 | 6.66 | 7.76 | 11.74 | 0.91 |

Class Y Shares | 12/30/2011 | 27.82 | 6.78 | 7.87 | 11.78 | 0.79 |

BENCHMARK |

Russell 2500 Index | | 27.77 | 10.33 | 8.93 | 12.58 | — |

PERFORMANCE AT PUBLIC OFFERING PRICE INCLUDING SALES CHARGES** |

Class A Shares | 12/30/2005 | 20.96 | 4.56 | 6.34 | 10.84 | 1.20 |

Class C Shares | 12/30/2005 | 25.40 | 5.55 | 6.64 | 10.59 | 1.95 |

* Reflects the expense ratio as reported in the Prospectus dated February 28, 2020. ** The maximum sales charge for Class A shares on purchases and for Class C shares on certain redemptions are 5.00% and 1.00%, respectively. |

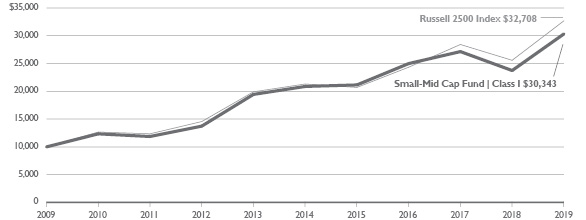

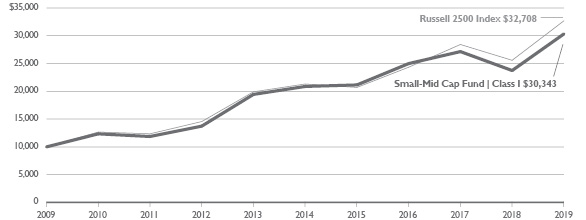

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill Small-Mid Cap Fund Class I(A) and the Russell 2500 Index.

| (A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A, Class C and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell 2500 Index (“Index”). The Index is an unmanaged market capitalization weighted index measuring performance of the smallest 2,500 companies by market capitalization in the Russell 3000 Index. The Russell 3000 Index is an unmanaged market capitalization weighted index measuring the performance of the 3,000 largest U.S. companies based on total market capitalization. The Index does not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

| Historical performance for Class Y shares prior to its inception is based on the performance of Class A shares. Class Y performance has been adjusted to reflect differences in sales charges and expenses between classes. |

| Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.diamond-hill.com. |

12 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM |

Diamond Hill Mid Cap Fund |

2019 Portfolio Commentary

The Diamond Hill Mid Cap Fund (Class I) returned 25.82% in 2019 compared to a 30.54% return for the benchmark Russell Midcap Index. For the five-year period ended December 31, 2019, the Fund’s return was 8.29%, while the Russell Midcap Index returned 9.33% over the same period. The 2019 underperformance relative to the benchmark was driven by our high- single-digit average cash position in a strong up market, as well as a sizable underweight in the information technology sector plus unfavorable stock selection in the technology and financials sectors. These items were partially offset by favorable stock selection in the consumer discretionary and communication services sectors.

With U.S. equity markets hitting multiple new highs during 2019, it has been especially important for us to maintain our valuation discipline. We estimate the intrinsic value of businesses using our internal research and valuation framework, in which maintaining a long-term time horizon is an essential part of our process. We buy securities for the portfolio when we feel there is a satisfactory discount, or margin of safety, between the market price and our estimate of intrinsic value.

There were limited opportunities to deploy capital in such discounted equity securities in 2019, but we took advantage of the openings that arose. One such opportunity involved adding to our position in electrical industrial distributor WESCO International, Inc. (WCC) during the late summer time frame. We initially purchased WCC in the second quarter of 2019 after the stock sold off on fears of both an economic slowdown and competition from Amazon. We believed WCC was well-positioned for the long-term based on the value-added services it provides to customers, so we initiated a small position.

As the calendar moved to July and August, investor concerns continued, and WCC’s stock price eventually fell to approximately eight times our estimate of normalized earnings. We believed this valuation level implied either a steadily declining business, which we were confident was not the case, or a significantly lower level of normalized earnings relative to our estimates. After performing additional research and stress tests, we felt comfortable more than doubling the position size of WCC in the portfolio by the end of August to approximately 1.25%. As investors’ fears diminished over the course of the remainder of the year and WCC explored potential consolidation activity in the industrial distribution sector, the stock rose as much as 40% from our lowest purchase price in August.

We encountered a similar experience with auto supplier BorgWarner, Inc. (BWA), where we were also able to add to the position in August at a valuation of around eight times our estimate of normalized earnings, a level we viewed as far too low for a company with BWA’s favorable business position and strong balance sheet. The short-term concerns about tariff pressures and an economic slowdown faded through year-end, allowing the roughly 40% gain in BWA’s stock price from our lowest buy price.

The volatility in late summer also presented us with an opportunity to add another new position, Wolverine World Wide (WWW), to the portfolio at the lower end of our market cap range. We monitored WWW closely for the last two years and were drawn to the quality of its primary

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM 13 |

Diamond Hill Mid Cap Fund |

footwear brands, but we thought the valuation was too high to provide an adequate margin of safety. When WWW traded down sharply on trade concerns, we understood WWW’s exposure to tariffs and thought the decline in the stock price more than reflected the potential impact from tariffs. We took the opportunity to establish a position at a share price that has since increased more than 35% from our initial purchase.

In a market environment where valuations are high and opportunities are few, we must maintain our discipline while being aggressively optimistic when we get the chance. We did that in the case of the above examples, and also in the fourth quarter of 2018, as explained in last year’s annual letter. Despite these opportunities, cash averaged over 7% for the full year and was a meaningful drag on portfolio returns in the strong up market. We will continue to show patience and discipline, while maintaining our intent to stay at least 90% invested at all times.

I’d like to once again acknowledge our large team of analysts and research associates who work hard to generate ideas and deliver strong returns to clients. Their breadth and depth of research allows us to always maintain a portfolio that we believe is best positioned to deliver favorable returns to you over the next five years.

Historically low interest rates as well as renewed balance sheet expansion from the Federal Reserve have created a positive environment for equities. This has been reinforced by more favorable sentiment on trade. While price-to-earnings ratios are short of historical peak levels, a key variable will be the ability of companies to maintain profit margins at their current all-time high levels. This factor, largely the result of the favorable macro backdrop, has generally supported higher multiples and returns from equities. If we continue to benefit from this scenario, equities will likely generate adequate returns going forward. However, it would not take much to disrupt the favorable environment to which equity investors have grown accustomed, and the Federal Reserve has far less flexibility to support valuations through accommodative policy measures at this point.

We thus remind investors that our approach to investing centers on maintaining a margin of safety in our stock selections, and we remain ever-mindful of key risks when we assess investment opportunities for the portfolio. Through our focused research process, we are always prepared to take advantage of price dislocations to drive long-term favorable returns for our investors, but we are first and foremost focused on preserving the capital you place with us.

We appreciate your ongoing support and look forward to continuing to work with you in the coming years.

Chris Welch, CFA

Portfolio Manager

14 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM |

Diamond Hill Mid Cap Fund |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2019

| Inception

Date | One

Year | Three

Years | Five

Years | Since

Inception

(12/31/13) | Expense

Ratio* |

PERFORMANCE AT NAV WITHOUT SALES CHARGES |

Class A Shares | 12/31/2013 | 25.36% | 7.28% | 7.97% | 7.90% | 1.05% |

Class I Shares | 12/31/2013 | 25.82 | 7.62 | 8.29 | 8.22 | 0.76 |

Class Y Shares | 12/31/2013 | 25.91 | 7.72 | 8.40 | 8.34 | 0.64 |

BENCHMARK |

Russell Midcap Index | | 30.54 | 12.06 | 9.33 | 9.97 | — |

PERFORMANCE AT PUBLIC OFFERING PRICE INCLUDING SALES CHARGES** |

Class A Shares | 12/31/2013 | 19.05 | 5.47 | 6.87 | 6.98 | 1.05 |

* Reflects the expense ratio as reported in the Prospectus dated February 28, 2020. ** The maximum sales charge for Class A shares on purchases is 5.00%. |

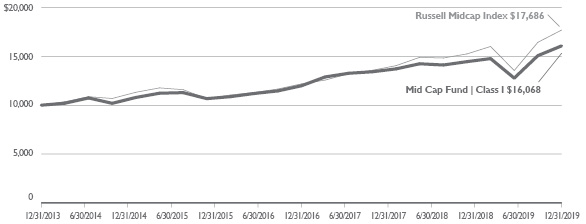

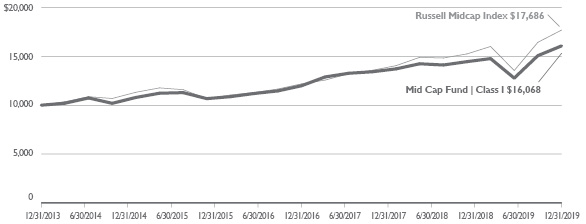

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill Mid Cap Fund Class I(A) and the Russell Midcap Index.

(A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell Midcap Index (“Index”). The Index is an unmanaged market capitalization weighted index measuring performance of the smallest 800 companies by market capitalization in the Russell 1000 Index. The Russell 1000 Index is an unmanaged market capitalization weighted index measuring the performance of the largest 1,000 companies by market capitalization in the Russell 3000 Index. The Russell 3000 Index is an unmanaged market capitalization weighted index measuring the performance of the 3,000 largest U.S. companies based on total market capitalization. The Index does not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

| Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.diamond-hill.com. |

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM 15 |

Diamond Hill Large Cap Fund |

2019 Portfolio Commentary

The Diamond Hill Large Cap Fund (Class I) returned 32.18% in 2019 compared to 31.43% for the Russell 1000 Index. The year was very gratifying as the strong performance followed an extremely disappointing fourth quarter of 2018. The selloff at the end of 2018 provided attractive valuations which led to the outsized opportunity in 2019. Much of the 2019 performance can be explained by the actions of the Federal Reserve. Following several tightening moves in the preceding year, the Federal Reserve began the easing process which led to the rapid market recovery. The rally was somewhat counterintuitive in light of very muted corporate earnings growth during the calendar year. However, earnings multiples expanded in an environment of accommodative central bank action and low long-term interest rates. As 2019 came to an end the market was at an all-time high and earnings multiples had expanded meaningfully. While these valuations are historically high, they appear justified in an environment of secularly low long-term interest rates and continued economic expansion.

The impact of Federal Reserve easing can be seen in the sector performance as well. The financials sector was the largest contributor to the Fund’s outperformance in 2019. This represented a recovery from the previous year’s performance during the Federal Reserve tightening cycle. The largest holding in the portfolio, Citigroup, Inc., returned in excess of 50% as an inexpensive valuation combined with an improvement in earnings provided meaningful outperformance for the stock. Other financials sector holdings such as Discover Financial Services and JPMorgan Chase & Co. returned in excess of 40% for the year, illustrating the value of maintaining a long-term perspective even when near-term fundamentals may be challenging. The financials sector disappointed in 2018 due to concerns about a slowing economy, but valuations continued to be attractive. By maintaining these positions during periods of temporary duress the Fund was able to benefit from the 2019 recovery.

The communications services sector also contributed meaningfully to the Fund’s positive performance in 2019. Charter Communications, Inc. returned slightly more than 70% for the year and the company continued to focus on its high-speed digital services. The legacy cable entertainment business remains important, but the strategic direction of the company is in the higher growth digital services business. Walt Disney Co. was the largest holding in the communications services sector, and it returned 34% for the year. We increased the Fund’s position in Disney during the year as market skepticism toward the successful transition to streaming services allowed us to purchase the shares at an attractive valuation. The combination of the company’s unique assets combined with some of the best management in corporate America gave us the confidence to make this a top 10 holding.

The consumer discretionary sector holdings reflect a wide variety of industries tied to the health of the domestic economy. Our most successful investment in this sector for 2019 was NVR, Inc. This is a high-quality homebuilder whose shares had become unusually inexpensive due to concerns regarding rising interest rates. As interest rates retreated during the year the share price increased. Housing activity remained strong throughout the year allowing the company to achieve its financial goals. Similarly, TJX Cos., Inc. was very strong throughout the year as the retailer continued to gain market share from traditional mall-based department stores. Rising

16 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM |

Diamond Hill Large Cap Fund |

costs did pressure margins, but the continued strong revenue growth allowed TJX to report a very successful 2019. Our weaker holdings in the consumer discretionary sector were generally tied to the automotive industry. General Motors Co. provided a positive return, but it trailed the market as domestic and Chinese automotive sales were disappointing. While the shares remain inexpensive, the disappointing worldwide automotive market remains a risk to the company.

Our small underweight position in the information technology sector was the largest detractor to 2019 relative performance, more than offsetting very good stock selection in the sector. Microsoft Corp. was a large holding that returned in excess of 57% as strong growth in its cloud business drove improved earnings growth and an expansion of the earnings multiple. Microsoft remains a large holding as we are optimistic regarding its future growth opportunities. Fidelity National Information Systems entered the portfolio as a result of the Worldpay acquisition. The 85% return this security provided made this our best performer in 2019. We still own the shares in the portfolio as the growth opportunity is compelling. However, the strong performance of Fidelity National Information Systems and Microsoft was not enough to compensate for our relatively small exposure to the group.

As 2019 concludes, the financials sector remains the largest exposure for the portfolio. This sector has been attractive for several years as the continued recovery in profitability combined with inexpensive valuations to make this sector an attractive investment in an environment of record-high equity valuations. However, while the financials sector weight was stable there has been meaningful rotation of the holdings within the sector. The property/casualty insurers are much bigger weightings in the portfolio as are new specialty financial services companies such as Charles Schwab Corp. In order to provide capital for these investments, we have reduced our exposure to the traditional banking sector. Citigroup, Inc. remains the largest position, but other banks have been trimmed or eliminated.

2019 was an excellent year for investors despite relatively slow earnings growth for corporate America. In an environment where 10-year Treasury bonds yield less than 2%, equities have provided an attractive alternative. And while we remain optimistic, it would be prudent for investors to remain disciplined regarding expected future returns. Higher equity valuation levels will require future returns to come from earnings growth and dividend yield, with less opportunity for multiple expansion. Fortunately, earnings growth should improve in 2020 and dividend yields are reasonable considering the low interest rate environment. Therefore, long-term equity investors should be able to receive a normal equity risk premium at current market valuations.

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM 17 |

Diamond Hill Large Cap Fund |

We appreciate the faith investors have placed in us. We have experienced a wide variety of market environments and each provides unique challenges. We have found these challenges are best met with a long-term perspective. Thank you for your continued support and we look forward to new opportunities in the new decade ahead.

|

|

Chuck Bath, CFA

Portfolio Manager | Austin Hawley, CFA

Portfolio Manager |

18 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM |

Diamond Hill Large Cap Fund |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2019

| Inception

Date | One

Year | Three

Years | Five

Years | Ten

Years | Expense

Ratio* |

PERFORMANCE AT NAV WITHOUT SALES CHARGES |

Class A Shares | 6/29/2001 | 31.80% | 12.52% | 9.99% | 11.78% | 0.96% |

Class C Shares | 9/25/2001 | 30.84 | 11.68 | 9.17 | 10.94 | 1.71 |

Class I Shares | 1/31/2005 | 32.18 | 12.84 | 10.31 | 12.09 | 0.67 |

Class Y Shares | 12/30/2011 | 32.34 | 12.97 | 10.43 | 12.14 | 0.55 |

BENCHMARK |

Russell 1000 Index | | 31.43 | 15.05 | 11.48 | 13.54 | — |

PERFORMANCE AT PUBLIC OFFERING PRICE INCLUDING SALES CHARGES** |

Class A Shares | 6/29/2001 | 25.23 | 10.62 | 8.87 | 11.20 | 0.96 |

Class C Shares | 9/25/2001 | 29.84 | 11.68 | 9.17 | 10.94 | 1.71 |

* Reflects the expense ratio as reported in the Prospectus dated February 28, 2020. ** The maximum sales charge for Class A shares on purchases and for Class C shares on certain redemptions are 5.00% and 1.00%, respectively. |

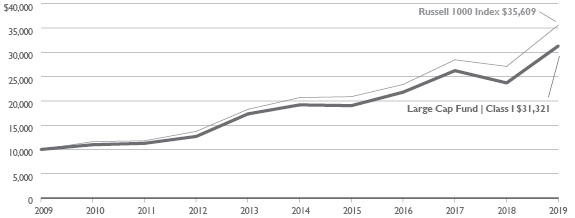

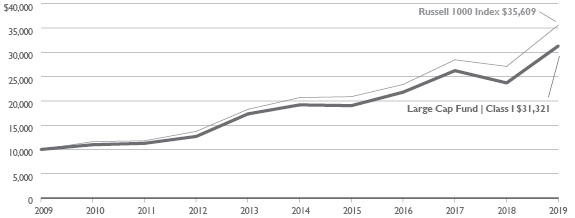

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill Large Cap Fund Class I(A) and the Russell 1000 Index.

(A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A, Class C and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell 1000 Index (“Index”). The Index is an unmanaged market capitalization weighted index measuring the performance of the largest 1,000 companies by market capitalization in the Russell 3000 Index. The Russell 3000 Index is an unmanaged market capitalization weighted index measuring the performance of the 3,000 largest U.S. companies based on total market capitalization. The Index does not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

| Historical performance for Class Y shares prior to its inception is based on the performance of Class A shares. Class Y performance has been adjusted to reflect differences in sales charges and expenses between classes. |

| Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.diamond-hill.com. |

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM 19 |

Diamond Hill All Cap Select Fund |

2019 Portfolio Commentary

Equity markets posted very strong performance in 2019. By May 1, the fourth quarter selloff in 2018 had largely been recovered, and from that point to the end of the year, the Russell 3000 Index gained another 9%, finishing the year up 31.02%. Growth stocks again outperformed value stocks, with the Russell 3000 Growth Index returning 35.85%, while the Russell 3000 Value Index returned 26.26%. Additionally, larger companies again outperformed, with the Russell 1000 Index returning 31.43% while the Russell 2000 Index returned 25.52%. Despite these headwinds, the All Cap Select Fund (Class I) managed to keep pace with the exceptional returns of the Russell 3000 Index, returning 30.77%.

Equity market returns were aided by more accommodative central bank behavior, with the Federal Reserve reducing short-term interest rates three times in 2019. Sentiment on trade negotiations with China was volatile, seeming to bounce back and forth with each presidential tweet, but directionally trade tensions eased through the year. The combination of more dovish Federal Reserve policy and optimism about a potential resolution to ongoing trade tensions provided tailwinds for more economically sensitive sectors of the market. The energy sector was a clear exception to these trends, posting the worst returns of any sector in 2019 despite rising Brent Crude and West Texas Intermediate oil prices. The divergence between energy stocks and the underlying commodities was likely due to the realization that transportation infrastructure to move U.S. shale oil is constrained and that the quick-cycle nature of shale oil drilling ensures that excess returns are very quickly competed away. On the positive side, the information technology sector continued its strong run of performance, with the sector up nearly 50% and shares of several of the largest companies rising considerably more. Apple, the largest U.S.-based company, saw its shares rise nearly 90% to a market capitalization of almost $2 trillion.

Our largest sector exposure throughout 2019, and the past several years, was financials. The financials sector was the largest absolute contributor to Fund return in 2019 and a modestly positive contributor to relative return. Several holdings in the financials sector appreciated by 30% or more during the year, with specialty banking franchises Bank OZK and First Republic Bank producing the strongest returns at nearly 40%. New holdings KKR & Co., Inc. (Cl A) and Charles Schwab Corp. were strong contributors to performance over relatively short holding periods, reflecting strong earnings prospects and value creating M&A activity. All of our holdings in the financials sector benefitted to some degree from looser monetary policy and the resulting recovery in economic growth expectations, which allowed most of our holdings to more than recover the sharp losses experienced in the fourth quarter of 2018.

Industrials were once again a bright spot for the Fund, with six out of seven holdings in 2019 producing returns of more than 30%, and the sector registering our largest positive relative performance during the year. The industrials sector benefitted from an improving economic growth outlook over the course of 2019, and our focus on niche businesses like Cimpress PLC, Colfax Corp., Hub Group, Inc. and Kirby Corp. as well as improving airline fundamentals have helped us produce strong relative returns over the past couple of years.

20 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM |

Diamond Hill All Cap Select Fund |

Information technology was the Fund’s worst-performing sector relative to its benchmark, driven by our significant underweight to the sector compared to the Russell 3000 Index. Through most of 2019 we held a stake in only one technology company, Sanmina Corp. Sanmina produced improved earnings in 2019 and saw its stock price appreciate by over 40%, but trailed the 49% return of the information technology sector of the benchmark. While the Fund continues to be meaningfully underweight in the technology sector, we believe this analysis underrepresents the exposure we have to innovative and fast-growing firms. Alphabet, Inc. and Facebook, Inc. are notable examples of firms that we think of as providing “technology” exposure, and each produced strong results in 2019, but both reside in the communications service sector.

Another challenging sector for us was energy, one in which we owned two U.S. shale oil producers but ultimately exited those holdings. Our view has been, and still is, that U.S. shale producers will increasingly be called upon to balance the world market as OPEC has learned that it is a losing battle to attempt to protect market share by capping prices. This still appears to be accurate, but we now also believe, as mentioned above, that the structure of the U.S. shale oil industry is such that reasonable returns on capital will be very difficult to achieve. There are multiple problems: unlike deep water wells, shale wells can be drilled and begin producing very quickly, meaning demand-driven price increases are very short lived; secrets are hard to keep in the oil patch, meaning any technology edge gained by an individual driller is quickly incorporated by its competitors; when volumes do ramp up to meet demand, there is a chronic lack of capacity in the transportation system to affordably move product to market; and the market for formerly valuable by-products such as natural gas and natural gas-liquids (NGL) is proving to be inelastic resulting in significant price declines and lost profits.

As we discussed in last year’s annual letter, we were busier than usual in the final quarter of 2018, repositioning the Fund to capitalize on the sharp sell-off in both existing holdings and new ideas that had been on our on-deck list. On balance, our activity during that brief period provided a modest positive boost to Fund results in 2019. In contrast, our turnover has been greatly reduced over the course of 2019 as valuations for many businesses we would like to own have moved higher and higher, eroding any margin of safety that may have existed. We continue to scour our universe of potential investments for overlooked and misunderstood companies, but in the absence of more significant market volatility we are happy to participate in the value creating activities of our current portfolio holdings, whether it be investments for future growth or returns of cash to shareholders via dividends and buybacks.

We appreciate your continued support.

|

|

Austin Hawley, CFA

Portfolio Manager | Rick Snowdon, CFA

Portfolio Manager |

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM 21 |

Diamond Hill All Cap Select Fund |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2019

| Inception

Date | One

Year | Three

Years | Five

Years | Ten

Years | Expense

Ratio* |

PERFORMANCE AT NAV WITHOUT SALES CHARGES |

Class A Shares | 12/30/2005 | 30.41% | 11.10% | 8.13% | 11.04% | 1.16% |

Class C Shares | 12/30/2005 | 29.39 | 10.29 | 7.32 | 10.21 | 1.91 |

Class I Shares | 12/30/2005 | 30.77 | 11.45 | 8.45 | 11.35 | 0.87 |

Class Y Shares | 12/30/2011 | 30.96 | 11.58 | 8.56 | 11.39 | 0.75 |

BENCHMARK |

Russell 3000 Index | | 31.02 | 14.57 | 11.24 | 13.42 | — |

PERFORMANCE AT PUBLIC OFFERING PRICE INCLUDING SALES CHARGES** |

Class A Shares | 12/30/2005 | 23.85 | 9.23 | 7.03 | 10.47 | 1.16 |

Class C Shares | 12/30/2005 | 28.39 | 10.29 | 7.32 | 10.21 | 1.91 |

* Reflects the expense ratio as reported in the Prospectus dated February 28, 2020. ** The maximum sales charge for Class A shares on purchases and for Class C shares on certain redemptions are 5.00% and 1.00%, respectively. |

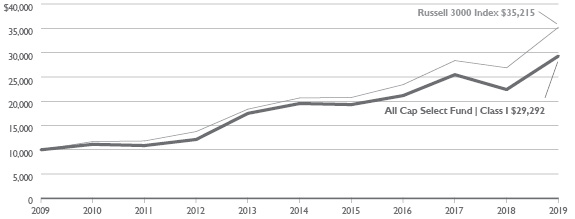

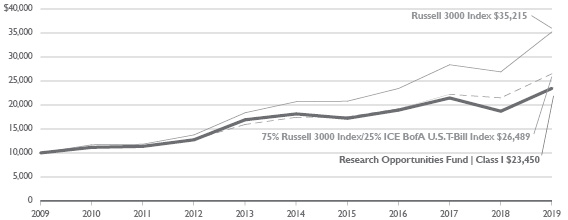

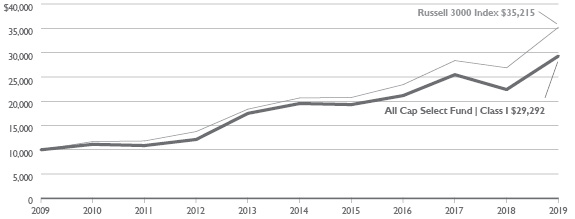

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill All Cap Select Fund Class I(A) and the Russell 3000 Index.

(A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A, Class C and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell 3000 Index (“Index”). The Index is an unmanaged market capitalization weighted index measuring the performance of the 3,000 largest U.S. companies by total market capitalization. The Index does not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

| Historical performance for Class Y shares prior to its inception is based on the performance of Class A shares. Class Y performance has been adjusted to reflect differences in sales charges and expenses between classes. |

| Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month end, please visit www.diamond-hill.com. |

22 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM |

Diamond Hill Long-Short Fund |

2019 Portfolio Commentary

The Diamond Hill Long-Short Fund (Class I) returned 23.11% in 2019 compared to 31.43% for the long-only Russell 1000 Index and 19.15% for the blended benchmark (60% Russell 1000 Index/40% ICE BofA U.S. T-Bill 0-3 Month Index). The portfolio lagged the long-only benchmark in a strong market, but outperformed the blended benchmark, which considers the portfolio’s general 60% net long bias, by close to 4% for the year. The Fund’s five-year annualized return was 5.74%. This trailed both the Russell 1000 Index and blended benchmark, which increased 11.48% and 7.37% respectively. During the year, the long side of the portfolio outperformed the Russell 1000 Index by 187 basis points while the short portfolio underperformed by 1,243 basis points. We are pleased with the relative performance from both sides of the portfolio for the year, particularly the short portfolio.

The net exposure of the portfolio declined throughout the year. We entered the year with net exposure of 69%, towards the upper end of our range and well above our long-term average of around 60%. The strong market sell-off in December of 2018 presented us with attractive opportunities on the long side of the portfolio and reduced the opportunity set on the short side as we entered 2019. As the market rallied throughout the year, this situation reversed itself with narrower discounts to our intrinsic value estimates in the long portfolio and short opportunities becoming more plentiful. As a result, we reduced net exposure throughout the year and ended the year with net exposure of 57%, slightly below our long-term average. Gross exposure moved higher throughout the year, starting the year at 109% and ending 2019 at 116%. This is consistent with our intention to increase gross exposure from the levels of recent years.

On the long side of the portfolio, the largest positive contributions to performance came from the financials sector lead by Citigroup, the Fund’s largest position throughout the year. Citi continues to improve its return profile as it executes its expense initiatives. Improvements in the company’s credit card business, along with expense controls, created operating leverage and resulted in operating earnings growth throughout the year despite a sluggish overall revenue environment. Further, the company continues to return capital to shareholders at a healthy pace and the stock price remains relatively attractive despite its strong outperformance in 2019.

We had several long positions announce agreements to be acquired during 2019, including World Pay, which was acquired by Fidelity National Information Services, Inc. We like the strategic positioning of the combined company in the global payments industry and we remain shareholders of Fidelity National Information Services as the stock is trading below our estimate of intrinsic value. Allergan PLC announced an agreement to be acquired by AbbVie, Inc. for a combination of stock and cash in a transaction we view as favorable for both companies. The deal is expected to close by the end of the first quarter of 2020.

Other strong contributors to the long portfolio were Facebook, Inc. (Cl A) and Johnson Controls International PLC. Facebook reported strong revenue growth throughout the year and customer engagement trends are encouraging. Entering 2019, Facebook’s valuation was depressed, reflecting concerns regarding data privacy issues. Throughout 2019 the multiple expanded, reflecting reduced concerns as the company has managed the data privacy issues reasonably well to date. The company continues to face regulatory concerns, but we expect this to be manageable

DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM 23 |

Diamond Hill Long-Short Fund |

over the long term. Finally, Johnson Controls’ fundamental performance continues to improve as improving free cash flow conversion is allowing the company to reinvest in the business, de-lever the balance sheet, and repurchase shares at attractive prices.

We were pleased that the short portfolio meaningfully underperformed the Russell 1000 Index during the year. The largest contributor to the short portfolio was Stamps.com, Inc., which declined 75% from the beginning of the year through when we covered the position during the second quarter. Stamps.com was a long-time short position and was a negative contributor to performance for most of the holding period through 2018. However, early this year our thesis came to fruition as the U.S. Postal Service modified its relationship with Stamps.com including changes to the postage reseller program, which we estimated represented a disproportionate amount of the company’s profitability. As a result, Stamps.com issued disappointing 2019 guidance in February and significantly reduced guidance further in May. At that point, we exited the position as the stock price approached our estimate of intrinsic value and reflected our estimate of normalized profitability.

Last year we wrote that the outlook for domestic equities had improved meaningfully after the sell-off in late 2018. As we write this in early 2020, our outlook for long-term returns are more muted following a 30%-plus return from the equity markets in 2019. We view mid-single-digit long-term returns from the domestic equity market as a reasonable expectation from current levels. This should be a favorable environment for the Fund relative to the long-only benchmark. We remain focused on adding alpha on both the long and short sides of the portfolio. Notably, if we achieve these goals, the Fund should achieve better relative returns in a lower return environment while experiencing lower long-term volatility than long-only alternatives.

We appreciate your continued support.

|

|

Chris Bingaman, CFA

Portfolio Manager | Jason Downey, CFA

Portfolio Manager |

| | |

|

|

Chuck Bath, CFA

Assistant Portfolio Manager | Nate Palmer, CFA

Assistant Portfolio Manager |

24 DIAMOND HILL FUNDS | ANNUAL REPORT | DECEMBER 31, 2019 | DIAMOND-HILL.COM |

Diamond Hill Long-Short Fund |

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2019

| Inception

Date | One

Year | Three

Years | Five

Years | Ten

Years | Expense

Ratio* |

PERFORMANCE AT NAV WITHOUT SALES CHARGES |

Class A Shares | 6/30/2000 | 22.74% | 6.33% | 5.44% | 6.70% | 1.84% |

Class C Shares | 2/13/2001 | 21.80 | 5.53 | 4.65 | 5.91 | 2.59 |

Class I Shares | 1/31/2005 | 23.11 | 6.65 | 5.74 | 7.01 | 1.55 |

Class Y Shares | 12/30/2011 | 23.23 | 6.76 | 5.87 | 7.05 | 1.43 |

BENCHMARK |

Russell 1000 Index | | 31.43 | 15.05 | 11.48 | 13.54 | — |

60% Russell 1000 Index/40% ICE BofA U.S. T-Bill 0-3 Month Index | | 19.15 | 9.69 | 7.37 | 8.37 | — |

PERFORMANCE AT PUBLIC OFFERING PRICE INCLUDING SALES CHARGES** |

Class A Shares | 6/30/2000 | 16.60 | 4.53 | 4.36 | 6.16 | 1.84 |

Class C Shares | 2/13/2001 | 20.80 | 5.53 | 4.65 | 5.91 | 2.59 |

* Reflects the expense ratio as reported in the Prospectus dated February 28, 2020. ** The maximum sales charge for Class A shares on purchases and for Class C shares on certain redemptions are 5.00% and 1.00%, respectively. |

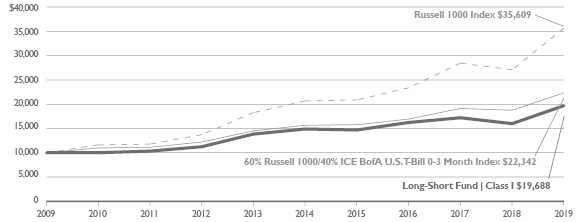

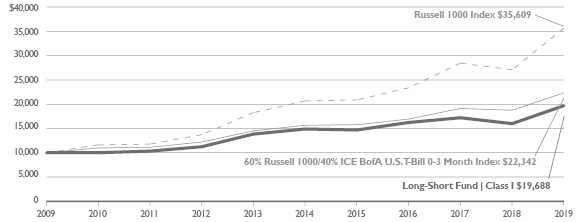

GROWTH OF $10,000

Comparison of the change in value of a $10,000 Investment in the Diamond Hill Long-Short Fund Class I(A), the Russell 1000 Index and the Blended Index (60% Russell 1000 Index and 40% ICE BofA U.S. T-Bill 0-3 Month Index)

(A) | The growth of $10,000 chart represents the performance of Class I shares only, which will vary from the performance of Class A, Class C and Class Y shares based on the difference in loads and fees paid by shareholders in the different classes. |

| The performance of the above Fund does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| The chart above represents a comparison of a hypothetical $10,000 investment and the reinvestment of dividends and capital gains in the indicated share class versus a similar investment in the Russell 1000 Index and the blended index. The Russell 1000 Index is an unmanaged market capitalization weighted index measuring the performance of the largest 1,000 companies by market capitalization in the Russell 3000 Index. The Russell 3000 Index is an unmanaged market capitalization weighted index measuring the performance of the 3,000 largest U.S. companies based on total market capitalization. The Blended Index represents a 60% weighting of the Russell 1000 Index as described above and a 40% weighting of the ICE BofA U.S. T-Bill 0-3 Month Index. The ICE BofA U.S. T-Bill 0-3 Month Index is an unmanaged index measuring the performance of U.S. dollar denominated U.S. Treasury Bills with a term to maturity of less than 3 months. The index data referenced herein is the property of ICE Data Indices, LLC, its affiliates (“ICE Data”) and/or its third party suppliers and has been licensed for use by Diamond Hill Capital Management, Inc. ICE Data and its third party suppliers accept no liability in connection with its use. See diamond-hill.com for a full copy of the disclaimer. These indices do not incur fees and expenses (which would lower returns) and are not available for direct investment. ICE Data was not involved in the creation of the blended index. Both indices do not reflect the deduction of fees associated with a mutual fund such as investment management and accounting fees. The Fund’s performance reflects the deduction of fees for these services. Investors cannot invest directly in an index although they can invest in the underlying securities. |

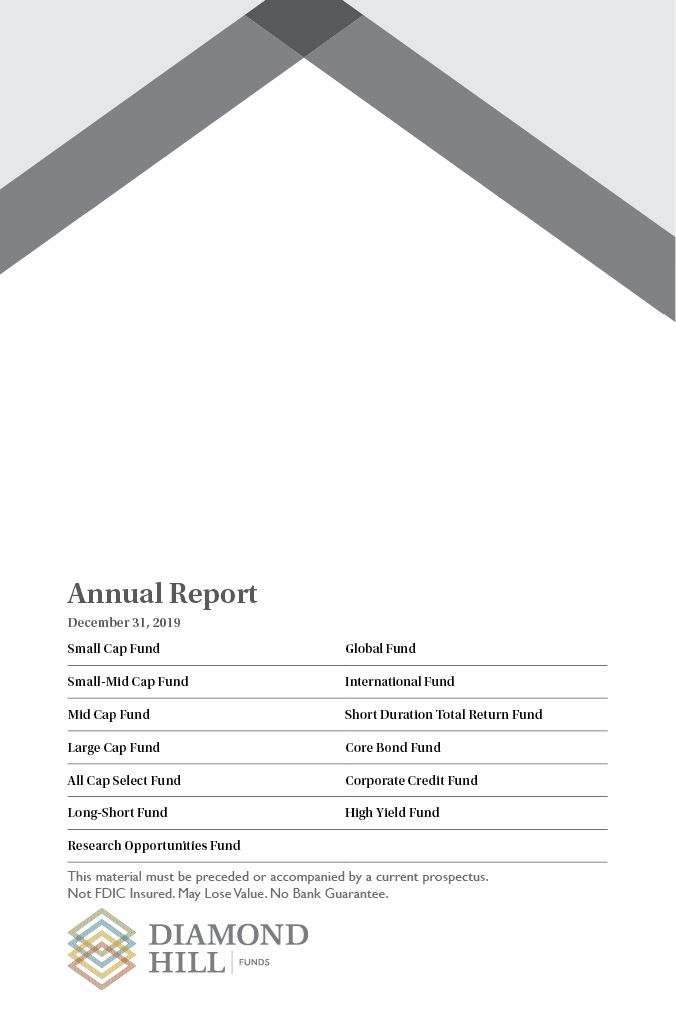

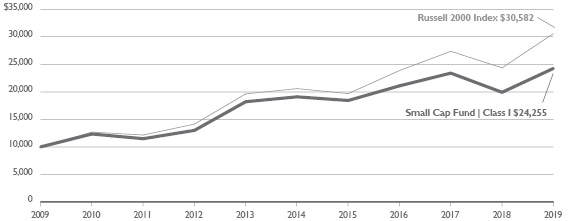

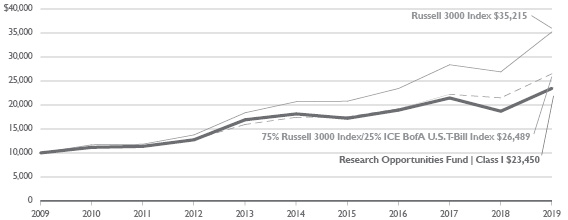

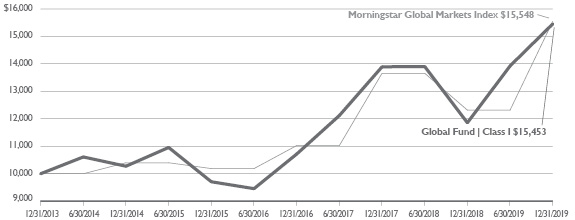

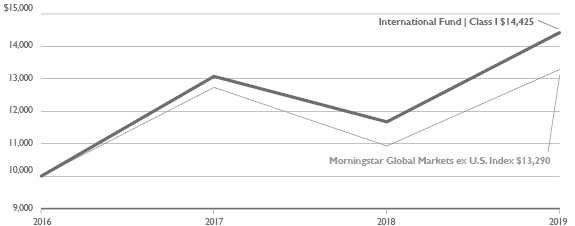

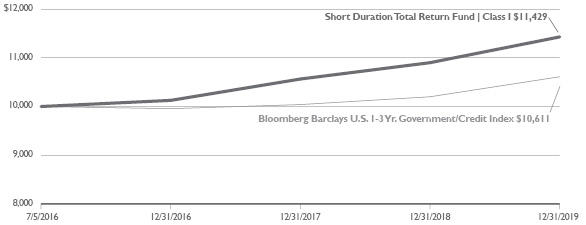

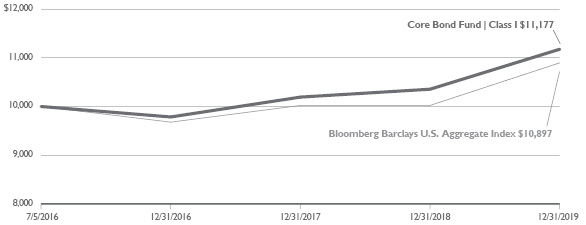

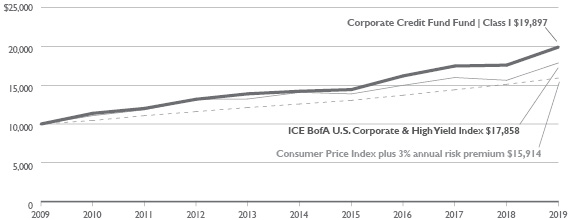

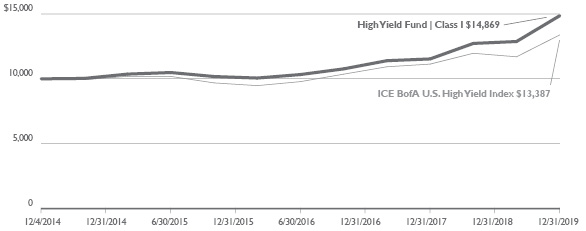

| Historical performance for Class Y shares prior to its inception is based on the performance of Class A shares. Class Y performance has been adjusted to reflect differences in sales charges and expenses between classes. |