Lazard Retirement Series, Inc. (the “Fund”) was incorporated in Maryland on February 13, 1997 and is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company. The Fund is comprised of seven no-load portfolios (each referred to as a “Portfolio”), which are offered only to separate accounts established by insurance companies to fund variable annuity contracts and variable life insurance policies. The Fund may also be offered to certain qualified pension and retirement plans and accounts permitting accumulation of assets on a tax-deferred basis. Currently, only the following four Portfolios, each of which is “diversified”, as defined in the Act, are offered: Lazard Retirement Equity Portfolio (“Equity Portfolio”), Lazard Retirement Small Cap Portfolio (“Small Cap Portfolio”), Lazard Retirement International Equity Portfolio (“International Equity Portfolio”) and Lazard Retirement Emerging Markets Portfolio (“Emerging Markets Portfolio”). Each of the other three Portfolios had not commenced operations as of June 30, 2005.

If events materially affecting the value of securities occur between the close of the exchange or market on which the security is principally traded and the time when a Portfolio’s net asset value is calculated, such securities will be valued at their fair values as determined by, or in accordance with procedures approved by, the Board of Directors. The fair value of foreign securities may be determined with the assistance of a pricing service, using correlations between the movement of prices of such securities and indices of domestic securities and other appropriate indicators, such as closing market prices of relevant ADRs or futures contracts. The effect of using fair value pricing is that the net asset value of a Portfolio will reflect the affected securities’ values as determined in the judgment of the Board of Directors or its designee instead of being determined by the market. Using a fair value pricing methodology to price securities may result in a value that is different from the most recent closing price of a security and from the prices used by other investment companies to calculate their portfolios’ net asset values.

Securities for which current market quotations are not readily available are valued at fair value as determined in good faith in accordance with procedures approved by the Board of Directors.

Under these procedures, in the event that Lazard Asset Management LLC, the Fund’s investment manager (the “Investment Manager”) and a wholly-owned subsidiary of Lazard Frères & Co. LLC (“Lazard”), determines that a significant event has occurred after the close of a market on which a foreign security is traded but before the close of regular trading on the NYSE, such that current market quotations for a security or securities are not readily available, a Valuation Committee of the Investment Manager will evaluate a variety of factors to determine the fair value of the affected securities. These factors include, but are not limited to, the type of security, the value of comparable securities, observations from financial institutions and relevant news events. Input from the Investment Manager’s analysts will also be considered.

Lazard Retirement Series, Inc.

Notes to Financial Statements (continued)

June 30, 2005 (unaudited)

The Portfolios do not isolate the portion of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in their market prices. Such fluctuations are included in net realized and unrealized gain (loss) on investments. Net realized gain (loss) on foreign currency transactions represents net foreign currency gain (loss) from disposition of foreign currencies, currency gain (loss) realized between the trade and settlement dates on securities transactions, and the difference between the amount of dividends, interest and foreign withholding taxes recorded on a Portfolio’s accounting records and the U.S. dollar equivalent amounts actually received or paid. Net unrealized foreign currency gain (loss) arises from changes in the value of assets and liabilities, other than investments in securities, as a result of changes in exchange rates.

(e) Federal Income Taxes—The Fund’s policy is to continue to have each Portfolio qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and to distribute all of its taxable income, including any realized net capital gains, to shareholders. Therefore, no federal income tax provision is required.

At December 31, 2004, the following Portfolio had available for federal income tax purposes unused realized capital losses which can be used to offset future realized capital gains as follows:

| Portfolio | | Expiring 2010 | | Expiring 2011 |

| |

| |

|

| Equity | | $521,864 | | $114,878 |

Under current tax law, certain capital and net foreign currency losses realized after October 31 within the taxable year may be deferred and treated as occurring on the first day of the following tax year. For the tax year ended December 31, 2004, the Equity Portfolio elected to defer net capital and currency losses of $2,482 arising between November 1, 2004 and December 31, 2004.

(f) Dividends and Distributions—Each Portfolio intends to declare and to pay dividends annually from net investment income. During any particular year, net realized gains from investment transactions in excess of available capital loss carryforwards would be taxable to the Portfolio if not distributed. The Portfolios intend to declare and distribute these amounts, at least annually, to shareholders; however, to avoid taxation, a second distribution may be required.

Income dividends and capital gains distributions are determined in accordance with federal income tax regulations which may differ from U.S. generally accepted accounting principles. These book/tax differences, which may result in distribution reclassifications, are primarily due to differing treatments of foreign currency transactions. Book/tax differences relating to shareholder distributions may result in reclassifications among certain capital accounts.

(g) Allocation of Expenses—Expenses not directly chargeable to a specific Portfolio are allocated among the Portfolios primarily on the basis of relative net assets.

(h) Expense Reductions—Portfolios leaving excess cash in demand deposit accounts may receive credits which are available to offset custody expenses. The Statements of Operations report gross custody expenses, and report the amount of such credits separately as an expense reduction.

(i) Estimates—The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires the Fund to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

3. Investment Management, Administrative and Distribution Agreements

The Fund, on behalf of the Portfolios, has entered into an interim investment management agreement (the “Interim Management Agreement”) with the Investment Manager. Pursuant to the Management Agreement, the Investment Manager regularly provides each Portfolio with investment research, advice and supervision and furnishes continuously an investment program for each Portfolio consistent with its investment objective and policies, including the purchase, retention and disposition of securities. The Interim Management Agreement requires all management fees earned by the Investment Manager to be escrowed pending shareholder approval of a new management agreement with the Investment Manager as a result of the initial public offering of securities of a parent company of the Investment Manager and other related changes in the structure of the Lazard organization which occurred on May 5, 2005. For its services provided to the Fund, the Investment Manager earns a management fee, accrued daily and payable by each Portfolio monthly, at the annual rate set forth below as a percentage of its average daily net assets:

| Portfolio | | Annual Rate | |

| |

|

|

| Equity | | 0.75 | % |

| Small Cap | | 0.75 | |

| International Equity | | 0.75 | |

| Emerging Markets | | 1.00 | |

32

Lazard Retirement Series, Inc.

Notes to Financial Statements (concluded)

June 30, 2005 (unaudited)

The Investment Manager has voluntarily agreed to reduce its fees and, if necessary, reimburse the following Portfolios if annualized operating expenses exceed the following percentages of average daily net assets:

| | | Annual |

| Portfolio | | Operating Expenses |

| |

|

|

| Equity | | 1.25 | % |

| Small Cap | | 1.25 | |

| International Equity | | 1.25 | |

| Emerging Markets | | 1.60 | |

The Fund has entered into an administrative agreement with State Street Bank and Trust Company (“State Street”) to provide certain administrative services. Each Portfolio bears the cost of such services at a fixed annual rate of $37,500, plus 0.02% of average daily net assets up to $1 billion and 0.01% of average daily net assets over $1 billion. State Street agreed to waive one half of the $37,500 base fee for the Equity Portfolio until the Portfolio’s net assets reach $25 million.

The Fund has a distribution agreement with Lazard Asset Management Securities LLC (the “Distributor”), a wholly-owned subsidiary of the Investment Manager, to serve as the distributor of each Portfolio’s shares and bears the cost of printing and mailing prospectuses to potential investors and of certain expenses in connection with the offering of Portfolio shares.

Under a Distribution and Servicing Plan in accordance with Rule 12b-1 under the Act (the “Plan”), each Portfolio pays a monthly fee to the Distributor, at an annual rate of 0.25% of the average daily net assets of the Portfolio, for distribution and servicing of accounts. The Distributor may make payments to participating insurance companies, certain financial institutions, securities dealers and other industry professionals for providing these services.

4. Directors’ Compensation

Certain Directors of the Fund are Managing Directors or former employees of the Investment Manager. The Fund pays each Director who is not an employee or an affiliated person of the Investment Manager its allocated portion of a fixed fee of $50,000 per year, plus $2,500 per meeting attended ($1,000 per meeting attended by telephone) for the Fund, The Lazard Funds, Inc., Lazard Global Total Return and Income Fund, Inc. and Lazard World Dividend & Income Fund Inc. (collectively, the “Lazard Funds”), each a registered management investment company advised by the Investment Manager, and reimburses such Directors for travel and other out of pocket expenses. In addition, the Chairman of the Audit Committees for the Lazard Funds also receives an annual fee of $5,000.

5. Securities Transactions and Transactions with Affiliates

Purchases and sales of portfolio securities (excluding short-term securities) for the period ended June 30, 2005 were as follows:

| Portfolio | | Purchases | | Sales |

| |

| |

|

| Equity | | $ 1,809,703 | | $ 1,997,701 |

| Small Cap | | 59,735,763 | | 43,847,228 |

| International Equity | | 84,131,799 | | 57,916,343 |

| Emerging Markets | | 20,259,815 | | 9,932,803 |

For the period ended June 30, 2005, no brokerage commissions were paid to affiliates of the Investment Manager or other affiliates of the Fund for portfolio transactions executed on behalf of the Fund.

6. Foreign Securities Investment Risks

Certain Portfolios invest in securities of foreign entities and securities denominated in foreign currencies which involve risks not typically involved in domestic investments. Foreign securities carry special risks, such as exposure to currency fluctuations, less developed or less efficient trading markets, political instability, a lack of company information, differing auditing and legal standards and, potentially, less liquidity. To the extent a Portfolio invests in companies in emerging market countries, it is exposed to additional volatility. A Portfolio’s performance will be influenced by political, social and economic factors affecting companies in emerging market countries. Emerging market countries generally have economic structures that are less diverse and mature, and political systems that are less stable, than those of developed countries.

7. Reorganization

On April 29, 2005, Small Cap Portfolio acquired the net assets of Phoenix-Lazard Small-Cap Value Series (“Phoenix Portfolio”), a series of The Phoenix Edge Series Fund, pursuant to a plan of reorganization approved by Phoenix Portfolio shareholders on April 26, 2005. The acquisition was accomplished by a tax-free exchange of 771,728 shares (valued at $12,046,680) of Small Cap Portfolio for the 960,107 shares of Phoenix Portfolio outstanding on April 29, 2005. Phoenix Portfolio's net assets at that date, including $714,260 of unrealized appreciation and $254,282 of accumulated realized net gain, were combined with those of Small Cap Portfolio. The aggregate net assets of Small Cap Portfolio and Phoenix Portfolio immediately before the reorganization were $104,311,297 and $12,046,680, respectively. The aggregate net assets of Small Cap Portfolio immediately after the reorganization were $116,357,977.

33

Lazard Retirement Series, Inc.

Board of Directors and Officers Information

(unaudited)

| Name (Age) | | Position(s) and Term | | Principal Occupation(s) During Past 5 Years |

| Address(1) | | with the Fund(2) | | and Other Directorships Held |

|

| Non-Interested Directors: | | | | |

| |

| John J. Burke (77) | | Director | | Lawyer and Private Investor; Director, Lazard Alternative Strategies Fund, |

| | | | | LLC; Director, Pacific Steel & Recycling; Director, Sletten Construction Com- |

| | | | | pany; Trustee Emeritus, The University of Montana Foundation. |

| |

| Kenneth S. Davidson (60) | | Director | | President, Davidson Capital Management Corporation; Trustee, The Juilliard |

| | | | | School; Chairman of the Board, Bridgehampton Chamber Music Festival; |

| | | | | Trustee, American Friends of the National Gallery/London. |

| |

| William Katz (50) | | Director | | Retired President and Chief Executive Officer, BBDO New York, an advertis- |

| | | | | ing agency; Retired Director, BBDO Worldwide. |

| |

| Lester Z. Lieberman (75) | | Director | | Private Investor; Chairman, Healthcare Foundation of NJ; Director, Cives |

| | | | | Steel Co.; Director, Northside Power Transmission Co.; Advisory Trustee, New |

| | | | | Jersey Medical School; Director, Public Health Research Institute; Trustee |

| | | | | Emeritus, Clarkson University; Council of Trustees, New Jersey Performing |

| | | | | Arts Center. |

| |

| Richard Reiss, Jr. (61) | | Director | | Chairman, Georgica Advisors LLC, an investment manager; Director, Lazard |

| | | | | Alternative Strategies Fund, LLC; Director, O’Charley’s, Inc., a restaurant |

| | | | | chain. |

| |

| Robert M. Solmson (57) | | Director | | Director, Colonial Williamsburg Co.; Director, Lazard Alternative Strategies |

| | | | | Fund, LLC; Former Chief Executive Officer and Chairman, RFS Hotel |

| | | | | Investors, Inc.; Former Director, Morgan Keegan, Inc.; Former Director, |

| | | | | Independent Bank, Memphis. |

| |

| Interested Directors(3): | | | | |

| |

| Norman Eig (64) | | Chairman of the Board | | Private Investor; Senior Adviser of the Investment Manager from January 2005 |

| | | | | to April 2005; Chairman of the Investment Manager from March 2004 to Jan- |

| | | | | uary 2005; previously Co-Chief Executive Officer of the Investment Manager |

| | | | | and Member of the Management Committee of Lazard. |

| |

| Charles Carroll (44) | | Director and President | | Deputy Chairman and Head of Global Marketing of the Investment Manager. |

| |

| Ashish Bhutani (45) | | Director | | Chief Executive Officer of the Investment Manager since March 2004; previ- |

| | | | | ously Head of New Products and Strategic Planning of Lazard from June |

| | | | | 2003 to March 2004; Co-Chief Executive Officer North America of Dresdner |

| | | | | Kleinwort Wasserstein from 2001 to end of 2002, and was a member of its |

| | | | | Global Corporate and Markets Board and the Global Executive Committee; |

| | | | | Deputy Chairman of Wasserstein Perella Group from 1989 to 2001 and Chief |

| | | | | Executive Officer of Wasserstein Perella Securities from 1995 to 2001. |

| (1) | The address of each Director is Lazard Asset Management LLC, 30 Rockefeller Plaza, New York, New York 10112-6300. |

| (2) | Each Director became a Director in April 1997, except that Mr. Solmson became a Director in September 2004, Mr. Carroll became Director and President in June 2004 and Mr. Bhutani became a Director in July 2005, and serves as a Director for each of the Lazard Funds (total comprised of 19 investment portfolios). Each Director serves an indefinite term, until his successor is elected, and serves in the same capacity for the other Lazard Funds. |

| (3) | Mr. Eig, Mr. Carroll and Mr. Bhutani are "interested persons" (as defined in the Act) of the Fund ("Interested Directors") because of their positions, or former position in the case of Mr. Eig, with the Investment Manager. |

| |

The Fund’s Statement of Additional Information contains further information about the Directors and is available without charge by calling 800-887-4929.

34

Lazard Retirement Series, Inc.

Board of Directors and Officers Information (concluded)

(unaudited)

| Name (Age) | | Position(s) and Term | | |

| Address(1) | | with the Fund(2) | | Principal Occupation(s) During Past 5 Years |

| |

| |

|

| |

| Officers: | | | | |

| |

| Nathan A. Paul (32) | | Vice President | | Managing Director and General Counsel of the Investment Manager; |

| | | and Secretary | | Associate at Schulte Roth & Zabel LLP, a law firm, from September 1997 |

| | | since April 2002 | | to October 2000. |

| |

| John H. Blevins (40) | | Chief Compliance | | Senior Vice President and Chief Compliance Officer of the Investment |

| | | Officer | | Manager; Director of Compliance for North America, Citi Asset Management |

| | | since September 2004 | | Group, from November 1999 to July 2000. |

| |

| Stephen St. Clair (46) | | Treasurer | | Vice President of the Investment Manager. |

| | | since April 2003 | | |

| |

| Brian D. Simon (43) | | Assistant Secretary | | Director of Legal Affairs of the Investment Manager; Vice President, Law & |

| | | since November 2002 | | Regulation at J. & W. Seligman & Co., from July 1999 to October 2002. |

| |

| David A. Kurzweil (31) | | Assistant Secretary | | Vice President of the Investment Manager; Associate at Kirkpatrick & |

| | | since April 2005 | | Lockhart LLP, a law firm, from August 1999 to January 2003. |

| |

| Cesar A. Trelles (30) | | Assistant Treasurer | | Fund Administration Manager of the Investment Manager; Manager for |

| | | since December 2004 | | Mutual Fund Finance Group at UBS Global Asset Management, from August |

| | | | | 1998 to August 2004. |

| (1) | The address of each officer is Lazard Asset Management LLC, 30 Rockefeller Plaza, New York, New York 10112-6300. |

| |

| (2) | Each officer serves for an indefinite term, until his successor is elected and qualified, and serves in the same capacity for the other Lazard Funds. |

| |

35

Lazard Retirement Series, Inc.

Other Information

(unaudited)

Proxy Voting

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to its portfolio securities is available (1) without charge, upon request, by calling (800) 823-6300 or (2) on the Securities and Exchange Commission (“SEC”) website at www.sec.gov.

The Fund’s proxy voting record for the most recent 12-month period ended June 30 is available (1) without charge, upon request, by calling (800) 823-6300 or (2) on the SEC’s website at www.sec.gov. Information as of June 30 each year will generally be available by the following August 31.

Form N-Q

The Fund files a complete schedule of each Portfolio’s holdings for the first and third quarters of its fiscal year with the SEC on Form N-Q. The Fund’s Form N-Q is available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the SEC’s Public Reference Room may be obtained by calling 1-800-SEC-0330.

Board Consideration of Management Agreements

At the meeting of the Fund’s Board of Directors held on February 15, 2005, the Board considered the approval of the new Management Agreement between the Fund, on behalf of the Portfolios, and the Investment Manager (the “New Management Agreement”) as a result of the initial public offering of securities of a parent company of the Investment Manager and other related changes in the structure of the Lazard organization which occurred on May 5, 2005 (the “Restructuring”). The Directors who are not interested persons (as defined in the Act) of the Fund (the “Independent Directors”) were assisted in their review by independent legal counsel and met with counsel in executive session separate from representatives of the Investment Manager. A shareholder meeting to approve the New Management Agreement is scheduled for September 15, 2005.

At a meeting of the Fund’s Board of Directors held on April 19, 2005, the Board considered the approval of the Interim Management Agreement under conclusions and determinations substantially identical to those described below for the New Management Agreement, largely by reference to information presented and discussed at the Board meeting on February 15, 2005 supporting the same conclusions and determinations for the Interim Management Agreement. Representatives of the Investment Manager had confirmed for the Board that there had been no significant changes in referenced information, and the Board confirmed its understanding of the application of this information.

Services Provided

Representatives of the Investment Manager gave a presentation to the Board about the nature, extent and quality of services that the Investment Manager provides the Fund, including a brief discussion of the Investment Manager and its clients (of which the Lazard Funds comprise approximately $4 billion of the approximately $73 billion of total assets under the management of the Investment Manager and its global affiliates) and outlining the Investment Manager’s global structure, including technology and operational support and expanded marketing and distribution channels, all of which provide realized benefits through investment in the Investment Manager’s investment advisory business. The Directors agreed that the Fund benefits from all of the services of the Investment Manager’s global platforms, and that such services would be different than those provided to a $4 billion fund complex. The representatives of the Investment Manager reviewed the Fund’s distribution channels and the relationships the Investment Manager has with various intermediaries and the different needs of each. The representatives of the Investment Manager reviewed the asset growth or decline in each Portfolio.

The Directors discussed the nature, extent and quality of the services provided by the Investment Manager to each Portfolio. The Directors considered the various services provided by the Investment Manager to each Portfolio and considered the Investment Manager’s research and portfolio management capabilities and that the Investment Manager also provides oversight of day-to-day operations of the Fund and its Portfolios, including fund accounting and administration and assistance in meeting legal and regulatory requirements. The Directors also considered the Investment Manager’s extensive administrative, accounting and compliance infrastructure.

36

Lazard Retirement Series, Inc.

Other Information (continued)

(unaudited)

The Directors assessed the implications of the Restructuring for the Investment Manager and its ability to continue to provide services to the Fund and the Portfolios of the same scope and quality as are currently provided. In particular, the Board inquired as to the impact of the Restructuring on the Investment Manager’s personnel, management, facilities and financial capabilities, and received assurances in this regard from senior management of the Investment Manager that the Restructuring would not adversely affect the Investment Manager’s ability to fulfill its obligations under the New Management Agreement, and to operate its business in a manner consistent with past practices. The Board also considered that the New Management Agreement, and the fees paid thereunder, are substantively identical in all respects to the previous management agreement between the Fund and the Investment Manager (the “Previous Management Agreement”), except for the time periods covered by the agreements.

Comparative Performance and Fees and Expenses

The Directors reviewed and placed significant emphasis on the relative performance and advisory fees and expense ratios for each Portfolio, including comparative information prepared by Lipper.

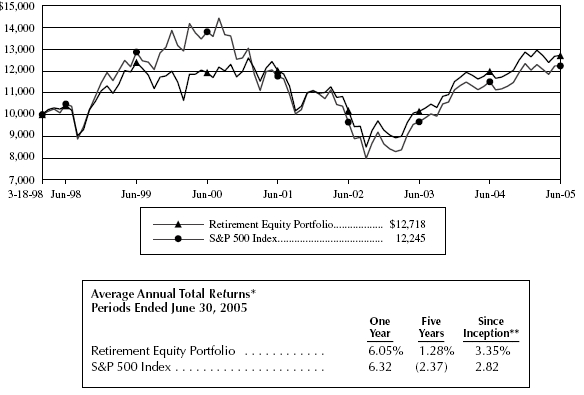

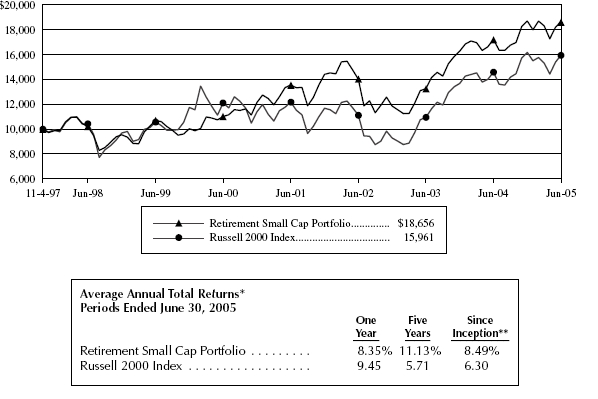

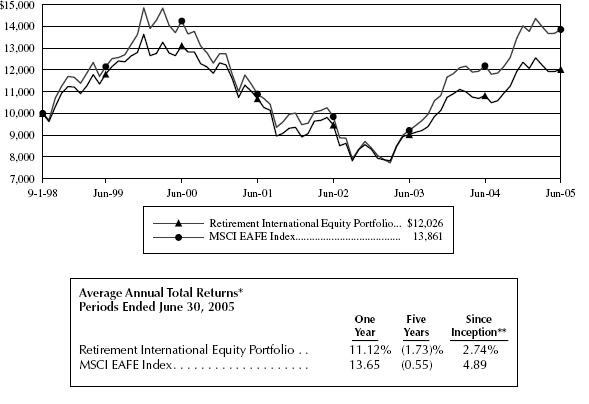

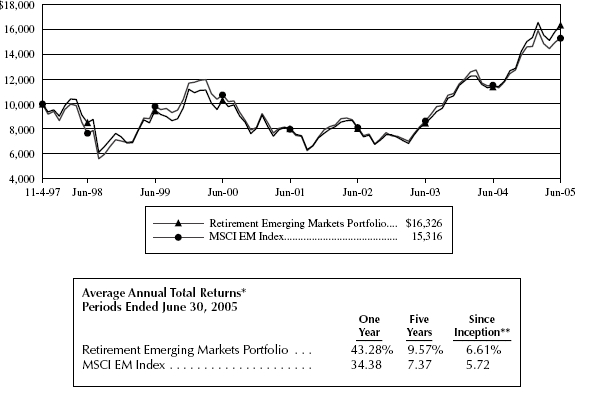

Performance. The Directors noted that the Portfolios each had achieved competitive long-term performance on a relative basis. It also was noted that each Portfolio, other than as discussed below, is generally within the median ranges of the relevant Lipper comparison group and Lipper category ranking.

It was noted that the performance of the Small Cap Portfolio is generally around the median ranges of the relevant comparison group, but has tended to be below in certain time periods. Representatives of the Investment Manager stated that, in order to address the Portfolio’s performance, the Investment Manager has changed the composition of the portfolio management team, including adding additional personnel. The Investment Manager’s representatives stated that the Investment Manager believes that the Portfolio will provide satisfactory overall performance over longer periods and that the Portfolio’s personnel and performance are, and would continue to be, closely monitored by the Investment Manager.

Advisory Fees and Expenses. The Directors also discussed the advisory fees and current expense ratios for each Portfolio, which were proposed to be the same under the New Management Agreement as under the Previous Management Agreement, and it was noted that they are generally within the median ranges of each Portfolio’s comparison group and Lipper category average. The Investment Manager’s representatives noted that the advisory fees for the Portfolios are competitive within each Portfolio’s Lipper comparison group and that, in order to maintain such competitiveness, the Investment Manager is continuing to provide fee waivers and expense reimbursements for each Portfolio.

An extended discussion of the fees to be charged and services to be provided under the New Management Agreement ensued. The Directors considered and evaluated the historical performance and expense ratios of the Portfolios. They agreed with the Investment Manager’s characterization of the Portfolios’ performance and expense ratios compared to the Portfolios’ respective comparison groups, and agreed that the fees charged were reasonable in light of the services provided by the Investment Manager and the Portfolios’ overall performance.

The Directors also considered comparison groups composed solely of funds sub-advised by the Investment Manager in the same Lipper category as each Portfolio, as well as the Investment Manager’s separately managed accounts with similar investment objectives, policies and strategies (for each Portfolio, collectively with such funds sub-advised by the Investment Manager, “Similar Accounts”). For each Portfolio, the Directors discussed the fee paid to the Investment Manager compared to the fee paid to the Investment Manager by Similar Accounts. For each Portfolio the Directors reviewed the nature of the Similar Accounts and the differences, from the Investment Manager’s perspective, in management of the different types of Similar Accounts as compared to management of the Portfolio. The Directors considered the relevance of the fee information provided for Similar Accounts managed by the Investment Manager to evaluate the appropriateness and reasonableness of each Portfolio’s advisory fees. A discussion ensued with respect to each Portfolio, as a consequence of which the Board recognized that any differences in fees paid by Similar Accounts was consistent with the differences in the services provided.

Investment Manager Profitability and Economies of Scale

The Directors reviewed information prepared by the Investment Manager for each Portfolio concerning the costs to and profits realized by the Investment Manager and its affiliates resulting from the Previous Management Agreement, reviewing the dollar amount of expenses allocated and profit received by the Investment Manager and the method used to

37

Lazard Retirement Series, Inc.

Other Information (continued)

(unaudited)

determine such expenses and profit. The representatives of the Investment Manager stated that neither the Investment Manager nor its affiliates, including Lazard, receive any significant indirect benefits from managing the Portfolios. The Investment Manager’s representatives stated that Lazard is used for very limited brokerage purposes and that there is no ability for the Investment Manager to benefit from any money flow (float) in connection with transactions in the Portfolios’ shares. The Investment Manager’s representatives noted that the Investment Manager does obtain soft dollar research, as reviewed by the Board each quarter. The Directors agreed that the information provided substantiated statements of the Investment Manager’s representatives.

The representatives of the Investment Manager reminded the Board that the Investment Manager is continuing to support distribution relationships through direct payments from its own resources to third parties in connection with shareholder servicing and other administrative and recordkeeping services and noted that the Fund does not bear any related costs other than the 0.25% fees pursuant to the Distribution and Servicing Plan adopted for the Portfolios.

It was noted that for each Portfolio the profitability percentages were within ranges determined by appropriate court cases not to be so disproportionately large that they bore no reasonable relationship to the services rendered and, given the overall performance and generally superior service levels, were thought not to be excessive, and the Board concurred with this analysis.

The Directors considered the Investment Manager’s profitability with respect to each Portfolio under the Previous Management Agreement as part of their evaluation of whether the Portfolio’s fee under the New Management Agreement bears a reasonable relationship to the mix of services provided by the Investment Manager, including the nature, extent and quality of such services. The Directors evaluated the costs of the services to be provided and profits to be realized by the Investment Manager and its affiliates from the relationship with the Fund in light of the relevant circumstances for each Portfolio, including the trend in asset growth or decline, the extent to which economies of scale would be realized as the Portfolio grows and whether economies of scale are shared with the Portfolio. It was noted that a discussion of economies of scale should be predicated on increasing assets and that if a Portfolio’s assets had been decreasing, the extent to which the Investment Manager may have realized any economies of scale would be muted. The Directors also considered potential benefits to the Investment Manager and its affiliates from the Investment Manager acting as investment adviser to the Portfolios.

At the conclusion of these discussions, each of the Independent Directors expressed the opinion that he had been furnished with sufficient information to make an informed business decision with respect to the approval of the New Management Agreement. Based on its discussions and considerations as described above, the Board made the following conclusions and determinations.

- The Board concluded that the nature, extent and quality of the services provided by the Investment Manager are adequate and appropriate, especially including the benefits of advisory and research services associated with a $73 billion asset management business.

- The Board determined that the Restructuring of the Investment Manager’s parent companies would not be a detriment to the Investment Manager’s ability to continue to provide services to the Fund and the Portfolios of the same scope and quality as provided under the Previous Management Agreement, and that the Restructuring would not adversely affect the Investment Manager’s ability to fulfill its obligations under the New Management Agreement and to operate its business in a manner consistent with past practices.

- The Board was satisfied with each Portfolio’s overall performance, which, except as discussed, was generally within the median ranges of the relevant comparison group and Lipper category ranking. The Board was satisfied with the Investment Manager’s efforts to improve performance and monitor and resolve short-term issues with respect to the Small Cap Portfolio.

- The Board concluded that each Portfolio’s fee paid to the Investment Manager, which were proposed to be the same under the New Management Agreement as under the Previous Management Agreement, was reasonable in light of comparative performance and expense and advisory fee information, costs of the services provided and profits to be realized and benefits derived or to be derived by the Investment Manager from the relationship with the Fund.

38

Lazard Retirement Series, Inc.

Other Information (concluded)

(unaudited)

- The Board recognized that economies of scale may be realized as the assets of the Portfolios increase. They believed, based on relatively stable profitability levels and the enhanced services and increased investment in the Fund’s material business, that there was no evidence that economies of scale were not being shared. The Board determined that, to the extent that material economies of scale had not been shared with the Fund, the Board would seek to do so.

The Board considered these conclusions and determinations and, without any one factor being dispositive, determined that approval of the New Management Agreement for the Fund was in the best interests of the Fund and its shareholders.

39

[This page intentionally left blank]

Lazard Retirement Series, Inc.

30 Rockefeller Plaza

New York, New York 10112-6300

Telephone: 800-887-4929

http://www.LazardNet.com

Investment Manager

Lazard Asset Management LLC

30 Rockefeller Plaza

New York, New York 10112-6300

Telephone: 800-887-4929

Distributor

Lazard Asset Management Securities LLC

30 Rockefeller Plaza

New York, New York 10112-6300

Custodian

State Street Bank and Trust Company

225 Franklin Street

Boston, Massachusetts 02110

Transfer Agent and Dividend Disbursing Agent

Boston Financial Data Services, Inc.

P.O. Box 8514

Boston, Massachusetts 02266-8514

Telephone: 800-986-3455

Independent Registered Public Accounting Firm

Anchin, Block & Anchin LLP

1375 Broadway

New York, New York 10018

http://www.anchin.com

Legal Counsel

Stroock & Stroock & Lavan LLP

180 Maiden Lane

New York, New York 10038-4982

http://www.stroock.com

| Lazard Retirement Series, Inc. | | 30 Rockefeller Plaza | | Tel 800-887-4929 |

| | | | New York, NY 10112- 6300 | | www.LazardNet.com |

| | | | | | R T 0 3 1 0 1 |

ITEM 2. CODE OF ETHICS.

Not applicable.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable.

ITEM 6. SCHEDULE OF INVESTMENTS

Not applicable.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED END

MANAGEMENT INVESTMENTCOMPANIES.

Not applicable.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT

COMPANIES.

Not applicable.

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT

COMPANY AND AFFILIATED PURCHASERS.

Not applicable.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

The Registrant has a Nominating Committee (the "Committee") of the

Board of Directors (the "Board"), which is currently comprised of all of the

Directors who are not "interested persons" (as

defined in the Investment Company Act of 1940, as amended) of the Registrant.

The Committee's function is to select and nominate candidates for election to

the Board. The Committee will consider recommendations for nominees from

stockholders sent to the Secretary of the Registrant, 30 Rockefeller Plaza, New

York, New York 10112. Nominations may be submitted only by a stockholder or

group of stockholders that, individually or as a group, has beneficially owned

the lesser of (a) 1% of the Registrant's outstanding shares or (b) $500,000 of

the Registrant's shares for at least one year prior to the date such stockholder

or group submits a candidate for nomination. Not more than one nominee for

Director may be submitted by such a stockholder or group each calendar year.

In evaluating potential nominees, including any nominees recommended by

stockholders, the Committee takes into consideration the factors listed in the

Nominating Committee Procedures and Charter, including character and integrity,

business and professional experience, and whether the Committee believes that

the person has the ability to apply sound and independent business judgment and

would act in the interests of the Registrant and its stockholders. A nomination

submission must include all information relating to the recommended nominee that

is required to be disclosed in solicitations or proxy statements for the

election of Directors, as well as information sufficient to evaluate the factors

listed above. Nomination submissions must be accompanied by a written consent of

the individual to stand for election if nominated by the Board and to serve if

elected by the stockholders, and such additional information must be provided

regarding the recommended nominee as reasonably requested by the Committee.

ITEM 11. CONTROLS AND PROCEDURES.

(a) The Registrant's principal executive and principal financial officers have

concluded, based on their evaluation of the Registrant's disclosure controls and

procedures as of a date within 90 days of the filing date of this report, that

the Registrant's disclosure controls and procedures are reasonably designed to

ensure that information required to be disclosed by the Registrant on Form N-CSR

is recorded, processed, summarized and reported within the required time periods

and that information required to be disclosed by the Registrant in the reports

that it files or submits on Form N-CSR is accumulated and communicated to the

Registrant's management, including its principal executive and principal

financial officers, as appropriate to allow timely decisions regarding required

disclosure.

(b) There were no changes to the Registrant's internal control over financial

reporting that occurred during the most recently ended fiscal half-year covered

by this report that have materially affected, or are reasonably likely to

materially affect, the Registrant's internal control over financial reporting.

ITEM 12. EXHIBITS.

(a)(1) Not applicable.

(a)(2) Certifications of principal executive and principal financial officers as

required by Rule 30a-2(a) under the Investment Company Act of 1940.

(a)(3) Not applicable.

(b) Certifications of principal executive and principal financial officers as

required by Rule 30a-2(b) under the Investment Company Act of 1940.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the

Investment Company Act of 1940, the registrant has duly caused this report to be

signed on its behalf by the undersigned, thereunto duly authorized.

Lazard Retirement Series, Inc.

By /s/ Charles Carroll

------------------------------

Charles Carroll

Chief Executive Officer

Date August 24, 2005

Pursuant to the requirements of the Securities Exchange Act of 1934 and the

Investment Company Act of 1940, this report has been signed below by the

following persons on behalf of the registrant and in the capacities and on the

dates indicated.

By /s/ Charles Carroll

------------------------------

Charles Carroll

Chief Executive Officer

Date August 24, 2005

By /s/ Stephen St. Clair

------------------------------

Stephen St. Clair

Chief Financial Officer

Date August 24, 2005