floods in the third quarter. Thai and Malaysian shares finished sharply higher despite ongoing political disharmony in Thailand, and due to the prospect of greater capital markets activity (in the form of possible privatizations) in Malaysia. Indonesian and Philippine equities experienced a continuing period of strong performance. Chinese shares, harmed by concerns over real estate prices and industrial production, performed relatively poorly.

All Latin American markets witnessed significant rises over the period. Argentinean, Chilean, and Peruvian equities were the best performers, helped by strong commodity prices and the aftermath of a debt renegotiation in Argentina. Mexican stocks also rose strongly, helped by the improving U.S. economic outlook. Brazilian shares rose by a more modest amount, held back by the record size of Petro-bras’s secondary offering and despite the election of Dilma Rousseff as president.

Mixed performance was registered across most of Eastern Europe, the Middle East, and Africa. Share prices rose sharply in South Africa and Russia towards year-end as commodity prices rose, and investor concerns over changes in the taxation treatment of oil in Russia appeared to dissipate. Elsewhere, despite buoyant economic conditions, Turkish stocks experienced considerable profit-taking after a period of impressive performance, due to a weaker lira caused by a reduction in money market rates. Hungarian and Czech equities fell, and Polish shares finished modestly higher over the year as the European fiscal crises negatively impacted conditions.

All sectors in the EM Index finished the year higher. The consumer discretionary, consumer staples, industrials, health care, and materials sectors outperformed the EM Index. The utilities, energy, and telecom services sectors were the weakest performers over the year.

Lazard Retirement U.S. Strategic Equity Portfolio

For the year ended December 31, 2010, the Lazard Retirement U.S. Strategic Equity Portfolio’s Service Shares posted a total return of 12.85%, as compared with the 15.06% return for the S&P 500® Index.

During the year, the Portfolio benefited from stock selection in the consumer discretionary sector. Shares of AutoZone, a leading auto parts retailer, performed well on a series of strong quarterly earnings. Stock selection in the energy sector also helped returns. Shares of ConocoPhillips, one of the largest U.S. integrated oil companies, rose as the company

executed on its strategy to sell non-core assets in order to fund debt reduction and share buybacks.

In contrast, stock selection in the consumer staples sector detracted from performance. Shares of retailer Wal-Mart underperformed as the market focused on consumer names with more exposure to discretionary spending. The company also had slightly negative U.S. year-over-year comparisons, largely due to food deflation. Stock selection in the information technology sector also hurt returns. Shares of Symantec, an information technology security and management firm, were weak as the company faced execution issues and market headwinds. However, the company’s latest quarter saw an implementation improvement, and maintenance/subscription revenues remained a solid generator of cash flow.

Lazard Retirement U.S. Small-Mid Cap Equity Portfolio

For the year ended December 31, 2010, the Lazard Retirement U.S. Small-Mid Cap Equity Portfolio’s Service Shares posted a total return of 23.72%, as compared with the 26.71% return for the Russell 2500® Index.

For the year 2010, stock selection in the health care and information technology sectors detracted from performance, while stock selection in the consumer discretionary and materials sectors helped returns.

Stock selection in the health care sector was the leading detractor over the year. Shares of XenoPort, a biotechnology company, fell significantly, as the U.S. Food and Drug Administration surprisingly rejected one of its later-stage pipeline drugs. This failure broke the investment thesis for this stock, and we eliminated the position from the Portfolio in 2010. Tenet Healthcare declined following an announcement that it was considering acquiring a large Australian hospital corporation, as investors were worried about the company’s debt levels if such an acquisition occurred. The company also declined based on lower-than-expected first-quarter 2010 volumes. We sold our position in Tenet during the year.

Stock selection in the information technology sector, especially the technology hardware and equipment space, also detracted from returns during 2010. Early in the year, Brocade Communications Systems missed earnings estimates by a large margin, structurally changing our outlook for the company and leading us to eliminate the position. FLIR Systems, a maker of thermal imaging systems, also fell early in 2010 on weaker-than-expected guidance due to uncer-

tainty about its order book. SMART Technologies, a developer of interactive technology solutions such as digital whiteboards, fell short of consensus revenue expectations during the year. The company went on to reduce its full-year revenue estimates based on weaker education budgets, causing its share price to drop. Following this, we sold our position in SMART Technologies.

The Portfolio’s performance in 2010 was helped by stock selection in the consumer discretionary sector. Tenneco, a designer and manufacturer of automotive emission control and ride control products, benefited from the recovery in automobile demand and posted very strong second-quarter earnings. In the retail segment, Family Dollar Stores, a discount retail chain, performed well, as its business remained strong during what proved to be a volatile year for consumers. Gymboree, a children’s clothing retailer, agreed to be acquired by asset management firm Bain Capital Partners in October 2010. We exited the position following the strong rally in Gymboree’s share price after the announcement of the acquisition.

Lazard Retirement International Equity Portfolio

For the year ended December 31, 2010, the Lazard Retirement International Equity Portfolio’s Service Shares posted a total return of 6.72%, as compared with the 7.75% return of the MSCI Europe, Australasia and Far East (EAFE®) Index.

The strongest positive effect on the Portfolio stemmed from stock selection in the financials sector. Banks and real estate were the primary drivers, as positions in U.K. banks Barclays and Lloyds, emerging markets bank Banco do Brasil, and Japanese real estate company Daito Trust Construction, contributed to positive returns. We exited the position in Barclays during 2010.

Stock selection in the energy sector also contributed to returns as the Portfolio benefited by minimizing losses with the early sale of a position in BP following the oil spill. Positions in oil services companies AMEC, Aker Solutions, and Technip were also beneficial.

In contrast, the largest drag on the Portfolio’s performance over the year was a low exposure to, and stock selection in, the industrials sector, which performed well on improved global demand and capital expenditure growth. Within the sector, positions in Atlantia and TNT hurt performance.

The Portfolio’s low exposure to the materials sector also detracted from returns, as the sector performed well on renewed demand and commodity price strength. Stock selection partially offset this low exposure, as Xstrata and Potash performed well.

Lazard Retirement Emerging Markets Equity Portfolio

For the year ended December 31, 2010, the Lazard Retirement Emerging Markets Equity Portfolio’s Service Shares posted a total return of 22.69%, while Investor Shares posted a total return of 23.05%, as compared with the 18.88% return for the EM Index.

Stock selection in the financials sector helped the Portfolio’s performance over the year, as a position in Banco do Brasil, a Brazilian bank, rose on improved sentiment following a capital raise. Stock selection in Brazil also added to returns, as a position in Brazilian tobacco company Souza Cruz benefited from strong operating trends.

Additionally, a higher-than-index exposure to consumer staples and a lower-than-index exposure to China helped performance. A lower-than-index exposure and stock selection in the energy sector also added to returns.

HTC, a Taiwanese smartphone designer and manufacturer, was one of the top-performing positions during the year. The company performed well on the successful introduction of new products. The Portfolio also benefited from holding shares of Kumba Iron Ore, a South African iron ore producer, which rose on sharply higher iron ore prices.

In contrast, stock selection in Korea hurt performance during the year. A position in Hite, a Korean beer producer, experienced profit-taking on expectation of lower volumes and concerns over corporate structure.

Stock selection in the telecom services sector also hurt performance. Shares of the Egyptian Company for Mobile Services (or Mobinil), an Egyptian cellular operator, performed poorly following a weaker-than-expected earnings release.

A position in Redecard was one of the worst performers over the year. Shares of the Brazilian credit card operator declined on disappointing earnings results.

Annual Report 5

Notes to Investment Overviews:

All returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolios may have been waived or reimbursed by Lazard Asset Management LLC, the Fund’s Investment Manager (the “Investment Manager”), or State Street Bank and Trust Company, the Fund’s Administrator (“State Street”); without such waiver/reimbursement of expenses, the Portfolios’ returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. Past performance is not indicative, or a guarantee, of future results.

The performance data of the indices and other market data have been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to their accuracy. These indices are unmanaged, have no fees or costs and are not available for investment.

The views of the Investment Manager and the securities described in this report are as of December 31, 2010; these views and portfolio holdings may have changed subsequent to this date. Nothing herein should be construed as a recommendation to buy, sell, or hold a particular security. There is no assurance that the securities discussed herein will remain in each Portfolio at the time you receive this report, or that securities sold will not have been repurchased. The specific securities discussed may, in aggregate, represent only a small percentage of each Portfolio’s holdings. It should not be assumed that securities identified and discussed were, or will be, profitable, or that the investment decisions made in the future will be profitable, or equal the investment performance of the securities discussed herein.

The views and opinions expressed are provided for general information only, and do not constitute specific tax, legal, or investment advice to, or recommendations for, any person. There can be no guarantee as to the accuracy of the outlooks for markets, sectors and securities as discussed herein. You should read the Fund’s prospectus or each Portfolio’s summary prospectus for a more detailed discussion of each Portfolio’s investment objective, strategies, risks and fees.

6 Annual Report

|

|

Lazard Retirement Series, Inc. Performance Overviews |

|

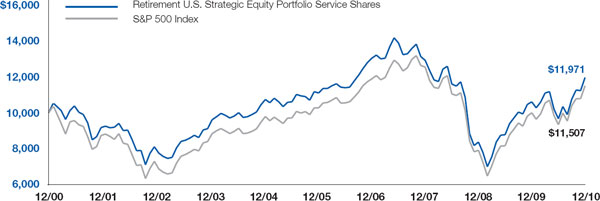

Lazard Retirement U.S. Strategic Equity Portfolio

Comparison of Changes in Value

of $10,000 Investment in the

Service Shares of Lazard Retire-

ment U.S. Strategic Equity

Portfolio and S&P 500® Index*

| | | | | | | |

Average Annual Total Returns* | | | | | | | |

Year Ended December 31, 2010 | | One | | Five | | Ten | |

| | Year | | Years | | Years | |

| | | | | | | | |

| | | | | | | |

Service Shares | | 12.85% | | 1.51% | | 1.82% | |

| | | | | | | |

| | | | | | | | |

| | | | | | | |

S&P 500 Index | | 15.06% | | 2.29% | | 1.41% | |

| | | | | | | |

| | | | | | | | |

| |

* | All returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reimbursed by the Portfolio’s Investment Manager or State Street; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| |

| The performance quoted represents past performance. Current performance may be lower or higher than the performance quoted. Past performance is not indicative, or a guarantee, of future results; the investment return and principal value of the Portfolio will fluctuate, so that Portfolio shares, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| |

| The performance data of the index has been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to its accuracy. The S&P 500 Index is a market capitalization-weighted index of 500 common stocks, designed to measure performance of the broad domestic economy through changes in the aggregate market value of these stocks, which represent all major industries. The index is unmanaged, has no fees or costs and is not available for investment. |

| |

| Before May 1, 2007, the Portfolio was known as Lazard Retirement Equity Portfolio and had a different investment strategy. |

Annual Report 7

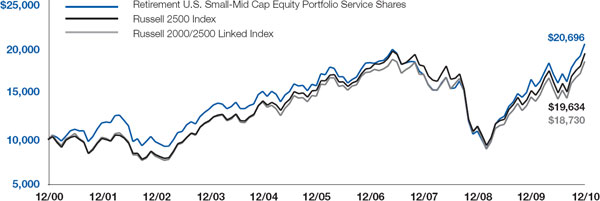

Lazard Retirement U.S. Small-Mid Cap Equity Portfolio

Comparison of Changes in Value

of $10,000 Investment in the Ser-

vice Shares of Lazard Retirement

U.S. Small-Mid Cap Equity Port-

folio, Russell 2500® Index and

Russell 2000/2500 Linked Index*

| | | | | | | |

Average Annual Total Returns*

Year Ended December 31, 2010 | | One | | Five | | Ten | |

| | Year | | Years | | Years | |

| | | | | | | | |

| | | | | | | |

Service Shares | | 23.72% | | 5.27% | | 7.54% | |

| | | | | | | |

| | | | | | | | |

| | | | | | | |

Russell 2500 Index | | 26.71% | | 4.86% | | 6.98% | |

| | | | | | | |

| | | | | | | | |

| | | | | | | |

Russell 2000/2500 Linked Index | | 26.71% | | 4.76% | | 6.48% | |

| | | | | | | |

| | | | | | | | |

| |

* | All returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reimbursed by the Portfolio’s Investment Manager or State Street; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| |

| The performance quoted represents past performance. Current performance may be lower or higher than the performance quoted. Past performance is not indicative, or a guarantee, of future results; the investment return and principal value of the Portfolio will fluctuate, so that Portfolio shares, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| |

| The performance data of the indices have been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to their accuracy. The Russell 2500 Index is comprised of the 2,500 smallest U.S. companies included in the Russell 3000® Index (which consists of the 3,000 largest U.S. companies by capitalization). The Russell 2000/2500 Linked Index is an index created by the Portfolio’s Investment Manager, which links the performance of the Russell 2000® Index for all periods prior to June 1, 2009 and the Russell 2500 Index for all periods thereafter. The Russell 2000 Index is comprised of the 2,000 smallest U.S. companies included in the Russell 3000 Index. The indices are unmanaged, have no fees or costs and are not available for investment. |

| |

| The Portfolio was previously known as Lazard Retirement U.S. Small Cap Equity Portfolio. As of June 1, 2009, the Portfolio changed its name to Lazard U.S. Small-Mid Cap Equity Portfolio and changed its investment strategy to invest in equity securities of small-mid cap U.S. companies. |

8 Annual Report

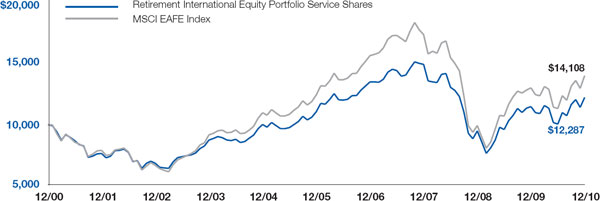

Lazard Retirement International Equity Portfolio

Comparison of Changes in Value

of $10,000 Investment in the

Service Shares of Lazard Retire-

ment International Equity

Portfolio and Morgan Stanley

Capital International (MSCI®)

Europe, Australasia and Far East

(EAFE®) Index*

| | | | | | | |

Average Annual Total Returns*

Year Ended December 31, 2010 | | One | | Five | | Ten | |

| | Year | | Years | | Years | |

| | | | | | | | |

| | | | | | | |

Service Shares | | 6.72% | | 2.08% | | 2.08% | |

| | | | | | | |

| | | | | | | | |

| | | | | | | |

MSCI EAFE Index | | 7.75% | | 2.46% | | 3.50% | |

| | | | | | | |

| | | | | | | | |

| |

* | All returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reimbursed by the Portfolio’s Investment Manager or State Street; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| |

| The performance quoted represents past performance. Current performance may be lower or higher than the performance quoted. Past performance is not indicative, or a guarantee, of future results; the investment return and principal value of the Portfolio will fluctuate, so that Portfolio shares, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| |

| The performance data of the index has been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to its accuracy. The MSCI EAFE Index is a broadly diversified international index comprised of equity securities of approximately 1,000 companies located outside the United States. The index is unmanaged, has no fees or costs and is not available for investment. |

Annual Report 9

Lazard Retirement Emerging Markets Equity Portfolio

Comparison of Changes in Value

of $10,000 Investment in the

Service Shares of Lazard Retire-

ment Emerging Markets Equity

Portfolio and MSCI Emerging

Markets (EM®) Index*

| | | | | | | | | | | |

Average Annual Total Returns*

Periods Ended December 31, 2010 | | Service Shares | | Investor Shares | |

| | One | | Five | | Ten | | One | | Since | |

| | Year | | Years | | Years | | Year | | Inception | † |

| | | | | | | | | | | | |

| | | | | | | | | | | |

Retirement Emerging Markets Equity Portfolio** | | 22.69% | | 13.11% | | 17.14% | | 23.05% | | 10.47% | |

| | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | |

MSCI EM Index | | 18.88% | | 12.78% | | 15.89% | | 18.88% | | 8.96% | |

| | | | | | | | | | | |

| | | | | | | | | | | | |

| |

* | All returns reflect reinvestment of all dividends and distributions, if any. Certain expenses of the Portfolio have been waived or reimbursed by the Portfolio’s Investment Manager or State Street; without such waiver/reimbursement of expenses, the Portfolio’s returns would have been lower. Performance information does not reflect the fees and charges imposed by participating insurance companies at the separate account level, and such charges will have the effect of reducing performance. |

| |

| The performance quoted represents past performance. Current performance may be lower or higher than the performance quoted. Past performance is not indicative, or a guarantee, of future results; the investment return and principal value of the Portfolio will fluctuate, so that Portfolio shares, when redeemed, may be worth more or less than their original cost. Within the longer periods illustrated there may have been short-term fluctuations, counter to the overall trend of investment results, and no single period of any length may be taken as typical of what may be expected in future periods. |

| |

| The performance data of the index has been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to its accuracy. The MSCI EM Index is comprised of emerging market securities in countries open to non-local investors. The index is unmanaged, has no fees or costs and is not available for investment. |

| |

** | The performance of Service Shares may be greater than or less than the performance of Investor Shares, primarily based on the differences in fees borne by shareholders investing in different classes. |

| |

† | The inception date for Investor Shares was May 1, 2006. |

10 Annual Report

|

|

Lazard Retirement Series, Inc. Information About Your Portfolio’s Expenses |

|

Expense Example

As a shareholder in a Portfolio of the Fund, you incur ongoing costs, including management fees, distribution and service (12b-1) fees (Service Shares only), and other expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The Example is based on an investment of $1,000 invested at the beginning of the six month period from July 1, 2010 through December 31, 2010 and held for the entire period.

Actual Expenses

For each Share class of the Portfolios, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000=8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each Share class of the Portfolios, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholders reports of the other funds.

Please note that you also bear fees and charges imposed by participating insurance companies at the separate account level, which are described in the separate prospectuses issued by the insurance companies. Such charges will have the effect of reducing account value.

| | | | | | | | | | | | | | | | | | | | | |

Portfolio | | | Beginning

Account Value

7/1/10 | | | Ending

Account Value

12/31/10 | | | Expenses Paid

During Period*

7/1/10 - 12/31/10 | | | Annualized Expense

Ratio During Period

7/1/10 - 12/31/10 | |

| | | | | | | | | | | | | | | | | | | | | |

Retirement U.S. Strategic Equity Portfolio | | | | | | | | | | | | | | | | | | | | | |

Service Shares | | | | | | | | | | | | | | | | | | | | | |

Actual | | | | $1,000.00 | | | | | $1,242.20 | | | | | $6.71 | | | | | 1.19 | % | |

Hypothetical (5% Return Before Expenses) | | | | $1,000.00 | | | | | $1,019.22 | | | | | $6.04 | | | | | 1.19 | % | |

| | | | | | | | | | | | | | | | | | | | | |

Retirement U.S. Small-Mid Cap Equity Portfolio | | | | | | | | | | | | | | | | | | | | | |

Service Shares | | | | | | | | | | | | | | | | | | | | | |

Actual | | | | $1,000.00 | | | | | $1,275.40 | | | | | $6.84 | | | | | 1.19 | % | |

Hypothetical (5% Return Before Expenses) | | | | $1,000.00 | | | | | $1,019.19 | | | | | $6.07 | | | | | 1.19 | % | |

| | | | | | | | | | | | | | | | | | | | | |

Retirement International Equity Portfolio | | | | | | | | | | | | | | | | | | | | | |

Service Shares | | | | | | | | | | | | | | | | | | | | | |

Actual | | | | $1,000.00 | | | | | $1,216.80 | | | | | $6.40 | | | | | 1.15 | % | |

Hypothetical (5% Return Before Expenses) | | | | $1,000.00 | | | | | $1,019.43 | | | | | $5.83 | | | | | 1.15 | % | |

| | | | | | | | | | | | | | | | | | | | | |

Retirement Emerging Markets Equity Portfolio | | | | | | | | | | | | | | | | | | | | | |

Service Shares | | | | | | | | | | | | | | | | | | | | | |

Actual | | | | $1,000.00 | | | | | $1,267.80 | | | | | $8.35 | | | | | 1.46 | % | |

Hypothetical (5% Return Before Expenses) | | | | $1,000.00 | | | | | $1,017.84 | | | | | $7.43 | | | | | 1.46 | % | |

Investor Shares | | | | | | | | | | | | | | | | | | | | | |

Actual | | | | $1,000.00 | | | | | $1,269.70 | | | | | $6.93 | | | | | 1.21 | % | |

Hypothetical (5% Return Before Expenses) | | | | $1,000.00 | | | | | $1,019.10 | | | | | $6.17 | | | | | 1.21 | % | |

| |

* | Expenses are equal to the annualized expense ratio of each Share class multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

Annual Report 11

|

|

Lazard Retirement Series, Inc. Portfolio Holdings Presented by Sector December 31, 2010 |

|

| | | | | | | | | | | | | | | | | | | | | |

Sector* | | | Lazard

Retirement

U.S. Strategic

Equity Portfolio | | | Lazard

Retirement

U.S. Small-Mid Cap

Equity Portfolio | | | Lazard

Retirement

International

Equity Portfolio | | | Lazard

Retirement

Emerging Markets

Equity Portfolio | |

| | | | | | | | | | | | | | | | | | | | | |

Consumer Discretionary | | | | 13.6 | % | | | | 14.8 | % | | | | 12.7 | % | | | | 5.8 | % | |

Consumer Staples | | | | 13.1 | | | | | 3.4 | | | | | 10.0 | | | | | 11.1 | | |

Energy | | | | 12.8 | | | | | 6.8 | | | | | 8.6 | | | | | 5.8 | | |

Financials | | | | 12.6 | | | | | 19.5 | | | | | 25.1 | | | | | 22.9 | | |

Health Care | | | | 11.2 | | | | | 7.7 | | | | | 9.1 | | | | | — | | |

Industrials | | | | 9.0 | | | | | 14.1 | | | | | 9.9 | | | | | 5.4 | | |

Information Technology | | | | 19.6 | | | | | 16.9 | | | | | 11.1 | | | | | 18.4 | | |

Materials | | | | 5.7 | | | | | 8.0 | | | | | 5.2 | | | | | 16.0 | | |

Telecommunication Services | | | | — | | | | | — | | | | | 4.1 | | | | | 9.1 | | |

Utilities | | | | — | | | | | 4.5 | | | | | 1.2 | | | | | 1.3 | | |

Short-Term Investments | | | | 2.4 | | | | | 4.3 | | | | | 3.0 | | | | | 4.2 | | |

Total Investments | | | | 100.0 | % | | | | 100.0 | % | | | | 100.0 | % | | | | 100.0 | % | |

| |

* | Represents percentage of total investments. |

12 Annual Report

|

|

Lazard Retirement Series, Inc. Portfolios of Investments December 31, 2010 |

|

| | | | | | | |

| | | | | |

| | | | | |

Description | | Shares | | Value | |

| | | | | |

| | | | | | | |

Lazard Retirement U.S. Strategic Equity Portfolio | | | | | | | |

| | | | | | | |

Common Stocks | 97.2% | | | | | | | |

| | | | | | | |

| | | | | | | |

Aerospace & Defense | 2.3% | | | | | | | |

Raytheon Co. | | | 3,010 | | $ | 139,483 | |

| | | | | | | |

Agriculture | 1.1% | | | | | | | |

Monsanto Co. | | | 990 | | | 68,944 | |

| | | | | | | |

Alcohol & Tobacco | 2.1% | | | | | | | |

Molson Coors Brewing Co., Class B | | | 2,630 | | | 132,000 | |

| | | | | | | |

Automotive | 0.6% | | | | | | | |

Ford Motor Co. (a) | | | 2,325 | | | 39,037 | |

| | | | | | | |

Banking | 5.2% | | | | | | | |

Bank of America Corp. | | | 3,925 | | | 52,360 | |

JPMorgan Chase & Co. | | | 3,270 | | | 138,713 | |

Wells Fargo & Co. | | | 4,195 | | | 130,003 | |

| | | | | | 321,076 | |

Cable Television | 4.3% | | | | | | | |

Comcast Corp., Class A | | | 12,695 | | | 264,183 | |

| | | | | | | |

Chemicals | 0.9% | | | | | | | |

Dow Chemical Co. | | | 1,580 | | | 53,941 | |

| | | | | | | |

Coal | 0.5% | | | | | | | |

Massey Energy Co. | | | 580 | | | 31,117 | |

| | | | | | | |

Commercial Services | 1.7% | | | | | | | |

Apollo Group, Inc., Class A (a) | | | 770 | | | 30,407 | |

Corrections Corp. of America (a) | | | 2,890 | | | 72,423 | |

| | | | | | 102,830 | |

Computer Software | 6.8% | | | | | | | |

Microsoft Corp. | | | 6,390 | | | 178,409 | |

Oracle Corp. | | | 6,065 | | | 189,834 | |

Symantec Corp. (a) | | | 3,275 | | | 54,824 | |

| | | | | | 423,067 | |

Consumer Products | 4.2% | | | | | | | |

Avon Products, Inc. | | | 2,545 | | | 73,958 | |

Mattel, Inc. | | | 705 | | | 17,928 | |

Newell Rubbermaid, Inc. | | | 2,390 | | | 43,450 | |

Stanley Black & Decker, Inc. | | | 910 | | | 60,852 | |

The Procter & Gamble Co. | | | 1,025 | | | 65,938 | |

| | | | | | 262,126 | |

| | | | | | | |

| | | | | |

| | | | | |

Description | | Shares | | Value | |

| | | | | |

| | | | | | | |

Energy Exploration & Production | 2.8% | | | | | | | |

Apache Corp. | | | 504 | | $ | 60,092 | |

Devon Energy Corp. | | | 565 | | | 44,358 | |

EQT Corp. | | | 1,565 | | | 70,175 | |

| | | | | | 174,625 | |

Energy Integrated | 7.4% | | | | | | | |

Chevron Corp. | | | 1,120 | | | 102,200 | |

ConocoPhillips | | | 4,770 | | | 324,837 | |

CONSOL Energy, Inc. | | | 600 | | | 29,244 | |

| | | | | | 456,281 | |

Energy Services | 1.0% | | | | | | | |

Halliburton Co. | | | 810 | | | 33,072 | |

Noble Corp. | | | 800 | | | 28,616 | |

| | | | | | 61,688 | |

Financial Services | 6.7% | | | | | | | |

Ameriprise Financial, Inc. | | | 2,235 | | | 128,624 | |

MasterCard, Inc., Class A | | | 230 | | | 51,545 | |

Morgan Stanley | | | 3,400 | | | 92,514 | |

NYSE Euronext | | | 2,115 | | | 63,408 | |

State Street Corp. | | | 1,705 | | | 79,010 | |

| | | | | | 415,101 | |

Food & Beverages | 1.8% | | | | | | | |

General Mills, Inc. | | | 1,630 | | | 58,012 | |

PepsiCo, Inc. | | | 805 | | | 52,590 | |

| | | | | | 110,602 | |

Insurance | 1.5% | | | | | | | |

The Travelers Cos., Inc. | | | 1,620 | | | 90,250 | |

| | | | | | | |

Leisure & Entertainment | 1.1% | | | | | | | |

Darden Restaurants, Inc. | | | 620 | | | 28,793 | |

McDonald’s Corp. | | | 515 | | | 39,531 | |

| | | | | | 68,324 | |

Manufacturing | 4.5% | | | | | | | |

Dover Corp. | | | 1,035 | | | 60,496 | |

Emerson Electric Co. | | | 865 | | | 49,452 | |

Honeywell International, Inc. | | | 1,925 | | | 102,333 | |

Illinois Tool Works, Inc. | | | 1,200 | | | 64,080 | |

| | | | | | 276,361 | |

Medical Products | 1.1% | | | | | | | |

Medtronic, Inc. | | | 1,865 | | | 69,173 | |

| | | | | | | |

Metal & Glass Containers | 2.5% | | | | | | | |

Ball Corp. | | | 2,230 | | | 151,751 | |

| | | | | | | |

Metals & Mining | 1.3% | | | | | | | |

Nucor Corp. | | | 1,780 | | | 78,000 | |

The accompanying notes are an integral part of these financial statements.

Annual Report 13

| | | | | | | |

| | | | | |

| | | | | |

Description | | Shares | | Value | |

| | | | | |

| | | | | | | |

Lazard Retirement U.S. Strategic Equity Portfolio (concluded) | | | | | | | |

| | | | | | | |

Pharmaceutical & Biotechnology | 10.1% | | | | | | | |

Amgen, Inc. (a) | | | 1,375 | | $ | 75,488 | |

Forest Laboratories, Inc. (a) | | | 1,400 | | | 44,772 | |

Gilead Sciences, Inc. (a) | | | 1,420 | | | 51,461 | |

Johnson & Johnson | | | 1,470 | | | 90,919 | |

Merck & Co., Inc. | | | 1,539 | | | 55,466 | |

Pfizer, Inc. | | | 17,285 | | | 302,660 | |

| | | | | | 620,766 | |

Refining | 1.1% | | | | | | | |

Valero Energy Corp. | | | 2,820 | | | 65,198 | |

| | | | | | | |

Retail | 11.6% | | | | | | | |

AutoZone, Inc. (a) | | | 471 | | | 128,390 | |

Big Lots, Inc. (a) | | | 1,340 | | | 40,816 | |

Lowe’s Cos., Inc. | | | 1,150 | | | 28,842 | |

The Gap, Inc. | | | 3,970 | | | 87,896 | |

Wal-Mart Stores, Inc. | | | 3,760 | | | 202,777 | |

Walgreen Co. | | | 5,820 | | | 226,747 | |

| | | | | | 715,468 | |

Semiconductor & Components | 2.3% | | | | | | | |

Intel Corp. | | | 6,835 | | | 143,740 | |

| | | | | | | |

Technology | 3.8% | | | | | | | |

AOL, Inc. (a) | | | 1,090 | | | 25,844 | |

Computer Sciences Corp. | | | 600 | | | 29,760 | |

eBay, Inc. (a) | | | 3,620 | | | 100,745 | |

Google, Inc., Class A (a) | | | 130 | | | 77,216 | |

| | | | | | 233,565 | |

| | | | | | | |

| | | | | |

| | | | | |

Description | | Shares | | Value | |

| | | | | |

| | | | | | | |

Technology Hardware | 5.8% | | | | | | | |

Cisco Systems, Inc. (a) | | | 4,295 | | $ | 86,888 | |

EMC Corp. (a) | | | 2,185 | | | 50,037 | |

International Business Machines Corp. | | | 1,515 | | | 222,341 | |

| | | | | | 359,266 | |

Transportation | 1.1% | | | | | | | |

Norfolk Southern Corp. | | | 1,110 | | | 69,730 | |

| | | | | | | |

Total Common Stocks | | | | | | | |

(Identified cost $5,015,130) | | | | | | 5,997,693 | |

| | | | | | | |

Preferred Stock | 0.5% | | | | | | | |

| | | | | | | |

Automotive | 0.5% | | | | | | | |

Better Place, Inc., Series B | | | | | | | |

(Identified cost $31,701) | | | 10,567 | | | 31,701 | |

| | | | | | | |

Short-Term Investment | 2.4% | | | | | | | |

State Street Institutional Treasury | | | | | | | |

Money Market Fund | | | | | | | |

(Identified cost $146,204) | | | 146,204 | | | 146,204 | |

| | | | | | | |

Total Investments | 100.1% | | | | | | | |

(Identified cost $5,193,035) (b) | | | | | $ | 6,175,598 | |

| | | | | | | |

Liabilities in Excess of Cash and | | | | | | | |

Other Assets | (0.1)% | | | | | | (3,531 | ) |

| | | | | | | |

Net Assets | 100.0% | | | | | $ | 6,172,067 | |

The accompanying notes are an integral part of these financial statements.

14 Annual Report

| | | | | | | |

| | | | | | | |

| | | | | | | |

Description | | | Shares | | | Value | |

| | | | | | | |

| | | | | | | |

Lazard Retirement U.S. Small-Mid Cap Equity Portfolio |

| | | | | | | |

Common Stocks | 99.3% | | | | | | | |

| | | | | | | |

Automotive | 2.0% | | | | | | | |

Dorman Products, Inc. (a) | | | 6,500 | | $ | 235,560 | |

Modine Manufacturing Co. (a) | | | 108,670 | | | 1,684,385 | |

Tenneco, Inc. (a) | | | 24,850 | | | 1,022,826 | |

| | | | | | 2,942,771 | |

Banking | 6.3% | | | | | | | |

BancorpSouth, Inc. | | | 47,800 | | | 762,410 | |

City National Corp. | | | 33,863 | | | 2,077,834 | |

Fulton Financial Corp. | | | 140,300 | | | 1,450,702 | |

PacWest Bancorp | | | 124,550 | | | 2,662,879 | |

Wintrust Financial Corp. | | | 67,780 | | | 2,238,773 | |

| | | | | | 9,192,598 | |

Chemicals | 3.7% | | | | | | | |

GrafTech International, Ltd. (a) | | | 66,200 | | | 1,313,408 | |

Kronos Worldwide, Inc. | | | 25,700 | | | 1,091,993 | |

Rockwood Holdings, Inc. (a) | | | 42,830 | | | 1,675,510 | |

Solutia, Inc. (a) | | | 60,300 | | | 1,391,724 | |

| | | | | | 5,472,635 | |

Commercial Services | 2.3% | | | | | | | |

Equifax, Inc. | | | 42,200 | | | 1,502,320 | |

Team, Inc. (a) | | | 78,500 | | | 1,899,700 | |

| | | | | | 3,402,020 | |

Computer Software | 6.1% | | | | | | | |

Akamai Technologies, Inc. (a) | | | 19,300 | | | 908,065 | |

BMC Software, Inc. (a) | | | 45,300 | | | 2,135,442 | |

Nuance Communications, Inc. (a) | | | 69,700 | | | 1,267,146 | |

Quest Software, Inc. (a) | | | 84,600 | | | 2,346,804 | |

Red Hat, Inc. (a) | | | 50,850 | | | 2,321,302 | |

| | | | | | 8,978,759 | |

Construction & Engineering | 2.1% | | | | | | | |

Orion Marine Group, Inc. (a) | | | 85,100 | | | 987,160 | |

Quanta Services, Inc. (a) | | | 101,600 | | | 2,023,872 | |

| | | | | | 3,011,032 | |

Consumer Products | 6.5% | | | | | | | |

Central Garden & Pet Co., Class A (a) | | | 222,662 | | | 2,199,901 | |

Mattel, Inc. | | | 59,290 | | | 1,507,745 | |

Matthews International Corp., Class A | | | 42,980 | | | 1,503,440 | |

Newell Rubbermaid, Inc. | | | 79,100 | | | 1,438,038 | |

Tempur-Pedic International, Inc. (a) | | | 37,790 | | | 1,513,867 | |

The Middleby Corp. (a) | | | 17,000 | | | 1,435,140 | |

| | | | | | 9,598,131 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Description | | | Shares | | | Value | |

| | | | | | | |

| | | | | | | |

Electric | 1.6% | | | | | | | |

Northeast Utilities | | | 74,940 | | $ | 2,389,087 | |

| | | | | | | |

Energy Integrated | 2.9% | | | | | | | |

Cimarex Energy Co. | | | 25,510 | | | 2,258,400 | |

James River Coal Co. (a) | | | 75,850 | | | 1,921,281 | |

| | | | | | 4,179,681 | |

Energy Services | 4.2% | | | | | | | |

Helmerich & Payne, Inc. | | | 46,690 | | | 2,263,531 | |

Key Energy Services, Inc. (a) | | | 128,800 | | | 1,671,824 | |

Oceaneering International, Inc. (a) | | | 30,220 | | | 2,225,099 | |

| | | | | | 6,160,454 | |

Financial Services | 3.3% | | | | | | | |

NYSE Euronext | | | 75,900 | | | 2,275,482 | |

Stifel Financial Corp. (a) | | | 41,100 | | | 2,549,844 | |

| | | | | | 4,825,326 | |

Food & Beverages | 2.1% | | | | | | | |

Ralcorp Holdings, Inc. (a) | | | 28,500 | | | 1,852,785 | |

Snyders-Lance, Inc. | | | 51,650 | | | 1,210,676 | |

| | | | | | 3,063,461 | |

Forest & Paper Products | 2.3% | | | | | | | |

Rock-Tenn Co., Class A | | | 33,500 | | | 1,807,325 | |

Schweitzer-Mauduit International, Inc. | | | 25,600 | | | 1,610,752 | |

| | | | | | 3,418,077 | |

Gas Utilities | 3.1% | | | | | | | |

New Jersey Resources Corp. | | | 57,800 | | | 2,491,758 | |

Piedmont Natural Gas Co., Inc. | | | 74,200 | | | 2,074,632 | |

| | | | | | 4,566,390 | |

Health Services | 2.1% | | | | | | | |

Community Health Systems, Inc. (a) | | | 29,000 | | | 1,083,730 | |

VCA Antech, Inc. (a) | | | 84,200 | | | 1,961,018 | |

| | | | | | 3,044,748 | |

Housing | 1.0% | | | | | | | |

Trex Co., Inc. (a) | | | 58,385 | | | 1,398,905 | |

| | | | | | | |

Insurance | 2.2% | | | | | | | |

Arch Capital Group, Ltd. (a) | | | 23,600 | | | 2,077,980 | |

Aspen Insurance Holdings, Ltd. | | | 41,200 | | | 1,179,144 | |

| | | | | | 3,257,124 | |

Leisure & Entertainment | 2.1% | | | | | | | |

Darden Restaurants, Inc. | | | 34,190 | | | 1,587,783 | |

Texas Roadhouse, Inc. (a) | | | 90,510 | | | 1,554,057 | |

| | | | | | 3,141,840 | |

The accompanying notes are an integral part of these financial statements.

Annual Report 15

| | | | | | | |

| | | | | | | |

| | | | | | | |

Description | | | Shares | | | Value | |

| | | | | | | |

| | | | | | | |

Lazard Retirement U.S. Small-Mid Cap Equity Portfolio (concluded) |

| | | | | | | |

Manufacturing | 7.9% | | | | | | | |

Altra Holdings, Inc. (a) | | | 109,930 | | $ | 2,183,210 | |

BE Aerospace, Inc. (a) | | | 37,600 | | | 1,392,328 | |

FLIR Systems, Inc. (a) | | | 70,140 | | | 2,086,665 | |

Generac Holdings, Inc. | | | 69,173 | | | 1,118,527 | |

Harsco Corp. | | | 96,400 | | | 2,730,048 | |

Regal-Beloit Corp. | | | 29,960 | | | 2,000,130 | |

| | | | | | 11,510,908 | |

Medical Products | 4.9% | | | | | | | |

CareFusion Corp. (a) | | | 66,540 | | | 1,710,078 | |

Haemonetics Corp. (a) | | | 15,140 | | | 956,545 | |

Hospira, Inc. (a) | | | 39,870 | | | 2,220,360 | |

Life Technologies Corp. (a) | | | 42,200 | | | 2,342,100 | |

| | | | | | 7,229,083 | |

Metal & Glass Containers | 1.8% | | | | | | | |

Ball Corp. | | | 20,470 | | | 1,392,983 | |

Owens-Illinois, Inc. (a) | | | 42,010 | | | 1,289,707 | |

| | | | | | 2,682,690 | |

Metals & Mining | 1.4% | | | | | | | |

Schnitzer Steel Industries, Inc., Class A | | | 29,930 | | | 1,987,053 | |

| | | | | | | |

Pharmaceutical & Biotechnology | 1.0% | | | | | | | |

Warner Chilcott PLC, Class A | | | 67,030 | | | 1,512,197 | |

| | | | | | | |

Real Estate | 8.6% | | | | | | | |

CB Richard Ellis Group, Inc., Class A (a) | | | 38,500 | | | 788,480 | |

Digital Realty Trust, Inc. REIT | | | 26,250 | | | 1,352,925 | |

Extra Space Storage, Inc. REIT | | | 123,800 | | | 2,154,120 | |

Kilroy Realty Corp. REIT | | | 39,850 | | | 1,453,330 | |

LaSalle Hotel Properties REIT | | | 75,100 | | | 1,982,640 | |

The Macerich Co. REIT | | | 51,022 | | | 2,416,912 | |

UDR, Inc. REIT | | | 101,400 | | | 2,384,928 | |

| | | | | | 12,533,335 | |

Retail | 6.7% | | | | | | | |

American Eagle Outfitters, Inc. | | | 101,020 | | | 1,477,922 | |

Brown Shoe Co., Inc. | | | 139,100 | | | 1,937,663 | |

Family Dollar Stores, Inc. | | | 30,270 | | | 1,504,722 | |

Iconix Brand Group, Inc. (a) | | | 100,120 | | | 1,933,317 | |

Liz Claiborne, Inc. (a) | | | 199,230 | | | 1,426,487 | |

Williams-Sonoma, Inc. | | | 41,700 | | | 1,488,273 | |

| | | | | | 9,768,384 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Description | | | Shares | | | Value | |

| | | | | | | |

| | | | | | | |

Semiconductor & Components | 3.4% | | | | | | | |

FARO Technologies, Inc. (a) | | | 11,400 | | $ | 374,376 | |

ON Semiconductor Corp. (a) | | | 224,200 | | | 2,215,096 | |

Xilinx, Inc. | | | 82,200 | | | 2,382,156 | |

| | | | | | 4,971,628 | |

Technology | 1.8% | | | | | | | |

SS&C Technologies Holdings, Inc. | | | 131,200 | | | 2,690,912 | |

| | | | | | | |

Technology Hardware | 3.6% | | | | | | | |

EchoStar Corp., Class A (a) | | | 3,300 | | | 82,401 | |

Ingram Micro, Inc., Class A (a) | | | 86,400 | | | 1,649,376 | |

Polycom, Inc. (a) | | | 46,900 | | | 1,828,162 | |

Teradyne, Inc. (a) | | | 121,100 | | | 1,700,244 | |

| | | | | | 5,260,183 | |

Transportation | 2.3% | | | | | | | |

Echo Global Logistics, Inc. (a) | | | 154,460 | | | 1,859,699 | |

UTI Worldwide, Inc. | | | 74,226 | | | 1,573,591 | |

| | | | | | 3,433,290 | |

Total Common Stocks | | | | | | | |

(Identified cost $116,977,188) | | | | | | 145,622,702 | |

| | | | | | | |

Preferred Stock | 0.6% | | | | | | | |

| | | | | | | |

Automotive | 0.6% | | | | | | | |

Better Place, Inc., Series B | | | | | | | |

(Identified cost $864,900) | | | 288,300 | | | 864,900 | |

| | | | | | | |

Short-Term Investment | 4.5% | | | | | | | |

State Street Institutional Treasury | | | | | | | |

Money Market Fund | | | | | | | |

(Identified cost $6,572,154) | | | 6,572,154 | | | 6,572,154 | |

| | | | | | | |

Total Investments | 104.4% | | | | | | | |

(Identified cost $124,414,242) (b) | | | | | $ | 153,059,756 | |

| | | | | | | |

Liabilities in Excess of Cash and | | | | | | | |

Other Assets | (4.4)% | | | | | | (6,416,009 | ) |

| | | | | | | |

Net Assets | 100.0% | | | | | $ | 146,643,747 | |

The accompanying notes are an integral part of these financial statements.

16 Annual Report

| | | | | | | |

| | | | | | | |

| | | | | | | |

Description | | | Shares | | | Value | |

| | | | | | | |

| | | | | | | |

Lazard Retirement International Equity Portfolio |

| | | | | | | |

Common Stocks | 95.6% | | | | | | | |

| | | | | | | |

Australia | 2.2% | | | | | | | |

QBE Insurance Group, Ltd. | | | 217,100 | | $ | 4,030,206 | |

Telstra Corp., Ltd. | | | 2,159,700 | | | 6,162,948 | |

Total Australia | | | | | | 10,193,154 | |

| | | | | | | |

Belgium | 2.2% | | | | | | | |

Anheuser-Busch InBev NV | | | 177,400 | | | 10,146,151 | |

| | | | | | | |

Brazil | 2.6% | | | | | | | |

Banco do Brasil SA | | | 366,842 | | | 6,943,479 | |

Cielo SA | | | 645,600 | | | 5,230,916 | |

Total Brazil | | | | | | 12,174,395 | |

| | | | | | | |

Canada | 1.7% | | | | | | | |

Potash Corp. of Saskatchewan, Inc. | | | 27,200 | | | 4,225,123 | |

Rogers Communications, Inc. | | | 109,600 | | | 3,813,900 | |

Total Canada | | | | | | 8,039,023 | |

| | | | | | | |

China | 1.5% | | | | | | | |

Industrial and Commercial Bank of | | | | | | | |

China, Ltd., Class H | | | 5,695,600 | | | 4,228,028 | |

Weichai Power Co., Ltd., Class H | | | 491,000 | | | 3,035,270 | |

Total China | | | | | | 7,263,298 | |

| | | | | | | |

Denmark | 1.2% | | | | | | | |

Novo Nordisk A/S, Class B | | | 50,400 | | | 5,683,276 | |

| | | | | | | |

Finland | 0.9% | | | | | | | |

Sampo Oyj, A Shares | | | 158,900 | | | 4,257,378 | |

| | | | | | | |

France | 9.9% | | | | | | | |

BNP Paribas SA | | | 115,080 | | | 7,321,532 | |

Danone SA | | | 112,870 | | | 7,091,941 | |

Sanofi-Aventis | | | 171,280 | | | 10,951,977 | |

Technip SA | | | 72,900 | | | 6,731,464 | |

Total SA | | | 126,572 | | | 6,706,328 | |

Valeo SA (a) | | | 141,400 | | | 8,023,881 | |

Total France | | | | | | 46,827,123 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Description | | | Shares | | | Value | |

| | | | | | | |

| | | | | | | |

Germany | 4.4% | | | | | | | |

Bayerische Motoren Werke AG | | | 72,300 | | $ | 5,685,762 | |

SAP AG | | | 89,000 | | | 4,531,259 | |

Siemens AG | | | 82,838 | | | 10,261,558 | |

Total Germany | | | | | | 20,478,579 | |

| | | | | | | |

Hong Kong | 1.2% | | | | | | | |

AIA Group, Ltd. | | | 377,600 | | | 1,061,466 | |

Esprit Holdings, Ltd. | | | 1 | | | 5 | |

Kerry Properties, Ltd. | | | 858,600 | | | 4,451,623 | |

Total Hong Kong | | | | | | 5,513,094 | |

| | | | | | | |

Israel | 0.9% | | | | | | | |

Teva Pharmaceutical Industries, Ltd., | | | | | | | |

Sponsored ADR | | | 80,600 | | | 4,201,678 | |

| | | | | | | |

Italy | 1.0% | | | | | | | |

Atlantia SpA | | | 240,802 | | | 4,913,637 | |

| | | | | | | |

Japan | 19.3% | | | | | | | |

Asics Corp. | | | 199,960 | | | 2,571,231 | |

Benesse Holdings, Inc. | | | 88,400 | | | 4,072,127 | |

Canon, Inc. | | | 191,600 | | | 9,935,164 | |

Daito Trust Construction Co., Ltd. | | | 140,900 | | | 9,649,021 | |

Don Quijote Co., Ltd. | | | 107,800 | | | 3,283,525 | |

eAccess, Ltd. | | | 5,615 | | | 3,395,695 | |

Honda Motor Co., Ltd. | | | 209,300 | | | 8,287,960 | |

Hoya Corp. | | | 256,800 | | | 6,237,340 | |

JS Group Corp. | | | 190,500 | | | 4,192,924 | |

Keyence Corp. | | | 14,900 | | | 4,316,394 | |

Kubota Corp. | | | 1 | | | 10 | |

Mitsubishi Corp. | | | 178,600 | | | 4,835,113 | |

Mitsubishi Estate Co., Ltd. | | | 319,000 | | | 5,917,157 | |

Nidec Corp. | | | 49,500 | | | 5,005,481 | |

Sumitomo Mitsui Financial Group, Inc. | | | 193,900 | | | 6,906,747 | |

Yahoo Japan Corp. | | | 18,343 | | | 7,116,695 | |

Yamada Denki Co., Ltd. | | | 77,080 | | | 5,259,554 | |

Total Japan | | | | | | 90,982,138 | |

| | | | | | | |

Mexico | 0.8% | | | | | | | |

Grupo Televisa SA Sponsored ADR (a) | | | 150,900 | | | 3,912,837 | |

The accompanying notes are an integral part of these financial statements.

Annual Report 17

| | | | | | |

| | | | | | |

| | | | | |

Description | | Shares | | Value | |

| | | | | | |

| | | | | | |

Lazard Retirement International Equity Portfolio (concluded) |

| | | | | | |

Netherlands | 2.6% | | | | | | |

ING Groep NV (a) | | 673,430 | | $ | 6,551,305 | |

TNT NV | | 210,337 | | | 5,551,198 | |

Total Netherlands | | | | | 12,102,503 | |

| | | | | | |

Norway | 0.9% | | | | | | |

Aker Solutions ASA | | 245,400 | | | 4,174,077 | |

| | | | | | |

Russia | 0.9% | | | | | | |

Sberbank | | 1,284,500 | | | 4,376,292 | |

| | | | | | |

Singapore | 0.9% | | | | | | |

Singapore Telecommunications, Ltd. | | 1,819,200 | | | 4,327,627 | |

| | | | | | |

South Korea | 2.3% | | | | | | |

Hyundai Mobis (a) | | 21,300 | | | 5,339,545 | |

Samsung Electronics Co., Ltd. GDR (c) | | 13,100 | | | 5,526,890 | |

Total South Korea | | | | | 10,866,435 | |

| | | | | | |

Spain | 1.1% | | | | | | |

Amadeus IT Holding SA, A Shares | | 252,700 | | | 5,294,869 | |

| | | | | | |

Sweden | 0.9% | | | | | | |

Assa Abloy AB, Class B | | 151,500 | | | 4,268,621 | |

| | | | | | |

Switzerland | 7.0% | | | | | | |

Julius Baer Group, Ltd. | | 103,300 | | | 4,839,080 | |

Nestle SA | | 133,140 | | | 7,796,166 | |

Novartis AG | | 217,800 | | | 12,800,117 | |

UBS AG (a) | | 445,160 | | | 7,308,242 | |

Total Switzerland | | | | | 32,743,605 | |

| | | | | | |

Turkey | 0.8% | | | | | | |

Turkiye Garanti Bankasi AS ADR | | 772,700 | | | 3,979,405 | |

| | | | | | |

| | | | | | |

| | | | | | |

Description | | Shares | | Value | |

| | | | | | |

| | | | | | |

United Kingdom | 28.4% | | | | | | |

AMEC PLC | | 154,800 | | $ | 2,775,508 | |

BAE Systems PLC | | 778,900 | | | 4,007,462 | |

BG Group PLC | | 245,900 | | | 4,968,637 | |

BHP Billiton PLC | | 228,100 | | | 9,072,135 | |

British Airways PLC (a) | | 1 | | | 4 | |

British American Tobacco PLC | | 172,840 | | | 6,638,509 | |

GlaxoSmithKline PLC | | 453,200 | | | 8,761,639 | |

HSBC Holdings PLC | | 998,791 | | | 10,139,022 | |

Informa PLC | | 969,324 | | | 6,158,435 | |

International Power PLC | | 823,900 | | | 5,621,155 | |

Lloyds Banking Group PLC (a) | | 6,391,578 | | | 6,547,073 | |

Prudential PLC | | 1,017,330 | | | 10,595,271 | |

Royal Dutch Shell PLC, A Shares | | 304,400 | | | 10,149,103 | |

Standard Chartered PLC | | 278,875 | | | 7,502,367 | |

Tullow Oil PLC | | 233,700 | | | 4,594,598 | |

Unilever PLC | | 308,000 | | | 9,426,376 | |

Vodafone Group PLC | | 1,822,541 | | | 4,711,244 | |

William Morrison Supermarkets PLC | | 1,295,900 | | | 5,406,689 | |

WPP PLC | | 483,000 | | | 5,945,290 | |

Xstrata PLC | | 453,400 | | | 10,642,313 | |

Total United Kingdom | | | | | 133,662,830 | |

| | | | | | |

Total Common Stocks

(Identified cost $382,880,058) | | | | | 450,382,025 | |

| | | | | | |

Short-Term Investment | 2.9% | | | | | | |

State Street Institutional Treasury | | | | | | |

Money Market Fund | | | | | | |

(Identified cost $13,681,301) | | 13,681,301 | | | 13,681,301 | |

| | | | | | |

Total Investments | 98.5%

(Identified cost $396,561,359) (b) | | | | $ | 464,063,326 | |

| | | | | | |

Cash and Other Assets in | | | | | | |

Excess of Liabilities | 1.5% | | | | | 6,967,139 | |

| | | | | | |

Net Assets | 100.0% | | | | $ | 471,030,465 | |

The accompanying notes are an integral part of these financial statements.

18 Annual Report

| | | | | | |

| | | | | | |

| | | | | | |

Description | | Shares | | Value | |

| | | | | | |

| | | | | | |

Lazard Retirement Emerging Markets Equity Portfolio | | | | | | |

| | | | | | |

Common Stocks | 92.2% | | | | | | |

| | | | | | |

Brazil | 17.4% | | | | | | |

Banco do Brasil SA | | 1,769,566 | | $ | 33,493,834 | |

Cielo SA | | 2,916,600 | | | 23,631,488 | |

Companhia de Concessoes Rodoviarias | | 258,800 | | | 7,311,879 | |

Companhia Energetica de Minas | | | | | | |

Gerais SA Sponsored ADR | | 624,710 | | | 10,363,939 | |

Companhia Siderurgica Nacional SA | | | | | | |

Sponsored ADR | | 801,600 | | | 13,362,672 | |

Natura Cosmeticos SA | | 422,800 | | | 12,146,585 | |

Redecard SA | | 1,683,657 | | | 21,349,988 | |

Souza Cruz SA | | 160,311 | | | 8,729,224 | |

Vale SA Sponsored ADR | | 865,800 | | | 29,930,706 | |

Total Brazil | | | | | 160,320,315 | |

| | | | | | |

Canada | 1.7% | | | | | | |

First Quantum Minerals, Ltd. | | 145,000 | | | 15,749,774 | |

| | | | | | |

China | 2.5% | | | | | | |

China Construction Bank Corp., Class H | | 10,038,390 | | | 9,040,337 | |

NetEase.com, Inc. Sponsored ADR (a) | | 248,300 | | | 8,976,045 | |

Weichai Power Co., Ltd., Class H | | 847,000 | | | 5,235,996 | |

Total China | | | | | 23,252,378 | |

| | | | | | |

Egypt | 3.1% | | | | | | |

Commercial International Bank | | 1,195,442 | | | 9,750,935 | |

Eastern Co. | | 159,553 | | | 3,298,253 | |

Egyptian Company for Mobile Services | | 120,465 | | | 3,405,393 | |

Orascom Construction Industries | | 242,444 | | | 12,019,877 | |

Total Egypt | | | | | 28,474,458 | |

| | | | | | |

France | 0.7% | | | | | | |

CFAO SA | | 142,659 | | | 6,208,989 | |

| | | | | | |

| | | | | | |

Hong Kong | 0.0% | | | | | | |

China High Speed Transmission | | | | | | |

Equipment Group Co., Ltd. | | 91,000 | | | 140,490 | |

Shougang Concord International | | | | | | |

Enterprises Co., Ltd. (a) | | 1,565,500 | | | 227,590 | |

Total Hong Kong | | | | | 368,080 | |

| | | | | | |

| | | | | | |

| | | | | | |

Description | | Shares | | Value | |

| | | | | | |

| | | | | | |

Hungary | 1.2% | | | | | | |

OTP Bank Nyrt (a) | | 443,258 | | $ | 10,694,989 | |

| | | | | | |

| | | | | | |

India | 4.6% | | | | | | |

Bank of India | | 889,272 | | | 9,028,950 | |

Infosys Technologies, Ltd. | | | | | | |

Sponsored ADR | | 91,200 | | | 6,938,496 | |

Jindal Steel & Power, Ltd. | | 579,759 | | | 9,228,949 | |

Punjab National Bank, Ltd. | | 646,817 | | | 17,677,350 | |

Total India | | | | | 42,873,745 | |

| | | | | | |

Indonesia | 4.7% | | | | | | |

PT Bank Mandiri Tbk | | 8,047,100 | | | 5,805,344 | |

PT Semen Gresik (Persero) Tbk | | 6,560,500 | | | 6,880,880 | |

PT Tambang Batubara Bukit Asam Tbk | | 2,832,000 | | | 7,213,585 | |

PT Telekomunikasi Indonesia Tbk | | | | | | |

Sponsored ADR | | 483,600 | | | 17,240,340 | |

PT United Tractors Tbk | | 2,496,450 | | | 6,594,396 | |

Total Indonesia | | | | | 43,734,545 | |

| | | | | | |

Malaysia | 0.5% | | | | | | |

British American Tobacco Malaysia Berhad | | 335,000 | | | 4,888,925 | |

| | | | | | |

Mexico | 6.5% | | | | | | |

America Movil SAB de CV ADR, Series L | | 232,900 | | | 13,354,486 | |

Desarrolladora Homex SAB de CV ADR (a) | | 149,390 | | | 5,050,876 | |

Fomento Economico Mexicano | | | | | | |

SAB de CV Sponsored ADR | | 161,590 | | | 9,036,113 | |

Grupo Mexico SAB de CV, Series B | | 3,773,854 | | | 15,535,444 | |

Grupo Televisa SA Sponsored ADR (a) | | 454,600 | | | 11,787,778 | |

Kimberly-Clark de Mexico SAB de CV, | | | | | | |

Series A | | 907,200 | | | 5,535,022 | |

Total Mexico | | | | | 60,299,719 | |

| | | | | | |

Pakistan | 1.2% | | | | | | |

Oil & Gas Development Co., Ltd. | | 2,377,200 | | | 4,722,501 | |

Pakistan Petroleum, Ltd. | | 2,543,244 | | | 6,444,467 | |

Total Pakistan | | | | | 11,166,968 | |

| | | | | | |

Philippines | 1.9% | | | | | | |

Philippine Long Distance Telephone Co. | | | | | | |

Sponsored ADR | | 293,700 | | | 17,113,899 | |

The accompanying notes are an integral part of these financial statements.

Annual Report 19

| | | | | | | |

| | | | | | | |

| | | | | | | |

Description | | Shares | | Value | |

| | | | | | | |

| | | | | | | |

Lazard Retirement Emerging Markets Equity Portfolio (concluded) | |

| | | | | | | |

Russia | 6.4% | | | | | | | |

Magnit OJSC Sponsored GDR (c), (d) | | | 243,275 | | $ | 7,127,958 | |

Mobile TeleSystems Sponsored ADR | | | 604,500 | | | 12,615,915 | |

OAO LUKOIL Sponsored ADR | | | 213,100 | | | 12,058,834 | |

Oriflame Cosmetics SA SDR | | | 131,230 | | | 6,907,202 | |

TNK-BP Holding | | | 2,774,636 | | | 7,352,785 | |

Uralkali Sponsored GDR | | | 345,952 | | | 12,703,357 | |

Total Russia | | | | | | 58,766,051 | |

| | | | | | | |

South Africa | 11.0% | | | | | | | |

Bidvest Group, Ltd. | | | 88,347 | | | 2,102,223 | |

Kumba Iron Ore, Ltd. | | | 265,116 | | | 17,084,135 | |

Massmart Holdings, Ltd. | | | 379,486 | | | 8,450,944 | |

Murray & Roberts Holdings, Ltd. | | | 1,428,865 | | | 8,713,094 | |

Nedbank Group, Ltd. | | | 395,135 | | | 7,818,725 | |

Pretoria Portland Cement Co., Ltd. | | | 1,725,893 | | | 9,156,730 | |

Sanlam, Ltd. | | | 3,002,628 | | | 12,726,129 | |

Shoprite Holdings, Ltd. | | | 536,293 | | | 8,112,577 | |

Standard Bank Group, Ltd. | | | 513,586 | | | 8,384,998 | |

Tiger Brands, Ltd. | | | 302,441 | | | 8,889,814 | |

Truworths International, Ltd. | | | 896,727 | | | 9,753,395 | |

Total South Africa | | | | | | 101,192,764 | |

| | | | | | | |

South Korea | 13.3% | | | | | | | |

Hite Brewery Co., Ltd. (a) | | | 38,295 | | | 4,066,039 | |

Hyundai Mobis (a) | | | 42,245 | | | 10,590,098 | |

KB Financial Group, Inc. (a) | | | 140,600 | | | 7,433,254 | |

Korea Life Insurance Co., Ltd. | | | 1,683,452 | | | 11,792,619 | |

KT&G Corp. (a) | | | 247,810 | | | 14,127,506 | |

NHN Corp. (a) | | | 85,271 | | | 17,055,703 | |

Samsung Electronics Co., Ltd. GDR (c) | | | 50,673 | | | 21,378,939 | |

Shinhan Financial Group Co., Ltd. (a) | | | 570,858 | | | 26,608,854 | |

Woongjin Coway Co., Ltd. (a) | | | 268,786 | | | 9,544,520 | |

Total South Korea | | | | | | 122,597,532 | |

| | | | | | | |

Taiwan | 7.5% | | | | | | | |

Advanced Semiconductor | | | | | | | |

Engineering, Inc. | | | 6,653,516 | | | 7,701,753 | |

Delta Electronics, Inc. | | | 1,558,000 | | | 7,614,597 | |

Hon Hai Precision Industry Co., Ltd. | | | 3,287,959 | | | 13,250,396 | |

HTC Corp. | | | 220,385 | | | 6,802,823 | |

MediaTek, Inc. | | | 1,014,675 | | | 14,529,412 | |

Taiwan Semiconductor | | | | | | | |

Manufacturing Co., Ltd. | | | 7,727,642 | | | 18,817,848 | |

Total Taiwan | | | | | | 68,716,829 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Description | | | Shares | | | Value | |

| | | | | | | |

| | | | | | | |

Thailand | 1.7% | | | | | | | |

Banpu Public Co., Ltd. | | | 350,800 | | $ | 9,170,025 | |

Kasikornbank Public Co., Ltd. | | | 1,473,600 | | | 6,379,326 | |

Total Thailand | | | | | | 15,549,351 | |

| | | | | | | |

Turkey | 6.3% | | | | | | | |

Akbank TAS | | | 1,833,796 | | | 10,190,395 | |

Koc Holding AS | | | 1,368,119 | | | 6,663,377 | |

Turkcell Iletisim Hizmetleri AS | | | 2,806,857 | | | 19,178,978 | |

Turkiye Is Bankasi AS, C Shares | | | 6,067,162 | | | 21,612,300 | |

Total Turkey | | | | | | 57,645,050 | |

| | | | | | | |

Total Common Stocks | | | | | | | |

(Identified cost $671,085,834) | | | | | | 849,614,361 | |

| | | | | | | |

Preferred Stocks | 2.6% | | | | | | | |

| | | | | | | |

Brazil | 2.6% | | | | | | | |

Companhia de Bebidas das Americas SA | | | | | | | |

Sponsored ADR | | | 9,600 | | | 297,888 | |

Eletropaulo Metropolitana SA | | | 92,000 | | | 1,779,590 | |

Ultrapar Participacoes SA | | | 100,200 | | | 6,343,988 | |

Usinas Siderurgicas de Minas Gerais SA, | | | | | | | |

A Shares | | | 1,297,000 | | | 14,970,193 | |

Vale Fertilizantes SA (a) | | | 75,500 | | | 863,702 | |

Total Brazil | | | | | | 24,255,361 | |

| | | | | | | |

Total Preferred Stocks | | | | | | | |

(Identified cost $23,896,916) | | | | | | 24,255,361 | |

| | | | | | | |

Short-Term Investment | 4.2% | | | | | | | |

State Street Institutional Treasury | | | | | | | |

Money Market Fund | | | | | | | |

(Identified cost $38,605,417) | | | 38,605,417 | | | 38,605,417 | |

| | | | | | | |

Total Investments | 99.0% | | | | | | | |

(Identified cost $733,588,167) (b) | | | | | $ | 912,475,139 | |

| | | | | | | |

Cash and Other Assets in | | | | | | | |

Excess of Liabilities | 1.0% | | | | | | 9,282,671 | |

| | | | | | | |

Net Assets | 100.0% | | | | | $ | 921,757,810 | |

The accompanying notes are an integral part of these financial statements.

20 Annual Report

|

|

Lazard Retirement Series, Inc. Notes to Portfolios of Investments December 31, 2010 |

|

| |

(a) | Non-income producing security. |

| |

(b) | For federal income tax purposes, the aggregate cost, aggregate gross unrealized appreciation, aggregate gross unrealized depreciation and the net unrealized appreciation are as follows: |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Portfolio | | Aggregate

Cost | | Aggregate Gross

Unrealized

Appreciation | | Aggregate Gross

Unrealized

Depreciation | | Net Unrealized

Appreciation | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

Retirement U.S. Strategic Equity | | $ | 5,279,084 | | | $ | 927,329 | | | | $ | 30,815 | | | | $ | 896,514 | | |

Retirement U.S. Small-Mid Cap Equity | | | 124,578,910 | | | | 29,003,836 | | | | | 522,990 | | | | | 28,480,846 | | |

Retirement International Equity | | | 408,341,905 | | | | 61,097,342 | | | | | 5,375,921 | | | | | 55,721,421 | | |

Retirement Emerging Markets Equity | | | 746,134,424 | | | | 179,149,883 | | | | | 12,809,168 | | | | | 166,340,715 | | |

| |

(c) | Pursuant to Rule 144A under the Securities Act of 1933, these securities may only be traded among “qualified institutional buyers.” At December 31, 2010, these securities amounted to 1.2% and 3.1% of net assets of Lazard Retirement International Equity Portfolio and Lazard Retirement Emerging Markets Equity Portfolio, respectively, and are considered to be liquid. |

| |

(d) | Categorized based on Level 2 inputs. (Note 8) |

| | |

Security Abbreviations: |

ADR | — | American Depositary Receipt |

GDR | — | Global Depositary Receipt |

REIT | — | Real Estate Investment Trust |

SDR | — | Swedish Depositary Receipt |

The accompanying notes are an integral part of these financial statements.

Annual Report 21

Portfolio holdings by industry (as percentage of net assets), for those Portfolios previously presented by country:

| | | | | | | | | | | |

| | | | | | | |

Industry | | Lazard

Retirement

International

Equity Portfolio | | Lazard

Retirement

Emerging Markets

Equity Portfolio | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Agriculture | | | 0.9 | % | | | | 1.5 | % | | |

Alcohol &Tobacco | | | 3.6 | | | | | 3.9 | | | |

Automotive | | | 4.7 | | | | | — | | | |

Banking | | | 11.9 | | | | | 17.1 | | | |

Building Materials | | | — | | | | | 1.0 | | | |

Commercial Services | | | 4.5 | | | | | 3.2 | | | |

Computer Software | | | 1.0 | | | | | 2.8 | | | |

Construction & Engineering | | | 0.6 | | | | | 2.2 | | | |

Consumer Products | | | — | | | | | 3.1 | | | |

Diversified | | | — | | | | | 0.9 | | | |

Electric | | | 1.2 | | | | | 1.3 | | | |

Energy Exploration & Production | | | 1.0 | | | | | 1.2 | | | |

Energy Integrated | | | 4.6 | | | | | 3.9 | | | |

Energy Services | | | 2.3 | | | | | — | | | |

Financial Services | | | 4.3 | | | | | 6.6 | | | |

Food & Beverages | | | 5.2 | | | | | 1.9 | | | |

Forest & Paper Products | | | — | | | | | 0.6 | | | |

Gas Utilities | | | — | | | | | 0.7 | | | |

Housing | | | 2.9 | | | | | 1.3 | | | |

Insurance | | | 4.2 | | | | | 1.3 | | | |

Leisure & Entertainment | | | 3.0 | | | | | 1.3 | | | |

Manufacturing | | | 6.6 | | | | | 2.4 | | | |

Metals & Mining | | | 4.2 | | | | | 12.6 | | | |

Pharmaceutical & Biotechnology | | | 9.0 | | | | | — | | | |

Real Estate | | | 2.2 | | | | | — | | | |

Retail | | | 3.5 | | | | | 3.6 | | | |

Semiconductors & Components | | | 4.6 | | | | | 7.6 | | | |

Technology | | | 2.6 | | | | | 0.8 | | | |

Technology Hardware | | | — | | | | | 2.2 | | | |

Telecommunications | | | 4.8 | | | | | 9.0 | | | |

Transportation | | | 2.2 | | | | | 0.8 | | | |

Subtotal | | | 95.6 | | | | | 94.8 | | | |

Short-Term Investments | | | 2.9 | | | | | 4.2 | | | |

Total Investments | | | 98.5 | % | | | | 99.0 | % | | |

The accompanying notes are an integral part of these financial statements.

22 Annual Report

|

|

Lazard Retirement Series, Inc. Statements of Assets and Liabilities |

|

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

December 31, 2010 | | Lazard

Retirement

U.S. Strategic

Equity Portfolio | | Lazard

Retirement

U.S. Small-Mid Cap

Equity Portfolio | | Lazard

Retirement

International

Equity Portfolio | | Lazard

Retirement

Emerging Markets

Equity Portfolio | |

| | | | | | | | | |

| | | | | | | | | | | | | |

ASSETS | | | | | | | | | | | | | |

Investments in securities, at value | | | $ | 6,175,598 | | | | $ | 153,059,756 | | | | $ | 464,063,326 | | | | $ | 912,475,139 | | |

Foreign currency | | | | — | | | | | — | | | | | 127,092 | | | | | 2,928,496 | | |

Receivables for: | | | | | | | | | | | | | | | | | | | | | |

Capital stock sold | | | | 3,716 | | | | | 162,248 | | | | | 7,519,185 | | | | | 5,906,250 | | |

Investments sold | | | | 5,123 | | | | | 263,057 | | | | | — | | | | | 2,481,648 | | |

Dividends and interest | | | | 3,495 | | | | | 105,676 | | | | | 910,378 | | | | | 1,708,441 | | |

Amount due from Investment Manager (Note 3) | | | | 6,009 | | | | | — | | | | | — | | | | | — | | |

Total assets | | | | 6,193,941 | | | | | 153,590,737 | | | | | 472,619,981 | | | | | 925,499,974 | | |

| | | | | | | | | | | | | | | | | | | | | |

LIABILITIES | | | | | | | | | | | | | | | | | | | | | |

Payables for: | | | | | | | | | | | | | | | | | | | | | |

Management fees | | | | — | | | | | 94,995 | | | | | 289,550 | | | | | 745,401 | | |

Accrued distribution fees | | | | 1,292 | | | | | 31,514 | | | | | 95,420 | | | | | 117,400 | | |

Accrued directors’ fees | | | | 10 | | | | | 224 | | | | | 680 | | | | | 1,318 | | |

Capital stock redeemed | | | | 2,776 | | | | | 6,529,731 | | | | | 529,465 | | | | | 217,263 | | |

Investments purchased | | | | 9,835 | | | | | 270,769 | | | | | 617,064 | | | | | 1,380,626 | | |

Foreign capital gains taxes | | | | — | | | | | — | | | | | — | | | | | 1,124,674 | | |

Other accrued expenses and payables | | | | 7,961 | | | | | 19,757 | | | | | 57,337 | | | | | 155,482 | | |

Total liabilities | | | | 21,874 | | | | | 6,946,990 | | | | | 1,589,516 | | | | | 3,742,164 | | |

Net assets | | | $ | 6,172,067 | | | | $ | 146,643,747 | | | | $ | 471,030,465 | | | | $ | 921,757,810 | | |

| | | | | | | | | | | | | | | | | | | | | |

NET ASSETS | | | | | | | | | | | | | | | | | | | | | |

Paid in capital | | | $ | 6,353,389 | | | | $ | 115,126,040 | | | | $ | 503,045,908 | | | | $ | 802,632,040 | | |

Undistributed net investment income | | | | 11,531 | | | | | — | | | | | 1,528,413 | | | | | 1,506,840 | | |

Accumulated undistributed net realized gain (loss) | | | | (1,175,416 | ) | | | | 2,872,193 | | | | | (101,083,771 | ) | | | | (60,143,330 | ) | |

Net unrealized appreciation (depreciation) on: | | | | | | | | | | | | | | | | | | | | | |

Investments | | | | 982,563 | | | | | 28,645,514 | | | | | 67,501,967 | | | | | 177,762,298 | | |

Foreign currency | | | | — | | | | | — | | | | | 37,948 | | | | | (38 | ) | |

Net assets | | | $ | 6,172,067 | | | | $ | 146,643,747 | | | | $ | 471,030,465 | | | | $ | 921,757,810 | | |

| | | | | | | | | | | | | | | | | | | | | |

Service Shares | | | | | | | | | | | | | | | | | | | | | |

Net assets | | | $ | 6,172,067 | | | | $ | 146,643,747 | | | | $ | 471,030,465 | | | | $ | 581,859,134 | | |

Shares of capital stock outstanding* | | | | 671,997 | | | | | 13,285,662 | | | | | 45,824,607 | | | | | 24,938,452 | | |

Net asset value, offering and redemption price per share | | | $ | 9.18 | | | | $ | 11.04 | | | | $ | 10.28 | | | | $ | 23.33 | | |

| | | | | | | | | | | | | | | | | | | | | |

Investor Shares | | | | | | | | | | | | | | | | | | | | | |

Net assets | | | | — | | | | | — | | | | | — | | | | $ | 339,898,676 | | |

Shares of capital stock outstanding* | | | | — | | | | | — | | | | | — | | | | | 14,669,543 | | |

Net asset value, offering and redemption price per share | | | | — | | | | | — | | | | | — | | | | $ | 23.17 | | |

| | | | | | | | | | | | | | | | | | | | | |

Cost of investments in securities | | | $ | 5,193,035 | | | | $ | 124,414,242 | | | | $ | 396,561,359 | | | | $ | 733,588,167 | | |

Cost of foreign currency | | | | — | | | | | — | | | | $ | 126,165 | | | | $ | 2,918,785 | | |

* $0.001 par value 1,400,000,000 shares authorized for the Portfolios in total.

The accompanying notes are an integral part of these financial statements.

Annual Report 23

|

|

Lazard Retirement Series, Inc. Statements of Operations |

|

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

For the Year Ended December 31, 2010 | | Lazard

Retirement

U.S. Strategic

Equity Portfolio | | Lazard

Retirement

U.S. Small-Mid Cap

Equity Portfolio | | Lazard

Retirement

International

Equity Portfolio | | Lazard

Retirement

Emerging Markets

Equity Portfolio | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Investment Income | | | | | | | | | | | | | |

Income | | | | | | | | | | | | | | | | | | | | | |

Dividends | | | $ | 104,351 | | | | $ | 2,076,616 | | | | $ | 9,925,278 | | | | $ | 20,804,558 | | |

Interest | | | | 16 | | | | | 807 | | | | | 1,209 | | | | | 3,571 | | |

Total investment income* | | | | 104,367 | | | | | 2,077,423 | | | | | 9,926,487 | | | | | 20,808,129 | | |

| | | | | | | | | | | | | | | | | | | | | |

Expenses | | | | | | | | | | | | | | | | | | | | | |

Management fees (Note 3) | | | | 40,993 | | | | | 1,065,091 | | | | | 2,917,845 | | | | | 6,717,508 | | |

Distribution fees (Service Shares) | | | | 13,783 | | | | | 355,030 | | | | | 972,615 | | | | | 1,090,520 | | |

Custodian fees | | | | 51,138 | | | | | 57,263 | | | | | 219,346 | | | | | 935,902 | | |

Administration fees | | | | 43,603 | | | | | 70,903 | | | | | 120,310 | | | | | 176,851 | | |

Professional services | | | | 32,372 | | | | | 55,484 | | | | | 89,486 | | | | | 126,819 | | |

Shareholders’ reports | | | | 13,704 | | | | | 40,105 | | | | | 57,069 | | | | | 91,344 | | |

Shareholders’ services | | | | 13,820 | | | | | 15,717 | | | | | 18,618 | | | | | 33,598 | | |

Directors’ fees and expenses | | | | 187 | | | | | 4,803 | | | | | 13,072 | | | | | 22,445 | | |

Registration fees | | | | — | | | | | — | | | | | 10,989 | | | | | 27,141 | | |

Other | | | | 2,179 | | | | | 6,014 | | | | | 12,420 | | | | | 19,221 | | |

Total gross expenses | | | | 211,779 | | | | | 1,670,410 | | | | | 4,431,770 | | | | | 9,241,349 | | |

Management fees waived and expenses reimbursed | | | | (125,897 | ) | | | | — | | | | | — | | | | | — | | |

Administration fees waived | | | | (18,750 | ) | | | | — | | | | | — | | | | | — | | |

Expense reductions (Note 2(h)) | | | | — | | | | | (39 | ) | | | | — | | | | | — | | |

Total net expenses | | | | 67,132 | | | | | 1,670,371 | | | | | 4,431,770 | | | | | 9,241,349 | | |

Net investment income | | | | 37,235 | | | | | 407,052 | | | | | 5,494,717 | | | | | 11,566,780 | | |

| | | | | | | | | | | | | | | | | | | | | |

Net Realized and Unrealized Gain (Loss) on Investments | | | | | | | | | | | | | | | | | | | | | |

and Foreign Currency | | | | | | | | | | | | | | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | | | | | | | | | | | | | | |

Investments** | | | | 414,434 | | | | | 23,617,156 | | | | | (6,210,216 | ) | | | | 42,367,287 | | |

Foreign currency | | | | — | | | | | — | | | | | (268,889 | ) | | | | (644,440 | ) | |

Net change in unrealized appreciation (depreciation) on: | | | | | | | | | | | | | | | | | | | | | |

Investments† | | | | 246,291 | | | | | 3,521,513 | | | | | 34,880,828 | | | | | 89,371,218 | | |

Foreign currency | | | | — | | | | | — | | | | | 6,596 | | | | | (7,952 | ) | |

Net realized and unrealized gain on investments and

foreign currency | | | | 660,725 | | | | | 27,138,669 | | | | | 28,408,319 | | | | | 131,086,113 | | |

Net increase in net assets resulting from operations | | | $ | 697,960 | | | | $ | 27,545,721 | | | | $ | 33,903,036 | | | | $ | 142,652,893 | | |

| | | | | | | | | | | | | | | | | | | | | |

* Net of foreign withholding taxes of | | | $ | — | | | | $ | — | | | | $ | 818,765 | | | | $ | 1,749,582 | | |

** Net of foreign capital gains taxes of | | | $ | — | | | | $ | — | | | | $ | — | | | | $ | 140,536 | | |

† Includes net change in unrealized foreign capital gains taxes of | | | $ | — | | | | $ | — | | | | $ | — | | | | $ | 563,328 | | |

The accompanying notes are an integral part of these financial statements.

24 Annual Report

|

|

Lazard Retirement Series, Inc. Statements of Changes in Net Assets |

|

| | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | Lazard Retirement

U.S. Strategic Equity Portfolio | | Lazard Retirement

U.S. Small-Mid Cap Equity Portfolio | | |

| | Year Ended

December 31,

2010 | | Year Ended

December 31,

2009 | | Year Ended

December 31,

2010 | | Year Ended

December 31,

2009 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Increase in Net Assets | | | | | | | | | | | | | |

Operations | | | | | | | | | | | | | |

Net investment income (loss) | | | $ | 37,235 | | | | $ | 43,169 | | | | $ | 407,052 | | | | $ | (163,976 | ) | |

Net realized gain (loss) on investments | | | | 414,434 | | | | | (400,565 | ) | | | | 23,617,156 | | | | | 5,740,143 | | |

Net change in unrealized appreciation on investments | | | | 246,291 | | | | | 1,460,002 | | | | | 3,521,513 | | | | | 34,363,003 | | |

Net increase in net assets resulting from operations | | | | 697,960 | | | | | 1,102,606 | | | | | 27,545,721 | | | | | 39,939,170 | | |

| | | | | | | | | | | | | | | | | | | | | |

Distributions to shareholders | | | | | | | | | | | | | | | | | | | | | |

Service Shares | | | | | | | | | | | | | | | | | | | | | |

From net investment income | | | | (39,648 | ) | | | | (43,552 | ) | | | | (408,572 | ) | | | | — | | |

From net realized gains | | | | — | | | | | — | | | | | (11,603,165 | ) | | | | — | | |