SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Under Rule 14a-12 |

PLUMTREE SOFTWARE, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

PLUMTREE SOFTWARE, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

MAY 20, 2004

TO THE STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Plumtree Software, Inc. (the “Company”), a Delaware corporation with offices located at 500 Sansome Street, San Francisco, California 94111, will be held on Thursday, May 20, 2004, at 8:00 a.m., local time, at the Omni San Francisco Hotel’s Nob Hill Room, 500 California Street at Montgomery, San Francisco, California 94104 for the following purposes:

| | 1. | To elect Class I directors to serve for the ensuing three-year term and until their successors are duly elected and qualified; |

| | 2. | To consider and ratify the appointment of the Company’s independent auditors; and |

| | 3. | To transact such other business as may properly come before the meeting or any adjournment thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Each of these items will be discussed at the Annual Meeting with reasonable time allotted for stockholder questions.

Only stockholders of record at the close of business on March 22, 2004 (the “Record Date”) are entitled to notice of and to vote at the meeting. A copy of the Company’s 2003 Annual Report to Stockholders, which includes certified financial statements, was mailed with this Notice and Proxy Statement on or about April 22, 2004 to all stockholders of record on the record date.

All stockholders are cordially invited to attend the meeting in person. However, to assure your representation at the meeting, you are urged to mark, sign, date and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope enclosed for that purpose, or to vote by telephone pursuant to instructions provided on the proxy card. Any stockholder attending the meeting may vote in person even if he or she has previously returned a proxy.

Sincerely,

GREGORY P.G. WHARTON

Secretary

San Francisco, California

April 22, 2004

PLUMTREE SOFTWARE, INC.

500 Sansome Street

San Francisco, California 94111

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

General

This proxy statement (“Proxy Statement”) is furnished by Plumtree Software, Inc. (“Plumtree” or the “Company”), for use at the Annual Meeting of Stockholders to be held on Thursday, May 20, 2004, at 8:00 a.m. local time or at any postponement or continuation of the meeting, if applicable, or at any adjournment thereof (the “Annual Meeting”), for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held at the Omni San Francisco Hotel’s Nob Hill Room, 500 California Street at Montgomery, San Francisco, California 94104. These proxy solicitation materials were mailed on or about April 22, 2004 to all stockholders entitled to vote at the Annual Meeting.

Record Date and Share Ownership

Only stockholders of record at the close of business on March 22, 2004 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting. As of the Record Date, 31,650,418 shares of the Company’s Common Stock were issued and outstanding.

Revocability of Proxies

The enclosed proxy is solicited by the Board of Directors of the Company (the “Board”). Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to the Company a written notice of revocation or a duly executed proxy bearing a later date, or by attending the Annual Meeting and voting in person. Attendance at the meeting will not, by itself, revoke a proxy.

Voting and Solicitation

A quorum will be present if a majority of the votes entitled to be cast are present in person or by valid proxy. Except with respect to the election of directors, all matters to be considered and acted upon by the stockholders at the Annual Meeting must be approved by a majority of the shares represented at the Annual Meeting and entitled to vote. Directors shall be elected by a plurality of the votes of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors. Consequently, abstentions will have the same legal effect as votes against a proposal. In contrast, broker “non-votes” resulting from a broker’s inability to vote a client’s shares on non-discretionary matters will have no effect on the approval of such matters.

If the enclosed proxy is properly executed and returned to the Company in time to be voted at the Annual Meeting, it will be voted as specified on the proxy, unless it is properly revoked prior thereto. Telephone voting will also be allowed pursuant to instructions provided on the proxy card submitted with this proxy.

The cost of this solicitation will be borne by the Company. The Company may reimburse brokerage firms and other persons representing beneficial owners of shares for expenses incurred in forwarding solicitation material to such beneficial owners. Proxies may also be solicited by certain of the Company’s directors, officers and regular employees, personally or by telephone or telecopier, without additional compensation.

1

Deadline for Receipt of Stockholder Proposals

Proposals of stockholders of the Company that are intended to be presented by such stockholders at the annual meeting of the Company for the fiscal year ending December 31, 2004 (“2005 Annual Meeting”) must be received by the Company no later than December 23, 2004, in order to be included in the proxy statement and form of proxy relating to the 2005 Annual Meeting. Stockholders who wish to present a proposal for consideration for our 2005 Annual Meeting but do not want such proposal included in our proxy statement must submit such proposals in accordance with our bylaws between February 19, 2004 and March 21, 2005. Proposals we receive after that date will be considered untimely and may not be presented at our 2005 Annual Meeting.

ELECTION OF CLASS I DIRECTORS (Proposal No. 1)

Nominees.Three Class I directors are to be elected to the Board at the Annual Meeting. The nominees named below are currently directors of the Company. In the event that a nominee of the Company becomes unavailable for any reason or if a vacancy should occur before election (which events are not anticipated), the shares represented by the enclosed proxy may be voted for such other person as may be determined by the holders of such proxy. In such event, the specific nominee(s) to be voted for will be determined by the proxy holders in their discretion. The term of office of each person elected as a Class I director will continue for three (3) years and until his successor has been duly elected and qualified.

The names of each nominee and certain biographical information relating to the nominee are set forth below.

| | | | | | |

Name of Nominees

| | Age

| | Current Position(s)

| | Director Since

|

John Dillon | | 54 | | Director | | September 1997 |

Rupen Dolasia | | 41 | | Director | | June 1998 |

David Pratt | | 64 | | Director | | December 2003 |

John Dillonhas been a director of Plumtree since September 1997. Since April 2002, Mr. Dillon has served as Chief Executive Officer and President of Navis, Inc. Mr. Dillon served as President and Chief Executive Officer of DiCarta from November 2001 to March 2002. Mr. Dillon served as the President and Chief Executive Officer of Salesforce.com from September 1999 to November 2001. Before joining Salesforce.com, Mr. Dillon was interim President and Chief Executive Officer for Sanctum. Prior to that, Mr. Dillon spent six years with Hyperion Solutions (formerly Arbor Software) from December 1993 to May 1999 as Vice President of Sales and then as President and Chief Executive Officer. Mr. Dillon’s professional history also includes management positions in sales and engineering for Oracle Corporation and EDS. Mr. Dillon currently serves on the boards of directors of several private companies. Mr. Dillon served on active duty in the United States Navy as an officer in the nuclear submarine service.

Rupen Dolasiahas been a director of Plumtree since June 1998 and Chairman of the Board since May 2003. Mr. Dolasia is a founding member and Managing Director of Granite Ventures LLC (formerly H&Q Venture Associates, LLC), a venture capital firm formed in July 1998. Prior to founding H&Q Venture Associates, Mr. Dolasia was a Vice President in Hambrecht & Quist’s Venture Capital Department, which he joined in 1994. Prior to joining H&Q, Mr. Dolasia was the Manager of Information Systems consulting at PEI Consultants. Prior to joining PEI Consultants, Mr. Dolasia co-founded Grata Systems, Inc., a vendor of PC-based control and monitoring software. Mr. Dolasia focuses on information technology investments. Mr. Dolasia currently serves on the boards of directors of several private companies.

David Pratt has been a director of Plumtree since December 2003. Mr. Pratt served as Interim President and Chief Executive Officer of AvantGo, Inc. from October 2002 to February 2003. From April 2002 until October 2002, he volunteered as Interim President and Chief Executive Officer of the YMCA of the Mid-Peninsula and

2

remains a member of its board of directors. From January 2000 to March 2001, Mr. Pratt served as President and Chief Executive Officer of gForce Systems, an enterprise software company focusing on e-learning. Prior to joining gForce in January 2000, Mr. Pratt was President and Chief Executive Officer of Flashpoint Technologies from October 1998 to January 2000. From May 1988 to January 1998, Mr. Pratt was also Executive Vice President and Chief Operating Officer of Adobe Systems, Inc., where he helped to lead the company from $50 million in revenue to almost $1 billon in revenue. Mr. Pratt has also served on the board of directors of Wind River Systems and several private companies.

The vote required to elect these nominees to the Board is a plurality of the votes of the shares present in person or represented by proxy and entitled to vote on the election of directors.

THE BOARD RECOMMENDS UNANIMOUSLY THAT THE STOCKHOLDERS VOTE “FOR” THE NOMINEES LISTED ABOVE.

BOARD STRUCTURE AND COMPENSATION

Classified Board of Directors

Our certificate of incorporation provides for a classified Board consisting of three classes of directors, each serving staggered three-year terms. As a result, a portion of our Board will be elected each year for three-year terms. Mr. Pratt is being proposed as a Class I director whose term shall be voted on at the 2004 annual meeting of stockholders. If elected, his term will expire at the 2007 annual meeting of stockholders. Mr. Pratt was elected to the Board by the standing directors on December 3, 2003. Mr. Pratt was introduced to the company by several existing board members with whom he had previously served as director for a public company.

Messrs. Dillon and Dolasia are also designated Class I directors whose terms expire at the 2004 annual meeting of stockholders. If re-elected, their term will expire at the 2007 annual meeting of stockholders. Mr. Kunze and Mr. Whitney are designated Class II directors whose terms expire at the 2005 annual meeting of stockholders. Mr. Richardson is designated as a Class III director whose term expires at the 2006 annual meeting of stockholders.

Executive officers are appointed by the Board and serve at the pleasure of the Board until their successors have been duly elected and qualified. There are no family relationships among any of our directors, officers or key employees.

Board Meetings and Committees

The Board held a total of eight regularly scheduled meetings during the fiscal year ended December 31, 2003. During the fiscal year ended December 31, 2003, no incumbent director attended fewer than 75% of the aggregate of: (i) the total number of meetings of the Board while he served on the Board; and (ii) the total number of meetings held by all committees on which he served.

Although we do not have a formal policy regarding attendance by members of the Board at our annual meeting of stockholders, we strongly encourage directors to attend. In 2003, all of our directors attended our annual meeting. The Corporate Governance and Nominating Committee will give consideration during the upcoming year of adopting a formal policy, so as to encourage further attendance by directors.

During the fiscal year ended December 31, 2003, the Audit Committee of the Board consisted of directors Bernard Whitney, John Dillon and James Richardson. Each of the Audit Committee members satisfies the definition of independent director as established in the Nasdaq corporate governance listing standards. During the year, in accordance with section 407 of Sarbanes-Oxley Act of 2002, Plumtree identified Bernard Whitney as the

3

Audit Committee’s “financial expert.” Pursuant to the Audit Committee charter, the Audit Committee reviews, acts and reports to the full Board on various auditing and accounting matters, including the appointment of the Company’s independent accountants, the scope of the Company’s annual audits, fees to be paid to the Company’s independent accountants, the performance of the Company’s independent accountants and the Company’s accounting and financial management practices. The Audit Committee acts pursuant to a written charter adopted by the Board most recently amended on March 4, 2004, which is attached to this proxy statement as Appendix A and posted on our website at www.plumtree.com. A report of the Audit Committee is set forth below. The Audit Committee met six times during the last fiscal year.

During the fiscal year ended December 31, 2003, the Compensation Committee consisted of directors John Dillon, James Richardson and Rupen Dolasia. The Compensation Committee reviews employee and Board compensation and makes recommendations thereon to the Board, and advises the full Board on administration of the Company’s stock incentive plans. The Compensation Committee also advises the full Board, upon review of relevant information, on the employees to whom options shall be granted. The Compensation Committee acts pursuant to a written charter most recently amended by the Board on April 13, 2004, which is posted on our website at www.plumtree.com. The Compensation Committee met four times during the last fiscal year. A report of the Compensation Committee is set forth below.

During the fiscal year ended December 31, 2003, the Nominating Committee consisted of Rupen Dolasia, Bernard Whitney, and John Dillon. The Nominating Committee, which was reconstituted as the Corporate Governance and Nominating Committee on March 4, 2004, reviews and makes recommendations to the Board with respect to the responsibilities and functions of the Board and Board committees; makes recommendations to the Board concerning the composition and governance of the Board, including recommending candidates to fill vacancies on, or to be elected or re-elected to, the Board; oversees evaluations of the directors, Board committees and the Board; and makes recommendations to the Board concerning candidates for election as Chief Executive Officer and other corporate officers. The Corporate Governance and Nominating Committee acts pursuant to a written charter adopted by the Board on March 4, 2004 and most recently amended on April 13, 2004, which is available on our website at www.plumtree.com. The Nominating Committee (now the Corporate Governance and Nominating Committee) met two times during the last fiscal year.

DISCUSSION OF BOARD CONSIDERING STOCKHOLDER NOMINEES

In evaluating director nominees, the Corporate Governance and Nominating Committee considers the following factors:

| | • | the business-related knowledge, skills and experience of nominees, including their understanding of the enterprise software industry and the Company’s business in particular; |

| | • | the resulting mix of talents and experience of our directors as a group; |

| | • | experience with corporate governance matters and the compliance obligations of public companies, including experience with disclosure and accounting rules and practices; |

| | • | the desire to maintain diversity, in the broadest sense, in the directors then comprising the Board; |

| | • | the integrity of the nominee; |

| | • | the desire to balance the considerable benefit of continuity with the periodic introduction of the fresh perspective provided by new members; and |

| | • | the other business and professional commitments of the nominee, including the number of other boards on which the nominee serves, including public and private company boards as well as not-for-profit boards. |

4

The Corporate Governance and Nominating Committee may also consider such other factors, in addition to the ones listed above, as it may deem are in the best interests of the Company and its stockholders. The Corporate Governance and Nominating Committee’s goal is to assemble a board that encompasses a variety of perspectives and skills derived from high-quality business and professional experience.

We have no stated minimum criteria for director nominees. The Corporate Governance and Nominating Committee does, however, believe it appropriate for at least one member of the Board to meet the criteria for an “audit committee financial expert” as defined by SEC rules, and that a majority of the members of the Board meet the definition of “independent director” under rules of the Nasdaq Stock Market. The Corporate Governance and Nominating Committee also believes it may be appropriate for certain members of our management, in particular the Chief Executive Officer, to participate as a member of the Board.

The Corporate Governance and Nominating Committee identifies nominees for the class of directors being elected at each annual meeting of stockholders by first evaluating the current members of such class of directors willing to continue in service. Current members of the Board with skills and experience that are relevant to our business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. If any member of such class of directors does not wish to continue in service or if the Corporate Governance and Nominating Committee or the Board decides not to re-nominate a member of such class of directors for re-election, the Corporate Governance and Nominating Committee identifies the desired skills and experience of a new nominee in light of the criteria above. Current members of the Corporate Governance and Nominating Committee and Board are polled for suggestions as to individuals meeting the criteria of the Corporate Governance and Nominating Committee. Research may also be performed to identify qualified individuals. The Board may, in its discretion, engage third party search firms to identify and assist in recruiting potential nominees to the Board. Candidates may also come to the attention of the Corporate Governance and Nominating Committee through management, stockholders or other persons.

The Corporate Governance and Nominating Committee will consider persons properly recommended by the Company’s stockholders in the same manner as set forth above as persons recommended by the Board, individual directors or management. Stockholder nominations must be timely submitted, in the manner described above, in writing to the Secretary of the Company and include the recommended candidate’s name, biographical data and qualifications, in each case, in accordance with the Company’s bylaws, certificate of incorporation and applicable federal proxy rules. The Corporate Governance and Nominating Committee Charter permits any stockholder to make a nomination.

The Corporate Governance and Nominating Committee may take such measures that it considers appropriate in connection with its evaluation of a candidate, including candidate interviews, inquiry of the person recommending the candidate, engagement of an outside search firm to gather additional information, or reliance on the knowledge of the members of the Corporate Governance and Nominating Committee, the Board or management.

Contacting the Board of Directors

Any stockholder who desires to contact our chairman of the Board or any of the other members of our Board may do so electronically by sending an email to the following address: investor.relations@plumtree.com, Attn: Board of Directors. Alternatively, a stockholder can contact our chairman of the Board or any of the other members of our Board by writing to: Board of Directors, c/o Chief Financial Officer, Plumtree Software, Inc., 500 Sansome Street, San Francisco, California 94111. Communications received electronically or in writing will be collected, organized and processed by our Chief Financial Officer, who will ensure that the communications are distributed to the chairman of the Board or the other members of the Board as appropriate depending on the facts and circumstances outlined in the communication received. Where the nature of a communication warrants, the Chief Financial Officer may decide to obtain the more immediate attention of the appropriate committee of the Board or an independent director, or the Company’s management or independent advisors, as the Chief Financial Officer considers appropriate.

5

Director Independence

The Board follows Nasdaq Marketplace Rule 4200 for director independence standards. In accordance with these standards, the Board has determined that, except for Mr. Kunze, each of our directors qualifies as an independent director under the Nasdaq rules. Mr. Kunze is not considered independent because he serves as Chief Executive Officer of the Company.

6

DIRECTOR COMPENSATION

We did not pay directors who are also employees of the Company any compensation for their service as directors during the fiscal year ended 2003. During fiscal year ended 2003, compensation for each non-employee director included the following:

Description

| | | |

Annual stipends for members | | $ | 15,000 |

Annual additional stipends for Audit Committee members | | $ | 10,000 |

Annual additional stipend for Audit Committee chairman | | $ | 20,000 |

Expenses of attending Board and Committee meetings and expenses incurred for director education | | | — |

Annual stock option grants to purchase shares of Common Stock, pursuant to the Company’s Director Option Plan, at the fair market value on the date of the annual stockholder meeting | | | 20,000 |

During fiscal year 2003, compensation for each independent director included cash compensation and stock options. Directors received automatic stock option grants under the 2002 Director Option Plan. Directors also received separate discretionary grants under the 2002 Stock Plan. Pursuant to the 2003 Independent Director Compensation Plan adopted by the Board in March 2003, cash compensation for directors during fiscal year 2003 was as follows: $15,000 per annum for each independent director; an additional $10,000 per annum for each independent director serving on the Audit Committee (except for the chairman of the Audit Committee who will receive an additional $20,000 per annum), paid quarterly in arrears; and reimbursement for travel and other expenses incurred in attending meetings or participating in professional development and education activities. The 2002 Director Option Plan provides that each independent director who has been a director for at least six months shall receive an option to purchase 20,000 shares following each annual meeting of our stockholders. This option will vest as to 1/12 of the shares subject to the option each month following the date of grant, provided that the independent director remains a director on such dates.

Under the 2004 Outside Director Stock in Lieu of Fees Plan, adopted by the Board on March 4, 2004, each independent director may elect to receive shares of the Company’s stock in lieu of cash payment for compensation due to such director under the 2003 Independent Director Compensation Plan. The number of shares received by any outside director electing to receive stock in lieu of cash shall equal the amount of foregone cash compensation divided by the fair market value of the share on the last market trading day of the calendar quarter in respect of which the cash compensation otherwise would have been paid to such outside director. The fair market value is determined to be the closing bid price of the Company’s common stock on a national exchange. Directors must make their election in writing at least three months prior to the beginning of the calendar quarter to which the election relates. Directors may make a revocable standing election for up to two years at a time.

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

(Proposal No. 2)

Subject to ratification by the stockholders at the Annual Meeting, the Board has reappointed KPMG LLP as independent auditors to audit the consolidated financial statements of the Company and its subsidiaries for the year ending December 31, 2004. KPMG LLP has issued its report, included in the Company’s Form 10-K, on the consolidated financial statements of the Company for the year ended December 31, 2003.

7

FEES BILLED BY KPMG LLP DURING FISCAL 2003 AND 2002. The following tables set forth the approximate aggregate fees billed to Plumtree during the fiscal years ended December 31, 2003 and 2002 by KPMG LLP:

2003 Fees:

| | | |

Audit Fees | | $ | 409,306 |

Audit-Related Fees | | | 0 |

Tax-Related Services | | | 0 |

All Other Fees | | | 0 |

Total Fees | | $ | 409,306 |

2002 Fees:

| | | | |

Audit Fees | | $ | 778,000 | |

Audit-Related Fees | | | 0 | |

Tax-Related Services | | | 0 | |

All Other Fees | | | 0 | |

Total Fees | | $ | 778,000 | (1) |

| (1) | Includes $572,000 of fees related to the Company’s Initial Public Offering on June 4, 2002 |

The Audit Committee has the sole authority to approve all audit engagement fees and terms and all non-audit engagement fees as may be permissible. The Audit Committee approved all of the KPMG LLP fees, as set forth above, in the fiscal years ending in 2002 and 2003.

Representatives of KPMG LLP are expected to be present at the Annual Meeting, to have the opportunity to make a statement, if they desire to do so, and to be available to respond to appropriate questions.

The affirmative vote of a majority of the votes cast on this proposal shall constitute ratification of the appointment of KPMG LLP.

THE BOARD RECOMMENDS UNANIMOUSLY THAT THE STOCKHOLDERS VOTE “FOR” THE PROPOSAL TO RATIFY THE APPOINTMENT OF KPMG LLP AS INDEPENDENT AUDITORS AS NOTED ABOVE.

Directors and Officers of the Company

The following table sets forth information regarding the executive officers, directors, and key employees of Plumtree as of December 31, 2003(1), unless otherwise noted:

| | | | |

Name

| | Position

| | Age

|

John Kunze | | President, Chief Executive Officer and Director | | 40 |

Eric Borrmann | | Vice President and Chief Financial Officer | | 42 |

Eric Zocher | | Vice President of Engineering | | 43 |

Glenn Kelman | | Co-Founder, Vice President of Product Management and Marketing | | 32 |

John Hogan | | Vice President of Enterprise Web Solutions | | 38 |

Jim Flatley | | Vice President of Worldwide Field Operations (resigned April 2003) | | 43 |

John Dillon | | Director | | 54 |

Rupen Dolasia | | Director | | 41 |

David Pratt | | Director | | 64 |

James Richardson | | Director | | 56 |

Bernard Whitney | | Director | | 47 |

| (1) | In March 2004, Plumtree hired Paul Ciandrini as its Chief Operating Officer and Ira Pollack as Vice President of Worldwide Sales. Biographical descriptions are provided below for Messrs. Ciandrini and Pollack. |

8

John Kunzehas been President, Chief Executive Officer and member of the Board since August 1998. Before joining Plumtree, Mr. Kunze spent his entire professional career, from 1985 to 1998, at Adobe Systems. Mr. Kunze led development for the first releases of Adobe Illustrator and PhotoShop. Mr. Kunze became Director and then Vice President of Product and Marketing at Adobe Systems, with responsibility for all product marketing and strategic acquisitions. Mr. Kunze was later promoted to Vice President of Adobe Systems Internet Products Division, which defined Adobe Systems’ Internet strategy.

Eric Borrmannhas been Vice President and Chief Financial Officer since July 2000. Before joining Plumtree, Mr. Borrmann served as Corporate Treasurer at Network Associates from July 1999 until July 2000, where he was responsible for all financial planning and investor relations at the global security and network management company. From September 1995 to July 1999, he held several senior management positions at Network Associates (formerly Network General) where he served most recently as its Vice President of Finance and Operations for Europe, the Middle East and Africa. Mr. Borrmann’s experience also includes management and engineering positions at Conner Peripherals from 1990 to 1995 and Electronic Data Systems from 1985 to 1988.

Eric Zocher has been Vice President of Engineering since September 2003. Before joining Plumtree, Mr. Zocher was Executive Vice President of Product Development and Chief Technology Officer at WildTangent from February 2002 to September 2003. Mr. Zocher also has led engineering efforts as Executive Vice President and Chief Scientist as InfoSpace from October 2000 to March 2001. Prior to the acquisition of Go2Net by InfoSpace, Mr. Zocher was the Chief Technology Officer from May 2000 to October 2000. Mr. Zocher was also the Executive Vice President and Managing Director of Broadband at Go2Net from August 1999 to May 2000. From March 1999 to August 1999, Mr. Zocher was Executive Vice President and General Manager, Internet Division of FlashPoint Technology.

Glenn Kelman, Co-Founder and Vice President of Product Management and Marketing since February 1997, is responsible for corporate and product marketing as well as business development and collaborates with our engineering department to set the features and design of our products. Mr. Kelman managed the design and development of the first release of the Plumtree Corporate Portal. Before founding Plumtree, Mr. Kelman was a senior product manager at Informix Software, a company he joined via the acquisition of Stanford Technology Group, from January 1995 to February 1997. As a product manager for software following Informix Software’s acquisition of Stanford Technology Group, Mr. Kelman was involved in designing and launching a major release of Informix Software’s On-Line Analytical Processing product line.

John Hoganhas been Vice President of Enterprise Web Solutions since September 2003. Previously, Mr. Hogan served as Vice President of Engineering from March 1998 to September 2003. Before joining Plumtree, Mr. Hogan was the Director of Engineering for Informix Software’s On-Line Analytical Processing products from 1997 to 1998. Mr. Hogan also worked at Informix Software as a business development manager from 1996 to 1997. Before joining Informix Software, Mr. Hogan was a senior developer for Stanford Technology Group from 1994 to 1995. Mr. Hogan also worked as a manager in various development and consulting organizations at Oracle Corporation from 1989 to 1994.

James Flatley was Vice President of Worldwide Field Operations from July 1999 to April 2003. Before joining Plumtree, Mr. Flatley was Vice President from March 1999 to June 1999 at Siebel Systems. Prior to working at Siebel, Mr. Flatley managed a division of 700 sales operations employees across the U.S., Latin America and Canada for Network General and its successor, Network Associates from 1990 to 1999. There Mr. Flatley held sales and management positions responsible for both channel and corporate sales. Mr. Flatley worked at AT&T from 1988 to 1990 as head of sales and marketing for a custom software solution to the airline industry, and IBM from 1982 to 1988, in sales and marketing.

9

Paul Ciandrini has been Chief Operating Officer, responsible for worldwide sales, consulting, marketing, product management, channel and business development since March 2004. From December 2002 to March 2004, Mr. Ciandrini was Senior Vice President of North American Application Sales at Oracle Corporation. Prior to his work at Oracle, from July 1993 to November 2002, Mr. Ciandrini held several positions at BearingPoint, Inc. (formerly KPMG Consulting) in the firm’s high technology practice and most recently served as its Group Executive Vice President for Product Services Consulting, with responsibilities for over $700 million in annual revenue and served on BearingPoint’s executive committee. From January 1988 until July 1993, Mr. Ciandrini held several positions at Walker Interactive Systems, where he was most recently its Vice President of Marketing.

Ira Pollack has been Vice President of Worldwide Sales since March 2004. Before joining Plumtree, Mr. Pollack held several positions with BearingPoint, Inc. (formerly KPMG Consulting, Inc.) from July 1995 to March 2004, where he was most recently the Vice President of North America Sales for the firm’s Consumer Industrial and Technology (CIT) industry vertical. In this capacity, Mr. Pollack was responsible for all aspects of demand creation, pipeline development, forecasting and bookings for BearingPoint Consulting Solutions. Previously, from 1990 to 1995, Mr. Pollack held several positions with Walker Interactive Systems where he most recently served as Regional Sales Manager.

James Richardson has been a director of Plumtree since January 2003. Since April 2001, Mr. Richardson has been a consultant to several high technology companies. From July 1998 to June 2001, Mr. Richardson was the Senior Vice President and Chief Financial Officer of WebTrends Corporation, a web server management and web analytics company which merged with Net IQ Corporation in March 2001. Prior to joining WebTrends Corporation in July 1998, Mr. Richardson was the Chief Financial Officer at Network General Corporation from April 1994 until January 1998, which merged with McAfee Associates in December 1997 resulting in the creation of Network Associates, Inc. Before joining Network General Corporation, Mr. Richardson was Vice President of Finance and Administration and Chief Financial Officer of Logic Modeling Corporation from August 1992 to March 1994, now a division of Synopsys. From November 1989 to June 1992, he was Vice President and Chief Financial Officer of Advanced Logic Research. Mr. Richardson currently serves on the board of directors of FEI Company and Digimarc Corporation. Mr. Richardson also served as the chairman of the board of AvantGo, Inc, which was acquired by Sybase in February 2003. Mr. Richardson also serves on the board of a private company.

Bernard Whitneyhas been a director of Plumtree since November 2000. Mr. Whitney served as Chief Financial Officer of Handspring, Inc. from June 1999 to July 2002. From August 1997 to June 1999, he served as Executive Vice President and Chief Financial Officer of Sanmina, Inc., an electronics manufacturing company. From June 1995 to August 1997, Mr. Whitney served as Vice President of Finance for Network General Corporation, a network fault tolerance and performance management solutions company. From 1987 to June 1995, Mr. Whitney held a variety of corporate finance positions at Conner Peripherals, a storage device manufacturer.

For the biographies of Messrs. Dillon, Dolasia and Pratt, please see disclosure under Proposal No. 1, Election of Directors.

10

Security Ownership of Certain Beneficial Owners and Management

The following table and footnotes thereto set forth the beneficial ownership of Common Stock of the Company as of the Record Date, by (a) each director and nominee for director of the Company who owned shares as of such date, (b) each of the Named Officers (defined below), (c) all directors and executive officers of the Company as a group and (d) each person known by the Company to be the beneficial owner of more than 5% of the outstanding shares of Common Stock.

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock subject to options held by that person that are currently exercisable or exercisable within sixty days of March 22, 2004 are deemed outstanding. Such shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person.

Unvested options granted from the Company’s inception through July 2000 were immediately exercisable upon grant, provided that upon the optionee’s cessation of service, any unvested shares would be subject to repurchase by the Company at the original exercise price paid per share. In computing the number of shares beneficially owned by a person, shares that are subject to options that are not exercisable and will not be vested for at least sixty days after March 22, 2004 are not included.

The percentages in the table below are based on shares of our common stock outstanding as of the Record Date. Except as indicated in the footnotes to this table and pursuant to applicable community property laws, to our knowledge, each stockholder named in the table has had sole voting and investment power with respect to the shares set forth opposite such stockholders’ name.

| | | | | | |

Name

| | Number

of Shares

Beneficially

Owned

| | | Percent

of Total

| |

John Kunze | | 1,279,940 | (1) | | 4.0 | % |

Eric Borrmann | | 295,583 | (2) | | .9 | |

Eric Zocher | | 5,000 | (3) | | — | |

Glenn Kelman | | 1,197,467 | (4) | | 3.8 | |

John Hogan | | 503,218 | (5) | | 1.6 | |

Jim Flatley | | 0 | (6) | | — | |

John Dillon | | 115,000 | (7) | | .4 | |

Rupen Dolasia | | 2,183,783 | (8) | | 7.1 | |

David Pratt | | 5000 | (9) | | — | |

James Richardson | | 47,521 | (10) | | .2 | |

Bernard Whitney | | 103,751 | (11) | | .3 | |

All executive officers and directors as a group (11 persons) | | 4,504,893 | (12) | | 14.2 | |

| | |

Entities affiliated with Sequoia Capital 3000 Sand Hill Road Building 4, Suite 280 Menlo Park, CA 94002 | | 7,029,650 | (13) | | 22.2 | |

| | |

Entities affiliated with Granite Ventures LLC One Bush Street San Francisco, CA 94104 | | 2,103,783 | (14) | | 6.6 | |

| | |

Ashford Capital Management, Inc. | | 2,179,600 | (15) | | 6.9 | |

| (1) | Includes 1,279,940 shares of common stock issuable pursuant to stock options exercisable within 60 days after the Record Date which includes 75,000 shares subject to a repurchase right in favor of Plumtree, which will lapse as to 5,555 of such shares within 60 days of the Record Date. |

11

| (2) | Includes 294,794 shares of common stock issuable pursuant to stock options exercisable within 60 days after the Record Date, which includes 48,611 shares subject to a repurchase right in favor of Plumtree, which will lapse as to 16,204 of such shares within 60 days of the Record Date. Also, includes 789 stock options that had been previously exercised. |

| (3) | Includes 5,000 shares of common stock Mr. Zocher purchased independently. |

| (4) | Includes 185,939 shares of common stock issuable pursuant to stock options exercisable as of within 60 days after the Record Date, which includes 6,249 shares subject to a repurchase right in favor of Plumtree, which will lapse as to 3125 of such shares within 60 days of the Record Date. Also, includes 1,011,528 shares of common stock. received as a founder of the Company. |

| (5) | Includes 359,064 shares of common stock issuable pursuant to stock options exercisable as of within 60 days after the Record Date, which includes 37,500 shares subject to a repurchase right in favor of Plumtree, which will lapse as to 2,777 of such shares within 60 days of the Record Date. Also, includes 144,154 stock options that had been previously exercised. |

| (6) | Mr. Flatley has reported holding no shares of common stock of Plumtree as of the Record Date. |

| (7) | Includes 10,000 shares of common stock Mr. Dillon purchased independently. Includes 60,000 shares of common stock issuable pursuant to stock options exercisable as of within 60 days after the Record Date. Also, includes 37,500 shares from stock options that had been previously exercised and 7,500 shares purchased privately. |

| (8) | Includes 80,000 shares of common stock issuable pursuant to stock options exercisable within 60 days after the Record Date. Also, includes 2,103,783 shares owned by the entities affiliated with Granite Ventures, LLC. Mr. Dolasia, a member of these entities, disclaims beneficial ownership of the shares held by such entities except to the extent of his pro rata interest in these entities. |

| (9) | Includes 5,000 shares of common stock Mr. Pratt purchased independently. |

| (10) | Includes 37,221 shares of common stock issuable pursuant to stock options exercisable within 60 days after the Record Date. Includes 10,300 shares of common stock Mr. Richardson purchased independently. |

| (11) | Includes 103,751 shares of common stock issuable pursuant to stock options exercisable within 60 days after the Record Date. |

| (12) | Includes 2,400,709 shares of common stock issuable pursuant to stock options exercisable within 60 days after the Record Date. |

| (13) | Includes 6,223,317 shares of common stock held by Sequoia Capital VII, 31,035 shares of common stock held by Sequoia 1995 LLC, 56,271 shares of common stock held by Sequoia 1997 LLC, 276,890 shares of common stock held by Sequoia Technology Partners VII, 92,099 shares of common stock held by Sequoia International Partners, 100,038 shares of common stock held by SQP 1997, 30,000 shares of common stock held by Sequoia Capital Franchise Partners, 220,000 shares of common stock held by Sequoia Capital Franchise Fund. |

| (14) | Includes 1,960,000 shares of common stock held by H&Q Plumtree Investors, L.P. and 143, 783 shares of common stock held by TODD US Ventures, LLC. |

| (15) | Shares reported for Ashford Capital Management are based on a Schedule 13G filed by Ashford Capital Management on February 11, 2004. |

12

AUDIT COMMITTEE REPORT FOR THE YEAR ENDED DECEMBER 31, 2003

The Audit Committee is comprised solely of independent directors, as defined in the Marketplace Rules of the Nasdaq Stock Market, and it operates under a written charter adopted by the Board of Directors. The composition of the Audit Committee, the attributes of its members and the responsibilities of the Committee, as reflected in its charter, are intended to be in accordance with applicable requirements for corporate audit committees. The Committee reviews and assesses the adequacy of its charter on at least an annual basis. Each of the Audit Committee members satisfies the definition of independent director as established in the Nasdaq corporate governance listing standards. During the year, in accordance with section 407 of the Sarbanes-Oxley Act of 2002, Plumtree identified Bernard Whitney as the Audit Committee’s “Financial Expert.”

As described more fully in its charter, the purpose of the Audit Committee is to assist the Board in its general oversight of the Company’s financial reporting, internal controls and audit functions. Management is responsible for the preparation, presentation and integrity of the Company’s financial statements, accounting and financial reporting principles, internal controls and procedures designed to ensure compliance with accounting standards, applicable laws and regulations. KPMG LLP, the Company’s independent auditing firm, is responsible for performing an independent audit of the consolidated financial statements in accordance with generally accepted auditing standards.

The Audit Committee members are not professional accountants or auditors, and their functions are not intended to duplicate or to certify the activities of management or the independent auditor, nor can the Committee certify that the independent auditor is “independent” under applicable rules. The Audit Committee serves a Board-level oversight role, in which it provides advice, counsel and direction to management and the auditors on the basis of the information it receives, discussions with management and the auditors and the experience of the Committee’s members in business, financial and accounting matters.

Among other matters, the Audit Committee monitors the activities and performance of the Company’s internal and external auditors, including the audit scope, external audit fees, auditor independence matters and the extent to which the independent auditors may be retained to perform non-audit services. The Audit Committee and the Board have ultimate authority and responsibility to select, evaluate and, when appropriate, replace the Company’s independent auditor. The Audit Committee also reviews the results of the internal and external audit work with regard to the adequacy and appropriateness of the Company’s financial, accounting and internal controls. The Audit Committee also covers with management and the independent auditors various topics and events, including the effect of regulatory and accounting initiatives that may have a significant financial impact on the Company or that are the subject of discussions between management and the independent auditor. In addition, the Audit Committee generally oversees the Company’s internal compliance programs. The Audit Committee regularly reports its activities to the full Board, as appropriate.

The Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent auditors. The Audit Committee has also discussed with the independent auditor the materials required to be discussed by Statement of Auditing Standard 61, or SAS 61. The independent auditor provided the Audit Committee with written disclosures required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” and the Committee discussed with the independent auditor that firm’s independence. The Audit Committee considered whether the provision by the independent auditor of non-audit services is compatible with maintaining independence of the independent auditor.

Based on the foregoing review and discussion, the Audit Committee recommended to the Board that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2003 for filing by the company with the SEC.

Audit Committee

Bernard Whitney, Chairman

James Richardson

John Dillon

13

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table indicates information concerning compensation of our chief executive officer and the company’s three other executive officers other than the chief executive officer. This table also includes two individuals who would have been among the four most highly compensated executive officers other than the chief executive officer but for the fact that the individuals were not serving as executive officers at the end of 2003. These executives are referred to as the named executive officers elsewhere in this proxy statement.

Mr. Zocher was appointed as our Vice President of Engineering in September 2003. On an annualized basis, Mr. Zocher’s salary was $230,000 for 2003 and he was eligible to receive an annual bonus of up to $69,000 in 2003. Mr. Hogan was our Vice President of Engineering until September 2003, at which point he transitioned to his current position as Vice President of Enterprise Web Solutions, a non-executive officer role within the Company. Mr. Flatley resigned from the Company in April 2003.

| | | | | | | | | | | |

| | | Annual Compensation

| | Long-Term

Compensation

Awards

| | | |

Name and Principal Position

| | Year

| | Salary

($)

| | Bonus ($)

| | Securities Underlying Options (#)

| | All Other Compensation($)

| |

John Kunze | | 2003 | | 250,000 | | — | | 300,000 | | — | |

President and Chief Executive Officer | | 2002 | | 250,000 | | — | | — | | — | |

| | | 2001 | | 250,000 | | — | | 100,000 | | | |

| | | | | |

Eric Borrmann | | 2003 | | 230,000 | | 25,875 | | 200,000 | | — | |

Vice President and Chief Financial Officer | | 2002 | | 230,000 | | 54,683 | | — | | — | |

| | | 2001 | | 192,500 | | 43,500 | | 50,000 | | — | |

| | | | | |

Eric Zocher | | 2003 | | 64,000 | | — | | 300,000 | | | |

Vice President of Engineering | | | | | | | | | | | |

| | | | | |

Glenn Kelman | | 2003 | | 160,000 | | 18,000 | | 200,000 | | — | |

Co-Founder, Vice President of Product | | 2002 | | 160,000 | | 39,000 | | — | | — | |

Management and Marketing | | 2001 | | 155,000 | | 12,000 | | 75,000 | | | |

| | | | | |

John Hogan | | 2003 | | 170,000 | | 14,152 | | 50,000 | | — | |

Vice President of Enterprise Web Solutions | | 2002 | | 170,000 | | 37,868 | | — | | — | |

| | | 2001 | | 170,000 | | 14,250 | | 75,000 | | | |

| | | | | |

James Flatley | | 2003 | | 62,000 | | 235,186 | | 0 | | 100,000 | (1) |

Vice President of Worldwide Field Operations | | 2002 | | 200,000 | | 398,487 | | — | | — | |

(resigned April 2003) | | 2001 | | 200,000 | | 680,949 | | 200,000 | | | |

| (1) | Severance paid to Mr. Flatley upon his departure from Plumtree. |

Employment Agreements

We have offer letters with Mr. Kunze, Mr. Borrmann, Mr. Zocher and Mr. Hogan. Each of these officers may leave or be terminated at any time. Each of these offer letters, with the exception of Mr. Hogan’s and Mr. Zocher’s letters, provides that if the executive’s employment is terminated by us without cause within the first year of employment, the executive will receive twelve months of base salary continuation, or, if so terminated following the first year of employment, six months of base salary continuation. Generally, cause means a willful act or omission involving material injury to Plumtree, gross misconduct or fraud, willful disobedience of reasonable directives of the board of directors, or conviction of a felony. In the event of an acquisition of Plumtree or the sale of all or substantially all of the assets of Plumtree, 50% of the executive’s then unvested

14

shares subject to stock options vest immediately, except that, in the case of Mr. Hogan and Mr. Zocher, all such unvested shares vest.

Under the applicable offer letter, Mr. Kunze was given an annual salary of $200,000 and eligibility for a potential bonus of $100,000; Mr. Hogan was given an annual salary of $150,000 and Mr. Borrmann was given an annual salary of $180,000 and eligibility for a potential bonus of $40,000. Payment of bonuses is dependent on the attainment of objectives established by our board of directors. As set forth in the table above, the board of directors has since periodically reviewed and adjusted the aforementioned salary rates for Messrs. Kunze, Borrmann and Hogan and has adopted a 2004 Bonus Plan which supercedes the bonus rates set forth in the offer letters.

Option Grants In Last Fiscal Year

In the fiscal year ended December 31, 2003, we granted options to purchase up to an aggregate of 5,258,900 shares to employees, directors and consultants. All options were granted under our 2002 Stock Plan and 2002 Director’s Option Plan at exercise prices at the fair market value of our common stock on the date of grant, as determined in good faith by the Board. All options have a term of ten years. Generally, option shares vest over four years, with 25% of the option shares vesting one year after the option grant date, and the remaining option shares vesting ratably each month for the next thirty-six months. Initial grants under the 2002 Director’s Option Plan vest ratably over three years, 1/3 on each anniversary and subsequent grants vest ratably over twelve months, 1/12 per month.

The following table shows all grants of options to acquire shares of Plumtree common stock granted to the named executive officers listed in the Summary Compensation Table for the fiscal year ended December 31, 2003.

| | | | | | | | | | | | | | | | |

Name

| | Number of

Securities

Underlying

Options

Granted

(#)(1)

| | % of Total

Options Granted

to Plumtree

Employees in

Fiscal Year

| | | Exercise or

Base Price ($/Share)(2)

| | Expiration

Date

| | Potential Realizable

Value at Assumed

Annual Rates of Stock

Price Appreciation for

Option Term ($)

|

| | | | | | 5%(3)

| | 10%(3)

|

John Kunze | | 300,000 | | 5.7 | % | | $ | 3.56 | | 1/23/2013 | | $ | 671,659 | | $ | 754,500 |

Eric Borrmann | | 200,000 | | 3.8 | % | | $ | 3.56 | | 1/23/2013 | | $ | 447,773 | | $ | 503,000 |

Eric Zocher | | 300,000 | | 5.7 | % | | $ | 4.35 | | 10/9/2013 | | $ | 671,659 | | $ | 754,500 |

Glenn Kelman | | 200,000 | | 3.8 | % | | $ | 3.56 | | 1/23/2013 | | $ | 447,773 | | $ | 503,000 |

John Hogan | | 50,000 | | .95 | % | | $ | 3.56 | | 1/23/2013 | | $ | 111,943 | | $ | 125,750 |

James Flatley | | 0 | | 0 | | | | — | | — | | $ | 0 | | $ | 0 |

| (1) | The options granted are exercisable 25% after the first year, and then 1/48 become exercisable each month thereafter. |

| (2) | The options were granted at an exercise price equal to the fair market value of Plumtree common stock on the grant date, calculated as the closing price on that date. |

| (3) | Potential realizable value assumes that the common stock appreciates at the rate shown (compounded annually) from the grant date until the option expiration date. It is calculated based on the SEC requirements and does not represent the estimated growth of the future stock price by Plumtree nor the present value of the stock options. |

15

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table shows aggregate exercises of options to purchase Plumtree’s common stock in the fiscal year ended December 31, 2003 by the named executive officers.

| | | | | | | | | | | | | | | | | | |

| | | Year

| | Shares

Acquired

on

Exercise

(#)

| | Value

Realized ($)

| | Number of Securities

Underlying Unexercised

Options at Fiscal Year-End (#)

| | Value of Unexercised

In-The-Money Options

at Fiscal Year-End ($)(1)

|

Name

| | | | | Exercisable

| | | Unexercisable

| | Exercisable

| | Unexercisable

|

John Kunze | | 2003 | | 785,951 | | $ | 2843921 | | 1,195,773 | (2) | | 345,833 | | $ | 4,858,790 | | $ | 543,390 |

Eric Borrmann | | 2003 | | 0 | | | 0 | | 227,084 | (3) | | 222,916 | | $ | 420,000 | | $ | 228,000 |

Eric Zocher | | 2003 | | 0 | | | 0 | | 0 | | | 300,000 | | $ | 0 | | $ | 105,000 |

Glenn Kelman | | 2003 | | 0 | | | 0 | | 115,625 | (4) | | 234,375 | | $ | 172,500 | | $ | 228,000 |

John Hogan | | 2003 | | 0 | | | 0 | | 325,347 | | | 124,653 | | $ | 1,292,005 | | $ | 57,000 |

James Flatley | | 2003 | | 368,506 | | | 1,171,562 | | 0 | | | 0 | | $ | 0 | | $ | 0 |

| (1) | The “Value of Unexercised In-the-Money Options at Fiscal Year End” is based on a value of $4.70 per share, the fair market value of our common stock as of December 31, 2003, as determined by the Board, less the per share exercise price, multiplied by the number of shares issued upon exercise of the option. Options were granted under our 1997 Equity Incentive Plan and our 2002 Stock Plan. |

| (2) | Includes 80,502 options that are unvested as of December 31, 2003 and if exercised, would be subject to a right of repurchase. |

| (3) | Includes 54,414 options that are unvested as of December 31, 2003 and if exercised, would be subject to a right of repurchase. |

| (4) | Includes 9,374 options that are unvested as of December 31, 2003 and if exercised, would be subject to a right of repurchase. |

COMPENSATION COMMITTEE REPORT FOR THE YEAR ENDED DECEMBER 31, 2003

The Company’s executive compensation program is designed to align stockholder interests with our business strategy, values and management initiatives. The compensation guidelines of the Compensation Committee were developed to combine competitive levels of compensation and rewards for superior performance and to align relative compensation with the achievement of essential corporate goals, satisfaction of customers, and the maximization of stockholder value. The Compensation Committee believes that stock option grants to management are beneficial in aligning management and stockholder interests, and consequently serve to increase stockholder value.

Executive officers’ and employees’ compensation is comprised of the following: annual cash compensation (consisting of base salary and annual incentive awards paid in cash); long-term incentive awards; and additional features which are available to most other employees, including a 401(k) plan, health insurance, life insurance, and an employee stock purchase plan, some of which allocate payments generally based on an individual’s level of annual cash compensation. Benefits under some of these general plans are indirectly tied to our performance.

The cornerstone of our compensation program is to pay for performance. In addition to base salary, all major elements of our compensation program vary directly with both corporate and individual performance.

Annual Cash Compensation

Amounts paid as base salary, including merit salary increases, are determined by performance, placement in the salary range established for a given position and the salaries offered in the industry for comparable positions.

16

Salaries for our executive officers are determined primarily on the basis of the executive officer’s responsibility, general salary practices of peer companies and the executive’s individual qualifications and experience. The Compensation Committee monitors and approves changes in base salary for executive officers.

Bonus

The Plumtree Software, Inc. 2003 Employee Bonus Plan (“2003 Bonus Plan”) provided for cash compensation to be paid quarterly to eligible employees (mostly managers, director-level employees and above) when certain individual and company performance targets were achieved. During fiscal year 2003, the executive officers participated in the 2003 Bonus Plan. Actual bonuses paid to executive officers were based on achievement of revenue and earnings goals established for each performance period.

The Plumtree Software, Inc. 2004 Employee Bonus Plan (“2004 Bonus Plan”) provides for cash compensation to be paid quarterly to eligible employees (mostly managers, director-level employees and above) when certain individual performance targets are achieved and annually when certain Company revenue and earnings targets and individual targets are achieved. During fiscal year 2003, the executive officers will also participate in the 2004 Bonus Plan. Their cash compensation under the 2004 Bonus Plan will be payable on an annual basis, if certain Company revenue and earnings targets are achieved.

John Kunze has served as our President and Chief Executive Officer since 1998. The Compensation Committee used the executive compensation practices described above to determine Mr. Kunze’s fiscal 2003 compensation. In setting both the cash-based and equity-based elements of Mr. Kunze’s compensation, the Compensation Committee made an overall assessment of Mr. Kunze leadership in reaching our long-term and short-term strategic, operational and business goals for 2003. Mr. Kunze’s total compensation reflects a consideration of both competitive forces and our performance. More specifically, the Compensation Committee reviewed salaries paid to CEOs in other comparable companies in our geographic area and industry. During 2003, Mr. Kunze did not receive any increase in his base salary, and he did not receive any cash bonus, but was granted options to purchase an aggregate of 300,000 shares of common stock at an exercise price of $3.56 per share. In addition, the Compensation Committee determined that option awards for Mr. Kunze for 2004 shall be subject to a satisfactory performance review.

Long-Term Incentive Awards

Long-term incentive awards are made under the 2002 Stock Plan, as amended (the “Plan”). The Plan, which is administered by the Compensation Committee, is an omnibus plan and provides stock based awards to eligible employees, including the Company’s executive officers.

Stock option awards are based on guidelines that provide for larger awards commensurate with position levels that reflect competitive grant practices within a broad peer group of companies in the software and technology industries. Because of the direct relationship between the value of an option and the Company’s stock price, the Compensation Committee believes that options motivate executive officers to manage the Company in a manner consistent with stockholder interests. The Plan does not provide any quantitative method for weighting these factors, and a decision to grant an award is primarily based upon a subjective evaluation of past as well as future anticipated performance.

Compensation Committee

James Richardson, Chairman

John Dillon

Rupen Dolasia

17

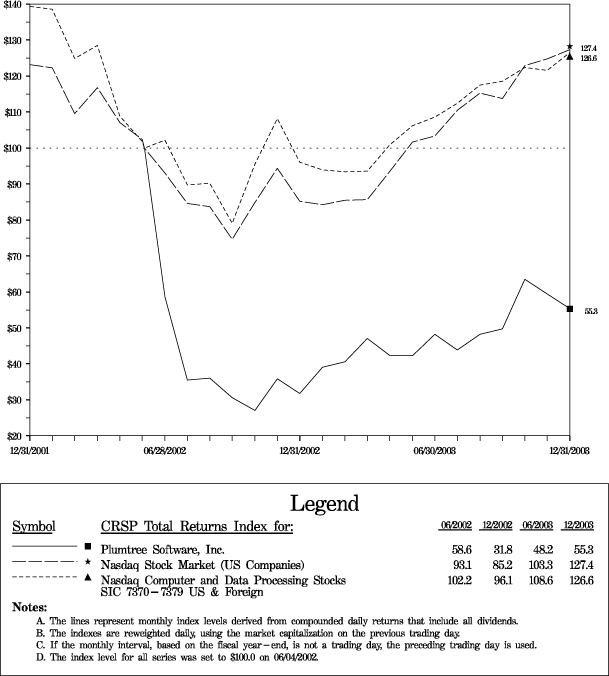

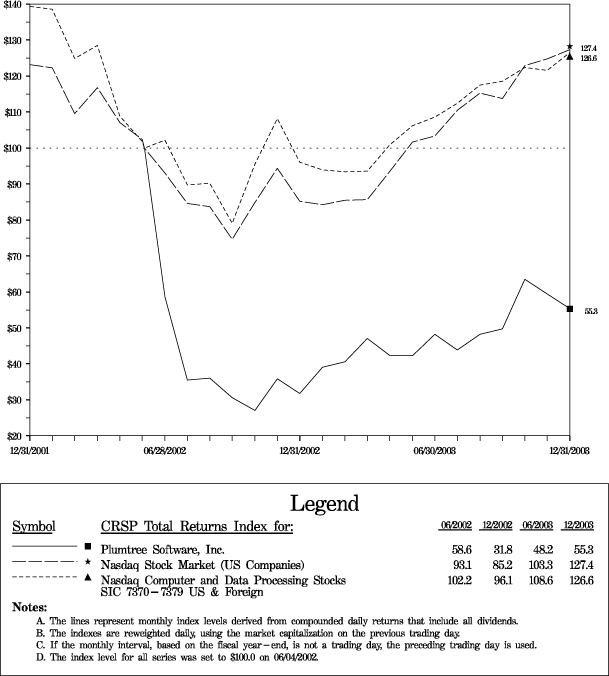

COMPARISON OF CUMULATIVE TOTAL RETURNS

AMONG PLUMTREE, PEER GROUP AND NASDAQ MARKET

Comparison of Five-Year Cumulative Total Returns

Performance Graph for

Plumtree Software Inc.

Produced on 03/19/2004 including data to 12/31/2003

18

Certain Relationships and Related Transactions

During the fiscal year ended December 31, 2003, there has not been, nor is there currently proposed, any transaction or series of similar transactions to which we were or are to be a party in which the amount involved exceeds $60,000 and in which any director, executive officer or holder of more than 5% of our common stock, or an immediate family member of any of the foregoing, had or will have a direct or indirect interest other than:

| | • | compensation arrangements, which are described where required under “Management” |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities and Exchange Act of 1934, as amended requires the Company’s directors and executive officers, and persons who own more than ten (10%) percent of a registered class of the Company’s equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Officers, directors and greater than ten percent (10%) stockholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

To the Company’s knowledge, based on review of the copies of such reports furnished to the Company and written representations that no other reports were required, during the year ended December 31, 2003, all Section 16(a) filing requirements applicable to its officers, directors and ten percent stockholders were complied with except for the following: entities affiliated with Granite Ventures LLC, of which Rupen Dolasia, one of the Company’s directors is a member, delinquently filed two (2) Form 4 reports regarding sales of Plumtree shares beneficially owned by Mr. Dolasia as a result of his relationship with Granite Ventures LLC. In addition, several officers and directors have also recently filed amended Form 4s to correct technical deficiencies in previous timely filings.

OTHER MATTERS

The Board is not aware of any matters that will be presented for consideration at the Annual Meeting other than those described in this Proxy Statement. If any other matters properly come before the Annual Meeting, the persons named on the accompanying Proxy will have the authority to vote on those matters in accordance with their own judgment.

10-K Report

A copy of the Company’s annual report on Form 10-K for the fiscal year ended December 31, 2003, including the financial statements and schedules thereto, required to be filed with the Securities and Exchange Commission, are available without charge upon receipt of a written request. Such requests should be directed to: Investor Relations, Plumtree Software, Inc., 500 Sansome Street, San Francisco, CA 94111. Copies of filings made with the SEC are also available through the SEC’s electronic data gathering analysis retrieval system (EDGAR) at www.sec.gov.

By Order of the Board of Directors

Gregory P.G. Wharton, Secretary

April 22, 2004

19

Appendix A

PLUMTREE SOFTWARE, INC.

CHARTER OF THE AUDIT COMMITTEE

OF THE BOARD OF DIRECTORS

Purpose Of The Committee

The Committee’s purpose is to

| | • | Oversee the accounting and financial reporting processes of Plumtree Software, Inc., (the “Corporation”) and audits of the financial statements of the Corporation; |

| | • | Appoint independent auditors to audit the Corporation’s financial statements; |

| | • | Assist the Board in oversight and monitoring of (i) the integrity of the Corporation’s financial statements, (ii) the Corporation’s compliance with legal and regulatory requirements as they relate to financial statements or accounting matters, (iii) the independent auditor’s qualifications, independence and performance, and (iv) the Corporation’s internal accounting and financial controls; |

| | • | Prepare the report that the rules of the Securities and Exchange Commission (the “SEC”) require be included in the Corporation’s annual proxy statement; |

| | • | Provide the Corporation’s Board with the results of its monitoring and recommendations derived therefrom; and |

| | • | Provide to the Board such additional information and materials as it may deem necessary to make the Board aware of significant financial matters that require the attention of the Board. |

In addition, the Audit Committee will undertake those specific duties and responsibilities listed below and such other duties as the Board of Directors may from time to time prescribe.

Composition Of The Committee

The Committee shall be comprised of three or more directors as determined from time to time by resolution of the Board. The Chairman of the Committee shall be designated by the Board,provided that if the Board does not so designate a Chairman, the members of the Committee, by majority vote, may designate a Chairman. Each member of the Committee shall be qualified to serve on the Committee pursuant to the following requirements (as well as any criteria required by the SEC)

| | • | Each member will be an independent director, as defined in (i) NASDAQ Rule 4200,(ii) Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended; and (iii) the rules and regulations of the SEC provide that one non-independent, non-employee director may serve on the Audit Committee if (i) the Board has made the required determination under Nasdaq Rule 4350(d); and (ii) such Nasdaq rule is in effect or has not otherwise been superseded; |

| | • | Each member will be able to read and understand fundamental financial statements, in accordance with the NASDAQ National Market Audit Committee requirements; and |

| | • | At least one member will have past employment experience in finance or accounting, requisite professional certification in accounting, or other comparable experience or background, including a current or past position as a principal financial officer or other senior officer with financial oversight responsibilities. |

Meetings of the Committee

The Committee shall meet with such frequency and at such intervals as it shall determine is necessary to carry out its duties and responsibilities; provided, however, that the Committee shall meet at least four (4) times per year. The Committee, in its discretion, will ask members of management or others to attend its meetings (or portions thereof) and to provide pertinent information as necessary. The Committee will meet separately with the Chief Executive Officer and separately with the Chief Financial Officer of the Corporation at such times as are appropriate to review the financial affairs of the Corporation. The Committee will also meet with the Corporation’s independent auditors, investment bankers or financial analysts who follow the Corporation. The Committee may establish its own schedule and shall maintain minutes of its meetings and records relating to those meetings and provide copies of such minutes to the Board.

Duties and Responsibilities of the Committee

In carrying out its duties and responsibilities, the Committee’s policies and procedures should remain flexible, so that it may be in a position to best react or respond to changing circumstances or conditions. While there is no “blueprint” to be followed by the Committee in carrying out its duties and responsibilities, the following should be considered within the authority of the Committee:

| | • | Appointing, compensating and overseeing the work of the independent auditors (including resolving disagreements between management and the independent auditors regarding financial reporting) for the purpose of preparing or issuing an audit report or performing other audit, review or attest services or related work; |

| | • | Pre-approving audit and non-audit services provided to the Corporation by the independent auditors (or subsequently approving non-audit services in those circumstances where a subsequent approval is necessary and permissible); in this regard, the Committee shall have the sole authority to approve the hiring and firing of the independent auditors, all audit engagement fees and terms and all non-audit engagements, as may be permissible, with the independent auditors; |

| | • | Review the performance of the Corporation’s independent auditors and make recommendations to the Board regarding the replacement or termination of the independent auditors when circumstances warrant, including a determination of whether it is appropriate to adopt a policy of rotating independent auditors on a regular basis; |

| | • | Oversee the independence of the Corporation’s independent auditors by, among other things: |

| | • | requiring the independent auditors to deliver to the Committee on a periodic basis a formal written statement delineating all relationships between the independent auditors and the Corporation; |

| | • | actively engaging in a dialogue with the independent auditors with respect to any disclosed relationships or services that may impact the objectivity and independence of the independent auditors and recommending that the Board take appropriate action in to satisfy itself of the auditors’ independence; |

| | • | reviewing the independent auditors’ peer review conducted every three years; |

| | • | discussing with the Corporation’s independent auditors the financial statements and audit findings, including any significant adjustments, management judgments and accounting estimates, significant new accounting policies and disagreements with management and any other matters described in SAS No. 61, as may be modified or supplemented; and |

| | • | reviewing reports submitted to the audit committee by the independent auditors in accordance with the applicable SEC requirements; |

| | • | Instruct the Corporation’s independent auditors that they are ultimately accountable to the Committee and the Board, and that the Committee and the Board are responsible for the selection, evaluation and termination of the Corporation’s independent auditors; |

A-2

| | • | Review and accept, if appropriate, the annual audit plan of the Corporation’s independent auditors, including the scope of audit activities, and monitor such plan’s progress and results during the year; |

| | • | Review and discuss the results of the year-end audit of the Corporation, including any comments or recommendations of the Corporation’s independent auditors, and the audited financial statements and related MD&A to be included in the Corporation’s Annual Report on Form 10-K; |

| | • | Directing the Corporation’s independent auditors to review before filing with the SEC the Corporation’s interim financial statements included in Quarterly Reports on Form 10-Q, using professional standards and procedures for conducting such reviews; |

| | • | Review with management and the Corporation’s independent auditors such accounting policies (and changes therein) of the Corporation, including any financial reporting issues which could have a material impact on the Corporation’s financial statements, as are deemed appropriate for review by the Committee prior to any interim or year-end filings with the SEC or other regulatory body; |

| | • | Review with management and the independent auditors the Corporation’s interim financial statements and the related MD&A included in Quarterly Reports on Form 10-Q, including the results of the independent auditor’s reviews of the quarterly financial statements; |

| | • | Review the adequacy and effectiveness of the Corporation’s accounting and internal control policies and procedures through inquiry discussion and periodic meetings with the Corporation’s independent auditors and management of the Corporation and to review before release the disclosure regarding such system of internal controls required under SEC rules to be contained in the Corporation’s periodic filings and the attestations or reports by the independent auditors relating to such disclosure; |

| | • | Conducting a post-audit review of the financial statements and audit findings, including any significant suggestions for improvements provided to management by the independent auditors; |

| | • | Reviewing before release the unaudited quarterly operating results in the Corporation’s quarterly earnings release; |

| | • | Overseeing compliance with the requirements of the SEC for disclosure of auditor’s services and audit committee members, member qualifications and activities; |

| | • | Review with management the Corporation’s administrative, operational and accounting internal controls, and evaluate whether the Corporation is operating in accordance with its prescribed policies, procedures and codes of conduct; |

| | • | Receive periodic reports from the Corporation’s independent auditors and management of the Corporation to review the selection, application and disclosure of Corporation’s significant accounting and access the impact of other financial reporting developments that may have a bearing on the Corporation, including an analysis of the effect of alternative GAAP methods on the Corporation’s financial statements and a description of any transactions as to which management obtained Statement on Auditing Standards No. 50 letters; |

| | • | Review with management and the independent auditor the effect of regulatory and accounting initiatives as well as off-balance sheet structures on the Corporation’s financial statements; |

| | • | Review the experience and qualifications of the senior members of the independent auditor team and the quality control procedures of the independent auditor; |

| | • | Recommend to the Board guidelines for the Corporation’s hiring of employees of the independent auditor who were engaged on the Corporation’s account; |

| | • | Review with management and the independent auditor any correspondence with regulators or governmental agencies and any employee complaints or published reports which raise material issues regarding the Corporation’s financial statements or accounting policies; |

A-3

| | • | Establish and maintain free and open means of communication between and among the Board, the Committee, the Corporation’s independent auditors, the Corporation’s internal auditing department and management, including providing such parties with appropriate opportunities to meet privately with the Committee; |

| | • | Review and reassess annually the adequacy of the Committee’s charter-structure, process and membership requirements; |