Filed by NSTAR Pursuant to Rule 425

Under the Securities Act of 1933

And Deemed Filed Pursuant to Rule 14a-12

Under the Securities Exchange Act of 1934

Subject Company: NSTAR

Commission File No.: 001-14768

The following slides were presented by Jim Judge, Senior Vice President and Chief Financial Officer of NSTAR, at a utility symposium on December 8, 2010.

Wells Fargo Securities 9 Annual Utility Symposium New York, NY December 8, 2010 Jim Judge Senior Vice President and CFO th |

Information Concerning Forward-Looking Statements In addition to historical information, this presentation may contain a number of “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Words such as anticipate, expect, project, intend, plan, believe, and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. Forward-looking statements relating to the proposed merger include, but are not limited to: statements about the benefits of the proposed merger involving NSTAR and Northeast Utilities, including future financial and operating results; NSTAR’s and Northeast Utilities’ plans, objectives, expectations and intentions; the expected timing of completion of the transaction; and other statements relating to the merger that are not historical facts. Forward-looking statements involve estimates, expectations and projections and, as a result, are subject to risks and uncertainties. There can be no assurance that actual results will not materially differ from expectations. Important factors could cause actual results to differ materially from those indicated by such forward-looking statements. With respect to the proposed merger, these factors include, but are not limited to: risks and uncertainties relating to the ability to obtain the requisite NSTAR and Northeast Utilities shareholder approvals; the risk that NSTAR or Northeast Utilities may be unable to obtain governmental and regulatory approvals required for the merger, or required governmental and regulatory approvals may delay the merger or result in the imposition of conditions that could reduce the anticipated benefits from the merger or cause the parties to abandon the merger; the risk that a condition to closing of the merger may not be satisfied; the length of time necessary to consummate the proposed merger; the risk that the businesses will not be integrated successfully; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers, employees or suppliers; the diversion of management time on merger-related issues; the effect of future regulatory or legislative actions on the companies; and the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect. These risks, as well as other risks associated with the merger, are more fully discussed in the joint proxy statement/prospectus that is included in the Registration Statement on Form S-4 (Registration No. 333-170754) that was filed by Northeast Utilities with the SEC in connection with the merger. Additional risks and uncertainties are identified and discussed in NSTAR’s and Northeast Utilities’ reports filed with the SEC and available at the SEC’s website at www.sec.gov. Forward-looking statements included in this release speak only as of the date of this release. Neither NSTAR nor Northeast Utilities undertakes any obligation to update its forward-looking statements to reflect events or circumstances after the date of this release. |

Additional Information and Where To Find It This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed merger between Northeast Utilities and NSTAR, on November 22, 2010, Northeast Utilities filed with the SEC a Registration Statement on Form S-4(Registration No. 333-170754) that includes a preliminary joint proxy statement of Northeast Utilities and NSTAR that also constitutes a preliminary prospectus of Northeast Utilities. These materials are not yet final and may be amended. Northeast Utilities and NSTAR will mail the final joint proxy statement/prospectus to their respective shareholders. Northeast Utilities and NSTAR urge investors and shareholders to read the joint proxy statement/prospectus regarding the proposed merger when it becomes available, as well as other documents filed with the SEC, because they will contain important information. You may obtain copies of all documents filed with the SEC regarding this proposed transaction, free of charge, at the SEC’s website (www.sec.gov). You may also obtain these documents, free of charge, from Northeast Utilities’ website (www.nu.com) under the tab “Investors” and then under the heading "Financial/SEC Reports." You may also obtain these documents, free of charge, from NSTAR’s website (www.nstar.com) under the tab “Investor Relations.” Participants in the Merger Solicitation Northeast Utilities, NSTAR and their respective trustees, executive officers and certain other members of management and employees may be soliciting proxies from Northeast Utilities and NSTAR shareholders in favor of the merger and related matters. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of Northeast Utilities and NSTAR shareholders in connection with the proposed merger will be set forth in the joint proxy statement/prospectus when it is filed with the SEC. You can find information about NSTAR’s executive officers and trustees in its definitive proxy statement filed with the SEC on March 12, 2010. You can find information about Northeast Utilities’ executive officers and trustees in its definitive proxy statement filed with the SEC on April 1, 2010. Additional information about Northeast Utilities’ executive officers and trustees and NSTAR’s executive officers and trustees can be found in the above-referenced Registration Statement on Form S-4 when it becomes available. You can obtain free copies of these documents from NSTAR and Northeast Utilities using the website information above. |

Today’s Agenda NSTAR and Northeast Utilities Merger Structure Benefits Executive Team Regulatory Timeframe NSTAR Update Performance Results Current Transmission Projects Future Transmission Opportunities |

Key Merger Terms Timing / Approvals: Expected to close within 9 – 12 months Shareholders, federal, and state Headquarters: Dual – Hartford and Boston Company Name: Northeast Utilities Consideration: 100% NU shares Exchange Ratio: 1.312 shares of NU per NSTAR share Pro Forma Ownership: 56% NU shareholders 44% NSTAR shareholders Pro Forma Dividend: Following close, dividend increase for NU shareholders to NSTAR level Dividend parity for NSTAR shareholders Governance: Chuck Shivery to be non-executive Chairman Tom May to be President and CEO 14 Board members 7 nominated by Northeast Utilities including Chuck Shivery 7 nominated by NSTAR including Tom May Balanced Terms and Governance |

NSTAR and NU Merger – Creates Largest Utility Company in New England Significant transmission investment opportunities combined with balance sheet strength provides for substantial growth potential Larger, more diverse and better positioned to support economic growth in New England Accretive to earnings in Year 1 and provides enhanced total shareholder return proposition Enhances service quality capabilities to the largest customer base in New England Highly experienced and complementary leadership team with proven track record NSTAR Electric Service Area NSTAR Gas Service Area Northeast Utilities Electric Service Area Northeast Utilities Gas Service Area ME NY VT NH M A RI Combined Service Territory |

Building A Larger, More Diverse and Better Positioned Regulated Utility Business FERC 31% CT 26% NH 11% MA 32% Rate Base By State / Federal Electric Generation 4% Electric Distribution 54% Gas Distribution 11% Electric Transmission 31% Rate Base By Business Combined 2009 Rate Base: $10.8 billion |

Transaction is Accretive NU Stand Alone Growth Rate Avoidance of Equity Issuance NSTAR Earnings Growth Additional Shares Less NU Parent Debt Issuance Lower Financing Costs Implementing Best Practices Illustrative Impact on Growth Rate 9% Merged Company Growth Rate 9% Components Affecting Expected Accretion 6% 6% |

Executive Management Organization Tom May President & Chief Executive Officer Greg Butler General Counsel David McHale Chief Administrative Officer Lee Olivier Chief Operating Officer Christine Carmody Human Resources Jim Judge Chief Financial Officer Joe Nolan Corporate Relations Chuck Shivery Non-Executive Chairman |

Regulatory Timeline Oct 2010 Closing Expected in 9 – 12 months Q4 2010 Q1 2011 Q2 2011 Q3 2011 Merger Announced Commenced Regulatory Filings Filed Joint Proxy Statement/Prospectus on November 22 Secure Regulatory Approvals FERC, SEC, NRC, DOJ, MDPU, FCC Northeast Utilities and NSTAR Shareholder Meetings Develop Transition Implementation Plans Receive Regulatory Approvals Close Merger MDPU–November 24th FERC – mid December DOJ – mid December nd |

NSTAR – A Track Record of Strong Performance High levels of customer service and reliability Solid, consistent financial results Cost control Strong credit profile and positive cash flow Constructive regulatory outcomes |

A Long History of Negotiated, Multi-Year Distribution Rate Agreements 25 years of rate agreements – last litigated rate increase in 1986 Fully reconciling pension & post-retirement mechanism and recovery of energy supply Current electric rate plan through December 31, 2012 10.5% ROE with +/- 2% neutral zone Plan to pursue a new rate agreement effective in 2013 |

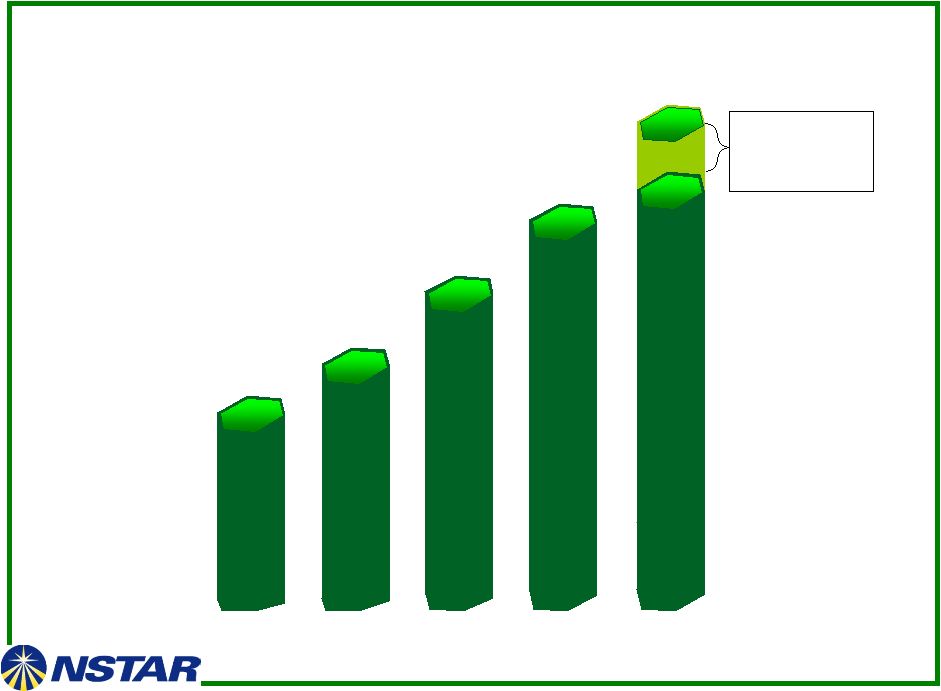

13 Earnings Growth of 7% Outperforms Industry …19 Consecutive Years of Operating Earnings Growth… $2.22 2006 2007 $1.93 $2.07 2008 2009 $2.37 $2.45 - $2.60 2010 Guidance |

14 Consistent Dividend Growth …13 Consecutive Years of Increase… $1.30 $1.40 $1.50 2007 2008 $1.60 2009 2010 2011 $1.70 |

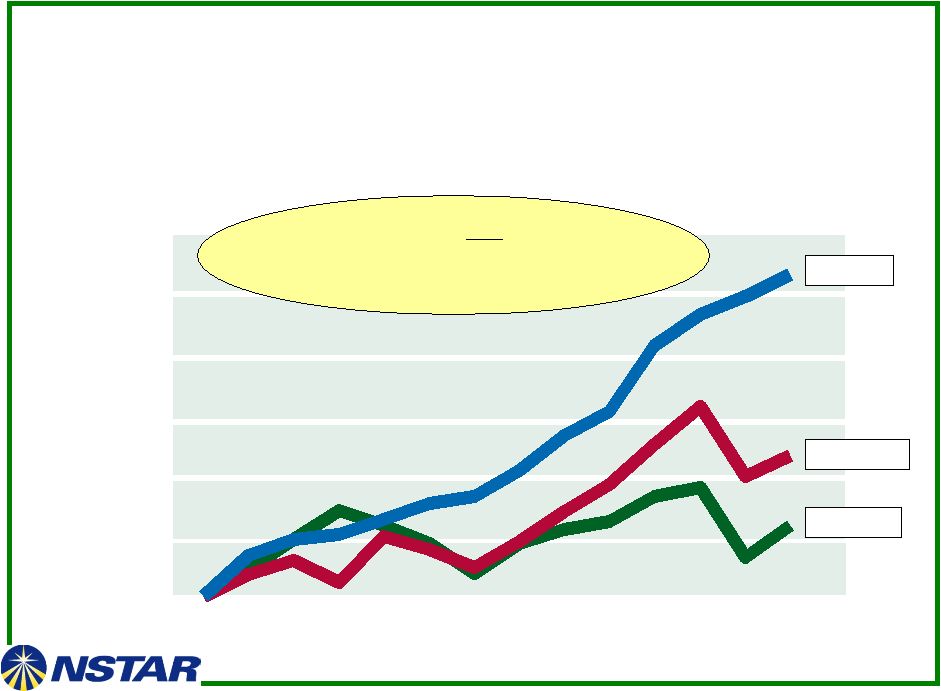

15 Total Shareholder Return Outperforms the Industry NSTAR Utility Index S&P 500 1996 2009 $1,000 $1,750 $2,500 $3,250 $4,000 $4,750 $5,500 Only company in any industry to deliver 13 consecutive years of positive total shareholder return |

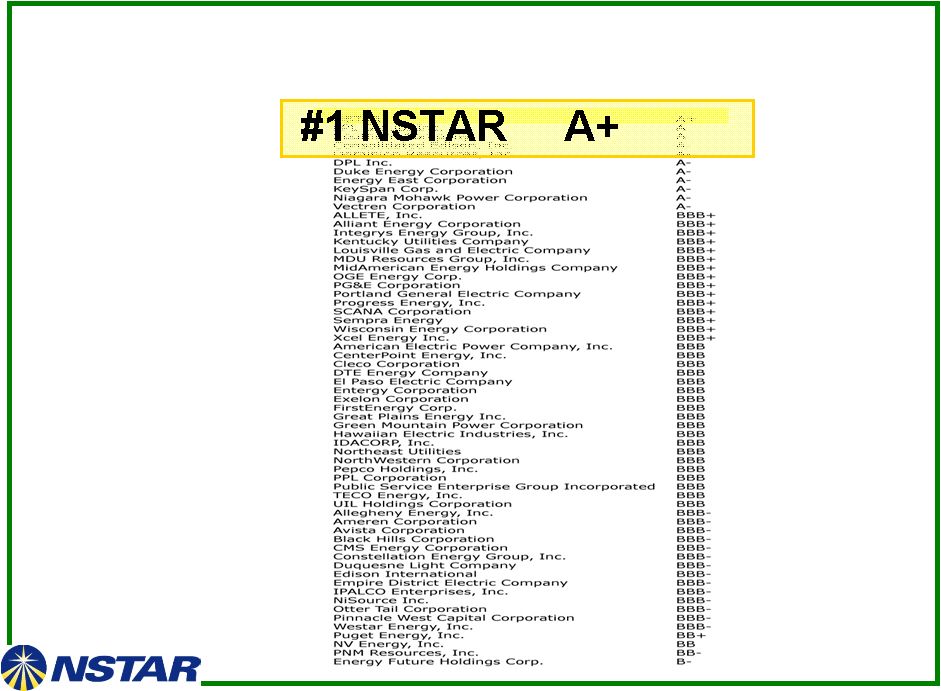

16 Highest Credit Ratings In The Industry |

NSTAR System Has Significant Transmission Investment Ahead Transmission Rate Base is expected to double within 5 years to approximately $1.6 billion Northern Pass: $280 million (2012-2015) Growth/reliability spending averages $100 million per year Incremental Major Projects: Cape Cod Line $120 million (2011-2012) South Boston Circuit $45-$50 million (2014-2015) Mid Cape Line $25-$30 million (2013-2014) Renewable Transmission Consortium |

The merger creates New England’s premier energy provider More diverse, stable and higher earnings growth profile than could be achieved standalone Highly experienced management teams with proven track records of success Combined company will have one of the most attractive total return profiles in the industry Summary Key Takeaways |

|