UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08189 |

|

J.P. Morgan Fleming Mutual Fund Group, Inc. |

(Exact name of registrant as specified in charter) |

|

522 Fifth Avenue New York, NY | | 10036 |

(Address of principal executive offices) | | (Zip code) |

|

Stephen M. Benham 522 Fifth Avenue New York, NY 10036 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (800) 480-4111 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | January 1, 2005 to December 31, 2005 | |

| | | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

ANNUAL REPORT DECEMBER 31, 2005

JPMorgan Funds

U.S. Equity

Mid/Small Cap

Funds

JPMorgan Capital Growth Fund

JPMorgan Dynamic Small Cap Fund

JPMorgan Growth Advantage Fund

JPMorgan Micro Cap Fund

JPMorgan Mid Cap Equity Fund

JPMorgan Mid Cap Value Fund

JPMorgan Small Cap Core Fund

JPMorgan Small Cap Equity Fund

JPMorgan U.S. Small Company Fund

JPMorgan Value Advantage Fund

CONTENTS

| President's Letter | | | 1 | | |

|

| Fund Commentaries: | |

|

| JPMorgan Capital Growth Fund | | | 3 | | |

|

| JPMorgan Dynamic Small Cap Fund | | | 6 | | |

|

| JPMorgan Growth Advantage Fund | | | 9 | | |

|

| JPMorgan Micro Cap Fund | | | 12 | | |

|

| JPMorgan Mid Cap Equity Fund | | | 15 | | |

|

| JPMorgan Mid Cap Value Fund | | | 18 | | |

|

| JPMorgan Small Cap Core Fund | | | 21 | | |

|

| JPMorgan Small Cap Equity Fund | | | 24 | | |

|

JPMorgan U.S. Small Company

Fund | | | 27 | | |

|

| JPMorgan Value Advantage Fund | | | 30 | | |

|

| Schedules of Portfolio Investments | | | 33 | | |

|

| Financial Statements | | | 85 | | |

|

| Financial Highlights | | | 110 | | |

|

| Notes to Financial Statements | | | 130 | | |

|

| Report of Independent Registered Public Accounting Firm | | | 144 | | |

|

| Trustees | | | 145 | | |

|

| Officers | | | 147 | | |

|

| Schedule of Shareholder Expenses | | | 149 | | |

|

| Board Approval of Renewal of Investment Advisory Agreement | | | 153 | | |

|

| Tax Letter | | | 159 | | |

|

Highlights

• U.S. equity market overcame several challenges

• FOMC raised rates at a measured pace

• Outlook for equity markets somewhat mixed

Investments in a Fund are not bank deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Fund's share price is lower than when you invested.

Past performance is no guarantee for future performance. The general market views expressed in this report are opinions based on current market conditions and are subject to change without notice. These views are not intended to predict the future performance of a Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

Prospective investors should refer to the Fund's prospectus for a discussion of the Fund's investment objective, strategies and risks. Call JPMorgan Funds Service Center at (800) 480-4111 for a prospectus containing more complete information about a Fund, including management fees and other expenses. Please read it carefully before investing.

JPMorgan

U.S. Equity Mid and Small Cap Funds

PRESIDENT'S LETTER JANUARY 10, 2006 (Unaudited)

"The U.S. equity market overcame several challenges during the reporting period..."

Dear Shareholder:

We are pleased to present this annual report for the JPMorgan U.S. Equity Mid/Small Cap Funds. Inside, you'll find information detailing the performance of the Funds for the 12 months ended December 31, 2005, along with reports from the portfolio managers.

Stocks Produce Modest Gains

The U.S. equity market overcame several challenges during the reporting period, including rising interest rates, surging oil prices, a devastating hurricane season and geopolitical issues. While these factors often overshadowed solid corporate profit growth, the overall market ultimately produced positive returns during the year.

As expected, the Federal Open Market Committee (FOMC) continued to raise interest rates at a measured pace in an attempt to ward off inflation. After five rate hikes in 2004, the FOMC raised rates eight additional times in 2005. All told, short-term rates moved to 4.25% by the end of the period. Despite these actions and the destruction inflicted by hurricanes Katrina, Rita and Wilma, the U.S. economy continued to expand at a brisk pace in 2005. U.S. gross domestic product (GDP) was 3.8% in the first quarter of the year. Higher oil prices, which surpassed $70 a barrel, were cited as a reason for a fall in GDP to 3.1% in the second quarter of 2005. However, the economy demonstrated its resiliency by expanding 4.1% in the third quarter.

Mixed Stock Performance

The broad stock market, as measured by the S&P 500 Index, returned 4.91% during the 12-month period ended December 31, 2005. While there were hopes for another strong rally in the fourth quarter of the year—similar to the 12.18% and 9.23% returns in the fourth quarters of 2003 and 2004, respectively—this did not come to pass in 2005. Concerns over further rate hikes by the FOMC and inflationary pressures tempered the market's gains at the end of the year. Elsewhere during the 12-month period, mid-capitalization stocks generated significant returns, with the Russell Midcap Index gaining 12.65%. Large-capitalization stocks outperformed their small-capitalization counterparts over the period, as the Russell 1000 Index and Russell 2000 Index returned 6.27% and 4.55%, respectively.

Outlook

As we begin the new year, the outlook for equity markets is somewhat mixed. Positives include a solid economy, relatively lower oil prices and the possibility of the FOMC ending its rate hike campaign. On the other hand, corporate profits are expected to decelerate in 2006. In addition, should inflation increase, the FOMC may continue to raise rates. Given these uncertainties, investors should take a long-term approach to investments and maintain a diversified portfolio.

JPMorgan

U.S. Equity Mid and Small Cap Funds

CONTINUED (Unaudited)

On behalf of us all at JPMorgan Asset Management, thank you for your confidence and the continued trust you have placed in us. We look forward to serving your investment needs for many years to come. Should you have any questions, please feel free to contact the JPMorgan Funds Service Center at 1-800-480-4111.

Sincerely yours,

George C.W. Gatch

President

JPMorgan Funds

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS2

JPMorgan

Capital Growth Fund

AS OF DECEMBER 31, 2005 (Unaudited)

| FUND FACTS | |

| Fund Inception | | 9/23/87 | |

| Fiscal Year End | | December 31 | |

Net Assets as of 12/31/2005

(In Thousands) | | $785,480 | |

| Primary Benchmark | | Russell Midcap

Growth Index | |

Q: HOW DID THE FUND PERFORM?

A: The JPMorgan Capital Growth Fund, which seeks capital growth over the long term,* returned 9.77% (A Shares) over the 12 months ended December 31, 2005, compared to the 12.10% return of the Russell Midcap Growth Index over the same period.

Q: WHY DID THE FUND PERFORM IN THIS WAY?

A: U.S. equity markets were dominated by interest rate concerns in 2005, as economic data was closely observed for signs that the Federal Open Market Committee's (FOMC) tightening cycle was winding down. Although there were bumps in the road, most particularly slowed growth and increased inflation following the hurricanes of late summer, the economy was generally supportive of equity gains in 2005. Equity markets were also supported by continued strength in corporate profits.

Despite posting a solid absolute return for the year, the Fund underperformed its benchmark due to overall stock selection in the consumer discretionary and information technology sectors. For most of the year, consumers faced headwinds of rising interest rates, increasing winter heating costs and a softening U.S. housing market. At the individual stock level, Flir System Inc. and VeriSign Inc. were large detractors from performance. Flir Systems Inc., a manufacturer of thermal imaging and infrared camera systems, announced that third-quarter earnings would not meet expectations due to disappointing results in its imaging business and European thermography division. The company reduced its full-year outlook as it did not expect to make up the third-quarter earnings and revenue shortfall in the fourth quarter. VeriSign Inc., an Internet and telecommunication infrastructure provider, experienced mixed results as second-quarter sal es decreased in its ring tone business divisions. Other parts of the company's business remain on track.

The Fund was positively impacted by overall stock selection in the energy and industrials sectors. Individual holdings, such as Grant Prideco Inc. and Omnicare Inc., were among the top individual contributors to performance. Grant Prideco Inc., an international provider of energy exploration products, generated strong results, stemming from increased production and strong energy prices. Omnicare Inc., a leading provider of pharmaceutical care for the elderly, acquired rival provider NeighborCare Inc., offering cost savings and improved purchasing power, which could lead to accelerated earnings growth.

Q: HOW WAS THE FUND MANAGED?

A: We employ a bottom-up approach to stock selection, constructing portfolios based on company fundamentals, quantitative screening and proprietary fundamental analysis. Our aim is designed to identify dominant franchises with predictable business models deemed capable of achieving sustained growth. We sought to maintain significant sector diversification in the Fund to avoid any large allocations contingent on macroeconomic or sector trends.

* The advisor seeks to achieve the Fund's objective. There can be no guarantee it will be achieved.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS3

JPMorgan

Capital Growth Fund

CONTINUED

(Unaudited)

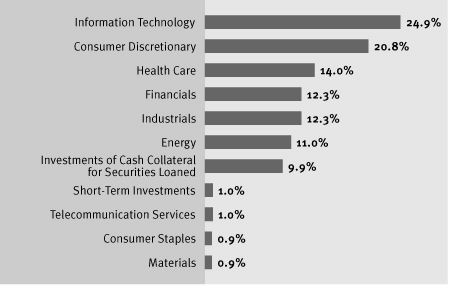

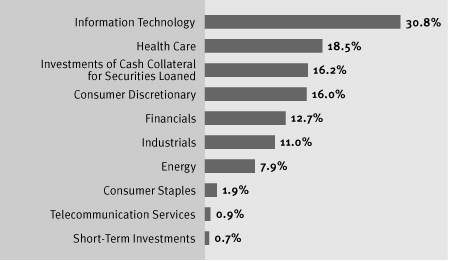

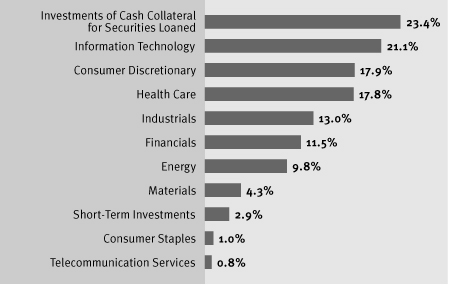

PORTFOLIO COMPOSITION*

TOP TEN EQUITY HOLDINGS

OF THE PORTFOLIO* | |

| 1. West Corp. | | | 2.3 | % | |

| 2. Amphenol Corp. | | | 2.2 | % | |

| 3. Sherwin-Williams Co. (The) | | | 1.5 | % | |

| 4. Polo Ralph Lauren Corp. | | | 1.5 | % | |

| 5. Seagate Technology | | | 1.5 | % | |

| 6. Zions Bancorp | | | 1.5 | % | |

| 7. Jabil Circuit, Inc. | | | 1.5 | % | |

8. J.B.Hunt Transport

Services, Inc. | | | 1.5 | % | |

| 9. Microchip Technology, Inc. | | | 1.4 | % | |

| 10. Alliance Data Systems Corp. | | | 1.4 | % | |

* Percentages indicated are based on net assets as of December 31, 2005. The portfolio's composition is subject to change.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS4

ANNUAL REPORT DECEMBER 31

2005

(Unaudited)

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2005

| | | 1 YEAR | | 5 YEARS | | 10 YEARS | |

| CLASS A SHARES | |

| Without Sales Charge | | | 9.77 | % | | | 3.71 | % | | | 9.59 | % | |

| With Sales Charge* | | | 4.01 | % | | | 2.60 | % | | | 9.00 | % | |

| CLASS B SHARES | |

| Without CDSC | | | 9.23 | % | | | 3.20 | % | | | 9.15 | % | |

| With CDSC** | | | 4.23 | % | | | 2.84 | % | | | 9.15 | % | |

| CLASS C SHARES | |

| Without CDSC | | | 9.26 | % | | | 3.17 | % | | | 8.95 | % | |

| With CDSC*** | | | 8.26 | % | | | 3.17 | % | | | 8.95 | % | |

| SELECT CLASS SHARES | | | 10.08 | % | | | 4.20 | % | | | 10.05 | % | |

* Sales charge for class A shares is 5.25%.

** Assumes 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC for the ten year period.

*** Assumes a 1% CDSC for the one year period and 0% CDSC thereafter.

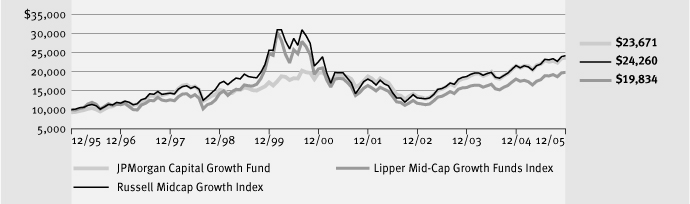

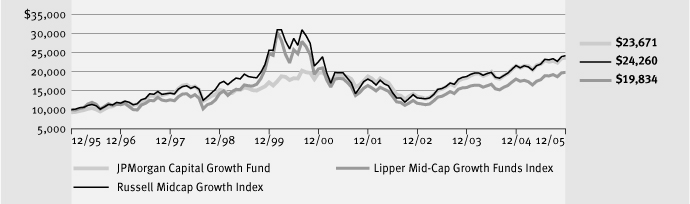

TEN YEAR PERFORMANCE (12/31/95 TO 12/31/05)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risk. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on 9/23/87.

Returns for the Select Class Shares prior to 1/25/96 (offering date of the Select Class Shares) are calculated using the historical expenses of the Class A Shares, which are higher than the expenses of the Select Shares.

Returns for the Class C Shares prior to 1/2/98 (offering date of the Class C Shares) are calculated using the historical expenses of the Class A Shares. During this period, the actual returns of Class C Shares would have been lower than shown because Class C Shares have higher expenses than Class A Shares.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Capital Growth Fund, Russell Midcap Growth Index, and Lipper Mid-Cap Growth Funds Index from December 31, 1995 to December 31, 2005. The performance of the Fund assumes reinvestment of all dividends and capital gains and includes a sales charge. The performance of the indices does not include expenses or a sales charge and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The Russell Midcap Growth Index measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher financial growth values. The Lipper Mid-Cap Growth Funds Index represents the total returns of the funds in the indicated category, as defined by Lipper, Inc. Investors cannot invest directly in an index.

Class A shares have a $1,000 minimum initial investment and carry a 5.25% sales charge.

Performance may reflect the waiver and reimbursement of the Fund's fees/expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS5

JPMorgan

Dynamic Small Cap Fund

AS OF DECEMBER 31, 2005 (Unaudited)

| FUND FACTS | |

| Fund Inception | | 5/19/97 | |

| Fiscal Year End | | December 31 | |

Net Assets as of 12/31/2005

(In Thousands) | | $182,344 | |

| Primary Benchmark | | Russell 2000 Growth Index | |

Q: HOW DID THE FUND PERFORM?

A: The JPMorgan Dynamic Small Cap Fund, which seeks capital growth over the long term,* returned 5.29% (A Shares) over the 12 months ended December 31, 2005, compared to the 4.15% return of the Russell 2000 Growth Index over the same period.

Q: WHY DID THE FUND PERFORM IN THIS WAY?

A: U.S. equity markets were dominated by interest rate concerns in 2005, as economic data was closely observed for signs that the Federal Open Market Committee's (FOMC) tightening cycle was winding down. Although there were bumps in the road, most particularly slowed growth and increased inflation following the hurricanes of late summer, the economy was generally supportive of equity gains in 2005. Equity markets were also supported by continued strength in corporate profits.

The Fund outperformed the benchmark due primarily to stock selection in the materials and healthcare sectors. At the individual stock level, VeriFone Holdings Inc. and Chemed Corp. were positive contributors to performance. VeriFone Holdings Inc., a leading global provider of electronic payment technology, reported strong financial results and consistently raised earnings guidance. Chemed Corp., which operates VITAS Healthcare Corporation, a provider of end-of-life care, and Roto-Rooter, a plumbing and drain cleaning service provider, reported strong earnings growth resulting from increased revenues across business segments.

The Fund was negatively impacted by overall stock selection in the energy sector and an underweight in information technology. Avocent Corp. and Lions Gate Entertainment Corp. were among top individual detractors from performance. Avocent Corp., a computer equipment maker, experienced mixed results. The company slashed its first-quarter revenue guidance due to lower sales, the launch of its DSView 3 software and greater-than-expected seasonal softness. Lions Gate Entertainment Corp., an independent producer of motion pictures, television programming and family entertainment, lowered the company's earnings outlook for its fiscal year ending March 31, 2006, citing softness in home entertainment products, direct-to-video releases and disappointment in box office sales.

Q: HOW WAS THE FUND MANAGED?

A: We employ a bottom-up approach to stock selection, constructing portfolios based on company fundamentals, quantitative screening and proprietary fundamental analysis. Our aim is to identify growth companies with leading competitive positions, run by highly motivated and talented management that can sustain growth over a period of many years. Potential investments are subjected to rigorous financial analysis and a disciplined approach to valuation. Late in the third quarter of 2005, the Fund's strategy was slightly modified to include a lower number of holdings, allowing us to focus on companies where we possess a greater degree of conviction in their fundamentals.

* The advisor seeks to achieve the Fund's objective. There can be no guarantee it will be achieved.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS6

ANNUAL REPORT DECEMBER 31

2005

(Unaudited)

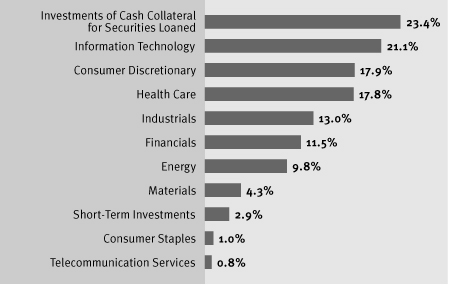

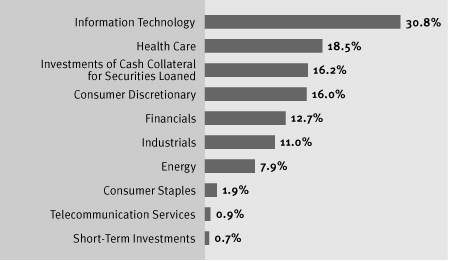

PORTFOLIO COMPOSITION*

TOP TEN EQUITY HOLDINGS

OF THE PORTFOLIO* | |

1. Marlin Business

Services, Inc. | | | 2.4 | % | |

| 2. Oshkosh Truck Corp. | | | 2.4 | % | |

| 3. Charming Shoppes, Inc. | | | 2.3 | % | |

| 4. Chemed Corp. | | | 2.3 | % | |

5. Foundation Coal

Holdings, Inc. | | | 2.3 | % | |

| 6. Champion Enterprises, Inc. | | | 2.2 | % | |

| 7. General Cable Corp. | | | 2.2 | % | |

| 8. Hyperion Solutions Corp. | | | 2.2 | % | |

9. Affiliated Managers

Group, Inc. | | | 2.1 | % | |

| 10. Epicor Software Corp. | | | 2.0 | % | |

* Percentages indicated are based on net assets as of December 31, 2005. The portfolio's composition is subject to change.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS7

JPMorgan

Dynamic Small Cap Fund

CONTINUED

(Unaudited)

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2005

| | | 1 YEAR | | 5 YEARS | | SINCE

INCEPTION

(5/19/97) | |

| CLASS A SHARES | |

| Without Sales Charge | | | 5.29 | % | | | 1.16 | % | | | 10.31 | % | |

| With Sales Charge* | | | (0.23 | %) | | | 0.07 | % | | | 9.63 | % | |

| CLASS B SHARES | |

| Without CDSC | | | 4.66 | % | | | 0.53 | % | | | 9.63 | % | |

| With CDSC** | | | (0.34 | %) | | | 0.13 | % | | | 9.63 | % | |

| CLASS C SHARES | |

| Without CDSC | | | 4.67 | % | | | 0.53 | % | | | 9.59 | % | |

| With CDSC*** | | | 3.67 | % | | | 0.53 | % | | | 9.59 | % | |

| SELECT CLASS SHARES | | | 5.70 | % | | | 1.58 | % | | | 10.64 | % | |

* Sales charge for class A shares is 5.25%.

** Assumes 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC for the period since inception.

*** Assumes a 1% CDSC for the one year period and 0% CDSC thereafter.

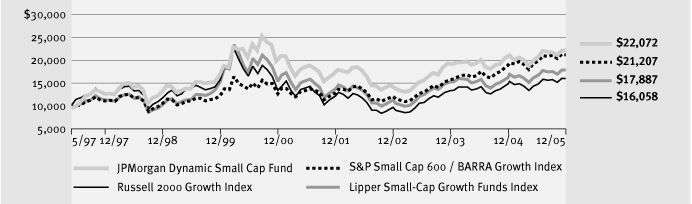

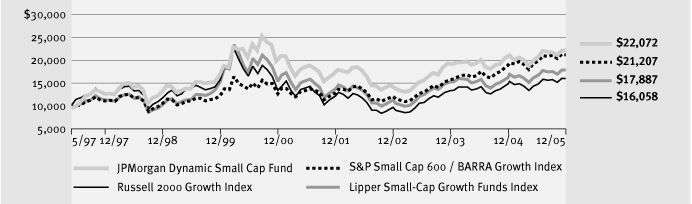

LIFE OF FUND PERFORMANCE (5/19/97 TO 12/31/05)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risk. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on 5/19/97.

Returns for the Select Class Shares prior to 4/5/99 (offering date of the Select Class Shares) are calculated using the historical expenses of the Class A Shares, which are higher than the expenses of the Select Shares. Returns for the Class C Shares prior to 1/7/98 (offering date of the Class C Shares) are calculated using the historical expenses of the Class B Shares, which are similar to the expenses of the Class C Shares.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Dynamic Small Cap Fund, Russell 2000 Growth Index, S&P SmallCap 600/BARRA Growth Index, and Lipper Small-Cap Growth Funds Index from May 19, 1997 to June 30, 2005. The performance of the Fund assumes reinvestment of all dividends and capital gains and includes a sales charge. The performance of the indices reflects an initial investment at the end of the month following the Fund's inception. The performance of the indices does not include expenses or a sales charge and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The Russell 2000 Growth Index is an unmanaged, capitalization weighted price only index, which is comprised of 2000 of the smallest stocks (on the basis of capitalization) in the Russell 3000 Index. The S&P SmallCap 600/ BARRA Growth Ind ex is a capitalization-weighted index of all the stocks in the S&P SmallCap 600 Index with higher price-to-book ratios. The benchmark for the Fund was changed from the S&P SmallCap 600/BARRA Growth Index to the Russell 2000 Growth Index because the adviser believes the Russell 2000 Growth Index more accurately reflects the Fund's investment strategy. The Lipper Small-Cap Growth Funds Index represents the total returns of the funds in the indicated category, as defined by Lipper, Inc. Investors cannot invest directly in an index.

Class A Shares have a $1,000 minimum initial investment and carry a 5.25% sales charge.

Performance may reflect the waiver and reimbursement of the Fund's fees/expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS8

JPMorgan

Growth Advantage Fund

AS OF DECEMBER 31, 2005 (Unaudited)

| FUND FACTS | |

| Fund Inception | | 10/29/99 | |

| Fiscal Year End | | December 31 | |

Net Assets as of 12/31/2005

(In Thousands) | | $56,096 | |

| Primary Benchmark | | Russell 3000 Growth Index, | |

Q: HOW DID THE FUND PERFORM?

A: The JPMorgan Growth Advantage Fund, which seeks to provide long-term capital growth,* returned 10.63% (A Shares)1 over the 12 months ended December 31, 2005, compared to the 5.17% return of the Russell 3000 Growth Index over the same period.

Q: WHY DID THE FUND PERFORM IN THIS WAY?

A: U.S. equity markets were dominated by interest rate concerns in 2005, as economic data was closely observed for signs that the Federal Open Market Committee's (FOMC) tightening cycle was winding down. Although there were bumps in the road, most particularly slowed growth and increased inflation following the hurricanes of late summer, the economy was generally supportive of equity gains in 2005.

The Fund was positively impacted by overall stock selection in the energy and technology sectors. Holdings, such as Apple Computer Inc. and Omnicare Inc., were among the top contributors. Apple Computer Inc., a manufacturer and marketer of personal computers, benefited from the expansion of its iPod digital music player business lines. Sales increased as the company introduced less expensive models, flash memory-based products and video playing versions. Omnicare Inc., a leading provider of pharmaceutical care for the elderly, acquired rival provider NeighborCare Inc., offering cost savings and improved purchasing power, which could lead to accelerated earnings growth.

Stock selection in consumer discretionary detracted from performance during the year. Exposure to OSI Pharmaceuticals Inc. and VeriSign Inc. detracted from performance. Shares of OSI Pharmaceuticals Inc. declined sharply after the company announced its acquisition of Eyetech Pharmaceuticals for a substantial premium. VeriSign Inc., an internet and telecommunication infrastructure provider, experienced mixed results as second-quarter sales decreased in its ring tone business divisions. Other parts of the company's business remain on track.

Q: HOW WAS THE FUND MANAGED?

A: Our focus remains on stock selection, believing that quality companies, regardless of their economic sector, trading at attractive valuations will outperform in the long term. Our aim is designed to identify companies with predictable and durable business models deemed capable of achieving sustained growth. We sought to maintain significant sector diversification in the Fund to avoid any large allocations contingent on macroeconomic or sector trends.

1 Effective August 17, 2005, the JPMorgan Mid Cap Growth Fund's name, investment objective, strategy and process changed to the current JPMorgan Growth Advantage Fund. Effective August 17, 2005, the funds benchmark was changed from the Russell Midcap® Growth Index to the Russell 3000 Growth Index.

* The advisor seeks to achieve the Fund's objective. There can be no guarantee it will be achieved.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS9

JPMorgan

Growth Advantage Fund

CONTINUED

(Unaudited)

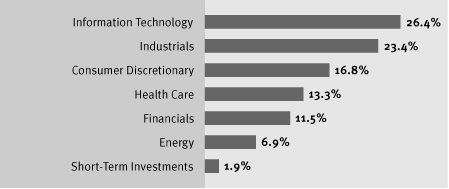

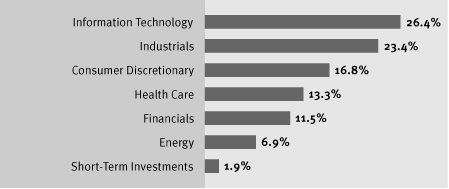

PORTFOLIO COMPOSITION*

TOP TEN EQUITY HOLDINGS

OF THE PORTFOLIO* | |

| 1. West Corp. | | | 2.3 | % | |

| 2. Amphenol Corp. | | | 2.2 | % | |

| 3. Sherwin-Williams Co. (The) | | | 1.6 | % | |

| 4. Seagate Technology | | | 1.5 | % | |

| 5. Norfolk Southern Corp. | | | 1.5 | % | |

| 6. Polo Ralph Lauren Corp. | | | 1.5 | % | |

| 7. Zions Bancorp | | | 1.5 | % | |

| 8. Jabil Circuit, Inc. | | | 1.5 | % | |

9. Alliance Data Systems

Corp. | | | 1.4 | % | |

| 10. McAfee, Inc. | | | 1.4 | % | |

* Percentages indicated are based on net assets as of December 31, 2005. The portfolio's composition is subject to change.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS10

ANNUAL REPORT DECEMBER 31

2005

(Unaudited)

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2005

| | | 1 YEAR | | 5 YEARS | | SINCE

INCEPTION

(10/29/99) | |

| CLASS A SHARES1 | |

| Without Sales Charge | | | 10.63 | % | | | (2.09 | %) | | | (6.75 | %) | |

| With Sales Charge* | | | 4.79 | % | | | (3.14 | %) | | | (7.56 | %) | |

| CLASS B SHARES | |

| Without CDSC | | | 9.75 | % | | | (2.77 | %) | | | (7.41 | %) | |

| With CDSC** | | | 4.75 | % | | | (3.22 | %) | | | (7.41 | %) | |

1 Effective August 17, 2005, the JPMorgan Mid Cap Growth Fund's name, investment objective, strategy and process changed to the current JPMorgan Growth Advantage Fund.

* Sales charge for class A shares is 5.25%.

** Assumes 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC for the period since inception.

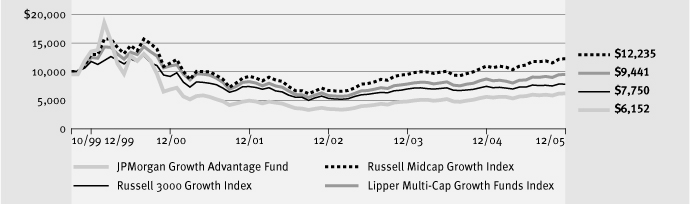

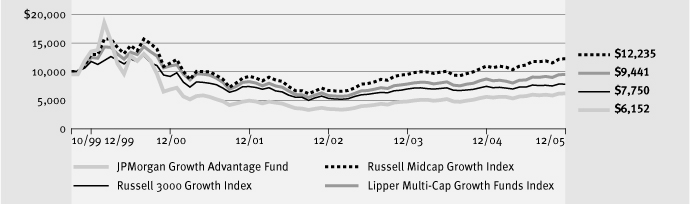

LIFE OF FUND PERFORMANCE (10/29/99 TO 12/31/05)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risk. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The JPMorgan Growth Advantage Fund commenced operations on 10/29/99.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Growth Advantage Fund, Russell 3000 Growth Index, Russell Midcap Growth Index, and Lipper Multi-Cap Growth Funds Index from October 29, 1999 to June 30, 2005. The performance of the Fund assumes reinvestment of all dividends and capital gains and includes a sales charge. The performance of the indices reflects an initial investment at the end of the month following the Fund's inception. The performance of the indices does not include expenses or a sales charge and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The Russell 3000 Growth Index measures the performance of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell Midcap Growth Index measures the performance of those Russell Midcap compan ies with higher price to-book ratios and higher forecasted growth values. The benchmark for the Fund was changed from the Russell Midcap Growth Index to the Russell 3000 Growth Index because the adviser believes the new Index more accurately reflects the Fund's investment strategy. The Lipper Multi-Cap Growth Funds Index represents the total returns of the funds in the indicated category, as defined by Lipper, Inc. Investors cannot invest directly in an index.

Class A Shares have a $1,000 minimum initial investment and carry a 5.25% sales charge.

Performance may reflect the waiver and reimbursement of the Fund's fees/expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS11

JPMorgan

Micro Cap Fund

AS OF DECEMBER 31, 2005 (Unaudited)

| FUND FACTS | |

| Fund Inception | | 10/31/05 | |

| Fiscal Year End | | December 31 | |

Net Assets as of 12/31/2005

(In Thousands) | | $5,158 | |

| Primary Benchmark | | Russell Microcap Index | |

Q: HOW DID THE FUND PERFORM?

A: The JPMorgan Micro Cap Fund, which seeks capital growth over the long term,* returned 3.20% (Select Shares) since inception (10/31/05) ended December 31, 2005, compared to the 4.42% return of the Russell Microcap Index over the same period.

Q: WHY DID THE FUND PERFORM IN THIS WAY?

A: U.S. equity markets were dominated by interest rate concerns in 2005, as economic data was closely observed for signs that the Federal Open Market Committee's (FOMC) tightening cycle was winding down. Although there were bumps in the road, most particularly slowed growth and increased inflation following the hurricanes of late summer, the economy was generally supportive of equity gains in 2005. Equity markets were also supported by continued strength in corporate profits.

The Fund underperformed the benchmark due primarily to overall stock selection in the consumer discretionary and industrials sectors. Consumers were faced with the headwinds of rising interest rates, increasing winter heating costs and a softening U.S. housing market. At the individual stock level, Hudson Highland Group Inc. and Youbet.com Inc. were among the top detractors from performance. Hudson Highland Group Inc, a specialty staffing company, announced that 2005 results would be lower than expected due to hiring softness in New Zealand, Australia and North America. Youbet.com Inc., an operator of online horse race wagering, announced that revenue growth for the fourth quarter would be below expectations, as the number of race days were reduced due to disruptions caused by Hurricanes Rita and Katrina, and issues specific to a California race track.

The Fund was positively impacted by overall stock selection in the financial sector and a lack of exposure to the telecommunication services sector. Lo Jack Corp. and NMT Medical Inc. were among the top individual contributors to performance. Lo Jack Corp., a provider of theft assistance technology and services for automobiles, reported strong results as the company continues to penetrate both new and existing domestic markets. Additionally, the company posted a 45% increase in international sales. The stock of NMT Medical Inc., a developer of cardiac implant technologies, rose on the back of increased optimism toward the company's efforts to find a treatment for migraine headaches.

Q: HOW WAS THE FUND MANAGED?

A: We employ a bottom-up approach to stock selection, constructing portfolios based on company fundamentals, quantitative screening and proprietary fundamental analysis. Our aim is to identify micro cap companies with durable franchises and strong management that will, in our opinion, generate solid returns over the long term. Our research involves separating those with strong long-term prospects from those that exhibit deteriorating business fundamentals or experience deep cyclicality. Potential investments are subjected to rigorous financial analysis and a disciplined approach to valuation.

* The advisor seeks to achieve the Fund's objective. There can be no guarantee it will be achieved.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS12

ANNUAL REPORT DECEMBER 31

2005

(Unaudited)

PORTFOLIO COMPOSITION*

TOP TEN EQUITY HOLDINGS

OF THE PORTFOLIO* | |

| 1. Celebrate Express, Inc. | | | 3.4 | % | |

| 2. PDF Solutions, Inc. | | | 3.2 | % | |

| 3. Collectors Universe | | | 3.0 | % | |

| 4. FirstService Corp. (Canada) | | | 3.0 | % | |

| 6. Bankrate, Inc. | | | 2.5 | % | |

| 5. Lo Jack Corp. | | | 2.5 | % | |

| 7. Unica Corp. | | | 2.5 | % | |

8. American Dental

Partners, Inc. | | | 2.4 | % | |

| 9. Lufkin Industries, Inc. | | | 2.3 | % | |

| 10. Interface, Inc. | | | 2.2 | % | |

* Percentages indicated are based on net assets as of December 31, 2005. The portfolio's composition is subject to change.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS13

JPMorgan

Micro Cap Fund

CONTINUED

(Unaudited)

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2005

| | | SINCE

INCEPTION

(10/31/05) | |

| CLASS A SHARES | |

| Without Sales Charge | | | 3.13 | % | |

| With Sales Charge* | | | (2.17 | %) | |

| CLASS C SHARES | |

| Without CDSC | | | 3.07 | % | |

| With CDSC** | | | 2.07 | % | |

| SELECT CLASS SHARES | | | 3.20 | % | |

| RUSSELL MICROCAP INDEX | | | 4.79 | % | |

* Sales charge for class A shares is 5.25%.

** Assumes a 1% CDSC for the one year period and 0% CDSC thereafter.

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risk. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on 10/31/05.

The performance of the index does not include expenses or a sales charge and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The Russell Microcap Index is an unmanaged, capitalization weighed price only index, which is comprised of 1,000 of the smallest stocks (on the basis of capitalization) in the small-cap Russell 2000 Index plus the next 1,000 smallest securities. Investors cannot invest directly in an index.

Performance may reflect the waiver and reimbursement of the Fund's fees / expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS14

JPMorgan

Mid Cap Equity Fund

AS OF DECEMBER 31, 2005 (Unaudited)

| FUND FACTS | |

| Fund Inception | | 1/1/97 | |

| Fiscal Year End | | December 31 | |

Net Assets as of 12/31/2005

(In Thousands) | | $268,582 | |

| Primary Benchmark | | Russell Midcap Index | |

Q: HOW DID THE FUND PERFORM?

A: The JPMorgan Mid Cap Equity Fund, whose objective is long-term capital growth,* returned 9.61% (Select Shares) over the 12 months ended December 31, 2005, compared to the 12.65% return of the Russell Midcap Index over the same period.

Q: WHY DID THE FUND PERFORM IN THIS WAY?

A: U.S. equity markets were dominated by interest rate concerns in 2005, as economic data was closely observed for signs that the Federal Open Market Committee's (FOMC) tightening cycle was winding down. Although there were bumps in the road, most particularly slowed growth and increased inflation following the hurricanes of late summer, the economy was generally supportive of equity gains in 2005. Equity markets were also supported by continued strength in corporate profits.

The Fund underperformed the benchmark due primarily to overall stock selection in the consumer discretionary and materials sectors, as consumers faced headwinds of rising interest rates, increasing winter heating costs and a softening U.S. housing market while many materials manufacturers faced increased costs associated with higher energy prices. At the individual stock level, IPC Holdings Ltd. and VeriSign Inc. were top detractors from performance. IPC Holdings Ltd., a provider of property catastrophe reinsurance, announced significant insured losses resulting from Hurricanes Katrina and Rita. Despite relatively stable operating results prior to the hurricanes, the storms negatively impacted the company's third-quarter financial results. VeriSign Inc., an Internet and telecommunication infrastructure provider, experienced mixed results as second-quarter sales decreased in its ring tone business divisions. Other parts of the co mpany's business remain on track.

The Fund was positively impacted by overall stock selection in industrials and an overweight in energy. Coventry Health Care Inc. and Burlington Resources Inc. were among the top contributors to performance. Coventry Health Care Inc., a managed healthcare company, experienced accelerated earning growth in 2005 due to improved margins and realized synergies from its acquisition of First Health Group Corporation. Burlington Resources Inc., an energy exploration and production company, reported strong results resulting from higher energy prices, growth in production and accelerated share repurchases. In addition, the stock strengthened in December as the company agreed to be acquired by ConocoPhillips.

Q: HOW WAS THE FUND MANAGED?

A: We employ a bottom-up approach to stock selection, constructing portfolios based on company fundamentals, quantitative screening and proprietary fundamental analysis. The research process is designed to identify companies with predictable and durable business models deemed capable of achieving sustainable growth. Above-average growth, sustainable cash flows and attractive valuations are characteristics of the investments in this portfolio. Potential investments are subjected to rigorous financial analysis and a disciplined approach to valuation.

* The advisor seeks to achieve the Fund's objective. There can be no guarantee it will be achieved.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS15

JPMorgan

Mid Cap Equity Fund

CONTINUED

(Unaudited)

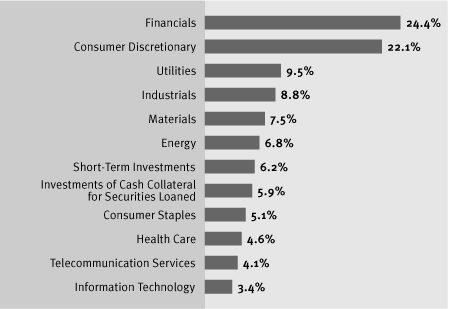

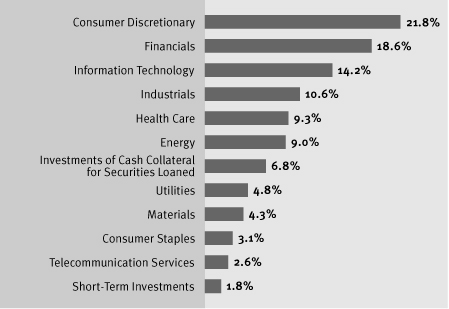

PORTFOLIO COMPOSITION*

TOP TEN EQUITY HOLDINGS

OF THE PORTFOLIO* | |

| 1. Coventry Health Care, Inc. | | | 1.5 | % | |

| 2. Amphenol Corp. | | | 1.5 | % | |

| 3. Sherwin-Williams Co. (The) | | | 1.3 | % | |

| 4. V.F. Corp. | | | 1.2 | % | |

| 5. Assurant, Inc. | | | 1.2 | % | |

| 6. West Corp. | | | 1.1 | % | |

| 7. Omnicare, Inc. | | | 1.1 | % | |

| 8. Burlington Resources, Inc. | | | 1.0 | % | |

| 9. M&T Bank Corp. | | | 1.0 | % | |

| 10. Zions Bancorp | | | 1.0 | % | |

* Percentages indicated are based on net assets as of December 31, 2005. The portfolio's composition is subject to change.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS16

ANNUAL REPORT DECEMBER 31

2005

(Unaudited)

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2005

| | | 1 YEAR | | 5 YEAR | | 10 YEARS | |

| SELECT CLASS SHARES | | | 9.61 | % | | | 7.56 | % | | | 11.48 | % | |

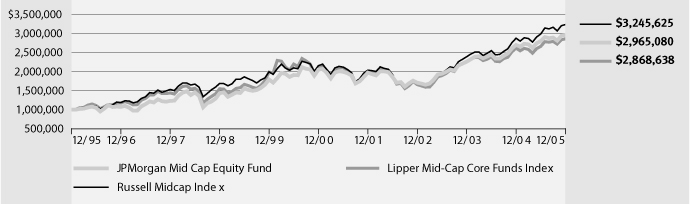

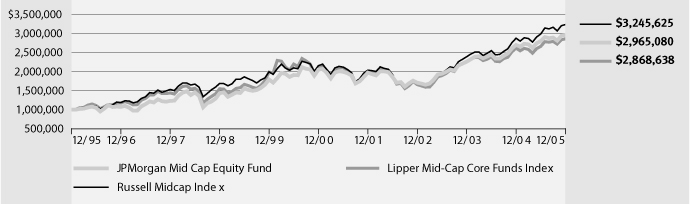

LIFE OF FUND PERFORMANCE (12/31/95 TO 12/31/05)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risk. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on 1/1/97.

Returns for the Fund prior to 1/1/97 (offering date of the Select Class Shares) are the returns of a common trust fund adjusted to reflect the Fund's expense levels (absent reimbursements) that were in place at the time the Fund recieved the common trust fund assets. The common trust fund was not registered with the SEC and was not subject to investment restrictions of registered mutual funds. If the common trust fund had been registered, performance may have been adversely affected.

The graph illustrates comparative performance for $1,000,000 invested in the JPMorgan Mid Cap Equity Fund, Russell Midcap Index, and Lipper Mid-Cap Core Funds Index from December 31, 1995 to June 30, 2005. The performance of the Fund assumes reinvestment of all dividends and capital gains. The performance of the indices does not include expenses and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The Russell Midcap Index measures the performance of the smallest 800 companies of the Russell 1000 Index, which represents approximately 25% of the total market capitalization of the Russell 1000 Index. The Lipper Mid-Cap Core Funds Index represents the total returns of the funds in the indicated category, as defined by Lipper, Inc. Investors cannot invest directly in an Index.

Select Class Shares have a $1,000,000 minimum initial investment and carry no sales charge.

Performance may reflect the waiver and reimbursement of the Fund's fees/expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS17

JPMorgan

Mid Cap Value Fund

AS OF DECEMBER 31, 2005 (Unaudited)

| FUND FACTS | |

| Fund Inception | | 11/13/97 | |

| Fiscal Year End | | December 31 | |

Net Assets as of 12/31/2005

(In Thousands) | | $7,016,803 | |

| Primary Benchmark | | Russell Midcap Value Index | |

Q: HOW DID THE FUND PERFORM?

A: The JPMorgan Mid Cap Value Fund, which seeks growth from capital appreciation,* returned 9.42% (Institutional Shares) over the 12 months ended December 31, 2005, compared to the 12.65% return of the Russell Midcap Value Index over the same period.

Q: WHY DID THE FUND PERFORM IN THIS WAY?

A: U.S. equity markets were dominated by interest rate concerns in 2005, as economic data was closely observed for signs that the Federal Open Market Committee's (FOMC) tightening cycle was winding down. Although there were bumps in the road, most particularly slowed growth and increased inflation following the hurricanes of late summer, the economy was generally supportive of equity gains in 2005. Equity markets were also supported by continued strength in corporate profits.

The Fund underperformed the benchmark due primarily to overall stock selection in the consumer discretionary and materials sectors, as consumers faced headwinds of rising interest rates, increasing winter heating costs and a softening U.S. housing market while many materials manufacturers faced increased costs associated with higher energy prices. At the individual stock level, IPC Holdings Ltd. and Gannett Co. Inc. were among the top detractors from performance. IPC Holdings Ltd., a provider of property catastrophe reinsurance, announced significant insured losses resulting from Hurricanes Katrina and Rita. Despite relatively stable operating results prior to the hurricanes, the storms negatively impacted the company's third-quarter financial results. Gannett Co., Inc., a media conglomerate, experienced weaker revenues due to reduced ad sales.

The Fund was positively impacted by overall stock selection in the industrials and consumer staples sectors. Burlington Resources, Inc. and Coventry Health Care Inc. were among the top individual contributors to performance. Burlington Resources, Inc., an energy exploration and production company, reported strong results resulting from higher energy prices, growth in production and accelerated share repurchases. In addition, the stock strengthened in December as the company agreed to be acquired by ConocoPhillips. Coventry Health Care Inc., a managed health care company, experienced accelerated earning growth in 2005 due to improved margins and realized synergies from its acquisition of First Health Group Corporation.

Q: HOW WAS THE FUND MANAGED?

A: We employ a bottom-up approach to stock selection, constructing portfolios based on company fundamentals, quantitative screening and proprietary fundamental analysis. Our aim is to identify undervalued companies that have the potential to grow their intrinsic values per share and to purchase these companies at a discount. The research process is designed to identify companies with predictable and durable business models deemed capable of achieving sustainable growth. Potential investments are subjected to rigorous financial analysis and a disciplined approach to valuation.

* The advisor seeks to achieve the Fund's objective. There can be no guarantee it will be achieved.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS18

ANNUAL REPORT DECEMBER 31

2005

(Unaudited)

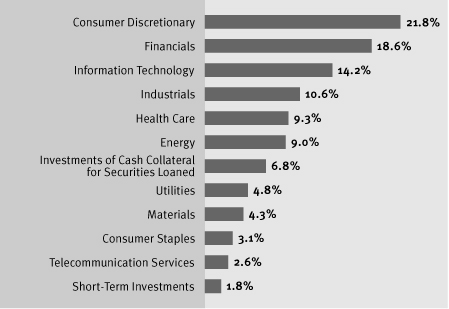

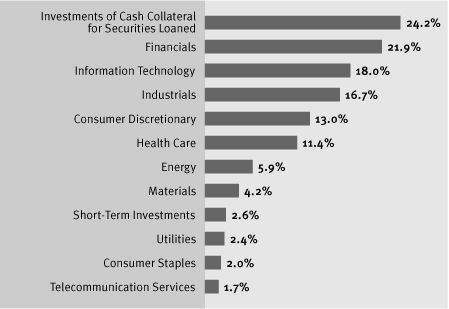

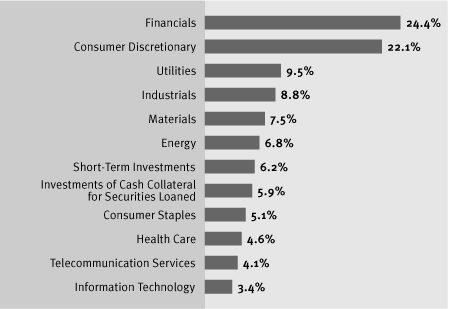

PORTFOLIO COMPOSITION*

TOP TEN EQUITY HOLDINGS

OF THE PORTFOLIO* | |

| 1. V.F. Corp. | | | 2.4 | % | |

| 2. Assurant, Inc. | | | 2.3 | % | |

| 3. Burlington Resources, Inc. | | | 2.0 | % | |

| 4. M&T Bank Corp. | | | 1.9 | % | |

| 5. Coventry Health Care, Inc. | | | 1.9 | % | |

| 6. Devon Energy Corp. | | | 1.8 | % | |

| 7. CenturyTel, Inc. | | | 1.8 | % | |

| 8. AutoZone, Inc. | | | 1.8 | % | |

| 9. North Fork Bancorp, Inc. | | | 1.7 | % | |

| 10. Kinder Morgan, Inc. | | | 1.7 | % | |

* Percentages indicated are based on net assets as of December 31, 2005. The portfolio's composition is subject to change.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS19

JPMorgan

Mid Cap Value Fund

CONTINUED

(Unaudited)

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2005

| | | 1 YEAR | | 5 YEARS | | SINCE

INCEPTION

(11/13/97) | |

| CLASS A SHARES | |

| Without Sales Charge | | | 8.87 | % | | | 13.88 | % | | | 17.49 | % | |

| With Sales Charge* | | | 3.16 | % | | | 12.66 | % | | | 16.71 | % | |

| CLASS B SHARES | |

| Without CDSC | | | 8.31 | % | | | 13.18 | % | | | 17.04 | % | |

| With CDSC** | | | 3.31 | % | | | 12.94 | % | | | 17.04 | % | |

| CLASS C SHARES | |

| Without CDSC | | | 8.34 | % | | | 13.23 | % | | | 17.07 | % | |

| With CDSC*** | | | 7.34 | % | | | 13.23 | % | | | 17.07 | % | |

| SELECT CLASS SHARES | | | 9.16 | % | | | 14.18 | % | | | 17.68 | % | |

| INSTITUTIONAL CLASS SHARES | | | 9.42 | % | | | 14.43 | % | | | 17.83 | % | |

* Sales charge for class A shares is 5.25%.

** Assumes 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC for the period since inception.

*** Assumes a 1% CDSC for the one year period and 0% CDSC thereafter.

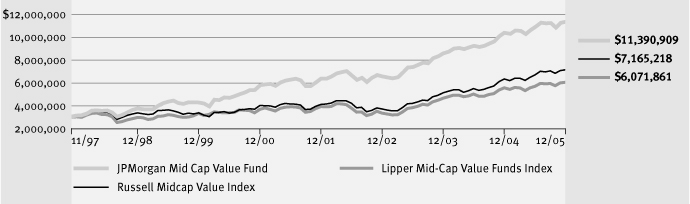

LIFE OF FUND PERFORMANCE (11/13/97 TO 12/31/05)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risk. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on 11/13/97.

Returns for the Select Class Shares prior to 10/31/01 (offering date of the Select Class Shares) are calculated using the historical expenses of the Institutional Class Shares. During the period, the actual returns of Select Class Shares would have been lower than shown because Select Class Shares have higher expenses Institutional Class Shares.

Returns for the Class A, Class B, and Class C Shares prior to 4/30/01 (offering date of the Class A, Class B, and Class C Shares) are calculated using the historical expenses of the Institutional Class Shares. During this period, the actual returns of Class A, Class B, and Class C Shares would have been lower than shown because Class A, Class B, and Class C Shares have higher expenses than Institutional Class Shares.

The graph illustrates comparative performance for $3,000,000 invested in Institutional Class Shares of the JPMorgan Mid Cap Value Fund, Russell Midcap Value Index, and Lipper Mid-Cap Value Funds Index from November 13, 1997 to June 30, 2005. The performance of the Fund assumes reinvestment of all dividends and capital gains. The performance of the indices reflects an initial investment at the end of the month following the Fund's inception. The performance of the indices does not include expenses or a sales charge and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The Russell Midcap Value Index is an unmanaged, capitalization weighted, price only index that measures the performance of those companies included in the Russell Midcap Index that have lower price-to-book ratios and lower forecasted growth rates. The Lipper Mid-Cap Value Funds Index represents the total returns of the funds in the indicated category, as defined by Lipper, Inc. Investors cannot invest directly in an index.

Institutional Class Shares have a $3,000,000 minimum initial investment and carry no sales charge.

Performance may reflect the waiver and reimbursement of the Fund's fees/expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS20

JPMorgan

Small Cap Core Fund

AS OF DECEMBER 31, 2005 (Unaudited)

| FUND FACTS | |

| Fund Inception | | 1/1/97 | |

| Fiscal Year End | | December 31 | |

Net Assets as of 12/31/2005

(In Thousands) | | $815,905 | |

| Primary Benchmark | | Russell 2000

Index | |

Q: HOW DID THE FUND PERFORM?

A: The JPMorgan Small Cap Core Fund, which seeks capital growth over the long term,* returned 3.90% (Select Shares) over the 12 months ended December 31, 2005, compared to the 4.55% return of the Russell 2000 Index over the same period.

Q: WHY DID THE FUND PERFORM THIS WAY?

A: U.S. equity markets produced solid returns in 2005. Concerns that a slowdown in the housing sector would cut the legs out from under consumer spending were more than offset by increased consumer confidence due primarily to rapidly falling gasoline prices in the third and fourth quarters.

Stock selection in the finance and pharmaceutical sectors primarily detracted from results. At the security level, a top detractor was R&G Financial Corp., a diversified financial services company, whose shares declined in April on the back of restated earnings for 2004. The company's shares also fell in sync with a major Puerto Rico-based lender that has undergone a formal accounting probe by the SEC. Another major detractor was Cypress Biosciences Inc., a biotechnology company. Shares of Cypress Biosciences Inc. fell at the end of September after the company and its drug development partner, Forest Laboratories Inc., announced early data from a Phase III clinical trial showing that the drug milnacipran was statistically ineffective in treating fibromyalgia, a condition causing chronic muscle pain and stiffness. Despite the setback, Forest Laboratories and Cypress Biosciences stated that they will continue to pursue two add itional Phase III clinical trials for the drug, but admitted their plan could change in the near future.

Although the Fund underperformed its benchmark, stock selection in the industrial cyclical and utility sectors aided performance. Among the top contributors were Dobson Communications Corp., an Oklahoma City-based provider of wireless communications services, and GUESS? Inc., an apparel retailer. In June, Dobson Communications Corp. shares benefited from positive earnings guidance due to increased revenue per subscriber. The company also initiated discussions with Cingular, the largest U.S. cell phone provider, aimed at setting up a roaming agreement. Additionally, the company agreed to buy the Cellular One brand from Alltel Corp., a telecommunications company, for $1.3 million. GUESS? Inc. shares increased after the company reported record revenues throughout the year, which were driven by the performance in its European business.

Q: HOW WAS THE FUND MANAGED?

A: The Fund strives to add value exclusively through stock selection rather than sector, style or theme bets. To minimize sector risk, we weight sectors in the Fund within +/-1% of the sector weights of the benchmark. We have found that minimizing sector bets is one of the most effective ways of reducing residual risk from a portfolio without reducing the ability to add performance. Finally, to control stock-specific risk, individual stock weights in the Fund are limited to +/-1% of the stock's weight in the Russell 2000 Index.

* The advisor seeks to achieve the Fund's objective. There can be no guarantee it will be achieved.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS21

JPMorgan

Small Cap Core Fund

CONTINUED

(Unaudited)

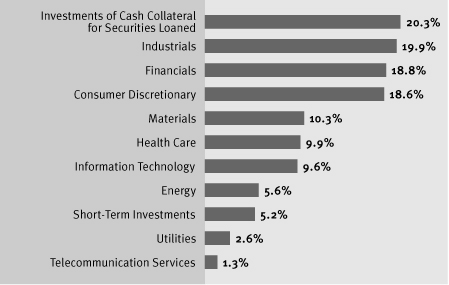

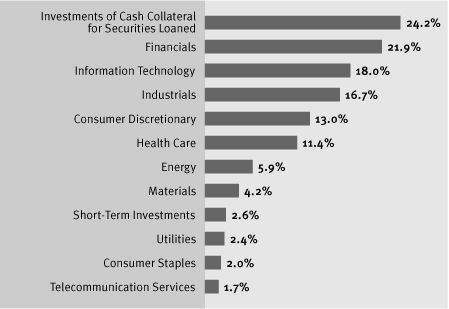

PORTFOLIO COMPOSITION*

TOP TEN EQUITY HOLDINGS

OF THE PORTFOLIO* | |

1. Applied Industrial

Technologies, Inc. | | | 1.1 | % | |

| 2. Houston Exploration Co. | | | 0.9 | % | |

| 3. Kilroy Realty Corp. | | | 0.9 | % | |

| 4. Aaron Rents, Inc. | | | 0.8 | % | |

5. Universal Forest Products,

Inc. | | | 0.8 | % | |

6. Mid-America Apartment

Communities, Inc. | | | 0.8 | % | |

| 7. Moog, Inc., Class A | | | 0.8 | % | |

| 8. Delphi Financial Group, Inc. | | | 0.8 | % | |

| 9. Commercial Metals Co. | | | 0.7 | % | |

10. Zenith National Insurance

Corp. | | | 0.7 | % | |

* Percentages indicated are based on net assets as of December 31, 2005. The portfolio's composition is subject to change.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS22

ANNUAL REPORT DECEMBER 31

2005

(Unaudited)

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2005

| | | 1 YEAR | | 5 YEARS | | 10 YEARS | |

| SELECT CLASS SHARES | | | 3.90 | % | | | 6.42 | % | | | 7.57 | % | |

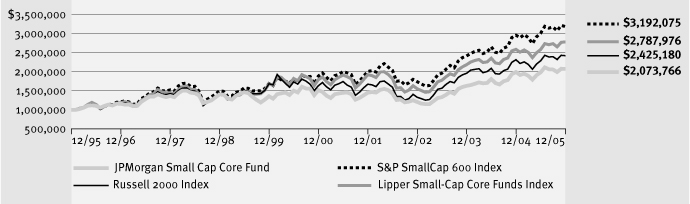

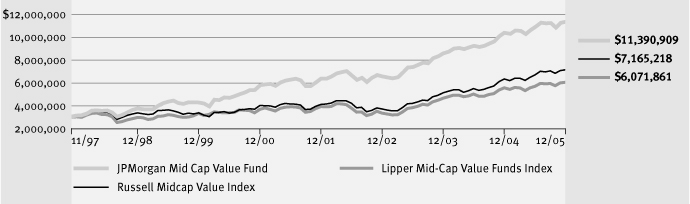

TEN YEAR FUND PERFORMANCE (12/31/95 TO 12/31/05)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risk. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on 1/1/97.

Returns for the Fund prior to 1/1/97 (offering date of the Select Class Shares) are the returns of a common trust fund adjusted to reflect the Fund's expense levels (absent reimbursements) that were in place at the time the Fund received the common trust fund assets. The common trust fund was not registered with the SEC and was not subject to investment restrictions of registered mutual funds. If the common trust fund had been registered, performance may have been adversely affected.

The graph illustrates comparative performance for $1,000,000 invested in the JPMorgan Small Cap Core Fund, Russell 2000 Index, S&P SmallCap 600/BARRA Index and Lipper Small-Cap Core Funds Index from June 30, 1995 to June 30, 2005.

The performance of the Fund assumes reinvestment of all dividends and capital gains and includes a sales charge. The performance of the indices does not include expenses and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The Russell 2000 Index is an unmanaged, capitalization weighted price only index, which is comprised of 2000 of the smallest stocks (on the basis of capitalization) in the Russell 3000 Index. The S&P SmallCap 600 Index includes 600 stocks of small U.S. Companies chosen for market size, liquidity, and industry group representation. During the year ended December 31, 2004, the Fund changed its benchmark from the S&P SmallCap 600 Index to the Russell 2000 Index, because the adviser believes the Russell 2000 Index more accurately reflects the Fund's investment strategy. The Lipper Small-Cap Core Funds Index represents the total return s of the funds in the indicated category, as defined by Lipper, Inc. Investor's cannot invest directly in an index.

Select Class Shares have a $1,000,000 minimum initial investment and carry no sales charge.

Performance may reflect the waiver and reimbursement of the Fund's fees/expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS23

JPMorgan

Small Cap Equity Fund

AS OF DECEMBER 31, 2005 (Unaudited)

| FUND FACTS | |

| Fund Inception | | 12/20/94 | |

| Fiscal Year End | | December 31 | |

Net Assets as of 12/31/2005

(In Thousands) | | $480,542 | |

| Primary Benchmark | | Russell 2000

Index | |

Q: HOW DID THE FUND PERFORM?

A: The JPMorgan Small Cap Equity Fund, which seeks capital growth over the long term,* returned 12.39% (A Shares) over the 12 months ended December 31, 2005, compared to the 4.55% return of the Russell 2000 Index over the same period.

Q: WHY DID THE FUND PERFORM IN THIS WAY?

A: U.S. equity markets were dominated by interest rate concerns in 2005, as economic data was closely observed for signs that the Federal Open Market Committee's (FOMC) tightening cycle was winding down. Although there were bumps in the road, most particularly slowed growth and increased inflation following the hurricanes of late summer, the economy was generally supportive of equity gains in 2005. Equity markets were also supported by continued strength in corporate profits.

The Fund outperformed its benchmark due primarily to stock selection in the industrials and materials sectors. At the individual stock level, Southwestern Energy Co., an integrated energy company, and St. Mary Land & Exploration Co., a natural gas producer, were positive contributors to performance. Shares of Southwestern Energy Co. rose on significantly increased production volumes, higher natural gas prices and a capital investment program to fund exploration and production in 2006. St. Mary Land & Exploration Co. reported its fifth consecutive quarter of increased production. In addition, the company announced an increase in its 2005 forecast of exploration and development costs to sustain future growth.

The Fund was negatively impacted by overall stock selection in the telecommunication service and healthcare sectors. Georgia Gulf Corp. and Avocent Corp. were large detractors from performance. Georgia Gulf Corp., a manufacturer of chemical and plastic products, experienced decreased earnings growth due to industry-wide concerns of an economic slowdown and the effects of Hurricanes Rita and Katrina. Supply constraints and lowered inventories from hurricane-related activity disrupted business and contributed to reduced third-quarter earnings. Avocent Corp., a computer equipment maker, experienced mixed results. The company slashed its first-quarter revenue guidance due to lower sales, the launch of its DSView 3 software and greater-than-expected seasonal softness. Despite this lowered forecast, Avocent reported a rise in third-quarter profit, which was attributed to strong demand for digital and embedded products, and robust sale s in Asia.

Q: HOW WAS THE FUND MANAGED?

A: We employ a bottom-up approach to stock selection, constructing portfolios based on company fundamentals, quantitative screening and proprietary fundamental analysis. Our aim is to identify undervalued small-cap companies with leading competitive positions and strong management. The research process is designed to identify companies that exhibit sustainable free cash flow, high barriers to entry and a proven management team. Potential investments are subjected to rigorous financial analysis and a disciplined approach to valuation.

* The advisor seeks to achieve the Fund's objective. There can be no guarantee it will be achieved.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS24

ANNUAL REPORT DECEMBER 31

2005

(Unaudited)

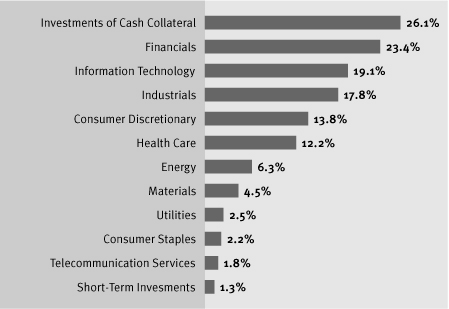

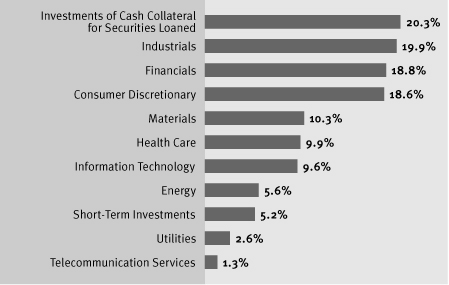

PORTFOLIO COMPOSITION*

TOP TEN EQUITY HOLDINGS

OF THE PORTFOLIO* | |

1. Williams Scotsman

International, Inc. | | | 2.4 | % | |

| 2. United Bancshares, Inc. | | | 2.1 | % | |

| 3. ProAssurance Corp. | | | 2.0 | % | |

| 4. Scotts Miracle-Gro Co. (The) | | | 2.0 | % | |

5. St. Mary Land &

Exploration Co. | | | 2.0 | % | |

| 6. Watsco, Inc. | | | 1.9 | % | |

| 7. Alderwoods Group, Inc. | | | 1.8 | % | |

| 8. Jarden Corp. | | | 1.8 | % | |

| 9. Hudson Highland Group, Inc. | | | 1.7 | % | |

| 10. Waste Connections, Inc. | | | 1.6 | % | |

* Percentages indicated are based on net assets as of December 31, 2005. The portfolio's composition is subject to change.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS25

JPMorgan

Small Cap Equity Fund

CONTINUED

(Unaudited)

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2005

| | | 1 YEAR | | 5 YEARS | | 10 YEARS | |

| CLASS A SHARES | |

| Without Sales Charge | | | 12.39 | % | | | 8.43 | % | | | 11.80 | % | |

| With Sales Charge* | | | 6.47 | % | | | 7.27 | % | | | 11.20 | % | |

| CLASS B SHARES | |

| Without CDSC | | | 11.85 | % | | | 7.67 | % | | | 11.14 | % | |

| With CDSC** | | | 6.85 | % | | | 7.37 | % | | | 11.14 | % | |

| CLASS C SHARES | |

| Without CDSC | | | 11.81 | % | | | 7.66 | % | | | 11.00 | % | |

| With CDSC*** | | | 10.81 | % | | | 7.66 | % | | | 11.00 | % | |

| SELECT CLASS SHARES | | | 12.98 | % | | | 9.02 | % | | | 12.34 | % | |

* Sales charge for Class A Shares is 5.25%.

** Assumes 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC for the ten year period.

*** Assumes a 1% CDSC for the one year period and 0% CDSC thereafter.

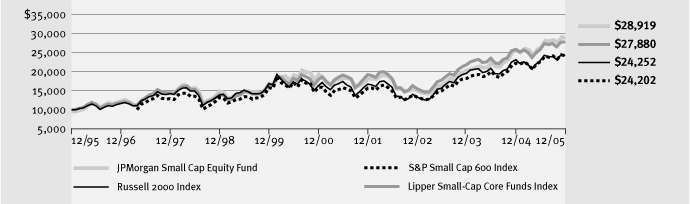

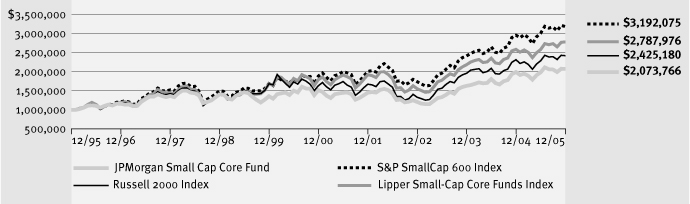

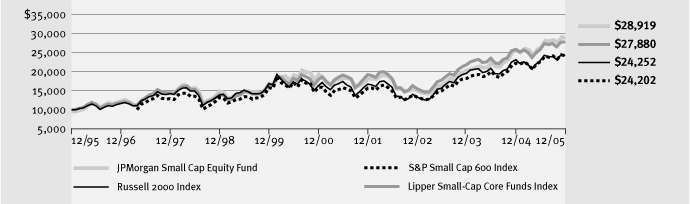

TEN YEAR PERFORMANCE (12/31/95 TO 12/31/05)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risk. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on 12/20/94.

Returns for the Select Class Shares prior to 5/7/96 (offering date of the Select Class Shares) are calculated using the historical expenses of the Class A Shares, which are higher than the expenses of the Select Class Shares.

Returns for the Class B Shares prior to 3/28/95 (offering date of the Class B Shares) are calculated using the historical expenses of the Class A Shares, which are lower than the expenses of the Class B Shares. In addition, returns for the Class C Shares prior to 2/19/05 (offering date of the Class C Shares) are calculated using the historical expenses of the Class B Shares, which are similar to the expenses of the Class C Shares. During this period, the actual returns of Class B and Class C Shares would have been lower than shown because Class B and Class C Shares have higher expenses than Class A Shares.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Small Cap Equity Fund, Russell 2000 Index, S&P SmallCap 600 Index and Lipper

Small-Cap Core Funds Index from June 30, 1995 to June 30, 2005.

The performance of the Fund assumes reinvestment of all dividends and capital gains and includes a sales charge. The performance of the indices does not include expenses or a sales charge and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The Russell 2000 Index is an unmanaged, capitalization weighted price only index, which is comprised of 2000 of the smallest stocks (on the basis of capitalization) in the Russell 3000 Index. The S&P SmallCap 600 Index includes 600 stocks of small U.S. Companies chosen for market size, liquidity and industry group representation. The Lipper Small-Cap Core Funds Index represents the total returns of the funds in the indicated category, as defined by Lipper, Inc. Investors cannot invest directly in an index.

Class A Shares have a $1,000 minimum initial investment and carry a 5.25% sales charge.

Performance may reflect the waiver and reimbursement of the Fund's fees/expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS26

JPMorgan

U.S. Small Company Fund

AS OF DECEMBER 31, 2005 (Unaudited)

| FUND FACTS | |

| Fund Inception | | 11/4/93 | |

| Fiscal Year End | | December 31 | |

Net Assets as of 12/31/2005

(In Thousands) | | $148,693 | |

| Primary Benchmark | | Russell 2000

Index | |

Q: HOW DID THE FUND PERFORM?

A: The JPMorgan U.S. Small Company Fund, which seeks to provide high total return from a portfolio of small-company stocks,* returned 4.18% (Institutional Shares) over the 12 months ended December 31, 2005, compared to the 4.55% return of the Russell 2000 Index over the same period.

Q: WHY DID THE FUND PERFORM THIS WAY?

A: U.S. equity markets produced solid returns in 2005. Concerns that a slowdown in the housing sector would cut the legs out from under consumer spending were more than offset by increased consumer confidence due primarily to rapidly falling gasoline prices in the third and fourth quarters.

Stock selection in the finance and pharmaceutical sectors primarily detracted from results. At the security level, a top detractor was R&G Financial Corp., a diversified financial services company, whose shares declined in April on the back of restated earnings for 2004. The company's shares also fell in sync with other major Puerto Rico lenders after Doral Financial Corp., the island's largest residential mortgage lender, disclosed that the SEC had changed an informal accounting probe into a formal one. Another major detractor was Cypress Biosciences Inc., a biotechnology company. Shares of Cypress Biosciences, Inc. fell at the end of September after the company and its drug development partner, Forest Laboratories Inc., announced early data from a Phase III clinical trial showing that the drug milnacipran was statistically ineffective in treating fibromyalgia, a condition causing chronic muscle pain and stiffness. Despite the setback, Forest Laboratories and Cypress Biosciences Inc. stated that they will continue to pursue two additional Phase III clinical trials for the drug, but admitted their plan could change in the near future.

Although the Fund underperformed its benchmark, stock selection in the industrial cyclical and utility sectors aided performance. Among the top contributors were Dobson Communications Corp., an Oklahoma City-based provider of wireless communications services, and GUESS? Inc., an apparel retailer. In June, Dobson Communications Corp. shares benefited from positive earnings guidance due to increased revenue per subscriber. The company also initiated discussions with Cingular, the largest U.S. cell phone provider, aimed at setting up a roaming agreement. Additionally, the company agreed to buy the Cellular One brand from Alltel Corp., a telecommunications company, for $1.3 million. GUESS? Inc. shares increased after the company reported record revenues throughout the year, which were driven by the performance in its European business.

Q: HOW WAS THE FUND MANAGED?

A: The Fund strives to add value exclusively through stock selection rather than sector, style or theme bets. To minimize sector risk, we weight sectors in the Fund within +/-1% of the sector weights of the benchmark. We have found that minimizing sector bets is one of the most effective ways of reducing residual risk from a portfolio without reducing the ability to add performance. Finally, to control stock-specific risk, individual stock weights in the Fund are limited to +/-1% of the stock's weight in the Russell 2000 Index.

* The advisor seeks to achieve the Fund's objective. There can be no guarantee it will be achieved.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS27

JPMorgan

U.S. Small Company Fund

CONTINUED

(Unaudited)

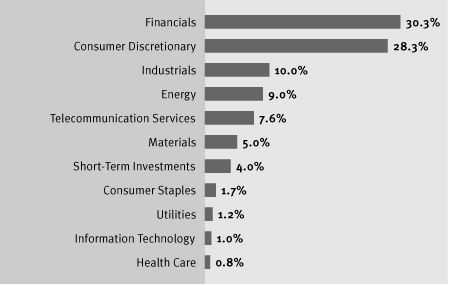

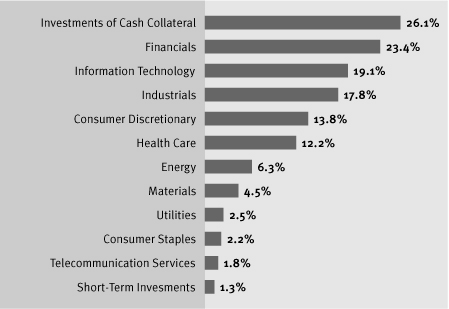

PORTFOLIO COMPOSITION*

TOP TEN EQUITY HOLDINGS

OF THE PORTFOLIO* | |

1. Applied Industrial

Technologies, Inc. | | | 1.2 | % | |

| 2. Houston Exploration Co. | | | 1.0 | % | |

| 3. Kilroy Realty Corp. | | | 0.9 | % | |

| 4. Aaron Rents, Inc. | | | 0.9 | % | |

5. Universal Forest

Products, Inc. | | | 0.9 | % | |

6. Mid-America Apartment

Communities, Inc. | | | 0.9 | % | |

| 7. Moog, Inc. | | | 0.8 | % | |

| 8. Delphi Financial Group, Inc. | | | 0.8 | % | |

| 9. Commercial Metals Co. | | | 0.8 | % | |

| 10. Todco | | | 0.7 | % | |

* Percentages indicated are based on net assets as of December 31, 2005. The portfolio's composition is subject to change.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS28

ANNUAL REPORT DECEMBER 31

2005

(Unaudited)

AVERAGE ANNUAL TOTAL RETURNS AS OF DECEMBER 31, 2005

| | | 1 YEAR | | 5 YEARS | | 10 YEARS | |

| SELECT CLASS SHARES | | | 3.93 | % | | | 3.64 | % | | | 8.08 | % | �� |

| INSTITUTIONAL CLASS SHARES | | | 4.18 | % | | | 3.81 | % | | | 8.25 | % | |

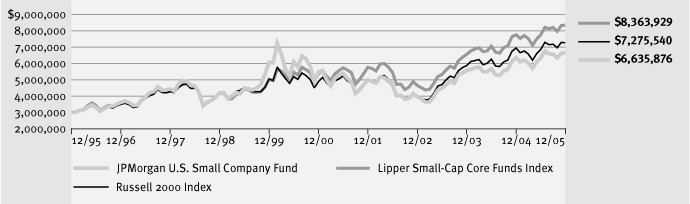

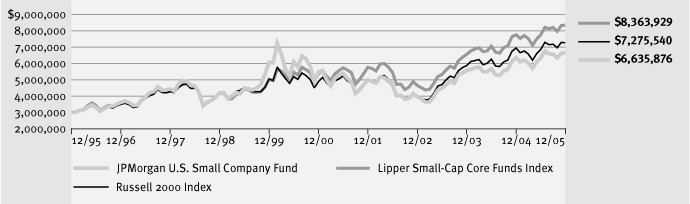

TEN YEAR FUND PERFORMANCE (12/31/95 TO 12/31/05)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risk. Investment returns and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on 11/4/93 and prior to 9/7/01, operated in a master feeder structure.

Returns for the Institutional Class Shares prior to 9/10/01 (offering date of the Institutional Class Shares) are calculated using the historical expenses of an institutional feeder, the J.P. Morgan Institutional U.S. Small Company Fund, whose expenses are substantially similar to the expenses of the Institutional Class Shares.

Returns for the Select Class Shares prior to 9/10/01 (offering date of the Select Class Shares) are calculated using the historical expenses of a retail feeder, the J.P. Morgan U.S. Small Company Fund, whose expenses are substantially similar to the expenses of the Select Class Shares.

The graph illustrates comparative performance for $3,000,000 invested in Institutional Class Shares of the JPMorgan U.S. Small Company Fund, Russell 2000 Index, and Lipper Small-Cap Core Funds Index from June 30, 1995 to June 30, 2005.

The performance of the Fund assumes reinvestment of all dividends and capital gains. The performance of the indices does not include expenses and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The Russell 2000 Index is an unmanaged, capitalization weighted price only index, which is comprised of 2000 of the smallest stocks (on the basis of capitalization) in the Russell 3000 Index. The Lipper Small-Cap Core Funds Index represents the total returns of the funds in the indicated category, as defined by Lipper, Inc. Investors cannot invest directly in an index.

Institutional Class Shares have a $3,000,000 minimum initial investment and carry no sales charge.

Performance may reflect the waiver and reimbursement of the Fund's fees/expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.

JPMORGAN U.S. EQUITY MID/SMALL CAP FUNDS29

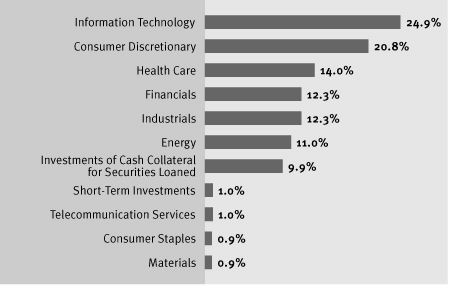

JPMorgan

Value Advantage Fund

AS OF DECEMBER 31, 2005 (Unaudited)

| FUND FACTS | |

| Fund Inception | | 3/1/05 | |

| Fiscal Year End | | December 31 | |

Net Assets as of 12/31/2005

(In Thousands) | | $104,165 | |

| Primary Benchmark | | Russell 3000 Value Index | |

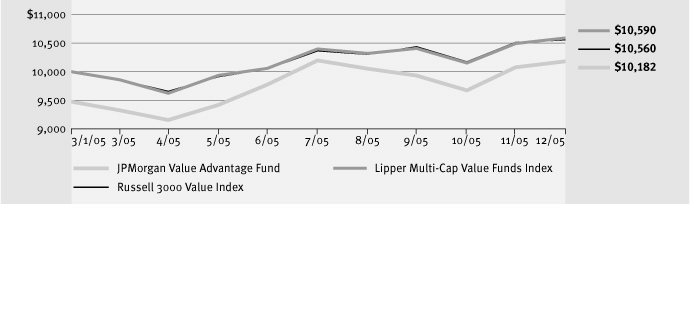

Q: HOW DID THE FUND PERFORM?

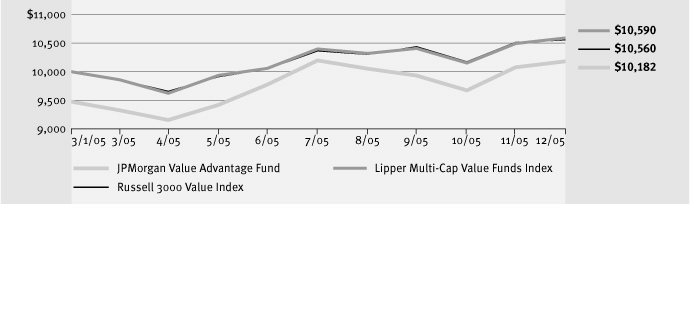

A: The JPMorgan Value Advantage Fund, which seeks to provide long-term total return from a combination of income and capital gains,* returned 7.46% (Class A Shares) since inception (2/28/05) ended December 31, 2005, compared to the 6.85% return of the Russell 3000 Value Index over the same period.

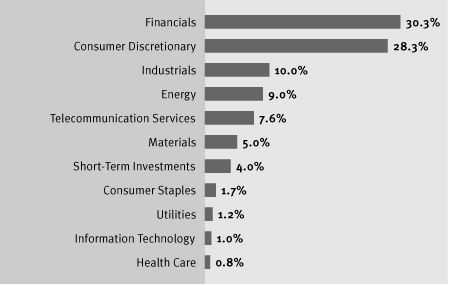

Q: WHY DID THE FUND PERFORM IN THIS WAY?

A: U.S. equity markets were dominated by interest rate concerns in 2005, as economic data was closely observed for signs that the Federal Open Market Committee's (FOMC) tightening cycle was winding down. Although there were bumps in the road, most particularly slowed growth and increased inflation following the hurricanes of late summer, the economy was generally supportive of equity gains in 2005. Equity markets were also supported by continued strength in corporate profits.