Past performance is no guarantee for future performance. The general market views expressed in this report are opinions based on current market conditions and are subject to change without notice. These views are not intended to predict the future performance of the Fund or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of any Fund.

Prospective investors should refer to the Fund’s prospectus for a discussion of the Fund’s investment objective, strategies and risks. Call JPMorgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about the Fund including management fees and other expenses. Please read it carefully before investing.

PRESIDENT’S LETTER

JULY 6, 2007 (Unaudited)

Dear Shareholder:

We are pleased to present this annual report for the JPMorgan Mid/Multi Cap Funds for the 12 months ended June 30, 2007. Inside, you’ll find information detailing the performance of the Funds, along with reports from the portfolio managers.

| |

“Residential construction activity has declined significantly within the last year, and we continue to look for weakness in housing-related employment and consumer spending.”

|

The 12-month period began with the financial markets absorbing the 17th consecutive interest-rate increase from the Federal Reserve (Fed). That 25-basis-point (bp) hike, initiated on June 29, 2006, lifted the fed funds target to 5.25%, where it remained for the next 12 months.

After the Fed’s decision to halt its rate-tightening campaign in August 2006, the financial markets initially speculated that the Fed’s next move would be an easing. A sharp slowdown in the housing market combined with declines in manufacturing activity had triggered the Fed’s pause, and investors anticipated that the resulting slowdown in gross domestic product (GDP) growth would prompt a rate cut.

This sentiment slowly unraveled throughout the rest of the year, though, as the Fed remained on hold. The economy had its ups and downs, but generally held up better than most observers expected, which reduced the chances for a change in monetary policy. What’s more, inflation pressures continued to irritate the Fed and diminish the prospects for a rate cut.

Stocks roll over roadblocks

Nevertheless, no challenge seemed too great for the U.S. stock market — not the increase in oil prices throughout the latter half of 2006; not the sharp, but short-lived, China-market-inspired correction of late February; not the anemic third-quarter 2006 or first-quarter 2007 GDP growth rate of 2.0% and 0.7%, respectively; not the growing fallout from housing-market weakness; not the increasing default rate tied to the sub-prime mortgage market; and not the Fed’s persistent inflation warnings.

Despite these obstacles, the U.S. stock market posted strong returns for the 12-month period. For example, among the capitalization universes, the Russell Midcap Index was the top performer, returning 20.83% for the period. Large-cap stocks followed, with a return of 20.43%, as measured by the Russell 1000 Index, while the small-cap Russell 2000 Index returned 16.43%. In terms of style, there was only a modest difference in the performance of value stocks versus growth stocks. Overall, value stocks maintained a slight performance edge in the large- and mid-cap universes, while growth stocks prevailed in the small-cap universe.

Outside the U.S., stock performance was even stronger. Robust global growth, combined with the relative decline in the U.S. dollar, helped propel international stocks to extraordinary gains. Developed markets, as measured by the MSCI EAFE Index, returned 32.11% for the period, while the MSCI Emerging Markets Index posted a 12-month total return of 50.29%. U.S. stocks, as measured by the S&P 500 Index, posted a return of 20.59% for the one-year period.

Investors generally pointed to abundant liquidity and robust merger-and-acquisition activity, including private equity deals, as drivers of stock market gains. In addition, optimism regarding continued, albeit slow, economic growth, a healthy global economy, higher-than-expected corporate earnings growth, and modest core inflation data provided support.

Volatility resurfaces

A bout of volatility late in the fiscal year reminded investors of the challenges lingering in the market. Rising bond yields and anxiety regarding credit quality helped push stock market returns into negative territory during June.

In early June, the re-rating of U.S. growth prospects caused Treasury yields to move sharply higher. Furthermore, the Fed retained its tightening bias but left the fed funds target unchanged. The market changed its expectations for future Fed policy. Whereas market participants previously had expected the Fed to cut rates during the second half of 2007, it ended the period convinced that the Fed would remain on hold for the rest of the year.

Economy continues to grow, but at a sub-par pace

Overall, economic growth should remain at a below-trend pace of approximately 2.1% for 2007 as a whole. Residential construction activity has declined significantly over the last year, and we continue to look for weakness in housing-related employment and consumer spending. Although this may lead to some periods of unease ahead, we would view such spillovers as positive from a long-term perspective, because they would provide a conclusive arrest of the inflation threat and could lead to a decisive shift in the Fed’s monetary policy bias.

On behalf of everyone at JPMorgan Asset Management, thank you for your confidence and the continued trust you have placed in us. We look forward to serving your investment needs for many years to come. Should you have any questions, please feel free to contact the JPMorgan Funds Service Center at 1-800-480-4111.

George C.W. Gatch

President

JPMorgan Funds

JUNE 30, 2007 JPMORGAN MID CAP/MULTI-CAP FUNDS 1

JPMorgan Capital Growth Fund

FUND COMMENTARY

AS OF JUNE 30, 2007 (Unaudited)

FUND FACTS

| Fund Inception | | | | September 23, 1987 |

| Fiscal Year-End | | | | June 30 |

Net Assets as of 6/30/2007

| | | | | | |

| (In Thousands) | | | | $968,592 |

| Primary Benchmark | | | | Russell Midcap Growth Index |

Q: | | HOW DID THE FUND PERFORM? |

A: | | The JPMorgan Capital Growth Fund, which seeks capital growth over the long term, returned 19.01%* (Class A Shares, no sales charge) over the 12 months ended June 30, 2007, compared to the 19.73% return for the Russell Midcap Growth Index over the same period.** |

Q: | | WHY DID THE FUND PERFORM THIS WAY? |

A: | | The Fund underperformed its benchmark for the period due primarily to stock selection in the information technology and healthcare sectors as well as an underweight in the materials sector. At the individual stock level, Panera Bread Co., a chain of casual bakery cafes, was among the detractors from performance. The company cut its same-store sales growth target for the second quarter. In addition, the company reported that its margins were under pressure due to a shift away from products made in its fresh dough facilities along with higher gasoline and other input costs. Corporate Executive Board Co., which provides research, decision support tools and executive education, also hurt returns. The company was forced to lower its guidance for full-year 2007 earnings due to weaker-than-expected revenue growth. The revised outlook reflects a weaker-than-expected sales increase and slow start to the current sales year. Consol Energy Inc., a multi-fuel energy provider, also negatively impacted performance. The company’s shares declined after it reported that first-quarter profits fell due to reduced coal sales in a flat pricing environment. Additionally, the company trimmed its 2007 production guidance. |

On the positive side, stock selection in the industrials, consumer discretionary and telecommunication service sectors aided returns. At the individual stock level, General Cable Corp., which designs, manufactures and markets copper, aluminum and fiber-optic wire and cable products, was among the contributors to performance. The company’s shares advanced as worldwide demand for electrical infrastructure contributed to double-digit revenue and earnings growth. These positive results were driven by increased demand, particularly for overhead transmission cables in the U.S. and Europe. GameStop Corp., which retails video games and PC entertainment software, also helped returns. The company reported fiscal first-quarter earnings that more than doubled due to sales of new gaming systems like Nintendo Wii and games like “Guitar Hero II.” Amphenol Corp., an electronic and fiber-optic connector manufacturer, also supported performance. The company reported that first-quarter profits increased on double-digit growth, which beat expectations.

Q: | | HOW WAS THE FUND MANAGED? |

A: | | We employ a bottom-up approach to stock selection, constructing portfolios based on company fundamentals, quantitative screening and proprietary fundamental analysis. We look for dominant franchises with predictable business models deemed capable of achieving sustained growth. Potential investments are subjected to rigorous financial analysis and a disciplined approach to valuation. We seek to maintain sector diversification in the Fund by avoiding large allocations that are contingent on macroeconomic or sector trends. |

TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO***

| 1. | | General Cable Corp. | | | 2.5 | % |

| 2. | | VeriFone Holdings, Inc. | | | 2.0 | |

| 3. | | Roper Industries, Inc. | | | 1.9 | |

| 4. | | Amphenol Corp., Class A | | | 1.8 | |

| 5. | | Gentex Corp. | | | 1.5 | |

| 6. | | Time Warner Telecom, Inc., Class A | | | 1.5 | |

| 7. | | Corrections Corp. of America | | | 1.4 | |

| 8. | | GameStop Corp., Class A | | | 1.4 | |

| 9. | | Celgene Corp. | | | 1.4 | |

| 10. | | DreamWorks Animation SKG, Inc., Class A | | | 1.4 | |

PORTFOLIO COMPOSITION***

| Information Technology | | | | | 23.3 | % |

| Consumer Discretionary | | | | | 20.3 | |

| Health Care | | | | | 16.1 | |

| Industrials | | | | | 12.5 | |

| Financials | | | | | 8.8 | |

| Energy | | | | | 8.5 | |

| Telecommunication Services | | | | | 4.9 | |

| Materials | | | | | 2.7 | |

| Consumer Staples | | | | | 1.4 | |

| Utilities | | | | | 0.9 | |

| Short-Term Investment | | | | | 0.6 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights which reflect adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based upon total investments (excluding Investments of Cash Collateral for Securities on Loan) as of June 30, 2007. The Fund’s composition is subject to change. |

2 JPMORGAN MID CAP/MULTI-CAP FUNDS JUNE 30, 2007

AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2007

| | | | INCEPTION DATE

OF CLASS

| | 1 YEAR

| | 5 YEAR

| | 10 YEAR

|

|---|

CLASS A SHARES | | | | | 9/23/87 | | | | | | | | | | | | | |

| Without Sales Charge | | | | | | | | | 19.01 | % | | | 13.45 | % | | | 8.56 | % |

| With Sales Charge* | | | | | | | | | 12.77 | | | | 12.23 | | | | 7.98 | |

CLASS B SHARES | | | | | 11/4/93 | | | | | | | | | | | | | |

| Without CDSC | | | | | | | | | 18.41 | | | | 12.88 | | | | 8.13 | |

| With CDSC** | | | | | | | | | 13.41 | | | | 12.63 | | | | 8.13 | |

CLASS C SHARES | | | | | 1/2/98 | | | | | | | | | | | | | |

| Without CDSC | | | | | | | | | 18.44 | | | | 12.86 | | | | 7.93 | |

| With CDSC*** | | | | | | | | | 17.44 | | | | 12.86 | | | | 7.93 | |

SELECT CLASS SHARES | | | | | 1/25/96 | | | | 19.30 | | | | 13.84 | | | | 9.01 | |

| * | | Sales Charge for Class A Shares is 5.25%. |

| ** | | Assume 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| *** | | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

TEN YEAR PERFORMANCE (6/30/97 TO 6/30/07)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on September 23, 1987.

Returns for the Class C Shares prior to their inception date are based on the performance of Class B Shares, whose expenses are substantially similar to those of Class C Shares.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Capital Growth Fund, Russell Midcap Growth Index, and Lipper Mid-Cap Growth Funds Index from June 30, 1997 to June 30, 2007. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any, and includes a sales charge. The performance of the Russell Midcap Growth Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The performance of the Lipper Mid-Cap Growth Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses charged by the Fund. The Russell Midcap Growth Index is an unmanaged index, which measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher financial growth values. The Lipper Mid-Cap Growth Funds Index is an index based on total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Class A shares have a $1,000 minimum initial investment and carry a 5.25% sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

JUNE 30, 2007 JPMORGAN MID CAP/MULTI-CAP FUNDS 3

JPMorgan Diversified Mid Cap Growth Fund

FUND COMMENTARY

AS OF JUNE 30, 2007 (Unaudited)

FUND FACTS

| Fund Inception | | | | March 2, 1989 |

| Fiscal Year End | | | | June 30 |

Net Assets as of 6/30/2007

|

| (In Thousands) | | | | $1,385,625 |

| Primary Benchmark | | | | Russell Midcap Growth Index |

Q: | | HOW DID THE FUND PERFORM? |

A: | | The JPMorgan Diversified Mid Cap Growth Fund, which seeks growth of capital and, secondarily, current income by investing primarily in equity securities, returned 18.95%* (Select Class Shares) over the 12 months ended June 30, 2007, compared to the 19.73% return for the Russell Midcap Growth Index over the same period.** |

Q: | | WHY DID THE FUND PERFORM THIS WAY? |

A: | | The Fund underperformed its benchmark for the period due primarily to stock selection in the information technology and healthcare sectors as well as an underweight in the materials sector. At the individual stock level, Panera Bread Co., a chain of casual bakery cafes, was among the detractors from performance. The company cut its same-store sales growth target for the second quarter. In addition, the company reported that its margins were under pressure due to a shift away from products made in its fresh dough facilities along with higher gasoline and other input costs. Corporate Executive Board Co., which provides research, decision support tools and executive education, also hurt returns. The company was forced to lower its guidance for full-year 2007 earnings due to weaker-than-expected revenue growth. The revised outlook reflects a weaker-than-expected sales increase and slow start to the current sales year. Consol Energy Inc., a multi-fuel energy provider, also negatively impacted performance. The company’s shares declined after it reported that first-quarter profits fell due to reduced coal sales in a flat pricing environment. Additionally, the company trimmed its 2007 production guidance. |

On the positive side, stock selection in the industrials, consumer discretionary and telecommunication service sectors aided returns. At the individual stock level, General Cable Corp., which designs, manufactures and markets copper, aluminum and fiber-optic wire and cable products, was among the contributors to performance. The company’s shares advanced as worldwide demand for electrical infrastructure contributed to double-digit revenue and earnings growth. These positive results were driven by increased demand, particularly for overhead transmission cables in the U.S. and Europe. GameStop Corp., which retails video games and PC entertainment software, also helped returns. The company reported fiscal first-quarter earnings that more than doubled due to sales of new gaming systems like Nintendo Wii and games like “Guitar Hero II.” Amphenol Corp., an electronic and fiber-optic connector manufacturer, also supported performance. The company reported that first-quarter profits increased on double-digit growth, which beat expectations.

Q: | | HOW WAS THE FUND MANAGED? |

A: | | We employ a bottom-up approach to stock selection, constructing portfolios based on company fundamentals, quantitative screening and proprietary fundamental analysis. We look for dominant franchises with predictable business models deemed capable of achieving sustained growth. Potential investments are subjected to rigorous financial analysis and a disciplined approach to valuation. We seek to maintain sector diversification in the Fund by avoiding large allocations that are contingent on macroeconomic or sector trends. |

TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO***

| 1. | | General Cable Corp. | | | 2.4 | % |

| 2. | | VeriFone Holdings, Inc. | | | 1.9 | |

| 3. | | Roper Industries, Inc. | | | 1.9 | |

| 4. | | Amphenol Corp., Class A | | | 1.7 | |

| 5. | | Gentex Corp. | | | 1.5 | |

| 6. | | Time Warner Telecom, Inc., Class A | | | 1.4 | |

| 7. | | Corrections Corp. of America | | | 1.4 | |

| 8. | | GameStop Corp., Class A | | | 1.4 | |

| 9. | | Celgene Corp. | | | 1.4 | |

| 10. | | DreamWorks Animation SKG, Inc., Class A | | | 1.4 | |

PORTFOLIO COMPOSITION***

| Information Technology | | | | | 22.9 | % |

| Consumer Discretionary | | | | | 20.0 | |

| Health Care | | | | | 15.8 | |

| Industrials | | | | | 12.3 | |

| Financials | | | | | 8.7 | |

| Energy | | | | | 8.3 | |

| Telecommunication Services | | | | | 4.7 | |

| Materials | | | | | 2.6 | |

| Consumer Staples | | | | | 1.4 | |

| Utilities | | | | | 0.9 | |

| Short-Term Investment | | | | | 2.4 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights which reflect adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based upon total investments (excluding Investments of Cash Collateral for Securities on Loan) as of June 30, 2007. The Fund’s composition is subject to change. |

4 JPMORGAN MID CAP/MULTI-CAP FUNDS JUNE 30, 2007

AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2007

| | | | INCEPTION DATE

OF CLASS

| | 1 YEAR

| | 5 YEAR

| | 10 YEAR

|

|---|

CLASS A SHARES | | | | | 2/18/92 | | | | | | | | | | | | | |

| Without Sales Charge | | | | | | | | | 18.65 | % | | | 11.85 | % | | | 11.29 | % |

| With Sales Charge* | | | | | | | | | 12.41 | | | | 10.66 | | | | 10.69 | |

CLASS B SHARES | | | | | 1/14/94 | | | | | | | | | | | | | |

| Without CDSC | | | | | | | | | 17.98 | | | | 11.10 | | | | 10.62 | |

| With CDSC** | | | | | | | | | 12.98 | | | | 10.83 | | | | 10.62 | |

CLASS C SHARES | | | | | 11/4/97 | | | | | | | | | | | | | |

| Without CDSC | | | | | | | | | 17.95 | | | | 11.09 | | | | 10.58 | |

| With CDSC*** | | | | | | | | | 16.95 | | | | 11.09 | | | | 10.58 | |

SELECT CLASS SHARES | | | | | 3/2/89 | | | | 18.95 | | | | 12.14 | | | | 11.58 | |

ULTRA SHARES | | | | | 2/22/05 | | | | 19.13 | | | | 12.21 | | | | 11.61 | |

| * | | Sales Charge for Class A Shares is 5.25%. |

| ** | | Assumes 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| *** | | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

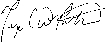

TEN YEAR PERFORMANCE (6/30/97 TO 6/30/07)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on March 2, 1989. Returns for the Class C Shares and Ultra Shares prior to their inception date are based on the performance of Select Class Shares. Historical Class C Shares performance has been adjusted to reflect the differences in expenses and sales charges between classes prior to the class inception. The actual returns of Ultra Shares would have been different than those shown because Ultra Shares have different expenses than Select Class Shares.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan Diversified Mid Cap Growth Fund, Russell Midcap Growth Index and the Lipper Mid-Cap Growth Funds Index from June 30, 1997 to June 30, 2007. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any, and does not include a sales charge. The performance of the Russell Midcap Growth Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The performance of the Lipper Mid-Cap Growth Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses charged by the Fund. The Russell Midcap Growth Index is an unmanaged index, which measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. The Lipper Mid-Cap Growth Funds Index is an index based on total returns of certain mutual funds within the Fund’s designated category as determined by Lipper Inc. Investors cannot invest directly in an index.

Select Class Shares have a $1,000,000 minimum initial investment and carry no sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

JUNE 30, 2007 JPMORGAN MID CAP/MULTI-CAP FUNDS 5

JPMorgan Diversified Mid Cap Value Fund

FUND COMMENTARY

AS OF JUNE 30, 2007 (Unaudited)

FUND FACTS

| Fund Inception | | | | March 2, 1989 |

| Fiscal Year End | | | | June 30 |

Net Assets as of 6/30/2007

|

| (In Thousands) | | | | $739,380 |

| Primary Benchmark | | | | Russell Midcap Value Index |

Q: | | HOW DID THE FUND PERFORM? |

A: | | The JPMorgan Diversified Mid Cap Value Fund, which seeks capital appreciation with the secondary goal of achieving current income by investing primarily in equity securities, returned 19.97%* (Select Class Shares) over the 12 months ended June 30, 2007, compared to the 22.09% return for the Russell Midcap Value Index over the same period.** |

Q: | | WHY DID THE FUND PERFORM THIS WAY? |

A: | | The Fund underperformed its benchmark for the period due primarily to stock selection in the healthcare, utility, and industrials sectors. At the individual stock level, McClatchy Co., the third-largest newspaper company in the U.S., was among the detractors from performance. The company experienced a difficult start to 2007 as advertising revenues declined sharply on the back of disappointing real estate ads. Omnicare Inc., a geriatric pharmaceutical services company, also hurt returns. The company’s shares came under pressure as several events, including legal disputes with regulators and an ongoing lawsuit against UnitedHealthcare, lowered investor sentiment toward the stock. |

On the positive side, stock selection in the consumer discretionary, financial and materials sectors helped returns. At the individual stock level, Tiffany and Co., a global fine jeweler, was among the top contributors to performance. The company’s shares advanced following the announcement that Nelson Peltz’s Trian Fund Management bought a 5.45% stake in the company. Trian seeks to help Tiffany improve its margins and earnings-per-share growth as well as address various operational and strategic issues. SUPERVALU Inc., a grocery retailer and distributor, also helped returns. The company reported solid financial results that surpassed analysts’ estimates, driven primarily by its acquisition of Albertson Inc.’s retail properties in 2006.

Q: | | HOW WAS THE FUND MANAGED? |

A: | | We employ a bottom-up approach to stock selection, constructing portfolios based on company fundamentals, quantitative screening and proprietary fundamental analysis. We look for undervalued companies that have the potential to grow intrinsic value per share. The research process is designed to find companies with predictable and durable business models deemed capable of achieving sustainable growth. Potential investments are subjected to rigorous financial analysis and a disciplined approach to valuation. |

TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO***

| 1. | | Brown-Forman Corp., Class B | | | 1.7 | % |

| 2. | | SUPERVALU, Inc. | | | 1.4 | |

| 3. | | Assurant, Inc. | | | 1.3 | |

| 4. | | American Electric Power Co., Inc. | | | 1.2 | |

| 5. | | Clear Channel Communications, Inc. | | | 1.2 | |

| 6. | | Coventry Health Care, Inc. | | | 1.1 | |

| 7. | | FirstEnergy Corp. | | | 1.1 | |

| 8. | | Tiffany & Co. | | | 1.1 | |

| 9. | | Fortune Brands, Inc. | | | 1.1 | |

| 10. | | Ball Corp. | | | 1.1 | |

PORTFOLIO COMPOSITION***

| Financials | | | | | 25.0 | % |

| Consumer Discretionary | | | | | 19.9 | |

| Utilities | | | | | 12.7 | |

| Industrials | | | | | 8.9 | |

| Consumer Staples | | | | | 8.2 | |

| Materials | | | | | 6.2 | |

| Energy | | | | | 5.3 | |

| Health Care | | | | | 4.9 | |

| Information Technology | | | | | 4.0 | |

| Telecommunication Services | | | | | 3.3 | |

| Short-Term Investment | | | | | 1.6 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights which reflect adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based upon total investments (excluding Investments of Cash Collateral for Securities on Loan) as of June 30, 2007. The Fund’s composition is subject to change. |

6 JPMORGAN MID CAP/MULTI-CAP FUNDS JUNE 30, 2007

AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2007

| | | | INCEPTION DATE

OF CLASS

| | 1 YEAR

| | 5 YEAR

| | 10 YEAR

|

|---|

CLASS A SHARES | | | | | 2/18/92 | | | | | | | | | | | | | |

| Without Sales Charge | | | | | | | | | 19.66 | % | | | 12.49 | % | | | 12.12 | % |

| With Sales Charge* | | | | | | | | | 13.39 | | | | 11.29 | | | | 11.52 | |

CLASS B SHARES | | | | | 1/14/94 | | | | | | | | | | | | | |

| Without CDSC | | | | | | | | | 18.97 | | | | 11.74 | | | | 11.44 | |

| With CDSC** | | | | | | | | | 13.97 | | | | 11.48 | | | | 11.44 | |

CLASS C SHARES | | | | | 3/22/99 | | | | | | | | | | | | | |

| Without CDSC | | | | | | | | | 18.97 | | | | 11.74 | | | | 11.35 | |

| With CDSC*** | | | | | | | | | 17.97 | | | | 11.74 | | | | 11.35 | |

SELECT CLASS SHARES | | | | | 3/2/89 | | | | 19.97 | | | | 12.77 | | | | 12.39 | |

ULTRA SHARES | | | | | 2/22/05 | | | | 20.13 | | | | 12.86 | | | | 12.43 | |

| * | | Sales Charge for Class A Shares is 5.25%. |

| ** | | Assumes 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| *** | | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

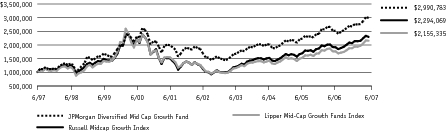

TEN YEAR PERFORMANCE (6/30/97 TO 6/30/07)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on March 2, 1989. Returns for the Class C Shares and Ultra Shares prior to their inception date are based on the performance of Select Class Shares. Historical Class C Shares performance has been adjusted to reflect the differences in expenses and sales charges between classes prior to the class inception. The actual returns of Ultra Shares would have been different than those shown because Ultra Shares have different expenses than Select Class Shares.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan Diversified Mid Cap Value Fund, Russell Midcap Value Index and the Lipper Mid-Cap Value Funds Index from June 30, 1997 to June 30, 2007. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any, and does not include a sales charge. The performance of the Russell Midcap Value Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The performance of the Lipper Mid-Cap Value Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses charged by the Fund. The Russell Midcap Value Index is an unmanaged index, which measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values. The Lipper Mid-Cap Value Funds Index is an index based on total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Select Class Shares have a $1,000,000 minimum initial investment and carry no sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

JUNE 30, 2007 JPMORGAN MID CAP/MULTI-CAP FUNDS 7

JPMorgan Growth Advantage Fund

FUND COMMENTARY

AS OF JUNE 30, 2007 (Unaudited)

FUND FACTS

| Fund Inception | | | | October 29, 1999 |

| Fiscal Year End | | | | June 30 |

Net Assets as of 6/30/2007

| | | | | | |

| (In Thousands) | | | | $62,519 |

| Primary Benchmark | | | | Russell 3000 Growth Index |

Q: | | HOW DID THE FUND PERFORM? |

A: | | The JPMorgan Growth Advantage Fund, which seeks to provide long-term capital growth, returned 23.53%* (Class A Shares, no sales charge) over the 12 months ended June 30, 2007, compared to the 18.84% return for the Russell 3000 Growth Index over the same period.** |

Q: | | WHY DID THE FUND PERFORM THIS WAY? |

A: | | The Fund outperformed its benchmark for the period due primarily to stock selection in the industrials, consumer discretionary and telecommunication service sectors. At the individual stock level, General Cable Corp., which designs, manufactures and markets copper, aluminum and fiber-optic wire and cable products, was among the contributors to performance. The company’s shares advanced as worldwide demand for electrical infrastructure contributed to double-digit revenue and earnings growth. These positive results were driven by increased demand, particularly for overhead transmission cables in the U.S. and Europe. Apple Inc., which produces hardware, software and Internet tools, also helped returns. The company’s shares advanced as hype surrounding the release of its much-anticipated iPhone continued to drive up the stock’s price. Additionally, the company benefited from upbeat sales. GameStop Corp., which retails video games and PC entertainment software, also supported performance. The company reported fiscal first-quarter earnings that more than doubled due to sales of new gaming systems like Nintendo Wii and games like “Guitar Hero II.” |

On the negative side, stock selection in the information technology and financial sectors as well as an underweight in the materials sector detracted from performance. At the individual stock level, Adams Respiratory Therapeutics Inc., a specialty pharmaceutical company, was among the detractors from performance. The company announced that lower-than-expected trade orders during its fiscal third quarter and a lack of severity in reported levels of upper respiratory ailments would impact sales for its major products for the remainder of the fiscal year. Isilon Systems Inc., which produces clustered storage systems for storing and managing digital content, also hurt returns. The company’s shares declined after it reported a narrower first-quarter loss that missed expectations. Rackable Systems Inc., a leading provider of server and storage products for large, scale-out data center deployments, also negatively impacted performance. The company reported a first-quarter loss due to lower revenue and increased expenses. Intense competition from rivals for the company’s largest customers forced it to cut prices, resulting in a first-quarter warning and subsequent loss.

Q: | | HOW WAS THE FUND MANAGED? |

A: | | We employ a bottom-up approach to stock selection, constructing portfolios based on company fundamentals, quantitative screening and proprietary fundamental analysis. We look for dominant franchises with predictable business models deemed capable of achieving sustained growth. Potential investments are subjected to rigorous financial analysis and a disciplined approach to valuation. We seek to maintain sector diversification in the Fund by avoiding large allocations that are contingent on macroeconomic or sector trends. |

TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO***

| 1. | | General Cable Corp. | | | 2.4 | % |

| 2. | | Cisco Systems, Inc. | | | 2.4 | |

| 3. | | Microsoft Corp. | | | 2.2 | |

| 4. | | Google, Inc., Class A | | | 2.0 | |

| 5. | | VeriFone Holdings, Inc. | | | 2.0 | |

| 6. | | Roper Industries, Inc. | | | 1.8 | |

| 7. | | Research In Motion Ltd. (Canada) | | | 1.7 | |

| 8. | | Amphenol Corp., Class A | | | 1.7 | |

| 9. | | Merck & Co., Inc. | | | 1.6 | |

| 10. | | Schering-Plough Corp. | | | 1.6 | |

PORTFOLIO COMPOSITION***

| Information Technology | | | | | 31.4 | % |

| Health Care | | | | | 18.8 | |

| Consumer Discretionary | | | | | 15.7 | |

| Industrials | | | | | 12.0 | |

| Financials | | | | | 7.6 | |

| Energy | | | | | 5.7 | |

| Telecommunication Services | | | | | 4.2 | |

| Consumer Staples | | | | | 2.6 | |

| Materials | | | | | 1.1 | |

| Utilities | | | | | 0.8 | |

| Short-Term Investment | | | | | 0.1 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights which reflect adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based upon total investments (excluding Investments of Cash Collateral for Securities on Loan) as of June 30, 2007. The Fund’s composition is subject to change. |

8 JPMORGAN MID CAP/MULTI-CAP FUNDS JUNE 30, 2007

AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2007

| | | | INCEPTION DATE

OF CLASS

| | 1 YEAR

| | 5 YEAR

| | SINCE INCEPTION

|

|---|

CLASS A SHARES | | | | | 10/29/99 | | | | | | | | | | | | | |

| Without Sales Charge | | | | | | | | | 23.53 | % | | | 14.79 | % | | | (2.28 | )% |

| With Sales Charge* | | | | | | | | | 17.00 | | | | 13.54 | | | | (2.96 | ) |

CLASS B SHARES | | | | | 10/29/99 | | | | | | | | | | | | | |

| Without CDSC | | | | | | | | | 22.75 | | | | 13.97 | | | | (2.96 | ) |

| With CDSC** | | | | | | | | | 17.75 | | | | 13.74 | | | | (2.96 | ) |

CLASS C SHARES | | | | | 5/1/06 | | | | | | | | | | | | | |

| Without CDSC | | | | | | | | | 22.56 | | | | 13.97 | | | | (2.96 | ) |

| With CDSC*** | | | | | | | | | 21.56 | | | | 13.97 | | | | (2.96 | ) |

SELECT CLASS SHARES | | | | | 5/1/06 | | | | 23.80 | | | | 14.87 | | | | (2.24 | ) |

| * | | Sales Charge for Class A Shares is 5.25%. |

| ** | | Assumes 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| *** | | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

LIFE OF FUND PERFORMANCE (10/29/99 TO 6/30/07)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The JPMorgan Growth Advantage Fund commenced operations on 10/29/99.

As of 8/17/05, the Fund changed its name, investment objective, certain investment policies and benchmark. Prior to that time, the Fund operated as JPMorgan Mid Cap Growth Fund. Although past performance is not necessarily an indication of how the Fund will perform in the future, in view of these changes, the Fund’s performance record prior to 8/17/05 might be less pertinent for investors considering whether to purchase shares of the Fund. The performance for the Class A and Class B Shares before 3/23/01 is based on the performance of the Class A and Class B Shares of the Fund’s predecessor, H&Q IPO & Emerging Company Fund, a series of Hambrecht & Quist Fund Trust, which transferred all of its assets and liabilities to the Fund pursuant to a reorganization on that date. The predecessor’s investment program was identical to that of the Fund prior to 12/3/01. The predecessor’s Class A and Class B expenses were substantially similar to those of Class A and Class B of the Fund. Returns for the Class C Shares prior to their inception date are based on the performance of Class B Shares, whose expenses are substantially similar to those of Class C Shares. Returns for the Select Class Shares prior to their inception date are based on the performance of Class A Shares. During this period, the actual returns of Select Class Shares would have been different because Select Class Shares have different expenses than Class A Shares.

The graph illustrates comparative performance for $10,000 invested in Class A Shares of the JPMorgan Growth Advantage Fund, Russell 3000 Growth Index and Lipper Multi-Cap Growth Funds Index from October 29, 1999 to June 30, 2007. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any, and includes a sales charge. The performance of the indices reflects an initial investment at the end of the month following the Fund’s inception. The performance of the Russell 3000 Growth Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The performance of the Lipper Multi-Cap Growth Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses charged by the Fund. The Russell 3000 Growth Index is an unmanaged index, which measures the performance of those Russell 3000 Index companies (largest 3000 U.S. companies) with higher price-to-book ratios and higher forecasted growth values. The Lipper Multi-Cap Growth Funds Index is an index based on total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Class A Shares have a $1,000 minimum initial investment and carry a 5.25% sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

JUNE 30, 2007 JPMORGAN MID CAP/MULTI-CAP FUNDS 9

JPMorgan Mid Cap Equity Fund

FUND COMMENTARY

AS OF JUNE 30, 2007 (Unaudited)

FUND FACTS

| Fund Inception | | | | January 1, 1997 |

| Fiscal Year End | | | | June 30 |

Net Assets as of 6/30/2007

| | | | | | |

| (In Thousands) | | | | $284,546 |

| Primary Benchmark | | | | Russell Midcap Index |

Q: | | HOW DID THE FUND PERFORM? |

A: | | The JPMorgan Mid Cap Equity Fund, which seeks long-term capital growth, returned 18.97%* (Select Class Shares) over the 12 months ended June 30, 2007, compared to the 20.83% return for the Russell Midcap Index over the same period.** |

Q: | | WHY DID THE FUND PERFORM THIS WAY? |

A: | | The Fund underperformed its benchmark for the period due primarily to stock selection in the healthcare, utility and information technology sectors. At the individual stock level, Omnicare Inc., a geriatric pharmaceutical services company, was among the detractors from performance. The company’s shares came under pressure as several events, including legal disputes with regulators and an ongoing lawsuit against UnitedHealthcare, lowered investor sentiment toward the stock. Panera Bread Co., a chain of casual bakery cafes, also hurt returns. The company cut its same-store sales growth target for the second quarter. In addition, the company reported that its margins were under pressure due to a shift away from products made in its fresh dough facilities along with higher gasoline and other input costs. |

On the positive side, stock selection in the consumer discretionary, telecommunication service and energy sectors helped returns. At the individual stock level, General Cable Corp., which designs, manufactures and markets copper, aluminum and fiber-optic wire and cable products, was among the contributors to performance. The company’s shares advanced as worldwide demand for electrical infrastructure contributed to double-digit revenue and earnings growth. These positive results were driven by increased demand, particularly for overhead transmission cables in the U.S. and Europe. Tiffany and Co., a global fine jeweler, also helped returns. The company’s shares advanced following the announcement that Nelson Peltz’s Trian Fund Management bought a 5.45% stake in the company. Trian seeks to help Tiffany improve its margins and earnings-per-share growth as well as address various operational and strategic issues.

Q: | | HOW WAS THE FUND MANAGED? |

A: | | We employ a bottom-up approach to stock selection, constructing portfolios based on company fundamentals, quantitative screening and proprietary fundamental analysis. We look for dominant franchises with predictable business models deemed capable of achieving sustained growth and undervalued companies with the potential to grow their intrinsic value per share. Potential investments are subjected to rigorous financial analysis and a disciplined approach to valuation. |

TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO***

| 1. | | Amphenol Corp., Class A | | | 1.3 | % |

| 2. | | General Cable Corp. | | | 1.2 | |

| 3. | | Assurant, Inc. | | | 1.2 | |

| 4. | | NCR Corp. | | | 1.2 | |

| 5. | | Everest Re Group Ltd. (Bermuda) | | | 1.1 | |

| 6. | | Coventry Health Care, Inc. | | | 1.1 | |

| 7. | | Questar Corp. | | | 1.1 | |

| 8. | | Tiffany & Co. | | | 1.0 | |

| 9. | | VeriFone Holdings, Inc. | | | 1.0 | |

| 10. | | Northern Trust Corp. | | | 1.0 | |

PORTFOLIO COMPOSITION***

| Consumer Discretionary | | | | | 20.3 | % |

| Financials | | | | | 17.7 | |

| Information Technology | | | | | 13.0 | |

| Industrials | | | | | 10.7 | |

| Health Care | | | | | 10.5 | |

| Energy | | | | | 6.8 | |

| Utilities | | | | | 6.3 | |

| Telecommunication Services | | | | | 4.5 | |

| Consumer Staples | | | | | 4.4 | |

| Materials | | | | | 3.9 | |

| Short-Term Investment | | | | | 1.9 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights which reflect adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based upon total investments (excluding Investments of Cash Collateral for Securities on Loan) as of June 30, 2007. The Fund’s composition is subject to change. |

10 JPMORGAN MID CAP/MULTI-CAP FUNDS JUNE 30, 2007

AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2007

| | | | INCEPTION DATE

OF CLASS

| | 1 YEAR

| | 5 YEAR

| | 10 YEAR

|

|---|

SELECT CLASS SHARES | | | | | 1/1/97 | | | | 18.97 | % | | | 14.83 | % | | | 12.48 | % |

TEN YEAR FUND PERFORMANCE (6/30/97 TO 6/30/07)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on 1/1/97.

The graph illustrates comparative performance for $1,000,000 invested in the JPMorgan Mid Cap Equity Fund, Russell Midcap Index, and Lipper Mid-Cap Core Funds Index from June 30, 1997 to June 30, 2007. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any. The performance of the Russell Midcap Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The performance of the Lipper Mid-Cap Core Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses charged by the Fund. The Russell Midcap Index is an unmanaged index, which measures the performance of the smallest 800 companies of the Russell 1000 Index. The Lipper Mid-Cap Core Funds Index is an index based on total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an Index.

Select Class Shares have a $1,000,000 minimum initial investment and carry no sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights which reflect adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America.

JUNE 30, 2007 JPMORGAN MID CAP/MULTI-CAP FUNDS 11

JPMorgan Mid Cap Value Fund

FUND COMMENTARY

AS OF JUNE 30, 2007 (Unaudited)

FUND FACTS

| Fund Inception | | | | November 13, 1997 |

| Fiscal Year End | | | | June 30 |

Net Assets as of 6/30/2007

| | | | | | |

| (In Thousands) | | | | $8,628,707 |

| Primary Benchmark | | | | Russell Midcap Value Index |

Q: | | HOW DID THE FUND PERFORM? |

A: | | The JPMorgan Mid Cap Value Fund, which seeks growth from capital appreciation, returned 18.82%* (Institutional Class Shares) over the 12 months ended June 30, 2007, compared to the 22.09% return for the Russell Midcap Value Index over the same period.** |

Q: | | WHY DID THE FUND PERFORM THIS WAY? |

A: | | The Fund underperformed its benchmark for the period due primarily to stock selection in the healthcare, industrials and utilities sectors. At the individual stock level, Omnicare Inc., a geriatric pharmaceutical services company, was among the detractors from performance. The company’s shares came under pressure as several events, including legal disputes with regulators and an ongoing lawsuit against UnitedHealthcare, lowered investor sentiment toward the stock. Furthermore, the company released quarterly results below expectations, as higher costs associated with Medicare Part D and the temporary closure of a repackaging facility reduced profits. McClatchy Co., the third-largest newspaper company in the U.S., also hurt performance. The company experienced a difficult start to 2007 as advertising revenues declined sharply on the back of disappointing real estate ads. |

On the positive side, stock selection in the consumer discretionary and energy sectors as well as an overweight in the telecommunication sector helped performance. At the individual stock level, Vulcan Materials Co., a leader in the production of construction aggregates and other construction materials, was among the contributors to performance. The company’s shares rose when its plan to acquire Florida Rock Industries Inc. for about $4.6 billion was received favorably by investors. The company’s acquisition expanded its presence in Florida and other high-growth markets in the Southeast and Mid-Atlantic states while providing significant future earnings prospects and cost synergies. AutoZone Inc., an auto parts retailer, also helped returns. The company announced better-than-expected earnings due to cost containment efforts and an aggressive share repurchasing program. The company’s ongoing initiatives, which focus on improving the customer’s shopping experience, have led to measurable increases in customer service metrics, which benefited its shares.

Q: | | HOW WAS THE FUND MANAGED? |

A: | | We employ a bottom-up approach to stock selection, constructing portfolios based on company fundamentals, quantitative screening and proprietary fundamental analysis. We look for undervalued companies that have the potential to grow intrinsic value per share. The research process is designed to find companies with predictable and durable business models deemed capable of achieving sustainable growth. Potential investments are subjected to rigorous financial analysis and a disciplined approach to valuation. |

TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO***

| 1. | | Assurant, Inc. | | | 2.4 | % |

| 2. | | Coventry Health Care, Inc. | | | 2.3 | |

| 3. | | Synovus Financial Corp. | | | 1.9 | |

| 4. | | Williams Cos., Inc. | | | 1.8 | |

| 5. | | V.F. Corp. | | | 1.8 | |

| 6. | | Brown-Forman Corp., Class B | | | 1.8 | |

| 7. | | M&T Bank Corp. | | | 1.7 | |

| 8. | | Fortune Brands, Inc. | | | 1.7 | |

| 9. | | American Electric Power Co., Inc. | | | 1.7 | |

| 10. | | Genuine Parts Co. | | | 1.6 | |

PORTFOLIO COMPOSITION***

| Financials | | | | | 26.5 | % |

| Consumer Discretionary | | | | | 20.4 | |

| Utilities | | | | | 11.7 | |

| Industrials | | | | | 9.0 | |

| Consumer Staples | | | | | 7.5 | |

| Materials | | | | | 5.1 | |

| Energy | | | | | 5.0 | |

| Health Care | | | | | 4.9 | |

| Telecommunication Services | | | | | 4.2 | |

| Information Technology | | | | | 2.9 | |

| Short-Term Investment | | | | | 2.8 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights which reflect adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based upon total investments (excluding Investments of Cash Collateral for Securities on Loan) as of June 30, 2007. The Fund’s composition is subject to change. |

12 JPMORGAN MID CAP/MULTI-CAP FUNDS JUNE 30, 2007

AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2007

| | | | INCEPTION DATE

OF CLASS

| | 1 YEAR

| | 5 YEAR

| | SINCE INCEPTION

|

|---|

CLASS A SHARES | | | | | 4/30/01 | | | | | | | | | | | | | |

| Without Sales Charge | | | | | | | | | 18.21 | % | | | 16.04 | % | | | 17.32 | % |

| With Sales Charge* | | | | | | | | | 12.00 | | | | 14.79 | | | | 16.67 | |

CLASS B SHARES | | | | | 4/30/01 | | | | | | | | | | | | | |

| Without CDSC | | | | | | | | | 17.65 | | | | 15.36 | | | | 16.86 | |

| With CDSC** | | | | | | | | | 12.65 | | | | 15.13 | | | | 16.86 | |

CLASS C SHARES | | | | | 4/30/01 | | | | | | | | | | | | | |

| Without CDSC | | | | | | | | | 17.64 | | | | 15.36 | | | | 16.88 | |

| With CDSC*** | | | | | | | | | 16.64 | | | | 15.36 | | | | 16.88 | |

SELECT CLASS SHARES | | | | | 10/31/01 | | | | 18.54 | | | | 16.34 | | | | 17.53 | |

INSTITUTIONAL CLASS SHARES | | | | | 11/13/97 | | | | 18.82 | | | | 16.62 | | | | 17.70 | |

| * | | Sales Charge for Class A Shares is 5.25%. |

| ** | | Assume 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| *** | | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

LIFE OF FUND PERFORMANCE (11/13/97 TO 6/30/07)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on 11/13/97.

Returns for the Class A, Class B, Class C and Select Shares prior to their inception date are based on the performance of Institutional Class Shares. During these periods, the actual returns of Class A, Class B, Class C and Select Shares would have been lower than shown because Class A, Class B, Class C and Select Shares have higher expenses than Institutional Class Shares.

The graph illustrates comparative performance for $3,000,000 invested in Institutional Class Shares of the JPMorgan Mid Cap Value Fund, Russell Midcap Value Index, and Lipper Mid-Cap Value Funds Index from November 13, 1997 to June 30, 2007. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any, and does not include a sales charge. The performance of the indices reflects an initial investment at the end of the month following the Fund’s inception. The performance of the Russell Midcap Value Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The performance of the Lipper Mid-Cap Value Funds Index includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses charged by the Fund. The Russell Midcap Value Index is an unmanaged index that measures the performance of those Russell Midcap companies included in the Russell Midcap Index that have lower price-to-book ratios and lower forecasted growth rates. The Lipper Mid-Cap Value Funds Index is an index based on total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Institutional Class Shares have a $3,000,000 minimum initial investment and carry no sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights which reflect adjustments made to the net asset values in accordance with accounting principles generally accepted in the United States of America.

JUNE 30, 2007 JPMORGAN MID CAP/MULTI-CAP FUNDS 13

JPMorgan Multi-Cap Market Neutral Fund

FUND COMMENTARY

AS OF JUNE 30, 2007 (Unaudited)

FUND FACTS

| Fund Inception | | | | May 23, 2003 |

| Fiscal Year End | | | | June 30 |

Net Assets as of 6/30/2007

| | | | | | |

| (In Thousands) | | | | $2,268,724 |

| Primary Benchmark | | | | Merrill Lynch 3-Month

US Treasury Bill Index* |

Q: | | HOW DID THE FUND PERFORM? |

A: | | The JPMorgan Multi-Cap Market Neutral Fund, which seeks long-term capital preservation and growth by using strategies designed to produce returns which have no correlation with general domestic market performance, returned 5.59%** (Select Class Shares) over the 12 months ended June 30, 2007, compared to the 5.21% return for the Merrill Lynch 3-Month U.S. Treasury Bill Index over the same period.*** |

Q: | | WHY DID THE FUND PERFORM THIS WAY? |

A: | | The Fund outperformed its benchmark due to its overall stock selection process, driven by valuation and fundamentals. In particular, both fundamentals and valuation worked on the long side of the Fund. However, although valuation worked on the short side, fundamentals did not. Stocks are assigned to one of five super-sectors: consumer, financial, industrials, technology and healthcare. Four of these super-sectors generated positive returns during the period, as industrials worked the best and financials the least. The Fund continued to employ a sector-neutral approach, selecting the best stocks and industries within each of 20 sectors. The Fund’s top three industry overweights were property and casualty insurance, managed care and semiconductor production equipment, while its top three industry underweights were brokers, core semiconductors and food products. |

Q: | | HOW WAS THE FUND MANAGED? |

A: | | We rank stocks within a universe of approximately 1,300 large-cap, mid-cap and high-end small-cap stocks. We owned more than 400 positions in the Fund during the period. The Fund is extremely well diversified and sector-neutral. No individual stock has a material impact on the Fund. In essence, we go long on inexpensive stocks with improving fundamentals and short on expensive stocks with deteriorating fundamentals. |

TOP TEN EQUITY LONG HOLDINGS OF THE PORTFOLIO****

| 1. | | ArvinMeritor, Inc. | | | 0.5 | % |

| 2. | | Tidewater, Inc. | | | 0.5 | |

| 3. | | Amkor Technology, Inc. | | | 0.5 | |

| 4. | | Accenture Ltd., Class A | | | 0.5 | |

| 5. | | Global Industries Ltd. | | | 0.5 | |

| 6. | | Energizer Holdings, Inc. | | | 0.4 | |

| 7. | | Dollar Tree Stores, Inc. | | | 0.4 | |

| 8. | | Arris Group, Inc. | | | 0.4 | |

| 9. | | Freeport-McMoRan Copper & Gold, Inc., Class B | | | 0.4 | |

| 10. | | priceline.com, Inc. | | | 0.4 | |

TOP TEN EQUITY SHORT HOLDINGS OF THE PORTFOLIO****

| 1. | | Flowserve Corp. | | | 0.5 | % |

| 2. | | Shaw Group, Inc. (The) | | | 0.5 | |

| 3. | | Rite Aid Corp. | | | 0.5 | |

| 4. | | Cypress Semiconductor Corp. | | | 0.4 | |

| 5. | | Cheniere Energy, Inc. | | | 0.4 | |

| 6. | | Fluor Corp. | | | 0.4 | |

| 7. | | Alcon, Inc. (Switzerland) | | | 0.4 | |

| 8. | | WMS Industries, Inc. | | | 0.4 | |

| 9. | | DST Systems, Inc. | | | 0.4 | |

| 10. | | Quicksilver Resources, Inc. | | | 0.4 | |

PORTFOLIO COMPOSITION LONG POSITIONS****

| Consumer Discretionary | | | | | 20.0 | % |

| Information Technology | | | | | 15.7 | |

| Industrials | | | | | 14.2 | |

| Financials | | | | | 12.3 | |

| Health Care | | | | | 9.8 | |

| Energy | | | | | 7.2 | |

| Materials | | | | | 6.3 | |

| Utilities | | | | | 4.9 | |

| Consumer Staples | | | | | 3.3 | |

| Telecommunication Services | | | | | 1.3 | |

| Short-Term Investment | | | | | 5.0 | |

PORTFOLIO COMPOSITION SHORT POSITIONS****

| Information Technology | | | | | 18.9 | % |

| Consumer Discretionary | | | | | 17.1 | |

| Industrials | | | | | 13.6 | |

| Financials | | | | | 11.5 | |

| Health Care | | | | | 11.2 | |

| Energy | | | | | 10.1 | |

| Consumer Staples | | | | | 5.9 | |

| Materials | | | | | 5.1 | |

| Utilities | | | | | 4.5 | |

| Telecommunication Services | | | | | 2.1 | |

| * | | Effective November 1, 2006, the Advisor changed the Fund’s benchmark to this index because it believes the new benchmark is more closely correlated with total return and is the industry standard. |

| ** | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights which reflect adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| *** | | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| **** | | Percentages indicated are based upon total investments as of June 30, 2007. The Fund’s composition is subject to change. |

14 JPMORGAN MID CAP/MULTI-CAP FUNDS JUNE 30, 2007

AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2007

| | | | INCEPTION DATE

OF CLASS

| | 1 YEAR

| | 3 YEAR

| | SINCE INCEPTION

|

|---|

CLASS A SHARES | | | | | 5/23/03 | | | | | | | | | | | | | |

| Without Sales Charge | | | | | | | | | 5.27 | % | | | 4.88 | % | | | 5.11 | % |

| With Sales Charge* | | | | | | | | | (0.27 | ) | | | 3.00 | | | | 3.75 | |

CLASS B SHARES | | | | | 5/23/03 | | | | | | | | | | | | | |

| Without CDSC | | | | | | | | | 4.56 | | | | 4.10 | | | | 4.35 | |

| With CDSC** | | | | | | | | | (0.44 | ) | | | 3.17 | | | | 3.92 | |

CLASS C SHARES | | | | | 5/23/03 | | | | | | | | | | | | | |

| Without CDSC | | | | | | | | | 4.56 | | | | 4.10 | | | | 4.35 | |

| With CDSC*** | | | | | | | | | 3.56 | | | | 4.10 | | | | 4.35 | |

SELECT CLASS SHARES | | | | | 5/23/03 | | | | 5.59 | | | | 5.15 | | | | 5.38 | |

| * | | Sales Charge for Class A Shares is 5.25%. |

| ** | | Assume 5% CDSC (contingent deferred sales charge) for the one year period, 2% CDSC for the five year period and 0% CDSC thereafter. |

| *** | | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

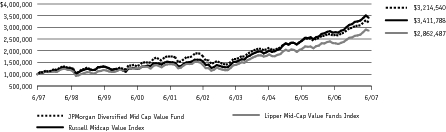

LIFE OF FUND PERFORMANCE (5/23/03 TO 6/30/07)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on May 23, 2003.

The graph illustrates comparative performance for $1,000,000 invested in Select Class Shares of the JPMorgan Multi-Cap Market Neutral Fund, the Merrill Lynch 3-Month US Treasury Bill Index, the Merrill Lynch 91-Day U.S. Treasury (Auction Rate) Index and the Lipper Equity Market-Neutral Funds Average from May 23, 2003 to June 30, 2007. The performance of the Fund assumes reinvestment of all dividends and capital gains, if any, and does not include a sales charge. The performance of the indices reflects an initial investment at the end of the month following the Fund’s inception. The performance of the Merrill Lynch 3-Month US Treasury Bill Index and Merrill Lynch 91-Day U.S. Treasury (Auction Rate) Index does not reflect the deduction of expenses or a sales charge associated with a mutual fund and has been adjusted to reflect reinvestment of all dividends and capital gains of the securities included in the benchmark. The performance of the Lipper Equity Market-Neutral Funds Average includes expenses associated with a mutual fund, such as investment management fees. These expenses are not identical to the expenses charged by the Fund. The Merrill Lynch 3-Month US Treasury Bill Index is an unmanaged index which represents the performance of 3-month U.S. Treasury bills and it is based on a single issue held for a month, sold and then rolled into a new issue the next month. The Merrill Lynch 91-Day Treasury (Auction Rate) Index is an unmanaged index, which reflects the total return of a hypothetical Treasury bill with a discount rate equal to the average rate established at each of the auctions during a given month. The Advisor changed the Fund’s benchmark to this index because it believes the new benchmark is more closely correlated with total return and is the industry standard. The Lipper Equity Market-Neutral Funds Average is an index based on total returns of certain mutual funds within the Fund’s designated category as determined by Lipper, Inc. Investors cannot invest directly in an index.

Select Class Shares have a $1,000,000 minimum initial investment and carry no sales charge.

Performance may reflect the waiver of the Fund’s fees and reimbursement of expenses for certain periods since the inception date. Without these waivers and reimbursements performance would have been lower. Also, performance shown in this section does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The returns shown are based on net asset values calculated for shareholder transactions and may differ from the return shown in the financial highlights which reflect adjustments made to the net assets value in accordance with accounting principles generally accepted in the United States of America.

JUNE 30, 2007 JPMORGAN MID CAP/MULTI-CAP FUNDS 15

JPMorgan Value Advantage Fund

FUND COMMENTARY

AS OF JUNE 30, 2007 (Unaudited)

FUND FACTS

| Fund Inception | | | | February 28, 2005 |

| Fiscal Year End | | | | June 30 |

Net Assets as of 6/30/2007

| | | | | | |

| (In Thousands) | | | | $510,539 |

| Primary Benchmark | | | | Russell 3000 Value Index |

Q: | | HOW DID THE FUND PERFORM? |

A: | | The JPMorgan Value Advantage Fund, which seeks to provide long-term total return from a combination of income and capital gains, returned 21.58%* (Class A Shares, no sales charge) over the 12 months ended June 30, 2007, compared to the 21.33% for the Russell 3000 Value Index over the same period.** |

Q: | | WHY DID THE FUND PERFORM THIS WAY? |

A: | | The Fund outperformed its benchmark for the period due primarily to stock selection in the materials and financial sectors. At the individual stock level, Devon Energy Corp. was among the contributors to performance. The company continued to benefit from higher energy prices, aggressive deepwater exploration initiatives and its acquisition of privately held Chief Holdings LLC, a natural gas producer. Teekay Shipping Corp., a provider of crude oil and petroleum product transportation services, also helped results. The company began transitioning its business from depending on volatile short-term spot rates to more long-term fixed-rate contracts. Rinker Group LTD, a cement producer, also supported performance. The company’s shares rose sharply after Cemex S.A.B. de C.V. announced intentions to acquire it. Cemex was aggressive in its offer, as it was extended numerous times and eventually increased over 20% above the original offer price. In addition, the company produced solid financial results due primarily to cost-cutting initiatives and price increases that were implemented the prior fiscal year. |

On the negative side, stock selection in the industrials sector as well as an underweight in the utility sector detracted from performance. Walter Industries Inc., a diversified industrial company, was among the detractors from performance. Lower coal production resulting from geographical concerns at one of the company’s mining facilities led to revenues and earnings that fell below expectations. Griffon Corp., a diversified manufacturer, also hurt returns. The stock came under pressure, as the company noted a significant decline in garage door sales and installations due to the slowdown in new home construction and home resale markets. McClatchy Co., the third-largest newspaper company in the U.S., also negatively impacted performance. The company experienced a difficult start to 2007 as advertising revenues declined sharply on the back of disappointing real estate ads.

Q: | | HOW WAS THE FUND MANAGED? |

A: | | We employ a bottom-up approach to stock selection, constructing portfolios based on company fundamentals, quantitative screening and proprietary fundamental analysis. We look for undervalued companies that have the potential to grow intrinsic value per share. The research process is designed to find companies with predictable and durable business models deemed capable of achieving sustainable growth. Potential investments are subjected to rigorous financial analysis and a disciplined approach to valuation. |

TOP TEN EQUITY HOLDINGS OF THE PORTFOLIO***

| 1. | | Devon Energy Corp. | | | 3.3 | % |

| 2. | | Washington Post Co. (The), Class B | | | 3.0 | |

| 3. | | W.P. Carey & Co. LLC | | | 2.7 | |

| 4. | | Clear Channel Communications, Inc. | | | 2.7 | |

| 5. | | Berkshire Hathaway, Inc., Class A | | | 2.4 | |

| 6. | | Agree Realty Corp. | | | 2.1 | |

| 7. | | Assurant, Inc. | | | 2.1 | |

| 8. | | M&T Bank Corp. | | | 2.1 | |

| 9. | | Charles Schwab Corp. (The) | | | 2.0 | |

| 10. | | Synovus Financial Corp. | | | 2.0 | |

PORTFOLIO COMPOSITION***

| Financials | | | | | 37.2 | % |

| Consumer Discretionary | | | | | 18.9 | |

| Energy | | | | | 8.9 | |

| Industrials | | | | | 5.7 | |

| Consumer Staples | | | | | 4.8 | |

| Health Care | | | | | 3.7 | |

| Telecommunication Services | | | | | 3.0 | |

| Materials | | | | | 2.9 | |

| Information Technology | | | | | 1.7 | |

| Investment Company | | | | | 1.3 | |

| Short-Term Investment | | | | | 11.9 | |

| * | | The return shown is based on net asset value calculated for shareholder transactions and may differ from the return shown in the financial highlights which reflect adjustments made to the net asset value in accordance with accounting principles generally accepted in the United States of America. |

| ** | | The advisor seeks to achieve the Fund’s objective. There can be no guarantee it will be achieved. |

| *** | | Percentages indicated are based upon total investments as of June 30, 2007. The Fund’s composition is subject to change. |

16 JPMORGAN MID CAP/MULTI-CAP FUNDS JUNE 30, 2007

AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2007

| | | | INCEPTION DATE

OF CLASS

| | 1 YEAR

| | SINCE INCEPTION

| |

|---|

CLASS A SHARES | | | | | 2/28/05 | | | | | | | | | | | | | |

| Without Sales Charge | | | | | | | | | 21.58 | % | | | 15.95 | % | | | | |

| With Sales Charge* | | | | | | | | | 15.21 | | | | 13.31 | | | | | |

CLASS C SHARES | | | | | 2/28/05 | | | | | | | | | | | | | |

| Without CDSC | | | | | | | | | 21.00 | | | | 15.38 | | | | | |

| With CDSC** | | | | | | | | | 20.00 | | | | 15.38 | | | | | |

SELECT CLASS SHARES | | | | | 2/28/05 | | | | 21.89 | | | | 16.24 | | | | | |

INSTITUTIONAL CLASS SHARES | | | | | 2/28/05 | | | | 22.16 | | | | 16.25 | | | | | |

| * | | Sales Charge for Class A Shares is 5.25%. |

| ** | | Assumes a 1% CDSC for the one year period and 0% CDSC thereafter. |

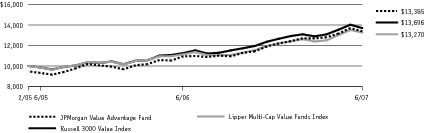

LIFE OF FUND PERFORMANCE (2/28/05 TO 6/30/07)

Source: Lipper, Inc. The performance quoted is past performance and is not a guarantee of future results. Mutual funds are subject to certain market risks. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data shown. For up-to-date month-end performance information please call 1-800-480-4111.

The Fund commenced operations on 2/28/05.