UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1 TO

SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant |X| Filed by a Party other than the Registrant |_|

Check the appropriate box:

|X| Preliminary Proxy Statement

|_| CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE

14A-6(E)(2))

|_| Definitive Proxy Statement

|_| Definitive Additional Materials

|_| Soliciting Material Pursuant to ss.240.14a-12

WELLSFORD REAL PROPERTIES, INC.

(Name of Registrant as Specified In Its Charter)

- --------------------------------------------------------------------------------

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|_| No fee required

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

(1) Title of each class of securities to which transaction applies:

-------------------------------------------------------------------

(2) Aggregate number of securities to which transaction applies:

-------------------------------------------------------------------

(3) Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

-------------------------------------------------------------------

(4) Proposed maximum aggregate value of transaction:

-------------------------------------------------------------------

(5) Total fee paid:

-------------------------------------------------------------------

|X| Fee paid previously with preliminary materials.

-------------------------------------------------------------------

|_| Check box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2) and identify the filing for which the offsetting fee was

paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

-------------------------------------------------------------------

(2) Form, Schedule or Registration Statement No.:

-------------------------------------------------------------------

(3) Filing Party:

-------------------------------------------------------------------

(4) Date Filed:

-------------------------------------------------------------------

TABLE OF CONTENTS

INTRODUCTION.................................................................1

Summary Term Sheet....................................................2

Special Factors Relating to the Stock Split...........................5

Risk Factors.........................................................20

Stockholders Entitled to Vote at the Meeting.........................27

How to Vote Your Shares..............................................28

How to Revoke Your Proxy.............................................28

Voting at the Annual Meeting.........................................28

The Board's Recommendation...........................................28

Votes Required to Approve Each Item..................................28

PROPOSAL 1 -- PLAN OF LIQUIDATION...........................................29

What You Are Being Asked To Approve..................................29

The Board's Recommendation...........................................29

What the Plan of Liquidation Contemplates............................29

Key Provisions of the Plan...........................................30

Reasons for the Liquidation..........................................31

Background...........................................................33

Expected Distributions...............................................39

Modification of Plan of Liquidation; No Further Stockholder

Action Required....................................................41

Effect of Distributions Made Under the Plan Upon Stock Options.......42

Cancellation of Common Shares........................................42

Steps Taken Consistent with the Plan.................................42

Dissolution..........................................................43

Transferability of Shares; AMEX Listing..............................44

Liquidating Trust....................................................44

Our Advisor..........................................................45

Certain Transactions and Possible Effects of the Approval of

the Plan of Liquidation Upon Directors and Officers..............45

Appraisal Rights of Stockholders.....................................47

Material Federal Income Tax Consequences of the Plan of Liquidation..48

PROPOSAL 2 -- REVERSE/FORWARD STOCK SPLIT - AMENDMENT TO THE COMPANY'S

ARTICLES OF AMENDMENT....................................................51

What You Are Being Asked To Approve..................................51

The Board's Recommendation...........................................51

What the Stock Split Contemplates....................................51

Background...........................................................52

Basic Terms of the Stock Split.......................................52

Split Effective Date.................................................53

Exchange of Certificates for Cash Payment or Common Shares...........53

Source of Funds and Financial Effect of the Stock Split..............54

Fees and Expenses....................................................54

Accounting Consequences..............................................54

Certain Legal Matters................................................54

Conduct of the Company's Business after the Stock Split..............55

Reservation of Right to Abandon the Stock Split......................55

Escheat Laws.........................................................56

Appraisal Rights of Stockholders.....................................56

Material Federal Income Tax Consequences of Stock Split..............56

FINANCIAL STATEMENTS........................................................60

PROPOSAL 3 -- ELECTION OF DIRECTORS.........................................61

Nominees for Election as Directors...................................62

The Board's Recommendation...........................................63

Other Directors......................................................63

Board of Directors' Meetings.........................................63

Board Committees.....................................................64

Code of Business Conduct and Ethics..................................66

Compensation of Directors............................................66

Executive Officers...................................................67

Executive Compensation...............................................67

Employment Agreements................................................69

Management Incentive Plans...........................................71

Compensation Committee Interlocks and Insider Participation..........71

Compensation Committee Report on Executive Compensation..............71

Security Ownership of Certain Beneficial Owners and Management

and Related Stockholder Matters....................................74

Certain Relationships and Related Transactions.......................75

Audit Committee Report...............................................78

Principal Independent Registered Public Accounting Firm

Fees and Services..................................................79

Common Share Price Performance Graph.................................80

PROPOSAL 4 -- RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM....................................................81

The Board's Recommendation...........................................81

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE.....................81

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING INFORMATION.................81

WHERE YOU CAN FIND MORE AVAILABLE INFORMATION...............................82

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE...........................82

WHO CAN HELP ANSWER YOUR QUESTIONS..........................................83

STOCKHOLDER PROPOSALS.......................................................83

FINANCIAL AND OTHER INFORMATION.............................................83

EXPENSES OF SOLICITATION....................................................83

OTHER MATTERS...............................................................84

PLAN OF LIQUIDATION.................................................Appendix A

ARTICLES OF AMENDMENT (REVERSE STOCK SPLIT).......................Appendix B-1

ARTICLES OF AMENDMENT (FORWARD STOCK SPLIT).......................Appendix B-2

APPRAISAL BY HUBBELL REALTY SERVICES, INC...........................Appendix C

WELLSFORD REAL PROPERTIES, INC.

535 MADISON AVENUE, 26TH FLOOR

NEW YORK, NY 10022

(212) 838-3400

_____ __, 2005

Dear Stockholder:

You are cordially invited to attend the 2005 Annual Meeting of

Stockholders which will be held on ____ __, 2005, at 9:30 a.m., local time, at

the offices of Bryan Cave LLP, 1290 Avenue of the Americas, 31st floor, New

York, NY 10104.

Information about the meeting and the various matters on which the

stockholders will act is included in the Notice of Annual Meeting of

Stockholders and Proxy Statement which follow. Also included is a Proxy Card and

postage paid return envelope.

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING. WHETHER

OR NOT YOU PLAN TO ATTEND, WE HOPE THAT YOU WILL COMPLETE AND RETURN YOUR PROXY

CARD IN THE ENCLOSED ENVELOPE AS PROMPTLY AS POSSIBLE.

Sincerely,

JEFFREY H. LYNFORD

Chairman of the Board,

Chief Executive Officer and President

WELLSFORD REAL PROPERTIES, INC.

535 MADISON AVENUE, 26TH FLOOR

NEW YORK, NY 10022

(212) 838-3400

--------------------

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD _____ __, 2005

--------------------

The 2005 Annual Meeting of Stockholders of Wellsford Real Properties,

Inc., a Maryland Corporation (the "Company"), will be held at the offices of

Bryan Cave LLP, 1290 Avenue of the Americas, 31st floor, New York, NY 10104 on

______ __, 2005 at 9:30 a.m., local time, for the following purposes:

1. To consider and vote upon the plan of liquidation and

dissolution of the Company.

2. To consider and vote upon the reverse/forward stock split.

3. To elect three directors to terms expiring at the 2008 annual

meeting of stockholders and upon the election and

qualification of their successors.

4. To ratify the appointment of Ernst & Young LLP as the

Company's independent registered public accounting firm for

the fiscal year ending December 31, 2005.

5. To transact such other business as may properly come before

the meeting or any adjournment(s) or postponement(s) thereof.

These items are fully described in the Proxy Statement, which is part

of this notice. We have not received notice of any other matters that may be

properly presented at the annual meeting.

The Board of Directors has fixed the close of business on _____ __,

2005 as the record date for determining the stockholders entitled to receive

notice of and to vote at the meeting.

STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON.

YOUR VOTE IS IMPORTANT. ACCORDINGLY, YOU ARE URGED TO COMPLETE, SIGN,

DATE AND RETURN THE ACCOMPANYING PROXY CARD WHETHER OR NOT YOU PLAN TO ATTEND

THE MEETING.

THE REVERSE/FORWARD STOCK SPLIT HAS NOT BEEN APPROVED OR DISAPPROVED BY

THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION, AND

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES

COMMISSION HAS PASSED UPON THE FAIRNESS OR MERITS OF THE REVERSE/FORWARD STOCK

SPLIT OR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS

DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

BY ORDER OF THE BOARD OF DIRECTORS

JAMES J. BURNS

Secretary

____ ___, 2005

New York, New York

WELLSFORD REAL PROPERTIES, INC.

535 MADISON AVENUE, 26TH FLOOR

NEW YORK, NY 10022

--------------------

PROXY STATEMENT

--------------------

_____ __, 2005

2005 ANNUAL MEETING OF STOCKHOLDERS

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation

by the Board of Directors (the "Board") of Wellsford Real Properties, Inc., a

Maryland corporation (which we refer to as "Wellsford," the "Company," "we,"

"our," or "us"), of proxies from the holders of the Company's issued and

outstanding shares of common stock, par value $.02 per share (the "Regular

Common Shares"), and Class A-1 common stock, par value $.02 per share (the "A-1

Common Shares" and, together with the Regular Common Shares, the "Common

Shares"), to be exercised at the 2005 Annual Meeting of Stockholders to be held

on ____ __, 2005, at the offices of Bryan Cave LLP, 1290 Avenue of the Americas,

31st floor, New York, NY 10104, at 9:30 a.m., local time, and at any

adjournment(s) or postponement(s) of such meeting (the "Annual Meeting"), for

the purposes set forth in the accompanying Notice of Annual Meeting of

Stockholders.

This Proxy Statement and enclosed Proxy Card are being mailed to the

stockholders on or about _____ __, 2005.

Among the matters to be considered at the Annual Meeting are:

o A proposal to adopt a plan of liquidation (the "Plan"), which

would authorize the Board to liquidate all of the Company's

assets and, after making the necessary and appropriate

reserves against liabilities, make distributions of the

proceeds of the liquidation to the Company's stockholders and

dissolve the Company;

o A proposal to amend the Company's charter to effect a reverse

stock split followed immediately by a forward stock split (the

"Stock Split") which, if approved, will (i) enable the Company

to end its obligations to file annual and periodic reports

with, and comply with the rules and regulations of, the

Securities and Exchange Commission (the "SEC") and continue

future operations as a private company, and (ii) result in the

termination of the American Stock Exchange ("AMEX") listing of

our Common Shares;

o The election of three directors; and

o The ratification of the selection of Ernst & Young LLP as the

Company's independent registered public accounting firm.

The Summary Term Sheet which follows provides a summary of the material

terms of the Plan, the Stock Split and the transactions contemplated in

connection with each of the above. The Proxy Statement contains a more detailed

description and background of each of the proposals, and we encourage you to

read the entire Proxy Statement and each of the documents that we have attached

as exhibits.

SUMMARY TERM SHEET

Summary of Proposed Plan of Liquidation

The following is a summary of the steps to be undertaken in connection

with, and the material terms of, the proposed Plan, which is attached as

Appendix A to this Proxy Statement, and the other transactions contemplated

in connection with the Plan. We encourage you to read carefully the entire

Proxy Statement and the attached exhibit for a more detailed description of

the terms of the proposed Plan.

o General. Under the Plan, we intend to effectuate the orderly

sale of each of the Company's remaining assets, which may take

place in connection with the dissolution of substantially all

Company joint ventures, partnerships and limited liability

companies, the collection of all outstanding loans and

receivables, an orderly disposition or completion of

construction of our development projects, the discharge of all

outstanding liabilities to third parties, and, after the

provision of appropriate reserves, the distribution of all

remaining cash to our stockholders and the dissolution of the

Company. See also the information under the caption "Proposal

1--What the Plan of Liquidation Contemplates."

o Total Distributions. Through the execution of the Plan, we

expect that stockholders will receive aggregate cash

distributions of between $18.00 and $20.50 per Common Share.

At March 31, 2005, our book value per Common Share was $14.84,

and during the period January 1, 2005 through May 18, 2005,

the date preceding the Company's announcement of the Board's

adoption of the Plan and authorization of the Stock Split, the

intraday trading range of our Regular Common Shares was

between $13.75 and $15.44 per share. After the announcement of

the Board's adoption of the Plan and authorization of the

Stock Split on May 19, 2005, and through June 10, 2005, the

intraday trading range of our Regular Common Shares was

between $16.79 and $17.80 per share.

o Initial Distribution. We anticipate making an initial

distribution ("Initial Distribution") of between $12.00 to

$14.00 per Common Share. The amount of the Initial

Distribution will be a function primarily of the net sale

proceeds received by the Company upon its sale of the three

operating residential rental phases of Palomino Park

("Palomino Park"), which comprise 1,184 units within our

multifamily residential rental project in Highlands Ranch, a

southern suburb of Denver, Colorado. Other components of the

Initial Distribution are expected to include a portion of the

cash and cash equivalents that we have on hand and may include

proceeds from:

o the sale of the remaining properties owned by, and

distribution of net cash by, Wellsford/Whitehall

Group, LLC ("Wellsford/Whitehall"), a joint venture

in which the Company has a 35.21% equity interest;

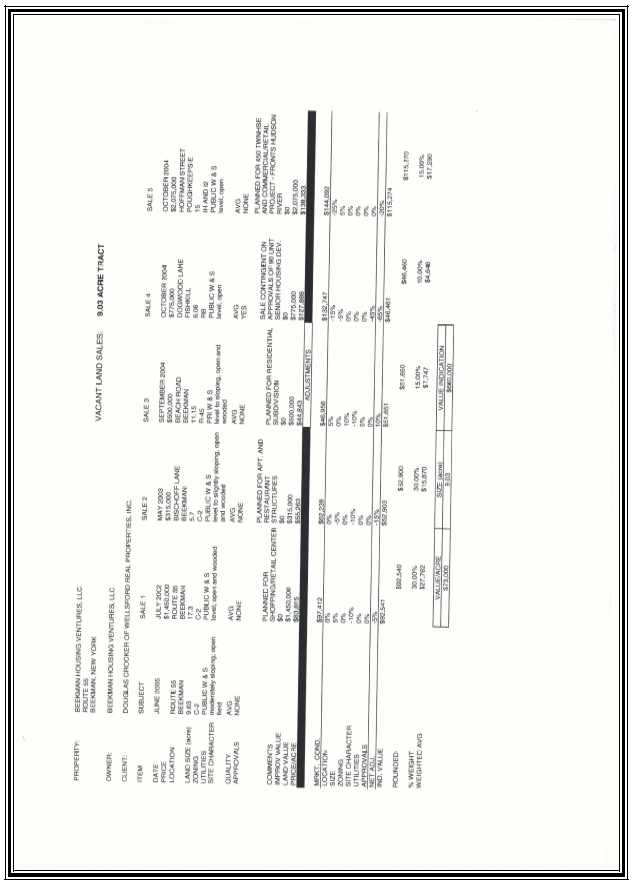

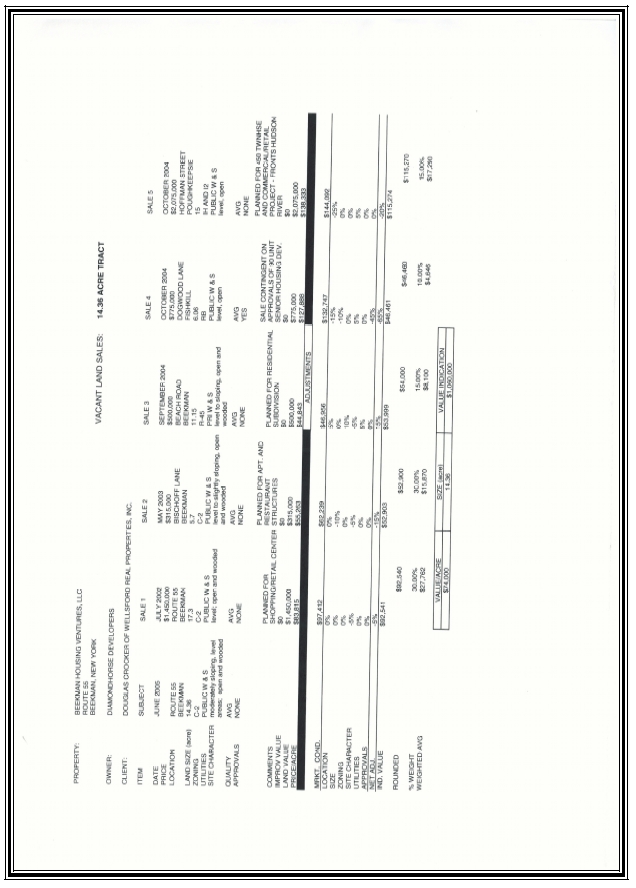

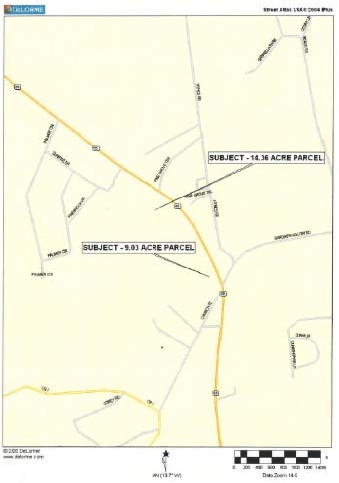

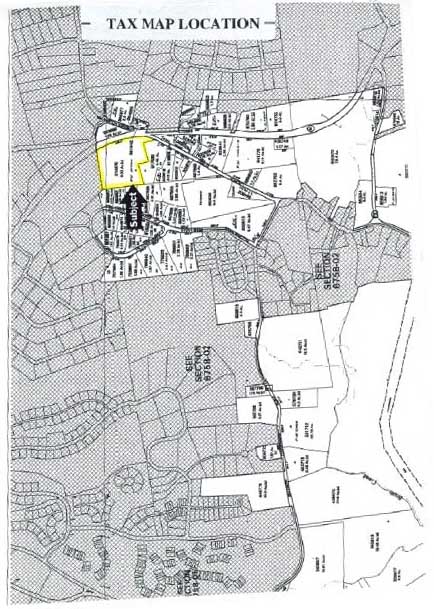

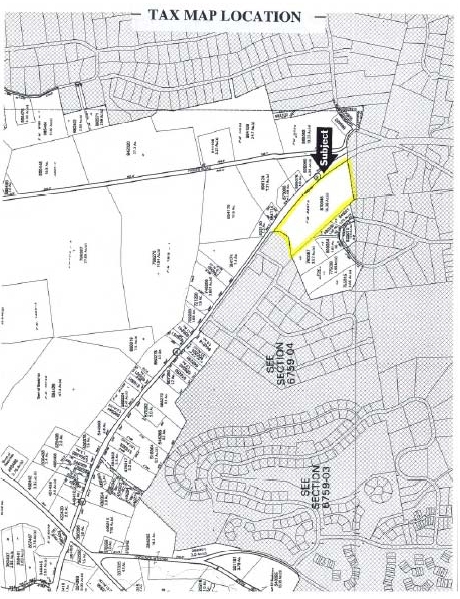

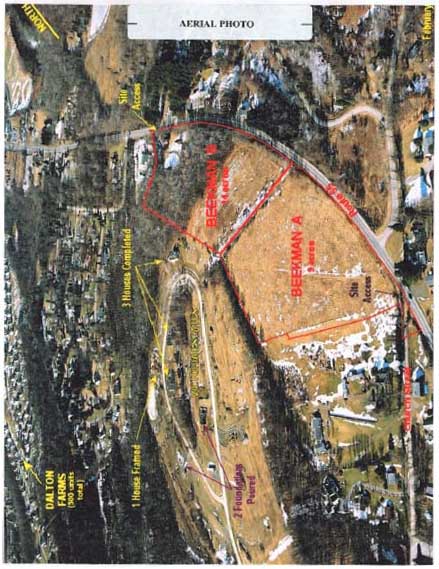

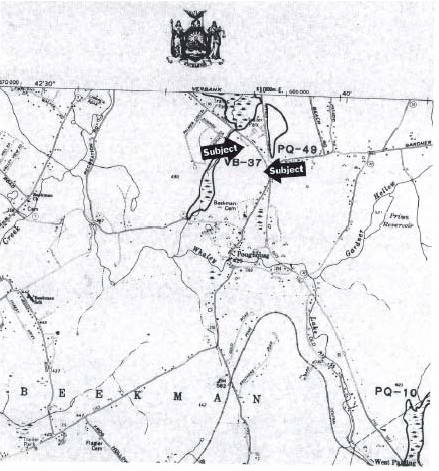

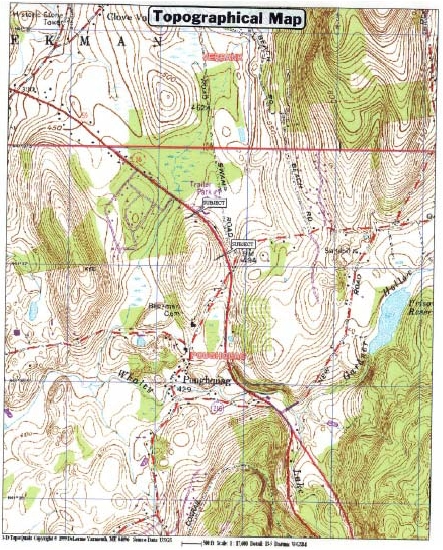

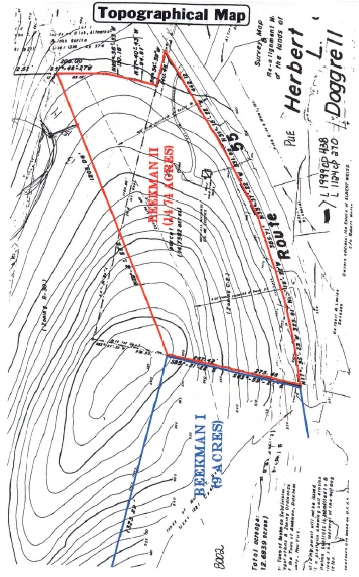

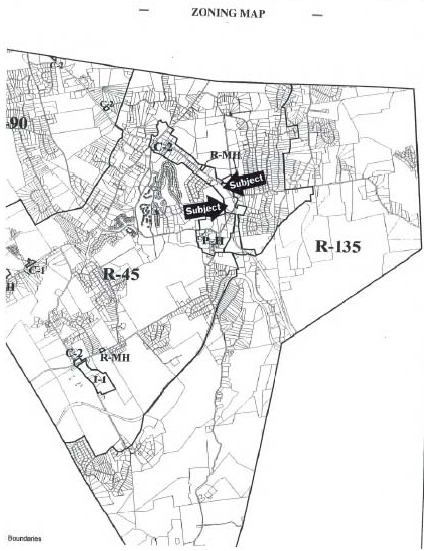

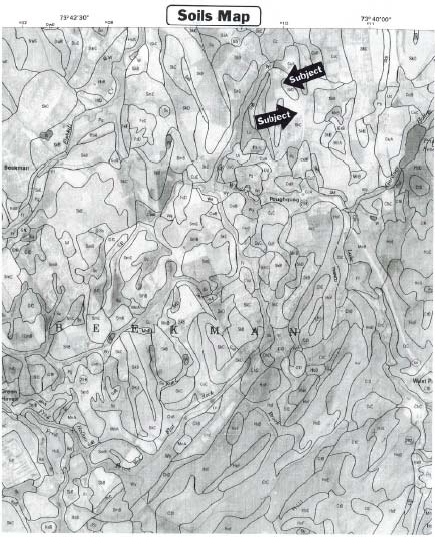

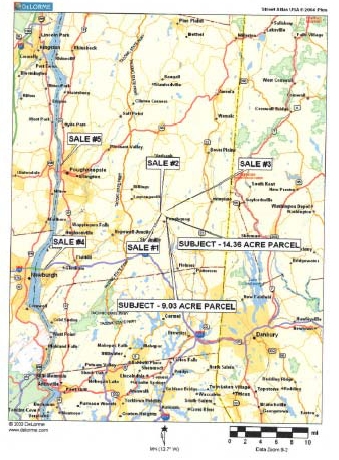

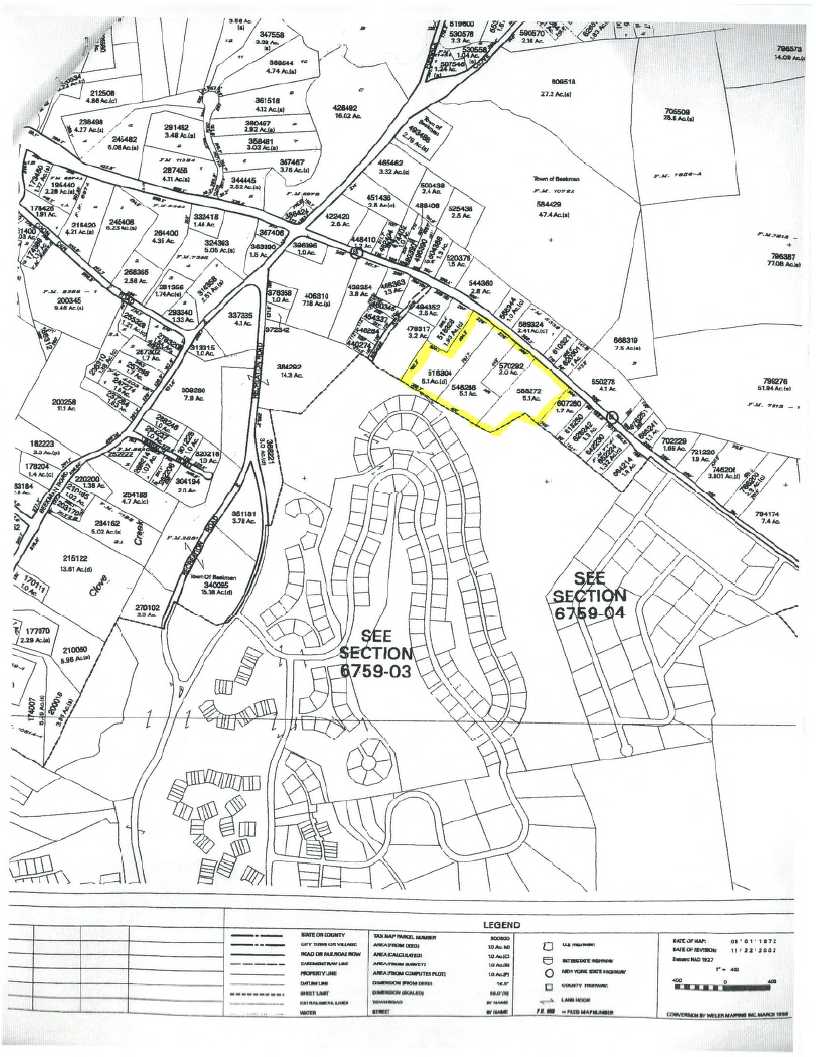

o the direct or indirect sale of the Company's interest

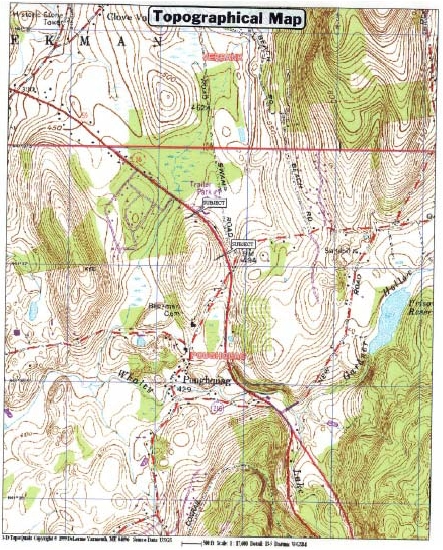

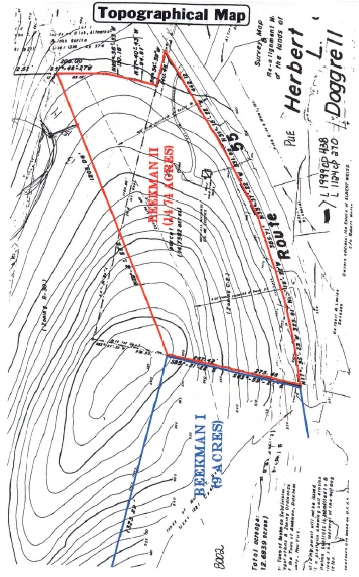

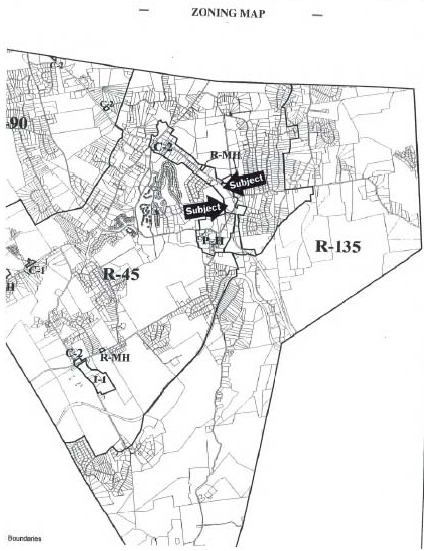

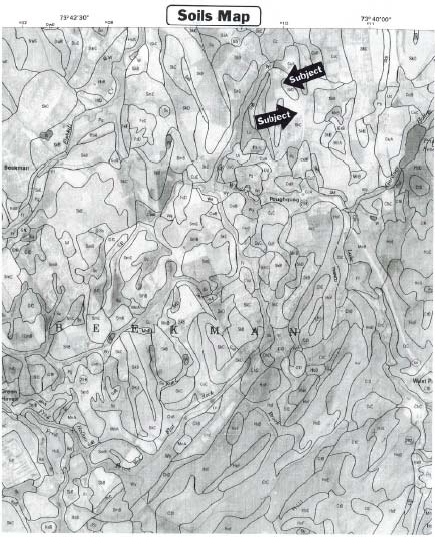

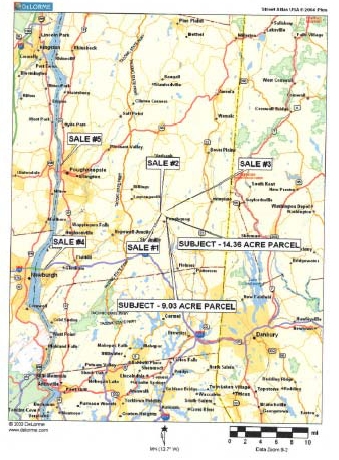

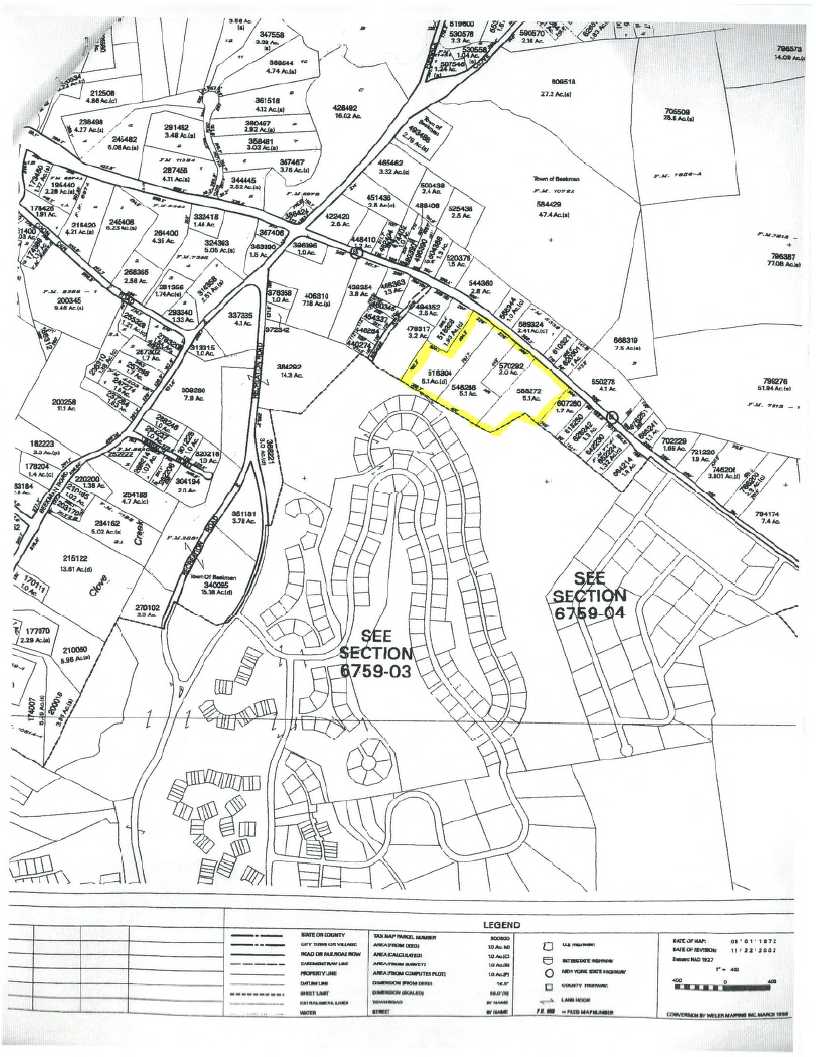

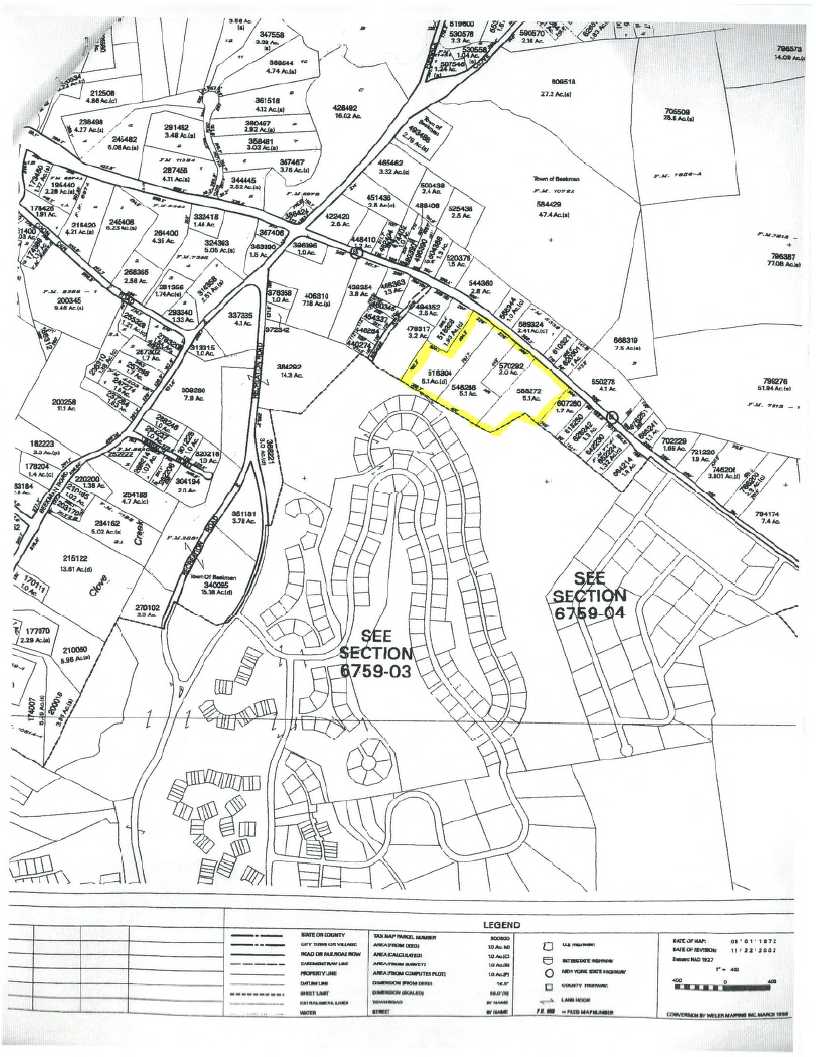

in two contiguous undeveloped parcels of land in

Beekman, New York (the "Beekman Properties"), to

Jeffrey H. Lynford, the Company's Chief Executive

Officer, and Edward Lowenthal, a member of the Board,

or an entity controlled by them (the "Beekman

Acquirors") at a price determined by the independent

members of the Board to be equal to the greater of

either (i) the fair market value of the Beekman

Properties, based on an independent appraisal, or

(ii) the total costs incurred by the Company with

respect to the Beekman Properties (which through May

31, 2005 aggregated approximately $1 million); and

o the orderly sale of the remaining unsold condominium

units at The Fordham residential tower in Chicago

("Fordham Tower") owned by a joint venture in which

we have a 10% equity interest.

We anticipate making the Initial Distribution within 30 days after the

later of stockholder approval of the Plan and completion of the sale of

the three rental phases of Palomino Park. See the information under the

caption "Proposal 1--What the Plan of Liquidation Contemplates;

--Expected Distributions: Calculation of Estimated Distributions; and

--Certain Transactions and Possible Effects of the Approval of the Plan

of Liquidation upon Directors and Officers: Purchase of Beekman by the

Beekman Acquirors."

2

o Additional Distributions. The balance of the cash to be

received by stockholders will be distributed in one or more

installments, over a 12 to 36 month period after adoption of

the Plan, as we wind up our operations and dissolve the

Company. See the information under the caption "Proposal

1--Key Provisions of the Plan of Liquidation; --Dissolution."

These distributions will be the result of several

transactions, including:

o the collection of two notes payable to the Company

(the "Guggenheim and Mantua Loans");

o the sale to a third party of Reis, Inc. ("Reis"), a

real estate information and database company (our

interest is approximately 21.6% of Reis' equity on an

as-converted basis at May 31, 2005), or a sale of our

ownership interest in Reis; and

o the completion of construction and sale of

residential units at the Gold Peak phase of Palomino

Park ("Gold Peak"), Claverack, New York ("Claverack")

and East Lyme, Connecticut ("The Orchards").

Alternatively, or in combination, the Company may

sell the land at Gold Peak and The Orchards projects

to another developer and our joint venture interest

in Claverack to our partner in that venture.

o Distribution to a Liquidating Trust. Upon a determination made

by the Board at any time prior to the dissolution of the

Company, the Board may transfer and assign to a liquidating

trust the Company's remaining cash and property to pay (or

adequately provide for) all the remaining debts and

liabilities of the Company. Any remaining assets of the

liquidating trust would be distributed to the holders of our

Common Shares. See the information under the caption "Proposal

1--Key Provisions of the Plan of Liquidation; --Liquidating

Trust."

o Amending or Abandoning the Plan. The Board may amend or

abandon the Plan for any reason without further action by our

stockholders. See the information under the caption "Proposal

1--Key Provisions of the Plan of Liquidation; --Modification

of Plan of Liquidation; No Further Stockholder Action

Required."

o Appraisal Rights. No appraisal rights are available under

Maryland law to stockholders in connection with the

liquidation and dissolution of the Company. See also the

information under the caption "Proposal 1 -- Appraisal Rights

of Stockholders."

o Required Vote. The affirmative vote of two-thirds of all the

votes entitled to be cast by holders of the Common Shares is

required to approve and adopt the Plan.

In March 2004, the Board retained the services of Lazard Ltd. ("Lazard") for

advice as to the strategic alternatives available to the Company, among which

were the Company's continuation of its business operations as an independent

public entity, a sale of the Company and a liquidation of the Company. As part

of its engagement, Lazard assisted management in connection with its

determination of a range of potential liquidation proceeds. This included

performing various sensitivity analyses of management's projections relating to

the amount of cash distributions that could be made to stockholders. Lazard did

not independently verify management's budgets and projections, and it did not

appraise any of the assets of the Company, although Lazard did perform the

mathematical compilations and computations of management's budgets and

projections necessary to complete the sensitivity analysis. A full description

of assumptions made, procedures followed, matters considered, and the

qualifications and limitations on the scope of the review undertaken by the

Board in connection with its determination of the range of liquidation values is

set forth under the captions "Introduction--Risk Factors; Proposal

1--Background"; and " -- Expected Distributions" in this Proxy Statement.

3

Summary of Proposed Stock Split

The following is a summary of the material terms and conditions of the

Stock Split and the two related Articles of Amendment, attached as Appendices

B-1 and B-2 to this Proxy Statement, and the anticipated effects of the

Stock Split. We encourage you to read carefully the entire Proxy Statement

and each of the attached exhibits for a more detailed description of the

terms of the proposed Stock Split.

o Terms of the Stock Split. The Board has authorized a 1-for-100

reverse stock split (the "Reverse Stock Split") to be followed

immediately by a 100-for-1 forward stock split (the "Forward

Stock Split"). The Reverse Stock Split and the Forward Stock

Split together constitute the Stock Split. As a result of the

Stock Split, if you hold less than 100 Regular Common Shares

in any account, those shares will be cancelled and exchanged

for cash in the amount of $20.50 per pre-split Regular Common

Share which will be paid at the time the Stock Split is

effective. If you hold 100 or more Regular Common Shares in an

account, you will be unaffected by the Stock Split and will

not need to exchange or return any existing stock

certificates, which, after the Forward Stock Split, will

continue to evidence ownership of the same number of shares as

they evidenced before the Stock Split. See the information

under the captions "Proposal 2 -- What the Stock Split

Contemplates", "-- Basic Terms of the Stock Split", "--

Exchange of Certificates for Cash Payment or Shares", and "--

Effects of the Stock Split" in this Proxy Statement.

o Fairness of the Stock Split. The Board has determined that the

Stock Split and the price being paid per pre-split Regular

Common Share are fair to and in the best interests of all our

stockholders, including unaffiliated stockholders, those

stockholders who will receive cash in lieu of their Regular

Common Shares and those who will remain stockholders after the

Stock Split. The Board did not seek a fairness opinion in this

matter. See the information under the caption "Introduction --

Special Factors Relating to the Stock Split -- Fairness of the

Stock Split."

o Payment to Holders of Less than 100 Regular Common Shares. The

Board has authorized the payment of $20.50 per pre-split

share, which is the high end of the range of the amount per

Common Share expected to be distributed under the Plan. The

Board has reserved the right not to effectuate the Stock Split

if the aggregate amount to be paid to redeem all fractional

shares exceeds $1 million. A full description of the

assumptions made, procedures followed, advisors consulted,

matters considered, the qualifications and limitations on the

scope of the review undertaken by the Board in connection with

the Board's determination of the fairness of the Stock Split,

and the amount to be paid for each pre-split Regular Common

Share held by stockholders owning less than 100 Regular Common

Shares in accounts are set forth under the captions

"Introduction -- Special Factors Related to Stock Split --

Fairness of the Stock Split," and " Proposal 2 -- Reservation

of Right to Abandon Stock Split" in this Proxy Statement.

o Conduct of the Company Following the Stock Split. If our

stockholders approve the proposed Stock Split but not the

proposed Plan, then the Company will continue its business

operations and retain its net cash equity, but without having

to meet the reporting requirements and associated obligations

of a public company under the Exchange Act. If our

stockholders reject the Stock Split, but approve the Plan, or

we exercise our right not to effectuate the Stock Split, we

intend to execute the Plan but will continue to bear the costs

associated with a public reporting company even after we

distribute a substantial portion of our net cash equity to our

stockholders. In such event, the amounts distributed under the

Plan will be reduced by our incremental costs of remaining a

public company. The Board has recommended the adoption of both

the Plan and the Stock Split. See the information under the

captions "Proposal 2 -- Effects of the Stock Split: Effects of

the Stock Split on the Company" and "-- Conduct of the

Company's Business After the Stock Split" in this Proxy

Statement.

o Abandonment of the Stock Split. The Board reserves the right

not to effect the Stock Split at any time preceding the

effective date of the Stock Split (the "Split Effective

Date"). Furthermore, the Board has reserved the right not to

effect the Stock Split if the aggregate amount to be paid to

redeem all fractional shares exceeds $1 million. See the

information under the captions "Proposal 2 -- What the Stock

Split Contemplates", "-- Source of Funds and Financial Effect

of the Stock Split", "--Reservation of Right to Abandon the

Stock Split" and "-- Split Effective Date" in this Proxy

Statement.

4

o Appraisal Rights. If the Stock Split takes place, you will not

be entitled to appraisal rights under either our governance

documents or the Maryland General Corporation Law ("MGCL") as

a result of the Stock Split. See also the information under

the caption "Proposal 2 -- Appraisal Rights" in this Proxy

Statement.

o Effects of the Stock Split. As of June 10, 2005, we had

6,467,639 Common Shares outstanding. Our Regular Common

Shares, of which 6,297,736 are issued and outstanding, are

currently registered pursuant to the Securities Exchange Act

of 1934, as amended (the "Exchange Act"), and listed on the

AMEX (trading symbol: WRP), and we are subject to registration

and periodic reporting obligations under the Exchange Act. On

June 3, 2005, our Regular Common Shares were held by 576

stockholders of record, and we believe that the Stock Split

will reduce this number to approximately 112. If the number of

record holders is reduced to below 300, then we will terminate

our public registration, reporting, and other obligations

under the Exchange Act, delist our Regular Common Shares from

trading on the AMEX, and be relieved of approximately $1.9

million of administrative costs annually. See the information

under the captions "Proposal 2 -- Reasons for, Potential

Advantages of, and Purpose of the Stock Split", "-- Fairness

of the Stock Split" and "-- Effects of the Stock Split" in

this Proxy Statement.

o Required Vote. The affirmative vote of a majority of all the

votes entitled to be cast by holders of the Common Shares is

required to approve and adopt the Stock Split.

SPECIAL FACTORS RELATING TO THE STOCK SPLIT

PURPOSES, ALTERNATIVES, REASONS AND EFFECTS OF THE STOCK SPLIT

Purpose of the Stock Split

The purpose of the Stock Split is to terminate the Company's

registration and periodic reporting obligations under the Exchange Act,

terminate the AMEX listing of our Regular Common Shares, and continue future

operations as a non-public company, whether or not our proposed Plan of

Liquidation (Proposal 1) is adopted. We are permitted to terminate our

registration under the Exchange Act if there are fewer than 300 record holders

of our outstanding Regular Common Shares. Through the Stock Split, we intend to

reduce the number of stockholders of record of our Common Shares to fewer than

300 by cashing out the stockholders who hold less than 100 Regular Common Shares

(the "Cashed-Out Stockholders"). As a result of these actions, our Board and

management expect that the Company will be relieved of significant costs,

administrative burdens and compliance obligations associated with operating as a

listed public company. However, the actual savings to be realized from

terminating the Company's registration and periodic reporting obligations under

the Exchange Act and the listing of our Regular Common Shares on the AMEX may be

higher or lower than such estimates.

Background to the Stock Split

As discussed in greater detail under the caption "Proposal 1 --

Background," in March 2004 we retained Lazard to assist us in evaluating our

strategic alternatives with a view to maximizing stockholder value. Among the

strategic alternatives initially considered by the Board and Lazard were

continuing business operations as they existed, repurchasing Regular Common

Shares in a privately negotiated transaction with a major stockholder, entering

into a business combination, undertaking a corporate liquidation, or some

combination of these alternatives. Management also discussed with the Board its

belief that it would be worthwhile to discuss possible business opportunities

with other third parties and consider other strategic alternatives. As part of

our review of our strategic alternatives, the Board considered the possibility

of terminating the registration of its Regular Common Shares under the Exchange

Act and delisting the Regular Common Shares from the AMEX as one of several

alternatives in the context of other strategic alternatives, such as a

liquidation or continuing the Company's operations as they existed in order to

realize significant cost savings. At each Board meeting discussing these

matters, management, the Board and representatives from Lazard were present, as

were attorneys from Bryan Cave LLP and Willkie Farr & Gallagher LLP.

5

The Board first discussed the possibility of a reverse stock split

during its meeting on May 19, 2004. At that meeting, management reported to the

Board about their previous discussions with Bryan Cave regarding the legal and

tax implications of the various strategic alternatives including, but not

limited to, a reverse stock split followed by a modified Dutch auction tender

offer with the hope that such alternatives would result in deregistration of the

Regular Common Shares from the Exchange Act and delisting the Regular Common

Shares from the AMEX.

The Board revisited the possibility of deregistering its Regular Common

Shares from the Exchange Act and delisting them from the AMEX and of engaging in

a reverse stock split during its January 27, 2005 meeting. At the meeting, the

Board discussed how best to accomplish terminating its registration and periodic

reporting requirements under the Exchange Act and delisting its Regular Common

Shares from the AMEX in the event the Company adopted a plan of liquidation or

continued its present business operations, including a modified Dutch auction

tender offer. If such an auction were undertaken, management stated that it

would probably not tender its shares, thus potentially increasing its ownership

in the surviving entity. Management indicated that given the Company's cash

resources it could not acquire enough shares from a sufficient number of

stockholders to ensure that the tender offer alone would result in the Company

having less than 300 stockholders so that the Company could terminate its

registration and periodic reporting requirements under the Exchange Act.

Management also indicated that the Company would need to effectuate a Reverse

Stock Split, with or without a tender offer, in order to enable the Company to

terminate its registration and periodic reporting requirements under the

Exchange Act and delist its Regular Common Shares from the AMEX. The Board also

discussed the possibility that indefinitely continuing the Company's present

operations as a public company, with its accompanying Sarbanes-Oxley reporting

requirements, could erode the value of the stockholders' equity.

The Board continued its consideration of deregistering its Regular

Common Shares from the Exchange Act and delisting them from the AMEX and of

engaging in a reverse stock split during its March 22, 2005 meeting. At that

meeting, management advised that, based on current shareholdings, the intended

effect from the Reverse Stock Split could be accomplished through a 1-for-100

reverse stock split because the 1-for-100 ratio would allow the Company to cash

out odd-lot stockholders to reduce the number of stockholders to below 300.

Management based, in part, its recommendation for the Reverse Stock Split upon

the Board's consideration, in its January 27, 2005 meeting, of the advantages

and disadvantages of various options to terminate its registration and periodic

reporting requirements under the Exchange Act. Management and Lazard reviewed

the recommendations with the Board. The Board discussed the advantages and

disadvantages associated with the Company's various strategic alternatives. The

Board authorized management to continue consulting with the Company's counsel

regarding legal and procedural implications of these transactions and with

Lazard to finalize its analysis of the Company's strategic alternatives. The

Board, however, deferred acting on management's proposal until its next meeting.

At the May 19, 2005, Board meeting, the Board approved the Plan and the

Stock Split, both subject to stockholder approval, following a presentation by

Mr. Lynford of, among other things, the estimated liquidation value of the

Company, the general purpose and features of the Stock Split (and how it

compared favorably to effectuating solely a Reverse Stock Split because, among

other reasons, it obviated a need to exchange stock certificates), the

advantages and disadvantages of the Stock Split and other matters relating to

the Plan and Stock Split. In making its determination, the Board also considered

the presentation made by representatives from Lazard, who reviewed the services

performed by Lazard; Lazard's observations about the Company and its assets;

Lazard's view of the benefits and considerations associated with various

strategic alternatives; the process Lazard and the Company engaged in relating

to a merger or sale of the Company; the Company's cash distribution

alternatives; a review of a possible range of values of the Company's assets in

a liquidation (the ranges were based on management's projections and

assumptions); and a sensitivity analysis with respect to the timing and amount

of the potential cash distributions to shareholders in a liquidation (the

analysis was based on management's projections and assumptions). As part of its

deliberations regarding the merits of the Stock Split, the Board considered the

additional cost savings that could be realized by terminating the registration

of its Regular Common Shares under the Exchange Act and delisting the Regular

Common Shares from the AMEX and how these cost savings could be distributed to

our stockholders during the course of the liquidation described by the Plan.

6

The Board determined that the Reverse Stock Split ratio of 1-for-100

was appropriate after considering other ratios and several other factors. The

Board considered and reviewed, to the extent that information was available, the

number of Regular Common Shares held by each registered stockholder and

determined that a significant majority owned less than 100 Regular Common

Shares. After reviewing these findings and the potential costs of redeeming

fractional shares following the Reverse Stock Split, the Board determined that a

Reverse Stock Split at a 1-for-100 ratio would likely assure that the Company

would be able to terminate its registration and periodic reporting requirements

under the Exchange Act in a cost-efficient manner, which would allow for greater

cash distributions under the Plan.

Alternatives to the Stock Split

The Board and our management considered the possibility of engaging in

a limited tender offer, of purchasing Regular Common Shares in the market, or of

effectuating a reverse stock split to accomplish the termination of the

registration of its Regular Common Shares under the Exchange Act and the

delisting of the Regular Common Shares from the AMEX. In weighing the Company's

options, the Board and our management determined that, unlike a reverse stock

split, neither a limited tender offer nor repurchase of Regular Common Shares in

the market could give the Company a high degree of confidence in being able to

terminate its registration of Regular Common Shares under the Exchange Act (by

causing there to be fewer than 300 record stockholders). Furthermore, the Board

and our management determined that a reverse stock split would require the

Company to repurchase the fewest number of Regular Common Shares to allow it to

terminate the registration of the Regular Common Shares under the Exchange Act

and their delisting from the AMEX. Management also believed that the cost of

effecting the Stock Split would be less than the cost of effectuating the other

alternatives and the Company would have to expend less funds to qualify for

deregistering its Regular Common Shares under the Exchange Act and, therefore,

have more funds available to distribute to stockholders if the Plan is approved

by stockholders. Therefore, in light of the cost considerations outlined above

and in light of the likelihood of success, the Board and our management

determined that the Reverse Stock Split was superior to other alternatives of

accomplishing the purpose of this proposal and should be effectuated whether or

not the Plan is adopted.

Reasons for Deregistering and Delisting the Regular Common Shares

The Company has been a public reporting company since it commenced

business operations in May 1997. In considering the desirability of the Stock

Split, the Board decided that the significant tangible and intangible costs of

our being a public company are no longer justified because we have not been able

to realize many of the benefits that publicly traded companies sometimes

realize. These benefits include the creation of a trading market which would

provide adequate liquidity to stockholders, provide a meaningful incentive for

our key employees, serve as a tool to enhance our ability to hire new employees

and facilitate raising equity capital. However, as discussed in greater detail

below, we have not been able to take advantage of these benefits. Specifically,

the Board considered, among other factors, the following reasons why the Company

no longer benefits from being a public company and having its Regular Common

Shares listed on the AMEX:

Creation of trading market. The limited public float and thin trading

market in our Regular Common Shares has impaired our stockholders' ability to

sell their Regular Common Shares by not providing adequate liquidity to realize

the full benefits of holding publicly traded stock and has provided neither a

meaningful incentive for our key employees nor a meaningful tool to enhance our

ability to hire new employees. The average daily trading volume of our Regular

Common Shares was approximately 3,500 shares over the 12 months prior to May 19,

2005, the date on which the Board adopted and announced the Plan and Stock

Split. The Board considered the low daily trading volume and the fact that a

majority of the Company's shares were owned by a few stockholders to be

impediments to the creation of a trading market. The average daily trading

volume of our Regular Common Shares was approximately 117,000 shares between May

19, 2005 and June 10, 2005. Such volume was significantly higher immediately

following May 19, 2005, and significantly lower closer to June 10, 2005 (with

daily volume at a high of 758,200 on May 20, 2005, and a low of 1,400 on June 7,

2005). From January 1, 2003 to May 18, 2005, our market capitalization has

ranged from $89 million to $128 million, and on May 18, 2005, the day prior to

the date we announced the Board's adoption of the Plan and authorization of the

Stock Split, our market capitalization was approximately $90 million. As a

result of the limited number of our Regular Common Shares being publicly traded,

other than our stock specialist on the AMEX, who makes a market in our Regular

Common Shares, we have received limited interest from market makers and

institutional investors, notwithstanding our management's efforts to persuade

and induce market makers to make a market or for our Regular Common Shares and

analysts to issue reports on the Company. The small size of our market

capitalization also limits the interest in financial analysts who might report

on our activity to the investment community. The Board has come to the

conclusion that without the issuance of a significant number of additional

Regular Common Shares, for which we don't believe there would be sufficient

demand at the price the Company would seek, it would be difficult, if not

impossible, to create a more active trading market in our Regular Common Shares.

For these and other reasons set forth below, we believe that we can no longer

justify the considerable expenses that we incur as a publicly reporting company.

7

Access to Capital Markets. One significant advantage to the Company of

its status as a public reporting and listed company is access to the capital

markets for the purpose of raising equity capital and making acquisitions in

exchange for its stock. With the decline in our Regular Common Share price, and

the illiquidity of our Regular Common Shares, we are far less likely to have

access to the public capital markets, which would be one of the primary benefits

of public ownership, and cannot effectively use our stock to acquire other

companies. In addition, the level of our transaction activity has not

necessitated that the Company raise capital. Therefore, the benefits with

respect to raising capital that the Company and its stockholders would typically

expect to derive from the Company's status as a public company are not being

realized and are not likely to be realized in the foreseeable future. If the

Stock Split is approved and effected, the inability of the Company to access the

public capital markets will, of course, become permanent.

Cost Savings. The Company incurs direct and indirect costs associated

with its status as a public reporting and listed company. Among the most

significant are the costs associated with compliance with the registration and

periodic reporting obligations imposed by the SEC. For example, in 2003 our

accounting costs aggregated approximately $450,000; in contrast, in 2004, our

accounting costs, which include the costs of complying fully with the

Sarbanes-Oxley Act of 2002, tripled compared to the previous year and increased

to approximately $1,350,000. We estimate that the direct costs associated with

compliance with our registration and periodic reporting obligations under the

Exchange Act and AMEX and consequently, the saving to the Company from such

deregistration from the Exchange Act and delisting from the AMEX include, but

are not limited to, the following:

Estimated Future Annual Savings that May Be Realized by Deregistering

under the Exchange Act and Delisting from the American Stock Exchange

Audit and Accounting Fees $450,000

Sarbanes-Oxley Compliance 600,000

Transfer Agent Fees 20,000

Annual Proxy Statement Expenses 30,000

Financial Printing Expenses 17,000

Legal Fees 350,000

American Stock Exchange Listing Fees 18,000

Salaries, Miscellaneous Clerical and Other Administrative Expenses 455,000

----------

Total $1,940,000

==========

As a comparison, the Company estimates that the legal, accounting,

financial consulting and other fees payable in connection with the Stock Split

will be approximately $1.8 million, including the maximum amount of $1 million

the Company estimates will be payable for fractional shares resulting from the

Stock Split. Indirect costs associated with compliance with the registration and

periodic reporting obligations under the Exchange Act include, among other

things, the time the Company's executive officers expend to prepare and review

the Company's internal and public periodic reports mandated by the Exchange Act

and comply with the rules and regulations of the SEC, the Exchange Act and the

AMEX. The Company estimates that compliance with SEC, Exchange Act and AMEX

rules requires approximately 35% of the total time the officers expend in the

management of the Company. Due to additional regulations and compliance

procedures required of public companies under the Sarbanes-Oxley Act of 2002,

the direct and indirect costs identified above have increased significantly in

recent years.

8

The Stock Split will also decrease the administrative expenses we incur

in servicing a large number of record stockholders who own relatively small

amounts of our Common Shares. The cost of administering each registered

stockholder's account is the same regardless of the number of shares held in

that account. As of June 3, 2005, there were approximately 576 stockholders of

record of the Company's Regular Common Shares and approximately 464 stockholders

of record held fewer than 100 shares, representing approximately 81% of the

total number of holders of record of the Company's Regular Common Shares. The

administrative burden and cost to us of maintaining records with respect to

these numerous small accounts and the associated cost of preparing, printing and

mailing information to them is, in the Board's view, excessive given our limited

size and the nature of our operations. These expenditures result in no material

benefit to the Company. The Stock Split will enable us to cash out these small

shareholdings at the high end of the expected range of liquidation proceeds and

to eliminate much of these costs, with the savings being passed on to the

remaining stockholders in the form of increased distributions in the event that

they approve the proposed Plan (Proposal 1).

The Board considered the cost to the Company of continuing to prepare

and file periodic reports with the SEC and complying with the rules and

regulations of the SEC and the AMEX and compared them to the benefits to the

Company and its stockholders of continuing to operate as a public company. In

addition, the Board determined that under the current circumstances the benefits

that the Company and its stockholders would typically expect to derive from the

Company's status as a public company are not being realized and are not likely

to be realized in the foreseeable future. As a result, the Board concluded that

the elimination of the direct and indirect costs of complying with the Company's

registration and periodic reporting obligations under the Exchange Act and AMEX

outweighed the benefits of continuing to be a public company and incurring such

costs. The Company is, therefore, proposing the Stock Split to save the Company

the substantial costs, which are only expected to increase over time, and

resources required to comply with the registration and periodic reporting

obligations under the Exchange Act and AMEX and other obligations associated

with operating as a public-reporting company. We believe that the costs of

operating as a public company, particularly legal and audit fees, continue to

increase year to year. The savings from ceasing our obligations as a public

reporting company will inure to the benefit of our stockholders who will receive

distributions upon liquidation of the Company in accordance with the Plan.

However, the actual savings to be realized from terminating the Company's

registration and periodic reporting obligations under the Exchange Act and AMEX

may be higher or lower than such estimates.

Even if our current plans to liquidate the Company are not adopted by

our stockholders, in the Board's judgment, the elimination of the costs of

operating as a listed public company outweigh any foreseeable future benefit

from remaining a listed public company.

Effects of the Stock Split

Effects of the Stock Split on Stockholders Who Hold Less than 100 Regular Common

Shares of the Company in a Single Account

When the Stock Split is effected, stockholders holding less than 100

Regular Common Shares in a single account immediately prior to the Split

Effective Date will not receive a fractional share of the Company's Regular

Common Shares as a result of the Stock Split, but rather will receive cash equal

to $20.50 for each Regular Common Share held immediately prior to the Split

Effective Date. The Company intends to pay any reasonable transaction or bonding

fees that may be imposed on the Cashed-Out Stockholders by a bank, brokerage

firm or other nominee. Given that Cashed-Out Stockholders will not have to pay

any service charges or brokerage commissions in connection with the cashing out

of their shares as a result of the Stock Split, the Company believes the

structure of the Stock Split to be a benefit to the Cashed-Out Stockholders.

Among the potential detriments of the Stock Split is the fact that after the

Stock Split, Cashed-Out Stockholders will have no further ownership interest in

the Company, and will no longer be entitled to vote as a stockholder or share in

the Company's future assets, earnings and profits, if any, or distributions,

including such as may result from the Plan. The Cashed-Out Stockholder's only

right will be to receive cash for their Regular Common Shares.

9

All amounts owed to the Cashed-Out Stockholders as a result of the

Stock Split will be subject to applicable U.S. Federal and state income taxes

and state abandoned property, or escheat laws. Stockholders of the Company

following the Stock Split who do not receive any cash in the stock split will

recognize neither a gain nor loss with respect to their Regular Common Shares.

Cashed-Out Stockholders, who will receive cash in lieu of fractional Regular

Common Shares, will be treated as receiving cash as payment in exchange for

their fractional Regular Common Shares and may recognize capital gain or loss in

an amount equal to the difference between the amount of cash received and the

adjusted basis of the fractional Regular Common Shares surrendered for cash.

Additional details regarding the U.S. Federal tax consequences of the Stock

Split are described later in this Proxy Statement under the heading "Proposal

2--Material Federal Income Tax Consequences." Additional details regarding state

abandoned property, or escheat laws are described later in this Proxy Statement

under the heading "Proposal 2--Escheat Laws."

Effects of the Stock Split on Stockholders Who Hold 100 or More of the Company's

Regular Common Shares in a Single Account

When the Stock Split is effected, stockholders with 100 or more Regular

Common Shares in a single account immediately prior to the Effective Date of the

Stock Split and the holder of the A-1 Common Shares (the "Remaining

Stockholders") will be unaffected. Generally, we expect that nominees (such as

banks or brokers holding shares on behalf of their clients in "street name"),

when determining what accounts will be subject to being cashed out as a

consequence of the Reverse Stock Split, will aggregate all accounts of a

beneficial holder (i.e. all accounts having the same tax identification or

social security number and having the same registered name) held by such

nominee. In other words, if a stockholder has opened multiple accounts with a

nominee, each of which holds our Common Shares, and if all such accounts are

registered in the same name, then we expect that the nominee will aggregate all

such holdings to determine whether such stockholder will become a Cashed-Out

Stockholder as a result of the Reverse Stock Split. However, we can offer you no

assurance that nominees will follow this procedure, and we encourage you to

contact your bank or broker directly to determine what they intend to do to

effect the Stock Split on our behalf and how to consolidate your holdings, if

necessary, so that you may remain a stockholder rather than become a Cashed-Out

Stockholder.

Although the Remaining Stockholders will benefit from having the

opportunity to share in the future successes of the Company, if any, and in any

earnings resulting from the Plan, if implemented, among the detriments of the

Stock Split to the Remaining Stockholders is the fact that they will not have

the option to liquidate any or all of their shares like the Cashed-Out

Stockholders. Further, once the Company has deregistered its Regular Common

Shares from the Exchange Act and delisted its Regular Common Shares from the

AMEX, there will be no public market for the Regular Common Shares, and any

market that may develop is likely to be significantly less liquid than even

today's public market; as a result, it will be even more difficult to value such

shares. Accordingly, it may be more difficult for the Remaining Stockholders to

sell their Regular Common Shares if they should so desire.

If we terminate the registration of the Regular Common Shares under the

Exchange Act, we will no longer be required to file public reports of the

Company's financial condition and other aspects of the Company's business with

the SEC. Unless otherwise required by law, we do not currently intend to

distribute any more financial and other Company information to our stockholders.

As a result, stockholders and brokers will have less access to information about

the Company's business and results of operations than they had prior to the

Stock Split. Nevertheless, we may decide in our sole discretion to provide

certain financial and other information to our stockholders at some time in the

future.

In addition, if we terminate the registration of the Regular Common

Shares under the Exchange Act, the Regular Common Shares will cease to be

eligible for trading on any securities market except the "pink sheets," which

may not be available as a source of liquidity. In order for the Regular Common

Shares to be quoted on the "pink sheets" (a centralized quotation system that

collects and publishes market maker quotes for securities), one or more

broker-dealers must act as a market maker and sponsor the Regular Common Shares

on the "pink sheets." Following consummation of the Stock Split and the absence

of current information about the Company being filed under the Exchange Act,

there can be no assurance that any broker-dealer would be willing to act as a

market maker in the Regular Common Shares. There is also no assurance that the

Regular Common Shares will be available for purchase or sale after the Stock

Split has been consummated.

10

General Examples of Potential Effects of the Stock Split

In general, the results of the Stock Split can be illustrated by the

following examples:

HYPOTHETICAL SCENARIOS RESULT

- ---------------------------- --------------------------------------------------

Stockholder A is a Instead of receiving a fractional share of

registered stockholder who the Company's Regular Common Shares

holds 50 Regular Common immediately after the Stock Split,

Shares in her record account Stockholder A's 50 shares will be converted

on the Split Effective Date. into the right to receive $1,025.00 (50 x

$20.50).

Note: If Stockholder A wants to continue her

investment in the Company, she can buy at least 50

more Regular Common Shares and hold the shares in

her record account. Stockholder A would have to

act far enough in advance of the Split Effective

Date so that the purchase is complete before the

close of business on that date.

Stockholder B has two Stockholder B will be entitled to receive cash

separate record accounts. payments equal to the number of Regular Common

As of the Split Effective Shares that he holds in each record account,

Date, he holds 40 Regular instead of receiving fractional shares.

Common Shares in one account Stockholder B would receive $1,640.00 ($820.00 for

and 40 Regular Common Shares the cash out of each account's 40 Regular Common

in the other. All of his Shares at $20.50 per Regular Common Share).

shares are registered in his

name only. Note: Generally, we expect that nominees (such as

banks or brokers holding shares on behalf of their

clients in "street name"), when determining what

accounts will be subject to being cashed out as a

consequence of the Reverse Stock Split, will

aggregate all accounts of a beneficial holder

(i.e. all accounts having the same tax

identification or social security number and

having the same registered name) held by such

nominee. In other words, if a stockholder has

opened multiple accounts with a nominee, each of

which holds our Common Shares, and if all such

accounts are registered in the same name, then we

expect that the nominee will aggregate all such

holdings to determine whether such stockholder

will become a Cashed-Out Stockholder as a result

of the Reverse Stock Split. Accordingly, if a

stockholder owned 60 Regular Common Shares in each

of two accounts held at the same brokerage firm

and under the same social security number, our

expectation is that such stockholder would not

become a Cashed-Out Stockholder because the total

number of Regular Common Shares that he

beneficially owns at the brokerage house is

greater than 99. However, we can offer you no

assurance that nominees will follow this

procedure, and we encourage you to contact your

bank or broker directly to determine what they

intend to do to effect the Stock Split on our

behalf.

Stockholder C holds 525 After the Stock Split, Stockholder C will continue

Regular Common Shares in his to hold 525 Regular Common Shares in his record

record account as of the account.

Split Effective Date.

11

Effect of the Stock Split on Option Holders

Regardless of whether an outstanding stock option provides a right to

purchase more than, less than, or exactly 100 Regular Common Shares, the number

of Regular Common Shares underlying each such outstanding stock option, whether

granted under our 1997 Management Incentive Plan, 1998 Management Incentive

Plan, or Rollover Stock Option Plan (collectively, the "Incentive Plans"), will

not change as a result of the Stock Split. The Board, as administrator of the

Incentive Plans, has determined that no adjustment to the outstanding stock

options is necessary or appropriate in connection with the Stock Split. The

Stock Split will leave all option holders relatively unaffected. However,

because the total number of outstanding Regular Common Shares will decrease

slightly as a result of the Stock Split, all of the participants of our

Incentive Plans, including management, will own a slightly larger portion of the

Company upon exercise of their options, than they would have if the Stock Split

had not been effected. Similarly, any holder of more than 100 Common Shares will

similarly own a slightly larger portion of the Company after the Stock Split is

effected.

Effects of the Stock Split on the Company

As of June 10, 2005, 6,297,736 of the Company's Regular Common Shares

were outstanding. If we were to expend the proposed maximum of $1 million to

cash out fractional shares in the Stock Split, we would retire 48,780 Regular

Common Shares. The shares cashed out in the Stock Split will be cancelled and

will become authorized but unissued Regular Common Shares, which may be reissued

without stockholder approval and without increasing the number of Regular Common

Shares authorized under the Company's Charter. Any such future issuance of

Common Shares cancelled in the Stock Split may have a slight dilutive effect on

the ownership percentage of the Company's stockholders who remain stockholders

after the Stock Split.

The Company's Regular Common Shares are currently registered under the

Exchange Act and listed on AMEX and consequently the Company is subject to

registration and periodic reporting obligations under the Exchange Act. The

Company believes the reduction in the number of record holders of Regular Common

Shares from approximately 576 to approximately 112 as a result of the Stock

Split will allow the Company to file to terminate its registration and periodic

reporting obligations under the Exchange Act, delist its Regular Common Shares

from the AMEX, and continue future operations as a private company. As a result,

the Company would be relieved of the costs, administrative burdens and

competitive disadvantages associated with a operating as a public company. In

the event that the number of record holders of Regular Common Shares increases

over 300 before we can cease public registration under the Exchange Act or if

the number of record holders of Regular Common Shares increases over 500 after

we cease public registration under the Exchange Act, we will remain, or once

again become, subject to the Exchange Act, and we will continue to operate our

business as a going concern, or in liquidation if the Plan is adopted by our

stockholders, without the benefit of any cost savings that operating as a

private company would have afforded us.

If a sufficient number of stockholders holding less than 100 Regular

Common Shares purchase enough Regular Common Shares to remain stockholders

following the Stock Split, then the number of holders of record of the Company's

Regular Common Shares may not be reduced below 300 and the Company may be

ineligible to terminate its registration and periodic reporting obligations

under the Exchange Act. If this occurs, we will continue to operate our business

as a going concern, or as a concern in liquidation if the Plan is adopted by our

stockholders, without the benefit of the cost savings that operating as a

private company would have afforded us.

Following the Stock Split, our Regular Common Shares will continue to

have the same par value as before the Stock Split, and the holders of our

Regular Common Shares will have the identical rights and privileges as

stockholders that they had before the Stock Split.

The Company has no current plans to issue Regular Common Shares other

than pursuant to the Company's existing stock plans, but the Company reserves

the right to do so at any time and from time to time at such prices and on such

terms as our Board determines to be in the Company's best interests and the best

interests of the Company's then stockholders. The Company's Board will take such

action, as it deems necessary or appropriate to make equitable adjustments to

the terms of any outstanding stock options.

Following the Stock Split, our senior management will remain the same,

and the terms of their employment shall also remain the same. Our management,

and in particular our Chief Executive Officer and Chief Financial Officer, were

particularly involved in determining the potential values of our assets under

various circumstances, assessing future business prospects, causing the

preparation of projections of earnings and liquidation values under various

scenarios, evaluating third-party offers to purchase assets of the Company or

the entire Company, providing Lazard with information about the Company and

reviewing Lazard's work product.

12

Detriments of the Stock Split

Completion of the Stock Split could have a detrimental effect upon the

Company's Cashed-Out Stockholders. These stockholders will have no further

ownership interest in the Company and will no longer be entitled to vote as a

stockholder or share in the Company's future assets, earnings and profits, if

any, or distributions, including those that may be made under the Plan. It will

not be possible for Cashed-Out Stockholders to reacquire an equity interest in

the Company unless they purchase an interest from the Remaining Stockholders.

Furthermore, approval of the Stock Split and the effectuation of the Stock Split

will mean that unaffiliated stockholders who are also Cashed-Out Stockholders

will not have the right to liquidate their Regular Common Shares at a time and

for a price of their choosing because by operation of law they will

involuntarily surrender their shares for cash.

Completion of the Stock Split could also have a detrimental effect upon

the Company's Remaining Stockholders. Upon completion of the Stock Split, and

upon completion of the deregistration of its Regular Common Shares from the

Exchange Act and delisting its Regular Common Shares from the AMEX, there will

be no public market for the Regular Common Shares, and any market that may

develop is likely to be significantly less liquid than even today's public

market; as a result, it will be even more difficult to value the Regular Common

Shares. Accordingly, it may be more difficult for the Remaining Stockholders to

sell their Regular Common Shares. Furthermore, by terminating its reporting

obligations under the Exchange Act, the Remaining Stockholders will have less

access to information about the Company's business and results of operation than

they had prior to the Stock Split. Another result of the termination of the

Company's Exchange Act obligations and AMEX listing requirements is that we will

no longer be subject to the provisions of the Sarbanes-Oxley Act, the liability

provisions of the Exchange Act, or the corporate governance standards of the

AMEX (though the Board intends to maintain some of its existing corporate

governance practices). Furthermore, our officers will no longer be required to

certify to the accuracy of our financials.

Holders of Regular Common Shares who dissent from the Stock Split,

regardless of whether they will become Cashed-Out Stockholders or Remaining

Stockholders following the Stock Split, do not have a right of appraisal. The

laws of the State of Maryland, the jurisdiction under which the Company is

incorporated, do not provide dissenting stockholders with appraisal rights for

the fair value of their Regular Common Shares as a result of the Stock Split.

The Stock Split will change the percentage of beneficial ownership of

each of the officers and directors of the Company. On June 10, 2005, before the

Stock Split, the Company's directors and officers, as a group, and the Company's

non-qualified deferred compensation trust, under which some members of

management are beneficiaries, beneficially owned 6.3% of the Common Shares

(exclusive of any options that may have been exercisable as of June 10, 2005).

Immediately after taking into account the effect of the Stock Split, we estimate

that our directors and officers, as a group, and the Company's non-qualified

deferred compensation trust, under which some members of management are

beneficiaries, will beneficially own 6.4% of the Common Shares (exclusive of any

options that may have been exercisable as of June 10, 2005). See also

information under the caption "Proposal 3--Security Ownership of Certain

Beneficial Owners and Management and Related Stockholder Matters" in this Proxy

Statement.

FAIRNESS OF STOCK SPLIT

The Board has analyzed the Stock Split and its anticipated effects on

the Company's stockholders, including its unaffiliated stockholders, and has

unanimously determined that the Stock Split is substantively and procedurally

fair to, and in the best interests of, the Company's stockholders, including its

unaffiliated stockholders, whether they are cashed out and/or remain as

stockholders following the Stock Split. In reaching this conclusion, the Board

considered, in no particular order and without preference, the following

factors:

Substantive Factors Favoring the Stock Split

Valuation Considerations. The Stock Split offers all stockholders

holding less than 100 Regular Common Shares the opportunity to dispose of their

holdings at a premium above current market prices and average historic market

price without brokerage commissions. The Board considered several methods for

valuing our Regular Common Shares to determine the $20.50 price per share to pay

to stockholders who will have only fractional Regular Common Shares as a result

of the Stock Split and will, therefore, be cashed out following the Stock Split.

These valuation considerations included the following:

13

o Current and historical market price of our Common

Shares. The Company's Regular Common Shares have

traded within a narrow intraday trading range

between $13.75 to $16.00 per share for the 12

months prior to May 19, 2005. In light of the fact

that the Board has determined that a liquidation of

the Company's assets, followed by a distribution to

its stockholders of the cash proceeds, would

maximize its stockholders' returns, the Board has

determined that our Regular Common Shares' current

market prices and historical market prices should

be of minor consideration.

o Net Book Value. As of the March 31, 2005

consolidated balance sheet, the net book value per

share of our outstanding Common Shares was $14.84.

In light of the proposed Plan, the Board considered

net book value to be of minor consideration.

o Going Concern Value. Although the Board considered

our going concern value, it believed that our

liquidation value would be higher and, therefore,

the going concern value should not be a

significant consideration. The Board's

determination of the Company's going concern value

was based in part on a consideration of our future

prospects and the inability to find favorably

priced assets that would yield an appropriate

return on investment at an acceptable level of risk.

The Board also considered the fact that because of

its strategic decision to sell fully valued assets

and not reinvest its cash at this time, it would be

unlikely for us to generate significant earnings

in the near future.

o Liquidation Value. Our Board believes that the

Company's liquidation value is between $18.00 to

$20.50 per Common Share. The Board determined this

range after an exhaustive review of the materials

presented by management and Lazard and after many

consultations with management, including our Chief

Executive Officer and Chief Financial Officer, and

Lazard at which the parties discussed the

potential value under various circumstances of our

assets and the potential proceeds which may be

derived from their sale in a liquidation over

various periods of time. Lazard's role was to

assist and advise management in connection with

management's determination of a range of potential

liquidation proceeds by performing mathematical

compilations and computations and sensitivity

analyses of the amounts that could be distributed

to stockholders based on management's projections

(which projections Lazard did not independently

verify) of the proceeds from the Company's asset

sales and the timing of such sales as well as

costs and operating expenses over various time

frames for liquidation. Therefore, Lazard's role

in the analysis and development of the range of

possible liquidation values was largely mechanical

and Lazard did not make any conclusion with

respect to the valuation of assets. The

sensitivity analyses were based on discount rates

of 7.5%, 10%, 12.5% and 15% and considered the

possibility of liquidating certain assets either

within one year of the adoption of the Plan or

alternatively, within three years from the

adoption of the Plan.