WELLSFORD REAL PROPERTIES, INC.

535 MADISON AVENUE, 26TH FLOOR

NEW YORK, NY 10022

(212) 838-3400

_____ __, 2005

Dear Stockholder:

You are cordially invited to attend the 2005 Annual Meeting of

Stockholders which will be held on ____ __, 2005, at 9:30 a.m., local time, at

the offices of Bryan Cave LLP, 1290 Avenue of the Americas, 31st floor, New

York, New York 10104.

Information about the meeting and the various matters on which the

stockholders will act is included in the Notice of Annual Meeting of

Stockholders and Proxy Statement which follow. Also included is a Proxy Card and

postage paid return envelope.

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING. WHETHER

OR NOT YOU PLAN TO ATTEND, WE HOPE THAT YOU WILL COMPLETE AND RETURN YOUR PROXY

CARD IN THE ENCLOSED ENVELOPE AS PROMPTLY AS POSSIBLE.

Sincerely,

JEFFREY H. LYNFORD

Chairman of the Board, Chief Executive Officer

and President

WELLSFORD REAL PROPERTIES, INC.

535 MADISON AVENUE, 26TH FLOOR

NEW YORK, NY 10022

(212) 838-3400

____________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD _____ __, 2005

____________________

The 2005 Annual Meeting of Stockholders of Wellsford Real Properties,

Inc., a Maryland Corporation (the "Company"), will be held at the offices of

Bryan Cave LLP, 1290 Avenue of the Americas, 31st floor, New York, NY 10104 on

______ __, 2005 at 9:30 a.m., local time, for the following purposes:

1. To consider and vote upon the plan of liquidation and dissolution of

the Company.

2. To elect three directors to terms expiring at the 2008 annual

meeting of stockholders and upon the election and qualification of

their successors.

3. To ratify the appointment of Ernst & Young LLP as the Company's

independent registered public accounting firm for the fiscal year

ending December 31, 2005.

4. To transact such other business as may properly come before the meeting

or any adjournment(s) or postponement(s) thereof.

These items are fully described in the Proxy Statement, which is part

of this notice. We have not received notice of any other matters that may be

properly presented at the annual meeting.

The Board of Directors has fixed the close of business on _____ __,

2005 as the record date for determining the stockholders entitled to receive

notice of and to vote at the meeting.

STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON.

YOUR VOTE IS IMPORTANT. ACCORDINGLY, YOU ARE URGED TO COMPLETE, SIGN,

DATE AND RETURN THE ACCOMPANYING PROXY CARD WHETHER OR NOT YOU PLAN TO ATTEND

THE MEETING.

BY ORDER OF THE BOARD OF DIRECTORS

JAMES J. BURNS

Secretary

____ ___, 2005

New York, New York

WELLSFORD REAL PROPERTIES, INC.

535 MADISON AVENUE, 26TH FLOOR

NEW YORK, NY 10022

____________________

PROXY STATEMENT

____________________

_____ __, 2005

2005 ANNUAL MEETING OF STOCKHOLDERS

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation

by the Board of Directors (the "Board") of Wellsford Real Properties, Inc., a

Maryland corporation (which we refer to as "Wellsford," the "Company," "we,"

"our," or "us"), of proxies from the holders of the Company's issued and

outstanding shares of common stock, par value $.02 per share (the "Regular

Common Shares"), and Class A-1 common stock, par value $.02 per share (the "A-1

Common Shares" and, together with the Regular Common Shares, the "Common

Shares"), to be exercised at the 2005 Annual Meeting of Stockholders to be held

on ____ __, 2005, at the offices of Bryan Cave LLP, 1290 Avenue of the Americas,

31st floor, New York, NY 10104, at 9:30 a.m., local time, and at any

adjournment(s) or postponement(s) of such meeting (the "Annual Meeting"), for

the purposes set forth in the accompanying Notice of Annual Meeting of

Stockholders.

This Proxy Statement and enclosed Proxy Card are being mailed to the

stockholders on or about _____ __, 2005.

Among the matters to be considered at the Annual Meeting are:

o A proposal to adopt a plan of liquidation (the "Plan"), which

would authorize the Board to liquidate all of the Company's

assets and, after making the necessary and appropriate

reserves against liabilities, make distributions of the

proceeds of the liquidation to the Company's stockholders and

dissolve the Company;

o The election of three directors; and

o The ratification of the selection of Ernst & Young LLP as the

Company's independent registered public accounting firm.

The Summary of Proposed Plan of Liquidation which follows provides a

summary of the material terms of the Plan and the transactions contemplated in

connection with the Plan. The Proxy Statement contains a more detailed

description and background of each of the proposals, and we encourage you to

read the entire Proxy Statement and each of the documents that we have attached

as exhibits.

SUMMARY OF PROPOSED PLAN OF LIQUIDATION

The following is a summary of the steps to be undertaken in connection

with, and the material terms of, the proposed Plan, which is attached as

Appendix A to this Proxy Statement, and the other transactions contemplated in

connection with the Plan. We encourage you to read carefully the entire Proxy

Statement and Appendix A for a more detailed description of the terms of the

proposed Plan.

o General. Under the Plan, we intend to effectuate the orderly

sale of each of the Company's remaining assets, which may take

place in connection with the dissolution of substantially all

Company joint ventures, partnerships and limited liability

companies, the collection of all outstanding loans and

receivables, an orderly disposition or completion of

construction of our development projects, the discharge of all

outstanding liabilities to third parties, and, after the

provision of appropriate reserves, the distribution of all

remaining cash to our stockholders and the dissolution of the

Company. See also the information under the caption "Proposal

1--What the Plan of Liquidation Contemplates."

o Total Distributions. Through the execution of the Plan, we

expect that stockholders will receive aggregate cash

distributions of between $18.00 and $20.50 per Common Share.

At June 30, 2005, our book value per Common Share was $15.30.

On September 13, 2005 the closing price of a Regular Common

Share was $9.14.

o Initial Distribution. We anticipate making an initial

distribution ("Initial Distribution") of between $12.00 to

$14.00 per Common Share. The amount of the Initial

Distribution will be a function primarily of the net sale

proceeds received by the Company upon its sale of the three

rental phases of Palomino Park ("Palomino Park"), which

comprise 1,184 units within our multifamily residential rental

project in Highlands Ranch, a southern suburb of Denver,

Colorado. On August 24, 2005, our subsidiary entered into an

agreement to sell the three residential rental phases of

Palomino Park for $176 million to TIAA-CREF, a national

financial services organization. This agreement and the

purchase price are subject to the satisfactory completion, by

September 23, 2005, of due diligence by the purchaser.

We anticipate making the Initial Distribution within 30 days

after completion of the sale of the rental phases of Palomino

Park. The sale is subject to the approval of the Plan by our

stockholders. See the information under the caption "Proposal

1--What the Plan of Liquidation Contemplates; --Expected

Distributions: Calculation of Estimated Distributions; and

--Certain Transactions and Possible Effects of the Approval of

the Plan of Liquidation upon Directors and Officers: Purchase

of Beekman by the Beekman Acquirors."

o Additional Distributions. The balance of the cash to be

received by stockholders is anticipated to be distributed in

one or more installments, over a 12 to 36 month period after

adoption of the Plan, as we wind up our operations and

dissolve the Company. See the information under the caption

"Proposal 1--Key Provisions of the Plan of Liquidation;

--Dissolution." These distributions will be the result of

several transactions, including:

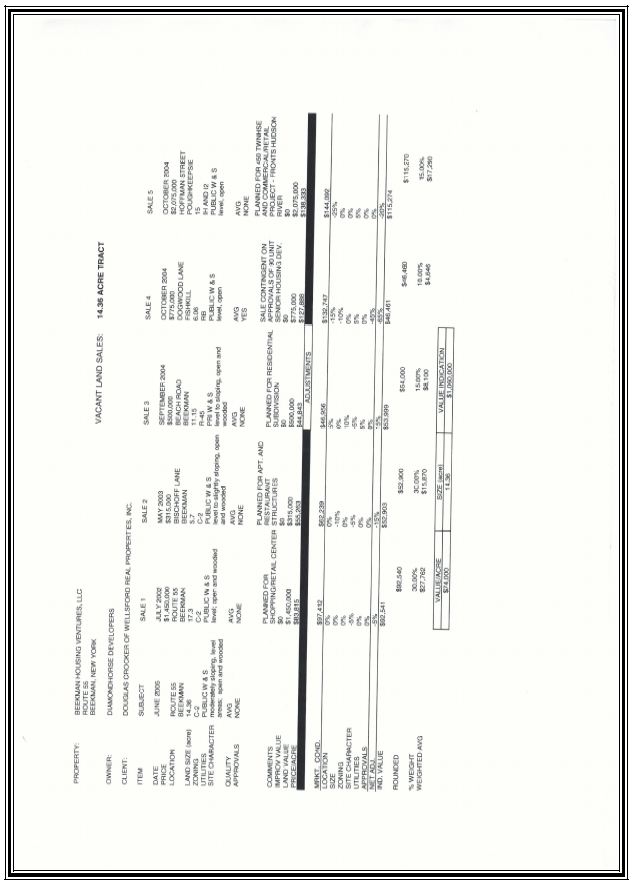

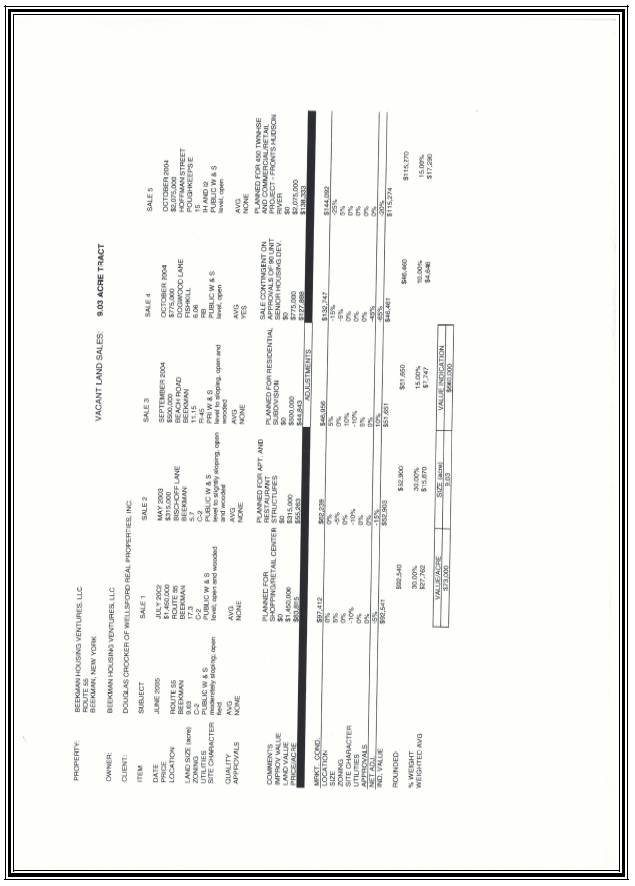

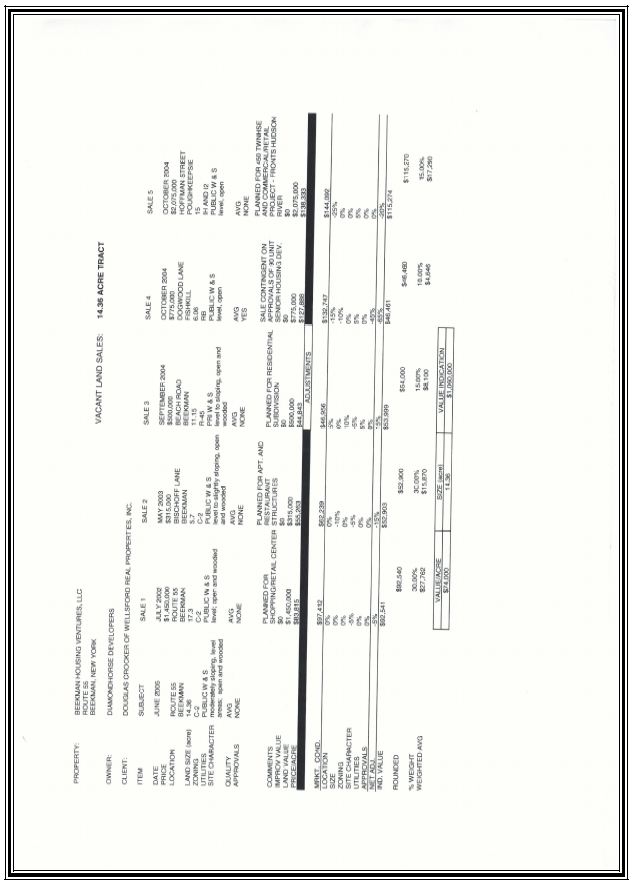

o the direct or indirect sale of the Company's interest

in two contiguous undeveloped parcels of land in

Beekman, New York (the "Beekman Properties"), to

Jeffrey H. Lynford, the Company's Chief Executive

Officer, and Edward Lowenthal, a member of the Board,

or an entity controlled by them (the "Beekman

Acquirors") at a price determined by the independent

members of the Board to be equal to the greater of

(i) the fair market value of the Beekman Properties,

based on an independent appraisal, or (ii) the total

costs incurred by the Company with respect to the

Beekman Properties (which through August 31, 2005

aggregated approximately $1.1 million, an amount

greater than the appraised fair market value);

2

o the orderly sale of the remaining unsold condominium

units at The Fordham residential tower in Chicago

("Fordham Tower") owned by a joint venture in which

we have a 10% equity interest;

o the redemption by Wellsford/Whitehall Group, LLC

("Wellsford/Whitehall"), of our entire interest in

Wellsford/Whitehall, a joint venture in which we have

a 35.21% equity interest, for an agreed price of

approximately $8.3 million, the consummation of which

is subject to final negotiation and execution of

documents;

o the collection of a note payable to the Company (the

"Mantua Loan");

o the sale to a third party of Reis, Inc. ("Reis"), a

real estate information and database company (our

interest is approximately 21.6% of Reis' equity on an

as-converted basis at August 31, 2005), or a sale of

our ownership interest in Reis; and

o the completion of construction and sale of

residential units at the Gold Peak phase of Palomino

Park ("Gold Peak"), Claverack, New York ("Claverack")

and East Lyme, Connecticut ("The Orchards").

Alternatively, or in combination, the Company may

sell the land at Gold Peak and The Orchards projects

to another developer and our joint venture interest

in Claverack to our partner in that venture.

o Distribution to a Liquidating Trust. Upon a determination made

by the Board at any time prior to the dissolution of the

Company, the Board may transfer and assign to a liquidating

trust the Company's remaining cash and property to pay (or

adequately provide for) all the remaining debts and

liabilities of the Company. Any remaining assets of the

liquidating trust would be distributed to the holders of our

Common Shares. See the information under the caption "Proposal

1--Key Provisions of the Plan of Liquidation; --Liquidating

Trust."

o Amending or Abandoning the Plan. The Board may amend or

abandon the Plan for any reason without further action by our

stockholders. See the information under the caption "Proposal

1--Key Provisions of the Plan of Liquidation; --Modification

of Plan of Liquidation; No Further Stockholder Action

Required."

o Appraisal Rights. No appraisal rights are available under

Maryland law to stockholders in connection with the

liquidation and dissolution of the Company. See also the

information under the caption "Proposal 1 -- Appraisal Rights

of Stockholders."

o Required Vote. The affirmative vote of two-thirds of all the

votes entitled to be cast by holders of the Common Shares is

required to approve and adopt the Plan. On August 31, 2005,

our directors and officers, as a group, and our non-qualified

deferred compensation trust, under which some members of

management are beneficiaries, beneficially owned 6.3% of the

Common Shares (exclusive of any options that may have been

exercisable as of August 31, 2005). Our directors and officers

have indicated that they intend to vote in favor of the Plan.

In addition, the Company has directed the trustee of the

Company's non-qualified deferred compensation trust to vote

all of the Regular Common Shares held in the non-qualified

defined compensation trust in favor of the Plan.

In March 2004, the Board retained the services of Lazard Ltd.

("Lazard"), an international investment banking firm, for advice as to the

strategic alternatives available to the Company, among which were the Company's

continuation of its business operations as an independent public entity, a sale

of the Company and a liquidation of the Company. As part of its engagement,

Lazard assisted management in connection with its determination of a range of

potential liquidation proceeds. This included performing various sensitivity

analyses of management's projections relating to the amount of cash

distributions that could be made to stockholders. Lazard did not independently

verify management's budgets and projections, and it did not appraise any of the

assets of the Company, although Lazard did perform the mathematical compilations

and computations of management's budgets and projections necessary to complete

the sensitivity analysis. A full description of assumptions made, procedures

followed, matters considered, and the qualifications and limitations on the

scope of the review undertaken by the Board in connection with its determination

of the range of liquidation values is set forth under the captions

"Introduction--Risk Factors; Proposal 1--Background"; and " -- Expected

Distributions" in this Proxy Statement.

3

RISK FACTORS

RISKS RELATED TO PLAN OF LIQUIDATION

We do not know the exact amount or timing of liquidation distributions.

We cannot assure you of the precise nature and amount of any

distribution to our stockholders pursuant to the Plan. Furthermore, the timing

of our distributions will be affected, in large part, by our ability to sell in

a timely and orderly manner our remaining assets.

The methods used by management in estimating the values of our assets

(other than cash and cash equivalents) and liabilities are based on estimates

which are inexact and may not approximate values actually realized or the actual

costs incurred. The Board's assessment assumes that the estimates of our assets,

liabilities, construction and operating costs, and sale prices of our remaining

assets are accurate, but those estimates are subject to numerous uncertainties

beyond our control, including any new contingent liabilities that may

materialize and other matters discussed below. In addition, the Board has relied

on (i) management's estimates as to the value of the Company's properties, other

assets, costs and operating expenses and (ii) Lazard's mathematical compilations

and computations of such estimates and has not obtained or sought an appraisal

of any of the properties that it proposes to liquidate except for the Beekman

Properties. For all of these reasons, the actual net proceeds distributed to

stockholders in liquidation may be more or less than the estimated amounts.

We have estimated the range of distributions based upon management's

estimates of the values of the assets after considering, among other factors,

internally prepared budgets, projections and models, comparable sales figures,

and values ascribed to certain assets during discussions with bidders and

brokers for the Company. Lazard assisted us by helping to develop and

stress-test financial models and providing sophisticated analyses of these

models. There can be no assurance that we will be able to find buyers for all

the remaining assets, and if we are able to sell such assets, there can be no

guaranty that the value received upon such sale will be consistent with

management's estimates.

If our stockholders approve the Plan, potential purchasers of our

assets may try to take advantage of our liquidation process and offer

less-than-optimal prices for our assets. We intend to seek and obtain the

highest sales prices reasonably available for our assets, and believe that we

can out-wait bargain-hunters; however, we cannot predict how changes in local

real estate markets or in the national economy may affect the prices that we can

obtain in the liquidation process. Therefore, there can be no assurance that the

announcement and approval of our Plan will not hinder management's ability to

obtain the best price possible in the liquidation of our assets.

We currently estimate that an aggregate of between $116 million and

$133 million may be available for distribution to holders of our Common Shares

under the Plan, which would result in a total distribution of between $18.00 and

$20.50 per Common Share. The actual amount available for distribution could be

more or less or could be delayed, depending on a number of other factors

including (i) unknown liabilities or claims, (ii) unexpected or greater or

lesser than expected expenses, and (iii) greater or lesser than anticipated net

proceeds of asset sales. Alternatively, if we sold the land at the Gold Peak or

The Orchards projects to another developer, or our joint venture interest in

Claverack to our partner in that venture, the net proceeds from such a sale or

sales would be less than the net proceeds from the sale of completed residential

units.

Although we anticipate making an initial distribution of $12.00 to

$14.00 per Common Share to our stockholders within 30 days after the sale of the

three rental phases of Palomino Park (which is conditioned upon stockholder

approval of the Plan), interim and final distributions will depend on the amount

of proceeds we receive, when we receive them, and the extent to which we must

establish reserves for current or future liabilities. In this regard, we note

that although we have entered into an agreement to sell the three rental phases

of Palomino Park, the agreement is subject to the purchaser completing its due

diligence and the purchaser may, for any reason, negotiate to reduce the

purchase price or terminate its purchase obligation at any time during its

diligence review period, which expires September 23, 2005. In addition, although

we expect that a distribution of substantially all of the remaining amount will

be made to stockholders within three years following the adoption of the Plan by

our stockholders, the actual time of distribution may be longer in the event

that we have difficulties disposing of our properties or if a creditor seeks the

intervention of the Maryland courts to enjoin dissolution.

4

We are currently unable to predict the precise timing of any

distributions pursuant to the Plan. The timing of any distribution will depend

upon and could be delayed by, among other things, the timing of the sale of the

Company's assets, in particular, the three rental phases of Palomino Park, Gold

Peak, Wellsford/Whitehall, Fordham Tower, The Orchards, Claverack, and Reis or

the Company's interests in Reis. Additionally, a creditor could seek an

injunction against our making distributions to our stockholders on the ground

that the amounts to be distributed were needed for the payment of the

liabilities and expenses. Any action of this type could delay or substantially

diminish the amount, if any, available for distribution to our stockholders.

Valuations of our real estate assets are subject to general risks associated

with real estate assets and within the real estate industry.

The value of our real estate assets and consequently the value of your

investment, is subject to certain risks applicable to our assets and inherent in

the real estate industry. The following factors, among others, may adversely

affect the value of our real estate assets:

o downturns in the national, regional and local economic climate

where our properties are located;

o macroeconomic as well as specific regional and local market

conditions;

o competition from other rental residential properties and

for-sale housing developments;

o local real estate market conditions, such as oversupply of, or

reduction in demand for, residential homes and condominium

units;

o declines in occupancy and lease rents;

o increased operating costs, including insurance premiums,

utilities, and real estate taxes;

o increases in interest rates on financing; and

o cost of complying with environmental, zoning, and other laws.

We face specific risks associated with property development and construction.

We currently intend to continue to develop residential projects at Gold

Peak, The Orchards and Claverack, through the subdivision, construction, and

sale of condominium units or single family homes. Alternatively, or in

combination, we may sell the land at the Gold Peak and The Orchards projects to

another developer and sell our joint venture interest in Claverack to our

partner in that venture, thus foregoing potential development profits associated

with these properties. Our development and construction activities give rise to

risks, which, if they materialize, could have a material adverse effect on our

business, results of operations and financial condition or the timing or amount

of distributions made to our stockholders and include:

o the possibility that we may abandon development opportunities

after expending significant resources to determine

feasibility;

o the possibility that we may not obtain for the Claverack

project construction financing on reasonable terms and

conditions or an increased number of building lots, which

would affect the number of single family homes we can build

and sell;

5

o the possibility that development, construction, and the sale

of our projects, may not be completed on schedule resulting in

increased debt service expense, construction costs and general

and administrative expenses;

o our inability to obtain, or costly delays in obtaining,

zoning, land-use, building, occupancy and other required

governmental permits and authorizations, which could delay or

prevent commencement of development activities or delay

completion of such activities;

o the fact that properties under development or acquired for

development usually generate little or no cash flow until

completion of development and sale of a significant number of

units and may experience operating deficits after the date of

completion; and

o increases in the cost of construction materials.

We face potential risks with asset sales.

Risks associated with the sale of properties which, if they

materialize, may have a material adverse effect on amounts you may receive,

include:

o lack of demand by prospective buyers;

o inability to find qualified buyers;

o inability of buyers to obtain satisfactory financing;

o lower than anticipated sale prices; and

o the inability to close on sales of properties under contract.

Our ownership interest in Reis is relatively illiquid and we may not be able to

sell such interest for an undiscounted amount.

Our estimate of the total liquidation value of the Company assumes a

sale of Reis as an entity to a third-party buyer. However, we only own a

minority interest in Reis and therefore have no control over whether or when a

sale would take place or at what price. It is likely that if we sold our

interest in Reis outside of the context of the sale of Reis as an entity to a

third party, we would receive a discounted purchase price to reflect the fact

that our interest represents a minority interest and is relatively illiquid. Any

attempt to sell our interest independently of concurrent sales by other Reis

stockholders may be restricted or impeded as a result of agreements made among

Reis's stockholders or with Reis. These provisions may also decrease the value

of the interest being sold. Furthermore, a portion of our ownership interest in

Reis is through an entity in which we have two partners, all of whom must

consent to any disposition of assets owned by that entity.

Our stockholders could vote against the Plan of Liquidation.

Our stockholders could vote against the Plan. If our stockholders do

not approve the Plan, we would have to continue our business operations from a

difficult position, in light of the announced intent to liquidate and dissolve.

Employees, customers and other third parties may refuse to continue to conduct

business with us if they are uncertain as to our future, particularly with

respect to long-term relationships that would be advantageous to the conduct of

our business as a going concern. In addition, the Company will have to continue

operations while being faced with the same strategic issues it considered in

determining to adopt the Plan.

6

If we are unable to satisfy all of our obligations to creditors, or if we have

underestimated our future expenses, the amount of liquidation proceeds will be

reduced.

We have current and future obligations to creditors. Claims,

liabilities and expenses from operations (such as operating costs, salaries,

directors' and officers' insurance, payroll and local taxes, legal, accounting

and consulting fees and miscellaneous office expenses) will continue to be

incurred through the liquidation process. As part of this process, we will

attempt to satisfy any obligations with creditors remaining after the sale of

our assets. These expenses will reduce the amount of assets available for

ultimate distribution to our stockholders. To the extent our liabilities exceed

the estimates that we have made, the amount of liquidation proceeds will be

reduced.

Stockholders may be liable to our creditors for amounts received from us if our

reserves are inadequate.

If the Plan is approved by the stockholders, we intend to file Articles

of Dissolution with the State Department of Assessments and Taxation of Maryland

("SDAT") promptly after the sale of all our remaining assets or at such time as

our directors have transferred the Company's remaining assets, subject to its

liabilities, into a liquidating trust. Pursuant to the MGCL, the Company will

continue to exist for the purpose of discharging any debts or obligations,

collecting and distributing its assets, and doing all other acts required to

liquidate and wind up its business and affairs. We intend to pay for all

liabilities and distribute all of our remaining assets before we file our

Articles of Dissolution.

Under the MGCL, certain obligations or liabilities imposed by law on

our stockholders, directors, or officers cannot be avoided by the dissolution of

a company. For example, if we make distributions to our stockholders without

making adequate provisions for payment of creditors' claims, our stockholders

would be liable to the creditors to the extent of the unlawful distributions.

The liability of any stockholder is, however, limited to the amounts previously

received by such stockholder from us (and from any liquidating trust).

Accordingly, in such event, a stockholder could be required to return all

liquidating distributions previously made to such stockholder and a stockholder

could receive nothing from us under the Plan. Moreover, in the event a

stockholder has paid taxes on amounts previously received as a liquidation

distribution, a repayment of all or a portion of such amount could result in a

stockholder incurring a net tax cost if the stockholder's repayment of an amount

previously distributed does not cause a commensurate reduction in taxes payable.

Therefore, to the extent that we have underestimated the size of our contingency

reserve and distributions to our stockholders have already been made, our

stockholders may be required to return some or all of such distributions.

You will not be able to buy or sell our Common Shares after we file our Articles

of Dissolution.

If the Plan is approved by our stockholders, we intend to close our

transfer books on the date on which we file Articles of Dissolution with the

SDAT (the "Final Record Date"). We anticipate that the Final Record Date will be

shortly after the sale of all of our assets or such earlier time as when our

Board transfers all of our remaining assets into a liquidating trust. The Final

Record Date is likely to be 12 to 36 months after the approval of the Plan by

our stockholders. Your interests in a liquidating trust are likely to be

non-transferable except in certain limited circumstances. After the Final Record

Date, we will not record any further transfers of our Common Shares except

pursuant to the provisions of a deceased stockholder's will, intestate

succession or operation of law and we will not issue any new stock certificates

other than replacement certificates or certificates representing your interest

in a liquidating trust. In addition, after the Final Record Date, we will not

issue any Common Shares upon exercise of outstanding options. It is anticipated

that no further transfers of our Common Shares will occur after the Final Record

Date.

Our success depends on key personnel whose continued service is not guaranteed.

Jeffrey H. Lynford has been Chairman of the Board since our formation

in 1997. He has also been our President and Chief Executive Officer since April

1, 2002. Mr. Lynford's employment agreement with us expires December 31, 2007.

Our ability to locate buyers for our remaining assets and negotiate and complete

those sales depend to a large extent upon the experience and abilities of Mr.

Lynford. The loss of the services of Mr. Lynford could have an adverse effect on

our operations and the terms and conditions under which we dispose of our assets

and consequently the amounts and timing of distributions to our stockholders.

Furthermore, Mr. Lynford's contract provides that since the Company has disposed

of all or substantially all of two of its business units, he is no longer

required to devote substantially all of his time, attention and energies during

business hours to the Company's activities. He may now perform services for and

engage in business activities with other persons so long as such services and

activities do not prevent him from fulfilling his fiduciary responsibilities to

the Company.

7

In addition, our business operations and ability to complete the Plan

in a timely manner and sell our assets for the estimated proceeds could be

negatively impacted if we are unable to retain the services of other key

personnel or hire suitable replacements.

Our Chief Executive Officer and one of our directors have conflicts of interest.

The employment agreement of Mr. Lynford contains provisions which

entitles him to certain benefits and payments, including, but not limited to,

health, dental and life insurance benefits, in the event he terminates his

employment agreement following a "change of control" (as defined in his

employment agreement and which definition includes adoption of a plan of

liquidation as a "change of control"). Accordingly, if the Plan is approved by

our stockholders, Mr. Lynford, if he elects to terminate his employment with the

Company, would be entitled to the payment of $643,000, which would otherwise be

due to him on January 1, 2008, and an amount equal to the balance of his salary

and minimum annual bonus (each payable at a rate of $375,000 per year) due to

him through December 30, 2007 plus the continued payment by the Company of

certain other benefits such as health, dental and life insurance premiums

through December 30, 2007. Consequently, Mr. Lynford may have been influenced by

the potential severance payment to support and to vote to approve the Plan.

Messrs. Lynford and Lowenthal have expressed an interest to directly or

indirectly acquire the Beekman Properties if our stockholders adopt the Plan.

The independent members of our Board believe that the appraisal process that was

used in determining the minimum purchase price to be paid by Messrs. Lynford and

Lowenthal is fair to the Company and that Messrs. Lynford and Lowenthal have

fully disclosed their interests in the purchase of the Beekman Properties.

Although the Plan was unanimously approved by the Board, Messrs. Lynford and

Lowenthal may have had a conflict of interest in approving the Plan in light of

their interest in acquiring the Beekman Properties.

As part of the transaction, certain assets (including Company Regular

Common Shares) held in our deferred compensation trust, representing vested

compensation previously earned by Messrs. Lynford and Lowenthal, and deferred by

them beginning in 1994 by a predecessor company (the "Deferred Compensation

Assets") will be transferred to an entity owning the Beekman Properties for the

benefit of Messrs. Lynford and Lowenthal. In connection therewith, the Company

will be relieved of its obligations to pay to Messrs. Lynford and Lowenthal an

amount equal to the Deferred Compensation Assets (the "Deferred Compensation

Obligations"). To simplify the structure and for tax purposes, the Company's

Regular Common Shares comprising the Deferred Compensation Assets may be

transferred back to the Company and canceled and the Company's obligations to

make the distributions with respect to such shares would then be evidenced by a

written agreement to satisfy those obligations as if such shares remained

outstanding.

Mr. Lynford, the Company's Chairman, is the brother of Lloyd Lynford, a

stockholder, director and the president of Reis. Mr. Lowenthal, who currently

serves on the Company's Board of Directors, has served on the Board of Directors

of Reis since the third quarter of 2000.

Our Board may abandon or amend the Plan even if our stockholders approve it.

Even if our stockholders vote to approve the Plan, our Board may

abandon the Plan without further stockholder approval. Furthermore, the Plan

provides that it may be modified as necessary to implement this Plan but any

material amendments to the Plan must be approved by the affirmative vote of the

holders of a majority of our issued and outstanding Common Shares. Thus, we may

decide to conduct the liquidation differently than described in this Proxy

Statement, to the extent we are permitted to do so by Maryland law.

8

Liquidation and dissolution may not maximize value for our stockholders.

Although our Board believes that the Plan is more likely to result in

greater returns to stockholders than if we continued the status quo or pursued

other alternatives, it is possible that one or more of the other alternatives

would be better for us and our stockholders, in which case, we will be foregoing

such alternatives if we implement the Plan.

Approval of the Plan may reduce our stock price, increase its volatility and

reduce the liquidity of our shares.

If our stockholders approve the Plan, but believe that we will be

unable to complete our Plan in a timely manner, the price of our Regular Common

Shares may decline. In addition, as we sell our assets, pay off our liabilities

and make liquidating distributions to stockholders, our stock price will likely

decline and our Regular Common Shares will likely become less liquid.

In addition, Our Regular Common Shares may no longer be eligible for

listing on the American Stock Exchange (the "AMEX") as a result of adopting the

Plan, thus reducing liquidity of the Regular Common Shares. Being delisted by

the AMEX would further decrease the market demand and liquidity for, and price

of, our Regular Common Shares. The policy of the AMEX is to consider delisting a

company if, among other reasons:

o the total number of public stockholders is less than 300;

o if the aggregate market value of shares publicly held is less

than $1 million; or

o if liquidation has been authorized by a company's board of

directors and stockholders.

Furthermore, in the event that the Board elects to transfer the

Company's remaining assets into a liquidating trust, the trust certificates to

be issued to each stockholder will not be transferable except in certain very

limited circumstances, such as upon death of the holder.

Approval of the Plan may lead to stockholder litigation which could result in

substantial costs and distract management.

Historically, extraordinary corporation actions, such as the proposed

Plan, often lead to securities class action lawsuits being filed against a

company. Such litigation is likely to be expensive and, even if we ultimately

prevail, the process will be time consuming and divert management's attention

from implementing the Plan and otherwise operating our business. If we do not

prevail in any such lawsuit, we may be liable for damages, the validity of a

stockholder vote approving the Plan may be challenged, or we may be unable to

complete some transactions that we contemplate as part of the Plan. We cannot

predict the cost of defense or the amount of such damages but they may be

significant and would likely reduce our cash available for distribution.

Approval of the Plan could cause our methodology of accounting to change, which

may require us to reduce the net carrying value of our assets.

Once our stockholders approve the proposed Plan, we could change our

basis of accounting from the going-concern basis to that of the liquidation

basis of accounting.

In order for our financial statements to be in accordance with

generally accepted accounting principles under the liquidation basis of

accounting, all of our assets must be stated at their estimated net realizable

value, and all of our liabilities (including those related to commitments under

employment agreements) must be recorded at the estimated amounts at which the

liabilities are expected to be settled. Based on the most recent available

information, if the Plan is adopted, we expect to make liquidating distributions

that exceed the carrying amount of our net assets. However, we cannot assure you

what the ultimate amounts of such liquidating distributions will be. Therefore,

there is a risk that the liquidation basis of accounting may entail write downs

of certain of our assets to values substantially less than their current

respective carrying amounts, and may require that certain of our liabilities be

increased or certain other liabilities be recorded to reflect the anticipated

effects of an orderly liquidation.

9

Until we determine that the Plan is about to be approved, we will

continue to use the going-concern basis of accounting. If our stockholders do

not approve the Plan, we will continue to account for our assets and liabilities

under the going-concern basis of accounting. Under the going-concern basis,

assets and liabilities are expected to be realized in the normal course of

business. However, long-lived assets to be sold or disposed of should be

reported at the lower of carrying amount or estimated fair value less costs to

sell. For long-lived assets to be held and used, when a change in circumstances

occurs, our management must assess whether we can recover the carrying amounts

of our long-lived assets. If our management determines that based on all of the

available information, we cannot recover those carrying amounts, an impairment

of value of our long-lived assets has occurred and the assets would be written

down to their estimated fair value.

Our management has determined that the carrying amounts of our

long-lived assets at June 30, 2005, had not been impaired, other than to the

extent of amounts already recorded in prior accounting periods. We may, however,

be required to make write downs of our assets in the future. Such write downs

could reduce our stock price.

We may be subject to regulation under the Investment Company Act of 1940.

If we were deemed to be an investment company as that term is defined

under the Investment Company Act of 1940 (the "1940 Act") because of our

investment securities holdings, we must register as an investment company under

the 1940 Act. As a registered investment company, we would be subject to the

further regulatory oversight of the Securities Exchange Commission, and our

activities would be subject to substantial regulation under the 1940 Act and the

federal securities law in general, and we would be subject to additional

compliance and regulatory expenses.

We are not registered as an investment company under the 1940 Act. We

believe that either we are not within the definition of "investment company"

thereunder or, alternatively, may rely on one or more of the 1940 Act's

exemptions. We intend to continue to conduct our operations in a manner that

will exempt us from the registration requirements of the 1940 Act. If we were to

become an "investment company" under the 1940 Act and if we failed to qualify

for an exemption thereunder, we would have to change how we conduct business.

The 1940 Act places significant restrictions on the capital structure and

corporate governance of a registered investment company, and materially

restricts its ability to conduct transactions with affiliates. Such changes

could have a material adverse affect on our business, results of operations and

financial condition.

In addition, if we were deemed to have been an investment company and

did not register under the 1940 Act, we would be in violation of the 1940 Act

and we would be prohibited from engaging in business or certain other types of

transactions and could be subject to civil and criminal actions for doing so. In

addition, our contracts would be voidable and a court could appoint a receiver

to take control of us and liquidate us. Therefore, our classification as an

investment company could materially adversely affect our business, results of

operations, financial condition and ability to liquidate the Company pursuant to

the Plan if it is adopted by our stockholders.

STOCKHOLDERS ENTITLED TO VOTE AT THE MEETING

Only the holders of record of Common Shares at the close of business on

____ __, 2005 (the "Record Date") are entitled to notice of and to vote at the

Annual Meeting. Each Common Share is entitled to one vote on all matters with

each vote having equal weight, regardless of the class of common stock. As of

the Record Date, an aggregate of 6,297,736 Regular Common Shares and 169,903

Class A-1 Common Shares were outstanding.

HOW TO VOTE YOUR SHARES

Your vote is important. Your shares can be voted at the Annual Meeting

only if you are present in person or represented by proxy. Even if you plan to

attend the meeting, we urge you to vote now by completing and submitting the

attached Proxy Card. If you own your shares in record name, you may cast your

vote by marking your Proxy Card, and then dating, signing, and returning it in

the postage-paid envelope provided.

10

Stockholders who hold their shares beneficially in street name through

a nominee (such as a bank or broker) may be able to vote by telephone or the

internet as well as by mail. You should follow the instructions you receive from

your nominee to vote these shares.

HOW TO REVOKE YOUR PROXY

You may revoke your proxy at any time before it is voted at the meeting

by:

o properly executing and delivering a later-dated proxy;

o voting by ballot at the meeting; or

o sending a written notice of revocation to the inspectors of

election in care of the Secretary of the Company at the

address disclosed on the cover of this Proxy Statement.

VOTING AT THE ANNUAL MEETING

The method by which you vote will in no way limit your right to vote at

the meeting if you later decide to attend in person. If you hold your shares in

street name, you must obtain a proxy executed in your favor from your nominee

(such as a bank or broker) to be able to vote at the meeting.

Your shares will be voted at the meeting as directed by the

instructions on your Proxy Card if: (i) you are entitled to vote, (ii) your

proxy was properly executed, (iii) we received your proxy prior to the Annual

Meeting, and (iv) you did not revoke your proxy prior to the meeting.

THE BOARD'S RECOMMENDATION

If you send a properly executed Proxy Card without specific voting

instructions, your shares represented by that proxy will be voted as recommended

by the Board:

o FOR THE APPROVAL AND ADOPTION OF THE PLAN AND THE DISSOLUTION

OF THE COMPANY;

o FOR THE ELECTION OF THE NOMINATED SLATE OF DIRECTORS; AND

o FOR APPROVAL OF RATIFICATION OF THE APPOINTMENT OF ERNST &

YOUNG LLP AS THE COMPANY'S INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2005.

The Company does not presently know of any other business which may

come before the Annual Meeting.

VOTES REQUIRED TO APPROVE EACH ITEM

A majority of all the votes entitled to be cast at the Annual Meeting

will constitute a quorum for the transaction of business at the Annual Meeting.

The following votes are required to approve each item of business at

the meeting:

o Plan of Liquidation Proposal: The affirmative vote of

two-thirds of all the votes entitled to be cast by the holders

of the Common Shares is required to approve and adopt the Plan

(Proposal 1).

o Election of Directors: A plurality of all the votes cast at

the Annual Meeting is sufficient to elect a director (Proposal

2).

11

o Ratification of Independent Registered Public Accounting Firm:

The affirmative vote of a majority of all the votes entitled

to be cast by the holders of the Common Shares is required to

ratify the appointment of Ernst & Young LLP as the Company's

independent registered public accounting firm (Proposal 3).

Abstentions and broker non-votes will be counted for purposes of

determining the presence of a quorum. Abstentions have no effect on the outcome

of the vote for the election of directors (Proposal 2). However, abstentions and

broker non-votes will have the effect of a vote against the proposals to adopt

the Plan and the ratification of the independent registered public accounting

firm (Proposals 1 and 3, respectively). A "broker non-vote" occurs when a

nominee (such as a bank or broker) returns an executed proxy, but does not have

the authority to vote on a particular proposal because it has not received

voting instructions from the beneficial owner and has no discretionary authority

to vote on the proposal.

As of August 31, 2005, the directors and executive officers of the

Company collectively own an aggregate of 1.7% of all outstanding Common Shares.

As of August 31, 2005, our non-qualified deferred compensation trust owned 4.6%

of all outstanding Common Shares. The Company has directed the trustee of the

Company's non-qualified deferred compensation trust to vote all of the Regular

Common Shares held in the non-qualified defined compensation trust in favor of

all of the Proposals.

PROPOSAL 1 -- PLAN OF LIQUIDATION

WHAT YOU ARE BEING ASKED TO APPROVE

You are being asked to approve our proposed Plan. By voting in favor of

the Plan, you will also approve the transactions described in this Proxy

Statement, including the sale of all or substantially all of our assets, which

we and our Board have undertaken or will undertake in connection with the

recommendation that the stockholders approve the Plan.

THE BOARD'S RECOMMENDATION

THE BOARD RECOMMENDS THAT YOU VOTE "FOR" THE PLAN OF LIQUIDATION.

WHAT THE PLAN OF LIQUIDATION CONTEMPLATES

The Plan contemplates the orderly sale of each of the Company's

remaining assets which may take place in connection with the dissolution of

substantially all Company joint ventures, partnerships and limited liability

corporations, the collection of all outstanding loans to third parties, an

orderly disposition or completion of construction of development properties, the

discharge of all outstanding liabilities to third parties, and after the

establishment of appropriate reserves, the distribution of all remaining cash to

stockholders. Specifically, we intend to take the following steps in connection

with the Plan once we receive our stockholders' approval:

o the sale to TIAA-CREF, a national financial services

organization, of the three rental phases of Palomino Park and

related amenities for $176 million (which sale is subject to

satisfactory completion of due diligence by the purchaser by

September 23, 2005);

o making the Initial Distribution within 30 days after the sale

of the three rental phases of Palomino Park;

o the redemption by Wellsford/Whitehall of our entire interest

in that entity for approximately $8.3 million, subject to

execution of documents;

o the sale of the remaining unsold condominium units at Fordham

Tower;

o the collection of the Mantua Loan;

12

o the participation in a sale to a third party of Reis, or our

ownership interests in Reis;

o the completion of construction and sale of residential units

at Gold Peak, Claverack and The Orchards, or alternatively, or

in combination, the Company could sell the land at Gold Peak

and The Orchards projects to another developer and our joint

venture interest in Claverack to our partner in that venture;

o the direct or indirect sale of our interests in the Beekman

Properties to the Beekman Acquirors and the transfer of the

Deferred Compensation Assets to an entity owning the Beekman

Properties in connection with relieving the Company of the

Deferred Compensation Obligations in an amount equal to the

Deferred Compensation Assets.

o the orderly sale of the remainder of our assets for cash or

such other form of consideration, depending on the value of

the non-cash consideration being offered, as may be

conveniently distributed to stockholders;

o paying (or providing for) our liabilities and expenses;

o after the establishment of appropriate reserves, the

distribution of the balance of the proceeds from the sale of

our assets or the collection of all outstanding loans to third

parties, which may occur in one or more installments over a 12

to 36 month period after adoption of the Plan;

o winding up our operations and dissolving the Company, in

accordance with the Plan; and

o filing Articles of Dissolution with the SDAT.

KEY PROVISIONS OF THE PLAN

The Plan provides, in part, that:

o we may not engage in any business activities, except to the

extent necessary to (i) exercise our right to acquire land

contiguous to The Orchards, (ii) acquire one of the parcels of

land comprising the Beekman Properties, assuming that we have

not sold the Beekman Properties (or the interests in an entity

that owns the Beekman Properties) to the Beekman Acquirors;

(iii) complete the financing and development of The Orchards,

Claverack, and Gold Peak; (iv) sell the homes or condominiums,

as the case may be, to be built at The Orchards, Claverack,

and Gold Peak; (v) to the extent that we do not develop any of

The Orchards, Claverack and Gold Peak, then the sale of the

land at the Gold Peak and The Orchards projects to another

developer and the sale of our joint venture interest in

Claverack to our partner in that venture; (vi) repurchase our

Common Shares (vii) purchase additional shares of Reis from

other investors in Reis or Reis itself; (viii) preserve and

sell our assets; (ix) wind up our business and affairs; (x)

discharge and pay all our liabilities; and (xi) distribute our

assets to our stockholders. We may also engage in any

activities that the Board determines will enhance the value of

our assets or business and any other activities related to or

incidental to the foregoing.

o we will sell the Beekman Properties (or our interests in an

entity that owns the Beekman Properties) to the Beekman

Acquirors in a transaction approved by our independent

directors;

o if the Board determines that we will not have completed the

full distribution of our assets within three years after the

effectiveness of the proposed Plan, or if our Board determines

it to be necessary to do so at an earlier date, we may

transfer to a liquidating trust our remaining cash and

property and pay for (or adequately provide for) all our

remaining debts and liabilities so that the liquidating trust

can make liquidating distributions to stockholders;

13

o the Board has the discretion, without further stockholder

approval, to determine the terms of any liquidating trust and

to appoint the trustees of any such trust;

o upon our transfer to a liquidating trust of our remaining

assets, those assets will be held solely for the benefit of an

ultimate distribution to our stockholders after payment of

unsatisfied debts and liabilities;

o if we form a liquidating trust, the stockholders' certificates

for shares will be deemed to represent certificates for

identical interests in the liquidating trust, unless separate

trust certificates are issued in place of the shares, and the

certificates representing an interest in the trust will not be

transferable except under limited circumstances such as the

death of the holder;

o if we form a liquidating trust, the distributions of cash or

other property to our stockholders, or the transfer to a

liquidating trust of our remaining cash and property, are

anticipated to be in complete liquidation of the Company and

in cancellation of all issued and outstanding Common Shares;

o until the date we file our Articles of Dissolution, our

Charter and bylaws will not contain provisions relating to the

liability and indemnification of our officers and directors

that are any less favorable to such officers and directors

than those that existed immediately before the approval of the

Plan, and our Charter and bylaws will not be amended in any

manner that adversely affects the rights of such persons;

furthermore, the Company will be required to maintain

directors' and officers' insurance to cover these individuals;

o our Board and officers are, or the trustees of the liquidating

trust will be, authorized to interpret the provisions of the

Plan and to take such further actions and to execute such

agreements, conveyances, assignments, transfers, certificates

and other documents, as may in their judgment be necessary or

desirable in order to wind up expeditiously our affairs and

complete the liquidation; and

o notwithstanding approval of the Plan by our stockholders, the

Board may abandon, modify, or amend the plan without further

action by the stockholders to the extent permitted under then

current law.

REASONS FOR THE LIQUIDATION

In reaching its determination that the Plan is fair to, and in the best

interests of, our stockholders and approving the Plan and recommending that our

stockholders vote to approve the Plan, our Board consulted with our senior

management and our financial and legal advisors and considered the following

factors:

o the Board's review of possible alternatives to the proposed

liquidation, including consolidating or merging the Company

with other companies, selling the Company, going private,

conducting a self-tender offer for a limited number of shares,

repurchasing our shares in the open market, distributing

excess cash to our stockholders, acquiring other companies,

selling some of the Company's assets, and continuing our

operations in the ordinary course of business. Based on a

variety of factors, including the analyses and presentations

by our senior management and Lazard, the Board concluded that

none of the alternatives considered was reasonably likely to

provide equal or greater value to our stockholders than the

proposed Plan;

o the inability to identify a buyer or strategic alliance

partner who offered terms acceptable to the Board;

14

o the Board's belief that management and the Board had, with the

assistance of Lazard, thoroughly explored the market interest

in various strategic alternatives;

o if we continued our operations as a going concern, the length

of time necessary to evaluate and restructure our business,

which our management estimated to be at least two years, and

the significant risks associated with restructuring our

business, which would require a substantial influx of

additional capital and affect the Company's ability to raise

that additional capital on satisfactory terms and conditions;

o the prevailing economic conditions, both generally and within

the real estate development and merchant banking sectors and,

in particular, management's belief that premiums are being

paid for many real estate asset categories;

o the aggregate cash liquidating distributions, which we

estimate will range between $18.00 and $20.50 per Common

Share, and the fact that a distribution of $18.00 per Common

Share (which is at the lower end of that range), or $20.50 per

Common Share (which is at the high end of that range), would

represent a 27% and 44% premium, respectively, over the

average closing trading price over the 30 days from April 19,

2005 to May 18, 2005, which is the day preceding the

announcement of the Board's adoption of the Plan;

o the Board's belief that the range of cash liquidating

distributions that we estimate we will make to our

stockholders was fair relative to the Board's own assessment,

based on presentations made by our management, of our current

and expected future financial condition, earnings, business

opportunities, strategies and competitive position and the

nature of the market environment in which we operate;

o the per Common Share price to be received by our stockholders

in the liquidation is likely to be payable in cash, thereby

eliminating any uncertainties in valuing the consideration to

be received by our stockholders; and

o the terms and conditions of the Plan.

The Board believed that each of the above factors generally supported

its determination and recommendation. The Board also considered and reviewed

with management potentially negative factors concerning the Plan, including

those listed below:

o there can be no assurance that the Company would be successful

in disposing of its assets for amounts equal to or exceeding

its estimates or that these dispositions would occur as early

as expected;

o our costs while executing the Plan may be greater than we

estimated;

o the fact that following the adoption of the proposed Plan and

the sale of our assets, our stockholders will no longer

participate in any future earnings or growth from any

additional investments or from acquisitions of additional

assets except to the extent additional land may be acquired or

developed with respect to our existing residential development

projects;

o the potential that our stock price may decline or become more

volatile, due to the existing illiquidity of our Common Shares

and our gradual liquidation of our assets and the distribution

of proceeds from these liquidations;

o if we establish a liquidating trust, the trust will provide

for a prohibition of the transfer of trust interests subject

to certain limited exceptions;

15

o the actual or potential conflicts of interest which certain of

our executive officers and directors have in connection with

the liquidation, including those specified under the heading

"Introduction -- Risk Factors" and "Proposal 1 -- Certain

Transactions and Possible Effects of the Approval of the Plan

of Liquidation Upon Directors and Officers," such as certain

severance payments and the sale of the Beekman Properties to

the Beekman Acquirors;

o the costs to be incurred by the Company including significant

accounting, financial advisory and legal fees in connection

with the liquidation process;

o the possibility that stockholders may, depending on their tax

basis in their stock, recognize taxable gains (ordinary and/or

capital gains) in connection with the completion of the

liquidation; and

o the fact that no fairness opinion with respect to the

liquidation was obtained, nor were there any formal

third-party appraisals (other than for the Beekman Properties)

made of our assets to determine their liquidation value.

The above discussion concerning the information and factors considered

by the Board is not intended to be exhaustive, but includes the material factors

considered by the Board in making its determination. In view of the variety of

factors considered in connection with its evaluation of the Plan and the

proposed liquidation, the Board did not quantify or otherwise attempt to assign

relative weights to the specific factors it considered. In addition, individual

members of the Board may have given different weight to different factors and,

therefore, may have viewed certain factors more positively or negatively than

others.

BACKGROUND

On May 19, 2005, the Board unanimously voted to adopt and recommend the

Plan and a 1-for-100 reverse stock split and 100-for-1 forward stock split

(together, the "Stock Split") to stockholders, to be voted on at the Company's

2005 Annual Meeting. The purpose of the Stock Split was to terminate our

registration and periodic reporting obligations under the Exchange Act of 1934

(the "Exchange Act"), terminate the AMEX listing of our Regular Common Shares,

and continue future operations as a non-public company. As a result of these

actions, our Board and management expected that the Company would be relieved of

significant costs, administrative burdens and compliance obligations associated

with operating as a listed public company. On September 12, 2005, the Board

unanimously voted to abandon the Stock Split. The background of the Board's

decisions is as follows:

For the past few years, the Company has followed a plan of selling

assets, retiring debt and maximizing cash. In the context of this general plan

and market conditions, management has considered alternatives to maximize

stockholder value.

On February 13, 2004, Third Avenue Management LLC ("Third Avenue")

converted its previous ownership filing on Schedule 13G to a filing on Schedule

13D. Third Avenue filed a Schedule 13D because it had been contacted by a third

party interested in discussing a possible acquisition of the Company's Common

Shares beneficially owned by Third Avenue's clients in a transaction which could

include an acquisition of all of the Company's outstanding securities. Third

Avenue indicated in its Schedule 13D filing that it did not intend for the

Schedule 13D filing to be interpreted as an indication that Third Avenue changed

its position with respect to being supportive of management or that Third Avenue

had initiated discussions concerning a potential transaction. Third Avenue

stated that the Schedule 13D filing was intended to provide it with the

flexibility to listen to and discuss these proposals with the respective third

parties and with management of the Company, as a means of fulfilling its

fiduciary duties to its clients.

On February 17, 2004, Kensington Investment Group, Inc. ("Kensington")

converted its previous ownership filing on Schedule 13G to a filing on Schedule

13D. Kensington had also been contacted by the same third party that contacted

Third Avenue. The third party had indicated that it was interested in discussing

a possible acquisition of the Company's Common Shares beneficially owned by

Kensington's clients in a transaction which could include an acquisition of all

of the Company's outstanding securities. In addition, Kensington indicated that

it had discussed the third-party contact with one other stockholder. Kensington

indicated in its Schedule 13D filing that it did not intend for the Schedule 13D

filing to be interpreted as an indication that Kensington changed its position

with respect to being supportive of management of the Company or that Kensington

had initiated discussions concerning a potential transaction. Kensington stated

that the Schedule 13D was intended to provide it with the flexibility to listen

to and discuss these proposals with the respective third parties and with

management of the Company, as a means of fulfilling its fiduciary duties to its

clients.

16

From February 13, 2004 through March 16, 2004, the Company's management

considered the various issues raised by the Schedule 13D filings and consulted

with Bryan Cave LLP ("Bryan Cave"), the Company's outside counsel, and Willkie

Farr & Gallagher LLP ("Willkie Farr"), the Company's special counsel. On

February 19, 2004, the Company's Chairman and one of its directors met with

Third Avenue to discuss its Schedule 13D filing. At this meeting, and during

subsequent conversations with management, Third Avenue indicated its interest in

obtaining liquidity for its investment in the Company. At Third Avenue's

request, management had several conversations and meetings with the CEO of First

Union Real Estate Equity and Mortgage Investments ("FUR"), the third party that

had contacted Third Avenue and Kensington. Between February 13, 2004 and March

16, 2004, the Company's management met with the CEO of FUR three times with

representatives of Bryan Cave in attendance. The Company and FUR reviewed each

other's assets and liabilities, properties, business operations and perceived

business opportunities.

On March 16, 2004, the Board held a meeting and reviewed the Schedule

13D filings and the reasons the filers expressed for making these filings. The

two Schedule 13D filers held at that time approximately 2.5 million (or 39%) of

the Company's 6.45 million outstanding Common Shares. It was noted at the time

that the Company's public trading volume averaged approximately 3,000 shares

daily. In addition, the Board reviewed the Company's existing equity and debt

capitalization including the specific names and total shareholdings of its 17

largest common stockholders who in the aggregate held approximately 5.77 million

shares (or 92%) of the outstanding Common Shares. Also, the Board reviewed the

terms and conditions of the Company's outstanding $25 million 8.25% convertible

trust preferred securities issue (the "Convertible Trust Preferred Securities")

which was convertible into an additional 1,123,696 additional Regular Common

Shares at $22.248 per share. It was further noted that on three previous

occasions over the last five years, the Company had purchased a total of

approximately 4 million Regular Common Shares from stockholders.

The Board also discussed with counsel various matters, including: (i)

relevant provisions of the Maryland Business Combination Act and various

provisions within the Company's Charter and bylaws relating thereto; (ii)

various procedures relating to corporate liquidations and self-tenders; and

(iii) various covenants in the Company's Indenture Agreement relating to the

outstanding Convertible Trust Preferred Securities. Management then presented

the following five alternatives that initially should be examined in order to

maximize stockholder value in a responsible way: (a) continuing business

operations as they existed; (b) repurchasing approximately 1.95 million Regular

Common Shares held by Third Avenue; (c) entering into a business combination;

(d) undertaking a corporate liquidation, or (e) some combination of these

alternatives. Management also discussed with the Board its belief that it would

be worthwhile to discuss possible business opportunities with other third

parties and consider other strategic alternatives and that the Company was

requiring any party who wanted to have substantive discussions with the Company

to execute a confidentiality agreement. Management reported to the Board that as

of that date, four parties, including FUR, had executed confidentiality

agreements. Management informed the Board that it would continue to sell assets

owned by the Company and its joint ventures in the ordinary course of their

businesses and as appropriate prices could be obtained.

Management advised the Board that it had been consulting with Bryan

Cave and Willkie Farr as special counsel, and Venable LLP ("Venable"), the

Company's Maryland counsel, regarding all strategic alternatives and their

respective legal implications. The Board also directed management to retain a

financial advisor to assist in evaluating the strategic alternatives, with a

view to maximizing stockholder value. Based on prior informal conversations with

Board members regarding the retention of a financial advisor, management had

invited representatives of two investment banking firms to make presentations to

the Board at the meeting.

The representatives of the two investment banking firms then met with

the Board, described their background, experience and expertise, reviewed the

written materials they had distributed and responded to questions from the

Board. After the representatives of the two investment banking firms departed

the meeting, the Board authorized the Company to retain Lazard as the Company's

financial advisor. Bryan Cave and Willkie Farr responded to questions during the

meeting.

17

Between March 16, 2004 and May 19, 2004, management regularly met with

representatives from Lazard to construct financial models to value the Company's

assets and liabilities, analyze existing joint ventures and their covenants, and

evaluate a wide range of financial considerations. Also, management met and

consulted extensively with Bryan Cave regarding the legal and tax implications

of the various strategic alternatives and met with representatives from Ernst &

Young regarding certain tax issues. Specifically, management requested that

Bryan Cave explore the positive and negative legal implications, consequences,

processes and procedures relating to the Company's strategic alternatives and

methods of obtaining value for the Company's substantial net operating losses.

Management, on an informal but periodic basis, updated Board members on these

discussions with Lazard, its legal counsel and its accountants. Also during that

time, management spoke to or met with representatives from several of the

parties who had executed confidentiality agreements. During this period,

management determined that to maintain or increase the Company's value, the

Company would have to reinvest the proceeds from recent and ongoing sales, raise

additional capital and realize the value from new investments.

On March 22, 2004, the Company announced that Wellsford/Whitehall, of

which the Company is a member, had withheld partial payment on a venture debt

(the "Nomura Loan") in order to initiate a dialogue with the special servicer of

this obligation. On April 13, 2004, the Company announced that the same venture

sold an office building for $18.4 million. On May 4, 2004 the Company announced

that it sold an office building it owned directly for $2.7 million and 10

condominium units at the Silver Mesa phase of Palomino Park for $2.3 million

during the first quarter of operations.

On May 19, 2004, the Board held a meeting at which Lazard reported on

its activities since being retained, reviewed the Company's current economic and

financial condition, reviewed asset valuations and alternatives to monetize such

assets, and reviewed issues and benefits relative to the various strategic

alternatives being considered, with particular emphasis on the value of the

Company's interests in Palomino Park, Wellsford/Whitehall and Second Holding and

the Company's business alternatives with respect to such assets. Lazard also

indicated its belief that the restrictive nature of the agreements governing the

aforementioned investments could potentially negatively impact sales values.

Management reported to the Board about their previous discussions with Bryan

Cave regarding the legal and tax implications of the various strategic

alternatives including, but not limited to, a reverse stock split followed by a

modified Dutch auction which would result in deregistration of the Regular

Common Shares from the Exchange Act and delisting from the AMEX, the increased

costs of operating as a public company since the adoption of the Sarbanes-Oxley

Act of 2002, and the limited transferability of the Company's net operating

losses. The Board authorized Lazard to speak to some of the Company's largest

stockholders and to prepare a confidential information memorandum and other

written materials for discussions with third parties regarding possible business

combinations. The Board, however, did not make any decision regarding the

strategic alternatives. Bryan Cave, Willkie Farr and Lazard responded to

questions during the meeting.

Following the May 19, 2004 Board meeting, Lazard prepared a

confidential information memorandum for distribution to select parties that

management and Lazard believed might be interested in, and capable of

completing, a business combination with the Company. On July 24, 2004, Lazard

distributed the confidential information memorandum to 12 interested parties,

all of whom had signed confidentiality agreements. Lazard requested initial

responses from the parties by August 13, 2004. After July 24, 2004, management

responded to questions raised by various parties who received the confidential

information memorandum.

Between May 19, 2004 and August 12, 2004, management continued

discussions with its joint venture partners in Wellsford/Whitehall relating to

the sale of venture assets subject to existing agreements. On July 28, 2004, the

Company announced that Wellsford/Whitehall had transferred six office properties

and a land parcel to one of the partners in this venture. With this transfer

came the elimination of a tax indemnity which restricted most future asset sales

of Wellsford/Whitehall through 2007 and simultaneously resolved the outstanding

negotiations with the special servicer of the Nomura Debt discussed above. On

August 3, 2004, the Company announced the sale of 19 Silver Mesa condominiums

for $4.7 million during the second quarter of operations and that one partner in

Second Holding would not approve the purchase of any further investments. The

Company's management and its other partners began to evaluate the alternative