| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

FORM N-CSR |

CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

MANAGEMENT INVESTMENT COMPANIES |

| Investment Company Act File Number: 811-08203 |

| T. Rowe Price Diversified Small-Cap Growth Fund, Inc. |

| (Exact name of registrant as specified in charter) |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Address of principal executive offices) |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: (410) 345-2000 |

| Date of fiscal year end: December 31 |

| Date of reporting period: June 30, 2010 |

Item 1: Report to Shareholders

|

| Diversified Small-Cap Growth Fund | June 30, 2010 |

The views and opinions in this report were current as of June 30, 2010. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our E-mail Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Manager’s Letter

Fellow Shareholders

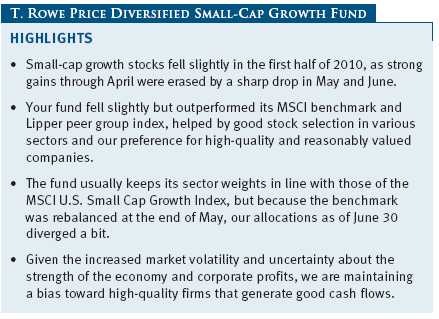

Small-cap growth stocks fell slightly in the first half of 2010, as the market’s strong gains through April were erased by a sharp correction—traditionally defined as a drop of at least 10%—in May and June. The remarkable rally that started in March 2009 was disrupted by a Greek debt crisis and worries that measures to contain it would lead to slower European economic growth. Concerns about tighter monetary policy and lending practices in China, rising military tensions between North and South Korea, U.S. financials sector reforms, the sustainability of the U.S. economic recovery, and fallout from the huge Gulf of Mexico oil spill also weighed on investor sentiment.

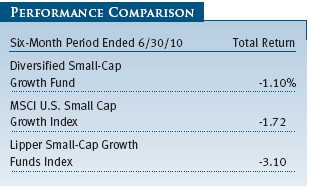

Your fund returned -1.10% in the first half of the year. As shown in the Performance Comparison table, the fund outperformed its MSCI benchmark and Lipper peer group index. Our focus on high-quality and reasonably valued companies with good cash flows and other favorable attributes continued to serve investors well during our reporting period. As stocks climbed sharply through April, the fund outperformed competing small-cap growth portfolios. As the market tumbled in the last two months, the fund retained much of its performance advantage versus its competitors.

In the last six months, fund performance relative to the MSCI index was helped by good stock selection in several sectors, especially consumer discretionary, health care, and consumer staples. However, weakness among our information technology (IT) holdings reduced our performance advantage. As usual, sector allocations in aggregate had little impact on our relative results, as our allocations are fairly similar to those of the MSCI benchmark.

MARKET ENVIRONMENT

The U.S. economic recovery, which started in the third quarter of 2009, seems to be moderating. According to the most recent estimates, gross domestic product (GDP) grew at a brisk annualized rate of 5.6% in the fourth quarter of 2009 but at a slower pace of 2.7% in the first quarter of 2010. While employment growth has resumed, residential real estate markets have stabilized, and demand for capital goods has increased, we believe the economy is likely to grow at a sluggish pace in the months ahead.

Led by small-caps, U.S. stocks produced strong gains and extended last year’s rally in the first four months of 2010 as corporate earnings showed continued improvement and the U.S. economy seemed to be gaining traction. However, the market fell sharply starting in late April as a Greek debt crisis threatened to spread to other highly indebted European nations, such as Spain and Portugal. In response, investors abandoned aggressive investments in favor of U.S. Treasury securities, and the dollar surged versus most currencies. By June, global markets seemed to stabilize as the European Union and the International Monetary Fund (IMF) proposed and began to implement measures to contain the debt crisis. However, the month ended with a sharp sell-off that sent most major U.S. stock indexes to their lowest levels of the year amid concerns that the U.S. economic recovery was faltering.

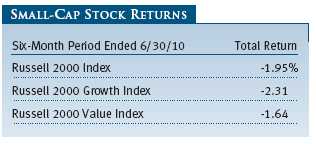

Small-cap shares significantly outperformed large-caps in the last six months. The small-cap Russell 2000 Index returned -1.95% versus -6.65% for the large-cap S&P 500 Index. As measured by various Russell indexes, value stocks held up better than growth stocks across all market capitalizations. Despite dropping roughly 13% to 18% from late April through the end of June, most major indexes remain more than 50% above their March 2009 lows.

Most sectors in the MSCI U.S. Small Cap Growth Index fell moderately in the first half of 2010. Materials and energy were among the weakest sectors as fears of weaker global demand for raw materials and the catastrophic oil spill in the Gulf of Mexico dented investor sentiment toward natural resource stocks. Consumer discretionary shares bucked the negative trend, however, and produced good returns in a challenging environment. Health care stocks edged higher, despite the passage of reform legislation that some fear will lead to higher costs and lower profits.

PORTFOLIO CHARACTERISTICS

Before we discuss the portfolio’s performance in detail, we would like to welcome new shareholders to the fund and thank our longer-term investors for confidence in our portfolio management abilities, particularly as market volatility has picked up again. As you may know, the fund’s time horizon for investing is much longer than its typical 6- and 12-month reporting periods, so we remain committed to our strategy and investment process. We believe these will help us navigate through the years ahead and reward patient investors with long-term capital growth:

• We favor companies that have a high return on capital and use cash flows wisely in a manner that benefits shareholders. We prefer companies that generate substantial free cash flow.

• We seek companies with good earnings quality and sustainable growth characteristics.

• We look for companies with attractive valuations relative to other firms in the same industry and relative to the small-cap growth universe as a whole. We like companies with reasonable valuations relative to their earnings and sales growth rates.

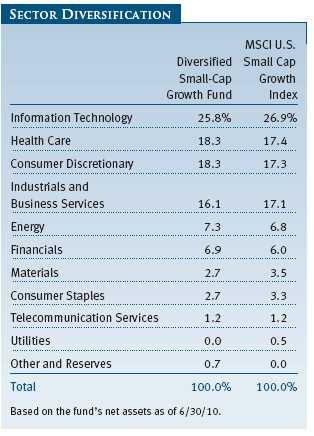

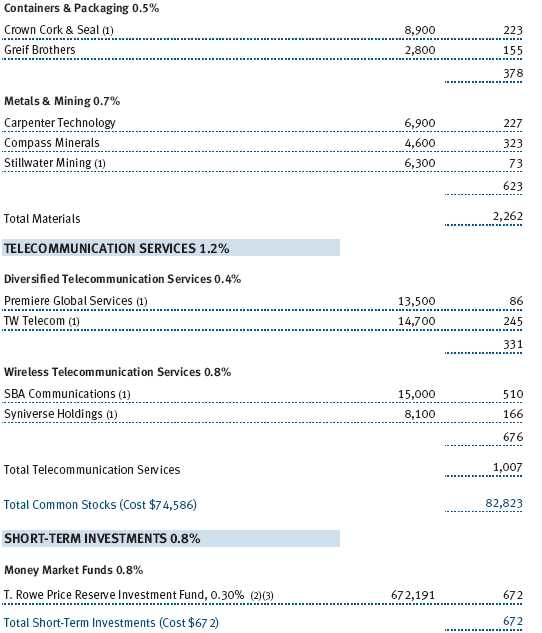

While our stock selection is based on a quantitative model, we do take into consideration the fundamental research done by T. Rowe Price’s equity analysts. In constructing the portfolio, we do not usually make big sector bets, but we will occasionally overweight or underweight certain sectors based on our analysis. The fund usually keeps its sector weights in line with those of the MSCI U.S. Small Cap Growth Index, but because the benchmark was rebalanced at the end of May, our allocations diverged a bit, as shown in the Sector Diversification table on page 7.

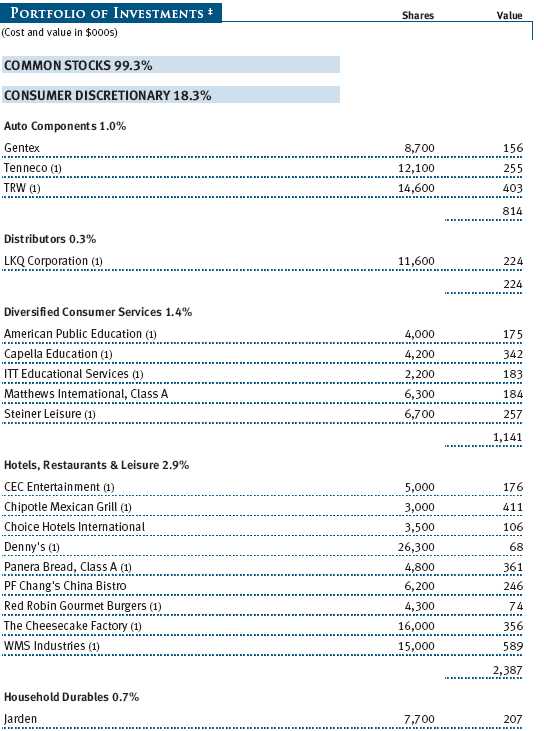

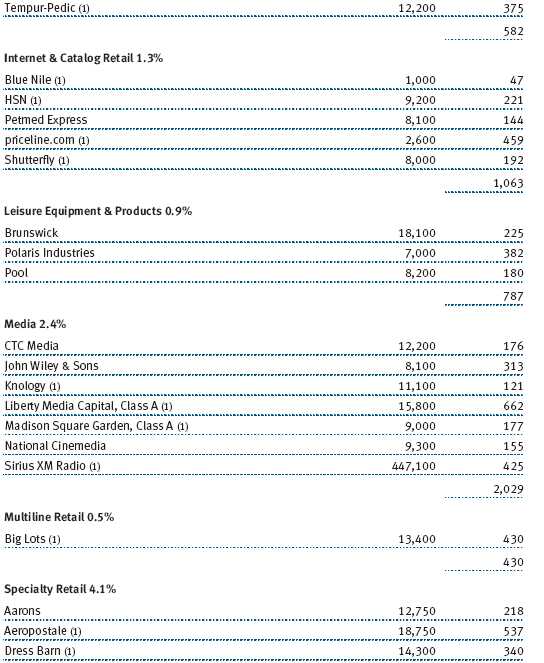

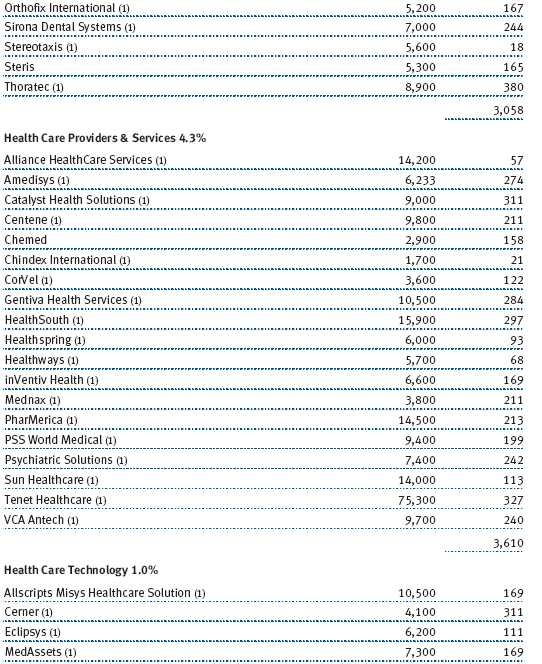

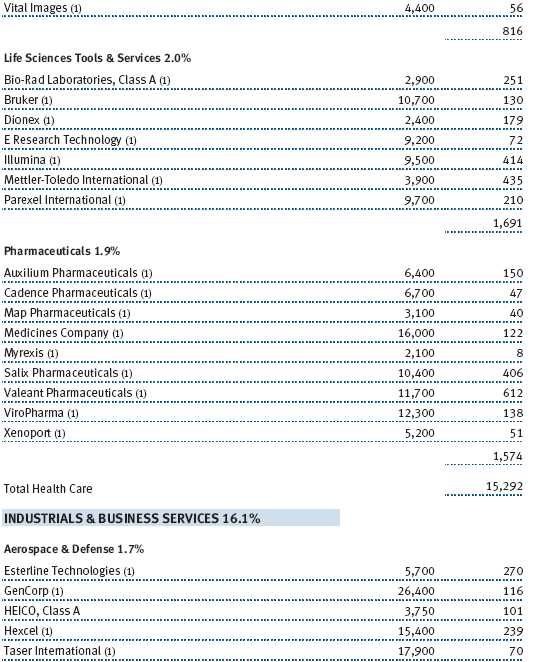

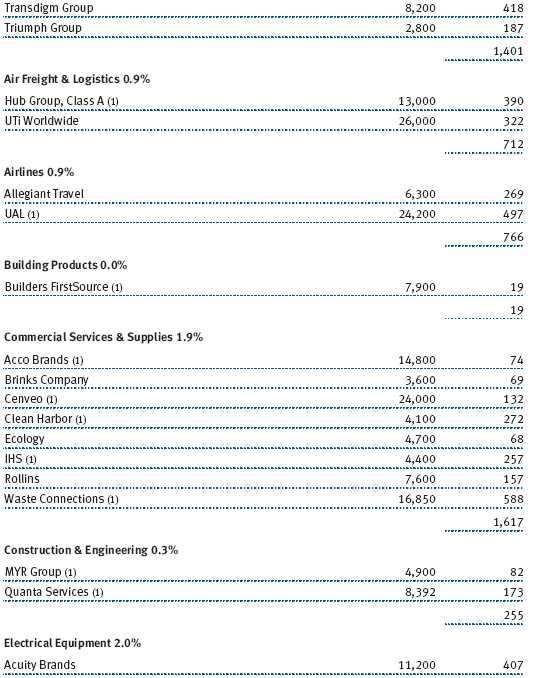

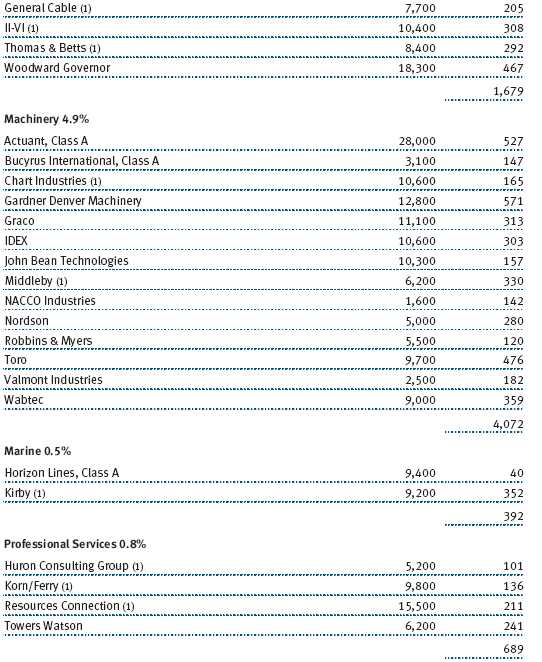

At the end of June, our largest sector commitments in absolute terms were information technology, health care, consumer discretionary, and industrials and business services. Allocations to energy and financials were notably smaller. Our exposure to the materials, consumer staples, and telecommunication services sectors was lower but similar to the benchmark’s allocations. We did not own any utility companies at the end of June. In relative terms, we had small overweights (approximately 100 basis points, or one percentage point) in the health care, consumer discretionary, and financials sectors. We were underweighted in the information technology and industrials and business services sectors by a similar margin. We are reducing these overweights and underweights opportunistically.

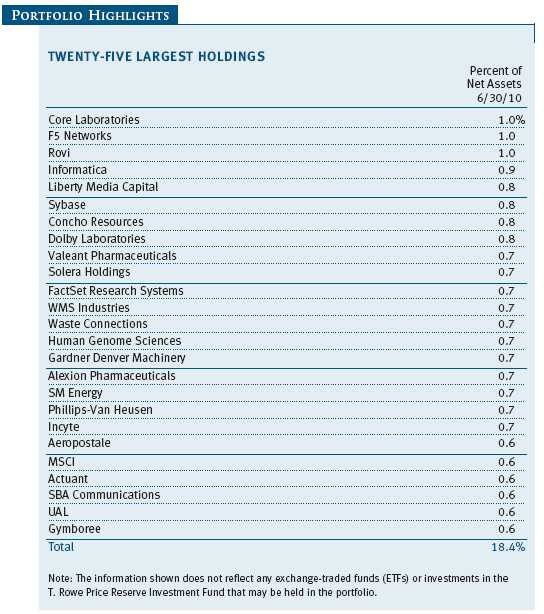

Our strategy is to try to outperform our benchmark by owning a large number of good stocks instead of making large investments in a small number of stocks. The portfolio usually holds approximately 300 to 320 names. Currently we have more than 340, reflecting our commitment to broad diversification and risk management in an uncertain environment, as well as the fact that a greater number of companies seem to have favorable prospects at the onset of an economic recovery. Very few of our positions represent 1% or more of the fund’s net assets at any given time. This level of diversification should help manage the risk of investing in small-cap growth stocks. (Of course, diversification cannot assure a profit or protect against loss in a declining market.)

Cash reserves are a drag on long-term performance in a rising market, so we try to keep our cash position low. Trading is another cost that reduces returns, so we trade electronically and in low-cost venues when possible. The fund tends to have a fairly low annual turnover rate because our time horizon is longer than that of other small-cap growth portfolios. Our portfolio turnover rate in the 12-month period ended June 30, 2010, was 20.8%, which is substantially less than the 2009 average of 130.1% for small-cap growth funds, according to data from Morningstar Direct. (Morningstar only calculates portfolio turnover for their averages at year-end using the most recent year-end portfolio turnover figures provided to Morningstar by each of the underlying funds in the average.) This means our holding period for a typical stock is almost five years, whereas our average competitor holds a given stock for less than one year.

PORTFOLIO REVIEW

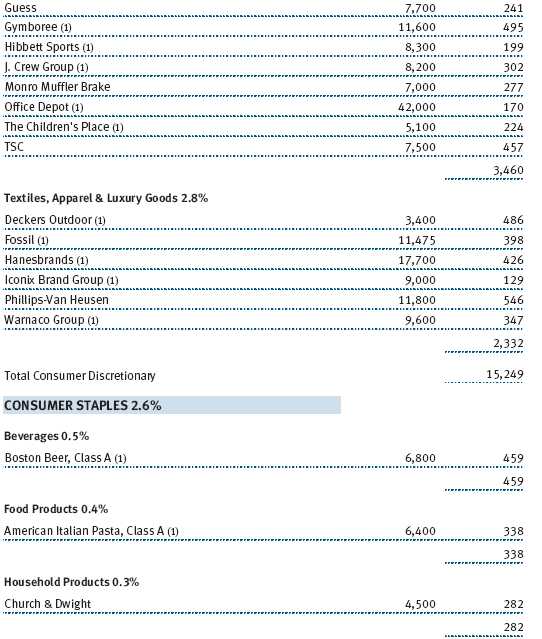

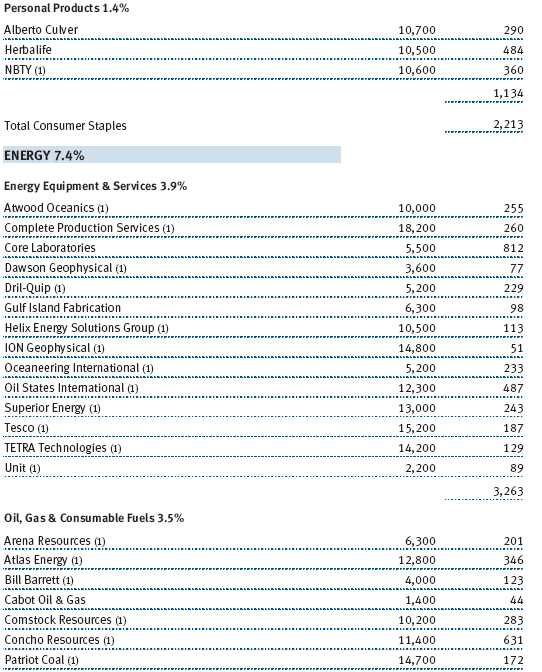

Our holdings in the consumer discretionary sector contributed the most to absolute performance, and good stock selection in the sector helped results relative to our MSCI benchmark. Our media stocks did best, largely due to strength in Liberty Media Capital. This Liberty Media Corporation subsidiary, which owns the Atlanta Braves baseball team and a variety of entertainment assets including stakes in other media companies, benefited from the parent company’s announcement of a restructuring. Similarly, our hotel, restaurant, and leisure stocks did well primarily because of Chipotle Mexican Grill. Shares rose briskly as the company reported favorable earnings and began expanding in Europe. On the other hand, Internet and catalog retailers sagged, with online travel services company priceline.com among our weakest holdings in the portfolio. Specialty retailers were mixed, with the poor performance of Office Depot, Guess, and J. Crew Group offsetting strength in Aeropostale and The Children’s Place. (Please refer to the fund’s portfolio of investments for a complete listing of holdings and the amount each represents in the portfolio.)

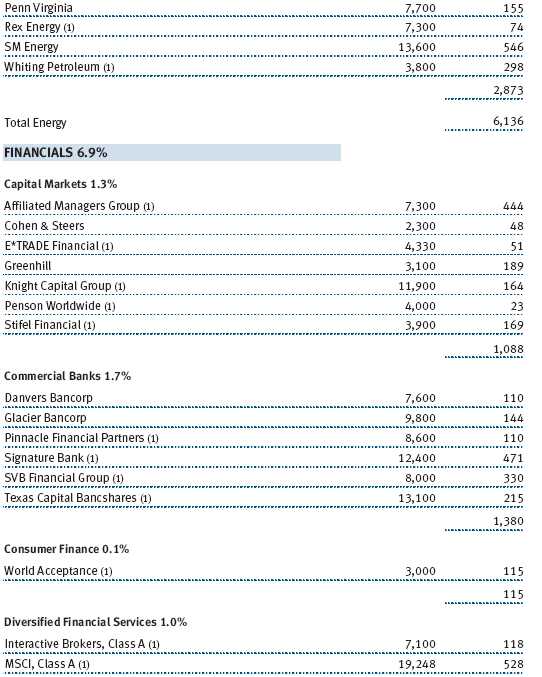

Health care stocks produced mild gains in the last six months—a remarkable achievement considering the controversial reform legislation passed a few months ago and the market’s general headwinds since the end of April. Good stock selection helped our relative performance. Health care equipment and supply companies fared best amid perceptions that increased coverage would lead to greater demand for medical devices and instruments. Two of our best holdings in this segment were Thoratec, a maker of devices that support blood circulation, and Edwards Lifesciences, whose products are used to treat cardiovascular diseases. Drug makers also did well, particularly Valeant Pharmaceuticals and Salix Pharmaceuticals. In the life sciences segment, Illumina produced excellent returns. The company, which provides systems to help with genetic research, reported strong first-quarter earnings and increased revenues. Biotechnology stocks fell broadly due to uncertainty about health care reform, but OSI Pharmaceuticals rose sharply—and we eliminated it from the fund—after Japanese drugmaker Astellas Pharma offered to acquire the company.

Information technology stocks fell moderately in the last six months. The sector, which remains the largest in the fund and benchmark, detracted the most from the fund’s absolute performance, and weakness among our holdings hurt the fund’s results relative to the benchmark. Semiconductor-related stocks fared the worst. IT services shares also slumped, though electronic payment services provider CyberSource surged after receiving a takeover offer from credit card giant Visa. Communications equipment companies were mixed as weakness in several names was offset by excellent performance from F5 Networks and Acme Packet, a provider of switching equipment for Internet service providers. Investors have been enthusiastic about Acme’s ability to profit from growing demand for Internet voice transmission and other high-bandwidth services. Software stocks fared best, thanks to strength in shares of Sybase, which is being acquired by German software giant SAP, and Rovi, a provider of digital home entertainment technology solutions. The company generates substantial revenue from licensing interactive program guide technology to cable and satellite TV providers.

The materials sector was one of the weakest in the small-cap growth universe in absolute terms, though our stock selection and underweighting in this small sector reduced the negative impact on the portfolio. Most of our holdings were chemical companies that declined in value, but Airgas, a distributor of industrial, medical, and specialty gases, climbed following a takeover offer from Air Products & Chemicals. Our two containers and packaging companies were lackluster, but our metals and mining companies fared somewhat better, such as Carpenter Technology, a maker of stainless steels and specialty alloys.

Financials, another relatively small sector in our investment universe, also detracted from our absolute performance amid concerns about new regulations and the durability of the U.S. economic recovery. Capital markets companies sagged as global financial markets fell sharply in the last few months, with Stifel Financial among our weakest holdings. However, RiskMetrics Group, a provider of financial risk management analytics, performed well following a takeover offer from MSCI.

Our commercial banks did best, led by Signature Bank and Texas Capital Bancshares. Both companies have demonstrated improving financial health and have fully repaid the money they received from the Treasury Department’s Troubled Asset Relief Program (TARP).

Industrials and business services stocks were mostly lackluster in the last six months. Aerospace and defense companies did best, led by Hexcel, a new portfolio holding that develops composites and materials for use in military and commercial aircraft. The company was lifted by favorable sales growth projections for the next few years. On the other hand, professional services companies struggled amid concerns that the U.S. economic recovery was faltering. Resources Connection, a provider of accounting and finance consulting services to corporations, was one of our weakest holdings in the entire portfolio.

The energy sector was one of the weakest in our investment universe amid expectations that the Gulf oil spill will lead to broader regulation that could crimp revenues and earnings of various companies. Most of our holdings in the sector declined in value, especially those involved with offshore drilling, but there were a few notable exceptions. Two of our top performers were Concho Resources, an onshore exploration and production firm that recently reported a significant increase in revenues, and Core Laboratories, which analyzes oil and natural gas samples from reservoirs and recommends how the reservoirs should be managed to maximize production and minimize environmental damage.

We have been following developments in the Gulf closely and, as stewards of your capital, made some changes to our energy sector holdings to take advantage of what we believe are good investment opportunities. We eliminated Dresser-Rand Group, which makes rotating equipment to extract oil from the ground, and Goodrich Petroleum, an independent oil and gas explorer in Texas and Louisiana. We established positions in Rex Energy, an independent oil and gas explorer in the Appalachian, Illinois Basin, and Rockies regions; Whiting Petroleum, another independent oil and gas explorer with interests in several regions of the U.S.; Dril-Quip, a maker of offshore drilling and production equipment; and Helix Energy Solutions Group, which produces oil and gas from its own fields and provides services to other energy producers.

OUTLOOK

At the end of 2009, we noted that stocks were fairly valued—neither cheap nor expensive. The recent downdraft in the market should allow investors to find good bargains. Many firms surpassed earnings estimates by cutting expenses and produced good cash flows by reducing capital expenditures. We believe these firms must show revenue growth in the period ahead to sustain their current valuations. Once companies report second-quarter earnings and issue projections, we should have a better indication of the direction of earnings.

In the last few months, we observed a spike in volatility as well as high correlations between different equity market segments. There were signs of investors becoming risk averse in most global markets. The increase in volatility resulted in high-quality stock outperformance, which helped your fund’s results. Even though stock selection is not very effective in an environment where stocks are highly correlated, we are maintaining a bias toward high-quality firms that generate good cash flows.

While the economy is growing, there are a number of risks we must consider. Over the next few months, we will have a better idea about the impact of the end of federal fiscal stimulus. The Federal Reserve is expected to hold short-term interest rates at record low levels, which should help support stocks. There is fear in the market about a double-dip recession. We cannot predict if this will occur, but current data suggest that GDP and employment growth will be muted relative to previous recoveries. There is also the possibility that some of the efforts to stabilize the weaker European economies might not work, and additional measures might be required.

In any event, our core mission remains the same. We will continue to invest broadly in the small-cap growth universe and look for companies that we believe have favorable attributes and are well positioned to thrive over the long term.

Thank you for investing with T. Rowe Price.

Respectfully submitted,

Sudhir Nanda

Chairman of the fund’s Investment Advisory Committee

July 23, 2010

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the fund’s investment program.

RISKS OF INVESTING

As with all stock mutual funds, the fund’s share price can fall because of weakness in the stock market, a particular industry, or specific holdings. Stock markets can decline for many reasons, including adverse political or economic developments, changes in investor psychology, or heavy institutional selling. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment. In addition, the investment manager’s assessment of companies held in a fund may prove incorrect, resulting in losses or poor performance even in rising markets.

Growth stocks can be volatile for several reasons. Since these companies usually invest a high portion of earnings in their businesses, they may lack the dividends of value stocks that can cushion stock prices in a falling market. Also, earnings disappointments often lead to sharply falling prices because investors buy growth stocks in anticipation of superior earnings growth.

Investing in small companies involves greater risk than is customarily associated with larger companies. Stocks of smaller companies are subject to more abrupt or erratic price movements than larger-company stocks. Small companies often have limited product lines, markets, or financial resources, and their managements may lack depth and experience. Such companies seldom pay significant dividends that could cushion returns in a falling market.

GLOSSARY

Earnings growth rate (current fiscal year): Measures the annualized percent change in earnings per share from the prior fiscal year to the current fiscal year.

Fed funds target rate: An overnight lending rate set by the Federal Reserve and used by banks to meet reserve requirements. Banks also use the fed funds rate as a benchmark for their prime lending rates.

Inflation: A sustained increase in prices throughout the economy.

Lipper indexes: Consist of a small number (10 to 30) of the largest mutual funds in a particular category as tracked by Lipper Inc.

MSCI U.S. Small Cap Growth Index: Tracks the performance of domestic small-cap growth stocks as defined by MSCI.

Price-to-earnings (P/E) ratio – 12 months forward: A valuation measure calculated by dividing the price of a stock by the analysts’ forecast of the next 12 months’ expected earnings. The ratio is a measure of how much investors are willing to pay for the company’s future earnings. The higher the P/E, the more investors are paying for a company’s earnings growth in the next 12 months.

Projected earnings growth rate (IBES): A company’s expected earnings per share growth rate for a given time period based on the forecast from the Institutional Brokers’ Estimate System, which is commonly referred to as IBES.

Return on equity (ROE) – current fiscal year: A valuation measure calculated by dividing the company’s current fiscal year net income by shareholders’ equity (i.e., the company’s book value). ROE measures how much a company earns on each dollar that common stock investors have put into the company. It indicates how effectively and efficiently a company and its management are using stockholder investments.

Russell 2000 Growth Index: Measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values.

Russell 2000 Index: Tracks the stocks of 2,000 small U.S. companies.

Russell 2000 Value Index: Measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values.

S&P 500 Index: Tracks the stocks of 500 primarily large U.S. companies.

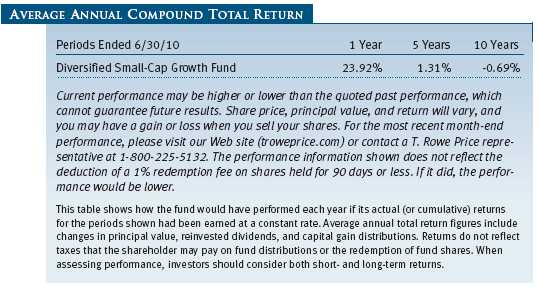

Performance and Expenses

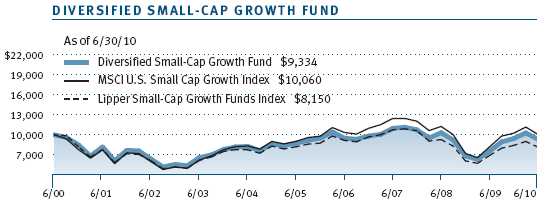

| GROWTH OF $10,000 |

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

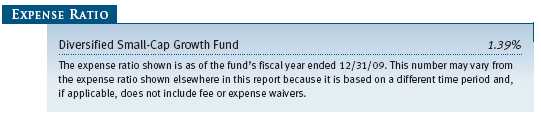

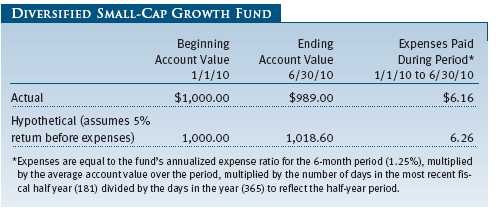

| FUND EXPENSE EXAMPLE |

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (“Actual”) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (“Hypothetical”) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual small-account maintenance fee of $10, generally for accounts with less than $2,000 ($500 for UGMA/UTMA). The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $25,000 or more, accounts employing automatic investing, and IRAs and other retirement plan accounts that utilize a prototype plan sponsored by T. Rowe Price (although a separate custodial or administrative fee may apply to such accounts). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

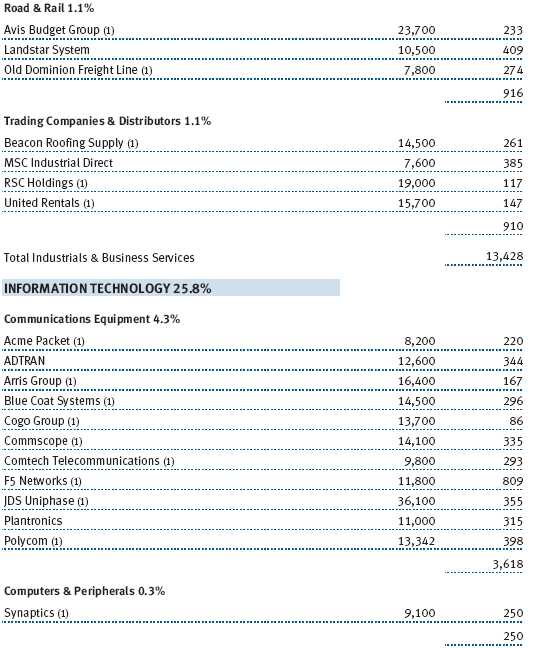

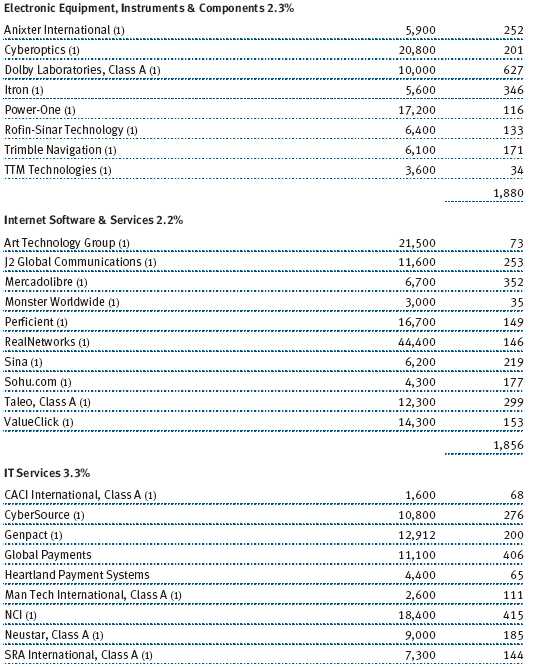

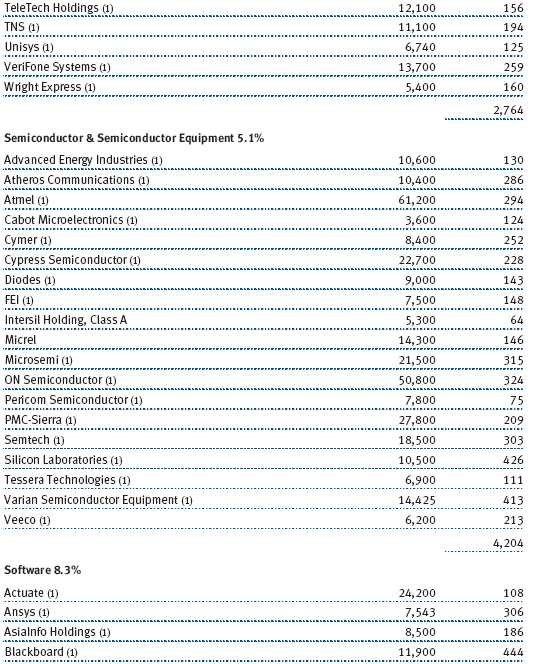

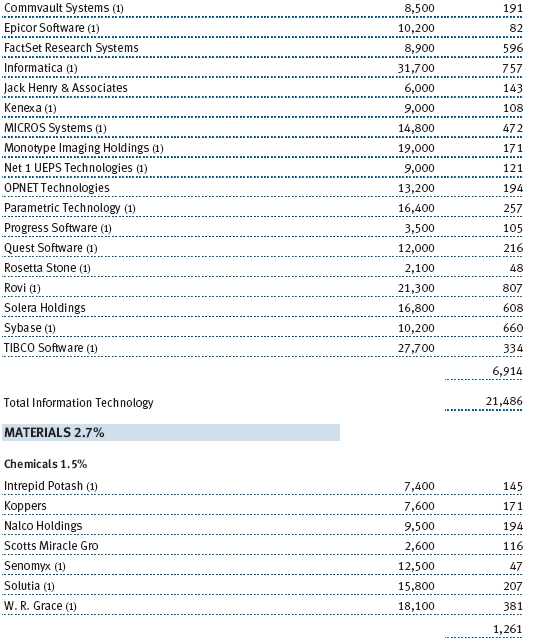

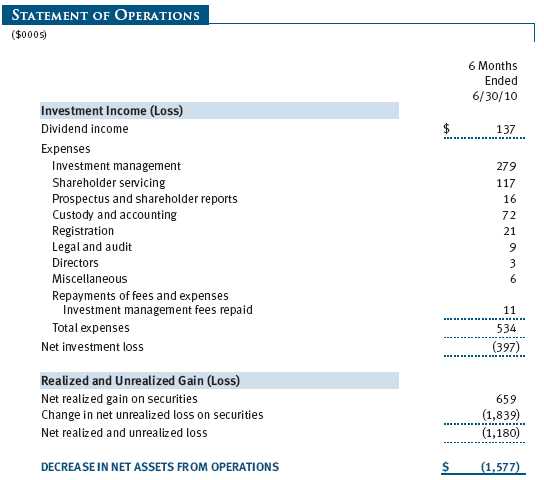

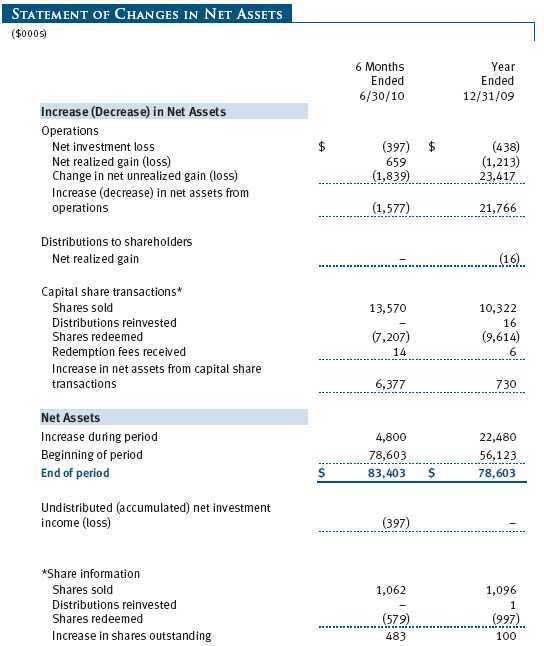

Unaudited

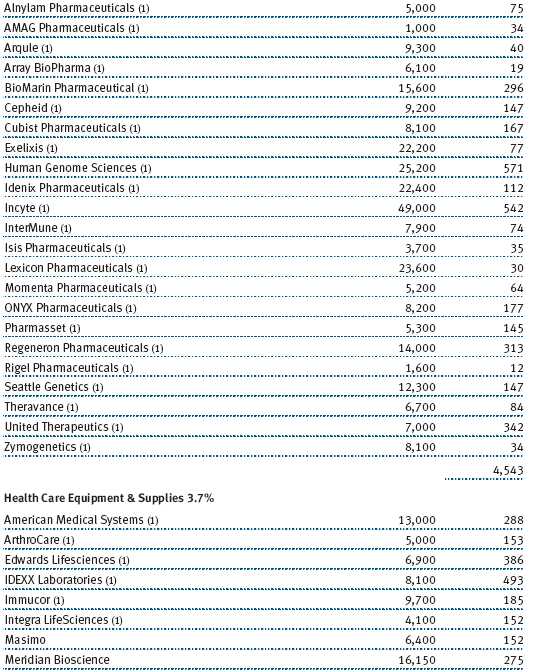

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

| NOTES TO FINANCIAL STATEMENTS |

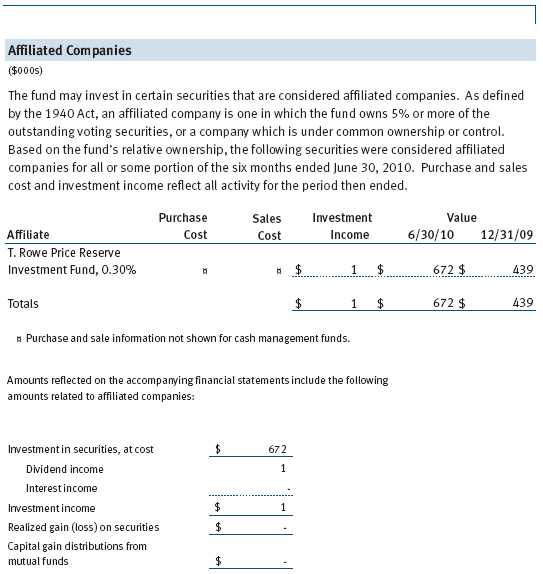

T. Rowe Price Diversified Small-Cap Growth Fund, Inc. (the fund), is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund commenced operations on June 30, 1997. The fund seeks long-term growth of capital by investing primarily in common stocks of small growth companies.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), which require the use of estimates made by fund management. Fund management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale of securities.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared and paid annually. Capital gain distributions, if any, are generally declared and paid by the fund annually.

Rebates and Credits Subject to best execution, the fund may direct certain security trades to brokers who have agreed to rebate a portion of the related brokerage commission to the fund in cash. Commission rebates are reflected as realized gain on securities in the accompanying financial statements. Additionally, the fund earns credits on temporarily uninvested cash balances held at the custodian, which reduce the fund’s custody charges. Custody expense in the accompanying financial statements is presented before reduction for credits.

Redemption Fees A 1% fee is assessed on redemptions of fund shares held for 90 days or less to deter short-term trading and to protect the interests of long-term shareholders. Redemption fees are withheld from proceeds that shareholders receive from the sale or exchange of fund shares. The fees are paid to the fund and are recorded as an increase to paid-in capital. The fees may cause the redemption price per share to differ from the net asset value per share.

New Accounting Pronouncement On January 1, 2010, the fund adopted new accounting guidance that requires enhanced disclosures about fair value measurements in the financial statements. Adoption of this guidance had no impact on the fund’s net assets or results of operations.

NOTE 2 - VALUATION

The fund’s investments are reported at fair value as defined by GAAP. The fund determines the values of its assets and liabilities and computes its net asset value per share at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day that the NYSE is open for business.

Valuation Methods Equity securities listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made, except for OTC Bulletin Board securities, which are valued at the mean of the latest bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the latest bid and asked prices for domestic securities and the last quoted sale price for international securities.

Investments in mutual funds are valued at the mutual fund’s closing net asset value per share on the day of valuation.

Other investments, including restricted securities, and those financial instruments for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors.

Valuation Inputs Various inputs are used to determine the value of the fund’s financial instruments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical financial instruments

Level 2 – observable inputs other than Level 1 quoted prices (including, but not limited to, quoted prices for similar financial instruments, interest rates, prepayment speeds, and credit risk)

Level 3 – unobservable inputs

Observable inputs are those based on market data obtained from sources independent of the fund, and unobservable inputs reflect the fund’s own assumptions based on the best information available. The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level. On June 30, 2010, all of the fund’s investments were classified as Level 1, based on the inputs used to determine their values.

NOTE 3 - OTHER INVESTMENT TRANSACTIONS

Purchases and sales of portfolio securities other than short-term securities aggregated $12,048,000 and $5,959,000, respectively, for the six months ended June 30, 2010.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. The amount and character of tax-basis distributions and composition of net assets are finalized at fiscal year-end; accordingly, tax-basis balances have not been determined as of the date of this report.

The fund intends to retain realized gains to the extent of available capital loss carryforwards. As of December 31, 2009, the fund had $2,321,000 of unused capital loss carryforwards, all which expire in fiscal 2017.

At June 30, 2010, the cost of investments for federal income tax purposes was $75,258,000. Net unrealized gain aggregated $8,237,000 at period-end, of which $18,126,000 related to appreciated investments and $9,889,000 related to depreciated investments.

NOTE 5 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (the manager or Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. The investment management agreement between the fund and the manager provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.35% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.285% for assets in excess of $220 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At June 30, 2010, the effective annual group fee rate was 0.30%.

The fund is also subject to a contractual expense limitation through April 30, 2012. During the limitation period, the manager is required to waive its management fee and reimburse the fund for any expenses, excluding interest, taxes, brokerage commissions, and extraordinary expenses that would otherwise cause the fund’s ratio of annualized total expenses to average net assets (expense ratio) to exceed its expense limitation of 1.25%. The fund is required to repay the manager for expenses previously reimbursed and management fees waived to the extent the fund’s net assets have grown or expenses have declined sufficiently to allow repayment without causing the fund’s expense ratio to exceed its expense limitation. However, no repayment will be made more than three years after the date of any reimbursement or waiver or later than April 30, 2014. Pursuant to this agreement, management fees in the amount of $11,000 were repaid during the six months ended June 30, 2010. Including these amounts, management fees waived in the amount of $165,000 remain subject to repayment at June 30, 2010.

In addition, the fund has entered into service agreements with Price Associates and two wholly owned subsidiaries of Price Associates (collectively, Price). Price Associates computes the daily share price and provides certain other administrative services to the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend disbursing agent. T. Rowe Price Retirement Plan Services, Inc., provides subaccounting and recordkeeping services for certain retirement accounts invested in the fund. For the six months ended June 30, 2010, expenses incurred pursuant to these service agreements were $42,000 for Price Associates; $82,000 for T. Rowe Price Services, Inc.; and $4,000 for T. Rowe Price Retirement Plan Services, Inc. The total amount payable at period-end pursuant to these service agreements is reflected as Due to Affiliates in the accompanying financial statements.

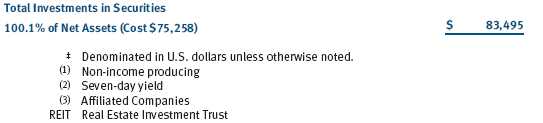

The fund may invest in the T. Rowe Price Reserve Investment Fund and the T. Rowe Price Government Reserve Investment Fund (collectively, the T. Rowe Price Reserve Investment Funds), open-end management investment companies managed by Price Associates and considered affiliates of the fund. The T. Rowe Price Reserve Investment Funds are offered as cash management options to mutual funds, trusts, and other accounts managed by Price Associates and/or its affiliates and are not available for direct purchase by members of the public. The T. Rowe Price Reserve Investment Funds pay no investment management fees.

| INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s Web site, www.sec.gov. The description of our proxy voting policies and procedures is also available on our Web site, www.troweprice.com. To access it, click on the words “Our Company” at the top of our corporate homepage. Then, when the next page appears, click on the words “Proxy Voting Policies” on the left side of the page.

Each fund’s most recent annual proxy voting record is available on our Web site and through the SEC’s Web site. To access it through our Web site, follow the directions above, then click on the words “Proxy Voting Records” on the right side of the Proxy Voting Policies page.

| HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s Web site (www.sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 450 Fifth St. N.W., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| APPROVAL OF INVESTMENT MANAGEMENT AGREEMENT |

On March 9, 2010, the fund’s Board of Directors (Board) unanimously approved the continuation of the investment advisory contract (Contract) between the fund and its investment manager, T. Rowe Price Associates, Inc. (Adviser). The Board considered a variety of factors in connection with its review of the Contract, also taking into account information provided by the Adviser during the course of the year, as discussed below:

Services Provided by the Adviser

The Board considered the nature, quality, and extent of the services provided to the fund by the Adviser. These services included, but were not limited to, management of the fund’s portfolio and a variety of related activities, as well as financial and administrative services, reporting, and communications. The Board also reviewed the background and experience of the Adviser’s senior management team and investment personnel involved in the management of the fund. The Board concluded that it was satisfied with the nature, quality, and extent of the services provided by the Adviser.

Investment Performance of the Fund

The Board reviewed the fund’s average annual total returns over the 1-, 3-, 5-, and 10-year periods, as well as the fund’s year-by-year returns, and compared these returns with a wide variety of previously agreed upon comparable performance measures and market data, including those supplied by Lipper and Morningstar, which are independent providers of mutual fund data. On the basis of this evaluation and the Board’s ongoing review of investment results, and factoring in the severity of the market turmoil during 2008 and 2009, the Board concluded that the fund’s performance was satisfactory.

Costs, Benefits, Profits, and Economies of Scale

The Board reviewed detailed information regarding the revenues received by the Adviser under the Contract and other benefits that the Adviser (and its affiliates) may have realized from its relationship with the fund, including research received under “soft dollar” agreements and commission-sharing arrangements with broker-dealers. The Board considered that the Adviser may receive some benefit from its soft-dollar arrangements pursuant to which it receives research from broker-dealers that execute the applicable fund’s portfolio transactions. The Board also received information on the estimated costs incurred and profits realized by the Adviser and its affiliates from advising T. Rowe Price mutual funds. The Board did not review information regarding profits realized from managing the fund in particular because the fund had not achieved sufficient scale in terms of portfolio asset size to produce meaningful profit margin percentages. The Board concluded that the Adviser’s profits from advising T. Rowe Price mutual funds were reasonable in light of the services provided to the fund. The Board also considered whether the fund or other funds benefit under the fee levels set forth in the Contract from any economies of scale realized by the Adviser. Under the Contract, the fund pays a fee to the Adviser composed of two components—a group fee rate based on the aggregate assets of certain T. Rowe Price mutual funds (including the fund) that declines at certain asset levels and an individual fund fee rate that is assessed on the assets of the fund. The Board concluded that the advisory fee structure for the fund continued to provide for a reasonable sharing of benefits from any economies of scale with the fund’s investors.

Fees

The Board reviewed the fund’s management fee rate, operating expenses, and total expense ratio and compared them with fees and expenses of other comparable funds based on information and data supplied by Lipper. The information provided to the Board indicated that the fund’s management fee rate (including any reductions of the management fee rate as a result of any applicable fee waivers or expenses paid by the Adviser) was below the median for comparable funds. The information also indicated that the fund’s total expense ratio was above the median for certain groups of comparable funds but below the median for other groups of comparable funds. The Board also reviewed the fee schedules for institutional accounts of the Adviser and its affiliates with smaller mandates. Management informed the Board that the Adviser’s responsibilities for institutional accounts are more limited than its responsibilities for the fund and other T. Rowe Price mutual funds that it or its affiliates advise and that the Adviser performs significant additional services and assumes greater risk for the fund and other T. Rowe Price mutual funds that it advises than it does for institutional accounts. On the basis of the information provided, the Board concluded that the fees paid by the fund under the Contract were reasonable.

Approval of the Contract

As noted, the Board approved the continuation of the Contract. No single factor was considered in isolation or to be determinative to the decision. Rather, the Board was assisted by the advice of independent legal counsel and concluded, in light of a weighting and balancing of all factors considered, that it was in the best interests of the fund to approve the continuation of the Contract, including the fees to be charged for services thereunder.

Item 2. Code of Ethics.

A code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions is filed as an exhibit to the registrant’s annual Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the registrant’s most recent fiscal half-year.

Item 3. Audit Committee Financial Expert.

Disclosure required in registrant’s annual Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Disclosure required in registrant’s annual Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is filed with the registrant’s annual Form N-CSR.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

SIGNATURES | |

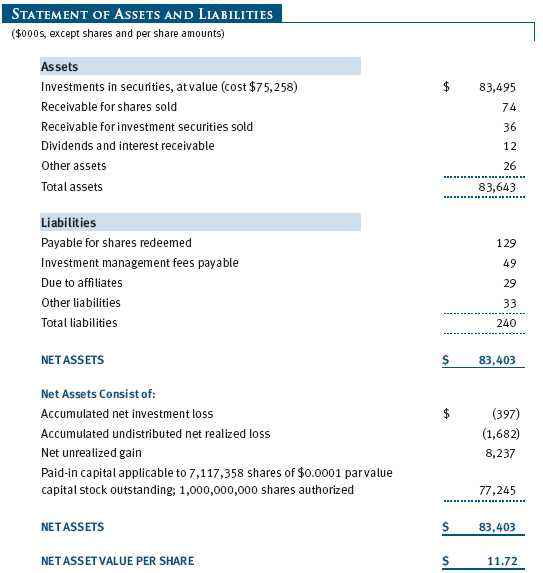

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment | |

| Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the | |

| undersigned, thereunto duly authorized. | |

| T. Rowe Price Diversified Small-Cap Growth Fund, Inc. | |

| By | /s/ Edward C. Bernard |

| Edward C. Bernard | |

| Principal Executive Officer | |

| Date | August 17, 2010 |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment | |

| Company Act of 1940, this report has been signed below by the following persons on behalf of | |

| the registrant and in the capacities and on the dates indicated. | |

| By | /s/ Edward C. Bernard |

| Edward C. Bernard | |

| Principal Executive Officer | |

| Date | August 17, 2010 |

| By | /s/ Gregory K. Hinkle |

| Gregory K. Hinkle | |

| Principal Financial Officer | |

| Date | August 17, 2010 |