UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-08203

T. Rowe Price Integrated Equity Funds, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

Annual Shareholder Report

December 31, 2024

Integrated U.S. Large-Cap Value Equity Fund

This annual shareholder report contains important information about Integrated U.S. Large-Cap Value Equity Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary. This report describes changes to the fund that occurred during the reporting period.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Integrated U.S. Large-Cap Value Equity Fund - Investor Class | $78 | 0.72% |

|---|

What drove fund performance during the past 12 months?

Large-cap value stocks in the U.S. posted solid gains in 2024, helped by easing inflation pressures and looser monetary policy from the Federal Reserve.

Relative to the Russell 1000 Value Index, stock selection in the information technology sector—such as Intel and Dell Technologies, both of which we eliminated—made a strong contribution to relative performance. Stock choices among utility companies and real estate companies also contributed materially to relative results.

On the other hand, our stock selection in the industrials and business services sector—such as tool maker Stanley Black & Decker and freight railroad CSX—detracted from relative performance. Stock choices among consumer staples companies and an underweight allocation to the energy sector also detracted.

The fund seeks long-term capital growth by investing primarily in common stocks of U.S. companies that appear to be undervalued by various measures. Our disciplined, long-term-oriented investment approach represents an integration of quantitative and fundamental insights and analysis, and we seek companies with high-quality characteristics, which include a high return on capital employed, good earnings quality, and stability of earnings. Notable changes in positioning during the year include increased exposure to financials and utilities stocks as well as reduced exposure to industrials and business services, information technology, and energy stocks. While we generally keep the fund’s sector allocations close to those of the Russell index, we may take larger positions in sectors in which we find stocks of quality companies that appear inexpensive versus their respective industries and the overall equity universe.

How has the fund performed?

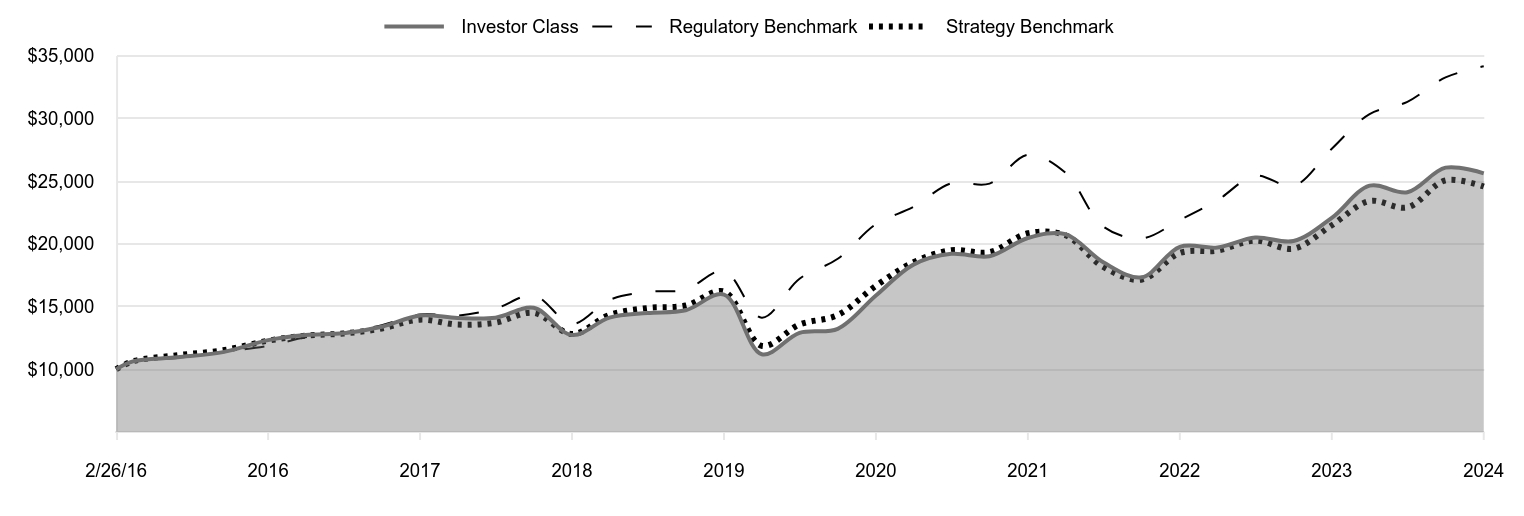

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Investor Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 2/26/16 | 10,000 | 10,000 | 10,000 |

|---|

| 3/31/16 | 10,630 | 10,627 | 10,637 |

|---|

| 6/30/16 | 10,960 | 10,907 | 11,124 |

|---|

| 9/30/16 | 11,370 | 11,387 | 11,511 |

|---|

| 12/31/16 | 12,328 | 11,866 | 12,280 |

|---|

| 3/31/17 | 12,735 | 12,547 | 12,681 |

|---|

| 6/30/17 | 12,878 | 12,926 | 12,852 |

|---|

| 9/30/17 | 13,397 | 13,517 | 13,252 |

|---|

| 12/31/17 | 14,290 | 14,373 | 13,958 |

|---|

| 3/31/18 | 14,089 | 14,281 | 13,563 |

|---|

| 6/30/18 | 14,110 | 14,836 | 13,722 |

|---|

| 9/30/18 | 14,901 | 15,893 | 14,505 |

|---|

| 12/31/18 | 12,729 | 13,620 | 12,804 |

|---|

| 3/31/19 | 14,117 | 15,533 | 14,332 |

|---|

| 6/30/19 | 14,484 | 16,169 | 14,883 |

|---|

| 9/30/19 | 14,706 | 16,357 | 15,085 |

|---|

| 12/31/19 | 15,960 | 17,845 | 16,202 |

|---|

| 3/31/20 | 11,197 | 14,115 | 11,872 |

|---|

| 6/30/20 | 12,904 | 17,224 | 13,568 |

|---|

| 9/30/20 | 13,227 | 18,810 | 14,327 |

|---|

| 12/31/20 | 15,881 | 21,572 | 16,655 |

|---|

| 3/31/21 | 18,346 | 22,941 | 18,530 |

|---|

| 6/30/21 | 19,208 | 24,832 | 19,495 |

|---|

| 9/30/21 | 19,019 | 24,806 | 19,343 |

|---|

| 12/31/21 | 20,469 | 27,108 | 20,846 |

|---|

| 3/31/22 | 20,772 | 25,677 | 20,692 |

|---|

| 6/30/22 | 18,532 | 21,388 | 18,166 |

|---|

| 9/30/22 | 17,334 | 20,434 | 17,145 |

|---|

| 12/31/22 | 19,764 | 21,901 | 19,275 |

|---|

| 3/31/23 | 19,713 | 23,474 | 19,469 |

|---|

| 6/30/23 | 20,509 | 25,442 | 20,262 |

|---|

| 9/30/23 | 20,227 | 24,615 | 19,621 |

|---|

| 12/31/23 | 22,073 | 27,586 | 21,484 |

|---|

| 3/31/24 | 24,640 | 30,350 | 23,415 |

|---|

| 6/30/24 | 24,116 | 31,326 | 22,907 |

|---|

| 9/30/24 | 26,076 | 33,277 | 25,068 |

|---|

| 12/31/24 | 25,622 | 34,154 | 24,571 |

|---|

202501-4140694, 202502-4108734

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 2/26/16 |

|---|

| Integrated U.S. Large-Cap Value Equity Fund (Investor Class) | 16.08% | 9.93% | 11.22% |

|---|

| Russell 3000 Index (Regulatory Benchmark) | 23.81 | 13.86 | 14.90 |

|---|

| Russell 1000 Value Index (Strategy Benchmark) | 14.37 | 8.68 | 10.70 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$60,814

- Number of Portfolio Holdings151

- Investment Advisory Fees Paid (000s)$(161)

- Portfolio Turnover Rate67.5%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Financials | 24.7% |

| Health Care | 16.7 |

| Industrials & Business Services | 12.9 |

| Consumer Staples | 8.3 |

| Energy | 7.5 |

| Information Technology | 7.1 |

| Utilities | 6.7 |

| Consumer Discretionary | 4.3 |

| Real Estate | 3.9 |

| Other | 7.9 |

Top Ten Holdings (as a % of Net Assets)

| Berkshire Hathaway | 2.4% |

| Bank of America | 2.2 |

| JPMorgan Chase | 2.2 |

| Citigroup | 1.6 |

| Philip Morris International | 1.3 |

| Medtronic | 1.3 |

| Wells Fargo | 1.3 |

| Lowe's | 1.3 |

| UnitedHealth Group | 1.3 |

| Exxon Mobil | 1.2 |

How has the fund changed?

This is a summary of certain material changes Integrated U.S. Large-Cap Value Equity Fund. Effective March 1, 2025, the fund will normally invest at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of large-cap companies with value characteristics. The fund’s March 1, 2025 prospectus contains more information.

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Frank Russell Company "LSE" does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Integrated U.S. Large-Cap Value Equity Fund

Investor Class (TQMVX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

Integrated U.S. Large-Cap Value Equity Fund

This annual shareholder report contains important information about Integrated U.S. Large-Cap Value Equity Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary. This report describes changes to the fund that occurred during the reporting period.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Integrated U.S. Large-Cap Value Equity Fund - Advisor Class | $107 | 0.99% |

|---|

What drove fund performance during the past 12 months?

Large-cap value stocks in the U.S. posted solid gains in 2024, helped by easing inflation pressures and looser monetary policy from the Federal Reserve.

Relative to the Russell 1000 Value Index, stock selection in the information technology sector—such as Intel and Dell Technologies, both of which we eliminated—made a strong contribution to relative performance. Stock choices among utility companies and real estate companies also contributed materially to relative results.

On the other hand, our stock selection in the industrials and business services sector—such as tool maker Stanley Black & Decker and freight railroad CSX—detracted from relative performance. Stock choices among consumer staples companies and an underweight allocation to the energy sector also detracted.

The fund seeks long-term capital growth by investing primarily in common stocks of U.S. companies that appear to be undervalued by various measures. Our disciplined, long-term-oriented investment approach represents an integration of quantitative and fundamental insights and analysis, and we seek companies with high-quality characteristics, which include a high return on capital employed, good earnings quality, and stability of earnings. Notable changes in positioning during the year include increased exposure to financials and utilities stocks as well as reduced exposure to industrials and business services, information technology, and energy stocks. While we generally keep the fund’s sector allocations close to those of the Russell index, we may take larger positions in sectors in which we find stocks of quality companies that appear inexpensive versus their respective industries and the overall equity universe.

How has the fund performed?

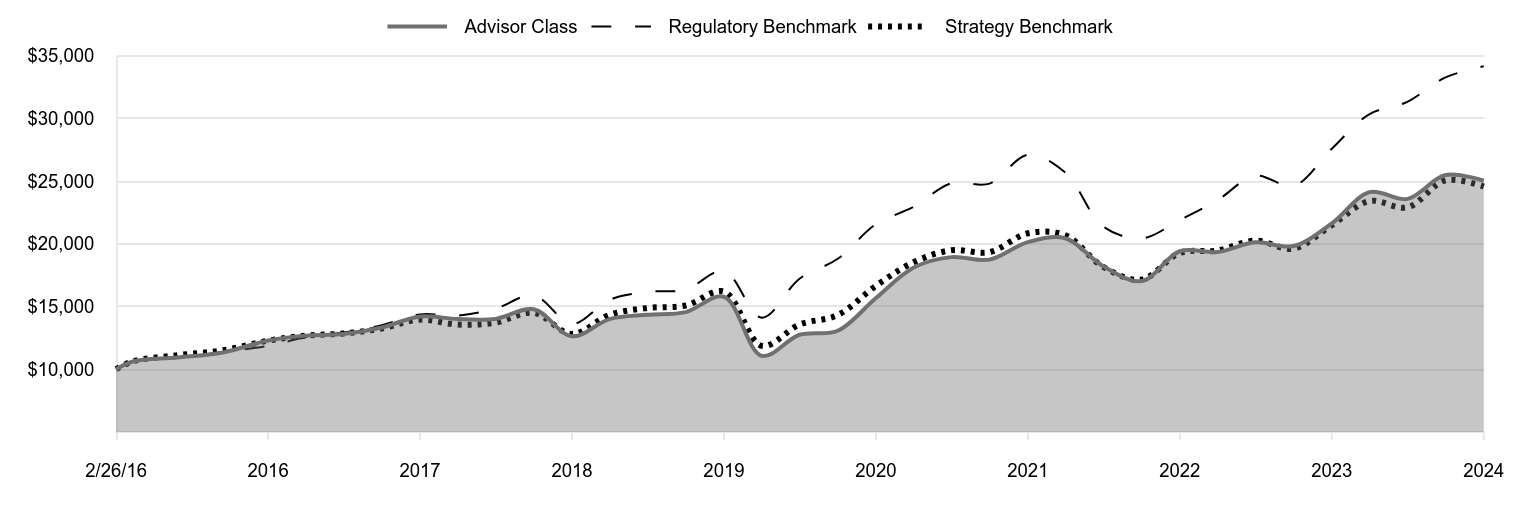

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Advisor Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 2/26/16 | 10,000 | 10,000 | 10,000 |

|---|

| 3/31/16 | 10,620 | 10,627 | 10,637 |

|---|

| 6/30/16 | 10,940 | 10,907 | 11,124 |

|---|

| 9/30/16 | 11,340 | 11,387 | 11,511 |

|---|

| 12/31/16 | 12,299 | 11,866 | 12,280 |

|---|

| 3/31/17 | 12,684 | 12,547 | 12,681 |

|---|

| 6/30/17 | 12,816 | 12,926 | 12,852 |

|---|

| 9/30/17 | 13,334 | 13,517 | 13,252 |

|---|

| 12/31/17 | 14,214 | 14,373 | 13,958 |

|---|

| 3/31/18 | 14,004 | 14,281 | 13,563 |

|---|

| 6/30/18 | 14,015 | 14,836 | 13,722 |

|---|

| 9/30/18 | 14,791 | 15,893 | 14,505 |

|---|

| 12/31/18 | 12,632 | 13,620 | 12,804 |

|---|

| 3/31/19 | 13,998 | 15,533 | 14,332 |

|---|

| 6/30/19 | 14,340 | 16,169 | 14,883 |

|---|

| 9/30/19 | 14,561 | 16,357 | 15,085 |

|---|

| 12/31/19 | 15,782 | 17,845 | 16,202 |

|---|

| 3/31/20 | 11,074 | 14,115 | 11,872 |

|---|

| 6/30/20 | 12,754 | 17,224 | 13,568 |

|---|

| 9/30/20 | 13,074 | 18,810 | 14,327 |

|---|

| 12/31/20 | 15,681 | 21,572 | 16,655 |

|---|

| 3/31/21 | 18,101 | 22,941 | 18,530 |

|---|

| 6/30/21 | 18,943 | 24,832 | 19,495 |

|---|

| 9/30/21 | 18,744 | 24,806 | 19,343 |

|---|

| 12/31/21 | 20,144 | 27,108 | 20,846 |

|---|

| 3/31/22 | 20,444 | 25,677 | 20,692 |

|---|

| 6/30/22 | 18,217 | 21,388 | 18,166 |

|---|

| 9/30/22 | 17,032 | 20,434 | 17,145 |

|---|

| 12/31/22 | 19,410 | 21,901 | 19,275 |

|---|

| 3/31/23 | 19,347 | 23,474 | 19,469 |

|---|

| 6/30/23 | 20,120 | 25,442 | 20,262 |

|---|

| 9/30/23 | 19,828 | 24,615 | 19,621 |

|---|

| 12/31/23 | 21,626 | 27,586 | 21,484 |

|---|

| 3/31/24 | 24,122 | 30,350 | 23,415 |

|---|

| 6/30/24 | 23,585 | 31,326 | 22,907 |

|---|

| 9/30/24 | 25,492 | 33,277 | 25,068 |

|---|

| 12/31/24 | 25,033 | 34,154 | 24,571 |

|---|

202501-4140694, 202502-4108734

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 2/26/16 |

|---|

| Integrated U.S. Large-Cap Value Equity Fund (Advisor Class) | 15.75% | 9.67% | 10.93% |

|---|

| Russell 3000 Index (Regulatory Benchmark) | 23.81 | 13.86 | 14.90 |

|---|

| Russell 1000 Value Index (Strategy Benchmark) | 14.37 | 8.68 | 10.70 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$60,814

- Number of Portfolio Holdings151

- Investment Advisory Fees Paid (000s)$(161)

- Portfolio Turnover Rate67.5%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Financials | 24.7% |

| Health Care | 16.7 |

| Industrials & Business Services | 12.9 |

| Consumer Staples | 8.3 |

| Energy | 7.5 |

| Information Technology | 7.1 |

| Utilities | 6.7 |

| Consumer Discretionary | 4.3 |

| Real Estate | 3.9 |

| Other | 7.9 |

Top Ten Holdings (as a % of Net Assets)

| Berkshire Hathaway | 2.4% |

| Bank of America | 2.2 |

| JPMorgan Chase | 2.2 |

| Citigroup | 1.6 |

| Philip Morris International | 1.3 |

| Medtronic | 1.3 |

| Wells Fargo | 1.3 |

| Lowe's | 1.3 |

| UnitedHealth Group | 1.3 |

| Exxon Mobil | 1.2 |

How has the fund changed?

This is a summary of certain material changes Integrated U.S. Large-Cap Value Equity Fund. Effective March 1, 2025, the fund will normally invest at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of large-cap companies with value characteristics. The fund’s March 1, 2025 prospectus contains more information.

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Frank Russell Company "LSE" does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Integrated U.S. Large-Cap Value Equity Fund

Advisor Class (TQVAX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

Integrated U.S. Large-Cap Value Equity Fund

This annual shareholder report contains important information about Integrated U.S. Large-Cap Value Equity Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary. This report describes changes to the fund that occurred during the reporting period.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Integrated U.S. Large-Cap Value Equity Fund - I Class | $58 | 0.54% |

|---|

What drove fund performance during the past 12 months?

Large-cap value stocks in the U.S. posted solid gains in 2024, helped by easing inflation pressures and looser monetary policy from the Federal Reserve.

Relative to the Russell 1000 Value Index, stock selection in the information technology sector—such as Intel and Dell Technologies, both of which we eliminated—made a strong contribution to relative performance. Stock choices among utility companies and real estate companies also contributed materially to relative results.

On the other hand, our stock selection in the industrials and business services sector—such as tool maker Stanley Black & Decker and freight railroad CSX—detracted from relative performance. Stock choices among consumer staples companies and an underweight allocation to the energy sector also detracted.

The fund seeks long-term capital growth by investing primarily in common stocks of U.S. companies that appear to be undervalued by various measures. Our disciplined, long-term-oriented investment approach represents an integration of quantitative and fundamental insights and analysis, and we seek companies with high-quality characteristics, which include a high return on capital employed, good earnings quality, and stability of earnings. Notable changes in positioning during the year include increased exposure to financials and utilities stocks as well as reduced exposure to industrials and business services, information technology, and energy stocks. While we generally keep the fund’s sector allocations close to those of the Russell index, we may take larger positions in sectors in which we find stocks of quality companies that appear inexpensive versus their respective industries and the overall equity universe.

How has the fund performed?

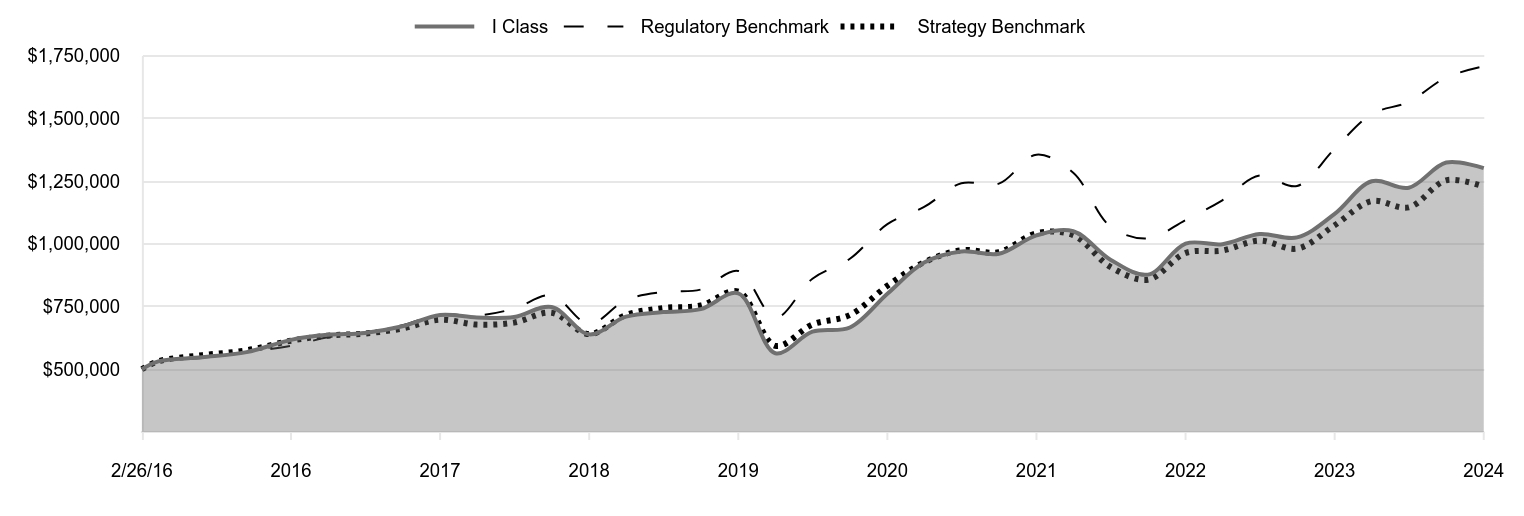

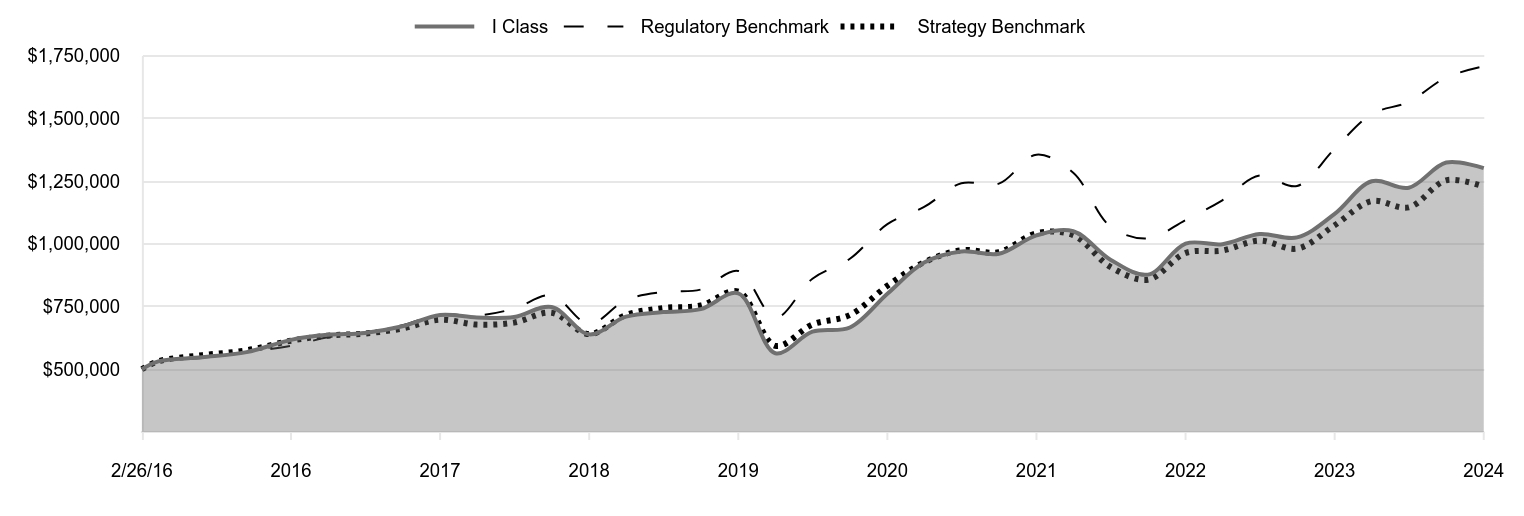

Cumulative Returns of a Hypothetical $500,000 Investment as of December 31, 2024

| I Class | Regulatory Benchmark | Strategy Benchmark |

|---|

| 2/26/16 | 500,000 | 500,000 | 500,000 |

|---|

| 3/31/16 | 531,500 | 531,373 | 531,838 |

|---|

| 6/30/16 | 548,000 | 545,350 | 556,213 |

|---|

| 9/30/16 | 568,500 | 569,334 | 575,574 |

|---|

| 12/31/16 | 617,419 | 593,299 | 614,002 |

|---|

| 3/31/17 | 637,270 | 627,374 | 634,071 |

|---|

| 6/30/17 | 644,905 | 646,292 | 642,597 |

|---|

| 9/30/17 | 671,373 | 675,837 | 662,613 |

|---|

| 12/31/17 | 716,602 | 718,667 | 697,903 |

|---|

| 3/31/18 | 706,554 | 714,035 | 678,128 |

|---|

| 6/30/18 | 708,140 | 741,802 | 686,100 |

|---|

| 9/30/18 | 748,334 | 794,648 | 725,234 |

|---|

| 12/31/18 | 639,341 | 680,996 | 640,205 |

|---|

| 3/31/19 | 709,636 | 776,631 | 716,610 |

|---|

| 6/30/19 | 728,046 | 808,434 | 744,160 |

|---|

| 9/30/19 | 739,762 | 817,833 | 754,247 |

|---|

| 12/31/19 | 802,735 | 892,234 | 810,124 |

|---|

| 3/31/20 | 564,115 | 705,760 | 593,578 |

|---|

| 6/30/20 | 649,833 | 861,221 | 678,404 |

|---|

| 9/30/20 | 666,629 | 940,518 | 716,345 |

|---|

| 12/31/20 | 801,081 | 1,078,602 | 832,772 |

|---|

| 3/31/21 | 925,510 | 1,147,060 | 926,500 |

|---|

| 6/30/21 | 969,948 | 1,241,575 | 974,754 |

|---|

| 9/30/21 | 960,468 | 1,240,312 | 967,151 |

|---|

| 12/31/21 | 1,033,937 | 1,355,383 | 1,042,301 |

|---|

| 3/31/22 | 1,050,377 | 1,283,840 | 1,034,612 |

|---|

| 6/30/22 | 937,119 | 1,069,424 | 908,279 |

|---|

| 9/30/22 | 877,446 | 1,021,678 | 857,257 |

|---|

| 12/31/22 | 1,001,066 | 1,095,055 | 963,734 |

|---|

| 3/31/23 | 998,476 | 1,173,684 | 973,430 |

|---|

| 6/30/23 | 1,039,269 | 1,272,118 | 1,013,093 |

|---|

| 9/30/23 | 1,025,671 | 1,230,726 | 981,029 |

|---|

| 12/31/23 | 1,119,551 | 1,379,297 | 1,074,204 |

|---|

| 3/31/24 | 1,249,747 | 1,517,494 | 1,170,727 |

|---|

| 6/30/24 | 1,223,987 | 1,566,296 | 1,145,369 |

|---|

| 9/30/24 | 1,324,245 | 1,663,863 | 1,253,377 |

|---|

| 12/31/24 | 1,301,624 | 1,707,677 | 1,228,548 |

|---|

202501-4140694, 202502-4108734

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 2/26/16 |

|---|

| Integrated U.S. Large-Cap Value Equity Fund (I Class) | 16.26% | 10.15% | 11.42% |

|---|

| Russell 3000 Index (Regulatory Benchmark) | 23.81 | 13.86 | 14.90 |

|---|

| Russell 1000 Value Index (Strategy Benchmark) | 14.37 | 8.68 | 10.70 |

|---|

The preceding line graph shows the value of a hypothetical $500,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$60,814

- Number of Portfolio Holdings151

- Investment Advisory Fees Paid (000s)$(161)

- Portfolio Turnover Rate67.5%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Financials | 24.7% |

| Health Care | 16.7 |

| Industrials & Business Services | 12.9 |

| Consumer Staples | 8.3 |

| Energy | 7.5 |

| Information Technology | 7.1 |

| Utilities | 6.7 |

| Consumer Discretionary | 4.3 |

| Real Estate | 3.9 |

| Other | 7.9 |

Top Ten Holdings (as a % of Net Assets)

| Berkshire Hathaway | 2.4% |

| Bank of America | 2.2 |

| JPMorgan Chase | 2.2 |

| Citigroup | 1.6 |

| Philip Morris International | 1.3 |

| Medtronic | 1.3 |

| Wells Fargo | 1.3 |

| Lowe's | 1.3 |

| UnitedHealth Group | 1.3 |

| Exxon Mobil | 1.2 |

How has the fund changed?

This is a summary of certain material changes Integrated U.S. Large-Cap Value Equity Fund. Effective March 1, 2025, the fund will normally invest at least 80% of its net assets (plus any borrowings for investment purposes) in equity securities of large-cap companies with value characteristics. The fund’s March 1, 2025 prospectus contains more information.

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

Frank Russell Company "LSE" does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Integrated U.S. Large-Cap Value Equity Fund

I Class (TQVIX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors has determined that Mr. Paul F. McBride qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. McBride is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

| | | | | | | | | | | | | | |

| | | | 2024 | | | | | | 2023 | |

| | Audit Fees | | $ | 23,525 | | | | | | | $ | 23,064 | |

| | Audit-Related Fees | | | - | | | | | | | | - | |

| | Tax Fees | | | - | | | | | | | | - | |

| | All Other Fees | | | - | | | | | | | | - | |

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,262,000 and $1,524,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a – b) Report pursuant to Regulation S-X.

Financial

Highlights

Portfolio

of

Investments

Financial

Statements

and

Notes

Additional

Fund

Information

Financial

Statements

and

Other

Information

For

more

insights

from

T.

Rowe

Price

investment

professionals,

go

to

troweprice.com

.

T.

ROWE

PRICE

TQMVX

Integrated

U.S.

Large-

Cap

Value

Equity

Fund

TQVAX

Integrated

U.S.

Large-

Cap

Value

Equity

Fund–

.

Advisor Class

TQVIX

Integrated

U.S.

Large-

Cap

Value

Equity

Fund–

.

I Class

T.

ROWE

PRICE

Integrated

U.S.

Large-Cap

Value

Equity

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Investor

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

15.99

$

15.38

$

16.91

$

13.46

$

13.84

Investment

activities

Net

investment

income

(1)(2)

0.28

0.29

0.32

0.27

0.33

Net

realized

and

unrealized

gain/loss

2.32

1.50

(0.91)

3.61

(0.40)

Total

from

investmen

t

activities

2.60

1.79

(0.59)

3.88

(0.07)

Distributions

Net

investment

income

(0.26)

(0.30)

(0.33)

(0.28)

(0.27)

Net

realized

gain

(1.15)

(0.88)

(0.61)

(0.15)

(0.04)

Total

distributions

(1.41)

(1.18)

(0.94)

(0.43)

(0.31)

NET

ASSET

VALUE

End

of

period

$

17.18

$

15.99

$

15.38

$

16.91

$

13.46

Ratios/Supplemental

Data

Total

return

(2)(3)

16.08%

11.68%

(3.44)%

28.89%

(0.50)%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

1.68%

1.84%

1.50%

1.52%

2.17%

Net

expenses

after

waivers/

payments

by

Price

Associates

0.72%

0.73%

0.71%

0.73%

0.72%

Net

investment

income

1.59%

1.83%

1.94%

1.65%

2.81%

Portfolio

turnover

rate

67.5%

64.0%

74.6%

41.5%

40.8%

Net

assets,

end

of

period

(in

thousands)

$22,635

$19,666

$21,950

$37,863

$19,557

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Integrated

U.S.

Large-Cap

Value

Equity

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Advisor

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

16.11

$

15.32

$

16.83

$

13.41

$

13.81

Investment

activities

Net

investment

income

(1)(2)

0.24

0.24

0.27

0.22

0.29

Net

realized

and

unrealized

gain/loss

2.33

1.50

(0.89)

3.59

(0.38)

Total

from

investment

activities

2.57

1.74

(0.62)

3.81

(0.09)

Distributions

Net

investment

income

(0.21)

(0.07)

(0.28)

(0.24)

(0.27)

Net

realized

gain

(1.15)

(0.88)

(0.61)

(0.15)

(0.04)

Total

distributions

(1.36)

(0.95)

(0.89)

(0.39)

(0.31)

NET

ASSET

VALUE

End

of

period

$

17.32

$

16.11

$

15.32

$

16.83

$

13.41

Ratios/Supplemental

Data

Total

return

(2)(3)

15.75%

11.41%

(3.64)%

28.47%

(0.64)%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

2.33%

1.86%

1.59%

1.79%

2.32%

Net

expenses

after

waivers/payments

by

Price

Associates

0.99%

1.00%

0.98%

1.00%

0.99%

Net

investment

income

1.33%

1.54%

1.69%

1.37%

2.46%

Portfolio

turnover

rate

67.5%

64.0%

74.6%

41.5%

40.8%

Net

assets,

end

of

period

(in

thousands)

$107

$97

$268

$186

$148

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Integrated

U.S.

Large-Cap

Value

Equity

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

I

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

16.08

$

15.46

$

16.98

$

13.52

$

13.86

Investment

activities

Net

investment

income

(1)(2)

0.33

0.32

0.35

0.29

0.36

Net

realized

and

unrealized

gain/loss

2.32

1.50

(0.89)

3.63

(0.39)

Total

from

investment

activities

2.65

1.82

(0.54)

3.92

(0.03)

Distributions

Net

investment

income

(0.31)

(0.32)

(0.37)

(0.31)

(0.27)

Net

realized

gain

(1.15)

(0.88)

(0.61)

(0.15)

(0.04)

Total

distributions

(1.46)

(1.20)

(0.98)

(0.46)

(0.31)

NET

ASSET

VALUE

End

of

period

$

17.27

$

16.08

$

15.46

$

16.98

$

13.52

Ratios/Supplemental

Data

Total

return

(2)(3)

16.26%

11.84%

(3.18)%

29.07%

(0.21)%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

1.39%

1.55%

1.30%

1.37%

1.99%

Net

expenses

after

waivers/payments

by

Price

Associates

0.54%

0.54%

0.53%

0.54%

0.54%

Net

investment

income

1.81%

2.01%

2.16%

1.81%

2.99%

Portfolio

turnover

rate

67.5%

64.0%

74.6%

41.5%

40.8%

Net

assets,

end

of

period

(in

thousands)

$38,072

$11,832

$14,538

$2,526

$1,224

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Integrated

U.S.

Large-Cap

Value

Equity

Fund

December

31,

2024

Shares

$

Value

(Cost

and

value

in

$000s)

‡

COMMON

STOCKS

98.8%

COMMUNICATION

SERVICES

3.4%

Diversified

Telecommunication

Services

0.8%

AT&T

9,855

225

Verizon

Communications

6,684

267

492

Media

2.4%

Charter

Communications,

Class

A (1)

2,070

710

Comcast,

Class

A

11,707

439

Fox,

Class

B

3,973

182

Nexstar

Media

Group

785

124

1,455

Wireless

Telecommunication

Services

0.2%

T-Mobile

U.S.

550

121

121

Total

Communication

Services

2,068

CONSUMER

DISCRETIONARY

4.3%

Hotels,

Restaurants

&

Leisure

1.0%

Las

Vegas

Sands

6,175

317

Travel

+

Leisure

5,357

270

587

Household

Durables

0.8%

Lennar,

Class

A

1,672

228

Toll

Brothers

2,261

285

513

Specialty

Retail

1.8%

Bath

&

Body

Works

5,438

211

Home

Depot

268

104

Lowe's

3,089

762

1,077

Textiles,

Apparel

&

Luxury

Goods

0.7%

Tapestry

6,755

441

441

Total

Consumer

Discretionary

2,618

CONSUMER

STAPLES

8.3%

Beverages

0.5%

Molson

Coors

Beverage,

Class

B

5,061

290

290

T.

ROWE

PRICE

Integrated

U.S.

Large-Cap

Value

Equity

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

Consumer

Staples

Distribution

&

Retail

1.1%

Target

1,301

176

Walmart

5,631

509

685

Food

Products

1.2%

Archer-Daniels-Midland

4,409

223

Bunge

Global

2,619

203

Pilgrim's

Pride (1)

7,053

320

746

Household

Products

2.8%

Colgate-Palmolive

3,516

319

Kimberly-Clark

5,492

720

Procter

&

Gamble

3,806

638

1,677

Personal

Care

Products

1.1%

Kenvue

32,478

693

693

Tobacco

1.6%

Altria

Group

3,490

183

Philip

Morris

International

6,758

813

996

Total

Consumer

Staples

5,087

ENERGY

7.5%

Energy

Equipment

&

Services

0.7%

TechnipFMC

14,499

420

420

Oil,

Gas

&

Consumable

Fuels

6.8%

BP,

ADR

11,342

335

Chevron

1,931

280

ConocoPhillips

4,903

486

Devon

Energy

6,230

204

Exxon

Mobil

6,932

746

Kinder

Morgan

17,739

486

Marathon

Petroleum

3,237

452

Shell,

ADR

1,940

121

Suncor

Energy

11,017

393

TotalEnergies

,

ADR (2)

5,955

324

Valero

Energy

2,306

283

4,110

Total

Energy

4,530

T.

ROWE

PRICE

Integrated

U.S.

Large-Cap

Value

Equity

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

FINANCIALS

24.7%

Banks

9.2%

Bank

of

America

30,533

1,342

Citigroup

14,179

998

Credicorp

1,269

233

Huntington

Bancshares

21,589

351

JPMorgan

Chase

5,450

1,306

KeyCorp

22,541

386

Webster

Financial

3,510

194

Wells

Fargo

10,961

770

5,580

Capital

Markets

2.5%

Affiliated

Managers

Group

939

174

Bank

of

New

York

Mellon

9,152

703

Morgan

Stanley

1,565

197

State

Street

4,672

458

1,532

Consumer

Finance

1.7%

Ally

Financial

2,939

106

Capital

One

Financial

593

106

OneMain

Holdings

5,531

288

Synchrony

Financial

8,614

560

1,060

Financial

Services

6.6%

Berkshire

Hathaway,

Class

B (1)

3,187

1,444

Corebridge

Financial

15,703

470

Corpay

(1)

1,128

382

Equitable

Holdings

11,979

565

Fidelity

National

Information

Services

3,026

244

Fiserv (1)

2,147

441

Global

Payments

4,039

453

3,999

Insurance

4.7%

Chubb

2,402

664

Everest

Group

742

269

Hartford

Financial

Services

Group

6,008

657

MetLife

6,290

515

RenaissanceRe

Holdings

2,335

581

Unum

Group

2,529

185

2,871

Total

Financials

15,042

T.

ROWE

PRICE

Integrated

U.S.

Large-Cap

Value

Equity

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

HEALTH

CARE

16.7%

Biotechnology

2.0%

AbbVie

1,544

275

Biogen (1)

3,238

495

Gilead

Sciences

4,926

455

1,225

Health

Care

Equipment

&

Supplies

3.9%

Becton

Dickinson

&

Company

2,894

656

Hologic

(1)

7,236

522

Medtronic

9,670

772

Zimmer

Biomet

Holdings

4,048

428

2,378

Health

Care

Providers

&

Services

6.3%

Cardinal

Health

5,664

670

Cencora

1,454

327

Centene

(1)

3,361

203

Cigna

Group

1,991

550

Elevance

Health

934

344

McKesson

784

447

Tenet

Healthcare (1)

4,295

542

UnitedHealth

Group

1,502

760

3,843

Life

Sciences

Tools

&

Services

1.7%

ICON (1)

1,928

404

Thermo

Fisher

Scientific

1,156

602

1,006

Pharmaceuticals

2.8%

Bristol-Myers

Squibb

2,613

148

Johnson

&

Johnson

3,185

461

Sanofi,

ADR

7,808

376

Viatris

55,985

697

1,682

Total

Health

Care

10,134

INDUSTRIALS

&

BUSINESS

SERVICES

12.9%

Aerospace

&

Defense

0.6%

Textron

4,499

344

344

Air

Freight

&

Logistics

2.1%

FedEx

2,407

677

T.

ROWE

PRICE

Integrated

U.S.

Large-Cap

Value

Equity

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

United

Parcel

Service,

Class

B

4,772

602

1,279

Building

Products

1.1%

Builders

FirstSource

(1)

1,480

211

Masco

3,537

257

Owens

Corning

996

170

638

Ground

Transportation

1.6%

Canadian

National

Railway

2,494

253

CSX

22,490

726

979

Industrial

Conglomerates

2.0%

3M

4,320

558

Honeywell

International

841

190

Siemens,

ADR

4,582

443

1,191

Machinery

2.6%

Allison

Transmission

Holdings

2,135

231

Cummins

1,483

517

Dover

1,352

253

Fortive

2,485

186

Stanley

Black

&

Decker

4,878

392

1,579

Professional

Services

2.9%

Booz

Allen

Hamilton

Holding

3,449

444

Leidos

Holdings

4,624

666

SS&C

Technologies

Holdings

8,857

671

1,781

Total

Industrials

&

Business

Services

7,791

INFORMATION

TECHNOLOGY

7.1%

Communications

Equipment

0.4%

Cisco

Systems

3,697

219

219

Electronic

Equipment,

Instruments

&

Components

1.7%

Flex (1)

5,339

205

Jabil

1,677

241

TD

SYNNEX

1,940

228

TE

Connectivity

2,421

346

1,020

T.

ROWE

PRICE

Integrated

U.S.

Large-Cap

Value

Equity

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

IT

Services

1.2%

Accenture,

Class

A

450

159

GoDaddy

,

Class

A (1)

3,011

594

753

Semiconductors

&

Semiconductor

Equipment

2.6%

Analog

Devices

1,700

361

Applied

Materials

1,325

216

NXP

Semiconductors

1,550

322

QUALCOMM

4,353

669

1,568

Software

1.2%

Gen

Digital

10,730

294

Salesforce

1,359

454

748

Total

Information

Technology

4,308

MATERIALS

3.3%

Chemicals

1.0%

CF

Industries

Holdings

3,286

280

RPM

International

2,864

353

633

Containers

&

Packaging

0.9%

Berry

Global

Group

2,366

153

International

Paper

6,779

365

518

Metals

&

Mining

1.4%

Nucor

1,319

154

Reliance

794

214

Steel

Dynamics

3,997

456

824

Total

Materials

1,975

REAL

ESTATE

3.9%

Health

Care

Real

Estate

Investment

Trusts

0.6%

Ventas,

REIT

5,933

349

349

Hotel

&

Resort

Real

Estate

Investment

Trusts

0.2%

Host

Hotels

&

Resorts,

REIT

7,483

131

131

T.

ROWE

PRICE

Integrated

U.S.

Large-Cap

Value

Equity

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

Industrial

Real

Estate

Investment

Trusts

0.5%

Prologis,

REIT

2,820

298

298

Office

Real

Estate

Investment

Trusts

0.8%

BXP,

REIT

2,916

217

Vornado

Realty

Trust,

REIT

7,109

299

516

Residential

Real

Estate

Investment

Trusts

0.5%

AvalonBay

Communities,

REIT

817

180

Essex

Property

Trust,

REIT

515

147

327

Specialized

Real

Estate

Investment

Trusts

1.3%

Gaming

&

Leisure

Properties,

REIT

3,065

148

Lamar

Advertising,

Class

A,

REIT

3,691

449

VICI

Properties,

REIT

6,251

183

780

Total

Real

Estate

2,401

UTILITIES

6.7%

Electric

Utilities

4.5%

Constellation

Energy

1,175

263

Entergy

6,980

529

Evergy

6,663

410

FirstEnergy

5,833

232

PG&E

29,772

601

Xcel

Energy

10,655

719

2,754

Independent

Power

&

Renewable

Electricity

Producers

0.5%

Vistra

2,270

313

313

Multi-Utilities

1.7%

Ameren

4,535

404

Dominion

Energy

5,730

309

NiSource

9,041

332

1,045

Total

Utilities

4,112

Total

Common

Stocks

(Cost

$53,130)

60,066

T.

ROWE

PRICE

Integrated

U.S.

Large-Cap

Value

Equity

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

‡

EQUITY

MUTUAL

FUNDS

1.0%

iShares

Russell

1000

Value

ETF (2)

3,430

635

Total

Equity

Mutual

Funds

(Cost

$640)

635

SHORT-TERM

INVESTMENTS

0.5%

Money

Market

Funds

0.5%

T.

Rowe

Price

Government

Reserve

Fund,

4.53% (3)(4)

315,409

315

Total

Short-Term

Investments

(Cost

$315)

315

SECURITIES

LENDING

COLLATERAL

1.0%

INVESTMENTS

IN

A

POOLED

ACCOUNT

THROUGH

SECURITIES

LENDING

PROGRAM

WITH

STATE

STREET

BANK

AND

TRUST

COMPANY 1.0%

Money

Market

Funds 1.0%

T.

Rowe

Price

Government

Reserve

Fund,

4.53% (3)(4)

604,928

605

Total

Investments

in

a

Pooled

Account

through

Securities

Lending

Program

with

State

Street

Bank

and

Trust

Company

605

Total

Securities

Lending

Collateral

(Cost

$605)

605

Total

Investments

in

Securities

101.3%

of

Net

Assets

(Cost

$54,690)

$

61,621

‡

Shares

are

denominated

in

U.S.

dollars

unless

otherwise

noted.

(1)

Non-income

producing

(2)

See

Note

3

.

All

or

a

portion

of

this

security

is

on

loan

at

December

31,

2024.

(3)

Seven-day

yield

(4)

Affiliated

Companies

ADR

American

Depositary

Receipts

ETF

Exchange-Traded

Fund

REIT

A

domestic

Real

Estate

Investment

Trust

whose

distributions

pass-through

with

original

tax

character

to

the

shareholder

T.

ROWE

PRICE

Integrated

U.S.

Large-Cap

Value

Equity

Fund

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

AFFILIATED

COMPANIES

($000s)

The

fund

may

invest

in

certain

securities

that

are

considered

affiliated

companies.

As

defined

by

the

1940

Act,

an

affiliated

company

is

one

in

which

the

fund

owns

5%

or

more

of

the

outstanding

voting

securities,

or

a

company

that

is

under

common

ownership

or

control.

The

following

securities

were

considered

affiliated

companies

for

all

or

some

portion

of

the

year

ended

December

31,

2024.

Net

realized

gain

(loss),

investment

income,

change

in

net

unrealized

gain/loss,

and

purchase

and

sales

cost

reflect

all

activity

for

the

period

then

ended.

Affiliate

Net

Realized

Gain

(Loss)

Change

in

Net

Unrealized

Gain/Loss

Investment

Income

T.

Rowe

Price

Government

Reserve

Fund,

4.53%

$

—

$

—

$

9++

Totals

$

—#

$

—

$

9+

Supplementary

Investment

Schedule

Affiliate

Value

12/31/23

Purchase

Cost

Sales

Cost

Value

12/31/24

T.

Rowe

Price

Government

Reserve

Fund,

4.53%

$

251

¤

¤

$

920

Total

$

920^

#

Capital

gain

distributions

from

underlying

Price

funds

represented

$0

of

the

net

realized

gain

(loss).

++

Excludes

earnings

on

securities

lending

collateral,

which

are

subject

to

rebates

and

fees

as

described

in

Note

3.

+

Investment

income

comprised

$9

of

dividend

income

and

$0

of

interest

income.

¤

Purchase

and

sale

information

not

shown

for

cash

management

funds.

^

The

cost

basis

of

investments

in

affiliated

companies

was

$920.

T.

ROWE

PRICE

Integrated

U.S.

Large-Cap

Value

Equity

Fund

December

31,

2024

Statement

of

Assets

and

Liabilities

($000s,

except

shares

and

per

share

amounts)

Assets

Investments

in

securities,

at

value

(cost

$54,690)

$

61,621

Receivable

for

investment

securities

sold

666

Receivable

for

shares

sold

119

Dividends

receivable

54

Due

from

affiliates

9

Cash

1

Other

assets

26

Total

assets

62,496

Liabilities

Payable

for

investment

securities

purchased

790

Obligation

to

return

securities

lending

collateral

605

Payable

for

shares

redeemed

232

Investment

management

fees

payable

19

Other

liabilities

36

Total

liabilities

1,682

Commitments

and

Contingent

Liabilities

(note

6

)

NET

ASSETS

$

60,814

T.

ROWE

PRICE

Integrated

U.S.

Large-Cap

Value

Equity

Fund

December

31,

2024

Statement

of

Assets

and

Liabilities

($000s,

except

shares

and

per

share

amounts)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Net

Assets

Consist

of:

Total

distributable

earnings

(loss)

$

6,846

Paid-in

capital

applicable

to

3,527,409

shares

of

$0.0001

par

value

capital

stock

outstanding;

1,000,000,000

shares

authorized

53,968

NET

ASSETS

$

60,814

NET

ASSET

VALUE

PER

SHARE

Investor

Class

(Net

assets:

$22,635;

Shares

outstanding:

1,317,337)

$

17.18

Advisor

Class

(Net

assets:

$107;

Shares

outstanding:

6,155)

$

17.32

I

Class

(Net

assets:

$38,072;

Shares

outstanding:

2,203,917)

$

17.27

T.

ROWE

PRICE

Integrated

U.S.

Large-Cap

Value

Equity

Fund

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Year

Ended

12/31/24

Investment

Income

(Loss)

Income

Dividend

(net

of

foreign

taxes

of

$10)

$

867

Securities

lending

1

Total

income

868

Expenses

Investment

management

180

Shareholder

servicing

Investor

Class

$

65

Advisor

Class

1

I

Class

7

73

Prospectus

and

shareholder

reports

Investor

Class

9

I

Class

4

13

Custody

and

accounting

200

Registration

71

Legal

and

audit

29

Miscellaneous

16

Waived

/

paid

by

Price

Associates

(

341

)

Total

expenses

241

Net

investment

income

627

Realized

and

Unrealized

Gain

/

Loss

–

Net

realized

gain

on

securities

2,886

Change

in

net

unrealized

gain

/

loss

on

securities

1,534

Net

realized

and

unrealized

gain

/

loss

4,420

INCREASE

IN

NET

ASSETS

FROM

OPERATIONS

$

5,047

T.

ROWE

PRICE

Integrated

U.S.

Large-Cap

Value

Equity

Fund

Statement

of

Changes

in

Net

Assets

Year

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Ended

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12/31/24

12/31/23

Increase

(Decrease)

in

Net

Assets

Operations

Net

investment

income

$

627

$

599

Net

realized

gain

2,886

2,130

Change

in

net

unrealized

gain

/

loss

1,534

684

Increase

in

net

assets

from

operations

5,047

3,413

Distributions

to

shareholders

Net

earnings

Investor

Class

(1,722)

(1,365)

Advisor

Class

(8)

(6)

I

Class

(1,411)

(819)

Decrease

in

net

assets

from

distributions

(3,141)

(2,190)

Capital

share

transactions

*

Shares

sold

Investor

Class

12,668

7,159

I

Class

31,525

5,098

Distributions

reinvested

Investor

Class

1,710

1,343

Advisor

Class

8

6

I

Class

1,363

772

Shares

redeemed

Investor

Class

(12,790)

(11,576)

Advisor

Class

(6)

(185)

I

Class

(7,165)

(9,001)

Increase

(decrease)

in

net

assets

from

capital

share

transactions

27,313

(6,384)

T.

ROWE

PRICE

Integrated

U.S.

Large-Cap

Value

Equity

Fund

Statement

of

Changes

in

Net

Assets

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Year

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Ended

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12/31/24

12/31/23

Net

Assets

Increase

(decrease)

during

period

29,219

(5,161)

Beginning

of

period

31,595

36,756

End

of

period

$

60,814

$

31,595

*Share

information

(000s)

Shares

sold

Investor

Class

709

452

I

Class

1,788

317

Distributions

reinvested

Investor

Class

97

85

Advisor

Class

–

(1)

–

(1)

I

Class

77

48

Shares

redeemed

Investor

Class

(719)

(734)

Advisor

Class

–

(1)

(11)

I

Class

(397)

(569)

Increase

(decrease)

in

shares

outstanding

1,555

(412)

(1)

Amount

rounds

to

less

than

1,000

shares

T.

ROWE

PRICE

Integrated

U.S.

Large-Cap

Value

Equity

Fund

NOTES

TO

FINANCIAL

STATEMENTS

T.

Rowe

Price

Integrated

Equity

Funds,

Inc. (the

corporation) is

registered

under

the

Investment

Company

Act

of

1940

(the

1940

Act).

The

Integrated

U.S.

Large-Cap

Value

Equity

Fund

(the

fund)

is a

diversified, open-end

management

investment

company

established

by

the

corporation. The

fund

seeks long-term

growth

of

capital.

The

fund

has three classes

of

shares:

the

Integrated

U.S.

Large-Cap

Value

Equity

Fund

(Investor

Class),

the

Integrated

U.S.

Large-Cap

Value

Equity

Fund–Advisor

Class

(Advisor

Class)

and

the

Integrated

U.S.

Large-Cap

Value

Equity

Fund–I

Class

(I

Class).

Advisor

Class

shares

are

sold

only

through

various

brokers

and

other

financial

intermediaries.

I

Class

shares

require

a

$500,000

initial

investment

minimum,

although

the

minimum

generally

is

waived

or

reduced

for

financial

intermediaries,

eligible

retirement

plans,

and

certain

other

accounts.

The

Advisor

Class

operates

under

a

Board-approved

Rule

12b-1

plan

pursuant

to

which

the

class

compensates

financial

intermediaries

for

distribution,

shareholder

servicing,

and/or

certain

administrative

services;

the

Investor

and

I

Classes

do

not

pay

Rule

12b-1

fees. Each

class

has

exclusive

voting

rights

on

matters

related

solely

to

that

class;

separate

voting

rights

on

matters

that

relate

to

all

classes;

and,

in

all

other

respects,

the

same

rights

and

obligations

as

the

other

classes.

NOTE

1

-

SIGNIFICANT

ACCOUNTING

POLICIES

Basis

of

Preparation

The fund

is

an

investment

company

and

follows

accounting

and

reporting

guidance

in

the

Financial

Accounting

Standards

Board

(FASB)

Accounting

Standards

Codification

Topic

946

(ASC

946).

The

accompanying

financial

statements

were

prepared

in

accordance

with

accounting

principles

generally

accepted

in

the

United

States

of

America

(GAAP),

including,

but

not

limited

to,

ASC

946.

GAAP

requires

the

use

of

estimates

made

by

management.

Management

believes

that

estimates

and

valuations

are

appropriate;

however,

actual

results

may

differ

from

those

estimates,

and

the

valuations

reflected

in

the

accompanying

financial

statements

may

differ

from

the

value

ultimately

realized

upon

sale

or

maturity.

Investment

Transactions,

Investment

Income,

and

Distributions

Investment

transactions

are

accounted

for

on

the

trade

date

basis.

Income

and

expenses

are

recorded

on

the

accrual

basis.

Realized

gains

and

losses

are

reported

on

the

identified

cost

basis. Income

tax-related

interest

and

penalties,

if

incurred,

are

recorded

as

income

tax

expense. Dividends

received

from other

investment

companies are

reflected

as

dividend income;

capital

gain

distributions

are

T.

ROWE

PRICE

Integrated

U.S.

Large-Cap

Value

Equity

Fund

reflected

as

realized

gain/loss. Dividend

income and

capital

gain

distributions

are

recorded

on

the

ex-dividend

date. Distributions

from

REITs

are

initially

recorded

as

dividend

income

and,

to

the

extent

such

represent

a

return

of

capital

or

capital

gain

for

tax

purposes,

are

reclassified

when

such

information

becomes

available. Non-cash

dividends,

if

any,

are

recorded

at

the

fair

market

value

of

the

asset

received. Proceeds

from

litigation

payments,

if

any,

are

included

in

either

net

realized

gain

(loss)

or

change

in

net

unrealized

gain/loss

from

securities. Distributions

to

shareholders

are

recorded

on

the

ex-dividend

date. Income

distributions,

if

any,

are

declared

and

paid

by

each

class annually. A

capital

gain

distribution,

if

any, may

also

be

declared

and

paid

by

the

fund

annually.

Class

Accounting

Shareholder

servicing,

prospectus,

and

shareholder

report

expenses

incurred

by

each

class

are

charged

directly

to

the

class

to

which

they

relate.

Expenses

common

to

all

classes,

investment

income,

and

realized

and

unrealized

gains

and

losses

are

allocated

to

the

classes

based

upon

the

relative

daily

net

assets

of

each

class.

The

Advisor

Class

pays

Rule

12b-1

fees,

in

an

amount

not

exceeding

0.25%

of

the

class’s

average

daily

net

assets;

during

the

year

ended

December

31,

2024,

the

Advisor