UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-08203

T. Rowe Price Integrated Equity Funds, Inc.

(Exact name of registrant as specified in charter)

100 East Pratt Street, Baltimore, MD 21202

(Address of principal executive offices)

David Oestreicher

100 East Pratt Street, Baltimore, MD 21202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Reports to Shareholders

(a) Report pursuant to Rule 30e-1

Annual Shareholder Report

December 31, 2024

Integrated Global Equity Fund

This annual shareholder report contains important information about Integrated Global Equity Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary. This report describes changes to the fund that occurred during the reporting period.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Integrated Global Equity Fund - Investor Class | $81 | 0.74% |

|---|

What drove fund performance during the past 12 months?

Global stocks produced strong gains in 2024, helped by easing inflation pressures in many economies and looser monetary policies from various central banks around the world. Benefiting from the strength in the U.S. dollar, U.S. stocks generally outperformed non-U.S. equity markets.

Relative to the MSCI All Country World Index Net, stock selection in the utilities sector—such as Vistra, an integrated retail electricity and power generation company that serves close to half of the states in the U.S.—contributed the most to relative performance. Stock choices among consumer staples and materials companies contributed to a lesser degree.

On the other hand, our stock selection in the communication services sector and an average underweight allocation to this strong-performing sector—such as underweighting Facebook’s parent company Meta Platforms—detracted from relative results. An average underweight in the information technology sector and stock choices among financials companies also detracted.

The fund seeks long-term capital growth by investing primarily in common stocks in the U.S. and in non-U.S. countries, including emerging markets. Our disciplined, long-term-oriented investment approach represents an integration of quantitative and fundamental insights and analysis. Notable changes in positioning during the year were focused on maintaining a broadly diversified global portfolio of stocks in which we have high conviction while staying fully invested and generally keeping the fund’s sector and country allocations in line with those of the MSCI index.

How has the fund performed?

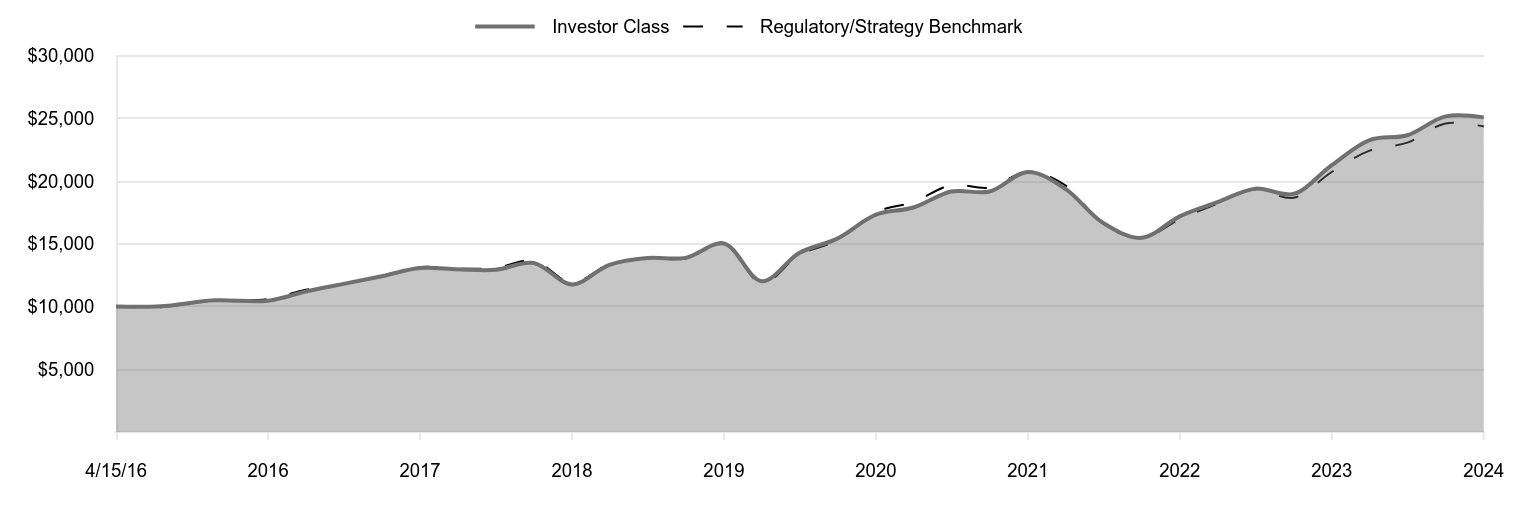

Cumulative Returns of a Hypothetical $10,000 Investment as of December 31, 2024

| Investor Class | Regulatory/Strategy Benchmark |

|---|

| 4/15/16 | 10,000 | 10,000 |

|---|

| 6/30/16 | 10,020 | 9,955 |

|---|

| 9/30/16 | 10,500 | 10,482 |

|---|

| 12/31/16 | 10,470 | 10,607 |

|---|

| 3/31/17 | 11,200 | 11,340 |

|---|

| 6/30/17 | 11,809 | 11,824 |

|---|

| 9/30/17 | 12,418 | 12,437 |

|---|

| 12/31/17 | 13,077 | 13,150 |

|---|

| 3/31/18 | 12,974 | 13,023 |

|---|

| 6/30/18 | 12,933 | 13,093 |

|---|

| 9/30/18 | 13,478 | 13,653 |

|---|

| 12/31/18 | 11,770 | 11,912 |

|---|

| 3/31/19 | 13,329 | 13,362 |

|---|

| 6/30/19 | 13,873 | 13,845 |

|---|

| 9/30/19 | 13,884 | 13,841 |

|---|

| 12/31/19 | 15,026 | 15,080 |

|---|

| 3/31/20 | 12,023 | 11,858 |

|---|

| 6/30/20 | 14,284 | 14,137 |

|---|

| 9/30/20 | 15,440 | 15,286 |

|---|

| 12/31/20 | 17,332 | 17,531 |

|---|

| 3/31/21 | 17,900 | 18,333 |

|---|

| 6/30/21 | 19,175 | 19,688 |

|---|

| 9/30/21 | 19,175 | 19,480 |

|---|

| 12/31/21 | 20,738 | 20,781 |

|---|

| 3/31/22 | 19,389 | 19,667 |

|---|

| 6/30/22 | 16,668 | 16,587 |

|---|

| 9/30/22 | 15,481 | 15,456 |

|---|

| 12/31/22 | 17,197 | 16,965 |

|---|

| 3/31/23 | 18,319 | 18,204 |

|---|

| 6/30/23 | 19,402 | 19,329 |

|---|

| 9/30/23 | 18,985 | 18,671 |

|---|

| 12/31/23 | 21,270 | 20,731 |

|---|

| 3/31/24 | 23,272 | 22,431 |

|---|

| 6/30/24 | 23,662 | 23,074 |

|---|

| 9/30/24 | 25,166 | 24,600 |

|---|

| 12/31/24 | 25,085 | 24,357 |

|---|

202501-4140694, 202502-4108710

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 4/15/16 |

|---|

| Integrated Global Equity Fund (Investor Class) | 17.94% | 10.79% | 11.13% |

|---|

| MSCI All Country World Index Net (Regulatory/Strategy Benchmark) | 17.49 | 10.06 | 10.76 |

|---|

The preceding line graph shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$61,407

- Number of Portfolio Holdings287

- Investment Advisory Fees Paid (000s)$(102)

- Portfolio Turnover Rate48.5%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Information Technology | 25.4% |

| Financials | 16.5 |

| Consumer Discretionary | 11.3 |

| Industrials & Business Services | 11.0 |

| Health Care | 9.0 |

| Communication Services | 8.0 |

| Consumer Staples | 6.6 |

| Energy | 3.5 |

| Utilities | 3.3 |

| Other | 5.4 |

Top Ten Holdings (as a % of Net Assets)

| Apple | 4.7% |

| Microsoft | 4.2 |

| NVIDIA | 3.8 |

| Amazon.com | 2.3 |

| Alphabet | 2.2 |

| Meta Platforms | 1.5 |

| Taiwan Semiconductor Manufacturing | 1.3 |

| Tesla | 1.1 |

| Visa | 0.9 |

| Mastercard | 0.9 |

How has the fund changed?

This is a summary of certain material changes to Integrated Global Equity Fund. The fund invests in at least five countries, including the U.S., and the fund will typically invest at least 25% of its net assets in securities of foreign issuers. The fund’s March 1, 2025 prospectus contains more information.

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

MSCI does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Integrated Global Equity Fund

Investor Class (TQGEX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Annual Shareholder Report

December 31, 2024

Integrated Global Equity Fund

This annual shareholder report contains important information about Integrated Global Equity Fund (the "fund") for the period of January 1, 2024 to December 31, 2024. You can find the fund’s prospectus, financial information on Form N‑CSR (which includes required tax information for dividends), holdings, proxy voting information, and other information atwww.troweprice.com/prospectus. You can also request this information without charge by contacting T. Rowe Price at 1‑800‑638‑5660 or info@troweprice.com or contacting your intermediary. This report describes changes to the fund that occurred during the reporting period.

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

| | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Integrated Global Equity Fund - I Class | $63 | 0.58% |

|---|

What drove fund performance during the past 12 months?

Global stocks produced strong gains in 2024, helped by easing inflation pressures in many economies and looser monetary policies from various central banks around the world. Benefiting from the strength in the U.S. dollar, U.S. stocks generally outperformed non-U.S. equity markets.

Relative to the MSCI All Country World Index Net, stock selection in the utilities sector—such as Vistra, an integrated retail electricity and power generation company that serves close to half of the states in the U.S.—contributed the most to relative performance. Stock choices among consumer staples and materials companies contributed to a lesser degree.

On the other hand, our stock selection in the communication services sector and an average underweight allocation to this strong-performing sector—such as underweighting Facebook’s parent company Meta Platforms—detracted from relative results. An average underweight in the information technology sector and stock choices among financials companies also detracted.

The fund seeks long-term capital growth by investing primarily in common stocks in the U.S. and in non-U.S. countries, including emerging markets. Our disciplined, long-term-oriented investment approach represents an integration of quantitative and fundamental insights and analysis. Notable changes in positioning during the year were focused on maintaining a broadly diversified global portfolio of stocks in which we have high conviction while staying fully invested and generally keeping the fund’s sector and country allocations in line with those of the MSCI index.

How has the fund performed?

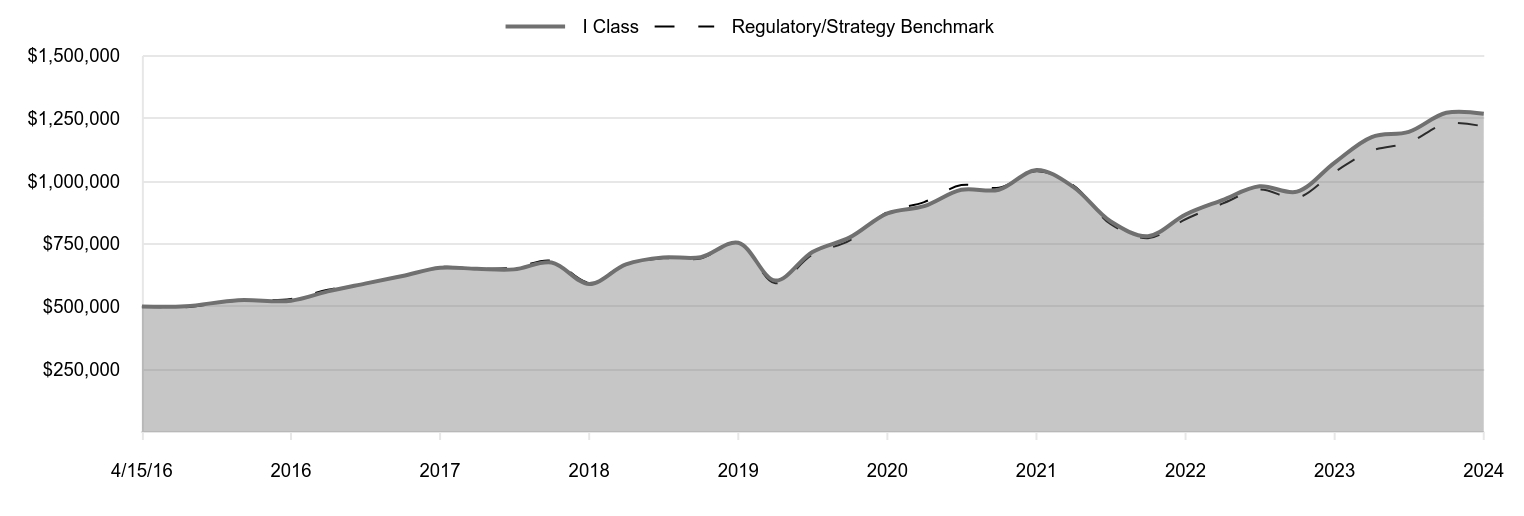

Cumulative Returns of a Hypothetical $500,000 Investment as of December 31, 2024

| I Class | Regulatory/Strategy Benchmark |

|---|

| 4/15/16 | 500,000 | 500,000 |

|---|

| 6/30/16 | 501,000 | 497,727 |

|---|

| 9/30/16 | 525,500 | 524,116 |

|---|

| 12/31/16 | 523,477 | 530,350 |

|---|

| 3/31/17 | 560,542 | 566,988 |

|---|

| 6/30/17 | 591,514 | 591,216 |

|---|

| 9/30/17 | 621,978 | 621,854 |

|---|

| 12/31/17 | 654,996 | 657,486 |

|---|

| 3/31/18 | 650,358 | 651,164 |

|---|

| 6/30/18 | 648,296 | 654,639 |

|---|

| 9/30/18 | 675,609 | 682,637 |

|---|

| 12/31/18 | 589,993 | 595,588 |

|---|

| 3/31/19 | 668,273 | 668,101 |

|---|

| 6/30/19 | 696,118 | 692,232 |

|---|

| 9/30/19 | 696,643 | 692,053 |

|---|

| 12/31/19 | 754,547 | 753,999 |

|---|

| 3/31/20 | 603,744 | 592,905 |

|---|

| 6/30/20 | 717,779 | 706,855 |

|---|

| 9/30/20 | 775,862 | 764,325 |

|---|

| 12/31/20 | 871,392 | 876,560 |

|---|

| 3/31/21 | 900,438 | 916,631 |

|---|

| 6/30/21 | 965,523 | 984,400 |

|---|

| 9/30/21 | 965,523 | 974,022 |

|---|

| 12/31/21 | 1,044,609 | 1,039,051 |

|---|

| 3/31/22 | 977,320 | 983,350 |

|---|

| 6/30/22 | 840,028 | 829,352 |

|---|

| 9/30/22 | 780,879 | 772,793 |

|---|

| 12/31/22 | 867,258 | 848,240 |

|---|

| 3/31/23 | 924,592 | 910,211 |

|---|

| 6/30/23 | 979,290 | 966,437 |

|---|

| 9/30/23 | 958,201 | 933,553 |

|---|

| 12/31/23 | 1,074,055 | 1,036,565 |

|---|

| 3/31/24 | 1,175,958 | 1,121,525 |

|---|

| 6/30/24 | 1,196,338 | 1,153,705 |

|---|

| 9/30/24 | 1,272,426 | 1,230,009 |

|---|

| 12/31/24 | 1,268,552 | 1,217,846 |

|---|

202501-4140694, 202502-4108710

Average Annual Total Returns

| | 1 Year | 5 Years | Since Inception 4/15/16 |

|---|

| Integrated Global Equity Fund (I Class) | 18.11% | 10.95% | 11.28% |

|---|

| MSCI All Country World Index Net (Regulatory/Strategy Benchmark) | 17.49 | 10.06 | 10.76 |

|---|

The preceding line graph shows the value of a hypothetical $500,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The fund’s performance information included in the line graph and table above is compared with a regulatory required index that represents an overall securities market (Regulatory Benchmark). In addition, the line graph and table may also include one or more indexes that more closely aligns to the fund's investment strategy (Strategy Benchmark(s)). Due to new SEC Rules on shareholder reporting the fund adopted a new broad-based securities market index, referred to as the Regulatory Benchmark. Market index returns do not include expenses, which are deducted from fund returns. The fund's total return figures reflect the reinvestment of dividends and capital gains, if any.Neither the fund’s returns nor the index returns reflect the deduction of taxes that a shareholder would pay on fund distributions or redemptions of fund shares.The fund’s past performance is not a good predictor of the fund’s future performance.Updated performance information can be found at www.troweprice.com.

What are some fund statistics?

- Total Net Assets (000s)$61,407

- Number of Portfolio Holdings287

- Investment Advisory Fees Paid (000s)$(102)

- Portfolio Turnover Rate48.5%

What did the fund invest in?

Sector Allocation (as a % of Net Assets)

| Information Technology | 25.4% |

| Financials | 16.5 |

| Consumer Discretionary | 11.3 |

| Industrials & Business Services | 11.0 |

| Health Care | 9.0 |

| Communication Services | 8.0 |

| Consumer Staples | 6.6 |

| Energy | 3.5 |

| Utilities | 3.3 |

| Other | 5.4 |

Top Ten Holdings (as a % of Net Assets)

| Apple | 4.7% |

| Microsoft | 4.2 |

| NVIDIA | 3.8 |

| Amazon.com | 2.3 |

| Alphabet | 2.2 |

| Meta Platforms | 1.5 |

| Taiwan Semiconductor Manufacturing | 1.3 |

| Tesla | 1.1 |

| Visa | 0.9 |

| Mastercard | 0.9 |

How has the fund changed?

This is a summary of certain material changes to Integrated Global Equity Fund. The fund invests in at least five countries, including the U.S., and the fund will typically invest at least 25% of its net assets in securities of foreign issuers. The fund’s March 1, 2025 prospectus contains more information.

If you invest directly with T. Rowe Price, you can elect to receive future shareholder reports or other important documents through electronic delivery by enrolling at www.troweprice.com/paperless. If you invest through a financial intermediary such as an investment advisor, a bank, retirement plan sponsor or a brokerage firm, please contact that organization and ask if it can provide electronic delivery.

MSCI does not accept any liability for any errors or omissions in the indexes or data, and hereby expressly disclaim all warranties of originality, accuracy, completeness, timeliness, merchantability and fitness for a particular purpose. No party may rely on any indexes or data contained in this communication. Visit www.troweprice.com/en/us/market-data-disclosures for additional legal notices & disclaimers.

Integrated Global Equity Fund

I Class (TQGIX)

T. Rowe Price Investment Services, Inc.

100 East Pratt Street

Baltimore, MD 21202

Item 1. (b) Notice pursuant to Rule 30e-3.

Not applicable.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors has determined that Mr. Paul F. McBride qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. McBride is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

| | | | | | | | | | |

| | | 2024 | | | 2023 | | | |

| | | | | | | |

Audit Fees | | | $26,450 | | | | $25,925 | |

Audit-Related Fees | | | - | | | | - | |

Tax Fees | | | - | | | | - | |

All Other Fees | | | - | | | | - | | | |

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,262,000 and $1,524,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 7 of this Form N-CSR.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a – b) Report pursuant to Regulation S-X.

Financial

Highlights

Portfolio

of

Investments

Financial

Statements

and

Notes

Additional

Fund

Information

Financial

Statements

and

Other

Information

For

more

insights

from

T.

Rowe

Price

investment

professionals,

go

to

troweprice.com

.

T.

ROWE

PRICE

TQGEX

Integrated

Global

Equity

Fund

TQGIX

Integrated

Global

Equity

Fund–

.

I Class

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Investor

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

15.83

$

13.18

$

19.21

$

16.18

$

14.16

Investment

activities

Net

investment

income

(1)(2)

0.22

0.21

0.31

0.12

0.14

Net

realized

and

unrealized

gain/loss

2.63

2.90

(3.59)

3.06

2.03

Total

from

investment

activities

2.85

3.11

(3.28)

3.18

2.17

Distributions

Net

investment

income

(0.22)

(0.22)

(0.34)

(0.12)

(0.14)

Net

realized

gain

(0.54)

(0.24)

(2.41)

(0.03)

(0.01)

Total

distributions

(0.76)

(0.46)

(2.75)

(0.15)

(0.15)

NET

ASSET

VALUE

End

of

period

$

17.92

$

15.83

$

13.18

$

19.21

$

16.18

Ratios/Supplemental

Data

Total

return

(2)(3)

17.94%

23.68%

(17.08)%

19.65%

15.34%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

1.51%

1.90%

2.18%

1.77%

2.05%

Net

expenses

after

waivers/

payments

by

Price

Associates

0.74%

0.75%

0.73%

0.76%

0.74%

Net

investment

income

1.22%

1.47%

1.83%

0.67%

1.04%

Portfolio

turnover

rate

48.5%

44.7%

102.9%

25.6%

32.5%

Net

assets,

end

of

period

(in

thousands)

$26,984

$16,554

$12,547

$30,478

$22,638

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

For

a

share

outstanding

throughout

each

period

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

I

Class

..

Year

..

..

Ended

.

12/31/24

12/31/23

12/31/22

12/31/21

12/31/20

NET

ASSET

VALUE

Beginning

of

period

$

15.81

$

13.16

$

19.25

$

16.20

$

14.16

Investment

activities

Net

investment

income

(1)(2)

0.24

0.24

0.37

0.15

0.16

Net

realized

and

unrealized

gain/loss

2.64

2.89

(3.64)

3.07

2.03

Total

from

investment

activities

2.88

3.13

(3.27)

3.22

2.19

Distributions

Net

investment

income

(0.26)

(0.24)

(0.41)

(0.14)

(0.14)

Net

realized

gain

(0.54)

(0.24)

(2.41)

(0.03)

(0.01)

Total

distributions

(0.80)

(0.48)

(2.82)

(0.17)

(0.15)

NET

ASSET

VALUE

End

of

period

$

17.89

$

15.81

$

13.16

$

19.25

$

16.20

Ratios/Supplemental

Data

Total

return

(2)(3)

18.11%

23.84%

(16.98)%

19.88%

15.49%

Ratios

to

average

net

assets:

(2)

Gross

expenses

before

waivers/payments

by

Price

Associates

1.31%

1.70%

2.21%

1.72%

1.97%

Net

expenses

after

waivers/payments

by

Price

Associates

0.58%

0.59%

0.58%

0.60%

0.60%

Net

investment

income

1.37%

1.64%

2.30%

0.84%

1.16%

Portfolio

turnover

rate

48.5%

44.7%

102.9%

25.6%

32.5%

Net

assets,

end

of

period

(in

thousands)

$34,423

$17,078

$11,558

$1,268

$791

0%

0%

0%

0%

0%

(1)

Per

share

amounts

calculated

using

average

shares

outstanding

method.

(2)

Includes

the

impact

of

expense-related

arrangements

with

Price

Associates.

(3)

Total

return

reflects

the

rate

that

an

investor

would

have

earned

on

an

investment

in

the

fund

during

each

period,

assuming

reinvestment

of

all

distributions,

and

payment

of

no

redemption

or

account

fees,

if

applicable.

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

December

31,

2024

Shares

$

Value

(

Cost

and

value

in

$000s)

‡

ARGENTINA 0.6%

Common

Stocks 0.6%

MercadoLibre

(USD) (1)

104

177

Tenaris

(EUR)

10,155

192

Total

Argentina

(Cost

$390)

369

AUSTRALIA 1.5%

Common

Stocks 1.5%

ANZ

Group

Holdings

10,118

178

Aristocrat

Leisure

3,974

168

Brambles

9,828

117

Coles

Group

7,943

93

Computershare

7,722

162

Northern

Star

Resources

6,182

59

Qantas

Airways (1)

12,187

67

Scentre

Group

38,709

82

Total

Australia

(Cost

$852)

926

AUSTRIA 0.5%

Common

Stocks 0.5%

Erste

Group

Bank

3,359

208

voestalpine

5,997

114

Total

Austria

(Cost

$315)

322

BELGIUM 0.4%

Common

Stocks 0.4%

Groupe

Bruxelles

Lambert

2,214

151

Warehouses

De

Pauw

5,289

104

Total

Belgium

(Cost

$318)

255

BRAZIL 0.6%

Common

Stocks 0.5%

Petroleo

Brasileiro

15,165

98

Suzano

6,210

63

TOTVS

10,259

44

Vale

12,080

107

312

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

Preferred

Stocks 0.1%

Itau

Unibanco

Holding

16,666

82

82

Total

Brazil

(Cost

$474)

394

CANADA 3.5%

Common

Stocks 3.5%

Canadian

National

Railway

2,203

224

Cenovus

Energy

(USD)

9,445

143

Constellation

Software

94

291

Constellation

Software,

Warrants,

3/31/40 (1)(2)

76

—

Descartes

Systems

Group (1)

1,474

167

Fairfax

Financial

Holdings

127

177

George

Weston

765

119

Granite

Real

Estate

Investment

Trust

1,501

73

Kinaxis (1)(3)

1,747

210

Kinross

Gold

12,479

116

Loblaw

1,125

148

Parkland (3)

4,877

110

Suncor

Energy

4,453

159

TFI

International

1,486

201

Total

Canada

(Cost

$1,766)

2,138

CHILE 0.1%

Common

Stocks 0.1%

Banco

de

Chile

491,538

56

Total

Chile

(Cost

$51)

56

CHINA 2.7%

Common

Stocks 2.2%

Alibaba

Group

Holding,

ADR

(USD)

2,347

199

Aluminum

Corp.

of

China,

Class

H

(HKD)

70,000

40

China

Coal

Energy,

Class

H

(HKD)

51,000

61

China

Merchants

Bank,

Class

H

(HKD)

21,500

110

COSCO

SHIPPING

Holdings,

Class

H

(HKD)

36,500

60

PDD

Holdings,

ADR

(USD) (1)

1,261

122

Tencent

Holdings

(HKD)

6,500

347

Tingyi

Cayman

Islands

Holding

(HKD)

72,000

93

Xiaomi,

Class

B

(HKD) (1)

47,600

209

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

ZTO

Express

Cayman

(HKD)

4,350

85

1,326

Common

Stocks

-

China

A

Shares 0.5%

CNOOC

Energy

Technology

&

Services,

A

Shares

(CNH)

179,700

105

CRRC,

A

Shares

(CNH)

78,400

90

Eastroc

Beverage

Group,

A

Shares

(CNH)

3,320

113

308

Total

China

(Cost

$1,510)

1,634

COLOMBIA 0.1%

Common

Stocks 0.1%

Bancolombia,

ADR

(USD)

1,998

63

Total

Colombia

(Cost

$64)

63

DENMARK 1.0%

Common

Stocks 1.0%

Carlsberg,

Class

B

2,031

195

Genmab (1)

720

151

Novo

Nordisk,

Class

B

3,397

293

Total

Denmark

(Cost

$640)

639

FRANCE 2.1%

Common

Stocks 2.1%

AXA

4,849

173

Cie

Generale

des

Etablissements

Michelin

2,979

98

Dassault

Aviation

678

138

Edenred

2,046

67

Engie

8,352

132

Eurofins

Scientific

1,611

82

Euronext

1,575

177

TotalEnergies

3,116

174

Verallia

4,295

108

Vinci

1,061

109

Total

France

(Cost

$1,340)

1,258

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

GERMANY 2.7%

Common

Stocks 2.7%

adidas

610

150

Allianz

819

252

Deutsche

Post

3,905

138

Deutsche

Telekom

7,411

222

Muenchener

Rueckversicherungs-Gesellschaft

375

189

Puma

3,282

151

SAP

556

137

Scout24

2,073

183

Zalando (1)

6,422

215

Total

Germany

(Cost

$1,514)

1,637

HONG

KONG 0.1%

Common

Stocks 0.1%

HKT

Trust

&

HKT

66,000

82

Total

Hong

Kong

(Cost

$83)

82

HUNGARY 0.2%

Common

Stocks 0.2%

OTP

Bank

1,909

104

Total

Hungary

(Cost

$82)

104

INDIA 0.9%

Common

Stocks 0.9%

Infosys

5,912

129

Page

Industries

113

63

Petronet

LNG

25,921

104

Power

Grid

Corp.

of

India

24,128

87

Shriram

Finance

3,286

111

Vedanta

8,096

42

Total

India

(Cost

$461)

536

INDONESIA 0.1%

Common

Stocks 0.1%

Bank

Mandiri

Persero

221,900

78

Total

Indonesia

(Cost

$86)

78

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

IRELAND 0.6%

Common

Stocks 0.6%

Kingspan

Group

1,403

102

TE

Connectivity

(USD)

1,732

248

Total

Ireland

(Cost

$384)

350

ITALY 1.2%

Common

Stocks 1.2%

DiaSorin

973

100

Enel

20,071

143

FinecoBank

Banca

Fineco

7,629

133

Intesa

Sanpaolo

40,730

164

UniCredit

4,707

189

Total

Italy

(Cost

$589)

729

JAPAN 6.2%

Common

Stocks 6.2%

AGC

3,300

96

Asahi

Group

Holdings

9,800

103

Asics

9,200

179

Daiwa

Securities

Group

14,800

98

Food

&

Life

7,200

151

Inpex

6,400

80

JFE

Holdings

6,000

68

KDDI

5,800

185

MatsukiyoCocokara

11,000

160

Mitsubishi

Estate

11,800

164

Mitsubishi

UFJ

Financial

Group

19,800

231

Nippon

Steel

6,500

131

Nomura

Real

Estate

Holdings

6,100

150

Olympus

9,200

137

Panasonic

Holdings

17,500

179

Recruit

Holdings

3,400

236

Renesas

Electronics

13,700

173

Seven

&

i

Holdings

12,600

198

SoftBank

Group

2,900

166

Sony

Group

11,700

247

Subaru

8,300

147

Sumitomo

4,600

100

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

Suntory

Beverage

&

Food (3)

2,100

67

Taiheiyo

Cement

6,100

138

Takeda

Pharmaceutical

5,300

140

TIS

4,100

97

Total

Japan

(Cost

$3,797)

3,821

MEXICO 0.4%

Common

Stocks 0.4%

Coca-Cola

Femsa

10,287

80

Gruma,

Class

B

4,558

71

Grupo

Aeroportuario

del

Sureste,

Class

B

3,122

80

Total

Mexico

(Cost

$272)

231

NETHERLANDS 1.4%

Common

Stocks 1.4%

Adyen (1)

125

186

ASML

Holding

(USD)

146

101

Koninklijke

Ahold

Delhaize

3,842

126

Koninklijke

KPN

42,311

154

Koninklijke

Philips (1)

6,603

167

NN

Group

3,330

145

Total

Netherlands

(Cost

$871)

879

NORWAY 0.2%

Common

Stocks 0.2%

Kongsberg

Gruppen

1,063

120

Total

Norway

(Cost

$110)

120

PERU 0.1%

Common

Stocks 0.1%

Credicorp

(USD)

492

90

Total

Peru

(Cost

$81)

90

PHILIPPINES 0.2%

Common

Stocks 0.2%

BDO

Unibank

44,022

109

Total

Philippines

(Cost

$95)

109

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

PORTUGAL 0.2%

Common

Stocks 0.2%

Jeronimo

Martins

7,931

151

Total

Portugal

(Cost

$166)

151

QATAR 0.1%

Common

Stocks 0.1%

Qatar

National

Bank

14,868

71

Total

Qatar

(Cost

$62)

71

SAUDI

ARABIA 0.3%

Common

Stocks 0.3%

Nahdi

Medical

2,403

75

Saudi

National

Bank

12,766

113

Total

Saudi

Arabia

(Cost

$222)

188

SINGAPORE 0.5%

Common

Stocks 0.5%

DBS

Group

Holdings

5,990

192

United

Overseas

Bank

5,100

135

Total

Singapore

(Cost

$246)

327

SOUTH

AFRICA 0.2%

Common

Stocks 0.2%

Absa

Group

9,071

91

Woolworths

Holdings

15,611

51

Total

South

Africa

(Cost

$144)

142

SOUTH

KOREA 1.0%

Common

Stocks 1.0%

DB

Insurance

1,007

70

HD

Korea

Shipbuilding

&

Offshore

Engineering (1)

666

102

Hyundai

Mobis

636

101

KB

Financial

Group

1,566

88

KT

2,614

78

Samsung

Electronics

2,238

80

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

Samsung

Fire

&

Marine

Insurance

357

87

Total

South

Korea

(Cost

$648)

606

SPAIN 0.2%

Common

Stocks 0.2%

Iberdrola (3)

10,277

142

Total

Spain

(Cost

$153)

142

SWEDEN 0.6%

Common

Stocks 0.6%

Essity,

Class

B

6,106

163

Telefonaktiebolaget

LM

Ericsson,

Class

B

25,031

203

Total

Sweden

(Cost

$338)

366

SWITZERLAND 0.6%

Common

Stocks 0.6%

Logitech

International

1,204

99

SIG

Group

7,175

142

Sonova

Holding

369

121

Total

Switzerland

(Cost

$381)

362

TAIWAN 2.2%

Common

Stocks 2.2%

Accton

Technology

9,000

211

Chailease

Holding

2,353

8

Delta

Electronics

10,000

131

MediaTek

5,000

215

Taiwan

Semiconductor

Manufacturing

24,000

780

Total

Taiwan

(Cost

$839)

1,345

THAILAND 0.1%

Common

Stocks 0.1%

Bangkok

Dusit

Medical

Services,

Class

F

124,000

89

Total

Thailand

(Cost

$94)

89

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

UNITED

ARAB

EMIRATES 0.2%

Common

Stocks 0.2%

Abu

Dhabi

National

Oil

for

Distribution

108,088

104

Total

United

Arab

Emirates

(Cost

$103)

104

UNITED

KINGDOM 2.7%

Common

Stocks 2.7%

3i

Group

2,987

133

Auto

Trader

Group

14,986

148

Barclays

58,144

194

BT

Group

71,087

128

Bunzl

4,226

174

Compass

Group

6,387

213

Imperial

Brands

5,591

179

Informa

10,088

101

Rolls-Royce

Holdings (1)

28,783

204

Unilever

2,714

154

Total

United

Kingdom

(Cost

$1,249)

1,628

UNITED

STATES 62.8%

Common

Stocks 62.8%

3M

1,842

238

AbbVie

622

111

Accenture,

Class

A

702

247

Agilent

Technologies

1,606

216

Alphabet,

Class

A

7,144

1,352

Amazon.com (1)

6,322

1,387

Ameren

1,345

120

Ameriprise

Financial

298

159

Apple

11,473

2,873

Applied

Materials

1,481

241

AppLovin,

Class

A (1)(3)

1,214

393

Autodesk (1)(3)

966

286

AutoZone (1)

78

250

Bank

of

America

9,953

437

Bank

of

New

York

Mellon

4,347

334

Bath

&

Body

Works

5,524

214

Becton

Dickinson

&

Company

1,171

266

Berkshire

Hathaway,

Class

B (1)

230

104

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

Booking

Holdings

67

333

Booz

Allen

Hamilton

Holding

1,725

222

Broadcom

2,335

541

Broadridge

Financial

Solutions

1,003

227

Cardinal

Health

2,188

259

Cencora

677

152

Charles

Schwab

4,038

299

Charter

Communications,

Class

A (1)

666

228

Chubb

964

266

Cigna

Group

773

213

Citigroup

4,961

349

Coca-Cola

2,156

134

Colgate-Palmolive

2,508

228

Constellation

Energy

1,068

239

Corebridge

Financial

7,301

219

Corning (3)

3,831

182

Corpay (1)

793

268

Corteva

3,496

199

CSX

8,172

264

Cummins

736

257

Dover

1,157

217

Eli

Lilly

455

351

Entergy

2,912

221

Equity

Residential,

REIT

869

62

Evergy

3,473

214

Exelon

5,745

216

Exxon

Mobil

1,440

155

Fair

Isaac (1)

96

191

FedEx (3)

955

269

Fidelity

National

Information

Services

1,760

142

Fortinet (1)

3,628

343

Fortive (3)

2,859

214

Gaming

&

Leisure

Properties,

REIT

2,699

130

Gen

Digital

4,582

125

General

Electric

1,498

250

Global

Payments

2,109

236

GoDaddy,

Class

A (1)

1,586

313

Hartford

Financial

Services

Group

2,455

269

HCA

Healthcare

592

178

Hilton

Worldwide

Holdings

733

181

Hologic (1)

2,648

191

Home

Depot

1,069

416

International

Paper (3)

3,187

172

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

Jabil (3)

914

132

JPMorgan

Chase

960

230

Keurig

Dr

Pepper

5,613

180

KeyCorp

12,596

216

Kimberly-Clark

2,018

264

Kinder

Morgan

10,639

292

L3Harris

Technologies

1,193

251

Las

Vegas

Sands

3,146

162

Leidos

Holdings

1,334

192

Lowe's

1,211

299

Marsh

&

McLennan

1,241

264

Mastercard,

Class

A

1,030

542

McKesson

370

211

Medtronic

3,493

279

Merck

750

75

Meta

Platforms,

Class

A

1,577

923

MetLife

3,071

251

Mettler-Toledo

International (1)

190

233

Microsoft

6,095

2,569

Molina

Healthcare (1)

766

223

Mosaic

5,661

139

Netflix (1)

536

478

Northrop

Grumman

534

251

NVIDIA

17,497

2,350

NXP

Semiconductors

838

174

O'Reilly

Automotive (1)

153

181

Parker-Hannifin

424

270

PG&E

10,224

206

Philip

Morris

International

2,801

337

Procter

&

Gamble

2,230

374

PTC (1)

921

169

Public

Storage,

REIT

268

80

QUALCOMM (3)

2,164

332

Reliance

525

141

ResMed

762

174

RPM

International

1,156

142

Salesforce

999

334

Schlumberger

5,179

199

SS&C

Technologies

Holdings

2,769

210

Stanley

Black

&

Decker

2,469

198

State

Street

2,056

202

Stryker

550

198

Synchrony

Financial

2,983

194

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

T-Mobile

U.S.

669

148

Tesla (1)

1,603

647

Textron

2,552

195

Thermo

Fisher

Scientific

668

348

United

Parcel

Service,

Class

B (3)

2,002

252

UnitedHealth

Group

355

180

Valero

Energy (3)

2,058

252

Ventas,

REIT

784

46

Verisk

Analytics

655

180

Viatris

18,445

230

VICI

Properties,

REIT

4,002

117

Visa,

Class

A

1,787

565

Vistra

1,196

165

Walmart

1,650

149

Xcel

Energy

2,488

168

Zebra

Technologies,

Class

A (1)

565

218

Zimmer

Biomet

Holdings

1,964

207

Total

United

States

(Cost

$28,630)

38,551

VIETNAM 0.2%

Common

Stocks 0.2%

Saigon

Beer

Alcohol

Beverage

24,000

52

Vietnam

Dairy

Products

20,300

51

Total

Vietnam

(Cost

$111)

103

SHORT-TERM

INVESTMENTS 0.4%

Money

Market

Funds 0.4%

T.

Rowe

Price

Government

Reserve

Fund,

4.53% (4)(5)

235,412

235

Total

Short-Term

Investments

(Cost

$235)

235

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

Shares

$

Value

(Cost

and

value

in

$000s)

SECURITIES

LENDING

COLLATERAL 4.2%

INVESTMENTS

IN

A

POOLED

ACCOUNT

THROUGH

SECURITIES

LENDING

PROGRAM

WITH

JPMORGAN

CHASE

BANK 4.2%

Money

Market

Funds 4.2%

T.

Rowe

Price

Government

Reserve

Fund,

4.53% (4)(5)

2,570,909

2,571

Total

Investments

in

a

Pooled

Account

through

Securities

Lending

Program

with

JPMorgan

Chase

Bank

2,571

Total

Securities

Lending

Collateral

(Cost

$2,571)

2,571

Total

Investments

in

Securities

103.9%

of

Net

Assets

(Cost

$52,337)

$

63,801

‡

Country

classifications

are

generally

based

on

MSCI

categories

or

another

unaffiliated

third

party

data

provider;

Shares

are

denominated

in

the

currency

of

the

country

presented

unless

otherwise

noted.

(1)

Non-income

producing

(2)

See

Note

2.

Level

3

in

fair

value

hierarchy.

(3)

See

Note

3.

All

or

a

portion

of

this

security

is

on

loan

at

December

31,

2024.

(4)

Seven-day

yield

(5)

Affiliated

Companies

ADR

American

Depositary

Receipts

CNH

Offshore

China

Renminbi

EUR

Euro

HKD

Hong

Kong

Dollar

REIT

A

domestic

Real

Estate

Investment

Trust

whose

distributions

pass-through

with

original

tax

character

to

the

shareholder

USD

U.S.

Dollar

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

AFFILIATED

COMPANIES

($000s)

The

fund

may

invest

in

certain

securities

that

are

considered

affiliated

companies.

As

defined

by

the

1940

Act,

an

affiliated

company

is

one

in

which

the

fund

owns

5%

or

more

of

the

outstanding

voting

securities,

or

a

company

that

is

under

common

ownership

or

control.

The

following

securities

were

considered

affiliated

companies

for

all

or

some

portion

of

the

year

ended

December

31,

2024.

Net

realized

gain

(loss),

investment

income,

change

in

net

unrealized

gain/loss,

and

purchase

and

sales

cost

reflect

all

activity

for

the

period

then

ended.

Affiliate

Net

Realized

Gain

(Loss)

Change

in

Net

Unrealized

Gain/Loss

Investment

Income

T.

Rowe

Price

Government

Reserve

Fund,

4.53%

$

—

$

—

$

16++

Totals

$

—#

$

—

$

16+

Supplementary

Investment

Schedule

Affiliate

Value

12/31/23

Purchase

Cost

Sales

Cost

Value

12/31/24

T.

Rowe

Price

Government

Reserve

Fund,

4.53%

$

1,345

¤

¤

$

2,806

Total

$

2,806^

#

Capital

gain

distributions

from

underlying

Price

funds

represented

$0

of

the

net

realized

gain

(loss).

++

Excludes

earnings

on

securities

lending

collateral,

which

are

subject

to

rebates

and

fees

as

described

in

Note

3.

+

Investment

income

comprised

$16

of

dividend

income

and

$0

of

interest

income.

¤

Purchase

and

sale

information

not

shown

for

cash

management

funds.

^

The

cost

basis

of

investments

in

affiliated

companies

was

$2,806.

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

December

31,

2024

Statement

of

Assets

and

Liabilities

($000s,

except

shares

and

per

share

amounts)

Assets

Investments

in

securities,

at

value

(cost

$52,337)

$

63,801

Receivable

for

shares

sold

561

Receivable

for

investment

securities

sold

534

Dividends

receivable

48

Cash

44

Foreign

currency

(cost

$39)

38

Due

from

affiliates

13

Other

assets

47

Total

assets

65,086

Liabilities

Obligation

to

return

securities

lending

collateral

2,571

Payable

for

investment

securities

purchased

991

Payable

for

shares

redeemed

38

Investment

management

fees

payable

27

Other

liabilities

52

Total

liabilities

3,679

Commitments

and

Contingent

Liabilities

(note

6

)

NET

ASSETS

$

61,407

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

December

31,

2024

Statement

of

Assets

and

Liabilities

($000s,

except

shares

and

per

share

amounts)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Net

Assets

Consist

of:

Total

distributable

earnings

(loss)

$

11,387

Paid-in

capital

applicable

to

3,429,574

shares

of

$0.0001

par

value

capital

stock

outstanding;

1,000,000,000

shares

authorized

50,020

NET

ASSETS

$

61,407

NET

ASSET

VALUE

PER

SHARE

Investor

Class

(Net

assets:

$26,984;

Shares

outstanding:

1,505,834)

$

17.92

I

Class

(Net

assets:

$34,423;

Shares

outstanding:

1,923,740)

$

17.89

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

Year

Ended

12/31/24

Investment

Income

(Loss)

Income

Dividend

(net

of

foreign

taxes

of

$67)

$

949

Securities

lending

4

Total

income

953

Expenses

Investment

management

259

Shareholder

servicing

Investor

Class

$

47

I

Class

8

55

Prospectus

and

shareholder

reports

Investor

Class

7

I

Class

5

12

Custody

and

accounting

210

Legal

and

audit

74

Registration

57

Miscellaneous

13

Waived

/

paid

by

Price

Associates

(361)

Total

expenses

319

Net

investment

income

634

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Year

Ended

12/31/24

Realized

and

Unrealized

Gain

/

Loss

–

Net

realized

gain

(loss)

Securities

(net

of

foreign

taxes

of

$10)

3,587

Foreign

currency

transactions

(41)

Net

realized

gain

3,546

Change

in

net

unrealized

gain

/

loss

Securities

(net

of

increase

in

deferred

foreign

taxes

of

$14)

3,148

Other

assets

and

liabilities

denominated

in

foreign

currencies

(2)

Change

in

net

unrealized

gain

/

loss

3,146

Net

realized

and

unrealized

gain

/

loss

6,692

INCREASE

IN

NET

ASSETS

FROM

OPERATIONS

$

7,326

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

Statement

of

Changes

in

Net

Assets

Year

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Ended

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12/31/24

12/31/23

Increase

(Decrease)

in

Net

Assets

Operations

Net

investment

income

$

634

$

438

Net

realized

gain

3,546

999

Change

in

net

unrealized

gain

/

loss

3,146

4,597

Increase

in

net

assets

from

operations

7,326

6,034

Distributions

to

shareholders

Net

earnings

Investor

Class

(1,048)

(464)

I

Class

(1,453)

(497)

Decrease

in

net

assets

from

distributions

(2,501)

(961)

Capital

share

transactions

*

Shares

sold

Investor

Class

18,512

3,559

I

Class

19,396

9,197

Distributions

reinvested

Investor

Class

763

286

I

Class

1,415

469

Shares

redeemed

Investor

Class

(11,197)

(2,352)

Advisor

Class

–

(359)

I

Class

(5,939)

(6,673)

Increase

in

net

assets

from

capital

share

transactions

22,950

4,127

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

Statement

of

Changes

in

Net

Assets

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Year

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Ended

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12/31/24

12/31/23

Net

Assets

Increase

during

period

27,775

9,200

Beginning

of

period

33,632

24,432

End

of

period

$

61,407

$

33,632

*Share

information

(000s)

Shares

sold

Investor

Class

1,040

239

I

Class

1,103

646

Distributions

reinvested

Investor

Class

42

18

I

Class

77

30

Shares

redeemed

Investor

Class

(622)

(163)

Advisor

Class

–

(25)

I

Class

(336)

(474)

Increase

in

shares

outstanding

1,304

271

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

NOTES

TO

FINANCIAL

STATEMENTS

T.

Rowe

Price

Integrated

Equity

Funds,

Inc.

(the

corporation)

is

registered

under

the

Investment

Company

Act

of

1940

(the

1940

Act).

The

Integrated

Global

Equity

Fund

(the

fund)

is

a

diversified,

open-end

management

investment

company

established

by

the

corporation.

The

fund

seeks

long-term

growth

of

capital.

The

fund

has

two classes

of

shares:

the

Integrated

Global

Equity

Fund

(Investor

Class) and

the

Integrated

Global

Equity

Fund–I

Class

(I

Class). I

Class

shares

require

a

$500,000

initial

investment

minimum,

although

the

minimum

generally

is

waived

or

reduced

for

financial

intermediaries,

eligible

retirement

plans,

and

certain

other

accounts.

Each

class

has

exclusive

voting

rights

on

matters

related

solely

to

that

class;

separate

voting

rights

on

matters

that

relate

to

all

classes;

and,

in

all

other

respects,

the

same

rights

and

obligations

as

the

other

class.

NOTE

1

-

SIGNIFICANT

ACCOUNTING

POLICIES

Basis

of

Preparation

The fund

is

an

investment

company

and

follows

accounting

and

reporting

guidance

in

the

Financial

Accounting

Standards

Board

(FASB)

Accounting

Standards

Codification

Topic

946

(ASC

946).

The

accompanying

financial

statements

were

prepared

in

accordance

with

accounting

principles

generally

accepted

in

the

United

States

of

America

(GAAP),

including,

but

not

limited

to,

ASC

946.

GAAP

requires

the

use

of

estimates

made

by

management.

Management

believes

that

estimates

and

valuations

are

appropriate;

however,

actual

results

may

differ

from

those

estimates,

and

the

valuations

reflected

in

the

accompanying

financial

statements

may

differ

from

the

value

ultimately

realized

upon

sale

or

maturity.

Investment

Transactions,

Investment

Income,

and

Distributions

Investment

transactions

are

accounted

for

on

the

trade

date

basis.

Income

and

expenses

are

recorded

on

the

accrual

basis.

Realized

gains

and

losses

are

reported

on

the

identified

cost

basis. Income

tax-related

interest

and

penalties,

if

incurred,

are

recorded

as

income

tax

expense. Dividends

received

from other

investment

companies are

reflected

as

dividend income;

capital

gain

distributions

are

reflected

as

realized

gain/loss. Dividend

income and

capital

gain

distributions

are

recorded

on

the

ex-dividend

date. Distributions

from

REITs

are

initially

recorded

as

dividend

income

and,

to

the

extent

such

represent

a

return

of

capital

or

capital

gain

for

tax

purposes,

are

reclassified

when

such

information

becomes

available. Non-cash

dividends,

if

any,

are

recorded

at

the

fair

market

value

of

the

asset

received. Proceeds

from

litigation

payments,

if

any,

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

are

included

in

either

net

realized

gain

(loss)

or

change

in

net

unrealized

gain/loss

from

securities. Distributions

to

shareholders

are

recorded

on

the

ex-dividend

date. Income

distributions,

if

any,

are

declared

and

paid

by

each

class annually. A

capital

gain

distribution,

if

any, may

also

be

declared

and

paid

by

the

fund

annually.

Currency

Translation

Assets,

including

investments,

and

liabilities

denominated

in

foreign

currencies

are

translated

into

U.S.

dollar

values

each

day

at

the

prevailing

exchange

rate,

using

the

mean

of

the

bid

and

asked

prices

of

such

currencies

against

U.S.

dollars

as

provided

by

an

outside

pricing

service.

Purchases

and

sales

of

securities,

income,

and

expenses

are

translated

into

U.S.

dollars

at

the

prevailing

exchange

rate

on

the

respective

date

of

such

transaction.

The

effect

of

changes

in

foreign

currency

exchange

rates

on

realized

and

unrealized

security

gains

and

losses

is

not

bifurcated

from

the

portion

attributable

to

changes

in

market

prices.

Class

Accounting

Shareholder

servicing,

prospectus,

and

shareholder

report

expenses

incurred

by

each

class

are

charged

directly

to

the

class

to

which

they

relate.

Expenses

common

to

all

classes,

investment

income,

and

realized

and

unrealized

gains

and

losses

are

allocated

to

the

classes

based

upon

the

relative

daily

net

assets

of

each

class.

In-Kind

Redemptions

In

accordance

with

guidelines

described

in

the

fund’s

prospectus,

and

when

considered

to

be

in

the

best

interest

of

all

shareholders,

the

fund

may

distribute

portfolio

securities

rather

than

cash

as

payment

for

a

redemption

of

fund

shares

(in-kind

redemption).

Gains

and

losses

realized

on

in-kind

redemptions

are

not

recognized

for

tax

purposes

and

are

reclassified

from

undistributed

realized

gain

(loss)

to

paid-in

capital.

During

the

year ended

December

31,

2024,

the

fund

realized

$1,520,000 of

net

gain

on

$3,594,000

of

in-kind

redemptions.

Capital

Transactions

Each

investor’s

interest

in

the

net

assets

of the

fund

is

represented

by

fund

shares. The

fund’s

net

asset

value

(NAV)

per

share

is

computed

at

the

close

of

the

New

York

Stock

Exchange

(NYSE),

normally

4

p.m.

Eastern

time,

each

day

the

NYSE

is

open

for

business.

However,

the

NAV

per

share

may

be

calculated

at

a

time

other

than

the

normal

close

of

the

NYSE

if

trading

on

the

NYSE

is

restricted,

if

the

NYSE

closes

earlier,

or

as

may

be

permitted

by

the

SEC.

Purchases

and

redemptions

of

fund

shares

are

transacted

at

the

next-computed

NAV

per

share,

after

receipt

of

the

transaction

order

by

T.

Rowe

Price

Associates,

Inc.,

or

its

agents.

T.

ROWE

PRICE

Integrated

Global

Equity

Fund

New

Accounting

Guidance

In December

2023,

the

FASB

issued

Accounting

Standards

Update

(ASU),

ASU

2023-09,

Income

Taxes

(Topic

740)

–

Improvements

to

Income

Taxes

Disclosures,

which

enhances

the

transparency

of

income

tax

disclosures.

The

ASU

requires

public

entities,

on

an

annual

basis,

to

provide

disclosure

of

specific

categories

in

the

rate

reconciliation,

as

well

as

disclosure

of

income

taxes

paid

disaggregated

by

jurisdiction.

The

amendments

under

this

ASU

are

required

to

be

applied

prospectively

and

are

effective

for

fiscal

years

beginning

after

December

15,

2024.

Management

expects

that

adoption

of

the

guidance

will

not

have

a

material

impact

on

the

fund’s

financial

statements.

Indemnification

In

the

normal

course

of

business, the

fund

may

provide

indemnification

in

connection

with

its

officers

and

directors,

service

providers,

and/or

private

company

investments. The

fund’s

maximum

exposure

under

these

arrangements

is

unknown;

however,

the

risk

of

material

loss

is

currently

considered

to

be

remote.

NOTE

2

-

VALUATION

Fair

Value

The

fund’s

financial

instruments

are

valued

at

the

close

of

the

NYSE

and

are

reported

at

fair

value,

which

GAAP

defines

as

the

price

that

would

be

received

to

sell

an

asset

or

paid

to

transfer

a

liability

in

an

orderly