UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-08257

STATE STREET INSTITUTIONAL FUNDS

(Exact name of registrant as specified in charter)

One Iron Street

Boston, Massachusetts 02210

(Address of principal executive offices)(Zip code)

| | |

| (Name and Address of Agent for Service) | | Copy to: |

| |

Sean O’Malley, Esq. Senior Vice President and Deputy General Counsel c/o SSGA Funds Management, Inc. One Iron Street Boston, Massachusetts 02210 | | Timothy W. Diggins, Esq. Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, Massachusetts 02199-3600 |

Registrant’s telephone number, including area code: 800-242-0134

Date of fiscal year end: September 30

Date of reporting period: March 31, 2021

Item 1. Shareholder Report.

(a) The Report to Shareholders is attached herewith.

(b) Not Applicable.

Semi-Annual Report

March 31, 2021

State Street Institutional Funds

State Street Institutional Funds

Semi-Annual Report

March 31, 2021

Table of Contents

This report has been prepared for shareholders and may be distributed to others only if accompanied with a current prospectus and/or summary prospectus.

State Street Institutional Funds

Notes to Performance — March 31, 2021 (Unaudited)

Total return performance shown in this report for the State Street Institutional Funds (the “Trust”) and each of its series portfolios (each, a “Fund” and collectively, the “Funds”) takes into account changes in share price and assumes reinvestment of dividends and capital gains distributions, if any. Total returns shown are net of Fund expenses.

The performance data quoted represents past performance; past performance does not guarantee future results. Investment return and principal value will fluctuate, so your shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Periods of less than one year are not annualized. Please call toll-free (800) 242-0134 or visit the Funds’ website at www.ssga.com/geam for the most recent month-end performance data.

An investment in a Fund is not a deposit of any bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any other government agency. An investment in a Fund is subject to risk, including possible loss of principal invested.

State Street Global Advisors Funds Distributors, LLC, member of FINRA & SIPC is the principal underwriter and distributor of the State Street Institutional Funds and an indirect wholly-owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. The Funds pay State Street Bank and Trust Company for its services as custodian and Fund Accounting agent, and pay SSGA Funds Management, Inc. (“SSGA FM” or the “Adviser”) for investment advisory and administrative services.

State Street Institutional U.S. Equity Fund

Understanding Your Fund’s Expenses — March 31, 2021 (Unaudited)

As a shareholder of the Fund you incur ongoing costs. Ongoing costs include portfolio management fees, distribution and service fees (for Service Class shares) and trustees’ fees. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class of the Fund during the period. The information in the following table is based on an investment of $1,000, which is invested at the beginning of the period and held for the entire six-month period ended March 31, 2021.

Actual Expenses

The first section of the table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your class under the heading “Expenses paid during the period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholders reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs, such as sales charges or redemption fees, if any. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | |

Investment Class | | Actual

Fund Return | | | Hypothetical

5% Return

(2.5% for

the period) | |

Actual Fund Return | | | | | | | | |

Beginning Account Value October 1, 2020 | | $ | 1,000.00 | | | $ | 1,000.00 | |

Ending Account Value March 31, 2021 | | $ | 1,188.40 | | | $ | 1,023.20 | |

Expenses Paid During Period* | | $ | 1.91 | | | $ | 1.77 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.37% for Investment Class shares and 0.62% for Service Class shares (for the period October 1, 2020-March 31, 2021), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

| | | | | | | | |

Service Class | | Actual

Fund Return | | | Hypothetical

5% Return

(2.5% for

the period) | |

Actual Fund Return | | | | | | | | |

Beginning Account Value October 1, 2020 | | $ | 1,000.00 | | | $ | 1,000.00 | |

Ending Account Value March 31, 2021 | | $ | 1,186.90 | | | $ | 1,021.90 | |

Expenses Paid During Period* | | $ | 3.27 | | | $ | 3.02 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.37% for Investment Class shares and 0.62% for Service Class shares (for the period October 1, 2020-March 31, 2021), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

| | |

| 2 | | State Street Institutional U.S. Equity Fund |

State Street Institutional U.S. Equity Fund

Fund Information — March 31, 2021 (Unaudited)

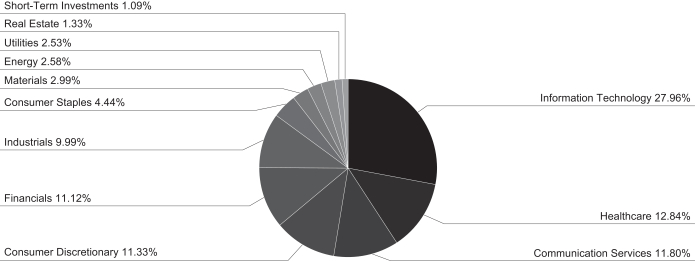

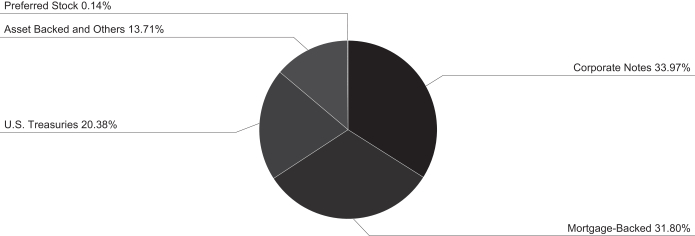

Sector Allocation

Portfolio Composition as a % of Fair Value of $548,508 (in thousands) as of March 31, 2021 (a)(b)

Top Ten Largest Holdings

as of March 31, 2021 (as a % of Fair Value) (a)(b)

| | | | |

Microsoft Corp. | | | 5.73 | % |

Amazon.com Inc. | | | 4.71 | % |

Apple Inc. | | | 4.65 | % |

Alphabet Inc., Class A | | | 3.23 | % |

JPMorgan Chase & Co. | | | 2.83 | % |

Facebook Inc., Class A | | | 2.64 | % |

Visa Inc., Class A | | | 2.43 | % |

Applied Materials Inc. | | | 1.91 | % |

Boston Scientific Corp. | | | 1.85 | % |

Lowe’s Companies Inc. | | | 1.82 | % |

| (a) | Fair Value basis is inclusive of short-term investment in State Street Institutional U.S. Government Money Market Fund – Class G Shares. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

| | |

| State Street Institutional U.S. Equity Fund | | 3 |

State Street Institutional U.S. Equity Fund

Schedule of Investments — March 31, 2021 (Unaudited)

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

| | | | | | | | |

| |

| Common Stock - 98.9%† | | | | | |

Aerospace & Defense - 0.5% | | | | | |

Raytheon Technologies Corp. | | | 39,136 | | | | 3,024,039 | |

| | | | | | | | |

|

Air Freight & Logistics - 0.8% | |

United Parcel Service Inc., | | | | | | | | |

Class B | | | 24,432 | | | | 4,153,196 | |

| | | | | | | | |

|

Apparel Retail - 1.4% | |

Ross Stores Inc. | | | 62,916 | | | | 7,544,258 | |

| | | | | | | | |

|

Application Software - 2.4% | |

Adobe Inc. (a) | | | 7,268 | | | | 3,454,989 | |

Intuit Inc. | | | 2,618 | | | | 1,002,851 | |

salesforce.com Inc. (a) | | | 37,774 | | | | 8,003,178 | |

Splunk Inc. (a) | | | 6,484 | | | | 878,452 | |

| | | | | | | | |

| | | | | | 13,339,470 | |

| | | | | | | | |

|

Asset Management & Custody Banks - 0.3% | |

The Blackstone Group Inc. | | | 19,955 | | | | 1,487,246 | |

| | | | | | | | |

|

Automotive Retail - 0.6% | |

O’Reilly Automotive Inc. (a) | | | 6,006 | | | | 3,046,543 | |

| | | | | | | | |

|

Biotechnology - 0.9% | |

BioMarin Pharmaceutical Inc. (a) | | | 24,132 | | | | 1,822,208 | |

Vertex Pharmaceuticals Inc. (a) | | | 13,343 | | | | 2,867,277 | |

| | | | | | | | |

| | | | | | 4,689,485 | |

| | | | | | | | |

|

Building Products - 1.8% | |

Allegion PLC | | | 20,290 | | | | 2,548,830 | |

Trane Technologies PLC | | | 43,535 | | | | 7,207,654 | |

| | | | | | | | |

| | | | | | 9,756,484 | |

| | | | | | | | |

|

Cable & Satellite - 1.5% | |

Charter Communications Inc., Class A (a) | | | 7,721 | | | | 4,764,011 | |

Comcast Corp., Class A | | | 66,204 | | | | 3,582,299 | |

| | | | | | | | |

| | | | | | 8,346,310 | |

| | | | | | | | |

|

Construction Materials - 0.9% | |

Martin Marietta Materials Inc. | | | 14,569 | | | | 4,892,562 | |

| | | | | | | | |

|

Data Processing & Outsourced Services - 4.5% | |

Fidelity National Information Services Inc. | | | 12,939 | | | | 1,819,353 | |

Mastercard Inc., Class A | | | 17,032 | | | | 6,064,243 | |

PayPal Holdings Inc. (a) | | | 13,265 | | | | 3,221,273 | |

Visa Inc., Class A | | | 63,030 | | | | 13,345,342 | |

| | | | | | | | |

| | | | | | | 24,450,211 | |

| | | | | | | | |

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

Diversified Banks - 2.8% | |

JPMorgan Chase & Co. | | | 101,910 | | | | 15,513,759 | |

| | | | | | | | |

|

Diversified Support Services - 0.6% | |

Cintas Corp. | | | 9,806 | | | | 3,346,886 | |

| | | | | | | | |

| | |

Electric Utilities - 0.9% | | | | | | | | |

NextEra Energy Inc. | | | 64,609 | | | | 4,885,086 | |

| | | | | | | | |

|

Electronic Components - 2.6% | |

Amphenol Corp., Class A | | | 80,944 | | | | 5,339,876 | |

Corning Inc. | | | 201,304 | | | | 8,758,737 | |

| | | | | | | | |

| | | | | | | 14,098,613 | |

| | | | | | | | |

|

Electronic Equipment & Instruments - 0.7% | |

Keysight Technologies Inc. (a) | | | 26,778 | | | | 3,839,965 | |

| | | | | | | | |

|

Environmental & Facilities Services - 1.5% | |

Waste Management Inc. | | | 64,472 | | | | 8,318,177 | |

| | | | | | | | |

|

Financial Exchanges & Data - 1.6% | |

CME Group Inc. | | | 23,972 | | | | 4,895,801 | |

MSCI Inc. | | | 2,131 | | | | 893,486 | |

S&P Global Inc. | | | 5,794 | | | | 2,044,529 | |

| | | | | | | | |

| | |

Tradeweb Markets Inc., | | | | | | | | |

Class A | | | 16,364 | | | | 1,210,936 | |

| | | | | | | | |

| | | | | | | 9,044,752 | |

| | | | | | | | |

|

Footwear - 0.8% | |

NIKE Inc., Class B | | | 31,692 | | | | 4,211,550 | |

| | | | | | | | |

|

Healthcare Equipment - 4.1% | |

Becton Dickinson & Co. | | | 16,921 | | | | 4,114,341 | |

Boston Scientific Corp. (a) | | | 262,409 | | | | 10,142,108 | |

Edwards Lifesciences Corp. (a) | | | 30,338 | | | | 2,537,470 | |

Medtronic PLC | | | 30,059 | | | | 3,550,870 | |

Zimmer Biomet Holdings Inc. | | | 15,059 | | | | 2,410,645 | |

| | | | | | | | |

| | | | | | | 22,755,434 | |

| | | | | | | | |

|

Healthcare Services - 0.6% | |

Cigna Corp. | | | 13,726 | | | | 3,318,123 | |

| | | | | | | | |

| |

Home Improvement Retail - 2.2% | | | | | |

Lowe’s Companies Inc. | | | 52,547 | | | | 9,993,388 | |

The Home Depot Inc. | | | 5,983 | | | | 1,826,311 | |

| | | | | | | | |

| | | | | | | 11,819,699 | |

| | | | | | | | |

|

Hotels, Resorts & Cruise Lines - 1.1% | |

Marriott International Inc., | | | | | | | | |

Class A | | | 41,776 | | | | 6,187,443 | |

| | | | | | | | |

See Notes to Schedules of Investments and Notes to Financial Statements.

| | |

| 4 | | State Street Institutional U.S. Equity Fund |

State Street Institutional U.S. Equity Fund

Schedule of Investments, continued — March 31, 2021 (Unaudited)

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

| | | | | | | | |

Household Products - 1.4% | |

Colgate-Palmolive Co. | | | 26,369 | | | | 2,078,668 | |

The Procter & Gamble Co. | | | 41,315 | | | | 5,595,291 | |

| | | | | | | | |

| | | | | | | 7,673,959 | |

| | | | | | | | |

|

Hypermarkets & Super Centers - 0.4% | |

Walmart Inc. | | | 15,496 | | | | 2,104,822 | |

| | | | | | | | |

|

Industrial Conglomerates - 2.1% | |

Honeywell International Inc. | | | 43,662 | | | | 9,477,711 | |

Roper Technologies Inc. | | | 5,477 | | | | 2,209,093 | |

| | | | | | | | |

| | | | | | | 11,686,804 | |

| | | | | | | | |

|

Industrial Gases - 1.5% | |

Air Products & Chemicals Inc. | | | 29,763 | | | | 8,373,522 | |

| | | | | | | | |

|

Industrial Machinery - 0.4% | |

Xylem Inc. | | | 20,536 | | | | 2,159,976 | |

| | | | | | | | |

|

Insurance Brokers - 0.2% | |

Marsh & McLennan | | | | | | | | |

Companies Inc. | | | 11,095 | | | | 1,351,371 | |

| | | | | | | | |

|

Integrated Oil & Gas - 0.9% | |

Chevron Corp. | | | 29,065 | | | | 3,045,721 | |

Exxon Mobil Corp. | | | 35,601 | | | | 1,987,604 | |

| | | | | | | | |

| | | | | | | 5,033,325 | |

| | | | | | | | |

|

Interactive Home Entertainment - 0.3% | |

Activision Blizzard Inc. | | | 15,568 | | | | 1,447,824 | |

| | | | | | | | |

|

Interactive Media & Services - 7.4% | |

Alphabet Inc., Class C (a) | | | 3,989 | | | | 8,251,765 | |

Alphabet Inc., Class A (a) | | | 8,601 | | | | 17,739,735 | |

Facebook Inc., Class A (a) | | | 49,134 | | | | 14,471,437 | |

| | | | | | | | |

| | | | | | | 40,462,937 | |

| | | | | | | | |

|

Internet & Direct Marketing Retail - 4.7% | |

Amazon.com Inc. (a) | | | 8,351 | | | | 25,838,663 | |

| | | | | | | | |

|

Investment Banking & Brokerage - 0.4% | |

The Charles Schwab Corp. | | | 30,796 | | | | 2,007,283 | |

| | | | | | | | |

|

IT Consulting & Other Services - 0.4% | |

Accenture PLC, Class A | | | 7,522 | | | | 2,077,953 | |

| | | | | | | | |

| |

Life & Health Insurance - 0.2% | | | | | |

Lincoln National Corp. | | | 13,659 | | | | 850,546 | |

| | | | | | | | |

|

Life Sciences Tools & Services - 1.2% | |

IQVIA Holdings Inc. (a) | | | 33,732 | | | | 6,514,998 | |

| | | | | | | | |

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

Managed Healthcare - 2.0% | |

Centene Corp. (a) | | | 71,781 | | | | 4,587,524 | |

UnitedHealth Group Inc. | | | 17,504 | | | | 6,512,713 | |

| | | | | | | | |

| | | | | | | 11,100,237 | |

| | | | | | | | |

|

Movies & Entertainment - 2.3% | |

Netflix Inc. (a) | | | 6,739 | | | | 3,515,467 | |

The Walt Disney Co. (a) | | | 50,337 | | | | 9,288,183 | |

| | | | | | | | |

| | | | | | | 12,803,650 | |

| | | | | | | | |

|

Multi-Line Insurance - 0.3% | |

American International | | | | | | | | |

Group Inc. | | | 33,934 | | | | 1,568,090 | |

| | | | | | | | |

|

Multi-Sector Holdings - 1.2% | |

Berkshire Hathaway Inc., | | | | | | | | |

Class B (a) | | | 25,202 | | | | 6,438,355 | |

| | | | | | | | |

|

Multi-Utilities - 1.6% | |

Sempra Energy | | | 67,688 | | | | 8,974,075 | |

| | | | | | | | |

|

Oil & Gas Equipment & Services - 0.3% | |

Schlumberger N.V. | | | 52,409 | | | | 1,425,001 | |

| | | | | | | | |

|

Oil & Gas Exploration & Production - 1.4% | |

ConocoPhillips | | | 107,469 | | | | 5,692,633 | |

Pioneer Natural Resources Co. | | | 12,606 | | | | 2,002,085 | |

| | | | | | | | |

| | | | | | | 7,694,718 | |

| | | | | | | | |

|

Packaged Foods & Meats - 1.4% | |

Mondelez International Inc., | | | | | | | | |

Class A | | | 129,912 | | | | 7,603,749 | |

| | | | | | | | |

|

Personal Products - 0.4% | |

The Estee Lauder | | | | | | | | |

Companies Inc., Class A | | | 8,230 | | | | 2,393,696 | |

| | | | | | | | |

|

Pharmaceuticals - 4.0% | |

Bristol-Myers Squibb Co. | | | 63,382 | | | | 4,001,306 | |

Elanco Animal Health Inc. (a) | | | 119,372 | | | | 3,515,505 | |

Johnson & Johnson | | | 18,218 | | | | 2,994,128 | |

Merck & Company Inc. | | | 123,163 | | | | 9,494,636 | |

Viatris Inc. (a) | | | 152,227 | | | | 2,126,611 | |

| | | | | | | | |

| | | | | | | 22,132,186 | |

| | | | | | | | |

|

Property & Casualty Insurance - 1.1% | |

Chubb Ltd. | | | 37,932 | | | | 5,992,118 | |

| | | | | | | | |

|

Railroads - 0.7% | |

Union Pacific Corp. | | | 17,357 | | | | 3,825,656 | |

| | | | | | | | |

See Notes to Schedules of Investments and Notes to Financial Statements.

| | |

| State Street Institutional U.S. Equity Fund | | 5 |

State Street Institutional U.S. Equity Fund

Schedule of Investments, continued — March 31, 2021 (Unaudited)

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

| | | | | | | | |

Regional Banks - 3.0% | |

First Republic Bank | | | 43,183 | | | | 7,200,765 | |

Regions Financial Corp. | | | 306,952 | | | | 6,341,628 | |

SVB Financial Group (a) | | | 6,431 | | | | 3,174,728 | |

| | | | | | | | |

| | | | | | | 16,717,121 | |

| | | | | | | | |

|

Restaurants - 0.6% | |

McDonald’s Corp. | | | 15,481 | | | | 3,469,911 | |

| | | | | | | | |

|

Semiconductor Equipment - 1.9% | |

Applied Materials Inc. | | | 78,504 | | | | 10,488,134 | |

| | | | | | | | |

|

Semiconductors - 4.2% | |

NVIDIA Corp. | | | 11,568 | | | | 6,176,502 | |

QUALCOMM Inc. | | | 66,957 | | | | 8,877,829 | |

Texas Instruments Inc. | | | 41,230 | | | | 7,792,058 | |

| | | | | | | | |

| | | | | | | 22,846,389 | |

| | | | | | | | |

|

Soft Drinks - 0.8% | |

PepsiCo Inc. | | | 32,324 | | | | 4,572,230 | |

| | | | | | | | |

|

Specialized REITs - 1.3% | |

American Tower Corp. | | | 30,539 | | | | 7,300,653 | |

| | | | | | | | |

|

Specialty Chemicals - 0.6% | |

DuPont de Nemours Inc. | | | 15,998 | | | | 1,236,326 | |

Ecolab Inc. | | | 4,245 | | | | 908,727 | |

PPG Industries Inc. | | | 6,397 | | | | 961,213 | |

| | | | | | | | |

| | | | | | | 3,106,266 | |

| | | | | | | | |

|

Systems Software - 6.7% | |

Microsoft Corp. | | | 133,407 | | | | 31,453,368 | |

Oracle Corp. | | | 45,003 | | | | 3,157,861 | |

ServiceNow Inc. (a) | | | 4,147 | | | | 2,073,956 | |

| | | | | | | | |

| | | | | | | 36,685,185 | |

| | | | | | | | |

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

Technology Hardware, Storage & Peripherals - 4.6% | |

Apple Inc. | | | 208,868 | | | | 25,513,226 | |

| | | | | | | | |

|

Trading Companies & Distributors - 1.5% | |

United Rentals Inc. (a) | | | 24,313 | | | | 8,006,514 | |

| | | | | | | | |

| | |

Trucking - 0.1% | | | | | | | | |

Lyft Inc., Class A (a) | | | 8,137 | | | | 514,096 | |

| | | | | | | | |

|

Wireless Telecommunication Services - 0.3% | |

T-Mobile US Inc. (a) | | | 13,524 | | | | 1,694,422 | |

| | | | | | | | |

| | |

Total Common Stock

(Cost $330,898,275) | | | | | | | 542,518,952 | |

| | | | | | | | |

|

| Short-Term Investments - 1.1% | |

State Street Institutional U.S. Government Money Market Fund - Class G Shares 0.04% (b)(c)(d) | | | 5,988,802 | | | | 5,988,802 | |

| | | | | | | | |

| | |

Total Investments

(Cost $336,887,077) | | | | | | | 548,507,754 | |

| |

Other Assets and Liabilities,

net - 0.0%* | | | | 272,878 | |

| | | | | | | | |

| | |

| NET ASSETS - 100.0% | | | | | | | 548,780,632 | |

| | | | | | | | |

Other Information:

The Fund had the following short futures contracts open at March 31, 2021:

| | | | | | | | | | | | | | | | | | | | |

| Description | | Expiration

date | | | Number of

Contracts | | | Notional

Amount | | | Value | | | Unrealized

Appreciation

(Depreciation) | |

E-MINI S&P 500 INDEX | | | June 2021 | | | | 8 | | | $ | (1,586,883) | | | $ | (1,586,960) | | | $ | (77 | ) |

| | | | | | | | | | | | | | | | | | | | |

During the period ended March 31, 2021, average notional values related to long and short futures contracts was $2,472,714 and $274,594, respectively.

See Notes to Schedules of Investments and Notes to Financial Statements.

| | |

| 6 | | State Street Institutional U.S. Equity Fund |

State Street Institutional U.S. Equity Fund

Schedule of Investments, continued — March 31, 2021 (Unaudited)

Notes to Schedule of Investments — March 31, 2021 (Unaudited)

The views expressed in this document reflect our judgment as of the publication date and are subject to change at any time without notice. The securities cited may not be representative of the Fund’s future investments and should not be construed as a recommendation to purchase or sell a particular security. See the Fund’s summary prospectus and statutory prospectus for complete descriptions of investment objectives, policies, risks and permissible investments.

| (a) | Non-income producing security. |

| (b) | At March 31, 2021, all or a portion of this security was pledged to cover collateral requirements for futures and/or TBAs. |

| (c) | Coupon amount represents effective yield. |

| (d) | Sponsored by SSGA Funds Management, Inc., the Fund’s investment adviser and administrator, and an affiliate of State Street Bank & Trust Co., the Fund’s sub-administrator, custodian and accounting agent. |

| † | Percentages are based on net assets as of March 31, 2021. |

Abbreviations:

REITs - Real Estate Investment Trusts

The following table presents the Fund’s investments measured at fair value on a recurring basis at March 31, 2021:

| | | | | | | | | | | | | | | | | | |

| Fund | | Investments | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | | | | |

| State Street Institutional | | | | | | | | | | | | | | | | | | |

| | | | | |

| U.S. Equity Fund | | Investments in Securities | | | | | | | | | | | | | | | | |

| | | | | |

| | Common Stock | | $ | 542,518,952 | | | $ | — | | | $ | — | | | $ | 542,518,952 | |

| | | | | |

| | Short-Term Investments | | | 5,988,802 | | | | — | | | | — | | | | 5,988,802 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | Total Investments in Securities | | $ | 548,507,754 | | | $ | — | | | $ | — | | | $ | 548,507,754 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | Other Financial Instruments | | | | | | | | | | | | | | | | |

| | | | | |

| | Short Futures Contracts - | | | | | | | | | | | | | | | | |

| | | | | |

| | Unrealized Depreciation | | $ | (77) | | | $ | — | | | $ | — | | | $ | (77 | ) |

| | | | | | | | | | | | | | | | | | |

Affiliate Table

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Number of

Shares

Held at

9/30/20 | | | Value at

9/30/20 | | | Cost of

Purchases | | | Proceeds

from

Shares Sold | | | Realized

Gain

(Loss) | | | Change in

Unrealized

Appreciation

(Depreciation) | | | Number of

Shares

Held at

3/31/21 | | | Value at

3/31/21 | | | Dividend

Income | |

State Street Institutional U.S. Government Money Market Fund, Class G Shares | | | 5,363,497 | | | $ | 5,363,497 | | | $ | 30,391,995 | | | $ | 29,766,690 | | | $ | — | | | $ | — | | | | 5,988,802 | | | $ | 5,988,802 | | | $ | 2,089 | |

See Notes to Schedules of Investments and Notes to Financial Statements.

| | |

| State Street Institutional U.S. Equity Fund | | 7 |

State Street Institutional Premier Growth Equity Fund

Understanding Your Fund’s Expenses — March 31, 2021 (Unaudited)

As a shareholder of the Fund you incur ongoing costs. Ongoing costs include portfolio management fees, distribution and service fees (for Service Class shares) and trustees’ fees. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class of the Fund during the period. The information in the following table is based on an investment of $1,000, which is invested at the beginning of the period and held for the entire six-month period ended March 31, 2021.

Actual Expenses

The first section of the table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your class under the heading “Expenses paid during period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholders reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs, such as sales charges or redemption fees, if any. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | |

Investment Class | | Actual

Fund Return | | | Hypothetical

5% Return

(2.5% for

the period) | |

Actual Fund Return | | | | | | | | |

Beginning Account Value October 1, 2020 | | $ | 1,000.00 | | | $ | 1,000.00 | |

Ending Account Value March 31, 2021 | | $ | 1,137.80 | | | $ | 1,022.70 | |

Expenses Paid During Period* | | $ | 2.40 | | | $ | 2.27 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.46% for Investment Class shares and 0.71% for Service Class shares (for the period October 1, 2020-March 31, 2021), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

| | | | | | | | |

Service Class | | Actual

Fund Return | | | Hypothetical

5% Return

(2.5% for

the period) | |

Actual Fund Return | | | | | | | | |

Beginning Account Value October 1, 2020 | | $ | 1,000.00 | | | $ | 1,000.00 | |

Ending Account Value March 31, 2021 | | $ | 1,136.40 | | | $ | 1,021.40 | |

Expenses Paid During Period* | | $ | 3.73 | | | $ | 3.53 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.46% for Investment Class shares and 0.71% for Service Class shares (for the period October 1, 2020-March 31, 2021), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

| | |

| 8 | | State Street Institutional Premier Growth Equity Fund |

State Street Institutional Premier Growth Equity Fund

Fund Information — March 31, 2021 (Unaudited)

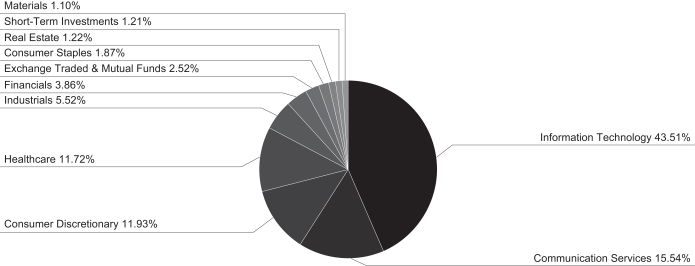

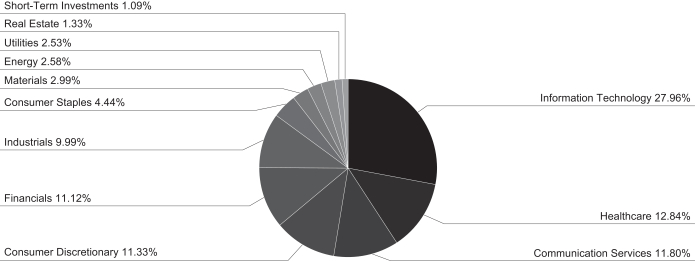

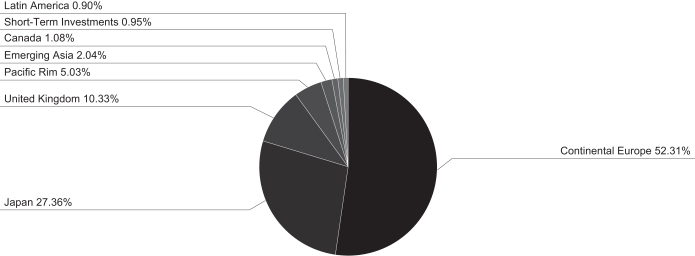

Sector Allocation

Portfolio Composition as a % of Fair Value of $90,956 (in thousands) as of March 31, 2021 (a)(b)

Top Ten Largest Holdings

as of March 31, 2021 (as a % of Fair Value) (a)(b)

| | | | |

| |

Microsoft Corp. | | | 9.19 | % |

| |

Apple Inc. | | | 8.70 | % |

| |

Amazon.com Inc. | | | 6.01 | % |

| |

Alphabet Inc., Class C | | | 5.38 | % |

| |

Facebook Inc., Class A | | | 5.35 | % |

| |

Visa Inc., Class A | | | 4.61 | % |

| |

Applied Materials Inc. | | | 3.47 | % |

| |

QUALCOMM Inc. | | | 3.14 | % |

| |

UnitedHealth Group Inc. | | | 3.11 | % |

| |

salesforce.com Inc. | | | 3.09 | % |

| (a) | Fair Value basis is inclusive of short-term investment in State Street Institutional U.S. Government Money Market Fund – Class G Shares. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

| | |

| State Street Institutional Premier Growth Equity Fund | | 9 |

State Street Institutional Premier Growth Equity Fund

Schedule of Investments — March 31, 2021 (Unaudited)

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

| | | | | | | | |

|

| Common Stock - 96.3%† | |

|

Apparel Retail - 1.8% | |

Ross Stores Inc. | | | 14,004 | | | | 1,679,220 | |

| | | | | | | | |

|

Application Software - 5.0% | |

Adobe Inc. (a) | | | 1,214 | | | | 577,099 | |

salesforce.com Inc. (a) | | | 13,254 | | | | 2,808,125 | |

Splunk Inc. (a) | | | 8,437 | | | | 1,143,045 | |

| | | | | | | | |

| | | | | | | 4,528,269 | |

| | | | | | | | |

|

Biotechnology - 2.8% | |

BioMarin Pharmaceutical Inc. (a) | | | 14,736 | | | | 1,112,715 | |

Vertex Pharmaceuticals Inc. (a) | | | 6,546 | | | | 1,406,670 | |

| | | | | | | | |

| �� | | | | | | 2,519,385 | |

| | | | | | | | |

|

Building Products - 0.8% | |

Trane Technologies PLC | | | 4,260 | | | | 705,286 | |

| | | | | | | | |

|

Cable & Satellite - 1.5% | |

Charter Communications Inc., | | | | | | | | |

Class A (a) | | | 2,136 | | | | 1,317,955 | |

| | | | | | | | |

|

Data Processing & Outsourced Services - 7.3% | |

Fidelity National Information | | | | | | | | |

Services Inc. | | | 6,669 | | | | 937,728 | |

Mastercard Inc., Class A | | | 4,286 | | | | 1,526,030 | |

Visa Inc., Class A | | | 19,829 | | | | 4,198,394 | |

| | | | | | | | |

| | | | | | | 6,662,152 | |

| | | | | | | | |

|

Electronic Components - 1.9% | |

Corning Inc. | | | 39,883 | | | | 1,735,309 | |

| | | | | | | | |

|

Financial Exchanges & Data - 1.3% | |

S&P Global Inc. | | | 3,221 | | | | 1,136,594 | |

| | | | | | | | |

|

Healthcare Equipment - 3.7% | |

Boston Scientific Corp. (a) | | | 56,829 | | | | 2,196,441 | |

Intuitive Surgical Inc. (a) | | | 1,622 | | | | 1,198,560 | |

| | | | | | | | |

| | | | | | | 3,395,001 | |

| | | | | | | | |

|

Home Improvement Retail - 2.9% | |

Lowe’s Companies Inc. | | | 14,082 | | | | 2,678,115 | |

| | | | | | | | |

|

Industrial Conglomerates - 1.8% | |

Honeywell International Inc. | | | 7,708 | | | | 1,673,176 | |

| | | | | | | | |

|

Industrial Gases - 1.1% | |

Air Products & Chemicals Inc. | | | 3,547 | | | | 997,913 | |

| | | | | | | | |

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

Interactive Media & Services - 12.7% | |

Alphabet Inc., Class C (a) | | | 2,366 | | | | 4,894,379 | |

Alphabet Inc., Class A (a) | | | 845 | | | | 1,742,829 | |

Facebook Inc., Class A (a) | | | 16,513 | | | | 4,863,574 | |

| | | | | | | | |

| | | | | | | 11,500,782 | |

| | | | | | | | |

|

Internet & Direct Marketing Retail - 7.1% | |

Alibaba Group Holding Ltd.

ADR (a) | | | 4,518 | | | | 1,024,366 | |

Amazon.com Inc. (a) | | | 1,768 | | | | 5,470,334 | |

| | | | | | | | |

| | | | | | | 6,494,700 | |

| | | | | | | | |

|

Investment Banking & Brokerage - 1.3% | |

The Charles Schwab Corp. | | | 17,942 | | | | 1,169,460 | |

| | | | | | | | |

|

Managed Healthcare - 3.1% | |

UnitedHealth Group Inc. | | | 7,598 | | | | 2,826,988 | |

| | | | | | | | |

|

Movies & Entertainment - 1.5% | |

The Walt Disney Co. (a) | | | 7,141 | | | | 1,317,657 | |

| | | | | | | | |

|

Pharmaceuticals - 2.1% | |

Elanco Animal Health Inc. (a) | | | 65,237 | | | | 1,921,230 | |

| | | | | | | | |

|

Regional Banks - 1.3% | |

First Republic Bank | | | 7,184 | | | | 1,197,932 | |

| | | | | | | | |

|

Semiconductor Equipment - 3.5% | |

Applied Materials Inc. | | | 23,599 | | | | 3,152,826 | |

| | | | | | | | |

|

Semiconductors - 5.7% | |

NVIDIA Corp. | | | 4,400 | | | | 2,349,292 | |

QUALCOMM Inc. | | | 21,516 | | | | 2,852,806 | |

| | | | | | | | |

| | | | | | | 5,202,098 | |

| | | | | | | | |

|

Soft Drinks - 1.9% | |

PepsiCo Inc. | | | 12,004 | | | | 1,697,966 | |

| | | | | | | | |

|

Specialized REITs - 1.2% | |

American Tower Corp. | | | 4,658 | | | | 1,113,541 | |

| | | | | | | | |

|

Systems Software - 11.4% | |

Microsoft Corp. | | | 35,439 | | | | 8,355,453 | |

ServiceNow Inc. (a) | | | 4,041 | | | | 2,020,944 | |

| | | | | | | | |

| | | | | | | 10,376,397 | |

| | | | | | | | |

|

Technology Hardware, Storage & Peripherals - 8.7% | |

Apple Inc. | | | 64,784 | | | | 7,913,366 | |

| | | | | | | | |

|

Trading Companies & Distributors - 2.0% | |

United Rentals Inc. (a) | | | 5,516 | | | | 1,816,474 | |

| | | | | | | | |

See Notes to Schedules of Investments and Notes to Financial Statements.

| | |

| 10 | | State Street Institutional Premier Growth Equity Fund |

State Street Institutional Premier Growth Equity Fund

Schedule of Investments, continued — March 31, 2021 (Unaudited)

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

| | | | | | | | |

Trucking - 0.9% | |

Lyft Inc., Class A (a) | | | 13,154 | | | | 831,070 | |

| | | | | | | | |

| |

Total Common Stock

(Cost $43,973,729) | | | | 87,560,862 | |

| | | | | | | | |

|

| Exchange Traded & Mutual Funds - 2.5% | |

The Consumer Discretionary Select Sector SPDR Fund (b) | | | 9,145 | | | | 1,537,000 | |

The Technology Select Sector SPDR Fund (b) | | | 5,675 | | | | 753,697 | |

| | | | | | | | |

| |

Total Exchange Traded & Mutual Funds

(Cost $1,914,316) | | | | 2,290,697 | |

| | | | | | | | |

| |

Total Investments in Securities

(Cost $45,888,045) | | | | 89,851,559 | |

| | | | | | | | |

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

| |

| Short-Term Investments - 1.2% | | | | | |

State Street Institutional U.S. Government Money Market Fund - Class G Shares 0.04% (b)(c)(d) | | | 1,104,475 | | | | 1,104,475 | |

| | | | | | | | |

Total Investments

(Cost $46,992,520) | | | | | | | 90,956,034 | |

| |

Liabilities in Excess of Other

Assets, net - (0.0)%* | | | | (39,898 | ) |

| | | | | | | | |

| | |

| NET ASSETS - 100.0% | | | | | | | 90,916,136 | |

| | | | | | | | |

Other Information:

The Fund had the following long futures contracts open at March 31, 2021:

| | | | | | | | | | | | | | | | | | | | |

| Description | | Expiration

Date | | | Number of

Contracts | | | Notional

Amount | | | Value | | | Unrealized

Appreciation

(Depreciation) | |

| | | | | | | | | | | | | | | | | | | | |

S&P 500 Emini Index Futures | | | June 2021 | | | | 1 | | | $ | 196,365 | | | $ | 198,370 | | | $ | 2,005 | |

| | | | | | | | | | | | | | | | | | | | |

During the period ended March 31, 2021, average notional values related to long and short futures contracts was $995,539 and $47,886, respectively.

Notes to Schedule of Investments — March 31, 2021 (Unaudited)

The views expressed in this document reflect our judgment as of the publication date and are subject to change at any time without notice. The securities cited may not be representative of the Fund’s future investments and should not be construed as a recommendation to purchase or sell a particular security. See the Fund’s summary prospectus and statutory prospectus for complete descriptions of investment objectives, policies, risks and permissible investments.

| (a) | Non-income producing security. |

| (b) | Sponsored by SSGA Funds Management, Inc., the Fund’s investment adviser and administrator, and an affiliate of State Street Bank & Trust Co., the |

| | Fund’s sub-administrator, custodian and accounting agent. |

| (c) | Coupon amount represents effective yield. |

| (d) | At March 31, 2021, all or a portion of this security was pledged to cover collateral requirements for futures, swaps and/or TBAs. |

| † | Percentages are based on net assets as of March 31, 2021. |

Abbreviations:

ADR - American Depositary Receipt

REITs - Real Estate Investment Trusts

SPDR - Standard and Poor’s Depositary Receipt

See Notes to Schedules of Investments and Notes to Financial Statements.

| | |

| State Street Institutional Premier Growth Equity Fund | | 11 |

State Street Institutional Premier Growth Equity Fund

Schedule of Investments, continued — March 31, 2021 (Unaudited)

The following table presents the Fund’s investments measured at fair value on a recurring basis at March 31, 2021:

| | | | | | | | | | | | | | | | | | |

| Fund | | Investments | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| | | | | |

| State Street Institutional | | | | | | | | | | | | | | | | | | |

| | | | | |

| Premier Growth Equity | | | | | | | | | | | | | | | | | | |

Fund | | Investments in Securities | | | | | | | | | | | | | | | | |

| | | | | |

| | Common Stock | | $ | 87,560,862 | | | $ | — | | | $ | — | | | $ | 87,560,862 | |

| | | | | |

| | Exchange Traded & Mutual | | | | | | | | | | | | | | | | |

| | | | | |

| | Funds | | | 2,290,697 | | | | — | | | | — | | | | 2,290,697 | |

| | | | | |

| | Short-Term Investments | | | 1,104,475 | | | | — | | | | — | | | | 1,104,475 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | Total Investments in Securities | | $ | 90,956,034 | | | $ | — | | | $ | — | | | $ | 90,956,034 | |

| | | | | | | | | | | | | | | | | | |

| | | | | |

| | Other Financial Instruments | | | | | | | | | | | | | | | | |

| | | | | |

| | Long Futures Contracts - | | | | | | | | | | | | | | | | |

| | | | | |

| | Unrealized Appreciation | | $ | 2,005 | | | $ | — | | | $ | — | | | $ | 2,005 | |

| | | | | | | | | | | | | | | | | | |

Affiliate Table

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Number of

Shares

Held at

9/30/20 | | | Value at

9/30/20 | | | Cost of

Purchases | | | Proceeds

from

Shares

Sold | | | Realized

Gain

(Loss) | | | Change in

Unrealized

Appreciation (Depreciation) | | | Number of

Shares

Held at

3/31/21 | | | Value at

3/31/21 | | | Dividend

Income | |

State Street Institutional U.S. Government | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Money Market Fund, Class G Shares | | | 1,019,025 | | | $ | 1,019,025 | | | $ | 6,492,391 | | | $ | 6,406,941 | | | $ | — | | | $ | — | | | | 1,104,475 | | | $ | 1,104,475 | | | $ | 496 | |

The Technology Select Sector SPDR Fund | | | 1,111 | | | | 129,653 | | | | 609,328 | | | | 5,043 | | | | 273 | | | | 19,486 | | | | 5,675 | | | | 753,697 | | | | 2,068 | |

The Consumer Discretionary Select Sector SPDR Fund | | | 6,161 | | | | 905,544 | | | | 576,256 | | | | 81,085 | | | | 18,030 | | | | 118,255 | | | | 9,145 | | | | 1,537,000 | | | | 3,817 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

TOTAL | | | | | | $ | 2,054,222 | | | $ | 7,677,975 | | | $ | 6,493,069 | | | $ | 18,303 | | | $ | 137,741 | | | | | | | $ | 3,395,172 | | | $ | 6,381 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

See Notes to Schedules of Investments and Notes to Financial Statements.

| | |

| 12 | | State Street Institutional Premier Growth Equity Fund |

State Street Institutional Small-Cap Equity Fund

Understanding Your Fund’s Expenses — March 31, 2021 (Unaudited)

As a shareholder of the Fund you incur ongoing costs. Ongoing costs include portfolio management fees, distribution and service fees (for Service Class shares) and trustees’ fees. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

To illustrate these ongoing costs, we have provided an example and calculated the expenses paid by investors in each share class of the Fund during the period. The information in the following table is based on an investment of $1,000, which is invested at the beginning of the period and held for the entire six-month period ended March 31, 2021.

Actual Expenses

The first section of the table provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your class under the heading “Expenses paid during the period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholders reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs, such as sales charges or redemption fees, if any. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | |

Investment Class | | Actual

Fund Return | | | Hypothetical

5% Return

(2.5% for

the period) | |

Actual Fund Return | | | | | | | | |

Beginning Account Value October 1, 2020 | | $ | 1,000.00 | | | $ | 1,000.00 | |

Ending Account Value March 31, 2021 | | $ | 1,453.20 | | | $ | 1,020.80 | |

Expenses Paid During Period* | | $ | 5.02 | | | $ | 4.13 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.88% for Investment Class shares and 1.13% for Service Class shares (for the period October 1, 2020-March 31, 2021), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

| | | | | | | | |

Service Class | | Actual

Fund Return | | | Hypothetical

5% Return

(2.5% for

the period) | |

Actual Fund Return | | | | | | | | |

Beginning Account Value October 1, 2020 | | $ | 1,000.00 | | | $ | 1,000.00 | |

Ending Account Value March 31, 2021 | | $ | 1,452.10 | | | $ | 1,019.30 | |

Expenses Paid During Period* | | $ | 6.91 | | | $ | 5.69 | |

| * | Expenses are equal to the Fund’s annualized expense ratio of 0.88% for Investment Class shares and 1.13% for Service Class shares (for the period October 1, 2020-March 31, 2021), multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

| | |

| State Street Institutional Small-Cap Equity Fund | | 13 |

State Street Institutional Small-Cap Equity Fund

Fund Information — March 31, 2021 (Unaudited)

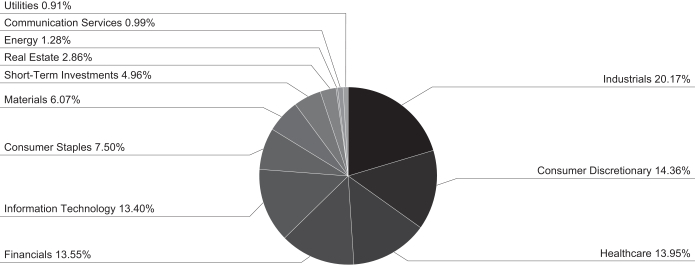

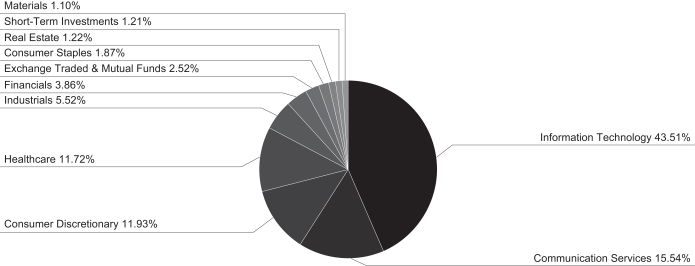

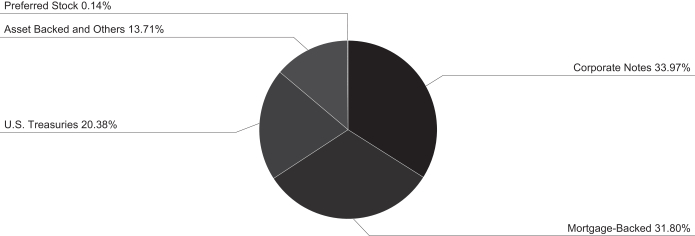

Sector Allocation

Portfolio Composition as a % of Fair Value of $1,302,628 (in thousands) as of March 31, 2021 (a)(b)

Top Ten Largest Holdings

as of March 31, 2021 (as a % of Fair Value) (a)(b)

| | | | |

Ingevity Corp. | | | 1.33 | % |

| |

Darling Ingredients Inc. | | | 1.32 | % |

| |

The Brink’s Co. | | | 1.26 | % |

| |

Dycom Industries Inc. | | | 1.24 | % |

| |

Extended Stay America Inc. | | | 1.20 | % |

| |

Thor Industries Inc. | | | 1.12 | % |

| |

Altra Industrial Motion Corp. | | | 1.07 | % |

| |

Polaris Inc. | | | 1.06 | % |

| |

The Timken Co. | | | 1.04 | % |

| |

Sanderson Farms Inc. | | | 1.03 | % |

| (a) | Fair Value basis is inclusive of short-term investment in State Street Institutional U.S. Government Money Market Fund – Class G Shares. |

| (b) | The securities information regarding holdings, allocations and other characteristics is presented to illustrate examples of securities that the Fund has bought and the diversity of areas in which the Fund may invest as of a particular date. It may not be representative of the Fund’s current or future investments and should not be construed as a recommendation to purchase or sell a particular security. |

| | |

| 14 | | State Street Institutional Small-Cap Equity Fund |

State Street Institutional Small-Cap Equity Fund

Schedule of Investments — March 31, 2021 (Unaudited)

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

| | | | | | | | |

|

| Common Stock - 94.9%† | |

Aerospace & Defense - 0.5% | |

Teledyne Technologies Inc. (a) | | | 14,751 | | | | 6,101,751 | |

| | | | | | | | |

|

Agricultural & Farm Machinery - 0.8% | |

AGCO Corp. | | | 70,799 | | | | 10,170,276 | |

| | | | | | | | |

|

Agricultural Products - 1.3% | |

Darling Ingredients Inc. (a) | | | 233,531 | | | | 17,183,211 | |

| | | | | | | | |

|

Air Freight & Logistics - 0.3% | |

Atlas Air Worldwide Holdings Inc. (a) | | | 7,258 | | | | 438,673 | |

Echo Global Logistics Inc. (a) | | | 29,654 | | | | 931,432 | |

Forward Air Corp. | | | 13,690 | | | | 1,215,809 | |

Hub Group Inc., Class A (a) | | | 13,014 | | | | 875,582 | |

| | | | | | | | |

| | | | | | | 3,461,496 | |

| | | | | | | | |

|

Airlines - 0.1% | |

Allegiant Travel Co. | | | 4,242 | | | | 1,035,303 | |

| | | | | | | | |

|

Aluminum - 0.2% | |

Alcoa Corp. (a) | | | 90,029 | | | | 2,925,042 | |

| | | | | | | | |

|

Apparel Retail - 0.8% | |

American Eagle Outfitters Inc. | | | 133,824 | | | | 3,913,014 | |

Burlington Stores Inc. (a) | | | 9,801 | | | | 2,928,539 | |

The Buckle Inc. | | | 89,823 | | | | 3,528,247 | |

| | | | | | | | |

| | | | | | | 10,369,800 | |

| | | | | | | | |

|

Application Software - 4.8% | |

ACI Worldwide Inc. (a) | | | 159,694 | | | | 6,076,357 | |

Altair Engineering Inc., Class A (a) | | | 59,853 | | | | 3,745,002 | |

Blackbaud Inc. | | | 126,960 | | | | 9,024,317 | |

Blackline Inc. (a) | | | 53,564 | | | | 5,806,338 | |

Box Inc., Class A (a) | | | 31,140 | | | | 714,974 | |

Cornerstone OnDemand Inc. (a) | | | 74,034 | | | | 3,226,402 | |

Envestnet Inc. (a) | | | 37,500 | | | | 2,708,625 | |

J2 Global Inc. (a) | | | 5,955 | | | | 713,766 | |

Medallia Inc. (a) | | | 222,500 | | | | 6,205,525 | |

Mitek Systems Inc. (a) | | | 68,917 | | | | 1,004,810 | |

New Relic Inc. (a) | | | 123,000 | | | | 7,562,040 | |

Q2 Holdings Inc. (a) | | | 60,360 | | | | 6,048,072 | |

Sumo Logic Inc. (a) | | | 13,405 | | | | 252,818 | |

Upland Software Inc. (a) | | | 18,432 | | | | 869,806 | |

Workiva Inc. (a) | | | 40,500 | | | | 3,574,530 | |

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

Yext Inc. (a) | | | 332,000 | | | | 4,807,360 | |

| | | | | | | | |

| | | | | | | 62,340,742 | |

| | | | | | | | |

Asset Management & Custody Banks - 0.2% | |

Artisan Partners Asset Management Inc., Class A | | | 14,219 | | | | 741,805 | |

Blucora Inc. (a) | | | 25,526 | | | | 424,752 | |

Diamond Hill Investment Group Inc. | | | 3,681 | | | | 574,273 | |

Federated Hermes Inc., Class B | | | 18,086 | | | | 566,092 | |

| | | | | | | | |

| | | | | | | 2,306,922 | |

| | | | | | | | |

| |

Auto Parts & Equipment - 1.0% | | | | | |

Dana Inc. | | | 100,615 | | | | 2,447,963 | |

Dorman Products Inc. (a) | | | 73,981 | | | | 7,593,410 | |

LCI Industries | | | 13,795 | | | | 1,824,803 | |

Standard Motor Products Inc. | | | 20,273 | | | | 842,951 | |

| | | | | | | | |

| | | | | | | 12,709,127 | |

| | | | | | | | |

| |

Automobile Manufacturers - 1.1% | | | | | |

Thor Industries Inc. | | | 107,838 | | | | 14,530,092 | |

| | | | | | | | |

|

Automotive Retail - 1.6% | |

America’s Car-Mart Inc. (a) | | | 21,101 | | | | 3,215,159 | |

Camping World Holdings Inc., Class A | | | 14,643 | | | | 532,712 | |

Group 1 Automotive Inc. | | | 39,667 | | | | 6,259,056 | |

Monro Inc. | | | 29,774 | | | | 1,959,129 | |

Murphy USA Inc. | | | 65,315 | | | | 9,441,937 | |

| | | | | | | | |

| | | | | | | 21,407,993 | |

| | | | | | | | |

| | |

Biotechnology - 1.5% | | | | | | | | |

Avid Bioservices Inc. (a) | | | 122,434 | | | | 2,231,972 | |

Catalyst Pharmaceuticals Inc. (a) | | | 297,791 | | | | 1,372,816 | |

CytomX Therapeutics Inc. (a) | | | 44,909 | | | | 347,147 | |

Eagle Pharmaceuticals Inc. (a) | | | 7,041 | | | | 293,891 | |

Emergent BioSolutions Inc. (a) | | | 79,215 | | | | 7,359,866 | |

Heron Therapeutics Inc. (a) | | | 155,937 | | | | 2,527,739 | |

Ironwood Pharmaceuticals Inc. (a) | | | 42,651 | | | | 476,838 | |

Novavax Inc. (a) | | | 2,934 | | | | 531,963 | |

Puma Biotechnology Inc. (a) | | | 115,529 | | | | 1,122,942 | |

Radius Health Inc. (a) | | | 55,373 | | | | 1,155,081 | |

Vanda Pharmaceuticals Inc. (a) | | | 32,400 | | | | 486,648 | |

See Notes to Schedules of Investments and Notes to Financial Statements.

| | |

| State Street Institutional Small-Cap Equity Fund | | 15 |

State Street Institutional Small-Cap Equity Fund

Schedule of Investments, continued — March 31, 2021 (Unaudited)

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

| | | | | | | | |

Veracyte Inc. (a) | | | 23,500 | | | | 1,263,125 | |

| | | | | | | | |

| | | | | | | 19,170,028 | |

| | | | | | | | |

|

Building Products - 1.0% | |

American Woodmark Corp. (a) | | | 13,428 | | | | 1,323,732 | |

Builders FirstSource Inc. (a) | | | 31,393 | | | | 1,455,694 | |

CSW Industrials Inc. | | | 16,000 | | | | 2,160,000 | |

Gibraltar Industries Inc. (a) | | | 62,483 | | | | 5,717,819 | |

UFP Industries Inc. | | | 31,698 | | | | 2,403,976 | |

| | | | | | | | |

| | | | | | | 13,061,221 | |

| | | | | | | | |

Commodity Chemicals - 0.5% | |

Koppers Holdings Inc. (a) | | | 200,324 | | | | 6,963,262 | |

| | | | | | | | |

| |

Communications Equipment - 0.7% | | | | | |

Casa Systems Inc. (a) | | | 86,488 | | | | 824,231 | |

| | | | | | | | |

CommScope Holding Company Inc. (a) | | | 50,800 | | | | 780,288 | |

Extreme Networks Inc. (a) | | | 290,892 | | | | 2,545,305 | |

Lumentum Holdings Inc. (a) | | | 17,704 | | | | 1,617,260 | |

NETGEAR Inc. (a) | | | 14,433 | | | | 593,196 | |

Plantronics Inc. | | | 56,104 | | | | 2,183,007 | |

Viavi Solutions Inc. (a) | | | 70,933 | | | | 1,113,648 | |

| | | | | | | | |

| | | | | | | 9,656,935 | |

| | | | | | | | |

|

Computer & Electronics Retail - 0.2% | |

Rent-A-Center Inc. | | | 36,841 | | | | 2,124,252 | |

| | | | | | | | |

| |

Construction & Engineering - 1.7% | | | | | |

Comfort Systems USA Inc. | | | 9,827 | | | | 734,765 | |

Dycom Industries Inc. (a) | | | 174,343 | | | | 16,187,747 | |

EMCOR Group Inc. | | | 9,352 | | | | 1,048,920 | |

MasTec Inc. (a) | | | 12,468 | | | | 1,168,252 | |

Valmont Industries Inc. | | | 12,636 | | | | 3,003,198 | |

| | | | | | | | |

| | | | | | | 22,142,882 | |

| | | | | | | | |

|

Construction Machinery & Heavy Trucks - 1.2% | |

Alamo Group Inc. | | | 16,939 | | | | 2,645,025 | |

Astec Industries Inc. | | | 41,883 | | | | 3,158,816 | |

Meritor Inc. (a) | | | 87,954 | | | | 2,587,607 | |

The Greenbrier Companies Inc. | | | 52,550 | | | | 2,481,411 | |

The Manitowoc Company Inc. (a) | | | 102,504 | | | | 2,113,632 | |

Trinity Industries Inc. | | | 32,049 | | | | 913,076 | |

Wabash National Corp. | | | 87,011 | | | | 1,635,807 | |

| | | | | | | | |

| | | | | | | 15,535,374 | |

| | | | | | | | |

|

Construction Materials - 0.1% | |

Eagle Materials Inc. | | | 12,374 | | | | 1,663,189 | |

| | | | | | | | |

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

Consumer Electronics - 0.3% | |

GoPro Inc., Class A (a) | | | 78,828 | | | | 917,558 | |

Sonos Inc. (a) | | | 28,050 | | | | 1,051,033 | |

Turtle Beach Corp. (a) | | | 33,624 | | | | 896,752 | |

Universal Electronics Inc. (a) | | | 9,344 | | | | 513,640 | |

| | | | | | | | |

| | | | | | | 3,378,983 | |

| | | | | | | | |

|

Consumer Finance - 0.3% | |

Curo Group Holdings Corp. | | | 35,714 | | | | 521,067 | |

Prog Holdings Inc. | | | 78,668 | | | | 3,405,538 | |

| | | | | | | | |

| | | | | | | 3,926,605 | |

| | | | | | | | |

|

Data Processing & Outsourced Services - 1.4% | |

Broadridge Financial Solutions Inc. | | | 25,950 | | | | 3,972,945 | |

Cass Information Systems Inc. | | | 116,550 | | | | 5,392,768 | |

CSG Systems International Inc. | | | 66,796 | | | | 2,998,472 | |

EVERTEC Inc. | | | 28,644 | | | | 1,066,130 | |

MAXIMUS Inc. | | | 10,267 | | | | 914,174 | |

TTEC Holdings Inc. | | | 7,204 | | | | 723,642 | |

Verra Mobility Corp. (a) | | | 198,389 | | | | 2,685,195 | |

| | | | | | | | |

| | | | | | | 17,753,326 | |

| | | | | | | | |

|

Distillers & Vintners - 0.7% | |

MGP Ingredients Inc. | | | 155,978 | | | | 9,226,099 | |

| | | | | | | | |

| | |

Distributors - 0.5% | | | | | | | | |

LKQ Corp. (a) | | | 149,397 | | | | 6,323,975 | |

| | | | | | | | |

| |

Diversified Metals & Mining - 0.3% | | | | | |

Compass Minerals International Inc. | | | 47,193 | | | | 2,959,945 | |

Materion Corp. | | | 10,790 | | | | 714,730 | |

| | | | | | | | |

| | | | | | | 3,674,675 | |

| | | | | | | | |

| | |

Diversified REITs - 0.2% | | | | | | | | |

American Assets Trust Inc. | | | 52,507 | | | | 1,703,327 | |

Essential Properties Realty Trust Inc. | | | 41,502 | | | | 947,491 | |

Gladstone Commercial Corp. | | | 31,089 | | | | 608,101 | |

| | | | | | | | |

| | | | | | | 3,258,919 | |

| | | | | | | | |

| |

Diversified Support Services - 1.6% | | | | | |

Healthcare Services Group Inc. | | | 134,119 | | | | 3,759,356 | |

IAA Inc. (a) | | | 44,272 | | | | 2,441,158 | |

Matthews International Corp., Class A | | | 67,891 | | | | 2,685,089 | |

See Notes to Schedules of Investments and Notes to Financial Statements.

| | |

| 16 | | State Street Institutional Small-Cap Equity Fund |

State Street Institutional Small-Cap Equity Fund

Schedule of Investments, continued — March 31, 2021 (Unaudited)

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

| | | | | | | | |

Ritchie Bros Auctioneers Inc. | | | 175,869 | | | | 10,297,130 | |

UniFirst Corp. | | | 6,402 | | | | 1,432,191 | |

| | | | | | | | |

| | | | | | | 20,614,924 | |

| | | | | | | | |

|

Education Services - 0.3% | |

American Public | | | | | | | | |

Education Inc. (a) | | | 17,421 | | | | 620,710 | |

Perdoceo Education Corp. (a) | | | 23,548 | | | | 281,634 | |

Stride Inc. (a) | | | 90,308 | | | | 2,719,174 | |

| | | | | | | | |

| | | | | | | 3,621,518 | |

| | | | | | | | |

| | |

Electric Utilities - 0.7% | | | | | | | | |

ALLETE Inc. | | | 16,243 | | | | 1,091,367 | |

IDACORP Inc. | | | 79,998 | | | | 7,997,400 | |

| | | | | | | | |

| | | | | | | 9,088,767 | |

| | | | | | | | |

Electrical Components & Equipment - 0.4% | |

Acuity Brands Inc. | | | 7,505 | | | | 1,238,325 | |

Atkore Inc. (a) | | | 23,140 | | | | 1,663,766 | |

Regal Beloit Corp. | | | 18,000 | | | | 2,568,240 | |

| | | | | | | | |

| | | | | | | 5,470,331 | |

| | | | | | | | |

|

Electronic Components - 1.4% | |

Belden Inc. | | | 174,202 | | | | 7,729,343 | |

II-VI Inc. (a) | | | 14,892 | | | | 1,018,166 | |

Littelfuse Inc. | | | 28,773 | | | | 7,608,732 | |

Rogers Corp. (a) | | | 7,623 | | | | 1,434,725 | |

| | | | | | | | |

| | | | | | | 17,790,966 | |

| | | | | | | | |

|

Electronic Equipment & Instruments - 0.3% | |

National Instruments Corp. | | | 98,478 | | | | 4,252,772 | |

OSI Systems Inc. (a) | | | 2,435 | | | | 234,004 | |

| | | | | | | | |

| | | | | | | 4,486,776 | |

| | | | | | | | |

|

Electronic Manufacturing Services - 0.4% | |

Methode Electronics Inc. | | | 38,431 | | | | 1,613,333 | |

Plexus Corp. (a) | | | 25,045 | | | | 2,300,133 | |

Sanmina Corp. (a) | | | 23,725 | | | | 981,741 | |

| | | | | | | | |

| | | | | | | 4,895,207 | |

| | | | | | | | |

|

Environmental & Facilities Services - 0.7% | |

Clean Harbors Inc. (a) | | | 106,704 | | | | 8,969,538 | |

| | | | | | | | |

| | |

Food Distributors - 0.4% | | | | | | | | |

Performance Food Group Co. (a) | | | 92,585 | | | | 5,333,822 | |

| | | | | | | | |

| | |

Food Retail - 0.1% | | | | | | | | |

Sprouts Farmers Market Inc. (a) | | | 32,709 | | | | 870,714 | |

| | | | | | | | |

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

Footwear - 0.7% | | | | | | | | |

Deckers Outdoor Corp. (a) | | | 9,220 | | | | 3,046,472 | |

Wolverine World Wide Inc. | | | 165,500 | | | | 6,341,960 | |

| | | | | | | | |

| | | | | | | 9,388,432 | |

| | | | | | | | |

| | |

Gas Utilities - 0.1% | | | | | | | | |

Spire Inc. | | | 21,502 | | | | 1,588,783 | |

| | | | | | | | |

|

Health Care REITs - 0.3% | |

CareTrust REIT Inc. | | | 49,680 | | | | 1,156,799 | |

LTC Properties Inc. | | | 10,510 | | | | 438,477 | |

National Health Investors Inc. | | | 25,781 | | | | 1,863,451 | |

| | | | | | | | |

| | | | | | | 3,458,727 | |

| | | | | | | | |

|

Healthcare Distributors - 0.6% | |

AdaptHealth Corp. (a) | | | 94,077 | | | | 3,458,270 | |

Covetrus Inc. (a) | | | 168,076 | | | | 5,037,238 | |

| | | | | | | | |

| | | | | | | 8,495,508 | |

| | | | | | | | |

|

Healthcare Equipment - 5.2% | |

Accuray Inc. (a) | | | 105,935 | | | | 524,378 | |

AtriCure Inc. (a) | | | 92,500 | | | | 6,060,600 | |

Cantel Medical Corp. (a) | | | 85,000 | | | | 6,786,400 | |

Cardiovascular Systems Inc. (a) | | | 146,500 | | | | 5,616,810 | |

CONMED Corp. | | | 73,000 | | | | 9,533,070 | |

Electromed Inc. (a) | | | 32,922 | | | | 346,998 | |

Envista Holdings Corp. (a) | | | 34,200 | | | | 1,395,360 | |

Globus Medical Inc., Class A (a) | | | 65,000 | | | | 4,008,550 | |

Hill-Rom Holdings Inc. | | | 74,188 | | | | 8,196,290 | |

Integra LifeSciences Holdings Corp. (a) | | | 123,910 | | | | 8,560,942 | |

IntriCon Corp. (a) | | | 67,053 | | | | 1,719,239 | |

LeMaitre Vascular Inc. | | | 26,369 | | | | 1,286,280 | |

Masimo Corp. (a) | | | 7,500 | | | | 1,722,450 | |

Natus Medical Inc. (a) | | | 49,031 | | | | 1,255,684 | |

Outset Medical Inc. (a) | | | 24,500 | | | | 1,332,555 | |

Penumbra Inc. (a) | | | 18,500 | | | | 5,005,730 | |

Tactile Systems Technology Inc. (a) | | | 75,000 | | | | 4,086,750 | |

Vapotherm Inc. (a) | | | 39,500 | | | | 948,790 | |

| | | | | | | | |

| | | | | | | 68,386,876 | |

| | | | | | | | |

|

Healthcare Facilities - 0.9% | |

Acadia Healthcare Company Inc. (a) | | | 124,923 | | | | 7,138,100 | |

Hanger Inc. (a) | | | 72,756 | | | | 1,660,292 | |

Select Medical Holdings Corp. (a) | | | 38,898 | | | | 1,326,422 | |

The Ensign Group Inc. | | | 13,608 | | | | 1,276,975 | |

| | | | | | | | |

| | | | | | | 11,401,789 | |

| | | | | | | | |

See Notes to Schedules of Investments and Notes to Financial Statements.

| | |

| State Street Institutional Small-Cap Equity Fund | | 17 |

State Street Institutional Small-Cap Equity Fund

Schedule of Investments, continued — March 31, 2021 (Unaudited)

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

| | | | | | | | |

Healthcare Services - 0.8% | |

Addus HomeCare Corp. (a) | | | 9,845 | | | | 1,029,689 | |

Amedisys Inc. (a) | | | 4,854 | | | | 1,285,291 | |

AMN Healthcare Services Inc. (a) | | | 28,596 | | | | 2,107,525 | |

Cross Country Healthcare Inc. (a) | | | 46,187 | | | | 576,876 | |

InfuSystem Holdings Inc. (a) | | | 45,582 | | | | 928,049 | |

MEDNAX Inc. (a) | | | 114,936 | | | | 2,927,420 | |

ModivCare Inc. (a) | | | 3,802 | | | | 563,152 | |

Tivity Health Inc. (a) | | | 27,872 | | | | 622,103 | |

| | | | | | | | |

| | | | | | | 10,040,105 | |

| | | | | | | | |

|

Healthcare Supplies - 0.7% | |

Avanos Medical Inc. (a) | | | 124,660 | | | | 5,452,628 | |

BioLife Solutions Inc. (a) | | | 55,312 | | | | 1,991,232 | |

Meridian Bioscience Inc. (a) | | | 25,066 | | | | 657,983 | |

Merit Medical Systems Inc. (a) | | | 7,456 | | | | 446,465 | |

Pulmonx Corp. (a) | | | 20,050 | | | | 917,087 | |

| | | | | | | | |

| | | | | | | 9,465,395 | |

| | | | | | | | |

|

Healthcare Technology - 1.0% | |

Computer Programs and | | | | | | | | |

Systems Inc. | | | 20,460 | | | | 626,076 | |

Inspire Medical Systems Inc. (a) | | | 25,000 | | | | 5,174,750 | |

NextGen Healthcare Inc. (a) | | | 94,986 | | | | 1,719,246 | |

Omnicell Inc. (a) | | | 45,964 | | | | 5,969,345 | |

| | | | | | | | |

| | | | | | | 13,489,417 | |

| | | | | | | | |

| | |

Home Building - 1.2% | | | | | | | | |

Cavco Industries Inc. (a) | | | 7,925 | | | | 1,787,959 | |

Century Communities Inc. (a) | | | 12,801 | | | | 772,156 | |

Green Brick Partners Inc. (a) | | | 27,439 | | | | 622,317 | |

Installed Building Products Inc. | | | 6,366 | | | | 705,862 | |

LGI Homes Inc. (a) | | | 3,587 | | | | 535,575 | |

M/I Homes Inc. (a) | | | 9,236 | | | | 545,571 | |

Meritage Homes Corp. (a) | | | 7,681 | | | | 706,037 | |

Skyline Champion Corp. (a) | | | 22,874 | | | | 1,035,277 | |

Taylor Morrison Home Corp. (a) | | | 124,865 | | | | 3,847,091 | |

TopBuild Corp. (a) | | | 19,511 | | | | 4,086,189 | |

Tri Pointe Homes Inc. (a) | | | 29,514 | | | | 600,905 | |

| | | | | | | | |

| | | | | | | 15,244,939 | |

| | | | | | | | |

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

Home Furnishing Retail - 0.2% | |

The Aaron’s Company Inc. | | | 111,084 | | | | 2,852,637 | |

| | | | | | | | |

|

Home Furnishings - 0.3% | |

Hooker Furniture Corp. | | | 20,810 | | | | 758,733 | |

La-Z-Boy Inc. | | | 64,495 | | | | 2,739,747 | |

| | | | | | | | |

| | | | | | | 3,498,480 | |

| | | | | | | | |

| |

Home Improvement Retail - 0.0%* | | | | | |

Lumber Liquidators | | | | | | | | |

Holdings Inc. (a) | | | 17,746 | | | | 445,780 | |

| | | | | | | | |

|

Hotel & Resort REITs - 0.2% | |

RLJ Lodging Trust | | | 207,612 | | | | 3,213,834 | |

| | | | | | | | |

|

Hotels, Resorts & Cruise Lines - 1.2% | |

Extended Stay America Inc. | | | 789,170 | | | | 15,586,107 | |

Wyndham Hotels & Resorts Inc. | | | 7,341 | | | | 512,255 | |

| | | | | | | | |

| | | | | | | 16,098,362 | |

| | | | | | | | |

|

Household Appliances - 0.1% | |

Helen of Troy Ltd. (a) | | | 5,301 | | | | 1,116,709 | |

| | | | | | | | |

|

Household Products - 0.2% | |

Central Garden & Pet Co., Class A (a) | | | 31,055 | | | | 1,611,444 | |

Central Garden & Pet Co. (a) | | | 13,580 | | | | 787,776 | |

| | | | | | | | |

| | | | | | | 2,399,220 | |

| | | | | | | | |

|

Human Resource & Employment Services - 0.2% | |

ASGN Inc. (a) | | | 12,445 | | | | 1,187,751 | |

Kforce Inc. | | | 25,423 | | | | 1,362,673 | |

TriNet Group Inc. (a) | | | 8,341 | | | | 650,264 | |

| | | | | | | | |

| | | | | | | 3,200,688 | |

| | | | | | | | |

|

Hypermarkets & Super Centers - 0.1% | |

BJ’s Wholesale Club Holdings Inc. (a) | | | 27,099 | | | | 1,215,661 | |

| | | | | | | | |

|

Industrial Machinery - 7.2% | |

Albany International Corp., Class A | | | 12,500 | | | | 1,043,375 | |

Altra Industrial Motion Corp. | | | 251,722 | | | | 13,925,261 | |

Barnes Group Inc. | | | 210,593 | | | | 10,432,777 | |

Crane Co. | | | 134,855 | | | | 12,664,233 | |

Enerpac Tool Group Corp. | | | 329,858 | | | | 8,615,891 | |

ESCO Technologies Inc. | | | 7,500 | | | | 816,675 | |

Evoqua Water Technologies Corp. (a) | | | 250,000 | | | | 6,575,000 | |

See Notes to Schedules of Investments and Notes to Financial Statements.

| | |

| 18 | | State Street Institutional Small-Cap Equity Fund |

State Street Institutional Small-Cap Equity Fund

Schedule of Investments, continued — March 31, 2021 (Unaudited)

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

| | | | | | | | |

John Bean Technologies Corp. | | | 73,500 | | | | 9,800,490 | |

L B Foster Co., Class A (a) | | | 28,032 | | | | 501,773 | |

Lydall Inc. (a) | | | 45,817 | | | | 1,545,866 | |

Mueller Industries Inc. | | | 125,395 | | | | 5,185,083 | |

Standex International Corp. | | | 28,200 | | | | 2,695,074 | |

The Timken Co. | | | 167,113 | | | | 13,564,562 | |

TriMas Corp. (a) | | | 141,240 | | | | 4,282,397 | |

Woodward Inc. | | | 22,102 | | | | 2,666,164 | |

| | | | | | | | |

| | | | | | | 94,314,621 | |

| | | | | | | | |

|

Industrial REITs - 0.6% | |

EastGroup Properties Inc. | | | 45,665 | | | | 6,542,881 | |

Innovative Industrial Properties Inc. | | | 5,285 | | | | 952,146 | |

| | | | | | | | |

| | | | | | | 7,495,027 | |

| | | | | | | | |

|

Insurance Brokers - 0.1% | |

BRP Group Inc., Class A (a) | | | 43,000 | | | | 1,171,750 | |

| | | | | | | | |

|

Interactive Media & Services - 0.0%* | |

Cargurus Inc. (a) | | | 17,300 | | | | 412,259 | |

| | | | | | | | |

|

Internet & Direct Marketing Retail - 0.5% | |

1-800-Flowers.com Inc., Class A (a) | | | 35,378 | | | | 976,787 | |

Revolve Group Inc. (a) | | | 115,324 | | | | 5,181,507 | |

| | | | | | | | |

| | | | | | | 6,158,294 | |

| | | | | | | | |

|

Internet Services & Infrastructure - 0.1% | |

Brightcove Inc. (a) | | | 40,957 | | | | 824,055 | |

| | | | | | | | |

|

Investment Banking & Brokerage - 1.2% | |

Houlihan Lokey Inc. | | | 17,447 | | | | 1,160,400 | |

Moelis & Co., Class A | | | 9,675 | | | | 530,964 | |

Piper Sandler Cos. | | | 35,148 | | | | 3,853,978 | |

PJT Partners Inc., Class A | | | 7,137 | | | | 482,818 | |

Raymond James Financial Inc. | | | 47,092 | | | | 5,771,596 | |

Stifel Financial Corp. | | | 49,465 | | | | 3,168,728 | |

Stonex Group Inc. (a) | | | 7,672 | | | | 501,595 | |

Virtu Financial Inc., Class A | | | 14,019 | | | | 435,290 | |

| | | | | | | | |

| | | | | | | 15,905,369 | |

| | | | | | | | |

|

IT Consulting & Other Services - 0.5% | |

Perficient Inc. (a) | | | 16,211 | | | | 951,910 | |

Unisys Corp. (a) | | | 217,286 | | | | 5,523,410 | |

| | | | | | | | |

| | | | | | | 6,475,320 | |

| | | | | | | | |

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

Leisure Products - 1.4% | | | | | | | | |

Acushnet Holdings Corp. | | | 15,132 | | | | 625,406 | |

Johnson Outdoors Inc., Class A | | | 9,406 | | | | 1,342,706 | |

Malibu Boats Inc., Class A (a) | | | 15,264 | | | | 1,216,236 | |

MasterCraft Boat Holdings Inc. (a) | | | 35,417 | | | | 941,738 | |

Polaris Inc. | | | 103,214 | | | | 13,779,069 | |

| | | | | | | | |

| | | | | | | 17,905,155 | |

| | | | | | | | |

|

Life & Health Insurance - 0.3% | |

American Equity Investment Life Holding Co. | | | 66,740 | | | | 2,104,312 | |

Trupanion Inc. (a) | | | 31,216 | | | | 2,378,972 | |

| | | | | | | | |

| | | | | | | 4,483,284 | |

| | | | | | | | |

|

Life Sciences Tools & Services - 2.8% | |

Bruker Corp. | | | 93,904 | | | | 6,036,149 | |

ICON PLC (a) | | | 45,447 | | | | 8,924,428 | |

Medpace Holdings Inc. (a) | | | 11,018 | | | | 1,807,503 | |

Repligen Corp. (a) | | | 47,674 | | | | 9,268,302 | |

Syneos Health Inc. (a) | | | 135,738 | | | | 10,295,727 | |

| | | | | | | | |

| | | | | | | 36,332,109 | |

| | | | | | | | |

Marine - 0.1% | | | | | | | | |

Kirby Corp. (a) | | | 32,552 | | | | 1,962,235 | |

| | | | | | | | |

| |

Metal & Glass Containers - 0.1% | | | | | |

Silgan Holdings Inc. | | | 19,305 | | | | 811,389 | |

| | | | | | | | |

Multi-Line Insurance - 0.2% | |

Horace Mann Educators Corp. | | | 59,806 | | | | 2,584,217 | |

| | | | | | | | |

|

Multi-Utilities - 0.1% | |

Black Hills Corp. | | | 17,431 | | | | 1,163,868 | |

| | | | | | | | |

| | |

Office REITs - 0.6% | | | | | | | | |

Corporate Office Properties Trust | | | 54,226 | | | | 1,427,771 | |

Cousins Properties Inc. | | | 141,787 | | | | 5,012,170 | |

Easterly Government Properties Inc. | | | 94,643 | | | | 1,961,949 | |

| | | | | | | | |

| | | | | | | 8,401,890 | |

| | | | | | | | |

| |

Office Services & Supplies - 0.8% | | | | | |

Herman Miller Inc. | | | 21,634 | | | | 890,239 | |

HNI Corp. | | | 37,769 | | | | 1,494,142 | |

MSA Safety Inc. | | | 57,454 | | | | 8,619,249 | |

| | | | | | | | |

| | | | | | | 11,003,630 | |

| | | | | | | | |

See Notes to Schedules of Investments and Notes to Financial Statements.

| | |

| State Street Institutional Small-Cap Equity Fund | | 19 |

State Street Institutional Small-Cap Equity Fund

Schedule of Investments, continued — March 31, 2021 (Unaudited)

| | | | | | | | |

| | | Number

of Shares | | | Fair

Value $ | |

| | | | | | | | |

Oil & Gas Drilling - 0.2% | | | | | | | | |

Helmerich & Payne Inc. | | | 81,212 | | | | 2,189,475 | |

| | | | | | | | |

|

Oil & Gas Equipment & Services - 0.2% | |

ChampionX Corp. (a) | | | 73,634 | | | | 1,600,067 | |

Oil States International Inc. (a) | | | 244,935 | | | | 1,476,958 | |

| | | | | | | | |

| | | | | | | 3,077,025 | |

| | | | | | | | |

|

Oil & Gas Exploration & Production - 0.9% | |

Cimarex Energy Co. | | | 46,748 | | | | 2,776,364 | |

Denbury Inc. (a) | | | 37,218 | | | | 1,782,370 | |

Northern Oil & Gas Inc. (a) | | | 131,682 | | | | 1,590,719 | |

PDC Energy Inc. (a) | | | 121,216 | | | | 4,169,830 | |

Southwestern Energy Co. (a) | | | 232,467 | | | | 1,080,971 | |

| | | | | | | | |

| | | | | | | 11,400,254 | |

| | | | | | | | |

| |

Packaged Foods & Meats - 3.8% | | | | | |

B&G Foods Inc. | | | 54,500 | | | | 1,692,770 | |

Calavo Growers Inc. | | | 14,925 | | | | 1,158,777 | |

Hostess Brands Inc. (a) | | | 459,500 | | | | 6,589,230 | |

J&J Snack Foods Corp. | | | 25,000 | | | | 3,925,750 | |

John B Sanfilippo & Son Inc. | | | 13,635 | | | | 1,232,195 | |

Lancaster Colony Corp. | | | 42,000 | | | | 7,365,120 | |

Sanderson Farms Inc. | | | 86,134 | | | | 13,417,954 | |

The Simply Good Foods Co. (a) | | | 263,400 | | | | 8,012,628 | |

TreeHouse Foods Inc. (a) | | | 96,000 | | | | 5,015,040 | |

Utz Brands Inc. | | | 73,000 | | | | 1,809,670 | |

| | | | | | | | |

| | | | | | | 50,219,134 | |

| | | | | | | | |

|

Paper Packaging - 0.0%* | |

UFP Technologies Inc. (a) | | | 10,301 | | | | 513,196 | |

| | | | | | | | |

|

Personal Products - 0.5% | |

elf Beauty Inc. (a) | | | 161,000 | | | | 4,319,630 | |

Lifevantage Corp. (a) | | | 26,601 | | | | 248,719 | |

Medifast Inc. | | | 5,330 | | | | 1,129,001 | |