UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant [ ]

Filed by a Party other than the Registrant [X]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [X] | Soliciting Material Pursuant to § 240.14a-12 |

The Dow Chemical Company

------------------------------------------------------------------------------------

(Name of Registrant as Specified In Its Charter)

Third Point LLC

Third Point Offshore Master Fund L.P.

Third Point Ultra Master Fund L.P.

Third Point Partners L.P.

Third Point Partners Qualified L.P.

Third Point Reinsurance Co. Ltd.

Lyxor/Third Point Fund Limited

Daniel S. Loeb

Robert Steven Miller

Raymond J. Milchovich

-----------------------------------------------------------------------------------

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

---------------------------------------------------------------------------------

| 2) | Aggregate number of securities to which transaction applies: |

---------------------------------------------------------------------------------

| 3) | Per unit price or other underlying value of transaction computed |

pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

---------------------------------------------------------------------------------

| 4) | Proposed maximum aggregate value of transaction: |

---------------------------------------------------------------------------------

| 5) | Total fee paid: |

---------------------------------------------------------------------------------

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule |

0-11(a)(2) and identify the filing for which the offsetting fee was paid

previously. Identify the previous filing by registration statement

number or the Form or Schedule and the date of its filing.

| 1) | Amount Previously Paid |

---------------------------------------------------------------------------------

| 2) | Form, Schedule or Registration Statement No.: |

---------------------------------------------------------------------------------

| 3) | Filing Party: |

---------------------------------------------------------------------------------

| 4) | Date Filed: |

---------------------------------------------------------------------------------

On November 13, 2014, the following materials were posted by Third Point LLC (“Third Point”) tohttp://www.value-dow.com:

In connection with their intended proxy solicitation, Third Point LLC and certain of its affiliates intend to file a proxy statement with the Securities and Exchange Commission (the “SEC”) to solicit stockholders of The Dow Chemical Company (the “Company”). THIRD POINT LLC STRONGLY ADVISES ALL STOCKHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS IN ANY SUCH PROXY SOLICITATION. SUCH PROXY STATEMENT, WHEN FILED, AND ANY OTHER RELEVANT DOCUMENTS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT HTTP://WWW.SEC.GOV.

THIRD POINT PARTICIPANT INFORMATION

In accordance with Rule 14a-12(a)(1)(i) under the Securities Exchange Act of 1934, as amended, the following persons are anticipated to be, or may be deemed to be, participants in any such proxy solicitation: Third Point LLC, Daniel S. Loeb, Third Point Partners, L.P., Third Point Partners Qualified, L.P., Third Point Offshore Master Fund L.P., Third Point Ultra Master Fund LP, Third Point Reinsurance Co. Ltd., Lyxor/Third Point Fund Limited, Robert Steven Miller and Raymond J. Milchovich. Certain of these persons hold direct or indirect interests with respect to any such proxy solicitation. On November 13, 2014, Third Point LLC filed additional proxy materials with the SEC describing such interests. Such proxy materials are available at no charge on the SEC’s website at http://www.sec.gov.

Nothing on this Site is intended to be, nor should it be construed or used as, investment, tax, legal or financial advice, a recommendation whether or how to vote any proxy or any other kind of recommendation, an opinion of the appropriateness of any security or investment, or an offer, or the solicitation of any offer, to buy or sell any security or investment. The Sponsor is not soliciting any action based upon the Site and is not responsible for any decision by any shareholder, and the Site should not be construed as a solicitation to procure, withhold or revoke any proxy.

| ||

| ||

BROKEN PROMISE

$10 BILLION ADJ. EBITDA

BROKEN PROMISE

25% ADJ. EBIDTA MARGINS

BROKEN PROMISE

ACCOUNTABILITY AND TRANSPARENCY

BROKEN PROMISE

NOT A PETROCHEMICAL COMPANY

BROKEN PROMISE

NO EXCUSES COMPANY

BROKEN PROMISE

DIVIDEND IS SAFE

BROKEN PROMISE

$4 ADJ. EPS TARGET

BROKEN PROMISE

MARGIN TARGETS

The following is a telescript from the video at http://www.Value-Dow.Com and http://vimeo.com/thirdpoint/brokenpromises:

| Graphics | Audio | |

| [Narrator] | ||

THERE

IS

NO

EXCUSE

DOW | It’s a story of an American icon, known globally for its legacy of innovation and its products. But, it has become a story of broken promises to investors. Leadership who has lost its way. This is the story of today’s Dow Chemical. | |

| [Narrator] | ||

Bad decisions

Broken promises

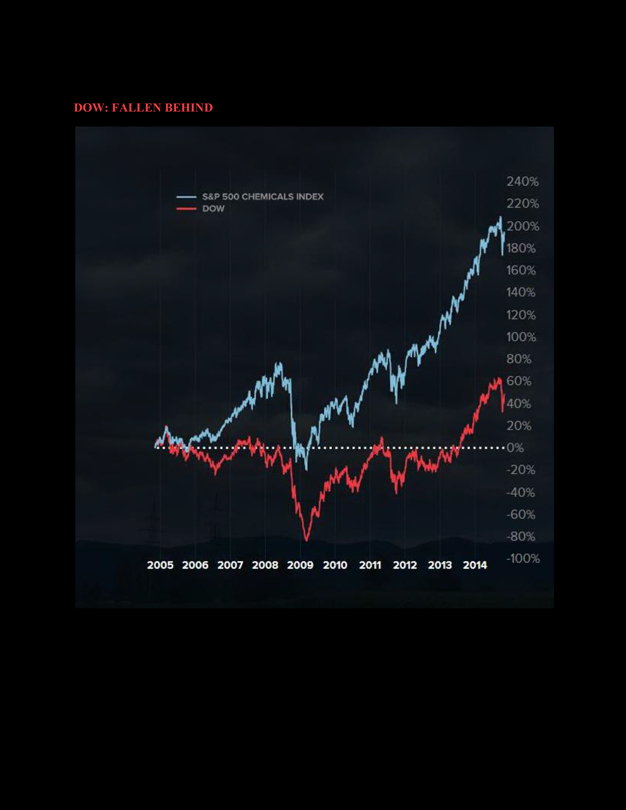

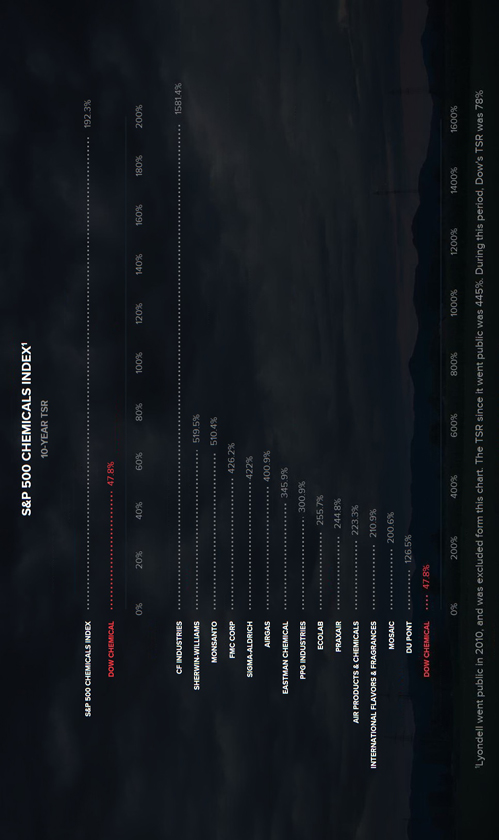

Dow | Over the past ten years, Dow has fallen behind while others have pulled ahead. The result of bad decisions and broken promises. | |

| [Narrator] | ||

January 2006

“But whatever the world throws at us, we think we are ready.”

“We are, what I call, a ‘no excuses company.’” – Andrew Liveris Q4 2005 earnings call, 1/26/06

February 2008

“This is still a “no excuses” company ...” - Andrew Liveris, The Dow Chemical Company 2007 10-K and Stockholder Summary, 2/14/08 | Dow CEO Andrew Liveris has told investors over and over again that Dow is a “no excuses company.” | |

| [Narrator] | ||

| No excuses? | The truth is that Dow has had to make plenty of excuses while it continually breaks its promises to shareholders. | |

| [News person] | ||

October 2011

DOW STICKS TO $10B PROFIT TARGET

DOW READY TO MAKE $475M IN COST CUTS | Well, Dow recommitted today to its near-term goal, which means essentially in the next couple of years, it’s near-term goal of ten billion dollars in EBITDA. | |

| [Narrator] | ||

$10 Billion

Broken promise | Dow has been promising ten billion in EBITDA every year since two thousand and nine, but has failed over and over again to keep its promise. | |

| [Narrator] | ||

No excuses?

Only excuses | In fact, the “no excuses company” fails to meet its goals and instead Dow continues to give investors only excuses. | |

| [Andrew Liveris] | ||

July 2014

DOW CHEMICAL (DOW) Q2 EPS $0.74 EX-ITEMS VS. $0.72 EST.

Dow Excuse July 2014

DOW CHEMICAL (DOW) Q2 Revs. $14.6B VS. $14.482B EST.

Dow Excuse July 2013 | And frankly we’ve had world event after world event after world event as you well know, so as a consequence we are a large, global, very integrated company but we’re exposed to a lot of macros … we’ve had to readjust our operating template. | |

| [Andrew Liveris] | ||

July 2013

DOW CHEMICAL (DOW) Q2 Revs. $14.6B VS. $14.482B EST.

Dow Excuse July 2013 | Where my competition is state-owned enterprises, you know, and they don’t have the same return criteria and they’re certainly not looked at every quarter on Wall Street like I am. | |

| [Narrator] | ||

Dow

Ultimate Broken Promise

Dow October 2008

DOW CHEMICAL EUROPE SALES WERE $5.79B | And, then the ultimate broken promise.

[Andrew Liveris]

Firstly, three hundred and eighty eight consecutive quarters of never cutting the dividend, I will tell you this, this CEO will never cut the dividend. | |

| [Narrator] | ||

February 2009

“Dow Chemical cuts dividend by 64%” – New York Times, 2/12/09

“Dow Chemical lowers dividend for the first time.” – MarketWatch, 2/12/09 | It was the first time Dow cut its dividend since nineteen twelve. | |

| [Narrator] | ||

| Andrew Liveris and his management team have broken promise after promise to Dow shareholders. Given excuse after excuse while calling themselves a no excuses company. And shareholders are fed up. | ||

| [Narrator] | ||

Independent directors

Hold management accountable

No broken promises

No excuses | Dow needs independent leaders in the boardroom. Ones who will think like owners and hold management accountable. Ones who do not break promises and accept no excuses. | |

| [Narrator] | ||

| Third Point | Third Point is one of Dow’s largest shareholders. Like our fellow owners, we have heard enough excuses. | |

| [Narrator] | ||

| Third Point | Together, we can ensure they keep their promises to shareholders. | |

DOW HAS CONSISTENTLY BROKEN PROMISES MADE TO SHAREHOLDERS UNDER THE LEADERSHIP OF CEO ANDREW LIVERIS AND THE CURRENT BOARD. FOR A SAMPLING OF DOW’S PROMISES AND SUBSEQUENT EXCUSES, SCROLL THROUGH THE TIMELINE BELOW.

DOW PROMISE

But whatever the world throws at us, we think we are ready. We are, what I call, a “no excuses company”.

Andrew Liveris, CEO, January 26, 2006

BROKEN PROMISE

In fact, Dow has repeatedly made excuses for missing its targets, blaming everything from China “tanking,” competition from state-owned enterprises, and an “uncertain” economy.

DOW PROMISE

The focus is clearly on acquisitions that are accretive as soon as possible, that provide a much higher return on capital than the overall returns that we are getting, more in line with many of our specialty businesses.

Geoffery Merszei, CFO, October 26, 2006

BROKEN PROMISE

We believe Liveris’ largest acquisition during his tenure as CEO was dilutive to overall return on capital. Combined Return-On-Assets for the Electronics & Functional Materials and Coatings & Infrastructure segments (predominantly former Rohm & Haas) in 2013 was 3.3%1, which compares to 5.8% for the total company.

1 Represents Net Operating Profit After Tax (NOPAT) / Assets. Combined Return-On-Assets for Electronics & Functional Materials and Coatings & Infrastructure segments calculated using Dow’s 2013 effective tax rate of 29%, and prior to any allocation of corporate assets or losses. Total company Return-On-Assets includes corporate.

DOW PROMISE

The bottom line is this is a powerful New Dow as evidenced by how the Rohm & Haas transaction will impact our earnings per share. Without the acquisition of Rohm and Haas and, as I have shown to you before, Dow’s [adjusted] EPS for the next industry trough would have been approximately $3.50. That number jumps closer to $4 with the addition of Rohm and Haas. With our 10% earnings per share growth target, we expect to earn well north of $10 per share.

Andrew Liveris, CEO, July 10, 2008

BROKEN PROMISE

Dow has never come close to achieving its “Industry trough” adjusted EPS target, despite massive unforeseen cost tailwinds from the North American shale revolution. In fact, industry trough adjusted EPS turned out to be $0.63 (2009) instead of $4.00.

DOW PROMISE

But as I said this morning, the dividend is safe. This CEO is never going to cut it. I’m not going to be the first.

Andrew Liveris, CEO, October 23, 2008

BROKEN PROMISE

Dow’s dividend was cut by 64% on February 12, 2009.

DOW PROMISE

But at Dow, we don’t just sit in back rooms and say, oh, woe is me. We actually get moving and implement better, faster, stronger to deliver the economic goals that we promise.

Andrew Liveris, CEO, December 1, 2008

BROKEN PROMISE

Dow has repeatedly missed its own goals, including segment margin targets, adjusted EBITDA, and adjusted EPS.

DOW PROMISE

What’s the earnings power of the new Dow? With all of these elements we have now put in place, we see [adjusted] EPS growing to the $4 to $4.50 range around 2012 and also with earnings power of greater than $10 per share.

Andrew Liveris, CEO, November 12, 2009

BROKEN PROMISE

In 2012, Dow adjusted EPS was $1.90, which was less than half of the forecasted $4.00-4.50 range. Importantly, this forecast was made after the financial crisis and before the North American shale revolution.

DOW PROMISE

The fundamentals for Ag are as strong as ever… we expect normalized [adjusted] EBITDA margins in this segment in the area of 25%.

Andrew Liveris, CEO, November 12, 2009

BROKEN PROMISE

[Adjusted EBITDA] Margins peaked in 2011 at 16%. What does Liveris consider “normalized”?

DOW PROMISE

Batteries in particular, this is a huge market in the making, and we have taken the decision that we want to participate as the Dow Chemical Company. Why do we do that? I think we are ideally qualified from an electro chemistry standpoint. That’s, after all, what the company is based on – on a huge side. But we have all the technical ingredients to do that.

Heinz Haller, Head of Performance Systems, November 12, 2009

BROKEN PROMISE

Dow sold the Dow Kokam battery business after taking an impairment in 2012 of $304 million. We believe that Dow clearly did not have the ingredients to make this venture work.

DOW PROMISE

You can see we have reached a new level of performance with more than $2 billion of structural enhancements. And we have additional levers we could pull. However, this does mean that we would expect our portfolio to deliver [adjusted] EBITDA north of $8 billion or approximately [adjusted EPS of] $2.50 per share even under the conditions of ‘08, ‘09.

Andrew Liveris, CEO, October 4, 2011

BROKEN PROMISE

The following year (2012), the Company earned $7.5 billion in adjusted EBITDA and $1.90 in adjusted EPS. One can only imagine how poor results would have been had economic conditions been as weak as they were in 2008-09.

DOW PROMISE

We are looking at [being] more market-focused [and] customer-centric. By doing all this, we would expect further to increase our [adjusted] EBITDA margins [in the Performance Materials segment] by 300 basis points over this time period, which will really make sure that our performance is exceeding pre-recessionary levels easily.

Joe Harlan, President of Performance Materials, October 4, 2011

BROKEN PROMISE

The Performance Materials segment head forecasted that [adjusted EBITDA] margins would expand by 300 bps. In fact, they have contracted. In addition, he gave “near-term” and “earnings power” adjusted EBITDA targets of $2.5 and $3.4 billion, respectively, compared to 2012 and 2013 actual adjusted EBITDA of $1.6 and $1.5 billion, respectively.

DOW PROMISE

I am acutely aware that we need to demonstrate that Dow can deliver against its earnings targets and ensure we achieve the minimum of $8 billion [adjusted] EBITDA [in 2012] that we described a year ago. There can and will be no excuses. We are intervening fully to focus, to generate cash and to deliver against these targets.

Andrew Liveris, CEO, October 24, 2012

BROKEN PROMISE

Liveris made this statement with only 2 months left in 2012, and then still missed the minimum adjusted EBITDA target of $8 billion for that year.

DOW PROMISE

You can rest assured that we are driven to intervene and get us to the $8 billion minimum [of adjusted EBITDA] and get us to the $10 billion [of adjusted EBITDA] through the two mechanisms I’ve articulated on this call, which is the interventions, which are substantial [adjusted] EBITDA generators and cash generators next year and the year after, 2013, 2014, and the low-cost drivers embedded in the ethane propane feedstock advantage we have in the United States. Those two things alone will get us to the $10 billion in the next several years.

Andrew Liveris, CEO, October 24, 2012

BROKEN PROMISE

Liveris has claimed that Dow would achieve $10 billion of adjusted EBITDA in the “near-term” for 5 consecutive years. “Interventions” (e.g. productivity and cost-cutting) and low cost feedstocks were supposed to get Dow to $10 billion of adjusted EBITDA. Currently, achieving the $10 billion in adjusted EBITDA depends on significant capital expenditures on new projects such as PDH, Sadara and Gulf Coast investments.

DOW PROMISE

We have taken a number of consistent aggressive actions since 2006, both in the upstream low-cost assets and the downstream value-add businesses, to reshape and position our company for consistent long-term earnings growth… Throughout this process and with deliberate and strategic moves and full transparency, we have regularly check-pointed with our Board tracking our milestones… This transparency, this accountability demonstrates our commitment to continually challenge all aspects of our operations.

Andrew Liveris, CEO, January 29, 2014

BROKEN PROMISE

We question words such as “accountability” and “milestones” given Liveris’ track record of missing targets, including the ones in the table below. Assuring investors that these decisions were “check-pointed” with the Board (which he chairs) shows a complete lack of personal accountability. Furthermore, we question the Board’s ability to “check-point” when Dow’s segment disclosure and selective raw material transfer pricing is so opaque.

DOW PROMISE

It is honestly impossible to think of Dow as a petrochemical company anymore.

Andrew Liveris, CEO, January 29, 2014

BROKEN PROMISE

How can the CEO of North America’s largest ethylene producer claim that he does not run a petrochemical company and expect investors to take him seriously? The majority of Dow’s profits are generated from ethylene cracking. It is nonsensical to suggest that Dow is not a petrochemical company.

IT’S TIME FOR DOW TO KEEP ITS PROMISES.

To get the most up-to-date information, sign up to receive email updates.

your email address...

|

SUBSCRIBE

Privacy Policy | Disclaimer | Terms | Contact Us |

© Copyright 2014 Third Point

| Page 1 of 4 |

Third Point Announces Launch of www.Value-Dow.com and Formation of Dow Advisory Board

November 13, 2014

NEW YORK, NEW YORK, November 13, 2014: Third Point LLC, a significant Dow shareholder, today unveiled several constructive initiatives in its effort to increase the Company’s value.

First Quarter 2014 Investor Letter

May 1, 2014

Download the letter by clicking here. |

Fourth Quarter 2013 Investor Letter

January 21, 2014

Download the letter by clicking here. |

To get the most up-to-date information, sign up to receive email updates.

SUBSCRIBE

| Page 2 of 4 |

THIRD POINT ANNOUNCES LAUNCH OF WWW.VALUE-DOW.COM AND

FORMATION OF DOW ADVISORY THIRD POINT ANNOUNCES LAUNCH OF

WWW.VALUE-DOW.COM AND FORMATION OF DOW ADVISORY BOARD

NEW YORK, NEW YORK, November 13, 2014: Third Point LLC, a significant Dow shareholder, today unveiled several constructive initiatives in its effort to increase the Company’s value.

First, Third Point has launchedwww.Value-Dow.com, a website designed for proactive shareholder engagement. The site includes a video (http://vimeo.com/thirdpoint/brokenpromises) narrative detailing how Dow has fallen behind due to poor strategic decision-making by a Management team and Board best known for their track record of broken promises to shareholders. Value-Dow.com will serve as a central repository of information for investors who share Third Point’s concerns about Dow’s persistent under-earning, questionable capital allocation decisions, and lack of accountability to stakeholders.

Second, Third Point has created an Advisory Board of executives with substantive, relevant restructuring experience who are providing guidance on how Dow can increase value. R. Steve Miller, the current Chairman of American International Group (AIG), has led the successful restructuring of the prominent insurance conglomerate since 2010. His restructuring career started almost three decades ago when he served as the Vice-Chairman of Chrysler under then-Chairman Lee Iacocca. Since then, Mr. Miller has helped more than a dozen troubled companies restore and increase stakeholder value. In 2012, he served as the CEO of Hawker Beechcraft, Inc., a Kansas-based airplane manufacturer. Steve currently serves on the boards of Symantec and WLRH and has served previously on the boards of United Airlines, US Bank, Reynolds Tobacco, and Waste Management.

Steve is joined by Raymond J. “Ray” Milchovich, who as Chairman, CEO, and President, led Foster Wheeler AG from 2001 to 2011. During his tenure, Ray spearheaded the restructuring of Foster Wheeler’s oil and natural gas, liquid natural gas, refining, chemical, and pharmaceutical facility construction businesses by working closely with other stakeholders to transform the company into an investment-grade industry leader. Ray has been the lead Director of Nucor Corporation, the largest steel producer in the United States, since 2012. He also represents the private equity firm Aurora Capital Partners on the board of NTS. Ray previously served as the President, Chairman, and CEO of Kaiser Aluminum and Chemical Corporation and on the Board of Delphi Automotive Holdings.

| Page 3 of 4 |

Both Steve and Ray have a long-term compensation arrangement with Third Point related to their work on Dow that fully aligns them with shareholders.

Third Point encourages its fellow shareholders to visitwww.Value-Dow.com for further information about Third Point’s plans to increase shareholder value at Dow.

About Third Point LLC: Third Point LLC is an SEC-registered investment adviser headquartered in New York, managing over $17 billion in assets. Founded in 1995, Third Point follows an event-driven approach to investing globally. For more information about Third Point, visit www.thirdpoint.com.

Contact:

Elissa Doyle

Managing Director of Communications

edoyle@thirdpoint.com

(212) 715 – 4907

| Page 4 of 4 |

© Copyright 2014 Third Point

| Third Point LLC 390 Park Avenue New York, NY 10022 Tel 212 715 3880 |

January 21, 2014

Fourth Quarter 2013 Investor Letter

Equity Position: The Dow Chemical Company

Third Point’s largest current investment is in The Dow Chemical Company (“Dow”). Dow shares have woefully underperformed over the last decade, generating a return of 46% (including dividends) compared to a 199% return for the S&P 500 Chemicals Index and a 101% return for the S&P 500.1 Indeed, in April 1999, nearly 15 years ago, an investor could have purchased Dow shares for the same price that they trade at today! These results reflect a poor operational track record across multiple business segments, a history of under-delivering relative to management’s guidance and expectations, and the ill-timed acquisition of Rohm & Haas. The company’s weak performance is even more surprising given that the North American shale gas revolution has been a powerful tailwind for Dow’s largest business exposure – petrochemicals.

We believe that Dow would best serve shareholders’ interests by engaging outside advisors to conduct a formal assessment of whether the current petrochemical operational strategy maximizes profits and if these businesses align with Dow’s goal of transforming into a “specialty” chemicals company. The review should explicitly explore whether separating Dow’s petrochemical businesses via a spin-off would drive greater stakeholder value.

Dow’s petrochemical operational strategy has been to migrate downstream, supposedly to earn higher margins, to become more “specialty,” and to increase the number of customer-facing products. Over the past five years, the shale revolution in North America has led to a boom in natural gas liquids production which has dramatically reduced raw material costs, while China and other emerging market economies have aggressively grown downstream derivatives capacity. This combination has led to significant upstream margin expansion in North America, where Dow is the largest ethylene producer, and a commoditization of numerous downstream derivatives margins. Dow’s current petrochemical strategy seems misaligned with the changed landscape.

Perhaps unsurprisingly, our analysis suggests that Dow’s downstream migration strategy within petrochemicals has not yielded material benefits so far and instead may be a significant drag on profitability. We have examined Dow’s aggregate petrochemical capacities (and associated industry product margins) and compared its petrochemical cost base and profitability with pure-play peers. Our work suggests that upside from bothcost-cutting and operating optimization could amount to several billion dollars in annual

| 1. | Capital IQ data as of 1/10/14. Includes stock appreciation plus dividends paid. |

EBITDA. We suspect that Dow’s push downstream has led the company to use its upstream assets to subsidize certain downstream derivatives either by sacrificing operational efficiency or making poor capital allocation decisions, or both. Poor segment disclosure combined with Dow’s opaque and inconsistent transfer pricing methodology for internally sourced raw materials makes it difficult for shareholders (and presumably, the Board of Directors) to ascertain which business units are most challenged. What is easily ascertainable is that the magnitude of the aggregate under-earning warrants a comprehensive strategic review, preferably with the assistance of an objective outside advisor answerable to a special committee of the Board.

We believe Dow should apply the intelligent logic of its recently announced chlor-alkali separation to the entirety of its petrochemical businesses by creating a standalone company housing Dow’s commodity petrochemical segments (“Dow Petchem Co.”).2 Such a separation would accomplish two important objectives. First, the split would accelerate Dow’s transition to a true “specialty chemicals” company focused on attractive end-markets such as agriculture, food, pharmaceuticals, and electronics. Second, the standalone Dow Petchem Co. could realign its strategy away from largely focusing on downstream migration/integration and towards overall profit maximization.

The optimization of Dow Petchem Co. combined with the significant step-up in earnings from organic growth initiatives already put in place by management – the PDH plant, the Sadara JV, and the U.S. Gulf Coast greenfield ethylene cracker – could translate into future EBITDA well in excess of $9 billion on a stand-alone basis. This would be before any improvement attributable to what management refers to as the “ethylene upcycle”. Both the “self-help” and cyclical upside opportunities create a compelling investment case, which is not reflected in Dow’s current share price considering the entire company’s 2013 EBITDA base is ~$8 billion.

Despite Dow’s best efforts to migrate downstream and become a specialty chemicals company, the market remains unconvinced. By creating Dow Petchem Co., the strategic direction of these businesses would no longer be dictated by the broader Dow strategy of becoming more specialty-focused. Instead, management could transform these businesses into a best-in-class, low-cost commodity petrochemical company.

| 2. | Dow Petchem Co. would generally consist of the Feedstocks & Energy, Performance Plastics, and Performance Materials segments. |

The remaining Dow Chemical (“Dow Specialty Co.”)3 would be the specialty chemicals leader that Dow has aspired to become over much of the past decade. Here too, we see meaningful upside over the coming years:

| • | In Dow’s Agricultural Sciences segment, significant investments have been made in R&D which have yet to translate to profits, most notably in the development of Dow’s ENLIST trait package. We are optimistic that ENLIST will be successfully adopted in the South American soybean market, where it has a natural first-mover advantage given that the 2,4-D herbicide is approved for use in Brazil and Argentina. The South American soybean opportunity alone for ENLIST could increase divisional EBITDA by 30-40% once fully penetrated. |

| • | In the Electronics & Functional Materials segment, we see niches with strong end-market growth and high barriers to entry, leading to above-GDP growth rates and sustainably robust returns on invested capital. |

| • | Finally, the Dow Corning JV represents a valuable call option on solar power adoption as total system costs for solar continue to compress and become increasingly competitive with other fossil-fuel electricity alternatives in much of the world. |

Dow Specialty Co. should command a premium to Dow’s current multiple, and potentially a premium to other specialty chemicals companies given its attractive EBITDA growth prospects. The market is skeptical of Dow’s divisional margin targets given the lack of clarity around how they were derived and the lack of progress toward achieving them. However, even if management fails to attain their targets, we still see the potential for Dow Specialty Co. EBITDA to ramp up to the $4-5 billion range over the next 3 to 5 years, compared to a 2013 base of ~$2.8 billion.

We believe management’s main concern about a spin-off of Dow Petchem Co. will likely relate to the integrated nature of Dow’s overall portfolio. Importantly, the majority of the integration in Dow’s portfolio exists between upstream / downstream petrochemicals and these businesses would remain together in Dow Petchem Co. In addition, the integration between Dow Petchem Co. and Dow Specialty Co. is limited to commoditized raw material transfers. Having some amount of commoditized raw material integration does not create differentiation in specialty products nor does it materially increase margins (unless the raw material inputs are being subsidized by Dow’s petrochemical segments). The segments within Dow Specialty Co. which primarily consist of legacy Rohm & Haas

| 3. | Dow Specialty Co. would generally consist of the Agricultural Sciences, Coatings & Infrastructure, and Electronic & Functional Materials segments. |

businesses and Dow’s Agricultural Sciences segment have successfully operated without raw material integration in the past, or have peers that are able to achieve higher margins without any raw material integration.

We appreciate this consideration; it is why we have contemplated a scenario in which both the upstream and downstream petrochemical businesses are spun-off together into Dow Petchem Co. We believe the benefits from a spin-off, including financial uplift from operational improvements at Dow Petchem Co. and the potential valuation uplift from increased business focus and disclosure, far outweigh the supposed integration benefits.

Finally, as Dow management looks to further its journey in unlocking value for shareholders, it now has the balance sheet flexibility to consider a meaningful share buyback that could more than offset the share issuance from the conversion of the Warren Buffett/KIA securities issued in conjunction with the financing of the Rohm & Haas acquisition.4 Combined with the Dow Petchem Co. spin-off, Dow could pave a path toward increased disclosure, greater management accountability for individual business segment performances, and enhanced alignment of interests between management and shareholders. With the difficult task of balance sheet de-levering behind it, Dow finally has the opportunity to embark on its next transformational deal during CEO Andrew Liveris’ tenure.

Sincerely,

Third Point LLC

Third Point LLC (“Third Point”) is an SEC-registered investment adviser headquartered in New York. Third Point is primarily engaged in providing discretionary investment advisory services to its proprietary private investment funds (each a “Fund” collectively, the “Funds”).

The information and opinions contained herein are based on publicly available information. All information provided herein is for informational purposes only and should not be deemed as a recommendation to buy or sell securities. All investments involve risk including the loss of principal. This transmission does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product. Any such offer or solicitation may only be made by means of delivery of an approved confidential offering memorandum.

Specific companies or securities shown in this presentation are meant to demonstrate Third Point’s investment style and the types of industries and instruments in which we invest and are not selected based on past performance. The analyses and conclusions of Third Point contained in this presentation include certain statements, assumptions, estimates and projections that reflect various assumptions by Third Point concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations, express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials herein. Third Point may buy, sell, cover or otherwise change the nature, form or amount of its investments, including any investments identified in this letter, without further notice and in Third Point’s sole discretion and for any reason. Third Point hereby disclaims any duty to update any information in this letter.

| 4. | Dow has $4.0 billion in outstanding 8.5% convertible preferred securities issued to Berkshire Hathaway and the Kuwait Investment Authority. The $340 million annual dividend payments are not tax-deductible. The securities may be converted to equity at Dow’s option beginning in April 2014, if Dow’s closing share price exceeds $53.72 (130% of the “conversion price”) for 20 trading days within any period of 30 consecutive trading days. |

| Third Point LLC 390 Park Avenue New York, NY 10022 Tel 212 715 3880 |

May 1, 2014

First Quarter 2014 Investor Letter

Equity Position Update: The Dow Chemical Company (“Dow”)

Since we disclosed our stake in January, Dow’s management has taken several shareholder-friendly actions including increasing the company’s dividend, approving a $4.5 billion buyback to address the impending conversion of the Warren Buffett/KIA preferred securities, and committing to more portfolio divestitures. Management’s level of shareholder engagement has also risen notably, demonstrating an admirable and strong commitment to addressing long-standing concerns.

We also applaud Dow’s recently stated initiative to increase transparency. Shareholders have long called for the company to increase disclosure, improve the clarity of their reporting, and clearly identify underlying business drivers. On Dow’s first quarter earnings call, management suggested it could simplify the portfolio reporting structure by reclassifying (or removing) the Feedstocks & Energy segment. In our view, simply joining the Feedstocks & Energy and Performance Plastics segments would not effectively increase transparency. Instead, the priority should be to implement a consistent, market-based transfer pricing methodology acrossand within all segments so shareholders can clearly understand each business unit’s underlying profitability. Further, to be consistent with its peers, all of Dow’s petrochemical capacities need to be disclosed in detail so that shareholders can more easily benchmark performance versus competitors. All shareholders eagerly anticipate progress on these important initiatives.

Despite the positive steps taken, we still believe Dow is under-earning its potential in its petrochemical businesses, a concern that management has yet to adequately address. To quantify the extent of under-earning, we sought to compare Dow’s capacity and profits relative to peers and industry average margins. The result of this carefully researched analysis led us to conclude that Dow’s integrated strategy does not maximize profits.

Petrochemical Under-Earning

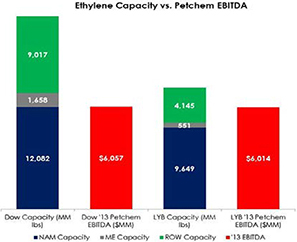

Dow’s management has yet to address the crux of Third Point’s case for increasing value: curing under-earning in the Petrochemical businesses. This under-earning is clear when one compares Dow to its largest North American petchem peer, LyondellBasell (“Lyondell”). Dow has ~30% more North American ethylene capacity, triple the Middle Eastern ethylene capacity, and more North American derivatives capacity than Lyondell, yet the two companies generate the same amount of EBITDA in their respective

petrochemical businesses.1 Additionally, Dow engages in multiple downstream businesses in its Performance Materials segment that Lyondell does not.

Figure 1:2

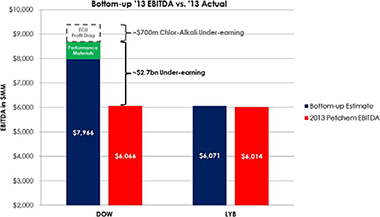

This discrepancy is difficult for the market to identify, because Dow does not disclose any of its capacities. Therefore, to identify the magnitude of under-earning, we did our own bottom-up analysis examining: i) the capacities for the petrochemicals Dow produces, ii) average 2013 industry margins for those capacities, and iii) the actual 2013 feedslate mixes by plant (where applicable). The result of this bottom-up analysis shows a meaningful gap between what Dow’s capacities indicate potential EBITDAshould be and the amount of EBITDAactually generated:

Figure 2:3,4

1 Dow’s petrochemical business includes the Feedstocks & Energy, Performance Plastics, and Performance Materials segments. LYB’s petrochemical business includes all segments except Refining and Technology.

2 Dow’s Petchem EBITDA includes all Feedstocks & Energy, Performance Plastics, and Performance Materials. We allocate corporate expense to Dow’s 2013 segment EBITDA based on an estimate of Dow’s Petchem % of total employees. LYB Petchem EBITDA includes all segments except Refining and Technology. LYB allocates corporate expense to segment EBITDA. Both Dow and LYB 2013 EBITDA has been adjusted to include an estimate of JV EBITDA in excess of equity income. Source: Company filings, Third Point estimates. Capacity data: IHS, company filings, Third Point.

3 See Footnote 2 for Petchem EBITDA composition. We estimate that non-service cost related pension expenses included in reported EBITDA amount to ~$400 million for Dow and $20 million for LYB in 2013; pension adjustments have not been included. Source: Company filings, Third Point estimates.

4 Bottom-up EBITDA calculated using 2013 industry avg margin, with adjustments for both Dow and LYB where relevant. Actual 2013 feedslate mixes used for NAM ethylene and 100% naphtha for RoW (ex-ME). Source: Third Point estimates, IHS, The Hodson Report, company data.

We estimate the under-earning to be at least $2.5 billion, which we believe is the result of a strategy focused more on selling downstream products than on maximizing profits.

In this analysis, we have incorporated Dow-specific adjustments where using industry average margin or effective capacity may be overly optimistic. These adjustments include assuming a significant discount to spot pricing for European merchant ethylene volume, and low capacity utilization in both Argentine ethylene and Canadian polyethylene. Additionally, while the Performance Materials segment (where capacities and spreads do not exist) reported $1.5 billion of EBITDA in 2013, we have only assumed ~$800 million in our estimate. Since Dow moves numerous self-sourced inputs at cost, a portion of this segment’s EBITDA is transferred from upstream assets in the form of a raw material subsidy. The lack of disclosure and inconsistent transfer pricing make it difficult to isolate the portion of Performance Materials EBITDA that is actually generated by assets within the segment. The ~$800 million estimate represents our “best guess” as to what segment EBITDA would have been without any upstream subsidization into products like propylene oxide, polyurethanes, epoxies, chlorinated organics, and oxygenated solvents.

At the top of the Dow “bottom-up” bar graph, we have also highlighted $700 million of under-earning related to chlor-alkali. We show it separately to account for two significant structural deficiencies in Dow’s footprint: i) the suboptimal use of ethylene that is being combined with chlorine in the production of EDC, and ii) Dow’s chlorohydrin propylene oxide production process, which consumes caustic and consequently causes Dow to lose a meaningful portion of its merchant caustic potential. We do not believe this lost ECU margin is clawed back further downstream where propylene oxide is consumed in products such as polyurethanes. In both cases, Dow is hamstrung by excess chlorine capacity and its desire to supply downstream derivative products with subsidized raw materials.

Importantly, when we replicate the same bottom-up analysis for Lyondell (i.e. what Lyondellcould earn vs. what it actually earns), the difference between our estimate and Lyondell’s actual EBITDA is negligible. This result reflects a management team that is focused on being the lowest cost commodity petrochemical producer and a clear strategy that is driven by upstream profit maximization.

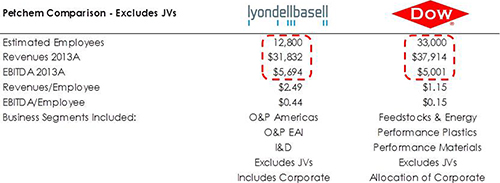

In Figure 3, we see that Dow has ~20% greater sales than Lyondell, which is consistent with Dow’s larger upstream capacity and presence in downstream derivatives. However, the downstream businesses require significant headcount, facilities, R&D, and SG&A. Dow’s headcount is ~2.5 times more than Lyondell’s, which is not a reflection of poor efficiency, but rather that Dow is engaged in numerous downstream derivatives that Lyondell is not.

Yet, the incremental sales and headcount do not generate additional profits as illustrated below:

Figure 3:5,6

This is the underlying problem with Dow’s strategy: many upstream petrochemical molecules do not gain incremental EBITDA as they move downstream, often through 3 or 4 business units, before they are sold to the end-customer. In fact, our under-earning analysis suggests that Dow’s commitment to the downstream integrated strategy has actually created a significant drag on upstream profitability.

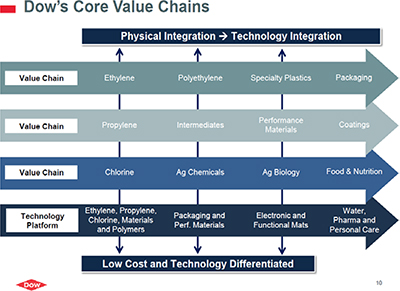

Unconvincing Integrated Strategy

Figure 4 is the visual representation of what Dow’s management describes as taking low cost inputs and using value-add innovation to make differentiated downstream products. This, in our opinion, is the essence of why Dow’s strategy is flawed – none of ethylene, propylene, or chlorine provides any product differentiation or specialization in packaging, coatings, or food & nutrition products:

5 LYB headcount excludes ~500 employees assumed for the Refining segment. Dow headcount excludes ~12,000 employees in Electronic & Functional Materials and Coatings & Infrastructure, and ~8,000 in Agricultural Sciences. Source: Company filings, press releases, Third Point.

6 See Footnote 2 for segments contributing to EBITDA. Figure 3 EBITDA excludes JVs in order to be consistent with associated revenue and headcount.

Figure 4:7

On the Q4 earnings call, CEO Andrew Liveris claimed that “more than half the profits that are coming out of [the petchem] chain come from innovation, not from low-cost feedstocks”. We respectfully disagree. The fact that Dow’s petchem businesses under-earn their capacities (see Figure 2) suggests that this claim is impossible. Dow needs to provide investors analytical or numerical evidence about the value derived from integration and innovation if the market is to believe these claims.

Given Dow’s decision to exit chlor-alkali, it appears that Dow believes that its Ag Chemicals and Ag Biology businesses do not derive value-add differentiation from chlorine integration. We take this logic one step further and question whether Dow’s specialty segments need ethylene or propylene integration.8 Within petrochemicals, there are upstream and downstream products in which we see few identifiable niches where incremental value from integration exists (notwithstanding the value derived from raw materials being transferred at cost rather than market price). Rather, as we stated above, there appears to be negative value from converting upstream petrochemical molecules into downstream products.

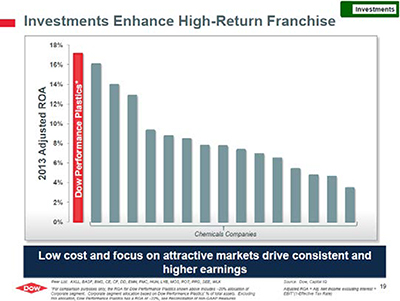

Poor Returns, Poor Capital Allocation, Misleading Benchmarking

Dow recently shared a benchmarking analysis comparing the Return-On-Assets (“ROA”) of its Performance Plastics segment with a self-selected chemicals universe.9 The comparison is not apples-to-apples because the Performance Plastics segment is Dow’s most profitable division and is almost exclusively a polyethylene business, whereas the chemicals universe is comprised of entire companies, many of which are in very different businesses.

7 Source:Dow Strategic Update, Slide Presentation 3/19/2014.

8 Specialty segments include Agricultural Sciences, Coatings & Infrastructure, and Electronic & Functional Materials.

9 Chemicals universe consists of Axiall, BASF, Bemis, Celanese, CF Industries, Dupont, Eastman, FMC, Huntsman, LyondellBasell, Mosaic, Potash, PPG, Sealed Air, and Westlake. Source:Dow Strategic Update, Slide Presentation 3/19/2014.

Figure 5:10

The Performance Plastics segment also receives the entirety of its ethylene inputs at cost from the Feedstocks & Energy segment. Again, due to inadequate disclosure, it is not clear whether the numerator or the denominator in Performance Plastics’ ROA is an accurate reflection of true profitability or assets. We believe a more fair assessment would be to examine the ROA of Feedstocks & Energy, Performance Plastics, and Performance Materials together, which encompasses all of Dow’s upstream-downstream integrated petrochemical returns and assets. To be consistent, we have used Dow’s own ROA calculation and constructed a table with all of the segment ROAs:

Figure 6:11

| ROA Calculations | ||||||||||||||||||||||||||||||||

($ in millions)

| PP | F&E | PM | Total Dow Petchem | C&I | EF&M | AG | Total Company | ||||||||||||||||||||||||

Segment Adj. EBITDA | $4,092 | $837 | $1,459 | $6,388 | $892 | $1,040 | $969 | $9,289 | ||||||||||||||||||||||||

Segment D&A | (707) | (128) | (666) | (1,501) | (466) | (425) | (189) | (2,581) | ||||||||||||||||||||||||

Segment EBIT | $3,385 | $709 | $793 | $4,887 | $426 | $615 | $780 | $6,708 | ||||||||||||||||||||||||

Segment Tax (at Effective Rate) | (989) | (207) | (232) | (1,428) | (124) | (180) | (228) | (1,960) | ||||||||||||||||||||||||

Segment NOPAT | $2,396 | $502 | $561 | $3,459 | $302 | $435 | $552 | $4,748 | ||||||||||||||||||||||||

Share of Corp Adjustment | (145) | (129) | (178) | (453) | (82) | (82) | (110) | (727) | ||||||||||||||||||||||||

Adj. NOPAT | $2,251 | $373 | $383 | $3,006 | $219 | $353 | $442 | $4,021 | ||||||||||||||||||||||||

Reported Segment Assets | $10,920 | $5,772 | $9,850 | $26,542 | $11,438 | $11,067 | $7,058 | $56,105 | ||||||||||||||||||||||||

Adj. For Share of Corp. Assets | 2,679 | 2,376 | 3,286 | 8,341 | 1,517 | 1,517 | 2,022 | 13,396 | ||||||||||||||||||||||||

Total Assets | $13,599 | $8,148 | $13,136 | $34,883 | $12,955 | $12,584 | $9,080 | $69,501 | ||||||||||||||||||||||||

| Adjusted ROA | 16.5% | 4.6% | 2.9% | 8.6% | 1.7% | 2.8% | �� | 4.9% | 5.8% | |||||||||||||||||||||||

Unadjusted (Ex-Corp) ROA | 21.9% | 8.7% | 5.7% | 13.0% | 2.6% | 3.9% | 7.8% | 8.5% | ||||||||||||||||||||||||

10 Source:Dow Strategic Update, Slide Presentation 3/19/2014.

11 Assumes Dow 2013 consolidated tax rate of 29% for all segments. Corporate allocation for Performance Plastics based on Dow’s assumption of a 20% allocation. Other segments based on estimate of employee count by division. Source: Company filings, Third Point estimates.

When looked at in aggregate, we estimate total Dow petchem ROA to be 8.6%. This is not a surprise to us – we have highlighted that: i) Dow under-earns its capacity due to its misaligned downstream strategy, and ii) inconsistent transfer pricing makes it impossible to benchmark any of the individual petchem segments. Underlying Performance Plastics ROA is likely lower than 16.5% and similarly, underlying Feedstocks & Energy ROA is probably higher than 4.6%, but what should matter to shareholders is thatDow’s overall petchem ROA of 8.6% is certainly not best-in-class among the comparison universe. Furthermore, Dow’s company-wide ROA of 5.8% would place it near the bottom quartile of Dow’s selected universe, which is consistent with how the market views Dow’s track record. Management needs to focus on what is driving this underperformance and how to cure it.

Improving petchem ROA should come from underlying operational improvement and better capital allocation rather than from flattering returns with equity income from Sadara. We view Sadara as another example of Dow embellishing returns and capital allocation:

Figure 7:12

Sadara JV Return on Assets

($ in millions)

| Low | Mid | High | |||||||||

Dow Revenue Guidance | $6,000 | $7,000 | $8,000 | |||||||||

Dow EBITDA Margin Guidance | 30.0% | 35.0% | 40.0% | |||||||||

Implied EBITDA | $1,800 | $2,450 | $3,200 | |||||||||

Estimated DD&A (30-Year Life) | (643) | (643) | (643) | |||||||||

EBIT | $1,157 | $1,807 | $2,557 | |||||||||

Taxes at 20% | (231) | (361) | (511) | |||||||||

Gross NOPAT | $925 | $1,445 | $2,045 | |||||||||

Gross Capital Invested | $19,300 | $19,300 | $19,300 | |||||||||

Implied ROA | 4.8% | 7.5% | 10.6% | |||||||||

Dow WACC | 9.2% | 9.2% | 9.2% | |||||||||

EVA

|

| (4.4%)

|

|

| (1.7%)

|

| 1.4%

| |||||

Capex Multiple of EBITDA | 10.7x | 7.9x | 6.0x | |||||||||

When taking into account gross capital invested (both equityand debt financed) and Dow’s latest guidance, we estimate that the ROA of the Sadara project (the company’s largest investment since Rohm & Haas) will be 5% - 10%. Only in Dow’s bull case would the returns from Sadara exceed Dow’s own 9% cost of capital.13

Looking Forward:

Harnessing the full potential of Dow’s petrochemical assets will take time as it could require a combination of closures, modifications, brownfield investments, and divestitures. Our suggestion to management is to recognize that Dow is involved in numerous

12 Company guidance. Source:Sadara Spotlight: Site and Enterprise Readiness, Slide Presentation, 3/20/14.Sadara Spotlight, Slide Presentation 9/26/13. Tax rate assumed to be Saudi Arabia’s corporate tax rate.

13 Weighted Average Cost of Capital of 9.2%. Source: Bloomberg, 4/29/14.

commoditizing derivative products and to make a more clear-cut delineation between low-cost feedstock and downstream value-add related profitability. We have urged management to embrace the fact that it is running one of the world’s largest commodity petrochemical businesses, which historically has been a challenge.14 Conducting an operational review (with market price based raw material transfers) will undoubtedly result in increased scrutiny as to the specialty nature of some of Dow’s petchem business units. This acknowledgement and the subsequent review are crucial to becoming a best-in-class, low-cost petrochemical operator. After a decade of underperformance, shareholders deserve greater transparency and a comprehensive reassessment of Dow’s strategy. We appreciate management’s engagement with all of its shareholders, and look forward to furthering discussions regarding strategy and capital allocation in the pursuit of maximizing Dow’s great potential.

Sincerely,

Third Point LLC

Third Point LLC (“Third Point”) is an SEC-registered investment adviser headquartered in New York. Third Point is primarily engaged in providing discretionary investment advisory services to its proprietary private investment funds (each a “Fund” collectively, the “Funds”).

The information and opinions contained herein are based on publicly available information. All information provided herein is for informational purposes only and should not be deemed as a recommendation to buy or sell securities. All investments involve risk including the loss of principal. This transmission does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product. Any such offer or solicitation may only be made by means of delivery of an approved confidential offering memorandum.

Specific companies or securities shown in this presentation are meant to demonstrate Third Point’s investment style and the types of industries and instruments in which we invest and are not selected based on past performance. The analyses and conclusions of Third Point contained in this presentation include certain statements, assumptions, estimates and projections that reflect various assumptions by Third Point concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations, express or implied, are made as to the accuracy or completeness of such statements, assumptions, estimates or projections or with respect to any other materials herein. Third Point may buy, sell, cover or otherwise change the nature, form or amount of its investments, including any investments identified in this letter, without further notice and in Third Point’s sole discretion and for any reason. Third Point hereby disclaims any duty to update any information in this letter.

14 “It is honestly impossible to think of Dow as a petrochemical company anymore.” – CEO Andrew Liveris, Fourth Quarter 2013 earnings call. “Lots of the K-Dow scope is now sold. We’ve actually done the divestment of what might have been called a petchem business, the traditional commodity business.” – CEO Andrew Liveris, Fourth Quarter 2013 earnings call.

Third Point believes Dow needs to be held to its “no excuses” standard by new leaders with outside perspectives, who will put shareholders’ interests first. Third Point has assembled a best-in-class Advisory Board to offer fresh perspectives to help Dow meet and exceed its peers’ success. R. “Steve” Miller and Raymond J. Milchovich each have significant expertise in corporate turnarounds and operational management, skillsets Dow desperately needs to move forward. Below you will find more detailed credentials for our Advisory Board.

RAYMOND J. MILCHOVICH

| Raymond J. Milchovich served in various roles including Chairman, President, and CEO for Foster Wheeler AG, a company that engineers and constructs facilities for the oil and gas, liquefied natural gas, refining, chemical, pharmaceutical and power industries, from 2001 until 2011. During his time at Foster Wheeler, Mr. Milchovich led the company through a restructuring by working closely with other stakeholders to transform the company into an investment-grade industry leader. Before leading the Foster Wheeler restructuring, Mr. Milchovich held a variety of operational management positions for several decades at various firms.

Mr. Milchovich has been the lead director of Nucor Corporation, the largest steel producer in the United States, since 2012. He also served on the board of Nucor from 2002 to 2007 before voluntarily resigning from the position to devote more time to his position as CEO of Foster Wheeler. He also represents the private equity firm Aurora Capital Partners on the board of NTS. Previously, Mr. Milchovich served as Chairman, President and CEO of Kaiser Aluminum and Chemical Corporation. He also served as a Director on the Board of Delphi Corporation from 2005 to 2009, working alongside Chairman R. “Steve” Miller. | |

To get the most up-to-date information, sign up to receive email updates.

SUBSCRIBE

© Copyright 2014 Third Point

R. “STEVE” MILLER

| R. “Steve” Miller has served as the Chairman of American International Group (“AIG”) since 2010, overseeing the global insurance conglomerate’s remarkable recovery from the financial crisis. Mr. Miller’s decades of experience as a “turnaround executive” included serving as the Vice-Chairman of Chrysler Corporation in the 1980’s under its then-Chairman, Lee Iacocca. Since then, Mr. Miller has since helped more than a dozen troubled companies restore and increase stakeholder value. In 2012, he served as the CEO of Hawker Beechcraft, Inc., a Kansas-based airplane manufacturer. Before joining Hawker Beechcraft, he served as Chairman and CEO of Delphi Corporation, a diversified global automotive parts supplier, during the company’s restructuring from 2005 to 2009.

Mr. Miller is also the Chairman of MidOcean Partners, a New York-based middle-market private equity firm. He currently serves on the boards for Symantec (computer security software) and WLRH (special purpose company chaired by Wilbur Ross). Previously, Mr. Miller served as a director of numerous public companies, including United Airlines, Reynolds Tobacco, Waste Management, and US Bank. | |

To get the most up-to-date information, sign up to receive email updates.

SUBSCRIBE

© Copyright 2014 Third Point

| CONTACT - Broken Promises | Page 1 of 2 |

To stay up to date on shareholders’ efforts to increase value at Dow,

please submit your contact information below.

SEND MESSAGE

To get the most up-to-date information, sign up to receive email updates.

| CONTACT - Broken Promises | Page 2 of 2 |

SUBSCRIBE

© Copyright 2014 Third Point

Terms of Use

This website, http://www.value-dow.com (the “Site”), sponsored by Third Point LLC (the “Sponsor”), is for informational purposes only. You may use the Site for non-commercial, lawful purposes only. Your access to and use of the Site is subject to and governed by these Terms and Conditions. By accessing and browsing the Site, you accept, without limitation or qualification, and agree to be bound by, these Terms and Conditions and all applicable laws.

Nothing on this Site is intended to be, nor should it be construed or used as, investment, tax, legal or financial advice, a recommendation whether or how to vote any proxy or any other kind of recommendation, an opinion of the appropriateness of any security or investment, or an offer, or the solicitation of any offer, to buy or sell any security or investment. The Sponsor is not soliciting any action based upon the Site and is not responsible for any decision by any shareholder, and the Site should not be construed as a solicitation to procure, withhold or revoke any proxy.

1. You should assume that everything you see or read on the Site is material owned or exclusively represented by the Sponsor and protected by copyright unless otherwise expressly noted, and may not be used except as provided in these Terms and Conditions or in the text of the Site without the Sponsor’s written permission. The Sponsor expressly neither warrants nor represents that your use of materials displayed on the Site will not infringe rights of third parties not owned by or affiliated with the Sponsor.

2. While the Sponsor endeavors to ensure that only accurate and up to date information is on the Site, the Sponsor makes no warranties or representations as to the accuracy of any of the posted information. The Sponsor assumes no liability or responsibility for any errors or omissions in the content of the Site.

3. The Site is provided “AS IS.” The Sponsor does not make any representations or warranties, whether express or implied, regarding or relating to the Site or any associated hardware or software, including the content or operations of either.

4. YOU EXPRESSLY ACKNOWLEDGE THAT USE OF THE SITE IS AT YOUR SOLE RISK. NEITHER THE SPONSOR OR ITS AFFILIATED COMPANIES NOR ANY OF THEIR RESPECTIVE EMPLOYEES, AGENTS, AFFILIATES, THIRD PARTY CONTENT PROVIDERS OR LICENSORS (COLLECTIVELY THE “SPONSOR PARTIES”) WARRANTS THAT THE SITE WILL BE UNINTERRUPTED OR ERROR FREE, NOR DO THEY MAKE ANY WARRANTY AS TO THE RESULTS THAT MAY BE OBTAINED FROM USE OF THE SITE, OR AS TO THE ACCURACY, RELIABILITY OR CONTENT OF ANY INFORMATION, SERVICE, OR MERCHANDISE PROVIDED THROUGH THE SITE. THE SITE IS PROVIDED ON AN “AS IS” BASIS WITHOUT WARRANTIES OF ANY KIND, EITHER EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, WARRANTIES OF TITLE OR IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE, OTHER THAN THOSE WARRANTIES WHICH ARE IMPLIED BY AND INCAPABLE OF EXCLUSION, RESTRICTION OR MODIFICATION UNDER THE LAWS APPLICABLE TO THESE TERMS AND CONDITIONS.

THIS DISCLAIMER OF LIABILITY APPLIES TO ANY DAMAGES OR INJURY CAUSED BY ANY FAILURE OF PERFORMANCE, ERROR, OMISSION, INTERRUPTION, DELETION, DEFECT, DELAY IN OPERATION OR TRANSMISSION, COMPUTER VIRUS, COMMUNICATION LINE FAILURE, THEFT OR DESTRUCTION OR UNAUTHORIZED ACCESS TO, ALTERATION OF, OR USE OF RECORD, WHETHER FOR BREACH OF CONTRACT, TORTIOUS BEHAVIOR, NEGLIGENCE, OR UNDER ANY OTHER CAUSE OF ACTION. YOU SPECIFICALLY ACKNOWLEDGE THAT THE SPONSOR IS NOT LIABLE FOR THE DEFAMATORY, OFFENSIVE OR ILLEGAL CONDUCT OF OTHER USERS OR THIRD PARTIES AND THAT THE RISK OF INJURY FROM THE FOREGOING RESTS ENTIRELY WITH YOU.

IN NO EVENT WILL THE SPONSOR, THE SPONSOR PARTIES, OR ANY PERSON OR ENTITY INVOLVED IN CREATING, PRODUCING OR DISTRIBUTING THE SITE BE LIABLE FOR ANY INDIRECT, INCIDENTAL, SPECIAL, CONSEQUENTIAL OR PUNITIVE DAMAGES ARISING OUT OF THE USE OF OR INABILITY TO USE THE SITE. YOU HEREBY ACKNOWLEDGE THAT THE PROVISIONS OF THIS SECTION SHALL APPLY TO ALL CONTENT ON THE SITE.

IN ADDITION TO THE TERMS SET FORTH ABOVE, NEITHER THE SPONSOR NOR THE SPONSOR PARTIES SHALL BE LIABLE, REGARDLESS OF THE CAUSE OR DURATION, FOR ANY ERRORS, INACCURACIES, OMISSIONS, OR OTHER DEFECTS IN, OR UNTIMELINESS OR UNAUTHENTICITY OF, THE INFORMATION CONTAINED WITHIN THE SITE, OR FOR ANY DELAY OR INTERRUPTION IN THE TRANSMISSION THEREOF TO YOU, OR FOR ANY CLAIMS OR LOSSES ARISING THEREFROM OR OCCASIONED THEREBY.

NONE OF THE FOREGOING PARTIES SHALL BE LIABLE FOR ANY THIRD-PARTY CLAIMS OR LOSSES OF ANY NATURE, INCLUDING, BUT NOT LIMITED TO, LOST PROFITS, PUNITIVE OR CONSEQUENTIAL DAMAGES AND THE AGGREGATE TOTAL LIABILITY OF THE SPONSOR PARTIES TO YOU OR ANY END USER FOR ALL DAMAGES, INJURY, LOSSES AND CAUSES OF ACTION (WHETHER IN CONTRACT, TORT OR OTHERWISE) ARISING FROM OR RELATING TO THESE TERMS AND CONDITIONS OR THE USE OF OR INABILITY TO USE THE SITE SHALL BE LIMITED TO PROVEN DIRECT DAMAGES IN AN AMOUNT NOT TO EXCEED ONE HUNDRED DOLLARS ($100).

SOME JURISDICTIONS DO NOT ALLOW THE LIMITATION OR EXCLUSION OF CERTAIN LIABILITY OR WARRANTIES, IN WHICH EVENT SOME OF THE ABOVE LIMITATIONS MAY NOT APPLY TO YOU. In such jurisdictions, the Sponsor’s liability is limited to the greatest extent permitted by law. You should check your local laws for any restrictions or limitations regarding the exclusion of implied warranties.

5. Artwork, images, names, and likenesses displayed on the Site are either the property of, or permissibly used by, the Sponsor. The reproduction and use of any of these by you is prohibited unless specific permission is provided on the Site or otherwise. Any unauthorized use may violate copyright laws, trademark laws, privacy and publicity laws, and/or communications regulations and statutes.

6. The trademarks, service marks, logos, and other indicia, including of the Sponsor (collectively the “Trademarks”), which appear on the Site are registered and unregistered trademarks of the Sponsor and others. Nothing contained on the Site should be construed as granting, by implication or otherwise, any right, license or title to any of the Trademarks without the advance written permission of the Sponsor or such third party as may be appropriate. All rights are expressly reserved and retained by the Sponsor. Your misuse of any of the Trademarks displayed on the Site, or any other content on the Site, except as provided in these Terms and Conditions, is strictly prohibited. You are also advised that the Sponsor considers its intellectual property to be among its most valuable assets, and will aggressively enforce its intellectual property rights to the fullest extent of the law.

7. THIS SITE INCLUDES NEWS AND INFORMATION, COMMENTARY, AND OTHER CONTENT RELATING TO THE DOW CHEMICAL COMPANY (THE “COMPANY”), INCLUDING BY PERSONS OR COMPANIES THAT ARE NOT AFFILIATED WITH THE SPONSOR (“THIRD PARTY CONTENT”). THE AUTHOR AND SOURCE OF ALL THIRD PARTY CONTENT AND DATE OF PUBLICATION IS CLEARLY AND PROMINENTLY IDENTIFIED. THIRD PARTY CONTENT IS AVAILABLE THROUGH FRAMED AREAS, THROUGH HYPERLINKS TO THIRD PARTY WEB SITES, OR IS SIMPLY PUBLISHED ON THE SITE. THE SPONSOR AND ITS AFFILIATES HAVE NOT BEEN INVOLVED IN THE PREPARATION, ADOPTION OR EDITING OF THIRD PARTY CONTENT AND DO NOT EXPLICITLY OR IMPLICITLY ENDORSE OR APPROVE SUCH CONTENT. THE PURPOSE OF MAKING THE THIRD PARTY CONTENT AVAILABLE IS TO PROVIDE RELEVANT INFORMATION TO SHAREHOLDERS OF THE COMPANY IN CONNECTION WITH THE ELECTION OF DIRECTORS TO THE BOARD OF DIRECTORS OF THE COMPANY AT ITS 2015 ANNUAL MEETING OF SHAREHOLDERS AND THE MANAGEMENT AND AFFAIRS OF THE COMPANY IN GENERAL.

8. If any provision of the Terms and Conditions or any application thereof is held to be invalid or unenforceable for any reason, that provision shall be deemed severable and the remainder of the Terms and Conditions and the application of that provision in other situations shall not be affected.

9. YOU AGREE TO INDEMNIFY, DEFEND AND HOLD HARMLESS THE SPONSOR FROM AND AGAINST ANY AND ALL THIRD PARTY CLAIMS, DEMANDS, LIABILITIES, COSTS AND EXPENSES, INCLUDING REASONABLE ATTORNEYS’ FEES, ARISING FROM OR RELATED TO ANY BREACH BY YOU OF ANY OF THE TERMS AND CONDITIONS OR APPLICABLE LAW, INCLUDING THOSE REGARDING INTELLECTUAL PROPERTY.

1. The Sponsor may at any time revise these Terms and Conditions by updating this posting. You are bound by any such revisions and should therefore periodically visit this page to review the then current Terms and Conditions to which you are bound.

1. The Sponsor knows that the privacy of your personal information is important to you. Therefore, the Sponsor has established a Privacy Policy governing the use of this information, which is located at http://www.value-dow.com/privacy-policy.

2. The Sponsor owns, protects and enforces copyrights in its own creative material and respects the copyright properties of others. Materials may be made available on or via the Site by third parties not within the control of the Sponsor. It is our policy not to permit materials known by us to be infringing to remain on the Site. You should notify us promptly if you believe any materials on the Site infringe a third party copyright. Upon our receipt of a proper notice of claimed infringement under the Digital Millennium Copyright Act (“DMCA”), the Sponsor will respond expeditiously to follow the procedures specified in the DMCA to resolve the claim between the notifying party and the alleged infringer who provided the content at issue, including, where applicable, by removing or disabling access to material claimed to be infringing or removing or disabling access to links to such material. Pursuant to the DMCA 17 U.S.C. 512(c), the Sponsor has designated itself as the agent for notification of claims of copyright infringement with respect to information residing, at the direction of a user, on the Site. The contact information is:

Third Point LLC

Attn: Investor Relations—Value Dow

390 Park Avenue, 19th Floor

Tel: 212.715.6707

Email: ir@thirdpoint.com

Important Notice and Disclaimer

Forward-Looking Statements

This website may contain forward-looking statements. These statements may be identified by the use of forward-looking terminology such as the words “expects,” “intends,” “believes,” “anticipates” and other terms with similar meaning indicating possible future events or actions relating to the business or shareholders of The Dow Chemical Company (the “Company”). These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties include, among others, the ability to successfully solicit sufficient proxies to elect the director nominees (the “Nominees”) nominated by Third Point Partners, L.P., Third Point Partners Qualified, L.P., Third Point Offshore Master Fund L.P., Third Point Ultra Master Fund LP, Third Point Reinsurance Co. Ltd. and Lyxor/Third Point Fund Limited to the Company’s board of directors at the Company’s 2015 Annual Meeting of Shareholders (the “2015 Annual Meeting”), the ability of the Nominees to work with the other members of the Company’s board of directors to improve the corporate governance and performance of the Company and risk factors associated with the business of the Company, as described in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014, and in other periodic reports of the Company, which are available at no charge at the website of the Securities and Exchange Commission (“SEC”) at http://www.sec.gov. Accordingly, you should not rely upon forward-looking statements as a prediction of actual results.

Information on Website

This website includes information based on data found in filings with the SEC, independent industry publications and other sources. Although the Anticipated Participants (as defined below) believe that the data is reliable, the Anticipated Participants do not guarantee the accuracy or completeness of this information and have not independently verified any such information. Other than as expressly indicated otherwise on this website, consent of the author and publication has not been obtained to use any previously published material included in this website as proxy soliciting material.

Many of the statements on this website reflect the subjective belief of the Anticipated Participants. Although the Anticipated Participants have reviewed and analyzed the information that has informed such opinions, the accuracy of any such beliefs cannot be guaranteed.

Anticipated Participants’ Information; Proxy Statement

Third Point LLC and the other Anticipated Participants intend to file with the SEC a preliminary proxy statement and accompanying proxy card in connection with its solicitation of proxies for the election of the Nominees at the 2015 Annual Meeting.

In connection with their intended proxy solicitation, Third Point LLC and certain of its affiliates intend to file a proxy statement with the Securities and Exchange Commission (the “SEC”) to solicit stockholders of the Company. THIRD POINT LLC STRONGLY ADVISES ALL

STOCKHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT WHEN IT BECOMES AVAILABLE BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS IN ANY SUCH PROXY SOLICITATION. SUCH PROXY STATEMENT, WHEN FILED, AND ANY OTHER RELEVANT DOCUMENTS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT HTTP://WWW.SEC.GOV.

THIRD POINT ANTICIPATED PARTICIPANT INFORMATION

In accordance with Rule 14a-12(a)(1)(i) under the Securities Exchange Act of 1934, as amended, the following persons are anticipated to be, or may be deemed to be, participants in any such proxy solicitation: Third Point LLC, Daniel S. Loeb, Third Point Partners, L.P., Third Point Partners Qualified, L.P., Third Point Offshore Master Fund L.P., Third Point Ultra Master Fund LP, Third Point Reinsurance Co. Ltd., Lyxor/Third Point Fund Limited, Robert Steven Miller and Raymond J. Milchovich (the “Anticipated Participants”). Certain of these persons hold direct or indirect interests with respect to any such proxy solicitation. On November 13, 2014, Third Point LLC filed additional proxy materials with the SEC describing such interests. Such proxy materials are available at no charge on the SEC’s website at http://www.sec.gov.

This communication is not a solicitation of a proxy, which may be done only pursuant to a definitive proxy statement.

Privacy Policy

Our Commitment to Privacy

The sponsor of this website, http://www.value-dow.com (the “Site”), is Third Point LLC (the “Sponsor”). We respect and value your privacy. This statement outlines our privacy policies (the “Privacy Policy”) which are designed to assist you in understanding how we collect, use and safeguard information we collect and to assist you in making informed decisions when using the Site. The core of our Privacy Policy is this:

We want you to feel safe and comfortable when you use the Site, and we are dedicated to developing and upholding high standards for protecting your privacy. You should read and familiarize yourself with this Privacy Policy and with our Terms and Conditions. When you use the Site, you agree to abide by these terms.

What Information Do We Collect?

When you visit any website you may provide two types of information: personal information you knowingly choose to disclose that is collected on an individual basis, and website use information collected on an aggregate basis as you browse the website.

Personal Information.

Our Site does not ask you to provide your personal information.

Clickstream Data.

As you use the Internet, a trail of electronic information is left at each website you visit. This information, which is sometimes referred to as “clickstream data,” can be collected and stored by a website’s server. Clickstream data can tell us the type of computer and browsing software you use and the address of the website from which you linked to our Site. We may use clickstream data as a form of non-personally identifiable information to anonymously determine how much time visitors spend on each page of the Site, how visitors navigate throughout the Site and how we may tailor our web pages to better meet the needs of visitors. This information will be used to improve the Site. Any collection or use of clickstream data will be anonymous and aggregate.

Do We Disclose Information to Outside Parties?

We may provide aggregate information about our users, Site traffic patterns and related Site information to our affiliates or reputable third parties.

What About Legally Compelled Disclosure of Information

We may disclose information when we, in good faith, believe that the law requires it or for the protection of our legal rights.

What About Other Websites Linked to Our Site?

We are not responsible for the practices employed by websites linked to or from our Site nor the information or content contained therein. Often links to other websites are provided solely as pointers to information on topics that may be useful to the users of our Site. Please remember that your browsing and interaction on any other website, including websites which have a link on our Site, is subject to that website’s own rules and policies. Please read over those rules and policies before proceeding.

Your Consent.

By using the Site you consent to this Privacy Policy. We reserve the right to make changes to this Privacy Policy from time to time. Revisions will be posted on this page. We suggest you check this page occasionally for updates.

Contacting Us.

If you have any questions about this Privacy Policy, the practices of the Site, or your dealings with the Site, you can contact:

Third Point LLC

Attn: Investor Relations—Value Dow

390 Park Avenue, 19th Floor

Tel: 212.715.6707

Email: ir@thirdpoint.com