UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2011

Commission File Number: 000-11743

WACOAL HOLDINGS CORP.

(Translation of registrant’s name into English)

29, Nakajima-cho, Kisshoin, Minami-ku

Kyoto, Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F þ Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note:Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note:Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No þ

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- N/A

Information furnished on this form:

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | |

WACOAL HOLDINGS CORP. (Registrant) |

| |

| By: | | /s/ Ikuo Otani |

| | Ikuo Otani |

| | Director and General Manager of Corporate Planning |

Date: May 13, 2011

Exhibit 1

Consolidated Financial Statements for the Fiscal Year Ended March 31, 2011 (U.S. Accounting Standards)

[Translation]

May 13, 2011

| | |

Listed Company: Wacoal Holdings Corp. | | Stock Exchanges: Tokyo (1st section), Osaka (1st section) |

Code Number: 3591 | | URL:http://www.wacoalholdings.jp/ |

Representative: (Position) Representative Director | | (Name) Yoshikata Tsukamoto |

For Inquiries: (Position) Director and General Manager of Corporate Planning | | (Name) Ikuo Otani Tel: +81 (075) 682-1028 |

| Scheduled date of Ordinary Shareholders’ Meeting: June 29, 2011 | | Scheduled Commencement Date of Dividend Payment: June 6, 2011 |

| Scheduled date of Annual Securities Report Filing: June 29, 2011 | | |

| Supplementary materials regarding Annual Business Results: Yes | | |

| Explanatory meeting regarding Annual Business Results: Yes | | |

(Amounts less than 1 million yen have been rounded.)

| 1. | Consolidated Results for the Fiscal Year Ended March 31, 2011 (April 1, 2010 – March 31, 2011) |

| | (1) | Consolidated Business Results |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (% indicates changes from prior fiscal year) | |

| | | | |

| | | Sales | | | Operating Income | | | Pre-tax Net Income | | | Net Income

Attributable to Wacoal

Holdings Corp. | |

| | | Million Yen | | | % | | | Million Yen | | | % | | | Million Yen | | | % | | | Million Yen | | | % | |

Fiscal Year Ended March 31, 2011 | | | 165,726 | | | | 1.5 | | | | 4,255 | | | | 11.7 | | | | 3,739 | | | | 19.7 | | | | 2,615 | | | | 3.6 | |

Fiscal Year Ended March 31, 2010 | | | 163,297 | | | | (5.2 | ) | | | 3,810 | | | | (62.4 | ) | | | 3,123 | | | | (59.1 | ) | | | 2,524 | | | | (51.7 | ) |

| | |

(Note) Comprehensive income (loss): | | Fiscal Year ended March 31, 2011: (1,469) million yen (—%) |

| | Fiscal Year ended March 31, 2010: 8,202 million yen (—%) |

| | | | | | | | | | | | | | | | | | | | |

| | | Net Income

Attributable to

Wacoal Holdings

Corp. Per Share | | | Diluted Net

Earnings

Attributable to

Wacoal Holdings

Corp. Per Share | | | Ratio of Net Income

Attributable to

Wacoal Holdings

Corp. to

Shareholders’ Equity | | | Ratio of Pre-tax

Net Income to

Total Assets | | | Ratio of

Operating

Income to Sales | |

| | | Yen | | | Yen | | | % | | | % | | | % | |

Fiscal Year Ended March 31, 2011 | | | 18.53 | | | | 18.51 | | | | 1.5 | | | | 1.7 | | | | 2.6 | |

Fiscal Year Ended March 31, 2010 | | | 17.86 | | | | 17.85 | | | | 1.5 | | | | 1.4 | | | | 2.3 | |

| | |

(Reference) Equity in income/(loss) of equity-method investment: | | Fiscal Year ended March 31, 2011: 990 million yen |

| | Fiscal Year ended March 31, 2010: 907 million yen |

| | (2) | Consolidated Financial Condition |

| | | | | | | | | | | | | | | | | | | | |

| | | Total Assets | | | Total Equity

(Net Assets) | | | Total Shareholders’

Equity | | | Total Shareholders’

Equity Ratio | | | Shareholders’

Equity

Per Share | |

| | | Million Yen | | | Million Yen | | | Million Yen | | | % | | | Yen | |

Fiscal Year Ended March 31, 2011 | | | 215,345 | | | | 168,867 | | | | 166,967 | | | | 77.5 | | | | 1,185.44 | |

Fiscal Year Ended March 31, 2010 | | | 223,387 | | | | 173,553 | | | | 171,630 | | | | 76.8 | | | | 1,215.52 | |

| | (3) | Consolidated Cash Flow Status |

| | | | | | | | | | | | | | | | |

| | | Cash Flow from

Operating Activities | | | Cash Flow used in

Investing Activities | | | Cash Flow used in

Financing Activities | | | Balance of Cash and Cash

Equivalents at End of Fiscal

Year | |

| | | Million Yen | | | Million Yen | | | Million Yen | | | Million Yen | |

Fiscal Year Ended March 31, 2011 | | | 10,054 | | | | (1,546 | ) | | | (4,899 | ) | | | 26,981 | |

Fiscal Year Ended March 31, 2010 | | | 9,449 | | | | (2,698 | ) | | | (5,438 | ) | | | 24,317 | |

- 1 -

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Annual Dividend | | | Total

Amount of

Dividends

(annual) | | | Payout Ratio

(consolidated) | | | Ratio of

Dividend to

Shareholders’

Equity

(consolidated) | |

| | | End of

First

Quarter | | | End of

Second

Quarter | | | End of

Third

Quarter | | | Year-End | | | Annual | | | | |

| | | Yen | | | Yen | | | Yen | | | Yen | | | Yen | | | Million Yen | | | % | | | % | |

Fiscal Year Ended March 31, 2010 | | | — | | | | — | | | | — | | | | 20.00 | | | | 20.00 | | | | 2,824 | | | | 112.0 | | | | 1.7 | |

Fiscal Year Ended March 31, 2011 | | | — | | | | — | | | | — | | | | 20.00 | | | | 20.00 | | | | 2,817 | | | | 107.9 | | | | 1.7 | |

| | | | | | | | |

Fiscal Year Ending March 31, 2012 (Estimates) | | | — | | | | — | | | | — | | | | 20.00 | | | | 20.00 | | | | | | | | 70.4 | | | | | |

| 3. | Forecast of Consolidated Results for the Fiscal Year Ending March 31, 2012 (April 1, 2011 – March 31, 2012) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (% indicates changes from the prior fiscal year for annual and from the six-month period ended September 30, 2010 for the six-month period) | |

| | | | | |

| | | Sales | | | Operating Income | | | Pre-tax Net Income | | | Net Income

Attributable to

Wacoal Holdings

Corp. | | | Net Income

Attributable to

Wacoal Holdings

Corp. Per Share | |

| | | Million Yen | | | % | | | Million Yen | | | % | | | Million Yen | | | % | | | Million Yen | | | % | | | Yen | |

Six-Month Period Ending September 30, 2011 | | | 85,300 | | | | (0.7 | ) | | | 4,700 | | | | (23.6 | ) | | | 4,900 | | | | (8.1 | ) | | | 2,600 | | | | (6.5 | ) | | | 18.46 | |

Annual | | | 167,000 | | | | 0.8 | | | | 6,500 | | | | 52.8 | | | | 6,800 | | | | 81.9 | | | | 4,000 | | | | 53.0 | | | | 28.40 | |

| | (1) | Changes in significant subsidiaries during the fiscal year ended March 31, 2011 (change in scope of consolidation): None |

New: None

Excluded: None

(Note) For details, please see “(7) Basic Significant Matters in Preparation of Consolidated Financial Statements” in Section 4 “Consolidated Financial Statements” on page 19.

| | (2) | Changes in Accounting Principles, Procedures and Indication Method: |

| | (i) | Changes due to modifications in accounting standards, etc.: None |

| | (ii) | Changes other than (i) above: None |

| | (3) | Number of Issued Shares (Common Stock) |

| | | | | | | | |

| | | Fiscal Year Ended

March 31, 2011 | | | Fiscal Year Ended

March 31, 2010 | |

(i) Number of issued shares (including treasury stock) as of period end: | | | 143,378,085 shares | | | | 143,378,085 shares | |

(ii) Number of shares held as treasury stock as of period end: | | | 2,529,607 shares | | | | 2,179,739 shares | |

(iii) Average number of shares during the period: | | | 141,145,190 shares | | | | 141,353,141 shares | |

(Reference) Summary of Non-Consolidated Results

| 1. | Non-Consolidated Results for the Fiscal Year Ended March 31, 2011 (April 1, 2010 – March 31, 2011) |

| | (1) | Non-Consolidated Business Results |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (% indicates changes from prior fiscal year) | |

| | | | |

| | | Sales | | | Operating Income | | | Ordinary Income | | | Net Income | |

| | | Million Yen | | | % | | | Million Yen | | | % | | | Million Yen | | | % | | | Million Yen | | | % | |

Fiscal Year Ended March 31, 2011 | | | 7,662 | | | | 9.9 | | | | 3,885 | | | | 28.1 | | | | 4,000 | | | | 28.7 | | | | 3,432 | | | | 18.8 | |

Fiscal Year Ended March 31, 2010 | | | 6,968 | | | | 12.9 | | | | 3,032 | | | | 51.1 | | | | 3,106 | | | | 48.3 | | | | 2,887 | | | | 128.7 | |

| | | | | | | | |

| | | Net Income

Per Share | | | Diluted Net Earnings

Per Share | |

| | | Yen | | | Yen | |

Fiscal Year Ended March 31, 2011 | | | 24.30 | | | | 24.28 | |

Fiscal Year Ended March 31, 2010 | | | 20.39 | | | | 20.38 | |

- 2 -

| | (2) | Non-Consolidated Financial Condition |

| | | | | | | | | | | | | | | | |

| | | (% indicates changes from prior fiscal year) | |

| | | | |

| | | Total Assets | | | Net Assets | | | Capital-to-Asset Ratio | | | Net Asset per Share | |

| | | Million Yen | | | Million Yen | | | % | | | Yen | |

Fiscal Year Ended March 31, 2011 | | | 146,121 | | | | 142,451 | | | | 97.3 | | | | 1,010.29 | |

Fiscal Year Ended March 31, 2010 | | | 146,898 | | | | 142,459 | | | | 96.9 | | | | 1,006.55 | |

| (Reference) Equity Capital: | As of the end of the fiscal year ended March 31, 2011: 142,297 million yen |

| | As of the end of the fiscal year ended March 31, 2010: 142,355 million yen |

*Notes on Implementation of Audit Procedures

This financial statement is not subject to the audit procedures based on the Financial Instruments and Exchange Law. The audit procedures for annual financial statements based on the Financial Instruments and Exchange Law had not been completed as of the time of disclosure of this financial statement.

*Cautionary Statement regarding Forward Looking Statements

The foregoing estimates are made based on information available as of the date this data was released, and actual results may differ from estimates due to various factors arising in the future.

Statements made in this report regarding Wacoal’s or management’s intentions, beliefs, expectations, or predictions for the future are forward-looking statements that are based on Wacoal’s and managements’ current expectations, assumptions, estimates and projections about its business and the industry. These forward-looking statements, such as statements regarding fiscal 2011 revenues and operating and net profitability, are subject to various risks, uncertainties and other factors that could cause Wacoal’s actual results to differ materially from those contained in any forward-looking statement.

These risks, uncertainties and other factors include: the impact of weak consumer spending in Japan and our other markets on our sales and profitability; the impact on our business of anticipated continued weakness of department stores and other general retailers in Japan; our ability to successfully develop, manufacture and market products in Japan and our other markets that meet the changing tastes and needs of consumers and to deliver high quality products; the highly competitive nature of our business and the strength of our competitors; our ability to successfully expand our network of our own specialty retail stores and achieve profitable operations at these stores; our ability to further develop our catalog and Internet sales capabilities; our ability to effectively manage our inventory levels; our ability to reduce costs; our ability to recruit and maintain qualified personnel; effects of seasonality on our business and performance; risks related to conducting our business internationally; risks from acquisitions and other strategic transactions with third parties; risks relating to intellectual property; risks relating to protection of personal information and Wacoal’s confidential information; risks relating to internal control; the impact of weakness in the Japanese equity markets on our holdings of Japanese equity securities; direct or indirect adverse effects on the Company of the major earthquake and tsunami that struck Northeast Japan on March 11, 2011 and the impact of any other natural disaster or epidemic on our business; risks relating to return of investment for development of new market; and other risks referred to from time to time in Wacoal’s filings on Form 20-F of its annual report and other filings with the United States Securities and Exchange Commission.

- 3 -

Table of Contents for Attached Materials

- 4 -

Qualitative Information and Financial Statements

(1) Analysis of Results

Results For the Fiscal Year Ended March 2011

During the fiscal year ended March 31, 2011 (fiscal 2011), although there was a sign of partial recovery as a result of a recovery trend and policy effects implemented in the global economy as well as the growth of emerging markets, the outlook of the Japanese economy has continued to remain severe. This is a result of the continued severe state of employment, appreciation of the yen, reaction to the policy effects, general concerns about the direction of the economy caused by the global economic downturn, as well as downturn factors such as the impact of the Tohoku Region Pacific Ocean Offshore Earthquake and subsequent tsunami (the “Earthquake”).

In this business environment, our group (primarily Wacoal Corp., our core operating entity) implemented a new mid-term plan in April 2010, and sought to improve profitability through structural reform of our domestic business and began making efforts in strengthening growth by active development of our overseas business, mainly in China.

As a result of the above, with respect to our consolidated business results for the fiscal 2011, while sales from Wacoal Corp. were below the results from the previous fiscal year, overall sales increased as compared to the results from the previous fiscal year due to the (i) favorable performance of our overseas business in the United States and China, which increased compared to the results from the previous fiscal year, (ii) consolidation of the business results of Lecien Corporation (“Lecien”), which became our wholly-owned subsidiary last year, and (iii) improvement in sales generated by Nanasai Co., Ltd. (“Nanasai”). Operating income increased as compared to the results from the previous fiscal year due to (i) Wacoal Corp.’s efforts in reducing cost and expense and (ii) improvement in income generated by Nanasai.

| | |

| Sales: | | 165,726 million yen (an increase of 1.5% as compared to the previous fiscal year) |

| |

| Operating income: | | 4,255 million yen (an increase of 11.7% as compared to the previous fiscal year) |

| |

| Pre-tax net income: | | 3,739 million yen (an increase of 19.7% as compared to the previous fiscal year) |

| |

| Net income attributable to Wacoal Holdings Corp.: | | 2,615 million yen (an increase of 3.6% as compared to the previous fiscal year) |

Business Overview of the Operating Segment

| a. | Wacoal Business (Domestic) |

In Wacoal Corp.’s Wacoal brand business, sales of most of the core brassieres showed strong performance as a result of the direct benefits of our campaign products, which have been well received by our consumers, and our successful promotional campaign based on the key-word “body aging (physiological changes associated with aging)”, which stemmed from the results of Wacoal Corp. Human Science research Center’s research announced in April 2010. Conversely, sales our new Style Science functional underwear series showed weak performance and overall sales of girdles were below the results from the previous fiscal year. Sales of our seasonal undergarments were also largely below the results from the previous fiscal year due to products sold by our competitors. In addition to the above, sales in March fell as a result of the impact of the Earthquake, and, as a result, overall sales of our core Wacoal brand business were below the results from the previous fiscal year.

In our Wing brand business, delivery was suppressed largely due to clients’ inventory adjustments. Although in-store performance of brassieres was steady, sales of our undergarments were affected by mass merchandisers’ private-label brand products and the products sold by our competitors. Consequently, sales of girdles showed poor performance, and the results of these items were below the results from the previous fiscal year. With respect to men’s undergarments, although sales of products targeted at senior consumers and new brands expanded, sales were below the results from the previous fiscal year at a result of the poor performance of our basic Style Science products. Due to the above, overall sales of our Wing brand business were below the results from the previous fiscal year.

Regarding our specialty retail stores business, sales of our reasonably-priced brassiere products from our direct retail store APMHI showed a strong performance. Furthermore, overall sales exceeded the results from the previous fiscal year due to steady sales from our Wacoal Factory Stores in general, despite the partial impact of the Earthquake.

Although sales from our existing stores of Une Nana Cool Corp. (a subsidiary of Wacoal Corp. that engages in the specialty retail store business) were below the results from the previous fiscal year, new store openings helped overall sales to exceed the results from the previous fiscal year.

- 5 -

In our wellness business, because we actively covered the demand from a boom in running and trekking, sales of our “CW-X” brand products showed favorable performance. In addition, sales of our business footwear, which focuses on functionality showed favorable performance as a result of advertisements made in public transportation and a campaign for walking. As a result, overall sales from our wellness business exceeded the results from the previous fiscal year.

In our catalog sales business, sales fell below the results from the previous fiscal year due to a slow start in purchases in our catalogue sales as a result of the cool summer at the beginning of the season and lingering heat, as well as the impact of the Earthquake. However, our online sales showed favorable performance after the sales of limited items on the website gained significant popularity. As a result, overall sales from our catalog sales business remained the same as the results from the previous fiscal year.

As seen above, although sales from our specialty retail stores business and wellness business performed strongly, the overall sales of Wacoal Corp. were below the results from the previous fiscal year due to lower sales of our core Wacoal and Wing brand products. Our operating income, however, exceeded the operating income for the previous fiscal year due to our successful efforts in improving our sales-to-profit ratio and cost-cutting initiatives, which are a part of our structural reform that we have implemented from fiscal 2011.

| | |

| Sales: | | 110,856 million yen (a decrease of 2.7% as compared to the previous fiscal year) |

| |

| Operating income: | | 5,620 million yen (an increase of 23.7% as compared to the previous fiscal year) |

| b. | Wacoal Business (Overseas) |

As for our overseas operations (from January 2010 to December 2010), we actively made efforts in expanding our U.S. market share and enhancing our product lineup, as well as in expanding sales in surrounding countries, while consumer spending recovered and the economy showed steady performance in the United States. Although sales denominated in U.S. dollars exceeded the results from the previous fiscal year as a result of the strong performance of our reasonably-priced brassiere and functional bottom products and the launch of our internet sales, sales fell below the results from the previous fiscal year due to an exchange fluctuation. With respect to profitability, in addition to an increase in sales, operating income exceeded the results from the previous fiscal year due to an improvement in our sales-to-profit ratio and cost reduction efforts. The exchange rate in the fiscal year ended March 31, 2011 was 87 yen per dollar (compared to 92 per dollar for the previous fiscal year).

As for our business in China, while economy in China continued to expand despite elements of instability, we actively promoted the opening of new stores in inner mainland China. Although sales from these new stores were below our original expectations due to a lack of brand recognition, overall sales exceeded the results from the previous fiscal year. Operating income was below the results from the previous fiscal year as a result of increases in expenses incurred for shop openings and promotional expenses.

| | |

| Sales: | | 20,052 million yen (an increase of 6.1% as compared to the previous fiscal year) |

| |

| Operating income: | | 1,321 million yen (a decrease of 0.7% as compared to the previous fiscal year) |

With respect to Peach John Co., Ltd. (for the period from March 2010 to February 2011), mail-order sales fell below the results from the previous fiscal year due to a weak number of catalogue orders, except for our cosmetic beauty catalogue. Sales from our direct retail stores also fell below the results from the previous fiscal year due to a decrease in the number of shops as compared to the previous fiscal year. As for our directly-managed overseas stores, we continued to actively expand the number of shops and opened five shops in Shanghai, in addition to our two directly-managed stores in Hong Kong; however, overall sales from our Peach John business were significantly affected by the weak performance of our domestic business and were below the results from the previous fiscal year. With respect to profitability, despite our efforts to achieve efficiency by reducing the number of catalogues published and reassessing the media through which we advertize, we suffered an operating loss as a result of a decrease in sales and integration, elimination of business offices as a result of structural reform and an increase in expenses incurred for voluntary retirement.

Furthermore, we have drafted a business plan for the next five fiscal years after fiscal 2012 while taking into account the impact of the Earthquake, and accordingly we have recorded an impairment loss of 1,772 million yen after reassessing the fair value of Peach John.

| | |

| Sales: | | 11,711 million yen (a decrease of 11.4% as compared to the previous fiscal year) |

| |

| Operating income: | | (3,024) million yen (as compared to 1,325 million yen of operating loss incurred for the previous fiscal year) |

- 6 -

With respect to the business of Lecien, we liquidated underperforming businesses during the previous fiscal year and made efforts in selecting and focusing management resources. Sales from our core innerwear and outerwear products were below the results from the previous fiscal year due to increased competition in the mass merchandiser market, which is our core sales channel. In the Art/Hobby business, sales of embroidery thread and sewing fabrics for handicrafts showed steady performance and remained the same as the results from the previous fiscal year; however, in our material business, which handles lace materials, sales were below the results from the previous fiscal year. Overall sales from Lecien exceeded the results from the previous fiscal year because the consolidated financial results of Lecien was for the 12-month-period for fiscal 2011, while it was for the 8-month-period for the previous fiscal year. Although operating income improved from the results for the previous fiscal year as a result of our successful efforts in liquidating underperforming businesses and cost-cutting initiatives, we suffered an operating loss partially due to a shortage of reserves for our retirement pension.

As for Nanasai, which engages in the manufacturing, sales and rental business of mannequins and interior design and construction of stores at commercial facilities, sales exceeded the results from the previous fiscal year as a result of favorable product sales, as well as steady orders for rental mannequins and shop renovations from department stores, which constitute our major clients. In addition, in terms of profitability, operating income greatly improved as compared to the results from the previous fiscal year, and we achieved a surplus as we were successful in implementing a thorough reassessment of costs.

| | |

| Sales: | | 23,107 million yen (an increase of 34.0% as compared to the previous fiscal year) |

| |

| Operating income: | | 338 million yen (as compared to 737 million yen of operating loss incurred for the previous fiscal year) |

Forecast for Next Fiscal Year

With strong concerns about the impact of the Earthquake and economic downturn, we anticipate that the management environment will continued to remain severe. However, we plan to accelerate the implementation of our mid-term plan (from fiscal 2011 to fiscal 2013), which we implemented in April of 2010, and nevertheless expand sales by continuously developing products with real value using our group’s high-quality and high-functionality manufacturing technologies.

As for Wacoal Corp., we will seek to improve the profitability structure of our domestic business through structural reform and to promote rebuilding the brand channel strategies. In addition, we will actively make efforts to expand our specialty retail store business and wellness business, which we believe have further growth potential, and to rebuild our supply chain management which can exercise the resources of our group, as a whole, including Lecien.

As for our overseas business, our business in the United States continues to show steady performance and we will make efforts to further enhance our product lineup including by the launch of new products, and to expand our sales channels. In China, where we expect further economic growth, we will accelerate our shop openings while responding to changes in the business environment and proactively conduct promotional activities to enhance our brand recognition.

As for the Peach John business, in an aim to shift to a business entity that can ensure a stable rate of return, we will reassess our business model to respond to changes in the business environment, develop new products, and promote our overseas operations.

Our forecast for next fiscal year are based on the following preconditions:

For the primary exchange rates, the exchange rate for the U.S. dollar is assumed to be 82 yen to the dollar and for the Chinese yuan is assumed to be 13 yen to the yuan. The possible impact of the Earthquake on our business activities that we can anticipate at this time has been incorporated in our forecast of consolidated business results for the fiscal year; however, actual results in the future may differ largely from our estimates due to future events.

| | |

| Sales: | | 167,000 million yen (an increase of 0.8% as compared to the previous fiscal year) |

| |

| Operating income: | | 6,500 million yen (an increase of 52.8% as compared to the previous fiscal year) |

| |

| Pre-tax net income: | | 6,800 million yen (an increase of 81.9% as compared to the previous fiscal year) |

| |

Net income attributable to Wacoal Holdings Corp.: | | 4,000 million yen (an increase of 53.0% as compared to the previous fiscal year) |

| 1 | In our annual report on Form 20-F for the year ended March 31, 2010, that was filed with the SEC on July 16, 2010, Nanasai was presented as a separate business segment rather than within the “Other” business segment. Including Nanasai in the Other business segment in this earnings release is consistent with our internal management reporting practice and permissible under Japanese law based on the earnings release form. In our annual report on Form 20-F for the year ended March 31, 2011, however, we expect to include Nanasai in the Other business segment as we do in this earnings release, as the share of Nanasai’s contribution to our operations has changed. |

- 7 -

(2) Analysis of Financial Condition

Status of Assets, Liabilities and Shareholders’ Equity

Our total assets as of the end of this consolidated fiscal year ended March 31, 2011 was 215,345 million yen, a decrease of 8,042 million yen from the end of the previous fiscal year, as a result of a decrease in investments due to changes in stock prices and a decrease in other intangible fixed assets.

In terms of liabilities, our current liabilities were 46,478 million yen, a decrease of 3,356 million yen from the end of the previous fiscal year, as a result of a decrease in short-term bank loans under current liabilities, and a decrease of deferred tax liabilities under long-term liabilities.

Shareholders’ equity was 166,967 million yen, a decrease of 4,663 million yen from the end of the previous fiscal year, due to foreign currency exchange adjustments and fluctuations of unrealized gain on securities.

As a result of the above, our total shareholders’ equity ratio as of the end of this consolidated fiscal year ended March 31, 2011 was 77.5%, an increase of 0.7% from the end of the previous fiscal year.

Cash Flows Status

Cash flow from operating activities during fiscal 2011 was 10,054 million yen, an increase of 605 million yen as compared to the previous fiscal year, after adjustments of deferred taxes and equity in net income of affiliated companies, to the net income of 2,737 million yen plus the adjustments of depreciation expenses and an impairment loss of intangible fixed assets.

Cash flow used in investment activities was 1,546 million yen, a decrease of 1,152 million yen as compared to the previous fiscal year, due to the acquisition of marketable securities and tangible fixed assets, despite proceeds from the sale and redemption of marketable securities.

Cash flow used in financing activities was 4,899 million yen, a decrease of 539 million yen as compared to the previous fiscal year, due to the repayment of short-term bank loans and cash dividend payments.

As a result, the balance of cash and cash equivalents at the end of fiscal 2011, calculated by excluding the exchange difference on cash and cash equivalents from the above total, was 26,981 million yen, an increase of 2,664 million yen as compared to the previous fiscal year.

Free cash flow, which was calculated by subtracting the amount of capital investment from the cash flow from operating activities, amounted to 6,721 million yen.

Trends in certain cash-flow indicators

| | | | | | | | | | | | | | | | | | | | |

| | | Fiscal Year

ended

March 31, 2007 | | | Fiscal Year

ended

March 31, 2008 | | | Fiscal Year

ended

March 31, 2009 | | | Fiscal Year

ended

March 31, 2010 | | | Fiscal Year

ended

March 31, 2011 | |

Shareholders’ equity ratio (%) | | | 77.2 | | | | 76.6 | | | | 77.7 | | | | 76.8 | | | | 77.5 | |

Shareholders’ equity ratio based on the market value (%) | | | 83.9 | | | | 87.4 | | | | 75.0 | | | | 73.8 | | | | 68.5 | |

Debt redemption years (years) | | | 0.6 | | | | 0.4 | | | | 0.6 | | | | 0.9 | | | | 0.6 | |

Interest coverage ratio (times) | | | 133.4 | | | | 182.4 | | | | 108.9 | | | | 96.4 | | | | 110.5 | |

Shareholders’ equity ratio = shareholders’ equity/total assets

Shareholders’ equity ratio based on the market value = aggregate market value of shareholders’ equity/total assets

Debt redemption years = interest-bearing debt/cash flow from operating activities

Interest coverage ratio = cash flow from operating activities/interest payment

Interest payment = “cash payment/interest” as described in the supplemental information to the consolidated cash flow statements

- 8 -

(3) Basic Policy Regarding Distribution of Profits and Dividends for Fiscal 2011 and Fiscal 2012

Our basic policy regarding the distribution of profits to our shareholders is to pay steady dividends and increase our earnings per share, while giving due consideration to the improvement of corporate value through active investment that will result in increased profitability. As for retained earnings, with the aim of improving our corporate value, we have actively invested in developing new specialty retail stores, developing new points of contact with customers and actively investing in overseas businesses. We are also concentrating on new business investments, such as entry into new markets, strategic business alliances and M&A activities. We hope that these efforts will benefit our shareholders by improving future profitability. We also intend to acquire treasury stock from time to time, and we will try to improve capital efficiency and return profits to our shareholders.

As initially announced, the dividend payable for fiscal 2011 will be 20.00 yen per share. For fiscal 2012, we hope to be able to distribute 20.00 yen per share.

(4) Business Risks

These matters have not significantly changed since disclosure in our annual report for the year ended March 2010, and are omitted.

For a financial summary for the year ended March 2010 disclosing the above matters, please refer to the following URL.

(Our homepage)

http://www.wacoalholdings.jp/ir/library.html

- 9 -

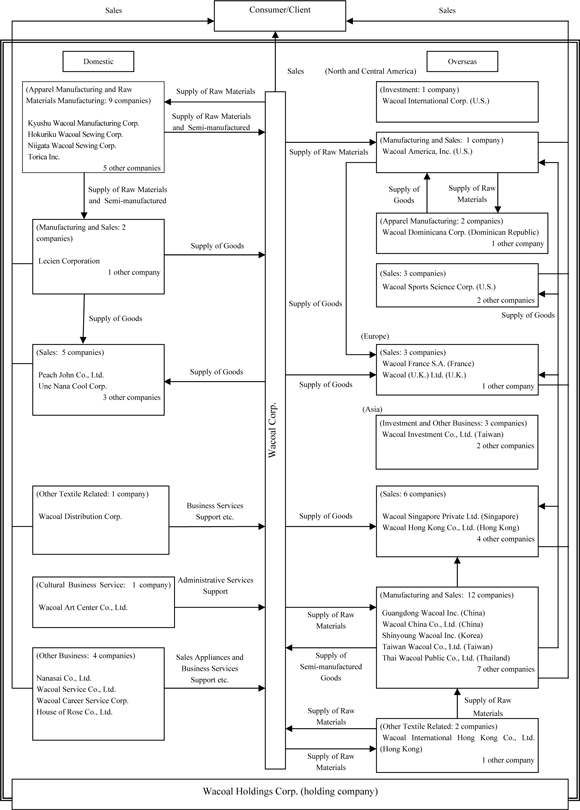

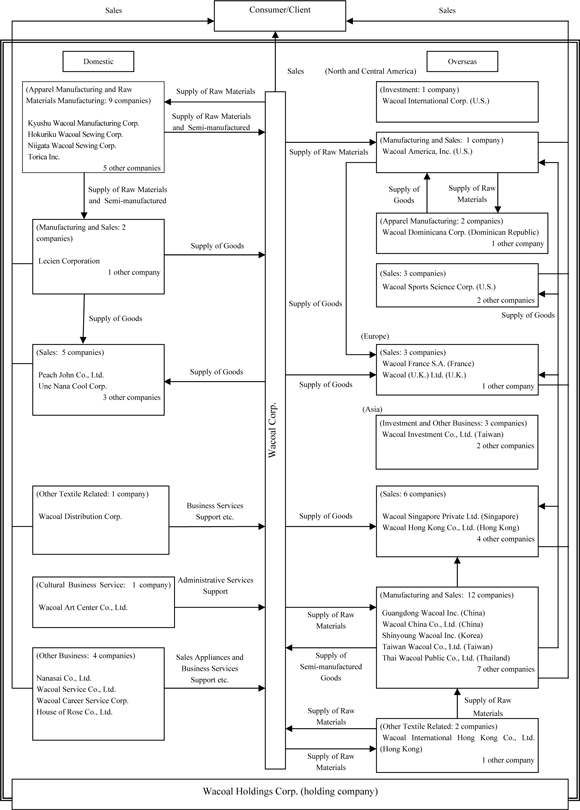

| 2. | Status of Corporate Group |

Our corporate group consists of Wacoal Holdings Corp. (the “Company”), 47 subsidiaries and 9 affiliates, and is principally engaged in the manufacturing and wholesale distribution of innerwear (primarily women’s foundation wear, lingerie, nightwear and children’s underwear), outerwear, sportswear, and other textile goods and related products, as well as the direct sale of certain products to consumers. Our corporate group also conducts business in the restaurant, culture, services, and interior design businesses.

Segment information and a summary of the various companies that make up our corporate group are as follows.

| | | | |

Business Segment | | Operating Segment | | Major Affiliated Companies |

| Wacoal Business (Domestic) | | Manufacturing and Sales | | Wacoal Corporation One other company |

| | | | (Total: 2 companies) |

| | |

| | Sales | | Une Nana Cool Corp. Two other companies |

| | | | (Total: 3 companies) |

| | |

| | Apparel Manufacturing | | Kyushu Wacoal Sewing Corp., Hokuriku Wacoal Sewing Corp., Niigata Wacoal Sewing Corp., Torica Inc. Two other companies |

| | | | (Total: 6 companies) |

| | |

| | Other Textile Related | | Wacoal Distribution Corp. |

| | | | (Total: 1 company) |

| | |

| | Cultural Business Service | | Wacoal Art Center, Ltd. |

| | | | (Total: 1 company) |

| | |

| | Other Business | | Wacoal Holdings Corp. Seven other companies |

| | | | (Total: 8 companies) |

| | |

| Wacoal Business (Overseas) | | Manufacturing and Sales | | Wacoal America, Inc., Wacoal China Co., Ltd., Taiwan Wacoal Co., Ltd. One other company |

| | | | (Total: 4 companies) |

| | |

| | Sales | | Wacoal Singapore Private Ltd., Wacoal Hong Kong Co., Ltd., Wacoal France Société Anonyme, Wacoal (UK) Ltd. Three other companies |

| | | | (Total: 7 companies) |

| | |

| | Apparel Manufacturing | | Wacoal Dominicana Corp. (Dominican Republic), Guandong Wacoal Inc. Two other companies |

| | | | (Total: 4 companies) |

| | |

| | Other Textile Related | | Wacoal International Hong Kong Co., Ltd. |

| | | | (Total: 1 company) |

| | |

| | Other Business | | Wacoal International Corp. (U.S.) Wacoal Investment Co., Ltd. (Taiwan) One other company |

| | | | (Total: 3 companies) |

| | |

| Peach John Business | | Sales | | Peach John Co., Ltd. Three other companies |

| | | | (Total: 4 companies) |

| | |

Other | | Manufacturing and Sales | | Lecien Corporation One other company |

| | | | (Total: 2 companies) |

| | |

| | Apparel Manufacturing | | Lecien Nagasaki Corporation, Dalian Lecien Fashion Co., Ltd. Three other companies |

| | | | (Total: 5 companies) |

| | |

| | Other Textile Related | | Lecien U.S.A., Inc. One other company |

| | | | (Total: 2 companies) |

| | |

| | Other Business | | Nanasai Co., Ltd., Wacoal Service Co., Ltd., Wacoal Career Service Corp. One other company |

| | | | (Total: 4 companies) |

- 10 -

The business distribution diagram is as follows:

- 11 -

The following matters have not significantly changed since the disclosure in the financial statements for the fiscal year ended March 31, 2010 (disclosed on March 11, 2010), and are omitted.

| | (2) | Measures for Business Targets |

| | (3) | Our Medium- and Long-Term Business Strategy |

For the financial statements for the fiscal year ended March 31, 2010 disclosing the above matters, please refer to the following URL.

(Our homepage)

http://www.wacoalholdings.jp/ir/financial_results.html

(The Tokyo Stock Exchange homepage (listed company search))

http://www.tse.or.jp/listing/compsearch/index.html

While our core domestic sales channels (department stores, mass merchandisers and specialty stores) remain weak, our sales channels strategies that are based on consumer behavior have become considerably important. We have launched our structural reform and have been making and will steadily make efforts to ensure a proper profitability structure in order to respond to a drastic change in business scale. We will also need to build a system which can accurately respond to changes in consumer needs (as seen in the price reduction in low-price, high volume products) by drawing on our group’s collective strength.

Under such an environment, we will actively make investments into new business lines that we believe may generally add to sales as necessary. Among other things, we consider our overseas innerwear business as our group’s biggest growth engine and we believe it is essential for us to develop a business which focuses on building brands, cultivates business expansion and actively makes investments in the emerging and new markets, as well as strategic business alliances.

<Wacoal Business (Domestic)>

(Promotion of Structural Reform)

With respect to our existing domestic innerwear wholesale business, in aim to shift to a profitability structure which can respond to a change in business scale, we will promote a structural reform that will achieve “department store business reform”, “manufacturing productivity improvement”, “streamlined distribution” and “business infrastructure reform”.

(Rebuilding of Brand Channel Strategy)

With respect to department store channels, we will rebuild our brand recognition by reviewing the product layouts of the entire high volume products business and by aiming to efficiently develop products and attain a new customer segment of career-focused customers. In the mass merchandisers channel, we will sort out the roles to be played by Wacoal brand, Wing brand and Lecien, which is within our “Other” business segment, and will put and locate products by each shop’s features. In the specialty stores channel, we will identify the needs of each business partner and will provide other appropriate support through reviewing respective transaction terms, supporting sales promotion, and utilizing the group’s products.

(Acceleration and Expansion of Retail Business)

We will review our organization, strengthen our high volume products and strategically control the regions in which we operate in order to respond to changing customer needs and trends with appropriate business location and product development.

(Rebuilding of Supply Chain Management)

While there remaining uncertainties concerning production in China and dominance of ASEAN countries is increasing, we will use the production and/or distribution infrastructures of the entire group and will start working to build an efficient supply chain management from production to distribution including in emerging markets.

- 12 -

<Wacoal Business (Overseas)>

(United States)

We will expand and enrich product lineups by cultivating new brands or developing body-shaping underwear with functionality. We will also work on enhancing internet sales and business expansion mainly in the United States, as well as the United Kingdom, Canada, Brazil and Mexico, through considering strategic acquisitions.

(China)

We will continue to accelerate our shop openings and will work to improve our brand recognition and customer management. In addition, we will develop products mainly at Wacoal (Shanghai) Human Science R&D Co., Ltd., and will consider a launch of new-price range products in association with Lecien.

(ASEAN Countries)

We will work to improve our brand recognition including our joint venture’s brand. We will also make efforts to ensure sustainable growth and stable profitability.

(Other Regions)

We will formulate a specific plan to enter into new markets in India, Germany, Russia and other European countries.

(Peach John Business)

The improvement of declined profits caused by the weak performance of our catalog sales business and underperforming direct retail stores in Japan is the biggest challenge that we are facing. In addition, we still have issues in stabilizing operations at our direct retail stores overseas. At the end of the previous fiscal year, as a part of our structural reform plan, we reassessed our organizational system, consolidated business offices, and solicited special voluntary retirement of employees. While we will continue to liquidate our underperforming shops and to cut costs, we will review our sales schedule for the expansion of sales, and will work on developing new brands and products.

With respect to the business in China, which we believe has further growth potential, we will establish a business infrastructure including an inventory function that controls the inventories covering Hong Kong, China and Japan and will make efforts to expand sales.

<Other>

(Lecien)

We will develop new value-added brands for mass merchandising, which is our core sales channel, in aim to establish a stable revenue base. In order to make the utmost use of the synergy effect within our group, we will incorporate the production infrastructure held by Lecien into our group’s supply chain management, and will expand the group’s demands for the lace materials handled by Lecien. In addition, with respect to the apparel business, we will make efforts to expand sales by working on the development of high value-added products based on the outcome from Wacoal Human Science Research Center’s research.

(Nanasai)

We will need to consider how to improve our profitability when the orders for shop openings and shop renovations from department stores have slowed down. We will make efforts to expand Nanasai’s rental and sales business, its core competencies, by making full use of its design and quality of mannequins, figure models and/or objects.

- 13 -

| 4. | Consolidated Financial Statements (Unaudited) |

(1) Consolidated Balance Sheet

| | | | | | | | | | | | |

Accounts | | As of March 31, 2010 | | | As of March 31, 2011 | | | Amount

Increased/(Decreased) | |

| (Assets) | | Million Yen | | | Million Yen | | | Million Yen | |

I. Current assets | | | | | | | | | | | | |

Cash and cash equivalents | | | 24,317 | | | | 26,981 | | | | 2,664 | |

Time deposits | | | — | | | | 698 | | | | 698 | |

Marketable securities | | | 6,529 | | | | 4,819 | | | | (1,710 | ) |

Receivables | | | | | | | | | | | | |

Notes receivable | | | 469 | | | | 500 | | | | 31 | |

Accounts receivable-trade | | | 21,116 | | | | 20,371 | | | | (745 | ) |

| | | | | | | | | | | | |

| | | 21,585 | | | | 20,871 | | | | (714 | ) |

Allowance for returns and doubtful receivables | | | (1,972 | ) | | | (1,549 | ) | | | 423 | |

| | | | | | | | | | | | |

| | | 19,613 | | | | 19,322 | | | | (291 | ) |

Inventories | | | 32,103 | | | | 30,956 | | | | (1,147 | ) |

Deferred tax assets | | | 4,595 | | | | 5,134 | | | | 539 | |

Other current assets | | | 2,776 | | | | 2,586 | | | | (190 | ) |

| | | | | | | | | | | | |

Total current assets | | | 89,933 | | | | 90,496 | | | | 563 | |

| | | |

II. Tangible fixed assets | | | | | | | | | | | | |

Land | | | 22,012 | | | | 21,774 | | | | (238 | ) |

Buildings and structures | | | 61,585 | | | | 60,322 | | | | (1,263 | ) |

Machinery and equipment | | | 14,773 | | | | 14,023 | | | | (750 | ) |

Construction in progress | | | 103 | | | | 93 | | | | (10 | ) |

| | | | | | | | | | | | |

| | | 98,473 | | | | 96,212 | | | | (2,261 | ) |

Accumulated depreciation | | | (46,653 | ) | | | (46,467 | ) | | | 186 | |

| | | | | | | | | | | | |

Net tangible fixed assets | | | 51,820 | | | | 49,745 | | | | (2,075 | ) |

| | | |

III. Other assets | | | | | | | | | | | | |

Investments in affiliated companies | | | 14,769 | | | | 14,702 | | | | (67 | ) |

Investments | | | 35,828 | | | | 32,672 | | | | (3,156 | ) |

Goodwill | | | 11,203 | | | | 10,367 | | | | (836 | ) |

Other intangible fixed assets | | | 12,351 | | | | 10,325 | | | | (2,026 | ) |

Prepaid pension cost | | | 263 | | | | 158 | | | | (105 | ) |

Deferred tax assets | | | 935 | | | | 879 | | | | (56 | ) |

Others | | | 6,285 | | | | 6,001 | | | | (284 | ) |

| | | | | | | | | | | | |

Total other assets | | | 81,634 | | | | 75,104 | | | | (6,530 | ) |

| | | | | | | | | | | | |

Total Assets | | | 223,387 | | | | 215,345 | | | | (8,042 | ) |

| | | | | | | | | | | | |

- 14 -

| | | | | | | | | | | | |

Accounts | | As of March 31, 2010 | | | As of March 31, 2011 | | | Amount

Increased/(Decreased) | |

| (Liabilities) | | Million Yen | | | Million Yen | | | Million Yen | |

I. Current Liabilities | | | | | | | | | | | | |

Short-term bank loans | | | 7,941 | | | | 6,117 | | | | (1,824 | ) |

| | | |

Payables | | | | | | | | | | | | |

Notes payable | | | 2,174 | | | | 1,623 | | | | (551 | ) |

Accounts payable-trade | | | 9,161 | | | | 10,507 | | | | 1,346 | |

Accounts payable | | | 5,975 | | | | 5,700 | | | | (275 | ) |

| | | | | | | | | | | | |

| | | 17,310 | | | | 17,830 | | | | 520 | |

| | | |

Accrued payroll and bonuses | | | 5,927 | | | | 6,201 | | | | 274 | |

Accrued taxes | | | 2,105 | | | | 1,870 | | | | (235 | ) |

Other current liabilities | | | 2,400 | | | | 2,405 | | | | 5 | |

| | | | | | | | | | | | |

Total current liabilities | | | 35,683 | | | | 34,423 | | | | (1,260 | ) |

| | | |

II. Long-term liabilities | | | | | | | | | | | | |

Reserves for retirement benefit | | | 2,269 | | | | 2,200 | | | | (69 | ) |

Deferred tax liability | | | 9,380 | | | | 7,441 | | | | (1,939 | ) |

Other long-term liabilities | | | 2,502 | | | | 2,414 | | | | (88 | ) |

| | | | | | | | | | | | |

Total long-term liabilities | | | 14,151 | | | | 12,055 | | | | (2,096 | ) |

| | | | | | | | | | | | |

Total liabilities | | | 49,834 | | | | 46,478 | | | | (3,356 | ) |

| | | |

(Equity) | | | | | | | | | | | | |

| | | |

I. Common stock | | | 13,260 | | | | 13,260 | | | | — | |

II. Additional paid-in capital | | | 29,366 | | | | 29,401 | | | | 35 | |

III. Retained earnings | | | 137,155 | | | | 136,946 | | | | (209 | ) |

IV. Accumulated other comprehensive income (loss) | | | | | | | | | | | | |

Foreign currency exchange adjustment | | | (7,505 | ) | | | (10,344 | ) | | | (2,839 | ) |

Unrealized gain on securities | | | 3,669 | | | | 2,596 | | | | (1,073 | ) |

Pension liability adjustment | | | (1,783 | ) | | | (2,002 | ) | | | (219 | ) |

V. Treasury stock | | | (2,532 | ) | | | (2,890 | ) | | | (358 | ) |

| | | | | | | | | | | | |

Total shareholders’ equity | | | 171,630 | | | | 166,967 | | | | (4,663 | ) |

VI. Noncontrolling interests | | | 1,923 | | | | 1,900 | | | | (23 | ) |

| | | | | | | | | | | | |

Total equity | | | 173,553 | | | | 168,867 | | | | (4,686 | ) |

| | | | | | | | | | | | |

Total liabilities and equity | | | 223,387 | | | | 215,345 | | | | (8,042 | ) |

| | | | | | | | | | | | |

- 15 -

(2) Consolidated Income Statement

| | | | | | | | | | | | | | | | | | | | |

Accounts | | Fiscal Year Ended

March 31, 2010 | | | Fiscal Year Ended

March 31, 2011 | | | Amount

Increased/(Decreased) | |

| | | Million Yen | | | % | | | Million Yen | | | % | | | Million Yen | |

I. Sales | | | 163,297 | | | | 100.0 | | | | 165,726 | | | | 100.0 | | | | 2,429 | |

II. Operating expenses | | | | | | | | | | | | | | | | | | | | |

Cost of sales | | | 79,953 | | | | 49.0 | | | | 81,895 | | | | 49.4 | | | | 1,942 | |

Selling, general and administrative expenses | | | 78,511 | | | | 48.1 | | | | 77,804 | | | | 46.9 | | | | (707 | ) |

Impairment loss on intangible fixed assets | | | 1,023 | | | | 0.6 | | | | 1,772 | | | | 1.1 | | | | 749 | |

| | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 159,487 | | | | 97.7 | | | | 161,471 | | | | 97.4 | | | | 1,984 | |

| | | | | | | | | | | | | | | | | | | | |

Operating income | | | 3,810 | | | | 2.3 | | | | 4,255 | | | | 2.6 | | | | 445 | |

III. Other income (expenses) | | | | | | | | | | | | | | | | | | | | |

Interest income | | | 144 | | | | 0.1 | | | | 135 | | | | 0.1 | | | | (9 | ) |

Interest expense | | | (98 | ) | | | (0.1 | ) | | | (88 | ) | | | (0.0 | ) | | | 10 | |

Dividend income | | | 619 | | | | 0.4 | | | | 643 | | | | 0.4 | | | | 24 | |

Gain (loss) on sale and gain from exchange of marketable securities and/or investment securities | | | 7 | | | | 0.0 | | | | 374 | | | | 0.2 | | | | 367 | |

Valuation loss on marketable securities and/or investment securities | | | (1,460 | ) | | | (0.9 | ) | | | (1,585 | ) | | | (1.0 | ) | | | (125 | ) |

Other profit (loss), net | | | 101 | | | | 0.1 | | | | 5 | | | | 0.0 | | | | (96 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total other income (expense) | | | (687 | ) | | | (0.4 | ) | | | (516 | ) | | | (0.3 | ) | | | 171 | |

| | | | | | | | | | | | | | | | | | | | |

Pre-tax net income | | | 3,123 | | | | 1.9 | | | | 3,739 | | | | 2.3 | | | | 616 | |

| | | | | | | | | | | | | | | | | | | | |

Income taxes | | | | | | | | | | | | | | | | | | | | |

Current | | | 3,161 | | | | 2.0 | | | | 3,463 | | | | 2.1 | | | | 302 | |

Deferred | | | (1,587 | ) | | | (1.0 | ) | | | (1,471 | ) | | | (0.9 | ) | | | 116 | |

| | | | | | | | | | | | | | | | | | | | |

Total income taxes | | | 1,574 | | | | 1.0 | | | | 1,992 | | | | 1.2 | | | | 418 | |

| | | | | | | | | | | | | | | | | | | | |

Equity in net income of affiliated companies and net income before adjustment of profit and loss attributable to non-controlling interests | | | 1,549 | | | | 0.9 | | | | 1,747 | | | | 1.1 | | | | 198 | |

Equity in net income of affiliated companies | | | 907 | | | | 0.6 | | | | 990 | | | | 0.6 | | | | 83 | |

| | | | | | | | | | | | | | | | | | | | |

Net income | | | 2,456 | | | | 1.5 | | | | 2,737 | | | | 1.7 | | | | 281 | |

| | | | | | | | | | | | | | | | | | | | |

Profit (loss) attributable to non-controlling interests | | | 68 | | | | 0.0 | | | | (122 | ) | | | (0.1 | ) | | | (190 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net income attributable to Wacoal Holdings Corp. | | | 2,524 | | | | 1.5 | | | | 2,615 | | | | 1.6 | | | | 91 | |

| | | | | | | | | | | | | | | | | | | | |

- 16 -

(3) Consolidated Comprehensive Income Statement

| | | | | | | | | | | | |

Accounts | | Fiscal Year Ended

March 31, 2010 | | | Fiscal Year Ended

March 31, 2011 | | | Amount

Increased/(Decreased) | |

| | | Million Yen | | | Million Yen | | | Million Yen | |

I. Net income | | | 2,456 | | | | 2,737 | | | | 281 | |

| | | | | | | | | | | | |

II. Other comprehensive profit (loss) – after adjustment of tax effect | | | | | | | | | | | | |

Foreign currency exchange adjustment | | | 795 | | | | (2,915 | ) | | | (3,710 | ) |

Net unrealized gain on securities | | | 3,351 | | | | (1,072 | ) | | | (4,423 | ) |

Pension liability adjustment | | | 1,600 | | | | (219 | ) | | | (1,819 | ) |

| | | | | | | | | | | | |

Total of other comprehensive profit (loss) | | | 5,746 | | | | (4,206 | ) | | | (9,952 | ) |

| | | | | | | | | | | | |

Comprehensive profit (loss) | | | 8,202 | | | | (1,469 | ) | | | (9,671 | ) |

Comprehensive profit (loss) attributable to non-controlling interests | | | 49 | | | | (47 | ) | | | (96 | ) |

| | | | | | | | | | | | |

Comprehensive profit (loss) attributable to Wacoal Holdings Corp. | | | 8,251 | | | | (1,516 | ) | | | (9,767 | ) |

| | | | | | | | | | | | |

(4) Consolidated Shareholders’ Equity Statement

Fiscal Year Ended March 31, 2010

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Item | | Equity | |

| | No. of Shares

Held Outside

the

Company | | | Common

Stock | | | Additional

Paid-in

Capital | | | Retained

Earnings | | | Accumulated other

comprehensive

income | | | Treasury

stock | | | Total

Shareholders’

Equity | | | Non-controlling

Interests | | | Total Equity | |

| | | Thousand

shares | | | Million

Yen | | | Million

Yen | | | Million

Yen | | | Million Yen | | | Million

Yen | | | Million Yen | | | Million Yen | | | Million Yen | |

As of April 1, 2009 | | | 140,451 | | | | 13,260 | | | | 29,316 | | | | 138,235 | | | | (11,346 | ) | | | (3,592 | ) | | | 165,873 | | | | 2,094 | | | | 167,967 | |

Cash dividends paid to the shareholders of the Company (25.00 yen per share) | | | | | | | | | | | | | | | (3,511 | ) | | | | | | | | | | | (3,511 | ) | | | | | | | (3,511 | ) |

Cash dividends paid to non-controlling interests | | | | | | | | | | | | | | | | | | | | | | | | | | | — | | | | (76 | ) | | | (76 | ) |

Purchase of treasury stock | | | (1,372 | ) | | | | | | | | | | | | | | | | | | | (1,540 | ) | | | (1,540 | ) | | | | | | | (1,540 | ) |

Sale of treasury stock | | | 11 | | | | | | | | | | | | | | | | | | | | 13 | | | | 13 | | | | | | | | 13 | |

Diminution of treasury stock for stock swap | | | 2,104 | | | | | | | | | | | | (93 | ) | | | | | | | 2,582 | | | | 2,489 | | | | | | | | 2,489 | |

Other | | | 4 | | | | | | | | 50 | | | | | | | | | | | | 5 | | | | 55 | | | | (46 | ) | | | 9 | |

Net income | | | | | | | | | | | | | | | 2,524 | | | | | | | | | | | | 2,524 | | | | (68 | ) | | | 2,456 | |

Other comprehensive profit (loss) | | | | | | | | | | | | | | | | | | | 5,727 | | | | | | | | 5,727 | | | | 19 | | | | 5,746 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

As of March 31, 2010 | | | 141,198 | | | | 13,260 | | | | 29,366 | | | | 137,155 | | | | (5,619 | ) | | | (2,532 | ) | | | 171,630 | | | | 1,923 | | | | 173,553 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fiscal Year Ended March 31, 2011

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Item | | Equity | |

| | No. of Shares

Held Outside

the

Company | | | Common

Stock | | | Additional

Paid-in

Capital | | | Retained

Earnings | | | Accumulated other

comprehensive

income | | | Treasury

stock | | | Total

Shareholders’

Equity | | | Non-controlling

Interests | | | Total Equity | |

| | | Thousand

shares | | | Million

Yen | | | Million

Yen | | | Million

Yen | | | Million Yen | | | Million

Yen | | | Million Yen | | | Million Yen | | | Million Yen | |

As of April 1, 2010 | | | 141,198 | | | | 13,260 | | | | 29,366 | | | | 137,155 | | | | (5,619 | ) | | | (2,532 | ) | | | 171,630 | | | | 1,923 | | | | 173,553 | |

Cash dividends paid to the shareholders of the Company (20.00 yen per share) | | | | | | | | | | | | | | | (2,824 | ) | | | | | | | | | | | (2,824 | ) | | | | | | | (2,824 | ) |

Cash dividends paid to non-controlling interests | | | | | | | | | | | | | | | | | | | | | | | | | | | — | | | | (70 | ) | | | (70 | ) |

Purchase of treasury stock | | | (586 | ) | | | | | | | | | | | | | | | | | | | (655 | ) | | | (655 | ) | | | | | | | (655 | ) |

Sale of treasury stock | | | 236 | | | | | | | | | | | | | | | | | | | | 297 | | | | 297 | | | | | | | | 297 | |

Other | | | | | | | | | | | 35 | | | | | | | | | | | | | | | | 35 | | | | | | | | 35 | |

Net income | | | | | | | | | | | | | | | 2,615 | | | | | | | | | | | | 2,615 | | | | 122 | | | | 2,737 | |

Other comprehensive profit (loss) | | | | | | | | | | | | | | | | | | | (4,131 | ) | | | | | | | (4,131 | ) | | | (75 | ) | | | (4,206 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

As of March 31, 2011 | | | 140,848 | | | | 13,260 | | | | 29,401 | | | | 136,946 | | | | (9,750 | ) | | | (2,890 | ) | | | 166,967 | | | | 1,900 | | | | 168,867 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- 17 -

(5) Consolidated Cash Flow Statement

| | | | | | | | | | | | |

Accounts | | Fiscal Year Ended

March 31, 2010 | | | Fiscal Year Ended

March 31, 2011 | | | Amount

Increased/(Decreased) | |

| | | Million Yen | | | Million Yen | | | Million Yen | |

I. Operating activities | | | | | | | | | | | | |

1. Net income | | | 2,456 | | | | 2,737 | | | | 281 | |

2. Adjustment of net income to cash flow from operating activities | | | | | | | | | | | | |

(1) Depreciation and amortization | | | 4,807 | | | | 4,678 | | | | (129 | ) |

(2) Allowance for returns and doubtful receivables | | | (360 | ) | | | (378 | ) | | | (18 | ) |

(3) Deferred taxes | | | (1,587 | ) | | | (1,471 | ) | | | 116 | |

(4) Gain (loss) on sale of fixed assets | | | 25 | | | | 105 | | | | 80 | |

(5) Impairment loss on fixed assets | | | 23 | | | | 107 | | | | 84 | |

(6) Impairment loss on intangible fixed assets | | | 1,023 | | | | 1,772 | | | | 749 | |

(7) Valuation loss on marketable securities and/or investment securities | | | 1,460 | | | | 1,585 | | | | 125 | |

(8) Gain (loss) on sale and gain from exchange of marketable securities and/or investment securities | | | (7 | ) | | | (374 | ) | | | (367 | ) |

(9) Equity in net income of affiliated companies (after dividend income) | | | (492 | ) | | | (566 | ) | | | (74 | ) |

(10) Changes in assets and liabilities | | | | | | | | | | | | |

Decrease in receivables | | | 1,794 | | | | 421 | | | | (1,373 | ) |

Decrease in inventories | | | 806 | | | | 420 | | | | (386 | ) |

Decrease in other current assets | | | 331 | | | | 125 | | | | (206 | ) |

Increase (decrease) in payables | | | (2,525 | ) | | | 1,007 | | | | 3,532 | |

Increase (decrease) in reserves for retirement benefits | | | 439 | | | | (315 | ) | | | (754 | ) |

Increase (decrease) in other liabilities | | | 996 | | | | (166 | ) | | | (1,162 | ) |

(11) Other | | | 260 | | | | 367 | | | | 107 | |

| | | | | | | | | | | | |

Net cash flow from operating activities | | | 9,449 | | | | 10,054 | | | | 605 | |

| | | |

II. Investing activities | | | | | | | | | | | | |

1. Net increase (decrease) in time deposits | | | — | | | | (730 | ) | | | (730 | ) |

2. Proceeds from sale and redemption of marketable securities | | | 12,131 | | | | 3,253 | | | | (8,878 | ) |

3. Acquisition of marketable securities | | | (7,846 | ) | | | (1,286 | ) | | | 6,560 | |

4. Proceeds from sales of tangible fixed assets | | | 468 | | | | 550 | | | | 82 | |

5. Acquisition of tangible fixed assets | | | (3,998 | ) | | | (2,662 | ) | | | 1,336 | |

6. Acquisition of intangible fixed assets | | | (1,755 | ) | | | (671 | ) | | | 1,084 | |

7. Proceeds from sale of investments | | | 5 | | | | 988 | | | | 983 | |

8. Acquisition of investments | | | (2,019 | ) | | | (975 | ) | | | 1,044 | |

9. Proceeds from acquisition of shares of the newly consolidated subsidiaries | | | 362 | | | | — | | | | (362 | ) |

10. Others | | | (46 | ) | | | (13 | ) | | | 33 | |

| | | | | | | | | | | | |

Net cash flow from investing activities | | | (2,698 | ) | | | (1,546 | ) | | | 1,152 | |

| | | |

III. Financing activities | | | | | | | | | | | | |

1. Decrease in short-term bank loans | | | (442 | ) | | | (1,798 | ) | | | (1,356 | ) |

2. Proceeds from long-term debt | | | — | | | | 200 | | | | 200 | |

3. Repayment of long-term debt | | | (350 | ) | | | (104 | ) | | | 246 | |

4. Increase (decrease) in treasury stock | | | (1,135 | ) | | | (373 | ) | | | 762 | |

5. Dividend payment | | | (3,511 | ) | | | (2,824 | ) | | | 687 | |

| | | | | | | | | | | | |

Net cash flow from financing activities | | | (5,438 | ) | | | (4,899 | ) | | | 539 | |

| | | | | | | | | | | | |

IV. Effect of exchange rate on cash and cash equivalents | | | 65 | | | | (945 | ) | | | (1,010 | ) |

| | | | | | | | | | | | |

V. Increase (decrease) in cash and cash equivalents | | | 1,378 | | | | 2,664 | | | | 1,286 | |

VI. Initial balance of cash and cash equivalents | | | 22,939 | | | | 24,317 | | | | 1,378 | |

| | | | | | | | | | | | |

VII. Year end balance of cash and cash equivalents | | | 24,317 | | | | 26,981 | | | | 2,664 | |

| | | | | | | | | | | | |

- 18 -

Additional Information

| | | | | | | | | | | | |

Accounts | | Fiscal Year Ended

March 31, 2010 | | | Fiscal Year Ended

March 31, 2011 | | | Amount

Increased/(Decreased) | |

Cash paid for | | | | | | | | | | | | |

Interest | | | 98 | | | | 91 | | | | (7 | ) |

Income taxes, etc. | | | 2,078 | | | | 3,627 | | | | 1,549 | |

Investment activities without cash disbursement | | | | | | | | | | | | |

Acquisition amount of investment securities through stock swap | | | 11 | | | | — | | | | (11 | ) |

Acquisition amount of shares of consolidated subsidiaries through stock swap | | | 2,489 | | | | — | | | | (2,489 | ) |

(6) Notes on Going Concern

Not applicable.

(7) Basic Significant Matters in Preparation of Consolidated Financial Statements

| | (i) | Matters Regarding the Scope of Consolidation and Application of the Equity Method |

Major consolidated subsidiaries:

Wacoal Corporation, Peach John Co., Ltd., Lecien Corporation, Kyushu Wacoal Manufacturing Corp., Torica Co., Ltd., Nanasai Co., Ltd., Wacoal International Corp., Wacoal America Inc., Wacoal France S.A., Wacoal Hong Kong Co., Ltd., Wacoal Investment Co. (Taiwan), Ltd., Wacoal China Co., Ltd. and Wacoal International Hong Kong Co., Ltd.

Major Affiliated Companies:

Shinyoung Wacoal Inc., Taiwan Wacoal Co., Ltd. and Thai Wacoal Public Co., Ltd.

| | (ii) | Changes Regarding Subsidiaries and Affiliates |

Consolidated (new):

Wacoal minette Co., Ltd., Wacoal Direct Corp., Peach John Shanghai Co., Ltd.

Consolidated (excluded):

Maruka Corp., Lecien Kantou Distribution Co. Ltd., Lecien Business Service Co,. Ltd.

| | (iii) | Standard of Preparation of Consolidated Financial Statements |

The consolidated financial statements have been prepared based on terms, format and preparation methods in compliance with accounting standards generally accepted in the United States as required in relation to the issuance of American Depositary Receipts. For this reason, the consolidated financial statements may be different from those that have been prepared based on the Consolidated Financial Statement Regulations and Standard of Preparation of Consolidated Financial Statements etc.

| | (iv) | Significant Accounting Policies |

| | a. | Valuation Standard of Inventories |

The average cost method was mainly used for goods, products and supplies, and the first-in first-out method was used for raw materials, with both valued at the lower of cost or market accounting method.

| | b. | Valuation Standard of Tangible Fixed Assets and Method of Depreciation |

Tangible fixed assets are valued at the acquisition cost. Depreciation expenses are calculated mainly using the straight-line method based on the estimated useful lives of the assets (the lease term is used for capitalized leased assets).

| | c. | Valuation Standard of Marketable Securities and Investment Securities |

Based on the provisions of U.S. Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) 320, marketable securities and investment securities have been classified as available for sale securities and for sale and purchase securities, and valued at fair value. Gain or loss on sale of marketable securities is calculated based on the acquisition cost using the moving-average method. The valuation standard and valuation method of nonmarketable securities are valued at cost using the moving-average method.

| | d. | Reserve for Retirement Benefits |

This is accounted for based on the provisions of FASB ASC 715.

- 19 -

Based on the provisions of FASB ASC 840, capital leases have been capitalized at fair value of the lease payments and its corresponding accrued liabilities have been accounted.

| | f. | Accounting Procedure for Consumption Tax, etc. |

Accounting procedure for consumption tax, etc., is based on the tax-excluded method.

| | g. | Consolidated Cash Flow Statement |

Upon preparing the consolidated cash flow statements, time deposits and certificates of deposit with original maturities of three (3) months or less have been included in cash and cash equivalents.

(8) Notes to the Consolidated Financial Statements

| | (i) | Market Value, etc. of Securities |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (Unit: Million Yen) | |

| | |

| | | As of March 31, 2010 | | | As of March 31, 2011 | |

| | | Acquisition

Cost | | | Total Unrealized

Profit | | | Total Unrealized

Loss | | | Fair

Value | | | Acquisition

Cost | | | Total Unrealized

Profit | | | Total Unrealized

Loss | | | Fair

Value | |

Securities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

National and Local Government Bonds | | | 1,160 | | | | 10 | | | | — | | | | 1,170 | | | | 510 | | | | 3 | | | | — | | | | 513 | |

Corporate Bonds | | | 1,885 | | | | 12 | | | | 42 | | | | 1,855 | | | | 1,300 | | | | 4 | | | | 27 | | | | 1,277 | |

Bank Bonds | | | 100 | | | | 0 | | | | — | | | | 100 | | | | — | | | | — | | | | — | | | | — | |

Trust Fund | | | 3,229 | | | | 176 | | | | 1 | | | | 3,404 | | | | 2,657 | | | | 117 | | | | 2 | | | | 2,772 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 6,374 | | | | 198 | | | | 43 | | | | 6,529 | | | | 4,467 | | | | 124 | | | | 29 | | | | 4,562 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investment | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Equities | | | 23,841 | | | | 9,415 | | | | 604 | | | | 32,652 | | | | 22,165 | | | | 7,488 | | | | 516 | | | | 29,137 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 23,841 | | | | 9,415 | | | | 604 | | | | 32,652 | | | | 22,165 | | | | 7,488 | | | | 516 | | | | 29,137 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Note) | The securities which are classified as available for sale securities are shown in the above table and the unlisted securities which are included in the investment securities are not shown. |

| | (ii) | Contract Amount, Market Value and Valuation Profit/Loss of Derivative Transactions |

In order to hedge exchange rate and interest rate risks, forward exchange contracts have been utilized as financial derivative products. The profits and losses of such contracts have been omitted as the amounts involved are non-material.

| | (iii) | Information on Par Share |

| | | | | | |

| | | Fiscal Year Ended

March 31, 2010 | | Fiscal Year Ended

March 31, 2011 | |

Net income attributable to Wacoal Holdings Corp. | | 2,524 million yen | | | 2,615 million yen | |

Number of average shares issued during the year (excluding treasury stock) | | 141,353,141 shares | | | 141,145,190 shares | |

Net income attributable to Wacoal Holdings Corp. per share | | 17.86 yen | | | 18.53 yen | |

Diluted net earnings attributable to Wacoal Holdings Corp. per share | | 17.85 yen | | | 18.51 yen | |

- 20 -

| | a. | Segment Information by Type of Business |

Fiscal Year Ended March 31, 2010 (April 1, 2009 - March 31, 2010)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (Unit: Million Yen) | |

| | | | | | | |

| | | Wacoal

business

(Domestic) | | | Wacoal

business

(Overseas) | | | Peach John

business | | | Other | | | Total | | | Elimination

or corporate | | | Consolidated | |

Sales | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) Sales to outside customers | | | 113,929 | | | | 18,899 | | | | 13,224 | | | | 17,245 | | | | 163,297 | | | | — | | | | 163,297 | |

(2) Internal sales or transfers among segments | | | 1,793 | | | | 6,226 | | | | 7 | | | | 3,204 | | | | 11,230 | | | | (11,230 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 115,722 | | | | 25,125 | | | | 13,231 | | | | 20,449 | | | | 174,527 | | | | (11,230 | ) | | | 163,297 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating expenses | | | 111,180 | | | | 23,795 | | | | 13,053 | | | | 21,186 | | | | 169,214 | | | | (11,230 | ) | | | 157,984 | |

Customer related depreciation | | | — | | | | — | | | | 480 | | | | — | | | | 480 | | | | — | | | | 480 | |

Impairment loss on intangible fixed assets | | | — | | | | — | | | | 1,023 | | | | — | | | | 1,023 | | | | — | | | | 1,023 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 111,180 | | | | 23,795 | | | | 14,556 | | | | 21,186 | | | | 170,717 | | | | (11,230 | ) | | | 159,487 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income (loss) | | | 4,542 | | | | 1,330 | | | | (1,325 | ) | | | (737 | ) | | | 3,810 | | | | — | | | | 3,810 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fiscal Year Ended March 31, 2011 (April 1, 2010 - March 31, 2011)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (Unit: Million Yen) | |

| | | | | | | |

| | | Wacoal

business

(Domestic) | | | Wacoal

business

(Overseas) | | | Peach John

business | | | Other | | | Total | | | Elimination

or corporate | | | Consolidated | |

Sales | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) Sales to outside customers | | | 110,856 | | | | 20,052 | | | | 11,711 | | | | 23,107 | | | | 165,726 | | | | — | | | | 165,726 | |

(2) Internal sales or transfers among segments | | | 2,134 | | | | 6,121 | | | | 76 | | | | 4,588 | | | | 12,919 | | | | (12,919 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 112,990 | | | | 26,173 | | | | 11,787 | | | | 27,695 | | | | 178,645 | | | | (12,919 | ) | | | 165,726 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating expenses | | | 107,370 | | | | 24,852 | | | | 12,763 | | | | 27,357 | | | | 172,342 | | | | (12,919 | ) | | | 159,423 | |

Customer related depreciation | | | — | | | | — | | | | 276 | | | | — | | | | 276 | | | | — | | | | 276 | |

Impairment loss on intangible fixed assets | | | — | | | | — | | | | 1,772 | | | | — | | | | 1,772 | | | | — | | | | 1,772 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 107,370 | | | | 24,852 | | | | 14,811 | | | | 27,357 | | | | 174,390 | | | | (12,919 | ) | | | 161,471 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income | | | 5,620 | | | | 1,321 | | | | (3,024 | ) | | | 338 | | | | 4,255 | | | | — | | | | 4,255 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(Note) Core products of respective businesses:

| | |

| |

Wacoal business (domestic): | | innerwear (foundation, lingerie, nightwear and children’s innerwear), outerwear, sportswear, hosiery, restaurant, culture services, etc. |

| |

Wacoal business (overseas): | | innerwear (foundation, lingerie, nightwear and children’s innerwear), outerwear, sportswear, hosiery, etc. |

| |

Peach John business: | | innerwear (foundation, lingerie, nightwear and children’s innerwear), outerwear, and other textile-related products |

| |

Other: | | innerwear (foundation, lingerie, nightwear and children’s innerwear), outerwear, other textile-related products, mannequins, shop design and implementation, etc. |

- 21 -

Fiscal Year Ended March 31, 2010 (April 1, 2009 to March 31, 2010)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | (Unit: Million Yen) | |

| | | | | | |

| | | Japan | | | Asia | | | Europe/N.A. | | | Total | | | Elimination or

corporate | | | Consolidated | |

I. Sales | | | | | | | | | | | | | | | | | | | | | | | | |

Sales to outside customers | | | 144,048 | | | | 7,885 | | | | 11,364 | | | | 163,297 | | | | — | | | | 163,297 | |

II. Operating income | | | 1,775 | | | | 965 | | | | 1,070 | | | | 3,810 | | | | — | | | | 3,810 | |

III. Long-lived assets | | | 47,392 | | | | 2,527 | | | | 1,901 | | | | 51,820 | | | | — | | | | 51,820 | |

Fiscal Year Ended March 31, 2011 (April 1, 2010 to March 31, 2011)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | (Unit: Million Yen) | |

| | | | | | |

| | | Japan | | | Asia | | | Europe/N.A. | | | Total | | | Elimination or

Corporate | | | Consolidated | |

I. Sales | | | | | | | | | | | | | | | | | | | | | | | | |

Sales to outside customers | | | 145,136 | | | | 9,155 | | | | 11,435 | | | | 165,726 | | | | — | | | | 165,726 | |

II. Operating income | | | 2,551 | | | | 438 | | | | 1,266 | | | | 4,255 | | | | — | | | | 4,255 | |

III. Long-lived assets | | | 45,820 | | | | 2,344 | | | | 1,581 | | | | 49,745 | | | | — | | | | 49,745 | |

| | | | | | |

(Note) | | | 1. | | | Countries or areas are classified according to geographical proximity. |

| | | 2. | | | Main countries and areas belonging to classifications other than Japan |

| | | | | | Asia: various countries of East Asia and Southeast Asia |

| | | | | | Europe/N.A.: North America and European countries |

| | | 3. | | | Sales in respect of consolidated companies are categorized by location. |

| | | 4. | | | Long-lived assets include tangible fixed assets. |

Fiscal Year Ended March 31, 2010 (April 1, 2009 - March 31, 2010)

| | | | | | | | | | | | |

| | | (Unit: Million Yen) | |

| | | |

| | | Asia | | | Europe/N.A. | | | Total | |

I. Overseas sales | | | 7,885 | | | | 11,364 | | | | 19,249 | |

II. Consolidated sales | | | — | | | | — | | | | 163,297 | |

III. Ratio of overseas sales in consolidated sales | | | 4.8 | % | | | 7.0 | % | | | 11.8 | % |

Fiscal Year Ended March 31, 2011 (April 1, 2010 - March 31, 2011)

| | | | | | | | | | | | |