UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of July, 2011

Commission File Number: 000-11743

WACOAL HOLDINGS CORP.

(Translation of registrant’s name into English)

29, Nakajima-cho, Kisshoin, Minami-ku

Kyoto, Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F þ Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note:Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note:Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No þ

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- N/A

Information furnished on this form:

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | |

WACOAL HOLDINGS CORP. (Registrant) |

| |

| By: | | /s/ Ikuo Otani |

| | Ikuo Otani |

| | Managing Director and General Manager of Corporate Planning |

Date: July 29, 2011

Exhibit 1

[Translation]

July 29, 2011

To whom it may concern:

| | |

| | WACOAL HOLDINGS CORP. |

| | Yoshikata Tsukamoto, President and Representative Director |

| | (Code Number: 3591) |

| | (Tokyo Stock Exchange, First Section) |

| | (Osaka Securities Exchange, First Section) |

| | Ikuo Otani, Managing Director and General Manager of Corporate Planning |

| | (Telephone: 075-682-1010) |

Announcement of Revisions to the Forecast of Financial Results for the Fiscal Year ending March 31, 2012

In accordance with the current developments of our business, we have revised our forecast of financial results for the consolidated second quarter of the Fiscal Year ending March 31, 2012 (April 1, 2011 - September 30, 2011) and for the Fiscal Year ending March 31, 2012 (April 1, 2011 - March 31, 2012), which we announced on May 13, 2011, as follows:

Details

| 1. | Revised Forecast of Consolidated Financial Results |

For the consolidated second quarter of Fiscal Year Ending March 31, 2012 (April 1, 2011 - September 30, 2011)

| | | | | | | | | | | | | | | | | | | | |

| (U.S. accounting basis) | | | (Unit: millions of yen, unless otherwise indicated) | |

| | | Net sales | | | Operating

income | | | Pre-tax net

income1 | | | Net income

attributable to

Wacoal

Holdings

Corp. | | | Net income

per share

attributable to

Wacoal

Holdings

Corp.

(in Yen) | |

Previous Forecast (“A”) | | | 85,300 | | | | 4,700 | | | | 4,900 | | | | 2,600 | | | | 18.46 | |

Revised Forecast (“B”) | | | 86,000 | | | | 6,000 | | | | 6,500 | | | | 3,800 | | | | 26.98 | |

Variance (B - A) | | | 700 | | | | 1,300 | | | | 1,600 | | | | 1,200 | | | | — | |

Variance in Percentage (%) | | | 0.8 | % | | | 27.7 | % | | | 32.7 | % | | | 46.2 | % | | | — | |

(Reference) Results for First Six-Month of the Previous Fiscal Year ended March 31, 2011 | | | 85,884 | | | | 6,153 | | | | 5,332 | | | | 2,782 | | | | 19.70 | |

| |

| For the Fiscal Year Ending March 31, 2012 (April 1, 2011 - March 31, 2012) | | | | | |

| |

| (U.S. accounting basis) | | | (Unit: millions of yen, unless otherwise indicated) | |

| | | Net sales | | | Operating

income | | | Pre-tax net

income | | | Net income

attributable to

Wacoal

Holdings

Corp. | | | Net income

per share

attributable to

Wacoal

Holdings

Corp.

(in Yen) | |

Previous Forecast (“A”) | | | 167,000 | | | | 6,500 | | | | 6,800 | | | | 4,000 | | | | 28.40 | |

Revised Forecast (“B”) | | | 167,700 | | | | 7,800 | | | | 8,400 | | | | 5,200 | | | | 36.92 | |

Variance (B - A) | | | 700 | | | | 1,300 | | | | 1,600 | | | | 1,200 | | | | — | |

Variance in Percentage (%) | | | 0.4 | % | | | 20.0 | % | | | 23.5 | % | | | 30.0 | % | | | — | |

(Reference) Results for the Previous Fiscal Year ended March 31, 2011 | | | 165,726 | | | | 4,255 | | | | 3,739 | | | | 2,615 | | | | 18.53 | |

The consolidated figures above are based on U.S. accounting standards, under which “pre-tax net income” is set forth under “ordinary income”.

| 1 | This item refers to “income before income taxes, equity in net income (loss) of affiliated companies, and net loss (income) attributable to noncontrolling interests” in the consolidated statements of income included in our annual report on Form 20-F for the fiscal year ended March 31, 2011. |

Despite our initial expectations at the beginning of the current Fiscal Year that the sales would fall due to the effect of the major earthquake and tsunami that struck Northeast Japan on March 11, 2011, sales are exceeding our expectations and we believe the impact of the earthquake and tsunami up to date is limited. In addition, in terms of profit, our cost cutting initiatives have been effective, and we have also experienced an increase in profit on sales as a result of the increased sales. As a result of the above and that financial result of the first quarter is exceeding our initial expectations at the beginning of the current Fiscal Year, we have revised our forecast of financial results for the consolidated second quarter of the Fiscal Year ending March 31, 2012 and also our forecast of financial results for the Fiscal Year ending March 31, 2012 according to such revisions.

*Cautionary Statement

The forecast of business results is based on information available as of the date this data were released and, due to various risks, uncertainties and other factors arising in the future, actual results in the future may differ largely from our estimates.

These risks, uncertainties and other factors include: the impact of the ongoing global economic downturn and financial crisis; the impact of weak consumer spending in Japan and our other markets on our sales and profitability; the impact on our business of anticipated continued weakness of department stores and other general retailers in Japan; our ability to successfully develop, manufacture, market and sell products in Japan and our other markets that meet the changing tastes and needs of consumers and to deliver high quality products; the highly competitive nature of our business and the strength of our competitors; our ability to successfully expand and operate our network of specialty retail stores and achieve profitable operations at these stores; our ability to further develop our catalog and Internet sales capabilities; our ability to effectively manage our inventory levels; our ability to reduce costs; our ability to attract and retain highly qualified personnel; effects of irregular weather events on our business and performance; risks related to conducting our business internationally; risks from acquisitions and other strategic transactions with third parties; risks from disputes relating to intellectual property; our ability to fully comply with all applicable laws and regulations regarding the protection of customer information and our ability to protect our trade secrets; our ability to establish and maintain effective internal controls; the impact of weakness in the Japanese equity markets on our holdings of Japanese equity securities; direct or indirect adverse effects on the Company of the major earthquake and tsunami that struck Northeast Japan on March 11, 2011 and the impact of any other natural disaster or epidemic on our business; risks of not successfully collecting return of investment in new markets; and other risks referred to from time to time in Wacoal Holdings’ filings on Form 20-F of its annual report and other filings with the United States Securities and Exchange Commission.

End

Exhibit 2

[English Translation]

July 29, 2011

To Whom It May Concern:

| | | | |

| | WACOAL HOLDINGS CORP. Yoshikata Tsukamoto President and Representative Director (Code Number: 3591) (Tokyo Stock Exchange, First Section) (Osaka Securities Exchange, First Section) |

| | For Inquiries: | | Ikuo Otani Managing Director and General Manager of Corporate Planning (Telephone: 075-682-1010) |

Announcement Regarding Stock Option Grants (Stock Acquisition Rights)

Wacoal Holdings Corp. (the “Company”) hereby announces that its board of directors (the “Board”) resolved at a meeting held on July 29, 2011 to issue and offer stock options in the form of stock acquisition rights as follows:

Details

| I. | Reason for Granting Stock Acquisition Rights |

The Company will issue stock acquisition rights to the directors of the Company (excluding outside directors) and the directors of Wacoal Corporation, a subsidiary of the Company, so that the directors can share in the potential benefit of an increase in stock value as well as bear the risk of a decline in stock value as a further incentive to improve the Company’s stock price and corporate value.

| II. | Terms and Conditions of the Stock Acquisition Rights (Eligible Recipients: directors of the Company, excluding outside directors) |

| | 1. | Name of the Stock Acquisition Rights: Wacoal Holdings Corp. Seventh Stock Acquisition Rights |

| | 2. | Total Number of Stock Acquisition Rights: 48 |

The total number of stock acquisition rights above is the expected number to be granted. If the number of stock acquisition rights to be granted turns out to be less than the number shown above because of a shortage of applications or other circumstances, the number of stock acquisition rights issued will be the actual number of stock acquisition rights to be granted.

| | 3. | Class and Number of Shares to be Issued upon the Exercise of the Stock Acquisition Rights |

The class of shares to be issued upon the exercise of the stock acquisition rights will be the common stock of the Company, and the number of shares to be issued for each stock acquisition right (the “Conversion Ratio”) will be 1,000.

1

In the event that the Company conducts a stock split (including the gratis allocation of shares of common stock of the Company; hereinafter the same) or a reverse split of its common stock, the Conversion Ratio will be adjusted in accordance with the following formula:

| | | | | | | | | | |

| Adjusted Conversion Ratio | | = | | Conversion Ratio prior to adjustment | | X | | Ratio of stock split or reverse stock split | | |

| | | | | |

This adjustment will apply from the day following the record date in the case of a stock split and from the day on which the reverse stock split becomes effective in the case of a reverse stock split. However, in the event that the Company conducts a stock split that is conditioned on approval at a general meeting of shareholders of the Company of an increase in stockholders’ equity or additional paid-in capital by decreasing the amount of surplus, and provided that the record date for such stock split is set prior to the conclusion of such general meeting of shareholders, from the day following the conclusion of such general meeting of shareholders the adjustment will apply retroactively from the day following the record date.

In addition to the above, the Conversion Ratio shall be reasonably adjusted as may be required in unavoidable circumstances.

Any fractional shares which result from the above adjustment will be rounded down to the nearest whole share.

Furthermore, in the case of any adjustment of the Conversion Ratio, the Company shall make any necessary notification or announcement to each of the holders of stock acquisition rights who are registered as holders of stock acquisition rights (“Optionholders”) no later than the day immediately preceding the day on which the adjusted Conversion Ratio becomes effective. However, if the Company is unable to provide such notification or announcement by such date, the Company shall provide prompt notification or announcement thereafter.

| | 4. | Amount Capitalized upon Exercise of Stock Acquisition Rights |

The amount capitalized upon the exercise of each stock acquisition right shall be calculated by multiplying (i) the exercise price of one (1) yen per share to be paid upon exercise of the stock acquisition rights and (ii) the Conversion Ratio.

| | 5. | Exercise Period for Stock Acquisition Rights |

September 2, 2011 to September 1, 2031.

| | 6. | Matters concerning Increases in Capital Stock and Additional Paid-in Capital in the Case of an Issuance of Shares due to the Exercise of Stock Acquisition Rights |

| | (1) | In the event that shares are issued due to the exercise of stock acquisition rights, shareholders’ equity shall be increased by half the limit for increases in common stock which are calculated in accordance with Article 17-1 of the Japanese Company Accounting Regulations. Any amount less than one (1) yen shall be rounded up to the nearest yen. |

| | (2) | In the event that shares are issued due to the exercise of stock acquisition rights, additional paid-in capital shall be increased by the amount remaining after deducting the increase in the limit for increase in common stock stipulated in (1) above. |

| | 7. | Limitation on the Acquisition of Stock Acquisition Rights by Transfer |

The acquisition of stock acquisition rights by transfer shall be subject to approval by resolution of the Board.

2

| | 8. | Provisions for the Acquisition of Stock Acquisition Rights |

In the event that a general meeting of shareholders of the Company approves any of the following (or, when shareholder approval is not necessary, in the event that the Board or the representative executive officer approves of any of the following), the Company may acquire stock acquisition rights without compensation on a date separately specified by the Board:

| | (1) | a proposed merger agreement under which the Company is to be dissolved; |

| | (2) | a proposed corporate division agreement or plan under which the Company would be split; |

| | (3) | a proposed share transfer agreement or plan that makes the Company a wholly owned subsidiary; |

| | (4) | a proposed amendment of the Articles of Incorporation to add a provision that prescribes that the Company, with respect to all of its issued shares, shall be required to obtain the approval of the shareholders of the Company for the acquisition of such shares by transfer; |

| | (5) | a proposed approval for an amendment of the Articles of Incorporation to add a provision that prescribes that the Company shall be required to obtain the approval of the shareholders of the Company for the acquisition of the shares to be issued upon the exercise of stock acquisition rights by transfer or that the Company shall obtain all of the shares of said class by a resolution of the general meeting of shareholders. |

| | 9. | Policy to Determine the Cancellation of Stock Acquisition Rights upon Organizational Restructuring and Issuance of Stock Acquisition Rights by the Surviving Company |

In the event that the Company conducts a merger (limited to a merger that would result in the dissolution of the Company), absorption-type demerger, incorporation-type demerger, stock swap or share transfer (hereinafter collectively referred to as an “Organizational Restructuring”), stock acquisition rights of the joint stock companies (kabushiki kaisha) listed in Article 236, Paragraph 1, Item 8, (a) through (e) of the Company Law (the “Surviving Company”) shall be granted to each holder of stock acquisition rights remaining immediately prior to the Organizational Restructuring takes effect (the “Residual Stock Acquisition Rights”) (i.e. for an absorption-type demerger, the date on which the demerger takes effect; for an incorporation-type demerger, the date on which the new company is incorporated; for a stock swap, the date on which the stock swap takes effect; and for share transfer, the date on which the wholly-owning parent company is incorporated by share transfer) in accordance with the following terms and conditions. In such case, the Remaining Stock Acquisition Rights shall be cancelled, and the Surviving Company shall issue new stock acquisition rights; provided, however, that this shall be limited to the case where the grant of stock acquisition rights of the Surviving Company pursuant to the following conditions is stipulated in the absorption-type demerger agreement, incorporation-type demerger agreement, merger and spin-off agreement, new spin-off plan, stock swap agreement or share transfer plan:

| | (1) | Number of Stock Acquisition Rights of the Surviving Company to be Granted: |

| | | The number of stock acquisition rights to be granted shall be equal to the number of Residual Stock Acquisition Rights. |

| | (2) | Class of Shares of the Surviving Company to be Issued upon Exercise of the Stock Acquisition Rights: |

| | | Common stock of the Surviving Company. |

| | (3) | Number of Shares of the Surviving Company to be Issued upon Exercise of the Stock Acquisition Rights: |

| | | To be determined pursuant to Section 3 above after taking into consideration the terms and conditions of the Organizational Restructuring. |

3

| | (4) | Amount Capitalized upon Exercise of Stock Acquisition Rights: |

The amount capitalized upon the exercise of each stock acquisition right to be granted shall be the amount paid after restructuring as prescribed below multiplied by the number of shares of the Surviving Company to be issued upon the exercise of the stock acquisition rights as determined in accordance with (3) above. The amount paid after restructuring shall be one (1) yen per share of the Surviving Company which may be granted upon exercise of each stock acquisition right to be granted.

| | (5) | Exercise Period for Stock Acquisition Rights: |

From the later of (i) the starting date of the exercise period for stock acquisition rights as stipulated in Section 5 above and (ii) the effective date of Organizational Restructuring, and lasting until the expiration date for the exercise of stock acquisition rights as stipulated in Section 5 above.

| | (6) | Matters concerning Increases in Capital Stock and Additional Paid-in Capital in the Case of an Issuance of Shares due to the Exercise of Stock Acquisition Rights: |

To be determined pursuant to Section 6 above.

| | (7) | Restrictions on the Acquisition of Stock Acquisition Rights by Transfer: |

The acquisition of stock acquisition rights by transfer shall be subject to approval by resolution of the board of directors of the Surviving Company.

| | (8) | Provisions for the Acquisition of Stock Acquisition Rights: |

To be determined pursuant to Section 8 above.

| | (9) | Other Conditions for the Exercise of Stock Acquisition Rights: |

To be determined pursuant to Section 11 below.

| | 10. | Fractions of Less than One (1) Share Arising upon the Exercise of Stock Acquisition Rights |

Fractions of less than one (1) share in the number of shares to be granted to Optionholders who exercise their stock acquisition rights shall be rounded down.

| | 11. | Other Conditions relating to the Exercise of Stock Acquisition Rights |

| | (1) | Optionholders may exercise their stock acquisition rights in the event that they lose their status as director (including officers of a company that has adopted the committee system), auditor or executive officer of the Company and Wacoal Corporation (the “Date of Loss of Status”); provided, however, that in such case, such Optionholder may only exercise his or her stock acquisition rights until the earlier of (i) the expiration date as stipulated in Section 5 above and (ii) the five (5) year anniversary of the day after the Date of Loss of Status (the “Exercise Start Date”). |

| | (2) | Notwithstanding the foregoing, during the period set forth in Section 5 above, the Optionholders may exercise their stock acquisition rights in the following cases (for item (ii), excluding the case where the stock acquisition rights of the Surviving Company are granted to the Optionholders pursuant to Section 9 above) only during the respective periods designated below: |

| | (i) | if the Exercise Start Date of the Optionholder has not occurred by September 1, 2030 |

| | | From September 2, 2030 until September 1, 2031. |

| | (ii) | if the general meeting of shareholders of the Company approves a merger agreement pursuant to which the Company is to be dissolved or a stock swap agreement or share transfer plan that makes the Company a wholly owned subsidiary (or, in the event a resolution of the general meeting of shareholders is not required, if a resolution of the Board or determination by the chief executive officer of the Company is passed): |

| | | For fifteen (15) days from the day after the date of said approval. |

4

| | (3) | If an Optionholder waives his or her stock acquisition rights, such Optionholder may not exercise said Stock Acquisition Rights. |

| | 12. | Amount to be Paid for Stock Acquisition Rights |

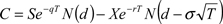

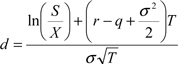

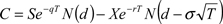

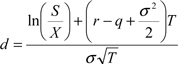

The amount to be paid for stock acquisition rights shall be the amount determined from the Black Scholes Option Pricing Model as described below multiplied by the Conversion Ratio:

Where:

| | (1) | Option price per share (C). |

| | (2) | Stock Price (S): The closing price of Wacoal stock on the Tokyo Stock Exchange on September 1, 2011 (or, if there is no final trading price on such date, the reference price with respect to the next trading day). |

| | (3) | Exercise Price (X): 1 yen. |

| | (4) | Expected time to expiration (T): 3 years and 9 months. |

| | (5) | Volatility (s): The volatility of our stock based on the daily closing price for 3 years and 9 months from December 1, 2007 to August 31, 2011. |

| | (6) | Risk-free interest rate (r): the rate of interest on government bonds for the number of years that corresponds to the remaining life of the option. |

| | (7) | Dividend rate (q): The per share dividend (based on dividends actually paid over the most recent 12 month period (i.e. the dividend payment as of March 2011)) divided by the stock price as set forth in (2) above. |

| | (8) | Standard normal cumulative distribution function (N). |

| | * | The amount calculated pursuant to the above formula is the fair value of the stock acquisition rights and is not evidence of a discounted issuance. |

| | * | The Company shall be deemed to owe remuneration to the eligible recipient in cash in the amount equivalent to the fair value of the stock acquisition right granted, and the right to receive such remuneration shall be offset against the obligation to pay the fair value as determined by the above formula of the stock acquisition rights granted. |

| | 13. | Allotment Date of Stock Acquisition Rights |

September 1, 2011.

5

| | 14. | Payment Date for Stock Acquisition Rights |

September 1, 2011.

| | 15. | Number of Stock Acquisition Rights to be Allotted and Number of Eligible Recipients |

Forty-eight (48) stock acquisition rights will be allotted to five (5) directors of the Company.

| III. | Terms and Conditions of Stock Acquisition Rights (Eligible Recipients: directors of Wacoal Corporation, a subsidiary of the Company) |

| | 1. | Name of the Stock Acquisition Rights: Wacoal Holdings Corp. Eighth Stock Acquisition Rights |

| | 2. | Total Number of Stock Acquisition Rights: 21 |

The total number of stock acquisition rights above is the expected number to be granted. If the number of stock acquisition rights to be granted turns out to be less than the number shown above because of a shortage of applications or other circumstances, the number of stock acquisition rights issued will be the actual number of stock acquisition rights to be granted.

| | 3. | Class and Number of Shares to be Issued upon the Exercise of the Stock Acquisition Rights |

The class of shares to be issued upon the exercise of the stock acquisition rights will be the common stock of the Company, and the number of shares to be issued for each stock acquisition right (the “Conversion Ratio”) will be 1,000.

In the event that the Company conducts a stock split (including the gratis allocation of shares of common stock of the Company; hereinafter the same) or a reverse split of its common stock, the Conversion Ratio will be adjusted in accordance with the following formula:

| | | | | | | | | | |

| Adjusted Conversion Ratio | | = | | Conversion Ratio prior to adjustment | | X | | Ratio of stock split or reverse stock split | | |

| | | | | |

This adjustment will apply from the day following the record date in the case of a stock split and from the day on which the reverse stock split becomes effective in the case of a reverse stock split. However, in the event that the Company conducts a stock split that is conditioned on approval at a general meeting of shareholders of the Company of an increase in stockholders’ equity or additional paid-in capital by decreasing the amount of surplus, and provided that the record date for such stock split is set prior to the conclusion of such general meeting of shareholders, from the day following the conclusion of such general meeting of shareholders the adjustment will apply retroactively from the day following the record date.

In addition to the above, the Conversion Ratio shall be reasonably adjusted as may be required in unavoidable circumstances.

Any fractional shares which result from the above adjustment will be rounded down to the nearest whole share.

Furthermore, in the case of any adjustment of the Conversion Ratio, the Company shall make any necessary notification or announcement to each of the holders of stock acquisition rights who are registered as holders of stock acquisition rights (“Optionholders”) no later than the day immediately preceding the day on which the adjusted Conversion Ratio becomes effective. However, if the Company is unable to provide such notification or announcement by such date, the Company shall provide prompt notification or announcement thereafter.

6

| | 4. | Amount Capitalized upon Exercise of Stock Acquisition Rights |

The amount capitalized upon the exercise of each stock acquisition right shall be calculated by multiplying (i) the exercise price of one (1) yen per share to be paid upon exercise of the stock acquisition rights and (ii) the Conversion Ratio.

| | 5. | Exercise Period for Stock Acquisition Rights |

September 2, 2011 to September 1, 2031.

| | 6. | Matters concerning Increases in Capital Stock and Additional Paid-in Capital in the Case of an Issuance of Shares due to the Exercise of Stock Acquisition Rights |

| | (1) | In the event that shares are issued due to the exercise of stock acquisition rights, shareholders’ equity shall be increased by half the limit for increases in common stock which are calculated in accordance with Article 17-1 of the Japanese Company Accounting Regulations. Any amount less than one (1) yen shall be rounded up to the nearest yen. |

| | (2) | In the event that shares are issued due to the exercise of stock acquisition rights, additional paid-in capital shall be increased by the amount remaining after deducting the increase in the limit for increase in common stock stipulated in (1) above. |

| | 7. | Limitation on the Acquisition of Stock Acquisition Rights by Transfer |

The acquisition of stock acquisition rights by transfer shall be subject to approval by resolution of the Board.

| | 8. | Provisions for the Acquisition of Stock Acquisition Rights |

In the event that a general meeting of shareholders of the Company approves any of the following (or the Board approves a resolution where the approval of the shareholders is not required), the Company may acquire stock acquisition rights without compensation on a date separately specified by the Board:

| | (1) | a proposed merger agreement under which the Company is to be dissolved; |

| | (2) | a proposed corporate division agreement or plan under which the Company would be split; |

| | (3) | a proposed share transfer agreement or plan that makes the Company a wholly owned subsidiary; |

| | (4) | a proposed amendment of the Articles of Incorporation to add a provision that prescribes that the Company, with respect to all of its issued shares, shall be required to obtain the approval of the shareholders of the Company for the acquisition of such shares by transfer; |

| | (5) | a proposed approval for an amendment of the Articles of Incorporation to add a provision that prescribes that the Company shall be required to obtain the approval of the shareholders of the Company for the acquisition of the shares to be issued upon the exercise of stock acquisition rights by transfer or that the Company shall obtain all of the shares of said class by a resolution of the general meeting of shareholders. |

7

| | 9. | Policy to Determine the Cancellation of Stock Acquisition Rights upon Organizational Restructuring and Issuance of Stock Acquisition Rights by the Surviving Company |

In the event that the Company conducts a merger (limited to a merger that would result in the dissolution of the Company), absorption-type demerger, incorporation-type demerger, stock swap or share transfer (hereinafter collectively referred to as an “Organizational Restructuring”), stock acquisition rights of the joint stock companies (kabushiki kaisha) listed in Article 236, Paragraph 1, Item 8, (a) through (e) of the Company Law (the “Surviving Company”) shall be granted to each holder of stock acquisition rights remaining immediately prior to the Organizational Restructuring takes effect (the “Residual Stock Acquisition Rights”) (i.e. for an absorption-type demerger, the date on which the demerger takes effect; for an incorporation-type demerger, the date on which the new company is incorporated; for a stock swap, the date on which the stock swap takes effect; and for share transfer, the date on which the wholly-owning parent company is incorporated by share transfer) in accordance with the following terms and conditions. In such case, the Remaining Stock Acquisition Rights shall be cancelled, and the Surviving Company shall issue new stock acquisition rights; provided, however, that this shall be limited to the case where the grant of stock acquisition rights of the Surviving Company pursuant to the following conditions is stipulated in the absorption-type demerger agreement, incorporation-type demerger agreement, merger and spin-off agreement, new spin-off plan, stock swap agreement or share transfer plan:

| | (1) | Number of Stock Acquisition Rights of the Surviving Company to be Granted: |

The number of stock acquisition rights to be granted shall be equal to the number of Residual Stock Acquisition Rights.

| | (2) | Class of Shares of the Surviving Company to be Issued upon Exercise of the Stock Acquisition Rights: |

Common stock of the Surviving Company.

| | (3) | Number of Shares of the Surviving Company to be Issued upon Exercise of the Stock Acquisition Rights: |

To be determined pursuant to Section 3 above after taking into consideration the terms and conditions of the Organizational Restructuring.

| | (4) | Amount Capitalized upon Exercise of Stock Acquisition Rights: |

The amount capitalized upon the exercise of each stock acquisition right to be granted shall be the amount paid after restructuring as prescribed below multiplied by the number of shares of the Surviving Company to be issued upon the exercise of the stock acquisition rights as determined in accordance with (3) above. The amount paid after restructuring shall be one (1) yen per share of the Surviving Company which may be granted upon exercise of each stock acquisition right to be granted.

| | (5) | Exercise Period for Stock Acquisition Rights: |

From the later of (i) the starting date of the exercise period for stock acquisition rights as stipulated in Section 5 above and (ii) the effective date of Organizational Restructuring, and lasting until the expiration date for the exercise of stock acquisition rights as stipulated in Section 5 above.

| | (6) | Matters concerning Increases in Capital Stock and Additional Paid-in Capital in the Case of an Issuance of Shares due to the Exercise of Stock Acquisition Rights: |

To be determined pursuant to Section 6 above.

| | (7) | Restrictions on the Acquisition of Stock Acquisition Rights by Transfer: |

The acquisition of stock acquisition rights by transfer shall be subject to approval by resolution of the board of directors of the Surviving Company.

| | (8) | Provisions for the Acquisition of Stock Acquisition Rights: |

To be determined pursuant to Section 8 above.

8

| | (9) | Other Conditions for the Exercise of Stock Acquisition Rights: |

To be determined pursuant to Section 11 below.

| | 10. | Fractions of Less Than One (1) Share Arising upon the Exercise of Stock Acquisition Rights |

Fractions of less than one (1) share in the number of shares to be granted to Optionholders who exercised their stock acquisition rights shall be rounded down.

| | 11. | Other Conditions relating to the Exercise of Stock Acquisition Rights |

| | (1) | Optionholders may exercise their stock acquisition rights in the event that they lose their status as director (including officers of a company that has adopted the committee system), auditor or executive officer of the Company and Wacoal Corporation (the “Date of Loss of Status”); provided, however, that in such case, such Optionholder may only exercise his or her stock acquisition rights until the earlier of (i) the expiration date as stipulated in Section 5 above and (ii) the five (5) year anniversary of the day after the Date of Loss of Status (the “Exercise Start Date”). |

| | (2) | Notwithstanding the foregoing, during the period set forth in Section 5 above, the Optionholders may exercise their stock acquisition rights in the following cases (for item (ii), excluding the case where the stock acquisition rights of the Surviving Company are granted to the Optionholders pursuant to Section 9 above) only during the respective periods designated below: |

| | (i) | if the Exercise Start Date of the Optionholder has not occurred by September 1, 2030 |

From September 2, 2030 until September 1, 2031.

| | (ii) | if the general meeting of shareholders of the Company approves a merger agreement pursuant to which the Company is to be dissolved or a stock swap agreement or share transfer plan that makes the Company a wholly owned subsidiary (or, in the event a resolution of the general meeting of shareholders is not required, if a resolution of the Board or determination by the chief executive officer of the Company is passed): |

For fifteen (15) days from the day after the date of said approval.

| | (3) | If an Optionholder waives his or her stock acquisition rights, such Optionholder may not exercise said Stock Acquisition Rights. |

| | 12. | Amount to be Paid for Stock Acquisition Rights |

No payment of money shall be required in exchange for stock acquisition rights.

| | * | The stock acquisition rights will be allotted as compensation for the performance of duty and for this reason, the terms of issuance will not be advantageous for the eligible recipients. |

| | 13. | Allotment Date of Stock Acquisition Rights |

September 1, 2011.

| | 14. | Number of Stock Acquisition Rights to be Allotted and Number of Eligible Recipients |

Twenty-one (21) stock acquisition rights will be allotted to five (5) directors of Wacoal Corporation, a subsidiary of the Company.

- End -

9