UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2012

Commission File Number: 000-11743

WACOAL HOLDINGS CORP.

(Translation of registrant’s name into English)

29, Nakajima-cho, Kisshoin, Minami-ku

Kyoto, Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F þ Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note:Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note:Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No þ

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- N/A

Information furnished on this form:

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | |

WACOAL HOLDINGS CORP. (Registrant) |

| |

| By: | | /s/ Ikuo Otani |

| | Ikuo Otani |

| | Managing Director and General Manager of Corporate Planning |

Date: May 15, 2012

[Exhibit 1]

Consolidated Financial Statements for the Fiscal Year Ended March 31, 2012 (U.S. Accounting Standards)

[Translation]

| | |

| | May 15, 2012 |

Listed Company: Wacoal Holdings Corp. | | Stock Exchanges: Tokyo (1st section), Osaka (1st section) |

Code Number: 3591 | | URL:http://www.wacoalholdings.jp/ |

Representative: (Position) Representative Director | | (Name) Yoshikata Tsukamoto |

For Inquiries: (Position) Managing Director and General Manager of Corporate Planning | | (Name) Ikuo Otani Tel: +81 (075) 682-1028 |

| Scheduled date of Ordinary Shareholders’ Meeting: June 28, 2012 | | Scheduled Commencement Date of Dividend Payment: June 5, 2012 |

| Scheduled date of Annual Securities Report Filing: June 28, 2012 | | |

| Supplementary materials regarding Annual Business Results: Yes | | |

| Explanatory meeting regarding Annual Business Results: Yes | | |

(Amounts less than 1 million yen have been rounded.)

| 1. | Consolidated Results for the Fiscal Year Ended March 31, 2012 (April 1, 2011 – March 31, 2012) |

| | (1) | Consolidated Business Results |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (% indicates changes from previous fiscal year) | |

| | | | |

| | | Sales | | | Operating Income | | | Pre-tax Net Income | | | Net Income

Attributable to Wacoal

Holdings Corp. | |

| | | Million Yen | | | % | | | Million Yen | | | % | | | Million Yen | | | % | | | Million Yen | | | % | |

Fiscal Year Ended March 31, 2012 | | | 171,897 | | | | 3.8 | | | | 10,377 | | | | 135.8 | | | | 10,207 | | | | 159.9 | | | | 6,913 | | | | 148.2 | |

Fiscal Year Ended March 31, 2011 | | | 165,548 | | | | 1.2 | | | | 4,401 | | | | 14.9 | | | | 3,927 | | | | 24.5 | | | | 2,785 | | | | 12.5 | |

| | |

(Note) Comprehensive income (loss): | | Fiscal Year ended March 31, 2012: 6,862 million yen (—%) |

| | Fiscal Year ended March 31, 2011: (1,186) million yen (—%) |

| | | | | | | | | | | | | | | | | | | | |

| | | Net Income

Attributable to

Wacoal Holdings

Corp. Per Share | | | Diluted Net

Earnings

Attributable to

Wacoal Holdings

Corp. Per Share | | | Ratio of Net Income

Attributable to

Wacoal Holdings

Corp. to

Shareholders’ Equity | | | Ratio of Pre-tax

Net Income to

Total Assets | | | Ratio of

Operating

Income to Sales | |

| | | Yen | | | Yen | | | % | | | % | | | % | |

Fiscal Year Ended March 31, 2012 | | | 49.08 | | | | 49.02 | | | | 4.1 | | | | 4.7 | | | | 6.0 | |

Fiscal Year Ended March 31, 2011 | | | 19.73 | | | | 19.72 | | | | 1.7 | | | | 1.8 | | | | 2.7 | |

| | |

(Reference) Equity in income/(loss) of equity-method investment: | | Fiscal Year ended March 31, 2012: 1,008 million yen |

| | Fiscal Year ended March 31, 2011: 990 million yen |

(Note) As described in “(7) Basic Significant Matters in Preparation of Consolidated Financial Statements” on page 19, retroactive adjustments have been made to the results for the fiscal year ended March 31, 2011, including with respect to (2), (3) and Section 2 below.

| | (2) | Consolidated Financial Condition |

| | | | | | | | | | | | | | | | | | | | |

| | | Total Assets | | | Total Equity

(Net Assets) | | | Total Shareholders’

Equity | | | Total Shareholders’

Equity Ratio | | | Shareholders’

Equity

Per Share | |

| | | Million Yen | | | Million Yen | | | Million Yen | | | % | | | Yen | |

Fiscal Year Ended March 31, 2012 | | | 221,098 | | | | 173,428 | | | | 171,496 | | | | 77.6 | | | | 1,217.57 | |

Fiscal Year Ended March 31, 2011 | | | 215,276 | | | | 169,380 | | | | 167,480 | | | | 77.8 | | | | 1,189.08 | |

| | (3) | Consolidated Cash Flow Status |

| | | | | | | | | | | | | | | | |

| | | Cash Flow from

Operating Activities | | | Cash Flow used in

Investing Activities | | | Cash Flow used in

Financing Activities | | | Balance of Cash and Cash

Equivalents at End of Fiscal

Year | |

| | | Million Yen | | | Million Yen | | | Million Yen | | | Million Yen | |

Fiscal Year Ended March 31, 2012 | | | 9,917 | | | | (3,324 | ) | | | (2,824 | ) | | | 29,985 | |

Fiscal Year Ended March 31, 2011 | | | 10,441 | | | | (703 | ) | | | (4,965 | ) | | | 26,316 | |

- 1 -

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Annual Dividend | | | Total

Amount of

Dividends

(annual) | | | Payout Ratio

(consolidated) | | | Ratio of

Dividend to

Shareholders’

Equity

(consolidated) | |

| | | End of

First

Quarter | | | End of

Second

Quarter | | | End of

Third

Quarter | | | Year-end | | | Annual | | | | |

| | | Yen | | | Yen | | | Yen | | | Yen | | | Yen | | | Million Yen | | | % | | | % | |

Fiscal Year Ended March 31, 2011 | | | — | | | | — | | | | — | | | | 20.00 | | | | 20.00 | | | | 2,817 | | | | 101.4 | | | | 1.7 | |

Fiscal Year Ended March 31, 2012 | | | — | | | | — | | | | — | | | | 28.00 | | | | 28.00 | | | | 3,944 | | | | 57.0 | | | | 2.3 | |

| | | | | | | | |

Fiscal Year Ending March 31, 2013 (Estimates) | | | — | | | | — | | | | — | | | | 28.00 | | | | 28.00 | | | | | | | | 51.9 | | | | | |

| 3. | Forecast of Consolidated Results for the Fiscal Year Ending March 31, 2013 (April 1, 2012 – March 31, 2013) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(% indicates changes from the previous fiscal year with respect to “Annual” and from the six-month period ended September 30, 2011 with respect to “Six-month

Period Ending September 30, 2012”) | |

| | | | | |

| | | Sales | | | Operating Income | | | Pre-tax Net Income | | | Net Income

Attributable to

Wacoal Holdings

Corp. | | | Net Income

Attributable to

Wacoal Holdings

Corp. Per Share | |

| | | Million Yen | | | % | | | Million Yen | | | % | | | Million Yen | | | % | | | Million Yen | | | % | | | Yen | |

Six-month Period Ending September 30, 2012 | | | 92,500 | | | | 4.2 | | | | 7,500 | | | | (14.7 | ) | | | 7,700 | | | | (10.1 | ) | | | 4,500 | | | | (12.7 | ) | | | 31.95 | |

Annual | | | 185,000 | | | | 7.6 | | | | 11,500 | | | | 10.8 | | | | 12,000 | | | | 17.6 | | | | 7,600 | | | | 9.9 | | | | 53.96 | |

| | (1) | Changes in significant subsidiaries during the fiscal year ended March 31, 2012 (change in scope of consolidation): None |

New: None

Excluded: None

(Note) For details, please see “(7) Basic Significant Matters in Preparation of Consolidated Financial Statements” in Section 4 “Consolidated Financial Statements” on page19.

| | (2) | Changes in Accounting Principles, Procedures and Indication Method: |

| | (i) | Changes due to modifications in accounting standards, etc.: None |

| | (ii) | Changes other than (i) above: Yes |

(Note) For details, please see “(7) Basic Significant Matters in Preparation of Consolidated Financial Statements” in Section 4 “Consolidated Financial Statements” on page 19.

| | (3) | Number of Issued Shares (Common Stock) |

| | | | | | | | |

| | | Fiscal Year Ended

March 31, 2012 | | | Fiscal Year Ended

March 31, 2011 | |

(i) Number of issued shares (including treasury stock) as of period-end: | | | 143,378,085 shares | | | | 143,378,085 shares | |

(ii) Number of shares held as treasury stock as of period-end: | | | 2,527,015 shares | | | | 2,529,607 shares | |

(iii) Average number of shares during the period: | | | 140,848,576 shares | | | | 141,145,190 shares | |

(Reference) Summary of Non-consolidated Results

| 1. | Non-consolidated Results for the Fiscal Year Ended March 31, 2012 (April 1, 2011 – March 31, 2012) |

| | (1) | Non-consolidated Business Results |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (% indicates changes from previous fiscal year) | |

| | | | |

| | | Sales | | | Operating Income | | | Ordinary Income | | | Net Income | |

| | | Million Yen | | | % | | | Million Yen | | | % | | | Million Yen | | | % | | | Million Yen | | | % | |

Fiscal Year Ended March 31, 2012 | | | 7,874 | | | | 2.7 | | | | 3,917 | | | | 0.8 | | | | 3,981 | | | | (0.4 | ) | | | 3,756 | | | | 9.4 | |

Fiscal Year Ended March 31, 2011 | | | 7,662 | | | | 9.9 | | | | 3,885 | | | | 28.1 | | | | 4,000 | | | | 28.7 | | | | 3,432 | | | | 18.8 | |

| | | | | | | | |

| | | Net Income

Per Share | | | Diluted Net Earnings

Per Share | |

| | | Yen | | | Yen | |

Fiscal Year Ended March 31, 2012 | | | 26.67 | | | | 26.63 | |

Fiscal Year Ended March 31, 2011 | | | 24.30 | | | | 24.28 | |

- 2 -

| | (2) | Non-consolidated Financial Condition |

| | | | | | | | | | | | | | | | |

| | | (% indicates changes from previous fiscal year) | |

| | | | |

| | | Total Assets | | | Net Assets | | | Capital-to-asset Ratio | | | Net Asset per Share | |

| | | Million Yen | | | Million Yen | | | % | | | Yen | |

Fiscal Year Ended March 31, 2012 | | | 146,341 | | | | 143,380 | | | | 97.8 | | | | 1,016.54 | |

Fiscal Year Ended March 31, 2011 | | | 146,121 | | | | 142,451 | | | | 97.3 | | | | 1,010.29 | |

| (Reference) Equity Capital: | As of the end of the fiscal year ended March 31, 2012: 143,180 million yen |

| | As of the end of the fiscal year ended March 31, 2011: 142,297 million yen |

*Notes on Implementation of Audit Procedures

These financial statements are not subject to the audit procedures based on the Financial Instruments and Exchange Law. The audit procedures for annual financial statements based on the Financial Instruments and Exchange Law had not been completed as of the time of disclosure of these financial statements.

*Cautionary Statement regarding Forward Looking Statements

The foregoing estimates are made based on information available as of the date this data was released, and actual results may differ from estimates due to various factors arising in the future.

Statements made in this report regarding Wacoal’s or management’s intentions, beliefs, expectations, or predictions for the future are forward-looking statements that are based on Wacoal’s and managements’ current expectations, assumptions, estimates and projections about its business and the industry. These forward-looking statements, such as statements regarding fiscal 2013 revenues and operating and net profitability, are subject to various risks, uncertainties and other factors that could cause Wacoal’s actual results to differ materially from those contained in any forward-looking statement.

These risks, uncertainties and other factors include: the impact of weak consumer spending in Japan and our other markets on our sales and profitability; the impact on our business of anticipated continued weakness of department stores and other general retailers in Japan; our ability to successfully develop, manufacture and market products in Japan and our other markets that meet the changing tastes and needs of consumers and to deliver high quality products; the highly competitive nature of our business and the strength of our competitors; our ability to successfully expand our network of our own specialty retail stores and achieve profitable operations at these stores; our ability to further develop our catalog and Internet sales capabilities; our ability to effectively manage our inventory levels; our ability to reduce costs; our ability to recruit and maintain qualified personnel; effects of seasonality on our business and performance; risks related to conducting our business internationally; risks from acquisitions and other strategic transactions with third parties; risks relating to intellectual property; risks relating to protection of personal information and Wacoal’s confidential information; risks relating to internal control; the impact of weakness in the Japanese equity markets on our holdings of Japanese equity securities; direct or indirect adverse effects on the Company of the major earthquake and tsunami that struck Northeast Japan on March 11, 2011 and the impact of any other natural disaster or epidemic on our business; risks relating to return of investment for development of new market; and other risks referred to from time to time in Wacoal’s filings on Form 20-F of its annual report and other filings with the United States Securities and Exchange Commission.

- 3 -

Table of Contents for Attached Materials

- 4 -

Qualitative Information and Financial Statements

(1) Analysis of Business Results

Results For the Fiscal Year Ended March 2012

Our group (primarily Wacoal Corp., our core operating entity) entered the second year of our three-year mid-term plan and sought to improve profitability through structural reform of our domestic business and made efforts to strengthening growth by actively developing our overseas business, mainly in China.

As a result of the above, with respect to our consolidated business results for the fiscal 2012, overall sales increased as compared to the previous fiscal year mainly due to the expansion of sales attributable to our Wacoal brand business, Peach John business and our business in China. Operating income increased as compared to the previous fiscal year due to increased profits from sales attributable to our Wacoal brand business and due to improvement in the profitability of our domestic subsidiaries.

| | |

| Sales: | | 171,897 million yen (an increase of 3.8% as compared to the previous fiscal year) |

| |

| Operating income: | | 10,377 million yen (an increase of 135.8% as compared to the previous fiscal year) |

| |

| Pre-tax net income: | | 10,207 million yen (an increase of 159.9% as compared to the previous fiscal year) |

| |

| Net income attributable to Wacoal Holdings Corp.: | | 6,913 million yen (an increase of 148.2% as compared to the previous fiscal year) |

Business Overview of Our Operating Segments

| a. | Wacoal Business (Domestic) |

In our Wacoal brand business, sales of core brassieres and bottom products showed strong performance due to our success in appealing to consumers through our product lineup and promotional activities based on our announcement entitled “body aging (physiological changes associated with aging)”, which was based on the results of Wacoal Corp. Human Science Research Center’s research. However, this was partially offset by sales of our undergarments, which fell below the results of the previous fiscal year due to competition and unsteady weather conditions despite the strong performance of certain products using natural materials. Thus, overall sales of our core Wacoal brand business exceeded the results for the previous fiscal year as a result of the performance of our brassieres and bottom products.

In our Wing brand business, although sales of our brassieres and bottom products showed steady performance, which was similar to that of our Wacoal brand business, sales of men’s innerwear fell below the results for the previous fiscal year due to the poor performance and clearance of Style Science series products. Thus, although in-store performance was steady, overall sales of our Wing brand business remained unchanged from the results for the previous fiscal year due to clients’ inventory adjustments, which resulted in fewer deliveries of our products.

Regarding our retail business, sales at our direct retail store AMPHI expanded as a result of strong performance of our existing shops due to improvement of brand recognition and the opening of new stores. Sales from our Wacoal Factory Stores were steady in general due to our improvement in product lineup, despite the partial damage to certain stores as a result of the effects of the earthquake that struck Japan on March 11, 2011 and subsequent tsunami (the “Earthquake”). As a result, overall sales of our retail business also exceeded the results for the previous fiscal year.

In our wellness business, despite the steady performance of sports tights from our sports conditioning wear “CW-X” brand and functionality-focused business pumps, overall sales from our wellness business remained unchanged from the results for the previous fiscal year due to a decrease in sales from TV infomercials subsequent to a decrease in the number of TV infomercials run after the Earthquake.

In our catalog sales business, overall sales exceeded the results for the previous fiscal year due to the steady performance of catalog sales and the expansion of internet sales.

- 5 -

In sum, overall sales of Wacoal Corp. exceeded the results for the previous fiscal year due to strong performance of our core operating business, Wacoal brand, and the expansion of our retail business. Our operating income also exceeded the results for the previous fiscal year due to increased net sales and our success in reducing cost of sales and in improving our selling and administrative expenses ratio.

| | |

| Sales: | | 115,870 million yen (an increase of 4.5% as compared to the previous fiscal year) |

| |

| Operating income: | | 8,172 million yen (an increase of 45.4% as compared to the previous fiscal year) |

| b. | Wacoal Business (Overseas) |

In our overseas operations, we made aggressive efforts in expanding our U.S. market share and enhancing our product lineup at department stores, which are our major clients, as well as in expanding sales in countries neighboring Japan and internet retailing. Despite the impact of exchange rate fluctuation, sales exceeded the results for the previous fiscal year as a result of strong performance of our reasonably-priced brassieres and functional bottom products and our internet sales, which exceeded our original expectations. In addition to an increase in net sales, operating income exceeded the results for the previous fiscal year due to an improvement in our sales-to-profit ratio accompanied with cost reduction efforts. The exchange rate in the fiscal 2012 was 78 yen per dollar (compared to 85 yen per dollar for the previous fiscal year).

In our business in China, we made efforts to strengthen our product lineup and promote the opening of new stores mainly in inner mainland China. Although net sales exceeded the results for the previous fiscal year, the growth in net sales slowed due to a significant decline in the number of visitors to department stores, which are our major clients, which in turn was attributable to certain government administrative guidance on the regulations on misleading advertisements and a lack of differentiation of our products from competing products and sales promotions. Despite our efforts in reassessing costs due to the slowed sales, we suffered an operating loss as a result of an increase in selling and administrative expenses incurred due to an increase in our numbers of stores. The exchange rate in the fiscal 2012 was 12 yen per Chinese yuan (compared to 13 yen per Chinese yuan).

| | |

| Sales: | | 21,396 million yen (an increase of 6.9% as compared to the previous fiscal year) |

| |

| Operating income: | | 1,440 million yen (an increase of 8.9% as compared to the previous fiscal year) |

With respect to Peach John Co., Ltd. (“Peach John”), sales from our core mail-order catalogues showed strong performance as a result of successful rescheduling of our catalog publication timing, which was in line with the change of our sales schedule. Net sales from our direct retail stores exceeded the results from the previous fiscal year as a result of strong performance of our existing shops that conducted effective advertising campaigns and improved their product lineup, despite a decrease in the number of shops as compared to the number of shops for previous fiscal year. As for our directly-managed overseas stores, although the seven stores operated in China showed weak performance, our two directly-managed stores in Hong Kong showed strong performance. As a result of the above, our Peach John business exceeded the results from the previous fiscal year.

Despite an increase in expenses incurred in connection with our business development in China and effect of our amortization costs, which we record every fiscal year, our domestic business showed gradual improvement, and we achieved operating profit with respect to our Peach John business as a result of recovered sales, efforts to cut labor costs and fixed expenses through the integration and elimination of business offices conducted during the previous fiscal year as well as a lower cost-to-sales ratio.

| | |

| Sales: | | 13,836 million yen (an increase of 19.5% as compared to the previous fiscal year) |

| |

| Operating income: | | 529 million yen (as compared to 2,879 million yen of operating loss incurred for the previous fiscal year) |

With respect to Lecien Corporation (“Lecien”), sales from our core innerwear products showed strong performance as a result of expansion of offered products jointly developed with our major clients. However, net sales from our apparel business, which offers outerwear products, fell below the results for the previous fiscal year due to a reduction in the number of unprofitable products. As a result, net sales from Lecien remained at the same level for the previous fiscal year due to the above. However, we suffered an operating loss as a result of losses incurred in connection with the withdrawal from our employees’ pension fund, which was only partially offset by improved operating income at the business level.

As for Nanasai Co., Ltd. (“Nanasai”), which engages in the manufacturing, sales and rental business of mannequins and interior design and construction of stores at commercial facilities, net sales fell below the results for the previous fiscal year despite strong sales performance of our products. This was due to the completion of the shop renovations of department stores commenced during the previous fiscal year, as well as the poor performance of short-term rental business of mannequins due to the restrained investments and the cancellation of various events by our business partners caused by the impact of the Earthquake. Operating income fell below the results for the previous fiscal year in connection with a decrease in sales, despite our efforts to achieve efficiency by cutting expenses.

| | |

| Sales: | | 20,795 million yen (a decrease of 10.0% as compared to the previous fiscal year) |

| |

| Operating income: | | 236 million yen (a decrease of 30.2% as compared to the previous fiscal year) |

- 6 -

Forecast for Next Fiscal Year

Despite the sign of gradual recovery in the Japanese economy, we anticipate that the management environment surrounding our group will continue to remain severe with an increasingly uncertain outlook for the economy due to several factors including limited power supply and nuclear hazard. However, we plan to ensure the implementation of our mid-term plan (from fiscal 2011 to fiscal 2013), which will end during fiscal 2013, and make fiscal 2013 a year to build the foundation for our growth strategies under the next mid-term plan.

In our Wacoal business (domestic), we will make efforts, mainly through Wacoal Corp., our core operating entity, to expand our share in the domestic innerwear market by developing products based on the key concept of “body aging” and strengthening high volume products. We will also continue to seek to improve the profitability structure of our domestic business through structural reform and will begin working on structural reform of manufacturing domain through reduction of production and/or procurement expenses. We will also make aggressive efforts to expand our retail business, wellness business and online business, which we believe have further growth potential, and will work on rebuilding supply chain management which can exercise the resources of our group (including our subsidiaries), as a whole.

In our Wacoal business (overseas), our business in the United States continues to show steady performance and we will make efforts to further enhance our product lineup, including by launching new products, and to expand our sales channels and regions. In China, where we expect further economic growth, we will continue to work on expanding sales and improving profitability, while responding to changes in the business environment. In addition, we will make efforts to strengthen our operating base and expand sales in the European markets by utilizing the resources of Eveden Group Limited, an English company, which became our subsidiary in April 2012.

In our Peach John business, we will seek to establish a sustainable and stable profit structure and will make efforts to elevate our sales policies by effectively utilizing the mail-order catalogues and internet and to expand sales.

In our Other segment, Lecien will aim to build a business structure which can generate stable revenues by improving profit margins. In addition, Nanasai will make efforts to establish stable profit-making business structure by developing high value-added products utilizing figure models and store construction quality and making proposals to clients.

Our forecast for next fiscal year is based on the following preconditions:

For the primary exchange rates, the exchange rate for the U.S. dollar is assumed to be 81 yen to the dollar and for the Chinese yuan is assumed to be 13 yen to the yuan.

| | |

| Sales: | | 185,000 million yen (an increase of 7.6% as compared to the previous fiscal year) |

| |

| Operating income: | | 11,500 million yen (an increase of 10.8% as compared to the previous fiscal year) |

| |

| Pre-tax net income: | | 12,000 million yen (an increase of 17.6% as compared to the previous fiscal year) |

| |

| Net income attributable to Wacoal Holdings Corp.: | | 7,600 million yen (an increase of 9.9% as compared to the previous fiscal year) |

(2) Analysis of Financial Condition

Status of Assets, Liabilities and Shareholders’ Equity

Our total assets as of March 31, 2012 was 221,098 million yen, an increase of 5,822 million yen from the end of the previous fiscal year, as a result of increases in inventories and receivables.

In terms of liabilities, our current liabilities were 47,670 million yen, an increase of 1,774 million yen from the end of the previous fiscal year, as a result of an increase in accounts payable under current liabilities and an increase in reserves for retirement benefit under long-term liabilities.

Shareholders’ equity was 171,496 million yen, an increase of 4,016 million yen from the end of the previous fiscal year, due to increases in retained earnings and unrealized gain on securities.

- 7 -

As a result of the above, our total shareholders’ equity ratio as of March 31, 2012 was 77.6%, a decrease of 0.2% from the end of the previous fiscal year.

Cash Flows Status

Cash flow from operating activities:

Cash flow from operating activities during fiscal 2012 was 9,917 million yen, a decrease of 524 million yen as compared to the previous fiscal year, which reflects the result after adjusting the net income of 7,016 million yen for deferred taxes and equity in net income of affiliated companies, as well as depreciation expenses and an increase in payables.

Cash flow used in investment activities:

Cash flow used in investment activities was 3,324 million yen, an increase of 2,621 million yen as compared to the previous fiscal year, due to the acquisition of marketable securities and tangible fixed assets, despite proceeds from the sale and redemption of marketable securities.

Cash flow used in financing activities:

Cash flow used in financing activities was 2,824 million yen, a decrease of 2,141 million yen as compared to the previous fiscal year, due to the repayment of short-term bank loans and cash dividend payments.

As a result, the balance of cash and cash equivalents at the end of fiscal 2012, calculated by excluding the exchange difference on cash and cash equivalents from the above total, was 29,985 million yen, an increase of 3,669 million yen as compared to the previous fiscal year.

Free cash flow, which was calculated by subtracting the amount of capital investment from the cash flow from operating activities, amounted to 6,363 million yen.

Trends in certain cash-flow indicators

| | | | | | | | | | | | |

| | | Fiscal Year

Ended

March 31, 2010 | | | Fiscal Year

Ended

March 31, 2011 | | | Fiscal Year

Ended

March 31, 2012 | |

Shareholders’ equity ratio (%) | | | 77.1 | | | | 77.8 | | | | 77.6 | |

Shareholders’ equity ratio based on the market value (%) | | | 74.0 | | | | 68.6 | | | | 62.5 | |

Debt redemption years (years) | | | 0.9 | | | | 0.6 | | | | 0.7 | |

Interest coverage ratio (times) | | | 104.6 | | | | 114.0 | | | | 110.2 | |

Shareholders’ equity ratio = shareholders’ equity/total assets

Shareholders’ equity ratio based on the market value = aggregate market value of shareholders’ equity/total assets

Debt redemption years = interest-bearing debt/cash flow from operating activities

Interest coverage ratio = cash flow from operating activities/interest payment

Interest payment = “cash payment/interest” as described in the supplemental information to the consolidated cash flow statements

(3) Basic Policy Regarding Distribution of Profits and Dividends for Fiscal 2012 and Fiscal 2013

Out basic policy regarding the distribution of profits to our shareholders is to pay steady dividends and increase our earnings per share, while giving due consideration to the improvement of corporate value through active investment that will result in increased profitability. As for retained earnings, with the aim of improving our corporate value, we have actively invested in developing new specialty retail stores, developing new points of contact with customers and actively investing in overseas businesses. We also concentrate on new business investments, such as entry into new markets, strategic business alliances and M&A activities. With these efforts, we seek to benefit our shareholders by improving future profitability. We also intend to acquire treasury stock from time to time, and we will try to improve capital efficiency and return profits to our shareholders.

Based on our steady performance of the business results for the fiscal year ended March 31, 2012, we would like to amend the dividend payable for fiscal 2012 to 28.00 yen per share, an increase of 5.00 yen per share from 23.00 yen per share, as initially announced. For fiscal year ending March 31, 2013, we hope to be able to distribute 28.00 yen per share.

- 8 -

(4) Business Risks

These matters have not significantly changed since disclosure in our annual report for the year ended March 2011, and are omitted.

For a financial summary for the year ended March 2011 disclosing the above matters, please refer to the following URL.

Our homepage:

http://www.wacoalholdings.jp/ir/library02.html

- 9 -

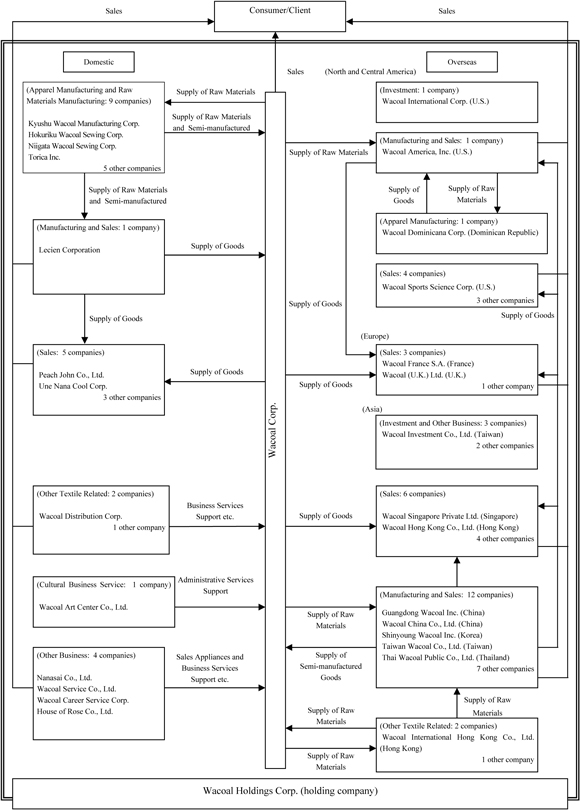

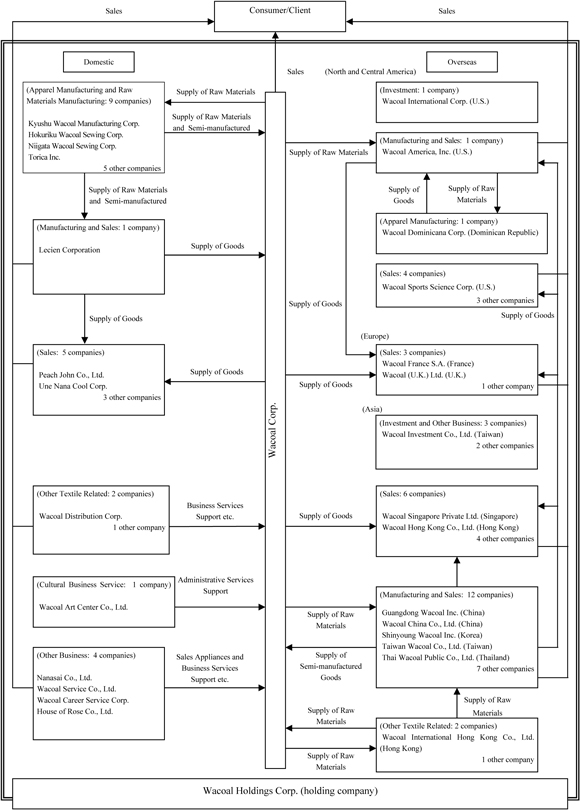

| 2. | Status of Corporate Group |

Our corporate group consists of Wacoal Holdings Corp. (the “Company”), 47 subsidiaries and 9 affiliates, and is principally engaged in the manufacturing and wholesale distribution of innerwear (primarily women’s foundation wear, lingerie, nightwear and children’s underwear), outerwear, sportswear, and other textile goods and related products, as well as the direct sale of certain products to consumers. Our corporate group also conducts business in the restaurant, culture, services, and interior design businesses.

Segment information and a summary of the various companies that make up our corporate group are as follows.

| | | | |

Business Segment | | Operating Segment | | Major Affiliated Companies |

| Wacoal Business (Domestic) | | Manufacturing and Sales | | Wacoal Corporation |

| | | | (Total: 1 company) |

| | |

| | Sales | | Une Nana Cool Corp. Two other companies |

| | | | (Total: 3 companies) |

| | |

| | Apparel Manufacturing | | Kyushu Wacoal Sewing Corp., Hokuriku Wacoal Sewing Corp., Niigata Wacoal Sewing Corp., Torica Inc. Two other companies |

| | | | (Total: 6 companies) |

| | |

| | Other Textile Related | | Wacoal Distribution Corp. One other company |

| | | | (Total: 2 companies) |

| | |

| | Cultural Business Service | | Wacoal Art Center, Ltd. |

| | | | (Total: 1 company) |

| | |

| | Other Business | | Wacoal Holdings Corp. Seven other companies |

| | | | (Total: 8 companies) |

| | |

| Wacoal Business (Overseas) | | Manufacturing and Sales | | Wacoal America, Inc., Wacoal China Co., Ltd., Taiwan Wacoal Co., Ltd. One other company |

| | | | (Total: 4 companies) |

| | |

| | Sales | | Wacoal Singapore Private Ltd., Wacoal Hong Kong Co., Ltd., Wacoal France Société Anonyme, Wacoal (UK) Ltd. Four other companies |

| | | | (Total: 8 companies) |

| | |

| | Apparel Manufacturing | | Wacoal Dominicana Corp. (Dominican Republic), Guandong Wacoal Inc. One other company |

| | | | (Total: 3 companies) |

| | |

| | Other Textile Related | | Wacoal International Hong Kong Co., Ltd. |

| | | | (Total: 1 company) |

| | |

| | Other Business | | Wacoal International Corp. (U.S.) Wacoal Investment Co., Ltd. (Taiwan) One other company |

| | | | (Total: 3 companies) |

| | |

| Peach John Business | | Sales | | Peach John Co., Ltd. Three other companies |

| | | | (Total: 4 companies) |

| | |

Other | | Manufacturing and Sales | | Lecien Corporation One other company |

| | | | (Total: 2 companies) |

| | |

| | Apparel Manufacturing | | Lecien Nagasaki Corporation, Dalian Lecien Fashion Co., Ltd. Three other companies |

| | | | (Total: 5 companies) |

| | |

| | Other Textile Related | | Lecien U.S.A., Inc. One other company |

| | | | (Total: 2 companies) |

| | |

| | Other Business | | Nanasai Co., Ltd., Wacoal Service Co., Ltd., Wacoal Career Service Corp. One other company |

| | | | (Total: 4 companies) |

- 10 -

The business distribution diagram is as follows:

- 11 -

The following matters have not significantly changed since the disclosure in the financial statements for the fiscal year ended March 31, 2010 (disclosed on March 11, 2010), and are omitted.

| | (2) | Measures for Business Targets |

| | (3) | Our Medium- and Long-term Business Strategy |

For the financial statements for the fiscal year ended March 31, 2010 disclosing the above matters, please refer to the following URL.

Our homepage:

http://www.wacoalholdings.jp/ir/financial_results.html

The Tokyo Stock Exchange homepage (listed company search):

http://www.tse.or.jp/listing/compsearch/index.html

“Maintaining and/or expanding sales from our domestic business” is the most important factor for our group to continue growth. While our core domestic sales channels (department stores, mass merchandisers and specialty stores) remain weak, our sales channel strategies that are based on consumer behavior have become considerably important. We have launched a structural reform and have been making and will steadily make efforts to ensure a proper profitability structure in order to respond to the drastic change in the scale of business in our markets. We will also need to build a system which can accurately respond to changes in consumer needs (as seen in the price reduction in high volume products) by drawing on our group’s collective strength. In such an environment, we will actively make investments into new business lines that we believe will general contribute to sales. Among other things, we consider our overseas innerwear business as our group’s biggest growth engine and we believe it is essential for us to develop a business which focuses on building brands, cultivates business expansion and actively makes investments in the emerging and new markets.

The second key factor is “improving profitability”. In order to reduce production costs, we will rebuild our entire group’s supply chain. We will also aim to achieve high-profitability structure by reducing logistics costs or indirect expenses and improving the productivity of each of our employees.

The third key factor is “strengthening the group management”. In aim to solving mid- and long-term issues to establish worldwide fame of Wacoal, we will strengthen our management control system of each business entity and rebuild the style and direction of alliances within our group to effectively facilitate our group’s capabilities

Wacoal Business (Domestic)

Seizing Share in Domestic Innerwear Market:

We will expand our share in sales volume and quantity and secure firm position in the domestic market by further developing the idea of “body aging” for customers and strengthening the high volume products.

Continued Efforts on Structural Reform and Expansion into Manufacturing Domain:

With respect to our existing domestic innerwear wholesale business, aiming to shift to a profitability structure which can respond to the change in the scale of business in our markets, we will continue to promote a structural reform that will achieve “department store business reform”, “manufacturing productivity improvement”, “streamlined distribution” and “business infrastructure reform” and will make efforts to establish a stable revenue base. Further, we will begin working on structural reform of manufacturing domain to reduce production and/or procurement expenses, build production channels for high volume products, in the future, and aim to establish an effective product supply channel for our entire group.

Establishing Pillar of Sales-potential Business:

With respect to our retail business, we will strategically control the regions in which we operate in order to respond to changing customer needs and trends with appropriate business location and product development and will aim to strengthen our high volume products and gain market share. In our wellness business, we will aim to expand sales by strengthening points of contact with customers and /or product items, mainly our sports conditioning wear “CW-X” brand. With respect to our online business, we will aim to strengthen the functionality of and items on our Company’s website and will also consider developing on other companies’ websites. As for men’s innerwear business, we will make efforts to expand sales and strengthen brand recognition by deepening collaboration with our business partners.

- 12 -

Wacoal Business (Overseas)

United States:

We will expand and enrich our product lineup by expanding market shares of new brands or developing body-shaping underwear with high functionality. We will also work on enhancing internet sales, and improving recognition and expanding market shares in the surrounding countries including Canada, Brazil and Mexico.

China:

We will make efforts to expand sales and/or market shares by utilizing commercial agents, to improve profitability by lowering cost ratio, to develop products mainly at Wacoal (Shanghai) Human Science R&D Co., Ltd. and to expand customer segments with mid-priced products through interactions with Lecien.

Asia:

We will work to strengthen alliances within our group by utilizing our production and/or planning capabilities as well as our joint venture’s brand to ensure sustainable growth and stable profitability.

Europe:

We will seek to establish the Wacoal brand in Europe and make efforts to improve growth and strengthen profitability. We will also make efforts to strengthen our operating base and expand sales in the European markets by utilizing the resources of Eveden Group Limited.

Peach John Business

We will continue to work on promoting the reform of our domestic business structure and aim to restore our brand and expand sales by improving product planning and/or precision of order placements as well as strategic advertisements in order to achieve a sustainable high-profit system. In Hong Kong, we will continue to expand our customer segments and will aim to stabilize our operating base and generate revenues in China at an early stage.

Other

Lecien:

We will develop new value-added products for the mass merchandisers, which are our core sales channel, to establish a stable revenue base. In addition, in order to make the utmost use of synergies within our group, we will incorporate the production infrastructure held by Lecien into our group’s supply chain management, and will expand the group’s demands for the lace materials handled by Lecien. With respect to the apparel business, we will make efforts to expand sales by working on the development of high value-added products based on the outcome from Wacoal Human Science Research Center’s research.

Nanasai:

We will need to work on the improvement of the profitability once the demands for store openings and/or renovations of department stores slow down. We will make efforts to expand Nanasai’s rental and sales business, its core competencies, by making full use of its design and quality of mannequins, figure models and/or objects.

- 13 -

| 4. | Consolidated Financial Statements (Unaudited) |

(1) Consolidated Balance Sheet

| | | | | | | | | | | | |

Accounts | | As of March 31, 2011 | | | As of March 31, 2012 | | | Amount

Increased/(Decreased) | |

| (Assets) | | Million Yen | | | Million Yen | | | Million Yen | |

I. Current assets | | | | | | | | | | | | |

Cash and cash equivalents | | | 26,316 | | | | 29,985 | | | | 3,669 | |

Time deposits | | | 706 | | | | 733 | | | | 27 | |

Marketable securities | | | 4,840 | | | | 5,179 | | | | 339 | |

Receivables | | | 21,171 | | | | 22,725 | | | | 1,554 | |

Allowance for returns and doubtful receivables | | | (1,617 | ) | | | (1,460 | ) | | | 157 | |

Inventories | | | 31,116 | | | | 32,847 | | | | 1,731 | |

Deferred tax assets | | | 5,212 | | | | 4,234 | | | | (978 | ) |

Other current assets | | | 2,666 | | | | 3,052 | | | | 386 | |

| | | | | | | | | | | | |

Total current assets | | | 90,410 | | | | 97,295 | | | | 6,885 | |

| | | |

II. Tangible fixed assets | | | | | | | | | | | | |

Land | | | 21,787 | | | | 21,783 | | | | (4 | ) |

Buildings and structures | | | 60,318 | | | | 60,077 | | | | (241 | ) |

Machinery and equipment | | | 14,068 | | | | 14,039 | | | | (29 | ) |

Construction in progress | | | 93 | | | | 22 | | | | (71 | ) |

| | | | | | | | | | | | |

| | | 96,266 | | | | 95,921 | | | | (345 | ) |

Accumulated depreciation | | | (46,532 | ) | | | (46,843 | ) | | | (311 | ) |

| | | | | | | | | | | | |

Net tangible fixed assets | | | 49,734 | | | | 49,078 | | | | (656 | ) |

| | | |

III. Other assets | | | | | | | | | | | | |

Investments in affiliated companies | | | 14,702 | | | | 14,599 | | | | (103 | ) |

Investments | | | 32,685 | | | | 34,064 | | | | 1,379 | |

Goodwill | | | 10,367 | | | | 10,367 | | | | — | |

Other intangible fixed assets | | | 10,325 | | | | 9,541 | | | | (784 | ) |

Prepaid pension cost | | | 158 | | | | — | | | | (158 | ) |

Deferred tax assets | | | 876 | | | | 597 | | | | (279 | ) |

Others | | | 6,019 | | | | 5,557 | | | | (462 | ) |

| | | | | | | | | | | | |

Total other assets | | | 75,132 | | | | 74,725 | | | | (407 | ) |

| | | | | | | | | | | | |

Total Assets | | | 215,276 | | | | 221,098 | | | | 5,822 | |

| | | | | | | | | | | | |

- 14 -

| | | | | | | | | | | | |

Accounts | | As of March 31, 2011 | | | As of March 31, 2012 | | | Amount

Increased/(Decreased) | |

| (Liabilities) | | Million Yen | | | Million Yen | | | Million Yen | |

I. Current Liabilities | | | | | | | | | | | | |

Short-term bank loans | | | 6,152 | | | | 5,780 | | | | (372 | ) |

| | | |

Payables | | | | | | | | | | | | |

Notes payable | | | 1,617 | | | | 1,429 | | | | (188 | ) |

Accounts payable-trade | | | 10,474 | | | | 10,737 | | | | 263 | |

Accounts payable | | | 5,112 | | | | 6,948 | | | | 1,836 | |

| | | | | | | | | | | | |

| | | 17,203 | | | | 19,114 | | | | 1,911 | |

| | | |

Accrued payroll and bonuses | | | 6,133 | | | | 6,411 | | | | 278 | |

Accrued taxes | | | 1,932 | | | | 1,747 | | | | (185 | ) |

Other current liabilities | | | 2,460 | | | | 2,555 | | | | 95 | |

| | | | | | | | | | | | |

Total current liabilities | | | 33,880 | | | | 35,607 | | | | 1,727 | |

| | | |

II. Long-term liabilities | | | | | | | | | | | | |

Reserves for retirement benefit | | | 2,183 | | | | 2,817 | | | | 634 | |

Deferred tax liability | | | 7,441 | | | | 7,085 | | | | (356 | ) |

Other long-term liabilities | | | 2,392 | | | | 2,161 | | | | (231 | ) |

| | | | | | | | | | | | |

Total long-term liabilities | | | 12,016 | | | | 12,063 | | | | 47 | |

| | | | | | | | | | | | |

Total liabilities | | | 45,896 | | | | 47,670 | | | | 1,774 | |

| | | |

(Equity) | | | | | | | | | | | | |

| | | |

I. Common stock | | | 13,260 | | | | 13,260 | | | | — | |

II. Additional paid-in capital | | | 29,401 | | | | 29,447 | | | | 46 | |

III. Retained earnings | | | 137,274 | | | | 141,370 | | | | 4,096 | |

IV. Accumulated other comprehensive income (loss) | | | | | | | | | | | | |

Foreign currency exchange adjustment | | | (10,159 | ) | | | (10,916 | ) | | | (757 | ) |

Unrealized gain on securities | | | 2,596 | | | | 4,197 | | | | 1,601 | |

Pension liability adjustment | | | (2,002 | ) | | | (2,976 | ) | | | (974 | ) |

V. Treasury stock | | | (2,890 | ) | | | (2,886 | ) | | | 4 | |

| | | | | | | | | | | | |

Total shareholders’ equity | | | 167,480 | | | | 171,496 | | | | 4,016 | |

VI. Noncontrolling interests | | | 1,900 | | | | 1,932 | | | | 32 | |

| | | | | | | | | | | | |

Total equity | | | 169,380 | | | | 173,428 | | | | 4,048 | |

| | | | | | | | | | | | |

Total liabilities and equity | | | 215,276 | | | | 221,098 | | | | 5,822 | |

| | | | | | | | | | | | |

- 15 -

(2) Consolidated Income Statement

| | | | | | | | | | | | | | | | | | | | |

Accounts | | Fiscal Year Ended

March 31, 2011 | | | Fiscal Year Ended

March 31, 2012 | | | Amount

Increased/(Decreased) | |

| | | Million Yen | | | % | | | Million Yen | | | % | | | Million Yen | |

I. Sales | | | 165,548 | | | | 100.0 | | | | 171,897 | | | | 100.0 | | | | 6,349 | |

II. Operating expenses | | | | | | | | | | | | | | | | | | | | |

Cost of sales | | | 81,659 | | | | 49.3 | | | | 81,891 | | | | 47.6 | | | | 232 | |

Selling, general and administrative expenses | | | 77,611 | | | | 46.9 | | | | 79,627 | | | | 46.4 | | | | 2,016 | |

Gain (loss) on sales of tangible fixed assets, net | | | 105 | | | | 0.1 | | | | 2 | | | | 0.0 | | | | (103 | ) |

Impairment loss on intangible fixed assets | | | 1,772 | | | | 1.0 | | | | — | | | | — | | | | (1,772 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 161,147 | | | | 97.3 | | | | 161,520 | | | | 94.0 | | | | 373 | |

| | | | | | | | | | | | | | | | | | | | |

Operating income | | | 4,401 | | | | 2.7 | | | | 10,377 | | | | 6.0 | | | | 5,976 | |

III. Other income (expenses) | | | | | | | | | | | | | | | | | | | | |

Interest income | | | 137 | | | | 0.1 | | | | 112 | | | | 0.1 | | | | (25 | ) |

Interest expense | | | (88 | ) | | | (0.1 | ) | | | (93 | ) | | | (0.0 | ) | | | (5 | ) |

Dividend income | | | 643 | | | | 0.5 | | | | 724 | | | | 0.4 | | | | 81 | |

Gain (loss) on sale or exchange of marketable securities and/or investment securities | | | 372 | | | | 0.2 | | | | 25 | | | | 0.0 | | | | (347 | ) |

Valuation loss on marketable securities and/or investment securities | | | (1,585 | ) | | | (1.0 | ) | | | (831 | ) | | | (0.5 | ) | | | 754 | |

Other profit (loss), net | | | 47 | | | | 0.0 | | | | (107 | ) | | | (0.1 | ) | | | (154 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total other income (expense) | | | (474 | ) | | | (0.3 | ) | | | (170 | ) | | | (0.1 | ) | | | 304 | |

| | | | | | | | | | | | | | | | | | | | |

Pre-tax net income | | | 3,927 | | | | 2.4 | | | | 10,207 | | | | 5.9 | | | | 6,280 | |

| | | | | | | | | | | | | | | | | | | | |

Income taxes | | | | | | | | | | | | | | | | | | | | |

Current | | | 3,480 | | | | 2.1 | | | | 3,523 | | | | 2.0 | | | | 43 | |

Deferred | | | (1,470 | ) | | | (0.9 | ) | | | 676 | | | | 0.4 | | | | 2,146 | |

| | | | | | | | | | | | | | | | | | | | |

Total income taxes | | | 2,010 | | | | 1.2 | | | | 4,199 | | | | 2.4 | | | | 2,189 | |

| | | | | | | | | | | | | | | | | | | | |

Equity in net income of affiliated companies and net income before adjustment of profit and loss attributable to non-controlling interests | | | 1,917 | | | | 1.2 | | | | 6,008 | | | | 3.5 | | | | 4,091 | |

Equity in net income of affiliated companies | | | 990 | | | | 0.6 | | | | 1,008 | | | | 0.6 | | | | 18 | |

| | | | | | | | | | | | | | | | | | | | |

Net income | | | 2,907 | | | | 1.8 | | | | 7,016 | | | | 4.1 | | | | 4,109 | |

| | | | | | | | | | | | | | | | | | | | |

Profit (loss) attributable to non-controlling interests | | | (122 | ) | | | (0.1 | ) | | | (103 | ) | | | (0.1 | ) | | | 19 | |

| | | | | | | | | | | | | | | | | | | | |

Net income attributable to Wacoal Holdings Corp. | | | 2,785 | | | | 1.7 | | | | 6,913 | | | | 4.0 | | | | 4,128 | |

| | | | | | | | | | | | | | | | | | | | |

- 16 -

(3) Consolidated Comprehensive Income Statement

| | | | | | | | | | | | |

Accounts | | Fiscal Year Ended

March 31, 2011 | | | Fiscal Year Ended

March 31, 2012 | | | Amount

Increased/(Decreased) | |

| | | Million Yen | | | Million Yen | | | Million Yen | |

I. Net income | | | 2,907 | | | | 7,016 | | | | 4,109 | |

| | | | | | | | | | | | |

II. Other comprehensive profit (loss) – after adjustment of tax effect | | | | | | | | | | | | |

Foreign currency exchange adjustment | | | (2,802 | ) | | | (782 | ) | | | 2,020 | |

Net unrealized gain on securities | | | (1,072 | ) | | | 1,602 | | | | 2,674 | |

Pension liability adjustment | | | (219 | ) | | | (974 | ) | | | (755 | ) |

| | | | | | | | | | | | |

Total of other comprehensive profit (loss) | | | (4,093 | ) | | | (154 | ) | | | 3,939 | |

| | | | | | | | | | | | |

Comprehensive profit (loss) | | | (1,186 | ) | | | 6,862 | | | | 8,048 | |

Comprehensive profit (loss) attributable to non-controlling interests | | | (47 | ) | | | (79 | ) | | | (32 | ) |

| | | | | | | | | | | | |

Comprehensive profit (loss) attributable to Wacoal Holdings Corp. | | | (1,233 | ) | | | 6,783 | | | | 8,016 | |

| | | | | | | | | | | | |

(4) Consolidated Shareholders’ Equity Statement

Fiscal Year Ended March 31, 2011

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Item | | Equity | |

| | No. of Shares

Held Outside

the

Company | | | Common

Stock | | | Additional

Paid-in

Capital | | | Retained

Earnings | | | Accumulated other

comprehensive

income | | | Treasury

stock | | | Total

Shareholders’

Equity | | | Non-controlling

Interests | | | Total Equity | |

| | | Thousand

shares | | | Million

Yen | | | Million

Yen | | | Million

Yen | | | Million Yen | | | Million

Yen | | | Million Yen | | | Million Yen | | | Million Yen | |

As of April 1, 2010 | | | 141,198 | | | | 13,260 | | | | 29,366 | | | | 137,313 | | | | (5,547 | ) | | | (2,532 | ) | | | 171,860 | | | | 1,923 | | | | 173,783 | |

Cash dividends paid to the shareholders of the Company (20.00 yen per share) | | | | | | | | | | | | | | | (2,824 | ) | | | | | | | | | | | (2,824 | ) | | | | | | | (2,824 | ) |

Cash dividends paid to non-controlling interests | | | | | | | | | | | | | | | | | | | | | | | | | | | — | | | | (70 | ) | | | (70 | ) |

Purchase of treasury stock | | | (586 | ) | | | | | | | | | | | | | | | | | | | (655 | ) | | | (655 | ) | | | | | | | (655 | ) |

Sale of treasury stock | | | 236 | | | | | | | | | | | | | | | | | | | | 297 | | | | 297 | | | | | | | | 297 | |

Other | | | | | | | | | | | 35 | | | | | | | | | | | | | | | | 35 | | | | | | | | 35 | |

Net income | | | | | | | | | | | | | | | 2,785 | | | | | | | | | | | | 2,785 | | | | 122 | | | | 2,907 | |

Other comprehensive profit (loss) | | | | | | | | | | | | | | | | | | | (4,018 | ) | | | | | | | (4,018 | ) | | | (75 | ) | | | (4,093 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

As of March 31, 2011 | | | 140,848 | | | | 13,260 | | | | 29,401 | | | | 137,274 | | | | (9,565 | ) | | | (2,890 | ) | | | 167,480 | | | | 1,900 | | | | 169,380 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fiscal Year Ended March 31, 2012

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Item | | Equity | |

| | No. of Shares

Held Outside

the

Company | | | Common

Stock | | | Additional

Paid-in

Capital | | | Retained

Earnings | | | Accumulated other

comprehensive

income | | | Treasury

stock | | | Total

Shareholders’

Equity | | | Non-controlling

Interests | | | Total

Equity | |

| | | Thousand

shares | | | Million

Yen | | | Million

Yen | | | Million

Yen | | | Million Yen | | | Million

Yen | | | Million Yen | | | Million Yen | | | Million

Yen | |

As of April 1, 2011 | | | 140,848 | | | | 13,260 | | | | 29,401 | | | | 137,274 | | | | (9,565 | ) | | | (2,890 | ) | | | 167,480 | | | | 1,900 | | | | 169,380 | |

Cash dividends paid to the shareholders of the Company (20.00 yen per share) | | | | | | | | | | | | | | | (2,817 | ) | | | | | | | | | | | (2,817 | ) | | | | | | | (2,817 | ) |

Cash dividends paid to non-controlling interests | | | | | | | | | | | | | | | | | | | | | | | | | | | — | | | | (47 | ) | | | (47 | ) |

Purchase of treasury stock | | | (15 | ) | | | | | | | | | | | | | | | | | | | (15 | ) | | | (15 | ) | | | | | | | (15 | ) |

Sale of treasury stock | | | 6 | | | | | | | | | | | | | | | | | | | | 5 | | | | 5 | | | | | | | | 5 | |

Other | | | 12 | | | | | | | | 46 | | | | | | | | | | | | 14 | | | | 60 | | | | | | | | 60 | |

Net income | | | | | | | | | | | | | | | 6,913 | | | | | | | | | | | | 6,913 | | | | 103 | | | | 7,016 | |

Other comprehensive profit (loss) | | | | | | | | | | | | | | | | | | | (130 | ) | | | | | | | (130 | ) | | | (24 | ) | | | (154 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

As of March 31, 2012 | | | 140,851 | | | | 13,260 | | | | 29,447 | | | | 141,370 | | | | (9,695 | ) | | | (2,886 | ) | | | 171,496 | | | | 1,932 | | | | 173,428 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- 17 -

(5) Consolidated Cash Flow Statement

| | | | | | | | | | | | |

Accounts | | Fiscal Year Ended

March 31, 2011 | | | Fiscal Year Ended

March 31, 2012 | | | Amount

Increased/(Decreased) | |

| | | Million Yen | | | Million Yen | | | Million Yen | |

I. Operating activities | | | | | | | | | | | | |

1. Net income | | | 2,907 | | | | 7,016 | | | | 4,109 | |

2. Adjustment of net income to cash flow from operating activities | | | | | | | | | | | | |

(1) Depreciation and amortization | | | 4,685 | | | | 4,660 | | | | (25 | ) |

(2) Stock-based compensation expense | | | 50 | | | | 60 | | | | 10 | |

(3) Allowance for returns and doubtful receivables | | | (364 | ) | | | (155 | ) | | | 209 | |

(4) Deferred taxes | | | (1,470 | ) | | | 676 | | | | 2,146 | |

(5) Gain (loss) on sale of fixed assets | | | 122 | | | | (35 | ) | | | (157 | ) |

(6) Impairment loss on fixed assets | | | 107 | | | | 37 | | | | (70 | ) |

(7) Impairment loss on intangible fixed assets | | | 1,772 | | | | — | | | | (1,772 | ) |

(8) Valuation loss on marketable securities and/or investment securities | | | 1,585 | | | | 831 | | | | (754 | ) |

(9) Gain (loss) on sale and exchange of marketable securities and/or investment securities | | | (372 | ) | | | (25 | ) | | | 347 | |

(10) Equity in net income of affiliated companies (after dividend income) | | | (566 | ) | | | (451 | ) | | | 115 | |

(11) Changes in assets and liabilities | | | | | | | | | | | | |

Decrease (increase) in receivables | | | 493 | | | | (1,589 | ) | | | (2,082 | ) |

Decrease (increase) in inventories | | | 400 | | | | (1,801 | ) | | | (2,201 | ) |

Decrease (increase) in other current assets | | | 194 | | | | (377 | ) | | | (571 | ) |

Increase in payables | | | 1,251 | | | | 1,973 | | | | 722 | |

Decrease in reserves for retirement benefits | | | (331 | ) | | | (685 | ) | | | (354 | ) |

Decrease in other liabilities | | | (267 | ) | | | (513 | ) | | | (246 | ) |

(12) Other | | | 245 | | | | 295 | | | | 50 | |

| | | | | | | | | | | | |

Net cash flow from operating activities | | | 10,441 | | | | 9,917 | | | | (524 | ) |

| | | |

II. Investing activities | | | | | | | | | | | | |

1. Increase in time deposits | | | (1,809 | ) | | | (515 | ) | | | 1,294 | |

2. Decrease in time deposits | | | 1,991 | | | | 488 | | | | (1,503 | ) |

3. Proceeds from sale and redemption of marketable securities | | | 3,242 | | | | 8,372 | | | | 5,130 | |

4. Acquisition of marketable securities | | | (1,344 | ) | | | (8,417 | ) | | | (7,073 | ) |

5. Proceeds from sales of tangible fixed assets | | | 538 | | | | 451 | | | | (87 | ) |

6. Acquisition of tangible fixed assets | | | (2,652 | ) | | | (2,708 | ) | | | (56 | ) |

7. Acquisition of intangible fixed assets | | | (687 | ) | | | (846 | ) | | | (159 | ) |

8. Proceeds from sale of investments | | | 988 | | | | 417 | | | | (571 | ) |

9. Acquisition of investments | | | (960 | ) | | | (590 | ) | | | 370 | |

10. Others | | | (10 | ) | | | 24 | | | | 34 | |

| | | | | | | | | | | | |

Net cash flow from investing activities | | | (703 | ) | | | (3,324 | ) | | | (2,621 | ) |

| | | |

III. Financing activities | | | | | | | | | | | | |

1. Decrease in short-term bank loans | | | (1,794 | ) | | | (368 | ) | | | 1,426 | |

2. Proceeds from long-term debt | | | 200 | | | | 500 | | | | 300 | |

3. Repayment of long-term debt | | | (104 | ) | | | (82 | ) | | | 22 | |

4. Acquisition of treasury stock | | | (655 | ) | | | (15 | ) | | | 640 | |

5. Sale of treasury stock | | | 282 | | | | 5 | | | | (277 | ) |

6. Dividend payment to Wacoal Holdings Corp. | | | (2,824 | ) | | | (2,817 | ) | | | 7 | |

7. Dividend payment to non-controlling interests | | | (70 | ) | | | (47 | ) | | | 23 | |

| | | | | | | | | | | | |

Net cash flow from financing activities | | | (4,965 | ) | | | (2,824 | ) | | | 2,141 | |

| | | | | | | | | | | | |

IV. Effect of exchange rate on cash and cash equivalents | | | (785 | ) | | | (100 | ) | | | 685 | |

| | | | | | | | | | | | |

V. Increase (decrease) in cash and cash equivalents | | | 3,988 | | | | 3,669 | | | | (319 | ) |

VI. Initial balance of cash and cash equivalents | | | 22,328 | | | | 26,316 | | | | 3,988 | |

| | | | | | | | | | | | |

VII. Year-end balance of cash and cash equivalents | | | 26,316 | | | | 29,985 | | | | 3,669 | |

| | | | | | | | | | | | |

- 18 -

Additional Information

| | | | | | | | | | | | |

Accounts | | Fiscal Year Ended

March 31, 2011 | | | Fiscal Year Ended

March 31, 2012 | | | Amount

Increased/(Decreased) | |

Cash paid for | | | | | | | | | | | | |

Interest | | | 91 | | | | 90 | | | | (1 | ) |

Income taxes, etc. | | | 3,645 | | | | 3,702 | | | | 57 | |

Investment activities without cash disbursement | | | | | | | | | | | | |

Acquisition amount of investment securities through stock swap | | | — | | | | 126 | | | | 126 | |

Acquisition amount of shares of consolidated subsidiaries through assumption of liabilities | | | 200 | | | | — | | | | (200 | ) |

(6) Notes on Going Concern

Not applicable.

(7) Basic Significant Matters in Preparation of Consolidated Financial Statements

| | (i) | Matters Regarding the Scope of Consolidation and Application of the Equity Method |

Major consolidated subsidiaries:

Wacoal Corporation, Peach John Co., Ltd., Lecien Corporation, Kyushu Wacoal Manufacturing Corp., Torica Co., Ltd., Nanasai Co., Ltd., Wacoal International Corp., Wacoal America Inc., Wacoal France S.A., Wacoal Hong Kong Co., Ltd., Wacoal Investment Co. (Taiwan), Ltd., Wacoal China Co., Ltd. and Wacoal International Hong Kong Co., Ltd.

Major Affiliated Companies:

Shinyoung Wacoal Inc., Taiwan Wacoal Co., Ltd. and Thai Wacoal Public Co., Ltd.

| | (ii) | Changes Regarding Subsidiaries and Affiliates |

Consolidated (new):

Wacoal Canada Inc, Wacoal Kyoto South Distribution Corp.

Consolidated (excluded):

Kabushiki Kaisha Wacoal Dublevé, General Fashions Corp.

| | (iii) | Standard of Preparation of Consolidated Financial Statements |

The consolidated financial statements have been prepared based on terms, format and preparation methods in compliance with accounting standards generally accepted in the United States as required in relation to the issuance of American Depositary Receipts. For this reason, the consolidated financial statements may be different from those that have been prepared based on the Consolidated Financial Statement Regulations and Standard of Preparation of Consolidated Financial Statements etc.

| | (iv) | Significant Accounting Policies |

| | a. | Valuation Standard of Inventories |

The average cost method was mainly used for goods, products and supplies, and the first-in first-out method was used for raw materials, with both valued at the lower of cost or market accounting method.

| | b. | Valuation Standard of Tangible Fixed Assets and Method of Depreciation |

Tangible fixed assets are valued at the acquisition cost. Depreciation expenses are calculated mainly using the straight-line method based on the estimated useful lives of the assets (the lease term is used for capitalized leased assets).

| | c. | Valuation Standard of Marketable Securities and Investment Securities |

Based on the provisions of U.S. Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) 320, marketable securities and investments have been classified as available for sale securities and for sale and purchase securities, and valued at fair value. Gain or loss on sale of marketable securities is calculated based on the acquisition cost using the moving-average method. The valuation standard and valuation method of nonmarketable securities are valued at cost using the moving-average method.

| | d. | Reserve for Retirement Benefits |

This is accounted for based on FASB ASC 715.

- 19 -

Based on FASB ASC 840, capital leases have been capitalized at fair value of the lease payments and its corresponding accrued liabilities have been accounted.

| | f. | Accounting Procedure for Consumption Tax, etc. |

Accounting procedure for consumption tax, etc., is based on the tax-excluded method.

| | g. | Consolidated Cash Flow Statement |

Upon preparing the consolidated cash flow statements, time deposits and certificates of deposit with original maturities of three (3) months or less have been included in cash and cash equivalents.

| | (v) | Change of Accounting Closing Month of Fiscal Year of Subsidiaries |

During the current consolidated fiscal year (fiscal 2012), in order to reflect more appropriate periodic profit and loss statement in the consolidated financial statements, the accounting closing month of fiscal year of certain consolidated subsidiaries has been changed from December to March, to be consistent with our fiscal year end. In connection with this change, we have made retroactive adjustments to the consolidated balance sheet, consolidated income statement, consolidated comprehensive income statement, consolidated shareholders’ equity statement, consolidated cash flow statement, market value, etc. of securities, par-share information, segment information, and status of sales, in order to reflect the change of fiscal year-end at those consolidated subsidiaries. The amounts of such retroactive adjustments to the net income attributable to Wacoal Holdings Corp., total equity and total assets are as follows.

| | | | | | | | |

| | | | | | (Unit: Million Yen) | |

| | |

| | | Before Retroactive Adjustments | | | After Retroactive Adjustments | |

Net income attributable to Wacoal Holdings Corp. | | | 2,615 | | | | 2,785 | |

Total equity | | | 168,867 | | | | 169,380 | |

Total Assets | | | 215,345 | | | | 215,276 | |

(8) Notes to the Consolidated Financial Statements

| | (i) | Market Value, etc. of Securities |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (Unit: Million Yen) | |

| | |

| | | As of March 31, 2011 | | | As of March 31, 2012 | |

| | | Acquisition

Cost | | | Total Unrealized

Profit | | | Total Unrealized

Loss | | | Fair

Value | | | Acquisition

Cost | | | Total Unrealized

Profit | | | Total Unrealized

Loss | | | Fair

Value | |

Securities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

National and Local Government Bonds | | | 510 | | | | 3 | | | | — | | | | 513 | | | | 10 | | | | — | | | | — | | | | 10 | |

Corporate Bonds | | | 1,300 | | | | 4 | | | | 27 | | | | 1,277 | | | | 1,500 | | | | 1 | | | | 61 | | | | 1,440 | |

Trust Fund | | | 2,657 | | | | 117 | | | | 2 | | | | 2,772 | | | | 2,581 | | | | 156 | | | | 4 | | | | 2,733 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 4,467 | | | | 124 | | | | 29 | | | | 4,562 | | | | 4,091 | | | | 157 | | | | 65 | | | | 4,183 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investment | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Equities | | | 22,165 | | | | 7,488 | | | | 516 | | | | 29,137 | | | | 21,803 | | | | 9,341 | | | | 14 | | | | 31,130 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 22,165 | | | | 7,488 | | | | 516 | | | | 29,137 | | | | 21,803 | | | | 9,341 | | | | 14 | | | | 31,130 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Note) | The securities which are classified as available for sale securities are shown in the above table and the unlisted securities which are included in the investment securities are not shown. |

| | (ii) | Contract Amount, Market Value and Valuation Profit/Loss of Derivative Transactions |

In order to hedge exchange rate and interest rate risks, forward exchange contracts have been utilized as financial derivative products. The profits and losses of such contracts have been omitted as the amounts involved are non-material.

- 20 -

| | (iii) | Information on Par Share |

| | | | | | |

| | | Fiscal Year Ended

March 31, 2011 | | Fiscal Year Ended

March 31, 2012 | |

Net income attributable to Wacoal Holdings Corp. | | 2,785 million yen | | | 6,913 million yen | |

Number of average shares issued during the year (excluding treasury stock) | | 141,145,190 shares | | | 140,848,576 shares | |

Net income attributable to Wacoal Holdings Corp. per share | | 19.73 yen | | | 49.08 yen | |

Diluted net earnings attributable to Wacoal Holdings Corp. per share | | 19.72 yen | | | 49.02 yen | |

| | a. | Segment Information by Type of Business |

Fiscal Year Ended March 31, 2011 (April 1, 2010 - March 31, 2011)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (Unit: Million Yen) | |

| | | | | | | |

| | | Wacoal

business

(Domestic) | | | Wacoal

business

(Overseas) | | | Peach John

business | | | Other | | | Total | | | Elimination

or corporate | | | Consolidated | |

Sales | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) Sales to outside customers | | | 110,856 | | | | 20,010 | | | | 11,575 | | | | 23,107 | | | | 165,548 | | | | — | | | | 165,548 | |

(2) Internal sales or transfers among segments | | | 2,134 | | | | 6,118 | | | | 73 | | | | 4,588 | | | | 12,913 | | | | (12,913 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 112,990 | | | | 26,128 | | | | 11,648 | | | | 27,695 | | | | 178,461 | | | | (12,913 | ) | | | 165,548 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating expenses | | | 107,370 | | | | 24,806 | | | | 12,479 | | | | 27,357 | | | | 172,012 | | | | (12,913 | ) | | | 159,099 | |

Customer related depreciation | | | — | | | | — | | | | 276 | | | | — | | | | 276 | | | | — | | | | 276 | |

Impairment loss on intangible fixed assets | | | — | | | | — | | | | 1,772 | | | | — | | | | 1,772 | | | | — | | | | 1,772 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 107,370 | | | | 24,806 | | | | 14,527 | | | | 27,357 | | | | 174,060 | | | | (12,913 | ) | | | 161,147 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income (loss) | | | 5,620 | | | | 1,322 | | | | (2,879 | ) | | | 338 | | | | 4,401 | | | | — | | | | 4,401 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Fiscal Year Ended March 31, 2012 (April 1, 2011 - March 31, 2012)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | (Unit: Million Yen) | |

| | | | | | | |

| | | Wacoal

business

(Domestic) | | | Wacoal

business

(Overseas) | | | Peach John

business | | | Other | | | Total | | | Elimination

or corporate | | | Consolidated | |

Sales | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) Sales to outside customers | | | 115,870 | | | | 21,396 | | | | 13,836 | | | | 20,795 | | | | 171,897 | | | | — | | | | 171,897 | |

(2) Internal sales or transfers among segments | | | 2,719 | | | | 6,541 | | | | 193 | | | | 5,744 | | | | 15,197 | | | | (15,197 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 118,589 | | | | 27,937 | | | | 14,029 | | | | 26,539 | | | | 187,094 | | | | (15,197 | ) | | | 171,897 | |

| | | | | | | | | �� | | | | | | | | | | | | | | | | | | | |

Operating expenses | | | 110,417 | | | | 26,497 | | | | 13,318 | | | | 26,303 | | | | 176,535 | | | | (15,197 | ) | | | 161,338 | |

Customer related depreciation | | | — | | | | — | | | | 182 | | | | — | | | | 182 | | | | — | | | | 182 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 110,417 | | | | 26,497 | | | | 13,500 | | | | 26,303 | | | | 176,717 | | | | (15,197 | ) | | | 161,520 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income | | | 8,172 | | | | 1,440 | | | | 529 | | | | 236 | | | | 10,377 | | | | — | | | | 10,377 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(Note) Core products of respective businesses:

| | |

| |

Wacoal business (domestic): | | innerwear (foundation, lingerie, nightwear and children’s innerwear), outerwear, sportswear, hosiery, restaurant, culture services, etc. |

| |

Wacoal business (overseas): | | innerwear (foundation, lingerie, nightwear and children’s innerwear), outerwear, sportswear, hosiery, etc. |

| |

Peach John business: | | innerwear (foundation, lingerie, nightwear and children’s innerwear), outerwear, and other textile-related products |

| |

Other: | | innerwear (foundation, lingerie, nightwear and children’s innerwear), outerwear, other textile-related products, mannequins, shop design and implementation, etc. |

- 21 -

Fiscal Year Ended March 31, 2011 (April 1, 2010 to March 31, 2011)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | (Unit: Million Yen) | |

| | | | | | |

| | | Japan | | | Asia | | | Europe/N.A. | | | Total | | | Elimination or

corporate | | | Consolidated | |

I. Sales | | | | | | | | | | | | | | | | | | | | | | | | |

Sales to outside customers | | | 144,999 | | | | 9,167 | | | | 11,382 | | | | 165,548 | | | | — | | | | 165,548 | |

II. Operating income | | | 3,341 | | | | 75 | | | | 985 | | | | 4,401 | | | | — | | | | 4,401 | |

III. Long-lived assets | | | 45,792 | | | | 2,349 | | | | 1,593 | | | | 49,734 | | | | — | | | | 49,734 | |

Fiscal Year Ended March 31, 2012 (April 1, 2011 to March 31, 2012)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | (Unit: Million Yen) | |

| | | | | | |

| | | Japan | | | Asia | | | Europe/N.A. | | | Total | | | Elimination or

Corporate | | | Consolidated | |

I. Sales | | | | | | | | | | | | | | | | | | | | | | | | |

Sales to outside customers | | | 149,587 | | | | 10,527 | | | | 11,783 | | | | 171,897 | | | | — | | | | 171,897 | |

II. Operating income | | | 9,174 | | | | 93 | | | | 1,110 | | | | 10,377 | | | | — | | | | 10,377 | |

III. Long-lived assets | | | 45,240 | | | | 2,334 | | | | 1,504 | | | | 49,078 | | | | — | | | | 49,078 | |

| | | | | | |

(Note) | | | 1. | | | Countries or areas are classified according to geographical proximity. |

| | | 2. | | | Main countries and areas belonging to classifications other than Japan |

| | | | | | Asia: various countries of East Asia and Southeast Asia |

| | | | | | Europe/N.A.: North America and European countries |

| | | 3. | | | Sales in respect of consolidated companies are categorized by location. |

| | | 4. | | | Long-lived assets include tangible fixed assets. |

Fiscal Year Ended March 31, 2011 (April 1, 2010 - March 31, 2011)

| | | | | | | | | | | | |

| | | (Unit: Million Yen) | |

| | | |

| | | Asia | | | Europe/N.A. | | | Total | |

I. Overseas sales | | | 9,167 | | | | 11,382 | | | | 20,549 | |

II. Consolidated sales | | | — | | | | — | | | | 165,548 | |

III. Ratio of overseas sales in consolidated sales | | | 5.5 | % | | | 6.9 | % | | | 12.4 | % |

Fiscal Year Ended March 31, 2012 (April 1, 2011 - March 31, 2012)

| | | | | | | | | | | | |

| | | (Unit: Million Yen) | |

| | | |

| | | Asia | | | Europe/N.A. | | | Total | |

I. Overseas sales | | | 10,527 | | | | 11,783 | | | | 22,310 | |

II. Consolidated sales | | | — | | | | — | | | | 171,897 | |

III. Ratio of overseas sales in consolidated sales | | | 6.1 | % | | | 6.9 | % | | | 13.0 | % |

| | | | | | |

(Note) | | | 1. | | | Countries or areas are classified according to geographical proximity. |