UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of July, 2012

Commission File Number: 000-11743

WACOAL HOLDINGS CORP.

(Translation of registrant’s name into English)

29, Nakajima-cho, Kisshoin, Minami-ku

Kyoto, Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F þ Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note:Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note:Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Information furnished on this form:

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | |

WACOAL HOLDINGS CORP. (Registrant) |

| |

| By: | | /s/ Ikuo Otani |

| | Ikuo Otani |

| | Senior Managing Director and General Manager of Corporate Planning |

Date: July 31, 2012

[Exhibit 1]

[Translation]

Consolidated Business Results for the First Quarter of the Fiscal Year Ending March 31, 2013

[U.S. GAAP]

July 31, 2012

| | | | |

Listed Company: | | Wacoal Holdings Corp. | | Stock Exchanges: Tokyo, Osaka |

Code Number: | | 3591 (URL:http://www.wacoalholdings.jp/) | | |

Representative: | | Position: President and Representative Director |

| | Name: Yoshikata Tsukamoto | | |

For Inquiries: | | Position: Senior Managing Director and General Manager of Corporate Planning |

| | Name: Ikuo Otani | | Tel: +81 (075) 682-1028 |

| | | | |

| Scheduled quarterly report submission date: | | August 14, 2012 | | |

| Scheduled dividend payment start date: | | — | | |

Supplementary materials regarding quarterly business results: | | None |

Explanatory meeting regarding quarterly business results: | | None |

(Amounts less than 1 million yen have been rounded)

| 1. | First Quarter of the Fiscal Year Ending March 31, 2013 (April 1, 2012 – June 30, 2012) |

| (1) | Consolidated Business Results |

(% indicates increase (decrease) from the corresponding period of the previous fiscal year)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net Sales | | | Operating Income | | | Pre-tax Net Income1 | | | Net Income

Attributable to

Wacoal Holdings

Corp. | |

| | | Million Yen | | | % | | | Million Yen | | | % | | | Million Yen | | | % | | | Million Yen | | | % | |

First Quarter ended June 30, 2012 | | | 43,362 | | | | 1.1 | | | | 3,939 | | | | (2.8 | ) | | | 3,921 | | | | (12.3 | ) | | | 2,752 | | | | (1.3 | ) |

First Quarter ended June 30, 2011 | | | 42,890 | | | | 3.6 | | | | 4,051 | | | | 43.3 | | | | 4,470 | | | | 106.8 | | | | 2,787 | | | | 114.5 | |

| | | | |

| (Note) | | Quarterly comprehensive income: | | 1,442 million yen (decrease of 58.4%) for the first quarter ended June 30, 2012 |

| | | | 3,469 million yen (-%) for the first quarter ended June 30, 2011 |

| | | | | | | | |

| | | Net Income

Attributable to

Wacoal Holdings

Corp. Per Share | | | Diluted Net Earnings

Attributable to

Wacoal Holdings

Corp. Per Share | |

| | | Yen | | | Yen | |

First Quarter ended June 30, 2012 | | | 19.54 | | | | 19.51 | |

First Quarter ended June 30, 2011 | | | 19.79 | | | | 19.77 | |

| | |

| (Note) | | As described in “2. Matters Concerning Summaries (Other Information) (3) Summary of Changes in Accounting Principles” on page 5, retroactive adjustments have been made to the results for the first quarter ended June 30, 2012. |

| 1 | This item refers to “income before income taxes, equity in net income (loss) of affiliated companies, and net loss (income) attributable to noncontrolling interests” in the consolidated statements of income included in our annual report on Form 20-F for the fiscal year ended March 31, 2012. |

| (2) | Consolidated Financial Condition |

| | | | | | | | | | | | | | | | | | | | |

| | | Total Assets | | | Total Equity

(Net Assets) | | | Total

Shareholders’

Equity | | | Total

Shareholders’

Equity Ratio | | | Shareholders’

Equity Per Share | |

| | | Million Yen | | | Million Yen | | | Million Yen | | | % | | | Yen | |

As of June 30, 2012 | | | 231,483 | | | | 171,065 | | | | 168,909 | | | | 73.0 | | | | 1,199.23 | |

As of the end of Fiscal Year (March 31, 2012) | | | 221,098 | | | | 173,428 | | | | 171,496 | | | | 77.6 | | | | 1,217.57 | |

| | | | | | | | | | | | | | | | | | | | |

| | | Annual Dividend | |

| | | End of First

Quarter | | | End of Second

Quarter | | | End of Third

Quarter | | | Year-End | | | Total | |

| | | Yen | | | Yen | | | Yen | | | Yen | | | Yen | |

Fiscal Year Ended March 31, 2012 | | | — | | | | — | | | | — | | | | 28.00 | | | | 28.00 | |

Fiscal Year Ending March 31, 2013 | | | — | | | | | | | | | | | | | | | | | |

Fiscal Year Ending March 31, 2013 (Estimates) | | | | | | | — | | | | — | | | | 28.00 | | | | 28.00 | |

| | |

| (Note) | | Revision of estimated dividends announced during the latest quarter: No |

| 3. | Forecast of Consolidated Business Results for the Fiscal Year Ending March 31, 2013 (April 1, 2012 – March 31, 2013) |

(% indicates increase (decrease) from the previous fiscal year with respect to “Annual” and from the six-month period ended September 30, 2011 with respect to “Six-month Period Ending September 30, 2012”)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Net Sales | | | Operating

Income | | | Pre-tax Net

Income | | | Net Income

Attributable to

Wacoal Holdings

Corp. | | | Net Income

Attributable to

Wacoal Holdings

Corp. Per Share | |

| | | Million Yen | | | % | | | Million Yen | | | % | | | Million Yen | | | % | | | Million Yen | | | % | | | Yen | |

Six-month Period Ending September 30, 2012 | | | 92,500 | | | | 4.2 | | | | 7,500 | | | | (14.7 | ) | | | 7,700 | | | | (10.1 | ) | | | 4,500 | | | | (12.7 | ) | | | 31.95 | |

Annual | | | 185,000 | | | | 7.6 | | | | 11,500 | | | | 10.8 | | | | 12,000 | | | | 17.6 | | | | 7,600 | | | | 9.9 | | | | 53.96 | |

| | | | |

| (Note) | | Revision of forecast of consolidated business results announced during the latest quarter: No |

| (1) | Changes in significant subsidiaries in the first quarter of the current fiscal year (i.e., changes in specified subsidiaries (tokutei kogaisha) which involve change in scope of consolidation): None |

| (2) | Application of simplified accounting methods and specific accounting methods: None |

| (3) | Changes in accounting principles: |

| | (i) | Changes due to modifications in accounting standards, etc.: None |

| | (ii) | Changes other than (i) above: Yes |

(Note) For details, please see “2. Matters Concerning Summaries (Other Information) (3) Summary of Changes in Accounting Principles” on page 5.

| (4) | Number of Issued Shares (Common Stock) |

| | | | | | | | | | |

| | | | | First Quarter ended

June 30, 2012 | | | Fiscal Year ended

March 31, 2012 | |

| | | |

(i) | | Number of issued shares (including treasury stock) as of the end of: | | | 143,378,085 shares | | | | 143,378,085 shares | |

| | | |

(ii) | | Number of shares held as treasury stock as of the end of: | | | 2,530,021 shares | | | | 2,527,015 shares | |

| | | |

(iii) | | Average number of shares during consolidated first quarter: | | | 140,849,379 shares | | |

| 140,847,377 shares

(first quarter ended June 30, 2011 |

) |

*Notes on Implementation of Quarterly Review Procedures

This summary of quarterly financial results is not subject to the quarterly review procedures based on the Financial Instruments and Exchange Law. The review procedures for the quarterly financial statements based on the Financial Instruments and Exchange Law had not been completed at the time of disclosure of this summary of quarterly financial results.

*Cautionary Statement regarding Forecast of Business Results

The forecast of business results is based on information available as of the date this data were released and, due to various risks, uncertainties and other factors arising in the future, actual results in the future may differ largely from the estimates set out in this document.

These risks, uncertainties and other factors include: the impact of the ongoing global economic downturn on our sales and profitability in Japan and our other market; the impact on our business of anticipated continued weakness of department stores and other general retailers in Japan; our ability to successfully develop, manufacture, and market products in Japan and our other markets that meet the changing tastes and needs of consumers and to deliver high quality products; the highly competitive nature of our business and the strength of our competitors; our ability to successfully expand our network of our own specialty retail stores and achieve profitable operations at these stores; our ability to further develop our catalog and Internet sales capabilities; our ability to effectively manage our inventory levels; our ability to reduce costs; our ability to attract and retain highly qualified personnel; effects of irregular weather events on our business and performance; risks related to conducting our business internationally; risks from acquisitions and other strategic transactions with third parties; risks relating to return of investment for development of new markets; risks relating to intellectual property; risks relating to protection of customer information and our ability to protect our trade secrets; risks relating to internal controls over financial reporting; the impact of weakness in the Japanese equity markets on our holdings of Japanese equity securities; the impact of any natural disaster or epidemic on our business; and other risks referred to from time to time in Wacoal Holdings’ filings on Form 20-F of its annual report and other filings with the United States Securities and Exchange Commission.

Table of Contents for Attached Materials

- 1 -

| 1. | Qualitative Information Regarding Consolidated Performance during the First Quarter |

| (1) | Qualitative Information Regarding Consolidated Business Results |

| | (i) | Performance Overview of the First Quarter |

Our group (primarily Wacoal Corp., our core operating entity) entered the final year of our three-year mid-term plan and sought to improve profitability through market share expansion of and structural reform of our domestic innerwear business and made efforts to strengthen growth by actively developing our overseas business, mainly in China.

As a result of the above, with respect to our consolidated business results for the first quarter of the current fiscal year, overall sales increased as compared to the corresponding period of the previous fiscal year mainly due to the expansion of sales attributable to our Wacoal brand business and our businesses in the United States and China. Operating income decreased as compared to the corresponding period of the previous fiscal year due to the impact of the strategic investments made for to our Wacoal brand business, despite the improvement seen in the profitability of our overseas subsidiaries.

We have not reflected the results of Eveden Group Limited, an English company, which became our subsidiary in April 2012, in our consolidated business results for the first quarter of the current fiscal year, but its results will be reflected in our consolidated business results starting with the second quarter of the current fiscal year.

| | |

Net sales: | | 43,362 million yen (an increase of 1.1% as compared to the corresponding period of the previous fiscal year) |

| |

Operating income: | | 3,939 million yen (a decrease of 2.8% as compared to the corresponding period of the previous fiscal year) |

| |

Pre-tax net income:2 | | 3,921 million yen (a decrease of 12.3% as compared to the corresponding period of the previous fiscal year) |

| |

| Net income attributable to Wacoal Holdings Corp.: | | 2,752 million yen (a decrease of 1.3% as compared to the corresponding period of the previous fiscal year) |

| | (ii) | Business Overview of Our Operating Segments |

| | a. | Wacoal Business (Domestic) |

In our Wacoal brand business, sales of core brassieres and bottom products showed strong performance due to our success in appealing to consumers through our product lineup and promotional activities based on our announcement entitled “body aging (physiological changes associated with aging)”. However, this was partially offset by sales of our seasonal undergarments, which showed poor performance despite the strong performance of our core products using natural materials due to the impact of poor performance of other products and unsteady weather conditions. As a result of the above, overall sales of our Wacoal brand business exceeded the results for the corresponding period of the previous fiscal year.

In our Wing brand business, sales of in-store performance were weak. With respect to brassieres, sales of certain of our campaign products showed poor performance. Sales of undergarments and men’s innerwear were impacted by the intensifying competition among merchandisers’ private-label brand products and the products sold by our competitors as well as the unsteady weather conditions. Although in-store performance was weak, overall sales of our Wing brand business exceeded the results for the corresponding period of the previous fiscal year due to the addition of new products associated with the brand restructuring based on “body aging” and the promotion of product development in collaboration with our major clients.

| 2 | This item refers to “income before income taxes, equity in net income (loss) of affiliated companies, and net loss (income) attributable to noncontrolling interests” in the consolidated statements of income included in our annual report on Form 20-F for the fiscal year ended March 31, 2012. |

- 2 -

In our retail business, sales at our direct retail store AMPHI expanded as a result of the strong performance of our existing shops due to improved brand recognition and the opening of new stores. Sales from our Wacoal Factory Stores also showed steady performance. As a result, overall sales of our retail business exceeded the results for the corresponding period of the previous fiscal year.

In our wellness business, sales of sports tights from our sports conditioning wear “CW-X” brand fell below the results for the corresponding period of the previous fiscal year due to the declining impact of certain TV infomercials that introduced the brand and contributed to its sales expansion during the previous fiscal year, while the sales of our functionality-focused business pumps showed steady performance. As a result, overall sales from our wellness business exceeded the results for the corresponding period of the previous fiscal year.

In our catalog sales business, overall sales exceeded the results for the corresponding period of the previous fiscal year due to the steady performance of catalog sales and the expansion of internet sales.

In sum, overall sales of Wacoal Corp. exceeded the results for the corresponding period of the previous fiscal year due to the strong performance of our core operating businesses. Our operating income fell below the results for the corresponding period of the previous fiscal year due to the impact of strategic investments intended to strengthen the development of sales space and promotional activities

| | |

Net sales: | | 29,508 million yen (an increase of 3.3% as compared to the corresponding period of the previous fiscal year) |

| |

Operating income: | | 2,536 million yen (a decrease of 10.0% as compared to the corresponding period of the previous fiscal year) |

| | b. | Wacoal Business (Overseas) |

In our overseas operations, we made aggressive efforts in expanding our U.S. market share and enhancing our product lineup mainly at department stores, which are our major clients, as well as in expanding our sales areas and channels. Sales exceeded the results for the corresponding period of the previous fiscal year as a result of extended sales of our reasonably-priced brassieres which continued to show strong performance since the previous fiscal year and the strong performance of our internet sales. With respect to profit, in addition to an increase in net sales, operating income exceeded the results for the corresponding period of the previous fiscal year due to an improvement in our sales-to-profit ratio that resulted from our cost reduction efforts. The exchange rate in the first quarter of the current fiscal year was 79 yen per dollar (compared to 81 yen per dollar for the corresponding period of the previous fiscal year).

With respect to our business in China, sales exceeded the results for the corresponding period of the previous fiscal year due to our successful efforts in strengthening our product lineup, improving the retention rates of in-store sales representatives and opening of new stores mainly in inner mainland China. With respect to profit, operating income exceeded the results for the corresponding period of the previous fiscal year due to the lower ratio of selling, general and administrative expenses to our sales. The exchange rate in the first quarter of the current fiscal year was 13 yen per Chinese yuan (compared to 13 yen per Chinese yuan for the corresponding period of the previous fiscal year).

| | |

Net sales: | | 6,254 million yen (an increase of 6.9% as compared to corresponding period of the previous fiscal year) |

| |

Operating income: | | 916 million yen (an increase of 26.9% as compared to the corresponding period of the previous fiscal year) |

With respect to Peach John Co., Ltd. (“Peach John”), although sales of innerwear showed strong performance, sales from our core mail-order catalogues fell below the results for the corresponding period of the previous fiscal year as a result of poor performance of the outerwear and general merchandise. Net sales from our direct retail stores exceeded the results for the corresponding period of the previous fiscal year as a result of the strong performance of our existing shops due to an improvement in selection of goods. With respect to our directly-managed overseas stores, although an underperforming store was wound up, sales from China exceeded the results for the corresponding period of the previous fiscal year due to the opening of new stores, while our directly-managed stores in Hong Kong showed weak performance.

- 3 -

As a result of the above, the results from our Peach John business fell below the results for the corresponding period of the previous fiscal year. With respect to profit, despite an improvement in profit as a result of a lower cost-to-sales ratio, our Peach John business was less profitable than it was for the corresponding period of the previous fiscal year due to the reduced sales.

| | |

Net sales: | | 3,158 million yen (a decrease of 7.1% as compared to the corresponding period of the previous fiscal year) |

| |

Operating income: | | 176 million yen (a decrease of 39.1% as compared to the corresponding period of the previous fiscal year) |

With respect to the business of Lecien Corporation (“Lecien”), sales from our core innerwear products exceeded the results for the corresponding period of the previous fiscal year due to the increased number of products supplied to our group companies and the strong performance of products offered to our major clients. Conversely, as a result of the termination of the unprofitable products at our apparel business, which offers outerwear products, overall sales from Lecien fell below the results for the corresponding period of the previous fiscal year. In terms of profit, operating income exceeded the results for the corresponding period of the previous fiscal year due to our successful efforts in the improvement of profitability from our apparel business and cost reduction.

As for Nanasai Co., Ltd. (“Nanasai”), which engages in the manufacturing, sales and rental business of mannequins and interior design and construction of stores at commercial facilities, net sales were below the results for the corresponding period of the previous fiscal year despite good performance of sales business. This was due to the poor performance of rental business due to the restrained investments by our business partners and the closing down of department stores. With respect to profit, we were less profitable than it was for the corresponding period of the previous fiscal year in connection with a decrease in sales, despite our efforts to achieve efficiency by lowering costs and cutting expenses.

| | |

Net sales: | | 4,442 million yen (a decrease of 12.8% as compared to the corresponding period of the previous fiscal year) |

| |

Operating income: | | 311 million yen (an increase of 40.1% as compared to the corresponding period of the previous fiscal year) |

| (2) | Qualitative Information regarding Consolidated Financial Condition |

Assets, liabilities and total shareholders’ equity as of the end of the current consolidated first quarter reflect the addition of Eveden Group Limited, an English company, which became our subsidiary in April 2012. On the other hand, the cash flow for the current consolidated first quarter does not reflect the results of Eveden Group Limited, which will be reflected in our consolidated results starting with the consolidated second quarter of the current fiscal year.

| | (i) | Assets, Liabilities and Total Shareholders’ Equity |

Our total assets as of the end of the current consolidated first quarter were 231,483 million yen, an increase of 10,385 million yen from the end of the previous fiscal year, due to an increase in goodwill as a result of the acquisition of Eveden Group Limited.

Our total liabilities were 60,418 million yen, an increase of 12,748 million yen from the end of the previous fiscal year, due to an increase in short-term bank loans, despite a decrease in other payables, a decrease in accrued bonuses as a result of the payment of summer bonuses and a decrease in income taxes payable as a result of payment of income taxes.

Total Wacoal Holdings Corp. shareholders’ equity was 168,909 million yen, a decrease of 2,587 million yen from the end of the previous fiscal year, due to the cash dividend payments and the changes in unrealized gain/loss on securities.

As a result of the above, our total shareholders’ equity ratio as of the end of the current consolidated first quarter was 73.0%, a decrease of 4.6% from the end of the previous fiscal year.

- 4 -

Cash and cash equivalents as of the end of the consolidated first quarter of the current fiscal year were 20,293 million yen, a decrease of 9,692 million yen from the end of the previous fiscal year.

(Cash Provided by Operating Activities)

Cash flow provided by operating activities was 2,465 million yen, an increase of 1,771 million yen as compared to the corresponding period of the previous fiscal year, after adjustments of changes in assets and liabilities to our net income of 2,813 million yen plus the adjustments of depreciation expenses and deferred taxes.

(Cash Used in Investment Activities)

Cash flow used in investment activities was 17,956 million yen, an increase of 17,538 million yen as compared to the corresponding period of the previous fiscal year, due to the acquisition of a new subsidiary and other factors, despite proceeds from the sale and redemption of marketable securities.

(Cash Provided by Financing Activities)

Cash flow provided by financing activities was 5,939 million yen, an increase of 6,992 million yen as compared to the corresponding period of the previous fiscal year, due to an increase in short-term bank loans and other factors, despite the cash dividend payments.

| (3) | Qualitative Information regarding Forecast of Consolidated Business Results |

We have not revised our forecast of consolidated business results for the consolidated second quarter and the fiscal year ending March 31, 2013 since our announcement on May 15, 2012.

In our domestic business, we will make efforts to expand our share in the domestic innerwear market by developing products based on the key concept of “body aging” and strengthening high volume products. We will also make aggressive efforts to expand our retail business, wellness business and online business, which we believe have further growth potential, and will work on rebuilding supply chain management which can exercise the resources of our group (including our subsidiaries), as a whole.

In our overseas business, we will make efforts to further enhance our product lineup, mainly in the United States and China, and will continue to work on expanding sales and improving profitability, while responding to changes in the business environment. In addition, we will make efforts to strengthen our operating base and expand sales in the European markets by utilizing the resources of Eveden Group Limited, an English company, which became our subsidiary in April 2012.

| 2. | Matters Concerning Summaries (Other Information) |

| (1) | Summary of Changes in Significant Subsidiaries during the Current Consolidated Quarter: |

On April 10, 2012, Eveden Group Limited became our wholly-owned subsidiary, through our acquisition of all of the outstanding shares of Eveden Group Limited.

| (2) | Application of Simplified Accounting Methods and Specific Accounting Methods: |

Not applicable.

| (3) | Summary of Changes in Accounting Principles: |

(Change in the Fiscal Year End of Certain Subsidiaries)

During the previous consolidated fiscal year (fiscal 2012), the fiscal year ends of certain consolidated subsidiaries were changed from December and February to March to be consistent with our fiscal year end. In connection with this change, we made retroactive adjustments to the consolidated income statement, consolidated comprehensive income statement, consolidated cash flow statement, segment information, and status of sales, in order to reflect the change of fiscal year end at those consolidated subsidiaries.

- 5 -

| 3. | Consolidated Financial Statements |

| (1) | Consolidated Balance Sheets |

| | | | | | | | | | | | | | |

Accounts | | Previous Fiscal Year

as of March 31, 2012 | | | Current Consolidated

First Quarter

as of June 30, 2012 | | | Increase/(Decrease) | |

| | | | | Million Yen | | | Million Yen | | | Million Yen | |

| (Assets) | | | | | | | | | | | | |

I. | | Current assets: | | | | | | | | | | | | |

| | Cash and cash equivalents | | | 29,985 | | | | 20,293 | | | | (9,692 | ) |

| | Time deposits | | | 733 | | | | 440 | | | | (293 | ) |

| | Marketable securities | | | 5,179 | | | | 4,942 | | | | (237 | ) |

| | Trade accounts | | | 22,725 | | | | 24,745 | | | | 2,020 | |

| | Allowance for returns and doubtful receivables | | | (1,460 | ) | | | (2,070 | ) | | | (610 | ) |

| | Inventories | | | 32,847 | | | | 35,909 | | | | 3,062 | |

| | Deferred income taxes | | | 4,234 | | | | 3,859 | | | | (375 | ) |

| | Other current assets | | | 3,052 | | | | 4,520 | | | | 1,468 | |

| | | | | | | | | | | | | | |

| | Total current assets | | | 97,295 | | | | 92,638 | | | | (4,657 | ) |

| | | | |

II. | | Property, plant and equipment: | | | | | | | | | | | | |

| | | | |

| | Land | | | 21,783 | | | | 21,858 | | | | 75 | |

| | Buildings and building improvements | | | 60,077 | | | | 60,514 | | | | 437 | |

| | Machinery and equipment | | | 14,039 | | | | 14,236 | | | | 197 | |

| | Construction in progress | | | 22 | | | | 21 | | | | (1 | ) |

| | | | | 95,921 | | | | 96,629 | | | | 708 | |

| | Accumulated depreciation | | | (46,843 | ) | | | (47,217 | ) | | | (374 | ) |

| | | | | | | | | | | | | | |

| | Net property, plant and equipment | | | 49,078 | | | | 49,412 | | | | 334 | |

| | | | |

III. | | Other assets: | | | | | | | | | | | | |

| | | | |

| | Investments in affiliated companies | | | 14,599 | | | | 15,220 | | | | 621 | |

| | Investments | | | 34,064 | | | | 32,451 | | | | (1,613 | ) |

| | Goodwill | | | 10,367 | | | | 20,766 | | | | 10,399 | |

| | Other intangible assets | | | 9,541 | | | | 14,700 | | | | 5,159 | |

| | Deferred income taxes | | | 597 | | | | 669 | | | | 72 | |

| | Other | | | 5,557 | | | | 5,627 | | | | 70 | |

| | | | | | | | | | | | | | |

| | Total other assets | | | 74,725 | | | | 89,433 | | | | 14,708 | |

| | | | | | | | | | | | | | |

| | Total assets | | | 221,098 | | | | 231,483 | | | | 10,385 | |

| | | | | | | | | | | | | | |

- 6 -

| | | | | | | | | | | | | | |

Accounts | | Previous Fiscal Year

as of March 31, 2012 | | | Current Consolidated

First Quarter

as of June 30, 2012 | | | Increase/(Decrease) | |

| | | | | Million Yen | | | Million Yen | | | Million Yen | |

(Liabilities) | | | | | | | | | | | | |

I. | | Current liabilities: | | | | | | | | | | | | |

| | Short-term bank loans | | | 5,780 | | | | 18,057 | | | | 12,277 | |

| | Notes and accounts payables: | | | | | | | | | | | | |

| | Trade notes | | | 1,429 | | | | 1,556 | | | | 127 | |

| | Trade accounts | | | 10,737 | | | | 11,424 | | | | 687 | |

| | Other payables | | | 6,948 | | | | 4,869 | | | | (2,079 | ) |

| | | | | 19,114 | | | | 17,849 | | | | (1,265 | ) |

| | Accrued payroll and bonuses | | | 6,411 | | | | 5,088 | | | | (1,323 | ) |

| | Income taxes payable | | | 1,747 | | | | 1,122 | | | | (625 | ) |

| | Other current liabilities | | | 2,555 | | | | 5,558 | | | | 3,003 | |

| | | | | | | | | | | | | | |

| | Total current liabilities | | | 35,607 | | | | 47,674 | | | | 12,067 | |

| | | | |

II. | | Long-term liabilities: | | | | | | | | | | | | |

| | Liability for termination and retirement benefits | | | 2,817 | | | | 2,428 | | | | (389 | ) |

| | Deferred income taxes | | | 7,085 | | | | 7,794 | | | | 709 | |

| | Other long-term liabilities | | | 2,161 | | | | 2,522 | | | | 361 | |

| | | | | | | | | | | | | | |

| | Total long-term liabilities | | | 12,063 | | | | 12,744 | | | | 681 | |

| | | | | | | | | | | | | | |

| | Total liabilities | | | 47,670 | | | | 60,418 | | | | 12,748 | |

| | | | |

| | (Equity) | | | | | | | | | | | | |

| | | | |

I. | | Common stock | | | 13,260 | | | | 13,260 | | | | — | |

II. | | Additional paid-in capital | | | 29,447 | | | | 29,457 | | | | 10 | |

III. | | Retained earnings | | | 141,370 | | | | 140,178 | | | | (1,192 | ) |

IV. | | Accumulated other comprehensive income (loss): | | | | | | | | | | | | |

| | Foreign currency translation adjustment | | | (10,916 | ) | | | (10,839 | ) | | | 77 | |

| | Unrealized gain (loss) on securities | | | 4,197 | | | | 2,606 | | | | (1,591 | ) |

| | Pension liability adjustment | | | (2,976 | ) | | | (2,864 | ) | | | 112 | |

V. | | Treasury stock | | | (2,886 | ) | | | (2,889 | ) | | | (3 | ) |

| | | | | | | | | | | | | | |

| | Total Wacoal Holdings Corp. shareholders’ equity | | | 171,496 | | | | 168,909 | | | | (2,587 | ) |

VI. | | Noncontrolling interests | | | 1,932 | | | | 2,156 | | | | 224 | |

| | | | | | | | | | | | | | |

| | Total equity | | | 173,428 | | | | 171,065 | | | | (2,363 | ) |

| | | | | | | | | | | | | | |

| | Total liabilities and equity | | | 221,098 | | | | 231,483 | | | | 10,385 | |

| | | | | | | | | | | | | | |

- 7 -

| (2) | Consolidated Quarterly Income Statement |

| | | | | | | | | | | | | | | | | | | | | | |

Accounts | | Previous Consolidated

First Quarter

(From April 1, 2011

to June 30, 2011) | | | Current Consolidated

First Quarter

(April 1, 2012

to June 30, 2012) | | | Increase/

(Decrease) | |

| | | | | Million Yen | | | % | | | Million Yen | | | % | | | Million Yen | |

I. | | Net Sales | | | 42,890 | | | | 100.0 | | | | 43,362 | | | | 100.0 | | | | 472 | |

II. | | Operating costs and expenses | | | | | | | | | | | | | | | | | | | | |

| | Cost of sales | | | 19,890 | | | | 46.4 | | | | 19,881 | | | | 45.8 | | | | (9 | ) |

| | Selling, general and administrative expenses | | | 18,949 | | | | 44.2 | | | | 19,542 | | | | 45.1 | | | | 593 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Total operating expenses | | | 38,839 | | | | 90.6 | | | | 39,423 | | | | 90.9 | | | | 584 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Operating income | | | 4,051 | | | | 9.4 | | | | 3,939 | | | | 9.1 | | | | (112 | ) |

III. | | Other income (expenses): | | | | | | | | | | | | | | | | | | | | |

| | Interest income | | | 26 | | | | | | | | 46 | | | | | | | | 20 | |

| | Interest expense | | | (22 | ) | | | | | | | (32 | ) | | | | | | | (10 | ) |

| | Dividend income | | | 426 | | | | | | | | 399 | | | | | | | | (27 | ) |

| | Gain (loss) on sale or exchange of marketable securities and investments | | | 40 | | | | | | | | (9 | ) | | | | | | | (49 | ) |

| | Valuation loss on investment in marketable securities and/or investment securities | | | (50 | ) | | | | | | | (64 | ) | | | | | | | (14 | ) |

| | Other profit and (loss), net | | | (1 | ) | | | | | | | (358 | ) | | | | | | | (357 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| | Total other income (expenses) | | | 419 | | | | 1.0 | | | | (18 | ) | | | (0.1 | ) | | | (437 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| | Pre-tax net income | | | 4,470 | | | | 10.4 | | | | 3,921 | | | | 9.0 | | | | (549 | ) |

| | Income taxes | | | 2,034 | | | | 4.7 | | | | 1,749 | | | | 4.0 | | | | (285 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| | Equity in net income of affiliated companies and net income before profit (loss) attributable to noncontrolling interests | | | 2,436 | | | | 5.7 | | | | 2,172 | | | | 5.0 | | | | (264 | ) |

| | Equity in net income of affiliated companies | | | 395 | | | | 0.9 | | | | 641 | | | | 1.5 | | | | 246 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | Net income | | | 2,831 | | | | 6.6 | | | | 2,813 | | | | 6.5 | | | | (18 | ) |

| | Profit and (loss) attributable to noncontrolling interests | | | (44 | ) | | | (0.1 | ) | | | (61 | ) | | | (0.2 | ) | | | (17 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| | Net income attributable to Wacoal Holdings Corp. | | | 2,787 | | | | 6.5 | | | | 2,752 | | | | 6.3 | | | | (35 | ) |

| | | | | | | | | | | | | | | | | | | | | | |

| (3) | Consolidated Quarterly Comprehensive Income Statement |

| | | | | | | | | | | | | | |

Accounts | | Previous Consolidated

First Quarter

(From April 1, 2011

to June 30, 2011) | | | Current Consolidated

First Quarter

(April 1, 2012

to June 30, 2012) | | | Increase/

(Decrease) | |

| | | | | Million Yen | | | Million Yen | | | Million Yen | |

I. | | Net income | | | 2,831 | | | | 2,813 | | | | (18 | ) |

| | | | | | | | | | | | | | |

II. | | Other comprehensive profit (loss) - after adjustment of tax effect: | | | | | | | | | | | | |

| | Foreign currency exchange adjustment | | | 265 | | | | 110 | | | | (155 | ) |

| | Net unrealized gain (loss) on securities | | | 297 | | | | (1,593 | ) | | | (1,890 | ) |

| | Pension liability adjustment | | | 76 | | | | 112 | | | | 36 | |

| | | | | | | | | | | | | | |

| | Total other comprehensive profit (loss) | | | 638 | | | | (1,371 | ) | | | (2,009 | ) |

| | | | | | | | | | | | | | |

| | Comprehensive profit (loss) | | | 3,469 | | | | 1,442 | | | | (2,027 | ) |

| | Comprehensive profit (loss) attributable to non-controlling interests | | | (51 | ) | | | (92 | ) | | | (41 | ) |

| | | | | | | | | | | | | | |

| | Comprehensive profit (loss) attributable to Wacoal Holdings Corp. | | | 3,418 | | | | 1,350 | | | | (2,068 | ) |

| | | | | | | | | | | | | | |

- 8 -

| (4) | Consolidated Cash Flow Statements |

| | | | | | | | | | | | | | |

Accounts | | Previous Consolidated First Quarter

(April 1, 2011 to June 30, 2011) | | | Current Consolidated First Quarter

(April 1, 2012 to June 30, 2012) | |

| | | | | | | | | Million Yen | | | Million Yen | |

I. | | | | | | Operating activities | | | | | | | | |

| | 1. | | | | Net income | | | 2,831 | | | | 2,813 | |

| | 2. | | | | Adjustments of net income to cash flow from operating activities | | | | | | | | |

| | | | (1) | | Depreciation and amortization | | | 1,152 | | | | 1,082 | |

| | | | (2) | | Allowance for returns and doubtful receivables | | | 460 | | | | 548 | |

| | | | (3) | | Deferred taxes | | | 1,178 | | | | 519 | |

| | | | (4) | | Gain (loss) on sale of fixed assets | | | 32 | | | | 6 | |

| | | | (5) | | Gain (loss) on sale and exchange of marketable securities and investment securities | | | (40 | ) | | | 9 | |

| | | | (6) | | Valuation loss on investment in marketable securities and investment securities | | | 50 | | | | 64 | |

| | | | (7) | | Equity in net income of affiliated companies (after dividend income) | | | (149 | ) | | | (120 | ) |

| | | | (8) | | Changes in assets and liabilities | | | | | | | | |

| | | | | | Increase in receivables | | | (1,839 | ) | | | (14 | ) |

| | | | | | Decrease in inventories | | | 170 | | | | 140 | |

| | | | | | Increase in other current assets | | | (969 | ) | | | (950 | ) |

| | | | | | Decrease in payables and accounts payable | | | (1,373 | ) | | | (1,945 | ) |

| | | | | | Decrease in reserves for retirement benefits | | | (192 | ) | | | (265 | ) |

| | | | | | Increase (decrease) in other liabilities | | | (738 | ) | | | 30 | |

| | | | (9) | | Other | | | 121 | | | | 548 | |

| | | | | | | | | | | | | | |

| | | | | | Net cash flow from (used in) operating activities | | | 694 | | | | 2,465 | |

| | | | | |

II. | | | | | | Investing activities | | | | | | | | |

| | 1. | | | | Increase in time deposits | | | (518 | ) | | | (120 | ) |

| | 2. | | | | Decrease in time deposits | | | 893 | | | | 413 | |

| | 3. | | | | Proceeds from sales and redemption of marketable securities | | | 700 | | | | 281 | |

| | 4. | | | | Acquisition of marketable securities | | | (780 | ) | | | (158 | ) |

| | 5. | | | | Proceeds from sales of fixed assets | | | 14 | | | | 15 | |

| | 6. | | | | Acquisition of tangible fixed assets | | | (586 | ) | | | (323 | ) |

| | 7. | | | | Acquisition of intangible fixed assets | | | (123 | ) | | | (184 | ) |

| | 8. | | | | Proceeds from sales of investments | | | — | | | | 82 | |

| | 9. | | | | Acquisition of investments | | | (88 | ) | | | (1,058 | ) |

| | 10. | | | | Acquisition of new subsidiary (net acquisition amount in cash) | | | — | | | | (16,906 | ) |

| | 11. | | | | Other | | | 70 | | | | 2 | |

| | | | | | | | | | | | | | |

| | | | | | Net cash flow provided by (used in) investing activities | | | (418 | ) | | | (17,956 | ) |

| | | | | |

III. | | | | | | Financing activities | | | | | | | | |

| | 1. | | | | Net increase in short-term bank loans | | | 1,824 | | | | 12,063 | |

| | 2. | | | | Financing from long-term debt | | | — | | | | 500 | |

| | 3. | | | | Repayment of long-term debt | | | (18 | ) | | | (2,608 | ) |

| | 4. | | | | Acquisition of treasury stock | | | (4 | ) | | | (3 | ) |

| | 5. | | | | Sale of treasury stock | | | 0 | | | | 0 | |

| | 6. | | | | Dividends paid in cash to Wacoal Holdings Corp. | | | (2,817 | ) | | | (3,944 | ) |

| | 7. | | | | Dividends paid in cash to the non-controlling interests | | | (45 | ) | | | (69 | ) |

| | 8. | | | | Other | | | 7 | | | | — | |

| | | | | | | | | | | | | | |

| | | | | | Net cash flow provided by (used in) financing activities | | | (1,053 | ) | | | 5,939 | |

| | | | | | | | | | | | | | |

IV. | | | | | | Effect of exchange rate on cash and cash equivalents | | | (70 | ) | | | (140 | ) |

| | | | | | | | | | | | | | |

V. | | | | | | Decrease in cash and cash equivalents | | | (847 | ) | | | (9,692 | ) |

VI. | | | | | | Initial balance of cash and cash equivalents | | | 26,316 | | | | 29,985 | |

| | | | | | | | | | | | | | |

VII. | | | | | | Period end balance of cash and cash equivalents | | | 25,469 | | | | 20,293 | |

| | | | | | | | | | | | | | |

|

| Additional Information | |

| | | | | |

| | | | | | Cash paid for: | | | | | | | | |

| | | | | | Interest | | | 19 | | | | 30 | |

| | | | | | Income taxes, etc. | | | 2,354 | | | | 2,168 | |

| | | | | | Investment activities without cash disbursement: | | | | | | | | |

| | | | | | Acquisition amount of investment securities through stock swap | | | 126 | | | | — | |

| | | | | | Acquisition cost of fixed assets | | | — | | | | 313 | |

- 9 -

| (5) | Notes on Going Concern |

Not applicable.

| (i) | Operating Segment Information |

Previous Consolidated First Quarter (From April 1, 2011 to June 30, 2011)

(Unit: Million Yen)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Wacoal business

(Domestic) | | | Wacoal

business

(Overseas) | | | Peach John

business | | | Other | | | Total | | | Elimination

or corporate | | | Consolidated | |

Net sales | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) Net sales to outside customers | | | 28,552 | | | | 5,848 | | | | 3,398 | | | | 5,092 | | | | 42,890 | | | | — | | | | 42,890 | |

(2) Internal sales or transfers among segments | | | 797 | | | | 1,495 | | | | 48 | | | | 1,238 | | | | 3,578 | | | | (3,578 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 29,349 | | | | 7,343 | | | | 3,446 | | | | 6,330 | | | | 46,468 | | | | (3,578 | ) | | | 42,890 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income | | | 2,818 | | | | 722 | | | | 289 | | | | 222 | | | | 4,051 | | | | — | | | | 4,051 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Current Consolidated First Quarter (From April 1, 2012 to June 30, 2012)

(Unit: Million Yen)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Wacoal business

(Domestic) | | | Wacoal

business

(Overseas) | | | Peach John

business | | | Other | | | Total | | | Elimination

or corporate | | | Consolidated | |

Net sales | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) Net sales to outside customers | | | 29,508 | | | | 6,254 | | | | 3,158 | | | | 4,442 | | | | 43,362 | | | | — | | | | 43,362 | |

(2) Internal sales or transfers among segments | | | 549 | | | | 1,840 | | | | 53 | | | | 1,392 | | | | 3,834 | | | | (3,834 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 30,057 | | | | 8,094 | | | | 3,211 | | | | 5,834 | | | | 47,196 | | | | (3,834 | ) | | | 43,362 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income | | | 2,536 | | | | 916 | | | | 176 | | | | 311 | | | | 3,939 | | | | — | | | | 3,939 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| (Note) | | 1. | | Core products of respective businesses: |

| | | | Wacoal business (Domestic): | | innerwear (foundation, lingerie, nightwear and children’s innerwear), outerwear, sportswear, hosiery, etc. |

| | | | Wacoal business (Overseas): | | innerwear (foundation, lingerie, nightwear and children’s innerwear), outerwear, sportswear, hosiery, etc. |

| | | | Peach John business: | | innerwear (foundation, lingerie, nightwear and children’s innerwear), outerwear, and other textile-related products, etc. |

| | | | Other: | | innerwear (foundation, lingerie, nightwear and children’s innerwear), outerwear, sportswear, other textile-related products, mannequins, shop design and implementation, etc. |

| | 2. | | Asset-related information by operating segment: |

| | | | During the current consolidated first quarter, the amount of asset in “Other” segment increased 23,558 million yen from the amount of such assets as of the end of the previous fiscal year, as a result of making Eveden Group Limited and its subsidiary our wholly-owned subsidiaries. Accordingly, the amount of asset in “Other” segment as of the end of the current consolidated first quarter was 44,124 million yen. |

- 10 -

| (ii) | Segment Information by Region |

Previous Consolidated First Quarter (From April 1, 2011 to June 30, 2011)

(Unit: Million Yen)

| | | | | | | | | | | | | | | | |

| | | Japan | | | Asia | | | Europe/N.A. | | | Consolidated | |

Net sales to outside customers | | | 36,855 | | | | 2,737 | | | | 3,298 | | | | 42,890 | |

Distribution ratio | | | 85.9 | % | | | 6.4 | % | | | 7.7 | % | | | 100.0 | % |

| | | | | | | | | | | | | | | | |

Operating income | | | 3,389 | | | | 179 | | | | 483 | | | | 4,051 | |

| | | | | | | | | | | | | | | | |

Current Consolidated First Quarter (From April 1, 2012 to June 30, 2012)

(Unit: Million Yen)

| | | | | | | | | | | | | | | | |

| | | Japan | | | Asia | | | Europe/N.A. | | | Consolidated | |

Net sales to outside customers | | | 36,902 | | | | 3,052 | | | | 3,408 | | | | 43,362 | |

Distribution ratio | | | 85.1 | % | | | 7.0 | % | | | 7.9 | % | | | 100.0 | % |

| | | | | | | | | | | | | | | | |

Operating income | | | 3,077 | | | | 309 | | | | 553 | | | | 3,939 | |

| | | | | | | | | | | | | | | | |

| | | | |

(Note) | | 1. | | Countries or areas are classified according to geographical proximity. |

| | 2. | | Major countries and areas included in the respective segments other than Japan: |

| | | | Asia: various countries of East Asia and Southeast Asia |

| | | | Europe/N.A.: North America and European countries |

| | 3. | | Sales are classified according to the locations of the consolidated companies. |

| (7) | Notes on Significant Changes in the Amount of Total Shareholders’ Equity |

Not applicable.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Type of product | | Previous First Quarter

(April 1, 2011 to

June 30, 2011) | | | Current First Quarter

(April 1, 2012 to

June 30, 2012) | | | Increase/(Decrease) | |

| | Amount | | | Distribution Ratio | | | Amount | | | Distribution Ratio | | | Amount | | | Distribution Ratio | |

| | | | | Million Yen | | | % | | | Million Yen | | | % | | | Million Yen | | | % | |

Innerwear | | Foundation and lingerie | | | 30,579 | | | | 71.3 | | | | 31,814 | | | | 73.4 | | | | 1,235 | | | | 4.0 | |

| | Nightwear | | | 2,488 | | | | 5.8 | | | | 2,647 | | | | 6.1 | | | | 159 | | | | 6.4 | |

| | Children’s underwear | | | 480 | | | | 1.1 | | | | 495 | | | | 1.1 | | | | 15 | | | | 3.1 | |

| | Subtotal | | | 33,547 | | | | 78.2 | | | | 34,956 | | | | 80.6 | | | | 1,409 | | | | 4.2 | |

Outerwear/Sportswear | | | 4,221 | | | | 9.9 | | | | 3,749 | | | | 8.7 | | | | (472 | ) | | | (11.2 | ) |

Hosiery | | | 511 | | | | 1.2 | | | | 444 | | | | 1.0 | | | | (67 | ) | | | (13.1 | ) |

Other textile goods and related

products | | | 2,162 | | | | 5.0 | | | | 1,926 | | | | 4.4 | | | | (236 | ) | | | (10.9 | ) |

Other | | | 2,449 | | | | 5.7 | | | | 2,287 | | | | 5.3 | | | | (162 | ) | | | (6.6 | ) |

| | Total | | | 42,890 | | | | 100.0 | | | | 43,362 | | | | 100.0 | | | | 472 | | | | 1.1 | |

- 11 -

[Exhibit 2]

[English Translation]

July 31, 2012

To Whom It May Concern:

| | | | |

| | WACOAL HOLDINGS CORP. |

| | Yoshikata Tsukamoto

President and Representative Director |

| | (Code Number: 3591) |

| | (Tokyo Stock Exchange, First Section) |

| | (Osaka Securities Exchange, First Section) |

| | For Inquiries: Ikuo Otani Senior Managing Director and

General Manager of Corporate Planning (Telephone: 075-682-1010) |

| |

| |

Announcement Regarding Stock Option Grants (Stock Acquisition Rights)

We hereby announce that our board of directors (the “Board”) resolved at a meeting held on July 31, 2012 to issue and offer stock options in the form of stock acquisition rights as follows:

Details

| I. | Reason for Granting Stock Acquisition Rights |

We will issue stock acquisition rights to our directors (excluding outside directors) and the directors of Wacoal Corporation, our subsidiary, so that the directors can share in the potential benefit of an increase in stock value as well as bear the risk of a decline in stock value as a further incentive to improve our stock price and corporate value.

| II. | Terms and Conditions of the Stock Acquisition Rights (Eligible Recipients: our directors, excluding outside directors) |

| | 1. | Name of the Stock Acquisition Rights: Wacoal Holdings Corp. Ninth Stock Acquisition Rights |

| | 2. | Total Number of Stock Acquisition Rights: 53 |

The total number of stock acquisition rights above is the expected number to be granted. If the number of stock acquisition rights to be granted turns out to be less than the number shown above because of a shortage of applications or other circumstances, the number of stock acquisition rights issued will be the actual number of stock acquisition rights to be granted.

| | 3. | Class and Number of Shares to be Issued upon the Exercise of the Stock Acquisition Rights |

The class of shares to be issued upon the exercise of the stock acquisition rights will be our common stock, and the number of shares to be issued for each stock acquisition right (the “Conversion Ratio”) will be 1,000.

In the event that we conduct a stock split (including the gratis allocation of shares of our common stock; hereinafter the same) or a reverse split of its common stock, the Conversion Ratio will be adjusted in accordance with the following formula:

1

| | | | | | | | | | |

Adjusted Conversion

Ratio | | = | | Conversion Ratio prior to adjustment | | X | | Ratio of stock split or

reverse stock split | | |

This adjustment will apply from the day following the record date in the case of a stock split and from the day on which the reverse stock split becomes effective in the case of a reverse stock split. However, in the event that we conduct a stock split that is conditioned on approval at a general meeting of our shareholders of an increase in stockholders’ equity or additional paid-in capital by decreasing the amount of surplus, and provided that the record date for such stock split is set prior to the conclusion of such general meeting of shareholders, from the day following the conclusion of such general meeting of shareholders the adjustment will apply retroactively from the day following the record date.

In addition to the above, the Conversion Ratio shall be reasonably adjusted as may be required in unavoidable circumstances.

Any fractional shares which result from the above adjustment will be rounded down to the nearest whole share.

Furthermore, in the case of any adjustment of the Conversion Ratio, we shall make any necessary notification or announcement to each of the holders of stock acquisition rights who are registered as holders of stock acquisition rights (“Optionholders”) no later than the day immediately preceding the day on which the adjusted Conversion Ratio becomes effective. However, if we are unable to provide such notification or announcement by such date, we shall provide prompt notification or announcement thereafter.

| | 4. | Amount Capitalized upon Exercise of Stock Acquisition Rights |

The amount capitalized upon the exercise of each stock acquisition right shall be calculated by multiplying (i) the exercise price of one (1) yen per share to be paid upon exercise of the stock acquisition rights and (ii) the Conversion Ratio.

| | 5. | Exercise Period for Stock Acquisition Rights |

September 4, 2012 to September 3, 2032.

| | 6. | Matters concerning Increases in Capital Stock and Additional Paid-in Capital in the Case of an Issuance of Shares due to the Exercise of Stock Acquisition Rights |

| | (1) | In the event that shares are issued due to the exercise of stock acquisition rights, shareholders’ equity shall be increased by half the limit for increases in common stock which are calculated in accordance with Article 17-1 of the Japanese Company Accounting Regulations. Any amount less than one (1) yen shall be rounded up to the nearest yen. |

| | (2) | In the event that shares are issued due to the exercise of stock acquisition rights, additional paid-in capital shall be increased by the amount remaining after deducting the increase in the limit for increase in common stock stipulated in (1) above. |

| | 7. | Limitation on the Acquisition of Stock Acquisition Rights by Transfer |

The acquisition of stock acquisition rights by transfer shall be subject to approval by resolution of the Board.

| | 8. | Provisions for the Acquisition of Stock Acquisition Rights |

In the event that any of the following is approved at a general meeting of our shareholders (or, when shareholder approval is not necessary, in the event that the Board or the representative executive officer approves of any of the following), we may acquire stock acquisition rights without compensation on a date separately specified by the Board:

2

| | (1) | a proposed merger agreement under which we are to be dissolved; |

| | (2) | a proposed corporate division agreement or plan under which we would be split; |

| | (3) | a proposed share transfer agreement or plan that makes us a wholly owned subsidiary; |

| | (4) | a proposed amendment of the Articles of Incorporation to add a provision that prescribes that we, with respect to all of its issued shares, shall be required to obtain the approval of our shareholders for the acquisition of such shares by transfer; |

| | (5) | a proposed approval for an amendment of the Articles of Incorporation to add a provision that prescribes that we shall be required to obtain the approval of our shareholders for the acquisition of the shares to be issued upon the exercise of stock acquisition rights by transfer or that we shall obtain all of the shares of said class by a resolution of the general meeting of shareholders. |

| | 9. | Policy to Determine the Cancellation of Stock Acquisition Rights upon Organizational Restructuring and Issuance of Stock Acquisition Rights by the Surviving Company |

In the event that we conduct a merger (limited to a merger that would result in our dissolution), absorption-type demerger, incorporation-type demerger, stock swap or share transfer (hereinafter collectively referred to as an “Organizational Restructuring”), stock acquisition rights of the joint stock companies (kabushiki kaisha) listed in Article 236, Paragraph 1, Item 8, (a) through (e) of the Company Law (the “Surviving Company”) shall be granted to each holder of stock acquisition rights remaining immediately prior to the Organizational Restructuring takes effect (the “Residual Stock Acquisition Rights”) (i.e. for an absorption-type demerger, the date on which the demerger takes effect; for an incorporation-type demerger, the date on which the new company is incorporated; for a stock swap, the date on which the stock swap takes effect; and for share transfer, the date on which the wholly-owning parent company is incorporated by share transfer) in accordance with the following terms and conditions. In such case, the Remaining Stock Acquisition Rights shall be cancelled, and the Surviving Company shall issue new stock acquisition rights; provided, however, that this shall be limited to the case where the grant of stock acquisition rights of the Surviving Company pursuant to the following conditions is stipulated in the absorption-type demerger agreement, incorporation-type demerger agreement, merger and spin-off agreement, new spin-off plan, stock swap agreement or share transfer plan:

| | (1) | Number of Stock Acquisition Rights of the Surviving Company to be Granted: |

The number of stock acquisition rights to be granted shall be equal to the number of Residual Stock Acquisition Rights.

| | (2) | Class of Shares of the Surviving Company to be Issued upon Exercise of the Stock Acquisition Rights: |

Common stock of the Surviving Company.

| | (3) | Number of Shares of the Surviving Company to be Issued upon Exercise of the Stock Acquisition Rights: |

To be determined pursuant to Section 3 above after taking into consideration the terms and conditions of the Organizational Restructuring.

| | (4) | Amount Capitalized upon Exercise of Stock Acquisition Rights: |

The amount capitalized upon the exercise of each stock acquisition right to be granted shall be the amount paid after restructuring as prescribed below multiplied by the number of shares of the Surviving Company to be issued upon the exercise of the stock acquisition rights as determined in accordance with (3) above. The amount paid after restructuring shall be one (1) yen per share of the Surviving Company which may be granted upon exercise of each stock acquisition right to be granted.

3

| | (5) | Exercise Period for Stock Acquisition Rights: |

From the later of (i) the starting date of the exercise period for stock acquisition rights as stipulated in Section 5 above and (ii) the effective date of Organizational Restructuring, and lasting until the expiration date for the exercise of stock acquisition rights as stipulated in Section 5 above.

| | (6) | Matters concerning Increases in Capital Stock and Additional Paid-in Capital in the Case of an Issuance of Shares due to the Exercise of Stock Acquisition Rights: |

To be determined pursuant to Section 6 above.

| | (7) | Restrictions on the Acquisition of Stock Acquisition Rights by Transfer: |

The acquisition of stock acquisition rights by transfer shall be subject to approval by resolution of the board of directors of the Surviving Company.

| | (8) | Provisions for the Acquisition of Stock Acquisition Rights: |

To be determined pursuant to Section 8 above.

| | (9) | Other Conditions for the Exercise of Stock Acquisition Rights: |

To be determined pursuant to Section 11 below.

| | 10. | Fractions of Less than One (1) Share Arising upon the Exercise of Stock Acquisition Rights |

Fractions of less than one (1) share in the number of shares to be granted to Optionholders who exercise their stock acquisition rights shall be rounded down.

| | 11. | Other Conditions relating to the Exercise of Stock Acquisition Rights |

| | (1) | Optionholders may exercise their stock acquisition rights in the event that they lose their status as director (including officers of a company that has adopted the committee system), auditor or executive officer of Wacoal Holdings Corp. and Wacoal Corporation (the “Date of Loss of Status”); provided, however, that in such case, such Optionholder may only exercise his or her stock acquisition rights until the earlier of (i) the expiration date as stipulated in Section 5 above and (ii) the five (5) year anniversary of the day after the Date of Loss of Status (the “Exercise Start Date”). |

| | (2) | Notwithstanding the foregoing, during the period set forth in Section 5 above, the Optionholders may exercise their stock acquisition rights in the following cases (for item (ii), excluding the case where the stock acquisition rights of the Surviving Company are granted to the Optionholders pursuant to Section 9 above) only during the respective periods designated below: |

| | (i) | if the Exercise Start Date of the Optionholder has not occurred by September 1, 2031 |

From September 2, 2031 until September 3, 2032.

| | (ii) | if the general meeting of our shareholders approves a merger agreement pursuant to which we are to be dissolved or a stock swap agreement or share transfer plan that makes us a wholly owned subsidiary (or, in the event a resolution of the general meeting of shareholders is not required, if a resolution of the Board or determination by our chief executive officer is passed): |

4

For fifteen (15) days from the day after the date of said approval.

| | (3) | If an Optionholder waives his or her stock acquisition rights, such Optionholder may not exercise said Stock Acquisition Rights. |

| | 12. | Amount to be Paid for Stock Acquisition Rights |

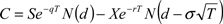

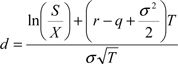

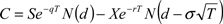

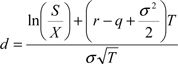

The amount to be paid for stock acquisition rights shall be the amount determined from the Black Scholes Option Pricing Model as described below multiplied by the Conversion Ratio:

Where:

| | (1) | Option price per share (C). |

| | (2) | Stock Price (S): The closing price of Wacoal stock on the Tokyo Stock Exchange on September 3, 2012 (or, if there is no final trading price on such date, the reference price with respect to the next trading day). |

| | (3) | Exercise Price (X): 1 yen. |

| | (4) | Expected time to expiration (T): 3 years and 1 month. |

| | (5) | Volatility (s): The volatility of our stock based on the daily closing price for 3 years and 1 month from August 3, 2009 to August 31, 2012. |

| | (6) | Risk-free interest rate (r): the rate of interest on government bonds for the number of years that corresponds to the remaining life of the option. |

| | (7) | Dividend rate (q): The per share dividend (based on dividends actually paid over the most recent 12 month period (i.e. the dividend payment as of March 2012)) divided by the stock price as set forth in (2) above. |

| | (8) | Standard normal cumulative distribution function (N). |

*The amount calculated pursuant to the above formula is the fair value of the stock acquisition rights and is not evidence of a discounted issuance.

*We shall be deemed to owe remuneration to the eligible recipient in cash in the amount equivalent to the fair value of the stock acquisition right granted, and the right to receive such remuneration shall be offset against the obligation to pay the fair value as determined by the above formula of the stock acquisition rights granted.

| | 13. | Allotment Date of Stock Acquisition Rights |

September 3, 2012.

| | 14. | Payment Date for Stock Acquisition Rights |

September 3, 2012.

5

| | 15. | Number of Stock Acquisition Rights to be Allotted and Number of Eligible Recipients |

Fifty-three (53) stock acquisition rights will be allotted to our five (5) directors.

| III. | Terms and Conditions of Stock Acquisition Rights (Eligible Recipients: directors of Wacoal Corporation, our subsidiary) |

| | 1. | Name of the Stock Acquisition Rights: Wacoal Holdings Corp. Tenth Stock Acquisition Rights |

| | 2. | Total Number of Stock Acquisition Rights: 14 |

The total number of stock acquisition rights above is the expected number to be granted. If the number of stock acquisition rights to be granted turns out to be less than the number shown above because of a shortage of applications or other circumstances, the number of stock acquisition rights issued will be the actual number of stock acquisition rights to be granted.

| | 3. | Class and Number of Shares to be Issued upon the Exercise of the Stock Acquisition Rights |

The class of shares to be issued upon the exercise of the stock acquisition rights will be our common stock, and the number of shares to be issued for each stock acquisition right (the “Conversion Ratio”) will be 1,000.

In the event that we conduct a stock split (including the gratis allocation of shares of our common stock; hereinafter the same) or a reverse split of its common stock, the Conversion Ratio will be adjusted in accordance with the following formula:

| | | | | | | | | | |

Adjusted Conversion

Ratio | | = | | Conversion Ratio prior to adjustment | | X | | Ratio of stock split or

reverse stock split | | |

This adjustment will apply from the day following the record date in the case of a stock split and from the day on which the reverse stock split becomes effective in the case of a reverse stock split. However, in the event that we conduct a stock split that is conditioned on approval at a general meeting of our shareholders of an increase in stockholders’ equity or additional paid-in capital by decreasing the amount of surplus, and provided that the record date for such stock split is set prior to the conclusion of such general meeting of shareholders, from the day following the conclusion of such general meeting of shareholders the adjustment will apply retroactively from the day following the record date.

In addition to the above, the Conversion Ratio shall be reasonably adjusted as may be required in unavoidable circumstances.

Any fractional shares which result from the above adjustment will be rounded down to the nearest whole share.

Furthermore, in the case of any adjustment of the Conversion Ratio, we shall make any necessary notification or announcement to each of the holders of stock acquisition rights who are registered as holders of stock acquisition rights (“Optionholders”) no later than the day immediately preceding the day on which the adjusted Conversion Ratio becomes effective. However, if we are unable to provide such notification or announcement by such date, we shall provide prompt notification or announcement thereafter.

| | 4. | Amount Capitalized upon Exercise of Stock Acquisition Rights |

The amount capitalized upon the exercise of each stock acquisition right shall be calculated by multiplying (i) the exercise price of one (1) yen per share to be paid upon exercise of the stock acquisition rights and (ii) the Conversion Ratio.

6

| | 5. | Exercise Period for Stock Acquisition Rights |

September 4, 2012 to September 3, 2032.

| | 6. | Matters concerning Increases in Capital Stock and Additional Paid-in Capital in the Case of an Issuance of Shares due to the Exercise of Stock Acquisition Rights |

| | (1) | In the event that shares are issued due to the exercise of stock acquisition rights, shareholders’ equity shall be increased by half the limit for increases in common stock which are calculated in accordance with Article 17-1 of the Japanese Company Accounting Regulations. Any amount less than one (1) yen shall be rounded up to the nearest yen. |

| | (2) | In the event that shares are issued due to the exercise of stock acquisition rights, additional paid-in capital shall be increased by the amount remaining after deducting the increase in the limit for increase in common stock stipulated in (1) above. |

| | 7. | Limitation on the Acquisition of Stock Acquisition Rights by Transfer |

The acquisition of stock acquisition rights by transfer shall be subject to approval by resolution of the Board.

| | 8. | Provisions for the Acquisition of Stock Acquisition Rights |

In the event that any of the following is approved at a general meeting of our shareholders (or the Board approves a resolution where the approval of the shareholders is not required), we may acquire stock acquisition rights without compensation on a date separately specified by the Board:

| | (1) | a proposed merger agreement under which we are to be dissolved; |

| | (2) | a proposed corporate division agreement or plan under which we would be split; |

| | (3) | a proposed share transfer agreement or plan that makes us a wholly owned subsidiary; |

| | (4) | a proposed amendment of the Articles of Incorporation to add a provision that prescribes that we, with respect to all of its issued shares, shall be required to obtain the approval of our shareholders for the acquisition of such shares by transfer; |

| | (5) | a proposed approval for an amendment of the Articles of Incorporation to add a provision that prescribes that we shall be required to obtain the approval of our shareholders for the acquisition of the shares to be issued upon the exercise of stock acquisition rights by transfer or that we shall obtain all of the shares of said class by a resolution of the general meeting of shareholders. |

| | 9. | Policy to Determine the Cancellation of Stock Acquisition Rights upon Organizational Restructuring and Issuance of Stock Acquisition Rights by the Surviving Company |

In the event that we conduct a merger (limited to a merger that would result in our dissolution), absorption-type demerger, incorporation-type demerger, stock swap or share transfer (hereinafter collectively referred to as an “Organizational Restructuring”), stock acquisition rights of the joint stock companies (kabushiki kaisha) listed in Article 236, Paragraph 1, Item 8, (a) through (e) of the Company Law (the “Surviving Company”) shall be granted to each holder of stock acquisition rights remaining immediately prior to the Organizational Restructuring takes effect (the “Residual Stock Acquisition Rights”) (i.e. for an absorption-type demerger, the date on which the demerger takes effect; for an incorporation-type demerger, the date on which the new company is incorporated; for a stock swap, the date on which the stock swap takes effect; and for share transfer, the date on which the wholly-owning parent company is incorporated by share transfer) in accordance with the following terms and conditions. In such case, the Remaining Stock Acquisition Rights shall be cancelled, and the Surviving Company shall issue new stock acquisition rights; provided, however, that this shall be limited to the case where the grant of stock acquisition rights of the Surviving Company pursuant to the following conditions is stipulated in the absorption-type demerger agreement, incorporation-type demerger agreement, merger and spin-off agreement, new spin-off plan, stock swap agreement or share transfer plan:

7

| | (1) | Number of Stock Acquisition Rights of the Surviving Company to be Granted: |

The number of stock acquisition rights to be granted shall be equal to the number of Residual Stock Acquisition Rights.

| | (2) | Class of Shares of the Surviving Company to be Issued upon Exercise of the Stock Acquisition Rights: |

Common stock of the Surviving Company.

| | (3) | Number of Shares of the Surviving Company to be Issued upon Exercise of the Stock Acquisition Rights: |

To be determined pursuant to Section 3 above after taking into consideration the terms and conditions of the Organizational Restructuring.

| | (4) | Amount Capitalized upon Exercise of Stock Acquisition Rights: |

The amount capitalized upon the exercise of each stock acquisition right to be granted shall be the amount paid after restructuring as prescribed below multiplied by the number of shares of the Surviving Company to be issued upon the exercise of the stock acquisition rights as determined in accordance with (3) above. The amount paid after restructuring shall be one (1) yen per share of the Surviving Company which may be granted upon exercise of each stock acquisition right to be granted.

| | (5) | Exercise Period for Stock Acquisition Rights: |

From the later of (i) the starting date of the exercise period for stock acquisition rights as stipulated in Section 5 above and (ii) the effective date of Organizational Restructuring, and lasting until the expiration date for the exercise of stock acquisition rights as stipulated in Section 5 above.

| | (6) | Matters concerning Increases in Capital Stock and Additional Paid-in Capital in the Case of an Issuance of Shares due to the Exercise of Stock Acquisition Rights: |

To be determined pursuant to Section 6 above.

| | (7) | Restrictions on the Acquisition of Stock Acquisition Rights by Transfer: |

The acquisition of stock acquisition rights by transfer shall be subject to approval by resolution of the board of directors of the Surviving Company.

| | (8) | Provisions for the Acquisition of Stock Acquisition Rights: |

To be determined pursuant to Section 8 above.

| | (9) | Other Conditions for the Exercise of Stock Acquisition Rights: |

To be determined pursuant to Section 11 below.

8

| | 10. | Fractions of Less Than One (1) Share Arising upon the Exercise of Stock Acquisition Rights |

Fractions of less than one (1) share in the number of shares to be granted to Optionholders who exercised their stock acquisition rights shall be rounded down.

| | 11. | Other Conditions relating to the Exercise of Stock Acquisition Rights |

| | (1) | Optionholders may exercise their stock acquisition rights in the event that they lose their status as director (including officers of a company that has adopted the committee system), auditor or executive officer of Wacoal Holdings Corp. and Wacoal Corporation (the “Date of Loss of Status”); provided, however, that in such case, such Optionholder may only exercise his or her stock acquisition rights until the earlier of (i) the expiration date as stipulated in Section 5 above and (ii) the five (5) year anniversary of the day after the Date of Loss of Status (the “Exercise Start Date”). |

| | (2) | Notwithstanding the foregoing, during the period set forth in Section 5 above, the Optionholders may exercise their stock acquisition rights in the following cases (for item (ii), excluding the case where the stock acquisition rights of the Surviving Company are granted to the Optionholders pursuant to Section 9 above) only during the respective periods designated below: |

| | (i) | if the Exercise Start Date of the Optionholder has not occurred by September 1, 2031 |

From September 2, 2031 until September 3, 2032.

| | (ii) | if the general meeting of our shareholders approves a merger agreement pursuant to which we are to be dissolved or a stock swap agreement or share transfer plan that makes us a wholly owned subsidiary (or, in the event a resolution of the general meeting of shareholders is not required, if a resolution of the Board or determination by our chief executive officer is passed): |

For fifteen (15) days from the day after the date of said approval.

| | (3) | If an Optionholder waives his or her stock acquisition rights, such Optionholder may not exercise said Stock Acquisition Rights. |

| | 12. | Amount to be Paid for Stock Acquisition Rights |

No payment of money shall be required in exchange for stock acquisition rights.

*The stock acquisition rights will be allotted as compensation for the performance of duty and for this reason, the terms of issuance will not be advantageous for the eligible recipients.

| | 13. | Allotment Date of Stock Acquisition Rights |

September 3, 2012.

| | 14. | Number of Stock Acquisition Rights to be Allotted and Number of Eligible Recipients |

Fourteen (14) stock acquisition rights will be allotted to four (4) directors of Wacoal Corporation, our subsidiary.

- End -

9