UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-08243 |

|

Direxion Funds |

(Exact name of registrant as specified in charter) |

|

1301 Avenue of the Americas (6th Ave.), 35th Floor New York , NY | | 10019 |

(Address of principal executive offices) | | (Zip code) |

|

1301 Avenue of the Americas (6th Ave.), 35th Floor New York , NY 10019 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 646-572-3390 | |

|

Date of fiscal year end: | October 31, 2014 | |

|

Date of reporting period: | October 31, 2014 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Stockholders.

ANNUAL REPORT OCTOBER 31, 2014

1301 Avenue of the Americas (6th Ave.), 35th Floor New York, New York 10019 www.direxioninvestments.com

Direxion Indexed Commodity Strategy Fund (Consolidated)

Direxion/Wilshire Dynamic Fund

Direxion Indexed Managed Futures Strategy Fund (Consolidated)

Direxion Indexed CVT Strategy Fund

(Formerly Direxion Indexed Synthetic Convertible Strategy Fund)

Letter to Shareholders | | | 4 | | |

| Performance Summary | | | 8 | | |

| Expense Example | | | 12 | | |

| Expense Example Table | | | 13 | | |

| Allocation of Portfolio Holdings | | | 14 | | |

| Schedules of Investments | | | 15 | | |

| Statements of Assets and Liabilities | | | 20 | | |

| Statements of Operations | | | 22 | | |

| Statements of Changes in Net Assets | | | 23 | | |

| Financial Highlights | | | 25 | | |

| Notes to the Financial Statements | | | 27 | | |

Report of Independent Registered Public

Accounting Firm | | | 40 | | |

| Supplemental Information (Unaudited) | | | 41 | | |

Investment Advisory Agreement Approvals

(Unaudited) | | | 42 | | |

| Trustees and Officers | | | 45 | | |

Help Preserve the Environment – Go Green!

Go paperless with Direxion e-Delivery – a service allowing shareholders to reduce clutter with full online access to regulatory documents. Begin the preservation process with e-delivery.

With Direxion e-Delivery you can:

• Receive email notifications when your most recent shareholder communications are available for review.

• Access prospectuses, annual reports and semiannual reports online.

It's easy to enroll:

1. Visit www.direxioninvestments.com/edelivery

2. Follow the simple enrollment instructions

If you have questions about Direxion e-Delivery services, contact one of our shareholder representatives at 800-851-0511.

Dear Shareholders,

This Annual Report for the Direxion Funds covers the period from November 1, 2013 to October 31, 2014, (the "Annual Period").

Market Review:

The last year added to an established financial market history of volatility upswings taking place in the months of September and October. Equity markets around the world corrected during the first two weeks of October 2014, erasing gains accumulated earlier in the year. The change in market sentiment was driven mainly by growing concerns about global economic growth amid soft data out of Europe, Japan and China at a time when the U.S. Federal Reserve was concluding an historic period of accommodative monetary policy. High-yield debt and commodities added to losses begun in late June while developed country government bonds and the U.S. dollar provided safe havens.

Fortunately, it wasn't too long before the equity market found firmer footing. Major stock markets regained most of their losses by the end of the Annual Period with the S&P 500 Index posting a solid 17% gain following last year's 27% return, and the Tech-laden NASDAQ Index marking a 14-year high. Each fixed income sector gained ground during the month of October but high yield bonds only partially recovered losses established earlier in the Annual Period to end with a return near 5% (as measured by the iBoxx HY Index) and close to that of the 10-year Treasury. WTI Crude Oil and Brent Crude Oil moved significantly lower in October taking their performances in the Annual Period to -18% and -23%, respectively.

Peering ahead, most economists are forecasting slightly faster U.S. and global economic growth in 2015 than in 2014. The U.S. economy has proved itself to be durable the past two quarters and is expected to continue to benefit from supportive fiscal and monetary backdrops in the year ahead. Japan's economy has contracted the past two quarters and is seen as a drag on the global economy. On October 7, the International Monetary Fund shaved its global economic growth forecast to 3.3% in 2014 and 3.8% in 2015. Translating the economic outlook to the financial markets, Wall Street research analysts are forecasting S&P 500 earnings per share growth of 10.7% in the year ahead according to Bloomberg LLP.

As a new annual period begins, short and medium term risks that could reduce confidence in the investment outlook includes geopolitical risks, slowing growth in emerging market economies as they mature, the legacy of high debt burdens, unemployment and mediocre long-term growth prospects in several developed economies, and the prospect of higher interest rates at some point in the future.

Fund Performance Review:

The Direxion Indexed Managed Futures Strategy Fund (the "Managed Futures Fund") seeks to match, after expenses, the return of the Auspice Managed Futures Index, a long/short managed futures index. The Auspice Managed Futures Index aims to capture upward and downward trends in the commodity and financial markets while attempting to carefully manage risk. The Auspice Managed Futures Index uses a quantitative methodology to track either long or short positions in a diversified portfolio of twenty-one exchange traded futures which track the energy, metal, agricultural, interest rate, and currency sectors. It attempts to incorporate dynamic risk management and contract rolling methods to take advantage of price anomalies across different tenors and maturities (expiration dates) of futures contracts. During the Annual Period, the Auspice Managed Futures Index returned 5.60%, while the Managed Futures Fund's Class A returned 3.86%.

The Managed Futures Fund posted modest gains for the Annual Period but the year really had two distinct halves with choppy markets alongside low volatility leading to negative performance in the first half and steady positive performance taking root in the second half amid higher volatility and clearer trends. The Managed Futures Fund faced early headwinds in Agricultural, Interest Rate and Currencies as the Annual Period commenced. In January, the Metals sector corrected. A number of trend reversals took place in the first three months of 2014 and the Managed Futures Fund ended March 75% long. Volatility reached low levels in many asset classes in the spring but Cotton and Grains prices moved sharply lower in

DIREXION ANNUAL REPORT

4

May. Fortunes began to turn upward in June. Volatility peaked and Energy prices rose, with Crude making a new high for the year. In July the fund shifted to be more negative on Currencies and Commodities. Short positions in Corn, Copper, Wheat and Sugar helped gains in the Agricultural sector more than make up for losses in Energy, Metals and Currencies. A rally in the US dollar and lower rates aided the Managed Futures Fund in August. Broad-based volatility gains gave way to beneficial trends in Currencies and Commodities in September. The year ended well for the fund with four of five sectors of the index – Energy, Metals, Interest Rates and Currencies – adding to performance. The Managed Futures Fund ended the Annual Period positioned for lower Commodity prices and Interest Rates alongside a stronger US dollar.

The Direxion Indexed Commodity Strategy Fund (the "Commodity Fund") seeks to match, after expenses, the return of the Auspice Broad Commodity Index, a long/flat commodities index. A long/flat approach allows the Commodity Fund to attempt to take advantage of higher commodity prices, and at the same time shift into a cash position of an individual commodity that shows a downward trend in price. The Auspice Broad Commodity Index attempts to capture upward trends in the commodity markets while minimizing risk during down trends. The Auspice Broad Commodity Index will use a quantitative methodology to track either long or flat positions in a diversified portfolio of twelve commodity futures which cover the energy, metal, and agricultural sectors. It attempts to incorporate dynamic risk management and contract rolling methods. During the Annual Period, the Auspice Broad Commodity Index returned -7.62%, while the Commodity Fund's Class A returned -8.81%.

The Direxion Indexed Commodity Strategy Fund experienced choppy but flat performance in the first half of the Annual Period followed by losses in the second half of the period that were stopped out by the strategy's long-flat methodology while the peer group continued to post losses as the Annual Period ended. A rally in the Energy sector ensued as winter got underway. Geopolitical tensions, cold weather and drought concerns helped the Commodity Fund post gains in all three sectors – Energy, Metals and Agriculture – even though half the positions were flat in February. This proved to be the highpoint for the Annual Period. The Commodity Fund faced losses in March but firming prices in general led to the fund holding 9 long positions out of a possible 12 at month's end. This led to gains in April. In May the Commodity Fund suffered as Agricultural prices moved sharply lower, especially Corn and Wheat. Markets then calmed down until most commodities sold off aggressively in July leaving the strategy with just 4 long positions. Further commodity price softness took the fund to just 2 long positions in August and a completely flat stance in September which proved beneficial in October.

The Direxion/Wilshire Dynamic Fund (the "Wilshire Fund") seeks capital appreciation through the use of built-in tactical strategies to attempt to capitalize on short-term market inefficiencies and is designed for investors seeking to outperform a traditional strategic (long-term only) asset allocation approach. To achieve its investment objective, the Wilshire Fund combines a strategic asset allocation with a "tactical overlay" to position the Wilshire Fund defensively or aggressively, depending upon the outlook of the Wilshire Associates Incorporated (the "Sub-Adviser"). Under normal circumstances, the Wilshire Fund is managed by Rafferty Asset Management, LLC (the "Adviser") pursuant to the Sub-Adviser's traditional asset allocation model. This model allocates approximately 60% of the Wilshire Fund's total assets to equity securities and 40% to fixed income securities, with a tactical overlay to increase or decrease the Fund's risk exposure based on the Sub-adviser's outlook for the market. The Sub-Adviser's tactical model evaluates asset class allocations on a monthly basis. In response to market conditions, the Sub-Adviser may recommend that the Adviser rebalance the Wilshire Fund's portfolio, use short positions and/or employ leverage in its tactical allocations. For the Annual Period, the Wilshire Fund's Class A returned 3.51%, as compared to a total net return of 8.67% from the MSCI World Index, 4.14% for the Barclays Capital Aggregate Bond Index and 6.86% for a 60:40 respective composite of the two.

The Wilshire Fund's allocation mix within equities was the largest detractor to relative performance during the Annual Period, as developed international equities were favored relative to U.S. equities. Overweight allocations to high yield and tactical positioning in developed market debt also detracted from relative performance. Conversely, an underweight allocation to investment grade fixed income early in the period added value, as did the Wilshire Fund's systematic reduction of its higher quality fixed income underweight position throughout the Annual Period.

Over the course of the Annual Period, the Wilshire Fund made a number of tactical changes, a few of which are highlighted here. In December 2013 the Wilshire Fund decreased its position in non-U.S. fixed income to underweight and increased its already overweight stance in non-U.S. equities as the European Central Bank affirmed its accommodative policy stance

DIREXION ANNUAL REPORT

5

by lowering key interest rates by 0.25%. In March, the Wilshire Fund consolidated its EAFE exposure through use of the iShares MSCI EAFE ETF rather than through specific country/regional ETFs. In April the Wilshire Fund shifted to a neutral stance between equities and Fixed Income after several months of favoring equities. In September the Fund shifted to an overweight position in emerging market equities and in October the Wilshire Fund moved to favor large cap equities over small cap equities.

The Direxion Indexed CVT Strategy Fund seeks investments results, before fees and expenses, which track the performance of the QES Synthetic Convertible Index. The QES Synthetic Convertible Index seeks to replicate the total return of the U.S. convertible bond market while also providing the potential for added liquidity and transparency and freedom from capital constraints that may impact convertible bond strategies. The QES Synthetic Convertible Index is designed to capture high correlation and similar overall returns to the convertible bond universe by investing in liquid market instruments with comparable characteristics to convertible bonds.

The Direxion Indexed CVT Strategy Fund returned 11.45% from its February 5, 2014 inception date through the end of the Annual Period with the fund's high point taking place on July 3, 2014, the same date that volatility bottomed, as measured by the Chicago Board Options Exchange SPX Volatility Index, best known as the VIX Index. The QES Synthetic Convertible Index returned 13.60% over the same period.

As always, we thank you for using the Direxion Funds and we look forward to our mutual success.

Regards,

| |

| |

Eric Falkeis | | Patrick Rudnick | |

Principal Executive Officer | | Principal Financial Officer | |

The performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate and an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. To obtain performance data current to the most recent month-end, please call toll-free, 1.800.851.0511, or visit www.direxioninvestments.com.

An investment in the Funds involves risk, including the possible loss of principal. There is no guarantee the Funds will achieve their objective. The Funds are non-diversified and include risks associated with concentration risk which results from the Funds' investments in a particular industry or sector and can increase volatility over time. Diversification does not ensure a profit nor guarantee against loss. For certain Funds the performance of the portfolio is based upon the price movements of a physical commodity which may be subject to greater volatility. Certain Funds performance is linked to daily performance of the spot price of the exchange rate in foreign currencies which can be highly volatile due to political, economic and legal factors the Fund cannot control. The use of derivatives may subject the Funds to market risks that may cause their prices to fluctuate over time and may result in larger losses or smaller gains than investing in other financial instruments. Leverage by the Funds can accelerate the velocity of potential losses. Some Funds use investment techniques that may be considered aggressive and may entail a significantly higher than normal risk. For a detailed explanation of these risks, please read the prospectus. An investment in any of the Direxion Funds is subject to a number of risks that could affect the value of its shares. It is important that investors closely review and understand these risks before making an investment.

An investor should consider the investment objectives, risks, charges and expenses of the Direxion Funds carefully before investing. The prospectus contains this and other information about the Direxion Funds. To obtain a

DIREXION ANNUAL REPORT

6

prospectus, please call the Direxion Funds at 1-800-851-0511 or visit www.direxioninvestments.com. The prospectus should be read carefully before investing.

The views in this report were those of the Adviser as of October 31, 2014 and may not reflect their views on the date this report is first published or anytime thereafter. These views are intended to assist shareholders of the Fund in understanding their investments in the Fund and do not constitute investment advice.

The total annual fund operating expense ratios of the Direxion Indexed Managed Futures Strategy Fund Class A, Direxion Indexed Commodity Strategy Fund Class A, Direxion/Wilshire Dynamic Fund Class A and Direxion Indexed CVT Strategy Fund is 1.45%, 1.26%, 1.43% and 1.51%, respectively, gross of any fee, waivers or expense reimbursements.

The total annual fund operating expense ratios include Acquired Fund Fees and Expenses, indirect fees and expenses the Funds incur that are required to be disclosed. Without Acquired Fund Fees and Expenses, total annual operating expense ratios of the Direxion Indexed Managed Futures Strategy Fund Class A, Direxion Indexed Commodity Strategy Fund Class A, Direxion/Wilshire Dynamic Fund Class A and Direxion Indexed CVT Strategy Fund is 1.45%, 1.26%, 1.16% and 1.35% , respectively. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced. The Adviser has contractually agreed to waive expenses of the Funds through September 1, 2016.

The Auspice Managed Futures Index aims to capture upward and downward trends in the commodity and financial markets. The Index will use a quantitative methodology to track either long or short positions in a diversified portfolio of 21 exchange-traded futures which cover the energy, metal, agricultural, interest rate, and currency sectors.

The Auspice Broad Commodity Index aims to capture upward trends in the commodity markets while minimizing risk during downtrends. The index will use a quantitative methodology to track either long or flat positions in a diversified portfolio of 12 commodity futures which cover the energy, metal, and agricultural sectors.

The QES Synthetic Convertible Index seeks to replicate the total return of the US convertible bond market while also providing the potential for added liquidity and transparency and freedom from capital constraints that may impact convertible bond strategies.

The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. As of December 31, 2013, the MSCI World Index consisted of the following 24 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States.

The Barclays Capital U.S. Aggregate Bond Index is an unmanaged, market value weighted index of investment grade, fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of at least one year.

Please note that you cannot invest directly in an index, although you may invest in the underlying securities represented in the index. Index returns are adjusted to reflect the reinvestment of dividends on securities in the index but do not reflect the expenses of the Fund.

Distributed by: Rafferty Capital Markets, LLC

DIREXION ANNUAL REPORT

7

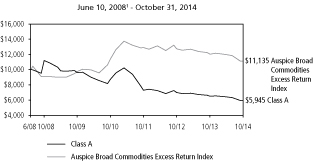

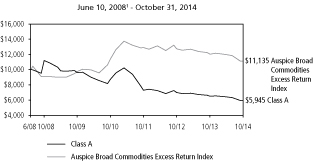

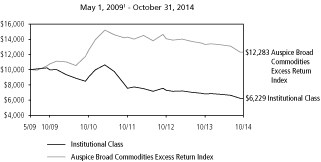

Direxion Indexed Commodity Strategy Fund (Consolidated)

Performance Summary (Unaudited)

Class A

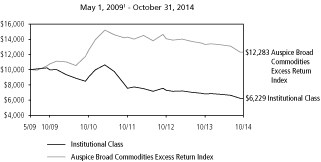

Institutional Class

Class C

These charts illustrate the performance of a hypothetical $10,000 investment made on the inception date of each Fund class, and is not intended to imply any future performance. The returns shown do not reflect the deduction or taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The performance of the Auspice Broad Commodity Index, the Fund's benchmark, does not reflect the deduction of fees associated with a mutual fund, such as investment management fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

An up-front sales charge of 5.50% is associated with the purchase of Class A shares of the Fund. Prior to February 1, 2012, the Class A shares were called Investor Class shares. On February 1, 2012, all Investor Class shares were converted to Class A shares. Those investors whose Investor Class shares were converted to Class A Shares were not charged this sales charge.

The Fund may impose a 1.00% redemption fee on Class A and Institutional Class shares redeemed (through sales or exchanges) within 30 days of the date of purchase. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced.

The Fund imposes a 1.00% contingent deferred sales charge of the net amount of the redemption of Class C shares if redeemed within 12 months of purchase.

The performance data shown represents past performance and does not guarantee future results.

| | | Average Annual Total Return2 | |

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception | |

Class A | | | (8.81 | )% | | | (6.58 | )% | | | (9.18 | )% | | | (7.81 | )% | |

Auspice Broad

Commodities

Excess Return

Index | | | (7.62 | )% | | | (4.86 | )% | | | 2.68 | % | | | 1.70 | % | |

| | | Average Annual Total Return2 | |

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception | |

Institutional Class | | | (8.58 | )% | | | (6.36 | )% | | | (8.96 | )% | | | (8.24 | )% | |

Auspice Broad

Commodities

Excess Return

Index | | | (7.62 | )% | | | (4.86 | )% | | | 2.68 | % | | | 3.81 | % | |

| | | Average Annual Total Return2 | |

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception | |

Class C3 | | | (9.50 | )% | | | (7.25 | )% | | | N/A | | | | (8.56 | )% | |

Auspice Broad

Commodities

Excess Return

Index | | | (7.62 | )% | | | (4.86 | )% | | | N/A | | | | 2.44 | % | |

Market Exposure

Investment Type | | Percent of

Net Assets | |

Futures Contracts | | | 0.0 | % | |

Total Exposure | | | 0.0 | % | |

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents divided by net assets.

1 Commencement of operations.

2 As of October 31, 2014.

3 These returns do not include the contingent deferred sales charge. Had this sales charge been included the 1 year total return would be (10.41)%.

DIREXION ANNUAL REPORT

8

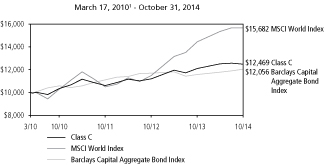

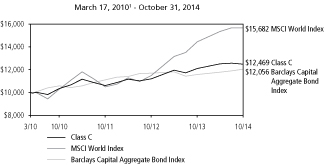

Direxion/Wilshire Dynamic Fund

Performance Summary (Unaudited)

Class A

Class C

These charts illustrate the performance of a hypothetical $10,000 investment made on the inception date of each Fund class, and is not intended to imply any future performance. The returns shown do not reflect the deduction or taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The performance of the MSCI World Index and Barclays Capital Aggregate Bond Index does not reflect the deduction of fees associated with a mutual fund, such as investment management fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

An up-front sales charge of 5.50% is associated with the purchase of Class A shares of the Fund. Prior to February 1, 2012, the Class A shares were called Investor Class shares. On February 1, 2012, all Investor Class shares were converted to Class A shares. Those investors whose Investor Class shares were converted to Class A Shares were not charged this sales charge.

The Fund may impose a 1.00% redemption fee on Class A shares redeemed (through sales or exchanges) within 30 days of the date of purchase. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced.

The Fund imposes a 1.00% contingent deferred sales charge of the net amount of the redemption of Class C shares if redeemed within 12 months of purchase.

The performance data shown represents past performance and does not guarantee future results.

| | | Average Annual Total Return2 | |

| | | 1 Year | | 3 Year | | 5 Year | | Since Inception | |

Class A | | | 3.69 | % | | | 6.35 | % | | | 6.60 | % | | | 12.16 | % | |

MSCI World Index | | | 8.67 | % | | | 14.37 | % | | | 11.41 | % | | | 19.19 | % | |

Barclays Capital

Aggregate Bond

Index | | | 4.14 | % | | | 2.73 | % | | | 4.22 | % | | | 5.00 | % | |

| | | Average Annual Total Return2 | |

| | | 1 Year | | 3 Year | | Since Inception | |

Class C3 | | | 2.92 | % | | | 5.56 | % | | | 4.89 | % | |

MSCI World Index | | | 8.67 | % | | | 14.37 | % | | | 10.22 | % | |

Barclays Capital Aggregate

Bond Index | | | 4.14 | % | | | 2.73 | % | | | 4.13 | % | |

Market Exposure

Investment Type | | Percent of

Net Assets | |

Investment Companies | | | 85.1 | % | |

Swap Contracts | | | 11.1 | % | |

Total Exposure | | | 96.2 | % | |

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents divided by net assets.

1 Commencement of operations.

2 As of October 31, 2014.

3 These returns do not include the contingent deferred sales charge. Had this sales charge been included the 1 year total return would be 1.89%.

DIREXION ANNUAL REPORT

9

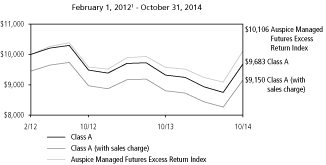

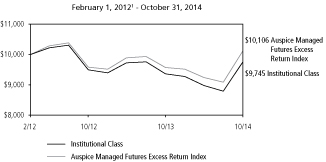

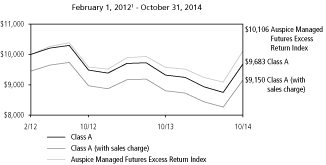

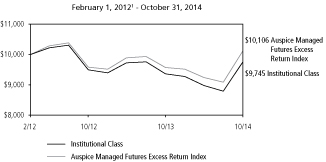

Direxion Indexed Managed Futures Strategy Fund (Consolidated)

Performance Summary (Unaudited)

Class A

Institutional Class

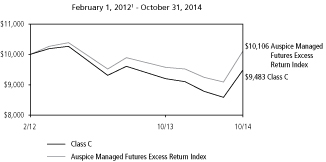

Class C

These charts illustrate the performance of a hypothetical $10,000 investment made on the inception date of each Fund class, and is not intended to imply any future performance. The returns shown do not reflect the deduction or taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The performance of the Auspice Managed Futures Excess Return Index, the Fund's benchmark, does not reflect the deduction of fees associated with a mutual fund, such as investment management fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

An up-front sales charge of 5.50% is associated with the purchase of Class A shares of the Fund.

The Fund may impose a 1.00% redemption fee on Class A and Institutional Class shares redeemed (through sales or exchanges) within 30 days of the date of purchase. Performance data does not reflect the redemption fee. If reflected, total returns would be reduced.

The Fund imposes a 1.00% contingent deferred sales charge of the net amount of the redemption of Class C shares if redeemed within 12 months of purchase.

The performance data shown represents past performance and does not guarantee future results.

| | | Average Annual Total Return2 | |

| | | 1 Year | | Since Inception | |

Class A | | | 3.86 | % | | | (1.17 | )% | |

Class A (with sales charge) | | | (1.85 | )% | | | (3.18 | )% | |

Auspice Managed Futures Excess

Return Index | | | 5.60 | % | | | 0.39 | % | |

| | | Average Annual Total Return2 | |

| | | 1 Year | | Since Inception | |

Institutional Class | | | 4.14 | % | | | (0.94 | )% | |

Auspice Managed Futures Excess

Return Index | | | 5.60 | % | | | 0.39 | % | |

| | | Average Annual Total Return2 | |

| | | 1 Year | | Since Inception | |

Class C3 | | | 3.07 | % | | | (1.92 | )% | |

Auspice Managed Futures Excess

Return Index | | | 5.60 | % | | | 0.39 | % | |

Market Exposure

Investment Type | | Percent of

Net Assets | |

Futures Contracts | | | (113.7 | )% | |

Total Exposure | | | (113.7 | )% | |

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents divided by net assets.

1 Commencement of operations.

2 As of October 31, 2014.

3 This return does not include the contingent deferred sales charge. Had this sales charge been included the 1 year total return would be 2.04%.

DIREXION ANNUAL REPORT

10

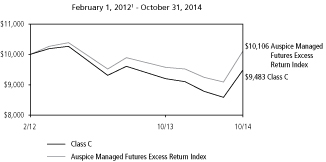

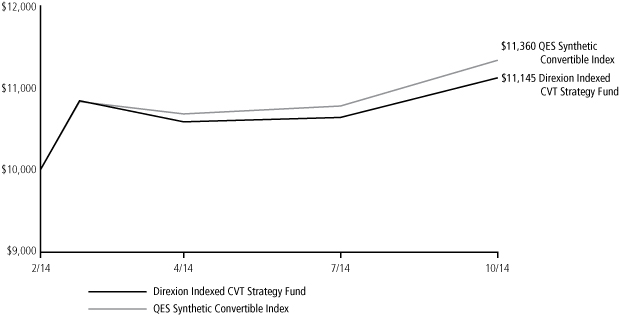

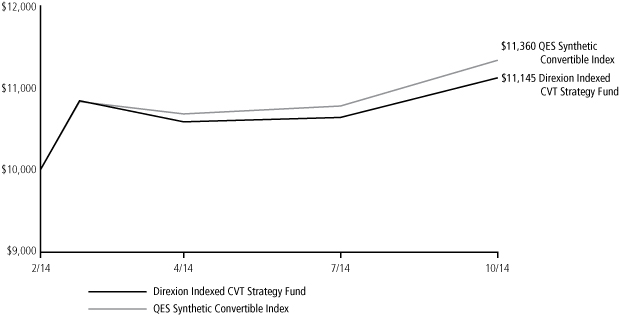

Direxion Indexed CVT Strategy Fund

February 5, 20141 - October 31, 2014 (Unaudited)

Investment Objective: Seeks investment results, before fees and expenses, that track the performance of the QES Synthetic Convertible Index. The QES Synthetic Convertible Index seeks to replicate the total return of the U.S. Convertible bond market.

| | | Average Annual Total Return2 | |

| | | Since Inception | |

Direxion Indexed CVT Strategy Fund | | | 11.45 | % | |

QES Synthetic Convertible Index | | | 13.60 | % | |

This chart illustrates the performance of a hypothetical $10,000 investment made on the Fund's inception, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions of the redemption of fund shares. The performance of the QES Synthetic Convertible Index does not reflect the deduction of fees associated with a mutual fund, such as investment management fees. Investors cannot invest directly in an index, although they can invest in its underlying securities.

The performance data shown represents past performance and does not guarantee future results.

Market Exposure2

Investment Type | | Percent of

Net Assets | |

Investment Companies | | | 36.3 | % | |

Swap Contracts | | | 92.6 | % | |

Futures Contracts | | | 11.3 | % | |

Total Exposure | | | 140.2 | % | |

"Market Exposure" includes the value of total investments (including the contract value of any derivatives) and excludes any short-term investments and cash equivalents divided by Net Assets.

1 Commencement of operations.

2 As of October 31, 2014.

DIREXION ANNUAL REPORT

11

October 31, 2014 (Unaudited)

As a shareholder of a mutual fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in a fund and to compare costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held the entire period (May 1, 2014 — October 31, 2014).

Actual expenses

The first line of the following table provides information about actual account values and actual expenses. You will be charged a sales charge of 5.50% as a percentage of the offering price on your purchases of Class A shares of the Fund. You will be charged a redemption fee equal to 1.00% of the net amount of the redemption if you redeem Class A or Institutional Class shares of the Fund that have been held for less than 90 days. You may be charged a contingent deferred sales charge of 1.00% of the net amount of the redemption if you redeem Class A shares of the Fund within 24 months of purchase and a contingent deferred sales charge of 1.00% on Class C shares of the Fund within 12 months of purchase. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Funds' actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds' actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as wire transfers, redemption fees, sales charges (loads), returned checks or stop payment orders. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

DIREXION ANNUAL REPORT

12

October 31, 2014 (Unaudited)

| | | Expense

Ratio1 | | Beginning

Account Value

May 1, 2014 | | Ending

Account Value

October 31, 2014 | | Expenses

Paid During

Period2 | |

Direxion Indexed Commodity Strategy

Fund (Consolidated) Class A | |

Based on actual fund return | | | 1.26 | % | | $ | 1,000.00 | | | $ | 906.70 | | | $ | 6.06 | | |

Based on hypothetical 5% return | | | 1.26 | % | | | 1,000.00 | | | | 1,018.85 | | | | 6.41 | | |

Direxion Indexed Commodity Strategy

Fund (Consolidated) Institutional Class | |

Based on actual fund return | | | 1.01 | % | | | 1,000.00 | | | | 908.10 | | | | 4.86 | | |

Based on hypothetical 5% return | | | 1.01 | % | | | 1,000.00 | | | | 1,020.11 | | | | 5.14 | | |

Direxion Indexed Commodity Strategy

Fund (Consolidated) Class C | |

Based on actual fund return | | | 2.01 | % | | | 1,000.00 | | | | 903.50 | | | | 9.64 | | |

Based on hypothetical 5% return | | | 2.01 | % | | | 1,000.00 | | | | 1,015.07 | | | | 10.21 | | |

Direxion/Wilshire Dynamic Fund Class A | |

Based on actual fund return | | | 1.16 | % | | | 1,000.00 | | | | 999.60 | | | | 5.85 | | |

Based on hypothetical 5% return | | | 1.16 | % | | | 1,000.00 | | | | 1,019.36 | | | | 5.90 | | |

Direxion/Wilshire Dynamic Fund Class C | |

Based on actual fund return | | | 1.91 | % | | | 1,000.00 | | | | 995.90 | | | | 9.61 | | |

Based on hypothetical 5% return | | | 1.91 | % | | | 1,000.00 | | | | 1,015.58 | | | | 9.70 | | |

Direxion Indexed Managed Futures Strategy

Fund (Consolidated) Class A | |

Based on actual fund return | | | 1.45 | % | | | 1,000.00 | | | | 1,084.30 | | | | 7.62 | | |

Based on hypothetical 5% return | | | 1.45 | % | | | 1,000.00 | | | | 1,017.90 | | | | 7.38 | | |

Direxion Indexed Managed Futures Strategy

Fund (Consolidated) Institutional Class | |

Based on actual fund return | | | 1.20 | % | | | 1,000.00 | | | | 1,085.50 | | | | 6.31 | | |

Based on hypothetical 5% return | | | 1.20 | % | | | 1,000.00 | | | | 1,019.16 | | | | 6.11 | | |

Direxion Indexed Managed Futures Strategy

Fund (Consolidated) Class C | |

Based on actual fund return | | | 2.20 | % | | | 1,000.00 | | | | 1,080.00 | | | | 11.53 | | |

Based on hypothetical 5% return | | | 2.20 | % | | | 1,000.00 | | | | 1,014.11 | | | | 11.17 | | |

Direxion Indexed CVT Strategy Fund Investor Class | |

Based on actual fund return | | | 1.28 | % | | | 1,000.00 | | | | 1,052.00 | | | | 6.62 | | |

Based on hypothetical 5% return | | | 1.28 | % | | | 1,000.00 | | | | 1,018.75 | | | | 6.51 | | |

1 Annualized.

2 Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by the number of days in period of May 1, 2014 to October 31, 2014, then divided by 365.

DIREXION ANNUAL REPORT

13

Allocation of Portfolio Holdings

| | | Cash* | | Investment

Companies | | Futures | | Swaps | | Total | |

Direxion Indexed Commodity Strategy Fund (Consolidated) | | | 100 | % | | | — | | | | — | | | | — | | | | 100 | % | |

Direxion/Wilshire Dynamic Fund | | | 15 | % | | | 85 | % | | | — | | | | 0 | %** | | | 100 | % | |

Direxion Indexed Managed Futures Strategy Fund (Consolidated) | | | 91 | % | | | — | | | | 9 | % | | | — | | | | 100 | % | |

Direxion Indexed CVT Strategy Fund | | | 63 | % | | | 36 | % | | | 0 | %** | | | 1 | % | | | 100 | % | |

Allocation of Portfolio Holdings reflects percentages of net assets.

* Cash, cash equivalents and other assets less liabilities.

** Percentage is less than 0.5%.

DIREXION ANNUAL REPORT

14

Direxion Indexed Commodity Strategy Fund (Consolidated)

| | | | | Value | |

No reportable investments. | |

| | | TOTAL INVESTMENTS

(Cost $0) - 0.0% | | $ | — | | |

| | | Other Assets in Excess of

Liabilities - 100.0% | | | 62,124,557 | | |

| | | TOTAL NET ASSETS - 100.0% | | $ | 62,124,557 | | |

Percentages are stated as a percent of net assets.

The accompanying notes are an integral part of these financial statements.

DIREXION ANNUAL REPORT

15

Direxion/Wilshire Dynamic Fund

Shares | | | | Value | |

INVESTMENT COMPANIES - 85.1% | | | |

| | 6,906 | | | iShares 7-10 Year Treasury

Bond ETF | | $ | 725,268 | | |

| | 3,315 | | | iShares Core U.S. Aggregate

Bond ETF | | | 364,915 | | |

| | 50,244 | | | iShares MSCI EAFE ETF | | | 3,213,104 | | |

| | 16,595 | | | iShares MSCI Emerging

Markets ETF | | | 699,479 | | |

| | 6,837 | | | Market Vectors Emerging Markets

Local Currency Bond ETF | | | 156,636 | | |

| | 22,561 | | | SPDR Barclays High Yield Bond ETF | | | 910,562 | | |

| | 2,643 | | | Vanguard Emerging Markets

Government Bond ETF | | | 210,541 | | |

| | 14,896 | | | Vanguard S&P 500 ETF | | | 2,754,717 | | |

| | 2,004 | | | Vanguard Small-Cap ETF | | | 231,723 | | |

| | | | | TOTAL INVESTMENT COMPANIES

(Cost $9,155,378) | | $ | 9,266,945 | | |

| | | | | TOTAL INVESTMENTS

(Cost $9,155,378) - 85.1% | | $ | 9,266,945 | | |

| | | | | Other Assets in Excess of

Liabilities - 14.9% (a) | | | 1,617,685 | | |

| | | | | TOTAL NET ASSETS - 100.0% | | $ | 10,884,630 | | |

Percentages are stated as a percent of net assets.

(a) $200,000 of cash is pledged as collateral for swap contracts.

Long Equity Swap Contracts

October 31, 2014

Counterparty | | Reference Entity | | Number of

Contracts | | Notional

Amount | | Interest

Rate

Received/

(Paid) | | Termination

Date | | Unrealized

Appreciation/

(Depreciation) | |

Credit Suisse Capital, LLC | | Vanguard Total International Bond ETF | | | 22,950 | | | $ | 1,174,357 | | | | (0.504 | %) | | 7/13/2015 | | $ | 31,015 | | |

The accompanying notes are an integral part of these financial statements.

DIREXION ANNUAL REPORT

16

Direxion Indexed Managed Futures Strategy Fund (Consolidated)

| | | | | Value | |

No reportable investments. | | | |

| | | | | TOTAL INVESTMENTS

(Cost $0) - 0.0% | | $ | — | | |

| | | | | Other Assets in Excess of

Liabilities - 100.0% | | | 89,759,040 | | |

| | | TOTAL NET ASSETS - 100.0% | | $ | 89,759,040 | | |

Percentages are stated as a percent of net assets.

Long Futures Contracts

October 31, 2014

Contracts | | | | Unrealized

Appreciation/

(Depreciation) | |

| | 95 | | | U.S. 5 Year T-Note Futures

Expiring December 2014 (Underlying Face Amount at Market Value $11,345,820) | | $ | 52,308 | | |

| | 57 | | | U.S. 10 Year T-Note Futures

Expiring December 2014 (Underlying Face Amount at Market Value $7,202,484) | | | 39,083 | | |

| | 78 | | | U.S. Dollar Index Futures

Expiring December 2014 (Underlying Face Amount at Market Value $6,787,249) | | | 225,432 | | |

| | 32 | | | U.S. Long T-Bond Futures

Expiring December 2014 (Underlying Face Amount at Market Value $4,515,000) | | | 57,380 | | |

| | | | | | | $ | 374,203 | | |

Short Futures Contracts

October 31, 2014

Contracts | | | | Unrealized

Appreciation/

(Depreciation) | |

| | 44 | | | Australian Dollar Futures

Expiring December 2014 (Underlying Face Amount at Market Value $3,858,360) | | $ | 99,301 | | |

| | 55 | | | British Pound Futures

Expiring December 2014 (Underlying Face Amount at Market Value $5,494,844) | | | 39,075 | | |

| | 58 | | | Canadian Dollar Futures

Expiring December 2014 (Underlying Face Amount at Market Value $5,138,800) | | | 87,881 | | |

| | 169 | | | Copper Futures

Expiring December 2014 (Underlying Face Amount at Market Value $12,873,575) | | | (72,497 | ) | |

| | 448 | | | Corn Futures

Expiring March 2015 (Underlying Face Amount at Market Value $8,719,200) | | | (87,630 | ) | |

| | 241 | | | Cotton No. 2 Futures

Expiring December 2014 (Underlying Face Amount at Market Value $7,766,225) | | | 1,264,816 | | |

| | 37 | | | Euro FX Futures

Expiring December 2014 (Underlying Face Amount at Market Value $5,795,125) | | | 167,249 | | |

| | 97 | | | Gasoline RBOB Futures

Expiring March 2015 (Underlying Face Amount at Market Value $8,887,838) | | | (41,389 | ) | |

| | 130 | | | Gold Futures

Expiring December 2014 (Underlying Face Amount at Market Value $15,230,800) | | | 770,004 | | |

| | 46 | | | Japanese Yen Futures

Expiring December 2014 (Underlying Face Amount at Market Value $5,122,100) | | | 296,003 | | |

| | 126 | | | NY Harbor ULSD Futures

Expiring January 2015 (Underlying Face Amount at Market Value $13,269,161) | | | 1,544,336 | | |

| | 158 | | | Natural Gas Futures

Expiring January 2015 (Underlying Face Amount at Market Value $6,255,220) | | | 508,272 | | |

| | 41 | | | Silver Futures

Expiring December 2014 (Underlying Face Amount at Market Value $3,301,730) | | | 642,591 | | |

The accompanying notes are an integral part of these financial statements.

DIREXION ANNUAL REPORT

17

Direxion Indexed Managed Futures Strategy Fund (Consolidated)

Contracts | | | | Unrealized

Appreciation/

(Depreciation) | |

| | 150 | | | Soybean Futures

Expiring May 2015 (Underlying Face Amount at Market Value $7,935,000) | | $ | 10,700 | | |

| | 361 | | | Sugar No. 11 Futures

Expiring March 2015 (Underlying Face Amount at Market Value $6,485,293) | | | 593,800 | | |

| | 98 | | | WTI Crude Oil Futures

Expiring June 2015 (Underlying Face Amount at Market Value $7,861,560) | | | 1,054,598 | | |

| | 289 | | | Wheat Futures

Expiring March 2015 (Underlying Face Amount at Market Value $7,886,088) | | | 389,791 | | |

| | | | | | | $ | 7,266,901 | | |

The accompanying notes are an integral part of these financial statements.

DIREXION ANNUAL REPORT

18

Direxion Indexed CVT Strategy Fund

Shares | | | | Value | |

INVESTMENT COMPANIES - 36.3% | |

| | 701,431 | | | iShares iBoxx $ High Yield

Corporate Bond ETF | | $ | 64,903,410 | | |

| | | TOTAL INVESTMENT COMPANIES

(Cost $64,914,505) | | $ | 64,903,410 | | |

| | | TOTAL INVESTMENTS

(Cost $64,914,505) - 36.3% | | $ | 64,903,410 | | |

| | | Other Assets in Excess of

Liabilities - 63.7% (a)(b) | | | 114,019,697 | | |

| | | TOTAL NET ASSETS - 100.0% | | $ | 178,923,107 | | |

Percentages are stated as a percent of net assets.

(a) Includes $21,896,009 cash segregated as collateral for swap contracts.

(b) $145,910 of cash is pledged as collateral for futures contracts.

Long Futures Contracts

October 31, 2014

Contracts | | | | Unrealized

Appreciation/

(Depreciation) | |

| | 170 | | | U.S. 5 Year T-Note Futures

Expiring December 2014 (Underlying Face Amount at Market Value $20,303,047) | | $ | (53,051 | ) | |

Long Equity Swap Contracts

October 31, 2014

Counterparty | | Reference Entity | | Number of

Contracts | | Notional

Amount | | Interest

Rate

Received/

(Paid) | | Termination

Date | | Unrealized

Appreciation/

(Depreciation) | |

Credit Suisse International | | iShares 3-7 Year Treasury Bond ETF | | | 2,492 | | | $ | 305,520 | | | | (0.504 | %) | | 8/6/2015 | | $ | (634 | ) | |

Credit Suisse International | | iShares Russell 2000 ETF | | | 564,703 | | | | 64,328,097 | | | | (0.154 | %) | | 8/6/2015 | | | 1,492,736 | | |

Credit Suisse International | | iShares iBoxx $ Investment Grade

Corporate Bond ETF | | | 343,201 | | | | 41,020,300 | | | | (0.504 | %) | | 8/6/2015 | | | (64,701 | ) | |

Credit Suisse International | | SPDR S&P 500 ETF Trust | | | 290,170 | | | | 57,569,475 | | | | (0.504 | %) | | 8/6/2015 | | | 943,405 | | |

| | | | | | | $ | 163,223,392 | | | | | | | $ | 2,370,806 | | |

The accompanying notes are an integral part of these financial statements.

DIREXION ANNUAL REPORT

19

Statements of Assets & Liabilities

| | | Direxion Indexed

Commodity Strategy

Fund (Consolidated) | | Direxion/Wilshire

Dynamic Fund | | Direxion Indexed

Managed Futures

Strategy Fund

(Consolidated) | | Direxion Indexed CVT

Strategy Fund | |

Assets: | |

Investments, at fair value (Note 2) | | $ | — | | | $ | 9,266,945 | | | $ | — | | | $ | 64,903,410 | | |

Cash | | | 62,240,679 | | | | 901,986 | | | | 83,196,855 | | | | 54,693,439 | | |

Receivable for Fund shares sold | | | 44,947 | | | | 27,150 | | | | 273,992 | | | | 58,542,172 | | |

Receivable for investment

securities sold | | | — | | | | 4,383,865 | | | | — | | | | — | | |

Deposit at broker for futures | | | — | | | | — | | | | — | | | | 145,910 | | |

Deposit at broker for swaps | | | — | | | | 200,000 | | | | — | | | | 21,896,009 | | |

Due from broker for swaps | | | — | | | | 192 | | | | — | | | | 79,512 | | |

Unrealized appreciation on swaps | | | — | | | | 31,015 | | | | — | | | | 2,436,141 | | |

Due from broker for futures | | | — | | | | — | | | | 6,966,659 | | | | — | | |

Receivable for variation margin | | | — | | | | — | | | | 685,409 | | | | — | | |

Total Assets | | | 62,285,626 | | | | 14,811,153 | | | | 91,122,915 | | | | 202,696,593 | | |

Liabilities: | |

Payable for Fund shares redeemed | | | 102,432 | | | | 1,500 | | | | 45,064 | | | | 137,061 | | |

Payable for investment securities

purchased | | | — | | | | 3,912,974 | | | | — | | | | 22,134,143 | | |

Deposits from brokers for futures | | | — | | | | — | | | | 1,214,044 | | | | — | | |

Due to broker for swaps | | | — | | | | — | | | | — | | | | 1,375,268 | | |

Unrealized depreciation on swaps | | | — | | | | — | | | | — | | | | 65,335 | | |

Due to broker for futures | | | — | | | | — | | | | — | | | | 32,482 | | |

Payable for variation margin | | | — | | | | — | | | | — | | | | 19,933 | | |

Accrued investment advisory fees | | | 45,952 | | | | 6,877 | | | | 67,143 | | | | 2,406 | | |

Accrued operating services fees | | | 8,650 | | | | 1,467 | | | | 17,669 | | | | 4,001 | | |

Accrued distribution expenses | | | 4,035 | | | | 3,705 | | | | 19,955 | | | | 2,857 | | |

Total Liabilities | | | 161,069 | | | | 3,926,523 | | | | 1,363,875 | | | | 23,773,486 | | |

Net Assets | | $ | 62,124,557 | | | $ | 10,884,630 | | | $ | 89,759,040 | | | $ | 178,923,107 | | |

Net Assets Consist of: | |

Capital stock | | $ | 62,856,180 | | | $ | 9,440,769 | | | $ | 83,841,868 | | | $ | 180,931,632 | | |

Undistributed (accumulated) net

investment income (loss) | | | (731,623 | ) | | | 114,631 | | | | (1,037,733 | ) | | | 126,610 | | |

Undistributed (accumulated) net

realized gain (loss) | | | — | | | | 1,186,648 | | | | (686,199 | ) | | | (4,441,795 | ) | |

Net unrealized appreciation

(depreciation) on: | |

Investments | | | — | | | | 111,567 | | | | — | | | | (11,095 | ) | |

Futures | | | — | | | | — | | | | 7,641,104 | | | | (53,051 | ) | |

Swaps | | | — | | | | 31,015 | | | | — | | | | 2,370,806 | | |

Net Assets | | $ | 62,124,557 | | | $ | 10,884,630 | | | $ | 89,759,040 | | | $ | 178,923,107 | | |

Cost of Investments | | $ | — | | | $ | 9,155,378 | | | $ | — | | | $ | 64,914,505 | | |

The accompanying notes are an integral part of these financial statements.

DIREXION ANNUAL REPORT

20

Statements of Assets & Liabilities, continued

| | | Direxion Indexed

Commodity Strategy

Fund (Consolidated) | | Direxion/Wilshire

Dynamic Fund | | Direxion Indexed

Managed Futures

Strategy Fund

(Consolidated) | | Direxion Indexed CVT

Strategy Fund | |

Calculation of Net Asset Value

Per Share: | |

Class A Shares: | |

Net assets | | $ | 11,476,663 | | | $ | 8,067,662 | | | $ | 30,628,784 | | | | N/A | | |

Shares outstanding (unlimited

shares of beneficial interest

authorized, no par value) | | | 663,681 | | | | 171,182 | | | | 790,865 | | | | N/A | | |

Net asset value, redemption price

and offering price per share | | $ | 17.29 | | | $ | 47.13 | | | $ | 38.73 | | | | N/A | | |

Institutional Class Shares: | |

Net assets | | $ | 46,601,721 | | | | N/A | | | $ | 51,666,484 | | | | N/A | | |

Shares outstanding (unlimited

shares of beneficial interest

authorized, no par value) | | | 2,666,662 | | | | N/A | | | | 1,325,382 | | | | N/A | | |

Net asset value, redemption price

and offering price per share | | $ | 17.48 | | | | N/A | | | $ | 38.98 | | | | N/A | | |

Class C Shares: | |

Net assets | | $ | 4,046,173 | | | $ | 2,816,968 | | | $ | 7,463,772 | | | | N/A | | |

Shares outstanding (unlimited

shares of beneficial interest

authorized, no par value) | | | 241,414 | | | | 60,900 | | | | 196,769 | | | | N/A | | |

Net asset value, redemption price

and offering price per share | | $ | 16.76 | | | $ | 46.26 | | | $ | 37.93 | | | | N/A | | |

Investor Class Shares: | |

Net assets | | | N/A | | | | N/A | | | | N/A | | | $ | 178,923,107 | | |

Shares outstanding (unlimited

shares of beneficial interest

authorized, no par value) | | | N/A | | | | N/A | | | | N/A | | | | 4,013,639 | | |

Net asset value, redemption price

and offering price per share | | | N/A | | | | N/A | | | | N/A | | | $ | 44.5788 | | |

The accompanying notes are an integral part of these financial statements.

DIREXION ANNUAL REPORT

21

For the Year Ended October 31, 2014

| | | Direxion Indexed

Commodity Strategy

Fund (Consolidated) | | Direxion/Wilshire

Dynamic Fund | | Direxion Indexed

Managed Futures

Strategy Fund

(Consolidated) | | Direxion Indexed CVT

Strategy Fund1 | |

Investment Income: | |

Dividend income | | $ | — | | | $ | 347,756 | | | $ | — | | | $ | 337,979 | | |

Interest income | | | 20,192 | | | | 298 | | | | 25,063 | | | | 1,190 | | |

Total investment income | | | 20,192 | | | | 348,054 | | | | 25,063 | | | | 339,169 | | |

Expenses: | |

Investment advisory fees | | | 651,976 | | | | 91,341 | | | | 927,589 | | | | 125,641 | | |

Operating services fees | | | 122,724 | | | | 19,486 | | | | 244,102 | | | | 58,633 | | |

Distribution expenses — Class A

Shares | | | 79,286 | | | | 22,349 | | | | 104,198 | | | | — | | |

Distribution expenses — Class C

Shares | | | 47,011 | | | | 32,392 | | | | 62,823 | | | | — | | |

Distribution expenses — Investor

Class Shares | | | — | | | | — | | | | — | | | | 41,880 | | |

Total expenses | | | 900,997 | | | | 165,568 | | | | 1,338,712 | | | | 226,154 | | |

Less: Reimbursement of

expenses from Adviser | | | — | | | | — | | | | — | | | | (13,595 | ) | |

Net Expenses | | | 900,997 | | | | 165,568 | | | | 1,338,712 | | | | 212,559 | | |

Net investment income (loss) | | | (880,805 | ) | | | 182,486 | | | | (1,313,649 | ) | | | 126,610 | | |

Realized and unrealized gain

(loss) on investments: | |

Net realized gain (loss) on: | |

Investments | | | — | | | | 1,281,831 | | | | — | | | | (1,297,428 | ) | |

Futures | | | (7,153,920 | ) | | | — | | | | (6,059,844 | ) | | | (13,089 | ) | |

Swaps | | | — | | | | 295,393 | | | | — | | | | (3,131,278 | ) | |

| | | | (7,153,920 | ) | | | 1,577,224 | | | | (6,059,844 | ) | | | (4,441,795 | ) | |

Capital gain distributions from

regulated investment companies | | | — | | | | 2,620 | | | | — | | | | — | | |

Change in net unrealized

appreciation (depreciation) on: | |

Investments | | | — | | | | (1,243,825 | ) | | | — | | | | (11,095 | ) | |

Futures | | | 923,921 | | | | — | | | | 7,796,847 | | | | (53,051 | ) | |

Swaps | | | — | | | | (102,354 | ) | | | — | | | | 2,370,806 | | |

| | | | 923,921 | | | | (1,346,179 | ) | | | 7,796,847 | | | | 2,306,660 | | |

Net realized and unrealized

gain (loss) on investments | | | (6,229,999 | ) | | | 233,665 | | | | 1,737,003 | | | | (2,135,135 | ) | |

Net increase (decrease) in net

assets resulting from

operations | | $ | (7,110,804 | ) | | $ | 416,151 | | | $ | 423,354 | | | $ | (2,008,525 | ) | |

1 Represents the period from February 5, 2014 (commencement of operations) to October 31, 2014.

The accompanying notes are an integral part of these financial statements.

DIREXION ANNUAL REPORT

22

Statements of Changes in Net Assets

| | | Direxion Indexed Commodity

Strategy Fund (Consolidated) | | Direxion/Wilshire

Dynamic Fund | |

| | | Year Ended

October 31, 2014 | | Year Ended

October 31, 2013 | | Year Ended

October 31, 2014 | | Year Ended

October 31, 2013 | |

Increase (decrease) in net assets from: | |

Operations: | |

Net investment income (loss) | | $ | (880,805 | ) | | $ | (726,913 | ) | | $ | 182,486 | | | $ | 151,665 | | |

Net realized gain (loss) on investments | | | (7,153,920 | ) | | | (4,076,732 | ) | | | 1,577,224 | | | | 1,816,433 | | |

Capital gain distributions from regulated

investment companies | | | — | | | | — | | | | 2,620 | | | | — | | |

Change in net unrealized appreciation

(depreciation) on investments | | | 923,921 | | | | 367,034 | | | | (1,346,179 | ) | | | (436,820 | ) | |

Net increase (decrease) in net assets

resulting from operations | | | (7,110,804 | ) | | | (4,436,611 | ) | | | 416,151 | | | | 1,531,278 | | |

Distributions to shareholders: | |

Net investment income: | |

Class A Shares | | | — | | | | — | | | | (205,555 | ) | | | (356,372 | ) | |

Institutional Class Shares | | | — | | | | — | | | | — | | | | — | | |

Class C Shares | | | — | | | | — | | | | (45,371 | ) | | | (28,332 | ) | |

Net realized gains | |

Class A Shares | | | — | | | | — | | | | (380,722 | ) | | | (435,668 | ) | |

Institutional Class Shares | | | — | | | | — | | | | — | | | | — | | |

Class C Shares | | | — | | | | — | | | | (131,626 | ) | | | (89,294 | ) | |

Total distributions to shareholders | | | — | | | | — | | | | (763,274 | ) | | | (909,666 | ) | |

Capital share transactions: | |

Total increase (decrease) in net assets from

net change in capital share transactions(a) | | | 4,924,704 | | | | 12,542,768 | | | | (3,221,514 | ) | | | (19,541,371 | ) | |

Total increase (decrease) in net assets | | | (2,186,100 | ) | | | 8,106,157 | | | | (3,568,637 | ) | | | (18,919,759 | ) | |

Net assets: | |

Beginning of year | | | 64,310,657 | | | | 56,204,500 | | | | 14,453,267 | | | | 33,373,026 | | |

End of year | | $ | 62,124,557 | | | $ | 64,310,657 | | | $ | 10,884,630 | | | $ | 14,453,267 | | |

Undistributed (accumulated) net

investment income (loss), end of year | | $ | (731,623 | ) | | $ | (1,107,309 | ) | | $ | 114,631 | | | $ | 185,637 | | |

(a) Summary of capital share transactions is as follows:

| | | Direxion Indexed Commodity Strategy Fund

(Consolidated) | | Direxion/Wilshire Dynamic Fund | |

| | | Year Ended

October 31, 2014 | | Year Ended

October 31, 2013 | | Year Ended

October 31, 2014 | | Year Ended

October 31, 2013 | |

| | | Shares | | Value | | Shares | | Value | | Shares | | Value | | Shares | | Value | |

Shares sold | |

Class A Shares | | | 944,270 | | | $ | 17,788,021 | | | | 1,460,193 | | | $ | 28,995,490 | | | | 20,361 | | | $ | 952,794 | | | | 73,244 | | | $ | 3,373,883 | | |

Institutional Class

Shares | | | 2,598,064 | | | | 48,583,825 | | | | 936,060 | | | | 18,919,636 | | | | — | | | | — | | | | — | | | | — | | |

Class C Shares | | | 85,704 | | | | 1,563,848 | | | | 127,050 | | | | 2,465,371 | | | | 2,788 | | | | 128,298 | | | | 14,200 | | | | 646,137 | | |

Shares issued in

reinvestment

of distributions | |

Class A Shares | | | — | | | | — | | | | — | | | | — | | | | 12,606 | | | | 568,132 | | �� | | 14,705 | | | | 662,915 | | |

Institutional Class

Shares | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | |

Class C Shares | | | — | | | | — | | | | — | | | | — | | | | 3,842 | | | | 171,078 | | | | 2,611 | | | | 116,391 | | |

Shares redeemed | |

Class A Shares | | | (2,371,857 | ) | | | (43,406,540 | ) | | | (1,213,330 | ) | | | (24,120,917 | ) | | | (86,806 | ) | | | (4,039,637 | ) | | | (467,519 | ) | | | (21,104,589 | ) | |

Institutional Class

Shares | | | (978,767 | ) | | | (17,924,020 | ) | | | (603,564 | ) | | | (12,099,427 | ) | | | — | | | | — | | | | — | | | | — | | |

Class C Shares | | | (94,208 | ) | | | (1,680,430 | ) | | | (82,885 | ) | | | (1,617,385 | ) | | | (21,629 | ) | | | (1,002,179 | ) | | | (71,280 | ) | | | (3,236,108 | ) | |

Net increase (decrease) | | | 183,206 | | | $ | 4,924,704 | | | | 623,524 | | | $ | 12,542,768 | | | | (68,838 | ) | | $ | (3,221,514 | ) | | | (434,039 | ) | | $ | (19,541,371 | ) | |

The accompanying notes are an integral part of these financial statements.

DIREXION ANNUAL REPORT

23

Statements of Changes in Net Assets

| | | Direxion Indexed Managed Futures

Strategy Fund (Consolidated) | | Direxion Indexed CVT

Strategy Fund | |

| | | Year Ended

October 31, 2014 | | Year Ended

October 31, 2013 | | February 5, 20141 through

October 31, 2014 | |

Increase (decrease) in net assets from: | |

Operations: | |

Net investment income (loss) | | $ | (1,313,649 | ) | | $ | (1,161,028 | ) | | $ | 126,610 | | |

Net realized loss on investments | | | (6,059,844 | ) | | | (2,643,830 | ) | | | (4,441,795 | ) | |

Change in net unrealized appreciation on investments | | | 7,796,847 | | | | 544,874 | | | | 2,306,660 | | |

Net increase (decrease) in net assets resulting from

operations | | | 423,354 | | | | (3,259,984 | ) | | | (2,008,525 | ) | |

Distributions to shareholders: | |

Total distributions to shareholders | | | — | | | | — | | | | — | | |

Capital share transactions: | |

Total increase (decrease) in net assets from

net change in capital share transactions(a) | | | (29,062,895 | ) | | | 68,155,558 | | | | 180,931,632 | | |

Total increase (decrease) in net assets | | | (28,639,541 | ) | | | 64,895,574 | | | | 178,923,107 | | |

Net assets: | |

Beginning of year/period | | | 118,398,581 | | | | 53,503,007 | | | | — | | |

End of year/period | | $ | 89,759,040 | | | $ | 118,398,581 | | | $ | 178,923,107 | | |

Undistributed (accumulated) net investment

income (loss), end of year/period | | $ | (1,037,733 | ) | | $ | (1,025,316 | ) | | $ | 126,610 | | |

(a) Summary of capital share transactions is as follows:

| | | Direxion Indexed Managed Futures

Strategy Fund (Consolidated) | | Direxion Indexed CVT

Strategy Fund | |

| | | Year Ended

October 31, 2014 | | Year Ended

October 31, 2013 | | February 5, 20141 through

October 31, 2014 | |

| | | Shares | | Value | | Shares | | Value | | Shares | | Value | |

Shares sold | |

Class A Shares | | | 400,744 | | | $ | 14,861,557 | | | | 1,197,644 | | | $ | 46,190,131 | | | | — | | | $ | — | | |

Institutional Class Shares | | | 1,092,897 | | | | 40,710,985 | | | | 1,920,962 | | | | 73,872,859 | | | | — | | | | — | | |

Class C Shares | | | 124,926 | | | | 4,536,131 | | | | 113,273 | | | | 4,276,910 | | | | — | | | | — | | |

Investor Class Shares | | | — | | | | — | | | | — | | | | — | | | | 9,243,847 | | | | 404,680,123 | | |

Shares redeemed | |

Class A Shares | | | (1,065,260 | ) | | | (38,334,105 | ) | | | (812,137 | ) | | | (30,838,183 | ) | | | — | | | | — | | |

Institutional Class Shares | | | (1,369,662 | ) | | | (49,374,811 | ) | | | (617,808 | ) | | | (23,773,600 | ) | | | — | | | | — | | |

Class C Shares | | | (41,087 | ) | | | (1,462,652 | ) | | | (41,704 | ) | | | (1,572,559 | ) | | | — | | | | — | | |

Investor Class Shares | | | — | | | | — | | | | — | | | | — | | | | (5,230,208 | ) | | | (223,748,491 | ) | |

Net increase (decrease) | | | (857,442 | ) | | $ | (29,062,895 | ) | | | 1,760,230 | | | $ | 68,155,558 | | | | 4,013,639 | | | $ | 180,931,632 | | |

1 Commencement of operations.

The accompanying notes are an integral part of these financial statements.

DIREXION ANNUAL REPORT

24

| | | | | RATIOS TO AVERAGE NET ASSETS | |

| | | Net Asset

Value,

Beginning

of Year/

Period | | Net

Investment

Income

(Loss)1 | | Net Realized on

and Unrealized

Gain (Loss)

Investments | | Net Increase

(Decrease) in

Net Asset

Value Resulting

from Operations | | Dividends

from Net

Investment

Income | | Distributions

from

Realized

Capital Gains | | Return of

Capital

Distribution | | Total

Distributions | | Redemption

Fees Paid

to Fund | | Net

Asset

Value,

End of

Year/

Period | | Total

Return2 | | Net

Assets,

End of

Year/

Period

(,000) | | Total

Expenses3 | | Net

Expenses3 | | Net Investment

Income (Loss)

after Expense

Reimbursement/

Recoupment3 | | Portfolio

Turnover

Rate4 | |

Direxion Indexed Commodity Strategy Fund (Consolidated) | |

Class A Shares | |

Year ended October 31, 2014 | | $ | 18.96 | | | $ | (0.23 | ) | | $ | (1.44 | ) | | $ | (1.67 | ) | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | —5 | | | $ | 17.29 | | | | (8.81 | )% | | $ | 11,477 | | | | 1.26 | % | | | 1.26 | % | | | (1.23 | )% | | | 0 | % | |

Year ended October 31, 2013 | | $ | 20.32 | | | | (0.24 | ) | | | (1.12 | ) | | | (1.36 | ) | | | — | | | | — | | | | — | | | | — | | | | —5 | | | $ | 18.96 | | | | (6.69 | )% | | $ | 39,656 | | | | 1.26 | % | | | 1.26 | % | | | (1.20 | )% | | | 0 | % | |

Year ended October 31, 2012 | | $ | 21.23 | | | | (0.28 | ) | | | (0.64 | ) | | | (0.92 | ) | | | — | | | | — | | | | — | | | | — | | | | 0.01 | | | $ | 20.32 | | | | (4.29 | )% | | $ | 37,480 | | | | 1.42 | % | | | 1.42 | % | | | (1.33 | )% | | | 0 | % | |

Year ended October 31, 2011 | | $ | 25.43 | | | | (0.46 | ) | | | (3.77 | ) | | | (4.23 | ) | | | — | | | | — | | | | — | | | | — | | | | 0.03 | | | $ | 21.23 | | | | (16.52 | )% | | $ | 60,639 | | | | 1.74 | % | | | 1.74 | % | | | (1.69 | )% | | | 0 | % | |

Year ended October 31, 2010 | | $ | 28.81 | | | | (0.43 | ) | | | (2.19 | ) | | | (2.62 | ) | | | (0.77 | ) | | | — | | | | —5 | | | | (0.77 | ) | | | 0.01 | | | $ | 25.43 | | | | (9.24 | )% | | $ | 126,967 | | | | 1.78 | % | | | 1.78 | % | | | (1.66 | )% | | | 0 | % | |

Institutional Class Shares | |

Year ended October 31, 2014 | | $ | 19.12 | | | | (0.18 | ) | | | (1.46 | ) | | | (1.64 | ) | | | — | | | | — | | | | — | | | | — | | | | —5 | | | $ | 17.48 | | | | (8.58 | )% | | $ | 46,602 | | | | 1.01 | % | | | 1.01 | % | | | (0.99 | )% | | | 0 | % | |

Year ended October 31, 2013 | | $ | 20.44 | | | | (0.19 | ) | | | (1.13 | ) | | | (1.32 | ) | | | — | | | | — | | | | — | | | | — | | | | —5 | | | $ | 19.12 | | | | (6.46 | )% | | $ | 20,026 | | | | 1.01 | % | | | 1.01 | % | | | (0.95 | )% | | | 0 | % | |

Year ended October 31, 2012 | | $ | 21.29 | | | | (0.21 | ) | | | (0.64 | ) | | | (0.85 | ) | | | — | | | | — | | | | — | | | | — | | | | —5 | | | $ | 20.44 | | | | (3.99 | )% | | $ | 14,610 | | | | 1.09 | % | | | 1.09 | % | | | (1.00 | )% | | | 0 | % | |

Year ended October 31, 2011 | | $ | 25.46 | | | | (0.32 | ) | | | (3.85 | ) | | | (4.17 | ) | | | — | | | | — | | | | — | | | | — | | | | —5 | | | $ | 21.29 | | | | (16.38 | )% | | $ | 26,772 | | | | 1.24 | % | | | 1.24 | % | | | (1.19 | )% | | | 0 | % | |

Year ended October 31, 2010 | | $ | 28.87 | | | | (0.30 | ) | | | (2.24 | ) | | | (2.54 | ) | | | (0.87 | ) | | | — | | | | — | | | | (0.87 | ) | | | —5 | | | $ | 25.46 | | | | (8.98 | )% | | $ | 21,317 | | | | 1.27 | % | | | 1.27 | % | | | (1.16 | )% | | | 0 | % | |

Class C Shares | |

Year ended October 31, 2014 | | $ | 18.52 | | | | (0.36 | ) | | | (1.40 | ) | | | (1.76 | ) | | | — | | | | — | | | | — | | | | — | | | | — | | | $ | 16.76 | | | | (9.50 | )% | | $ | 4,046 | | | | 2.01 | % | | | 2.01 | % | | | (1.98 | )% | | | 0 | % | |

Year ended October 31, 2013 | | $ | 20.00 | | | | (0.38 | ) | | | (1.10 | ) | | | (1.48 | ) | | | — | | | | — | | | | — | | | | — | | | | — | | | $ | 18.52 | | | | (7.40 | )% | | $ | 4,629 | | | | 2.01 | % | | | 2.01 | % | | | (1.95 | )% | | | 0 | % | |

Year ended October 31, 2012 | | $ | 21.03 | | | | (0.41 | ) | | | (0.62 | ) | | | (1.03 | ) | | | — | | | | — | | | | — | | | | — | | | | — | | | $ | 20.00 | | | | (4.90 | )% | | $ | 4,115 | | | | 2.08 | % | | | 2.08 | % | | | (1.99 | )% | | | 0 | % | |

Year ended October 31, 2011 | | $ | 25.35 | | | | (0.57 | ) | | | (3.75 | ) | | | (4.32 | ) | | | — | | | | — | | | | — | | | | — | | | | —5 | | | $ | 21.03 | | | | (17.04 | )% | | $ | 4,943 | | | | 2.24 | % | | | 2.24 | % | | | (2.20 | )% | | | 0 | % | |

March 4, 20106 to October 31, 2010 | | $ | 25.46 | | | | (0.33 | ) | | | 0.22 | | | | (0.11 | ) | | | — | | | | — | | | | — | | | | — | | | | — | | | $ | 25.35 | | | | (0.43 | )% | | $ | 372 | | | | 2.24 | % | | | 2.24 | % | | | (2.10 | )% | | | 0 | % | |

Direxion/Wilshire Dynamic Fund | |

Class A Shares | |

Year ended October 31, 2014 | | $ | 48.25 | | | | 0.80 | | | | 0.85 | | | | 1.65 | | | | (0.97 | ) | | | (1.80 | ) | | | — | | | | (2.77 | ) | | | —5 | | | $ | 47.13 | | | | 3.69 | % | | $ | 8,068 | | | | 1.16 | % | | | 1.16 | % | | | 1.70 | % | | | 223 | % | |

Year ended October 31, 2013 | | $ | 45.55 | | | | 0.33 | | | | 3.70 | | | | 4.03 | | | | (0.60 | ) | | | (0.73 | ) | | | — | | | | (1.33 | ) | | | —5 | | | $ | 48.25 | | | | 9.07 | % | | $ | 10,857 | | | | 1.16 | % | | | 1.16 | % | | | 0.72 | % | | | 272 | % | |

Year ended October 31, 2012 | | $ | 43.96 | | | | (0.10 | ) | | | 2.81 | | | | 2.71 | | | | (0.05 | ) | | | (1.08 | ) | | | — | | | | (1.13 | ) | | | 0.01 | | | $ | 45.55 | | | | 6.37 | % | | $ | 27,541 | | | | 1.21 | % | | | 1.21 | % | | | (0.23 | )% | | | 40 | % | |

Year ended October 31, 2011 | | $ | 45.03 | | | | (0.13 | ) | | | 1.46 | | | | 1.33 | | | | — | | | | (2.46 | ) | | | — | | | | (2.46 | ) | | | 0.06 | | | $ | 43.96 | | | | 3.17 | % | | $ | 19,184 | | | | 1.41 | % | | | 1.41 | % | | | (0.28 | )% | | | 151 | % | |

Year ended October 31, 2010 | | $ | 41.75 | | | | (0.14 | ) | | | 4.60 | | | | 4.46 | | | | (0.10 | ) | | | (1.09 | ) | | | — | | | | (1.19 | ) | | | 0.01 | | | $ | 45.03 | | | | 10.92 | % | | $ | 15,531 | | | | 1.55 | % | | | 1.55 | % | | | (0.33 | )% | | | 107 | % | |

Class C Shares | |

Year ended October 31, 2014 | | $ | 47.39 | | | | 0.44 | | | | 0.85 | | | | 1.29 | | | | (0.62 | ) | | | (1.80 | ) | | | — | | | | (2.42 | ) | | | — | | | $ | 46.26 | | | | 2.92 | % | | $ | 2,817 | | | | 1.91 | % | | | 1.91 | % | | | 0.94 | % | | | 223 | % | |

Year ended October 31, 2013 | | $ | 44.74 | | | | 0.01 | | | | 3.60 | | | | 3.61 | | | | (0.23 | ) | | | (0.73 | ) | | | — | | | | (0.96 | ) | | | — | | | $ | 47.39 | | | | 8.22 | % | | $ | 3,597 | | | | 1.91 | % | | | 1.91 | % | | | 0.03 | % | | | 272 | % | |

Year ended October 31, 2012 | | $ | 43.50 | | | | (0.40 | ) | | | 2.75 | | | | 2.35 | | | | (0.03 | ) | | | (1.08 | ) | | | — | | | | (1.11 | ) | | | — | | | $ | 44.74 | | | | 5.59 | % | | $ | 5,832 | | | | 1.94 | % | | | 1.94 | % | | | (0.91 | )% | | | 40 | % | |

Year ended October 31, 2011 | | $ | 44.90 | | | | (0.42 | ) | | | 1.48 | | | | 1.06 | | | | — | | | | (2.46 | ) | | | — | | | | (2.46 | ) | | | — | | | $ | 43.50 | | | | 2.40 | % | | $ | 3,981 | | | | 2.05 | % | | | 2.05 | % | | | (0.97 | )% | | | 151 | % | |

March 17, 20106 to October 31, 2010 | | $ | 43.37 | | | | (0.34 | ) | | | 1.87 | | | | 1.53 | | | | — | | | | — | | | | — | | | | — | | | | — | | | $ | 44.90 | | | | 3.53 | % | | $ | 1,911 | | | | 2.05 | % | | | 2.05 | % | | | (1.26 | )% | | | 107 | % | |

1 Net investment income (loss) per share represents net investment income (loss) divided by the daily average shares of beneficial interest outstanding throughout each period.

2 All returns reflect reinvested dividends, if any, but do not reflect the impact of taxes. Total return for a period of less than one year is not annualized. Class C returns do not include the contingent deferred sales charge.

3 For periods of less than one year, these ratios are annualized.

4 Portfolio turnover is not annualized and is calculated without regard to short-term securities having a maturity of less than one year. Investments in options, swaps, forward contracts, futures contracts and repurchase agreements are deemed short-term securities.

5 Amount is less than $0.005.

6 Commencement of operations.

The accompanying notes are an integral part of these financial statements.

DIREXION ANNUAL REPORT

25

| | | | | RATIOS TO AVERAGE NET ASSETS | |

| | | Net Asset

Value,

Beginning

of Year/

Period | | Net

Investment

Income

(Loss)1 | | Net Realized on

and Unrealized

Gain (Loss)

Investments | | Net Increase

(Decrease) in

Net Asset

Value Resulting

from Operations | | Dividends

from Net

Investment

Income | | Distributions

from

Realized

Capital Gains | | Return of

Capital

Distribution | | Total

Distributions | | Redemption

Fees Paid

to Fund | | Net

Asset

Value,

End of

Year/

Period | | Total

Return2 | | Net

Assets,

End of

Year/

Period

(,000) | | Total

Expenses3 | | Net

Expenses3 | | Net Investment

Income (Loss)

after Expense

Reimbursement/

Recoupment3 | | Portfolio

Turnover

Rate4 | |

Direxion Indexed Managed Futures Strategy Fund (Consolidated) | |

Class A Shares | |

Year ended October 31, 2014 | | $ | 37.29 | | | $ | (0.52 | ) | | $ | 1.96 | | | $ | 1.44 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | —5 | | | $ | 38.73 | | | | 3.86 | % | | $ | 30,629 | | | | 1.45 | % | | | 1.45 | % | | | (1.42 | )% | | | 0 | % | |

Year ended October 31, 2013 | | $ | 37.94 | | | | (0.54 | ) | | | (0.11 | ) | | | (0.65 | ) | | | — | | | | — | | | | — | | | | — | | | | —5 | | | $ | 37.29 | | | | (1.71 | )% | | $ | 54,271 | | | | 1.45 | % | | | 1.45 | % | | | (1.40 | )% | | | 0 | % | |

February 1, 20126 to October 31, 2012 | | $ | 40.00 | | | | (0.38 | ) | | | (1.68 | ) | | | (2.06 | ) | | | — | | | | — | | | | — | | | | — | | | | —5 | | | $ | 37.94 | | | | (5.15 | )% | | $ | 40,588 | | | | 1.45 | % | | | 1.45 | % | | | (1.32 | )% | | | 0 | % | |

Institutional Class Shares | |

Year ended October 31, 2014 | | $ | 37.43 | | | | (0.43 | ) | | | 1.97 | | | | 1.54 | | | | — | | | | — | | | | — | | | | — | | | | 0.01 | | | $ | 38.98 | | | | 4.14 | % | | $ | 51,666 | | | | 1.20 | % | | | 1.20 | % | | | (1.17 | )% | | | 0 | % | |

Year ended October 31, 2013 | | $ | 37.98 | | | | (0.44 | ) | | | (0.12 | ) | | | (0.56 | ) | | | — | | | | — | | | | — | | | | — | | | | 0.01 | | | $ | 37.43 | | | | (1.45 | )% | | $ | 59,972 | | | | 1.20 | % | | | 1.20 | % | | | (1.15 | )% | | | 0 | % | |

February 1, 20126 to October 31, 2012 | | $ | 40.00 | | | | (0.32 | ) | | | (1.70 | ) | | | (2.02 | ) | | | — | | | | — | | | | — | | | | — | | | | —5 | | | $ | 37.98 | | | | (5.05 | )% | | $ | 11,355 | | | | 1.20 | % | | | 1.20 | % | | | (1.08 | )% | | | 0 | % | |

Class C Shares | |

Year ended October 31, 2014 | | $ | 36.80 | | | | (0.77 | ) | | | 1.90 | | | | 1.13 | | | | — | | | | — | | | | — | | | | — | | | | — | | | $ | 37.93 | | | | 3.07 | % | | $ | 7,464 | | | | 2.20 | % | | | 2.20 | % | | | (2.17 | )% | | | 0 | % | |

Year ended October 31, 2013 | | $ | 37.72 | | | | (0.81 | ) | | | (0.11 | ) | | | (0.92 | ) | | | — | | | | — | | | | — | | | | — | | | | — | | | $ | 36.80 | | | | (2.44 | )% | | $ | 4,155 | | | | 2.20 | % | | | 2.20 | % | | | (2.15 | )% | | | 0 | % | |

February 1, 20126 to October 31, 2012 | | $ | 40.00 | | | | (0.60 | ) | | | (1.68 | ) | | | (2.28 | ) | | | — | | | | — | | | | — | | | | — | | | | — | | | $ | 37.72 | | | | (5.70 | )% | | $ | 1,560 | | | | 2.20 | % | | | 2.20 | % | | | (2.07 | )% | | | 0 | % | |

Direxion Indexed CVT Strategy Fund | |

Investor Class Shares | |

February 5, 20146 to October 31, 2014 | | $ | 40.0000 | | | | 0.2370 | | | | 4.3418 | | | | 4.5788 | | | | — | | | | — | | | | — | | | | — | | | | — | | | $ | 44.5788 | | | | 11.45 | %7 | | $ | 178,923 | | | | 1.35 | % | | | 1.27 | % | | | 0.76 | %8 | | | 840 | % | |

1 Net investment income (loss) per share represents net investment income (loss) divided by the daily average shares of beneficial interest outstanding throughout each period.

2 All returns reflect reinvested dividends, if any, but do not reflect the impact of taxes. Total return for a period of less than one year is not annualized. Class C returns do not include the contingent deferred sales charge.

3 For periods of less than one year, these ratios are annualized.

4 Portfolio turnover is not annualized and is calculated without regard to short-term securities having a maturity of less than one year. Investments in options, swaps, forward contracts, futures contracts and repurchase agreements are deemed short-term securities.

5 Amount is less than $0.005.

6 Commencement of operations.

7 The Advisor voluntarily reimbursed expenses of the Fund. If this reimbursement had not been made, the total return would have been 0.01% lower.

8 Net investment income (loss) ratio before expense reimbursement/recoupment for the period ended October 31, 2014 was 0.67%.

The accompanying notes are an integral part of these financial statements.

DIREXION ANNUAL REPORT

26

NOTES TO THE FINANCIAL STATEMENTS

1. ORGANIZATION