UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08243

Direxion Funds

(Exact name of registrant as specified in charter)

1301 Avenue of the Americas (6th Ave.), 28th Floor

New York, NY 10019

(Address of principal executive offices) (Zip code)

Direxion Funds

1301 Avenue of the Americas (6th Ave.), 28th Floor

New York, NY 10019

(Name and address of agent for service)

1-800-851-0511

Registrant’s telephone number, including area code

Date of fiscal year end: August 31, 2024

Date of reporting period: August 31, 2024

Item 1. Reports to Stockholders.

| (a) | A copy of the reports transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (“Act”), is filed herewith. |

| | |

| Direxion Monthly High Yield Bull 1.2X Fund | |

| Investor | DXHYX |

| Annual Shareholder Report | August 31, 2024 |

This annual shareholder report contains important information about the Direxion Monthly High Yield Bull 1.2X Fund for the period of September 1, 2023, to August 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion Monthly High Yield Bull 1.2X Fund | $142 | 1.35% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Direxion Monthly High Yield Bull 1.2X Fund seeks to provide 120% of the calendar month return of the Solactive High Yield Beta Index. The Solactive High Yield Beta Index is a rules-based, systematic strategy index that provides exposure to an equal-weighted portfolio of three high-yield ETFs. The allocation to each U.S. High Yield Corporate Bond ETF is adjusted on a monthly basis. The index is calculated and distributed by Solactive AG and is calculated and published in U.S. Dollars. To determine if the Fund has met its monthly investment goals, the Advisor, Rafferty Asset Management, LLC, maintains models which indicate the expected performance of the Fund as compared to the underlying index. The models do not take into account the expense ratio or any transaction or trading fees associated with creating or maintaining the Fund’s portfolio. Deviation from the model may be due to a combination of asset fluctuation, expenses, transaction costs, including swap contract related costs and underlying volatility. For the Annual Period, the Solactive High Yield Beta Index returned 11.74%. For the same period, the Direxion Monthly High Yield Bull 1.2X Fund returned 10.90%, while the model indicated an expected return of 14.20%. Given the calendar month investment objective of the Fund and the path dependency of returns for longer periods, the return of the index alone should not generate expectations of performance of the Fund.

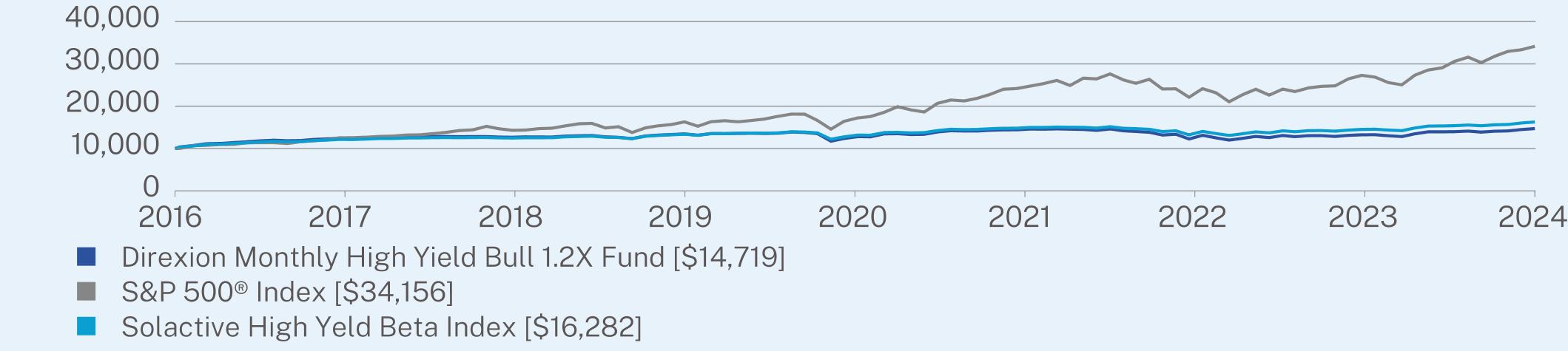

HOW DID THE FUND PERFORM FOR THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the Fund. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Direxion Monthly High Yield Bull 1.2X Fund | PAGE 1 | TSR-AR-254939127 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | Since Inception

(02/17/2016) |

Direxion Monthly High Yield Bull 1.2X Fund | 10.90 | 1.61 | 4.63 |

S&P 500® Index | 27.14 | 15.92 | 15.48 |

Solactive High Yeld Beta Index | 11.74 | 3.66 | 5.88 |

Visit https://connect.rightprospectus.com/Direxion for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $59,327,502 |

Number of Holdings | 4 |

Net Advisory Fee | $338,703 |

Portfolio Turnover | 869% |

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

| |

Market Exposure | |

Investment Companies | 80.0% |

Total Return Swap Contracts | 40.0% |

Total (as % of net assets) | 120.0% |

| |

Constituents of Index | (%) |

iShares iBoxx $ High Yield Corporate Bond ETF | 33.4% |

PIMCO 0-5 Year High Yield Corporate Bond Index ETF | 33.3% |

SPDR Bloomberg High Yield Bond ETF | 33.3% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion

The Fund is distributed by ALPS Distributors, Inc..

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Rafferty Asset Management, LLC documents not be householded, please contact Rafferty Asset Management, LLC at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Rafferty Asset Management, LLC or your financial intermediary.

| Direxion Monthly High Yield Bull 1.2X Fund | PAGE 2 | TSR-AR-254939127 |

118291278613017135921350214645125271327114719114001325115857163201990026102231712686634156115731251312853136011383115067135421457016282

| | |

| Direxion Monthly NASDAQ-100® Bull 1.25X Fund | |

| Investor | DXNLX |

| Annual Shareholder Report | August 31, 2024 |

This annual shareholder report contains important information about the Direxion Monthly NASDAQ-100® Bull 1.25X Fund for the period of September 1, 2023, to August 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion Monthly NASDAQ-100® Bull 1.25X Fund | $132 | 1.15% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Direxion Monthly NASDAQ-100® Bull 1.25X Fund seeks to provide 125% of the calendar month return of the NASDAQ-100® Index. The NASDAQ-100® Index includes 100 of the largest domestic and international non-financial companies listed on the NASDAQ Stock Market® based on market capitalization. All companies listed on the index have an average daily trading volume of at least 200,000 shares. To determine if the Fund has met its monthly investment goals, the Advisor, Rafferty Asset Management, LLC, maintains models which indicate the expected performance of the Fund as compared to the underlying index. The models do not take into account the expense ratio or any transaction or trading fees associated with creating or maintaining the Fund’s portfolio. Deviation from the model may be due to a combination of asset fluctuation, expenses, transaction costs, including swap contract related costs and underlying volatility. For the Annual Period, the NASDAQ-100® Index returned 27.30%. For the same period, the Direxion Monthly NASDAQ-100® Bull 1.25X Fund returned 30.30%, while the model indicated an expected return of 34.61%. Given the calendar month investment objective of the Fund and the path dependency of returns for longer periods, the return of the index alone should not generate expectations of performance of the Fund.

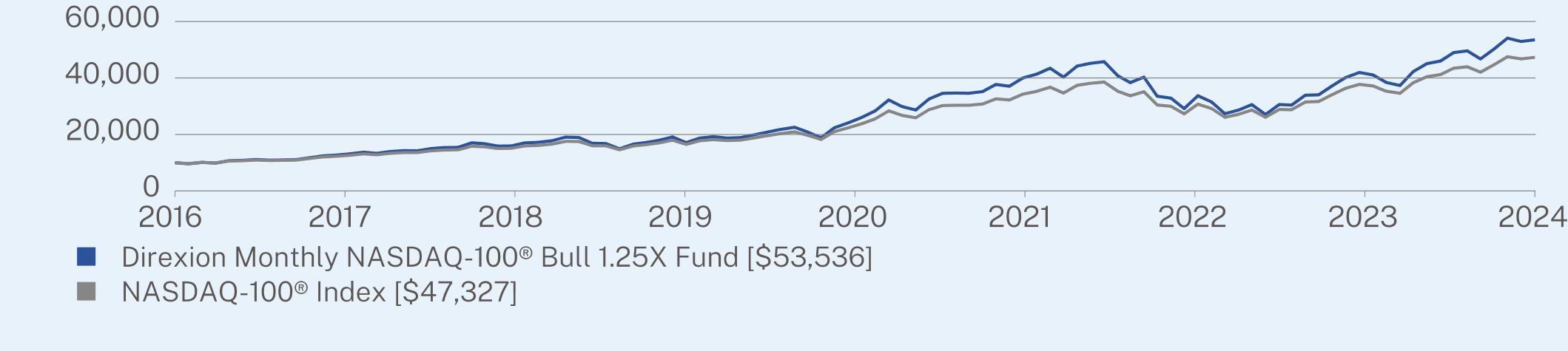

HOW DID THE FUND PERFORM FOR THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the Fund. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Direxion Monthly NASDAQ-100® Bull 1.25X Fund | PAGE 1 | TSR-AR-25460D101 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | Since Inception

(03/31/2016) |

Direxion Monthly NASDAQ-100® Bull 1.25X Fund | 30.30 | 23.38 | 22.05 |

NASDAQ-100® Index | 27.30 | 21.55 | 20.28 |

Visit https://connect.rightprospectus.com/Direxion for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $12,831,117 |

Number of Holdings | 5 |

Net Advisory Fee | $75,452 |

Portfolio Turnover | 1,132% |

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

| |

Market Exposure | |

Total Return Swap Contracts | 82.1% |

Investment Companies | 42.9% |

Total (as % of net assets) | 125.0% |

| |

Index Composition | (%) |

Information Technology | 50.9% |

Communication Services | 15.5% |

Consumer Discretionary | 12.4% |

Health Care | 6.4% |

Consumer Staples | 6.3% |

Industrials | 4.5% |

Materials | 1.5% |

Utilities | 1.3% |

Financials | 0.5% |

Energy | 0.5% |

Real Estate | 0.2% |

| |

Top 10 Constituents of Index | (%) |

Apple, Inc. | 9.3% |

Microsoft Corp. | 8.1% |

NVIDIA Corp. | 7.7% |

Broadcom, Inc. | 5.0% |

Meta Platforms, Inc. Class A | 4.8% |

Amazon.com, Inc. | 4.7% |

Costco Wholesale Corp. | 2.7% |

Tesla, Inc. | 2.6% |

Alphabet Inc. Class A | 2.5% |

Alphabet Inc. Class C | 2.4% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion

The Fund is distributed by ALPS Distributors, Inc..

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Rafferty Asset Management, LLC documents not be householded, please contact Rafferty Asset Management, LLC at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Rafferty Asset Management, LLC or your financial intermediary.

| Direxion Monthly NASDAQ-100® Bull 1.25X Fund | PAGE 2 | TSR-AR-25460D101 |

108331427419039187223221643468315154108553536107051359617557178372836136755291723717747327

| | |

| Direxion Monthly NASDAQ-100® Bull 1.75X Fund | |

| Investor | DXQLX |

| Annual Shareholder Report | August 31, 2024 |

This annual shareholder report contains important information about the Direxion Monthly NASDAQ-100® Bull 1.75X Fund for the period of September 1, 2023, to August 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion Monthly NASDAQ-100® Bull 1.75X Fund | $162 | 1.35% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Direxion Monthly NASDAQ-100® Bull 1.75X Fund seeks to provide 175% of the calendar month return of the NASDAQ-100® Index. The NASDAQ-100® Index includes 100 of the largest domestic and international non-financial companies listed on the NASDAQ Stock Market® based on market capitalization. All companies listed on the index have an average daily trading volume of at least 200,000 shares. To determine if the Fund has met its monthly investment goals, the Advisor, Rafferty Asset Management, LLC, maintains models which indicate the expected performance of the Fund as compared to the underlying index. The models do not take into account the expense ratio or any transaction or trading fees associated with creating or maintaining the Fund’s portfolio. Deviation from the model may be due to a combination of asset fluctuation, expenses, transaction costs, including swap contract related costs and underlying volatility. For the Annual Period, the NASDAQ-100® Index returned 27.30%. For the same period, the Direxion Monthly NASDAQ-100® Bull 1.75X Fund returned 40.74%, while the model indicated an expected return of 49.73%. Given the calendar month investment objective of the Fund and the path dependency of returns for longer periods, the return of the index alone should not generate expectations of performance of the Fund.

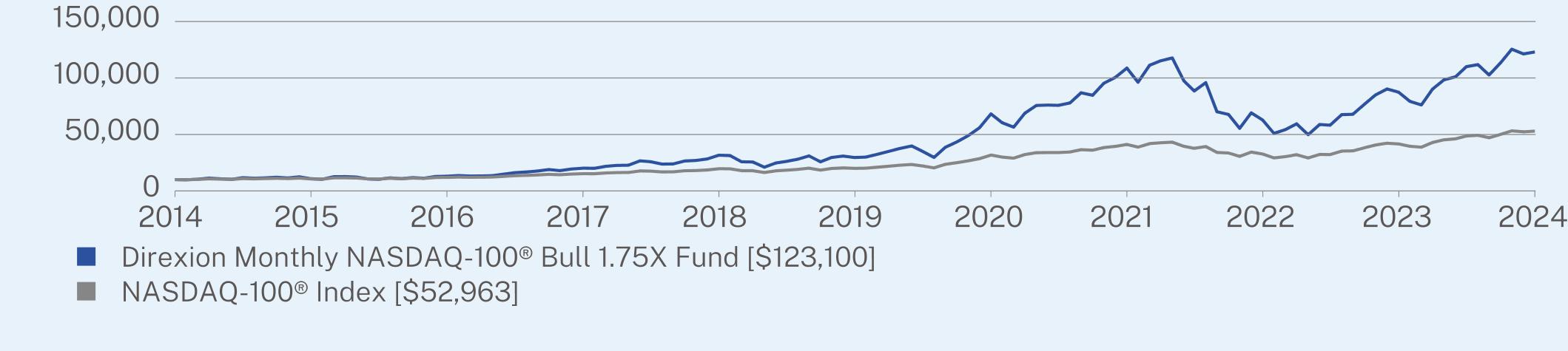

HOW DID THE FUND PERFORM FOR THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the Fund. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Direxion Monthly NASDAQ-100® Bull 1.75X Fund | PAGE 1 | TSR-AR-254939200 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Direxion Monthly NASDAQ-100® Bull 1.75X Fund | 40.74 | 33.00 | 28.54 |

NASDAQ-100® Index | 27.30 | 21.55 | 18.14 |

Visit https://connect.rightprospectus.com/Direxion for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $445,946,122 |

Number of Holdings | 5 |

Net Advisory Fee | $3,049,715 |

Portfolio Turnover | 12% |

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

| |

Market Exposure | |

Total Return Swap Contracts | 118.4% |

Investment Companies | 56.6% |

Total (as % of net assets) | 175.0% |

| |

Index Composition | (%) |

Information Technology | 50.9% |

Communication Services | 15.5% |

Consumer Discretionary | 12.4% |

Health Care | 6.4% |

Consumer Staples | 6.3% |

Industrials | 4.5% |

Materials | 1.5% |

Utilities | 1.3% |

Financials | 0.5% |

Energy | 0.5% |

Real Estate | 0.2% |

| |

Top 10 Constituents of Index | (%) |

Apple, Inc. | 9.3% |

Microsoft Corp. | 8.1% |

NVIDIA Corp. | 7.7% |

Broadcom, Inc. | 5.0% |

Meta Platforms, Inc. Class A | 4.8% |

Amazon.com, Inc. | 4.7% |

Costco Wholesale Corp. | 2.7% |

Tesla, Inc. | 2.6% |

Alphabet Inc. Class A | 2.5% |

Alphabet Inc. Class C | 2.4% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion

The Fund is distributed by ALPS Distributors, Inc..

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Rafferty Asset Management, LLC documents not be householded, please contact Rafferty Asset Management, LLC at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Rafferty Asset Management, LLC or your financial intermediary.

| Direxion Monthly NASDAQ-100® Bull 1.75X Fund | PAGE 2 | TSR-AR-254939200 |

1000010770130192012031614295846823410881362736874671231001000010595119801521519648199623173841132326464160452963

| | |

| Direxion Monthly S&P 500® Bull 1.75X Fund | |

| Investor | DXSLX |

| Annual Shareholder Report | August 31, 2024 |

This annual shareholder report contains important information about the Direxion Monthly S&P 500® Bull 1.75X Fund for the period of September 1, 2023, to August 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion Monthly S&P 500® Bull 1.75X Fund | $163 | 1.35% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Direxion Monthly S&P 500® Bull 1.75X Fund seeks to provide 175% calendar month return of the S&P 500® Index. Standard & Poor’s® selects the stocks comprising the S&P 500® Index on the basis of market capitalization, financial viability of the company and the public float, liquidity and price of a company’s shares outstanding. The index is a float-adjusted, market capitalization-weighted index. To determine if the Fund has met its monthly investment goals, the Advisor, Rafferty Asset Management, LLC, maintains models which indicate the expected performance of the Fund as compared to the underlying index. The models do not take into account the expense ratio or any transaction or trading fees associated with creating or maintaining the Fund’s portfolio. Deviation from the model may be due to a combination of asset fluctuation, expenses, transaction costs, including swap contract related costs and underlying volatility. For the Annual Period, the S&P 500® Index returned 27.14%. For the same period, the Direxion Monthly S&P 500® Bull 1.75X Fund returned 41.07%, while the model indicated an expected return of 50.06%. Given the calendar month investment objective of the Fund and the path dependency of returns for longer periods, the return of the index alone should not generate expectations of performance of the Fund.

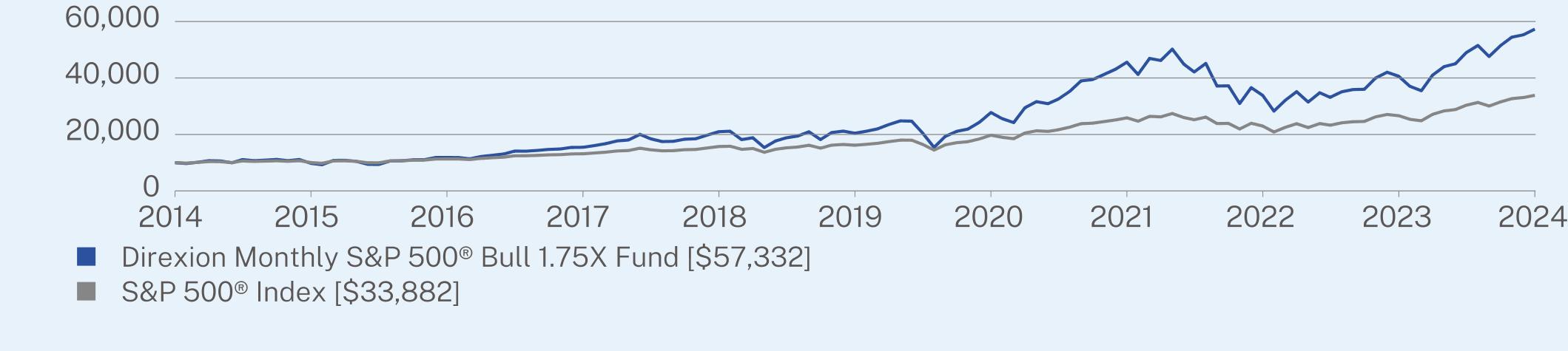

HOW DID THE FUND PERFORM FOR THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the Fund. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Direxion Monthly S&P 500® Bull 1.75X Fund | PAGE 1 | TSR-AR-254939705 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Direxion Monthly S&P 500® Bull 1.75X Fund | 41.07 | 22.93 | 19.08 |

S&P 500® Index | 27.14 | 15.92 | 12.98 |

Visit https://connect.rightprospectus.com/Direxion for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $119,743,099 |

Number of Holdings | 5 |

Net Advisory Fee | $795,565 |

Portfolio Turnover | 0% |

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

| |

Market Exposure | |

Total Return Swap Contracts | 120.7% |

Investment Companies | 54.3% |

Total (as % of net assets) | 175.0% |

| |

Index Composition | (%) |

Information Technology | 31.0% |

Financials | 13.3% |

Health Care | 12.2% |

Consumer Discretionary | 9.7% |

Communication Services | 8.8% |

Industrials | 8.5% |

Consumer Staples | 6.0% |

Energy | 3.5% |

Utilities | 2.4% |

Real Estate | 2.4% |

Materials | 2.2% |

| |

Top 10 Constituents of Index | (%) |

Apple, Inc. | 7.0% |

Microsoft Corp. | 6.5% |

NVIDIA Corp. | 6.2% |

Amazon.com, Inc. | 3.5% |

Meta Platforms, Inc. Class A | 2.4% |

Alphabet Inc. Class A | 2.0% |

Berkshire Hathaway Inc. Class B | 1.8% |

Alphabet Inc. Class C | 1.7% |

Eli Lilly and Company | 1.6% |

Broadcom, Inc. | 1.5% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion

The Fund is distributed by ALPS Distributors, Inc..

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Rafferty Asset Management, LLC documents not be householded, please contact Rafferty Asset Management, LLC at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Rafferty Asset Management, LLC or your financial intermediary.

| Direxion Monthly S&P 500® Bull 1.75X Fund | PAGE 2 | TSR-AR-254939705 |

1000097621185115446209862042027770455963383640641573321000010048113091314515730161891974025893229862665033882

| | |

| Direxion Monthly Small Cap Bull 1.75X Fund | |

| Investor | DXRLX |

| Annual Shareholder Report | August 31, 2024 |

This annual shareholder report contains important information about the Direxion Monthly Small Cap Bull 1.75X Fund for the period of September 1, 2023, to August 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion Monthly Small Cap Bull 1.75X Fund | $150 | 1.35% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Direxion Monthly Small Cap Bull 1.75X Fund seeks to provide 175% of the calendar month return of the Russell 2000® Index. The Russell 2000® Index measures the performance of approximately 2,000 small-capitalization companies in the Russell 3000® Index, based on a combination of their market capitalization and current index membership. To determine if the Fund has met its monthly investment goals, the Advisor, Rafferty Asset Management, LLC, maintains models which indicate the expected performance of the Fund as compared to the underlying index. The models do not take into account the expense ratio or any transaction or trading fees associated with creating or maintaining the Fund’s portfolio. Deviation from the model may be due to a combination of asset fluctuation, expenses, transaction costs, including swap contract related costs and underlying volatility. For the Annual Period, the Russell 2000® Index returned 18.47%. For the same period, the Direxion Monthly Small Cap Bull 1.75X Fund returned 22.18%, while the model indicated an expected return of 30.10%. Given the calendar month investment objective of the Fund and the path dependency of returns for longer periods, the return of the index alone should not generate expectations of annual performance of the Fund.

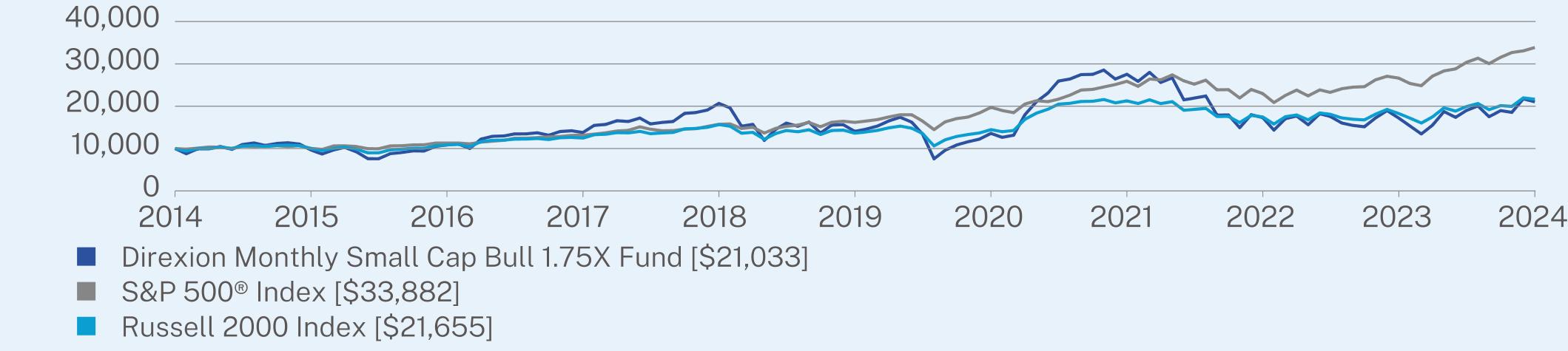

HOW DID THE FUND PERFORM FOR THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the Fund. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Direxion Monthly Small Cap Bull 1.75X Fund | PAGE 1 | TSR-AR-254939838 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Direxion Monthly Small Cap Bull 1.75X Fund | 22.18 | 8.41 | 7.72 |

S&P 500® Index | 27.14 | 15.92 | 12.98 |

Russell 2000 Index | 18.47 | 9.68 | 8.03 |

Visit https://connect.rightprospectus.com/Direxion for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $14,732,664 |

Number of Holdings | 5 |

Net Advisory Fee | $87,982 |

Portfolio Turnover | 35% |

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

| |

Market Exposure | |

Total Return Swap Contracts | 119.5% |

Investment Companies | 55.5% |

Total (as % of net assets) | 175.0% |

| |

Index Composition | (%) |

Financials | 18.4% |

Health Care | 17.7% |

Industrials | 16.9% |

Information Technology | 12.7% |

Consumer Discretionary | 9.7% |

Real Estate | 6.3% |

Energy | 5.7% |

Materials | 4.4% |

Consumer Staples | 2.8% |

Utilities | 2.8% |

Communication Services | 2.6% |

| |

Top 10 Constituents of Index | (%) |

FTAI Aviation Ltd. | 0.5% |

Insmed, Inc. | 0.5% |

Sprouts Farmers Market, Inc. | 0.4% |

Fabrinet | 0.3% |

Vaxcyte, Inc. | 0.3% |

Fluor Corp. | 0.3% |

The Ensign Group, Inc. | 0.3% |

Mueller Industries, Inc. | 0.3% |

Halozyme Therapeutics, Inc. | 0.3% |

Applied Industrial Technologies, Inc. | 0.3% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion

The Fund is distributed by ALPS Distributors, Inc..

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Rafferty Asset Management, LLC documents not be householded, please contact Rafferty Asset Management, LLC at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Rafferty Asset Management, LLC or your financial intermediary.

| Direxion Monthly Small Cap Bull 1.75X Fund | PAGE 2 | TSR-AR-254939838 |

10000966610874137962067014048135772754317305172142103310000100481130913145157301618919740258932298626650338821000010003108621248315659136401446121270174661827821655

| | |

| Direxion Monthly 7-10 Year Treasury Bull 1.75X Fund | |

| Investor | DXKLX |

| Annual Shareholder Report | August 31, 2024 |

This annual shareholder report contains important information about the Direxion Monthly 7-10 Year Treasury Bull 1.75X Fund for the period of September 1, 2023, to August 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion Monthly 7-10 Year Treasury Bull 1.75X Fund | $137 | 1.35% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Direxion Monthly 7-10 Year Treasury Bull 1.75X Fund seeks to provide 175% of the calendar month return of the ICE U.S. Treasury 7-10 Year Bond Index, respectively. The ICE U.S. Treasury 7-10 Year Bond Index is a market value weighted index that includes publicly issued U.S. Treasury securities that have a remaining maturity of greater than seven years and less than or equal to ten years. Eligible securities must be fixed rate, denominated in U.S. Dollars, and have $300 million or more of outstanding face value, excluding amounts held by the Federal Reserve. Securities excluded from the index are zero-coupon STRIPS, inflation-linked securities, floating-rate notes, cash management and Treasury bills, and any government agency debt that is issued with or without a government guarantee. To determine if the Fund has met its monthly investment goals, the Advisor, Rafferty Asset Management, LLC, maintains models which indicate the expected performance of the Fund as compared to the underlying index. The models do not take into account the expense ratio or any transaction or trading fees associated with creating or maintaining the Fund’s portfolio. Deviation from the model may be due to a combination of asset fluctuation, expenses, transaction costs, including swap contract related costs and underlying volatility. For the Annual Period, the ICE U.S. Treasury 7-10 Year Bond Index returned 6.09%. For the same period, the Direxion Monthly 7-10 Year Treasury Bull 1.75X Fund returned 3.09%, while the model indicated an expected return of 10.33%. Given the calendar month investment objective of the Fund and the path dependency of returns for longer periods, the return of the index alone should not generate expectations of performance of the Fund.

HOW DID THE FUND PERFORM FOR THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the Fund. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Direxion Monthly 7-10 Year Treasury Bull 1.75X Fund | PAGE 1 | TSR-AR-254939689 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Direxion Monthly 7-10 Year Treasury Bull 1.75X Fund | 3.09 | -6.93 | -1.47 |

Bloomberg U.S. Aggregate Bond Index | 7.30 | -0.04 | 1.64 |

Bloomberg Intermediate Government/Credit Index | 7.11 | 0.96 | 1.80 |

ICE US Treasury 7-10 Year Bond Index | 6.09 | -1.17 | 1.28 |

Visit https://connect.rightprospectus.com/Direxion for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $12,598,043 |

Number of Holdings | 5 |

Net Advisory Fee | $72,728 |

Portfolio Turnover | 399% |

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

| |

Market Exposure | |

Total Return Swap Contracts | 110.5% |

Investment Companies | 64.5% |

Total (as % of net assets) | 175.0% |

| |

Top 10 Constituents of Index | (%) |

United States 10 Year Treasury Note | |

4.375%, 2034-05-15 | 9.2% |

4.000%, 2034-02-15 | 8.8% |

4.500%, 2033-11-15 | 8.8% |

3.875%, 2033-08-15 | 7.9% |

4.125%, 2032-11-15 | 7.4% |

3.500%, 2033-02-15 | 7.0% |

1.250%, 2031-08-15 | 7.0% |

2.875%, 2032-05-15 | 7.0% |

3.375%, 2033-05-15 | 7.0% |

1.375%, 2031-11-15 | 6.9% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion

The Fund is distributed by ALPS Distributors, Inc..

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Rafferty Asset Management, LLC documents not be householded, please contact Rafferty Asset Management, LLC at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Rafferty Asset Management, LLC or your financial intermediary.

| Direxion Monthly 7-10 Year Treasury Bull 1.75X Fund | PAGE 2 | TSR-AR-254939689 |

100001040911572109129973123541389812777948883668625100001015610761108141070111789125531254211098109651176510000101471056110647105391139512073120931110111162119561000010355110901092110588120411307412706111221070011352

| | |

| Direxion Monthly 7-10 Year Treasury Bear 1.75X Fund | |

| Investor | DXKSX |

| Annual Shareholder Report | August 31, 2024 |

This annual shareholder report contains important information about the Direxion Monthly 7-10 Year Treasury Bear 1.75X Fund for the period of September 1, 2023, to August 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Direxion Monthly 7-10 Year Treasury Bear 1.75X Fund | $135 | 1.35% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Direxion Monthly 7-10 Year Treasury Bear 1.75X Fund seeks to provide -175% of the calendar month return of the ICE U.S. Treasury 7-10 Year Bond Index, respectively. The ICE U.S. Treasury 7-10 Year Bond Index is a market value weighted index that includes publicly issued U.S. Treasury securities that have a remaining maturity of greater than seven years and less than or equal to ten years. Eligible securities must be fixed rate, denominated in U.S. Dollars, and have $300 million or more of outstanding face value, excluding amounts held by the Federal Reserve. Securities excluded from the index are zero-coupon STRIPS, inflation-linked securities, floating-rate notes, cash management and Treasury bills, and any government agency debt that is issued with or without a government guarantee. To determine if the Fund has met its monthly investment goals, the Advisor, Rafferty Asset Management, LLC, maintains models which indicate the expected performance of the Fund as compared to the underlying index. The models do not take into account the expense ratio or any transaction or trading fees associated with creating or maintaining the Fund’s portfolio. Deviation from the model may be due to a combination of asset fluctuation, expenses, transaction costs, including swap contract related costs and underlying volatility. For the Annual Period, the ICE U.S. Treasury 7-10 Year Bond Index returned 6.09%. For the same period, the Direxion Monthly 7-10 Year Treasury Bear 1.75X Fund returned 0.02%, while the model indicated an expected return of -11.49%. Given the calendar month investment objective of the Fund and the path dependency of returns for longer periods, the return of the index alone should not generate expectations of performance of the Fund.

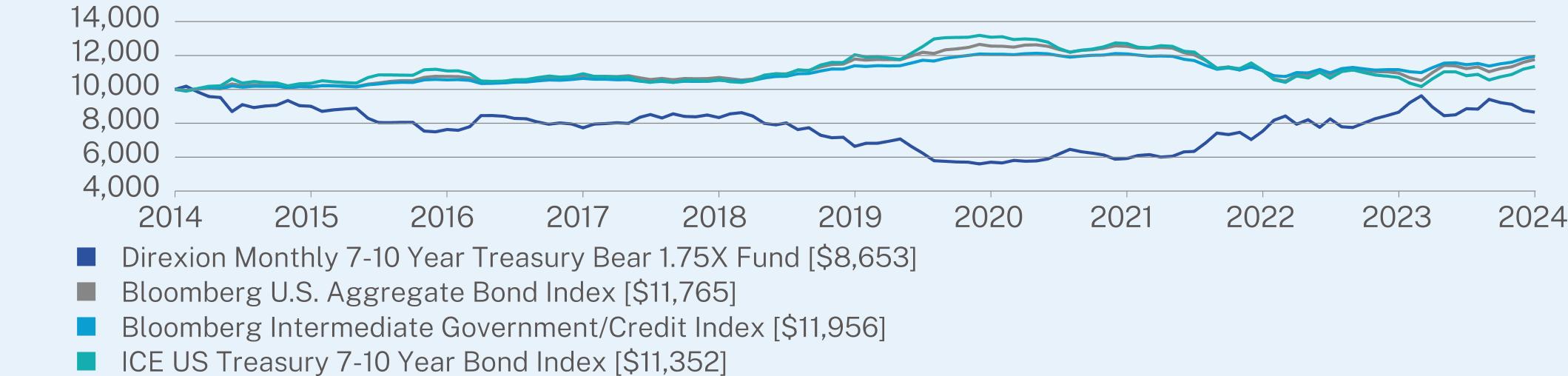

HOW DID THE FUND PERFORM FOR THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the Fund. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Direxion Monthly 7-10 Year Treasury Bear 1.75X Fund | PAGE 1 | TSR-AR-254939184 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Direxion Monthly 7-10 Year Treasury Bear 1.75X Fund | 0.02 | 5.44 | -1.44 |

Bloomberg U.S. Aggregate Bond Index | 7.30 | -0.04 | 1.64 |

Bloomberg Intermediate Government/Credit Index | 7.11 | 0.96 | 1.80 |

ICE US Treasury 7-10 Year Bond Index | 6.09 | -1.17 | 1.28 |

Visit https://connect.rightprospectus.com/Direxion for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $3,187,559 |

Number of Holdings | 4 |

Net Advisory Fee | $39,042 |

Portfolio Turnover | 0% |

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

| |

Market Exposure | (%) |

Total Return Swap Contracts | -175.0% |

Total (as % of net assets) | -175.0% |

| |

Top 10 Constituents of Index | (%) |

United States 10 Year Treasury Note | |

4.375%, 2034-05-15 | 9.2% |

4.000%, 2034-02-15 | 8.8% |

4.500%, 2033-11-15 | 8.8% |

3.875%, 2033-08-15 | 7.9% |

4.125%, 2032-11-15 | 7.4% |

3.500%, 2033-02-15 | 7.0% |

1.250%, 2031-08-15 | 7.0% |

2.875%, 2032-05-15 | 7.0% |

3.375%, 2033-05-15 | 7.0% |

1.375%, 2031-11-15 | 6.9% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion

The Fund is distributed by ALPS Distributors, Inc..

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Rafferty Asset Management, LLC documents not be householded, please contact Rafferty Asset Management, LLC at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Rafferty Asset Management, LLC or your financial intermediary.

| Direxion Monthly 7-10 Year Treasury Bear 1.75X Fund | PAGE 2 | TSR-AR-254939184 |

100009004763577318336663957055920753486518653100001015610761108141070111789125531254211098109651176510000101471056110647105391139512073120931110111162119561000010355110901092110588120411307412706111221070011352

| | |

| Hilton Tactical Income Fund | |

| Institutional Class | HCYIX |

| Annual Shareholder Report | August 31, 2024 |

This annual shareholder report contains important information about the Hilton Tactical Income Fund for the period of September 1, 2023, to August 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Hilton Tactical Income Fund Institutional Class | $93 | 0.87% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Hilton Tactical Income Fund primarily seeks income with a secondary investment objective of capital appreciation consistent with the preservation of capital. The Fund utilizes a disciplined approach to balancing fixed income investments with historically higher income producing equity investments, with a focus on minimizing risk and volatility. For the Annual Period the Institutional Class returned 14.38% while the Fund’s benchmark, a blend of 60% of the Bloomberg Intermediate U.S. Government/Credit Index and 40% S&P 500® Index, returned 15.12% for the same period.

Over the course of the Annual Period, the portfolio management team pivoted the portfolio to a more aggressive allocation in which several factors led to that realignment. Long-time investors will note the “neutral” allocation is 40% in equities and 60% in fixed income. The three main factors in that decision came from the macro-outlook at Hilton Capital. First, there was the consistent moderating of the inflation readings. That, coupled with a softening in the labor markets, justified the Federal Reserve’s pivot from a tightening cycle to an easing cycle. As of the end of the Annual Period, the Federal Reserve has not initiated any interest rate cuts, but has signaled they are coming. The federal funds markets are pricing in three to four cuts in 2024, and a total of ten cuts by the end of 2025. The second factor in the allocation changes was the resilience of corporate earnings. In the latter half of the Annual Period, earnings for the S&P 500 grew at an 8% and 10% pace and are projecting overall growth of 10% for 2024 and 12% for 2025. Very optimistic growth numbers, which to date have been met. The third factor influencing position changes came from overall gross domestic product (GDP) growth. In the middle of 2023, there were still questions if the economy was in for a hard landing and possible recession after historic rate hikes. By the beginning of 2024 those fears were lessened, GDP growth did contract from post-Covid highs, but still hovered in the 1.5% to 2.5% range for most of the Annual Period. Those factors gave the portfolio management team the green light to be a bit more “risk-on” in the portfolio.

One of the key characteristics of the Tactical Income strategy is the ability of the portfolio management team to tactically adjust the risk characteristics in the portfolio to match the macro-outlook and corresponding market outlook. They achieve that by increasing, or decreasing, the allocation to equity securities, as well as increasing or decreasing the credit profile of the fixed income securities in the portfolio. In the Annual Period the overall exposure to equities increased from 40.6% to 45.2% and had a high near 48%. The sectors with the largest increases were REITs, financials and industrials, while the portfolio management team trimmed communications services, energy and technology. On the fixed income side is where the portfolio management team expressed an even more optimistic outlook by adding more credit risk to the portfolio. The portfolio management team had come into the Annual Period with 33% of the portfolio in US treasuries, mostly in short duration, which served very well through the Federal Reserve’s hiking cycle. By the end of the Annual Period, as the Federal Reserve pivoted to a future easing cycle, the portfolio management team lowered that treasury allocation to 8%, or a drop 25%. That was reallocated to several asset classes of fixed income. The portfolio management team added a mortgage-backed securities position of 8%, increased the allocation to corporate bonds by 6%, added to collateralized loan obligations by 3% and increased the preferred position by 2.6%. At the end of the Annual Period, the fund held 2.7% in cash, 52.1% in Fixed Income and 45.2% in Equities.

| Hilton Tactical Income Fund | PAGE 1 | TSR-AR-254939168 |

| |

Top Contributors |

| ↑ | JPMorgan Nasdaq Equity Premium Income ETF |

| ↑ | Communication Services Select Sector SPDR ETF |

| ↑ | Microsoft Corp |

| ↑ | Taiwan Semiconductor Manufacturing Co Ltd |

| ↑ | Eli Lilly and Company |

| |

Top Detractors |

| ↓ | Cisco Systems Inc |

| ↓ | Becton Dickinson and Company |

| ↓ | Nike, Inc. Class B |

| ↓ | Energy Select Sector SPDR Fund |

| ↓ | Zimmer Biomet Holdings, Inc. |

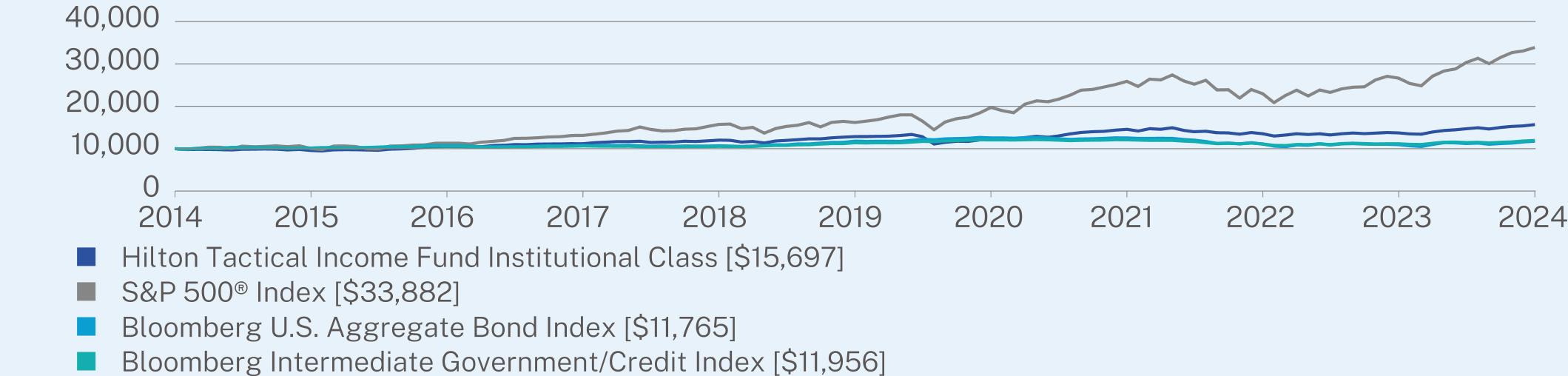

HOW DID THE FUND PERFORM FOR THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the Fund. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Hilton Tactical Income Fund Institutional Class | 14.38 | 4.07 | 4.61 |

S&P 500® Index | 27.14 | 15.92 | 12.98 |

Bloomberg U.S. Aggregate Bond Index | 7.30 | -0.04 | 1.64 |

Bloomberg Intermediate Government/Credit Index | 7.11 | 0.96 | 1.80 |

Visit https://connect.rightprospectus.com/Direxion for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $123,469,214 |

Number of Holdings | 105 |

Net Advisory Fee | $934,600 |

Portfolio Turnover | 83% |

Distribution Yield | 3.21% |

| Hilton Tactical Income Fund | PAGE 2 | TSR-AR-254939168 |

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

| |

Top 10 Holdings | (%) |

Janus Henderson AAA CLO ETF | 6.5% |

iShares MBS ETF | 5.5% |

JPMorgan Nasdaq Equity Premium Income ETF | 4.0% |

United States 10 Year Treasury Note, 4.125%, 2027-09-30 | 3.7% |

iShares Preferred & Income Securities ETF | 3.5% |

SPDR Blackstone Senior Loan ETF | 3.4% |

United States 10 Year Treasury Note, 5.500%, 2028-08-15 | 3.0% |

Simplify MBS ETF | 3.0% |

Alerian MLP ETF | 2.2% |

Microsoft Corp. | 2.2% |

| |

Security Type | (%) |

Common Stocks | 35.6% |

Investment Companies | 34.5% |

Corporate Bonds | 19.5% |

U.S. Government Obligations | 6.7% |

Preferred Stocks | 1.0% |

Cash & Other | 2.7% |

| |

Market Exposure | |

Fixed Income | 52.1% |

Equity | 45.2% |

Other | 2.7% |

Total (as % of net assets) | 100.0% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion

The Fund is distributed by ALPS Distributors, Inc..

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Rafferty Asset Management, LLC documents not be householded, please contact Rafferty Asset Management, LLC at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Rafferty Asset Management, LLC or your financial intermediary.

| Hilton Tactical Income Fund | PAGE 3 | TSR-AR-254939168 |

100009575104931116412027128591244014578135381372415697100001004811309131451573016189197402589322986266503388210000101561076110814107011178912553125421109810965117651000010147105611064710539113951207312093111011116211956

| | |

| Hilton Tactical Income Fund | |

| Investor Class | HCYAX |

| Annual Shareholder Report | August 31, 2024 |

This annual shareholder report contains important information about the Hilton Tactical Income Fund for the period of September 1, 2023, to August 31, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Direxion. You can also request this information by contacting us at 866-476-7523.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

| Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Hilton Tactical Income Fund Investor Class | $120 | 1.12% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Hilton Tactical Income Fund primarily seeks income with a secondary investment objective of capital appreciation consistent with the preservation of capital. The Fund utilizes a disciplined approach to balancing fixed income investments with historically higher income producing equity investments, with a focus on minimizing risk and volatility. For the Annual Period the Investor Class returned 14.12% while the Fund’s benchmark, a blend of 60% of the Bloomberg Intermediate U.S. Government/Credit Index and 40% S&P 500® Index, returned 15.12% for the same period.

Over the course of the Annual Period, the portfolio management team pivoted the portfolio to a more aggressive allocation in which several factors led to that realignment. Long-time investors will note the “neutral” allocation is 40% in equities and 60% in fixed income. The three main factors in that decision came from the macro-outlook at Hilton Capital. First, there was the consistent moderating of the inflation readings. That, coupled with a softening in the labor markets, justified the Federal Reserve’s pivot from a tightening cycle to an easing cycle. As of the end of the Annual Period, the Federal Reserve has not initiated any interest rate cuts, but has signaled they are coming. The federal funds markets are pricing in three to four cuts in 2024, and a total of ten cuts by the end of 2025. The second factor in the allocation changes was the resilience of corporate earnings. In the latter half of the Annual Period, earnings for the S&P 500 grew at an 8% and 10% pace and are projecting overall growth of 10% for 2024 and 12% for 2025. Very optimistic growth numbers, which to date have been met. The third factor influencing position changes came from overall gross domestic product (GDP) growth. In the middle of 2023, there were still questions if the economy was in for a hard landing and possible recession after historic rate hikes. By the beginning of 2024 those fears were lessened, GDP growth did contract from post-Covid highs, but still hovered in the 1.5% to 2.5% range for most of the Annual Period. Those factors gave the portfolio management team the green light to be a bit more “risk-on” in the portfolio.

One of the key characteristics of the Tactical Income strategy is the ability of the portfolio management team to tactically adjust the risk characteristics in the portfolio to match the macro-outlook and corresponding market outlook. They achieve that by increasing, or decreasing, the allocation to equity securities, as well as increasing or decreasing the credit profile of the fixed income securities in the portfolio. In the Annual Period the overall exposure to equities increased from 40.6% to 45.2% and had a high near 48%. The sectors with the largest increases were REITs, financials and industrials, while the portfolio management team trimmed communications services, energy and technology. On the fixed income side is where the portfolio management team expressed an even more optimistic outlook by adding more credit risk to the portfolio. The portfolio management team had come into the Annual Period with 33% of the portfolio in US treasuries, mostly in short duration, which served very well through the Federal Reserve’s hiking cycle. By the end of the Annual Period, as the Federal Reserve pivoted to a future easing cycle, the portfolio management team lowered that treasury allocation to 8%, or a drop 25%. That was reallocated to several asset classes of fixed income. The portfolio management team added a mortgage-backed securities position of 8%, increased the allocation to corporate bonds by 6%, added to collateralized loan obligations by 3% and increased the preferred position by 2.6%. At the end of the Annual Period, the fund held 2.7% in cash, 52.1% in Fixed Income and 45.2% in Equities.

| Hilton Tactical Income Fund | PAGE 1 | TSR-AR-254939176 |

| |

Top Contributors |

| ↑ | JPMorgan Nasdaq Equity Premium Income ETF |

| ↑ | Communication Services Select Sector SPDR ETF |

| ↑ | Microsoft Corp |

| ↑ | Taiwan Semiconductor Manufacturing Co Ltd |

| ↑ | Eli Lilly and Company |

| |

Top Detractors |

| ↓ | Cisco Systems Inc |

| ↓ | Becton Dickinson and Company |

| ↓ | Nike, Inc. Class B |

| ↓ | Energy Select Sector SPDR Fund |

| ↓ | Zimmer Biomet Holdings, Inc. |

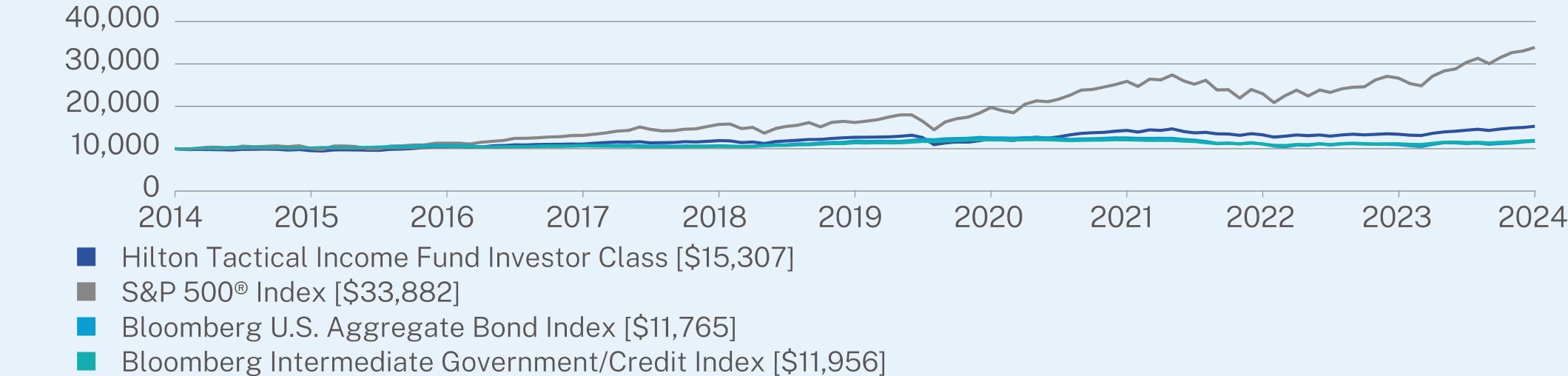

HOW DID THE FUND PERFORM FOR THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the Fund. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Hilton Tactical Income Fund Investor Class | 14.12 | 3.81 | 4.35 |

S&P 500® Index | 27.14 | 15.92 | 12.98 |

Bloomberg U.S. Aggregate Bond Index | 7.30 | -0.04 | 1.64 |

Bloomberg Intermediate Government/Credit Index | 7.11 | 0.96 | 1.80 |

Visit https://connect.rightprospectus.com/Direxion for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $123,469,214 |

Number of Holdings | 105 |

Net Advisory Fee | $934,600 |

Portfolio Turnover | 83% |

Distribution Yield | 2.98% |

| Hilton Tactical Income Fund | PAGE 2 | TSR-AR-254939176 |

WHAT DID THE FUND INVEST IN? (as of August 31, 2024)

| |

Top 10 Holdings | (%) |

Janus Henderson AAA CLO ETF | 6.5% |

iShares MBS ETF | 5.5% |

JPMorgan Nasdaq Equity Premium Income ETF | 4.0% |

United States 10 Year Treasury Note, 4.125%, 2027-09-30 | 3.7% |

iShares Preferred & Income Securities ETF | 3.5% |

SPDR Blackstone Senior Loan ETF | 3.4% |

United States 10 Year Treasury Note, 5.500%, 2028-08-15 | 3.0% |

Simplify MBS ETF | 3.0% |

Alerian MLP ETF | 2.2% |

Microsoft Corp. | 2.2% |

| |

Security Type | (%) |

Common Stocks | 35.6% |

Investment Companies | 34.5% |

Corporate Bonds | 19.5% |

U.S. Government Obligations | 6.7% |

Preferred Stocks | 1.0% |

Cash & Other | 2.7% |

| |

Market Exposure | |

Fixed Income | 52.1% |

Equity | 45.2% |

Other | 2.7% |

Total (as % of net assets) | 100.0% |

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://connect.rightprospectus.com/Direxion

The Fund is distributed by ALPS Distributors, Inc..

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Rafferty Asset Management, LLC documents not be householded, please contact Rafferty Asset Management, LLC at 866-476-7523, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Rafferty Asset Management, LLC or your financial intermediary.

| Hilton Tactical Income Fund | PAGE 3 | TSR-AR-254939176 |

100009547104371107811906126941225114326132641341315307100001004811309131451573016189197402589322986266503388210000101561076110814107011178912553125421109810965117651000010147105611064710539113951207312093111011116211956

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s board of trustees has determined that there is at least one audit committee financial expert serving on its audit committee. Kathleen Berkery is the “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | FYE 8/31/2024 | FYE 8/31/2023 |

| (a) Audit Fees | $227,400 | $223,600 |

| (b) Audit-Related Fees | $0 | $0 |

| (c) Tax Fees | $57,368 | $68,950 |

| (d) All Other Fees | $0 | $0 |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) The percentage of fees billed by Ernst & Young LLP to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | FYE 8/31/2024 | FYE 8/31/2023 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

(f) All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

(g) The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years.

| Non-Audit Related Fees | FYE 8/31/2024 | FYE 8/31/2023 |

| Registrant | NONE | NONE |

| Registrant’s Investment Adviser | NONE | NONE |

(h) Because no non-audit services were rendered, the audit committee of the board of trustees did not consider whether the provision of non-audit services that were rendered to the registrant’s investment adviser is compatible with maintaining the principal accountant’s independence, and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

| (a) | Schedule of Investments is included as part of the report to shareholders filed under Item 7(a) of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

| (a) | The registrant’s Financial Statements are filed herewith. |

TABLE OF CONTENTS

Direxion Monthly High Yield Bull 1.2X Fund

Schedule of Investments

August 31, 2024

| | | | | | | |

| | | INVESTMENT COMPANIES — 79.9%

| | | |

298,661 | | | iShares iBoxx High Yield Corporate Bond ETF(a) | | | $23,695,764 |

244,720 | | | SPDR Bloomberg High Yield Bond ETF(a) | | | 23,693,790 |

| | | TOTAL INVESTMENT COMPANIES

(Cost $45,703,159) | | | 47,389,554 |

| | | SHORT TERM INVESTMENTS — 3.8%

| | | |

| | | Money Market Funds — 3.8%

| | | |

2,260,000 | | | Invesco Government & Agency Portfolio Institutional Shares, 5.18%(b)(c) | | | 2,260,000 |

| | | TOTAL SHORT TERM INVESTMENTS

(Cost $2,260,000) | | | 2,260,000 |

| | | TOTAL INVESTMENTS

(Cost $47,963,159) — 83.7% | | | $49,649,554 |

| | | Other Assets in Excess of Liabilities — 16.3% | | | 9,677,948 |

| | | TOTAL NET ASSETS — 100.0% | | | $59,327,502 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The geographic location of all investments is United States unless otherwise indicated.

(a)

| Shareholders may obtain the financial statements of these investment companies at www.sec.gov. |

(b)

| Represents annualized seven-day yield at August 31, 2024. |

(c)

| All or a portion of these securities have been segregated as collateral for swap contracts. Total value of securities segregated amounted to $2,260,000. |

Long Total Return Swap Contracts

August 31, 2024

| | | | | | | | | | | | | | | | | | | |

Total return of PIMCO 0-5 Year High Yield Corporate Bond Index ETF | | | 5.8500% representing

1 month SOFR

rate + spread | | | UBS Securities

LLC | | | 10/9/2024 | | | 250,691 | | | $23,121,265 | | | $657,564 |

| | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Direxion Monthly NASDAQ-100® Bull 1.25X Fund

Schedule of Investments

August 31, 2024

| | | | | | | |

| | | INVESTMENT COMPANIES — 43.0%

| | | |

11,573 | | | Invesco QQQ Trust Series 1(a) | | | $5,511,873 |

| | | TOTAL INVESTMENT COMPANIES

(Cost $4,923,943) | | | 5,511,873 |

| | | SHORT TERM INVESTMENTS — 8.4%

| |

| | | Money Market Funds — 8.4%

| | | |

664,081 | | | Goldman Sachs Financial Square Treasury Instruments Fund Institutional Shares,

5.12%(b)(c) | | | 664,081 |

410,000 | | | Invesco Government & Agency Portfolio Institutional Shares, 5.18%(b)(c) | | | 410,000 |

| | | TOTAL SHORT TERM INVESTMENTS

(Cost $1,074,081) | | | 1,074,081 |

| | | TOTAL INVESTMENTS

(Cost $5,998,024) — 51.4% | | | $6,585,954 |

| | | Other Assets in Excess of Liabilities — 48.6% | | | 6,245,163 |

| | | TOTAL NET ASSETS — 100.0% | | | $12,831,117 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The geographic location of all investments is United States unless otherwise indicated.

(a)

| Shareholders may obtain the financial statements of these investment companies at www.sec.gov.

|

(b)

| Represents annualized seven-day yield at August 31, 2024.

|

(c)

| All or a portion of these securities have been segregated as collateral for swap contracts. Total value of securities segregated amounted to $1,074,081. |

Long Total Return Swap Contracts

August 31, 2024

| | | | | | | | | | | | | | | | | | | |

Total return of

NASDAQ-100® Index | | | 6.1000% representing

1 month SOFR

rate + spread | | | Bank of America

Merrill Lynch | | | 12/11/2024 | | | 385 | | | $7,436,571 | | | $ 84,972 |

Total return of

NASDAQ-100® Index | | | 6.1500% representing

1 month SOFR

rate + spread | | | UBS Securities

LLC | | | 12/17/2024 | | | 153 | | | 2,952,416 | | | 453 |

| | | | | | | | | | | | | | | $10,388,987 | | | $85,425 |

| | | | | | | | | | | | | | | | | | | |

.

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Direxion Monthly NASDAQ-100® Bull 1.75X Fund

Schedule of Investments

August 31, 2024

| | | | | | | |

| | | INVESTMENT COMPANIES — 56.6%

| | | |

529,737 | | | Invesco QQQ Trust Series 1(a) | | | $252,297,841 |

| | | TOTAL INVESTMENT COMPANIES

(Cost $163,072,788) | | | 252,297,841 |

| | | SHORT TERM INVESTMENTS — 15.9%

| | | |

| | | Money Market Funds — 15.9%

| | | |

66,371,830 | | | Goldman Sachs Financial Square Treasury Instruments Fund Institutional Shares,

5.12%(b)(c) | | | 66,371,830 |

4,510,000 | | | Invesco Government & Agency Portfolio Institutional Shares, 5.18%(b)(c) | | | 4,510,000 |

| | | TOTAL SHORT TERM INVESTMENTS

(Cost $70,881,830) | | | 70,881,830 |

| | | TOTAL INVESTMENTS

(Cost $233,954,618) — 72.5% | | | $ 323,179,671 |

| | | Other Assets in Excess of Liabilities — 27.5% | | | 122,766,451 |

| | | TOTAL NET ASSETS — 100.0% | | | $445,946,122 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The geographic location of all investments is United States unless otherwise indicated.

(a)

| Shareholders may obtain the financial statements of these investment companies at www.sec.gov.

|

(b)

| Represents annualized seven-day yield at August 31, 2024.

|

(c)

| All or a portion of these securities have been segregated as collateral for swap contracts. Total value of securities segregated amounted to $70,881,830. |

Long Total Return Swap Contracts

August 31, 2024

| | | | | | | | | | | | | | | | | | | |

Total return of

NASDAQ-100® Index | | | 6.1000 % representing

1 month SOFR

rate + spread | | | Bank of America

Merrill Lynch | | | 12/11/2024 | | | 13,500 | | | $ 274,507,489 | | | $ (12,104,576) |

Total return of

NASDAQ-100® Index | | | 6.1500 % representing

1 month SOFR

rate + spread | | | UBS Securities

LLC | | | 12/17/2024 | | | 13,492 | | | 223,459,496 | | | 32,323,572 |

| | | | | | | | | | | | | | | $497,966,985 | | | $20,218,996 |

| | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Direxion Monthly S&P 500® Bull 1.75X Fund

Schedule of Investments

August 31, 2024

| | | | | | | |

| | | INVESTMENT COMPANIES — 54.4%

| | | |

114,865 | | | iShares Core S&P 500 ETF(a) | | | $65,099,739 |

| | | TOTAL INVESTMENT COMPANIES

(Cost $46,873,946) | | | 65,099,739 |

| | | SHORT TERM INVESTMENTS — 18.0%

| | | |

| | | Money Market Funds — 18.0%

| | | |

16,040,000 | | | Goldman Sachs Financial Square Treasury Instruments Fund Institutional Shares, 5.12%(b)(c) | | | 16,040,000 |

5,530,000 | | | Invesco Government & Agency Portfolio Institutional Shares, 5.18%(b)(c) | | | 5,530,000 |

| | | TOTAL SHORT TERM INVESTMENTS

(Cost $21,570,000) | | | 21,570,000 |

| | | TOTAL INVESTMENTS

(Cost $68,443,946) — 72.4% | | | $86,669,739 |

| | | Other Assets in Excess of Liabilities — 27.6% | | | 33,073,360 |

| | | TOTAL NET ASSETS — 100.0% | | | $119,743,099 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The geographic location of all investments is United States unless otherwise indicated.

(a)

| Shareholders may obtain the financial statements of these investment companies at www.sec.gov.

|

(b)

| Represents annualized seven-day yield at August 31, 2024.

|

(c)

| All or a portion of these securities have been segregated as collateral for swap contracts. Total value of securities segregated amounted to $21,570,000. |

Long Total Return Swap Contracts

August 31, 2024

| | | | | | | | | | | | | | | | | | | |

Total return of S&P 500® Index | | | 6.1000% representing

1 month SOFR

rate + spread | | | Bank of America

Merrill Lynch | | | 12/11/2024 | | | 14,337 | | | $75,748,106 | | | $ 4,354,760 |

Total return of S&P 500® Index | | | 6.1400% representing

1 month SOFR

rate + spread | | | UBS Securities

LLC | | | 12/17/2024 | | | 11,251 | | | 59,234,848 | | | 3,463,345 |

| | | | | | | | | | | | | | | $134,982,954 | | | $7,818,105 |

| | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Direxion Monthly Small Cap Bull 1.75X Fund

Schedule of Investments

August 31, 2024

| | | | | | | |

| | | INVESTMENT COMPANIES — 55.5%

| | | |

37,156 | | | iShares Russell 2000 ETF(a) | | | $8,177,293 |

| | | TOTAL INVESTMENT COMPANIES

(Cost $7,014,112) | | | 8,177,293 |

| | | SHORT TERM INVESTMENTS — 30.0%

| | | |

| | | Money Market Funds — 30.0%

| | | |

1,451,941 | | | Goldman Sachs Financial Square Treasury Instruments Fund Institutional Shares,

5.12%(b)(c) | | | 1,451,941 |

2,970,000 | | | Invesco Government & Agency Portfolio Institutional Shares, 5.18%(b)(c) | | | 2,970,000 |

| | | TOTAL SHORT TERM INVESTMENTS

(Cost $4,421,941) | | | 4,421,941 |

| | | TOTAL INVESTMENTS

(Cost $11,436,053) — 85.5% | | | $ 12,599,234 |

| | | Other Assets in Excess of Liabilities — 14.5% | | | 2,133,430 |

| | | TOTAL NET ASSETS — 100.0% | | | $14,732,664 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The geographic location of all investments is United States unless otherwise indicated.

(a)

| Shareholders may obtain the financial statements of these investment companies at www.sec.gov.

|

(b)

| Represents annualized seven-day yield at August 31, 2024.

|

(c)

| All or a portion of these securities have been segregated as collateral for swap contracts. Total value of securities segregated amounted to $4,421,941. |

Long Total Return Swap Contracts

August 31, 2024

| | | | | | | | | | | | | | | | | | | |

Total return of Russell 2000® Index | | | 5.9500 % representing

1 month SOFR

rate + spread | | | Bank of America

Merrill Lynch | | | 12/11/2024 | | | 3,408 | | | $6,481,487 | | | $891,433 |

Total return of Russell 2000® Index | | | 5.9500 % representing

1 month SOFR

rate + spread | | | UBS Securities

LLC | | | 12/17/2024 | | | 4,534 | | | 9,879,650 | | | 125,854 |

| | | | | | | | | | | | | | | $16,361,137 | | | $ 1,017,287 |

| | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Direxion Monthly 7-10 Year Treasury Bull 1.75X Fund

Schedule of Investments

August 31, 2024

| | | | | | | |

| | | INVESTMENT COMPANIES — 64.5%

| | | |

83,755 | | | iShares 7-10 Year Treasury Bond ETF(a) | | | $8,130,098 |

| | | TOTAL INVESTMENT COMPANIES

(Cost $8,004,670) | | | 8,130,098 |

| | | SHORT TERM INVESTMENTS — 18.0%

| | | |

| | | Money Market Funds — 18.0%

| | | |

1,560,000 | | | Goldman Sachs Financial Square Treasury Instruments Fund Institutional Shares,

5.12%(b)(c) | | | 1,560,000 |

701,472 | | | Invesco Government & Agency Portfolio Institutional Shares, 5.18%(b)(c) | | | 701,472 |

| | | TOTAL SHORT TERM INVESTMENTS

(Cost $2,261,472) | | | 2,261,472 |

| | | TOTAL INVESTMENTS

(Cost $10,266,142) — 82.5% | | | $ 10,391,570 |

| | | Other Assets in Excess of Liabilities — 17.5% | | | 2,206,473 |

| | | TOTAL NET ASSETS — 100.0%

| | | $12,598,043 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The geographic location of all investments is United States unless otherwise indicated.

(a)

| Shareholders may obtain the financial statements of these investment companies at www.sec.gov.

|

(b)

| Represents annualized seven-day yield at August 31, 2024.

|

(c)

| All or a portion of these securities have been segregated as collateral for swap contracts. Total value of securities segregated amounted to $2,261,472. |

Long Total Return Swap Contracts

August 31, 2024

| | | | | | | | | | | | | | | | | | | |

Total return of iShares

7-10 Year Treasury Bond

ETF | | | 5.9500% representing

1 month SOFR

rate + spread | | | Bank of America

Merrill Lynch | | | 12/11/2024 | | | 80,886 | | | $7,784,953 | | | $34,263 |

Total return of iShares

7-10 Year Treasury Bond

ETF | | | 6.1300% representing

1 month SOFR

rate + spread | | | UBS Securities

LLC | | | 12/17/2024 | | | 62,557 | | | 5,883,277 | | | 148,759 |

| | | | | | | | | | | | | | | $13,668,230 | | | $183,022 |

| | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Direxion Monthly 7-10 Year Treasury Bear 1.75X Fund

Schedule of Investments

August 31, 2024

| | | | | | | |

| | | SHORT TERM INVESTMENTS — 48.3%

| | | |

| | | Money Market Funds — 48.3%

| | | |

1,360,000 | | | Goldman Sachs Financial Square Treasury Instruments Fund Institutional Shares,

5.12%(a)(b) | | | $1,360,000 |

180,000 | | | Invesco Government & Agency Portfolio Institutional Shares, 5.18%(a)(b) | | | 180,000 |

| | | TOTAL SHORT TERM INVESTMENTS

(Cost $1,540,000) | | | 1,540,000 |

| | | TOTAL INVESTMENTS

(Cost $1,540,000) — 48.3% | | | $1,540,000 |

| | | Other Assets in Excess of Liabilities — 51.7% | | | 1,647,559 |

| | | TOTAL NET ASSETS — 100.0% | | | $3,187,559 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The geographic location of all investments is United States unless otherwise indicated.

(a)

| Represents annualized seven-day yield at August 31, 2024.

|

(b)

| All or a portion of these securities have been segregated as collateral for swap contracts. Total value of securities segregated amounted to $1,540,000. |

Short Total Return Swap Contracts

August 31, 2024

| | | | | | | | | | | | | | | | | | | |

5.7500 % representing 1 month SOFR rate + spread | | | Total return of iShares

7-10 Year Treasury

Bond ETF | | | Bank of America

Merrill Lynch | | | 12/11/2024 | | | 49,756 | | | $4,681,340 | | | $(105,975) |

5.4500 % representing 1 month SOFR rate + spread | | | Total return of iShares

7-10 Year Treasury

Bond ETF | | | UBS Securities

LLC | | | 12/17/2024 | | | 7,667 | | | 734,233 | | | (3,105) |

| | | | | | | | | | | | | | | $5,415,573 | | | $(109,080) |

| | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Statements of Assets & Liabilities

August 31, 2024

| | | | | | | | | | |

Assets:

| | | | | | | | | |

Investments, at fair value (Note 2) | | | $49,649,554 | | | $6,585,954 | | | $323,179,671 |

Cash | | | 3,150,000 | | | — | | | 290,000 |

Cash equivalents | | | 164,263 | | | 2,859,701 | | | 102,143,762 |

Receivable for Fund shares sold | | | 9,363,359 | | | 3,329,734 | | | 148,571 |

Due from Custodian | | | 3,876,825 | | | — | | | — |

Unrealized appreciation on swap contracts | | | 657,564 | | | 85,425 | | | 32,323,572 |

Dividends and interest receivable | | | 42,327 | | | 16,244 | | | 765,567 |

Prepaid expenses and other assets | | | 49,941 | | | 38,168 | | | 39,658 |

Total assets | | | 66,953,833 | | | 12,915,226 | | | 458,890,801 |

Liabilities:

| | | | | | | | | |

Payable for Fund shares redeemed | | | 88,849 | | | 5,400 | | | 220,805 |

Payable for investments purchased | | | 7,458,819 | | | — | | | — |

Deposits from broker for swap contracts | | | — | | | 50,000 | | | — |

Unrealized depreciation on swap contracts | | | — | | | — | | | 12,104,576 |

Due to Adviser, net (Note 4) | | | 7,816 | | | 15,259 | | | 258,471 |

Accrued distribution expenses | | | 11,114 | | | 1,646 | | | 90,899 |

Accrued expenses and other liabilities | | | 59,733 | | | 11,804 | | | 269,928 |

Total liabilities | | | 7,626,331 | | | 84,109 | | | 12,944,679 |

Net Assets | | | $59,327,502 | | | $12,831,117 | | | $445,946,122 |

Net Assets Consist of:

| | | | | | | | | |

Capital stock | | | $91,825,890 | | | $13,989,292 | | | $342,525,255 |

Total distributable earnings (loss) | | | (32,498,388) | | | (1,158,175) | | | 103,420,867 |

Net assets | | | $59,327,502 | | | $12,831,117 | | | $445,946,122 |

Calculation of Net Asset Value Per Share:

| | | | | | | | | |

Net assets | | | $59,327,502 | | | $12,831,117 | | | $445,946,122 |

Shares outstanding (unlimited shares of beneficial interest authorized, no par value) | | | 3,388,798 | | | 171,072 | | | 5,397,621 |

Net asset value, redemption price and offering price per share | | | $17.5069 | | | $75.0042 | | | $82.6190 |

Cost of Investments | | | $47,963,159 | | | $5,998,024 | | | $233,954,618 |

| | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Statements of Assets & Liabilities

August 31, 2024 (Continued)

| | | | | | | |

Assets:

| | | | | | |

Investments, at fair value (Note 2) | | | $86,669,739 | | | $12,599,234 |

Cash equivalents | | | 28,962,001 | | | 1,864,371 |

Receivable for Fund shares sold | | | 6,530 | | | 54,834 |

Due from broker for swap contracts | | | — | | | 1,296 |

Unrealized appreciation on swap contracts | | | 7,818,105 | | | 1,017,287 |

Dividends and interest receivable | | | 217,150 | | | 25,984 |

Prepaid expenses and other assets | | | 21,305 | | | 13,331 |

Total assets | | | 123,694,830 | | | 15,576,337 |

Liabilities:

| | | | | | |

Payable for Fund shares redeemed | | | 184,507 | | | 5,040 |

Deposits from broker for swap contracts | | | 3,580,000 | | | 800,000 |

Due to Adviser, net (Note 4) | | | 71,079 | | | 20,137 |

Accrued distribution expenses | | | 24,218 | | | 2,881 |

Accrued expenses and other liabilities | | | 91,927 | | | 15,615 |

Total liabilities | | | 3,951,731 | | | 843,673 |

Net Assets | | | $119,743,099 | | | $14,732,664 |

Net Assets Consist of:

| | | | | | |

Capital stock | | | $83,658,115 | | | $20,971,373 |

Total distributable earnings (loss) | | | 36,084,984 | | | (6,238,709) |

Net assets | | | $119,743,099 | | | $14,732,664 |

Calculation of Net Asset Value Per Share:

| | | | | | |