OMB APPROVAL

OMB Number: 3235-0570

Expires: August 31, 2010

Estimated average burden hours per response...18.9

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08261

MEMBERS Mutual Funds

(Exact name of registrant as specified in charter)

550 Science Drive, Madison, WI 53711

(Address of principal executive offices)(Zip code)

Pamela M. Krill

Madison/Mosaic Legal and Compliance Department

550 Science Drive

Madison, WI 53711

(Name and address of agent for service)

Registrant's telephone number, including area code: 608-274-0300

Date of fiscal year end: October 31

Date of reporting period: October 31, 2009

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspoection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. s 3507.

Item 1. Report to Shareholders.

MEMBERS(R) Mutual Funds

Annual Reprt

October 31, 2009

Conservative Allocation Fund

Moderate Allocation Fund

Aggressive Allocation Fund

Cash Reserves Fund

Bond Fund

High Income Fund

Diversified Income Fund

Large Cap Value Fund

Large Cap Growth Fund

Mid Cap Value Fund

Mid Cap Growth Fund

Small Cap Value Fund

Small Cap Growth Fund

International Stock Fund

This material is for reporting purposes only and shall not be used in connection with a solicitation, offer or any proposed sale of securitis unless preceded or accompanied by a prospectus.

Table of Contents

| | Page |

Management’s Discussion of Fund Performance | |

Economic Overview

| 2

|

Outlook

| 2

|

Conservative Allocation Fund

| 2

|

Moderate Allocation Fund

| 4

|

Aggressive Allocation Fund

| 5

|

Bond Fund

| 7

|

High Income Fund

| 8

|

Diversified Income Fund

| 10

|

Large Cap Value Fund

| 11

|

Large Cap Growth Fund

| 13

|

Mid Cap Value Fund

| 14

|

Mid Cap Growth Fund

| 16

|

Small Cap Value Fund

| 18

|

Small Cap Growth Fund

| 20

|

International Stock Fund

| 22

|

Notes to Management’s Discussion of Fund Performance

| 25

|

Portfolios of Investments | |

Conservative Allocation Fund

| 28

|

Moderate Allocation Fund

| 29

|

Aggressive Allocation Fund

| 30

|

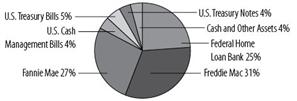

Cash Reserves Fund

| 31

|

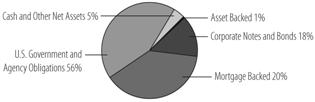

Bond Fund

| 32

|

High Income Fund

| 35

|

Diversified Income Fund

| 40

|

Large Cap Value Fund

| 44

|

Large Cap Growth Fund

| 46

|

Mid Cap Value Fund

| 48

|

Mid Cap Growth Fund

| 50

|

Small Cap Value Fund

| 52

|

Small Cap Growth Fund

| 54

|

International Stock Fund

| 57

|

Financial Statements | |

Statements of Assets and Liabilities

| 60

|

Statements of Operations

| 64

|

Statements of Changes in Net Assets

| 68

|

Financial Highlights

| 74

|

Notes to Financial Statements

| 95

|

Report of Independent Registered Public Accounting Firm

| 109

|

Other Information

| 110

|

Trustees and Officers

| 114

|

Nondeposit investment products are not federally insured, involve investment risk, may lose value and are not obligations of or guaranteed by any financial institution. For more complete information about MEMBERS Mutual Funds, including charges and expenses, request a prospectus from your financial advisor or from MEMBERS Mutual Funds, P.O. Box 8390, Boston, MA 02266-8390. Consider the investment objectives, risks, and charges and expenses of any fund carefully before investing. The prospectus contains this and other information about the investment company. For more current performance information, please call 1-800-877-6089 or visit our website at www.membersfunds.com. Current performance may be lower or higher than the performance data quoted within. Past performance does not guarantee future results. Nothing in this report represents a recommendation of a security by the investment adviser. Portfolio holdings may have changed since the date of this report.

1

Management’s Discussion of Fund Performance

ECONOMIC OVERVIEW

As the period began on November 1, 2008, we were in the midst of a worldwide financial crisis that was creating sell-offs in virtually every asset class, other than the most secure assets issued or insured by the federal government. Banks were unwilling to lend to each other and the general market mood was characterized by fear. Concerned with a possible meltdown of the U.S. financial system, Congress continued government-sponsored “bailouts” in an attempt to aid banking balance sheets and get credit flowing again.

As our one-year period got underway, we witnessed continued unrest in the financial sector and a realization that the credit problems would not be confined to just a few financial institutions. As the credit crisis spread across the economy it became clear that we were in the midst of what could prove to be the worst recession of our times. Conditions appeared to worsen in early 2009. By the beginning of March, talk about another depression and the collapse of the global financial system was widespread and the broad stock indices were down close to 25% on top of the record-setting losses of 2008. Then sentiment shifted, in the mysterious way that is characteristic of investor psychology, and money began to flow into stocks and riskier bonds. To get a sense of the gyrations, the S&P 500, considered a proxy for the overall stock market, rose 15.9% in the second quarter, and continued to rally in the third quarter of 2009, tacking on another 15.6%, to create one of the steepest rebounds in market history.

This rally, at least at first, was not so much driven by positive news as it was by diminishing worry. In other words, investors who were once worried about the collapse of the global financial system and another great depression were beginning to believe that the economic problems were deep, but not fathomless. By the latter part of the period, some of the important economic indicators showed signs of bottoming and other problem areas showed decreasing losses, even as other economic data, such as unemployment, remained in troubling territory. These positive signs, however modest, were eagerly noted by investors looking for hints of recovery and the period ended with a market characterized by stronger performance of higher-risk investments.

OUTLOOK

We are investing with the belief that over a full market cycle, holding the highest quality securities within our applicable investment objectives and guidelines will provide the best results with the least volatility. While we are getting early economic data and leading indicators suggesting improvement in the general economy, the indicators are improving from extremely low levels. We are also concerned that we could eventually hit an inflationary problem that develops directly from current monetary and fiscal policy, although we don’t see this as an immediate threat.

The biggest risks we see right now are associated with the economy. Despite all the chatter about the improving economic data, we remain concerned that small improvements from a level of deep trouble may produce undeserved optimism. Consumer spending is still muted and with unemployment remaining high, and credit difficult to come by, it seems unlikely that we will see a consumer-driven rally anytime soon. Risky assets are clearly priced for solid and significant economic improvement and this strikes us as a time to be diligent by seeking to invest in securities that have the best possible fundamentals.

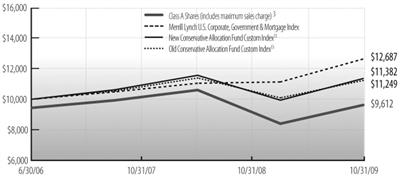

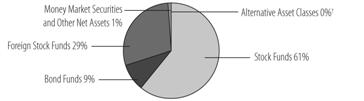

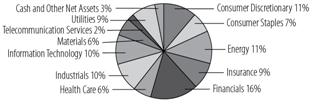

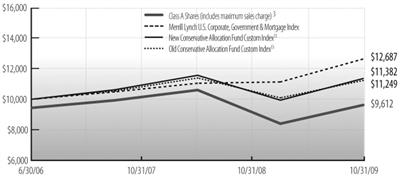

CONSERVATIVE ALLOCATION FUND

How did the Fund perform for the period November 1, 2008 – October 31, 2009?

For the trailing year ended October 31, 2009, the MEMBERS Conservative Allocation Fund returned 14.91% (Class A shares at net asset value), outperforming the New Conservative Allocation Custom Fund Index return of 14.57% and underperforming the Morningstar Conservative Allocation category average return of 15.92%. Bonds make up the largest portion of the Fund, and our higher quality positioning held the Fund’s performance back relative to its peers as lower quality issues outperformed substantially.

2

Management’s Discussion of Fund Performance

CONSERVATIVE ALLOCATION FUND (continued)

What significant changes did you make to the portfolio since November 1, 2008?

During the late fall of 2008, we trimmed roughly 5% from the equity allocation of the Fund. The lower equity weight added to relative returns through the first quarter of 2009 as markets continued to decline, but was then a detriment to performance during the market rally.

To capitalize on what we viewed as an opportunity in corporate bonds, we added Dodge & Cox Income Fund to the portfolio in early 2009. At the time, the Fund held nearly 50% of its portfolio in corporate bonds. This move proved to be beneficial as corporate bond spreads have narrowed tremendously in 2009, resulting in double digit returns for investment grade bonds.

Recently, we have been trimming back risk and moving the portfolio even higher in quality. We have sold our dedicated mid cap position, and are lowering our international equity position. Given the number of headwinds facing the U.S. consumer and economy, we anticipate the markets will level off from their torrid advance since March and volatility will remain elevated for some time. Looking ahead, our focus will be on risk management and striving for more consistent returns through higher quality investments.

What were the strongest contributors to Fund performance?

Our allocation to corporate bonds, specifically below-investment-grade bonds, was the single greatest contributor to performance. MEMBERS High Income Fund Class Y, a below-investment grade fund, returned 29.4% over the trailing year. Positions in both international stocks and bonds also contributed significantly as measured by returns in Oppenheimer International Bond Fund Class Y which returned 26.1% and MEMBERS International Stock Fund Class Y which returned 23.3%. Finally, Dodge & Cox Income Fund returned 22.4%, bolstered by its corporate bond positions.

What were the largest constraints on performance?

Our largest position, MEMBERS Bond Fund Class Y was the greatest detractor, returning 10.3% since October 31, 2008. It’s very rare that a double digit return on a bond fund would be considered a detriment to performance, but 2009 was anything but ordinary. Throughout the year, the Fund stayed true to the high quality allocation that protected investors so well in 2008. However, so far 2009 has proven to be a risk taker’s market and lower quality bonds have outperformed higher quality issues by a very wide margin. Our modest position in Nakoma Absolute Return Fund which returned -9.3% was the other notable detractor.

Cumulative Performance of $10,000 Investment Since Inception1,2

3

Management’s Discussion of Fund Performance

CONSERVATIVE ALLOCATION FUND (continued)

Average Annual Total Return through October 31, 20092 |

| | % Return Without Sales Charge | % Return After Sales Charge6 |

| | 1 Year | Since

6/30/06

Inception7 | Since

2/29/08

Inception8 | 1 Year | Since

Inception |

Class A Shares 3 | 14.91%

| 0.59%

| —

| 8.31%

| (1.18)%7 |

Class B Shares4 | 14.09

| (0.15)

| —

| 9.59

| (1.00)7 |

Class C Shares5 | 14.21

| —

| (4.56)%

| 13.21

| (4.56)8 |

Merrill Lynch U.S. Corporate, Government & Mortgage Index | 13.74

| 7.38

| 6.15

| NA

| NA

|

New Conservative Allocation Fund Custom Index13 | 14.57

| 3.95

| 0.07

| NA

| NA

|

Old Conservative Allocation Fund Custom Index13 | 11.45

| 3.58

| 0.03

| NA

| NA

|

See accompanying Notes to Management’s Discussion of Fund Performance.

MODERATE ALLOCATION FUND

How did the Fund perform for the period November 1, 2008 – October 31, 2009?

For the trailing year ended October 31, 2009, the MEMBERS Moderate Allocation Fund returned 14.12% (Class A shares at net asset value), underperforming the New Moderate Allocation Custom benchmark return of 16.22% and the Morningstar Moderate Allocation category average return of 15.73%. High quality bonds underperformed riskier bonds, and this was a drag on relative performance as the Fund retained its high-quality bond bias. Additionally, value stocks underperformed the market in general, which was compounded by the manner in which our selected value instrument, MEMBERS Large Cap Value, underperformed its peers.

What significant changes did you make to the portfolio since November 1, 2008?

During the late fall of 2008, we trimmed roughly 5% from the equity allocation of the Fund. The lower equity weight added to relative returns through the first quarter of 2009 as markets continued to decline, but was then a detriment to performance during the market rally.

To capitalize on what we viewed as an opportunity in corporate bonds, we added Dodge & Cox Income Fund to the portfolio in early 2009. At the time, the Fund held nearly 50% of its portfolio in corporate bonds. This move proved to be beneficial as corporate bond spreads have narrowed tremendously in 2009, resulting in double digit returns for investment grade bonds.

Recently, we have been trimming back risk and moving the portfolio even higher in quality. We have reduced our mid cap positions, and lowered our international equity weight. Given the number of headwinds facing the U.S. consumer and economy, we anticipate the markets will level off from their torrid advance since March and volatility will remain elevated for some time. Looking ahead, our focus will be on risk management and striving for more consistent returns through higher quality investments.

What were the strongest contributors to Fund performance?

Our allocation to corporate bonds, specifically below-investment-grade bonds, was the single greatest contributor to performance. MEMBERS High Income Fund Class Y, a below-investment grade fund, returned 29.4% over the trailing year. Positions in both international stocks and bonds also contributed significantly as measured by returns in Oppenheimer International Bond Fund Class Y which returned 26.1% and MEMBERS International Stock Fund Class Y which returned 23.3%. Bolstered by corporate bonds, Dodge & Cox Income Fund returned 22.4%, and other notable contributors were MEMBERS Mid Cap Growth Fund Class Y and MEMBERS Large Cap Growth Fund Class Y which returned 21.7% and 19.3%, respectively.

4

Management’s Discussion of Fund Performance

MODERATE ALLOCATION FUND (continued)

What were the largest constraints on performance?

MEMBERS Bond Fund Class Y and MEMBERS Large Cap Value Fund Class Y which returned 10.3% and 2.2%, respectively, were the greatest detractors. It’s very rare that a double digit return on a bond fund would be considered a detriment to performance, but 2009 was anything but ordinary. Throughout the year the Fund stayed true to the high quality allocation that protected investors so well in 2008. However, so far 2009 has proven to be a risk taker’s market and lower quality bonds have outperformed higher quality issues by a very wide margin. MEMBERS Large Cap Value Fund Class Y was challenged by heavy losses in the financial sector early in the year, however financials have boosted performance since the rally took hold in March. Other notable detractors were Nakoma Absolute Return Fund and Gateway Fund Class Y which returned -9.3% and 1.1%, respectively.

Cumulative Performance of $10,000 Investment Since Inception1,2

Average Annual Total Return through October 31, 20092 |

| | % Return Without Sales Charge | % Return After Sales Charge6 |

| | 1 Year | Since

6/30/06

Inception7 | Since

2/29/08

Inception8 | 1 Year | Since

Inception |

Class A Shares3 | 14.12%

| (2.30)%

| —

| 7.54%

| (4.01)%7 |

Class B Shares4 | 13.20

| (3.01)

| —

| 8.70

| (3.86)7 |

Class C Shares5 | 13.20

| —

| (10.41)%

| 12.20

| (10.41)8 |

S&P 500 Index13 | 9.80

| (3.91)

| (13.21)

| NA

| NA

|

Russell 1000¨ Index13 | 11.20

| (3.86)

| (13.20)

| NA

| NA

|

New Moderate Allocation Fund Custom Index13 | 16.22

| 1.62

| (4.07)

| NA

| NA

|

Old Moderate Allocation Fund Custom Index13 | 13.59

| 0.92

| (4.61)

| NA

| NA

|

See accompanying Notes to Management’s Discussion of Fund Performance.

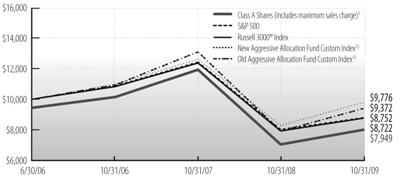

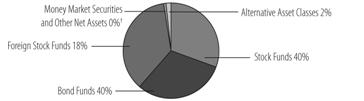

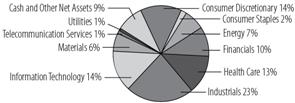

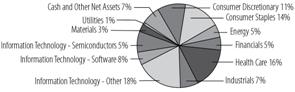

AGGRESSIVE ALLOCATION FUND

How did the Fund perform for the period November 1, 2008 – October 31, 2009?

For the trailing year ended October 31, 2009, the MEMBERS Aggressive Allocation Fund returned 14.00% (Class A shares at net asset value), underperforming the New Aggressive Allocation Custom benchmark return of 18.64% and outperforming the Morningstar Large Blend category average return of 11.86%. The Fund’s gains in performance from exposure to international

5

Management’s Discussion of Fund Performance

AGGRESSIVE ALLOCATION FUND (continued)

stocks and high yield bonds were offset by underperformance in large and small cap value stocks relative to the index. However, the gains more than offset the detractions when compared to the peer group.

What significant changes did you make to the portfolio since November 1, 2008?

During the late fall of 2008, we trimmed roughly 15% from the equity allocation of the Fund and initiated a fixed income allocation. The lower equity weight added to relative returns through the first quarter of 2009 as markets continued to decline, but was then a detriment to performance during the market rally.

Recently, we have been trimming back risk and moving the portfolio even higher in quality. We have reduced our mid cap positions, and lowered our international equity weight. Given the number of headwinds facing the U.S. consumer and economy, we anticipate the markets will level off from their torrid advance since March and volatility will remain elevated for some time. In turn, moving forward our focus will be on risk management and striving for more consistent returns through higher quality investments.

What were the strongest contributors to Fund performance?

The strongest contributors to performance came from Laudus International MarketMasters Fund which returned 33.8% over the period, MEMBERS High Income Fund Class Y which returned 29.4%, MEMBERS International Stock Fund Class Y which returned 23.3%, MEMBERS Mid Cap Growth Fund Class Y which returned 21.7%, and MEMBERS Large Cap Growth Fund Class Y which returned 19.3%. International equities have rallied stronger than domestic stocks since the rally began in March, benefiting from a heightened appetite for risk and the corresponding decline in the U.S. dollar.

What were the largest constraints on performance?

MEMBERS Large Cap Value Fund Class Y, which returned 2.2%, was the largest detractor from performance. The Fund experienced heavy losses from the financial sector through the fall and into early 2009. Smaller caps also experienced large losses during the downturn. MEMBERS Small Cap Growth Fund Class Y and MEMBERS Small Cap Value Fund Class Y returned -3.3% and 13.5% respectively, and held down performance. The other notable detractor was Gateway Fund Class Y, which returned 1.1% for the period.

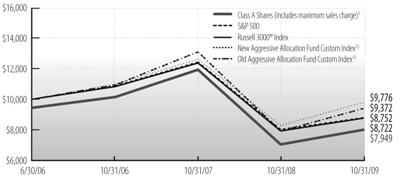

Cumulative Performance of $10,000 Investment Since Inception1,2

6

Management’s Discussion of Fund Performance

AGGRESSIVE ALLOCATION FUND (continued)

Average Annual Total Return through October 31, 20092 |

| | % Return Without Sales Charge | % Return After Sales Charge6 |

| | 1 Year | Since

6/30/06

Inception7 | Since

2/29/08

Inception8 | 1 Year | Since

Inception |

Class A Shares3 | 14.00%

| (4.97)%

| —

| 7.40%

| (6.64)%7 |

Class B Shares4 | 13.06

| (5.69)

| —

| 8.56

| (6.52)7 |

Class C Shares5 | 13.20

| —

| (15.59)%

| 12.20

| (15.59)8 |

S&P 500 Index13 | 9.80

| (3.91)

| (13.21)

| NA

| NA

|

Russell 3000¨ Index13 | 10.83

| (4.01)

| (13.04)

| NA

| NA

|

New Aggressive Allocation Fund Custom Index13 | 18.64

| (0.68)

| (8.35)

| NA

| NA

|

Old Aggressive Allocation Fund Custom Index13 | 19.20

| (1.92)

| (10.92)

| NA

| NA

|

See accompanying Notes to Management’s Discussion of Fund Performance.

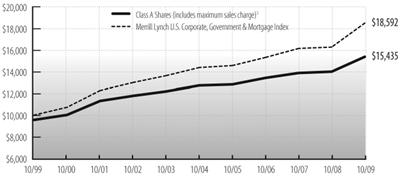

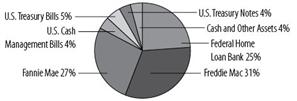

BOND FUND

How did the Fund perform for the period November 1, 2008 – October 31, 2009?

For the trailing year ended October 31, 2009, the MEMBERS Bond Fund returned 9.91% (Class A shares at net asset value) compared to 13.74% returned by the Merrill Lynch U.S. Corporate, Government & Mortgage Index and 17.86% returned by the Morningstar Intermediate-Term Bond category average for the same period.

What were the strongest contributors to Fund performance?

Positive contributions to performance for the period included the Fund’s holdings in a small amount of out-of-index asset classes. These asset classes included asset-backed and commercial mortgage-backed securities, which outperformed the overall index and contributed positively to performance.

What were the largest constraints on performance?

One of the primary reasons for the negative performance relative to the index and peer group was the Fund’s higher quality bias. Throughout the period, the Fund remained overweight relative to the index in Treasury debt and underweight mortgage-backed and corporate debt compared to the index. Mortgage-backed and corporate debt outperformed Treasuries over the period, so our quality bias hurt performance with respect to these sectors.

From a macroeconomic perspective, yield curve posture was negative as interest rates declined over the period and the Fund was generally short duration – implying cash flows were reinvested at lower absolute interest rates. It should be noted, however, that the entire drop in interest rates occurred during the final two months of 2008 and rates have trended upward since such that the Fund’s yield curve posture was accretive to performance during 2009 calendar year-to-date. Relative to the Morningstar peer group, a lower allocation to investment grade and high yield corporate debt was the primary driver of the Fund’s overall underperformance for the period.

How is the Fund positioned going forward?

We continue to believe that the “green shoots” are not self sustaining and the government stimulus will be unsustainable. Additionally, we believe many of the problems which caused the financial and economic crisis have been papered over, not resolved. Because we believe a bond fund is first and foremost about providing a foundation for any investment strategy and preserving capital, a very conservative posture will be maintained going forward given our perspective noted in the comments above.

7

Management’s Discussion of Fund Performance

BOND FUND (continued)

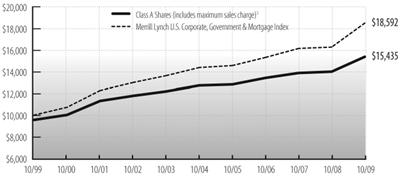

Cumulative Performance of $10,000 Investment Since Inception1,2

Average Annual Total Return through October 31, 20092 |

| | % Return Without Sales Charge | % Return After Sales Charge6 |

| | 1 Year | 3 Years | 5 Years | 10 Years | Since

6/30/06

Inception | 1 Year | 3 Years | 5 Years | 10 Years |

Class A Shares3 | 9.91%

| 4.67%

| 3.88%

| 4.92%

| —

| 4.93%

| 3.06%

| 2.92%

| 4.44%

|

Class B Shares4 | 9.20

| 3.92

| 3.12

| 4.14

| —

| 4.70

| 2.83

| 2.77

| 4.14

|

Class Y Shares9 | 10.30

| —

| —

| —

| 5.77%

| —

| —

| —

| —

|

Merrill Lynch U.S. Corporate,

Government & Mortgage Index | 13.74

| 6.53

| 5.19

| 6.40

| 7.38

| NA

| NA

| NA

| NA

|

See accompanying Notes to Management’s Discussion of Fund Performance.

HIGH INCOME FUND

After experiencing one of the worst financial crises on record in 2008, the U.S. financial markets have roared back over the first 10 months of 2009. During the rebound, the high yield sector has been the superstar performer as it has significantly outpaced every U.S. equity and fixed income sector. For example, for the 12 month period ended October 31, 2009, the Merrill Lynch High Yield Index gained 48.8%, the S&P 500 gained 9.8% and Merrill Lynch Investment Grade Index gained 30.8%. One key driver of the strong performance for high yield has been that the default environment has improved dramatically. This positive development has been due to a combination of robust capital markets and an improvement in the economic outlook. Portfolio managers have drastically reduced their estimates for defaults in 2009 and 2010. Most strategists now estimate a 13% default rate in 2009, while the default rate for 2010 is expected to plunge to 5%. This represents a considerable improvement in the default outlook year-over-year and a much faster decline to the long-term average than experienced during either the early 1990s or early 2000 default cycles. The improvement in the default outlook has resulted in a dramatic decrease in yield spreads, or risk premiums, which has caused bonds prices to gap up significantly over the past 12 months.

How did the Fund perform for the period November 1, 2008 – October 31, 2009?

For the trailing year ended October 31, 2009, the MEMBERS High Income Fund returned 28.98% (Class A shares at net asset value), underperforming the Merrill Lynch U.S. High Yield Master II Constrained Index return of 49.54% and the Morningstar High Yield Bond category average return of 35.58%. Although the Fund’s returns were substantial and exceeded nearly every major equity index, they lagged the return of the index.

8

Management’s Discussion of Fund Performance

HIGH INCOME FUND (continued)

What were the strongest contributors and largest constraints to Fund performance?

The primary driver contributing to the Fund’s performance variance from the index has been its limited weighting in deep discount and lower-rated securities. For example, during the 12 months ended October 31, 2009, bonds priced below $70, which had an average weighting of 26% in the index, contributed over 36% of the total index return, as compared to the Fund’s average of 4.4% weighting in this stressed sector. Over the latter half of the reporting period, we have been an active participant in the new issue calendar as this segment of the high yield universe provides credit structures that are significantly better than many of the legacy issues that came to market in 2006-2008.

Augmenting our new issue purchases have been significant purchases on the secondary market. Also, we have attempted to selectively add issuers that, despite having somewhat weaker credit profiles than our average portfolio holding, we believe still have the flexibility to withstand a protracted period of economic weakness. Although we have incrementally added some lower quality issuers to the portfolio during the past 12 months, the overall credit quality for the portfolio remains strong with an average B/B2 rating. Furthermore, as of October 31, 2009, the Fund had approximately 87% of its holdings with a ratio of cash-flow to cash-interest expense greater than 2x. The portfolio’s top industry weightings are healthcare, support-services, telecom, utilities, and oil and gas, all of which positively contributed to performance. Notable sectors in which the Fund is not invested are the homebuilding, banking, and real estate sectors.

How is the Fund positioned going forward?

Although the high yield bond market’s recent performance has exceeded all expectations, our outlook for 2010 remains favorable. Our constructive outlook for high yield is predicated on continued robust demand from investors seeking high current income in the face of low yields from alternative investments; a continued shift in allocations to credit-driven strategies; expectations for sharply declining default rates in 2010 as many of the sickest companies have already collapsed; and attractive spreads in excess of 750 basis points relative to 10-year Treasuries which represents a compelling risk premium.

Cumulative Performance of $10,000 Investment Since Inception1,2

9

Management’s Discussion of Fund Performance

HIGH INCOME FUND (continued)

Average Annual Total Return through October 31, 20092 |

| | % Return Without Sales Charge | % Return After Sales Charge6 |

| | 1 Year | 3 Years | 5 Years | 10 Years | Since

6/30/06

Inception | 1 Year | 3 Years | 5 Years | 10 Years |

Class A Shares3 | 28.98%

| 4.31%

| 4.80%

| 5.16%

| —

| 23.23%

| 2.70%

| 3.83%

| 4.68%

|

Class B Shares4 | 28.08

| 3.51

| 4.03

| 4.38

| —

| 23.58

| 2.50

| 3.72

| 4.38

|

Class Y Shares9 | 29.35

| —

| —

| —

| 5.53%

| —

| —

| —

| —

|

Merrill Lynch U.S. High Yield

Master II Constrained Index | 49.54

| 5.67

| 6.07

| 6.43

| 6.84

| NA

| NA

| NA

| NA

|

See accompanying Notes to Management’s Discussion of Fund Performance.

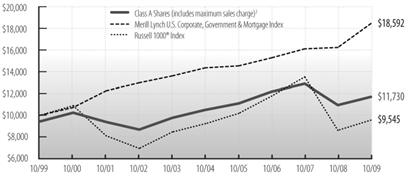

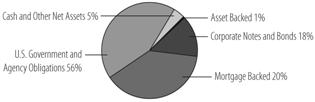

DIVERSIFIED INCOME FUND

How did the Fund perform for the period November 1, 2008 – October 31, 2009?

For the trailing year ended October 31, 2009, the MEMBERS Diversified Income Fund returned 7.07% (Class A shares at net asset value), compared to the Merrill Lynch U.S. Corporate, Government & Mortgage Index return of 13.74%, the Russell 1000® Index return of 11.20%, and the Morningstar Moderate Allocation category average return of 15.73%. Overall underperformance was due primarily to stock selection within the financial sector as described below, and additionally, dividend yielding stocks lagged the Russell 1000® Index for the period.

During the period, U.S. stocks experienced a cascade of dividend reductions, unlike anything seen since the depression of the 1930s. For the equity portion of the Fund, we chose to protect the Fund’s income stream in a move that turned out to be more costly relative to index returns than we anticipated. We replaced many of our financial stocks that reduced their dividend payouts with higher yielding stocks. The financial stocks we sold subsequently rebounded sharply in price, and accounted for approximately 7 points of the 12.6 points by which the equity portion trailed the Russell 1000® Index returns.

What were the strongest contributors to Fund performance?

The Fund’s strongest stock contributors for the twelve month period included pharmaceutical company Wyeth which was recently acquired by Pfizer, consumer products manufacturer Procter & Gamble, Intel, United Parcel Service, and industrial products provider Tyco International. For the Fund’s bond segment, positive contributions to performance for the period included the Fund’s significant overweight position relative to the index in credit.

What were the largest constraints on performance?

Detracting from performance within the Fund’s equity segment included holdings in JPMorgan Chase, Bank of America, U.S. Bancorp, General Electric and PNC Financial, all of which were sold during the period except for U.S. Bancorp. In addition, relative to the Russell 1000® Index, we held a much smaller position in technology stocks, due to their low dividend yields. This accounted for nearly 3 points of the 12.6 point lag versus Russell 1000® Index returns. This type of lag will occur occasionally when technology stocks appreciate sharply, as they did during the fiscal year, rising over 31%. Our large lag in the financial sector is something that has not occurred before and we do not anticipate it will happen again, given that the flood of dividend reductions seem likely to only happen in extreme circumstances and infrequently, such as the 1930s and 2008-09. The bond segment of the Fund held a modest underweight position relative to the index in mortgage-backed securities which hurt performance, but not to nearly the extent that the overweight position in credit helped.

10

Management’s Discussion of Fund Performance

DIVERSIFIED INCOME FUND (continued)

How is the Fund positioned going forward?

We have been adding to what we believe are the most attractive, high-yielding stocks. These are predominantly “Blue Chip” companies which as a group lagged during the period ended October 30, 2009. We believe they generally have solid fundamentals, international exposure, and appear to us to be undervalued. Given the number of headwinds facing the U.S. consumer and economy, we anticipate that the markets will level off from their torrid advance since March and that volatility will remain elevated for some time. In turn, moving forward our focus will be on risk management and striving for more consistent returns through higher quality investments.

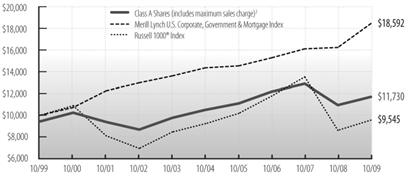

Cumulative Performance of $10,000 Investment Since Inception1,2

Average Annual Total Return through October 31, 20092 |

| | % Return Without Sales Charge | % Return After Sales Charge6 |

| | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years |

Class A Shares3 | 7.07%

| (1.36)%

| 2.22%

| 2.21%

| 0.86%

| (3.30)%

| 1.02%

| 1.60%

|

Class B Shares4 | 6.24

| (2.12)

| 1.45

| 1.45

| 1.74

| (3.07)

| 1.13

| 1.45

|

Russell 1000® Index | 11.20

| (6.84)

| 0.71

| (0.46)

| NA

| NA

| NA

| NA

|

Merrill Lynch U.S. Corporate,

Government & Mortgage Index | 13.74

| 6.53

| 5.19

| 6.40

| NA

| NA

| NA

| NA

|

See accompanying Notes to Management’s Discussion of Fund Performance.

LARGE CAP VALUE FUND

How did the Fund perform for the period November 1, 2008 – October 31, 2009?

For the trailing year ended October 31, 2009, the MEMBERS Large Cap Value Fund returned 2.08% (Class A shares at net asset value) compared with the Russell 1000® Value Index return of 4.78% and the Morningstar Large Value category average return of 9.52%. Nearly half of the Fund’s overall underperformance was due to allocation and stock selection within the consumer sectors. Additional relative underperformance within the health care and telecomm sectors detracted, as did the Fund’s cash holding which hurt the Fund in a rising market. Though several of the Fund’s individual stocks total returns were disappointing as discussed below, the Fund’s underperformance was a widespread cumulative effect of many securities, thus as a whole the Fund underperformed.

11

Management’s Discussion of Fund Performance

LARGE CAP VALUE FUND (continued)

What significant changes did you make to the portfolio since November 1, 2008?

The focus of the fund was narrowed to our favorite holdings which resulted in fewer stocks, dropping the portfolio holdings to approximately 60 stocks from 135 held as of October 31, 2008. During this process, we assessed our holdings and other candidates on their stock price upside and downside potential, as well as level of risk, and purchased those with the best overall potential. We considered valuation, financial leverage, return on capital, and expected future stability of business operations. Overall portfolio diversification was taken into account, though we did find better value in energy and health care, so our weighting rose in those sectors.

What were the strongest contributors to Fund performance?

The strongest contributors to performance relative to the index included our overweight positions relative to the index in mining company Freeport-McMoran Copper, biotechnology research tool developer Life Technologies, financial services company Prudential Financials, and investment management company Blackrock Inc., as the stocks outperformed. In addition, owning out-of-index Noble Corp contributed to performance.

What were the largest constraints on performance?

Detracting from performance was the Fund’s underweight position within the consumer discretionary sector, as the sector outperformed. Individual stock holdings which hurt performance included Citigroup which dropped nearly 70% for the period and was subsequently sold, and out-of-index oil and gas drilling equipment and service company Weatherford International. Also detracting was the Fund’s overweight position relative to the index in Bank of New York Mellon which had a depressed stock price over investors’ concerns about profitability in the current low interest rate environment. We continue to hold Weatherford International as we believe it is undervalued and should continue to gain market share, and Bank of New York Mellon as we believe the stock is undervalued and has a sustainable global competitive advantage. Also hurting performance was not owning Ford Motor Co. which shot up 219.6% for the period, and holding cash which averaged a bit under a modest 2% for the period, but was still detractive in a rising market.

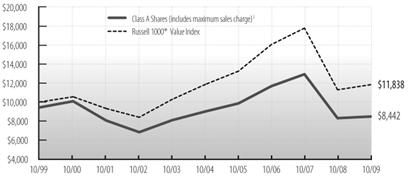

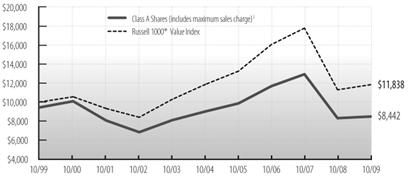

Cumulative Performance of $10,000 Investment Since Inception1,2

12

Management’s Discussion of Fund Performance

LARGE CAP VALUE FUND (continued)

Average Annual Total Return through October 31, 20092 |

| | % Return Without Sales Charge | % Return After Sales Charge6 |

| | 1 Year | 3 Years | 5 Years | 10 Years | Since

6/30/06

Inception | 1 Year | 3 Years | 5 Years | 10 Years |

Class A Shares3 | 2.08%

| (10.27)%

| (1.23)%

| (1.09)%

| —

| (3.82)%

| (12.02)%

| (2.39)%

| (1.68)%

|

Class B Shares4 | 1.23

| (10.94)

| (1.97)

| (1.84)

| —

| (3.25)

| (11.96)

| (2.35)

| (1.84)

|

Class Y Shares9 | 2.24

| —

| —

| —

| (6.43)%

| —

| —

| —

| —

|

Russell 1000® Value Index | 4.78

| (9.79)

| (0.05)

| 1.70

| (6.30)

| NA

| NA

| NA

| NA

|

See accompanying Notes to Management’s Discussion of Fund Performance.

LARGE CAP GROWTH FUND

How did the Fund perform for the period November 1, 2008 – October 31, 2009?

The MEMBERS Large Cap Growth Fund had strong absolute as well as relative results for the period. On an absolute basis, positive gains of 18.99% (Class A shares at net asset value) were achieved. The Fund beat the 17.51% return for the Russell 1000® Growth index by 148 basis points, and also beat the 15.35% return for the Morningstar Large Growth category average return by 364 basis points. The Fund had a very solid year of performance despite very unstable market conditions. Our philosophy and process kept us open-minded during the periods of high market volatility experienced this year. It helped us continue to refresh the Fund with attractive stocks as stock prices moved in response to recessionary forces and attempts to avert financial collapse. We tended to take positions in companies with strong balance sheets, that generate excess cash flow, and that have intrinsic factors leading to growth in earnings or cash flow, as higher quality companies tend to have more resources to weather a financial calamity. These stocks were ultimately recognized by the market during the period and are reflected in the Fund’s relative outperformance.

What significant changes did you make to the portfolio since November 1, 2008?

Over time, we have reduced the number of holdings in the Fund to approximately 65 from approximately 100, as we gained more conviction on our best ideas due to more clarity in the stability of economic conditions. The Fund continues to have a bias towards quality growth companies and remains well diversified.

What were the strongest contributors to Fund performance?

The largest contributors to performance included the Fund’s holdings within the healthcare sector, energy sector, and financials sector. Healthcare was an area of focus since incipient policy reform created heightened uncertainty about future operating conditions, causing other investors to step back from the sector and creating what we thought were attractive stock price entry points. On an individual basis, the Fund’s significant holding in Genentech within the healthcare sector materially added to performance. The Fund’s emphasis in the energy sector, due to our anticipation in a rise in oil prices as a result of decreased drilling productivity and potential supply disruption, aided results throughout the period. Within this sector, Petrohawk Energy Corp., a high growth natural gas producer, was a strong contributor to performance.

What were the largest constraints on performance?

Specific holdings in consumer related areas and materials detracted from Fund performance for the reporting period. Yum! Brands Inc, the quick-service restaurant company which operates Pizza Hut, Taco Bell, and KFC, disappointed for the period. However, we believe its strong growth in China will separate it from competitors.

13

Management’s Discussion of Fund Performance

LARGE CAP GROWTH FUND (continued)

How is the Fund positioned going forward?

We expect overall market volatility to increase as questions develop about the sustainability of the recovery. Also, we believe it is likely the market will narrow rather than broaden and stock selection will become increasingly important. The recovery will be questioned because the economic problems are structural rather than merely cyclical. While we do not think “it is different this time,” we do think it is foreign enough to all living participants to feel that way and believe this is especially true for policy makers. Since there is no playbook for answers, we believe there will be more false steps along the path to prosperity.

Notwithstanding, some companies will thrive in the “new normal” economy. Our bias is that investors will gravitate towards those companies which continue to demonstrate superiority. We envision bouts of broad speculative moves such as last quarter, to be followed by sharp sell offs in companies which do not meet expectations. Serially, investors will gravitate towards those that don’t disappoint. Our portfolio is positioned to take advantage of that expected market environment.

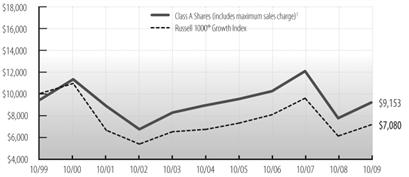

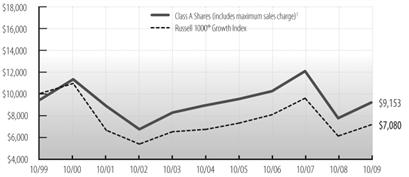

Cumulative Performance of $10,000 Investment Since Inception1,2

Average Annual Total Return through October 31, 20092 |

| | % Return Without Sales Charge | % Return After Sales Charge6 |

| | 1 Year | 3 Years | 5 Years | 10 Years | Since

6/30/06

Inception | 1 Year | 3 Years | 5 Years | 10 Years |

Class A Shares3 | 18.99%

| (3.59)%

| 0.57%

| (0.29)%

| —

| 12.10%

| (5.48)%

| (0.62)%

| (0.88)%

|

Class B Shares4 | 18.06

| (4.31)

| (0.18)

| (1.02)

| —

| 13.56

| (5.44)

| (0.58)

| (1.02)

|

Class Y Shares9 | 19.26

| —

| —

| —

| (0.94)%

| —

| —

| —

| —

|

Russell 1000® Growth Index | 17.51

| (4.05)

| 1.27

| (3.39)

| (1.59)

| NA

| NA

| NA

| NA

|

See accompanying Notes to Management’s Discussion of Fund Performance.

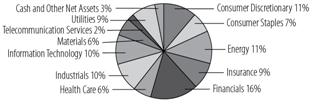

MID CAP VALUE FUND

How did the Fund perform for the period November 1, 2008 - October 31, 2009?

For the trailing year ended October 31, 2009, the MEMBERS Mid Cap Value Fund gained 11.74% (Class A shares at net asset

value) compared with the Russell MidCap® Value Index return of 14.52% and the Morningstar Mid-Cap Value category average return of 17.86%.

14

Management’s Discussion of Fund Performance

MID CAP VALUE FUND (continued)

What significant changes did you make to the portfolio since November 1, 2008?

Wellington Management’s small/mid cap value investment team was removed from managing approximately 20% of the Fund’s assets on July 1, 2009. Livia Asher of Madison Asset Management remains the lead portfolio manager of the Fund. Subsequently, the number of individual stock holdings was reduced and concentrated into a “best ideas” portfolio comprised of roughly 70 stocks, down from roughly 230. The Fund moved away from a more defensive posture and reduced its weight in the utilities sector and reduced the underweight position in financial stocks, and moved towards higher quality stocks with greater long-term appreciation potential. Post the market trough in March 2009, higher beta stocks outperformed. That trade appears to be waning in favor of superior company fundamentals and the portfolio has been tilted in that direction.

What were the strongest contributors to Fund performance?

Greatest contribution came from stock selection within the healthcare and materials sectors. Within healthcare, the Fund benefitted from owning biotechnology research tools developer Life Technologies Corp. and health care and related benefit provider CIGNA Corp. Within the materials sector, the overweight in the exploration, mining, and producer of mineral resources Freeport McMoRan Copper & Gold, Inc., that gained 150%, was a large contributor. More broadly, the greatest individual contribution came from owning out of benchmark investment manager BlackRock, Inc., as its price increased by approximately 70%. Also adding to performance relative to the index were stocks that were not owned. Here, avoiding airline stocks as they declined 50-60% on average, proved positive as did not owning several index banking names such as Huntington Bancshares Inc. and Synovus Financial Corp., which fell by 60-80% during the period.

For the small/mid cap portion of the Fund that was subadvised by Wellington Management Company through June 30, 2009, top relative contributors overall included O’Reilly Automotive, Inc. and Stage Stores, Inc. within the consumer discretionary sector. Delphi Financial Group, Inc., an insurance company specializing in life & disability and excess workers compensation was a key individual contributor in financials, while Herbalife, LTD. and Hormel Foods Corp. were strong performers in consumer staples.

What were the largest constraints on performance?

Stock selection within the consumer discretionary and industrials sectors had the largest negative impact on performance. Within industrials, our defensive position in business information and technology solution provider Dun & Bradstreet Corp. proved not to be as it missed earnings. In addition, not owning several index media stocks, such as Virgin Media Inc., Liberty Media Corp., and Discovery Communications Inc., that surged during the period also detracted from performance. Several index names were also subject to takeovers and not owning several of those, Sun Microsystems Inc. and Coca-Cola Enterprises, for example, proved negative. Finally, the Fund’s avoidance of poor quality stocks during the market’s snapback such as Ford Motor Corp., Hartford Financial Services Group Inc., and Genworth Financial, all of which gained well in excess of 100%, added to the underperformance.

For the small/mid-cap portion of the Fund that was subadvised by Wellington Management Company through June 30, 2009, detractors from relative performance included Webster Financial Corp., International Bancshares Corp., and MB Financial, Inc. in the financials sector. Shares of Arbitron, Inc. (consumer discretionary), the leading provider of media audience rating services for the radio industry, were also relatively weak.

For the period, the stock selection within the consumer discretionary and industrial sectors which had the greatest detraction on performance, along with the Fund’s avoidance of several index names that produced high returns, could not be overcome by the strong stock selection within health care and materials, and not owning several declining index names. This resulted in the Fund underperforming both the index and peer group.

15

Management’s Discussion of Fund Performance

MID CAP VALUE FUND (continued)

How is the Fund positioned going forward?

The Fund used the period of compressed valuations to upgrade the quality of the stocks held in the portfolio. Stocks have been added that appear to have competitive advantages relative to peers and as the economy gains its footing, we believe those stocks will outperform in the longer-term. The Fund’s recent underperformance has resulted from avoidance of the “junk” trade. That phase of the cycle appears to be ending, and we expect earnings and revenues to take center stage.

Cumulative Performance of $10,000 Investment Since Inception1,2

Average Annual Total Return through October 31, 20092 |

| | % Return Without Sales Charge | % Return After Sales Charge6 |

| | 1 Year | 3 Years | 5 Years | Since

2/28/01

Inception10 | Since

6/30/06

Inception | 1 Year | 3 Years | 5 Years | Since

Inception10 |

Class A Shares3 | 11.74%

| (8.87)%

| 0.34%

| 2.76%

| —

| 5.28%

| (10.66)%

| (0.85)%

| 2.06%

|

Class B Shares4 | 11.01

| (9.58)

| (0.44)

| 1.96

| —

| 6.51

| (10.34)

| (0.71)

| 1.96

|

Class Y Shares9 | 12.12

| —

| —

| —

| (5.57)%

| —

| —

| —

| —

|

Russell Midcap® Value Index | 14.52

| (8.39)

| 2.05

| 5.42

| (5.44)

| NA

| NA

| NA

| NA

|

See accompanying Notes to Management’s Discussion of Fund Performance.

MID CAP GROWTH FUND

How did the Fund perform for the period November 1, 2008 – October 31, 2009?

For the trailing year ended October 31, 2009, the MEMBERS Mid Cap Growth Fund returned 21.03% (Class A shares at net asset value), compared to the Russell Midcap® Growth Index return of 22.48% and the Morningstar Mid-Cap Growth category average return of 16.23%.

Stock selection in the consumer discretionary, information technology, and financial sectors contributed the most to relative performance versus the Russell Midcap® Growth Index. In addition, an overweight position in the energy and information technology sectors along with under weights to the utilities and telecommunication services sectors were also positive contributors to relative returns. However, these positive results were more than offset by weak stock selection in the health care, telecommunication services, and industrial sectors, which resulted in slight underperformance compared to the Russell Midcap®

16

Management’s Discussion of Fund Performance

MID CAP GROWTH FUND (continued)

Growth Index. Despite modestly underperforming the index, we were pleased to outperform the Morningstar Mid-Cap Growth peer category average return by almost 5%.

What significant changes did you make to the portfolio since November 1, 2008?

Rich Eisinger, head of Madison’s mid-cap equity team, became the portfolio manager of the Fund mid-year. Rich and his team replaced Wellington Management’s mid-cap growth investment team on July 1, 2009.

Subsequently, as the year progressed, we increased our exposure to the financial sector, particularly in insurance, and now maintain an overweight position. New insurance purchases in the year included Odyssey Re, specialty insurer Markel and property & casualty insurer RLI. Top active positions include Brookfield Asset Management and diversified holding company Leucadia. We expect to maintain an overweight position relative to the index in financials as we believe long-term prospects are excellent and valuations are attractive.

After maintaining an overweight position relative to the index in the technology sector for most of the year, we reduced our technology exposure and now have an underweight position. Our technology holdings generated very strong returns in the first eight months of the fund year. With valuations less attractive, we felt it prudent to reduce exposure and rotate into other sectors with better return prospects.

What were the strongest contributors to Fund performance?

Key individual contributors to relative performance in the consumer discretionary sector were apparel companies True Religion, Aeropostale and the Buckle. Global online travel company Priceline.com and specialty retailer of automotive aftermarket parts O’Reilly Automotive were also strong contributors. In information technology, networking solutions supplier Brocade Communication Systems, network storage equipment manufacturer NetApp, and Akamai Technologies, a provider of services for accelerating the delivery of content and application over the Internet, were strong relative performers.

What were the largest constraints on performance?

Detractors from relative performance in industrials included asset-light freight transportation management company Hub Group, and Terex, a global manufacturer of construction machinery. Huntington Bancshares (financials), Hercules Offshore (energy), and NII Holdings (telecommunication services) were also relatively weak.

How is the Fund positioned going forward?

As we enter the 2010 fund year, we remain cautiously optimistic about further market gains. Many leading economic indicators are signaling the end of the recession and problematic areas such as home prices appear to be stabilizing.

Although the mood is more upbeat, economic support has come mainly from inventory destocking and government stimulus. The sustainability of the economic recovery will be largely dependent on a resurgence in consumer demand beyond short term fixes such as “Cash for Clunkers.” High unemployment rates, stagnant personal income growth and a growing savings rate leave us questioning the strength of a consumer rebound. While we remain optimistic about the prospect for a sustained economic recovery, we believe it may unfold at a slower pace than many currently expect.

17

Management’s Discussion of Fund Performance

MID CAP GROWTH FUND (continued)

Cumulative Performance of $10,000 Investment Since Inception1,2

Average Annual Total Return through October 31, 20092 |

| | % Return Without Sales Charge | % Return After Sales Charge6 |

| | 1 Year | 3 Years | 5 Years | Since

2/29/00

Inception11 | Since

6/30/06

Inception | 1 Year | 3 Years | 5 Years | Since

Inception11 |

Class A Shares3 | 21.03%

| (7.36)%

| 0.64%

| (6.94)%

| —

| 14.06%

| (9.16)%

| (0.53)%

| (7.51)%

|

Class B Shares4 | 20.10

| (8.09)

| (0.15)

| (7.64)

| —

| 15.60

| (9.17)

| (0.55)

| (7.64)

|

Class Y Shares9 | 21.65

| —

| —

| —

| (4.34)%

| —

| —

| —

| —

|

Russell Midcap® Growth Index | 22.48

| (5.61)

| 2.22

| (3.19)

| (3.67)

| NA

| NA

| NA

| NA

|

See accompanying Notes to Management’s Discussion of Fund Performance.

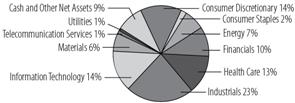

SMALL CAP VALUE FUND

How did the Fund perform for the period November 1, 2008 – October 31, 2009?

For the trailing year ended October 31, 2009, the MEMBERS Small Cap Value Fund returned 13.30% (Class A shares at net asset value), outperforming the Russell 2000® Value Index, which returned 1.96%, and the Morningstar Small Value category average return of 11.22%.

Equity markets posted strong positive returns for the one year ended October 31, 2009 following a weak start. Mid cap stocks (18.2%) outperformed small (6.5%) and large cap stocks (9.8%), as measured by the S&P MidCap 400, Russell 2000® and S&P 500 Indices, respectively. Growth stocks (11.3%) outpaced Value stocks (1.9%), as measured by the Russell 2000® Growth and Russell 2000® Value Indices. Within the Russell 2000® Value index, sector returns were mixed. Materials, information technology, and consumer discretionary posted double-digit gains and were the strongest positive performers. Financials, energy, and utilities trailed and were the only three sectors to post negative returns.

Overall outperformance was a result of stock selection which drove favorable relative returns in the financials, industrials, and consumer staples sectors and more than offset less favorable results in materials, consumer discretionary, and information technology. In addition, sector allocation, a residual of our bottom-up stock selection, was additive due to the Fund’s underweight to financials and overweight to consumer discretionary, while an underweight to the strong-performing information technology sector detracted from relative returns.

18

Management’s Discussion of Fund Performance

SMALL CAP VALUE FUND (continued)

What significant changes did you make to the portfolio since November 1, 2008?

The small cap value investment approach emphasizes individual stock selection; sector weights are a residual of the process. We do, however, carefully consider diversification across economic sectors to limit risk. Based on bottom-up stock decisions, the Fund’s overweight to the consumer staples sector increased and the underweight to financials and information technology narrowed, while overweight positions to the consumer discretionary and industrials sectors decreased.

What were the strongest contributors to Fund performance?

Key individual contributors to relative performance were Carlisle (industrials), Stage Stores (consumer discretionary), and Delphi Financial Group (financials). Diversified global manufacturer Carlisle posted better-than-expected second quarter results. Specialty department store operator Stage Stores announced a narrower-than-expected first quarter loss as the company succeeded at managing inventories and costs in a difficult retail environment. Life & Disability and workers compensation insurance provider Delphi benefited as its investment portfolio stabilized in a more favorable environment. As of the end of the period, we continued to hold all three securities.

What were the largest constraints on performance?

Detractors from relative performance during the period included Penn Virginia (energy), Modine Manufacturing (consumer discretionary), and Webster Financial (financials). Early in the year, oil and gas exploration and production company Penn Virginia announced disappointing drilling results and lowered its production growth target. Modine Manufacturing, which makes heating and cooling systems for vehicles and industrial applications, suffered from investor concerns over the impact of declining levels of auto sales on a company with a balance sheet levered to more robust auto production. Connecticut-based banking and investment services company Webster Financial was negatively impacted by significant writedowns on its investment portfolio and larger-than expected losses on loans. We continued to hold Penn Virginia and Webster Financial, but eliminated Modine Manufacturing.

How is the Fund positioned going forward?

Based on our two- to three-year time horizon, we continue to find attractively valued investment opportunities in a volatile environment.

Cumulative Performance of $10,000 Investment Since Inception1,2

19

Management’s Discussion of Fund Performance

SMALL CAP VALUE FUND (continued)

Average Annual Total Return through October 31, 20092 |

| | % Return Without Sales Charge | % Return After Sales Charge6 |

| | 1 Year | Since

12/27/06

Inception12 | Since

1/9/07

Inception | 1 Year | Since

12/27/06

Inception12 |

Class A Shares 3 | 13.30%

| (5.75)%

| —

| 6.85%

| (7.69)%

|

Class B Shares4 | 12.98

| (6.23)

| —

| 8.48

| (7.38)

|

Class Y Shares9 | 13.53

| —

| (4.96)%

| —

| —

|

Russell 2000¨ Value Index | 1.96

| (11.93)

| (11.56)

| NA

| NA

|

See accompanying Notes to Management’s Discussion of Fund Performance.

SMALL CAP GROWTH FUND

How did the Fund perform for the period November 1, 2008 – October 31, 2009?

For the trailing year ended October 31, 2009 the MEMBERS Small Cap Growth Fund returned -3.36% (Class A shares at net asset value) which lagged the Russell 2000® Growth Index return of 11.34% and the Morningstar Small Growth category average return of 13.17%. The period included a recession and some of the most volatile markets witnessed in the last 20 years. These markets caused tremendous disruptions to quantitative processes and risk models alike. The first quarter of 2009 contained the inflection point of March 9, and the Fund did not keep pace following this rapid shift in market drivers. The portfolio was further disadvantaged during the second quarter of 2009 by a rally in poorer quality securities. Although market returns for the second quarter were impressive, the underlying fundamentals were not; consequently, the rally was labeled as a ‘dash to trash’ in which the Fund did not participate. Also detracting from performance in the early third quarter of 2009 was the relatively larger weighted average market cap versus the index in the quarter. As a result, the Fund significantly underperformed over the past year.

The majority of the Fund’s performance shortfall was due to stock selection in each sector, although sector allocation was a detractor as well, most notably in information technology, consumer discretionary, and healthcare. Information technology was a strong performing sector for the index, returning close to 30% for the period. The Fund was underweight this sector which detracted from performance, but the larger shortfall came from stock selection in this sector. Consumer discretionary index names which were not held in the Fund cost the Fund relative performance, as did the Fund’s underweight position in this sector which returned 32% for the period. Additionally, within the healthcare sector, the Fund saw similar results of performance shortfall due to benchmark names which performed well, but were not held in the Fund.

What significant changes did you make to the portfolio since November 1, 2008?

There were no significant changes to the portfolio investment process during the twelve month period. The portfolio was recently rebalanced which left the largest active sector weights unchanged; healthcare at an approximate 8% underweight relative to the index and industrials at a rough 6% overweight.

What were the strongest contributors to Fund performance?

The strongest contributing sectors to overall Fund performance for the past twelve months were materials, utilities, telecommunication services, consumer staples and finance. The top five contributors from a security standpoint were clinical software developer and marketer Allscripts-Misys Healthcare Solutions Inc., men’s attire retailer Men’s Wearhouse Inc., predictive analytics software provider SPSS Inc which was acquired by IBM in October 2009, business consulting and staffing service provider MPS Group Inc., and digital entertainment technology provider Rovi Corporation.

20

Management’s Discussion of Fund Performance

SMALL CAP GROWTH FUND (continued)

What were the largest constraints on performance?

The largest detractors from performance from a security standpoint were semiconductor designer and manufacturer Microsemi Corporation and MKS Instruments within the information technology sector, oil and natural gas producer Penn Virginia, rail industry technology and service provider Wabtec Corporation, air transportation service provider UAL Corp, and behavioral health service provider Psychiatric Solutions Inc. Within the consumer discretionary sector, not holding strong performers Cheesecake Factory, J Crew, and Bally Technologies were a few names that were costly. Similarly within the healthcare sector, the omission of Human Genome, Dendreon, Corp, and Medarex Inc were costly to Fund performance as these stocks also performed well during the period.

Additional Comments

The Funds’ board of trustees approved the removal of Paradigm Asset Management as the Fund’s subadviser, along with the merger of the Small Cap Growth Fund with and into the Small Cap Value Fund which was completed November 30, 2009. Wellington Management will continue as the subadviser to the merged fund, which is now named the MEMBERS Small

Cap Fund.

Cumulative Performance of $10,000 Investment Since Inception1,2

Average Annual Total Return through October 31, 20092 |

| | % Return Without Sales Charge | % Return After Sales Charge6 |

| | 1 Year | Since

12/27/06

Inception12 | Since

1/9/07

Inception | 1 Year | Since

12/27/06

Inception12 |

Class A Shares 3 | (3.36)%

| (15.88)%

| —

| (8.90)%

| (17.61)%

|

Class B Shares4 | (4.06)

| (16.52)

| —

| (8.38)

| (17.55)

|

Class Y Shares9 | (3.34)

| —

| (15.44)%

| —

| —

|

Russell 2000¨ Growth Index | 11.34

| (7.91)

| (7.66)

| NA

| NA

|

See accompanying Notes to Management’s Discussion of Fund Performance.

21

Management’s Discussion of Fund Performance

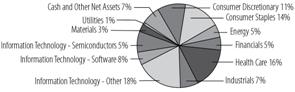

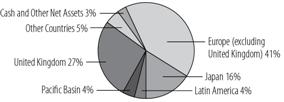

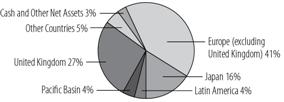

INTERNATIONAL STOCK FUND

How did the Fund perform for the period November 1, 2008 – October 31, 2009?

For the trailing year ended October 31, 2009, the MEMBERS International Stock Fund returned 22.82% (Class A shares at net asset value), compared to the MSCI EAFE Index which returned 28.41% and the Morningstar Foreign Large Blend category average return of 25.04%.

Over the period, international equity markets experienced two very different periods. The first part of the period was characterized by a continuation of the prior market declines, followed by a sharp rally from early March through mid-October. In the first segment, the credit crisis and world recession were front and center and traditionally defensive sectors, such as health care, utilities, telecom services and consumer staples, outperformed on a relative basis. The second segment witnessed strong sector rotation into financials and cyclical sectors, such as industrials, materials, and information technology, as investors anticipated better times in both credit markets and the economy. However, while global stocks have risen significantly, they remain well below the peak reached in October of 2007. International small-cap stocks also experienced a down period followed by a sharply positive period over the year. Small-caps performed strongly in 2009, posting only two negative monthly performances thus far this year. Shares in the developing world began 2009 with a period of considerable weakness caused by pessimistic sentiment over the outlook for global financial institutions, but ended the quarter with a significant rebound due to value hunting by investors, who were following some signs of improvement in the credit markets. From the start of the second quarter of 2009 through the end of the third quarter, emerging markets equities experienced an extraordinary recovery. With the exception of brief periods of respite in June and August, emerging markets stocks rose very strongly throughout the six-month period, as credit and global equity markets as well as investor sentiment demonstrated significant signs of improvement. The developing world took a break in October, ending the period with a flat monthly performance. For the year in total, The MSCI Emerging Markets Index increased by over 64%, as shares in Asia and Latin America performed better than those in Europe. Every sector and most countries in the Index rose during the year. Commodity prices remained generally buoyant, with crude oil reaching more than $80 per barrel and gold moving above $1,000 per ounce by the end of the period.

What significant changes did you make to the portfolio since November 1, 2008?

Over the last year, the Fund transitioned to a less defensive position than in the recent past, as long-term opportunities appeared during this tumultuous period. The Fund’s exposure to financials has changed dramatically, moving from an underweight at the end of February 2009 to an overweight by the end of October 2009. During the period, we added to our positions in several insurance and investment banking companies—QBE Insurance Group, Tokio Marine, Credit Suisse Group, and Nomura—that were trading at very low valuations given their sustainable return on equity. There were also unique opportunities in the banks segment, where Barclays, for example, was trading over 60% lower than its February 2007 highs.

Furthermore, the Fund was able to capitalize on the recent period by investing in companies that were trading at close to all-time historical valuation lows, including Hong Kong-based retailer Esprit, pharmaceuticals company Novo Nordisk, and automation-focused Fanuc.

Additionally, the Fund increased exposure to emerging markets. Notable additions within the asset class included Brazilian credit card payment processing company VisaNet, Banco do Brasil, Industrial & Commercial Bank of China (ICBC), Russian energy company Lukoil, and Mexican media company Grupo Televisa.

What were the strongest contributors to Fund performance?

Stock selection in the financials sector contributed to returns over the period. Positions in Prudential, Allianz, QBE Insurance Group, Nomura, Credit Suisse Group, ICBC, and BNP Paribas all added to performance. An underweight position relative to the

22

Management’s Discussion of Fund Performance

INTERNATIONAL STOCK FUND (continued)

index and stock selection in the consumer discretionary sector also added to returns, as positions in automaker Daimler and in media companies WPP and Informa performed strongly. A position in Banco do Brasil, a Brazilian bank, performed well as loan growth recovered, asset quality deterioration seemed to approach a bottom, and the local currency strengthened. Bank Mandiri, Indonesia’s leading financial company, performed well on the expectation that slowing inflation will lead to rate cuts. Shares of Telekomunikasi Indonesia, an Indonesian telecommunication services company, were up on the back of improving domestic usage, which also helped returns over the period.

What were the largest constraints on performance?

During the 12-month period, the Fund underperformed a very strong MSCI EAFE Index. High exposure and stock selection in consumer staples detracted from relative returns. Japan Tobacco, Imperial Tobacco Group, Diageo, and Heineken suffered from sector rotation. High exposure and stock selection in the health care sector also detracted from returns over the year, as did an underweight position relative to the index in the materials sector. Stock selection in the industrials sector also hurt performance, notably in capital goods company BAE Systems, which fell due to uncertain prospects in governmental defense spending. Exposure to small-cap stocks also detracted from the fund’s returns over the period. Shares of Satyam Computer Services, an Indian software company, were weak due to investor concerns over an alleged fraud. Prime Minister Putin’s attack on Mechel, a coking coal company, caused the shares to fall sharply due to the resultant forced selling by local speculative investors. Evraz Group, a Russian steel company, saw its stock suffer from sharply lower steel prices before we sold the position in April.

Our disadvantage to the benchmarks can be attributed to the Fund’s sector allocations, as well as poor stock selection within consumer staples as several stocks suffered from sector rotation, which could not be overcome by strong stock selection within the financial and consumer discretionary sectors.

How is the Fund positioned going forward?

While the global economy’s rate of decline is slowing, and some leading indicators have begun to rebound, the world continues to face numerous credit and growth challenges, including high unemployment, rising taxes, and bad debts; a slowdown in consumer spending and capital expenditures; continued deleveraging; and the imbalances caused by increasing public debt. We feel the stocks currently held within the Fund are, on average, competitively strong, with good management teams and robust balance sheets. This strength is complemented by attractive valuations and strong, sustainable financial productivity. We believe this leaves the Fund well positioned for the period ahead. We still remain reasonably optimistic about emerging markets in the medium and long term, but are concerned, and therefore neutral, in the short term. Valuations have increased considerably due to a dramatic change in investor attitudes—from deeply bearish six to nine months ago, when we were bullish about the outlook, to widely enthusiastic now. We would therefore advise investors not to be aggressive in emerging markets at this time.

23

Management’s Discussion of Fund Performance

INTERNATIONAL STOCK FUND (continued)

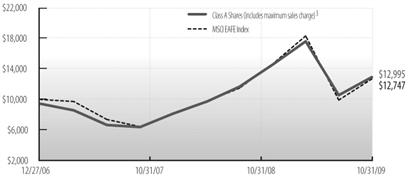

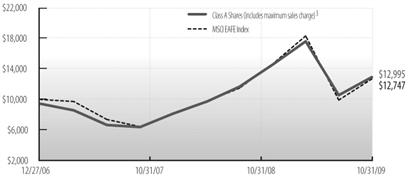

Cumulative Performance of $10,000 Investment Since Inception1,2

Average Annual Total Return through October 31, 20092 |

| | % Return Without Sales Charge | % Return After Sales Charge6 |

| | 1 Year | 3 Years | 5 Years | 10 Years | Since

6/30/06

Inception | 1 Year | 3 Years | 5 Years | 10 Years |

Class A Shares3 | 22.82%

| (3.93)%

| 6.03%

| 3.26%

| —

| 15.71%

| (5.82)%

| 4.79%

| 2.65%

|

Class B Shares4 | 21.91

| (4.68)

| 5.23

| 2.49

| —

| 17.41

| (5.50)

| 4.93

| 2.49

|

Class Y Shares9 | 23.25

| —

| —

| —

| (1.18)%

| —

| —

| —

| —

|

MSCI EAFE Index | 28.41

| (4.74)

| 5.59

| 2.46

| (0.99)

| NA

| NA

| NA

| NA

|

See accompanying Notes to Management’s Discussion of Fund Performance.

24

Notes to Management’s Discussion of Fund Performance

NA Not Applicable. Index returns do not reflect sales charges, fees or expenses.

1 This chart compares a $10,000 investment made in the fund to a $10,000 investment made in the index.

2 Fund returns are calculated after fund expenses have been subtracted and assume that dividends and capital gains are reinvested in additional shares of the fund. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than when purchased. Further information relating to the fund’s performance is contained in the Prospectus and elsewhere in this report. The fund’s past performance is not indicative of future performance. Current performance may be lower or higher than the performance data cited. For fund performance data current to the most recent month-end, please call 1-800-877-6089 or visit www.membersfunds.com. Indices are unmanaged and investors cannot invest in them directly. Index returns do not reflect fees or expenses.

3 Maximum sales charge is 5.75% for class A shares for the Conservative, Moderate and Aggressive Allocation Funds and the Diversified Income, Large Cap Value, Large Cap Growth, Mid Cap Value, Mid Cap Growth, Small Cap Value, Small Cap Growth and International Stock Funds. The maximum sales charge is 4.50% for the Bond and High Income Fund class A shares.

4 Maximum contingent deferred sales charge (CDSC) is 4.50% for class B shares, which is reduced after 12 months and eliminated after six years.

5 Maximum contingent deferred sales charge (CDSC) is 1% for class C shares, which is eliminated after one year.

6 Assumes maximum applicable sales charge.

7 The Conservative, Moderate and Aggressive Allocation Funds’ class A and B Shares commenced investment operations on June 30, 2006.

8 The Conservative, Moderate and Aggressive Allocation Funds’ class C Shares commenced investment operations on February 29, 2008.