OMB APPROVAL

OMB Number: 3235-0570

Expires: January 31, 2014

Estimated average burden hours per response...20.6

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08261

Madison Funds

(Exact name of registrant as specified in charter)

550 Science Drive, Madison, WI 53711

(Address of principal executive offices)(Zip code)

Pamela M. Krill

Madison/Mosaic Legal and Compliance Department

550 Science Drive

Madison, WI 53711

(Name and address of agent for service)

Registrant's telephone number, including area code: 608-274-0300

Date of fiscal year end: October 31*

Date of reporting period: September 30, 2013

*This N-CSR relates to two series of Madison Funds that reorganized from another investment company registrant that had a September 30 fiscal year end. The two funds whose reports are contained in this Form N-CSR have since transitioned their fiscal year end to match those of the registrant and will be included in the complete Form N-CSR for all series of the registrant for the fiscal year end October 31, 2013.

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. s 3507.

Item 1. Report to Shareholders.

Annual Report

September 30, 2013

Madison Tax-Free Virginia Fund

Madison Tax-Free National Fund

Madison Funds®

September 30, 2013

Contents

| Management’s Discussion of Fund Performance | 2 |

| Virginia Fund | 2 |

| National Fund | 3 |

| Portfolio of Investments | |

| Virginia Fund | 4 |

| National Fund | 6 |

| Statements of Assets and Liabilities | 9 |

| Statements of Operations | 10 |

| Statements of Changes in Net Assets | 10 |

| Financial Highlights for a Share of Beneficial Interest Outstanding | 11 |

| Notes to Financial Statements | 12 |

| Report of Independent Registered Public Accounting Firm | 16 |

| Other Information | 17 |

| Trustees and Officers | 21 |

1

September 30, 2013

Management’s Discussion of Fund Performance

NOTE: Due to the reorganization of the Madison Mosaic Funds into the Madison Funds in April 2013, you are receiving this annual report for the Madison Tax-Free Virginia Fund (“Virginia Fund” f/k/a Madison Mosaic Virginia Tax-Free Fund) and Madison Tax-Free National Fund (“National Fund”) (together, “the Funds”) for their 12-month fiscal year ended September 30, 2013. As a part of the Madison Funds family, the Funds’ fiscal years will transition to match the fiscal years of the other Madison Funds. Specifically, the Funds’ new fiscal year will be October 31. As a result, you will be receiving an additional annual report dated October 31, 2013.

The annual period ended September 30, 2013 saw losses, but relative outperformance over peer groups, for the Funds as interest rates rose, driving down the value of a wide range of bonds. One-year total returns were: -2.77% for the Virginia Fund and -3.03% for the National Fund. Over the one-year period of this report the National Fund’s peer group, Morningstar Municipal National Long Category, was down -4.70%. The Morningstar Municipal Single State Long Category, the peer group for the Virginia Fund, dropped -5.42% over the year. Some indication of the manner in which interest rate sensitivity influenced returns over this period can be seen by looking at the Morningstar Single State Intermediate and Short Categories which lost -3.05% and -1.37%, respectively. As interest rates rise, the value of longer maturity bonds tends to drop more than shorter maturity bonds. While both of the Funds are in long bond maturity categories, we took a more conservative approach due to concerns over the possibility of interest rates rising from their historic lows. As a result, some of the outperformance compared to the longer bond maturity peer group is attributable to positioning the portfolio with shorter term bonds.

A second factor was the performance by quality. In a period which contained the bankruptcy of Detroit, the largest municipal default in U.S. history, investors showed renewed scrutiny regarding bond issuers. The Funds had no direct exposure to the Detroit default. An indication of the importance of security selection can be seen in the Morningstar High Yield Muni Category, which lost -6.06% for the period. Although it is never pleasant to report negative returns, we were pleased with the Funds’ relative performance and our decision to manage interest rate and issuer risk.

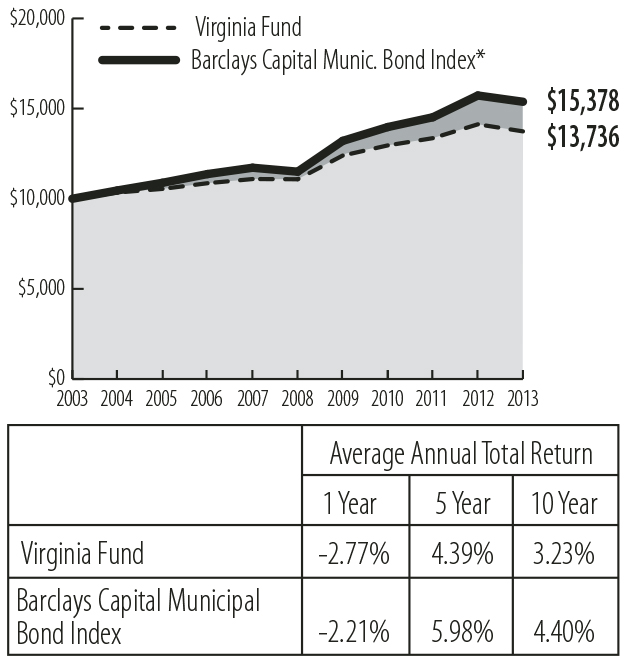

VIRGINIA FUND

The Commonwealth of Virginia maintains a Standard & Poor’s AAA general obligation bond rating based on a well-diversified economy that emphasizes services and government. The Virginia Fund had a total return of -2.77% for the annual period and the 30-day SEC yield was 2.49% as of September 30, 2013. The effective duration of the portfolio was 6.92 years and the average maturity was 10.35 years. In terms of quality holdings, approximately 32.9% of the portfolio was rated by at least one agency

at the highest level (AAA for Standard and Poor’s), 50.6% was the equivalent of S&P’s AA, 14.4% A, and 2.1% BBB. Recently purchased securities included Norfolk Economic Development Authority for Sentara Healthcare revenue bonds and Virginia State Resource Authority Clean Water revenue bonds.

COMPARISON OF CHANGES IN THE VALUE OF A $10,000 INVESTMENT WITH THE BARCLAYS CAPITAL MUNICIPAL BOND INDEX FOR MADISON TAX-FREE VIRGINIA FUND

Past performance is not predictive of future performance. Graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

*The Barclays Capital Municipal Bond Index is a benchmark index produced by Barclays Capital that includes tax-exempt bonds with maturities greater than two years selected from issues larger than $50 million.

Management’s Discussion of Fund Performance | concluded | September 30, 2013

INDUSTRY ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 9/30/13 | |

| Airport | 0.6% |

| Development | 5.4% |

| Education | 13.9% |

| Facilities | 13.3% |

| General | 5.8% |

| General Obligation | 12.9% |

| Medical | 10.6% |

| Multifamily Housing | 8.8% |

| Power | 4.0% |

| Transportation | 5.1% |

| Utilities | 4.1% |

| Water | 12.7% |

| Net Other Assets and Liabilities | 2.8% |

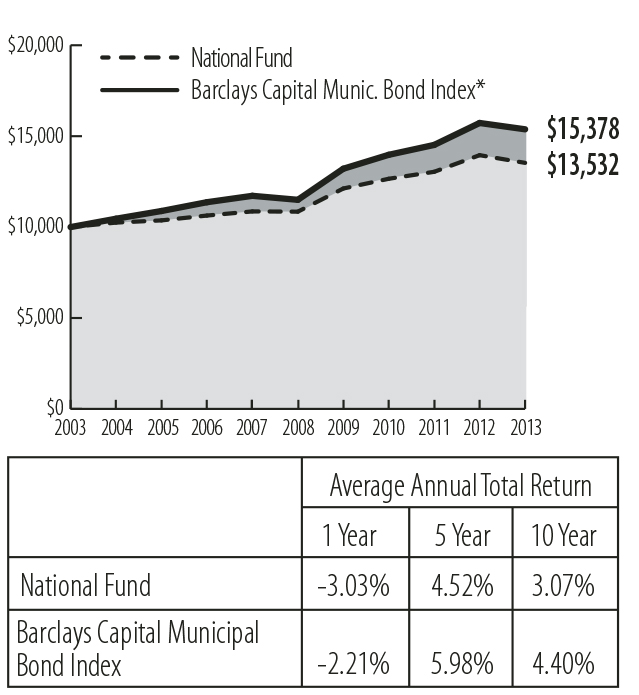

NATIONAL FUND

The National Fund had a total return of -3.03% for the annual period and the 30-day SEC yield was 2.39% as of September 30, 2013. The effective duration of the portfolio

COMPARISON OF CHANGES IN THE VALUE OF A $10,000 INVESTMENT WITH THE BARCLAYS CAPITAL MUNICIPAL BOND INDEX FOR MADISON TAX-FREE NATIONAL FUND

Past performance is not predictive of future performance. Graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

*The Barclays Capital Municipal Bond Index is a benchmark index produced by Barclays Capital that includes tax-exempt bonds with maturities greater than two years selected from issues larger than $50 million.

was 6.56 years and the average maturity was 10.11 years. In terms of quality holdings, approximately 29.3% of the portfolio was rated by at least one agency at the highest level (AAA for Standard and Poor’s), 53.6% was the equivalent of S&P’s AA, 13.3% A, 2.6% BBB and one security was nonrated by the rating agencies of 1.2%. Recently purchased securities included South Carolina State Ports Authority revenue bonds and Orlando Florida Utilities Commission utility systems revenue bonds.

STATE ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 9/30/13 | |

| Alabama | 6.6% |

| Arizona | 2.5% |

| Arkansas | 1.8% |

| Colorado | 1.5% |

| Florida | 13.5% |

| Georgia | 2.5% |

| Illinois | 2.9% |

| Indiana | 8.8% |

| Iowa | 2.6% |

| Maryland | 2.5% |

| Massachusetts | 2.4% |

| Michigan | 3.2% |

| Minnesota | 1.6% |

| Mississippi | 1.8% |

| Missouri | 3.3% |

| New Jersey | 3.0% |

| New York | 3.8% |

| North Carolina | 2.6% |

| Ohio | 2.0% |

| Pennsylvania | 1.8% |

| South Carolina | 2.2% |

| Tennessee | 0.4% |

| Texas | 16.0% |

| Virginia | 5.6% |

| Washington | 1.9% |

| Wisconsin | 0.7% |

| Net other Assets and Liabilities | 2.5% |

We appreciate your confidence in Madison Funds and reaffirm our commitment to provide you with competitive returns to meet your investment objectives.

Sincerely,

(signature)

Michael J. Peters, CFA

Vice President and Portfolio Manager

Vice President and Portfolio Manager

September 30, 2013

Virginia Fund Portfolio of Investments

| Par Value | Value (Note 1) | |||

| MUNICIPAL BONDS - 97.2% | ||||

| Airport - 0.6% | ||||

| Capital Region Airport Commission, (Prerefunded 7/1/15 @ $100) (AGM), 5%, 7/1/20 | $125,000 | $ 135,168 | ||

| Development - 5.4% | ||||

| Norfolk Economic Development Authority, 5%, 11/1/29 | 480,000 | 496,623 | ||

| Prince William County Industrial Development Authority, 5.25%, 2/1/18 | 675,000 | 765,794 | ||

| 1,262,417 | ||||

| Education - 13.9% | ||||

| Henrico County Economic Development Authority, 4%, 4/15/42 | 220,000 | 191,717 | ||

| Lexington Industrial Development Authority, 4.25%, 12/1/20 | 150,000 | 166,694 | ||

| Prince William County Industrial Development Authority, (Prerefunded 10/1/13 @ $101), 5%, 10/1/18 | 150,000 | 151,500 | ||

| University of Virginia, 5%, 6/1/40 | 255,000 | 268,614 | ||

| Virginia College Building Authority, (ST APPROP), 5%, 2/1/23 | 500,000 | 594,250 | ||

| Virginia College Building Authority, (ST APPROP), 5%, 9/1/26 | 140,000 | 154,105 | ||

| Virginia College Building Authority, (ST APPROP), 5%, 2/1/29 | 375,000 | 410,887 | ||

| Virginia Commonwealth University, Series A, 5%, 5/1/26 | 385,000 | 430,311 | ||

| Virginia Public School Authority, 5%, 12/1/18 | 100,000 | 115,755 | ||

| Virginia Public School Authority, (ST APPROP), 5%, 8/1/27 | 350,000 | 383,208 | ||

| Virginia Public School Authority, (ST AID WITHHLDG), 3%, 8/1/33 | 450,000 | 355,855 | ||

| 3,222,896 | ||||

| Facilities - 13.3% | ||||

| Gloucester County Industrial Development Authority, (NATL-RE), 4.375%, 11/1/25 | 500,000 | 507,980 | ||

| Henrico County Economic Development Authority, 5%, 10/1/18 | 170,000 | 196,401 | ||

| Newport News Economic Development Authority, (Prerefunded 7/1/16 @ $100), 5%, 7/1/25 | 745,000 | 832,999 | ||

| Northwestern Regional Jail Authority, (Prerefunded 7/1/15 @ $100) (NATL-RE), 5%, 7/1/19 | 50,000 | 54,022 | ||

| Prince William County Park Authority, 4%, 4/15/24 | 320,000 | 332,720 | ||

| Par Value | Value (Note 1) | |||

| Roanoke County Economic Development Authority, (ASSURED GTY), 5%, 10/15/16 | $200,000 | $ 222,444 | ||

| Stafford County & Staunton Industrial Development Authority, (Prerefunded 8/1/15 @ $100) (NATL-RE), 4.5%, 8/1/25 | 185,000 | 198,727 | ||

| Stafford County & Staunton Industrial Development Authority, (NATL-RE), 4.5%, 8/1/25 | 515,000 | 517,935 | ||

| Virginia Public Building Authority, 5.25%, 8/1/23 | 200,000 | 227,298 | ||

| 3,090,526 | ||||

| General - 5.8% | ||||

| Fairfax County Economic Development Authority, 4.25%, 8/1/29 | 340,000 | 347,262 | ||

| James City County Economic Development Authority, 4%, 6/15/24 | 360,000 | 377,996 | ||

| Puerto Rico Public Finance Corp, (Escrowed To Maturity) (AMBAC*), 5.5%, 8/1/27 | 100,000 | 121,894 | ||

| Territory of Guam, 5%, 1/1/26 | 150,000 | 160,874 | ||

| Virgin Islands Public Finance Authority, (NATL-RE FGIC), 5%, 10/1/23 | 100,000 | 103,052 | ||

| Virginia Resources Authority, (MORAL OBLG), 5%, 11/1/23 | 200,000 | 230,826 | ||

| 1,341,904 | ||||

| General Obligation - 12.9% | ||||

| City of Hampton VA, 5%, 1/15/21 | 250,000 | 284,192 | ||

| City of Richmond VA, (ST AID WITHHLDG), 5%, 7/15/22 | 100,000 | 115,776 | ||

| City of Richmond VA, (Prerefunded 7/15/14 @ $100) (AGM), 5%, 7/15/23 | 400,000 | 414,956 | ||

| City of Roanoke VA, (ST AID WITHHLDG), 5%, 2/1/25 | 230,000 | 257,448 | ||

| City of Virginia Beach VA, Series A, 4%, 8/1/22 | 545,000 | 603,462 | ||

| Commonwealth of Virginia, 5%, 6/1/27 | 150,000 | 170,270 | ||

| County of Arlington VA, (Prerefunded 1/15/17 @ $100), 5%, 1/15/25 | 175,000 | 199,136 | ||

| County of Henrico VA, (Prerefunded 12/1/18 @ $100), 5%, 12/1/24 | 200,000 | 235,724 | ||

| County of Henrico VA, 5%, 7/15/25 | 150,000 | 169,560 | ||

| County of Loudoun VA, (Prerefunded 12/1/17 @ $100) (ST AID WITHHLDG), 5%, 12/1/18 | 165,000 | 191,027 | ||

| County of Prince George VA, (ASSURED GTY ST AID WITHHLDG), 5%, 2/1/20 | 200,000 | 223,518 | ||

| Town of Leesburg VA, 5%, 1/15/41 | 135,000 | 141,622 | ||

| 3,006,691 | ||||

See accompanying Notes to Financial Statements.

Virginia Fund Portfolio of Investments | concluded | September 30, 2013

| Par Value | Value (Note 1) | |||||

| MUNICIPAL BONDS - continued | ||||||

| Medical - 10.6% | ||||||

| Charlotte County Industrial Development Authority, 5%, 9/1/16 | $335,000 | $ 356,326 | ||||

| Fredericksburg Economic Development Authority, 5.25%, 6/15/18 | 250,000 | 273,558 | ||||

| Harrisonburg Industrial Development Authority, (AMBAC*), 4%, 8/15/16 | 200,000 | 216,440 | ||||

| Harrisonburg Industrial Development Authority, (AMBAC*), 5%, 8/15/46 | 180,000 | 180,799 | ||||

| Henrico County Economic Development Authority, (NATL-RE), 6%, 8/15/16 | 165,000 | 171,735 | ||||

| Norfolk Economic Development Authority, 5%, 11/1/36 | 480,000 | 493,382 | ||||

| Roanoke Economic Development Authority, (Escrowed To Maturity) (NATL-RE), 6.125%, 7/1/17 | 500,000 | 551,120 | ||||

| Smyth County Industrial Development Authority, 5%, 7/1/15 | 200,000 | 212,754 | ||||

| 2,456,114 | ||||||

| Multifamily Housing - 8.8% | ||||||

| Fairfax County Redevelopment & Housing Authority, 4.75%, 10/1/36 | 725,000 | 731,017 | ||||

| Fairfax County Redevelopment & Housing Authority, 5%, 10/1/39 | 300,000 | 305,910 | ||||

| Suffolk Redevelopment & Housing Authority, 5.6%, 2/1/33 | 750,000 | 750,405 | ||||

| Virginia Housing Development Authority, 4.8%, 10/1/39 | 250,000 | 250,598 | ||||

| 2,037,930 | ||||||

| Power - 4.0% | ||||||

| Chesterfield County Economic Development Authority, 5%, 5/1/23 | 565,000 | 618,070 | ||||

| Puerto Rico Electric Power Authority, (BHAC-CR MBIA-RE FGIC), 5.25%, 7/1/24 | 290,000 | 305,315 | ||||

| 923,385 | ||||||

| Transportation - 5.1% | ||||||

| Puerto Rico Highways & Transportation Authority, (ASSURED GTY), 5.25%, 7/1/34 | 100,000 | 82,599 | ||||

| Richmond Metropolitan Authority, (Escrowed To Maturity) (NATL-RE FGIC), 5.25%, 7/15/22 | 60,000 | 70,739 | ||||

| Richmond Metropolitan Authority, (NATL-RE FGIC), 5.25%, 7/15/22 | 140,000 | 158,136 | ||||

| Virginia Commonwealth Transportation Board, Series A, 5%, 9/15/24 | 225,000 | 257,281 | ||||

| Virginia Commonwealth Transportation Board, 5%, 3/15/25 | 535,000 | 608,530 | ||||

| 1,177,285 | ||||||

| Par Value | Value (Note 1) | |||||

| Utilities - 4.1% | ||||||

| City of Richmond VA, (AGM), 4.5%, 1/15/33 | $940,000 | $ 950,237 | ||||

| Water - 12.7% | ||||||

| Fairfax County Water Authority, 5.25%, 4/1/23 | 180,000 | 219,903 | ||||

| Hampton Roads Sanitation District, 5%, 11/1/20 | 200,000 | 234,048 | ||||

| Hampton Roads Sanitation District, 5%, 4/1/33 | 250,000 | 266,435 | ||||

| Henry County Public Service Authority, (AGM), 5.25%, 11/15/15 | 150,000 | 160,698 | ||||

| Upper Occoquan Sewage Authority, (NATL-RE), 5.15%, 7/1/20 | 1,000,000 | 1,152,720 | ||||

| Virginia Resources Authority, (ST AID WITHHLDG), 5%, 10/1/23 | 500,000 | 582,800 | ||||

| Virginia Resources Authority, (ST AID WITHHLDG), 4.5%, 10/1/28 | 160,000 | 172,531 | ||||

| Virginia Resources Authority, 5%, 11/1/31 | 160,000 | 170,502 | ||||

| 2,959,637 | ||||||

| TOTAL INVESTMENTS - 97.2% (Cost $22,323,034**) | 22,564,190 | |||||

| NET OTHER ASSETS AND LIABILITIES - 2.8% | 651,185 | |||||

| TOTAL NET ASSETS - 100.0% | $23,215,375 | |||||

| * | This bond is covered by insurance issued by Ambac Assurance Corporation (“AMBAC”). On November 8, 2010, Ambac Financial Group, Inc., the holding company of AMBAC, announced that it had filed for Chapter 11 bankruptcy protection. The impact that this event may have on the ability of AMBAC to guarantee timely payment of principal and interest on these bonds, should they default, is not known at this time. |

| ** | Aggregate cost for Federal tax purposes was $22,323,034. |

| AGM | Assured Guaranty Municipal Corp. |

| AMBAC | AMBAC Indemnity Corp. |

| ASSURED GTY | Assured Guaranty |

| BHAC-CR | Berkshire Hathaway Assuranty Corp. |

| FGIC | Financial Guaranty Insurance Co. |

| MBIA-RE | MBIA Insurance Corp. |

| MORAL OBLG | Moral Obligation |

| NATL-RE | National Public Finance Guarantee Corp. |

| ST AID WITHHLDG | State Aid Withholding |

| ST APPROP | State Appropriations |

See accompanying Notes to Financial Statements.

September 30, 2013

National Fund Portfolio of Investments

| Par Value | Value (Note 1) | |||

| MUNICIPAL BONDS - 97.5% | ||||

| Alabama - 6.6% | ||||

| Alabama Incentives Financing Authority, 5%, 9/1/29 | $300,000 | $ 316,938 | ||

| Troy University, (ASSURED GTY), 4.125%, 11/1/23 | 420,000 | 447,989 | ||

| Tuscaloosa Public Educational Building Authority, (ASSURED GTY), 6.375%, 7/1/28 | 295,000 | 327,942 | ||

| University of South Alabama, (AMBAC*), 5%, 12/1/24 | 700,000 | 769,650 | ||

| 1,862,519 | ||||

| Arizona - 2.5% | ||||

| Glendale Western Loop 101 Public Facilities Corp., (Prerefunded 1/1/14 @ $100), 6%, 7/1/24 | 525,000 | 532,434 | ||

| Northern Arizona University, Certificate Participation, (Prerefunded 9/1/15 @ $100) (AMBAC*), 5%, 9/1/23 | 150,000 | 163,214 | ||

| 695,648 | ||||

| Arkansas - 1.8% | ||||

| City of Fort Smith AR Water & Sewer Revenue, (AGM), 5%, 10/1/21 | 175,000 | 194,987 | ||

| Lake Hamilton School District No 5 of Garland County, General Obligation Ltd., (ST AID WITHHLDG), 3%, 4/1/21 | 320,000 | 324,589 | ||

| 519,576 | ||||

| Colorado - 1.5% | ||||

| El Paso County Facilities Corp., Certificate Participation, 5%, 12/1/27 | 400,000 | 434,768 | ||

| Florida - 13.5% | ||||

| City of Port St. Lucie FL Utility System Revenue, 5%, 9/1/27 | 600,000 | 653,976 | ||

| Emerald Coast Utilities Authority, (NATL-RE), 5%, 1/1/25 | 300,000 | 301,383 | ||

| Highlands County Health Facilities Authority, 5%, 11/15/20 | 455,000 | 485,389 | ||

| Hillsborough County Industrial Development Authority, 5%, 10/1/34 | 450,000 | 454,230 | ||

| Lee County Industrial Development Authority, 5%, 11/1/28 | 500,000 | 525,195 | ||

| Orlando Utilities Commission, Series C, 5%, 10/1/22 | 525,000 | 620,393 | ||

| Peace River/Manasota Regional Water Supply Authority, (AGM), 5%, 10/1/23 | 750,000 | 785,512 | ||

| 3,826,078 | ||||

| Par Value | Value (Note 1) | |||

| Georgia - 2.5% | ||||

| City of Atlanta GA Water & Wastewater Revenue, (AGM), 5.75%, 11/1/30 | $300,000 | $ 352,632 | ||

| Georgia State Road & Tollway Authority, 5%, 6/1/21 | 90,000 | 101,907 | ||

| Gwinnett County Development Authority, Certificate Participation, (NATL-RE), 5.25%, 1/1/21 | 100,000 | 116,744 | ||

| Private Colleges & Universities Authority, 5%, 9/1/38 | 130,000 | 134,801 | ||

| 706,084 | ||||

| Illinois - 2.9% | ||||

| County of Winnebago IL, General Obligation, (Prerefunded 6/30/15 @ $100) (NATL-RE), 5%, 12/30/24 | 500,000 | 540,150 | ||

| Regional Transportation Authority, (AMBAC* GO of AUTH), 7.2%, 11/1/20 | 240,000 | 271,889 | ||

| 812,039 | ||||

| Indiana - 8.8% | ||||

| Indiana Finance Authority, 5%, 2/1/21 | 400,000 | 465,040 | ||

| Indiana Finance Authority, 4.5%, 10/1/22 | 345,000 | 369,498 | ||

| Indianapolis Local Public Improvement Bond Bank, (ASSURED GTY), 5.5%, 1/1/38 | 475,000 | 498,517 | ||

| Western Boone Multi-School Building Corp., General Obligation, (AGM) (ST AID WITHHLDG), 5%, 1/10/20 | 1,015,000 | 1,153,162 | ||

| 2,486,217 | ||||

| Iowa - 2.6% | ||||

| City of Bettendorf IA, General Obligation, 5%, 6/1/28 | 475,000 | 516,985 | ||

| City of Bettendorf IA, General Obligation, 5%, 6/1/30 | 210,000 | 223,426 | ||

| 740,411 | ||||

| Maryland - 2.5% | ||||

| Maryland State Transportation Authority, (Escrowed To Maturity), 6.8%, 7/1/16 | 40,000 | 43,123 | ||

| Montgomery County Revenue Authority, 5%, 5/1/31 | 600,000 | 662,796 | ||

| 705,919 | ||||

| Massachusetts - 2.4% | ||||

| Massachusetts School Building Authority, (Prerefunded 8/15/15 @ $100) (AGM), 5%, 8/15/23 | 635,000 | 690,264 | ||

See accompanying Notes to Financial Statements.

National Fund Portfolio of Investments | continued | September 30, 2013

| Par Value | Value (Note 1) | |||

| MUNICIPAL BONDS - continued | ||||

| Michigan - 3.2% | ||||

| Detroit City School District, General Obligation, (FGIC Q-SBLF), 6%, 5/1/20 | $400,000 | $ 458,288 | ||

| Redford Unified School District No. 1, General Obligation, (AMBAC* Q-SBLF), 5%, 5/1/22 | 410,000 | 452,980 | ||

| 911,268 | ||||

| Minnesota - 1.6% | ||||

| Litchfield Independent School District No. 465, General Obligation, (SD CRED PROG), 3%, 2/1/20 | 420,000 | 440,752 | ||

| Mississippi - 1.8% | ||||

| Harrison County Wastewater Management District, (Escrowed To Maturity) (FGIC), 7.75%, 2/1/14 | 500,000 | 512,275 | ||

| Missouri - 3.3% | ||||

| City of O’Fallon MO, Certificate Participation, (NATL-RE), 5.25%, 11/1/16 | 100,000 | 111,333 | ||

| County of St Louis MO, (Escrowed To Maturity), 5.65%, 2/1/20 | 500,000 | 604,975 | ||

| St Louis Industrial Development Authority, 6.65%, 5/1/16 | 200,000 | 224,538 | ||

| 940,846 | ||||

| New Jersey - 3.0% | ||||

| New Jersey State Turnpike Authority, (Escrowed To Maturity) (NATL-RE-IBC), 6.5%, 1/1/16 | 525,000 | 563,687 | ||

| New Jersey State Turnpike Authority, (BHAC-CR FSA), 5.25%, 1/1/28 | 250,000 | 286,308 | ||

| 849,995 | ||||

| New York - 3.8% | ||||

| City of North Tonawanda NY, General Obligation, 4%, 4/1/21 | 240,000 | 255,965 | ||

| New York State Dormitory Authority, (BHAC-CR AMBAC*), 5.5%, 7/1/31 | 250,000 | 296,250 | ||

| Port Authority of New York & New Jersey, (GO of AUTH), 5.375%, 3/1/28 | 455,000 | 521,771 | ||

| 1,073,986 | ||||

| North Carolina - 2.6% | ||||

| North Carolina Medical Care Commission, (HUD SECT 8), 5.5%, 10/1/24 | 500,000 | 521,285 | ||

| State of North Carolina, 4.5%, 5/1/27 | 200,000 | 218,196 | ||

| 739,481 | ||||

| Ohio - 2.0% | ||||

| Cleveland-Cuyahoga County Port Authority, 5%, 7/1/24 | 500,000 | 572,930 | ||

| Par Value | Value (Note 1) | |||

| Pennsylvania - 1.8% | ||||

| Lehigh County General Purpose Authority, (NATL-RE GO of HOSP), 7%, 7/1/16 | $485,000 | $ 521,157 | ||

| South Carolina - 2.2% | ||||

| South Carolina State Ports Authority, 5%, 7/1/19 | 130,000 | 150,678 | ||

| York County School District No. 1, General Obligation, (SCSDE), 5%, 3/1/27 | 440,000 | 481,342 | ||

| 632,020 | ||||

| Tennessee - 0.4% | ||||

| Jackson Energy Authority, 4.75%, 6/1/25 | 100,000 | 109,972 | ||

| Texas - 16.0% | ||||

| Beaumont Independent School District, General Obligation, (PSF-GTD), 4.75%, 2/15/38 | 300,000 | 307,101 | ||

| City of San Antonio TX, Water System Revenue, 5.125%, 5/15/29 | 500,000 | 545,570 | ||

| City of Sugar Land TX, General Obligation Ltd., 5%, 2/15/28 | 350,000 | 378,438 | ||

| County of Harris TX, General Obligation Ltd., (Prerefunded 10/1/18 @ $100), 5.75%, 10/1/24 | 250,000 | 302,820 | ||

| Frisco Independent School District, General Obligation, (PSF-GTD), 3%, 8/15/35 | 505,000 | 399,268 | ||

| Liberty Hill Independent School District, General Obligation, (PSF-GTD), 5%, 8/1/26 | 410,000 | 458,409 | ||

| Lower Colorado River Authority, (Escrowed To Maturity) (AMBAC*), 6%, 1/1/17 | 305,000 | 351,021 | ||

| Mueller Local Government Corp, 5%, 9/1/25 | 1,280,000 | 1,413,299 | ||

| State of Texas, General Obligation, 5%, 8/1/27 | 330,000 | 372,943 | ||

| 4,528,869 | ||||

| Virginia - 5.6% | ||||

| City of Virginia Beach VA, General Obligation, Series A, 4%, 8/1/22 | 600,000 | 664,362 | ||

| Fairfax County Redevelopment & Housing Authority, 5%, 10/1/39 | 265,000 | 270,220 | ||

| Henry County Public Service Authority, (AGM), 5.25%, 11/15/15 | 150,000 | 160,698 | ||

| Virginia Commonwealth Transportation Board, 5%, 3/15/23 | 200,000 | 234,544 | ||

| Virginia Housing Development Authority, 4.8%, 10/1/39 | 250,000 | 250,598 | ||

| 1,580,422 | ||||

| Washington - 1.9% | ||||

| University of Washington, 5%, 7/1/32 | 500,000 | 534,655 | ||

See accompanying Notes to Financial Statements.

National Fund Portfolio of Investments | concluded | September 30, 2013

| Par Value | Value (Note 1) | |||||

| MUNICIPAL BONDS - concluded | ||||||

| Wisconsin - 0.7% | ||||||

| Wisconsin Health & Educational Facilities Authority, 5.25%, 10/1/21 | $200,000 | $ 204,496 | ||||

| TOTAL INVESTMENTS - 97.5% (Cost $27,059,426**) | 27,632,647 | |||||

| NET OTHER ASSETS AND LIABILITIES - 2.5% | 695,662 | |||||

| TOTAL NET ASSETS - 100.0% | $28,328,309 | |||||

| * | This bond is covered by insurance issued by Ambac Assured Corporation (“AMBAC”). On November 8, 2010, Ambac Financial Group, Inc., the holding company of AMBAC, announced that it had filed for Chapter 11 bankruptcy protection. The impact that this event may have on the ability of AMBAC to guarantee timely payment of principal and interest on these bonds, should they default, is not known at this time. |

| ** | Aggregate cost for Federal tax purposes was $27,059,426. |

| AGM | Assured Guaranty Municipal Corp. |

| AMBAC | AMBAC Indemnity Corp. |

| ASSURED GTY | Assured Guaranty |

| BHAC-CR | Berkshire Hathaway Assuranty Corp. |

| FGIC | Financial Guaranty Insurance Co. |

| FSA | Financial Security Assurance |

| GO of AUTH | General Obligation of the Authority |

| GO of HOSP | General Obligation of the Hospital District |

| HUD SECT 8 | HUD Insured Multifamily Housing |

| IBC | Insured Bond Certificate |

| NATL-RE | National Public Finance Guarantee Corp. |

| PSF GTD | Permanent School Fund Guaranteed |

| Q-SBLF | Qualified School Board Loan Fund |

| SCSDE | South Carolina School District-Enhanced (State of SC’s Intercept program) |

| SD CRED PROG | School District Credit Program |

| ST AID WITHHLDG | State Aid Withholding |

See accompanying Notes to Financial Statements.

September 30, 2013

Statements of Assets and Liabilities

| Virginia* Fund | National* Fund | |||||

| Assets | ||||||

| Investments: | ||||||

| Investments at cost | ||||||

| Unaffiliated issuers | $22,323,034 | $27,059,426 | ||||

| Net unrealized appreciation | ||||||

| Unaffiliated issuers | 241,156 | 573,221 | ||||

| Total investments | 22,564,190 | 27,632,647 | ||||

| Cash | 375,795 | 324,622 | ||||

| Receivables: | ||||||

| Fund shares sold | 1,200 | 43,499 | ||||

| Interest | 292,896 | 369,563 | ||||

| Total assets | 23,234,081 | 28,370,331 | ||||

| Liabilities: | ||||||

| Payables | ||||||

| Fund shares repurchased | 210 | 1,715 | ||||

| Advisory agreement fees | 9,430 | 11,460 | ||||

| Service agreement fees | 6,601 | 8,022 | ||||

| Accrued expenses and other payables | 2,465 | 20,825 | ||||

| Total liabilities | 18,706 | 42,022 | ||||

Net Assets | $23,215,375 | $28,328,309 | ||||

| Net assets consists of: | ||||||

| Paid in capital | $22,595,808 | $27,624,211 | ||||

| Accumulated undistributed net investment income | 2,838 | 3,740 | ||||

| Accumulated net realized gain on investments | 375,573 | 127,137 | ||||

| Net unrealized appreciation on investments | 241,156 | 573,221 | ||||

| Net Assets | $23,215,375 | $28,328,309 | ||||

| Shares: | ||||||

| Net Assets | $23,215,375 | $28,328,309 | ||||

| Shares of beneficial interest outstanding | 2,018,973 | 2,647,590 | ||||

| Net Asset Value and redemption price per share | $11.50 | $10.70 | ||||

| * | The Statements of Assets and Liabilities presented herein reflect the historical operating results of the Virginia Tax-Free Fund and Tax-Free National Fund, both series of the Madison Mosaic Tax-Free Trust. See Note 1 for a discussion of the Funds’ reorganization. |

See accompanying Notes to Financial Statements.

September 30, 2013

Statements of Operations

For the year ended September 30, 2013

| Virginia* Fund | National* Fund | |

| Investment Income | ||

| Interest income | $ 881,718 | $ 1,139,296 |

| Expenses | ||

| Advisory agreement fees | 123,756 | 151,198 |

| Service agreement fees | 86,629 | 105,839 |

| Total expenses | 210,385 | 257,037 |

Net Investment Income | 671,333 | 882,259 |

| Realized and Unrealized Gain (Loss) on Investments | ||

| Net realized gain on investments | ||

| Unaffiliated issuers | 375,573 | 127,137 |

| Net change in unrealized depreciation of investments | ||

| Unaffiliated issuers | (1,727,417) | (1,915,420) |

Net Realized and Unrealized Loss on Investments | (1,351,844) | (1,788,283) |

Net Decrease in Net Assets from Operations | $ (680,511) | $ (906,024) |

| * | The Statements of Operations presented herein reflect the historical operating results of the Virginia Tax-Free Fund and Tax-Free National Fund, both series of the Madison Mosaic Tax-Free Trust. See Note 1 for a discussion of the Funds’ reorganization. |

Statements of Changes in Net Assets

| Virginia Fund* | National Fund* | |||||||||||

| Year Ended September 30, | 2013 | 2012 | 2013 | 2012 | ||||||||

| Net Assets at beginning of period | $26,117,230 | $25,008,718 | $31,526,202 | $31,318,612 | ||||||||

| Increase (decrease) in net assets from operations: | ||||||||||||

| Net investment income | 671,333 | 732,285 | 882,259 | 938,373 | ||||||||

| Net realized gain | 375,573 | 182,600 | 127,137 | 211,524 | ||||||||

| Net change in unrealized appreciation (depreciation) | (1,727,417) | 518,009 | (1,915,420) | 982,635 | ||||||||

| Net increase (decrease) in net assets from operations | (680,511) | 1,432,894 | (906,024) | 2,132,532 | ||||||||

| Distribution to shareholders from: | ||||||||||||

| Net investment income | (668,495) | (732,285) | (878,519) | (938,373) | ||||||||

| Net realized gains | (182,600) | (17,310) | (209,589) | (108,328) | ||||||||

| Total distributions | (851,095) | (749,595) | (1,088,108) | (1,046,701) | ||||||||

| Capital Stock transactions: | ||||||||||||

| Shares sold | 682,000 | 1,789,012 | 2,694,374 | 2,201,412 | ||||||||

| Issued to shareholders in reinvestment of distributions | 812,522 | 710,910 | 799,526 | 779,789 | ||||||||

| Shares redeemed | (2,864,771) | (2,074,709) | (4,697,661) | (3,859,442) | ||||||||

| Total net increase from capital stock transactions | (1,370,249) | 425,213 | (1,203,761) | (878,241) | ||||||||

| Total increase (decrease) in net assets | (2,901,855) | 1,108,512 | (3,197,893) | 207,590 | ||||||||

| Net Assets at end of period | $23,215,375 | $26,117,230 | $28,328,309 | $31,526,202 | ||||||||

| Undistributed net investment income | $ 2,838 | $ – | $ 3,740 | $ – | ||||||||

| Capital Share transactions: | ||||||||||||

| Shares sold | 56,915 | 147,504 | 242,273 | 195,306 | ||||||||

| Issued to shareholders in reinvestment of distributions | 68,072 | 58,811 | 71,600 | 69,345 | ||||||||

| Shares redeemed | (238,995) | (171,359) | (422,286) | (342,824) | ||||||||

| Net increase (decrease) in shares outstanding | (114,008) | 34,956 | (108,413) | (78,173) | ||||||||

| * | The Statements of Changes in Net Assets presented herein reflect the historical operating results of the Virginia Tax-Free Fund and Tax-Free National Fund, both series of the Madison Mosaic Tax-Free Trust. See Note 1 for a discussion of the Funds’ reorganization. |

See accompanying Notes to Financial Statements.

September 30, 2013

Financial Highlights for a Share of Beneficial Interest Outstanding

VIRGINIA FUND* | |||||

| Year Ended September 30, | |||||

| 2013 | 2012 | 2011 | 2010 | 2009 | |

| Net Asset Value at beginning of period | $12.24 | $11.92 | $11.98 | $11.87 | $11.01 |

| Income from Investment Operations: | |||||

Net investment income 1 | 0.32 | 0.35 | 0.35 | 0.37 | 0.37 |

| Net realized and unrealized gain (loss) on investments | (0.650) | 0.33 | – | 0.16 | 0.91 |

| Total from investment operations | (0.330) | 0.68 | 0.35 | 0.53 | 1.28 |

| Less Distributions: | |||||

| Distributions from net investment income | (0.320) | (0.350) | (0.350) | (0.370) | (0.370) |

| Distributions from capital gains | (0.090) | (0.010) | (0.060) | (0.050) | (0.050) |

| Total distributions | (0.410) | (0.360) | (0.410) | (0.420) | (0.420) |

| Net increase (decrease) in net asset value | (0.740) | 0.32 | (0.060) | 0.11 | 0.86 |

| Net Asset Value at end of period | $11.50 | $12.24 | $11.92 | $11.98 | $11.87 |

| Total return (%) | (2.770) | 5.75 | 3.10 | 4.54 | 11.87 |

| Ratios/Supplemental Data: | |||||

| Net Assets at end of year (in 000’s) | $23,215 | $26,117 | $25,009 | $26,170 | $25,883 |

| Ratio of expenses to average net assets (%) | 0.85 | 0.98 | 1.03 | 1.03 | 1.03 |

| Ratio of net investment income to average net assets (%) | 2.71 | 2.88 | 3.03 | 3.10 | 3.26 |

| Portfolio turnover (%) | 24 | 12 | 7 | 19 | 18 |

NATIONAL FUND* | |||||

| Year Ended September 30, | |||||

| 2013 | 2012 | 2011 | 2010 | 2009 | |

| Net Asset Value at beginning of period | $11.44 | $11.05 | $11.16 | $11.09 | $10.34 |

| Income from Investment Operations: | |||||

Net investment income 1 | 0.32 | 0.33 | 0.34 | 0.36 | 0.37 |

| Net realized and unrealized gain (loss) on investments | (0.660) | 0.43 | (0.020) | 0.12 | 0.82 |

| Total from investment operations | (0.340) | 0.76 | 0.32 | 0.48 | 1.19 |

| Less Distributions: | |||||

| Distributions from net investment income | (0.320) | (0.330) | (0.340) | (0.360) | (0.370) |

| Distributions from capital gains | (0.080) | (0.040) | (0.090) | (0.050) | (0.070) |

| Total distributions | (0.400) | (0.370) | (0.430) | (0.410) | (0.440) |

| Net increase (decrease) in net asset value | (0.740) | 0.39 | (0.110) | 0.07 | 0.75 |

| Net Asset Value at end of period | $10.70 | $11.44 | $11.05 | $11.16 | $11.09 |

| Total return (%) | (3.030) | 7.02 | 3.02 | 4.43 | 11.73 |

| Ratios/Supplemental Data: | |||||

| Net Assets at end of year (in 000’s) | $28,328 | $31,526 | $31,319 | $29,347 | $29,143 |

| Ratio of expenses to average net assets (%) | 0.85 | 1.00 | 1.06 | 1.06 | 1.06 |

| Ratio of net investment income to average net assets (%) | 2.92 | 2.97 | 3.11 | 3.26 | 3.44 |

| Portfolio turnover (%) | 24 | 13 | 13 | 19 | 17 |

| * | The Financial Highlights presented herein reflect the historical operating results of the Virginia Tax-Free Fund and Tax-Free National Fund, both series of the Madison Mosaic Tax-Free Trust. See Note 1 for a discussion of the Funds’ reorganization. |

1 | Net investment income calculated excluding permanent tax adjustments to undistributed net investment income. |

See accompanying Notes to Financial Statements.

September 30, 2013

Notes to Financial Statements

1. Summary of Significant Accounting Policies. The Madison Mosaic Tax-Free Trust (the “Mosaic Trust“) was registered with the Securities and Exchange Commission (the “SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act“) as an open-end, diversified investment management company. The Mosaic Trust maintained two separate funds, the Virginia Tax-Free Fund and the Tax-Free National Fund. On April 19, 2013, each fund was reorganized from the Mosaic Trust into Madison Funds Trust, a Delaware business Trust (“the Trust“). Specifically, the Virginia Tax-Free Fund became the Madison Tax-Free Virginia Fund (the “Virginia Fund”) and the Tax-Free National Fund became the Madison Tax-Free National Fund (the “National Fund”) (each a “Fund” and together the “Funds”). The Trust is registered under the 1940 Act, as amended, as a diversified open-end, management investment company. As of the date of this report, the Trust offers twenty one funds including the Virginia Fund and National Fund. The Funds invest principally in securities exempt from federal income taxes, commonly known as “municipal” securities. The Virginia Fund invests solely in securities exempt from both federal and Virginia state income taxes. The National Fund invests in securities exempt from federal taxes. Both Funds invest in intermediate and long-term securities. The Madison Funds Declaration of Trust permits the Trustees to issue an unlimited number of shares of beneficial interest of the Trust without par value. This report was prepared to present the final period during which the Funds operated under the Mosaic Trust, and the initial period during which they operated as a series of the Madison Funds.

Portfolio Valuation: Securities having maturities of 60 days or less are valued at amortized cost, which approximates market value. Securities having longer maturities, for which quotations are readily available, are valued at their bid price. Securities for which market quotations are not readily available are valued at their fair value as determined in good faith under procedures approved by the Board of Trustees.

In determining the value of a particular investment, pricing services may use certain information with respect to transactions in such investments, quotations from dealers, pricing matrices, market transactions in comparable investments, various relationships observed in the market between investments and calculated yield measures based on valuation technology commonly employed in the market for such investments.

Each Fund has adopted the Financial Accounting Standards Board (“FASB”) applicable guidance on fair value measurements. Fair value is defined as the price that each Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. A three-tier hierarchy is used to maximize the use of observable market data “inputs,” minimize the use of unobservable “inputs” and establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (for example, the risk inherent in a particular valuation technique used to measure fair value including such a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs

that reflect the assumptions market participants would use in pricing the asset or liability, developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed using an entity’s own assumptions which are developed based on the best information available in the circumstances. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below:

Level 1 – unadjusted quoted prices in active markets for identical securities

Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rate volatilities, prepayment speeds, credit risk, benchmark yields, transactions, bids, offers, new issues, spreads and other relationships observed in the markets among comparable securities, underlying equity of the issuer; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data, etc.)

Level 3 – significant unobservable inputs (including the Funds’ own assumptions in determining the fair value of investments)

The valuation techniques used by the Funds to measure fair value for the year ended September 30, 2013 maximized the use of observable inputs and minimized the use of unobservable inputs. As of September 30, 2013 and during the year then ended, neither of the Funds held securities deemed a Level 3 investment and there were no transfers between classification levels.

The following is a summary used as of September 30, 2013 in valuing the Funds’ investments carried at fair value (please see the Portfolio of Investments for each Fund for a listing of all securities within each category):

| Fund | Quoted Prices in Active Markets for Identical Investments (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Value at 9/30/2013 |

| Virginia Fund | ||||

| Municipal Bonds | $– | $22,564,190 | $– | $22,564,190 |

| – | 22,564,190 | – | 22,564,190 | |

| National Fund | ||||

| Municipal Bonds | – | 27,632,647 | – | 27,632,647 |

| – | 27,632,647 | – | 27,632,647 | |

Notes to Financial Statements | continued | September 30, 2013

In May 2011, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2011-04, modifying Topic 820, Fair Value Measurements and Disclosures. At the same time, the International Accounting Standards Board (“IASB”) issued International Financial Reporting Standard (“IFRS”) 13, Fair Value Measurement. The objective by the FASB and IASB is convergence of their guidance on fair value measurements and disclosures. The Funds adopted the disclosures required by this update.

Municipal securities are traded via a network among dealers and brokers that connect buyers with sellers. From time to time, liquidity in the tax-exempt bond market may be reduced as a result of overall economic conditions and credit tightening. There may be little trading in the secondary market for particular bonds and other debt securities, which may make them more difficult to value or sell.

Investment Transactions: Investment transactions are recorded on a trade date basis. The cost of investments sold is determined on the identified cost basis for financial statement and Federal income tax purposes.

Investment Income: Interest income is recorded on an accrual basis. Bond premium is amortized and original issue discount and market discount are accreted over the expected life of each applicable security using the effective interest method.

Distribution of Income and Gains: Distributions are recorded on the ex-dividend date. Net investment income, determined as gross investment income less total expenses, is declared as a regular dividend and distributed to shareholders monthly. Capital gain distributions, if any, are declared and paid annually at calendar year-end. Additional distributions may be made if necessary. The tax character of distributions paid during the fiscal years ended September 30, 2013 and 2012 may differ from the Statements of Changes in Net Assets because for tax purposes dividends are recognized when actually paid.

The tax character of distributions paid for the Virginia Fund was $182,600 long-term capital gain for the year ended September 30, 2013 and $17,310 long-term capital gain for the year ended September 30, 2012. There were no ordinary income distributions for the Virginia Fund for the years ended September 30, 2013 and September 30, 2012. The tax character of distributions paid for the National Fund was $24,210 ordinary income and $185,379 long-term capital gain for the year ended September 30, 2013 and $25,516 ordinary income and $82,812 long-term capital gain for the year ended September 30, 2012.

As of September 30, 2013, the components of distributable earnings on a tax basis were as follows:

Notes to Financial Statements | continued | September 30, 2013

| Virginia Fund: | |

| Accumulated net realized gains | $ 375,573 |

| Net unrealized appreciation on investments | 241,156 |

| $ 616,729 | |

| National Fund: | |

| Accumulated net realized gains | $ 127,137 |

| Net unrealized appreciation on investments | 573,221 |

| $ 700,358 | |

Certain ordinary losses incurred after December 31 and within the taxable year are deemed to arise on the first day of the Funds’ next taxable year, if the Funds so elect. Certain capital losses incurred after October 31 and within the taxable year are deemed to arise on the first day of the Funds’ next taxable year, if the Funds so elect. For the year ended September 30, 2013, the Funds had no post-December ordinary losses and no post-October capital losses that are being deferred for tax purposes

Net realized gains or losses may differ for financial and tax reporting purposes as a result of loss deferrals related to wash sales and post-October transactions.

Income Tax: No provision is made for Federal income taxes since it is the intention of the Funds to comply with the provisions of the Internal Revenue Code available to investment companies and to make the requisite distribution to shareholders of taxable income which will be sufficient to relieve it from all or substantially all Federal income taxes.

As of and during the year ended September 30, 2013, the Funds did not have a liability for any unrecognized tax benefits. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of operations. During the period, the Funds did not incur any interest or penalties.

Tax years open to examination by tax authorities under the statute of limitations include 2010 through 2013.

Cash Concentration: At times, the Funds maintain cash balances at financial institutions in excess of federally insured limits. The Funds monitor this credit risk and have not experienced any losses related to this risk.

Use of Estimates: The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions. Such estimates affect the reported amounts of assets and liabilities and reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Indemnifications: Under the Funds’ organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties

to the Funds. In the normal course of business, the Funds enters into contracts that contain a variety of representations and that provide general indemnifications. The Funds’ maximum liability exposure under these arrangements is unknown, as future claims that have not yet occurred may be made against the Funds. However, based on experience, management expects the risk of loss to be remote.

2. Investment Advisory Fees. The investment adviser to the Trust, Madison Asset Management, LLC (the “Adviser”), earns an advisory fee. This fee is equal to 0.50% per annum of the average net assets for the Funds as of the date of this report. The fees are accrued daily and are paid monthly.

3. Other Expenses. Under a separate Services Agreement, the Adviser will provide or arrange for each Fund to have all necessary operational and support services for a fee based on a percentage of each Fund’s average net assets. This fee is 0.35% per annum of the average net assets for the Funds as of the date of this report. The Funds’ Independent Trustees and independent registered public accountants fees and expenses were paid out of this fee on behalf of the Funds.

Expenses paid by the Funds and not covered within the Services Agreement referenced above include fees related to portfolio holdings and extraordinary or nonrecurring fees.

4. Aggregate Cost and Unrealized Appreciation. The aggregate cost for federal income tax purposes and the net unrealized appreciation (depreciation) are stated as follows as of September 30, 2013:

| Virginia Fund | National Fund | |||||

| Aggregate Cost | $22,323,034 | $27,059,426 | ||||

| Gross unrealized appreciation | 707,947 | 1,014,094 | ||||

| Gross unrealized depreciation | (466,791) | (440,873) | ||||

| Net unrealized appreciation | $ 241,156 | $ 573,221 | ||||

14

Notes to Financial Statements | concluded | September 30, 2013

5. Investment Transactions. Purchases and sales of securities (excluding short-term securities) for the years ended September 30, 2013, were as follows:

| Purchases | Sales | |

| Virginia Fund | $5,751,410 | $7,419,468 |

| National Fund | $7,169,783 | $8,644,558 |

6. Discussion of Risks. Please see the most current version of the Funds’ prospectus for a discussion of risks associated with investing in the Funds. Although the Adviser seeks to appropriately address and manage the risks identified and disclosed to you in connection with the management of the securities in the Funds, you should understand that the very nature of the securities markets includes the possibility that there may be additional risks. We certainly seek to identify all applicable risks and then appropriately address them, take appropriate action to reasonably manage them and, of course, to make you aware of them so you can determine if they exceed your risk tolerance. Nevertheless, the often volatile nature of the securities markets and the global economy in which we work suggests that the risk of the unknown is something to consider in connection with an investment in securities.

7. Subsequent Events. No events have taken place that meet the definition of a subsequent event that requires adjustment to, or disclosure in the financial statements.

15

September 30, 2013

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Trustees of Madison Funds:

We have audited the accompanying statements of assets and liabilities, including the portfolios of investments, of Madison Tax-Free Virginia Fund and Madison Tax-Free National Fund (collectively, the “Funds”), each a series of Madison Funds, as of September 30, 2013, and the related statements of operations, statements of changes in net assets, and financial highlights for the year then ended. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The statements of changes in net assets for the year ended September 30, 2012 and the financial highlights for the period ended prior to October 1, 2012 were audited by other auditors, whose report, dated November 14, 2012, expressed an unqualified opinion on the statements of changes in net assets and financial highlights.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Funds are not required to have, nor were we engaged to perform, an audit of their internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Funds’ internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of September 30, 2013, by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of each of the Funds as of September 30, 2013, the results of their operations, the changes in their net assets, and the financial highlights for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

(signature)

Deloitte & Touche LLP

Milwaukee, WI

November 26, 2013

November 26, 2013

16

September 30, 2013

Other Information

Fund Expenses (unaudited)

Example

This Example is intended to help you understand your costs (in dollars) of investing in a Fund and to compare these costs with the costs of investing in other mutual funds.

This Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period ended September 30, 2013. Expenses paid during the period in the tables below are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half fiscal year period).

Actual Expenses

The following table titled “Based on Actual Total Return” provides information about actual account values and actual expenses. You may use the information provided in this table, together with the amount you invested, to estimate the expenses that you paid over the period. To estimate the expenses you paid on your account, divide your ending account value by $1,000 (for example, an $8,500 ending account value divided by $1,000=8.5), then multiply the result by the number under the heading entitled “Expenses Paid During the Period.”

Based on Actual Total Return1 | |||||

Actual Total Return2 | Beginning Account Value | Ending Account Value | Annualized Expense Ratio3 | Expenses Paid During the Period3 | |

| Virginia Fund | (2.850)% | $1,000.00 | $971.50 | 0.85% | $4.20 |

| National Fund | (3.470)% | $1,000.00 | $965.30 | 0.85% | $4.19 |

1 | For the six-months ended September 30, 2013. |

2 | Assumes reinvestment of all dividends and capital gains distributions, if any, at net asset value. |

3 | Expenses are equal to the respective Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year, then divided by 365. |

Hypothetical Example for Comparison Purposes

The table below titled “Based on Hypothetical Total Return” provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio and an assumed rate of return of 5.00% per year before expenses, which is not either Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use the information provided in this table to compare the ongoing costs of investing in a Fund and other funds. To do so, compare the 5.00% hypothetical

example relating to the Fund with the 5.00% hypothetical examples that appear in the shareholder reports of the other funds.

Based on Hypothetical Total Return1 | |||||

| Hypothetical Annualized Total Return | Beginning Account Value | Ending Account Value | Annualized Expense Ratio2 | Expenses Paid During the Period2 | |

| Virginia Fund | 5.00% | $1,000.00 | $1,020.81 | 0.85% | $4.31 |

| National Fund | 5.00% | $1,000.00 | $1,020.81 | 0.85% | $4.31 |

1 | For the six-months ended September 30, 2013. |

2 | Expenses are equal to the respective Fund’s annualized expense ratio multiplied by the average account value over the |

17

Other Information | continued | September 30, 2013

Federal Tax Information. The Form 1099-DIV you receive in January 2014 will show the tax status of all distributions paid to your account in calendar 2013. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in a Fund. The Tax-Free Virginia and Tax-Free National Funds designate 100% and 100%, respectively, of dividends from net investment income as exempt-interest dividends for fiscal years ended 2013 and 2012, respectively.

Forward-Looking Statement Disclosure. One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered “forward-looking statements.” Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as “estimate,” “may,” “will,” “expect,” “believe,” “plan” and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

Proxy Voting Information. The Funds only invest in non-voting securities. Nevertheless, the Trust adopted policies that provide guidance and set forth parameters for the voting of proxies relating to securities held in the Trust’s portfolios. These policies are available to you upon request and free of charge by calling toll-free at 1-800-877-6089. The Trust’s proxy voting policies may also be obtained by visiting the SEC’s web site at www.sec.gov.

N-Q Disclosure. The Trust files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each year on Form N-Q. The Trust’s Forms N-Q are available on the SEC’s website. The Trust’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information about the operation of the Public Reference Room may be obtained by calling the SEC at 1-202-551-8090. Form N-Q and other information about the Trust are available on the EDGAR Database on the SEC’s Internet site at http://www.sec.gov. Copies of this information may also be obtained, upon payment of a duplicating fee, by electronic request at the following address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Section, Washington DC 20549-0102. Finally, you may call 1-800-877-6089 if you would like a copy of Form N-Q mailed to you at no charge.

Discussion of Contract Renewal (Unaudited). The Board reviewed a variety of matters in connection with its considerations of the renewal of the Trust’s investment advisory contract with Madison Asset Management, LLC (the “Adviser”). The following description of the Board’s considerations summarizes this process which occurred at an in-person meeting on July 24, 2013:

With regard to the nature, extent and quality of the services to be provided by the Adviser, the Board reviewed the biographies and tenure of the personnel involved in management of the Tax-Free National and Virginia Funds (each a “Fund,” together the “Funds” and each a portfolio of Madison Funds that is referred to as the “Trust”) and the experience of the Adviser and its affiliates as investment manager to other

investment companies with similar investment strategies or to individual clients or institutions with similar investment strategies. They recognized the wide array of investment professionals employed by the respective firm or firms. Representatives of the Adviser discussed the firm’s ongoing investment philosophies and strategies intended to provide performance consistent with each Fund’s investment objectives under various market scenarios. The Trustees also noted their familiarity with the Adviser and its affiliates due to the Advisers’ history of providing advisory services to its proprietary investment company clients.

The Board also discussed the quality of services provided to the Funds by its transfer agent, fund administrator and custodian as well as the various administrative services provided directly by the Adviser. Such services included arranging for third party service providers to provide all necessary administration to Fund portfolios.

18

Other Information | continued | September 30, 2013

With regard to the investment performance of the Funds and the investment adviser, the Board reviewed current performance information provided in the written Board materials. They discussed the reasons for both outperformance and underperformance compared with peer groups and applicable indices and benchmarks. They reviewed both long-term and short-term performance and considered the effect on long-term performance that may have been attributable to any previous investment advisers to any Fund. They also considered whether any relative underperformance was appropriate in view of the Adviser’s conservative investment philosophy. The Board performed this review in connection with the Adviser. In connection with the review of performance, the Board engaged in a comprehensive discussion of market conditions and discussed the reasons for Fund performance under such conditions. With regard to fixed-income Funds, the Board considered the relatively conservative investment philosophy followed by the Funds during a period of historically low interest rates and the relative risks to fixed-income Funds in the current environment. Representatives of the Adviser discussed with the Board the methodology for arriving at peer groups and indices used for performance comparisons.

With regard to the costs of the services to be provided and the profits to be realized by the investment adviser and its affiliates from the relationship with the Trust, the Board reviewed the expense ratios for a variety of other funds in each Fund portfolio’s peer group with similar investment objectives.

The Board noted that the Adviser or its affiliates provided investment management services to other investment company and/or non-investment company clients and considered the fees charged by the Adviser to such Funds and clients for purposes of determining whether the given advisory fee was disproportionately large under the so-called Gartenberg standard traditionally used by investment company boards in connection with contract renewal considerations. The Board took those fees into account and considered the differences in services and time required by the various types of funds and clients to which the Adviser provided services. The Board recognized that significant differences may exist between the services provided to one type of fund or client and those provided to others, such as those resulting from a greater frequency of shareholder redemptions in a mutual fund and the higher turnover of mutual fund assets. The Board gave such comparisons the weight that they merit in light of the similarities and differences between the services that the Funds require and were wary of “inapt comparisons.” They considered that, if the services rendered by the Adviser to one type of fund or client differed significantly from others, then the comparison should not be used. In the case of non-investment company clients for which the Adviser may act as either investment adviser or subadviser, the Board noted that the fee may be lower than the fee charged to the Funds. The Board noted too the various administrative, operational, compliance, legal and corporate communication services required to be handled by the Adviser which are performed for investment company clients but are not performed for other institutional clients.

The Trustees reviewed each Fund’s fee structure based on the total Fund expense ratio as well as by comparing advisory fees to other advisory fees. The Board noted the simple expense structure maintained by the Trust: an advisory fee and a capped

administrative “services” expense. The Board reviewed total expense ratios paid by other funds with similar investment objectives, recognizing that such a comparison, while not dispositive, was an important consideration.

The Trustees sought to ensure that fees paid by the Funds were appropriate. The Board reviewed materials demonstrating that although the Adviser is compensated for a variety of the administrative services it provides or arranges to provide to the Funds pursuant to its administrative services agreement with the Trust, such compensation does not always cover all costs due to the cap on administrative expenses. Administrative, operational, regulatory and compliance fees and costs in excess of the Services Agreement fees are paid by the Adviser from the investment advisory fees earned. In this regard, the Trustees noted that examination of each Fund’s total expense ratio compared to those of other investment companies was more meaningful than a simple comparison of basic “investment management only” fee schedules.

19

Other Information | concluded | September 30, 2013

In reviewing costs and profits, the Board noted that the salaries of all Fund portfolio management personnel, trading desk personnel, corporate accounting personnel and employees of the Adviser who serve as Trust officers, as well as facility costs (rent), could not be supported by fees received from the Fund portfolios alone. However, the Board recognized that the Funds specifically and the Trust in general are profitable to the Adviser because such salaries and fixed costs are already paid in whole or in part from revenue generated by management of other client assets managed by the Adviser including the Trust as a consolidated Fund family. The Trustees noted that total assets managed by the Adviser and its affiliates were in excess of $15 billion at the time of the meeting. As a result, although the fees paid by each Fund portfolio at its present size might not be sufficient to profitably support a stand-alone fund, the Trust is reasonably profitable to the Adviser as part of its larger, diversified organization. In sum, the Trustees recognized that the Trust is important to the Adviser and is managed with the attention given to the Adviser’s other clients.

With regard to the extent to which economies of scale would be realized as each Fund portfolio grows, the Trustees recognized that at their current sizes, it was premature to discuss any economies of scale not already factored into existing advisory and services agreements.

Counsel to the Independent Trustees confirmed that the Trusts’ Independent Trustees met previously and reviewed the written contract renewal materials provided by the Adviser. He noted that the Independent Trustees had considered such materials in light of the aforementioned Gartenberg standards as well as criteria either set forth or discussed in the recent Supreme Court decision in Jones v. Harris regarding the investment company contract renewal process under Section 15(c) of the Investment Company Act of 1940, as amended. The Independent Trustees made a variety of additional inquiries regarding such written materials to the Adviser and representatives of the Adviser discussed each matter raised.

After further discussion, analysis and review of the totality of the information presented, including the information set forth above and the other information considered by the Board of Trustees, the Trustees, including the Independent Trustees, concluded that the respective Funds’ advisory fees are fair and reasonable for each respective Fund portfolio and that renewal of their respective Advisory and Services Agreements are in the best interests of each respective Fund portfolio and its shareholders.

Finally, the Board also reviewed the Trust’s distribution agreements and the information provided in written materials regarding the distributor as well as applicable Codes of Ethics.

20

September 30, 2013

Trustees and Officers

The address of each Trustee and officer is 550 Science Drive, Madison, Wisconsin 3711, except for Mr. Mason for which it is 8777 N. Gainey Center Drive, #220, Scottsdale, Arizona 85258. The Statement of Additional Information, which includes additional information about the trustees and officers, is available at no cost on the Funds’ website at www.madisonfunds.com or by calling 1-800-877-6089.

Interested Trustees and Officers

| Name and Year of Birth | Position(s) and Length of Time Served | Principal Occupation(s) During Past Five Years | Portfolios Overseen in Fund Complex by Director/Trustee1 | Other Directorships Held by Director/ Trustee During Past Five Years |

Katherine L. Frank2 1960 | Trustee and President, 2009 - Present | Madison Investment Holdings, Inc. (“MIH”) (affiliated investment advisory firm the Adviser), Executive Director and Chief Operating Officer, 2010 - Present; Managing Director and Vice President, 1986 - 2010 Madison Asset Management, LLC (“Madison”), Executive Director and Chief Operating Officer, 2010 - Present; Vice President, 2004 - 2010 Madison Investment Advisors, LLC (“MIA”) (affiliated investment advisory firm of Madison), Executive Director and Chief Operating Officer, 2010 - Present; President, 1996 - 2010 Madison Strategic Sector Premium Fund (closed end fund), President, 2005 - Present; Ultra Series Fund (16) (mutual funds), President, 2009 - Present; Madison Covered Call & Equity Strategy Fund (closed end fund), President, December 2012 - Present | 38 | Madison Strategic Sector Premium Fund, 2005 - Present; Ultra Series Fund (16), 2009 - Present; Madison Mosaic Trusts (except Madison Mosaic Equity Trust) (12), 1996-2013 |

Jay R. Sekelsky 1959 | Vice President, 2009 - Present | MIH, Executive Director and Chief Investment Officer, 2010 - Present; Managing Director and Vice President, 1990 - 2010 Madison, Executive Director and Chief Investment Officer, 2010 - Present MIA, Executive Director and Chief Investment Officer, 2010 - Present; Vice President, 1996 - 2010 Madison Strategic Sector Premium Fund, Vice President, 2005 - Present; Ultra Series Fund (16), Vice President, 2009 - Present; Madison Covered Call & Equity Strategy Fund, Vice President, December 2012 - Present | N/A | N/A |

Paul Lefurgey 1964 | Vice President, 2009 - Present | MIH, Managing Director and Head of Fixed Income Investments, 2005 - Present; Madison and MIA, Managing Director and Head of Fixed Income Investments, 2010 - Present MEMBERS Capital Advisors, Inc. (“MCA”) (investment advisory firm), Madison, WI, Vice President, 2003 - 2005 Madison Strategic Sector Premium Fund, Vice President, 2010 - Present; Ultra Series Fund (16), Vice President, 2009 - Present; Madison Covered Call & Equity Strategy Fund, Vice President, December 2012 - Present | N/A | N/A |

1 | As of the date of this report, the fund complex consists of Madison Funds with 21 portfolios, the Ultra Series Fund with 16 portfolios, the Madison Strategic Sector Premium Fund (a closed-end fund) and the Madison Covered Call & Equity Strategy Fund (closed end fund) (“MCN”), for a grand total of 39 separate portfolios in the fund complex. Not every Trustee is a member of the Board of Trustees of every fund in the fund complex, as noted above. References to the “Fund Complex” in the following tables have the meaning disclosed in this paragraph. |

2 | “Interested person” as defined in the 1940 Act. Considered an interested Trustee because of the position held with the investment adviser of Madison Funds. |

21

Other Information | continued | September 30, 2013

| Name and Year of Birth | Position(s) and Length of Time Served | Principal Occupation(s) During Past Five Years | Portfolios Overseen in Fund Complex by Director/Trustee1 | Other Directorships Held by Director/ Trustee During Past Five Years |

Greg D. Hoppe 1969 | Treasurer, 2009 - Present | MIH and MIA, Vice President, 1999 - Present; Madison, Vice President, 2009 - Present Madison Strategic Sector Premium Fund, Treasurer, 2009 - Present; Chief Financial Officer, 2005 - 2009; Ultra Series Fund (16), Treasurer, 2009 - Present; Madison Covered Call & Equity Strategy Fund, Treasurer, December 2012 - Present | N/A | N/A |

Holly S. Baggot 1960 | Secretary, 1999 - Present Assistant Treasurer, 1999 - 2007; 2009 - Present Treasurer, 2008 - 2009 | MIH and MIA, Vice President, 2010 - Present; Madison, Vice President, 2009 - Present; MFD Distributor, LLC (“MFD”) (an affiliated brokerage firm of Madison), Vice President, 2012 - Present MCA, Director-Mutual Funds, 2008-2009; Director-Mutual Fund Operations, 2006-2008; Operations Officer-Mutual Funds, 2005-2006; Senior Manager-Product & Fund Operations, 2001-2005 Madison Strategic Sector Premium Fund, Secretary and Assistant Treasurer, 2010 - Present; Ultra Series Fund (16), Secretary, 1999-Present and Treasurer, 2008-2009 and Assistant Treasurer, 1997-2007 and 2009-Present; Madison Covered Call & Equity Strategy Fund, Secretary and Assistant Treasurer, December 2012 - Present | N/A | N/A |

W. Richard Mason 1960 | Chief Compliance Officer, Corporate Counsel and Assistant Secretary, 2009 - Present | MIH, MIA, Madison and Madison Scottsdale, LC (an affiliated investment advisory firm of Madison), Chief Compliance Officer and Corporate Counsel, 2009 - Present; General Counsel and Chief Compliance Officer, 1996 - 2009 MFD, Principal, 1998 - Present; Concord Asset Management, LLC (“Concord”) (an affiliated investment advisory firm of Madison), General Counsel, 1996 - 2009; NorthRoad Capital Management LLC (“NorthRoad”) (an affiliated investment advisory firm of Madison), Chief Compliance Officer and Corporate Counsel, 2011 - Present Madison Strategic Sector Premium Fund, Chief Compliance Officer, Corporate Counsel and Assistant Secretary, 2009 - Present; Secretary, General Counsel and Chief Compliance Officer, 2005 - 2009; Madison Covered Call & Equity Strategy Fund, Chief Compliance Officer, Corporate Counsel and Assistant Secretary, December 2012 - Present Ultra Series Fund (16), Chief Compliance Officer, Corporate Counsel and Assistant Secretary, 2009 - Present | N/A | N/A |

1 | As of the date of this report, the fund complex consists of Madison Funds with 21 portfolios, the Ultra Series Fund with 16 portfolios, the Madison Strategic Sector Premium Fund (a closed-end fund) and the Madison Covered Call & Equity Strategy Fund (closed end fund) (“MCN”), for a grand total of 39 separate portfolios in the fund complex. Not every Trustee is a member of the Board of Trustees of every fund in the fund complex, as noted above. References to the “Fund Complex” in the following tables have the meaning disclosed in this paragraph. |

22

Other Information | continued | September 30, 2013

| Name and Year of Birth | Position(s) and Length of Time Served | Principal Occupation(s) During Past Five Years | Portfolios Overseen in Fund Complex by Director/Trustee1 | Other Directorships Held by Director/ Trustee During Past Five Years |

Pamela M. Krill 1966 | General Counsel, Chief Legal Officer and Assistant Secretary, 2009 - Present | MIH, MIA, Madison, Madison Scottsdale, LC, MFD, and Concord, General Counsel and Chief Legal Officer, 2009 - Present NorthRoad, General Counsel & Chief Legal Officer, 2011 - Present Madison Strategic Sector Premium Fund, General Counsel, Chief Legal Officer and Assistant Secretary, 2010 - Present; Ultra Series Fund (16), General Counsel, Chief Legal Officer and Assistant Secretary, 2009 - Present; Madison Covered Call & Equity Strategy Fund, General Counsel, Chief Legal Officer and Assistant Secretary, December 2012 - Present CUNA Mutual Insurance Society (insurance company with affiliated investment advisory, brokerage and mutual fund operations), Madison, WI, Managing Associate General Counsel-Securities & Investments, 2007 - 2009 Godfrey & Kahn, S.C. (law firm), Madison and Milwaukee, WI, Partner/Shareholder, Securities Practice Group, 1994-2007 | N/A | N/A |

Independent Trustees

| Name and Year of Birth | Position(s) and Length of Time Served1 | Principal Occupation(s) During Past Five Years | Portfolios Overseen in Fund Complex2 | Other Directorships Held by Director/ Trustee During Past Five Years |