| | | OMB APPROVAL |

| OMB Number: 3235-0570 |

| Expires: January 31, 2017 |

| Estimated average burden hours per response...20.6 |

| | UNITED STATES SECURITIES AND EXCHANGE COMMISSION |

| Washington, DC 20549 |

| | FORM N-CSR |

| | CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

| | Investment Company Act file number 811-08261 |

| | Madison Funds |

| (Exact name of registrant as specified in charter) |

| | 550 Science Drive, Madison, WI 53711 |

| (Address of principal executive offices) (Zip code) |

| | Lisa R. Lange |

| Chief Legal Officer and Chief Compliance Officer |

| 550 Science Drive |

| Madison, WI 53711 |

| (Name and address of agent for service) |

| | Registrant’s telephone number, including area code: 608-274-0300 |

| | Date of fiscal year end: October 31 |

| | Date of reporting period: October 31, 2016 |

| Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles. |

| | A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N- CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. s 3507. |

| Item 1. Report to Shareholders. |

| | | |

| |

Annual Report

October 31, 2016

Madison Conservative Allocation Fund

Madison Moderate Allocation Fund

Madison Aggressive Allocation Fund

Madison Government Money Market Fund

Madison Tax-Free Virginia Fund

Madison Tax-Free National Fund

Madison High Quality Bond Fund

Madison Core Bond Fund

Madison Corporate Bond Fund

Madison High Income Fund

Madison Diversified Income Fund

Madison Covered Call & Equity Income Fund

Madison Dividend Income Fund

Madison Large Cap Value Fund

Madison Investors Fund

Madison Mid Cap Fund

Madison Small Cap Fund

Madison International Stock Fund

Madison Hansberger International Growth Fund

| Madison Funds | October 31, 2016 |

| |

| |

| Table of Contents |

| | | Page |

| Management’s Discussion of Fund Performance | | |

Period in Review | | 2 |

Outlook | | 2 |

Allocation Funds Summary | | 3 |

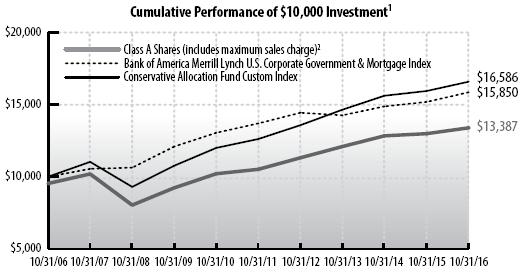

Conservative Allocation Fund | | 3 |

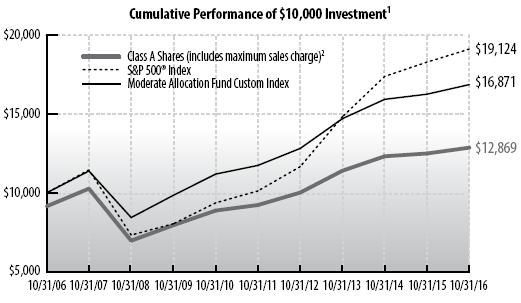

Moderate Allocation Fund | | 4 |

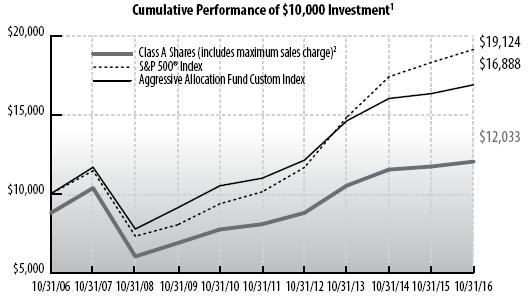

Aggressive Allocation Fund | | 4 |

Government Money Market Fund | | 5 |

Tax-Free Virginia Fund | | 6 |

Tax-Free National Fund | | 6 |

High Quality Bond Fund | | 7 |

Core Bond Fund | | 8 |

Corporate Bond Fund | | 8 |

High Income Fund | | 9 |

Diversified Income Fund | | 10 |

Covered Call & Equity Income Fund | | 11 |

Dividend Income Fund | | 12 |

Large Cap Value Fund | | 12 |

Investors Fund | | 13 |

Mid Cap Fund | | 14 |

Small Cap Fund | | 15 |

International Stock Fund | | 16 |

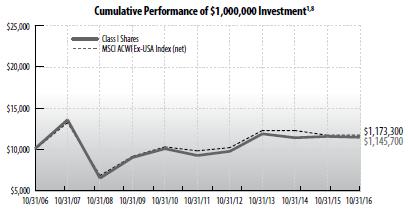

Hansberger International Growth Fund | | 17 |

Notes to Management’s Discussion of Fund Performance | | 18 |

| Portfolios of Investments | | |

Conservative Allocation Fund | | 20 |

Moderate Allocation Fund | | 20 |

Aggressive Allocation Fund | | 20 |

Government Money Market Fund | | 21 |

Tax-Free Virginia Fund | | 21 |

Tax-Free National Fund | | 22 |

High Quality Bond Fund | | 24 |

Core Bond Fund | | 24 |

Corporate Bond Fund | | 27 |

High Income Fund | | 28 |

Diversified Income Fund | | 29 |

Covered Call & Equity Income Fund | | 32 |

Dividend Income Fund | | 33 |

Large Cap Value Fund | | 34 |

Investors Fund | | 34 |

Mid Cap Fund | | 35 |

Small Cap Fund | | 35 |

International Stock Fund | | 36 |

Hansberger International Growth Fund | | 37 |

| Financial Statements | | |

Statements of Assets and Liabilities | | 38 |

Statements of Operations | | 40 |

Statements of Changes in Net Assets | | 42 |

Financial Highlights | | 47 |

| Notes to Financial Statements | | 57 |

| Report of Independent Registered Public Accounting Firm | | 68 |

| Other Information | | 69 |

| Trustees and Officers | | 74 |

| | Although each Fund’s name begins with the word “Madison,” the word “Madison” may be omitted in this report for simplicity when referring to any particular Fund, group of Funds or list of Funds. |

| | |

| | Nondeposit investment products are not federally insured, involve investment risk, may lose value and are not obligations of or guaranteed by any financial institution. |

| | |

| | For more complete information about Madison Funds, including charges and expenses, request a prospectus from your financial advisor or from Madison Funds, P.O. Box 8390, Boston, MA 02266-8390. Consider the investment objectives, risks, and charges and expenses of any fund carefully before investing. The prospectus contains this and other information about the investment company. |

| | |

| | For more current performance information, please call 1-800-877-6089 or visit our website at www.madisonfunds.com. Current performance may be lower or higher than the performance data quoted within. Past performance does not guarantee future results. |

| | |

| | Nothing in this report represents a recommendation of a security by the investment adviser. Portfolio holdings may have changed since the date of this report. |

Madison Funds | October 31, 2016

Management’s Discussion of Fund Performance (unaudited)

Period in Review

Point-to-point, U.S. stocks posted modest gains for the fiscal year ended October 31, 2016. These modest gains, however, masked a year of volatility. By mid-February, the value of the S&P 500® Index had fallen 12% since October 31 of last year as markets focused on struggles in Europe, tepid economic growth in the U.S., and the ongoing need for central bank accommodation to prop up global growth and asset values. From its February low, however, domestic stocks staged an almost 20% rally by mid-August, interrupted only briefly by a sharp pullback after the UK’s decision to leave the European Union in June. For the fiscal year, the S&P 500 returned 4.51%. Mid cap stocks, as represented by the Russell Mid Cap® Index returned only slightly less at 4.17%. Foreign equities were the underperformers for the year, as the MSCI EAFE Index returned -2.68% over the last twelve months.

Fixed income markets were similarly volatile. Longer-term interest rates (10-year U.S. Treasury benchmark rate) began fiscal 2016 at 2.14% and quickly rose 20 basis points (“bps”) by mid-November on fears that the Federal Reserve (the “Fed”) would soon begin tightening monetary policy. After a 25bps increase in the benchmark Fed Funds Rate in December, it became evident that economic growth was stalling, inflation remained under control, and the case for additional Fed tightening was weak. The resulting lack of confidence in the U.S. economy, declining oil prices and weak food prices allowed the Fed to step off of the brake pedal, and a December, 2015 Fed Funds rate hike was the only monetary policy tightening of the fiscal year period. This allowed interest rates across the yield curve to fall, and by early July, the 10-year Treasury yield had fallen almost 100bps from its November, 2015 peak. The Fed, however, resumed its monetary sabre rattling late in the fiscal year, causing longer-term yields to rise modestly by the end of October. Nonetheless, bonds posted returns competitive with stocks as yields, point-to-point, fell by nearly one-half percent. The Bloomberg Barclays Aggregate Bond Index totaled 4.37% for the fiscal year-to-date, and the Bloomberg Barclays Intermediate Government/Credit Index rose 3.19% for the period.

Outlook

The U.S. economy is accelerating and inflation measures are firming. Real GDP growth, which began the year below a 1% annualized rate, is now running closer to 3% and is expected to continue to move grudgingly higher. The Unemployment Rate is currently at 4.6% – down incrementally from the beginning of the fiscal year. This metric suggests modest improvement in the overall employment situation in the U.S. over the last year. In reality, over 2.5 million new jobs have been created in the last twelve months as previously discouraged job seekers have re-entered the labor force. Commensurate with more jobs, household incomes have rebounded as well, leading to forecasts of continued advance in consumption spending. The buoyancy of the labor markets, and an inflation rate approaching the Fed’s 2% target, have reignited the debate over the need for monetary tightening. Recent comments by Fed officials suggest a higher Fed Funds rate may come sooner rather than later. We expect that the Fed will raise the Fed Funds rate at its December, 2016 meeting.

Fiscal policy in 2017 will likely prove stimulative to the economy. Initiatives offered so far by incoming President-elect Trump and the Republican-controlled Congress suggest the potential for lower tax rates, higher infrastructure spending, and a looser regulatory environment. As a result, we expect overall economic activity to continue to advance at a moderate pace and inflation to inch higher, sufficient for the Federal Reserve to continue raising short-term interest rates in the year ahead. Rising short-term interest rates will continue to have a negative effect on the U.S. bond market as yields across the term structure adjust to reflect the reality of tighter monetary policy. At some point, rising interest rates will catch the attention of the stock market too.

The blend of better economic growth here in the U.S., buoyant labor markets, advancing incomes, and rising (although still relatively tame) inflation paint a challenging backdrop for U.S. financial markets. Combined with historically full equity valuations, rising interest rates both here and abroad, and persistent fears over the soundness of Europe’s banking system, near-term caution is warranted. We believe that investors will be well-served going forward by focusing on lower-risk, higher-quality companies along with shorter duration, higher-quality bonds in their portfolios. This approach should provide a margin of safety as volatile markets persist.

Madison Funds | Management’s Discussion of Fund Performance - continued | October 31, 2016

The Madison Conservative Allocation, Moderate Allocation and Aggressive Allocation Funds (the “Funds”) invest primarily in shares of registered investment companies (the “Underlying Funds”). The Funds will be diversified among a number of asset classes and their allocation among Underlying Funds will be based on an asset allocation model developed by Madison Asset Management, LLC (“Madison”), the Funds’ investment adviser. The team may use multiple analytical approaches to determine the appropriate asset allocation, including:

| • | | Asset allocation optimization analysis – considers the degree to which returns in different asset classes do or do not move together, and the Funds’ aim to achieve a favorable overall risk profile for any targeted portfolio return. |

| • | | Scenario analysis – historical and expected return data is analyzed to model how individual asset classes and combinations of asset classes would affect the Funds under different economic and market conditions. |

| • | | Fundamental analysis – draws upon Madison’s investment teams to judge each asset class against current and forecasted market conditions. Economic, industry and security analysis is used to develop return and risk expectations that may influence asset class selection. In addition, Madison has a flexible mandate which permits the Funds, at the sole discretion of Madison, to materially reduce equity risk exposures when and if conditions are deemed to warrant such an action. |

| MADISON CONSERVATIVE ALLOCATION FUND |

| |

| INVESTMENT STRATEGY HIGHLIGHTS |

Under normal circumstances, the Madison Conservative Allocation Fund’s total net assets will be allocated among various asset classes and Underlying Funds, including those whose shares trade on a stock exchange (exchange traded funds or “ETFs”), with target allocations over time of approximately 35% equity investments and 65% fixed income investments. Underlying Funds in which the Fund invests may include funds advised by Madison and/or its affiliates, including other Madison Funds (the “Affiliated Underlying Funds”). Generally, Madison will not invest more than 75% of the Fund’s net assets, at the time of purchase, in Affiliated Underlying Funds. Although actual allocations may vary, the Fund’s asset allocation among asset classes and Underlying Funds is expected to be approximately:

| • | | 0-20% money market funds; |

| • | | 20-80% debt securities (e.g., bond funds and convertible bond funds); |

| • | | 0-20% below-investment grade (“junk”) debt securities (e.g., high income funds); |

| • | | 10-50% equity securities (e.g., U.S. stock funds); |

| • | | 0-40% foreign securities (e.g., international stock and bond funds, including emerging market securities); and |

| • | | 0-20% alternative asset classes (e.g., real estate investment trust funds, natural resources funds, precious metal funds and long/short funds). |

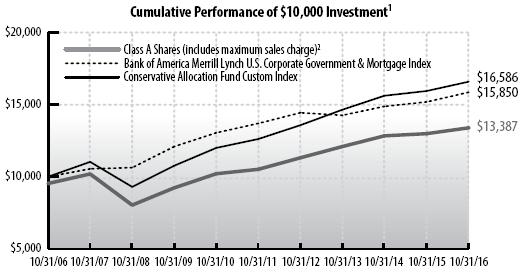

| | Average Annual Total Return through October 31, 20161 |

| | | | | % Return Without Sales Charge | | | % Return After Sales Charge5 |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | Since | | Since | | | | | | | | | | | | | | | | | | Since | | Since |

| | | | 1 | | 3 | | 5 | | 10 | | 6/30/06 | | 2/29/08 | | 1 | | 3 | | 5 | | 10 | | 6/30/06 | | 2/29/08 |

| | | | Year | | Years | | Years | | Years | | Inception | | Inception | | Year | | Years | | Years | | Years | | Inception | | Inception |

| |

| | Class A Shares2 | | | 3.10 | | | | 3.45 | | | | 4.95 | | | | 3.46 | | | | 3.86 | | | | – | | | | -2.84 | | | | 1.43 | | | | 3.71 | | | | 2.85 | | | | 3.26 | | | | – | |

| |

| | Class B Shares3 | | | 2.27 | | | | 2.69 | | | | 4.16 | | | | 2.84 | | | | 3.27 | | | | – | | | | -2.15 | | | | 1.59 | | | | 3.82 | | | | 2.84 | | | | 3.27 | | | | – | |

| |

| | Class C Shares4 | | | 2.37 | | | | 2.69 | | | | 4.16 | | | | – | | | | – | | | | 2.82 | | | | 1.39 | | | | 2.69 | | | | 4.16 | | | | – | | | | – | | | | 2.82 | |

| |

| | Bank of America | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Merrill Lynch | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | US Corp, Govt & | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Mortgage Index | | | 4.39 | | | | 3.59 | | | | 2.97 | | | | 4.71 | | | | 5.01 | | | | 4.28 | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | |

| |

| | Conservative | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Allocation Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Custom Index | | | 4.05 | | | | 4.23 | | | | 5.63 | | | | 5.19 | | | | 5.59 | | | | 5.10 | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | |

See accompanying Notes to Management’s Discussion of Fund Performance.

The Madison Conservative Allocation Fund (Class A at NAV) returned 3.10% for the one-year period, compared to its blended benchmark’s return of 4.05%. The Fund underperformed its peers as measured by the Morningstar Conservative Allocation category, which returned 3.53% for the year.

Contributing positively to the Fund’s performance were overweight allocations to U.S. Technology stocks, high yield bonds/bank loans, gold and U.S. TIPS, as well as an underweight allocation to U.S. small cap stocks. The Fund also benefited from strong relative returns among its core actively managed U.S. equity holdings. Finally, the timely addition of Energy equities in February provided a boost to performance. On the negative side, the Fund was held back by its elevated cash position and more defensive posturing (equity underweight) during the strong market advance from the February market low. Also detracting from performance was our preference for developed markets over emerging markets stocks within the international equity allocation.

We continue to maintain a more defensive, underweight, equity allocation relative to the Fund’s benchmark. Broadly speaking, we believe the U.S. equity market is marked by an elevated valuation level that will act as a headwind for future returns without an improving earnings outlook. Slowing global trade and economic growth, in addition to increasing unit labor costs, indicate to us that earnings will remain under pressure. We believe caution is warranted.

| PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 | | | |

| |

| Alternative Funds | | 3.0 | % |

| Bond Funds | | 60.9 | % |

| Foreign Stock Funds | | 9.1 | % |

| Money Market Funds | | 2.7 | % |

| Stock Funds | | 24.4 | % |

| Other Net Assets and Liabilities | | (0.1 | )% |

| |

| | | | |

| TOP TEN HOLDINGS AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 | | | |

| |

| Madison Core Bond Fund Class Y | | 21.2 | % |

| iShares 7-10 Year Treasury Bond ETF | | 8.0 | % |

| Madison Corporate Bond Fund Class Y | | 7.1 | % |

| iShares TIPS Bond Fund ETF | | 7.1 | % |

| Madison Dividend Income Fund Class Y | | 5.5 | % |

| PowerShares Senior Loan Portfolio | | 5.3 | % |

| Baird Aggregate Bond Fund Institutional Shares | | 5.0 | % |

| Vanguard Growth ETF | | 4.5 | % |

| Madison Investors Fund Class Y | | 4.5 | % |

| Vanguard FTSE All-World ex-U.S. ETF | | 4.2 | % |

| |

Madison Funds | Management’s Discussion of Fund Performance - continued | October 31, 2016

| MADISON MODERATE ALLOCATION FUND |

| |

| INVESTMENT STRATEGY HIGHLIGHTS |

Under normal circumstances, the Madison Moderate Allocation Fund’s total net assets will be allocated among various asset classes and Underlying Funds, including those whose shares trade on a stock exchange (exchange traded funds or “ETFs”), with target allocations over time of approximately 60% equity investments and 40% fixed income investments. Underlying Funds in which the Fund invests may include Affiliated Underlying Funds. Generally, Madison will not invest more than 75% of the Fund’s net assets, at the time of purchase, in Affiliated Underlying Funds. Although actual allocations may vary, the Fund’s asset allocation among asset classes and Underlying Funds is expected to be approximately:

| • | | 0-15% money market funds; |

| • | | 10-60% debt securities (e.g., bond funds and convertible bond funds); |

| • | | 0-20% below-investment grade (“junk”) debt securities (e.g., high income funds); |

| • | | 20-80% equity securities (e.g., U.S. stock funds); |

| • | | 0-50% foreign securities (e.g., international stock and bond funds, including emerging market securities); and |

| • | | 0-20% alternative asset classes (e.g., real estate investment trust funds, natural resources funds, precious metal funds and long/short funds). |

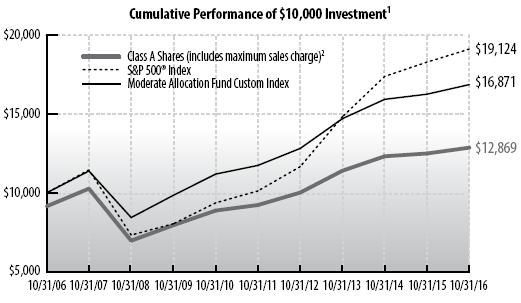

| | Average Annual Total Return through October 31, 20161 |

| |

| | | | | | % Return Without Sales Charge | | | | % Return After Sales Charge5 |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | Since | | Since | | | | | | | | | | | | | | | | | | Since | | Since |

| | | | | 1 | | 3 | | 5 | | 10 | | 6/30/06 | | 2/29/08 | | 1 | | 3 | | 5 | | 10 | | 6/30/06 | | 2/29/08 |

| | | | | Year | | Years | | Years | | Years | | Inception | | Inception | | Year | | Years | | Years | | Years | | Inception | | Inception |

| |

| | Class A Shares2 | | | | 2.95 | | | | 4.10 | | | | 6.88 | | | | 3.47 | | | | 3.99 | | | | – | | | | -2.98 | | | | 2.07 | | | | 5.61 | | | | 2.86 | | | | 3.39 | | | | – | |

| |

| | Class B Shares3 | | | | 2.15 | | | | 3.31 | | | | 6.07 | | | | 2.84 | | | | 3.39 | | | | – | | | | -2.17 | | | | 2.24 | | | | 5.75 | | | | 2.84 | | | | 3.39 | | | | – | |

| |

| | Class C Shares4 | | | | 2.15 | | | | 3.31 | | | | 6.07 | | | | – | | | | – | | | | 2.87 | | | | 1.19 | | | | 3.31 | | | | 6.07 | | | | – | | | | – | | | | 2.87 | |

| |

| | S&P 500® Index | | | | 4.51 | | | | 8.84 | | | | 13.57 | | | | 6.70 | | | | 7.37 | | | | 7.87 | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | |

| |

| | Moderate | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Allocation Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Custom Index | | | | 3.73 | | | | 4.67 | | | | 7.52 | | | | 5.37 | | | | 5.86 | | | | 5.47 | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | |

See accompanying Notes to Management’s Discussion of Fund Performance.

The Madison Moderate Allocation Fund (Class A at NAV) returned 2.95% for the one-year period, compared to its blended benchmark’s return of 3.73%. The Fund outperformed its peers as measured by the Morningstar Moderate Allocation category, which advanced 2.75% for the period.

Contributing positively to the Fund’s performance were overweight allocations to U.S. Technology stocks, high yield bonds/bank loans, gold and U.S. TIPS, as well as an underweight allocation to U.S. small cap stocks. The Fund also benefited from strong relative returns among its core actively managed U.S. equity holdings. Finally, the timely addition of Energy equities in February provided a boost to performance. On the negative side, the Fund was held back by its elevated cash position and more defensive posturing (equity underweight) during the strong market advance from the February market low. Also detracting from performance was our preference for developed markets over emerging markets stocks within the international equity allocation.

We continue to maintain a more defensive, underweight, equity allocation relative to the Fund’s benchmark. Broadly speaking, we believe the U.S. equity market is marked by an elevated valuation level that will act as a headwind for future returns without an improving earnings outlook. Slowing global trade and economic growth, in addition to increasing unit labor costs, indicate to us that earnings will remain under pressure. We believe caution is warranted.

| PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 | | | |

| |

| Alternative Funds | | 3.0 | % |

| Bond Funds | | 35.9 | % |

| Foreign Stock Funds | | 16.0 | % |

| Money Market Funds | | 2.0 | % |

| Stock Funds | | 43.1 | % |

| Other Net Assets and Liabilities | | | – |

| |

| | | | |

| TOP TEN HOLDINGS AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 | | | |

| |

| Madison Core Bond Fund Class Y | | 15.7 | % |

| Madison Dividend Income Fund Class Y | | 10.1 | % |

| Madison Investors Fund Class Y | | 10.0 | % |

| Vanguard FTSE All-World ex-U.S. ETF | | 8.5 | % |

| Vanguard Growth ETF | | 7.0 | % |

| iShares 7-10 Year Treasury Bond ETF | | 5.0 | % |

| iShares Core S&P Mid-Cap ETF | | 4.5 | % |

| iShares TIPS Bond Fund ETF | | 4.1 | % |

| Baird Aggregate Bond Fund Institutional Shares | | 4.0 | % |

| SPDR Gold Shares | | 3.0 | % |

| |

| MADISON AGGRESSIVE ALLOCATION FUND |

| |

| INVESTMENT STRATEGY HIGHLIGHTS |

Under normal circumstances, the Aggressive Allocation Fund’s total net assets will be allocated among various asset classes and Underlying Funds, including those whose shares trade on a stock exchange (exchange traded funds or “ETFs”), with target allocations over time of approximately 80% equity investments and 20% fixed income investments. Underlying Funds in which the Fund invests may include Affiliated Underlying Funds. Generally, Madison will not invest more than 75% of Fund’s net assets, at the time of purchase, in Affiliated Underlying Funds. Although actual allocations may vary, the Fund’s asset allocation among asset classes and Underlying Funds is expected to be approximately:

| • | | 0-10% money market funds; |

| • | | 0-30% debt securities, all of which could be in below investment grade (“junk”) debt securities (e.g., bond funds, convertible bond funds and high income funds); |

| • | | 30-90% equity securities (e.g., U.S. stock funds); |

| • | | 0-60% foreign securities (e.g., international stock and bond funds, including emerging market securities); and |

| • | | 0-20% alternative asset classes (e.g., real estate investment trust funds, natural resources funds, precious metal funds and long/short funds). |

Madison Funds | Management’s Discussion of Fund Performance - Madison Aggressive Allocation Fund - continued | October 31, 2016

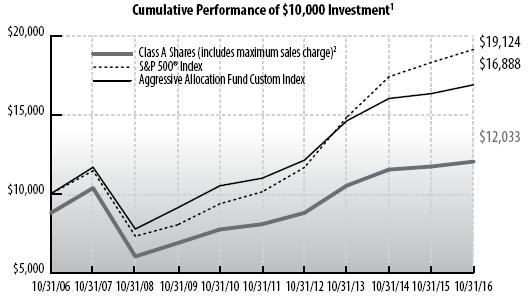

| | Average Annual Total Return through October 31, 20161 |

| | |

| | | | | % Return Without Sales Charge | | | | % Return After Sales Charge5 |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | Since | | Since | | | | | | | | | | | | | | | | | | Since | | Since |

| | | | | 1 | | 3 | | 5 | | 10 | | 6/30/06 | | 2/29/08 | | 1 | | 3 | | 5 | | 10 | | 6/30/06 | | 2/29/08 |

| | | | | Year | | Years | | Years | | Years | | Inception | | Inception | | Year | | Years | | Years | | Years | | Inception | | Inception |

| |

| | Class A Shares2 | | | | 2.65 | | | | 4.60 | | | | 8.30 | | | | 3.20 | | | | 3.83 | | | | – | | | | -3.22 | | | | 2.54 | | | | 7.02 | | | | 2.59 | | | | 3.23 | | | | – | |

| |

| | Class B Shares3 | | | | 1.88 | | | | 3.80 | | | | 7.49 | | | | 2.58 | | | | 3.22 | | | | – | | | | -2.31 | | | | 2.78 | | | | 7.19 | | | | 2.58 | | | | 3.22 | | | | – | |

| |

| | Class C Shares4 | | | | 1.87 | | | | 3.80 | | | | 7.48 | | | | – | | | | – | | | | 2.60 | | | | 0.95 | | | | 3.80 | | | | 7.48 | | | | – | | | | – | | | | 2.60 | |

| |

| | S&P 500 Index | | | | 4.51 | | | | 8.84 | | | | 13.57 | | | | 6.70 | | | | 7.37 | | | | 7.87 | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | |

| |

| | Aggressive | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Allocation Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Custom Index | | | | 3.42 | | | | 4.96 | | | | 8.99 | | | | 5.38 | | | | 5.94 | | | | 5.62 | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | |

See accompanying Notes to Management’s Discussion of Fund Performance.

The Madison Aggressive Allocation Fund (Class A at NAV) returned 2.65% for the one-year period, compared to its blended benchmark’s return of 3.42%. The Fund outperformed its peers as measured by the Morningstar Aggressive Allocation category, which returned 2.42% for the period.

Contributing positively to the Fund’s performance were overweight allocations to U.S. Technology stocks and gold, as well as an underweight allocation to U.S. small cap stocks. The Fund also benefited from strong relative returns among its core actively managed U.S. equity holdings. Finally, the timely addition of energy equities in February provided a boost to performance. On the negative side, the Fund was held back by its elevated cash position and more defensive posturing (equity underweight) during the strong market advance from the February market low. Also detracting from performance was our preference for developed markets over emerging markets stocks within the international equity allocation.

We continue to maintain a more defensive, underweight, equity allocation relative to the Fund’s benchmark. Broadly speaking, we believe the U.S. equity market is marked by an elevated valuation level that will act as a headwind for future returns without an improving earnings outlook. Slowing global trade and economic growth, in addition to increasing unit labor costs, indicate to us that earnings will remain under pressure. We believe caution is warranted.

| PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 | | | |

| |

| Alternative Funds | | 3.1 | % |

| Bond Funds | | 15.2 | % |

| Foreign Stock Funds | | 22.3 | % |

| Money Market Funds | | 2.4 | % |

| Stock Funds | | 56.7 | % |

| Other Net Assets and Liabilities | | 0.3 | % |

| |

| | | | |

| TOP TEN HOLDINGS AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 | | | |

| |

| Vanguard FTSE All-World ex-U.S. ETF | | 12.1 | % |

| Madison Dividend Income Fund Class Y | | 12.0 | % |

| Madison Investors Fund Class Y | | 11.8 | % |

| Vanguard Growth ETF | | 9.0 | % |

| Madison Core Bond Fund Class Y | | 8.4 | % |

| iShares Core S&P Mid-Cap ETF | | 7.7 | % |

| iShares 7-10 Year Treasury Bond ETF | | 4.7 | % |

| Vanguard Information Technology ETF | | 3.5 | % |

| Madison Mid Cap Fund Class Y | | 3.5 | % |

| WisdomTree Europe Hedged Equity Fund | | 3.4 | % |

| |

| MADISON GOVERNMENT MONEY MARKET FUND |

| |

| INVESTMENT STRATEGY HIGHLIGHTS |

The Madison Government Money Market Fund (formerly the Cash Reserve Fund) invests at least 99.5% of its total assets in cash, government securities, and/or repurchase agreements that are collateralized by cash or government securities, including but not limited to the Federal National Mortgage Association, Federal Home Loan Banks, Federal Home Loan Mortgage Corporate, and Federal Farm Credit Banks.

The fund is a money market fund that seeks to maintain a stable net asset value (“NAV”) of $1.00 per share. The fund’s investments must have a remaining maturity of no more than 397 days and must be high quality. The fund maintains a dollar-weighted average portfolio maturity of 60 days or less.

The Madison Government Money Market Fund (Class A) returned 0.00% for the prior twelve months, compared to a 0.22% return on the Fund’s 90 day Treasury Bill benchmark. Despite a 25 basis point increase in the Federal Funds Rate in December, 2015, short-term interest rates generally remained close to the zero mark experienced over the last few years as Federal Reserve policy continued to be extremely accommodative. The Fund was unable to pay dividends to shareholders despite continuing to waive its fees in order to preserve capital. Recent comments by Fed policymakers suggest that the economy and inflation have recovered to a level which could support future short-term interest rate increases. Thus, changes to Fed policy we believe are once again likely coming in the next fiscal year, and we are hopeful that the Fund will be able to resume paying a dividend.

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 | | | |

| |

| Fannie Mae | | 11.3 | % |

| Federal Home Loan Bank | | 56.7 | % |

| Freddie Mac | | 19.7 | % |

| Money Market Funds | | 2.6 | % |

| U.S. Treasury Notes | | 9.8 | % |

| Net Other Assets and Liabilities | | (0.1 | )% |

| |

Madison Funds | Management’s Discussion of Fund Performance - continued | October 31, 2016

| MADISON TAX-FREE VIRGINIA FUND |

| |

| INVESTMENT STRATEGY HIGHLIGHTS |

The Madison Tax-Free Virginia Fund seeks to achieve its investment objective by investing at least 80% of its net assets in municipal bonds that are exempt from federal and state income tax for residents of Virginia. These securities may be issued by state governments, their political subdivisions (for example, cities and counties) and public authorities (for example, school districts and housing authorities). The Fund may also invest in bonds that, under federal law, are exempt from federal and state income taxation, such as bonds issued by the District of Columbia, Puerto Rico, the Virgin Islands and Guam. The Fund invests in intermediate and long-term bonds having average, aggregate maturities (at the portfolio level) of 7 to 15 years.

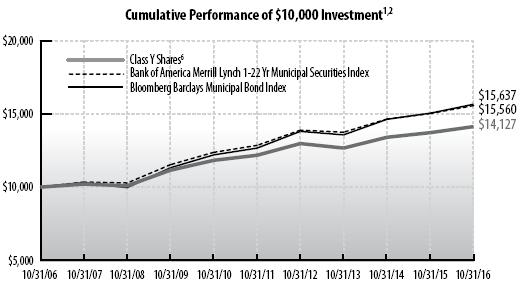

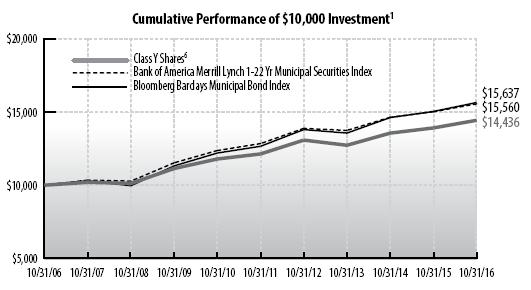

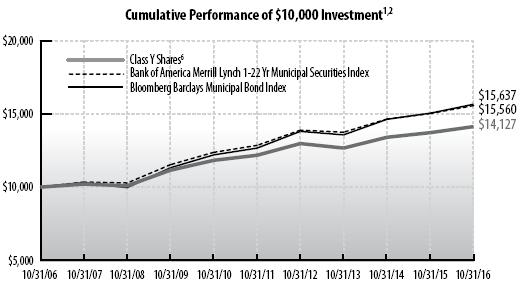

| | Average Annual Total Return through October 31, 20162 |

| | |

| | | | | | % Return Without Sales Charge |

| | | | | |

| | | | | | 1 Year | | | | 3 Years | | | | 5 Years | | | | 10 Years | |

| |

| | Class Y Shares6 | | | | 3.01 | | | | 3.72 | | | | 3.02 | | | | 3.52 | |

| |

| | Bank of America Merrill Lynch 1-22 Yr Municipal

Securities Index | | | | 3.60 | | | | 4.22 | | | | 3.91 | | | | 4.52 | |

| |

| | Bloomberg Barclays Municipal Bond Index | | | | 4.06 | | | | 4.89 | | | | 4.34 | | | | 4.57 | |

See accompanying Notes to Management’s Discussion of Fund Performance.

The Madison Tax-Free Virginia Fund (Class Y) returned 3.01% for the one-year period, underperforming the Bloomberg Barclays Municipal Bond Index®, which returned 4.06%, and the Bank of America Merrill Lynch (“BAML”) 1-22 year Municipal Index, which returned 3.60%. The Fund outperformed the Morningstar Municipal Single State Intermediate peer group which gained 2.97% for the period.

The underperformance of the Fund versus its BAML 1-22 year Municipal Index benchmark was primarily attributable to the Fund’s concentration in a single, high quality state. Benefiting performance was the Fund’s slightly longer maturity profile which provided incremental yield and resulted in greater price appreciation as Treasury yields declined. The overall duration (a measure of interest rate risk) of the Virginia Fund was 5.23 years versus 4.89 years for the benchmark. Also benefiting performance was the zero exposure to troubled states represented in the benchmark and limited exposure to U.S. territories. Detracting from performance was our bias towards higher credit quality as evidenced by the Fund’s less-than-benchmark exposure to the more volatile revenue subsectors, including housing, tax-revenue and transportation bonds.

Our outlook for the U.S. economy, inflation and Fed policy decisions leads us to believe interest rates will move higher in coming quarters. In addition, we anticipate an increase in risk premiums given our expectation for steady muni issuance coupled with declining credit metrics for select general obligation issuers. As interest rates shift, we aim to continue positioning securities along the steepest part of the yield curve, currently 8-12 year maturities. We plan to maintain the Fund’s well-diversified holdings and prefer to position essential service revenue bonds (e.g. water/sewer, education), general obligation bonds issued by high quality local issuers, and call structures with limited extension risk.

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 | | | |

| |

| Airport | | 1.0 | % |

| Development | | 7.4 | % |

| Education | | 13.7 | % |

| Facilities | | 4.0 | % |

| General | | 11.2 | % |

| General Obligation | | 25.5 | % |

| Medical | | 6.6 | % |

| Multifamily Housing | | 6.1 | % |

| Power | | 4.3 | % |

| Transportation | | 5.6 | % |

| Utilities | | 1.5 | % |

| Water | | 11.4 | % |

| Net Other Assets and Liabilities | | 1.7 | % |

| |

| | | | |

| TOP TEN HOLDINGS AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 | | | |

| |

| Northern Virginia Transportation Authority, 5.0%, 6/1/30 | | 4.2 | % |

| Fairfax County Redevelopment & Housing Authority, 4.75%, 10/1/36 | | 3.4 | % |

| City of Portsmouth VA, 5.0%, 2/1/31 | | 3.3 | % |

| Virginia Commonwealth Transportation Board, 5.0%, 3/15/25 | | 2.9 | % |

| Commonwealth of Virginia, 5.0%, 6/1/23 | | 2.8 | % |

| Chesterfield County Economic Development Authority, 5.0%, 5/1/23 | | 2.8 | % |

| Virginia College Building Authority, 5.0%, 2/1/23 | | 2.7 | % |

| Virginia Resources Authority, 5.0%, 10/1/23 | | 2.5 | % |

| Norfolk Economic Development Authority, 5.0%, 11/1/29 | | 2.5 | % |

| Norfolk Economic Development Authority, 5.0%, 11/1/36 | | 2.5 | % |

| |

| MADISON TAX-FREE NATIONAL FUND |

| |

| INVESTMENT STRATEGY HIGHLIGHTS |

The Madison Tax-Free National Fund seeks to achieve its investment objective by investing at least 80% of its net assets in municipal bonds that are exempt from federal income taxes. These securities may be issued by state governments, their political subdivisions (for example, cities and counties) and public authorities (for example, school districts and housing authorities). The Fund may also invest in bonds that, under federal law, are exempt from federal and state income taxation, such as bonds issued by the District of Columbia, Puerto Rico, the Virgin Islands and Guam. The Fund invests in intermediate and long-term bonds having average, aggregate maturities (at the portfolio level) of seven to 15 years. The primary difference between this Fund and the Madison Tax-Free Virginia Fund is that the Madison Tax-Free Virginia Fund will invest in bonds that are exempt from federal and state income tax for residents of Virginia, while this Fund will invest in bonds that are exempt from federal income tax.

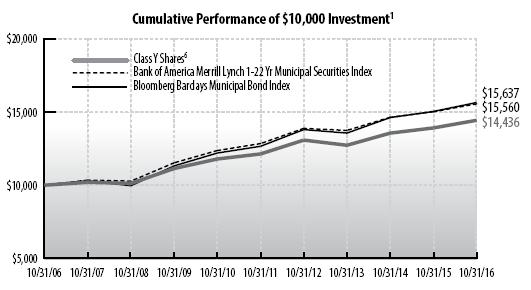

| | Average Annual Total Return through October 31, 20161 |

| | |

| | | | | | % Return Without Sales Charge |

| | | | | |

| | | | | | 1 Year | | | | 3 Years | | | | 5 Years | | | | 10 Years | |

| |

| | Class Y Shares6 | | | | 3.75 | | | | 4.28 | | | | 3.53 | | | | 3.74 | |

| |

| | Bank of America Merrill Lynch 1-22 Yr Municipal

Securities Index | | | | 3.60 | | | | 4.22 | | | | 3.91 | | | | 4.52 | |

| |

| | Bloomberg Barclays Municipal Bond Index | | | | 4.06 | | | | 4.89 | | | | 4.34 | | | | 4.57 | |

See accompanying Notes to Management’s Discussion of Fund Performance.

The Madison Tax-Free National Fund (Class Y) returned 3.75% for the one-year period, underperforming the Bloomberg Barclays Municipal Bond Index®,

Madison Funds | Management’s Discussion of Fund Performance - Madison Tax-Free National Fund - continued | October 31, 2016

which returned 4.06%, but outperforming the Bank of America Merrill Lynch (“BAML”) 1-22 year Municipal Securities Index, which returned 3.60%. The Fund underperformed the Morningstar Muni National Long peer group which gained 4.47%.

The outperformance of the Fund versus the BAML 1-22 year Municipal Index benchmark was primarily attributable to the Fund’s slightly longer maturity profile which provided incremental yield and resulted in greater price appreciation as Treasury yields declined. The overall duration (a measure of interest rate risk) of the National Fund was 5.17 years versus 4.89 years for the benchmark. Also benefiting performance was limited exposure to troubled states such as Alaska, Connecticut and Illinois as well as municipal issues secured by bond insurers. Detracting from performance was our bias towards higher credit quality as evidenced by the Fund’s less-than-benchmark exposure to the more volatile revenue subsectors, including housing, tax-revenue and transportation bonds.

Our outlook for the U.S. economy, inflation and Fed policy decisions leads us to believe interest rates will move higher in coming quarters. In addition, we anticipate an increase in risk premiums given our expectation for steady muni issuance coupled with declining credit metrics for select general obligation issuers. As interest rates shift, we aim to continue positioning securities along the steepest part of the yield curve, currently 8-12 year maturities. We plan to maintain the Fund’s well-diversified holdings and prefer to position essential service revenue bonds (e.g. water/sewer, education), general obligation bonds issued by high quality state and local issuers, and call structures with limited extension risk.

| STATE ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 | | | |

| |

| Alabama | | 2.4 | % |

| Arkansas | | 0.7 | % |

| Colorado | | 1.8 | % |

| Delaware | | 1.5 | % |

| Florida | | 17.1 | % |

| Georgia | | 4.8 | % |

| Hawaii | | 2.0 | % |

| Illinois | | 0.7 | % |

| Indiana | | 3.5 | % |

| Iowa | | 2.8 | % |

| Kansas | | 3.3 | % |

| Maryland | | 3.1 | % |

| Michigan | | 3.4 | % |

| Missouri | | 6.1 | % |

| New Jersey | | 4.2 | % |

| New Mexico | | 1.8 | % |

| New York | | 3.3 | % |

| North Carolina | | 5.3 | % |

| Ohio | | 2.2 | % |

| South Carolina | | 7.0 | % |

| Tennessee | | 0.4 | % |

| Texas | | 9.8 | % |

| Virginia | | 2.5 | % |

| Washington | | 3.1 | % |

| Wisconsin | | 3.6 | % |

| Net Other Assets and Liabilities | | 3.6 | % |

| |

| | | | |

| TOP TEN HOLDINGS AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 | | | |

| |

| City of Margate FL General Obligation, 5.0%, 7/1/25 | | 3.6 | % |

| Anderson County School District No. 1, General Obligation, 5.0%, 3/1/25 | | 3.3 | % |

| Maple School District, General Obligation, 5.0%, 4/1/24 | | 2.9 | % |

| City of Rockville MD, General Obligation, 5.0%, 6/1/24 | | 2.7 | % |

| City of Port St. Lucie FL Utility System Revenue, 5.0%, 9/1/27 | | 2.6 | % |

| City of Wichita KS, General Obligation, 5.0%, 12/1/24 | | 2.3 | % |

| County of Miami-Dade FL, 5.0%, 3/1/25 | | 2.3 | % |

| Orlando Utilities Commission, 5.0%, 10/1/22 | | 2.3 | % |

| Town of Cary NC Combined Utility Systems Revenue, 5.0%, 12/1/23 | | 2.2 | % |

| Cleveland-Cuyahoga County Port Authority, 5.0%, 7/1/24 | | 2.2 | % |

| |

| MADISON HIGH QUALITY BOND FUND |

| |

| INVESTMENT STRATEGY HIGHLIGHTS |

The Madison High Quality Bond Fund seeks to achieve its investment objectives through diversified investments in a broad range of corporate debt securities, obligations of the U.S. Government and its agencies, and money market instruments. In seeking to achieve the Fund’s goals, the Fund’s management will (1) shorten or lengthen the dollar weighted average maturity of the Fund based on its anticipation of the movement of interest rates (the dollar weighted average maturity is expected to be ten years or less), and (2) monitor the yields of the various bonds that satisfy the Fund’s investment guidelines to determine the best combination of yield, credit risk and diversification for the Fund. Under normal market conditions, the Fund will invest at least 80% of its net assets in higher quality bond issues and, therefore, intends to maintain an overall portfolio quality rating of A by Standard & Poor’s and/or A2 by Moody’s or equivalent.

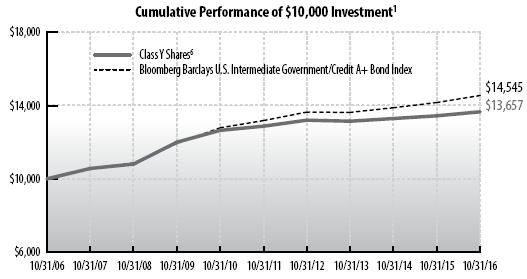

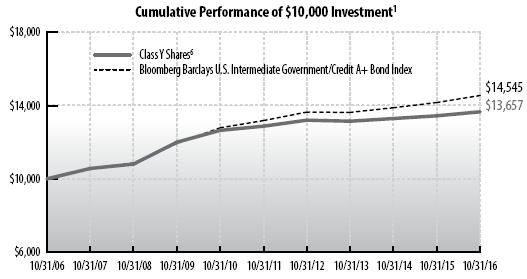

| | Average Annual Total Return through October 31, 20161 |

| | |

| | | | | % Return Without Sales Charge |

| | | | | |

| | | | | | 1 Year | | | | 3 Years | | | | 5 Years | | | | 10 Years | |

| |

| | Class Y Shares6 | | | | 1.62 | | | | 1.28 | | | | 1.19 | | | | 3.17 | |

| |

| | Bloomberg Barclays U.S. Intermediate Govt/Credit

A+ Bond Index | | | | 2.69 | | | | 2.20 | | | | 1.99 | | | | 3.82 | |

See accompanying Notes to Management’s Discussion of Fund Performance.

The Madison High Quality Bond Fund (Class Y) returned 1.62% for the one-year period, lagging the benchmark Bloomberg Barclays U.S. Intermediate Government Credit A+ Bond Index which returned 2.69%. The Fund underperformed the Morningstar Short-Term Bond category peer group’s return of 1.91% over the same period.

Underperformance during the last 12 months compared to the market benchmark was due largely to conservative maturity positioning. As interest rates declined over the period, the Fund’s underweight in longer maturities detracted from total return. The portfolio’s conservative maturity profile also produced a yield difference that was detractive to total return. Some of the yield shortfall was mitigated by the Fund’s sector overweight in corporate bonds. Security selection and credit sector selection were additive to returns over the period as the Fund participated in positive individual bond performance and avoided some volatile credit sectors.

Looking forward, we view recent positive relative performance as a sign of opportunities ahead. The coming months will likely see continued rate volatility as investors, and the Fed, evaluate domestic fundamentals amid an uncertain international backdrop. At current yield levels, we believe a conservative duration posture is warranted to protect against potential monetary policy normalization. We project 10-year Treasury yields will move higher and volatility will increase. Our forecast for higher rates also assumes short term rates shift upward as expectations for Fed policy normalization react to improving economic fundamentals and a more certain global backdrop.

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 | | | |

| |

| Consumer Discretionary | | 6.6 | % |

| Consumer Staples | | 1.5 | % |

| Energy | | 1.4 | % |

| Fannie Mae | | 10.4 | % |

| Financials | | 12.6 | % |

| Freddie Mac | | 2.5 | % |

| Health Care | | 3.0 | % |

| Industrials | | 3.5 | % |

| Information Technology | | 7.5 | % |

| Money Market Funds | | 1.0 | % |

| Real Estate | | 1.8 | % |

| U.S. Treasury Notes | | 47.6 | % |

| Net Other Assets and Liabilities | | 0.6 | % |

| |

Madison Funds | Management’s Discussion of Fund Performance - Madison High Quality Bond Fund - continued | October 31, 2016

| TOP TEN HOLDINGS AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 | | | |

| |

| U.S. Treasury Note, 3.875%, 5/15/18 | | 4.5 | % |

| U.S. Treasury Note, 1.125%, 12/31/19 | | 4.3 | % |

| U.S. Treasury Note, 1.5%, 8/15/26 | | 4.1 | % |

| U.S. Treasury Note, 3.625%, 2/15/20 | | 4.1 | % |

| U.S. Treasury Note, 3.125%, 5/15/19 | | 4.0 | % |

| U.S. Treasury Note, 1.5%, 3/31/19 | | 3.8 | % |

| U.S. Treasury Note, 1.5%, 12/31/18 | | 3.8 | % |

| U.S. Treasury Note, 3.0%, 2/28/17 | | 3.8 | % |

| U.S. Treasury Note, 1.25%, 1/31/19 | | 3.8 | % |

| Fannie Mae, 1.25%, 1/30/17 | | 3.8 | % |

| |

| MADISON CORE BOND FUND |

| |

| INVESTMENT STRATEGY HIGHLIGHTS |

Under normal market conditions, the Madison Core Bond Fund invests at least 80% of its net assets in bonds. To keep current income relatively stable and to limit share price volatility, the Fund emphasizes investment grade securities and maintains an intermediate (typically 3-7 year) average portfolio duration, with the goal of being between 85-115% of the market benchmark duration. The Fund strives to add incremental return in the portfolio by making strategic decisions related to credit risk, sector exposure and yield curve positioning. The Fund may invest in corporate debt securities, U.S. Government debt securities, foreign government debt securities, non-rated debt securities, and asset-backed, mortgage-backed and commercial mortgage-backed securities.

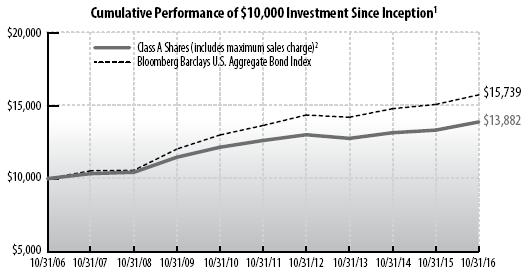

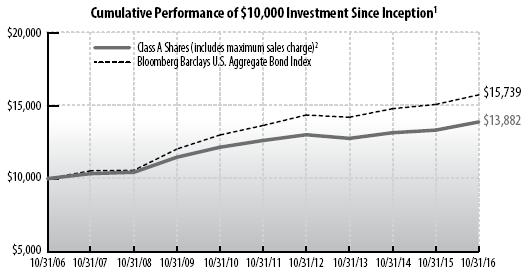

| | Average Annual Total Return through October 31, 20161 |

| | |

| | | | | % Return Without Sales Charge | | | | % Return After Sales Charge5 |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | Since | | Since | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | 6/30/06 | | 4/19/13 | | | | | | | | | | | | | | | | |

| | | | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Inception | | Inception | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

| |

| | Class A Shares2 | | | | 4.21 | | | | 2.86 | | | | 1.93 | | | | 3.33 | | | | – | | | | – | | | | -0.53 | | | | 1.29 | | | | 1.00 | | | | 2.85 | |

| |

| | Class B Shares3 | | | | 3.43 | | | | 2.09 | | | | 1.19 | | | | 2.72 | | | | – | | | | – | | | | -1.07 | | | | 0.96 | | | | 0.82 | | | | 2.72 | |

| |

| | Class Y Shares6 | | | | 4.40 | | | | 3.11 | | | | 2.19 | | | | 3.59 | | | | 3.90 | | | | – | | | | – | | | | – | | | | – | | | | – | |

| |

| | Class R6 Shares7 | | | | 4.59 | | | | 3.20 | | | | – | | | | – | | | | – | | | | 2.17 | | | | – | | | | – | | | | – | | | | – | |

| |

| | Bloomberg Barclays U.S.

Aggregate Bond Index | | | | 1.96 | | | | 1.65 | | | | 3.03 | | | | 4.72 | | | | 4.99 | | | | 4.27 | | | | NA | | | | NA | | | | NA | | | | NA | |

See accompanying Notes to Management’s Discussion of Fund Performance.

The Madison Core Bond Fund (Class Y) returned 4.40% for the one-year period, edging the Fund’s benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index, which advanced 4.37%. The Fund outperformed the Morningstar Intermediate-Term Bond peer group, which gained 4.34% for the period.

The Fund’s outperformance versus its benchmark was mainly due to an overweight in corporate and municipal bonds. Credit spreads tightened significantly over the last twelve months as investors reached for yield in a low rate environment. The Fund’s corporate and municipal bond holdings handily beat those of the Barclay’s Corporate Index. The largest detractor from performance was our conservative duration positioning (90% of benchmark). Five-year and longer interest rates fell 20-30 basis points during the trailing twelve months. As of October 31, 2016, the Fund is currently yielding 2.30% (before expenses) with an effective duration of 4.87 years.

| PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 | | | |

| |

| Asset Backed Securities | | 3.1 | % |

| Collateralized Mortgage Obligations | | 3.0 | % |

| Commercial Mortgage-Backed Securities | | 3.1 | % |

| Corporate Notes and Bonds | | 33.6 | % |

| Long Term Municipal Bonds | | 9.0 | % |

| Mortgage Backed Securities | | 22.0 | % |

| Short-Term Investments | | 2.1 | % |

| U.S. Government and Agency Obligations | | 23.1 | % |

| Other Net Assets and Liabilities | | 1.0 | % |

| |

| | | | |

| TOP TEN HOLDINGS AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 | | | |

| |

| U.S. Treasury Note, 3.125%, 5/15/21 | | 1.9 | % |

| U.S. Treasury Bond, 4.5%, 5/15/38 | | 1.7 | % |

| U.S. Treasury Note, 2.75%, 2/28/18 | | 1.4 | % |

| U.S. Treasury Note, 2.625%, 1/31/18 | | 1.4 | % |

| U.S. Treasury Note, 1.875%, 10/31/17 | | 1.4 | % |

| U.S. Treasury Note, 1.375%, 2/28/19 | | 1.4 | % |

| U.S. Treasury Bond, 6.625%, 2/15/27 | | 1.3 | % |

| U.S. Treasury Note, 3.875%, 5/15/18 | | 1.3 | % |

| U.S. Treasury Note, 4.25%, 11/15/17 | | 1.2 | % |

| U.S. Treasury Note, 2.0%, 10/31/21 | | 1.2 | % |

| |

| | | | |

| MADISON CORPORATE BOND FUND |

| |

| INVESTMENT STRATEGY HIGHLIGHTS |

The Madison Corporate Bond Fund seeks to achieve its investment objective through diversified investment in a broad range of corporate debt securities. Under normal market conditions, the Fund will invest at least 80% of its net assets in income-producing corporate bonds, and at least 80% of its assets in investment grade bonds. Up to 20% of the Fund’s assets may be invested in non-investment grade fixed-income securities commonly referred to as “high yield” or “junk” bonds. The Fund expects to maintain an average overall portfolio quality of BBB or better, an overall portfolio dollar weighted average maturity of 15 years or less, and an overall portfolio duration within 25% of the Bloomberg Barclays U.S. Credit Bond Index benchmark (with the flexibility to occasionally vary from the benchmark by up to 50% when the investment adviser believes interest rates are likely to materially change).

Madison Funds | Management’s Discussion of Fund Performance - Madison Corporate Bond Fund - continued | October 31, 2016

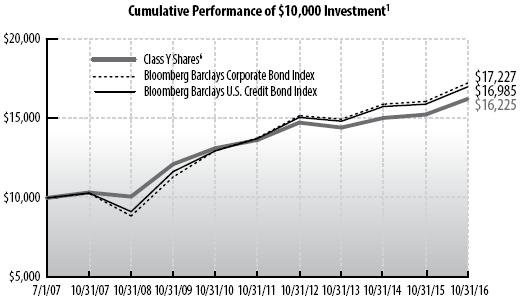

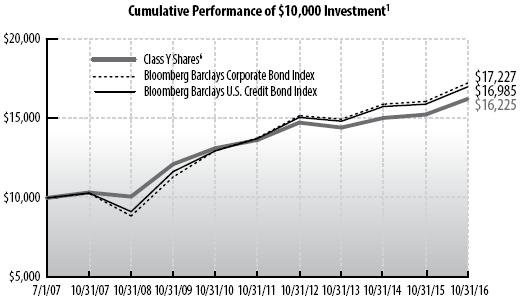

| | Average Annual Total Return through October 31, 20161 |

| | |

| | | | | % Return Without Sales Charge |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | Since |

| | | | | | | | | | | | | | | | | | | | | 7/1/07 |

| | | | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Inception |

| |

| | Class Y Shares6 | | | | 6.45 | | | | 4.00 | | | | 3.53 | | | | – | | | | 5.32 | |

| |

| | Bloomberg Barclays U.S. Corporate

Bond Index | | | | 7.23 | | | | 4.82 | | | | 4.59 | | | | 5.74 | | | | 6.00 | |

| |

| | Bloomberg Barclays U.S. Credit

Bond Index | | | | 6.87 | | | | 4.64 | | | | 4.35 | | | | 5.60 | | | | 5.84 | |

See accompanying Notes to Management’s Discussion of Fund Performance.

The Madison Corporate Bond Fund (Class Y) gained 6.45% for the year period, versus the Bloomberg Barclays U.S. Corporate Bond Index® which gained 7.23% and the Bloomberg Barclays U.S. Credit Index®, which returned 6.87%. The Fund underperformed its peer group, the Morningstar Corporate Bond category, which posted a 7.12% gain.

Versus the Bloomberg Barclays U.S. Corporate Bond Index®, its benchmark, the Fund benefited from being overweight in oil/gas refiners and oil/gas pipelines, both of which generated strong excess returns over the past year. The Fund also benefited from owning high yield bonds, which significantly outperformed investment grade bonds during the period. The Fund focused heavily on the new issue market where yield premiums were more attractive. Some of the bonds purchased on the new issue market during the past year that have performed well include Anheuser-Busch, Newell Brands, and Diamond 1 Finance. The Fund’s underweight to 30-year bonds detracted from performance, as longer-term bonds significantly outperformed intermediate-term bonds over the past year as the Treasury curve flattened. The Fund’s underweight to Metal and Mining bonds also detracted from performance, as this sector performed very well with the recovery in certain commodity prices. On a duration basis, the Fund continues to have an underweight to the 30-year part of the yield curve, as we believe overall yields and credit spreads on corporate bonds remain too low given weakening credit fundamentals. Despite having a lower duration than the benchmark, the overall yield of the Fund is very similar to the benchmark.

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 | | | |

| |

| Consumer Discretionary | | 15.1 | % |

| Consumer Staples | | 4.8 | % |

| Energy | | 12.2 | % |

| Financials† | | 26.7 | % |

| Health Care | | 5.5 | % |

| Industrials | | 9.7 | % |

| Information Technology | | 6.6 | % |

| Long Term Municipal Bonds | | 2.8 | % |

| Materials | | 3.3 | % |

| Money Market Funds | | 3.1 | % |

| Real Estate | | 4.0 | % |

| Telecommunication Services | | 5.1 | % |

| Utilities | | 0.4 | % |

| Net Other Assets and Liabilities | | 0.7 | % |

| |

| †Financials includes securities in the following industries: Banks, Diversified Financial Services and Insurance. | | | |

| | | | |

| TOP TEN HOLDINGS AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 | | | |

| |

| Simon Property Group L.P., 4.125%, 12/1/21 | | 1.8 | % |

| Berkshire Hathaway Finance Corp., 5.4%, 5/15/18 | | 1.8 | % |

| General Electric Co., 6.75%, 3/15/32 | | 1.7 | % |

| Valero Energy Corp., 6.625%, 6/15/37 | | 1.7 | % |

| Comcast Corp., 6.45%, 3/15/37 | | 1.7 | % |

| AT&T Inc., 5.0%, 3/1/21 | | 1.4 | % |

| Energy Transfer Partners L.P., 5.2%, 2/1/22 | | 1.4 | % |

| Prudential Financial Inc., 3.5%, 5/15/24 | | 1.3 | % |

| Affiliated Managers Group Inc., 4.25%, 2/15/24 | | 1.3 | % |

| Packaging Corp. of America, 3.65%, 9/15/24 | | 1.3 | % |

| |

| | | | |

| MADISON HIGH INCOME FUND |

| |

| INVESTMENT STRATEGY HIGHLIGHTS |

The Madison High Income Fund invests primarily in lower-rated, higher-yielding income bearing securities, such as “junk” bonds. Because the performance of these securities has historically been strongly influenced by economic conditions, the Fund may rotate securities selection by business sector according to economic outlook. Under normal market conditions, the Fund invests at least 80% of its net assets in bonds rated lower than investment grade (BBB/Baa) and their unrated equivalents or other high-yielding securities.

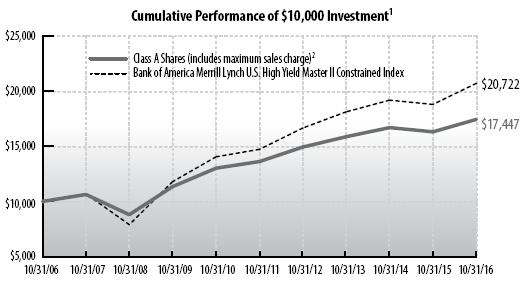

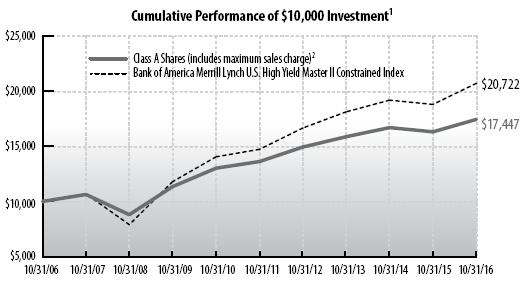

| | Average Annual Total Return through October 31, 20161 |

| | |

| | | | | | % Return Without Sales Charge | | | | % Return After Sales Charge5 |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | Since | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | 6/30/06 | | | | | | | | | | | | | | | | |

| | | | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Inception | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

| |

| | Class A Shares2 | | | | 6.91 | | | | 3.20 | | | | 5.08 | | | | 5.72 | | | | – | | | | 2.09 | | | | 1.61 | | | | 4.11 | | | | 5.23 | |

| |

| | Class B Shares3 | | | | 6.07 | | | | 2.40 | | | | 4.27 | | | | 5.10 | | | | – | | | | 1.57 | | | | 1.44 | | | | 3.98 | | | | 5.10 | |

| |

| | Class Y Shares6 | | | | 7.15 | | | | 3.50 | | | | 5.39 | | | | 6.02 | | | | 6.28 | | | | – | | | | – | | | | – | | | | – | |

| |

| | Bank of America Merrill | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Lynch U.S. High Yield | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Master II Constrained

Index | | | | 10.18 | | | | 4.54 | | | | 7.07 | | | | 7.56 | | | | 7.84 | | | | NA | | | | NA | | | | NA | | | | NA | |

See accompanying Notes to Management’s Discussion of Fund Performance.

The Madison High Income Fund (Class A) returned 6.91% over the twelve-month period, underperforming the Bank of America Merrill Lynch U.S. High Yield Master II Constrained Index benchmark return of 10.18%. The fund slightly underperformed the Morningstar High Yield Bond category peer group, which returned 6.96% over the same period.

The Fund’s underperformance can largely be attributed to an underweight to triple-C and below rated securities. Triple-C and below rated securities returned 18.49% during the trailing twelve months, more than double the returns of less-risky B and BB rated bonds. On a sector level, the Fund had little exposure to big movers Metals & Mining (+27.39%) and Steel (+26.31%), both of which significantly outpaced the overall market. The Fund also had an overweight to Services (+7.51%) and Healthcare (+3.47%), which both lagged the overall market return of 10.16%. Positive contributors to performance included an overweight in Technology (+12.32%) and Cable & Satellite (+9.92%). The Fund is currently yielding 5.31% (before expenses) with a duration to worst of 3.35 years. The average rating within the Fund was Ba3 as of October 31, 2016.

Madison Funds | Management’s Discussion of Fund Performance - Madison High Income Fund - continued | October 31, 2016

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 | | | |

| |

| Bond Funds | | 1.1 | % |

| Consumer Discretionary | | 20.2 | % |

| Consumer Staples | | 3.5 | % |

| Energy | | 7.5 | % |

| Financials | | 8.9 | % |

| Health Care | | 5.7 | % |

| Industrials | | 12.6 | % |

| Information Technology | | 8.9 | % |

| Materials | | 6.6 | % |

| Money Market Funds | | 9.2 | % |

| Telecommunication Services | | 7.0 | % |

| Utilities | | 7.6 | % |

| Net Other Assets and Liabilities | | 1.2 | % |

| |

| | | | |

| TOP TEN HOLDINGS AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 | | | |

| |

| AmeriGas Finance LLC / AmeriGas Finance Corp., 7.0%, 5/20/22 | | 2.4 | % |

| Outfront Media Capital LLC / Outfront Media Capital Corp., 5.625%, 2/15/24 | | 2.2 | % |

| Donnelley Financial Solutions Inc., 8.25%, 10/15/24 | | 2.2 | % |

| Belden Inc., 5.5%, 9/1/22 | | 2.2 | % |

| Rayonier AM Products Inc., 5.5%, 6/1/24 | | 2.1 | % |

| Unit Corp., 6.625%, 5/15/21 | | 2.0 | % |

| Diebold Inc., 8.5%, 4/15/24 | | 1.8 | % |

| Ardagh Packaging Finance PLC / Ardagh Holdings USA Inc., 6.75%, 1/31/21 | | 1.7 | % |

| Alliance Data Systems Corp., 6.375%, 4/1/20 | | 1.7 | % |

| AES Corp., 5.5%, 3/15/24 | | 1.7 | % |

| |

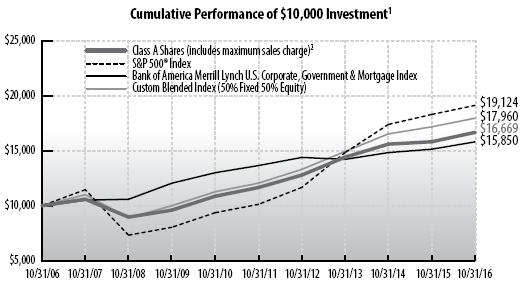

| MADISON DIVERSIFIED INCOME FUND |

| |

| INVESTMENT STRATEGY HIGHLIGHTS |

The Madison Diversified Income Fund seeks income by investing in a broadly diversified array of securities including bonds, common stocks, real estate securities, foreign market bonds and stocks and money market instruments. Bonds, stock and cash components will vary, reflecting the portfolio managers’ judgments of the relative availability of attractively yielding and priced stocks and bonds; however, under normal market conditions, the Fund’s portfolio managers generally attempt to target a 40% bond and 60% stock investment allocation. Nevertheless, bonds may constitute up to 80% of the Fund’s assets, stocks will constitute up to 70% of the Fund’s assets, real estate securities will constitute up to 25% of the Fund’s assets, foreign stocks and bonds will constitute up to 25% of the Fund’s assets and money market instruments may constitute up to 25% of the Fund’s assets. The Fund intends to limit the investment in lower credit quality bonds to less than 50% of the Fund’s assets.

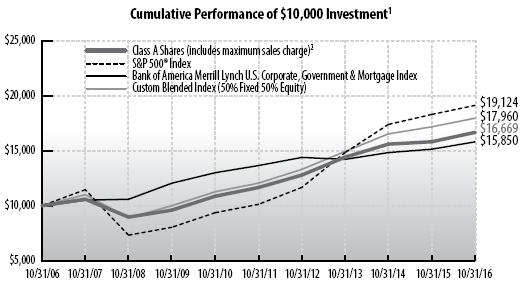

| | Average Annual Total Return through October 31, 20161 |

| | |

| | | | | | % Return Without Sales Charge | | | % Return After Sales Charge5 |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | Since | | | | | | | | | | | | | | | | | | Since |

| | | | | | | | | | | | | | | | | | | | | 7/31/12 | | | | | | | | | | | | | | | | | | 7/31/12 |

| | | | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Inception | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Inception |

| |

| | Class A Shares2 | | | | 5.38 | | | | 4.96 | | | | 7.42 | | | | 5.24 | | | | – | | | | -0.68 | | | | 2.90 | | | | 6.16 | | | | 4.62 | | | | – | |

| |

| | Class B Shares3 | | | | 4.63 | | | | 4.16 | | | | 6.62 | | | | 4.61 | | | | – | | | | 0.13 | | | | 3.07 | | | | 6.31 | | | | 4.61 | | | | – | |

| |

| | Class C Shares4 | | | | 4.63 | | | | 4.18 | | | | – | | | | – | | | | 5.92 | | | | 3.63 | | | | 4.18 | | | | – | | | | – | | | | 5.92 | |

| |

| | Bank of | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | America Merrill | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Lynch US | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Corp, Govt & | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Mortgage Index | | | | 4.39 | | | | 3.59 | | | | 2.97 | | | | 4.71 | | | | 2.32 | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | |

| |

| | S&P 500® | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Index | | | | 4.51 | | | | 8.84 | | | | 13.57 | | | | 6.70 | | | | 13.11 | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | |

| |

| | Custom | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Blended Index | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (50% Fixed | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 50% Equity) | | | | 4.57 | | | | 6.35 | | | | 8.30 | | | | 6.03 | | | | 7.74 | | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | |

See accompanying Notes to Management’s Discussion of Fund Performance.

The Madison Diversified Income Fund (A Class) returned 5.38% for the one-year period, beating its blended benchmark index (50% Bank of America Merrill Lynch U.S. Corporate, Government and Mortgage Index and 50% S&P 500® Index) which returned 4.57%. The Fund also outperformed its Morningstar Moderate Allocation category peer group, which advanced 2.75% over the last year.

In the equity portion of the Fund, sector allocation was mildly positive, while stock selection was strong and accounted for a significant share of the Fund’s outperformance. Stock selection yielded positive results in Health Care, Consumer Discretionary, Technology, and Energy, while Financials and Telecommunications negatively impacted the portfolio. Within Health Care, pharmaceutical firm Johnson & Johnson (JNJ) favorably impacted performance. In Consumer Discretionary, global fast food restaurant company McDonald’s (MCD) contributed nicely to results. Another notable outperforming stock in Technology was analog semiconductor firm Linear Technologies (LLTC), which was the most additive stock in the portfolio. On the negative side, in Financials, regional bank company Wells Fargo (WFC) negatively impacted performance. Within Consumer Staples, global snack food manufacturer Nestle (NSRGY) was the most detractive stock in the portfolio, while rival firm Mondelez (MDLZ) also hurt results. The Fund sold MDLZ and continues to hold the other stocks discussed above.

The fixed income portion of the Fund continued to perform well during the 12 month period. The fixed income allocation of the Fund outperformed (before expenses) the Bank of America Merrill Lynch U.S. Corporate, Government, and Mortgage Index by 62 basis points (bps). The Fund’s conservative duration posture, relative credit overweight, and mortgage underweight all impacted performance positively. The Fund’s credit positioning was aided by an overweight to BBB rated issuers and further aided by a small exposure to BB rated issuers. Furthermore, the Fund’s relative underweight to Financial issues was additive as Financials underperformed late in the quarter when several European banks caused renewed sector concerns. The portfolio’s conservative duration positioning, mostly through underweighting Treasury issues, contributed to performance as interest rates across the yield curve moved higher post-Brexit. Relative fixed income performance has improved meaningfully in recent months as credit spreads have widened and interest rates have begun to migrate higher. Importantly, the Fund’s lower risk profile, from both duration and credit perspectives, helped it to perform well relative to its peers.

Madison Funds | Management’s Discussion of Fund Performance - Madison Diversified Income Fund - continued | October 31, 2016

| PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 |

| |

| Asset Backed Securities | | 1.4 | % |

| Collateralized Mortgage Obligations | | 1.3 | % |

| Commercial Mortgage-Backed Securities | | 1.2 | % |

| Common Stocks | | 54.0 | % |

| Corporate Notes and Bonds | | 13.7 | % |

| Long Term Municipal Bonds | | 3.5 | % |

| Mortgage Backed Securities | | 8.8 | % |

| Short-Term Investments | | 6.1 | % |

| U.S. Government and Agency Obligations | | 9.9 | % |

| Other Net Assets and Liabilities | | 0.1 | % |

| |

| TOP TEN HOLDINGS AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 |

| |

| Johnson & Johnson | | 2.3 | % |

| Travelers Cos. Inc./The | | 2.2 | % |

| Cisco Systems Inc. | | 2.1 | % |

| Microsoft Corp. | | 1.9 | % |

| Exxon Mobil Corp. | | 1.9 | % |

| Pfizer Inc. | | 1.8 | % |

| US Bancorp | | 1.8 | % |

| Verizon Communications Inc. | | 1.6 | % |

| United Technologies Corp. | | 1.6 | % |

| General Electric Co. | | 1.5 | % |

| |

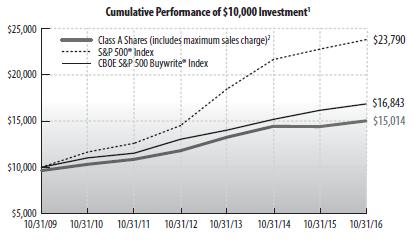

| MADISON COVERED CALL & EQUITY INCOME FUND |

| |

| INVESTMENT STRATEGY HIGHLIGHTS |

The Madison Covered Call & Equity Income Fund invests, under normal market conditions, primarily in common stocks of large-and mid-capitalization companies that are, in the view of the Fund’s investment adviser, selling at a reasonable price in relation to their long-term earnings growth rates. The portfolio managers will allocate the Fund’s assets among stocks in sectors of the economy based upon their views on forward earnings growth rates, adjusted to reflect their views on economic and market conditions and sector risk factors.

The Fund will seek to generate current earnings from option premiums by writing (selling) covered call options on a substantial portion of its portfolio securities. The extent of option writing activity will depend upon market conditions and the portfolio manager’s ongoing assessment of the attractiveness of writing call options on the Fund’s stock holdings. In addition to providing income, covered call writing helps to reduce the volatility (and risk profile) of the Fund by providing downside protection.

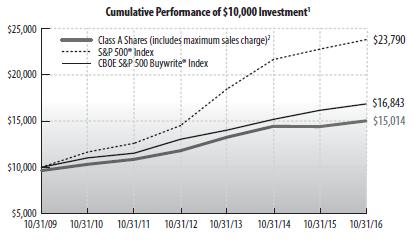

| | Average Annual Total Return through October 31, 20161 |

| | |

| | | | | | % Return Without Sales Charge | | % Return After Sales Charge5 |

| | | | | | | | |

| | | | | | | | | | | | | | | | Since | | Since | | | | | | | | | | | | | | Since | | Since |

| | | | | | | | | | | | | | | | 10/30/09 | | 7/31/12 | | | | | | | | | | | | | | 10/30/09 | | 7/31/12 |

| | | | 1 Year | | 3 Years | | 5 Years | | Inception | | Inception | | 1 Year | | 3 Years | | 5 Years | | Inception | | Inception |

| |

| | Class A Shares2 | | | 4.29 | | | | 4.27 | | | | 6.69 | | | | 6.53 | | | | – | | | | 1.73 | | | | 2.23 | | | | 5.43 | | | | 5.63 | | | | – | |

| |

| | Class C Shares4 | | | 3.53 | | | | 3.51 | | | | – | | | | – | | | | 5.81 | | | | 2.56 | | | | 3.51 | | | | – | | | | – | | | | 5.81 | |

| |

| | Class Y Shares6 | | | 4.63 | | | | 4.55 | | | | 6.95 | | | | 6.78 | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | |

| |

| | Class R6 Shares7 | | | 4.72 | | | | 4.68 | | | | – | | | | – | | | | 6.99 | | | | – | | | | – | | | | – | | | | – | | | | – | |

| |

| | S&P 500® Index | | | 4.51 | | | | 8.84 | | | | 13.57 | | | | 13.09 | | | | 13.11 | | | | – | | | | – | | | | – | | | | – | | | | – | |

| |

| | CBOE S&P 500

BuyWrite® Index | | | 4.27 | | | | 6.32 | | | | 7.89 | | | | 7.64 | | | | 6.49 | | | | – | | | | – | | | | – | | | | – | | | | – | |

See accompanying Notes to Management’s Discussion of Fund Performance.

The Madison Covered Call & Equity Income Fund (Class Y) returned 4.63% for the one-year period, beating the passive strategy of its covered call benchmark, the CBOE S&P 500 Buy/Write® Index (BXM), which returned 4.27%. The Fund also outperformed its Morningstar Option Writing category peer group, which returned 1.44% over the same period.

As cracks formed in the foundation of the long bull market over the past year, the Fund maintained a relatively defensive stance, while preserving sufficient flexibility to participate in further movement to the upside. Relative to the S&P 500, the Fund performed well during bouts of instability in early 2016 and surrounding the Brexit decision in late June, while giving up relative performance as the market rebounded from these periods. With the exception of the short-lived periods of market decline, the bulk of the year was characterized by low volatility and relatively poor option pricing that was not particularly advantageous for call option writing.

During the period, stock selection within the Fund was quite strong relative to the overall market led by companies targeted in takeover activity, including Linear Technology and Hershey. Additionally, strong performers such as Apache, Agilent Technologies, Jacobs Engineering and T-Mobile were additive to performance. The Fund’s position in the SPDR Gold Trust also provided good performance and an attractive risk diversifier due to gold’s minimal correlation to the market. Somewhat offsetting these were underperformers within the Health Care sector which were negatively impacted by pricing and political pressures such as McKesson, Express Scripts and Gilead. From a sector allocation perspective, the Fund’s absence from the Utilities sector was the single biggest headwind as Utilities were the top performing area of the market. The Technology sector also performed very strongly and the Fund’s underweighting was a drag on performance. In all, sector allocation was a small detractor from overall performance. The option writing portion of the Fund, as well as the overall cash position, provided a relatively small performance lag which is typical in a market with positive absolute returns.

Given our expectation for an increasingly volatile equity environment, the Fund has remained in a defensive posture as we deal with uneven economic growth prospects, rising geo-political pressure and near-term domestic political instability.

| SECTOR ALLOCATION AS A PERCENTAGE OF TOTAL INVESTMENTS AS OF 10/31/16 |

| |

| Consumer Discretionary | | 11.6 | % |

| Consumer Staples | | 5.7 | % |

| Energy | | 10.7 | % |

| Financials | | 9.1 | % |

| Health Care | | 15.0 | % |

| Industrials | | 6.6 | % |

| Information Technology | | 12.8 | % |

| Materials | | 1.2 | % |

| Telecommunication Services | | 2.3 | % |

| Exchange Traded Funds | | 6.2 | % |

| U.S. Government and Agency Obligations | | 4.6 | % |

| Short-Term Investments | | 14.4 | % |

| Net Other Assets & Liabilities | | (0.2 | )% |

| |

Madison Funds | Management’s Discussion of Fund Performance - Madison Covered Call & Equity Income Fund - continued | October 31, 2016

| TOP TEN HOLDINGS AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 |

| |

| Gilead Sciences Inc. | | 2.9 | % |

| SPDR S&P 500 ETF Trust | | 2.6 | % |

| T-Mobile U.S. Inc. | | 2.4 | % |

| PNC Financial Services Group Inc./The | | 2.3 | % |

| Apache Corp. | | 2.3 | % |

| QUALCOMM Inc. | | 2.3 | % |

| Cerner Corp. | | 2.2 | % |

| Baker Hughes Inc. | | 2.2 | % |

| Express Scripts Holding Co. | | 2.1 | % |

| Dollar General Corp. | | 2.1 | % |

| |

| MADISON DIVIDEND INCOME FUND |

| |

| INVESTMENT STRATEGY HIGHLIGHTS |

The Madison Dividend Income Fund invests in equity securities of companies with a market capitalization of over $1 billion and a history of paying dividends, with the ability to increase dividends over time. Under normal market conditions, at least 80% of the Fund’s net assets will be invested in dividend paying equity securities. The Fund typically owns 30-60 securities which are chosen for having a current yield exceeding the S&P 500’s average yield, strong fundamentals including an attractive balance sheet and reasonable valuations at the time of purchase. A key attraction for management is a company with a history of increasing dividend payments and a business model that supports the possibility of continuing these increases in the future.

| | Average Annual Total Return through October 31, 20161 | | | | | | | | |

| | | | % Return Without Sales Charge |

| | | | |

| | | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

| |

| | Class Y Shares6 | | 6.16 | | 6.69 | | 11.18 | | 6.71 |

| |

| | S&P 500® Index | | 4.51 | | 8.84 | | 13.57 | | 6.70 |

See accompanying Notes to Management’s Discussion of Fund Performance.

Madison Dividend Income Fund (Class Y) returned 6.16% for the annual period, beating its benchmark S&P 500® Index, which advanced 4.51%. The Fund also outperformed its Morningstar Large Value category peer group, which returned 3.72% over the same period.

Relative to the Index, sector allocation was slightly negative while, stock selection was positive and accounted for all of the Fund’s outperformance. In terms of stock selection, there were positive results in Health Care, Consumer Discretionary, Technology, and Energy, while Financials and Telecommunications negatively impacted the portfolio. Within Health Care, pharmaceutical firm Johnson & Johnson (JNJ) favorably impacted performance. In Consumer Discretionary, global fast food restaurant company McDonald’s (MCD) contributed nicely to results. Another notable outperforming stock in Technology was analog semiconductor firm Linear Technologies (LLTC), which was the most additive stock in the portfolio. On the negative side, in Financials, regional bank company Wells Fargo (WFC) negatively impacted performance. Within Consumer Staples, global snack food manufacturer Nestle (NSRGY) was the most detractive stock in the portfolio, while rival firm Mondelez (MDLZ) also hurt results. The Fund sold MDLZ and continues to hold the other stocks discussed above.

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 |

| |

| Consumer Discretionary | | 6.6 | % |

| Consumer Staples | | 8.1 | % |

| Energy | | 7.7 | % |

| Financials | | 15.5 | % |

| Health Care | | 14.1 | % |

| Industrials | | 16.4 | % |

| Information Technology | | 15.8 | % |

| Materials | | 2.9 | % |

| Money Market Funds | | 6.6 | % |

| Telecommunication Services | | 2.8 | % |

| Utilities | | 3.4 | % |

| Net Other Assets and Liabilities | | 0.1 | % |

| |

| TOP TEN HOLDINGS AS A PERCENTAGE OF NET ASSETS AS OF 10/31/16 |

| |

| Johnson & Johnson | | 4.0 | % |

| Travelers Cos. Inc./The | | 3.6 | % |

| Cisco Systems Inc. | | 3.6 | % |

| Microsoft Corp. | | 3.3 | % |

| US Bancorp | | 3.2 | % |

| Exxon Mobil Corp. | | 3.2 | % |

| Pfizer Inc. | | 3.0 | % |

| Verizon Communications Inc. | | 2.8 | % |

| General Electric Co. | | 2.8 | % |

| United Technologies Corp. | | 2.7 | % |

| |

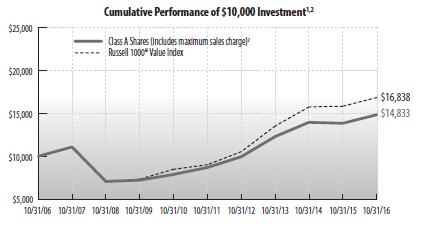

| MADISON LARGE CAP VALUE FUND |

| |

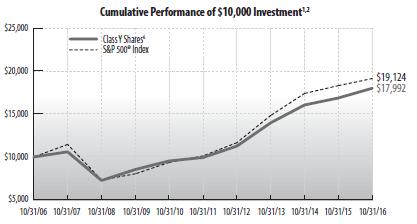

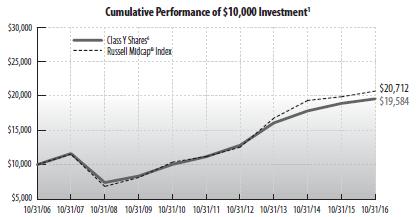

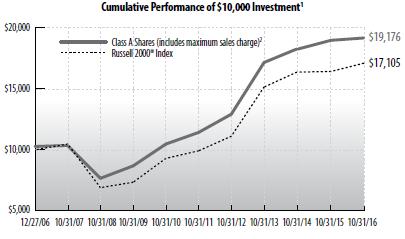

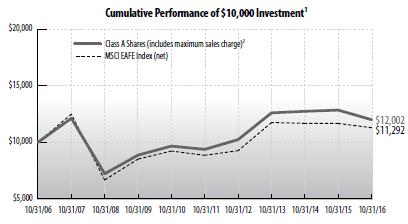

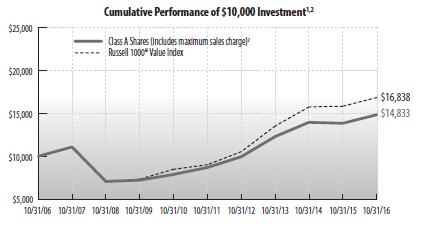

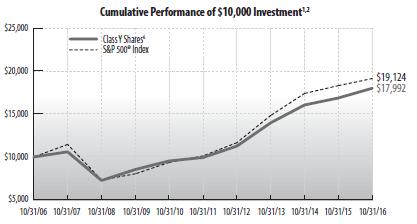

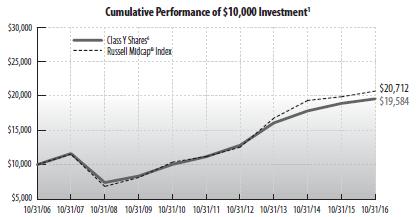

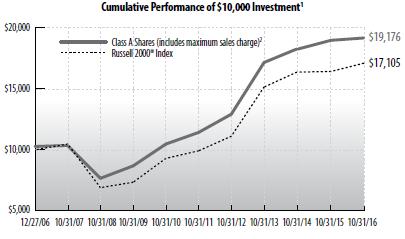

| INVESTMENT STRATEGY HIGHLIGHTS |