OMB APPROVAL

OMB Number: 3235-0570

Expires: September 30, 2025

Estimated average burden hours per response...20.59

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08261

Madison Funds

(Exact name of registrant as specified in charter)

550 Science Drive, Madison, WI 53711

(Address of principal executive offices)(Zip code)

Steve J. Fredricks

Chief Legal Officer & Chief Compliance Officer

550 Science Drive

Madison, WI 53711

(Name and address of agent for service)

Registrant's telephone number, including area code: 608-274-0300

Date of fiscal year end: October 31

Date of reporting period: October 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Shareholders.

Madison Funds | October 31, 2023

Although each fund’s name begins with the word “Madison,” the word “Madison” may be omitted in this report for simplicity when referring to any particular fund, group of funds or list of funds.

Nondeposit investment products are not federally insured, involve investment risk, may lose value and are not obligations of or guaranteed by any financial institution.

For more complete information about Madison Funds, including charges and expenses, request a prospectus from your financial advisor or from Madison Funds, P.O. Box 219083, Kansas City, MO 64121-9083. Consider the investment objectives, risks, and charges and expenses of any fund carefully before investing. The prospectus contains this and other information about the funds.

For more current performance information, please call 1-800-877-6089 or visit our website at www.madisonfunds.com. Current performance may be lower or higher than the performance data quoted within this report. Performance data shown represents past performance, past performance does not guarantee future results.

Nothing in this report represents a recommendation of a security by the investment adviser. Portfolio holdings may have changed since the date of this report.

Madison Funds | October 31, 2023

Management’s Discussion of Fund Performance (unaudited)

Period In Review

The trailing year provided investors a much-needed respite from the savage declines of 2022, where both broad stock and bond market indexes experienced double digit drawdowns. Fears of an impending recession driven by the Federal Reserve’s (Fed) breakneck interest rate hikes crested early in the period. Instead, investors became emboldened by the belief that the Fed would soon cease raising rates, and cuts were a distinct possibility in 2023 or early 2024. Economic growth surprised to the upside driven by a resilient labor market that helped keep consumers in a spending mood.

From a high-level perspective, the year appeared to be quite successful for equity investors, as the S&P 500 Index gained a pleasing +10.14%. However, from a broader point of view there were many stocks, and entire sectors, left out of the fun. The index was driven higher by a very small set of mega cap growth companies, coined the “Magnificent Seven” during their ascent. The bulk of this group saw gains of over 30% and two of the seven (NVIDA and Meta) jumped by over a staggering 200%! Stripping away the impact of these select big gainers showed a considerably less healthy broad US stock market. Both mid and smaller cap stocks were down for the period with the Russell Mid Cap Index declining -1.01% and the Russell 2000 Index falling -8.56%. Six out of the eleven S&P 500 Index sectors failed to generate a positive return over the past twelve months.

Bonds had a more muted performance as measured by the Bloomberg US Aggregate Bond Index return of +0.36%, yet still a very welcome development considering the continued interest rate volatility and vicious bear market of 2021-22. Rates remained volatile as investors weighed declining inflation against future Fed policy. By the end of the period, hopes of interest rate cuts around the corner were dashed by reaccelerating inflation in the late summer/early fall and an acceptance that rates would indeed need to remain higher for longer to truly quell inflation. Incongruent with the stock market, where companies deemed lower quality or more susceptible to higher rates suffered, lower quality and higher risk bonds outperformed. With recession risk being priced out of the market, interest rate spreads remained tame and the higher yields offered from riskier bonds generated more favorable returns.

So, while the respite from a woeful 2022 can be relished, important questions remain. Monetary policy works with notoriously long and variable lags. The Fed took rates from zero to 5.25% in less than 1.5 years, with the last hike coming in late July, meaning much of the effects of the Fed’s restrictive policy have yet to make their way into and be felt by the economy. Will a steady jobs market continue to embolden consumers? Will consumers continue to spend with admittedly low confidence and sticky inflation? Will investors continue to pay a high premium for growth stocks in a period of heightened uncertainty and elevated interest rates? Has a recession been avoided or just postponed?

The unquestionably good news is that over the past couple years, yield has been built back into fixed income and investors no longer need to take undue or unnecessary risk to reach for return. With high quality bonds yielding above 5%, and limited prospects for further material increases in interest rates, bonds once again offer a viable alternative to stocks. Within equities, we are firm believers that the highly uncertain economic conditions combined with the elevated valuations imbedded in the broad US equity market provides an ideal environment for risk-aware, active portfolio management.

Madison Funds | Management’s Discussion of Fund Performance - continued | October 31, 2023

Allocation Funds Summary

The Madison Conservative Allocation, Moderate Allocation, Aggressive Allocation and Diversified Income Funds invest primarily in shares of registered investment companies (the “Underlying Funds”). The funds are diversified among a number of asset classes and their allocation among Underlying Funds are based on an asset allocation model developed by Madison Asset Management, LLC (“Madison”), the funds’ investment adviser. The team may use multiple analytical approaches to determine the appropriate asset allocation, including:

| · | Asset allocation optimization analysis – considers the degree to which returns in different asset classes do or do not move together, and the funds’ aim to achieve a favorable overall risk profile for any targeted portfolio return. |

| · | Scenario analysis– historical and expected return data is analyzed to model how individual asset classes and combinations of asset classes would affect the funds under different economic and market conditions. |

| · | Fundamental analysis – draws upon Madison’s investment teams to judge each asset class against current and forecasted market conditions. Economic, industry and security analysis is used to develop return and risk expectations that may influence asset class selection. In addition, Madison has a flexible mandate which permits the funds, at the sole discretion of Madison, to materially reduce equity risk exposures when and if conditions are deemed to warrant such an action. |

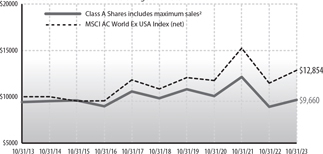

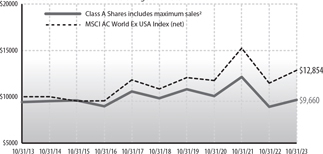

Madison Conservative Allocation Fund

INVESTMENT STRATEGY HIGHLIGHTS

Under normal circumstances, the Madison Conservative Allocation Fund’s total net assets will be allocated among various asset classes and Underlying Funds, including those whose shares trade on a stock exchange (exchange traded funds or “ETFs”), with target allocations over time of approximately 35% equity investments and 65% fixed income investments. Underlying Funds in which the Fund invests may include funds advised by Madison and/or its affiliates, including other Madison Funds (the “Affiliated Underlying Funds”). Generally, Madison will not invest more than 75% of the Fund’s net assets, at the time of purchase, in Affiliated Underlying Funds.

PERFORMANCE DISCUSSION

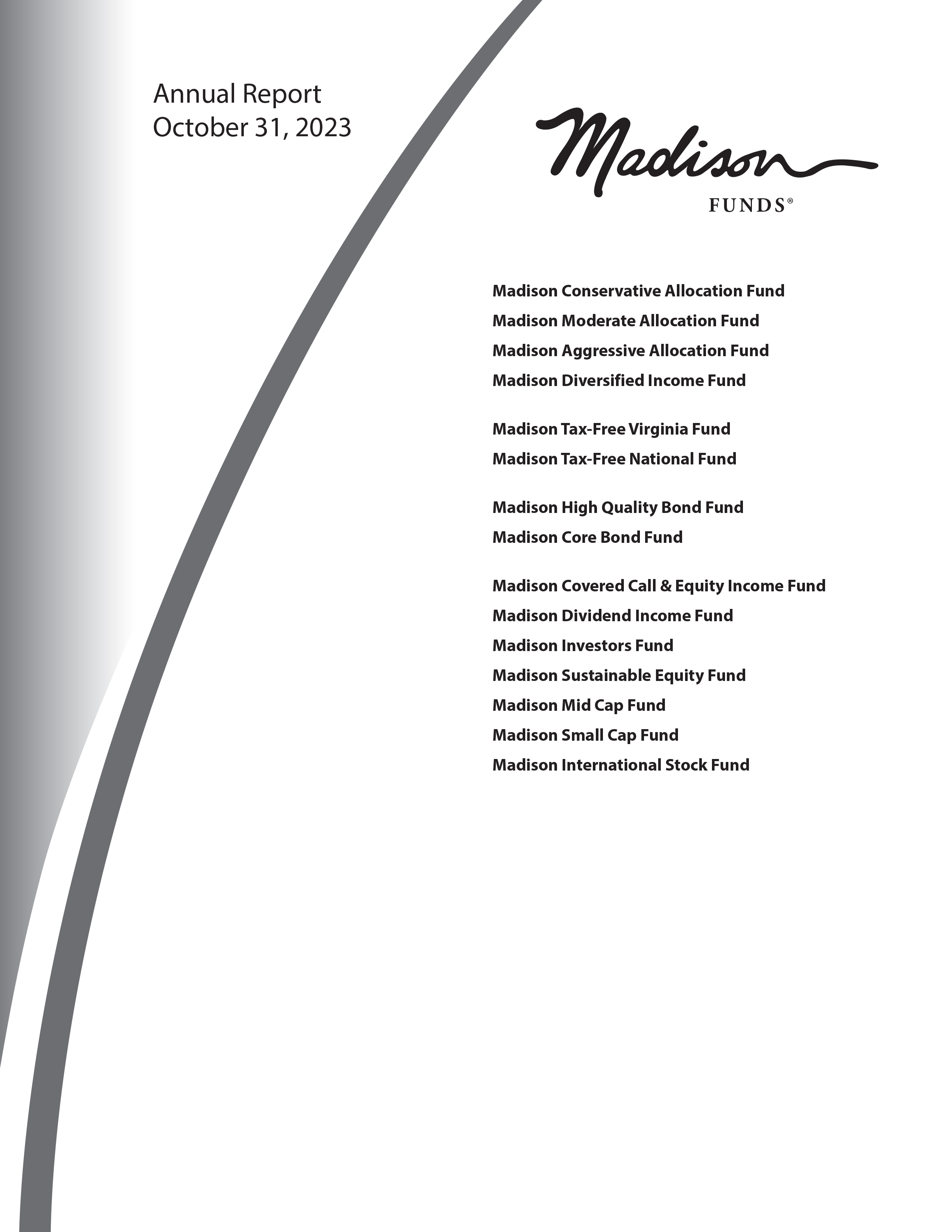

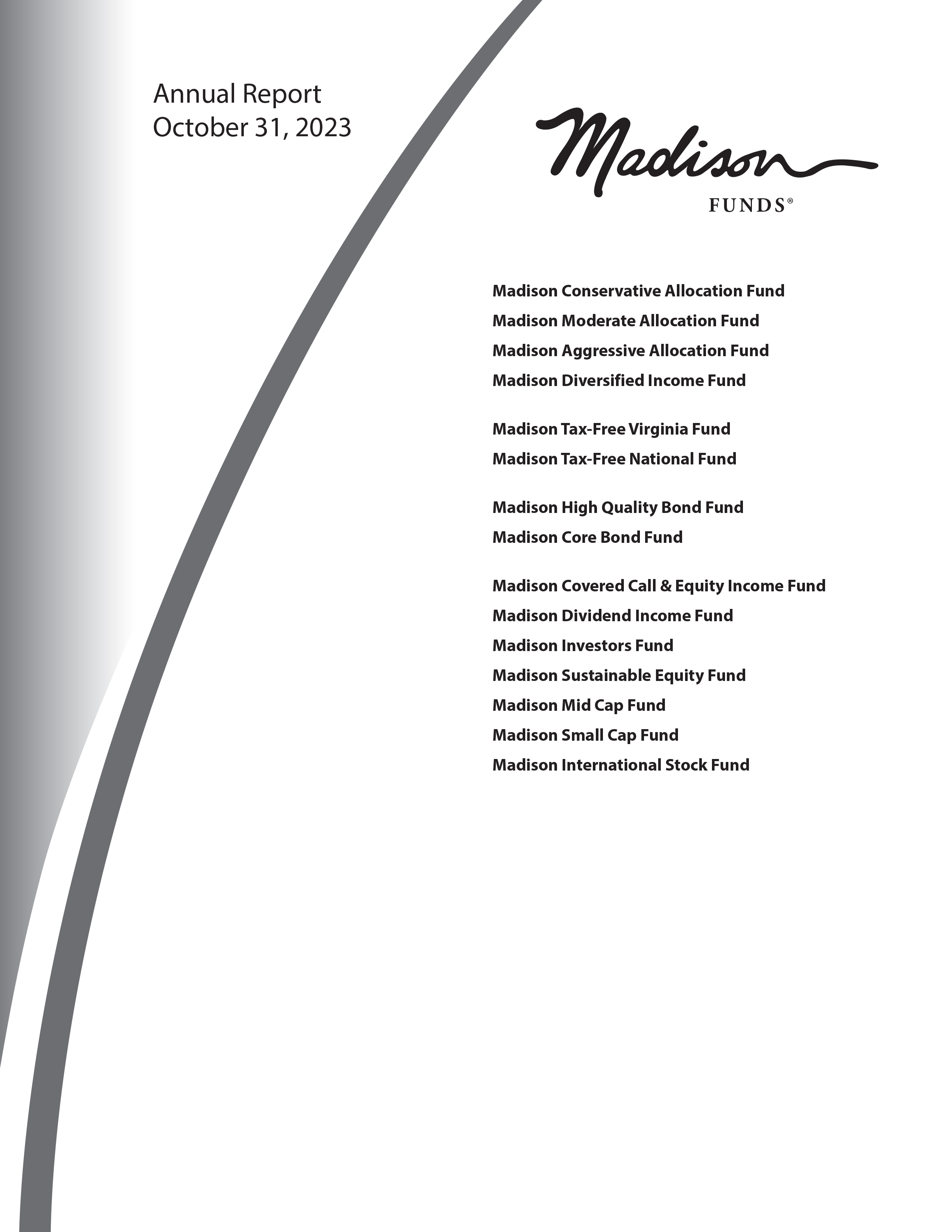

Cumulative Performance of $10,000 Investment1

Class A Shares initial amount invested was $9,425 to reflect deduction of maximum sales charge of 5.75%

Average Annual Total Return through October 31, 20231

| | | % Return Without Sales Charge | | | % Return After Sales Charge | |

| | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | |

| Class A | | | 1.36 | % | | | -2.76 | % | | | 1.40 | % | | | 2.46 | % | | | -4.47 | % | | | -4.66 | % | | | 0.21 | % | | | 1.85 | % |

| Class C | | | 0.60 | % | | | -3.51 | % | | | 0.63 | % | | | 1.69 | % | | | -0.40 | % | | | -3.51 | % | | | 0.63 | % | | | 1.69 | % |

| ICE Bank of America Merrill Lynch US Corp, Govt & Mortgage Index | | | 0.38 | % | | | -5.71 | % | | | -0.07 | % | | | 0.91 | % | | | NA | | | | NA | | | | NA | | | | NA | |

| Conservative Allocation Fund Custom Index | | | 3.62 | % | | | -0.99 | % | | | 3.10 | % | | | 3.60 | % | | | NA | | | | NA | | | | NA | | | | NA | |

The Madison Conservative Allocation Fund (Class A at NAV) returned 1.36% for the one-year period, underperforming the Conservative Allocation Custom Index return of 3.62%. The Fund underperformed its peers as measured by the Morningstar US Allocation 15%-30% Equity category, which returned 2.22%.

Market returns over the past 12 months easily outpaced consensus expectations going into the period. We entered the period on the heels of substantial declines in both stocks and bonds. There was widespread belief that the economy was on the cusp of recession after being suffocated by the rapid increase in interest rates brought on by the Federal Reserve’s (Fed) tightening campaign. However, as they often do, markets surprised, and rallied throughout most of the period, with a few bouts of downside along the way.

US stocks, as measured by the Russell 3000 Index gained 8.38%, led by a very narrow set of mega cap growth companies, the so called “Magnificent Seven”, a term brought to bear by their outsized gains amongst more modest, and often negative, returns across the rest of the broader market. Maybe more surprising was the 12.07% advance from the international MSCI ACWI ex-USA Index. Again, entering the period it appeared that the European economy was on its death bed with serious questions around energy supplies due to the war in Ukraine, but a mild winter and boost from the reopening of the Chinese economy served to ameliorate the situation. Finally, bonds were flat with the Bloomberg US Aggregate Bond Index advancing just 0.36%, yet a satisfactory result and stemmed the pain brought on by a vicious bear market in bonds over 2021-22.

The Fund underperformed its blended benchmark for the period. Much of the underperformance came from the positioning that served the Fund so well during the previous 12-month period, most notably, an underweight allocation to risky assets. The Fund was underweight stocks relative to the blended benchmark, and while the cash held in-lieu of equities outperformed traditional bonds with a return of over 4% it was no match for the bigger gains in stocks. Compounding the issue was that the underweight to equites was concentrated in the international markets, which as mentioned above outpaced the US market. The other area that really helped in the prior period, but detracted this time around, was in the Fund's exposure to energy, commodities, and dividend paying stocks. Balancing out equity performance were overweight allocations to the technology sector, Japanese equities, and sizeable exposure to high quality US large cap companies. Within fixed income our preference for higher quality US Treasury and mortgage-backed securities detracted from returns, while our slightly underweight allocation to bonds was additive.

While it is never pleasing to underperform, we invest for the longer-term cycle and many leading indicators we follow continue to point to a weakening economy with a serious risk of recession in the near term. Market pricing and expectations are not aligned with these leading indicators. US stock valuations remain at a premium and expectations are for double-digit earnings growth in 2024. Elevated valuations and earnings expectations appear to be at odds with sticky inflation, higher interest rates, and low consumer confidence.

Madison Funds | Management’s Discussion of Fund Performance - continued | October 31, 2023

We readily admit to underappreciating the staying power of past stimulus efforts and consumers willingness to spend more despite savage inflation. However, given the status and breadth of the indicators we follow, we believe a recession has not been avoided, but postponed. As such, we believe the defensive posture we have been employing is still prudent in this highly uncertain environment.

| PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 10/31/23 | | | |

| Bond Funds | | | 68.6 | % |

| Foreign Stock Funds | | | 4.9 | % |

| Short-Term Investments | | | 2.2 | % |

| Stock Funds | | | 24.7 | % |

| Net Other Assets and Liabilities | | | (0.4 | )% |

| TOP TEN HOLDINGS AS A PERCENTAGE OF NET ASSETS AS OF 10/31/23 | | | |

| Madison Core Bond Fund | | | 29.8 | % |

| iShares 7-10 Year Treasury Bond ETF | | | 9.7 | % |

| Madison Investors Fund | | | 9.0 | % |

| iShares Treasury Floating Rate Bond ETF | | | 8.8 | % |

| Janus Henderson Mortgage-Backed Securities ETF | | | 8.3 | % |

| Schwab Intermediate-Term U.S. Treasury ETF | | | 6.4 | % |

| Distillate U.S. Fundamental Stability & Value ETF | | | 6.0 | % |

| iShares Aaa - A Rated Corporate Bond ETF | | | 3.6 | % |

| Vanguard Information Technology ETF | | | 3.2 | % |

| Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Quality ETF | | | 2.4 | % |

Madison Moderate Allocation Fund

INVESTMENT STRATEGY HIGHLIGHTS

Under normal circumstances, the Madison Moderate Allocation Fund’s total net assets will be allocated among various asset classes and Underlying Funds, including those whose shares trade on a stock exchange (exchange traded funds or “ETFs”), with target allocations over time of approximately 60% equity investments and 40% fixed income investments. Underlying Funds in which the Fund invests may include Affiliated Underlying Funds. Generally, Madison will not invest more than 75% of the Fund’s net assets, at the time of purchase, in Affiliated Underlying Funds.

PERFORMANCE DISCUSSION

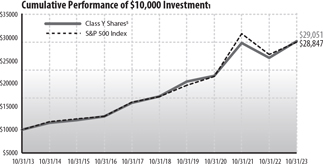

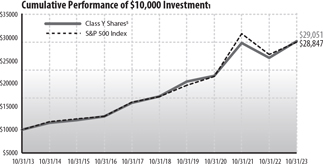

Cumulative Performance of $10,000 Investment1

Class A Shares initial amount invested was $9,425 to reflect deduction of maximum sales charge of 5.75%

Average Annual Total Return through October 31, 20231

| | | % Return Without Sales Charge | | | % Return After Sales Charge | |

| | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | |

| Class A | | | 2.55 | % | | | -0.56 | % | | | 2.66 | % | | | 3.88 | % | | | -3.39 | % | | | -2.49 | % | | | 1.45 | % | | | 3.27 | % |

| Class C | | | 1.79 | % | | | -1.29 | % | | | 1.89 | % | | | 3.10 | % | | | 0.79 | % | | | -1.29 | % | | | 1.89 | % | | | 3.10 | % |

| S&P 500® Index | | | 10.14 | % | | | 10.36 | % | | | 11.01 | % | | | 11.18 | % | | | NA | | | | NA | | | | NA | | | | NA | |

| Moderate Allocation Fund Custom Index | | | 5.94 | % | | | 2.26 | % | | | 5.20 | % | | | 5.43 | % | | | NA | | | | NA | | | | NA | | | | NA | |

The Madison Moderate Allocation Fund (Class A at NAV) returned 2.55% for the one-year period, underperforming its blended benchmark, the Moderate Allocation Custom Index, which returned 5.94%. The Fund underperformed its peers as measured by the Morningstar Allocation 50-70% Equity category, which returned 4.21%.

Market returns over the past 12 months easily outpaced consensus expectations going into the period. We entered the period on the heels of substantial declines in both stocks and bonds. There was widespread belief that the economy was on the cusp of recession after being suffocated by the rapid increase in interest rates brought on by the Federal Reserve’s (Fed) tightening campaign. However, as they often do, markets surprised, and rallied throughout most of the period, with a few bouts of downside along the way.

US stocks, as measured by the Russell 3000 Index gained 8.38%, led by a very narrow set of mega cap growth companies, the so called “Magnificent Seven”, a term brought to bear by their outsized gains amongst more modest, and often negative, returns across the rest of the broader market. Maybe more surprising was the 12.07% advance from the international MSCI ACWI ex-USA Index. Again, entering the period it appeared that the European economy was on its death bed with serious questions around energy supplies due to the war in Ukraine, but a mild winter and boost from the reopening of the Chinese economy served to ameliorate the situation. Finally, bonds were flat with the Bloomberg US Aggregate Bond Index advancing just 0.36%, yet a satisfactory result and stemmed the pain brought on by a vicious bear market in bonds over 2021-22.

The Fund underperformed its blended benchmark for the period. Much of the underperformance came from the positioning that served the Fund so well during the previous 12-month period, most notably, an underweight allocation to risky assets. The Fund was underweight stocks relative to the blended benchmark, and while the cash held in-lieu of equities outperformed traditional bonds with a return of over 4% it was no match for the bigger gains in stocks. Compounding the issue was that the underweight to equites was concentrated in the international markets, which as mentioned above outpaced the US market. The other area that really helped in the prior period, but detracted this time around, was in the Fund's exposure to energy, commodities, and dividend paying stocks. Balancing out equity performance were overweight allocations to the technology sector, Japanese equities, and sizeable exposure to high quality US large cap companies. Within fixed income our preference for higher quality US Treasury and mortgage-backed securities detracted from returns, while our slightly underweight allocation to bonds was additive.

While it is never pleasing to underperform, we invest for the longer-term cycle and many leading indicators we follow continue to point to a weakening economy with a serious risk of recession in the near term. Market pricing and expectations are not aligned with these leading indicators. US stock valuations remain at a premium and expectations are for double-digit earnings growth in 2024. Elevated valuations and earnings expectations appear to be at odds with sticky inflation, higher interest rates, and low consumer confidence.

Madison Funds | Management’s Discussion of Fund Performance - continued | October 31, 2023

We readily admit to underappreciating the staying power of past stimulus efforts and consumers willingness to spend more despite savage inflation. However, given the status and breadth of the indicators we follow, we believe a recession has not been avoided, but postponed. As such, we believe the defensive posture we have been employing is still prudent in this highly uncertain environment.

| PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 10/31/23 | | | |

| Bond Funds | | | 46.3 | % |

| Foreign Stock Funds | | | 10.6 | % |

| Short-Term Investments | | | 8.6 | % |

| Stock Funds | | | 41.1 | % |

| Net Other Assets and Liabilities | | | (6.6 | )% |

| TOP TEN HOLDINGS AS A PERCENTAGE OF NET ASSETS AS OF 10/31/23 | | | |

| Madison Core Bond Fund | | | 18.9 | % |

| Madison Investors Fund | | | 13.1 | % |

| Distillate U.S. Fundamental Stability & Value ETF | | | 8.9 | % |

| iShares Treasury Floating Rate Bond ETF | | | 8.2 | % |

| iShares 7-10 Year Treasury Bond ETF | | | 6.7 | % |

| Vanguard Information Technology ETF | | | 6.1 | % |

| Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Quality ETF | | | 5.9 | % |

| Janus Henderson Mortgage-Backed Securities ETF | | | 5.0 | % |

| Schwab Intermediate-Term U.S. Treasury ETF | | | 4.2 | % |

| Energy Select Sector SPDR Fund ETF | | | 3.7 | % |

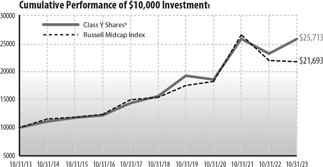

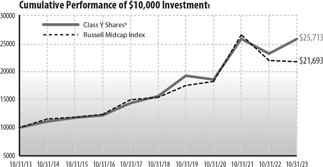

Madison Aggressive Allocation Fund

INVESTMENT STRATEGY HIGHLIGHTS

Under normal circumstances, the Madison Aggressive Allocation Fund’s total net assets will be allocated among various asset classes and Underlying Funds, including those whose shares trade on a stock exchange (exchange traded funds or “ETFs”), with target allocations over time of approximately 80% equity investments and 20% fixed income investments. Underlying Funds in which the Fund invests may include Affiliated Underlying Funds. Generally, Madison will not invest more than 75% of the Fund’s net assets, at the time of purchase, in Affiliated Underlying Funds.

PERFORMANCE DISCUSSION

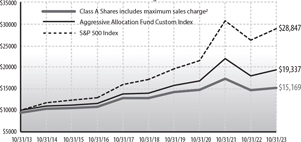

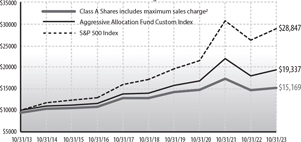

Cumulative Performance of $10,000 Investment1

Class A Shares initial amount invested was $9,425 to reflect deduction of maximum sales charge of 5.75%

Average Annual Total Return through October 31, 20231

| | | % Return Without Sales Charge% | | | Return After Sales Charge5 | |

| | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | |

| Class A | | | 3.62 | % | | | 1.02 | % | | | 3.44 | % | | | 4.87 | % | | | -2.34 | % | | | -0.96 | % | | | 2.23 | % | | | 4.25 | % |

| Class C | | | 2.83 | % | | | 0.24 | % | | | 2.67 | % | | | 4.08 | % | | | 1.83 | % | | | 0.24 | % | | | 2.67 | % | | | 4.08 | % |

| S&P 500® Index | | | 10.14 | % | | | 10.36 | % | | | 11.01 | % | | | 11.18 | % | | | NA | | | | NA | | | | NA | | | | NA | |

| Aggressive Allocation Fund Custom Index | | | 7.77 | % | | | 4.84 | % | | | 6.77 | % | | | 6.82 | % | | | NA | | | | NA | | | | NA | | | | NA | |

The Madison Aggressive Allocation Fund (Class A at NAV) returned 3.62% for the one-year period, underperforming its blended benchmark, the Aggressive Allocation Fund Custom Index, which returned 7.77%. The Fund underperformed its peers as measured by the Morningstar Allocation: 70-85% Equity category, which returned 4.69%.

Market returns over the past 12 months easily outpaced consensus expectations going into the period. We entered the period on the heels of substantial declines in both stocks and bonds. There was widespread belief that the economy was on the cusp of recession after being suffocated by the rapid increase in interest rates brought on by the Federal Reserve’s (Fed) tightening campaign. However, as they often do, markets surprised, and rallied throughout most of the period, with a few bouts of downside along the way.

US stocks, as measured by the Russell 3000 Index gained 8.38%, led by a very narrow set of mega cap growth companies, the so called “Magnificent Seven”, a term brought to bear by their outsized gains amongst more modest, and often negative, returns across the rest of the broader market. Maybe more surprising was the 12.07% advance

from the international MSCI ACWI ex-USA Index. Again, entering the period it appeared that the European economy was on its death bed with serious questions around energy supplies due to the war in Ukraine, but a mild winter and boost from the reopening of the Chinese economy served to ameliorate the situation. Finally, bonds were flat with the Bloomberg US Aggregate Bond Index advancing just 0.36%, yet a satisfactory result and stemmed the pain brought on by a vicious bear market in bonds over 2021-22.

The Fund underperformed its blended benchmark for the period. Much of the underperformance came from the positioning that served the Fund so well during the previous 12-month period, most notably, an underweight allocation to risky assets. The Fund was underweight stocks relative to the blended benchmark, and while the cash held in-lieu of equities outperformed traditional bonds with a return of over 4% it was no match for the bigger gains in stocks. Compounding the issue was that the underweight to equites was concentrated in the international markets, which as mentioned above outpaced the US market. The other area that really helped in the prior period, but detracted this time around, was in the Fund's exposure to energy, commodities, and dividend paying stocks. Balancing out equity performance were overweight allocations to the technology sector, Japanese equities, and sizeable exposure to high quality US large cap companies. Within fixed income our preference for higher quality US Treasury and mortgage-backed securities detracted from returns, while our slightly underweight allocation to bonds was additive.

While it is never pleasing to underperform, we invest for the longer-term cycle and many leading indicators we follow continue to point to a weakening economy with a serious risk of recession in the near term. Market pricing and expectations are not aligned with these leading indicators. US stock valuations remain at a premium and expectations are for double-digit earnings growth in 2024. Elevated valuations and earnings expectations appear to be at odds with sticky inflation, higher interest rates, and low consumer confidence.

Madison Funds | Management’s Discussion of Fund Performance - continued | October 31, 2023

We readily admit to underappreciating the staying power of past stimulus efforts and consumers willingness to spend more despite savage inflation. However, given the status and breadth of the indicators we follow, we believe a recession has not been avoided, but postponed. As such, we believe the defensive posture we have been employing is still prudent in this highly uncertain environment.

| PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 10/31/23 | | |

| Bond Funds | | | 28.2 | % |

| Foreign Stock Funds | | | 14.9 | % |

| Short-Term Investments | | | 13.4 | % |

| Stock Funds | | | 54.0 | % |

| Net Other Assets and Liabilities | | | (10.5 | )% |

| TOP TEN HOLDINGS AS A PERCENTAGE OF NET ASSETS AS OF 10/31/23 | | |

| Madison Investors Fund | | | 16.2 | % |

| Distillate U.S. Fundamental Stability & Value ETF | | | 10.0 | % |

| Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Quality ETF | | | 9.9 | % |

| iShares Treasury Floating Rate Bond ETF | | | 9.2 | % |

| Madison Core Bond Fund | | | 8.5 | % |

| Vanguard Information Technology ETF | | | 8.1 | % |

| Vanguard FTSE All-World ex-U.S. ETF | | | 5.0 | % |

| Energy Select Sector SPDR Fund ETF | | | 4.8 | % |

| Franklin FTSE Japan ETF | | | 4.2 | % |

| iShares 7-10 Year Treasury Bonf ETF | | | 3.9 | % |

Diversified Income Fund

INVESTMENT STRATEGY HIGHLIGHTS

On July 31, 2023, the Madison Diversified Income Fund transitioned from a fund that invests in individual stocks and bonds to a fund that invests primarily in shares of other registered investment companies, including those whose shares trade on a stock exchange (exchange traded funds or “ETFs”). In connection with this change, the Fund’s day-to-day portfolio management team and principal investment strategies changed, but the Fund’s investment objective will remain the same. As of the same date, the investment management fee was reduced from 0.65% to 0.20%; however, the Fund's total annual fund operating expenses remained the same.

Under normal circumstances, the Fund’s total net assets will be allocated among various asset classes and underlying funds, including those whose shares trade on a stock exchange (exchange traded funds or “ETFs”), with target allocations over time of approximately 60% equity investments and 40% fixed income investments. Underlying funds in which the Fund invests may include funds advised by Madison and/or its affiliates, including other Madison Funds and ETFs. Generally, Madison will not invest more than 80% of the Fund’s net assets, at the time of purchase, in affiliated underlying funds.

PERFORMANCE DISCUSSION

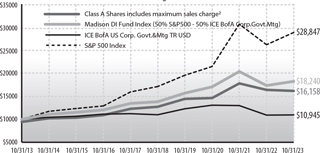

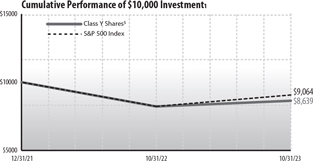

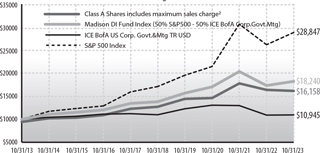

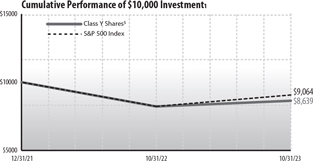

Cumulative Performance of $10,000 Investment1

Class A Shares initial amount invested was $9,425 to reflect deduction of maximum sales charge of 5.75%

Average Annual Total Return through October 31, 20231

| | | % Return Without Sales Charge | | % Return After Sales Charge |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

| Class A | | | -1.35 | % | | | 3.41 | % | | | 4.92 | % | | | 5.54 | % | | | -7.03 | % | | | 1.38 | % | | | 3.69 | % | | | 4.91 | % |

| Class C | | | -2.14 | % | | | 2.61 | % | | | 4.15 | % | | | 4.75 | % | | | -3.05 | % | | | 2.61 | % | | | 4.15 | % | | | 4.75 | % |

| Custom Blended Index (50% Fixed 50% Equity) | | | 5.29 | % | | | 2.29 | % | | | 5.73 | % | | | 6.19 | % | | | NA | | | | NA | | | | NA | | | | NA | |

| ICE BofA US Corp. Govt. & Mtg. Index | | | 0.38 | % | | | -5.71 | % | | | -0.07 | % | | | 0.91 | % | | | NA | | | | NA | | | | NA | | | | NA | |

| S&P 500® Index | | | 10.14 | % | | | 10.36 | % | | | 11.01 | % | | | 11.18 | % | | | NA | | | | NA | | | | NA | | | | NA | |

The Madison Diversified Income Fund (Class A at NAV) returned -1.35% for the one-year period, underperforming its blended benchmark index (50% Bank of America Merrill Lynch U.S. Corporate, Government and Mortgage Index and 50% S&P 500® Index) which returned 5.29%. The Fund underperformed its peers as measured by the Morningstar Moderate Allocation category, which returned 4.21%.

It was a difficult period for dividend stocks. Prior to the significant rise in interest rates over the past two plus years, rates had spent the time since the end of the Great Financial Crisis of 2008 grinding down to almost zero. This had the perverse effect of sending traditional yield-based investors running to stocks from bonds to grab income via dividends. After enjoying a strong run, the relative valuation differential between dividend paying stocks and fixed income assets (bonds) is no longer favorable for dividend payers. This deterioration of relative valuation weighed on dividend stocks over the course of the past year and pressured the fund’s performance.

The silver lining in the bear market in bonds is that we are now back to some semblance of normalcy in the fixed income markets. Yield-seeking investors can once again find reasonable yields in traditional low-risk bond investments. In turn, during the period we took the opportunity to reallocate a sizable percentage of the stock overweight that has existed, and greatly benefited the fund’s return over the past several years, to the newfound amply yielding bond market.

Another notable change was the introduction of a covered call strategy to augment our high-quality dividend paying stocks. This addition provides the potential for dual positive impacts of materially increasing the fund’s overall yield and is likely to help mitigate volatility should the more challenging market and economic environment we envision come to fruition.

Unfortunately, we expect volatility to stick around. To us, the weight of the evidence is too great in favor of an economy slow-rolling into recession. Most measures point to the exhaustion, or near exhaustion, of the excess savings provided by the massive stimulus payments of years past. At the same time, credit card debt has risen dramatically, and student loan payments must be made once again. With a stressed consumer, we find it unlikely that companies will be able to grow revenues to the degree necessary to

Madison Funds | Management’s Discussion of Fund Performance - continued | October 31, 2023

justify today’s lofty earnings estimates for the year ahead. Yet, equities remain priced at a premium, with the S&P 500 forward price-to-earnings ratio still hovering at nearly 18x, roughly two full multiple points above the 30-year average. In short, we don’t see value in the broad US stock market. That said, we still see value in the energy and commodities sectors where underinvestment provides continued opportunity in these now free cash flow rich companies.

The story is much different within bonds. On an absolute level, yields haven’t been this attractive in decades. Prior to the pandemic, investors were forced to reach for yield by sacrificing credit quality for any hint of yield. The move higher in interest rates offers an opportunity to allocate to sectors of the fixed income market that carry attractive yields without having to sacrifice credit quality. We believe one of the most attractive areas within fixed income can be found in the securitized sector, specifically Agency and non-Agency mortgage-backed securities. Mortgages offer the inherent credit quality of the US Government while simultaneously providing additional yield compared to duration equivalent Treasuries.

| PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 10/31/23 |

| Asset Backed Securities | | | 0.1 | % |

| Collateralized Mortgage Obligations* | | | 0.0 | % |

| Common Stocks | | | 2.9 | % |

| Investment Companies | | | 96.6 | % |

| Mortgage Backed Securities* | | | 0.0 | % |

| Short-Term Investments | | | 2.1 | % |

| Net Other Assets and Liabilities | | | (1.7 | )% |

*less than 0.05%

| TOP TEN HOLDINGS AS A PERCENTAGE OF NET ASSETS AS OF 10/31/23 |

| Madison Covered Call ETF | | | 25.5 | % |

| Madison Dividend Value ETF | | | 19.5 | % |

| Madison Short-Term Strategic Income ETF | | | 19.2 | % |

| Madison Aggregate Bond ETF | | | 15.2 | % |

| Janus Henderson Mortgage-Backed Securities ETF | | | 9.9 | % |

| iShares Aaa - A Rated Corporate Bond ETF | | | 6.4 | % |

| Global X MLP ETF | | | 1.0 | % |

| CME Group, Inc. | | | 0.2 | % |

| EOG Resources, Inc. | | | 0.2 | % |

| Comcast Corp., Class A | | | 0.2 | % |

Madison Tax-Free Virginia Fund

INVESTMENT STRATEGY HIGHLIGHTS

The Madison Tax-Free Virginia Fund seeks to achieve its investment objectives by investing at least 80% of its net assets in municipal bonds that are exempt from federal and state income tax for residents of Virginia. These securities may be issued by state governments, their political subdivisions (for example, cities and counties) and public authorities (for example, school districts and housing authorities). The Fund may also invest in bonds that, under federal law, are exempt from federal and state income taxation, such as bonds issued by the District of Columbia, Puerto Rico, the Virgin Islands and Guam. The Fund invests in intermediate and long-term bonds having average, aggregate maturities (at the portfolio level) of 7 to 15 years.

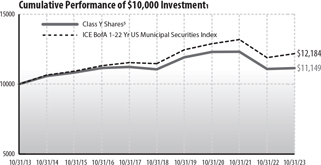

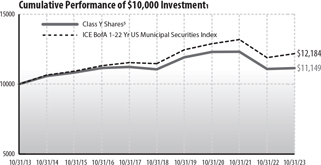

PERFORMANCE DISCUSSION

Average Annual Total Return through October 31, 20231

| | | % Return Without Sales Charge | | | |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | |

| Class Y | | | 0.56 | % | | | -3.24 | % | | | 0.16 | % | | | 1.09 | % | |

| ICE BofA 1-22 Yr US Municipal Securities Index | | | 2.39 | % | | | -1.87 | % | | | 1.22 | % | | | 1.99 | % | |

The Madison Tax-Free Virginia Fund (Class Y) returned 0.56% for the one-year period, underperforming its benchmark, the ICE BofA 1-22 Yr US Municipal Securities Index which returned 2.39%. The Fund underperformed its peers as measured by the Morningstar Municipal Single State Intermediate category, which returned 0.88% for the period.

The Fund’s relative performance is attributable to yield curve positioning, sector allocation, coupon structure and the overall credit profile of the individual holdings. The Fund has consistently been positioned with a shorter overall maturity structure than the index which was additive to performance except for the fourth quarter of 2022 when the market posted a large positive return. Coupon structure was detractive to performance as interest rates increased due to high inflation data and the Federal Reserve’s tightening cycle to contain it. Specifically, municipal bonds with 3% and 4% coupon rates traded at a discount to par which accelerated book losses due to the Di Minimis tax rule which treats the discount accretion as ordinary income. This was the main driver for the underperformance in the Fund. In addition, the Fund’s “up in quality” bias was detractive to performance as lower quality bonds enhanced overall yield and benefited from tightening spreads leading to price appreciation.

Yield curve positioning was detractive to performance as the combination of lower coupon longer maturity bonds underperformed in a rising rate environment. In addition, the Fund under yielded the benchmark throughout the timeframe as state-specific Virginia bonds inherently yield less than the general market index.

Credit quality in the municipal bond market continued to be a bright spot in the midst of rising interest rates. The unexpectedly resilient economy has bolstered tax revenues with many states reporting record “rainy day” fund balances to offset leaner times that are sure to come at some point in the business cycle. Outside of the health care and higher education sectors, most municipal finances seem to be in pretty good shape. However, we will keep a close eye on any slowing economic trends and the increased borrowing costs that could lead to tighter state and local budgets. Specific to Viginia, the commonwealth continues to garner a top-tier AAA rating by all the independent rating agencies and enjoys a strong and diverse economy.

The outlook for the municipal bond market seems to be trending in a positive direction. Although we were surprised by the upside volatility in interest rates over the summer months of 2023, we believe that most of the interest rate increases are in the rearview mirror. Inflation has come down considerably and the labor market, although very

Madison Funds | Management’s Discussion of Fund Performance - continued | October 31, 2023

strong, is showing signs of moving lower. Generationally high borrowing rates and a broad lending pullback are typical signs of a slowing economy. Municipal bonds typically outperform corporates in a slowing economy as tax revenues and essential service fees are more predictable streams of revenue than pullbacks in consumer spending.

In general, we believe it is prudent to be conservatively positioned in a volatile interest rate environment. We are cognizant of the fact that when the Fed pivots, rates will move lower rather quickly but “the higher for longer” mantra will provide windows of opportunity to add longer maturities and lock in higher yields as economic conditions evolve.

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 10/31/23 |

| Airport | | | 3.7 | % |

| Development | | | 11.2 | % |

| Education | | | 8.2 | % |

| Facilities | | | 9.9 | % |

| General Obligation | | | 40.0 | % |

| Medical | | | 1.6 | % |

| Multifamily Housing | | | 1.0 | % |

| Power | | | 4.8 | % |

| Transportation | | | 9.9 | % |

| Water | | | 8.1 | % |

| Net Other Assets and Liabilities | | | 1.6 | % |

| TOP TEN HOLDINGS AS A PERCENTAGE OF NET ASSETS AS OF 10/31/23 |

| Northern Virginia Transportation Authority, 5.0%, 6/1/30 | | | 4.7 | % |

| Arlington County, 5.0%, 8/15/30 | | | 3.7 | % |

| James City County Economic Development Authority, 5.0%, 6/15/30 | | | 3.2 | % |

| Metropolitan Washington Airports Authority Aviation Revenue, 5.0%, 10/1/43 | | | 2.9 | % |

| Norfolk, 5.0%, 8/1/47 | | | 2.9 | % |

| Hampton Roads Transportation Accountability Commission, 5.0%, 7/1/42 | | | 2.9 | % |

| Loudoun County Economic Development Authority, 4.0%, 12/1/37 | | | 2.8 | % |

| Greater Richmond Convention Center Authority, 5.0%, 6/15/26 | | | 2.8 | % |

| Poquoson, 4.0%, 2/15/29 | | | 2.6 | % |

| Hampton Roads Sanitation District, 5.0%, 10/1/35 | | | 2.6 | % |

Madison Tax-Free National Fund

INVESTMENT STRATEGY HIGHLIGHTS

The Madison Tax-Free National Fund seeks to achieve its investment objective by investing at least 80% of its net assets in municipal bonds that are exempt from federal income taxes. These securities may be issued by state governments, their political subdivisions (for example, cities and counties) and public authorities (for example, school districts and housing authorities). The Fund may also invest in bonds that, under federal law, are exempt from federal and state income taxation, such as bonds issued by the District of Columbia, Puerto Rico, the Virgin Islands and Guam. The Fund invests in intermediate and long-term bonds having average, aggregate maturities (at the portfolio level) of 7 to 15 years. The primary difference between this Fund and the Madison Tax-Free Virginia Fund is that the Madison Tax-Free Virginia Fund will invest in bonds that are exempt from federal and state income tax for residents of Virginia, while this Fund will invest in bonds that are exempt from federal income tax.

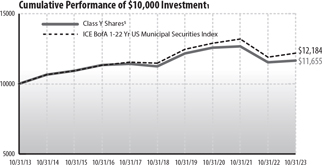

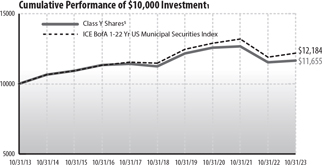

PERFORMANCE DISCUSSION

Average Annual Total Return through October 31, 20231

| | | % Return Without Sales Charge | | |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

| Class Y | | | 1.06 | % | | | -2.50 | % | | | 0.72 | % | | | 1.54 | % |

| ICE BofA 1-22 Yr US Municipal Securities Index | | | 2.39 | % | | | -1.87 | % | | | 1.22 | % | | | 1.99 | % |

The Madison Tax-Free National Fund (Class Y) returned 1.06% for the one-year period, underperforming its benchmark, the ICE BofA 1-22 Yr US Municipal Securities Index which returned 2.39%. The Fund underperformed its peers as measured by the Morningstar Municipal National Intermediate category, which returned 2.41%.

The Fund’s relative performance is attributable to yield curve positioning, sector allocation, coupon structure and the overall credit profile of the individual holdings. The Fund has consistently been positioned with a shorter overall maturity structure than the index which was additive to performance except for the fourth quarter of 2022 when the market posted a large positive return. Coupon structure was detractive to performance as interest rates increased due to high inflation data and the Federal Reserve’s tightening cycle to contain it. Specifically, municipal bonds with 3% and 4% coupon rates traded at a discount to par which accelerated book losses due to the Di Minimis tax rule which treats the discount accretion as ordinary income. In addition, the Fund’s “up in quality” bias was detractive to performance as lower quality bonds enhanced overall yield and benefited from tightening spreads leading to price appreciation.

Yield curve positioning was neutral to performance as the uncharacteristically flat municipal yield curve, and at times, inverted curve provided outsized income in the shorter tenors of the curve versus duration risk with little or no additional yield for longer maturities. Finally, even with a relatively shorter duration posture versus the index, the Fund was able to capture a similar portfolio yield as the benchmark.

Credit quality in the municipal bond market continued to be a bright spot in the midst of rising interest rates. The unexpectedly resilient economy has bolstered tax revenues with many states reporting record “rainy day” fund balances to offset leaner times that are sure to come at some point in the business cycle. Outside of the health care and higher education sectors, most municipal finances seem to be in pretty good shape. However, we will keep a close eye on any slowing economic trends and the increased borrowing costs that could lead to tighter state and local budgets.

Madison Funds | Management’s Discussion of Fund Performance - continued | October 31, 2023

The outlook for the municipal bond market seems to be trending in a positive direction. Although we were surprised by the upside volatility in interest rates over the summer months of 2023, we believe that most of the interest rate increases are in the rearview mirror. Inflation has come down considerably and the labor market, although very strong, is showing signs of moving lower. Generationally high borrowing rates and a broad lending pullback are typical signs of a slowing economy. Municipal bonds typically outperform corporates in a slowing economy as tax revenues and essential service fees are more predictable streams of revenue than pullbacks in consumer spending.

In general, we believe it is prudent to be conservatively positioned in a volatile interest rate environment. We are cognizant of the fact that when the Fed pivots, rates will move lower rather quickly but “the higher for longer” mantra will provide windows of opportunity to add longer maturities and lock in higher yields as economic conditions evolve.

| STATE ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 10/31/23 |

| Alabama | | | 5.6 | % |

| Arkansas | | | 1.0 | % |

| California | | | 0.7 | % |

| Colorado | | | 3.8 | % |

| Florida | | | 2.1 | % |

| Georgia | | | 2.4 | % |

| Hawaii | | | 2.6 | % |

| Idaho | | | 2.9 | % |

| Illinois | | | 10.7 | % |

| Indiana | | | 6.2 | % |

| Kansas | | | 1.3 | % |

| Kentucky | | | 2.6 | % |

| Louisiana | | | 0.9 | % |

| Michigan | | | 3.2 | % |

| Mississippi | | | 2.9 | % |

| Montana | | | 1.8 | % |

| Nebraska | | | 1.7 | % |

| New Jersey | | | 4.0 | % |

| New Mexico | | | 1.1 | % |

| New York | | | 3.9 | % |

| Oklahoma | | | 4.0 | % |

| Pennsylvania | | | 5.6 | % |

| Texas | | | 6.8 | % |

| Utah | | | 3.2 | % |

| Virginia | | | 6.1 | % |

| Washington | | | 1.2 | % |

| West Virginia | | | 2.7 | % |

| Wisconsin | | | 7.2 | % |

| Net Other Assets and Liabilities | | | 1.8 | % |

| TOP TEN HOLDINGS AS A PERCENTAGE OF NET ASSETS AS OF 10/31/23 |

| Mobile County, 5.0%, 2/1/39 | | | 3.7 | % |

| Cook County School District No. 111 Burbank, 5.0%, 12/1/35 | | | 3.3 | % |

| Austin, 5.0%, 9/1/26 | | | 3.3 | % |

| City of Burlington WI, 4.0%, 4/1/36 | | | 3.2 | % |

| Vanderburgh County Redevelopment District, Tax Allocation, 5.0%, 2/1/26 | | | 3.0 | % |

| Idaho Health Facilities Authority, 5.0%, 3/1/34 | | | 2.9 | % |

| Medical Center Educational Building Corp., 5.0%, 6/1/30 | | | 2.9 | % |

| Southampton County Industrial Development Authority, 5.0%, 6/1/35 | | | 2.7 | % |

| West Virginia Economic Development Authority, 5.0%, 7/1/37 | | | 2.7 | % |

| Du Page County School District No. 45, 4.0%, 1/1/26 | | | 2.7 | % |

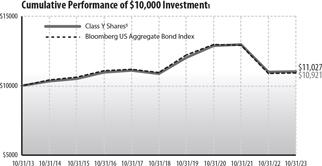

High Quality Bond Fund

INVESTMENT STRATEGY HIGHLIGHTS

The Madison High Quality Bond Fund seeks to achieve its investment objective through diversified investments in a broad range of corporate debt securities, obligations of the US Government and its agencies, and money market instruments. In seeking to achieve the Fund’s goals, the Fund’s management will (1) shorten or lengthen the dollar weighted average maturity of the Fund based on its anticipation of the movement of interest rates (the dollar weighted average maturity is expected to be ten years or less), and (2) monitor the yields of the various bonds that satisfy the Fund’s investment guidelines to determine the best combination of yield, credit risk and diversification for the Fund. Under normal market conditions, the Fund will invest at least 80% of its net assets in higher quality bond issues and, therefore, intends to maintain an overall portfolio quality rating of A by Standard & Poor’s and/or A2 by Moody’s.

PERFORMANCE DISCUSSION

Average Annual Total Return through October 31, 20231

| | | % Return Without Sales Charge | | |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | | Since

Inception

02/28/2022 |

| Class Y | | | 1.92 | % | | | -2.83 | % | | | 0.33 | % | | | 0.46 | % | | | - | |

| Class I | | | 2.00 | % | | | - | | | | - | | | | - | | | | -4.56 | % |

| Bloomberg US Intermediate Gov’t Credit A+ Bond Index | | | 1.83 | % | | | -3.09 | % | | | 0.78 | % | | | 0.95 | % | | | -6.05 | % |

Madison Funds | Management’s Discussion of Fund Performance - continued | October 31, 2023

The Madison High Quality Bond Fund (Class Y) returned 1.92% for the one-year period, outperforming its benchmark, the Bloomberg US Intermediate Government/Credit A+ Bond Index, which returned 1.83%. The Fund underperformed its peers as measured by the Morningstar Short-Term Bond category, which returned 3.90%.

The past 12 months provided little respite for the bond investors. After a challenging first half featuring a volatile rate environment and credit concerns in the financial sector, the fiscal year closed out with a rapid move to yield levels not seen in over fifteen years providing few places to hide. Though this has been a truly challenging period for fixed income investors, the welcomed silver lining may be how the current environment sets up for favorable bond returns going forward now that the ‘income’ component has at long last returned to the fixed income markets.

The Fed Remains Engaged

The Fed (Federal Reserve) stayed true to their word and reiterated that their restrictive policy stance would remain in place until significant headway is made lowering inflationary pressures. Interest rates marched higher as economic data releases remained surprisingly strong in the face of meaningfully higher mortgage rates, rising energy costs, and faltering consumer confidence. As we begin the final months of 2023, we are likely approaching the end of a historic, nearly two-year, monetary tightening campaign yet lower interest rates may still be some time away.

The Fed met twice, in July and September, and raised the Fed Funds Rate by 25 bps at the July meeting and then paused at the September meeting, perhaps marking the final rate hike in this cycle. The ‘pause’ marks a change in the Fed’s policy normalization campaign, acknowledging that the final hikes may be at hand. Interestingly, both the formal policy statement and subsequent speeches stressed that additional hikes are possible and rate cuts remain a distant possibility, strongly reiterating the ‘higher for longer’ message.

Importantly, Fed members indicated that fewer interest rate cuts will be needed in 2024 and 2025. The policy rate is expected to be 5.125% at the end of 2024 and 3.875% at the end of 2025, both 0.50% higher than what was expected in June. This shift in expectations by the Fed helped push intermediate and long bond yields higher testing levels not seen for nearly a decade.

Focus Remains on Fundamentals

The Fed’s top priority remains inflation, and while progress has been achieved the Fed’s desired target of 2% remains a distant goal. The latest reading on the Core US Personal Consumption Expenditure Pricing Index fell to 3.9%, slightly lower than the last reading of 4.3%. Clearly, some progress has been made on the inflation front but not enough to satisfy Fed members. The US economy has remained surprising strong despite higher interest rates, rising energy prices, and falling consumer savings rates. Stable labor markets and resilient consumers give the Fed additional runway to maintain restrictive monetary policy while battling inflation pressures.

A clear risk to the Fed’s policy outlook would be sharp declines in economic growth while inflation pressures persist. Resultingly, economic data will remain scrutinized as the lagged impact of Fed rate hikes work through the system. While we are skeptical of the Fed’s ability to navigate a ‘soft landing’ we do expect growth to gradually decline as consumers feel the impact of higher interest rates and price levels. As investors embrace the possibility of an economic ‘soft landing,’ risk-based market indicators including credit spreads have performed well. Lower probability of a recession translates in reduced corporate bond credit spreads. Lower quality sectors such as high yield and BBB-rated corporate bonds have performed the best relative to Treasuries so far this year.

Performance and Positioning

In response to the Fed’s continued rate tightening campaign, yields moved higher over the period. However, those same higher yield contributed meaningful yield to total returns helping provide welcome positive returns over the period. During the fiscal year ended October 31, 2023, the Madison High Quality Bond Fund outperformed the benchmark by 29 basis points, returning 2.12% (gross of fees) versus the Bloomberg US Intermediate Government/Credit A+ Bond Index return of 1.83%.

Conservative duration positioning was additive to returns to performance over the course of the period as interest rates moved sharply higher in response to the Fed’s continued tightening campaign in the face of stubborn inflation measures. Sector/quality was additive to performance during the period as credit spreads narrowed following the financial sector concerns easing mid-year. Portfolio yield/income proved to be slightly additive to performance as higher yields contributed positively to performance. The meaningful flattening in the yield curve detracted slightly from performance as yields on shorter maturities rose more than yields on longer maturities. Security selection detracted slightly for returns as risk premiums on high quality names narrowed slightly less than lower quality issues and the portfolio maintained its high-quality bias.

Our conservative approach to portfolio construction remains in place while we look for opportunities to extend portfolio maturities. Conservative duration positioning continues to contribute positive relative performance as interest rates adjust higher. Higher market yields have allowed the strategy to add meaningful long-term yield and we anticipate being able to continue adding to these positions in the months ahead. The past 12 months continues to reinforce the need for portfolio diversification and has rewarded those who have maintained exposure to high quality fixed income within their overall portfolio allocation. With meaningful yield returning to fixed income assets, we are optimistic about the future prospects for bond investors.

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 10/31/23 |

| Communication Services | | | 2.6 | % |

| Consumer Discretionary | | | 1.9 | % |

| Consumer Staples | | | 5.6 | % |

| Fannie Mae | | | 10.1 | % |

| Financials | | | 20.1 | % |

| Health Care | | | 1.3 | % |

| Industrials | | | 3.5 | % |

| Information Technology | | | 1.3 | % |

| Short-Term Investments | | | 5.3 | % |

| U.S. Treasury Notes | | | 50.8 | % |

| Utilities | | | 0.8 | % |

| Net Other Assets and Liabilities | | | (3.3 | )% |

| TOP TEN HOLDINGS AS A PERCENTAGE OF NET ASSETS AS OF 10/31/23 |

| Federal National Mortgage Association, 2.125%, 4/24/26 | | | 4.4 | % |

| Federal National Mortgage Association, 0.750%, 10/8/27 | | | 3.2 | % |

| U.S. Treasury Notes, 2.250%, 11/15/24 | | | 3.2 | % |

| U.S. Treasury Notes, 2.125%, 5/15/25 | | | 3.1 | % |

| U.S. Treasury Notes, 3.875%, 11/30/29 | | | 3.1 | % |

| U.S. Treasury Notes, 3.875%, 12/31/29 | | | 3.1 | % |

| U.S. Treasury Notes, 1.625%, 5/15/26 | | | 3.0 | % |

| U.S. Treasury Notes, 1.500%, 8/15/26 | | | 3.0 | % |

| U.S. Treasury Notes, 2.250%, 11/15/27 | | | 3.0 | % |

| U.S. Treasury Notes, 2.375%, 8/15/24 | | | 2.7 | % |

Madison Funds | Management’s Discussion of Fund Performance - continued | October 31, 2023

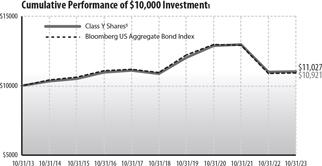

Core Bond Fund

INVESTMENT STRATEGY HIGHLIGHTS

Under normal market conditions, the Madison Core Bond Fund invests at least 80% of its net assets in bonds. To keep current income relatively stable and to limit share price volatility, the Fund emphasizes investment grade securities and maintains an intermediate (typically 3-7 year) average portfolio duration, with the goal of being between 85-115% of the market benchmark duration. The Fund strives to add incremental return to the portfolio by making strategic decisions related to credit risk, sector exposure and yield curve positioning. The Fund may invest in corporate debt securities, US Government debt securities, foreign government debt securities, non-rated debt securities, and asset-backed, mortgage-backed, and commercial mortgage-backed securities.

PERFORMANCE DISCUSSION

Average Annual Total Return through October 31, 20231

| | | | % Return Without Sales Charge | | | | % Return After Sales Charge | |

| | | | | | | | | | | | | | | | | | | | Since

Inception | | | | Since

Inception | | | | | | | | | | | | | | | | | |

| | | | 1 Year | | | | 3 Years | | | | 5 Years | | | | 10 Years | | | | 2/26/2021 | | | | 2/28/2022 | | | | 1 Year | | | | 3 Years | | | | 5 Years | | | | 10 Years | |

| Class A | | | 0.07 | % | | | -5.36 | % | | | 0.02 | % | | | 0.71 | % | | | - | | | | - | | | | -4.46 | % | | | -6.81 | % | | | -0.90 | % | | | 0.25 | % |

| Class Y | | | 0.32 | % | | | -5.04 | % | | | 0.31 | % | | | 0.98 | % | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Class I | | | 0.42 | % | | | - | | | | - | | | | - | | | | -5.51 | % | | | - | | | | - | | | | - | | | | - | | | | - | |

| Class R6 | | | 0.50 | % | | | - | | | | - | | | | - | | | | - | | | | -11.78 | % | | | - | | | | - | | | | - | | | | - | |

| Bloomberg US Aggregate Bond Index | | | 0.36 | % | | | -5.57 | % | | | -0.06 | % | | | 0.88 | % | | | -5.87 | % | | | -12.58 | % | | | NA | | | | NA | | | | NA | | | | NA | |

The Madison Core Bond Fund (Class Y) returned 0.32% for the one-year period, underperforming its benchmark, the Bloomberg US Aggregate Bond Index, which returned 0.36%. The Fund underperformed its peers as measured by the Morningstar Intermediate Core Bond category, which returned 0.43%.

The primary drivers of fund performance versus the benchmark was overweight to higher coupon agency mortgage-backed securities and an overweight to asset-backed securities. Performance was also positively impacted by a yield advantage over the benchmark which averaged 25 basis points (bps) during the last year. The yield advantage has increased over the past year given the additional non-Treasury allocations and steepening of the yield curve.

Looking at the securitized sector, the Fund owned fewer low coupon agency mortgage-backed securities which benefited performance. Mortgages underperformed other sectors due to the impact from the Federal Reserve’s (Fed) quantitative tightening program and banks reducing purchases given liquidity concerns. Additionally, higher interest rate volatility pressured mortgage spreads throughout the last year. The Fund added to its asset-backed securities holdings as valuations improved given concerns about the health of the consumer.

Finally, the Fund's performance was helped by having relatively less duration within the 20 and 30-year part of the yield curve versus the benchmark. Since October 2022, the yield curve has steepened with the two-year, ten-year, and thirty-year Treasury yields increased 61, 88 and 93 basis points, respectively.

In the coming year, the Fund will continue to reduce exposure in corporate bonds given the uncertain economic outlook. The Fund will also continue to allocate towards agency mortgage-backed securities given attractive valuations and will further shift its corporate bond exposure into financials versus industrials given better relative valuations.

| PORTFOLIO ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 10/31/23 |

| Asset Backed Securities | | | 6.1 | % |

| Collateralized Mortgage Obligations | | | 5.2 | % |

| Commercial Mortgage-Backed Securities | | | 3.1 | % |

| Corporate Notes and Bonds | | | 28.0 | % |

| Foreign Corporate Bonds | | | 3.2 | % |

| Mortgage Backed Securities | | | 29.0 | % |

| Short-Term Investments | | | 1.6 | % |

| U.S. Government and Agency Obligations | | | 24.0 | % |

| Net Other Assets and Liabilities | | | (0.2 | )% |

| TOP TEN HOLDINGS AS A PERCENTAGE OF NET ASSETS AS OF 10/31/23 | | |

| U.S. Treasury Notes, 2.875%, 5/15/28 | | | 3.0 | % |

| U.S. Treasury Notes, 2.250%, 11/15/25 | | | 2.7 | % |

| U.S. Treasury Notes, 2.625%, 2/15/29 | | | 2.7 | % |

| U.S. Treasury Notes, 2.375%, 5/15/27 | | | 2.5 | % |

| U.S. Treasury Notes, 4.0%, 2/29/28 | | | 2.4 | % |

| U.S. Treasury Bonds, 3.750%, 8/15/41 | | | 1.9 | % |

| Federal Home Loan Mortgage Corp., 2.500%, 1/1/52 | | | 1.6 | % |

| U.S. Treasury Bonds, 2.250%, 5/15/41 | | | 1.5 | % |

| U.S. Treasury Notes, 3.875%, 11/30/29 | | | 1.2 | % |

| U.S. Treasury Bonds, 6.625%, 2/15/27 | | | 1.2 | % |

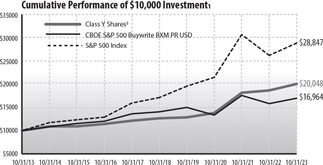

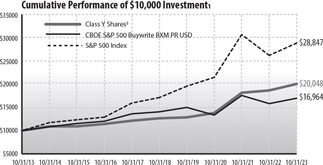

Madison Covered Call & Equity Income Fund

INVESTMENT STRATEGY HIGHLIGHTS

The Madison Covered Call & Equity Income Fund invests, under normal market conditions, primarily in common stocks of large- and mid-capitalization companies that are, in the view of the Fund’s investment adviser, selling at a reasonable price in relation to their long-term earnings growth rates. The portfolio managers will allocate the Fund’s assets among stocks in sectors of the economy based upon their views on forward earnings growth rates, adjusted to reflect their views on economic and market conditions and sector risk factors. The Fund will seek to generate current earnings from option premiums by writing (selling) covered call options on a substantial portion of its portfolio securities. The extent of option writing activity will depend upon market conditions and the portfolio managers’ ongoing assessment of the attractiveness of writing call options on the Fund’s stock holdings. In addition to providing income, covered call writing helps to reduce the volatility (and risk profile) of the Fund by providing downside protection.

Madison Funds | Management’s Discussion of Fund Performance - continued | October 31, 2023

PERFORMANCE DISCUSSION

Average Annual Total Return through October 31, 20231

| | | % Return Without Sales Charge | | % Return After Sales Charge |

| | | 1

Year | | 3

Years | | 5

Years | | 10 Years | | Since

Inception

02/28/2022 | | 1

Year | | 3

Years | | 5

Years | | 10

Years |

| Class A | | | 7.18 | % | | | 12.96 | % | | | 9.39 | % | | | 6.94 | % | | | - | | | | 1.03 | % | | | 10.73 | % | | | 8.10 | % | | | 6.31 | % |

| Class C | | | 6.41 | % | | | 12.18 | % | | | 8.61 | % | | | 6.16 | % | | | - | | | | 5.43 | % | | | 12.18 | % | | | 8.61 | % | | | 6.16 | % |

| Class Y | | | 7.49 | % | | | 13.27 | % | | | 9.65 | % | | | 7.20 | % | | | - | | | | - | | | | - | | | | - | | | | - | |

| Class R6 | | | 7.71 | % | | | 13.43 | % | | | 9.82 | % | | | 7.36 | % | | | - | | | | - | | | | - | | | | - | | | | - | |

| Class I | | | 7.61 | % | | | - | | | | - | | | | - | | | | 10.00 | % | | | - | | | | - | | | | - | | | | - | |

| S&P 500® Index | | | 10.14 | % | | | 10.36 | % | | | 11.01 | % | | | 11.18 | % | | | -1.46 | % | | | NA | | | | NA | | | | NA | | | | NA | |

| CBOE S&P 500 BuyWrite Index | | | 7.27 | % | | | 8.30 | % | | | 3.85 | % | | | 5.43 | % | | | -2.44 | % | | | NA | | | | NA | | | | NA | | | | NA | |

Madison Covered Call & Equity Income Fund (Class Y) returned 7.49% for the one-year period, underperforming its benchmark the S&P 500® return of 10.14% and outperforming its benchmark the CBOE S&P 500 BuyWrite Index of 7.27%. The Fund outperformed its peers as measured by the Morningstar Derivative Income category, which returned 7.08%.

Relative to the S&P 500, sector allocation was detractive, stock selection was neutral, and the impact of cash and the options overlay was additive to results. For sector allocation, an underweight position in Technology negatively impacted performance. In terms of stock selection, there were positive results in Energy, Consumer Discretionary, Financials and Materials, which was offset by weakness in Communication Services, Utilities, Health Care and Consumer Staples. Within Energy, deepwater oil drilling company Transocean (RIG) was the most additive stock in the portfolio, and oilfield services firm Baker Hughes (BKR) also outperformed. In Technology, software firm Adobe Systems (ADBE) and semiconductor manufacturer Analog Devices (ADI) contributed nicely to results. Another notable outperforming stock was casino company Las Vegas Sands (LVS) in Consumer Discretionary. In general, these stocks had improving underlying fundamentals that benefited their businesses. On the negative side, in Utilities, power generation and utility service provider AES (AES) was the most detractive stock in the portfolio. In Consumer Discretionary, payments provider PayPal (PYPL) and retailer Target (TGT) negatively impacted performance. Within Health Care, drug retailer and managed care company CVS Health (CVS) was an underperforming stock. Another notable underperforming stock was Lumen Technologies (LUMN) in Communication Services. In general, these stocks had weak earnings results and deterioration in their businesses.

| ALLOCATION AS A PERCENTAGE OF TOTAL INVESTMENTS AS OF 10/31/23 |

| Communication Services | | | 6.3 | % |

| Consumer Discretionary | | | 6.3 | % |

| Consumer Staples | | | 9.9 | % |

| Energy | | | 8.1 | % |

| Equity Real Estate Investment Trusts (REITs) | | | 2.9 | % |

| Exchange Traded Funds | | | 1.7 | % |

| Financials | | | 8.0 | % |

| Health Care | | | 14.1 | % |

| Industrials | | | 3.2 | % |

| Information Technology | | | 4.8 | % |

| Materials | | | 6.4 | % |

| Short-Term Investments | | | 23.8 | % |

| Utilities | | | 4.5 | % |

| TOP TEN EQUITY HOLDINGS AS A PERCENTAGE OF NET ASSETS AS OF 10/31/23 |

| Las Vegas Sands Corp. | | | 4.2 | % |

| Transocean Ltd. | | | 3.3 | % |

| American Tower Corp. | | | 2.9 | % |

| APA Corp. | | | 2.7 | % |

| Barrick Gold Corp. | | | 2.5 | % |

| Medtronic PLC | | | 2.5 | % |

| Elevance Health, Inc. | | | 2.4 | % |

| AES Corp. | | | 2.4 | % |

| BlackRock, Inc. | | | 2.3 | % |

| Abbott Laboratories | | | 2.2 | % |

Dividend Income Fund

INVESTMENT STRATEGY HIGHLIGHTS

The Madison Dividend Income Fund invests in equity securities of companies with a market capitalization of over $1 billion and a history of paying dividends, with the ability to increase dividends over time. Under normal market conditions, at least 80% of the Fund’s net assets will be invested in dividend paying equity securities. The Fund typically owns 30-60 securities which generally have a dividend yield of at least the S&P 500 ® Index’s average yield, a strong balance sheet, a dividend that has been maintained and likely to increase and trades at a high relative dividend yield due to issues viewed by the adviser as temporary, among other characteristics.

PERFORMANCE DISCUSSION

Average Annual Total Return through October 31, 20231

| | | % Return Without Sales Charge | | % Return After Sales Charge |

| | | 1

Year | | 3

Years | | 5

Years | | 10

Years | | Since

Inception

05/29/2020 | | Since

Inception

08/31/2020 | | Since

Inception

02/28/2022 | | 1

Year | | 3

Years | | 5

Years | | 10

Years | | Since

Inception

05/29/2020 |

| Class A | | | -5.23 | % | | | 6.35 | % | | | - | | | | - | | | | 6.92 | % | | | - | | | | - | | | | -10.70 | % | | | 4.27 | % | | | - | | | | - | | | | 5.08 | % |

| Class Y | | | -4.99 | % | | | 6.61 | % | | | 6.64 | % | | | 8.16 | % | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Class I | | | -4.90 | % | | | - | | | | - | | | | - | | | | - | | | | 5.15 | % | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Class R6 | | | -4.82 | % | | | - | | | | - | | | | - | | | | - | | | | - | | | | -8.87 | % | | | - | | | | - | | | | - | | | | - | | | | - | |

| S&P 500® Index | | | 10.14 | % | | | 10.36 | % | | | 11.01 | % | | | 11.18 | % | | | 11.57 | % | | | 7.53 | % | | | -1.46 | % | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | |

| Russell 1000® Value Index | | | 0.13 | % | | | 10.21 | % | | | 6.60 | % | | | 7.60 | % | | | 10.02 | % | | | 8.34 | % | | | -5.94 | % | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | |

| Lipper Equity Income Funds Index | | | 0.77 | % | | | 9.96 | % | | | 7.51 | % | | | 7.87 | % | | | 9.75 | % | | | 7.88 | % | | | -3.89 | % | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | |

Madison Funds | Management’s Discussion of Fund Performance - continued | October 31, 2023

The Madison Dividend Income Fund (Class Y) returned -4.99% for the one-year period, underperforming its benchmark, the S&P 500® Index, which returned 10.14%. The Fund underperformed its peers as measured by the Morningstar US Large Value category, which returned 0.75%.

Relative to the index, sector allocation and stock selection were detractive to results. For sector allocation, an underweight position in Technology and Communication Services negatively impacted performance. In terms of stock selection, there were positive results in Industrials and Energy, which was more than offset by weakness in Health Care, Technology, Utilities, Consumer Staples, and Consumer Discretionary. Within Financials, exchange operator CME Group (CME) was the most additive stock in the portfolio. In Communication Services, media conglomerate Comcast (CMCSA) contributed nicely to results. Within Energy, oilfield services firm Baker Hughes (BKR) was an outperforming stock. Other notable outperforming stocks were industrial distributor Fastenal (FAST) in Industrials and software and router maker Cisco Systems (CSCO) within Technology. In general, these stocks had improving underlying fundamentals that benefited their businesses. On the negative side, in Financials, regional bank US Bancorp (USB) was the most detractive stock in the portfolio. In Consumer Staples, agricultural processor Archer-Daniels-Midland negatively impacted performance. Within Health Care, pharmaceutical companies Bristol Myers-Squibb (BMY) and Pfizer (PFE) were underperforming stocks. Another notable underperforming stock was Utility firm NextEra Energy (NEE). In general, these stocks had weak earnings results and deterioration in their businesses. The fund continues to hold all stocks mentioned above.

| SECTOR ALLOCATION AS A PERCENTAGE OF NET ASSETS AS OF 10/31/23 |

| Communication Services | | | 3.6 | % |

| Consumer Discretionary | | | 8.8 | % |

| Consumer Staples | | | 9.5 | % |

| Energy | | | 14.5 | % |

| Equity Real Estate Investment Trusts (REITs) | | | 1.3 | % |

| Financials | | | 17.8 | % |

| Health Care | | | 12.8 | % |

| Industrials | | | 15.1 | % |

| Information Technology | | | 7.5 | % |

| Materials | | | 3.2 | % |

| Short-Term Investments | | | 2.4 | % |

| Utilities | | | 3.3 | % |

| Net Other Assets and Liabilities | | | 0.2 | % |

| TOP TEN HOLDINGS AS A PERCENTAGE OF NET ASSETS AS OF 10/31/23 |

| CME Group, Inc. | | | 4.1 | % |

| EOG Resources, Inc. | | | 4.1 | % |

| Fastenal Co. | | | 3.8 | % |

| Cisco Systems, Inc. | | | 3.8 | % |

| Baker Hughes Co. | | | 3.6 | % |

| Comcast Corp. | | | 3.6 | % |

| Johnson & Johnson | | | 3.4 | % |

| Home Depot, Inc. | | | 3.4 | % |

| Medtronic PLC | | | 3.3 | % |

| NextEra Energy, Inc. | | | 3.3 | % |

Investors Fund

INVESTMENT STRATEGY HIGHLIGHTS

The Madison Investors Fund invests primarily in the common stocks of established, high-quality growth companies selected via bottom-up fundamental analysis. The Fund typically owns 25-40 securities which have demonstrated stable revenue and earnings growth patterns, have high profitability metrics, and have maintained proportionately low levels of debt. A rigorous analytical process is followed when evaluating companies. The business model, the management team and the valuation of each potential investment are considered. Management strives to purchase securities trading at a discount to their intrinsic value as determined by discounted cash flows. Management corroborates this valuation work with additional valuation methodologies. The Fund typically sells a stock when the valuation target the portfolio managers have set for the stock has been exceeded, the fundamental business prospects for the company have materially changed, or the portfolio managers find a more attractive alternative.

PERFORMANCE DISCUSSION

Average Annual Total Return through October 31, 20231

| | | % Return Without Sales Charge | | % Return After Sales Charge |

| | | 1

Year | | 3

Years | | 5

Years | | 10

Years | | Since

Inception

09/23/2013 | | Since

Inception

08/31/2020 | | 1

Year | | 3

Years | | 5

Years | | 10

Years | | Since

Inception

09/23/2013 |

| Class A | | | 13.75 | % | | | 10.11 | % | | | 10.82 | % | | | 10.98 | % | | | 11.06 | % | | | - | | | | 7.22 | % | | | 7.96 | % | | | 9.51 | % | | | 10.32 | % | | | 10.41 | % |

| Class Y | | | 14.03 | % | | | 10.38 | % | | | 11.09 | % | | | 11.25 | % | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Class I | | | 14.17 | % | | | - | | | | - | | | | - | | | | - | | | | 8.97 | % | | | - | | | | - | | | | - | | | | - | | | | - | |

| Class R6 | | | 14.23 | % | | | 10.58 | % | | | 11.29 | % | | | 11.46 | % | | | 11.55 | % | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| S&P 500® Index | | | 10.14 | % | | | 10.36 | % | | | 11.01 | % | | | 11.18 | % | | | 11.42 | % | | | 7.53 | % | | | NA | | | | NA | | | | NA | | | | NA | | | | NA | |

The Madison Investors Fund (Class Y) returned 14.03% for the one-year period, outperforming its benchmark, the S&P 500® Index, which returned 10.14%. The Fund outperformed its peers as measured by the Morningstar US Large Blend category, which returned 7.56%.

True to our bottom-up approach, the Fund's outperformance was entirely driven by stock selection. Overall, the Fund's concentrated yet diverse collection of above average businesses performed well. As is often the case in financial markets, there was no shortage of market-moving narratives during the year. War, inflation, and banking industry instability are just several concerns that captured the attention of investors. Our aim is not to have to react to such concerns, but to assemble an all-weather portfolio of resilient, growing, well-managed, and conservatively capitalized companies that ultimately provides a satisfactory return for investors with below-average risk. In that regard, we are pleased with the results in 2023.

Portfolio turnover was 22%, within our typical annual range of 20%-30%. During the year we exited four portfolio companies and sold a small spin-off from one of our healthcare holdings that we assessed to be appropriately valued. We initiated new positions in four companies: two in the Health Care sector, one in the Financials sector, and

Madison Funds | Management’s Discussion of Fund Performance - continued | October 31, 2023

one in the Information Technology sector. Importantly, each of these companies meets our three investment pillars: good business model, high-quality management, and attractive valuation. We will briefly touch on each.

Elevance, formerly Anthem, is the largest for-profit Blue Cross Blue Shield plan in the country, with 47 million members. In the 14 states where Elevance operates, it has the #1 or #2 market share which provides both national and local scale. We also believe the management team is top-notch. Since joining Elevance from a senior leadership position at peer UnitedHealth Group, CEO Gail Boudreaux has further leveraged the company’s scale advantage by expanding its internal healthcare services capabilities through a newly formed business unit called Carelon. As the industry transitions to a reimbursement system that emphasizes patient outcomes over procedure or testing volume, data analytics will be a crucial tool in managing patient care. Carelon has become the repository for many of these data analytics and healthcare service capabilities, and it should be an attractive growth platform for many years to come. Concerns around a possible slowdown in government-sponsored programs in Medicare Advantage and managed Medicaid gave us an opportunity to invest at a good price.

Charles Schwab has been the runaway winner in attracting investor assets for the past few decades as it has consistently provided fantastic client service at highly competitive prices. Schwab’s many industry awards and accolades attest to the quality of its franchise, and we believe its scale and sticky asset base will allow the company to navigate any changes in industry trends. Founder Charles Schwab is still involved as Co-Chairman with a meaningful 6% ownership stake in the company. Fears of deposit outflows at Schwab’s banking unit provided us with an attractive price to buy into this quality wealth management franchise.