0001040612 ck0001040612:C000057654Member us-gaap:ShortTermInvestments 2024-10-31

OMB APPROVAL

OMB Number: 3235-0570

Expires: September 30, 2026

Estimated average burden hours per response...7.78

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08261

Madison Funds

(Exact name of registrant as specified in charter)

550 Science Drive, Madison, WI 53711

(Address of principal executive offices)(Zip code)

Steve J. Fredricks

Chief Legal Officer & Chief Compliance Officer

550 Science Drive

Madison, WI 53711

(Name and address of agent for service)

Registrant’s telephone number, including area code: 608-274-0300

Date of fiscal year end: October 31

Date of reporting period: October 31, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Shareholders.

| Annual Shareholder Report October 31, 2024 |

Conservative Allocation Fund Class A

Madison Conservative Allocation Fund

MCNAX

Fund Overview

This annual shareholder report contains important information about Conservative Allocation Fund Class A for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.madisonfunds.com/documents. You can also request this information by contacting us at 1-800-877-6089.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| | | Cost of a $10,000

investment | | | Costs paid as a

percentage of a

$10,000 investment | |

| Class A | | | $75 | | | | 0.70% | |

| | | | | | | | | |

How did the Fund perform last year and what affected its performance?

Entering the period, there was a high level of concern over the health of the economy and many traditional indicators of recession were flashing red. However, the stalling of the inflationary impulse in late 2023 led to an abrupt shift in market expectations for much lower interest rates by the end of 2024. The bellwether 10-year US Treasury yield fell over 1% over the first two months of the period and risk markets were off to the races.

The Fund’s sizeable absolute return was aided by the strong market backdrop across all major asset classes. However, our economic outlook and conservative DNA had us guarded for a more challenging market and the Fund’s underweight to equity risk (overweight to cash) provided the largest headwind to relative performance. Within our US equity allocation, our core positions failed to keep up with the highly concentrated mega cap led market, which compounded the hit to relative performance. Across equities, the Fund benefited from an overweight to the US Technology sector and a heavy preference for domestic versus international stocks. The Fund’s fixed income allocation outperformed the benchmark Bloomberg US Aggregate Bond Index by overweighting the securitized sector, specifically mortgage-backed securities, a big contribution from a long-duration US Treasury holding, and the strong showing from the Fund’s core actively managed bond fund position.

We ended the period cautiously optimistic for the year ahead, and while still a touch defensive overall, we have increased equity exposure by expanding our allocations to smaller cap stocks and the financial sector.

| Conservative Allocation Fund Class A | MCNAX |

Fund Performance

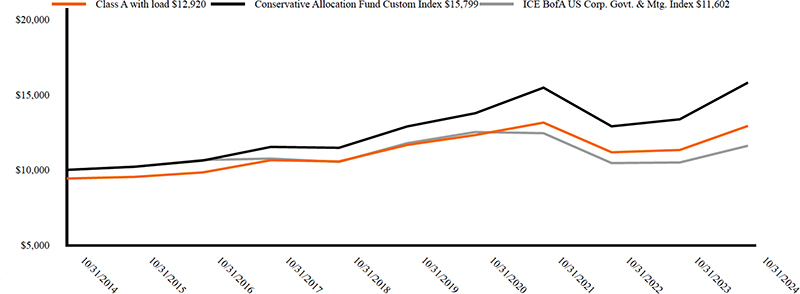

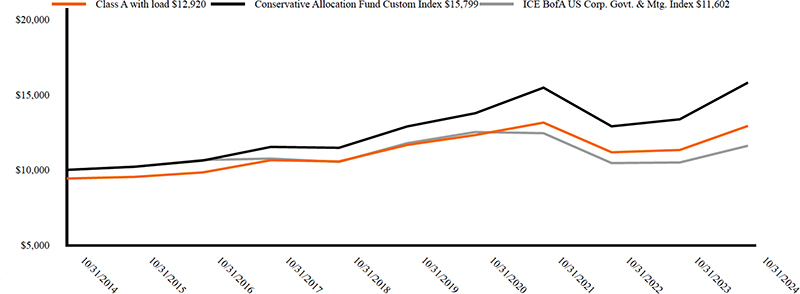

The chart below illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter).

| Average Annual Total Returns (%) | |

| | 1 Year | 5 Years | 10 Years |

| Class A | 14.12% | 2.08% | 3.20% |

| Class A with load | 7.51% | 0.87% | 2.59% |

| Conservative Allocation Fund Custom Index | 18.26% | 4.16% | 4.68% |

| ICE BofA US Corp. Govt. & Mtg. Index | 10.58% | (0.29%) | 1.50% |

1. Fund returns are calculated after fund expenses have been subtracted and assume that dividends and capital gains are reinvested in additional shares of a fund. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than original cost. Further information relating to the fund’s performance is contained in the prospectus and elsewhere in this report. The fund’s past performance is not indicative of future performance.

2. Maximum sales charge is 5.75% for Class A shares.

3. The Conservative Allocation Fund Custom Index consists of 65% Bloomberg Barclays US Aggregate Bond Index, 24.5% Russell 3000 Index and 10.5% MSCI ACWI ex-US Index.

4. The ICE BofA U.S. Corporate, Government & Mortgage Index is a broad-based measure of the total rate of return performance of the US investment grade bond markets. The index is a capitalization-weighted aggregation of outstanding US treasury, agency, and supranational mortgage pass-through, and investment grade corporate bonds meeting specified selection criteria.

| Key Fund Statistics (As of October 31, 2024) | | | | | | | | |

| Total Net Assets | | | | | | | $43,095,706 | |

| # of Portfolio Holdings | | | | | | | 15 | |

| Portfolio Turnover Rate | | | | | | | 51% | |

| Total Advisory Fees Paid | | | | | | | $89,059 | |

| Conservative Allocation Fund Class A | MCNAX |

What does the Fund invest in?

The Fund invested primarily in shares of other registered investment companies. The Fund’s total net assets were allocated among various asset classes and underlying funds, with target allocations over time of approximately 35% equity investments and 65% fixed income investments.

| Top Ten Holdings (% of Net Assets) | | | |

| Madison Core Bond Fund, Class R6 | | 38.9 | % |

| Schwab Intermediate-Term U.S. Treasury ETF | | 14.1 | % |

| Madison Investors Fund, Class R6 | | 7.0 | % |

| iShares Aaa - A Rated Corporate Bond ETF | | 5.5 | % |

| Distillate U.S. Fundamental Stability & Value ETF | | 5.3 | % |

| Invesco S&P 500 Quality ETF | | 5.2 | % |

| Janus Henderson Mortgage-Backed Securities ETF | | 5.0 | % |

| iShares Treasury Floating Rate Bond ETF | | 4.1 | % |

| Vanguard Information Technology ETF | | 3.5 | % |

| Vanguard FTSE Europe ETF | | 3.1 | % |

| Portfolio Allocation (% of Net Assets) | | | |

| Exchange Traded Funds | | 52.3 | % |

| Investment Companies | | 45.9 | % |

| Short-Term Investments | | 7.9 | % |

| Other Assets and Liabilities, Net | | (6.1 | %) |

| | | | |

Material Fund Changes

On November 6, 2024, the Board of Trustees of the Trust approved the termination of all outstanding Class C shares of the Madison Funds. Effective after the close of business on Friday, February 14, 2025, all Madison Conservative Allocation Class C shares will be automatically converted to Class A shares. The conversion of Class C to Class A shares of the same fund is not a taxable event, and no contingent deferred sales charges will be assessed, if applicable, on this one-time conversion of shares.

This is a summary of certain planned changes to the Fund since October 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by February 28th, 2025 at www.madisonfunds.com or upon request by calling 1-800-877-6089.

Additional Information If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.madisonfunds.com/documents. Phone: 1-800-877-6089 |  |

| | Annual Shareholder Report

October 31, 2024 |

| Conservative Allocation Fund Class A | MCNAX |

| Annual Shareholder Report October 31, 2024 |

Conservative Allocation Fund Class C

Madison Conservative Allocation Fund

MCOCX

Fund Overview

This annual shareholder report contains important information about Conservative Allocation Fund Class C for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.madisonfunds.com/documents. You can also request this information by contacting us at 1-800-877-6089.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| | | Cost of a $10,000

investment | | | Costs paid as a

percentage of a

$10,000 investment | |

| Class C | | | $156 | | | | 1.46% | |

| | | | | | | | | |

How did the Fund perform last year and what affected its performance?

Entering the period, there was a high level of concern over the health of the economy and many traditional indicators of recession were flashing red. However, the stalling of the inflationary impulse in late 2023 led to an abrupt shift in market expectations for much lower interest rates by the end of 2024. The bellwether 10-year US Treasury yield fell over 1% over the first two months of the period and risk markets were off to the races.

The Fund’s sizeable absolute return was aided by the strong market backdrop across all major asset classes. However, our economic outlook and conservative DNA had us guarded for a more challenging market and the Fund’s underweight to equity risk (overweight to cash) provided the largest headwind to relative performance. Within our US equity allocation, our core positions failed to keep up with the highly concentrated mega cap led market, which compounded the hit to relative performance. Across equities, the Fund benefited from an overweight to the US Technology sector and a heavy preference for domestic versus international stocks. The Fund’s fixed income allocation outperformed the benchmark Bloomberg US Aggregate Bond Index by overweighting the securitized sector, specifically mortgage-backed securities, a big contribution from a long-duration US Treasury holding, and the strong showing from the Fund’s core actively managed bond fund position.

We ended the period cautiously optimistic for the year ahead, and while still a touch defensive overall, we have increased equity exposure by expanding our allocations to smaller cap stocks and the financial sector.

| Conservative Allocation Fund Class C | MCOCX |

Fund Performance

The chart below illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter).

| Average Annual Total Returns (%) | |

| | 1 Year | 5 Years | 10 Years |

| Class C | 13.26% | 1.31% | 2.42% |

| Conservative Allocation Fund Custom Index | 18.26% | 4.16% | 4.68% |

| ICE BofA US Corp. Govt. & Mtg. Index | 10.58% | (0.29%) | 1.50% |

1. Fund returns are calculated after fund expenses have been subtracted and assume that dividends and capital gains are reinvested in additional shares of a fund. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than original cost. Further information relating to the fund’s performance is contained in the prospectus and elsewhere in this report. The Fund’s past performance is not indicative of future performance.

2. The Conservative Allocation Fund Custom Index consists of 65% Bloomberg Barclays US Aggregate Bond Index, 24.5% Russell 3000 Index and 10.5% MSCI ACWI ex-US Index.

3. The ICE BofA U.S. Corporate, Government & Mortgage Index is a broad-based measure of the total rate of return performance of the US investment grade bond markets. The index is a capitalization-weighted aggregation of outstanding US treasury, agency, and supranational mortgage pass-through, and investment grade corporate bonds meeting specified selection criteria.

| Key Fund Statistics (As of October 31, 2024) | | | | | | | | |

| Total Net Assets | | | | | | | $43,095,706 | |

| # of Portfolio Holdings | | | | | | | 15 | |

| Portfolio Turnover Rate | | | | | | | 51% | |

| Total Advisory Fees Paid | | | | | | | $89,059 | |

| Conservative Allocation Fund Class C | MCOCX |

What does the Fund invest in?

The Fund invested primarily in shares of other registered investment companies. The Fund’s total net assets were allocated among various asset classes and underlying funds, with target allocations over time of approximately 35% equity investments and 65% fixed income investments.

| Top Ten Holdings (% of Net Assets) | | | |

| Madison Core Bond Fund, Class R6 | | 38.9 | % |

| Schwab Intermediate-Term U.S. Treasury ETF | | 14.1 | % |

| Madison Investors Fund, Class R6 | | 7.0 | % |

| iShares Aaa - A Rated Corporate Bond ETF | | 5.5 | % |

| Distillate U.S. Fundamental Stability & Value ETF | | 5.3 | % |

| Invesco S&P 500 Quality ETF | | 5.2 | % |

| Janus Henderson Mortgage-Backed Securities ETF | | 5.0 | % |

| iShares Treasury Floating Rate Bond ETF | | 4.1 | % |

| Vanguard Information Technology ETF | | 3.5 | % |

| Vanguard FTSE Europe ETF | | 3.1 | % |

| Portfolio Allocation (% of Net Assets) | | | |

| Exchange Traded Funds | | 52.3 | % |

| Investment Companies | | 45.9 | % |

| Short-Term Investments | | 7.9 | % |

| Other Assets and Liabilities, Net | | (6.1 | %) |

| | | | |

Material Fund Changes

On November 6, 2024, the Board of Trustees of the Trust approved the termination of all outstanding Class C shares of the Madison Funds. Effective after the close of business on Friday, February 14, 2025, all Madison Conservative Allocation Class C shares will be automatically converted to Class A shares. The conversion of Class C to Class A shares of the same fund is not a taxable event, and no contingent deferred sales charges will be assessed, if applicable, on this one-time conversion of shares.

This is a summary of certain planned changes to the Fund since October 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by February 28th, 2025 at www.madisonfunds.com or upon request by calling 1-800-877-6089.

Additional Information If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.madisonfunds.com/documents. Phone: 1-800-877-6089 |  |

| | Annual Shareholder Report

October 31, 2024 |

| Conservative Allocation Fund Class C | MCOCX |

| Annual Shareholder Report October 31, 2024 |

Moderate Allocation Fund Class A

Madison Moderate Allocation Fund

MMDAX

Fund Overview

This annual shareholder report contains important information about Moderate Allocation Fund Class A for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.madisonfunds.com/documents. You can also request this information by contacting us at 1-800-877-6089.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| | | Cost of a $10,000

investment | | | Costs paid as a

percentage of a

$10,000 investment | |

| Class A | | | $76 | | | | 0.70% | |

| | | | | | | | | |

How did the Fund perform last year and what affected its performance?

Entering the period, there was a high level of concern over the health of the economy and many traditional indicators of recession were flashing red. However, the stalling of the inflationary impulse in late 2023 led to an abrupt shift in market expectations for much lower interest rates by the end of 2024. The bellwether 10-year US Treasury yield fell over 1% over the first two months of the period and risk markets were off to the races.

The Fund’s sizeable absolute return was aided by the strong market backdrop across all major asset classes. However, our economic outlook and conservative DNA had us guarded for a more challenging market and the Fund’s underweight to equity risk (overweight to cash) provided the largest headwind to relative performance. Within our US equity allocation, our core positions failed to keep up with the highly concentrated mega cap led market, which compounded the hit to relative performance. Across equities, the Fund benefited from an overweight to the US Technology sector and a heavy preference for domestic versus international stocks. The Fund’s fixed income allocation outperformed the benchmark Bloomberg US Aggregate Bond Index by overweighting the securitized sector, specifically mortgage-backed securities, a big contribution from a long-duration US Treasury holding, and the strong showing from the Fund’s core actively managed bond fund position.

We ended the period cautiously optimistic for the year ahead, and while still a touch defensive overall, we have increased equity exposure by expanding our allocations to smaller cap stocks and the financial sector.

| Moderate Allocation Fund Class A | MMDAX |

Fund Performance

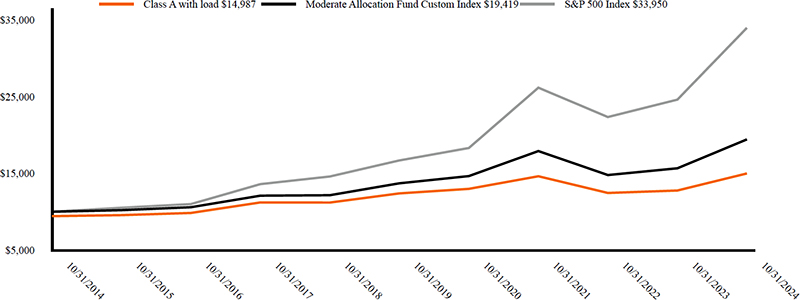

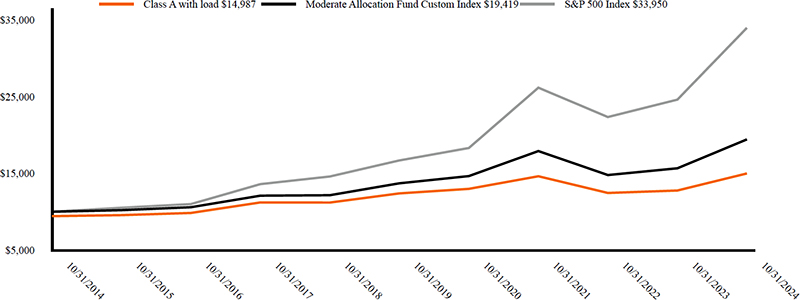

The chart below illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter).

| Average Annual Total Returns (%) | |

| | 1 Year | 5 Years | 10 Years |

| Class A | 17.42% | 3.88% | 4.75% |

| Class A with load | 10.69% | 2.65% | 4.13% |

| Moderate Allocation Fund Custom Index | 24.03% | 7.23% | 6.86% |

| S&P 500 Index | 38.02% | 15.27% | 13.00% |

1. Fund returns are calculated after fund expenses have been subtracted and assume that dividends and capital gains are reinvested in additional shares of a fund. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than original cost. Further information relating to the fund’s performance is contained in the prospectus and elsewhere in this report. The fund’s past performance is not indicative of future performance.

2. Maximum sales charge is 5.75% for Class A shares.

3. The Moderate Allocation Fund Custom Index consists of 42% Russell 3000 Index, 40% Bloomberg Barclays US Aggregate Bond Index and 18% MSCI ACWI ex-US Index.

4. The S&P 500 Index is a large-cap market index which measures the performance of a representative sample of 500 leading companies in leading industries in the US.

| Key Fund Statistics (As of October 31, 2024) | | | | | | | | |

| Total Net Assets | | | | | | | $92,341,391 | |

| # of Portfolio Holdings | | | | | | | 15 | |

| Portfolio Turnover Rate | | | | | | | 51% | |

| Total Advisory Fees Paid | | | | | | | $191,611 | |

| Moderate Allocation Fund Class A | MMDAX |

What does the Fund invest in?

The Fund invested primarily in shares of other registered investment companies. The Fund’s total net assets were allocated among various asset classes and underlying funds, with target allocations over time of approximately 60% equity investments and 40% fixed income investments.

| Top Ten Holdings (% of Net Assets) | | | |

| Madison Core Bond Fund, Class R6 | | 25.3 | % |

| Madison Investors Fund, Class R6 | | 12.5 | % |

| Invesco S&P 500 Quality ETF | | 9.5 | % |

| Schwab Intermediate-Term U.S. Treasury ETF | | 9.4 | % |

| Distillate U.S. Fundamental Stability & Value ETF | | 8.3 | % |

| iShares Treasury Floating Rate Bond ETF | | 6.8 | % |

| Vanguard FTSE Europe ETF | | 5.6 | % |

| Vanguard Information Technology ETF | | 5.4 | % |

| iShares MSCI Emerging Markets Asia ETF | | 4.4 | % |

| Franklin FTSE Japan ETF | | 3.7 | % |

| Portfolio Allocation (% of Net Assets) | | | |

| Exchange Traded Funds | | 61.5 | % |

| Investment Companies | | 37.9 | % |

| Short-Term Investments | | 6.4 | % |

| Other Assets and Liabilities, Net | | (5.8 | %) |

| | | | |

Material Fund Changes

On November 6, 2024, the Board of Trustees of the Trust approved the termination of all outstanding Class C shares of the Madison Funds. Effective after the close of business on Friday, February 14, 2025, all Madison Moderate Allocation Class C shares will be automatically converted to Class A shares. The conversion of Class C to Class A shares of the same fund is not a taxable event, and no contingent deferred sales charges will be assessed, if applicable, on this one-time conversion of shares.

This is a summary of certain planned changes to the Fund since October 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by February 28th, 2025 at www.madisonfunds.com or upon request by calling 1-800-877-6089.

Additional Information If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.madisonfunds.com/documents. Phone: 1-800-877-6089 |  |

| | Annual Shareholder Report

October 31, 2024 |

| Moderate Allocation Fund Class A | MMDAX |

| Annual Shareholder Report October 31, 2024 |

Moderate Allocation Fund Class C

Madison Moderate Allocation Fund

MMDCX

Fund Overview

This annual shareholder report contains important information about Moderate Allocation Fund Class C for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.madisonfunds.com/documents. You can also request this information by contacting us at 1-800-877-6089.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| | | Cost of a $10,000

investment | | | Costs paid as a

percentage of a

$10,000 investment | |

| Class C | | | $157 | | | | 1.45% | |

| | | | | | | | | |

How did the Fund perform last year and what affected its performance?

Entering the period, there was a high level of concern over the health of the economy and many traditional indicators of recession were flashing red. However, the stalling of the inflationary impulse in late 2023 led to an abrupt shift in market expectations for much lower interest rates by the end of 2024. The bellwether 10-year US Treasury yield fell over 1% over the first two months of the period and risk markets were off to the races.

The Fund’s sizeable absolute return was aided by the strong market backdrop across all major asset classes. However, our economic outlook and conservative DNA had us guarded for a more challenging market and the Fund’s underweight to equity risk (overweight to cash) provided the largest headwind to relative performance. Within our US equity allocation, our core positions failed to keep up with the highly concentrated mega cap led market, which compounded the hit to relative performance. Across equities, the Fund benefited from an overweight to the US Technology sector and a heavy preference for domestic versus international stocks. The Fund’s fixed income allocation outperformed the benchmark Bloomberg US Aggregate Bond Index by overweighting the securitized sector, specifically mortgage-backed securities, a big contribution from a long-duration US Treasury holding, and the strong showing from the Fund’s core actively managed bond fund position.

We ended the period cautiously optimistic for the year ahead, and while still a touch defensive overall, we have increased equity exposure by expanding our allocations to smaller cap stocks and the financial sector.

| Moderate Allocation Fund Class C | MMDCX |

Fund Performance

The chart below illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter).

| Average Annual Total Returns (%) | |

| | 1 Year | 5 Years | 10 Years |

| Class C | 16.51% | 3.11% | 3.97% |

| Moderate Allocation Fund Custom Index | 24.03% | 7.23% | 6.86% |

| S&P 500 Index | 38.02% | 15.27% | 13.00% |

1. Fund returns are calculated after fund expenses have been subtracted and assume that dividends and capital gains are reinvested in additional shares of a fund. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than original cost. Further information relating to the fund’s performance is contained in the prospectus and elsewhere in this report. The Fund’s past performance is not indicative of future performance.

2. The Moderate Allocation Fund Custom Index consists of 42% Russell 3000 Index, 40% Bloomberg Barclays US Aggregate Bond Index and 18% MSCI ACWI ex-US Index.

3. The S&P 500 Index is a large-cap market index which measures the performance of a representative sample of 500 leading companies in leading industries in the US.

| Key Fund Statistics (As of October 31, 2024) | | | | | | | | |

| Total Net Assets | | | | | | | $92,341,391 | |

| # of Portfolio Holdings | | | | | | | 15 | |

| Portfolio Turnover Rate | | | | | | | 51% | |

| Total Advisory Fees Paid | | | | | | | $191,611 | |

| Moderate Allocation Fund Class C | MMDCX |

What does the Fund invest in?

The Fund invested primarily in shares of other registered investment companies. The Fund’s total net assets were allocated among various asset classes and underlying funds, with target allocations over time of approximately 60% equity investments and 40% fixed income investments.

| Top Ten Holdings (% of Net Assets) | | | |

| Madison Core Bond Fund, Class R6 | | 25.3 | % |

| Madison Investors Fund, Class R6 | | 12.5 | % |

| Invesco S&P 500 Quality ETF | | 9.5 | % |

| Schwab Intermediate-Term U.S. Treasury ETF | | 9.4 | % |

| Distillate U.S. Fundamental Stability & Value ETF | | 8.3 | % |

| iShares Treasury Floating Rate Bond ETF | | 6.8 | % |

| Vanguard FTSE Europe ETF | | 5.6 | % |

| Vanguard Information Technology ETF | | 5.4 | % |

| iShares MSCI Emerging Markets Asia ETF | | 4.4 | % |

| Franklin FTSE Japan ETF | | 3.7 | % |

| Portfolio Allocation (% of Net Assets) | | | |

| Exchange Traded Funds | | 61.5 | % |

| Investment Companies | | 37.9 | % |

| Short-Term Investments | | 6.4 | % |

| Other Assets and Liabilities, Net | | (5.8 | %) |

| | | | |

Material Fund Changes

On November 6, 2024, the Board of Trustees of the Trust approved the termination of all outstanding Class C shares of the Madison Funds. Effective after the close of business on Friday, February 14, 2025, all Madison Moderate Allocation Class C shares will be automatically converted to Class A shares. The conversion of Class C to Class A shares of the same fund is not a taxable event, and no contingent deferred sales charges will be assessed, if applicable, on this one-time conversion of shares.

This is a summary of certain planned changes to the Fund since October 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by February 28th, 2025 at www.madisonfunds.com or upon request by calling 1-800-877-6089.

Additional Information If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.madisonfunds.com/documents. Phone: 1-800-877-6089 |  |

| | Annual Shareholder Report

October 31, 2024 |

| Moderate Allocation Fund Class C | MMDCX |

| Annual Shareholder Report October 31, 2024 |

Aggressive Allocation Fund Class A

Madison Aggressive Allocation Fund

MAGSX

Fund Overview

This annual shareholder report contains important information about Aggressive Allocation Fund Class A for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.madisonfunds.com/documents. You can also request this information by contacting us at 1-800-877-6089.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| | | Cost of a $10,000

investment | | | Costs paid as a

percentage of a

$10,000 investment | |

| Class A | | | $77 | | | | 0.70% | |

| | | | | | | | | |

How did the Fund perform last year and what affected its performance?

Entering the period, there was a high level of concern over the health of the economy and many traditional indicators of recession were flashing red. However, the stalling of the inflationary impulse in late 2023 led to an abrupt shift in market expectations for much lower interest rates by the end of 2024. The bellwether 10-year US Treasury yield fell over 1% over the first two months of the period and risk markets were off to the races.

The Fund’s sizeable absolute return was aided by the strong market backdrop across all major asset classes. However, our economic outlook and conservative DNA had us guarded for a more challenging market and the Fund’s underweight to equity risk (overweight to cash) provided the largest headwind to relative performance. Within our US equity allocation, our core positions failed to keep up with the highly concentrated mega cap led market, which compounded the hit to relative performance. Across equities, the Fund benefited from an overweight to the US Technology sector and a heavy preference for domestic versus international stocks. The Fund’s fixed income allocation outperformed the benchmark Bloomberg US Aggregate Bond Index by overweighting the securitized sector, specifically mortgage-backed securities, a big contribution from a long-duration US Treasury holding, and the strong showing from the Fund’s core actively managed bond fund position.

We ended the period cautiously optimistic for the year ahead, and while still a touch defensive overall, we have increased equity exposure by expanding our allocations to smaller cap stocks and the financial sector.

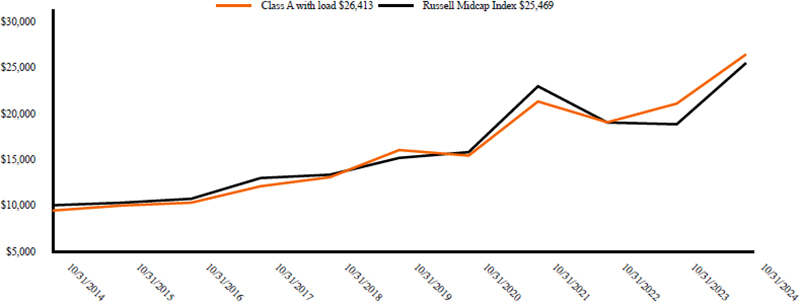

| Aggressive Allocation Fund Class A | MAGSX |

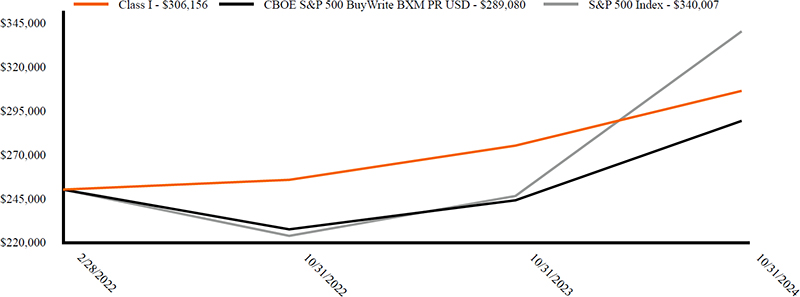

Fund Performance

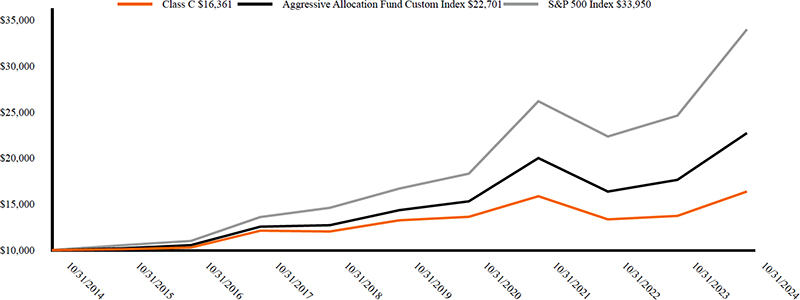

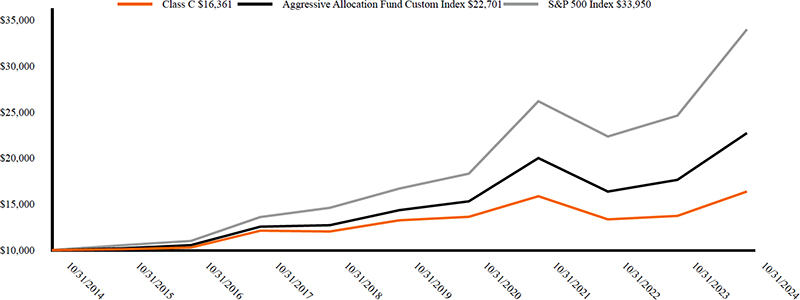

The chart below illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter).

| Average Annual Total Returns (%) | |

| | 1 Year | 5 Years | 10 Years |

| Class A | 20.11% | 5.10% | 5.83% |

| Class A with load | 13.25% | 3.87% | 5.21% |

| Aggressive Allocation Fund Custom Index | 28.80% | 9.62% | 8.54% |

| S&P 500 Index | 38.02% | 15.27% | 13.00% |

1. Fund returns are calculated after fund expenses have been subtracted and assume that dividends and capital gains are reinvested in additional shares of a fund. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than original cost. Further information relating to the fund’s performance is contained in the prospectus and elsewhere in this report. The fund’s past performance is not indicative of future performance.

2. Maximum sales charge is 5.75% for class A shares.

3. The Aggressive Allocation Fund Custom Index consists of 56% Russell 3000 Index, 24% MSCI ACWI ex-US Index and 20% Bloomberg Barclays US Aggregate Bond Index.

4. The S&P 500 Index is a large-cap market index which measures the performance of a representative sample of 500 leading companies in leading industries in the US.

| Key Fund Statistics (As of October 31, 2024) | | | | | | | | |

| Total Net Assets | | | | | | | $54,212,672 | |

| # of Portfolio Holdings | | | | | | | 14 | |

| Portfolio Turnover Rate | | | | | | | 55% | |

| Total Advisory Fees Paid | | | | | | | $110,318 | |

| Aggressive Allocation Fund Class A | MAGSX |

What does the Fund invest in?

The Fund invested primarily in shares of other registered investment companies. The Fund’s total net assets were allocated among various asset classes and underlying funds, with target allocations over time of approximately 80% equity investments and 20% fixed income investments.

| Top Ten Holdings (% of Net Assets) | | | |

| Madison Investors Fund, Class R6 | | 16.1 | % |

| Invesco S&P 500 Quality ETF | | 13.5 | % |

| Madison Core Bond Fund, Class R6 | | 13.1 | % |

| Distillate U.S. Fundamental Stability & Value ETF | | 10.5 | % |

| Vanguard FTSE Europe ETF | | 8.2 | % |

| Vanguard Information Technology ETF | | 7.6 | % |

| iShares Treasury Floating Rate Bond ETF | | 7.2 | % |

| iShares MSCI Emerging Markets Asia ETF | | 5.8 | % |

| Schwab Intermediate-Term U.S. Treasury ETF | | 5.6 | % |

| Franklin FTSE Japan ETF | | 5.0 | % |

| Portfolio Allocation (% of Net Assets) | | | |

| Exchange Traded Funds | | 68.9 | % |

| Investment Companies | | 29.1 | % |

| Short-Term Investments | | 9.8 | % |

| Other Assets and Liabilities, Net | | (7.8 | %) |

| | | | |

Material Fund Changes

On November 6, 2024, the Board of Trustees of the Trust approved the termination of all outstanding Class C shares of the Madison Funds. Effective after the close of business on Friday, February 14, 2025, all Madison Aggressive Allocation Class C shares will be automatically converted to Class A shares. The conversion of Class C to Class A shares of the same fund is not a taxable event, and no contingent deferred sales charges will be assessed, if applicable, on this one-time conversion of shares.

This is a summary of certain planned changes to the Fund since October 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by February 28th, 2025 at www.madisonfunds.com or upon request by calling 1-800-877-6089.

Additional Information If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.madisonfunds.com/documents. Phone: 1-800-877-6089 |  |

| | Annual Shareholder Report

October 31, 2024 |

| Aggressive Allocation Fund Class A | MAGSX |

| Annual Shareholder Report October 31, 2024 |

Aggressive Allocation Fund Class C

Madison Aggressive Allocation Fund

MAACX

Fund Overview

This annual shareholder report contains important information about Aggressive Allocation Fund Class C for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.madisonfunds.com/documents. You can also request this information by contacting us at 1-800-877-6089.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| | | Cost of a $10,000

investment | | | Costs paid as a

percentage of a

$10,000 investment | |

| Class C | | | $160 | | | | 1.46% | |

| | | | | | | | | |

How did the Fund perform last year and what affected its performance?

Entering the period, there was a high level of concern over the health of the economy and many traditional indicators of recession were flashing red. However, the stalling of the inflationary impulse in late 2023 led to an abrupt shift in market expectations for much lower interest rates by the end of 2024. The bellwether 10-year US Treasury yield fell over 1% over the first two months of the period and risk markets were off to the races.

The Fund’s sizeable absolute return was aided by the strong market backdrop across all major asset classes. However, our economic outlook and conservative DNA had us guarded for a more challenging market and the Fund’s underweight to equity risk (overweight to cash) provided the largest headwind to relative performance. Within our US equity allocation, our core positions failed to keep up with the highly concentrated mega cap led market, which compounded the hit to relative performance. Across equities, the Fund benefited from an overweight to the US Technology sector and a heavy preference for domestic versus international stocks. The Fund’s fixed income allocation outperformed the benchmark Bloomberg US Aggregate Bond Index by overweighting the securitized sector, specifically mortgage-backed securities, a big contribution from a long-duration US Treasury holding, and the strong showing from the Fund’s core actively managed bond fund position.

We ended the period cautiously optimistic for the year ahead, and while still a touch defensive overall, we have increased equity exposure by expanding our allocations to smaller cap stocks and the financial sector.

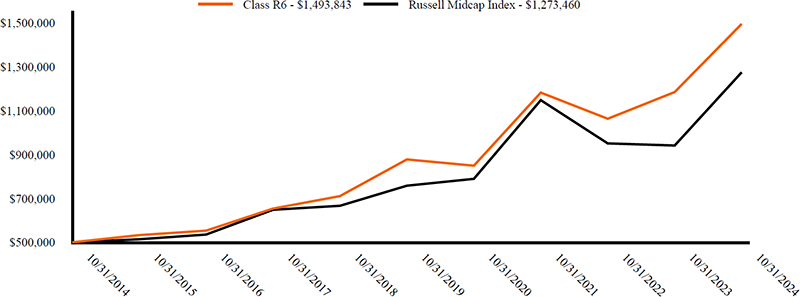

| Aggressive Allocation Fund Class C | MAACX |

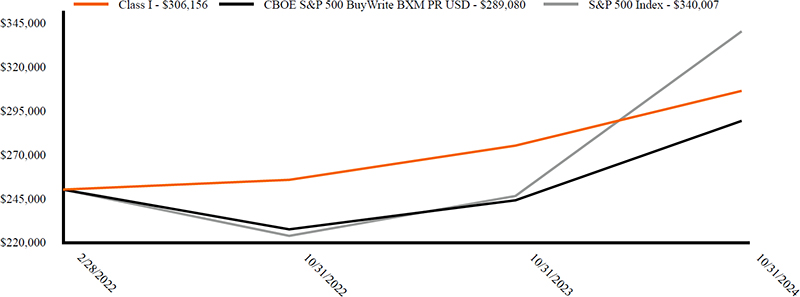

Fund Performance

The chart below illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter).

| Average Annual Total Returns (%) | |

| | 1 Year | 5 Years | 10 Years |

| Class C | 19.28% | 4.33% | 5.05% |

| Aggressive Allocation Fund Custom Index | 28.80% | 9.62% | 8.54% |

| S&P 500 Index | 38.02% | 15.27% | 13.00% |

1. Fund returns are calculated after fund expenses have been subtracted and assume that dividends and capital gains are reinvested in additional shares of a fund. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than original cost. Further information relating to the fund’s performance is contained in the prospectus and elsewhere in this report. The Fund’s past performance is not indicative of future performance.

2. The Aggressive Allocation Fund Custom Index consists of 56% Russell 3000® Index, 24% MSCI ACWI ex-US Index and 20% Bloomberg Barclays US Aggregate Bond Index.

3. The S&P® 500 Index is a large-cap market index which measures the performance of a representative sample of 500 leading companies in leading industries in the US.

| Key Fund Statistics (As of October 31, 2024) | | | | | | | | |

| Total Net Assets | | | | | | | $54,212,672 | |

| # of Portfolio Holdings | | | | | | | 14 | |

| Portfolio Turnover Rate | | | | | | | 55% | |

| Total Advisory Fees Paid | | | | | | | $110,318 | |

| Aggressive Allocation Fund Class C | MAACX |

What does the Fund invest in?

The Fund invested primarily in shares of other registered investment companies. The Fund’s total net assets were allocated among various asset classes and underlying funds, with target allocations over time of approximately 80% equity investments and 20% fixed income investments.

| Top Ten Holdings (% of Net Assets) | | | |

| Madison Investors Fund, Class R6 | | 16.1 | % |

| Invesco S&P 500 Quality ETF | | 13.5 | % |

| Madison Core Bond Fund, Class R6 | | 13.1 | % |

| Distillate U.S. Fundamental Stability & Value ETF | | 10.5 | % |

| Vanguard FTSE Europe ETF | | 8.2 | % |

| Vanguard Information Technology ETF | | 7.6 | % |

| iShares Treasury Floating Rate Bond ETF | | 7.2 | % |

| iShares MSCI Emerging Markets Asia ETF | | 5.8 | % |

| Schwab Intermediate-Term U.S. Treasury ETF | | 5.6 | % |

| Franklin FTSE Japan ETF | | 5.0 | % |

| Portfolio Allocation (% of Net Assets) | | | |

| Exchange Traded Funds | | 68.9 | % |

| Investment Companies | | 29.1 | % |

| Short-Term Investments | | 9.8 | % |

| Other Assets and Liabilities, Net | | (7.8 | %) |

| | | | |

Material Fund Changes

On November 6, 2024, the Board of Trustees of the Trust approved the termination of all outstanding Class C shares of the Madison Funds. Effective after the close of business on Friday, February 14, 2025, all Madison Aggressive Allocation Class C shares will be automatically converted to Class A shares. The conversion of Class C to Class A shares of the same fund is not a taxable event, and no contingent deferred sales charges will be assessed, if applicable, on this one-time conversion of shares.

This is a summary of certain planned changes to the Fund since October 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by February 28th, 2025 at www.madisonfunds.com or upon request by calling 1-800-877-6089.

Additional Information If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.madisonfunds.com/documents. Phone: 1-800-877-6089 |  |

| | Annual Shareholder Report

October 31, 2024 |

| Aggressive Allocation Fund Class C | MAACX |

| Annual Shareholder Report October 31, 2024 |

Diversified Income Fund Class A

Madison Diversified Income Fund

MBLAX

Fund Overview

This annual shareholder report contains important information about Diversified Income Fund Class A for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.madisonfunds.com/documents. You can also request this information by contacting us at 1-800-877-6089.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| | | Cost of a $10,000

investment | | | Costs paid as a

percentage of a

$10,000 investment | |

| Class A | | | $70 | | | | 0.66% | |

| | | | | | | | | |

How did the Fund perform last year and what affected its performance?

It was a phenomenal 12 month stretch for asset markets. That said, equity market gains were heavily skewed toward mega cap growth stocks and not nearly as rewarding to high quality dividend payers.

Contrary to the equity market, where yield seeking detracted from return, yield was the big winner within bonds. Investors poured money into both high yield (“junk”) and investment grade corporates alike, ratcheting their spreads over equivalent US Treasuries to historically low levels.

The Fund’s absolute return was a direct result of the double-digit gains across the asset markets. From a relative standpoint, outside of our dividend focused equity holdings, performance was held back by our core allocation to a hedged equity/covered call strategy. The strategy provides a very high level of income for the Fund but is prone to sizeable underperformance in runaway-up markets, where potential gains get called away. Within bonds, the Fund benefited from allocations to high quality corporate bond and mortgage-backed security ETFs. The Fund’s return per unit of duration was very favorable relative to the Bloomberg US Aggregate Bond Index.

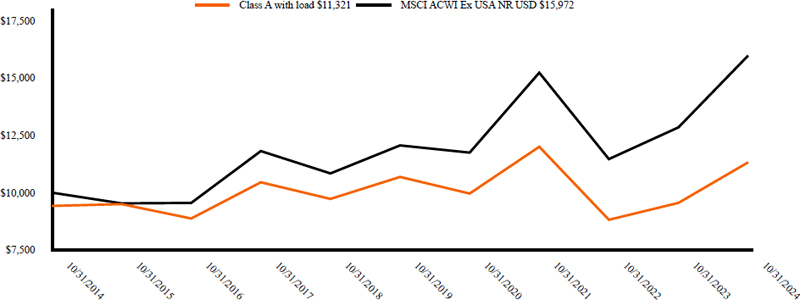

| Diversified Income Fund Class A | MBLAX |

Fund Performance

The chart below illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter).

| Average Annual Total Returns (%) | |

| | 1 Year | 5 Years | 10 Years |

| Class A | 13.50% | 4.91% | 6.04% |

| Class A with load | 6.94% | 3.68% | 5.42% |

| Madison DI Fund Index (50% S&P 500 - 50% ICE BofA Corp. Govt. Mtg) | 23.69% | 7.55% | 7.38% |

| ICE BofA US Corp. Govt. & Mtg. Index | 10.58% | (0.29%) | 1.50% |

| S&P 500 Index | 38.02% | 15.27% | 13.00% |

1. Fund returns are calculated after fund expenses have been subtracted and assume that dividends and capital gains are reinvested in additional shares of a fund. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than original cost. Further information relating to the fund’s performance is contained in the prospectus and elsewhere in this report. The fund’s past performance is not indicative of future performance.

2. Maximum sales charge is 5.75% for class A shares.

3. The Madison DI Fund Index consists of 50% S&P 500 Index and 50% ICE Bank of America Merrill Lynch US Corporate, Government & Mortgage Index.

4. The ICE BofA US Corp. Govt. & Mtg USD Index is a broad-based measure of the total rate of return performance of the US investment grade bond markets. The index is a capitalization-weighted aggregation of outstanding US treasury, agency, and supranational mortgage pass-through, and investment grade corporate bonds meeting specified selection criteria.

5. The S&P 500 Index is a large-cap market index which measures the performance of a representative sample of 500 leading companies in leading industries in the US.

| Key Fund Statistics (As of October 31, 2024) | | | | | | | | |

| Total Net Assets | | | | | | | $137,625,353 | |

| # of Portfolio Holdings | | | | | | | 19 | |

| Portfolio Turnover Rate | | | | | | | 8% | |

| Total Advisory Fees Paid | | | | | | | $283,023 | |

| Diversified Income Fund Class A | MBLAX |

What does the Fund invest in?

The Fund invested primarily in shares of other registered investment companies. The Fund’s total net assets were allocated among various asset classes and underlying funds, with target allocations over time of approximately 50% equity investments and 50% fixed income investments.

| Top Ten Holdings (% of Net Assets) | | | |

| Madison Covered Call ETF | | 22.5 | % |

| Madison Short-Term Strategic Income ETF | | 21.4 | % |

| Madison Dividend Value ETF | | 17.5 | % |

| Madison Aggregate Bond ETF | | 17.4 | % |

| Janus Henderson Mortgage-Backed Securities ETF | | 8.3 | % |

| Vanguard Dividend Appreciation ETF | | 4.5 | % |

| Global X MLP ETF | | 3.1 | % |

| iShares Aaa - A Rated Corporate Bond ETF | | 2.6 | % |

| Government National Mortgage Association, 6.500%, due 02/20/29 | | 0.0 | % |

| Federal National Mortgage Association, 7.000%, due 11/01/31 | | 0.0 | % |

| Portfolio Allocation (% of Net Assets) | | | |

| Exchange Traded Funds | | 97.2 | % |

| Short-Term Investments | | 4.0 | % |

| Mortgage Backed Securities | | 0.0 | % |

| Collateralized Mortgage Obligations | | 0.0 | % |

| Commercial Mortgage-Backed Securities | | 0.0 | % |

| Other Assets and Liabilities, Net | | (1.2 | %) |

Material Fund Changes

On November 6, 2024, the Board of Trustees of the Trust approved the termination of all outstanding Class C shares of the Madison Funds. Effective after the close of business on Friday, February 14, 2025, all Madison Diversified Income Class C shares will be automatically converted to Class A shares. The conversion of Class C to Class A shares of the same fund is not a taxable event, and no contingent deferred sales charges will be assessed, if applicable, on this one-time conversion of shares.

This is a summary of certain planned changes to the Fund since October 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by February 28th, 2025 at www.madisonfunds.com or upon request by calling 1-800-877-6089.

Additional Information If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.madisonfunds.com/documents. Phone: 1-800-877-6089 |  |

| | Annual Shareholder Report

October 31, 2024 |

| Diversified Income Fund Class A | MBLAX |

| Annual Shareholder Report October 31, 2024 |

Diversified Income Fund Class C

Madison Diversified Income Fund

MBLCX

Fund Overview

This annual shareholder report contains important information about Diversified Income Fund Class C for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.madisonfunds.com/documents. You can also request this information by contacting us at 1-800-877-6089.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| | | Cost of a $10,000

investment | | | Costs paid as a

percentage of a

$10,000 investment | |

| Class C | | | $149 | | | | 1.40% | |

| | | | | | | | | |

How did the Fund perform last year and what affected its performance?

It was a phenomenal 12 month stretch for asset markets. That said, equity market gains were heavily skewed toward mega cap growth stocks and not nearly as rewarding to high quality dividend payers.

Contrary to the equity market, where yield seeking detracted from return, yield was the big winner within bonds. Investors poured money into both high yield (“junk”) and investment grade corporates alike, ratcheting their spreads over equivalent US Treasuries to historically low levels.

The Fund’s absolute return was a direct result of the double-digit gains across the asset markets. From a relative standpoint, outside of our dividend focused equity holdings, performance was held back by our core allocation to a hedged equity/covered call strategy. The strategy provides a very high level of income for the Fund but is prone to sizeable underperformance in runaway-up markets, where potential gains get called away. Within bonds, the Fund benefited from allocations to high quality corporate bond and mortgage-backed security ETFs. The Fund’s return per unit of duration was very favorable relative to the Bloomberg US Aggregate Bond Index.

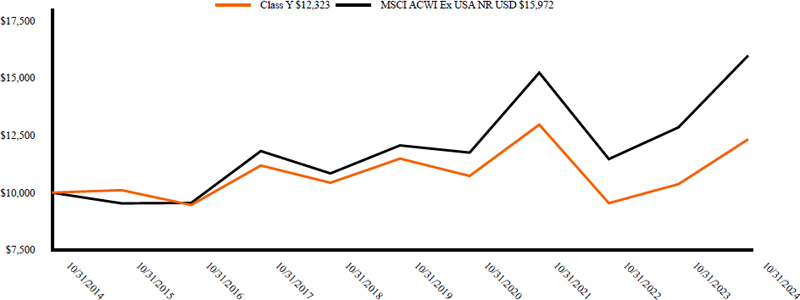

| Diversified Income Fund Class C | MBLCX |

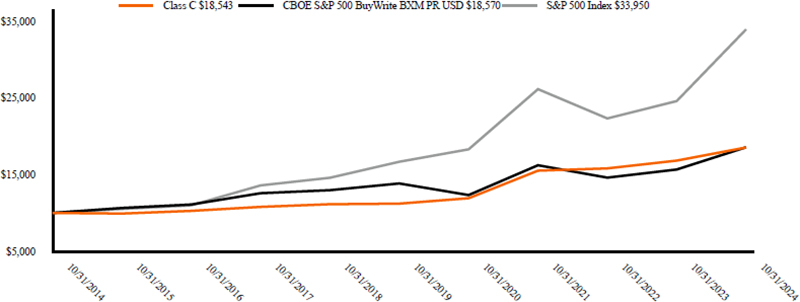

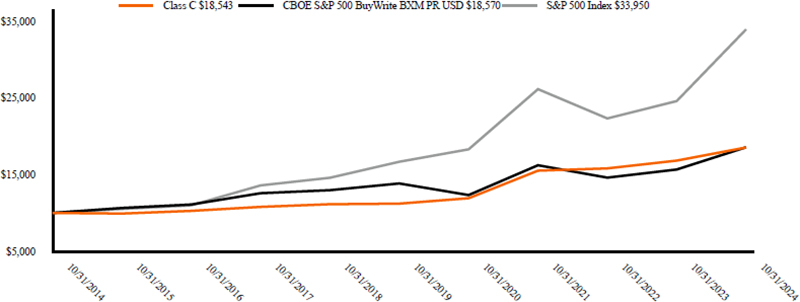

Fund Performance

The chart below illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter).

| Average Annual Total Returns (%) | |

| | 1 Year | 5 Years | 10 Years |

| Class C | 12.74% | 4.15% | 5.27% |

| Madison DI Fund Index (50% S&P 500 - 50% ICE BofA Corp. Govt. Mtg) | 23.69% | 7.55% | 7.38% |

| ICE BofA US Corp. Govt. & Mtg. Index | 10.58% | (0.29%) | 1.50% |

| S&P 500 Index | 38.02% | 15.27% | 13.00% |

1. Fund returns are calculated after fund expenses have been subtracted and assume that dividends and capital gains are reinvested in additional shares of a fund. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than original cost. Further information relating to the fund’s performance is contained in the prospectus and elsewhere in this report. The Fund’s past performance is not indicative of future performance.

2. The Madison DI Fund Index consists of 50% S&P 500 Index and 50% ICE Bank of America Merrill Lynch US Corporate, Government & Mortgage Index.

3. The ICE BofA US Corp. Govt. & Mtg USD Index is a broad-based measure of the total rate of return performance of the US investment grade bond markets. The index is a capitalization-weighted aggregation of outstanding US treasury, agency, and supranational mortgage pass-through, and investment grade corporate bonds meeting specified selection criteria.

4. The S&P 500 Index is a large-cap market index which measures the performance of a representative sample of 500 leading companies in leading industries in the US.

| Key Fund Statistics (As of October 31, 2024) | | | | | | | | |

| Total Net Assets | | | | | | | $137,625,353 | |

| # of Portfolio Holdings | | | | | | | 19 | |

| Portfolio Turnover Rate | | | | | | | 8% | |

| Total Advisory Fees Paid | | | | | | | $283,023 | |

| Diversified Income Fund Class C | MBLCX |

What does the Fund invest in?

The Fund invested primarily in shares of other registered investment companies. The Fund’s total net assets were allocated among various asset classes and underlying funds, with target allocations over time of approximately 50% equity investments and 50% fixed income investments.

| Top Ten Holdings (% of Net Assets) | | | |

| Madison Covered Call ETF | | 22.5 | % |

| Madison Short-Term Strategic Income ETF | | 21.4 | % |

| Madison Dividend Value ETF | | 17.5 | % |

| Madison Aggregate Bond ETF | | 17.4 | % |

| Janus Henderson Mortgage-Backed Securities ETF | | 8.3 | % |

| Vanguard Dividend Appreciation ETF | | 4.5 | % |

| Global X MLP ETF | | 3.1 | % |

| iShares Aaa - A Rated Corporate Bond ETF | | 2.6 | % |

| Government National Mortgage Association, 6.500%, due 02/20/29 | | 0.0 | % |

| Federal National Mortgage Association, 7.000%, due 11/01/31 | | 0.0 | % |

| Portfolio Allocation (% of Net Assets) | | | |

| Exchange Traded Funds | | 97.2 | % |

| Short-Term Investments | | 4.0 | % |

| Mortgage Backed Securities | | 0.0 | % |

| Collateralized Mortgage Obligations | | 0.0 | % |

| Commercial Mortgage-Backed Securities | | 0.0 | % |

| Other Assets and Liabilities, Net | | (1.2 | %) |

Material Fund Changes

On November 6, 2024, the Board of Trustees of the Trust approved the termination of all outstanding Class C shares of the Madison Funds. Effective after the close of business on Friday, February 14, 2025, all Madison Diversified Income Class C shares will be automatically converted to Class A shares. The conversion of Class C to Class A shares of the same fund is not a taxable event, and no contingent deferred sales charges will be assessed, if applicable, on this one-time conversion of shares.

This is a summary of certain planned changes to the Fund since October 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by February 28th, 2025 at www.madisonfunds.com or upon request by calling 1-800-877-6089.

Additional Information If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.madisonfunds.com/documents. Phone: 1-800-877-6089 |  |

| | Annual Shareholder Report

October 31, 2024 |

| Diversified Income Fund Class C | MBLCX |

| Annual Shareholder Report October 31, 2024 |

Tax-Free Virginia Fund Class Y

Madison Tax-Free Virginia Fund

GTVAX

Fund Overview

This annual shareholder report contains important information about Tax-Free Virginia Fund Class Y for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.madisonfunds.com/documents. You can also request this information by contacting us at 1-800-877-6089.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| | | Cost of a $10,000

investment | | | Costs paid as a

percentage of a

$10,000 investment | |

| Class Y | | | $89 | | | | 0.86% | |

| | | | | | | | | |

How did the Fund perform last year and what affected its performance?

The Fund’s relative performance is attributable to yield curve positioning, sector allocation, coupon structure and the overall credit profile of the individual holdings. The Fund has consistently been positioned with a shorter overall maturity structure than the index, which was detractive to performance as the municipal bond market posted strong returns for most of the 12-month period. Coupon structure was neutral to performance as interest rates were somewhat rangebound and lower coupon structures with below par pricing were less volatile as the Federal Reserve began to lower the Federal Funds rate. The Di Minimis tax rule creates price declines on municipal bonds trading below par in rising interest rate environments. Although these coupon structures continue to trade below their intrinsic value, stable interest rates and forecasted lower rates will benefit price action on these bonds. In addition, the Fund’s “up in quality” bias was detractive to performance as lower quality bonds enhanced overall yield and benefited from tightening spreads leading to price appreciation.

The Yield curve positioning was detractive to performance as the fund had a lower allocation to longer dated bonds versus its benchmark. The generic municipal yield curve has reoriented from an uncommon “inverted” structure during the Fed’s tightening cycle to a relatively “flat” yield structure in tenors going out to 10-years. Longer dated maturities offer incremental yield gains throughout the 15 to 30-year range, which is the typical structure. Finally, even with a relatively shorter duration posture versus the index, the Fund was able to capture a similar portfolio yield as the benchmark.

Credit quality in the municipal bond market continued to be quite strong. The upgrade to downgrade ratio was 3/2 during the first three quarters of the year as state and local governments benefited to a surprisingly resilient economy, strong income and sales tax collections and solid fund balances built up from Federal transfer payments during the pandemic. Outside of the health care and higher education sectors, most municipal finances seem to be in pretty good shape. However, with most of the Federal relief funds sunsetting in 2025 and record needs for investments in infrastructure and social services, budgets could be challenged if the overall economy slows precipitously.

| Tax-Free Virginia Fund Class Y | GTVAX |

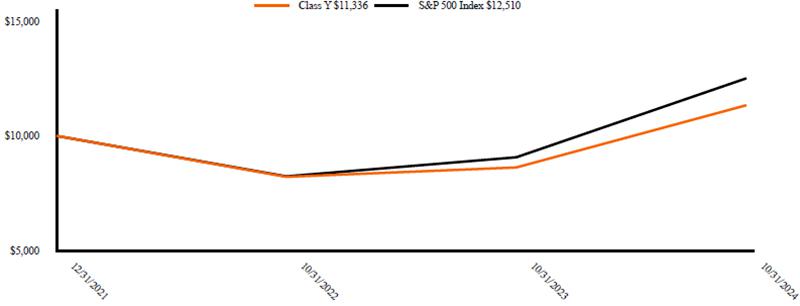

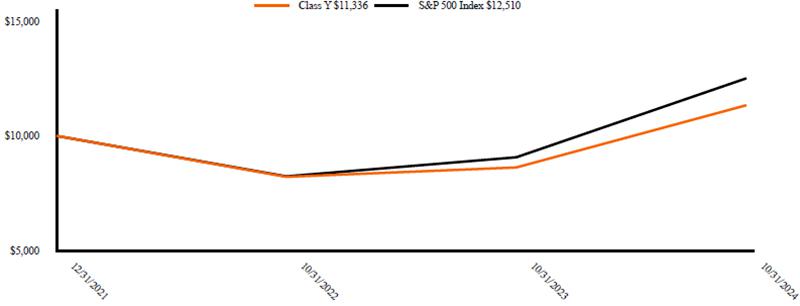

Fund Performance

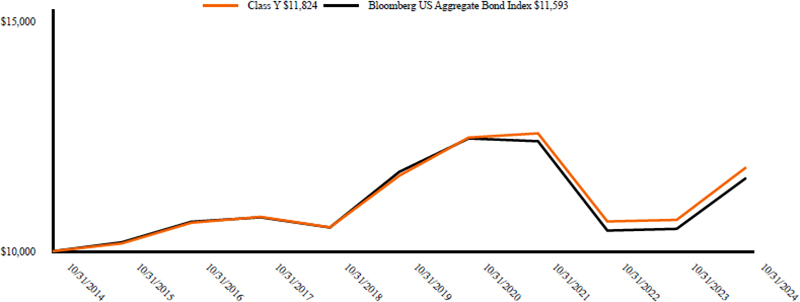

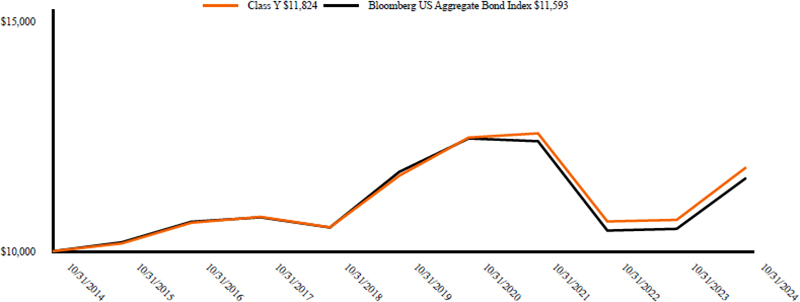

The chart below illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter).

| Average Annual Total Returns (%) | |

| | 1 Year | 5 Years | 10 Years |

| Class Y | 7.21% | 0.05% | 1.23% |

| ICE BofA 1-22 Yr Municipal Securities Index | 8.61% | 1.21% | 2.19% |

1. Fund returns are calculated after fund expenses have been subtracted and assume that dividends and capital gains are reinvested in additional shares of a fund. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than original cost. Further information relating to the fund’s performance is contained in the prospectus and elsewhere in this report. The Fund’s past performance is not indicative of future performance.

2. The ICE BofA 1-22 Yr Municipal Securities Index tracks the performance of US dollar denominated investment grade tax-exempt debt publicly issued by US states and territories, their political subdivisions, in the US domestic market, with a remaining term to final maturity less than 22 years.

| Key Fund Statistics (As of October 31, 2024) | | | | | | | | |

| Total Net Assets | | | | | | | $16,722,742 | |

| # of Portfolio Holdings | | | | | | | 61 | |

| Portfolio Turnover Rate | | | | | | | 12% | |

| Total Advisory Fees Paid | | | | | | | $85,322 | |

| Tax-Free Virginia Fund Class Y | GTVAX |

What does the Fund invest in?

The Fund invested in intermediate and long-term bonds with average aggregate maturities of 7 to 15 years in municipal bonds that were exempt from federal and state income tax for residents of Virginia.

| Top Ten Holdings (% of Net Assets) | | | |

| Northern Virginia Transportation Authority, 5.000%, due 06/01/30 | | 4.6 | % |

| County of Arlington, 5.000%, due 08/15/30 | | 3.7 | % |

| James City County Economic Development Authority, 5.000%, due 06/15/30 | | 3.2 | % |

| Metropolitan Washington Airports Authority Aviation Revenue, 5.000%, due 10/01/43 | | 3.1 | % |

| Loudoun County Economic Development Authority, 4.000%, due 12/01/37 | | 3.0 | % |

| City of Norfolk, 5.000%, due 08/01/47 | | 3.0 | % |

| Hampton Roads Transportation Accountability Commission, 5.000%, due 07/01/42 | | 2.9 | % |

| Greater Richmond Convention Center Authority, 5.000%, due 06/15/26 | | 2.8 | % |

| City of Poquoson, 4.000%, due 02/15/29 | | 2.6 | % |

| Hampton Roads Sanitation District, 5.000%, due 10/01/35 | | 2.6 | % |

| Portfolio Allocation (% of Net Assets) | | | |

| General Obligation | | 39.6 | % |

| Development | | 11.0 | % |

| Transportation | | 10.9 | % |

| Water | | 9.8 | % |

| Education | | 8.8 | % |

| Facilities | | 7.6 | % |

| Airport | | 3.9 | % |

| Power | | 3.0 | % |

| Medical | | 2.3 | % |

| Multifamily Housing | | 1.1 | % |

| Other investments less than 1% | | 0.7 | % |

| Other Assets and Liabilities, Net | | 1.3 | % |

Material Fund Changes

On November 6, 2024, the Board of Trustees of the Madison Funds approved the liquidation of the Madison Tax-Free Virginia. The liquidation is expected to occur on or about February 21, 2025.

This is a summary of certain planned changes to the Fund since October 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available by February 28th, 2025 at www.madisonfunds.com or upon request by calling 1-800-877-6089.

Additional Information If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.madisonfunds.com/documents. Phone: 1-800-877-6089 |  |

| | Annual Shareholder Report

October 31, 2024 |

| Tax-Free Virginia Fund Class Y | GTVAX |

| Annual Shareholder Report October 31, 2024 |

Tax-Free National Fund Class Y

MadisonTax-Free National Fund

GTFHX

Fund Overview

This annual shareholder report contains important information about Tax-Free National Fund Class Y for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.madisonfunds.com/documents. You can also request this information by contacting us at 1-800-877-6089.

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| | | Cost of a $10,000

investment | | | Costs paid as a

percentage of a

$10,000 investment | |

| Class Y | | | $79 | | | | 0.76% | |

| | | | | | | | | |

How did the Fund perform last year and what affected its performance?

The Fund’s relative performance is attributable to yield curve positioning, sector allocation, coupon structure and the overall credit profile of the individual holdings. The Fund has consistently been positioned with a shorter overall maturity structure than the index, which was detractive to performance as the municipal bond market posted strong returns for most of the 12-month period. Coupon structure was neutral to performance as interest rates were somewhat rangebound and lower coupon structures with below par pricing were less volatile as the Federal Reserve began to lower the Federal Funds rate. The Di Minimis tax rule creates price declines on municipal bonds trading below par in rising interest rate environments. Although these coupon structures continue to trade below their intrinsic value, stable interest rates and forecasted lower rates will benefit price action on these bonds. In addition, the Fund’s “up in quality” bias was detractive to performance as lower quality bonds enhanced overall yield and benefited from tightening spreads leading to price appreciation.

The Yield curve positioning was detractive to performance as the fund had a lower allocation to longer dated bonds versus its benchmark. The generic municipal yield curve has reoriented from an uncommon “inverted” structure during the Fed’s tightening cycle to a relatively “flat” yield structure in tenors going out to 10-years. Longer dated maturities offer incremental yield gains throughout the 15 to 30-year range, which is the typical structure. Finally, even with a relatively shorter duration posture versus the index, the Fund was able to capture a similar portfolio yield as the benchmark.

Credit quality in the municipal bond market continued to be quite strong. The upgrade to downgrade ratio was 3/2 during the first three quarters of the year as state and local governments benefited to a surprisingly resilient economy, strong income and sales tax collections and solid fund balances built up from Federal transfer payments during the pandemic. Outside of the health care and higher education sectors, most municipal finances seem to be in pretty good shape. However, with most of the Federal relief funds sunsetting in 2025 and record needs for investments in infrastructure and social services, budgets could be challenged if the overall economy slows precipitously.

| Tax-Free National Fund Class Y | GTFHX |

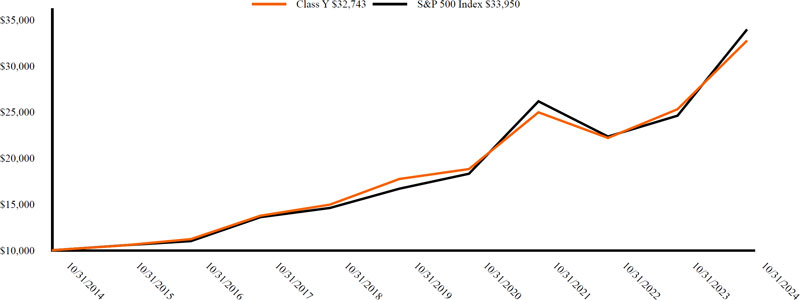

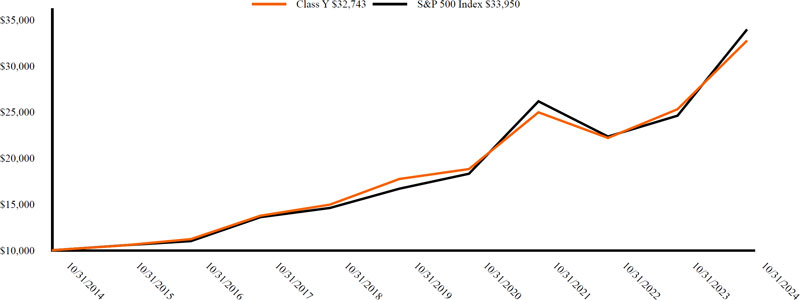

Fund Performance

The chart below illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter).

| Average Annual Total Returns (%) | |

| | 1 Year | 5 Years | 10 Years |

| Class Y | 6.66% | 0.43% | 1.56% |

| ICE BofA 1-22 Yr Municipal Securities Index | 8.61% | 1.21% | 2.19% |

1. Fund returns are calculated after fund expenses have been subtracted and assume that dividends and capital gains are reinvested in additional shares of a fund. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than original cost. Further information relating to the fund’s performance is contained in the prospectus and elsewhere in this report. The Fund’s past performance is not indicative of future performance.

2. The ICE BofA 1-22 Yr Municipal Securities Index tracks the performance of US dollar denominated investment grade tax-exempt debt publicly issued by US states and territories, their political subdivisions, in the US domestic market, with a remaining term to final maturity less than 22 years.

| Key Fund Statistics (As of October 31, 2024) | | | | | | | | |

| Total Net Assets | | | | | | | $17,478,684 | |

| # of Portfolio Holdings | | | | | | | 56 | |

| Portfolio Turnover Rate | | | | | | | 13% | |

| Total Advisory Fees Paid | | | | | | | $71,080 | |

| Tax-Free National Fund Class Y | GTFHX |

What does the Fund invest in?

The Fund invested in intermediate and long-term bonds with average aggregate maturities of 7 to 15 years in municipal bonds that were exempt from federal income taxes.

| Top Ten Holdings (% of Net Assets) | | | |

| County of Mobile, 5.000%, due 02/01/39 | | 3.7 | % |

| City of Burlington, 4.000%, due 04/01/36 | | 3.3 | % |

| Cook County School District No. 111 Burbank, 5.000%, due 12/01/35 | | 3.3 | % |

| Vanderburgh County Redevelopment District, 5.000%, due 02/01/26 | | 2.9 | % |

| Idaho Health Facilities Authority, 5.000%, due 03/01/34 | | 2.9 | % |

| Medical Center Educational Building Corp., 5.000%, due 06/01/30 | | 2.8 | % |

| Southampton County Industrial Development Authority, 5.000%, due 06/01/35 | | 2.8 | % |

| West Virginia Economic Development Authority, 5.000%, due 07/01/37 | | 2.7 | % |

| Eastern Kentucky University, 5.000%, due 04/01/33 | | 2.6 | % |

| City of Hialeah Utility System, 5.000%, due 10/01/35 | | 2.5 | % |

| Portfolio Allocation (% of Net Assets) | | | |

| Government | | 69.4 | % |

| General | | 7.0 | % |

| Development | | 4.9 | % |

| Health Care | | 4.2 | % |

| General Obligation | | 3.0 | % |

| Education | | 2.4 | % |

| Financials | | 2.1 | % |

| Facilities | | 1.5 | % |

| Utilities | | 1.4 | % |

| Transportation | | 1.4 | % |

| Water | | 1.2 | % |

| Other Assets and Liabilities, Net | | 1.5 | % |

Additional Information If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.madisonfunds.com/documents. Phone: 1-800-877-6089 |  |

| | Annual Shareholder Report

October 31, 2024 |

| Tax-Free National Fund Class Y | GTFHX |

| Annual Shareholder Report October 31, 2024 |

High Quality Bond Fund Class Y

Madison High Quality Bond Fund

MIIBX

Fund Overview

This annual shareholder report contains important information about High Quality Bond Fund Class Y for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.madisonfunds.com/documents. You can also request this information by contacting us at 1-800-877-6089.

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| | | Cost of a $10,000

investment | | | Costs paid as a

percentage of a

$10,000 investment | |

| Class Y | | | $52 | | | | 0.50% | |

| | | | | | | | | |

How did the Fund perform last year and what affected its performance?

In response to the Fed’s shift away from restrictive monetary policy, yields stabilized and moved lower in recent months. Higher yield levels and some improved price movement over the period aided in providing a positive return environment for fixed income assets. In recent months the debate has evolved from whether the Fed has achieved a ‘soft landing’ to how to maintain it. The Fed, far from proclaiming a ‘mission accomplished’ moment has shifted their focus to avoiding labor market deterioration. This new focus was clear during the September FOMC meeting and the resulting 50 basis point cut.

While their direction is increasingly clear, the path forward is far from obvious. Continued data volatility and changing market expectations will drive markets until a clear policy end point emerges. The challenge to continue reducing inflation without materially slowing the economy will dictate policy changes over the coming months. We are pleased to see fixed income portfolios benefitting as yields decline but current yield levels, while still offering value, are less attractive than earlier this year. We are pleased to have increased duration exposure and yield in portfolio’s while we evaluate future Fed policy. We expect further yield movement will be dictated by changing economic fundamentals and stand ready to take further action as expectations for monetary policy adjust in the months ahead.

| High Quality Bond Fund Class Y | MIIBX |

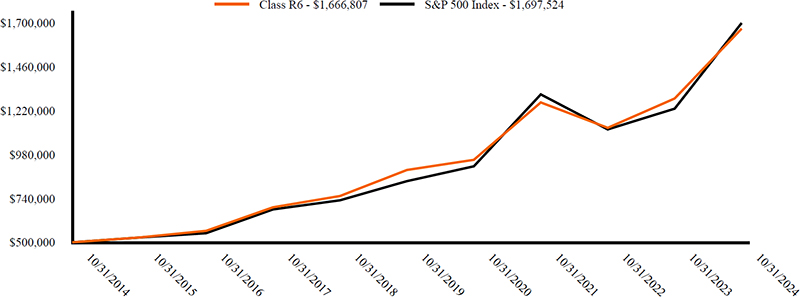

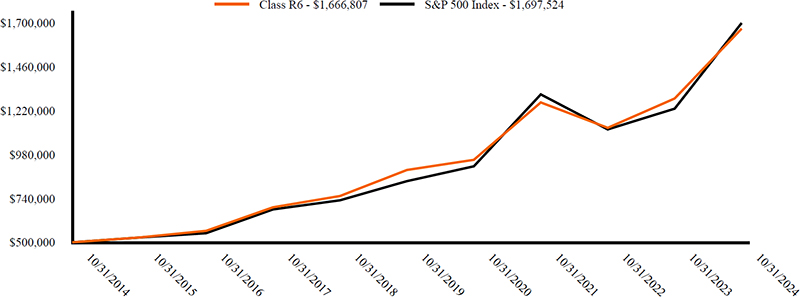

Fund Performance

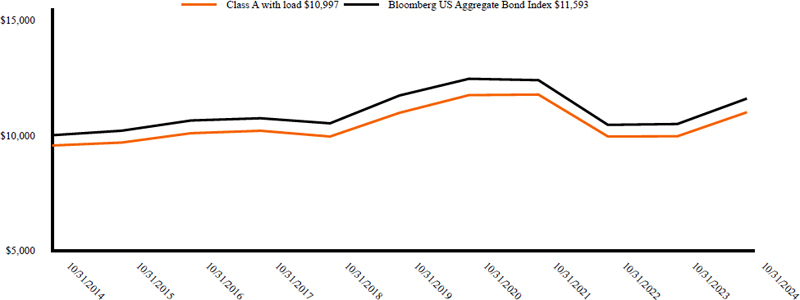

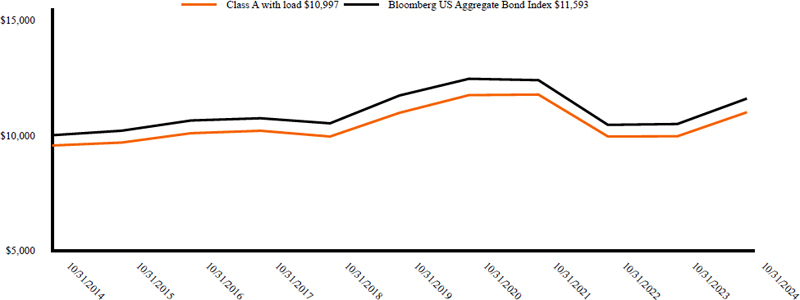

The chart below illustrates the total value of a hypothetical $10,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter).

| Average Annual Total Returns (%) | |

| | 1 Year | 5 Years | 10 Years |

| Class Y | 7.20% | 0.47% | 1.05% |

| Bloomberg US Intermediate Gov’t/Credit A+ Index | 7.58% | 0.67% | 1.51% |

1. Fund returns are calculated after fund expenses have been subtracted and assume that dividends and capital gains are reinvested in additional shares of a fund. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Investment return and principal value will fluctuate, so an investor’s shares, when redeemed, may be worth more or less than original cost. Further information relating to the fund’s performance is contained in the prospectus and elsewhere in this report. The Fund’s past performance is not indicative of future performance.

2. The Bloomberg US Intermediate Govt/Credit A+ Index measures the performance of US dollar denominated US Treasuries, government related and investment grade US corporate securities with quality ratings of A3/A- or better and maturities between one and 10 years.

| Key Fund Statistics (As of October 31, 2024) | | | | | | | | |

| Total Net Assets | | | | | | | $61,517,774 | |

| # of Portfolio Holdings | | | | | | | 58 | |

| Portfolio Turnover Rate | | | | | | | 33% | |

| Total Advisory Fees Paid | | | | | | | $180,522 | |

| High Quality Bond Fund Class Y | MIIBX |

What does the Fund invest in?

The Fund invested in a broad range of corporate debt securities, obligations of the U.S. Government and its agencies, and money market instruments, while maintaining an overall portfolio quality rating of A by Standard & Poor’s and/or A2 by Moody’s.

| Top Ten Holdings (% of Net Assets) | | | |

| U.S. Treasury Notes, 4.875%, due 10/31/28 | | 4.2 | % |

| U.S. Treasury Notes, 3.625%, due 05/31/28 | | 4.0 | % |

| Federal National Mortgage Association, 2.125%, due 04/24/26 | | 3.7 | % |

| U.S. Treasury Notes, 4.000%, due 07/31/30 | | 3.6 | % |

| U.S. Treasury Notes, 3.875%, due 11/30/29 | | 3.6 | % |

| U.S. Treasury Notes, 3.875%, due 12/31/29 | | 3.6 | % |

| U.S. Treasury Notes, 4.000%, due 02/29/28 | | 3.2 | % |

| U.S. Treasury Notes, 4.000%, due 06/30/28 | | 3.2 | % |

| U.S. Treasury Notes, 3.875%, due 09/30/29 | | 3.2 | % |

| U.S. Treasury Notes, 3.250%, due 06/30/27 | | 3.2 | % |

| Portfolio Allocation (% of Net Assets) | | | |

| U.S. Government and Agency Obligations | | 63.0 | % |

| Corporate Notes and Bonds | | 34.0 | % |

| Short-Term Investments | | 6.1 | % |

| Foreign Corporate Bonds | | 1.6 | % |

| Other Assets and Liabilities, Net | | (4.7 | %) |

| | | | |

Additional Information If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.madisonfunds.com/documents. Phone: 1-800-877-6089 |  |

| | Annual Shareholder Report

October 31, 2024 |

| High Quality Bond Fund Class Y | MIIBX |

| Annual Shareholder Report October 31, 2024 |

High Quality Bond Fund Class I

Madison High Quality Bond Fund

MIIRX

Fund Overview

This annual shareholder report contains important information about High Quality Bond Fund Class I for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at www.madisonfunds.com/documents. You can also request this information by contacting us at 1-800-877-6089.

What were the Fund costs for last year?

(based on a hypothetical $10,000 investment)

| | | Cost of a $10,000

investment | | | Costs paid as a

percentage of a

$10,000 investment | |

| Class I | | | $43 | | | | 0.41% | |

| | | | | | | | | |

How did the Fund perform last year and what affected its performance?

In response to the Fed’s shift away from restrictive monetary policy, yields stabilized and moved lower in recent months. Higher yield levels and some improved price movement over the period aided in providing a positive return environment for fixed income assets. In recent months the debate has evolved from whether the Fed has achieved a ‘soft landing’ to how to maintain it. The Fed, far from proclaiming a ‘mission accomplished’ moment has shifted their focus to avoiding labor market deterioration. This new focus was clear during the September FOMC meeting and the resulting 50 basis point cut.

While their direction is increasingly clear, the path forward is far from obvious. Continued data volatility and changing market expectations will drive markets until a clear policy end point emerges. The challenge to continue reducing inflation without materially slowing the economy will dictate policy changes over the coming months. We are pleased to see fixed income portfolios benefitting as yields decline but current yield levels, while still offering value, are less attractive than earlier this year. We are pleased to have increased duration exposure and yield in portfolio’s while we evaluate future Fed policy. We expect further yield movement will be dictated by changing economic fundamentals and stand ready to take further action as expectations for monetary policy adjust in the months ahead.

| High Quality Bond Fund Class I | MIIRX |

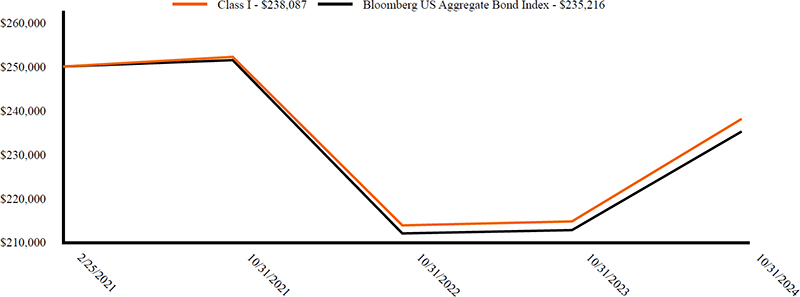

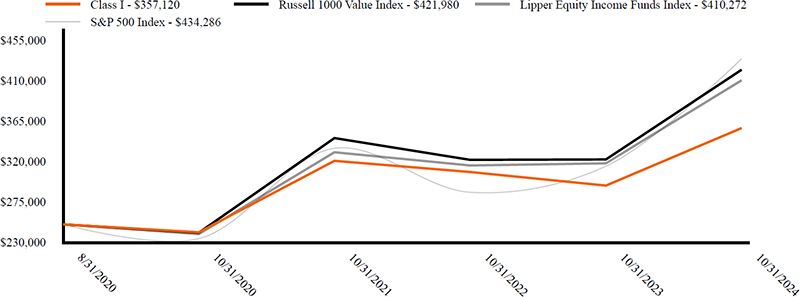

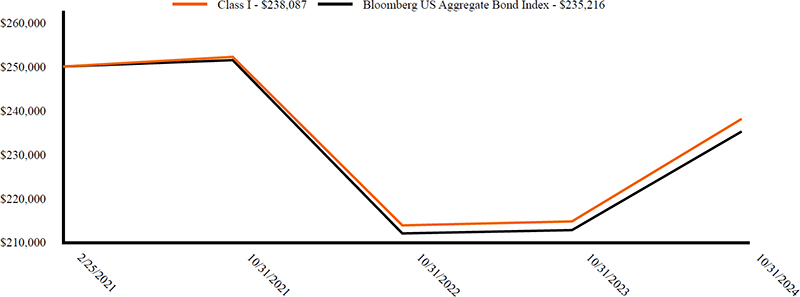

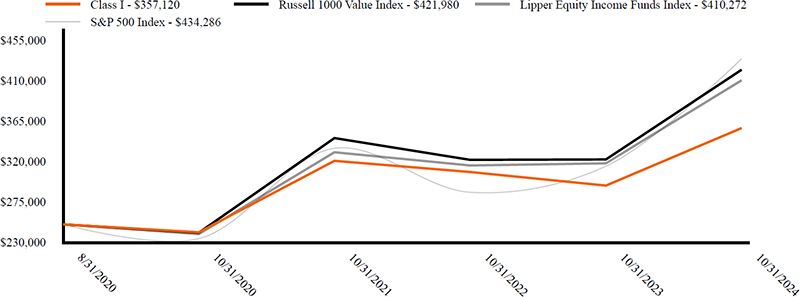

Fund Performance

The chart below illustrates the total value of a hypothetical $250,000 investment in the Fund over the past 10 years (or for the life of the Fund if shorter).

| Average Annual Total Returns (%) | |

| | 1 Year | Since Inception 2/28/22 |

| Class I | 7.35% | 0.91% |

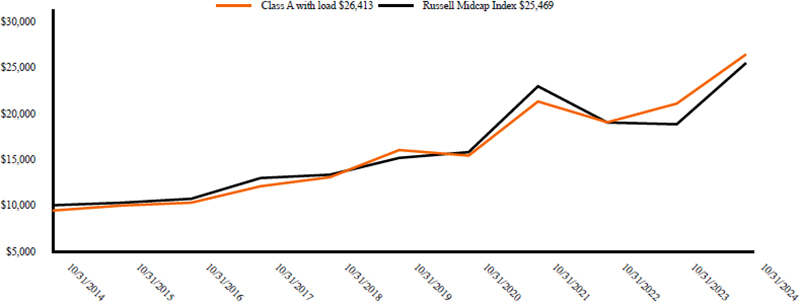

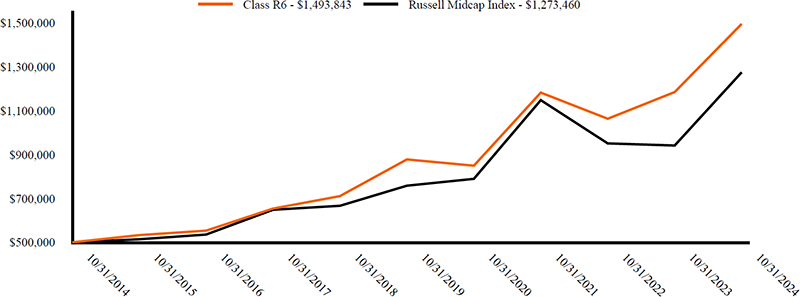

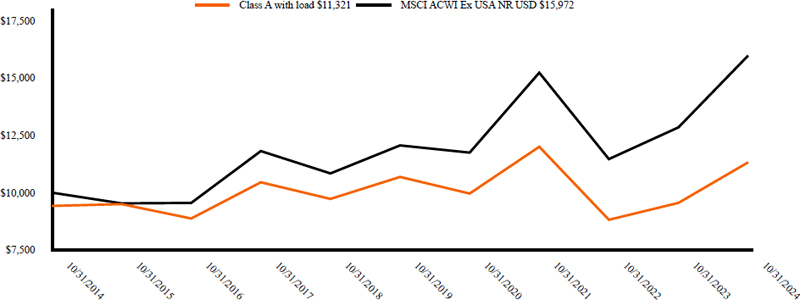

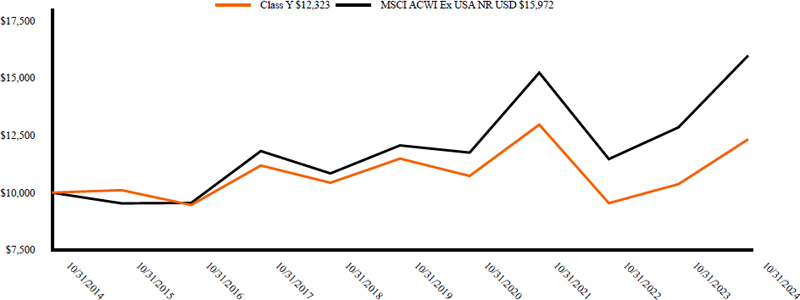

| Bloomberg US Intermediate Gov’t/Credit A+ Index | 7.58% | 0.40% |