united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

| Investment Company Act file number | 811-08253 |

| The Boyar Value Fund, Inc. |

| (Exact name of registrant as specified in charter) |

| 35 East 21st Street, New York, | NY 10010 |

| (Address of principal executive offices) | (Zip code) |

| James Ash, Gemini Fund Services, LLC |

| 80 Arkay Drive Suite 110, Hauppauge, NY 11788 |

(Name and address of agent for service)

| Registrant’s telephone number, including area code: | 212 995-8300 |

| Date of fiscal year end: | 12/31 |

| Date of reporting period: | 6/30/24 |

Item 1. Reports to Stockholders.

(a)

Boyar Value Fund, Inc. - A (BOYAX)

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Boyar Value Fund, Inc. for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at www.boyarassetmanagement.com/individual-investors-boyar-value-fund. You can also request this information by contacting us at 1-800-266-5566.

What were the Fund’s costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| A | $82 | 1.65% |

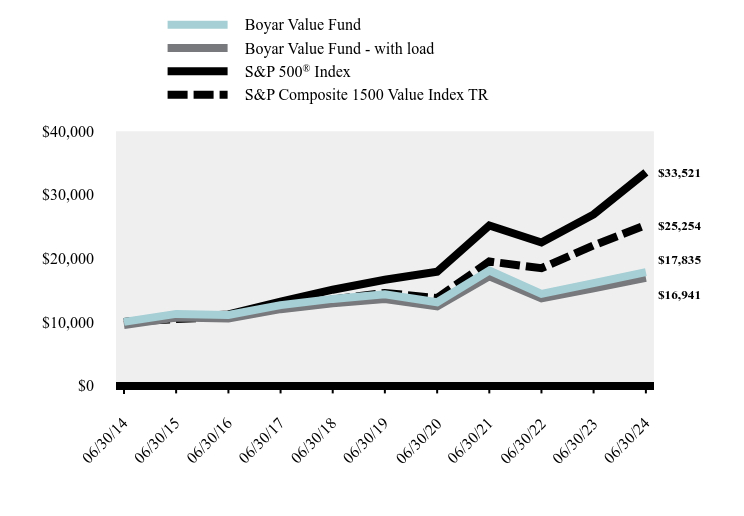

How has the Fund performed over the last ten years?

Total Return Based on $10,000 Investment

| Boyar Value Fund | Boyar Value Fund - with load | S&P 500® Index | S&P Composite 1500 Value Index TR |

|---|

| 06/30/14 | $10,000 | $9,499 | $10,000 | $10,000 |

| 06/30/15 | $11,257 | $10,692 | $10,742 | $10,443 |

| 06/30/16 | $11,094 | $10,538 | $11,171 | $10,767 |

| 06/30/17 | $12,636 | $12,002 | $13,170 | $12,516 |

| 06/30/18 | $13,618 | $12,935 | $15,064 | $13,538 |

| 06/30/19 | $14,329 | $13,611 | $16,633 | $14,558 |

| 06/30/20 | $13,090 | $12,434 | $17,881 | $13,751 |

| 06/30/21 | $18,075 | $17,169 | $25,175 | $19,499 |

| 06/30/22 | $14,416 | $13,693 | $22,503 | $18,454 |

| 06/30/23 | $16,105 | $15,297 | $26,912 | $22,044 |

| 06/30/24 | $17,835 | $16,941 | $33,521 | $25,254 |

Average Annual Total Returns

| 6 months | 1 Year | 5 Years | 10 Years |

|---|

| Boyar Value Fund | | | | |

| Without Load | 4.43% | 10.75% | 4.47% | 5.96% |

| With Load | | 5.22% | 3.41% | 5.41% |

S&P 500® Index | 15.29% | 24.56% | 15.05% | 12.86% |

| S&P Composite 1500 Value Index TR | 5.17% | 14.56% | 11.65% | 9.71% |

The Fund's past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

- Net Assets$28,532,781

- Number of Portfolio Holdings40

- Advisory Fee $73,580

- Portfolio Turnover2%

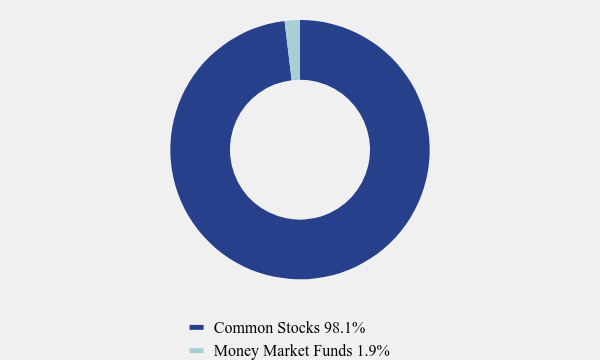

Asset Weighting (% of total investments)

| Value | Value |

|---|

| Common Stocks | 98.1% |

| Money Market Funds | 1.9% |

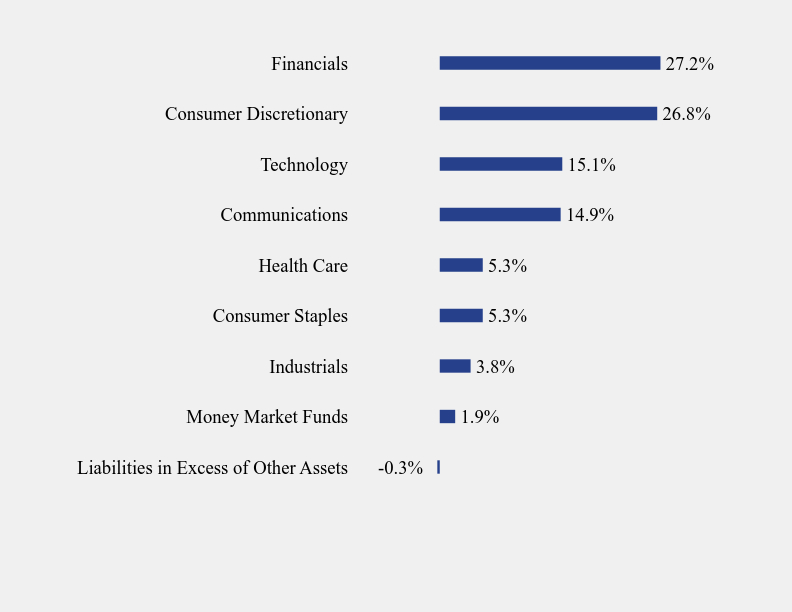

What did the Fund invest in?

Sector Weighting (% of net assets)

| Value | Value |

|---|

| Liabilities in Excess of Other Assets | -0.3% |

| Money Market Funds | 1.9% |

| Industrials | 3.8% |

| Consumer Staples | 5.3% |

| Health Care | 5.3% |

| Communications | 14.9% |

| Technology | 15.1% |

| Consumer Discretionary | 26.8% |

| Financials | 27.2% |

Top 10 Holdings (% of net assets)

| Holding Name | % of Net Assets |

| Ameriprise Financial, Inc. | 12.6% |

| Microsoft Corporation | 12.1% |

| Home Depot, Inc. (The) | 7.7% |

| JPMorgan Chase & Company | 6.5% |

| Uber Technologies, Inc. | 5.1% |

| Bank of America Corporation | 4.3% |

| Atlanta Braves Holdings, Inc. - Class C | 3.7% |

| Walt Disney Company (The) | 3.3% |

| Madison Square Garden Sports Corporation | 3.3% |

| McDonald's Corporation | 2.7% |

No material changes occurred during the period ended June 30, 2024.

Boyar Value Fund, Inc. - A (BOYAX)

Semi-Annual Shareholder Report - June 30, 2024

Where can I find additional information about the Fund?

Additional information is available on the Fund's website ( www.boyarassetmanagement.com/individual-investors-boyar-value-fund ), including its:

Prospectus

Financial information

Holdings

Proxy voting information

(b) Not applicable

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Companies.

Not applicable to open-end investment companies.

Item 6. Investments.

The Registrant’s schedule of investments in unaffiliated issuers is included in the Financial Statements under Item 7 of this form.

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

(a) Included Long Form Financial Statements

| BOYAR VALUE FUND, INC. |

| SCHEDULE OF INVESTMENTS (Unaudited) |

| June 30, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.4% | | | | |

| | | | | APPAREL & TEXTILE PRODUCTS - 0.4% | | | | |

| | 24,070 | | | Hanesbrands, Inc.(a) | | $ | 118,665 | |

| | | | | | | | | |

| | | | | ASSET MANAGEMENT - 12.6% | | | | |

| | 8,500 | | | Ameriprise Financial, Inc. | | | 3,631,116 | |

| | | | | | | | | |

| | | | | BANKING - 11.9% | | | | |

| | 31,421 | | | Bank of America Corporation | | | 1,249,613 | |

| | 4,430 | | | Citigroup, Inc. | | | 281,128 | |

| | 9,150 | | | JPMorgan Chase & Company | | | 1,850,679 | |

| | | | | | | | 3,381,420 | |

| | | | | BEVERAGES - 1.2% | | | | |

| | 5,226 | | | Coca-Cola Company (The) | | | 332,635 | |

| | | | | | | | | |

| | | | | BIOTECH & PHARMA - 4.0% | | | | |

| | 7,500 | | | Bristol-Myers Squibb Company | | | 311,475 | |

| | 2,500 | | | Johnson & Johnson | | | 365,400 | |

| | 16,000 | | | Pfizer, Inc. | | | 447,680 | |

| | | | | | | | 1,124,555 | |

| | | | | CABLE & SATELLITE - 2.5% | | | | |

| | 18,268 | | | Comcast Corporation, Class A | | | 715,375 | |

| | | | | | | | | |

| | | | | ENTERTAINMENT CONTENT - 4.1% | | | | |

| | 9,500 | | | Walt Disney Company (The) | | | 943,255 | |

| | 28,687 | | | Warner Bros Discovery, Inc.(a) | | | 213,431 | |

| | | | | | | | 1,156,686 | |

| | | | | FOOD - 2.1% | | | | |

| | 9,000 | | | Mondelez International, Inc., A | | | 588,960 | |

| | | | | | | | | |

| | | | | HEALTH CARE FACILITIES & SERVICES - 1.3% | | | | |

| | 6,500 | | | CVS Health Corporation | | | 383,890 | |

| | | | | | | | | |

| | | | | HOME & OFFICE PRODUCTS - 1.8% | | | | |

| | 7,900 | | | Scotts Miracle-Gro Company (The) | | | 513,974 | |

| BOYAR VALUE FUND, INC. |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| June 30, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.4% (Continued) | | | | |

| | | | | HOUSEHOLD PRODUCTS - 0.3% | | | | |

| | 3,200 | | | Energizer Holdings, Inc. | | $ | 94,528 | |

| | | | | | | | | |

| | | | | INSTITUTIONAL FINANCIAL SERVICES - 2.7% | | | | |

| | 12,707 | | | Bank of New York Mellon Corporation (The) | | | 761,022 | |

| | | | | | | | | |

| | | | | INTERNET MEDIA & SERVICES - 8.3% | | | | |

| | 2,700 | | | Alphabet, Inc., Class A | | | 491,805 | |

| | 28,752 | | | Angi, Inc., Class A(a) | | | 55,204 | |

| | 7,715 | | | IAC, Inc.(a) | | | 361,448 | |

| | 20,248 | | | Uber Technologies, Inc.(a) | | | 1,471,624 | |

| | | | | | | | 2,380,081 | |

| | | | | LEISURE FACILITIES & SERVICES - 13.4% | | | | |

| | 26,727 | | | Atlanta Braves Holdings, Inc.(a) | | | 1,054,113 | |

| | 7,629 | | | Madison Square Garden Entertainment Corporation(a) | | | 261,141 | |

| | 4,934 | | | Madison Square Garden Sports Corporation(a) | | | 928,233 | |

| | 8 | | | Marriott International, Inc., Class A | | | 1,934 | |

| | 3,000 | | | McDonald’s Corporation | | | 764,520 | |

| | 9,500 | | | MGM Resorts International(a) | | | 422,180 | |

| | 7,629 | | | Sphere Entertainment Company(a) | | | 267,473 | |

| | 1,500 | | | Starbucks Corporation | | | 116,775 | |

| | | | | | | | 3,816,369 | |

| | | | | LEISURE PRODUCTS - 3.5% | | | | |

| | 10,000 | | | Acushnet Holdings Corporation | | | 634,800 | |

| | 23,910 | | | Topgolf Callaway Brands Corporation(a) | | | 365,823 | |

| | | | | | | | 1,000,623 | |

| | | | | MACHINERY - 1.4% | | | | |

| | 22,554 | | | Mueller Water Products, Inc. | | | 404,168 | |

| | | | | | | | | |

| | | | | RETAIL - CONSUMER STAPLES - 0.7% | | | | |

| | 1,425 | | | Target Corporation | | | 210,957 | |

| | | | | | | | | |

| | | | | RETAIL - DISCRETIONARY - 7.7% | | | | |

| | 6,385 | | | Home Depot, Inc. (The) | | | 2,197,972 | |

| BOYAR VALUE FUND, INC. |

| SCHEDULE OF INVESTMENTS (Unaudited) (Continued) |

| June 30, 2024 |

| Shares | | | | | Fair Value | |

| | | | | COMMON STOCKS — 98.4% (Continued) | | | | |

| | | | | SEMICONDUCTORS - 0.9% | | | | |

| | 8,000 | | | Intel Corporation | | $ | 247,760 | |

| | | | | | | | | |

| | | | | SOFTWARE - 12.1% | | | | |

| | 7,734 | | | Microsoft Corporation | | | 3,456,711 | |

| | | | | | | | | |

| | | | | TECHNOLOGY HARDWARE - 2.1% | | | | |

| | 12,500 | | | Cisco Systems, Inc. | | | 593,875 | |

| | | | | | | | | |

| | | | | TRANSPORTATION & LOGISTICS - 2.4% | | | | |

| | 5,000 | | | United Parcel Service, Inc., B | | | 684,250 | |

| | | | | | | | | |

| | | | | WHOLESALE - CONSUMER STAPLES - 1.0% | | | | |

| | 4,000 | | | Sysco Corporation | | | 285,560 | |

| | | | | | | | | |

| | | | | TOTAL COMMON STOCKS (Cost $11,051,282) | | | 28,081,152 | |

| | | | | | | | | |

| | | | | SHORT-TERM INVESTMENT — 1.9% | | | | |

| | | | | MONEY MARKET FUND - 1.9% | | | | |

| | 542,048 | | | Dreyfus Institutional Preferred Government, Hamilton Class, 5.21% (Cost $542,048)(b) | | | 542,048 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS - 100.3% (Cost $11,593,330) | | $ | 28,623,200 | |

| | | | | LIABILITIES IN EXCESS OF OTHER ASSETS - (0.3)% | | | (90,419 | ) |

| | | | | NET ASSETS - 100.0% | | $ | 28,532,781 | |

| (a) | Non-income producing security. |

| (b) | Rate disclosed is the seven day effective yield as of June 30, 2024. |

See accompanying notes which are an integral part of these financial statements.

| BOYAR VALUE FUND, INC. |

| STATEMENT OF ASSETS AND LIABILITIES (Unaudited) |

| June 30, 2024 |

| ASSETS | | | |

| Investment securities, at cost | | $ | 11,593,330 | |

| Investment securities, at value | | $ | 28,623,200 | |

| Dividends and interest receivable | | | 9,171 | |

| Prepaid expenses and other assets | | | 2,692 | |

| TOTAL ASSETS | | | 28,635,063 | |

| | | | | |

| LIABILITIES | | | | |

| Advisory fees payable | | | 24,249 | |

| Distribution fees (12b-1) payable | | | 16,330 | |

| Payable to service providers | | | 31,761 | |

| Audit fees payable | | | 8,776 | |

| Accrued Director fees | | | 3,579 | |

| Accrued expenses and other liabilities | | | 17,587 | |

| TOTAL LIABILITIES | | | 102,282 | |

| NET ASSETS | | $ | 28,532,781 | |

| | | | | |

| Net Assets Consist Of: | | | | |

| Paid in capital | | $ | 11,117,672 | |

| Accumulated earnings | | | 17,415,109 | |

| NET ASSETS | | $ | 28,532,781 | |

| | | | | |

| Shares of capital stock outstanding (1,000,000,000 shares authorized, $0.001 par value) | | | 931,430 | |

| Net asset value and redemption price per share (Net assets ÷ shares outstanding)(a) | | $ | 30.63 | |

| Maximum offering price per share (maximum sales charge of 5.00%) (b) | | $ | 32.24 | |

| (a) | For certain purchases of $1 million or more, a 1.00% contingent deferred sales charge may apply to redemptions made within twelve months of purchase. Redemptions made within 60 days of purchase may be assessed a redemption fee of 2.00%. |

| (b) | On investments of $50,000 or more, the offering price is reduced. |

See accompanying notes which are an integral part of these financial statements.

| BOYAR VALUE FUND, INC. |

| STATEMENT OF OPERATIONS (Unaudited) |

| For the Six Months Ended June 30, 2024 |

| INVESTMENT INCOME | | | |

| Dividends | | $ | 257,961 | |

| Interest | | | 26,376 | |

| TOTAL INVESTMENT INCOME | | | 284,337 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees | | | 73,580 | |

| Distribution (12b-1) fees | | | 36,790 | |

| Administrative services fees | | | 30,039 | |

| Legal fees | | | 19,525 | |

| Transfer agent fees | | | 18,855 | |

| Accounting services fees | | | 12,636 | |

| Compliance officer fees | | | 9,667 | |

| Insurance expense | | | 9,248 | |

| Audit fees | | | 9,100 | |

| Printing and postage expenses | | | 5,430 | |

| Registration fees | | | 4,868 | |

| Custodian fees | | | 3,690 | |

| Directors’ fees and expenses | | | 2,956 | |

| Other expenses | | | 4,668 | |

| TOTAL EXPENSES | | | 241,052 | |

| NET INVESTMENT INCOME | | | 43,285 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | | |

| Net realized gain from security transactions | | | 341,954 | |

| Net change in unrealized appreciation of investments | | | 877,378 | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 1,219,332 | |

| | | | | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 1,262,617 | |

See accompanying notes which are an integral part of these financial statements.

| BOYAR VALUE FUND, INC. |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | For the Six Months | | | For the Year | |

| | | Ended | | | Ended | |

| | | June 30, 2024 | | | December 31, 2023 | |

| | | (Unaudited) | | | | |

| FROM OPERATIONS | | | | | | | | |

| Net investment income | | $ | 43,285 | | | $ | 109,757 | |

| Net realized gain from security transactions | | | 341,954 | | | | 39,216 | |

| Net change in unrealized appreciation on investments | | | 877,378 | | | | 3,444,087 | |

| Net increase in net assets resulting from operations | | | 1,262,617 | | | | 3,593,060 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Total distributions paid (Note 8) | | | — | | | | (142,798 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 88,098 | | | | 183,426 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | — | | | | 136,128 | |

| Payments for shares redeemed | | | (1,736,265 | ) | | | (461,890 | ) |

| Redemption fee proceeds (Note 7) | | | — | | | | 3 | |

| Net decrease in net assets from capital share transactions | | | (1,648,167 | ) | | | (142,333 | ) |

| | | | | | | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | (385,550 | ) | | | 3,307,929 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of Period | | | 28,918,331 | | | | 25,610,402 | |

| End of Period | | $ | 28,532,781 | | | $ | 28,918,331 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares Sold | | | 2,908 | | | | 6,742 | |

| Shares Reinvested | | | — | | | | 4,834 | |

| Shares Redeemed | | | (57,161 | ) | | | (17,195 | ) |

| Net decrease in shares outstanding | | | (54,253 | ) | | | (5,619 | ) |

See accompanying notes which are an integral part of these financial statements.

| BOYAR VALUE FUND, INC. |

| FINANCIAL HIGHLIGHTS |

| |

| Per Share Data and Ratios for a Share of Capital Stock Outstanding Throughout Each Period Presented |

| | | For the | | | Year | | | Year | | | Year | | | Year | | | Year | |

| | | Six Months Ended | | | Ended | | | Ended | | | Ended | | | Ended | | | Ended | |

| | | June 30, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| | | 2024 | | | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| | | (Unaudited) | | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 29.34 | | | $ | 25.84 | | | $ | 32.52 | | | $ | 27.53 | | | $ | 26.92 | | | $ | 23.48 | |

| Activity from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) (1) | | | 0.04 | | | | 0.11 | | | | 0.13 | | | | (0.03 | ) | | | 0.04 | | | | 0.11 | |

| Net realized and unrealized gain (loss) on investments | | | 1.25 | | | | 3.54 | | | | (6.68 | ) | | | 5.15 | | | | 1.08 | | | | 4.37 | |

| Total from investment operations | | | 1.29 | | | | 3.65 | | | | (6.55 | ) | | | 5.12 | | | | 1.12 | | | | 4.48 | |

| Paid-in-Capital from Redemption Fees (1) | | | — | | | | 0.00 | (2) | | | — | | | | — | | | | — | | | | 0.00 | (2) |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | — | | | | (0.12 | ) | | | (0.12 | ) | | | — | | | | (0.04 | ) | | | (0.11 | ) |

| Net realized gains | | | — | | | | (0.03 | ) | | | (0.01 | ) | | | (0.13 | ) | | | (0.47 | ) | | | (0.93 | ) |

| Total distributions | | | — | | | | (0.15 | ) | | | (0.13 | ) | | | (0.13 | ) | | | (0.51 | ) | | | (1.04 | ) |

| Net Asset Value, End of Period | | $ | 30.63 | | | $ | 29.34 | | | $ | 25.84 | | | $ | 32.52 | | | $ | 27.53 | | | $ | 26.92 | |

| Total Return (3) | | | 4.43 | % (6) | | | 14.13 | % | | | (20.14 | )% | | | 18.61 | % | | | 4.23 | % | | | 19.15 | % |

| Net Assets, End of Period | | $ | 28,532,781 | | | $ | 28,918,331 | | | $ | 25,610,402 | | | $ | 32,762,135 | | | $ | 28,072,250 | | | $ | 27,942,062 | |

| Ratio of gross expenses to average net assets | | | 1.65 | % (7) | | | 1.71 | % | | | 1.64 | % | | | 1.53 | % | | | 1.78 | % (4) | | | 1.75 | % (4) |

| Ratio of net expenses to average net assets | | | 1.65 | % (7) | | | 1.71 | % | | | 1.64 | % | | | 1.55 | % (5) | | | 1.75 | % | | | 1.75 | % |

| Ratio of net investment income (loss) to average net assets | | | 0.30 | % (7) | | | 0.41 | % | | | 0.46 | % | | | -0.08 | % | | | 0.15 | % | | | 0.42 | % |

| Portfolio Turnover Rate | | | 2 | % (6) | | | 0 | % | | | 0 | % | | | 1 | % | | | 14 | % | | | 9 | % |

| (1) | Per share amounts calculated using the average shares method. |

| (2) | Amount represents less than $0.005 per share. |

| (3) | Total returns shown are historical in nature and assume changes in share price, reinvestment of dividends and capital gains distributions, if any, and exclude the effect of applicable sales loads/redemption fees. Had the Adviser not waived their fees and/or reimbursed expenses for the years ended 2019 and 2020, total returns would have been lower. |

| (4) | Represents the ratio of expenses to average net assets absent fee waivers and/or expense reimbursements by the Adviser. |

| (5) | Represents the ratio of expenses to average net assets inclusive of expense recapture by the Adviser. |

See accompanying notes which are an integral part of these financial statements.

| BOYAR VALUE FUND, INC. |

| NOTES TO FINANCIAL STATEMENTS (Unaudited) |

| June 30, 2024 |

Boyar Value Fund, Inc. (the “Fund”) was incorporated on February 28, 1997 under the laws of the State of Maryland and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end, diversified management investment company. The Fund’s investment objective is long-term capital appreciation.

Under the Fund’s organizational documents, its officers and Board of Directors (“Directors”) are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts with its vendors and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects that risk of loss to be remote.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 “Financial Services – Investment Companies”.

Securities valuation – Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading session of the primary exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ at the NASDAQ Official Closing Price. In the absence of a sale such securities shall be valued at the mean between the current bid and ask prices on the day of valuation. Short-term debt obligations having 60 days or less remaining until maturity, at time of purchase, may be valued at amortized cost.

The Fund may hold securities, such as private investments, interests in commodity pools, other non-traded securities or temporarily illiquid securities, for which market quotations are not readily available or are determined to be unreliable. These securities are valued using the “fair value” procedures approved by the Board. The Board has designated the adviser as its valuation designee (the “Valuation Designee”) to execute these procedures. The Board may also enlist third party consultants such a valuation specialist at a public accounting firm, valuation consultant or financial officer of a security issuer on an as-needed basis to assist the Valuation Designee in determining a security-specific fair value. The Board is responsible for reviewing and approving fair value methodologies utilized by the Valuation Designee, approval of which shall be based upon whether the Valuation Designee followed the valuation procedures established by the Board.

| BOYAR VALUE FUND, INC. |

| NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued) |

| June 30, 2024 |

Fair Valuation Process – The applicable investments are valued by the Valuation Designee pursuant to valuation procedures established by the Board. For example, fair value determinations are required for the following securities: (i) securities for which market quotations are insufficient or not readily available on a particular business day (including securities for which there is a short and temporary lapse in the provision of a price by the regular pricing source); (ii) securities for which, in the judgment of the Valuation Designee, the prices or values available do not represent the fair value of the instrument; factors which may cause the Valuation Designee to make such a judgment include, but are not limited to, the following: only a bid price or an asked price is available; the spread between bid and asked prices is substantial; the frequency of sales; the thinness of the market; the size of reported trades; and actions of the securities markets, such as the suspension or limitation of trading; (iii) securities determined to be illiquid; and (iv) securities with respect to which an event that affects the value thereof has occurred (a “significant event”) since the closing prices were established on the principal exchange on which they are traded, but prior to a Fund’s calculation of its net asset value. Specifically, interests in commodity pools or managed futures pools are valued on a daily basis by reference to the closing market prices of each futures contract or other asset held by a pool, as adjusted for pool expenses. Restricted or illiquid securities, such as private investments or non-traded securities are valued based upon the current bid for the security from two or more independent dealers or other parties reasonably familiar with the facts and circumstances of the security (who should take into consideration all relevant factors as may be appropriate under the circumstances). If a current bid from such independent dealers or other independent parties is unavailable, the Valuation Designee shall determine the fair value of such security using the following factors: (i) the type of security; (ii) the cost at date of purchase; (iii) the size and nature of the Fund’s holdings; (iv) the discount from market value of unrestricted securities of the same class at the time of purchase and subsequent thereto; (v) information as to any transactions or offers with respect to the security; (vi) the nature and duration of restrictions on disposition of the security and the existence of any registration rights; (vii) how the yield of the security compares to similar securities of companies of similar or equal creditworthiness; (viii) the level of recent trades of similar or comparable securities; (ix) the liquidity characteristics of the security; (x) current market conditions; and (xi) the market value of any securities into which the security is convertible or exchangeable.

The Fund utilizes various methods to measure the fair value of all of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

| BOYAR VALUE FUND, INC. |

| NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued) |

| June 30, 2024 |

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument in an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following table summarizes the inputs used as of June 30, 2024 for the Fund’s investments measured at fair value:

| Assets* | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 28,081,152 | | | $ | — | | | $ | — | | | $ | 28,081,152 | |

| Short-Term Investment | | | 542,048 | | | | — | | | | — | | | | 542,048 | |

| Total | | $ | 28,623,200 | | | $ | — | | | $ | — | | | $ | 28,623,200 | |

The Fund did not hold any Level 3 securities during the period.

| * | Refer to the Schedule of Investments for security classifications. |

Security Transactions and Related Income – Security transactions are accounted for on trade date. Interest income is recognized on an accrual basis. Dividend income is recorded on the ex-dividend date. Realized gains or losses from sales of securities are determined by comparing the identified cost of the security lot sold with the net sales proceeds.

| BOYAR VALUE FUND, INC. |

| NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued) |

| June 30, 2024 |

Dividends and Distributions to Shareholders – Dividends from net investment income, if any, are declared and paid annually. Distributable net realized capital gains, if any, are declared and distributed annually. Dividends and distributions paid and distributed to shareholders are recorded on ex-dividend date.

Dividends from net investment income and distributions from net realized gains are determined in accordance with Federal income tax regulations, which may differ from GAAP. These “book/tax” differences are considered either temporary (i.e., deferred losses) or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the composition of net assets based on their Federal tax-basis treatment; temporary differences do not require reclassification. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of each Fund.

Federal Income Taxes – The Fund intends to continue to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its taxable income to its shareholders. Therefore, no provision for Federal income tax is required. The Fund will recognize the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for open tax years ended December 31, 2021 to December 31, 2023, or expected to be taken in the Fund’s December 31, 2024 year-end tax returns. The Fund identifies its major tax jurisdictions as U.S. Federal, Maryland and foreign jurisdictions where the Fund makes significant investments. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

Use of Estimates – The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the reporting period. Actual results could differ from those estimates.

| 3. | INVESTMENT TRANSACTIONS |

For the six months ended June 30, 2024, cost of purchases and proceeds from sales of portfolio securities, other than short-term investments, amounted to $566,132 and $1,453,998, respectively.

| BOYAR VALUE FUND, INC. |

| NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued) |

| June 30, 2024 |

| 4. | AGGREGATE UNREALIZED APPRECIATION AND DEPRECIATION |

At June 30, 2024, the tax cost of investments and unrealized appreciation (depreciation) are as follows:

| | | | | | Gross Unrealized | | | Gross Unrealized | | | Net Unrealized | |

| Fund | | Tax Cost | | | Appreciation | | | Depreciation | | | Appreciation | |

| Boyar Value Fund | | $ | 11,593,330 | | | $ | 18,091,686 | | | $ | (1,061,816 | ) | | $ | 17,029,870 | |

| 5. | INVESTMENT ADVISORY AGREEMENT AND TRANSACTIONS WITH SERVICE PROVIDERS |

Boyar Asset Management, Inc. (the “Adviser”) provides continuous advisory services to the Fund and Northern Lights Distributors, LLC (the “Distributor”) acts as distributor of the Fund’s shares.

Pursuant to an Investment Advisory Agreement among the Adviser and the Fund, the Adviser agrees to furnish continuous investment advisory services to the Fund. For these services, the Fund pays the Adviser an investment advisory fee, which is computed and accrued daily and paid monthly, at an annual rate of 0.50% of the Fund’s average daily net assets. For the six months ended June 30, 2024, the Fund incurred $73,580 in advisory fees.

Pursuant to a written contract, the Adviser has agreed to waive a portion of its advisory fees and the to reimburse certain expenses of the Fund (excluding interest, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, Underlying or Acquired Fund Fees and Expenses, and other extraordinary expenses not incurred in the ordinary course of the Fund’s business) to the extent necessary to limit the Fund’s total annual operating expenses (subject to the same exclusions) to 1.75% of the Fund’s average daily net assets (the “expense limitation”). The Adviser is permitted to subsequently recover reimbursed expenses and/or waived fees (within 2 years after the fiscal year end in which the waiver/reimbursement occurred) from the Fund to the extent that the Fund’s expense ratio is less than the expense limitation. The Adviser has agreed to maintain this expense limitation through at least May 1, 2025. At June 30, 2024 the Advisor did not waive any of its fees and had no available recapture.

The Fund has adopted a Shareholder Servicing and Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act. The Plan provides that a monthly service fee is calculated by the Fund at an annual rate of 0.25% of its average daily net assets and is paid to the Distributor, to provide compensation for ongoing services and/or maintenance of the Fund’s shareholder accounts, not otherwise required to be provided by the Adviser. For the six months ended June 30, 2024, the Fund incurred $36,790 in distribution (12b-1) fees.

| BOYAR VALUE FUND, INC. |

| NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued) |

| June 30, 2024 |

For the six months ended June 30, 2024, the Distributor received $0 from front-end sales charges, of which $0 was retained by the principal underwriter or other affiliated broker-dealers.

Ultimus Fund Solutions, LLC (“UFS”)

UFS, an affiliate of the Distributor, provides administration, fund accounting, and transfer agent services to the Fund. Pursuant to a separate servicing agreement with UFS, the Fund pays UFS customary fees for providing administration, fund accounting and transfer agency services to the Fund. Certain Directors and officers of the Fund are also officers of the Adviser or UFS, and are not paid any fees directly by the Fund for serving in such capacities.

In addition, certain affiliates of UFS provide services to the Fund as follows:

Northern Lights Compliance Services, LLC (“NLCS”)

NLCS, an affiliate of UFS and the Distributor, provides a Chief Compliance Officer to the Fund, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Fund. Under the terms of such agreement, NLCS receives customary fees from the Fund.

Blu Giant, LLC (“Blu Giant”)

Blu Giant, an affiliate of UFS and the Distributor, provides EDGAR conversion and filing services as well as print management services for the Fund on an ad-hoc basis. For the provision of these services, Blu Giant receives customary fees from the Fund.

Custody Administration

Pursuant to the terms of the Fund’s Custody Agreement with Bank of New York Mellon (the “Custody Agreement”), the Fund pays an asset-based custody fee in decreasing amounts as Fund assets reach certain breakpoints. The Fund also pays certain transaction fees and out-of-pocket expenses pursuant to the Custody Agreement. UFS receives a portion of these fees for performing certain custody administration services. UFS’s share of such fees collected for the six months ended June 30, 2024 was $2,210. The Custodian fees listed in the Statement of Operations include the fees paid to UFS as Custody Administrator.

Directors

The Fund pays each Director an annual fee of $3,000 and $500 for each meeting attended. Expenses incurred in connection with attendance at board meetings may be reimbursed. No employee of the Adviser, UFS or any of their respective affiliates will receive any compensation from the Fund for acting as either an officer or Director. None of the executive officers receive any compensation from the Fund.

| BOYAR VALUE FUND, INC. |

| NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued) |

| June 30, 2024 |

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a Fund creates presumption of control of the Fund, under Section 2(a)(9) of the 1940 Act. As of June 30, 2024, National Financial Services LLC held approximately 47.6% of the voting securities of the Boyar Value Fund while Vector Group Ltd. held approximately 35.9%.

The Fund may assess a short-term redemption fee of 2.00% of the total redemption amount if a shareholder sells their shares after holding them for less than 60 days. The redemption fee is paid directly to the Fund. This fee does not apply to shares acquired through reinvestment of dividends and other distributions. For certain purchases of $1 million or more the Fund may also assess a contingent deferred sales charge of 1.00% to redemptions made within twelve months of purchase. For the six months ended June 30, 2024, the Fund had $0 in redemption fees.

| 8. | DISTRIBUTIONS TO SHAREHOLDERS AND TAX COMPONENTS OF CAPITAL |

The tax character of fund distributions paid for the year ended December 31, 2022 and December 31, 2023 was as follows:

| | | Fiscal Year Ended | | | Fiscal Year Ended | |

| | | December 31, 2023 | | | December 31, 2022 | |

| Ordinary Income | | $ | 112,511 | | | $ | 124,934 | |

| Long-Term Capital Gain | | | 30,287 | | | | 6,359 | |

| | | $ | 142,798 | | | $ | 131,293 | |

| | | | | | | | | |

As of December 31, 2023, the components of accumulated earnings/(deficit) on a tax basis were as follows:

| Undistributed | | | Capital Loss | | | Unrealized | | | Total | |

| Ordinary | | | Carry | | | Appreciation/ | | | Accumulated | |

| Income | | | Forwards | | | (Depreciation) | | | Earnings/(Deficits) | |

| $ | — | | | $ | — | | | $ | 16,152,492 | | | $ | 16,152,492 | |

| BOYAR VALUE FUND, INC. |

| NOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued) |

| June 30, 2024 |

At December 31, 2023, the Fund had capital loss carry forwards for federal income tax purposes available to offset future capital gains. The Fund utilized past capital loss carry forwards for federal income tax purposes, as follows:

| Short-Term | | | Long-Term | | | Total | | | CLCF Utilized | |

| $ | — | | | $ | — | | | $ | — | | | $ | 8,929 | |

Permanent book and tax differences, primarily attributable to tax adjustments for distributions in excess, resulted in reclassifications for the Fund for the fiscal year ended December 31, 2023, as follows:

| Paid In Capital | | | Distributable Earnings | |

| $ | (2,040 | ) | | $ | 2,040 | |

Subsequent events after the date of the Statement of Assets and Liabilities have been evaluated through the date the financial statements were issued. Management has determined that no events or transactions occurred requiring adjustment or disclosure in the financial statements.

PROXY VOTING POLICY

Information regarding how the Fund voted proxies relating to portfolio securities for the most recent six month period ended June 30 as well as a description of the policies and procedures that the Fund uses to determine how to vote proxies is available without charge, upon request, by calling 1-800-266-5566 or by referring to the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

PORTFOLIO HOLDINGS

Funds file a complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT, within sixty days after the end of the period. Form N-PORT reports are available at the SEC’s website at www.sec.gov.

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| INVESTMENT ADVISOR |

| Boyar Asset Management, Inc. |

| 32 West 39th Street, 9th Floor |

| New York, New York 10018 |

| |

| ADMINISTRATOR |

| Ultimus Fund Solutions, LLC |

| 225 Pictoria Drive, Suite 450 |

| Cincinnati, OH 45246 |

Item 8. Changes in and Disagreements with Accountants for Open-End Management Investment Companies.

Not applicable

Item 9. Proxy Disclosures for Open-End Management Investment Companies.

Not applicable

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies.

Included under Item 7

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

Included under Item 7

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable

Item 13. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable

Item 14. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable

Item 15. Submission of Matters to a Vote of Security Holders.

None

Item 16. Controls and Procedures

(a) The registrant’s Principal Executive Officer and Principal Financial Officer have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Act) are effective in design and operation and are sufficient to form the basis of the certifications required by Rule 30a-(2) under the Act, based on their evaluation of these disclosure controls and procedures as of a date within 90 days of this report on Form N-CSR.

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable

Item 18. Recovery of Erroneously Awarded Compensation.

(a) Not applicable

(b) Not applicable

Item 19. Exhibits.

(a)(1) Code of Ethics for Principal Executive and Senior Financial Officers.

Not applicable

(a)(2) Not applicable

(a)(3) A separate certification for each principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the Act (17 CFR 270.30a-2(a)):

Attached hereto. Exhibit 99. CERT

(a)(4) Not applicable

(b) Certifications required by Rule 30a-2(b) under the Act (17 CFR 270.30a-2(b)):

Attached hereto Exhibit 99.906CERT

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) | The Boyar Value Fund, Inc. |

By (Signature and Title)

| * | /s/ Sam Singh |

| | Sam Singh, Principal Executive Officer/President |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title)

| * | /s/ Sam Singh |

| | Sam Singh, Principal Executive Officer/President |

By (Signature and Title)

| * | /s/ Dawn Borelli |

| | Dawn Borelli, Principal Financial Officer/Treasurer |

| * | Print the name and title of each signing officer under his or her signature. |