NOTICE OF ANNUAL STOCKHOLDERS’ MEETING

June 28, 2005

10:00 A.M. Eastern Time

Dear Stockholder,

You are cordially invited to attend the 2005 annual meeting of stockholders of I.C. ISAACS & COMPANY, INC. which will be held at 10:00 AM local time on June 28, 2005 at the offices of Arent Fox PLLC located on the 34th floor at 1675 Broadway, New York, New York 10019. At the meeting, you will be asked to consider and vote on the following proposals:

| | 1. to elect nine directors, each to hold office until the 2006 annual meeting of stockholders and until their respective successors shall have been duly elected or appointed; |

| | 2. to authorize our adoption of the 2005 Non-Employee Directors’ Stock Option Plan, |

| | 3. to ratify the appointment of BDO Seidman, LLP as our independent auditors for the year ending December 31, 2005; and |

| | 4. to transact such other business as may properly come before the meeting. |

Shareholders of record at the close of business on May 24, 2005 are entitled to notice of and to vote at the annual meeting and any adjournments or postponements thereof.

Enclosed are copies of the Annual Report to our Stockholders consisting of a letter from our Chief Executive Officer and our Form 10-K for the year ended December 31, 2004 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2005.

| | The Board of Directors,

|

| | EUGENE WIELEPSKI,

Secretary |

New York, New York

May 27, 2005

YOUR VOTE IS IMPORTANT

We are offering registered stockholders the opportunity to vote their shares electronically through the internet. Please see the Proxy Statement and the enclosed Proxy for details about electronic voting. You are urged to date, sign and promptly return the enclosed proxy, or to vote electronically through the internet, so that your shares may be voted in accordance with your wishes and so that the presence of a quorum may be assured. Voting promptly, regardless of the number of shares you hold, will aid us in reducing the expense of proxy solicitation. Voting your shares by the enclosed proxy, or electronically through the internet, does not affect your right to vote in person in the event you attend the meeting. You are cordially invited to attend the meeting, and we request that you indicate your plans in this respect in the space provided on the enclosed form of Proxy or as prompted if you vote electronically through the internet.

TABLE OF CONTENTS

i

I.C. ISAACS & COMPANY, INC.

3840 Bank Street

Baltimore, Maryland 21224-2522

PROXY STATEMENT

The enclosed proxy is solicited by the Board of Directors of I.C. Isaacs & Company, Inc. for the Annual Stockholders’ Meeting to be held at the offices of Arent Fox PLLC located on the 34th floor at 1675 Broadway, New York, New York 10019, on Monday, June 28, 2005, at 10:00 a.m. Eastern Time, and at any postponement or adjournment of the meeting, for the purposes set forth in the accompanying Notice of Annual Stockholders’ Meeting.

Record Date; Quorum; Share Ownership and Voting Requirements for Election of Directors and Adoption of Proposals

Only stockholders of record on the books of the company at the close of business on May 24, 2005 will be entitled to vote at the annual meeting. Presence in person or by proxy of a majority of the shares of common stock outstanding on the record date is required for a quorum. If you held your shares on that date, you may vote your shares at the meeting either in person or by your duly authorized proxy. As of the close of business on May 24, 2005, the company had 11,707,573 outstanding shares of common stock. Copies of this proxy statement were first available to stockholders on May 27, 2005.

Our common stock is our only class of securities that will be entitled to vote at the annual meeting. The presence, in person or represented by proxy, of at least a majority of the total number of outstanding shares of our common stock is necessary to constitute a quorum at the annual meeting. Shares of common stock present in person or represented by proxy will be counted as present at the annual meeting for purposes of determining a quorum, without regard to whether the proxy is marked as casting a vote or abstaining. Shares of common stock held by nominees that are voted on at least one matter coming before the annual meeting will also be counted as present for purposes of determining a quorum, even if the beneficial owner’s discretion has been withheld (a “broker non-vote”) for voting on some or all other matters.

Each share of common stock is entitled to one vote on all matters that may properly come before the annual meeting other than the election of directors. In the election of directors, each share is entitled to cast one vote for each director to be elected. Directors shall be elected by a plurality of votes cast at the annual meeting. You may not vote your shares of common stock cumulatively for the election of directors. For purposes of the election of directors, abstentions and broker non-votes are not considered to be votes cast and do not affect the plurality vote required for the election of directors.

All other matters to come before the annual meeting require the approval of a majority of the shares of common stock present, in person or by proxy, at the meeting and entitled to vote. Therefore, abstentions will have the same effect as votes against the proposals on such matters. Broker non-votes, however, will be deemed shares not present to vote on such matters, and therefore will not count as votes for or against the proposals, and will not be included in calculating the number of votes necessary for approval of such matters.

Submitting and Revoking Your Proxy

If you complete and submit the enclosed form of proxy by mail or if you submit your proxy electronically by accessing the internet site stated on the enclosed form of proxy, the shares represented by your proxy will be voted at the annual meeting in accordance with your

1

instructions. Without affecting any vote previously taken, your proxy may be revoked by giving notice of revocation to us in writing addressed to us at 3840 Bank Street, Baltimore, Maryland 21224-2522, Attention: Corporate Secretary, or by accessing the internet site stated on the form of proxy, or by stating your desire to revoke your proxy at the annual meeting. You may also change your vote by executing and returning to us a later-dated proxy, by a later-dated electronic vote through the internet site, or by voting in person at the annual meeting. All properly executed proxies received by the Board of Directors, and properly authenticated electronic votes recorded through the internet, will be voted as directed by you. If you hold shares through a bank or brokerage firm, you must contact that firm to revoke any prior voting instructions.

All properly executed proxies received by the Board of Directors that do not specify how your shares should be voted will be voted:

| • | FOR the election of the nominees for director set forth in “Proposal 1: Election of Directors”, |

| |

| • | FOR adoption of the 2005 Non-Employee Directors’ Stock Option Plan and |

| |

| • | FOR ratification of the appointment of BDO Seidman, LLP as our independent registered public accountants for 2005. |

In addition, if other matters come before the annual meeting, the persons named as proxies will vote on such matters in accordance with their best judgment. We have not received notice of other matters that may properly be presented at the annual meeting.

Solicitation of proxies may be made by mail, personal interview and telephone by officers, directors and other employees of the Company. We will reimburse all banks, brokers, and other custodians, nominees and fiduciaries for their reasonable costs in sending proxy materials to our stockholders.

The internet procedures for voting and for revoking or changing a vote are designed to authenticate our stockholders’ identities, to allow our stockholders to give their voting instructions and to confirm that stockholders’ instructions have been properly recorded. Stockholders that vote through the internet should understand that there may be costs associated with electronic access, such as usage charges from internet access providers and telephone companies, which will be borne by the stockholder.

PROPOSAL 1—ELECTION OF DIRECTORS

The Board of Directors is currently composed of nine directors. Eight of the nine current directors have been nominated for reelection, and one new candidate has been nominated for election to the ninth Board seat. If any director nominee is unable or unwilling to serve as a nominee at the time of the annual meeting, the proxies may be voted either (i) for a substitute nominee designated by the present Board of Directors to fill the vacancy or (ii) for the balance of the nominees, leaving a vacancy. Alternatively, the Board of Directors may reduce the size of the Board. The Board of Directors has no reason to believe that any of the following nominees will be unwilling or unable to serve if elected as a director. Such persons have been nominated to serve until the next annual stockholders’ meeting following the 2005 annual meeting or until their successors, if any, are elected or appointed. Set forth in this section are the names and biographical information for each of the nominees.

The Board of Directors recommends a vote “FOR” the election of each of the following nominees.

2

Nominees for Election as Directors

Peter J. Rizzo

Age 52

Director since February 2004

Chief Executive Officer of the Company | | Mr. Rizzo has worked within the apparel industry during the past 27 years. He became the Company’s Chief Executive Officer in December, 2003, and was appointed to the Board in February 2004. During the two years prior to joining the Company, Mr. Rizzo was a consultant to the Neiman Marcus Group. He was President and Vice Chairman of Bergdorf Goodman from 1999 to 2002. From 1997 to 1999, he served as President of Polo Retail at Polo Ralph Lauren. From 1978 to 1997, he was Executive Vice President and Head Merchant of Barneys New York. |

| |

Olivier Bachellerie

Age: 44

Director since 2002

President and Director General of GI

Promotion and Cravatatakiller S.A. | | Mr. Bachellerie has served since 1997 as President and Director General of GI

Promotion and Cravatatakiller S.A., and as President of Fashion Services of America, Inc., each of which is beneficially owned by Marithé Bachellerie and François Girbaud. Mr. Bachellerie is the son of Marithé Bachellerie, who together with Mr. Girbaud, indirectly own and possess the right to vote approximately 39% of the Company’s outstanding shares of common stock. |

| |

René Faltz

Age: 51

Director since 2002

Senior Partner, Cabinet D’Avocats René Faltz | | Mr. Faltz has practiced law in the Grand Duchy of Luxembourg since 1976. He has been with Cabinet D’Avocats René Faltz since March 2000 after leaving the firm of Faltz & Kremer. Mr. Faltz is one of the Managing Directors of, and serves as counsel to, several companies that, since 2002, have been beneficially owned by Marithé Bachellerie and François Girbaud in connection with the conduct of their business activities as designers and marketers of clothing and other items bearing the various Girbaud trademarks. |

3

Neal J. Fox

Age: 70

Director since 1998

Consultant | | Mr. Fox has held senior management positions at Neiman Marcus, Bergdorf Goodman and I. Magnin. From 1983 to 1988, he was employed by Garfinkel’s, Raleigh & Co., or its predecessor, most recently as Chairman and Chief Executive Officer, and was also a principal shareholder of that company. From 1989 through March 1999, Mr. Fox served as the President and Chief Executive Officer of Sulka, an international menswear retailer. In 1999, Mr. Fox founded NJF Associates, Incorporated, a consulting firm specializing in brand management and business development for the apparel, accessories and luxury goods industries. Mr. Fox served as a director of Today’s Man, a 30 unit menswear retailer. In March 2003, Today’s Man filed a petition under Chapter 11 of the US Bankruptcy Code. |

| |

François Girbaud

Age: 60

Director since 2004 | | Mr. Girbaud, an internationally renowned designer and manufacturer of clothing, and licensor of clothing designs and trademarks for more than 25 years, became one of the Company’s directors in October 2004. Pursuant to agreements that the Company has with companies co-owned directly or indirectly by Mr. Girbaud and Marithé Bachellerie, the Company licenses the Girbaud trademarks and designs for use in the manufacture and sale of various items of clothing in North America. |

| |

Jon Hechler

Age: 52

Director since 1984

President, T. Eliot, Inc. | | Mr. Hechler was employed by Ira J. Hechler and Associates, an investment company, from 1980 to 1999. He is President of T. Eliot, Inc., manufacturer of the Sani Seat® hygienic toilet seat system. |

| |

Roland Loubet

Age: 62

Director since 2002

Chief Executive Officer of Cedrico, S.A. | | Mr. Loubet has been employed as the Chief Executive Officer and sole owner of Cedrico, S.A., a manufacturer and marketer of women’s clothing, since 1997. |

| |

John McCoy II

Age: 59

President of Components by John McCoy, Inc. | | Mr. McCoy has worked within the apparel industry during the past 38 years. In 1970, he began working for Pierre Cardin’s sales operations and held the position of Executive Vice President—Clothing when he left that firm in 1977 to found Fitzgerald by John McCoy, a US manufacturer of European styled clothing. In 1985, Mr. McCoy founded Components by John McCoy, Inc., a manufacturer and distributor of luxury clothing brands, including Gran Sasso, Mason’s, Coast, Moncler, Lenor Romano and Alfred Dunhill. |

4

Robert Stephen Stec

Age: 50

Director since 2002

Chairman and Chief Executive Officer of

Lexington Home Brands | | Mr. Stec was a Division President of VF Corporation and had sole responsibility for VF’s Girbaud division in the United States from 1989 through 1993. From 1996 to 1998, he served as President of London Fog Industries, Inc., a leading manufacturer and marketer of branded outerwear. During 1997 and 1998, Mr. Stec served as a part-time consultant to Girbaud Design, Inc. and certain of its affiliates. In 1999, Mr. Stec served as a consultant to London Fog for several months. Mr. Stec has been employed as President and Chief Executive Officer of Lexington Home Brands, a leading branded marketer of home furnishings, since 1999. |

Except as noted above, each nominee for election as a director has been engaged in the principal occupation described during the past five years. There are no family relationships among any directors or executive officers of the company. Stock ownership information is shown under the heading “Security Ownership of Certain Beneficial Owners and Management” on page 7 and is based upon information furnished by the respective individuals.

Principal Executive Officers of the Company Who Are Not Also Directors

The following table sets forth the names and ages of our principal executive officers who are not directors. The table also provides a description of the positions of employment held by each of such executives for at least the past five years.

Jesse de la Rama

Age: 51

Chief Operating Officer of the Company | | Mr. de la Rama began his employment with the Company in March 2004 as Vice President of Merchandise Planning and Retail Development. In December 2004, he began serving as the Company’s Chief Operating Officer. Mr. de la Rama engaged in business during the period from 1997 through February 2004 as a consultant to the fashion retail industry and other clients, including Calvin Klein, Inc., Lambertson/Truex and Sotheby’s, Inc., as president of his own company, Jesse de la Rama, Inc. Between 1994 and October 1997, Mr. de la Rama was Senior Vice President—Retail of Bally of Switzerland. Between 1979 and September 1994, he was employed by Barney’s New York and served in various executive capacities, including Vice President—Outlet Division and Warehouse Sales (1992-1994) and Vice President—Merchandise Planning (1983-1992). |

5

Eugene C. Wielepski

Age: 57

Vice President—Finance, Chief Financial

Officer, Treasurer and Secretary | | Mr. Wielepski was a director of the Company from 1991-May, 2002. He has served as Vice President–Finance since 1991. He served as Chief Financial Officer of the Company from 1991-April 2003, and began serving in that capacity again in December 2004. He has also held the positions of Secretary and Treasurer since 1976. From 1976 to 1990, he was Controller. He is a Certified Public Accountant and has been employed by the Company since 1973. |

Board Committees and Meetings

The Board of Directors currently has standing Audit, Compensation and Nominating Committees.

The Audit Committee has a written charter approved by the Board. Only independent directors, as that term is defined by the Marketplace Rules of The Nasdaq Stock Market, may serve as members of the Audit Committee.

The members of the Audit Committee are Neal J. Fox (Chairman), Jon Hechler and Robert Stec.

The Audit Committee assists the Board of Directors in its general oversight of the Company’s financial reporting, internal controls and audit functions. During 2004, the Audit Committee held eight meetings. The Board of Directors has determined that Neal J. Fox, the Chairman of the Audit Committee, is an “audit committee financial expert,” as such term is defined under applicable SEC regulations.

The members of the Compensation Committee are Messrs. Hechler (Chairman), Fox, Loubet and Stec.

The Compensation Committee administers the Company’s Amended and Restated Omnibus Stock Plan (the “Plan”), including the review and grant of stock options to officers and other employees under the Plan. The Compensation Committee also reviews and approves various other company compensation policies and matters, and reviews and approves salaries and other matters relating to compensation of the executive officers of the company. The Compensation Committee held five meetings during 2004.

In October 2004, the Board of Directors created a Nominating Committee, adopted a charter governing that committee’s operations, and appointed Messrs. Stec (Chairman), Fox and Loubet to serve as the members thereof. The Nominating Committee did not hold any meetings in 2004.

The Board of Directors held nine meetings during 2004. Each director is expected to attend each meeting of the Board and the committees on which he serves. In addition to meetings, the Board and its committees review and act upon matters through written consent procedures. No director attended less than 75% of all the meetings of the Board and the committees on which he served in 2004.

Directors’ Compensation

Directors who are employed by us or any of our subsidiaries receive no compensation for serving on the Board of Directors. Directors who are not so employed (the “Outside Directors”) receive an annual retainer fee of $10,000 for their services and attendance fees of $750 per Board or committee meeting attended. The Chairman of the Audit Committee receives an additional $10,000 for the services he renders in that capacity. All directors are reimbursed for expenses incurred in connection with attendance at Board or committee meetings. In addition, members of the Board of Directors are eligible to participate in the Plan. In the event that our stockholders adopt the 2005 Non-Employee Directors’ Stock Option Plan (the “Directors’ Plan”) at the meeting (see Proposal 2), all stock option awards to our Outside Directors will thereafter be made under, and governed by, the Directors’ Plan. In 2002, our Outside Directors were awarded nonqualified stock options to purchase an aggregate of 210,000 shares of common stock at an exercise price of $0.58 per share. Those options vested in December 2004. No other options have been granted to our Outside Directors since that 2002 award.

6

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

Set forth below is information concerning the common stock ownership as of May 24, 2005 by (i) each person who the Company knows owns beneficially 5% or more of its outstanding common stock, (ii) the Company’s Chief Executive Officer and each of its other “Named Executive Officers,” (iii) each director and director-nominee, and (iv) all of the Company’s directors and officers as a group:

| | | Shares Beneficially Owned

|

Name and Address of Beneficial Owner(1)

| | Number

| | Percent(2)

|

| | | | | | | | |

Wurzburg, S.A.(3) | | | 4,549,167 | (4) | | | 38.9 | % |

Peter J. Rizzo | | | 228,500 | (5) | | | 1.9 | |

Robert J. Conologue(6) | | | 35,950 | (7) | | | * | |

Daniel J. Gladstone(8) | | | — | | | | * | |

Eugene Wielepski | | | 44,500 | (9) | | | * | |

Olivier Bachellerie(10) | | | 30,000 | (11) | | | * | |

René Faltz(12) | | | 30,000 | (11) | | | * | |

Neal J. Fox(13) | | | 52,000 | (14) | | | * | |

Jon Hechler(15) | | | 211,091 | (16) | | | 1.8 | |

Roland Loubet(17) | | | 380,000 | (18) | | | 3.2 | |

John McCoy II(19) | | | — | | | | * | |

Robert Stephen Stec(20) | | | 30,000 | (11) | | | * | |

All Officers, Directors and Nominees for Director as a Group (of 10) | | | 1,042,041 | (21) | | | 8.4 | |

| | | | | | | | |

* Less than one percent

| | | |

| (1) | | All shares are owned beneficially and of record unless indicated otherwise. Unless otherwise noted, the address of each stockholder is c/o the company, 3840 Bank Street, Baltimore, Maryland 21224. |

| | | |

| (2) | | Based upon 11,707,573 shares outstanding on the date of this proxy statement, plus, where applicable, any shares issuable pursuant to options exercisable within 60 days of such date. |

| | | |

| (3) | | The address of this stockholder is 41, Avenue de la Gare, L-1611 Luxembourg. |

| | | |

| (4) | | Includes 3,966,667 shares owned beneficially and of record by this stockholder’s wholly owned subsidiary, Textile Investment International, S.A. |

| | | |

| (5) | | Includes 228,500 shares that Mr. Rizzo may acquire pursuant to an option exercisable by him within 60 days of the date of this proxy statement. |

| | | |

| (6) | | The address of this stockholder is 216 LeRoy Avenue, Darien, CT. |

| | | |

| (7) | | Includes 35,950 shares that Mr. Conologue may acquire pursuant to an option exercisable by him within 60 days of the date of this proxy statement. |

| | | |

| (8) | | The address of this stockholder is 11 Annandale Drive, Chappaqua, NY. |

| | | |

| (9) | | Includes 44,500 shares that Mr. Wielepski may acquire pursuant to options exercisable by him within 60 days of the date of this proxy statement. |

| | | |

| (10) | | Mr. Bachellerie’s address is 15 Rue Louis Blanc, 75010 Paris, France. |

| | | |

| (11) | | Includes 30,000 shares that this person may acquire pursuant to an option exercisable by him within 60 days of the date of this proxy statement. |

| | | |

| (12) | | Mr. Faltz’s address is 41 Avenue de la Gare, Luxembourg, L-1611, Grand Duchy of Luxembourg. |

| | | |

| (13) | | The address of this stockholder is 33 East 70th Street, New York, New York. |

| | | |

| (14) | | Includes 52,000 shares that Mr. Fox may acquire pursuant to options exercisable by him within 60 days of the date of this proxy statement. |

(footnotes continued on next page)

7

(footnotes continued from previous page)

| | | |

| (15) | | The address of this stockholder is 603 Wellington Avenue, Seattle, Washington. |

| | | |

| (16) | | Includes 37,000 shares that Mr. Hechler may acquire pursuant to options exercisable by him within 60 days of the date of this proxy statement. |

| | | |

| (17) | | Mr. Loubet’s address is Avenue du Leman 20, 1025 St-Sulpice, Ch-Switzerland. |

| | | |

| (18) | | Includes 30,000 shares that Mr. Loubet may acquire pursuant to an option exercisable by him within 60 days of the date of this proxy statement. Also includes 250,000 shares issuable pursuant to two warrants aggregating 500,000 shares that are exercisable within 60 days of the date of this proxy statement. Mr. Loubet is deemed to hold an indirect 50% beneficial ownership interest in those warrants. |

| | | |

| (19) | | Mr. McCoy’s address is 20 West 55th Street, New York, New York. |

| | | |

| (20) | | Mr. Stec’s address is c/o Lexington Home Brands, 411 South Salisbury Street, Lexington, NC. |

| | | |

| (21) | | Includes 767,950 shares that may be acquired by Messrs. Rizzo, Conologue, Wielepski, Bachellerie, Faltz, Fox, Hechler, Loubet and Stec pursuant to options and/or warrants exercisable by them within 60 days of the date of this proxy statement. |

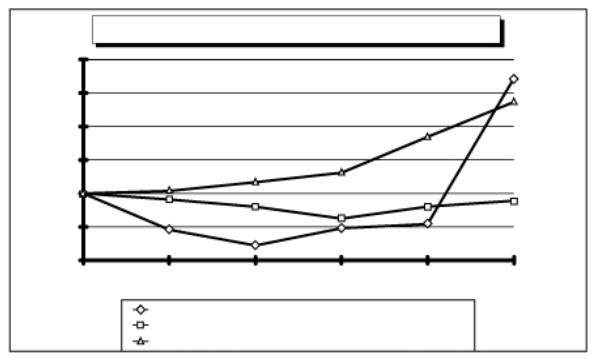

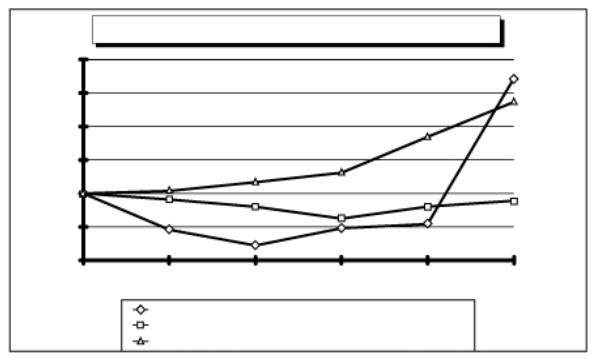

STOCK PRICE PERFORMANCE GRAPH

The performance graph which follows compares the cumulative total stockholder returns on our common stock for the five-year period ended December 31, 2004 with the S&P 500 Index and a peer group comprising the Apparel, Accessories and Luxury Goods industry segment of the S&P 600. The graph assumes that the value of our common stock and the value of each Index was $100 on December 31, 1999. This data was furnished by Standard & Poor’s Compustat Services, Inc.

COMPARISON OF CUMULATIVE FIVE YEAR TOTAL RETURN

$300

$250

$200

$150

$100

$50

$0

Dec99

Dec00

Dec01

Dec02

Dec03

Dec04

I.C. ISAACS & COMPANY INC

S&P 500 INDEX

S&P 600 APPAREL, ACCESSORIES & LUXURY GOODS

8

REPORT OF THE COMPENSATION

COMMITTEE ON EXECUTIVE COMPENSATION

Objectives

The Company’s compensation policies and procedures have historically been aligned with its entrepreneurial traditions. The Company seeks to compensate its officers (including the Named Executive Officers) in a manner which is:

| • | consistent with the Company’s conservative traditions and cost structure; |

| |

| • | sufficient to attract and retain key executives critical to the success of the Company; |

| |

| • | reflective of current performance of both the individual officer and the Company; and |

| |

| • | remuneration of successful long-term strategic management and enhancement of shareholder values. |

Components of Compensation

The Compensation Committee (the “Committee”) approves the design of, assesses the effectiveness of, and administers the executive compensation programs of the Company in support of stockholder interests. The key elements of the Company’s executive compensation program are base salary, annual incentives and long-term compensation. These key elements are addressed separately below. In determining each component of compensation, the Committee considers all elements of an executive’s total compensation package.

Base Salary

The Committee regularly reviews each executive’s base salary. Base salaries are not necessarily compared to other institutions, although market rates for comparable executives with comparable responsibilities are considered in some cases. Base salaries are adjusted by the Committee to recognize varying levels of responsibility, experience, breadth of knowledge, internal equity issues, as well as external pay practices. Increases to base salaries are driven primarily by individual performance. Individual performance is evaluated based on sustained levels of individual contribution to the Company.

During 2004, the Committee continued the substantial reorganization effort it began in 2003 regarding the composition of, and compensation payable to, its management. As mentioned at pp. 11-13 in the section entitled “Employment Contracts, Termination Of Employment And Change In Control Arrangements,” the Company

| • | revised the compensation package and extended the term of employment of its Chief Executive Officer to account for the extraordinary operational and financial results achieved during his first year at the helm of the Company and |

| |

| • | engaged the services of Jesse de la Rama as the Company’s new COO at an annual base salary of $175,000 during an initial term ending on February 28, 2006, and approved an amendment to his compensation package providing for an increase in his base salary to a more competitive $250,000 per year, and providing for the same incentive compensation structure that we have applied to the Company’s other senior executives. |

Annual Incentives

Prior to 2003, the annual incentive program that the Company employed with regard to some of our Named Executive Officers involved direct financial incentives in the form of annual cash bonuses to achieve performance goals that were usually based upon the Company’s “top line,” i.e., its gross revenues. This resulted in the payment of substantial top-line based bonuses to the Company’s most senior executives with regard to 2001 and 2002, even though the Company incurred multi-million dollar net losses in each of those years.

9

During the first quarter of 2003, the Company adopted for its executives whose activities are directly related to profitability a different annual incentive compensation philosophy that is “bottom line” oriented. Since then, the employment agreements that the Company has entered into with its senior operating executives have contained significant cash bonus incentives that are tied to three predetermined annual performance goals:

| • | earnings before interest and taxes, |

| |

| • | cash provided by operating activities and |

| |

| • | inventory turns—which is a measure of the level of efficiency employed by the Company in matching its annual purchases of inventory to the annual sales of merchandise to its customers. |

Each of Messrs. Rizzo and de la Rama can earn a minimum of 4.2% of his base salary (subject to an annual minimum of $175,000 in Mr. Rizzo’s case), up to a maximum of 70% of that base salary ($175,000 for Mr. de la Rama and $350,000 for Mr. Rizzo).

In 2004, one of the most profitable years in the Company’s history, the Company accrued (and paid in 2005) the following performance bonuses:

$350,000 to Peter J. Rizzo

$54,688 to Jesse de la Rama

$40,000 to Eugene Wielepski

Long-Term Incentives

In keeping with the Company’s commitment to provide a total compensation package which includes at-risk components of pay, long-term incentive compensation comprises a significant portion of the value of an executive’s total compensation package. When awarding long-term grants, the Committee considers an executive’s level of responsibility, prior compensation experience, historical award data, and individual performance criteria. Long-term incentives are in the form of stock option awards under the Plan.

Stock options are granted at an option price equal to the fair market value of our common stock on the date of grant. Accordingly, stock options have value only if the stock price appreciates. This design focuses executives on the creation of stockholder value over the long term. The size of stock option grants is based on competitive practice, individual performance factors and historical award data. In 2004, the Company granted an additional option to purchase 100,000 shares of common stock to Mr. Rizzo in connection with the revision of his employment agreement, and it granted an option to purchase 25,000 shares of common stock to Mr. de la Rama in connection with his hiring. No other grants were made to any of the Named Executive Officers.

Conclusion

The Committee believes these executive compensation policies and programs serve the interests of the Company and its stockholders effectively. The various compensation vehicles offered are appropriately balanced to provide increased motivation for executives to contribute to the Company’s overall future success, thereby enhancing the value of the Company for the stockholders’ benefit.

We will continue to monitor the effectiveness of the Company’s total compensation program to meet the current and future needs of the Company.

Members of the Compensation Committee:

| | Jon Hechler (Chairman) | | Roland Loubet |

| | Neal J. Fox | | Robert S. Stec |

10

EMPLOYMENT CONTRACTS, TERMINATION OF EMPLOYMENT AND

CHANGE IN CONTROL ARRANGEMENTS

Peter J. Rizzo

Peter J. Rizzo, the Company’s Chief Executive Officer, is employed by the Company’s subsidiary, I.C. Isaacs & Company, LP (the “LP”), pursuant to an employment agreement dated December 9, 2003, which was amended on October 19, 2004. That agreement, as amended, provides:

| • | for an initial term that will end on December 9, 2007, and for automatic one year renewals of the agreement unless either party gives notice of its non-renewal not later than June 30, 2007 or June 30 of the then current renewal year; |

| |

| • | for payment of an annual base salary of $500,000 during the initial term increasing by 10% per year during each one year renewal term, and incentive compensation provisions, subject to a guaranteed annual minimum of $175,000, that are based upon the Company’s achievement of pre-determined earnings, cash flow and inventory turns targets; |

| |

| • | for the issuance under the Plan of a five year option to purchase 500,000 shares of common stock at an exercise price of $.95 per share vesting ratably on December 9, 2004 and December 9, 2005; |

| |

| • | for the issuance under the Plan of a ten year option to purchase up to 100,000 shares of common stock at an exercise price of $3.10 per share on or after December 9, 2007; |

| |

| • | that, as long as the Nominating Committee of the Company’s Board continues to approve Mr. Rizzo as a director, he will be included on the slate of nominees that the Company will propose for election as directors throughout the term of his employment agreement; |

| |

| • | that, if (a) Mr. Rizzo is not appointed as Chairman of the Board or he is removed from that position, (b) his duties as CEO are materially adversely changed or reduced, (c) his employment is terminated by the LP without cause or if, as a result of the occurrence of any of the events described in clauses (a) or (b), he resigns, he will be entitled to receive the following severance benefits: |

| |

| |

| • | If such termination occurs on or before December 31, 2006, he will be entitled to receive severance in an aggregate amount equal to 1.5 times his base salary and incentive compensation for the immediately preceding year (a minimum of $937,500 up to as much as $1,275,000), |

| |

| • | If such termination occurs after December 31, 2006, he will be entitled to receive severance in an aggregate amount equal to his base salary plus a pro-rata portion of any incentive compensation that otherwise would have become due and payable to him if his employment had not been terminated prior to the end of the year (a minimum of $625,000 up to as much as $850,000) and |

| |

| • | All unvested options granted to Mr. Rizzo under the Plan will immediately vest in full and will be exercisable by him for a period of one year after his employment is terminated. |

The maximum amount of incentive compensation that Mr. Rizzo may earn in any year of the initial term and any renewal year is $350,000.

Jesse de la Rama

On March 1, 2004, the LP entered into an employment agreement with Jesse de la Rama, the Company’s Chief Operating Officer, that provides:

| • | for an initial term that will end on February 28, 2006, and for automatic one year renewals of the agreement unless either party gives notice of its non-renewal not later than December 31, 2005 or December 31 of the then current renewal year; |

| |

| • | for payment of an annual base salary of $175,000, and incentive compensation provisions that are based upon the achievement of pre-determined earnings, cash flow and inventory turns targets; |

11

| • | for the issuance under the Plan of a five year option to purchase 25,000 shares of common stock at an exercise price of $.86 per share which shall vest ratably on March 1, 2005, 2006 and 2007; |

| |

| • | that, in the event that Mr. de la Rama’s employment is terminated without cause, he shall receive severance payments ranging between three and 12 months salary depending on the length of his employment at the time of termination. |

In December 2004, the Compensation Committee approved an amendment to Mr. de la Rama’s employment agreement providing for

| • | an increase in his base salary to $250,000; |

| |

| • | addition of an incentive compensation structure based upon the Company’s achievement of pre-determined earnings, cash flow and inventory turns targets |

| |

| • | modification of the severance provisions of the agreement to entitle Mr. de la Rama to receive 12 months’ severance in the event his employment is terminated without cause or due to a change of control of the Company; and |

In February 2005, the Compensation Committee authorized the issuance of a Plan option entitling Mr. de la Rama to purchase up to 75,000 shares of common stock.

The Compensation Committee also decided that the bonus to be paid to Mr. de la Rama for 2004 would be determined by adding 11⁄12 of the bonus he would have received pursuant to his agreement to 1⁄12 of the bonus he would have received if the above mentioned restructured bonus provision had been in effect for the entire year. Mr. de la Rama received in 2005, pursuant to the foregoing formula, an incentive compensation payment of $54,688 for 2004. The maximum amount of incentive compensation that Mr. de la Rama may earn in 2005 and any renewal year is $175,000.

Daniel J. Gladstone

Daniel J. Gladstone, the former President of the Company’s Girbaud Division, was employed by the LP pursuant to an employment agreement dated April 17, 2002, which was amended on May 15, 2003. That agreement, as amended, provided:

| • | for an initial term ending on December 31, 2005, and for automatic one year renewals of the agreement unless either party gave notice of its non-renewal not later than September 30, 2005 or September 30 of the then current renewal year; |

| |

| • | for payment of an annual base salary of $350,000, and incentive compensation provisions based upon the Company’s achievement of pre-determined earnings, cash flow and inventory turns targets, subject to guaranteed minimum annual bonuses of $100,000 in 2003 and $125,000 thereafter; |

| |

| • | that, if Mr. Gladstone’s employment was terminated without cause or he was constructively discharged |

| |

| |

| • | after January 21, 2005, the LP would pay him an amount equal to one year of his base salary plus a severance payment in a lump sum equal to his incentive compensation for the last full year prior to his termination (the “Severance Payment”); or |

| |

| • | prior to January 21, 2005, the LP would pay him the aggregate amount of his base salary through December 31, 2005, plus a Severance Payment within 90 days after each year remaining during the term of the agreement; |

| |

| |

| • | that, if the LP decided not to renew the agreement, it would be required to pay Mr. Gladstone an amount equal to one year of his current base salary plus a Severance Payment; and |

| |

| • | if Mr. Gladstone’s employment was terminated for cause, he would forfeit all rights and benefits he otherwise would have been entitled to receive under the agreement including, but not limited to, his rights to receive salary, severance and incentive compensation, and all rights under any Plan options granted to him prior to such termination. |

Mr. Gladstone did not earn any incentive compensation in 2003 other than the $100,000 guaranteed minimum bonus due under his employment agreement. In April 2005, Mr. Gladstone’s employment was

12

terminated for cause. Accordingly, no incentive compensation payment was made to him with regard to 2004.

Robert J. Conologue

In March 2003, the LP entered into an employment agreement (with effect from February 18, 2003) with Robert J. Conologue, the Company’s former Chief Operating Officer and Chief Financial Officer, that provided:

| • | for an initial term that ending on December 31, 2005, and for automatic one year renewals of the agreement unless either party gave notice of its non-renewal not later than September 30, 2005 or September 30 of the then current renewal year; |

| |

| • | for payment of an annual base salary of $315,000 per year, and incentive compensation provisions based upon the Company’s achievement of pre-determined earnings, cash flow and inventory turns targets; |

| |

| • | for the issuance under the Plan of a five year option to purchase 225,000 shares of common stock at an exercise price of $.68 per share vesting ratably on March 31, 2004, 2005 and 2006; |

| |

| • | for the issuance under the Plan of a five year fully vested option to purchase 150,000 shares of common stock at an exercise price of $.48 per share; |

| |

| • | that, in the event that Mr. Conologue’s employment was terminated without cause at any time after December 31, 2003 or as a result of a change of control of the company, for the payment of a severance payment equal to his base salary for a period of 12 months. |

On November 29, 2004, the LP terminated Mr. Conologue’s employment without cause. Pursuant to a post-termination separation agreement executed by Mr. Conologue and the LP, he will receive severance payments equal to his base salary during the 12 month period ending on November 28, 2005, he received $185,000 in payment of all incentive compensation due to him in 2004 and the unexercised portion of the 150,000 share option (35,950 shares) shall remain exercisable through November 28, 2005.

Eugene Wielespki

In April 2002, the LP entered into an amended and restated employment agreement with Eugene Wielepski who was then the Company’s Vice President and Chief Financial Officer. In March 2003, the LP and Mr. Wielepski entered into an amendment of that agreement. As so amended, the agreement provides:

| • | that Mr. Wielepski shall serve as Vice President—Finance for an initial term that will end on May 15, 2006, and for automatic one year renewals of the agreement unless either party gives notice of its non-renewal not later than March 16, 2006 or March 16 of the then current renewal year; |

| |

| • | for payment of a base salary of $180,000 per year; |

| |

| • | for the issuance under the Plan of a fully vested ten year option to purchase 10,000 shares of common stock at an exercise price of $1.71 per share; |

| |

| • | that, if Mr. Wielepski’s employment is terminated without cause after May 15, 2005, the LP must pay him an amount equal to one year of his base salary; and |

| |

| • | that, if the LP decides not to renew the agreement, it must pay Mr. Wielepski an amount equal to one year of his current base salary. |

Mr. Wielepski received in 2005 an incentive compensation payment of $40,000 for 2004.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In November 1997, we entered into an exclusive license agreement (the “Girbaud Men’s Agreement”) with Girbaud Design, Inc. and its affiliate, Wurzburg Holding S.A. (“Wurzburg”), both of which are companies wholly owned, directly or indirectly, by one of our directors, François Girbaud, and Marithé Bachellerie. The Girbaud Men’s Agreement granted to us the right to manufacture and

13

market men’s jeanswear, casualwear and outwear under the Girbaud brand and certain related trademarks (the “Girbaud Marks”) in all channels of distribution in the United States, including Puerto Rico and the U.S. Virgin Islands. In January and March 1998, the Girbaud Men’s Agreement was amended and restated to name Latitude Licensing Corp. (“Latitude”) another member of the Girbaud Group(1) of companies, as the licensor and to include active influenced sportswear as a licensed product category. Also in March 1998, we entered into an exclusive license agreement (the “Girbaud Women’s Agreement” and together with the Girbaud Men’s Agreement, the “Girbaud Agreements”) with Latitude to manufacture and market women’s jeanswear, casualwear and outerwear, including active influenced sportswear, under the Girbaud Marks in all channels of distribution in the United States including Puerto Rico and the U.S. Virgin Islands.

Under the Girbaud Men’s Agreement, we are required to make payments to Latitude in an amount equal to 6.25% of our net sales of regular licensed merchandise and 3.0% in the case of certain irregular and closeout licensed merchandise. Except as noted below, we are subject to guaranteed minimum annual royalty payments of $3.0 million each year from 2002 through 2007. The Company is required to spend the greater of an amount equal to 3% of Girbaud men’s net sales or $500,000 in advertising and related expenses promoting the men’s Girbaud brand products in each year through the term of the Girbaud men’s agreement. During 2004, we made royalty payments under the Girbaud Men’s Agreement aggregating approximately $3,028,100.

Under the Girbaud Women’s Agreement we are required to make payments to Latitude in an amount equal to 6.25% of our net sales of regular licensed merchandise and 3.0% in the case of certain irregular and closeout licensed merchandise. Except as noted below, we are subject to guaranteed minimum annual royalty payments of $1.5 million each year from 2002 through 2007. The Company is required to spend the greater of an amount equal to 3% of Girbaud women’s net sales of $400,000 in advertising and related expenses promoting the women’s Girbaud brand products in each year through the term of the Girbaud Women’s Agreement. In addition, over the term of the Girbaud Women’s Agreement we are required to contribute $190,000 per year to Latitude’s advertising and promotional expenditures for the Girbaud brand. During 2004, we made royalty payments under the Girbaud Women’s Agreement aggregating $1,125,000.

We are obligated to pay a minimum of $7.4 million during 2005 in the form of minimum and deferred royalty payments, fashion show and advertising and promotional expenses pursuant to the Girbaud Agreements. In 2005, we expect that substantially all of our net sales will come from apparel associated with the Girbaud licenses.

In connection with the refinancing of our credit facility in December 2004, Latitude agreed to defer approximately $2.3 million of the 2004 minimum and additional royalty payments to 2005. We expect to pay these amounts in the first half of 2005 and pay all 2005 royalty payments as they become due. In 2004, we made royalty payments of approximately $4.2 million.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

IN COMPENSATION DECISIONS

None of the directors serving on the Compensation Committee is an employee of the Company, and neither the Chief Executive Officer nor any of the Named Executive Officers has served on the Compensation Committee. No director or executive officer of the Company is a director or executive officer of any other corporation that has a director or executive officer who is also a director or board committee member of the Company.

|

| (1) | | Mr. Girbaud, Ms. Bachellerie, together with Wurzburg, Latitude and the various companies that they directly and indirectly control, are collectively referred to as the “Girbaud Group.” |

14

EXECUTIVE COMPENSATION

The following table sets forth certain information regarding the compensation paid during each of our last three fiscal years to our Chief Executive Officer and to each of our executive officers other than the Chief Executive Officer whose total annual salary and bonus amounted to more than $100,000 and who (except for Mr. Conologue) were serving as executive officers at the end of 2004 (collectively, the “Named Executive Officers”). No compensation that would qualify as payouts pursuant to long-term incentive plans (“LTIP Payouts”) or “All Other Compensation” was paid to any of the Named Executive Officers during the three year period ended on December 31, 2004, and we did not issue any SARs during that period of time.

Summary Compensation Table

| | | Annual Compensation(1)

| | Long Term Compensation Awards

|

Name and Principal Position

| | Year

| | Salary($)

| | Bonus($)

| | Other Annual

Compensation($)

| | Restricted

Stock

Awards($)

| | Securities

Underlying

Options(#)

|

Peter J. Rizzo, CEO | | | 2004 | | | $ | 490,761 | | | | — | | | | — | | | — | | | 100,000 | |

| | | 2003 | (2) | | | 28,846 | | | | — | | | | — | | | — | | | 500,000 | |

| | | 2002 | | | | — | | | | — | | | | — | | | — | | | — | |

Daniel J. Gladstone, Acting

| | | | | | | | | | | | | | | | | | | | | | |

CEO (2003), Former

| | | | | | | | | | | | | | | | | | | | | | |

President—Girbaud

| | | | | | | | | | | | | | | | | | | | | | |

Division (2002

| | | | | | | | | | | | | | | | | | | | | | |

| and 2004) | | | 2004 | | | | 340,922 | | | | 100,000 | | | | 339,896 | (3) | | — | | | — | |

| | | 2003 | | | | 357,091 | | | | 207,895 | | | | — | | | — | | | — | |

| | | 2002 | | | | 345,781 | | | | 221,199 | | | | — | | | — | | | — | |

Robert J. Conologue,

| | | | | | | | | | | | | | | | | | | | | | |

| Former COO and CFO | | | 2004 | (4) | | | 315,757 | | | | 40,000 | | | | 625,342 | (3) | | — | | | — | |

| | | 2003 | | | | 273,828 | | | | — | | | | — | | | — | | | 375,000 | |

| | | 2002 | | | | — | | | | — | | | | — | | | — | | | — | |

Jesse de la Rama, Sr. VP

| | | | | | | | | | | | | | | | | | | | | | |

| and COO | | | 2004 | (5) | | | 136,694 | | | | — | | | | — | | | — | | | 25,000 | |

Eugene C. Wielepski, Vice

| | | | | | | | | | | | | | | | | | | | | | |

| President and CFD | | | 2004 | | | | 181,393 | | | | — | | | | — | | | — | | | — | |

| | | 2003 | | | | 184,571 | | | | — | | | | — | | | — | | | — | |

| | | 2002 | | | | 196,764 | | | | — | | | | — | | | — | | | 10,000 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | |

| (1) | | The LP also provided various perquisites and other benefits that did not exceed the lesser of $50,000 or 10% of the aggregate amounts reflected in the salary and bonus columns for each of the Named Executive Officers. |

| | | |

| (2) | | Mr. Rizzo was only employed for a period of 23 days (from December 9–December 31) in 2003. |

| | | |

| (3) | | Compensation resulting from exercise of Plan Option. |

| | | |

| (4) | | Mr. Conologue’s employment was terminated without cause on November 29, 2004. |

| | | |

| (5) | | Mr. de la Rama started his employment on March 1, 2004. |

Option/SAR Grants in Last Fiscal Year

We did not grant any SARs to any of the Named Executive Officers during the year ended December 31, 2004. The following table sets forth information regarding grants of options made to the Named Executive Officers during 2004.

15

| | | Individual Grants

| | Potential Realizable

Value at Assumed

Annual Rates of Stock

Appreciation for

Option Term(1)

|

Name

| | Number of

Securities

Underlying

Options

Granted

| | Percent of

Total

Options

Granted to

Employees

| | Exercise

Price

Per

Share

| | Expiration

Date

| | 5%

| | 10%

|

| | | | | | | | | | | | | | | | | | | | | | | | |

Peter J. Rizzo | | | 100,000 | | | | 80% | | | $ | 3.10 | | | | 10-14-14 | | | $ | 196,000 | | | $ | 493,000 | |

Jesse de la Rama | | | 25,000 | | | | 20% | | | $ | 0.87 | | | | 03-01-09 | | | $ | 13,750 | | | $ | 35,500 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| (1) | | In accordance with U.S. Securities and Exchange Commission rules, these columns show gains that could accrue for the Named Executive Officer’s option, assuming that the market price of the Company’s common stock appreciates from the date of grant over a period of 10 years at an annualized rate of 5% and 10%, respectively. If the stock price does not increase above the exercise price at the time of exercise, realized value to the Named Executive Officer from this option will be zero. |

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR AND

FISCAL YEAR-END OPTION/SAR VALUES

The following table sets forth information concerning the number and value of unexercised options to purchase our common stock held on December 31, 2004 by the Named Executive Officers.

Name

| | Shares

Acquired on

Exercise

| | Value Realized

| | Number of Securities

Underlying Unexercised

Options at

Fiscal Year-End

Exercisable/Unexercisable

| | Value of Unexercised

In-the-Money Options at

Fiscal Year-End

Exercisable/Unexercisable

|

| | | | | | | | | | |

Peter J. Rizzo | | 0 | | 0 | | | 250,000/350,000 | | | $737,500/$817,500 |

Daniel J. Gladstone | | 111,350 | | $339,896 | | | 372,650/0 | | | $921,326/$0 |

Robert J. Conologue | | 182,000 | | $625,342 | | | 43,000/0 | | | $147,060/$0 |

Jesse de la Rama | | 0 | | 0 | | | 0/25,000 | | | $0/$75,750 |

Eugene Wielepski | | 0 | | 0 | | | 44,500/0 | | | $117,494/$0 |

| | | | | | | | | | |

DEFINED BENEFIT PENSION PLAN

We maintain a defined benefit pension plan (the “Pension Plan”) for our employees, and the employees of our subsidiaries. The normal retirement benefit, payable at age 65, is 20.0% of base compensation up to $10,000 plus 39.5% of base compensation over $10,000 and up to a maximum of $75,000, prorated for service less than 30 years. A reduced benefit is also payable on early retirement, after attainment of age 55 and completion of 15 years of service. The Pension Plan also provides disability retirement and death benefits. We pay the full cost of the benefits under the Pension Plan through contributions to a trust. Our cash contributions to the Pension Plan during the year ended December 31, 2004 aggregated approximately $175,000.

16

The Pension Plan Table below provides the estimated annual benefits payable under the Pension Plan upon retirement in specified compensation and years of service classifications:

| | | | | | | Years of Service

|

| | Remuneration

| | 15

| | 20

| | 25

| | 30

| | 35

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 100,000 | | | | $ | 13,838 | | | $ | 18,451 | | | $ | 23,063 | | | $ | 27,676 | | | $ | 27,676 | |

| | | 125,000 | | | | | 13,838 | | | | 18,451 | | | | 23,063 | | | | 27,676 | | | | 27,676 | |

| | | 150,000 | | | | | 13,838 | | | | 18,451 | | | | 23,063 | | | | 27,676 | | | | 27,676 | |

| | | 175,000 | | | | | 13,838 | | | | 18,451 | | | | 23,063 | | | | 27,676 | | | | 27,676 | |

| | | 200,000 | | | | | 13,838 | | | | 18,451 | | | | 23,063 | | | | 27,676 | | | | 27,676 | |

| | | 225,000 | | | | | 13,838 | | | | 18,451 | | | | 23,063 | | | | 27,676 | | | | 27,676 | |

| | | 250,000 | | | | | 13,838 | | | | 18,451 | | | | 23,063 | | | | 27,676 | | | | 27,676 | |

| | | 300,000 | | | | | 13,838 | | | | 18,451 | | | | 23,063 | | | | 27,676 | | | | 27,676 | |

| | | 400,000 | | | | | 13,838 | | | | 18,451 | | | | 23,063 | | | | 27,676 | | | | 27,676 | |

| | | 450,000 | | | | | 13,838 | | | | 18,451 | | | | 23,063 | | | | 27,676 | | | | 27,676 | |

| | | 500,000 | | | | | 13,838 | | | | 18,451 | | | | 23,063 | | | | 27,676 | | | | 27,676 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

The compensation considered in determining benefits under the Pension Plan (as provided in the column titled “Remuneration”) is the annual average compensation for the five consecutive calendar years producing the highest average. The compensation considered is limited to $75,000. All amounts of salary, bonus and other compensation as reported in the Summary Compensation Table, up to $75,000, are included in compensation considered under the Pension Plan. The amounts provided in the Pension Plan Table are the benefits payable per year in equal monthly installments for the life expectancy of the participants (i.e., straight life annuity amounts). The Pension Plan is integrated with Social Security, and its benefit formula is as follows: (i) 0.6667% of compensation, multiplied by years of service up to 30 years; plus (ii) 0.65% of compensation in excess of $10,000 multiplied by years of service up to 30 years.

The estimated credited years of service for each of the Named Executive Officers as of January 1, 2004 were as follows:

| | Name

| | Estimated Credited

Years of Service

|

| | | | | | |

| | Peter J. Rizzo | | | 1 | |

| | Daniel J. Gladstone | | | 6 | |

| | Robert J. Conologue | | | 1 | |

| | Jesse De La Rama | | | 0 | |

| | Eugene Wielepski | | | 31 | |

| | | | | | |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

Plan Category

| | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights

| | Weighted average

exercise price of

outstanding

options, warrants

and rights

| | Number of securities

remaining available

for future issuance

|

| | | | | | | | | | | | |

Equity compensation plans approved by security holders | | | 1,522,817 | | | $ | 1.09 | | | | 455,400 | |

Equity compensation plans not approved by security holders | | | 0 | | | | N/A | | | | N/A | |

Totals | | | 1,522,817 | | | $ | 1.09 | | | | 455,400 | |

| | | | | | | | | | | | |

17

PROPOSAL 2—ADOPTION OF THE 2005 NON-EMPLOYEE DIRECTORS’

STOCK OPTION PLAN

On April 28, 2005, the Board adopted the I.C. Isaacs & Company, Inc. 2005 Non-Employee Directors’ Stock Option Plan (“Directors’ Plan”), subject to stockholder approval. There are 450,000 shares of Common Stock reserved for issuance under the Directors’ Plan.

If the proposal to adopt the Directors’ Plan is adopted by our stockholders, then, without any action by the Board or any committee of the Board:

| • | each Outside Director who is serving on the Board on the date of this year’s annual meeting automatically shall be granted a fully vested, nonqualified ten year option to purchase 15,000 shares of our common stock; |

| |

| • | each person who first becomes as Outside Director at this year’s annual meeting or at any time after the date of that meeting will be entitled to receive a ten year nonqualified option, which may be subject to a one year vesting requirement, to purchase 15,000 shares of our common stock upon his or her initial election or appointment to our Board; and |

| |

| • | immediately following each annual meeting of our stockholders, commencing with the 2006 annual meeting, each Outside Director automatically will be granted a fully vested nonqualified option to purchase an additional 15,000 shares of our common stock, provided he or she has served as a director for at least one year. |

The Board of Directors unanimously recommends a vote FOR approval of Proposal 2

The discussion that follows summarizes the salient features of the Directors’ Plan. However, it is qualified in its entirety by reference to the full text of the Directors’ Plan which appears as Appendix A to this Proxy Statement.

General

Purpose. In light of the fact that all of the Board members who are charged with duty of administering and granting awards under our Plan are Outside Directors, the Board adopted the Directors’ Plan in order to:

| • | eliminate any actual or potential conflicts of interest which might result from a grant of stock options to an Outside Director by other Outside Directors under our Plan; |

| |

| • | facilitate the retention of the services of currently serving Outside Directors; |

| |

| • | secure and retain the services of new Outside Directors; and |

| |

| • | provide incentives for such persons to exert maximum efforts for the success of the Company and its Affiliates. |

Shares Available Under The Plan. The aggregate number of shares of our common stock that may be issued pursuant to options granted under the Directors’ Plan is 450,000 shares. If any option expires or terminates for any reason, in whole or in part, without having been exercised in full, the shares of common stock not acquired under such option will become available for future issuance under the Directors’ Plan.

The following types of shares issued under the Directors’ Plan may again become available for the grant of new options: (i) any shares withheld to satisfy withholding taxes, (ii) any shares used to pay the exercise price of an option in a net exercise arrangement, and (iii) shares tendered to us to pay the exercise price of an option. Shares issued under the Directors’ Plan may be previously unissued shares or reacquired shares bought on the market or otherwise. As of the date hereof, no shares of Common Stock have been issued under the Directors’ Plan.

Administration of the Directors’ Plan. The Board will administer the Directors’ Plan. The Board may not delegate administration of the Directors’ Plan to a Board committee. The Board will determine the provisions of each option to the extent not specified in the Directors’ Plan.

18

Participation. All directors of the Company (including directors who are consultants to the Company) who are not employees of the Company or any of its subsidiaries are eligible for participation in the Directors’ Plan.

Stock Options

Unless the Board provides otherwise, each option to be granted under the Directors’ Plan shall be a fully vested, nonqualified ten year option to purchase shares of our common stock.

The exercise price of options granted under the Directors’ Plan will be equal to the fair market value of our common stock on the date of grant.

No option granted under the Directors’ Plan may be exercised after the expiration of ten years from the date it was granted. If an option holder’s service as an Outside Director is terminated for cause, the option will terminate immediately upon the option holder’s termination date. If an option holder’s service as an Outside Director terminates as of or within 12 months following a specified change in control transaction, the option holder may exercise his or her options for a period of three months following the option holder’s termination of service. In no event, however, may an option be exercised beyond the expiration of its term.

The exercise price of an option may be paid in any combination of the following: (i) cash or check, (ii) pursuant to a broker-assisted cashless exercise, or (iii) by tender of other Common Stock previously owned by the option holder.

Options granted under the Directors’ Plan are generally not transferable except by will, the laws of descent and distribution, or pursuant to a domestic relations order.

Automatic Grants

Pursuant to the Directors’ Plan:

| • | each Outside Director who is serving on the Board on the date of this year’s annual meeting automatically shall be granted a fully vested, nonqualified ten year option to purchase 15,000 shares of our common stock; |

| |

| • | each person who first becomes as Outside Director at this year’s annual meeting or at any time after the date of that meeting will be entitled to receive a ten year nonqualified option, which may be subject to a one year vesting requirement, to purchase 15,000 shares of our common stock upon his or her initial election or appointment to our Board; and |

| |

| • | immediately following each annual meeting of our stockholders, commencing with the 2006 annual meeting, each Outside Director automatically will be granted a fully vested nonqualified option to purchase an additional 15,000 shares of our common stock, provided he or she has served as a director for at least one year. |

Changes in Capital Structure

In the event that there is a specified type of change in our capital structure, such as a stock split, appropriate adjustments will be made to (i) the number of shares reserved under the Directors’ Plan, (ii) the number of shares to be issued pursuant to initial and annual grants, and (iii) the number of shares and exercise price of all outstanding nonqualified options.

Corporate Transactions

In the event of certain corporate transactions, as defined in the Directors’ Plan, all outstanding options under the Directors’ Plan may be assumed, continued or substituted for by any surviving or acquiring entity (or its parent company). If the surviving or acquiring entity (or its parent company) elects not to assume, continue or substitute for such options, then such options will be terminated if not exercised prior to the effective date of the corporate transaction.

19

Duration, Amendment and Termination

The Board may suspend or terminate the Directors’ Plan at any time; provided, however, that such suspension or termination may not impair the rights and obligations under any options granted prior to such suspension or termination without the written consent of the affected Outside Director.

The Board may also amend the Directors’ Plan or options granted under the Directors’ Plan at any time; provided, however, that the amendment of an option may not impair the rights of the affected Outside Director without his or her written consent. In addition, no amendment of the Directors’ Plan will be effective unless approved by our stockholders to the extent such approval is necessary to satisfy applicable law. The Board may submit any other amendments to the Directors’ Plan for stockholder approval.

Federal Income Tax Consequences

The following is a general summary of the current federal income tax treatment of stock options which are authorized to be granted under the Directors’ Plan based upon the current provisions of the Internal Revenue Code of 1986, as currently in effect (“the Code”) and regulations promulgated thereunder.

Nonqualified Stock Options. No tax consequences result from the grant of a nonqualified stock option. An option holder who exercises a nonqualified stock option with cash generally will realize compensation taxable as ordinary income in an amount equal to the difference between the exercise price and the fair market value of the shares on the date of exercise, and we will be entitled to a deduction from income in the same amount in the fiscal year in which the exercise occurred. The option holder’s basis in such shares will be the fair market value on the date income is realized, and when the holder disposes of the shares he or she will recognize capital gain or loss, either long-term or short-term, depending on the holding period of the shares.

Disallowance Of Deductions. The Code disallows deductions for publicly held corporations with respect to compensation in excess of $1,000,000 paid to the corporation’s chief executive officer and its four other most highly compensated officers. However, compensation payable solely on account of attainment of one or more performance goals is not subject to this deduction limitation if the performance goals are objective, pre-established and determined by a compensation committee comprised solely of two or more outside directors, the material terms under which the compensation is to be paid are disclosed to the stockholders and approved by a majority vote, and the compensation committee certifies that the performance goals and other material terms were in fact satisfied before the compensation is paid. Under this exception, the deduction limitation does not apply with respect to compensation otherwise deductible on account of stock options and stock appreciation rights granted at fair market value under a plan which limits the number of shares that may be issued to any individual and which is approved by the corporation’s stockholders.

New Plan Benefits

The following table presents certain information with respect to options to be granted under the Directors’ Plan to our Outside Directors as a group, assuming stockholder approval of the Directors’ Plan:

New Plan Benefits

I.C. Isaacs & Company, Inc. 2005 Non-Employee Directors’ Stock Option Plan

Name and Position

| | Number of Shares

Underlying

Options to be Granted

|

| | | | |

All Non-Employee Directors as a Group | | | 450,000 | |

20

REPORT OF THE AUDIT COMMITTEE

The operations of this Committee are governed by a written charter which is reproduced at Appendix B to this proxy statement. Only independent directors, as that term is defined by the Marketplace Rules of The Nasdaq Stock Market, may serve as members of this Committee.

The primary function of this Committee is to assist the Board in fulfilling its oversight responsibilities by reviewing:

| • | the financial reports and other financial information provided by the Company to any governmental body or the public, |

| |

| • | the Company’s systems of internal controls regarding finance, accounting, legal compliance and ethics that management and the Board have established, and |

| |

| • | the Company’s auditing, accounting and financial reporting processes generally. |

This Committee performs its oversight regarding the Company’s financial reporting obligations by engaging in dialogs with management and with BDO Seidman, LLP, the Company’s independent registered public accounting firm during the year ended December 31, 2004. The discussions in which we engage pertain to issues germane to the preparation of the Company’s quarterly and annual financial statements, and the conduct and completion of the audit of the Company’s annual financial statements.

This Committee has reviewed and discussed the Company’s consolidated annual financial statements with management and with representatives of BDO Seidman, LLP. We also discussed with representatives of that accounting firm the matters required to be discussed with the Company’s independent registered public accounting firm pursuant to Statement of Accounting Standards No. 61, as amended, “Communication with Audit Committees.”

BDO Seidman, LLP also provided to this Committee the written disclosures required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” and we discussed the question of BDO Seidman, LLP’s independence with representatives of that firm.

Based upon those reviews and discussions, and the report of BDO Seidman, LLP regarding its audit of the Company’s financial statements for the year ended December 31, 2004, this Committee recommended to the Company’s Board of Directors that such audited financial statements be included in the Annual Report on Form 10-K that the Company filed with respect to that year.

All of the non-audit services provided by BDO Seidman, LLP during 2004, and the fees and costs incurred in connection with those services, were pre-approved by this Committee in accordance with our policy of pre-approval of audit and permissible non-audit services. (This policy is discussed in further detail below at Proposal 4) Before approving the retention of BDO Seidman, LLP for these non-audit services, this Committee considered whether such retention was compatible with maintaining BDO Seidman, LLP’s auditor independence. In reliance on the reviews and discussions with management and BDO Seidman, LLP referred to above, this Committee believes that the non-audit services provided by BDO Seidman, LLP were compatible with, and did not impair, BDO Seidman, LLP’s auditor independence.

| Neal J. Fox (Chairman) |

| Jon Hechler | Robert S. Stec |

PROPOSAL 3—RATIFICATION OF SELECTION OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTANTS

At the annual meeting, our stockholders will be asked to ratify the Board’s appointment of BDO Seidman, LLP (“Seidman”) as our independent registered public accountants for the year ending December 31, 2005. It is expected that a representative of Seidman will be present at the meeting.

21

Principal Accounting Fees and Services

The following table shows the fees that the Company paid or accrued for the audit and other services provided by BDO Seidman, LLP in 2004 and 2003.

| | | | Years Ended

December 31,

|

| | | | 2004

| | 2003

|

| | Audit Fees(1) | | $ | 249,000 | | | $ | 255,605 | |

| | Audit-related fees | | | 51,566 | (2) | | | 24,170 | (3) |

| | Tax Fees | | | 15,500 | | | | 15,355 | |

| | | | |

| | | |

| |

| | Total | | $ | 316,066 | | | $ | 295,130 | |

| | | | |

| | | |

| |

| | | | | | | | | | |

| | | |

| (1) | | Includes audit of the Company’s consolidated financial statements and quarterly review of its financial statements and filings on SEC forms 10-Q. |

| | | |

| (2) | | Includes consultation regarding accounting and reporting matters, an audit of the Company’s employee benefit plan, the Company’s preparation of registration statements on SEC forms S-3 and S-8 and out of pocket expenses. |

| | | |

| (3) | | Includes consultation regarding accounting and reporting matters, and an audit of the Company’s employee benefit plan. |

All audit and audit related services were pre-approved by the Audit Committee, which concluded that the performance of such services by BDO Seidman, LLP was compatible with the maintenance of that firm’s independence in the conduct of its auditing functions.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accountants

Beginning in fiscal 2003, our Audit Committee instituted a policy of pre-approving all audit and permissible non-audit services provided by our independent certified public accountants. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally detailed as to the particular service or category of services and is generally subject to a specific budget. Our independent certified public accountants and management are required to periodically report to the Audit Committee regarding the extent of services provided by our independent certified public accountants in accordance with this pre-approval requirement, and the fees that we have incurred for those services. The Audit Committee may also pre-approve additional services on a case-by-case basis. The Audit Committee does not delegate to management its responsibilities to pre-approve services performed by our independent certified public accountants.

The Board of Directors unanimously recommends a vote FOR approval of Proposal 3

OTHER MATTERS

Stockholder Proposals

Stockholders who wish to present proposals for action at the 2006 Annual Meeting of Stockholders should submit their proposals in writing to our Corporate Secretary at our address set forth on the first page of this proxy statement. It is anticipated that the 2006 Annual Meeting will be held in or about June 2006. Accordingly, proposals must be received by the Secretary on or before December 30, 2005 in order to be considered for inclusion in next year’s proxy materials.

Annual Report to Stockholders

Our Annual Report to Stockholders consisting of a letter from our Chief Executive Officer our Annual Report on Form 10-K for the year ended December 31, 2004, including audited financial statements, and our quarterly report on Form 10-Q for the quarter ended March 31, 2005

22

has been mailed to our stockholders concurrently herewith, but such reports are not incorporated in this proxy statement and are not deemed to be part of the proxy solicitation material.

Communications from Stockholders to the Board

The Board recommends that stockholders initiate any communications with the Board in writing and send them in care of the Corporate Secretary. Stockholders can send communications by mail to Eugene Wielepski, Corporate Secretary, I.C. Isaacs & Company, Inc., 3840 Bank Street, Baltimore, MD 21224-2522. This process will assist the Board in reviewing and responding to stockholder communications in an appropriate manner. The name of any specific intended Board recipient should be noted in the communication. The Board has instructed the Corporate Secretary to forward such correspondence only to the intended recipients; however, the Board has also instructed the Corporate Secretary, prior to forwarding any correspondence, to review such correspondence and, in his discretion, not to forward certain items if they are deemed of a commercial or frivolous nature or otherwise inappropriate for the Board’s consideration. In such cases, some of that correspondence may be forwarded elsewhere in the Company for review and possible response.

Section 16(a) Beneficial Ownership Reporting Compliance