NOTICE OF ANNUAL STOCKHOLDERS' MEETING

June 26, 2006

10:00 A.M. Eastern Time

Dear Stockholder,

You are cordially invited to attend the 2006 annual meeting of stockholders of I.C. ISAACS & COMPANY, INC. which will be held at 10:00 AM local time on June 26, 2006 at the offices of Arent Fox PLLC located on the 34th floor at 1675 Broadway, New York, New York 10019. At the meeting, you will be asked to consider and vote on the following proposals:

| | 1. to elect eight directors, each to hold office until the 2007 annual meeting of stockholders and until their respective successors shall have been duly elected or appointed; |

| | 2. to ratify the appointment of BDO Seidman, LLP as our independent registered public accounting firm for the year ending December 31, 2006; and |

| | 3. to transact such other business as may properly come before the meeting. |

Stockholders of record at the close of business on May 23, 2006 are entitled to notice of and to vote at the annual meeting and any adjournments or postponements thereof.

Enclosed are copies of the Annual Report to our Stockholders consisting of a letter from our Chief Executive Officer and our Form 10-K for the year ended December 31, 2005 and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2006.

| | The Board of Directors,

|

| |  |

| | GREGG A. HOLST,

Secretary |

New York, New York

May 26, 2006

VOTING

We are offering registered stockholders the opportunity to vote their shares electronically through the internet. Please see the Proxy Statement and the enclosed Proxy for details about electronic voting. You are urged to date, sign and promptly return the enclosed proxy, or to vote electronically through the internet, so that your shares may be voted in accordance with your wishes and so that the presence of a quorum may be assured. Voting promptly, regardless of the number of shares you hold, will aid us in reducing the expense of proxy solicitation. Voting your shares by the enclosed proxy, or electronically through the internet, does not affect your right to vote in person in the event you attend the meeting. You are cordially invited to attend the meeting, and we request that you indicate your plans in this respect in the space provided on the enclosed form of Proxy or as prompted if you vote electronically through the internet.

TABLE OF CONTENTS

i

I.C. ISAACS & COMPANY, INC.

3840 Bank Street

Baltimore, Maryland 21224-2522

PROXY STATEMENT

The enclosed proxy is solicited by the Board of Directors of I.C. Isaacs & Company, Inc. for the Annual Stockholders' Meeting to be held at the offices of Arent Fox PLLC located on the 34th floor at 1675 Broadway, New York, New York 10019, on Monday, June 26, 2006, at 10:00 a.m. Eastern Time, and at any postponement or adjournment of the meeting, for the purposes set forth in the accompanying Notice of Annual Stockholders' Meeting.

Record Date; Quorum; Share Ownership and Voting Requirements for Election of Directors and Adoption of Proposals

Only stockholders of record on the books of the company at the close of business on May 23, 2006 will be entitled to vote at the annual meeting. Presence in person or by proxy of a majority of the shares of common stock outstanding on the record date is required for a quorum. If you held your shares on that date, you may vote your shares at the meeting either in person or by your duly authorized proxy. As of the close of business on May 23, 2006, the company had 11,996,485 outstanding shares of common stock. Copies of this proxy statement were first available to stockholders on May 26, 2006.

Our common stock is our only class of securities that will be entitled to vote at the annual meeting. The presence, in person or represented by proxy, of at least a majority of the total number of outstanding shares of our common stock is necessary to constitute a quorum at the annual meeting. Shares of common stock present in person or represented by proxy will be counted as present at the annual meeting for purposes of determining a quorum, without regard to whether the proxy is marked as casting a vote or abstaining.

Each share of common stock is entitled to one vote on all matters that may properly come before the annual meeting other than the election of directors. In the election of directors, each share is entitled to cast one vote for each director to be elected. Directors shall be elected by a plurality vote of the shares represented in person or by proxy at the annual meeting. That means that the eight nominees for election as directors who receive the most votes will be elected to the Board. You may not vote your shares of common stock cumulatively for the election of directors. For purposes of the election of directors, abstentions will not affect the determination as to whether a director nominee has received the plurality vote required for election.

All other matters to come before the annual meeting require the approval of a majority of the shares of common stock present, in person or by proxy, at the meeting and entitled to vote. For the purpose of determining whether our stockholders have approved matters other than the election of directors, abstentions are treated as shares present or represented and voting, so abstaining has the same effect as a negative vote. Shares held by banks or brokers that do not have discretionary authority to vote on a particular matter and that have not received voting instructions from their customers are not counted or deemed to be present or represented for the purpose of determining whether stockholders have approved that matter, but they are counted as present for the purpose of determining the existence of a quorum at the annual meeting. Please note that banks and brokers that have not received voting instructions from their clients cannot vote on their clients' behalf on “non-routine” proposals, but may vote their clients' shares on the two “routine” proposals that will be considered at the annual meeting—the election of directors and the ratification of BDO Seidman, LLP as our independent registered public accounting firm.

1

Solicitation of Proxies

All costs of solicitation of proxies will be borne by us. In addition to solicitations by mail, our directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone, facsimile transmission, email and personal interviews and we reserve the right to retain outside agencies for the purpose of soliciting proxies. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the owners of our common stock held in their names. We will reimburse them for their reasonable out-of-pocket expenses incurred in connection with the distribution of proxy materials.

Submitting and Revoking Your Proxy

If you complete and submit the enclosed form of proxy by mail or if you submit your proxy electronically by accessing the internet site stated on the enclosed form of proxy, the shares represented by your proxy will be voted at the annual meeting in accordance with your instructions. Without affecting any vote previously taken, your proxy may be revoked by giving notice of revocation to us in writing addressed to us at 3840 Bank Street, Baltimore, Maryland 21224-2522, Attention: Corporate Secretary, or by accessing the internet site stated on the form of proxy, or by stating your desire to revoke your proxy at the annual meeting. You may also change your vote by executing and returning to us a later-dated proxy, by a later-dated electronic vote through the internet site, or by voting in person at the annual meeting. All properly executed proxies received by the Board of Directors, and properly authenticated electronic votes recorded through the internet, will be voted as directed by you. If you hold shares through a bank or brokerage firm, you must contact that firm to revoke any prior voting instructions.

All properly executed proxies received by the Board of Directors that do not specify how your shares should be voted will be voted:

| • | FOR the election of the nominees for director set forth in “Proposal 1—Election of Directors”, and |

| |

| • | FOR ratification of the appointment of BDO Seidman, LLP, as our independent registered public accountants for 2006. |

In addition, if other matters to come before the annual meeting, the persons named as proxies will vote on such matters in accordance with their best judgment. We have not received notice of other matters that may properly be presented at the annual meeting.

Solicitation of proxies may be made by mail, personal interview and telephone by officers, directors and other employees of the Company. We will reimburse all banks, brokers, and other custodians, nominees and fiduciaries for their reasonable costs in sending proxy materials to our stockholders.

The internet procedures for voting and for revoking or changing a vote are designed to authenticate our stockholders' identities, to allow our stockholders to give their voting instructions and to confirm that stockholders' instructions have been properly recorded. Stockholders that vote through the internet should understand that there may be costs associated with electronic access, such as usage charges from internet access providers and telephone companies, which will be borne by the stockholder.

PROPOSAL 1—ELECTION OF DIRECTORS

The Board of Directors is currently composed of eight directors. At last year's annual meeting, our stockholders elected a slate of nine directors to the Board. The death of Roland Loubet, who served on the Board as one of our independent directors, resulted in a vacancy on the Board and reduced the number of independent directors to four. In order to once again have a Board consisting of a majority of independent members, our Nominating Committee is engaged in a search for a new independent director. To avoid presenting less than a full slate of nominees at this year's annual meeting, the size of the Board has been reduced to eight members. If, as and when the Nominating Committee identifies a suitable candidate to serve as an independent

2

director, and the Board acts favorably on that person's candidacy, the size of the Board will be increased once again to nine members. All eight of our current directors have been nominated for reelection. If any director nominee is unable or unwilling to serve as a nominee at the time of the annual meeting, the proxies may be voted either (i) for a substitute nominee designated by the present Board of Directors to fill the vacancy or (ii) for the balance of the nominees, leaving a vacancy. Alternatively, the Board of Directors may reduce the size of the Board. The Board of Directors has no reason to believe that any of the following nominees will be unwilling or unable to serve if elected as a director. Such persons have been nominated to serve until the next annual stockholders' meeting following the 2006 annual meeting or until their successors, if any, are elected or appointed. Set forth in this section are the names and biographical information for each of the nominees.

The Board of Directors recommends a vote “FOR” the election of each of the following nominees.

Nominees for Election as Directors

Peter J. Rizzo

Age 53

Chief Executive Officer of the Company

Director since February 2004 and Chairman

since July 2004 | | Mr. Rizzo has worked within the apparel industry during the past 27 years. He became the Company's Chief Executive Officer in December, 2003, was appointed to the Board in February 2004 and has served as Chairman of the Board since July 2004. During the two years prior to joining the Company, Mr. Rizzo was a consultant to the Neiman Marcus Group. He was President and Vice Chairman of Bergdorf Goodman from 1999 to 2002. From 1997 to 1999, he served as President of Polo Retail at Polo Ralph Lauren. From 1978 to 1997, he was Executive Vice President and Head Merchant of Barneys New York. |

| | | |

Olivier Bachellerie

Age: 45

Director since 2002

President and Director General of GI

Promotion and Cravatatakiller S.A. | | Mr. Bachellerie has served since 1997 as President and Director General of GI Promotion and Cravatatakiller S.A., and as President of Fashion Services of America, Inc., each of which is beneficially owned by Marithé Bachellerie and François Girbaud. Mr. Bachellerie is the son of Marithé Bachellerie, who together with Mr. Girbaud, indirectly own and possess the right to vote approximately 38% of the Company's outstanding shares of common stock. |

| | | |

René Faltz

Age: 52

Director since 2002

Senior Partner, Cabinet D'Avocats René Faltz | | Mr. Faltz has practiced law in the Grand Duchy of Luxembourg since 1976. He has been with Cabinet D'Avocats René Faltz since March 2000 after leaving the firm of Faltz & Kremer. Mr. Faltz is one of the Managing Directors of, and serves as counsel to, several companies that, since 2002, have been beneficially owned by Marithé Bachellerie and François Girbaud in connection with the conduct of their business activities as designers and marketers of clothing and other items bearing the various Girbaud trademarks. |

3

Neal J. Fox

Age: 71

Director since 1998

Consultant

Member of the Audit (Chairman),

Compensation and Nominating Committees | | Mr. Fox has held senior management positions at Neiman Marcus, Bergdorf Goodman and I. Magnin. From 1983 to 1988, he was employed by Garfinkel's, Raleigh & Co., or its predecessor, most recently as Chairman and Chief Executive Officer, and was also a principal stockholder of that company. From 1989 through March 1999, Mr. Fox served as the President and Chief Executive Officer of Sulka, an international menswear retailer. In 1999, Mr. Fox founded NJF Associates, Incorporated, a consulting firm specializing in brand management and business development for the apparel, accessories and luxury goods industries. Mr. Fox served as a director of Today's Man, a 30 unit menswear retailer. In March, 2003, Today's Man filed a petition under Chapter 11 of the US Bankruptcy Code. |

| | | |

François Girbaud

Age: 61

Director since 2004 | | Mr. Girbaud, an internationally renowned designer and manufacturer of clothing, and licensor of clothing designs and trademarks for more than 25 years, became one of the Company's directors in October 2004 Pursuant to agreements that the Company has with companies co-owned directly or indirectly by Mr. Girbaud and Marithé Bachellerie, the Company licenses the Girbaud trademarks and designs for use in the manufacture and sale of various items of clothing in North America. |

| | | |

Jon Hechler

Age: 53

Director since 1984

President, T. Eliot, Inc.

Member of the Audit, Compensation (Chairman) and Nominating Committees | | Mr. Hechler was employed by Ira J. Hechler and Associates, an investment company, from 1980 to 1999. He is President of T. Eliot, Inc., manufacturer of the Sani Seat® hygienic toilet seat system. |

| | | |

Robert Stephen Stec

Age: 51

Director since 2002

Chairman and Chief Executive Officer of

Lexington Home Brands

Member of the Audit, Compensation and

Nominating (Chairman) Committees | | Mr. Stec was a Division President of VF Corporation and had sole responsibility for VF's Girbaud division in the United States from 1989 through 1993. From 1996 to 1998, he served as President of London Fog Industries, Inc., a leading manufacturer and marketer of branded outerwear. During 1997 and 1998, Mr. Stec served as a part-time consultant to Girbaud Design, Inc. and certain of its affiliates. In 1999, Mr. Stec served as a consultant to London Fog for several months. Mr. Stec has been employed as President and Chief Executive Officer of Lexington Home Brands, a leading branded marketer of home furnishings, since 1999. |

4

John McCoy II

Age: 59

Director since 2005

President of Components by John McCoy, Inc.

Member of the Nominating Committee | | Mr. McCoy has worked within the apparel industry during the past 38 years. In 1970, he began working for Pierre Cardin's sales operations and held the position of Executive Vice President—Clothing when he left that firm in 1977 to found Fitzgerald by John McCoy, a US manufacturer of European styled clothing. In 1985, Mr. McCoy founded Components by John McCoy, Inc., a manufacturer and distributor of luxury clothing brands, including Gran Sasso, Mason's, Coast, Moncler, Lenor Romano and Alfred Dunhill. |

Except as noted above, each nominee for election as a director has been engaged in the principal occupation described during the past five years. There are no family relationships among any directors or executive officers of the company. Stock ownership information is shown under the heading “Security Ownership of Certain Beneficial Owners and Management” on page 8 and is based upon information furnished by the respective individuals.

Principal Executive Officers of the Company Who Are Not Also Directors

The following table sets forth the names and ages of our principal executive officers who are not directors. The table also provides a description of the positions of employment held by each of such executives for at least the past five years.

Jesse de la Rama

Age: 51

Chief Operating Officer of the Company | | Mr. de la Rama began his employment with the Company in March 2004 as Vice President of Merchandise Planning and Retail Development. In December 2004, he began serving as the Company's Chief Operating Officer. Mr. de la Rama engaged in business during the period from 1997 through February 2004 as a consultant to the fashion retail industry and other clients, including Calvin Klein, Inc., Lambertson/Truex and Sotheby's, Inc., as president of his own company, Jesse de la Rama, Inc. Between 1994 and October 1997, Mr. de la Rama was Senior Vice President—Retail of Bally of Switzerland. Between 1979 and September 1994, he was employed by Barney's New York and served in various executive capacities, including Vice President—Outlet Division and Warehouse Sales (1992-1994) and Vice President—Merchandise Planning (1983-1992). |

5

Gregg A. Holst

Age: 47

Executive Vice President and Chief Financial

Officer; Corporate Secretary | | Mr. Holst began his employment with the Company in December 2005. Prior to the commencement of his employment by Registrant's wholly owned subsidiary, I.C. Isaacs & Company LP (the “LP”), Mr. Holst served (from 2003-December 2005) as Chief Financial Officer, The Americas, for BBDO Worldwide, Inc. During 2000-2002, Mr. Holst was Executive Vice President, Finance for the Warnaco Group, Inc. From 1992 to 2000, Mr. Holst held several finance positions with the General Electric Company and prior to 1992 he was employed in the New York office of Arthur Andersen & Co. Mr. Holst is a certified public accountant. |

CORPORATE GOVERNANCE

Independence of Directors

We are not subject to any law or market listing requirement that would obligate us to have a minimum number of “independent directors.” However, we believe that the interests of the stockholders of a public company are best served when a majority of the directors meet the standards required of independent directors set forth in the applicable rules promulgated by the Securities and Exchange Commission and the Nasdaq Stock Market. Prior to the death of our former director, Roland Loubet, in 2005, five of the nine members who were then serving on our Board—Messrs. Fox, Hechler, Loubet, McCoy and Stec—met those standards. Our Nominating Committee has been engaged in a search for a fifth independent director. We have reduced the size of our Board to eight members, and have nominated our four current independent directors for re-election to the Board. If, as and when the Nominating Committee identifies a suitable candidate to serve as a fifth independent director, and the Board acts favorably on that person's candidacy, the size of the Board will be increased once again to nine members, a majority of whom will once again be independent directors.

Board and Stockholder Meetings

The Board of Directors held four meetings during 2005. Each director is expected to attend each meeting of the Board and the committees on which he serves. However, it is not our policy to require Board members to attend our annual stockholder meetings. In addition to meetings, the Board and its committees review and act upon matters through written consent procedures. No director attended less than 75% of all the meetings of the Board and the committees on which he served in fiscal 2005.

Board Committees and Meetings

The Board of Directors currently has standing Audit, Compensation and Nominating Committees. The operations of each of those committees are governed by written charters approved by the Board. Links to each committee's current charter are located on the Investor Relations page of the company's website at www.icisaacs.com/news/corporate governance. The membership requirements contained in the charters of each of our standing committees state that each of the members of those committees must satisfy the director independence standards set forth in the applicable rules promulgated by the Securities and Exchange Commission and the Nasdaq Stock Market, as such rules may be amended from time to time, and subject to any exceptions authorized under such rules. The members of the committees, each of whom satisfies the applicable director independence standards, are, as follows:

6

| | Audit: | | Messrs. Fox (Chair), Hechler and Stec |

| | Compensation: | | Messrs. Hechler (Chair), Fox and Stec |

| | Nominating: | | Messrs. Stec (Chair), Fox, Hechler and McCoy |

The Audit Committee assists the Board of Directors in its general oversight of the company's financial reporting, internal controls and audit functions. The Board of Directors has determined that Neal J. Fox, the Chairman of the Audit Committee, is an “audit committee financial expert,” as such term is defined under applicable SEC regulations. During 2005, the Audit Committee held eight meetings. For further information, see “Report of the Audit Committee” on page 19.

The Compensation Committee administers our Amended and Restated Omnibus Stock Incentive Plan, which we will refer to as the Plan from now on in this proxy statement. The Compensation Committee also reviews and approves various other company compensation policies and matters, and reviews and approves salaries and other matters relating to compensation of our executive officers. The Compensation Committee held eight meetings during 2005. For further information, see “Report of the Compensation Committee on Executive Compensation” on page 11.

The Nominating Committee identifies individuals qualified to serve as members of the Board, and makes recommendations to the Board regarding the selection of nominees for election as directors of the company. The Nominating Committee held one meeting in 2005.

Director Candidates

The Nominating Committee recommended the director nominees proposed for election as directors. When a vacancy opens on the Board, the Nominating Committee will make an initial assessment of the skills and experience of the current directors in order to determine the particular skills and experience that would be desirable in a new director so as to complement and enhance the combined skills and experience of the existing Board members. The Nominating Committee will then ask Board members and others for recommendations, conduct meetings from time to time to evaluate biographical information and background material relating to potential candidates and interview selected candidates. In considering whether to recommend any particular candidate for inclusion in the Board of Directors' slate of recommended director nominees, the Nominating Committee takes into consideration a number of factors. These factors include a prospective candidate's understanding of and experience regarding manufacturing, finance and marketing. These factors, and others considered useful by the Committee, are reviewed in the context of an assessment of the perceived needs of the Board at a particular point in time. As a result, the priorities and emphasis of the Committee and of the Board may change from time to time to take into account changes in business and other trends. In determining whether to recommend a current director for re-election, the Committee considers, in addition to the basic qualifications for a new director which are described above, the director's past attendance at and participation in meetings and his or her overall contributions to the activities of the Board. During 2005, we did not employ a search firm or pay fees to other third parties in connection with seeking or evaluating Board nominee candidates. Stockholders may recommend individuals to the Nominating Committee for consideration as potential director candidates by submitting their names, together with appropriate biographical information and background materials. Assuming that appropriate biographical and background material has been provided on a timely basis, the Nominating Committee will evaluate stockholder-recommended candidates by following substantially the same process, and applying the same criteria, as it does in considering other candidates. For information on how to submit a director nominee recommendation and what should be included in and with that submission, see “Other Matters—Stockholder Proposals and Director Nomination Recommendations” at page 20.

Compensation Committee Interlocks and Insider Participation

All members of the Compensation Committee during 2005 were independent directors, and none of them were our employees or former employees. During 2005, none of our executive

7

officers served on the compensation committee (or equivalent), or the board of directors, of another entity whose executive officer(s) served on our Compensation Committee or Board.

Codes of Ethics

We have adopted a Code of Ethics for Senior Financial Executives that applies to every employee or officer who holds the office of principal executive officer, principal financial officer, principal accounting officer, treasurer or controller, or any person performing similar functions. The Company also has adopted a Code of Ethics and Business Conduct that applies to each officer, director and employee of the Company and each of its subsidiaries. Links to our two ethics codes are located on the Investor Relations page of the company's website at www.icisaacs.com news/corporate governance.

Communicating with our Directors

The Board of Directors will give appropriate attention to written communications that are submitted by stockholders, and will respond if and as appropriate.

Stockholders can send communications by mail to Gregg A. Holst, Corporate Secretary, I.C. Isaacs & Company, Inc., 3840 Bank Street, Baltimore, Maryland 21224-2522. The name of any specific intended Board recipient should be noted in the communication. The Board has instructed our Corporate Secretary to forward such correspondence only to the intended recipients; however, the Board has also instructed our Corporate Secretary, prior to forwarding any correspondence, to review such correspondence and, in his discretion, not to forward certain items if he deems them to be of a commercial or frivolous nature or otherwise inappropriate for the Board's consideration. In such cases, our Corporate Secretary may forward some of that correspondence elsewhere in the company for review and possible response.

DIRECTORS' COMPENSATION

Directors who are employed by us or any of our subsidiaries receive no compensation for serving on the Board of Directors. Directors who are not so employed (the “Outside Directors”) receive an annual retainer fee of $10,000 for their services and attendance fees of $750 per Board or committee meeting attended. The Chairman of the Audit Committee receives an additional $10,000 for the services he renders in that capacity. All directors are reimbursed for expenses incurred in connection with attendance at Board or committee meetings. In addition, Outside Directors are eligible to participate in the our 2005 Non-Employee Directors' Stock Option Plan (the “Directors' Plan”). In 2002, our Outside Directors were awarded nonqualified stock options to purchase an aggregate of 210,000 shares of common stock at an exercise price of $0.58 per share. Those options vested in December 2004. In 2005, our Outside Directors were awarded fully vested non-qualified stock options under the Directors' Plan to purchase an aggregate of 120,000 shares of common stock at an exercise price of $5.60 per share.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

Set forth below is information concerning the common stock ownership as of May 23, 2006 by (i) each person who the Company knows owns beneficially 5% or more of its outstanding common stock, (ii) the Company's Chief Executive Officer and each of its other “Named Executive Officers,” (iii) each director and (iv) all of the Company's directors and officers as a group:

8

| | | Shares Beneficially Owned

|

Name and Address of Beneficial Owner(1)

| | Number

| | Percent(2)

|

| | | | | | | | |

Würzburg S.A.(3) | | | 4,549,167 | (4) | | | 37.9 | |

Trafelet & Co LLC(5) | | | 1,037,000 | | | | 8.6 | |

Microcapital Fund LP(6) | | | 992,513 | | | | 8.3 | |

Jeffrey L. Feinberg(7) | | | 805,900 | | | | 6.7 | |

Peter J. Rizzo | | | 478,500 | (8) | | | 3.8 | |

Jesse de la Rama | | | 41,666 | (9) | | | * | |

Gregg A. Holst | | | — | | | | * | |

François Girbaud(10) | | | 4,564,167 | (11) | | | 38.0 | |

Olivier Bachellerie(12) | | | 45,000 | (13) | | | * | |

René Faltz(14) | | | 45,000 | (13) | | | * | |

Neal J. Fox | | | 67,000 | (15) | | | * | |

Jon Hechler | | | 226,091 | (16) | | | 1.9 | |

Robert Stephen Stec(17) | | | 45,000 | (13) | | | * | |

John McCoy II(19) | | | 15,000 | (18) | | | * | |

All Officers and Directors as a Group (of 10) | | | 5,527,424 | (20) | | | 43.2 | |

| | | | | | | | |

* Less than one percent

| | | |

| (1) | | All shares are owned beneficially and of record unless indicated otherwise. Unless otherwise noted, the address of each stockholder is c/o the company, 3840 Bank Street, Baltimore, Maryland 21224. |

| | | |

| (2) | | Based upon 11,996,485 shares outstanding on the date of this proxy statement, plus, where applicable, any shares issuable pursuant to options or warrants exercisable within 60 days of such date. |

| | | |

| (3) | | Based on information set forth in a Schedule 13D amendment filed with the SEC on April 26, 2005 by Würzburg SA (“Würzburg”) and certain related entities including Textile Investment International SA (“Textile”), François Girbaud and Marithé Bachellerie (collectively, the “Girbaud Group”), reporting shared power to vote or direct the vote of, and shared power to dispose or direct the disposition of 4,549,167 shares. The address of this stockholder is 41, Avenue de la Gare, L-1611 Luxembourg. |

| | | |

| (4) | | Includes 3,966,667 shares owned beneficially and of record by this stockholder's wholly owned subsidiary, Textile. |

| | | |

| (5) | | Based on information set forth in a Schedule 13G amendment filed with the SEC on February 14, 2006 by Trafelet & Company, LLC and a related party reporting shared power to vote or direct the vote of, and shared power to dispose or direct the disposition of 1,037,000 shares. The address of this stockholder is 900 Third Avenue, 5th Floor, New York, New York. |

| | | |

| (6) | | Based on information set forth in a Schedule 13G filed with the SEC on February 14, 2006 by MicroCapital, LLC and related parties reporting shared power to vote or direct the vote of, and shared power to dispose or direct the disposition of 992,513 shares. The address of this stockholder is 623 Fifth Avenue, Suite 2502, New York, New York. |

| | | |

| (7) | | Based on information set forth in a Schedule 13G amendment filed with the SEC on February 9, 2006 by Jeffrey L. Feinberg and related parties reporting shared power to vote or direct the vote of, and shared power to dispose or direct the disposition of 805,900 shares. The address of this stockholder is c/o JLF Asset Management, L.L.C., 2775 Via de la Valle, Suite 204, Del Mar, California. |

| | | |

| (8) | | Includes 478,500 shares that Mr. Rizzo may acquire pursuant to an option exercisable by him within 60 days of the date of this proxy statement. |

| | | |

| (9) | | Includes 41,666 shares that Mr. de la Rama may acquire pursuant to an option exercisable by him within 60 days of the date of this proxy statement. |

9

| | | |

| (10) | | Mr. Girbaud's address is 8 Rue Du Centre, Vevey, Switzerland. |

| | | |

| (11) | | Includes the shares held by the Girbaud Group. Also includes 15,000 shares that Mr. Girbaud may acquire pursuant to an option exercisable by him within 60 days of the date of this proxy statement. |

| | | |

| (12) | | Mr. Bachellerie's address is 15 Rue Louis Blanc, 75010 Paris, France. |

| | | |

| (13) | | Includes 45,000 shares that this person may acquire pursuant to options exercisable by him within 60 days of the date of this proxy statement. |

| | | |

| (14) | | Mr. Faltz's address is 41 Avenue de la Gare, Luxembourg, L-1611, Grand Duchy of Luxembourg. |

| | | |

| (15) | | Includes 67,000 shares that Mr. Fox may acquire pursuant to options exercisable by him within 60 days of the date of this proxy statement. |

| | | |

| (16) | | Includes 52,000 shares that Mr. Hechler may acquire pursuant to options exercisable by him within 60 days of the date of this proxy statement. |

| | | |

| (17) | | Mr. Stec's address is c/o Lexington Home Brands, 411 South Salisbury Street, Lexington, NC. |

| | | |

| (18) | | Mr. McCoy's address is c/o Components by John McCoy, Inc., 21 West 55th Street, New York, NY. |

| | | |

| (19) | | Includes 15,000 shares that Mr. McCoy may acquire pursuant to an option exercisable by him within 60 days of the date of this proxy statement. |

| | | |

| (20) | | Includes 804,166 shares that may be acquired by Messrs. Rizzo, de la Rama, Bachellerie, Falz, Fox, Girbaud, Hechler, McCoy and Stec pursuant to options exercisable by them within 60 days of the date of this proxy statement. |

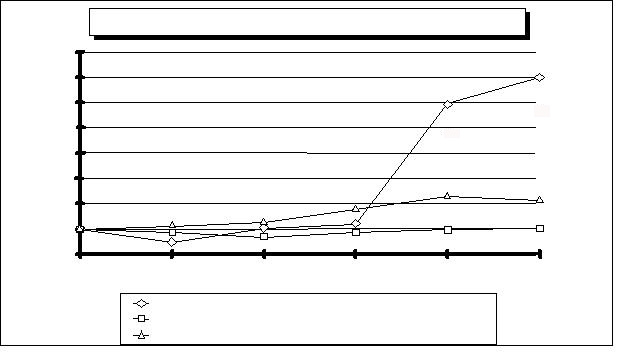

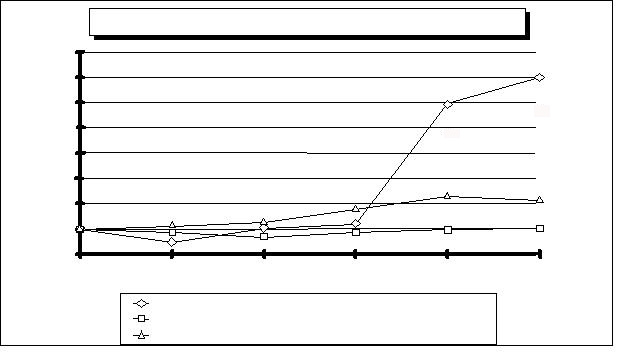

STOCK PRICE PERFORMANCE GRAPH

The performance graph which follows compares the cumulative total stockholder returns on our common stock for the five-year period ended December 31, 2005 with the S&P 500 Index and a peer group comprising the Apparel, Accessories and Luxury Goods industry segment of the S&P 600. The graph assumes that the value of our common stock and the value of each Index was $100 on December 31, 2000. This data was furnished by Standard & Poor's Compustat Services, Inc.

I.C. ISAACS & COMPANY INC

S&P 500 INDEX

S&P 600 APPAREL, ACCESSORIES & LUXURY GOODS

COMPARISON OF CUMULATIVE FIVE YEAR TOTAL RETURN

Dec00

Dec01

Dec02

Dec03

Dec04

$0

$200

$100

$300

$400

$500

$800

$600

$700

Dec05

10

REPORT OF THE COMPENSATION

COMMITTEE ON EXECUTIVE COMPENSATION

Objectives

The Company's compensation policies and procedures have historically been aligned with its entrepreneurial traditions. The Company seeks to compensate its officers (including the Named Executive Officers) in a manner which is:

| • | consistent with the Company's conservative traditions and cost structure; |

| |

| • | sufficient to attract and retain key executives critical to the success of the Company; |

| |

| • | reflective of current performance of both the individual officer and the Company; and |

| |

| • | remuneration of successful long-term strategic management and enhancement of stockholder values. |

Components of Compensation

The Compensation Committee (the “Committee”) approves the design of, assesses the effectiveness of, and administers the executive compensation programs of the Company in support of stockholder interests. The key elements of the Company's executive compensation program are base salary, annual incentives and long-term compensation. These key elements are addressed separately below. In determining each component of compensation, the Committee considers all elements of an executive's total compensation package.

Base Salary

The Committee regularly reviews each executive's base salary. Base salaries are not necessarily compared to other institutions, although market rates for comparable executives with comparable responsibilities are considered in some cases. Base salaries are adjusted by the Committee to recognize varying levels of responsibility, experience, breadth of knowledge, internal equity issues, as well as external pay practices. Increases to base salaries are driven primarily by individual performance. Individual performance is evaluated based on sustained levels of individual contribution to the Company.

The Committee commenced in 2003, and completed in 2004, a substantial reorganization effort regarding the composition of, and compensation payable to, management. During 2005, the Committee's activities were primarily limited to the hiring of one new senior executive—Gregg A. Holst, the Company's Executive Vice President and Chief Financial Officer. See, “Employment Contracts, Termination of Employment and Change in Control Arrangements” at page 12.

Annual Incentives

Prior to 2003, the annual incentive program that the Company employed with regard to some of our Named Executive Officers involved direct financial incentives in the form of annual cash bonuses to achieve performance goals that were usually based upon the Company's “top line,” i.e., its gross revenues. This resulted in the payment of substantial top-line based bonuses to the Company's most senior executives with regard to 2001 and 2002, even though the Company incurred multi-million dollar net losses in each of those years.

During the first quarter of 2003, the Company adopted for its executives whose activities are directly related to profitability a different annual incentive compensation philosophy that is “bottom line” oriented. Since then, the employment agreements that the Company has entered into with its senior operating executives have contained significant cash bonus incentives that are tied to three predetermined annual performance goals:

| • | earnings before interest and taxes, |

| |

| • | cash provided by operating activities and |

11

| • | inventory turns—which is a measure of the level of efficiency employed by the Company in matching its annual purchases of inventory to the annual sales of merchandise to its customers. |

Each of Messrs. Rizzo, de la Rama and Holst can earn a minimum of 4.2% of his base salary (subject to an annual minimum of $175,000 in Mr. Rizzo's case and a guaranteed minimum in 2006 of $96,250 in Mr. Holst's case), up to a maximum of 70% of that base salary ($175,000 for Mr. de la Rama, $192,500 for Mr. Holst and $350,000 for Mr. Rizzo).

In 2005, the Company accrued (and paid in 2006) the following performance bonuses:

$175,000 to Peter J. Rizzo

$14,000 to Jesse de la Rama

Long-Term Incentives

In keeping with the Company's commitment to provide a total compensation package which includes at-risk components of pay, long-term incentive compensation comprises a significant portion of the value of an executive's total compensation package. When awarding long-term grants, the Committee considers an executive's level of responsibility, prior compensation experience, historical award data, and individual performance criteria. Long-term incentives are in the form of stock option awards under the Plan.

Stock options are granted at an option price equal to the fair market value of our common stock on the date of grant. Accordingly, stock options have value only if the stock price appreciates. This design focuses executives on the creation of stockholder value over the long term. The size of a stock option grant is based on competitive practice, individual performance factors and historical award data. In 2005, the Company granted an additional option to purchase 75,000 shares of common stock to Mr. de la Rama, and it granted an option to purchase 100,000 shares of common stock to Mr. Holst in connection with his hiring. No other grants were made to any of the Named Executive Officers.

Conclusion

The Committee believes these executive compensation policies and programs serve the interests of the Company and its stockholders effectively. The various compensation vehicles offered are appropriately balanced to provide increased motivation for executives to contribute to the Company's overall future success, thereby enhancing the value of the Company for the stockholders' benefit.

We will continue to monitor the effectiveness of the Company's total compensation program to meet the current and future needs of the Company.

The Compensation Committee:

| | Jon Hechler (Chair) | | |

| | Neal J. Fox | | |

| | Robert S. Stec | | |

EMPLOYMENT CONTRACTS, TERMINATION OF EMPLOYMENT AND

CHANGE IN CONTROL ARRANGEMENTS

Peter J. Rizzo

Peter J. Rizzo, the Company's Chief Executive Officer, is employed by the Company's subsidiary, I.C. Isaacs & Company, LP (the “LP”), pursuant to an employment agreement dated December 9, 2003, which was amended on October 19, 2004. That agreement, as amended, provides:

| • | for an initial term that will end on December 9, 2007, and for automatic one year renewals of the agreement unless either party gives notice of its non-renewal not later than June 30, 2007 or June 30 of the then current renewal year; |

| |

| • | for payment of an annual base salary of $500,000 during the initial term increasing by 10% per year during each one year renewal term, and incentive compensation provisions, subject to a guaranteed annual minimum of $175,000, that are based upon the Company's achievement of pre-determined earnings, cash flow and inventory turns targets; |

12

| • | for the issuance under the Plan of a five year option to purchase 500,000 shares of common stock at an exercise price of $.95 per share vesting ratably on December 9, 2004 and December 9, 2005; |

| |

| • | for the issuance under the Plan of a ten year option to purchase up to 100,000 shares of common stock at an exercise price of $3.10 per share on or after December 9, 2007; |

| |

| • | that, as long as the Nominating Committee of the Company's Board continues to approve Mr. Rizzo as a director, he will be included on the slate of nominees that the Company will propose for election as directors throughout the term of his employment agreement; |

| |

| • | that, if (a) Mr. Rizzo is not appointed as Chairman of the Board or he is removed from that position, (b) his duties as CEO are materially adversely changed or reduced, (c) his employment is terminated by the LP without cause or if, as a result of the occurrence of any of the events described in clauses (a) or (b), he resigns, he will be entitled to receive the following severance benefits: |

| |

| |

| • | If such termination occurs on or before December 31, 2006, he will be entitled to receive severance in an aggregate amount equal to 1.5 times his base salary and incentive compensation for the immediately preceding year (a minimum of $937,500 up to as much as $1,275,000), |

| |

| • | If such termination occurs after December 31, 2006, he will be entitled to receive severance in an aggregate amount equal to his base salary plus a pro-rata portion of any incentive compensation that otherwise would have become due and payable to him if his employment had not been terminated prior to the end of the year (a minimum of $675,000 up to as much as $850,000) and |

| |

| • | All unvested options granted to Mr. Rizzo under the Plan will immediately vest in full and will be exercisable by him for a period of one year after his employment is terminated. |

The maximum amount of incentive compensation that Mr. Rizzo may earn in any year of the initial term and any renewal year under his employment agreement is $350,000.

Jesse de la Rama

Jesse de la Rama is employed by the LP, pursuant to an employment agreement dated March 1, 2004, which was amended with effect from December 6, 2004. That agreement, as amended, provides:

| • | for an initial term that ended on February 28, 2006, and for automatic one year renewals of the agreement unless either party gives notice of its non-renewal not later than December 31, 2005 or December 31 of the then current renewal year; |

| |

| • | for payment of an annual base salary of $250,000, and incentive compensation provisions that are based upon the achievement of pre-determined earnings, cash flow and inventory turns targets; |

| |

| • | for the issuance under the Plan of a five year option to purchase 25,000 shares of common stock at an exercise price of $.86 per share which shall vest ratably on March 1, 2005, 2006 and 2007; |

| |

| • | for the issuance under the Plan of a ten year option to purchase 75,000 shares of common stock at an exercise price of $6.00 per share which shall vest ratably on February 10, 2006, 2007 and 2008; |

| |

| • | that, in the event that Mr. de la Rama's employment is terminated without cause or due to a change in control of the Company, he shall receive 12 months' severance. |

Mr. de la Rama's base salary was increased to $275,000 effective January 1, 2006. The maximum amount of incentive compensation that Mr. de la Rama may earn in 2006 and any renewal year under his employment agreement, as amended, is $175,000.

13

Gregg A. Holst

Gregg A. Holst, the Company's Chief Financial Officer, is employed by the LP, pursuant to an employment agreement dated December 19, 2005. That agreement provides:

| • | for an initial term that will end on December 31, 2008, and for automatic one year renewals of the agreement unless either party gives notice of its non-renewal not later than June 30, 2008 or June 30 of the then current renewal year; |

| |

| • | for payment of an annual base salary of $275,000, a signing bonus of $50,000 which was paid in January 2006 and incentive compensation provisions, subject to a guaranteed minimum in 2006 of $96,250, that are based upon the achievement of pre-determined earnings, cash flow and inventory turns targets; |

| |

| • | for the issuance under the Plan of a five year option to purchase 100,000 shares of common stock at an exercise price of $4.40 per share which shall vest ratably on December 27, 2006, 2007 and 2008; |

| |

| • | that, in the event that Mr. Holst's employment is terminated without cause, or due to his death or disability, or if he shall resign for a good reason, as that term is defined in his employment agreement, he shall receive severance payments in the aggregate amount of his base salary, as in effect on the date of termination. |

The maximum amount of incentive compensation that Mr. Holst may earn in 2006 and any renewal year is $192,500.

14

EXECUTIVE COMPENSATION

The following table sets forth certain information regarding the compensation paid during each of the Company's last three fiscal years to its Chief Executive Officer and to each of its executive officers other than the Chief Executive Officer whose total annual salary and bonus amounted to more than $100,000 and who served as executive officers at any time during 2005 (collectively, the “Named Executive Officers”). No compensation that would qualify as payouts pursuant to long-term incentive plans (“LTIP Payouts”) or “All Other Compensation” was paid to any of the Named Executive Officers during the three year period ended on December 31, 2005, and the Company did not issue any SARs during that period of time.

| | | Annual Compensation(1)

| | Long Term Compensation

Awards

|

Name and Principal Position

| | Year

| | Salary($)

| | Bonus($)

| | Other Annual

Compensation($)

| | Restricted

Stock

Awards($)

| | Securities

Underlying

Options(#)

|

Peter J. Rizzo, CEO

| | | 2005

2004

2003 | (3) | | | 497,307

490,761

28,846 | | | | 350,000

—

— | | | | 151,575

—

— | (2) | | —

—

— | | | —

100,000

500,000 | |

Jesse De La Rama, Sr. VP and COO

| | | 2005

2004 | (4) | | | 250,000

136,694 | | | | 54,858

— | | | | —

— | | | —

— | | | 75,000

25,000 | |

Gregg A. Holst, Sr. VP and CFO | | | 2005 | (5) | | | — | | | | — | | | | — | | | — | | | 100,000 | |

Eugene C. Wielepski, Vice President

| | | 2005

2004

2003 | | | | 200,000

181,393

184,571 | | | | 40,000

—

— | | | | 181,504

—

— | (2) | | —

—

— | | | —

—

— | |

Daniel J. Gladstone, Acting CEO (2003), Former President—Girbaud Division (2002

and 2004)

| | | 2005

2004

2003 | (6) | | | 114,400

340,922

357,091 | | | | —

100,000

207,895 | | | | —

339,896

— |

(2) | | —

—

— | | | —

—

— | |

Robert J. Conologue, Former COO and

CFO

| | | 2005

2004

2003 |

(8) | | | —

315,757

273,828 | | | | —

40,000

— | | | | 727,013

625,342

— | (7)

(2) | | —

—

— | | | —

—

375,000 | |

| | | | | | | | | | | | | | | | | | | | | | |

| | | |

| (1) | | The LP also provided various perquisites and other benefits that did not exceed the lesser of $50,000 or 10% of the aggregate amounts reflected in the salary and bonus columns for each of the Named Executive Officers. |

| | | |

| (2) | | Compensation resulting from exercise of Plan Option. |

| | | |

| (3) | | Mr. Rizzo was only employed for a period of 23 days (from December 9–December 31) in 2003. |

| | | |

| (4) | | Mr. de la Rama started his employment on March 1, 2004. |

| | | |

| (5) | | Mr. Holst started his employment on December 27, 2005. |

| | | |

| (6) | | Mr. Gladstone's employment was terminated in April 2005. |

| | | |

| (7) | | Other Annual Compensation resulted from the exercise of Plan Options ($251,243) and severance paid in 2005 ($475,770). |

| | | |

| (8) | | Mr. Conologue's employment was terminated without cause on November 29, 2004. |

15

OPTION/SAR GRANTS IN LAST FISCAL YEAR

The Company did not grant any SARs to any of the Named Executive Officers during the year ended December 31, 2005. The following table sets forth information regarding grants of options made by the company to the Named Executive Officers during 2005.

| | | Individual Grants

| | Potential Realizable

Value at Assumed

Annual Rates of Stock

Appreciation for

Option Term(1)

|

Name

| | Number of

Securities

Underlying

Options

Granted

| | Percent of

Total

Options

Granted to

Employees

| | Exercise

Price

Per

Share

| | Expiration

Date

| | 5%

| | 10%

|

Jesse De La Rama | | | 75,000 | | | | 38% | | | $ | 6.00 | | | | 02-15-15 | | | $ | 283,000 | | | $ | 717,200 | |

Gregg A. Holst | | | 100,000 | | | | 51% | | | $ | 4.40 | | | | 12-27-10 | | | $ | 276,700 | | | $ | 701,200 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| (1) | | In accordance with U.S. Securities and Exchange Commission rules, these columns show gains that could accrue for the Named Executive Officer's option, assuming that the market price of the Company's common stock appreciates from the date of grant over a period of 10 years at an annualized rate of 5% and 10%, respectively. If the stock price does not increase above the exercise price at the time of exercise, realized value to the Named Executive Officer from this option will be zero. |

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR AND

FISCAL YEAR-END OPTION/SAR VALUES

The following table sets forth information concerning the number and value of unexercised options to purchase the Company's common stock held on December 31, 2005 by the Named Executive Officers.

Name

| | Shares

Acquired on

Exercise

| | Value Realized

| | Number of Securities

Underlying Unexercised

Options at

Fiscal Year-End

Exercisable/Unexercisable

| | Value of Unexercised

In-the-Money Options at

Fiscal Year-End

Exercisable/Unexercisable

|

Peter J. Rizzo | | | 21,500 | | | $ | 151,575 | | | | 478,500/100,000 | | | | $1,741,740/$149,000 | |

Jesse De La Rama | | | — | | | | — | | | | 8,333/91,667 | | | | $31,000/$62,000 | |

Gregg A. Holst | | | — | | | | — | | | | 0/100,000 | | | | $0/18,900 | |

Eugene Wielepski | | | 44,500 | | | $ | 181,504 | | | | — | | | | — | |

Robert J. Conologue | | | 43,000 | | | $ | 251,243 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

DEFINED BENEFIT PENSION PLAN

The Company maintains a defined benefit pension plan (the “Pension Plan”) for its employees, and the employees of its subsidiaries. The normal retirement benefit, payable at age 65, is 20.0% of base compensation up to $10,000 plus 39.5% of base compensation over $10,000 and up to a maximum of $75,000, prorated for service less than 30 years. A reduced benefit is also payable on early retirement, after attainment of age 55 and completion of 15 years of service. The Pension Plan also provides disability retirement and death benefits. The Company pays the full cost of the benefits under the Pension Plan through its contributions to a trust. The Company's cash contributions to the Pension Plan during the year ended December 31, 2005 aggregated approximately $315,000.

16

The Pension Plan Table below provides the estimated annual benefits payable under the Pension Plan upon retirement in specified compensation and years of service classifications:

| | | | | | | Years of Service

|

| | Remuneration

| | 15

| | 20

| | 25

| | 30

| | 35

|

| | $ | 100,000 | | | | $ | 13,838 | | | $ | 18,451 | | | $ | 23,063 | | | $ | 27,676 | | | $ | 27,676 | |

| | | 125,000 | | | | | 13,838 | | | | 18,451 | | | | 23,063 | | | | 27,676 | | | | 27,676 | |

| | | 150,000 | | | | | 13,838 | | | | 18,451 | | | | 23,063 | | | | 27,676 | | | | 27,676 | |

| | | 175,000 | | | | | 13,838 | | | | 18,451 | | | | 23,063 | | | | 27,676 | | | | 27,676 | |

| | | 200,000 | | | | | 13,838 | | | | 18,451 | | | | 23,063 | | | | 27,676 | | | | 27,676 | |

| | | 225,000 | | | | | 13,838 | | | | 18,451 | | | | 23,063 | | | | 27,676 | | | | 27,676 | |

| | | 250,000 | | | | | 13,838 | | | | 18,451 | | | | 23,063 | | | | 27,676 | | | | 27,676 | |

| | | 300,000 | | | | | 13,838 | | | | 18,451 | | | | 23,063 | | | | 27,676 | | | | 27,676 | |

| | | 400,000 | | | | | 13,838 | | | | 18,451 | | | | 23,063 | | | | 27,676 | | | | 27,676 | |

| | | 450,000 | | | | | 13,838 | | | | 18,451 | | | | 23,063 | | | | 27,676 | | | | 27,676 | |

| | | 500,000 | | | | | 13,838 | | | | 18,451 | | | | 23,063 | | | | 27,676 | | | | 27,676 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

The compensation considered in determining benefits under the Pension Plan (as provided in the column titled “Remuneration”) is the annual average compensation for the five consecutive calendar years producing the highest average. The compensation considered is limited to $75,000. All amounts of salary, bonus and other compensation as reported in the Summary Compensation Table, up to $75,000, are included in compensation considered under the Pension Plan. The amounts provided in the Pension Plan Table are the benefits payable per year in equal monthly installments for the life expectancy of the participants (i.e., straight life annuity amounts). The Pension Plan is integrated with Social Security, and its benefit formula is as follows: (i) 0.6667% of compensation, multiplied by years of service up to 30 years; plus (ii) 0.65% of compensation in excess of $10,000 multiplied by years of service up to 30 years.

The estimated credited years of service for each of the Named Executive Officers as of January 1, 2006 were as follows:

| | Name

| |

| Estimated Credited

Years of Service

| |

| | Peter J. Rizzo | | | 2 | |

| | Jesse De La Rama | | | 2 | |

| | Gregg A. Holst | | | — | |

| | Eugene Wielepski | | | 32 | |

| | Daniel J. Gladstone | | | 6 | |

| | | | | | |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

Plan Category

| | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights

| | Weighted average

exercise price of

outstanding

options, warrants

and rights

| | Number of securities

remaining available

for future issuance

|

Equity compensation plans approved by security holders (Omnibus Stock Option Plan) | | | 1,174,167 | | | $ | 1.96 | | | | 370,400 | |

Equity compensation plans approved by security holders (Directors Stock Option Plan) | | | 120,000 | | | $ | 5.60 | | | | 330,000 | |

Equity compensation plans not approved by security holders | | | 0 | | | | N/A | | | | N/A | |

Totals | | | 1,294,167 | | | $ | 2.30 | | | | 700,400 | |

| | | | | | | | | | | | |

17

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In November 1997, we entered into an exclusive license agreement (the “Girbaud Men's Agreement”) with Girbaud Design, Inc. and its affiliate, Wurzburg, both of which are part of the Girbaud Group of companies wholly owned, directly or indirectly, by one of our directors, François Girbaud, and Marithé Bachellerie. The Girbaud Men's Agreement granted to us the right to manufacture and market men's jeanswear, casualwear and outwear under the Girbaud brand and certain related trademarks (the “Girbaud Marks”) in all channels of distribution in the United States, including Puerto Rico and the U.S. Virgin Islands. In January and March 1998, the Girbaud Men's Agreement was amended and restated to name Latitude Licensing Corp. (“Latitude”) another member of the Girbaud Group, as the licensor and to include active influenced sportswear as a licensed product category. Also in March 1998, we entered into an exclusive license agreement (the “Girbaud Women's Agreement” and together with the Girbaud Men's Agreement, the “Girbaud Agreements”) with Latitude to manufacture and market women's jeanswear, casualwear and outerwear, including active influenced sportswear, under the Girbaud Marks in all channels of distribution in the United States including Puerto Rico and the U.S. Virgin Islands.

Under the Girbaud Men's Agreement, we are required to make payments to Latitude in an amount equal to 6.25% of our net sales of regular licensed merchandise and 3.0% in the case of certain irregular and closeout licensed merchandise. Except as noted below, the Company is subject to guaranteed minimum annual royalty payments of $3.0 million each year from 2002 through 2007. The Company is required to spend the greater of an amount equal to 3% of Girbaud men's net sales or $500,000 (increased by $200,000 in 2007, 2008 and 2009) in advertising and related expenses promoting the men's Girbaud brand products in each year through the term of the Girbaud Men's Agreement. During 2005, the Company made royalty payments under the Girbaud Men's Agreement aggregating approximately $4,931,577 ($1,580,523 of which related to royalty payments that were due in 2004 but deferred until 2005).

Under the Girbaud Women's Agreement we are required to make payments to Latitude in an amount equal to 6.25% of our net sales of regular licensed merchandise and 3.0% in the case of certain irregular and closeout licensed merchandise. Except as noted below, the Company is subject to guaranteed minimum annual royalty payments of $1.5 million each year from 2002 through 2007. The Company is required to spend the greater of an amount equal to 3% of Girbaud women's net sales of $400,000 (increased by $200,000 in 2007, 2008 and 2009) in advertising and related expenses promoting the women's Girbaud brand products in each year through the term of the Girbaud Women's Agreement. In addition, over the term of the Girbaud Women's Agreement the Company is required to contribute $190,000 per year to Latitude's advertising and promotional expenditures for the Girbaud brand. During 2005, the Company made royalty payments to under the Girbaud Women's Agreement aggregating $2,125,000 ($750,000 of which related to royalty payments that were due in 2004 but deferred until 2005).

During each of the six years ended December 31, 2005, the amounts of advertising and related expenses incurred by the Company in marketing the Girbaud brand products were less than the amounts required under the agreements. In each of the various amendments to the men's and women's license agreements which were executed in 2002-2004, Latitude and the Company confirmed to one another that neither party was in default to the other in the performance of any of the obligations owed by either of them to the other. On March 29, 2006, Latitude also waived the Company's failure to spend the minimum amounts required under the men's and women's license agreements in 2005.

The Company is obligated to pay a minimum of $6.5 million during 2006 in the form of minimum royalty payments, fashion show and advertising and promotional expenses pursuant to the Girbaud Agreements. In 2006, the Company expects that substantially all of its net sales will come from apparel associated with the Girbaud licenses.

18

REPORT OF THE AUDIT COMMITTEE

The operations of this Committee are governed by a written charter adopted by the Board, a copy of which is posted on the Company's website at www.icisaacs.com news/corporate governance. Pursuant to the Charter, only independent directors, as that term is defined by the Marketplace Rules of The Nasdaq Stock Market, may serve as members of this Committee.

The primary function of this Committee is to assist the Board in fulfilling its oversight responsibilities by reviewing:

| • | the financial reports and other financial information provided by the Company to any governmental body or the public, |

| |

| • | the Company's systems of internal controls regarding finance, accounting, legal compliance and ethics that management and the Board have established, and |

| |

| • | the Company's auditing, accounting and financial reporting processes generally. |

This Committee performs its oversight regarding the Company's financial reporting obligations by engaging in dialogs with management and with BDO Seidman, LLP, the Company's independent registered public accounting firm during the year ended December 31, 2005. The discussions in which we engage pertain to issues germane to the preparation of the Company's quarterly and annual financial statements, and the conduct and completion of the audit of the Company's annual financial statements.

This Committee has reviewed and discussed the Company's consolidated annual financial statements with management and with representatives of BDO Seidman, LLP. We also discussed with representatives of that accounting firm the matters required to be discussed with the Company's independent registered public accounting firm, pursuant to Statement of Accounting Standards No. 61, as amended, “Communication with Audit Committees.”

BDO Seidman, LLP also provided to this Committee the written disclosures required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” and we discussed the question of BDO Seidman, LLP's independence with representatives of that firm.

Based upon those reviews and discussions, and the report of BDO Seidman, LLP regarding its audit of the Company's financial statements for the year ended December 31, 2005, this Committee recommended to the Company's Board of Directors that such audited financial statements be included in the Annual Report on Form 10-K that the Company filed with respect to that year.

All of the non-audit services provided by BDO Seidman, LLP during 2005, and the fees and costs incurred in connection with those services, were pre-approved by this Committee in accordance with our policy of pre-approval of audit and permissible non-audit services. (This policy is discussed in further detail below at Proposal 2). Before approving the retention of BDO Seidman, LLP for these non-audit services, this Committee considered whether such retention was compatible with maintaining BDO Seidman, LLP's auditor independence. In reliance on the reviews and discussions with management and BDO Seidman, LLP referred to above, this Committee believes that the non-audit services provided by BDO Seidman, LLP were compatible with, and did not impair, BDO Seidman, LLP's auditor independence.

| | The Audit Committee: |

| | |

| | Neal J. Fox (Chairman)

Jon Hechler

Robert S. Stec |

19

PROPOSAL 2—RATIFICATION OF SELECTION OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTANTS

At the annual meeting, our stockholders will be asked to ratify the Board's appointment of BDO Seidman, LLP (“Seidman”) as our independent registered public accountants for the year ending December 31, 2006. It is expected that a representative of Seidman will be present at the meeting.

Principal Accounting Fees and Services

The following table shows the fees that the Company paid or accrued for the audit and other services provided by BDO Seidman, LLP in 2005 and 2004.

| | | | Years Ended

December 31,

|

| | | | 2005

| | 2004

|

| | | | | | | | | | |

| | Audit Fees(1) | | $ | 370,800 | | | $ | 249,000 | |

| | Audit-related fees(2) | | | 46,300 | | | | 51,566 | |

| | Tax Fees | | | 21,500 | | | | 15,500 | |

| | | | |

| | | |

| |

| | Total | | $ | 438,600 | | | $ | 316,066 | |

| | | | |

| | | |

| |

| | | | | | | | | | |

| | | |

| (1) | | Includes the audit of the Company's consolidated financial statements and quarterly reviews of its financial statements and related filings on SEC Forms 10-K and 10-Q. |

| | | |

| (2) | | Includes consultation regarding accounting and reporting matters, an audit of the Company's employee benefit plan, and the Company's preparation of a registration statement on SEC Form S-2. |

All audit and audit related services were pre-approved by the Audit Committee, which concluded that the performance of such services by BDO Seidman, LLP was compatible with the maintenance of that firm's independence in the conduct of its auditing functions.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accountants

Beginning in 2003, our Audit Committee instituted a policy of pre-approving all audit and permissible non-audit services provided by our independent certified public accountants. These services may include audit services, audit-related services, tax services and other services. Pre-approval is generally detailed as to the particular service or category of services and is generally subject to a specific budget. Our independent certified public accountants and management are required to periodically report to the Audit Committee regarding the extent of services provided by our independent certified public accountants in accordance with this pre-approval requirement, and the fees that we have incurred for those services. The Audit Committee may also pre-approve additional services on a case-by-case basis. The Audit Committee does not delegate to management its responsibilities to pre-approve services performed by our independent certified public accountants.

The Board of Directors unanimously recommends a vote FOR approval of Proposal 2.

20

OTHER MATTERS

Stockholder Proposals and Director Nomination Recommendations

Our stockholders may submit proposals that they believe should be voted on at the annual meeting or recommend persons who they believe should be nominated for election to the Board. Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, some stockholder proposals may be eligible for inclusion in our 2007 proxy statement. We must receive all submissions no later than January 26, 2007. If the date of the 2007 annual meeting is advanced by more than 30 days or delayed (other than as a result of adjournment) by more than 30 days from the June 26, 2007 anniversary of the 2006 annual meeting, a stockholder must submit any such proposal or nomination recommendation no later than the close of business on the later of the 90th day prior to the 2007 annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made. The stockholder's submission must include certain specified information concerning the proposal or recommended nominee, as the case may be, and information as to the stockholder's ownership of our stock. We will not entertain any proposals or nomination recommendations at the annual meeting that do not meet these requirements. If the proposing or recommending stockholder does not also comply with the requirements of Rule 14a-4(c)(2) under the Securities Exchange Act of 1934, we may exercise discretionary voting authority under proxies that we solicit to vote in accordance with our best judgment on any such stockholder proposal or nomination recommendation. Any proposal or director nomination recommendation that a stockholder would like to make must be submitted by mail, along with proof of ownership of our stock in accordance with Rule 14a-8(b)(2) under the Securities Exchange Act of 1934. Such submissions should be addressed to Gregg A. Holst, Corporate Secretary, I.C. Isaacs & Company, Inc., 3840 Bank Street, Baltimore, Maryland 21224-2522. We strongly encourage stockholders to seek advice from knowledgeable counsel before submitting a proposal or a nomination.

Submitting a stockholder proposal or director nomination recommendation does not guarantee that we will include it in our proxy statement. The Nominating Committee reviews all stockholder proposals and director nomination recommendations and makes recommendations to the Board for action on such matters. For information on recommending individuals for consideration as director nominees, see “Corporate Governance, Director Candidates” at page 7.

Compliance with Section 16(a) of the Exchange Act

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers, directors and persons who beneficially own more than 10% of our common stock to file initial reports of ownership and reports of changes in ownership with the SEC. Such persons are required by SEC regulations to furnish us with copies of all Section 16(a) forms that they file. Based solely on our review of the forms furnished to us, we believe that all of those filing requirements were complied with by our executive officers and directors during 2005, except as follows:

| • | On May 4, 2005, Wurzburg filed an amendment to its initial filing on SEC Form 3 to disclose that it had inadvertently failed to disclose that it had purchased 82,500 shares of common stock on February 2, 2000. |

| |

| • | Although the conversion by Wurzburg of 3,300,000 shares of the Company's Series A Convertible Preferred Stock into an equal number of shares of common stock had been previously disclosed in the Company's Reports on Form 10-K and in its definitive proxy statements, due to an oversight, such conversion was not disclosed in any Form 4 or Form 5 filing made by Wurzburg until May 4, 2005. |

| |

| • | Although the issuance on September 18, 2002 to Textile of two common stock purchase warrants entitling it to purchase an aggregate of 500,000 shares of common stock had been previously disclosed in the Company's Reports on Form 10-K and in its definitive proxy statements, due to an oversight, such conversion was not disclosed in any Form 4 or Form 5 filing made by Wurzburg until May 4, 2005. |

21

| • | As a result of an oversight on our part, we did not file an initial statement of beneficial ownership of securities on SEC Form 3 for Mr. McCoy, who first became a director in June 2005 upon his election at our 2005 annual meeting of stockholders. We also failed to file a statement of changes in beneficial ownership on SEC Form 4 when we issued options to Messrs. Bachellerie, Faltz, Fox, Girbaud, Hechler and Stec in June 2005 under our Director's Plan. We corrected those oversights in May 2006. |

Annual and Quarterly Reports to Stockholders

Our Annual Report to Stockholders consisting of a letter from our Chief Executive Officer, our Annual Report on Form 10-K for the year ended December 31, 2005, including audited financial statements and our quarterly report on Form 10-Q for the quarter ended March 31, 2006 have been mailed to our stockholders concurrently herewith, but such reports are not incorporated in this Proxy Statement and are not deemed to be part of the proxy solicitation material.

Other Matters Coming Before the Meeting

The Board of Directors does not know of any other matters that are to be presented for action at the meeting. If any other matter is properly brought before the meeting or any adjournments thereof, and we did not receive notice of that matter on or before January 27, 2006, the persons named in the enclosed proxy will have the discretionary authority to vote all proxies received in accordance with their best judgment.

| | By order of the Board of Directors

|

| |  |

| | GREGG A. HOLST,

Secretary |

May 26, 2006

Baltimore, Maryland

22

[THIS PAGE INTENTIONALLY LEFT BLANK]

[THIS PAGE INTENTIONALLY LEFT BLANK]

Appendix I

PROXY

I.C. ISAACS & COMPANY, INC.

Proxy Solicited on Behalf of the Board of Directors of the Company for the Annual Meeting

June 26, 2006

The undersigned hereby constitutes and appoints Peter J. Rizzo and Gregg A. Holst, and each of them, the true and lawful agents and proxies of the undersigned with full power of substitution in each, to represent the undersigned at the Annual Meeting of Stockholders of I.C. Isaacs & Company, Inc. to be held at the offices ofArent Fox PLLC located on the 34th Floor at 1675 Broadway, New York, New York, on Monday, June 26, 2006, at 10:00 A.M., local time, and at any adjournments thereof, on all matters coming before said meeting.

You are encouraged to specify your choices by marking the appropriate boxes, SEE REVERSE SIDE, but you need not mark any boxes if you wish to vote in accordance with the Board of Directors’ recommendations. The proxies cannot vote your shares unless you either sign and return this card or vote electronically.

This proxy when properly executed will be voted in the manner directed herein. Unless a contrary direction is indicated, this proxy will be voted for all nominees listed in proposal 1 and for proposal 2, as more specifically described in the proxy statement.

(Continued and to be signed on the reverse side)

ANNUAL MEETING OF THE STOCKHOLDERS OF

I.C. ISAACS & COMPANY, INC.

Monday, June 26, 2006

| | |

| PROXY VOTING INSTRUCTIONS | |

| | |

| | |

MAIL– Date, sign and mail your proxy card in the envelope provided as soon as possible. | | COMPANY NUMBER |

| | |

– OR – | | |

| | ACCOUNT NUMBER |

| | |

INTERNET – Access “www.voteproxy.com” and follow the on-screen instructions. Have the proxy card available when you access the web page. | | |

You may enter your voting instructions at www.voteproxy.com up until 11:59 PM Eastern Time the day before the cut-off or meeting date

â Please detach along perforated line and mail in the envelope providedIF you are not voting via the internetâ

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE NOMINEES FOR DIRECTORS “FOR” PROPOSAL 2.

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE x

| | | | | | | | | | | | | | | |

1 | | Election of Directors | | | | | | | | | FOR | | AGAINST | | ABSTAIN |

| | | | | | | | | | | | | | | |

o | | FOR ALL NOMINEES | | NOMINEES:

O Peter J. Rizzo

O Olivier Bachellerie

O René Faltz

O Neal J. Fox

O François Girbaud

O Jon Hechler

O John McCoy II

O Robert Stephen Stec | | 2. | | Ratification ofthe appointment of BDO Seidman, LLP as the Company’s independent registered public accountants for the year ending December 31, 2006 | | | | | | |

o

| |

FOR ALL EXCEPT

(See instructions below)

| | | | o | | o | | o |

| | | | | | | | | | | | | |

| | | | | 3. | | In their discretion, the proxies are authorized to vote on such other business as may properly come before the meeting. |

| | | | | | | | | | | | | |

| | | | | | | I hereby revoke all proxies heretofore given by me to vote at said meeting or any adjournments thereof. |

| | | | | | | | |

INSTRUCTION: To withhold authority to vote for any individual nominee(s), mark “FOR ALL EXCEPT” and fill in the circle next to each nominee you wish to withhold as shown here.Ÿ | | | | |

| | | | |