UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

| Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| ý | | Soliciting Material Pursuant to §240.14a-12 |

ATMI, Inc. |

(Name of Registrant as Specified In Its Charter) |

N/A |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | (5) | | Total fee paid: |

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid: |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | (3) | | Filing Party: |

| | | (4) | | Date Filed: |

The following is a presentation for investors that was made available on the website of ATMI, Inc. on February 4, 2014 regarding the planned acquisition of ATMI, Inc. by Entegris, Inc.

February 4, 2014 Entegris to Acquire ATMI

Investor Presentation | * Cautionary Statement Regarding Forward-Looking Statements Statements about the expected timing, completion and effects of the proposed merger, and all other statements made in this news release that are not historical facts are forward-looking statements and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. In some cases, these forward-looking statements may be identified by the use of words such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” or “project,” or the negative of those words or other comparable words. Any forward-looking statements included in this news release are made as of the date hereof only, based on information available to Entegris and ATMI as of the date hereof, and, subject to any applicable law to the contrary, Entegris and ATMI undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Such forward-looking statements are subject to a number of risks, assumptions and uncertainties that could cause actual results to differ materially from those projected in such forward-looking statements. Such risks and uncertainties include: any conditions imposed on the parties in connection with consummation of the transaction described herein; approval of the merger by ATMI’s stockholders; the ability to obtain regulatory approvals of the transactions contemplated by the merger agreement on the proposed terms and schedule; the failure of ATMI’s stockholders to approve the transactions contemplated by the merger agreement; ATMI’s ability to maintain relationships with customers, employees or suppliers following the announcement of the merger agreement; the ability of third parties to fulfill their obligations relating to the proposed transactions, including providing financing under current financial market conditions; the ability of the parties to satisfy the conditions to closing of the transactions contemplated by the merger agreement; the risk that the transactions contemplated by the merger agreement may not be completed in the time frame expected by the parties or at all; and the risks that are described from time to time in Entegris and ATMI’S reports filed with the SEC, including Entegris’ Annual Report on Form 10-K for the fiscal year ended December 31, 2012, filed with the SEC on February 22, 2013, ATMI’s Annual Report on Form 10-K for the fiscal year ended December 31, 2012, filed with the SEC on February 22, 2013, and in other of Entegris and ATMI’s filings with the SEC from time to time, including Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and on general industry and economic conditions. Entegris and ATMI caution investors not to place substantial reliance on the forward-looking statements contained in this press release. These statements speak only as of the date of this press release and Entegris and ATMI do not undertake and expressly disclaim any obligation to update or revise them except as otherwise required by law.

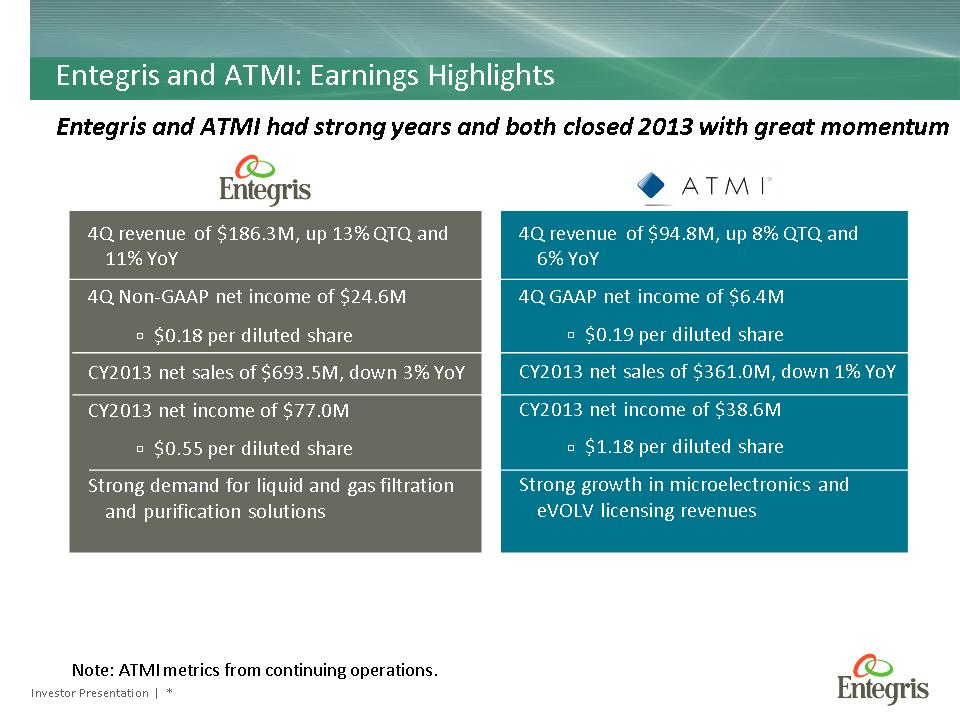

Investor Presentation | * 4Q revenue of $94.8M, up 8% QTQ and 6% YoY 4Q GAAP net income of $6.4M $0.19 per diluted share CY2013 net sales of $361.0M, down 1% YoY CY2013 net income of $38.6M $1.18 per diluted share Strong growth in microelectronics and eVOLV licensing revenues 4Q revenue of $186.3M, up 13% QTQ and 11% YoY 4Q Non-GAAP net income of $24.6M $0.18 per diluted share CY2013 net sales of $693.5M, down 3% YoY CY2013 net income of $77.0M $0.55 per diluted share Strong demand for liquid and gas filtration and purification solutions Entegris and ATMI: Earnings Highlights Note: ATMI metrics from continuing operations. Entegris and ATMI had strong years and both closed 2013 with great momentum

Investor Presentation | * Entegris to acquire ATMI in an all-cash transaction Creates technology leader in advanced process materials, contamination control and wafer handling Complementary capabilities, well-positioned to address semiconductor customer challenges Significant value creation potential through cost synergies and immediate earnings accretion Financed through cash and attractive debt, resulting in a more efficient balance sheet Transaction Overview

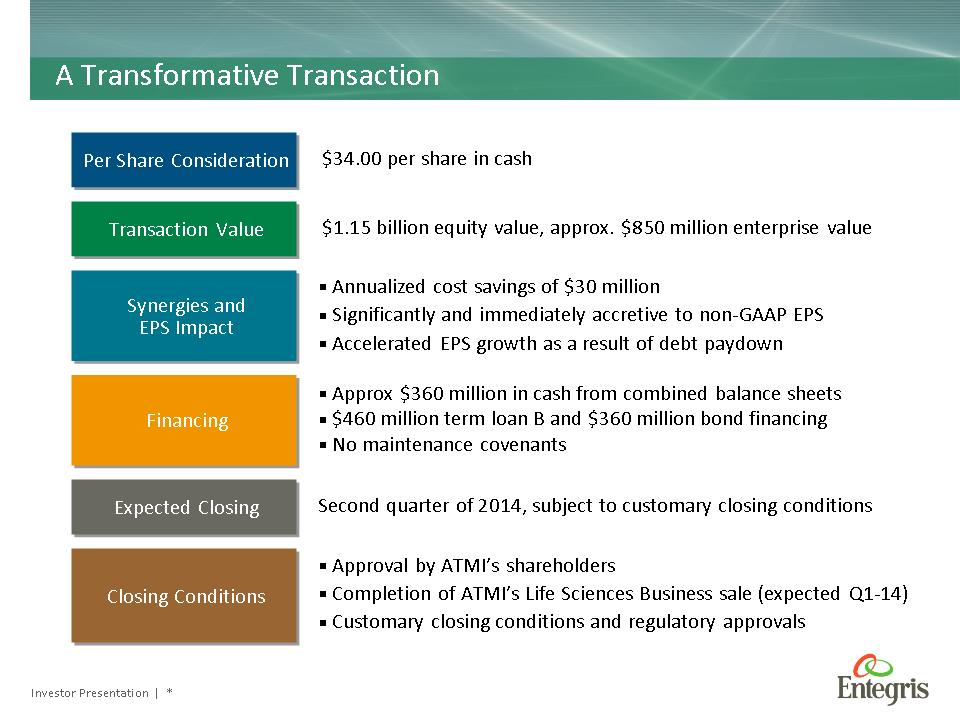

Investor Presentation | * A Transformative Transaction Per Share Consideration $34.00 per share in cash Transaction Value $1.15 billion equity value, approx. $850 million enterprise value Financing Approx $360 million in cash from combined balance sheets $460 million term loan B and $360 million bond financing No maintenance covenants Closing Conditions Approval by ATMI’s shareholders Completion of ATMI’s Life Sciences Business sale (expected Q1-14) Customary closing conditions and regulatory approvals Expected Closing Second quarter of 2014, subject to customary closing conditions Synergies and EPS Impact Annualized cost savings of $30 million Significantly and immediately accretive to non-GAAP EPS Accelerated EPS growth as a result of debt paydown

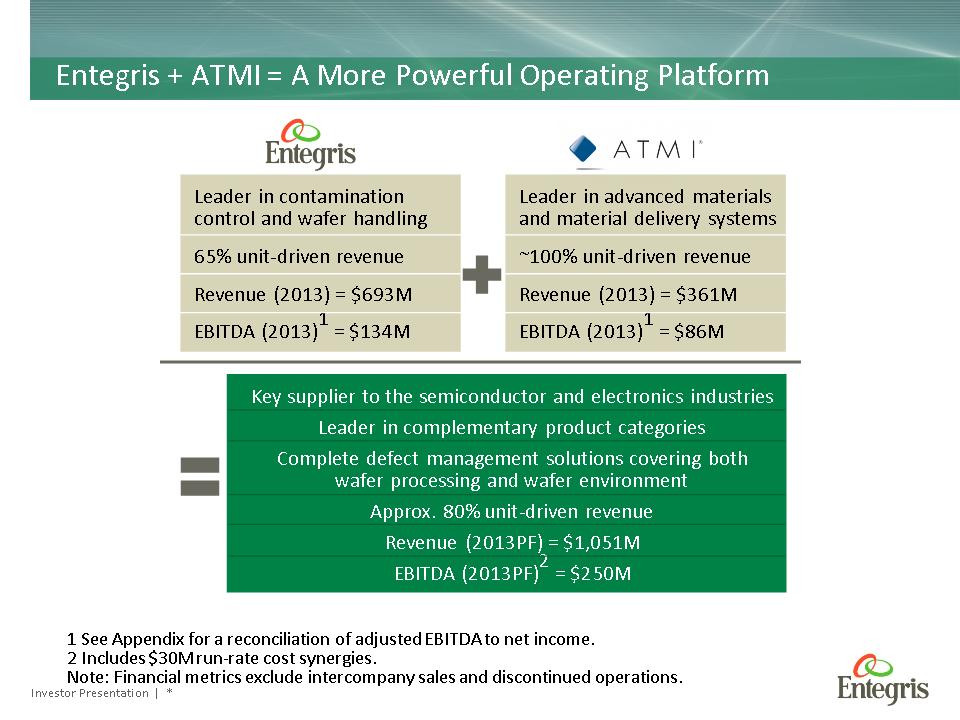

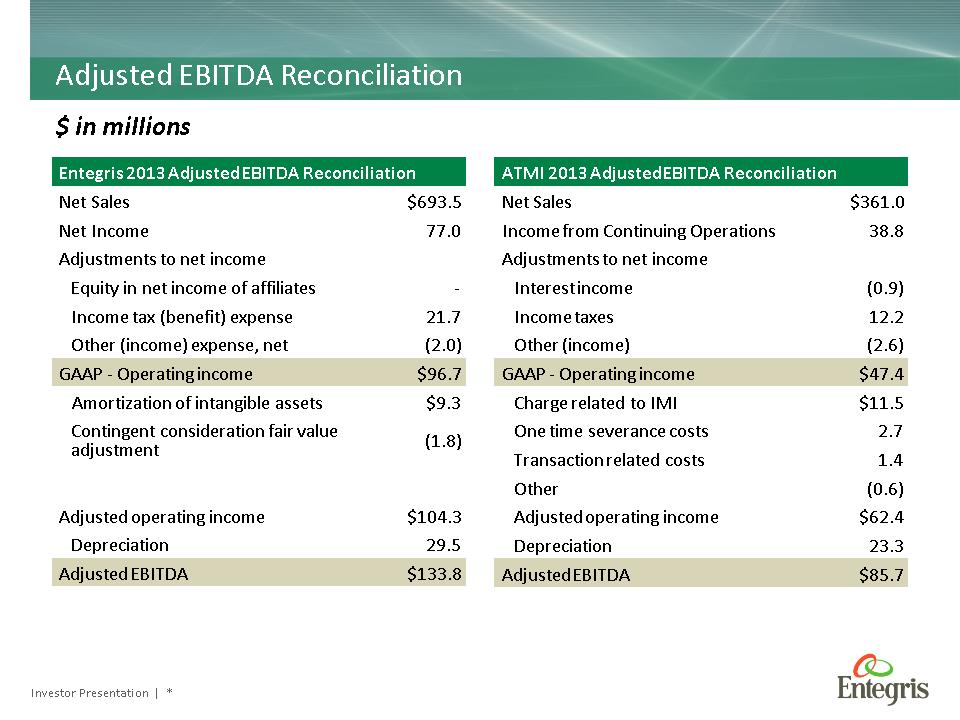

Investor Presentation | * Leader in contamination control and wafer handling 65% unit-driven revenue Revenue (2013) = $693M EBITDA (2013)1 = $134M Entegris + ATMI = A More Powerful Operating Platform 1 See Appendix for a reconciliation of adjusted EBITDA to net income. 2 Includes $30M run-rate cost synergies. Note: Financial metrics exclude intercompany sales and discontinued operations. Leader in advanced materials and material delivery systems ~100% unit-driven revenue Revenue (2013) = $361M EBITDA (2013)1 = $86M Key supplier to the semiconductor and electronics industries Leader in complementary product categories Complete defect management solutions covering both wafer processing and wafer environment Approx. 80% unit-driven revenue Revenue (2013PF) = $1,051M EBITDA (2013PF)2 = $250M

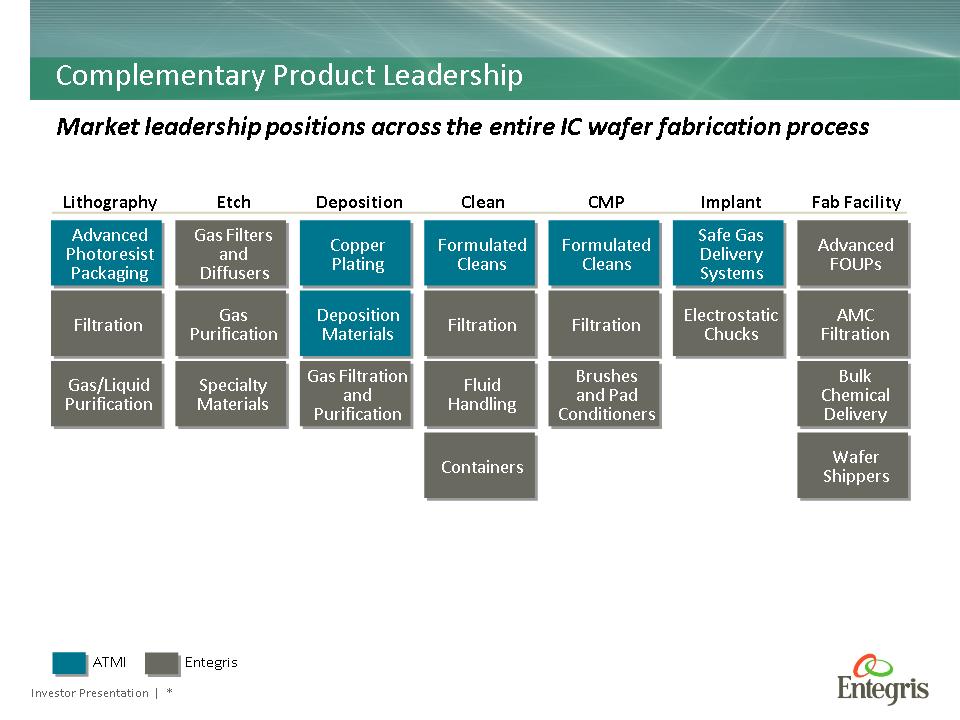

Investor Presentation | * Complementary Product Leadership Market leadership positions across the entire IC wafer fabrication process ATMI Lithography Advanced Photoresist Packaging Filtration Gas/Liquid Purification Etch Gas Filters and Diffusers Gas Purification Specialty Materials Deposition Copper Plating Deposition Materials Gas Filtration and Purification Clean Formulated Cleans Filtration Fluid Handling Containers CMP Formulated Cleans Filtration Brushes and Pad Conditioners Implant Safe Gas Delivery Systems Electrostatic Chucks Fab Facility Advanced FOUPs AMC Filtration Bulk Chemical Delivery Wafer Shippers Entegris

Investor Presentation | * A Great Combination Positioned to benefit from semiconductor industry trends Source: Industry data, company estimates. Industry Trend 1: Greater Complexity – Greater Cost More materials usage, more consumable usage, more specialized solutions Industry Trend 2: Critical Need for Defect Reduction Cleaner materials and more controlled shipment / delivery of process materials Estimated Yield Process Steps Semi Manufacturing Yields and Steps Technology Node in Nanometers

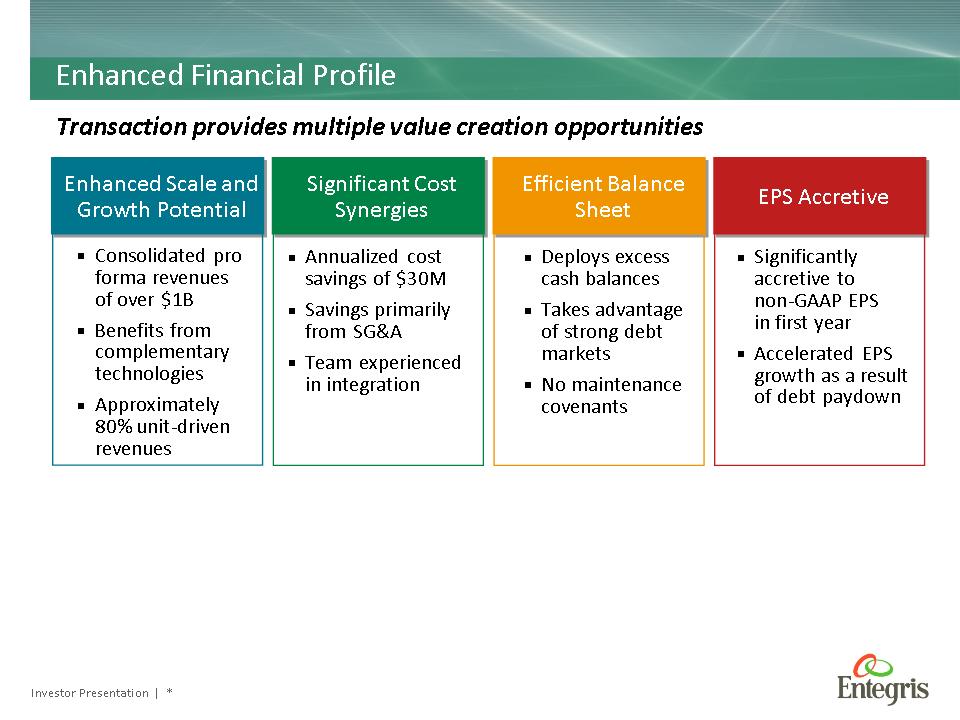

Investor Presentation | * Transaction provides multiple value creation opportunities Enhanced Financial Profile Enhanced Scale and Growth Potential Significant Cost Synergies Efficient Balance Sheet EPS Accretive Annualized cost savings of $30M Savings primarily from SG&A Team experienced in integration Deploys excess cash balances Takes advantage of strong debt markets No maintenance covenants Significantly accretive to non-GAAP EPS in first year Accelerated EPS growth as a result of debt paydown Consolidated pro forma revenues of over $1B Benefits from complementary technologies Approximately 80% unit-driven revenues

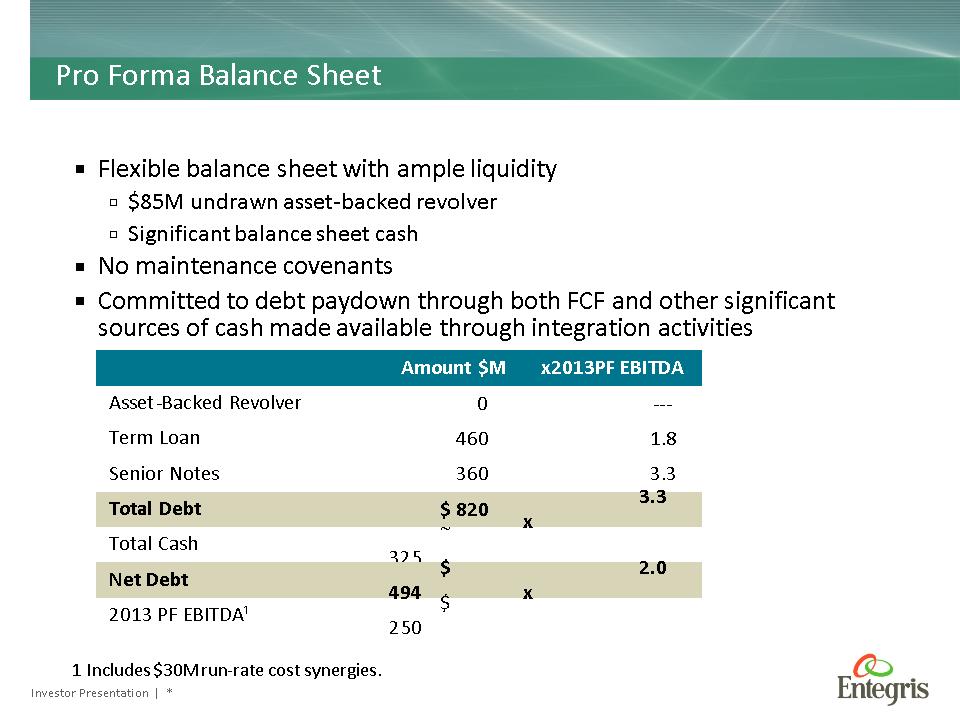

Investor Presentation | * Flexible balance sheet with ample liquidity $85M undrawn asset-backed revolver Significant balance sheet cash No maintenance covenants Committed to debt paydown through both FCF and other significant sources of cash made available through integration activities 1 Includes $30M run-rate cost synergies. Pro Forma Balance Sheet Amount $M x2013PF EBITDA Asset-Backed Revolver Asset-Backed Revolver 0 --- Term Loan Term Loan 460 1.8 Senior Notes 360 3.3 Total Debt Total Debt $ 820 3.3 x Total Cash Total Cash ~ 325 Net Debt Net Debt $ 494 2.0 x 2013 PF EBITDA¹ 2013 PF EBITDA¹ $ 250

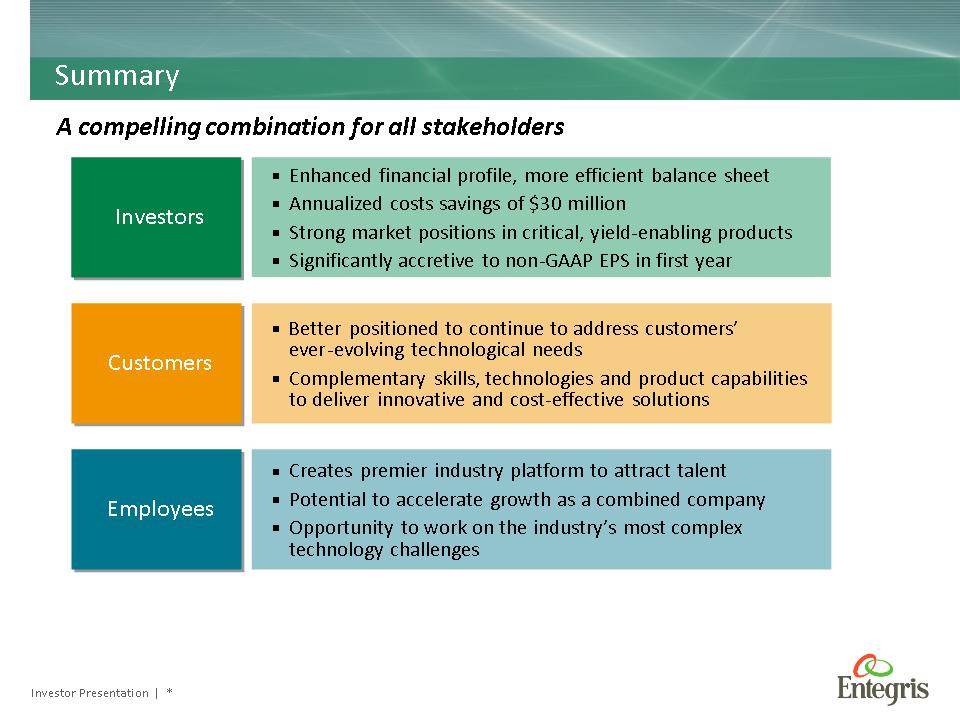

Investor Presentation | * A compelling combination for all stakeholders Summary Customers Better positioned to continue to address customers’ ever-evolving technological needs Complementary skills, technologies and product capabilities to deliver innovative and cost-effective solutions Employees Creates premier industry platform to attract talent Potential to accelerate growth as a combined company Opportunity to work on the industry’s most complex technology challenges Investors Enhanced financial profile, more efficient balance sheet Annualized costs savings of $30 million Strong market positions in critical, yield-enabling products Significantly accretive to non-GAAP EPS in first year

Entegris®, the Entegris Rings Design® and Creating a Material Advantage® are trademarks of Entegris, Inc. ©2013 Entegris, Inc. All rights reserved.

Investor Presentation | * Appendix Rev 4.0

Investor Presentation | * Entegris 2013 Adjusted EBITDA Reconciliation Entegris 2013 Adjusted EBITDA Reconciliation Net Sales $693.5 Net Income 77.0 Adjustments to net income Equity in net income of affiliates - Income tax (benefit) expense 21.7 Other (income) expense, net (2.0) GAAP – Operating income $96.7 Amortization of intangible assets $9.3 Contingent consideration fair value adjustment (1.8) Adjusted operating income $104.3 Depreciation 29.5 Adjusted EBITDA $133.8 Adjusted EBITDA Reconciliation $ in millions ATMI 2013 Adjusted EBITDA Reconciliation ATMI 2013 Adjusted EBITDA Reconciliation Net Sales $361.0 Income from Continuing Operations 38.8 Adjustments to net income Interest income (0.9) Income taxes 12.2 Other (income) (2.6) GAAP – Operating income $47.4 Charge related to IMI $11.5 One time severance costs 2.7 Transaction related costs 1.4 Other (0.6) Adjusted operating income $62.4 Depreciation 23.3 Adjusted EBITDA $85.7

Investor Presentation | *