As filed with the Securities and Exchange Commission on July 2, 2013

File No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

¨ Pre-Effective Amendment No.

¨ Post-Effective Amendment No.

NUVEEN INVESTMENT TRUST II

(Exact Name of Registrant as Specified in Charter)

333 West Wacker Drive

Chicago, Illinois 60606

(Address of Principal Executive Offices, Zip Code)

Registrant’s Telephone Number, including Area Code (312) 917-7700

Kevin J. McCarthy

Vice President and Secretary

333 West Wacker Drive

Chicago, Illinois 60606

(Name and Address of Agent for Service)

Copy to:

| | |

Deborah Bielicke Eades

Vedder Price P.C.

222 North LaSalle Street

Chicago, Illinois 60601 | | Eric F. Fess

Chapman and Cutler LLP

111 West Monroe Street

Chicago, Illinois 60603 |

Approximate date of proposed public offering: As soon as practicable after the effective date of this Registration Statement.

TITLE OF SECURITIES BEING REGISTERED: Shares of Beneficial Interest (par value $0.01 per share) of the Registrant.

No filing fee is required because of reliance on Section 24(f) and an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940.

It is proposed that this filing will become effective on August 1, 2013 pursuant to Rule 488 under the Securities Act of 1933.

Important Information for

Nuveen Mid Cap Select Fund Shareholders

At a special meeting of shareholders of Nuveen Mid Cap Select Fund (the “Target Fund”), a series of Nuveen Investment Funds, Inc. (the “Corporation”), you will be asked to vote upon an important change affecting your fund. The purpose of the special meeting is to allow you to vote on a reorganization of your fund into Nuveen Symphony Mid-Cap Core Fund (the “Acquiring Fund”), a series of Nuveen Investment Trust II, a Massachusetts business trust (the “Trust”). If the reorganization is approved and completed, you will become a shareholder of the Acquiring Fund. The Target Fund and the Acquiring Fund are collectively referred to herein as the “Funds” or individually as a “Fund.”

Although we recommend that you read the complete Proxy Statement/Prospectus, for your convenience, we have provided the following brief overview of the matter to be voted on.

| Q. | Why am I receiving this Proxy Statement/Prospectus? |

| A. | The shareholders of the Target Fund are being asked to approve a reorganization between the Target Fund and the Acquiring Fund pursuant to an Agreement and Plan of Reorganization, as described in more detail in this Proxy Statement/Prospectus. |

| Q. | Why has the reorganization been proposed for the Target Fund? |

| A. | Nuveen Fund Advisors, LLC (“Nuveen Fund Advisors”), each Fund’s investment adviser, has proposed the reorganization of the Target Fund into the Acquiring Fund as part of an initiative to eliminate certain redundancies among the products it offers and in an effort to achieve certain operating efficiencies. Although the Acquiring Fund has higher gross operating expenses than the Target Fund, the reorganization may result in slightly lower operating expenses for Target Fund shareholders after taking into account the lower expense limitation that will be in effect for the Acquiring Fund through September 30, 2014 if the reorganization is completed. In addition, Nuveen Fund Advisors and the Board of Directors of the Corporation believe that distribution opportunities for the Acquiring Fund are more attractive than those for the Target Fund and may result in economies of scale over time. |

| Q. | What are the similarities between the principal investment strategies of the Funds? |

| A. | The investment objectives of the Funds are substantially similar. The investment objective of the Target Fund is long-term growth of capital, and the investment objective of the Acquiring Fund is long-term capital appreciation. The Funds also have similar investment strategies. The Target Fund invests, under normal market conditions, at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in common stocks of mid-capitalization companies, defined as companies that have market capitalizations at the time of purchase within the market capitalization range of the companies in the Russell Midcap® Index immediately after its most recent reconstitution prior to such purchase. The Acquiring Fund invests, under normal market conditions, at least 80% of the sum of its net assets and the amount of any borrowings for investment purposes in equity securities of companies with market capitalizations at the time of investment comparable to companies in the Russell Midcap® Index. There are, however, some differences in investment strategies. The Target Fund may invest in non-U.S. and emerging |

| | markets securities and may utilize derivatives as principal investment strategies. Such investments are not principal investment strategies of the Acquiring Fund. A more detailed comparison of the investment objectives, strategies and risks of the Funds is contained in the Proxy Statement/Prospectus. |

| Q. | Are the Funds managed by the same sub-adviser? |

| A. | No. The Target Fund is sub-advised by Nuveen Asset Management, LLC, and the Acquiring Fund is sub-advised by Symphony Asset Management LLC. These sub-advisers manage the Funds using different investment processes, which are described in the Proxy Statement/Prospectus. |

| Q. | What will happen if shareholders do not approve the reorganization? |

| A. | If the reorganization is not approved by shareholders, the Board of Directors will take such actions as it deems to be in the best interests of the Target Fund, which may include additional solicitation, continuing to operate the Target Fund as a stand-alone fund, or liquidating the Target Fund. |

| Q. | Will Target Fund shareholders receive new shares in exchange for their current shares? |

| A. | Yes. If shareholders approve the reorganization and it is completed, each Target Fund shareholder will receive shares of the Acquiring Fund in an amount equal in total value to the total value of the Target Fund shares surrendered by such shareholder. |

| Q. | Will this reorganization create a taxable event for Target Fund shareholders? |

| A. | No. The reorganization is intended to qualify as a tax-free reorganization for federal income tax purposes. It is expected that Target Fund shareholders will recognize no gain or loss for federal income tax purposes as a direct result of the reorganization. Prior to the closing of the reorganization, the Target Fund expects to distribute all of its net investment income and net capital gains, if any. Such a distribution may be taxable to the Target Fund’s shareholders for federal income tax purposes. Due to the Target Fund’s capital loss carryforwards, a net capital gain distribution is not expected. However, in light of unrealized capital gains currently in each Fund’s portfolio, Target Fund shareholders may be subject to higher capital gain distributions in the future than they would have been absent the reorganization. |

| Q. | How do total operating expenses compare between the two Funds? |

| A. | While the current gross total operating expenses of the Acquiring Fund are higher than the current gross total operating expenses of the Target Fund, the net total operating expenses of the Acquiring Fund immediately following the reorganization are expected to be slightly lower than the net total operating expenses of the Target Fund for all share classes as a result of the expense cap that will be in effect for the Acquiring Fund through September 30, 2014 if the reorganization is completed. |

| Q. | Who will bear the costs of the reorganization? |

| A. | Each Fund will be allocated the costs of the reorganization in an amount up to its projected cost savings, if any, during the first year following the reorganization. Nuveen Fund Advisors estimates that the costs of the reorganization will be approximately $159,000 and that the cost savings during the first year following the reorganization will be approximately $2,600 for the Target Fund. The Acquiring Fund is not expected to realize cost savings and therefore will not be |

| | charged any costs of the reorganization. Based on current expense levels, it is anticipated that Nuveen Fund Advisors or its affiliates (“Nuveen”) will absorb all expenses charged to the Target Fund because payment of such amount would cause the Target Fund to exceed its current expense cap. If the reorganization is not approved or completed, Nuveen will pay all such reorganization expenses. |

| Q. | What is the timetable for the reorganization? |

| A. | If approved by shareholders on , 2013, the reorganization is expected to occur at the close of business on , 2013. |

| Q. | Whom do I call if I have questions? |

| A. | If you need any assistance, or have any questions regarding the proposal or how to vote your shares, please call Computershare Fund Services, your proxy solicitor, at ( ) - from 8 a.m. to 10 p.m. Central time on Monday through Friday or 11 a.m. to 5 p.m. Central time on Saturday. Please have your proxy materials available when you call. |

| Q. | How do I vote my shares? |

| A. | You may vote by mail, telephone or over the Internet: |

| | • | | To vote by mail, please mark, sign, date and mail the enclosed proxy card. No postage is required if mailed in the United States. |

| | • | | To vote by telephone, please call the toll-free number located on your proxy card and follow the recorded instructions, using your proxy card as a guide. |

| | • | | To vote over the Internet, go to the Internet address provided on your proxy card and follow the instructions, using your proxy card as a guide. |

| Q. | Will Nuveen contact me? |

| A. | You may receive a call from representatives of Computershare Fund Services, the proxy solicitation firm retained by Nuveen, to verify that you received your proxy materials and to answer any questions you may have about the reorganization. |

| Q. | How does the Board of Directors suggest that I vote? |

| A. | After careful consideration, the Board of Directors has agreed unanimously that the reorganization is in the best interests of your Fund and recommends that you vote “FOR” the reorganization. |

, 2013

Dear Shareholders:

We are pleased to invite you to the special meeting of shareholders of Nuveen Mid Cap Select Fund (the “Special Meeting”). The Special Meeting is scheduled for , 2013, at [ : ] p.m., Central time, at the offices of Nuveen Investments, Inc., 333 West Wacker Drive, Chicago, Illinois 60606.

At the Special Meeting, you will be asked to consider and approve a very important proposal. Subject to shareholder approval, Nuveen Symphony Mid-Cap Core Fund (the “Acquiring Fund”) will acquire all the assets and liabilities of Nuveen Mid Cap Select Fund (the “Target Fund” and together with the Acquiring Fund, the “Funds” and each a “Fund”) in exchange solely for shares of the Acquiring Fund, which will be distributed in complete liquidation and termination of the Target Fund to the shareholders of the Target Fund (the “Reorganization”).

Nuveen Fund Advisors, LLC (“Nuveen Fund Advisors”), each Fund’s investment adviser, has proposed the Reorganization involving the Target Fund, as well as a number of other reorganizations involving other funds advised by Nuveen Fund Advisors, to eliminate certain redundancies among the products it offers and in an effort to achieve certain operating efficiencies.

The Reorganization is being proposed because Nuveen Fund Advisors and the Board of Directors of Nuveen Investment Funds, Inc. believe that distribution opportunities for the Acquiring Fund are more attractive than those for the Target Fund and may result in economies of scale over time. In addition, following the Reorganization, the Acquiring Fund is expected to have slightly lower net total operating expenses than the Target Fund had prior to the Reorganization. The Board of Directors believes the Reorganization is in the best interests of the Target Fund and recommends that you vote “For” the proposed Reorganization.

The attached Proxy Statement/Prospectus has been prepared to give you information about this proposal.

All shareholders are cordially invited to attend the Special Meeting. In order to avoid delay and additional expense, and to assure that your shares are represented, please vote as promptly as possible, whether or not you plan to attend the Special Meeting. You may vote by mail, telephone or over the Internet.

| | • | | To vote by mail, please mark, sign, date and mail the enclosed proxy card. No postage is required if mailed in the United States. |

| | • | | To vote by telephone, please call the toll-free number located on your proxy card and follow the recorded instructions, using your proxy card as a guide. |

| | • | | To vote over the Internet, go to the Internet address provided on your proxy card and follow the instructions, using your proxy card as a guide. |

We appreciate your continued support and confidence in Nuveen and our family of funds.

Very truly yours,

Kevin J. McCarthy

Vice President and Secretary

, 2013

NUVEEN MID CAP SELECT FUND

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON , 2013

To the Shareholders:

Notice is hereby given that a special meeting of shareholders of Nuveen Mid Cap Select Fund (the “Target Fund”), a series of Nuveen Investment Funds, Inc. (the “Corporation”), a Maryland corporation, will be held at the offices of Nuveen Investments, Inc., 333 West Wacker Drive, Chicago, Illinois 60606, on , 2013 at [ : p.m.], Central time (the “Special Meeting”), for the following purposes:

1. To approve an Agreement and Plan of Reorganization (and the related transactions) which provides for (i) the transfer of all the assets of the Target Fund to Nuveen Symphony Mid-Cap Core Fund (the “Acquiring Fund”) in exchange solely for shares of beneficial interest of the Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Target Fund; and (ii) the distribution by the Target Fund of Class A, Class C and Class I shares of the Acquiring Fund to the shareholders of Class A, Class C and Class I shares, respectively, of the Target Fund in complete liquidation and termination of the Target Fund (the “Reorganization”). A vote in favor of the Reorganization will be considered a vote in favor of an amendment to the Corporation’s Articles of Incorporation effecting the Reorganization.

2. To transact such other business as may properly come before the Special Meeting.

Only shareholders of record as of the close of business on , 2013 are entitled to vote at the Special Meeting or any adjournments or postponements thereof.

All shareholders are cordially invited to attend the Special Meeting. In order to avoid delay and additional expense, and to assure that your shares are represented, please vote as promptly as possible, whether or not you plan to attend the Special Meeting. You may vote by mail, telephone or over the Internet.

| | • | | To vote by mail, please mark, sign, date and mail the enclosed proxy card. No postage is required if mailed in the United States. |

| | • | | To vote by telephone, please call the toll-free number located on your proxy card and follow the recorded instructions, using your proxy card as a guide. |

| | • | | To vote over the Internet, go to the Internet address provided on your proxy card and follow the instructions, using your proxy card as a guide. |

Kevin J. McCarthy

Vice President and Secretary

Proxy Statement/Prospectus

Dated , 2013

Relating to the Acquisition of the Assets and Liabilities of

NUVEEN MID CAP SELECT FUND

by NUVEEN SYMPHONY MID-CAP CORE FUND

This Proxy Statement/Prospectus is being furnished to shareholders of Nuveen Mid Cap Select Fund (the “Target Fund”), a series of Nuveen Investment Funds, Inc. (the “Corporation”), a Maryland corporation and an open-end investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and relates to the special meeting of shareholders of the Target Fund to be held at the offices of Nuveen Investments, Inc., 333 West Wacker Drive, Chicago, Illinois 60606, on , 2013 at [ : p.m.], Central time and at any and all adjournments and postponements thereof (the “Special Meeting”). This Proxy Statement/Prospectus is provided in connection with the solicitation by the Board of Directors of the Corporation of proxies to be voted at the Special Meeting, and any and all adjournments or postponements thereof. The purpose of the Special Meeting is to consider the proposed reorganization (the “Reorganization”) of the Target Fund into Nuveen Symphony Mid-Cap Core Fund (the “Acquiring Fund”), a series of Nuveen Investment Trust II, a Massachusetts business trust (the “Trust”) and an open-end investment company registered under the 1940 Act. The Target Fund and the Acquiring Fund are referred to herein collectively as the “Funds” and individually as a “Fund.” The Board of Directors of the Corporation and the Board of Trustees of the Trust, which are made up of the same individuals, are referred to herein as the “Board.” If shareholders approve the Reorganization and it is completed, shareholders of the Target Fund will receive shares of the corresponding class of the Acquiring Fund with the same total value as the total value of the Target Fund shares surrendered by such shareholders. The Board has determined that the Reorganization is in the best interests of the Target Fund. The address, principal executive office and telephone number of the Funds, the Trust and the Corporation is 333 West Wacker Drive, Chicago, Illinois 60606, (800) 257-8787.

A vote in favor of the Reorganization will be considered a vote in favor of an amendment to the Corporation’s Articles of Incorporation effecting the Reorganization.

The enclosed proxy and this Proxy Statement/Prospectus are first being sent to shareholders of the Target Fund on or about , 2013. Shareholders of record as of the close of business on , 2013 are entitled to vote at the Special Meeting and any adjournments or postponements thereof.

The Securities and Exchange Commission has not approved or disapproved these securities or determined whether the information in this Proxy Statement/Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This Proxy Statement/Prospectus concisely sets forth the information shareholders of the Target Fund should know before voting on the Reorganization (in effect, investing in Class A, Class C and Class I shares of the Acquiring Fund) and constitutes an offering of Class A, Class C and Class I shares of beneficial interest, par value $0.01 per share, of the Acquiring Fund. Please read it carefully and retain it for future reference.

The following documents have been filed with the Securities and Exchange Commission (“SEC”) and are incorporated into this Proxy Statement/Prospectus by reference and also accompany this Proxy Statement/Prospectus:

| | (i) | the Trust’s prospectus dated January 31, 2013, as supplemented through the date of this Proxy Statement/Prospectus, relating to the Acquiring Fund; and |

| | (ii) | the unaudited financial statements contained in the Trust’s Semi-Annual Report, relating to the Acquiring Fund for the six-month period ended March 31, 2013. |

The following documents contain additional information about the Funds, have been filed with the SEC and are incorporated into this Proxy Statement/Prospectus by reference:

| | (i) | the Statement of Additional Information relating to the proposed Reorganization, dated , 2013 (the “Reorganization SAI”); |

| | (ii) | the Corporation’s prospectus dated February 28, 2013, as supplemented through the date of this Proxy Statement/Prospectus, relating to the Target Fund; |

| | (iii) | the Trust’s statement of additional information dated January 31, 2013, as supplemented through the date of this Proxy Statement/Prospectus, relating to the Acquiring Fund; |

| | (iv) | the Corporation’s statement of additional information dated February 28, 2013, as supplemented through the date of this Proxy Statement/Prospectus, relating to the Target Fund; |

| | (v) | the audited financial statements contained in the Trust’s Annual Report, relating to the Acquiring Fund for the fiscal year ended September 30, 2012; |

| | (vi) | the audited financial statements contained in the Corporation’s Annual Report, relating to the Target Fund for the fiscal year ended October 31, 2012; and |

| | (vii) | the unaudited financial statements contained in the Corporation’s Semi-Annual Report, relating to the Target Fund for the six-month period ended April 30, 2013. |

No other parts of the documents referenced above are incorporated by reference herein.

Copies of the foregoing may be obtained without charge by calling or writing the Funds at the telephone number or address shown above. If you wish to request the Reorganization SAI, please ask for the “Reorganization SAI.” In addition, the Acquiring Fund will furnish, without charge, a copy of its most recent annual report and semi-annual report to a shareholder upon request. Any such request should be directed to the Acquiring Fund by calling (800) 257-8787 or by writing the Acquiring Fund at 333 West Wacker Drive, Chicago, Illinois 60606.

The Corporation and the Trust are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the 1940 Act, and in accordance therewith file reports and other information with the SEC. Reports, proxy statements, registration statements and other information filed by the Corporation or the Trust (including the registration statement relating to the Acquiring Fund on Form N-14 of which this Proxy Statement/Prospectus is a part) may be inspected without charge and copied (for a duplication fee at prescribed rates) at the SEC’s Public Reference

Room at 100 F Street, N.E., Washington, D.C. 20549 or at the SEC’s Northeast Regional Office (3 World Financial Center, New York, New York 10281) or Midwest Regional Office (175 W. Jackson Boulevard, Suite 900, Chicago, Illinois 60604). You may call the SEC at (202) 551-8090 for information about the operation of the Public Reference Room. You may obtain copies of this information, with payment of a duplication fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, Washington, D.C. 20549. You may also access reports and other information about the Funds on the EDGAR database on the SEC’s Internet site at http://www.sec.gov.

TABLE OF CONTENTS

-i-

TABLE OF CONTENTS

(continued)

-ii-

SUMMARY

The following is a summary of, and is qualified by reference to, the more complete information contained in this Proxy Statement/Prospectus and the information attached hereto or incorporated herein by reference, including the Agreement and Plan of Reorganization. As discussed more fully below and elsewhere in this Proxy Statement/Prospectus, the Board believes the proposed Reorganization is in the best interests of each Fund and that the interests of each Fund’s existing shareholders would not be diluted as a result of the Reorganization. If the Reorganization is approved and completed, shareholders of the Target Fund will become shareholders of the Acquiring Fund and will cease to be shareholders of the Target Fund.

Shareholders should read the entire Proxy Statement/Prospectus carefully together with the Acquiring Fund’s Prospectus that accompanies this Proxy Statement/Prospectus, which is incorporated herein by reference. This Proxy Statement/Prospectus constitutes an offering of Class A, Class C and Class I shares of the Acquiring Fund only.

Background

Nuveen Fund Advisors, LLC (“Nuveen Fund Advisors” or the “Adviser”), each Fund’s investment adviser, has proposed the reorganization of the Target Fund into the Acquiring Fund, as well as a number of other reorganizations involving other funds advised by Nuveen Fund Advisors, as part of an initiative to eliminate certain redundancies among the products it offers and in an effort to achieve certain operating efficiencies.

The Reorganization

This Proxy Statement/Prospectus is being furnished to shareholders of the Target Fund in connection with the proposed combination of the Target Fund with and into the Acquiring Fund pursuant to the terms and conditions of the Agreement and Plan of Reorganization among the Corporation, on behalf of the Target Fund, the Trust, on behalf of the Acquiring Fund, and Nuveen Fund Advisors (the “Agreement”). The Agreement provides for (i) the transfer of all the assets of the Target Fund to the Acquiring Fund in exchange solely for Class A, Class C and Class I shares of beneficial interest, par value $0.01 per share, of the Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Target Fund; and (ii) the distribution by the Target Fund of Class A, Class C and Class I shares of the Acquiring Fund to the shareholders of the corresponding class of the Target Fund in complete liquidation and termination of the Target Fund.

If shareholders approve the Reorganization and it is completed, Target Fund shareholders will become shareholders of the Acquiring Fund. The Board has determined that the Reorganization is in the best interests of the Target Fund and that the interests of existing shareholders will not be diluted as a result of the Reorganization. The Board unanimously approved the Reorganization and the Agreement at a meeting held on April 17-18, 2013. The Board recommends a vote “FOR” the Reorganization.

Each Fund will be allocated the costs of the Reorganization in an amount up to its projected cost savings, if any, during the first year following the Reorganization, subject to expense cap limitations. Nuveen Fund Advisors estimates that the costs of the Reorganization will be approximately $159,000 and that the cost savings during the first year following the Reorganization will be approximately $2,600 for the Target Fund. The Acquiring Fund is not expected to realize any cost savings. As a result,

1

the Target Fund is expected to be charged approximately $2,600 of the costs of the Reorganization, and the Acquiring Fund will not be charged any of the Reorganization costs. To the extent that payment of such Reorganization expenses causes the Target Fund to exceed the per share expense cap currently in effect, Nuveen Fund Advisors or its affiliates (“Nuveen”) will absorb the portion of the expenses necessary for the Target Fund to operate within the cap. Based on current expense levels, it is anticipated that Nuveen will absorb all expenses charged to the Target Fund. If the Reorganization is not approved or completed, Nuveen will pay all such Reorganization expenses.

The Board is asking shareholders of the Target Fund to approve the Reorganization at the Special Meeting to be held on , 2013. Approval of the Reorganization requires the affirmative vote of the holders of a majority of the total number of shares outstanding and entitled to vote. See “Voting Information and Requirements” below.

If shareholders of the Target Fund approve the Reorganization, it is expected that the closing of the Reorganization (the “Closing”) will occur at the close of business on , 2013 (the “Closing Date”), but it may be at a different time as described herein. If the Reorganization is not approved, the Board will take such action as it deems to be in the best interests of the Target Fund. The Closing may be delayed and the Reorganization may be abandoned at any time by the mutual agreement of the parties. In addition, either Fund may at its option terminate the Agreement at or before the Closing due to (i) a breach by any other party of any representation, warranty, or agreement contained in the Agreement to be performed at or before the Closing, if not cured within 30 days, (ii) a condition precedent to the obligations of the terminating party that has not been met and it reasonably appears that it will not or cannot be met, or (iii) a determination by the Board that the consummation of the transactions contemplated by the Agreement is not in the best interests of a Fund.

Reasons for the Proposed Reorganization

The Board believes that the proposed Reorganization would be in the best interests of each Fund. In approving the Reorganization, the Board considered a number of principal factors in reaching its determination, including the following:

| | • | | the similarities and differences in the Funds’ investment objectives and principal investment strategies; |

| | • | | the Funds’ relative risks; |

| | • | | the Funds’ relative sizes; |

| | • | | the relative investment performance of the Funds; |

| | • | | the relative fees and expense ratios of the Funds, including caps on the Funds’ expenses agreed to by the Adviser; |

| | • | | the anticipated federal income tax-free nature of the Reorganization; |

| | • | | the expected costs of the Reorganization and the extent to which the Funds would bear any such costs; |

| | • | | the terms of the Reorganization and whether the Reorganization would dilute the interests of shareholders of the Funds; |

2

| | • | | the effect of the Reorganization on shareholder services and shareholder rights; |

| | • | | alternatives to the Reorganization; and |

| | • | | any potential benefits of the Reorganization to the Adviser and its affiliates as a result of the Reorganization. |

For a more detailed discussion of the Board’s considerations regarding the approval of the Reorganization, see “The Board’s Approval of the Reorganization.”

Distribution, Purchase, Redemption, Exchange of Shares and Dividends

The Funds have identical procedures for purchasing, exchanging and redeeming shares. The Target Fund offers three classes of shares: Class A, Class C and Class I Shares. The Acquiring Fund offers four classes of shares: Class A, Class C, Class R3 and Class I Shares. The corresponding classes of each Fund have the same investment eligibility criteria. Each Fund normally declares and pays dividends from net investment income, if any, annually. Each Fund declares and pays any taxable capital gains or other taxable distributions once a year at year end. See “Comparison of the Funds—Distribution, Purchase, Redemption, Exchange of Shares and Dividends” below for a more detailed discussion.

Material Federal Income Tax Consequences of the Reorganization

As a condition to closing, the Funds will receive an opinion from Vedder Price P.C. (which will be based on certain factual representations and certain customary assumptions and exclusions) substantially to the effect that the Reorganization will qualify as a tax-free reorganization under Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, it is expected that neither Fund will recognize gain or loss for federal income tax purposes as a direct result of the Reorganization. In connection with the Reorganization, it is expected that a substantial portion of the Target Fund’s portfolio assets may be sold prior to the Reorganization, which may result in the Target Fund realizing capital gains prior to the Reorganization. However, due to the Target Fund’s capital loss carryforwards, it is not expected that any such portfolio sales would result in capital gain distributions to Target Fund shareholders. For a more detailed discussion of the federal income tax consequences of the Reorganization, please see “The Proposed Reorganization—Material Federal Income Tax Consequences” below.

3

COMPARISON OF THE FUNDS

Investment Objectives

The Funds have substantially similar investment objectives. The Target Fund’s investment objective is long-term growth of capital. The Acquiring Fund’s investment objective is long-term capital appreciation. The Acquiring Fund’s investment objective is fundamental and may not be changed without shareholder approval. The Target Fund’s investment objective may be changed without shareholder approval upon providing notice at least 60 days in advance.

Investment Strategies

The Target Fund and the Acquiring Fund also have similar principal investment strategies and risks. The similarities and differences of the principal investment strategies of the Funds are:

| | |

Target Fund | | Acquiring Fund |

| |

• Under normal market conditions, the Fund invests at least 80% of net assets, plus the amount of any borrowings for investment purposes, in common stocks of mid-capitalization companies, defined as companies that have market capitalizations at the time of purchase within the market capitalization range of the companies in the Russell Midcap® Index immediately after its most recent reconstitution prior to such purchase. | | • Under normal market conditions, the Fund invests at least 80% of the sum of its net assets and the amount of any borrowings for investment purposes in equity securities of companies with market capitalizations at the time of investment comparable to companies in the Russell Midcap® Index. |

| |

• In selecting stocks, the Fund’s sub-adviser invests in companies that it believes are attractively valued relative to other companies in the same industry or market; exhibit strong or improving cash flows, revenue and earnings growth or other fundamentals; maintain a strong competitive position; and/or exhibit an identifiable catalyst that could increase the value of the company’s stock over the next two years. | | • The sub-adviser’s investment process begins by identifying candidates with excess return potential from two complementary, separate sources: quantitative analysis and fundamental analysis. Investment ideas from these sources then undergo rigorous fundamental analysis. Through this bottom up stock selection process, the team seeks to identify companies likely to outperform their industry peers in the Russell Midcap® Index. Quantitative tools are used to optimize pre-determined risk factors and upside potential within set parameters, with ultimate allocation decisions made by the portfolio management team. |

| |

• The Fund may invest up to 15% of its total assets in non-dollar denominated equity securities of non-U.S. issuers. | | |

4

| | |

Target Fund | | Acquiring Fund |

| |

• The Fund may invest up to 25% of its assets, collectively, in non-dollar denominated equity securities of non-U.S. issuers and in dollar-denominated equity securities of non-U.S. issuers that are either listed on a U.S. stock exchange or represented by depositary receipts that may or may not be sponsored by a domestic bank. | | |

| |

• Up to 15% of the Fund’s total assets may be invested in equity securities of emerging market issuers. A country is considered to be an “emerging market” if it is defined as such by Morgan Stanley Capital International Inc. | | |

| |

• The Fund may utilize options, futures contracts, options on futures contracts, and forward foreign currency exchange contracts (“derivatives”). The Fund may use these derivatives to manage market or business risk, enhance the Fund’s return, or hedge against adverse movements in currency exchange rates. | | |

Comparison of Principal Investment Strategies

Although the investment objectives of the Funds are not the same, they are substantially similar and the Funds employ similar investment strategies to achieve their investment objectives. Both Funds focus on investing in securities of mid-capitalization companies, and particularly in companies within the market capitalization range of the Russell Midcap® Index. As of January 31, 2013, the Acquiring Fund had a weighted average market capitalization of $9.6 billion, and the Target Fund had a weighted average market capitalization of $8.3 billion.

The Funds have different sub-advisers. The Target Fund is sub-advised by Nuveen Asset Management, LLC (“Nuveen Asset Management”), and the Acquiring Fund is sub-advised by Symphony Asset Management LLC (“Symphony”). The two sub-advisers utilize different investment processes, as described above.

Also, the Target Fund has principal investment strategies that the Acquiring Fund does not. These principal investment strategies permit the Target Fund to (i) invest up to 15% of its total assets in non-dollar denominated equity securities of non-U.S. issuers and (ii) invest up to 25% of its assets, collectively, in non-dollar denominated equity securities of non-U.S. issuers and in dollar-denominated equity securities of non-U.S. issuers that are either listed on a U.S. stock exchange or represented by depositary receipts that may or may not be sponsored by a domestic bank. The Target Fund also may invest up to 15% of its total assets in equity securities of emerging market issuers. The Acquiring Fund does not have principal investment strategies with respect to investments in equity securities of non-U.S. or emerging market issuers.

5

In addition, the Target Fund may utilize options, futures contracts, options on futures contracts and forward foreign currency exchange contracts as a principal investment strategy. The Acquiring Fund does not have a similar principal investment strategy, but may utilize such financial instruments as a non-principal strategy.

In evaluating the Reorganization, each Target Fund shareholder should consider the risks of investing in the Acquiring Fund. The principal risks of investing in the Acquiring Fund are described in the section below entitled “Risk Factors.”

The Reorganization may result in one-time brokerage costs for the Target Fund to the extent it is necessary for the Target Fund to sell holdings prior to the Reorganization so that the Acquiring Fund’s portfolio immediately following the Reorganization remains in compliance with its investment policies and restrictions or to the extent that portfolio adjustments are deemed appropriate in light of the different investment processes of the sub-advisers described above. If the Reorganization had occurred as of March 31, 2013, the Target Fund would not have been required to dispose of any of its securities in order to comply with the Acquiring Fund’s investment policies and restrictions. However, based on the Funds’ portfolios as of March 31, 2013, it is estimated that the Target Fund will sell approximately 85% of its portfolio prior to the Reorganization because of the different investment processes utilized by the sub-advisers. Actual portfolio sales may be more or less than this amount, depending on the composition of the Funds’ portfolios at the time of the realignment. Any portfolio sales that occur prior to the Reorganization may result in the Target Fund realizing capital gains. However, due to the Target Fund’s capital loss carryforwards, it is not expected that any such portfolio sales would result in capital gain distributions to Target Fund shareholders. See “The Proposed Reorganization—Material Federal Income Tax Consequences” below.

Fees and Expenses

The tables below provide information about the fees and expenses attributable to each class of shares of the Funds, and the pro forma fees and expenses of the combined fund. You may qualify for sales charge discounts on purchases of Class A shares if you and your family invest, or agree to invest in the future, at least $50,000 in a Fund or other Nuveen mutual funds. Shareholder fees reflect the fees currently in effect for each Fund. Annual Fund Operating Expenses for the Acquiring Fund reflect the Fund’s fees and expenses as of its fiscal year ended September 30, 2012. Annual Fund Operating Expenses for the Target Fund reflect the Fund’s fees and expenses as of its fiscal year ended October 31, 2012. The pro forma fees and expenses are based on the amounts shown in the table for each Fund, assuming the Reorganization occurred as of September 30, 2012.

Shareholder Fees

(paid directly from your investment)

| | | | | | | | | | | | |

| | | Target

Fund

10/31/12 | | | Acquiring

Fund

9/30/12 | | | Combined

Fund Pro

Forma

9/30/12 | |

Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) | | | | | | | | | | | | |

Class A | | | 5.75% | | | | 5.75% | | | | 5.75% | |

Class C | | | None | | | | None | | | | None | |

Class I | | | None | | | | None | | | | None | |

6

| | | | | | | | | | | | |

| | | Target

Fund

10/31/12 | | | Acquiring

Fund

9/30/12 | | | Combined

Fund Pro

Forma

9/30/12 | |

Maximum Deferred Sales Charge (Load) (as a percentage of the lesser of purchase price or redemption proceeds) | | | | | | | | | | | | |

Class A | | | None | | | | None | | | | None | |

Class C1 | | | 1.00% | | | | 1.00% | | | | 1.00% | |

Class I | | | None | | | | None | | | | None | |

Maximum Sales Charge (Load) Imposed on Reinvested Dividends | | | | | | | | | | | | |

Class A | | | None | | | | None | | | | None | |

Class C | | | None | | | | None | | | | None | |

Class I | | | None | | | | None | | | | None | |

Exchange Fees | | | | | | | | | | | | |

Class A | | | None | | | | None | | | | None | |

Class C | | | None | | | | None | | | | None | |

Class I | | | None | | | | None | | | | None | |

Annual Low Balance Account fee (for accounts under $1,000)2 | | | | | | | | | | | | |

Class A | | | $15 | | | | $15 | | | | $15 | |

Class C | | | $15 | | | | $15 | | | | $15 | |

Class I | | | $15 | | | | $15 | | | | $15 | |

| 1 | The contingent deferred sales charge on Class C shares applies only to redemptions within 12 months of purchase. |

| 2 | Fee applies to the following types of accounts under $1,000 held directly with the Fund: individual retirement accounts (IRAs), Coverdell Education Savings Accounts and accounts established pursuant to the Uniform Transfers to Minors Act (UTMA) or Uniform Gifts to Minors Act (UGMA). |

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| | | | | | | | | | | | |

| | | Target

Fund

10/31/12 | | | Acquiring

Fund

9/30/12 | | | Combined

Fund Pro

Forma1

9/30/12 | |

Management Fees | | | | | | | | | | | | |

Class A | | | 0.90% | | | | 0.72% | | | | 0.75% | |

Class C | | | 0.90% | | | | 0.72% | | | | 0.75% | |

Class I | | | 0.90% | | | | 0.72% | | | | 0.75% | |

Distribution and Service (12b-1) Fees | | | | | | | | | | | | |

Class A | | | 0.25% | | | | 0.25% | | | | 0.25% | |

Class C | | | 1.00% | | | | 1.00% | | | | 1.00% | |

Class I | | | 0.00% | | | | 0.00% | | | | 0.00% | |

Other Expenses2 | | | | | | | | | | | | |

Class A | | | 0.69% | | | | 3.07% | | | | 0.81% | |

Class C | | | 0.69% | | | | 3.18% | | | | 0.81% | |

Class I | | | 0.69% | | | | 2.63% | | | | 0.81% | |

Total Annual Fund Operating Expenses | | | | | | | | | | | | |

Class A | | | 1.84% | | | | 4.04% | | | | 1.81% | |

Class C | | | 2.59% | | | | 4.90% | | | | 2.56% | |

Class I | | | 1.59% | | | | 3.35% | | | | 1.56% | |

Fee Waivers and/or Expense Reimbursements | | | | | | | | | | | | |

Class A | | | (0.43% | )3 | | | (2.67% | )4 | | | (0.41% | )5 |

Class C | | | (0.43% | )3 | | | (2.78% | )4 | | | (0.41% | )5 |

Class I | | | (0.43% | )3 | | | (2.23% | )4 | | | (0.41% | )5 |

7

| | | | | | | | | | | | |

| | | Target

Fund

10/31/12 | | | Acquiring

Fund

9/30/12 | | | Combined

Fund Pro

Forma1

9/30/12 | |

Total Annual Fund Operating Expenses–After Fee Waivers and/or Expense Reimbursements | | | | | | | | | | | | |

Class A | | | 1.41% | | | | 1.37% | | | | 1.40% | |

Class C | | | 2.16% | | | | 2.12% | | | | 2.15% | |

Class I | | | 1.16% | | | | 1.12% | | | | 1.15% | |

| 1 | Pro forma expenses do not include the expenses to be charged to the Target Fund in connection with the Reorganization. See “The Proposed Reorganization—Reorganization Expenses” for additional information about these expenses. |

| 2 | Other Expenses have been restated to reflect current contractual fees. |

| 3 | Nuveen Fund Advisors has contractually agreed to waive fees and/or reimburse other Target Fund expenses through February 28, 2014 so that total annual fund operating expenses, after fee waivers and/or expense reimbursements and excluding acquired fund fees and expenses, do not exceed 1.41%, 2.16% and 1.16% for Class A, Class C and Class I shares, respectively. Fee waivers and/or expense reimbursements will not be terminated prior to that time without the approval of the Board. |

| 4 | Nuveen Fund Advisors has agreed to waive fees and/or reimburse Acquiring Fund expenses through January 31, 2014 so that total annual fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, acquired fund fees and expenses, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses) do not exceed 1.15% (1.40% after January 31, 2014) of the average daily net assets of any class of Acquiring Fund shares. The expense limitation expiring January 31, 2014 may be terminated or modified prior to that date only with the approval of the Board. The expense limitation of 1.40% in effect thereafter may be terminated or modified only with the approval of shareholders of the Acquiring Fund. |

| 5 | If the Reorganization is approved by shareholders and completed, Nuveen Fund Advisors has agreed to waive fees and/or reimburse expenses commencing the first business day following the closing through September 30, 2014 so that total annual fund operating expenses (excluding 12b-1 distribution and/or service fees, interest expenses, taxes, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses) do not exceed 1.15% (1.40% after September 30, 2014) of the average daily net assets of any class of Acquiring Fund shares. The expense limitation expiring September 30, 2014 may be terminated or modified prior to that date only with the approval of the Board. The expense limitation of 1.40% in effect thereafter may be terminated or modified only with the approval of shareholders of the Acquiring Fund. |

Example

The example below is intended to help you compare the cost of investing in each Fund and the pro forma cost of investing in the combined fund. The example assumes you invest $10,000 in a Fund for the time periods indicated (based on information in the tables above) and then either redeem or do not redeem your shares at the end of a period. The example assumes that your investment has a 5% return each year and that a Fund’s expenses remain at the level shown in the table above. Expense caps are taken into account for the periods stated in the table above, including the permanent expense cap applicable to the Acquiring Fund. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | | | | | | | |

| | | Target

Fund | | | Acquiring

Fund | | | Combined

Fund Pro

Forma | |

1 Year | | | | | | | | | | | | |

| | | |

Assuming you sold your shares at the end of each period | | | | | | | | | | | | |

Class A | | $ | 710 | | | $ | 706 | | | $ | 711 | |

Class C | | $ | 219 | | | $ | 215 | | | $ | 220 | |

Class I | | $ | 118 | | | $ | 114 | | | $ | 119 | |

8

| | | | | | | | | | | | |

| | | Target

Fund | | | Acquiring

Fund | | | Combined

Fund Pro

Forma | |

Assuming you kept your shares | | | | | | | | | | | | |

Class A | | $ | 710 | | | $ | 706 | | | $ | 711 | |

Class C | | $ | 219 | | | $ | 215 | | | $ | 220 | |

Class I | | $ | 118 | | | $ | 114 | | | $ | 119 | |

| | | |

3 Years | | | | | | | | | | | | |

Assuming you sold your shares at the end of each period | | | | | | | | | | | | |

Class A | | $ | 1,081 | | | $ | 1,034 | | | $ | 1,044 | |

Class C | | $ | 765 | | | $ | 716 | | | $ | 727 | |

Class I | | $ | 460 | | | $ | 409 | | | $ | 421 | |

Assuming you kept your shares | | | | | | | | | | | | |

Class A | | $ | 1,081 | | | $ | 1,034 | | | $ | 1,044 | |

Class C | | $ | 765 | | | $ | 716 | | | $ | 727 | |

Class I | | $ | 460 | | | $ | 409 | | | $ | 421 | |

| | | |

5 Years | | | | | | | | | | | | |

Assuming you sold your shares at the end of each period | | | | | | | | | | | | |

Class A | | $ | 1,476 | | | $ | 1,383 | | | $ | 1,400 | |

Class C | | $ | 1,337 | | | $ | 1,243 | | | $ | 1,260 | |

Class I | | $ | 825 | | | $ | 726 | | | $ | 744 | |

Assuming you kept your shares | | | | | | | | | | | | |

Class A | | $ | 1,476 | | | $ | 1,383 | | | $ | 1,400 | |

Class C | | $ | 1,337 | | | $ | 1,243 | | | $ | 1,260 | |

Class I | | $ | 825 | | | $ | 726 | | | $ | 744 | |

| | | |

10 Years | | | | | | | | | | | | |

Assuming you sold your shares at the end of each period | | | | | | | | | | | | |

Class A | | $ | 2,576 | | | $ | 2,367 | | | $ | 2,399 | |

Class C | | $ | 2,893 | | | $ | 2,687 | | | $ | 2,719 | |

Class I | | $ | 1,853 | | | $ | 1,625 | | | $ | 1,660 | |

Assuming you kept your shares | | | | | | | | | | | | |

Class A | | $ | 2,576 | | | $ | 2,367 | | | $ | 2,399 | |

Class C | | $ | 2,893 | | | $ | 2,687 | | | $ | 2,719 | |

Class I | | $ | 1,853 | | | $ | 1,625 | | | $ | 1,660 | |

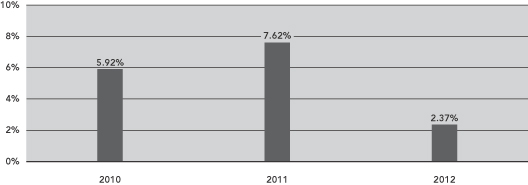

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect each Fund’s performance. The Funds’ portfolio turnover rates for the most recent fiscal periods for which financial statements are available are set forth below. The portfolio turnover rates for the semi-annual periods are not annualized.

| | | | | | | | | | | | | | | | |

Fund | | Fiscal Year Ended | | | Rate | | | Semi-Annual Period Ended | | | Rate | |

Target Fund | | | 10/31/12 | | | | 198% | | | | 4/30/13 | | | | 57% | |

Acquiring Fund | | | 9/30/12 | | | | 138% | | | | 3/31/13 | | | | 99% | |

After the Reorganization is completed, the portfolio managers of the Acquiring Fund may, in their discretion, sell securities acquired from the Target Fund. To the extent that the portfolio managers

9

choose to sell a significant percentage of such securities, the Acquiring Fund’s portfolio turnover rate and brokerage costs may be higher than they otherwise would have been. In addition, such sales may result in taxable distributions to shareholders of the Acquiring Fund.

Risk Factors

In evaluating the Reorganization, you should consider carefully the risks of the Acquiring Fund to which you will be subject if the Reorganization is approved and completed. Investing in a mutual fund involves risk, including the risk that you may receive little or no return on your investment or even that you may lose part or all of your investment. Because of these and other risks, you should consider an investment in the Acquiring Fund to be a long-term investment. An investment in the Acquiring Fund may not be appropriate for all shareholders. For a complete description of the risks of an investment in the Acquiring Fund, see the section in the Acquiring Fund’s Prospectus entitled “Principal Risks.”

Because the Funds have similar investment strategies, the principal risks of each Fund are similar. The principal risks of investing in the Acquiring Fund are described below. An investment in the Target Fund is also subject to these risks. In addition, the principal risks of the Target Fund include derivatives risk and non-U.S./emerging markets risk.

Equity Security Risk. Equity securities may decline significantly in price over short or extended periods of time, and such declines may occur in the equity market as a whole, or they may occur in only a particular country, company, industry, or sector of the market.

Mid-Cap Stock Risk. Stocks of mid-cap companies may be subject to more abrupt or erratic market movements than those of larger, more established companies or the market averages in general.

Fundamental Investment Restrictions

The Funds have substantially similar fundamental investment restrictions that cannot be changed without shareholder approval, with the exception that the Target Fund’s investment objective may be changed by the Board without shareholder approval. In addition, each Fund is a diversified fund. As a diversified fund, each Fund, with respect to 75% of its assets, may not invest more than 5% of its total assets in the securities of any one issuer (other than securities issued by other investment companies or by the U.S. government, its agencies, instrumentalities or authorities) and may not purchase more than 10% of the outstanding voting securities of any one issuer.

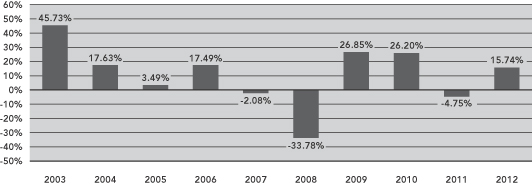

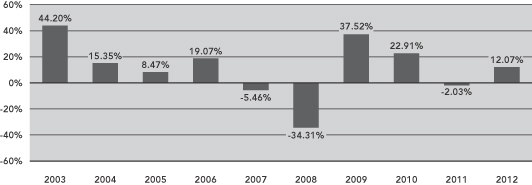

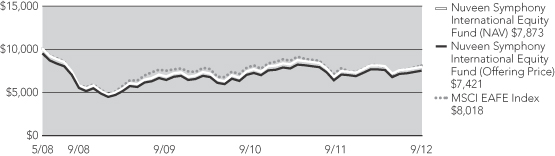

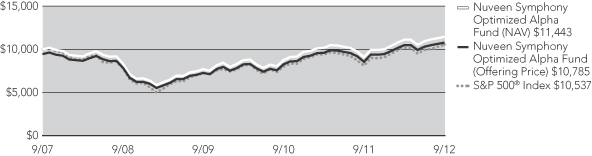

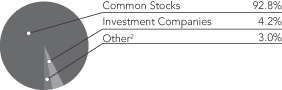

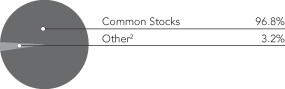

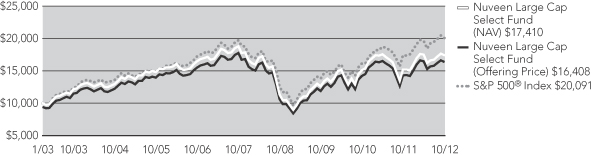

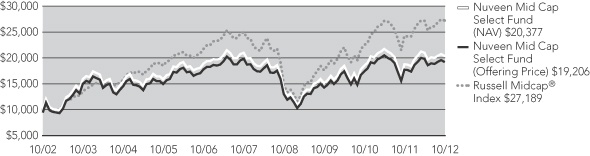

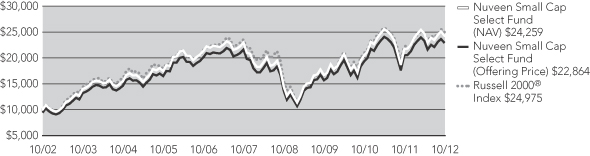

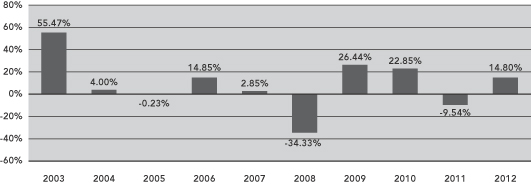

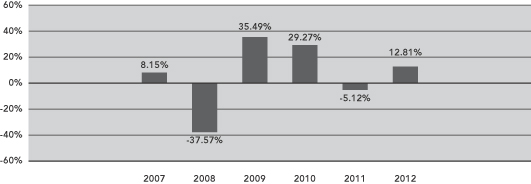

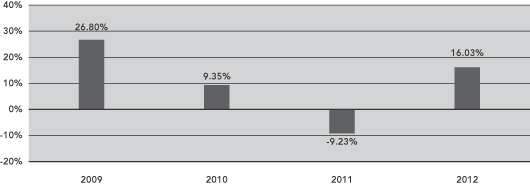

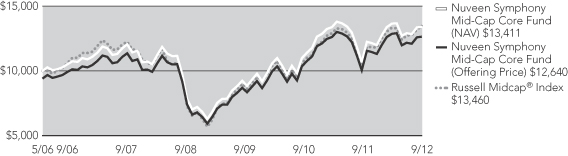

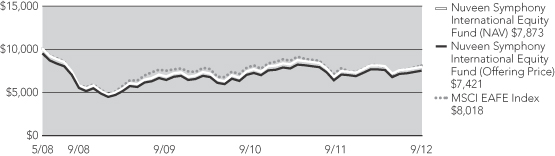

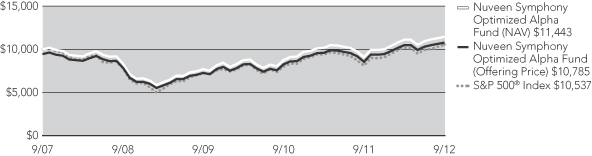

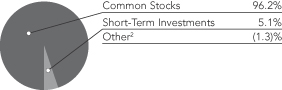

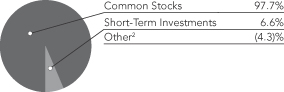

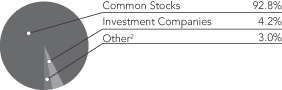

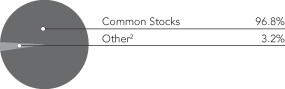

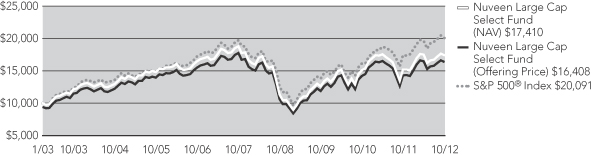

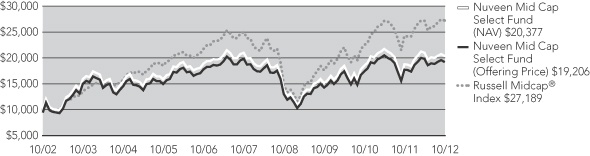

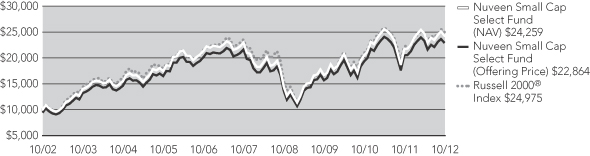

Performance Information

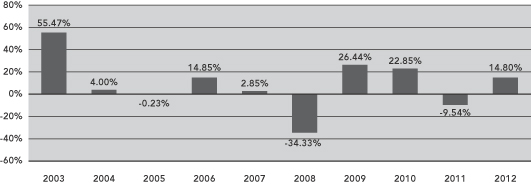

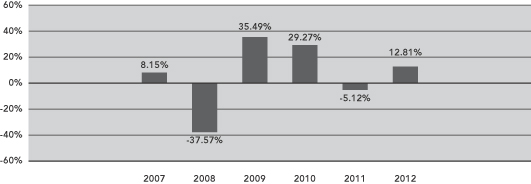

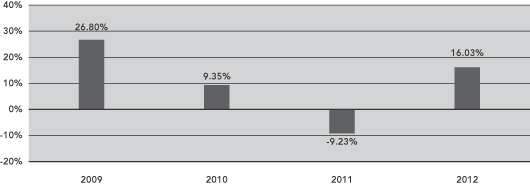

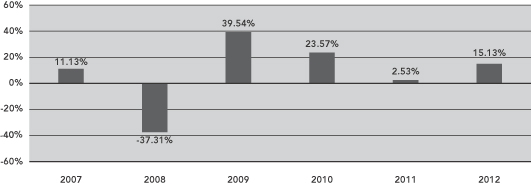

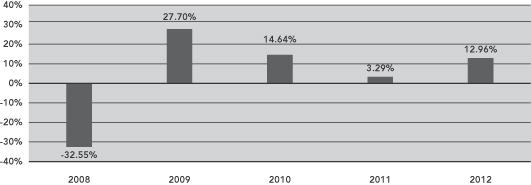

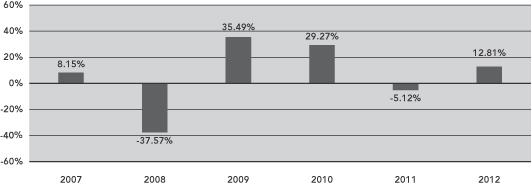

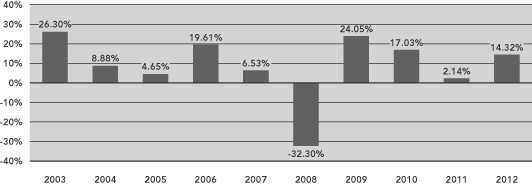

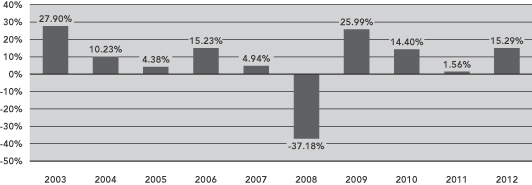

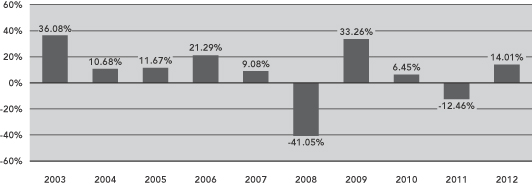

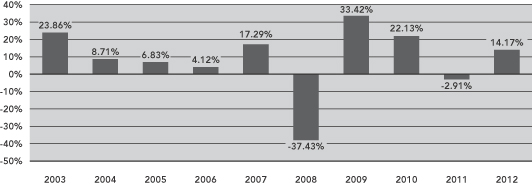

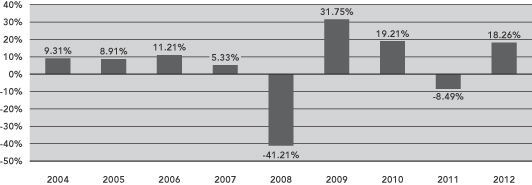

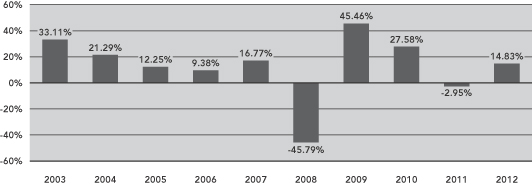

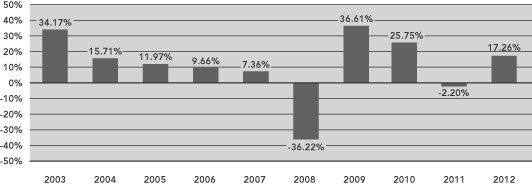

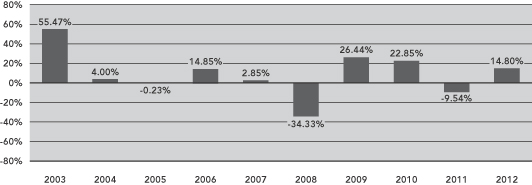

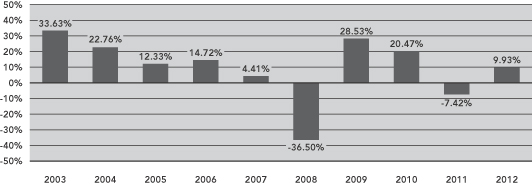

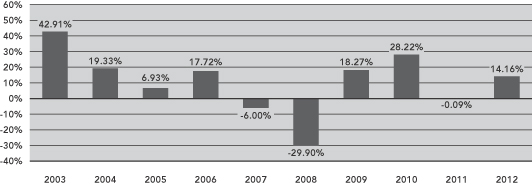

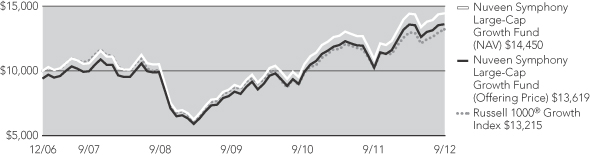

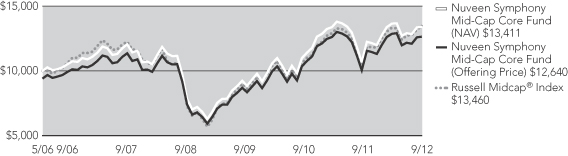

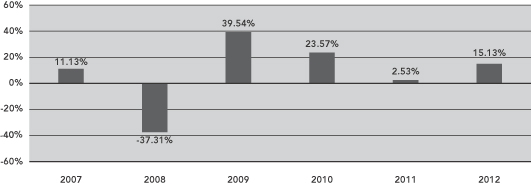

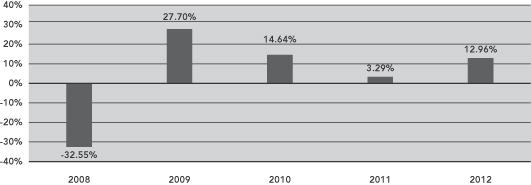

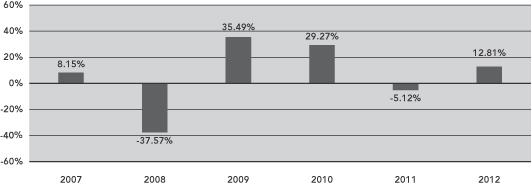

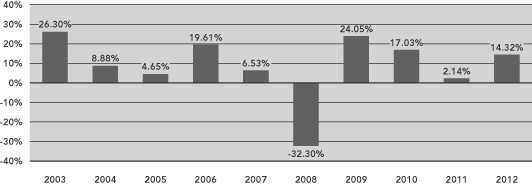

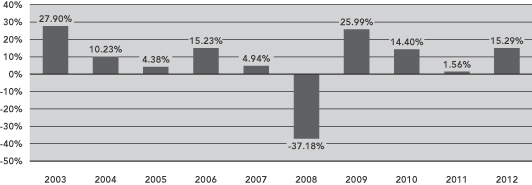

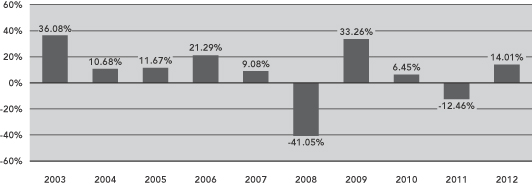

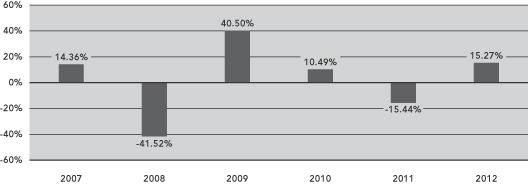

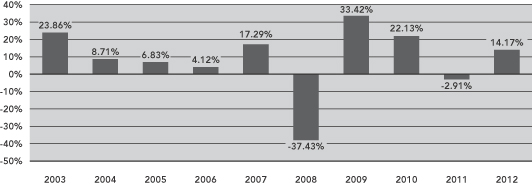

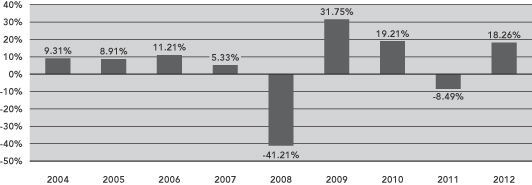

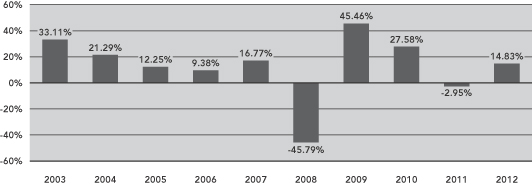

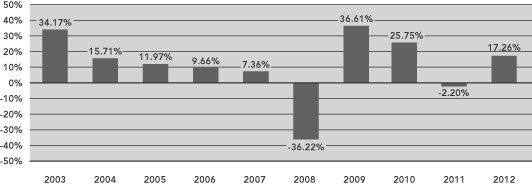

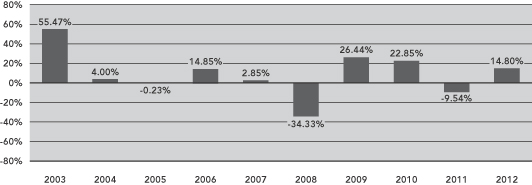

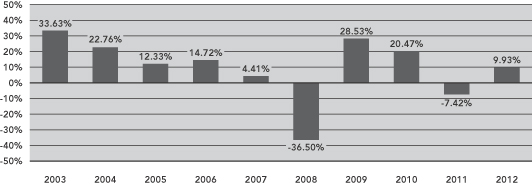

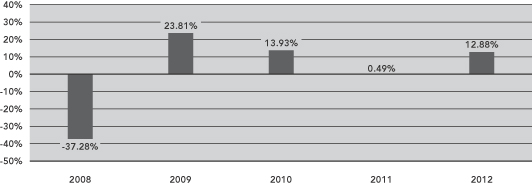

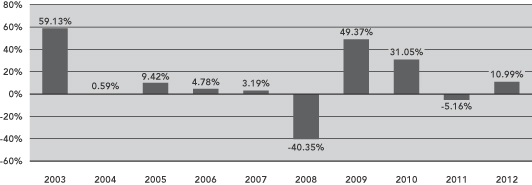

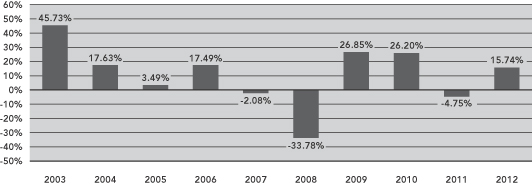

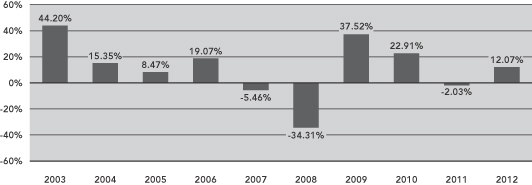

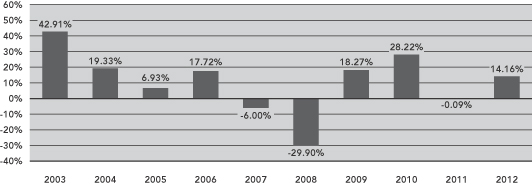

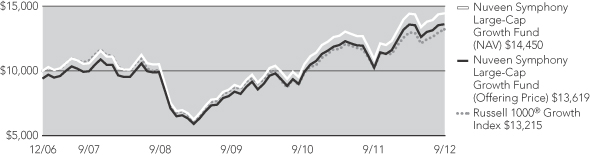

The total returns of the Funds for the periods ended December 31, 2012, based on historical fees and expenses for each period, are set forth in the bar charts and tables below.

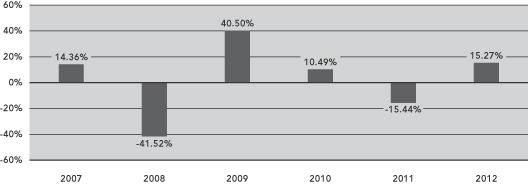

The following bar charts and tables provide some indication of the potential risks of investing in each Fund. Each Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available at www.nuveen.com/performance or by calling (800) 257-8787.

The bar charts below show the annual calendar year returns for each Fund’s Class A shares. The performance of the other share classes will differ due to their different expense structures. The bar charts and highest/lowest quarterly and year-to-date returns that follow do not reflect sales charges, and

10

if these charges were reflected, the returns would be less than those shown. The tables below show the average annual returns for the periods ended December 31, 2012 for each Fund. The tables also show how each Fund’s performance compares with the returns of a broad measure of market performance and an index of funds with similar investment objectives. This information is intended to help you assess the variability of Fund returns (and consequently, the potential risks of a Fund investment).

All after-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. After-tax returns are shown for Class A shares only; after-tax returns for Class C and Class I shares will vary. Your own actual after-tax returns will depend on your specific tax situation and may differ from what is shown here. After-tax returns are not relevant to investors who hold fund shares in tax-deferred accounts such as IRAs or employer-sponsored retirement plans.

Both the bar charts and the tables assume that all distributions have been reinvested. Performance reflects fee waivers, if any, in effect during the periods presented. If any such waivers were not in place, performance would be reduced.

The Target Fund’s performance for periods prior to May 4, 2009 reflects the Fund’s operations using different investment strategies than are currently in place. Effective October 3, 2005, the Target Fund’s principal investment strategy was changed from investing primarily in technology stocks to investing primarily in common stocks of small- and mid-capitalization companies, and the Target Fund’s name changed from First American Technology Fund to First American Small-Mid Cap Core Fund. Thereafter, effective May 4, 2009, the Target Fund’s principal investment strategy was changed from investing primarily in common stocks of small- and mid-capitalization companies to investing primarily in common stocks of mid-capitalization companies, and the Fund’s name changed from First American Small-Mid Cap Core Fund to First American Mid Cap Select Fund.

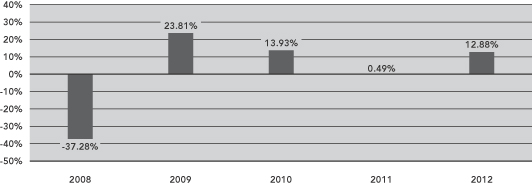

Target Fund – Class A Annual Total Return

During the periods shown in the bar chart, the Target Fund’s Class A shares highest and lowest calendar quarter returns were 28.88% and -22.43%, respectively, for the quarters ended June 30, 2003 and December 31, 2008. The Target Fund’s Class A shares year-to-date return through March 31, 2013 was 10.74%.

11

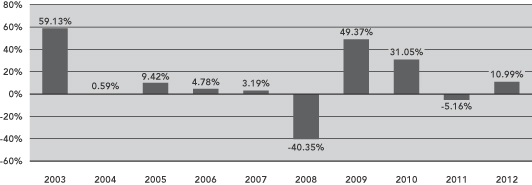

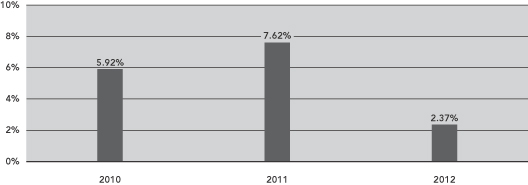

Acquiring Fund – Class A Total Return

During the periods shown in the bar chart, the Acquiring Fund’s Class A shares highest and lowest calendar quarter returns were 17.70% and -25.85%, respectively, for the quarters ended September 30, 2009 and December 31, 2008. The Acquiring Fund’s Class A shares year-to-date return through March 31, 2013 was 11.43%.

| | | | | | | | | | | | |

| | | Average Annual Total Returns for the Periods Ended

December 31, 2012 | |

Target Fund | | 1 Year | | | 5 Years | | | 10 Years | |

Class A (return before taxes) | | | 8.16 | % | | | (0.04 | %) | | | 6.65 | % |

Class A (return after taxes on distributions) | | | 8.08 | % | | | (0.07 | %) | | | 6.64 | % |

Class A (return after taxes on distributions and sale of fund shares) | | | 5.41 | % | | | (0.04 | %) | | | 5.86 | % |

Class C (return before taxes) | | | 13.97 | % | | | 0.40 | % | | | 6.49 | % |

Class I (return before taxes) | | | 15.07 | % | | | 1.39 | % | | | 7.55 | % |

Russell Midcap® Index (reflects no deduction for fees, expenses or taxes) | | | 17.28 | % | | | 3.57 | % | | | 10.65 | % |

Lipper Mid-Cap Core Classification Average (reflects no deduction for taxes or certain expenses) | | | 15.59 | % | | | 2.23 | % | | | 8.89 | % |

| | | | | | | | | | | | |

| | | Average Annual Total Returns for the Periods Ended

December 31, 2012 | |

Acquiring Fund | | 1 Year | | | 5 Years | | | Since Inception

(May 31, 2006) | |

Class A (return before taxes) | | | 6.31 | % | | | 1.98 | % | | | 3.76 | % |

Class A (return after taxes on distributions) | | | 6.19 | % | | | 1.95 | % | | | 3.42 | % |

Class A (return after taxes on distributions and sale of fund shares) | | | 4.26 | % | | | 1.69 | % | | | 3.05 | % |

Class C (return before taxes) | | | 11.96 | % | | | 2.43 | % | | | 3.91 | % |

Class I (return before taxes) | | | 13.14 | % | | | 3.46 | % | | | 4.96 | % |

Russell Midcap® Index (reflects no deduction for fees, expenses or taxes) | | | 17.28 | % | | | 3.57 | % | | | 5.07 | % |

Lipper Mid-Cap Core Classification Average (reflects no deduction for taxes or certain expenses) | | | 15.59 | % | | | 2.23 | % | | | 4.07 | % |

Investment Adviser and Sub-Adviser

Both Funds are managed by Nuveen Fund Advisors, which offers advisory and investment management services to a broad range of mutual fund clients. Nuveen Fund Advisors has overall responsibility for management of the Funds, oversees the management of the Funds’ portfolios, manages the Funds’ business affairs and provides certain clerical, bookkeeping and other administrative services. Nuveen Fund Advisors is located at 333 West Wacker Drive, Chicago,

12

Illinois 60606. Nuveen Fund Advisors is a subsidiary of Nuveen Investments, LLC (“Nuveen Investments”). On November 13, 2007, Nuveen Investments was acquired by investors led by Madison Dearborn Partners, LLC, which is a private equity investment firm based in Chicago, Illinois. The Nuveen family of advisers has been providing advice to investment companies since 1976.

Nuveen Fund Advisors has selected its affiliate, Nuveen Asset Management, located at 333 West Wacker Drive, Chicago, Illinois 60606, to serve as a sub-adviser to the Target Fund. Nuveen Asset Management manages the investment of the Target Fund’s assets on a discretionary basis, subject to the supervision of Nuveen Fund Advisors. Anthony R. Burger and Scott M. Tonneson are the portfolio managers for the Target Fund.

Anthony R. Burger, CFA, has been a portfolio manager of the Target Fund since May 2005. Mr. Burger entered the financial services industry in 1994 and joined FAF Advisors, Inc. (“FAF”) in 2003. He joined Nuveen Asset Management as a Senior Vice President on January 1, 2011 in connection with the firm’s acquisition of a portion of FAF’s asset management business. Prior to joining Nuveen Asset Management, he was Director of Quantitative Equity Research at FAF.

Scott M. Tonneson, CFA, has been a portfolio manager of the Target Fund since February 2012. Mr. Tonneson entered the financial services industry in 1994 and joined FAF in 2007. Prior to his current portfolio management role, he was a senior equity research analyst responsible for building quantitative models to deliver relevant data to the equity portfolio teams. He joined Nuveen Asset Management as a Vice President and Senior Research Analyst on January 1, 2011 in connection with the firm’s acquisition of a portion of FAF’s asset management business.

Nuveen Fund Advisors has selected its affiliate, Symphony, located at 555 California Street, Suite 2975, San Francisco, California 94104, to serve as sub-adviser to the Acquiring Fund, and Symphony will continue to serve as sub-adviser to the Acquiring Fund following the Reorganization. Symphony manages the investment of the Acquiring Fund’s assets on a discretionary basis, subject to the supervision of Nuveen Fund Advisors. Gunther Stein, Ross Sakamoto and Joel Drescher are the portfolio managers for the Acquiring Fund.

Gunther Stein, Chief Investment Officer and Chief Executive Officer at Symphony, has managed the Acquiring Fund since June 2010. Mr. Stein is responsible for leading Symphony’s fixed-income and equity investments strategies and research and overseeing firm trading. Prior to joining Symphony in 1999, Mr. Stein was a high yield portfolio manager at Wells Fargo Bank, where he managed a high yield portfolio, was responsible for investing in public high yield bonds and bank loans and managed a team of credit analysts.

Ross Sakamoto, Co-Director of Equity at Symphony, has managed the Acquiring Fund since July 2010. He is responsible for co-heading Symphony’s equity investment strategies along with Joel Drescher and overseeing the equity trading and research activities. Mr. Sakamoto has over twenty years of industry experience and returned to Symphony after having spent six years with Symphony from 1996 to 2002 as an Equity Portfolio Manager of long-only and hedged strategies. Most recently, Mr. Sakamoto was a Director in the Quantitative Services group at Deutsche Bank Advisors focusing on business development. Prior to joining Deutsche Bank in 2008, he focused on program trading at Bear Stearns & Company from 2002 to 2007.

Joel Drescher, Co-Director of Equity at Symphony, has managed the Acquiring Fund since June 2012. He is responsible for co-heading Symphony’s equity investment strategies along with Ross

13

Sakamoto. Prior to joining Symphony in 2012, Mr. Drescher was a Sector Manager at Ascend Capital, where he was responsible for managing all aspects of the investment process for the firm’s consumer discretionary portfolio. Previously, he was the Chief Operations Officer and a Senior Research Analyst at Odyssey Value Advisors and earlier in his career a Financial Analyst in the investment banking group at ING Barings, LLC.

For a complete description of the advisory services provided to the Acquiring Fund, see the section of the Acquiring Fund’s Prospectus entitled “Who Manages the Funds” and the sections of the Acquiring Fund’s Statement of Additional Information entitled “Investment Adviser” and “Sub-Adviser.” Additional information about the portfolio manager compensation structure, other accounts managed by the portfolio managers and the portfolio managers’ ownership of securities in the respective Fund is provided in such Fund’s Statement of Additional Information.

Advisory and Other Fees

Pursuant to investment management agreements between Nuveen Fund Advisors and the Trust, on behalf of the Acquiring Fund, and Nuveen Fund Advisors and the Corporation, on behalf of the Target Fund, each Fund pays Nuveen Fund Advisors a fund-level fee, payable monthly, at the annual rates set forth below:

| | | | | | | | | | |

Target Fund - Management Fee | | | Acquiring Fund - Management Fee | |

Average Daily Net Assets | | Fee Rate | | | Average Daily Net Assets | | Fee Rate | |

For the first $125 million | | | 0.7000% | | | For the first $125 million | | | 0.5500% | |

For the next $125 million | | | 0.6875% | | | For the next $125 million | | | 0.5375% | |

For the next $250 million | | | 0.6750% | | | For the next $250 million | | | 0.5250% | |

For the next $500 million | | | 0.6625% | | | For the next $500 million | | | 0.5125% | |

For the next $1 billion | | | 0.6500% | | | For the next $1 billion | | | 0.5000% | |

For net assets over $2 billion | | | 0.6250% | | | For net assets over $2 billion | | | 0.4750% | |

In addition to the fund-level fee, each Fund pays a complex-level fee. The maximum complex level fee is 0.20% of the Fund’s average daily net assets, based upon complex-level “eligible assets” of $55 billion. Therefore, the maximum management fee rate for each Fund is the fund-level fee rate plus 0.20%. As complex-level eligible assets increase, the complex-level fee rate decreases pursuant to a breakpoint schedule. Each Fund’s individual complex-level fee rate is determined by taking the current overall complex-level fee rate, which is based on the aggregate amount of the “eligible assets” of all Nuveen funds, and making an upward adjustment to that rate (subject to the maximum 0.20% rate noted above) based upon the percentage of the Fund’s assets, if any, that are not “eligible assets.” For each Nuveen Fund that was formerly a First American Fund, including the Target Fund, the portion of the Fund’s assets classified as “eligible assets” excludes some or all of the Fund’s assets, based on the Fund’s size relative to its size at the time Nuveen Fund Advisors became the Fund’s investment adviser. As a result, the Target Fund’s complex-level fee rate is higher than the complex-level fee rate for the Acquiring Fund. As of March 31, 2013 the complex-level fee rate applicable to the Acquiring Fund was 0.1668%, and the complex-level fee rate applicable to the Target Fund was 0.2000%. Because the Target Fund has experienced net redemptions subsequent to the time Nuveen Fund Advisors became the Fund’s investment adviser, none of the Target Fund’s assets are eligible assets. The Acquiring Fund’s assets after the Reorganization attributable to the Target Fund will retain their status as ineligible assets for purposes of calculating the combined fund’s complex-level fee. As a result, the combined fund will have a higher complex-level fee rate than the Acquiring Fund. Information regarding the considerations by the Board with respect to the approval of the investment

14

management agreements for the Funds is currently available in the Target Fund’s and Acquiring Fund’s annual reports to shareholders for the fiscal year ended October 31, 2012 and September 30, 2012, respectively.

If the Reorganization is approved by shareholders and completed, Nuveen Fund Advisors has agreed to waive fees and/or reimburse expenses for the combined fund so that total annual fund operating expenses, excluding 12b-1 distribution and/or service fees, interest expenses, taxes, fees incurred in acquiring and disposing of portfolio securities and extraordinary expenses, after fee waivers and/or expense reimbursements do not exceed 1.15% (1.40% after September 30, 2014) of the average daily net assets of any share class. The expense limitation expiring September 30, 2014 may not be terminated or modified prior to that date without approval of the Board. The expense limitation of 1.40% in effect thereafter may be terminated or modified only with the approval of shareholders of the Acquiring Fund.

For the Acquiring Fund’s fiscal year ended September 30, 2012 and for the Target Fund’s fiscal year ended October 31, 2012, each Fund paid its investment adviser the following management fees (net of any fee waivers and expense reimbursements) as a percentage of average net assets:

| | | | |

| | | Management Fee Rate | |

Target Fund | | | 0.41 | % |

Acquiring Fund | | | — | * |

| * | For the most recent fiscal year, Nuveen Fund Advisors reimbursed expenses in excess of management fees. |

Each Fund has adopted a distribution and service plan (the “Plans”) pursuant to Rule 12b-1 under the 1940 Act. Under the Plans, for each Fund (a) Class A shares are subject to an annual service fee of 0.25% of the average daily net assets of Class A shares and (b) Class C shares are subject to (i) an annual distribution fee of 0.75% of the average daily net assets of Class C shares and (ii) an annual service fee of 0.25% of the average daily net assets of Class C shares. Class I shares are not subject to either distribution or service fees.

For a complete description of these arrangements for the Acquiring Fund, see the section of the Fund’s Prospectus entitled “What Share Classes We Offer” and the section of the Fund’s Statement of Additional Information entitled “Distributor.”

Board Members and Officers

The same individuals constitute the Board of each Fund, and the Funds have the same officers. The management of each Fund, including general oversight of the duties performed by Nuveen Fund Advisors under the Investment Management Agreement for each Fund, is the responsibility of the Board. There are currently ten members of the Board, one of whom is an “interested person” (as defined in the 1940 Act) and nine of whom are not interested persons (the “independent board members”). The names and business addresses of the board members and officers of the Acquiring Fund and their principal occupations and other affiliations during the past five years are set forth under “Management” in the Statement of Additional Information for the Acquiring Fund, which is incorporated herein by reference.

Distribution, Purchase, Redemption, Exchange of Shares and Dividends

The Target Fund offers three classes of shares: Class A, Class C and Class I shares. The Acquiring Fund offers four classes of shares: Class A, Class C, Class R3 and Class I shares. You may

15

purchase, redeem or exchange shares of the Funds on any business day, which is any day the New York Stock Exchange is open for business. You may purchase, redeem or exchange shares of each Fund through a financial advisor or other financial intermediary or directly from such Fund. No initial sales charge or contingent deferred sales charges will be imposed on shares of the Acquiring Fund received or shares of the Target Fund exchanged in connection with the Reorganization. Any purchases of any class of shares made after the Reorganization will be subject to the standard fee structure applicable to such class. Class R3 shares of the Acquiring Fund are available only through certain retirement plans and are not offered through this Proxy Statement/Prospectus. The Acquiring Fund’s initial and subsequent investment minimums generally are set forth in the following table, although the Fund may reduce or waive the minimums in some cases. The Target Fund’s investment minimums for Class A, Class C and Class I shares are identical to the Acquiring Fund’s investment minimums for Class A, Class C and Class I shares, respectively.

| | | | |

| | | Class A and Class C | | Class I |

| Eligibility and Minimum Initial Investment | | $3,000 for all accounts except: • $2,500 for Traditional/Roth IRA accounts. • $2,000 for Coverdell Education Savings Accounts. • $250 for accounts opened through fee-based programs. • No minimum for retirement plans. | | Available only through fee-based programs and certain retirement plans, and to other limited categories of investors as described in the prospectus. $100,000 for all accounts except: • $250 for clients of financial intermediaries and family offices that have accounts holding Class I shares with an aggregate value of at least $100,000 (or that are expected to reach this level). • No minimum for eligible retirement plans and certain other categories of eligible investors as described in the prospectus. |

| Minimum Additional Investment | | $ 100 | | No minimum. |

For a complete description of purchase, redemption and exchange options, see the section of the Acquiring Fund’s Prospectus entitled “How You Can Buy and Sell Shares,” and “General Information,” and the section of the Acquiring Fund’s Statement of Additional Information entitled “Purchase and Redemption of Fund Shares.”

Each Fund normally declares and pays dividends from net investment income, if any, annually. Each Fund declares and pays any taxable capital gains or other taxable distributions once a year at year end. If the Reorganization is approved by the shareholders of the Target Fund, the Target Fund intends to distribute to its shareholders, prior to the closing of the Reorganization, all its net investment income and net capital gains, if any, for the fiscal period ending on the Closing Date. Due to the Target Fund’s capital loss carryforwards, a net capital gain distribution is not expected. However, in light of unrealized capital gains currently in each Fund’s portfolio, Target Fund shareholders may be subject to higher capital gain distributions in the future than they would have been absent the Reorganization. See “The Proposed Reorganization—Material Federal Income Tax Consequences” below.

16

Tax Information

The Funds’ distributions are taxable and will generally be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred account, such as an IRA or 401(k) plan.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of a Fund through a broker-dealer or other financial intermediary (such as a bank or financial advisor), the Fund, its distributor or its investment adviser may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary and your salesperson to recommend the Fund over another investment. Ask your financial advisor or visit your financial intermediary’s website for more information.

Further Information

Additional information concerning the Acquiring Fund and Target Fund is contained in this Proxy Statement/Prospectus and additional information regarding the Acquiring Fund is contained in the accompanying Acquiring Fund prospectus. The cover page of this Proxy Statement/Prospectus describes how you may obtain further information.

THE PROPOSED REORGANIZATION

The proposed Reorganization will be governed by the Agreement, a form of which is attached as Appendix I. The Agreement provides that the Target Fund will transfer all of its assets to the Acquiring Fund solely in exchange for the issuance of full and fractional shares of the Acquiring Fund and the assumption by the Acquiring Fund of all the liabilities of the Target Fund. The closing of the Reorganization will take place at the close of business on the Closing Date. The following discussion of the Agreement is qualified in its entirety by the full text of the Agreement.

The Target Fund will transfer all of its assets to the Acquiring Fund, and in exchange, the Acquiring Fund will assume all the liabilities of the Target Fund and deliver to the Target Fund a number of full and fractional shares of the Acquiring Fund having a net asset value equal to the value of the assets of the Target Fund less the liabilities of the Target Fund assumed by the Acquiring Fund. At the designated time on the Closing Date as set forth in the Agreement, the Target Fund will distribute in complete liquidation and termination of the Target Fund, pro rata to its shareholders of record, by class, all Acquiring Fund shares received by the Target Fund. This distribution will be accomplished by the transfer of the Acquiring Fund shares credited to the account of the Target Fund on the books of the Acquiring Fund to open accounts on the share records of the Acquiring Fund in the name of the Target Fund shareholders, and representing the respective pro rata number of Acquiring Fund shares due such shareholders. All issued and outstanding shares of the Target Fund will be canceled on the books of the Target Fund. As a result of the proposed Reorganization, each Target Fund Class A, Class C and Class I shareholder will receive a number of Acquiring Fund Class A, Class C and Class I shares, respectively, equal in value, as of the close of regular trading on the New York Stock Exchange on the Closing Date, to the value of the Target Fund Class A, Class C and Class I shares surrendered by such shareholder.

The consummation of the Reorganization is subject to the terms and conditions of, and the representations and warranties being true as set forth in, the Agreement. The Agreement may be

17

terminated by mutual agreement of the Funds. In addition, either Fund may at its option terminate the Agreement at or before the Closing due to (i) a breach by any other party of any representation, warranty, or agreement to be performed at or before the Closing, if not cured within 30 days, (ii) a condition precedent to the obligations of the terminating party that has not been met and it reasonably appears that it will not or cannot be met, or (iii) a determination by the Board that the consummation of the transactions contemplated by the Agreement is not in the best interests of a Fund.