SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of June, 2020

Commission File Number 1-14668

COMPANHIA PARANAENSE DE ENERGIA

(Exact name of registrant as specified in its charter)

Energy Company of Paraná

(Translation of Registrant's name into English)

Rua Coronel Dulcídio, 800

80420-170 Curitiba, Paraná

Federative Republic of Brazil

+55 (41) 3331-4011

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

Companhia Paranaense de Energia

Corporate Taxpayer's ID (CNPJ/MF) 76.483.817/0001-20

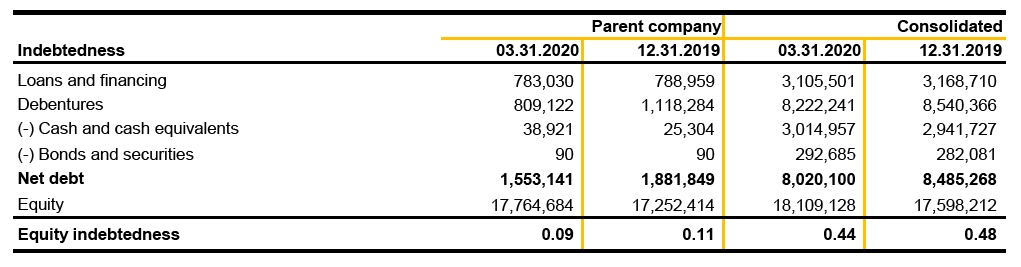

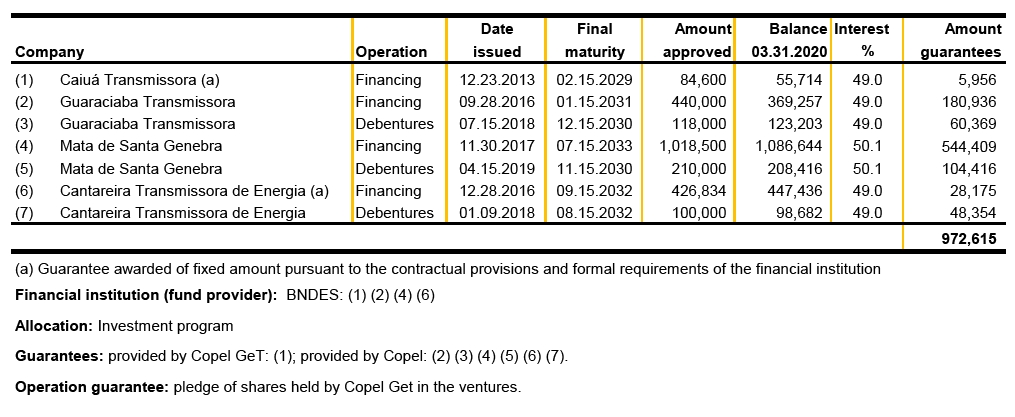

State Registration 10146326-50

Publicly-Held Company - CVM 1431-1

www.copel.com copel@copel.com

Rua Coronel Dulcídio, 800, Batel - Curitiba - PR

CEP 80420-170

QUARTERLY INFORMATION

March / 2020

CONTENTS

| | | |

| FINANCIAL STATEMENTS | | 3 |

| Statements of Financial Position | 3 | |

| Statements of Income | 5 | |

| Statements of Comprehensive Income | 6 | |

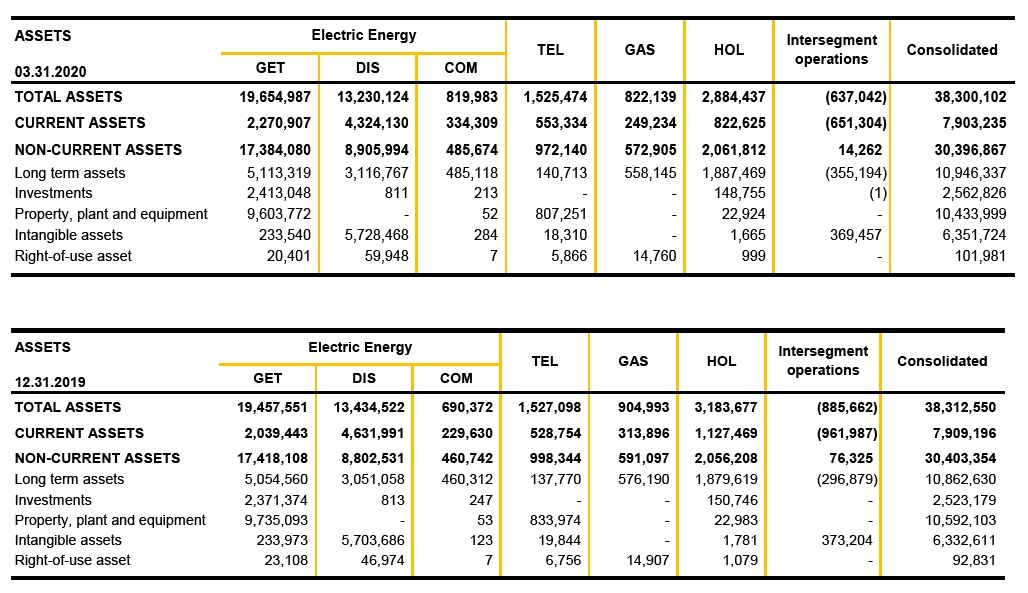

| Statements of Changes in Equity | 7 | |

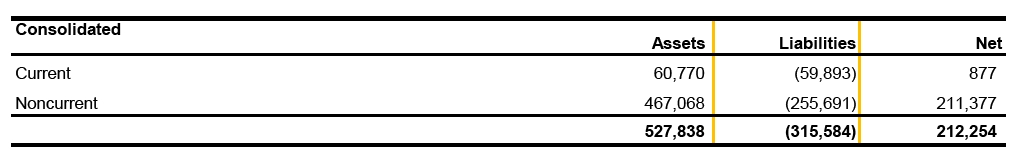

| Statements of Cash Flows | 8 | |

| Statements of Added Value | 10 | |

| NOTES TO THE FINANCIAL STATEMENTS | | 12 |

| 1 | Operations | 12 | |

| 2 | Concessions and Authorizations | 19 | |

| 3 | Basis of Preparation | 22 | |

| 4 | Significant Accounting Policies | 24 | |

| 5 | Cash and Cash Equivalents | 24 | |

| 6 | Bonds and Securities | 25 | |

| 7 | Trade Accounts Receivable | 26 | |

| 8 | CRC Transferred to the Paraná State Government | 28 | |

| 9 | Net Sectorial Financial Assets and Liabilities | 29 | |

| 10 | Accounts Receivable - Concessions | 30 | |

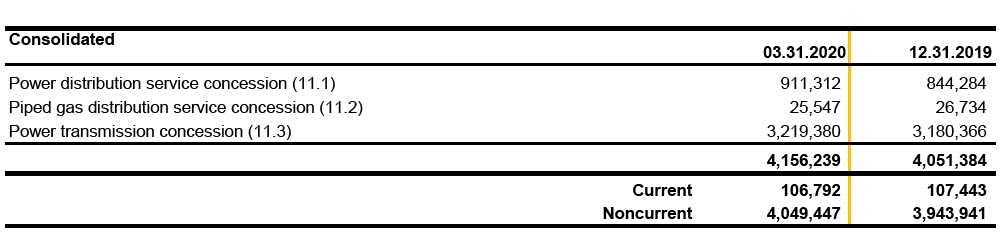

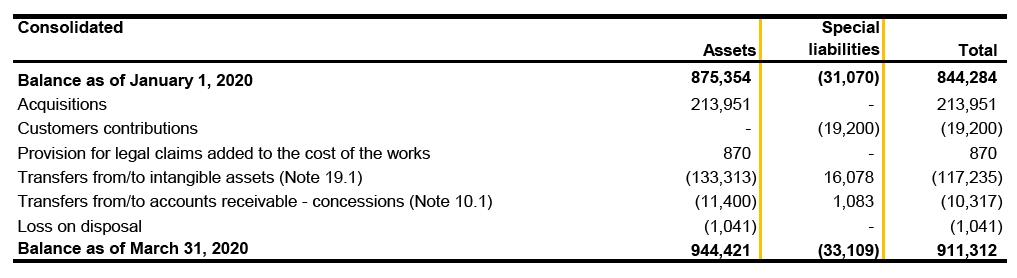

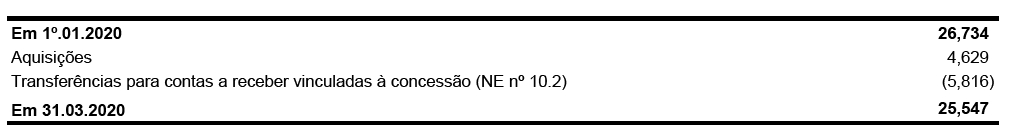

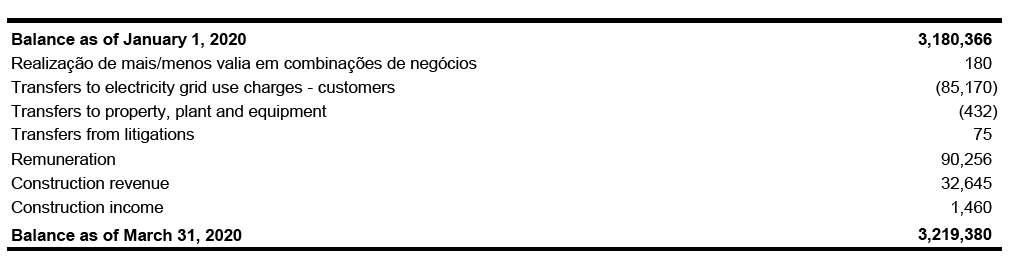

| 11 | Contract assets | 32 | |

| 12 | Other Receivables | 33 | |

| 13 | Taxes | 34 | |

| 14 | Prepaid Expenses | 36 | |

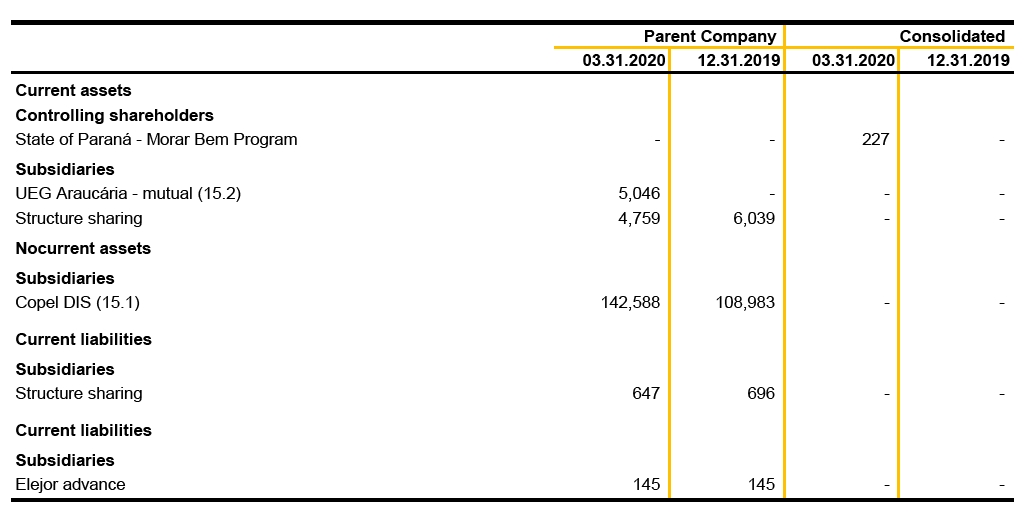

| 15 | Receivables from Related Parties | 37 | |

| 16 | Judicial Deposits | 38 | |

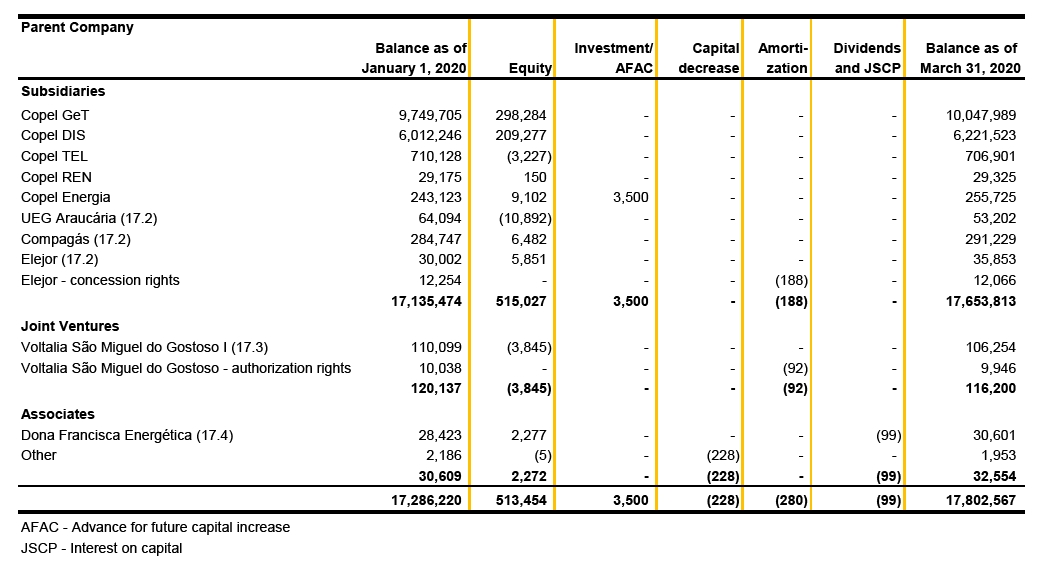

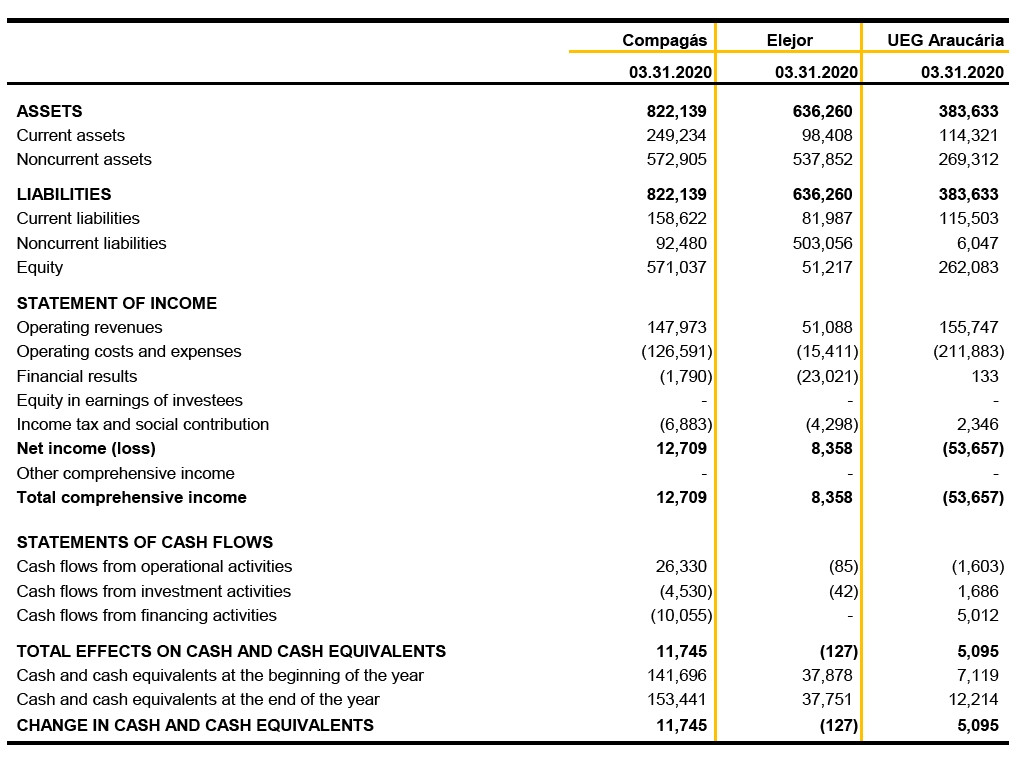

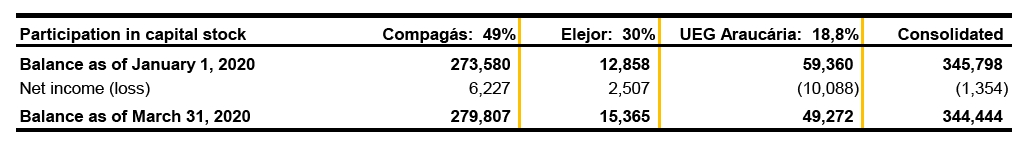

| 17 | Investments | 38 | |

| 18 | Property, Plant and Equipment | 41 | |

| 19 | Intangible assets | 44 | |

| 20 | Payroll, Social Charges and Accruals | 46 | |

| 21 | Accounts Payable to Suppliers | 46 | |

| 22 | Loans and Financing | 47 | |

| 23 | Debentures | 51 | |

| 24 | Post-employment Benefits | 53 | |

| 25 | Sectorial Charges Due | 55 | |

| 26 | Research and Development and Energy Efficiency | 55 | |

| 27 | Accounts Payable Related to Concessions | 56 | |

| 28 | Right-of-use asset and lease liability | 56 | |

| 29 | Other Accounts Payable | 58 | |

| 30 | Provisions for Legal Claims and Contingent Liabilities | 58 | |

| 31 | Equity | 65 | |

| 32 | Net Operating Revenue | 66 | |

| 33 | Operating Costs and Expenses | 69 | |

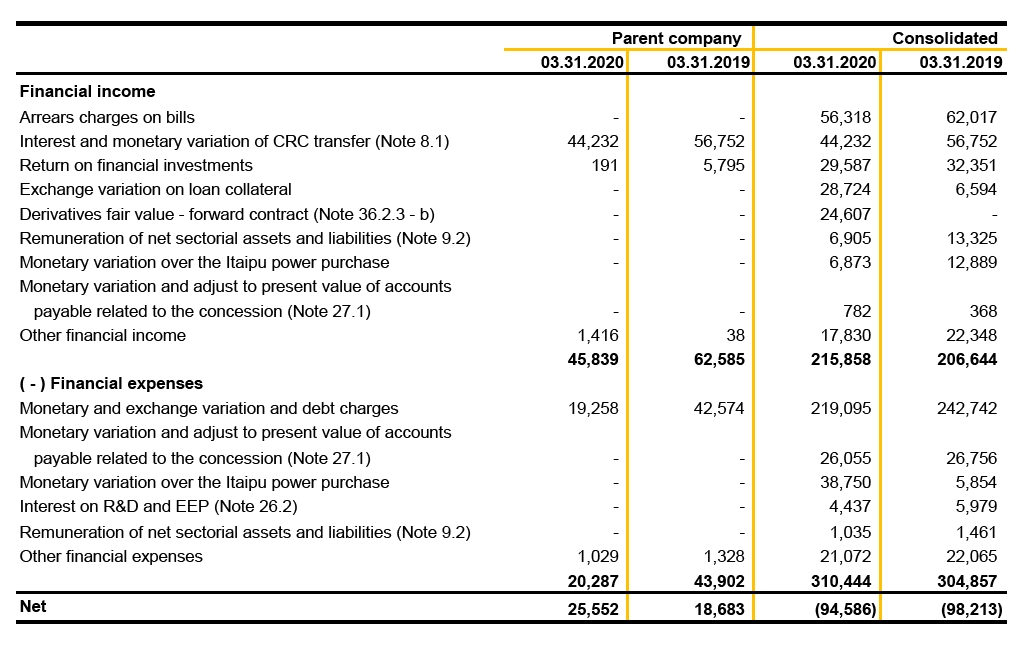

| 34 | Financial Results | 73 | |

| 35 | Operating Segments | 73 | |

| 36 | Financial Instruments | 77 | |

| 37 | Related Party Transactions | 93 | |

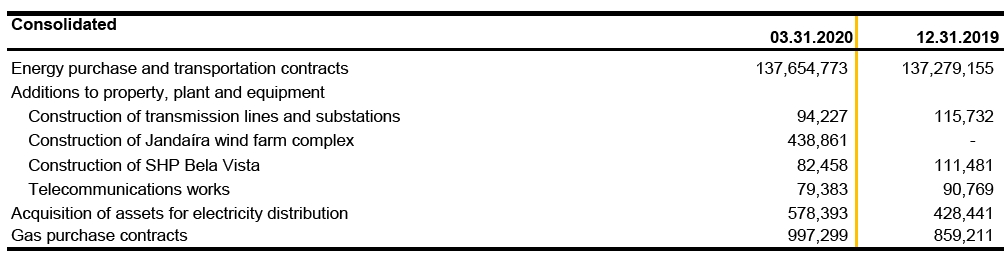

| 38 | Commitments | 96 | |

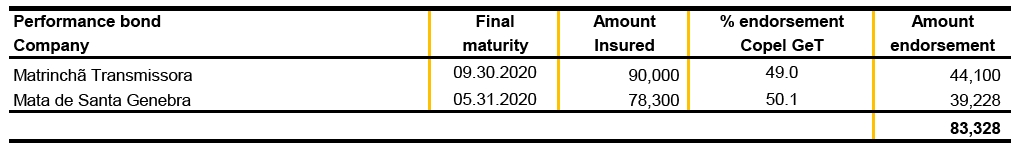

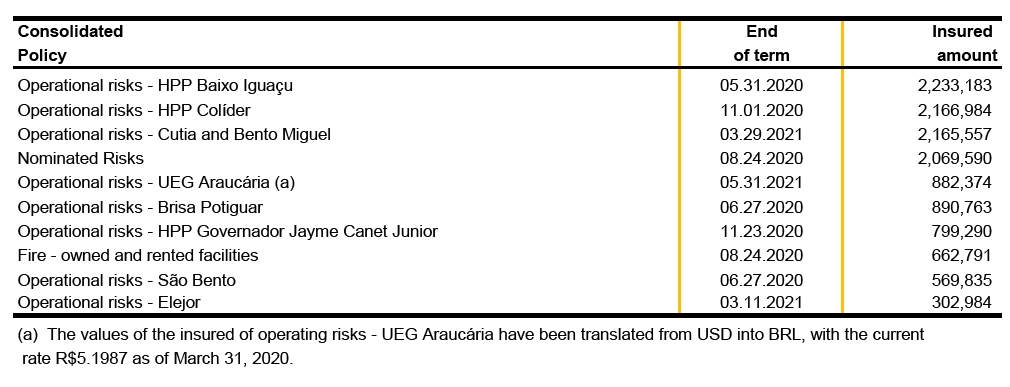

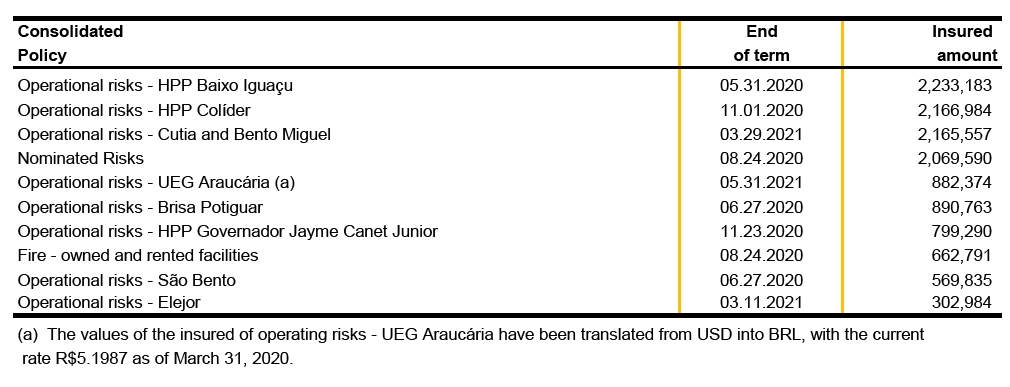

| 39 | Insurance | 97 | |

| 40 | Additional information to the Statement of Cash Flows | 97 | |

| 41 | Subsequent events | 98 | |

| COMMENTS ON PERFORMANCE | | 100 |

| 1 | Distribution Lines | 100 | |

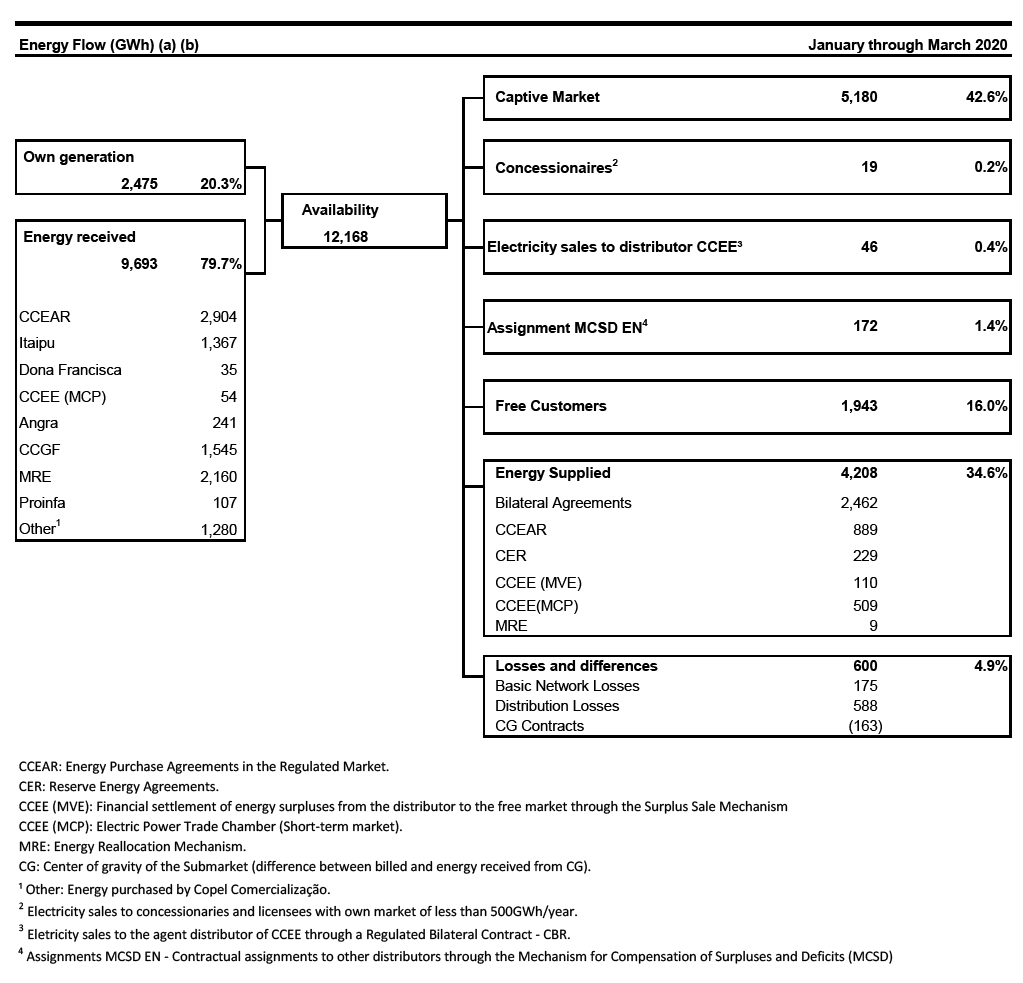

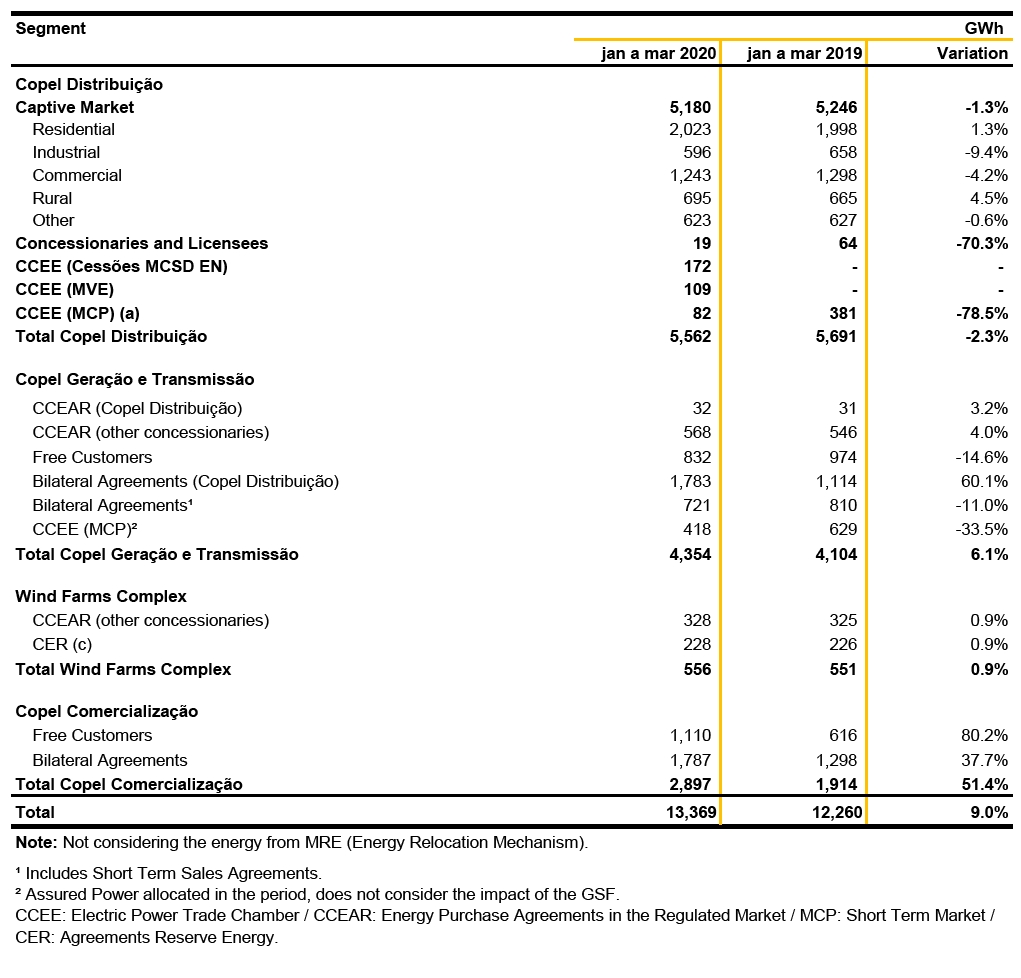

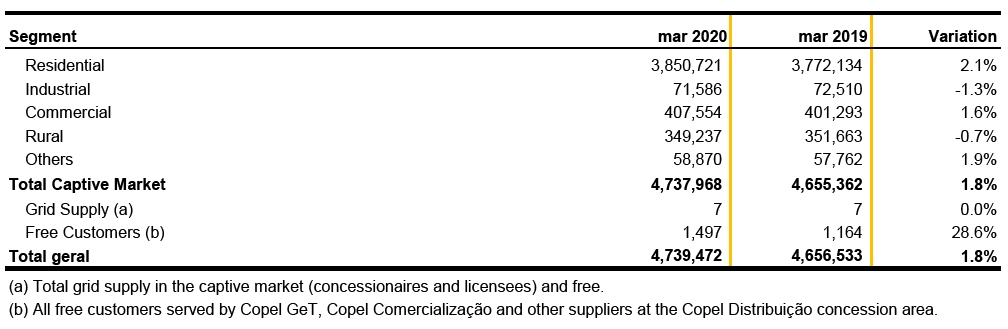

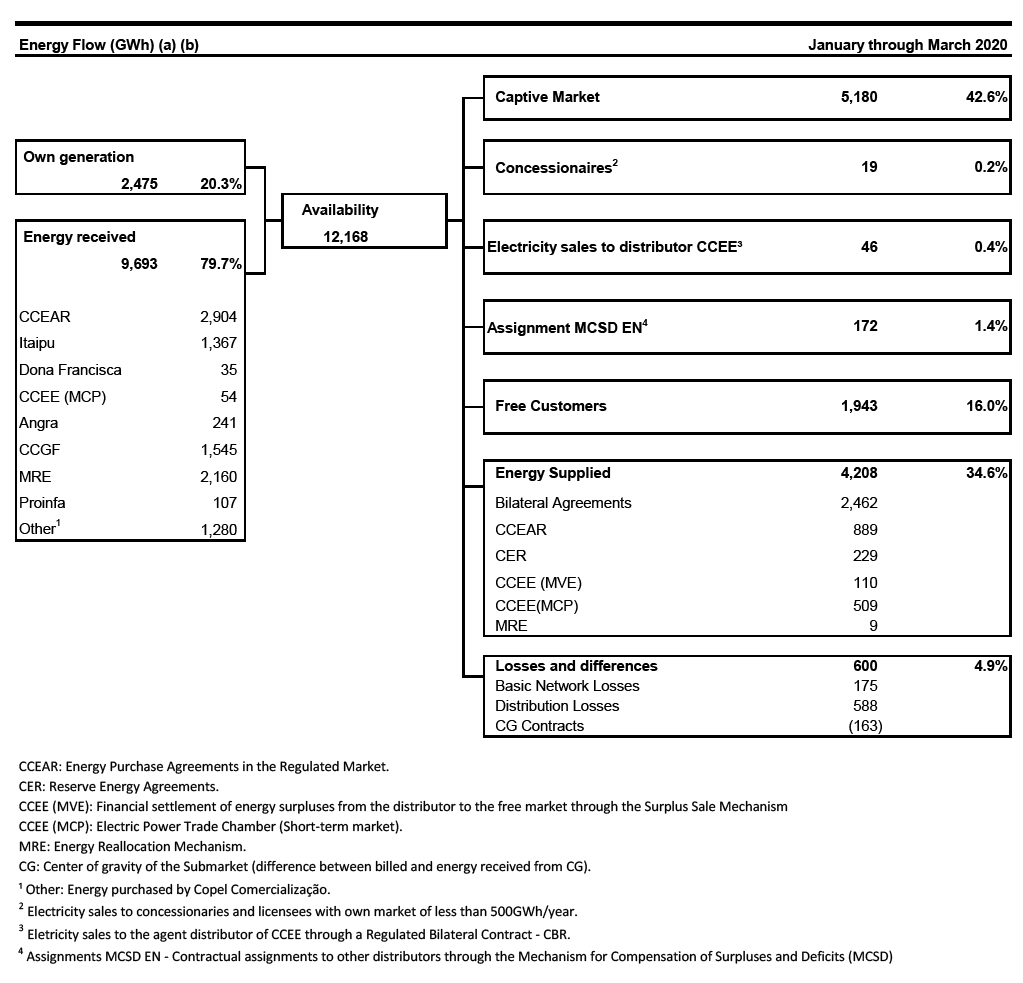

| 2 | Power Market | 101 | |

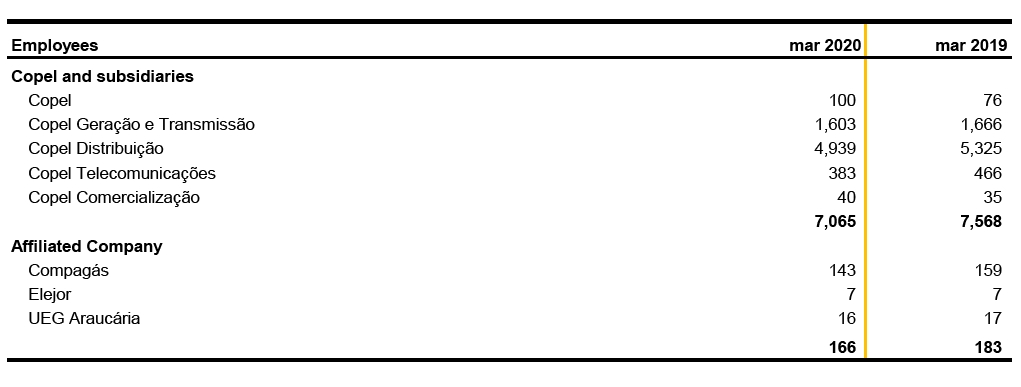

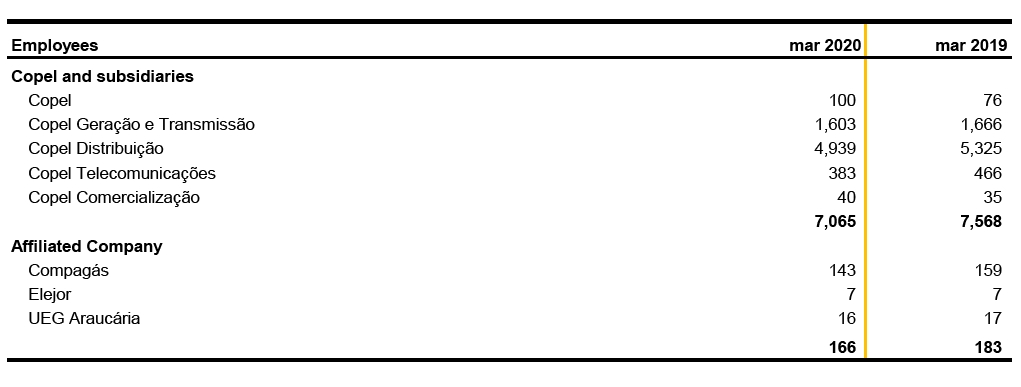

| 3 | Management | 104 | |

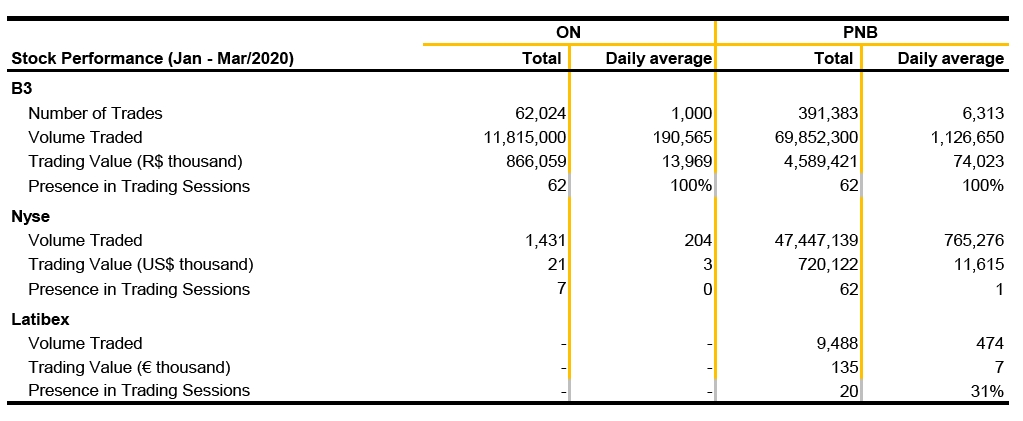

| 4 | Market Relations | 105 | |

| 5 | Tariffs | 106 | |

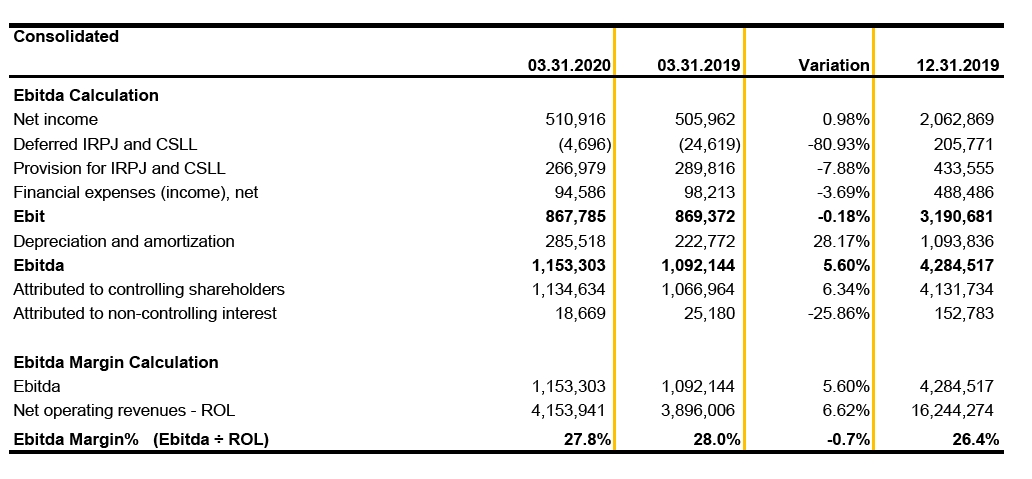

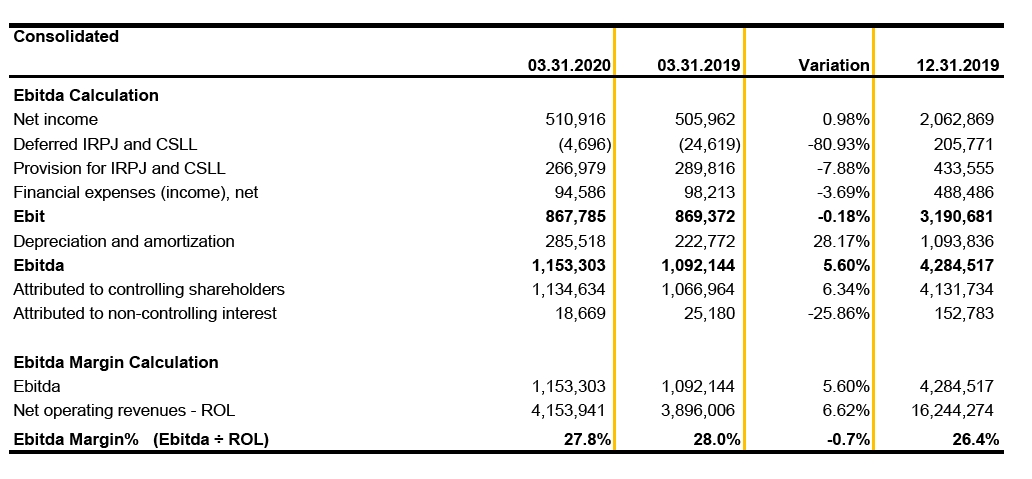

| 6 | Economic and Financial Results | 107 | |

| COMPOSITION OF GROUPS RESPONSIBLE FOR GOVERNANCE | | 110 |

| REPORT ON REVIEW OF INTERIM FINANCIAL INFORMATION | | 111 |

| SUPERVISORY BOARD'S OPINION | | 113 |

| S T A T E M E N T | | 114 |

FINANCIAL STATEMENTS

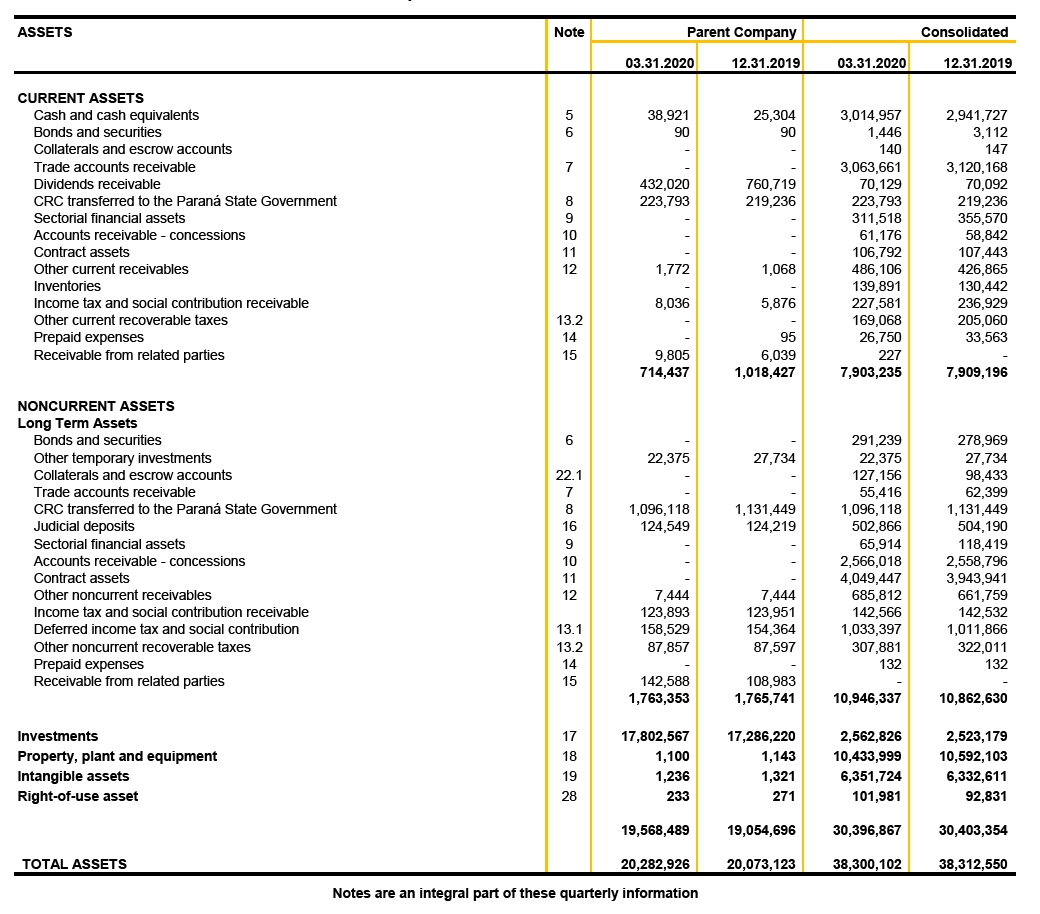

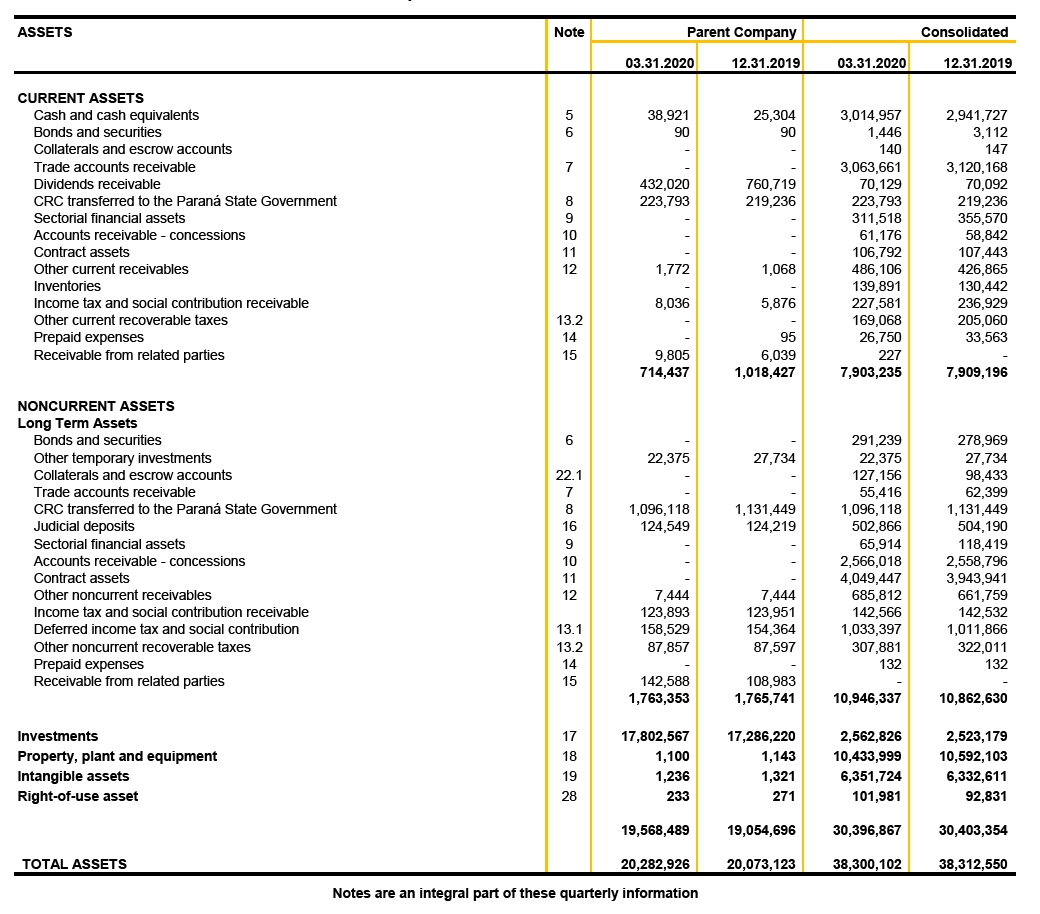

Statements of Financial Position

as of March 31, 2020 and December 31, 2019

All amounts expressed in thousands of Brazilian reais

3

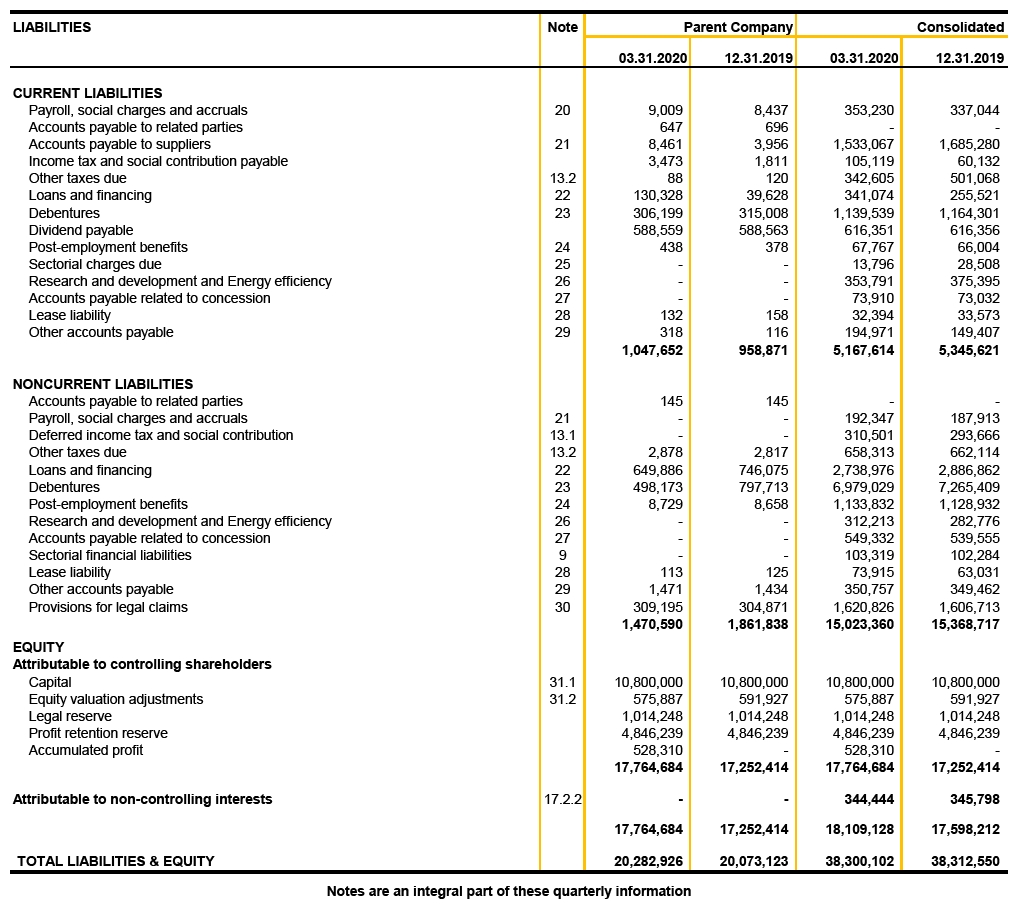

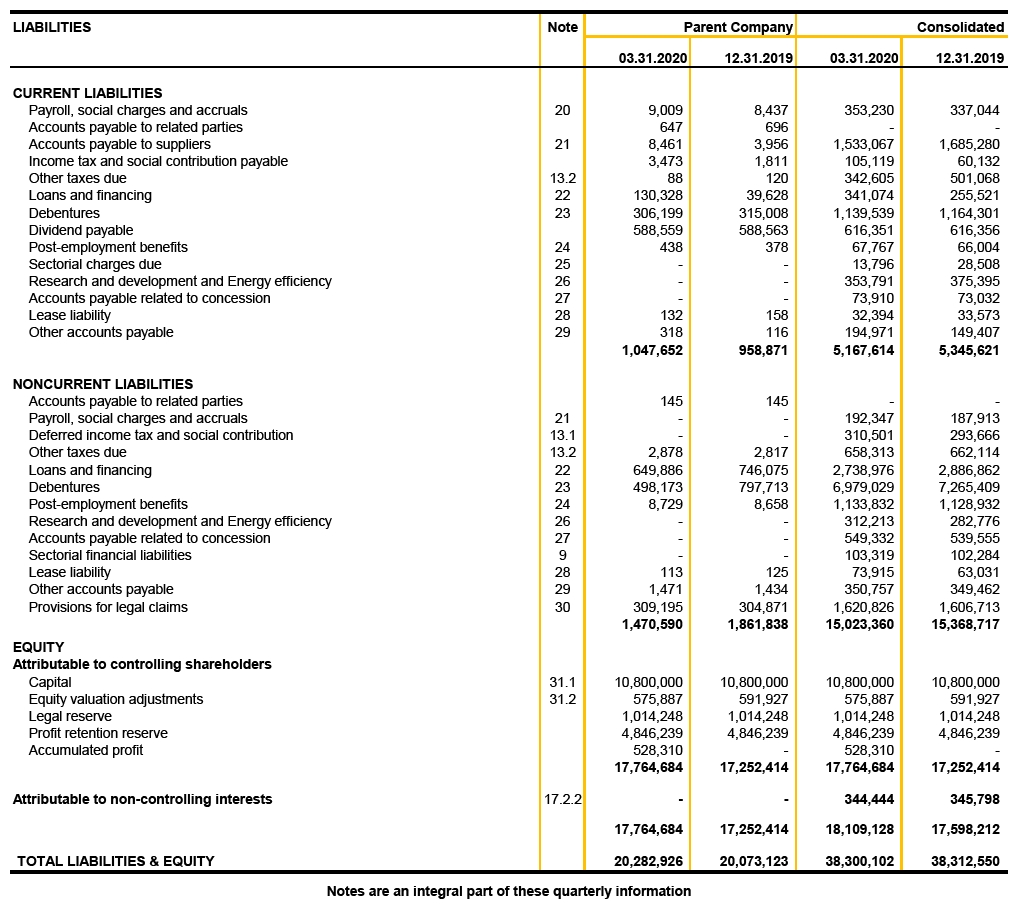

Statements of Financial Position

as of March 31, 2020 and December 31, 2019 (continued)

All amounts expressed in thousands of Brazilian reais

4

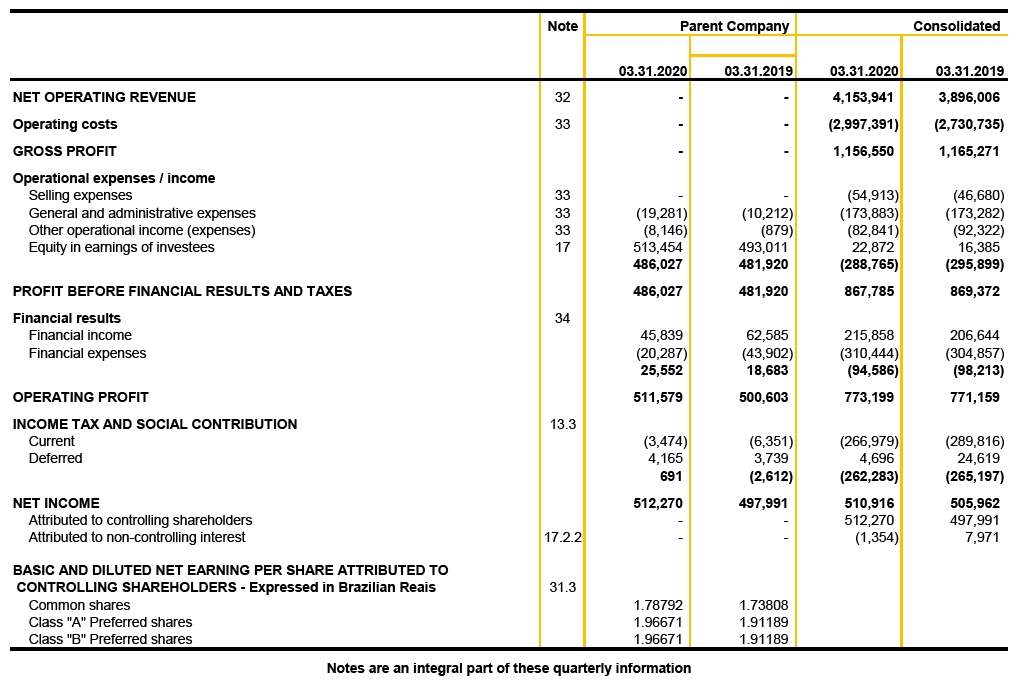

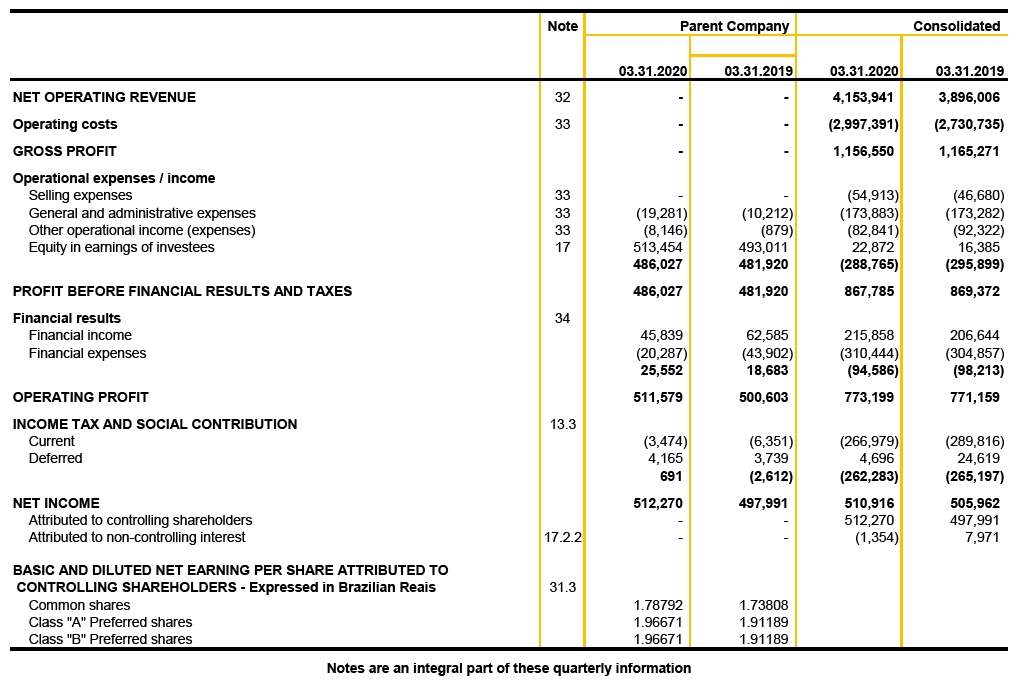

for the quarter ended March 31, 2020 and 2019

All amounts expressed in thousands of Brazilianreais

5

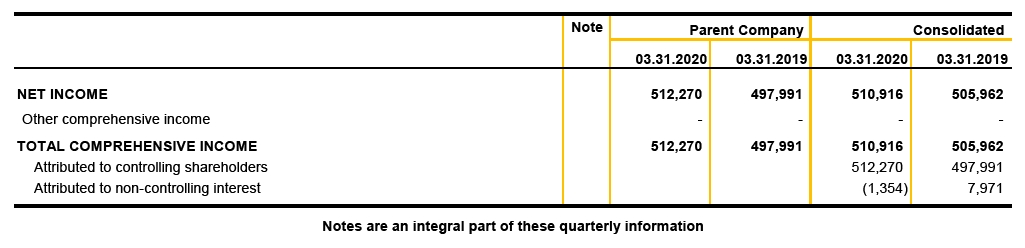

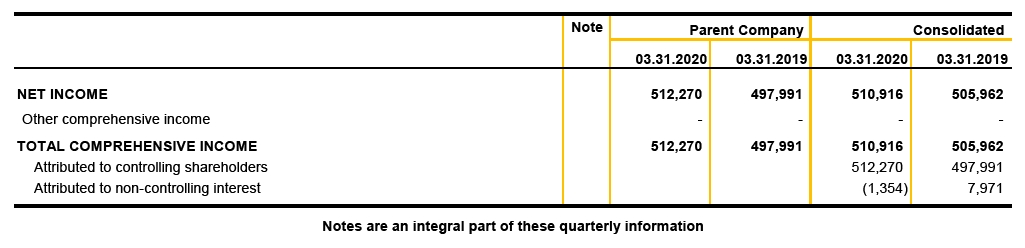

Statements of Comprehensive Income

for the quarter ended March 31, 2020 and 2019

All amounts expressed in thousands of Brazilianreais

6

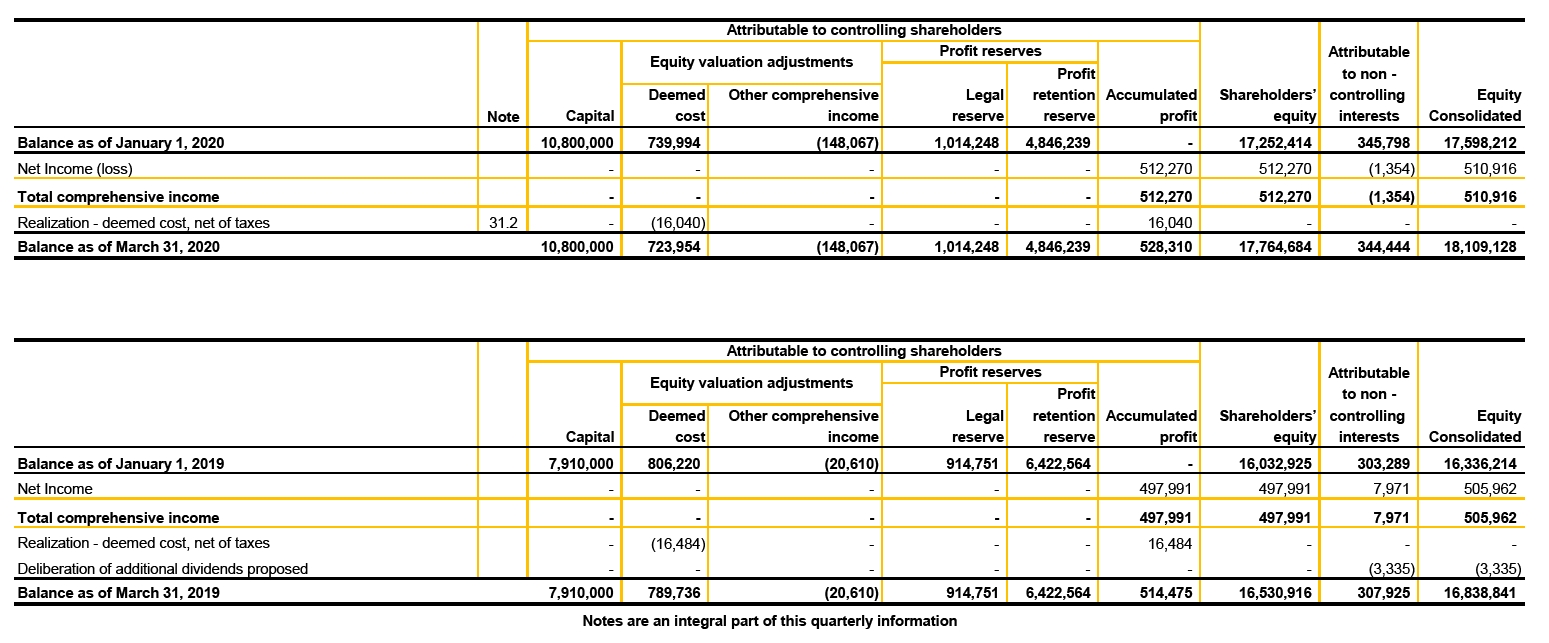

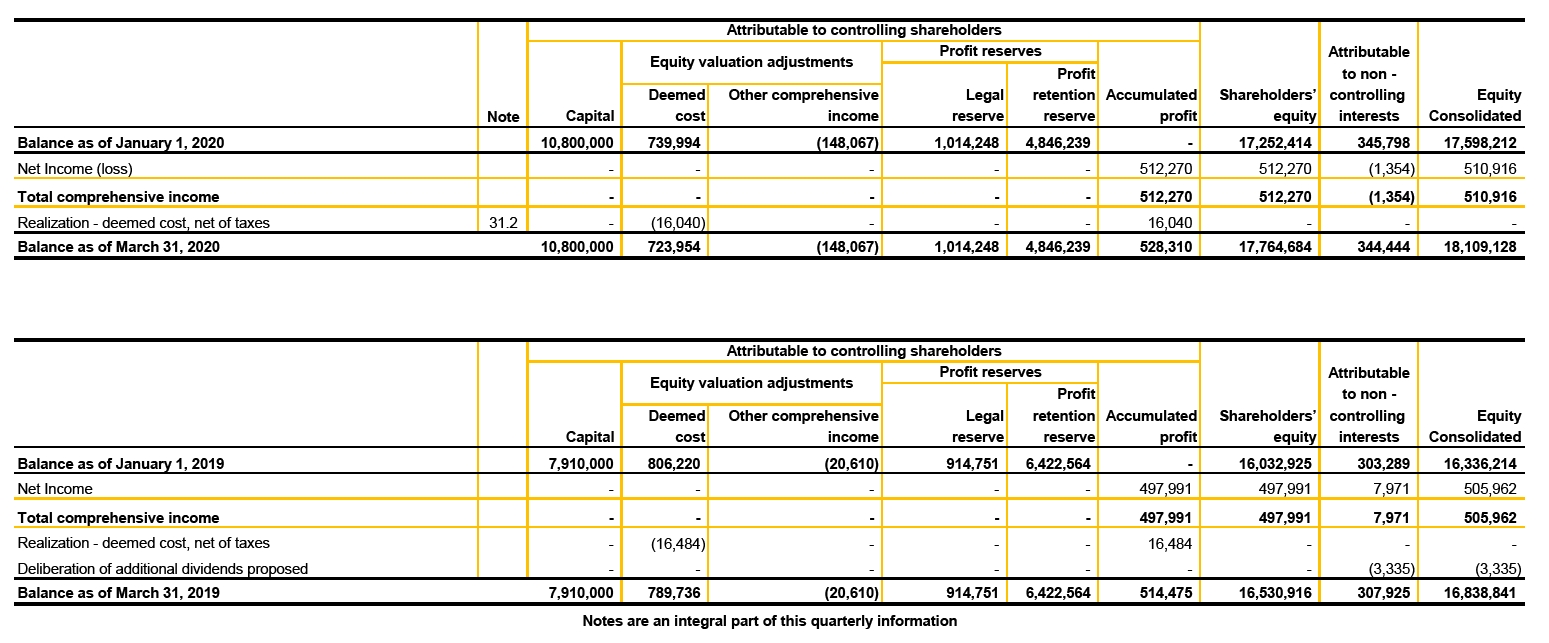

Statements of Changes in Equity

for the quarter ended March 31, 2020 and 2019

All amounts expressed in thousands of Brazilianreais

7

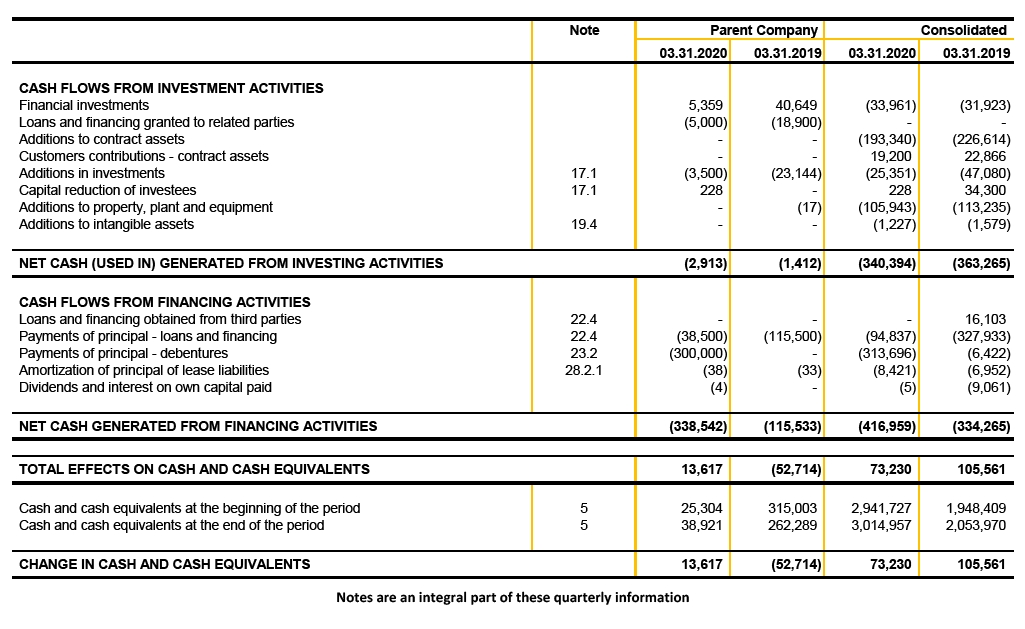

Statements of Cash Flows

for the quarter ended March 31, 2020 and 2019

All amounts expressed in thousands of Brazilianreais

8

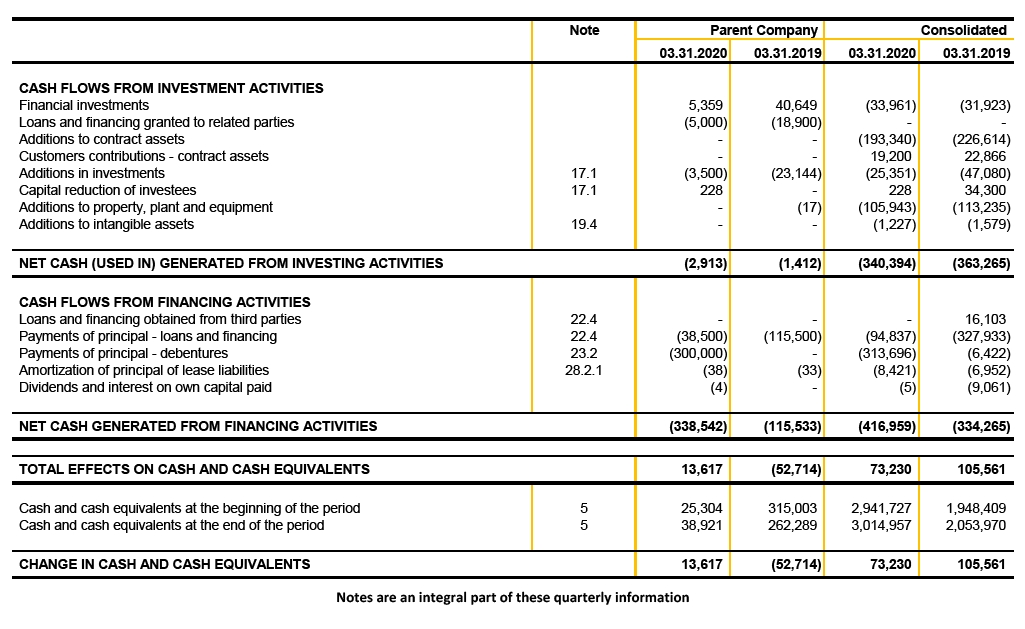

Statements of Cash Flows

for the quarter ended March 31, 2020 and 2019 (continued)

All amounts expressed in thousands of Brazilianreais

9

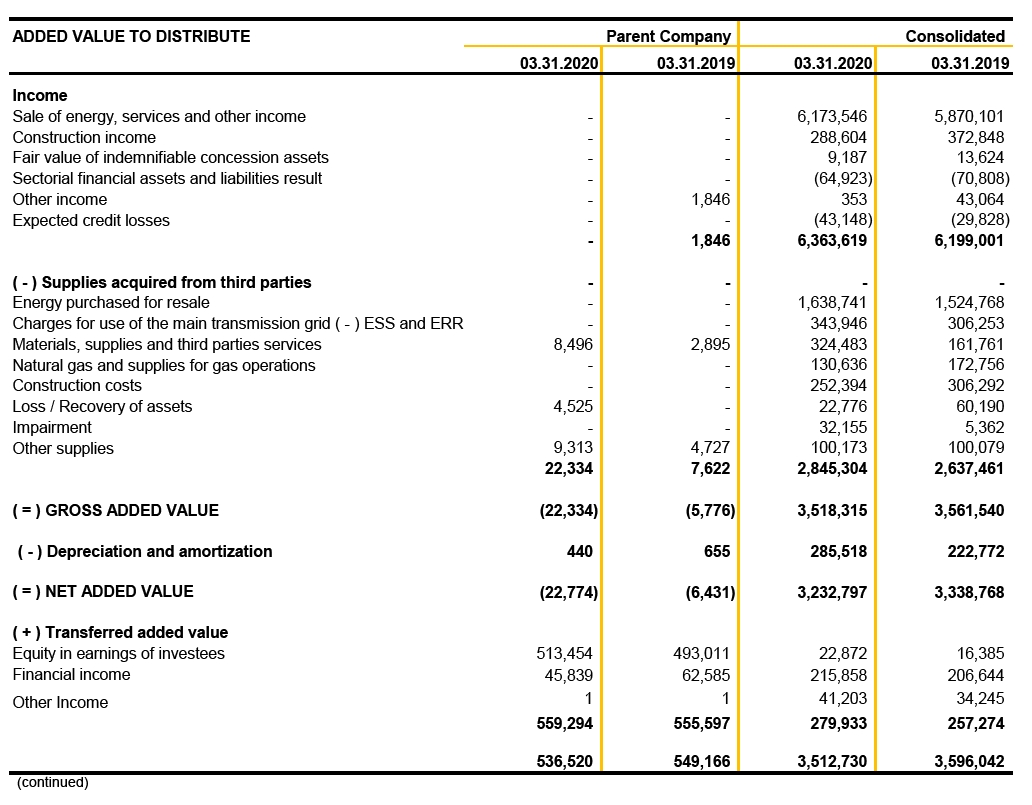

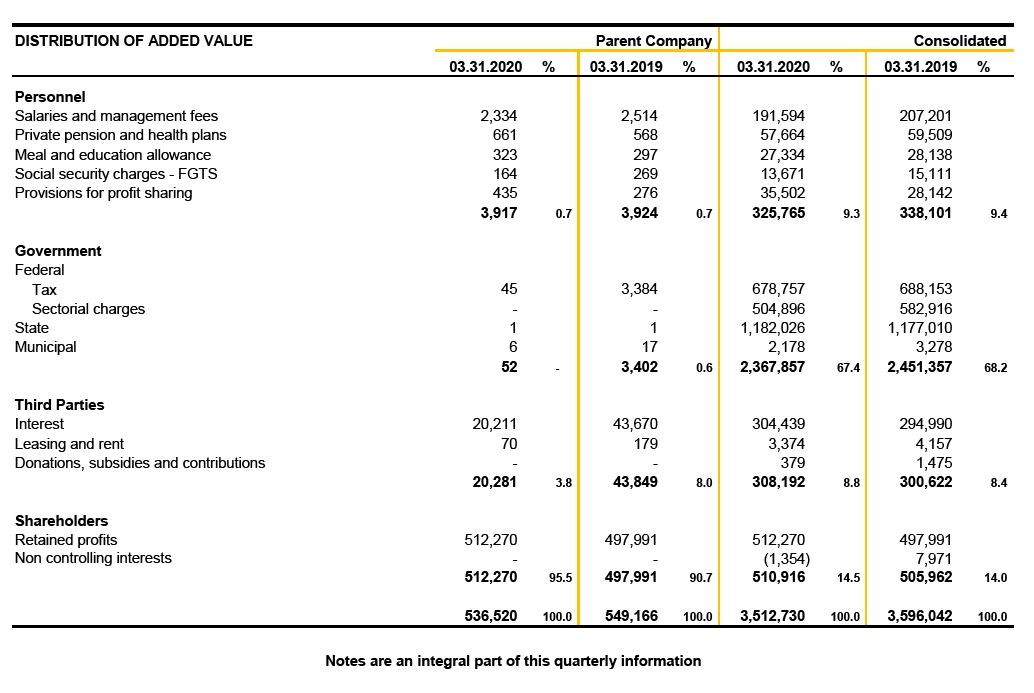

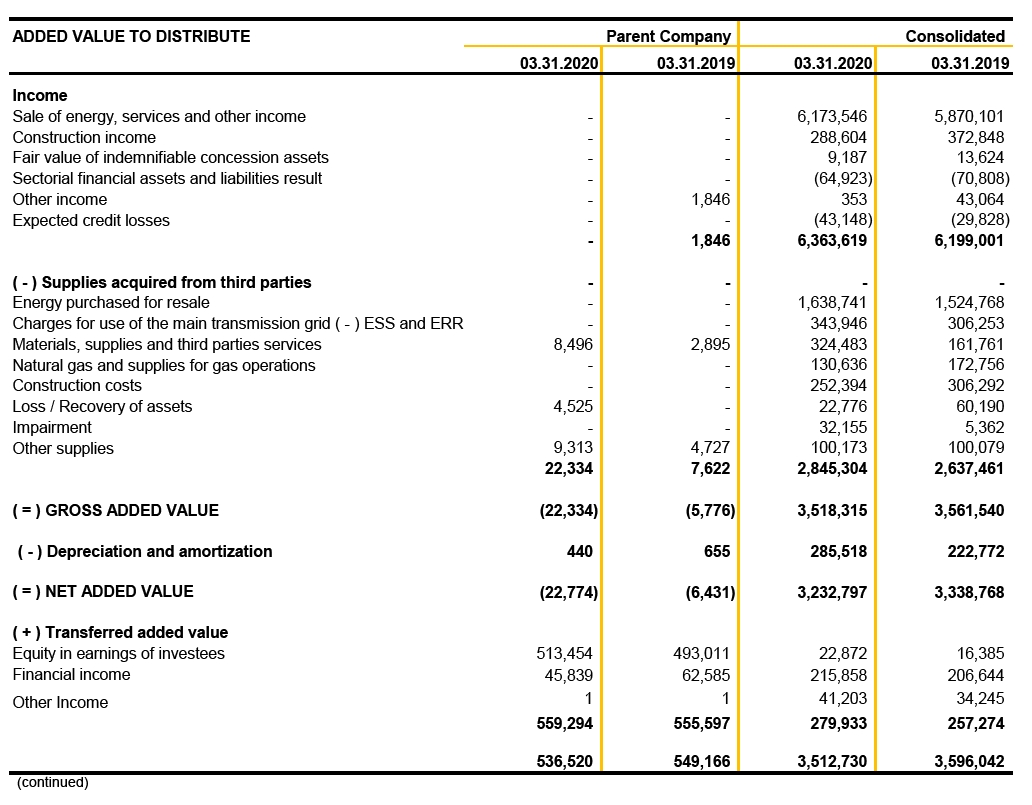

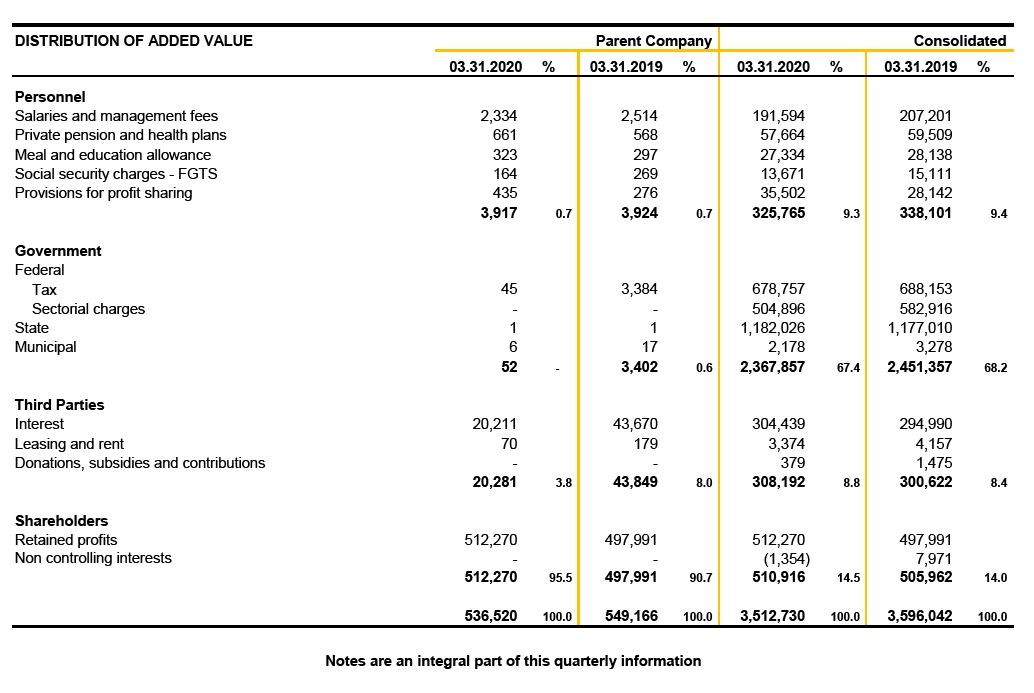

Statements of Added Value

for the quarter ended March 31, 2020 and 2019

All amounts expressed in thousands of Brazilian reais

10

Statements of Added Value

for the quarter ended March 31, 2020 and 2019 (continued)

All amounts expressed in thousands of Brazilian reais

11

NOTES TO THE FINANCIAL STATEMENTS

As of March 31, 2020

All amounts expressed in thousands of Brazilianreais

1 Operations

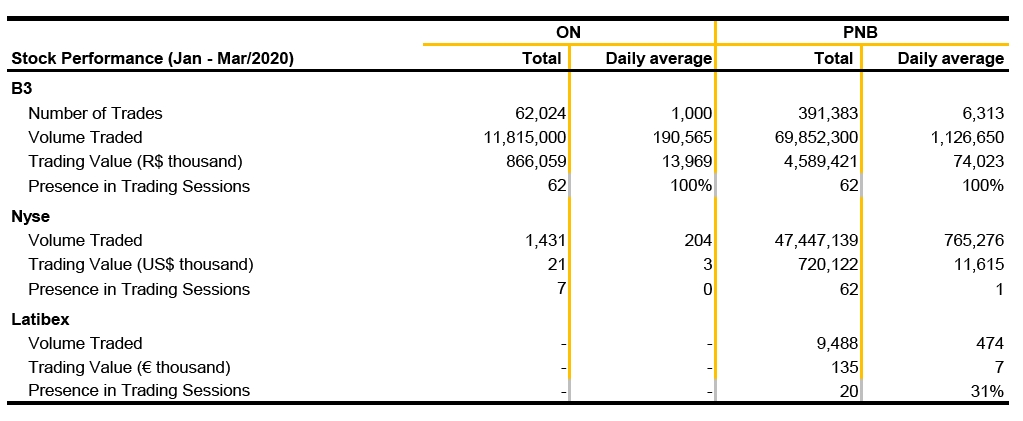

Companhia Paranaense de Energia (Copel, Company or Parent Company), with its head office located at Rua Coronel Dulcídio, 800, Curitiba - State of Paraná, is a publicly-held mixed capital company controlled by the State of Paraná and its shares are traded at Corporate Governance Level 1 of the Special Listing Segments of B3 S.A. - Brasil, Bolsa Balcão Stock Exchange and also on the New York Stock Exchange (NYSE) and on the Madrid Stock Exchange, in the Latin American segment (Latibex).

The core activities of Copel and its subsidiaries, which are regulated by the Brazilian Electricity Regulatory Agency (ANEEL), linked to the Brazilian Ministry of Mines and Energy (MME), are to carry out research, study, planning, and asset building activities related to the generation, transformation, distribution and trading of energy in any of its forms, primarily electricity. Furthermore, Copel participates in consortiums and in private sector and mixed-capital companies for the purpose of engaging in activities, primarily in the fields of energy, telecommunications and natural gas.

a) Coronavirus pandemic (Covid-19) and its impacts

Coronavirus is a family of viruses that causes respiratory infections. The new coronavirus was discovered in 2019 after cases registered in China and causes the disease called Covid-19, which has clinical symptoms ranging from asymptomatic infections to severe respiratory conditions.

In the first weeks of 2020, the epidemic affected regions in Asia and the Middle East, being limited to some regions in China, South Korea and Iran. In mid-February, the first cases of Covid-19 were identified in Europe, specifically in Italy, with a rapid escalation of its spread across Europe. On 02.26.2020 the first case of coronavirus infection was identified in Brazil, in the city of São Paulo and on 03.11.2020, WHO attributed the status of pandemic to coronavirus, in view of the spread of contamination throughout the world. In Brazil, federal, state and municipal governments have implemented several measures to deal with the public healthemergency. In the state of Paraná, measures included social isolation and restrictions on the operation of non-essential activities as a means to slow the spread of the disease.

As of March 2020, based on all the events mentioned above, Copel's Management issued rules that aim to ensure compliance with the measures to contain the spread of the disease in the Company and minimize its impacts and potential impacts on the administrative, operations and economic-financial areas.

12

Accordingly, Copel established a Contingency Commission, whose objective is to monitor and mitigate the impacts and consequences in the main activities of the Company, as new risks may arise that may impact Copel. The 4 pillars defined are: (i) safety of personnel, (ii) continuity of essential activities, (iii) monitoring of the guidelines and requirements of regulatory bodies, and (iv) preservation of adequate financial conditions to withstand the crisis.

Among the main initiatives implemented by the Company, there are actions to prevent and mitigate the effects of contagion in the workplace, such as: adoption of home office in areas where it is possible to adopt this format, travel restrictions, meetings by video conference, daily monitoring of the health and well-being of employees and contingency protocols in order to fully maintain the operations of the electric power, telecommunications and piped gas infrastructure, preserving the health of its professionals, their safe access to locations, an environment that preserves distance between individuals, hygiene and access to personal protective equipment

Likewise, Copel has adopted several activities in favor of its customers, maintaining the reliability and availability of its plants, the transmission and distribution systems of electric power and gas and telecommunications, so that they can remain connected and take advantage of Company services in this critical moment of pandemic and social distancing. Copel and its employees go to great lengths to ensure that Copel customers and their families remain healthy and safe in their homes, maintaining all the services that contribute to providing comfort and connectivity for everyone.

In this scenario, for the purposes of preparing and disclosing the interim financial statements for the quarter ended March 31, 2020, the Company's management evaluated its estimates in order to identify the possible impacts of Covid-19 on the Company's business, as follows:

13

a.1) Expected credit losses

A potentially relevant risk in the emergence of Covid-19 is related to customer default. In this scenario, the Company maintains regular contact with its main customers, adding flexibility to the collection policy during the pandemic period and increasing the level of digitalization in the relationship with Copel.

The Company's accounts receivable position as of March 31, 2020, as well as the estimates of expected credit losses reflect in a timely manner the best analysis by Management at this time on the quality and recoverability of this financial asset.

Although the loss indicator has not significantly worsened, the Company may face pressure on this indicator throughout the year.

In the first quarter of 2020, there was an increase in the estimate of expected credit losses, in the amount of R$ 13,320, mainly due to the application of macroeconomic projections in the preparation of the estimates due to the worsening of the economic context.

a.2) Impairment of non-financial assets - impairment

The Company assessed the indications of impairment of assets resulting from the pandemic and concluded that there is no significant change in the recoverable amount of its fixed and intangible assets. The assumptions for all non-financial assets were assessed individually and the conclusion is that the net carrying amount of the assets is recoverable.

The main assumptions applied in the preparation of cash flow models did not have a significant impact in the short term, given that most of the energy is already contracted and the amount of energy exposed to Settlement Price of the Differences (PLD) is not significant. In the medium term, there was impact on the prices negotiated in the free market on the portion of non-contracted energy, but with no significant impact on the Company. Finally, in the long term, the main assumptions used to calculate the impairment (future energy prices and Generation Scaling Factor - GSF levels) did not change significantly, accordingly evidencing the recoverability of assets.

Therefore, the Company concluded that there is no need to set up an additional provision for impairment.

a.3) Recovery of deferred tax assets

The Company has a balance of R$ 1,033,398 related to deferred tax assets on income tax and social contribution losses and temporary differences recorded at March 31, 2020. The Company assessed its estimates of expected future taxable income and did not identify the need for a provision for loss.

a.4) Fair value of future energy purchase and sale operations

The effects of Covid-19 on the mark-to-market of electric power purchase and sale agreements occurred mainly in the variation of short-term future prices due to more favorable hydrology and load reduction. In the long-term, future electric power prices did not change significantly. Therefore, at this time, the effects of thepandemic did not have a significant impact on the fair value of the Company's future energy purchase and sale operations.

14

a.5) Fair value of other assets and liabilities

At the present time, the effects of the pandemic did not have a significant impact on the fair value of the Company's assets and liabilities, mainly on assets originating from concession agreements that are made in the long-term and are contractually guaranteed to receive residual balance at the end of the concession and/ or unconditional right to receive cash during the concession. Accordingly, considering that there were no changes in long-term estimates and assumptions, and that the Company's assets are essential and indicate continuity of operations and cash flows in the medium and long term, up to the present date, despite the fact that the pandemic effects remain uncertain, its effects did not have a significant impact on the fair value of the Company's assets and liabilities.

a.6) Post-employment benefits

The Company's management has constantly monitored the fair value of the actuarial asset of the post-employment benefit plans due to the instability of the interest rate, which is determined based on market data. Due to the economic instability in this pandemic period, the fair value of the plan assets fell at 03.31.2020 in relation to the fair value at 12.31.2019. However, the benefit plans did not generate additional obligations due to the existence of a surplus in the pension plan and the fact that the actuarial liability of the plan is recognized in a sufficient amount, in light of the current assessment.

a.7) Liquidity

The Company currently has a solid financial situation with good liquidity ratios and believes that its working capital is sufficient for its current requirements. However, an expectation of economic impacts caused by a slowdown of business activities resulting from the restrictions imposed during the Covid-19 pandemic, with subsequent effects on Copel's operations, may affect the Company's financial results.

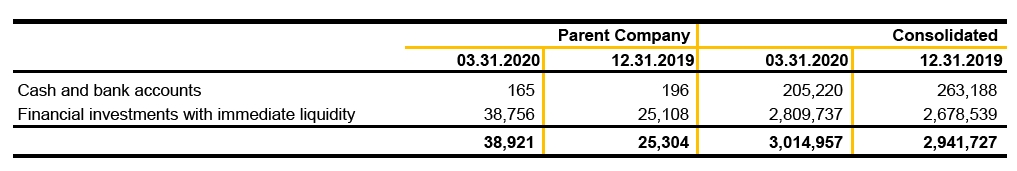

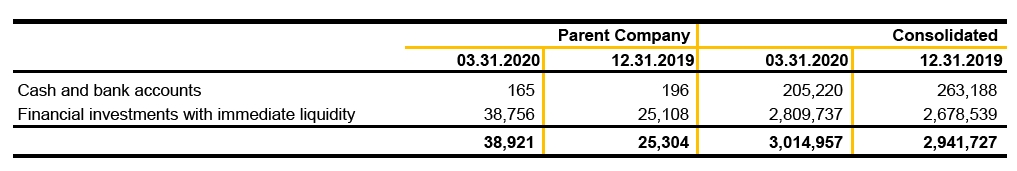

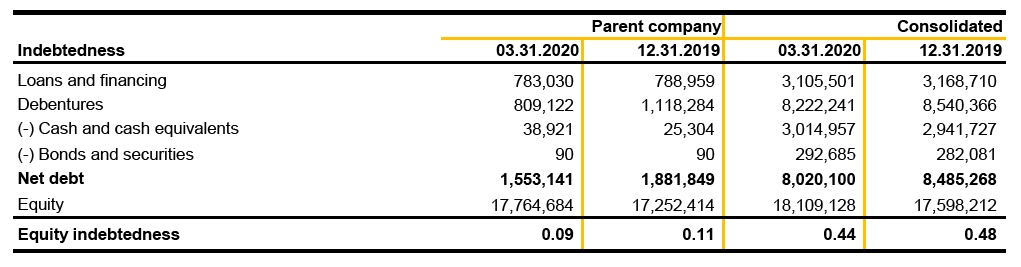

At March 31, 2020, the Company's consolidated net working capital totals R$ 2,735,621 (R$ 2,563,575, at 12.31.2019) with a balance of cash and cash equivalents of R$ 3,014,957, compared to the balance of R$ 2,941,727 at 12.31.2019.

The Company has been monitoring its financial liquidity, considering the possibility of raising funds and the prospect of cash retention, using measures from the Federal Government and other sectorial institutions, already implemented and under preparation, and taking necessary actions in our operations such as cost reduction and postponement of investments with the objective of guaranteeing compliance with financial obligations in due time.

15

a.8) Other assets

The Company has not identified any changes in circumstances that indicate impairment of other assets. It should be noted that the Company records changes in sectorial financial assets and liabilities, updated up to the date of the tariff adjustment/review when, the Granting Authority ratifies the transfer on the tariff base and the Company transfers it to the consumer during the next annual cycle, which at Copel occurs as of June 24 of each year. Management understands that the assets at March 31, 2020 were not impacted and that, with the emergency measures for the electric power sector provided for in Provisional Act No. 950 dated April 8, 2020, the realization of the sectorial financial assets and liabilities is sustained.

In view of all of the above, it should be noted that there was no significant or material impact on the Company's business that could change the measurement of its assets and liabilities presented in the quarterly information at March 31, 2020, and until the date of this publication. However, considering that, like all companies, Copel is exposed to risks arising from any legal and market restrictions that may be imposed, it is not possible to ensure that there will be no impact on operations or that the result will not be affected by the future consequences of the pandemic.

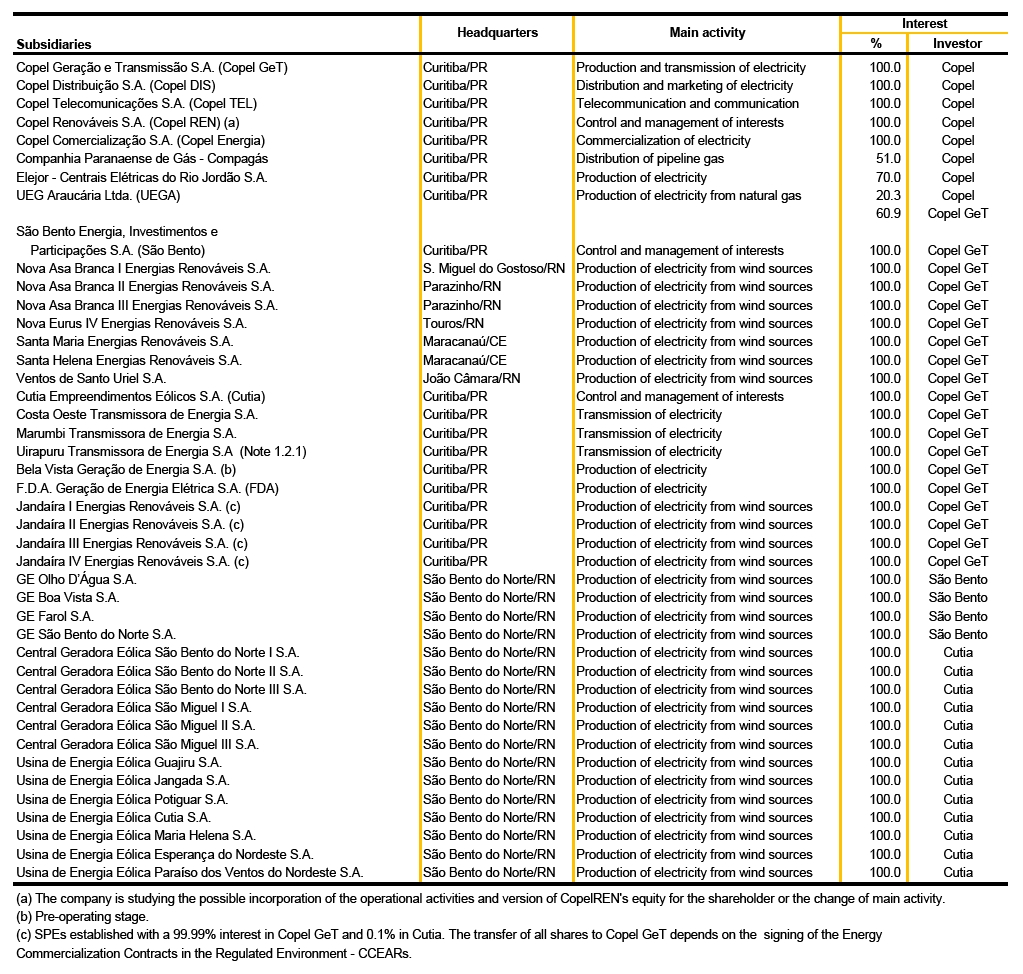

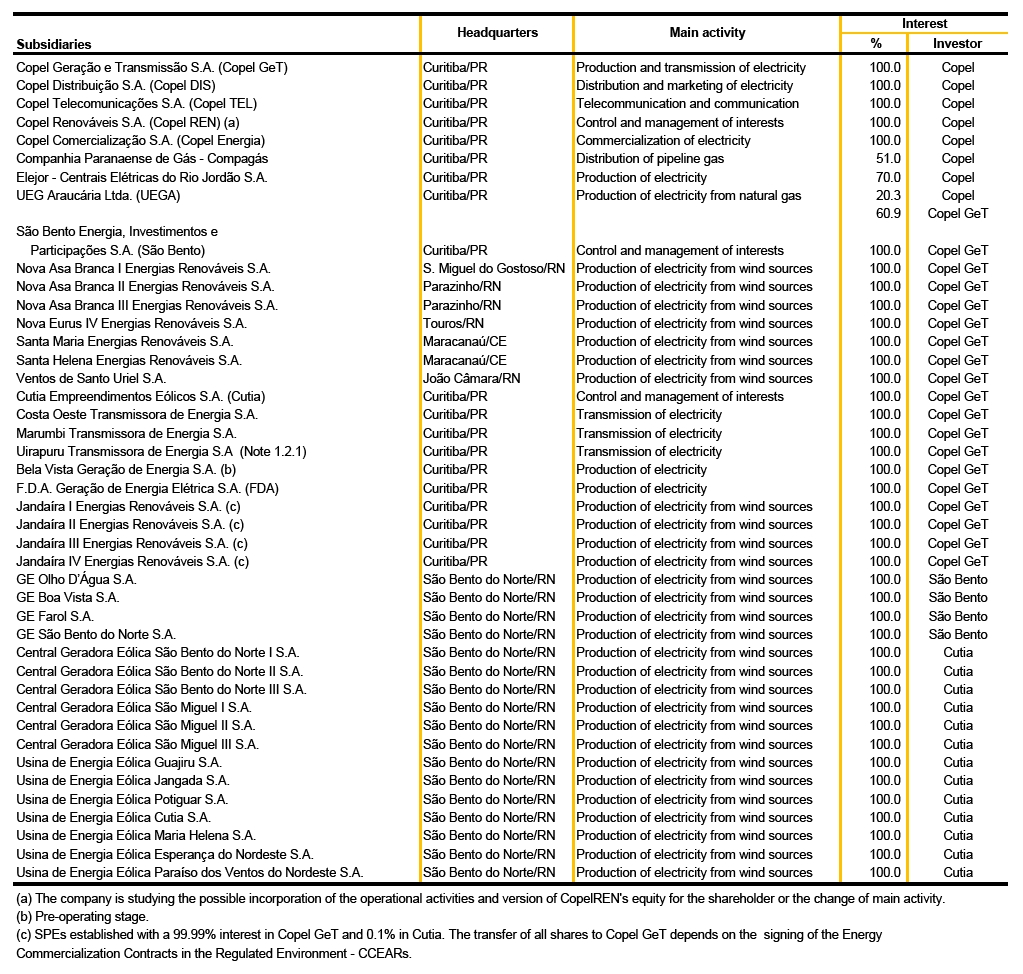

1.1 Copel's equity interests

Copel has direct and indirect interests in subsidiaries (1.1.1), joint ventures (1.1.2), associates (1.1.3) and joint operations (1.1.4).

There was no change in equity interests at December 31, 2019.

16

1.1.1 Subsidiaries

17

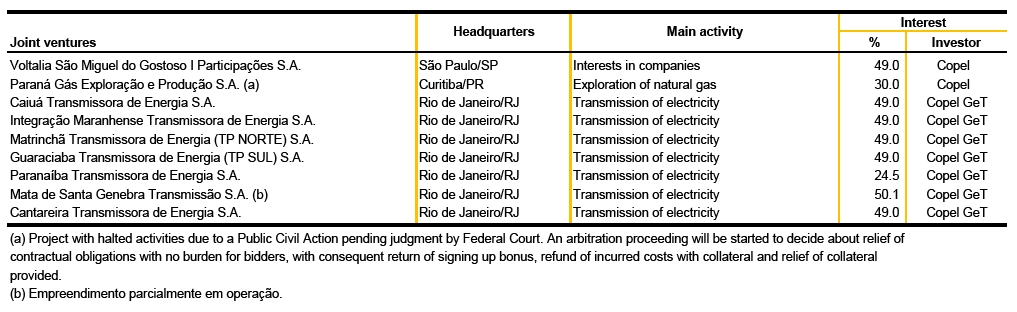

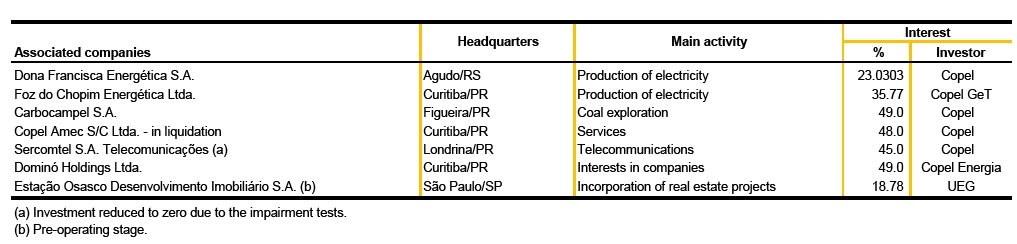

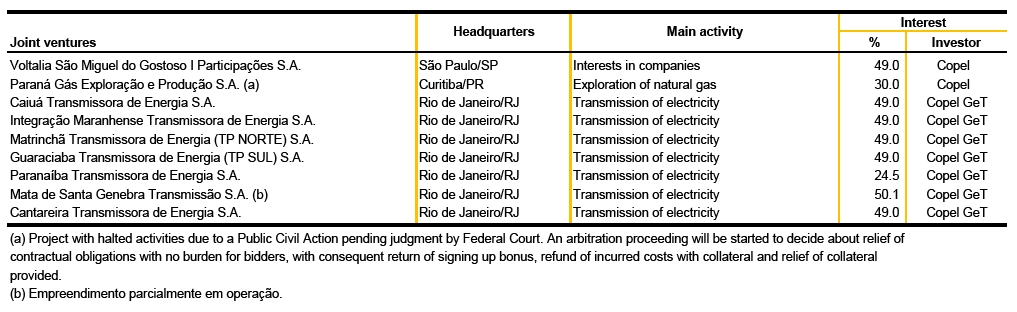

1.1.2 Joint ventures

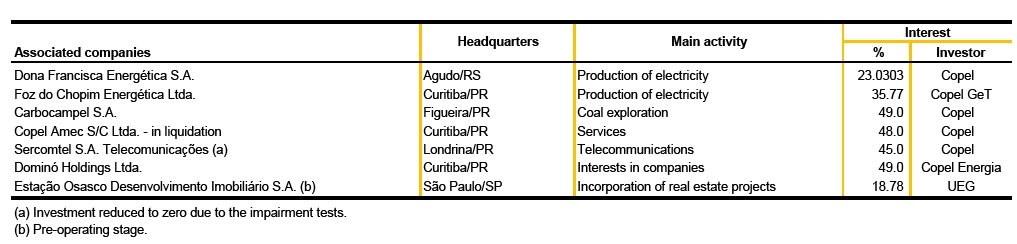

1.1.3 Associates

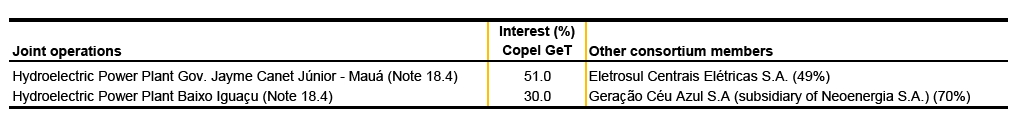

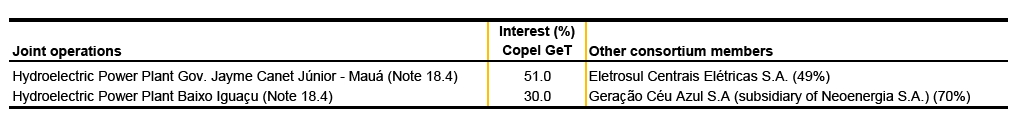

1.1.4 Joint operations (consortiums)

18

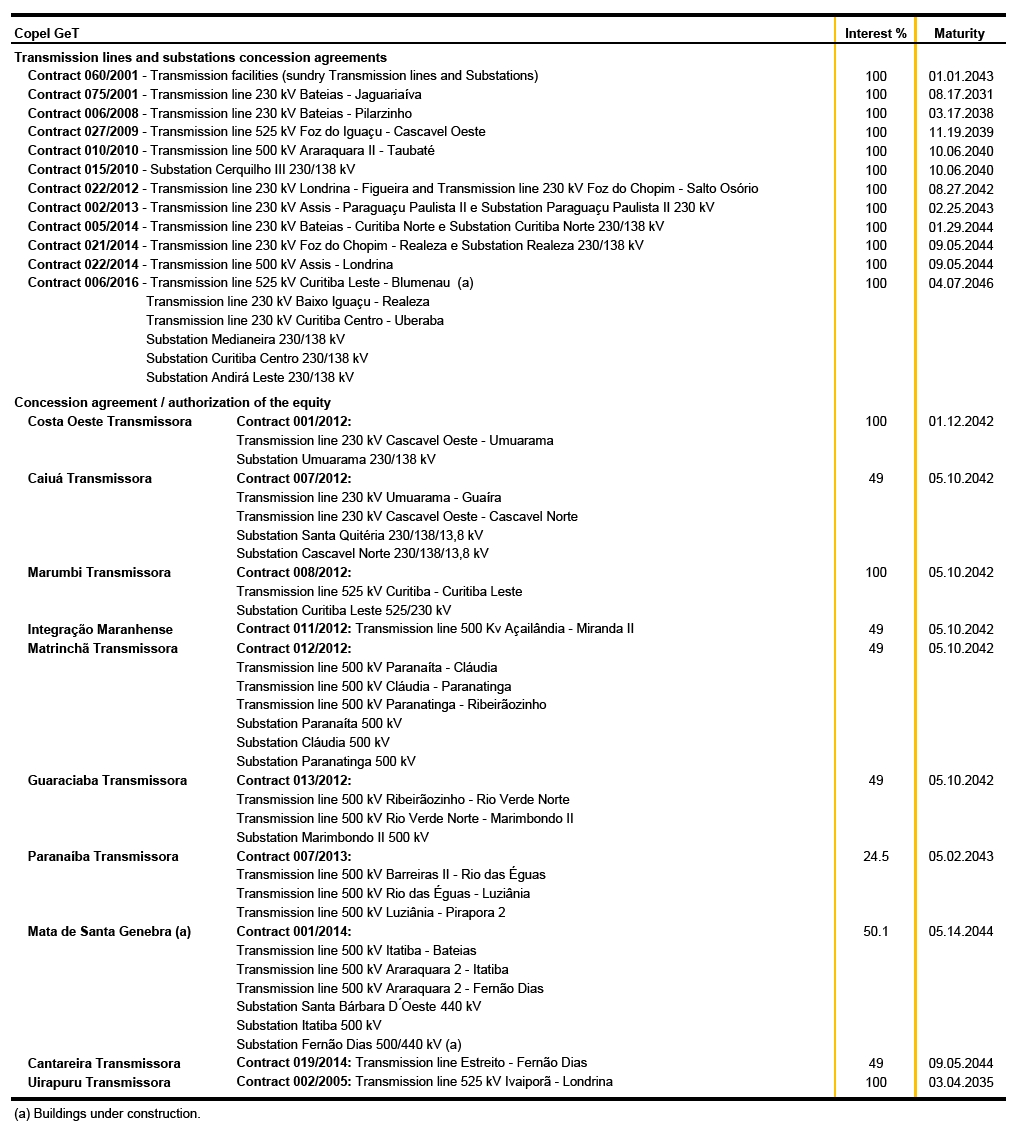

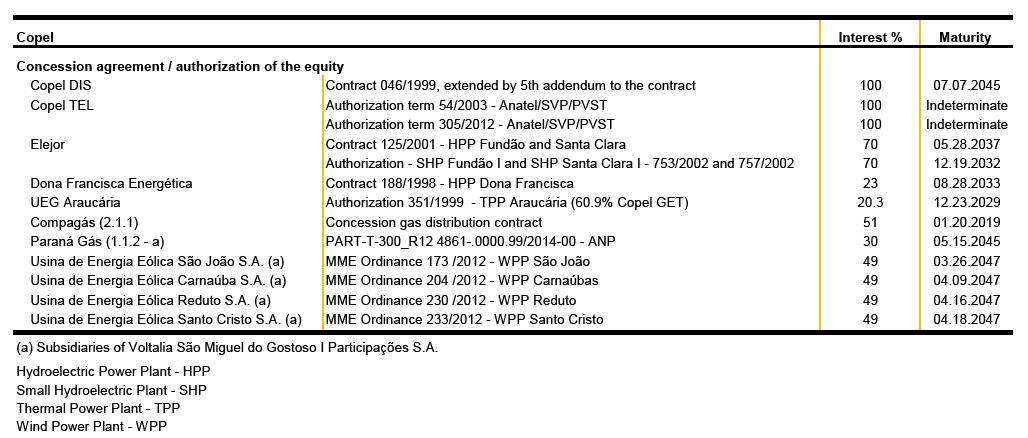

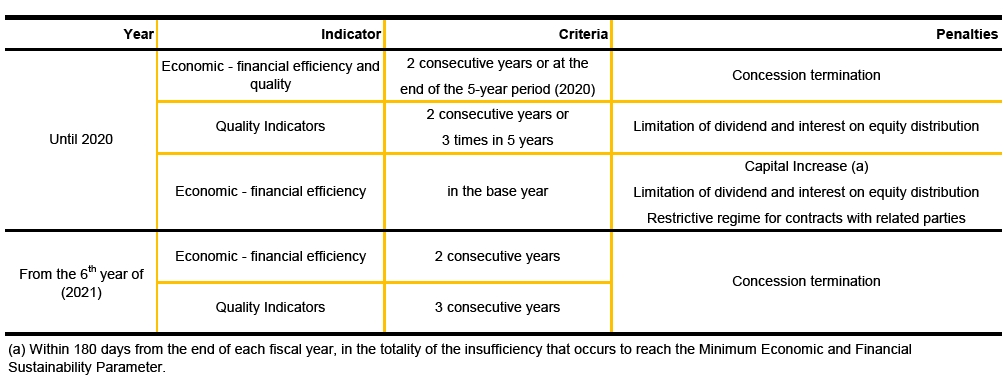

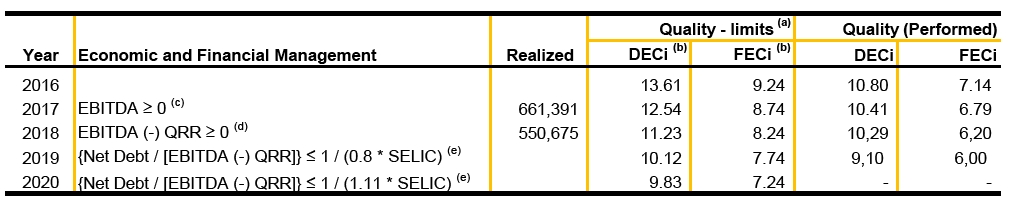

2 Concessions and Authorizations

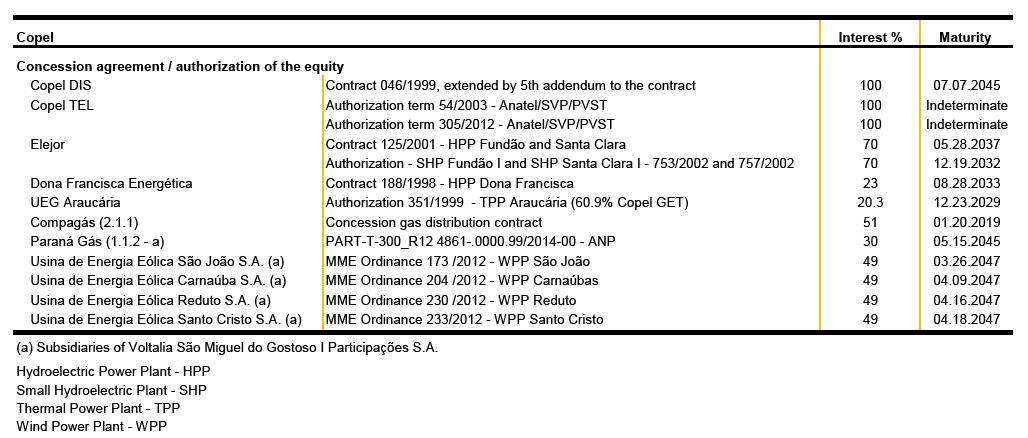

2.1 Concession contracts or authorizations obtained by Copel

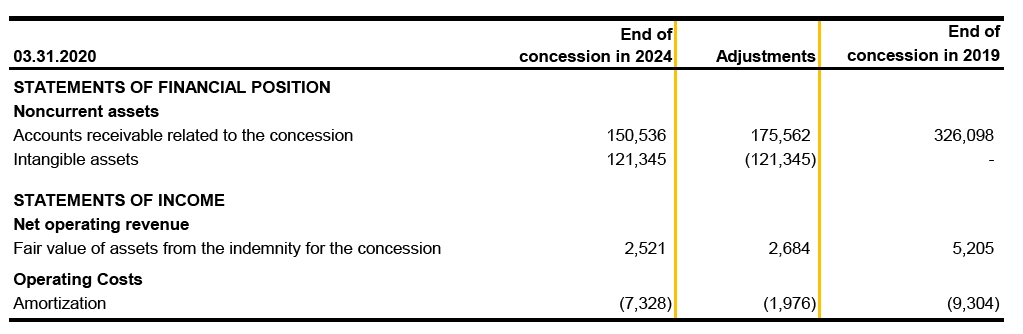

2.1.1 Compagás

Compagás is a party to a concession agreement entered into with the Concession Grantor, the State of Paraná, which determines the date of July 6, 2024 as the concession's expiration date.

On December 7, 2017, the State of Paraná published Complementary Law 205, introducing a new interpretation to the end of the concession, understanding that expiration occurred on January 20, 2019. The Management of Compagás, its Parent company and other shareholders are challenging the effects of the aforesaid law since they understand that it conflicts with the provisions of the concession agreement currently in force. Compagás filed a lawsuit challenging the early termination of the concession and, on October 30, 2018, a preliminary injunction was granted in favor of the Company's understanding of the terms of the concession contract and the continuity of its operations until July 2024. The Company is awaiting the trial on merit of the case.

Considering that until this date there was no extension/bidding of the concession, the law provides that the concession operator may, after the expiration of the term, remain responsible for its performance until the assumption of the new concession operator, subject to the conditions established.

Considering that the lawsuit continues outstanding and the law continues in force, it was necessary to consider these effects in this quarterly information. The impacts recorded are as follows:

19

Management will continue to make its best efforts to protect the Company's interests, aiming at appropriately settle the impacts of the new interpretation given by the Concession Grantor and looking for the necessary alternatives to maintain the concession in a sustainable manner.

20

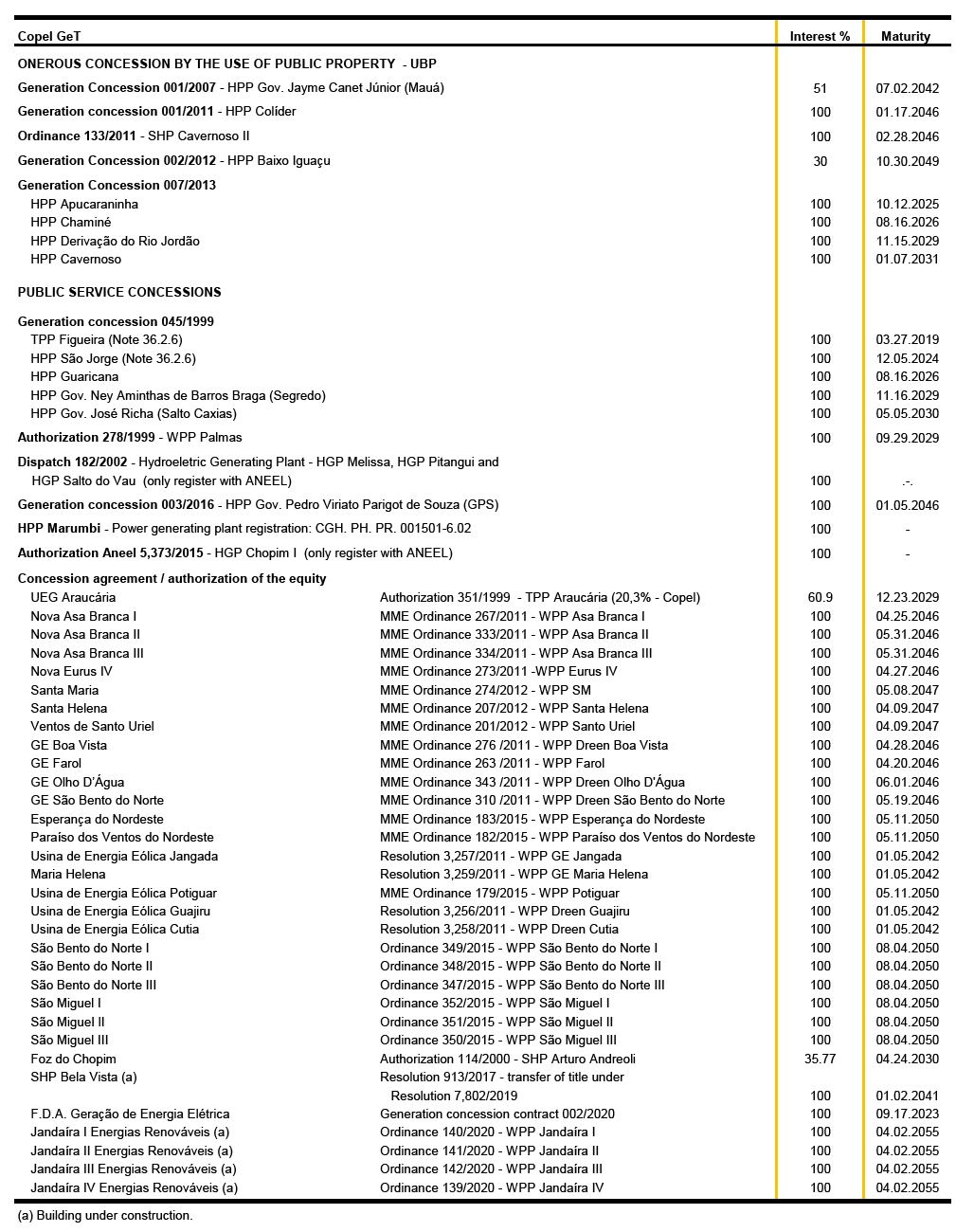

2.2 Concession contracts or authorizations obtained by Copel Get and its investees

21

During 2019, three important enterprises started their commercial operations:

-UHE Colíder: in March, May and December 2019, the three generating units of the plant entered into commercial operation, respectively, in all cases with 100 MW of installed power.

-UHE Baixo Iguaçu: Commercial operation of units 1 and 2 began in February 2019, with unit 3 starting in April 2019, with a total installed capacity of 350.2 MW.

22

- Cutia and Bento Miguel Wind Complexes: From the last two week of December 2018 to March 2019, all wind farms went into commercial operation, with a total installed capacity of 312.9 MW.

3 Basis of Preparation

3.1 Statements of compliance

The individual financial statements of the Parent Company and the consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board, IASB, as well as with accounting practices adopted in Brazil (BR GAAP), which comprise the standards, guidelines and interpretations issued by the Accounting Pronouncements Committee (Comitê de Pronunciamentos Contábeis or CPC) and approved by the Brazilian Securities and Exchange Commission (Comissão de Valores Mobiliários or CVM) and the Federal Accounting Council (Conselho Federal de Contabilidade or CFC).

Management declares that all relevant information from the individual and consolidated quarterly information, and only those, are being evidenced and corresponds to that used in management.

The issuance of these individual and consolidated quarterly information was approved by Management on May 14, 2020.

3.2 Functional and presentation currency

The individual and consolidated quarterly information is presented in Brazilian Reais, which is the functional and presentation currency of the Company. Balances herein have been rounded to the nearest thousand, unless otherwise indicated.

3.3 Basis of measurement

The individual and consolidated quarterly information were prepared based on the historical cost, except for certain financial instruments and investments measured at fair value, as described in the respective accounting policies and notes.

3.4 Use of estimates and judgments

In the preparation of this individual and consolidated quarterly information, Management used judgments, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities, income and expenses of Copel and its subsidiaries. Actual results may differ from those estimates.

Estimates and assumptions are reviewed on a continuous basis. Changes in estimates are recognized in the period in which they occur.

23

Information about the use of estimates and judgment referring to the adoption of accounting policies which impact the amounts recognized in the quarterly information is the same as that disclosed in note 3.4 to the financial statements at December 31, 2019.

3.5 Management's judgment on going concern

Management has concluded that there are no material uncertainties that cast doubt on the Company's ability to continue as a going concern. No events or conditions were identified that, individually or in the aggregate, may raise significant doubts on its ability to continue as a going concern.

The main bases of judgment used for such conclusion are: (i) main activities resulting from long-term concessions; (ii) robust equity; (iii) strong operating cash generation, including financial capacity to settle commitments entered into with financial institutions; (iv) historical profitability; and (v) fulfillment of the objectives and targets set forth in the Company's Strategic Planning, which is approved by Management, monitored and reviewed periodically, seeking the continuity of its activities.

4 Significant Accounting Policies

The Company's accounting policies are consistent with those presented in the financial statements for the year ended December 31, 2019.

4.1 Standards applicable to the Company effective January 1, 20

From January 1, 2020, changes in the following pronouncements will be in effect, without significant impacts on the Company's financial statements:

(i) CPC 00 (R2)/ IAS 1 Conceptual framework;

(ii) Annual review of CPC No. 14/2019: changes in pronouncements arising from the review of CPC 00, change in the definition of business in CPC 15 (R1) / IFRS 3 and change in the definition of materiality in CPC 26 (IAS 1) and CPC 23 (IAS 8).

5 Cash and Cash Equivalents

These comprise cash on hand, deposits with banks and short-term highly-liquid investments, which can be redeemed in cash within 90 days from the investment date. Temporary short-term investments are recorded at cost at the reporting date, plus earnings accrued. Cash and cash equivalents are subject to an insignificant risk of change invalue.

24

Financial investments of the Company and its subsidiaries refer to Bank Deposit Certificates - CDBs and Repurchase Agreements, which are the sale of a security with the commitment of the seller (Bank) to repurchase it, and of the purchaser to resell it in the future. Investments are remunerated between 78.0% and 100.8% of Interbank Deposit Certificate (Certificado de Depósito Interbancário - CDI) interest.

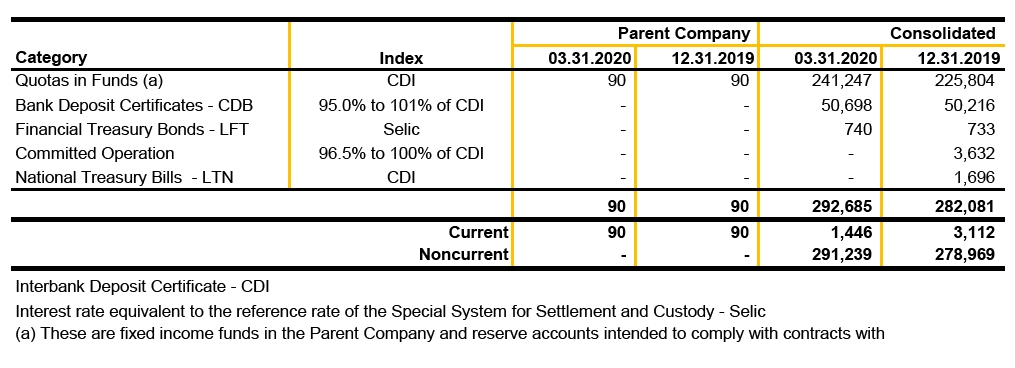

6 Bonds and Securities

The Company and its subsidiaries hold securities that yield variable interest rates. The term of these securities ranges from 2 to 58 months from the end of the reporting period.

25

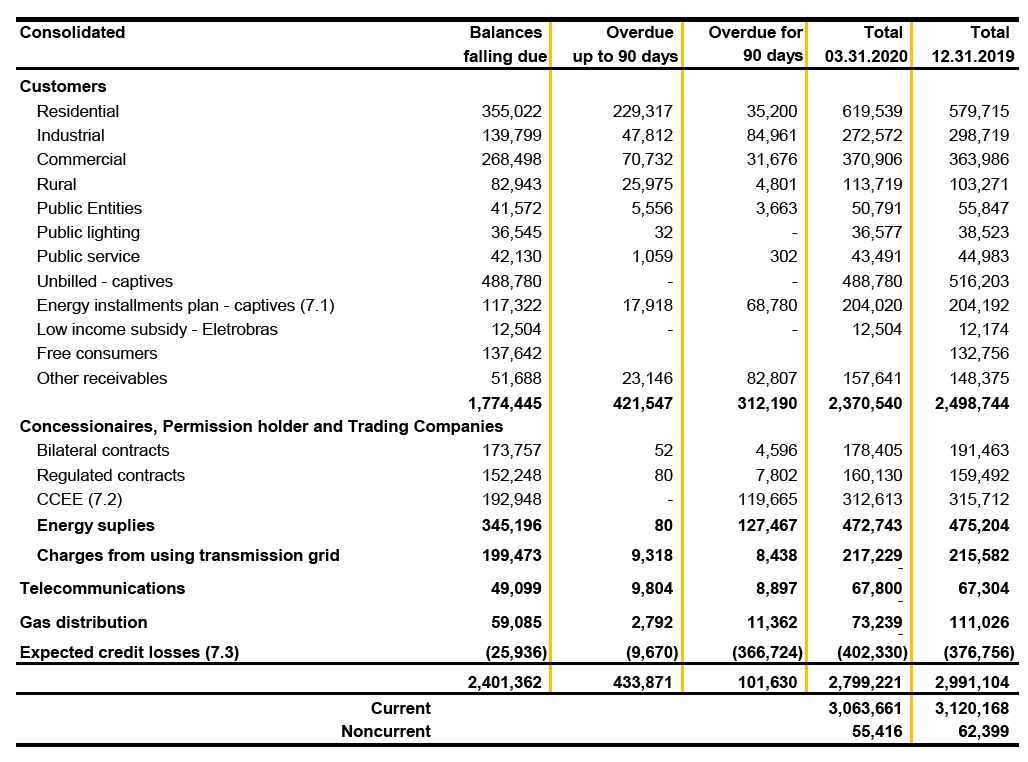

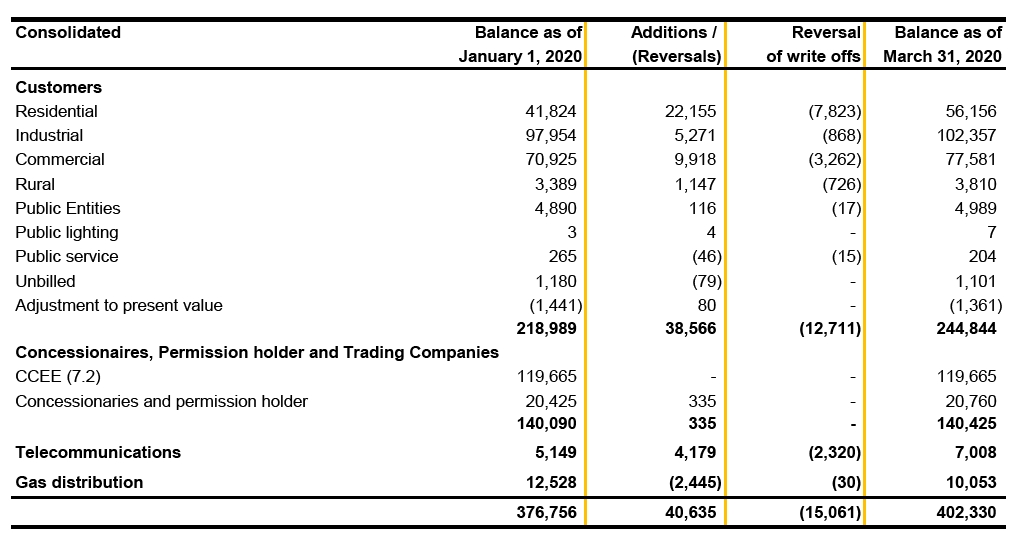

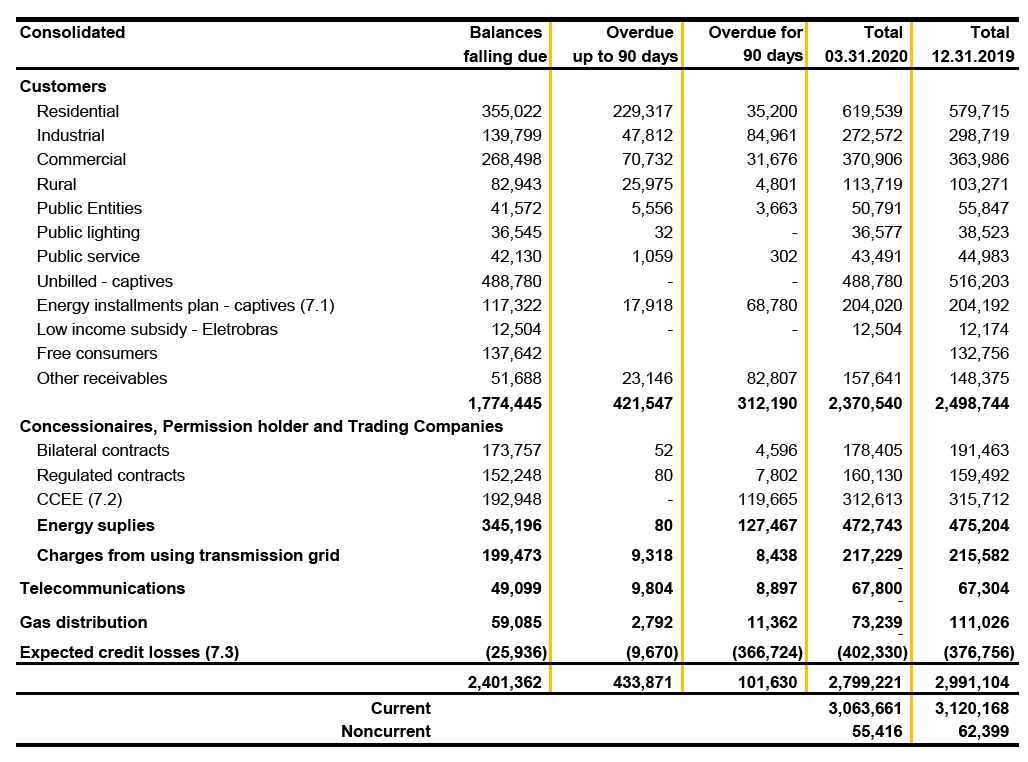

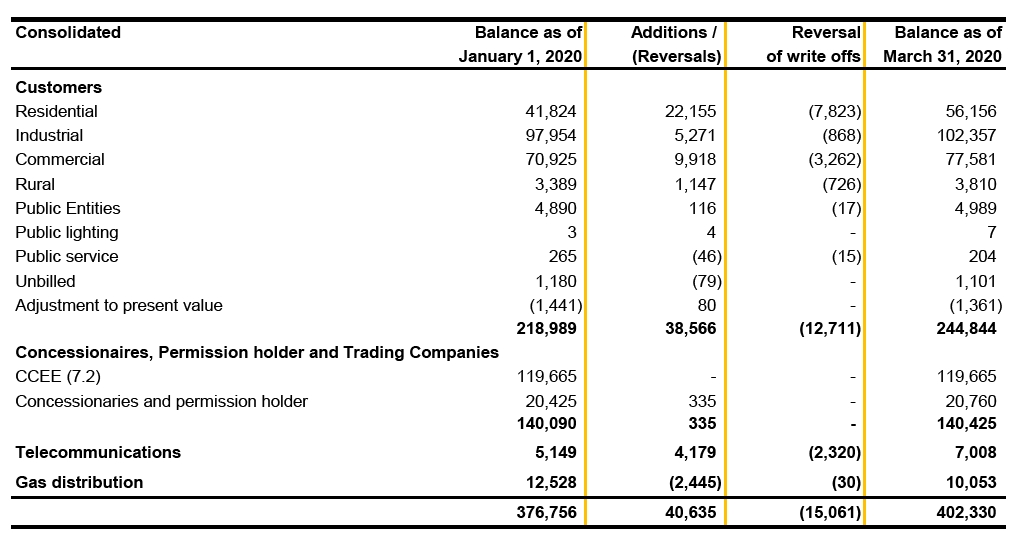

7 Trade Accounts Receivable

7.1 Energy installments plan

The trade accounts receivable renegotiated are discounted to present value as of March 31, 2020, taking into consideration the future value, the maturity dates, the dates of settlement and the discount rate ranging from 0.29% to 2.81% p.m.

7.2 Electricity Trading Chamber - CEEE

Balance receivable by the electricity generation, trading and distribution subsidiaries deriving from the positive position in the monthly settlement of the spot market centralized by CCEE. Amounts are received in the second month following the recognition of revenue or offset against future settlements when the result is negative for the subsidiary.

Additionally, as a result of unforeseeable circumstances and force majeure, the power plant had its commercial start-up delayed, which was initially scheduled for January 2015. The Company is contesting in court, filing a request for exclusion of liability so that the mandatory supply of energy contracted by the plant, in the period in delay, is postponed.

26

Copel GeT filed an administrative request for the exclusion of liability at ANEEL, which was denied, and subsequently, at 12.18.2017, it filed an ordinary lawsuit with request for advance protection with the Court, requesting the reversal of the agency's decision. On April 6, 2018, the Federal Court of the 1st Region fully granted the advance relief requested in the interlocutory appeal to exempt the Company from any burden, charges or restrictions on the rights arising from the displacement of the UHE Colíder implementation schedule. The Company is awaiting judgment on the merits of the lawsuit.

The contracted energy of the plant is 125 MW mean. For overdue periods the contract was fulfilled as described below:

- From January 2015 to May 2016, with suspension of energy delivery by operation because of the injunction obtained by Management;

- In June 2016, with partial reduction through a bilateral agreement and suspended remaining balance due to the court injunction;

- From July 2016 to December 2018, with reduction of all supply contracts of the CCEARs - Energy Trading Agreement in the Regulated Environment, through a bilateral agreement and participation in the New Energy and Decrease Clearing Facility ("Mecanismo de Compensação de Sobras e Déficits de Energia Nova - MCSD-EN"); and

- From January to March 2019, the firmed contracts in the regulated environment became effective again, however, energy supply continued suspended, in light of the injunction obtained. As of March 9, 2019, the plant started commercial production of its first generating unit.

Due to the fact it is awaiting a decision on the merits of the lawsuit, in the period in delay of the plant, the Company recognized in the income for the years revenue limited to the financial covenants of the agreement and the regulatory rules, as well as the cost of energy to cover the contractual guarantee.

From the amount determined by CCEE, for the controversial portion arising from the effects of the injunction for exemption of responsibility of Colíder HPP, an allowance for expected losses was recognized in the amount of R$119,665 (Note 7.3).

27

7.3 Expected credit losses

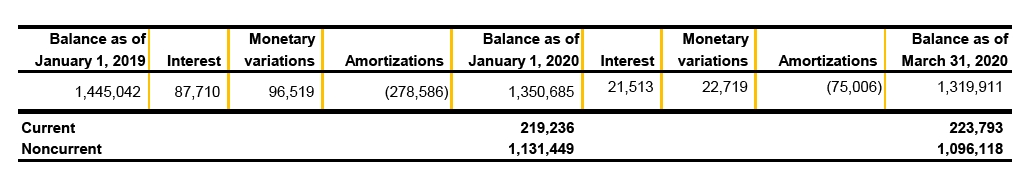

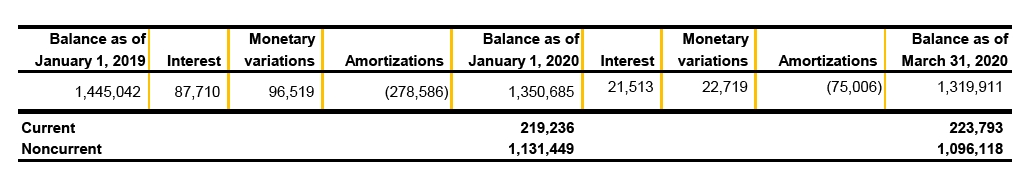

8 CRC Transferred to the Paraná State Government

The Company's Management and the Paraná State Government formalized on October 31, 2017 the fifth amendment to the agreement for renegotiation of the Account for Compensation of Income and Losses - CRC. The State of Paraná complied with the agreed terms and made the payments of the monthly interest until December 2017.With the end of the grace period, the State of Paraná has complied with the payments under the agreed terms, remaining 61 monthly installments to be paid. The contract balance is updated by the IGP-DI variation and interest of 6.65% p.y.

8.1 Changes in CRC

8.2 Maturity of noncurrent installments

28

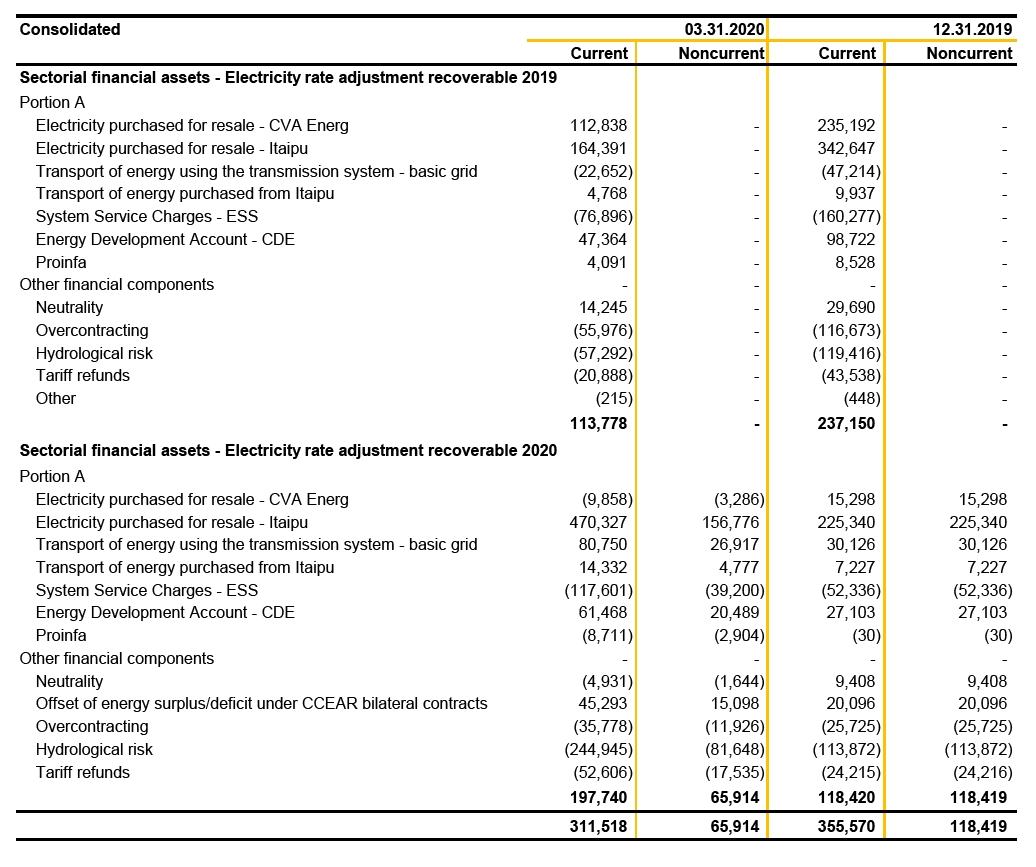

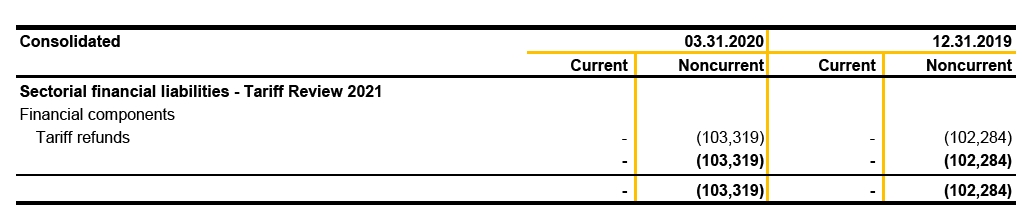

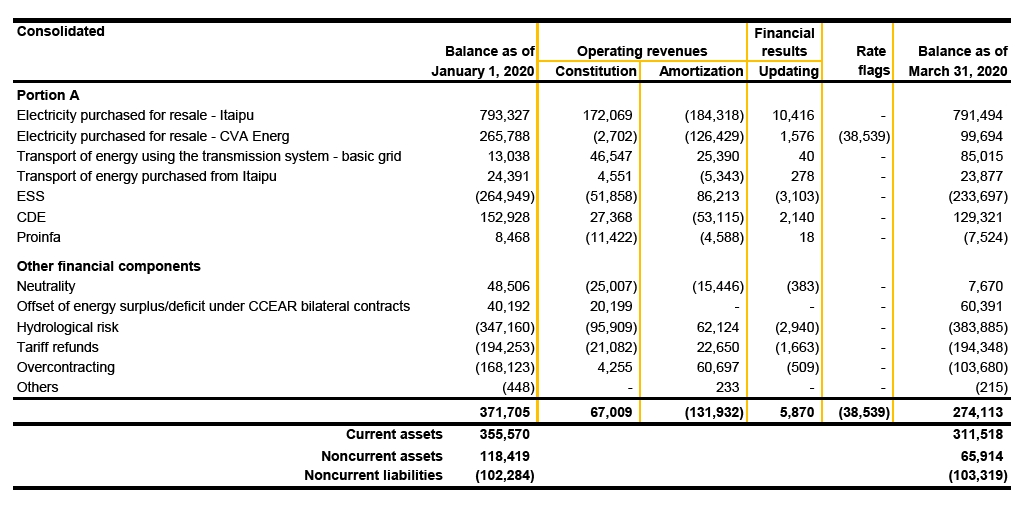

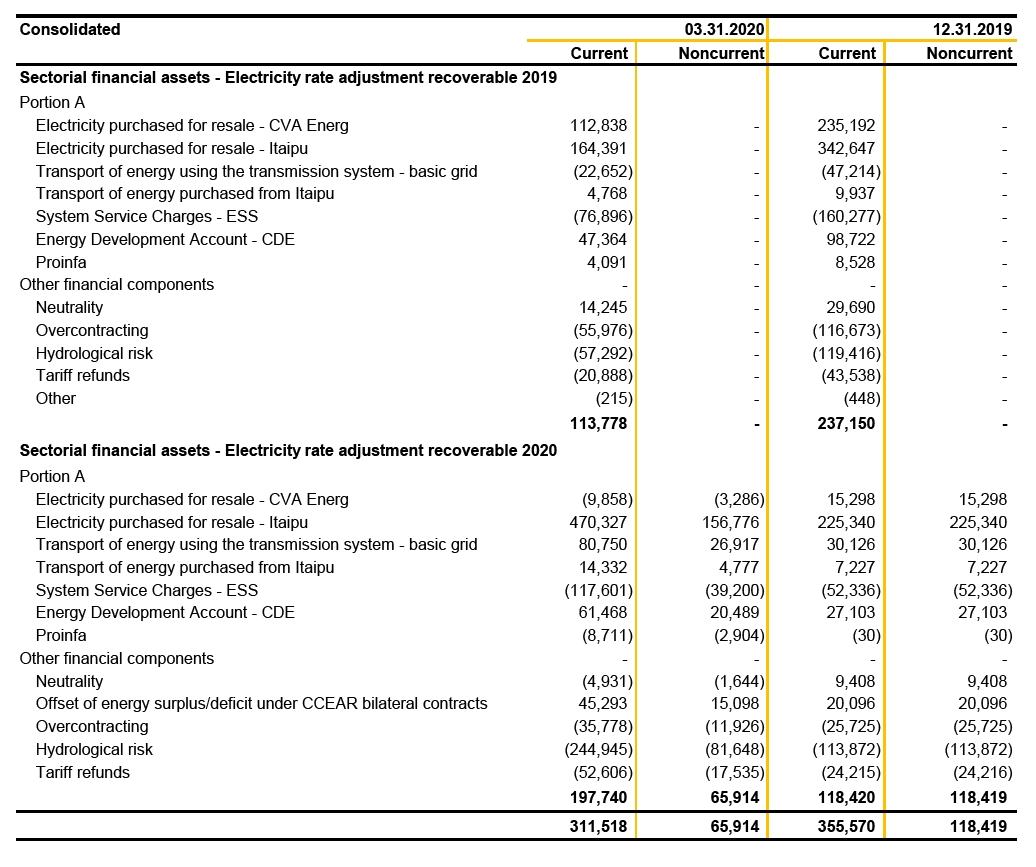

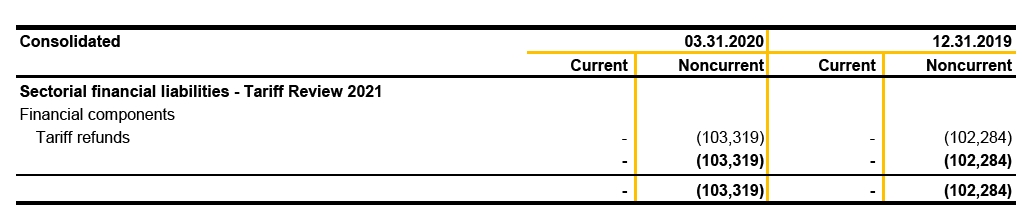

9 Net Sectorial Financial Assets and Liabilities

9.1 Composition of net sectorial financial assets and liabilities balances per tariffcycle

29

9.2 Changes in net sectorial financial assets and liabilities

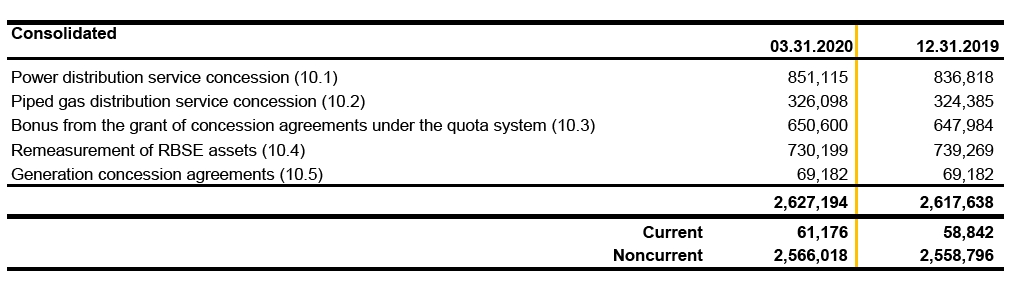

10 Accounts Receivable - Concessions

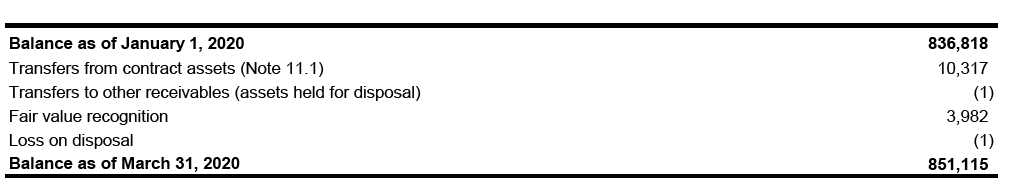

10.1 Power distribution service concession

The distribution concession agreement amount is measured at fair value and its collection is assured by the Concession Grantor through an indemnity upon the return of these assets at the end of the concession period.

30

10.2 Piped gas distribution service concession

10.3 Bonus from the grant of concession agreements under the quotasystem

10.4 Remeasurement of RBSE financialassets

Refers to the right recognized, emerging of Concession Agreement No. 060/2001 arising from the Annual Permitted Revenue - RAP not received in the period from January 2013 to June 2017. The balance includes monetary restatement and interest.

On June 27, 2017, ANEEL published Resolution 2,258 establishing the Annual Permitted Revenues (RAP) for the 2017-2018 tariff cycle, considering a court decision on the injunction of April 11, 2017 related to a lawsuit filed by business associations, which determines the deduction of the"compensation",provided for in article 15, paragraph 2 of Law 12,783/2013, on a temporary basis. The same decision was applied to the other tariff cycles. The compensation being challenged in court related to the cost of equity calculated for the RBSE assets from January 2013 to June 2017, at the time of filing of the lawsuit, is R$201,795.

Based on the opinion of its legal counsel, Copel GeT understands that this is a provisional decision that does not oppose its right to receive the due amounts related to RSBE assets, and that these are guaranteed by law. Therefore, the receivables considered in the receipt flow of this asset are recorded in noncurrentassets.

10.5 Power generation concession contract

The balance of R$69,182 (R$69,182 as of December 31, 2018) refers to the residual balances of the electricity generation assets of HPP GPS and HPP Mourão I. Copel GeT depreciated the plants until the expiration date of the concessions and the remaining balance was reclassified to accounts receivable linked to the concession.

31

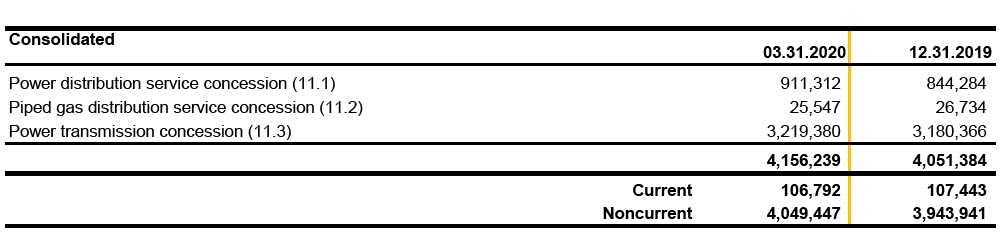

11 Contract assets

11.1 Power distribution service concession contract

The costs of loans, financing and debentures capitalized in the in the first quarter of 2020 totaled R$1,728 at an average rate of 0.07% p.y. (R$1,621, at an average rate of 0.09% p.y. during the first quarter of 2019).

11.2 Piped gas distribution service concession contract

11.3 Transmission service concession contract

32

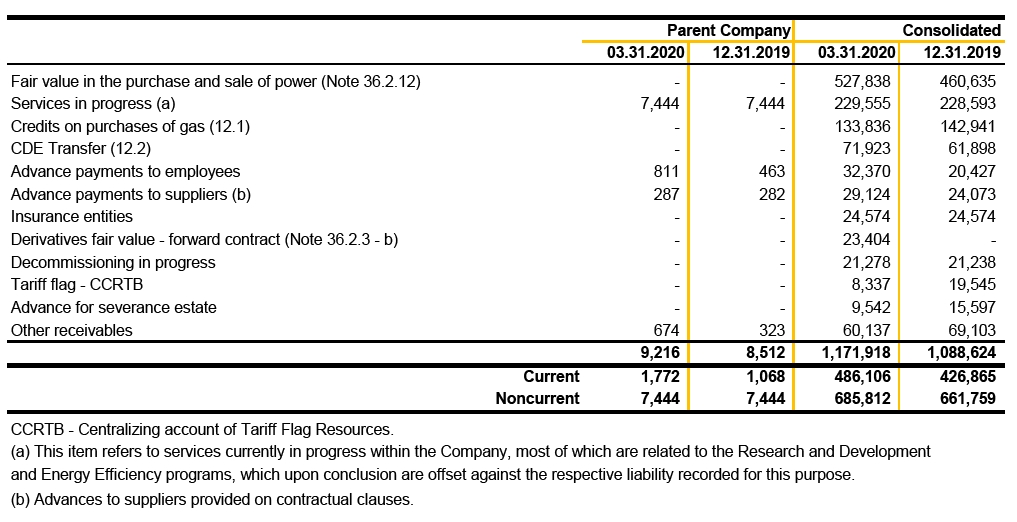

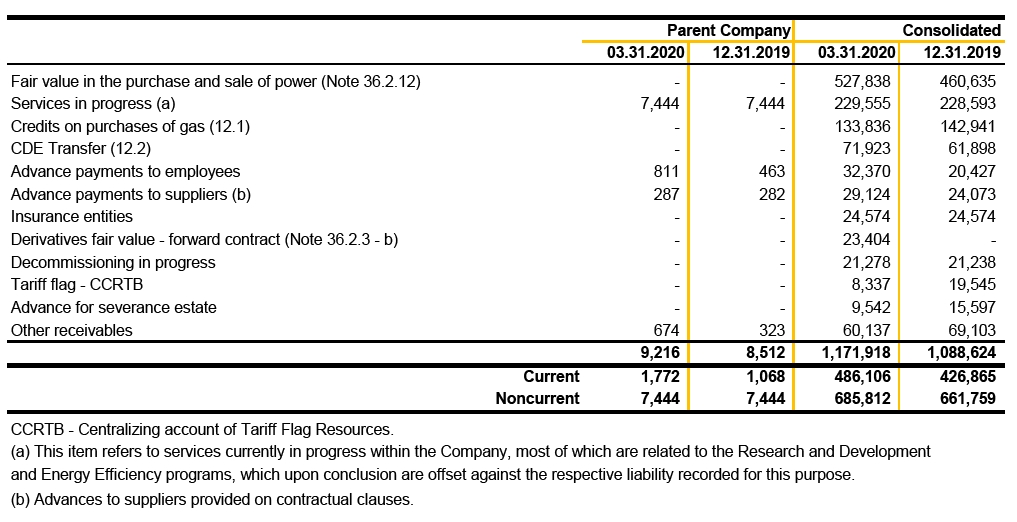

12 Other Receivables

12.1 Credits on purchases of gas - Compagás

This balance refers to the gas acquisition of contracted and guaranteed volumes, higher than those actually withdrawn and used, and contains a future compensation clause. Compagás has the right to use the gas in subsequent months and can compensate the volume contracted and not consumed until 2022. According to the contractual provisions and consumption perspectives, derived from the review of the projects and scenarios for the next years, Compagás estimates to fully offset the contracted volumes in the course of its operation. The contracts with Petrobras provide for the right to assign of this asset. The expiration date of the concession is in discussion with the Concession Grantor, as described in Note 2.1.1.

12.2 CDE Transfer

The balance on March 31, 2020 refers to CDE amounts to be transferred to the Company to cover the tariff discounts applicable to the tariff, in accordance with Law 10,438/2002 and Decree 7,891/2013. The amount transferred to Copel DIS for the period from June 2018 to May 2019, in accordance with Resolution 2,402/2018, was R$ 62,699 per month. As from June 2019, this amount was changed to R$ 51,200 per month, by Resolution 2,559, dated June 18, 2019, which approved the result of the last Annual Tariff Adjustment.

33

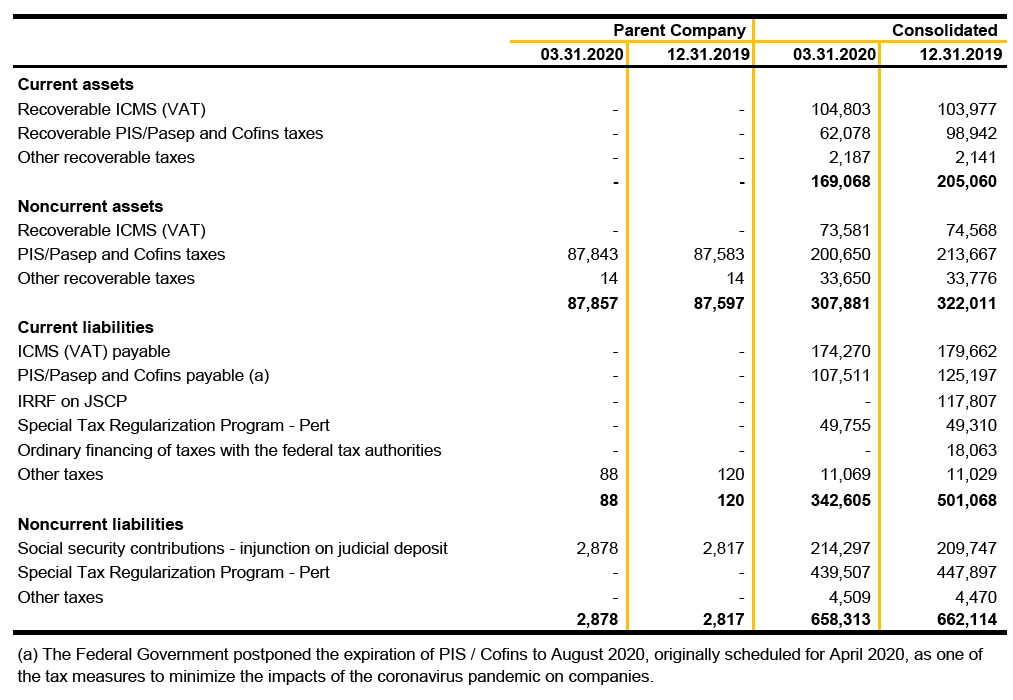

13 Taxes...............

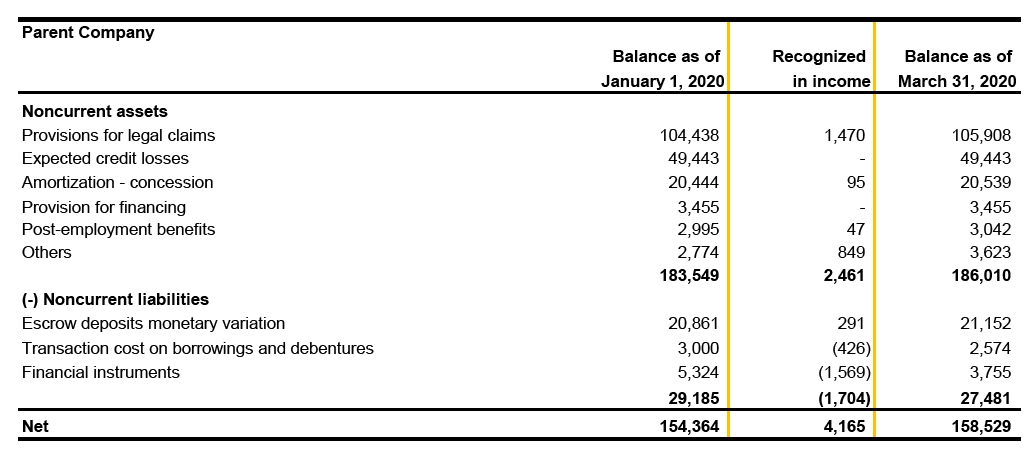

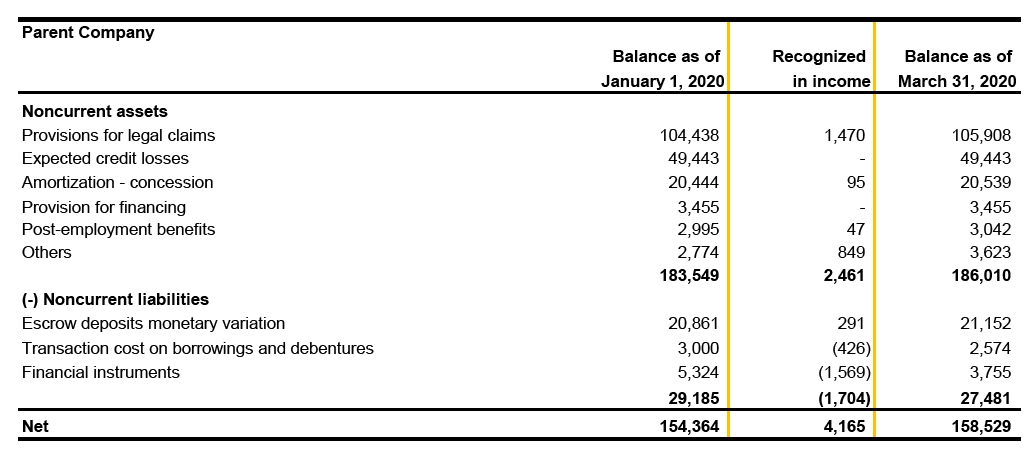

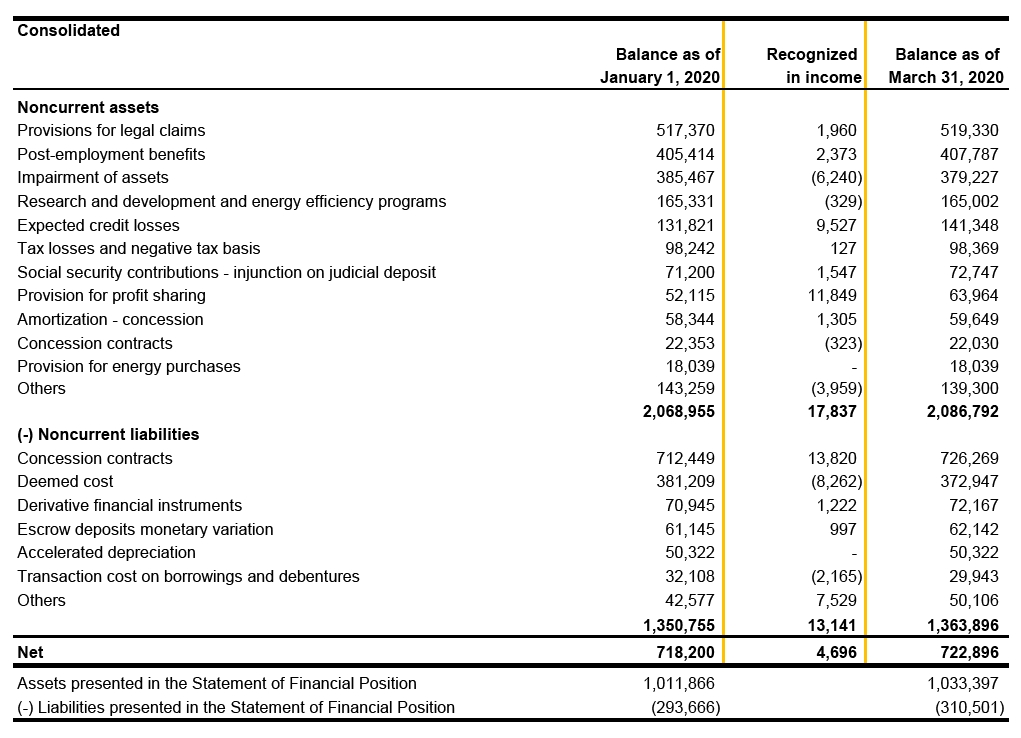

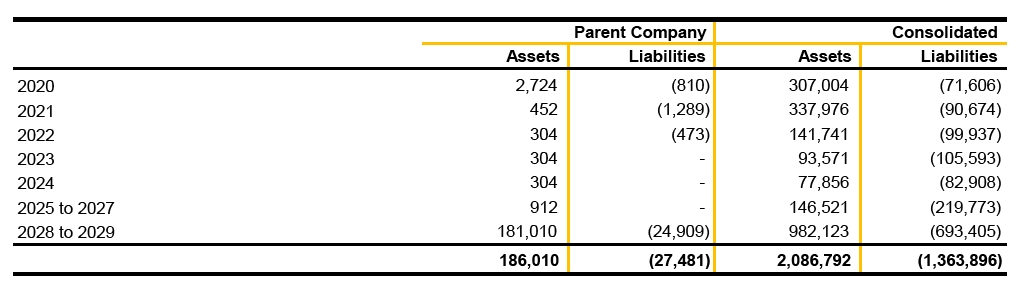

13.1 Deferred income tax and social contribution

13.1.1 Deferred income tax and social contribution

34

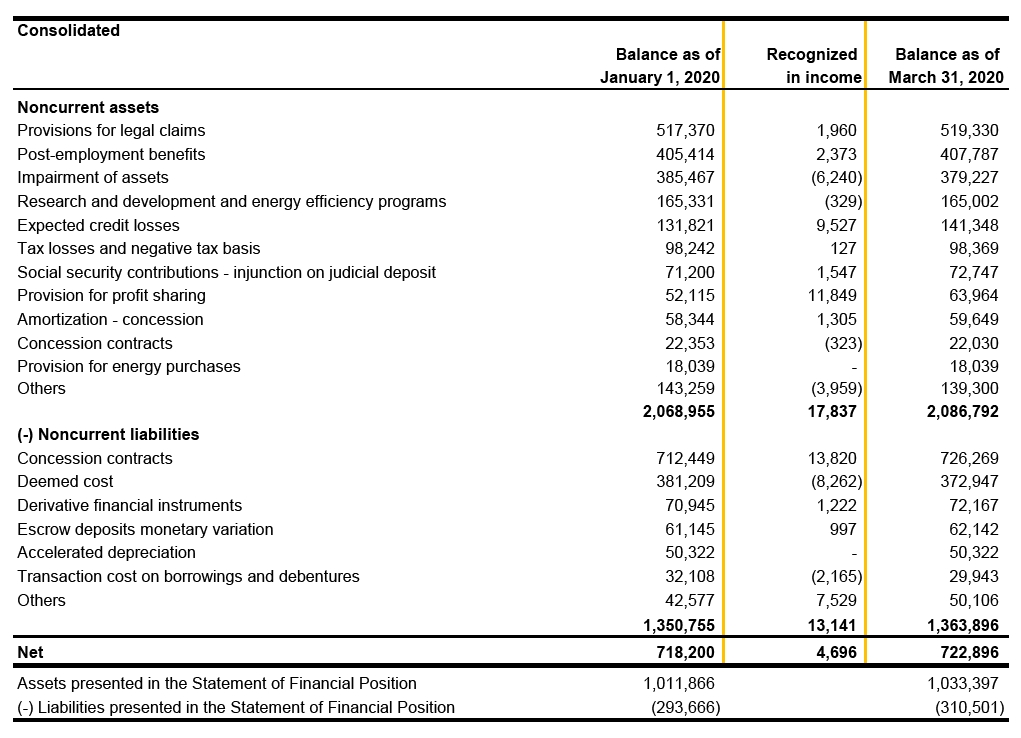

13.1.2 Projection for realization of deferred income tax and social contribution

13.1.3 Unrecognized tax credits

As of March 31, 2020, UEG Araucária did not recognize income tax and social contribution credits on income tax and social contribution tax losses in the amount of R$80.434 (R$83.273 in December 31, 2019) for not having, at that moment, reasonable assurance of generation of future taxable profits sufficient to allow the utilization of these tax credits.

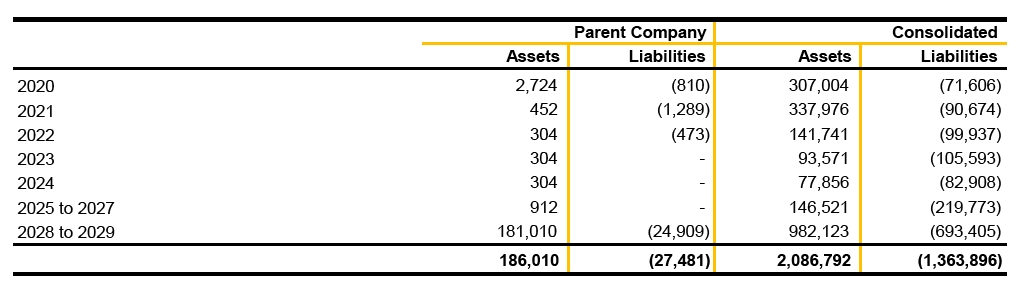

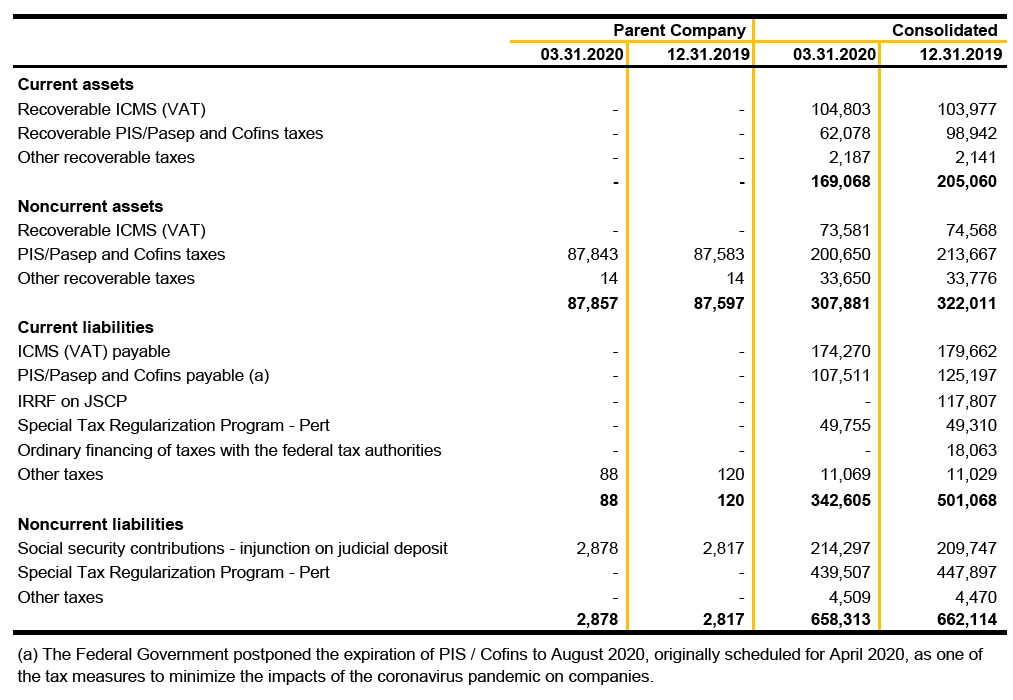

13.2 Other taxes recoverable and other tax obligations

35

13.2.1 Pis/Pasep and Cofins credit on ICMS

Copel DIS filed a writ of mandamus requesting the exclusion of the ICMS amount in the basis for calculating contributions to Pis and Cofins. The referred process is in the final stage of appeals at the Supreme Court of Justice and the Company has been obtaining favorable decisions in all previous stages of the process. The Company awaits the final and unappealable decision of the lawsuit, the modulation of the effects by the Supreme Federal Court of Extraordinary Appeal nº 574,706, as well as the final result of the Taking of Subsidies nº 005/2020 by ANEEL.

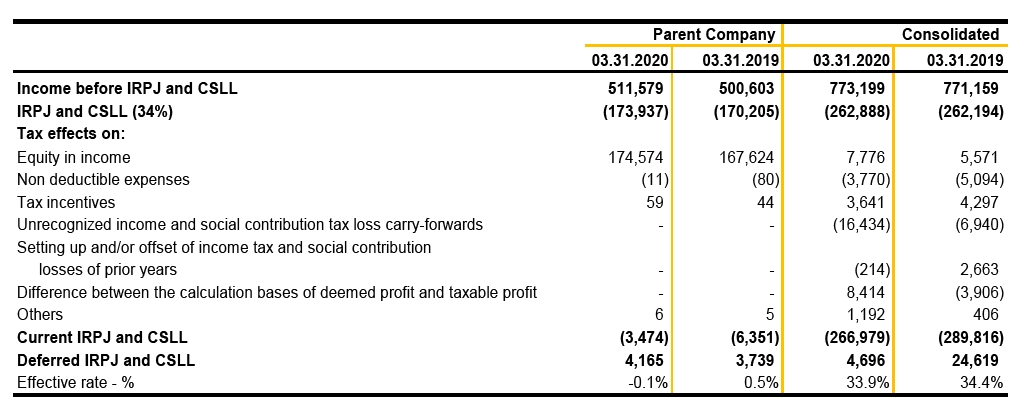

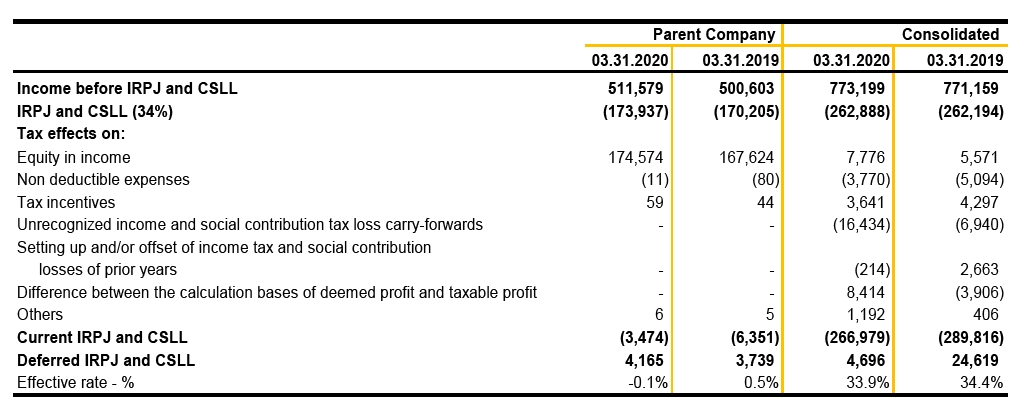

13.3 Reconciliation of provision for income tax (IRPJ) and social contribution (CSLL)

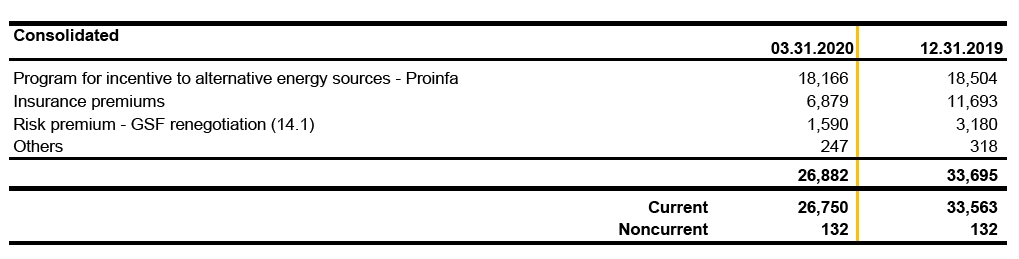

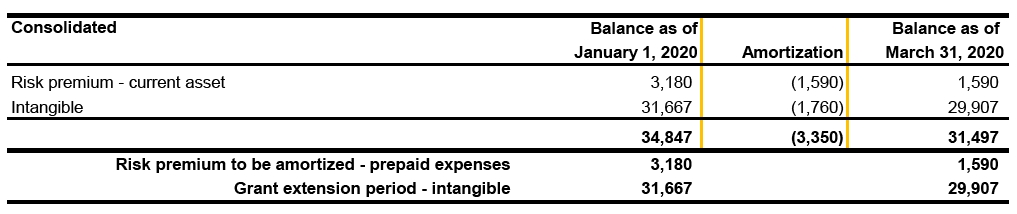

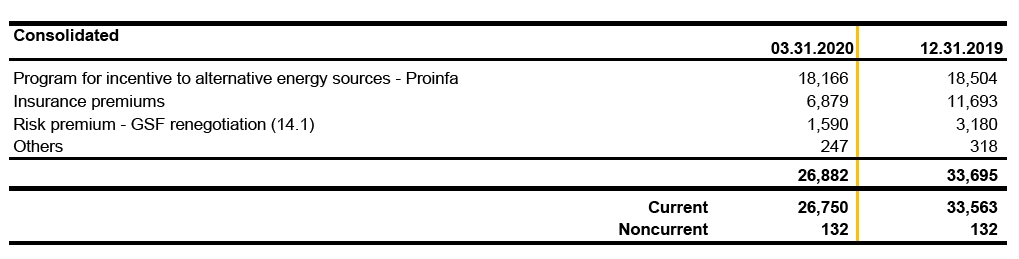

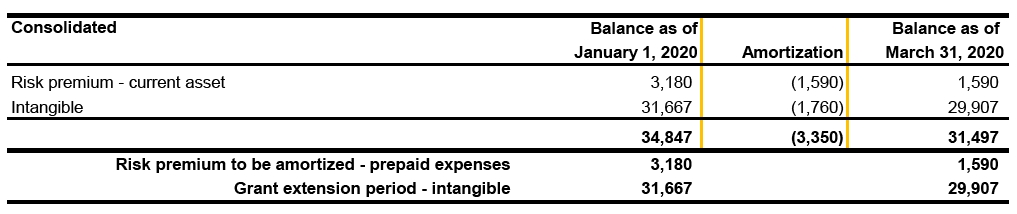

14 Prepaid Expenses

14.1 Hydrological risk renegotiation(Generation Scaling Factor - GSF)

36

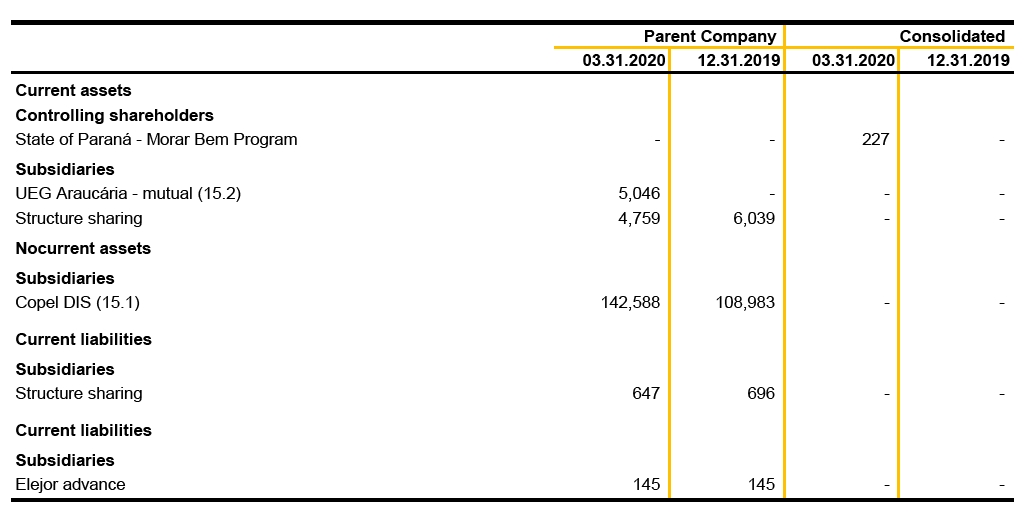

15 Receivables from Related Parties

15.1 Copel DIS - Financing transferred - STN

The Company transferred loans and financing to its wholly-owned subsidiaries at the time of its establishment in 2001. However, since the contracts for the transfers to the subsidiaries were not subject to formalization with the financial institutions, these commitments are also recorded in the Parent company.

The balance with Copel DIS refers to the National Treasury Department - STN financing, transferred with the same levy of charges assumed by the Company (Note 22) and shown as obligations for loans and financing at Copel DIS.

15.2 UEGA - Loan Agreement

On February 20, 2020, a loan agreement was signed between Companhia Paranaense de Energia - Copel and Copel Geração e Transmissão S.A. (lenders) and UEG Araucária Ltda. - UEGA (borrower), with approval of limits plus IOF (tax on financial transactions) and interest of 119 % of CDI, in order to provide funds to finance the company's activities and business and effective up to 12.31.2020. Of the approved limit value of R$ 40,000, R$ 5,000 was used. The amount of financial income in the first quarter was R$ 23.

37

16 Judicial Deposits

17 Investments

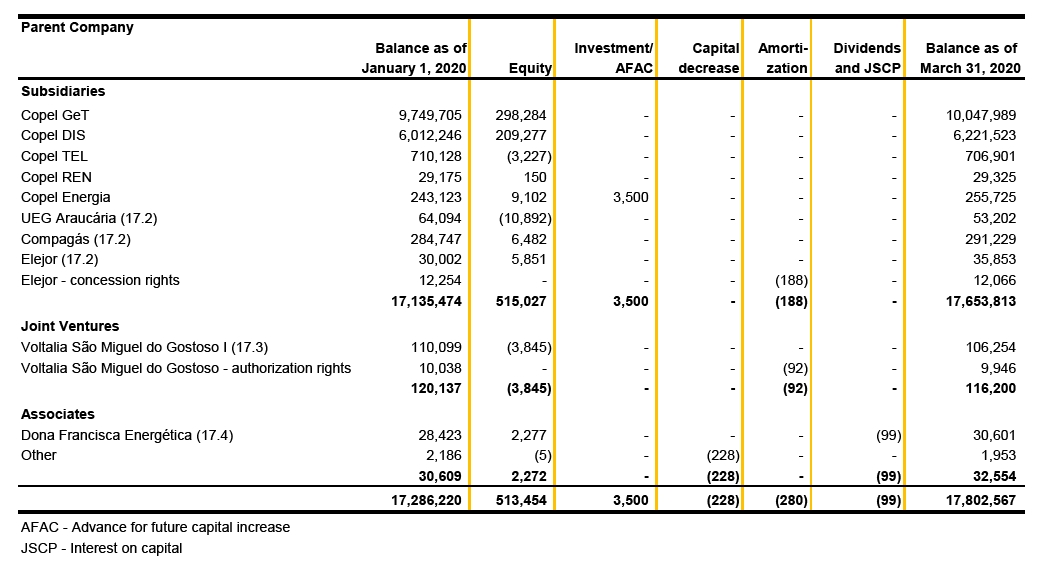

17.1 Changes in investments

38

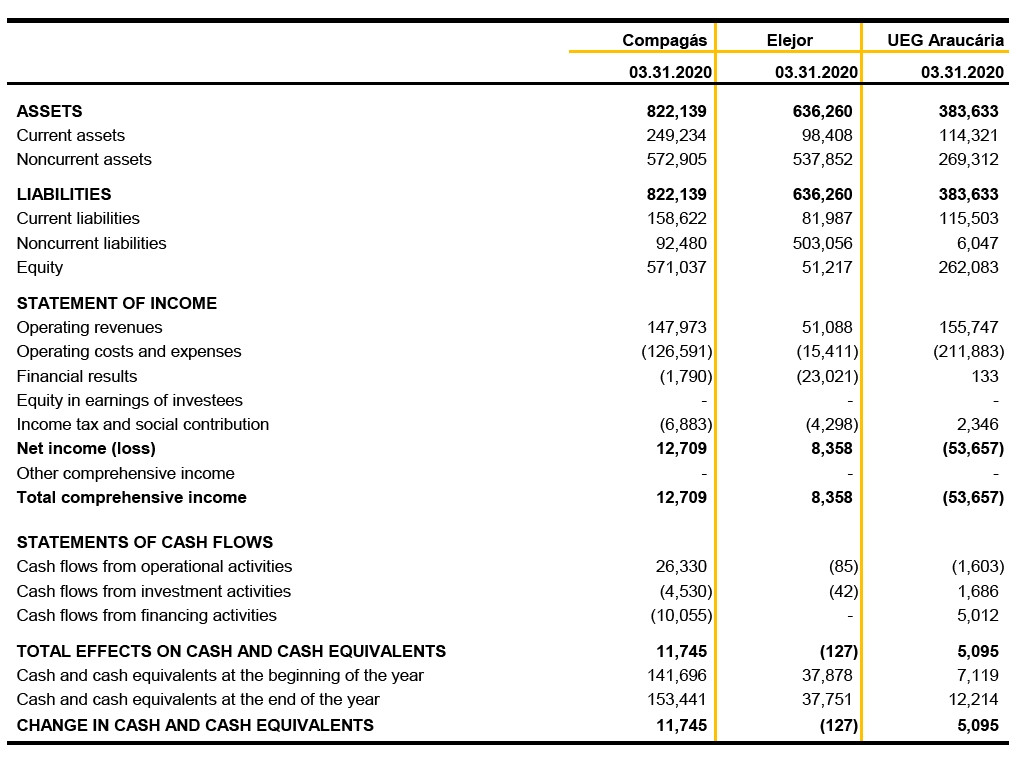

17.2 Subsidiaries with non-controlling interests

17.2.1 Summarized financial information

39

17.2.2 Changes in equity attributable to non-controllingshareholders

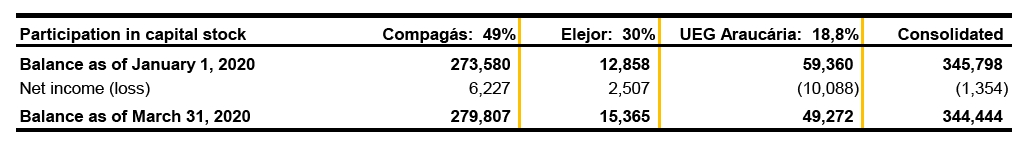

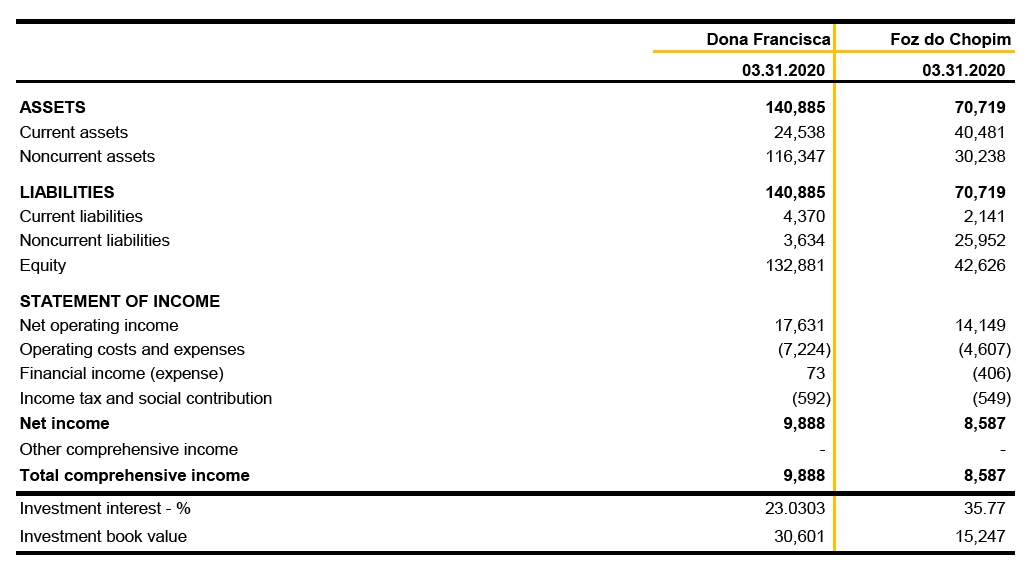

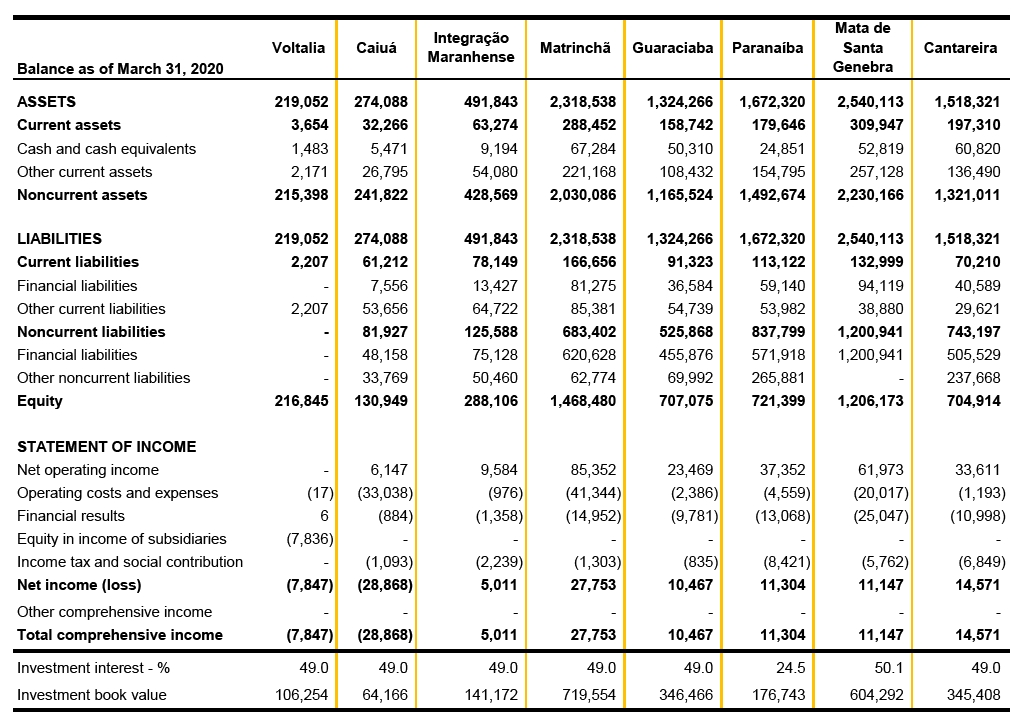

17.3 Total balances of the groups of assets, liabilities, profit or loss and equity interest in commitments and contingent liabilities of the main jointventures

As of March 31, 2020, Copel's interest in the commitments assumed from its joint ventures is equivalent to R$2.639 (R$5.936 as of December 31, 2019) and in contingent liabilities is equivalent to R$67.013 (R$89.688 as of December 31, 2019).

The loss determined at Caiuá is mainly due to the recording of a supplement to the provision for legal claims, in the amount of R$ 31,904, resulting from the partial decision of an ongoing arbitration proceeding referring to the disputed value of the economic and financial rebalancing of the construction agreement.

40

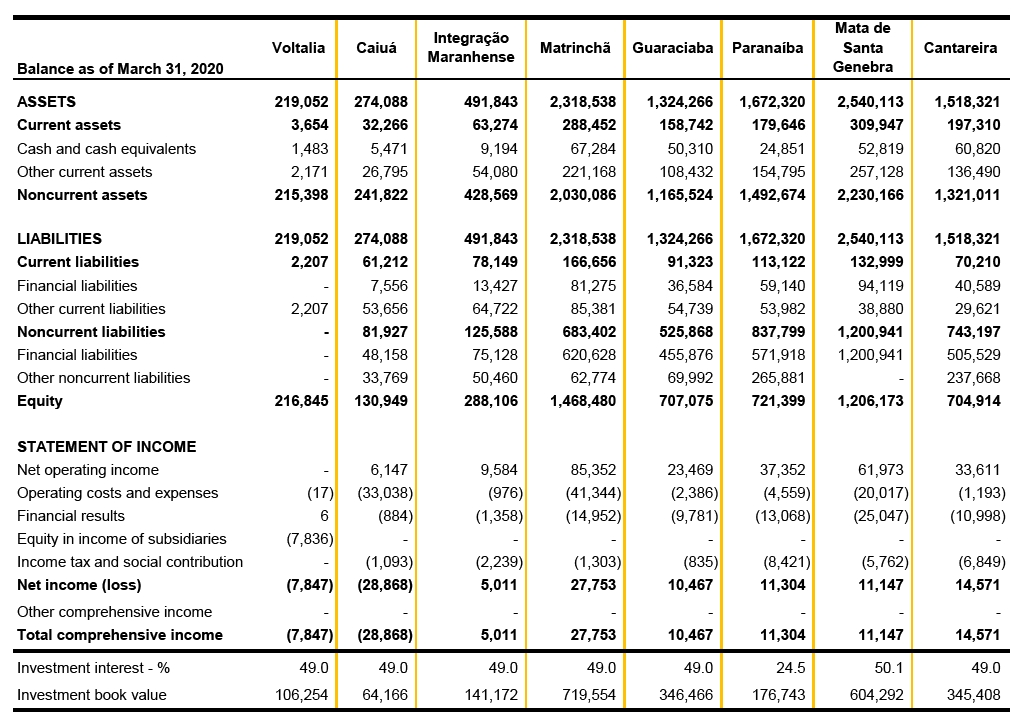

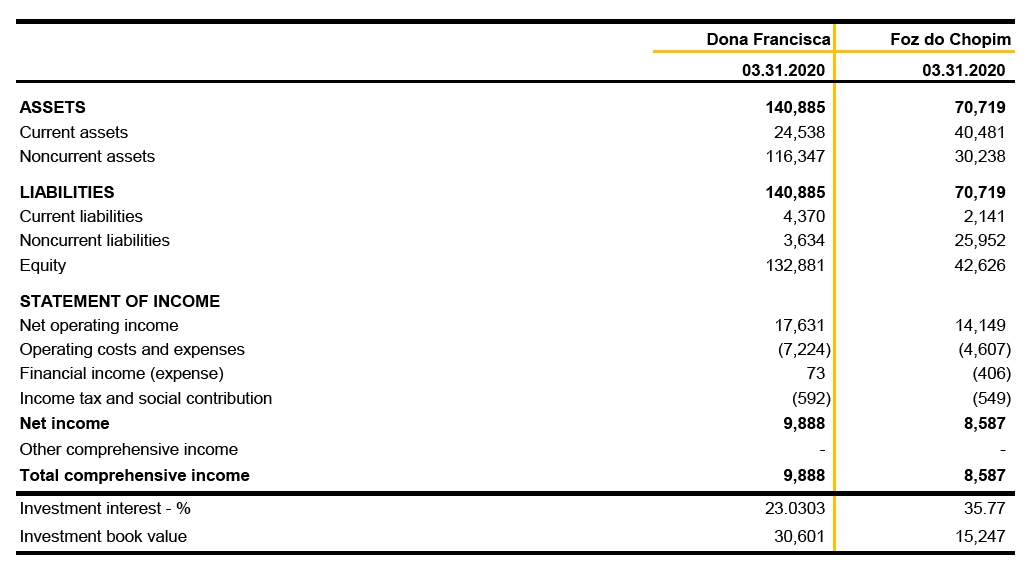

17.4 Total balances of the groups of assets, liabilities, profit or loss and equity interest in contingent liabilities of the mainassociates

As of March 31, 2020, Copel's interest in the contingent liabilities of its associates is equivalent to R$78.817 (R$78.793 as of December 31, 2019).

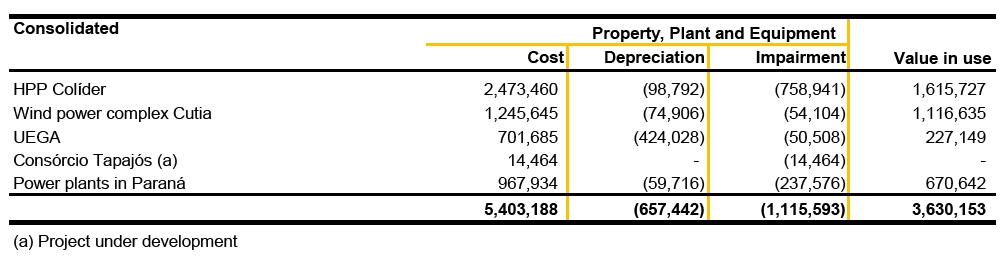

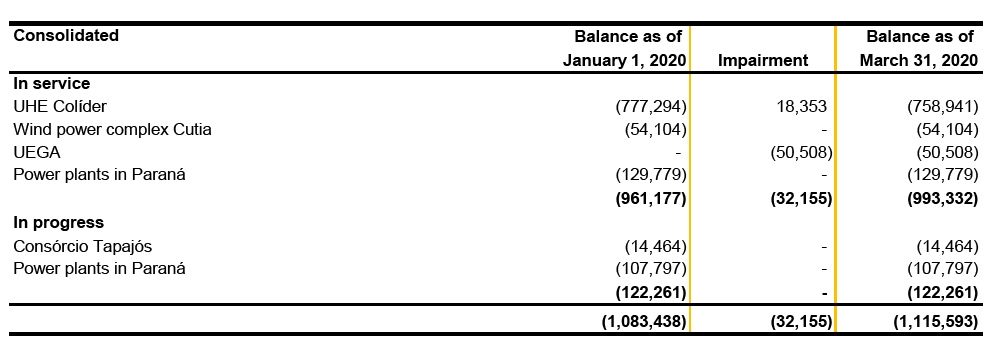

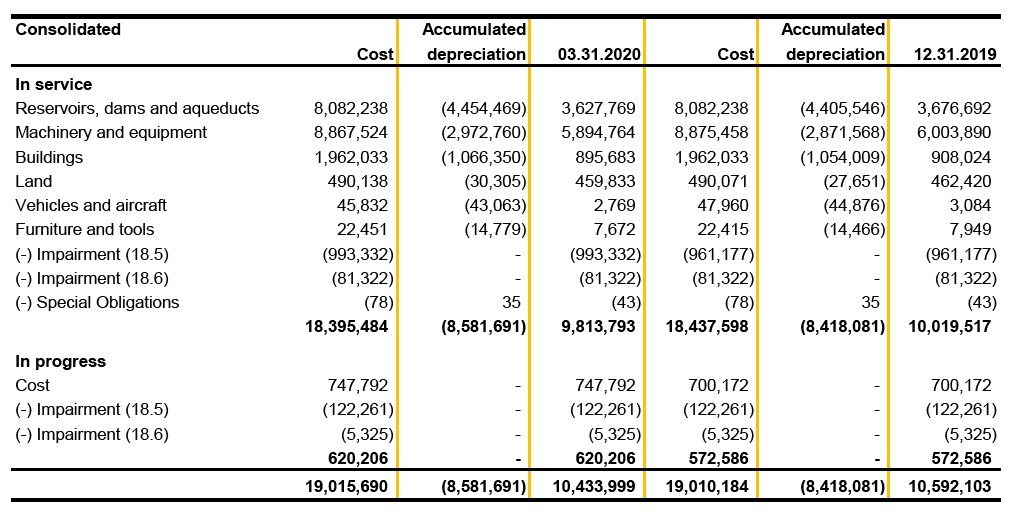

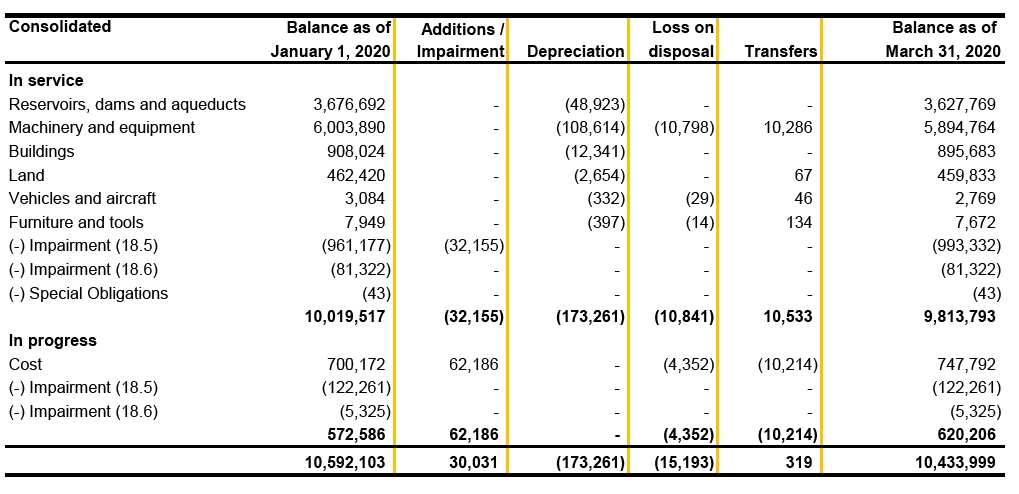

18 Property, Plant and Equipment

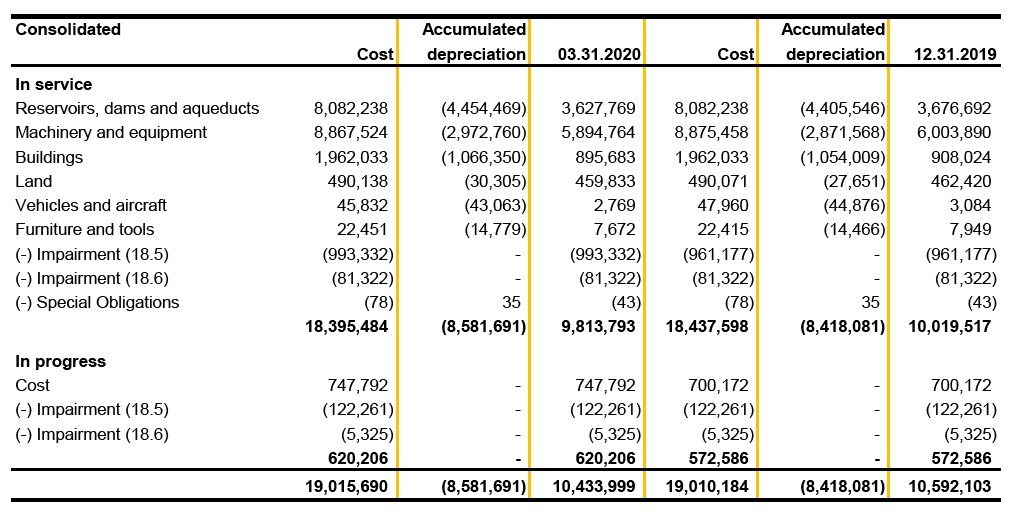

18.1 Property, plant and equipment by assetclass

41

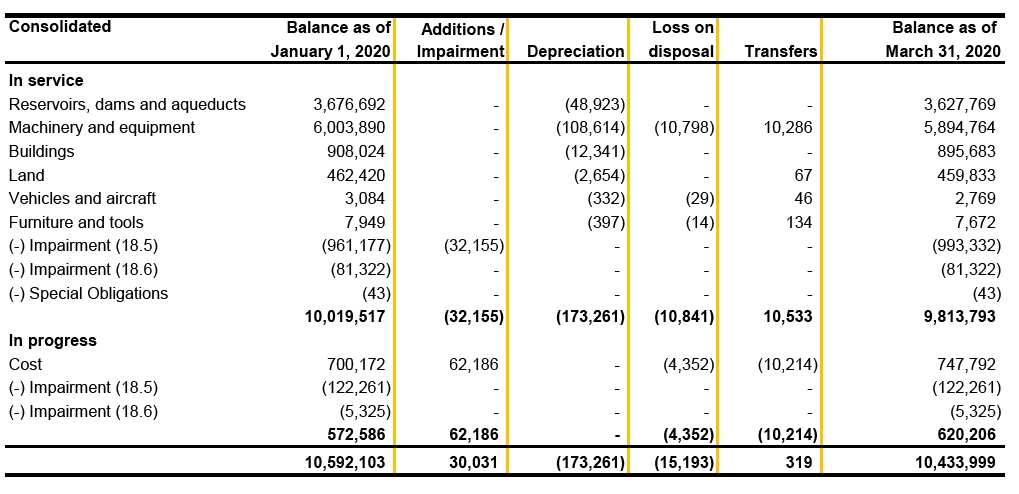

18.2 Changes in property, plant andequipment

18.3 Costs of loans and financing and debenturescapitalized

The costs of loans and financing and debentures capitalized in the first quarter of 2020 totaled R$644, at an average rate of 0.02% p.y. (R$1,169, at an average rate of 0.03% p.y. during the first quarter of 2019).

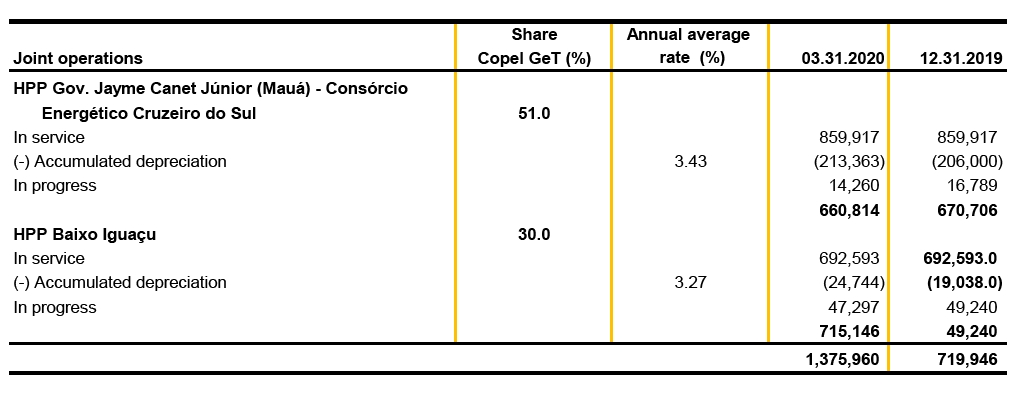

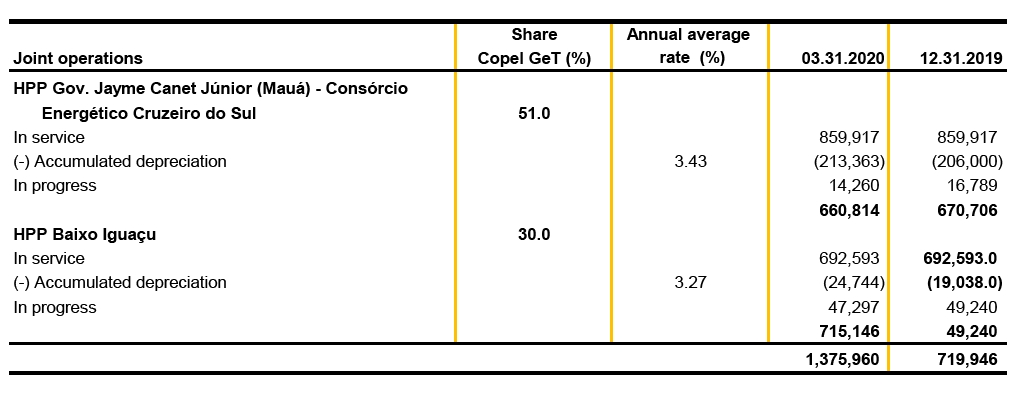

18.4 Joint operations - consortiums

The amounts recorded under property, plant and equipment referring to the share of interest of Copel GeT in consortiums are shown below:

42

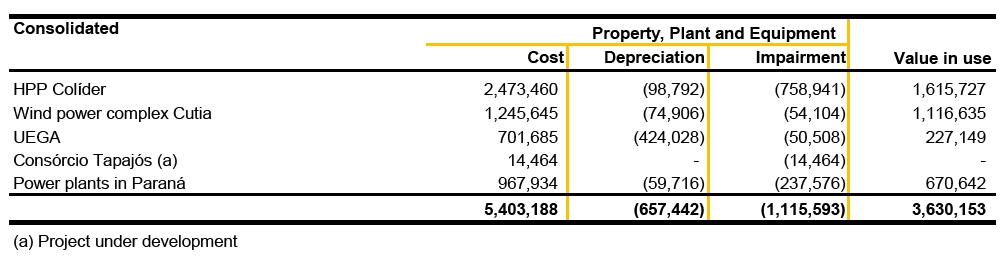

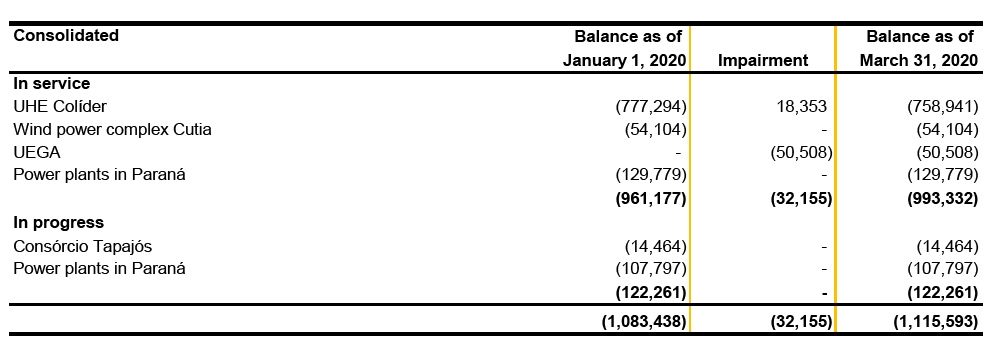

18.5 Impairment of generation segment assets

The projects with impairment balances recorded on March 31, 2020 are the following:

In the first quarter of 2020, the impairment changed as follows:

18.6 Property, Plant and Equipment of Copel Telecomunicações

The Company's Management continuously monitors the business environment of the telecommunications segment, paying particular attention to factors such as the increased competitiveness of the sector, the high degree of investment required to maintain its customer base and the expected return from this segment.

Management concluded that it is not necessary to record losses in addition to the amount recorded.

On March, 31, 2020, the balance of impairment is R$87,399 (R$87,399 as of December 31, 2019). In the first quarter of 2020 were recorded R$7,559 (R$20,425 in the first quarter of 2019) related to write-offs of values due to the decommissioning of assets

18.7 Plants under construction

18.7.1 SHP Bela Vista

With estimated investment of R$200,000, this plant, with installed capacity of 29.4 MW and physical guarantee of 18.4 MW mean, will be built on the Chopim River, in the municipalities of São João and Verê, located in the southwest region of the state of Paraná.

43

The participation in the A-6 auction held on August 31, 2018 led to sale of 14.7 MW mean in regulated contracts at the original price of R$ 195.70/MWh. The energy sale contracts provide for beginning of energy supply on January 1, 2024, with a 30-year term and annual adjustment by reference to IPCA variation.

The works started in August 2019, and the three-generating units are expected to start operating in February, March and April 2021, respectively.

18.7.2 Jandaíra Wind Complex

With estimated investment of R$401,000, this wind farm, with installed capacity of 90.1 MW and physical guarantee of 47.6 MW mean, will be built in the municipalities of Pedra Preta and Jandaíra, in the state of Rio Grande do Norte.

The participation in the new power generation auction A-6, held on October 18, 2019, led to sale of 14.4 MW mean in regulated contracts at the original price of R$ 98.00/MWh. The energy sale contracts provided for beginning of energy supply on January 1, 2025, with a 20-year term and annual adjustment by reference to IPCA variation.

The works are expected to start in May 2020, and the wind farm is expected to start operating between May 2022 and July 2022, on a phased basis, by wind turbine.

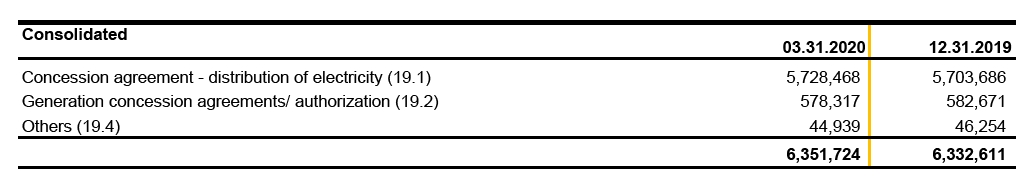

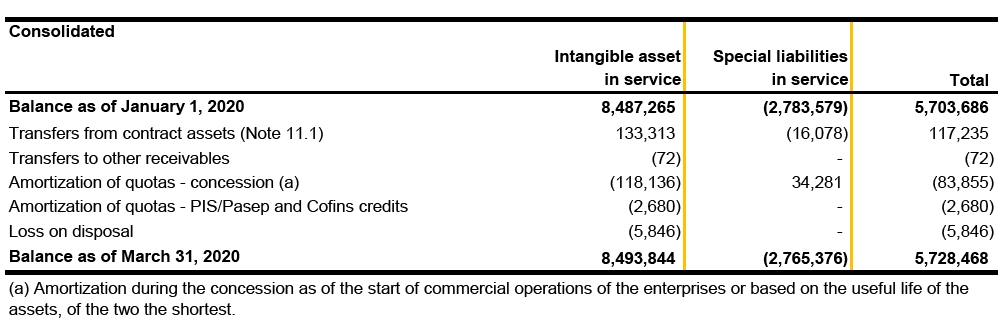

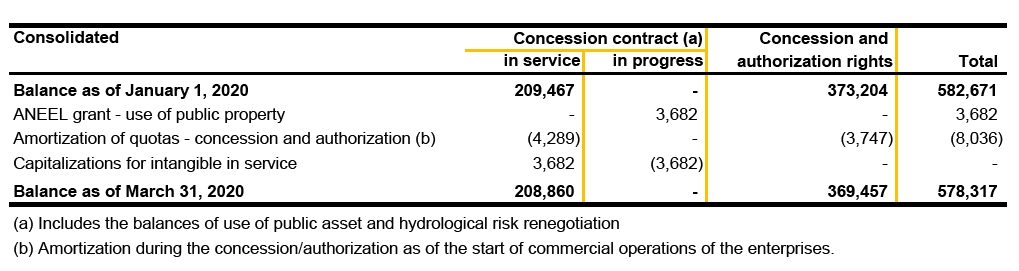

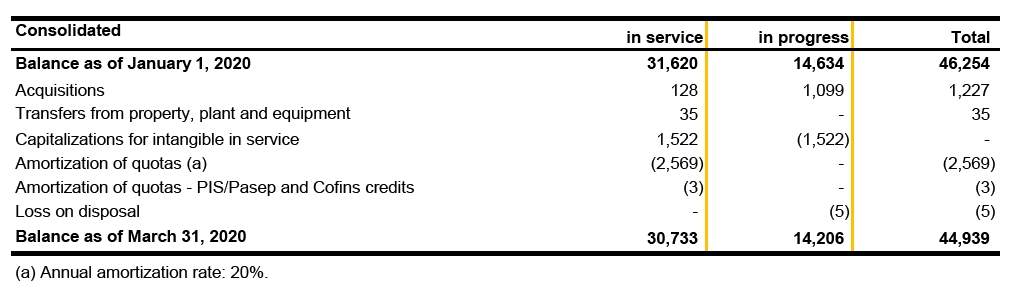

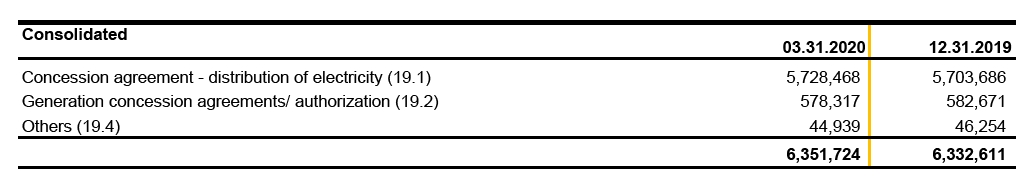

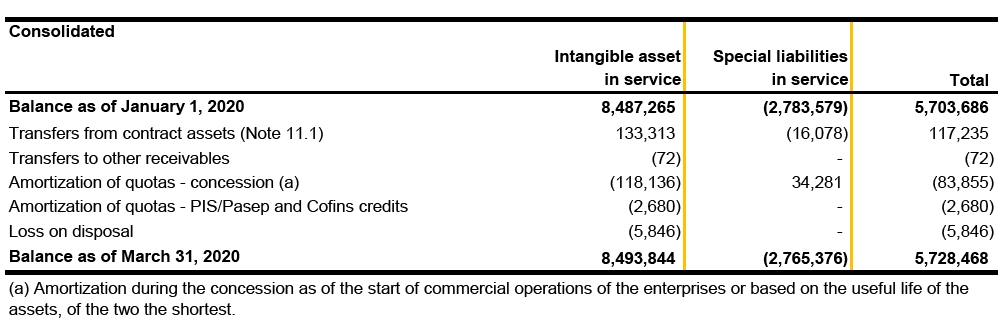

19 Intangible assets

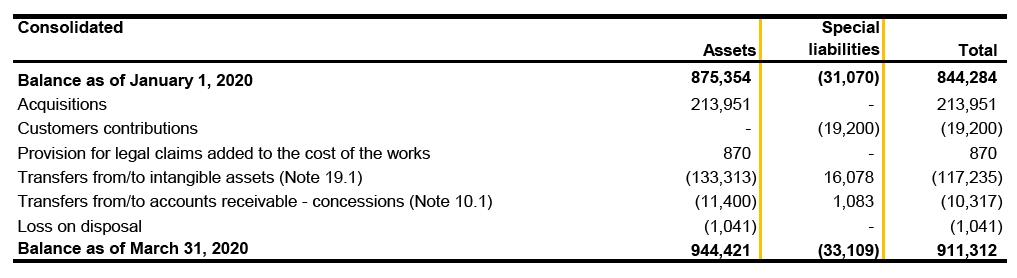

19.1 Power distribution service concession

44

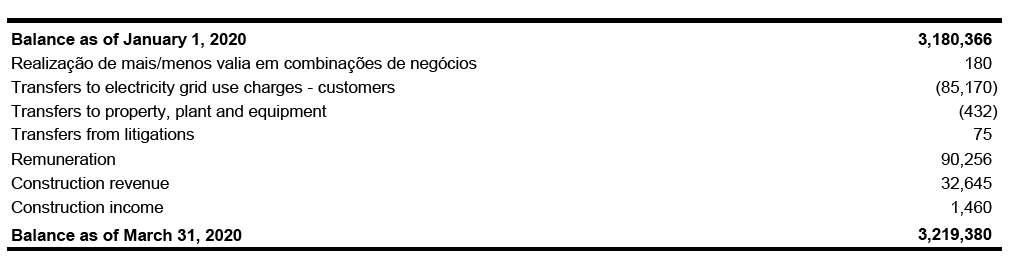

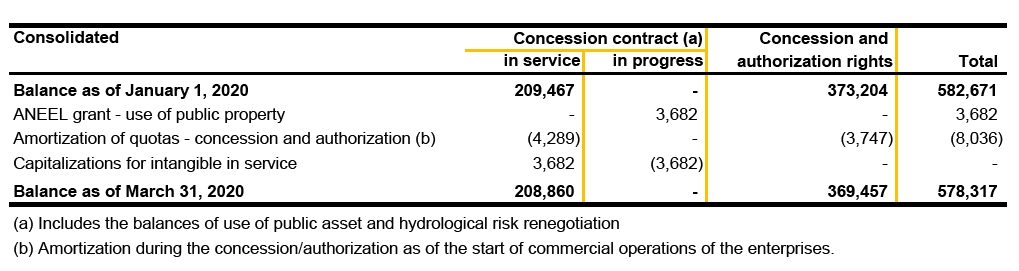

19.2 Generation concession agreements

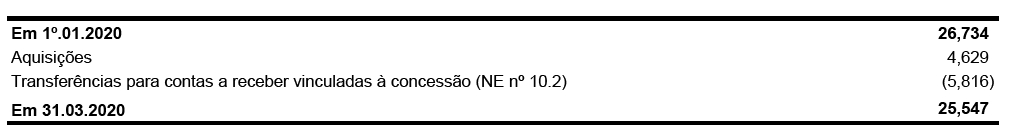

19.3 Piped gas distribution service concession

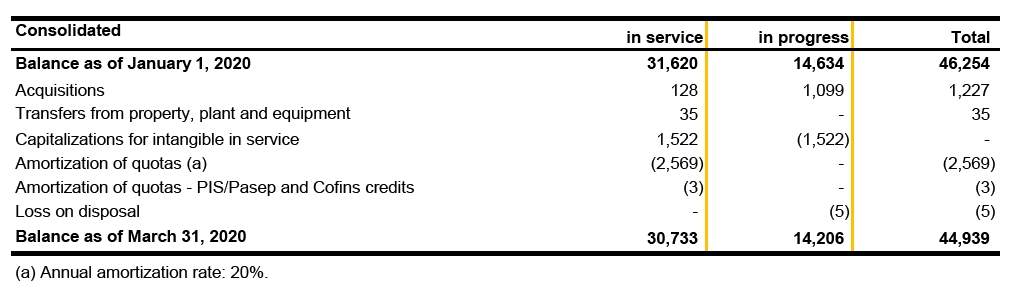

19.4 Other intangible assets

19.5 Costs of loans and financing and debentures capitalized

No loan, financing and debentures costs were capitalized in intangible assets during the first quarter of 2020 and 2019.

45

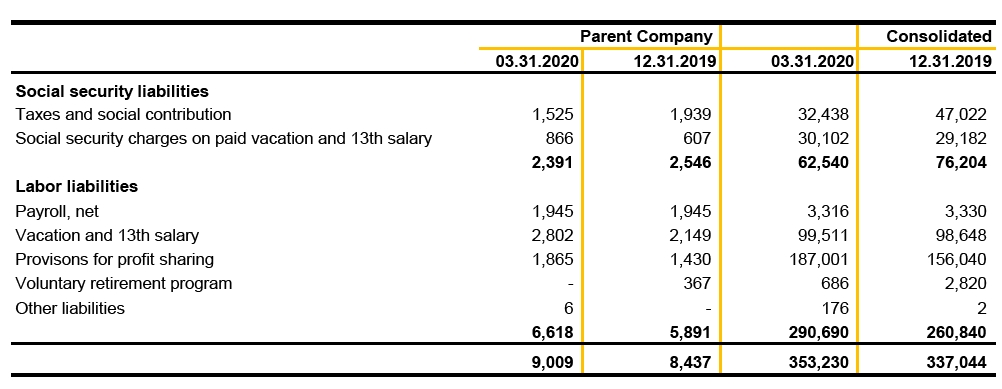

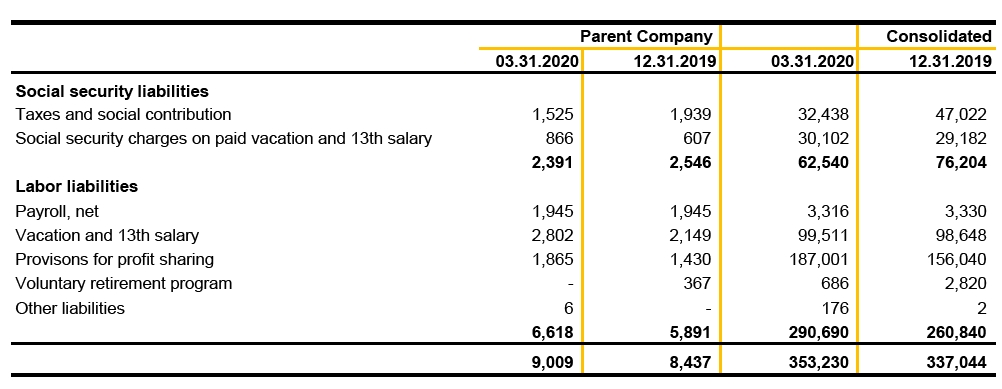

20 Payroll, Social Charges and Accruals

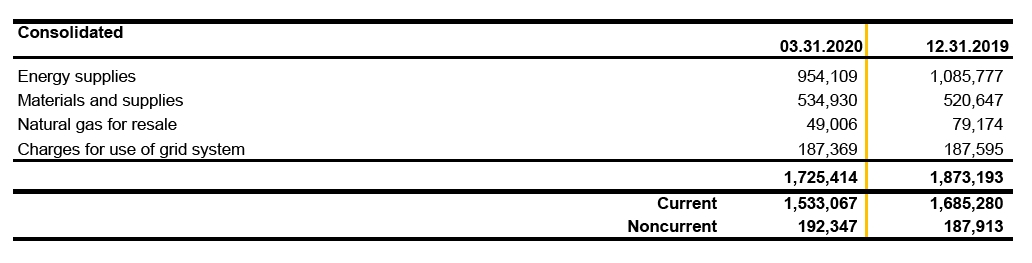

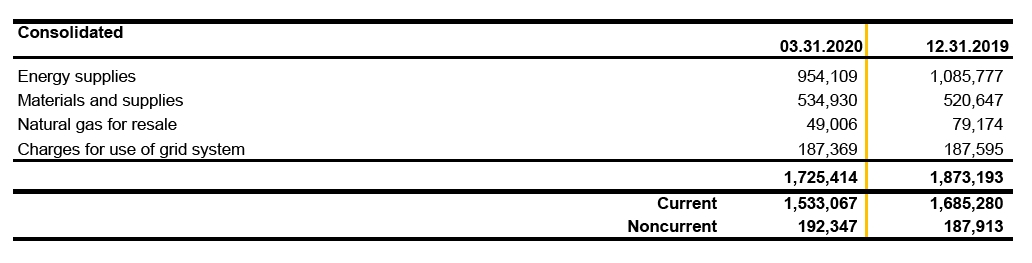

21 Accounts Payable to Suppliers

46

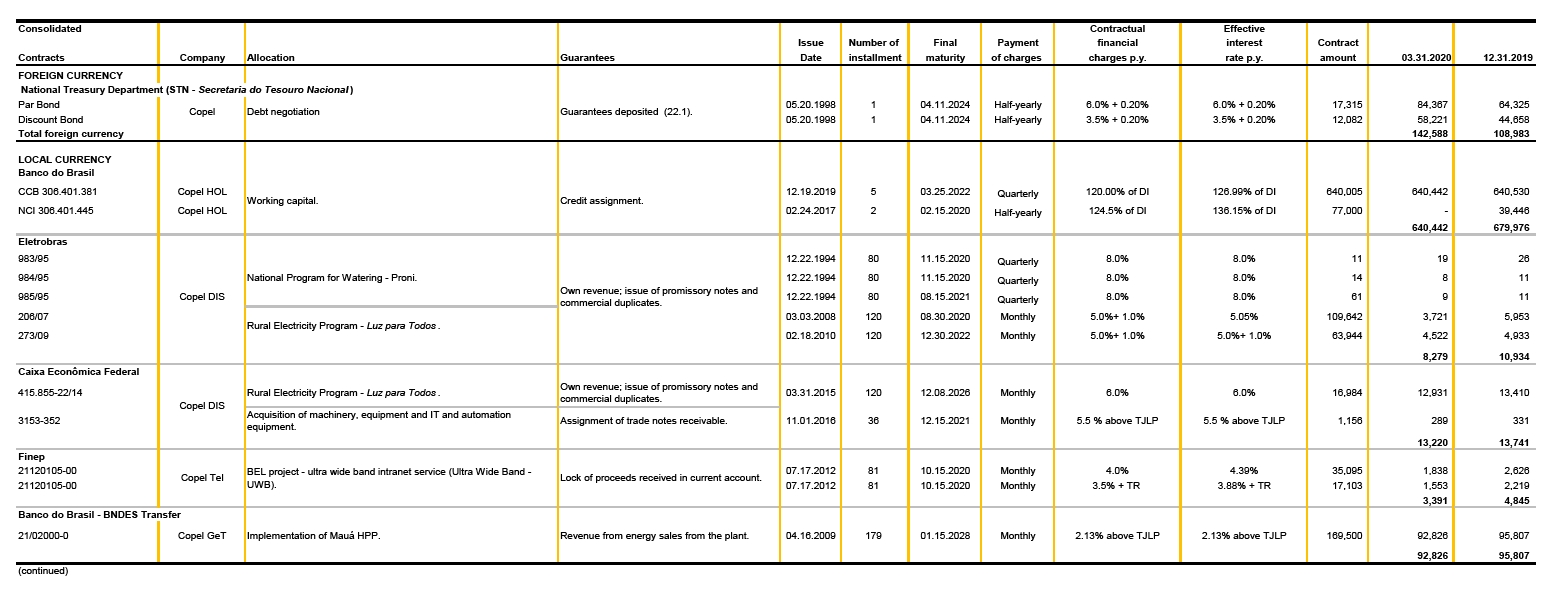

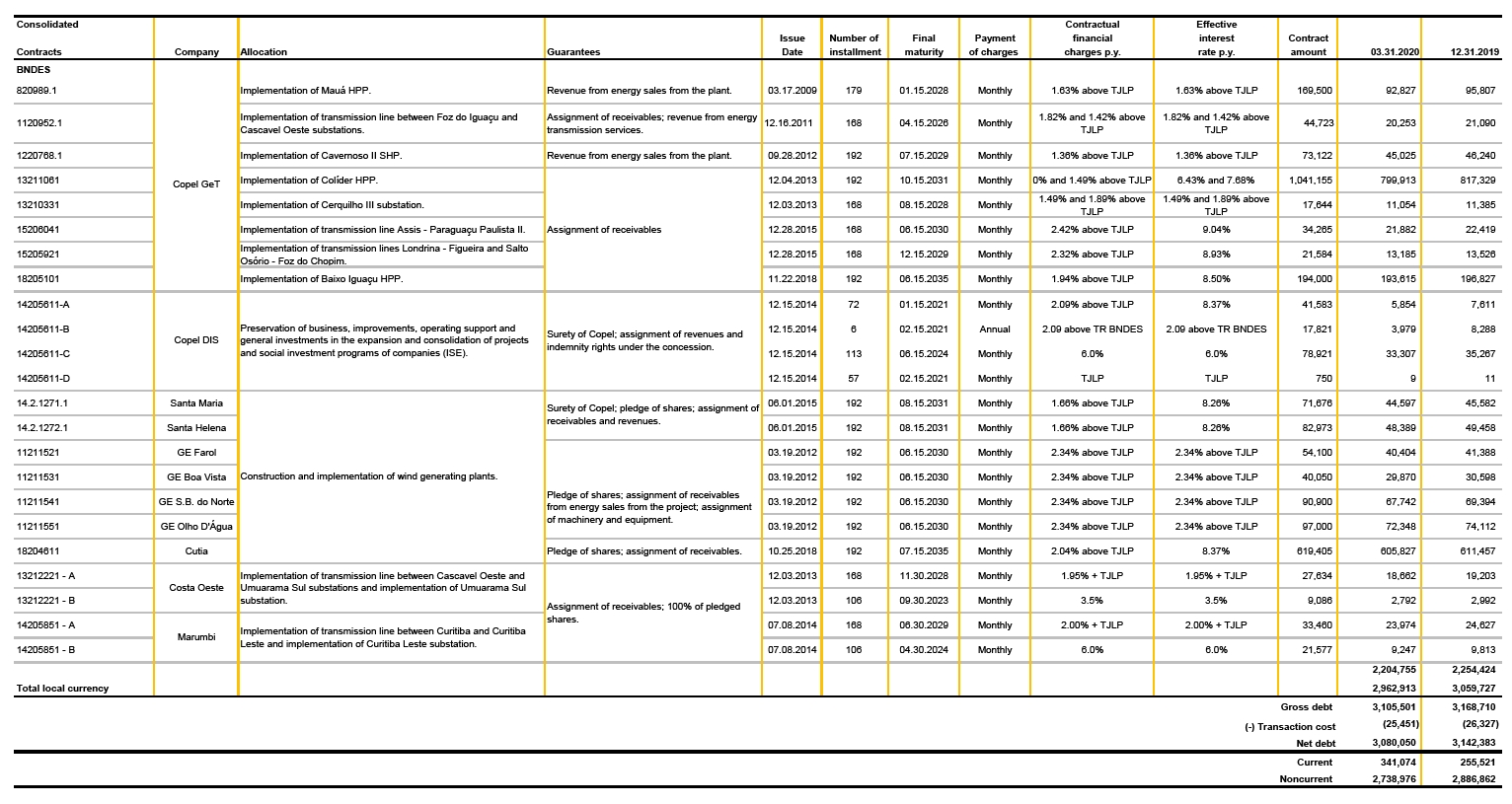

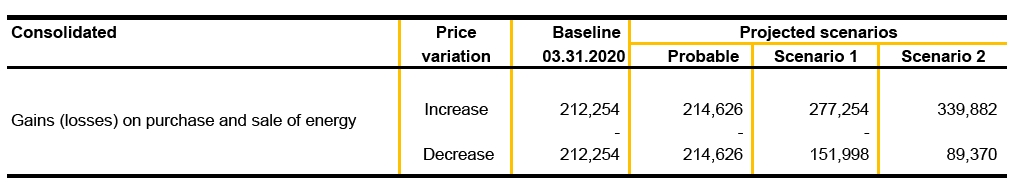

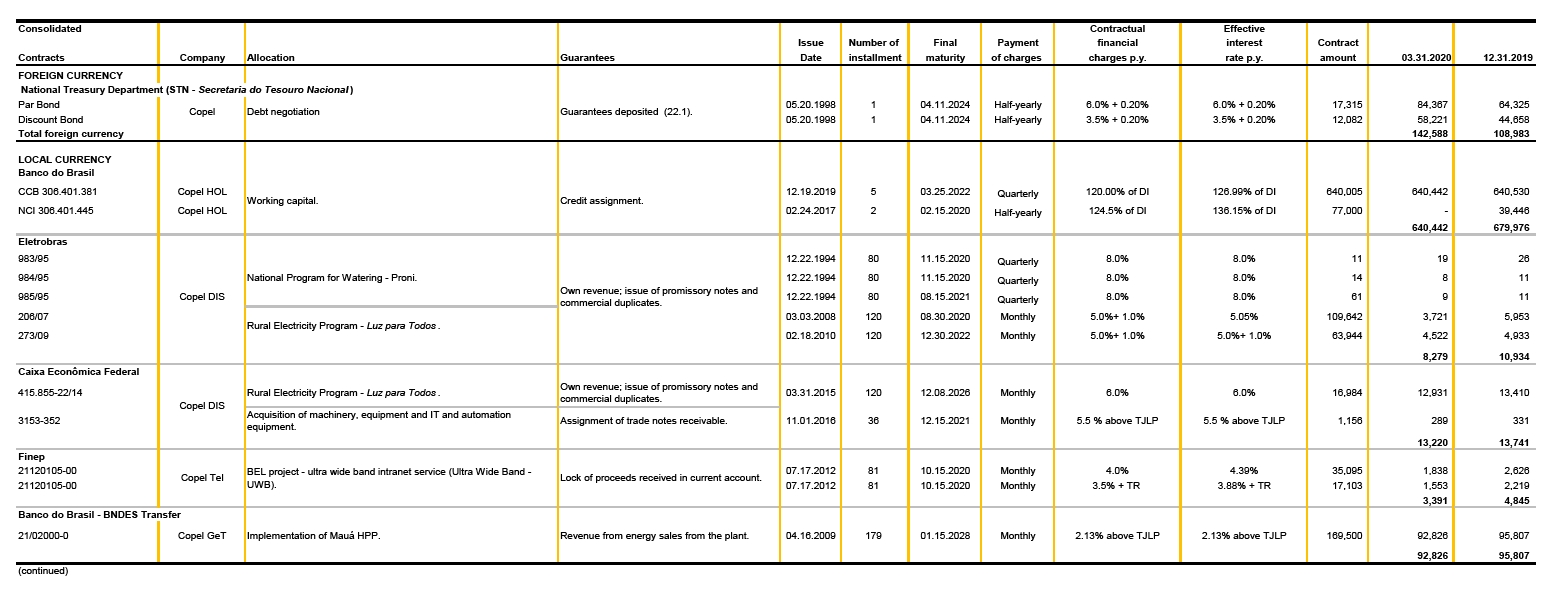

22 Loans and Financing

47

22.1 Collateral and escrow deposits - STN

Constitution of guarantees, in the form of a cash guarantee, Par Bond, in the amount of R$74.883 (R$57.968 at December 31, 2019), and Discount Bond, in the amount of R$52.273 (R$40.465 at December 31, 2019), intended to the repayment of the amount of principal related to the STN contracts, upon maturity on April 11, 2024. The amounts are adjusted by applying the weighted average of the percentage changes of the Zero-Coupon Bond prices of the United States of America Treasury, by the percentage share of each series of the instrument in the portfolio of collateral for repayment of principal, constituted pursuant to the Brazilian Financing Plan of 1992.

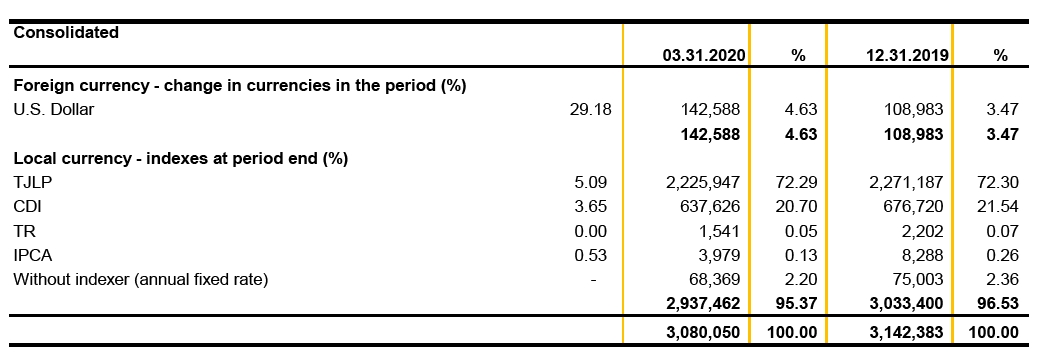

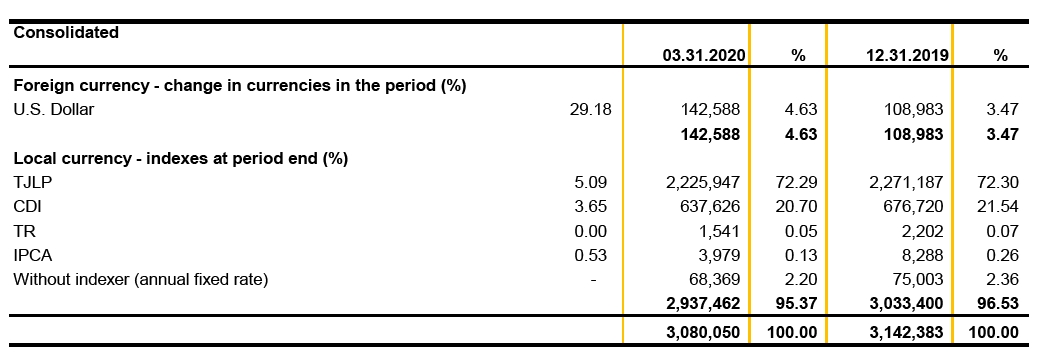

22.2 Breakdown of loans and financing by currency and index

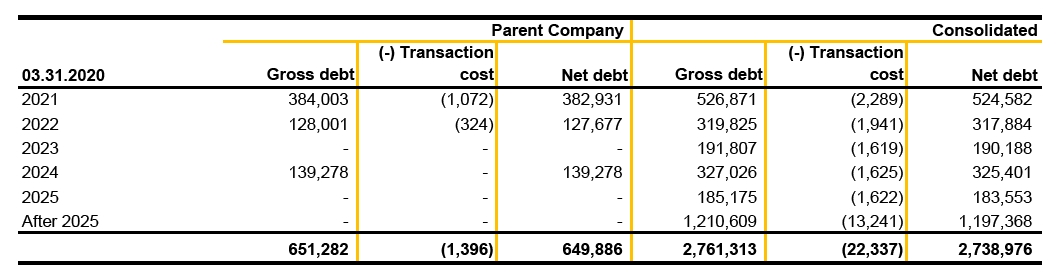

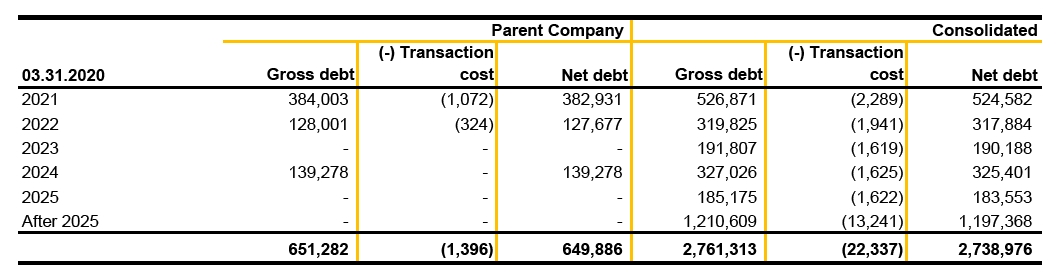

22.3 Maturity of noncurrent installments

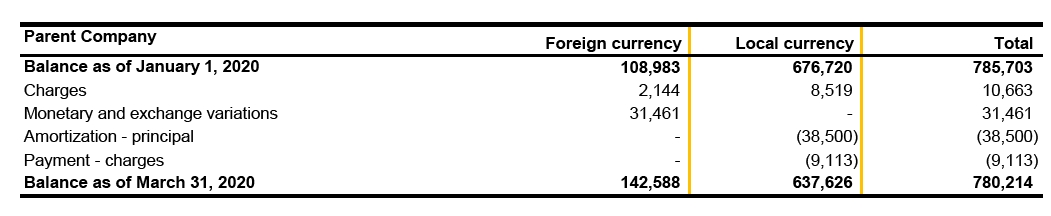

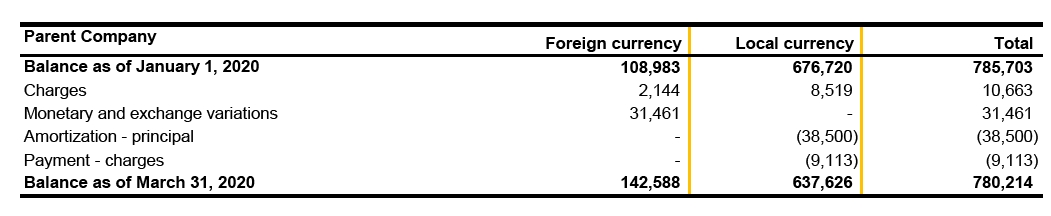

22.4 Changes in loans and financing

49

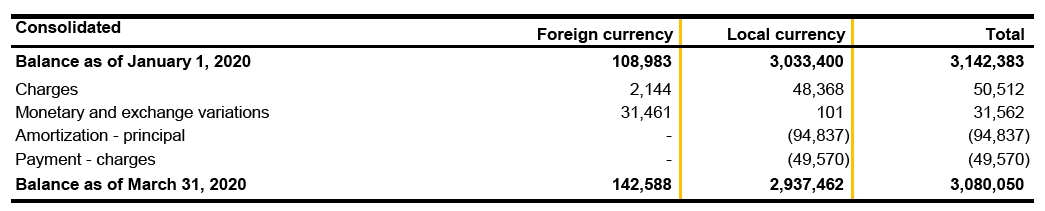

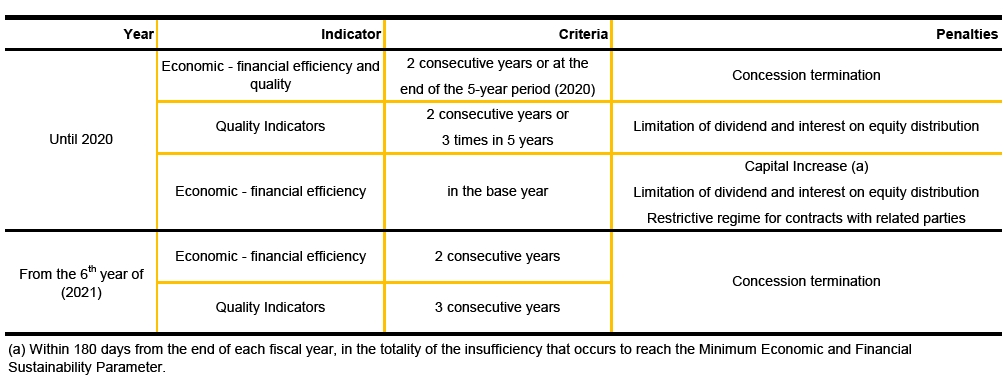

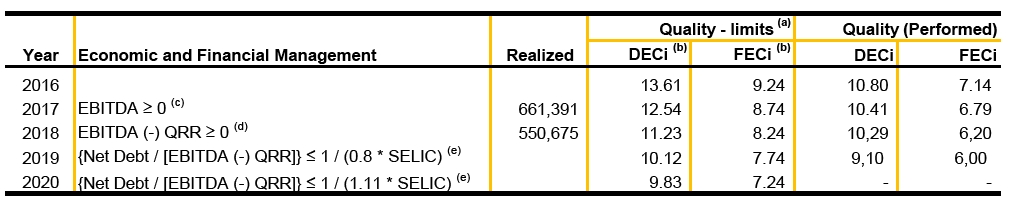

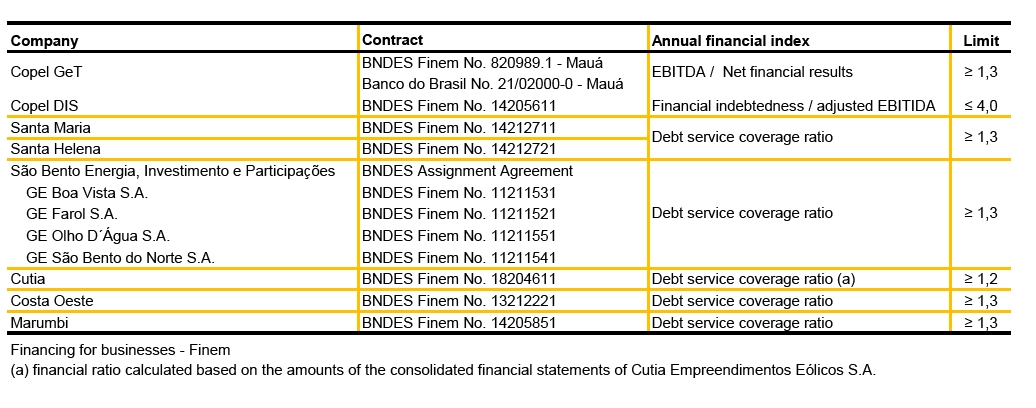

22.5 Covenants

The Company and its subsidiaries signed loans and financing agreements containing covenants that require economic and financial ratios to be maintained within pre-determined parameters, requiring annual fulfillment and other conditions to be complied with, such as not changing the Company's interest in the capital stock of subsidiaries that would represent change of control without prior consent.Failing to fulfill these conditions may lead to accelerated debt repayment and/or fines.

As of December 31, 2019, the Company was in compliance with all financial covenants measured only annually. As of March 31, 2020, Copel is in compliance with all other ratios and covenants.

The financial covenants contained in the agreements are presented below:

50

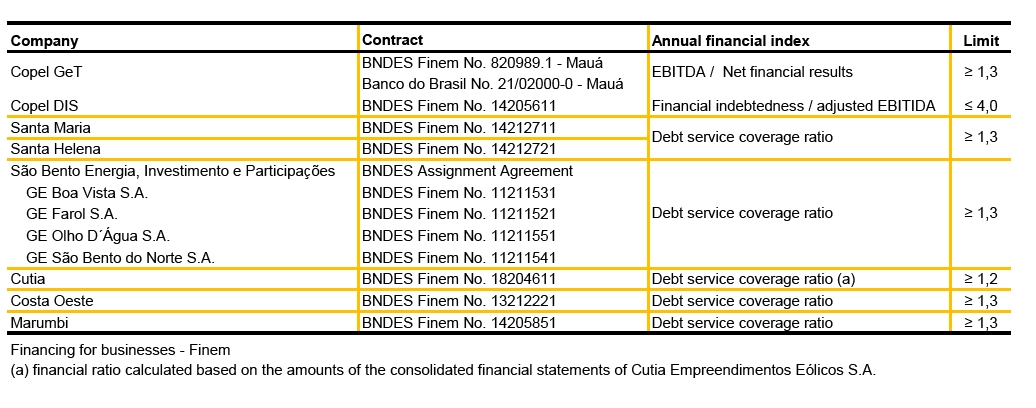

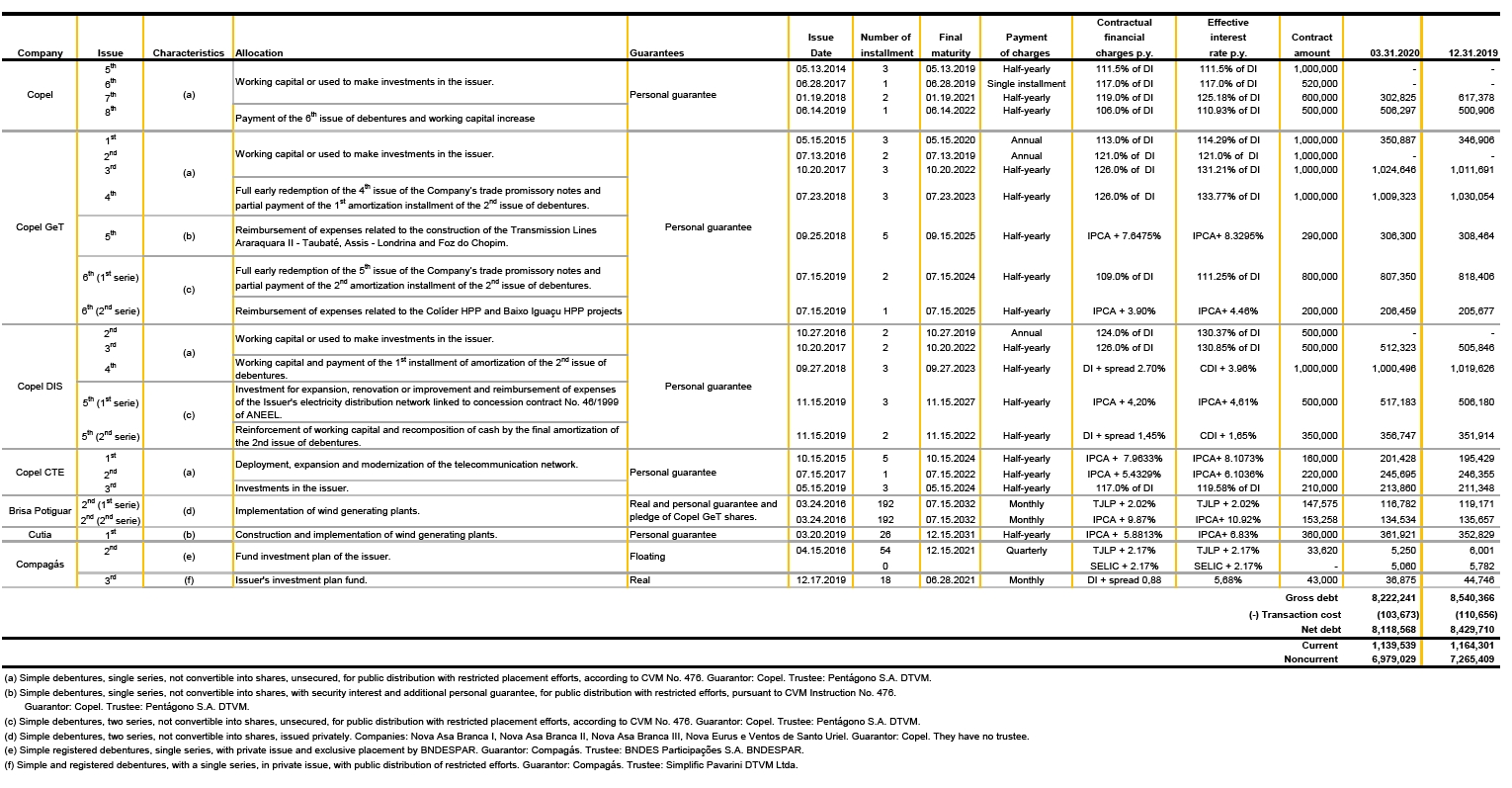

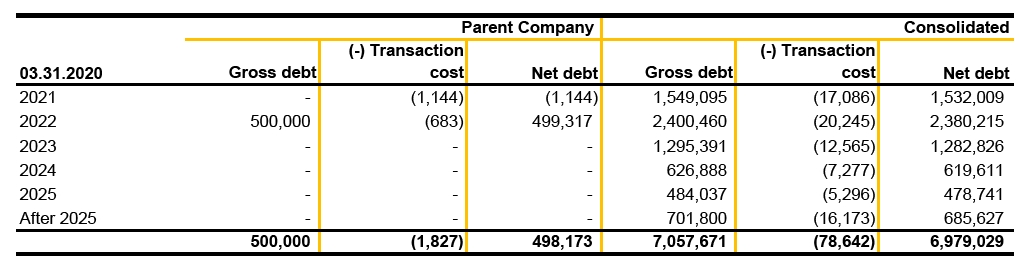

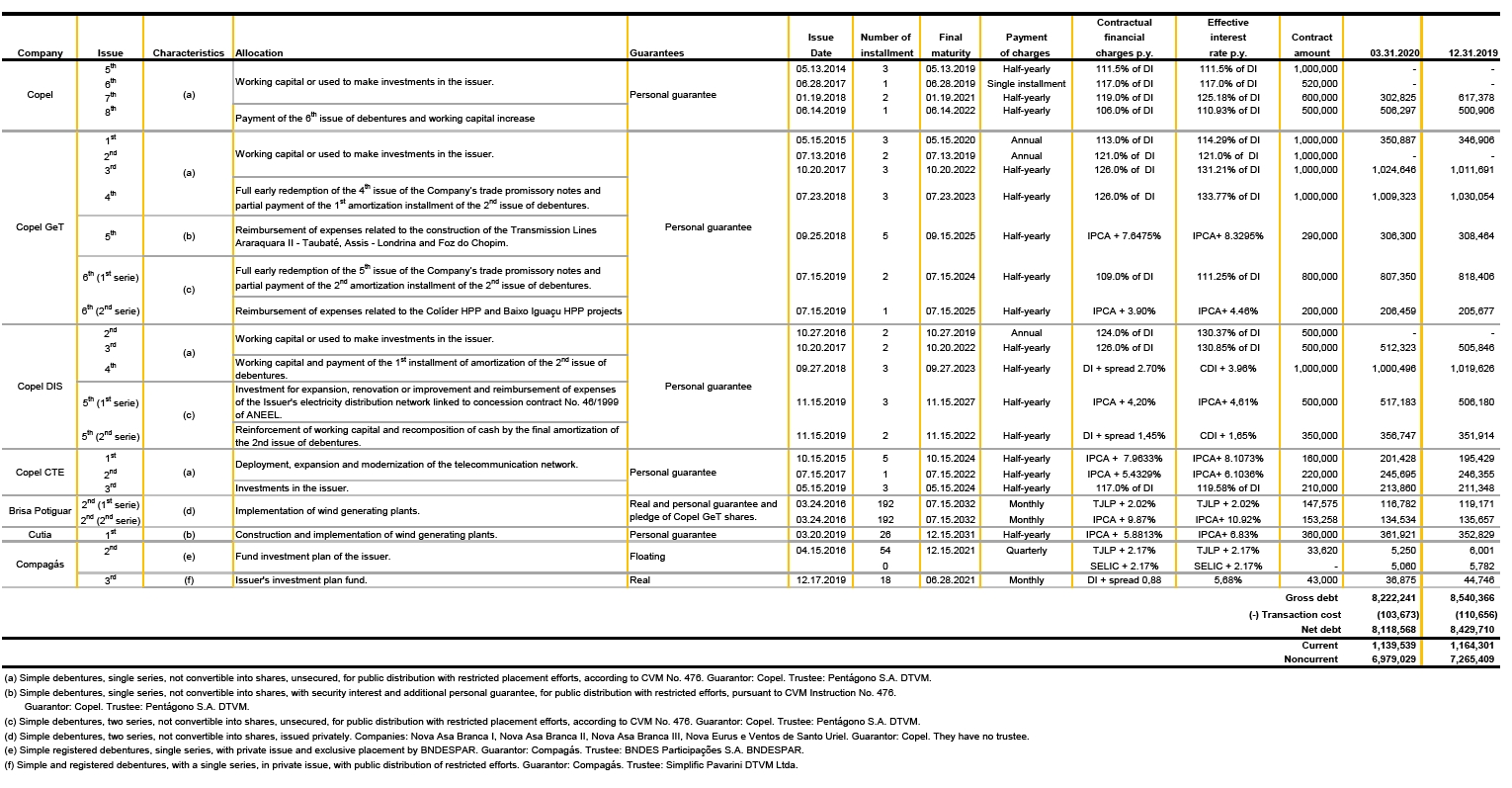

23 Debentures

51

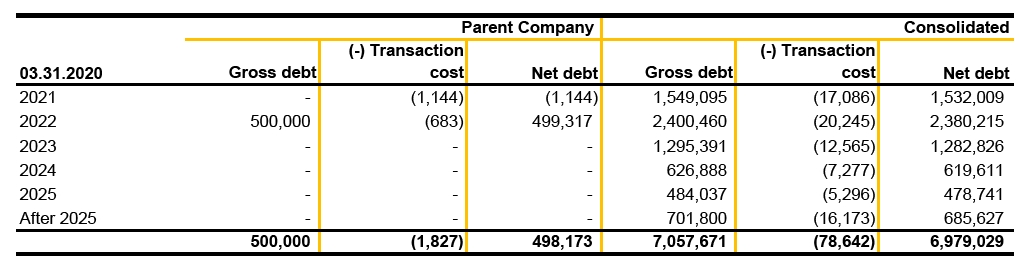

23.1 Maturity of noncurrent installments

23.2 Changes in debentures

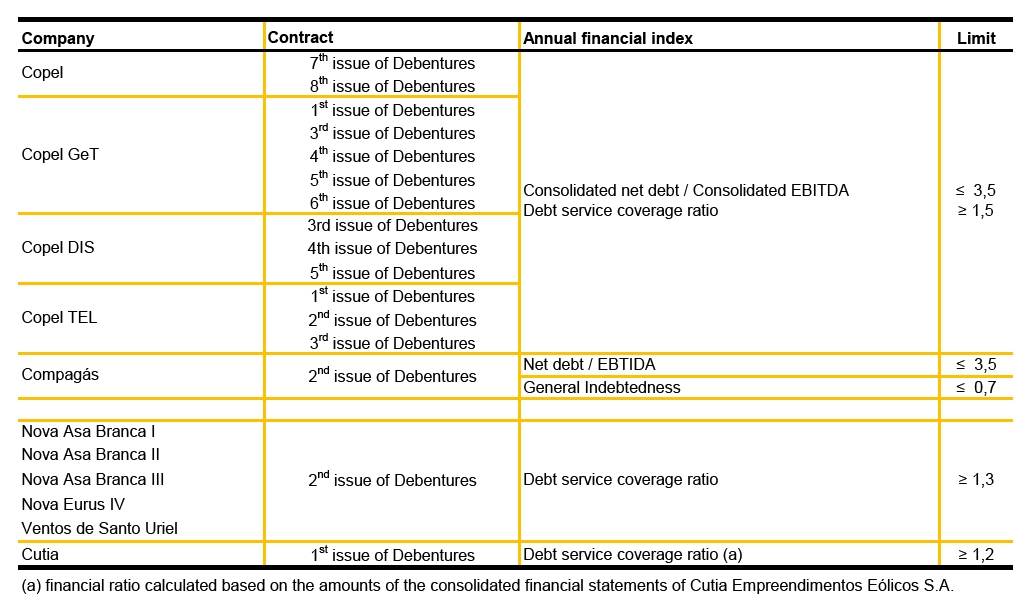

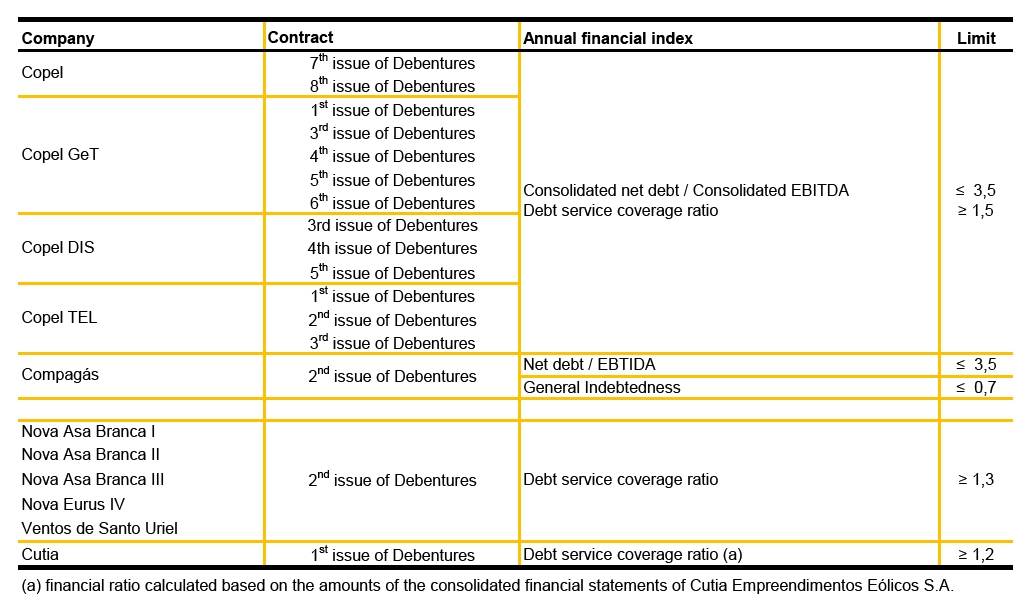

23.3 Covenants

Copel and its subsidiaries issued debentures containing covenants that require the maintenance of certain economic and financial ratios within pre-determined parameters, requiring annual fulfillment and other conditions to be complied with, such as not changing the Company's interest in the capital stock that would represent change of control without prior consent from the debenture holders; not paying out dividends or interest on capital if it is in arrears in relation to honoring any of its financial obligations or not maintaining the financial ratios as determined without prior written consent of the debenture holders. Failing to fulfill these conditions may lead to accelerated redemption of debentures and regulatory penalties.

As of December 31, 2019, the Company was in compliance with all financial covenants measured only annually. As of March 31, 2020, Copel is in compliance with all other ratios and covenants.

52

The financial covenants contained in the agreements are presented as follows:

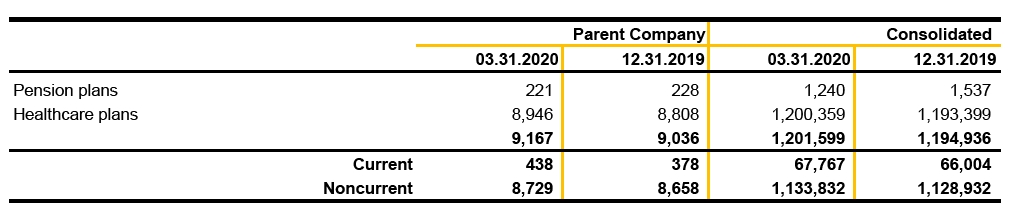

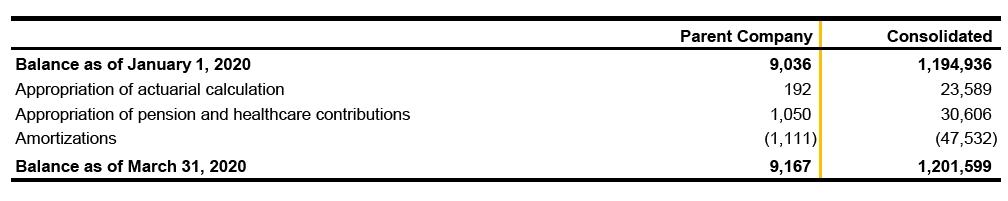

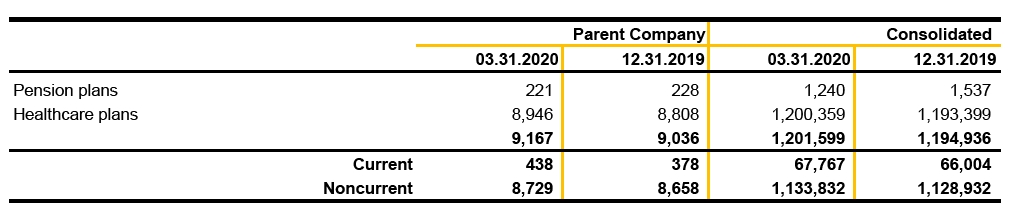

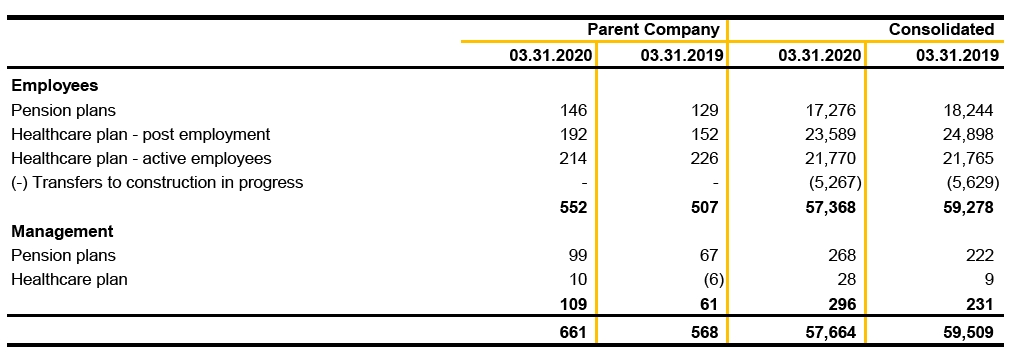

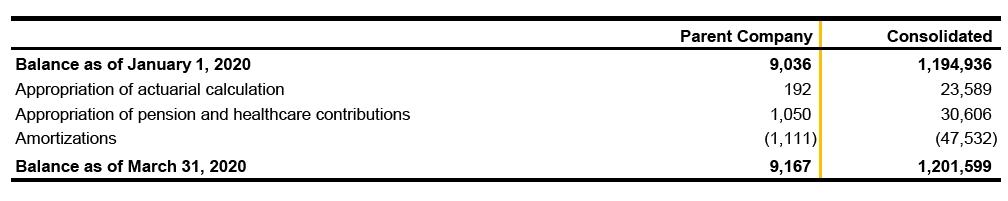

24 Post-employment Benefits

The Company and its subsidiaries sponsor private retirement and pension plans (Unified Plan and Plan III) and Healthcare Plan for medical and dental care ("ProSaúde II" and "ProSaúde III" Plans) for their active employees and their legal dependents. The lifetime sponsorship of the Healthcare Plan for retirees, pensioners and legal dependents is only applied to "Prosaúde II" plan participants.

The costs assumed by the sponsors for these plans are recognized according to the actuarial evaluation prepared annually by independent actuaries in accordance with CPC 33 (R1) - Employee Benefits, corresponding to IAS 19 and IFRIC 14. The economic and financial assumptions for purposes of the actuarial valuation are discussed with the independent actuaries and approved by the Parent company's Management.

Further information is available in the Financial Statements of December 31, 2019.

24.1 Pension plan

The Unified Plan is a Defined Benefit plan - BD in which the income is predetermined, according to each individual's salary. This plan is closed for new participants since 1998.

The Plan III is a Variable Contribution plan - CV, being the only plan available for new participants.

53

24.2 Healthcare Plan

The Company and its subsidiaries allocate resources for the coverage of healthcare expenses incurred by their employees and their dependents, within rules, limits and conditions set in "ProSaúde II" and "ProSaúde III" Plans' regulations. Coverage includes periodic medical exams in both plans and is extended to all retirees and pensioners for life only in the "ProSaúde II" plan.

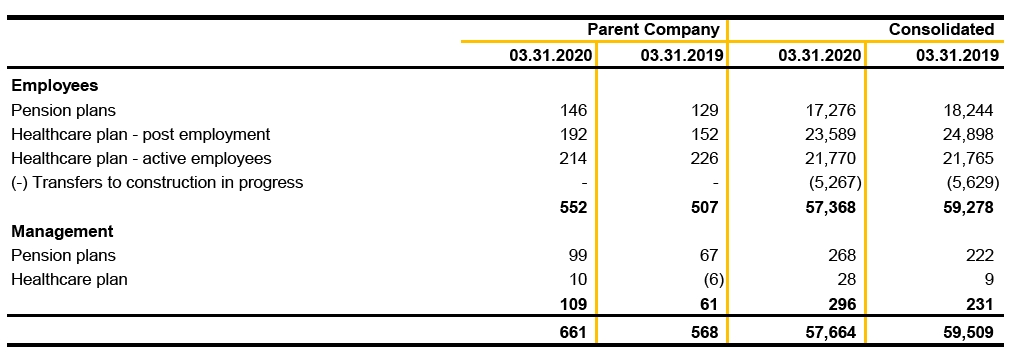

24.3 Balance sheet and statement of income

Amounts recognized in liabilities, under Post-employment benefits, are summarized below:

Amounts recognized in the statement of income are shown below:

24.4 Changes in post-employment benefits

54

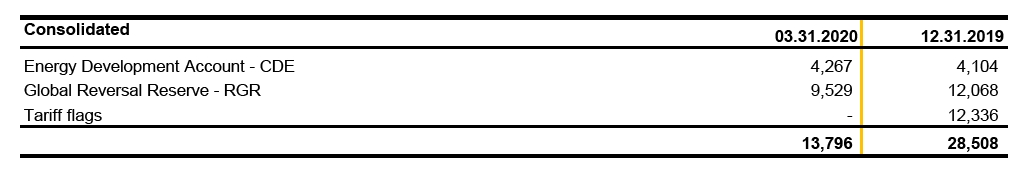

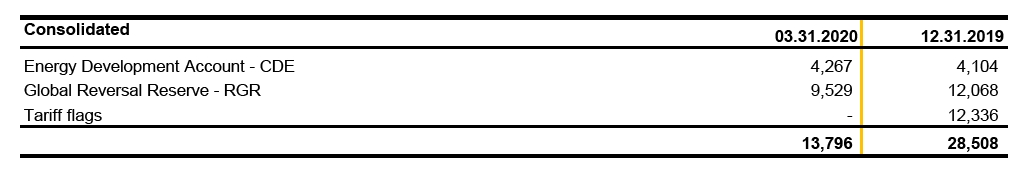

25 Sectorial Charges Due

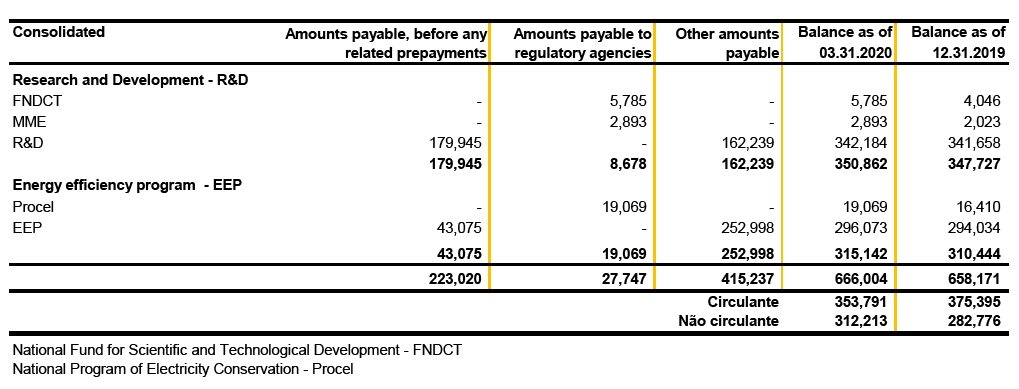

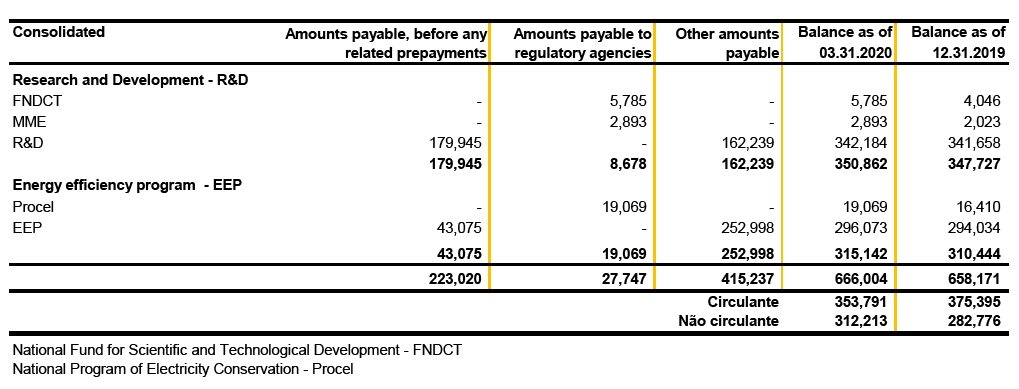

26 Research and Development and Energy Efficiency

26.1 Balances recognized for investment in Research and Development (R&D) activities and the Energy Efficiency Program(EEP)

26.2 Changes in R&D and EEPbalances

55

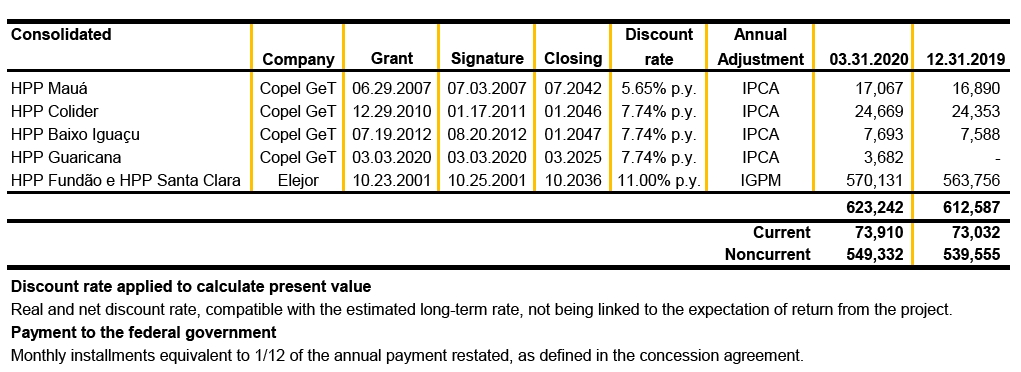

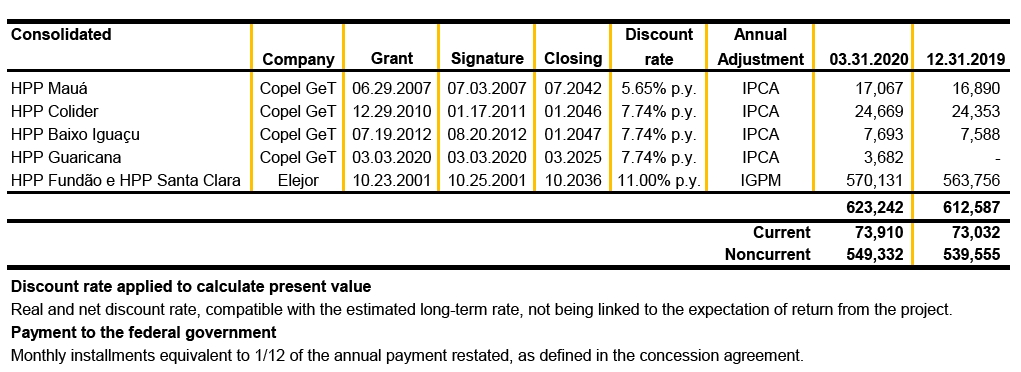

27 Accounts Payable Related to Concessions

27.1 Changes in accounts payable related to concessions

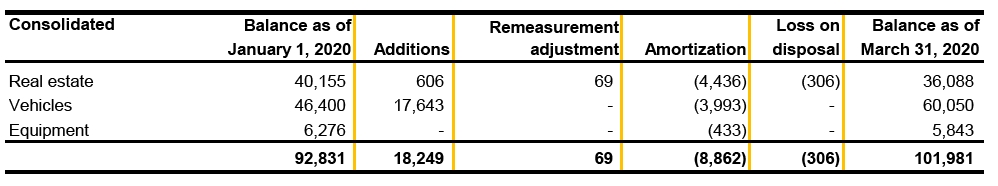

28 Right-of-use asset and lease liability

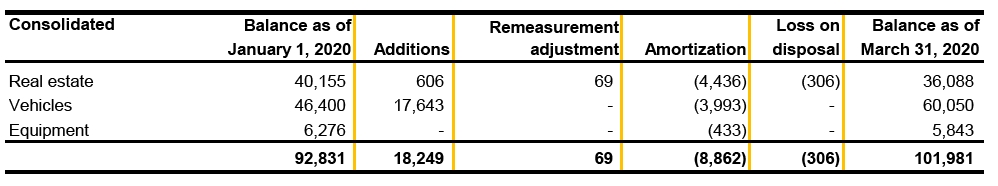

With the adoption of CPC 06 (R2)/IFRS 16, the Company recognized right-of-use asset and lease liability as follows:

28.1 Right-of-use asset

56

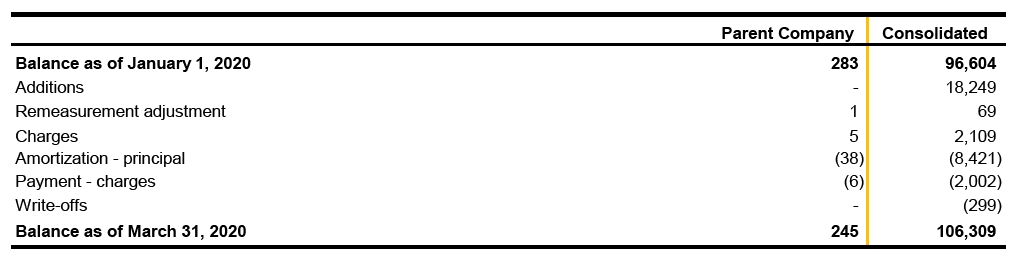

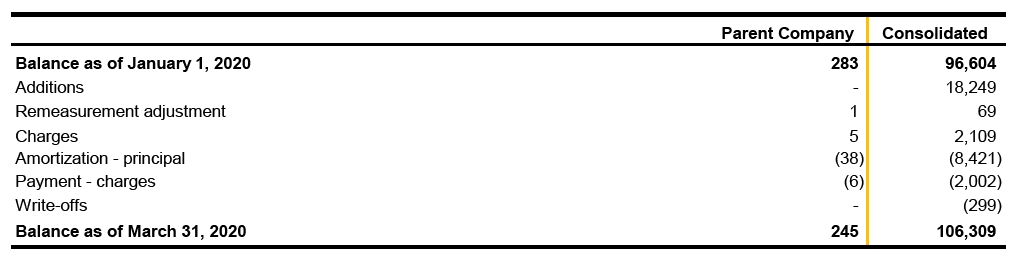

28.2 Lease liability

28.2.1 Changes in lease liability

The Company defines the discount rate based on the interest rateapplied to the last debentures fundraising, disregarding subsidized or incentivized funding. The last discount rate applied to contracts started in March 2020 was 5.10% p.y.

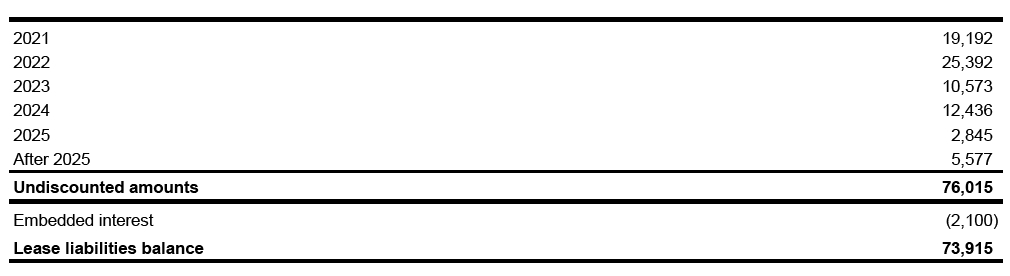

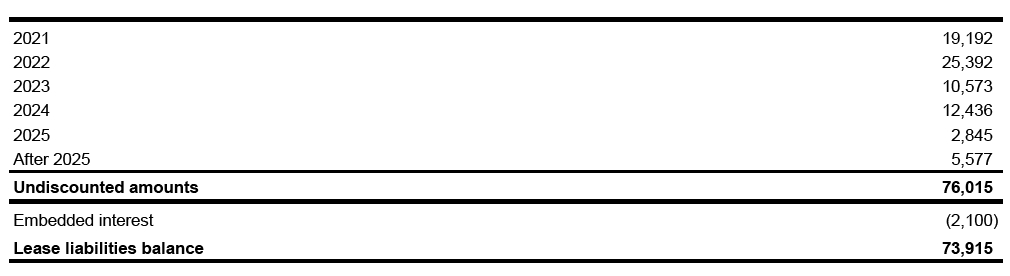

28.2.2 Maturity of noncurrent installments

28.2.3 Potential right to Pis/Cofins recoverable

The table below shows the potential right to Pis/Cofins recoverable for Pis/Cofins computed in lease consideration payable in the foreseen periods.

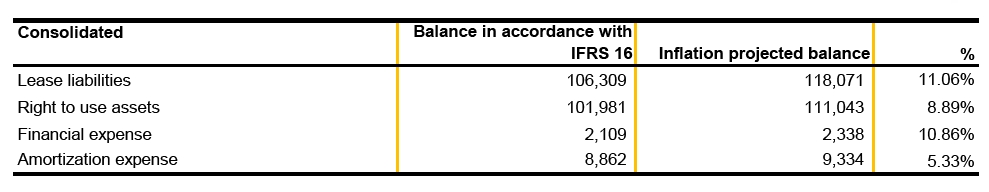

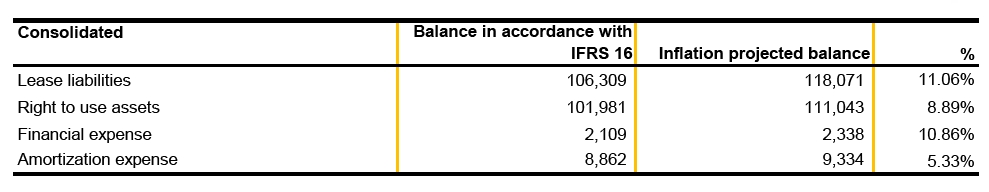

28.3 Impact of forecast inflation on discounted cash flows

In accordance with CPC 06 (R2) / IFRS 16, in measuring and remeasuring lease liabilities and right-of-use assets, the Company used the discounted cash flow method without considering forecast future inflation, according to the prohibition imposed by the standard.

However, given the current reality of long-term interest rates in the Brazilian economic environment, the table below shows the comparative balances between the information recorded in accordance with CPC 06 (R2) / IFRS 16 and the amount that would be recorded considering forecast inflation:

57

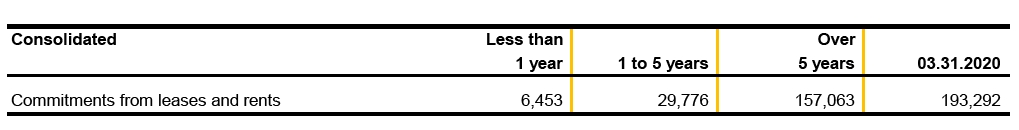

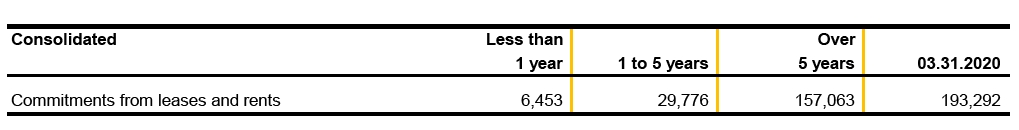

28.4 Commitments from leases and rentals

For leases of low value assets, such as computers, printers and furniture, short-term leases, as well as for leases of land for development of wind power generation projects, whose payment is made based on variable remuneration, the amounts are recognized in the statement of income as operating costs and/or expenses (Note 33.6). The balance of commitments from leases and rentals is shown below:

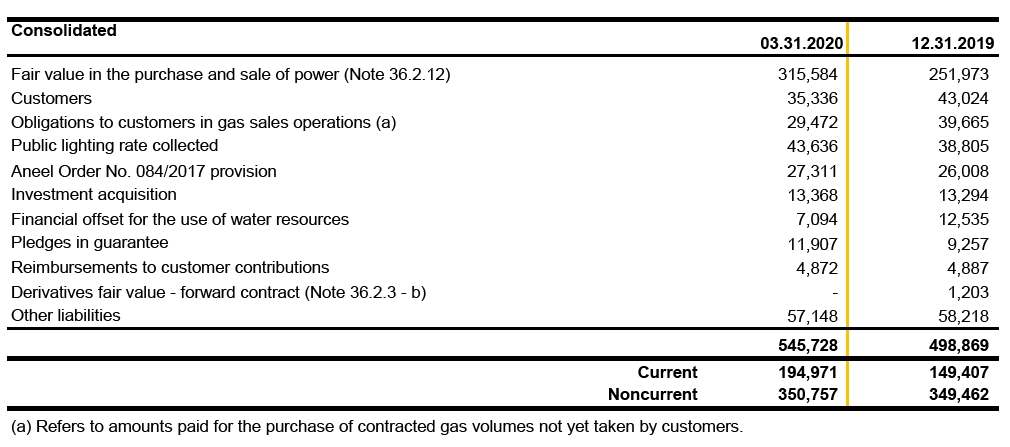

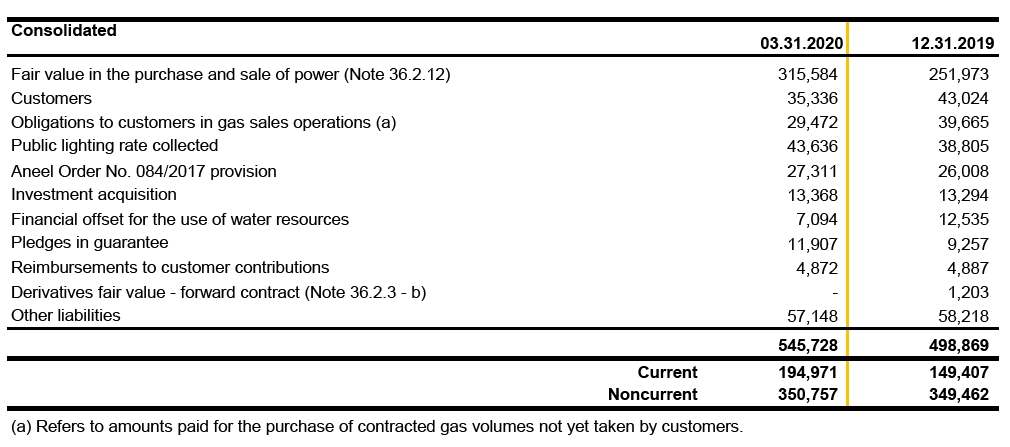

29 Other Accounts Payable

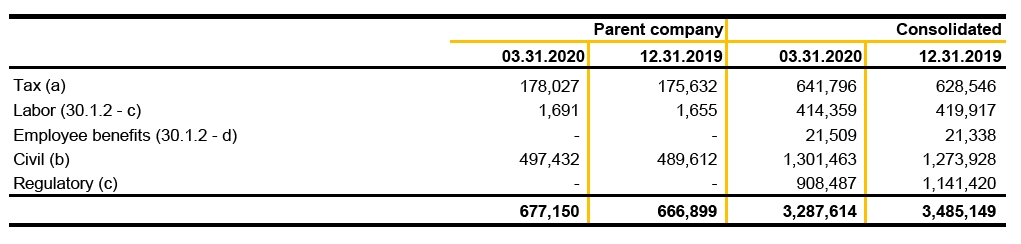

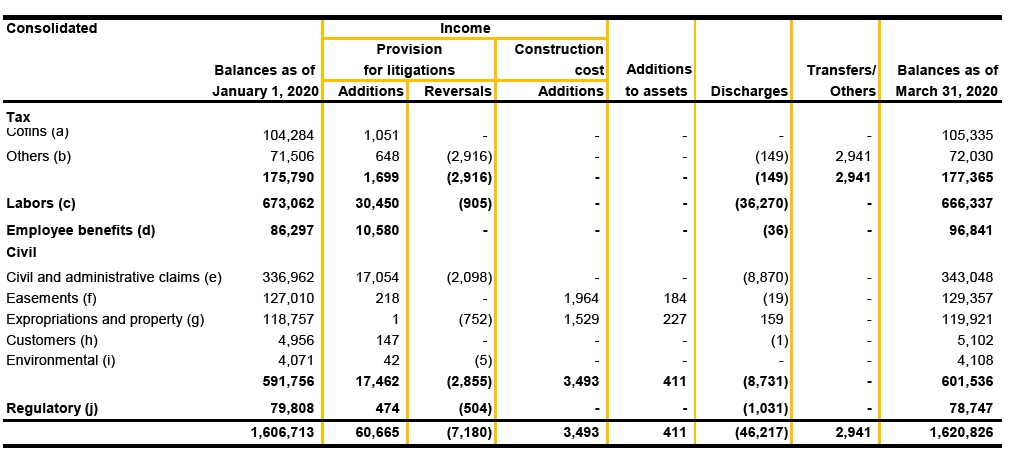

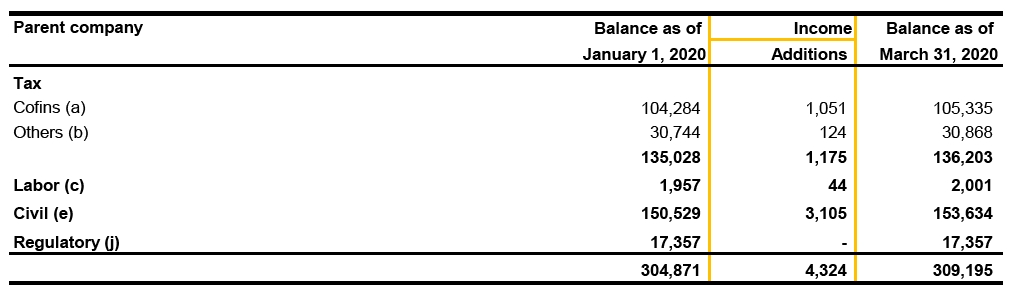

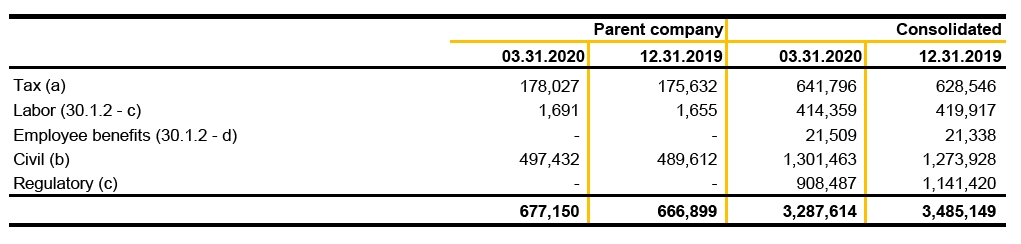

30 Provisions for Legal Claims and Contingent Liabilities

The Company and its subsidiaries are responsible for several legal and administrative proceedings before different courts. Based on assessments made by the Company's legal counsel, Management makes provisions for legal claims in which the losses are rated probable, when the criteria for recognition of provisioning described in Note 4.11 to the financial statements at December 31, 2019 are met.

58

The Company's management believes it is impracticable to provide information regarding the timing of any cash outflows related to the lawsuits for which the Company and its subsidiaries are responsible on the date of preparation of the quarterly information, in view of the unpredictability and dynamics of the Brazilian judicial, tax and regulatory systems, and that the final resolution depends on the conclusions of the lawsuits. For this reason, this information is not provided.

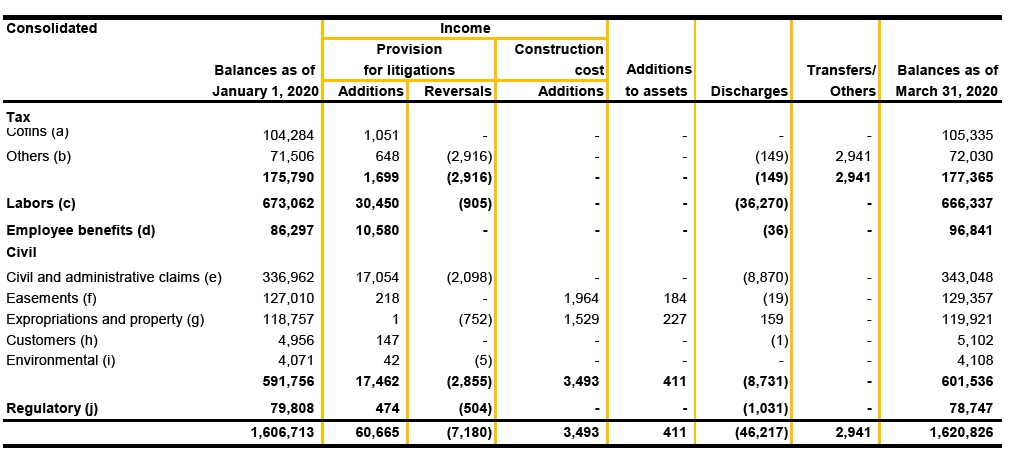

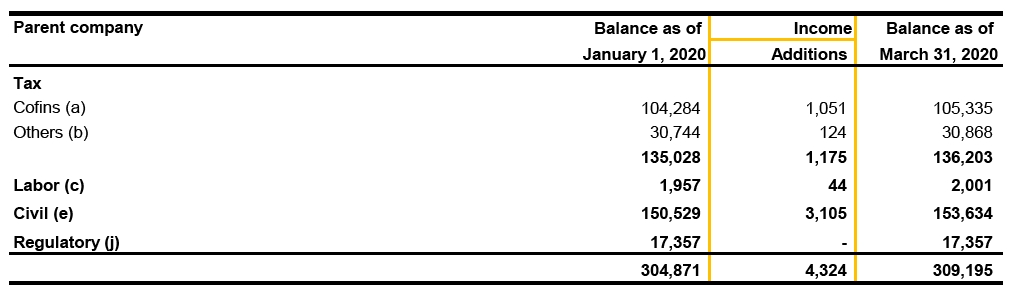

30.1 Provision for legal claims

30.1.1 Changes in provision for legal claims rated as involving probable losses

30.1.2 Description of nature and/or details of the principallawsuits

a) Contribution for Social Security Funding(COFINS)

Plaintiff:Federal Revenue of Brazil

Cofins payables and respective interest and fines from August 1995 to December 1996, due to the termination of a judicial decision that had recognized the Company's exemption fromCofins.

Current status: pending judgment of appeal.

59

b) Other tax provisions

Claims related to federal, state and municipal taxes, fees and other charges on which the Company discusses the incidence or not, as well as their bases and amounts for payment.

c) Labor

Labor claims comprise claims filed by employees and former employees of Copel and its subsidiaries in connection with the payment of overtime differences, hazardous working conditions, transfer bonuses, salary equality/reclassification and other matters, and also claims by former employees of contractors and third- parties (secondary responsibility) involving indemnity and other matters.

d) Employee benefits

Labor claims comprise claims filed by retired former employees of Copel and its wholly-owned subsidiaries against the Copel Foundation, which will have consequential impact on the Company and its wholly-owned subsidiaries, since additional contributions will be required.

e) Civil and administrative claims

Lawsuits involving billing, supposed irregular procedures, administrative contracts and contractual fines, indemnity for accidents with the electric power network or vehicles.

The balance also contains amounts being discussed by arbitration under secrecy and confidentiality, in the discovery phase, with no decision having been handed down to date.

The main lawsuit is described below:

| |

| Plaintiff:Tobacco growers | Estimated amount:R$41.510 |

Lawsuits filed by tobacco growers whose main cause is power failures leading to loss of production.

f) Easements

Lawsuits are filed challenging expropriation when there is a difference between the amount determined by Copel for payment and the amount claimed by the property owner and/or when the owner's documentation supporting title to the property may not be registered (when probate proceedings are still in progress, properties have no registry number with the land registry, etc.).

Cases may also arise from intervention in third-party adverse possession, either as a confronter, or in case of a property where there are areas of easement of passage, in order to preserve the limits and boundaries of expropriatedareas.

60

g) Expropriations and property

Expropriation and property lawsuits are filled when there is a difference between the amount determined by Copel for payment and the amount claimed by the property owner and/or when the owner's documentation supporting title to the property may not be registered (in case probate proceedings are still in progress, properties have no registry number with the land registry, etc.).

Possessory lawsuits include those for repossession of property owned by the concession operator. Litigation arises when there is a need to repossess properties invaded or occupied by third parties in areas owned by the Company.Cases may also arise from intervention in third-party adverse possession, or owners or occupants of contiguous properties or even in cases of properties to preserve limits and boundaries of expropriated areas.

The main lawsuits are as follows:

| |

| Plaintiff:property owner | Estimated value:R$29.462 |

Expropriation lawsuit for construction of electric substation that contests the indemnityamount.

Current status:lawsuit awaiting judgment at higher court.

| |

| Plaintiff:property owner | Estimated value:R$10,926 |

Lawsuit for the expropriation of the area used for the reservoir of the Mauá Plant filed by Consórcio Energético Cruzeiro do Sul, of which Copel GeT participates with 51%, in which discusses the indemnity amount of the property that is in a submergedpart.

Current status: The motion to clarify was judged and a special appeal was filed, with further consideration being denied, a bill of review appeal was filed and is pending judgment before the STJ (Superior Court of Justice).

h) Consumers

Lawsuits seeking compensation for damages caused in household appliances, industrial and commercial machines, lawsuits claiming damages for pain and suffering caused by service interruption and lawsuits filed by industrial consumers, challenging the lawfulness of the increase in electricity prices while Plano Cruzado (anti-inflation economic plan) was in effect and claiming reimbursement for the amounts paid by the Company.

61

i) Environmental

Public civil and class actions whose purpose is to obstruct the progress of environmental licensing for new projects or to recover permanent preservation areas located around the hydroelectric power plant dams unlawfully used by private individuals. If the outcome of the lawsuits is unfavorable to the Company, Management estimates only the cost to prepare new environmental studies and to recover the areas owned by CopelGeT. They also include the Commitment Agreements (Termos de Ajuste de Conduta - TAC, in Portuguese), which refer to the commitments agreed-upon and approved between the Company and the relevant bodies, for noncompliance with any condition provided for by the Installation and Operating Licenses.

j) Regulatory

The Company has been challenging, both at the administrative and judicial levels, notifications issued by the Regulatory Agency of alleged violations against regulations.The main action is described below:

Plaintiffs:Companhia Estadual de Energia Elétrica - CEEE and Dona Francisca Energética S.A.

Estimated amount:R$57.000

Copel, Copel GeT and Copel DIS are challenging lawsuits filed against ANEEL's Decision 288/2002 involving these companies.

Current status:awaiting judgment.

30.2 Contingent liabilities

30.2.1 Classification of lawsuits rated as possible losses

Contingent liabilities are present obligations arising from past events for which no provisions are recognized because it is not probable that an outflow of resources embodying economic benefits will be required to settle the obligation. The following information concerns the nature of contingent liabilities of the Company and its subsidiaries and potential losses arisingtherefrom:

62

30.2.2 Description of nature and/or details of the principal lawsuits

a) Tax

Claims related to federal, state and municipal taxes, fees and other charges on which the Company discusses the incidence or not, as well as their bases and amounts for payment.The main lawsuits are as follows:

| |

| Plaintiff:National Institute of Social Security (INSS) | Estimated amount:R$119.006 |

Tax requirements related to the social securitycontribution.

Current status:awaiting judgment in the Administrative Council of Tax Appeals - CARF or at the judicial level.

| |

| Plaintiff:State Tax Authority | Estimated amount:R$90.726 |

Copel Distribution received tax deficiency notice 6.587.156-4 from the State of Paraná for allegedly failing to pay ICMS (VAT) tax on the 'metered demand' highlighted in the electricity bills issued to a major consumer between May 2011 and December 2013.

The Company maintains its illegitimacy to appear in the taxable position of this tax assessment, since it was not included in the judicial proceeding, thus it cannot suffer the effects of the ruling rendered thereon, which would entail its illegitimacy to appear as liable taxpayer in tax deficiency notice issued.

The Company filed a writ of mandamus at 07.16.2019, having obtained an injunction to suspend the enforceability of the tax credit.

| |

| Plaintiff:City halls | Estimated amount:R$90.335 |

Tax Requirement on Urban Territorial Property on properties affected by the public electricity service. The case is pending judgment at lower court.

| |

| Plaintiff:City halls | Estimated amount:R$67.818 |

City halls tax requirement as ISS on construction services provided by third parties.

Current status: pending judgment of answers filed at the administrative or judicial levels.

| |

| Plaintiff:Brazilian Federal Revenue Office | Estimated amount:R$106.561 |

Requirement and administrative questioning related to federal taxes.

Current status: awaiting judgment in the Administrative Council of Tax Appeals - CARF or at the judicial level.

63

b) Civil

Lawsuits involving billing, supposed irregular procedures, administrative contracts and contractual fines, indemnity for accidents with the electric power network or vehicles, easements of passage, expropriations, patrimonial and environmental.

The balance also contains amounts being discussed by arbitration under secrecy and confidentiality, in the discovery phase, with no decision having been handed down to date.

The main lawsuits are as follows:

| |

| Plaintiff:Department of Roads and Roadworks | Estimated amount:R$88.213 |

The Department of Roads and Roadworks (Departamento de Estradas e Rodagens - DER, in Portuguese) - issued a tax assessment notice to Copel Distribuição which, in turn, filed a lawsuit challenging DER's Charge for Use or Occupancy of Highway Domain Range, since the Company understands that this charge is unconstitutional because it has a confiscatory nature.

Current status: awaiting sentence.

| |

| Plaintiff:Tobacco growers | Estimated amount:R$30.610 |

Lawsuits filed by tobacco growers whose main cause is power failures leading to loss of production.

Current status: awaiting judgment.

c) Regulatory

The Company is challenging, both at the administrative and judicial levels, notifications issued by the Regulatory Agency of alleged violations against regulations. The principal action is described below:

| |

| Plaintiff:Energia Sustentável do Brasil S.A. - ESBR | Estimated amount:R$800.146 |

ESBR filed Ordinary Lawsuit No. 10426-71.2013.4.01.4100 against ANEEL in the Federal Court of Rondônia, whose ruling: (i) acknowledged the exclusion of liability for the 535-day schedule overrun in the construction of the Jirau Hydropower Station; (ii) declares any obligations, penalties and costs imposed on ESBR as a result of the schedule overrun to be unenforceable, and (iii) annuls ANEEL Resolution 1,732/2013, which had recognized a schedule overrun of only 52 days. An appeal has been brought by ANEEL, pending judgment by the Federal Court of the 1stRegion.

The practical consequence of the ruling was, at the time it exempted ESBR, to expose the distributors with whom it entered into power trading contracts (CCEARs) to the Short-Term Market and to the high value of the Settlement Price of the Differences (Preço de Liquidação das Diferenças - PLD, in Portuguese) in the period, including Copel DIS. This occurred because the rules for the sale of electricity require that all energy consumed should have a corresponding contractual coverage.

64

If the lawsuits are judged unfavorably against Copel, the amount will be classified as Sectorial Financial Asset to be recovered through tariffrates.

Current status:awaiting judgment.

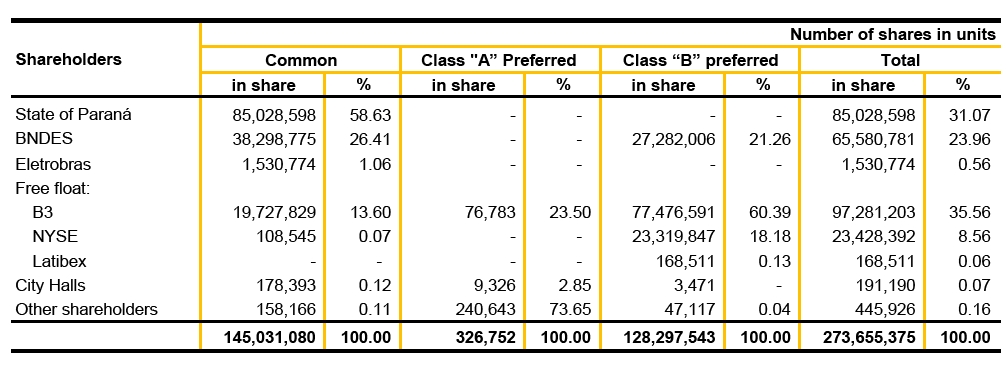

31 Equity...........

31.1 Capital

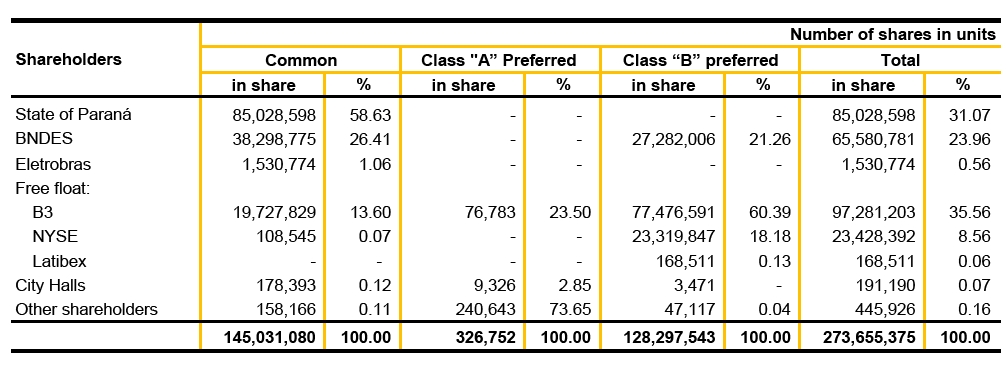

As of March 31, 2020, the paid-in capital is R$10,800,000 (R$10,800,000 as of December 31, 2019). Shareholding interests (comprising no par value shares) and main shareholders are shown below:

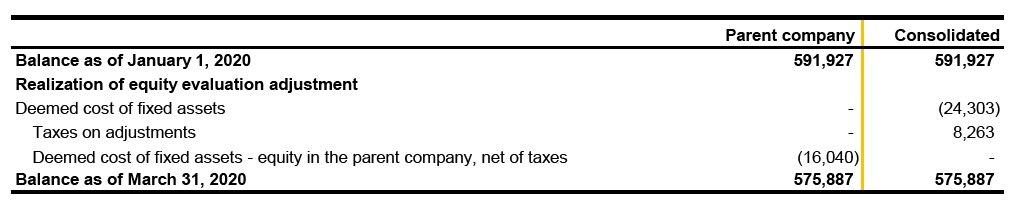

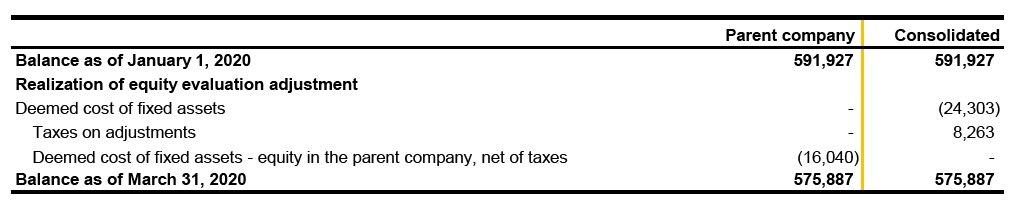

31.2 Equity valuation adjustments

65

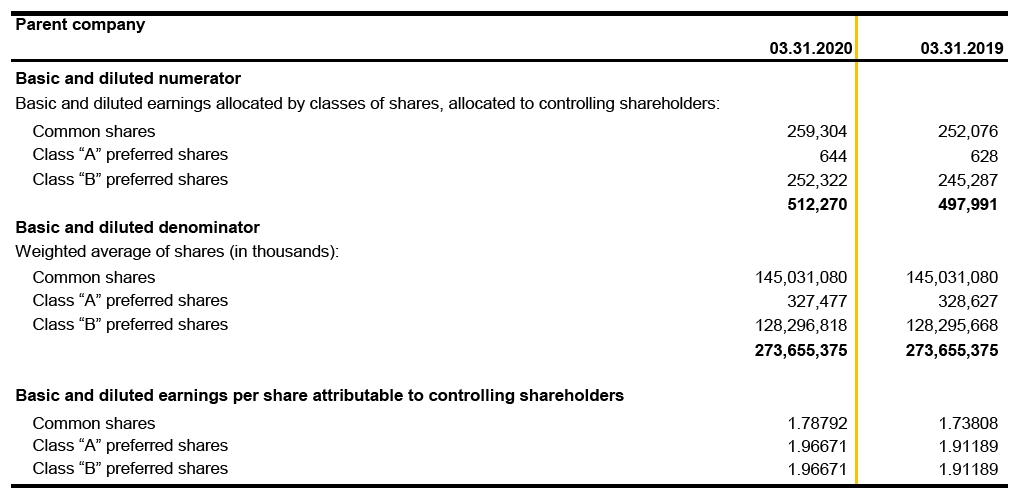

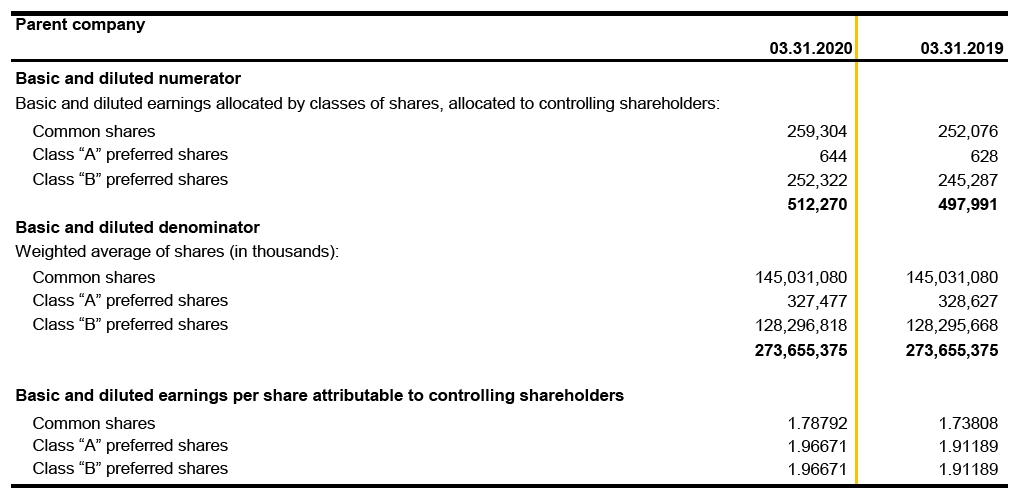

31.3 Earnings per share - basic and diluted

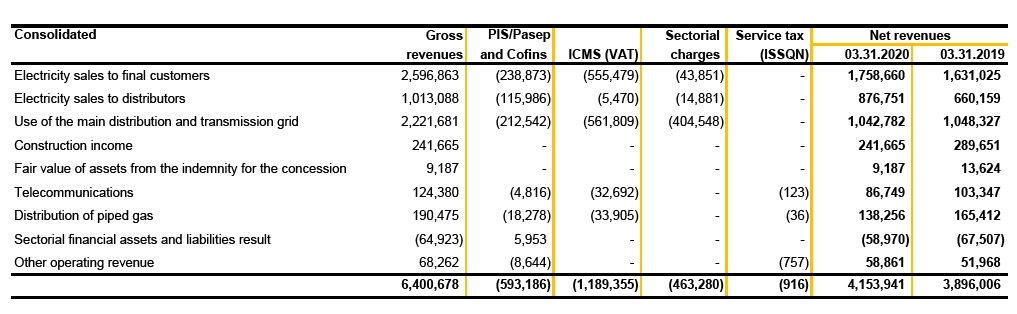

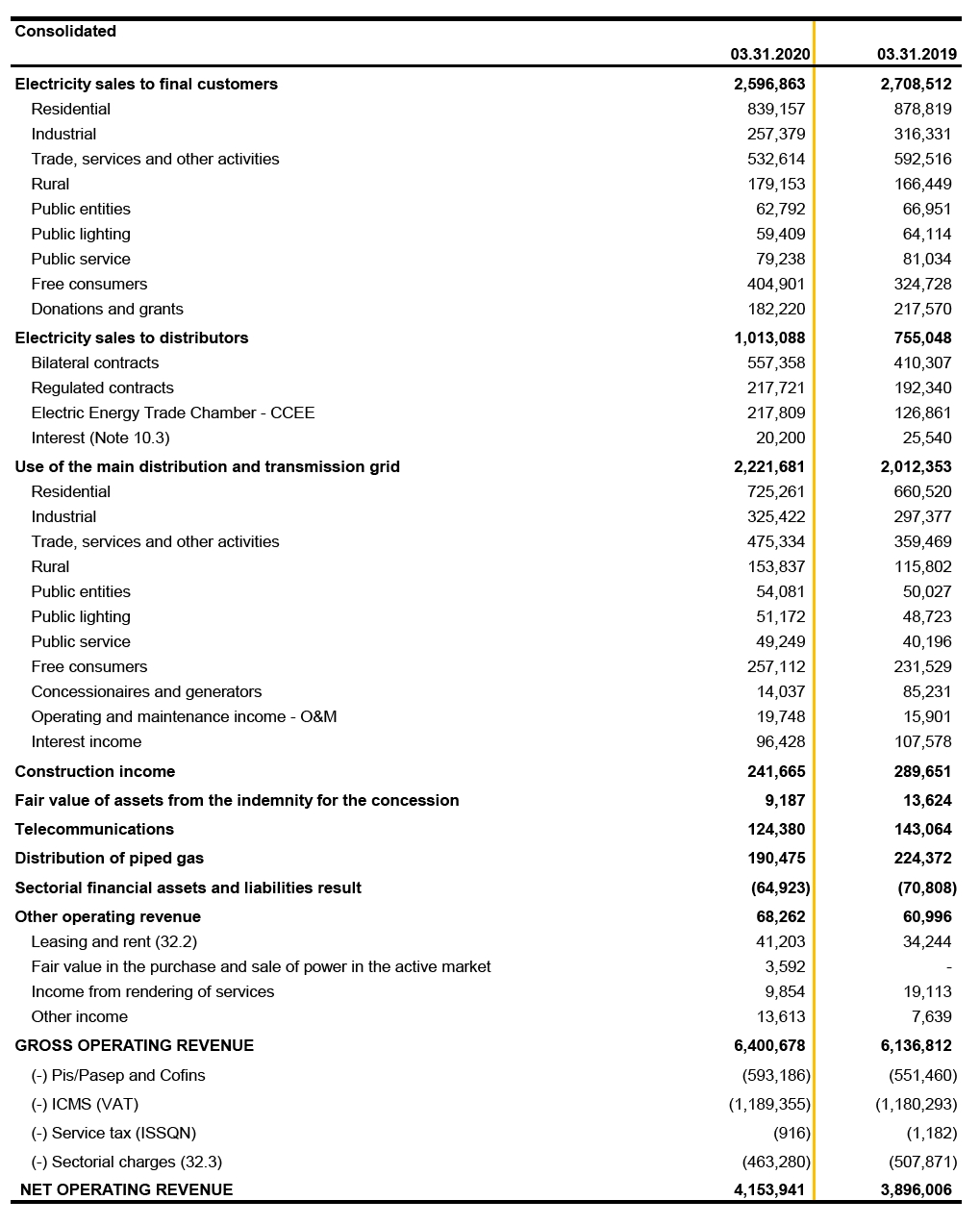

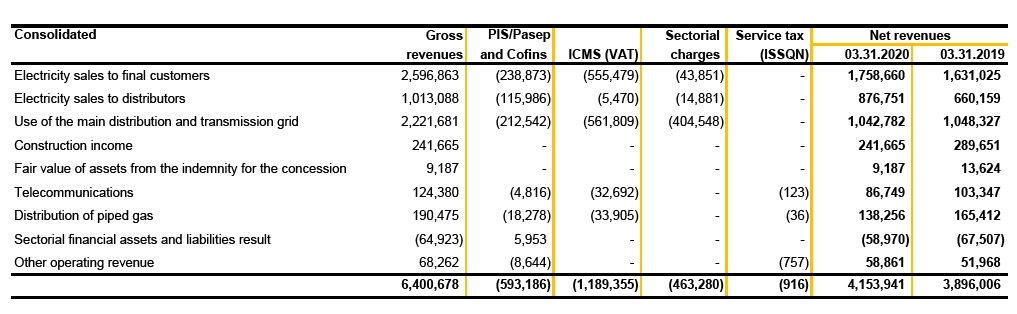

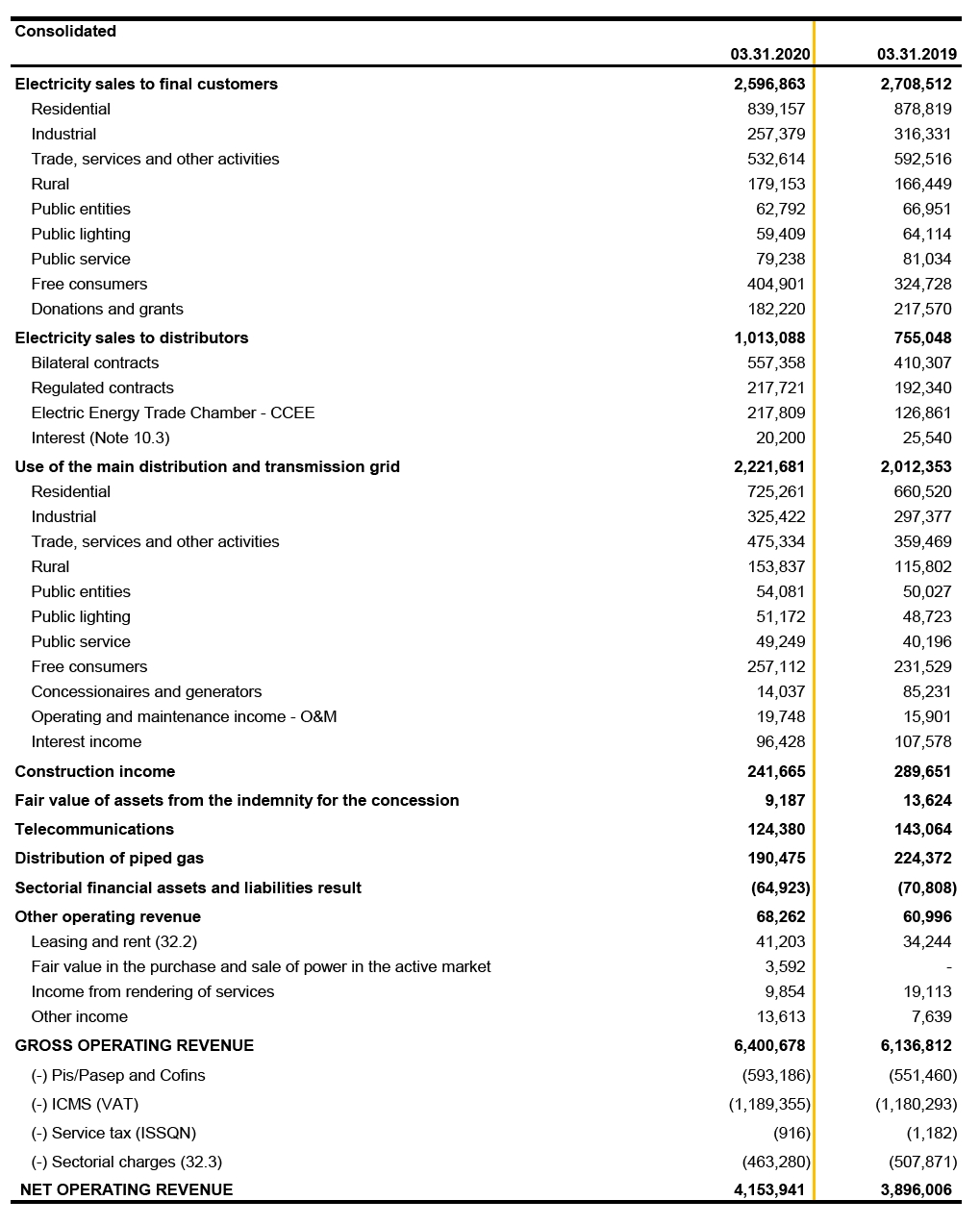

32 Net Operating Revenue

66

32.1 Revenue by type and / or class of consumers

67

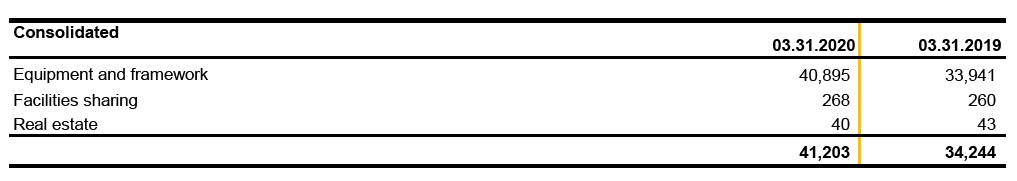

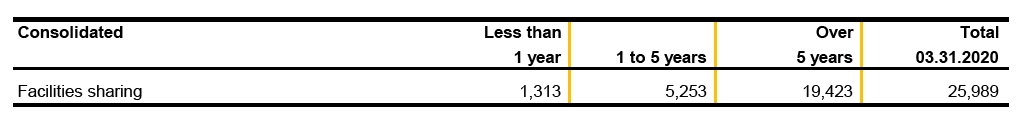

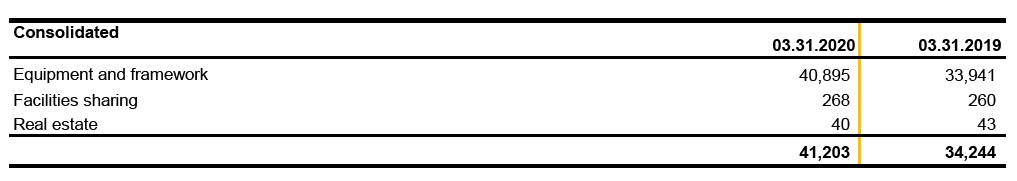

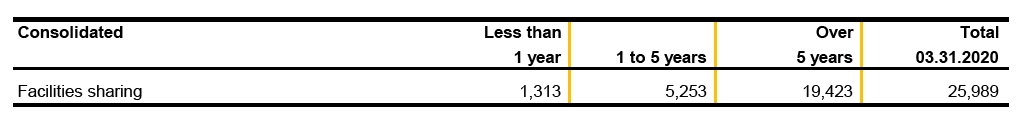

32.2 Leases and rentals

32.2.1 Revenues from leases and rentals

32.2.2 Receivables from leases

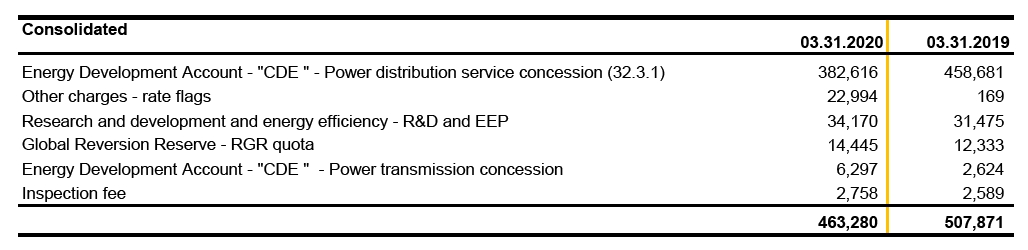

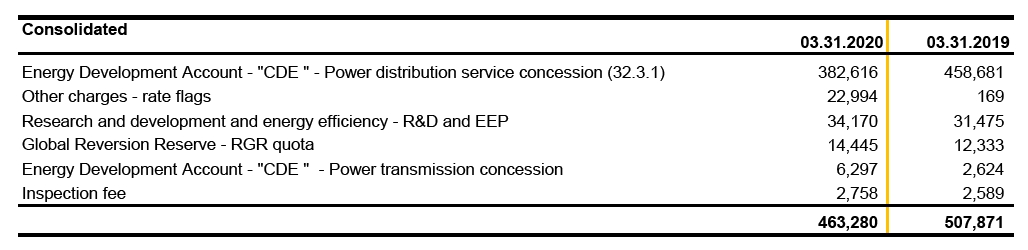

32.3 Regulatory charges

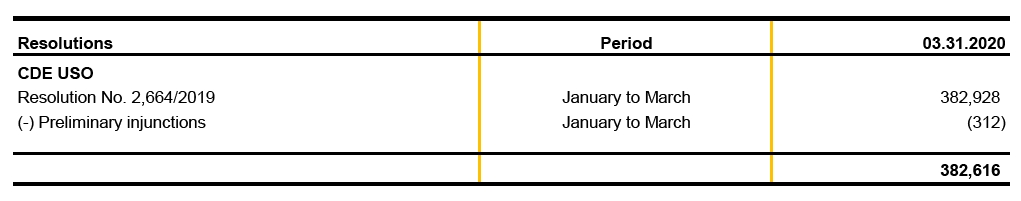

32.3.1 Energy Development Account - CDE - power distribution concession

The CDE was created by Law 10,438/2002, amended by Law 12,783/2013 and, in order to meet its objectives, it has among its sources of funds, quotas paid by agents that negotiate energy with end consumers, at a charge included in the tariffs.

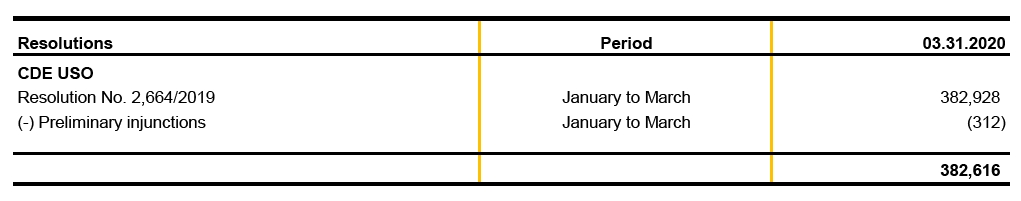

The Company makes payments for the "CDE USO" charge, intended to cover the CDE's objectives set forth by law.

The annual quotas for each distributor are defined by ANEEL through resolutions enacted by it. The balance at March 31, 2020 is as follows:

68

Preliminary injunctions

As a result of preliminary injunctions in favor of the Brazilian Association of Large Industrial Consumers and Free Consumers - ABRACE, and of the National Association of Energy Consumers - ANACE and other consumers, which challenge at court the tariff components of CDE-Use and CDE-Electricity, ANEEL, ratified the tariff calculation, deducting these charges from the tariffs of these consumers, as long as the preliminary injunctions granted in Judicial Proceedings are not overthrown.

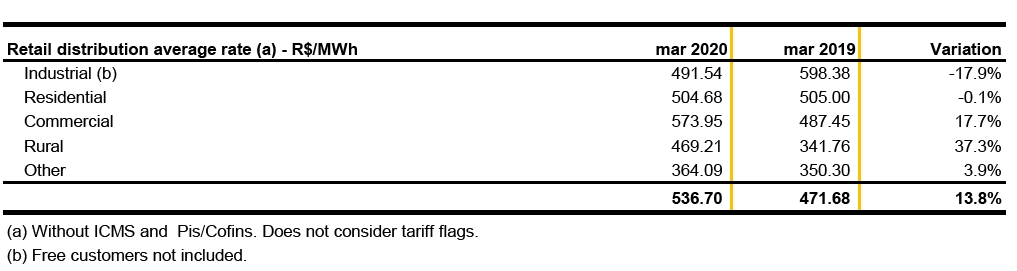

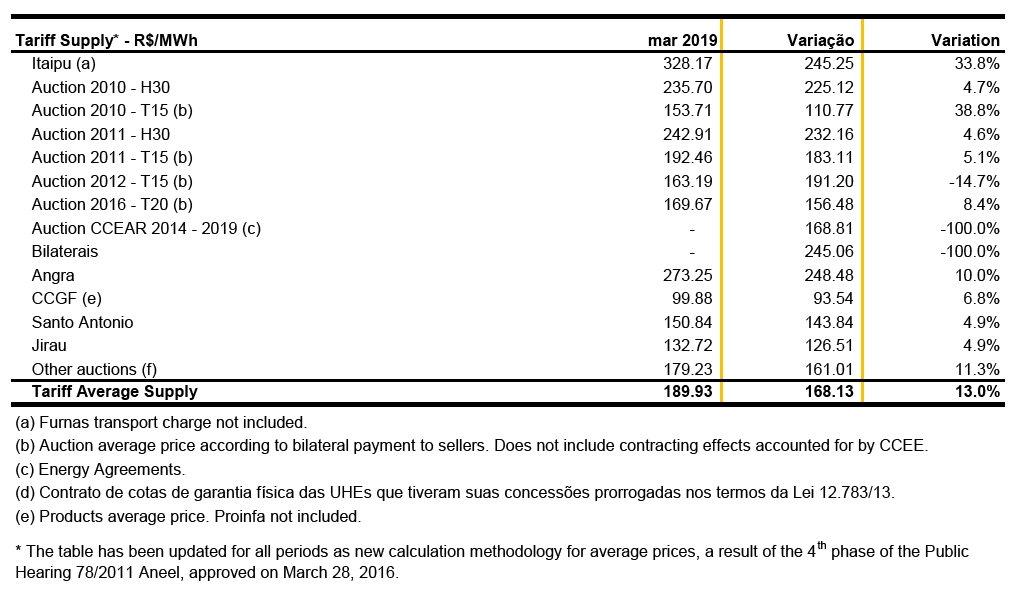

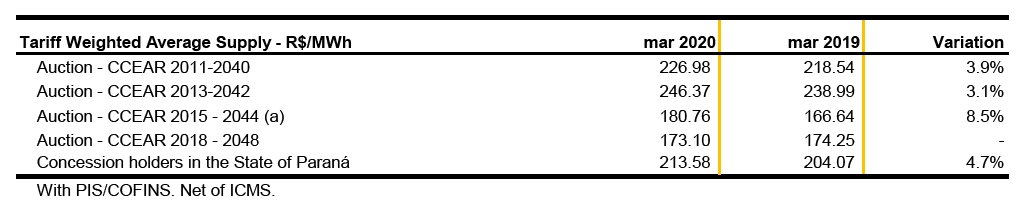

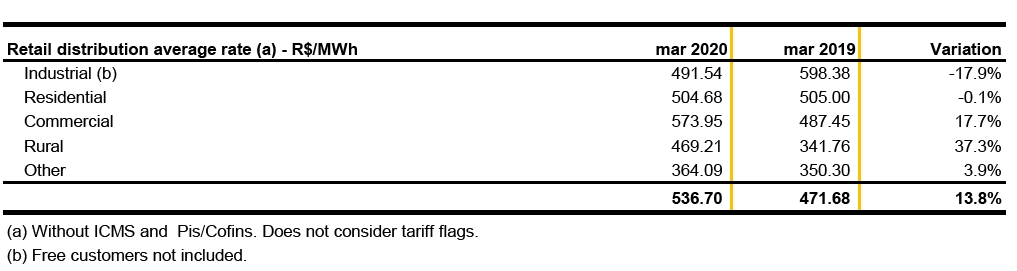

32.4 Copel DIS annual tariff adjustment

ANEEL approved the result of Copel DIS's Annual Tariff Adjustment through Homologatory Resolution No. 2,559, dated June 18, 2019, authorizing average adjustment of 3.41% (15.99% in 2018) applied to consumers and whose application occurred in full to tariffs as from June 24, 2019, and for high voltage consumers the adjustment was 4.32%, while for low voltage consumers it was 2.92%.

The tariff recomposition includes: 10.54% related to inclusion of financial components; 1.12% resulting from the update of Parcel B (operating costs, depreciation and remuneration); -3.08% related to the updating of Parcel A (energy, transmission, charges and irrecoverable revenue); and -5.17% that reflect the withdrawal of financial components from the previous tariff process.

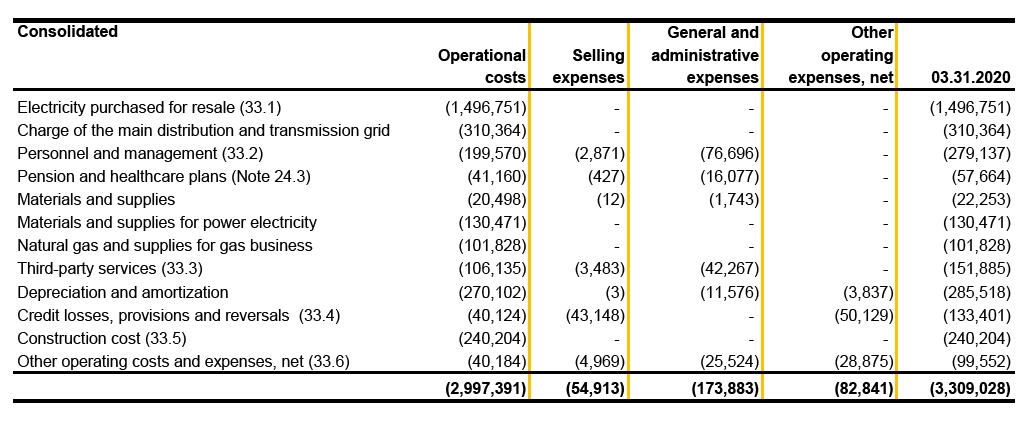

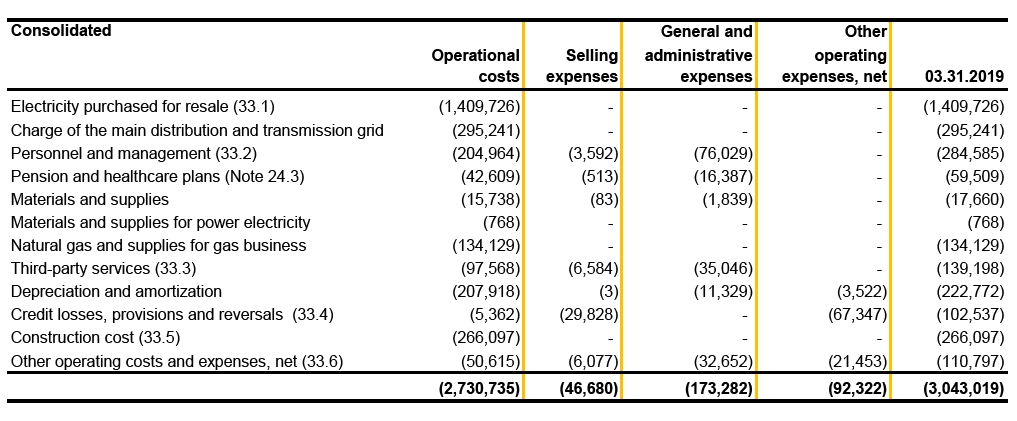

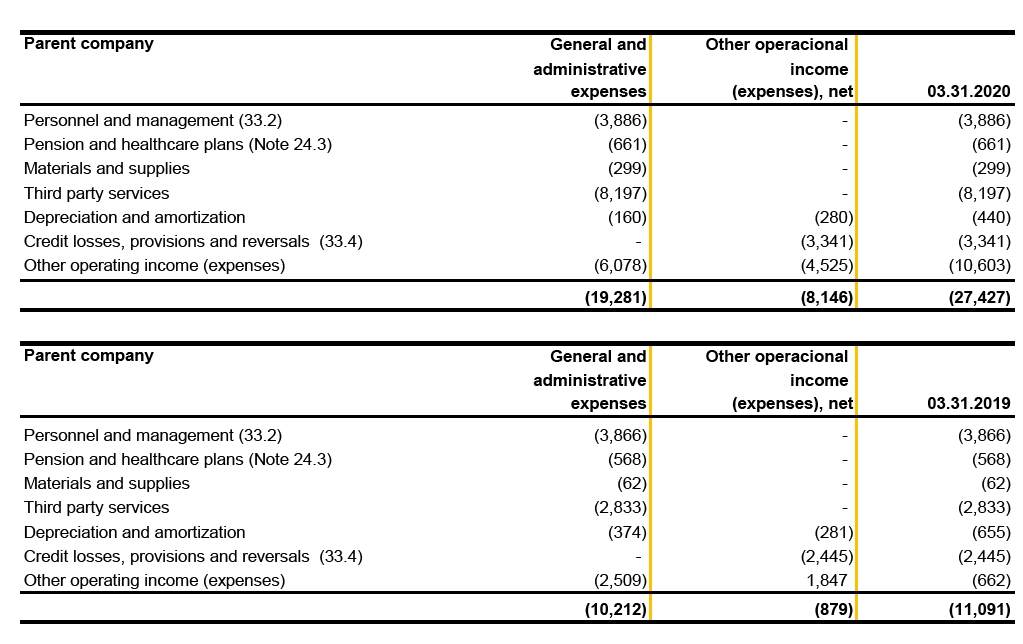

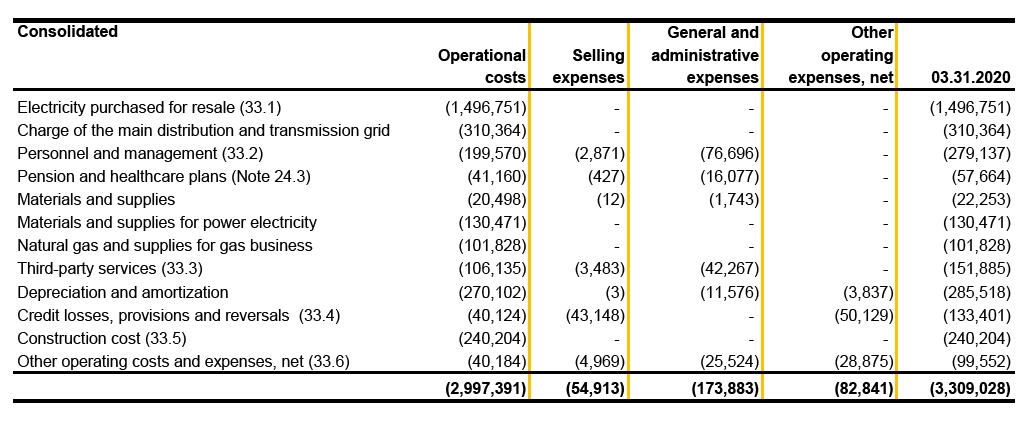

33 Operating Costs and Expenses

69

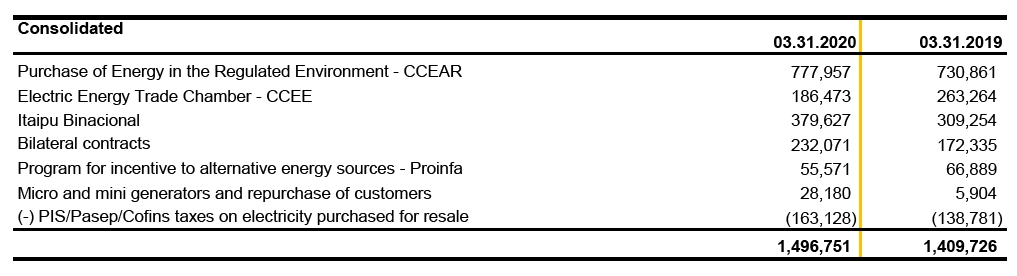

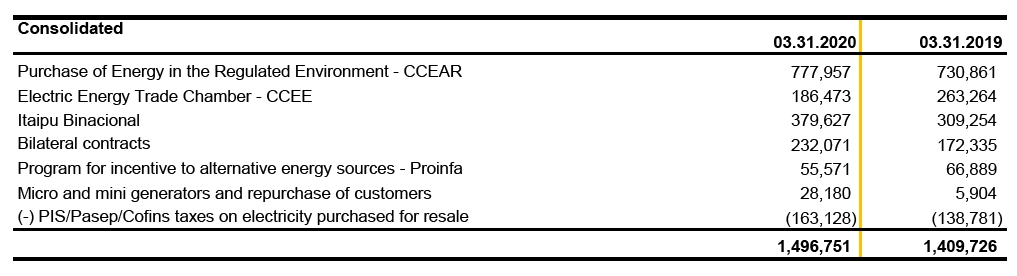

33.1 Electricity purchased for resale

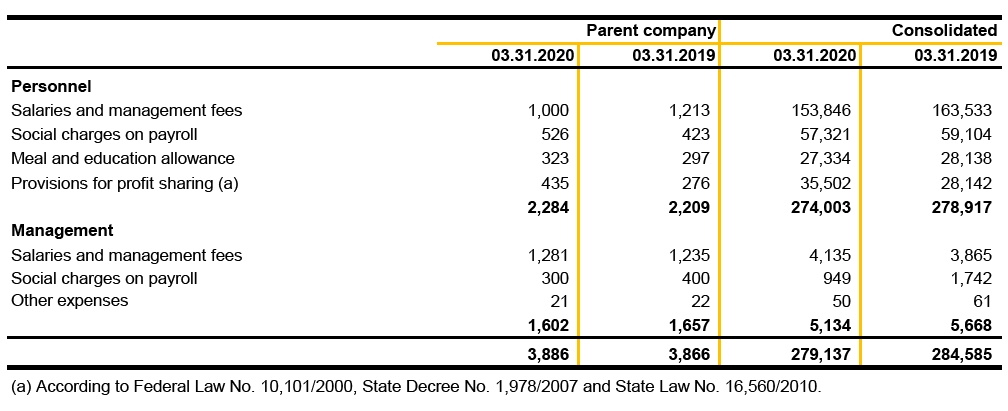

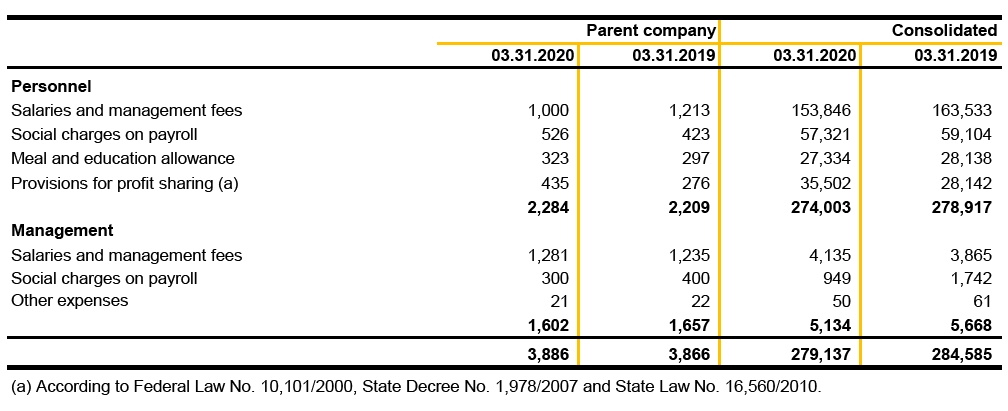

33.2 Personnel and management

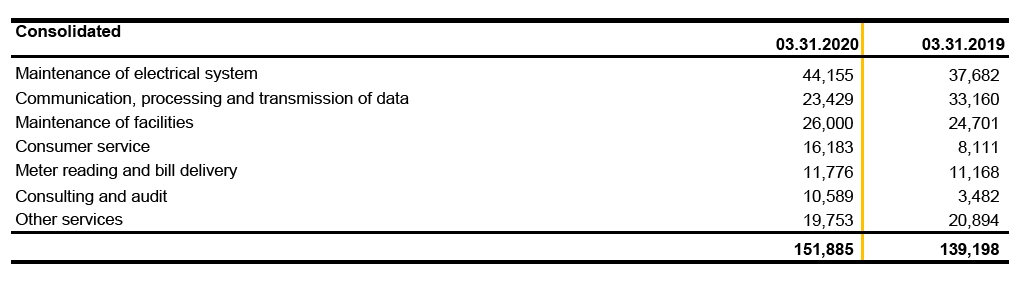

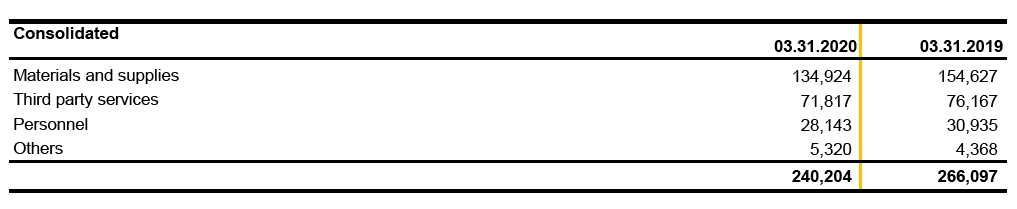

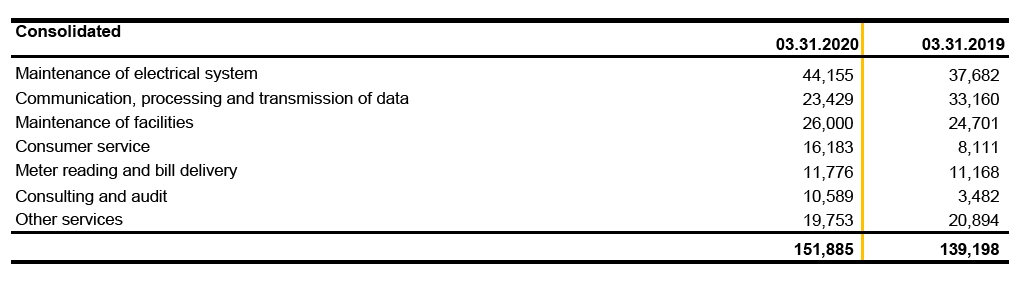

33.3 Third party services

71

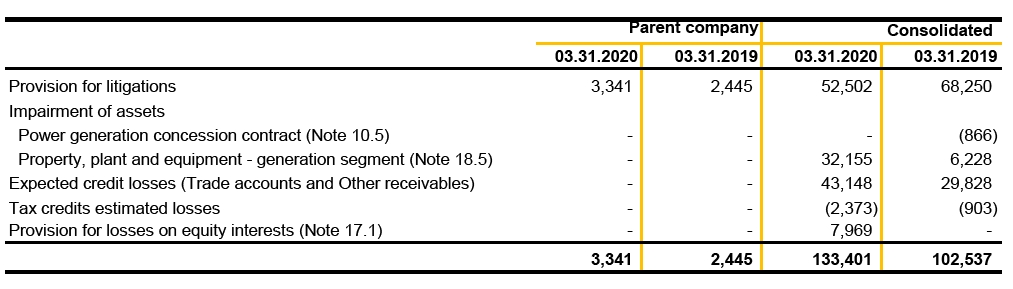

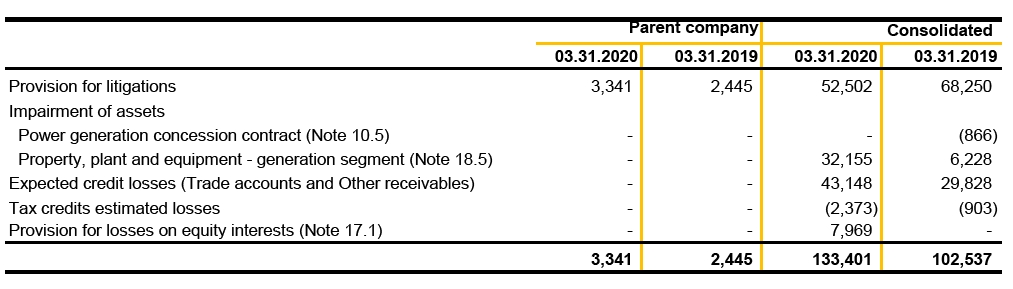

33.4 Credit losses, provisions and reversals

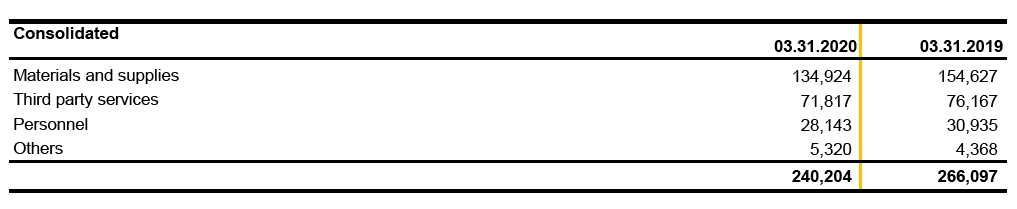

33.5 Construction costs

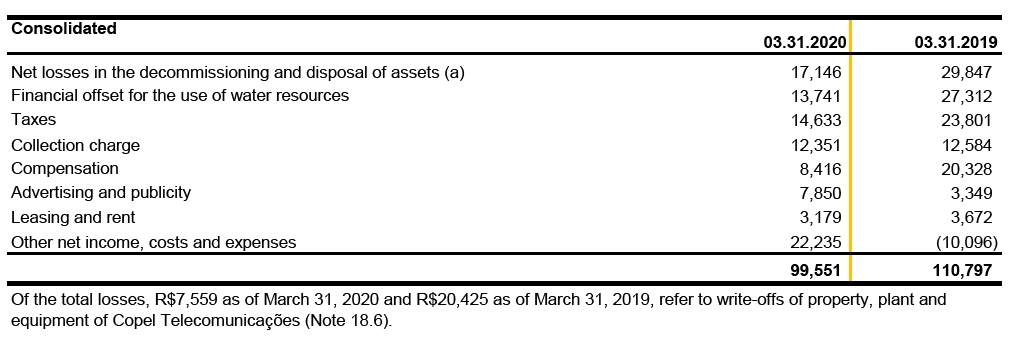

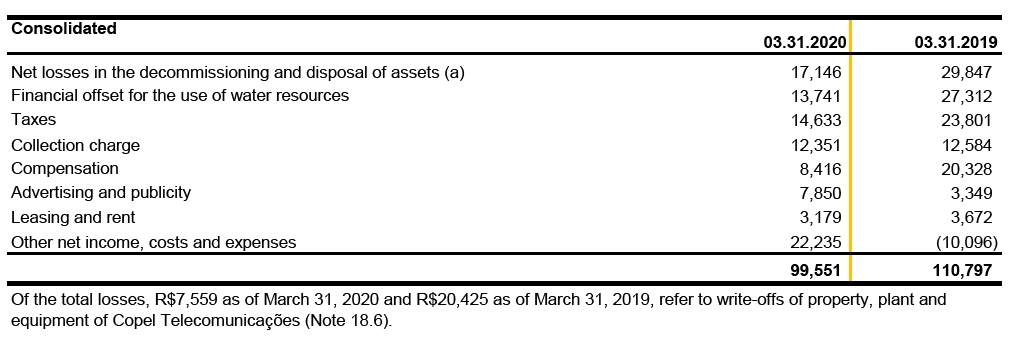

33.6 Other operating costs and expenses, net

72

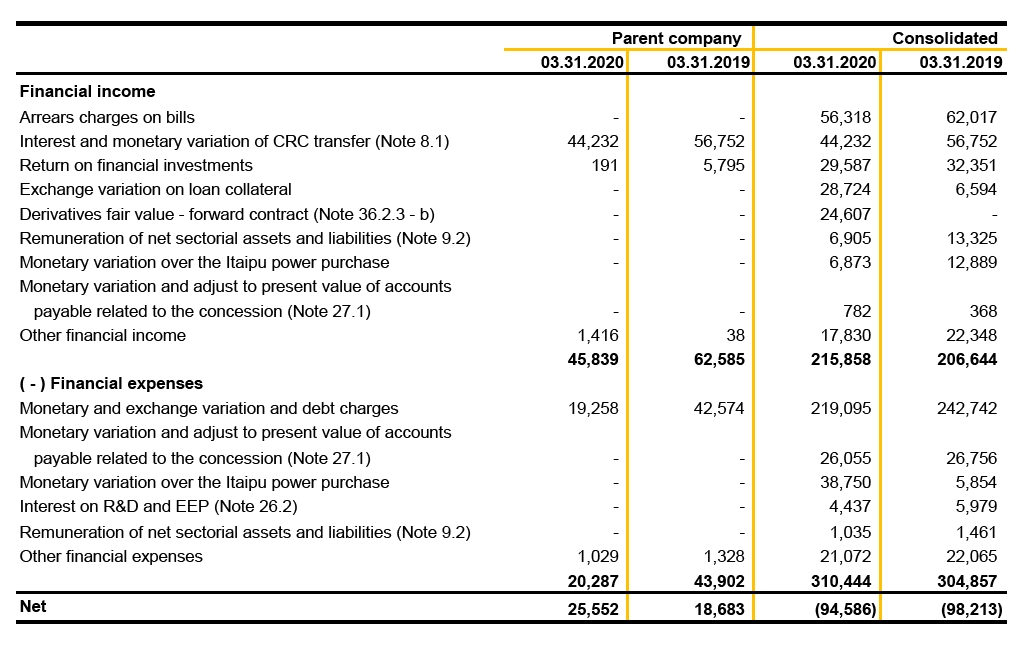

34 Financial Results

35 Operating Segments

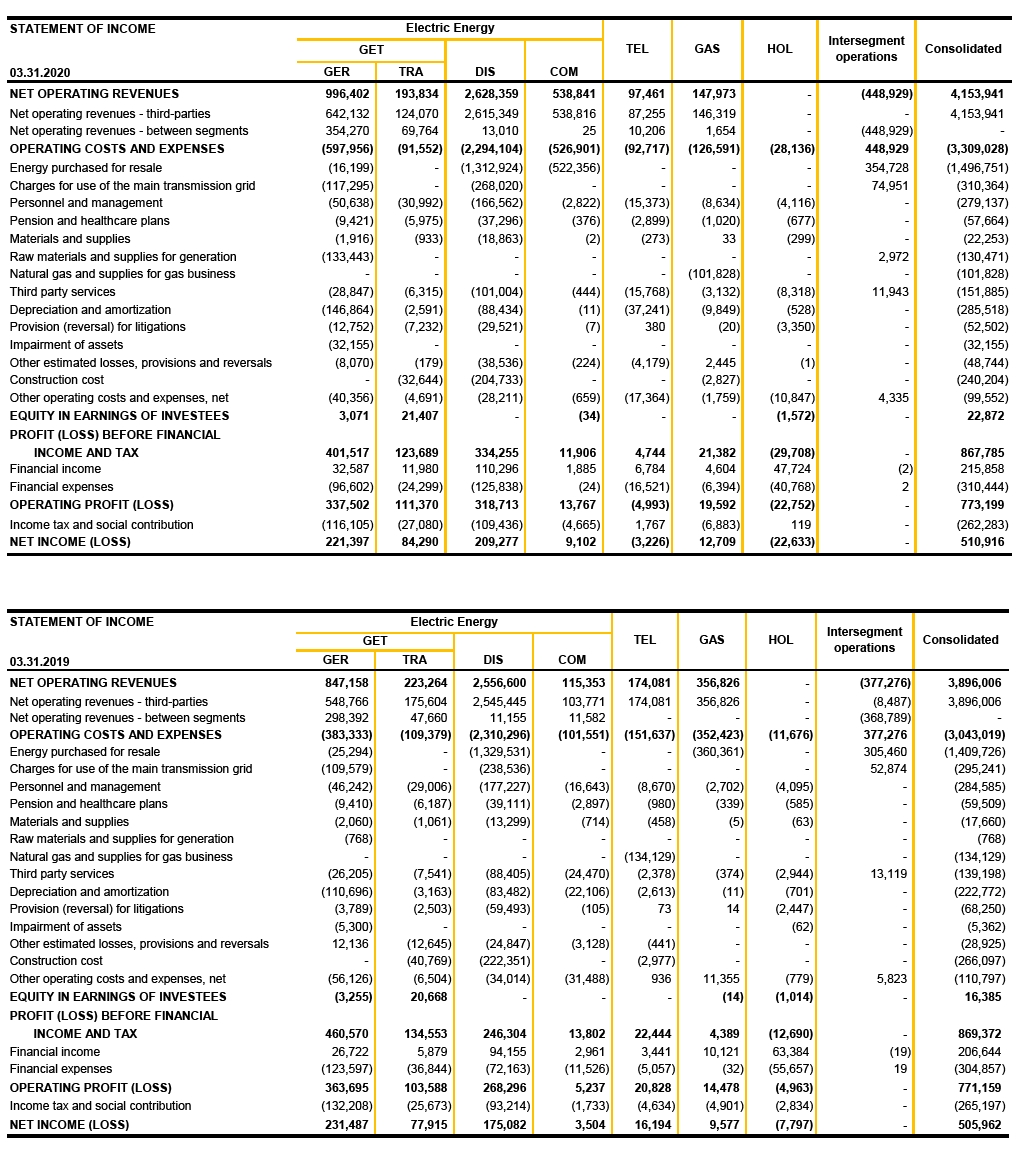

Operating segments are business activities that generate revenues and incur expenses, whose operating results are regularly reviewed by the executive boards of the Parent Company and subsidiaries and by key strategic decision-makers responsible for allocating funds and assessing performance.

35.1 Products and services from which the reportable segments have their revenues generated

The Company operates in reportable segments identified by Management, through the chief officers of each business area, taking into consideration the regulatory environments, the strategic business units and the different products and services. These segments are managed separately, since each business and each company require different technologies and strategies.

In the first quarter of 2020, all sales have been to customers within the Brazilian territory, in addition, all noncurrent assets are also located in the national territory.

The Company and its subsidiaries did not identify any customer who individually accounts for more than 10% of their total net revenue until the first quarter of 2020.

The Company evaluates the performance of each segment, based on information derived from the accountingrecords.

73

The accounting policies of the operating segments are the same as those described in Note 4 of the Financial Statements of December 31, 2019.

35.2 Company's reportablesegments

The reportable segments of the Company, in accordance with CPC 22/IFRS 8, are:

Power generation and transmission (GET)- its attribution is to produce electricity from hydraulic, wind, and thermal projects(GER)and to provide services of transmission and transformation of electric power, being responsible for the construction, operation and maintenance of substations, as well for the energy transmission lines(TRA); for managers, the assets and liabilities of the generation and transmission segments are shown on an aggregate basis while their result is presented separately;

Power distribution (DIS) -its attribution is to provide public electricity distribution services, being responsible for the operation and maintenance of the distribution infrastructure, as well as providing related services;

Telecommunications (TEL)- its attribution is to provide telecommunications and general communication services;

GAS- its attribution is to provide public service of piped natural gas distribution;

Power sale (COM)- its attribution is to trade energy and related services; and

Holding Company (HOL)- its attribution is to participate in other companies.

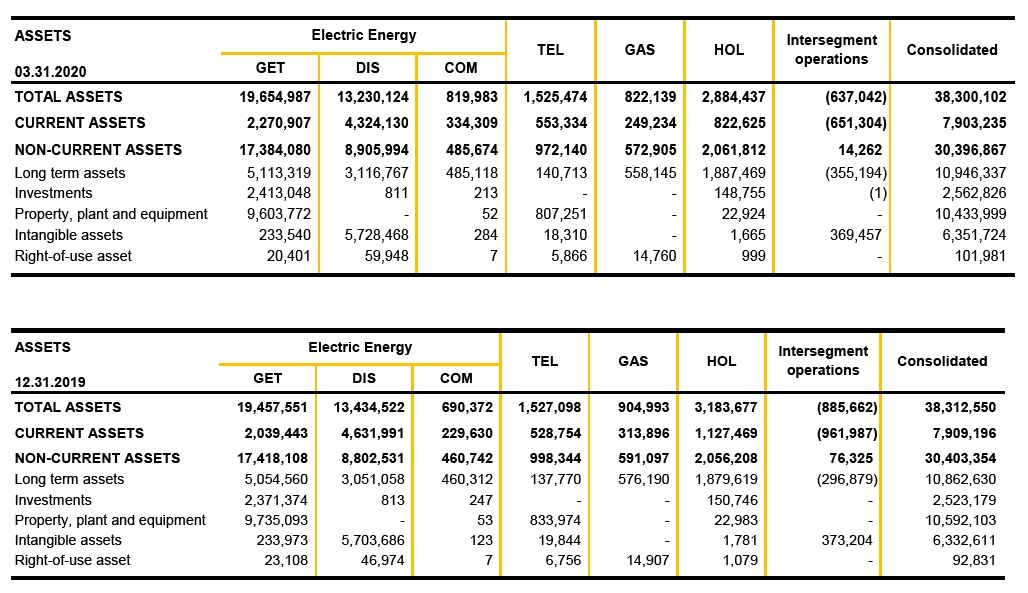

35.3 Assets by reportable segment

74

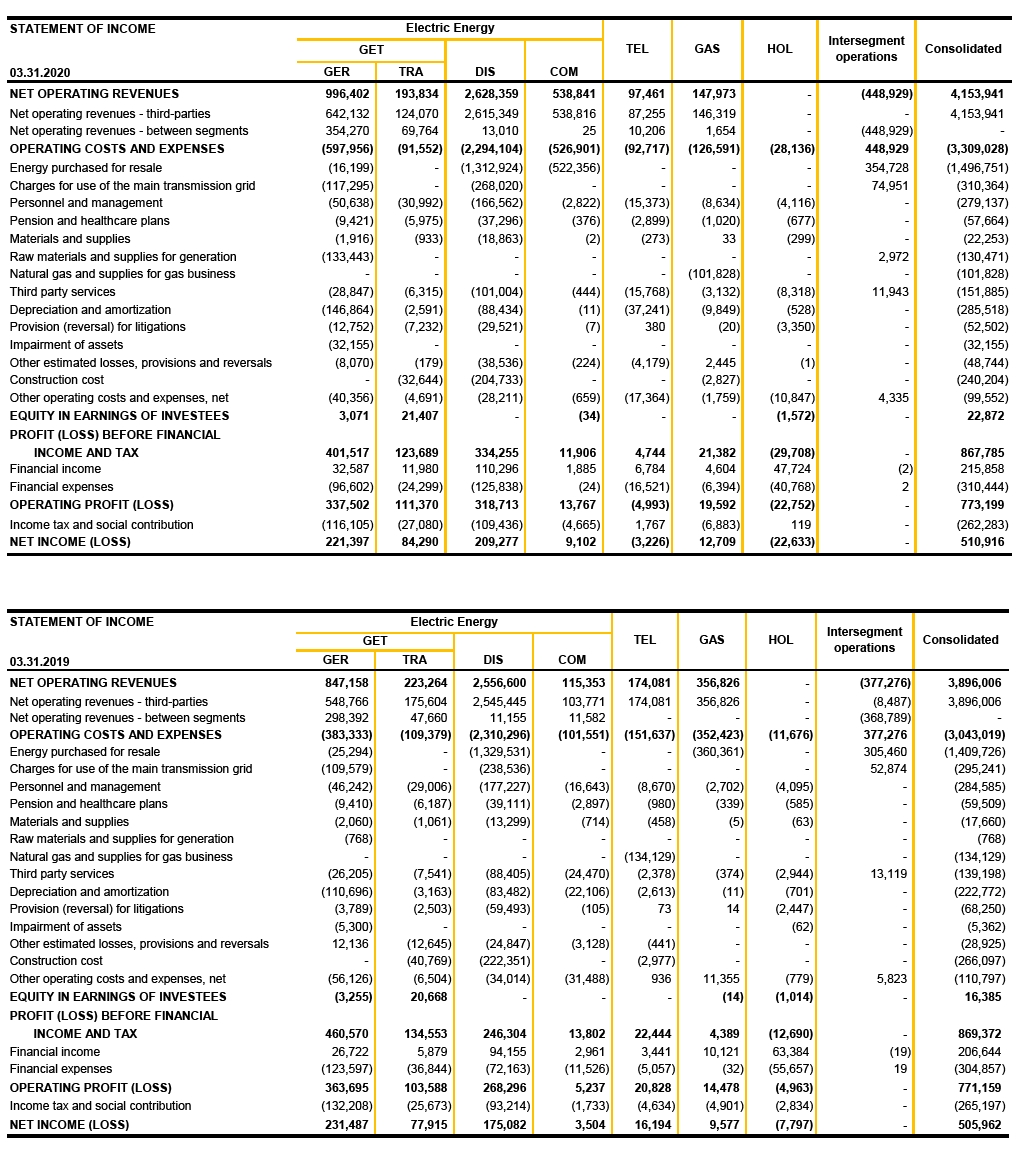

35.4 Statement of income by reportable segment

75

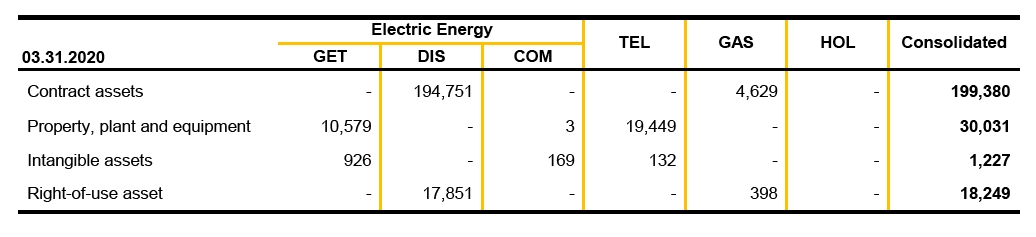

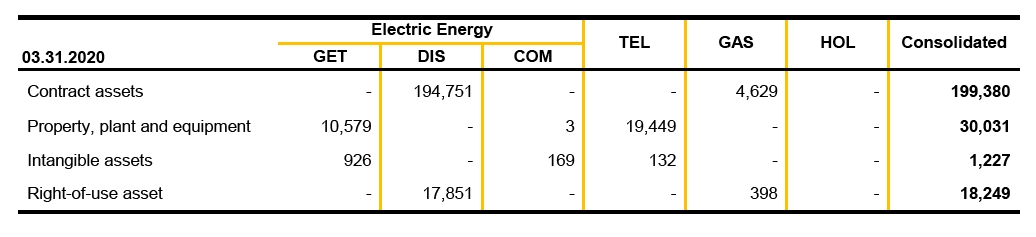

35.5 Additions to noncurrent assets by reportablesegment

76

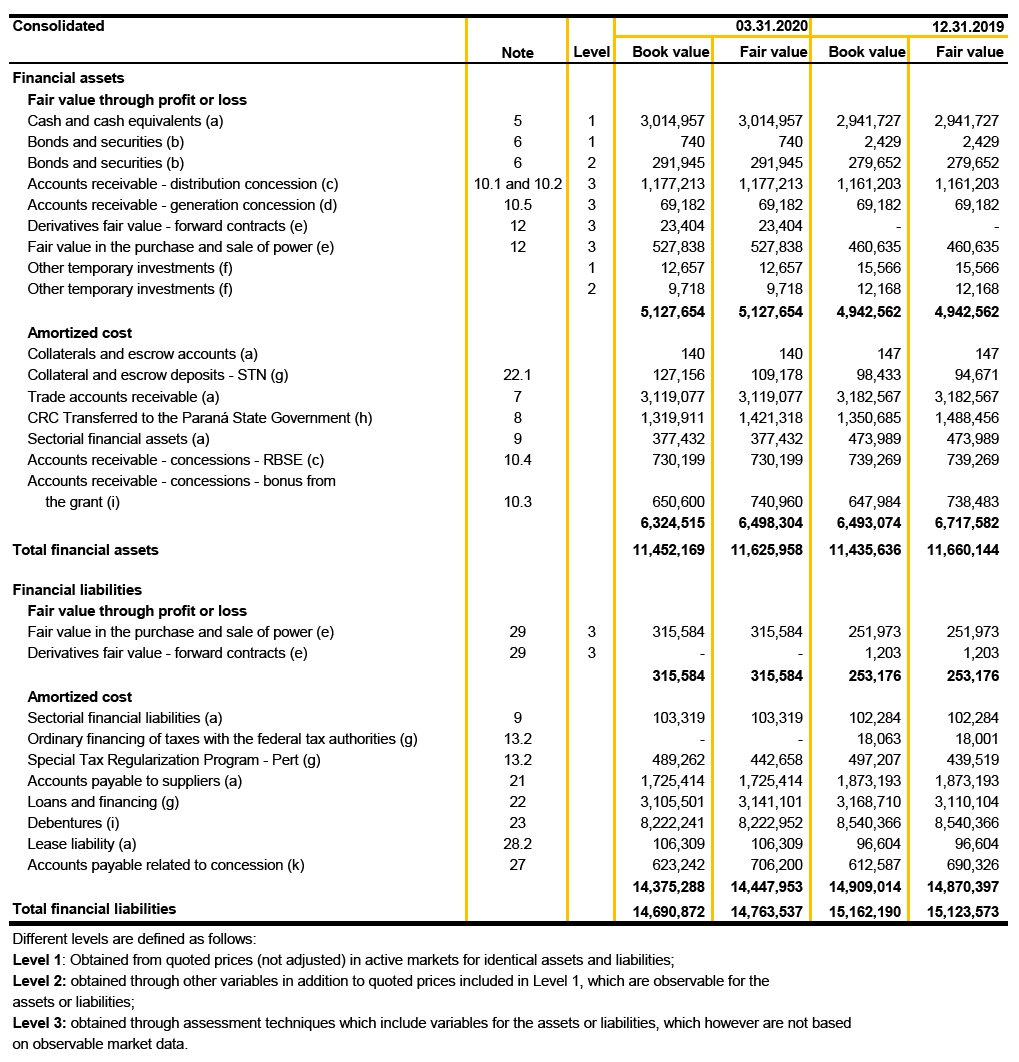

36 Financial Instruments

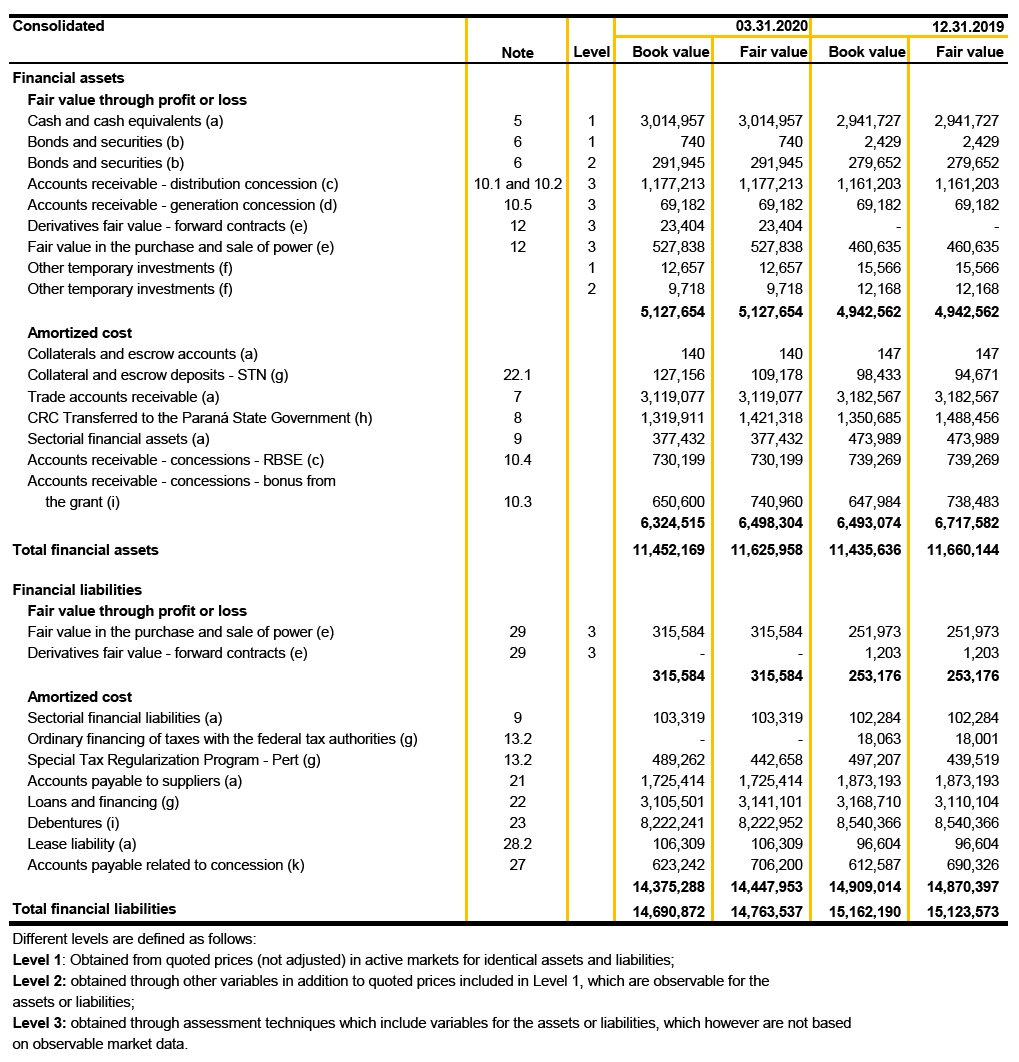

36.1 Categories and determination of fair value of financialinstruments

Determining fair values

a) Equivalent to their respective carrying values due to their nature and terms ofrealization.

b) Fair value is calculated based on informationmadeavailable by the financial agents and the market values of the bonds issued by the Braziliangovernment

77

c) The criteria are disclosed in Note4.4 to the financial statements on December 31, 2019.

d) The fair values of generation assets approximate their carrying amounts, according to Note4.4 to the financial statements on December 31, 2019.

e) The fair values of assets and liabilities are equivalent to their carrying amounts according to Note 4.15 to the financial statements on December 31, 2019.

f) Investments in other companies, stated at fair value, which is calculated according to the price quotations published in an active market, for assets classified as level 1 and determined in view of the comparative assessment model for assets classified as level2.

g) The cost of the last borrowing taken out by the Company is usedasa basic assumption,120.0% of CDI, for discount of the expected paymentflows.

h) The Company based its calculation on the comparison with a long-term and post-fixed National Treasury Bond (NTN-B) maturing on August 15, 2026, which yields approximately 3.52% p.y. plus the IPCA inflation index.

i) Receivables related to the concession agreement for providing electricity generation services under quota arrangements, having their fair value calculated by expected cash inflows, discounted at therateestablished by ANEEL auction notice 12/2015(9.04%).

j) Calculated from the Unit Price quotation (PU) for March 31, 2020, obtained from the Brazilian Association of Financial and Capital Markets (ANBIMA), net of unamortized financialcost.

k) Actual net discount rate of 8.26% p.y., in line with the Company's estimated rate for long-termprojects.

36.2 Financial risk management

The Company's business activities are exposed to the following risks arising from financial instruments:

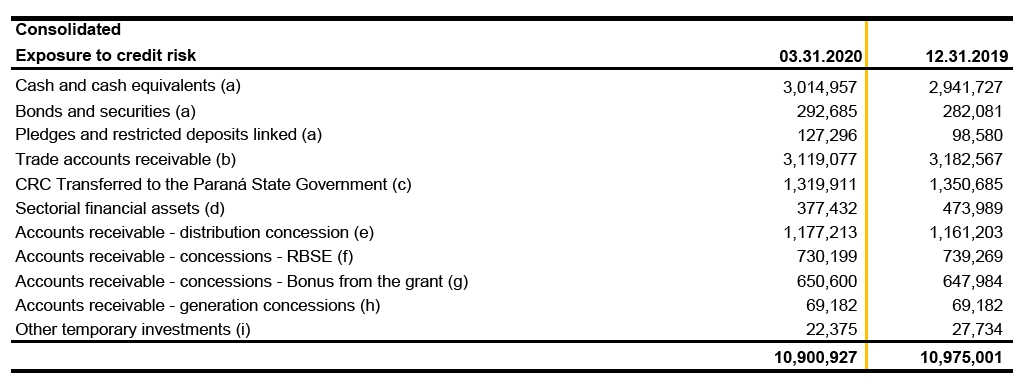

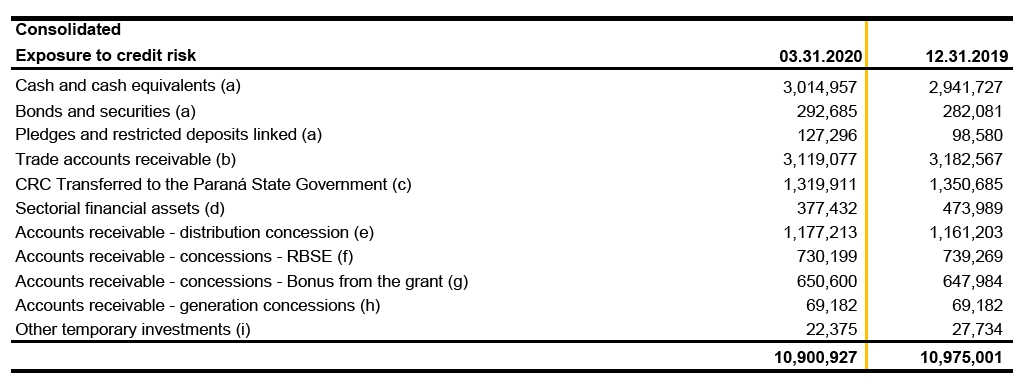

36.2.1 Credit risk

Credit risk is the risk of the Company incurring losses due to a customer or counterparty in a financial instrument, resulting from failure in complying with their contractual obligations.

78

a) The Company manages the credit risk of its assets in accordance with the Management’s policy of investing virtually all of its funds in federal banking institutions. As a result of legal and/or regulatory requirements, in exceptional circumstances the Company may invest funds in prime privatebanks.

b) The risk arises from the possibility that the Company might incur losses resulting from difficulties to receive its billings to customers. This risk is directly related to internal and external factors to Copel. To mitigate this type of risk, the Company manages its accounts receivable, detecting defaulting consumers, implementing specific collection policies and suspending the supply and/or recording of energy and the provision of service, as established in contract and regulatory standards.

c) Management believes this credit risk is low because repayments are secured by resources fromdividends.

d) Management considers the risk of this credit to be reduced, since the agreements signed guarantee the unconditional right to receive cash at the end of the concession to be paid by the Concession Grantor, corresponding to the costs not recovered through the tariff.

e) Management considers the risk of this credit to be reduced, since the agreements signed guarantee the unconditional right to receive cash at the end of the concession to be paid by the Concession Grantor, referring to investments in infrastructure not recovered through thetariff.

f) Management considers the credit risk reduced to the balance of RBSE assets, even in light of the injunctions that temporarily reduced the RAP to be received, as described in Note 10.4.

g) Management considers the risk of such credit to be low, as the contract for the sale of energy by quotas guarantees the receipt of an Annual Generation Revenue - RAG, which includes the annual amortization of this amount during the concessionterm.

79

h) For the generation concession assets, ANEEL published Normative Resolution 596/2013, which deals with the definition of criteria for calculating the New replacement value (Valor novo de reposição – VNR, in Portuguese), for the purposes of indemnification. Management's expectation of indemnification for these assets supports recoverability of the balances recorded.

i) This risk arises from the possibility that the Company might incur losses resulting from the volatility on the stock market. This type of risk involves external factors and has been managed through periodic assessment of the variations occurred in themarket.

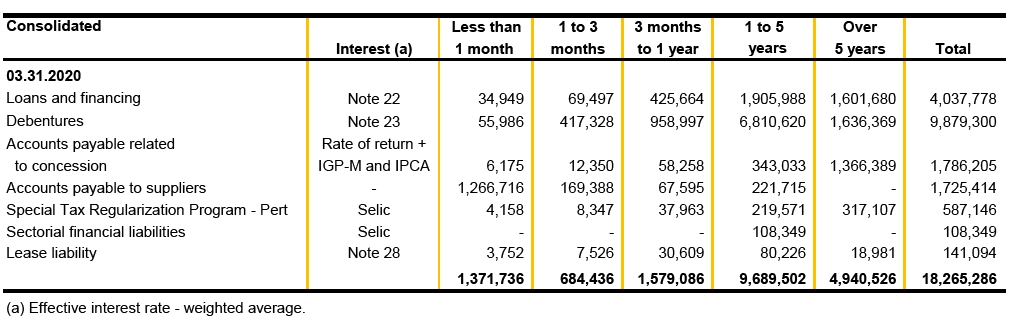

36.2.2 Liquidity risk

The Company's liquidity risk consists of the possibility of having insufficient funds, cash or other financial assets, to settle obligations on their scheduled maturity dates.

The Company manages liquidity risk relying on a set of methodologies, procedures and instruments applied to secure ongoing control over financial processes to ensure proper management of risks.

Investments are financed by incurring medium and long-term debt with financial institutions and capital markets.

Short, medium and long-term business projections are made and submitted to Management bodies for evaluation. The budget for the next fiscal year is annually approved.

Medium and long-term business projections cover monthly periods over the next five years. Short-term projections consider daily periods covering only the next 90 days.

The Company permanently monitors the volume of funds to be settled by controlling cash flows to reduce funding costs, the risk involved in the renewal of loan agreements and compliance with the financial investment policy, while concurrently keeping minimum cash levels.

The following table shows the expected undiscounted settlement amounts in each time range. Projections were based on financial indicators linked to the related financial instruments and forecast according to average market expectations as disclosed in the Central Bank of Brazil's Focus Report, which provides the average expectations of market analysts for these indicators for the current year and for the next 3 years. As from 2024, 2023 indicators are repeated on an unaltered basis throughout the forecast period.

80

As disclosed in Notes 22.5 and 23.3, the Company and its subsidiaries have loans and financing agreements and debentures with covenants that if breached may have their payment accelerated.

On March 31, 2020, Copel recorded negative net working capital of R$333,215 in the Parent Company’s balance sheet. Management has been monitoring the liquidity and taking actions to balance the short-term financial capacity, with emphasis on: reduction of the Company's investment program and maintenance of cost reduction actions, as well as the extension of debt, already provided for by Administration.

36.2.3 Market risk

Market risk is the risk that the fair value or the future cash flows of a financial instrument shall oscillate due to changes in market prices, such as currency rates, interest rates and stock price. The purpose of managing this risk is to control exposures within acceptable limits, while optimizing return.

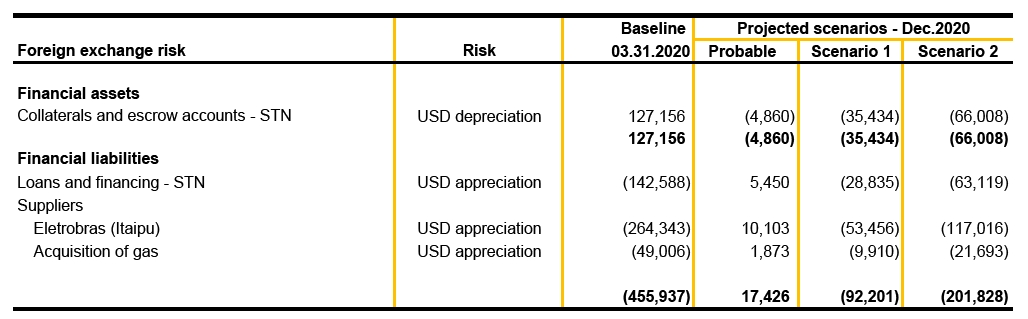

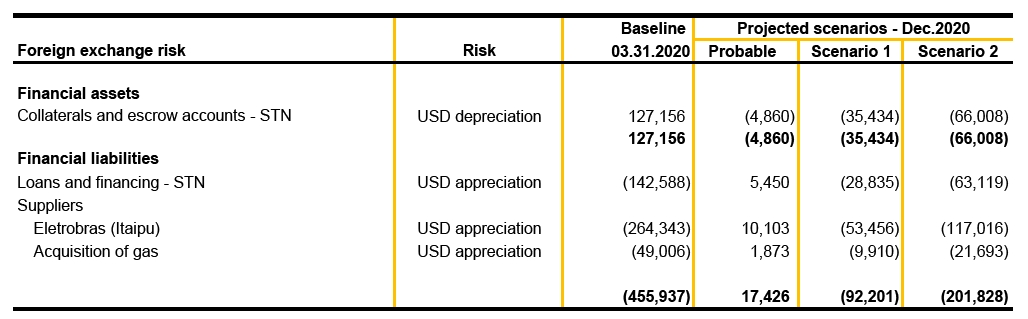

a) Foreign currency risk (US Dollar)

This risk comprises the possibility of losses due to fluctuations in foreign exchange rates, which may reduce assets or increase liabilities denominated in foreign currencies.

The Company's foreign currency indebtedness is not significant and it is not exposed to foreign exchange derivatives. The Company monitors all relevant foreign exchangerates.

The effect of the exchange rate variation resulting from the power purchase agreement with Eletrobras (Itaipu) is transferred to customers in Copel DIS's next tariffadjustment.

The exchange rate risk posed by the purchase of gas arises from the possibility of Compagás reporting losses on the fluctuations in foreign exchange rates, increasing the amount in Reais of the accounts payable related to the gas acquired from Petrobras. This risk is mitigated by the monitoring and transfer of the price fluctuation through tariff, when possible. The Company monitors these fluctuations on an ongoing basis.

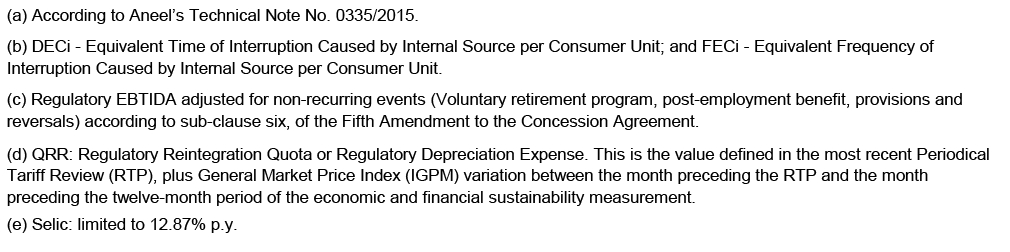

Sensitivity analysis of foreign currency risk - Dollar

The Company has developed a sensitivity analysis in order to measure the impact of the devaluation of the US dollar on itsloans and financing subject to currency risk.

81

The baseline scenario takes into account the existing balances in each account as of March 31, 2020and the probable scenario assumes a variation in the foreign exchange rate - prevailing at the end of the period (R$/US$5.00) based on the median market expectation for 2020 reported in the CentralBank'sFocus report of April 30, 2020. For the scenarios 1 and 2, deteriorations of 25% and 50%, respectively, were considered for the main risk factor for the financial instrument compared to the rate used in the probable scenario.

In addition to the sensitivity analysis required by CVM Resolution 475/2008, the Company evaluates its financial instruments considering the possible effects on profit and loss and equity of the risks evaluated by the Company's Management on the date of the quarterly information, as recommended by CPC 40 (R1) - Financial Instruments: Disclosure. Based on the equity position and the notional value of the financial instruments held as of March 31, 2020, it is estimated that these effects will approximate the amounts stated in the above table in the column for the forecast probable scenario, since the assumptions used by the Company are similar to those previouslydescribed.

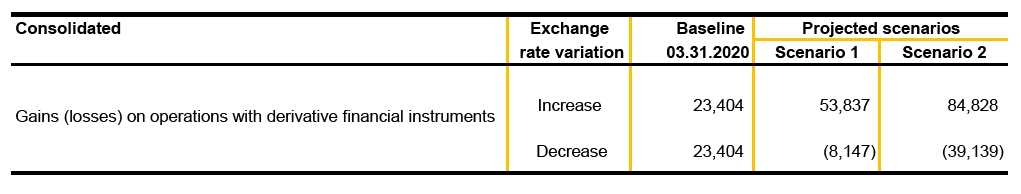

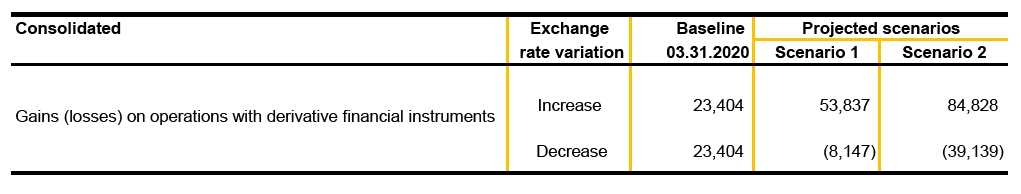

b) Foreign exchange risk - euro

This risk arises from the possibility of loss due to fluctuations in exchange rates affecting fair value of Non-Deliverable Forward (NDF) transactions, whose gains and losses are recognized in the Company's statement of income.

Based on the notional amount of 22 million euros outstanding as of December 31, 2019, the fair value was estimated by the difference between the amounts contracted under the respective terms and the forward currency quotations (B3 reference rates), discounted to present value at the fixed rate as of the same date. The active balance, recorded as of March 31, 2020, is shown in Note 12. The liability balance, as of December 31, 2019, is presented in Note 29.

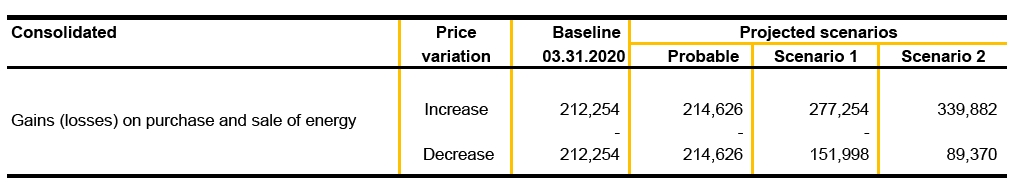

Sensitivity analysis of operations with derivative financial instruments

The Company developed a sensitivity analysis in order to measure the impact from exposure to fluctuation in exchange rate to Euro (€).

82

The sensitivity analyses were prepared in accordance with CVM Instruction 475/08, considering, for scenarios 1 and 2, 25% and 50% increase or decrease in exchange rates, applied to the forward rate as of March 31, 2020. The results obtained are shown below:

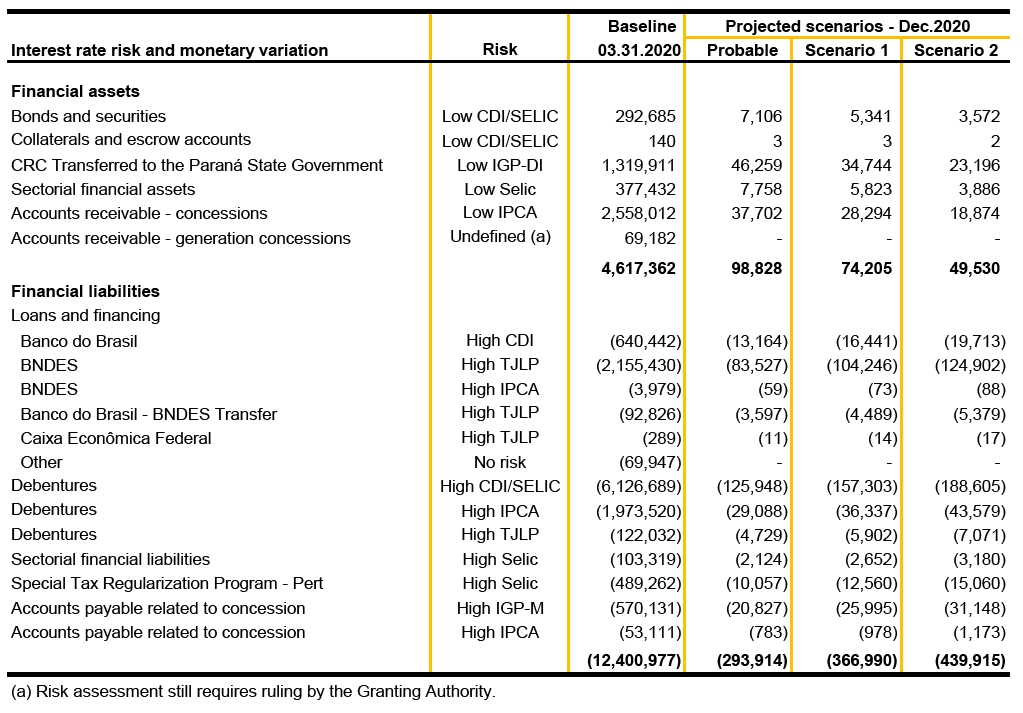

c) Interest rate and monetary variation risk

This risk comprises the possibility of losses due to fluctuations in interest rates or other indicators, which may reduce financial income or financial expenses or increase the financial expenses related to the assets and liabilities raised in the market.

The Company has not entered into derivative contracts to cover this risk, but has been continuously monitoring interest rates and market indexes in order to observe any need for contracting.

Sensitivity analysis of interest rate and monetary variation risk

The Company has developed a sensitivity analysis in order to measure the impact of variable interest rates and monetary variations on its financial assets and liabilities subject to these risks.

The baseline scenario takes into account the existing balances in each account as of March 31, 2020 while the probable scenario assumes balances reflecting varying indicators CDI/Selic: -2.75%, IPCA: -1.97%, IGP-DI: -4.70%, IGP-M: -4.90% and TJLP:-5.20%. estimated as market average projections for 2020 according to the Focus Report issued by the Central Bank of Brazil asof April 30, 2020, except TJLP that considers the Company's internalprojection.

For the scenarios 1 and 2, deteriorations of 25% and 50%, respectively, were considered for the main risk factor for the financial instrument compared to the rate used in the probable scenario.

83