SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of June, 2020

Commission File Number 1-14668

COMPANHIA PARANAENSE DE ENERGIA

(Exact name of registrant as specified in its charter)

Energy Company of Paraná

(Translation of Registrant's name into English)

Rua Coronel Dulcídio, 800

80420-170 Curitiba, Paraná

Federative Republic of Brazil

+55 (41) 3331-4011

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

Notice to the Market - 15/20

Copel GeT and BNDES sign a R$432 million

Financing Agreement for “Lote E”

Companhia Paranaense de Energia - COPEL, a company that generates, transmits, distributes and sells power, with shares listed on B3 (CPLE3, CPLE5, CPLE6), the NYSE (ELPVY, ELP) and the LATIBEX (XCOP), hereby announces to its shareholders and the market in general that Copel Geração e Transmissão (“Copel GeT”) and the National Bank for Economic and Social Development (“BNDES”) signed, on June 3, 2020, the Financing Agreement for financial support for the construction and implementation of the set of assets of transmission included in Contract No. 006/16, known as “Lot E”. With a total amount of R$432.1 million and interest equivalent to the IPCA variation plus interest of 4.82% (“IPCA + 4.82%”) per year, the financing will be amortized monthly up to 283 installments, with final maturity on December 15, 2043 (23.5 years). Such operation, which has COPEL as an intervening party, had already been approved by the 50th Ordinary Meeting of the Board of Directors of Copel GeT and by the 199th Ordinary Meeting of the Board of Directors COPEL and depended on the decontamination of the credit limit for the public sector, in the terms of BACEN Resolution No. 4589/17, and such release occurred at an extraordinary meeting of the National Monetary Council (“CMN”) on June 1, 2020. The BNDES letter of effectiveness, which proves the registration and validity of the Funding was received today.

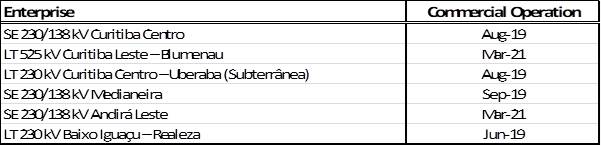

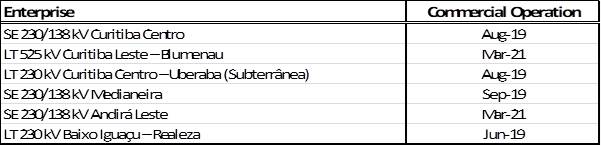

LOT E

With an investment of R$560.9 million, Lot E consists of several transmission assets, auctioned at Auction 005/15, as follows:

The funds from the financing are equivalent to approximately 77% of the total CAPEX of Lot E and will be used to conclude the works and recompose the cash disbursed in the implementation of the project. From 2016 to March 2020, R$424.4 million has already been invested in Lot E and the forecast is that R$135.8 million will be invested until the completion of the works.

Curitiba, June 10, 2020

Adriano Rudek de Moura

Chief Financial and Investor Relations Officer

For further information, please contact the Investor Relations team:

ri@copel.com or +55 41 3331-4011

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| COMPANHIA PARANAENSE DE ENERGIA – COPEL |

| | |

| By: | /S/ Daniel Pimentel Slaviero

| |

| | Daniel Pimentel Slaviero

Chief Executive Officer | |

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.