Prospectus Supplement No. 3 to

Prospectus dated July 12, 2007

Registration No. 333-143310

Filed pursuant to Rule 424(b)(3)

GOLDEN PHOENIX MINERALS, INC.

Supplement No. 3

To

Prospectus Dated July 12, 2007

This Prospectus Supplement supplements our Prospectus dated July 12, 2007 and filed with the Securities and Exchange Commission on July 12, 2007, and our Prospectus Supplement No. 1 dated August 22, 2007 and filed with the Securities and Exchange Commission on August 22, 2007, and our Prospectus Supplement No. 2 dated January 30, 2008 and filed with the Securities and Exchange Commission on January 30, 2008, (collectively, the “Prospectus”).

This Prospectus relates to the sale of 21,343,178 shares of common stock, no par value per share, by the Selling Security Holders listed under “Selling Security Holders” on page 36, of which 50,000 shares of common stock are to be issued in connection with financial advisory services. This Prospectus also covers the sale of 10,600,000 shares of our common stock by the Selling Security Holders upon the exercise of outstanding warrants.

This Prospectus Supplement No. 3 includes the attached Quarterly Report on Form 10-QSB Amendment No. 1 as filed with the Securities and Exchange Commission on February 8, 2008. We encourage you to read this Supplement carefully with the Prospectus.

Our common stock is quoted on the OTC Bulletin Board under the symbol “GPXM.OB”. On February 11, 2008, the last reported sale price for our common stock as reported on the OTC Bulletin Board was $0.27 per share. There is no public market for the warrants.

___________________

Investing in our common stock involves certain risks and uncertainties. See “Risk Factors” beginning on page 2 of the Prospectus and the risk factors included in our Annual Report on Form 10-KSB for the year ended December 31, 2006.

___________________

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus Supplement is February 11, 2008.

1

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-QSB/A

Amendment No. 1

(Mark One)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended September 30, 2007

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____.

Commission File No. 000-22905

GOLDEN PHOENIX MINERALS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Minnesota | | 41-1878178 |

(State or Other Jurisdiction Of Incorporation or Organization) | | (I.R.S. Employer Identification Number) |

| | | |

| 1675 East Prater Way, Suite 102, Sparks, Nevada | | 89434 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code (775) 853-4919

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.

Yes ¨ No x

As of November 14, 2007, there were 180,552,639 outstanding shares of the issuer’s common stock.

Transitional Small Business Disclosure Format (Check one):

Yes ¨ No x

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-QSB/A (“Form 10-QSB/A) to the Company’s Quarterly Report on Form 10-QSB for the period ended September 30, 2007 initially filed with the Securities and Exchange Commission on November 14, 2007 (“the Original Filing”) corrects a typographical error in Part II Other Information, Item 2. Recent Sales of Unregistered Securities and Use of Proceeds, specifically to now disclose the correct summation of the shares sold for the three months ended September 30, 2007, which is 161,167 shares, rather than 21,434,178 shares. In addition, the Original Filing has been amended to contain currently dated certifications from the Company’s Principal Executive Officer and Principal Financial Officer, as required by Sections 302 and 906 of the Sarbanes-Oxley Act (See Exhibits 31.1, 31.2, 32.1 and 32.2). This Amendment No. 1 continues to speak as of November 14, 2007, the date of the Original Filing and the Company has not updated the disclosure in this Amendment No. 1 to speak as of any later date.

GOLDEN PHOENIX MINERALS, INC.

FORM 10-QSB INDEX

| | Page Number |

| | |

| PART I – FINANCIAL INFORMATION | |

| Item 1. Condensed Consolidated Financial Statements | |

| Condensed Consolidated Balance Sheet as of September 30, 2007 (Unaudited) | 3 |

| Condensed Consolidated Statements of Operations for the Three Months Ended September 30, 2007 and 2006 (Unaudited) | 4 |

| Condensed Consolidated Statements of Operations for the Nine Months Ended September 30, 2007 and 2006 (Unaudited) | 5 |

| Condensed Consolidated Statements of Cash Flows for the Nine Months Ended September 30, 2007 and 2006 (Unaudited) | 6 |

| Notes to Condensed Consolidated Financial Statements | 7 |

| Item 2. Management’s Discussion and Analysis or Plan of Operation | 22 |

| Item 3T. Controls and Procedures | 40 |

| | |

| PART II – OTHER INFORMATION | |

| Item 1. Legal Proceedings | 41 |

| Item 2. Unregistered Sales of Securities and Use of Proceeds | 42 |

| Item 3. Defaults Upon Senior Securities | 43 |

| Item 4. Submission of Matters to a Vote of Security Holders | 43 |

| Item 5. Other Information | 44 |

| Item 6. Exhibits | 45 |

| Signature Page | 49 |

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

GOLDEN PHOENIX MINERALS, INC.

Condensed Consolidated Balance Sheet

September 30, 2007

(Unaudited)

| ASSETS | |

| Current assets: | | | |

| Cash and cash equivalents | | $ | 3,769,720 | |

| Receivables | | | 236,160 | |

| Prepaid expenses and other current assets | | | 248,684 | |

| Inventories | | | 645,613 | |

| Marketable securities | | | 269,467 | |

| Total current assets | | | 5,169,644 | |

| | | | | |

| Property and equipment, net | | | 1,710,048 | |

| | | | | |

| Other assets: | | | | |

| Restricted funds – reclamation obligations | | | 2,184,511 | |

| Prepaid bond insurance premiums | | | 288,079 | |

| Deposits | | | 60,996 | |

| Total other assets | | | 2,533,586 | |

| | | | | |

| | | $ | 9,413,278 | |

| | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 695,407 | |

| Accrued liabilities | | | 735,692 | |

| Current portion of severance obligations | | | 206,058 | |

| Current portion of long-term debt | | | 82,831 | |

| Production payment obligation – related party | | | 296,263 | |

| Production payment obligation | | | 1,974,456 | |

| Amounts due to related parties | | | 509,552 | |

| Total current liabilities | | | 4,500,259 | |

| | | | | |

| Long-term liabilities: | | | | |

| Reclamation obligations | | | 3,138,753 | |

| Severance obligations | | | 186,629 | |

| Long-term debt | | | 128,386 | |

| Total long-term liabilities | | | 3,453,768 | |

| | | | | |

| Total liabilities | | | 7,954,027 | |

| | | | | |

| Commitments and contingencies | | | | |

| | | | | |

| Minority Interest | | | 145,458 | |

| | | | | |

| Stockholders’ equity: | | | | |

| Common stock; no par value, 400,000,000 shares authorized, 180,552,639 shares issued and outstanding | | | 37,673,547 | |

| Other comprehensive income | | | 107,426 | |

| Accumulated deficit | | | (36,467,180 | ) |

| Total stockholders’ equity | | | 1,313,793 | |

| | | | | |

| | | $ | 9,413,278 | |

See accompanying notes to condensed consolidated financial statements

GOLDEN PHOENIX MINERALS, INC.

(Unaudited)

| | | Three Months Ended September 30, | |

| | | 2007 | | | 2006 | |

| | | | | | | |

| Sales | | $ | 1,381,376 | | | $ | — | |

| | | | | | | | | |

| Operating costs and expenses: | | | | | | | | |

| Costs of mining operations | | | 1,679,364 | | | | 242,127 | |

| Exploration, development and mineral property lease expenses | | | 105,161 | | | | 323,508 | |

| Accretion expense | | | 49,183 | | | | 40,620 | |

| General and administrative expenses | | | 779,371 | | | | 539,376 | |

| Depreciation and amortization expense | | | 59,030 | | | | 24,629 | |

| | | | | | | | | |

| Total operating costs and expenses | | | 2,672,109 | | | | 1,170,260 | |

| | | | | | | | | |

| Loss from operations | | | (1,290,733 | ) | | | (1,170,260 | ) |

| | | | | | | | | |

| Other income (expense): | | | | | | | | |

| Interest income | | | 50,191 | | | | 1,523 | |

| Interest expense | | | (26,040 | ) | | | (170,205 | ) |

| Gain (loss) on disposal of property and equipment | | | (2,017 | ) | | | (11,599 | ) |

| Gain on disposal of mineral properties | | | — | | | | 162,041 | |

| Other income | | | — | | | | 19,740 | |

| | | | | | | | | |

| Total other income (expense) | | | 22,134 | | | | 1,500 | |

| | | | | | | | | |

| Income (loss) before minority interest and income taxes | | | (1,268,599 | ) | | | (1,168,760 | ) |

| | | | | | | | | |

| Minority interest in net loss of consolidated joint venture | | | 194,056 | | | | — | |

| | | | | | | | | |

| Loss before income taxes | | | (1,074,543 | ) | | | (1,168,760 | ) |

| | | | | | | | | |

| Provision for income taxes | | | — | | | | — | |

| | | | | | | | | |

| Net loss | | | (1,074,543 | ) | | | (1,168,760 | ) |

| | | | | | | | | |

| Other comprehensive income (loss): | | | | | | | | |

| Unrealized gain (loss) on marketable securities | | | 28,200 | | | | (12,510 | ) |

| | | | | | | | | |

| Net comprehensive loss | | $ | (1,046,343 | ) | | $ | (1,181,270 | ) |

| | | | | | | | | |

| Income (loss) per common share, basic and diluted | | $ | (0.01 | ) | | $ | (0.01 | ) |

| | | | | | | | | |

| Weighted average number of shares outstanding | | | 180,481,389 | | | | 148,249,435 | |

See accompanying notes to condensed consolidated financial statements

GOLDEN PHOENIX MINERALS, INC.

Condensed Consolidated Statements of Operations

(Unaudited)

| | | Nine Months Ended September 30, | |

| | | 2007 | | | 2006 | |

| | | | | | | |

| Sales | | $ | 6,645,958 | | | $ | — | |

| | | | | | | | | |

| Operating costs and expenses: | | | | | | | | |

| Costs of mining operations | | | 5,287,416 | | | | 447,569 | |

| Exploration, development and mineral property lease expenses | | | 141,907 | | | | 2,569,013 | |

| Accretion expense | | | 141,628 | | | | 116,555 | |

| General and administrative expenses | | | 2,229,826 | | | | 1,363,396 | |

| Depreciation and amortization expense | | | 160,938 | | | | 79,580 | |

| | | | | | | | | |

| Total operating costs and expenses | | | 7,961,715 | | | | 4,576,113 | |

| | | | | | | | | |

| Loss from operations | | | (1,315,757 | ) | | | (4,576,113 | ) |

| | | | | | | | | |

| Other income (expense): | | | | | | | | |

| Interest income | | | 88,127 | | | | 4,109 | |

| Interest expense | | | (253,761 | ) | | | (981,188 | ) |

| Gain (loss) on disposal of property and equipment | | | 19,712 | | | | (27,466 | ) |

| Gain on extinguishment of debt | | | 537,309 | | | | 1,593,803 | |

| Gain on disposal of mineral properties | | | — | | | | 162,041 | |

| Other income | | | — | | | | 19,740 | |

| | | | | | | | | |

| Total other income (expense) | | | 391,387 | | | | 771,039 | |

| | | | | | | | | |

| Loss before minority interest and income taxes | | | (924,370 | ) | | | (3,805,074 | ) |

| | | | | | | | | |

| Minority interest in net income of consolidated joint venture | | | (327,525 | ) | | | — | |

| | | | | | | | | |

| Loss before income taxes | | | (1,251,895 | ) | | | (3,805,074 | ) |

| | | | | | | | | |

| Provision for income taxes | | | — | | | | — | |

| | | | | | | | | |

| Net loss | | | (1,251,895 | ) | | | (3,805,074 | ) |

| | | | | | | | | |

| Other comprehensive income (loss): | | | | | | | | |

| Unrealized gain (loss) on marketable securities | | | 63,524 | | | | (12,510 | ) |

| | | | | | | | | |

| Net comprehensive loss | | $ | (1,188,371 | ) | | $ | (3,817,584 | ) |

| | | | | | | | | |

| Loss per common share, basic and diluted | | $ | (0.01 | ) | | $ | (0.03 | ) |

| | | | | | | | | |

| Weighted average number of shares outstanding | | | 170,356,083 | | | | 142,185,509 | |

See accompanying notes to condensed consolidated financial statements

GOLDEN PHOENIX MINERALS, INC.

(Unaudited)

| | | Nine Months Ended September 30, | |

| | | 2007 | | | 2006 | |

| Cash flows from operating activities: | | | | | | |

| Net loss | | $ | (1,251,895 | ) | | $ | (3,805,074 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

| Depreciation and amortization | | | 160,938 | | | | 79,580 | |

| Accretion expense | | | 141,628 | | | | 116,555 | |

| Stock-based compensation | | | 78,441 | | | | — | |

| Gain on extinguishment of debt | | | (537,309 | ) | | | (1,593,803 | ) |

| Loss (gain) on disposal of property and equipment | | | (19,712 | ) | | | 27,466 | |

| Gain on disposal of mineral properties | | | — | | | | (162,041 | ) |

| Issuance of common stock for services | | | 144,105 | | | | 291,583 | |

| Issuance of common stock for exploration and property costs | | | — | | | | 373,380 | |

| Issuance of warrants for interest expense | | | 7,308 | | | | — | |

| Minority interest in net income (loss) of joint venture | | | 327,525 | | | | — | |

| Changes in operating assets and liabilities: | | | | | | | | |

| (Increase) decrease in receivables | | | (100,576 | ) | | | 135,806 | |

| Decrease in prepaid expenses and other current assets | | | 95,350 | | | | 160,698 | |

| (Increase) decrease in inventories | | | (598,357 | ) | | | 4,128 | |

| Increase in restricted funds – reclamation obligations | | | (7,016 | ) | | | (179,109 | ) |

| Increase in deposits | | | (235 | ) | | | (12,631 | ) |

| Increase in accounts payable | | | 280,539 | | | | 478,367 | |

| Increase (decrease) in accrued and other liabilities | | | 122,692 | | | | 839,377 | |

| Net cash used in operating activities | | | (1,156,574 | ) | | | (3,245,718 | ) |

| | | | | | | | | |

| Cash flows from investing activities: | | | | | | | | |

| Purchase of property and equipment | | | (565,189 | ) | | | (151,360 | ) |

| Proceeds from the sale of property and equipment | | | 40,000 | | | | 33,075 | |

| Minority interest capital contributions to joint venture | | | 360,000 | | | | — | |

| Cash distributions from joint venture to minority interest | | | (500,000 | ) | | | — | |

| Net cash used in investing activities | | | (665,189 | ) | | | (118,285 | ) |

| | | | | | | | | |

| Cash flows from financing activities: | | | | | | | | |

| Net proceeds from the sale of common stock | | | 6,744,505 | | | | 2,932,500 | |

| Proceeds from the exercise of options and warrants | | | 186,045 | | | | 139,610 | |

| Payments of severance obligations | | | (240,935 | ) | | | — | |

| Payments of notes payable and long-term debt | | | (816,360 | ) | | | — | |

| Payments of amounts due to related parties | | | (152,500 | ) | | | (273,047 | ) |

| Payments of production payment obligation – related party | | | (608,304 | ) | | | — | |

| Proceeds from amounts due to related parties | | | — | | | | 145,000 | |

| Proceeds from notes payable | | | — | | | | 265,000 | |

| Proceeds from production payment purchase agreement | | | — | | | | 650,000 | |

| Net cash provided by financing activities | | | 5,112,451 | | | | 3,859,063 | |

| | | | | | | | | |

| Net increase in cash and cash equivalents | | | 3,290,688 | | | | 495,060 | |

| Cash and cash equivalents, beginning of period | | | 479,032 | | | | 10,175 | |

| | | | | | | | | |

| Cash and cash equivalents, end of period | | $ | 3,769,720 | | | $ | 505,235 | |

See accompanying notes to condensed consolidated financial statements

GOLDEN PHOENIX MINERALS, INC.

Notes to Condensed Consolidated Financial Statements

September 30, 2007

(Unaudited)

NOTE 1 -DESCRIPTION OF BUSINESS AND BASIS OF FINANCIAL STATEMENT PRESENTATION

Golden Phoenix Minerals, Inc. (the “Company” or “Golden Phoenix”) was incorporated under the laws of the state of Minnesota on June 2, 1997. The Company is engaged in the operation, exploration and development of mineral properties primarily in the state of Nevada. The Company controls its mineral property interests through joint venture interests, direct ownership, leases, and mining claims. The Company is planning exploration and development of selected properties with the intent of conducting precious and base metal mining and production operations. The Company is investigating new mineral properties for potential exploration, development and operation.

On September 28, 2006, the Company entered into the Ashdown Project LLC Operating Agreement with Win-Eldrich Gold, Inc. in order to govern the management of Ashdown Project LLC (the “Ashdown LLC”) and the future mineral exploration, evaluation, development and mining operations by the Ashdown LLC on the real property contributed by the Company and Win-Eldrich Gold, Inc. and all other real property within the area of interest that is acquired by the Ashdown LLC. The Ashdown LLC commenced production of molybdenite concentrates in December 2006. The principal business focus of the Company for the nine months ended September 30, 2007 has been the management of the operations of the Ashdown LLC. At September 30, 2007, the Company held a 60% interest in the capital and profits of the Ashdown LLC (see Note 3). The Company has claim to an additional 9.5% interest, though contested, which would bring its total interest in the capital and profits of the Ashdown LLC to 69.5%.

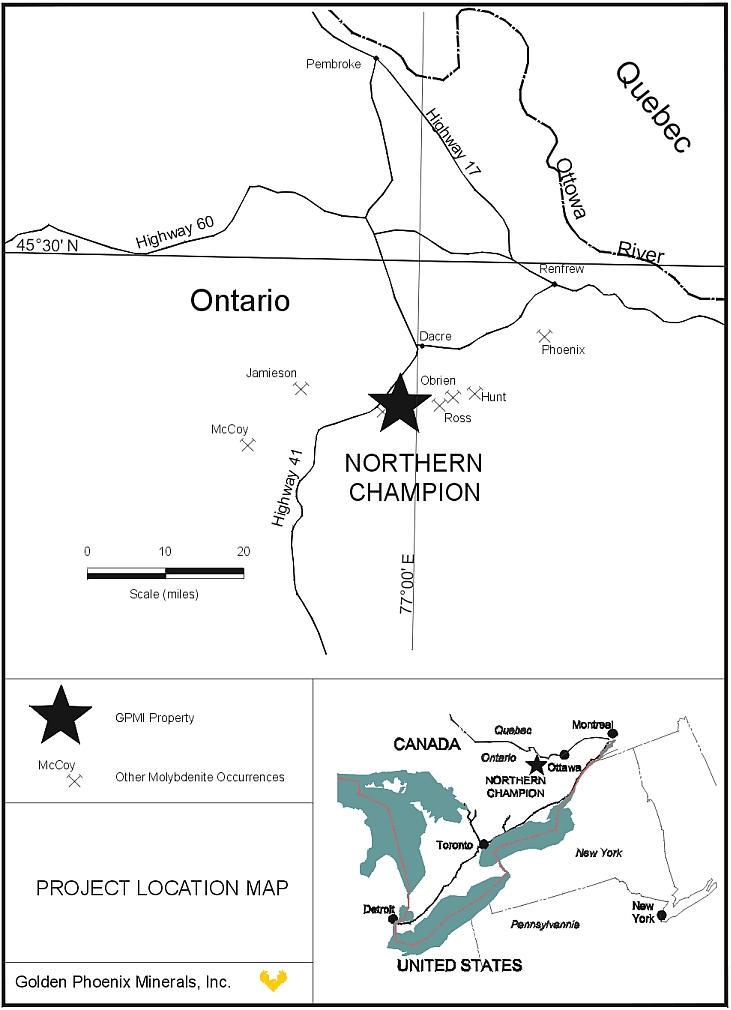

On April 18, 2006, the Company executed a Purchase Agreement with four individuals to acquire five (5) registered claims totaling 22 units on the Northern Champion Property together with a report describing a molybdenum deposit within the area of the claim. On February 12, 2007, the Purchase Agreement was amended to allow the Company to convert the remaining cash payments of $125,000 to an equivalent number of restricted shares valued at the market close on that date, and the purchase was completed. Through September 30, 2007, the Company has not performed significant exploration and development activities on the Northern Champion Property.

In mid-2003, the Company began formal operation of the Mineral Ridge property, and subsequently elected to suspend those operations in January 2005. As of September 30, 2007, the operations of the Mineral Ridge mine remain temporarily idled awaiting completion of an optimized mine plan.

The condensed consolidated financial statements of the Company as of September 30, 2007 and for the three months and nine months ended September 30, 2007 include the accounts of Golden Phoenix Minerals, Inc. and the Ashdown LLC, an entity controlled by Golden Phoenix Minerals, Inc. through its 60% member interest. All significant inter-company balances and transactions have been eliminated.

The interim financial information of the Company as of September 30, 2007 and for the three-month and nine-month periods ended September 30, 2007 and September 30, 2006 is unaudited. The accompanying condensed consolidated financial statements have been prepared in accordance with U. S. generally accepted accounting principles for interim financial statements. Accordingly, they omit or condense footnotes and certain other information normally included in financial statements prepared in accordance with U.S. generally accepted accounting principles. The accounting policies followed for quarterly financial reporting conform with the accounting policies disclosed in Note 1 to the Notes to Consolidated Financial Statements included in the Company's Annual Report on Form 10-KSB for the year ended December 31, 2006. In the opinion of management, all adjustments that are necessary for a fair presentation of the financial information for the interim periods reported have been made. All such adjustments are of a normal recurring nature. The results of operations for the three months and nine months ended September 30, 2007 are not necessarily indicative of the results that can be expected for the fiscal year ending December 31, 2007. The unaudited condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and the notes thereto included in the Company's Annual Report on Form 10-KSB for the year ended December 31, 2006.

NOTE 2 -GOING CONCERN

The Company’s condensed consolidated financial statements are prepared using accounting principles generally accepted in the United States of America applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. However, the Company has a history of operating losses since its inception in 1997, and has an accumulated deficit of $36,467,180 at September 30, 2007, which together raises doubt about the Company’s ability to continue as a going concern. The accompanying condensed consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

The Company has obtained working capital from debt and equity financing, the exercise of options and warrants, and from a production payment purchase agreement to fund the Company’s activities until sufficient revenues can be generated from operations. During the nine months ended September 30, 2007, the Company received net proceeds from the sale of its common stock of $6,744,505 and proceeds from the exercise of options and warrants of $186,045. The Ashdown LLC placed the Ashdown property into commercial operation in December 2006, and for the nine months ended September 30, 2007, generated sales of $6,645,958, which has funded a significant portion of the Company’s operating costs and expenses. Because commercial operations only recently commenced at the Ashdown property and the Ashdown LLC has not sustained a consistent level of production, the Company cannot predict the future operating cash flows from the Ashdown LLC. However, the Company anticipates that operating cash flows from the Ashdown LLC, after distributions to the minority interest member and after related production payment and debt obligations have been satisfied, will contribute to the working capital of the Company.

There can be no guarantee or assurance that the Company will be successful in its ability to sustain a profitable level of operations from the Ashdown LLC or to attain successful operations from its other properties, or to continue to raise capital at favorable rates or at all. The condensed consolidated financial statements do not include any adjustments that might result from the outcome of these uncertainties.

NOTE 3 -ASHDOWN PROJECT LLC

On September 28, 2006, the Company entered into the Ashdown Project LLC Operating Agreement with Win-Eldrich Gold, Inc. in order to govern the management of Ashdown LLC and the future mineral exploration, evaluation, development and mining operations by the Ashdown LLC on the real property contributed by the Company and Win-Eldrich Gold, Inc. and all other real property within the area of interest that is acquired by the Ashdown LLC. The Company will serve as the initial Manager of the Ashdown LLC until such a time that the Management Committee determines that the Ashdown LLC should manage itself with the Mine General Manager and the other officers of the Ashdown LLC being responsible for the day-to-day operations. The Ashdown LLC initiated mining activities on the property, subject to certain stipulations, in the fourth quarter of 2006, and completed the first sale of molybdenite concentrates in December 2006. The Ashdown LLC has a marketing agreement in place that facilitates the sale of the molybdenite concentrates (FOB mine) to an international metals broker. The Ashdown LLC will not be required to provide roasted material to the market, and does not have to locate third party roasting capacity under this contract. The Company plans to assess potential expansion into a larger operation.

Pursuant to the terms of a Letter Agreement dated September 28, 2006 (the “Letter Agreement”) entered into as part of the organization of the Ashdown LLC, on November 1, 2006, the Company believes that Win-Eldrich Gold, Inc. was required to pay the Company the aggregate amount of $309,391 related to the joint venture. On December 4, 2006, the Company informed Win-Eldrich Gold, Inc. that it was in default under the Letter Agreement, that the 30-day cure period had expired and that the matter had been referred to the Company’s Board of Directors for further consideration. On December 20, 2006, the Company notified Win-Eldrich Gold, Inc. of its intention, pursuant to the remedial provisions of the Letter Agreement, to invoke the remedy of dilution under subsection 7.5.2(a) of the Ashdown Project LLC Operating Agreement (the “Operating Agreement”) to decrease Win-Eldrich Gold, Inc.’s Ownership Interest from 40% to 30.5% and increase the Company’s Ownership Interest from 60% to 69.5%. Win-Eldrich Gold, Inc. disagrees that it is in default under the Letter Agreement and the Company anticipates that this disagreement will be resolved by an amicable agreement or under the dispute resolution provisions of the Operating Agreement providing for mediation and binding arbitration. While the Company is confident that its interpretation of the Letter Agreement and the remedial provisions of the Operating Agreement are correct, until the disagreement is resolved pursuant to the dispute resolution provisions of the Operating Agreement, or by the ongoing settlement discussions between the parties, it is uncertain whether the Company’s Ownership Interest in the Ashdown LLC will remain at 60% or increase to 69.5%. The Company does not anticipate that this disagreement will have a material adverse effect on the Ashdown LLC’s operations or on the Company’s consolidated financial condition or results of operations. Through September 30, 2007 the consolidated financial statements reflect the Company’s Ownership Interest in the Ashdown LLC at 60%.

As more fully described in these notes to the condensed consolidated financial statements, the Company’s share of production distributions from the LLC are encumbered by certain financing agreements.

NOTE 4 -STOCK-BASED COMPENSATION

The Company accounts for stock-based compensation in accordance with Statement of Financial Accounting Standards (“SFAS”) No. 123(R), Share Based Payments. Under the fair value recognition provisions of this statement, stock-based compensation cost is measured at the grant date based on the value of the award granted, using the Black-Scholes option pricing model, and recognized over the period in which the award vests. The stock-based compensation expense for the three-month periods ended September 30, 2007 and September 30, 2006 included in general and administrative expenses was $14,221 and $79,001, respectively. The stock-based compensation expense for the nine-month periods ended September 30, 2007 and September 30, 2006 included in general and administrative expenses was $78,441 and $183,829, respectively. There was no stock compensation expense capitalized during the three-month and nine-month periods ended September 30, 2007 and September 30, 2006.

No new stock options were issued by the Company during the nine months ended September 30, 2007. The following table summarizes the stock option activity during the nine months ended September 30, 2007:

| | | Options | | | Weighted Average Exercise Price | | | Weighted Average Remaining Contract Term | | | Aggregate Intrinsic Value | |

| | | | | | | | | | | | | |

| Outstanding at December 31, 2006 | | | 6,915,715 | | | $ | 0.22 | | | | | | | |

| Granted | | | - | | | | - | | | | | | | |

| Exercised | | | (886,667 | ) | | $ | 0.23 | | | | | | | |

| Expired or cancelled | | | (397,475 | ) | | $ | 0.19 | | | | | | | |

| | | | | | | | | | | | | | | |

| Outstanding at September 30, 2007 | | | 5,631,573 | | | $ | 0.22 | | | | 2.37 | | | $ | 610,517 | |

| | | | | | | | | | | | | | | | | |

| Options vested and exercisable at September 30, 2007 | | | 5,520,277 | | | $ | 0.22 | | | | 2.30 | | | $ | 610,517 | |

As of September 30, 2007, the total future compensation cost related to non-vested stock-based awards not yet recognized in the condensed consolidated statements of operations was $29,915.

NOTE 5 -STOCK WARRANTS

A summary of the status of the Company’s stock warrants as of September 30, 2007 and changes during the nine months then ended is presented below:

| | | Shares | | | Weighted Average Exercise Price | |

| | | | | | | |

| Outstanding, December 31, 2006 | | | 2,656,602 | | | $ | 0.17 | |

| | | | | | | | | |

| Granted | | | 10,636,576 | | | $ | 0.40 | |

| Canceled / Expired | | | - | | | | - | |

| Exercised | | | (1,193,178 | ) | | $ | 0.14 | |

| | | | | | | | | |

| Outstanding, September 30, 2007 | | | 12,100,000 | | | $ | 0.38 | |

The following summarizes the exercise price per share and expiration date of the Company's outstanding warrants to purchase common stock at September 30, 2007:

| Expiration Date | | Price | | | Number | |

| 2008 | | $ | 0.20 | | | | 800,000 | |

| 2009 | | $ | 0.20 | | | | 700,000 | |

| 2009 | | $ | 0.40 | | | | 10,600,000 | |

| | | | | | | | | |

| | | | | | | | 12,100,000 | |

NOTE 6 -EARNINGS (LOSS) PER SHARE

The computation of basic earnings per common share is based on the weighted average number of shares outstanding during the period. The computation of diluted earnings per common share is based on the weighted average number of shares outstanding during the period plus the weighted average common stock equivalents which would arise from the exercise of stock options and warrants outstanding using the treasury stock method and the average market price per share during the period.

A reconciliation of the number of shares used in the computation of the Company’s basic and diluted earnings per common share is as follows:

| | | Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| | | 2007 | | | 2006 | | | 2007 | | | 2006 | |

| | | | | | | | | | | | | |

| Weighted average number of common shares outstanding | | | 180,481,389 | | | | 148,249,435 | | | | 170,356,083 | | | | 142,185,509 | |

| Dilutive effect of: | | | | | | | | | | | | | | | | |

| Stock options | | | - | | | | - | | | | - | | | | - | |

| Warrants | | | - | | | | - | | | | - | | | | - | |

| Weighted average number of common shares outstanding, assuming dilution | | | 180,481,389 | | | | 148,249,435 | | | | 170,356,083 | | | | 142,185,509 | |

No stock options and warrants are included in the computation of weighted average number of shares because the effect would be anti-dilutive. At September 30 2007, the Company had outstanding options and warrants to purchase a total of 17,731,573 common shares of the Company that could have a future dilutive effect on the calculation of earnings per share. At September 30, 2007, a production payment obligation of $1,974,456, which is recorded as a current liability in the accompanying condensed consolidated balance sheet, is convertible into a maximum of 5,484,600 common shares of the Company that could have a future dilutive effect on the calculation of earnings per share.

NOTE 7 - PROPERTY AND EQUIPMENT

Property and equipment consist of the following at September 30, 2007:

| Land | | $ | 57,599 | |

| Buildings | | | 239,184 | |

| Mining and milling equipment | | | 1,559,410 | |

| Support equipment | | | 39,933 | |

| Vehicles | | | 79,930 | |

| Computer equipment | | | 140,142 | |

| Office furniture and equipment | | | 44,784 | |

| Construction in progress | | | 288,378 | |

| | | | 2,449,360 | |

| Less accumulated depreciation and amortization | | | (739,312 | ) |

| | | | | |

| | | $ | 1,710,048 | |

NOTE 8 -RESTRICTED FUNDS – RECLAMATION OBLIGATIONS

During May 2003, the Company entered into an insurance backed financial assurance program for a surety bond to secure the $2,693,000 reclamation bond for the Mineral Ridge property. The program structure includes an insurance policy that will pay reclamation expenses as they occur. During June 2003, the Company transferred to the insurance company approximately $1,800,000 of restricted cash for the reclamation of the Mineral Ridge property. The Company has paid an additional $526,505 of premiums on the reclamation bond policy through September 30, 2007. The Company is obligated to pay $11,311 annually thereafter which amount will be expensed during the year incurred.

Of the total initial premium of $2,326,505, $1,796,652 represents a Reclamation Experience Account which funds are directly available to the Company to use for closure, reclamation and remediation activities once they commence based on the existing known condition of the Mineral Ridge property. This amount has been included in the balance of the Restricted Funds - Reclamation Obligations asset in the accompanying condensed consolidated balance sheet as of September 30, 2007.

The prepaid bond insurance premiums of $526,505 are being amortized over the twelve (12) year term of the policy. The annual insurance premium of $11,311 is amortized over a twelve (12) month period. At September 30, 2007, the total current portion of the prepaid insurance premiums related to this policy totaled $43,212 and is included in prepaid expenses and other current assets in the accompanying condensed consolidated balance sheet. The long-term portion of the prepaid insurance premiums totaled $288,079 and is included in other assets in the accompanying condensed consolidated balance sheet as of September 30, 2007. This program allows the Company flexibility to increase its bond in the future to an aggregate limit of $4,000,000.

Restricted funds totaling $346,700 for a bond and other regulatory deposit requirements for the Ashdown property and a deposit of $41,159 for the Mineral Ridge property are also included in the balance of the Restricted Funds – Reclamation Obligations in the accompanying condensed consolidated balance sheet as of September 30, 2007.

NOTE 9 -RECLAMATION OBLIGATIONS

In accordance with SFAS No. 143, Accounting for Asset Retirement Obligations, which establishes a uniform methodology for accounting for estimated reclamation and abandoned costs, the Company has estimated reclamation costs for the Mineral Ridge and Ashdown properties. At September 30, 2007, the total amount recorded for estimated reclamation obligations was $3,138,753. Because the Mineral Ridge property has been idled and because the Ashdown LLC has not yet established proven or probable reserves, no related reclamation asset has been recorded at September 30, 2007.

Accretion expense related to the reclamation obligations for the three-month periods ended September 30, 2007 and 2006 was $49,183 and $40,620, respectively. Accretion expense for the nine-month periods ended September 30, 2007 and 2006 was $141,628 and $116,555, respectively.

NOTE 10 -SEVERANCE OBLIGATIONS

At a meeting of the Board on February 18, 2005, the directors unanimously approved a separation agreement for Michael Fitzsimonds, a former Chief Executive Officer of the Company. The terms of separation were that Mr. Fitzsimonds would be paid his full salary for one year including medical benefits, followed by 180 hours of vacation. The Company then would pay him $394,000 in 59 equal monthly payments. He would be allowed to use a company vehicle for one year at which time he exercised his option to purchase it. Mr. Fitzsimonds loaned $100,000 to the company in 1998 on which the Company pays $1,350 a month for interest (see Note 13). The principal is to be repaid on or before February 18, 2008. There is no prepayment penalty. The current portion of the severance obligation to Mr. Fitzsimonds of $80,136 is included in current liabilities and the long-term portion of the severance obligation of $186,629 is included in long-term liabilities in the accompanying condensed consolidated balance sheet as of September 30, 2007.

On January 31, 2007, the Company entered into an Employment Separation Agreement (the “Separation Agreement”) with Kenneth S. Ripley whereby Mr. Ripley resigned as the Chief Executive Officer of the Company and all other positions he held with the Company and on behalf of the Company, effective as of January 31, 2007 (the “Effective Date”). The Separation Agreement terminates the Employment Agreement dated as of March 8, 2006 between the Company and Mr. Ripley whereby Mr. Ripley assumed the role of Chief Executive Officer of the Company effective March 13, 2006 (the “Employment Agreement”).

Under the terms of the Separation Agreement: (i) subject to a “Cash Call Delay”, the Company agreed to pay Mr. Ripley his deferred salary of $115,000 (balance of $98,750 as of December 31, 2006) in twelve (12) equal monthly installments starting in March 2007 as severance pay; (ii) subject to a Cash Call Delay, the Company agreed to pay Mr. Ripley a performance bonus in the amount of $195,000 in twelve (12) equal monthly installments starting in March 2007 as bonus pay, with the unpaid portion of the bonus pay accruing simple interest at the rate of 18% per annum; (iii) subject to a Cash Call Delay, the Company agreed to pay the outstanding balance of the Mr. Ripley’s note payable and related accrued interest totaling $157,979, consisting of $89,897 in principal and $68,082 in accrued interest, in twelve (12) equal monthly installments starting in March 2007 as promissory note payments; (iv) the Company agreed to immediately vest the unvested portion of the Mr. Ripley’s stock options to purchase an aggregate amount of 30,000 shares of common stock granted pursuant to the Company’s Year 2002 Supplemental Employee/Consultant Stock Compensation Plan as of January 31, 2007 (the “Termination Date”); (v) Mr. Ripley agreed to a non-solicitation clause for a term of eighteen (18) months following the Termination Date; and (vi) Mr. Ripley provided the Company with a general release of liability and claims. Under the Separation Agreement, a “Cash Call Delay” is defined as a cash call or any cash payment required of the Company in connection with the Ashdown Project LLC.

In addition, pursuant to the Separation Agreement, the Company and Mr. Ripley further agreed that all payments to Mr. Ripley that are subject to a Cash Call Delay are to be suspended for such month and such monthly payments are to be deferred until the next month with the payment terms to be extended by such number of cash call delay months, provided however, such repayment term will not exceed April 30, 2008. The Company guaranteed that Mr. Ripley will receive at least one monthly installment of the payments due on or before April 1, 2007. The total severance obligation to Mr. Ripley as of September 30, 2007 of $125,922, including accrued interest payable of $13,005, is included in current liabilities in the accompanying condensed consolidated balance sheet as of September 30, 2007. Through September 30, 2007, no Cash Call Delays have occurred.

NOTE 11 -PRODUCTION PURCHASE AGREEMENT AND ASSIGNMENT

Schnack Agreements - On May 10, 2005, the Company entered into a financing agreement with William D. and Candida Schnack (“Schnack”), unrelated parties, (the “Prior Schnack Agreement”) wherein Schnack could advance to the Company up to $1,000,000 secured by production and sale of molybdenum concentrates from the Ashdown property. The advances were restricted to funding activities associated with the Ashdown mineral property. Advances were to be disbursed in accordance with the achievement by the Company of pre-approved milestones as set forth in the Agreement. In consideration of the advances, Schnack will receive the repayment of the advances, a premium of $2,000,000 and 1,000,000 two-year warrants to purchase common stock of the Company at an exercise price equal to $0.14 per share. In addition, the Company agreed that, during the period that is two (2) years from the date of the agreement, in the event there is any dilution of the stock of the Company, the number of warrants to Schnack shall be increased to reflect this dilution. Pursuant to this agreement, the Company received $735,000 in 2005 and $265,000 in 2006, and recognized $1,470,000 of the premium as interest expense in 2005 and $530,000 interest expense in 2006.

In conjunction with the anti-dilution provisions of the agreement, an additional 156,602 warrants were issued in 2006 and 2005, and the final 36,576 warrants valued at $7,309 were issued in May 2007.

On April 23, 2007, the Company entered into an Advance Sales Restructuring Agreement with Schnack (the “Restructuring Agreement”), which supersedes the Prior Schnack Agreement. Terms of the Restructuring Agreement include: that it be effective upon the closing of private placement equity financing; to provide for an early payment of $1 million; the restructuring of the remaining amounts owed under the Schnack Agreement into a Net Smelter Returns payment from the Company’s distributions from the Ashdown LLC; the exercise of Schnack’s warrants to purchase the Company’s common stock issued to Schnack pursuant to the Prior Schnack Agreement (the “Schnack Warrants”); and that the Company use its reasonable best efforts to include the shares purchased by Schnack upon the exercise of the Warrants on a registration statement to be filed with the SEC (which was done with a registration statement that went effective with the SEC on July 12, 2007).

Further terms include: that the remaining amounts owed to Schnack under the Prior Schnack Agreement shall be paid from a production payment in the amount of two million dollars ($2,000,000) paid exclusively from the Company’s share of production of base and precious minerals produced from the Ashdown Mine allocated to the Company pursuant to the Ashdown LLC. The rate of payment shall be equal to a fifteen percent (15%) Net Smelter (Refinery) Return on the entire production of precious and base minerals produced from the Ashdown Mine.

Further terms include that the Company, or its assignee, has the option to purchase the production payment provided for in the Restructuring Agreement for the following amounts during the time periods set forth below:

1. On or prior to August 31, 2007. The Company, or its assignee, has the option to purchase the production payment for one million three hundred thousand dollars ($1,300,000), less any amounts already paid pursuant to the Restructuring Agreement.

2. Between September 1, 2007 and December 31, 2007. The Company, or its assignee, has the option to purchase the production payment for one million five hundred thousand dollars ($1,500,000), less any amounts already paid pursuant to the Restructuring Agreement.

3. After December 31, 2007. The Company, or its assignee, has the option to purchase the production payment for two million dollars ($2,000,000), less any amounts already paid pursuant to the Restructuring Agreement.

4. Assignment of Option and Adjustment to Production Payment. If, and only if, the Company assigns its option to purchase the production payment provided for herein, then the following modifications to the production payment shall be made automatically immediately prior to the exercise of the option by the assignee, as follows. The aggregate amount of the production payment shall be equal to one hundred ten percent (110%) of the amount of the exercise price of the option, but in no case shall it exceed two million dollars ($2,000,000) less any amounts already paid. The production payment shall be paid in an amount equal to a five percent (5%) Net Smelter (Refinery) Returns instead of the fifteen percent (15%) Net Smelter (Refinery) Returns provided for above and paid solely from the Company’s share of production distributed to the Company pursuant to the Ashdown Project LLC.

On May 4, 2007, Schnack exercised 1,193,178 warrants, with total proceeds to the Company of $167,045, and the Company repaid $250,000 of the $1.0 million advance.

Crestview Agreement - On June 13, 2007, the Company entered into a Production Payment Purchase Agreement and Assignment (the “Purchase Agreement”) by and between the Company and Crestview Capital Master, LLC (“Crestview”). Pursuant to the terms of the Purchase Agreement, Crestview acquired from the Company the assignment of the Company’s purchase rights under the Restructuring Agreement in consideration of Crestview paying the seven hundred fifty thousand dollar ($750,000) payment due Schnack and Crestview immediately exercising the Company’s purchase rights to acquire the production payment, along with certain amendments to the Restructuring Agreement, for a combined purchase amount paid by Crestview to Schnack equal to one million seven hundred ninety-four thousand nine hundred sixty dollars ($1,794,960).

Further terms of the Purchase Agreement include: (i) that the aggregate amount of the production payment will be equal to one million nine hundred seventy four thousand four hundred fifty six dollars ($1,974,456), representing 110% of the actual cash paid by Crestview to satisfy the Company’s obligations to Schnack; (ii) that the production payment will be paid in an amount equal to a five percent (5%) Net Smelter (Refinery) Returns (“NSR”) paid solely from the Company’s share of production distributed to the Company pursuant to the Ashdown Project LLC Operating Agreement; and (iii) that so long as the production payment remains outstanding, the production payment shall be convertible, in whole or in part, into shares of the Company’s Common Stock at the option of Crestview or its assignee.

As a result of the Purchase Agreement and related agreements, the liabilities of the Company have been reduced by five hundred twenty thousand five hundred four dollars ($520,504), which has been recorded as a gain on extinguishment of debt in the accompanying condensed consolidated statement of operations for the three months ended September 30, 2007.

The production payment obligation to Crestview of $1,974,456 has been recorded as a current liability in the accompanying condensed consolidated balance sheet at September 30, 2007. So long as the production payment obligation remains outstanding, it may be converted in whole or in part into shares of the Company’s common stock at the option of Crestview. The number of shares of the Company’s common stock to be issued upon conversion of the production payment shall be calculated by dividing the remaining amount of the production payment by the number derived by multiplying the average of the volume weighted average price of the Company’s common stock for a period of ten (10) trading days prior to exercise of this conversion right by 0.80, but in no case less than $0.36 per share nor more than $0.46 per share. Provided that the shares of common stock underlying the conversion right have been registered with the U.S. Securities and Exchange Commission, the production payment shall automatically convert into shares of the Company’s common stock if the closing price of the Company’s common stock on the OTC Bulletin Board or other public trading market is greater than or equal to $0.65 per share for ten consecutive trading days.

The Company has determined, that in the event the market value per share of the Company’s common stock is greater than the $0.36 per share minimum conversion price per share, there is a beneficial conversion feature equal to the intrinsic value of the production payment obligation. The Company will calculate the beneficial conversion feature at the end of each quarterly reporting period, and record changes to the intrinsic value of the beneficial conversion to common stock and interest expense. At September 30, 2007, there was no beneficial conversion feature since the market price of the Company’s common stock was less that the $0.36 per share minimum conversion price.

NOTE 12 -ASHDOWN MILLING PRODUCTION PAYMENT PURCHASE AGREEMENT

On September 26, 2005, the Company entered into a Production Payment Purchase Agreement with Ashdown Milling Co LLC (“Ashdown Milling”). Under the terms of the agreement, Ashdown Milling agreed to purchase a production payment to be paid from the Company’s share of production from the Ashdown mine for a minimum of $800,000. In addition, Ashdown Milling is to receive one share of the Company’s common stock and one warrant to purchase one share of the Company’s common stock at $0.20 per share for each dollar paid to the Company. In addition, the Production Payment Purchase Agreement provides that, upon the request of the Company for additional funds, Ashdown Milling has the right, but not the obligation, to increase its investment in the production payment up to an additional $700,000 for a maximum purchase price of $1,500.000. The amount of the production payment to be paid to Ashdown Milling is equal to a 12% net smelter returns royalty on the minerals produced from the mine until an amount equal to 240% of the total purchase price has been paid. Robert P. Martin, President of the Company, and Kenneth S. Ripley, a former Chief Executive Officer of the Company, are members, managers, and lead investors in Ashdown Milling. The Company’s Board approved the transaction.

Because production payments from the Ashdown mine were not assured at the time of the agreement with Ashdown Milling, the transaction was originally accounted for as the sale of an interest in mineral properties with the related gain to be deferred until the Company began making payments according the terms of the agreement. During 2005 and 2006, $1,500,000 was advanced to the Company pursuant to this agreement, with $904,567 of the proceeds allocated to deferred revenue – related party, a current liability. With the commencement of mining operations at the Ashdown mine, the Company has reclassified the deferred revenue to a production payment obligation, a current liability, to be repaid from the Company’s share of production distributions received from the Ashdown LLC. The Company made payments of $241,474 in May 2007 and $366,830 in July 2007, reducing the obligation to a balance of $296,263 at September 30, 2007.

NOTE 13 -LONG-TERM DEBT

| Long-term debt consists of the following at September 30, 2007: | | | | |

| | | | | |

| | | | | |

| Note payable to GMAC, payable at $538 per month with no interest through May 2009, secured by vehicle | | $ | 10,751 | |

| Note payable to CitiFinancial, payable at $468 per month with interest at 15.7% through August 2007, secured by vehicle | | | 1,585 | |

| Note payable to Komatsu Equipment Company, with principal payments of $240,000 on July 6, 2007, $58,486 on June 30, 2008, $58,486 on June 30, 2009, and $58,485 on June 30, 2010, with interest at 8%, unsecured | | | 178,966 | |

| Capital lease payable to GE Capital, payable at $1,272 per month through March 2009, secured by equipment | | | 19,915 | |

| | | | | |

| Total | | | 211,217 | |

| Less current portion | | | 82,831 | |

| | | | | |

| Long-term portion | | $ | 128,386 | |

NOTE 14 -AMOUNTS DUE TO RELATED PARTIES

Amounts due to related parties included in current liabilities consist of the following at September 30, 2007:

| | | Principal | | | Interest | | | Total | |

| Note payable to Kenneth Ripley, a former Chief Executive Officer of the Company, with interest at an annual rate of 18%, plus a 5% origination fee | | $ | 37,397 | | | $ | 42,313 | | | $ | 79,710 | |

| Note payable to Michael Fitzsimonds, a former Chief Executive Officer of the Company, with interest payments of $1,350 per month, due on or before February 18, 2008 | | | 100,000 | | | | — | | | | 100,000 | |

| Note payable to an employee and the manager of the Ashdown mine for the purchase of a mill, equipment rental and other, with interest at 12% | | | 287,908 | | | | 41,934 | | | | 329,842 | |

| | | $ | 425,305 | | | $ | 84,247 | | | $ | 509,552 | |

In January 2007, the principal balance of the note payable to Mr. Ripley was reduced by $160,227 in connection with the exercise by Mr. Ripley of employee stock options.

Under the terms of an Employment Separation Agreement (see Note 10), the Company agreed to pay the then outstanding balance of the Mr. Ripley’s note payable in twelve (12) equal monthly installments starting in March 2007.

NOTE 15 -STOCKHOLDERS’ EQUITY

On April 24, 2007, the Company completed its private offering of 20,000,000 units of its common stock and warrants to purchase common stock (the “Private Offering”) to certain institutional and accredited investors. Each unit consists of one share of common stock, no par value per share, and one-half (1/2) of one two year warrant to purchase common stock, with each whole warrant entitling the holder to purchase one share of common stock at an exercise price of $0.40 per share. The units were sold at a per unit price of $0.30. The Company raised an aggregate amount of $6,000,000 from this Private Offering, less a placement fee of $210,000 and other offering expenses of $140,494.

Further, in connection with the Private Offering, the Company issued to its placement agent 150,000 shares of common stock and two-year warrants to purchase 600,000 shares of common stock at an exercise price of $0.40 per share.

On July 13, 2005, the Company entered into a Common Stock Purchase Agreement (the “Original Purchase Agreement”) with Fusion Capital Fund II, LLC (“Fusion Capital”), pursuant to which Fusion Capital had agreed, under certain conditions, to purchase on each trading day $12,500 of the Company’s common stock up to an aggregate of $6 million over a twenty-four (24) month period. On January 19, 2006, the Company and Fusion Capital entered into a Termination Agreement whereby the parties terminated the Original Purchase Agreement. On January 20, 2006, the Company entered into a new Common Stock Purchase Agreement (“Purchase Agreement”) with Fusion Capital. Under the Purchase Agreement, Fusion Capital committed to purchase up to $6 million of the Company’s common stock over a twenty-four (24) month period that commences when a registration statement filed with the SEC becomes effective. The SEC declared the registration statement effective on February 13, 2006. Pursuant to the Purchase Agreement, Fusion Capital was to purchase $12,500 of the Company’s common stock on each trading day during the term of the Purchase Agreement, subject to the Company’s right to increase, decrease or suspend purchases by Fusion Capital. The purchase price for each purchase of shares of common stock was equal to a price based upon the future market price of the common stock without any fixed discount to the market price. However, Fusion Capital did not have the right and was not obligated to purchase the Company’s stock in the event that the purchase price per share of common stock was below $0.10. The Company has used this financing vehicle on an as needed basis for working capital and general corporate purposes. On March 13, 2006, the Company initiated the sale of commencement shares under the Purchase Agreement.

During the nine months ended September 30, 2007, 3,441,066 shares of the Company’s common stock were purchased by Fusion Capital with proceeds to the Company of $1,034,999, or an average of $0.301 per share.

On April 23, 2007, the Company terminated the agreement with Fusion Capital.

In addition to the 23,441,066 common shares issued for cash to Fusion Capital and in the Private Offering, the Company issued 3,047,563 shares of its common stock during the nine months ended September 30, 2007 for the following consideration: 393,990 shares for services valued at $144,105; 423,728 shares issued for reduction of accounts payable of $125,000; 150,000 shares for stock issuance costs; and 2,079,845 shares issued for the exercise of options and warrants, $186,045 for cash, $27,373 reduction in accounts payable and $160,227 reduction in amounts due related parties. The prices per share recorded in non-cash equity transactions approximated the quoted market price of the Company’s common stock on the date the shares were issued. In those instances where the market price of the Company’s common stock on the date the shares are issued to repay debt or other obligations differs from the market price originally used to determine the number of shares to be issued, a gain or loss on extinguishment of debt is recorded. Depending on the delay in issuing these shares, the gain or loss may be material. For the nine months ended September 30, 2007, no gain or loss on extinguishment of debt repaid through the issuance of the Company’s common stock was recorded.

NOTE 16 - LEGAL MATTERS

Steven D. Craig — On August 30, 2006, Steven D. Craig filed a Complaint against Golden Phoenix Minerals, Inc. in the Second Judicial District for the State of Nevada in the County of Washoe. The Complaint alleges Breach of Contract regarding the failure to permit the exercise of stock options, failure to repay non-reimbursed business expenses, and failure to pay and account for the accrual of interest of deferred compensation. Steven D. Craig is seeking options issued by Golden Phoenix Minerals, Inc. with regard to back salaries owed in the following amounts: 984,300 shares at $0.15 per share; 340,000 shares at $0.37 per share; and 250,000 shares at $0.15 per share. Steven D. Craig is further seeking $5,500 for non-reimbursed expenses and $243,625.33 in deferred salaries with interest for both amounts. Payments have been made monthly since Mr. Craig’s termination in the amount of $5,000, and approximately $130,000 has been paid through September 30, 2007, resulting in a reduction of these claims.

On September 20, 2006, Golden Phoenix Minerals, Inc. filed an Answer to the Summons and Complaint. On September 29, 2006, Golden Phoenix Minerals, Inc. filed a Third-Party Complaint naming Collette Crater-Craig as an interested party with regard to community property issues due to the recent termination of marriage between her and Steven D. Craig. The Third-Party Complaint seeks declaratory relief to ascertain the respective parties’ rights and obligations with regard to the damages sought by the subject Complaint.

The Company currently is in discussions with Mr. Craig regarding settlement terms to this matter.

Twain Walker — On October 16, 2006, Twain Walker filed a Complaint against the Company in the Second Judicial District for the State of Nevada in the County of Washoe. The Complaint alleges breach of contract regarding the failure to permit the exercise of stock options and failure to pay and account for the accrual of interest on deferred compensation. On May 14, 2007, the parties executed a Settlement Agreement and release of claims and the Company paid Mr. Walker $4,400 in the settlement. The Second Judicial District Court for the State of Nevada, Washoe County, executed an order dismissing this action with prejudice on July 16, 2007.

Win-Eldrich Gold, Inc. — On April 4, 2007, Golden Phoenix participated in mediation proceedings with Win-Eldrich Gold, Inc. (“WEG”). The dispute, which was mediated, arises from Golden Phoenix’s November 2, 2006 formal notice of default to WEG that it failed to timely fund its share of the Program and Budget for the Ashdown Project, due on October 15, 2006. Payment was due pursuant to the Ashdown Project LLC Operating Agreement between WEG and Golden Phoenix dated September 28, 2006 and a related letter agreement of the same date. Golden Phoenix’s claim was that WEG owed $115,755 under both the Operating Agreement and the letter agreement. Additionally, by the same notice of default, Golden Phoenix reminded WEG that it did not timely pay to Golden Phoenix its share of revenues received by WEG for ore from stockpiles as required by the above-mentioned letter agreement. Golden Phoenix’s share of these monies was $193,391. The total amount in default totals $309,146. Pursuant to the agreements, interest accrues on these amounts at a rate equal to two percentage points over the Prime Rate to the maximum allowed by law. The Operating Agreement permits a defaulting party to cure if they pay the defaulted amount, plus interest at a rate of Prime plus 7%. WEG did not cure their default. Consequently, Golden Phoenix elected, as permitted under the Operating Agreement, to dilute WEG’s membership interest in the Ashdown Project LLC by notice dated December 20, 2006. Pursuant to a calculation formula contained in the Operating Agreement, Golden Phoenix contends WEG’s membership interest has been reduced from 40% to 30.5%. WEG is currently contesting this dilution of its interest in the Ashdown Project. WEG has disputed and continues to dispute the amount and timing of certain expenditures incurred by Golden Phoenix on the Ashdown property. As of the date of this Report the mediation has not resolved the dispute and the parties plan to proceed to arbitration pursuant to the terms of the Operating Agreement. Golden Phoenix expects this arbitration to be conducted in 2008. In addition, WEG has notified Golden Phoenix of certain provisions in the Operating Agreement that it contends Golden Phoenix has breached and has requested a meeting to discuss these provisions in accordance with the dispute resolution provisions of the Operating Agreement. Further, WEG has also notified Golden Phoenix that WEG may make a claim that Golden Phoenix exceeded the approved 2007 budget and would be liable to WEG for the budget overrun pursuant to the Operating Agreement. However, Golden Phoenix contends that the overrun is directly related to an increase in the rate of production that was ratified by WEG and therefore Golden Phoenix intends to defend such a claim, if it is made.

As of the date of this report, Golden Phoenix does not believe any of WEG’s allegations are material. The outcome of these matters cannot currently be determined. The consolidated financial statements of Golden Phoenix filed with this Report reflect Golden Phoenix’s ownership in the Ashdown Project LLC at 60% and do not reflect the potential impact of any ultimate resolution or arbitration.

NOTE 17 -SUPPLEMENTAL STATEMENT OF CASH FLOWS INFORMATION

During the nine months ended September 30, 2007 and 2006, the Company made no cash payments for income taxes.

During the nine months ended September 30, 2007 and 2006, the Company made cash payments for interest of $322,504 and $21,970, respectively.

During the nine months ended September 30, 2007, the Company had the following non-cash financing and investing activities:

| · | Increased marketable securities and other comprehensive income for unrealized gain on marketable securities of $63,524. |

| · | Common stock was issued to pay accounts payable of $125,000. |

| · | Amounts due related parties were reduced by $160,227 through the exercise of stock options and resultant increase in common stock. |

| · | Accounts payable was reduced by $27,373 through the exercise of stock options and resultant increase in common stock. |

| · | Accounts payable was reduced and long-term debt increased by $512,262. |

| · | Property and equipment was purchased through the issuance of debt of $30,949. |

| · | Notes payable and related accrued interest was reduced and production payment obligation was increased by $1,974,456. |

| · | The Company reclassified deferred revenue – related party of $904,567 to production payment obligation – related party. |

During the nine months ended September 30, 2006, the Company had the following non-cash financing and investing activities:

| · | Common stock was issued for debt of $173,765. |

NOTE 18 -RECENT ACCOUNTING PRONOUNCEMENTS

The FASB has issued Financial Interpretation No. 48, Accounting for Uncertainty in Income Taxes– An Interpretation of FASB Statement No. 109 (FIN 48). FIN 48 clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements in accordance with FASB Statement No. 109, Accounting for Income Taxes. FIN 48 also prescribes a recognition threshold and measurement standard for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. In addition, FIN 48 provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosure and transition. The Company adopted FIN 48 on January 1, 2007, and the provisions of FIN 48 were applied to all tax positions upon initial adoption of this standard. There was no financial statement impact of adopting FIN 48.

In September 2006, the FASB issued SFAS Statement No. 158, Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans. This new standard will require employers to fully recognize the obligations associated with single-employer defined benefit pension, retiree healthcare and other postretirement plans in their financial statements. The Company anticipates adopting SFAS No. 158 on December 31, 2007, and does not believe the adoption of the new accounting standard will result in a material impact on the consolidated financial statements of the Company since the Company currently does not sponsor the defined benefit pension or postretirement plans within the scope of the standard.

The FASB has issued SFAS Statement No. 157, Fair Value Measurements. This new standard provides enhanced guidance for using fair value to measure assets and liabilities, and requires expanded information about the extent to which companies measure assets and liabilities at fair value, the information used to measure fair value, and the effect of fair value measurements on earnings. The standard applies whenever other standards require (or permit) assets or liabilities to be measured at fair value. Under the new standard, fair value refers to the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants in the market in which the reporting entity transacts. The standard clarifies the principle that fair value should be based on the assumptions market participants would use when pricing the asset or liability. The new standard is effective for financial statements issued for fiscal years beginning after November 15, 2007, and interim periods within those fiscal years. Early adoption is permitted. The Company anticipates adopting SFAS No. 157 on January 1, 2008, but is currently unable to determine the impact of the adoption of the standard on its consolidated financial statements.

In March 2006, the FASB issued SFAS No. 156, Accounting for Servicing of Financial Assets. This statement amends SFAS 140, Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities, a replacement of FASB Statement 125, or SFAS 140, regarding (1) the circumstances under which a servicing asset or servicing liability must be recognized, (2) the initial and subsequent measurement of recognized servicing assets and liabilities, and (3) information required to be disclosed relating to servicing assets and liabilities. The Company adopted this standard on January 1, 2007, with no impact on its consolidated financial statements.

In February 2006, the FASB issued SFAS No. 155, Accounting for Certain Hybrid Financial Instruments, or SFAS 155. This statement amends SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities, to narrow the scope exception for interest-only and principal-only strips on debt instruments to include only such strips representing rights to receive a specified portion of the contractual interest or principal cash flows. SFAS 155 also amends SFAS 140 to allow qualifying special-purpose entities to hold a passive derivative financial instrument pertaining to beneficial interests that itself is a derivative financial instrument. The Company adopted this standard on January 1, 2007, with no impact on its consolidated financial statements.

In June 2006, the FASB ratified EITF, No. 06-3, How Taxes Collected from Customers and Remitted to Governmental Authorities Should Be Presented in the Income Statement (That Is, Gross versus Net Presentation). EITF No. 06-3 requires that, for interim and annual reporting periods beginning after December 15, 2006, companies disclose their policy related to the presentation of sales taxes and similar assessments related to their revenue transactions. The Company presents revenue net of sales taxes and any similar assessments. EITF No. 06-3 had no effect on the Company’s financial position and results of operations.

Item 2. Management’s Discussion And Analysis or Plan Of Operation

Forward-Looking Statements and Associated Risks. This filing contains forward-looking statements. Such forward-looking statements include statements regarding, among other things, (1) our estimates of mineral reserves and mineralized material, (2) our projected sales and profitability, (3) our growth strategies, (4) anticipated trends in our industry, (5) our future financing plans, (6) our anticipated needs for working capital, (7) our lack of operational experience and (8) the benefits related to ownership of our common stock. Forward-looking statements, which involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” or “project” or the negative of these words or other variations on these words or comparable terminology. This information may involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed or implied by any forward-looking statements. These statements may be found under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” as well as in this filing generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Certain Business Risk Factors” and matters described in this filing generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur as projected.

Overview

Golden Phoenix Minerals, Inc. (the “Company” or “Golden Phoenix”) is a mineral exploration, development and production company, formed in Minnesota on June 2, 1997, specializing in acquiring and consolidating mineral properties with potential production and future growth through exploration discoveries. Acquisition emphasis is focused on properties containing gold, silver, molybdenum and other strategic minerals that present low political and financial risk and exceptional upside potential. Our main focus is in Nevada.

Our corporate directors, officers, and managers have prior management experience with large and small mining companies. We believe that Golden Phoenix has created the basis for a competitive minerals exploration/development and operational company through assembling a group of individuals with experience in target generation, ore discovery, resource evaluation, mine development and mine operations.

We have transformed from an exploration and development company into a production stage company, and we intend to profitably operate our own mines. We also intend to continue to explore and develop properties. We plan to provide joint venture opportunities for mining companies to conduct exploration or development on mineral properties we own or control. We, together with any future joint venture partners, intend to explore and develop selected properties to a stage of proven and probable reserves, at which time we would then decide whether to sell our interest in a property or take the property into production alone or with our future partner(s). By joint venturing our properties, we may be able to reduce our costs for further work on those properties, while continuing to maintain and acquire interests in a portfolio of gold, and other strategic metals properties in various stages of mineral exploration and development. We expect that this corporate strategy will minimize the financial risk that we would incur by assuming all the exploration costs associated with developing any one property, while maximizing the potential for success and growth.

We have at least five sources of land available for exploration, development and mining: public lands, private fee lands, unpatented mining claims, patented mining claims, and tribal lands. The primary sources for acquisition of these lands are the United States government, through the Bureau of Land Management and the United States Forest Service, state and Canadian Provincial governments, tribal governments, and individuals or entities who currently hold title to or lease government and private lands.

There are numerous levels of government regulation associated with the activities of exploration and mining companies. Permits, which we are maintaining and amending include “Notice of Intent” to explore, “Plan of Operations” to explore, “Plan of Operations” to mine, “Reclamation Permit”, “Air Quality Permit”, “Water Quality Permit”, “Industrial Artificial Pond Permit”, and several other health and safety permits. These permits are subject to amendment or renewal during our operations. Although there is no guarantee that the regulatory agencies will timely approve, if at all, the necessary permits for our current operations or other anticipated operations, currently we have no reason to believe that necessary permits will not be issued in due course. The total cost and effects on our operations of the permitting and bonding process cannot be estimated at this time. The cost will vary for each project when initiated and could be material.

The Federal government owns public lands that are administered by the Bureau of Land Management or the United States Forest Service. Ownership of the subsurface mineral estate can be acquired by staking a twenty (20) acre mining claim granted under the General Mining Law of 1872, as amended (the “General Mining Law”). The Federal government still owns the surface estate even though the subsurface can be controlled with a right to extract through claim staking. Private fee lands are lands that are controlled by fee-simple title by private individuals or corporations. These lands can be controlled for mining and exploration activities by either leasing or purchasing the surface and subsurface rights from the private owner. Unpatented mining claims located on public land owned by another entity can be controlled by leasing or purchasing the claims outright from the owners. Patented mining claims are claims that were staked under the General Mining Law, and through application and approval the owners were granted full private ownership of the surface and subsurface estate by the Federal government. These lands can be acquired for exploration and mining through lease or purchase from the owners. Tribal lands are those lands that are under control by sovereign Native American tribes. Areas that show promise for exploration and mining can be leased or joint ventured with the tribe controlling the land.

Mining Properties and Projects

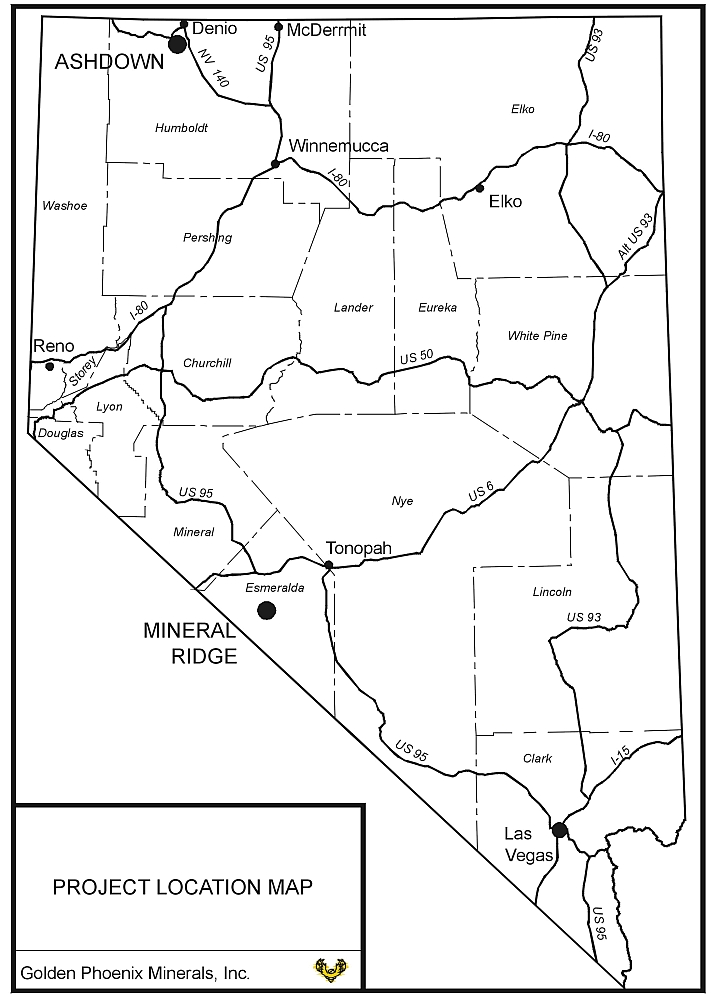

Our two primary mining property assets are the Ashdown molybdenum project operated by the Ashdown Project LLC (the “Ashdown LLC”), in which we currently own a 60% member interest (and have claim to an additional 9.5% interest, though contested, which would bring our total interest to 69.5%), and the Mineral Ridge gold mine (Figure 1). Management’s near-term goal is to extract the known molybdenum deposits at Ashdown while continuing to redevelop a plan for profitable production of gold and silver at Mineral Ridge.

As further discussed below, the Company completed a purchase agreement with four individuals for the Northern Champion molybdenum property located in Ontario, Canada (Figure 2), and plans to take bulk samples for metallurgical and market testing, and to actively explore and delineate molybdenum mineralization on the property.

Figure 1. Map showing the locations of the Nevada properties discussed in this report. Ashdown is the only active property, with Mineral Ridge idled in 2005.

Figure 2. Map showing the Northern Champion property located within the Province of Ontario, Canada. The acquisition of this property was completed in February 2007.