Prospectus Supplement No. 5 to

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended March 31, 2008

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____.

Commission File No. 000-22905

GOLDEN PHOENIX MINERALS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Minnesota | | 41-1878178 |

(State or Other Jurisdiction Of Incorporation or Organization) | (I.R.S. Employer Identification Number) |

| | |

| 1675 East Prater Way, Suite 102, Sparks, Nevada | 89434 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code (775) 853-4919

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by checkmark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-3 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | ¨ | Smaller reporting company | x |

| (Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.

As of May 15, 2008 there were 185,410,273 outstanding shares of the registrant’s common stock.

GOLDEN PHOENIX MINERALS, INC.

FORM 10-Q INDEX

| | Page Number |

| | |

| PART I – FINANCIAL INFORMATION | |

| Item 1. Financial Statements | |

| Condensed Consolidated Balance Sheets as of March 31, 2008 (Unaudited) and December 31, 2007 | 3 |

| Condensed Consolidated Statements of Operations for the Three Months Ended March 31, 2008 and 2007 (Unaudited) | 4 |

| Condensed Consolidated Statements of Cash Flows for the Three Months Ended March 31, 2008 and 2007 (Unaudited) | 5 |

| Notes to Condensed Consolidated Financial Statements | 6 |

| Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations | 19 |

| Item 3. Quantitative and Qualitative Disclosures About Market Risk | 35 |

| Item 4T. Controls and Procedures | 35 |

| | |

| PART II – OTHER INFORMATION | |

| Item 1. Legal Proceedings | 36 |

| Item 1A. Risk Factors | 37 |

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | 37 |

| Item 3. Defaults Upon Senior Securities | 37 |

| Item 4. Submission of Matters to a Vote of Security Holders | 37 |

| Item 5. Other Information | 37 |

| Item 6. Exhibits | 38 |

| Signature Page | 41 |

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

GOLDEN PHOENIX MINERALS, INC.

Condensed Consolidated Balance Sheets

| | | March 31, 2008 (Unaudited) | | | December 31, 2007 | |

| ASSETS | | | | | | |

| | | | | | | |

| Current assets: | | | | | | |

| Cash and cash equivalents | | $ | 2,146,543 | | | $ | 2,173,811 | |

| Receivables | | | 402,120 | | | | 951,873 | |

| Prepaid expenses and other current assets | | | 91,759 | | | | 153,962 | |

| Inventories | | | 384,034 | | | | 402,483 | |

| Marketable securities | | | 104,181 | | | | 163,958 | |

| Total current assets | | | 3,128,637 | | | | 3,846,087 | |

| | | | | | | | | |

| Property and equipment, net | | | 2,393,768 | | | | 1,815,654 | |

| | | | | | | | | |

| Other assets: | | | | | | | | |

| Restricted funds – reclamation obligations | | | 2,315,788 | | | | 2,246,824 | |

| Prepaid bond insurance premiums | | | 266,473 | | | | 277,276 | |

| Deposits | | | 145,549 | | | | 163,009 | |

| Total other assets | | | 2,727,810 | | | | 2,687,109 | |

| | | | | | | | | |

| | | $ | 8,250,215 | | | $ | 8,348,850 | |

| | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | | | | | | | | |

| | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Accounts payable | | $ | 835,322 | | | $ | 891,836 | |

| Accrued liabilities | | | 935,054 | | | | 980,287 | |

| Current portion of severance obligations | | | 80,136 | | | | 132,158 | |

| Current portion of long-term debt | | | 150,466 | | | | 103,721 | |

| Production payment obligation – related party | | | — | | | | 100,026 | |

| Production payment obligation | | | 1,974,456 | | | | 1,974,456 | |

| Amounts due to related parties | | | 735,038 | | | | 403,276 | |

| Total current liabilities | | | 4,710,472 | | | | 4,585,760 | |

| | | | | | | | | |

| Long-term liabilities: | | | | | | | | |

| Reclamation obligations | | | 3,363,930 | | | | 3,312,562 | |

| Severance obligations | | | 146,561 | | | | 166,595 | |

| Long-term debt | | | 240,716 | | | | 123,164 | |

| Total long-term liabilities | | | 3,751,207 | | | | 3,602,321 | |

| | | | | | | | | |

| Total liabilities | | | 8,461,679 | | | | 8,188,081 | |

| | | | | | | | | |

| Commitments and contingencies | | | | | | | | |

| | | | | | | | | |

| Minority Interest | | | 421,542 | | | | 34,034 | |

| | | | | | | | | |

| Stockholders’ equity (deficit): | | | | | | | | |

| Preferred stock, no par value, 50,000,000 shares authorized, none issued | | | — | | | | — | |

| Common stock; no par value, 400,000,000 shares authorized, 185,410,273 and 180,552,639 shares issued and outstanding, respectively | | | 38,738,777 | | | | 37,690,538 | |

| Common stock subscribed | | | 60,000 | | | | — | |

| Other comprehensive income (loss) | | | (57,860 | ) | | | 1,917 | |

| Accumulated deficit | | | (39,373,923 | ) | | | (37,565,720 | ) |

| Total stockholders’ equity (deficit) | | | (633,006 | ) | | | 126,735 | |

| | | | | | | | | |

| | | $ | 8,250,215 | | | $ | 8,348,850 | |

See accompanying notes to condensed consolidated financial statements

GOLDEN PHOENIX MINERALS, INC.

(Unaudited)

| | | Three Months Ended March 31, | |

| | | 2008 | | | 2007 | |

| | | | | | | |

| Sales | | $ | 4,061,224 | | | $ | 798,112 | |

| | | | | | | | | |

| Operating costs and expenses: | | | | | | | | |

| Costs of mining operations | | | 2,817,741 | | | | 1,599,474 | |

| Exploration, development and mineral property lease expenses | | | 312,195 | | | | 8,206 | |

| Accretion expense | | | 51,368 | | | | 45,619 | |

| General and administrative expenses | | | 1,036,611 | | | | 515,795 | |

| Depreciation and amortization expense | | | 91,718 | | | | 48,093 | |

| Royalties | | | 1,158,337 | | | | — | |

| | | | | | | | | |

| Total operating costs and expenses | | | 5,467,970 | | | | 2,217,187 | |

| | | | | | | | | |

| Loss from operations | | | (1,406,746 | ) | | | (1,419,075 | ) |

| | | | | | | | | |

| Other income (expense): | | | | | | | | |

| Interest income | | | 10,250 | | | | 1,555 | |

| Interest expense | | | (22,699 | ) | | | (163,155 | ) |

| Loss on extinguishment of debt | | | (1,500 | ) | | | — | |

| Loss on disposal of property and equipment | | | — | | | | (7,668 | ) |

| | | | | | | | | |

| Total other income (expense) | | | (13,949 | ) | | | (169,268 | ) |

| | | | | | | | | |

| Loss before minority interest and income taxes | | | (1,420,695 | ) | | | (1,588,343 | ) |

| | | | | | | | | |

| Minority interest in net (income) loss of consolidated joint venture | | | (387,508 | ) | | | 352,303 | |

| | | | | | | | | |

| Loss before income taxes | | | (1,808,203 | ) | | | (1,236,040 | ) |

| | | | | | | | | |

| Provision for income taxes | | | — | | | | — | |

| | | | | | | | | |

| Net loss | | | (1,808,203 | ) | | | (1,236,040 | ) |

| | | | | | | | | |

| Other comprehensive income (loss): | | | | | | | | |

| Unrealized gain (loss) on marketable securities | | | (59,777 | ) | | | 80,272 | |

| | | | | | | | | |

| Net comprehensive loss | | $ | (1,867,980 | ) | | $ | (1,155,768 | ) |

| | | | | | | | | |

| Loss per common share, basic and diluted | | $ | (0.01 | ) | | $ | (0.01 | ) |

| | | | | | | | | |

| Weighted average number of shares outstanding | | | 182,855,246 | | | | 156,082,727 | |

See accompanying notes to condensed consolidated financial statements

GOLDEN PHOENIX MINERALS, INC.

(Unaudited)

| | | Three Months Ended March 31, | |

| | | 2008 | | | 2007 | |

| Cash flows from operating activities: | | | | | | |

| Net loss | | $ | (1,808,203 | ) | | $ | (1,236,040 | ) |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | | | | | | |

| Depreciation and amortization | | | 91,718 | | | | 48,093 | |

| Accretion expense | | | 51,368 | | | | 45,619 | |

| Stock-based compensation | | | 32,993 | | | | 49,127 | |

| Loss on disposal of property and equipment | | | — | | | | 7,668 | |

| Issuance of common stock for services | | | 20,000 | | | | 68,380 | |

| Issuance of common stock for royalties | | | 840,000 | | | | — | |

| Subscription payable for royalties | | | 60,000 | | | | — | |

| Issuance of warrants for interest expense | | | — | | | | 6,563 | |

| Minority interest in net income (loss) of joint venture | | | 387,508 | | | | (352,303 | ) |

| Changes in operating assets and liabilities: | | | | | | | | |

| (Increase) decrease in receivables | | | 549,753 | | | | (64,888 | ) |

| Decrease in prepaid expenses and other current assets | | | 73,006 | | | | 242,984 | |

| (Increase) decrease in inventories | | | 18,449 | | | | (7,824 | ) |

| Increase in restricted funds – reclamation obligations | | | (68,964 | ) | | | (1,556 | ) |

| (Increase) decrease in deposits | | | 17,460 | | | | (355 | ) |

| Increase (decrease) in accounts payable | | | (167,948 | ) | | | 74,095 | |

| Increase in accrued and other liabilities | | | 70,645 | | | | 69,551 | |

| Net cash provided by (used in) operating activities | | | 167,785 | | | | (1,050,886 | ) |

| | | | | | | | | |

| Cash flows from investing activities: | | | | | | | | |

| Purchase of property and equipment | | | (384,159 | ) | | | (18,669 | ) |

| Minority interest capital contributions to joint venture | | | — | | | | 200,000 | |

| Net cash provided by (used in) investing activities | | | (384,159 | ) | | | 181,331 | |

| | | | | | | | | |

| Cash flows from financing activities: | | | | | | | | |

| Net proceeds from the sale of common stock | | | — | | | | 884,999 | |

| Proceeds from the exercise of options and warrants | | | 25,659 | | | | — | |

| Proceeds from amounts due related parties | | | 440,000 | | | | — | |

| Payments of severance obligations | | | (73,179 | ) | | | — | |

| Payments of notes payable and long-term debt | | | (13,451 | ) | | | (5,973 | ) |

| Payments of amounts due to related parties | | | (89,897 | ) | | | (7,500 | ) |

| Payments of production payment obligation – related party | | | (100,026 | ) | | | — | |

| Net cash provided by financing activities | | | 189,106 | | | | 871,526 | |

| | | | | | | | | |

| Net increase (decrease) in cash and cash equivalents | | | (27,268 | ) | | | 1,971 | |

| Cash and cash equivalents, beginning of period | | | 2,173,811 | | | | 479,032 | |

| | | | | | | | | |

| Cash and cash equivalents, end of period | | $ | 2,146,543 | | | $ | 481,003 | |

See accompanying notes to condensed consolidated financial statements

GOLDEN PHOENIX MINERALS, INC.

Notes to Condensed Consolidated Financial Statements

| NOTE 1 - | DESCRIPTION OF BUSINESS AND BASIS OF FINANCIAL STATEMENT PRESENTATION |

Golden Phoenix Minerals, Inc. (the “Company” or “Golden Phoenix”) is a mineral exploration, development and production company specializing in acquiring and consolidating mineral properties with potential production and future growth through exploration discoveries. Acquisition emphasis is focused on properties containing gold, silver, molybdenum and other strategic minerals that present low political and financial risk and exceptional upside potential. The Company’s main focus is in Nevada.

The Company was formed in Minnesota on June 2, 1997. On September 21, 2007 the shareholders of the Company voted in favor of a Plan of Merger to reincorporate from the State of Minnesota to the State of Nevada. The Company expects to reincorporate into the State of Nevada within the next several months.

Presently the Company’s primary mining property assets are the Ashdown molybdenum project operated by the Ashdown Project LLC (the “Ashdown LLC”), of which the Company currently own 60% (and has claim to an additional 9.5% interest, though contested, which would bring its total interest to 69.5%), and the (idled) Mineral Ridge gold mine. Management’s near-term goal is to continue to extract molybdenum deposits at Ashdown and to pursue profitable production of gold and silver at Mineral Ridge. In February 2007, the Company completed a purchase agreement with four individuals for the Northern Champion molybdenum property located in Ontario, Canada, and plans to take bulk samples for metallurgical and market testing, and to actively explore and delineate molybdenum mineralization on the property later in 2008.

The condensed consolidated financial statements of the Company as of March 31, 2008 and December 31, 2007 and for the three-month periods ended March 31, 2008 and 2007 include the accounts of Golden Phoenix Minerals, Inc. and the Ashdown LLC, an entity controlled by the Company through its 60% member interest. All significant inter-company balances and transactions have been eliminated.

The interim financial information of the Company as of March 31, 2008 and for the three-month periods ended March 31, 2008 and 2007 is unaudited, and the balance sheet as of December 31, 2007 is derived from audited financial statements. The accompanying condensed consolidated financial statements have been prepared in accordance with U. S. generally accepted accounting principles for interim financial statements. Accordingly, they omit or condense footnotes and certain other information normally included in financial statements prepared in accordance with U.S. generally accepted accounting principles. The accounting policies followed for quarterly financial reporting conform with the accounting policies disclosed in Note 1 to the Notes to Consolidated Financial Statements included in the Company's Annual Report on Form 10-KSB for the year ended December 31, 2007. In the opinion of management, all adjustments that are necessary for a fair presentation of the financial information for the interim periods reported have been made. All such adjustments are of a normal recurring nature. The results of operations for the three months ended March 31, 2008 are not necessarily indicative of the results that can be expected for the fiscal year ending December 31, 2008. The unaudited condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and the notes thereto included in the Company's Annual Report on Form 10-KSB for the year ended December 31, 2007.

The Company’s condensed consolidated financial statements are prepared using accounting principles generally accepted in the United States of America applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. However, the Company has a history of operating losses since its inception in 1997, and has an accumulated deficit of $39,373,923 and a total stockholders’ deficit of $633,006 at March 31, 2008, which together raises doubt about the Company’s ability to continue as a going concern. The accompanying condensed consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Historically, the Company has obtained working capital from debt and equity financing, the exercise of options and warrants, and from a production payment purchase agreement to fund the Company’s activities until sufficient revenues can be generated from operations. However, during the three months ended March 31, 2008, the Company had net cash provided by operating activities of $167,785. During the three months ended March 31, 2008, the Company received proceeds from the exercise of options and warrants of $25,659 and proceeds of $440,000 from amounts due related parties. The Ashdown LLC placed the Ashdown property into commercial operation in December 2006, and had sales of $10,398,361 for the year ended December 31, 2007 and sales of $4,061,224 for the three months ended March 31, 2008, which has funded a significant portion of the Company’s operating costs and expenses. As of February 25, 2008, the Company had proven reserves of molybdenum (Mo) of 2,773,908 pounds with a grade of 2.91% and probable reserves of 1,074,023 pounds with a grade of 0.78% pursuant to an independent third party Technical Report and Feasibility Study. The Ashdown LLC has not sustained a consistent level of production; however, the Company anticipates that operating cash flows from the Ashdown LLC, after distributions to the minority interest member and after related production payment, royalty and debt obligations have been satisfied, will contribute to the working capital of the Company.

There can be no guarantee or assurance that the Company will be successful in its ability to sustain a profitable level of operations from the Ashdown LLC or to attain successful operations from its other properties, or to continue to raise capital at favorable rates or at all. The condensed consolidated financial statements do not include any adjustments that might result from the outcome of these uncertainties.

| NOTE 3 - | ASHDOWN PROJECT LLC |

On September 28, 2006, the Company entered into the Ashdown Project LLC Operating Agreement (the “Operating Agreement”) with Win-Eldrich Gold, Inc. in order to govern the management of Ashdown LLC and the future mineral exploration, evaluation, development and mining operations by the Ashdown LLC on the real property contributed by the Company and Win-Eldrich Gold, Inc. and all other real property within the area of interest that is acquired by the Ashdown LLC. The Company has served as the initial Manager of the Ashdown LLC. Effective January 1, 2008, the Management Committee voted the project Stand Alone, with the Mine General Manager being responsible for the day to day operations, and the Company overseeing the project through its appointment of three of the five Directors on the Management Committee. The Ashdown LLC initiated mining activities on the property, subject to certain stipulations, in the fourth quarter of 2006, and completed the first sale of molybdenite concentrates in December 2006. The Ashdown LLC has a marketing agreement in place that facilitates the sale of the molybdenite concentrates (FOB mine) to an international metals broker. The Ashdown LLC will not be required to provide roasted material to the market, and does not have to locate third party roasting capacity under this contract. The Company plans to assess potential expansion into a larger operation.

Pursuant to the terms of a Letter Agreement dated September 28, 2006 (the “Letter Agreement”) entered into as part of the organization of the Ashdown LLC, the Company believes that Win-Eldrich Gold, Inc. was required to pay the Company on November 1, 2006 the aggregate amount of $309,391 related to the joint venture. On December 4, 2006, the Company informed Win-Eldrich Gold, Inc. that it was in default under the Letter Agreement, that the 30-day cure period had expired and that the matter had been referred to the Company’s Board of Directors for further consideration. On December 20, 2006, the Company notified Win-Eldrich Gold, Inc. of its intention, pursuant to the remedial provisions of the Letter Agreement, to invoke the remedy of dilution under subsection 7.5.2(a) of the Operating Agreement to decrease Win-Eldrich Gold, Inc.’s ownership interest from 40% to 30.5% and increase the Company’s ownership interest from 60% to 69.5%. Win-Eldrich Gold, Inc. disagrees that it is in default under the Letter Agreement and the Company anticipates that this disagreement will be resolved by an amicable agreement or under the dispute resolution provisions of the Operating Agreement providing for mediation and binding arbitration. While the Company is confident that its interpretation of the Letter Agreement and the remedial provisions of the Operating Agreement are correct, until the disagreement is resolved pursuant to the dispute resolution provisions of the Operating Agreement, or by the ongoing settlement discussions between the parties, it is uncertain whether the Company’s ownership interest in the Ashdown LLC will remain at 60% or increase to 69.5%. The Company does not anticipate that this disagreement will have a material adverse effect on the Ashdown LLC’s operations or on the Company’s consolidated financial condition or results of operations. Through March 31, 2008, the consolidated financial statements reflect the Company’s ownership interest in the Ashdown LLC at 60%.

As more fully described in these notes to the condensed consolidated financial statements, the Company’s share of production distributions from the Ashdown LLC are encumbered by certain financing agreements.

| NOTE 4 - | STOCK-BASED COMPENSATION |

The Company accounts for stock-based compensation in accordance with Statement of Financial Accounting Standards (“SFAS”) No. 123(R), Share Based Payments. Under the fair value recognition provisions of this statement, stock-based compensation cost is measured at the grant date based on the value of the award granted, using the Black-Scholes option pricing model, and recognized over the period in which the award vests. The stock-based compensation expense for the three-month periods ended March 31, 2008 and 2007 included in general and administrative expenses was $32,993 and $49,127, respectively. There was no stock compensation expense capitalized during the three-month periods ended March 31, 2008 and 2007.

During the three months ended March 31, 2008, options to purchase 100,000 shares of the Company’s common stock were issued to a director with an exercise price of $0.29 per share. The Company estimated the grant-date fair value of these options at $0.18 per share using the Black-Scholes option pricing model with the following assumptions:

| Expected dividend yield | | | 0.00 | % |

| Expected stock price volatility | | | 70.80 | % |

| Risk-free interest rate | | | 3.29 | % |

| Expected life of options | | 5 years | |

The following table summarizes the stock option activity during the three months ended March 31, 2008:

| | | Options | | | Weighted Average Exercise Price | | | Weighted Average Remaining Contract Term | | | Aggregrate Intrinsic Value | |

| | | | | | | | | | | | | |

| Outstanding at December 31, 2007 | | | 5,811,573 | | | $ | 0.22 | | | | | | | |

| Granted | | | 100,000 | | | $ | 0.29 | | | | | | | |

| Exercised | | | (1,024,300 | ) | | $ | 0.15 | | | | | | | |

| Expired or cancelled | | | - | | | $ | - | | | | | | | |

| | | | | | | | | | | | | | | |

| Outstanding at March 31, 2008 | | | 4,887,273 | | | $ | 0.24 | | | | 2.41 | | | $ | 91,314 | |

| | | | | | | | | | | | | | | | | |

| Options vested and exercisable at March 31, 2008 | | | 4,683,373 | | | $ | 0.24 | | | | 2.31 | | | $ | 91,314 | |

As of March 31, 2008, the total future compensation cost related to non-vested stock-based awards not yet recognized in the condensed consolidated statements of operations was $24,928.

A summary of the status of the Company’s stock warrants as of March 31, 2008 and changes during the three months then ended is presented below:

| | | | | | Weighted | |

| | | | | | Average | |

| | | Shares | | | Exercise Price | |

| | | | | | | |

| Outstanding, December 31, 2007 | | | 12,100,000 | | | $ | 0.38 | |

| | | | | | | | | |

| Granted | | | - | | | $ | - | |

| Canceled / Expired | | | - | | | $ | - | |

| Exercised | | | (300,000 | ) | | $ | 0.20 | |

| | | | | | | | | |

| Outstanding, March 31, 2008 | | | 11,800,000 | | | $ | 0.38 | |

The following summarizes the exercise price per share and expiration date of the Company's outstanding warrants to purchase common stock at March 31, 2008:

| Expiration Date | | Price | | Number |

| 2008 | | $ 0.20 | | 650,000 |

| 2009 | | $ 0.20 | | 550,000 |

| 2009 | | $ 0.40 | | 10,600,000 |

| | | | | |

| | | | | 11,800,000 |

| NOTE 6 – | EARNINGS (LOSS) PER SHARE |

The computation of basic earnings per common share is based on the weighted average number of shares outstanding during the period. The computation of diluted earnings per common share is based on the weighted average number of shares outstanding during the period plus the weighted average common stock equivalents which would arise from the exercise of stock options and warrants outstanding using the treasury stock method and the average market price per share during the period.

A reconciliation of the number of shares used in the computation of the Company’s basic and diluted earnings per common share is as follows:

| | | Three Months Ended March 31, | |

| | | 2008 | | | 2007 | |

| | | | | | | |

| Weighted average number of common shares | | | | | | |

| outstanding | | | 182,855,246 | | | | 156,082,727 | |

| Dilutive effect of: | | | | | | | | |

| Stock options | | | - | | | | - | |

| Warrants | | | - | | | | - | |

| Weighted average number of common shares | | | | | | | | |

| outstanding, assuming dilution | | | 182,855,246 | | | | 156,082,727 | |

No stock options and warrants are included in the computation of weighted average number of shares because the effect would be anti-dilutive. At March 31, 2008, the Company had outstanding options and warrants to purchase a total of 16,687,273 common shares of the Company that could have a future dilutive effect on the calculation of earnings per share. At March 31, 2008, a production payment obligation of $1,974,456, which is recorded as a current liability in the accompanying condensed consolidated balance sheet, is convertible into a maximum of 5,484,600 common shares of the Company that could have a future dilutive effect on the calculation of earnings per share.

| NOTE 7 – | PROPERTY AND EQUIPMENT |

Property and equipment consist of the following at March 31, 2008:

| | | | |

| Land | | $ | 57,599 | |

| Buildings | | | 242,122 | |

| Mining and milling equipment | | | 1,835,616 | |

| Computer equipment | | | 206,693 | |

| Drilling equipment | | | 311,763 | |

| Vehicles | | | 79,930 | |

| Support equipment | | | 249,091 | |

| Office furniture and equipment | | | 47,998 | |

| Construction in progress | | | 265,793 | |

| | | | 3,296,605 | |

| Less accumulated depreciation and amortization | | | (902,837 | ) |

| | | | | |

| | | $ | 2,393,768 | |

| NOTE 8 – | RESTRICTED FUNDS – RECLAMATION OBLIGATIONS |

During May 2003, the Company entered into an insurance backed financial assurance program for a surety bond to secure the $2,693,000 reclamation bond for the Mineral Ridge property. The program structure includes an insurance policy that will pay reclamation expenses as they occur. During June 2003, the Company transferred to the insurance company approximately $1,800,000 of restricted cash for the reclamation of the Mineral Ridge property. The Company has paid an additional $526,505 of premiums on the reclamation bond policy through March 31, 2008. The Company is obligated to pay $11,311 annually thereafter which amount will be expensed during the year incurred.

Of the total initial premium of $2,326,505, $1,796,652 represents a Reclamation Experience Account which funds are directly available to the Company to use for closure, reclamation and remediation activities once they commence based on the existing known condition of the Mineral Ridge property. This amount has been included in the balance of the Restricted Funds - Reclamation Obligations asset in the accompanying condensed consolidated balance sheet as of March 31, 2008.

The prepaid bond insurance premiums of $526,505 are being amortized over the twelve (12) year term of the policy. The annual insurance premium of $11,311 is amortized over a twelve (12) month period. At March 31, 2008, the total current portion of the prepaid insurance premiums related to this policy totaled $43,212 and is included in prepaid expenses and other current assets in the accompanying condensed consolidated balance sheet. The long-term portion of the prepaid insurance premiums totaled $266,473 and is included in other assets in the accompanying condensed consolidated balance sheet as of March 31, 2008. This program allows the Company flexibility to increase its bond in the future to an aggregate limit of $4,000,000.

Restricted funds totaling $476,813 for a bond and other regulatory deposit requirements for the Ashdown property and a deposit of $42,323 for the Mineral Ridge property are also included in the balance of the Restricted Funds – Reclamation Obligations in the accompanying condensed consolidated balance sheet as of March 31, 2008.

| NOTE 9 – | RECLAMATION OBLIGATIONS |

In accordance with SFAS No. 143, Accounting for Asset Retirement Obligations, which establishes a uniform methodology for accounting for estimated reclamation and abandoned costs, the Company has estimated reclamation costs for the Mineral Ridge and Ashdown properties. At March 31, 2008, the total amount recorded for estimated reclamation obligations was $3,363,930. Because the Company was unable to operate the Mineral Ridge mine profitably in accordance with the feasibility study completed in 2003 and has idled the project, and because the Ashdown LLC had not established proven or probable reserves until February 2008, no related reclamation asset has been recorded at March 31, 2008.

Accretion expense related to the reclamation obligations for the three-month periods ended March 31, 2008 and 2007 was $51,368 and $45,619, respectively.

| NOTE 10 – | SEVERANCE OBLIGATIONS |

At a meeting of the Board on February 18, 2005, the directors unanimously approved a separation agreement for Michael Fitzsimonds, a former Chief Executive Officer of the Company. The terms of separation were that Mr. Fitzsimonds would be paid his full salary for one year including medical benefits, followed by 180 hours of vacation. The Company then would pay him $394,000 in 59 equal monthly payments. He would be allowed to use a company vehicle for one year at which time he exercised his option to purchase it. Mr. Fitzsimonds loaned $100,000 to the Company in 1998 on which the Company pays $1,350 a month for interest (see Note 14). The principal was to be repaid on or before February 18, 2008, but was still outstanding as of the date of this Report. The current portion of the severance obligation to Mr. Fitzsimonds of $80,136 is included in current liabilities and the long-term portion of the severance obligation of $146,561 is included in long-term liabilities in the accompanying condensed consolidated balance sheet as of March 31, 2008.

During the three months ended March 31, 2008, the Company paid all remaining amounts payable to Kenneth S. Ripley, former Chief Executive Officer of the Company, under an employment separation agreement, with the exception of $3,715 in accrued interest payable. This agreement terminated an employment agreement dated as of March 8, 2006 between the Company and Mr. Ripley.

| NOTE 11 – | PRODUCTION PURCHASE AGREEMENT |

On June 13, 2007, the Company entered into a Production Payment Purchase Agreement and Assignment (the “Purchase Agreement”) by and between the Company and Crestview Capital Master, LLC (“Crestview”). Pursuant to the terms of the Purchase Agreement, Crestview acquired from the Company a production payment equal to one million nine hundred seventy four thousand four hundred fifty six dollars ($1,974,456). The production payment will be paid in an amount equal to a five percent (5%) Net Smelter (Refinery) Returns (“NSR”) paid solely from the Company’s share of production distributed to the Company pursuant to the Ashdown Project LLC Operating Agreement.

The production payment obligation to Crestview of $1,974,456 has been recorded as a current liability in the accompanying condensed consolidated balance sheet at March 31, 2008. So long as the production payment obligation remains outstanding, it may be converted in whole or in part into shares of the Company’s common stock at the option of Crestview. The number of shares of the Company’s common stock to be issued upon conversion of the production payment shall be calculated by dividing the remaining amount of the production payment by the number derived by multiplying the average of the volume weighted average price of the Company’s common stock for a period of ten (10) trading days prior to exercise of this conversion right by 0.80, but in no case less than $0.36 per share nor more than $0.46 per share. Provided that the shares of common stock underlying the conversion right have been registered with the U.S. Securities and Exchange Commission (which was initially done with a registration statement that went effective with the SEC in 2007), the production payment shall automatically convert into shares of the Company’s common stock if the closing price of the Company’s common stock on the OTC Bulletin Board or other public trading market is greater than or equal to $0.65 per share for ten consecutive trading days.

The Company has determined, that in the event the market value per share of the Company’s common stock is greater than the $0.36 per share minimum conversion price per share, there is a beneficial conversion feature equal to the intrinsic value of the production payment obligation. The Company will calculate the beneficial conversion feature at the end of each quarterly reporting period, and record changes to the intrinsic value of the beneficial conversion to common stock and interest expense. As of March 31, 2008, there was no beneficial conversion feature since the market price of the Company’s common stock was less that the $0.36 per share minimum conversion price.

| NOTE 12 – | ASHDOWN MILLING PRODUCTION PAYMENT PURCHASE AGREEMENT |

On September 26, 2005, the Company entered into a Production Payment Purchase Agreement with Ashdown Milling Co LLC (“Ashdown Milling”). Under the terms of the agreement, Ashdown Milling agreed to purchase a production payment to be paid from the Company’s share of production from the Ashdown mine for a minimum of $800,000. In addition, Ashdown Milling is to receive one share of the Company’s common stock and one warrant to purchase one share of the Company’s common stock at $0.20 per share for each dollar paid to the Company. In addition, the Production Payment Purchase Agreement provides that, upon the request of the Company for additional funds, Ashdown Milling has the right, but not the obligation, to increase its investment in the production payment up to an additional $700,000 for a maximum purchase price of $1,500,000. The amount of the production payment to be paid to Ashdown Milling is equal to a 12% net smelter returns royalty on the minerals produced from the mine until an amount equal to 240% of the total purchase price has been paid. Robert P. Martin, President of the Company, and Kenneth S. Ripley, a former Chief Executive Officer of the Company, are co-managers and two of the five members of Ashdown Milling. The Company’s Board approved the transaction.

Because production payments from the Ashdown mine were not assured at the time of the agreement with Ashdown Milling, the transaction was originally accounted for as the sale of an interest in mineral properties with the related gain to be deferred until the Company began making payments according the terms of the agreement. A total of $1,500,000 was advanced to the Company pursuant to this agreement, with the proceeds allocated as follows.

| Common stock | | $ | 370,100 | |

| Warrants | | | 225,333 | |

| Deferred revenue | | | 904,567 | |

| | | | | |

| | | $ | 1,500,000 | |

The allocation of the proceeds to common stock was based on the quoted market price of the Company’s common stock on the date the shares were issued to the Ashdown Milling members. The allocation of the proceeds to warrants, also recorded to common stock, was based on the estimated value of the warrants calculated using the Black-Scholes valuation model.

With the commencement of mining operations at the Ashdown mine, the Company reclassified the deferred revenue to a production payment obligation – related party, a current liability, to be repaid from the Company’s share of production distributions received from the Ashdown LLC. As of March 31, 2008, the Company had paid the $904,567 production payment obligation. Amounts paid to Ashdown Milling members in excess of the original obligation recorded of $904,567 will be reported as royalties expense.

On February 6, 2008 the Company bought out the membership interests of two members of Ashdown Milling, Charles D. Murphy and Acco Investment Inc., in exchange for 1,866,667 shares of the Company’s common stock and $139,092 cash paid to each of them. As a result, their membership interests in Ashdown Milling were extinguished, and the Company’s remaining production payment to be paid to Ashdown Milling was reduced from a 12% net smelter returns royalty on the minerals produced to 7.2%.

For the three months ended March 31, 2008, the Company reported royalties expense of $1,158,337 comprised of the following:

| Common stock – 3,733,334 shares at $0.225 per share | | $ | 840,000 | |

| Exercise of warrants – common stock subscribed | | | 60,000 | |

| Cash payments | | | 258,337 | |

| | | | | |

| | | $ | 1,158,337 | |

Long-term debt consists of the following at March 31, 2008:

Note payable to GMAC, payable at $538 per month with no interest through May 2009, secured by vehicle | | $ | 7,525 | |

Note payable to Komatsu Equipment Company, with principal payments $58,486 on June 30, 2008, $58,486 on June 30, 2009 and $58,485 on June 30, 2010, with interest at 8%, unsecured | | | 175,457 | |

Note payable to GE Capital, payable at $1,080 per month through January 2012, including interest at 5.40%, secured by equipment | | | 45,671 | |

Note payable to Daimler Chrysler, payable at $806 per month, through February 2012, including interest at 13.75%, secured by vehicle | | | 29,147 | |

Capital lease payable to GE Capital, payable at $1,272 per month through March 2009, secured by equipment | | | 14,910 | |

Capital lease payable to Thiessen Equipment Ltd., payable at $1,368 per month through December 2008, secured by equipment | | | 12,397 | |

Note payable to GE Capital, payable at $1,149 per month through April 2012, including interest at 5.40%, secured by equipment | | | 49,492 | |

Note payable to Maptek/KRJA Systems, Inc., payable at $3,047 per month through February 2010, including interest at 42.4%, secured by software | | | 46,056 | |

| Accrued interest payable | | | 10,527 | |

| Total | | | 391,182 | |

| Less current portion | | | 150,466 | |

| | | | | |

| Long-term portion | | $ | 240,716 | |

| NOTE 14 – | AMOUNTS DUE TO RELATED PARTIES |

Amounts due to related parties included in current liabilities consist of the following at March 31, 2008:

| | | Principal | | | Interest | | | Total | |

Interest payable to Kenneth Ripley, a former Chief Executive Officer of the Company | | $ | — | | | $ | 3,715 | | | $ | 3,715 | |

Note payable to Michael Fitzsimonds, a former Chief Executive Officer of the Company, with interest payments of $1,350 per month, due on or before February 18, 2008 | | | 100,000 | | | | — | | | | 100,000 | |

Note payable to an employee and the manager of the Ashdown mine for the purchase of a mill, equipment rental and other, with interest at 12% | | | 137,908 | | | | 52,162 | | | | 190,070 | |

Note payable to Win-Eldrich Gold, Inc., minority member in Ashdown LLC, due August 16, 2008, with interest at 8% | | | 440,000 | | | | 1,253 | | | | 441,253 | |

| | | $ | 677,908 | | | $ | 57,130 | | | $ | 735,038 | |

| NOTE 15 – | STOCKHOLDERS’ EQUITY |

During the three months ended March 31, 2008, the Company issued 4,857,634 shares of its common stock for the following consideration: 100,000 shares for consulting services valued at $20,000; 3,733,334 shares issued for royalties expense of $840,000 (Note 12); and 1,024,300 shares issued for the exercise of options and warrants, $25,658 for cash and $129,587 reduction in accrued liabilities (Note 16). The prices per share recorded in non-cash equity transactions approximated the quoted market price of the Company’s common stock on the date the shares were issued. In those instances where the market price of the Company’s common stock on the date the shares are issued to repay debt or other obligations differs from the market price originally used to determine the number of shares to be issued, a gain or loss on extinguishment of debt is recorded. Depending on the delay in issuing these shares, the gain or loss may be material. For the three months ended March 31, 2008, no gain or loss on extinguishment of debt repaid through the issuance of the Company’s common stock was recorded.

Steven D. Craig — On August 30, 2006, Steven D. Craig filed a Complaint against Golden Phoenix Minerals, Inc. in the Second Judicial District for the State of Nevada in the County of Washoe. The Complaint alleges Breach of Contract regarding the failure to permit the exercise of stock options, failure to repay non-reimbursed business expenses, and failure to pay and account for the accrual of interest of deferred compensation. On September 20, 2006, Golden Phoenix Minerals, Inc. filed an Answer to the Summons and Complaint. On September 29, 2006, Golden Phoenix Minerals, Inc. filed a Third-Party Complaint naming Collette Crater-Craig as an interested party with regard to community property issues due to the recent termination of marriage between her and Steven D. Craig. The Third-Party Complaint sought declaratory relief to ascertain the respective parties’ rights and obligations with regard to the damages sought by the subject Complaint. Collette Crater-Craig since became deceased on December 3, 2006.

On March 21, 2008 the parties entered into a Settlement Agreement and Release wherein the Company agreed to issue stock options for 984,300 shares of its Common Stock, with the underlying shares to be registered with the SEC. 492,150 stock options were issued to Mr. Craig and 492,150 stock options were issued to the Estate of Collette Crater-Craig. The Company expects that a dismissal of this matter with prejudice will be filed with the court within the next several months.

Win-Eldrich Gold, Inc. — On April 4, 2007, Golden Phoenix participated in mediation proceedings with Win-Eldrich Gold, Inc. (“WEG”). The dispute arises from Golden Phoenix’s November 2, 2006 formal notice of default to WEG stating that WEG failed to timely fund its share of the Program and Budget for the Ashdown mine, due on October 15, 2006. Payment was due pursuant to the Ashdown Project LLC Operating Agreement between WEG and Golden Phoenix dated September 28, 2006 and a related letter agreement of the same date. The amount claimed by Golden Phoenix to be owed under the agreement is $115,755. Additionally, by the same notice of default, Golden Phoenix reminded WEG that it did not timely pay to Golden Phoenix its share of revenues received by WEG for ore from stockpiles as required by the above-mentioned letter agreement. Golden Phoenix’s share of these monies was $193,391. The total amount in default totals $309,146. Pursuant to the agreements, interest accrues on these amounts at a rate equal to two percentage points over the Prime Rate to the maximum allowed by law. The agreement permits a defaulting party to cure if they pay the defaulted amount, plus interest at a rate of Prime plus 7%. WEG did not cure its default. Consequently, Golden Phoenix elected, as permitted under the agreement, to dilute WEG’s membership interest in the Ashdown LLC by notice dated December 20, 2006. Pursuant to a calculation formula contained in the agreement, Golden Phoenix contends WEG’s membership interest has been reduced from 40% to 30.5%. WEG is currently contesting this dilution of its interest in the Ashdown LLC. WEG has disputed and continues to dispute the amount and timing of certain expenditures incurred by Golden Phoenix on the Ashdown property. As of the date of this Quarterly Report, the mediation has not resolved the dispute and the parties plan to proceed to arbitration pursuant to the terms of the Operating Agreement. Golden Phoenix expects this arbitration to be conducted in 2008. In addition, Golden Phoenix has been notified by WEG of certain provisions in the Operating Agreement that it contends Golden Phoenix has breached and has requested a meeting to discuss these provisions in accordance with the dispute resolution provisions of the Operating Agreement. As of the date of this Quarterly Report, Golden Phoenix does not believe any of WEG’s allegations are material. The outcome of these matters cannot currently be determined. The consolidated financial statements of Golden Phoenix reflect Golden Phoenix’s ownership in the Ashdown LLC at 60% and do not reflect the potential impact of any ultimate resolution or arbitration.

| NOTE 17 – | SUPPLEMENTAL STATEMENT OF CASH FLOWS INFORMATION |

During the three months ended March 31, 2008 and 2007, the Company made no cash payments for income taxes.

During the three months ended March 31, 2008 and 2007, the Company made cash payments for interest of $53,133 and $16,239, respectively.

During the three months ended March 31, 2008, the Company had the following non-cash financing and investing activities:

| · | Decreased marketable securities and increased other comprehensive loss for unrealized loss on marketable securities of $59,777. |

| · | Accrued liabilities were reduced by $129,587 through the exercise of stock options and resultant increase in common stock. |

| · | Property and equipment was purchased through the issuance of debt of $174,239. |

| · | Property and equipment was purchased through the issuance of accounts payable of $111,434. |

During the three months ended March 31, 2007, the Company had the following non-cash financing and investing activities:

| · | Increased marketable securities and other comprehensive income for unrealized gain on marketable securities of $80,272. |

| · | Common stock was issued to pay accounts payable of $125,000. |

| · | Amounts due related parties were reduced by $160,227 through the exercise of stock options and resultant increase in common stock. |

| · | Accounts payable were reduced by $27,373 through the exercise of stock options and resultant increase in common stock. |

| NOTE 18 – | RECENT ACCOUNTING PRONOUNCEMENTS |

In March 2008, the FASB issued SFAS No. 161, Disclosures about Derivative Instruments and Hedging Activities. This statement changes the disclosure requirements for derivative instruments and hedging activities. Entities are required to provide enhanced disclosures about (a) how and why an entity uses derivative instruments, (b) how derivative instruments and related hedged items are accounted for under SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities, and its related interpretations, and (c) how derivative instruments and related hedged items affect an entity’s financial position, financial performance, and cash flows. This statement is effective for financial statements issued for fiscal years and interim periods beginning after November 15, 2008, or the Company’s fiscal year beginning January 1, 2009, with early application encouraged. This statement encourages, but does not require, comparative disclosures for earlier periods at initial adoption. The Company is currently unable to determine what impact the future application of this pronouncement may have on its consolidated financial statements.

In December 2007, the FASB issued SFAS No. 141 (revised 2007), Business Combinations. This statement replaces SFAS No. 141, Business Combinations and applies to all transactions or other events in which an entity (the acquirer) obtains control of one or more businesses (the acquiree), including those sometimes referred to as “true mergers” or “mergers of equals” and combinations achieved without the transfer of consideration. This statement establishes principles and requirements for how the acquirer: a) recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree; b) recognizes and measures the goodwill acquired in the business combination or a gain from a bargain purchase; and c) determines what information to disclose to enable users of the financials statements to evaluate the nature and financial effects of the business combination. This statement will be effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2008, or the Company’s fiscal year beginning January 1, 2009. Earlier adoption is prohibited. The Company is currently unable to determine what impact the future application of this pronouncement may have on its consolidated financial statements.

In December 2007, the FASB issued SFAS 160, Noncontrolling Interests in Consolidated Financial Statements. This statement applies to all entities that prepare consolidated financial statements, except not-for-profit organizations, and amends Accounting Research Bulletin (“ARB”) 51 to establish accounting and reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary. It also amends certain of ARB 51’s consolidation procedures for consistency with the requirements of SFAS No. 141 (revised 2007). This statement will be effective for fiscal years, and interim periods within those fiscal years, beginning on or after December 15, 2008, or the Company’s fiscal year beginning January 1, 2009. Earlier adoption is prohibited. The Company is currently unable to determine what impact the future application of this pronouncement may have on its consolidated financial statements.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities – Including an Amendment of FASB Statement No. 115. This statement permits entities to choose to measure many financial instruments and certain other items at fair value. Most of the provisions of SFAS No. 159 apply only to entities that elect the fair value option. However, the amendment to SFAS No. 115 Accounting for Certain Investments in Debt and Equity Securities applies to all entities with available-for-sale and trading securities. SFAS No. 159 is effective as of the beginning of an entity’s first fiscal year that begins after November 15, 2007, or the Company’s fiscal year beginning January 1, 2008. Early adoption is permitted as of the beginning of a fiscal year that begins on or before November 15, 2007, provided the entity also elects to apply the provision of SFAS No. 157, Fair Value Measurements. The Company adopted SFAS No. 159 on January 1, 2008, with no material impact on its consolidated financial statements.

In September 2006, the FASB issued SFAS No. 157, Fair Value Measurements. SFAS No. 157 defines fair value, establishes a framework for measuring fair value, and requires enhanced disclosures about fair value measurements. SFAS No. 157 requires companies to disclose the fair value of their financial instruments according to a fair value hierarchy as defined in the standard. Additionally, companies are required to provide enhanced disclosure regarding financial instruments in one of the categories, including a reconciliation of the beginning and ending balances separately for each major category of assets and liabilities. In February 2008, the FASB issued FASB Staff Position (FSP) No. FAS 157-2, which delays by one year the effective date of SFAS No. 157 for certain types of non-financial assets and non-financial liabilities. As a result, SFAS No. 157 will be effective for financial statements issued for fiscal years beginning after November 15, 2007, or the Company’s fiscal year beginning January 1, 2008, for financial assets and liabilities carried at fair value on a recurring basis, and on January 1, 2009, for non-recurring non-financial assets and liabilities that are recognized or disclosed at fair value. The Company adopted SFAS No. 157 on January 1, 2008 for financial assets and liabilities carried at fair value on a recurring basis, with no material impact on its consolidated financial statements. The Company is currently unable to determine what impact the application of SFAS No. 157 on January 1, 2009 for non-recurring non-financial assets and liabilities that are recognized or disclosed at fair value will have on its consolidated financial statements.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward Looking Statements

Except for historical information, the following Management’s Discussion and Analysis contains forward-looking statements based upon current expectations that involve certain risks and uncertainties. Such forward-looking statements include statements regarding, among other things, (a) our estimates of mineral reserves and mineralized material, (b) our projected sales and profitability, (c) our growth strategies, (d) anticipated trends in our industry, (e) our future financing plans, (f) our anticipated needs for working capital, (g) our lack of operational experience and (h) the benefits related to ownership of our common stock. Forward-looking statements, which involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” or “project” or the negative of these words or other variations on these words or comparable terminology. This information may involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed or implied by any forward-looking statements. These statements may be found under “Management’s Discussion and Analysis of Financial Condition” as well as in this Report generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described in this Report generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this Report will in fact occur as projected.

Overview

Golden Phoenix Minerals, Inc. is a mineral exploration, development and production company specializing in acquiring and consolidating mineral properties with potential production and future growth through exploration discoveries. Acquisition emphasis is focused on properties containing gold, silver, molybdenum and other strategic minerals that present low political and financial risk and exceptional upside potential. Our main focus is in Nevada.

We were formed in Minnesota on June 2, 1997. On September 21, 2007, our shareholders voted in favor of a Plan of Merger to reincorporate from the State of Minnesota to the State of Nevada. We expect to reincorporate into the State of Nevada within the next several months.

Our two primary mining property assets are the Ashdown molybdenum project operated by the Ashdown Project LLC (the “Ashdown LLC”), in which we currently own a 60% member interest (and have claim to an additional 9.5% interest, though contested, which would bring our total interest to 69.5%), and the Mineral Ridge gold mine (Figure 1). Management’s near-term goal is to extract the known molybdenum deposits at Ashdown and develop a plan for profitable production of gold and silver at Mineral Ridge. The Ashdown molybdenum project represents all of Golden Phoenix’s revenue.

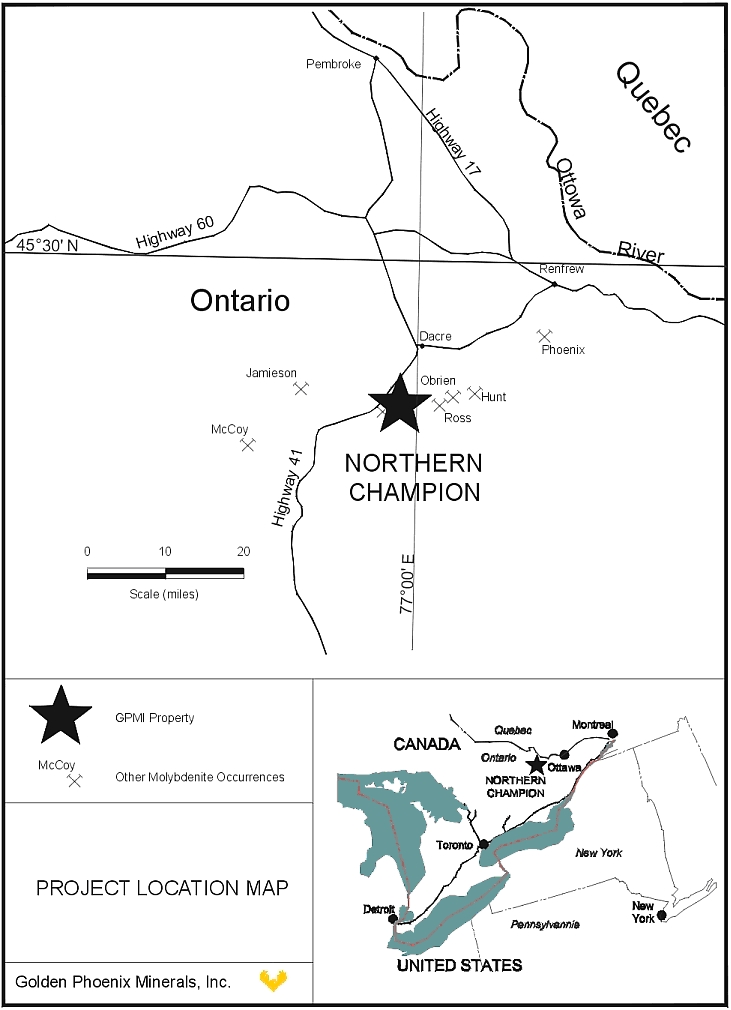

As further discussed below, the Company completed a purchase agreement with four individuals for the Northern Champion molybdenum property located in Ontario, Canada (Figure 2), and plans to take bulk samples for metallurgical and market testing, and to actively explore and delineate molybdenum mineralization on the property later in 2008.

The Ashdown LLC commenced production in December 2006, and the Company is working to put Ashdown into profitable production. As further discussed below, in 2003 we identified economically feasible gold reserves that could be recovered using a cyanide heap leaching process at the Mineral Ridge Project. We operated the Mineral Ridge Project in 2004 and 2005, but did not obtain the results projected in the engineering and feasibility study completed in 2003. Consequently, the Mineral Ridge mine was idled pending full reviews of engineering and metallurgy, and optimization of a revised mine and operations plan. We intend to commence further exploration of numerous targets and development of identified economic mineralization at Mineral Ridge in 2008. It is expected that this work, which will be contracted with a third party, will identify and delineate additional reserves for both open pit and underground deposits and ultimately extend the life of the mine.

Ashdown Project, Humboldt County, Nevada

The Ashdown molybdenum-gold project is located about 115 miles northwest of Winnemucca in Humboldt County, Nevada (the “Ashdown mine”). The property covers about nine (9) square miles and is controlled by 293 unpatented mining claims. As of February 25, 2008 we had proven reserves of molybdenum (Mo) of 2,773,908 pounds with a grade of 2.91% and probable reserves of 1,074,023 pounds with a grade of 0.78%, pursuant to an independent third party Technical Report and Feasibility Study. We signed a Joint Venture Agreement for the Ashdown property with Win-Eldrich on February 5, 2004. The terms of the agreement gave us the right to earn in to 60%, as manager and operator of the project, with Win-Eldrich retaining 40% as owner of the property. We were eligible to earn an undivided vested 60% interest in the project in either of two (2) ways: (1) by placing the project into profitable production using a small mill, or (2) by spending $5,000,000 toward development of the project. Upon signing, we paid Win-Eldrich $50,000, and beginning three (3) months after signing we paid $5,000 per month through December 2006. In May 2006, we exceeded the $5,000,000 benchmark for development expenditures at Ashdown mine and formally notified Win-Eldrich that we had vested our 60% interest as provided under clause (2) of the Letter Agreement. We have claim to an additional 9.5% interest in the Ashdown LLC, though contested, which would bring our total interest to 69.5%.

On September 28, 2006, we entered into the Ashdown Project LLC Operating Agreement with Win-Eldrich Gold, Inc. in order to govern the management of the Ashdown LLC and the future mineral exploration, evaluation, development and mining operations by the Ashdown LLC on the real property contributed by us and Win-Eldrich Gold, Inc. and all other real property within the area of interest that is acquired by the Ashdown LLC. Effective January 1, 2008, the Management Committee voted the project Stand Alone, with the Mine General Manager being responsible for the day to day operations, and the Company overseeing the project through its appointment of three of the five Directors on the Management Committee. Additionally, on September 28, 2006, we entered into a Contribution Agreement with the Ashdown LLC in order to recognize that we had incurred actual expenditures at the Ashdown mine of not less than $5,000,000 and to contribute all of our right, title and interest in the Ashdown mine, encumbered as set forth in the Settlement Agreement, dated August 26, 2005 by and between us, Earl Harrison, dba Western Mine Development, Retrievers LLC, John Tingue and Kris Tingue, to the Ashdown LLC. We agreed with the Ashdown LLC that value of our contribution was $5,000,000, which resulted in a sixty percent (60%) ownership interest in the Ashdown LLC. Simultaneously with the entry into the Contribution Agreement by us, Win-Eldrich Gold, Inc. entered into a Contribution Agreement with the Ashdown LLC in order to contribute all of its right, title and interest in and to certain personal property and certain unpatented mining claims situated in Humboldt County, Nevada in exchange for a forty percent (40%) ownership interest in the Ashdown LLC at an agreed-upon value of the contribution of $3,333,333.

Because the mineral property operated by the Ashdown LLC did not have proven or probable reserves supported by a current third-party feasibility study until February 25, 2008, the $5,000,000 in development expenditures incurred by us at the Ashdown mine have been expensed by us as incurred, with the exception of the cost of the mill and other tangible property and equipment, along with certain reclamation bonds and deposits contributed by us to the Ashdown LLC.

Because of our 60% ownership in the Ashdown LLC, we have consolidated the financial statements of the Ashdown LLC with those of the Company, effective October 1, 2006.

In May 2006, we completed permitting a mill designed to run about 100 tons per day of mine production. Construction on the mill and tailings impoundment was completed in 2006, and the facility is currently processing material as it is produced and delivered by the mine to the mill. We plan to assess expansion into a larger operation.

Currently the Ashdown mine produces a molybdenite concentrate product, which generally averages over 50% elemental molybdenum. We have a marketing agreement that facilitates the sale of the molybdenite concentrates (FOB mine) to an international metals broker, Derek Raphael & Company of London, England. We are not required to provide roasted material to the market, or locate a third party roasting capacity under this agreement.

Molybdenum is a base metal used in the manufacture of a wide variety of products, including steel production, catalytic converters, and specialty lubricants. It is used as a strengthening component in alloys, provides corrosion resistance in acidic environments, used as a hardener in the manufacture of machine tools, drill equipment, and pipelines, and is an essential component of stainless steel.

The molybdenum concentrate is produced by a flotation process at the Ashdown mine, and then bagged in Super Sacks, each weighing approximately 3,950 pounds. The concentrate is a molybdenum disulfide, which requires roasting at an outside facility to convert to a molybdenum oxide, the international standard form for its sale. The molybdenum disulfide product is shipped by truck from the mill in lots containing 12 Super Sacks. Once the product leaves the mill, it is transferred to a roasting facility of the broker’s choice, converted to molybdenum oxide and then sold on the world markets.

The broker takes custody and ownership of the product at the Ashdown mine and at our discretion makes 80% to 90% payment of the assayed value of the shipment at that time. The balance of approximately 10% to 20% is settled following processing of the shipment at the outside roasting facility and Final Assay, which can take between two and four months to complete.

As discussed below under “Financing Agreements”, the Company’s share of production distributions from the Ashdown LLC are encumbered by financing agreements pursuant to which funds were raised to develop the Ashdown mine.

Mineral Ridge Gold Mine, Esmeralda County, Nevada

The Mineral Ridge gold mine is located four miles northwest of the town of Silver Peak and thirty-two miles west of Tonopah in Esmeralda County, Nevada (“Mineral Ridge”). The property consists of 54 patented and 140 unpatented mining claims totaling nearly 3,880 acres, or 6 square miles. The property is accessed on the east side from state highway 265 and on the west side from a well-maintained gravel road. Heavy trucks access the site from the west entrance by way of state highway 264, which connects to state highway 773 and U. S. highway 6. We also control three (3) private land parcels, which are located outside the main Mineral Ridge mine area. These are the abandoned Blair town site, the Silver Peak mill site, and deeded land west of Mineral Ridge over some springs. These private lands total about 430 acres. The total combined acreage controlled by Golden Phoenix is equal to approximately 6.78 square miles.

Golden Phoenix purchased the Mineral Ridge mine in late 2000 out of bankruptcy for $225,000 cash and the assumption of a $382,000 liability to Sierra Pacific Power Co. for a facility charge for the installation of a grid power line. Additional commitments were also assumed, including obligations to pay advanced royalty payments of $60,000 per year and the annual permit cost for the Nevada Department of Environmental Protection of approximately $20,000 during the time the permits were being transferred to Golden Phoenix from the previous operator. We believe that prior mine operators had spent about $30 million on the property, which includes about $18 million in office, process, and ancillary facilities, about $2 million in engineering and feasibility studies, about $6 million in drilling and assays, $2 million in past permitting costs, and the remainder in site preparation.

The Mineral Ridge property holds three separate potentially economic mineable gold deposits, the Drinkwater, Mary, and Brodie. We believe that the property holds further mineral potential with identified targets potentially containing additional gold mineralization. Our operations have yielded certain amounts of precious metal product (dore, a mixture of gold and silver) that has been sold resulting in revenues of approximately $2.3 million in 2005 and 2004. In January 2005, we temporarily idled the mine pending full reviews of engineering and metallurgy, and optimization of a revised mine and operations plan. We intend to commence further exploration of numerous targets and development of identified economic mineralization at Mineral Ridge in 2008. It is expected that this work, consisting of over 50,000 feet of planned drilling, will identify and delineate reserves for both open pit and underground deposits and ultimately extend the life of the mine.

In 2001, Golden Phoenix filed a $1.8 million interim reclamation bond, which allowed the Company to hold the Mineral Ridge property while other permitting was underway. We negotiated an interim bond amount to keep the project at status quo until a new plan and bond amount could be negotiated. On May 8, 2003, we received the new amended operating permit and on June 23, 2003, we filed a $2.7 million reclamation bond with the Bureau of Land Management with respect to the Mineral Ridge mine. We utilized an insurance-backed financial assurance program to acquire the bond. The program structure includes an insurance policy that will pay reclamation expenses as they occur. The insurance enabled us to acquire the necessary reclamation bond at a fixed and discounted rate for a term of twelve (12) years. It also allows us the flexibility to increase our bond in the future as we recommence operations at Mineral Ridge. Operations began in 2003 once the bond was in place, including adding chemicals to the process solutions, plumbing the pad with drip lines and main trunk pipes, and mining both new and old stockpiled materials.

Mineral Ridge Royalty Obligations

We are obligated to honor two (2) prior royalty agreements. The first is to Mary Mining Company, which includes annual advance minimum royalty payments of $60,000, and a sliding-scale production royalty based on gold price divided by 100 in $50 increments with a cap at 8.5% (i.e. above a $850 per ounce gold price). The other agreement, which originated from Benquet Corp., is with private individuals on several patented claims. This agreement includes a 1.0% sliding-scale production royalty on production when gold prices are below $300 per ounce and 2.0% when gold prices are above $300 per ounce.

Figure 1. Map showing the locations of the Nevada properties discussed in this report. Ashdown is the only active property, with Mineral Ridge idled in 2005.

Northern Champion Property, Ontario, Canada

The Northern Champion Property is approximately 880 acres in Griffith and Brougham Townships in the Province of Ontario, Canada (“Northern Champion Property”). On April 18, 2006, we executed a Purchase Agreement with Robert R. Robitaille, Douglas Lalonde, Sheldon Davis and Ronald E. Dockweiler (collectively, the “Vendors”) to acquire five (5) registered claims totaling 22 units on the Northern Champion Property together with a NI 43-101 Technical Report and Feasibility Study describing a molybdenite deposit within the area of the claims.

Pursuant to the terms of the agreement, we were obligated to pay $125,000 in four (4) equal quarterly installments of $31,250 commencing on August 15, 2006. Each payment was to be distributed as follows, $9,991.50 to Mr. Lalonde, $9,247.45 to each of Messrs. Robitaille and Davis, and $2,763.61 to Mr. Dockweiler. In addition, the agreement provided that we would issue 735,000 shares of our common stock to the Vendors. Mr. Lalonde received 235,000 shares, each of Messrs. Robitaille and Davis received 217,500 shares and Mr. Dockweiler received 65,000 shares. The agreement also provides that the Vendors will retain a 3.3% Net Smelter Return (“NSR”) on the sales of minerals taken from the Northern Champion Property. Each of Messrs. Lalonde, Robitaille and Davis will be entitled to receive 1% of the Net Smelter Return and Mr. Dockweiler will be entitled to receive 0.3% of the Net Smelter Return. Additionally, we will have the right of first refusal to purchase 1.65% of said Net Smelter Return from the Vendors for $1,650,000. We will have the ability to purchase 0.5% of said Net Smelter Return from each of Messrs. Lalonde, Robitaille and Davis and 0.15% of said Net Smelter Return from Mr. Dockweiler.

On February 12, 2007, the parties agreed to convert the remaining cash payments to an equivalent number of restricted shares of our common stock valued at the market close of $0.295 per share on that date. On February 16, 2007, 423,729 restricted shares of our common stock were issued to the Vendors and the purchase was completed. We now own 100% of the Northern Champion Property subject to the NSR reserved by the Vendors.

Alaskan Royalties

We own a 1% net smelter return royalty on two properties located in Alaska, Glory Creek and Uncle Sam. We are not required to perform any work or make any payments for these royalties.

The Glory Creek property is 100% controlled by Great American Mineral Exploration, Inc. (“GAME”). It is located in the Bonnifield mining district, about 60 miles south of Fairbanks. Exploration work on the property has defined an anomalous zone of gold mineralization that requires drilling for the next phase of work. We do not know if or when a discovery of gold mineralization will be made.

The Uncle Sam property is also 100% controlled by GAME. The property is located in the Richardson Gold District, about 60 miles southeast of Fairbanks. Their work has defined a strongly anomalous gold zone that requires drilling for the next phase of work. We do not know if or when a discovery of gold mineralization will be made.

Figure 2. Map showing the Northern Champion property located within the Province of Ontario, Canada. The acquisition of this property was completed in February 2007.

Going Concern

Our independent auditors have added an explanatory paragraph to their audit opinion issued in connection with our consolidated financial statements for the years ended December 31, 2007 and 2006 with respect to their doubt about our ability to continue as a going concern due to our recurring losses from operations and our accumulated deficit. The Company has a history of operating losses since its inception in 1997, and has an accumulated deficit of $39,373,923 and a working capital deficit of $1,581,835 at March 31, 2008, which together raises doubt about the Company’s ability to continue as a going concern. Our ability to continue as a going concern will be determined by our ability to increase sales, sustain a successful level of operations and to continue to raise debt or equity capital. The accompanying condensed consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Critical Accounting Policies

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make a wide variety of estimates and assumptions that affect: (1) the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements, and (2) the reported amounts of revenues and expenses during the reporting periods covered by the financial statements. Our management routinely makes judgments and estimates about the effect of matters that are inherently uncertain. As the number of variables and assumptions affecting the future resolution of the uncertainties increases, these judgments become even more subjective and complex. We have identified certain accounting policies that are most important to the portrayal of our current financial condition and results of operations. Our significant accounting policies are disclosed in Note 1 of the Notes to the Consolidated Financial Statements, and several of those critical accounting policies are as follows:

Minority Interest. As of March 31, 2008, the minority interest balance is comprised of the portion of the members’ equity in the Ashdown LLC not owned by the Company. The operating income of the Ashdown LLC for the three-month period ended March 31, 2008 was allocated 40% to Win-Eldrich Gold, Inc., the minority member, based on its equity ownership percentage, thereby increasing the Company’s net loss. Similarly, the operating loss of the Ashdown LLC for the three-month period ended March 31, 2007 was allocated 40% to Win-Eldrich Gold, Inc., thereby reducing the Company’s net loss.

Accounts Receivable. Trade receivables are carried at original invoice amount less an estimate made for doubtful accounts. The Company maintains an allowance for doubtful accounts based upon historical collection experience and expected collectibility of all accounts receivable. The Company’s allowance for doubtful accounts was $116,407 at March 31, 2008. Trade receivables are written off when deemed uncollectible. Recoveries of trade receivables previously written off are recorded as income when received.

Inventories. Materials and supplies inventories are stated at the lower of cost (using the average cost method) or market. Market is determined on the basis of estimated realizable values.

Molybdenite concentrates finished goods inventories are stated at the lower of cost (using current period production costs) or market. Market is determined on the basis of current sales prices per pound of the molybdenite concentrates.

Marketable Securities. Marketable securities consist of shares of International Enexco Ltd. common stock received in the sale of mineral properties. The Company intends on holding these shares for the foreseeable future, and accordingly, the shares are accounted for as securities held-for-sale in accordance with Statement of Financial Accounting Standards (SFAS) No. 115, Accounting for Certain Investments in Debt and Equity Securities. The marketable securities are stated at fair value based on market quotes. Unrealized gains and losses are recorded as other comprehensive income, a component of stockholders’ deficit in our consolidated balance sheet. The total net unrealized loss on this investment for the three-month period ended March 31, 2008 was $59,777, and the total net unrealized gain on this investment for the three-month period ended March 31, 2007 was $80,272.

Property and Equipment. Property and equipment are stated at cost. Depreciation and amortization are calculated using the straight-line method over the respective estimated useful lives of the assets.

Mine development costs are capitalized after proven and probable reserves have been identified. Amortization of mine development costs will be calculated using the units-of-production method over the expected life of the operation based on the estimated proven and probable reserves. Prior to February 25, 2008, the Company had no proven or probable reserves. Accordingly, mining equipment and buildings are currently being depreciated on a straight-line basis over their estimated economic useful life rather than on a units-of-production method.