Exhibit 99.1 Palm Communities (a Carve-Out of Principal Senior Living Group) Combined Carve-Out Financial Statements Year Ended December 31, 2023

Palm Communities (a Carve-Out of Principal Senior Living Group) Financial Statements Year Ended December 31, 2023

Palm Communities (a Carve-Out of Principal Senior Living Group) Contents 2 Independent Auditor’s Report 3-4 Combined Carve-Out Financial Statements Balance Sheet as of December 31, 2023 5 Statement of Operations for the Year Ended December 31, 2023 6 Statement of Changes in Parent Net Investment for the Year Ended December 31, 2023 7 Statement of Cash Flows for the Year Ended December 31, 2023 8 Notes to Combined Carve-Out Financial Statements 9-15

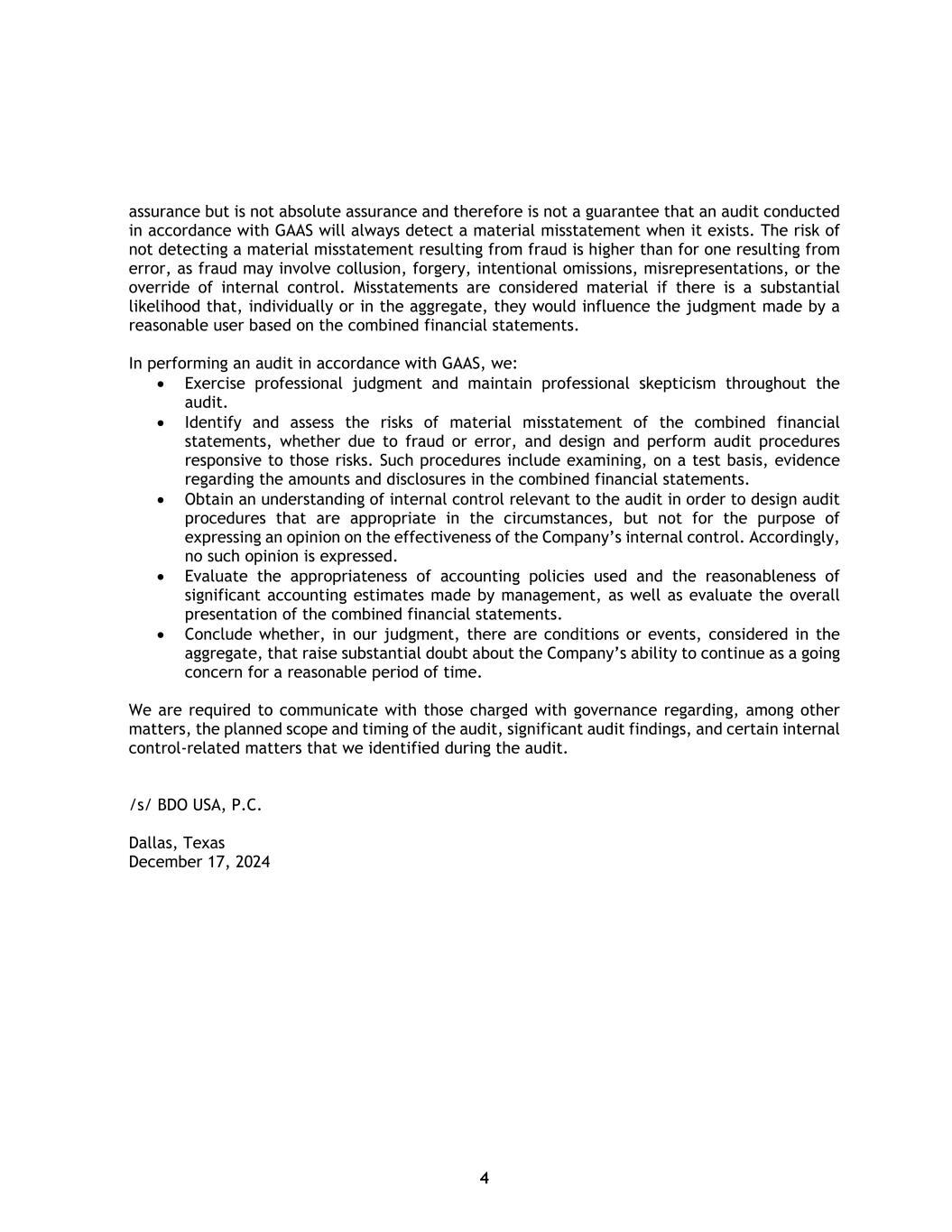

3 Independent Auditor’s Report Board of Directors Principal Senior Living Group Alpharetta, Georgia Opinion We have audited the combined financial statements of Palm Communities (A Carve-Out of Principal Senior Living Group) (the “Company”), which comprise the combined balance sheet as of December 31, 2023, and the related combined statements of operations, changes in parent net investment, and cash flows for the year then ended, and the related notes to the combined financial statements. In our opinion, the accompanying combined financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2023, and the results of its operations and its cash flows for the year then ended in accordance with accounting principles generally accepted in the United States of America. Basis for Opinion We conducted our audit in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Combined Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Responsibilities of Management for the Combined Financial Statements Management is responsible for the preparation and fair presentation of the combined financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of combined financial statements that are free from material misstatement, whether due to fraud or error. In preparing the combined financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern within one year after the date that the combined financial statements are available to be issued. Auditor’s Responsibilities for the Audit of the Combined Financial Statements Our objectives are to obtain reasonable assurance about whether the combined financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of

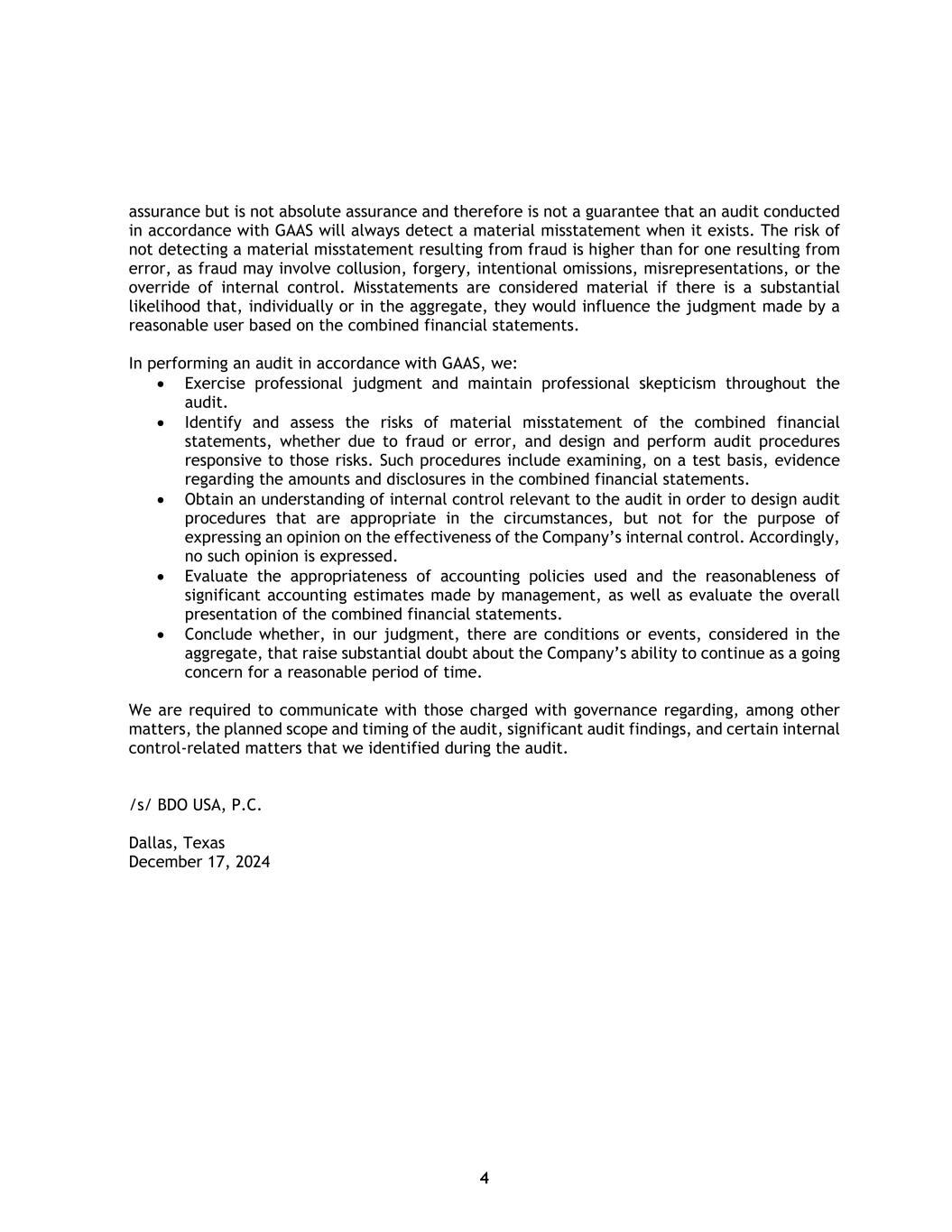

4 assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the combined financial statements. In performing an audit in accordance with GAAS, we: • Exercise professional judgment and maintain professional skepticism throughout the audit. • Identify and assess the risks of material misstatement of the combined financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the combined financial statements. • Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed. • Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the combined financial statements. • Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit. /s/ BDO USA, P.C. Dallas, Texas December 17, 2024

Palm Communities (a Carve-Out of Principal Senior Living Group) Combined Balance Sheet (in thousands) 5 December 31, 2023 Assets Current Assets Cash and cash equivalents $ 614 Restricted cash 1,599 Accounts receivable 164 Prepaid expenses and other 841 Total Current Assets 3,218 Non-Current Assets Property and equipment, net 96,038 Other assets, net 95 Total Non-Current Assets 96,133 Total Assets $ 99,351 Liabilities and Parent Net Investment Current Liabilities Accounts payable $ 865 Accrued expenses 2,871 Current portion of notes payable, net 31,511 Deferred revenue 145 Due to Parent 310 Due to related parties 1,867 Batson Cook Development Co loan 490 Kyle Diekmann loan 450 Total Current Liabilities 38,509 Non-Current Liabilities Long-term notes payable, net 57,530 Total Non-Current Liabilities 57,530 Commitments and Contingencies (Note 7) Parent Net Investment 3,312 Total Liabilities and Parent Net Investment $ 99,351 See notes to combined carve-out financial statements.

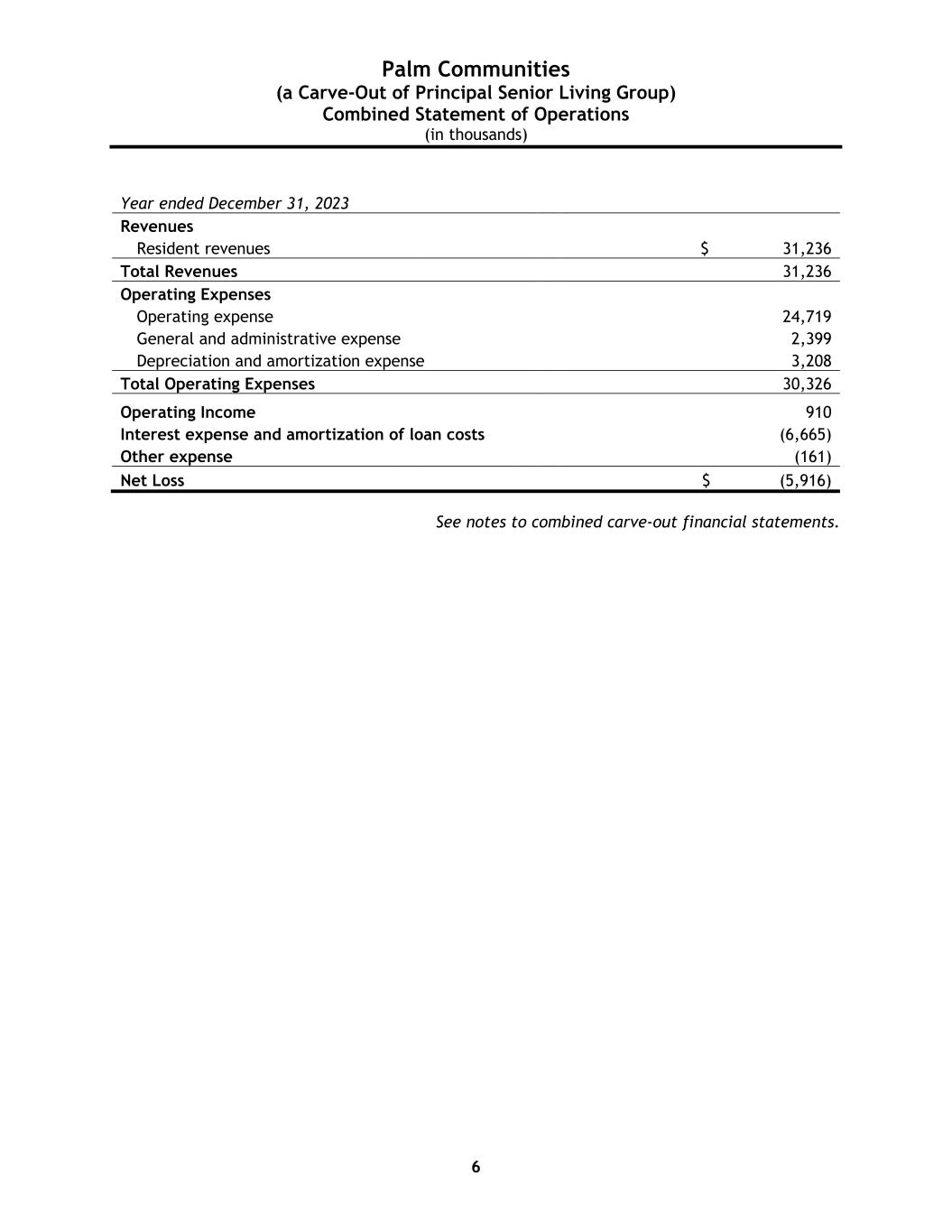

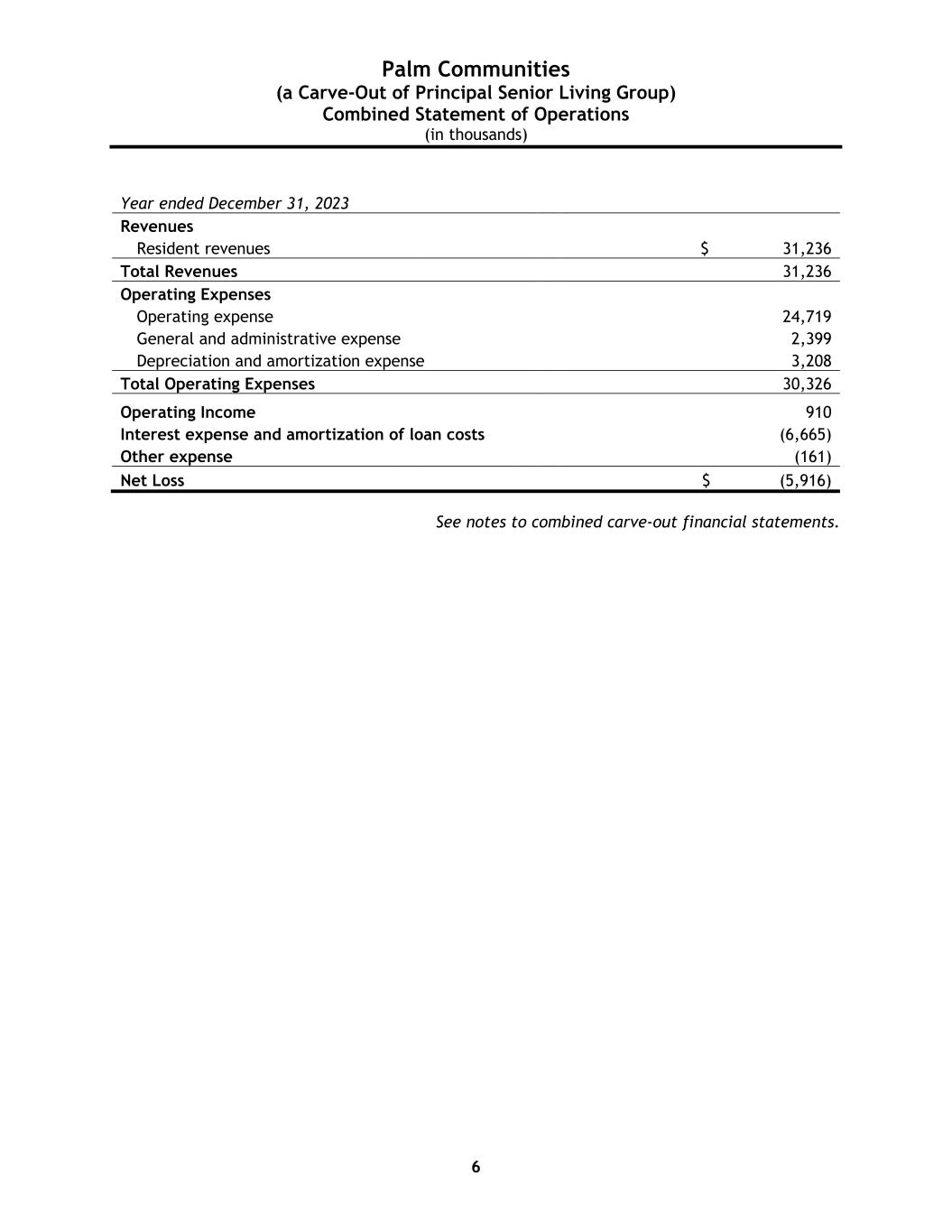

Palm Communities (a Carve-Out of Principal Senior Living Group) Combined Statement of Operations (in thousands) 6 Year ended December 31, 2023 Revenues Resident revenues $ 31,236 Total Revenues 31,236 Operating Expenses Operating expense 24,719 General and administrative expense 2,399 Depreciation and amortization expense 3,208 Total Operating Expenses 30,326 Operating Income 910 Interest expense and amortization of loan costs (6,665) Other expense (161) Net Loss $ (5,916) See notes to combined carve-out financial statements.

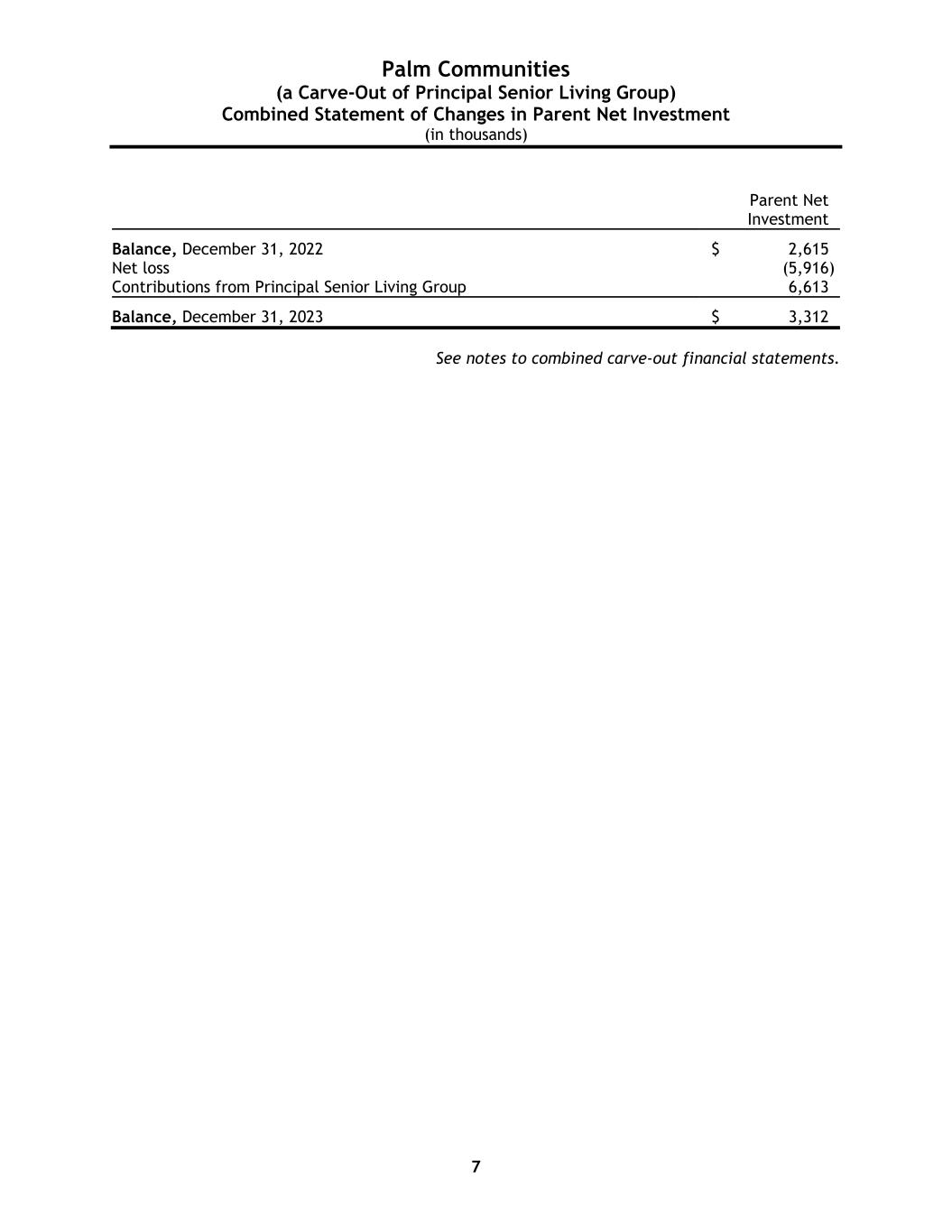

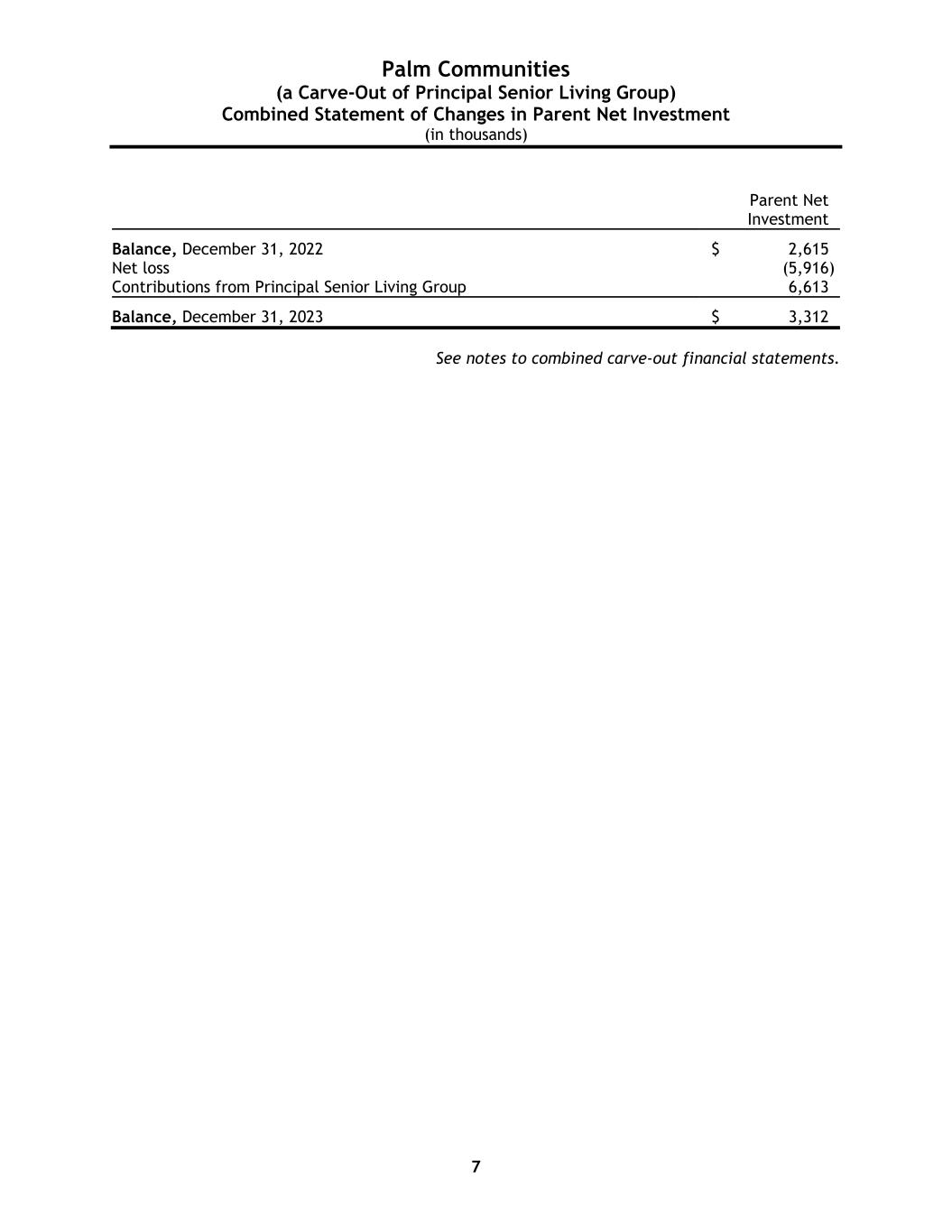

Palm Communities (a Carve-Out of Principal Senior Living Group) Combined Statement of Changes in Parent Net Investment (in thousands) 7 Parent Net Investment Balance, December 31, 2022 $ 2,615 Net loss (5,916) Contributions from Principal Senior Living Group 6,613 Balance, December 31, 2023 $ 3,312 See notes to combined carve-out financial statements.

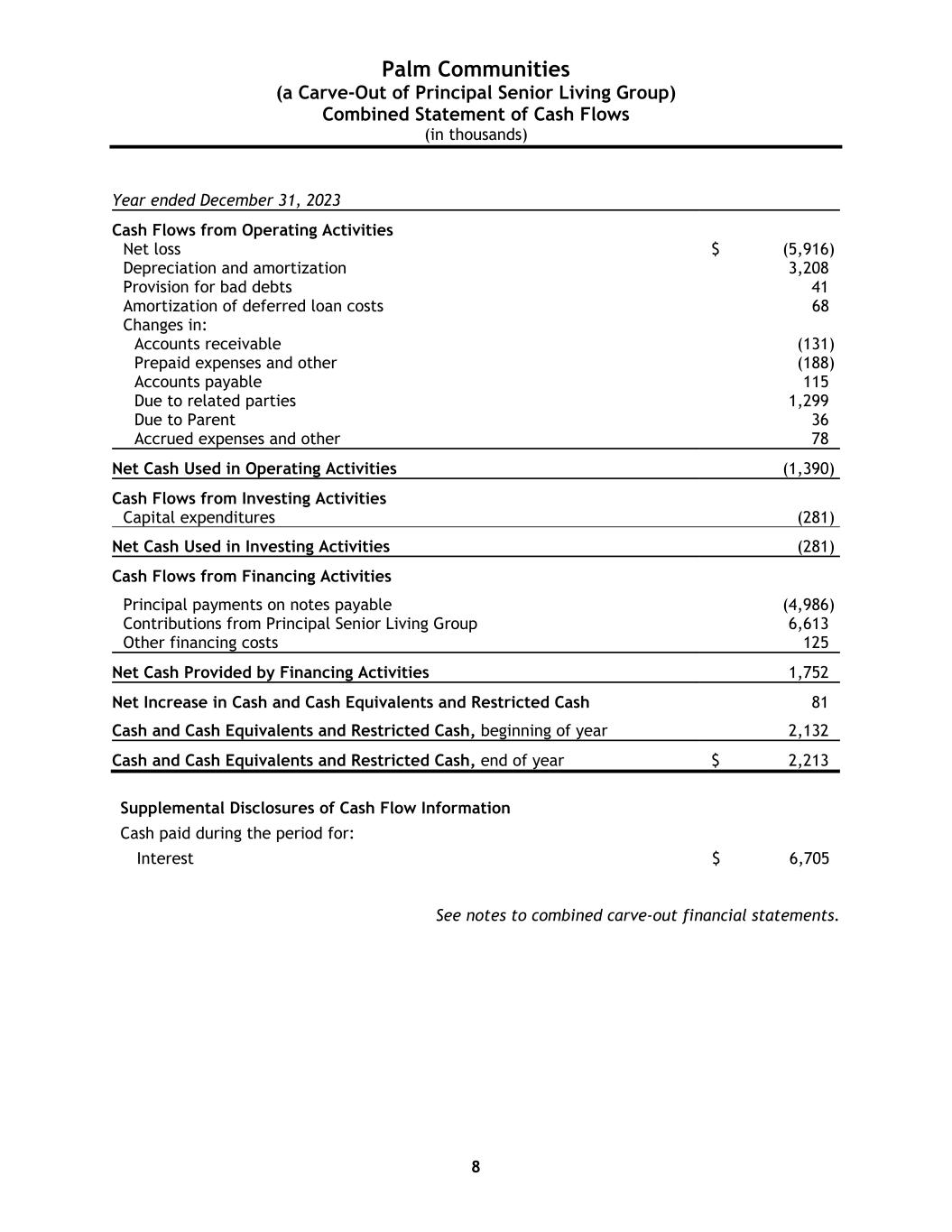

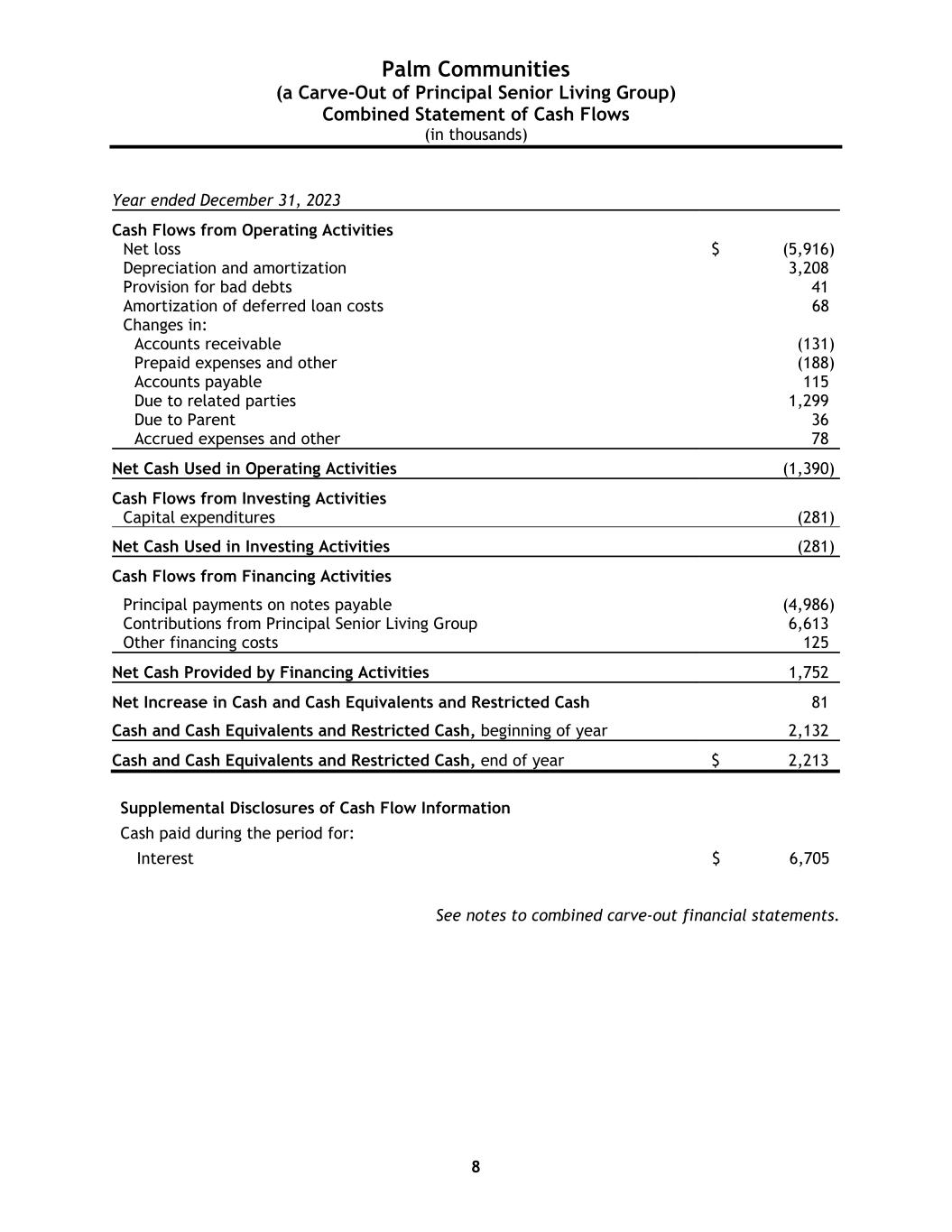

Palm Communities (a Carve-Out of Principal Senior Living Group) Combined Statement of Cash Flows (in thousands) 8 Year ended December 31, 2023 Cash Flows from Operating Activities Net loss $ (5,916) Depreciation and amortization 3,208 Provision for bad debts 41 Amortization of deferred loan costs 68 Changes in: Accounts receivable (131) Prepaid expenses and other (188) Accounts payable 115 Due to related parties 1,299 Due to Parent 36 Accrued expenses and other 78 Net Cash Used in Operating Activities (1,390) Cash Flows from Investing Activities Capital expenditures (281) Net Cash Used in Investing Activities (281) Cash Flows from Financing Activities Principal payments on notes payable (4,986) Contributions from Principal Senior Living Group 6,613 Other financing costs 125 Net Cash Provided by Financing Activities 1,752 Net Increase in Cash and Cash Equivalents and Restricted Cash 81 Cash and Cash Equivalents and Restricted Cash, beginning of year 2,132 Cash and Cash Equivalents and Restricted Cash, end of year $ 2,213 Supplemental Disclosures of Cash Flow Information Cash paid during the period for: Interest $ 6,705 See notes to combined carve-out financial statements.

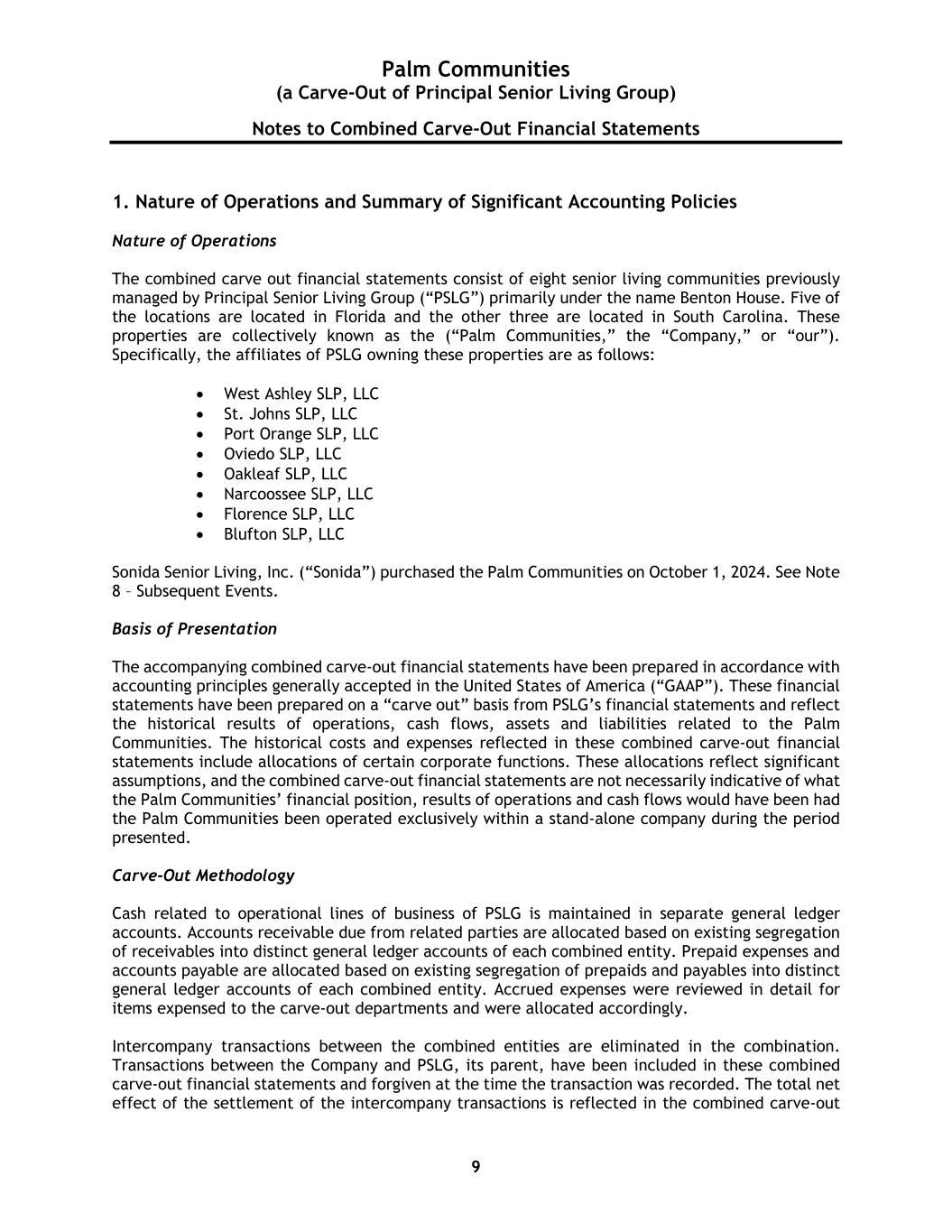

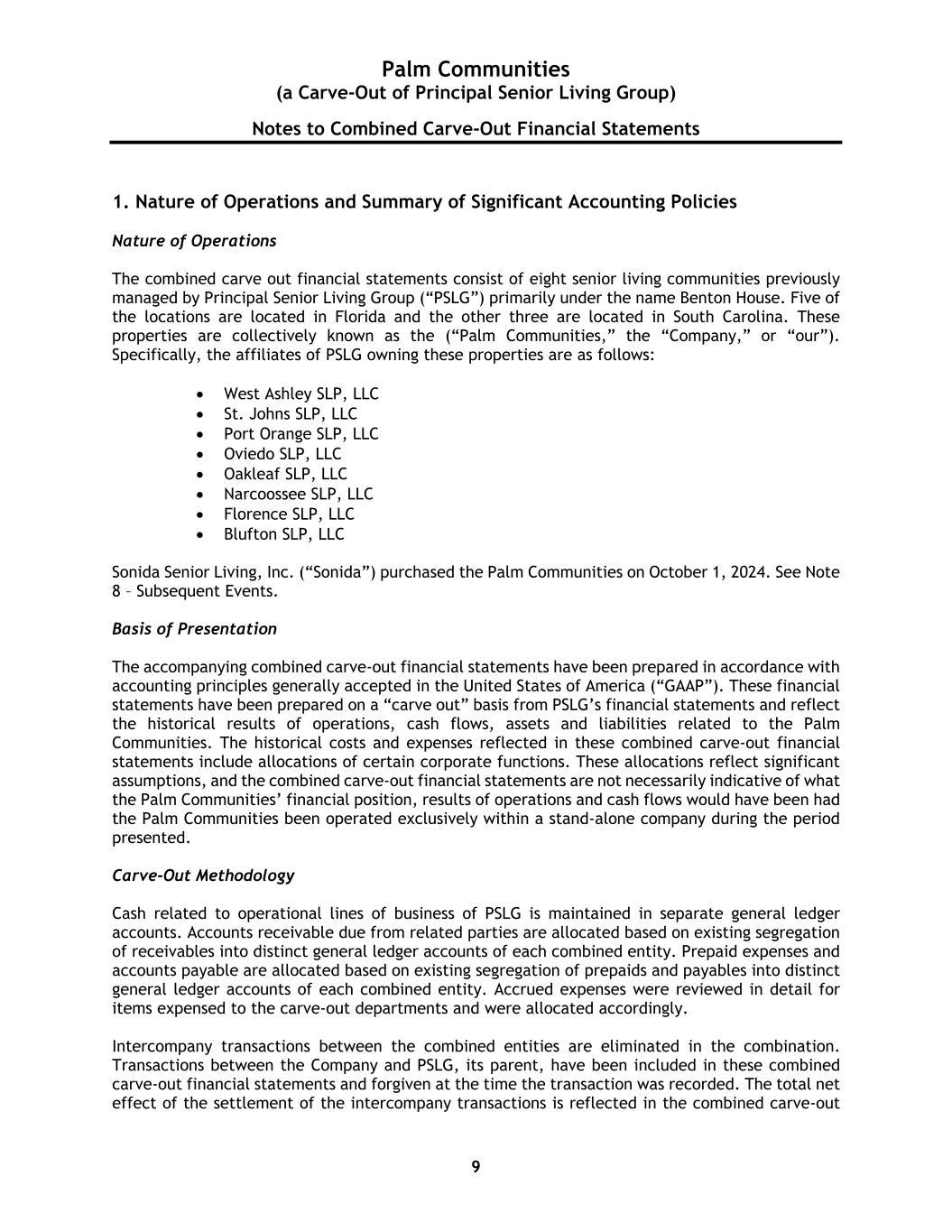

Palm Communities (a Carve-Out of Principal Senior Living Group) Notes to Combined Carve-Out Financial Statements 9 1. Nature of Operations and Summary of Significant Accounting Policies Nature of Operations The combined carve out financial statements consist of eight senior living communities previously managed by Principal Senior Living Group (“PSLG”) primarily under the name Benton House. Five of the locations are located in Florida and the other three are located in South Carolina. These properties are collectively known as the (“Palm Communities,” the “Company,” or “our”). Specifically, the affiliates of PSLG owning these properties are as follows: • West Ashley SLP, LLC • St. Johns SLP, LLC • Port Orange SLP, LLC • Oviedo SLP, LLC • Oakleaf SLP, LLC • Narcoossee SLP, LLC • Florence SLP, LLC • Blufton SLP, LLC Sonida Senior Living, Inc. (“Sonida”) purchased the Palm Communities on October 1, 2024. See Note 8 – Subsequent Events. Basis of Presentation The accompanying combined carve-out financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). These financial statements have been prepared on a “carve out” basis from PSLG’s financial statements and reflect the historical results of operations, cash flows, assets and liabilities related to the Palm Communities. The historical costs and expenses reflected in these combined carve-out financial statements include allocations of certain corporate functions. These allocations reflect significant assumptions, and the combined carve-out financial statements are not necessarily indicative of what the Palm Communities’ financial position, results of operations and cash flows would have been had the Palm Communities been operated exclusively within a stand-alone company during the period presented. Carve-Out Methodology Cash related to operational lines of business of PSLG is maintained in separate general ledger accounts. Accounts receivable due from related parties are allocated based on existing segregation of receivables into distinct general ledger accounts of each combined entity. Prepaid expenses and accounts payable are allocated based on existing segregation of prepaids and payables into distinct general ledger accounts of each combined entity. Accrued expenses were reviewed in detail for items expensed to the carve-out departments and were allocated accordingly. Intercompany transactions between the combined entities are eliminated in the combination. Transactions between the Company and PSLG, its parent, have been included in these combined carve-out financial statements and forgiven at the time the transaction was recorded. The total net effect of the settlement of the intercompany transactions is reflected in the combined carve-out

Palm Communities (a Carve-Out of Principal Senior Living Group) Notes to Combined Carve-Out Financial Statements 10 statement of cash flows as a financing activity and in the combined carve-out balance sheet as a parent net investment. The components of the net transfers to and from PSLG are as follows (in thousands): December 31, 2023 Cash pooling and general financing activities $ 6,613 Net Contribution from Principal Senior Living Group Investment $ 6,613 PSLG segregates financial transactions by operating departments for most statement of operations activity. Revenues for the carved-out entities were recorded in respective general ledger accounts as were the related expenses. General overhead expenses were allocated based either on a proportionate share of leased square footage, personnel costs or by a more exact method if detailed information was available. Use of Estimates The preparation of combined carve-out financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the combined financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Cash and Cash Equivalents and Restricted Cash The Company considers all liquid investments with original maturities of three months or less to be cash equivalents. The Company has deposits in banks that exceed the Federal Deposit Insurance Corporation insurance limits. Management believes that credit risk related to these deposits is minimal. Restricted cash consists of reserve accounts for debt service required by certain loan agreements. Accounts Receivable Accounts receivable are stated at the amount billed to residents. Ordinarily, accounts receivable are due within one month after the fee revenues are recognized. The Company provides an allowance for credit losses, if any, which is based upon a review of outstanding receivables, historical collection information and existing economic conditions. Accounts that are past due more than 60 days, are reviewed monthly to determine if they are collectible. Accounts deemed uncollectible are written off and charged against the allowance for credit losses. There were no allowances for credit losses as of December 31, 2023. Accrued Expense Accrued expenses primarily consist of accrued insurance expense of $1.3 million, accrued payroll expense of $0.9 million, accrued interest of $0.6 million, and other accrued expenses of $0.1 million as of December 31, 2023.

Palm Communities (a Carve-Out of Principal Senior Living Group) Notes to Combined Carve-Out Financial Statements 11 Income Taxes PSLG treats the single-member LLCs included in the Company as disregarded entities under the provisions of the Internal Revenue Code (“IRC”). Therefore, all income or loss related to the Company is included in the federal income tax return of PSLG. PSLG is a multi-member LLC that has elected to be taxed as a partnership. All income and expense from the LLCs are passed through to the individual members. Property and Equipment, Net Property and equipment, net are stated at cost and depreciated on a straight-line basis over the estimated useful lives of the assets. Ordinary maintenance and repairs are recorded as expenses when incurred. Renovations and improvements, which improve and/or extend the useful life of the asset, are capitalized and depreciated over the estimated useful life of the renovations or improvements. See “Note 2–Property and Equipment, net.” Recently Adopted Accounting Pronouncements In June 2016, the Financial Accounting Standards Board (“FASB”) issued ASU 2016-13, Financial Instruments – Credit Losses: Measurement of Credit Losses on Financial Instruments. Current GAAP requires an “incurred loss” methodology for recognizing credit losses that delays recognition until it is probable a loss has been incurred. ASU 2016-13 replaces the current incurred moss methodology for credit losses and removes the thresholds that companies apply to measure credit losses on financial statements measured at amortized cost, such as loans, receivables, and held-to-maturity debt securities with a methodology that reflects expected credit losses and requires consideration of a broader range of reasonable and supportable information to form credit loss estimates. The determination of the allowance for credit losses under the new standard would typically be based on evaluation of a number of factors, including, but not limited to, general economic conditions, payment status, historical collection patterns and loss experience, financial strength of the borrower, and nature, extent and value of the underlying collateral. It requires a cumulative effect adjustment to the balance sheet as of the beginning of the first reporting period in which the guidance is effective. The Company adopted ASU 2016-13 on January 1, 2023. The effect of the adoption had an immaterial impact on the combined carve-out financial statements. Revenue Recognition Revenues are recognized when control of the promised goods or services is transferred to our customers, in an amount that reflects the consideration we expect to be entitled to in exchange for those goods or services. The Company determines revenue recognition through the following steps: • Identification of the contract, or contracts, with a customer • Identification of the performance obligations in the contract • Determination of the transaction price • Allocation of the transaction price to the performance obligations in the contract

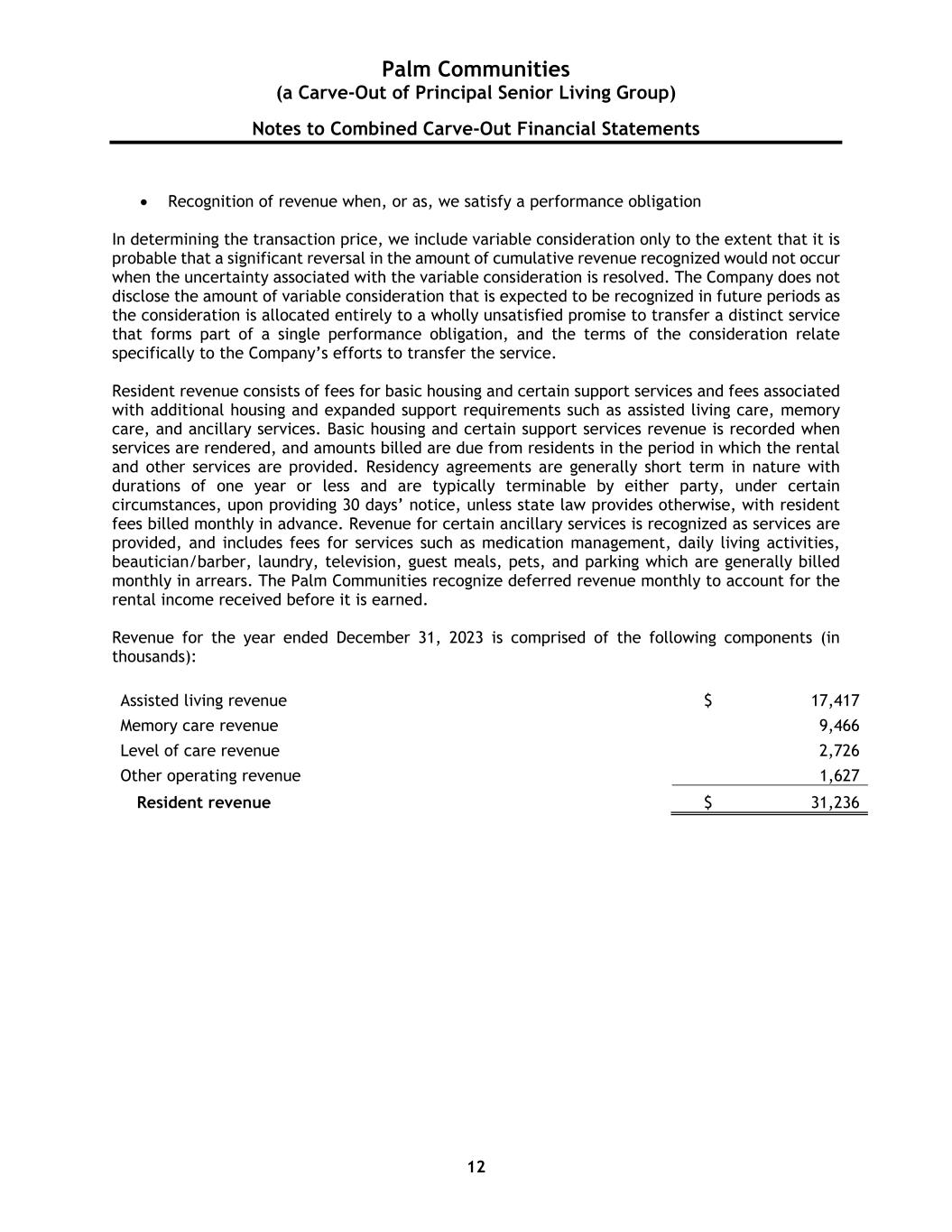

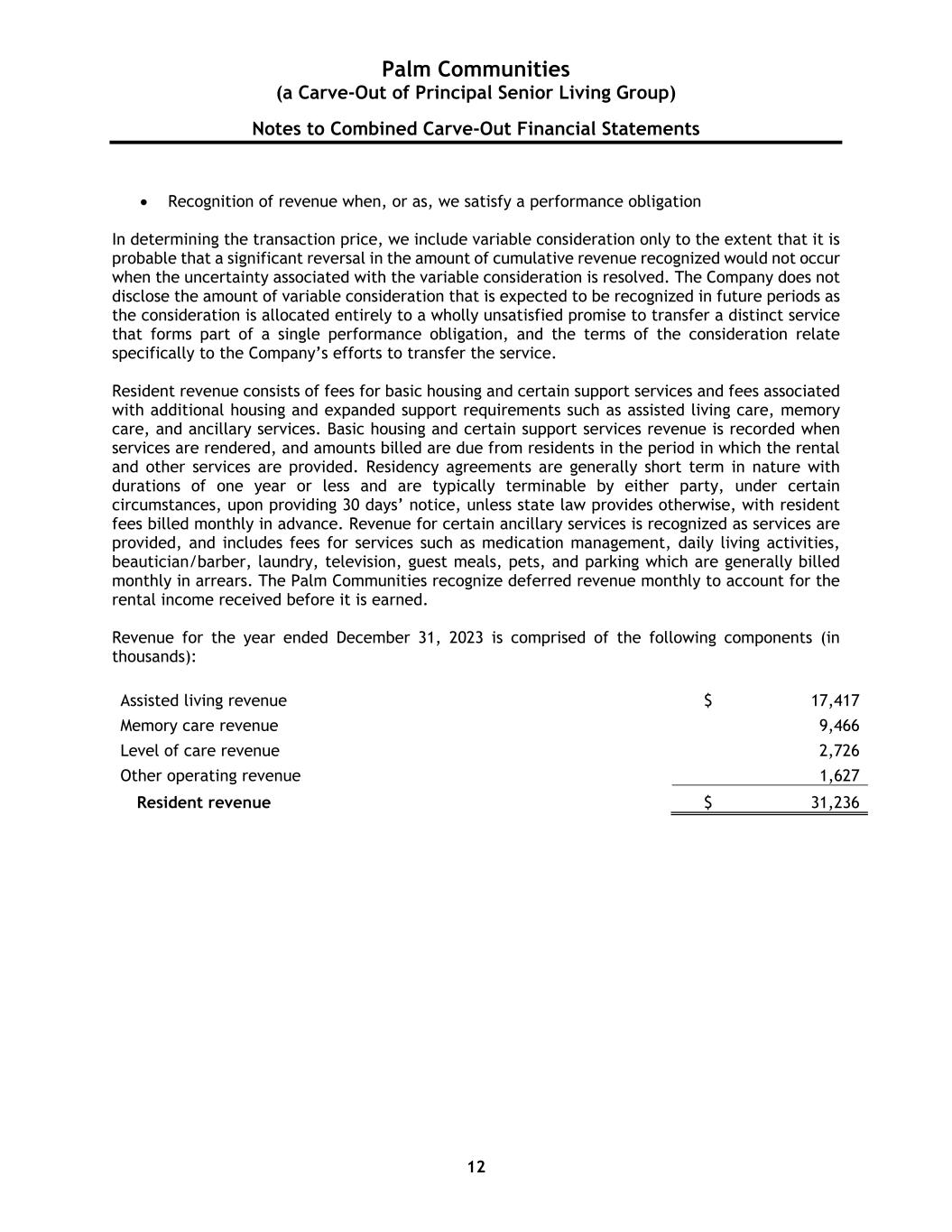

Palm Communities (a Carve-Out of Principal Senior Living Group) Notes to Combined Carve-Out Financial Statements 12 • Recognition of revenue when, or as, we satisfy a performance obligation In determining the transaction price, we include variable consideration only to the extent that it is probable that a significant reversal in the amount of cumulative revenue recognized would not occur when the uncertainty associated with the variable consideration is resolved. The Company does not disclose the amount of variable consideration that is expected to be recognized in future periods as the consideration is allocated entirely to a wholly unsatisfied promise to transfer a distinct service that forms part of a single performance obligation, and the terms of the consideration relate specifically to the Company’s efforts to transfer the service. Resident revenue consists of fees for basic housing and certain support services and fees associated with additional housing and expanded support requirements such as assisted living care, memory care, and ancillary services. Basic housing and certain support services revenue is recorded when services are rendered, and amounts billed are due from residents in the period in which the rental and other services are provided. Residency agreements are generally short term in nature with durations of one year or less and are typically terminable by either party, under certain circumstances, upon providing 30 days’ notice, unless state law provides otherwise, with resident fees billed monthly in advance. Revenue for certain ancillary services is recognized as services are provided, and includes fees for services such as medication management, daily living activities, beautician/barber, laundry, television, guest meals, pets, and parking which are generally billed monthly in arrears. The Palm Communities recognize deferred revenue monthly to account for the rental income received before it is earned. Revenue for the year ended December 31, 2023 is comprised of the following components (in thousands): Assisted living revenue $ 17,417 Memory care revenue 9,466 Level of care revenue 2,726 Other operating revenue 1,627 Resident revenue $ 31,236

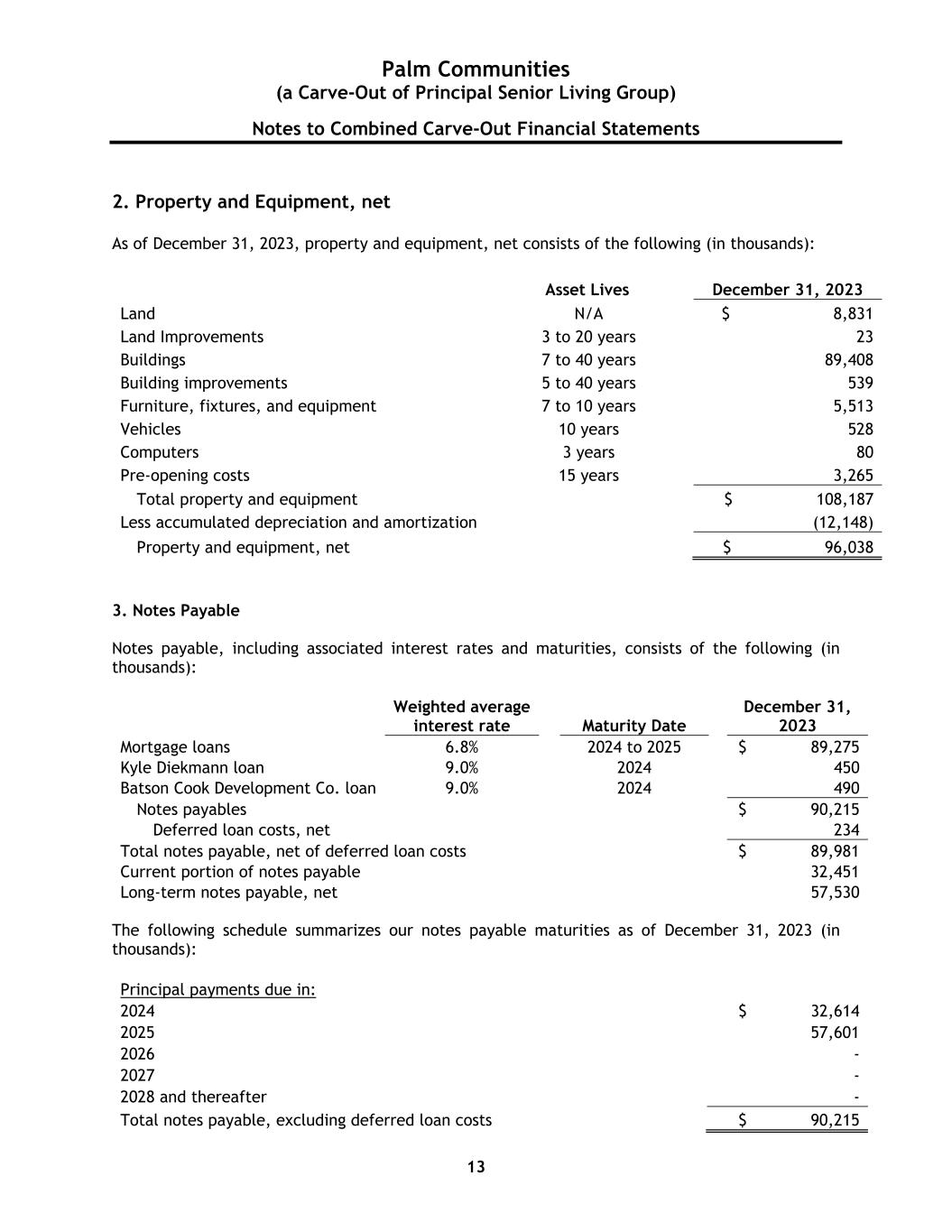

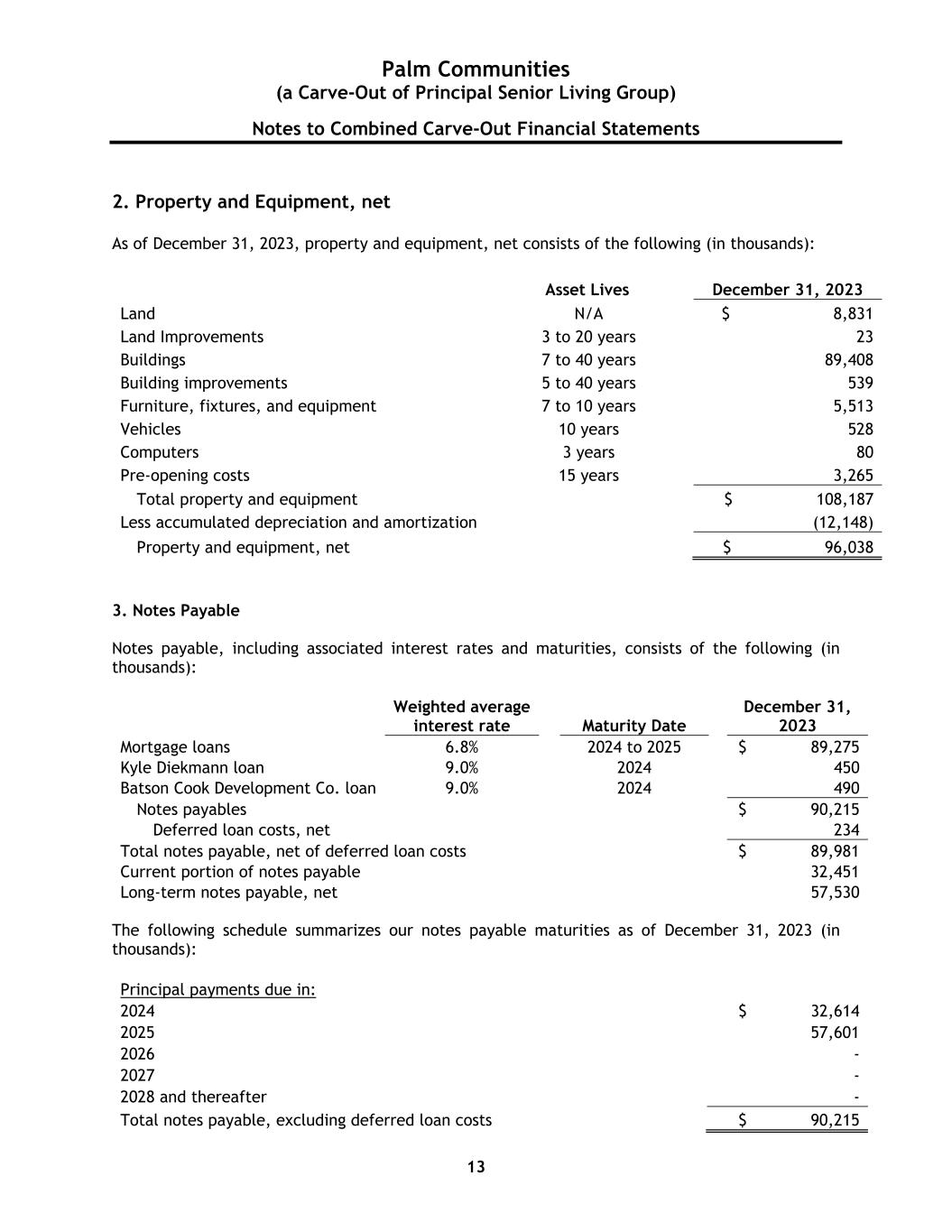

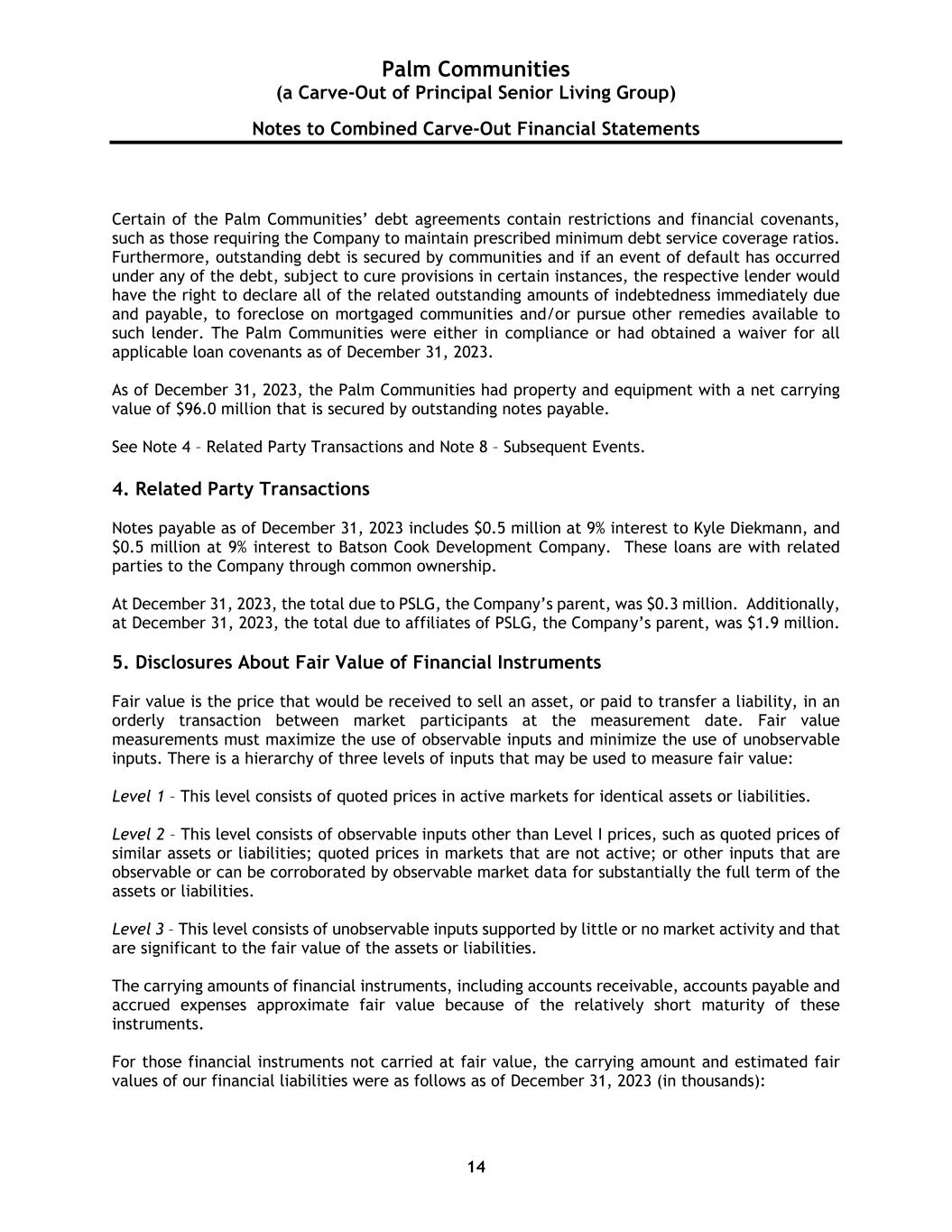

Palm Communities (a Carve-Out of Principal Senior Living Group) Notes to Combined Carve-Out Financial Statements 13 2. Property and Equipment, net As of December 31, 2023, property and equipment, net consists of the following (in thousands): Asset Lives December 31, 2023 Land N/A $ 8,831 Land Improvements 3 to 20 years 23 Buildings 7 to 40 years 89,408 Building improvements 5 to 40 years 539 Furniture, fixtures, and equipment 7 to 10 years 5,513 Vehicles 10 years 528 Computers 3 years 80 Pre-opening costs 15 years 3,265 Total property and equipment $ 108,187 Less accumulated depreciation and amortization (12,148) Property and equipment, net $ 96,038 3. Notes Payable Notes payable, including associated interest rates and maturities, consists of the following (in thousands): Weighted average interest rate Maturity Date December 31, 2023 Mortgage loans 6.8% 2024 to 2025 $ 89,275 Kyle Diekmann loan 9.0% 2024 450 Batson Cook Development Co. loan 9.0% 2024 490 Notes payables $ 90,215 Deferred loan costs, net 234 Total notes payable, net of deferred loan costs $ 89,981 Current portion of notes payable 32,451 Long-term notes payable, net 57,530 The following schedule summarizes our notes payable maturities as of December 31, 2023 (in thousands): Principal payments due in: 2024 $ 32,614 2025 57,601 2026 - 2027 - 2028 and thereafter - Total notes payable, excluding deferred loan costs $ 90,215

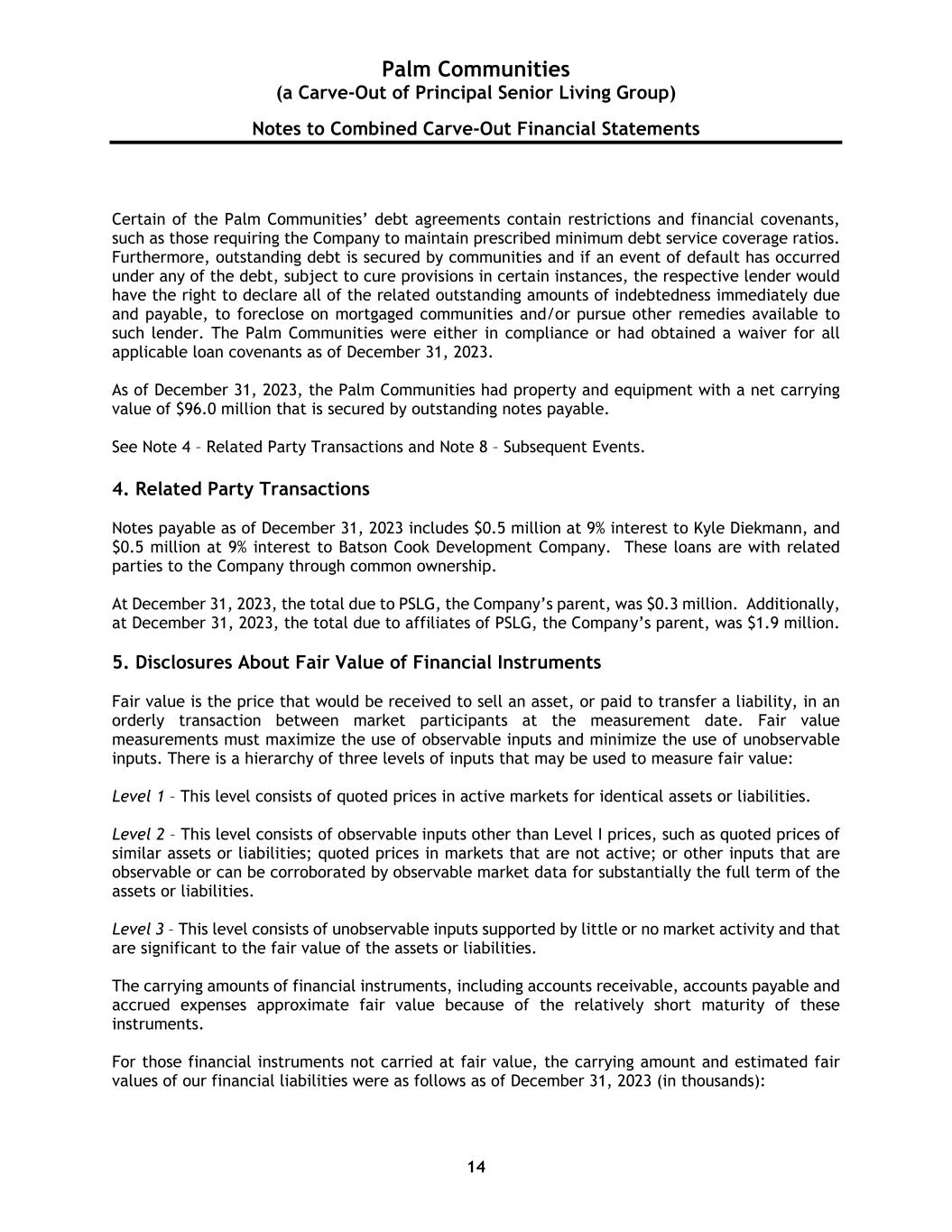

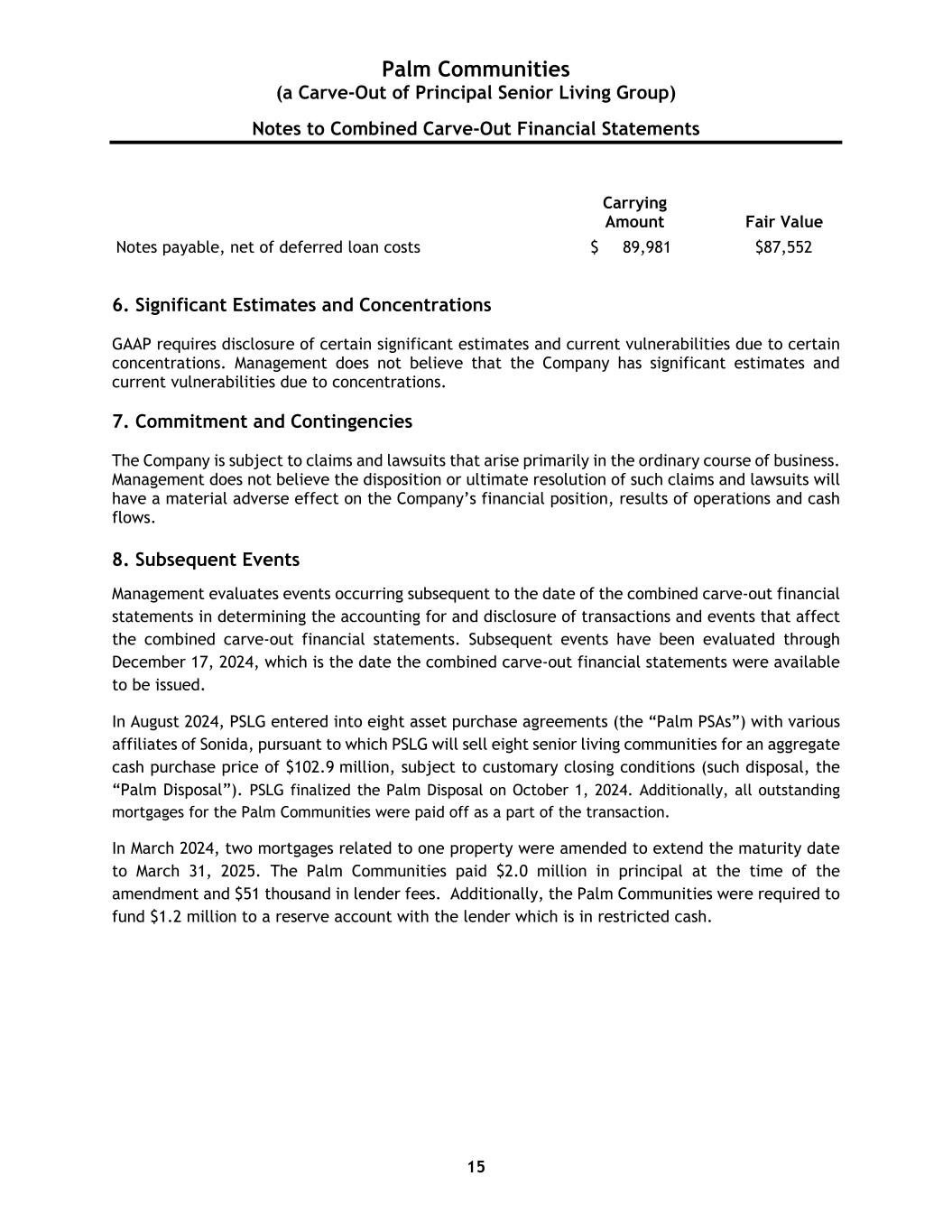

Palm Communities (a Carve-Out of Principal Senior Living Group) Notes to Combined Carve-Out Financial Statements 14 Certain of the Palm Communities’ debt agreements contain restrictions and financial covenants, such as those requiring the Company to maintain prescribed minimum debt service coverage ratios. Furthermore, outstanding debt is secured by communities and if an event of default has occurred under any of the debt, subject to cure provisions in certain instances, the respective lender would have the right to declare all of the related outstanding amounts of indebtedness immediately due and payable, to foreclose on mortgaged communities and/or pursue other remedies available to such lender. The Palm Communities were either in compliance or had obtained a waiver for all applicable loan covenants as of December 31, 2023. As of December 31, 2023, the Palm Communities had property and equipment with a net carrying value of $96.0 million that is secured by outstanding notes payable. See Note 4 – Related Party Transactions and Note 8 – Subsequent Events. 4. Related Party Transactions Notes payable as of December 31, 2023 includes $0.5 million at 9% interest to Kyle Diekmann, and $0.5 million at 9% interest to Batson Cook Development Company. These loans are with related parties to the Company through common ownership. At December 31, 2023, the total due to PSLG, the Company’s parent, was $0.3 million. Additionally, at December 31, 2023, the total due to affiliates of PSLG, the Company’s parent, was $1.9 million. 5. Disclosures About Fair Value of Financial Instruments Fair value is the price that would be received to sell an asset, or paid to transfer a liability, in an orderly transaction between market participants at the measurement date. Fair value measurements must maximize the use of observable inputs and minimize the use of unobservable inputs. There is a hierarchy of three levels of inputs that may be used to measure fair value: Level 1 – This level consists of quoted prices in active markets for identical assets or liabilities. Level 2 – This level consists of observable inputs other than Level I prices, such as quoted prices of similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities. Level 3 – This level consists of unobservable inputs supported by little or no market activity and that are significant to the fair value of the assets or liabilities. The carrying amounts of financial instruments, including accounts receivable, accounts payable and accrued expenses approximate fair value because of the relatively short maturity of these instruments. For those financial instruments not carried at fair value, the carrying amount and estimated fair values of our financial liabilities were as follows as of December 31, 2023 (in thousands):

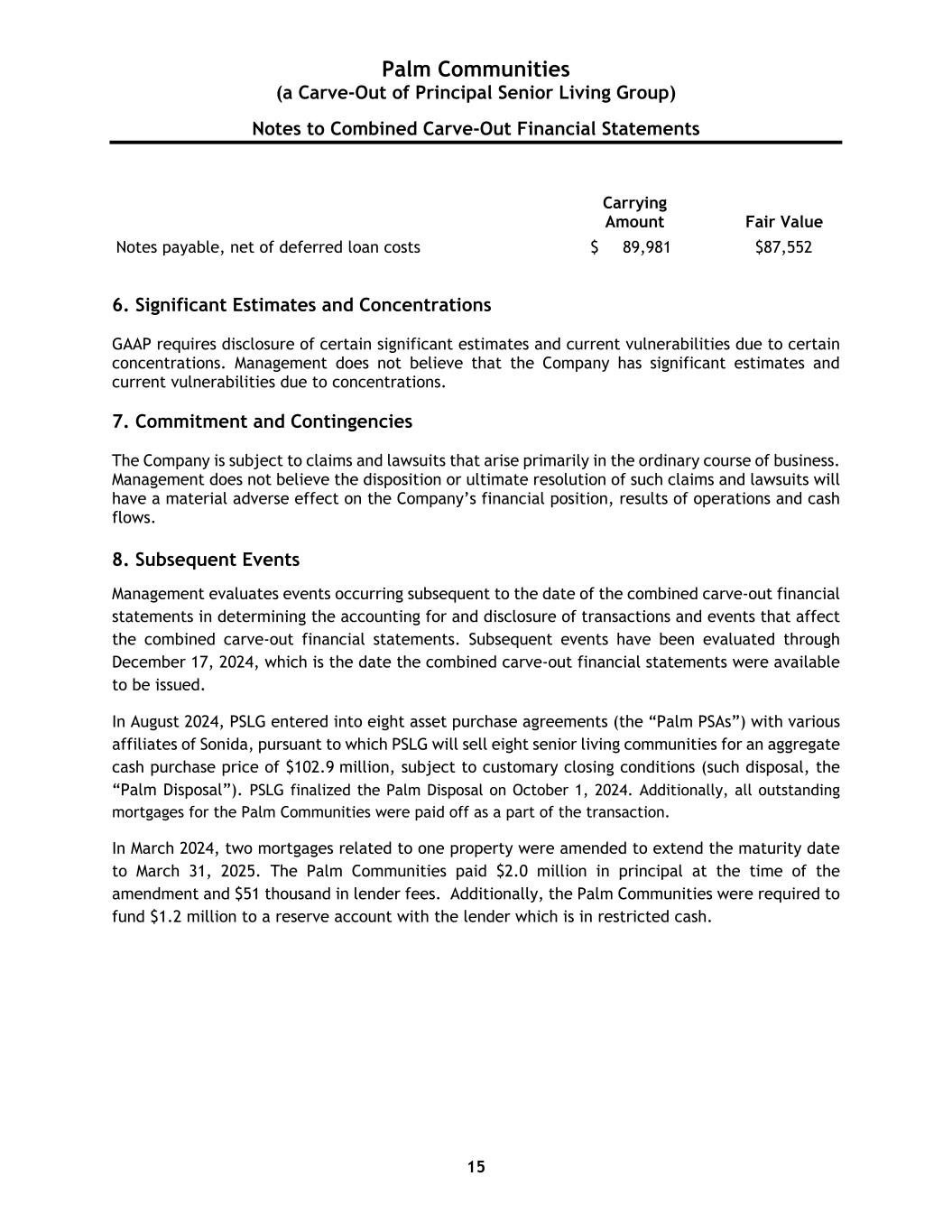

Palm Communities (a Carve-Out of Principal Senior Living Group) Notes to Combined Carve-Out Financial Statements 15 Carrying Amount Fair Value Notes payable, net of deferred loan costs $ 89,981 $87,552 6. Significant Estimates and Concentrations GAAP requires disclosure of certain significant estimates and current vulnerabilities due to certain concentrations. Management does not believe that the Company has significant estimates and current vulnerabilities due to concentrations. 7. Commitment and Contingencies The Company is subject to claims and lawsuits that arise primarily in the ordinary course of business. Management does not believe the disposition or ultimate resolution of such claims and lawsuits will have a material adverse effect on the Company’s financial position, results of operations and cash flows. 8. Subsequent Events Management evaluates events occurring subsequent to the date of the combined carve-out financial statements in determining the accounting for and disclosure of transactions and events that affect the combined carve-out financial statements. Subsequent events have been evaluated through December 17, 2024, which is the date the combined carve-out financial statements were available to be issued. In August 2024, PSLG entered into eight asset purchase agreements (the “Palm PSAs”) with various affiliates of Sonida, pursuant to which PSLG will sell eight senior living communities for an aggregate cash purchase price of $102.9 million, subject to customary closing conditions (such disposal, the “Palm Disposal”). PSLG finalized the Palm Disposal on October 1, 2024. Additionally, all outstanding mortgages for the Palm Communities were paid off as a part of the transaction. In March 2024, two mortgages related to one property were amended to extend the maturity date to March 31, 2025. The Palm Communities paid $2.0 million in principal at the time of the amendment and $51 thousand in lender fees. Additionally, the Palm Communities were required to fund $1.2 million to a reserve account with the lender which is in restricted cash.